UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2003

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-13309

VARCO INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

Delaware (State or other jurisdiction of incorporation or organization) | | 76-0252850 (I.R.S. Employer Identification No.) |

2000 W. Sam Houston Parkway South, Suite 1700, Houston, Texas (Address of principal executive offices) | | 77042 (Zip Code) |

(281) 953-2200

(Registrant’s telephone number, including area code)

None

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant is an accelerated filer (as defined in Rule 12b-2 of the Exchange Act). Yes x No ¨

The Registrant had 97,594,950 shares of common stock outstanding as of October 24, 2003.

VARCO INTERNATIONAL, INC.

Table of Contents

1

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements

2

VARCO INTERNATIONAL, INC.

CONSOLIDATED BALANCE SHEETS

| | | September 30, 2003

| | | December 31, 2002

| |

| | | (Unaudited) | | | | |

| | | (in thousands) | |

ASSETS | | | | | | | | |

Current assets: | | | | | | | | |

Cash and cash equivalents | | $ | 110,362 | | | $ | 105,997 | |

Accounts receivable, net | | | 344,062 | | | | 323,456 | |

Inventory, net | | | 316,762 | | | | 279,958 | |

Deferred tax assets | | | 17,394 | | | | 15,727 | |

Prepaid expenses and other | | | 27,954 | | | | 22,840 | |

| | |

|

|

| |

|

|

|

Total current assets | | | 816,534 | | | | 747,978 | |

| | |

|

|

| |

|

|

|

Property and equipment, net | | | 463,555 | | | | 450,131 | |

Identified intangibles, net | | | 32,630 | | | | 32,918 | |

Goodwill, net | | | 437,723 | | | | 418,659 | |

Other assets, net | | | 12,703 | | | | 11,374 | |

| | |

|

|

| |

|

|

|

Total assets | | $ | 1,763,145 | | | $ | 1,661,060 | |

| | |

|

|

| |

|

|

|

LIABILITIES AND EQUITY | | | | | | | | |

Current liabilities: | | | | | | | | |

Accounts payable | | $ | 94,760 | | | $ | 90,604 | |

Accrued liabilities | | | 132,323 | | | | 111,430 | |

Income taxes payable | | | 4,862 | | | | 9,252 | |

Current portion of long-term debt and short-term borrowings | | | 5,650 | | | | 7,045 | |

| | |

|

|

| |

|

|

|

Total current liabilities | | | 237,595 | | | | 218,331 | |

Long-term debt | | | 450,278 | | | | 460,883 | |

Pension liabilities and post-retirement obligations | | | 26,019 | | | | 24,899 | |

Deferred taxes payable | | | 45,482 | | | | 35,252 | |

Other liabilities | | | 4,214 | | | | 1,413 | |

| | |

|

|

| |

|

|

|

Total liabilities | | | 763,588 | | | | 740,778 | |

| | |

|

|

| |

|

|

|

Common stockholders’ equity: | | | | | | | | |

Common stock, $.01 par value, 200,000,000 shares authorized, 99,037,582 shares issued and 97,593,882 shares outstanding at September 30, 2003 (98,416,012 shares issued and 96,991,312 shares outstanding at December 31, 2002) | | | 990 | | | | 984 | |

Paid in capital | | | 534,108 | | | | 525,782 | |

Retained earnings | | | 490,043 | | | | 427,355 | |

Accumulated other comprehensive loss | | | (9,936 | ) | | | (18,509 | ) |

Less: treasury stock at cost (1,443,700 shares) | | | (15,648 | ) | | | (15,330 | ) |

| | |

|

|

| |

|

|

|

Total common stockholders’ equity | | | 999,557 | | | | 920,282 | |

| | |

|

|

| |

|

|

|

Total liabilities and equity | | $ | 1,763,145 | | | $ | 1,661,060 | |

| | |

|

|

| |

|

|

|

See notes to unaudited consolidated financial statements.

3

VARCO INTERNATIONAL, INC.

UNAUDITED CONSOLIDATED STATEMENTS OF INCOME

| | | Three Months Ended September 30,

| | | Nine Months Ended September 30,

| |

| | | 2003

| | | 2002

(restated)

| | | 2003

| | | 2002 (restated)

| |

| | | (in thousands, except per share data) | |

Revenue | | $ | 374,976 | | | $ | 333,939 | | | $ | 1,099,910 | | | $ | 980,560 | |

| | | | |

Costs and expenses: | | | | | | | | | | | | | | | | |

| | | | |

Costs of services and products sold | | | 267,077 | | | | 236,687 | | | | 796,728 | | | | 698,038 | |

| | | | |

Selling, general and administration | | | 44,495 | | | | 41,257 | | | | 136,164 | | | | 117,629 | |

| | | | |

Research and engineering costs | | | 15,325 | | | | 14,932 | | | | 46,512 | | | | 42,177 | |

| | | | |

Merger, transaction, and litigation costs | | | — | | | | 2,369 | | | | — | | | | 5,198 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Operating profit | | | 48,079 | | | | 38,694 | | | | 120,506 | | | | 117,518 | |

| | | | |

Other expense (income): | | | | | | | | | | | | | | | | |

| | | | |

Interest expense | | | 7,357 | | | | 6,243 | | | | 23,071 | | | | 18,357 | |

| | | | |

Interest income | | | (320 | ) | | | (262 | ) | | | (880 | ) | | | (611 | ) |

| | | | |

Other, net | | | 1,413 | | | | 2,399 | | | | 3,334 | | | | 8,511 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income before income taxes | | | 39,629 | | | | 30,314 | | | | 94,981 | | | | 91,261 | |

| | | | |

Provision for income taxes | | | 12,990 | | | | 10,262 | | | | 32,293 | | | | 32,859 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net income | | $ | 26,639 | | | $ | 20,052 | | | $ | 62,688 | | | $ | 58,402 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Earnings per common share: | | | | | | | | | | | | | | | | |

Basic earnings per common share | | $ | 0.27 | | | $ | 0.21 | | | $ | 0.64 | | | $ | 0.61 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Dilutive earnings per common share | | $ | 0.27 | | | $ | 0.21 | | | $ | 0.64 | | | $ | 0.60 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | |

Weighted average number of common shares outstanding: | | | | | | | | | | | | | | | | |

Basic | | | 97,503 | | | | 96,785 | | | | 97,335 | | | | 96,531 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Dilutive | | | 98,264 | | | | 97,505 | | | | 98,219 | | | | 97,353 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

See notes to unaudited consolidated financial statements.

4

VARCO INTERNATIONAL, INC.

UNAUDITED CONSOLIDATED STATEMENTS OF CASH FLOWS

| | | Nine Months Ended September 30,

| |

| | | 2003

| | | 2002 (restated)

| |

| | | (in thousands) | |

Cash flows from operating activities: | | | | | | | | |

Net income | | $ | 62,688 | | | $ | 58,402 | |

Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | |

Depreciation and amortization | | | 49,627 | | | | 43,045 | |

Other non-cash charges | | | 15,693 | | | | 10,449 | |

Changes in assets and liabilities, net of effects of acquired companies: | | | | | | | | |

Accounts receivable | | | (21,831 | ) | | | 26,886 | |

Inventory | | | (41,911 | ) | | | (41,648 | ) |

Prepaid expenses and other assets | | | (5,091 | ) | | | (900 | ) |

Accounts payable and accrued liabilities | | | 17,095 | | | | 5,241 | |

Federal and foreign income taxes payable | | | (2,388 | ) | | | (12,861 | ) |

| | |

|

|

| |

|

|

|

Net cash provided by operating activities | | | 73,882 | | | | 88,614 | |

| | |

|

|

| |

|

|

|

Cash flows used for investing activities: | | | | | | | | |

Capital expenditures | | | (43,424 | ) | | | (35,689 | ) |

Business acquisitions, net of cash acquired | | | (23,179 | ) | | | (146,784 | ) |

Other | | | (207 | ) | | | (2,211 | ) |

| | |

|

|

| |

|

|

|

Net cash used for investing activities | | | (66,810 | ) | | | (184,684 | ) |

| | |

|

|

| |

|

|

|

Cash flows provided by (used for) financing activities: | | | | | | | | |

Borrowings under financing agreements | | | 78 | | | | 90,018 | |

Principal payments under financing agreements | | | (9,978 | ) | | | (8,596 | ) |

Proceeds from sale of common stock, net | | | 7,510 | | | | 8,913 | |

Purchase of treasury stock | | | (317 | ) | | | — | |

| | |

|

|

| |

|

|

|

Net cash provided by (used for) financing activities | | | (2,707 | ) | | | 90,335 | |

| | |

|

|

| |

|

|

|

Net increase (decrease) in cash and cash equivalents | | | 4,365 | | | | (5,735 | ) |

| | |

Cash and cash equivalents: | | | | | | | | |

| | |

Beginning of period | | | 105,997 | | | | 57,499 | |

| | |

|

|

| |

|

|

|

End of period | | $ | 110,362 | | | $ | 51,764 | |

| | |

|

|

| |

|

|

|

| | |

Supplemental disclosure of cash flow information: | | | | | | | | |

| | |

Cash paid during the nine month period for: | | | | | | | | |

Interest | | $ | 19,926 | | | $ | 16,640 | |

| | |

|

|

| |

|

|

|

Taxes | | $ | 28,125 | | | $ | 44,630 | |

| | |

|

|

| |

|

|

|

See notes to unaudited consolidated financial statements.

5

VARCO INTERNATIONAL, INC.

Notes to Unaudited Consolidated Financial Statements

For the Three and Nine Months Ended September 30, 2003 and 2002

and as of December 31, 2002

1. Organization and Basis of Presentation of Interim Consolidated Financial Statements

The accompanying unaudited consolidated financial statements of Varco International, Inc. (the “Company”) and its wholly-owned subsidiaries have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission. Certain information in footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States have been condensed or omitted pursuant to these rules and regulations. The unaudited consolidated financial statements included in this report reflect all the adjustments, consisting of normal recurring accruals, and accruals associated with the Company’s acquisition of substantially all of the oilfield services business of ICO, Inc. in September 2002, which the Company considers necessary for a fair presentation of the results of operations for the interim periods covered and for the financial condition of the Company at the date of the interim balance sheet. Results for the interim periods are not necessarily indicative of results for the year.

The financial statements included in this report should be read in conjunction with the Company’s 2002 audited consolidated financial statements and accompanying notes included in the Company’s 2002 Form 10-K/A, filed under the Securities Exchange Act of 1934, as amended.

2. Revenue Recognition for Bill and Hold Transactions

Prior to January 1, 2003, the Company recognized revenue on bill and hold transactions when the related product had been completed and was ready to be shipped, title and risk of loss had passed to the customer and the Company believed that the other criteria set forth in Staff Accounting Bulletin (SAB) 101 had been satisfied. Beginning January 1, 2003, the Company recognizes revenue only when delivery has occurred and all other conditions for revenue recognition have been met. If revenue from all bill and hold transactions occurring during the three years ended December 31, 2002 was recognized upon shipment of the related product, rather than on the date previously recognized, the Company’s financial results for fiscal years 2002, 2001 and 2000 would not be materially affected. While the Company has not restated its financial results for these annual periods, it has restated its financial results for all quarterly periods in 2002 and 2001 to reflect recognition of revenue on bill and hold transactions upon shipment. The restated information is disclosed in the Company’s 2002 Form 10-K/A in Footnote 14 of the Notes to Consolidated Financial Statements. Restated results for the three and nine months ended September 30, 2002 are reflected in this report.

3. Acquisitions

The Company completed ten acquisitions in the nine months ended September 30, 2003. The combined purchase price for these acquisitions was approximately $21,502,000, including cash consideration of $20,255,000, noncash consideration of $900,000 and notes issued of $347,000. Goodwill associated with these transactions was approximately $10,366,000. Cash paid in 2003 for 2002 acquisitions was approximately $2,924,000.

4. Inventory

At September 30, 2003 and December 31, 2002, inventories consisted of the following (in thousands):

| | | September 30,

2003

| | | December 31,

2002

| |

Raw materials | | $ | 84,696 | | | $ | 83,660 | |

Work in process | | | 100,114 | | | | 65,192 | |

Finished goods | | | 173,636 | | | | 170,640 | |

Inventory reserves | | | (41,684 | ) | | | (39,534 | ) |

| | |

|

|

| |

|

|

|

Inventory, net | | $ | 316,762 | | | $ | 279,958 | |

| | |

|

|

| |

|

|

|

6

5. Comprehensive Income

Comprehensive income for the three and nine months ended September 30, 2003 and 2002 was as follows (in thousands):

| | | Three Months Ended

September 30,

| | | Nine Months Ended September 30,

| |

| | | 2003

| | | 2002 (restated)

| | | 2003

| | | 2002 (restated)

| |

Comprehensive income (loss): | | | | | | | | | | | | | | | | |

Net income | | $ | 26,639 | | | $ | 20,052 | | | $ | 62,688 | | | $ | 58,402 | |

Cumulative translation adjustment | | | (410 | ) | | | 114 | | | | 8,674 | | | | (1,069 | ) |

Amortization of gain on interest rate contract | | | (33 | ) | | | — | | | | (101 | ) | | | — | |

Unrealized loss on securities | | | — | | | | (835 | ) | | | — | | | | (835 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total comprehensive income | | $ | 26,196 | | | $ | 19,331 | | | $ | 71,261 | | | $ | 56,498 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

6. Stock Repurchase Program

During the third quarter of 2003, the Company’s Board of Directors authorized repurchases of up to $150,000,000 of the Company’s outstanding common stock from time to time at the Company’s discretion. As a part of this program, the Company repurchased 19,000 shares of Company common stock at an average price of $16.68 per share for a total consideration of approximately $317,000 during the third quarter ended September 30, 2003.

7. Accounting For Stock-Based Compensation

In 2003, the Company’s Board of Directors and stockholders approved amendments to the Amended and Restated 1996 Equity Participation Plan, now known as the 2003 Equity Participation Plan. The amendments included an increase in the number of authorized shares of common stock to be granted to officers, key employees, and non-employee members of the Board of Directors from 7,650,000 to 12,150,000 shares. Options granted under the plan to key employees generally become exercisable in installments over three years starting one year from the date of grant and expire ten years from the date of grant. Options granted under the plan to non-employee members of the Board of Directors become exercisable in installments over four year periods starting one year from the date of grant and expire ten years from the date of grant.

Options outstanding under plans the Company assumed in connection with acquisitions will maintain the terms under which the options were granted. These terms allow options granted to key employees and non-employee directors to be vested in installments from one to five years starting one year from the date of grant and expire ten years from the date of grant.

7

The Company accounts for its stock-based employee compensation plans using the intrinsic value method. If the Company had accounted for its stock-based employee compensation plans using the alternative fair value method, the Company’s pro forma net income and earnings per common share would have been as follows (in thousands, except per share data):

| | | Three Months Ended

September 30,

| | Nine Months Ended September 30,

|

| | | 2003

| | 2002

(restated)

| | 2003

| | 2002 (restated)

|

Pro forma net income and earnings per common share | | | | | | | | | | | | |

Net income, as reported | | $ | 26,639 | | $ | 20,052 | | $ | 62,688 | | $ | 58,402 |

Stock-based employee compensation cost, net of related tax effects | | | 2,172 | | | 1,858 | | | 6,071 | | | 5,438 |

| | |

|

| |

|

| |

|

| |

|

|

Pro forma net income | | $ | 24,467 | | $ | 18,194 | | $ | 56,617 | | $ | 52,964 |

| | |

|

| |

|

| |

|

| |

|

|

Earnings per common share: | | | | | | | | | | | | |

Basic earnings per common share, as reported | | $ | 0.27 | | $ | 0.21 | | $ | 0.64 | | $ | 0.61 |

| | |

|

| |

|

| |

|

| |

|

|

Basic earnings per common share, pro forma | | $ | 0.25 | | $ | 0.19 | | $ | 0.58 | | $ | 0.55 |

| | |

|

| |

|

| |

|

| |

|

|

Dilutive earnings per common share, as reported | | $ | 0.27 | | $ | 0.21 | | $ | 0.64 | | $ | 0.60 |

| | |

|

| |

|

| |

|

| |

|

|

Dilutive earnings per common share, pro forma | | $ | 0.25 | | $ | 0.19 | | $ | 0.58 | | $ | 0.54 |

| | |

|

| |

|

| |

|

| |

|

|

Weighted average number of common shares outstanding: | | | | | | | | | | | | |

Basic | | | 97,503 | | | 96,785 | | | 97,335 | | | 96,531 |

| | |

|

| |

|

| |

|

| |

|

|

Dilutive | | | 98,264 | | | 97,505 | | | 98,219 | | | 97,353 |

| | |

|

| |

|

| |

|

| |

|

|

8

8. Business Segments

The Company is organized into the following business segments based on the products and services it offers: Drilling Equipment Sales, Tubular Services, Drilling Services, and Coiled Tubing & Wireline Products.

Drilling Equipment Sales: This segment manufactures and sells systems and equipment for rotating and handling pipe on drilling rigs; a complete line of conventional drilling rig tools and equipment, including pipe handling tools, hoisting equipment and rotary equipment; pressure control and motion compensation equipment; and flow devices. Customers include major oil and gas companies and drilling contractors. Additionally, this segment provides after market spare parts for the Company’s installed base of drilling equipment, repair services and rental of drilling units.

Tubular Services: This segment provides internal coating products and services for tubular goods; inspection and quality assurance services for tubular goods; and fiberglass and composite pipe. Additionally, the Tubular Services business sells and rents proprietary equipment used to inspect tubular products at steel mills. The Tubular Services business also provides technical inspection services and quality assurance services for in-service pipelines used to transport oil and gas. Customers include major oil and gas companies, independent producers, national oil companies, drilling contractors, oilfield supply stores, major pipeline operators, and steel mills.

Drilling Services: This segment consists of the sale and rental of technical equipment used in, and the provision of services related to, the separation of drill cuttings (solids) from fluids used in the oil and gas drilling processes, and the sale and rental of computer based drilling instrumentation and communication equipment, as well as conventional drilling rig instrumentation. Customers include major oil and gas companies, independent producers, national oil companies and drilling contractors.

Coiled Tubing & Wireline Products: This segment consists of the sale of highly-engineered coiled tubing equipment, related pressure control equipment, pressure pumping equipment, wireline equipment and related tools to companies engaged in oil and gas well drilling and completion and remediation services. Customers include major oil and gas service companies, as well as national oil companies.

The Company evaluates the performance of its operating segments at the operating profit level which consists of income before interest expense (income), other expense (income), nonrecurring items and income taxes. Intersegment sales and transfers are not significant.

Summarized unaudited information for the Company’s reportable segments is contained in the following table. Other operating profit (loss) includes corporate expenses not allocated to product lines. Operating profit excludes merger, transaction and litigation costs of $2.829 million and $2.369 million recorded in the first quarter and third quarter of 2002, respectively. The first quarter 2002 charge was related to the May 2000 merger of the Company and Varco International, Inc., a California corporation. The third quarter 2002 charge was related to transaction costs associated with the acquisition of substantially all of the oilfield services assets of ICO, Inc. in September 2002.

| | | Three Months Ended

September 30,

| | | Nine Months Ended September 30,

| |

| | | 2003

| | | 2002

(restated)

| | | 2003

| | | 2002 (restated)

| |

| | | (in thousands) | | | (in thousands) | |

Revenue: | | | | | | | | | | | | | | | | |

Drilling Equipment Sales | | $ | 114,749 | | | $ | 120,344 | | | $ | 376,984 | | | $ | 364,060 | |

Tubular Services | | | 124,198 | | | | 91,339 | | | | 336,955 | | | | 242,772 | |

Drilling Services | | | 78,024 | | | | 69,525 | | | | 217,363 | | | | 207,196 | |

Coiled Tubing & Wireline Products | | | 58,005 | | | | 52,731 | | | | 168,608 | | | | 166,532 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total | | $ | 374,976 | | | $ | 333,939 | | | $ | 1,099,910 | | | $ | 980,560 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Operating Profit: | | | | | | | | | | | | | | | | |

Drilling Equipment Sales | | $ | 12,088 | | | $ | 19,094 | | | $ | 36,301 | | | $ | 55,509 | |

Tubular Services | | | 22,674 | | | | 15,304 | | | | 51,165 | | | | 36,792 | |

Drilling Services | | | 15,962 | | | | 11,626 | | | | 40,915 | | | | 37,528 | |

Coiled Tubing & Wireline Products | | | 11,471 | | | | 9,187 | | | | 33,364 | | | | 31,278 | |

Other | | | (14,116 | ) | | | (14,148 | ) | | | (41,239 | ) | | | (38,391 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total | | $ | 48,079 | | | $ | 41,063 | | | $ | 120,506 | | | $ | 122,716 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

9

9. Unaudited Condensed Consolidating Financial Information

On February 25, 1998, the Company issued $100,000,000 of 7 1/2% Senior Notes due 2008 (“2008 Notes”). On May 1, 2001, the Company issued $200,000,000 of 7 1/4% Senior Notes due 2011 (“2011 Notes”). On November 19, 2002, the Company issued $150,000,000 of 5 1/2% Senior Notes due 2012 (“2012 Notes”). The 2008 Notes, 2011 Notes, and 2012 Notes are fully and unconditionally guaranteed, on a joint and several basis, by certain wholly-owned subsidiaries of the Company (collectively “Guarantor Subsidiaries” and individually “Guarantor”). Each of the guarantees is an unsecured obligation of the Guarantor and rankspari passuwith the guarantees provided by and the obligations of such Guarantor Subsidiaries under the Company’s credit agreement and with all existing and future unsecured indebtedness of such Guarantor for borrowed money that is not, by its terms, expressly subordinated in right of payment to such guarantee.

The following condensed consolidating balance sheets as of September 30, 2003 and December 31, 2002 and related condensed consolidating statements of income for the three and nine months ended September 30, 2003 and 2002 and statement of cash flows for the nine months ended September 30, 2003 and 2002 should be read in conjunction with the notes to these unaudited consolidated financial statements.

10

VARCO INTERNATIONAL, INC.

Notes to Unaudited Consolidated Financial Statements (cont’d)

9. Unaudited Condensed Consolidating Financial Information (cont’d)

Balance Sheet

| | | September 30, 2003

| |

| | | Varco International, Inc. (Parent Company only)

| | | Guarantor

Subsidiaries

| | | Non-

Guarantor

Subsidiaries

| | | Eliminations

| | | Varco International,

Inc.

| |

| | | (in thousands) | |

ASSETS | | | | | | | | | | | | | | | | | | | | |

Current assets: | | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 5,757 | | | $ | 74,139 | | | $ | 30,466 | | | $ | — | | | $ | 110,362 | |

Accounts receivable, net | | | 253,848 | | | | 1,361,721 | | | | 913,324 | | | | (2,184,831 | ) | | | 344,062 | |

Inventory, net | | | — | | | | 186,034 | | | | 130,728 | | | | — | | | | 316,762 | |

Deferred tax asset | | | — | | | | 15,851 | | | | 1,543 | | | | — | | | | 17,394 | |

Other current assets | | | — | | | | 14,397 | | | | 13,557 | | | | — | | | | 27,954 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total current assets | | | 259,605 | | | | 1,652,142 | | | | 1,089,618 | | | | (2,184,831 | ) | | | 816,534 | |

Investment in subsidiaries | | | 1,326,778 | | | | 584,591 | | | | — | | | | (1,911,369 | ) | | | — | |

Property and equipment, net | | | — | | | | 317,835 | | | | 145,720 | | | | — | | | | 463,555 | |

Identified intangibles, net | | | — | | | | 29,100 | | | | 3,530 | | | | — | | | | 32,630 | |

Goodwill, net | | | — | | | | 300,955 | | | | 136,768 | | | | — | | | | 437,723 | |

Other assets, net | | | 3,719 | | | | 6,068 | | | | 2,916 | | | | — | | | | 12,703 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total assets | | $ | 1,590,102 | | | $ | 2,890,691 | | | $ | 1,378,552 | | | $ | (4,096,200 | ) | | $ | 1,763,145 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

LIABILITIES AND EQUITY | | | | | | | | | | | | | | | | | | | | |

Current liabilities: | | | | | | | | | | | | | | | | | | | | |

Accounts payable | | $ | 117,994 | | | $ | 1,445,809 | | | $ | 715,788 | | | $ | (2,184,831 | ) | | $ | 94,760 | |

Accrued liabilities | | | 10,009 | | | | 76,381 | | | | 45,933 | | | | — | | | | 132,323 | |

Income taxes payable | | | — | | | | 9,345 | | | | (4,483 | ) | | | — | | | | 4,862 | |

Current portion of long-term debt | | | — | | | | 4,003 | | | | 1,647 | | | | — | | | | 5,650 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total current liabilities | | | 128,003 | | | | 1,535,538 | | | | 758,885 | | | | (2,184,831 | ) | | | 237,595 | |

Long-term debt | | | 446,918 | | | | 3,096 | | | | 264 | | | | — | | | | 450,278 | |

Pension liabilities | | | 15,624 | | | | — | | | | 10,395 | | | | — | | | | 26,019 | |

Deferred taxes payable | | | — | | | | 24,951 | | | | 20,531 | | | | — | | | | 45,482 | |

Other liabilities | | | — | | | | 328 | | | | 3,886 | | | | — | | | | 4,214 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total liabilities | | | 590,545 | | | | 1,563,913 | | | | 793,961 | | | | (2,184,831 | ) | | | 763,588 | |

Common stockholders’ equity: | | | | | | | | | | | | | | | | | | | | |

Common stock | | | 990 | | | | — | | | | — | | | | — | | | | 990 | |

Paid in capital | | | 534,108 | | | | 731,834 | | | | 264,306 | | | | (996,140 | ) | | | 534,108 | |

Retained earnings | | | 490,043 | | | | 596,002 | | | | 329,163 | | | | (925,165 | ) | | | 490,043 | |

Accumulated other comprehensive loss | | | (9,936 | ) | | | (1,058 | ) | | | (8,878 | ) | | | 9,936 | | | | (9,936 | ) |

Treasury stock | | | (15,648 | ) | | | — | | | | — | | | | — | | | | (15,648 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total common stockholders’ equity | | | 999,557 | | | | 1,326,778 | | | | 584,591 | | | | (1,911,369 | ) | | | 999,557 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total liabilities and equity | | $ | 1,590,102 | | | $ | 2,890,691 | | | $ | 1,378,552 | | | $ | (4,096,200 | ) | | $ | 1,763,145 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

11

9. Unaudited Condensed Consolidating Financial Information (cont’d)

Balance Sheet

| | | December 31, 2002

| |

| | | Varco International,

Inc. (Parent Company Only)

| | | Guarantor

Subsidiaries

| | | Non- Guarantor Subsidiaries

| | | Eliminations

| | | Varco International,

Inc.

| |

| | | (in thousands) | |

ASSETS | | | | | | | | | | | | | | | | | | | | |

Current assets: | | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 4,221 | | | $ | 63,547 | | | $ | 38,229 | | | $ | — | | | $ | 105,997 | |

Accounts receivable, net | | | 272,340 | | | | 1,147,297 | | | | 1,072,233 | | | | (2,168,414 | ) | | | 323,456 | |

Inventory, net | | | — | | | | 193,787 | | | | 86,171 | | | | — | | | | 279,958 | |

Other current assets | | | — | | | | 26,057 | | | | 12,510 | | | | — | | | | 38,567 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total current assets | | | 276,561 | | | | 1,430,688 | | | | 1,209,143 | | | | (2,168,414 | ) | | | 747,978 | |

Investment in subsidiaries | | | 1,228,861 | | | | 521,277 | | | | — | | | | (1,750,138 | ) | | | — | |

Property and equipment, net | | | — | | | | 304,013 | | | | 146,118 | | | | — | | | | 450,131 | |

Identifiable intangibles, net | | | — | | | | 29,160 | | | | 3,758 | | | | — | | | | 32,918 | |

Goodwill, net | | | — | | | | 285,788 | | | | 132,871 | | | | — | | | | 418,659 | |

Other assets, net | | | 3,860 | | | | 3,689 | | | | 3,825 | | | | — | | | | 11,374 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total assets | | $ | 1,509,282 | | | $ | 2,574,615 | | | $ | 1,495,715 | | | $ | (3,918,552 | ) | | $ | 1,661,060 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

LIABILITIES AND EQUITY | | | | | | | | | | | | | | | | | | | | |

Current liabilities: | | | | | | | | | | | | | | | | | | | | |

Accounts payable | | $ | 118,009 | | | $ | 1,244,406 | | | $ | 896,603 | | | $ | (2,168,414 | ) | | $ | 90,604 | |

Accrued liabilities | | | 6,264 | | | | 66,831 | | | | 38,335 | | | | — | | | | 111,430 | |

Income taxes | | | — | | | | 9,348 | | | | (96 | ) | | | — | | | | 9,252 | |

Current portion of long-term debt | | | — | | | | 2,353 | | | | 4,692 | | | | — | | | | 7,045 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total current liabilities | | | 124,273 | | | | 1,322,938 | | | | 939,534 | | | | (2,168,414 | ) | | | 218,331 | |

Long-term debt | | | 449,839 | | | | 6,191 | | | | 4,853 | | | | — | | | | 460,883 | |

Pension liabilities | | | 14,888 | | | | — | | | | 10,011 | | | | — | | | | 24,899 | |

Deferred taxes payable | | | — | | | | 15,919 | | | | 19,333 | | | | — | | | | 35,252 | |

Other liabilities | | | — | | | | 706 | | | | 707 | | | | — | | | | 1,413 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total liabilities | | | 589,000 | | | | 1,345,754 | | | | 974,438 | | | | (2,168,414 | ) | | | 740,778 | |

| | | | | |

Common stockholder’s equity: | | | | | | | | | | | | | | | | | | | | |

Common stock | | | 984 | | | | — | | | | — | | | | — | | | | 984 | |

Paid in capital | | | 525,782 | | | | 720,068 | | | | 254,917 | | | | (974,985 | ) | | | 525,782 | |

Retained earnings | | | 427,355 | | | | 509,851 | | | | 283,811 | | | | (793,662 | ) | | | 427,355 | |

Cumulative translation adjustment | | | (18,509 | ) | | | (1,058 | ) | | | (17,451 | ) | | | 18,509 | | | | (18,509 | ) |

Treasury stock | | | (15,330 | ) | | | — | | | | — | | | | — | | | | (15,330 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total common stockholders’ equity | | | 920,282 | | | | 1,228,861 | | | | 521,277 | | | | (1,750,138 | ) | | | 920,282 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total liabilities and equity | | $ | 1,509,282 | | | $ | 2,574,615 | | | $ | 1,495,715 | | | $ | (3,918,552 | ) | | $ | 1,661,060 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

12

VARCO INTERNATIONAL, INC.

Notes to Unaudited Consolidated Financial Statements (cont’d)

9. Unaudited Condensed Consolidating Financial Information (cont’d)

Statements of Income

| | | Three Months Ended September 30, 2003

|

| | | Varco International, Inc. (Parent Company only)

| | | Guarantor

Subsidiaries

| | | Non-

Guarantor Subsidiaries

| | Eliminations

| | | Varco International,

Inc.

|

| | | (in thousands) |

Revenue | | $ | — | | | $ | 276,110 | | | $ | 139,844 | | $ | (40,978 | ) | | $ | 374,976 |

Cost of Sales | | | — | | | | 206,813 | | | | 101,242 | | | (40,978 | ) | | | 267,077 |

Selling, general and administrative | | | — | | | | 30,288 | | | | 14,207 | | | — | | | | 44,495 |

Research and engineering costs | | | — | | | | 13,570 | | | | 1,755 | | | — | | | | 15,325 |

| | |

|

|

| |

|

|

| |

|

| |

|

|

| |

|

|

Total costs | | | — | | | | 250,671 | | | | 117,204 | | | (40,978 | ) | | | 326,897 |

| | |

|

|

| |

|

|

| |

|

| |

|

|

| |

|

|

Operating profit | | | — | | | | 25,439 | | | | 22,640 | | | — | | | | 48,079 |

Other expenses (income) | | | 427 | | | | (672 | ) | | | 1,338 | | | — | | | | 1,093 |

Interest expense | | | 7,089 | | | | (43 | ) | | | 311 | | | — | | | | 7,357 |

| | |

|

|

| |

|

|

| |

|

| |

|

|

| |

|

|

Income (loss) before taxes | | | (7,516 | ) | | | 26,154 | | | | 20,991 | | | — | | | | 39,629 |

Provision for taxes | | | — | | | | 10,264 | | | | 2,726 | | | — | | | | 12,990 |

Equity in net income of subsidiaries | | | 34,155 | | | | 18,265 | | | | — | | | (52,420 | ) | | | — |

| | |

|

|

| |

|

|

| |

|

| |

|

|

| |

|

|

Net income | | $ | 26,639 | | | $ | 34,155 | | | $ | 18,265 | | $ | (52,420 | ) | | $ | 26,639 |

| | |

|

|

| |

|

|

| |

|

| |

|

|

| |

|

|

| | | Restated Three Months Ended September 30, 2002

|

| | | Varco International, Inc. (Parent Company only)

| | | Guarantor

Subsidiaries

| | Non-

Guarantor Subsidiaries

| | Eliminations

| | | Varco International,

Inc.

|

| | | (in thousands) |

Revenue | | $ | — | | | $ | 240,133 | | $ | 139,712 | | $ | (45,906 | ) | | $ | 333,939 |

Cost of Sales | | | — | | | | 176,198 | | | 106,395 | | | (45,906 | ) | | | 236,687 |

Selling, general and administrative | | | 120 | | | | 29,840 | | | 11,297 | | | — | | | | 41,257 |

Research and engineering costs | | | — | | | | 13,347 | | | 1,585 | | | — | | | | 14,932 |

Merger, transaction, and litigation costs | | | — | | | | 2,177 | | | 192 | | | — | | | | 2,369 |

| | |

|

|

| |

|

| |

|

| |

|

|

| |

|

|

Total costs | | | 120 | | | | 221,562 | | | 119,469 | | | (45,906 | ) | | | 295,245 |

| | |

|

|

| |

|

| |

|

| |

|

|

| |

|

|

Operating profit | | | (120 | ) | | | 18,571 | | | 20,243 | | | — | | | | 38,694 |

Other expenses (income) | | | 232 | | | | 322 | | | 1,583 | | | — | | | | 2,137 |

Interest expense | | | 5,748 | | | | 177 | | | 318 | | | — | | | | 6,243 |

| | |

|

|

| |

|

| |

|

| |

|

|

| |

|

|

Income (loss) before taxes | | | (6,100 | ) | | | 18,072 | | | 18,342 | | | — | | | | 30,314 |

Provision for taxes | | | — | | | | 6,081 | | | 4,181 | | | — | | | | 10,262 |

Equity in net income of subsidiaries | | | 26,152 | | | | 14,161 | | | — | | | (40,313 | ) | | | — |

| | |

|

|

| |

|

| |

|

| |

|

|

| |

|

|

Net income | | $ | 20,052 | | | $ | 26,152 | | $ | 14,161 | | $ | (40,313 | ) | | $ | 20,052 |

| | |

|

|

| |

|

| |

|

| |

|

|

| |

|

|

13

9. Unaudited Condensed Consolidating Financial Information (cont’d)

Statements of Income

| | | Nine Months Ended September 30, 2003

|

| | | Varco International, Inc. (Parent Company only)

| | | Guarantor

Subsidiaries

| | | Non-

Guarantor Subsidiaries

| | Eliminations

| | | Varco International,

Inc.

|

| | | (in thousands) |

Revenue | | $ | — | | | $ | 817,413 | | | $ | 412,068 | | $ | (129,571 | ) | | $ | 1,099,910 |

Cost of Sales | | | — | | | | 625,676 | | | | 300,623 | | | (129,571 | ) | | | 796,728 |

Selling, general and administrative | | | — | | | | 95,479 | | | | 40,685 | | | — | | | | 136,164 |

Research and engineering costs | | | — | | | | 41,233 | | | | 5,279 | | | — | | | | 46,512 |

| | |

|

|

| |

|

|

| |

|

| |

|

|

| |

|

|

Total costs | | | — | | | | 762,388 | | | | 346,587 | | | (129,571 | ) | | | 979,404 |

| | |

|

|

| |

|

|

| |

|

| |

|

|

| |

|

|

Operating profit | | | — | | | | 55,025 | | | | 65,481 | | | — | | | | 120,506 |

Other expenses (income) | | | 1,252 | | | | (980 | ) | | | 2,182 | | | — | | | | 2,454 |

Interest expense | | | 22,211 | | | | 133 | | | | 727 | | | — | | | | 23,071 |

| | |

|

|

| |

|

|

| |

|

| |

|

|

| |

|

|

Income (loss) before taxes | | | (23,463 | ) | | | 55,872 | | | | 62,572 | | | — | | | | 94,981 |

Provision for taxes | | | — | | | | 15,073 | | | | 17,220 | | | — | | | | 32,293 |

Equity in net income of subsidiaries | | | 86,151 | | | | 45,352 | | | | — | | | (131,503 | ) | | | — |

| | |

|

|

| |

|

|

| |

|

| |

|

|

| |

|

|

Net income | | $ | 62,688 | | | $ | 86,151 | | | $ | 45,352 | | $ | (131,503 | ) | | $ | 62,688 |

| | |

|

|

| |

|

|

| |

|

| |

|

|

| |

|

|

| | | Restated Nine Months Ended September 30, 2002

|

| | | Varco International , Inc.

| | | Guarantor Subsidiaries

| | Non- Guarantor Subsidiaries

| | Eliminations

| | | Consolidated

|

| | | (in thousands) |

Revenue | | $ | — | | | $ | 706,918 | | $ | 405,727 | | $ | (132,085 | ) | | $ | 980,560 |

Cost of Sales | | | — | | | | 532,913 | | | 297,210 | | | (132,085 | ) | | | 698,038 |

Selling, general and administrative | | | (940 | ) | | | 85,074 | | | 33,495 | | | — | | | | 117,629 |

Research and engineering costs | | | — | | | | 37,357 | | | 4,820 | | | — | | | | 42,177 |

Merger, transaction, and litigation costs | | | — | | | | 5,003 | | | 195 | | | — | | | | 5,198 |

| | |

|

|

| |

|

| |

|

| |

|

|

| |

|

|

Total costs | | | (940 | ) | | | 660,347 | | | 335,720 | | | (132,085 | ) | | | 863,042 |

| | |

|

|

| |

|

| |

|

| |

|

|

| |

|

|

Operating profit | | | 940 | | | | 46,571 | | | 70,007 | | | — | | | | 117,518 |

Other expense | | | 951 | | | | 382 | | | 6,567 | | | — | | | | 7,900 |

Interest expense | | | 16,776 | | | | 520 | | | 1,061 | | | — | | | | 18,357 |

| | |

|

|

| |

|

| |

|

| |

|

|

| |

|

|

Income (loss) before taxes | | | (16,787 | ) | | | 45,669 | | | 62,379 | | | — | | | | 91,261 |

Provision for taxes | | | — | | | | 12,298 | | | 20,561 | | | — | | | | 32,859 |

Equity in net income of subsidiaries | | | 75,189 | | | | 41,818 | | | — | | | (117,007 | ) | | | — |

| | |

|

|

| |

|

| |

|

| |

|

|

| |

|

|

Net income | | $ | 58,402 | | | $ | 75,189 | | $ | 41,818 | | $ | (117,007 | ) | | $ | 58,402 |

| | |

|

|

| |

|

| |

|

| |

|

|

| |

|

|

14

VARCO INTERNATIONAL, INC.

Notes to Unaudited Consolidated Financial Statements (cont’d)

9. Unaudited Condensed Consolidating Financial Information (cont’d)

Statement of Cash Flows

| | | Nine Months Ended September 30, 2003

| |

| | | Varco International, Inc. (Parent Company Only)

| | | Guarantor

Subsidiaries

| | | Non-

Guarantor Subsidiaries

| | | Eliminations

| | Varco International, Inc.

| |

| | | (in thousands) | |

Net cash provided by (used for) operating Activities | | $ | (5,703 | ) | | $ | 58,568 | | | $ | 21,017 | | | $

| —

| | $ | 73,882 | |

Net cash used for investing activities: | | | | | | | | | | | | | | | | | | | |

Capital expenditures | | | — | | | | (32,394 | ) | | | (11,030 | ) | | | — | | | (43,424 | ) |

Business acquisitions, net of cash acquired | | | — | | | | (13,790 | ) | | | (9,389 | ) | | | — | | | (23,179 | ) |

Other | | | — | | | | — | | | | (207 | ) | | | — | | | (207 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

| |

|

|

|

Net cash used for investing activities | | | — | | | | (46,184 | ) | | | (20,626 | ) | | | — | | | (66,810 | ) |

Cash flows provided by (used for) financing activities: | | | | | | | | | | | | | | | | | | | |

Net payments under financing agreements | | | 46 | | | | (1,792 | ) | | | (8,154 | ) | | | — | | | (9,900 | ) |

Net proceeds from sale of common stock | | | 7,510 | | | | — | | | | — | | | | — | | | 7,510 | |

Purchase of treasury stock | | | (317 | ) | | | — | | | | — | | | | — | | | (317 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

| |

|

|

|

Net cash provided by (used for) financing activities | | | 7,239 | | | | (1,792 | ) | | | (8,154 | ) | | | — | | | (2,707 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

| |

|

|

|

Net increase (decrease) in cash and cash equivalents | | | 1,536 | | | | 10,592 | | | | (7,763 | ) | | | — | | | 4,365 | |

Beginning of period | | | 4,221 | | | | 63,547 | | | | 38,229 | | | | — | | | 105,997 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

| |

|

|

|

End of period | | $ | 5,757 | | | $ | 74,139 | | | $ | 30,466 | | | $ | — | | $ | 110,362 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

| |

|

|

|

15

9. Unaudited Condensed Consolidating Financial Information (cont’d)

Statement of Cash Flows

| | | Restated Nine Months Ended September 30, 2002

| |

| | | Varco

International,

Inc.

| | | Guarantor Subsidiaries

| | | Non- Guarantor Subsidiaries

| | | Eliminations

| | Consolidated

| |

| | | (in thousands) | |

Net cash provided by (used for) operating activities | | $ | (96,353 | ) | | $ | 149,438 | | | $ | 35,529 | | | $ | — | | $ | 88,614 | |

Net cash used for investing activities: | | | | | | | | | | | | | | | | | | | |

Capital expenditures | | | — | | | | (22,381 | ) | | | (13,308 | ) | | | — | | | (35,689 | ) |

Business acquisitions, net of cash acquired | | | — | | | | (133,088 | ) | | | (13,696 | ) | | | — | | | (146,784 | ) |

Other | | | — | | | | — | | | | (2,211 | ) | | | — | | | (2,211 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

| |

|

|

|

Net cash used for investing activities | | | — | | | | (155,469 | ) | | | (29,215 | ) | | | — | | | (184,684 | ) |

Cash flows provided by (used for) financing activities: | | | | | | | | | | | | | | | | | | | |

Net payments under financing agreements | | | 89,987 | | | | (1,439 | ) | | | (7,126 | ) | | | — | | | 81,422 | |

Net proceeds from sale of common stock | | | 8,913 | | | | — | | | | — | | | | — | | | 8,913 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

| |

|

|

|

Net cash provided by (used for) financing activities | | | 98,900 | | | | (1,439 | ) | | | (7,126 | ) | | | — | | | 90,335 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

| |

|

|

|

Net increase (decrease) in cash and cash equivalents | | | 2,547 | | | | (7,470 | ) | | | (812 | ) | | | — | | | (5,735 | ) |

Beginning of period | | | 5,562 | | | | 25,137 | | | | 26,800 | | | | — | | | 57,499 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

| |

|

|

|

End of period | | $ | 8,109 | | | $ | 17,667 | | | $ | 25,988 | | | $ | — | | $ | 51,764 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

| |

|

|

|

10. New Accounting Standards

In August 2001, the Financial Accounting Standards Board (FASB) issued statement of Financial Accounting Standard No 143, “Accounting for Asset Retirement Obligations,” (SFAS 143). SFAS 143 requires a company to recognize a liability associated with a legal obligation to retire or remove any tangible long-lived assets. SFAS 143 is effective beginning in 2003 and did not have a material impact on the Company’s financial position or results of operations.

In July 2002, the FASB issued Statement of Financial Accounting Standards No. 146, “Accounting for Costs Associated with Exit or Disposal Activities” (SFAS 146) which addresses financial accounting and reporting costs associated with exit or disposal activities and nullifies EITF Issue No. 94-3, “Liability Recognition for Certain Employee Termination Benefits and Other Costs to Exit An Activity (including Certain Costs Incurred in a Restructuring).” SFAS 146 requires that a liability for a cost associated with an exit or disposal activity be recognized when the liability is incurred. Under Issue 94-3, a liability for an exit cost was recognized at the date of an entity’s commitment to an exit plan. The provisions of this statement are effective for exit or disposal activities that are initiated after December 31, 2002. If the Company had early adopted statement SFAS 146, it would not have affected the Company’s accounting for restructuring activities which occurred in the third quarter of 2002.

In January 2003, FASB Interpretation No. 46, Consolidation of Variable Interest Entities (“FIN 46”) was issued. FIN 46 requires the consolidation of each variable interest entity (“VIE”) in which an enterprise absorbs a majority of the entity’s expected losses or receives a majority of the entity’s expected residual returns, or both, as a result of ownership, contractual or other financial interests in the entity. The FASB has delayed the implementation date of FIN 46 to the first interim period ending after December 15, 2003. The Company does not believe the adoption of FIN 46 will have a material effect on the Company’s financial statements.

16

Item 2. Management’s Discussion and Analysis of Results of Operations and Financial Condition

General Operating Environment

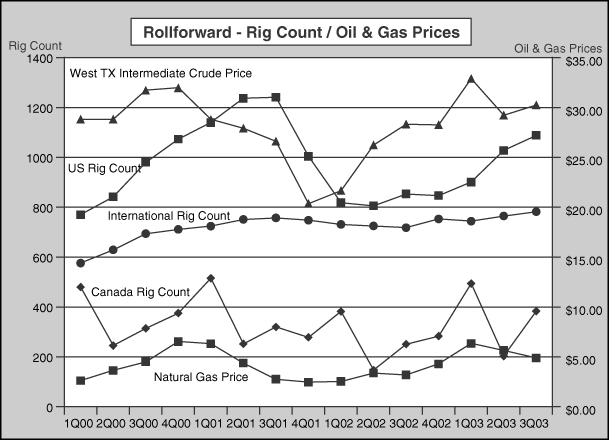

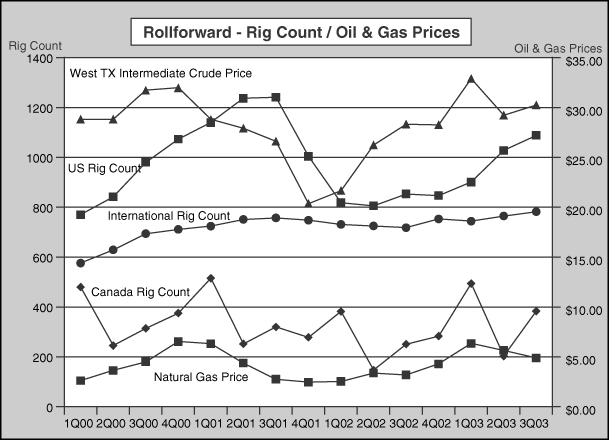

The worldwide and North America quarterly average rig count increased 24% (from 1,822 to 2,253) and 33% (from 1,104 to 1,471), respectively, in the third quarter of 2003 compared to the third quarter of 2002. The average per barrel price of West Texas Intermediate Crude increased 7% (from $28.32 to $30.26) and natural gas prices increased 53% (from $3.19 to $4.88) in the third quarter of 2003 compared to the same period of 2002. The Company’s North America services businesses benefited as a result of the increase in the 2003 North America rig count. North American revenue for the Company’s Inspection, Coating, Solids Control, and Instrumentation Services business was up $33.4 million or 49.9% compared to the same period of 2002. The increase was due to the September 2002 ICO asset acquisition and the increase in business activity as reflected by the greater average North America rig count. The North America rig activity remained strong through October 2003 with a rig count of 1,479 rigs at October 24, 2003, slightly above the average for the third quarter of 2003. The Company is expected to continue to experience improvements in its 2003 North America Services business compared to the same periods of 2002 due to the increase in 2003 North America rig activity. More specifically, oil and gas activity in Canada, Mexico, and the U.S. land markets has been strong and is expected to remain strong. However, some key markets including the Gulf of Mexico, North Sea, and Venezuela are expected to remain weak. The market for new capital equipment for drilling rigs is expected to remain weak.

The following graph details U.S., Canada, and International rig activity, West Texas Intermediate oil and natural gas prices for the past fifteen quarters on a quarterly basis:

Source: Rig Count: Baker Hughes, Inc. (www.bakerhughes.com)

West Texas Intermediate Crude Price & Natural Gas Price: Department of Energy, Energy Information Administration (www.eia.doe.gov).

17

Results of Operations

Three and Nine Months Ended September 30, 2003 and 2002

Revenue.Revenue was $375.0 million and $1.1 billion for the third quarter and first nine months of 2003, an increase of $41.0 million (or 12%) and $119.4 million (or 12%) compared to the third quarter and first nine months of 2002, respectively. The increase was due primarily to an increase in North America Services business revenue and the Company’s acquisition of substantially all of the oilfield services business of ICO Inc. in September 2002. These increases were offset by a decline in Drilling Equipment Sales in the third quarter of 2003 compared to the third quarter of 2002 due to lower shipments of drilling equipment units. The following table summarizes revenue by segment for the three and nine months ended September 30, 2003 and 2002 (in thousands):

| | | Three Months Ended

September 30,

| | Nine Months Ended September 30,

|

| | | 2003

| | 2002

(restated)

| | 2003

| | 2002 (restated)

|

Revenue: | | | | | | | | | | | |

Drilling Equipment Sales | | $ | 114,749 | | $ | 120,344 | | $376,984 | | $ | 364,060 |

Tubular Services | | | 124,198 | | | 91,339 | | 336,955 | | | 242,772 |

Drilling Services | | | 78,024 | | | 69,525 | | 217,363 | | | 207,196 |

Coiled Tubing & Wireline Product | | | 58,005 | | | 52,731 | | 168,608 | | | 166,532 |

| | |

|

| |

|

| |

| |

|

|

Total | | $ | 374,976 | | $ | 333,939 | | $1,099,910 | | $ | 980,560 |

| | |

|

| |

|

| |

| |

|

|

Drilling Equipment Sales revenue was $114.7 million and $377.0 million for the third quarter and first nine months of 2003, representing a decrease of $5.6 million (5%) and an increase of $12.9 million (4%) compared to the third quarter and first nine months of 2002, respectively. The decrease in the third quarter of 2003 was primarily related to lower shipments of drilling equipment units in the third quarter of 2003 compared to 2002, offset to some degree by greater revenue from drilling equipment rental, repairs, and services. New orders for the three months ended September 30, 2003 were $86.2 million compared to $160.6 million for the same period of 2002, while backlog at September 30, 2003 was $159.1 million compared to $235.1 million at September 30, 2002. Sequentially, backlog decreased by $28.5 million at September 30, 2003 compared to June 30, 2003.

Tubular Services revenue was $124.2 million and $337.0 million for the third quarter and first nine months of 2003, representing an increase of $32.9 million (36%) and $94.2 million (39%) compared to the third quarter and first nine months of 2002. The 2003 increases were due primarily to the acquisition of ICO’s oilfield services business in September 2002. Due to the ICO acquisition and increased activity in North America, North America inspection and coating revenue increased $25.7 million in the third quarter of 2003 over the third quarter of 2002. Revenue from the Company’s Fiberglass pipe operations also increased $8.0 million in the third quarter of 2003 compared to the third quarter of 2002 as a result of the increase in worldwide oilfield activity.

Drilling Services revenue was $78.0 million and $217.4 million for the third quarter and first nine months of 2003, representing an increase of $8.5 million (12%) and $10.2 million (5%) compared to the same periods of 2002. The third quarter 2003 increase in revenue was due to increases in North America Solids Control Services and instrumentation services of $7.7 million (24%), attributed to the 33% increase in rig activity in North America in the third quarter of 2003 compared to the third quarter of 2002.

Coiled Tubing and Wireline Products revenue was $58.0 million and $168.6 million for the third quarter and first nine months of 2003, an increase of $5.3 million (10%) and $2.1 million (1%) compared to the same periods of 2002. The increase was due to greater revenue from the Company’s Coiled Tubing and Hydra Rig operations in 2003 compared to 2002. Backlog for this segment was at $42.4 million at September 30, 2003 compared to $40.9 million at September 30, 2002. Sequentially, backlog decreased by $3.2 million at September 30, 2003 compared to June 30, 2003.

Gross Profit.Gross profit was $107.9 million (28.8% of revenue) and $303.2 million (27.6% of revenue) for the third quarter and first nine months of 2003 compared to $97.3 million (29.1% of revenue) and $282.5 million (28.8% of revenue) for the same periods of 2002. The results for the first nine months of 2003 included the second quarter 2003 recognition of $6.3 million of anticipated losses on a $30 million land drilling rig construction contract expected to be shipped in early 2004. The loss was the result of additional costs due to the structural complexity of the rig that has required substantially more engineering and design work than originally planned. This loss had an adverse effect on the year-to-date gross profit percents in 2003 compared to 2002. Excluding this loss, the gross profit percent for the nine months ending September 30, 2003 would have been 28.1%. The decline in gross profit percentages for the three and nine months ended September 30, 2003 compared to 2002 were due to the second quarter 2003 $6.3 million loss on the drilling rig contract and a decline in Drilling Equipment margins as a result of lower margins

18

on project management and equipment installation projects. These declines were offset to some degree by greater margins on the Company’s North America services business.

Selling, General, and Administrative Costs. Selling, general, and administrative costs were $44.5 million (11.9% of revenue) and $136.2 million (12.4% of revenue) for the three and nine month periods ended September 30, 2003 compared to $41.3 million (12.4% of revenue) and $117.6 million (12.0% of revenue) for the same periods of 2002. Costs were higher in 2003 compared to 2002 due to the acquisitions completed in 2002, greater selling costs associated with the Drilling Equipment operations, and higher insurance and employee compensation and benefit costs in 2003 compared to 2002.

Research and Engineering Costs. Research and engineering costs were $15.3 million and $46.5 million for the third quarter and first nine months of 2003, representing increases of $0.4 million and $4.3 million over the same periods of 2002. The increases for the third quarter of 2003 were due to the acquisitions completed in 2002 and greater research and engineering spending in the Drilling Services operations. The increase for the first nine months of 2003 compared to 2002 was spread amongst the Company’s four major operating segments due to technology development and sustaining engineering initiatives underway within the groups, and higher insurance and employee compensation and benefit costs in 2003 compared to 2002.

Merger, Transaction, and Litigation Costs.During the third quarter of 2002 the Company incurred $2.4 million of transaction costs associated with the acquisition of substantially all of the oilfield services business of ICO. In the first quarter of 2002 the Company incurred $2.8 million of severance costs resulting from early termination of employment agreements for several senior executives arising out of the May 2000 merger between Varco International, Inc., a California corporation, and the Company.

Operating Profit.Operating profit was $48.1 million and $120.5 million for the three and nine months ended September 30, 2003, compared to $38.7 million and $117.5 million for the same periods of 2002. The changes in operating profit were due to the factors discussed above.

Interest Expense.Interest expense was $7.4 million and $23.1 million for the three and nine months ended September 30, 2003, compared to $6.2 million and $18.4 million for the three and nine months ended September 30, 2002. The increases in interest expense were due to the greater average outstanding debt balances as a result of the $150.0 million 5 1/2% Senior Notes issued in November 2002.

Other Expense (Income).Other expense consists of interest income, foreign exchange, and other expense (income). Net other expense were losses of $1.1 million and $2.5 million for the three and nine months ended September 30, 2003 compared to losses of $2.1 million and $7.9 million in the three and nine months ended September 30, 2002. The 2002 results included foreign exchange losses of $2.0 million and $5.6 million for the third quarter and first nine months of 2002, respectively, while the 2003 results included foreign exchange losses of $0.2 million for both the third quarter and first nine months of 2003. The foreign exchange losses in 2002 were primarily due to the strengthening of the Euro and British pound sterling and $1.2 million in the first quarter of 2002 related to the revaluation of the Argentina peso.

Provision for Income Taxes. The Company’s effective tax rate for the third quarter and first nine months of 2003 was 33% and 34%, respectively, compared to 34% and 36% for the third quarter and first nine months of 2002, respectively. These rates vary from the domestic rate of 35%, due to charges not allowed under domestic and foreign jurisdictions, foreign earnings subject to tax rates differing from domestic rates, the benefit from the increased utilization of the extraterritorial income provisions, increase in research and development credits and the resolution of a tax audit in 2003.

Net Income.Net income for the third quarter and first nine months of 2003 was $26.6 million and $62.7 million compared to $20.1 million and $58.4 million for the same periods of 2002. The changes in 2003 results compared to 2002 were due to the factors discussed above.

19

Financial Condition and Liquidity

September 30, 2003

For the nine months ended September 30, 2003, cash provided by operating activities was $73.9 million compared to $88.6 million provided by operating activities for the nine months ended September 30, 2002. Cash was provided by operations in 2003 through net income of $62.7 million plus non-cash charges of $65.3 million, and an increase in accounts payable and accrued liabilities of $17.1 million. These items were offset to some extent by an increase in accounts receivable of $21.8 million, an increase in inventory of $41.9 million, an increase in prepaid expenses and other current assets of $5.1 million, and a decrease in income taxes payable of $2.4 million. The increase in accounts payable and accrued liabilities in the first nine months of 2003 was due to an increase in accruals related to employee benefit costs, an increase in accrued interest, an increase in accruals related to acquisitions, and an increase in accounts payable. Accounts receivable increased $21.8 million in the first nine months of 2003 due to greater revenue (up $20 million) in the third quarter of 2003 compared to the fourth quarter of 2002, and slightly higher days sales outstanding balances (83.9 days outstanding at December 31, 2002 compared to 84.4 days outstanding at September 30, 2003). The increase in inventory of $41.9 million was related primarily to the construction of certain land rig equipment for sale and to the Coiled Tubing & Wireline Products segments. The increase in prepaid expenses and other current assets was mainly due to the renewal of the Company’s insurance policies in the third quarter of 2003 and related prepayments of such policies.

For the nine months ended September 30, 2003, the Company used $66.8 million for investing activities compared to $184.7 million for the same period of 2002. The Company used $23.2 million to make business acquisitions (see Note 3 of Notes to Unaudited Consolidated Financial Statements). Capital spending of $43.4 million for the first nine months of 2003 was primarily related to the purchase of solids control equipment, rental drilling equipment units, equipment for the Company’s Pipeline operations, facility upgrades for manufacturing operations, and to acquire certain assets previously leased by the Company.

For the nine months ended September 30, 2003, the Company used $2.7 million of cash from financing activities compared to the generation of $90.3 million of cash for the nine months ending September 30, 2002. Cash was primarily used in the first nine months of 2003 to pay off $10.0 million of debt, offset by proceeds from stock of $7.5 million.

At September 30, 2003, the Company had $110.4 million in cash and cash equivalents and current and long-term debt of $455.9 million. At December 31, 2002, the Company had cash and cash equivalents of $106.0 million and current and long-term debt of $467.9 million. The Company’s outstanding debt at September 30, 2003 consisted of $149.3 million of 5 1/2% Senior Notes due 2012, $201.2 million of 7 1/4 % Senior Notes due 2011, $99.4 million of 7 1/2 Senior Notes due 2008 and other debt of $6.0 million.

On January 30, 2002, the Company entered into a new credit agreement with a syndicate of banks that provided up to $125 million of funds under a new revolving credit facility. In addition, the Company also obtained a bilateral letter of credit facility that provided up to $5.0 million of funds. The agreement was amended in the third quarter of 2002 to increase the available funds to $150.0 million. At September 30, 2003, there were $143.1 million of funds available under the revolving credit facility and $3.1 million of funds available under the bilateral letter of credit facility, with $6.9 million and $1.9 million being used for letters of credit, under the revolving credit facility and bilateral letter of credit facility, respectively.

During the third quarter of 2003, the Company’s Board of Directors authorized repurchases of up to $150 million of the Company’s outstanding common stock from time to time at the Company’s discretion. As a part of this program, the Company repurchased 19,000 shares of Company common stock at an average price of $16.68 per share for a total consideration of approximately $0.4 million during the third quarter ended September 30, 2003.

The Company believes that its September 30, 2003 cash and cash equivalents, its credit facility and cash flow from continuing operations will be sufficient to meet its capital expenditures and its operating cash needs for the foreseeable future.

20

Critical Accounting Policies and Estimates

In preparing the financial statements, the Company makes assumptions, estimates and judgments that affect the amounts reported. The Company periodically evaluates its estimates and judgments related to bad debts and inventory obsolescence; impairments of long-lived assets, including goodwill; reserves for product warranty claims; and assumptions related to pension and postretirement plans, incentive compensation, medical and workman’s compensation. Note 2 to the Notes to Consolidated Financial Statements in the Company’s Annual Report on Form 10-K/A for the year ended December 31, 2002 contains the accounting policies governing each of these matters. The Company’s estimates are based on historical experience and on its future expectations that it believes are reasonable. The combination of these factors forms the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results are likely to differ from the Company’s current estimates and those differences may be material.

The Company’s products and services are generally sold based upon purchase orders or contracts with the customer that include fixed or determinable prices and that do not include right of return or other similar provisions or other significant post delivery obligations. The Company records revenue at the time the product is shipped to the customer and all other conditions for revenue recognition have been met. Customer advances or deposits are deferred and recognized as revenue when the Company has completed all of its performance obligations related to the sale. The Company also recognizes revenue and related costs when services are performed. The amounts billed for shipping and handling costs are included in cost of sales.

In prior periods, the Company recognized revenue on bill and hold transactions when the related product had been completed and was ready to be shipped, title and risk of loss had passed to the customer and the Company believed that the other criteria set forth in Staff Accounting Bulletin (SAB) 101 had been satisfied. Beginning January 1, 2003, the Company recognizes revenue only when the product is shipped to the customer and all other conditions for revenue recognition have been met. If revenue from all bill and hold transactions occurring during the three years ended December 31, 2002 was recognized upon shipment of the related product, rather than on the date previously recognized, the Company’s financial results for fiscal years 2000, 2001 and 2002 would not be materially affected. While the Company has not restated its financial results for these annual periods, it has restated its financial results for all quarterly periods in 2001 and 2002, including the third quarter of 2002, to reflect recognition of revenue on bill and hold transactions upon shipment. The restated results for the third quarter and first nine months of 2002 are reflected in this report.

Reserves for bad debts are determined on a specific identification basis when the Company believes that the required payment of specific amounts owed to it is not probable. A substantial portion of the Company’s revenues come from international oil companies, international oilfield service companies and government-owned or government-controlled oil companies. Therefore, the Company has significant receivables in many foreign jurisdictions. If worldwide oil and gas drilling activity or changes in economic conditions in foreign jurisdictions deteriorate, the Company’s customers may be unable to repay these receivables, and additional allowances could be required.

Reserves for inventory obsolescence are determined based on historical usage of inventory on-hand as well as the Company’s future expectations related to requirements to provide spare parts for its substantial installed base and new products. Changes in worldwide oil and gas drilling activity and the development of new technologies associated with the drilling industry could require the Company to record additional allowances to reduce the value of inventory to the lower of its cost or net realizable value.

Accruals for warranty claims are provided based on historical experience at the time of sale. Product warranties generally cover periods from one to three years. The Company’s accruals for warranty claims are affected by the size of the Company’s installed base of products currently under warranty, as well as new products delivered to the market. If actual experience proves different from historical estimates, changes to the Company’s provision rates may be required.

Long-lived assets, which include property and equipment, goodwill, and identified intangible assets comprise a significant amount of the Company’s total assets. The Company makes judgments and estimates in conjunction with the carrying value of these assets, including amounts to be capitalized, depreciation and amortization methods and useful lives. Additionally, the carrying values of these assets are reviewed for impairment periodically or whenever events or changes in circumstances indicate that the carrying amounts may not be recoverable. An impairment loss is recorded in the period in which it is determined that the carrying amount is not recoverable. This requires the Company to make long-term forecasts of its future revenues and costs related to the assets subject to review. These forecasts require assumptions about demand for the Company’s products and services, future market conditions and technological developments. Significant and unanticipated changes to these assumptions or the intended use of these assets could require a provision for impairment in a future period.

The Company sponsors several pension and postretirement plans. The Company has two defined benefit pension plans covering substantially all of its employees in Germany, plans providing healthcare benefits to certain retired executives and employees

21

(Retiree Medical Plan), and a supplemental executive retirement plan. All of these plans are unfunded. See additional disclosure in Note 9 to the Notes to Consolidated Financial Statements in the Company’s Annual Report on Form 10-K/A for the year ended December 31, 2002.

The Company accounts for its defined benefit pension plans and its nonpension postretirement benefit plans using actuarial models required by Statement of Financial Accounting Standards (SFAS) No. 87, “Employers’ Accounting for Pensions” and SFAS NO. 106, “Employers’ Accounting for Postretirement Benefits Other Than Pensions,” respectively.

A significant element in determining the Company’s expense in accordance with SFAS No. 87 and SFAS No. 106 is the discount rate. The discount rate is an estimate of the current interest rate at which the pension and postretirement liabilities could be effectively settled at the end of the year. In estimating this rate, the Company looks to rates of return on high-quality, fixed-income investments currently available and expected to be available during the period to maturity of the pension and postretirement benefit obligation. Changes in the discount rates over the past three years have not materially affected pension expense and the net effect of changes in the discount rate, as well as the net effect of other changes in actuarial assumptions and experience, have been deferred in accordance with SFAS No. 87 and SFAS No. 106. The Company’s discount rates ranged from 6.5% to 6.75% at December 31, 2002.

Additionally, the health care cost trend rate can have a significant effect on the Company’s expense for the Retiree Medical Plan as reported in accordance with SFAS No. 106. The Company, in conjunction with its actuary reviews external data on its own historical trends for health care costs to determine the health care cost trend rates. The assumed health care cost trend rate for 2002 was 11% and was assumed to decrease gradually to 5% for 2008 and remain at that level thereafter. An increase of the health care cost trend rates by one percentage point each year would increase the accumulated postretirement benefit obligation as of December 31, 2002 by $1,205,056 and the aggregate of the service and interest cost components of net periodic postretirement benefit cost for 2002 by $77,000.

Forward Looking Statements