United States

Securities and Exchange Commission

Washington, D.C. 20549

Form N-CSR

Certified Shareholder Report of Registered Management Investment Companies

811-6061

(Investment Company Act File Number)

Federated Index Trust

_______________________________________________________________

(Exact Name of Registrant as Specified in Charter)

Federated Investors Funds

4000 Ericsson Drive

Warrendale, Pennsylvania 15086-7561

(Address of Principal Executive Offices)

(412) 288-1900

(Registrant's Telephone Number)

John W. McGonigle, Esquire

Federated Investors Tower

1001 Liberty Avenue

Pittsburgh, Pennsylvania 15222-3779

(Name and Address of Agent for Service)

(Notices should be sent to the Agent for Service)

Date of Fiscal Year End: 10/31/2011

Date of Reporting Period: 10/31/2011

Item 1. Reports to Stockholders

| | Annual Shareholder Report |

| | October 31, 2011 |

|

| Share Class | Ticker |

| C | MXCCX |

| R* | FMXKX |

| Institutional | FISPX |

| Service** | FMXSX |

*formerly, Class K Shares

**formerly, Institutional Service Shares

Federated Max-Cap Index Fund

A Portfolio of Federated Index Trust

CONTENTS

Management's Discussion of Fund Performance (unaudited)

The Fund's Class C Shares, Class R Shares, Institutional Shares and Service Shares produced total returns of 6.87%, 7.18%, 7.96% and 7.59%, respectively, based on net asset value for the 12-month reporting period ended October 31, 2011. The Standard & Poor's 500® Index (S&P 500),1 a broad-based securities market index, posted a total return of 8.09% for the same period. The total return of the Fund's shares reflects the impact of actual cash flows, transaction costs and other expenses.

MARKET OVERVIEW

At the start of the reporting period, the global economy appeared to be solidly in recovery mode and investors were optimistic as the U.S. Federal Reserve (the “Fed”) launched its second round of quantitative easing. Stock markets rallied despite the ongoing sovereign debt problems in Europe and inflationary pressures looming over emerging markets. Fixed income markets, however, saw yields move sharply upward (pushing prices down), especially on the long end of the historically steep yield curve. While high yield bonds benefited from the risk rally, most fixed income sectors declined in the fourth quarter of 2010. The tax-exempt municipal market faced additional headwinds as it became evident that the Build America Bond program would not be extended and municipal finance troubles burgeoned.

Early 2011 saw spikes of volatility as political turmoil swept across the Middle East/North Africa region and prices of oil and other commodities soared. Natural disasters in Japan disrupted industrial supply chains and concerns mounted regarding U.S. debt and deficit issues. Nevertheless, equities generally performed well early in the year as investors chose to focus on the continuing stream of strong corporate earnings and positive economic data. Credit markets were surprisingly resilient in this environment and yields regained relative stability in 2011. The tax-exempt market saw relief from its headwinds and steadily recovered from its fourth-quarter lows. Equities, commodities and high yield bonds outpaced higher-quality assets as investors increased their risk tolerance.

Annual Shareholder Report

However, the environment changed dramatically in the middle of the second quarter of 2011. Markets dropped sharply in May when fears mounted over the possibility of Greece defaulting on its debt, rekindling fears about the broader sovereign debt crisis. Concurrently, economic data signaled that the recovery had slowed in the United States and other developed nations. Confidence was further shaken by the prolonged debt ceiling debate in Washington, DC. On August 5, Standard & Poor's downgraded the U.S. government's credit rating and turmoil erupted in financial markets around the world. Extraordinary levels of volatility persisted in the months that followed as Greece teetered on the brink of default. Financial problems intensified in Italy and Spain and both countries faced credit rating downgrades. Debt worries spread to the core European nations of France and Germany, and the entire euro-zone banking system came under intense pressure. Late in the summer, economic data out of the United States and Europe grew increasingly bleak while China and other emerging economies began to show signs of slowing growth. By the end of the third quarter, equity markets had fallen nearly 20% from their April peak while safe-haven assets such as U.S. Treasuries, gold and the Swiss franc skyrocketed.October brought enough positive economic data to assuage fears of a double-dip recession in the United States and corporate earnings continued to be strong. Additionally, European policymakers demonstrated an increased willingness to unite in their struggle to resolve the region's debt and banking crisis. These encouraging developments brought many investors back from the sidelines and risk assets rallied through the month, albeit with large daily swings as investor reactions to news from Europe vacillated between faith and skepticism.

Overall, lower-risk investments including U.S. Treasuries, municipal securities and investment grade credits posted gains for the 6- and 12-month periods ended October 31, 2011. Risk assets, including equities and high yield debt, broadly declined over the six months, however U.S. stocks and high yield bonds remained in positive territory on a 12-month basis. Continued low short-term interest rates kept yields on money market securities near their all-time lows.

FUND PERFORMANCE

Against this backdrop, 9 of the 10 sectors2 within the S&P 500 recorded positive returns during the period. Energy led the way, advancing 19.22%, followed by Utilities, up 14.71%, and Consumer Discretionary, up 12.62%. The Financials sector posted the weakest results, down 5.90%. Apple Inc. (Information Technology), Exxon Mobil Corp. (Energy) and IBM, Inc. (Information Technology) posted the strongest contribution to performance in the index, while the Bank of America Corp. (Financials), Hewlett-Packard Co. (Information Technology) and Citigroup (Financials) contributed the least for the period.

Annual Shareholder Report

The enhanced index portion of the Fund outperformed the S&P 500 by 0.43%, contributing positively to the Fund's overall performance. Portfolio management of the enhanced portion of the Fund primarily entails overweighting and underweighting stocks relative to the S&P 500 based on quantitative factors and substitution strategies. Investment strategies based on earning announcements, momentum and external financing factors contributed positively to performance. Stock substitution strategies based on relative value, events, mergers and acquisitions also had a positive impact. Strategies based on earnings quality and earnings sustainability factors detracted from performance.The Fund invests in a stock-based strategy that also utilizes S&P 500 futures to provide equity exposure on the Fund's cash balances. While over the long term this strategy anticipates that the S&P 500 futures will mirror the performance of the S&P 500, pricing disparity can occur in the short term and the Fund can benefit from or be harmed by trading futures instead of stocks when money moves in or out of the Fund. During the reporting period, the trading of futures contracts had a negligible impact on the Fund's performance.

| 1 | The S&P 500 is a market capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The index is unmanaged and, unlike the Fund, is not affected by cash flows. Investments cannot be made in an index. “Standard & Poor's,® ” “S&P,® ” “S&P 500,® ” “Standard & Poor's 500” and “500” are trademarks of The McGraw-Hill Companies, Inc. and have been licensed for use by Federated Securities Corp. The Fund is not sponsored, endorsed, sold or promoted by, or affiliated with, Standard & Poor's (S&P). S&P makes no representation or warranty, express or implied, to the owners of the Fund or any member of the public regarding the advisability of investing in securities generally, or in the Fund particularly, or the ability of the S&P 500 to track general stock market performance. |

| 2 | Sector classifications are based upon the classification of the Standard & Poor's Global Industry Classification Standard (SPGICS). |

Annual Shareholder ReportFUND PERFORMANCE AND GROWTH OF A $10,000 INVESTMENT

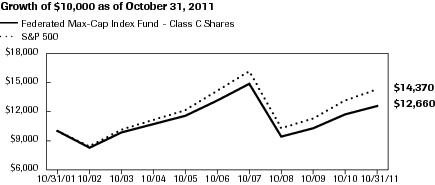

The Fund's Class R Shares commenced operations on April 8, 2003. The Fund offers three other classes of shares: Class C Shares, Institutional Shares and Service Shares. For the period prior to the commencement of operations of Class R Shares, the performance information shown is for the Fund's Institutional Shares, adjusted to reflect the expenses of Class R Shares. The Average Annual Total Return table below shows returns for each class averaged over the stated periods. The graphs below illustrate the hypothetical investment of $10,0001 in the Federated Max-Cap Index Fund (the “Fund”) from October 31, 2001 to October 31, 2011, compared to the Standard & Poor's 500 Index (S&P 500).2

Average Annual Total Returns for the Period Ended 10/31/2011

(returns reflect all applicable sales charges and contingent deferred sales charges as specified below in footnote #1)

| Share Class | 1 Year | 5 Years | 10 Years |

| Class C Shares | 5.87% | -0.98% | 2.39% |

| Class R Shares | 7.18% | -0.67% | 2.69% |

| Institutional Shares | 7.96% | 0.08% | 3.45% |

| Service Shares | 7.59% | -0.22% | 3.14% |

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month-end performance and after-tax returns, visit FederatedInvestors.com or call 1-800-341-7400. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured.

Annual Shareholder Report

Growth of a $10,000 Investment – CLASS C SHARES| Federated Max-Cap Index Fund - Class C Shares | C000024708 | S&P 500 |

| 10/31/2001 | 10,000 | 10,000 |

| 10/31/2002 | 8,372 | 8,490 |

| 10/31/2003 | 9,963 | 10,255 |

| 10/31/2004 | 10,767 | 11,221 |

| 10/31/2005 | 11,580 | 12,200 |

| 10/31/2006 | 13,301 | 14,195 |

| 10/31/2007 | 15,018 | 16,261 |

| 10/31/2008 | 9,480 | 10,392 |

| 10/31/2009 | 10,291 | 11,410 |

| 10/31/2010 | 11,847 | 13,294 |

| 10/31/2011 | 12,660 | 14,370 |

41 graphic description end -->

- Total returns shown include the maximum contingent deferred sales charge of 1.00%, as applicable.

Growth of a $10,000 Investment – CLASS R SHARES

| Federated Max-Cap Index Fund - Class R Shares | C000024709 | S&P 500 |

| 10/31/2001 | 10,000 | 10,000 |

| 10/31/2002 | 8,391 | 8,490 |

| 10/31/2003 | 10,022 | 10,255 |

| 10/31/2004 | 10,866 | 11,221 |

| 10/31/2005 | 11,708 | 12,200 |

| 10/31/2006 | 13,480 | 14,195 |

| 10/31/2007 | 15,272 | 16,261 |

| 10/31/2008 | 9,664 | 10,392 |

| 10/31/2009 | 10,528 | 11,410 |

| 10/31/2010 | 12,160 | 13,294 |

| 10/31/2011 | 13,034 | 14,370 |

41 graphic description end -->

Annual Shareholder Report

Growth of a $10,000 Investment – INSTITUTIONAL SHARES| Federated Max-Cap Index Fund - Institutional Shares | C000024710 | S&P 500 |

| 10/31/2001 | 10,000 | 10,000 |

| 10/31/2002 | 8,459 | 8,490 |

| 10/31/2003 | 10,166 | 10,255 |

| 10/31/2004 | 11,103 | 11,221 |

| 10/31/2005 | 12,056 | 12,200 |

| 10/31/2006 | 13,983 | 14,195 |

| 10/31/2007 | 15,959 | 16,261 |

| 10/31/2008 | 10,177 | 10,392 |

| 10/31/2009 | 11,172 | 11,410 |

| 10/31/2010 | 13,002 | 13,294 |

| 10/31/2011 | 14,037 | 14,370 |

41 graphic description end -->

Growth of a $10,000 Investment – SERVICE SHARES

| Federated Max-Cap Index Fund - Service Shares | C000024711 | S&P 500 |

| 10/31/2001 | 10,000 | 10,000 |

| 10/31/2002 | 8,433 | 8,490 |

| 10/31/2003 | 10,106 | 10,255 |

| 10/31/2004 | 11,005 | 11,221 |

| 10/31/2005 | 11,915 | 12,200 |

| 10/31/2006 | 13,778 | 14,195 |

| 10/31/2007 | 15,677 | 16,261 |

| 10/31/2008 | 9,969 | 10,392 |

| 10/31/2009 | 10,908 | 11,410 |

| 10/31/2010 | 12,665 | 13,294 |

| 10/31/2011 | 13,626 | 14,370 |

41 graphic description end -->

| 1 | Represents a hypothetical investment of $10,000 in the Fund after deducting applicable sales charges: For Class C Shares, a 1.00% contingent deferred sales charge would be applied to any redemption less than one year from the purchase date. The Fund's performance assumes the reinvestment of all dividends and distributions. The S&P 500 has been adjusted to reflect reinvestment of dividends on securities in the index. |

| 2 | The S&P 500 is not adjusted to reflect taxes, expenses or other fees that the Securities and Exchange Commission requires to be reflected in the Fund's performance. The S&P 500 is unmanaged and, unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an index. |

Annual Shareholder Report Portfolio of Investments Summary Table (unaudited)

At October 31, 2011, the Fund's sector composition1 for its equity securities investments was as follows:

| Sector | Percentage of

Total Net Assets |

| Information Technology | 19.0% |

| Financials | 13.6% |

| Energy | 11.9% |

| Health Care | 11.1% |

| Consumer Staples | 10.7% |

| Industrials | 10.4% |

| Consumer Discretionary | 10.3% |

| Materials | 3.5% |

| Utilities | 3.5% |

| Telecommunication Services | 2.9% |

| Other Securities2 | 0.6% |

| Derivative Contracts3 | 0.1% |

| Cash Equivalents4 | 2.5% |

| Other Assets and Liabilities — Net5 | (0.1)% |

| TOTAL6 | 100.0% |

| 1 | Except for Other Securities, Derivative Contracts, Cash Equivalents and Other Assets and Liabilities, sector classifications are based upon, and individual portfolio securities are assigned to, the classifications of the Global Industry Classification Standard (GICS) except that the Manager assigns a classification to securities not classified by the GICS and to securities for which the Manager does not have access to the classification made by the GICS. |

| 2 | Other Securities include an exchange-traded fund and a warrant. |

| 3 | Based upon net unrealized appreciation (depreciation) or value of the derivative contracts, as applicable. Derivative contracts may consist of futures, forwards, options and swaps. The impact of a derivative contract on the Fund's performance may be larger than its unrealized appreciation (depreciation) may indicate. In many cases, the notional value or notional principal amount of a derivative contract may provide a better indication of the contract's significance to the portfolio. More complete information regarding the Fund's direct investments in derivative contracts, including unrealized appreciation (depreciation) and notional values or amounts of such contracts, can be found in the table at the end of the Portfolio of Investments included in this Report. |

| 4 | Cash Equivalents include any investments in money market mutual funds and/or overnight repurchase agreements. |

| 5 | Assets, other than investments in securities and derivative contracts, less liabilities. See Statement of Assets and Liabilities. |

| 6 | The Fund purchases index futures contracts to efficiently manage cash flows resulting from shareholder purchases and redemptions, dividend and capital gain payments to shareholders and corporate actions while maintaining exposure to the Standard & Poor's 500 Composite Stock Price (S&P 500) Index and minimizing trading costs. Taking into consideration these open index futures contracts, the Fund's effective total exposure to the S&P 500 Index is effectively 99.8%. |

Annual Shareholder Report Portfolio of Investments

October 31, 2011

| Shares | | | Value |

| | COMMON STOCKS – 96.9%1 | |

| | Consumer Discretionary – 10.3% | |

| 1,701 | 2 | 99 Cents Only Stores | 37,082 |

| 1,760 | 2 | AMC Networks, Inc. | 57,411 |

| 4,480 | | Abercrombie & Fitch Co., Class A | 333,312 |

| 16,241 | 2 | Amazon.com, Inc. | 3,467,616 |

| 13,224 | 2 | Apollo Group, Inc., Class A | 626,156 |

| 2,222 | 2 | AutoNation, Inc. | 86,525 |

| 1,053 | 2 | AutoZone, Inc. | 340,740 |

| 18,810 | 2 | Bed Bath & Beyond, Inc. | 1,163,210 |

| 16,497 | | Best Buy Co., Inc. | 432,716 |

| 3,010 | 2 | Big Lots, Inc. | 113,447 |

| 11,317 | | Block (H&R), Inc. | 173,037 |

| 28,431 | | CBS Corp. (New), Class B | 733,804 |

| 8,292 | | Cablevision Systems Corp., Class A | 119,985 |

| 8,634 | 2 | CarMax, Inc. | 259,538 |

| 20,936 | | Carnival Corp. | 737,157 |

| 3,111 | 2 | Chipotle Mexican Grill, Inc. | 1,045,669 |

| 12,238 | | Coach, Inc. | 796,327 |

| 122,613 | | Comcast Corp., Class A | 2,875,275 |

| 10,064 | | D. R. Horton, Inc. | 112,012 |

| 32,195 | 2 | DIRECTV Group, Inc., Class A | 1,463,585 |

| 4,862 | | Darden Restaurants, Inc. | 232,793 |

| 2,200 | | DeVRY, Inc. | 82,896 |

| 11,918 | 2 | Discovery Communications, Inc. | 517,956 |

| 2,314 | 2 | Dollar Tree, Inc. | 185,027 |

| 7,094 | | Expedia, Inc. | 186,288 |

| 4,390 | | Family Dollar Stores, Inc. | 257,386 |

| 164,758 | 2 | Ford Motor Co. | 1,924,373 |

| 5,112 | 2 | GameStop Corp. | 130,714 |

| 10,765 | | Gannett Co., Inc. | 125,843 |

| 13,763 | | Gap (The), Inc. | 260,121 |

| 6,090 | | Genuine Parts Co. | 349,749 |

| 8,768 | 2 | Goodyear Tire & Rubber Co. | 125,908 |

| 10,763 | | Harley-Davidson, Inc. | 418,681 |

| 2,599 | | Harman International Industries, Inc. | 112,173 |

| 7,046 | | Hasbro, Inc. | 268,171 |

Annual Shareholder Report| Shares | | | Value |

| 69,074 | | Home Depot, Inc. | 2,472,849 |

| 10,835 | | International Game Technology | 190,588 |

| 17,529 | | Interpublic Group of Cos., Inc. | 166,175 |

| 25,533 | | Johnson Controls, Inc. | 840,802 |

| 10,205 | | Kohl's Corp. | 540,967 |

| 7,788 | | Leggett and Platt, Inc. | 170,557 |

| 5,937 | | Lennar Corp., Class A | 98,198 |

| 10,911 | | Limited Brands, Inc. | 466,009 |

| 54,978 | | Lowe's Cos., Inc. | 1,155,638 |

| 18,722 | | Macy's, Inc. | 571,583 |

| 11,612 | | Marriott International, Inc., Class A | 365,778 |

| 16,201 | | Mattel, Inc. | 457,516 |

| 44,527 | | McDonald's Corp. | 4,134,332 |

| 12,261 | | McGraw-Hill Cos., Inc. | 521,093 |

| 1,930 | 2 | NetFlix, Inc. | 158,414 |

| 10,721 | | Newell Rubbermaid, Inc. | 158,671 |

| 100,578 | | News Corp., Inc. | 1,762,127 |

| 18,057 | | Nike, Inc., Class B | 1,739,792 |

| 6,418 | | Nordstrom, Inc. | 325,328 |

| 5,225 | 2 | O'Reilly Automotive, Inc. | 397,361 |

| 12,683 | | Omnicom Group, Inc. | 564,140 |

| 5,254 | | Penney (J.C.) Co., Inc. | 168,548 |

| 2,225 | 2 | Priceline.com, Inc. | 1,129,677 |

| 12,156 | 2 | Pulte Group, Inc. | 62,968 |

| 2,659 | | Ralph Lauren Corp. | 422,223 |

| 5,255 | | Ross Stores, Inc. | 461,021 |

| 3,621 | | Scripps Networks Interactive | 153,820 |

| 1,415 | 2 | Sears Holdings Corp. | 110,625 |

| 41,713 | | Staples, Inc. | 624,026 |

| 34,023 | | Starbucks Corp. | 1,440,534 |

| 7,606 | | Starwood Hotels & Resorts Worldwide, Inc. | 381,137 |

| 22,950 | | TJX Cos., Inc. | 1,352,443 |

| 30,005 | | Target Corp. | 1,642,774 |

| 4,611 | | Tiffany & Co. | 367,635 |

| 14,556 | | Time Warner Cable, Inc. | 927,072 |

| 45,369 | | Time Warner, Inc. | 1,587,461 |

| 4,357 | 2 | Urban Outfitters, Inc. | 118,728 |

| 3,161 | | V.F. Corp. | 436,913 |

Annual Shareholder Report| Shares | | | Value |

| 32,963 | | Viacom, Inc., Class B | 1,445,428 |

| 85,197 | | Walt Disney Co. | 2,971,671 |

| 184 | | Washington Post Co., Class B | 62,589 |

| 2,742 | | Whirlpool Corp. | 139,321 |

| 6,032 | | Wyndham Worldwide Corp. | 203,097 |

| 3,601 | | Wynn Resorts Ltd. | 478,213 |

| 17,982 | | Yum! Brands, Inc. | 963,296 |

| | TOTAL | 55,061,821 |

| | Consumer Staples – 10.7% | |

| 84,352 | | Altria Group, Inc. | 2,323,898 |

| 24,639 | | Archer-Daniels-Midland Co. | 713,053 |

| 15,774 | | Avon Products, Inc. | 288,349 |

| 5,653 | | Beam, Inc. | 279,428 |

| 3,678 | | Brown-Forman Corp., Class B | 274,857 |

| 59,137 | | CVS Caremark Corp. | 2,146,673 |

| 6,526 | | Campbell Soup Co. | 216,990 |

| 5,708 | | Clorox Co. | 382,094 |

| 14,626 | | Coca-Cola Enterprises, Inc. | 392,269 |

| 20,938 | | Colgate-Palmolive Co. | 1,892,167 |

| 21,531 | | ConAgra Foods, Inc. | 545,380 |

| 23,264 | 2 | Constellation Brands, Inc., Class A | 470,398 |

| 22,663 | | Costco Wholesale Corp. | 1,886,695 |

| 6,566 | 2 | Dean Foods Co. | 63,822 |

| 14,547 | | Dr. Pepper Snapple Group, Inc. | 544,785 |

| 4,123 | | Estee Lauder Cos., Inc., Class A | 405,909 |

| 27,724 | | General Mills, Inc. | 1,068,206 |

| 12,358 | | H.J. Heinz Co. | 660,412 |

| 7,025 | | Hershey Foods Corp. | 402,041 |

| 20,418 | | Hormel Foods Corp. | 601,718 |

| 9,886 | | Kellogg Co. | 535,920 |

| 16,785 | | Kimberly-Clark Corp. | 1,170,082 |

| 79,734 | | Kraft Foods, Inc., Class A | 2,805,042 |

| 52,847 | | Kroger Co. | 1,224,993 |

| 5,841 | | Lorillard, Inc. | 646,365 |

| 4,829 | | McCormick & Co., Inc. | 234,496 |

| 7,423 | | Mead Johnson Nutrition Co. | 533,343 |

| 5,999 | | Molson Coors Brewing Co., Class B | 253,998 |

| 73,851 | | PepsiCo, Inc. | 4,648,920 |

Annual Shareholder Report| Shares | | | Value |

| 80,395 | | Philip Morris International, Inc. | 5,617,199 |

| 124,138 | | Procter & Gamble Co. | 7,943,591 |

| 13,366 | | Reynolds American, Inc. | 516,997 |

| 7,502 | | SUPERVALU, Inc. | 60,166 |

| 30,366 | | Safeway, Inc. | 588,189 |

| 27,820 | | Sara Lee Corp. | 495,196 |

| 4,221 | | Smucker (J.M.) Co. | 325,101 |

| 23,950 | | Sysco Corp. | 663,894 |

| 104,526 | | The Coca-Cola Co. | 7,141,216 |

| 10,871 | | Tyson Foods, Inc., Class A | 209,810 |

| 78,289 | | Wal-Mart Stores, Inc. | 4,440,552 |

| 39,211 | | Walgreen Co. | 1,301,805 |

| 6,419 | | Whole Foods Market, Inc. | 462,938 |

| | TOTAL | 57,378,957 |

| | Energy – 11.9% | |

| 27,800 | 2 | Alpha Natural Resources, Inc. | 668,312 |

| 21,860 | | Anadarko Petroleum Corp. | 1,716,010 |

| 18,696 | | Apache Corp. | 1,862,683 |

| 15,924 | | Baker Hughes, Inc. | 923,433 |

| 8,310 | | CONSOL Energy, Inc. | 355,336 |

| 4,122 | | Cabot Oil & Gas Corp., Class A | 320,362 |

| 10,183 | 2 | Cameron International Corp. | 500,393 |

| 24,094 | | Chesapeake Energy Corp. | 677,523 |

| 93,582 | | Chevron Corp. | 9,830,789 |

| 71,728 | | ConocoPhillips | 4,995,855 |

| 14,812 | 2 | Denbury Resources, Inc. | 232,548 |

| 20,780 | | Devon Energy Corp. | 1,349,661 |

| 9,466 | | Diamond Offshore Drilling, Inc. | 620,402 |

| 9,795 | | EOG Resources, Inc. | 875,967 |

| 13,980 | | EQT Corp. | 887,730 |

| 28,082 | | El Paso Corp. | 702,331 |

| 219,577 | | Exxon Mobil Corp. | 17,146,768 |

| 8,812 | 2 | FMC Technologies, Inc. | 394,954 |

| 40,429 | | Halliburton Co. | 1,510,427 |

| 5,400 | | Helmerich & Payne, Inc. | 287,172 |

| 12,804 | | Hess Corp. | 801,018 |

| 31,104 | | Marathon Oil Corp. | 809,637 |

| 15,588 | | Marathon Petroleum Corp. | 559,609 |

Annual Shareholder Report| Shares | | | Value |

| 8,792 | | Murphy Oil Corp. | 486,813 |

| 15,228 | 2 | Nabors Industries Ltd. | 279,129 |

| 22,895 | | National-Oilwell, Inc. | 1,633,100 |

| 4,818 | 2 | Newfield Exploration Co. | 193,973 |

| 10,011 | | Noble Corp. | 359,795 |

| 6,877 | | Noble Energy, Inc. | 614,391 |

| 36,932 | | Occidental Petroleum Corp. | 3,432,460 |

| 11,107 | | Peabody Energy Corp. | 481,711 |

| 4,632 | | Pioneer Natural Resources, Inc. | 388,625 |

| 7 | 2 | Precision Drilling Corp. | 81 |

| 11,069 | | QEP Resources, Inc. | 393,503 |

| 5,890 | | Range Resources Corp. | 405,468 |

| 4,572 | 2 | Rowan Cos., Inc. | 157,688 |

| 52,264 | | Schlumberger Ltd. | 3,839,836 |

| 12,754 | 2 | Southwestern Energy Co. | 536,178 |

| 27,521 | | Spectra Energy Corp. | 787,926 |

| 16,157 | | Sunoco, Inc. | 601,525 |

| 6,615 | 2 | Tesoro Petroleum Corp. | 171,593 |

| 26,016 | | Valero Energy Corp. | 639,994 |

| 21,471 | | Williams Cos., Inc. | 646,492 |

| | TOTAL | 64,079,201 |

| | Financials – 13.6% | |

| 12,294 | | AON Corp. | 573,146 |

| 17,452 | | Ace Ltd. | 1,259,162 |

| 29,005 | | Aflac, Inc. | 1,307,835 |

| 22,096 | | Allstate Corp. | 582,009 |

| 47,146 | | American Express Co. | 2,386,531 |

| 17,920 | 2 | American International Group, Inc. | 442,445 |

| 8,937 | | Ameriprise Financial, Inc. | 417,179 |

| 4,497 | | Apartment Investment & Management Co., Class A | 110,941 |

| 3,490 | | Assurant, Inc. | 134,505 |

| 3,415 | | Avalonbay Communities, Inc. | 456,551 |

| 25,414 | | BB&T Corp. | 593,163 |

| 460,366 | | Bank of America Corp. | 3,144,300 |

| 553 | | Bank of Montreal | 32,721 |

| 54,668 | | Bank of New York Mellon Corp. | 1,163,335 |

| 72,720 | 2 | Berkshire Hathaway, Inc. | 5,661,979 |

| 4,571 | | BlackRock, Inc. | 721,258 |

Annual Shareholder Report| Shares | | | Value |

| 5,441 | | Boston Properties, Inc. | 538,605 |

| 11,932 | 2 | CBRE Group, Inc. | 212,151 |

| 2,438 | | CME Group, Inc. | 671,815 |

| 27,055 | | Capital One Financial Corp. | 1,235,331 |

| 39,189 | | Charles Schwab Corp. | 481,241 |

| 11,262 | | Chubb Corp. | 755,117 |

| 8,599 | | Cincinnati Financial Corp. | 248,855 |

| 132,359 | | Citigroup, Inc. | 4,181,221 |

| 9,127 | | Comerica, Inc. | 233,195 |

| 41,945 | | Discover Financial Services | 988,224 |

| 8,986 | 2 | E*Trade Group, Inc. | 97,498 |

| 14,940 | | Equity Residential Properties Trust | 876,679 |

| 3,343 | 3 | Federated Investors, Inc. | 65,322 |

| 41,836 | | Fifth Third Bancorp | 502,450 |

| 9,583 | | First Horizon National Corp. | 66,985 |

| 6,642 | | Franklin Resources, Inc. | 708,236 |

| 5,040 | | General Growth Properties, Inc. | 74,088 |

| 17,855 | 2 | Genworth Financial, Inc., Class A | 113,915 |

| 18,442 | | Goldman Sachs Group, Inc. | 2,020,321 |

| 4,535 | | HCC Insurance Holdings, Inc. | 120,676 |

| 17,345 | | HCP, Inc. | 691,198 |

| 17,906 | | Hartford Financial Services Group, Inc. | 344,691 |

| 8,042 | | Health Care REIT, Inc. | 423,733 |

| 30,473 | | Host Marriott Corp. | 434,850 |

| 1,752 | 2 | Howard Hughes Corp. | 84,061 |

| 19,119 | | Hudson City Bancorp, Inc. | 119,494 |

| 31,139 | | Huntington Bancshares, Inc. | 161,300 |

| 3,039 | 2 | InterContinentalExchange, Inc. | 394,705 |

| 18,012 | | Invesco Ltd. | 361,501 |

| 191,744 | | J.P. Morgan Chase & Co. | 6,665,021 |

| 7,005 | | Janus Capital Group, Inc. | 45,953 |

| 43,705 | | KeyCorp | 308,557 |

| 30,155 | | Kimco Realty Corp. | 526,808 |

| 4,819 | | Legg Mason, Inc. | 132,523 |

| 7,205 | | Leucadia National Corp. | 193,310 |

| 11,535 | | Lincoln National Corp. | 219,742 |

| 13,079 | | Loews Corp. | 519,236 |

| 5,996 | | M & T Bank Corp. | 456,356 |

Annual Shareholder Report| Shares | | | Value |

| 23,324 | | Marsh & McLennan Cos., Inc. | 714,181 |

| 49,656 | | MetLife, Inc. | 1,745,905 |

| 7,690 | | Moody's Corp. | 272,918 |

| 54,124 | | Morgan Stanley | 954,747 |

| 12,006 | 2 | NASDAQ Stock Market, Inc. | 300,750 |

| 11,387 | | NYSE Euronext | 302,553 |

| 10,932 | | Northern Trust Corp. | 442,418 |

| 23,901 | | PNC Financial Services Group | 1,283,723 |

| 13,620 | | People's United Financial, Inc. | 173,655 |

| 5,896 | | Plum Creek Timber Co., Inc. | 222,043 |

| 12,424 | | Principal Financial Group | 320,291 |

| 29,006 | | Progressive Corp., OH | 551,404 |

| 17,889 | | ProLogis, Inc. | 532,377 |

| 26,253 | | Prudential Financial, Inc. | 1,422,913 |

| 6,028 | | Public Storage, Inc. | 777,913 |

| 45,703 | | Regions Financial Corp. | 179,613 |

| 23,606 | | SLM Corp. | 322,694 |

| 11,753 | | Simon Property Group, Inc. | 1,509,555 |

| 18,718 | | State Street Corp. | 756,020 |

| 35,485 | | SunTrust Banks, Inc. | 700,119 |

| 18,547 | | T. Rowe Price Group, Inc. | 980,024 |

| 28,352 | | The Travelers Cos., Inc. | 1,654,339 |

| 4,835 | | Torchmark Corp. | 197,897 |

| 84,536 | | U.S. Bancorp | 2,163,276 |

| 11,232 | | Unum Group | 267,771 |

| 11,197 | | Ventas, Inc. | 622,665 |

| 7,829 | | Vornado Realty Trust | 648,320 |

| 239,799 | | Wells Fargo & Co. | 6,213,192 |

| 19,780 | | Weyerhaeuser Co. | 355,644 |

| 14,783 | | XL Group PLC | 321,382 |

| 28,866 | | Zions Bancorp | 501,114 |

| | TOTAL | 72,673,440 |

| | Health Care – 11.1% | |

| 56,811 | | Abbott Laboratories | 3,060,408 |

| 22,226 | | Aetna, Inc. | 883,706 |

| 14,240 | 2 | Agilent Technologies, Inc. | 527,877 |

| 11,216 | | Allergan, Inc. | 943,490 |

| 12,162 | | AmerisourceBergen Corp. | 496,210 |

Annual Shareholder Report| Shares | | | Value |

| 40,738 | | Amgen, Inc. | 2,333,065 |

| 3,134 | | Bard (C.R.), Inc. | 269,367 |

| 24,419 | | Baxter International, Inc. | 1,342,557 |

| 8,746 | | Becton, Dickinson & Co. | 684,200 |

| 11,044 | 2 | Biogen Idec, Inc. | 1,285,080 |

| 139,234 | 2 | Boston Scientific Corp. | 820,088 |

| 76,572 | | Bristol-Myers Squibb Co. | 2,418,909 |

| 13,044 | | CIGNA Corp. | 578,371 |

| 13,846 | | Cardinal Health, Inc. | 612,962 |

| 25,218 | 2 | CareFusion Corp. | 645,581 |

| 16,729 | 2 | Celgene Corp. | 1,084,541 |

| 7,517 | 2 | Cerner Corp. | 476,803 |

| 6,796 | 2 | Coventry Health Care, Inc. | 216,181 |

| 17,990 | | Covidien PLC | 846,250 |

| 3,397 | 2 | DaVita, Inc. | 237,790 |

| 5,085 | | Dentsply International, Inc. | 187,942 |

| 4,344 | 2 | Edwards Lifesciences Corp. | 327,624 |

| 42,844 | | Eli Lilly & Co. | 1,592,083 |

| 575 | 2 | Emdeon, Inc. | 10,908 |

| 17,769 | 2 | Express Scripts, Inc., Class A | 812,576 |

| 13,627 | 2 | Forest Laboratories, Inc., Class A | 426,525 |

| 33,455 | 2 | Gilead Sciences, Inc. | 1,393,735 |

| 701 | 2 | HCA, Inc. | 16,438 |

| 1,503 | 2 | Healthspring, Inc. | 81,072 |

| 6,039 | 2 | Hospira, Inc. | 189,926 |

| 7,583 | | Humana, Inc. | 643,721 |

| 1,424 | 2 | Intuitive Surgical, Inc. | 617,817 |

| 124,395 | | Johnson & Johnson | 8,009,794 |

| 2,100 | 2 | Kinetic Concepts, Inc. | 143,619 |

| 4,921 | 2 | Laboratory Corp. of America Holdings | 412,626 |

| 8,674 | 2 | Life Technologies Corp. | 352,772 |

| 3,550 | 2 | LifePoint Hospitals, Inc. | 137,243 |

| 11,149 | | McKesson Corp. | 909,201 |

| 21,865 | 2 | Medco Health Solutions, Inc. | 1,199,514 |

| 45,701 | | Medtronic, Inc. | 1,587,653 |

| 139,358 | | Merck & Co., Inc. | 4,807,851 |

| 16,870 | 2 | Mylan Laboratories, Inc. | 330,146 |

| 29 | | Novartis AG, ADR | 1,638 |

Annual Shareholder Report| Shares | | | Value |

| 3,610 | | Patterson Cos., Inc. | 113,607 |

| 8,043 | | PerkinElmer, Inc. | 166,249 |

| 369,483 | | Pfizer, Inc. | 7,116,242 |

| 2,692 | | Pharmaceutical Product Development, Inc. | 88,809 |

| 5,763 | | Quest Diagnostics, Inc. | 321,575 |

| 12,032 | | St. Jude Medical, Inc. | 469,248 |

| 12,034 | | Stryker Corp. | 576,549 |

| 17,117 | 2 | Tenet Healthcare Corp. | 80,963 |

| 17,899 | 2 | Thermo Fisher Scientific, Inc. | 899,783 |

| 48,836 | | UnitedHealth Group, Inc. | 2,343,640 |

| 4,251 | 2 | Varian Medical Systems, Inc. | 249,619 |

| 4,121 | 2 | Waters Corp. | 330,174 |

| 9,863 | 2 | Watson Pharmaceuticals, Inc. | 662,399 |

| 16,346 | | Wellpoint, Inc. | 1,126,239 |

| 18,144 | 2 | Zimmer Holdings, Inc. | 954,919 |

| | TOTAL | 59,455,875 |

| | Industrials – 10.4% | |

| 27,320 | | 3M Co. | 2,158,826 |

| 3,783 | | Avery Dennison Corp. | 100,628 |

| 8,487 | 2 | Babcock & Wilcox Co. | 186,629 |

| 27,030 | | Boeing Co. | 1,778,304 |

| 7,490 | | C.H. Robinson Worldwide, Inc. | 520,031 |

| 52,483 | | CSX Corp. | 1,165,647 |

| 31,956 | | Caterpillar, Inc. | 3,018,564 |

| 4,131 | | Cintas Corp. | 123,476 |

| 8,299 | | Cummins, Inc. | 825,170 |

| 25,392 | | Danaher Corp. | 1,227,703 |

| 15,092 | | Deere & Co. | 1,145,483 |

| 6,752 | | Donnelley (R.R.) & Sons Co. | 110,058 |

| 6,993 | | Dover Corp. | 388,321 |

| 1,786 | | Dun & Bradstreet Corp. | 119,412 |

| 13,984 | | Eaton Corp. | 626,763 |

| 36,702 | | Emerson Electric Co. | 1,766,100 |

| 5,620 | | Equifax, Inc. | 197,543 |

| 7,987 | | Expeditors International Washington, Inc. | 364,207 |

| 10,811 | | Fastenal Co. | 411,791 |

| 13,359 | | FedEx Corp. | 1,093,167 |

| 2,022 | | Flowserve Corp. | 187,419 |

Annual Shareholder Report| Shares | | | Value |

| 7,897 | | Fluor Corp. | 448,944 |

| 13,402 | 2 | Fortune Brands Home & Security, Inc. | 194,731 |

| 22,990 | | General Dynamics Corp. | 1,475,728 |

| 495,486 | | General Electric Co. | 8,279,571 |

| 6,214 | | Goodrich (B.F.) Co. | 762,023 |

| 5,001 | | Grainger (W.W.), Inc. | 856,721 |

| 32,427 | | Honeywell International, Inc. | 1,699,175 |

| 140 | 2 | Huntington Ingalls Industries, Inc. | 4,130 |

| 6,747 | | ITT Corp. | 307,663 |

| 20,707 | | Illinois Tool Works, Inc. | 1,006,981 |

| 13,535 | | Ingersoll-Rand PLC, Class A | 421,345 |

| 9,275 | | Iron Mountain, Inc. | 286,876 |

| 4,704 | 2 | Jacobs Engineering Group, Inc. | 182,515 |

| 4,790 | | Joy Global, Inc. | 417,688 |

| 4,970 | | L-3 Communications Holdings, Inc. | 336,867 |

| 12,064 | | Lockheed Martin Corp. | 915,658 |

| 12,892 | | Masco Corp. | 123,763 |

| 15,780 | | Norfolk Southern Corp. | 1,167,562 |

| 14,678 | | Northrop Grumman Corp. | 847,654 |

| 16,565 | | PACCAR, Inc. | 716,271 |

| 4,218 | | Pall Corp. | 215,835 |

| 8,954 | | Parker-Hannifin Corp. | 730,199 |

| 9,054 | | Pitney Bowes, Inc. | 184,521 |

| 10,252 | | Precision Castparts Corp. | 1,672,614 |

| 7,678 | 2 | Quanta Services, Inc. | 160,393 |

| 16,892 | | Raytheon Co. | 746,457 |

| 14,656 | | Republic Services, Inc. | 417,110 |

| 18,832 | | Robert Half International, Inc. | 497,730 |

| 10,710 | | Rockwell Automation, Inc. | 724,531 |

| 5,637 | | Rockwell Collins | 314,714 |

| 3,492 | | Roper Industries, Inc. | 283,201 |

| 1,904 | | Ryder System, Inc. | 96,990 |

| 3,239 | | Snap-On, Inc. | 173,837 |

| 30,322 | | Southwest Airlines Co. | 259,253 |

| 6,164 | | Stanley Black & Decker, Inc. | 393,571 |

| 3,123 | 2 | Stericycle, Inc. | 261,020 |

| 31,017 | | Textron, Inc. | 602,350 |

| 22,560 | | Tyco International Ltd. | 1,027,608 |

Annual Shareholder Report| Shares | | | Value |

| 21,536 | | Union Pacific Corp. | 2,144,340 |

| 42,560 | | United Parcel Service, Inc. | 2,989,414 |

| 40,202 | | United Technologies Corp. | 3,134,952 |

| 19,092 | | Waste Management, Inc. | 628,700 |

| | TOTAL | 55,626,448 |

| | Information Technology – 19.0% | |

| 28,928 | | Accenture PLC | 1,743,201 |

| 20,061 | 2 | Adobe Systems, Inc. | 589,994 |

| 21,307 | 2 | Advanced Micro Devices, Inc. | 124,220 |

| 6,663 | 2 | Akamai Technologies, Inc. | 179,501 |

| 14,700 | | Altera Corp. | 557,424 |

| 6,786 | | Amphenol Corp., Class A | 322,267 |

| 13,686 | | Analog Devices, Inc. | 500,497 |

| 42,042 | 2 | Apple, Inc. | 17,017,761 |

| 48,200 | | Applied Materials, Inc. | 593,824 |

| 23,112 | 2 | Autodesk, Inc. | 799,675 |

| 20,963 | | Automatic Data Processing, Inc. | 1,096,994 |

| 6,452 | 2 | BMC Software, Inc. | 224,272 |

| 17,555 | 2 | Broadcom Corp. | 633,560 |

| 17,299 | | CA, Inc. | 374,696 |

| 238,777 | 4 | Cisco Systems, Inc. | 4,424,538 |

| 13,993 | 2 | Citrix Systems, Inc. | 1,019,110 |

| 12,273 | 2 | Cognizant Technology Solutions Corp. | 892,861 |

| 7,000 | | Computer Sciences Corp. | 220,220 |

| 7,904 | 2 | Compuware Corp. | 66,789 |

| 67,714 | | Corning, Inc. | 967,633 |

| 11,837 | 2 | Cypress Semiconductor Corp. | 226,205 |

| 96,439 | 2 | Dell, Inc. | 1,524,701 |

| 91,187 | 2 | EMC Corp. | 2,234,993 |

| 50,419 | 2 | eBay, Inc. | 1,604,837 |

| 31,114 | 2 | Electronic Arts, Inc. | 726,512 |

| 5,877 | | FLIR Systems, Inc. | 154,565 |

| 5,943 | 2 | F5 Networks, Inc. | 617,775 |

| 9,061 | | Fidelity National Information Services, Inc. | 237,217 |

| 2,155 | 2 | First Solar, Inc. | 107,254 |

| 6,411 | 2 | Fiserv, Inc. | 377,416 |

| 12,265 | 2 | Google, Inc. | 7,268,730 |

| 4,314 | | Harris Corp. | 162,853 |

Annual Shareholder Report| Shares | | | Value |

| 101,969 | | Hewlett-Packard Co. | 2,713,395 |

| 53,891 | | IBM Corp. | 9,949,895 |

| 241,856 | | Intel Corp. | 5,935,146 |

| 12,472 | | Intuit, Inc. | 669,372 |

| 8,578 | 2 | JDS Uniphase Corp. | 102,936 |

| 8,244 | | Jabil Circuit, Inc. | 169,497 |

| 19,543 | 2 | Juniper Networks, Inc. | 478,217 |

| 6,223 | | KLA-Tencor Corp. | 293,041 |

| 25,691 | 2 | LSI Logic Corp. | 160,569 |

| 2,915 | | Lexmark International Group, Class A | 92,406 |

| 8,317 | | Linear Technology Corp. | 268,722 |

| 8,131 | 2 | MEMC Electronic Materials, Inc. | 48,705 |

| 3,893 | | Mastercard, Inc. | 1,351,805 |

| 10,909 | | Microchip Technology, Inc. | 394,469 |

| 36,967 | 2 | Micron Technology, Inc. | 206,646 |

| 338,513 | | Microsoft Corp. | 9,014,601 |

| 4,985 | | Molex, Inc. | 123,080 |

| 4,993 | 2 | Monster Worldwide, Inc. | 46,085 |

| 17,721 | 2 | Motorola Mobility Holdings, Inc. | 688,992 |

| 13,686 | | Motorola, Inc. | 642,010 |

| 27,499 | 2 | NVIDIA Corp. | 406,985 |

| 15,585 | 2 | NetApp, Inc. | 638,362 |

| 1,873 | 2 | NetLogic Microsystems, Inc. | 92,152 |

| 2,601 | 2 | Novellus Systems, Inc. | 89,865 |

| 173,506 | | Oracle Corp. | 5,685,792 |

| 12,387 | | Paychex, Inc. | 360,957 |

| 75,179 | | Qualcomm, Inc. | 3,879,236 |

| 7,051 | 2 | Red Hat, Inc. | 350,082 |

| 9,900 | 2 | SAIC, Inc. | 123,057 |

| 4,939 | 2 | Salesforce.com, Inc. | 657,727 |

| 8,740 | 2 | Sandisk Corp. | 442,856 |

| 30,238 | 2 | Symantec Corp. | 514,348 |

| 15,802 | | TE Connectivity Ltd. | 561,761 |

| 16,912 | | Tellabs, Inc. | 73,229 |

| 6,734 | 2 | Teradata Corp. | 401,750 |

| 6,849 | 2 | Teradyne, Inc. | 98,078 |

| 53,252 | | Texas Instruments, Inc. | 1,636,434 |

| 6,606 | | Total System Services, Inc. | 131,393 |

Annual Shareholder Report| Shares | | | Value |

| 2,682 | 2 | Varian Semiconductor Equipment Associates, Inc. | 168,349 |

| 6,106 | 2 | Verisign, Inc. | 195,942 |

| 22,749 | | Visa, Inc., Class A | 2,121,572 |

| 10,556 | 2 | Western Digital Corp. | 281,212 |

| 23,017 | | Western Union Co. | 402,107 |

| 57,811 | | Xerox Corp. | 472,894 |

| 12,664 | | Xilinx, Inc. | 423,737 |

| 46,064 | 2 | Yahoo, Inc. | 720,441 |

| | TOTAL | 101,872,002 |

| | Materials – 3.5% | |

| 4,181 | | AK Steel Holding Corp. | 34,828 |

| 8,970 | | Air Products & Chemicals, Inc. | 772,676 |

| 3,202 | | Airgas, Inc. | 220,778 |

| 43,896 | | Alcoa, Inc. | 472,321 |

| 3,825 | | Allegheny Technologies, Inc. | 177,480 |

| 5,963 | | Ball Corp. | 206,141 |

| 7,996 | | Bemis Co., Inc. | 224,767 |

| 2,741 | | CF Industries Holdings, Inc. | 444,782 |

| 5,369 | | Cliffs Natural Resources, Inc. | 366,273 |

| 51,674 | | Dow Chemical Co. | 1,440,671 |

| 39,669 | | Du Pont (E.I.) de Nemours & Co. | 1,906,889 |

| 5,119 | | Eastman Chemical Co. | 201,125 |

| 8,519 | | Ecolab, Inc. | 458,663 |

| 3,203 | | FMC Corp. | 252,685 |

| 44,359 | | Freeport-McMoran Copper & Gold, Inc. | 1,785,893 |

| 11,180 | | International Flavors & Fragrances, Inc. | 677,061 |

| 31,431 | | International Paper Co. | 870,639 |

| 7,863 | | MeadWestvaco Corp. | 219,456 |

| 23,497 | | Monsanto Co. | 1,709,407 |

| 10,090 | | Mosaic Co./The | 590,870 |

| 2,999 | | Nalco Holding Co. | 113,092 |

| 21,218 | | Newmont Mining Corp. | 1,417,999 |

| 13,860 | | Nucor Corp. | 523,631 |

| 5,910 | 2 | Owens-Illinois, Inc. | 118,673 |

| 7,332 | | PPG Industries, Inc. | 633,558 |

| 12,467 | | Praxair, Inc. | 1,267,520 |

| 16,155 | | Sealed Air Corp. | 287,559 |

| 10,141 | | Sherwin-Williams Co. | 838,762 |

Annual Shareholder Report| Shares | | | Value |

| 4,455 | | Sigma-Aldrich Corp. | 291,713 |

| 2,780 | | Temple-Inland, Inc. | 88,432 |

| 3,073 | | Titanium Metals Corp. | 51,473 |

| 5,347 | | United States Steel Corp. | 135,600 |

| 4,768 | | Vulcan Materials Co. | 149,191 |

| | TOTAL | 18,950,608 |

| | Telecommunication Services – 2.9% | |

| 268,001 | | AT&T, Inc. | 7,855,109 |

| 16,011 | 2 | American Tower Corp. | 882,206 |

| 29,622 | | CenturyLink, Inc. | 1,044,472 |

| 51,499 | | Frontier Communications Corp. | 322,385 |

| 10,888 | 2 | MetroPCS Communications, Inc. | 92,548 |

| 109,826 | 2 | Sprint Nextel Corp. | 282,253 |

| 129,148 | | Verizon Communications, Inc. | 4,775,893 |

| 31,390 | | Windstream Corp. | 382,016 |

| | TOTAL | 15,636,882 |

| | Utilities – 3.5% | |

| 23,924 | 2 | AES Corp. | 268,427 |

| 25,768 | | Ameren Corp. | 821,484 |

| 20,928 | | American Electric Power Co., Inc. | 822,052 |

| 12,267 | | CMS Energy Corp. | 255,399 |

| 15,800 | | CenterPoint Energy, Inc. | 329,272 |

| 10,922 | | Consolidated Edison Co. | 632,056 |

| 8,972 | | Constellation Energy Group, Inc. | 356,188 |

| 1,620 | | DPL, Inc. | 49,167 |

| 6,210 | | DTE Energy Co. | 323,603 |

| 20,753 | | Dominion Resources, Inc. | 1,070,647 |

| 60,497 | | Duke Energy Corp. | 1,235,349 |

| 11,815 | | Edison International | 479,689 |

| 7,446 | | Entergy Corp. | 515,040 |

| 29,281 | | Exelon Corp. | 1,299,784 |

| 18,916 | | FirstEnergy Corp. | 850,463 |

| 3,544 | | Integrys Energy Group, Inc. | 187,513 |

| 2,093 | | NICOR, Inc. | 117,731 |

| 30,413 | 2 | NRG Energy, Inc. | 651,447 |

| 15,399 | | NextEra Energy, Inc. | 868,504 |

| 20,345 | | NiSource, Inc. | 449,421 |

| 6,440 | | Northeast Utilities Co. | 222,631 |

Annual Shareholder Report| Shares | | | Value |

| 4,706 | | ONEOK, Inc. | 357,891 |

| 16,211 | | P G & E Corp. | 695,452 |

| 21,149 | | PPL Corp. | 621,146 |

| 28,518 | | Pepco Holdings, Inc. | 564,656 |

| 6,202 | | Pinnacle West Capital Corp. | 282,687 |

| 11,311 | | Progress Energy, Inc. | 589,303 |

| 18,390 | | Public Service Enterprises Group, Inc. | 619,743 |

| 4,224 | | SCANA Corp. | 178,591 |

| 9,478 | | Sempra Energy | 509,253 |

| 35,305 | | Southern Co. | 1,525,176 |

| 7,863 | | TECO Energy, Inc. | 146,016 |

| 8,505 | | Wisconsin Energy Corp. | 275,817 |

| 20,235 | | Xcel Energy, Inc. | 523,075 |

| | TOTAL | 18,694,673 |

| | TOTAL COMMON STOCKS

(IDENTIFIED COST $230,103,172) | 519,429,907 |

| | EXCHANGE-TRADED FUND – 0.6% | |

| 25,944 | | SPDR Trust, Series 1

(IDENTIFIED COST $3,085,827) | 3,254,675 |

| | WARRANT – 0.0% | |

| | Consumer Discretionary – 0.0% | |

| 30,369 | | Ford Motor Co., Del., Warrants, Expiration Date 1/1/2013

(IDENTIFIED COST $151,845) | 102,343 |

| | MUTUAL FUND – 2.5% | |

| 13,531,400 | 3,5 | Federated Prime Value Obligations Fund, Institutional Shares, 0.18%

(AT NET ASSET VALUE) | 13,531,400 |

| | TOTAL INVESTMENTS — 100.0%

(IDENTIFIED COST $246,872,244)6 | 536,318,325 |

| | OTHER ASSETS AND LIABILITIES - NET — 0.0%7 | 153,803 |

| | TOTAL NET ASSETS — 100% | $536,472,128 |

SECURITIES SOLD SHORT

| Shares | | | Value |

| 6,747 | | Exelis Inc. | $76,241 |

| 3,373 | | ITT Corp. | 59,129 |

| | TOTAL SECURITIES SOLD SHORT (PROCEEDS $135,342) | $135,370 |

Annual Shareholder Report

At October 31, 2011, the Fund had the following outstanding futures contracts:1| Description | Number of

Contracts | Notional

Value | Expiration

Date | Unrealized

Appreciation |

| 2 S&P 500 E-Mini Index Long Futures | 23 | $1,436,695 | December 2011 | $100,902 |

| 2 S&P 500 Index Long Futures | 46 | $14,366,950 | December 2011 | $644,398 |

| UNREALIZED APPRECIATION ON FUTURES CONTRACTS | $745,300 |

Net Unrealized Appreciation on Futures Contracts and Value of Securities Sold Short is included in “Other Assets and Liabilities — Net.”

| 1 | The Fund purchases index futures contracts to efficiently manage cash flows resulting from shareholder purchases and redemptions, dividend and capital gain payments to shareholders and corporate actions while maintaining exposure to the S&P 500 Index and minimizing trading costs. The underlying face amount, at value, of open index futures contracts is $15,803,645 at October 31, 2011, which represents 2.9% of total net assets. Taking into consideration these open index futures contracts, the Fund's effective total exposure to the S&P 500 Index is 99.8%. |

| 2 | Non-income producing security. |

| 3 | Affiliated holdings. |

| 4 | Pledged as collateral to ensure the Fund is able to satisfy the obligations of its outstanding futures contracts. |

| 5 | 7-Day net yield. |

| 6 | The cost of investments for federal tax purposes amounts to $267,482,720. |

| 7 | Assets, other than investments in securities, less liabilities. See Statement of Assets and Liabilities. |

Note: The categories of investments are shown as a percentage of total net assets at October 31, 2011.

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in the three broad levels listed below:

Level 1 — quoted prices in active markets for identical securities, including investment companies with daily net asset values, if applicable.

Level 2 — other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). Also includes securities valued at amortized cost.

Level 3 — significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

As of October 31, 2011, all investments of the Fund utilized Level 1 inputs in valuing the Fund's assets carried at fair value.

The following acronyms are used throughout this portfolio:

| ADR | — American Depositary Receipt |

| REIT | — Real Estate Investment Trust |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report Financial Highlights – Class C Shares

(For a Share Outstanding Throughout Each Period)

| Year Ended October 31 | 2011 | 2010 | 2009 | 2008 | 2007 |

| Net Asset Value, Beginning of Period | $12.69 | $11.65 | $15.53 | $28.32 | $27.23 |

| Income From Investment Operations: | | | | | |

| Net investment income | 0.081 | 0.071 | 0.121 | 0.171 | 0.15 |

| Net realized and unrealized gain (loss) on investments, futures contracts, short sales and foreign currency transactions | 0.77 | 1.64 | 0.51 | (9.60) | 3.10 |

| TOTAL FROM INVESTMENT OPERATIONS | 0.85 | 1.71 | 0.63 | (9.43) | 3.25 |

| Less Distributions: | | | | | |

| Distributions from net investment income | (0.08) | (0.08) | (0.13) | (0.17) | (0.16) |

| Distributions from net realized gain on investments, futures contracts and foreign currency transactions | (0.63) | (0.59) | (4.38) | (3.21) | (2.00) |

| TOTAL DISTRIBUTIONS | (0.71) | (0.67) | (4.51) | (3.38) | (2.16) |

| Regulatory Settlement Proceeds | — | — | — | 0.022 | — |

| Net Asset Value, End of Period | $12.83 | $12.69 | $11.65 | $15.53 | $28.32 |

| Total Return3 | 6.87% | 15.11% | 8.55% | (36.87)%2 | 12.91% |

| Ratios to Average Net Assets: | | | | | |

| Net expenses | 1.43% | 1.43% | 1.43% | 1.41% | 1.40% |

| Net investment income | 0.59% | 0.58% | 1.14% | 0.78% | 0.59% |

| Expense waiver/reimbursement4 | 0.06% | 0.07% | 0.09% | 0.05% | 0.02% |

| Supplemental Data: | | | | | |

| Net assets, end of period (000 omitted) | $29,402 | $31,722 | $32,489 | $35,288 | $75,531 |

| Portfolio turnover | 53% | 34% | 31% | 47% | 49% |

| 1 | Per share numbers have been calculated using the average shares method. |

| 2 | During the year, the Fund received a regulatory settlement from an unaffiliated third party, which had an impact of 0.08% on the total return. |

| 3 | Based on net asset value, which does not reflect the sales charge, redemption fee or contingent deferred sales charge, if applicable. |

| 4 | This expense decrease is reflected in both the net expense and the net investment income ratios shown above. |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report Financial Highlights – Class R Shares

(For a Share Outstanding Throughout Each Period)

| Year Ended October 31 | 2011 | 2010 | 2009 | 2008 | 2007 |

| Net Asset Value, Beginning of Period | $12.76 | $11.71 | $15.58 | $28.41 | $27.30 |

| Income From Investment Operations: | | | | | |

| Net investment income | 0.121 | 0.111 | 0.151 | 0.241 | 0.23 |

| Net realized and unrealized gain (loss) on investments, futures contracts, short sales and foreign currency transactions | 0.77 | 1.65 | 0.53 | (9.65) | 3.13 |

| TOTAL FROM INVESTMENT OPERATIONS | 0.89 | 1.76 | 0.68 | (9.41) | 3.36 |

| Less Distributions: | | | | | |

| Distributions from net investment income | (0.12) | (0.12) | (0.17) | (0.23) | (0.25) |

| Distributions from net realized gain on investments, futures contracts and foreign currency transactions | (0.63) | (0.59) | (4.38) | (3.21) | (2.00) |

| TOTAL DISTRIBUTIONS | (0.75) | (0.71) | (4.55) | (3.44) | (2.25) |

| Regulatory Settlement Proceeds | — | — | — | 0.022 | — |

| Net Asset Value, End of Period | $12.90 | $12.76 | $11.71 | $15.58 | $28.41 |

| Total Return3 | 7.18% | 15.51% | 8.94% | (36.72)%2 | 13.29% |

| Ratios to Average Net Assets: | | | | | |

| Net expenses | 1.10% | 1.10% | 1.10% | 1.10% | 1.10% |

| Net investment income | 0.91% | 0.91% | 1.42% | 1.11% | 0.88% |

| Expense waiver/reimbursement4 | 0.06% | 0.06% | 0.09% | 0.05% | 0.02% |

| Supplemental Data: | | | | | |

| Net assets, end of period (000 omitted) | $32,474 | $30,980 | $25,796 | $21,739 | $73,702 |

| Portfolio turnover | 53% | 34% | 31% | 47% | 49% |

| 1 | Per share numbers have been calculated using the average shares method. |

| 2 | During the year, the Fund received a regulatory settlement from an unaffiliated third party, which had an impact of 0.08% on the total return. |

| 3 | Based on net asset value. |

| 4 | This expense decrease is reflected in both the net expense and the net investment income ratios shown above. |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report Financial Highlights – Institutional Shares

(For a Share Outstanding Throughout Each Period)

| Year Ended October 31 | 2011 | 2010 | 2009 | 2008 | 2007 |

| Net Asset Value, Beginning of Period | $12.82 | $11.76 | $15.62 | $28.48 | $27.36 |

| Income From Investment Operations: | | | | | |

| Net investment income | 0.221 | 0.201 | 0.241 | 0.401 | 0.45 |

| Net realized and unrealized gain (loss) on investments, futures contracts, short sales and foreign currency transactions | 0.77 | 1.66 | 0.53 | (9.67) | 3.12 |

| TOTAL FROM INVESTMENT OPERATIONS | 0.99 | 1.86 | 0.77 | (9.27) | 3.57 |

| Less Distributions: | | | | | |

| Distributions from net investment income | (0.22) | (0.21) | (0.25) | (0.40) | (0.45) |

| Distributions from net realized gain on investments, futures contracts and foreign currency transactions | (0.63) | (0.59) | (4.38) | (3.21) | (2.00) |

| TOTAL DISTRIBUTIONS | (0.85) | (0.80) | (4.63) | (3.61) | (2.45) |

| Regulatory Settlement Proceeds | — | — | — | 0.022 | — |

| Net Asset Value, End of Period | $12.96 | $12.82 | $11.76 | $15.62 | $28.48 |

| Total Return3 | 7.96% | 16.38% | 9.78% | (36.23)%2 | 14.13% |

| Ratios to Average Net Assets: | | | | | |

| Net expenses | 0.35% | 0.35% | 0.35% | 0.35% | 0.35% |

| Net investment income | 1.67% | 1.65% | 2.24% | 1.84% | 1.63% |

| Expense waiver/reimbursement4 | 0.09% | 0.09% | 0.10% | 0.07% | 0.03% |

| Supplemental Data: | | | | | |

| Net assets, end of period (000 omitted) | $187,164 | $208,399 | $170,766 | $215,731 | $651,327 |

| Portfolio turnover | 53% | 34% | 31% | 47% | 49% |

| 1 | Per share numbers have been calculated using the average shares method. |

| 2 | During the year, the Fund received a regulatory settlement from an unaffiliated third party, which had an impact of 0.08% on the total return. |

| 3 | Based on net asset value. |

| 4 | This expense decrease is reflected in both the net expense and the net investment income ratios shown above. |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report Financial Highlights – Service Shares

(For a Share Outstanding Throughout Each Period)

| Year Ended October 31 | 2011 | 2010 | 2009 | 2008 | 2007 |

| Net Asset Value, Beginning of Period | $12.77 | $11.71 | $15.58 | $28.41 | $27.30 |

| Income From Investment Operations: | | | | | |

| Net investment income | 0.181 | 0.161 | 0.201 | 0.331 | 0.35 |

| Net realized and unrealized gain (loss) on investments, futures contracts, short sales and foreign currency transactions | 0.76 | 1.66 | 0.52 | (9.64) | 3.12 |

| TOTAL FROM INVESTMENT OPERATIONS | 0.94 | 1.82 | 0.72 | (9.31) | 3.47 |

| Less Distributions: | | | | | |

| Distributions from net investment income | (0.18) | (0.17) | (0.21) | (0.33) | (0.36) |

| Distributions from net realized gain on investments, futures contracts and foreign currency transactions | (0.63) | (0.59) | (4.38) | (3.21) | (2.00) |

| TOTAL DISTRIBUTIONS | (0.81) | (0.76) | (4.59) | (3.54) | (2.36) |

| Regulatory Settlement Proceeds | — | — | — | 0.022 | — |

| Net Asset Value, End of Period | $12.90 | $12.77 | $11.71 | $15.58 | $28.41 |

| Total Return3 | 7.59% | 16.10% | 9.42% | (36.41)%2 | 13.78% |

| Ratios to Average Net Assets: | | | | | |

| Net expenses | 0.65% | 0.65% | 0.65% | 0.65% | 0.65% |

| Net investment income | 1.35% | 1.36% | 1.90% | 1.54% | 1.33% |

| Expense waiver/reimbursement4 | 0.38% | 0.38% | 0.41% | 0.32% | 0.29% |

| Supplemental Data: | | | | | |

| Net assets, end of period (000 omitted) | $287,432 | $231,807 | $227,316 | $235,167 | $490,722 |

| Portfolio turnover | 53% | 34% | 31% | 47% | 49% |

| 1 | Per share numbers have been calculated using the average shares method. |

| 2 | During the year, the Fund received a regulatory settlement from an unaffiliated third party, which had an impact of 0.08% on the total return. |

| 3 | Based on net asset value. |

| 4 | This expense decrease is reflected in both the net expense and the net investment income ratios shown above. |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report Statement of Assets and Liabilities

October 31, 2011

| Assets: | | |

| Total investments in securities, at value including $13,596,722 of investments in affiliated holdings (Note 5) (identified cost $246,872,244) | | $536,318,325 |

| Cash | | 1,032 |

| Restricted cash (Note 2) | | 1,154,000 |

| Income receivable | | 618,237 |

| Receivable for investments sold | | 637,438 |

| Receivable for shares sold | | 405,155 |

| TOTAL ASSETS | | 539,134,187 |

| Liabilities: | | |

| Securities sold short, at value (proceeds $135,342) | $135,370 | |

| Payable for investments purchased | 498,000 | |

| Payable for shares redeemed | 1,340,885 | |

| Payable for daily variation margin | 406,350 | |

| Payable for transfer and dividend disbursing agent fees and expenses | 106,500 | |

| Payable for Directors'/Trustees' fees | 223 | |

| Payable for distribution services fee (Note 5) | 42,265 | |

| Payable for shareholder services fee (Note 5) | 69,533 | |

| Accrued expenses | 62,933 | |

| TOTAL LIABILITIES | | 2,662,059 |

| Net assets for 41,526,659 shares outstanding | | $536,472,128 |

| Net Assets Consist of: | | |

| Paid-in capital | | $257,122,890 |

| Net unrealized appreciation of investments, futures contracts and short sales | | 290,191,353 |

| Accumulated net realized loss on investments, futures contracts and foreign currency transactions | | (10,953,562) |

| Undistributed net investment income | | 111,447 |

| TOTAL NET ASSETS | | $536,472,128 |

Annual Shareholder ReportStatement of Assets and Liabilities — continued| Net Asset Value, Offering Price and Redemption Proceeds Per Share | | |

| Class C Shares: | | |

| Net asset value per share ($29,402,084 ÷ 2,292,054 shares outstanding), no par value, unlimited shares authorized | | $12.83 |

| Offering price per share | | $12.83 |

| Redemption proceeds per share (99.00/100 of $12.83) | | $12.70 |

| Class R Shares: | | |

| Net asset value per share ($32,473,883 ÷ 2,516,888 shares outstanding), no par value, unlimited shares authorized | | $12.90 |

| Institutional Shares: | | |

| Net asset value per share ($187,164,013 ÷ 14,439,465 shares outstanding), no par value, unlimited shares authorized | | $12.96 |

| Service Shares: | | |

| Net asset value per share ($287,432,148 ÷ 22,278,252 shares outstanding), no par value, unlimited shares authorized | | $12.90 |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report Statement of Operations

Year Ended October 31, 2011

| Investment Income: | | | |

| Dividends (including $32,538 received from affiliated holdings (Note 5) and net of foreign taxes withheld of $213) | | | $11,614,377 |

| Interest | | | 6,560 |

| TOTAL INCOME | | | 11,620,937 |

| Expenses: | | | |

| Management fee (Note 5) | | $1,732,156 | |

| Custodian fees | | 118,143 | |

Transfer and dividend disbursing agent fees and

expenses (Note 2) | | 571,929 | |

| Directors'/Trustees' fees | | 10,488 | |

| Auditing fees | | 22,525 | |

| Legal fees | | 6,032 | |

| Portfolio accounting fees | | 147,284 | |

| Distribution services fee (Note 5) | | 1,319,869 | |

| Shareholder services fee (Note 5) | | 822,857 | |

| Account administration fee (Note 2) | | 20,638 | |

| Share registration costs | | 64,016 | |

| Printing and postage | | 52,872 | |

| Insurance premiums | | 5,099 | |

| Miscellaneous | | 34,958 | |

| TOTAL EXPENSES | | 4,928,866 | |

Annual Shareholder ReportStatement of Operations — continued| Waivers and Reimbursements: | | | |

| Waiver/reimbursement of management fee (Note 5) | $(361,546) | | |

| Waiver of distribution services fee (Note 5) | (765,432) | | |

| Reimbursement of transfer and dividend disbursing agent fees and expenses (Note 2) and (Note 5) | (249,038) | | |

| TOTAL WAIVERS AND REIMBURSEMENTS | | $(1,376,016) | |

| Net expenses | | | $3,552,850 |

| Net investment income | | | 8,068,087 |

Realized and Unrealized Gain (Loss) on Investments, Futures Contracts, Short Sales and Foreign

Currency Transactions: | | | |

| Net realized gain/loss on investments and foreign currency transactions | | | 8,520,400 |

| Net realized gain on futures contracts | | | 810,352 |

| Net change in unrealized appreciation of investments | | | 22,375,322 |

| Net change in unrealized appreciation of futures contracts | | | 121,091 |

| Net change in unrealized depreciation of short sales | | | (28) |

| Net realized and unrealized gain on investments, futures contracts, short sales and foreign currency transactions | | | 31,827,137 |

| Change in net assets resulting from operations | | | $39,895,224 |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report Statement of Changes in Net Assets

| Year Ended October 31 | 2011 | 2010 |

| Increase (Decrease) in Net Assets | | |

| Operations: | | |

| Net investment income | $8,068,087 | $6,522,496 |

| Net realized gain on investments, futures contracts and foreign currency transactions | 9,330,752 | 31,001,519 |

| Net change in unrealized appreciation/depreciation of investments, futures contracts, short sales and translation of assets and liabilites in foreign currency | 22,496,385 | 34,797,958 |

| CHANGE IN NET ASSETS RESULTING FROM OPERATIONS | 39,895,224 | 72,321,973 |

| Distributions to Shareholders: | | |

| Distributions from net investment income | | |

| Class C Shares | (181,556) | (215,656) |

| Class R Shares | (292,986) | (285,755) |

| Institutional Shares | (3,350,130) | (3,088,320) |

| Service Shares | (4,223,910) | (3,315,659) |

| Distributions from net realized gain on investments, futures contracts and foreign currency transactions | | |

| Class C Shares | (1,568,488) | (1,640,357) |

| Class R Shares | (1,527,804) | (1,291,207) |

| Institutional Shares | (10,066,143) | (8,513,387) |

| Service Shares | (14,732,888) | (11,320,879) |

| CHANGE IN NET ASSETS RESULTING FROM DISTRIBUTIONS TO SHAREHOLDERS | (35,943,905) | (29,671,220) |

| Share Transactions: | | |

| Proceeds from sale of shares | 211,309,478 | 111,654,754 |

| Net asset value of shares issued to shareholders in payment of distributions declared | 30,506,415 | 26,485,694 |

| Cost of shares redeemed | (212,203,594) | (134,248,764) |

| CHANGE IN NET ASSETS RESULTING FROM SHARE TRANSACTIONS | 29,612,299 | 3,891,684 |

| Change in net assets | 33,563,618 | 46,542,437 |

| Net Assets: | | |

| Beginning of period | 502,908,510 | 456,366,073 |

| End of period (including undistributed net investment income of $111,447 and $92,881, respectively) | $536,472,128 | $502,908,510 |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report Notes to Financial Statements

October 31, 2011

1. ORGANIZATION

Federated Index Trust (the “Trust”) is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company. The Trust consists of two portfolios. The financial statements included herein are only those of Federated Max-Cap Index Fund (the “Fund”), a diversified portfolio. The financial statements of the other portfolio are presented separately. The assets of each portfolio are segregated and a shareholder's interest is limited to the portfolio in which shares are held. Each portfolio pays its own expenses. The Fund offers four classes of shares: Class C Shares, Class R Shares, Institutional Shares and Service Shares. All shares of the Fund have equal rights with respect to voting, except on class-specific matters. The investment objective of the Fund is to provide investment results that generally correspond to the aggregate price and dividend performance of publicly traded common stocks comprising the Standard & Poor's 500 Index (S&P 500).

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. These policies are in conformity with U.S. generally accepted accounting principles (GAAP).

Investment Valuation

In calculating its net asset value (NAV), the Fund generally values investments as follows:

- Equity securities listed on an exchange or traded through a regulated market system are valued at their last reported sale price or official closing price in their principal exchange or market.

- Shares of other mutual funds are valued based upon their reported NAVs.

- Derivative contracts listed on exchanges are valued at their reported settlement or closing price.

- Over-the-counter (OTC) derivative contracts are fair valued using price evaluations provided by a pricing service approved by the Fund's Board of Trustees (the “Trustees”).

- Fixed-income securities acquired with remaining maturities of 60 days or less are valued at their cost (adjusted for the accretion of any discount or amortization of any premium), which approximates market value.

- Fixed-income securities acquired with remaining maturities greater than 60 days are fair valued using price evaluations provided by a pricing service approved by the Trustees.

- For securities that are fair valued in accordance with procedures established by and under the general supervision of the Trustees, certain factors may be considered such as: the purchase price of the security, information obtained by contacting the issuer, analysis of the issuer's financial statements or other available documents, fundamental analytical data, the nature and duration of restrictions on disposition, the movement of the market in which the security is normally traded and public trading in similar securities of the issuer or comparable issuers.

Annual Shareholder Report

If the Fund cannot obtain a price or price evaluation from a pricing service for an investment, the Fund may attempt to value the investment based upon the mean of bid and asked quotations or fair value the investment based on price evaluations, from one or more dealers. If any price, quotation, price evaluation or other pricing source is not readily available when the NAV is calculated, the Fund uses the fair value of the investment determined in accordance with the procedures described below. There can be no assurance that the Fund could purchase or sell an investment at the price used to calculate the Fund's NAV.Fair Valuation and Significant Events Procedures

The Trustees have authorized the use of pricing services to provide evaluations of the current fair value of certain investments for purposes of calculating the NAV. Factors considered by pricing services in evaluating an investment include the yields or prices of investments of comparable quality, coupon, maturity, call rights and other potential prepayments, terms and type, reported transactions, indications as to values from dealers and general market conditions. Some pricing services provide a single price evaluation reflecting the bid-side of the market for an investment (a “bid” evaluation). Other pricing services offer both bid evaluations and price evaluations indicative of a price between the prices bid and asked for the investment (a “mid” evaluation). The Fund normally uses bid evaluations for U.S. Treasury and Agency securities and mortgage-backed securities. The Fund normally uses mid evaluations for other types of fixed-income securities and OTC derivative contracts. In the event that market quotations and price evaluations are not available for an investment, the fair value of the investment is determined in accordance with procedures adopted by the Trustees.

The Trustees also have adopted procedures requiring an investment to be priced at its fair value whenever the Manager determines that a significant event affecting the value of the investment has occurred between the time as of which the price of the investment would otherwise be determined and the time as of which the NAV is computed. An event is considered significant if there is both an affirmative expectation that the investment's value will change in response to the event and a reasonable basis for quantifying the resulting change in value. Examples of significant events that may occur after the close of the principal market on which a security is traded, or after the time of a price evaluation provided by a pricing service or a dealer, include:

- With respect to securities traded in foreign markets, significant trends in U.S. equity markets or in the trading of foreign securities index futures or options contracts;

- With respect to price evaluations of fixed-income securities determined before the close of regular trading on the NYSE, actions by the Federal Reserve Open Market Committee and other significant trends in U.S. fixed-income markets;

- Political or other developments affecting the economy or markets in which an issuer conducts its operations or its securities are traded; and

- Announcements concerning matters such as acquisitions, recapitalizations, litigation developments, a natural disaster affecting the issuer's operations or regulatory changes or market developments affecting the issuer's industry.

Annual Shareholder Report

The Trustees have approved the use of a pricing service to determine the fair value of equity securities traded principally in foreign markets when the Manager determines that there has been a significant trend in the U.S. equity markets or in index futures trading. For other significant events, the Fund may seek to obtain more current quotations or price evaluations from alternative pricing sources. If a reliable alternative pricing source is not available, the Fund will determine the fair value of the investment using another method approved by the Trustees.Repurchase Agreements

The Fund may invest in repurchase agreements for short-term liquidity purposes. It is the policy of the Fund to require the other party to a repurchase agreement to transfer to the Fund's custodian or sub-custodian eligible securities or cash with a market value (after transaction costs) at least equal to the repurchase price to be paid under the repurchase agreement. The eligible securities are transferred to accounts with the custodian or sub-custodian in which the Fund holds a “securities entitlement” and exercises “control” as those terms are defined in the Uniform Commercial Code. The Fund has established procedures for monitoring the market value of the transferred securities and requiring the transfer of additional eligible securities if necessary to equal at least the repurchase price. These procedures also allow the other party to require securities to be transferred from the account to the extent that their market value exceeds the repurchase price or in exchange for other eligible securities of equivalent market value.

The insolvency of the other party or other failure to repurchase the securities may delay the disposition of the underlying securities or cause the Fund to receive less than the full repurchase price. Under the terms of the repurchase agreement, any amounts received by the Fund in excess of the repurchase price and related transaction costs must be remitted to the other party.

The Fund may enter into repurchase agreements in which eligible securities are transferred into joint trading accounts maintained by the custodian or sub-custodian for investment companies and other clients advised by the Fund's Manager and its affiliates. The Fund will participate on a pro rata basis with the other investment companies and clients in its share of the securities transferred under such repurchase agreements and in its share of proceeds from any repurchase or other disposition of such securities.

Annual Shareholder Report

Investment Income, Gains and Losses, Expenses and DistributionsInvestment transactions are accounted for on a trade-date basis. Realized gains and losses from investment transactions are recorded on an identified-cost basis. Interest income and expenses are accrued daily. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Foreign dividends are recorded on the ex-dividend date or when the Fund is informed of the ex-dividend date. Distributions of net investment income are declared and paid quarterly. Non-cash dividends included in dividend income, if any, are recorded at fair value. Investment income, realized and unrealized gains and losses, and certain fund-level expenses are allocated to each class based on relative average daily net assets, except that Class C Shares, Class R Shares, Institutional Shares and Service Shares may bear distribution services fees, shareholder services fees, account administration fees and certain transfer and dividend disbursing agent fees unique to those classes. For the year ended October 31, 2011, transfer and dividend disbursing agent fees and account administration fees for the Fund were as follows:

| Transfer and

Dividend

Disbursing

Agent Fees

Incurred | Transfer and

Dividend

Disbursing

Agent Fees

Reimbursed | Account

Administration

Fees Incurred |

| Class C Shares | $37,057 | $ — | $3,131 |

| Class R Shares | 92,849 | — | — |

| Institutional Shares | 130,611 | (52,906) | — |

| Service Shares | 311,412 | (196,132) | 17,507 |

| TOTAL | $571,929 | $(249,038) | $20,638 |

Dividends are declared separately for each class. No class has preferential dividend rights; differences in per share dividend rates are generally due to differences in separate class expenses.

Premium and Discount Amortization

All premiums and discounts on fixed-income securities are amortized/accreted using the effective interest rate method.

Federal Taxes

It is the Fund's policy to comply with the Subchapter M provision of the Internal Revenue Code and to distribute to shareholders each year substantially all of its income. Accordingly, no provision for federal income tax is necessary. As of and during the year ended October 31, 2011, the Fund did not have a liability for any uncertain tax positions. The Fund recognizes interest and penalties, if any, related to tax liabilities as income tax expense in the Statement of Operations. As of October 31, 2011, tax years 2008 through 2011 remain subject to examination by the Fund's major tax jurisdictions, which include the United States of America and the Commonwealth of Massachusetts.

Annual Shareholder Report

The Fund may be subject to taxes imposed by governments of countries in which it invests. Such taxes are generally based on either income or gains earned or repatriated. The Fund accrues and applies such taxes to net investment income, net realized gains and net unrealized gains as income and/or gains are earned.When-Issued and Delayed Delivery Transactions

The Fund may engage in when-issued or delayed delivery transactions. The Fund records when-issued securities on the trade date and maintains security positions such that sufficient liquid assets will be available to make payment for the securities purchased. Securities purchased on a when-issued or delayed delivery basis are marked to market daily and begin earning interest on the settlement date. Losses may occur on these transactions due to changes in market conditions or the failure of counterparties to perform under the contract.

Futures Contracts

The Fund purchases stock index futures contracts to manage cash flows, maintain exposure to the S&P 500 index and to potentially reduce transaction costs. Upon entering into a stock index futures contract with a broker, the Fund is required to deposit in a segregated account a specified amount of cash or U.S. government securities which is shown as Restricted Cash in the Statement of Assets and Liabilities. Futures contracts are valued daily and unrealized gains or losses are recorded in a “variation margin” account. Daily, the Fund receives from or pays to the broker a specified amount of cash based upon changes in the variation margin account. When a contract is closed, the Fund recognizes a realized gain or loss. Futures contracts have market risks, including the risk that the change in the value of the contract may not correlate with the changes in the value of the underlying securities. There is minimal counterparty risk to the Fund since futures are exchange traded and the exchange's clearinghouse, as counterparty to all exchange traded futures, guarantees the futures against default.

Futures contracts outstanding at period end are listed after the Fund's Portfolio of Investments.