UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

———————

FORM N-CSR

———————

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

INVESTMENT COMPANY ACT FILE NUMBER 811-06062

THE THAI CAPITAL FUND, INC.

(Exact name of registrant as specified in charter)

c/o Daiwa Securities Trust Company

One Evertrust Plaza, 9th Floor

Jersey City, New Jersey 07302-3051

(Address of principal executive offices) (Zip code)

c/o Daiwa Securities Trust Company

One Evertrust Plaza, 9th Floor

Jersey City, New Jersey 07302-3051

(Name and address of agent for service)

REGISTRANT'S TELEPHONE NUMBER, INCLUDING AREA CODE: (201) 915-3054

DATE OF FISCAL YEAR END: December 31

DATE OF REPORTING PERIOD: December 31, 2011

The Thai Capital Fund, Inc.

Item 1. Reports to Stockholders.

General Information (unaudited)

The Fund

The Thai Capital Fund, Inc. (the "Fund") is a non-diversified, closed-end management investment company. The Fund seeks long-term capital appreciation through investment primarily in equity securities of Thai companies. The Fund's investments in Thailand are made through a wholly-owned Investment Plan established under an agreement between SCB Asset Management Co., Ltd. (the "Manager"), the Fund's investment manager, and the Fund. The Fund's investments through the Investment Plan are managed by the Manager.

Stockholder Information

The Fund's shares are listed on the NYSE Amex US LLC ("NYSE Amex"), formerly the American Stock Exchange. The Fund understands that its shares may trade periodically on certain exchanges other than the NYSE Amex, but the Fund has not listed its shares on those other exchanges and does not encourage trading on those exchanges.

The Fund's NYSE Amex trading symbol is "TF". The Fund's daily net asset value ("NAV") is available by visiting www.daiwast.com or calling (800) 933-3440 or (201) 915-3020. Also, the Fund's website includes press releases, a monthly market review and a list of the Fund's top ten industries and holdings. The Fund has also placed its Fund governance documents on its website under the section titled "Corporate Governance", which includes the Fund's proxy voting policies and procedures, its code of ethics and its audit committee charter.

Proxy Voting Policies and Procedures

A description of the policies and procedures that are used by the Fund's Manager to determine how to vote proxies relating to the Fund's portfolio securities is available (1) without charge, upon request, by calling collect (201) 915-3054; (2) by visiting www.daiwast.com; and (3) as an exhibit to the Fund's annual report on Form N-CSR which is available on the website of the Securities and Exchange Commission (the "Commission") at www.sec.gov. Information regarding how the Manager votes these proxies is now available by calling the same number and is available on the Commission's website. The Fund has filed with the Commission its report on Form N-PX covering the Fund's proxy voting record for the 12-month period ended June 30, 2011.

Quarterly Portfolio of Investments

A Portfolio of Investments is filed with the Commission as of the end of the first and third quarters of each fiscal year on Form N-Q and is available on the Commission's website at www.sec.gov and the Fund's website at www.daiwast.com. Additionally, the Portfolio of Investments may be reviewed and copied at the Commission's Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330. The quarterly Portfolio of Investments are available without charge, upon request, by calling (201) 915-3054.

Inquiries

All general inquiries and requests for information should be directed to the Fund at (201) 915-3054. All written inquiries should be directed to the Fund at the following address:

The Thai Capital Fund, Inc.

c/o Daiwa Securities Trust Company

One Evertrust Plaza, 9th Floor

Jersey City, NJ 07302-3051

For specific information about your registered share account, please contact American Stock Transfer & Trust Company (the "Plan Agent") at the address shown below.

Certifications

The Fund's principal executive officer has certified to the NYSE Amex that, as of June 2, 2011, he was not aware of any violation by the Fund of applicable NYSE Amex corporate governance listing standards. The Fund also has included the certifications of the Fund's principal executive officer and principal financial officer as required by Section 302 and Section 906 of the Sarbanes-Oxley Act of 2002 in the Fund's Form N-CSR filed with the Commission for the period of this report.

Dividend Reinvestment and Cash Purchase Plan

A Dividend Reinvestment and Cash Purchase Plan (the "Plan") is available to provide stockholders with automatic reinvestment of dividends and capital gain distributions in additional Fund shares. The Plan also allows you to make optional semi-annual cash investments in Fund shares through the Plan Agent. A brochure fully describing the Plan's terms and conditions is available on the Fund's website at www.daiwast.com and from the Plan Agent at the following address:

The Thai Capital Fund, Inc.

c/o American Stock Transfer & Trust Company

Operations Center

6201 15th Avenue

Brooklyn, NY 11219

Telephone: (866) 669-9905; (718) 921-8124

www.amstock.com

A brief summary of the material aspects of the Plan follows:

Who can participate in the Plan? If you wish to participate and your shares are held in your name, you may elect to become a direct participant in the Plan by completing and mailing the Enrollment Authorization form on the back cover of the Dividend Reinvestment and Cash Purchase Plan Brochure to the Plan Agent. However, if your shares are held in the name of a financial institution, you should instruct your financial institution to participate in the Plan on your behalf. If your financial institution is unable to participate in the Plan for you, you should request that your shares be registered in your name, so that you may elect to participate directly in the Plan.

May I withdraw from the Plan? If your shares are held in your name and you wish to receive all dividends and capital gain distributions in cash rather than in shares, you may withdraw from the Plan without penalty at any time by contacting the Plan Agent. If your shares are held in the name of a financial institution, you should be able to withdraw from the Plan without a penalty at any time by sending written notice to your financial institution. If you withdraw, you or your financial institution will receive a share certificate for all full shares or, if you wish, the Plan Agent will sell your shares and send you the proceeds, after the deduction of brokerage commissions. The Plan Agent will convert any fractional shares to cash at the then-current market price and send you a check for the proceeds.

How are the dividends and distributions reinvested? If the market price of the Fund's shares on the payment date should equal or exceed their NAV per share, the Fund will issue new shares to you at the higher of NAV or 95% of the then-current market price. If the market price is lower than the NAV per share, the Fund will issue new shares to you at the market price. If the dividends or distributions are declared and payable as cash only, you will receive shares purchased for you by the Plan Agent on the NYSE Amex or otherwise on the open market to the extent available.

What is the Cash Purchase feature? The Plan participants have the option of making semi-annual investments in Fund shares through the Plan Agent. You may invest any amount from $100 to $5,000 semi-annually. The Plan Agent will purchase shares for you on the NYSE Amex or otherwise on the open market on or about February 15th and August 15th of each year. Plan participants should send voluntary cash payments to be received by the Plan Agent approximately ten days before the applicable purchase date. The Plan Agent will return any cash payments received more than thirty days prior to the purchase date. You may withdraw a voluntary cash payment by written notice, if the notice is received by the Plan Agent not less than two business days before the investment date.

Is there a cost to participate? There are no Plan charges or brokerage charges for shares issued directly by the Fund. However, each participant will pay a service fee of $2.50 for each investment and a pro rata portion of brokerage commissions for shares purchased on the NYSE Amex or on the open market by the Plan Agent.

What are the tax implications? The automatic reinvestment of dividends and distributions does not relieve you of any income tax which may be payable (or required to be withheld) on such dividends and distributions. In addition, the Plan Agent will reinvest dividends for foreign participants and for any participant subject to federal backup withholding after the deduction of the amounts required to be withheld.

Please note that, if you participate in the Plan through a brokerage account, you may not be able to continue as a participant if you transfer those shares to another broker. Contact your broker or financial institution or the Plan Agent to ascertain what is the best arrangement for you to participate in the Plan.

The Thai Capital Fund, Inc.

Shareholder Letter (unaudited)

January 10, 2012

Dear Shareholders:

The management of The Thai Capital Fund, Inc. (the "Fund") would like to take this opportunity to update its shareholders about the Thai economy, the activities of the Stock Exchange of Thailand ("SET") and the Fund's performance for the year ended December 31, 2011.

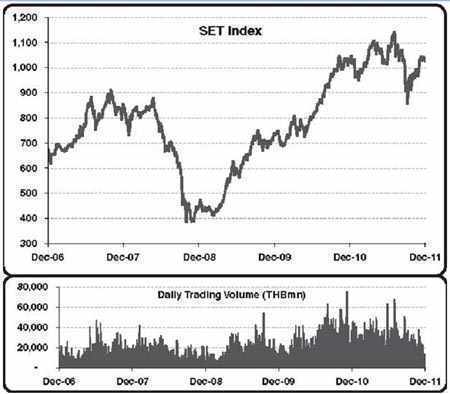

Thai Stock Market Overview

For the second half of 2011, the SET Index decreased by 16.16 points or 1.55% to close at 1025.32, with daily average turnover easing by 9.2% to Baht 27.6 billion from Baht 30.4 billion in the first half of 2011. Foreign investors posted net buying of Baht 9.6 billion, reversing net selling of Baht 14.7 billion in the previous six months.

In July 2011, the SET Index posted strong performance, mainly driven by political clarity after the Puea Thai Party won the majority in the election and formed a coalition government with high stability. External factors became more supportive as the European Union ("EU") approved the second bailout plan for Greece and fully backed the Greek sovereign debt. On the U.S. side, the uncertainty remained high during the month due to the U.S. debt ceiling issues, which pressured Asian stocks. However, Thailand's market outperformed market peers due to strong second quarter 2011 earnings in the banking sector and positive political developments.

In August 2011, the Thai market was very volatile with a major downward trend. Foreign equity outflows were seen throughout the month as Standard & Poor's downgraded the U.S. credit rating and continued strains in the European banking system and financial markets weighed on sentiment. However, Thai stocks still outperformed regional peers amid the global correction, supported by local political optimism and hopes for domestic stimulus policies.

In September 2011, global factors were negative and significantly weighed on Thai stocks. There was no clarity on whether Greece would receive the next bailout package worth €8.8 billion, and European countries remained split on the longer-term resolution for the region given the large amount of money required from the private sector. On the U.S. side, the Federal Reserve announced "Operation Twist" on September 21, 2011, which would involve the buying of long-term Treasuries financed by the selling of shorter-term ones. However, market reaction was net negative as the measures also signaled a significant downside in the growth of the U.S. economy. In Thailand, the Thai political situation had no impact on the market, and the new government was rolling out the populist measures campaigned during the election in July 2011. However, heavy rainfall had already caused flooding in many areas of Thailand.

The SET Index hit bottom in early October 2011 at 843 points and then bounced back almost 16% to close at 975 points. Even so, the SET Index underperformed regional peers during the month, mainly pressured by investors' concern over the widespread flooding covering most of the population centers in the country therefore affecting economic growth in the fourth quarter of 2011. A contraction had been widely anticipated in the final quarter of 2011 as GDP growth forecasts had been revised downward. However, there was some good news with progress being made in the resolution of Europe's debt crisis and the expansion of the European Financial Stability Facility ("EFSF"), which now appeared ready for implementation. These developments lead most investors to believe the situation in Europe touched bottom in October 2011.

Thai stocks had a sideways up pattern in November 2011 and noticeably outperformed regional peers. Although external sentiment remained negative given the contagion risk in European debt and liquidity problems, low valuations of energy stocks after an October 2011 sell-off and banking stocks due to the flooding crisis helped limit the market downside. U.S. economic releases were also generally favorable and underpinned the stock market. In the final week of November 2011, stronger buying from local institutions was witnessed.

In December 2011, the Thai stock market still had a sideways up pattern. The upward momentum was clearly seen in the early part of the month as global risk assets reacted positively to the Euro Summit, held on December 9, 2011, that announced a set of detailed plans to solve the European Union ("EU") debt turmoil. In the latter half of December 2011, the SET Index consolidated as foreign investors faded from the market ahead of the long holidays. It is also worth highlighting that local institution buying was absent, as the SET Index outlook in 2012 was highly uncertain.

Thai Stock Market Outlook

Global external factors appear more favorable than Thai domestic drivers as they relate to the directional impact on the SET Index. The onset of monetary loosening in China brings good sentiment for the Thai stock market. Meanwhile, the U.S. recovery appears to be gaining traction with the return of credit expansion, while the risk of liquidity runs on European banks has been reduced following the measures taken by the Federal Reserve in November 2011.

In Europe, the resolution of the euro debt crisis will remain the principal theme in 2012. All other themes are likely to be derivatives of the crisis, from the depth of the recession to national and regional political risks. European Union break-up is considered highly unlikely, but the crisis of confidence has gone deep. Resolution now requires fixing the flaws in the design of the Economic and Monetary Union ("EMU"), correcting the mistakes made in fighting the crisis, and EU willingness to finance itself through the European Central Bank ("ECB"), either directly or indirectly.

Looking forward to 2012, Thailand's economy is predicted to grow by 4.5% in 2012, with domestic demand likely to be the key driver. We expect rising consumption and investment to be mainly driven by various stimulus policies and post-flood rehabilitation activities. However, we anticipate sluggish growth in the first quarter of 2012 as manufacturing production is unlikely to fully recover until the second quarter of 2012. In the second half of 2012 the economy should see the full impact of government stimulus measures which in turn should help boost consumption and investment.

In January 2012, there are several external factors, both positive and negative for the Thai stock market. The possible positive factors include central bank meetings: ECB on January 12, 2012, U.S. Federal Reserve Open Market Committee ("FOMC") on January 24-25, 2012 and the Bank of Thailand's Monetary Policy Committee on January 25, 2012. The market has high hopes for the ECB and Bank of Thailand meetings, expecting that they each will result in another policy rate cut. However, the market has little hopes that the FOMC will engage in some new stimulus tools since U.S. economic data was better than expected at the end of 2011. The Chinese New Year on January 23, 2012 will be the point at which we can expect the Chinese government to enact economic stimulus policies, one of which the market expects to be a cut in the Reserve Requirement Ratio ("RRR") of 2% in 2012.

The negative factors consist of debt maturities in Europe, with €152 billion maturing in January, 2012. Most of this will be handled by the issue of new bonds, giving rise to investor concerns regarding bond demand and interest rate. At the same time, we see Europe as having some positives with regards to the meeting of the leaders of Germany and France on January 9, 2012 to attempt to arrive at a solution to counter the European debt crisis before the EU summit on January 30, 2012. Also, European finance ministers will meet on January 20-24, 2012 to discuss possible solutions ahead of the EU summit.

In terms of valuation, based on forecasted earnings-per-share ("EPS") growth of 14.8% for 2012, the Thai stock market is trading on price-to-earnings ("PER") for 2012 of 10.7x, price-to-book value of 1.87x with a dividend yield of 4.0% (Source: Bloomberg forecast as of 12/30/2011).

The European debt situation remains fragile, but at the same time, there is some improvement evidenced over the last two months with the assistance of the financial aid fund—EFSF or European Stabilization Mechanism ("ESM"). The market is likely to be volatile throughout 2012 as it could hit bottom in the first quarter of 2012 and come back up in the second half of the year. In January, commodities-related stocks could be the outstanding outperformers, driven by China's growth prospects. An easing in China's monetary stance via a cut in its RRR will help ease the market's concern over 2012 economic growth. Food-related and high dividend yield stocks are expected to provide outstanding returns in January 2012 as well.

Performance Evaluation

As of December 31, 2011, the Fund had net assets of US$35.8 million, equivalent to a net asset value ("NAV") per share of US$10.06. Of this amount, equity securities accounted for 97.06%; the remainder was in cash and bank deposits.

For the second half of 2011, the SET Index was down 1.55% in Thai Baht terms and the portfolio return was down 4.67%, underperforming the benchmark by 3.12%. For the year ended December 31, 2011, the SET Index was down 0.72% in Thai Baht terms and the portfolio return was down 10.71%, underperforming the benchmark by 9.99%. For the year ended December 31, 2011, in U.S. dollar terms, the NAV return, assuming reinvestment of the US$2.70 per share dividend paid on June 23, 2011, was negative 12.95% and the SET Index was negative 5.55%.

Portfolio Management

Effective June 22, 2011, Mr. Vijchu Chantatab resigned as the Fund's portfolio manager and was replaced by Mr. Suchai Sutapak and Ms. Charupatra Tonglongya. SCB Asset Management Co., Ltd. has employed Mr. Sutapak and Ms. Tonglongya since June 6, 2011. Mr. Sutapak previously was employed at Kasikorn Asset Management Co., Ltd. and Bualuang Securities Co., Ltd. as a Senior Fund Manager and has 16 years of experience as an analyst and portfolio manager. Ms. Tonglongya previously was employed at Kasikorn Asset Management Co., Ltd. as a Senior Vice President and has 21 years of experience as an analyst and portfolio manager.

Finally, the Fund's management would like to express its sincere thanks to all shareholders for their continued support and participation.

Sincerely yours,

/s/ Martin J. Gruber

Martin J. Gruber

Chairman of the Board

The Thai Capital Fund, Inc.

Consolidated Portfolio of Investments

December 31, 2011

| | | | | | |

| Banks—17.28% | | 217,500 | The Siam Cement | |

| 295,900 | Bangkok Bank Public | | | | Public Co., Ltd. | |

| | Co., Ltd. | $ 1,435,445 | | | | |

| 1,020,800 | Bank of Ayudhya Public | | | Energy—19.72% |

| | Co., Ltd. | 709,736 | | 79,200 | Banpu Public | |

| 494,800 | Kasikornbank Public | | | | Co., Ltd. | 1,366,631 |

| | Co., Ltd. | 1,907,756 | | 1,231,900 | IRPC Public | |

| 2,904,600 | Krung Thai Bank | | | | Co., Ltd. | 158,843 |

| | Public Co., Ltd. | 1,367,747 | | 249,700 | PTT Exploration and | |

| 642,800 | Tisco Financial Group | | | | Production Public | |

| | Public Co., Ltd. | | | | Co., Ltd. | 1,329,694 |

| | | | | 258,100 | PTT Public Co., Ltd | 2,593,871 |

| Commerce—8.76% | | 876,800 | Thai Oil Public | |

| 1,217,500 | CP ALL Public | | | | Co., Ltd. | |

| | Co., Ltd. | 1,991,190 | | | | |

| 1,187,000 | Home Product Center | | | Food & Beverage—11.11% |

| | Public Co., Ltd. | 412,645 | | 2,358,400 | Charoen Pokphand | |

| 97,600 | Siam Makro Public | | | | Foods Public | |

| | Co., Ltd. | | | | Co., Ltd. | 2,459,601 |

| | | | | 2,106,700 | Minor International | |

| Communication—7.50% | | | Public Co., Ltd. | 745,683 |

| 420,200 | Advanced Info Service | | | 420,500 | Thai Union Frozen | |

| | Public Co., Ltd. | 1,865,803 | | | Products Public | |

| 374,000 | Total Access | | | | Co., Ltd. | |

| | Communication | | | | | |

| | Public Co., Ltd. | | | Health Care Services—3.89% |

| | | | | 457,000 | Bangkok Dusit | |

| Construction—7.05% | | | Medical Services | |

| 195,600 | Dynasty Ceramic | | | | Public Co., Ltd. | 1,184,305 |

| | Public Co., Ltd. | 373,988 | | 142,700 | Bumrungrad Hospital | |

| 300 | Siam City Cement | | | | Public Co., Ltd. | |

| | Public Co., Ltd. | 2,446 | | | | |

See accompanying notes to consolidated financial statements.

The Thai Capital Fund, Inc.

Consolidated Portfolio of Investments (concluded)

December 31, 2011

COMMON STOCKS (concluded) | | |

| | | | | | |

| Media & Publishing—2.32% | | | U.S. DOLLAR—0.18% | |

| 585,300 | BEC World | | | $ 65 | JPMorgan Chase | ` |

| | Public Co., Ltd. | | | | Bank, | |

| Petrochemicals—11.75% | | | | 0.05%, due 1/3/12 | |

| 1,470,300 | Indorama Ventures | | | | (Cost—$65,366) | |

| | Public Co., Ltd. | 1,359,143 | | Total Investments—97.24% | |

| 1,480,262 | PTT Global Chemical | | | (Cost—$38,698,149) | 34,857,420 |

| | Public Co., Ltd. | | | Other assets less liabilities—2.76% | |

| | | | | NET ASSETS (Applicable to 3,564,814 | |

| Property Development—7.68% | | | shares of capital stock outstanding; | |

| 2,205,300 | Asian Property | | | equivalent to $10.06 per | |

| | Development | | | share)—100.00% | |

| | Public Co., Ltd. | 345,687 | | | | |

| 480,900 | Central Pattana | | | | | |

| | Public Co., Ltd. | 573,727 | | | | |

| 1,112,700 | L.P.N. Development | | | | | |

| | Public Co., Ltd. | 450,113 | | | | |

| 4,043,600 | Land and Houses | | | | | |

| | Public Co., Ltd. | 785,917 | | | | |

| 563,800 | SinoThai Engineering & | | | | | |

| | Construction Public | | | | | |

| | Co., Ltd. | 219,161 | | | | |

| 833,400 | Supalai Public Co., Ltd. | | | | | |

| | | | | | | |

| Total Common Stocks | | | | | |

| (Cost—$38,632,783) | | | | | |

See accompanying notes to consolidated financial statements.

The Thai Capital Fund, Inc.

EQUITY CLASSIFICATIONS HELD December 31, 2011 | | | TEN LARGEST EQUITY POSITIONS HELD December 31, 2011 |

| Industry | Percent of | | Issue | Percent of |

| Energy | 19.72% | | PTT Global Chemical Public | |

| Banks | 17.28 | | Co., Ltd. | 7.96% |

| Petrochemicals | 11.75 | | PTT Public Co., Ltd. | 7.24 |

| Food & Beverage | 11.11 | | Charoen Pokphand Foods Public | |

| Commerce | 8.76 | | Co., Ltd. | 6.86 |

| Property Development | 7.68 | | The Siam Cement Public Co., Ltd. | 6.00 |

| Communication | 7.50 | | CP ALL Public Co., Ltd. | 5.55 |

| Construction | 7.05 | | Kasikornbank Public Co., Ltd. | 5.32 |

| Health Care Services | 3.89 | | Advanced Info Service Public | |

| Media & Publishing | 2.32 | | Co., Ltd. | 5.21 |

| | | | Thai Oil Public Co., Ltd. | 4.52 |

| | | | Bangkok Bank Public Co., Ltd. | 4.00 |

| | | | Krung Thai Bank Public Co., Ltd. | 3.82 |

See accompanying notes to consolidated financial statements.

The Thai Capital Fund, Inc.

Consolidated Statement of Assets and Liabilities

| Assets | |

| Investment in securities, at value (cost—$38,698,149) | $34,857,420 |

| Cash denominated in foreign currency (cost—$992,585) | 978,498 |

| Interest and dividends receivable | 194,968 |

| Prepaid expenses | |

| Total assets | |

| Liabilities | |

| Accrued Thai tax provision | 19,869 |

| Audit and tax services | 88,330 |

| Payable for management fees | 21,469 |

| Accrued expenses and other liabilities | |

| Total liabilities | |

| Net Assets | |

| | |

| Net Assets consist of: | |

| Capital stock, $0.01 par value per share; total 100,000,000 shares authorized; 3,564,814 | |

| shares issued and outstanding | $ 35,648 |

| Paid-in capital in excess of par value | 39,508,304 |

| Accumulated net investment loss | (11,519) |

| Accumulated net realized loss on investments and foreign currency transactions | (97,908) |

| Net unrealized depreciation on investments and other assets and liabilities | |

| denominated in foreign currency | |

| Net assets applicable to shares outstanding | |

| Net Asset Value Per Share | |

See accompanying notes to consolidated financial statements.

The Thai Capital Fund, Inc.

Consolidated Statement of Operations

For the Year Ended December 31, 2011

| Investment income: | |

| Dividends | $ 1,586,719 |

| Interest | |

| Total investment income | |

| Expenses: | |

| Investment management fee and expenses | 265,047 |

| Administration fee | 171,000 |

| Investment advisory fee | 124,368 |

| Audit and tax services | 88,330 |

| Legal fees and expenses | 87,826 |

| Custodian fees and expenses | 49,573 |

| Reports and notices to stockholders | 47,361 |

| Directors' fees and expenses | 46,719 |

| Marketing expense | 20,634 |

| Transfer agency fee and expenses | 10,403 |

| Insurance expense | 6,763 |

| Other | |

| Total expenses before expense waivers | |

| Less waiver of: | |

| Administration fee | (49,393) |

| Investment advisory fee | |

| Net expenses | |

| Net investment income | |

| Realized and unrealized gains (losses) from investment activities | |

| and foreign currency transactions: | |

| Net realized losses on investments, net of $19,868 Thai tax provision | (63,934) |

| Net realized losses on foreign currency transactions | (140,309) |

| Net change in unrealized appreciation (depreciation) on equity investments | |

| net of ($791,840) Thai tax benefit | (7,805,019) |

| Net change in unrealized appreciation (depreciation) on short-term investments and other | |

| assets and liabilities denominated in foreign currency | |

| Net realized and unrealized losses from investment activities and foreign | |

| currency transactions | |

| Net decrease in net assets resulting from operations | |

See accompanying notes to consolidated financial statements.

The Thai Capital Fund, Inc.

Consolidated Statements of Changes in Net Assets

| | For the Years Ended |

| | | |

| Increase (decrease) in net assets from operations: | | |

Net investment income | $ 754,573 | $ 821,336 |

| Net realized gain (loss) on: | | |

Investments | (63,934) | 20,857,213 |

Foreign currency transactions | (140,309) | 195,331 |

| Net change in unrealized appreciation (depreciation) on: | | |

Investments in equity securities | (7,805,019) | (1,369,023) |

| Translation of short-term investments and other assets and liabilities | | |

denominated in foreign currency | | |

| Net increase (decrease) in net assets resulting from operations | | |

| Dividends and distributions to stockholders from: | | |

| Net realized gains from investment and foreign currency transactions | (8,980,989) | (9,675,555) |

Net investment income | | |

Total dividends and distributions to shareholders | | |

| From capital stock transactions: | | |

| Sale of capital stock resulting from reinvestment of dividends | | |

Net increase (decrease) in net assets | (15,402,978) | 14,376,090 |

| Net assets: | | |

Beginning of year | | |

| End of year (including accumulated net investment loss and undistributed | | |

| net investment income of $11,519 and $231,255, respectively) | | |

See accompanying notes to consolidated financial statements.

The Thai Capital Fund, Inc.

Notes to Consolidated Financial Statements

Organization and Significant Accounting Policies

The Thai Capital Fund, Inc. (the "Fund") was incorporated in Maryland on March 14, 1990 and commenced operations on May 30, 1990. It is registered with the U.S. Securities and Exchange Commission as a non-diversified, closed-end management investment company.

The Fund makes its investments in Thailand through a wholly-owned Investment Plan pursuant to a contract with SCB Asset Management Co., Ltd. (the "Manager"), the Fund's investment manager. The accompanying financial statements are prepared on a consolidated basis and present the financial position and results of operations of the Investment Plan and the Fund.

The Investment Plan has a 25-year duration through May 17, 2015 (subject to earlier termination) unless continuance thereof is approved by the Bank of Thailand. In addition, the Investment Plan will expire in 2015, unless continuance is approved by Thailand's Securities and Exchange Commission ("Thai SEC"), which is unlikely. Upon expiration or revocation of Thai SEC approval of the Investment Plan prior to that date, the Investment Plan will be required to liquidate. In the event of liquidation of the Investment Plan, the Fund's Board of Directors will consider, among other things, whether to liquidate the Fund, operate the Fund as a direct foreign investor (if then permitted under Thai law) or take other appropriate action.

The following significant accounting policies are in conformity with accounting principles generally accepted in the United States of America ("GAAP") for investment companies. Such policies are consistently followed by the Fund in the preparation of its financial statements. The preparation of its financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the amounts and disclosures in the financial statements. Actual reported results could differ from those estimates.

Valuation of Investments—The Fund determines net asset value ("NAV") based on valuations made as of 5:00 p.m. Bangkok time, on each day the NAV is calculated. Securities listed on the Stock Exchange of Thailand for which market quotations are readily available are valued at the last sales price prior to the time of determination, or, if there were no sales on such date, at the mean between the last current bid and ask prices. Securities that are traded over-the-counter, if bid and ask quotations are available, are valued at the mean between the current bid and ask prices. In instances where quotations are not readily available or where the price determined is deemed not to represent fair market value, fair value is determined in good faith in such manner as the Board of Directors (the "Board") may prescribe. Short-term investments having a maturity of sixty days or less are valued at amortized cost, except where the Board determines that such valuation does not represent the fair value of the investment. All other securities and assets are valued at fair value as determined in good faith by, or under the direction of, the Board.

Fair Value Measurements—In accordance with the authoritative guidance on fair value measurements and disclosures under GAAP, the Fund discloses the fair value of its investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value. The hierarchy gives the highest priority to valuations based upon unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to valuations based upon unobservable inputs that are significant to the valuation (Level 3 measurements). The guidance establishes three levels of fair value hierarchy as follows:

| | Level 1— | Inputs that reflect unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access at the measurement date; |

| | Level 2— | Inputs other than quoted prices that are observable for the asset or liability either directly or indirectly, including inputs in markets that are not considered to be active; |

| | Level 3— | Inputs that are unobservable. |

The Thai Capital Fund, Inc.

Notes to Consolidated Financial Statements (continued)

A financial instrument's level within the fair value hierarchy is based upon the lowest level of any input that is significant to the fair value measurement. However, the determination of what constitutes "observable" requires significant judgment by the Manager. The Manager considers observable data to be market data which is readily available, regularly distributed or updated, reliable and verifiable, not proprietary, and provided by independent sources that are actively involved in the relevant market.

The following is a summary of the inputs used as of December 31, 2011 in valuing the Fund's investments carried at value:

| Investments in Securities |

| Level 1—Quoted Prices | $34,857,420 |

| Level 2—Other Significant Observable Inputs | — |

| Level 3—Significant Unobservable Inputs | |

| Total | |

As all assets of the Fund are classified as Level 1, no reconciliation of Level 3 assets as of December 31, 2011 is presented. No transfers between Level 1 or Level 2 fair value measurements occurred for the year ended December 31, 2011.

All portfolio holdings designated as Level 1 are disclosed individually in the Portfolio of Investments ("POI"). Please refer to the POI for industry classifications of the portfolio holdings.

Tax Status—The Fund intends to continue to distribute substantially all of its taxable income and to comply with the minimum distribution and other requirements of the Internal Revenue Code of 1986, as amended applicable to regulated investment companies. Accordingly, no provision for U.S. federal income taxes is required. As of December 31, 2011, the Fund did not have any unrecognized tax benefits. As of December 31, 2011, the Fund had no uncertain tax positions that would require financial statement recognition, derecognition or disclosure. The Fund's federal tax returns for the current and prior three fiscal years remain subject to examination by the Internal Revenue Service.

The Fund provides for Thai taxation based upon its understanding of the application of Thai tax law to the Investment Plan. Thai Baht remittances from the Investment Plan to the Fund during the term of the Investment Plan are subject to a Thai withholding tax of 10% and such remittances are required by Thai law to be derived only from the Investment Plan's net income and net realized gains on the sale of securities. Remittances for the payment of expenses (other than Thai withholding tax) are not subject to a Thai withholding tax. The Fund records a provision for such taxes based upon the Investment Plan's overall net increase in net assets resulting from operations determined by reference to the Baht. The amount of Thai withholding taxes ultimately paid could be different from the amounts accrued depending on various factors, including whether unrealized gains are ultimately realized, the timing of the realization of gains, shareholder distribution reinvestment rates and the effect of exchange rates, and the difference could be material.

Dividends and Distributions to Stockholders—The Fund records dividends and distributions payable to its stockholders on the ex-dividend date. The amount of dividends and distributions from net investment income and net realized capital gains are determined in accordance with federal income tax regulations, which may differ from GAAP. These book basis/tax basis ("book/tax") differences are either considered temporary or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified within the capital accounts based on their federal tax-basis treatment; temporary differences do not require reclassification. Dividends and distributions which exceed net investment income and net realized capital gains for tax purposes are reported as distributions of paid-in-capital.

The Thai Capital Fund, Inc.

Notes to Consolidated Financial Statements (continued)

Foreign Currency Translation—The books and records of the Fund are maintained in U.S. dollars as follows: (1) the foreign currency market value of investment securities and other assets and liabilities stated in foreign currency are translated at the exchange rate prevailing at the end of the period; and (2) purchases, sales, income and expenses are translated at the rate of exchange prevailing on the respective dates of such transactions. The resulting exchange gains and losses are included in the Statement of Operations. The Fund does not isolate the effect of fluctuations in foreign exchange rates from the effect of fluctuations in the market price of securities.

Investment Transactions and Investment Income—Securities transactions are recorded on the trade date (the date upon which the order to buy or sell is executed). Realized and unrealized gains and losses from security and foreign currency transactions are calculated on the identified cost basis. Dividend income and corporate actions are recorded on the ex-date, except for certain dividends and corporate actions involving foreign securities which may be recorded after the ex-date, as soon as the Fund acquires information regarding such dividends or corporate actions. Interest income is recorded on an accrual basis.

Investment Manager and Investment Adviser

The Manager acts as the investment manager of the Investment Plan pursuant to the Investment Contract as amended. The Manager makes the investment management decisions relating to the Fund's assets held through the Investment Plan. For its management services, the Manager receives a fee, which accrues weekly and is payable monthly in Baht, at an annual rate of 0.60% of the Investment Plan's average weekly net assets. At December 31, 2011, the Fund owed the Manager $21,469. In addition, as permitted by the Investment Contract, the Fund reimburses the Manager for its out-of-pocket expenses related to the Fund. During the year ended December 31, 2011, expenses of $5,847 were paid to the Manager, representing reimbursement to the Manager for costs relating to the attendance by its employees at meetings of the Fund's Board. For the year ended December 31, 2011, the Manager earned $259,200 in management fees. At December 31, 2011, the Fund owed to the Manager $21,469 for management fees.

In connection with the Board of Directors' annual review of the Fund's International Investment Advisory Agreement, on June 2, 2011, the Board voted not to renew the Advisory Agreement. The Advisory Agreement between the Fund and Daiwa SB Investments (Singapore) Ltd. ("the Adviser") was terminated effective June 2, 2011. Prior to the termination of the Advisory Agreement, the Fund paid the Adviser a monthly fee in U.S. dollars at an annual rate equal to 0.60% of the Fund's average weekly net assets. The Adviser had voluntarily decreased its fee to 0.20% of the Fund's average weekly net assets for the fiscal year ended December 31, 2011. At December 31, 2011, the Fund owed the Adviser no fees. For the period January 1, 2011 to June 2, 2011 the Adviser earned $41,456 in advisory fees, net of fee waivers.

Administrator and Custodian and Other Related Parties

Daiwa Securities Trust Company ("DSTC") provides certain administrative services to the Fund. For such services, the Fund pays DSTC a monthly fee at an annual rate of 0.20% of the Fund's average weekly net assets, with a minimum annual fee of $150,000. DSTC has voluntarily decreased its minimum annual administration fee to $100,000 for the year ended December 31, 2011. In addition, as permitted by the Administration Agreement, the Fund reimburses DSTC for its out-of-pocket expenses related to the Fund. During the year ended December 31, 2011, no out-of-pocket expenses were paid to DSTC.

The Board has also approved the payment of the administrative compliance expense for the Fund in the amount of $21,000 per annum to DSTC, for services provided by DSTC staff in implementing the Fund's compliance management system and the Fund's compliance review program. This amount is included in the administration fee in the Fund's Statement of Operations.

The Thai Capital Fund, Inc.

Notes to Consolidated Financial Statements (continued)

DSTC also acts as custodian for the Fund's U.S. assets. As compensation for its services as custodian, DSTC receives a monthly fee of 0.10% of the average weekly net assets of the Fund representing U.S. assets and reimbursement of out-of-pocket expenses, with a minimum annual fee of $5,000. During the year ended December 31, 2011, DSTC earned $6,170, as compensation for its custodial services to the Fund.

At December 31, 2011, the Fund owed $8,333, $1,750 and $473 to DSTC for administration, compliance and custodian fees, respectively, which are included in accrued expenses and other liabilities on the Statement of Assets and Liabilities.

Bangkok Bank Public Company Ltd. is the custodian for the Fund's Thai assets. As compensation for its services as custodian, Bangkok Bank receives a monthly fee of 1/52 of 0.10% of the value of the weekly net assets of the Investment Plan and reimbursement of out-of-pocket expenses. For the year ended December 31, 2011, Bangkok Bank earned $34,605 as compensation for custodial services to the Fund. At December 31, 2011, the Fund owed to Bangkok Bank $11,395 for custody fees and expenses.

The Fund incurred $87,826 for the year ended December 31, 2011 for legal services in conjunction with the Fund's ongoing operations provided by the Fund's law firm, Clifford Chance US LLP, to which the Fund's Assistant Secretary is a consultant.

Investments in Securities and Federal Income Tax Matters

During the year ended December 31, 2011, the Fund made purchases of $81,351,327 and sales of $86,225,612 of investment securities, excluding short-term investments. The aggregate cost of investments at December 31, 2011 for U.S. federal income tax purposes was $38,643,000, excluding short-term investments. At December 31, 2011, net unrealized depreciation excluding short-term securities, aggregated $3,850,945 of which $1,640,214 related to appreciated securities and $5,491,159 related to depreciated securities.

Distributions to shareholders, which are determined in accordance with federal income tax regulations, and which may differ from generally accepted accounting principles, are recorded on the ex-dividend date. In order to present undistributed net investment income (loss) and accumulated net realized gains (losses) in the Statement of Assets and Liabilities in a way that more closely represents their tax character, an adjustment has been made to accumulated net investment loss and accumulated net realized loss on investments.

For the year ended December 31, 2011, the adjustment was to decrease ordinary income by $687,658, decrease accumulated net realized loss on investments by $1,290,904 and decrease paid-in capital by $603,246 primarily relating to the reclassification of realized foreign currency losses, and non-deductible net operating loss. Net investment income, net realized gains and net assets were not affected by this change.

The tax basis components of distributable earnings differ from the amounts reflected in the Statement of Assets and Liabilities and the Statements of Changes in Net Assets by temporary book/tax differences primarily arising from wash sales and Thai taxes paid. As of December 31, 2011, the components of accumulated earnings (deficit) on a tax basis were as follows:

| Accumulated Net Realized Gain | Unrealized Appreciation/Depreciation |

| — | $179,142 | $(3,589,352) |

The tax character of distributions paid was as follows:

| | | |

Ordinary Income | $6,792,427 | $5,234,317 |

Long-term Capital Gains | | |

Total | | |

The Thai Capital Fund, Inc.

Notes to Consolidated Financial Statements (concluded)

At December 31, 2011, the Fund had deferred post-October short-term capital losses of $246,965 and qualified late year ordinary losses of $11,519. For tax purposes, such gains will be reflected in the period ended December 31, 2012.

Concentration of Risk

The Fund's investments in Thailand involve certain considerations and risks not typically associated with domestic investments as a result of, among others, the possibility of future economic and political developments and the level of government supervision and regulation of securities markets.

The currency transactions of the Fund and the Investment Plan are subject to Thai foreign exchange control regulations. Remittances from the Investment Plan require the approval of the Exchange Control Officer of the Bank of Thailand. There can be no assurance that approval of remittances from the Investment Plan will be granted in a timely fashion or at all.

Capital Stock

There are 100,000,000 shares of $0.01 par value common stock authorized. During the year ended December 31, 2011, 123,822 shares were issued on June 23, 2011 at the reinvestment price of $9.36. The net asset value per share on that date was $10.77. Of the 3,564,814 shares outstanding at December 31, 2011, Daiwa Capital Markets America Holdings Inc., a lead underwriter of the Fund and an affiliate of DSTC, owned no shares. As of December 31, 2011, based on publicly available Schedule 13D and 13G disclosures filed with the Securities and Exchange Commission, City of London Investment Management Company Ltd. held 35.9% of the shares outstanding and First Wilshire Securities held 5.8% of the shares outstanding.

Recent Accounting Pronouncements

In May 2011, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update No. 2011-04, "Fair Value Measurements and Disclosures (Topic 820)—Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs" ("ASU 2011-04"). ASU 2011-04 clarifies the application of existing fair value measurement requirements, changes certain principles related to measuring fair value, and requires additional disclosures about fair value measurements.

Specifically, the guidance specifies that the concepts of highest and best use and valuation premise in a fair value measurement are only relevant when measuring the fair value of nonfinancial assets whereas they are not relevant when measuring the fair value of financial assets and liabilities.

Required disclosures are expanded under the new guidance, especially for fair value measurements that are categorized within Level 3 of the fair value hierarchy, for which quantitative information about the unobservable inputs used, and a narrative description of the valuation processes in place and sensitivity of recurring Level 3 measurements to changes in unobservable inputs will be required. Entities will also be required to disclose the categorization by level of the fair value hierarchy for items that are not measured at fair value in the statement of financial position but for which the fair value is required to be disclosed.

ASU 2011-04 is effective for annual periods beginning after December 15, 2011 and is to be applied prospectively. The Fund is currently assessing the impact of this guidance on its financial statements.

Subsequent Event

Management has evaluated subsequent transactions and events after the balance sheet date through the date on which these financial statements were issued and, except as already included in the notes to the financial statements, has determined that no additional items require disclosure.

The Thai Capital Fund, Inc.

Selected data for a share of capital stock outstanding during each year is presented below:

| | For the Years Ended December 31, |

| | | | | | |

| Net asset value, beginning of year | $14.89 | $11.62 | $ 7.32 | $13.27 | $10.11 |

| Net investment income | 0.21(a) | 0.26* | 0.13* | 0.14* | 0.17* |

| Net realized and unrealized gains (losses) on investments and | | | | | |

| foreign currency transactions | | | | | |

| Net increase (decrease) in net asset value resulting from operations | | | | | |

| Less: dividends and distributions to shareholders | | | | | |

| Net investment income | (0.09) | (0.06) | (0.17) | (0.08) | (0.20) |

| Net realized gains on investments and foreign currency | | | | | |

| transactions | | | | | |

| Total dividends and distributions to shareholders | | | | | |

| Dilutive effect of dividend reinvestment | | | | | |

| Net asset value, end of year | | | | | |

| Per share market value, end of year | | | | | |

| Total investment return: (b) | | | | | |

| Based on market price at beginning and end of year, assuming | | | | | |

| reinvestment of dividends | (18.70)% | 69.70% | 49.11% | (50.00)% | 23.09% |

| Based on net asset value at beginning and end of year, | | | | | |

| assuming reinvestment of dividends | (12.95)% | 56.83% | 61.57% | (44.14)% | 33.27% |

| Ratios and supplemental data: | | | | | |

| Net assets, end of year (in millions) | $35.8 | $51.2 | $36.9 | $23.2 | $42.0 |

| Ratios to average net assets of: | | | | | |

| Expenses, before waivers of Administration and Advisory fees | | | | | |

| and including Thai taxes applicable to net investment income | 2.30% | 2.65% | 3.12% | 3.19% | 2.74% |

| Expenses, before waivers of Administration and Advisory fees | | | | | |

| and excluding Thai taxes applicable to net investment income | 2.30% | 2.44% | 2.93% | 3.11% | 2.57% |

| Expenses, after waivers of Administration and Advisory fees | | | | | |

| and including Thai taxes applicable to net investment income | 1.99% | 2.14% | 2.55% | 2.65% | 2.20% |

| Expenses, after waivers of Administration and Advisory fees | | | | | |

| and excluding Thai taxes applicable to net investment income | 1.99% | 1.94% | 2.36% | 2.57% | 2.04% |

| Net investment income | 1.78% | 1.82% | 1.44% | 1.21% | 1.45% |

| Portfolio turnover | 199.06% | 244.77% | 70.92% | 80.06% | 90.30% |

_______________

| * | After Thai taxes applicable to net investment income and/or net realized and unrealized gains (losses). |

| (a) | Calculated based on average shares outstanding. |

| (b) | Total investment return based on market value is calculated assuming that shares of the Fund's common stock were purchased at the closing market price as of the beginning of the year, dividends, capital gains and other distributions were reinvested as provided for in the Fund's dividend reinvestment plan and then sold at the closing market price per share on the last day of the period. The computation does not reflect any sales commission investors may incur in purchasing or selling shares of the Fund. The total investment return based on the net asset value is similarily computed except that the Fund's net asset value is substituted for the closing market value. |

The Thai Capital Fund, Inc.

Report of Independent Registered Public Accounting Firm

To the Shareholders and

Board of Directors of

The Thai Capital Fund, Inc.

In our opinion, the accompanying consolidated statement of assets and liabilities, including the consolidated portfolio of investments, and the related consolidated statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of The Thai Capital Fund, Inc. (the "Fund") and its wholly owned Investment Plan at December 31, 2011, the results of their operations for the year then ended, the changes in their net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as "financial statements") are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2011 by correspondence with the custodians, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

New York, New York

February 28, 2012

The Thai Capital Fund, Inc.

Tax Information (unaudited)

The Fund is required by Subchapter M of the Internal Revenue Code of 1986, as amended, to advise you within 60 days of the Fund's fiscal year end (December 31, 2011) as to the federal tax status of distributions totaling $2.70 per share received by you during such fiscal year.

Accordingly, the Fund is hereby advising you that on June 2, 2011 the Board of Directors of the Fund declared a total distribution of $2.70 per share, which represents a $0.09 per share dividend from ordinary income, $1.88 per share distribution from short-term capital gain and a $0.73 per share distribution from long-term capital gain. The dividend was paid on June 23, 2011 to shares of record at the close of business on June 13, 2011. The entire amount of this distribution is reportable as 2011 income.

There is no foreign tax deduction or credit available to shareholders for calendar year 2011.

Shareholders are strongly advised to consult their own tax advisors with respect to the tax consequences of their investment in the Fund.

The Thai Capital Fund, Inc.

Information Concerning Directors and Officers (unaudited)

The following table sets forth information concerning each of the Directors and Officers of the Fund. The Directors of the Fund will serve for terms expiring on the date of subsequent Annual Meetings of Stockholders in the year 2013 for Class I Directors, 2014 for Class II Directors and 2012 for Class III Directors, or until their successors are duly elected and qualified.

Name (Age) and Address of Directors/Officers | Principal Occupation or Employment and Directorships in Publicly Held Companies During Past Five Years | Director or Officer of Fund Since | Number of Funds in Fund Complex for Which Director Serves* |

| Directors | | | |

Martin J. Gruber (74) 229 South Irving Street Ridgewood, NJ 07450 | Professor Emeritus and Scholar in Residence, Leonard N. Stern School of Business, New York University, since 2010; previously Professor of Finance, from 1965 to 2010; Director, The Singapore Fund, Inc., since 2000; Director, The Japan Equity Fund, Inc., since 1992; Trustee, DWS Scudder Mutual Funds, from 1992 to 2008; Trustee, C.R.E.F., from 2001 to 2005 and Chairman from December 2003 to 2005; Trustee, National Bureau of Economic Research, since August 2005. | Class I Director since 2000 | 2 |

David G. Harmer (68) 10911 Ashurst Way Highlands Ranch, CO 80130-6961 | Retired; Director of Community and Economic Development, City of Ogden, from July 2005 to October 2008; Public Services Department Director, City of Ogden, from February 2005 to July 2005; Executive Director, Department of Community and Economic Development for the State of Utah, from May 2002 to January 2005; Director, The Japan Equity Fund, Inc., since 1997; Director, The Singapore Fund, Inc., since 1996. | Class I Director since 2000 | 2 |

Richard J. Herring (65) 327 South Roberts Road Bryn Mawr, PA 19010 | Jacob Safra Professor of International Banking and Professor, Finance Department, The Wharton School, University of Pennsylvania, since July 1972; Founding Director, Wharton Financial Institutions Center, since July 1994; Director, Lauder Institute of International Management Studies, from July 2000 to June 2006; Director, The Singapore Fund, Inc., since 2007; Director, The Japan Equity Fund, Inc., since 2007; Trustee, DWS Scudder Mutual Funds (and certain predecessor funds), since 1990; Co-chair of the Shadow Financial Regulatory Committee, since 2000; Executive Director of the Financial Economists Roundtable, since 2008. | Class III Director since 2007 | 2 |

Rahn K. Porter (57) 944 East Rim Road Franktown, CO 80116 | Senior Vice President and Treasurer, Qwest Communications International Inc., from June 2008 to April 2011; Director, BlackRidge Financial, Inc., since March 2005; Senior Vice President of Investor Relations, Qwest Communications International Inc., from September 2007 to June 2008; Vice President of Finance, Qwest Communications International Inc., from March 2003 to September 2007; Director, The Singapore Fund, Inc., since 2007; Director, The Japan Equity Fund, Inc., since 2007; Director, CenturyLink Investment Management Company (formerly known as Qwest Asset Management Company), since 2006. | Class II Director since 2007 | 2 |

The Thai Capital Fund, Inc.

Information Concerning Directors and Officers (unaudited) (concluded)

Name (Age) and Address of Directors/Officers | Principal Occupation or Employment and Directorships in Publicly Held Companies During Past Five Years | Director or Officer of Fund Since | Number of Funds in Fund Complex for Which Director Serves* |

| Officers | | | |

John J. O'Keefe (52) One Evertrust Plaza Jersey City, NJ 07302-3051 | Vice President and Treasurer, The Japan Equity Fund, Inc. and The Singapore Fund, Inc., since 2000; Vice President, Fund Accounting Department of Daiwa Securities Trust Company since June 2000. | Vice President and Treasurer of the Fund since 2000; Secretary of the Fund since March 2011 | — |

Anthony Cambria (57) One Evertrust Plaza Jersey City, NJ 07302-3051 | Chief Compliance Officer, The Singapore Fund, Inc. and The Japan Equity Fund, Inc., since 2004; Director and Executive Vice President, Daiwa Securities Trust Company, since 1999. | Chief Compliance Officer of the Fund since 2004 | — |

Leonard B. Mackey, Jr. (61) 31 West 52nd Street New York, NY 10019-6131 | Consultant, since 2007, and Partner from 1983 to 2007, in the law firm of Clifford Chance US LLP; Assistant Secretary, The Singapore Fund, Inc. and The Japan Equity Fund, Inc., since 2004. | Assistant Secretary of the Fund since 2004 | — |

______________

| * | The Fund is considered part of the same Fund Complex as The Japan Equity Fund, Inc. The term "Fund Complex" means two or more U.S. registered investment companies that share the same investment adviser or principal underwriter or hold themselves out to investors as related companies for purposes of investment and investor services. There are no other U.S. registered investment companies advised by SCB Asset Management Co., Ltd. or its affiliates. The Fund and The Japan Equity Fund, Inc. share an administrator and have a common website and thus may be deemed to hold themselves out to investors as related companies. Additionally, Messrs. Gruber, Harmer, Herring and Porter serve as Directors of one other registered investment company that is not considered part of the same Fund Complex as the Fund, despite having a common administrator, because they do not hold themselves out to investors as related companies. |

BOARD OF DIRECTORS Martin J. Gruber, Chairman David G. Harmer Richard J. Herring Rahn K. Porter | | Annual Report December 31, 2011 |

OFFICERS John J. O'Keefe Vice President, Treasurer and Secretary Anthony Cambria Chief Compliance Officer Leonard B. Mackey, Jr. Assistant Secretary | |

ADDRESS OF THE FUND c/o Daiwa Securities Trust Company One Evertrust Plaza, 9th Floor Jersey City, NJ 07302-3051 | |

INVESTMENT MANAGER SCB Asset Management Co., Ltd. ADMINISTRATOR Daiwa Securities Trust Company CUSTODIANS Bangkok Bank Public Company, Ltd. (Thai Custodian) Daiwa Securities Trust Company (U.S. Custodian) TRANSFER AGENT AND REGISTRAR American Stock Transfer & Trust Company LEGAL COUNSEL Clifford Chance US LLP INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM PricewaterhouseCoopers LLP | |

Notice is hereby given in accordance with Section 23(c) of the Investment Company Act of 1940 that from time to time the Fund may purchase shares of its common stock in the open market at prevailing market prices. This report is sent to stockholders of the Fund for their information. It is not a prospectus, circular or representation intended for use in the purchase or sale of shares of the Fund or of any securities mentioned in the report. | |

Item 2. Code of Ethics.

| (a) | The registrant has adopted a code of ethics (the "Code of Ethics") that applies to the registrant's principal executive officer, principal financial officer and principal accounting officer. A copy of the registrant's Code of Ethics is attached hereto as Exhibit (a)(1). |

| (b) | No information need be disclosed pursuant to this paragraph. |

| (c) | The registrant has not amended the Code of Ethics during the period covered by the report to stockholders presented in Item 1 hereto. |

| (d) | The registrant has not granted a waiver or an implicit waiver from a provision of the Code of Ethics during the period covered by this report. |

| | (f) | (1) | The Code of Ethics is attached hereto as Exhibit (a)(1). |

Item 3. Audit Committee Financial Expert.

The registrant's board of directors has determined that the registrant has at least one audit committee financial expert serving on its audit committee. The audit committee financial expert is Rahn K. Porter who is "independent" for purposes of this item.

Item 4. Principal Accountant Fees and Services.

(a)(b)(c)(d) and (g). Based on fees billed for the periods shown:

| | 2011 | | |

| | | | |

| | Audit Fees | $79,420 | N/A |

| | | | |

| | Non-Audit Fees | | |

| | Audit-Related Fees | (2)$8,000 | – |

| | Tax Fees | (3)$8,910 | (4)$2,000 |

| | All Other Fees | – | – |

| | Total Non-Audit Fees | $16,910 | – |

| | | | |

| | Total | $96,330 | $2,000 |

| | | | |

| | 2010 | | |

| | | | |

| | Audit Fees | $69,110 | N/A |

| | | | |

| | Non-Audit Fees | | |

| | Audit-Related Fees | (2)$8,000 | – |

| | Tax Fees | (3)$8,650 | (4)$2,000 |

| | All Other Fees | – | – |

| | Total Non-Audit Fees | $16,650 | – |

| | | | |

| | Total | $85,760 | $2,000 |

_______________

| | N/A- Not applicable, as not required by Item 4. |

| (1) | "Covered Entities" include the registrant's investment adviser (excluding any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser) and any entity controlling, controlled by or under common control with the registrant's adviser that provides ongoing services to the registrant. |

| (2) | Audit Related Fees for 2010 and 2011 were $8,000 for the audit of the Thai Investment Plan performed by PricewaterhouseCoopers Bangkok. |

| (3) | Tax Fees represent fees received for tax compliance services provided to the registrant, including the review of tax returns. |

| (4) | Related to tax representative services for Daiwa SB Investments (H.K.) Ltd. performed by PricewaterhouseCoopers Taiwan. |

| | (e) | (1) | Before the registrant's principal accountant is engaged to render audit or non-audit services to the registrant and non-audit services to the registrant's investment adviser and its affiliates, each engagement is approved by the registrant's audit committee. |

| | (e) | (2) | 0% of the services described in each of (b) through (d) of this Item 4 were approved by the registrant's audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X. |

| (h) | The registrant's audit committee of the board of directors has considered whether the provision of non-audit services that were rendered to Covered Entities that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is compatible with maintaining the auditors' independence in performing audit services. |

Item 5. Audit Committee of Listed Registrants.

The registrant has a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the "Exchange Act") (15 U.S.C. 78c(a)(58)(A)). The members of the audit committee are as follows: Martin J. Gruber, David G. Harmer, Richard J. Herring and Rahn K. Porter.

Item 6. Schedule of Investments.

A schedule of investments is included as part of the report to stockholders filed under Item 1.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

The registrant has delegated to its investment adviser the voting of proxies relating to the registrant's portfolio securities. The registrant's policies and procedures and those used by its investment adviser to determine how to vote proxies relating to the registrant's portfolio securities, including the procedures used when a vote presents a conflict of interest involving the investment adviser or any of its affiliates, are contained in the investment adviser's Proxy Voting Guidelines, which are attached hereto as Exhibit (c).

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Mr. Suchai Satupak and Ms. Charupatra Tonglongya are currently responsible for the day-to-day management of the registrant's portfolio. They have been managing the registrant's portfolio since June 23, 2011, when SCB Asset Management appointed Mr. Suchai Satupak and Ms. Charupatra Tonglongya as primary portfolio managers of the registrant's portfolio. As of that day, Mr. Satupak and Ms. Tonlongya are jointly responsible for the day-to-day management of the registrant's portfolio.

Mr. Suchai Satupak joined SCB Asset Management in June 2011. Prior to that time, Mr. Suchai Satupak served as a senior fund manager at Kasikorn Asset Management Co., Ltd from June 2009 till April 2011. Before working at Kasikorn Asset Management Co., Ltd., Mr. Suchai Satupak was a senior fund manager at Bualuang Securities Co., Ltd from February 2008 till February 2009 and a senior fund manager at American International Assurance (AIA) Co., Ltd. from December 2005 till January 2008.

Ms. Charupatra Tonlongya joined SCB Asset Management in June 2011. Prior to which, Ms. Charupatra Tonlongya worked at Kasikorn Asset Management Co., Ltd. as the head of the risk management unit from October 2008 till May 2011 and as a senior vice president of the Equity Fund Management Division from January 2006 till September 2008.

Other Accounts Managed by the Portfolio Managers. As of December 31, 2011, Mr. Suchai Satupak and Ms. Charupatra Tonlongya also jointly managed 30 other registered investment companies, with a total of approximately $1,756 million in assets, 31 pooled investment vehicles other than registered investment companies, with a total of approximately $1,013 million in assets and 27 other accounts, with a total of approximately $437 million in assets.

Because Mr. Suchai Satupak and Ms. Charupatra Tonlongya manage assets for other investment companies, there may be an incentive to favor one client over another resulting in conflicts of interest.

For instance, Mr. Suchai Satupak and Ms. Charupatra Tonlongya may receive fees from certain funds that are higher than the fee they receive from the registrant. In those instances, Mr. Suchai Satupak and Ms. Charupatra Tonlongya may have an incentive to favor the higher fee accounts over the Fund. SCB Asset Management has adopted trade allocation and other policies and procedures that it believes are reasonably designed to address these and other conflicts of interest.

Securities Ownership of Portfolio Managers. As of December 31, 2011, Mr. Suchai Satupak and Ms. Charupatra Tonlongya each did not beneficially own any equity securities of the registrant.

Portfolio Manager Compensation Structure. Mr. Suchai Satupak and Ms. Charupatra Tonlongya each receive a combination of base compensation and discretionary compensation, comprising a cash bonus and several deferred compensation programs described below. The methodology used to determine portfolio manager compensation is applied across all accounts managed by Mr. Suchai Satupak and Ms. Charupatra Tonlongya.

Generally, each of Mr. Suchai Satupak's and Ms. Charupatra Tonlongya's base salary is based on the level of his/her position with the investment manager and the respective portfolio manager's competency and potential. Mr. Suchai Satupak and Ms. Charupatra Tonlongya may also receive discretionary compensation comprised of a cash bonus. The bonus is a function of the portfolio manager's key performance indicators (KPI). The majority of KPI is based on fund performance relative to a benchmark that is pre-specified at the beginning of every year. Other factors that affect KPI include contribution to the business objectives of the investment manager, the dollar amount of assets under management, client contribution and/or any market compensation contributions.

Item 9. Purchase of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

There were no purchases of equity securities made by the registrant or any "affiliated purchasers" during the period of this report.

Item 10. Submission of Matters to a Vote of Security Holders.

There have been no material changes to the procedures by which stockholders may recommend nominees to the registrant's board of directors.

Item 11. Controls and Procedures.

| (a) | The registrant's principal executive and principal financial officers have concluded that the registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended (the "1940 Act") (17 CFR 270.30a-3(c))) are effective, as of a date within 90 days of the filing date of this Form N-CSR based on their evaluation of these controls and procedures required by Rule 30a-3(b) under the 1940 Act (17 CFR 270.30a-3(b)) and Rules 13a-15(b) or 15d-15(b) under the Exchange Act (17 CFR 240.13a-15(b) or 240.15d-15(b)). |

| (b) | There were no changes in the registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the 1940 Act (17 CFR 270.30a-3(d))) that occurred during the registrant's second fiscal quarter that have materially affected, or are reasonably likely to materially affect, the registrant's internal control over financial reporting. |

Item 12. Exhibits.

| (a)(1) | Code of Ethics for Principal Executive and Senior Financial Officers. |

| (a)(2) | Certifications required by Rule 30a-2(a) of the Investment Company Act of 1940, as amended. |

| (b) | Certifications required by Section 906 of the Sarbanes-Oxley Act of 2002. |

| (c) | Proxy Voting Guidelines for the registrant and its adviser. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | The Thai Capital Fund, Inc. |

| | | |

| | | |

| | By | /s/ John J. O'Keefe |

| | | John J. O'Keefe, Principal Financial Officer |

Date: March 9, 2012

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| | By | /s/ John J. O'Keefe |

| | | John J. O'Keefe, Principal Financial Officer |

Date: March 9, 2012

| | By | /s/ Martin J. Gruber |

| | | Martin J. Gruber, Chairman |

Date: March 9, 2012

EXHIBIT (a)(1)

CODE OF ETHICS FOR PRINCIPAL EXECUTIVE AND SENIOR FINANCIAL

OFFICERS

| I. | This Code of Ethics (the "Code") for The Thai Capital Fund, Inc., The Singapore Fund, Inc. and The Japan Equity Fund, Inc. (each a "Fund" and collectively the "Funds") applies to each Fund's President and Treasurer (or persons performing similar functions) ("Covered Officers") for the purpose of promoting: |

| | · | honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; |

| | · | full, fair, accurate, timely and understandable disclosure in reports and documents that a Fund files with, or submits to, the Securities and Exchange Commission ("SEC") and in other public communications made by a Fund; |

| | · | compliance with applicable laws and governmental rules and regulations; |

| | · | prompt internal reporting of violations of the Code to an appropriate person or persons identified in the Code; and |

| | · | accountability for adherence to the Code. |

Each Covered Officer should adhere to a high standard of business ethics and should be sensitive to situations that may give rise to actual as well as apparent conflicts of interest. A Fund will expect all Covered Officers to comply at all times with the principles in this Code. A violation of this Code by an employee is grounds for disciplinary action up to and including discharge and possible legal prosecution. Any question about the application of the Code should be referred to the Audit Committee of the Fund's Board of Directors ( the "Audit Committee").

II. Covered Officers Should Handle Ethically Actual and Apparent Conflicts of Interest

Overview. A "conflict of interest" occurs when a Covered Officer's private interest interferes with the interests of, or his service to, a Fund. For example, a conflict of interest would arise if a Covered Officer, or a member of his family, receives improper personal benefits as a result of his position with a Fund.

Certain conflicts of interest arise out of the relationships between Covered Officers and a Fund and already are subject to conflict of interest provisions in the Investment Company Act of 1940 (the "Investment Company Act") and the Investment Advisers Act of 1940 (the "Investment Advisers Act"). For example, Covered Officers may not individually engage in certain transactions (such as the purchase or sale of securities or other property) with a Fund because of their status as "affiliated persons" of a Fund. The compliance programs and procedures of a Fund and the Fund's Investment Manager and Investment Adviser are designed to prevent, or identify and correct, violations of these provisions. Certain conflicts of interest also arise out of the personal securities trading activities of the Covered Officers and the possibility that they may use information regarding a Fund's securities trading activities for their personal benefit. Each Fund's Code of Ethics under Rule 17j-1 under the Investment Company Act is designed to address these conflicts of interest. This Code does not, and is not intended to, replace these programs and procedures or a Fund's Rule 17j-1 Code of Ethics, and this Code's provisions should be viewed as being additional and supplemental to such programs, procedures and code.

Although typically not presenting an opportunity for improper personal benefit, conflicts arise from, or as a result of, the contractual relationship between a Fund and its Investment Adviser or Investment Manager of which the Covered Officers are also officers or employees. As a result, this Code recognizes that the Covered Officers will, in the normal course of their duties (whether formally for a Fund or for its Investment Adviser or Investment Manager, or for all parties), be involved in establishing policies and implementing decisions that will have different effects on the Investment Adviser or Investment Manager and a Fund. The participation of the Covered Officers in such activities is inherent in the contractual relationship between a Fund and its Investment Adviser or Investment Manager and is consistent with the performance by the Covered Officers of their duties as officers of a Fund. Thus, if performed in conformity with the provisions of the Investment Company Act and the Investment Advisers Act, such activities will be deemed to have been handled ethically. In addition, it is recognized by a Fund's Board of Directors (the "Board") that the Covered Officers may also be officers or employees of one or more other investment companies covered by other codes.

Each Covered Officer must not:

| | · | use his personal influence or personal relationships improperly to influence investment decisions or financial reporting by a Fund whereby the Covered Officer would benefit personally to the detriment of a Fund; |

| | · | cause a Fund to take action, or fail to take action, for the individual personal benefit of the Covered Officer rather than the benefit of the Fund; and |