UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-06062 |

|

The Thai Capital Fund, Inc. |

(Exact name of registrant as specified in charter) |

|

1735 Market Street, 32nd Floor Philadelphia, PA | | 19103 |

(Address of principal executive offices) | | (Zip code) |

|

Ms. Andrea Melia Aberdeen Asset Management Inc. 1735 Market Street 32nd Floor Philadelphia, PA 19103 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 866-839-5205 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | December 31, 2012 | |

| | | | | | | | |

Item 1 — Reports to Stockholders —

The Thai Capital Fund, Inc.

General Information (unaudited)

The Fund

The Thai Capital Fund, Inc. (the "Fund") is a non-diversified, closed-end management investment company. The Fund seeks long-term capital appreciation through investment primarily in equity securities of Thai companies. The Fund's investments in Thailand are made through a wholly-owned Investment Plan established under an agreement between SCB Asset Management Co., Ltd. (the "Manager"), the Fund's investment manager, and the Fund. The Fund's investments through the Investment Plan are managed by the Manager.

Stockholder Information

The Fund's shares are listed on the NYSE MKT LLC ("NYSE MKT"). The Fund understands that its shares may trade periodically on certain exchanges other than the NYSE MKT, but the Fund has not listed its shares on those other exchanges and does not encourage trading on those exchanges.

The Fund's NYSE MKT trading symbol is "TF". The Fund's daily net asset value is available by contacting the Fund's administrator, Aberdeen Asset Management Inc., by:

• Calling toll free at 1-866-839-5205 in the United States,

• E-mailing InvestorRelations@aberdeen-asset.com, or

• Visiting the website at www.thaicapitalfund.com.

Also, the Fund's website includes press releases, a monthly market review and a list of the Fund's top ten industries and holdings. The Fund has also placed its Fund governance documents on its website under the section titled "Information", which includes the Fund's proxy voting policies and procedures, its code of ethics and its audit committee charter.

Inquiries

Inquiries concerning your registered share account should be directed to the American Stock Transfer & Trust Company (the "Plan Agent") at the number noted on the next page. All written inquiries should be directed to The Thai Capital Fund, Inc., c/o Aberdeen Asset Management Inc., 1735 Market Street, 32nd Floor, Philadelphia, PA 19103.

Proxy Voting Policies and Procedures

A description of the policies and procedures that are used by the Manager to determine how to vote proxies relating to the Fund's portfolio securities is available (1) without charge, upon request, by calling toll free 1-866-839-5205 in the United States; (2) by visiting www.thaicapitalfund.com; and (3) as an exhibit to the Fund's annual report on Form N-CSR which is available on the website of the Securities and Exchange Commission (the "Commission") at www.sec.gov. Information regarding how the Manager votes these proxies is now available by calling the same number and is available on the Commission's website. The Fund files with the Commission its report on Form N-PX covering the Fund's proxy voting record for the 12-month period ended June 30 by August 30 of the relevant year.

The Thai Capital Fund, Inc.

Quarterly Portfolio of Investments

A Portfolio of Investments is filed with the Commission as of the end of the first and third quarters of each fiscal year on Form N-Q and is available on the Commission's website at www.sec.gov and the Fund's website at www.thaicapitalfund.com. Additionally, the Portfolio of Investments may be reviewed and copied at the Commission's Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling (800) SEC- 0330. The quarterly Portfolio of Investments will be made available without charge, upon request, by calling 1-866-839-5205.

Dividend Reinvestment and Cash Purchase Plan

A Dividend Reinvestment and Cash Purchase Plan (the "Plan") is available to provide Stockholders with automatic reinvestment of dividends and capital gain distributions in additional Fund shares. The Plan also allows you to make optional annual cash investments in Fund shares through the Plan Agent. A brochure fully describing the Plan's terms and conditions is available on the Fund's website at www.thaicapitalfund.com and from the Plan Agent by calling (866) 669-9904 or by writing The Thai Capital Fund, Inc., c/o the American Stock Transfer & Trust Company, Operations Center, 6201 15th Avenue, Brooklyn, NY 11219.

A brief summary of the material aspects of the Plan follows:

Who can participate in the Plan? If you wish to participate and your shares are held in your name, you may elect to become a direct participant in the Plan by completing and mailing the Enrollment Authorization form on the back cover of the Dividend Reinvestment and Cash Purchase Plan Brochure to the Plan Agent. However, if your shares are held in the name of a financial institution, you should instruct your financial institution to participate in the Plan on your behalf. If your financial institution is unable to participate in the Plan for you, you should request that your shares be registered in your name, so that you may elect to participate directly in the Plan.

May I withdraw from the Plan? If your shares are held in your name and you wish to receive all dividends and capital gain distributions in cash rather than in shares, you may withdraw from the Plan without penalty at any time by contacting the Plan Agent. If your shares are held in the name of a financial institution, you should be able to withdraw from the Plan without a penalty at any time by sending written notice to your financial institution. If you withdraw, you or your financial institution will receive a share certificate for all full shares or, if you wish, the Plan Agent will sell your shares and send you the proceeds, after the deduction of brokerage commissions. The Plan Agent will convert any fractional shares to cash at the then-current market price and send you a check for the proceeds.

How are the dividends and distributions reinvested? If the market price of the Fund's shares on the payment date should equal or exceed their net asset value per share, the Fund will issue new shares to you at the higher of net asset value or 95% of the then-current market price. If the market price is lower than the net asset value per share, the Fund will issue new shares to you at the market price. If the dividends or distributions are declared and payable as cash only, you will receive shares purchased for you by the Plan Agent on the NYSE MKT or otherwise on the open market to the extent available.

What is the Cash Purchase feature? The Plan participants have the option of making semi-annual investments in Fund shares through the Plan Agent. You may invest any amount from $100 to $5,000 semi-annually. The Plan Agent will purchase shares for you on the NYSE MKT or otherwise on the open market on or about

2

The Thai Capital Fund, Inc.

February 15th and August 15th of each year. Plan participants should send voluntary cash payments to be received by the Plan Agent approximately ten days before the applicable purchase date. The Plan Agent will return any cash payments received more than thirty days prior to the purchase date. You may withdraw a voluntary cash payment by written notice, if the notice is received by the Plan Agent not less than two business days before the investment date.

Is there a cost to participate? There are no Plan charges or brokerage charges for shares issued directly by the Fund. However, each participant will pay a service fee of $2.50 for each investment and a pro rata portion of brokerage commissions for shares purchased on the NYSE MKT or on the open market by the Plan Agent.

What are the tax implications? The automatic reinvestment of dividends and distributions does not relieve you of any income tax which may be payable (or required to be withheld) on such dividends and distributions. In addition, the Plan Agent will reinvest dividends for foreign participants and for any participant subject to federal backup withholding after the deduction of the amounts required to be withheld.

Please note that, if you participate in the Plan through a brokerage account, you may not be able to continue as a participant if you transfer those shares to another broker. Contact your broker or financial institution or the Plan Agent to ascertain what is the best arrangement for you to participate in the Plan.

3

The Thai Capital Fund, Inc.

Stockholder Letter (unaudited)

January 9, 2013

Dear Stockholders:

The management of Thai Capital Fund, Inc. (the "Fund") would like to take this opportunity to update its stockholders about the Thai economy, the activities of the Stock Exchange of Thailand ("SET"), and the Fund's performance for the six months ended December 31, 2012.

Thai Stock Market Overview

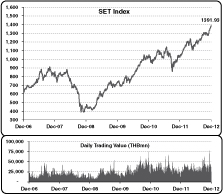

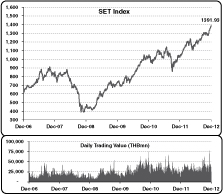

For the second half of 2012, the SET Index increased by 219.82 points or 18.75% to close at 1,391.93, with daily average turnover of Baht 32.6 billion. Foreign investors posted net buying of Baht 12.8 billion.

In July, Thailand's stock market moved up in a modest magnitude, backed by continued buying into banks, telecom and other domestic-oriented sectors, which had a good outlook based on expected Thai domestic demand recovery. However, the upside of the overall index was capped by the poor performance of energy stocks, amid uncertainty in Europe. The movement of foreign flows was quite volatile throughout the month as news flow from the West fluctuated from positive to negative.

In August, the Thai market moved up in a tight range, as investors continued to speculate on the announcement of monetary stimulus from the United States and Europe. While there was no U.S. Federal Reserve Open Market Committee ("FOMC") meeting or major announcement on non-conventional policy from the European Central Bank ("ECB"), the statements by policymakers kept markets afloat. Locally, second quarter 2012 earnings of domestic companies like telecom and real estate led to strong market performance of those companies. Interestingly, although the SET Index was on a sideways up pattern, foreign flows were quite slow, reflecting investor caution about market valuations.

4

The Thai Capital Fund, Inc.

In September, the Thai market performed quite strongly due to the positive impact of global stimulus policies and a resilient domestic economy. Asian and Thai stocks benefited from two major announcements, namely, i) the new bond purchase program by the ECB on September 6 and ii) Quantative Easing 3 from the U.S. Federal Reserve on September 13. On the Thai economic issues, though export momentum continued to deteriorate, private consumption and private investment remained solid and underpinned the earnings outlook of domestic sectors.

In October, the Thai market moved back and forth with high volatility as foreign investors took profits on Thai shares amid a few negative news items on major sectors like banks (surprised interest rate cut) and telecommunication (uncertainty on future mobile tariffs). The energy sector was more resilient, as investors braced for strong earnings rebound in the third quarter of 2012. Global factors were unexciting as there was no significant progress on the Spanish sovereign bailout and Greek Troika review. U.S. corporate earnings for the third quarter of 2012 surprised on the bottom line but top lines were weak, implying little enthusiasm in the U.S. economy.

In November, the Thai market moved up but was volatile. The SET Index had a corrected in the first two weeks of the month as concerns over the U.S. fiscal cliff and uncertainty on the Greek bailout weighed on global markets. However, the SET Index recovered strongly in the final week after Greece received the financial aid and U.S. politicians were more conciliatory on the cliff. Strong buying from local institutional investors, as the season for contributions to Long-Term Equity Funds ("LTF") and Retirement Mutual Funds (RMF) began, was also a major driver for the Thai market rebound in late November.

The Thai stock market was bullish in December due mainly to strong foreign inflows to reflect the U.S. announcement of further monetary stimulus, better sentiment on the global economic outlook as Purchasing Managers Index (PMI) surveys in major countries continued to show increased activity and local institutional investors entered the market as Thai individuals contributed funds into the tax-deductible LTFs.

Thai Stock Market Outlook

Although the fiscal cliff has been at least temporarily resolved, there are some concerns over U.S. growth prospects in the near-term. These include the fiscal drag of the fiscal cliff agreement and expected future big budget battles, which could further depress business confidence with negative implications for spending and hiring. The expiration of the U.S. payroll tax reduction is worth roughly $110 billion in lost 2013 disposable income to U.S. households, which is expected to subtract about 75 basis points from real U.S. Gross Domestic Product ("GDP") growth. Higher marginal income tax rates in addition to higher rates on capital gains and dividends will also have a mildly depressing impact on output that could result in another 25 basis points on lost output. In total, the real U.S. GDP for 2013 is expected to be affected by at least 1%.

The other U.S. Economic issue relates to the raising of the debt ceiling, which is expected to be addressed by late January or early February. There could be further budget cuts in connection with lifting the ceiling.

In Europe, after resigning, Italian Prime Minister Monti appears intent on leading an alliance of centrist parties ahead of the elections on February 24 and 25, 2013. Overall, Monti's agenda represents a step forward in a political debate that so far has not focused enough on concrete strategies to tackle Italy's key problem, namely, the interaction between the high level of public debt and the low potential GDP growth. A key benefit of Monti's participation would be to increase the likelihood that a pro-reform government can be formed after the election.

For the Thai economic outlook in 2013, we believe that risks have eased and the global economy should improve. Modest recovery in exports is anticipated as external demand improves. In addition, the current account

5

The Thai Capital Fund, Inc.

surplus is likely to expand due to import growth slowdown. Domestic consumption should maintain its positive momentum through 2013, supported by strong wage growth, farm income recovery and favorable credit conditions. Investment is likely to accelerate, particularly from the private sector. Serious drought is likely to fuel food inflation leading to a rise in headline inflation, while core inflation should stay flat.

The SET Index has surpassed its previous high point that was reached in 1994 thanks to massive global liquidity and strong earnings growth of Thai listed companies. However, we think there is still upside potential due to strong earnings growth in Thai listed companies as aforementioned and good prospects for the Thai economy. Therefore, the SET Index could make another new high this year. As a result, the Fund should be somewhat fully invested in Thai equities. However, due to high volatility of the Thai market, trading between cash and equities would be a good idea.

In terms of valuation based on Bloomberg forecasted earnings-per-share ("EPS") growth of 20.4% for 2013 (as of December 28, 2012), the Thai stock market is trading on price-to-earnings ("PER") for 2013 of 12.84x, price-to-book value ("P/BV") of 2.13x with a dividend yield of 3.55%. Compared to the five-year historical average of PER of 14.87x, P/BV of 1.72x and dividend yield of 4.2%, the Thai market is cheap in terms of PER, but expensive in terms of P/BV and dividend yield.

Performance Evaluation

As of December 31, 2012, the Fund had net assets of US$44.3 million, equivalent to a net asset value ("NAV") per share of US$12.42. Of this amount, equity securities accounted for 98.3% and the remainder was in cash and bank deposits.

For the second half of 2012, the SET Index was up 18.75% in Thai Baht terms and the Fund's portfolio returned 14.34%, underperforming the benchmark by 4.41%. For the year ended December 31, 2012 the SET Index was up 35.76% in Thai Baht terms and the portfolio returned 32.71%, underperforming the benchmark by 3.05%. For the year ended December 31, 2012, in U.S. dollar terms, the NAV returned assuming reinvestment of the US$0.99 per share dividend paid on January 11, 2013, was 33.34% and the SET Index was 40.43%.

Proposed Rights Offering

In December 2012, the Fund announced that it filed a Registration Statement with the Securities and Exchange Commission relating to a proposed rights offering (the "Offer") entitling the holders of the Fund's common stock to subscribe for a class of preferred stock of the Fund. The Fund is extending the Offer as a way to permit stockholders that support liquidation or reorganization of the Fund to accumulate sufficient voting shares of the Fund so that the Fund is able to obtain the necessary vote on liquidation, reorganization or other corporate actions with respect to the Fund. Shortly after expiration of the Offer, the Fund intends to hold a special meeting of stockholders to consider liquidation, reorganization or other corporate action with respect to the Fund.

Finally, the Fund's management would like to express its sincere thanks to all stockholders for their continued support and participation.

Sincerely yours,

Martin J. Gruber

Chairman of the Board

6

The Thai Capital Fund, Inc.

Consolidated Portfolio of Investments

As of December 31, 2012

LONG-TERM INVESTMENTS—98.3% | |

COMMON STOCKS—98.3% | |

Shares | | Description | | Value | |

Chemicals—9.7%(a) | | | |

| | 1,354,800 | | | Indorama

Ventures PCL | | $ | 1,128,484 | | |

| | 6,703,400 | | | IRPC PCL | | | 910,268 | | |

| | 978,862 | | | PTT Global

Chemical PCL | | | 2,264,672 | | |

| | | | 4,303,424 | | |

Commercial Banks—23.3%(a) | | | |

| | 558,000 | | | Bangkok Bank PCL | | | 3,587,580 | | |

| | 1,170,500 | | | Bank of Ayudhya PCL | | | 1,251,759 | | |

| | 335,900 | | | Kasikornbank PCL | | | 2,137,502 | | |

| | 2,973,600 | | | Krung Thai Bank PCL | | | 1,920,152 | | |

| | 23,148,400 | | | TMB Bank PCL | | | 1,414,610 | | |

| | | | 10,311,603 | | |

Diversified Telecommunication

Services—7.3%(a) | | | |

| | 327,900 | | | Advanced Info

Service PCL | | | 2,255,231 | | |

| | 577,500 | | | Jasmine

International PCL | | | 102,462 | | |

| | 488,000 | | | Thaicom PCL* | | | 369,941 | | |

| | 170,000 | | | Total Access

Communication PCL | | | 493,031 | | |

| | | | 3,220,665 | | |

Engineering & Construction—3.0%(a) | | | |

| | 251,500 | | | Airports of

Thailand PCL | | | 801,474 | | |

| | 1,195,300 | | | CH Karnchang PCL | | | 525,676 | | |

| | | | 1,327,150 | | |

Food Products—7.5%(a) | | | |

| | 2,555,400 | | | Charoen Pokphand

Foods PCL | | | 2,832,239 | | |

Shares | | Description | | Value | |

| | 203,240 | | | Thai Union Frozen

Products PCL | | $ | 479,589 | | |

| | | | 3,311,828 | | |

Healthcare Providers & Services—2.3%(a) | | | |

| | 100,000 | | | Bangkok Dusit

Medical

Services PCL | | | 371,915 | | |

| | 274,200 | | | Bumrungrad

Hospital PCL | | | 665,221 | | |

| | | | 1,037,136 | | |

Holding Companies—Diversified

Operations—4.7%(a) | | | |

| | 145,800 | | | Siam Cement PCL | | | 2,104,261 | | |

Home Builders—5.3%(a) | | | |

| | 3,061,100 | | | Asian Property

Development PCL | | | 856,176 | | |

| | 4,622,400 | | | Land and Houses PCL | | | 1,482,364 | | |

| | | | 2,338,540 | | |

Oil, Gas & Consumable Fuels—22.4%(a) | | | |

| | 600,261 | | | PTT Exploration &

Production PCL | | | 3,237,870 | | |

| | 411,500 | | | PTT PCL | | | 4,498,654 | | |

| | 989,700 | | | Thai Oil PCL | | | 2,208,957 | | |

| | | | 9,945,481 | | |

Real Estate—7.5% | | | |

| | 1,398,600 | | | Amata Corp PCL(a) | | | 745,842 | | |

| | 1,145,700 | | | Ananda

Development PCL* | | | 143,821 | | |

| | 7,265,400 | | | Hemaraj Land and

Development

PCL(a) | | | 720,127 | | |

See notes to consolidated financial statements.

7

The Thai Capital Fund, Inc.

Consolidated Portfolio of Investments (concluded)

As of December 31, 2012

COMMON STOCKS (concluded) | |

Shares | | Description | | Value | |

| | 1,445,700 | | | LPN

Development PCL(a) | | $ | 852,496 | | |

| | 1,453,700 | | | Supalai PCL(a) | | | 844,795 | | |

| | | | 3,307,081 | | |

Retail—5.3%(a) | | | |

| | 1,398,900 | | | CP ALL PCL | | | 2,103,500 | | |

| | 112,000 | | | Robinson Department

Store PCL | | | 244,892 | | |

| | | | 2,348,392 | | |

Total Long-Term Investments—98.3%

(cost $40,909,173) | | | 43,555,561 | | |

Total Investments—98.3%

(cost $40,909,173)(b) | | | 43,555,561 | | |

Other Assets in Excess of

Liabilities—1.7% | | | 731,428 | | |

| Net Assets—100.0% | | $ | 44,286,989 | | |

* Non-income producing security.

(a) Fair Valued Security. Fair Values are determined pursuant to procedures approved by the Board of Directors.

(b) See notes to consolidated financial statements for tax unrealized appreciation/depreciation of securities.

See notes to consolidated financial statements.

8

The Thai Capital Fund, Inc.

EQUITY CLASSIFICATIONS HELD

December 31, 2012 (unaudited) | |

Industry | | Percentage of

Net Assets | |

Commercial Banks | | | 23.3 | % | |

Oil, Gas & Consumable Fuels | | | 22.4 | | |

Chemicals | | | 9.7 | | |

Food Products | | | 7.5 | | |

Real Estate | | | 7.5 | | |

Diversified Telecommunication

Services | | | 7.3 | | |

Retail | | | 5.3 | | |

Home Builders | | | 5.3 | | |

Holding Companies-Diversified

Operations | | | 4.7 | | |

Engineering & Construction | | | 3.0 | | |

Healthcare Providers & Services | | | 2.3 | | |

| Other | | | 1.7 | | |

| | | | 100.0 | % | |

TEN LARGEST EQUITY POSITIONS HELD

December 31, 2012 (unaudited) | |

Name of Security | | Percentage of

Net Assets | |

PTT PCL | | | 10.2 | % | |

Bangkok Bank PCL | | | 8.1 | | |

PTT Exploration & Production PCL | | | 7.3 | | |

Charoen Pokphand Foods PCL | | | 6.4 | | |

PTT Global Chemical PCL | | | 5.1 | | |

Advanced Info Service PCL | | | 5.1 | | |

| Thai Oil PCL | | | 5.0 | | |

Kasikornbank PCL | | | 4.8 | | |

Siam Cement PCL | | | 4.8 | | |

| CP ALL PCL | | | 4.7 | | |

See notes to consolidated financial statements.

9

The Thai Capital Fund, Inc.

Consolidated Statement of Assets and Liabilities

As of December 31, 2012

Assets | |

Investments, at value (cost $40,909,173) | | $ | 43,555,561 | | |

Foreign currency, at value (cost $4,841,590) | | | 4,849,736 | | |

Cash | | | 21,804 | | |

Receivable for investments sold | | | 1,888,888 | | |

Interest and dividends receivable | | | 15,260 | | |

Prepaid expenses | | | 7,346 | | |

Total assets | | | 50,338,595 | | |

Liabilities | |

Dividends payable to common stockholders | | | 3,518,724 | | |

Payable for investments purchased | | | 1,363,534 | | |

| Accrued Thai tax provision | | | 938,053 | | |

Legal fees and expenses (Note 3) | | | 68,368 | | |

Administration fees payable (Note 3) | | | 27,891 | | |

Investment management fees payable (Note 3) | | | 24,295 | | |

Investor relations fees payable | | | 2,150 | | |

Director fees payable | | | 1,000 | | |

Accrued expenses | | | 107,591 | | |

| Total liabilities | | | 6,051,606 | | |

Net Assets | | $ | 44,286,989 | | |

Composition of Net Assets: | |

Common stock (par value $.01 per share) | | $ | 35,648 | | |

| Paid-in capital in excess of par | | | 39,508,304 | | |

Undistributed net investment income | | | 114,867 | | |

| Accumulated net realized gain from investments and foreign currency transactions | | | 2,254,354 | | |

Net unrealized appreciation on investments and translation of assets and liabilities

denominated in foreign currencies | | | 2,373,816 | | |

Net Assets | | $ | 44,286,989 | | |

Net asset value per common share based on 3,564,814 shares issued and outstanding | | $ | 12.42 | | |

See notes to consolidated financial statements.

10

The Thai Capital Fund, Inc.

Consolidated Statement of Operations

For the Year Ended December 31, 2012

Net investment income | |

Income | |

Dividends | | $ | 1,372,267 | | |

Interest | | | 12,662 | | |

| | | | 1,384,929 | | |

Expenses | |

Investment management fee (Note 3) | | | 259,755 | | |

Legal fees and expenses (Note 3) | | | 200,420 | | |

Administration fee (Note 3) | | | 160,521 | | |

Independent auditors' fees and expenses | | | 88,050 | | |

Custodian's fees and expenses (Note 3) | | | 52,927 | | |

Reports to stockholders and proxy solicitation | | | 49,984 | | |

Directors' fees and expenses | | | 49,672 | | |

Investor relations fees and expenses | | | 21,096 | | |

Transfer agent's fees and expenses | | | 10,210 | | |

Insurance expense | | | 8,112 | | |

Miscellaneous | | | 48,656 | | |

Total expenses before expense waivers | | | 949,403 | | |

Less waiver of: | |

Administration Fee | | | (37,500 | ) | |

Net expenses | | | 911,903 | | |

Net investment income | | | 473,026 | | |

Realized and unrealized gains/(losses) on investments and foreign currencies | |

Net realized gain/(loss) from: | |

| Investment transactions, net of $370,709 Thai tax provision | | | 5,493,585 | | |

Foreign currency transactions | | | 30,761 | | |

| | | 5,524,346 | | |

Net change in unrealized appreciation/(depreciation) on: | |

| Investments, net of $547,475 Thai tax provision | | | 5,939,642 | | |

Foreign currency translation | | | 23,526 | | |

| | | 5,963,168 | | |

| Net gain from investments and foreign currencies | | | 11,487,514 | | |

Net Increase in Net Assets Resulting from Operations | | $ | 11,960,540 | | |

See notes to consolidated financial statements.

11

The Thai Capital Fund, Inc.

Consolidated Statements of Changes in Net Assets

| | | For the Years Ended

December 31, | |

| | | 2012 | | 2011 | |

Increase/(decrease) in net assets operations: | |

Net investment income | | $ | 473,026 | | | $ | 754,573 | | |

| Net realized gain/(loss) from investment transactions | | | 5,493,585 | | | | (63,934 | ) | |

Net realized gain/(loss) from foreign currency transactions | | | 30,761 | | | | (140,309 | ) | |

| Net change in unrealized appreciation/depreciation on investments | | | 5,939,642 | | | | (7,805,019 | ) | |

Net change in unrealized appreciation/depreciation on foreign

currency translation | | | 23,526 | | | | (16,586 | ) | |

| Net increase/(decrease) in net assets resulting from operations | | | 11,960,540 | | | | (7,271,275 | ) | |

Distributions to stockholders from: | |

Net investment income | | | — | | | | (309,689 | ) | |

Net realized gains | | | (3,518,724 | ) | | | (8,980,989 | ) | |

Net decrease in net assets from distributions | | | (3,518,724 | ) | | | (9,290,678 | ) | |

Common stock transactions: | |

Reinvestment of dividends resulting in the issuance

of 0 and 123,822 shares of common stock, respectively | | | — | | | | 1,158,975 | | |

Net increase/(decrease) in net assets | | | 8,441,816 | | | | (15,402,978 | ) | |

Net assets: | |

| Beginning of year | | | 35,845,173 | | | | 51,248,151 | | |

End of year (including undistributed net investment income

(loss)) of $114,867 and ($11,519), respectively) | | $ | 44,286,989 | | | $ | 35,845,173 | | |

| | | | | | |

Amounts listed as "—" are $0 or round to $0. | |

See notes to consolidated financial statements.

12

The Thai Capital Fund, Inc.

Notes to Consolidated Financial Statements

1. Organization

The Thai Capital Fund, Inc. (the "Fund") was incorporated in Maryland on March 14, 1990 and commenced operations on May 30, 1990. It is registered with the U.S. Securities and Exchange Commission as a non-diversified, closed-end management investment company.

The Fund makes its investments in Thailand through a wholly-owned Investment Plan pursuant to a contract with SCB Asset Management Co., Ltd. (the "Manager"), the Fund's investment manager. The accompanying financial statements are prepared on a consolidated basis and present the financial position and results of operations of the Investment Plan and the Fund.

The Investment Plan has a 25-year duration through May 17, 2015 (subject to earlier termination) unless continuance thereof is approved by the Bank of Thailand. In addition, the Investment Plan will expire in 2015, unless continuance is approved by Thailand's Securities and Exchange Commission ("Thai SEC"), which is unlikely. Upon expiration or revocation of Thai SEC approval of the Investment Plan prior to that date, the Investment Plan will be required to liquidate. In the event of liquidation of the Investment Plan, the Fund's Board of Directors (the "Board") will consider, among other things, whether to liquidate the Fund, operate the Fund as a direct foreign investor (if then permitted under Thai law) or take other appropriate action.

2. Summary of Significant Accounting Policies

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The policies are in conformity with accounting principles generally accepted in the United States of America ("GAAP"). The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of income and expenses for the period. Actual results could differ from those estimates. The U.S. Dollar is used as both the functional and reporting currency.

(a) Security Valuation:

The Fund is required to value its securities at fair value, which is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

Prior to October 1, 2012, the Fund determined net asset value ("NAV") based on valuations as of 5:00 p.m. Bangkok time, on each day. Securities listed on the Stock Exchange of Thailand for which market quotations were readily available were valued at the last sales price prior to the time of determination, or, if there were no sales on such date, at the mean between the last current bid and asked prices. Securities that were traded over-the-counter, if bid and asked quotations were available, were valued at the mean between the current bid and asked prices. In instances where quotations were not readily available or where the price determined was deemed not to represent fair market value, fair value was determined in good faith in such manner as the Board prescribed. Short-term investments having a maturity of 60 days or less were valued at amortized cost, except where the Board determines that such valuation did not represent the fair value of the investment. All other securities and assets were valued at fair value as determined in good faith by, or under the direction of, the Board.

13

The Thai Capital Fund, Inc.

Notes to Consolidated Financial Statements (continued)

Effective October 1, 2012, equity securities that are traded on an exchange are valued at the last quoted sale price on the principal exchange on which the security is traded at the "Valuation Time," subject to application, when appropriate, of the fair valuation factors described in the paragraph below. The Valuation Time is as of the close of regular trading on the New York Stock Exchange (usually 4:00 p.m. Eastern Time). In the absence of a sale price, the security is valued at the mean of the bid/ask quoted at the close on the principal exchange on which the security is traded. Securities traded on NASDAQ are valued at the NASDAQ official closing price. A security using any of these pricing methodologies is determined as a Level 1 investment.

In addition, foreign equity securities that are traded on foreign exchanges that close prior to the Valuation Time are valued by applying fair valuation factors to the last sale price or the mean price as noted above. Fair valuation factors are provided by an independent pricing service provider. These factors are used when pricing the Fund's portfolio holding to estimate market movements between the time foreign markets close and the time the Fund values such foreign securities. These factors are based on inputs such as depositary receipts, S&P 500 Index/S&P 500 Futures, Nikkei 225 Futures, sector indices/ETFs, exchange rates, and historical opening and closing prices of each security. When the fair value prices are utilized, the value assigned to the foreign securities may not be the same as quoted or published prices of the securities on their primary markets. Fair valuation factors are not utilized if the pricing service is unable to provide a valuation factor or if the valuation factor falls below a predetermined threshold. A security that applies a fair valuation factor is determined as a Level 2 investment because the exchange traded price has been adjusted.

In the event that a security's market quotations are not readily available or are deemed unreliable, the fair value of a security is determined by the Fund's Pricing Committee, taking into account the relevant factors and surrounding circumstances. A security that has been fair valued by the Pricing Committee may be classified as Level 2 or 3 depending on the nature of the inputs.

In accordance with the authoritative guidance on fair value measurements and disclosures under GAAP, the Fund discloses the fair value of its investments using a three-level hierarchy that classifies the inputs to valuation techniques used to measure the fair value. The hierarchy assigns Level 1 measurements to valuations based upon unadjusted quoted prices in active markets for identical assets and Level 3 measurements to valuations based upon unobservable inputs that are significant to the valuation. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability, which are based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity's own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances. The three-tier hierarchy of inputs is summarized below:

Level 1—quoted prices in active markets for identical investments;

Level 2—other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, and credit risk); or

Level 3—significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments).

14

The Thai Capital Fund, Inc.

Notes to Consolidated Financial Statements (continued)

The following is a summary of the inputs used as of December 31, 2012 in valuing the Fund's investments carried at fair value. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. Please refer to the Portfolio of Investments for a detailed breakout of the security types:

Investments | | Level 1 | | Level 2 | | Level 3 | | Total | |

Chemicals | | $ | — | | | $ | 4,303,424 | | | $ | — | | | $ | 4,303,424 | | |

Commercial Banks | | | — | | | | 10,311,603 | | | | — | | | | 10,311,603 | | |

Diversified Telecommunications | | | — | | | | 3,220,665 | | | | — | | | | 3,220,665 | | |

Engineering & Construction | | | — | | | | 1,327,150 | | | | — | | | | 1,327,150 | | |

Food Products | | | — | | | | 3,311,828 | | | | — | | | | 3,311,828 | | |

Healthcare Providers | | | — | | | | 1,037,136 | | | | — | | | | 1,037,136 | | |

Holding Companies | | | — | | | | 2,104,261 | | | | — | | | | 2,104,261 | | |

Home Builders | | | — | | | | 2,338,540 | | | | — | | | | 2,338,540 | | |

Oil & Gas | | | — | | | | 9,945,481 | | | | — | | | | 9,945,481 | | |

Real Estate | | | 143,821 | | | | 3,163,260 | | | | — | | | | 3,307,081 | | |

Retail | | | — | | | | 2,348,392 | | | | — | | | | 2,348,392 | | |

Total Investments | | $ | 143,821 | | | $ | 43,411,740 | | | $ | — | | | $ | 43,555,561 | | |

The Fund held no Level 3 securities at December 31, 2012.

For movements between the levels within the fair value hierarchy, the Fund has adopted a policy of recognizing transfers at the end of each period. During the year ended December 31, 2012 , transfers from Level 1 to Level 2 occurred due to the utilization of the fair value factors, described above. For the year ended December 31, 2012, there have been no other significant changes to the fair valuation methodologies.

(b) Repurchase Agreements:

The Fund may enter into repurchase agreements. It is the Fund's policy that its custodian/counterparty segregate the underlying collateral securities, the value of which exceeds the principal amount of the repurchase transaction, including accrued interest. The repurchase price generally equals the price paid by the Fund plus interest negotiated on the basis of current short-term rates. To the extent that any repurchase transaction exceeds one business day, the collateral is valued on a daily basis to determine its adequacy. If the counterparty defaults and the value of the collateral declines or if bankruptcy proceedings are commenced with respect to the counterparty of the security, realization of the collateral by the Fund may be delayed or limited. There were no repurchase agreements outstanding during the year or as of December 31, 2012.

(c) Foreign Currency Translation:

The books and records of the Fund are maintained in U.S. dollars as follows: (1) the foreign currency market value of investment securities and other assets and liabilities stated in foreign currencies are translated at the exchange rates prevailing at the end of the period; and (2) purchases, sales, income and expenses are translated at the rate of exchange prevailing on the respective dates of such transactions. The resulting exchange

15

The Thai Capital Fund, Inc.

Notes to Consolidated Financial Statements (continued)

gains and losses are included in the Statement of Operations. The Fund does not isolate the effect of fluctuations in foreign exchange rates from the effect of fluctuations in the market price of securities. Foreign securities, currencies, and other assets and liabilities denominated in foreign currencies are translated into U.S. Dollars at the exchange rate of said currencies against the U.S. Dollar, as of the Valuation Time, as provided by an independent pricing service approved by the Board.

(d) Security Transactions, Investment Income and Expenses:

Investment transactions are recorded on the trade date (the date upon which the order to buy or sell is executed). Realized and unrealized gains and losses from security and foreign currency transactions are calculated on the identified cost basis. Dividend income and corporate actions are recorded generally on the ex-date, except for certain dividends and corporate actions which may be recorded after the ex-date, as soon as the Fund acquires information regarding such dividends or corporate actions. Interest income is recorded on an accrual basis.

(e) Distributions:

The Fund records dividends and distributions payable to its stockholders on the ex-dividend date. The amount of dividends and distributions from net investment income and net realized capital gains are determined in accordance with federal income tax regulations, which may differ from GAAP. These book basis/tax basis ("book/tax") differences are either considered temporary or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified within the capital accounts based on their federal tax-basis treatment; temporary differences do not require reclassification. Dividends and distributions which exceed net investment income and net realized capital gains for tax purposes are reported as return of capital.

(f) Federal Income Taxes:

The Fund intends to continue to distribute substantially all of its taxable income to comply with the minimum distribution and other requirements of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies. Accordingly, no provision for federal income taxes is required. As of December 31, 2012, the Fund had no uncertain tax positions that would require financial statement recognition, derecognition or disclosure. As of December 31, 2012, the Fund did not have any unrecognized tax benefits. The Fund's federal tax returns for each of the four fiscal years up to the most recent fiscal year ended December 31, 2012 remain subject to examination by the Internal Revenue Service.

The Fund provides for Thai taxation based upon its understanding of the application of Thai tax law to the Investment Plan. Thai Baht remittances from the Investment Plan to the Fund during the term of the Investment Plan are subject to a Thai withholding tax of 10% and such remittances are required by Thai law to be derived only from the Investment Plan's net income and net realized gains on the sale of securities. Remittances for the payment of expenses (other than Thai withholding tax) are not subject to a Thai withholding tax. The Fund records a provision for such taxes based upon change in the Investment Plan's expected liability for withholding taxes and the Fund's expected distributions required to comply with the requirements applicable to regulated investment companies. The amount of Thai withholding taxes ultimately paid could be different from the amounts accrued depending on various factors, including whether unrealized gains are ultimately realized, the timing of

16

The Thai Capital Fund, Inc.

Notes to Consolidated Financial Statements (continued)

the realization of gains, stockholder distribution reinvestment rates and the effect of exchange rates, and the difference could be material.

(g) Earnings Credits:

The Fund's U.S. custodial arrangements include a provision to reduce its custodial fees by the amount of earnings credits recognized on cash deposits in demand deposit accounts.

3. Agreements and Transactions with Affiliates

(a) Investment Manager:

The Manager acts as the investment manager of the Investment Plan pursuant to the Investment Contract, as amended. The Manager makes the investment management decisions relating to the Fund's assets held through the Investment Plan. For its management services, the Manager receives a fee, which accrues weekly and is payable monthly in Baht, at an annual rate of 0.60% of the Investment Plan's average weekly net assets. In addition, as permitted by the Investment Contract, the Fund reimburses the Manager for its out-of-pocket expenses related to the Fund. During the year ended December 31, 2012, no such expenses were paid to the Manager. For the year ended December 31, 2012, the Manager earned $259,755 in management fees. At December 31, 2012, the Fund owed the Manager $24,295 for management fees.

(b) Administrator and Custodian and Other Related Parties:

Under the terms of the Fund Administration Agreement effective September 28, 2012, Aberdeen Asset Management Inc. ("AAMI") provides various administrative and accounting services, including daily valuation of the Fund's shares, preparation of financial statements, tax returns, regulatory reports, and presentation of quarterly reports to the Board. For Fund Administration, the Fund pays AAMI an annual fee at a rate of 0.20% of the value of the Fund's average weekly net assets.

The Board has also approved the payment of the administrative compliance expense for the Fund in the amount of $21,000 per annum to AAMI, for services provided by AAMI staff in implementing the Fund's compliance management system and the Fund's compliance review program. This amount is included in the administration fee in the Fund's Statement of Operations. For the year ended December 31, 2012, AAMI earned $27,890 from the Fund for administrative services.

Prior to September 28, 2012, Daiwa Securities Trust Company ("DSTC"), provided certain administrative services to the Fund. For such services, the Fund paid DSTC a monthly fee at an annual rate of 0.20% of the Fund's average weekly net assets, with a minimum annual fee of $150,000. DSTC had voluntarily decreased its minimum annual administration fee to $100,000 for the year ended December 31, 2012. During the period ended January 1, 2012 through September 27, 2012, administration fees of $37,500 were waived by DSTC. For the year ended December 31, 2012, DSTC earned $90,750 from the Fund for administrative services. In addition, as permitted by the Administration Agreement, the Fund reimbursed DSTC for its out-of-pocket expenses related to the Fund. During the period ended January 1, 2012 through September 27, 2012, expenses of $4,381 were paid to DSTC, representing reimbursement to DSTC of costs relating to the attendance by its employees at meetings of the Fund's Board.

17

The Thai Capital Fund, Inc.

Notes to Consolidated Financial Statements (continued)

Prior to September 28, 2012, the Board had also approved the payment of the administrative compliance expense for the Fund in the amount of $21,000 per annum to DSTC, for services provided by DSTC staff in implementing the Fund's compliance management system and the Fund's compliance review program. This amount is included in the administration fee in the Fund's Statement of Operations.

Effective September 28, 2012, State Street became Custodian for the Fund's U.S. assets. Prior to September 28, 2012, DSTC also acted as custodian for the Fund's U.S. assets. As compensation for its services as custodian, DSTC received a monthly fee of 0.10% of the average weekly net assets of the Fund representing U.S. assets and reimbursement of out-of-pocket expenses, with a minimum annual fee of $5,000. During the year ended December 31, 2012, DSTC earned $4,543, as compensation for its custodial services to the Fund.

Bangkok Bank Public Company Ltd. ("Bangkok Bank") is the custodian for the Fund's Thai assets. As compensation for its services as custodian, Bangkok Bank receives a monthly fee of 1/52 of 0.10% of the value of the weekly net assets of the Investment Plan and reimbursement of out-of-pocket expenses. For the year ended December 31, 2012, Bangkok Bank earned $34,442.82 as compensation for custodial services to the Fund. At December 31, 2012, the Fund owed to Bangkok Bank $2,965.75 for custody fees and expenses.

During the year ended December 31, 2012, the Fund paid or accrued $195,475 for legal services in connection with the Fund's on-going operations to a law firm to which the Fund's Assistant Secretary is a consultant.

4. Tax Information

For federal income tax purposes, the cost of securities owned at December 31, 2012 was $40,917,485, excluding short-term investments. At December 31, 2012, the net unrealized appreciation of investments for federal income tax purposes, excluding short-term securities, of $2,638,076 was composed of gross appreciation of $3,099,694 for those investments having an excess of value over cost, and gross depreciation of $(461,618) for those investments having an excess of cost over value. For the year ended December 31, 2012, total aggregate cost of purchases and net proceeds from sales of portfolio securities, excluding short-term securities, were $51,367,578 and $55,220,947, respectively.

In order to present undistributed net investment income and accumulated net realized gain on the Statement of Assets and Liabilities that more closely represent their tax character, certain adjustments have been made to undistributed net investment income, accumulated net realized gain on investments and paid-in capital in excess of par value.

For the year ended December 31, 2012, the adjustments were to decrease net investment income and increase accumulated net realized gain by $346,640 primarily related to the reclassification of realized foreign currency gain/loss and taxes paid on foreign capital gains. Net investment income, net realized losses and net assets were not affected by this change.

The tax basis components of distributable earnings differ from the amounts reflected in the Statement of Assets and Liabilities and the Statements of Changes in Net Assets by temporary book/tax differences primarily

18

The Thai Capital Fund, Inc.

Notes to Consolidated Financial Statements (continued)

arising from wash sales and foreign taxes accrued. As of December 31, 2012, the components of accumulated earnings (deficit) on a tax basis were as follows:

Undistributed

Ordinary Income | | Undistributed

Capital Gains | | Other

Temporary Differences | | Unrealized

Appreciation/Depreciation | |

| $ | 1,764,508 | | | $ | 626,200 | | | $ | (13,175 | ) | | $ | 2,365,504 | | |

During the current year, the Fund has no capital loss carryforwards.

The tax character of distributions paid during the fiscal years ended December 31, 2012 and December 31, 2011 was as follows:

| | | December 31, 2012 | | December 31, 2011 | |

Distributions paid from: | |

Ordinary Income | | $ | 1,469,152 | | | $ | 6,792,427 | | |

| Net long-term capital gains | | | 2,049,572 | | | | 2,498,251 | | |

Total tax character of distributions | | $ | 3,518,724 | | | $ | 9,290,678 | | |

5. Capital

There are 100 million shares of $0.01 par value common stock authorized. During the year ended December 31, 2012, there were no shares issued. Of the 3,564,814 shares outstanding at December 31, 2012, Daiwa Capital Markets America Holdings Inc., a lead underwriter of the Fund and an affiliate of DSTC, owned no shares. As of December 31, 2012, based on publicly available Schedule 13D and 13G disclosures filed with the Securities and Exchange Commission, Bulldog Investors held 38.36% of the shares outstanding.

6. Concentration of Risk

The Fund's investments in Thailand involve certain considerations and risks not typically associated with domestic investments as a result of, among others, the possibility of future economic and political developments and the level of government supervision and regulation of securities markets.

The currency transactions of the Fund and the Investment Plan are subject to Thai foreign exchange control regulations. Remittances from the Investment Plan require the approval of the Exchange Control Officer of the Bank of Thailand. There can be no assurance that approval of remittances from the Investment Plan will be granted in a timely fashion or at all.

7. Recent Accounting Pronouncements

In December 2011, the Financial Accounting Standards Board ("FASB") issued an Accounting Standards Update ("ASU"), Disclosures about Offsetting Assets and Liabilities. The amendments in this update require an entity to disclose both gross and net information for derivatives and other financial instruments that are either offset in the statement of assets and liabilities or subject to an enforceable master netting arrangement or similar agreement. The ASU is effective during interim or annual reporting periods beginning on or after January 1,

19

The Thai Capital Fund, Inc.

Notes to Consolidated Financial Statements (concluded)

2013. Management is currently evaluating the implications of this ASU and its impact on the financial statements has not been determined.

8. Subsequent Events

As noted previously, in December 2012, the Fund announced that it filed a Registration Statement with the Securities and Exchange Commission relating to a proposed rights offering (the "Offer") entitling the holders of the Fund's common stock to subscribe for a class of preferred stock of the Fund. The Fund is extending the Offer as a way to permit stockholders that support liquidation or reorganization of the Fund to accumulate sufficient voting shares of the Fund so that the Fund is able to obtain the necessary vote on liquidation, reorganization or other corporate actions with respect to the Fund. Shortly after expiration of the Offer, the Fund intends to hold a special meeting of stockholders to consider liquidation, reorganization or other corporate action with respect to the Fund.

Management has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date the Financial Statements were issued. Based on this evaluation, no disclosures and/or adjustments were required to the Financial Statements as of December 31, 2012.

20

The Thai Capital Fund, Inc.

Financial Highlights

| | | For the Year Ended December 31, | |

| | | 2012 | | 2011 | | 2010 | | 2009 | | 2008 | |

Per Share Operating Performance: | |

Net asset value, beginning of year | | $ | 10.06 | | | $ | 14.89 | | | $ | 11.62 | | | $ | 7.32 | | | $ | 13.27 | | |

Net investment income | | | 0.13 | (a) | | | 0.21 | (a) | | | 0.26 | * | | | 0.13 | * | | | 0.14 | * | |

Net realized and unrealized gains/(losses) on investments and

foreign currencies | | | 3.22 | * | | | (2.29 | )* | | | 6.20 | * | | | 4.34 | * | | | (6.01 | ) | |

Total from investment operations | | | 3.35 | | | | (2.08 | ) | | | 6.46 | | | | 4.47 | | | | (5.87 | ) | |

Distributions from: | |

Net investment income | | | — | | | | (0.09 | ) | | | (0.06 | ) | | | (0.17 | ) | | | (0.08 | ) | |

Net realized gains | | | (0.99 | ) | | | (2.61 | ) | | | (3.05 | ) | | | — | | | | — | | |

Total distributions | | | (0.99 | ) | | | (2.70 | ) | | | (3.11 | ) | | | (0.17 | ) | | | (0.08 | ) | |

Dilutive effect of dividend reinvestment | | | — | | | | (0.05 | ) | | | (0.08 | ) | | | — | | | | — | | |

Net asset value, end of year | | $ | 12.42 | | | $ | 10.06 | | | $ | 14.89 | | | $ | 11.62 | | | $ | 7.32 | | |

Market value, end of year | | $ | 12.11 | | | $ | 8.60 | | | $ | 13.63 | | | $ | 9.83 | | | $ | 6.71 | | |

Total Investment Return Based on(b): | |

Market value | | | 52.09 | % | | | (18.70 | )% | | | 69.70 | % | | | 49.11 | % | | | (50.00 | )% | |

| Net asset value | | | 33.34 | % | | | (12.95 | )% | | | 56.83 | % | | | 61.57 | % | | | (44.14 | )% | |

Ratio to Average Net Assets/Supplementary Data: | |

Net assets, end of year (in millions) | | $ | 44.3 | | | $ | 35.8 | | | $ | 51.2 | | | $ | 36.9 | | | $ | 23.2 | | |

Expenses, after waivers of Administration and Advisory fees

and including Thai taxes applicable to net investment income | | | 2.14 | % | | | 1.99 | % | | | 2.14 | % | | | 2.55 | % | | | 2.65 | % | |

Expenses, after waivers of Administration and Advisory fees

and excluding Thai taxes applicable to net investment income | | | 2.14 | % | | | 1.99 | % | | | 1.94 | % | | | 2.36 | % | | | 2.57 | % | |

Expenses, before waivers of Administration and Advisory fees

and including Thai taxes applicable to net investment income | | | 2.23 | % | | | 2.30 | % | | | 2.65 | % | | | 3.12 | % | | | 3.19 | % | |

Expenses, before waivers of Administration and Advisory fees

and excluding Thai taxes applicable to net investment income | | | 2.23 | % | | | 2.30 | % | | | 2.44 | % | | | 2.93 | % | | | 3.11 | % | |

Net investment income | | | 1.11 | % | | | 1.78 | % | | | 1.82 | % | | | 1.44 | % | | | 1.21 | % | |

Portfolio turnover | | | 126 | % | | | 199 | % | | | 245 | % | | | 71 | % | | | 80 | % | |

* After Thai taxes applicable to net investment income and/or net realized and unrealized gains/(losses).

(a) Based on average shares outstanding.

(b) Total investment return is calculated assuming a purchase of common stock on the opening of the first day and a sale on the closing of the last day of each period reported. Dividends and distributions, if any, are assumed, for purposes of this calculation, to be reinvested at prices obtained under the Fund's dividend reinvestment plan. Total investment return does not reflect brokerage commissions.

21

The Thai Capital Fund, Inc.

Report of Independent Registered Public Accounting Firm

To the Board of Directors and

Shareholders of

The Thai Capital Fund, Inc.:

In our opinion, the accompanying consolidated statement of assets and liabilities, including the consolidated portfolio of investments, and the related consolidated statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of The Thai Capital Fund, Inc (the "Fund") and its wholly owned Investment Plan at December 31, 2012, the results of their operations for the year then ended, the changes in their net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as "financial statements") are the responsibility of the Fund's management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2012 by correspondence with the custodians, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

New York, New York

February 28, 2013

22

The Thai Capital Fund, Inc.

Tax Information (unaudited)

The Fund is required by Subchapter M of the Internal Revenue Code of 1986, as amended, to advise you as to the federal tax status of any distributions received by you during such fiscal year.

Accordingly, the Fund is hereby advising you that on December 21, 2012, the Board of Directors of the Fund declared a total distribution of $0.987071 per share, which represents a $0.412126 per share distribution from short-term capital gain and a $0.574945 per share distribution from long-term capital gain. The dividend was paid on January 11, 2013 to shares of record at the close of business on December 31, 2012. The entire amount of this distribution is reportable as 2012 income.

There is no foreign tax deduction or credit available to stockholders for calendar year 2012.

Stockholders are strongly advised to consult their own tax advisors with respect to the tax consequences of their investment in the Fund.

23

The Thai Capital Fund, Inc.

Information Concerning Directors and Officers (unaudited)

The following table sets forth information concerning each of the Directors and Officers of the Fund. The Directors of the Fund will serve for terms expiring on the date of subsequent Annual Meetings of Stockholders in the year 2013 for Class I Directors, 2014 for Class II Directors and 2015 for Class III Directors, or until their successors are duly elected and qualified.

Name, Address

and Year of Birth

of Directors/Officers | | Principal Occupation

or Employment and

Directorships in

Publicly Held Companies

During Past Five Years | | Director or

Officer of

Fund Since | | Number of

Funds in

Fund

Complex for

Which

Director

Serves (1) | |

Directors | |

Martin J. Gruber

229 South Irving Street

Ridgewood, NJ 07450

Year of Birth: 1937 | | Professor Emeritus and Scholar in Residence at the Leonard N. Stern School of Business, New York University, since 2010. He was previously Professor of Finance, from 1965 to 2010; Director, The Japan Equity Fund, Inc., since 2000; Director, The Singapore Fund, Inc., since 2000; Trustee, DWS Scudder Mutual Funds, from 1992 to 2008; Trustee, C.R.E.F., from 2001 to 2005 and Chairman from 2003 to 2005; Director, National Bureau of Economic Research, since 2005. | | Chairman of the Board since 2011 and Class I Director since 2000 | | | 2 | | |

David G. Harmer

10911 Ashurst Way

Highlands Ranch,

CO 80130-6961

Year of Birth: 1943 | | Retired; Director of Community and Economic Development, City of Ogden, from July 2005 to October 2008; Public Services Department Director, City of Ogden, from February 2005 to July 2005; Executive Director, Department of Community and Economic Development for the State of Utah, from May 2002 to January 2005; Director, The Japan Equity Fund, Inc., since 2000; Director, The Singapore Fund, Inc., since 1996. | | Class I Director since 2000 | | | 2 | | |

Richard J. Herring

327 South Roberts Road

Bryn Mawr, PA 19010

Year of Birth: 1946 | | Jacob Safra Professor of International Banking and Professor, Finance Department, The Wharton School, University of Pennsylvania, since July 1972; Co-Director, Wharton Financial Institutions Center, since July 2000; Director, Lauder Institute of International Management Studies, from July 2000 to June 2006; Director, The Japan Equity Fund, Inc., since 2007; Director, The Singapore Fund, Inc., since 2007; Trustee, DWS Scudder Mutual Funds (and certain predecessor funds), since 1990; Co-chair of the Shadow Financial Regulatory Committee, since 2000; Executive Director of the Financial Economists Roundtable, since 2008. | | Class III Director since 2007 | | | 2 | | |

Rahn K. Porter

944 East Rim Road

Franktown, CO 80116

Year of Birth: 1954 | | Senior Vice President and Treasurer, Qwest Communications International Inc., from June 2008 to April 2011; Senior Vice President of Investor Relations, Qwest Communications International Inc., from September 2007 to June 2008; Vice President of Finance, Qwest Communications International Inc., from March 2003 to September 2007; Director, The Japan Equity Fund, Inc., since 2007; Director, The Singapore Fund, Inc., since 2007. | | Class II Director since 2007 | | | 2 | | |

24

The Thai Capital Fund, Inc.

Information Concerning Directors and Officers (unaudited) (continued)

Name, Address

and Year of Birth

of Directors/Officers | | Principal Occupation

or Employment and

Directorships in

Publicly Held Companies

During Past Five Years | | Director or

Officer of

Fund Since | | Number of

Funds in

Fund

Complex for

Which

Director

Serves (1) | |

Officers | |

Alan Goodson*

Aberdeen Asset Management Inc.

1735 Market St., 32nd Floor

Philadelphia, PA 19103

Year of Birth: 1974 | | Currently, Head of Product US, overseeing both Product Management and Product Development for Aberdeen's registered and unregistered investment companies in the US and Canada. Mr. Goodson is Vice President of Aberdeen Asset Management Inc. and joined Aberdeen in 2000. | | President of the Fund since September 2012 | | | — | | |

Jeffrey Cotton*

Aberdeen Asset Management Inc.

1735 Market St., 32nd Floor

Philadelphia, PA 19103

Year of Birth: 1977 | | Currently, Vice President and Head of Compliance—U.S. for Aberdeen Asset Management Inc. Mr. Cotton joined Aberdeen in 2010. Prior to joining Aberdeen, Mr. Cotton was a Senior Compliance Officer at Old Mutual Asset Management (2009-2010) supporting its affiliated investment advisers and mutual fund platform. Mr. Cotton was also a VP, Senior Compliance Manager at Bank of America/Columbia Management (2006-2009). | | Vice President and Chief Compliance Officer of the Fund since September 2012 | | | — | | |

Andrea Melia*

Aberdeen Asset Management Inc.

1735 Market St., 32nd Floor

Philadelphia, PA 19103

Year of Birth: 1969 | | Currently, Vice President and Head of Fund Accounting for AAMI (since 2009). Prior to joining Aberdeen, Ms. Melia was Director of Fund Administration and accounting oversight for Princeton Administrators LLC, a division of BlackRock Inc. and had worked with Princeton Administrators since 1992. | | Treasurer of the Fund since September 2012 | | | — | | |

Megan Kennedy*

Aberdeen Asset Management Inc.

1735 Market St., 32nd Floor

Philadelphia, PA 19103

Year of Birth: 1974 | | Currently, Head of Product Management for AAMI (since 2009). Ms. Kennedy joined AAMI in 2005 as a Senior Fund Administrator. Ms. Kennedy was promoted to Assistant Treasurer Collective Funds/North American Mutual Funds in February 2008 and promoted to Treasurer Collective Funds/North American Mutual Funds in July 2008. | | Secretary and Vice President of the Fund since September 2012 | | | — | | |

Gary Marshall*

Aberdeen Asset Management Inc.

1735 Market St., 32nd Floor

Philadelphia, PA 19103

Year of Birth: 1961 | | Head of Americas since January 2010, which role includes responsibility for overseeing registered and unregistered investment companies in the US and Canada. Mr. Marshall is the Chief Executive of Aberdeen Asset Management Inc. and joined Aberdeen via the acquisition of Prolific Financial Management in 1997. | | Vice President of the Fund since September 2012 | | | — | | |

Jennifer Nichols*

Aberdeen Asset Management Inc.

1735 Market St., 32nd Floor

Philadelphia, PA 19103

Year of Birth: 1978 | | Currently, Global Head of Legal for Aberdeen (2012). Ms. Nichols serves as a Director and Vice President for AAMI since 2010. She previously served as Head of Legal—Americas from 2010-2012. She joined AAMI in October 2006. | | Vice President of the Fund since September 2012 | | | — | | |

25

The Thai Capital Fund, Inc.

Information Concerning Directors and Officers (unaudited) (concluded)

Name, Address

and Year of Birth

of Directors/Officers | | Principal Occupation

or Employment and

Directorships in

Publicly Held Companies

During Past Five Years | | Director or

Officer of

Fund Since | | Number of

Funds in

Fund

Complex for

Which

Director

Serves (1) | |

Officers | |

Christian Pittard*

Aberdeen Asset Management Inc.

1735 Market St., 32nd Floor

Philadelphia, PA 19103

Year of Birth: 1973 | | Currently, Group Head of Product Development for and Director of Aberdeen Asset Managers Limited (January 2010-present) and Aberdeen Fund Management Limited (January 2010-Present). Previously Director and Vice President (2006-2008), Chief Executive Officer (from October 2005 to September 2006) and employee (since June 2005) of Aberdeen Asset Management Inc.; Member of Executive Management Committee of Aberdeen Asset Management PLC (since August 2005); Managing Director of Aberdeen Asset Managers (C.I.) Limited (from 2000 to June 2005); Managing Director of Aberdeen Private Wealth Management Limited (from 2000 to May 2005). | | Vice President of the Fund since September 2012 | | | — | | |

Lucia Sitar*

Aberdeen Asset Management Inc.

1735 Market St., 32nd Floor

Philadelphia, PA 19103

Year of Birth: 1971 | | Currently, U.S. Counsel for AAMI. Ms. Sitar joined AAMI in July 2007. | | Vice President of the Fund since September 2012 | | | — | | |

John J. O'Keefe*

Aberdeen Asset Management Inc.

1735 Market St., 32nd Floor

Philadelphia, PA 19103

Year of Birth: 1959 | | Mr. O'Keefe joined AAMI as a Fund Accounting Manager in the Accounting Department in October 2012. Prior to that he served as Vice President, Fund Accounting Department of Daiwa Securities Trust Company, since 2000. Mr. O'Keefe previously served as Vice President and Treasurer, The Singapore Fund, Inc., The Thai Capital Fund, Inc. and The Japan Equity Fund, Inc., since June 2000. | | Assistant Treasurer of the Fund since September 2012 | | | — | | |

Heather Hasson*

Aberdeen Asset Management Inc.

1735 Market St., 32nd Floor

Philadelphia, PA 19103

Year of Birth: 1982 | | Currently, Senior Product Manager for Aberdeen Asset Management Inc. Ms. Hasson joined AAMI as a Fund Administrator in November 2006. | | Assistant Secretary of the Fund since September 2012 | | | — | | |

Leonard B. Mackey, Jr.*

31 West 52nd Street

New York, NY 10019-6131

Year of Birth: 1950 | | Consultant, since 2007 and Partner from 1983 to 2007 in the law firm of Clifford Chance US LLP; Assistant Secretary, The Japan Equity Fund, Inc. and The Singapore Fund, Inc., since 2004. | | Assistant Secretary of the Fund since 2004 | | | — | | |

1 "Fund Complex" includes the Fund and The Japan Equity Fund, Inc. which hold themselves out to investors as related companies for purposes of investment and investor services.

* As of September 2012, Messrs. Pittard, Cotton, Marshall, Goodson, O'Keefe and Mackey and Mses. Nichols, Melia, Kennedy, Sitar, and Hasson hold officer positions in The Japan Equity Fund, Inc. which may be deemed to be a part of the same "Fund Complex" as the Fund.

26

The Thai Capital Fund, Inc.

Board Consideration and Approval of Investment Management Agreement (unaudited)

Nature, Extent and Quality of Services

At a meeting (the "Meeting") of the Board of Directors of The Thai Capital Fund, Inc. (the "Fund") held on June 4, 2012, the Board reviewed and considered the nature and extent of the investment advisory services provided by SCB Asset Management Co., Ltd. (the "Investment Manager") under the Investment Management Agreement. The Board reviewed and considered the qualifications of the portfolio manager, the senior administrative managers and other key personnel of the Investment Manager who provide the investment advisory services to the Fund. The Board determined that the portfolio manager and key personnel of the Investment Manager are qualified by education and/or training and experience to perform the services in an efficient and professional manner. The Board concluded that the nature and extent of the advisory services provided were necessary and appropriate for the conduct of the business and investment activities of the Fund. The Board also concluded that the overall quality of the advisory services was satisfactory.

Performance Relative to the Fund's Benchmark

The Board reviewed and considered the Fund's performance for the last one-, three- and five-year periods, as well as for the last 20 quarters, as provided in the materials distributed to the Board prior to the Meeting, compared to the Fund's benchmark, the Stock Exchange of Thailand Index. The Board noted that the Fund's return on its net asset value of the last one-year was lower than the Fund's benchmark while the Fund's returns for the three-year and five-year periods were higher than the Fund's benchmark over the same periods. The Board further noted that, for the last 20 quarters, the Fund's performance varied as compared to the benchmark; however, the Fund generally performed in line with its benchmark. The Board concluded that the Fund's overall performance was competitive with that of its benchmark.

Fees Relative to Other Funds and Accounts Advised by the Investment Manager

The Board reviewed and considered the advisory fee paid by the Fund under the Investment Management Agreement (the "Advisory Fee") and information showing the advisory fees paid by other funds and accounts managed by the Investment Manager as compared to the Advisory Fee. The Board noted that while the Investment Manager does not manage any other U.S. registered funds, it does advise approximately 34 other closed- and open-end funds with advisory fees, with no funds having an advisory fee lower than the fee charged the Fund by the Investment Manager. The Board concluded that the Advisory Fee was appropriate as compared to other funds and accounts advised by the Investment Manager.

Fees and Expenses Relative to Comparable Funds Managed by Other Advisers

The Board reviewed the fee paid by the only other U.S. registered closed-end fund investing in Thailand, The Thai Fund. The Board noted that the advisory fee rate was higher for The Thai Fund than for the Fund despite the fact that the assets of The Thai Fund were significantly greater than that of the Fund. In addition, the Board examined the advisory fees paid to other closed-end funds investing in a single country. While the fees vary widely, the majority of these fees paid in connection with these country funds were in the 1.00% and higher range. The Board concluded that the Fund's Advisory Fee was competitive with these other country funds. The Board did, however, note that the total expense ratio of the Fund was higher than that of The Thai Fund and many other country funds. The Board attributed this higher total expense ratio to the lower net assets of the Fund.

27

The Thai Capital Fund, Inc.

Board Consideration and Approval of Investment Management Agreement (unaudited) (concluded)

Breakpoints and Economies of Scale

The Board reviewed and considered the structure of the Fund's advisory fee schedule under the Investment Management Agreement and noted that it does not include any breakpoints. The Board considered that the Fund is closed-end and that the Fund's assets are not likely to grow with new sales. The Board concluded that economies of scale for the Fund were not a factor that needed to be considered at the current asset levels.

Profitability of the Investment Manager

The Board reviewed and considered a profitability report for the Investment Manager for the last year included in the materials previously provided to the Board. Based on its review of the information it received, the Board concluded that the profits earned by the Investment Manager were not excessive in light of the advisory services provided to the Fund.

Investment Manager Financially Sound and Financially Capable of Meeting the Fund's Needs

The Board considered whether the Investment Manager is financially sound and has the resources necessary to perform its obligations under the Investment Management Agreement. The Board noted that the Investment Manager's operations remain profitable. The Board concluded that the Investment Manager has the financial resources necessary to fulfill its obligations under the Investment Management Agreement.

Historical Relationship Between the Fund and the Investment Manager

The Board also reviewed and considered the historical relationship between the Fund and the Investment Manager, including the organizational structure of the Investment Manager, the policies and procedures formulated and adopted by the Investment Manager for managing the Fund's assets and the Board's confidence in the competence and integrity of the Investment Manager's senior managers and key personnel. The Board concluded that it is beneficial for the Fund to continue its relationship with the Investment Manager.

Other Factors and Current Trends

The Board considered the controls and procedures adopted and implemented by the Investment Manager and monitored by the Fund's Chief Compliance Officer and concluded that the conduct of business by the Investment Manager indicates a good faith effort on its part to adhere to high ethical standards.

General Conclusion

After considering and weighing all of the above factors, the Board concluded it would be in the best interests of the Fund and its stockholders to approve renewal of the Investment Management Agreement for another year.

28

(This page has been left blank intentionally.)

(This page has been left blank intentionally.)

(This page has been left blank intentionally.)

BOARD OF DIRECTORS

Martin J. Gruber, Chairman

David G. Harmer

Richard J. Herring

Rahn K. Porter

OFFICERS

Alan Goodson

President

Jeffrey Cotton

Vice President and Chief Compliance Officer

Andrea Melia

Treasurer

Megan Kennedy

Secretary and Vice President

Gary Marshall

Vice President

Jennifer Nichols

Vice President

Christian Pittard

Vice President

Lucia Sitar

Vice President

John J. O'Keefe

Assistant Treasurer

Heather Hasson

Assistant Secretary

Leonard B. Mackey, Jr.

Assistant Secretary

ADDRESS OF THE FUND

c/o Aberdeen Asset Management Inc.

1735 Market Street, 32nd Floor

Philadelphia, PA 19103

INVESTMENT MANAGER

SCB Asset Management Co., Ltd.

ADMINISTRATOR