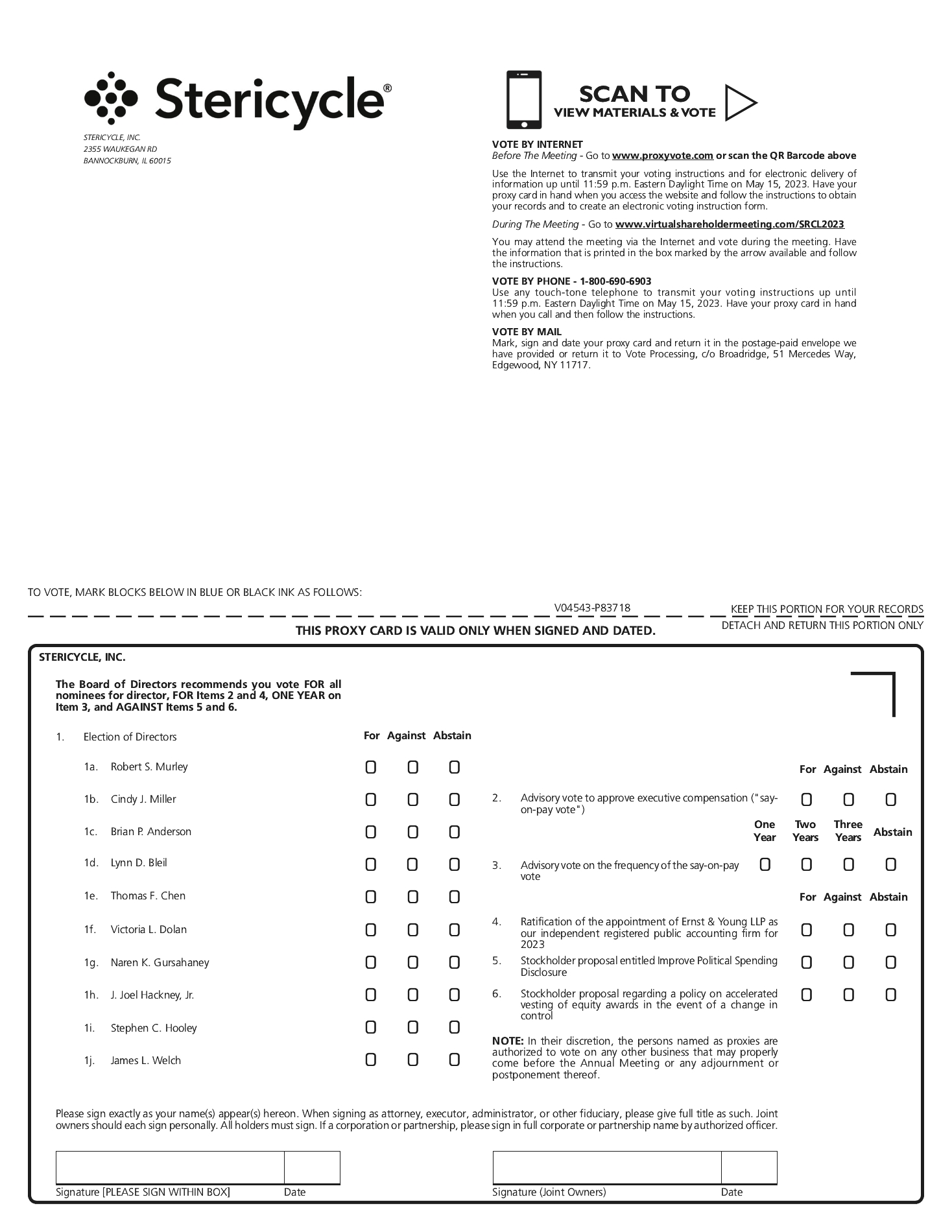

THE COMPANY’S STATEMENT IN OPPOSITION

The Board of Directors has carefully considered this proposal and believes this proposal is unnecessary and is not in the best interests of our stockholders. Consequently, the Board of Directors recommends a vote “AGAINST” this proposal for the reasons described below.

Our Board does not believe that adoption of a rigid policy restricting the acceleration of vesting and requiring partial forfeiture of executive officers' equity awards is in the best interests of the Company or our stockholders. Such a policy could put the Company at a competitive disadvantage in attracting and retaining key executives, it would disrupt the alignment of interests between our management and our stockholders by discouraging pursuit of any transaction that could result in a change in control, and it would unduly restrict our Compensation and Human Capital Committee from designing and administering appropriate compensation arrangements.

The stockholder proposal would result in a competitive disadvantage in attracting and retaining executives.

The proposed policy could jeopardize the objective of our compensation program to attract, retain, reward and incentivize exceptional, talented employees who will lead the Company in the successful execution of its strategy and maximize stockholder value, as it runs contrary to the common practice of the companies with which we compete for executive talent.

Most of the companies with which we compete for executive talent are not restricted in their ability to attract and retain key executives through the use of change in control equity vesting triggers, and in fact, routinely provide for accelerated vesting of equity-based awards upon a change in control. Further, based on our review, a substantial majority of companies, including many of the companies with which we compete for executive talent, fully vest outstanding equity awards upon a termination following a change in control. As a result, implementing the policy as outlined in the proposal could place us at a competitive disadvantage and jeopardize the objective of our executive compensation program to attract, retain, reward and incentivize executives.

In addition, we believe that our existing acceleration of vesting practice will motivate our employees, including our executive officers, to continue to work for us, even if they perceive that a change in control is imminent, which helps reduce the potential loss of key personnel at a time when retaining such employees could have a critical impact on the successful execution of a change in control transaction that would benefit our stockholders. The risk of job loss, coupled with the loss of significant equity awards, may present an unnecessary distraction for our executive officers and could lead to our executive officers beginning to seek new employment while a change in control transaction is being considered, negotiated or is pending.

The stockholder proposal could disrupt the alignment of interests between management and our stockholders during a time of uncertainty.

The Company’s 2021 Long-Term Incentive Plan provides for “double trigger” acceleration of the vesting of equity awards upon a change in control, meaning that vesting of equity awards will only occur if there is both (1) a change in control and (2) an accompanying involuntary termination of service without cause or a termination for good reason, within 24 months after the change in control (other than in the event awards are not continued, assumed, or replaced in connection with a corporate transaction, in which case they will accelerate upon the change in control). In such event, time-based full value awards will fully vest and performance-based full value awards will vest at the target level of performance.

One of the essential purposes of providing executives with equity-based awards is to align their interests with those of our stockholders. The Board believes that accelerating the vesting of equity awards in the event of a double trigger change in control serves to align the interests of our executive officers with those of our stockholders and will incentivize our executive officers to remain objective, avoid conflicts of interest and stay focused on executing a strategic change that could maximize stockholder value.

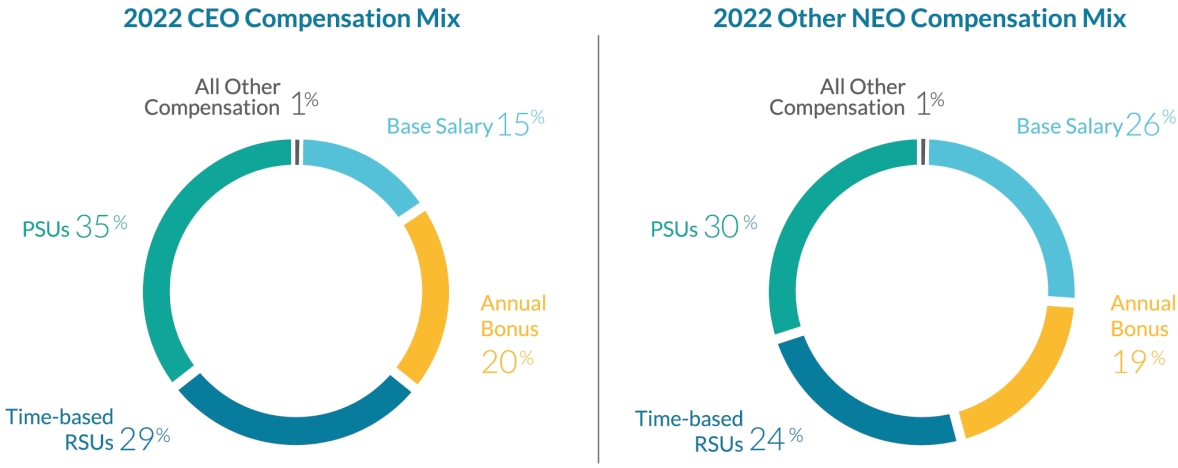

Putting executives’ equity compensation at risk in the event of a change in control could create an inherent conflict of interest if the Board believed a potential change in control transaction was in the best interests of our stockholders. As described under the heading “Compensation Discussion and Analysis” in this proxy statement, a significant percentage of each named executive officer’s long term compensation opportunity is in the form of RSUs and PSUs, with the majority in the form of PSUs. At any time, our executive officers’ unvested equity-based awards represent a significant portion of their total compensation.

The proposal would prohibit us from providing for accelerated vesting of unvested equity awards held by executive officers in connection with a change in control and permit only pro rata vesting of equity awards up to the time of the executive officer's termination of employment following a change in control. In the context of a potential change in control, any perceived lack of protection of the value of unvested equity awards can create conflicts of interest and distractions because of uncertainty that may arise for executives, such as loss of job security. Accelerated equity award vesting can eliminate potential disincentives for executives to forego pursuing a change in control transaction that would benefit stockholders. In particular, accelerated vesting aligns the interests of stockholders and executives by allowing key decision makers to remain objective and focused on maximizing stockholder value up to and following a potential change in control.

Further, the Compensation and Human Capital Committee believes that basing the accelerated vesting of performance-based equity awards on the target level of performance, rather than on a pro rata basis as provided in the stockholder’s proposal, provides more certainty and motivation to our executive officers. Performance-based equity awards are based on performance goals that were established in prior years, often ranging from one to three years prior to when a change in control transaction is being negotiated or is pending. Activities related to a potential change in control transaction can, and often do, disrupt the normal operations of a company, which can make the