- SRCL Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Stericycle (SRCL) DEF 14ADefinitive proxy

Filed: 9 Apr 20, 4:32pm

| ☑ Filed by the Registrant | ☐ Filed by a Party other than the Registrant |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☑ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under Rule 14a-12 |

| ☑ | No fee required. | ||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | ||

| (1) | Title of each class of securities to which transaction applies: | ||

| (2) | Aggregate number of securities to which transaction applies: | ||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

| (4) | Proposed maximum aggregate value of transaction: | ||

| (5) | Total fee paid: | ||

| ☐ | Fee paid previously with preliminary materials. | ||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||

| (1) | Amount Previously Paid: | ||

| (2) | Form, Schedule or Registration Statement No.: | ||

| (3) | Filing Party: | ||

| (4) | Date Filed: | ||

| 1. | election to the Board of Directors (the “Board”) of the twelve nominees for director named in this proxy statement; |

| 2. | an advisory vote to approve executive compensation (the “say-on-pay” vote); |

| 3. | approval of an amendment to the Stericycle, Inc. Employee Stock Purchase Plan increasing the number of shares available for issuance; |

| 4. | ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2020; |

| 5. | a stockholder proposal entitled Special Shareholder Meeting Improvement, if it is properly presented at our Annual Meeting; |

| 6. | a stockholder proposal with respect to amendment of our compensation clawback policy, if it is properly presented at our Annual Meeting; and |

| 7. | any other matter that properly comes before the Annual Meeting. |

| |

| Robert S. Murley | Cindy J. Miller |

| Chairman of the Board | President and Chief Executive Officer |

Stericycle, Inc. - 2020 Proxy Statement | 1 |

| 3 | |

| 5 | |

| 5 | |

| 6 | |

| 7 | |

| 10 | |

| 11 | |

| 13 | |

| 14 | |

| 18 | |

| 18 | |

| 18 | |

| 18 | |

| 20 | |

| 21 | |

| 36 | |

| 37 | |

| 39 | |

| 41 | |

| 44 | |

| 45 | |

| 46 | |

| 48 | |

| 51 | |

| 53 | |

| 54 | |

| 56 | |

| 58 | |

| 62 | |

| 64 | |

| 65 | |

| 68 |

| 2 | Stericycle, Inc. - 2020 Proxy Statement |

| Time and Date: | 8:30 a.m. Central Time on Friday, May 22, 2020 |

| Place: | The completely virtual Annual Meeting will be held at www.virtualshareholdermeeting.com/SRCL2020. |

| Record Date: | March 27, 2020 |

| Voting: | Stockholders as of the record date are entitled to vote. |

| Proxy Materials: | This proxy statement and our annual report to stockholders (which includes a copy of our Annual Report on Form 10-K for the year ended December 31, 2019) are first being made available to stockholders on or about April 9, 2020. |

| Agenda Item | Board Recommendation | Page |

| Election of twelve directors | FOR each Nominee | 5 |

| Advisory vote to approve executive compensation (the “say-on-pay” vote) | FOR | 20 |

| Approval of an amendment to the Stericycle, Inc. Employee Stock Purchase Plan increasing the number of shares available for issuance | FOR | 48 |

| Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2020 | FOR | 51 |

| Stockholder proposal entitled Special Shareholder Meeting Improvement | AGAINST | 54 |

| Stockholder proposal with respect to amendment of our compensation clawback policy | AGAINST | 56 |

Stericycle, Inc. - 2020 Proxy Statement | 3 |

| Nominee | Age | Director Since | Principal Occupation | Current Committees | |

| Robert S. Murley | 70 | 2017 | Chairman of the Board, Stericycle, Inc.; Senior Advisor, Credit Suisse, LLC | None | |

| Cindy J. Miller | 57 | 2019 | President and Chief Executive Officer, Stericycle Inc. | None | |

| Brian P. Anderson | 69 | 2017 | Former Executive Vice President, OfficeMax Incorporated | • Audit (Chair) | |

| Lynn D. Bleil | 56 | 2015 | Former Senior Partner, McKinsey & Company | • Compensation • Nominating and Governance (Chair) | |

| Thomas F. Chen | 70 | 2014 | Former Senior Vice President and President of International Nutrition, Abbott Laboratories | • Compensation • Nominating and Governance | |

| J. Joel Hackney, Jr. | 50 | 2019 | Chief Executive Officer, nThrive, Inc. | • Nominating and Governance | |

| Veronica M. Hagen | 74 | 2018 | Former President and Chief Executive Officer, Polymer Group Inc. | • Audit | |

| Stephen C. Hooley | 57 | 2019 | Former Chairman and Chief Executive Officer, DST Systems, Inc. | • Audit • Compensation | |

| James J. Martell | 65 | – | Former Chairman and Chief Executive Officer, Express-1 (the predecessor company to XPO Logistics, Inc.) | – | |

| Kay G. Priestly | 64 | 2018 | Former Chief Executive Officer, Turquoise Hill Resources Ltd. | • Audit | |

| James L. Welch | 65 | – | Former Chief Executive Officer, YRC Worldwide | – | |

| Mike S. Zafirovski | 66 | 2012 | Former Director, President and Chief Executive Officer, Nortel Networks Corporation | • Compensation (Chair) • Nominating and Governance |

| Named Executive Officer | Salary ($) | Bonus ($) | Stock Awards ($) | Option Awards ($) | Non-Equity Incentive Plan Compensation ($) | All Other Compensation ($) | Total Compensation ($) | |

| Cindy J. Miller | 804,808 | – | 1,344,412 | 844,387 | – | 222,306 | 3,215,913 | |

| Janet H. Zelenka | 331,730 | – | 444,429 | 338,914 | – | 2,654 | 1,117,727 | |

| Daniel V. Ginnetti | 575,000 | – | 462,965 | 350,826 | – | 3,000 | 1,391,791 | |

| Joseph A. Reuter | 353,077 | – | 222,253 | 193,591 | – | 169,078 | 937,999 | |

| David W. Stahl | 358,000 | – | 222,251 | 168,384 | – | 3,000 | 751,635 | |

| Charles A. Alutto | 342,308 | – | – | – | – | 1,473,077 | 1,815,385 | |

| William J. Seward | 276,923 | – | 315,545 | 422,642 | – | 61,038 | 1,076,148 | |

| Kurt M. Rogers | 500,000 | – | 311,102 | 235,748 | – | 3,000 | 1,049,850 |

| 4 | Stericycle, Inc. - 2020 Proxy Statement |

Board Independence | Board Tenure | Diversity of Director Nominees | |||

12 Directors | All Director nominees are independent except the President and CEO | Tenure of Director nominees (years of consecutive service) | 50% | Gender, ethnic or other minority representation | |

| 2.7 years | Average Tenure |  | ||

| |||||

| 6 | Stericycle, Inc. - 2020 Proxy Statement |

Age 70 Experience: Robert S. Murley has served as our Chairman since March 2018. Mr. Murley is a Senior Advisor to Credit Suisse, LLC, a financial services company. From 1975 to April 2012, Mr. Murley was employed by Credit Suisse, LLC and its predecessors. In 2005, he was appointed Chairman of Investment Banking in the Americas. Prior to that time, Mr. Murley headed the Global Industrial and Services Group within the Investment Banking Division, as well as the Chicago investment banking office. He was named a Managing Director in 1984 and appointed a Vice Chairman in 1998. Mr. Murley is a member of the board of directors of Health Insurance Innovations Inc., on privately held Brown Advisory Incorporated, and on the board of advisors of Harbour Group. He was formerly on the board of directors of Stone Energy Corporation and Apollo Education Group, Inc. Mr. Murley is an Emeritus Charter Trustee of Princeton University, a Trustee and the former Chairman of the Board of the Educational Testing Service in Princeton, New Jersey, is Vice Chairman of the Board of the Ann & Robert Lurie Children’s Hospital of Chicago and Chair of the Board of the Lurie Children’s Foundation, is a Trustee of the Museum of Science & Industry in Chicago, Illinois, and is Chairman of the Board of the UCLA Anderson Board of Advisors. |

Age 57 Experience: Ms. Miller joined Stericycle as President and Chief Operating Officer in October 2018. She was named President and Chief Executive Officer effective May 2019. Ms. Miller previously served as President, Global Freight Forwarding for United Parcel Service (“UPS”), a multinational package delivery and supply chain management company, from April 2016 to September 2018 and as President of UPS’s European region from March 2013 to March 2016. |

Age 69 Experience: Mr. Anderson served as Senior Vice President and Chief Financial Officer of OfficeMax Incorporated from 2004 to 2005 and as Senior Vice President and Chief Financial Officer of Baxter International from 1997 to 2004. He joined Baxter in 1991, as Vice President, Corporate Audit, and became Corporate Controller in 1993 and then Vice President, Finance in 1997. Before joining Baxter, he spent 15 years with Deloitte in the Chicago office and the Washington, D.C. office as an Audit Partner. He is a member of the Board of Directors of W. W. Grainger, Inc., PulteGroup, Inc., and James Hardie Industries plc. He currently serves as Chairman of the Audit Committee of James Hardie Industries plc, and is the former Chairman of the Nemours Foundation, Chairman of the Audit Committee of the Pulte Group, Inc. and Lead Director and Audit Committee Chairman of W. W. Grainger, Inc. Mr. Anderson serves on The Governing Board of the Center for Audit Quality and served on the Board of A.M. Castle & Co. from 2005 to 2016, as Audit Committee Chairman (2005-2010) and Chairman of the Board 2010-2016. |

Age 56 Experience: Ms. Bleil was the leader of the West Coast Healthcare Practice of McKinsey & Company (“McKinsey”), a management consulting firm. Ms. Bleil was also a leader of McKinsey’s worldwide Healthcare Practice. She retired in November 2013 as a Senior Partner (Director) in the Southern California Office of McKinsey. During her more than 25 years with McKinsey, she worked exclusively within the healthcare sector, advising senior management and boards of leading companies on corporate and business unit strategy, mergers and acquisitions and integration, marketing and sales, public policy and organization. Ms. Bleil also serves as a director of Amicus Therapeutics Inc., a biotechnology company, Alcon AG, Sonova Holdings AG, a global leader in hearing aids and cochlear implants, and Intermountain Healthcare’s Park City Medical Center, a non-profit healthcare organization. She was formerly a director of DST Systems, Inc. |

Stericycle, Inc. - 2020 Proxy Statement | 7 |

Age 70 Experience: Mr. Chen served as senior vice president and president of international nutrition of Abbott Laboratories (“Abbott”) before retiring in 2010. During his 22-year career at Abbott, Mr. Chen served in a number of roles with expanding responsibilities, primarily in Pacific/Asia/Africa where he oversaw expansion into emerging markets. Prior to Abbott, he held several management positions at American Cyanamid Company, which later merged with Pfizer, Inc. Mr. Chen currently serves as a director of Baxter International Inc. and an advisor to Cooperation Fund, a partnership between Goldman Sachs and the sovereign fund, China Investment Corporation, to bolster U.S. manufacturers’ market presence in China. Mr. Chen previously served as a director of Cyanotech Corporation. |

Age 50 Experience: Mr. Hackney has been the Chief Executive Officer and a director of nThrive, Inc., a revenue cycle management company providing medical billing and coding, business analytics and advisory services, since January 2016. Previously, he was the Chief Executive Officer and a director of AVINTV from June 2013 to November 2016. |

VERONICA M. HAGEN |

Age 74 Experience: From 2007 until her retirement in 2013, Ms. Hagen served as Chief Executive Officer of Polymer Group, Inc., a global engineering materials company, and served from 2007 to 2015 as a Director. She also served as President of Polymer Group, Inc. from January 2011 until her retirement in 2013. Prior to joining Polymer Group, Inc., Ms. Hagen was the President and Chief Executive Officer of Sappi Fine Paper, a division of Sappi Limited. She has served as Vice President and Chief Customer Officer at Alcoa Inc. and owned and operated Metal Sales Associates. She is a Director of American Water Works Company, Inc., and Newmont Mining Corporation. She previously served as a director of The Southern Company. |

Age 57 Experience: Mr. Hooley served as Chairman, Chief Executive Officer and President of DST Systems, Inc., a provider of advisory, technology and operations outsourcing to the financial and healthcare industries, from July 2014 to April 2018. He was Chief Executive Officer and President of DST Systems from September 2012 to July 2014 and President and Chief Operating Officer from July 2009 to September 2012. He was previously the President and Chief Executive Officer of Boston Financial Data Services. |

| 8 | Stericycle, Inc. - 2020 Proxy Statement |

Age 65 Experience: Mr. Martell is a logistics veteran with 40 years of industry experience previously serving as Chairman and Chief Executive Officer of Express-1, the predecessor company of XPO Logistics, Inc., a company engaged in freight logistics. Mr. Martell served on the XPO board until 2016. Mr. Martell joined Express-1 after serving as Chief Executive Officer of SmartMail, which he sold to DHL, from 1999 to 2006. Before that, Mr. Martell was a founding senior executive of UTi Worldwide, a global transportation and logistics company, which he managed from 1995 to 2000. Prior to UTi Worldwide, Mr. Martell spent nearly 14 years in various management positions at FedEx and UPS. Mr. Martell has served on the boards of multiple private logistics and transportation companies and has served on the board of publicly-traded Mobile Mini since 2010. |

Age 64 Experience: Ms. Priestly served as Chief Executive Officer of Turquoise Hill Resources Ltd., an international mining company, from May 2012 until her retirement in December 2014. She previously served as Chief Financial Officer of Rio Tinto Copper, a division of the Rio Tinto Group (“Rio Tinto”), from 2008 until her appointment as Chief Executive Officer of Turquoise Hill Resources in 2012. From 2006 to 2008, she was Vice President, Finance and Chief Financial Officer of Rio Tinto’s Kennecott Utah Copper operations. She previously spent over 24 years with global professional services firm Arthur Anderson, where she provided tax, consulting and M&A services to global companies across many industries. She is a director of TechnipFMC plc and Alacer Gold Corp. She formerly served as a director of New Gold Inc., FMC Technologies, Inc. SouthGobi Resources Ltd., Turquoise Hill Resources and Stone Energy Corporation. |

Director Nominee Director NomineeAge 65 Experience: Before retiring in 2018, Mr. Welch served as Chief Executive Officer of YRC Worldwide, a holding company of several brands focused on shipping and supply chain solutions in North America. In 2011, Mr. Welch re-joined YRC Worldwide from same-day transportation provider Dynamex Inc., where he had served as President and CEO since 2008. Prior to that, he served as a Consultant at Goldman Sachs Special Situations Group. Mr. Welch started his career in 1978 at Yellow Transportation, where he spent over 28 years and held multiple operations and sales positions across the organization, including President and CEO for seven years. Mr. Welch currently sits on the boards of Schneider National, where he has served since 2018, and SkyWest, Inc., where he has served since 2007. He previously sat on the boards of YRC Worldwide from August 2011 to July 2018, Roadrunner Transportation Systems from 2010 to 2011, and Spirit Aerosystems Holdings from 2008 to 2011. |

Director Since November 2012 Director Since November 2012Age 66 Experience: Mr. Zafirovski is the founder and President of The Zaf Group LLC, a management consulting and investment firm established in November 2012. Mr. Zafirovski has also served as an executive advisor to The Blackstone Group, a private investment banking company, since October 2011. From November 2005 to August 2009, Mr. Zafirovski served as President, Chief Executive Officer and a director of Nortel Networks Corporation. Prior to that, he was the President, Chief Operating Officer and a director of Motorola, Inc. from July 2002 to January 2005, and remained a consultant to and a director of Motorola until May 2005. He served as Executive Vice President and President of the personal communications sector of Motorola from June 2000 to July 2002. Prior to joining Motorola, Mr. Zafirovski spent nearly 25 years with General Electric Company, where he served in management positions, including 13 years as President and Chief Executive Officer of five businesses in the consumer, industrial and financial services areas, his most recent being President and Chief Executive Officer of GE Lighting from July 1999 to May 2000. Mr. Zafirovski also serves as a director of The Boeing Company and Apria Healthcare Group Inc. |

The Board of Directors recommends a vote “FOR” the election of these twelve Director nominees. Proxies solicited by the Board will be so voted unless stockholders specify a different choice. |

Stericycle, Inc. - 2020 Proxy Statement | 9 |

| • | public company board service and governance expertise, which provides directors with a solid understanding of their extensive and complex oversight responsibilities and furthers our goals of greater transparency, accountability for management and the Board, and protection of stockholder interests; |

| • | operational expertise, which gives directors specific insight into, and expertise that will foster active participation in the oversight, development and implementation of our operating plan and business strategy; |

| • | transportation and logistics expertise, as our business involves management of an extensive fleet. A deep understanding of routing, transportation and logistics brings insights to drive best practices and operational efficiencies; |

| • | financial reporting, compliance and risk management expertise, which enables directors to analyze our financial statements, capital structure and complex financial transactions and oversee our accounting, financial reporting and enterprise risk management; and |

| • | healthcare industry expertise, which is vital in understanding and reviewing our strategy as the majority of our customer base is healthcare. |

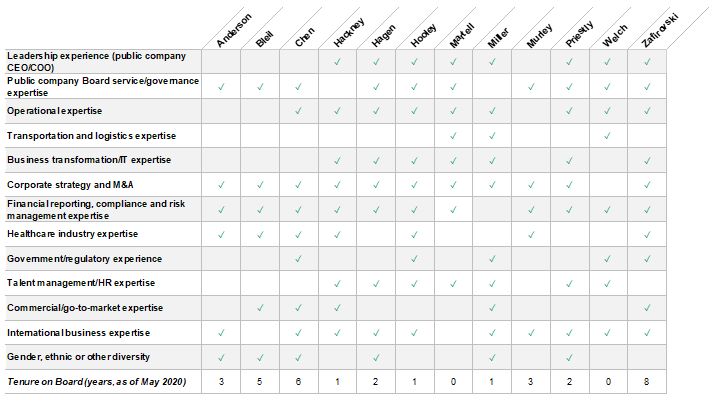

The following table highlights each nominee’s specific skills, knowledge and experiences in these areas. A particular director may possess additional skills, knowledge or experience even though they are not indicated below: |

| 10 | Stericycle, Inc. - 2020 Proxy Statement |

Stericycle, Inc. - 2020 Proxy Statement | 11 |

| 12 | Stericycle, Inc. - 2020 Proxy Statement |

| Director | Compensation Committee | Audit Committee | Nominating and Governance Committee | Operations and Safety Committee(1) |

Robert S. Murley(2) | ||||

Brian P. Anderson(3) | C | |||

| Lynn D. Bleil | X | C | ||

| Thomas F. Chen | X | X | ||

| J. Joel Hackney, Jr. | X | |||

| Veronica M. Hagen | X | X | ||

| Stephen C. Hooley | X | X | X | |

| Cindy J. Miller | C | |||

Kay G. Priestly(3) | X | |||

| Mike S. Zafirovski | C | X |

| X | Member |

| C | Committee Chair |

| (1) | The Operations and Safety Committee will be formed following the Annual Meeting and is expected to be comprised of the members noted above as well as Messrs. Martell and Welch. |

| (2) | Mr. Murley serves as the independent Chairman of the Board. |

| (3) | The Board of Directors has determined that Mr. Anderson, the Chair of the Audit Committee, and Ms. Priestly are “audit committee financial experts” as defined in the applicable SEC rules. |

Stericycle, Inc. - 2020 Proxy Statement | 13 |

| 14 | Stericycle, Inc. - 2020 Proxy Statement |

Stericycle, Inc. - 2020 Proxy Statement | 15 |

| 16 | Stericycle, Inc. - 2020 Proxy Statement |

| • | The Audit Committee and our company’s management have had additional and more frequent communications regarding our financial reporting, internal control environment and internal controls training to control owners. |

| • | We performed walkthroughs of our significant processes to identify and minimize the risks of material misstatement. We |

| • | We improved consistency in change management supported by standard operating procedures to govern the authorization, testing and approval of changes to systems supporting all of the Company’s internal control processes. |

| • | We expanded our finance, accounting, information technology, and technical accounting teams through the addition of experienced and qualified personnel. |

| • | We continued to expand our use of specialists to assist with highly complex and technical areas of accounting, valuation and new accounting standards adoption. |

| • | We formalized IT Global Risk and Compliance office responsibilities within the IT function to provide governance, drive accountability and perform GITC compliance monitoring. |

| • | We designed and implemented a technology enabled user entitlement review process. |

| • | We delivered additional internal controls training. |

Stericycle, Inc. - 2020 Proxy Statement | 17 |

| • | Chairman of the Board – $50,000 cash and $50,000 in RSUs |

| • | Chair of the Audit Committee – $20,000 |

| • | Chair of the Compensation Committee – $15,000 |

| • | Chair of the Nominating and Governance Committee – $12,500 |

| 18 | Stericycle, Inc. - 2020 Proxy Statement |

| Name | Fees Earned or Provided in Cash(1) ($) | Stock Awards(2) ($) | Total ($) |

| Robert S. Murley | 130,000 | 174,960 | 304,960 |

| Brian P. Anderson | 100,000 | 124,992 | 224,992 |

| Lynn D. Bleil | 46,250 | 171,207 | 217,457 |

| Thomas F. Chen | 80,000 | 124,992 | 204,992 |

| J. Joel Hackney Jr. | 50,545 | 124,992 | 175,537 |

| Veronica M. Hagen | 80,000 | 124,992 | 204,992 |

| Stephen C. Hooley | 10,545 | 164,972 | 175,517 |

| Kay G. Priestly | 80,000 | 124,992 | 204,992 |

| Mike S. Zafirovski | 87,500 | 124,992 | 212,492 |

| (1) | Ms. Bleil converted $46,250 of cash compensation into 904 DSUs, and Mr. Hooley converted $40,000 of his cash compensation into 782 DSUs. |

| (2) | Stock awards are valued in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718, based on the closing price of our common stock on the date of the grant. As of December 31, 2019, our non-employee directors held the following outstanding awards: |

Name | Stock Options | RSUs | DSUs |

| Robert S. Murley | 4,887 | 3,904 | 4,264 |

| Brian P. Anderson | 4,887 | 2,865 | 1,506 |

| Lynn D. Bleil | 16,522 | – | 5,586 |

| Thomas F. Chen | 21,720 | 2,604 | 1,506 |

| J. Joel Hackney, Jr. | – | 2,604 | – |

| Veronica M. Hagen | – | 2,604 | – |

| Stephen C. Hooley | – | – | 3,386 |

| Kay G. Priestly | – | 2,604 | – |

| Mike S. Zafirovski | 32,602 | – | 6,080 |

Stericycle, Inc. - 2020 Proxy Statement | 19 |

| 20 | Stericycle, Inc. - 2020 Proxy Statement |

| Stericycle’s Transformational Journey |

| 1. | Portfolio rationalization |

| 2. | Debt reduction and leverage improvement |

| 3. | Quality of revenue |

| 4. | Operational efficiencies |

| 5. | ERP implementation |

A New Leadership Team to Drive Change |

| • | Joseph A. Reuter was named Executive Vice President and Chief People Officer in January to fill a vacant position following the departure of Brenda R. Frank. |

| • | Daniel V. Ginnetti, former Chief Financial Officer, was named Executive Vice President, International in February following the departure of Robert Guice. |

Stericycle, Inc. - 2020 Proxy Statement | 21 |

| • | Richard Moore was named Executive Vice President, North American Operations in February to lead our U.S. and Canada field operations, a newly created role. |

| • | S. Cory White was named Executive Vice President, Communication and Related Services (“C&RS”) in April to drive stabilization in the C&RS business and support the subsequent divestitures of three C&RS businesses. Ruth-Ellen Abdulmassih, former Executive Vice President, C&RS departed the company at the end of January 2019. |

| • | The position of Executive Vice President and Chief Commercial Officer was created during February to advance global sales and marketing efforts. This role was originally filled by Bill Seward, who departed the company in September 2019, at which time Cory White was named Chief Commercial Officer. |

| • | Dominic Culotta was named Executive Vice President and Chief Engineer in April, a newly created role to drive centralization and standardization across our organization with specific emphasis on field operations. |

| • | Janet Zelenka joined as Executive Vice President and Chief Financial Officer in June. |

Our 2019 Named Executive Officers |

| Name | Title (as of December 31, 2019) | |

| Cindy J. Miller | President and Chief Executive Officer | |

| Janet H. Zelenka | Executive Vice President and Chief Financial Officer | |

| Daniel V. Ginnetti | Currently Executive Vice President, International Former Executive Vice President and Chief Financial Officer | |

| Joseph A. Reuter | Executive Vice President and Chief People Officer | |

| David W. Stahl | Executive Vice President and Chief Information Officer | |

| Charles A. Alutto | Former Chief Executive Officer | |

| William J. Seward | Former Executive Vice President and Chief Commercial Officer | |

| Kurt M. Rogers | Executive Vice President and General Counsel |

Stericycle’s Executive Compensation Philosophy |

| 1. | To attract, motivate, and retain highly qualified executive officers; and |

| 2. | To structure the bulk of executive compensation to be dependent on Stericycle’s attainment of measurable Company-wide performance targets and sustained growth in our stock price so that executives benefit only if our stockholders benefit. |

| What We Do: | What We Don’t Do: | |||

| ✓ | Deliver a significant percentage of target annual compensation as variable compensation tied to performance | ✗ | No re-pricing of underwater stock options | |

| ✓ | Align executives’ interests with stockholders’ interests through long-term incentive compensation paid in equity | ✗ | No excessive perquisites or personal benefits | |

| ✓ | Maintain an executive compensation clawback policy | ✗ | No employment contracts for NEOs | |

| ✓ | Cap annual and long-term incentive awards | |||

| ✓ | Retain an independent compensation consultant to advise the Compensation Committee | |||

| ✓ | Prohibit officers and directors from engaging in hedging, pledging or short sale transactions involving our securities | |||

| ✓ | Conduct a regular review of proxy advisor policies and corporate governance best practices | |||

| ✓ | Maintain stock ownership and retention guidelines | |||

| ✓ | Provide “double-trigger” vesting of equity awards in connection with a change in control | |||

Our Executive Compensation Program for 2019 |

Stericycle, Inc. - 2020 Proxy Statement | 23 |

Compensation Element | Form of Compensation | Performance and Vesting Criteria | Purpose | ||

| Base Salary | Cash | N/A | Provide fixed compensation to attract and retain key executives and to offset external factors that may impact incentive pay | ||

Annual Cash Bonus | Cash | Annual Adjusted EBITDA and Adjusted ROIC objectives | Incentivize executives to achieve annual performance goals and be rewarded commensurately | ||

Long-term Incentives | Stock Options (1/3) Time-based RSUs (1/3) Performance-based RSUs (1/3) | Three-year ratable vesting based on continuous service Vest, or not, in three equal annual installments depending on achievement of pre-established performance metrics | Incentivize long-term value creation and align management’s interests with those of our stockholders |

Outcomes of 2019 Incentive Compensation |

| A. | Annual Cash Performance Bonuses |

| B. | Performance-based Restricted Stock Units (PRSUs) |

| 24 | Stericycle, Inc. - 2020 Proxy Statement |

Executive Compensation Program Changes for 2020 Align with Our Transformation |

| Plan Impacted | Key Changes | Reasons | ||

Annual cash bonus | Most NEO cash bonus opportunities were unchanged compared to 2019; two changes were made effective February 9, 2020 – for the current CEO (Miller) and the current CFO (Zelenka) | To keep target cash compensation aligned with the median of our peer group and reflect company performance | ||

Selected new metrics of EBIT1 (40%), Free Cash Flow1 (35%), Safety Improvements (15%), and Service (10%) | To focus the emphasis on key metrics that represent Company performance and drive stockholder value | |||

Stock options | Eliminated stock options from the long-term incentive program | To align the long-term incentive program with peer group benchmarks and stockholder feedback indicating a desire for a higher concentration of performance-based awards | ||

Time-based RSUs | Adjusted the time-based RSU component of the total long-term incentive award to 45% of the total long-term incentive award | To allow for a long-term incentive mix that is consistent with market norms but weighted less heavily than PSUs | ||

Performance- based RSUs (PRSUs)/ Performance Stock Units (PSUs) | Replaced the performance-based RSU component of the long-term incentive award with PSUs which allow for payouts above 100% if achievement of performance goals exceeds targets and weighted the PSUs at 55% of the total long-term incentive award Added a second, equally-weighted performance metric to supplement EPS1 in the form of ROIC less goodwill and included an rTSR modifier to be measured over the 3-year period Changed vesting from a 3-year ratable schedule to a 3-year cliff vesting schedule which pays out only at the end of the 3-year period | Move from PRSUs to PSUs provides incentive for exceeding results; weighting at 55% results in over half of the long-term incentive to be linked to company performance goals Growth and return are classic value creation metrics and two metrics (rather than one) are considered better indicators of financial performance; rTSR modifier further aligns Stericycle payouts with stockholder return Ratable vesting for PSUs is uncommon and cliff vesting creates additional incentive for retention of NEOs | ||

Peer group | Peer group was adjusted to remove eight companies and add one company | Peer group analysis showed that the previous peer group contained a number of companies that were no longer categorized as a good industry fit; the revised peer group prioritizes quality over quantity and is a better benchmark for the Company |

Stericycle, Inc. - 2020 Proxy Statement | 25 |

Compensation Committee |

Decision-Making Processes |

| Compensation Consultant |

| Peer Group |

| 26 | Stericycle, Inc. - 2020 Proxy Statement |

| Company Name | 2019 Revenue ($MM) | Employees | Industry Focus | |||

| ABM Industries Incorporated | 6,499 | 140,000 | Environmental and Facilities Services | |||

| Advanced Disposal Services, Inc. | 1,623 | 6,200 | Environmental and Facilities Services | |||

| Cintas Corporation | 6,892 | 45,000 | Diversified Support Services | |||

| Clean Harbors, Inc. | 3,412 | 14,400 | Environmental and Facilities Services | |||

| Covanta Holding Corporation | 1,870 | 4,000 | Environmental and Facilities Services | |||

| Ecolab Inc. | 14,906 | 50,200 | Specialty Chemicals | |||

| Iron Mountain Incorporated | 4,263 | 5,000 | Business Services | |||

| Pitney Bowes, Inc. | 3,205 | 11,000 | Office Services and Supplies | |||

| Republic Services, Inc. | 10,299 | 36,000 | Environmental and Facilities Services | |||

| Tetra Tech, Inc. | 2,390 | 20,000 | Environmental and Facilities Services | |||

| Waste Connections, Inc. | 5,389 | 18,204 | Environmental and Facilities Services | |||

| Waste Management, Inc. | 15,455 | 44,900 | Environmental and Facilities Services | |||

| Stericycle, Inc. | 3,309 | 19,500 | Environmental and Facilities Services | |||

| Median | 4,826 | 22,500 |

Stericycle, Inc. - 2020 Proxy Statement | 27 |

| Base Salaries |

| 2019 Salary ($) | 2018 Salary ($) | 2017 Salary ($) | ||

| Ms. Miller | 625,000/900,0001 | 625,000 | N/A2 | |

| Ms. Zelenka | 575,000 | N/A3 | N/A3 | |

| Mr. Ginnetti | 575,000 | 550,000 | 380,000 | |

| Mr. Reuter | 360,000 | N/A3 | N/A3 | |

| Mr. Stahl | 358,000 | N/A3 | N/A3 | |

| Mr. Alutto | 1,000,000 | 1,000,000 | 585,000 | |

| Mr. Seward | 400,000 | N/A3 | N/A3 | |

| Mr. Rogers | 500,000 | 400,000 | N/A2 |

| Annual Cash Performance Bonuses |

| 28 | Stericycle, Inc. - 2020 Proxy Statement |

Adjusted EBITDA Cash Bonus Program for 2019 70% Total Cash Bonus | Adjusted ROIC Cash Bonus Program for 2019 30% Total Cash Bonus | |||||

Percentage of Award Payout | Percent Adjusted EBITDA Attainment | Adjusted EBITDA Target (in $ millions) | Percentage of Award Payout | Adjusted ROIC Target | ||

| Minimum | 25% | 94.7% | 660 | 50% | 6.14% | |

| Target | 100% | 100% | 697 | 100% | 7.06% | |

| Maximum | 200% | 107.6% or more | 750 or more | 200% | 7.98% or more | |

| Base Salary ($) | Cash Performance Bonus Percentage | ||

Ms. Miller (1) | 625,000 900,000 | 90% | |

| Ms. Zelenka | 575,000 | 75% | |

| Mr. Ginnetti | 575,000 | 75% | |

| Mr. Reuter | 360,000 | 60% | |

| Mr. Stahl | 358,000 | 60% | |

| Mr. Alutto | 1,000,000 | 100% | |

| Mr. Seward | 400,000 | 60% | |

| Mr. Rogers | 500,000 | 70% |

| Long-Term Equity Incentive Awards |

Stericycle, Inc. - 2020 Proxy Statement | 29 |

Number of Stock Options | Grant Date Fair Value | ||

| Ms. Miller | 55,476 | $ 844,386 | |

| Ms. Zelenka | 24,488 | 338,914 | |

| Mr. Ginnetti | 24,654 | 350,826 | |

| Mr. Reuter | 15,148 | 193,591 | |

| Mr. Stahl | 11,833 | 168,384 | |

| Mr. Alutto | – | – | |

| Mr. Seward | 27,842 | 422,642 | |

| Mr. Rogers | 16,567 | 235,748 |

Time-based Restricted Stock Units | Grant Date Fair Value | ||

| Ms. Miller | 16,080 | $ 816,617 | |

| Ms. Zelenka | 7,098 | 333,322 | |

| Mr. Ginnetti | 7,146 | 347,224 | |

| Mr. Reuter | 3,787 | 166,666 | |

| Mr. Stahl | 3,430 | 166,664 | |

| Mr. Alutto | – | – | |

| Mr. Seward | 3,421 | 176,626 | |

| Mr. Rogers | 4,802 | 233,329 |

| 30 | Stericycle, Inc. - 2020 Proxy Statement |

Performance-based Restricted Stock Units | Grant Date Fair Value | ||

| Ms. Miller | 31,858 | $ 527,795 | |

| Ms. Zelenka | 7,098 | 111,107 | |

| Mr. Ginnetti | 7,146 | 115,741 | |

| Mr. Reuter | 3,430 | 55,587 | |

| Mr. Stahl | 3,430 | 55,587 | |

| Mr. Alutto | – | – | |

| Mr. Seward | 8,575 | 138,919 | |

| Mr. Rogers | 4,802 | 77,773 |

Stericycle, Inc. - 2020 Proxy Statement | 31 |

Compensation Program for 2020 |

| 32 | Stericycle, Inc. - 2020 Proxy Statement |

2020 Executive Compensation Plans |

| Base Salary | Cash Performance Bonus Percentage | Granted Performance Share Units | Granted Time-based RSUs | |

| Ms. Miller | $900,000 | 125% | 37,335 | 30,546 |

| Ms. Zelenka | $575,000 | 90% | 17,136 | 14,021 |

| Mr. Ginnetti | $575,000 | 75% | 10,733 | 8,782 |

| Mr. Reuter | $360,000 | 60% | 8,107 | 6,633 |

| Mr. Stahl | $358,000 | 60% | 6,301 | 5,155 |

| Mr. Rogers | $300,000 | 70% |

(1) | Mr. Rogers' annualized base salary will be $300,000 through September 30,2020. Beginning October 1,2020, his annualized base salary will increase to $500,000. Subject to Board approval, Mr. Rogers will also receive a new-hire grant of RSUs with a grant date fair value of approximately $548,000 and an annual equity grant with a grant date fair value of $875,000 with 55% of such amount consisting of PSUs and 45% consisting |

Executive Severance and Change in Control Plan |

| • | An amount equal to the actual annual incentive the executive would have been paid had the executive remained employed on the payment date applicable to then current employees, prorated based on the executive’s period of service through the executive’s termination date. |

| • | An amount equal to the sum of the executive’s base salary and target annual incentive, each determined as of the termination date, multiplied by the applicable “severance multiple.” |

| • | For the Chief Executive Officer, the severance multiple is two. |

| • | For all other executive officers, the severance multiple is one. |

| • | Non-qualified deferred compensation benefits and employee welfare benefits pursuant to the terms of the applicable plans and policies. |

| • | Payment of or reimbursement for the cost of COBRA premiums in connection with the executive’s medical, vision, prescription and dental coverage in effect as of the date of termination, to the extent such premiums exceed the premiums paid for similar provided coverage by active employees, for up to 18 months. |

| • | Reimbursement for outplacement benefits up to $25,000. |

| • | An amount equal to the executive officer’s target annual incentive, prorated based on the executive officer’s period of service through the executive officer’s termination date. |

| • | An amount equal to the sum of the executive officer’s base salary and target annual incentive, each determined as of the termination date, multiplied by the applicable “severance multiple.” |

| • | For the Chief Executive Officer, the severance multiple is three. |

| • | For all other executive officers, the severance multiple is two. |

Stericycle, Inc. - 2020 Proxy Statement | 33 |

Retirement Plans and Deferred Compensation Arrangements |

Perquisites and Personal Benefits |

Stock Ownership Guidelines |

| 2019 Stock Ownership Guideline | 2020 Stock Ownership Guideline | |

| Chief Executive Officer | Four times annual base salary | Five times annual base salary |

| Other NEOs | Three times annual base salary | Three times annual base salary |

| Non-Employee Directors | Four times annual cash retainers | Five times annual cash retainers |

| • | The CEO must hold 75% of the net shares acquired upon the vesting or exercise of any equity awards (“Net Profit Shares”) until the minimum position requirement has been achieved; and |

| • | The other NEOs must hold 50% of their respective Net Profit Shares until the minimum position requirement has been achieved. |

| • | The non-employee directors must retain 75% of their Net Profit Shares until the minimum position requirement has been achieved. |

| • | Shares owned outright (including employee stock purchase plan shares and securities convertible into shares of common stock on an as-converted basis) by the executive officer or director or any of such person’s immediate family members residing in the same household; |

| • | Shares held in trust for the benefit of the executive officer or director or such person’s family; |

| • | Shares held in our employee benefit plans, including the 401(k) Savings Plan; |

| • | Shares obtained through stock option exercises and the in-the-money value of vested and unvested stock options; |

| • | Shares of unvested restricted stock and RSUs; and |

| 34 | Stericycle, Inc. - 2020 Proxy Statement |

| • | Shares of vested or unvested restricted stock or RSUs which are deferred under one of Stericycle’s deferred compensation plans (deferred stock units). |

Anti-Hedging and Anti-Pledging Policy |

Clawback Policy |

Stericycle, Inc. - 2020 Proxy Statement | 35 |

| Compensation Committee | |

| Mike S. Zafirovski, Chairman | |

| Lynn D. Bleil | |

| Thomas F. Chen | |

| Stephen C. Hooley |

| 36 | Stericycle, Inc. - 2020 Proxy Statement |

| Name and Principal Position | Year | Salary ($) | Bonus ($) | Stock Awards(1) ($) | Option Awards(2) ($) | Non-Equity Incentive Plan Compensation(3) ($) | All Other Compensations(4) ($) | Total ($) | |||||||||

Cindy J. Miller President and Chief Executive Officer | 2019 | 804,808 | – | 1,344,412 | 844,387 | – | 222,306 | 3,215,913 | |||||||||

| 2018 | 156,250 | – | 822,209 | 894,995 | – | 33,526 | 1,906,980 | ||||||||||

Janet H. Zelenka Executive Vice President and Chief Financial Officer | 2019 | 331,730 | – | 444,429 | 338,914 | – | 2,654 | 1,117,727 | |||||||||

Daniel V. Ginnetti(5) Executive Vice President, International | 2019 | 575,000 | – | 462,965 | 350,826 | – | 3,000 | 1,391,791 | |||||||||

| 2018 | 550,000 | – | 591,531 | 482,280 | 99,743 | 3,000 | 1,726,554 | ||||||||||

| 2017 | 550,000 | – | 555,444 | 489,363 | – | 3,000 | 1,597,807 | ||||||||||

Joseph A. Reuter Executive Vice President and Chief People Officer | 2019 | 353,077 | – | 222,253 | 193,591 | – | 169,078 | 937,999 | |||||||||

David W. Stahl Executive Vice President and Chief Information Officer | 2019 | 358,000 | – | 222,251 | 168,384 | – | 3,000 | 751,635 | |||||||||

Charles A. Alutto(6) Former President and Chief Executive Officer | 2019 | 342,308 | – | – | – | – | 1,473,077 | 1,815,385 | |||||||||

| 2018 | 1,000,000 | – | 1,582,185 | 1,289,942 | 241,800 | 5,693 | 4,119,620 | ||||||||||

| 2017 | 1,000,000 | – | 1,495,299 | 1,317,342 | – | 3,000 | 3,815,641 | ||||||||||

William J. Seward(7) Former Executive Vice President and Chief Commercial Officer | 2019 | 276,923 | – | 315,545 | 422,642 | – | 61,038 | 1,076,148 | |||||||||

Kurt M. Rogers(8) | 2019 | 500,000 | – | 311,102 | 235,748 | – | 3,000 | 1,049,850 | |||||||||

Executive Vice President and General Counsel | 2018 | 400,000 | – | 299,529 | 244,217 | 58,032 | 3,000 | 1,004,778 |

| (1) | The amounts shown represent the aggregate grant date fair value of the awards for fiscal years 2019, 2018 and 2017, determined in accordance with FASB ASC Topic 718, based on the closing price of our common stock on the date of the grant. The grant date fair value of time-based RSUs and performance-based RSUs granted in 2019 are as follows: |

| Name | Time-Based RSUs | Performance-Based RSUs |

Cindy J. Miller | $816,617 | $527,795 |

| Janet H. Zelenka | 333,322 | 111,107 |

| Daniel V. Ginnetti | 347,224 | 115,741 |

| Joseph A. Reuter | 166,666 | 55,587 |

| David W. Stahl | 166,664 | 55,587 |

| Charles A. Alutto | – | – |

| William J. Seward | 176,626 | 138,919 |

| Kurt M. Rogers | 233,329 | 77,773 |

| (2) | The amounts shown represent the aggregate grant date fair value of the awards for fiscal years 2019, 2018 and 2017. We calculated these amounts in accordance with the provisions of FASB ASC Topic 718, utilizing the assumptions discussed in Note 14 to our financial statements for the fiscal year ended December 31, 2019, Note 13 to our financial statements for the fiscal year ended December 31, 2018, and in Note 12 to our financial statements for the fiscal year ended December 31, 2017. |

| (3) | The amounts shown represent the gross amounts of the named executive officer’s annual cash incentive for the applicable fiscal year. |

Stericycle, Inc. - 2020 Proxy Statement | 37 |

| (4) | The amounts shown include the following. With respect to relocation expenses, the aggregate incremental cost to our Company is determined by the amounts paid to third-party providers. |

| Name | 401(k) Matching Contribution | Relocation Expenses | Tax Gross-Up on Relocation Expenses | Consulting Fees | Severance | |||||

| Cindy J. Miller | $ | 3,000 | $ | 122,131 | $ | 97,175 | $ | – | $ | – |

| Janet H. Zelenka | 2,654 | – | – | – | – | |||||

| Daniel V. Ginnetti | 3,000 | – | – | – | – | |||||

| Joseph A. Reuter | 3,000 | 96,666 | 69,412 | – | – | |||||

| David W. Stahl | 3,000 | – | – | – | – | |||||

| Charles A. Alutto | – | – | – | 150,000 | 1,323,077 | |||||

| William J. Seward | – | 61,038 | – | – | – | |||||

| Kurt M. Rogers | 3,000 | – | – | – | – |

| (5) | Mr. Ginnetti, our former Chief Financial Officer, transitioned to become Executive Vice President of International in June 2019. |

| (6) | Mr. Alutto stepped down as Chief Executive Officer and as a director in May 2019. Pursuant to his transition agreement, Mr. Alutto received: (i) cash separation pay, payable in accordance with our Executive Severance and Change in Control Plan, equal to two times the sum of his base salary and target annual incentive for 2019; and (ii) $50,000 per month from May through July for consulting services provided to the company. |

| (7) | Mr. Seward ceased employment with the Company in October 2019. |

| (8) | Mr. Rogers ceased employment with the Company in January 2020 and was subsequently rehired in March 2020. |

| 38 | Stericycle, Inc. - 2020 Proxy Statement |

Estimated Future Payouts Under Non-Equity Incentive Plan Awards(1) | Estimated Future Payouts Under Equity Incentive Plan Awards(2) | All Other Stock Awards: Number of Shares of Stock or Units(3) (#) | All Other Option Awards: Number of Securities Underlying Options(4) (#) | Exercise or Base Price of Option Awards ($/Share) | Grant Date Fair Value of Stock and Option Awards(5) ($) | ||||||

| Name | Grant Date | Threshold ($) | Target ($) | Maximum ($) | Threshold (#) | Target (#) | Maximum (#) | ||||

| Cindy J. Miller | 255,938 | 787,500 | 1,575,000 | ||||||||

| 3/12/2019 | 41,417 | 48.59 | 605,102 | ||||||||

| 5/02/2019 | 14,059 | 57.25 | 239,284 | ||||||||

| 3/12/2019 | 12,005 | 583,323 | |||||||||

| 5/02/2019 | 4,075 | 233,294 | |||||||||

| 3/12/2019 | 6,946 | 27,783 | 27,783 | 449,992 | |||||||

| 5/02/2019 | 1,019 | 4,075 | 4,075 | 77,803 | |||||||

Janet H. Zelenka | 81,758 | 251,563 | 503,125 | ||||||||

| 7/01/2019 | 24,488 | 46.96 | 338,914 | ||||||||

| 7/01/2019 | 7,098 | 333,322 | |||||||||

| 7/01/2019 | 1,775 | 7,098 | 7,098 | 111,107 | |||||||

Daniel V. Ginnetti | 140,156 | 431,250 | 862,500 | ||||||||

| 3/12/2019 | 24,654 | 48.59 | 350,826 | ||||||||

| 3/12/2019 | 7,146 | 347,224 | |||||||||

| 3/12/2019 | 1,787 | 7,146 | 7,146 | 115,741 | |||||||

Joseph A. Reuter | 70,200 | 216,000 | 432,000 | ||||||||

| 2/01/2019 | 15,148 | 44.01 | 193,591 | ||||||||

| 2/01/2019 | 3,787 | 166,666 | |||||||||

| 3/12/2019 | 858 | 3,430 | 3,430 | 55,587 | |||||||

| David W. Stahl | 69,810 | 214,800 | 429,600 | ||||||||

| 3/12/2019 | 11,833 | 48.59 | 168,384 | ||||||||

| 3/12/2019 | 3,430 | 166,664 | |||||||||

| 3/12/2019 | 858 | 3,430 | 3,430 | 55,587 | |||||||

Charles A. Alutto | 108,630 | 334,247 | 668,493 | ||||||||

| William J. Seward | 71,500 | 220,000 | 440,000 | ||||||||

| 3/01/2019 | 27,842 | 51.63 | 422,642 | ||||||||

| 3/01/2019 | 3,421 | 176,626 | |||||||||

| 3/12/2019 | 2,144 | 8,575 | 8,575 | 138,919 | |||||||

| Kurt M. Rogers | 113,750 | 350,000 | 700,000 | ||||||||

| 3/12/2019 | 16,567 | 48.59 | 235,748 | ||||||||

| 3/12/2019 | 4,802 | 233,329 | |||||||||

| 3/12/2019 | 1,201 | 4,802 | 4,802 | 77,773 | |||||||

| (1) | These amounts consist of the threshold, target and maximum cash award levels set in 2019 under the annual cash performance bonus program. For Mses. Miller and Zelenka and Messrs. Alutto and Seward the amounts reflect their prorated payout opportunities given their time of employment during 2019. The amounts included in the threshold column reflect the payout if threshold performance were achieved on both of the performance metrics. Please see “Compensation Discussion and Analysis” for further information regarding the annual cash performance bonus program. |

| (2) | The amounts shown at target represent the aggregate number of performance-based RSUs that may be earned under the 2017 Incentive Stock Plan. The performance-based RSUs vest, if at all, in three annual installments based on annual EPS performance goals. The earnout percentage may range from 0% to 100% of the target performance-based RSUs granted, with a range of 25%-100% earned at threshold to maximum performance. Please see “Long-Term Equity Incentive Awards – Performance-based Restricted Stock Units for 2019” in “Compensation Discussion and Analysis” above. |

Stericycle, Inc. - 2020 Proxy Statement | 39 |

| (3) | The amounts represent the time-based RSUs granted under the 2017 Incentive Stock Plan to the named executive officers. The time-based RSUs vest in equal annual installments over three years, beginning on the first anniversary of the grant date, provided that the executive is still employed by the Company on the vesting date. Please see “Compensation Discussion and Analysis” for further information regarding these RSU grants. |

| (4) | These amounts represent stock options granted under the 2014 Incentive Stock Plan and the 2011 Incentive Stock Plan to the named executive officers. These options vest in equal annual installments over three years, beginning on the first anniversary of the grant date, provided that the executive is still employed by the Company on the applicable vesting date. Please see “Compensation Discussion and Analysis” for further information regarding these stock option awards. |

| (5) | The grant date fair value of each time-based RSU award was computed in accordance with FASB ASC Topic 718 based on the closing stock price on the applicable grant date. Because the performance-related component of the performance-based RSUs is based on separate measurements of our performance for each year in the three-year performance cycle, FASB ASC Topic 718 requires the grant date fair value to be calculated with respect to one-third of the total performance-based RSUs in each year of the three-year performance cycle. For 2019, the grant date fair value of the performance-based RSUs, as measured in accordance with FASB ASC Topic 718, is based on our closing stock price on the grant date and the probable outcome of target performance of the annual performance-related component for 2019. With respect to the performance-based RSUs, target performance and maximum performance are the same. The grant date fair value of each option award was calculated in accordance with the provisions of FASB ASC Topic 718, utilizing the assumptions discussed in Note 14 to our financial statements for the fiscal year ended December 31, 2019. |

| Option Awards | Stock Awards | |||||||||||

| Name | Option Grant Date | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable(1) | Option Exercise Price ($) | Option Expiration Date | Stock Award Grant Date | Number of Shares or Units of Stock That Have Not Vested(2) (#) | Market Value of Shares or Units That Have Not Vested(3) ($) | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested(4) (#) | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested(3) ($) | ||

| Cindy J. Miller | 5/02/2019 | – | 14,059 | 57.25 | 5/02/2027 | 5/02/2019 | 4,075 | 260,026 | 4,075 | 260,026 | ||

| 3/12/2019 | – | 41,417 | 48.59 | 3/12/2027 | 3/12/2019 | 12,005 | 766,039 | 27,783 | 1,772,833 | |||

| 11/01/2018 | 12,079 | 48,312 | 50.78 | 11/01/2026 | 11/01/2018 | 8,928 | 569,696 | – | – | |||

| Janet H. Zelenka | 7/01/2019 | – | 24,488 | 46.96 | 7/01/2027 | 7/01/2019 | 7,098 | 452,923 | 7,098 | 452,923 | ||

| Daniel V. Ginnetti | 3/12/2019 | – | 24,654 | 48.59 | 3/12/2027 | 3/12/2019 | 7,146 | 455,986 | 7,146 | 455,986 | ||

| 3/01/2018 | 5,721 | 22,884 | 62.04 | 3/01/2026 | 3/01/2018 | 5,721 | 365,057 | 4,767 | 304,182 | |||

| 2/24/2017 | 147 | – | 82.93 | 2/24/2027 | 2/16/2017 | 3,000 | 191,430 | 1,666 | 106,307 | |||

| 2/16/2017 | 9,998 | 14,995 | 83.35 | 2/16/2025 | 2/05/2016 | 1,190 | 75,934 | – | – | |||

| 2/26/2016 | 508 | – | 115.54 | 2/26/2026 | ||||||||

| 2/05/2016 | 26,757 | 16,939 | 111.12 | 2/05/2024 | ||||||||

| 2/05/2016 | – | 899 | 111.12 | 2/05/2024 | ||||||||

| 2/06/2015 | 36,000 | 8,232 | 130.19 | 2/06/2023 | ||||||||

| 2/06/2015 | – | 768 | 130.19 | 2/06/2023 | ||||||||

| 8/01/2014 | 3,220 | – | 116.81 | 8/01/2022 | ||||||||

| 8/01/2014 | 4280 | – | 116.81 | 8/01/2022 | ||||||||

| 2/11/2014 | 15,000 | – | 115.69 | 2/11/2022 | ||||||||

| 2/20/2013 | 14,550 | – | 95.87 | 2/20/2023 | ||||||||

| 2/13/2012 | 11,200 | – | 86.24 | 2/13/2022 | ||||||||

| 2/08/2011 | 10,700 | – | 85.00 | 2/08/2021 | ||||||||

| 2/09/2010 | 6,000 | – | 51.55 | 2/09/2020 | ||||||||

| Joseph A. Reuter | 2/01/2019 | – | 15,148 | 44.01 | 2/01/2027 | 2/01/2019 | 3,787 | 241,648 | – | – | ||

| 3/12/2019 | – | – | 3,430 | 218,868 | ||||||||

| David W. Stahl | 3/12/2019 | – | 11,833 | 48.59 | 3/12/2027 | 3/12/2019 | 3,430 | 218,868 | 3,430 | 218,868 | ||

| 4/16/2018 | 1,551 | 6,201 | 60.18 | 4/16/2026 | 4/16/2018 | 1,551 | 98,969 | 1,292 | 82,443 | |||

| 3/01/2018 | 806 | 3,223 | 62.04 | 3/01/2026 | 3/01/2018 | 2,418 | 154,293 | – | – | |||

| 2/16/2017 | 900 | 1,350 | 83.35 | 2/16/2025 | 2/16/2017 | 810 | 51,686 | – | – | |||

| 9/06/2016 | 3,600 | 2,400 | 83.49 | 9/06/2024 | 9/06/2016 | 120 | 7,657 | – | – | |||

Stericycle, Inc. - 2020 Proxy Statement | 41 |

| Option Awards | Stock Awards | |||||||||||

| Name | Option Grant Date | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable(1) | Option Exercise Price ($) | Option Expiration Date | Stock Award Grant Date | Number of Shares or Units of Stock That Have Not Vested(2) (#) | Market Value of Shares or Units That Have Not Vested(3) ($) | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested(4) (#) | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested(3) ($) | ||

Charles A. Alutto | 3/01/2018 | 15,302 | – | 62.04 | 3/01/2026 | |||||||

| 2/24/2017 | 341 | – | 82.93 | 2/24/2027 | ||||||||

| 2/16/2017 | 26,912 | – | 83.35 | 2/16/2025 | ||||||||

| 2/26/2016 | 1,007 | – | 115.54 | 2/26/2026 | ||||||||

| 2/05/2016 | 63,244 | – | 111.12 | 2/05/2024 | ||||||||

| 2/06/2015 | 2,435 | – | 130.19 | 2/06/2025 | ||||||||

| 2/06/2015 | 88,000 | – | 130.19 | 2/06/2023 | ||||||||

| 2/11/2014 | 119,000 | – | 115.69 | 2/11/2022 | ||||||||

| 2/11/2014 | 1,873 | – | 115.69 | 2/11/2024 | ||||||||

| 2/20/2013 | 147,671 | – | 95.87 | 2/20/2023 | ||||||||

| 2/13/2012 | 60,000 | – | 86.24 | 2/13/2022 | ||||||||

| 2/08/2011 | 31,890 | – | 85.00 | 2/08/2021 | ||||||||

| 7/30/2010 | 6,984 | – | 63.00 | 7/30/2020 | ||||||||

| Kurt M. Rogers | 3/12/2019 | – | 16,567 | 48.59 | 3/12/2027 | 3/12/2019 | 4,802 | 306,416 | 4,802 | 306,416 | ||

| 3/01/2018 | 2,897 | 11,588 | 62.04 | 3/01/2026 | 3/01/2018 | 2,897 | 184,858 | 2,414 | 154,037 | |||

| 7/24/2017 | 4,798 | 7,197 | 76.41 | 7/24/2025 | 7/24/2017 | 1,440 | 91,886 | 800 | 51,048 | |||

| (1) | Options vest at the rate of one-fifth (20%) of the option shares on each of the first five anniversaries of the option grant date. |

| (2) | Represents time-based RSUs that vest in 20% increments on each of the first through fifth year anniversaries of the date of grant. |

| (3) | Market value is based on the share price of $63.81 as of December 31, 2019. |

| (4) | The numbers shown represent performance-based RSUs, which vest, if at all, in three equal annual installments based on annual EPS performance goals. Pursuant to SEC rules, the amounts shown reflect the number of units that may be earned over the three-year period if the threshold level of EPS is achieved in each of the years. |

| 42 | Stericycle, Inc. - 2020 Proxy Statement |

Option Awards | Stock Awards | |||||

| Name | Number of Shares Acquired on Exercise (#) | Value Realized Exercise ($)(1) | Number of Shares Acquired Upon Vesting (#) | Value Realized on Vesting ($)(2) | ||

| Cindy J. Miller | – | – | 2,231 | 130,826 | (3) | |

| Janet H. Zelenka | – | – | – | – | ||

| Daniel V. Ginnetti | 6,000 | 23,520 | (5) | 4,764 | 233,351 | (3)(4) |

| Joseph A. Reuter | – | – | – | – | ||

| David W. Stahl | – | – | 1,598 | 83,887 | (3)(4) | |

| Charles A. Alutto | – | – | 16,008 | 774,460 | (3)(4) | |

| William J. Seward | – | – | – | – | ||

| Kurt M. Rogers | – | – | 2,067 | 102,323 | (3)(4) | |

| (1) | Represents the difference between the market value of the shares acquired upon exercise and the aggregate exercise price of the shares acquired. |

| (2) | Represents the market value of the shares issued in settlement of time-based RSU awards and performance-based RSU awards on the date of the awards vested, calculated using the closing sale price reported on the Nasdaq Global Select Market on the vesting date. |

| (3) | The value realized upon vesting of time-based RSU awards was computed based on the following: |

Name | | Vesting Date | | Number of Shares Acquired on Vesting | Market Price at Vesting | Value Realized on Vesting | | ||

| Cindy J. Miller | 11/01/2019 | 2,231 | $ | 58.64 | $ | 130,826 | |||

| Daniel V. Ginnetti | | 2/05/2019 | | 594 | $ | 45.00 | $ | 26,730 | |

| | 2/16/2019 | | 999 | $ | 45.56 | $ | 45,514 | ||

| | 3/01/2019 | | 1,430 | $ | 51.63 | $ | 73,831 | ||

| David W. Stahl | | 2/16/2019 | | 270 | $ | 45.56 | $ | 12,301 | |

| | 3/01/2019 | | 604 | $ | 51.63 | $ | 31,185 | ||

| | 4/16/2019 | | 387 | $ | 56.69 | $ | 21,939 | ||

| | 9/06/2019 | | 60 | $ | 45.98 | $ | 2,759 | ||

| Charles A. Alutto | | 2/05/2019 | | 1,405 | $ | 45.00 | $ | 63,225 | |

| | 2/16/2019 | | 2,691 | $ | 45.56 | $ | 122,602 | ||

| | 3/01/2019 | | 3,825 | $ | 51.63 | $ | 197,485 | ||

| | 7/31/2019 | | 3,418 | $ | 45.96 | $ | 157,091 | ||

| Kurt M. Rogers | | 3/01/2019 | | 724 | $ | 51.63 | $ | 37,380 | |

| | 7/24/2019 | | 480 | $ | 47.24 | $ | 22,675 | ||

| (4) | The value realized upon vesting of performance-based RSU awards was computed based on the following: |

Name | Vesting Date | | Number of Shares Acquired on Vesting | Market Price at Vesting | Value Realized on Vesting | ||||

| Daniel V. Ginnetti | | 3/04/2019 | | 1,741 | $ | 50.13 | $ | 87,276 | |

| David W. Stahl | | 4/16/2019 | | 277 | $ | 56.69 | $ | 15,703 | |

| Charles A. Alutto | | 3/04/2019 | | 4,669 | $ | 50.13 | $ | 234,057 | |

| Kurt M. Rogers | | 3/04/2019 | | 519 | $ | 50.13 | $ | 26,017 | |

| | 7/24/2019 | | 344 | $ | 47.24 | $ | 16,251 | | |

| (5) | The value was computed as described in footnote 1 above and was based on the following: |

| Name | | Exercise Date | | Number of Options Exercised | Market Price at Exercise | Exercise Price | |||||

| Daniel V. Ginnetti | | 10/31/2019 | | 6,000 | $ | 55.47 | $ | 51.55 | | ||

Stericycle, Inc. - 2020 Proxy Statement | 43 |

| • | Upon a change in control, stock options and time-based RSU awards will vest in full and performance-based RSU awards will vest at target level and any restrictions on shares underlying the awards shall lapse. |

| • | Upon a termination of employment due to death, stock options and time-based RSU awards will vest in full and performance-based RSU awards will vest at target level, without regard to satisfaction of performance targets. In the case of stock options, the vested portion of the option will expire upon the earlier of (i) the first anniversary of the executive’s death or (ii) the option’s expiration date. |

| • | For terminations of employment other than by reason of death, any unvested portion of an award shall lapse and be canceled as of the executive’s termination date. In the case of stock options, the vested portion of the option will expire upon the earlier of (i) 90 days after the executive’s termination date or (ii) the option’s expiration date. |

| Name | Severance(1) ($) | Annual Incentive(2) ($) | Stock Options(3) ($) | RSUs(4) ($) | Continued Welfare and Other Benefits(5) ($) | | Total ($) | |||||

| Cindy J. Miller | 5,400,000 | – | | 1,352,099 | 3,628,619 | 25,000 | 10,405,718 | |||||

| Janet H. Zelenka | 2,012,500 | – | 412,623 | 905,847 | 25,000 | 3,355,970 | ||||||

| Daniel V. Ginnetti | 2,012,500 | – | 415,739 | 1,954,883 | 54,793 | 4,437,915 | ||||||

| Joseph A. Reuter | 1,152,000 | – | 299,930 | 460,517 | 25,000 | 1,937,447 | ||||||

| David W. Stahl | 1,145,600 | – | 208,313 | 832,784 | 54,793 | 2,241,490 |

| Name | Severance(6) ($) | Annual Incentive(2) ($) | Stock Options ($) | RSUs ($) | Continued Welfare and Other Benefits(5) ($) | Total ($) | |

Cindy J. Miller | 3,600,000 | – | – | – | 25,000 | 3,625,000 | |

| Janet H. Zelenka | 1,006,250 | – | – | – | 25,000 | 1,031,250 | |

Daniel V. Ginnetti | 1,006,250 | – | – | – | 54,793 | 1,061,043 | |

| Joseph A. Reuter | 576,000 | – | – | – | 25,000 | 601,000 | |

| David W. Stahl | 572,800 | – | – | – | 54,793 | 627,593 | |

| Charles A. Alutto | 1,323,077 | – | – | – | 8,690 | 1,331,767 | |

| William J. Seward | – | – | – | – | – | – | |

| Kurt M. Rogers | – | – | – | – | – | – |

| (1) | In accordance with the Executive Severance and Change-in-Control Plan (the “Executive Severance Plan”), amounts in this column represent severance payments equal to three times for Ms. Miller and two times for the other named executive officers the sum of the executive officer’s base salary and target annual incentive |

| (2) | In accordance with the Executive Severance Plan, the executive will receive a prorated annual incentive for the year in which the termination occurs, calculated based on actual performance during the year. |

| (3) | Stock options will vest in full upon (i) a change in control regardless of a termination or (ii) death. The value shown for stock options was determined by multiplying the number of unvested stock options by the difference between the closing stock price of $63.81 and the exercise price of the unvested stock options. |

| (4) | Time-based RSUs will vest in full and performance-based RSUs will vest at target level upon (i) a change in control regardless of a termination or (ii) death. The value shown for RSUs was determined by multiplying the closing stock price of $63.81 per share on December 31, 2019 by the number of unvested time-based and performance-based RSUs that would vest upon a change in control or death. |

| (5) | In accordance with the Executive Severance Plan, amounts in this column represent $25,000 in outplacement services plus the amount that would be paid by the company for the continuation of medical, dental, and vision insurance for a period of 24 months should the named executive officer elect COBRA coverage for these benefits based on their benefit elections in place on December 31, 2019. |

| (6) | In accordance with the Executive Severance Plan, amounts in this column represent severance payments equal to two times for Ms. Miller and one time for the other named executive officers the sum of the executive officer’s base salary and target annual incentive. |

| 44 | Stericycle, Inc. - 2020 Proxy Statement |

| Name | Executive Contributions in FY 2019 ($)(1) | Stericycle Contributions in FY 2019 ($) | Aggregate Earnings in FY 2019 ($)(2) | Aggregate Withdrawals/ Distributions in FY 2019 ($) | Aggregate Balance at 12/31/19 ($)(3) | |

| Cindy J. Miller | – | – | – | – | – | |

| Janet H. Zelenka | – | – | – | – | – | |

| Daniel V. Ginnetti | – | – | – | – | – | |

| Joseph A. Reuter | – | – | – | – | – | |

| David W. Stahl | 10,940 | – | 1,446 | – | 12,386 | |

| Charles A. Alutto | 12,901 | 4,241 | (33,640) | – | ||

| William J. Seward | – | – | – | – | – | |

| Kurt M. Rogers | – | – | – | – | – |

| (1) | The amount reported in this column is reported as “Salary” in the Summary Compensation Table for the fiscal year ended December 31, 2019. |

| (2 | The amount reported in this column was not reported in the Summary Compensation Table as part of an individual’s compensation for the fiscal year ended December 31, 2019. |

| (3) | All of this amount was previously reported as compensation in the Summary Compensation Table in previous years. |

Stericycle, Inc. - 2020 Proxy Statement | 45 |

| Deemed Investment Option | Fiscal Year 2019 Cumulative Return | |

| American Balanced Fund | 19.55% | |

| American Capital Income Builder | 17.75% | |

| American Capital World Bond Fund | 8.14% | |

| American Century Inflation Adjusted Bond Fund | 8.14% | |

| American Funds 2010 Target | 13.88% | |

| American Funds 2015 Target | 14.94% | |

| American Funds 2020 Target | 15.59% | |

| American Funds 2025 Target | 17.85% | |

| American Funds 2030 Target | 20.06% | |

| American Funds 2035 Target | 23.29% | |

| American Funds 2040 Target | 24.40% | |

| American Funds 2045 Target | 24.68% | |

| American Funds 2050 Target | 25.04% | |

| American Funds 2055 Target | 25.09% | |

| American Funds 2060 Target | 25.01% | |

| American Growth Fund of America | 28.54% | |

| American New Economy Fund | 26.85% | |

| Blackrock High Yield Bond Fund | 15.58% | |

| BlackRock Liquidity Fund | 1.59% | |

| Columbia Midcap Index Fund | 25.97% | |

| Columbia Quality Income Fund | 6.97% | |

| Columbia Small Cap Index Fund | 22.61% | |

| Deutsche Real Estate Securities Fund | 29.66% | |

| Eaton Vance Atlanta Capital SMID-Cap Fund | 34.44% | |

| Franklin Small Cap Growth Fund | 33.54% | |

| Franklin Small Cap Value Fund | 26.59% | |

| Invesco Comstock Fund | 25.82% | |

| Invesco Equally Weighted S&P 500 Fund | 29.11% | |

| Invesco Oppenheimer Global Opportunities Fund | 28.12% | |

| Invesco Oppenheimer International Growth Fund | 29.16% | |

| Lazard International Strategic Equity Portfolio | 21.55% | |

| Loomis Sayles Core Plus Bond Fund | 9.05% | |

| Lord Abbett Income Fund | 13.23% | |

| MFS International Intrinsic Value Fund | 25.99% | |

| MFS Massachusetts Investors Growth Stock Fund | 40.35% | |

| MFS Mid Cap Value Fund | 31.08% | |

| Van Eck CM Commodity Index Fund | 8.54% | |

| Virtus Vontobel Emerging Markets Opportunities Fund | 18.69% |

| 46 | Stericycle, Inc. - 2020 Proxy Statement |

• Australia—80 employees | • Netherlands—28 employees | |

• Belgium—14 employees | • Romania—285 employees | |

• France—84 employees | • South Korea—177 employees | |

• Germany—94 employees | • Singapore—24 employees | |

• Ireland—146 employees | • United Arab Emirates—23 employees | |

• Japan—100 employees |

| SCT Component | Actual Value from SCT ($) | Value Used for CEO Pay Ratio ($) | Rationale |

| Salary | 804,808 | 900,000 | Annualized CEO salary |

| Stock Awards | 1,344,412 | 1,555,513 | Increased to reflect stock award value had Ms. Miller been CEO for the entire year |

| Option Awards | 844,387 | 1,178,738 | Increased to reflect option award value had Ms. Miller been CEO for the entire year |

| Non-Equity Incentive Plan Compensation | – | – | No change needed as no payout was earned for any plan participant |

| All Other Compensation | 222,306 | 222,306 | No change since $3,000 is the maximum 401(k) match and the amount of relocation expenses and tax gross-ups would not have changed |

| Total | 3,215,913 | 3,856,557 |

Stericycle, Inc. - 2020 Proxy Statement | 47 |

Overview |

| Administration |

Number of Shares |

| 48 | Stericycle, Inc. - 2020 Proxy Statement |

Eligibility |

Offerings |

Election to Participate |

Payroll Deduction Percentage |

Grant of Options |

Option Price |

Exercise of Options |

Crediting of Option Shares |

Limitations |

Stericycle, Inc. - 2020 Proxy Statement | 49 |

Withdrawal from Offering |

Termination of Employment |

Transferability |

Reports |

Amendment and Termination |

| (a) | If the shares are sold more than two years from the date of the option grant (the first day of the offering) and more than one year from the date of the option exercise (the last day of the offering), the participant will incur a combination of ordinary income and long-term capital gain (or possibly just ordinary income) on the sale of the shares: |

| (1) | The ordinary income incurred will be the lesser of: |

| (A) | 15% of the fair market value of the shares on the first day of the offering, or |

| (B) | the gain realized on the sale of the shares (i.e., the excess of the amount realized on the sale of the shares over the aggregate option price). |

| (2) | Any gain in excess of the amount recognized by the participant as ordinary income will be treated as long-term capital gain. If the amount realized on the sale is less than the ordinary income incurred, the balance of the gain will be treated as long-term capital loss. |

| (b) | If the shares are sold without satisfying these income tax holding periods (i.e., the shares are sold sooner than two years from the date of the option grant—the first day of the offering—or sooner than one year from the date of the option exercise—the last day of the offering), the participant will incur a combination of ordinary income and capital gain or loss on the sale of the shares: |

| (1) | The ordinary income will be the excess of the fair market value of the shares on the last day of the offering (the exercise date) over the aggregate option price. |

| (2) | Any additional gain or loss on the sale will be long-term or short-term capital gain or loss, depending upon whether the shares were held for more than one year. |

| 50 | Stericycle, Inc. - 2020 Proxy Statement |

| • | Ernst & Young’s historical performance and its recent performance during its engagement for the 2019 fiscal year, including ability to meet deadlines and respond quickly; |

| • | Ernst & Young’s capability and expertise in handling engagements with the breadth and complexity of our operations, including its approach to resolving significant accounting and auditing matters and consultations with the firm’s national office; |

| • | The qualification and experience of key members of the engagement, including the lead audit partner; |

| • | The adequacy of information provided on accounting issues, auditing issues and regulatory developments; |

| • | The timeliness and quality of Ernst & Young’s communication with the Audit Committee, including communications regarding the conduct of the audit and with respect to issues identified in the audit; |

| • | External data on audit quality and performance, including the most recent Public Company Accounting Oversight Board (“PCAOB”) reports on Ernst & Young and its peer firms, and management feedback; |

| • | The appropriateness of Ernst & Young’s fees, on both an absolute basis and as compared to its peer firms; and |

| • | Ernst & Young’s reputation for integrity and competence in the fields of accounting and auditing. |

Stericycle, Inc. - 2020 Proxy Statement | 51 |

Fees Paid to Independent Auditors |

| Description of Fees | FY 2019 | FY 2018 | |

Audit Fees(1) | $12,247,929 | $10,240,000 | |

Audit-Related Fees(2) | 665,300 | 1,005,000 | |

Tax Fees(3) | 288,410 | 510,700 | |

All Other Fees(4) | 5,088 | 2,300 | |

| TOTAL | $13,206,727 | $11,758,000 |

| (1) | Includes fees for the audits of annual consolidated financial statements and internal control over financial reporting, reviews of interim financial statements included in our quarterly reports on Form 10-Q, certain statutory audits and assistance with and review of certain documents and letters filed with the SEC. |

| (2) | Includes fees related to transaction audit and integration services. |

| (3) | Includes fees related to tax compliance, tax advice and tax planning services. |

| (4) | Includes fees related to access to online research tools. |

Audit Committee Pre-Approval Policies |

| 52 | Stericycle, Inc. - 2020 Proxy Statement |

Stericycle, Inc. - 2020 Proxy Statement | 53 |

| 54 | Stericycle, Inc. - 2020 Proxy Statement |

Stericycle, Inc. - 2020 Proxy Statement | 55 |

| 56 | Stericycle, Inc. - 2020 Proxy Statement |

Stericycle, Inc. - 2020 Proxy Statement | 57 |

| Why Did I Receive This Proxy Statement and Other Materials? |

What Will Stockholders Vote on at the Annual Meeting? |

| • | election to the Board of the twelve nominees for director named in this proxy statement (Item 1); |

| • | an advisory vote to approve executive compensation (the “say-on-pay” vote) (Item 2); |

| • | approval of an amendment to the Stericycle, Inc. Employee Stock Purchase Plan increasing the number of shares available for issuance (Item 3); |

| • | ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2020 (Item 4); |

| • | a stockholder proposal entitled Special Shareholder Meeting Improvement, if properly presented at the Annual Meeting (Item 5); |

| • | any other matter that properly comes before the Annual Meeting. |

What Are the Board’s Voting Recommendations? |

| • | FOR each of the twelve nominees for election to the Board (Item 1); |

| • | FOR the advisory vote to approve executive compensation (Item 2); |

| • | FOR approval of an amendment to the Stericycle, Inc. Employee Stock Purchase Plan increasing the number of shares available for issuance (Item 3); |

| • | FOR ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2020 (Item 4); |

| • | AGAINST the stockholder proposal entitled Special Shareholder Meeting Improvement (Item 5); and |

| • | AGAINST the stockholder proposal with respect to amendment of our compensation clawback policy (Item 6) |

Who May Vote at the Annual Meeting? |

| 58 | Stericycle, Inc. - 2020 Proxy Statement |

Why Did I Receive Only a One-Page Notice in the Mail Regarding the Internet Availability of Proxy Materials Instead of Receiving a Full Set of Printed Proxy Materials? |

What Is the Difference Between a Stockholder of Record and a Beneficial Owner of Shares Held in Street Name? |

If I Am a Stockholder of Record, How Do I Vote? |

If I Am a Beneficial Owner of Shares Held in Street Name, How Do I Instruct My Broker How to Vote? |

What Happens if I Am a Stockholder of Record and Sign and Return the Proxy Card But Do Not Make Any Voting Choices? |

Stericycle, Inc. - 2020 Proxy Statement | 59 |

What Happens if I Am a Beneficial Owner of Shares Held in Street Name and Do Not Give Voting Instructions to My Broker? |

What Is the Quorum Required for the Annual Meeting? |

What Are My Choices in Voting on the Matters to Be Voted on at the Annual Meeting? |

What Are the Voting Requirements to Approve the Matters to Be Voted on at the Annual Meeting? |

| • | Item 1 (election of directors): Each nominee for election as a director will be elected by the vote of a majority of the votes cast and therefore must receive more “For” votes than “Against” votes in order to be elected as a director. Abstentions and broker non-votes will not have any effect on the result of the vote. |

| • | Item 2 (the say-on-pay vote): This proposal requires for approval the affirmative vote of a majority of the shares present, either online or represented by proxy, and entitled to vote. Abstentions will have the same effect as a vote “Against.” Broker non-votes will not have any effect on the result of the vote. |

| • | Item 3 (approval of an amendment to the Stericycle, Inc. Employee Stock Purchase Plan increasing the number of shares available for issuance): This proposal requires for approval the affirmative vote of a majority of the shares present, either online or represented by proxy, and entitled to vote. Abstentions will have the same effect as a vote “Against.” Broker non-votes will not have any effect on the result of the vote. |

| • | Item 4 (ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2020): This |

| • | Item 5 (the stockholder proposal entitled Special Shareholder Meeting Improvement): This proposal requires for approval the affirmative vote of a majority of the shares present, either online or represented by proxy, and entitled to vote. Abstentions will have the same effect as a vote “Against.” Broker non-votes will not have any effect on the result of the vote. |