- SRCL Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Stericycle (SRCL) DEF 14ADefinitive proxy

Filed: 10 Apr 19, 8:12am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

☑ Filed by the Registrant ☐ Filed by a Party other than the Registrant

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under Rule 14a-12 | |

STERICYCLE, INC.

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check the appropriate box):

| ☑ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

(1) | Title of each class of securities to which transaction applies:

| |||

(2) | Aggregate number of securities to which transaction applies:

| |||

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

(4) | Proposed maximum aggregate value of transaction:

| |||

(5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid:

| |||

(2) | Form, Schedule or Registration Statement No.:

| |||

(3) | Filing Party:

| |||

(4) | Date Filed:

| |||

We protect what matters.

2019 PROXY STATEMENT

Our Company At A Glance

Stericycle is a globalbusiness-to-business services company. We provide an

• Regulated waste management and compliance solutions

• Secure information destruction

• Environmental and sustainable solutions

• Brand protection solutions

• Patient and customer communication solutions

Every organization today must comply with increasingly strict regulatory

OUR PURPOSE:

To help our customers fulfill their

|

|

FOUNDED IN 1989 HEADQUARTERS LAKE FOREST, IL 2017 REVENUE OF $3.6 BILLION 680+ locations IN 21 COUNTRIES MORE THAN ONE MILLION CUSTOMERS WORLDWIDE 23,200+TEAM MEMBERS

Letter from the Chairman

DEAR SHAREHOLDERS –

At the beginning of 2018, Stericycle announced a comprehensive, multi-year program to transform the Company for long-term sustainability and to drive profitable growth and long-term shareholder returns. As part of this Business Transformation, we are rationalizing our business portfolio and monetizingnon-strategic assets, standardizing business processes around the globe and driving a metrics-driven culture. The backbone of this Transformation is an enterprise resource planning (ERP) platform which we expect will achieve efficiencies by reducing the number of information technology platforms, automating workflows, streamlining operations, and providing real-time, actionable data to all levels of the organization.

A similar transformation is underway regarding Stericycle’s governance. Over the past several years, the Board of Directors has been executing on a series of purposeful steps to evolve our governance, executive leadership, and financial controls. I’d like to take this opportunity to share this progress with you.

Governance Enhancements Aligned with Best Practices

The Board is focused on ensuring that we have the right skills and experience and fresh perspective on the Board to support the Company and provide effective oversight during the Business Transformation. To that end, we have added seven new Directors since the beginning of 2017.

| • | With this continued refreshment and our two recently appointed directors, our Board will have an average tenure of approximately two and half years with no members (excluding the Chief Executive Officer, who has announced his retirement) having served as a director of Stericycle for more than seven years. In comparison, the average tenure for the S&P 500 and Russell 3000 is nine years. |

| • | I was appointed as Independent Chairman in 2018 after joining the Board in 2017, and we have refreshed the composition and leadership of all of our Board committees during this time. |

| • | Our skills matrix (included with the enclosed proxy statement) highlights the depth and breadth of our Board’s diverse skills, experiences and attributes, including significant experience with business transformation and financial controls. |

Expanded Stericycle’s Leadership Team Breadth of Expertise

In addition to these significant changes to the Board, we have reconstituted the executive leadership team to ensure we have the right expertise and operational experience necessary to successfully drive the Company forward. Earlier this year we announced that Cindy J. Miller, who joined Stericycle as President and Chief Operating Officer in October 2018, will succeed Charlie A. Alutto as Chief Executive Officer, following Charlie’s retirement in May 2019. Cindy’s appointment as CEO was the culmination of a thoughtful executive leadership development and succession planning process designed to ensure the Company is strongly positioned to execute its Business Transformation and enhance financial and operational performance.

In addition to Cindy’s appointment as CEO, since 2017, we have appointed six new, highly-experienced executives to our senior leadership team:

| • | William J. Seward as Executive Vice President and Chief Commercial Officer; |

| • | Richard M. Moore as Executive Vice President of North American Operations; |

| • | Joseph A. Reuter as Executive Vice President and Chief People Officer; |

| • | Michael Weisman as Executive Vice President and Chief Ethics and Compliance Officer; |

| • | Kurt M. Rogers as Executive Vice President and General Counsel; and |

| • | David W. Stahl as Executive Vice President and Chief Information Officer. |

Additionally, Daniel Ginnetti, currently Executive Vice President and Chief Financial Officer, will transition to the position of Executive Vice President of International upon the appointment of a new Chief Financial Officer.

Strengthening Internal Controls

The Board, and particularly the Audit Committee, has been deeply engaged in overseeing the Company’s efforts to improve financial reporting, controls and disclosures, and we’ve made substantial progress since 2016. Moreover, following the implementation of the new ERP system (targeted to begin in the U.S. and Canada during 2020 and internationally in 2021), Stericycle expects to benefit from significantly enhanced systems and processes that will streamline and automate financial controls and reporting. Some highlights of this progress include:

| • | Stericycle has upgraded and expanded corporate and business unit finance, accounting and reporting, and information technology teams, and aligned incentive plans with effective internal controls. |

| • | With the guidance of industry-leading experts, we’ve been working diligently to mitigate material weaknesses and have made significant progress expanding policies, standardizing control processes, segregating duties, formalizing routine financial reviews, and training team members. |

| • | We’ve expanded our technical accounting team and the use of specialist involvement fornon-routine transactions, highly complex areas of accounting, and adoption of new accounting standards to ensure appropriate accounting. |

| • | We are leveraging advanced technology to monitor revenue recognition activities and implemented continuous monitoring of global financial reporting controls. |

| • | We’ve created a robust Disclosure Committee Process led by the General Counsel and Chief Accounting Officer. |

The Board of Directors believes strongly that Stericycle is an excellent company and we are excited about its future. We enjoy a leadership position in our large and growing core markets. Our business model focused on compliance-based, recurring service needs remains sound. Our customers are loyal and respond with strong satisfaction scores. Our team members are talented industry experts who have a passion for the work they do.

While the Company’s growth has been stagnant for the past two years, we believe it is a temporary and transitional phase. Stericycle is in the process of reinventing itself and reimagining its future and the changes are apparent in almost everything we do, from servicing our customers, to leading our teams, to advancing the technology we use, and to oversight and engagement from the Board.

On behalf of the Board of Directors, thank you for your investment in Stericycle. We ask for your voting support of our recommended actions on the items described in this proxy statement and will continue to work diligently to earn and keep your trust.

Sincerely,

Robert S. Murley

Chairman

Notice of 2019 Annual Meeting of Stockholders

Wednesday, May 22, 2019

8:30 a.m. Central Daylight Time

Loews Chicago O’Hare Hotel

5300 N. River Road

Rosemont, IL 60018

DEAR STOCKHOLDER:

You are cordially invited to attend our 2019 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on Wednesday, May 22, 2019 at 8:30 a.m. Central Daylight Time at the Loews Chicago O’Hare Hotel, 5300 N. River Road, Rosemont, IL 60018.

At the Annual Meeting, you will be asked to consider and vote on the following matters:

| 1. | the election to the Board of Directors (the “Board”) of the ten nominees for director named in this proxy statement; |

| 2. | an advisory vote to approve executive compensation (the“say-on-pay” vote); |

| 3. | ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2019; |

| 4. | a stockholder proposal entitled Special Shareholder Meeting Improvement, if it is properly presented at our Annual Meeting; and |

| 5. | any other matter that properly comes before the Annual Meeting. |

Only stockholders of record at the close of business on the record date of March 28, 2019 are entitled to vote at the Annual Meeting.

If you plan to attend the meeting in person, please email your request toInvestor@Stericycle.com. If you are the beneficial owner of shares held in street name, you must also provide confirmation of your stock ownership. All requests for admission must be received by May 15, 2019. Admission is not transferable.

If you do not plan to attend the Annual Meeting, please promptly vote your shares by telephone, via the internet atwww.proxyvote.com,or, if you received a paper copy of the materials, by signing, dating and returning the accompanying proxy card or voting instruction card. If you return your proxy card and later decide to attend the Annual Meeting and then vote in person, your earlier proxy (or earlier vote by telephone or Internet) will be revoked. Your attendance at the Annual Meeting, by itself, does not revoke an earlier proxy. If for any other reason you want to revoke your proxy, you may do so at any time before your proxy is voted.

For the Board of Directors

Dated: April 10, 2019

Lake Forest, Illinois

|  | |

| Robert S. Murley | Cindy J. Miller | |

| Chairman of the Board | President and Chief Operating Officer Chief Executive Officer Elect | |

Important Notice Regarding the Availability of Proxy Materials for the 2019

Annual Meeting of Stockholders to be Held on May 22, 2019:

The Proxy Statement, Notice of Annual Meeting and 2018 Annual Report to

Stockholders are available atwww.proxyvote.com

| Stericycle, Inc. - 2019 Proxy Statement | 1 |

| 2 | Stericycle, Inc. - 2019 Proxy Statement |

| Stericycle, Inc. - 2019 Proxy Statement | 3 |

This summary highlights information contained elsewhere in this proxy statement. It does not contain all information that you should consider, and you should read the entire proxy statement carefully before voting. In this proxy statement, “we,” “us,” “our,” “Stericycle” and the “Company” all refer to Stericycle, Inc.

Annual Meeting of Stockholders

Time and Date: | 8:30 a.m. central daylight time on Wednesday, May 22, 2019 | |

Place: | Loews Chicago O’Hare Hotel 5300 N. River Road Rosemont, IL 60018 | |

Record Date: | March 28, 2019 | |

Voting: | Stockholders as of the record date are entitled to vote | |

Attendance: | Stockholders who wish to attend the meeting in person should email their request toInvestor@Stericycle.com by May 15, 2019. | |

Proxy Materials: | This proxy statement and our annual report to stockholders (which includes a copy of our Annual Report on Form10-K for the year ended December 31, 2018) are first being made available to stockholders on or about April 10, 2019. |

Meeting Agenda and Voting Recommendations

| Agenda Item | Board Recommendation | Page | ||

Election of ten directors | FOR each Nominee | 12 | ||

Advisory vote to approve executive compensation (the“say-on-pay” vote) | FOR | 28 | ||

Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2019 | FOR | 55 | ||

Stockholder proposal entitled Special Shareholder Meeting Improvement | AGAINST | 58 |

| 4 | Stericycle, Inc. - 2018 Proxy Statement |

Board Nominees

The following table provides summary information about the nominees for director. Each director is elected by a majority of votes cast.

| Nominee | Age | Director Since | Principal Occupation | Current Committees | ||||

Robert S. Murley | 69 | 2017 | Chairman of the Board, Stericycle, Inc.; Senior advisor, Credit Suisse, LLC | None | ||||

Cindy J. Miller(1) | 56 | 2019 | President and Chief Operating Officer, Stericycle Inc. Chief Executive Officer Elect | None | ||||

Brian P. Anderson | 68 | 2017 | Former executive vice president of OfficeMax Incorporated | • Audit (Chair) | ||||

Lynn D. Bleil | 55 | 2015 | Former senior partner McKinsey & Company | • Compensation

• Nominating and Governance (Chair) | ||||

Thomas F. Chen | 69 | 2014 | Former senior vice president and president of international nutrition, Abbott Laboratories | • Compensation

• Nominating and Governance | ||||

J. Joel Hackney, Jr. | 49 | 2019 | Chief Executive Officer of nThrive, Inc. | • Nominating and Governance | ||||

Veronica M. Hagen | 73 | 2018 | Former President and Chief Executive Officer of Polymer Group Inc. | • Audit | ||||

Stephen C. Hooley | 56 | 2019 | Former Chairman and Chief Executive Officer of DST Systems, Inc. | • Compensation | ||||

Kay G. Priestly | 63 | 2018 | Former Chief Executive Officer of Turquoise Hill Resources Ltd. | • Audit | ||||

Mike S. Zafirovski(2) | 65 | 2012 | Former director, president and chief executive officer of Nortel Networks Corporation. | • Compensation

• Nominating and Governance | ||||

| (1) | Ms. Miller was appointed as President and Chief Executive Officer effective May 2, 2019. |

| (2) | Mr. Zafirovski is expected to be named as Chair of the Compensation Committee at the Board Meeting to be held in May 2019. He will succeed the current committee Chair, Thomas D. Brown, who is not standing forre-election at the Annual Meeting. |

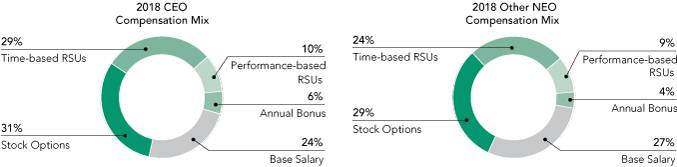

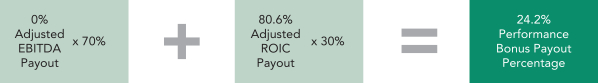

Compensation Highlights

Our compensation program is performance oriented and designed to incent our executive officers to improve our operating performance and thereby create value for all of our stockholders. The following table sets forth the 2018 compensation for each named executive officer as determined under the rules of the U.S. Securities and Exchange Commission (“SEC”). See the notes accompanying the Summary Compensation Table herein for more information.

| Named Executive Officer | Salary | Bonus | Option Awards | Stock Awards | Non-Equity Incentive Plan Compensation | All Other Compensation | Total Compensation | |||||||||||||||||||||

Charles A. Alutto | $ | 1,000,000 | – | $ | 1,289,942 | $ | 1,582,185 | $ | 241,800 | $ | 5,693 | $ | 4,119,620 | |||||||||||||||

Cindy J. Miller | 156,250 | – | 894,995 | 822,209 | – | 33,526 | 1,906,980 | |||||||||||||||||||||

Daniel V. Ginnetti | 550,000 | – | 482,280 | 591,531 | $ | 99,743 | 3,000 | 1,726,554 | ||||||||||||||||||||

Kurt M. Rogers | 400,000 | – | 244,217 | 299,529 | $ | 58,032 | 3,000 | 1,004,778 | ||||||||||||||||||||

Ruth-Ellen Abdulmassih | 370,000 | $ | 327,541 | 234,438 | 287,535 | $ | 58,153 | 26,681 | 1,304,348 | |||||||||||||||||||

Joseph B. Arnold | 550,000 | – | 482,280 | 591,531 | $ | 99,743 | 1,012,005 | 2,735,559 | ||||||||||||||||||||

Brenda R. Frank | 367,692 | $ | 198,616 | 252,546 | 309,704 | – | 19,571 | 1,148,129 | ||||||||||||||||||||

| Stericycle, Inc. - 2019 Proxy Statement | 5 |

Why Did I Receive This Proxy Statement and Other Materials?

The Board of Directors (the “Board”) of Stericycle, Inc. is soliciting proxies to vote shares of our common stock at the 2019 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on Wednesday, May 22, 2019 at 8:30 a.m. central daylight time, at the Loews Chicago O’Hare Hotel, 5300 N. River Road, Rosemont, IL 60018.

This proxy statement and our annual report to stockholders (which includes a copy of our Annual Report on Form10-K for the year ended December 31, 2018), are first being made available to stockholders on or about April 10, 2019. Although both are made available together, our annual report to stockholders is not part of this proxy statement.

What Will Stockholders Vote on at the Annual Meeting?

Stockholders will vote on following matters at the Annual Meeting:

| • | the election to the Board of the ten nominees for director named in this proxy statement (Item 1); |

| • | an advisory vote to approve executive compensation (the“say-on-pay” vote) (Item 2); |

| • | ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2019 (Item 3); |

| • | a stockholder proposal entitled Special Shareholder Meeting Improvement, if properly presented at the Annual Meeting (Item 4); and |

| • | any other matter that properly comes before the Annual Meeting. |

What Are the Board’s Voting Recommendations?

The Board recommends that you vote your shares:

| • | FOR each of the ten nominees for election to the Board (Item 1); |

| • | FOR the advisory vote to approve executive compensation (Item 2); |

| • | FOR ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2019 (Item 3); and |

| • | AGAINST the stockholder proposal (Item 4). |

Who May Vote at the Annual Meeting?

Only stockholders of record as of the close of business on March 28, 2019 are entitled to vote at the Annual Meeting. Each outstanding share of common stock as of the record date is entitled to one vote on all matters that come before the meeting. There is no cumulative voting.

As of the close of business on the record date of March 28, 2019, there were 90,771,802 shares of our common stock issued and outstanding.

Why Did I Receive Only aOne-Page Notice in the Mail Regarding the Internet Availability of Proxy Materials Instead of Receiving a Full Set of Printed Proxy Materials?

In accordance with the “notice and access” rules of the SEC, we have elected to provide access to our proxy materials, including this proxy statement and our annual report to stockholders, over the internet, and accordingly, we mailed our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) on or about April 10, 2019. This Notice contains instructions on how to access our proxy materials over the internet, how to request a printed or

electronic copy of these materials and how to vote by internet, telephone or mail. The voting facilities over the internet or by telephone will remain open until 11:59 p.m. eastern daylight time on May 21, 2019.

The Notice is not a proxy card and cannot be used to vote your shares.

| 6 | Stericycle, Inc. - 2019 Proxy Statement |

GENERAL INFORMATION

What Is the Difference Between a Stockholder of Record and a Beneficial Owner of Shares Held in Street Name?

If your shares are registered directly in your name with our stock registrar and transfer agent, EQ Shareowner Services, you are considered the stockholder of record for those shares and have the right to vote those shares directly. You may vote in person at the Annual Meeting or by proxy.

If your shares are held in an account at a brokerage firm, bank or other nominee (for convenient reference, a “broker”), you are considered the beneficial owner of those shares, which are said to be held in “street name,” and the broker is considered the stockholder of record for voting

purposes. As the beneficial owner you cannot vote the shares in your account directly, but you have the right to instruct the broker how to vote them.

As a beneficial owner, you are invited to attend the Annual Meeting, but because you are not a stockholder of record, you may not vote your shares at the Annual Meeting unless you obtain a valid proxy from your broker.

See “How Can I Attend the Annual Meeting?” below for further information and instructions.

If I Am a Stockholder of Record, How Do I Vote?

You may vote in several ways. You may vote in person at the Annual Meeting, or you may vote by proxy over the internet or by telephone by following the instructions provided in the Notice.

In addition, if you request copies of our proxy materials in printed form, you may vote by completing and signing the proxy card included in the materials and returning it in the postage-paid envelope provided.

If I Am a Beneficial Owner of Shares Held in Street Name, How Do I Instruct My Broker How to Vote?

If you are a beneficial owner of our common stock, the Notice was forwarded to you by your broker. You may instruct your broker how to vote over the internet or by telephone by following the instructions provided by your broker.

In addition, if you request copies of our proxy materials in printed form, you may instruct your broker how to vote by completing and signing the voting instruction card included in the materials and returning it in the postage-paid envelope provided.

What Happens if I Am a Stockholder of Record and Sign and Return the Proxy Card But Do Not Make Any Voting Choices?

The proxy holders (the persons named as proxies) will vote your shares in accordance with the Board’s voting recommendations for Items 1 through 4 described in this proxy statement. See “What Are the Board’s Voting Recommendations?” above.

We do not expect that any other matters will properly come before the Annual Meeting. If, however, any other matters do come before the meeting, the proxy holders will vote your shares in accordance with their judgment.

What Happens if I Am a Beneficial Owner of Shares Held in Street Name and Do Not Give Voting Instructions to My Broker?

Under the stock exchange and other rules governing brokers who are voting shares held in street name, brokers have authority to vote those shares at their discretion on “routine” matters but may not vote those shares on“non-routine” matters. The ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2019 (Item 3) is considered a routine matter under the relevant rules. All of the other items to be voted on (Items 1, 2 and 4) are considerednon-routine matters.

A “brokernon-vote” occurs when your broker returns a proxy card for your shares held in street name but does not vote on

a particular matter because (i) the broker has not received voting instructions from you and (ii) the broker does not have authority to vote on the matter without instructions because the matter is of anon-routine nature. Brokernon-votes will not have any effect on the result of the vote when they occur. There will not be any brokernon-votes on the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2019 (Item 3) because brokers will have discretionary authority to vote on this matter.

| Stericycle, Inc. - 2019 Proxy Statement | 7 |

GENERAL INFORMATION

What Is the Quorum Required for the Annual Meeting?

Holders of a majority of our outstanding shares entitled to vote at the Annual Meeting who are present in person or represented by proxy will constitute a quorum to conduct business at the Annual Meeting.

If you are a stockholder of record and vote your shares by proxy, your shares will be counted for purposes of

determining whether a quorum is present even if your voting choice is to abstain. Similarly, if you are a beneficial owner of shares held in street name and do not give voting instructions to your broker, your shares will be counted for purposes of determining whether a quorum is present if your broker votes your shares on any routine matter.

What Are My Choices in Voting on the Matters to Be Voted on at the Annual Meeting?

On Item 1 (the election of directors), you may vote “For” or “Against” each individual nominee or “Abstain” from voting on the nominee’s election.

On Item 2 (thesay-on-pay vote), Item 3 (ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2019), and Item 4 (the stockholder proposal), you may vote “For” or “Against” the proposal or “Abstain” from voting on the proposal.

What Are the Voting Requirements to Approve the Matters to Be Voted on at the Annual Meeting?

| • | Item 1 (election of directors): Each nominee for election as a director will be elected by the vote of a majority of the votes cast and therefore must receive more “For” votes than “Against” votes in order to be elected as a director. Abstentions and brokernon-votes will not have any effect on the result of the vote. |

| • | Item 2 (thesay-on-pay vote): This proposal requires for approval the affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote. Abstentions will have the same effect as a vote “Against.” Brokernon-votes will not have any effect on the result of the vote. |

| • | Item 3 (ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm |

for 2019): This proposal requires for approval the affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote. Abstentions will have the same effect as a vote “Against.” Brokers will have discretionary authority to vote on Item 3, and therefore, there will not be any brokernon-votes on this matter. |

| • | Item 4 (the stockholder proposal): This proposal requires for approval the affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote. Abstentions will have the same effect as a vote “Against.” Brokernon-votes will not have any effect on the result of the vote. |

Can I Change My Vote after I Have Voted?

If you are a stockholder of record, you may change your vote by voting again over the internet or by telephone (before those voting facilities are closed at 11:59 p.m. eastern daylight time on May 21, 2019) or by returning a new, properly completed proxy card bearing a later date than the date of your original proxy card. In addition, you may revoke your proxy by attending the Annual Meeting in person and requesting to vote. Attendance at the meeting in person will

not, by itself, revoke your proxy. You may also revoke your proxy any time before the final vote at the Annual Meeting by filing a signed notice of revocation with the Secretary of the Company at 28161 North Keith Drive, Lake Forest, Illinois 60045.

If you are a beneficial owner of shares held in street name, you may revoke your proxy by following the instructions provided by your broker.

How Can I Find Out the Voting Results of the Annual Meeting?

The preliminary voting results will be announced at the Annual Meeting, if available. The final voting results will be tallied by the inspector of elections and reported in a Current

Report on Form8-K which we will file with the SEC within four business days following the Annual Meeting.

| 8 | Stericycle, Inc. - 2019 Proxy Statement |

GENERAL INFORMATION

Who Is Paying for the Cost of This Proxy Solicitation?

We will bear the cost of this proxy solicitation. We have retained Georgeson, Inc. to help us solicit proxies. We will pay Georgeson Inc. a base fee of $20,000 plus reasonable expenses for its services. Some of our officers and employees may solicit proxies by personal conversations,

telephone, regular mail or email, but they will not receive any additional compensation for doing so. We will reimburse brokers and others for their reasonable charges and expenses in forwarding our proxy materials to stockholders who are beneficial owners of shares of our common stock.

Multiple Individuals Residing in My Home Are Beneficial Owners of Stericycle Common Stock. Why Did We Receive Only One Mailing?

We are sending only one envelope with multiple Notices to you if you share a single address with another stockholder, unless we have received instructions to the contrary from you. This practice, known as “householding,” is designed to eliminate duplicate mailings, conserve natural resources and reduce our printing and mailing costs. We will promptly deliver a separate Notice to you upon written or verbal request. If you

wish to receive duplicate mailings in the future, you may contact Investor Relations, Stericycle, Inc., 28161 North Keith Drive, Lake Forest, Illinois 60045. If you currently receive multiple Notices, you can request householding by contacting our Investor Relations as described above. If you own your shares through a broker, you can request householding by contacting the holder of record.

How Can I Attend the Annual Meeting?

We encourage our stockholders to attend the Annual Meeting. If you plan to attend the meeting in person, please email your request toInvestor@Stericycle.com. If you are the beneficial owner of shares held in street name, you must also provide confirmation of your stock ownership (for example, by providing a copy of a brokerage firm statement).

All requests for admission must be received by May 15, 2019. Admission is not transferable and will admit only the stockholder or stockholders to whom it was issued.

| Stericycle, Inc. - 2019 Proxy Statement | 9 |

Stock Ownership by Directors and Officers

The following table provides information about the beneficial ownership of shares of our common stock as of March 28, 2019 by (i) each of our directors, (ii) each of our named executive officers listed in the Summary Compensation Table herein, and (iii) all of our directors and executive officers as a group:

| Amount and Nature of Beneficial Ownership(1) | Percent of Class(2) | |||||||

Directors | ||||||||

Charles A. Alutto(3) | 568,935 | * | ||||||

Brian P. Anderson | 6,752 | * | ||||||

Lynn D. Bleil | 17,520 | * | ||||||

Thomas D. Brown | 56,827 | * | ||||||

Thomas F. Chen | 30,094 | * | ||||||

J. Joel Hackney, Jr. | – | * | ||||||

Veronica M. Hagen | – | * | ||||||

Stephen C. Hooley | – | * | ||||||

Cindy J. Miller(3) | – | * | ||||||

Mark C. Miller | 946,620 | 1.0% | ||||||

Robert S. Murley | 8,500 | * | ||||||

Kay G. Priestly | – | * | ||||||

Mike S. Zafirovski | 39,493 | * | ||||||

Named Executive Officers | ||||||||

Daniel V. Ginnetti | 155,231 | * | ||||||

Kurt M. Rogers | 5,634 | * | ||||||

Ruth-Ellen Abdulmassih(4) | 69,458 | * | ||||||

Joseph B. Arnold(5) | 157,011 | * | ||||||

Brenda R. Frank(6) | 784 | * | ||||||

All directors, named executive officers and executive officers as a group (23 persons) |

| 2,067,396 |

|

| 2.3% |

| ||

| * | Less than 1%. |

| (1) | This column includes shares of common stock issuable upon the exercise of stock options exercisable as of or within 60 days after March 28, 2019. These shares are held as follows: Mr. Alutto 564,659 shares; Mr. Anderson, 2,933 shares; Ms. Bleil, 14,947 shares; Mr. Brown, 47,279 shares; Mr. Chen, 21,720 shares; Mr. Miller, 753,683 shares; Mr. Murley, 2,933 shares; Mr. Zafirovski, 32,602 shares; Ms. Abdulmassih, 67,339 shares, Mr. Arnold, 152,998 shares; Mr. Ginnetti, 148,581 shares and; Mr. Rogers, 5,296 shares. Also includes deferred stock units (“DSUs”) allocated to certain of our directors pursuant to our director compensation plan. Such DSUs are as follows: Mr. Anderson, 3,467 units; Ms. Bleil, 2,078 units; Mr. Brown, 4,933 units; Mr. Chen, 3,476 units; Mr. Murley, 4,264 units; and Mr. Zafirovski, 3,476 units. |

| (2) | Shares of common stock issuable under a stock option exercisable as of or within 60 days after March 28, 2019 are considered outstanding for purposes of computing the percentage of the person holding the option but are not considered outstanding for purposes of computing the percentage of any other person. |

| (3) | Mr. Alutto and Ms. Miller are also named executive officers. Mr. Alutto will retire as Chief Executive Officer and as a director effective May 2, 2019. Ms. Miller has been appointed Chief Executive Officer effective as of that date. |

| (4) | Ms. Abdulmassih ceased employment with the Company in January 2019. |

| (5) | Mr. Arnold ceased to be an executive officer of the Company in September 2018. |

| (6) | Ms. Frank ceased employment with the Company in November 2018. |

| 10 | Stericycle, Inc. - 2019 Proxy Statement |

STOCK OWNERSHIP

Stock Ownership of Certain Stockholders

Stock Ownership of Certain Stockholders

The following table provides information about the beneficial ownership of our common stock by each person who was known to us to be the beneficial owner as of the record date (March 28, 2019) of more than 5% of our outstanding common stock:

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class | ||||||

The Vanguard Group, Inc.(1) | 8,172,270 | 9.02 | % | |||||

T. Rowe Price Associates, Inc.(2) | 9,181,105 | 10.1 | % | |||||

BlackRock, Inc.(3) | 7,616,828 | 8.4 | % | |||||

Baillie Gifford & Co.(4)

|

| 5,393,108

|

|

| 5.95

| %

| ||

| (1) | Based on a Schedule 13G/A filed with the SEC on February 11, 2019, the Vanguard Group has sole voting power with respect to 41,023 shares, shared voting power with respect to 10,221 shares, sole dispositive power with respect to 8,129,059 shares and shared dispositive power with respect to 43,211 shares. |

| (2) | Based on a Schedule 13G/A filed with the SEC on February 11, 2019, T Rowe Price Associates, Inc. has sole voting power with respect to 3,711,270 shares and sole dispositive power with respect to 9,161,119 shares. |

| (3) | Based on a Schedule 13G/A filed with the SEC on February 6, 2019, BlackRock, Inc. has sole voting power with respect to 7,204,157 shares, and sole dispositive power with respect to 7,616,828 shares. |

| (4) | Based on a Schedule 13G filed with the SEC on February 8, 2019, Baillie Gifford & Co. has sole voting power with respect to 4,610,118 shares, and sole dispositive power with respect to 5,393,108 shares. |

| Stericycle, Inc. - 2019 Proxy Statement | 11 |

ITEM 1 Election of Directors for aOne-Year Term

Our Board is currently composed of thirteen directors. Mr. Alutto, Mr. Brown and Mr. Miller are not standing forre-election at the Annual Meeting. Therefore, effective as of the annual meeting of shareholders, our board of directors has fixed the size of the board at ten. With the exception of Ms. Miller, our current President and Chief Operating Officer and our Chief Executive Officer Elect, all of our director nominees are outside directors (i.e., directors who are neither an officer nor an employee of ours). Mr. Murley, one of our independent directors, was elected as Chairman of the Board in March 2018. The Board has determined that all of our outside directors are independent under the applicable rules of the SEC and listing standards of the Nasdaq Global Select Market (“Nasdaq”).

Although all of the nominees proposed for election to our board of directors are currently members of our Board, Ms. Miller, Mr. Hackney, Ms. Hagen, Mr. Hooley and Ms. Priestly have not previously been elected by our stockholders. Ms. Miller was elected to our board in connection with her appointment as Chief Executive Officer. Mr. Hackney, Ms. Hagen, Mr. Hooley and Ms. Priestly were identified by the Nominating and Governance Committee as potential directors and were recommended by the Nominating and Governance Committee after it completed its interview and vetting process.

Each director elected at the Annual Meeting will hold office until our 2020 Annual Meeting of Stockholders or until his or her successor is duly elected and qualified.

Voting in Uncontested Director Elections

Under our bylaws, a nominee for election as a director must receive a majority of the votes cast in order to be elected as a director in an uncontested election (an election in which the number of nominees for election is the same as the number of directors to be elected). In other words, the nominee must receive more “for” votes than “against” votes, with abstentions and brokernon-votes not having any effect on the voting.

If a nominee for election as a director is an incumbent director and the nominee is notre-elected, Delaware law provides that the director continues to serve as a “holdover”

director until his successor is elected and qualified or until he resigns. Under our bylaws, an incumbent director who is notre-elected is required to tender his resignation as a director. Our Nominating and Governance Committee will review the circumstances and recommend to the Board whether to accept or reject the director’s resignation or take any other action. The Board is required to act on this recommendation and publicly disclose its decision and the rationale behind its decision within 90 days from the date that the election results are certified.

A number of changes have occurred in our Company’s Board of Directors over the past several years as part of our continuing efforts to ensure that our Board has the right skills and experience to best oversee management and the execution of our strategy and the associated risks.

Since the beginning of 2017, Ms. Miller, Mr. Murley, Mr. Anderson, Mr. Hackney, Ms. Hagen, Mr. Hooley and Ms. Priestly have all joined the Board. Mr. Murley, Mr. Anderson and Ms. Priestly all bring substantial experience in finance, accounting and financial reporting.

Ms. Priestly, Mr. Hackney, Ms. Hagen and Mr. Hooley each have broad experience in business transformation. In addition, since the beginning of 2017, several long-tenured directors have stepped down from the Board. The average tenure of the independent nominees for election as a director is less than 3 years. Further, with respect to Board leadership succession, Mr. Murley was elected as independent Chairman of the Board in March 2018 and new Chairs of the Audit, Compensation and Nominating and Governance Committees were elected in 2016 and 2017.

| 12 | Stericycle, Inc. - 2019 Proxy Statement |

ITEM 1 ELECTION OF DIRECTORS FOR AONE-YEAR TERM

Board Refreshment

A snapshot of our 2019 director nominees is set forth below.

Snapshot of 2019 Director Nominees

The nominees for Director are overwhelmingly independent. The nominees for Director also represent diverse points of view that contribute to a more effective decision-making process.

Board Independence | Board Tenure | Diversity of Director Nominees | ||||||||

10 Directors | All Director nominees are independent except the CEO Elect | Tenure of independent Director nominees (years of consecutive service) | 60% | Gender, ethnic or other minority representation | ||||||

| 2.5 years | Average Tenure |  | |||||||

| ||||||||||

| Stericycle, Inc. - 2019 Proxy Statement | 13 |

ITEM 1 ELECTION OF DIRECTORS FOR AONE-YEAR TERM

Nominees for Director

ROBERT S. MURLEY

Director since January 2017

Age 69

Experience: Robert S. Murley has served as our Chairman since March 2018. Mr. Murley is a Senior Adviser to Credit Suisse, LLC, a financial services company. From 1975 to April 2012, Mr. Murley was employed by Credit Suisse, LLC and its predecessors. In 2005, he was appointed Chairman of Investment Banking in the Americas. Prior to that time, Mr. Murley headed the Global Industrial and Services Group within the Investment Banking Division, as well as the Chicago investment banking office. He was named a Managing Director in 1984 and appointed a Vice Chairman in 1998. Mr. Murley is a member of the board of directors of Health Insurance Innovations Inc., of privately held Brown Advisory Incorporated, and of the board of advisors of Harbour Group. He was formerly on the board of directors of Stone Energy Corporation and Apollo Education Group, Inc. Mr. Murley is an Emeritus Charter Trustee of Princeton University, a Trustee and the former Chairman of the Board of the Educational Testing Service in Princeton, New Jersey, is Vice Chairman of the Board of the Ann & Robert Lurie Children’s Hospital of Chicago and Chair of the Board of the Lurie Children’s Foundation, is a Trustee of the Museum of Science & Industry in Chicago, Illinois, is Chairman of the Board of the UCLA Anderson Board of Advisors.

Skills & Qualifications: Mr. Murley’s existing public company board experience, his deep knowledge of the capital markets and the economy, and his extensive experience leading and advising a range of businesses across multiple industries make him a valuable member of the Board.

CINDY J. MILLER

Director since February 2019

Age 56

Experience: Ms. Miller joined Stericycle as President and Chief Operating Officer in October 2018. She was named President and Chief Executive Officer effective May 2019. Ms. Miller previously served as President, Global Freight Forwarding for United Parcel Service (UPS) from April 2016 to September 2018 and as President of UPS’s European region from March 2013 to March 2016.

Skills & Qualifications: Ms. Miller brings to the Board deep knowledge and experience in business transformation and change management, operations management, strategy, logistics, and international business.

BRIAN P. ANDERSON

Director since January 2017

Age 68

Experience: Mr. Anderson served as Senior Vice-President and Chief Financial Officer of OfficeMax Incorporated from 2004 to 2005 and as Senior Vice President and Chief Financial Officer of Baxter International from 1997 to 2004. He joined Baxter in 1991, as Vice President, Corporate Audit, became Corporate Controller in 1993 and then Vice President, Finance in 1997. Before joining Baxter, he spent 15 years with Deloitte in the Chicago office and the Washington, D.C. office as an Audit Partner. He is a member of the Board of Directors of W. W. Grainger, Inc., PulteGroup, Inc., and James Hardie Industries plc. He currently serves as Chairman of the Audit Committee of James Hardie Industries plc, and is the former Chairman of the Nemours Foundation, Chairman of the Audit Committee of the Pulte Group and Lead Director and Audit Committee Chairman of W. W. Grainger, Inc. Mr. Anderson serves on The Governing Board of the Center for Audit Quality and served on the Board of A.M. Castle & Co. from 2005 to 2016, as Audit Committee Chairman (2005-2010) and Chairman of the Board 2010-2016.

Skills & Qualifications: Mr. Anderson brings to our Board his significant experience as a chief financial officer of two large multinational companies,in-depth knowledge with respect to the preparation and review of complex financial reporting statements, and experience in risk management and risk assessment.

LYNN D. BLEIL

Director Since May 2015

Age 55

Experience: Ms. Bleil was the leader of the West Coast Healthcare Practice of McKinsey & Company, a management consulting firm. Ms. Bleil was also a leader of McKinsey’s worldwide Healthcare Practice. She retired in November 2013 as a Senior Partner (Director) in the Southern California Office of McKinsey. During her more than 25 years with McKinsey, she worked exclusively within the healthcare sector, advising senior management and boards of leading companies on corporate and business unit strategy, mergers and acquisitions and integration, marketing and sales, public policy and organization. Ms. Bleil also serves as a director of Amicus Therapeutics Inc., a biotechnology company, Alcon AG, Sonova Holdings AG, a global leader in hearing aids and cochlear implants, and Intermountain Healthcare’s Park City Medical Center, anon-profit healthcare organization. She was formerly a director of DST Systems, Inc.

Skills & Qualifications: Ms. Bleil brings to the Board significant experience in the healthcare industry, as well as commercial expertise and expertise in corporate strategy, mergers and acquisitions, and financial reporting, compliance and risk management.

| 14 | Stericycle, Inc. - 2019 Proxy Statement |

ITEM 1 ELECTION OF DIRECTORS FOR AONE-YEAR TERM

Nominees for Director

THOMAS F. CHEN

Director Since May 2014

Age 69

Experience: Mr. Chen served as senior vice president and president of international nutrition of Abbott Laboratories before retiring in 2010. During his22-year career at Abbott, Mr. Chen served in a number of roles with expanding responsibilities, primarily in Pacific/Asia/Africa where he oversaw expansion into emerging markets. Prior to Abbott, he held several management positions at American Cyanamid Company, which later merged with Pfizer, Inc. Mr. Chen currently serves as a director of Baxter International Inc. and an advisor to Cooperation Fund, a partnership between Goldman Sachs and the sovereign fund, China Investment Corporation, to bolster U.S. manufacturers’ market presence in China. Mr. Chen previously served as a director of Cyanotech Corporation.

Skills & Qualifications: With his extensive international business experience in pharmaceutical, hospital products and nutritionals through his22-year career at Abbott, Mr. Chen provides our Board with a distinct global perspective resulting from his experience with diverse geographies and healthcare products. He also provides our Board with significant operational, strategy, mergers and acquisitions, healthcare industry, governmental and regulatory, and commercial expertise.

J. JOEL HACKNEY, JR.

Director Since March 2019

Age 49

Experience: Mr. Hackney has been the Chief Executive Officer and a director of nThrive, Inc., a revenue cycle management company providing medical billing and coding, business analytics and advisory services, since January 2016. Previously, he was the Chief Executive Officer and a director of AVINTV from June 2013 to November 2016.

Skills & Qualifications: With more than 25 years of experience leading both private and public companies domestically and abroad, Mr. Hackney brings to our Board deep expertise in driving business transformation and profitable growth.

VERONICA M. HAGEN

Director Since June 2018

Age 73

Experience: From 2007 until her retirement in 2013, Ms. Hagen served as Chief Executive Officer of Polymer Group, Inc. and served from 2007 to 2015 as a Director. She also served as President of Polymer Group, Inc. from January 2011 until her retirement in 2013. Prior to joining Polymer Group, Inc., Ms. Hagen was the President and Chief Executive Officer of Sappi Fine Paper, a division of Sappi Limited. She has served as Vice President and Chief Customer Officer at Alcoa Inc. and owned and operated Metal Sales Associates. She is a Director of American Water Works Company, Inc., Newmont Mining Corporation and The Southern Company.

Skills & Qualifications: Ms. Hagen brings business transformation expertise, senior leadership experience, corporate governance knowledge and experience, environmental matters experience and risk management experience. Ms. Hagen’s experience as chief executive officer of two global companies allows her to contribute key valuable insights to our Board regarding operations management, customer service and strategic planning.

STEPHEN C. HOOLEY

Director Since March 2019

Age 56

Experience: Mr. Hooley served as Chairman, Chief Executive Officer and President of DST Systems, Inc. from July 2014 to April 2018. He was Chief Executive Officer and President of DST Systems from September 2012 to July 2014 and President and Chief Operating Officer from July 2009 to September 2012. He was previously the President and Chief Executive Officer of Boston Financial Data Services.

Skills & Qualifications: Mr. Hooley brings previous service as a public company chief executive officer and director, deep experience in the financial services and healthcare industries and extensive business transformation and strategy expertise.

| Stericycle, Inc. - 2019 Proxy Statement | 15 |

ITEM 1 ELECTION OF DIRECTORS FOR AONE-YEAR TERM

Nominees for Director

KAY G. PRIESTLY

Director Since June 2018

Age 62

Experience:Ms. Priestly served as Chief Executive Officer of Turquoise Hill Resources Ltd. from May 2012 until her retirement in December 2014. She previously served as Chief Financial Officer of Rio Tinto Copper, a division of the Rio Tinto Group, from 2008 until her appointment as Chief Executive Officer of Turquoise Hill Resources in 2012. From 2006 to 2008, she was Vice President, Finance and Chief Financial Officer of Rio Tinto’s Kennecott Utah Copper operations. She previously spent over 24 years with global professional services firm Arthur Anderson, where she provided tax, consulting and M&A services to global companies across many industries. She is a director of TechnipFMC plc and formerly served as a director of New Gold Inc., FMC Technologies, Inc. SouthGobi Resources Ltd., Turquoise Hill Resources and Stone Energy Corporation(1).

Skills & Qualifications: Ms. Priestly brings to our Board extensive executive management experience as a chief executive offer and senior officer of major organizations with international operations. She also brings substantial business transformation, accounting, financial, risk management, M&A and consulting expertise.

| (1) | When the Board appointed Ms. Priestly as a director in June 2018, it was aware that Stone Energy Corporation had filed for bankruptcy protection in 2016 while Ms. Priestly was serving as a director. The Board concluded that this event did not impair Ms. Priestley’s ability to serve as one of our directors. |

MIKE S. ZAFIROVSKI

Director Since November 2012

Age 65

Experience: Mr. Zafirovski is the founder and President of The Zaf Group LLC, a management consulting and investment firm established in November 2012. Mr. Zafirovski has also served as an executive advisor to The Blackstone Group, a private investment banking company, since October 2011. From November 2005 to August 2009, Mr. Zafirovski served as the President and Chief Executive Officer and a director of Nortel Networks Corporation. Prior to that, he was the President and Chief Operating Officer and a director of Motorola, Inc. from July 2002 to January 2005, and remained a consultant to and a director of Motorola until May 2005. He served as Executive Vice President and President of the personal communications sector of Motorola from June 2000 to July 2002. Prior to joining Motorola, Mr. Zafirovski spent nearly 25 years with General Electric Company, where he served in management positions, including 13 years as President and Chief Executive Officer of five businesses in the consumer, industrial and financial services areas, his most recent being President and Chief Executive Officer of GE Lighting from July 1999 to May 2000. Mr. Zafirovski also serves as a director of The Boeing Company and Apria Healthcare Group Inc.

Skills & Qualifications: Mr. Zafirovski provides guidance to the Board on a wide variety of strategic, operational and business matters based on his substantial experience leading enterprises with significant international operations. He also provides business transformation, information technology, mergers and acquisitions, healthcare industry, and government and regulatory expertise.

The Board of Directors recommends a vote “FOR” the election of these ten Director nominees. Proxies solicited by the Board will be so voted unless stockholders specify a different choice.

We believe that our ten director nominees possess the experience, qualifications and skills that warrant their election as directors. Our directors have in common, among other qualities, a breadth of business experience, seasoned judgment and an insistence on looking beyond the next quarter or the next year in directing and supporting our management. From their service on the boards of other public and private companies, our directors also bring to us the insights that they gain from the operating policies, governance structures and growth dynamics of these other companies.

The Nominating and Governance Committee seeks to ensure an experienced, exceptionally qualified Board with deep expertise in areas relevant to Stericycle. When evaluating

potential director nominees, the committee considers each individual’s professional expertise and background, in addition to his or her personal characteristics. The committee always conducts this evaluation in the context of the Board as a whole. The committee works with the Board to determine the appropriate mix of backgrounds and experiences that will foster and maintain a Board strong in its collective knowledge and best able to perpetuate our long-term success. To assist in this objective, the Nominating and Governance Committee conducts annual evaluations of the Board and the Board’s committees, assessing the experience, skills, qualifications, diversity, and contributions of each individual and of the group as a whole.

| 16 | Stericycle, Inc. - 2019 Proxy Statement |

ITEM 1 ELECTION OF DIRECTORS FOR AONE-YEAR TERM

Director Qualifications

The Nominating and Governance Committee regularly communicates with the Board to identify characteristics, professional experience and areas of expertise that will help meet specific Board needs, including:

| • | leadership experience, as directors who have served in significant leadership positions possess strong abilities to motivate and manage others and to identify and develop leadership qualities in others; |

| • | business transformation experience, as we are engaged in a multi-year program to transform our company for long-term sustainability and drive profitable growth and long-term shareholder returns; |

| • | public company board service and governance expertise, which provides directors with a solid understanding of their extensive and complex oversight responsibilities and |

furthers our goals of greater transparency, accountability for management and the Board and protection of stockholder interests; |

| • | operational expertise, which gives directors specific insight into, and expertise that will foster active participation in the oversight of the development and implementation of our operating plan and business strategy; |

| • | financial reporting,compliance and risk management expertise, which enables directors to analyze our financial statements, capital structure and complex financial transactions and oversee our accounting, financial reporting and enterprise risk management; and |

| • | healthcare industry expertise, which is vital in understanding and reviewing our strategy. |

The following table highlights each nominee’s specific skills, knowledge and experiences in these areas. A particular director may possess additional skills, knowledge or experience even though they are not indicated below:

| Anderson | Bleil | Chen | Hackney | Hagen | Hooley | Miller | Murley | Priestly | Zafirovski | |||||||||||

Leadership experience (public company CEO/COO) | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||

Public company Board service/governance expertise | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||

Operational expertise (logistics/supply chain or capital intensive industry) | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||

Business transformation/IT expertise | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||

Corporate strategy/M&A capability | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||

Financial reporting, compliance and risk management expertise | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||

Healthcare industry expertise | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||

Government/regulatory experience | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||

Talent management/HR expertise | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||

Commercial/go-to-market expertise | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||

International business expertise | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||

Gender, ethnic or other diversity | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||

Tenure on Board (years, as of May 2019) | 2 | 4 | 5 | <1 | 1 | <1 | <1 | 2 | 1 | 7 | ||||||||||

| Stericycle, Inc. - 2019 Proxy Statement | 17 |

ITEM 1 ELECTION OF DIRECTORS FOR AONE-YEAR TERM

Committees of the Board

Our Board of Directors has three standing committees: Compensation, Audit, and Nominating and Governance Committees. All of the members of each committee are outside directors who are independent under the applicable SEC rules and Nasdaq listing standards.

Compensation Committee

The Compensation Committee determines the structure, award and public disclosure of all elements of compensation and benefits paid to our CEO and other executive officers. The committee reviews and approves financial and strategic performance objectives with respect to our annual and long-term incentive plans. The committee reviews and approves the respective salaries of the Company’s executive officers in light of the Company’s goals and objectives relevant to each officer, including, as the committee deems appropriate, consideration of (i) the individual officer’s salary grade, scope of responsibilities and level of experience, (ii) the rate of inflation, (iii) the range of salary increases for the Company’s employees generally, and (iv) the salaries paid to comparable officers in comparable companies. The committee determines appropriate cash bonuses, if any, for the Company’s executive

officers, after consideration of specific individual and Company performance goals and criteria and periodically reviews the aggregate amount of compensation and benefits being paid or potentially payable to the Company’s executive officers. The committee also has responsibility for overseeing the Company’s regulatory compliance with respect to compensation matters. Pursuant to the committee’s charter, the committee has responsibility for facilitating a risk review of incentive compensation programs and assessing if those incentives create risks that are reasonably likely to have a material adverse effect on our company. At the request of the Board, the committee periodically reviews executive leadership development and CEO succession planning and makes recommendations to our Board of Directors.

Audit Committee

The Audit Committee assists the Board of Directors in fulfilling its oversight responsibilities relating to the integrity of our financial statements, the qualifications and experience of our independent accountants, the performance of our internal audit function and our independent accountants, and our compliance with legal and regulatory requirements.

The Audit Committee regularly reviews with the Company’s legal counsel any legal or regulatory matters that may have a material effect on the Company’s financial statements or operations. The Audit Committee also oversees, reviews and evaluates the adequacy and effectiveness of the Company’s compliance program. The Audit Committee reviews and evaluates the qualifications, performance and independence of our independent public accountants. The Audit Committee

also reviews the performance, effectiveness and objectivity of the Company’s internal audit function, including its staffing, audit plan, examinations and related management responses.

The Audit Committee reviews our risk management policies and practices and reports any significant issues to the Board. Matters of risk management are brought to the committee’s attention by our Executive Vice President and Chief Financial Officer, our Executive Vice President and General Counsel, our Executive Vice President and Chief Ethics and Compliance Officer, or by our principal internal auditor. Our management reviews and reports on potential areas of risk at the committee’s request or at the request of other members of the Board.

Nominating and Governance Committee

The Nominating and Governance Committee develops, recommends to the Board and oversees the implementation of our corporate governance policies and practices. The committee monitors ongoing legislative and regulatory changes and initiatives pertaining to corporate governance principles, SEC disclosure rules and Nasdaq listing rules. The committee identifies and evaluates possible nominees for election to the Board of Directors and recommends to the Board a slate of nominees for election at the annual meeting of stockholders. The committee also recommends to the Board director assignments to the Board’s committees.

As discussed above, the Nominating and Governance Committee considers a variety of factors in evaluating a candidate for selection as a nominee for election as a director. These factors include the candidate’s personal qualities, with a particular emphasis on probity, independence of judgment and analytical skills, and the candidate’s professional experience, educational background, knowledge of our business and healthcare services generally and experience serving on the boards of other public companies. In evaluating a candidate’s qualification for election to the Board, the committee also considers whether and how the candidate would contribute to

| 18 | Stericycle, Inc. - 2019 Proxy Statement |

ITEM 1 ELECTION OF DIRECTORS FOR AONE-YEAR TERM

Committees of the Board

the Board’s diversity, which we define broadly to include gender and ethnicity as well as background, experience and other individual qualities and attributes. The committee has not established any minimum qualifications that a candidate must possess. In determining whether to recommend an incumbent director forre-election, the committee also considers the director’s preparation for and participation in meetings of the Board of Directors and the committee or committees of the Board on which the director serves.

In identifying potential candidates for selection in the future as nominees for election as directors, the Nominating and Governance Committee relies on suggestions and recommendations from the other directors, management, stockholders and others and, when appropriate, may retain a search firm for assistance. In February 2019, the Nominating and Governance Committee retained a leading third-party search firm to assist with identifying potential director nominees. The committee will consider candidates proposed by stockholders and will evaluate any candidate proposed by a stockholder on the same basis that it evaluates any other candidate. Any stockholder who wants to propose a candidate should submit a written recommendation to the committee indicating the candidate’s qualifications and other relevant biographical information and providing preliminary confirmation that the candidate would be willing to serve as a director. Any such recommendation should be addressed to the Board of Directors, Stericycle, Inc., 28161 North Keith Drive, Lake Forest, Illinois 60045.

In addition to recommending director candidates to the Nominating and Governance Committee, stockholders may

also, pursuant to procedures established in our bylaws, directly nominate one or more director candidates to stand for election at an annual meeting of stockholders. A stockholder wishing to make such a nomination must deliver written notice of the nomination that satisfies the requirements set forth in our bylaws to the secretary of the Company not less than 90 days nor more than 120 days prior to the first anniversary of the preceding year’s annual meeting of stockholders. If, however, the date of the annual meeting is more than 30 days before or after the first anniversary, the stockholder’s notice must be received no more than 120 days prior to such annual meeting nor less than the later of (x) 90 days prior to such annual meeting and (y) the close of business on the 10thday following the date on which notice or public disclosure of the date of the meeting was first given or made.

Stockholders may also submit director nominees to the Board to be included in our annual proxy statement, known as “proxy access.” Stockholders who intend to submit director nominees for inclusion in our proxy materials for the 2020 Annual Meeting of Stockholders must comply with the requirements of proxy access as set forth in our bylaws. The stockholder or group of stockholders who wish to submit director nominees pursuant to proxy access must deliver the required materials to the Company not less than 120 days nor more than 150 days prior to theone-year anniversary of the date that the Company first mailed its proxy materials for the annual meeting of the previous year.

Process for Selecting Directors

Committee Charters

The charters of the Compensation, Audit and Nominating and Governance Committees are available on our investor relations website,http://investors.stericycle.com.

| Stericycle, Inc. - 2019 Proxy Statement | 19 |

ITEM 1 ELECTION OF DIRECTORS FOR AONE-YEAR TERM

Committees of the Board

Committee Members and Meetings

The following table provides information about the current membership of the committees of the Board of Directors.

Director | Compensation Committee | Audit Committee | Nominating and Governance Committee | |||||||||

Robert S. Murley(1) | ||||||||||||

Charles A. Alutto | ||||||||||||

Brian P. Anderson(2) |

|

|

| |||||||||

Lynn D. Bleil |

|

|

|

|

|

| ||||||

Thomas D. Brown(3) |

|

|

|

|

|

| ||||||

Thomas F. Chen |

|

|

|

|

|

| ||||||

J. Joel Hackney, Jr. |

|

|

| |||||||||

Veronica M. Hagen |

|

|

| |||||||||

Stephen C. Hooley |

|

|

| |||||||||

Cindy J. Miller | ||||||||||||

Mark C. Miller | ||||||||||||

Kay G. Priestly(2) |

|

|

| |||||||||

Mike S. Zafirovski(3) |

|

|

|

|

|

| ||||||

| Member |

| Committee Chair |

| (1) | Mr. Murley serves as the independent Chairman of the Board. |

| (2) | The Board of Directors has determined that Mr. Anderson, the Chair of the Audit Committee, and Ms. Priestly are “audit committee financial experts” as defined in the applicable SEC rules. |

| (3) | Mr. Brown is not standing forre-election at the Annual Meeting, and we expect that Mr. Zafirovski will succeed him as Chair of the Compensation Committee at that time. |

Our Board of Directors held 18 meetings in person or by telephone during 2018 and acted without a formal meeting on several occasions by the unanimous written consent of the directors. The Audit Committee held 15 meetings during the year. The Compensation Committee held six meetings during the year. The Nominating and Governance Committee held six meetings during the year. Each director attended 75% or more of the aggregate number of Board meetings and the total number of meetings of all Board committees on which he or she served during his or her term of service.

We encourage our directors to attend the annual meeting of stockholders. Each of the director nominees attended the 2018 Annual Meeting of Stockholders, and we anticipate that all of our director nominees will attend this year’s Annual Meeting.

Our Company’s Board of Directors does not have a current requirement that the roles of Chief Executive Officer and Chairman of the Board be either combined or separated because the Board believes it is in the best interest of our Company to make this determination based upon the position and direction of the Company and the constitution of the Board and management team. The Board regularly evaluates whether the roles of Chief Executive Officer and Chairman of the board should be combined or separated.

As part of the evolution of the Board of Directors, in March 2018, Mr. Murley, one of our independent directors, was elected Chairman of the Board, succeeding Mr. Miller. Mr. Miller is not standing forre-election as a director at the Annual Meeting.

The Chairman confers with our CEO on matters of general policy affecting theday-to-day management of our company’s business. The Chairman coordinates the scheduling and agenda of Board meetings and the preparation and distribution of agenda materials. The Chairman presides at all meetings of the Board of Directors and may call special meetings of the Board when he considers it appropriate. In general, the Chairman oversees the scope, quality, and timeliness of the flow of

| 20 | Stericycle, Inc. - 2019 Proxy Statement |

ITEM 1 ELECTION OF DIRECTORS FOR AONE-YEAR TERM

Board Leadership

information from our management to the Board and serves as an independent contact for stockholders wishing to communicate with the Board.

Our Board believes that an independent Chairman serves the Company and its stockholders well at this time. The combined experience and knowledge of Ms. Miller and Mr. Murley in their respective roles as CEO Elect and Chairman provide the Board and the Company with aday-to-day focus on the operations of the Company combined with independent oversight of the Board and management. Ournon-management directors further facilitate the Board’s independence by meeting frequently as a group and fostering a climate of transparent communication. A high level of contact between our Chairman and Chief Executive Officer between Board meetings also serves to foster effective Board leadership.

Executive Sessions of the Board

Our Board of Directors excuses our Chief Executive Officer, as well as any of our other executive officers who may be present by invitation, from a portion of each meeting of the Board in order to allow the Board, with our Chairman

presiding, to review the Chief Executive Officer’s performance and to enable each director to raise any matter of interest or concern without the presence of management.

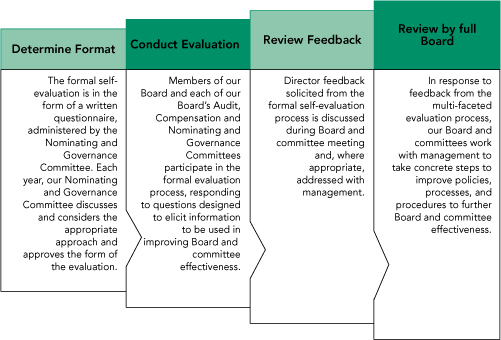

Board Evaluation

Our directors annually review the performance of the Board of Directors and its committees and the performance of their fellow directors by completing a confidential evaluation that is returned to the Chair of the Nominating and Governance Committee. The evaluations elicit input from our directors with respect to the Company’s vision, strategy, and operating performance, our CEO and senior management, and the composition and management of our Board and its committees. The evaluations also seek input from members of the Board committees in such areas as trends and issues affecting the Company, the roles and responsibilities of the committee members, the makeup and composition of the committees, participation and preparation of the committee members and the effectiveness of the committees. Each director also has the opportunity to provide confidential feedback on each other director. At a subsequent meeting of the Board, the chair of the Nominating and Governance Committee leads a discussion with the full Board of any issues and suggestions for improvement identified in the review of the director evaluations.

| Stericycle, Inc. - 2019 Proxy Statement | 21 |

ITEM 1 ELECTION OF DIRECTORS FOR AONE-YEAR TERM

Corporate Governance

Policy on Related Party Transactions

The Board of Directors has adopted a written policy requiring certain transactions with related parties to be approved in advance by the Audit Committee. For purposes of this policy, a related party includes any director, director nominee or executive officer or an immediate family member of any director, director nominee or executive officer. The transactions subject to review include any transaction, arrangement or relationship (or any series of similar transactions, arrangements and relationships) in which (i) we or one of our subsidiaries will be a participant, (ii) the aggregate amount involved exceeds $100,000 and (iii) a

related party will have a direct or indirect interest. In reviewing proposed transactions with related parties, the Audit Committee considers the benefits to us of the proposed transaction, the potential effect of the proposed transaction on the director’s independence (if the related party is a director), and the terms of the proposed transaction and whether those terms are comparable to the terms available to an unrelated third party or to employees generally. There were no such transactions during the year ended December 31, 2018 that required the Audit Committee’s approval.

Succession Planning

The strength of our leadership team is critical to our Company’s short and long-term success. As such, the recruitment, development and retention of talented executives and senior leaders is a priority for the Company and the Board.

On an annual basis, the Board devotes time during a dedicated session to discuss talent management and succession planning. Lead by our Chief People Officer, this session includes an overview of senior leaders across the Company’s service lines, global markets, and functional shared services up to and including the executive officers of the company. The Board is also given exposure to emerging, high-potential leaders through formal presentations to the Board and working groups with Board committees.

Beyond the annual succession planning session, the Board is routinely updated on workforce matters including key workforce indicators, team member engagement, recruiting programs, and talent development programs.

During 2018, Stericycle announced the appointment of Ms. Miller as President and Chief Operating Officer. The Board was heavily engaged in the recruitment and selection process for this role and leveraged the appointment of a new Chief Operating Officer to build a succession plan for the Chief Executive Officer role. With the announcement of Mr. Alutto’s retirement in February 2019, Ms. Miller was named Chief Executive Officer, effective May 2, 2019.

Shareholder Engagement

During 2018 and under the oversight of our Chairman of the Board, Stericycle expanded its efforts for engaging with shareholders. In addition to our Company’s previous monitoring and routine shareholder engagement practices, we introduced a proactive Board outreach program which focused on building relationships with our top 25 shareholders.

Our expanded engagement program included outreach during the spring of 2018 and again in the fall to gain a broader understanding of shareholder priorities. During these conversations, our Board members reviewed our corporate governance enhancements, the refreshment of our

Board of Directors, our executive compensation philosophy and program, and the expansion of the leadership team, which have all significantly evolved over the past three years. Additionally, we solicited feedback from shareholders on our progress and responded to their questions and concerns.

The outreach program provided our Board with useful input from our shareholders. Transparency and responsiveness is an important component of our governance commitment to shareholders. We expect to continue to expand our engagement practices in order to monitor the insights of our shareholders and proactively solicit ways to evolve our business.

Risk Oversight

The Board regularly devotes time during its meetings to review and discuss the most significant risks facing the Company, and management’s responses to those risks. During these discussions, the Chief Executive Officer, Chief Financial Officer, General Counsel and other members of senior management present management’s assessment of risks, a description of the most significant risks facing the

Company and any mitigating factors and plans or practices in place to address and monitor those risks.

Each Board committee addresses relevant risk topics as part of its committee responsibilities. The committees oversee the Company’s risk profile and exposures relating to matters within the scope of their authority and provide periodic

| 22 | Stericycle, Inc. - 2019 Proxy Statement |

ITEM 1 ELECTION OF DIRECTORS FOR AONE-YEAR TERM

Corporate Governance