As filed with the Securities and Exchange Commission December 22, 2009

1933 Act No.

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

| | | |

| Pre-Effective Amendment No. | | ¨ | |

| Post-Effective Amendment No. | | ¨ | |

(Check appropriate box or boxes.)

DIMENSIONAL INVESTMENT GROUP INC.

(Exact Name of Registrant as Specified in Charter)

6300 Bee Cave Road, Building One, Austin, TX 78746

(Address of Principal Executive Office) (Zip Code)

Registrant’s Telephone Number, including Area Code (512) 306-7400

Catherine L. Newell, Esquire, Vice President and Secretary

Dimensional Investment Group Inc.,

6300 Bee Cave Road, Building One, Austin, TX 78746

(Name and Address of Agent for Service)

Please send copies of all communications to:

Mark A. Sheehan, Esquire

Stradley, Ronon, Stevens & Young, LLP

2600 One Commerce Square

Philadelphia, PA 19103

(215) 564-8027

Approximate Date of Public Offering: As soon as practicable after this Registration Statement becomes effective under the Securities Act of 1933, as amended.

Title of securities being registered: Shares of common stock, with par value of one cent ($0.01) per share, of the U.S. Large Company Institutional Index Portfolio. No filing fee is due because Registrant is relying on section 24(f) of the Investment Company Act of 1940, as amended.

It is proposed that this filing will become effective on January 21, 2010, pursuant to Rule 488 under the Securities Act of 1933, as amended.

DIMENSIONAL FUND ADVISORS LP

Dimensional Investment Group Inc.

DFA Investment Dimensions Group Inc.

6300 Bee Cave Road, Building One

Austin, TX 78746

January [ ], 2010

Dear Shareholder:

We wish to provide you with some important information concerning your investment in the U.S. Large Company Portfolio (the “Target Fund”, a portfolio of DFA Investment Dimensions Group Inc. (“DFAIDG”). The Board of Directors of DFAIDG (the “DFAIDG Board”) has approved the reorganization of the Target Fund into the U.S. Large Company Institutional Index Portfolio (the “Acquiring Fund”), a portfolio of Dimensional Investment Group Inc. (“DIG”). The reorganization also has been approved by the Board of Directors of DIG (the “DIG Board”).

The Target Fund and the Acquiring Fund (each a “Fund,” and together the “Funds”) pursue identical investment objectives and have identical investment strategies. The Funds operate as feeder funds in a master-feeder structure, and each Fund invests substantially all of its assets in The U.S. Large Company Series (the “Master Fund”) of The DFA Investment Trust Company. The reorganization is expected to occur on February 26, 2010. Upon completion of the reorganization, you will become a shareholder of the Acquiring Fund, and you will receive shares of the Acquiring Fund equal in value to your shares in the Target Fund. As a shareholder of the Acquiring Fund, you will invest in a Fund that has total fees that are 0.045 of 1% lower than the total fees of the Target Fund. In conjunction with completing the reorganization, the Acquiring Fund will change its name to the “U.S. Large Company Portfolio.” Following the reorganization, the Acquiring Fund will continue to invest substantially all of its assets in the Master Fund. The reorganization is expected to be tax-free for federal income tax purposes, and no sales load, contingent deferred sales charge, commission, redemption fee, or other transaction fee will be charged by the Funds as a result of the reorganization.

The reorganization does not require shareholder approval, and you are not being asked to vote. However, we do ask that you review the enclosed combined Information Statement/Prospectus, which contains information about the Acquiring Fund, including fees and expenses.

Each of the DFAIDG Board and the DIG Board, including a majority of the independent directors of each Board, has approved unanimously the reorganization and believes the reorganization is in the best interests of the Target Fund and the Acquiring Fund, respectively, and their shareholders.

If you have questions, please call Dimensional Fund Advisors LP collect at 512-306-7400.

Thank you for investing with Dimensional.

Sincerely,

/s/ David G. Booth

David G. Booth

Chairman and Chief Executive Officer

INFORMATION STATEMENT/PROSPECTUS

Dated January [ ], 2010

Acquisition of Substantially All of the Assets of

U.S. LARGE COMPANY PORTFOLIO

(a portfolio of DFA Investment Dimensions Group Inc.)

By and in Exchange for Shares of

U.S. LARGE COMPANY INSTITUTIONAL INDEX PORTFOLIO

(a portfolio of Dimensional Investment Group Inc.)

Dimensional Investment Group Inc.

6300 Bee Cave Road, Building One

Austin, TX 78746

(512) 306-7400

This Information Statement/Prospectus is being furnished to shareholders of the U.S. Large Company Portfolio (the “Target Fund”), a portfolio of DFA Investment Dimensions Group Inc. (“DFAIDG”), in connection with an Agreement and Plan of Reorganization (the “Plan”) that has been approved by the Board of Directors of DFAIDG (the “DFAIDG Board”). The Plan is attached to this Information Statement/Prospectus as Exhibit A. Under the Plan, (i) the U.S. Large Company Institutional Index Portfolio (the “Acquiring Fund”), a portfolio of Dimensional Investment Group Inc. (“DIG”), will acquire substantially all of the assets of the Target Fund, in exchange solely for shares of common stock of the Acquiring Fund; (ii) the shares of the Acquiring Fund will be distributed to the shareholders of the Target Fund according to their respective interests in the Target Fund; and (iii) the Target Fund will be liquidated and dissolved (the “Reorganization”). The shares of the Acquiring Fund received by the shareholders of the Target Fund in the exchange will be equal in aggregate net asset value to the aggregate net asset value of their shares of the Target Fund as of the closing date of the Reorganization. The Reorganization also has been approved by the Board of Directors of DIG (the “DIG Board”). The Reorganization is expected to be effective on or about February 26, 2010.

The DFAIDG Board, including a majority of the independent directors, believes that the Reorganization is in the best interests of the Target Fund and that the interests of the Target Fund’s shareholders will not be diluted as a result of the Reorganization. Similarly, the DIG Board, including a majority of the independent directors, believes that the Reorganization is in the best interests of the Acquiring Fund, and that the interests of the Acquiring Fund’s shareholders will not be diluted as a result of the Reorganization. For federal income tax purposes, the Reorganization is intended to be structured as a tax-free transaction for the Target Fund, the Acquiring Fund, and their shareholders.

THIS INFORMATION STATEMENT/PROSPECTUS IS FOR INFORMATION PURPOSES ONLY, AND YOU DO NOT NEED TO DO ANYTHING IN RESPONSE TO RECEIVING IT. WE ARE NOT ASKING YOU FOR A PROXY, AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

The Target Fund is a diversified portfolio of DFAIDG, a corporation created under the laws of Maryland, which is registered with the U.S. Securities and Exchange Commission (the “Commission” or the “SEC”) as an open-end management investment company. The Acquiring Fund is a diversified portfolio of DIG, which also is a corporation created under the laws of Maryland, and which is registered with the Commission as an open-end management investment company. The investment objectives of the Target Fund and the Acquiring Fund (together, the “Funds”) are identical—to approximate the total investment return of the S&P 500® Index. The principal offices of DFAIDG and DIG are located at 6300 Bee Cave Road, Building One, Austin, Texas 78746. The Funds are sponsored by Dimensional Fund Advisors LP (“Dimensional”). The principal offices of Dimensional are located at 6300 Bee Cave Road, Building One, Austin, Texas 78746.

This Information Statement/Prospectus, which you should read carefully and retain for future reference, sets forth concisely the information that you should know before investing. A statement of additional information, dated January [ ], 2010, relating to this Information Statement/Prospectus and the proposed Reorganization, is available upon request and without charge by calling collect or writing to Dimensional at the phone number and address listed above. The prospectus of the Acquiring Fund, dated February 28, 2009 (as it may be supplemented through the date hereof)(the “Acquiring Fund Prospectus”) accompanies this Information Statement/Prospectus as Exhibit B, and is incorporated herein by reference, which means that the Acquiring Fund Prospectus is legally considered to be a part of this Information Statement/Prospectus.

Additional information about the Acquiring Fund, the Target Fund, and the proposed Reorganization, including the prospectuses, statements of additional information, and the most recent annual and semi-annual shareholder reports for the

Acquiring Fund and Target Fund, has been filed with the SEC and is available, free of charge, by (i) calling Dimensional collect at 512-306-7400, (ii) accessing the documents at the Funds’ website at http://www.dimensional.com, or (iii) writing to the Funds at the address listed on the cover of this Information Statement/Prospectus. In addition, these documents may be obtained from the EDGAR database on the Commission’s Internet site at http://www.sec.gov. You may review and copy the documents at the Commission’s Public Reference Room in Washington, DC (for information on the operation of the Commission’s Public Reference Room, call 202-551-8090). You may request documents by mail from the Commission, upon payment of a duplication fee, by writing to: Securities and Exchange Commission, Public Reference Section, 100 F Street, NE, Washington, DC 20549-0102. You also may obtain this information upon payment of a duplicating fee, by e-mailing the Commission at the following address: publicinfo@sec.gov.

This Information Statement/Prospectus, dated January [ ], 2010, and the Exhibits are expected to be mailed to shareholders of the Target Fund on or about January [ ], 2010.

AN INVESTMENT IN THE FUNDS IS NOT A DEPOSIT OF ANY BANK AND IS NOT INSURED OR GUARANTEED BY THE FEDERAL DEPOSIT INSURANCE CORPORATION OR ANY OTHER GOVERNMENT AGENCY. AN INVESTMENT IN THE FUNDS INVOLVES INVESTMENT RISK, INCLUDING THE POSSIBLE LOSS OF PRINCIPAL.

LIKE ALL MUTUAL FUNDS, THE COMMISSION HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES OR PASSED UPON THE ADEQUACY OF THIS INFORMATION STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

TABLE OF CONTENTS

i

SUMMARY

This Summary section is qualified in its entirety by reference to the additional information contained elsewhere in this Information Statement/Prospectus, the Agreement and Plan of Reorganization relating to the Reorganization, a form of which is attached to this Information Statement/Prospectus as Exhibit A, and the Acquiring Fund’s prospectus, which is attached as Exhibit B. Shareholders should read this entire Information Statement/Prospectus, including Exhibit A, carefully for more complete information.

How will the Reorganization work?

Under the Plan, substantially all of the Target Fund’s assets will be transferred to the Acquiring Fund, in exchange for shares of the Acquiring Fund of equivalent aggregate net asset value (“NAV”). Your shares of the Target Fund will be exchanged for shares of equivalent aggregate NAV of the Acquiring Fund. Because each Fund has a different NAV per share, the number of Acquiring Fund shares that you receive likely will be different than the number of Target Fund shares that you own, even though the total value of your investment will be the same immediately before and after the exchange. After shares of the Acquiring Fund are distributed to the Target Fund’s shareholders, the Target Fund will be completely liquidated and dissolved. (The proposed transaction is referred to in this Information Statement/Prospectus as the “Reorganization.”) As a result of the Reorganization, you will cease to be a shareholder of the Target Fund and will become a shareholder of the Acquiring Fund. This exchange will occur on the closing date of the Reorganization, which is the specific date on which the Reorganization takes place. The closing date of the Reorganization is expected to occur on or about February 26, 2010.

Why did the Boards approve the Reorganization?

The DFAIDG Board, including all of DFAIDG’s Directors who are not “interested persons” (as defined in the Investment Company Act of 1940, as amended (the “1940 Act”)) (together, the “Independent Directors”) of the Target Fund, Dimensional, the Fund’s administrator, or DFA Securities LLC (“DFAS”), the Funds’ principal underwriter, after careful consideration, has determined that the Reorganization is in the best interests of the Target Fund and will not dilute the interests of the existing shareholders of the Target Fund. The DFAIDG Board made this determination based on various factors, which include those that are discussed in this Information Statement/Prospectus, under the discussion of the Reorganization in the section entitled “Reasons for the Reorganization.”

Similarly, the DIG Board, including all of DIG’s Directors who are not “interested persons” (as defined in the 1940 Act) (together, the “Independent Directors”) of the Acquiring Fund, Dimensional, or DFAS, has approved the Reorganization with respect to the Acquiring Fund. The DIG Board has determined that the Reorganization is in the best interests of the Acquiring Fund and that the interests of the Acquiring Fund’s shareholders will not be diluted as a result of the Reorganization.

How will the Reorganization affect me?

If the Reorganization is consummated, you will cease to be a shareholder of the Target Fund and will become a shareholder of the Acquiring Fund. It is anticipated that the Reorganization will benefit you in several ways, including the following:

Cost Savings. The Target Fund presently pays an administrative fee of 0.095 of 1% to Dimensional for the administrative services that Dimensional provides to the Target Fund, and by investing in the Master Fund, pays a management fee of .025 of 1% to Dimensional, for a total fee of 0.12 of 1%. The Acquiring Fund pays an administrative fee of 0.05 of 1% to Dimensional for the administrative services that Dimensional provides to the Acquiring Fund, and by investing in the Master Fund, pays a management fee of 0.025 of 1% to Dimensional for a total fee of 0.075 of 1%. The proposed Reorganization will result in a lower administrative fee for the shareholders of the Target Fund, and the total fee investors will pay as investors in the Fund will decrease by 0.045 of 1%, from 0.12 of 1% to 0.075 of 1%.

1

For a more detailed comparison of the Funds’ fees and expenses, see the section below “What are the fees and expenses of the Funds and what might they be after the Reorganization?”

Operating Efficiencies and Diversification. Upon the Reorganization, the Target Fund’s shareholders will become shareholders of a larger fund that may be able to achieve greater operating efficiencies from economies of scale.

Who will bear the costs associated with the Reorganization?

It is anticipated that the total costs of the Reorganization, including the expenses of preparing, printing, and mailing this Information Statement/Prospectus, will be approximately $130,000. These expenses will be paid by the Target Fund.

What are the federal income tax consequences of the Reorganization?

As a condition to the closing of the Reorganization, the Target Fund and the Acquiring Fund must receive an opinion of Stradley, Ronon, Stevens & Young LLP (“Stradley Ronon”) to the effect that the Reorganization will constitute a “reorganization” within the meaning of Section 368 of the Internal Revenue Code of 1986, as amended (the “Code”). Accordingly, it is expected that neither you nor, in general, the Target Fund will recognize gain or loss as a direct result of the Reorganization of the Target Fund, and the holding period and aggregate tax basis for the Acquiring Fund shares that you receive will be the same as the holding period and aggregate tax basis of the Target Fund shares that you surrender in the Reorganization.

You should, however, consult your tax advisor regarding the effect, if any, of the Reorganization, in light of your individual circumstances. You should also consult your tax advisor about state and local tax consequences. For more information about the tax consequences of the Reorganization, please see the section “Information About the Reorganization—What are the tax consequences of the Reorganization?”

COMPARISON OF SOME IMPORTANT FEATURES OF THE FUNDS

How do the Funds’ investment objectives, investment strategies, and investment policies compare?

The Target Fund and the Acquiring Fund have identical investment objectives: to approximate the total investment return of the S&P 500® Index. Each Fund’s investment objective is fundamental and cannot be changed without shareholder approval. The Target Fund and the Acquiring Fund, as feeder funds, pursue identical investment strategies. Both Funds seek to achieve their investment objectives primarily by investing substantially all of their assets in the shares of the Master Fund, which intends to invest in all of the stocks that comprise the S&P 500® Index in approximately the proportions that the stocks are represented in the S&P 500® Index. The investment policies of the Funds are identical.

For further information about the Funds’ investment objectives and investment strategies, see “Comparison of the Funds’ Investment Objectives, Principal Investment Strategies, and Portfolio Management,” below.

The Funds have adopted identical fundamental investment restrictions, which may not be changed without prior shareholder approval. The Acquiring Fund’s fundamental investment restrictions are listed in the Acquiring Fund’s statement of additional information, dated February 29, 2009 (as supplemented through the date hereof), which is incorporated by reference into the statement of additional information relating to this Information Statement/Prospectus, and is available upon request.

What are the principal risks of an investment in the Funds?

An investment in each Fund involves risks common to most mutual funds. There is no guarantee against losses resulting from investments in the Funds, nor that the Funds will achieve their investment objectives. The risks associated with an investment in each Fund are identical, and include the risks associated with fluctuations in the securities markets—i.e., the risks associated with investment in equity securities. You may lose money if you invest in the Funds.

For further information about the risks of investments in the Funds, see “What are the principal risks of investing in the Funds?”

2

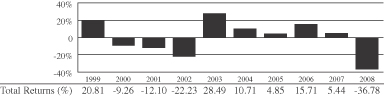

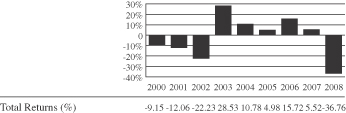

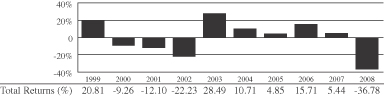

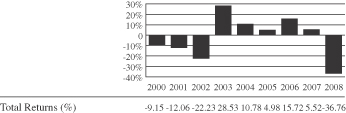

How do the performance records of the Funds compare?

The bar charts and tables below illustrate the variability of the Funds’ returns and are meant to provide some indication of the risks of investing in the Funds. The bar charts show the changes in performance from year to year. The tables illustrate how annualized one-year, five-year and since inception returns, both before and after taxes, compare with those of a broad measure of market performance. Past performance (before and after taxes) is not an indication of future results. The index in each table does not reflect a deduction for fees, expenses, or taxes.

The after-tax returns presented for the Funds are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown in the tables. In addition, the after-tax returns shown are not relevant to investors who hold shares of the Funds through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

U.S. Large Company Portfolio Institutional Class Shares

| | |

January 1999-December 2008

|

| Highest Quarter | | Lowest Quarter |

|

| 15.34 (4/03-6/03) | | -21.77(10/08-12/08) |

| | | | | | |

| | | Periods ending December 31, 2008

|

| Annualized Returns (%) | | One

Year | | Five

Years | | Ten

Years |

| |

| |

| |

|

U.S. Large Company Portfolio | | | | | | |

Return Before Taxes | | -36.78 | | -2.19 | | -1.47 |

Return After Taxes on Distributions | | -37.07 | | -2.53 | | -1.87 |

Return After Taxes on Distributions and Sale of Portfolio Shares | | -23.56 | | -1.82 | | -1.33 |

S&P 500® Index(1) | | -37.00 | | -2.19 | | -1.38 |

| | (1) | Copyright© 2007, Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. All rights reserved. | |

U.S. Large Company Institutional Index Portfolio

| | |

January 2000-December 2008

|

| Highest Quarter | | Lowest Quarter |

|

| 15.49 (4/03-6/03) | | -21.78 (10/08-12/08) |

| | | | | | |

| | | Periods ending December 31, 2008

|

| Annualized Returns (%) | | One Year | | Five

Years | | Since 9/23/99

Inception |

| |

| |

| |

|

U.S. Large Company Institutional Index Portfolio | | | | | | |

Return Before Taxes | | -36.76 | | -2.13 | | -2.04 |

Return After Taxes on Distributions | | -37.07 | | -2.50 | | -2.43 |

Return After Taxes on Distributions and Sale of Portfolio Shares | | -23.55 | | -1.78 | | -1.80 |

S&P 500® Index(1) | | -37.00 | | -2.19 | | -2.02 |

| | (1) | Copyright® 2007, Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. All rights reserved. | |

3

For the period January 1 to September 30, 2009, total returns were 19.39% (for the Target Fund) and 19.48% (for the Acquiring Fund).

What are the fees and expenses of the Funds and what might they be after the Reorganization?

Shareholders of both Funds pay various fees and expenses, either directly or indirectly. The tables below show the fees and expenses that you would pay if you were to buy and hold shares of each Fund. The fees and expenses in each table appearing below are based on the expenses of the Funds for the six month period ended April 30, 2009. The table also shows the pro forma expenses of the combined Acquiring Fund after giving effect to the Reorganization, based on pro forma net assets as of April 30, 2009. Pro forma numbers are estimated in good faith and are hypothetical. The tables below reflect the expenses of each Fund and the Master Fund through which the Funds invest in securities. Actual expenses may vary significantly. You will not pay any sales load, contingent deferred sales charge, commission, redemption fee, or other transaction fee in connection with the Reorganization.

| | | | | | |

| | | Target Fund

| | Acquiring Fund

| | Pro Forma—

Acquiring Fund

after

Reorganization

|

Shareholder Fees (fees paid directly from your investment): | | None | | None | | None |

Annual Fund Operating Expenses for the Target Fund and the Acquiring Fund

(expenses deducted from Fund assets)

| | | | | | | | | |

| | | Target Fund

| | | Acquiring Fund

| | | Pro Forma—

Acquiring Fund

after

Reorganization

| |

Management Fee* | | 0.12 | % | | 0.075 | % | | 0.075 | % |

Other Expenses | | 0.04 | % | | 0.045 | % | | 0.035 | % |

| | |

|

| |

|

| |

|

|

Total Annual Operating Expenses | | 0.16 | % | | 0.12 | % | | 0.11 | % |

| | |

|

| |

|

| |

|

|

Fee Waiver and/or Expense Reimbursements | | 0.01 | %** | | 0.02 | %*** | | 0.01 | %*** |

| | |

|

| |

|

| |

|

|

Net Expenses | | 0.15 | % | | 0.10 | % | | 0.10 | % |

| | |

|

| |

|

| |

|

|

| * | | The “Management Fee” includes the investment management fee payable by the Master Fund and an administration fee payable by the Fund. The amount set forth in “other expenses” represents the aggregate amount that is payable by both the Master Fund and the Fund. |

| ** | | Pursuant to the Fee Waiver and Expense Assumption Agreement for the Target Fund, Dimensional has agreed to waive its administration fee and to assume the Target Fund’s direct and indirect expenses (including the expenses the Target Fund bears as a shareholder of the Master Fund) to the extent necessary to limit the expenses of the Target Fund to 0.15% of the Target Fund’s average net assets on an annualized basis. At any time that the annualized expenses of the Target Fund are less than the rate listed above for the Target Fund on an annualized basis, Dimensional retains the right to seek reimbursement for any fees previously waived and/or expenses previously assumed to the extent that such reimbursement will not cause the Target Fund’s annualized expenses to exceed 0.15% of its average net assets on an annualized basis. The Target Fund is not obligated to reimburse Dimensional for fees previously waived or expenses previously assumed by Dimensional more than thirty-six months before the date of such reimbursement. |

| *** | | Pursuant to the Fee Waiver and Expense Assumption Agreement for the Acquiring Fund, Dimensional has agreed to waive its administration fee to the extent necessary to reduce the Acquiring Fund’s expenses to the extent that its total direct and indirect expenses (including the expenses the Acquiring Fund bears as a shareholder of the Master Fund) exceed 0.10% of the Acquiring Fund’s average daily net assets on an annualized basis. At any time that the total direct and indirect expenses of the Acquiring Fund are less than |

4

| | 0.10% of its average daily net assets on an annualized basis, Dimensional retains the right to seek reimbursement for any fees previously waived to the extent that such reimbursement will not cause the Acquiring Fund’s total direct and indirect expenses to exceed 0.10% of its average net assets on an annualized basis. The Acquiring Fund is not obligated to reimburse Dimensional for fees waived by Dimensional more than thirty-six months before the date of such reimbursement. The Fee Waiver and Expense Assumption Agreement will remain in effect for a period of one year from March 1, 2009 to March 1, 2010, and shall continue in effect from year to year thereafter unless terminated by DIG or Dimensional. |

Expense Examples

These Examples are meant to help you compare the cost of investing in the Acquiring Fund with the cost of investing in the Target Fund.

The Examples assume that you invest $10,000 in the Funds for the time periods indicated and then redeem all of your shares at the end of those periods. The Examples also assume that your investment has a 5% return each year and that a Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| | | | | | | | | | | | |

| | | 1 Year

| | 3 Years

| | 5 Years

| | 10 Years

|

Target Fund | | $ | 15 | | $ | 51 | | $ | 89 | | $ | 204 |

Acquiring Fund | | $ | 10 | | $ | 37 | | $ | 66 | | $ | 152 |

Pro Forma—Acquiring Fund after Reorganization | | $ | 10 | | $ | 34 | | $ | 61 | | $ | 140 |

These Examples summarize the aggregate estimated annual operating expenses before any waivers of both the Funds and the Master Fund. The costs for the Funds reflect the “Net Expenses” for the Funds that result from the contractual fee waivers in the first year only.

What are the distribution arrangements for the Funds?

The Funds are distributed by DFAS, which serves as the principal underwriter for the shares of the Funds. DFAS is a wholly-owned subsidiary of Dimensional. The principal business address of DFAS is 1299 Ocean Avenue, Santa Monica, California 90401. Pursuant to DFAS’s Amended and Restated Distribution Agreements (together, the “Distribution Agreements”) with each of DFAIDG and DIG, DFAS uses its best efforts to arrange for the sale of the Funds’ shares, which are continuously offered. No sales charges are paid by investors or the Funds. No compensation is paid by the Funds to DFAS under the Distribution Agreements.

The Target Fund is authorized to offer three classes of shares—the Institutional class, the Class R1, and the Class R2 shares. Presently, the Target Fund offers only the Institutional class shares, which do not charge a front-end sales load at the time of purchase or a contingent deferred sales load at the time of redemption.

The Acquiring Fund is authorized to, and currently offers, one class of shares, which does not charge a front-end sales load at the time of purchase or a contingent-deferred sales load at the time of redemption.

What are the Funds’ arrangements for purchases, exchanges, and redemptions?

The procedures for purchasing, exchanging and redeeming shares of the Target Fund and the Acquiring Fund, and the Funds’ policies regarding excessive or short-term trading, are identical. You may refer to the Acquiring Fund’s prospectus, attached hereto as Exhibit B, under the sections titled “Purchase of Shares” and “Redemption of Shares” for the procedures applicable to purchases, exchanges, and redemptions of the shares of each Fund.

Shares of each Fund generally are available to institutional investors, retirement plans, and clients of registered investment advisors. There is currently no minimum initial or subsequent investment requirement for either Fund. Shares may be purchased by an investor contacting Dimensional to notify Dimensional of the proposed investment. All investments are subject to the approval of Dimensional. Shares also may be purchased by individuals through certain securities firms and investment advisory organizations.

5

The purchase price of a share of each Fund is its NAV. The net asset value per share of each Fund is calculated after the close of the New York Stock Exchange (the “NYSE”) (normally, 1:00 p.m. Pacific Time) on each day the NYSE is open. Provided that Dimensional or the Fund’s transfer agent has received the investor’s Account Registration Form in good order, and the custodian has received the investor’s payment, shares of the Fund will be priced at the public offering price, which is the NAV of the shares next determined after receipt of the investor’s funds by the custodian. Each Fund reserves the right to reject any initial or subsequent investment request.

The Target Fund and the Acquiring Fund permit their shareholders to exchange shares of the Target Fund and the Acquiring Fund, respectively, for shares of other portfolios of DFAIDG and DIG. An exchange involves the simultaneous redemption of shares of one fund and the purchase of shares of another fund at each fund’s respective closing NAV next determined after the request for exchange has been received, and is a taxable transaction.

Each Fund redeems its shares at the NAV of such shares next determined after receipt of a written request for redemption in good order by the Fund’s transfer agent (or by a financial intermediary or sub-designee, if applicable).

Each Fund is intended for long-term investors and is not intended for investors that engage in excessive short-term trading activity that may be harmful to the Funds, including but not limited to market timing. The DFAIDG Board and the DIG Board have adopted an identical policy (the “Trading Policy”) that is designed to discourage and prevent market timing or excessive short-term trading in the Funds. Under purchase blocking procedures implemented by Dimensional, DFAS, and their agents, subject to certain exemptions, an investor who has engaged in any two purchases and two redemptions (including redemptions that are part of an exchange transaction) in a Fund in any rolling 30 calendar day monitoring period (i.e., two “round trips”) will be blocked from making any additional purchases in the Fund for 90 calendar days (a “purchase block”). You may refer to the Acquiring Fund’s prospectus, attached hereto as Exhibit B, under the section titled “Policy Regarding Excessive or Short-Term Trading,” for further information relating to the Trading Policy and the procedures applicable to purchase blocks.

What are the Funds’ dividend payment policies and pricing arrangements?

The dividend payment policies of the Funds are identical. Dividends from net investment income of each Fund are generally distributed quarterly (on a calendar basis) and any net realized capital gains (after any reductions for capital loss carryforwards) are distributed annually, typically in December. The Funds intend to make distributions that may be taxed as ordinary income and capital gains (which may be taxable at different rates, depending on the length of time a Fund holds the assets). The Funds may distribute such income dividends and capital gains more frequently, if necessary, in order to reduce or eliminate federal excise or income taxes on the Funds. Shareholders of each Fund automatically receive all income dividends and capital gains distributions in additional shares of the Fund at NAV, unless, upon written notice to Dimensional and completion of the requisite account information, another option is selected by shareholders. Both Funds notify their shareholders annually of the source and tax status of all dividends and distributions for federal income tax purposes. For additional information, you may refer to the Acquiring Fund’s prospectus, attached hereto as Exhibit B, under the section titled “Dividends, Capital Gains Distributions, and Taxes.”

The Funds have identical procedures for calculating their share prices and valuing their portfolio securities. The Funds determine their NAV per share after the close of the NYSE (normally, 1:00 p.m., Pacific Time). The Funds will not be priced on days that the NYSE is closed for trading. DFAIDG and DIG have adopted identical policies and procedures for valuing the Funds’ portfolio assets. For more information about the Acquiring Fund’s pricing procedures, you may refer to the Acquiring Fund’s prospectus, attached hereto as Exhibit B, under the section titled “Valuation of Securities.”

Who manages the Funds?

The management of the business and affairs of the Target Fund is the responsibility of the DFAIDG Board, while the management of the business and affairs of the Acquiring Fund is the responsibility of the DIG Board. The composition of the Boards of DFAIDG and DIG is identical. Each Board elects officers, who are responsible for the day-to-day operations of the Funds.

6

Because the Funds operate as feeder funds and invest substantially all of their assets in the shares of the Master Fund, the Funds do not have an investment advisor. The investment advisor for the Master Fund is Dimensional. Dimensional, located at 6300 Bee Cave Road, Building One, Austin, Texas 78746, is organized as a Delaware limited partnership, and is controlled by its general partner, Dimensional Holdings Inc., a Delaware corporation. Dimensional is registered with the SEC as an investment advisor. As of August 31, 2009, assets under management for all affiliated Dimensional advisors totaled approximately $148 billion. For its services to the Master Fund, Dimensional receives a fee equal to 0.025% of the Master Fund’s daily net assets. Stephen A. Clark is the portfolio manager who coordinates the efforts of all other portfolio managers with respect to day-to-day management of the Master Fund. Mr. Clark is a Senior Portfolio Manager and Vice President of Dimensional and Chairman of Dimensional’s Investment Committee. Mr. Clark joined Dimensional in 2001 and has been responsible for the portfolio management group since January 2006. Additional information about the Funds’ management can be found in the prospectus for the Acquiring Fund, which is attached hereto as Exhibit B, and the prospectus for the Target Fund, which is incorporated by reference and available without charge upon request, under the heading “Management of the Portfolio” and “Management of the Funds,” respectively, and in the statement of additional information relating to this Information Statement/Prospectus.

A discussion regarding the basis for the Board of Trustees approving the investment management agreement with respect to the Master Fund is available in the Semi-Annual Reports to Shareholders of the Acquiring Fund and the Target Fund for the period ended April 30, 2009.

INFORMATION ABOUT THE REORGANIZATION

Reasons for the Reorganization

Each of the DFAIDG Board and the DIG Board considered the Reorganization at a meeting held on December 18, 2009, and approved the Plan. In considering the Plan, the DFAIDG Board and the DIG Board requested and received detailed information from the officers of DFAIDG and DIG, and representatives of Dimensional regarding the Reorganization, including: (1) the specific terms of the Plan; (2) the investment objectives, investment strategies, and investment policies of the Target Fund and the Acquiring Fund; (3) comparative data analyzing the fees and expenses of the Funds; (4) the proposed plans for ongoing management, distribution, and operation of the Acquiring Fund; (5) the management, financial position, and business of Dimensional and its affiliates; (6) the impact of the Reorganization on the Funds and their shareholders; (7) the relative asset sizes of the Funds, including the benefits of a Fund combining with another Fund; and (8) historical performance data for the Funds.

In approving the Reorganization, the DFAIDG Board, including all of the Independent Directors, determined that (i) participation in the Reorganization is in the best interest of the Target Fund’s shareholders, and (ii) the interests of the Target Fund’s shareholders will not be diluted as a result of the Reorganization.

In making these determinations, the DFAIDG Board, including all of the Independent Directors, considered a number of factors, including the potential benefits and costs of the Reorganization to the shareholders of the Target Fund. These considerations included the following:

| • | | The Target Fund presently pays an administrative fee of 0.095 of 1% to Dimensional for the administrative services that Dimensional provides to the Target Fund, and by investing in the Master Fund, pays a management fee of .025 of 1% to Dimensional, for a total fee of 0.12 of 1%. The Acquiring Fund pays an administrative fee of 0.05 of 1% to Dimensional for the administrative services that Dimensional provides to the Acquiring Fund, and by investing in the Master Fund, pays a management fee of 0.025 of 1% to Dimensional for a total fee of 0.075 of 1%. The proposed Reorganization will result in a lower administrative fee for current shareholders of the Target Fund, and the total fee investors will pay as investors in the Fund will decrease by 0.045 of 1%, from 0.12 of 1% to 0.075 of 1%; |

| • | | The total expense ratio of the Acquiring Fund is expected to be less than the total expense ratio of the Target Fund; |

| • | | For the Target Fund, Dimensional has, pursuant to a Fee Waiver and Expense Assumption Agreement, agreed to waive its administrative fees and assume expenses of the Target Fund in order to limit expenses to |

7

| | 0.15%. For the Acquiring Fund, Dimensional has, pursuant to a Fee Waiver and Expense Assumption Agreement, agreed to waive its administrative fees in order to limit direct and indirect expenses of the Acquiring Fund to 0.10%; |

| • | | Shareholders of the Target Fund likely will benefit from economies of scale as fixed costs are shared, and operating efficiencies may be achieved; |

| • | | The investment objective, investment strategies, and investment policies of the Target Fund and the Acquiring Fund are identical; |

| • | | The Acquiring Fund will continue to operate as a feeder fund investing substantially all of its assets in the shares of the Master Fund, and thus, the Target Fund’s investment program will not change as a consequence of the Reorganization; |

| • | | The Acquiring Fund’s $100 million minimum initial investment requirement was eliminated; |

| • | | The Acquiring Fund may be more competitive in the marketplace; |

| • | | The Reorganization will eliminate the administrative and regulatory costs of operating each Fund as a separate mutual fund; |

| • | | The Target Fund will pay the costs of the Reorganization; |

| • | | The Reorganization is intended to be tax-free for federal income tax purposes for shareholders of the Target Fund; and |

| • | | The alternatives available for shareholders of the Target Fund, including the ability to redeem their shares in the Target Fund prior to the Reorganization. |

Based upon its evaluation of the relevant information presented to it, and in light of its fiduciary duties under federal and state law, the DFAIDG Board, including all of the Independent Directors, concluded that completing the Reorganization is in the best interests of the shareholders of the Target Fund and that no dilution of value would result to the shareholders of the Target Fund from the Reorganization.

The DIG Board, on behalf of the Acquiring Fund, also concluded that the Reorganization is in the best interests of the Acquiring Fund and its shareholders, and that no dilution in value would result to the shareholders of the Acquiring Fund from the Reorganization. Consequently, the DIG Board approved the Plan on behalf of the Acquiring Fund.

INFORMATION ABOUT THE PLAN

This is only a summary of the Plan. You should read the form of the Plan, which is attached as Exhibit A to this Information Statement/Prospectus and is incorporated by reference, for complete information about the Reorganization.

How will the Reorganization be carried out?

The Reorganization for the Target Fund will take place after various conditions are satisfied, including the preparation of certain documents. DFAIDG and DIG will determine a specific date, called the “closing date,” for the Reorganization to take place. Under the Plan, the Target Fund will transfer substantially all of its assets, free and clear of all liens, encumbrances, and claims whatsoever (other than shareholders’ rights of redemption), to the Acquiring Fund on the closing date, which is scheduled to occur on or about February 26, 2010, but which may occur on an earlier or later date as the parties may agree. Neither the Acquiring Fund nor DIG shall assume any liability of the Target Fund or DFAIDG. In exchange, DIG will issue shares of the Acquiring Fund that have an aggregate NAV equal to the dollar value of the assets delivered to the Acquiring Fund by the Target Fund. DFAIDG will distribute the Acquiring Fund shares it receives to the shareholders of the Target Fund. Each shareholder of the Target Fund will receive a number of Acquiring Fund shares with an aggregate NAV equal to the aggregate NAV of his or her shares of the Target Fund. The share transfer books of the Target Fund will be permanently closed as of 3:00 p.m., Central Time, on the closing date. The Target Fund will accept requests for

8

redemptions only if received in proper form before 3:00 p.m., Central Time, on the closing date. Requests received after that time will be considered requests to redeem shares of the Acquiring Fund. As soon as reasonably practicable after the transfer of its assets, the Target Fund will pay or make provision for payment of all its remaining liabilities, if any. In conjunction with completing the Reorganization, the Acquiring Fund will change its name to the “U.S. Large Company Portfolio.” The Target Fund will then terminate its existence as a separate series of DFAIDG.

The parties may agree to amend the Plan to the extent permitted by law. If DFAIDG and DIG agree, the Plan may be terminated or abandoned at any time before the Reorganization.

Each of DFAIDG and DIG has made representations and warranties in the Plan that are customary in matters such as the Reorganization. The obligations under the Plan of DFAIDG (with respect to the Target Fund) and DIG (with respect to the Acquiring Fund) are subject to various conditions, including:

| • | | DIG’s registration statement on Form N-14 under the Securities Act of 1933, of which this Information Statement/Prospectus is a part, shall have been filed with the SEC and such registration statement shall have become effective, and no stop-order suspending the effectiveness of the registration statement shall have been issued, and no proceeding for that purpose shall have been initiated or threatened by the SEC (and not withdrawn or terminated); and |

| • | | DFAIDG and DIG shall have received the tax opinion described below that the consummation of the Reorganization will not result in the recognition of gain or loss for federal income tax purposes for the Target Fund, the Acquiring Fund, or their shareholders. |

Who will pay the expenses of the Reorganization?

The Target Fund will pay all of the costs and expenses resulting from the Reorganization. The expenses are estimated to be $130,000. Because the Funds are feeder funds that invest in the Master Fund, it is not anticipated that there will be any brokerage costs as a result of the Reorganization.

What are the tax consequences of the Reorganization?

The Reorganization is intended to qualify as a tax-free reorganization for federal income tax purposes under Section 368(a)(1) of the Code. Based on certain assumptions made and representations to be made on behalf of the Acquiring Fund and the Target Fund, it is expected that Stradley Ronon will provide a legal opinion to the effect that, for federal income tax purposes: (i) shareholders of the Target Fund will not recognize any gain or loss as a result of the exchange of their shares of the Target Fund for shares of the Acquiring Fund; (ii) the Acquiring Fund and its shareholders will not recognize any gain or loss upon receipt of the Target Fund’s assets; and (iii) the holding period and aggregate tax basis for Acquiring Fund shares that are received by a Target Fund shareholder will be the same as the holding period and aggregate tax basis of the shares of the Target Fund previously held by such shareholder.

Opinions of counsel are not binding upon the Internal Revenue Service or the courts. If the Reorganization is consummated but does not qualify as a tax free reorganization under the Code, and thus is taxable, Target Fund would recognize gain or loss on the transfer of its assets to the Acquiring Fund and each shareholder of the Target Fund would recognize a taxable gain or loss equal to the difference between its tax basis in its Target Fund shares and the fair market value of the shares of the Acquiring Fund it received.

Capital losses can generally be carried forward to each of the eight (8) taxable years succeeding the loss year to offset future capital gains. However, any such capital losses are subject to an annual limitation if there is a more than 50% “change in ownership” of a fund. The Reorganization will result in a more than 50% “change in ownership” of the Acquiring Fund, as the smaller of the two Funds. As a result, the capital loss carryovers (together with any current year realized capital gain/loss and unrealized appreciation/depreciation in value of investments, collectively referred to as “total net capital loss carryovers”) of the Acquiring Fund will be subject to an annual limitation for federal income tax purposes. In addition, for five (5) years beginning after the closing date, neither Fund will be permitted to offset its “built-in” gains, if any, at the time of the Reorganization against

9

the capital losses (including capital loss carryforwards) built in to the other Fund at the time of the Reorganization. The total net capital loss carryovers of the Funds, and the approximate annual limitation on the use of the Acquiring Fund’s total net capital loss carryovers following the Reorganization, are as follows:

| | | | | | | | | | |

Line

| | | | U.S. Large

Company

Portfolio

[Target Fund]

| | | U.S. Large

Company

Institutional Index

Portfolio

[Acquiring Fund]

| |

1 | | Capital Loss Carryovers | | | | | | | | |

2 | | Expiring 2011-2017 | | ($ | 213,037,000 | ) | | | | |

3 | | Expiring 2010-2017 | | | | | | $ | (50,288,000 | ) |

4 | | Unrealized Appreciation (Depreciation) on a tax basis at 10/31/2009 | | $ | (158,074,000 | ) | | $ | (27,188,000 | ) |

5 | | Total Net Capital Loss Carryovers | | $ | (371,111,000 | ) | | $ | (77,476,000 | ) |

6 | | Net Unrealized Appreciation (Depreciation) for tax purposes as Percentage of NAV [L4 / L7] | | | -5.8 | % | | | -3.5 | % |

7 | | Net Asset Value at 10/31/2009 | | $ | 2,719,418,000 | | | $ | 785,688,704 | |

8 | | Tax-Exempt Rate (December 2009) | | | N/A | | | | 4.16 | % |

9 | | Annual Limitation (approximate) (1) [L7 x L8] | | | N/A | | | $ | 32,684,650 | |

The actual annual loss limitation will equal the aggregate net asset value of the Acquiring Fund on the closing date multiplied by the long-term tax-exempt rate for ownership changes during the month in which the Reorganization closes (such limitation is increased by the amount of any built-in gain; i.e., unrealized appreciation in value of investments of the Acquiring Fund on the closing date that is recognized in a taxable year). The annual limitation on the use of the Acquiring Fund’s total net capital loss carryovers may result in some portion of such carryovers expiring unutilized, depending on the facts at time of closing the Reorganization. However, the total net capital loss carryovers of the Target Fund will continue to be available without limitation to the benefit of all of the shareholders of the Funds. This might be viewed as resulting in a slight reduction in the available tax benefits for the shareholders of the Target Fund, although such capital loss carryovers are a tax benefit only to the extent such losses offset future capital gains.

Buying shares in a fund that has material unrealized appreciation in portfolio investments may be less tax efficient than buying shares in a fund with no such unrealized appreciation in value of investments. Conversely, buying shares in a fund with unrealized depreciation in value of investments may be more tax efficient because such deprecation when realized will offset other capital gains that otherwise might be distributed to shareholders, causing the shareholders to pay tax on such distributions. These same considerations apply in the case of a reorganization. As of October 31, 2009, the net unrealized depreciation in the value of the investments on a tax basis of the Target Fund and Acquiring Fund as a percentage of their respective net asset values on such date was 5.8% and 3.5%, respectively, and 5.3% on a combined basis. Based on these figures, the shareholders of the Target Fund are being exposed to slightly less unrealized depreciation in value of investments post-Reorganization relative to what they are presently exposed.

After the Reorganization, you will continue to be responsible for tracking the adjusted tax basis and holding period for your Fund shares for federal income tax purposes. You should consult your tax advisor regarding the effect, if any, of the Reorganization in light of your individual circumstances. You also should consult your tax advisor about the state and local tax consequences, if any, of the Reorganization because this discussion only relates to the federal income tax consequences.

CAPITAL STRUCTURE AND SHAREHOLDER RIGHTS

Capital Structure

Each Fund is a series of an open-end, registered management investment company, commonly referred to as a “mutual fund.” DFAIDG was organized as a Maryland corporation on June 15, 1981. DIG was organized as a Maryland corporation on March 19, 1990. (DFAIDG and DIG are each referred to as a “Company,” and together as the “Companies.”)

10

The operations of each Company are governed by its respective Charter, Bylaws, and Maryland state law. Each Company also must adhere to the 1940 Act, the rules and regulations promulgated by the Commission thereunder, and any applicable state securities laws.

Shares of the Acquiring Fund and the Target Fund have identical legal characteristics with respect to such matters as voting, dividend, redemption, conversion, liquidation and other rights and preferences, assessability, and transferability. Each Fund’s shares, when issued and paid for in accordance with the Fund’s prospectus, are fully paid and non-assessable, and shall have no preemptive or subscription rights other than such, if any, as the Board may determine and at such price or prices and upon such other terms as the Board may fix. Shareholders of the Target Fund and the Acquiring Fund have no appraisal rights. Each share issued by a Fund is entitled to one full vote, and each fractional share is entitled to a proportionate fractional vote.

Upon the closing of the Reorganization, former shareholders of the Target Fund whose shares are represented by outstanding share certificates will not receive certificates for shares in the Acquiring Fund and all outstanding Target Fund share certificates shall be cancelled.

Rights of Target Fund and Acquiring Fund Shareholders

Shareholders of the Target Fund and the Acquiring Fund have substantially identical rights. There are no material differences between the rights of shareholders under the respective Charter and Bylaws of each Company. Accordingly, shareholders of each Fund have equal rights with respect to dividends and distributions, liquidations, voting, and protection from liability. For example, shareholders of each Fund generally have the power to vote only: (i) for the election or removal of Directors; (ii) with respect to any contract as to which shareholder approval is required by the 1940 Act; (iii) with respect to certain amendments of the Charter; (iv) with respect to such additional matters relating to DFAIDG or DIG as may be required by the 1940 Act, the Charters, the Bylaws, or any registration of DFAIDG or DIG with the Commission or any state, or as the Directors may consider necessary or desirable.

Neither Fund is required to hold an annual shareholder meeting under its Company’s Charter or Bylaws. However, a special meeting of the shareholders of a Fund may be called by a Company’s Board or upon the written request of shareholders owning at least a majority of the shares entitled to vote. If a shareholder meeting is held, the Funds have identical record date, notice, quorum and adjournment requirements and voting standards. Both Funds generally require a majority vote of the shares present to decide any questions related to a particular matter, except a plurality shall elect a Director. Both funds provide for noncumulative voting in the election of Directors.

Neither the Charter nor the By-Laws of the Funds contain specific provisions regarding the personal liability of shareholders. However, under the Maryland corporate law, shareholders of a Maryland corporation generally will not be held personally liable for the acts or obligations of the corporation, except that a shareholder may be liable to the extent that (i) consideration for the shares has not been paid, (ii) the shareholder knowingly accepts a distribution in violation of the charter or Maryland law, or (iii) the shareholder receives assets of the corporation upon its liquidation and the corporation is unable to meet its debts and obligations, in which case the shareholder may be liable for such debts and obligations to the extent of the assets received in the distribution.

What is the capitalization of the Funds?

The following table sets forth the capitalization of the Target Fund and the Acquiring Fund as of April 30, 2009, and the pro forma combined capitalization of the Acquiring Fund as adjusted to give effect to the proposed Reorganization. The following are examples of the number of shares of the Acquiring Fund that would have been exchanged for the shares of the Target Fund if the Reorganization had been consummated on April 30, 2009 and do not reflect the number of shares or value of shares that would actually be received if the Reorganization, as described, occurs. Each shareholder of the Target Fund will receive the number of full and fractional shares of the Acquiring Fund equal in value to the value (as of the last valuation date) of the shares of the Target Fund.

11

| | | | | | | | | |

| | | Target Fund

(unaudited)*

| | Acquiring Fund

(unaudited)*

| | Pro Forma—Acquiring

Fund after Reorganization

(estimated)

|

Net assets (millions) | | $ | 2,272.2 | | $ | 643.3 | | $ | 2,915.5 |

Total shares outstanding | | | 88,242,833 | | | 93,639,033 | | | 424,385,612 |

Net asset value per share | | $ | 25.75 | | $ | 6.87 | | $ | 6.87 |

This information is for informational purposes only. There is no assurance that the Reorganization will be consummated. Moreover, if consummated, the capitalization of the Target Fund and the Acquiring Fund is likely to be different at the closing date as a result of daily share purchase and redemption activity in the Target Fund. Accordingly, the foregoing should not be relied upon to reflect the number of shares of the Acquiring Fund that actually will be received on or after such date.

ADDITIONAL INFORMATION ABOUT THE ACQUIRING FUND AND THE TARGET FUND

Comparison of the Funds’ Investment Objectives, Principal Investment Strategies, and Portfolio Management

The investment objectives, principal investment strategies, and portfolio management of the Funds are identical. Each Fund’s investment objective is to approximate the total investment return of the S&P 500® Index. As feeder funds, each Fund seeks to achieve its investment objective by buying shares of the Master Fund, which intends to invest in all of the stocks that comprise the S&P 500® Index in approximately the proportion they are represented in the S&P 500® Index. The S&P 500® Index is comprised of a broad and diverse group of stocks. Generally, these are the U.S. stocks with the largest market capitalizations and, as a group, the stocks represent approximately 70% of the total market capitalization of all publicly traded U.S. stocks as of February 28, 2009. Under normal market conditions, at least 95% of the Master Fund’s assets will be invested in the stocks that comprise the S&P 500® Index. As a non-fundamental policy, under normal circumstances, the Master Fund will invest at least 80% of its net assets in securities of large U.S. companies.

The Master Fund also may use derivatives, such as futures contracts and options on futures contracts, to gain market exposure on the Master Fund’s uninvested cash pending investment in securities or to maintain liquidity to pay redemptions. The Master Fund may enter into futures contracts and options on futures contracts for U.S. equity securities and indices. In addition to money market instruments and other short-term investments, the Master Fund may invest in affiliated and unaffiliated unregistered money market funds to manage the Master Fund’s cash pending investment in other securities or to maintain liquidity for the payment of redemptions or other purposes.

Ordinarily, portfolio securities will not be sold except to reflect additions or deletions of the stocks that comprise the S&P 500® Index, including as a result of mergers, reorganizations and similar transactions and, to the extent necessary, to provide cash to pay redemptions of the Master Fund’s shares. Given the impact on prices of securities affected by the reconstitution of the S&P 500® Index around the time of a reconstitution date, the Master Fund may purchase or sell securities that may be impacted by the reconstitution before or after a reconstitution date of the S&P 500® Index.

STANDARD & POOR’S INFORMATION AND DISCLAIMERS

Neither the Funds nor the Master Fund is sponsored, endorsed, sold, or promoted by Standard & Poor’s Rating Group, a division of The McGraw Hill Companies (“S&P”). S&P makes no representation or warranty, express or implied, to the owners of the Funds or the Master Fund or any member of the public regarding the advisability of investing in securities generally or in the Funds or the Master Fund particularly or the ability of the S&P 500® Index to track general stock market performance. S&P’s only relationship to the Funds or the Master Fund is the licensing of certain trademarks and trade names of S&P and of the S&P 500® Index, which is determined, composed, and calculated by S&P without regard to the Funds or the Master Fund. S&P has no obligation to take the needs of the Funds, the Master Fund, or their respective owners into consideration in

12

determining, composing, or calculating the S&P 500® Index. S&P is not responsible for, and has not participated in, the determination of the prices and amount of the Funds or the Master Fund, or the issuance or sale of the Funds or the Master Fund, or in the determination or calculation of the equation by which the Funds or the Master Fund is to be converted into cash. S&P has no obligation or liability in connection with the administration, marketing, or trading of the Funds or the Master Fund.

S&P DOES NOT GUARANTEE THE ACCURACY AND/OR THE COMPLETENESS OF THE S&P 500® INDEX OR ANY DATA INCLUDED THEREIN AND S&P SHALL HAVE NO LIABILITY FOR ANY ERRORS, OMISSIONS, OR INTERRUPTIONS THEREIN. S&P MAKES NO WARRANTY, EXPRESS OR IMPLIED, AS TO RESULTS TO BE OBTAINED BY LICENSEE, OWNERS OF THE PRODUCT, OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE S&P 500® INDEX OR ANY DATA INCLUDED THEREIN. S&P MAKES NO EXPRESS OR IMPLIED WARRANTIES, AND EXPRESSLY DISCLAIMS ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE WITH RESPECT TO THE S&P 500® INDEX OR ANY DATA INCLUDED THEREIN. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT SHALL S&P HAVE ANY LIABILITY FOR ANY SPECIAL, PUNITIVE, INDIRECT, OR CONSEQUENTIAL DAMAGES (INCLUDING LOST PROFITS), EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES.

How do the fundamental investment policies of the Funds compare?

The fundamental investment policies of the Target Fund and the Acquiring Fund are identical.

What are the principal risks of investing in the Funds?

The principal risks of investments in the Target Fund and Acquiring Fund are identical.

Market risk | Even a long-term investment approach cannot guarantee a profit. Economic, political and issuer specific events will cause the value of securities and the Master Fund, which owns them, and, in turn each Fund, to rise or fall. Because the value of your investment in the Fund will fluctuate, there is the risk that you may lose money. |

Derivatives risk | Derivatives are securities, such as futures contracts, whose value is derived from that of other securities or indices. The Master Fund may use derivatives, such as futures contracts and options on futures contracts, to gain market exposure on the Master Fund’s uninvested cash pending investment in securities or to maintain liquidity to pay redemptions. The use of derivatives for non-hedging purposes may be considered more speculative than other types of investments. When a Fund uses derivatives for non-hedging purposes, the Fund will be directly exposed to the risks of that derivative. Gains or losses from derivative investments may be substantially greater than the derivative’s original cost. |

Securities lending risk | The Master Fund may lend its portfolio securities to generate additional income. Securities lending involves the risk that the borrower may fail to return the securities in a timely manner or at all. As a result, the Master Fund may lose money and there may be a delay in recovering the loaned securities. The Master Fund also could lose money if the Master Fund does not recover the securities and/or the value of the collateral falls, including the value of investments made with cash collateral. Securities lending also may have certain potential adverse tax consequences. |

13

Where can I find more financial and performance information about the Funds?

More information about the Target Fund and the Acquiring Fund is included in: (i) the Target Fund’s prospectus, dated February 28, 2009 (as it may be supplemented through the date hereof), which is incorporated by reference and is available upon request without charge; (ii) the statement of additional information, dated February 28, 2009 (as supplemented through the date hereof), relating to the Target Fund’s prospectus; (iii) the Acquiring Fund’s prospectus, dated February 28, 2009 (as supplemented through the date hereof), which accompanies this Information Statement/Prospectus as Exhibit B, and is incorporated by reference and considered a part of this Information Statement/Prospectus; (iv) the statement of additional information, dated February 28, 2009 (as supplemented through the date hereof), relating to the Acquiring Fund’s prospectus; (v) the Annual Report to Shareholders of the Target Fund, for the fiscal year ended October 31, 2008; (vi) the Semi-Annual Report to Shareholders of the Target Fund for the period ended April 30, 2009; (vii) the Annual Report to Shareholders of the Acquiring Fund for the fiscal year ended October 31, 2008; (viii) the Semi-Annual Report to Shareholders of the Acquiring Fund for the period ended April 30, 2009; and (ix) the statement of additional information, dated January , 2010, relating to this Information Statement/Prospectus, which is incorporated by reference herein.

You may request free copies of the Target Fund’s prospectus or statement of additional information (including any supplement thereto), by calling collect at 512-306-7400, by accessing the documents at http://www.dimensional.com, or by writing to DFA Investment Dimensions Group Inc., 6300 Bee Cave Road, Building One, Austin, Texas 78746. You may request free copies of the Acquiring Fund’s statement of additional information or the statement of additional information relating to this Information Statement/Prospectus, by calling collect at 512-306-7400, by accessing the documents at http://www.dimensional.com, or by writing to Dimensional Investment Group Inc., 6300 Bee Cave Road, Building One, Austin, Texas 78746.

This Information Statement/Prospectus, which constitutes part of a Registration Statement filed by DIG with the Commission under the Securities Act of 1933, as amended, omits certain information contained in such Registration Statement. Reference is hereby made to the Registration Statement and to the exhibits and amendments thereto for further information with respect to the Acquiring Fund and the shares offered. Statements contained herein concerning the provisions of documents are necessarily summaries of such documents, and each such statement is qualified in its entirety by reference to the copy of the applicable document filed with the Commission.

Each Fund also files proxy materials, information statements, reports, and other information with the Commission in accordance with the informational requirements of the Securities Exchange Act of 1934, as amended, and the 1940 Act. These materials can be inspected and copied at the public reference facilities maintained by the Commission in Washington, DC, located at Room 1580, 100 F Street, N.E., Washington, DC 20549. Copies of such material can be obtained at prescribed rates from the Public Reference Branch, Office of Consumer Affairs and Information Services, SEC, Washington, DC 20549, or obtained electronically from the EDGAR database on the Commission’s Internet site (http://www.sec.gov).

PRINCIPAL SHAREHOLDERS

As of November 30, 2009, the officers and Directors of DFAIDG, as a group, owned or controlled less than 1% of the Target Fund. As of November 30, 2009, the following shareholders owned of record, or to the knowledge of the Target Fund, beneficially, 5% or more of the outstanding shares of the Target Fund:

| | |

Name and Address of Record or Beneficial Owner

| | Percentage of Target Fund

|

| |

Charles Schwab & Company, Inc.* 101 Montgomery Street San Francisco, CA 94104 | | 47.62% |

| |

National Financial Services LLC* 200 Liberty Street One World Financial Center New York, NY 10281 | | 11.42% |

14

| | |

Name and Address of Record or Beneficial Owner

| | Percentage of Target Fund

|

Ameritrade, Inc.* 1005 N. Ameritrade Place Bellevue, NE 68005 | | 8.72% |

As of November 30, 2009, the officers and Directors of DIG, as a group, owned or controlled less than 1% of the Acquiring Fund. As of November 30, 2009, the following shareholders owned of record, or to the knowledge of the Acquiring Fund beneficially, 5% or more of the outstanding shares of the Acquiring Fund:

| | |

Name and Address of Record or Beneficial Owner

| | Percentage of Acquiring Fund

|

Charles Schwab & Company, Inc.* 101 Montgomery Street San Francisco, CA 94104 | | 80.04% |

| |

National Financial Services LLC* 200 Liberty Street One World Financial Center New York, NY 10281 | | 10.47% |

| |

The RBB Fund Inc. Free Market US Equity Fund 5955 Deerfield Blvd. Mason, OH 45040 | | 6.41% |

| * | | Owner of record only (omnibus) |

ADDITIONAL INFORMATION

The Administrator and Transfer Agent. PNC Global Investment Servicing (U.S.) Inc., with offices at 301 Bellevue Parkway, Wilmington, Delaware 19809, serves as the accounting services, dividend disbursing, and transfer agent for the Funds.

Custodian. PFPC Trust Company, 301 Bellevue Parkway, Wilmington, Delaware 19809, is custodian of the Target Fund’s and Acquiring Fund’s investments.

Auditor. PricewaterhouseCoopers LLP, located at 2001 Market Street, Philadelphia, Pennsylvania 19103, serves as the independent registered public accounting firm to the Target Fund and the Acquiring Fund.

Master Feeder Structure. Other institutional investors, including other mutual funds, may invest in the Master Fund. Accordingly, the expenses of such other funds and, correspondingly, their returns may differ from those of the Target Fund and the Acquiring Fund. The aggregate amount of expenses for the Funds and the Master Fund may be greater than it would be if the Funds were to invest directly in the securities held by the Master Fund. However, the total expense ratios for the Funds and the Master Fund are expected to be less over time than such ratios would be if the Funds were to invest directly in the underlying securities. This arrangement enables various institutional investors, including the Funds, to pool their assets, which may be expected to result in economies by spreading certain fixed costs over a larger asset base. Each shareholder in the Master Fund, including each Fund, will pay its proportionate share of the expenses of the Master Fund.

Investment in the Master Fund by other institutional investors offers potential benefits to the Master Fund and, through their investments in the Master Fund, the Funds also. However, such economies and expense reductions might not be achieved, and additional investment opportunities, such as increased diversification, might not be available if other institutions do not invest in the Master Fund. Also, if an institutional investor were to redeem its interest in the Master Fund, the remaining investors in the Master Fund could experience higher pro rata operating expenses, thereby producing lower returns, and the Master Fund’s security holdings may become less diverse, resulting in increased risk.

If the DFAIDG Board or the DIG Board, as applicable, determines that it is in the best interest of the Target Fund or the Acquiring Fund, respectively, a Fund may withdraw its investment in the Master Fund at any time.

15

Upon any such withdrawal, the DFAIDG Board or the DIG Board would consider what action the Fund might take, including either seeking to invest its assets in another registered investment company with the same investment objective as the Fund (which might not be possible), or retaining an investment advisor to manage the Fund’s assets in accordance with the Fund’s own investment objective, possibly at increased cost. Shareholders of a Fund will receive written notice thirty days before the effective date of any changes in the investment objective of the Master Fund.

Shareholders Sharing the Same Address

If two or more shareholders share the same address, only one copy of the Information Statement/Prospectus is being delivered to that address, unless the Fund(s) have received contrary instructions from one or more of the shareholders at that shared address. Upon written or oral request, the Acquiring Fund will deliver promptly a separate copy of the Information Statement/Prospectus to a shareholder at a shared address. Please call collect (512)306-7400 or forward a written request to 6300 Bee Cave Road, Building One, Austin, TX 78746, if you would like to (1) receive a separate copy of the Information Statement/Prospectus; (2) receive your annual reports or Information Statements separately in the future; or (3) request delivery of a single copy of annual reports or Information Statements if you currently are receiving multiple copies at a shared address.

FINANCIAL HIGHLIGHTS

The following tables show the financial performance of each Fund for the past five fiscal years, and for the most recent semi-annual period ended April 30, 2009. The total returns in the tables represent the rate that you would have earned or lost on an investment in a Fund (assuming reinvestment of all dividends and distributions). The financial information in the following table and the notes thereto, for the six months ended April 30, 2009, is unaudited. The information for the remaining periods has been audited by PricewaterhouseCoopers LLP, the independent registered certified public accountant for the Funds, whose reports thereon are included in DFAIDG’s and DIG’s annual reports to shareholders for the fiscal year ended October 31, 2008. Each Company’s annual report is incorporated by reference into this Information Statement/Prospectus. Copies of each Fund’s annual report may be obtained without charge by calling collect at 512-306-7400.

16

DFA INVESTMENT DIMENSIONS GROUP INC.

FINANCIAL HIGHLIGHTS

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | U.S. Large Company Portfolio Institutional Class Shares

| |

| | | Period

Ended

Apr. 30,

2009***

(unaudited)

| | | Period

Ended

Oct. 31,

2008**

| | | Year

Ended

Nov. 30,

2007

| | | Year

Ended

Nov. 30,

2006

| | | Year

Ended

Nov. 30,

2005

| | | Year

Ended

Nov. 30,

2004

| | | Year

Ended

Nov. 30,

2003

| |

Net Asset Value, Beginning of Period | | $ | 28.57 | | | $ | 43.61 | | | $ | 41.24 | | | $ | 36.79 | | | $ | 34.59 | | | $ | 31.16 | | | $ | 27.56 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income From Investment Operations | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Investment Income (Loss) | | | 0.37 | # | | | 0.72 | # | | | 0.80 | # | | | 0.71 | # | | | 0.60 | | | | 0.61 | | | | 0.47 | |

Net Gains (Losses) on Securities (Realized and Unrealized) | | | (2.77 | ) | | | (14.96 | ) | | | 2.33 | | | | 4.41 | | | | 2.28 | | | | 3.31 | | | | 3.57 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total From Investment Operations | | | (2.40 | ) | | | (14.24 | ) | | | 3.13 | | | | 5.12 | | | | 2.88 | | | | 3.92 | | | | 4.04 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Less Distributions | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Investment Income | | | (0.42 | ) | | | (0.80 | ) | | | (0.76 | ) | | | (0.67 | ) | | | (0.68 | ) | | | (0.49 | ) | | | (0.44 | ) |

Net Realized Gains | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total Distributions | | | (0.42 | ) | | | (0.80 | ) | | | (0.76 | ) | | | (0.67 | ) | | | (0.68 | ) | | | (0.49 | ) | | | (0.44 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net Asset Value, End of Period | | $ | 25.75 | | | $ | 28.57 | | | $ | 43.61 | | | $ | 41.24 | | | $ | 36.79 | | | $ | 34.59 | | | $ | 31.16 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total Return | | | (8.31 | )%† | | | (33.14 | )%† | | | 7.66 | % | | | 14.12 | % | | | 8.41 | % | | | 12.68 | % | | | 14.90 | % |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net Assets, End of Period (thousands) | | $ | 2,272,229 | | | $ | 2,544,038 | | | $ | 3,415,833 | | | $ | 2,868,811 | | | $ | 2,088,128 | | | $ | 1,440,869 | | | $ | 1,017,265 | |

Ratio of Expenses to Average Net Assets* | | | 0.15 | %^ | | | 0.15 | %^ | | | 0.15 | % | | | 0.15 | % | | | 0.15 | % | | | 0.15 | % | | | 0.15 | % |