As filed with the Securities and Exchange Commission on December 11, 2017

File No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

| | | | |

| | THE SECURITIES ACT OF 1933 | | ☒ |

| | Pre-Effective Amendment No. | | ☐ |

| | Post-Effective Amendment No. | | ☐ |

(Check appropriate box or boxes)

Dimensional Investment Group Inc.

(Exact Name of Registrant as Specified in Charter)

6300 Bee Cave Road, Building One, Austin, TX 78746

(Address of Principal Executive Offices) (Number, Street, City, State, Zip Code)

(512) 306-7400

(Registrant’s Area Code and Telephone Number)

Catherine L. Newell, Esquire, President and General Counsel

Dimensional Investment Group, Inc.

6300 Bee Cave Road, Building One

Austin, TX 78746

(Name of Address of Agent for Service)

Send Copies of Communications to:

Jana L. Cresswell, Esquire

Stradley Ronon Stevens & Young, LLP

2600 One Commerce Square

Philadelphia, PA 19103

(215) 564-8048

Approximate Date of Public Offering: As soon as practicable after this Registration Statement becomes effective under the Securities Act of 1933, as amended.

Title of securities being registered:

Shares of common stock, with par value of one cent ($0.01) per share, of the DFA International Value Portfolio III and the U.S. Large Cap Value Portfolio III, each a series of the Registrant.

It is proposed that this Registration Statement will become effective on January 10, 2018 pursuant to Rule 488 under the Securities Act of 1933, as amended.

No filing fee is due because Registrant is relying on Section 24(f) of the Investment Company Act of 1940, as amended.

DIMENSIONAL FUND ADVISORS LP

Dimensional Investment Group Inc.

DFA Investment Dimensions Group Inc.

6300 Bee Cave Road, Building One

Austin, TX 78746

[ ], 2018

Dear Shareholder:

We are contacting you with some important information concerning your investment in:

| • | | DFA International Value Portfolio II, |

| • | | LWAS/DFA International High Book to Market Portfolio, and/or |

| • | | LWAS/DFA U.S. High Book to Market Portfolio. |

The Boards of Directors of DFA Investment Dimensions Group Inc. and Dimensional Investment Group Inc., on behalf of their respective Portfolios, have approved the reorganization (the “International Reorganization”) of the LWAS/DFA International High Book to Market Portfolio (the “LWAS International Target Portfolio”) and the DFA International Value Portfolio II (the “International II Target Portfolio”) into the DFA International Value Portfolio III (the “International Acquiring Portfolio”). The Board of Directors of Dimensional Investment Group Inc. also has approved the reorganization (the “U.S. Reorganization”) of the LWAS/DFA U.S. High Book to Market Portfolio (the “LWAS U.S. Target Portfolio”) into the U.S. Large Cap Value Portfolio III (the “U.S. Acquiring Portfolio”).

The LWAS International Target Portfolio, the International II Target Portfolio and the International Acquiring Portfolio (together, the “International Portfolios”) pursue identical investment objectives and have identical investment strategies. The International Portfolios operate as feeder funds in a master-feeder structure, and each Portfolio invests substantially all of its assets in The DFA International Value Series (the “International Master Fund”) of The DFA Investment Trust Company.

The LWAS U.S. Target Portfolio and the U.S. Acquiring Portfolio (together, the “U.S. Portfolios”) pursue identical investment objectives and have identical investment strategies. The U.S. Portfolios operate as feeder funds in a master-feeder structure, and each Portfolio invests substantially all of its assets in The U.S. Large Cap Value Series (the “U.S. Master Fund”) of The DFA Investment Trust Company.

Each reorganization is expected to occur on or about [February 26, 2018]. Upon completion of the International Reorganization, shareholders of the LWAS International Target Portfolio and International II Target Portfolio will become shareholders of the International Acquiring Portfolio, and will receive shares of the International Acquiring Portfolio equal in value to their shares in the respective Target Portfolio. Upon completion of U.S. Reorganization, shareholders of the LWAS U.S. Target Portfolio will become shareholders of the U.S. Acquiring Portfolio, and will receive shares of the U.S. Acquiring Portfolio equal in value to their shares in the LWAS U.S. Target Portfolio. Following each reorganization, each Acquiring Portfolio will continue to invest substantially all of its assets in its respective Master Fund. Each reorganization is expected to be tax-free for federal income tax purposes, and no sales load, contingent deferred sales charge, commission, redemption fee, or other transaction fee will be charged by the Portfolios as a result of the reorganization.

The reorganizations do not require shareholder approval, and you are not being asked to vote.

However, we do ask that you review the enclosed combined Information Statement/Prospectus, which contains information about the International Acquiring Portfolio and U.S. Acquiring Portfolio, including fees and expenses.

The Boards of Directors of DFA Investment Dimensions Group Inc. and Dimensional Investment Group Inc., including a majority of the independent directors of each Board, have approved unanimously the reorganizations and believe the reorganizations are in the best interests of the Portfolios and their shareholders.

If you have questions, please call Dimensional Fund Advisors LP collect at 512-306-7400.

Thank you for investing with Dimensional.

Sincerely,

David G. Booth

Chairman

INFORMATION STATEMENT/PROSPECTUS

Dated , 2018

DFA Investment Dimensions Group Inc.

6300 Bee Cave Road, Building One

Austin, TX 78746

(512) 306-7400

Dimensional Investment Group Inc.

6300 Bee Cave Road, Building One

Austin, TX 78746

(512) 306-7400

This Information Statement/Prospectus is being furnished to shareholders of the: DFA International Value Portfolio II (the “International II Target Portfolio”), the LWAS/DFA International High Book to Market Portfolio (the “LWAS International Target Portfolio”) and the LWAS/DFA U.S. High Book to Market Portfolio (the “LWAS U.S. Target Portfolio”) (each a “Target Portfolio” and together, the “Target Portfolios”) in connection with the reorganizations of the Target Portfolios into other portfolios in the Dimensional Fund Complex as described below.

The Board of Directors of DFA Investment Dimensions Group Inc. (“DFAIDG”) and/or the Board of Directors of Dimensional Investment Group Inc. (“DIG“) approved the following two reorganizations.

First, the Board of Directors of DIG and the Board of Directors of DFAIDG (together, the “Boards”) approved an Agreement and Plan of Reorganization (the “International Plan”) under which:

| | (i) | the DFA International Value Portfolio III (the “International Acquiring Portfolio”), a series of DIG, will acquire substantially all of the assets of the International II Target Portfolio, a series of DIG, and the LWAS International Target Portfolio, a series of DFAIDG, in exchange solely for shares of common stock of the International Acquiring Portfolio; |

| | (ii) | the shares of the International Acquiring Portfolio will be distributed to the shareholders of the International II Target Portfolio and LWAS International Target Portfolio according to their respective interests in such Target Portfolio; and |

| | (iii) | the International II Target Portfolio and the LWAS International Target Portfolio each will be liquidated and dissolved (the “International Reorganization”). |

Second, the Board of Directors of DIG also approved a Plan of Reorganization (the “U.S. Plan”) under which:

| | (i) | the U.S. Large Cap Value Portfolio III (the “U.S. Acquiring Portfolio”), a series of DIG, will acquire substantially all of the assets of the LWAS U.S. Target Portfolio (together with the U.S. Acquiring Portfolio, the “U.S. Portfolios”), another series of DIG, in exchange solely for shares of common stock of the U.S. Acquiring Portfolio; |

| | (ii) | the shares of the U.S. Acquiring Portfolio will be distributed to the shareholders of the LWAS U.S. Target Portfolio according to their respective interests in the LWAS U.S. Target Portfolio; and |

| | (iii) | the LWAS U.S. Target Portfolio will be liquidated and dissolved (the “U.S. Reorganization”). (The “International Plan” and the “U.S. Plan,” are each a “Plan” and together the “Plans,” and the “International Reorganization” and “U.S. Reorganization,” are each a “Reorganization,” and together, the “Reorganizations”). A copy of each Plan is provided in Exhibit A. |

The shares of the International Acquiring Portfolio or U.S. Acquiring Portfolio (each an “Acquiring Portfolio” and together, the “Acquiring Portfolios”) received by the shareholders of a Target Portfolio in the exchange will be equal in aggregate net asset value to the aggregate net asset value of their shares of the Target Portfolio as of the closing date of the Reorganization. Each Reorganization is expected to be effective on or about [February 26, 2018].

The Board of Directors of DFAIDG (the “DFAIDG Board”) and the Board of Directors of DIG (the “DIG Board”), including a majority of the independent directors of each Board, believes that each Reorganization is in the best interests of each of their respective Target Portfolios and that the interests of each Target Portfolio’s shareholders will not be diluted as a result of the Reorganization. Similarly, the DIG Board, including a majority of the independent directors, believes that each Reorganization is in the best interests of each respective Acquiring Portfolio, and that the interests of each Acquiring Portfolio’s shareholders will not be diluted as a result of the Reorganization. For federal income tax purposes, each Reorganization is intended to be structured as a tax-free transaction for the Target Portfolios, the Acquiring Portfolio, and their shareholders.

THIS INFORMATION STATEMENT/PROSPECTUS IS FOR INFORMATION PURPOSES ONLY, AND YOU DO NOT NEED TO DO ANYTHING IN RESPONSE TO RECEIVING IT. WE ARE NOT ASKING YOU FOR A PROXY, AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

The LWAS International Target Portfolio is a diversified portfolio of DFAIDG, a corporation created under the laws of Maryland, which is registered with the U.S. Securities and Exchange Commission (the “Commission” or the “SEC”) as an open-end management investment company. The International Target Portfolio II, the LWAS U.S. Target Portfolio and each Acquiring Portfolio is a diversified portfolio of DIG, which also is a corporation created under the laws of Maryland, and which is registered with the Commission as an open-end management investment company. The investment objectives of each Target Portfolio and each Acquiring Portfolio (together, the “Portfolios”) are identical—to achieve long-term capital appreciation. The principal offices of DFAIDG and DIG are located at 6300 Bee Cave Road, Building One, Austin, Texas 78746. The Portfolios are sponsored by Dimensional Fund Advisors LP (“Dimensional”). The principal offices of Dimensional are located at 6300 Bee Cave Road, Building One, Austin, Texas 78746.

This Information Statement/Prospectus, which you should read carefully and retain for future reference, sets forth concisely the information that you should know before investing. A statement of additional information, dated [ ], 2018, relating to this Information Statement/Prospectus and the proposed Reorganization, is available upon request and without charge by calling collect or writing to Dimensional at the phone number and address listed above. The prospectus of each Acquiring Portfolio, dated February 28, 2017 (as it may be supplemented through the date hereof) (the “Acquiring Portfolios’ Prospectus”) accompanies this Information Statement/Prospectus as Exhibit B, and is incorporated herein by reference, which means that the Acquiring Portfolios’ Prospectus is legally considered to be a part of this Information Statement/Prospectus.

Additional information about the Acquiring Portfolios, the Target Portfolios, and the proposed Reorganizations, including the prospectuses, statements of additional information, and the most recent annual and semi-annual shareholder reports for the Acquiring Portfolios and the Target Portfolios, has been filed with the SEC and is available, free of charge, by (i) calling Dimensional collect at 512-306-7400, (ii) accessing the documents at the Portfolios’ website at https://us.dimensional.com/fund-documents, or (iii) writing to the Portfolios at the address listed on the cover of this Information Statement/Prospectus. In addition, these documents may be obtained from the EDGAR database on the Commission’s Internet site at http://www.sec.gov. You may review and copy the documents at the Commission’s Public Reference Room in Washington, DC (for information on the operation of the Commission’s Public Reference Room, call 202-551-8090). You may request documents by mail from the Commission, upon payment of a duplication fee, by writing to: Securities and Exchange Commission, Public Reference Section, 100 F Street, NE, Washington, DC 20549-0102. You also may obtain this information upon payment of a duplicating fee, by e-mailing the Commission at the following address: publicinfo@sec.gov.

This Information Statement/Prospectus, dated , 2018, and the Exhibits are expected to be mailed to shareholders of the Target Portfolios on or about , 2018.

AN INVESTMENT IN THE PORTFOLIOS IS NOT A DEPOSIT OF ANY BANK AND IS NOT INSURED OR GUARANTEED BY THE FEDERAL DEPOSIT INSURANCE CORPORATION OR ANY OTHER GOVERNMENT AGENCY. AN INVESTMENT IN THE PORTFOLIOS INVOLVES INVESTMENT RISK, INCLUDING THE POSSIBLE LOSS OF PRINCIPAL.

LIKE ALL MUTUAL FUNDS, THE COMMISSION HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES OR PASSED UPON THE ADEQUACY OF THIS INFORMATION STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

2

Table of Contents

i

Summary

This Summary section is qualified in its entirety by reference to the additional information contained elsewhere in this Information Statement/Prospectus, each Plan relating to the Reorganizations, forms of which are attached to this Information Statement/Prospectus in Exhibit A, and the Acquiring Portfolios’ Prospectus, which are attached in Exhibit B. Shareholders should read this entire Information Statement/Prospectus, including Exhibit A, carefully.

How will the Reorganizations work?

Under each Plan, substantially all of a Target Portfolio’s assets will be transferred to its corresponding Acquiring Portfolio, in exchange for shares of the Acquiring Portfolio of equivalent aggregate net asset value (“NAV”). Your shares of the Target Portfolio will be exchanged for shares of equivalent aggregate NAV of the Acquiring Portfolio. Because each Portfolio has a different NAV per share, the number of Acquiring Portfolio shares that you receive likely will be different than the number of Target Portfolio shares that you own, even though the total value of your investment will be the same immediately before and after the exchange. After shares of the Acquiring Portfolio are distributed to a Target Portfolio’s shareholders, the Target Portfolio will be completely liquidated and dissolved. (The transaction is referred to in this Information Statement/Prospectus as a “Reorganization.”) As a result of the Reorganization, you will cease to be a shareholder of a Target Portfolio and will become a shareholder of the corresponding Acquiring Portfolio. This exchange will occur on the closing date of the Reorganization, which is the specific date on which the Reorganization takes place. The closing date of each Reorganization is expected to occur on or about [February 26, 2018].

Why did the Boards approve the Reorganizations?

The DFAIDG Board and the DIG Board, including all of each Board’s Directors who are not “interested persons” (as defined in the Investment Company Act of 1940, as amended (the “1940 Act”)) (together, the “Independent Directors”), after careful consideration, have determined that each Reorganization is in the best interests of each of its respective Target Portfolios and will not dilute the interests of the existing shareholders of such Target Portfolio. The DFAIDG Board and DIG Board each made this determination based on various factors, which include those that are discussed in this Information Statement/Prospectus, under the discussion of the Reorganization in the section entitled “Reasons for the Reorganizations.”

Similarly, the DIG Board, including all of DIG’s Independent Directors, has approved each Reorganization with respect to the Acquiring Portfolios. The DIG Board has determined that each Reorganization is in the best interests of each respective Acquiring Portfolio and that the interests of the Acquiring Portfolio’s shareholders will not be diluted as a result of the Reorganization.

How will the Reorganizations affect me?

If your Reorganization is consummated, you will cease to be a shareholder of a Target Portfolio and will become a shareholder of the corresponding Acquiring Portfolio. It is anticipated that the Reorganization will benefit you in several ways, including the following:

Cost Savings. Each Acquiring Portfolio has a lower total expense ratio than the corresponding Target Portfolios.

For a more detailed comparison of the Portfolios’ fees and expenses, see the section below “What are the fees and expenses of the Portfolios and what might they be after the Reorganization?”

Operating Efficiencies. Upon completion of each Reorganization, a Target Portfolio’s shareholders will become shareholders of a larger fund that may be able to achieve greater operating efficiencies from economies of scale.

1

Who will bear the costs associated with the Reorganizations?

It is anticipated that the total costs of the International Reorganization, including the expenses of preparing, printing, and mailing this Information Statement/Prospectus, will be approximately $96,000. It is anticipated that the total costs of the U.S. Reorganization, including the expenses of preparing, printing, and mailing this Information Statement/Prospectus, will be approximately $55,000. The expenses of each Reorganization will be paid by the Target Portfolios.

What are the federal income tax consequences of the Reorganizations?

As a condition to the closing of each Reorganization, the Target Portfolios and the Acquiring Portfolios must receive an opinion of Stradley, Ronon, Stevens & Young LLP (“Stradley Ronon”) to the effect that the Reorganization will constitute a “reorganization” within the meaning of Section 368 of the Internal Revenue Code of 1986, as amended (the “Code”). Accordingly, it is expected that neither you nor, in general, a Target Portfolio will recognize gain or loss as a direct result of the Reorganization of the Target Portfolio, and the holding period and aggregate tax basis for the Acquiring Portfolio shares that you receive will be the same as the holding period and aggregate tax basis of the Target Portfolio shares that you surrender in the Reorganization. At any time prior to the consummation of the Reorganization, you may redeem your Target Portfolio shares, generally resulting in the recognition of gain or loss for U.S. federal income tax purposes.

You should, however, consult your tax advisor regarding the effect, if any, of the Reorganization, in light of your individual circumstances. You should also consult your tax advisor about state and local tax consequences. For more information about the tax consequences of the Reorganization, please see the section “Information About the Reorganizations—What are the tax consequences of the Reorganizations?”

2

Comparison of Some Important Features of the Portfolios

How do the Portfolios’ investment objectives, investment strategies, and investment policies compare?

The Target Portfolios and the Acquiring Portfolios have identical investment objectives: to achieve long-term capital appreciation. Each Portfolio’s investment objective is fundamental and cannot be changed without shareholder approval. Each Target Portfolio and its corresponding Acquiring Portfolio, as feeder funds, pursue identical investment strategies. The LWAS International Target Portfolio, the International II Target Portfolio and the International Acquiring Portfolio (together, the “International Portfolios”) each seek to achieve its investment objective primarily by investing substantially all of its assets in the shares of The DFA International Value Series (the “International Master Fund”), which, using a market capitalization weighted approach, purchases securities of large non-U.S. companies in countries with developed markets that Dimensional determines to be value stocks. The investment policies of the International Portfolios are identical.

The LWAS U.S. Target Portfolio and the U.S. Acquiring Portfolio (together, the “U.S. Portfolios”) each seek to achieve its investment objective primarily by investing substantially all of its assets in the shares of The U.S. Large Cap Value Series (the “U.S. Master Fund”), which, using a market capitalization weighted approach, purchases a broad and diverse group of readily marketable securities of large U.S. companies that Dimensional determines to be value stocks. The investment policies of the U.S. Portfolios are identical.

For further information about the Portfolios’ investment objectives and investment strategies, see “Comparison of the Portfolios’ Investment Objectives, Principal Investment Strategies, and Principal Risks,” below.

The Portfolios have adopted identical fundamental investment restrictions, which may not be changed without prior shareholder approval. Each Acquiring Portfolio’s fundamental investment restrictions are listed in the Acquiring Portfolio’s statement of additional information, dated February 28, 2017 (as supplemented through the date hereof), which is incorporated by reference into the statement of additional information relating to this Information Statement/Prospectus, and is available upon request.

What are the principal risks of an investment in the Portfolios?

An investment in each Portfolio involves risks common to most mutual funds. There is no guarantee against losses resulting from investments in the Portfolios, nor that the Portfolios will achieve their investment objectives. The risks associated with an investment in each Target Portfolio and its corresponding Acquiring Portfolio are identical. You may lose money if you invest in the Portfolios.

For further information about the risks of investments in the Portfolios, see “Comparison of the Portfolios’ Investment Objectives, Principal Investment Strategies, and Principal Risks,” below.

How do the performance records of the Portfolios compare?

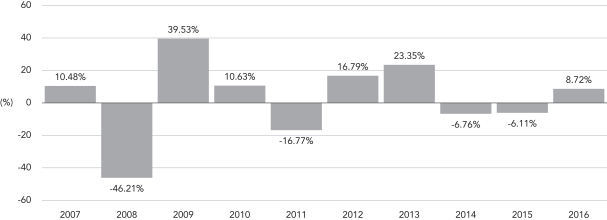

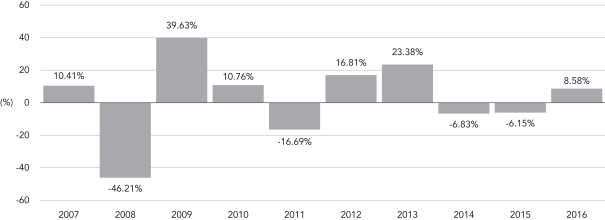

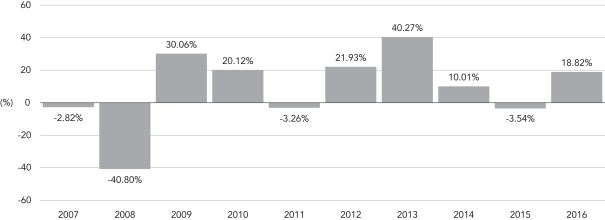

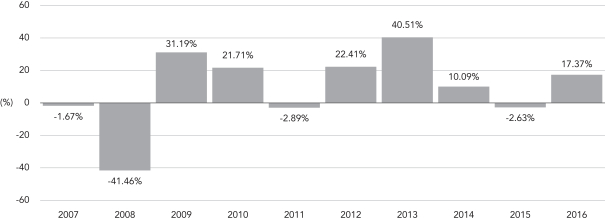

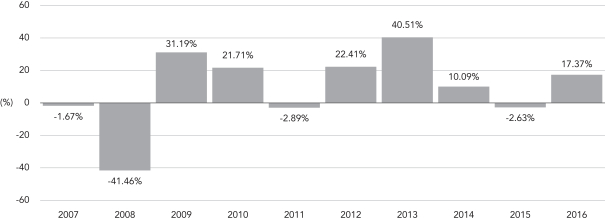

The bar charts and tables below illustrate the variability of the Portfolios’ returns and are meant to provide some indication of the risks of investing in the Portfolios. The bar charts show the changes in performance from year to year. The tables illustrate how annualized one-year, five-year and ten-year returns, both before and after taxes, compare with those of a broad measure of market performance. Past performance (before and after taxes) is not an indication of future results. The index in each table does not reflect a deduction for fees, expenses, or taxes.

The after-tax returns presented for the Portfolios are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown in the tables. In addition, the after-tax returns shown are not relevant to investors who hold shares of the Portfolios through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

3

LWAS International Target Portfolio

LWAS/DFA International High Book to Market Portfolio—Total Returns

| | |

January 2007-December 2016 |

Highest Quarter | | Lowest Quarter |

33.91% (4/09–6/09) | | -24.54% (10/08–12/08) |

As of September 30, 2017, the Portfolio’s year-to-date return was 19.60%.

Annualized Returns (%)

Periods ending December 31, 2016

| | | | | | | | | | | | | | | |

| | | |

| | | 1 Year | | 5 Years | | 10 Years |

| LWAS/DFA International High Book to Market Portfolio | | | | | | | | | | | | | | | |

Return Before Taxes | | | | 8.21 | % | | | | 6.22 | % | | | | 0.22 | % |

Return After Taxes on Distributions | | | | 7.30 | % | | | | 4.61 | % | | | | -1.69 | % |

Return After Taxes on Distributions and Sale of Portfolio Shares | | | | 5.29 | % | | | | 4.90 | % | | | | 0.26 | % |

MSCI World ex USA Index(1) (net dividends)

(reflects no deduction for fees, expenses, or taxes on sales) | | | | 2.75 | % | | | | 6.07 | % | | | | 0.86 | % |

| (1) | The MSCI World ex USA Index measures the developed markets in the entire developed world less the United States. |

4

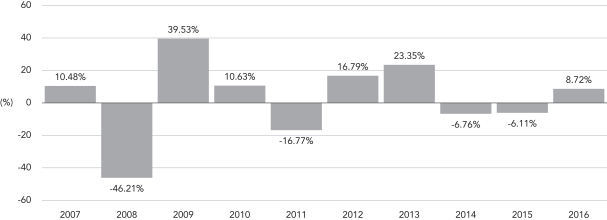

International II Target Portfolio

DFA International Value Portfolio II—Total Returns

| | |

January 2007-December 2016 |

Highest Quarter | | Lowest Quarter |

34.07% (4/09–6/09) | | -24.30% (10/08–12/08) |

As of September 30, 2017, the Portfolio’s year-to-date return was 19.53%.

Annualized Returns (%)

Periods ending December 31, 2016

| | | | | | | | | | | | |

| | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

| DFA International Value Portfolio II | | | | | | | | | | | | |

Return Before Taxes | | | 8.72 | % | | | 6.52 | % | | | 0.46 | % |

Return After Taxes on Distributions | | | 6.51 | % | | | 4.60 | % | | | -1.95 | % |

Return After Taxes on Distributions and Sale of Portfolio Shares | | | 6.56 | % | | | 5.08 | % | | | 0.35 | % |

MSCI World ex USA Index (net dividends)

(reflects no deduction for fees, expenses, or taxes on sales) | | | 2.75 | % | | | 6.07 | % | | | 0.86 | % |

5

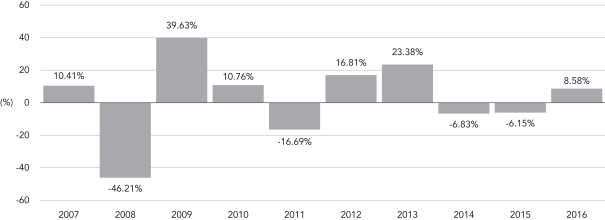

International Acquiring Portfolio

DFA International Value Portfolio III—Total Returns

| | |

January 2007-December 2016 |

Highest Quarter | | Lowest Quarter |

34.03% (4/09–6/09) | | -24.34% (10/08–12/08) |

As of September 30, 2017, the Portfolio’s year-to-date return was 19.67%.

Annualized Returns (%)

Periods ending December 31, 2016

| | | | | | | | | | | | | | | |

| | | |

| | | 1 Year | | 5 Years | | 10 Years |

| DFA International Value Portfolio III | | | | | | | | | | | | | | | |

Return Before Taxes | | | | 8.58 | % | | | | 6.47 | % | | | | 0.46 | % |

Return After Taxes on Distributions | | | | 7.59 | % | | | | 5.08 | % | | | | -0.59 | % |

Return After Taxes on Distributions and Sale of Portfolio Shares | | | | 5.47 | % | | | | 5.01 | % | | | | 0.34 | % |

MSCI World ex USA Index (net dividends)

(reflects no deduction for fees, expenses, or taxes on sales) | | | | 2.75 | % | | | | 6.07 | % | | | | 0.86 | % |

6

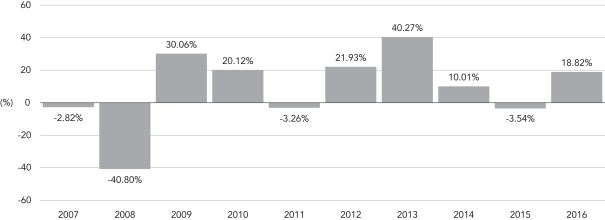

LWAS U.S. Target Portfolio

LWAS/DFA U.S. High Book to Market Portfolio—Total Returns

| | |

January 2007-December 2016 |

Highest Quarter | | Lowest Quarter |

23.54% (4/09–6/09) | | -27.86% (10/08–12/08) |

As of September 30, 2017, the Portfolio’s year-to-date return was 10.70%.

Annualized Returns (%)

Periods ending December 31, 2016

| | | | | | | | | | | | | | | |

| | | |

| | | 1 Year | | 5 Years | | 10 Years |

| LWAS/DFA U.S. High Book to Market Portfolio | | | | | | | | | | | | | | | |

Return Before Taxes | | | | 18.82 | % | | | | 16.61 | % | | | | 6.49 | % |

Return After Taxes on Distributions | | | | 16.63 | % | | | | 14.82 | % | | | | 5.42 | % |

Return After Taxes on Distributions and Sale of Portfolio Shares | | | | 12.40 | % | | | | 13.27 | % | | | | 5.10 | % |

Russell 1000® Value Index

(reflects no deduction for fees, expenses, or taxes) | | | | 17.34 | % | | | | 14.80 | % | | | | 5.72 | % |

7

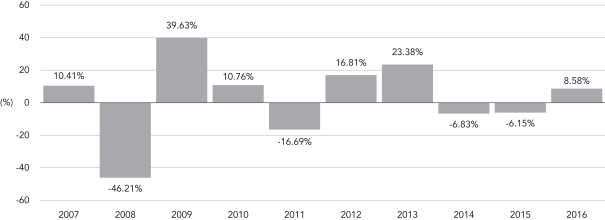

U.S. Acquiring Portfolio

U.S. Large Cap Value Portfolio III—Total Returns

| | |

January 2007-December 2016 |

Highest Quarter | | Lowest Quarter |

23.56% (4/09–6/09) | | -27.85% (10/08–12/08) |

As of September 30, 2017, the Portfolio’s year-to-date return was 10.80%.

Annualized Returns (%)

Periods ending December 31, 2016

| | | | | | | | | | | | | | | |

| | | |

| | | 1 Year | | 5 Years | | 10 Years |

| U.S. Large Cap Value Portfolio III | | | | | | | | | | | | | | | |

Return Before Taxes | | | | 19.09 | % | | | | 16.85 | % | | | | 6.70 | % |

Return After Taxes on Distributions | | | | 17.57 | % | | | | 15.47 | % | | | | 5.81 | % |

Return After Taxes on Distributions and Sale of Portfolio Shares | | | | 11.99 | % | | | | 13.49 | % | | | | 5.27 | % |

Russell 1000® Value Index

(reflects no deduction for fees, expenses, or taxes) | | | | 17.34 | % | | | | 14.80 | % | | | | 5.72 | % |

8

What are the fees and expenses of the Portfolios and what might they be after the Reorganizations?

Shareholders of the Portfolios pay various fees and expenses, either directly or indirectly. The tables below show the fees and expenses that you would pay if you were to buy and hold shares of each Portfolio. The fees and expenses in each table appearing below are based on the expenses of the Portfolios for the fiscal year ended October 31, 2017. Each table also shows the pro forma expenses of the combined Acquiring Portfolio after giving effect to the Reorganization, based on pro forma net assets as of October 31, 2017. Pro forma numbers are estimated in good faith and are hypothetical. The tables below reflect the expenses of each Portfolio and the Master Fund through which the Portfolios invest in securities. Actual expenses may vary significantly. You will not pay any sales load, contingent deferred sales charge, commission, redemption fee, or other transaction fee in connection with the Reorganization.

International Reorganization

| | | | | | | | | | | | | | | | | | | | |

| | | | |

| | | LWAS

International

Target

Portfolio | | International

II Target

Portfolio | | International

Acquiring

Portfolio | | Pro Forma—

International

Acquiring

Portfolio after

Reorganization |

Shareholder Fees (fees paid directly from your investment): | | | | None | | | | | None | | | | | None | | | | | None | |

Annual Portfolio Operating Expenses for LWAS International Target Portfolio,

International II Target Portfolio and the International Acquiring Portfolio

(expenses deducted from Portfolio assets)

| | | | | | | | | | | | | | | | | | | | |

| | | | |

| | | LWAS

International

Target

Portfolio | | International

II Target

Portfolio | | International

Acquiring

Portfolio | | Pro Forma—

Acquiring

Portfolio after

Reorganization |

| Management Fee* | | | | 0.41% | | | | | 0.41% | | | | | 0.41% | | | | | 0.41% | |

| Other Expenses | | | | 0.08% | ** | | | | 0.21% | | | | | 0.03% | | | | | 0.03% | |

| Total Annual Operating Expenses | | | | 0.49% | | | | | 0.62% | | | | | 0.44% | | | | | 0.44% | |

| Fee Waiver and/or Expense Reimbursements | | | | 0.20% | | | | | 0.20% | | | | | 0.20% | | | | | 0.20% | |

| Net Expenses | | | | 0.29% | | | | | 0.42% | | | | | 0.24% | | | | | 0.24% | |

| * | The “Management Fee” includes an investment management fee payable by the Portfolio and an investment management fee payable by the Master Fund. For any period when the Portfolio is invested in other funds managed by Dimensional (collectively, “Underlying Funds”), the Advisor has contractually agreed to permanently waive the Portfolio’s direct investment management fee to the extent necessary to offset the proportionate share of any Underlying Fund’s investment management fee paid by the Portfolio through its investment in such Underlying Fund. The amounts set forth under “Other Expenses” and “Total Annual Fund Operating Expenses” reflect the direct expenses of the Portfolio and the indirect expenses of the Portfolio’s portion of the expenses of the Master Fund. |

| ** | “Other Expenses” have been restated to reflect current fee components. Prior to February 28, 2017, the Portfolio was subject to a client services fee of 0.19%. |

9

U.S. Reorganization

| | | | | | | | | | | | | | | |

| | | |

| | | LWAS U.S.

Target Portfolio | | U.S. Acquiring

Portfolio | | Pro Forma—U.S.

Acquiring

Portfolio after

Reorganization |

Shareholder Fees (fees paid directly from your investment): | | | | None | | | | | None | | | | | None | |

Annual Portfolio Operating Expenses for the LWAS U.S.

Target Portfolio and the U.S. Acquiring Portfolio

(expenses deducted from Portfolio assets)

| | | | | | | | | | | | | | | |

| | | |

| | | LWAS U.S.

Target Portfolio | | U.S. Acquiring

Portfolio | | Pro Forma—U.S.

Acquiring

Portfolio after

Reorganization |

| Management Fee* | | | | 0.21% | | | | | 0.21% | | | | | 0.21% | |

| Other Expenses | | | | 0.07% | ** | | | | 0.02% | | | | | 0.02% | |

| Total Annual Operating Expenses | | | | 0.28% | | | | | 0.23% | | | | | 0.23% | |

| Fee Waiver and/or Expense Reimbursements | | | | 0.10% | | | | | 0.10% | | | | | 0.10% | |

| Net Expenses | | | | 0.18% | | | | | 0.13% | | | | | 0.13% | |

| * | The “Management Fee” includes an investment management fee payable by the Portfolio and an investment management fee payable by the Master Fund. For any period when the Portfolio is invested in other funds managed by Dimensional (collectively, “Underlying Funds”), the Advisor has contractually agreed to permanently waive the Portfolio’s direct investment management fee to the extent necessary to offset the proportionate share of any Underlying Fund’s investment management fee paid by the Portfolio through its investment in such Underlying Fund. The amounts set forth under “Other Expenses” and “Total Annual Fund Operating Expenses” reflect the direct expenses of the Portfolio and the indirect expenses of the Portfolio’s portion of the expenses of the Master Fund. |

| ** | “Other Expenses” have been restated to reflect current fee components. Prior to February 28, 2017, the Portfolio was subject to a client services fee of 0.15%. |

EXPENSE EXAMPLES

These Examples are meant to help you compare the cost of investing in the Acquiring Portfolios with the cost of investing in the Target Portfolios.

The Examples assume that you invest $10,000 in the Portfolios for the time periods indicated. The Examples also assume that your investment has a 5% return each year and that a Portfolio’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

International Reorganization

| | | | | | | | | | | | | | | | | | | | |

| | | | |

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years |

| LWAS International Target Portfolio | | | | $30 | | | | $ | 93 | | | | $ | 163 | | | | $ | 368 | |

| International II Target Portfolio | | | | $43 | | | | $ | 135 | | | | $ | 235 | | | | $ | 530 | |

| International Acquiring Portfolio | | | | $25 | | | | $ | 77 | | | | $ | 135 | | | | $ | 306 | |

| Pro Forma—International Acquiring Portfolio after Reorganization | | | | $25 | | | | $ | 77 | | | | $ | 135 | | | | $ | 306 | |

10

U.S. Reorganization

| | | | | | | | | | | | | | | | | | | | |

| | | | |

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years |

| LWAS U.S. Target Portfolio | | | | $18 | | | | $ | 58 | | | | $ | 101 | | | | $ | 230 | |

| U.S. Acquiring Portfolio | | | | $13 | | | | $ | 42 | | | | $ | 73 | | | | $ | 166 | |

| Pro Forma—U.S. Acquiring Portfolio after Reorganization | | | | $13 | | | | $ | 42 | | | | $ | 73 | | | | $ | 166 | |

These Examples reflect the aggregate annual operating expenses of a Portfolio and its corresponding Master Fund.

What are the distribution arrangements for the Portfolios?

The Portfolios are distributed by DFAS, which serves as the principal underwriter for the shares of the Portfolios. DFAS is a wholly-owned subsidiary of Dimensional. The principal business address of DFAS is 6300 Bee Cave Road, Building One, Austin, Texas 78746. Pursuant to DFAS’s Amended and Restated Distribution Agreements (together, the “Distribution Agreements”) with each of DFAIDG and DIG, DFAS uses its best efforts to arrange for the sale of the Portfolios’ shares, which are continuously offered. No sales charges are paid by investors or the Portfolios. No compensation is paid by the Portfolios to DFAS under the Distribution Agreements.

Each Portfolio is authorized to, and currently offers, one class of shares, which does not charge a front-end sales load at the time of purchase or a contingent-deferred sales load at the time of redemption.

What are the Portfolios’ arrangements for purchases, exchanges, and redemptions?

The procedures for purchasing, exchanging and redeeming shares of the Target Portfolios and the Acquiring Portfolios are substantially similar, and the Portfolios’ policies regarding excessive or short-term trading, are identical. You may refer to the Acquiring Portfolios’ Prospectus, attached hereto as Exhibit B, under the sections titled “Purchase of Shares” and “Redemption of Shares” for the procedures applicable to purchases, exchanges, and redemptions of the shares of each Portfolio.

Shares of each Acquiring Portfolio generally are available to 401(k) plans, clients of certain financial advisers and other institutional clients, in each case as approved by Dimensional. Shares of LWAS International Target Portfolio and LWAS U.S. Target Portfolio are available to clients of the financial adviser, LWI Financial Inc. Shares of International II Target Portfolio are available to 401(k) plans, clients, customers or members of certain institutions. There is currently no minimum initial or subsequent investment requirement for any of the Portfolios. All investments are subject to the approval of Dimensional. Shares may be purchased by shareholders of each Portfolio by contacting the shareholder’s financial adviser or other financial intermediary. Shareholders of each Target Portfolio will be eligible to purchase shares of the corresponding Acquiring Portfolio following the Reorganizations.

The purchase price of a share of each Portfolio is its NAV per share. The NAV per share of each Portfolio is calculated after the close of the New York Stock Exchange (the “NYSE”) (normally, 4:00 p.m. Eastern Time) on each day the NYSE is open. Provided that a Portfolio’s transfer agent or a transfer agent sub-designee has received the investor’s Account Registration Form in good order, shares of the Portfolio will be priced at the public offering price, which is the NAV of the shares next determined after receipt of the investor’s order. Each Portfolio reserves the right to reject any initial or subsequent investment request.

Each Target Portfolio and Acquiring Portfolio permits its shareholders to exchange shares of the Target Portfolios and the Acquiring Portfolios, respectively, for shares of certain other portfolios of DFAIDG and DIG. An exchange involves the simultaneous redemption of shares of one portfolio and the purchase of shares of another portfolio at each portfolio’s respective closing NAV next determined after the request for exchange has been received, and is a taxable transaction.

Each Portfolio redeems its shares at the NAV of such shares next determined after receipt of a written request for redemption in good order by the Portfolio’s transfer agent (or by a financial intermediary or sub-designee, if applicable).

11

Each Portfolio is intended for long-term investors and is not intended for investors that engage in excessive short-term trading activity that may be harmful to the Portfolios, including but not limited to market timing. The DFAIDG Board and the DIG Board have adopted an identical policy (the “Trading Policy”) that is designed to discourage and prevent market timing or excessive short-term trading in the Portfolios. Under purchase blocking procedures implemented by Dimensional, DFAS, and their agents, subject to certain exemptions, an investor who has engaged in any two purchases and two redemptions (including redemptions that are part of an exchange transaction) in a Portfolio in any rolling 30 calendar day monitoring period (i.e., two “round trips”) will be blocked from making any additional purchases in the Portfolio for 90 calendar days (a “purchase block”). You may refer to the Acquiring Portfolios’ Prospectus, attached hereto as Exhibit B, under the section titled “Policy Regarding Excessive or Short-Term Trading,” for further information relating to the Trading Policy and the procedures applicable to purchase blocks.

What are the Portfolios’ dividend payment policies and pricing arrangements?

The dividend payment policies of the Portfolios are identical. Dividends from net investment income of each Portfolio are generally distributed quarterly (on a calendar basis) and any net realized capital gains (after any reductions for capital loss carryforwards) are distributed annually, typically in December. The Portfolios intend to make distributions that may be taxed as ordinary income and capital gains (which may be taxable at different rates, depending on the length of time a Portfolio holds the assets). The Portfolios may distribute such income dividends and capital gains more frequently, if necessary, in order to reduce or eliminate federal excise or income taxes on the Portfolios. Shareholders of each Portfolio automatically receive all income dividends and capital gains distributions in additional shares of the Portfolio at NAV, unless, upon written notice to Dimensional and completion of the requisite account information, another option is selected by shareholders. All Portfolios notify their shareholders annually of the source and tax status of all dividends and distributions for federal income tax purposes. For additional information, you may refer to the Acquiring Portfolios’ Prospectus, attached hereto as Exhibit B, under the section titled “Dividends, Capital Gains Distributions, and Taxes.”

The Portfolios have identical procedures for calculating their share prices and valuing their portfolio securities. The Portfolios determine their NAV per share after the close of the NYSE (normally, 4:00 p.m., Eastern Time). The Portfolios will not be priced on days that the NYSE is closed for trading. DFAIDG and DIG have adopted identical policies and procedures for valuing the Portfolios’ portfolio assets. For more information about the Acquiring Portfolios’ pricing procedures, you may refer to the Acquiring Portfolios’ Prospectus, attached hereto as Exhibit B, under the section titled “Valuation of Shares.”

Who manages the Portfolios?

The management of the business and affairs of the LWAS International Target Portfolio is the responsibility of the DFAIDG Board, while the management of the business and affairs of the LWAS U.S. Target Portfolio, International II Target Portfolio and each Acquiring Portfolio is the responsibility of the DIG Board. The composition of the Boards of DFAIDG and DIG is identical. Each Board elects officers, who are responsible for the day-to-day operations of the Portfolios.

Dimensional serves as investment advisor to each Portfolio and to the International Master Fund and U.S. Master Fund. Pursuant to an Investment Management Agreement with each Master Fund, Dimensional is responsible for the Management of the Master Fund’s assets. With respect to an Investment Management Agreement with each Portfolio, Dimensional manages the portion of each Portfolio’s assets that are retained by the Portfolio for direct investment. If Dimensional believes it is in the best interests of the Portfolio and its shareholders to do so, at its discretion, Dimensional may make a determination to withdraw a Portfolio’s investment from its corresponding Master Fund to invest in another Master Fund or manage all the Portfolio’s assets directly.

12

The investment management fee for each Portfolio and Master Fund is listed below:

| | | | | |

| |

| Portfolio/Master Fund | | Management Fee |

| International Reorganization | | | | | |

| LWAS International Target Portfolio | | | | 0.21% | |

| International II Target Portfolio | | | | 0.21% | |

| International Acquiring Portfolio | | | | 0.21% | |

| International Master Fund | | | | 0.20% | |

| U.S. Reorganization | | | | | |

| LWAS U.S. Target Portfolio | | | | 0.11% | |

| U.S. Acquiring Portfolio | | | | 0.11% | |

| U.S. Master Fund | | | | 0.10% | |

As of the date of this Information Statement/Prospectus, each Portfolio invests substantially all of its assets in its corresponding Master Fund. The Portfolios and the Master Funds are managed using a team approach. The investment team includes the Investment Committee of Dimensional, portfolio managers, and trading personnel.

The Investment Committee is composed primarily of certain officers and directors of Dimensional who are appointed annually. As of the date of this Information Statement/Prospectus, the Investment Committee has twelve members. Investment strategies for the Portfolios and Master Funds are set by the Investment Committee, which meets on a regular basis and also as needed to consider investment issues. The Investment Committee also sets and reviews all investment related policies and procedures and approves any changes in regards to approved countries, security types, and brokers.

In accordance with the team approach used to manage the Portfolios and the Master Funds, the portfolio managers and portfolio traders implement the policies and procedures established by the Investment Committee. The portfolio managers and portfolio traders also make daily investment decisions regarding the Portfolios and Master Funds based on the parameters established by the Investment Committee. The individuals named below coordinate the efforts of all other portfolio managers or trading personnel with respect to the day-to-day management of the Portfolios.

LWAS International Target Portfolio, International II Target Portfolio and International Acquiring Portfolio

Joseph H. Chi is a Senior Portfolio Manager and Vice President of Dimensional and the Chairman of the Investment Committee. Mr. Chi has an MBA and BS from the University of California, Los Angeles and also a JD from the University of Southern California. Mr. Chi joined Dimensional as a portfolio manager in 2005 and has been responsible for the International Portfolios since 2010.

Jed S. Fogdall is a Senior Portfolio Manager and Vice President of Dimensional and a member of the Investment Committee. Mr. Fogdall has an MBA from the University of California, Los Angeles and a BS from Purdue University. Mr. Fogdall joined Dimensional as a portfolio manager in 2004 and has been responsible for the International Portfolios since 2010.

Mary T. Phillips is a Senior Portfolio Manager and Vice President of Dimensional and a member of the Investment Committee. Ms. Phillips holds an MBA from the University of Chicago Booth School of Business and a BA from the University of Puget Sound. Ms. Phillips joined Dimensional in 2012, has been a portfolio manager since 2014, and has been responsible for the International Portfolios since 2015.

Bhanu P. Singh is a Senior Portfolio Manager and Vice President of Dimensional. Mr. Singh received his MBA from the University of Chicago and his BA from the University of California, Los Angeles. Mr. Singh joined Dimensional originally in 2003, has been a portfolio manager since 2012 and has been responsible for the International Portfolios since 2015.

13

LWAS U.S. Target Portfolio and U.S. Acquiring Portfolio

Joseph H. Chi is a Senior Portfolio Manager and Vice President of Dimensional and the Chairman of the Investment Committee. Mr. Chi has an MBA and BS from the University of California, Los Angeles and also a JD from the University of Southern California. Mr. Chi joined Dimensional as a portfolio manager in 2005 and has been responsible for the U.S. Portfolios since 2012.

Jed S. Fogdall is a Senior Portfolio Manager and Vice President of Dimensional and a member of the Investment Committee. Mr. Fogdall has an MBA from the University of California, Los Angeles and a BS from Purdue University. Mr. Fogdall joined Dimensional as a portfolio manager in 2004 and has been responsible for the U.S. Portfolios since 2012.

Lukas J. Smart is a Senior Portfolio Manager and Vice President of Dimensional. Mr. Smart holds an MBA from the University of Chicago Booth School of Business and a BA from the University of San Diego. Mr. Smart joined Dimensional in 2007, has been a portfolio manager since 2010, and has been responsible for the U.S. Portfolios since 2015.

Dimensional provides each Portfolio and Master Fund with a trading department and selects brokers and dealers to effect securities transactions. Securities transactions are placed with a view to obtaining the best price and execution of such transactions. A discussion regarding the basis for the Board of Directors/Trustees approving the Investment Management Agreement with respect to each Portfolio and Master Fund is available in the semi-annual report for the Portfolios and the Master Funds for the fiscal period ending April 30, 2017. Dimensional’s address is 6300 Bee Cave Road, Building One, Austin, TX 78746. Dimensional has been engaged in the business of providing investment management services since May 1981. Dimensional is currently organized as a Delaware limited partnership and is controlled and operated by its general partner, Dimensional Holdings Inc., a Delaware corporation. As of January 31, 2017, assets under management for all Dimensional affiliated advisors totaled approximately $472 billion.

With respect to the International Portfolios and International Master Fund, Dimensional has entered into Sub-Advisory Agreements with Dimensional Fund Advisors Ltd. (“DFAL”) and DFA Australia Limited (“DFA Australia”), respectively. Pursuant to the terms of each Sub-Advisory Agreement, DFAL and DFA Australia (i) select brokers or dealers to execute purchases and sales of securities in the International Master Fund’s portfolio, and assist Dimensional in determining eligible securities available for purchase and sale in the International Master Fund; (ii) allocate trades among brokers or dealers; (iii) determine the best and most efficient means of purchasing and selling portfolio securities in order to receive best price and execution; (iv) make recommendations and elections on corporate actions; and (v) provide investment and ancillary services for Dimensional. Dimensional controls DFAL and DFA Australia. DFA Australia has been a U.S. federally registered investment advisor since 1994 and is located at Level 43 Gateway, 1 Macquarie Place, Sydney, New South Wales 2000, Australia. DFAL has been a U.S. federally registered investment advisor since 1991 and is located at 20 Triton Street, Regent’s Place, London, NW13BF, United Kingdom.

Pursuant to a Fee Waiver Agreement for the Portfolios, Dimensional has contractually agreed to permanently waive all or a portion of the management fee of each Portfolio to the extent necessary to limit the total management fees paid to Dimensional by a Portfolio, including the proportionate share of the management fees a Portfolio pays indirectly through its investment in other funds managed by Dimensional, except for the fees paid indirectly through its investment of securities lending cash collateral in an affiliated money market fund, to the rate listed below as a percentage of the average net assets of a class of a Portfolio on an annualized basis.

| | | | | |

| |

| Portfolio | | Expense Limitation

Amount |

| International Reorganization | | | | | |

| LWAS International Target Portfolio | | | | 0.21% | |

| International II Target Portfolio | | | | 0.21% | |

| International Acquiring Portfolio | | | | 0.21% | |

| U.S. Reorganization | | | | | |

| LWAS U.S. Target Portfolio | | | | 0.11% | |

| U.S. Acquiring Portfolio | | | | 0.11% | |

14

Information About the Reorganizations

Reasons for the Reorganizations

Each of the DFAIDG Board and the DIG Board considered the International Portfolios Reorganization and approved the International Plan. The DIG Board considered the U.S. Portfolios Reorganization and approved the U.S. Plan. In considering the Plans, the DFAIDG Board and the DIG Board requested and received detailed information from the officers of DFAIDG and DIG, and representatives of Dimensional regarding the Reorganizations, including: (1) the specific terms of each Plan; (2) the investment objectives, investment strategies, and investment policies of the Target Portfolios and the Acquiring Portfolios; (3) comparative data analyzing the fees and expenses of the Portfolios; (4) the proposed plans for ongoing management, distribution, and operation of the Acquiring Portfolios; (5) the management, financial position, and business of Dimensional and its affiliates; (6) the impact of each Reorganization on the Portfolios and their shareholders; (7) the relative asset sizes of the Portfolios, including the benefits of a Portfolio combining with another Portfolio; and (8) historical performance data for the Portfolios.

In approving the International Reorganization, the DFAIDG Board, including all of the Independent Directors, determined that (i) participation in the International Reorganization is in the best interest of the LWAS International Target Portfolio’s shareholders, and (ii) the interests of the LWAS International Target Portfolio’s shareholders will not be diluted as a result of the International Reorganization.

In approving the International Reorganization and the U.S. Reorganization, the DIG Board, including all of the Independent Directors, determined that (i) participation in each Reorganization is in the best interest of shareholders of the International II Target Portfolio and LWAS U.S. Target Portfolio, and (ii) the interests of shareholders of the International II Target Portfolio and LWAS U.S. Target Portfolio will not be diluted as a result of the Reorganizations.

In making these determinations, the DFAIDG Board and the DIG Board, as applicable, including all of the Independent Directors, considered a number of factors, including the potential benefits and costs of each Reorganizations to the shareholders of the Target Portfolios. These considerations included the following:

| • | | The total expense ratio of each Acquiring Portfolio is expected to be less than the total expense ratio of each corresponding Target Portfolio; |

| • | | Shareholders of each Target Portfolio likely will benefit from economies of scale as fixed costs are shared, and operating efficiencies may be achieved; |

| • | | The investment objective, investment strategies, and investment policies of each Target Portfolio and its corresponding Acquiring Portfolio are identical; |

| • | | Each Acquiring Portfolio will continue to operate as a feeder fund investing substantially all of its assets in the shares of a Master Fund, and thus, a Target Portfolio’s investment program will not change as a consequence of the Reorganization; |

| • | | Each Acquiring Portfolio may be more competitive in the marketplace; |

| • | | Each Reorganization will eliminate the administrative and regulatory costs of operating each Portfolio as a separate mutual fund; |

| • | | The Target Portfolios will pay the costs of each Reorganization; |

| • | | The Reorganization is intended to be tax-free for federal income tax purposes for shareholders of each Target Portfolio; and |

| • | | The alternatives available for shareholders of each Target Portfolio, including the ability to redeem their shares in the Target Portfolio prior to the Reorganization. |

15

Based upon their evaluation of the relevant information presented to them, and in light of its fiduciary duties under federal and state law, the DFAIDG Board and the DIG Board, including all of the Independent Directors, concluded that completing each Reorganization is in the best interests of the shareholders of their respective Target Portfolios and that no dilution of value would result to the shareholders of a Target Portfolio from a Reorganization.

The DIG Board, including all of the Independent Directors, on behalf of the Acquiring Portfolios, also concluded that each Reorganization is in the best interests of the Acquiring Portfolios and their shareholders, and that no dilution in value would result to the shareholders of the Acquiring Portfolios from the Reorganization. Consequently, the DIG Board approved the Plans on behalf of each Acquiring Portfolio.

16

Information About the Plans

This is only a summary of the Plans. You should read the form of each Plan, which are attached as Exhibit A to this Information Statement/Prospectus and are incorporated by reference, for complete information about the Reorganizations.

How will the Reorganizations be carried out?

Each Reorganization will take place after various conditions are satisfied, including the preparation of certain documents. DFAIDG and DIG, with respect to International Reorganization, and DIG, with respect to the U.S. Reorganization, will determine a specific date, called the “closing date,” for such Reorganization to take place. Under each Plan, each Target Portfolio will transfer substantially all of its assets, free and clear of all liens, encumbrances, and claims whatsoever (other than shareholders’ rights of redemption), to the respective Acquiring Portfolio on the closing date, which is scheduled to occur on or about [February 26, 2018], but which may occur on an earlier or later date as the parties may agree. An Acquiring Portfolio shall not assume any liability of a Target Portfolio. In exchange, DIG will issue shares of the respective Acquiring Portfolio that have an aggregate NAV equal to the dollar value of the assets delivered to the Acquiring Portfolio by such Target Portfolio. DFAIDG or DIG, as applicable, will distribute the Acquiring Portfolio shares it receives to the shareholders of the respective Target Portfolio. Each shareholder of a Target Portfolio will receive a number of Acquiring Portfolio shares with an aggregate NAV equal to the aggregate NAV of his or her shares of the Target Portfolio. The share transfer books of each Target Portfolio will be permanently closed as of 4:00 p.m., Eastern Time, on the closing date. Each Target Portfolio will accept requests for redemptions only if received in proper form before 4:00 p.m., Eastern Time, on the closing date. Requests received after that time will be considered requests to redeem shares of the respective Acquiring Portfolio. As soon as reasonably practicable after the transfer of its assets, each Target Portfolio will pay or make provision for payment of all its remaining liabilities, if any. Each Target Portfolio will then terminate its existence as a separate series of DFAIDG or DIG, as applicable.

The parties may agree to amend a Plan to the extent permitted by law. If the parties agree, a Plan may be terminated or abandoned at any time before the Reorganization.

Each of DFAIDG and DIG has made representations and warranties in the Plan that are customary in matters such as the Reorganization. The obligations under the Plan of DFAIDG (with respect to the LWAS International Target Portfolio) and DIG (with respect to the International II Target Portfolio, LWAS U.S. Target Portfolio, and the Acquiring Portfolios) are subject to various conditions, including:

| • | | DIG’s registration statement on Form N-14 under the Securities Act of 1933, of which this Information Statement/Prospectus is a part, shall have been filed with the SEC and such registration statement shall have become effective and shall not have been withdrawn or terminated, and no stop-order suspending the effectiveness of the registration statement shall have been issued, and no proceeding for that purpose shall have been initiated or threatened by the SEC; and |

| • | | DFAIDG and DIG shall have received a tax opinion described below that the consummation of the Reorganizations will not result in the recognition of gain or loss for federal income tax purposes for the Target Portfolios, the Acquiring Portfolios, or their shareholders. |

Who will pay the expenses of the Reorganization?

The Target Portfolios will pay all of the costs and expenses resulting from the Reorganizations. The expenses of the International Reorganization are estimated to be $96,000 and the expenses of the U.S. Reorganization are expected to be $55,000. Because the Portfolios are feeder funds that invest in their respective Master Fund, it is not anticipated that there will be any brokerage costs as a result of either Reorganization.

What are the tax consequences of the Reorganization?

Each Reorganization is intended to qualify as a tax-free reorganization for federal income tax purposes under Section 368(a)(1) of the Code. Based on certain assumptions made and representations to be made on behalf of each Acquiring Portfolio and each Target Portfolio, it is expected that Stradley Ronon will provide a legal opinion

17

to the effect that, for federal income tax purposes: (i) shareholders of a Target Portfolio will not recognize any gain or loss as a result of the exchange of their shares of the Target Portfolio for shares of an Acquiring Portfolio; (ii) an Acquiring Portfolio and its shareholders will not recognize any gain or loss upon receipt of a Target Portfolio’s assets; and (iii) the holding period and aggregate tax basis for Acquiring Portfolio shares that are received by a Target Portfolio shareholder will be the same as the holding period and aggregate tax basis of the shares of the Target Portfolio previously held by such shareholder. The financial information presented in this section as of October 31, 2017 is unaudited.

Notwithstanding the foregoing, no opinion will be expressed as to the effect of a Reorganization on a Target Portfolio or an Acquiring Portfolio with respect to any asset as to which unrealized gain or loss is required to be recognized for federal income tax purposes at the end of a taxable year (or on termination or transfer thereof) under a mark to market system of accounting. No Portfolio has requested or will request an advance ruling from the Internal Revenue Service (“IRS”) as to the U.S. federal income tax consequences of a Reorganization.

Prior to the closing of the Reorganization, each Target Portfolio but not the Acquiring Portfolios will distribute to its shareholders all of its investment company taxable income and net realized capital gain (after reduction by any available capital loss carryforwards), if any, and at least 90 percent of its net tax-exempt income, if any, that have not previously been distributed to them. Any distributions of investment company taxable income and net realized capital gain will be taxable to the shareholders.

Opinions of counsel are not binding upon the IRS or the courts. If the Reorganization is consummated but does not qualify as a tax free reorganization under the Code, and thus is taxable, a Target Portfolio would recognize gain or loss on the transfer of its assets to the Acquiring Portfolio and each shareholder of the Target Portfolio would recognize a taxable gain or loss equal to the difference between its tax basis in its Target Portfolio shares and the fair market value of the shares of the Acquiring Portfolio it received.

The tax attributes, including capital loss carryovers, of each of the LWAS International Target Portfolio and the International II Target Portfolio, on the one hand, and the LWAS U.S. Target Portfolio, move to the International Acquiring Portfolio and the U.S. Acquiring Portfolio, respectively, in each Reorganization. The capital loss carryovers of the Target Portfolios and their respective Acquiring Portfolio are available to offset future gains recognized by the combined Portfolio, subject to limitations under the Code. Where these limitations apply, all or a portion of a Portfolio’s capital loss carryovers may become unavailable, the effect of which may be to accelerate the recognition of taxable gain to the combined Portfolio and its shareholders post-closing. First, the capital loss carryovers of each Portfolio that experiences a more than 50% ownership change in a Reorganization (e.g., in a Reorganization of two Portfolios, the smaller Portfolio), increased by any current year loss or decreased by any current year gain, together with any net unrealized depreciation in the value of its portfolio investments (collectively, its “aggregate capital loss carryovers”), are expected to become subject to an annual limitation. Losses in excess of that limitation may be carried forward to succeeding tax years. The annual limitation will generally equal the NAV of a Portfolio on the Closing Date multiplied by the “long-term tax-exempt rate” published by the IRS. In the case of a Portfolio with net unrealized built-in gains at the time of closing of a Reorganization (i.e., unrealized appreciation in value of the Portfolio’s investments), the annual limitation for a taxable year will be increased by the amount of such built-in gains that are recognized in the taxable year. Second, if a Portfolio has built-in gains at the time of closing that are realized by the combined Portfolio in the five-year period following a Reorganization, such built-in gains, when realized, may not be offset by the losses (including any capital loss carryovers and recognized “built in losses”) of another Portfolio (“Five Year Limitation”). Third, the capital losses of a Target Portfolio that may be used by its Acquiring Portfolio (including to offset any “built-in gains” of a Target Fund itself) for the first taxable year ending after the Closing Date will be limited to an amount equal to the capital gain net income of the Acquiring Portfolio for such taxable year (excluding capital loss carryovers) treated as realized post-closing based on the number of days remaining in such year unless an election is made to use an alternative method permitted by the Code.

The Regulated Investment Company Modernization Act of 2010 (“RIC MOD”) eliminated the eight-year carryover period for capital losses that arise in taxable years beginning after its enactment date (December 22, 2010) for regulated investment companies, regardless of whether such regulated investment company is a party to a Reorganization. Consequently, these capital losses can be carried forward indefinitely. As of October 31, 2017, neither of the U.S. Portfolios had capital loss carryovers.

18

Based upon each Portfolio’s capital loss position as of October 31, 2017 (as shown in the table below), the annual limitations on the use of each Portfolio’s aggregate capital loss carryovers, if any, may not prevent the combined Portfolio from utilizing such losses, albeit over a period of time. However, the effect of these annual limitations may be to cause the combined Fund, post-closing, to distribute more capital gains in a taxable year than might otherwise have been the case if the Reorganization had not occurred. In addition, the capital gains recognized by the combined Portfolio on the sale of a Target Portfolio’s assets may not be fully offset by the capital loss carryovers of the Acquiring Portfolio due to the Five Year Limitation, resulting in a distribution of capital gains to shareholders following the Reorganization. The ability of the Acquiring Portfolio to absorb its own aggregate capital loss carryovers, if any, and those of the Target Portfolios, if any, post-closing depends upon a variety of factors that cannot be known in advance.

| | | | | | | | | | | | | | | |

| | | |

| Line | | LWAS International

Target Portfolio | | International II

Target Portfolio | | International

Acquiring

Portfolio |

| | | | | (as of 10/31/17) | | | | | (as of 10/31/17) | | | | | (as of 10/31/17) | |

| 1 Capital Loss Carryovers (not subject to expiration) | | | $ | — | | | | $ | (807,873) | 1 | | | $ | (26,401,597) | |

| 2 Unrealized Depreciation on a Tax Basis (“built-in losses”)2 | | | | | | | | $ | (1,448,886) | 3 | | | | | |

| 3 Aggregate Capital Loss Carryovers [L1 + L2] | | | $ | — | | | | $ | (2,256,759) | | | | $ | (26,401,597) | |

| 4 Unrealized Appreciation on a Tax Basis (“built-in gains”)2 | | | $ | 10,772,804 | | | | $ | — | | | | $ | 433,697,709 | |

5 Net Unrealized Appreciation (Depreciation) as a Percentage of NAV [L2/L6 or L4/L6] | | | | 18.53% | | | | | -10.97% | | | | | 17.06% | |

6 NAV | | | $ | 58,129,356 | | | | $ | 13,206,581 | | | | $ | 2,541,484,220 | |

| 7 Tax-Exempt Rate (December 2017) | | | | 1.96% | | | | | 1.96% | | | | | | |

| 8 Annual Limitation (approximate) [L6 x L7] | | | $ | 1,139,335 | | | | $ | 258,849 | | | | | N/A | |

| 1 | This amount may be subject to an existing annual limitation due to a prior ownership change of the Portfolio. |

| 2 | The built-in losses and built-in gains represent a Target Portfolio’s share of the unrealized gain/loss on investments held by the International Master Fund. The unrealized gain/loss on each Target Portfolio’s investment in the International Master Fund will be used for purposes of applying the applicable limitations described above on the use of each Target Portfolio’s aggregate capital loss carryovers, if any. |

| 3 | If this amount continues to be below the minimum threshold for net unrealized built-in losses under the Code on the Closing Date, this amount will not be included in the calculation of the Annual Limitation for the International II Target Portfolio. |

Shareholders of a Target Portfolio will receive a proportionate share of any taxable income and gains realized by the Acquiring Portfolio and not distributed to its shareholders prior to the Reorganization when such income and gains are eventually distributed by the Acquiring Portfolio. As a result, shareholders of a Target Portfolio may receive a greater amount of taxable distributions than they would have had the Reorganization not occurred. In addition, if the Acquiring Portfolio following the Reorganization has proportionately greater unrealized appreciation in its portfolio investments as a percentage of its NAV than a Target Portfolio, shareholders of the Target Portfolio, post-closing, may receive greater amounts of taxable gain as such portfolio investments are sold than they otherwise might have if the Reorganization had not occurred.

19

Capital Structure and Shareholder Rights

Capital Structure

Each Portfolio is a series of an open-end, registered management investment company, commonly referred to as a “mutual fund.” DFAIDG was organized as a Maryland corporation on June 15, 1981. DIG was organized as a Maryland corporation on March 19, 1990. (DFAIDG and DIG are each referred to as a “Company,” and together as the “Companies.”)

The operations of each Company are governed by its respective Charter, Bylaws, and Maryland state law. Each Company also must adhere to the 1940 Act, the rules and regulations promulgated by the Commission thereunder, and any applicable state securities laws.

Shares of each Acquiring Portfolio and each Target Portfolio have identical legal characteristics with respect to such matters as voting rights, assessability, conversion rights, and transferability. When issued for such consideration as the DFAIDG Board or DIG Board, as applicable, deems advisable, shares of each Portfolio are fully paid and non-assessable, and shall have no preemptive or subscription rights other than such, if any, as the Board may determine and at such price or prices and upon such other terms as the Board may fix. Shareholders of each Target Portfolio and each Acquiring Portfolio have no appraisal rights. Each share issued by a Portfolio is entitled to one full vote, and each fractional share is entitled to a proportionate fractional vote.

Upon the closing of the Reorganization, former shareholders of a Target Portfolio whose shares are represented by outstanding share certificates will not receive certificates for shares in the Acquiring Portfolio and all outstanding Target Portfolio share certificates shall be cancelled.

Rights of Target Portfolio and Acquiring Portfolio Shareholders

Shareholders of each Target Portfolio and its respective Acquiring Portfolio have substantially identical rights. There are no material differences between the rights of shareholders under the respective Charter and Bylaws of each Company. Accordingly, shareholders of each Portfolio have equal rights with respect to dividends and distributions, voting, and protection from liability. For example, shareholders of each Portfolio generally have the power to vote only: (i) for the election or removal of Directors; (ii) with respect to any contract as to which shareholder approval is required by the 1940 Act; (iii) with respect to certain amendments of the Charter; (iv) with respect to such additional matters relating to DFAIDG or DIG, as applicable, as may be required by the 1940 Act, the Charters, the Bylaws, or any registration of DFAIDG or DIG, as applicable, with the Commission or any state, or as the Directors may consider necessary or desirable.

Neither Portfolio is required to hold an annual shareholder meeting under its Company’s Charter or Bylaws. If a shareholder meeting is held, the Portfolios have identical notice, quorum and adjournment requirements and voting standards. Both Companies generally require a majority vote of the shares present to decide any questions related to a particular matter, except a plurality shall elect a Director.

Neither the Charter nor the By-Laws of the Companies contain specific provisions regarding the personal liability of shareholders. However, under the Maryland corporate law, shareholders of a Maryland corporation generally will not be held personally liable for the acts or obligations of the corporation, except that a shareholder may be liable to the extent that (i) consideration for the shares has not been paid, (ii) the shareholder knowingly accepts a distribution in violation of the charter or Maryland law, or (iii) the shareholder receives assets of the corporation upon its liquidation and the corporation is unable to meet its debts and obligations, in which case the shareholder may be liable for such debts and obligations to the extent of the assets received in the distribution.

What is the capitalization of the Portfolios?

The following table sets forth the unaudited capitalization of each Target Portfolio and each Acquiring Portfolio as of October 31, 2017, and the unaudited pro forma combined capitalization of each Acquiring Portfolio as adjusted to give effect to the proposed Reorganization. The following are examples of the number of shares of each Acquiring Portfolio that would have been exchanged for the shares of the Target Portfolios if the

20

Reorganization had been consummated on October 31, 2017, and do not reflect the number of shares or value of shares that would actually be received if the Reorganization, as described, occurs. Each shareholder of each Target Portfolio will receive the number of full and fractional shares of the Acquiring Portfolio equal in value to the value (as of the last valuation date) of the shares of the Target Portfolio.

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | LWAS

International

Target Portfolio | | International

II Target

Portfolio | | International

Acquiring

Portfolio | | Pro Forma

Adjustments† | | Pro Forma—

International

Acquiring Portfolio

after Reorganization

(estimated) |

| Net assets (thousands) | | | | $58,129 | | | | | $13,207 | | | | | $2,541,484 | | | | | $(38) | | | | | $2,612,782 | |

| Total shares outstanding | | | | 6,668,405 | | | | | 2,469,527 | | | | | 150,453,443 | | | | | (4,895,105) | | | | | 154,696,270 | |

| Net asset value per share | | | | $8.72 | | | | | $5.35 | | | | | $16.89 | | | | | — | | | | | $16.89 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | |

| | | LWAS U.S. Target

Portfolio | | U.S. Acquiring

Portfolio | | Pro Forma

Adjustments† | | Pro Forma—

Acquiring Portfolio

after Reorganization

(estimated) |

| Net assets (thousands) | | | | $57,069 | | | | | $3,708,961 | | | | | $(26) | | | | | $3,766,004 | |

| Total shares outstanding | | | | 2,834,905 | | | | | 135,912,498 | | | | | (747,037) | | | | | 138,000,366 | |

| Net asset value per share | | | | $20.13 | | | | | $27.29 | | | | | — | | | | | $27.29 | |

| † | Adjustments reflect the remaining costs of the Reorganizations to be incurred by the Target Portfolios. |

This information is for informational purposes only. There is no assurance that the Reorganizations will be consummated. Moreover, if consummated, the capitalization of each Target Portfolio and each Acquiring Portfolio is likely to be different at the closing date as a result of daily share purchase and redemption activity in the Target Portfolio. Accordingly, the foregoing should not be relied upon to reflect the number of shares of an Acquiring Portfolio that actually will be received on or after such date.

21

Additional Information About the Acquiring Portfolios and the Target Portfolios

Comparison of the Portfolios’ Investment Objectives, Principal Investment Strategies, and Principal Risks