UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-6067

DIMENSIONAL INVESTMENT GROUP INC.

(Exact name of registrant as specified in charter)

6300 Bee Cave Road, Building One, Austin, TX 78746

(Address of principal executive offices) (Zip code)

Catherine L. Newell, Esquire, Vice President and Secretary

Dimensional Investment Group Inc.,

6300 Bee Cave Road, Building One, Austin, TX 78746

(Name and address of agent for service)

Registrant’s telephone number, including area code: 512-306-7400

Date of fiscal year end: October 31

Date of reporting period: October 31, 2009

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

Dimensional Fund Advisors

6300 Bee Cave Road, Building One

Austin, TX 78746

December 2009

Dear Fellow Shareholder,

After sinking to ten-year lows, stock prices around the world rebounded sharply in March 2009 and posted steady gains in the seven months between March and September. March and April were among the best-return months in the life of Dimensional’s equity Funds.

The unexpected turns in the financial markets this year offered some valuable lessons. We were reminded that stock prices are unpredictable. We saw once again the benefits of staying disciplined in the market as it inevitably moves up and down. And I believe these markets showed very clearly why diversification is so important to long-term investment success.

Although diversification can’t prevent losses, it can help investors avoid the extreme outcomes that can result from concentrating investments in individual stocks or market segments. We believe that successful investing is about both increasing wealth and being able to sleep well at night. Investors who understand how markets work and have a realistic understanding of their own tolerance for risk are most likely to have a good overall experience.

More than $10 billion in net long-term assets flowed into Dimensional’s Funds during the first 10 months of 2009, a reflection of the trust our shareholders around the world have placed in us. We are grateful for that trust and want you to know that we take our responsibility as the steward of your investments in Dimensional’s Funds very seriously. We hope to have the opportunity to continue serving your needs for many years to come.

|

| Sincerely, |

|

|

|

| David G. Booth |

| Chairman and Chief Executive Officer |

[THIS PAGE INTENTIONALLY LEFT BLANK]

ANNUAL REPORT

Table of Contents

This report is submitted for the information of the Fund’s shareholders. It is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus.

i

[THIS PAGE INTENTIONALLY LEFT BLANK]

DIMENSIONAL INVESTMENT GROUP INC.

THE DFA INVESTMENT TRUST COMPANY

DEFINITIONS OF ABBREVIATIONS AND FOOTNOTES

Statement of Assets and Liabilities/Summary Schedule of Portfolio Holdings

Investment Abbreviations

| | | | |

| | FHLMC | | Federal Home Loan Mortgage Corporation |

| | FNMA | | Federal National Mortgage Association |

Investment Footnotes

| | | | |

| | † | | See Note B to Financial Statements. |

| | ** | | Calculated as a percentage of total net assets. Percentages shown parenthetically next to the category headings have been calculated as a percentage of total investments. “Other Securities” are those securities that are not among the top 50 holdings of the Fund or do not represent more than 1.0% of the net assets of the Fund. Some of the individual securities within this category may include Total or Partial Securities on Loan and/or Non-Income Producing Securities. |

| | * | | Non-Income Producing Securities. |

| | # | | Total or Partial Securities on Loan. |

| | @ | | Security purchased with cash proceeds from Securities on Loan. |

| | (r) | | The adjustable rate shown is effective as of October 31, 2009. |

| | (y) | | The rate shown is the effective yield. |

| | § | | Affiliated Fund. |

Financial Highlights

| | | | |

| | (A) | | Computed using average shares outstanding. |

| | (B) | | Annualized |

| | (C) | | Non-Annualized |

| | (D) | | Represents the combined ratios for the respective portfolio and its respective pro-rata share of its Master Fund Series. |

All Statements and Schedules

| | | | |

| | — | | Amounts designated as — are either zero or rounded to zero. |

| | REITs | | Real Estate Investment Trusts |

| | SEC | | Securities and Exchange Commission |

1

DIMENSIONAL INVESTMENT GROUP INC.

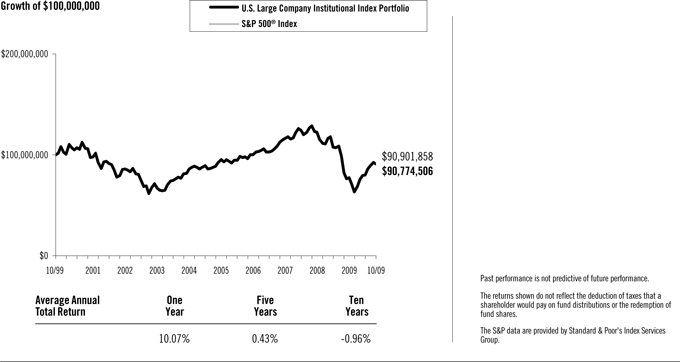

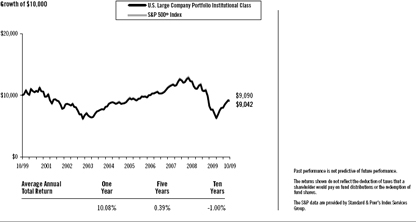

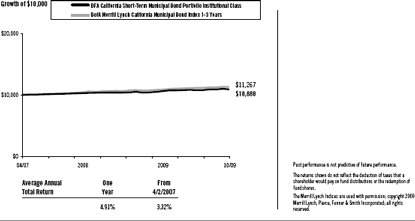

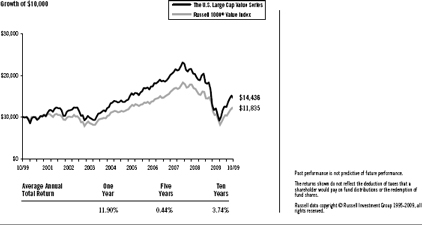

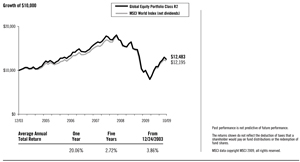

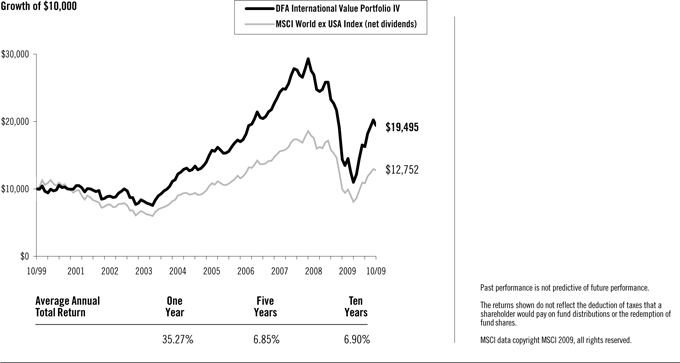

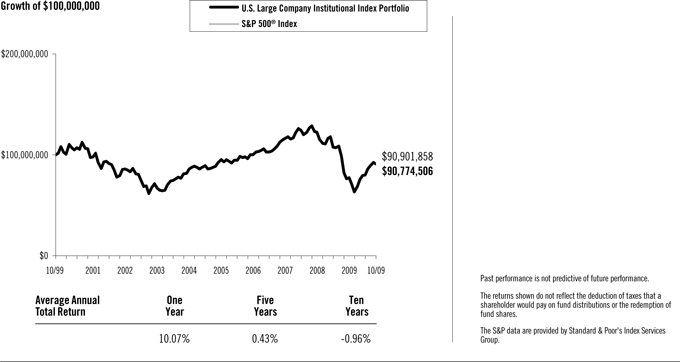

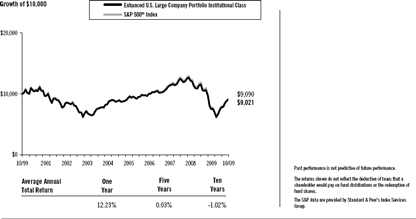

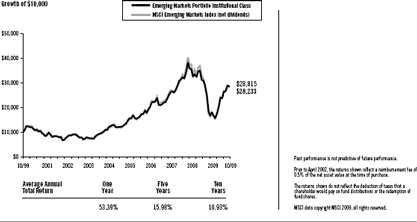

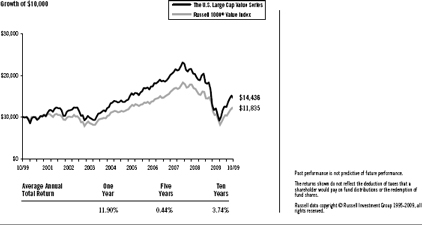

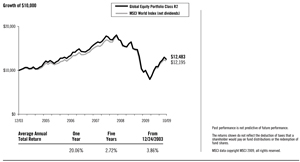

PERFORMANCE CHART

U.S. Large Company Institutional Index Portfolio vs.

S&P 500® Index

October 31, 1999-October 31, 2009

2

DIMENSIONAL INVESTMENT GROUP INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

| | |

| U.S. Equity Market Review | | 12 Months Ended October 31, 2009 |

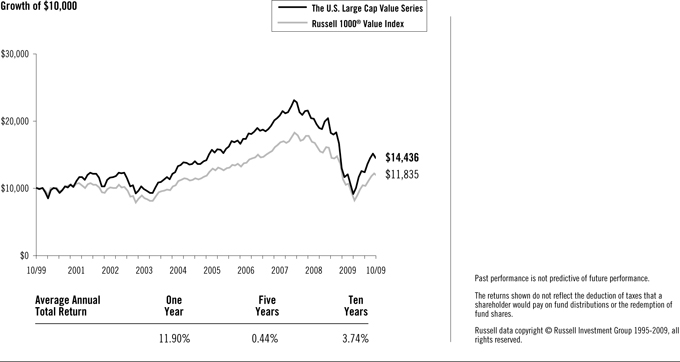

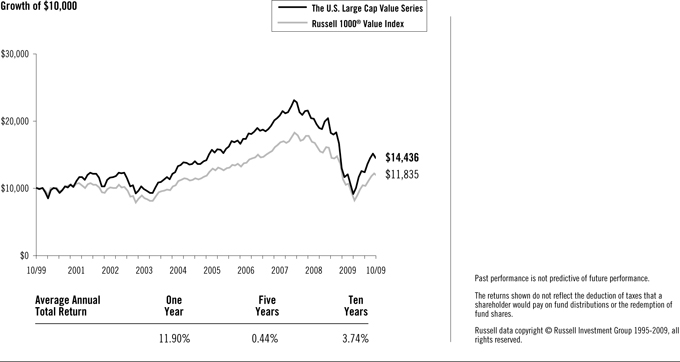

The year ending October 31, 2009, was among the most volatile periods in U.S. market history. Broad market returns were positive with stocks represented by the mid cap index outperforming those within both small cap and large cap indexes and stocks represented by the growth index outperforming those represented by the value index. Investors moving out of stocks, beginning in late 2008 and extending into early 2009, contributed to high volatility and negative returns over that period. Markets turned sharply higher in March, and the size and value premiums both turned positive over the eight months ending October 2009. Although the large cap index outperformed the small cap index, and the growth index outperformed the value index, returns within the broader market (Russell 3000® Index) demonstrate that there was a positive small size premium and a positive value premium. This counterintuitive result occurred because the stock markets were characterized by extreme volatility, and the indexes, which are reconstituted annually, were not able to rebalance during the course of the year to maintain their intended asset class exposure. Among the most important factors explaining differences in the behavior of diversified equity portfolios are the company size and company value/growth characteristics of the portfolio’s holdings. Size is measured by market capitalization, and value classification is a function of stock price relative to one or more fundamental characteristics. Compared to other stocks, value stocks often have lower market value relative to their earnings, dividends, and book value.

For the 12 months ended October 31, 2009, the total return of the Russell Microcap® Index was 5.06%, the Russell 2000® Index was 6.46%, the CRSP 6-10 Index was 20.94%, and the MSCI US Small Cap 1750 Index was 14.11%. Large cap growth stocks outperformed large cap value stocks, as measured by the Russell 1000® Growth Index and Russell 1000® Value Index®. Small cap growth stocks outperformed small cap value stocks, by a lesser amount than in large caps, as measured by the Russell 2000® Growth Index and Russell 2000® Value Index.

Total Return for 12 Months Ended October 31, 2009

| | | |

Russell 2000® Index (small cap companies) | | 6.46 | % |

Russell Midcap® Index (mid cap companies) | | 18.74 | % |

Russell 1000® Index (large cap companies) | | 11.19 | % |

Russell 3000® Value Index | | 4.55 | % |

Russell 3000® Growth Index | | 17.04 | % |

Further dividing the large, mid, and small cap market segments by value and growth characteristics shows more detail in the performance differences over the period.

Total Return for 12 Months Ended October 31, 2009

| | | |

Russell 1000® Value Index (large cap value companies) | | 4.78 | % |

Russell 1000® Growth Index (large cap growth companies) | | 17.50 | % |

Russell Midcap® Value Index (mid cap value companies) | | 14.52 | % |

Russell Midcap® Growth Index (mid cap growth companies) | | 22.48 | % |

Russell 2500TM Value Index (small/mid cap value companies) | | 8.56 | % |

Russell 2500TM Growth Index (small/mid cap growth companies) | | 18.20 | % |

Russell 2000® Value Index (small cap value companies) | | 1.95 | % |

Russell 2000® Growth Index (small cap growth companies) | | 11.34 | % |

Source: Russell data copyright © Russell Investment Group 1995-2009, all rights reserved.

Differences in returns for the various Dimensional U.S. equity funds over the 12 months ended October 31, 2009 were attributable primarily to differences in value/growth and size characteristics as well as the exclusion of REIT securities from most Dimensional portfolios, except for the DFA Real Estate Securities Portfolio and portfolios investing in the U.S. Large Company Series. Moreover, the portfolio construction approach used by Dimensional Fund Advisors (the “Advisor”) generally resulted in portfolios with greater emphasis on value or small company characteristics relative to widely used index benchmarks.

3

Master-Feeder Structure

The portfolio described below, called a “Feeder Fund”, does not buy individual securities directly; instead, the portfolio invests in a corresponding fund called a “Master Fund”. The Master Fund, in turn, purchase stocks and/or other securities.

U.S. Large Company Institutional Index Portfolio

The U.S. Large Company Institutional Index Portfolio seeks to approximate the returns of the S&P 500® Index by purchasing shares of a Master Fund that invests in S&P 500® Index stocks in approximately the same proportions as they are represented in the Index. The Portfolio was mostly invested in equities throughout the year: the average non-equitized cash level for the period was less than 1% of the Master Fund’s assets.

For the 12 months ended October 31, 2009, the total return was 10.07% for the Portfolio and 9.80% for the S&P 500® Index. Relative to the Index, outperformance was mostly due to the flexible trading approach employed by the Master Fund to gain exposure to the performance of the Index during periods of index reconstitution.

4

DIMENSIONAL INVESTMENT GROUP INC.

U.S. LARGE COMPANY INSTITUTIONAL INDEX PORTFOLIO

DISCLOSURE OF FUND EXPENSES

(Unaudited)

The following Expense Table is shown so that you can understand the impact of fees on your investment. All mutual funds have operating expenses. As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports, among others. Operating expenses, legal and audit services, which are deducted from a fund’s gross income, directly reduce the investment return of the fund. A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs, in dollars, of investing in the fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The Expense Table below illustrates your fund’s costs in two ways.

Actual Fund Return

This section helps you to estimate the actual expenses after fee waivers that you paid over the period. The “Ending Account Value” shown is derived from the fund’s actual return and “Expenses Paid During Period” reflect the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, a $7,500 account value divided by $1,000 = 7.5), then multiply the result by the number given for your fund under the heading “Expenses Paid During Period.”

Hypothetical Example for Comparison Purposes

This section is intended to help you compare your fund’s costs with those of other mutual funds. The hypothetical “Ending Account Value” and “Expenses Paid During Period” are derived from the fund’s actual expense ratio and an assumed 5% annual return before expenses. In this case, because the return used is not the fund’s actual return, the results do not apply to your investment. The example is useful in making comparisons because the SEC requires all mutual funds to calculate expenses based on a 5% annual return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect any transactional costs, if applicable. The “Annualized Expense Ratio” represents the actual expenses for the six-month period indicated.

Six Months Ended October 31, 2009

EXPENSE TABLE

| | | | | | | | | | | | |

| | | Beginning

Account

Value

05/01/09 | | Ending

Account

Value

10/31/09 | | Annualized

Expense

Ratio* | | | Expenses

Paid

During

Period* |

Actual Fund Return | | $ | 1,000.00 | | $ | 1,200.20 | | 0.10 | % | | $ | 0.55 |

Hypothetical 5% Annual Return | | $ | 1,000.00 | | $ | 1,024.70 | | 0.10 | % | | $ | 0.51 |

| * | Expenses are equal to the fund’s annualized expense ratio for the six-month period, multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month period (184), then divided by the number of days in the year (365) to reflect the six-month period. The Portfolio is a Feeder Fund. The expenses shown reflect the direct expenses of the Feeder Fund and the indirect payment of the Feeder Fund’s portion of the expenses of its Master Fund. |

5

DIMENSIONAL INVESTMENT GROUP INC.

U.S. LARGE COMPANY INSTITUTIONAL INDEX PORTFOLIO

DISCLOSURE OF PORTFOLIO HOLDINGS

(Unaudited)

The SEC requires that all Funds file a complete Schedule of Investments with the SEC for their first and third fiscal quarters on Form N-Q. For Dimensional Investment Group Inc., this would be for the fiscal quarters ending January 31 and July 31. The Form N-Q filing must be made within 60 days of the end of the quarter. Dimensional Investment Group Inc. filed its most recent Form N-Q with the SEC on September 29, 2009. It is available upon request, without charge, by calling collect: (512) 306-7400 or by mailing a request to Dimensional Fund Advisors LP, 6300 Bee Cave Road, Building One, Austin, Texas 78746, or by visiting the SEC’s website at http://www.sec.gov, or they may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. (call 1-800-732-0330 for information on the operation of the Public Reference Room).

PORTFOLIO HOLDINGS

The SEC requires that all Funds present their categories of portfolio holdings in a table, chart or graph format in their annual and semi-annual shareholder reports, whether or not a Schedule of Investments is utilized. The following table, which presents portfolio holdings as a percent of total investments before short-term investments and collateral for loaned securities, is provided in compliance with such requirement.

The categories of industry classification for the Affiliated Investment Company are represented in the Disclosure of Portfolio Holdings, which are included elsewhere within the report. Refer to the Summary Schedule of Portfolio Holdings for the underlying Master Fund’s holdings which reflect the investments by category.

| | | |

Affiliated Investment Company | | 100.0 | % |

6

DIMENSIONAL INVESTMENT GROUP INC.

U.S. LARGE COMPANY INSTITUTIONAL INDEX PORTFOLIO

STATEMENT OF ASSETS AND LIABILITIES

OCTOBER 31, 2009

(Amounts in thousands, except share and per share amounts)

| | | | |

ASSETS: | | | | |

Investment in The U.S. Large Company Series of The DFA Investment Trust Company

(Affiliated Investment Company) at Value† | | $ | 785,743 | |

Investment Securities Sold | | | 91 | |

Receivable for Fund Shares Sold | | | 337 | |

Prepaid Expenses and Other Assets | | | 24 | |

| | | | |

Total Assets | | | 786,195 | |

| | | | |

LIABILITIES: | | | | |

Payables: | | | | |

Fund Shares Redeemed | | | 428 | |

Due to Advisor | | | 25 | |

Accrued Expenses and Other Liabilities | | | 53 | |

| | | | |

Total Liabilities | | | 506 | |

| | | | |

NET ASSETS | | $ | 785,689 | |

| | | | |

SHARES OUTSTANDING, $0.01 PAR VALUE (1) | | | 96,246,158 | |

| | | | |

NET ASSET VALUE, OFFERING AND REDEMPTION PRICE PER SHARE | | $ | 8.16 | |

| | | | |

Investment in Affiliated Investment Company at Cost | | $ | 763,427 | |

| | | | |

NET ASSETS CONSIST OF: | | | | |

Paid-In Capital | | $ | 861,070 | |

Undistributed Net Investment Income (Distributions in Excess of Net Investment Income) | | | 2,126 | |

Accumulated Net Realized Gain (Loss) | | | (99,823 | ) |

Net Unrealized Appreciation (Depreciation) | | | 22,316 | |

| | | | |

NET ASSETS | | $ | 785,689 | |

| | | | |

(1) NUMBER OF SHARES AUTHORIZED | | | 500,000,000 | |

| | | | |

See accompanying Notes to Financial Statements.

7

DIMENSIONAL INVESTMENT GROUP INC.

U.S. LARGE COMPANY INSTITUTIONAL INDEX PORTFOLIO

STATEMENT OF OPERATIONS

FOR THE YEAR ENDED OCTOBER 31, 2009

(Amounts in thousands)

| | | | |

Investment Income | | | | |

Dividends | | $ | 17,067 | |

Interest | | | 29 | |

Income from Securities Lending | | | 830 | |

Expenses Allocated from Affiliated Investment Company | | | (409 | ) |

| | | | |

Total Investment Income | | | 17,517 | |

| | | | |

Expenses | | | | |

Administrative Services Fees | | | 340 | |

Accounting & Transfer Agent Fees | | | 25 | |

Filing Fees | | | 41 | |

Shareholders’ Reports | | | 47 | |

Directors’/Trustees’ Fees & Expenses | | | 13 | |

Audit Fees | | | 3 | |

Legal Fees | | | 27 | |

Other | | | 9 | |

| | | | |

Total Expenses | | | 505 | |

| | | | |

Fees Waived, Expenses Reimbursed, and/or Previously Waived Fees Recovered by Advisor (Note C) | | | (233 | ) |

| | | | |

Net Expenses | | | 272 | |

| | | | |

Net Investment Income (Loss) | | | 17,245 | |

| | | | |

Realized and Unrealized Gain (Loss) | | | | |

Net Realized Gain (Loss) on: | | | | |

Investment Securities Sold | | | (37,974 | ) |

Futures | | | 12,592 | |

Change in Unrealized Appreciation (Depreciation) of: | | | | |

Investment Securities | | | 73,084 | |

Futures | | | 1,948 | |

| | | | |

Net Realized and Unrealized Gain (Loss) | | | 49,650 | |

| | | | |

Net Increase (Decrease) in Net Assets Resulting from Operations | | $ | 66,895 | |

| | | | |

Investment Income and Realized and Unrealized Gain (Loss) were allocated from the Portfolio’s Master Fund (Affiliated Investment Company).

See accompanying Notes to Financial Statements.

8

DIMENSIONAL INVESTMENT GROUP INC.

U.S. LARGE COMPANY INSTITUTIONAL INDEX PORTFOLIO

STATEMENTS OF CHANGES IN NET ASSETS

(Amounts in thousands)

| | | | | | | | | | | | |

| | | Year

Ended

Oct. 31,

2009 | | | Period

Dec. 1, 2007

to

Oct. 31, 2008 | | | Year

Ended

Nov. 30,

2007 | |

Increase (Decrease) in Net Assets | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | |

Net Investment Income (Loss) | | $ | 17,245 | | | $ | 18,019 | | | $ | 18,174 | |

Net Realized Gain (Loss) on: | | | | | | | | | | | | |

Investment Securities Sold | | | (37,974 | ) | | | (22,091 | ) | | | 2,354 | |

Futures | | | 12,592 | | | | (4,079 | ) | | | 441 | |

Change in Unrealized Appreciation (Depreciation) of: | | | | | | | | | | | | |

Investment Securities | | | 73,084 | | | | (342,835 | ) | | | 48,691 | |

Futures | | | 1,948 | | | | 682 | | | | (119 | ) |

| | | | | | | | | | | | |

Net Increase (Decrease) in Net Assets Resulting from Operations | | | 66,895 | | | | (350,304 | ) | | | 69,541 | |

| | | | | | | | | | | | |

Distributions From: | | | | | | | | | | | | |

Net Investment Income | | | (18,243 | ) | | | (19,755 | ) | | | (17,347 | ) |

| | | | | | | | | | | | |

Total Distributions | | | (18,243 | ) | | | (19,755 | ) | | | (17,347 | ) |

| | | | | | | | | | | | |

Capital Share Transactions (1): | | | | | | | | | | | | |

Shares Issued | | | 156,796 | | | | 224,711 | | | | 178,336 | |

Shares Issued in Lieu of Cash Distributions | | | 17,318 | | | | 19,426 | | | | 16,995 | |

Shares Redeemed | | | (166,295 | ) | | | (147,002 | ) | | | (122,788 | ) |

| | | | | | | | | | | | |

Net Increase (Decrease) from Capital Share Transactions | | | 7,819 | | | | 97,135 | | | | 72,543 | |

| | | | | | | | | | | | |

Total Increase (Decrease) in Net Assets | | | 56,471 | | | | (272,924 | ) | | | 124,737 | |

Net Assets | | | | | | | | | | | | |

Beginning of Period | | | 729,218 | | | | 1,002,142 | | | | 877,405 | |

| | | | | | | | | | | | |

End of Period | | $ | 785,689 | | | $ | 729,218 | | | $ | 1,002,142 | |

| | | | | | | | | | | | |

(1) Shares Issued and Redeemed: | | | | | | | | | | | | |

Shares Issued | | | 22,124 | | | | 22,832 | | | | 15,525 | |

Shares Issued in Lieu of Cash Distributions | | | 2,474 | | | | 1,861 | | | | 1,500 | |

Shares Redeemed | | | (24,057 | ) | | | (15,126 | ) | | | (10,622 | ) |

| | | | | | | | | | | | |

Net Increase (Decrease) from Shares Issued and Redeemed | | | 541 | | | | 9,567 | | | | 6,403 | |

| | | | | | | | | | | | |

Undistributed Net Investment Income (Distributions in Excess of Net Investment Income) | | $ | 2,126 | | | $ | 3,125 | | | $ | 4,861 | |

See accompanying Notes to Financial Statements.

9

DIMENSIONAL INVESTMENT GROUP INC.

U.S. LARGE COMPANY INSTITUTIONAL INDEX PORTFOLIO

FINANCIAL HIGHLIGHTS

(for a share outstanding throughout each period)

��

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year

Ended

Oct. 31,

2009 | | | Period

Dec. 1, 2007

to Oct. 31, 2008 | | | Year Ended Nov. 30,

2007 | | | Year

Ended

Nov. 30,

2006 | | | Year

Ended

Nov. 30,

2005 | | | Year

Ended

Nov. 30,

2004 | |

| | |

Net Asset Value, Beginning of Period | | $ | 7.62 | | | $ | 11.63 | | | $ | 11.00 | | | $ | 9.82 | | | $ | 9.23 | | | $ | 8.32 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Income from Investment Operations | | | | | |

Net Investment Income (Loss) | | | 0.18 | (A) | | | 0.20 | (A) | | | 0.22 | (A) | | | 0.19 | (A) | | | 0.17 | | | | 0.17 | |

Net Gains (Losses) on Securities | | | | | | | | | | | | | | | | | | | | | | | | |

(Realized and Unrealized) | | | 0.55 | | | | (3.99 | ) | | | 0.62 | | | | 1.18 | | | | 0.61 | | | | 0.88 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from Investment Operations | | | 0.73 | | | | (3.79 | ) | | | 0.84 | | | | 1.37 | | | | 0.78 | | | | 1.05 | |

| | |

Less Distributions | | | | | | | | | | | | | | | | | | | | | | | | |

Net Investment Income | | | (0.19 | ) | | | (0.22 | ) | | | (0.21 | ) | | | (0.19 | ) | | | (0.19 | ) | | | (0.14 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Distributions | | | (0.19 | ) | | | (0.22 | ) | | | (0.21 | ) | | | (0.19 | ) | | | (0.19 | ) | | | (0.14 | ) |

| | |

Net Asset Value, End of Period | | $ | 8.16 | | | $ | 7.62 | | | $ | 11.63 | | | $ | 11.00 | | | $ | 9.82 | | | $ | 9.23 | |

| | |

Total Return | | | 10.07 | % | | | (33.10 | )%(C) | | | 7.71 | % | | | 14.11 | % | | | 8.50 | % | | | 12.66 | % |

| | |

| | | | | | |

Net Assets, End of Period (thousands) | | $ | 785,689 | | | $ | 729,218 | | | $ | 1,002,142 | | | $ | 877,405 | | | $ | 692,595 | | | $ | 534,285 | |

Ratio of Expenses to Average Net Assets (D) | | | 0.10 | % | | | 0.10 | %(B) | | | 0.10 | % | | | 0.10 | % | | | 0.10 | % | | | 0.10 | % |

Ratio of Expenses to Average Net Assets (Excluding Waivers and Assumption of Expenses and/or Recovery of Previously Waived Fees) (D) | | | 0.13 | % | | | 0.11 | %(B) | | | 0.11 | % | | | 0.11 | % | | | 0.14 | % | | | 0.15 | % |

Ratio of Net Investment Income to Average Net Assets | | | 2.53 | % | | | 2.10 | %(B) | | | 1.90 | % | | | 1.90 | % | | | 1.82 | % | | | 1.96 | % |

| | |

See Page 1 for the Definitions of Abbreviations and Footnotes.

See accompanying Notes to Financial Statements.

10

DIMENSIONAL INVESTMENT GROUP INC.

U.S. LARGE COMPANY INSTITUTIONAL INDEX PORTFOLIO

NOTES TO FINANCIAL STATEMENTS

A. Organization:

Dimensional Investment Group Inc. (the “Fund”) is an open-end management investment company registered under the Investment Company Act of 1940, whose shares are offered to institutional investors, retirement plans and clients of registered investment advisors. The Fund consists of fifteen portfolios, of which the U.S. Large Company Institutional lndex Portfolio (the “Portfolio”) is presented in this report.

The Portfolio primarily invests its assets in The U.S. Large Company Series (the “Series”), a corresponding series of The DFA Investment Trust Company. At October 31, 2009, the Portfolio owned 22% of the Series. The financial statements of the Series are included elsewhere in this report and should be read in conjunction with the financial statements of the Portfolio.

At a regular meeting of the Board of Directors/Trustees (the “Board”) on September 16, 2008, the Board voted to change the fiscal and tax year ends of the Portfolio from November 30 to October 31.

B. Significant Accounting Policies:

The following significant accounting policies are in conformity with accounting principles generally accepted in the United States of America. Such policies are consistently followed by the Fund in preparation of its financial statements. The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates and those differences could be material.

1. Security Valuation: The Portfolio’s investment reflects its proportionate interest in the net assets of the Series.

The Portfolios utilize a fair value hierarchy which prioritizes the inputs to valuation techniques used to measure fair value into three broad levels described below:

— Level 1 – quoted prices in active markets for identical securities

— Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)

— Level 3 – significant unobservable inputs (including the Portfolio’s own assumptions in determining the fair value of investments)

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. A summary of these inputs used to value the Portfolio’s net assets as of October 31, 2009 are listed below (in thousands):

| | | | | | | | | | |

| | | Valuation Inputs |

| | | Investments in

Securities

(Market Value) |

| | | Level 1 | | Level 2 | | Level 3 | | Total |

U.S. Large Company Institutional Index Portfolio | | $ | 785,743 | | — | | — | | $ | 785,743 |

2. Deferred Compensation Plan: Each eligible Director of the Fund may elect participation in the Deferred Compensation Plan (the “Plan”). Under the Plan, effective January 1, 2002, such Directors may defer payment of all or a portion of their total fees earned as a Director. These deferred amounts may be treated as though such amounts had been invested in shares of the following funds: U.S. Large Cap Value Portfolio; U.S. Core Equity 1

11

Portfolio; U.S. Core Equity 2 Portfolio; U.S. Vector Equity Portfolio; U.S. Micro Cap Portfolio; DFA International Value Portfolio; International Core Equity Portfolio; Emerging Markets Portfolio; Emerging Markets Core Equity Portfolio; and/or DFA Two-Year Global Fixed Income Portfolio. Contributions made under the Plan and the change in unrealized appreciation (depreciation) and income, are included in Directors’/Trustees’ Fees. At October 31, 2009, the total liability for deferred compensation to Directors is included in Accrued Expenses and Other Liabilities on the Statement of Assets and Liabilities in the amount of $19 (in thousands).

Each Director has the option to receive their distribution of proceeds in one of the following methods upon one year’s notice: lump sum; annual installments over a period of agreed upon years; or semi-annual installments over a period of agreed upon years. As of October 31, 2009, none of the Directors have requested distribution of proceeds.

3. Other: The Portfolio recognizes its pro-rata share, on a daily basis, of net investment income and realized and unrealized gains and losses of investment securities and futures from the Series, which is treated as a partnership for federal income tax purposes. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Distributions received on securities that represent a return of capital or capital gain are recorded as a reduction of cost of investments or as a realized gain, respectively. The Portfolio estimates the character of distributions received that may be considered return of capital distributions. Expenses directly attributable to the Portfolio are directly charged. Common expenses of the Fund are allocated using methods approved by the Board of Directors/Trustees, generally based on average net assets.

C. Investment Advisor:

Dimensional Fund Advisors LP (“Dimensional” or the “Advisor”) provides administrative services to the Portfolio, including supervision of services provided by others, providing information to the shareholders and to the Board of Directors/Trustees, and other administrative services. The Advisor provides investment advisory services to the Series. For the year ended October 31, 2009, the Portfolio’s administrative services fees were accrued daily and paid monthly to the Advisor at an effective annual rate of 0.05% of average daily net assets.

Pursuant to the Fee Waiver and Expense Assumption Agreement for the Portfolio, the Advisor has contractually agreed to waive its administration fee to the extent necessary to reduce the Portfolio’s expenses to the extent that its total direct and indirect expenses (including the expenses the Portfolio bears as a shareholder of the Series) exceed 0.10% of its average daily net assets on an annualized basis. At any time that the total direct and indirect expenses of the Portfolio are less than 0.10% of its average daily net assets on an annualized basis, the Advisor retains the right to recover any fees previously waived to the extent that such recovery will not cause the Portfolio’s total direct and indirect expenses to exceed 0.10% of its average daily net assets on an annualized basis. The Portfolio is not obligated to reimburse the Advisor for fees waived by the Advisor more than thirty-six months before the date of such recovery. The Fee Waiver and Expense Assumption Agreement will remain in effect for a period of one year from March 1, 2009 to March 1, 2010, and shall continue in effect from year to year thereafter unless terminated by the Fund or the Advisor. At October 31, 2009, approximately $418 (in thousands) of previously waived fees are subject to future recovery by the Advisor over various periods not exceeding October 31, 2012.

Fees Paid to Officers and Directors/Trustees:

Certain Officers and Directors/Trustees of the Advisor are also Officers and Directors/Trustees of the Fund; however, such Officers and Directors/Trustees (with the exception of the Chief Compliance Officer (“CCO”)) receive no compensation from the Fund. For the year ended October 31, 2009, the total related amounts paid by the Fund to the CCO were $27 (in thousands). The total related amounts paid by the Portfolio are included in Other Expenses on the Statement of Operations.

D. Federal Income Taxes:

The Portfolio has qualified and intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code for federal income tax purposes and to distribute substantially all of its taxable income and net capital gains to its shareholders. Accordingly, no provision has been made for federal income taxes.

Distributions from net investment income and net realized capital gains are determined in accordance with U.S. federal income tax regulations, which may differ from those amounts determined under accounting principles generally

12

accepted in the United States of America. These book/tax differences are either temporary or permanent in nature. To the extent these differences are permanent, they are charged or credited to paid-in capital, undistributed net investment income or accumulated net realized gains, as appropriate, in the period that the differences arise. Accordingly, the following permanent differences as of October 31, 2009, primarily attributable to net realized gains on securities were reclassified to the following accounts. These reclassifications had no effect on net assets or net asset value per share (amount in thousands):

| | | | |

Increase (Decrease) Paid-In-Capital | | Increase (Decrease) Undistributed Net Investment Income | | Increase (Decrease) Accumulated Net Realized Gains |

$(51,204) | | $(1) | | $51,205 |

The tax character of dividends and distributions declared and paid during the year ended November 30, 2007, the period December 1, 2007 to October 31, 2008 and the year ended October 31, 2009 were as follows (amounts in thousands):

| | | | | | |

| | | Net Investment

Income and

Short-Term

Capital Gains | | Long-Term Capital Gains | | Total |

2007 | | $17,347 | | — | | $17,347 |

2008 | | 19,755 | | — | | 19,755 |

2009 | | 18,243 | | — | | 18,243 |

As of October 31, 2009, the components of distributable earnings/(accumulated losses) were as follows (amounts in thousands):

| | | | | | |

Undistributed Net Investment Income and Short-Term Capital Gains | | Undistributed Long-Term Capital Gains | | Capital Loss Carryforwards | | Total Net Distributable Earnings/ (Accumulated Losses) |

$2,146 | | — | | $(50,288) | | $(48,142) |

For federal income tax purposes, the Fund measures its capital loss carryforwards annually at October 31, its fiscal year end. Capital loss carryforwards may be carried forward and applied against future capital gains. As of October 31, 2009, the Portfolio had capital loss carryforward available to offset future realized capital gains through the indicated expiration dates (amounts in thousands):

| | | | | | | | | | | | |

| Expires on October 31, | | |

2010 | | 2011 | | 2013 | | 2014 | | 2016 | | 2017 | | Total |

| $14,821 | | $13,996 | | $1,702 | | $1,944 | | $15,152 | | $2,673 | | $50,288 |

During the period ended October 31,2009, the Portfolio expired $50,824 of capital loss carryforwards.

At October 31, 2009, the total cost and aggregate gross unrealized appreciation and (depreciation) of securities for federal income tax purposes were different from amounts reported for financial reporting purposes (amounts in thousands):

| | | | | | |

Federal Tax Cost | | Unrealized Appreciation | | Unrealized (Depreciation) | | Net Unrealized Appreciation (Depreciation) |

$812,931 | | $104,059 | | $(131,247) | | $(27,188) |

Accounting for Uncertainty in Income Taxes sets forth a minimum threshold for financial statement recognition of the benefit of a tax position taken or expected to be in a tax return. Management has analyzed the Portfolio’s

13

financial tax position and has concluded that no provision for income tax is required in the Portfolio’s financial statements. The Portfolio is not aware of any tax position for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. The Portfolio’s federal tax returns for the prior three fiscal years remains subject to examination by the Internal Revenue Service.

E. Line of Credit:

The Fund, together with other Dimensional-advised portfolios, has entered into an amended and restated $250 million unsecured discretionary line of credit effective July 8, 2009 with an affiliate of its domestic custodian bank. Each portfolio is permitted to borrow, subject to its investment limitations, up to a maximum of $250 million, as long as total borrowings under the line of credit do not exceed $250 million in the aggregate. Borrowings under the line are charged interest at the then current Federal Funds Rate plus 1%. Each portfolio is individually, and not jointly, liable for its particular advances under the line of credit. There is no commitment fee on the unused portion of the line of credit. The agreement for the discretionary line of credit may be terminated by either party at any time. The line of credit is scheduled to expire on June 22, 2010. There were no borrowings by the Portfolio under this line of credit during the year ended October 31, 2009.

The Fund, together with other Dimensional-advised portfolios, has also entered into an additional $500 million unsecured line of credit effective January 15, 2009 with its international custodian bank. Each portfolio is permitted to borrow, subject to its investment limitations, up to a maximum of $500 million as long as total borrowings under the line of credit do not exceed $500 million in the aggregate. Each portfolio is individually, and not jointly, liable for its particular advances under the line of credit. Borrowings under the line of credit are charged interest at rates agreed to by the parties at the time of borrowing. There is no commitment fee on the unused portion of the line of credit. The agreement of the line of credit expires on January 15, 2010. There were no borrowings by the Portfolio under this line of credit during the year ended October 31, 2009.

F. Indemnitees; Contractual Obligations:

Under the Fund’s organizational documents, its officers and directors are indemnified against certain liabilities arising out of the performance of their duties to the Fund.

In the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties which provide general indemnification. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund and/or its affiliates that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

G. Other:

At October 31, 2009, two shareholders held approximately 91% of the outstanding shares of the Portfolio. One or more of the shareholders may be omnibus accounts, which typically hold shares for the benefit of several other underlying investors.

H. Subsequent Event Evaluations:

Management has evaluated the impact of all the subsequent events on the Series through December 23, 2009, the date the financial statements were available for issuance, and has determined that the following subsequent event requires recognition or disclosure in the financial statements.

On December 18, 2009, the Board of Directors of Dimensional Investment Group Inc., on behalf of the U.S. Large Company Institutional Index Portfolio (the “Large Company Institutional Portfolio”), approved an Agreement and Plan of Reorganization (the “Plan of Reorganization”), under which the U.S. Large Company Portfolio (the “Large Company Portfolio”), a portfolio of DFA Investment Dimensions Group Inc., will be reorganized with and into the Large Company Institutional Portfolio. Under the Plan of Reorganization, the Large Company Portfolio will transfer substantially all of its assets to the Large Company Institutional Portfolio in exchange solely for shares of the Large Company Institutional Portfolio (the “Reorganization”), which will be distributed to shareholders of the Large Company Portfolio according to their interests held in the Large Company Portfolio immediately prior to the Reorganization. As soon as practicable thereafter, the Large Company Portfolio will be liquidated and dissolved.

14

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders of U.S. Large Company Institutional Index Portfolio and

Board of Directors of Dimensional Investment Group Inc.:

In our opinion, the accompanying statement of assets and liabilities, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of U.S. Large Company Institutional Index Portfolio (one of the portfolios constituting Dimensional Investment Group Inc., hereafter referred to as the “Portfolio”) at October 31, 2009, the results of its operations for the year then ended, the changes in its net assets and the financial highlights for each of the periods indicated, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Portfolio’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at October 31, 2009 by correspondence with the transfer agent of the investee fund, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Philadelphia, Pennsylvania

December 23, 2009

15

RESULTS OF THE SHAREHOLDER MEETING

On June 2, 2009, June 5, 2009, and July 8, 2009, Dimensional Investment Group Inc. (“DIG”) held a Special Joint Meeting of Shareholders for the purpose of voting on several proposals affecting DIG and the Portfolio, including, among other items, the election of Directors, the amendment of certain fundamental investment limitations, and the elimination of certain fundamental investment limitations. The shareholders of the Portfolio approved each of the applicable proposals for DIG and the Portfolio presented at the Meeting. Listed below are the voting results from the Meeting. Please note that not all Proposals presented at the Meeting were voted on by the Portfolio. Additionally, the Proposal numbers reflected below correlate to the Proposal numbers presented for vote at the Meeting.

DIG

| | | | | | | | | | | | | | | | | | | | |

| | | | | Shares Voted | | Percent of Outstanding Shares Voted |

| | | | | For | | % | | Against | | % | | Abstain/ WithHold | | % | | For | | Against | | Abstain / WithHold |

| Proposal 1: Election of Directors for DIG* | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

1a | | David G. Booth | | 754,612,895 | | 96.26% | | — | | 0.00% | | 29,301,677 | | 3.74% | | 85.87% | | 0.00% | | 3.33% |

1b | | George M. Constantinides | | 753,991,785 | | 96.18% | | — | | 0.00% | | 29,922,787 | | 3.82% | | 85.80% | | 0.00% | | 3.41% |

1c | | John P. Gould | | 753,344,569 | | 96.10% | | — | | 0.00% | | 30,570,003 | | 3.90% | | 85.73% | | 0.00% | | 3.48% |

1d | | Roger G. Ibbotson | | 754,232,365 | | 96.21% | | — | | 0.00% | | 29,682,207 | | 3.79% | | 85.83% | | 0.00% | | 3.38% |

1e | | Robert C. Merton | | 754,598,874 | | 96.26% | | — | | 0.00% | | 29,315,698 | | 3.74% | | 85.87% | | 0.00% | | 3.34% |

1f | | Myron S. Scholes | | 754,057,040 | | 96.19% | | — | | 0.00% | | 29,857,532 | | 3.81% | | 85.81% | | 0.00% | | 3.40% |

1g | | Eduardo A. Repetto | | 753,295,592 | | 96.09% | | — | | 0.00% | | 30,618,979 | | 3.91% | | 85.72% | | 0.00% | | 3.48% |

1h | | Abbie J. Smith | | 754,123,603 | | 96.20% | | — | | 0.00% | | 29,790,969 | | 3.80% | | 85.82% | | 0.00% | | 3.39% |

| | | | | | | | | | | | | | | | | | | | | | |

| | | Shares Voted | | Percent of Outstanding Shares Voted |

| | | For | | % | | Against | | % | | Abstain/ WithHold | | % | | NonVote | | % | | For | | Against | | Abstain / WithHold |

Proposal 2: To approve Articles of Amendment and Restatement for DIG* | | 479,705,048 | | 93.81% | | 7,503,436 | | 1.47% | | 24,156,664 | | 4.72% | | NA | | NA | | 54.59% | | 0.85% | | 2.75% |

| * | Results are for all Portfolios within DIG |

U.S. Large Company Institutional Index Portfolio

| | | | | | | | | | | | | | | | | | | | |

| | | | | Shares Voted | | Percent of Outstanding Shares Voted |

| | | | | For | | % | | Against | | % | | Abstain/ WithHold | | % | | For | | Against | | Abstain / WithHold |

| Proposals: | | | | | | | | | | | | | | | | | | |

| | | | | |

5 | | To approve amendments to certain fundamental investment restrictions | | | | | | | | |

5a | | Borrowing Money | | 51,732,595 | | 96.87% | | 662,055 | | 1.24% | | 1,010,728 | | 1.89% | | 55.52% | | 0.71% | | 1.08% |

5b | | Making Loans | | 51,732,615 | | 96.87% | | 662,036 | | 1.24% | | 1,010,727 | | 1.89% | | 55.52% | | 0.71% | | 1.08% |

5c | | Investments in Real Estate | | 51,761,717 | | 96.92% | | 613,072 | | 1.15% | | 1,030,589 | | 1.93% | | 55.55% | | 0.66% | | 1.11% |

5d | | Investments in Commodities | | 51,789,882 | | 96.98% | | 610,543 | | 1.14% | | 4,004,953 | | 7.50% | | 55.58% | | 0.66% | | 4.30% |

5e | | Diversification of Investments | | 51,905,924 | | 97.19% | | 509,910 | | 0.95% | | 989,544 | | 1.85% | | 55.71% | | 0.55% | | 1.06% |

6 | | To approve the elimination of certain fundamental investment restrictions | | | | | | | | |

6b | | Purchasing Securities on Margin | | 51,634,695 | | 96.68% | | 764,925 | | 1.43% | | 1,005,758 | | 1.88% | | 55.41% | | 0.82% | | 1.08% |

8 | | Approval of Investment Advisory Agreement between Dimensional Fund Advisors LP and the Company | | 51,963,094 | | 97.30% | | 431,757 | | 0.81% | | 1,010,527 | | 1.89% | | 55.77% | | 0.46% | | 1.08% |

16

THE DFA INVESTMENT TRUST COMPANY

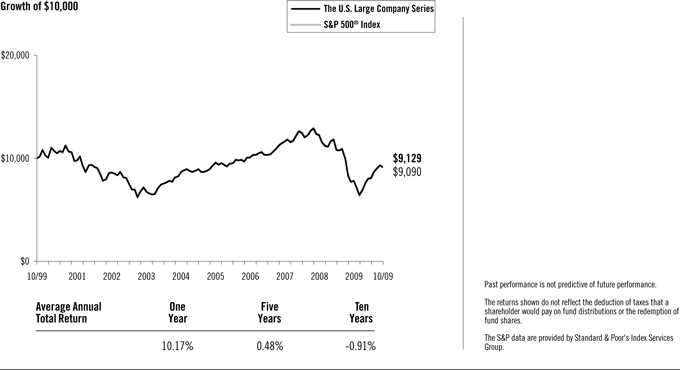

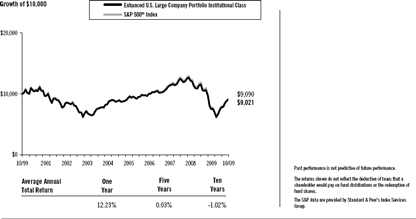

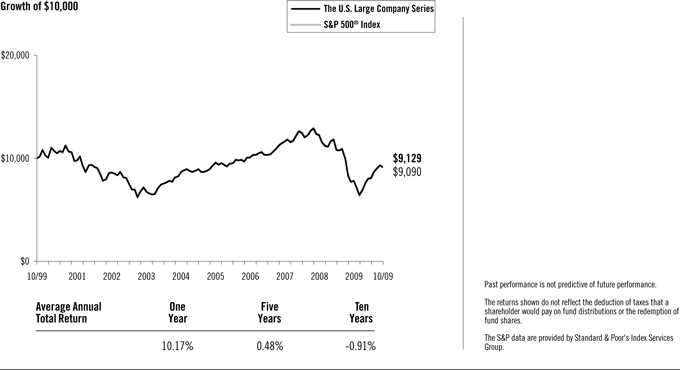

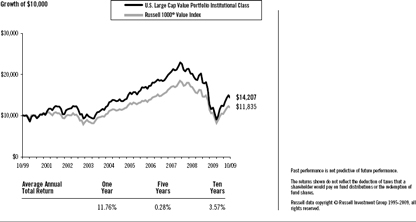

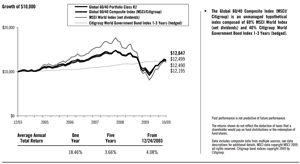

PERFORMANCE CHART

The U.S. Large Company Series vs.

S&P 500® Index

October 31, 1999-October 31, 2009

17

THE DFA INVESTMENT TRUST COMPANY

THE U.S. LARGE COMPANY SERIES

DISCLOSURE OF FUND EXPENSES

(Unaudited)

The following Expense Table is shown so that you can understand the impact of fees on your investment. All mutual funds have operating expenses. As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports, among others. Operating expenses, legal and audit services, which are deducted from a fund’s gross income, directly reduce the investment return of the fund. A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs, in dollars, of investing in the fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The Expense Table below illustrates your fund’s costs in two ways.

Actual Fund Return

This section helps you to estimate the actual expenses after fee waivers that you paid over the period. The “Ending Account Value” shown is derived from the fund’s actual return and “Expenses Paid During Period” reflect the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, a $7,500 account value divided by $1,000 = 7.5), then multiply the result by the number given for your fund under the heading “Expenses Paid During Period.”

Hypothetical Example for Comparison Purposes

This section is intended to help you compare your fund’s costs with those of other mutual funds. The hypothetical “Ending Account Value” and “Expenses Paid During Period” are derived from the fund’s actual expense ratio and an assumed 5% annual return before expenses. In this case, because the return used is not the fund’s actual return, the results do not apply to your investment. The example is useful in making comparisons because the SEC requires all mutual funds to calculate expenses based on a 5% annual return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect any transactional costs, if applicable. The “Annualized Expense Ratio” represents the actual expenses for the six-month period indicated.

Six Months Ended October 31, 2009

EXPENSE TABLE

| | | | | | | | | | |

| | | Beginning

Account

Value

05/01/09 | | Ending

Account

Value

10/31/09 | | Annualized

Expense

Ratio* | | Expenses

Paid

During

Period* |

Actual Fund Return | | $ | 1,000.00 | | $ | 1,200.50 | | 0.06% | | $0.33 |

Hypothetical 5% Annual Return | | $ | 1,000.00 | | $ | 1,024.90 | | 0.06% | | $0.31 |

| * | Expenses are equal to the fund’s annualized expense ratio for the six-month period, multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month period (184), then divided by the number of days in the year (365) to reflect the six-month period. |

18

THE DFA INVESTMENT TRUST COMPANY

THE U.S. LARGE COMPANY SERIES

DISCLOSURE OF PORTFOLIO HOLDINGS

(Unaudited)

The SEC requires that all Funds file a complete Schedule of Investments with the SEC for their first and third fiscal quarters on Form N-Q. For The DFA Investment Trust Company, this would be for the fiscal quarters ending January 31 and July 31. The Form N-Q filing must be made within 60 days of the end of the quarter. The DFA Investment Trust Company filed its most recent Form N-Q with the SEC on September 29, 2009. It is available upon request, without charge, by calling collect: (512) 306-7400 or by mailing a request to Dimensional Fund Advisors LP, 6300 Bee Cave Road, Building One, Austin, Texas 78746, or by visiting the SEC’s website at http://www.sec.gov, or they may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. (call 1-800-732-0330 for information on the operation of the Public Reference Room).

SEC regulations permit a fund to include in its reports to shareholders a “Summary Schedule of Portfolio Holdings” in lieu of a full Schedule of Investments. The Summary Schedule of Portfolio Holdings reports the fund’s 50 largest holdings in unaffiliated issuers and any investments that exceed one percent of the fund’s net assets at the end of the reporting period. The amendments also require that the Summary Schedule of Portfolio Holdings identify each category of investments that are held.

The fund is required to file a complete Schedule of Investments with the SEC on Form N-CSR within ten days after mailing the annual and semi-annual reports to shareholders. It will be available upon request, without charge, by calling collect: (512) 306-7400 or by mailing a request to Dimensional Fund Advisors LP, 6300 Bee Cave Road, Building One, Austin, Texas 78746, or by visiting the SEC’s website at http://www.sec.gov, or they may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. (call 1-800-732-0330 for information on the operation of the Public Reference Room).

PORTFOLIO HOLDINGS

The SEC requires that all Funds present their categories of portfolio holdings in a table, chart or graph format in their annual and semi-annual shareholder reports, whether or not a Schedule of Investments is utilized. The following table, which presents portfolio holdings as a percent of total investments before short-term investments and collateral for loaned securities, is provided in compliance with such requirement. The categories shown below represent broad industry sectors. Each industry sector consists of one or more specific industry classifications.

| | |

| The U.S. Large Company Series |

Consumer Discretionary | | 9.2% |

Consumer Staples | | 11.9% |

Energy | | 12.4% |

Financials | | 13.6% |

Health Care | | 12.6% |

Industrials | | 10.0% |

Information Technology | | 19.0% |

Materials | | 3.4% |

Real Estate Investment Trusts | | 1.1% |

Telecommunication Services | | 3.1% |

Utilities | | 3.7% |

| | |

| | 100.0% |

19

THE U.S. LARGE COMPANY SERIES

SUMMARY SCHEDULE OF PORTFOLIO HOLDINGS

October 31, 2009

| | | | | | | |

| | | Shares | | Value† | | Percentage of Net Assets** |

COMMON STOCKS — (92.1%) | | | | | | | |

Consumer Discretionary — (8.5%) | | | | | | | |

*Amazon.com, Inc. | | 126,572 | | $ | 15,038,019 | | 0.4% |

Comcast Corp. Class A | | 1,092,473 | | | 15,840,859 | | 0.4% |

Disney (Walt) Co. | | 707,515 | | | 19,364,686 | | 0.6% |

#Home Depot, Inc. | | 648,891 | | | 16,280,675 | | 0.5% |

McDonald’s Corp. | | 415,454 | | | 24,349,759 | | 0.7% |

Other Securities | | | | | 227,637,040 | | 6.5% |

| | | | | | | |

Total Consumer Discretionary | | | | | 318,511,038 | | 9.1% |

| | | | | | | |

| | | |

Consumer Staples — (11.0%) | | | | | | | |

Coca-Cola Co. | | 882,204 | | | 47,030,295 | | 1.3% |

Colgate-Palmolive Co. | | 189,741 | | | 14,919,335 | | 0.4% |

CVS Caremark Corp. | | 549,409 | | | 19,394,138 | | 0.6% |

Kraft Foods, Inc. | | 561,489 | | | 15,452,177 | | 0.4% |

PepsiCo, Inc. | | 593,045 | | | 35,908,875 | | 1.0% |

Philip Morris International, Inc. | | 736,409 | | | 34,876,330 | | 1.0% |

Procter & Gamble Co. | | 1,111,163 | | | 64,447,454 | | 1.8% |

Wal-Mart Stores, Inc. | | 822,201 | | | 40,846,946 | | 1.2% |

Other Securities | | | | | 141,728,671 | | 4.1% |

| | | | | | | |

Total Consumer Staples | | | | | 414,604,221 | | 11.8% |

| | | | | | | |

| | | |

Energy — (11.4%) | | | | | | | |

Chevron Corp. | | 763,458 | | | 58,435,075 | | 1.7% |

ConocoPhillips | | 564,511 | | | 28,327,162 | | 0.8% |

Exxon Mobil Corp. | | 1,829,468 | | | 131,117,972 | | 3.7% |

Occidental Petroleum Corp. | | 308,646 | | | 23,420,058 | | 0.7% |

Schlumberger, Ltd. | | 455,987 | | | 28,362,391 | | 0.8% |

Other Securities | | | | | 159,417,519 | | 4.5% |

| | | | | | | |

Total Energy | | | | | 429,080,177 | | 12.2% |

| | | | | | | |

| | | |

Financials — (12.5%) | | | | | | | |

American Express Co. | | 452,705 | | | 15,772,242 | | 0.4% |

Bank of America Corp. | | 3,293,490 | | | 48,019,084 | | 1.4% |

Citigroup, Inc. | | 4,964,744 | | | 20,305,803 | | 0.6% |

Goldman Sachs Group, Inc. | | 194,617 | | | 33,117,975 | | 0.9% |

JPMorgan Chase & Co. | | 1,497,052 | | | 62,531,862 | | 1.8% |

Morgan Stanley | | 517,407 | | | 16,619,113 | | 0.5% |

#U.S. Bancorp | | 727,850 | | | 16,900,677 | | 0.5% |

Wells Fargo & Co. | | 1,778,388 | | | 48,941,238 | | 1.4% |

Other Securities | | | | | 209,712,141 | | 6.0% |

| | | | | | | |

Total Financials | | | | | 471,920,135 | | 13.5% |

| | | | | | | |

| | | |

Health Care — (11.7%) | | | | | | | |

Abbott Laboratories | | 588,498 | | | 29,760,344 | | 0.8% |

*Amgen, Inc. | | 386,571 | | | 20,770,460 | | 0.6% |

Bristol-Myers Squibb Co. | | 754,098 | | | 16,439,336 | | 0.5% |

*Gilead Sciences, Inc. | | 344,234 | | | 14,647,157 | | 0.4% |

Johnson & Johnson | | 1,049,083 | | | 61,948,351 | | 1.8% |

Medtronic, Inc. | | 421,338 | | | 15,041,767 | | 0.4% |

#Merck & Co., Inc. | | 802,803 | | | 24,830,697 | | 0.7% |

Pfizer, Inc. | | 3,069,869 | | | 52,279,869 | | 1.5% |

Schering-Plough Corp. | | 622,008 | | | 17,540,626 | | 0.5% |

Other Securities | | | | | 186,020,772 | | 5.3% |

| | | | | | | |

Total Health Care | | | | | 439,279,379 | | 12.5% |

| | | | | | | |

| | | |

Industrials — (9.2%) | | | | | | | |

3M Co. | | 265,836 | | | 19,557,555 | | 0.6% |

20

THE U.S. LARGE COMPANY SERIES

CONTINUED

| | | | | | | | |

| | | Shares | | Value† | | Percentage of Net Assets** |

Industrials — (Continued) | | | | | | | | |

General Electric Co. | | | 4,045,427 | | $ | 57,687,789 | | 1.6% |

United Parcel Service, Inc. | | | 378,570 | | | 20,321,638 | | 0.6% |

United Technologies Corp. | | | 358,323 | | | 22,018,948 | | 0.6% |

Other Securities | | | | | | 228,629,561 | | 6.5% |

| | | | | | | | |

Total Industrials | | | | | | 348,215,491 | | 9.9% |

| | | | | | | | |

| | | |

Information Technology — (17.5%) | | | | | | | | |

*Apple, Inc. | | | 341,019 | | | 64,282,082 | | 1.8% |

*Cisco Sytems, Inc. | | | 2,195,717 | | | 50,172,133 | | 1.4% |

*Google, Inc. | | | 91,589 | | | 49,102,695 | | 1.4% |

Hewlett-Packard Co. | | | 902,618 | | | 42,838,250 | | 1.2% |

Intel Corp. | | | 2,131,047 | | | 40,724,308 | | 1.2% |

International Business Machines Corp. | | | 499,027 | | | 60,187,646 | | 1.7% |

Microsoft Corp. | | | 2,951,141 | | | 81,835,140 | | 2.4% |

Oracle Corp. | | | 1,486,799 | | | 31,371,459 | | 0.9% |

QUALCOMM, Inc. | | | 632,808 | | | 26,204,579 | | 0.8% |

Other Securities | | | | | | 214,771,869 | | 6.1% |

| | | | | | | | |

Total Information Technology | | | | | | 661,490,161 | | 18.9% |

| | | | | | | | |

| | | |

Materials — (3.1%) | | | | | | | | |

Other Securities | | | | | | 117,813,227 | | 3.4% |

| | | | | | | | |

| | | |

Real Estate Investment Trusts — (1.0%) | | | | | | | | |

Other Securities | | | | | | 37,279,130 | | 1.1% |

| | | | | | | | |

| | | |

Telecommunication Services — (2.8%) | | | | | | | | |

AT&T, Inc. | | | 2,246,012 | | | 57,655,128 | | 1.7% |

Verizon Communications, Inc. | | | 1,081,364 | | | 31,997,561 | | 0.9% |

Other Securities | | | | | | 17,544,350 | | 0.5% |

| | | | | | | | |

Total Telecommunication Services | | | | | | 107,197,039 | | 3.1% |

| | | | | | | | |

| | | |

Utilities — (3.4%) | | | | | | | | |

Other Securities | | | | | | 127,970,719 | | 3.6% |

| | | | | | | | |

TOTAL COMMON STOCKS | | | | | | 3,473,360,717 | | 99.1% |

| | | | | | | | |

| | | |

| | | Face Amount | | | | |

| | | (000) | | | | |

TEMPORARY CASH INVESTMENTS — (0.7%) | | | | | | | | |

Repurchase Agreement, PNC Capital Markets, Inc. 0.19%, 11/02/09 (Collateralized by $25,855,000, FNMA 6.50%, 06/25/39 valued at $27,826,444) to be repurchased at $27,414,434 | | $ | 27,414 | | | 27,414,000 | | 0.8% |

| | | | | | | | |

21

THE U.S. LARGE COMPANY SERIES

CONTINUED

| | | | | | | | | |

| | | Shares/

Face

Amount | | Value† | | Percentage

of Net Assets** | |

| | | (000) | | | | | |

SECURITIES LENDING COLLATERAL — (7.2%) | | | | | | | | | |

§@DFA Short Term Investment Fund LP | | | 269,088,352 | | $ | 269,088,352 | | 7.7 | % |

@Repurchase Agreement, Deutsche Bank Securities 0.08%, | | | | | | | | | |

11/02/09 (Collateralized by $2,507,470 FHLMC 5.793%(r), 01/01/37, valued at $1,408,594) to be repurchased at $1,367,576 | | $ | 1,368 | | | 1,367,567 | | 0.0 | % |

| | | | | | | | | |

TOTAL SECURITIES LENDING COLLATERAL | | | | | | 270,455,919 | | 7.7 | % |

| | | | | | | | | |

TOTAL INVESTMENTS — (100.0%) | | | | | | | | | |

(Cost $3,544,033,089) | | | | | $ | 3,771,230,636 | | 107.6 | % |

| | | | | | | | | |

Summary of inputs used to value the Series’ net assets as of October 31, 2009 is as follows (See Security Valuation Note):

| | | | | | | | | | | |

| | | Valuation Inputs |

| |

| | | Investment in Securities (Market Value) |

| | | Level 1 | | Level 2 | | Level 3 | | Total |

Common Stocks | | | | | | | | | | | |

Consumer Discretionary | | $ | 318,511,038 | | $ | — | | — | | $ | 318,511,038 |

Consumer Staples | | | 414,604,221 | | | — | | — | | | 414,604,221 |

Energy | | | 429,080,177 | | | — | | — | | | 429,080,177 |

Financials | | | 471,920,135 | | | — | | — | | | 471,920,135 |

Health Care | | | 439,279,379 | | | — | | — | | | 439,279,379 |

Industrials | | | 348,215,491 | | | — | | — | | | 348,215,491 |

Information Technology | | | 661,490,161 | | | — | | — | | | 661,490,161 |

Materials | | | 117,813,227 | | | — | | — | | | 117,813,227 |

Real Estate Investment Trusts | | | 37,279,130 | | | — | | — | | | 37,279,130 |

Telecommunication Services | | | 107,197,039 | | | — | | — | | | 107,197,039 |

Utilities | | | 127,970,719 | | | — | | — | | | 127,970,719 |

Temporary Cash Investments | | | — | | | 27,414,000 | | — | | | 27,414,000 |

Securities Lending Collateral | | | — | | | 270,455,919 | | — �� | | | 270,455,919 |

Other Financial Instruments** | | | 140,905 | | | — | | — | | | 140,905 |

| | | | | | | | | | | |

TOTAL | | $ | 3,473,501,622 | | $ | 297,869,919 | | — | | $ | 3,771,371,541 |

| | | | | | | | | | | |

| | ** | Other financial instruments are derivative instruments not reflected in the Schedule of Investments, such as futures and forwards which are valued at the unrealized appreciation/depreciation on the investment. |

See accompanying Notes to Financial Statements.

22

THE DFA INVESTMENT TRUST COMPANY

THE U.S. LARGE COMPANY SERIES

STATEMENT OF ASSETS AND LIABILITIES

OCTOBER 31, 2009

(Amounts in thousands)

| | |

ASSETS: | | |

Investments at Value (including $252,538 of securities on loan) | | $3,473,361 |

Temporary Cash Investments at Value & Cost | | 27,414 |

Collateral Received from Securities on Loan at Value & Cost | | 270,456 |

Cash | | 2,839 |

Receivables: | | |

Dividends and Interest | | 4,362 |

Fund Shares Sold | | 71 |

Securities Lending Income | | 62 |

Prepaid Expenses and Other Assets | | 1 |

| | |

Total Assets | | 3,778,566 |

| | |

LIABILITIES: | | |

Payables: | | |

Upon Return of Securities Loaned | | 270,456 |

Investment Securities Purchased | | 1,042 |

Fund Shares Redeemed | | 458 |

Due to Advisor | | 75 |

Futures Margin Variation | | 851 |

Accrued Expenses and Other Liabilities | | 233 |

| | |

Total Liabilities | | 273,115 |

| | |

NET ASSETS | | $3,505,451 |

| | |

Investments at Cost | | $3,246,163 |

| | |

See accompanying Notes to Financial Statements.

23

THE DFA INVESTMENT TRUST COMPANY

THE U.S. LARGE COMPANY SERIES

STATEMENT OF OPERATIONS

FOR THE YEAR ENDED OCTOBER 31, 2009

(Amounts in thousands)

| | | | |

Investment Income | | | | |

Dividends (Net of Foreign Taxes Withheld of $2) | | $ | 76,385 | |

Interest | | | 131 | |

Income from Securities Lending | | | 3,715 | |

| | | | |

Total Investment Income | | | 80,231 | |

| | | | |

Expenses | | | | |

Investment Advisory Services Fees | | | 762 | |

Accounting & Transfer Agent Fees | | | 341 | |

S&P 500® Fees | | | 90 | |

Custodian Fees | | | 47 | |

Shareholders’ Reports | | | 32 | |

Directors’/Trustees’ Fees & Expenses | | | 59 | |

Audit Fees | | | 63 | |

Legal Fees | | | 75 | |

Other | | | 359 | |

| | | | |

Total Expenses | | | 1,828 | |

| | | | |

Net Investment Income (Loss) | | | 78,403 | |

| | | | |

Realized and Unrealized Gain (Loss) | | | | |

Net Realized Gain (Loss) on: | | | | |

Investment Securities Sold | | | (215,329 | ) |

Futures | | | 20,268 | |

Change in Unrealized Appreciation (Depreciation) of: | | | | |

Investment Securities | | | 427,495 | |

Futures | | | (2,236 | ) |

| | | | |

Net Realized and Unrealized Gain (Loss) | | | 230,198 | |

| | | | |

Net Increase (Decrease) in Net Assets Resulting from Operations | | $ | 308,601 | |

| | | | |

See accompanying Notes to Financial Statements.

24

THE DFA INVESTMENT TRUST COMPANY

THE U.S. LARGE COMPANY SERIES

STATEMENTS OF CHANGES IN NET ASSETS

(Amounts in thousands)

| | | | | | | | | | | | |

| | | Year

Ended

Oct. 31,

2009 | | | Period

Dec. 1, 2007

to

Oct. 31, 2008 | | | Year

Ended

Nov. 30,

2007 | |

Increase (Decrease) in Net Assets | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | |

Net Investment Income (Loss) | | $ | 78,403 | | | $ | 84,705 | | | $ | 94,262 | |

Net Realized Gain (Loss) on: | | | | | | | | | | | | |

Investment Securities Sold | | | (215,329 | ) | | | (126,174 | ) | | | 10,206 | |

Futures | | | 20,268 | | | | (22,232 | ) | | | 3,585 | |

In-Kind Redemptions | | | — | | | | 24,362 | * | | | 529,199 | * |

Change in Unrealized Appreciation (Depreciation) of: | | | | | | | | | | | | |

Investment Securities | | | 427,495 | | | | (1,591,847 | ) | | | (217,829 | ) |

Futures | | | (2,236 | ) | | | 1,195 | | | | (216 | ) |

| | | | | | | | | | | | |

Net Increase (Decrease) in Net Assets Resulting from Operations | | | 308,601 | | | | (1,629,991 | ) | | | 419,207 | |

| | | | | | | | | | | | |

Transactions in Interest: | | | | | | | | | | | | |

Contributions | | | 363,357 | | | | 696,520 | | | | 616,294 | |

Withdrawals | | | (440,159 | ) | | | (299,226 | )* | | | (1,482,132 | )* |

| | | | | | | | | | | | |

Net Increase (Decrease) from Transactions in Interest | | | (76,802 | ) | | | 397,294 | | | | (865,838 | ) |

| | | | | | | | | | | | |

Total Increase (Decrease) in Net Assets | | | 231,799 | | | | (1,232,697 | ) | | | (446,631 | ) |

Net Assets | | | | | | | | | | | | |

Beginning of Period | | | 3,273,652 | | | | 4,506,349 | | | | 4,952,980 | |

| | | | | | | | | | | | |

End of Period | | $ | 3,505,451 | | | $ | 3,273,652 | | | $ | 4,506,349 | |

| | | | | | | | | | | | |

| * | See Note J in the Notes to Financial Statements. |

See accompanying Notes to Financial Statements.

25

THE DFA INVESTMENT TRUST COMPANY

THE U.S. LARGE COMPANY SERIES

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | |

| | | Year

Ended

Oct. 31,

2009 | | | Period

Dec. 1, 2007

to

Oct. 31, 2008 | | | Year

Ended

Nov. 30,

2007 | | | Year

Ended

Nov. 30,

2006 | | | Year

Ended

Nov. 30,

2005 | | | Year

Ended

Nov. 30,

2004 | |

Total Return | | 10.17 | % | | (33.10 | )%(C) | | 7.77 | % | | 14.25 | % | | 8.51 | % | | 12.77 | % |

Net Assets, End of Period (thousands) | | $3,505,451 | | | $3,273,652 | | | $4,506,349 | | | $4,952,980 | | | $4,238,712 | | | $3,493,919 | |

Ratio of Expenses to Average Net Assets | | 0.06 | % | | 0.04 | %(B) | | 0.04 | % | | 0.04 | % | | 0.05 | % | | 0.05 | % |

Ratio of Net Investment Incometo Average Net Assets | | 2.57 | % | | 2.16 | %(B) | | 1.96 | % | | 1.95 | % | | 1.87 | % | | 1.99 | % |

Portfolio Turnover Rate | | 10 | % | | 6 | %(C) | | 13 | %* | | 4 | % | | 6 | % | | 2 | % |

See Page 1 for the Definitions of Abbreviations and Footnotes.

| * | Excluding security sales due to the In-Kind Redemptions, the portfolio turnover rate would have been 5%. See Note J in the Notes to Financial Statements. |

See accompanying Notes to Financial Statements.

26

THE DFA INVESTMENT TRUST COMPANY

THE U.S. LARGE COMPANY SERIES

NOTES TO FINANCIAL STATEMENTS

A. Organization:

The DFA Investment Trust Company (the “Trust”) is an open-end management investment company registered under the Investment Company Act of 1940.The Trust consists of twelve investment portfolios, of which The U.S. Large Company Series (the “Series”) is presented in this report.

At a regular meeting of the Board of Directors/Trustees (the “Board”) on September 16, 2008, the Board voted to change the fiscal and tax year ends of the Series from November 30 to October 31.

B. Significant Accounting Policies:

The following significant accounting policies are in conformity with accounting principles generally accepted in the United States of America. Such policies are consistently followed by the Trust in preparation of its financial statements. The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates and those differences could be material.

1. Security Valuation: Securities held by the Series (including over-the-counter securities) are valued at the last quoted sale price of the day. Securities held by the Series that are listed on Nasdaq are valued at the Nasdaq Official Closing Price (“NOCP”). If there is no last reported sale price or NOCP for the day, the Series values the securities at the mean of the most recent quoted bid and asked prices. Price information on listed securities is taken from the exchange where the security is primarily traded. Generally, securities issued by open-end investment companies are valued using their respective net asset values or public offering prices, as appropriate, for purchase orders placed at the close of the New York Stock Exchange (NYSE).

Securities for which no market quotations are readily available (including restricted securities), or for which market quotations have become unreliable, are valued in good faith at fair value in accordance with procedures adopted by the Board of Directors/Trustees. Fair value pricing may also be used if events that have a significant effect on the value of an investment (as determined in the discretion of the Investment Committee of the Advisor) occur before the net asset value is calculated. When fair value pricing is used, the prices of securities used by the Series may differ from the quoted or published prices for the same securities on their primary markets or exchanges.

Futures contracts held by the Series are valued using the settlement price established each day on the exchange on which they are traded.

The Series utilizes a fair value hierarchy which prioritizes the inputs to valuation techniques used to measure fair value into three broad levels described below:

• Level 1 – quoted prices in active markets for identical securities

• Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)

• Level 3 – significant unobservable inputs (including the Series’ own assumptions in determining the fair value of investments)

A summary of the inputs used to value the Series’ net assets by each major security type, industry and/or country is disclosed at the end of the Summary Schedule of Portfolio Holdings. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

27

2. Deferred Compensation Plan: Each eligible Trustee of the Trust may elect participation in the Deferred Compensation Plan (the “Plan”). Under the Plan, effective January 1, 2002, such Trustees may defer payment of all or a portion of their total fees earned as a Trustee. These deferred amounts may be treated as though such amounts had been invested in shares of the following funds: U.S. Large Cap Value Portfolio; U.S. Core Equity 1 Portfolio; U.S. Core Equity 2 Portfolio; U.S. Vector Equity Portfolio; U.S. Micro Cap Portfolio; DFA International Value Portfolio; International Core Equity Portfolio; Emerging Markets Portfolio; Emerging Markets Core Equity Portfolio; and/or DFA Two-Year Global Fixed Income Portfolio. Contributions made under the Plan and the change in unrealized appreciation (depreciation) and income are included in Directors’/Trustees’ Fees & Expenses. At October 31, 2009, the total liability for deferred compensation to Trustees is included in Accrued Expenses and Other Liabilities on the Statement of Assets and Liabilities in the amount of $87 (in thousands).

Each Trustee has the option to receive their distribution of proceeds in one of the following methods upon one year’s notice: lump sum; annual installments over a period of agreed upon years; or semi-annual installments over a period of agreed upon years. As of October 31, 2009, none of the Trustees have requested distribution of proceeds.

3. Other: Security transactions are accounted for as of the trade date. Costs used in determining realized gains and losses on the sale of investment securities are on the basis of identified cost. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Distributions received on securities that represent a return of capital or capital gains are recorded as a reduction of cost of investments or as a realized gain, respectively. The Series estimate the character of distributions received that may be considered return of capital distributions. Interest income is recorded on the accrual basis. Discount and premium on securities purchased are amortized over the lives of the respective securities utilizing the effective interest method. Expenses directly attributable to a Series are directly charged. Common expenses of the Trust are allocated using methods approved by the Board of Directors/Trustees, generally based on average net assets.

C. Investment Advisor:

Dimensional Fund Advisors LP (“Dimensional” or the “Advisor”) provides investment advisory services to the Series. For the year ended October 31, 2009, the Series’ investment advisory services fees were accrued daily and paid monthly to the Advisor based on an effective annual rate of 0.025% of average daily net assets.

Fees Paid to Officers and Directors/Trustees:

Certain Officers and Directors/Trustees of the Advisor are also Officers and Directors/Trustees of the Trust; however, such Officers and Directors/Trustees (with the exception of the Chief Compliance Officer (“CCO”)) receive no compensation from the Trust. For the year ended October 31, 2009, the total related amounts paid by the Trust to the CCO were $98 (in thousands). The total related amounts paid by the Series are included in Other Expenses on the Statement of Operations.

D. Purchases and Sales of Securities:

For the year ended October 31, 2009, the Series made the following purchases and sales of investment securities, other than short-term securities and U.S. government securities (amounts in thousands):

| | | |

Purchases | | $ | 324,298 |

Sales | | | 294,824 |

There were no purchases or sales of long-term U.S. government securities.

28

E. Federal Income Taxes:

No provision for federal income taxes is required since the Series is treated as a partnership for federal income tax purposes. Any net investment income and realized and unrealized gains or losses have been deemed to have been “passed down” to its partners.

At October 31, 2009, the total cost and aggregate gross unrealized appreciation and (depreciation) of securities for federal income tax purposes were different from amounts reported for financial reporting purposes (amounts in thousands):

| | | | | | |

Federal

Tax Cost | | Unrealized

Appreciation | | Unrealized

(Depreciation) | | Net

Unrealized

Appreciation

(Depreciation) |

$3,858,145 | | $789,949 | | $(876,863) | | $(86,914) |