UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM N-CSR

Investment Company Act file number: 811-06073

Government Cash Management Portfolio

(Exact Name of Registrant as Specified in Charter)

345 Park Avenue

New York, NY 10154-0004

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: (212) 250-3220

Paul Schubert

60 Wall Street

New York, NY 10005

(Name and Address of Agent for Service)

| Date of fiscal year end: | 12/31 |

| | |

| Date of reporting period: | 12/31/2016 |

| ITEM 1. | REPORT TO STOCKHOLDERS |

December 31, 2016

Annual Report

to Shareholders

Deutsche Government Cash Management Fund

(formerly Cash Management Fund)

Contents

Deutsche Government Cash Management Fund 3 Portfolio Management Review 7 Statement of Assets and Liabilities 8 Statement of Operations 9 Statements of Changes in Net Assets 10 Financial Highlights 11 Notes to Financial Statements 15 Report of Independent Registered Public Accounting Firm 16 Information About Your Fund's Expenses 17 Tax Information Government Cash Management Portfolio 19 Investment Portfolio 26 Statement of Assets and Liabilities 27 Statement of Operations 28 Statements of Changes in Net Assets 29 Financial Highlights 30 Notes to Financial Statements 35 Report of Independent Registered Public Accounting Firm 36 Advisory Agreement Board Considerations and Fee Evaluation 41 Board Members and Officers 46 Account Management Resources |

This report must be preceded or accompanied by a prospectus. To obtain a summary prospectus, if available, or prospectus for any of our funds, refer to the Account Management Resources information provided in the back of this booklet. We advise you to consider the fund's objectives, risks, charges and expenses carefully before investing. The summary prospectus and prospectus contain this and other important information about the fund. Please read the prospectus carefully before you invest.

You could lose money by investing in the Fund. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The Fund's sponsor has no legal obligation to provide financial support to the Fund, and you should not expect that the sponsor will provide financial support to the Fund at any time. You should not rely on or expect the Advisor to enter into support agreements or take other actions to maintain the fund's $1.00 share price. The credit quality of the fund's holdings can change rapidly in certain markets, and the default of a single holding could have an adverse impact on the fund's share price. The fund's share price can also be negatively affected during periods of high redemption pressures and/or illiquid markets. The actions of a few large investors of the fund may have a significant adverse effect on the share price of the fund. See the prospectus for specific details regarding the fund's risk profile.

NOT FDIC/NCUA INSURED NO BANK GUARANTEE MAY LOSE VALUE NOT A DEPOSIT NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

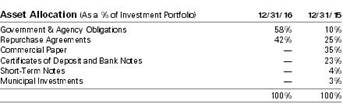

Portfolio Management Review (Unaudited)

Market Overview

All performance information below is historical and does not guarantee future results. Investment return and principal fluctuate, so your shares may be worth more or less when redeemed. Current performance may differ from performance data shown. Please visit deutscheliquidity.com/US for the fund's most recent month-end performance. The 7-day current yield refers to the income paid by the fund over a 7-day period expressed as an annual percentage rate of the fund's shares outstanding. Yields fluctuate and are not guaranteed.

Investment Objective On May 1, 2016, the fund changed its name to Deutsche Government Cash Management Fund. The fund now operates as a government money market fund and seeks maximum current income to the extent consistent with stability of principal. The fund is a feeder fund that invests substantially all of its assets in a "master portfolio," the Government Cash Management Portfolio (formerly Cash Management Portfolio) (the "Portfolio"), which will invest directly in securities and other instruments. The Portfolio has the same investment objective and strategies as the fund. |

Over the past 12 months ended December 31, 2016, rate levels within the money market yield curve — including short-term money market rates — fluctuated based on varying economic reports, investors’ interest rate expectations, geopolitical uncertainty and evolving U.S. Federal Reserve Board (the Fed) statements. In December 2015, the Fed had taken its first step in the normalization of U.S. short-term rates as the central bank raised the federal funds rate by 25 basis points. In May 2016, comments from Fed officials were seen as hawkish, and at least two rate hikes in 2016 seemed imminent. However, in June, the government’s non-farm payroll jobs report was extremely weak and short-term rates that had risen in anticipation of a federal funds rate increase came back down. In late June, the decision by British voters to leave the European Union shocked investors and rattled global markets. However, reassurances from central banks and the swift installation of a new British prime minister calmed investment markets. By the end of the third quarter, improved economic data had paved the way for an eventual Fed rate hike in December. Uncertainty regarding the U.S. presidential election rattled investment markets in the lead-up to November 8, but did not have a strong impact on short-term debt instruments. In the lead-up to the SEC’s money market reform, enacted in mid-October, a gradual transfer of approximately $1 trillion in assets from prime money market funds to government money funds took place, which caused the money market yield curve to steepen dramatically. The transfer, although orderly, created a squeeze on short-term government money market supply and drove down the yields of short-term government securities.

Fund Performance (as of December 31, 2016) Performance is historical and does not guarantee future results. Current performance may be lower or higher than the performance data quoted. You could lose money by investing in the Fund. Although the Fund seeks to preserve the value of your investment at $1.00 per share it cannot guarantee it will do so. An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The Fund's sponsor has no legal obligation to provide financial support to the Fund, and you should not expect that the sponsor will provide financial support to the Fund at any time. |

| 7-Day Current Yield |

| December 31, 2016 | .27%* |

| December 31, 2015 | .11%* |

* The investment advisor has agreed to waive fees/reimburse expenses. Without such fee waivers/expense reimbursements, the 7-day current yield would have been lower. Yields are historical, will fluctuate and do not guarantee future performance. The 7-day current yield refers to the income paid by the portfolio over a 7-day period expressed as an annual percentage rate of the fund's shares outstanding. Please visit our Web site at deutscheliquidity.com/US for the product's most recent month-end performance. |

Positive Contributors to Fund Performance

We were able to maintain a competitive yield for the fund during the annual period ended December 31, 2016. With government money market yields at increasingly low levels, the fund held a large percentage of portfolio assets in agency and Treasury floating-rate securities linked to LIBOR to take advantage of an incremental rise in those rates. At the same time, the fund invested in overnight agency repurchase agreements for liquidity and looked for yield opportunities from six-month agency and Treasury securities.

Negative Contributors to Fund Performance

The securities that the fund invested in had shorter maturities than securities that carry more interest rate risk. We preferred to be cautious during a time of market uncertainty. In the end this cost the fund some yield, but we believe that this represented a prudent approach to preserving principal.

Outlook and Positioning

Within government money markets, we believe that heavy demand will persist and that near-term supply will be variable. In the weeks leading up to the March 15, 2017 deadline for the U.S. government's debt ceiling to be raised, short-term Treasury supply could potentially by reduced by $200 billion if an increase in the debt ceiling is not passed by Congress. In anticipation of the deadline, the Treasury Department has been scaling back its Treasury bill auctions to investors. We think that Congress will likely raise the debt ceiling, and that following the deadline, the Treasury Department will ramp up short-term Treasury supply and relieve some of the downward pressure on government money market yields. In addition, our current forecast is for the federal funds rate to be raised two to three additional times during 2017, which should create some upward pressure on short-term rates.

We continue our insistence on the highest credit quality within the fund. We also plan to maintain our conservative investment strategies and standards under the current market conditions. We continue to apply a careful approach to investing on behalf of the fund and to seek competitive yield for our shareholders.

Portfolio Management Team

A group of investment professionals is responsible for the day-to-day management of the fund. These investment professionals have a broad range of experience managing money market funds.

The views expressed reflect those of the portfolio management team only through the end of the period of the report as stated on the cover. The management team's views are subject to change at any time based on market and other conditions and should not be construed as a recommendation. Past performance is no guarantee of future results. Current and future portfolio holdings are subject to risk.

Terms to Know

The yield curve is a graphical representation of how yields on bonds of different maturities compare. Normally, yield curves slant up, as bonds with longer maturities typically offer higher yields than short-term bonds.

A basis point is equal to one hundredth of a percentage point and is often used to illustrate differences and changes in fixed-income yields.

Floating-rate securities are debt instruments with floating-rate coupons that generally reset every 30 to 90 days. While floating-rate securities are senior to equity and fixed-income securities, there is no guaranteed return of principal in case of default. Floating-rate issues often have less interest-rate risk than other fixed-income investments. Floating-rate securities are most often secured assets, generally senior to a company's secured debt, and can be transferred to debt holders, resulting in potential downside risk.

LIBOR, or the London Interbank Offered Rate, is a widely used benchmark for short-term taxable interest rates.

A repurchase agreement, or "overnight repo," is an agreement between a seller and a buyer, usually of government securities, where the seller agrees to repurchase the securities at a given price and usually at a stated time. Repos are widely used money market instruments that serve as an interest-bearing, short-term "parking place" for large sums of money.

Statement of Assets and Liabilities

| as of December 31, 2016 |

| Assets |

| Investment in Government Cash Management Portfolio, at value | $ 1,990,602,902 |

| Other assets | 10,762 |

| Total assets | 1,990,613,664 |

| Liabilities |

| Payable for Fund shares redeemed | 589,785 |

| Distributions payable | 16,898 |

| Accrued Trustees' fees | 2,058 |

| Other accrued expenses and payables | 461,994 |

| Total liabilities | 1,070,735 |

| Net assets, at value | $ 1,989,542,929 |

| Net Assets Consist of |

| Undistributed net investment income | 1,254 |

| Paid-in capital | 1,989,541,675 |

| Net assets, at value | $ 1,989,542,929 |

| Net Asset Value |

Institutional Shares Net Asset Value, offering and redemption price per share ($1,989,542,929 ÷ 1,989,636,534 outstanding shares of beneficial interest, $.01 par value, unlimited number of shares authorized) | $ 1.00 |

The accompanying notes are an integral part of the financial statements.

Statement of Operations

| for the year ended December 31, 2016 |

| Investment Income |

Income and expenses allocated from Government Cash Management Portfolio: Interest | $ 6,659,678 |

| Other income | 10,467 |

| Expenses* | (1,626,629) |

| Net investment income allocated from Government Cash Management Portfolio | 5,043,516 |

Expenses: Administration fee | 1,557,726 |

| Services to shareholders | 73,288 |

| Distribution and service fees | 749,414 |

| Professional fees | 42,092 |

| Reports to shareholders | 18,036 |

| Registration fees | 25,703 |

| Trustees' fees and expenses | 6,672 |

| Other | 35,447 |

| Total expenses | 2,508,378 |

| Net investment income | 2,535,138 |

| Net realized gain (loss) allocated from Government Cash Management Portfolio | 105,366 |

| Net increase (decrease) in net assets resulting from operations | $ 2,640,504 |

* Net of $812,037 Advisor reimbursement allocated from Government Cash Management Portfolio for the year ended December 31, 2016.

The accompanying notes are an integral part of the financial statements.

Statements of Changes in Net Assets

| Increase (Decrease) in Net Assets | Years Ended December 31, |

| 2016 | 2015 |

Operations: Net investment income | $ 2,535,138 | $ 256,120 |

| Net realized gain (loss) | 105,366 | 30,277 |

| Net increase (decrease) in net assets resulting from operations | 2,640,504 | 286,397 |

Distributions to shareholders from: Net investment income | (2,533,884) | (257,613) |

Fund share transactions: Proceeds from shares sold | 5,299,050,426 | 5,505,541,370 |

| Reinvestment of distributions | 2,321,582 | 230,399 |

| Payments for shares redeemed | (5,513,874,997) | (4,215,113,404) |

| Net increase (decrease) in net assets from Fund share transactions | (212,502,989) | 1,290,658,365 |

| Increase (decrease) in net assets | (212,396,369) | 1,290,687,149 |

| Net assets at beginning of period | 2,201,939,298 | 911,252,149 |

| Net assets at end of period (including undistributed net investment income of $1,254 and $0, respectively) | $ 1,989,542,929 | $ 2,201,939,298 |

| Other Information |

| Shares outstanding at beginning of period | 2,202,139,523 | 911,481,158 |

| Shares sold | 5,299,050,426 | 5,505,541,370 |

| Shares issued to shareholders in reinvestment of distributions | 2,321,582 | 230,399 |

| Shares redeemed | (5,513,874,997) | (4,215,113,404) |

| Net increase (decrease) in Fund shares | (212,502,989) | 1,290,658,365 |

| Shares outstanding at end of period | 1,989,636,534 | 2,202,139,523 |

The accompanying notes are an integral part of the financial statements.

Financial Highlights

| Institutional Shares |

| | |

Years Ended December 31, |

| 2016 | 2015 | 2014 | 2013 | 2012 |

| Selected Per Share Data |

| Net asset value, beginning of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 |

Income from investment operations: Net investment income | .002 | .000* | .000* | .000* | .000* |

| Net realized gain (loss) | .000* | .000* | .000* | .000* | .000* |

| Total from investment operations | .002 | .000* | .000* | .000* | .000* |

Less distributions from: Net investment income | (.002) | (.000)* | (.000)* | (.000)* | (.000)* |

| Net asset value, end of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 |

| Total Return (%) | .16 | .01a | .01a | .01a | .01a |

| Ratios to Average Net Assets and Supplemental Data |

| Net assets, end of period ($ millions) | 1,990 | 2,202 | 911 | 1,536 | 2,476 |

| Ratio of expenses before expense reductions, including expenses allocated from Government Cash Management Portfolio (%) | .32 | .34 | .34 | .33 | .33 |

| Ratio of expenses after expense reductions, including expenses allocated from Government Cash Management Portfolio (%) | .27 | .24 | .18 | .21 | .27 |

| Ratio of net investment income (%) | .16 | .02 | .01 | .01 | .01 |

a Total return would have been lower had certain expenses not been reduced. * Amount is less than $.0005. |

Notes to Financial Statements

A. Organization and Significant Accounting Policies

Deutsche Government Cash Management Fund (formerly Cash Management Fund) (the "Fund") is a diversified series of Deutsche Money Market Trust (formerly DWS Money Market Trust) (the "Trust"), which is registered under the Investment Company Act of 1940, as amended (the "1940 Act"), as an open-end management investment company organized as a Massachusetts business trust. The Fund currently offers one class of shares, Institutional Shares, to investors.

The Fund is a feeder fund that seeks to achieve its investment objective by investing substantially all of its investable assets in a master portfolio, the Government Cash Management Portfolio (formerly Cash Management Portfolio) (the "Portfolio"), an open-end management investment company registered under the 1940 Act and organized as a New York trust advised by Deutsche Investment Management Americas Inc. ("DIMA" or the "Advisor"), an indirect, wholly owned subsidiary of Deutsche Bank AG. A master/feeder fund structure is one in which a fund (a "feeder fund"), instead of investing directly in a portfolio of securities, invests most or all of its investment assets in a separate registered investment company (the "master fund") with substantially the same investment objective and policies as the feeder fund. Such a structure permits the pooling of assets of two or more feeder funds, preserving separate identities or distribution channels at the feeder fund level. At December 31, 2016, the Fund owned approximately 17% of the Portfolio.

The Fund's financial statements are prepared in accordance with accounting principles generally accepted in the United States of America ("U.S. GAAP") which require the use of management estimates. Actual results could differ from those estimates. The Fund qualifies as an investment company under Topic 946 of Accounting Standards Codification of U.S. GAAP. The policies described below are followed consistently by the Fund in the preparation of its financial statements. The financial statements of the Portfolio, including the Investment Portfolio, are contained elsewhere in this report and should be read in conjunction with the Fund's financial statements.

Security Valuation. The Fund records its investment in the Portfolio at value, which reflects its proportionate interest in the net assets of the Portfolio. Valuation of the securities held by the Portfolio is discussed in the notes to the Portfolio's financial statements included elsewhere in this report.

Disclosure about the classification of fair value measurements is included in a table following the Portfolio's Investment Portfolio.

Federal Income Taxes. The Fund's policy is to comply with the requirements of the Internal Revenue Code, as amended, which are applicable to regulated investment companies, and to distribute all of its taxable income to its shareholders.

The Fund has reviewed the tax positions for the open tax years as of December 31, 2016 and has determined that no provision for income tax and/or uncertain tax provisions is required in the Fund's financial statements. The Fund's federal tax returns for the prior three fiscal years remain open subject to examination by the Internal Revenue Service.

Distribution of Income and Gains. Net investment income of the Fund is declared as a daily dividend and is distributed to shareholders monthly. The Fund may take into account capital gains and losses in its daily dividend declarations. The Fund may also make additional distributions for tax purposes if necessary.

Permanent book and tax differences relating to shareholder distributions will result in reclassifications to paid in capital. Temporary book and tax differences will reverse in a subsequent period. There were no significant book to tax differences for the Fund.

At December 31, 2016, the Fund's components of distributable earnings (accumulated losses) on a tax basis were as follows:

| Undistributed ordinary income* | $ 1,254 |

In addition, the tax character of distributions paid to shareholders by the Fund is summarized as follows:

| | Years Ended December 31, |

| | 2016 | 2015 |

| Distributions from ordinary income* | $ 2,533,884 | $ 257,613 |

* For tax purposes, short-term capital gain distributions are considered ordinary income distributions.

Contingencies. In the normal course of business, the Fund may enter into contracts with service providers that contain general indemnification clauses. The Fund's maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet been made. However, based on experience, the Fund expects the risk of loss to be remote.

Other. The Fund receives an allocation of the Portfolio's net investment income and net realized gains and losses in proportion to its investment in the Portfolio. Expenses directly attributed to a fund are charged to that fund, while expenses which are attributable to the Trust are allocated among the funds in the Trust on the basis of relative net assets.

B. Fees and Transactions with Affiliates

Management Agreement. Under the Investment Management Agreement with Deutsche Investment Management Americas Inc. ("DIMA" or the "Advisor"), an indirect, wholly owned subsidiary of Deutsche Bank AG, the Advisor serves as the investment manager to the Fund. The Advisor receives a management fee from the Portfolio pursuant to the master/feeder structure listed above in Note A.

Administration Fee. Pursuant to an Administrative Services Agreement, DIMA provides most administrative services to the Fund. For all services provided under the Administrative Services Agreement, the Fund pays the Advisor an annual fee ("Administration Fee") of 0.10% of the Fund's average daily net assets, computed and accrued daily and payable monthly.

For the period from January 1, 2016 through September 30, 2017, DIMA has contractually agreed to waive its fees and/or reimburse certain operating expenses of the Fund, including expenses of the Portfolio allocated to the Fund, to the extent necessary to maintain the total annual operating expenses (excluding certain expenses such as extraordinary expenses, taxes, brokerage and interest) at 0.30% of the Fund's average daily net assets.

For the year ended December 31, 2016, the Administration Fee was $1,557,726, of which $164,571 is unpaid.

Service Provider Fees. Deutsche AM Service Company ("DSC"), an affiliate of the Advisor, is the transfer agent, dividend-paying agent and shareholder service agent for the Fund. Pursuant to a sub-transfer agency agreement between DSC and DST Systems, Inc. ("DST"), DSC has delegated certain transfer agent, dividend-paying agent and shareholder service agent functions to DST. DSC compensates DST out of the shareholder servicing fee it receives from the Fund. For the year ended December 31, 2016, the amount charged to the Fund by DSC aggregated $63,115, of which $18,046 is unpaid.

Shareholder Servicing Fee. Deutsche AM Distributors, Inc. ("DDI"), an affiliate of the Advisor, provides information and administrative services for a fee ("Service Fee") to shareholders at an annual rate of up to 0.25% of average daily net assets. DDI in turn has various agreements with financial services firms that provide these services and pay these fees based upon the assets of shareholder accounts the firms service. For the year ended December 31, 2016, the Service Fee was as follows:

| | Total Aggregated | Unpaid at December 31, 2016 | Annual Effective Rate |

| Deutsche Government Cash Management Fund | $ 749,414 | $ 232,070 | .05% |

Typesetting and Filing Service Fees. Under an agreement with DIMA, DIMA is compensated for providing typesetting and certain regulatory filing services to the Fund. For the year ended December 31, 2016, the amount charged to the Fund by DIMA included in the Statement of Operations under "Reports to shareholders" aggregated $14,314, of which $5,790 is unpaid.

Trustees' Fees and Expenses. The Fund paid retainer fees to each Trustee not affiliated with the Advisor, plus specified amounts to the Board Chairperson and Vice Chairperson and to each committee Chairperson.

C. Concentration of Ownership

From time to time, the Fund may have a concentration of several shareholder accounts holding a significant percentage of shares outstanding. Investment activities of these shareholders could have a material impact on the Fund.

At December 31, 2016, there was one shareholder account that held approximately 77% of the outstanding shares of the Fund.

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of Deutsche Money Market Trust and Shareholders of Deutsche Government Cash Management Fund:

In our opinion, the accompanying statement of assets and liabilities and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Deutsche Government Cash Management Fund (formerly Cash Management Fund) (the "Fund") as of December 31, 2016, and the results of its operations, the changes in its net assets and the financial highlights for each of the periods indicated therein, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as "financial statements") are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities as of December 31, 2016 by correspondence with the transfer agent, provide a reasonable basis for our opinion.

Boston, Massachusetts

February 24, 2017 | PricewaterhouseCoopers LLP |

Information About Your Fund's Expenses

As an investor of the Fund, you incur two types of costs: ongoing expenses and transaction costs. Ongoing expenses include management fees and other Fund expenses. Examples of transaction costs include account maintenance fees, which are not shown in this section. The following tables are intended to help you understand your ongoing expenses (in dollars) of investing in the Fund and to help you compare these expenses with the ongoing expenses of investing in other mutual funds. The example in the table is based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period (July 1, 2016 to December 31, 2016).

The tables illustrate your Fund's expenses in two ways:

— Actual Fund Return. This helps you estimate the actual dollar amount of ongoing expenses (but not transaction costs) paid on a $1,000 investment in the Fund using the Fund's actual return during the period. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the "Expenses Paid per $1,000" line under the share class you hold.

— Hypothetical 5% Fund Return. This helps you to compare your Fund's ongoing expenses (but not transaction costs) with those of other mutual funds using the Fund's actual expense ratio and a hypothetical rate of return of 5% per year before expenses. Examples using a 5% hypothetical fund return may be found in the shareholder reports of other mutual funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Please note that the expenses shown in these tables are meant to highlight your ongoing expenses only and do not reflect any transaction costs. The "Expenses Paid per $1,000" line of the tables is useful in comparing ongoing expenses only and will not help you determine the relative total expense of owning different funds. If these transaction costs had been included, your costs would have been higher.

Expenses and Value of a $1,000 Investment

for the six months ended December 31, 2016 (Unaudited) |

| Actual Fund Return* | Institutional Shares |

| Beginning Account Value 7/1/16 | $ 1,000.00 |

| Ending Account Value 12/31/16 | $ 1,000.85 |

| Expenses Paid per $1,000* | $ 1.21 |

| Hypothetical 5% Fund Return | Institutional Class |

| Beginning Account Value 7/1/16 | $ 1,000.00 |

| Ending Account Value 12/31/16 | $ 1,023.93 |

| Expenses Paid per $1,000* | $ 1.22 |

* Expenses include amounts allocated proportionally from the master portfolio.

** Expenses are equal to the Fund's annualized expense ratio, multiplied by the average account value over the period, multiplied by 184 (the number of days in the most recent six-month period), then divided by 366.

| Annualized Expense Ratio | Institutional Shares |

| Deutsche Government Cash Management Fund | .24% |

For more information, please refer to the Fund's prospectus.

For an analysis of the fees associated with an investment in the Fund or similar funds, please refer to http://apps.finra.org/fundanalyzer/1/fa.aspx.

Tax Information (Unaudited)

A total of 36.13% of the dividends distributed during the fiscal year was derived from interest on U.S. government securities, which is generally exempt from state income tax.

Please contact a tax advisor if you have questions about federal or state income tax laws, or on how to prepare your tax returns. If you have specific questions about your account, please call (800) 728-3337.

(The following financial statements of the Government Cash Management Portfolio should be read in conjunction with the Fund's financial statements.)

Investment Portfolio as of December 31, 2016

| | Principal Amount ($) | Value ($) |

| | | | |

| Government & Agency Obligations 54.0% |

| U.S. Government Sponsored Agencies 50.8% |

| Federal Farm Credit Bank: |

| | 0.569%**, 4/10/2017 | 50,000,000 | 49,923,000 |

| | 0.719%*, 2/8/2017 | 15,000,000 | 15,000,000 |

| | 0.719%*, 4/20/2018 | 90,000,000 | 89,993,809 |

| | 0.724%*, 3/8/2017 | 40,000,000 | 39,999,617 |

| | 0.756%*, 6/20/2017 | 75,000,000 | 75,000,000 |

| | 0.786%*, 8/27/2018 | 75,000,000 | 74,990,348 |

| | 0.801%*, 8/29/2017 | 10,000,000 | 10,005,118 |

| | 0.819%*, 3/8/2018 | 30,000,000 | 29,998,171 |

| | 0.824%*, 3/22/2017 | 94,000,000 | 93,998,906 |

| | 0.826%*, 10/27/2017 | 100,000,000 | 100,000,000 |

| | 0.836%*, 2/28/2017 | 130,000,000 | 129,999,463 |

| | 0.854%*, 9/21/2017 | 80,000,000 | 80,000,000 |

| | 0.856%*, 12/5/2018 | 50,000,000 | 50,000,000 |

| | 0.859%*, 6/20/2018 | 40,000,000 | 40,000,000 |

| Federal Home Loan Bank: |

| | 0.3%**, 1/5/2017 | 50,000,000 | 49,998,361 |

| | 0.356%**, 1/18/2017 | 100,000,000 | 99,983,472 |

| | 0.361%**, 1/18/2017 | 138,325,000 | 138,301,811 |

| | 0.417%**, 3/1/2017 | 60,000,000 | 59,959,683 |

| | 0.455%*, 5/4/2017 | 48,250,000 | 48,250,000 |

| | 0.458%**, 1/13/2017 | 54,000,000 | 53,991,900 |

| | 0.458%**, 2/2/2017 | 34,000,000 | 33,986,400 |

| | 0.458%**, 2/10/2017 | 60,000,000 | 59,970,000 |

| | 0.468%**, 2/1/2017 | 50,000,000 | 49,980,195 |

| | 0.469%*, 5/8/2017 | 100,000,000 | 100,000,000 |

| | 0.483%**, 2/8/2017 | 40,000,000 | 39,979,944 |

| | 0.488%**, 1/27/2017 | 112,000,000 | 111,961,173 |

| | 0.493%**, 1/25/2017 | 35,000,000 | 34,988,683 |

| | 0.494%*, 5/10/2017 | 50,000,000 | 50,000,000 |

| | 0.554%**, 3/22/2017 | 38,500,000 | 38,453,372 |

| | 0.566%*, 4/19/2017 | 100,000,000 | 100,000,000 |

| | 0.569%**, 3/15/2017 | 13,000,000 | 12,985,238 |

| | 0.569%**, 4/5/2017 | 20,000,000 | 19,970,756 |

| | 0.585%**, 3/16/2017 | 137,000,000 | 136,838,073 |

| | 0.59%**, 5/12/2017 | 28,500,000 | 28,439,849 |

| | 0.624%*, 3/8/2018 | 105,000,000 | 105,000,000 |

| | 0.661%**, 5/23/2017 | 47,000,000 | 46,879,497 |

| | 0.671%*, 5/18/2017 | 106,000,000 | 106,000,000 |

| | 0.719%*, 5/8/2017 | 25,000,000 | 25,000,000 |

| | 0.726%*, 8/18/2017 | 160,000,000 | 159,853,549 |

| | 0.771%*, 5/30/2018 | 102,000,000 | 102,000,000 |

| | 0.773%*, 3/19/2018 | 95,000,000 | 95,000,000 |

| | 0.783%*, 4/5/2017 | 100,000,000 | 100,000,000 |

| | 0.806%*, 11/17/2017 | 126,550,000 | 126,512,043 |

| | 0.807%*, 10/30/2017 | 50,000,000 | 49,998,161 |

| | 0.823%*, 2/8/2017 | 110,000,000 | 110,007,081 |

| | 0.839%*, 2/22/2017 | 20,000,000 | 20,006,793 |

| | 0.9%*, 8/28/2017 | 285,000,000 | 284,981,195 |

| Federal Home Loan Mortgage Corp.: |

| | 0.32%**, 1/5/2017 | 23,500,000 | 23,499,178 |

| | 0.346%**, 1/18/2017 | 113,199,000 | 113,180,825 |

| | 0.366%**, 2/6/2017 | 60,000,000 | 59,978,400 |

| | 0.376%**, 2/13/2017 | 75,000,000 | 74,966,854 |

| | 0.376%**, 2/14/2017 | 35,000,000 | 34,984,172 |

| | 0.396%*, 4/11/2017 | 130,000,000 | 130,000,000 |

| | 0.397%**, 1/19/2017 | 43,500,000 | 43,491,518 |

| | 0.442%**, 2/3/2017 | 25,000,000 | 24,990,031 |

| | 0.447%**, 2/6/2017 | 75,000,000 | 74,967,000 |

| | 0.458%**, 5/3/2017 | 100,000,000 | 99,847,500 |

| | 0.463%**, 2/17/2017 | 45,000,000 | 44,973,269 |

| | 0.478%**, 3/1/2017 | 125,000,000 | 124,903,715 |

| | 0.478%**, 4/6/2017 | 35,000,000 | 34,956,590 |

| | 0.478%**, 4/7/2017 | 80,000,000 | 79,899,733 |

| | 0.483%**, 3/3/2017 | 54,000,000 | 53,956,538 |

| | 0.488%**, 5/1/2017 | 75,000,000 | 74,880,000 |

| | 0.489%*, 5/8/2017 | 140,000,000 | 140,000,000 |

| | 0.508%**, 4/25/2017 | 45,000,000 | 44,928,750 |

| | 0.508%**, 5/16/2017 | 150,000,000 | 149,718,750 |

| | 0.508%**, 5/17/2017 | 9,000,000 | 8,983,000 |

| | 0.519%**, 4/21/2017 | 70,000,000 | 69,890,917 |

| | 0.534%**, 5/5/2017 | 38,096,000 | 38,027,110 |

| | 0.559%**, 5/18/2017 | 45,000,000 | 44,905,813 |

| | 0.567%*, 5/16/2017 | 100,000,000 | 100,000,000 |

| | 0.632%*, 7/24/2018 | 80,000,000 | 80,000,000 |

| | 0.716%*, 2/22/2018 | 94,000,000 | 94,000,000 |

| | 0.874%*, 7/21/2017 | 60,000,000 | 59,996,601 |

| | 0.914%*, 12/21/2017 | 133,500,000 | 133,500,000 |

| | 0.971%*, 3/8/2018 | 65,000,000 | 65,000,000 |

| Federal National Mortgage Association: |

| | 0.325%**, 1/4/2017 | 87,500,000 | 87,497,667 |

| | 0.417%**, 1/3/2017 | 96,500,000 | 96,497,802 |

| | 0.417%**, 2/1/2017 | 55,000,000 | 54,980,582 |

| | 0.442%**, 2/1/2017 | 68,000,000 | 67,974,528 |

| | 0.759%*, 7/20/2017 | 80,000,000 | 79,997,780 |

| | 0.944%*, 3/21/2018 | 100,000,000 | 100,022,107 |

| | 6,087,582,391 |

| U.S. Treasury Obligations 3.2% |

| U.S. Treasury Bills: |

| | 0.376%**, 2/9/2017 | 28,000,000 | 27,988,777 |

| | 0.428%**, 1/19/2017 | 95,000,000 | 94,980,002 |

| | 0.428%**, 1/19/2017 | 12,000,000 | 11,997,420 |

| | 0.437%**, 1/19/2017 | 83,000,000 | 82,982,155 |

| | 0.498%**, 3/23/2017 | 65,000,000 | 64,928,338 |

| | 0.525%**, 3/9/2017 | 50,000,000 | 49,951,983 |

| U.S. Treasury Floating Rate Note, 0.63%*, 4/30/2017 | 25,000,000 | 24,991,678 |

| U.S. Treasury Note, 0.875%, 2/28/2017 | 22,000,000 | 22,013,054 |

| | 379,833,407 |

| Total Government & Agency Obligations (Cost $6,467,415,798) | 6,467,415,798 |

| |

| Repurchase Agreements 39.9% |

| Barclays Capital PLC, 0.5%, dated 12/30/2016, to be repurchased at $15,000,833 on 1/3/2017 (a) | 15,000,000 | 15,000,000 |

| Citigroup Global Markets, Inc., 0.51%, dated 12/30/2016, to be repurchased at $170,009,633 on 1/3/2017 (b) | 170,000,000 | 170,000,000 |

| Federal Reserve Bank of New York, 0.5%, dated 12/30/2016, to be repurchased at $3,500,194,444 on 1/3/2017 (c) | 3,500,000,000 | 3,500,000,000 |

| HSBC Securities, Inc., 0.45%, dated 12/30/2016, to be repurchased at $440,022,000 on 1/3/2017 (d) | 440,000,000 | 440,000,000 |

| JPMorgan Securities, Inc., 0.52%, dated 12/30/2016, to be repurchased at $100,005,778 on 1/3/2017 (e) | 100,000,000 | 100,000,000 |

| Merrill Lynch & Co., Inc., 0.5%, dated 12/30/2016, to be repurchased at $56,903,161 on 1/3/2017 (f) | 56,900,000 | 56,900,000 |

| Nomura Securities International, 0.51%, dated 12/30/2016, to be repurchased at $353,020,003 on 1/3/2017 (g) | 353,000,000 | 353,000,000 |

| Wells Fargo Bank, 0.5%, dated 12/30/2016, to be repurchased at $138,007,667 on 1/3/2017 (h) | 138,000,000 | 138,000,000 |

| Total Repurchase Agreements (Cost $4,772,900,000) | 4,772,900,000 |

| | % of Net Assets | Value ($) |

| | |

| Total Investment Portfolio (Cost $11,240,315,798)† | 93.9 | 11,240,315,798 |

| Other Assets and Liabilities, Net | 6.1 | 734,616,953 |

| Net Assets | 100.0 | 11,974,932,751 |

* Floating rate securities' yields vary with a designated market index or market rate, such as the coupon-equivalent of the U.S. Treasury Bill rate. These securities are shown at their current rate as of December 31, 2016.

** Annualized yield at time of purchase; not a coupon rate.

† The cost for federal income tax purposes was $11,240,315,798.

(a) Collateralized by:

| Principal Amount ($) | Security | Rate (%) | Maturity Date | Collateral Value ($) |

| 72,285 | U.S. Treasury Inflation-Indexed STRIPS | Zero Coupon | 4/15/2018–

4/15/2028 | 74,489 |

| 30,034,320 | U.S. Treasury STRIPS | Zero Coupon | 5/15/2017–

2/15/2045 | 15,225,511 |

| Total Collateral Value | 15,300,000 |

(b) Collateralized by $175,290,600 U.S. Treasury Note, 1.75%, maturing on 3/31/2022 with a value of $173,400,091.

(c) Collateralized by:

| Principal Amount ($) | Security | Rate (%) | Maturity Date | Collateral Value ($) |

| 1,030,390,200 | U.S. Treasury Bonds | 3.875–6.125 | 11/15/2027–8/15/2040 | 1,288,940,376 |

| 2,188,482,600 | U.S. Treasury Notes | 2.0–3.125 | 5/15/2021–

11/15/2021 | 2,211,254,139 |

| Total Collateral Value | 3,500,194,515 |

(d) Collateralized by:

| Principal Amount ($) | Security | Rate (%) | Maturity Date | Collateral Value ($) |

| 135,434,200 | U.S. Treasury Bonds | 2.5–4.5 | 8/15/2039–

2/15/2046 | 155,423,601 |

| 291,838,100 | U.S. Treasury Notes | 0.75–1.625 | 10/31/2017–8/31/2019 | 293,378,771 |

| Total Collateral Value | 448,802,372 |

(e) Collateralized by $98,673,060 Federal National Mortgage Association, with the various coupon rates from 3.0–5.0%, with various maturity dates of 12/1/2020–2/1/2043 with a value of $102,002,606.

(f) Collateralized by $59,811,300 U.S. Treasury Note, 1.25%, maturing on 10/31/2021 with a value of $58,038,004.

(g) Collateralized by:

| Principal Amount ($) | Security | Rate (%) | Maturity Date | Collateral Value ($) |

| 43,478,058 | Federal Home Loan Mortgage Corp. | 3.0–6.0 | 4/1/2021–

1/1/2047 | 46,024,590 |

| 204,645,545 | Federal National Mortgage Association | 3.0–6.0 | 3/1/2018–

1/1/2047 | 211,737,478 |

| 38,341,908 | Government National Mortgage Association | 3.0–9.0 | 2/15/2020–

11/20/2046 | 40,051,720 |

| 1,000 | U.S. Treasury Bill | Zero Coupon | 2/2/2017 | 1,000 |

| 184,700 | U.S. Treasury Bond | 5.375 | 2/15/2031 | 248,639 |

| 64,026,800 | U.S. Treasury Notes | 1.125–1.375 | 8/31/2021–

8/31/2023 | 61,996,529 |

| 100 | U.S. Treasury STRIPS | Zero Coupon | 8/15/2042 | 44 |

| Total Collateral Value | 360,060,000 |

(h) Collateralized by $140,188,678 Federal Home Loan Mortgage Corp., with the various coupon rates from 3.0–3.5%, with various maturity dates of 10/1/2046–12/1/2046 with a value of $140,760,001.

STRIPS: Separate Trading of Registered Interest and Principal Securities

Fair Value Measurements

Various inputs are used in determining the value of the Portfolio's investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable inputs (including the Portfolio's own assumptions in determining the fair value of investments). The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities. Securities held by the Portfolio are reflected as Level 2 because the securities are valued at amortized cost (which approximates fair value) and, accordingly, the inputs used to determine value are not quoted prices in an active market.

The following is a summary of the inputs used as of December 31, 2016 in valuing the Portfolio's investments. For information on the Portfolio's policy regarding the valuation of investments, please refer to the Security Valuation section of Note A in the accompanying Notes to Financial Statements.

| Assets | Level 1 | Level 2 | Level 3 | Total |

| |

| Investments in Securities (i) | $ — | $ 6,467,415,798 | $ — | $ 6,467,415,798 |

| Repurchase Agreements | — | 4,772,900,000 | — | 4,772,900,000 |

| Total | $ — | $ 11,240,315,798 | $ — | $ 11,240,315,798 |

There have been no transfers between fair value measurement levels during the year ended December 31, 2016.

(i) See Investment Portfolio for additional detailed categorizations.

The accompanying notes are an integral part of the financial statements.

Statement of Assets and Liabilities

| as of December 31, 2016 |

| Assets |

| Investments in non-affiliated securities, valued at amortized cost | $ 6,467,415,798 |

| Repurchase agreements, valued at amortized cost | 4,772,900,000 |

| Investments in securities, at value (cost $11,240,315,798) | 11,240,315,798 |

| Cash | 733,237,639 |

| Interest receivable | 2,132,539 |

| Other assets | 530,834 |

| Total assets | 11,976,216,810 |

| Liabilities |

| Accrued management fee | 514,778 |

| Accrued Trustees' fees | 190,325 |

| Other accrued expenses and payables | 578,956 |

| Total liabilities | 1,284,059 |

| Net assets, at value | $ 11,974,932,751 |

The accompanying notes are an integral part of the financial statements.

Statement of Operations

| for the year ended December 31, 2016 |

| Investment Income |

Income: Interest | $ 54,208,184 |

| Other income | 65,697 |

| Total income | 54,273,881 |

Expenses: Management fee | 14,355,667 |

| Administration fee | 3,774,703 |

| Custodian fee | 183,954 |

| Professional fees | 283,418 |

| Reports to shareholders | 53,673 |

| Trustees' fees and expenses | 877,210 |

| Other | 403,736 |

| Total expenses before expense reductions | 19,932,361 |

| Expense reductions | (6,573,295) |

| Total expenses after expense reductions | 13,359,066 |

| Net investment income | 40,914,815 |

| Net realized gain (loss) from investments | 982,819 |

| Net increase (decrease) in net assets resulting from operations | $ 41,897,634 |

The accompanying notes are an integral part of the financial statements.

Statements of Changes in Net Assets

| Increase (Decrease) in Net Assets | Years Ended December 31, |

| 2016 | 2015 |

Operations: Net investment income | $ 40,914,815 | $ 21,078,050 |

| Net realized gain (loss) | 982,819 | 452,645 |

| Net increase (decrease) in net assets resulting from operations | 41,897,634 | 21,530,695 |

Capital transactions in shares of beneficial interest: Proceeds from capital invested | 58,926,868,323 | 317,351,519,324 |

| Value of capital withdrawn | (65,014,865,274) | (319,269,518,924) |

| Net increase (decrease) in net assets from capital transactions in shares of beneficial interest | (6,087,996,951) | (1,917,999,600) |

| Increase (decrease) in net assets | (6,046,099,317) | (1,896,468,905) |

| Net assets at beginning of period | 18,021,032,068 | 19,917,500,973 |

| Net assets at end of period | $ 11,974,932,751 | $ 18,021,032,068 |

The accompanying notes are an integral part of the financial statements.

Financial Highlights

| | |

Years Ended December 31, |

| 2016 | 2015 | 2014 | 2013 | 2012 |

| Ratios to Average Net Assets and Supplemental Data |

| Net assets, end of period ($ millions) | 11,975 | 18,021 | 19,918 | 20,214 | 24,810 |

| Ratio of expenses before expense reductions (%) | .16 | .17 | .17 | .16 | .17 |

| Ratio of expenses after expense reductions (%) | .11 | .14 | .14 | .14 | .14 |

| Ratio of net investment income (%) | .32 | .11 | .05 | .08 | .14 |

| Total Return (%)a,b | .32 | .11 | .05 | .08 | .14 |

a Total return would have been lower had certain expenses not been reduced. b Total return for the Portfolio was derived from the performance of Deutsche Government Cash Reserves Fund Institutional. |

Notes to Financial Statements

A. Organization and Significant Accounting Policies

Government Cash Management Portfolio (formerly Cash Management Portfolio) (the "Portfolio") is registered under the Investment Company Act of 1940, as amended (the "1940 Act"), as an open-end management investment company organized as a New York trust.

The Portfolio is a master fund. A master/feeder fund structure is one in which a fund (a "feeder fund"), instead of investing directly in a portfolio of securities, invests most or all of its investment assets in a separate registered investment company (the "master fund") with substantially the same investment objective and policies as the feeder fund. Such a structure permits the pooling of assets of two or more feeder funds, preserving separate identities or distribution channels at the feeder fund level. The Portfolio may have several feeder funds, including affiliated Deutsche feeder funds and unaffiliated feeder funds; with a significant ownership percentage of the Portfolio's net assets. Investment activities of these feeder funds could have a material impact on the Portfolio. As of December 31, 2016, Deutsche Government Cash Management Fund, Deutsche Government Cash Reserves Fund Institutional, Deutsche Government Series and Deutsche Government Money Market Series owned approximately 17%, 3%, 1% and 76%, respectively, of the Portfolio.

The Portfolio's financial statements are prepared in accordance with accounting principles generally accepted in the United States of America ("U.S. GAAP") which require the use of management estimates. Actual results could differ from those estimates. The Fund qualifies as an investment company under Topic 946 of Accounting Standards Codification of U.S. GAAP. The policies described below are followed consistently by the Portfolio in the preparation of its financial statements.

Security Valuation. Various inputs are used in determining the value of the Portfolio's investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable inputs (including the Portfolio's own assumptions in determining the fair value of investments). The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities. Securities held by the Portfolio are reflected as Level 2 because the securities are valued at amortized cost (which approximates fair value) and, accordingly, the inputs used to determine value are not quoted prices in an active market.

The Portfolio values all securities utilizing the amortized cost method permitted in accordance with Rule 2a-7 under the 1940 Act and certain conditions therein. Under this method, which does not take into account unrealized capital gains or losses on securities, an instrument is initially valued at its cost and thereafter assumes a constant accretion/amortization rate to maturity of any discount or premium. Securities held by the Portfolio are reflected as Level 2 because the securities are valued at amortized cost (which approximates fair value) and, accordingly, the inputs used to determine value are not quoted prices in an active market.

Repurchase Agreements. The Portfolio may enter into repurchase agreements, under the terms of a Master Repurchase Agreement, with certain banks and broker/dealers whereby the Portfolio, through its custodian or a sub-custodian bank, receives delivery of the underlying securities, the amount of which at the time of purchase and each subsequent business day is required to be maintained at such a level that the value is equal to at least the principal amount of the repurchase price plus accrued interest. The custodian bank or another designated subcustodian holds the collateral in a separate account until the agreement matures. If the value of the securities falls below the principal amount of the repurchase agreement plus accrued interest, the financial institution deposits additional collateral by the following business day. If the financial institution either fails to deposit the required additional collateral or fails to repurchase the securities as agreed, the Portfolio has the right to sell the securities and recover any resulting loss from the financial institution. If the financial institution enters into bankruptcy, the Portfolio's claims on the collateral may be subject to legal proceedings.

As of December 31, 2016, the Portfolio held repurchase agreements with a gross value of $4,772,900,000. The value of the related collateral exceeded the value of the repurchase agreements at period end. The detail of the related collateral is included in the footnotes following the Portfolio's Investment Portfolio.

Federal Income Taxes. The Portfolio is considered a Partnership under the Internal Revenue Code, as amended. Therefore, no federal income tax provision is necessary.

It is intended that the Portfolio's assets, income and distributions will be managed in such a way that an investor in the Portfolio will be able to satisfy the requirements of Subchapter M of the Code, assuming that the investor invested all of its assets in the Portfolio.

The Portfolio has reviewed the tax positions for the open tax years as of December 31, 2016 and has determined that no provision for income tax and/or uncertain tax provisions is required in the Portfolio's financial statements. The Portfolio's federal tax returns for the prior three fiscal years remain open subject to examination by the Internal Revenue Service.

Contingencies. In the normal course of business, the Portfolio may enter into contracts with service providers that contain general indemnification clauses. The Portfolio's maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Portfolio that have not yet been made. However, based on experience, the Portfolio expects the risk of loss to be remote.

Other. Investment transactions are accounted for on trade date. Interest income is recorded on the accrual basis. Realized gains and losses from investment transactions are recorded on an identified cost basis. All discounts and premiums are accreted/amortized for both tax and financial reporting purposes.

The Portfolio makes an allocation of its net investment income and realized gains and losses from securities transactions to its investors in proportion to their investment in the Portfolio.

B. Fees and Transactions with Affiliates

Management Agreement. Under the Investment Management Agreement with Deutsche Investment Management Americas Inc. ("DIMA" or the "Advisor"), an indirect, wholly owned subsidiary of Deutsche Bank AG, the Advisor determines the securities, instruments and other contracts relating to investments to be purchased, sold or entered into by the Portfolio.

For the period from January 1, 2016 through April 30, 2016, under the Investment Management Agreement, the Portfolio paid the Advisor a monthly management fee based on its average daily net assets, computed and accrued daily and payable monthly, at the following annual rates:

| First $3.0 billion of the Portfolio's average daily net assets | .1500% |

| Next $4.5 billion of such net assets | .1325% |

| Over $7.5 billion of such net assets | .1200% |

Effective May 1, 2016, under the Investment Management Agreement, the Portfolio pays the Advisor a monthly management fee based on its average daily net assets, computed and accrued daily and payable monthly, at the following annual rates:

| First $3.0 billion of the Portfolio's average daily net assets | .1200% |

| Next $4.5 billion of such net assets | .1025% |

| Over $7.5 billion of such net assets | .0900% |

For the period from January 1, 2016 through February 28, 2016, the Advisor had voluntarily agreed to waive its fees and/or reimburse certain operating expenses to the extent necessary to maintain the total annual operating expenses (excluding certain expenses such as extraordinary expenses, taxes, brokerage and interest) at 0.14% of the Portfolio's average daily net assets.

For the period from February 29, 2016 through May 19, 2016, the Advisor had voluntarily agreed to waive its fees and/or reimburse certain operating expenses to the extent necessary to maintain the total annual operating expenses (excluding certain expenses such as extraordinary expenses, taxes, brokerage and interest) at 0.11% of the Portfolio's average daily net assets.

Effective May 20, 2016 through December 31, 2016, the Advisor has voluntarily agreed to waive its fees and/or reimburse certain operating expenses to the extent necessary to maintain the total annual operating expenses (excluding certain expenses such as extraordinary expenses, taxes, brokerage and interest) at 0.09% of the Portfolio's average daily net assets. This voluntary waiver or reimbursement may be terminated at any time at the option of the Advisor.

For the year ended December 31, 2016, the Advisor waived a portion of its management fee aggregating $6,573,295, and the amount charged aggregated $7,782,372, which was equivalent to an annual effective rate of 0.06%.

Administration Fee. Pursuant to an Administrative Services Agreement, DIMA provides most administrative services to the Portfolio. For all services provided under the Administrative Services Agreement, the Portfolio pays the Advisor an annual fee ("Administration Fee") of 0.03% of the Portfolio's average daily net assets, computed and accrued daily and payable monthly. For the year ended December 31, 2016, the Administration Fee was $3,774,703, of which $300,613 is unpaid.

Filing Service Fees. Under an agreement with DIMA, DIMA is compensated for providing certain regulatory filing services to the Portfolio. For the year ended December 31, 2016, the amount charged to the Portfolio by DIMA included in the Statement of Operations under "Reports to shareholders" aggregated $1,926, of which $689 is unpaid.

Trustees' Fees and Expenses. The Portfolio paid retainer fees to each Trustee not affiliated with the Advisor, plus specified amounts to the Board Chairperson and Vice Chairperson and to each committee Chairperson.

Transactions with Affiliates. The Portfolio may purchase securities from, or sell securities to, an affiliated fund provided the affiliation is solely due to having a common investment adviser, common officers, or common trustees. During the year ended December 31, 2016, the Portfolio engaged in securities purchases of $112,755,000 and securities sales of $47,960,000 with an affiliated fund in compliance with Rule 17a-7 under the 1940 Act.

C. Line of Credit

The Portfolio and other affiliated funds (the "Participants") share in a $400 million revolving credit facility provided by a syndication of banks. The Portfolio may borrow for temporary or emergency purposes, including the meeting of redemption requests that otherwise might require the untimely disposition of securities. The Participants are charged an annual commitment fee which is allocated based on net assets, among each of the Participants. Interest is calculated at a rate per annum equal to the sum of the Federal Funds Rate plus 1.25 percent plus if the one-month LIBOR exceeds the Federal Funds Rate, the amount of such excess. The Portfolio may borrow up to a maximum of 33 percent of its net assets under the agreement. The Portfolio had no outstanding loans at December 31, 2016.

Report of Independent Registered Public Accounting Firm

To the Board of Trustees and Holders of Beneficial Interest of Government Cash Management Portfolio:

In our opinion, the accompanying statement of assets and liabilities, including the portfolio of investments, and the related statements of operations and of changes in net assets and the financial highlights presents fairly, in all material respects, the financial position of Government Cash Management Portfolio (the "Portfolio") as of December 31, 2016, and the results of its operations, the changes in its net assets and the financial highlights for each of the periods indicated therein, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as "financial statements") are the responsibility of the Portfolio's management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities as of December 31, 2016 by correspondence with the custodian, brokers and transfer agent, and the application of alternative auditing procedures where such confirmations had not been received, provide a reasonable basis for our opinion.

Boston, Massachusetts

February 24, 2017 | PricewaterhouseCoopers LLP |

Advisory Agreement Board Considerations and Fee Evaluation

Deutsche Government Cash Management Fund (the "Fund"), a series of Deutsche Money Market Trust, invests substantially all of its assets in Government Cash Management Portfolio (the "Portfolio") in order to achieve its investment objective. The Portfolio’s Board of Trustees approved the renewal of the Portfolio’s investment management agreement (the "Portfolio Agreement") with Deutsche Investment Management Americas Inc. ("DIMA") and the Fund’s Board of Trustees (which consists of the same members as the Board of Trustees of the Portfolio) approved the renewal of the Fund’s investment management agreement with DIMA (the "Fund Agreement," and together with the Portfolio Agreement, the "Agreements") in September 2016. The Portfolio’s Board of Trustees and the Fund’s Board of Trustees are collectively referred to as the "Board" or "Trustees."

In terms of the process that the Board followed prior to approving the Agreements, shareholders should know that:

— During the entire process, all of the Portfolio’s and the Fund’s Trustees were independent of DIMA and its affiliates (the "Independent Trustees").

— The Board met frequently during the past year to discuss fund matters and dedicated a substantial amount of time to contract review matters. Over the course of several months, the Board’s Contract Committee reviewed extensive materials received from DIMA, independent third parties and independent counsel. These materials included an analysis of performance, fees and expenses, and profitability from a fee consultant retained by the Independent Trustees (the "Fee Consultant"). The Board also received extensive information throughout the year regarding performance of the Portfolio and the Fund.

— The Independent Trustees regularly meet privately with counsel to discuss contract review and other matters. In addition, the Independent Trustees were advised by the Fee Consultant in the course of their review of the Portfolio’s and the Fund’s contractual arrangements and considered a comprehensive report prepared by the Fee Consultant in connection with their deliberations.

— In connection with reviewing the Agreements, the Board also reviewed the terms of the Fund’s distribution agreement, administrative services agreement, transfer agency agreement and other material service agreements.

— Based on its evaluation of the information provided, the Contract Committee presented its findings and recommendations to the Board. The Board then reviewed the Contract Committee’s findings and recommendations.

In connection with the contract review process, the Contract Committee and the Board considered the factors discussed below, among others. The Board also considered that DIMA and its predecessors have managed the Portfolio and the Fund since their inception, and the Board believes that a long-term relationship with a capable, conscientious advisor is in the best interests of the Portfolio and the Fund. The Board considered, generally, that shareholders chose to invest or remain invested in the Fund knowing that DIMA managed the Portfolio and the Fund. DIMA is part of Deutsche Bank AG’s ("Deutsche Bank") Asset Management ("Deutsche AM") division. Deutsche AM is a global asset management business that offers a wide range of investing expertise and resources, including research capabilities in many countries throughout the world. Deutsche Bank has advised the Board that the U.S. asset management business continues to be a critical and integral part of Deutsche Bank, and that Deutsche Bank will continue to invest in Deutsche AM and seek to enhance Deutsche AM’s investment platform. Deutsche Bank also has confirmed its commitment to maintaining strong legal and compliance groups within the Deutsche AM division.

As part of the contract review process, the Board carefully considered the fees and expenses of each Deutsche fund overseen by the Board in light of the fund’s performance. In many cases, this led to the negotiation and implementation of expense caps. As part of these negotiations, the Board indicated that it would consider relaxing these caps in future years following sustained improvements in performance, among other considerations.

While shareholders may focus primarily on fund performance and fees, the Board considers these and many other factors, including the quality and integrity of DIMA’s personnel and such other issues as back-office operations, fund valuations, and compliance policies and procedures.

Nature, Quality and Extent of Services. The Board considered the terms of the Agreements, including the scope of advisory services provided under the Agreements. The Board noted that, under the Agreements, DIMA provides portfolio management services to the Portfolio and the Fund and that, pursuant to separate administrative services agreements, DIMA provides administrative services to the Portfolio and the Fund. The Board considered the experience and skills of senior management and investment personnel and the resources made available to such personnel. The Board reviewed the Portfolio’s and the Fund’s performance over short-term and long-term periods and compared those returns to various agreed-upon performance measures, including a peer universe compiled using information supplied by iMoneyNet, an independent fund data service. The Board also noted that it has put into place a process of identifying "Focus Funds" (e.g., funds performing poorly relative to a peer universe), and receives additional reporting from DIMA regarding such funds and, where appropriate, DIMA’s plans to address underperformance. The Board believes this process is an effective manner of identifying and addressing underperforming funds. Based on the information provided, the Board noted that for the one- and three-year periods ended December 31, 2015, the Fund’s gross performance (Institutional Shares) was in the 3rd quartile of the applicable iMoneyNet universe (the 1st quartile being the best performers and the 4th quartile being the worst performers). The Board noted that the Portfolio’s and the Fund’s strategy was changed during the year in order to permit the Portfolio and the Fund to operate as a "government money market fund" under applicable Securities and Exchange Commission rules.

Fees and Expenses. The Board considered the Portfolio’s and the Fund’s investment management fee schedules, the Fund’s operating expenses and total expense ratios, and comparative information provided by Broadridge Financial Solutions, Inc. ("Broadridge") and the Fee Consultant regarding investment management fee rates paid to other investment advisors by similar funds (1st quartile being the most favorable and 4th quartile being the least favorable). With respect to management fees paid to other investment advisors by similar funds, the Board noted that the contractual fee rates paid by the Portfolio and the Fund, which include 0.03% and 0.10% fees paid to DIMA under the respective administrative services agreements, were equal to the median (2nd quartile) of the applicable Broadridge peer group (based on Broadridge data provided as of December 31, 2015). The Board considered that the Portfolio’s management fee was reduced by 0.03% at all breakpoint levels in connection with the restructuring of the Portfolio and the Fund into government money market funds. The Board noted that, although shareholders of the Fund indirectly bear the Portfolio’s management fee, the Fund does not charge an additional investment management fee. Based on Broadridge data provided as of December 31, 2015, the Board noted that the Fund’s total (net) operating expenses, which include Portfolio expenses allocated to the Fund, were higher than the median of the applicable Broadridge expense universe for Institutional Shares (4th quartile). The Board noted the expense limitation agreed to by DIMA. The Board also noted the significant voluntary fee waivers implemented by DIMA to ensure the Fund maintained a positive yield. The Board considered the management fee rate as compared to fees charged by DIMA to comparable Deutsche U.S. registered funds ("Deutsche Funds") and considered differences between the Portfolio and the Fund and the comparable Deutsche Funds. The information requested by the Board as part of its review of fees and expenses also included information about institutional accounts (including any sub-advised funds and accounts) and funds offered primarily to European investors ("Deutsche Europe funds") managed by Deutsche AM. The Board noted that DIMA indicated that Deutsche AM does not manage any institutional accounts or Deutsche Europe funds comparable to the Portfolio and the Fund.

On the basis of the information provided, the Board concluded that management fees were reasonable and appropriate in light of the nature, quality and extent of services provided by DIMA.

Profitability. The Board reviewed detailed information regarding revenues received by DIMA under the Agreements. The Board considered the estimated costs and pre-tax profits realized by DIMA from advising the Deutsche Funds, as well as estimates of the pre-tax profits attributable to managing the Fund in particular. The Board also received information regarding the estimated enterprise-wide profitability of DIMA and its affiliates with respect to all fund services in totality and by fund. The Board and the Fee Consultant reviewed DIMA’s methodology in allocating its costs to the management of the Fund. Based on the information provided, the Board concluded that the pre-tax profits realized by DIMA in connection with the management of the Fund were not unreasonable. The Board also reviewed certain publicly available information regarding the profitability of certain similar investment management firms. The Board noted that while information regarding the profitability of such firms is limited (and in some cases is not necessarily prepared on a comparable basis), DIMA and its affiliates’ overall profitability with respect to the Deutsche Funds (after taking into account distribution and other services provided to the funds by DIMA and its affiliates) was lower than the overall profitability levels of most comparable firms for which such data was available.

Economies of Scale. The Board considered whether there are economies of scale with respect to the management of the Portfolio and the Fund and whether the Portfolio and the Fund benefit from any economies of scale. The Board noted that the Portfolio’s and the Fund’s investment management fee schedule includes fee breakpoints. The Board concluded that the Portfolio’s and the Fund’s fee schedule represents an appropriate sharing between the Portfolio and the Fund and DIMA of such economies of scale as may exist in the management of the Portfolio and the Fund at current asset levels.

Other Benefits to DIMA and Its Affiliates. The Board also considered the character and amount of other incidental benefits received by DIMA and its affiliates, including any fees received by DIMA for administrative services provided to the Portfolio and the Fund. The Board also considered benefits to DIMA related to brokerage and soft-dollar allocations, including allocating brokerage to pay for research generated by parties other than the executing broker dealers, which pertain primarily to funds investing in equity securities, along with the incidental public relations benefits to DIMA related to Deutsche Funds advertising and cross-selling opportunities among DIMA products and services. The Board considered these benefits in reaching its conclusion that the Fund’s management fees were reasonable.

Compliance. The Board considered the significant attention and resources dedicated by DIMA to documenting and enhancing its compliance processes in recent years. The Board noted in particular (i) the experience, seniority and time commitment of the individuals serving as DIMA’s and the Fund’s chief compliance officers; (ii) the large number of DIMA compliance personnel; and (iii) the substantial commitment of resources by DIMA and its affiliates to compliance matters.

Based on all of the information considered and the conclusions reached, the Board unanimously determined that the continuation of the Agreements is in the best interests of the Portfolio and the Fund. In making this determination, the Board did not give particular weight to any single factor identified above. The Board considered these factors over the course of numerous meetings, certain of which were in executive session with only the Independent Trustees and counsel present. It is possible that individual Independent Trustees may have weighed these factors differently in reaching their individual decisions to approve the continuation of the Agreements.

Board Members and Officers

The following table presents certain information regarding the Board Members and Officers of the fund. Each Board Member's year of birth is set forth in parentheses after his or her name. Unless otherwise noted, (i) each Board Member has engaged in the principal occupation(s) noted in the table for at least the most recent five years, although not necessarily in the same capacity; and (ii) the address of each Independent Board Member is c/o Keith R. Fox, Deutsche Funds Board Chair, c/o Thomas R. Hiller, Ropes & Gray LLP, Prudential Tower, 800 Boylston Street, Boston, MA 02199-3600. Except as otherwise noted below, the term of office for each Board Member is until the election and qualification of a successor, or until such Board Member sooner dies, resigns, is removed or as otherwise provided in the governing documents of the fund. Because the fund does not hold an annual meeting of shareholders, each Board Member will hold office for an indeterminate period. The Board Members may also serve in similar capacities with other funds in the fund complex.

| Independent Board Members |

| Name, Year of Birth, Position with the Fund and Length of Time Served1 | Business Experience and Directorships During the Past Five Years | Number of Funds in Deutsche Fund Complex Overseen | Other Directorships Held by Board Member |

Keith R. Fox, CFA (1954) Chairperson since 2017,2 and Board Member since 1996 | Managing General Partner, Exeter Capital Partners (a series of private investment funds) (since 1986). Directorships: Progressive International Corporation (kitchen goods importer and distributor); The Kennel Shop (retailer); former Chairman, National Association of Small Business Investment Companies; former Directorships: BoxTop Media Inc. (advertising); Sun Capital Advisers Trust (mutual funds) (2011–2012) | 98 | — |

Kenneth C. Froewiss (1945) Vice Chairperson since 2017,2 Board Member since 2001, and Chairperson (2013– December 31, 2016) | Retired Clinical Professor of Finance, NYU Stern School of Business (1997–2014); Member, Finance Committee, Association for Asian Studies (2002–present); Director, Mitsui Sumitomo Insurance Group (US) (2004–present); prior thereto, Managing Director, J.P. Morgan (investment banking firm) (until 1996) | 98 | — |

John W. Ballantine (1946) Board Member since 1999 | Retired; formerly, Executive Vice President and Chief Risk Management Officer, First Chicago NBD Corporation/The First National Bank of Chicago (1996–1998); Executive Vice President and Head of International Banking (1995–1996); former Directorships: Director and former Chairman of the Board, Healthways, Inc.3 (population well-being and wellness services) (2003–2014); Stockwell Capital Investments PLC (private equity); First Oak Brook Bancshares, Inc. and Oak Brook Bank; Prisma Energy International | 98 | Portland General Electric3 (utility company) (2003– present) |

Henry P. Becton, Jr. (1943) Board Member since 1990 | Vice Chair and former President, WGBH Educational Foundation. Directorships: Public Radio International; Public Radio Exchange (PRX); The Pew Charitable Trusts (charitable organization); former Directorships: Becton Dickinson and Company3 (medical technology company); Belo Corporation3 (media company); The PBS Foundation; Association of Public Television Stations; Boston Museum of Science; American Public Television; Concord Academy; New England Aquarium; Mass. Corporation for Educational Telecommunications; Committee for Economic Development; Public Broadcasting Service; Connecticut College; North Bennett Street School (Boston) | 98 | — |

Dawn-Marie Driscoll (1946) Board Member since 1987 | Emeritus Executive Fellow, Center for Business Ethics, Bentley University; formerly: President, Driscoll Associates (consulting firm); Partner, Palmer & Dodge (law firm) (1988–1990); Vice President of Corporate Affairs and General Counsel, Filene's (retail) (1978–1988). Directorships: Advisory Board, Center for Business Ethics, Bentley University; Trustee and former Chairman of the Board, Southwest Florida Community Foundation (charitable organization); former Directorships: ICI Mutual Insurance Company (2007–2015); Sun Capital Advisers Trust (mutual funds) (2007–2012), Investment Company Institute (audit, executive, nominating committees) and Independent Directors Council (governance, executive committees) | 98 | — |

Paul K. Freeman (1950) Board Member since 1993 | Consultant, World Bank/Inter-American Development Bank; Chair, Independent Directors Council; Investment Company Institute (executive and nominating committees); formerly, Chairman of Education Committee of Independent Directors Council; Project Leader, International Institute for Applied Systems Analysis (1998–2001); Chief Executive Officer, The Eric Group, Inc. (environmental insurance) (1986–1998); Directorships: Denver Zoo Foundation (December 2012–present); former Directorships: Prisma Energy International | 98 | — |

Richard J. Herring (1946) Board Member since 1990 | Jacob Safra Professor of International Banking and Professor, Finance Department, The Wharton School, University of Pennsylvania (since July 1972); Co-Director, Wharton Financial Institutions Center; formerly: Vice Dean and Director, Wharton Undergraduate Division (July 1995–June 2000); Director, Lauder Institute of International Management Studies (July 2000–June 2006) | 98 | Director, Aberdeen Singapore and Japan Funds (since 2007); Independent Director of Barclays Bank Delaware (since September 2010) |