click here for printer-friendly PDF version

click here for printer-friendly PDF version

| 2008 | PROVINCE OF NEW BRUNSWICK | iii |

| | | |

| | | |

TABLE OF CONTENTS |

| | | |

Audited Financial Statements |

| | | |

Introduction to Volume I | 1 |

| | | |

Statement of Responsibility | 2 |

| | | |

Results for the Year | 3 |

| | | |

Major Variance Analysis | 7 |

| | | |

Indicators of Financial Health | 13 |

| | | |

Auditor's Report | 21 |

| | | |

Statement of Financial Position | 22 |

| | | |

Statement of Operations | 23 |

| | | |

Statement of Cash Flow | 24 |

| | | |

Statement of Change in Net Debt | 25 |

| | | |

Statement of Change in Accumulated Deficit | 25 |

| | | |

Notes to the Financial Statements | 26 |

| | | |

Schedules to the Financial Statements | 56 |

| 2008 | PROVINCE OF NEW BRUNSWICK | 1 |

INTRODUCTION

VOLUME I

The Public Accounts of the Province of New Brunswick are presented in two volumes.

This volume contains the audited financial statements of the Provincial Reporting Entity as described in note 1 to the financial statements. They include a Statement of Financial Position, a Statement of Operations, a Statement of Cash Flow, a Statement of Change in Net Debt and a Statement of Change in Accumulated Deficit. This volume also contains the Auditor’s Report, Statement of Responsibility, management’s comments on the results of the year, major variance analysis and a discussion of the Indicators of Financial Health of the Province.

Volume II contains unaudited supplementary information to the Financial Statements presented in Volume I. It presents summary statements for revenue and expenditure as well as five-year comparative statements. This volume also contains detailed information on Supplementary Appropriations, Funded Debt, statements of the General Sinking Fund, Securities Held, and revenue and expenditure by government department.

In addition, the Government includes the following lists on the Office of the Comptroller web site at http://www.gnb.ca/0087:

·

Salary information of government employees and employees of certain government organizations in excess of $60,000. Salary information is for the calendar year and is reported under the department where the employee worked at 31 December;

·

Travel and other employee expenses in excess of $12,000 paid during the year to government employees, separated by department;

·

Payments made to suppliers during the year in excess of $25,000 separated by department as well as a global listing including payments made by all departments;

·

Loans disbursed to recipients during the year in excess of $25,000 separated by department.

| 2008 | PROVINCE OF NEW BRUNSWICK | 3 |

RESULTS FOR THE YEAR

General Comments

The Province’s summary financial statements report a surplus for the fiscal year ended 31 March 2008 of $86.7 million. This represents an increase of $49.6 million over the budgeted surplus of $37.1 million. The primary reason for the larger surplus is stronger-than-anticipated revenue during the year. The net income of New Brunswick Electric Finance Corporation (NBEFC) increased $104.5 million from the budget estimate published in Main Estimates based largely on improved results for NB Power, mainly due to the settlement of a lawsuit and accounting gains. Increases from budget related to metallic minerals tax revenue, income tax revenue and a new federal Equalization Program also contributed to stronger-than-anticipated revenue.

There were several other variances discussed in more detail in the major variance section that follows.

Summary Financial Information

| | |

($ millions) |

Statement of Financial Position |

| 2008 | 2007 |

Financial Assets | $ 1,832.7 | $ 1,941.9 |

Liabilities | (8,775.6) | (8,517.0) |

Net Debt | (6,942.9) | (6,575.1) |

Tangible Capital Assets net of Deferred Contributions |

5,393.9 |

4,965.3 |

Other Non Financial Assets | 144.4 | 110.6 |

Total Non Financial Assets | 5,538.3 | 5,075.9 |

Accumulated Deficit | $ (1,404.6) | $ (1,499.2) |

|

|

|

Statement of Operations |

| 2008 | 2007 |

Revenue – Provincial Own Sources | $ 4,384.7 | $ 4,153.5 |

Revenue – Federal Sources | 2,577.6 | 2,487.4 |

Total Revenue | 6,962.3 | 6,640.9 |

Expenses | 6,875.6 | 6,404.1 |

Surplus / (Deficit) | $ 86.7 | $ 236.8 |

|

|

|

Statement of Change in Net Debt |

| 2008 | 2007 |

Opening Net Debt | $ (6,575.1) | $ (6,714.2) |

(Increase) Decrease in Net Debt From Operations | (321.6) | 136.3 |

Accounting change | (46.2) | 2.8 |

Total Change in Net Debt | (367.8) | 139.1 |

Ending Net Debt | $ (6,942.9) | $ (6,575.1) |

| 4 | PROVINCE OF NEW BRUNSWICK | 2008 |

Revenue

Revenues of the Province for the past five years, as restated, are shown in the table below.

| | | | | |

($ millions) |

| 2004 | 2005 | 2006 | 2007 | 2008 |

Provincial Sources | $3,526.2 | $3,621.1 | $3,922.4 | $4,153.5 | $4,384.7 |

Federal Sources | 1,917.9 | 2,354.8 | 2,392.9 | 2,487.4 | 2,577.6 |

Total Revenue | $5,444.1 | $5,975.9 | $6,315.3 | $6,640.9 | $6,962.3 |

Average annual revenue growth over this period is 6.4%. This significantly exceeds the historical average revenue growth rate of 4.1% over the past 20 years. Among the contributing factors to revenue growth during the period was a relatively strong domestic economy, improved financial results of NBEFC and increased federal transfer payments. During this period, the federal Equalization Program underwent transformational changes, federal funding for health care was enriched, and a number of one-time funds and trusts were established, contributing to growth in federal transfers.

In 2007-2008, revenue increased by $321.4 million year-over-year, a 4.8% increase. Major factors were improved financial results for NBEFC; higher income tax revenue reflecting a growing tax base and the impact of 2007-2008 budget measures; and additional federal transfer revenue related to Equalization, Canada Health and Social Transfers and federal conditional grants.

Expense

Expenses of the Province for the past five years, as restated, are shown in the table below.

| | | | | |

($ millions) |

| 2004 | 2005 | 2006 | 2007 | 2008 |

Total Expense | $5,626.0 | $5,740.6 | $6,080.3 | $6,404.1 | $6,875.6 |

Average annual expense growth over this period is 5.2%. The average annual revenue growth is 1.2% higher than expense growth over this period. Spending increases were possible because of the increase in revenue. Among the factors contributing to expense growth during the period were increases in the demand for services, and the provision of new services to the public. The Province also experienced cost increases for various goods and services, including wages, fuel, prescription drugs, energy, materials and supplies. During this period additional federal funding, including a number of one-time funds and trusts, enabled the Province to make additional investments in healthcare, municipal infrastructure, and various other initiatives.

In 2007-2008, expenses increased by $471.5 million year-over-year, a 7.4% increase. The increase in expenses over 2006-2007 reflects additional investments made in healthcare, education, children and youth, and seniors.

| 2008 | PROVINCE OF NEW BRUNSWICK | 5 |

Surplus

Surpluses (or Deficits) of the Province for the past five years, as restated, are shown in the table below.

| | | | | |

($ millions) |

| 2004 | 2005 | 2006 | 2007 | 2008 |

Surplus/(Deficit) | $(181.9) | $235.3 | $235.0 | $236.8 | $86.7 |

Since 2004-2005, the province has achieved surpluses annually. The surplus for the year ended 31 March 2008 was $86.7 million which is significantly less than the $236.8 million surplus generated in the previous year and $49.6 million greater than the budgeted surplus of $37.1 million.

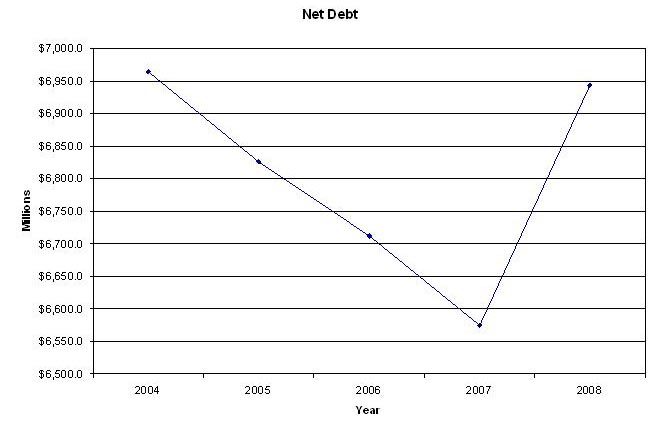

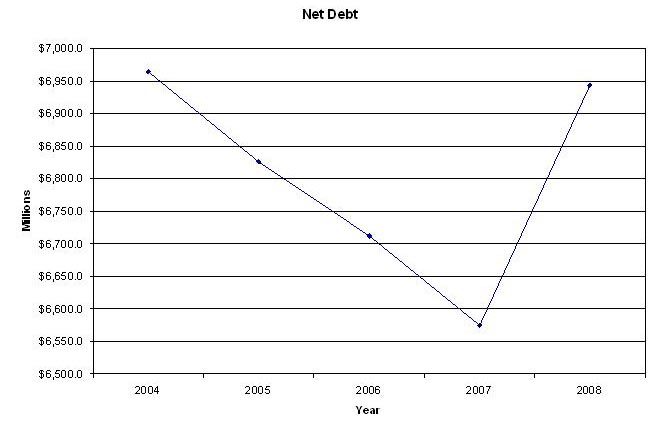

Net Debt

Net debt increased by $367.8 million during the year ended 31 March 2008 due primarily to a large investment in tangible capital assets during the year. In particular, the completion of the remaining sections of the Trans-Canada Highway between Woodstock and Grand Falls represented a $407.0 million increase in net debt. The following graph reports the net debt position as restated at the end of each of the past five years.

| | | | | |

($ millions) |

| 2004 | 2005 | 2006 | 2007 | 2008 |

Net Debt | $6,963.9 | $6,825.4 | $6,711.4 | $6,575.1 | $6,942.9 |

The reduction in net debt over this period has been $21.0 million.

| 6 | PROVINCE OF NEW BRUNSWICK | 2008 |

Cost of Servicing the Public Debt

The Province’s cost of servicing the Public Debt totaled $576.9 million for the year ended 31 March 2008. While this marks an increase from the 2006-2007 cost, the annual spending is $6.0 million less than what the Province spent in 2004. Favourable interest rates and a strong Canadian dollar in recent years are largely responsible for this difference.

| | | | | |

($ millions) |

| 2004 | 2005 | 2006 | 2007 | 2008 |

Cost of Servicing the Public Debt | $582.9 | $580.9 | $591.4 | $559.4 | $576.9 |

Results According to the Fiscal Responsibility and Balanced Budget Act

The Province adopted the Fiscal Responsibility and Balanced Budget Act (FRBBA) and repealed the Balanced Budget Act in 2006. The Act’s stated objective is for balanced budgets over designated fiscal periods. The current fiscal period commenced 1 April 2007 and will end on 31 March 2011. During the year, the Government generated an $86.7 million surplus for Balanced Budget purposes.

Surplus According to Fiscal Responsibility and Balanced Budget Act

| |

| 2008 |

Surplus - FRBBA | $ 86.7 million |

| 2008 | PROVINCE OF NEW BRUNSWICK | 7 |

MAJOR VARIANCE ANALYSIS

Explanations of major variances are described below, first for revenue, followed by expenses. In this analysis, comparisons are made between the actual results for 2007-2008 and either the 2007-2008 budget or actual results for 2006-2007.

REVENUE

Budget 2008 to Actual 2008 Comparison

| | | | |

2008 Budget to Actual ($ millions) |

Item | Budget | Actual | Change | % Change |

Provincial Sources |

Taxes | 3,154.7 | 3,199.6 | 44.9 | 1.4 |

Investment Income | 310.4 | 417.2 | 106.8 | 34.4 |

Other Provincial Revenue | 296.9 | 358.9 | 62.0 | 20.9 |

Federal Sources |

Fiscal Equalization Payments | 1,435.2 | 1,476.5 | 41.3 | 2.9 |

Conditional Grants | 345.6 | 361.8 | 16.2 | 4.7 |

Taxes

Taxes are up $44.9 million over budget, primarily because:

·

Metallic minerals tax is up $49.7 million due to increases in mineral prices, mining industry profits and a prior-year adjustment;

·

Personal income tax is up $46.1 million due to higher in-year revenue reflecting a strong domestic economy and a positive prior-year adjustment related to the 2006 taxation year;

·

Corporate income tax is up $27.8 million due to higher federal estimates of New Brunswick corporate taxable income;

·

Harmonized sales tax is down $68.2 million as a result of reduced in-year payments and a negative prior-year adjustment for the 2002-2006 taxation year period, related to revised revenue pool and share data in the federal HST allocation formula;

·

The provincial real property tax decreased by $16.7 million mainly because of the high energy use tax rebate introduced for pulp and paper mills as well as a larger-than-anticipated increase to the reserve for uncollectible accounts.

Investment Income

Investment income is up $106.8 million from budget as a result of a $104.5 million improvement in net income for the New Brunswick Electric Finance Corporation. NBEFC’s net income increase was largely attributable to improved results for NB Power, mainly due to the settlement of a lawsuit and accounting gains.

Other Provincial Revenue

Other Provincial Revenue is up $62.0 million from budget mainly because:

·

Recovery of $19.2 million related to the government's Credit Union stabilization package;

·

Motor vehicle act fines increased by $8.5 million as a result of uncollectible fines from previous years being recorded in 2007-2008;

·

Health Recovery Levy is up $3.7 million due to an increase in number of insured vehicles;

·

Various other accounts under $3.0 million each.

| 8 | PROVINCE OF NEW BRUNSWICK | 2008 |

Fiscal Equalization Payments

Fiscal Equalization Payments are up $41.3 million from budget reflecting the new federal formula announced in the 2007-2008 federal budget.

Conditional Grants

Conditional Grants are up $16.2 million from budget mainly due to additional federal funding for health and education. Increased funding includes but is not limited to Canada Health Infoway Master Service Agreement, Child Care Spaces Payment and Canada ecoTrust for Clean Air and Climate Change; increases are offset by the expiry or reduction in other funds.

Actual 2007 to Actual 2008 Comparison

| | | | |

2007 Actual to 2008 Actual ($ millions) |

Item | 2007 Actual | 2008 Actual |

Change | % Change |

Provincial Sources |

Taxes | 3,114.3 | 3,199.6 | 85.3 | 2.7 |

Investment Income | 308.6 | 417.2 | 108.6 | 35.2 |

Other Provincial Revenue | 320.4 | 358.9 | 38.5 | 12.0 |

Federal Sources |

Fiscal Equalization Payments | 1,450.8 | 1,476.5 | 25.7 | 1.8 |

Unconditional Grants | 708.8 | 739.3 | 30.5 | 4.3 |

Conditional Grants | 327.8 | 361.8 | 34.0 | 10.4 |

Taxes

Taxes are up $85.3 million over the previous year, mainly because:

·

Personal income tax is up $81.3 million resulting from growth in the tax base as well as the impact of 2007-2008 budget measures;

·

Corporate income tax is up $49.0 million as a result of higher in-year payments related to increased corporate taxable income and the impact of 2007-2008 budget measures;

·

This is partially offset by reduced revenue of $17.1 million year-over-year from gasoline and motive fuel taxes due to the full impact of the rate reduction introduced in October 2006;

·

Harmonized sales tax is down $31.1 million as a result of limited growth to in-year payments and negative prior-year adjustments in 2007-2008. This is related to revised revenue pool and share data in the federal HST allocation formula.

Investment Income

Investment Income is up $108.6 million from 2006-2007, mainly due to an increase in NBEFC and New Brunswick Liquor Corporation of $85.8 million and $13.4 million, respectively.

·

NBEFC’s net income increase was largely attributable to improved results for NB Power mainly due to the settlement of a lawsuit and accounting gains;

·

New Brunswick Liquor Corporation’s net income increased by $13.4 million consistent with direction provided in the 2007-2008 budget.

Other Provincial Revenue

Other Provincial Revenue is up $38.5 million from previous year mainly due to:

·

Recovery of $19.2 million related to the government's Credit Union stabilization package;

·

Motor vehicle act fines increased by $8.3 million as a result of uncollectible fines from previous years being recorded in 2007-2008;

·

Health Recovery Levy is up $4.9 million due to an increase in number of insured vehicles;

| 2008 | PROVINCE OF NEW BRUNSWICK | 9 |

·

Various other accounts under $4 million each.

Fiscal Equalization Payments

Fiscal Equalization Payments are up $25.7 million year-over-year due to the new federal formula announced in the 2007-2008 federal budget.

Unconditional Grants

Unconditional grants are up $30.5 million mainly due to the legislated funding increases to the Canada Health Transfer and the Canada Social Transfer.

Conditional Grants

Conditional Grants are up $34.0 million from the previous year as a result of increases in federal funding primarily related to education. Increased funding includes but is not limited to Post-Secondary Education Infrastructure Trust, Public Transit Capital Trust and Canada Health Infoway Master Service Agreement; increases are offset by the expiry or reduction in other funds.

EXPENSES

Budget 2008 to Actual 2008 Comparison

| | | | |

2008 Budget to Actual ($ millions) |

Item | Budget 2008 | Actual 2008 | Change | % Change |

Education and Training | 1,300.5 | 1,431.4 | 130.9 | 10.1 |

Health | 2,233.9 | 2,283.4 | 49.5 | 2.2 |

Social Development | 889.3 | 903.4 | 14.1 | 1.6 |

Protection Services | 183.5 | 187.2 | 3.7 | 2.0 |

Economic Development | 181.6 | 229.2 | 47.6 | 26.2 |

Labour and Employment | 119.6 | 119.1 | (0.5) | (0.4) |

Resources | 184.8 | 179.2 | (5.6) | (3.0) |

Transportation | 356.3 | 380.4 | 24.1 | 6.8 |

Central Government | 583.6 | 585.4 | 1.8 | 0.3 |

Service of the Public Debt | 606.9 | 576.9 | (30.0) | (4.9) |

Education and Training

Education and Training expenses were $130.9 million higher than budget mainly due to an additional $110.0 million grant to universities.

Health

Health expenses were $49.5 million higher than budget primarily due to the following factors:

Increased expenses in Hospital Services, mainly related to volume and inflationary growth within the Regional Health Authorities;

Increased expenses in Out-of-Province Hospital Payments, related to increases in the cost of in-patient and out-patient healthcare services received by New Brunswick residents in other provinces;

Decreased expenses for the Prescription Drug Program, related mainly to the use of more generic drugs.

| 10 | PROVINCE OF NEW BRUNSWICK | 2008 |

Social Development

Social Development expenses were $14.1 million higher than budget primarily due to a $10.6 million contribution to a trust fund for nursing homes’ pension plans.

Protection Services

Protection Services expenses were $3.7 million higher than budget primarily due to an increase in provision for loss expense.

Economic Development

Economic Development expenses were $47.6 million higher than budget primarily due to an increase in financial assistance to businesses and regional development initiatives.

Resources

Resource Sector expenses were $5.6 million less than budget primarily due to the following factors:

A decrease in expenses of the Energy Efficiency and Conservation Agency of New Brunswick due to the timing of program spending;

A decrease in Crown Land silviculture activities resulting from a reduction in voluntary levy contributions made by industry;

An increase in the cost of fire suppression activities and advanced mineral exploration.

Transportation

Transportation expenses were $24.1 million higher than budget primarily due to an increase in Winter Maintenance activities as a result of the length and severity of the winter, and an increase in fuel costs.

Central Government

Overall, the expenses for Central Government were $1.8 million higher than budget. Several major variances occurred within Central Government, as follows:

Pension expense was $31.2 million higher than budget primarily due to lower than anticipated investment returns;

Provision for Loss expense was $22.9 million higher than budget;

General Government was $50.3 million lower than budget due to lower expenses in Supplementary Funding Provision.

Service of the Public Debt

Service of the Public Debt expenses were $30 million less than budget due to the timing of cash flows resulting in higher than anticipated short-term interest earned, as well as a strengthening Canadian dollar.

| 2008 | PROVINCE OF NEW BRUNSWICK | 11 |

Actual 2007 to Actual 2008 Comparison

| | | | |

2007 Actual to 2008 Actual ($ millions) |

Item | 2007 Actual | 2008 Actual | Change | % Change |

Education and Training | 1,305.5 | 1,431.4 | 125.9 | 9.6 |

Health | 2,110.2 | 2,283.4 | 173.2 | 8.2 |

Social Development | 818.0 | 903.4 | 85.4 | 10.4 |

Protection Services | 233.8 | 187.2 | (46.6) | (19.9) |

Economic Development | 205.6 | 229.2 | 23.6 | 11.5 |

Labour and Employment | 120.4 | 119.1 | (1.3) | (1.1) |

Resources | 193.0 | 179.2 | (13.8) | (7.2) |

Transportation | 347.5 | 380.4 | 32.9 | 9.5 |

Central Government | 510.7 | 585.4 | 74.7 | 14.6 |

Service of the Public Debt | 559.4 | 576.9 | 17.5 | 3.1 |

Education and Training

Education and Training expenses were $125.9 million higher than in 2006-2007 primarily due to increased expenses in School District Operations for wages and initiatives related to class-size reduction, inclusive education and When Kids Come First initiatives, plus an increase in the grant to universities.

Health

Health expenses were $173.2 million higher than in 2006-2007 primarily due to the following factors:

Increased expenses in Hospital Services, mainly related to volume and inflationary growth within the Regional Health Authorities. Expenses include wages, medical supplies and prescription drugs.

Increased expenses for Medicare due to the annual contract increase for physicians, as well as the hiring of new physicians;

Increased expenses for Ambulance Services mainly due to the implementation of an enhanced ambulance strategy;

Increased expenses for Out-of-Province Hospital Payments, related to increases in the cost of in-patient and out-patient healthcare services received by New Brunswick residents in other provinces.

Social Development

Social Development expenses were $85.4 million higher than in 2006-2007 primarily due to the following factors:

Increased expenses for Long Term Care and Nursing Home Services due to an increase in the number of hours of care and an increase in nursing home operating costs;

A $10.6 million contribution to a trust fund for nursing homes’ pension plans in 2007-2008;

Increased demand for children’s services, treatment for children with autism spectrum disorder, and additional child care spaces.

Protection Services

Protection Services expenses were $46.6 million lower than in 2006-2007 primarily due to funding provided in 2006-2007 for Credit Union stabilization and support.

Economic Development

Economic Development expenses were $23.6 million higher than in 2006-2007 primarily due to increased spending on Community and Regional Development Initiatives and increased investment in municipal infrastructure through the Gas Tax Fund and the Public Transit Capital Trust. These increases were partially

| 12 | PROVINCE OF NEW BRUNSWICK | 2008 |

offset by a lower provision for loss expense in 2007-2008 and the completion of the Broadband Initiative in 2006-2007.

Labour and Employment

Labour and Employment expenses were $1.3 million lower than 2006-2007 primarily due to reduced demand for employment support services.

Resources

The Resource Sector’s expenses were $13.8 million lower than in 2006-2007 primarily due to a contribution in 2006-2007 to the Saint John Harbour clean-up.

Transportation

Transportation expenses were $32.9 million higher than in 2006-2007 primarily due to an increase in winter maintenance activities as a result of the length and severity of the winter, and an increase in amortization expense resulting from the completion of capital projects, including the Trans-Canada Highway between Woodstock and Grand Falls.

Central Government

Central Government expenses were $74.7 million higher than in 2006-2007 primarily due to the following factors:

An increase in pension expense due to lower than anticipated investment returns in 2007-2008;

An increase in Provision for Loss.

Service of the Public Debt

Service of the Public Debt expenses were $17.5 million higher than in 2006-2007 mainly due to a one-time foreign exchange gain in 2006-2007.

| 2008 | PROVINCE OF NEW BRUNSWICK | 13 |

INDICATORS OF FINANCIAL HEALTH

This section provides indicators of progress in the province’s financial condition and follows Canadian Institute of Chartered Accountants (CICA) guidelines, using information provided in the province’s financial statements as well as other standard socio-economic indicators such as nominal Gross Domestic Product (GDP) data from Statistics Canada.

The analysis provides results in a manner that improves transparency and provides a clearer understanding of recent trends in the province’s financial health. Trends over the last five years (2003-2004 to 2007-2008) are evaluated using sustainability, flexibility and vulnerability criteria established by the CICA and used by the Auditor General of New Brunswick. Though many potential indicators are available, those found to be the most relevant, measurable and transparent to users of government financial information are included. Similar data series are also widely used by banks and other financial institutions, investors and credit-rating agencies.

The Fiscal Responsibility and Balanced Budget Act also contains measures to enhance fiscal transparency and accountability. The Act’s stated objective is for balanced budgets over designated fiscal periods and a decrease in the net debt-to-GDP ratio over successive fiscal periods.

In evaluating a government’s financial health, it should be acknowledged that governments have exposure to a number of variables that are beyond their direct scope of control, but still can exert major influences on financial results and indicators. These include but are not limited to:

·

Changing global economic conditions such as energy prices, commodity prices, investment valuation and inflation;

·

Changes to international financial conditions that impact interest rates, currency fluctuations or availability of credit;

·

Changes to federal transfers or programs;

·

Natural disasters such as flooding or forest fires;

·

Developments affecting agencies such as NB Power that are reflected on the province’s books and;

·

Changes in generally accepted accounting principles.

| 14 | PROVINCE OF NEW BRUNSWICK | 2008 |

Sustainability

Sustainability is defined by CICA as the degree to which a government can maintain and meet existing creditor requirements without increasing the debt burden on the economy. It is measured in this analysis by:

·

Net debt as a proportion of GDP;

·

Net debt per capita.

Net Debt as a Proportion of GDP:

Net debt is an indication of the extent to which provincial government liabilities exceed financial assets. The net debt-to-GDP ratio shows the relationship between net debt and the economy. If the ratio is declining, growth in the economy is exceeding growth in net debt, resulting in improved sustainability. Conversely, an increasing net debt-to-GDP ratio indicates net debt is increasing faster than growth in the economy and serving to reduce the provincial government’s financial sustainability.

Under generally accepted accounting principles, a surplus can be achieved while at the same time net debt increases. This was the case in 2007-2008 when the full cost of the completion of the remaining sections of the Trans-Canada Highway between Woodstock and Grand Falls was taken onto the province’s books and resulted in an increase to net debt. Both accounting concepts are correct.

The province’s ratio of net debt-to-GDP has been trending downward. Over the last five years it has decreased from 31.1 percent to 26.3 percent. The following graph reports a steady improvement in the net debt-to-GDP ratio; a reduction of 5.2 percentage points from 2004 to 2007 and a small increase in the ratio in 2008. In 2007-2008, this ratio increased marginally as a result of the increase in net debt related to the cost of completing the Trans-Canada Highway. Overall, this indicator shows that the province has improved its ability to sustain programs and services.

For purposes of the Fiscal Responsibility and Balanced Budget Act, an improvement in the net debt-to-GDP ratio over successive fiscal periods is targeted. This means the net debt-to-GDP ratio for the year ended 31 March 2011 must be lower than the year ended 31 March 2007.

| 2008 | PROVINCE OF NEW BRUNSWICK | 15 |

Net Debt-to-GDP Ratio

| | | |

Fiscal Year Ending | Net Debt | GDP | Net Debt/GDP |

| ($ millions) | ($ millions) | (%) |

2004 | 6,963.9 | 22,366 | 31.1 |

2005 | 6,825.4 | 23,534 | 29.0 |

2006 | 6,711.4 | 24,190 | 27.7 |

2007 | 6,575.1 | 25,346 | 25.9 |

2008 | 6,942.9 | 26,410 | 26.3 |

Net Debt per Capita:

Net debt per capita is a statement of the net debt attributable to each New Brunswick resident. The level of net debt per capita had been trending downwards in recent years. However, in 2007-2008, net debt per capita increased to 2003-2004 levels due to the addition to the province’s debt of the full cost of the completion of the remaining sections of the Trans-Canada Highway.

| 16 | PROVINCE OF NEW BRUNSWICK | 2008 |

Net Debt per Capita

| | | |

Fiscal Year Ending | Net Debt | Population | Net Debt per Capita |

| ($ millions) | | ($) |

2004 | 6,963.9 | 752,040 | 9,260 |

2005 | 6,825.4 | 751,319 | 9,085 |

2006 | 6,711.4 | 749,225 | 8,958 |

2007 | 6,575.1 | 749,782 | 8,769 |

2008 | 6,942.9 | 749,782 | 9,260 |

Flexibility

Flexibility is defined by CICA as the degree to which a government can increase its financial resources to respond to its commitments by either extracting more revenue or increasing its debt burden, and is measured in this analysis by:

·

Own-source revenue as a proportion of GDP;

·

Cost of servicing the public debt as a proportion of total revenue.

Own-source Revenue as a Proportion of GDP:

This ratio measures own-source revenues of the provincial government as a percentage of the economy, as measured by nominal GDP. An increase in this ratio indicates that government own-source revenues are growing faster than the economy as a whole, reducing government’s flexibility to increase revenues without slowing growth in the economy. A decrease in the ratio is indicative of the government taking less revenue out of the economy on a relative basis, which increases its flexibility.

| 2008 | PROVINCE OF NEW BRUNSWICK | 17 |

Own-source revenue includes revenues from taxation, natural resources, fees, return on investment, lotteries, fines and penalties, etc., and is essentially all revenue minus federal transfers. While more controllable than federal transfers, as the province can influence revenues through its own tax rates and fiscal policy, own-source revenue is vulnerable to, among other factors:

·

Net income or revenue of outside agencies that affect the province’s books (e.g. NB Power);

·

Variability in provincial revenues that are collected or estimated by the federal government such as personal and corporate income taxes and the Harmonized Sales Tax;

·

Commodity tax revenues such as Metallic Minerals Tax that is vulnerable to world prices.

Own-source revenue as a proportion of GDP has trended upward over the last five years but overall has remained relatively stable with an increase of less than one percentage point. This measure indicates that the government’s flexibility has diminished marginally but is largely unchanged over the last five years.

Own-source Revenue as a Proportion of GDP

| | | |

Fiscal Year Ending | Own-source Revenue | GDP | Own-source Revenue as a Proportion of GDP |

| ($ millions) | ($ millions) | (%) |

2004 | 3,526.2 | 22,366 | 15.8 |

2005 | 3,621.1 | 23,534 | 15.4 |

2006 | 3,922.4 | 24,190 | 16.2 |

2007 | 4,153.5 | 25,346 | 16.4 |

2008 | 4,384.7 | 26,410 | 16.6 |

| 18 | PROVINCE OF NEW BRUNSWICK | 2008 |

Cost of Servicing the Public Debt as a Proportion of Total Revenue:

Debt service costs as a proportion of total revenue is an indicator of the province’s ability to satisfy existing credit requirements in the context of the government’s overall revenue. Debt service costs can be impacted by variables outside the direct control of government, such as credit ratings, interest rates, financial markets and currency fluctuations. Investment in public infrastructure resulting in a change in the stock of debt can also influence borrowing requirements.

The province’s proportion of debt service costs to revenue has declined steadily over the last five years, lowering the overall financial burden on the provincial economy. A decrease in this ratio indicates that debt service costs are a smaller proportion of provincial revenues overall, allowing the province more financial resources to provide essential programs and services. In 2007-2008, the province spent about 8.3 cents of each revenue dollar on interest on the provincial debt, compared to 10.7 cents in 2003-2004.

Cost of Servicing the Public Debt as a Proportion of Total Revenue

| | | |

Fiscal Year Ending | Cost of Servicing the Public Debt | Total Revenue | Cost of Servicing the Public Debt as a Proportion of Total Revenue |

| ($ millions) | ($ millions) | (%) |

2004 | 582.9 | 5,444.1 | 10.7 |

2005 | 580.9 | 5,975.9 | 9.7 |

2006 | 591.4 | 6,315.3 | 9.4 |

2007 | 559.4 | 6,640.9 | 8.4 |

2008 | 576.9 | 6,962.3 | 8.3 |

| 2008 | PROVINCE OF NEW BRUNSWICK | 19 |

Vulnerability

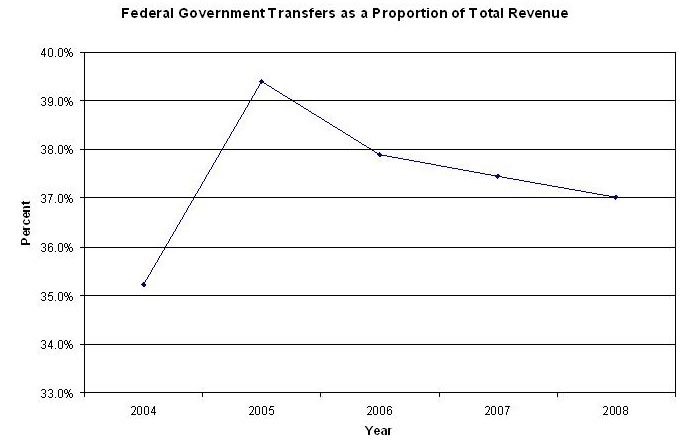

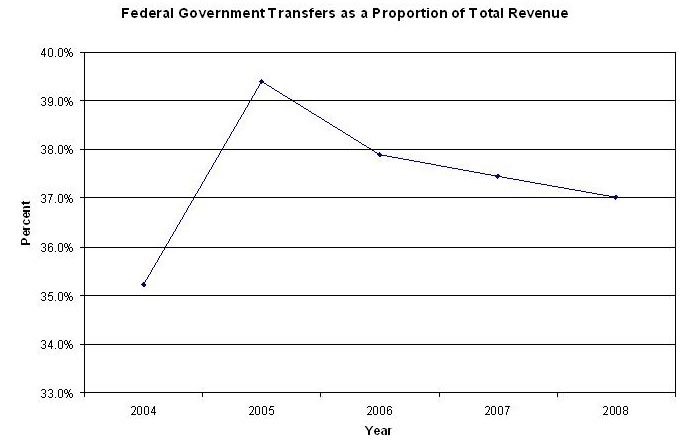

Vulnerability as defined by CICA is the degree to which a government becomes dependent on, and therefore vulnerable to, sources of funding outside its control or influence, both domestic and international. A common measurement of vulnerability is federal government transfers as a proportion of revenue.

Federal Government Transfers as a Proportion of Total Revenue:

Revenue from federal sources is comprised of conditional and unconditional grants from the federal government, including:

·

Fiscal Equalization Program payments;

·

The Canada Health Transfer and the Canada Social Transfer;

·

And conditional grants or capital revenue in support of economic development, infrastructure, education and labour training and other areas.

Federal transfer payments can be affected by both federal fiscal policy decisions, as well as the normal annual estimate process that guides federal payments under the Equalization Program and Canada Health and Social Transfers. Both of these factors can contribute to year-to-year changes in the level of transfers. In the past, adjustments related to prior-year estimates of Equalization and social program transfers have had a pronounced impact on this measurement year-to-year.

Comparing the level of federal transfers to total revenue provides an indication of the vulnerability of the province. Generally, if the ratio is increasing, the province is increasingly reliant on federal transfers, resulting in increased vulnerability. If the ratio is declining, vulnerability is diminished.

The dependence of the provincial government on federal transfers has declined considerably from levels of the early 1980s, and federal government transfers as a proportion of total revenue has declined annually over the past few years. This reflects, in part, a stronger fiscal and economic performance by the province and as a result, increased ability to fund essential programs and services from own-source revenues. This reduces the vulnerability of the province to changes in federal transfers that are outside of its direct control.

| 20 | PROVINCE OF NEW BRUNSWICK | 2008 |

Federal Government Transfers as a Proportion of Total Revenue

| | | |

Fiscal Year Ending | Federal Government Transfers | Total Revenue | Federal Government Transfers as a Proportion of Total Revenue |

| ($ millions) | ($ millions) | (%) |

2004 | 1,917.9 | 5,444.1 | 35.2 |

2005 | 2,354.8 | 5,975.9 | 39.4 |

2006 | 2,392.9 | 6,315.3 | 37.9 |

2007 | 2,487.4 | 6,640.9 | 37.5 |

2008 | 2,577.6 | 6,962.3 | 37.0 |

Summary

In general, over the 2003-2004 to 2007-2008 period, indicators of the province’s financial health have improved or remained relatively stable.

However, the increase to the province’s net debt of $367.8 million in 2007-2008, related to the full cost of completing the remaining sections of the Trans-Canada Highway between Woodstock and Grand Falls has resulted in increases to a number of measures for 2007-2008.

| 22 | PROVINCE OF NEW BRUNSWICK | 2008 |

STATEMENT OF FINANCIAL POSITION |

as at 31 March 2008 |

| | | | | |

| | | | (millions) | |

Schedule | | | 2008 | | 2007 |

| | | | | |

| FINANCIAL ASSETS | | | | |

| | | | | |

1 | Cash Net of Short Term Borrowing | $ --- | | $ 249.2 |

2 | Receivables and Advances | 402.9 | | 367.1 |

3 | Taxes Receivable | 899.1 | | 969.6 |

4 | Inventories for Resale | 7.8 | | 7.1 |

5 | Loans | 396.7 | | 353.4 |

6 | Investments | 126.2 | | (4.5) |

| Total Financial Assets | 1,832.7 | | 1,941.9 |

| | | | | |

| LIABILITIES | | | |

| | | | | |

1 | Short Term Borrowing Net of Cash | 283.0 | | --- |

7 | Accounts Payable and Accrued Expenses | 1,996.7 | | 1,951.9 |

8 | Allowance for Losses | 103.1 | | 95.8 |

| Unrealized Foreign Exchange Gains | 87.7 | | 48.9 |

9 | Deferred Revenue | 380.6 | | 364.9 |

10 | Deposits Held in Trust | 70.5 | | 60.2 |

11 | Obligations under Capital Leases (Note 7) | 798.9 | | 817.1 |

| Pension Surplus (Note 14) | (244.7) | | (126.4) |

| | | 3,475.8 | | 3,212.4 |

| | | | | |

| Funded Debt (Note 12) | 13,064.3 | | 12,981.9 |

| Borrowing for New Brunswick Electric Finance Corporation | (3,602.6) | | (3,709.1) |

| Funded Debt for Provincial Purposes | 9,461.7 | | 9,272.8 |

| Less: Sinking Fund Investments | 4,161.9 | | 3,968.2 |

| | | 5,299.8 | | 5,304.6 |

| Total Liabilities | 8,775.6 | | 8,517.0 |

| | | | | |

| NET DEBT | (6,942.9) | | (6,575.1) |

| | | | | |

| NON-FINANCIAL ASSETS | | | |

| | | | | |

| Tangible Capital Assets (Note 9) | 6,212.2 | | 5,645.5 |

| Deferred Capital Contributions (Note 10) | (818.3) | | (680.2) |

| Provincial Investment in Tangible Capital Assets | 5,393.9 | | 4,965.3 |

12 | Inventories of Supplies | 45.1 | | 42.0 |

13 | Prepaid and Deferred Charges | 99.3 | | 68.6 |

| Total Non-Financial Assets | 5,538.3 | | 5,075.9 |

| | | | | |

| ACCUMULATED DEFICIT | $ (1,404.6) | | $ (1,499.2) |

| | | | | |

| Contingent Liabilities - See Note 15 | | | | |

| Commitments - See Note 16 | | | | |

| | | | | |

| The accompanying notes are an integral part of these Financial Statements. | | | | |

| | | | | |

| /s/ Kim MacPherson | | | | |

| Kim MacPherson, C.A. | | | | |

| Comptroller | | | | |

| 2008 | PROVINCE OF NEW BRUNSWICK | 23 |

STATEMENT OF OPERATIONS |

for the fiscal year ended 31 March 2008 |

| | | | | | | |

| | | | | (millions) | | |

Schedule | | | 2008 | | 2008 | | 2007 |

| | | Budget | | Actual | | Actual |

| | | | | | | |

| REVENUE | | | | | | |

| | | | | | | |

| Provincial Sources | | | | | | |

14 | Taxes | | $ 3,154.7 | | $ 3,199.6 | | $ 3,114.3 |

15 | Licenses and Permits | | 108.3 | | 114.5 | | 109.7 |

16 | Royalties | | 65.2 | | 63.8 | | 68.7 |

17 | Investment Income | | 310.4 | | 417.2 | | 308.6 |

18 | Other Provincial Revenue | | 296.9 | | 358.9 | | 320.4 |

| Sinking Fund Earnings | | 227.5 | | 230.7 | | 231.8 |

| | | 4,163.0 | | 4,384.7 | | 4,153.5 |

| | | | | | | |

| Federal Sources | | | | | | |

| Fiscal Equalization Payments | | 1,435.2 | | 1,476.5 | | 1,450.8 |

19 | Unconditional Grants | | 733.3 | | 739.3 | | 708.8 |

20 | Conditional Grants | | 345.6 | | 361.8 | | 327.8 |

| | | 2,514.1 | | 2,577.6 | | 2,487.4 |

| | | 6,677.1 | | 6,962.3 | | 6,640.9 |

| | | | | | | |

| EXPENSE | | | | | | |

| | | | | | | |

21 | Education and Training | | 1,300.5 | | 1,431.4 | | 1,305.5 |

22 | Health | | 2,233.9 | | 2,283.4 | | 2,110.2 |

23 | Social Development | | 889.3 | | 903.4 | | 818.0 |

24 | Protection Services | | 183.5 | | 187.2 | | 233.8 |

25 | Economic Development | | 181.6 | | 229.2 | | 205.6 |

26 | Labour and Employment | | 119.6 | | 119.1 | | 120.4 |

27 | Resources | | 184.8 | | 179.2 | | 193.0 |

28 | Transportation | | 356.3 | | 380.4 | | 347.5 |

29 | Central Government | | 583.6 | | 585.4 | | 510.7 |

| Service of the Public Debt (Note 13) | | 606.9 | | 576.9 | | 559.4 |

| | | 6,640.0 | | 6,875.6 | | 6,404.1 |

| | | | | | | |

| | | | | | | |

| ANNUAL SURPLUS | | $ 37.1 | | $ 86.7 | | $ 236.8 |

| | | | | | | |

The accompanying notes are an integral part of these Financial Statements.

| 24 | PROVINCE OF NEW BRUNSWICK | 2008 |

STATEMENT OF CASH FLOW |

for the fiscal year ended 31 March 2008 |

| | | | |

| | | (millions) | |

| | 2008 | | 2007 |

| | | | |

OPERATING ACTIVITIES | | | | |

| | | | |

Surplus | | $ 86.7 | | $ 236.8 |

Non Cash Items | | | | |

Amortization of Premiums, Discounts and Issue Expenses | | 8.1 | | 7.3 |

Foreign Exchange Expense | | (16.8) | | (30.8) |

Increase in Allowance for Doubtful Accounts | | 58.6 | | 69.9 |

Amortization of Tangible Capital Assets | | 251.3 | | 238.1 |

Loss on Disposal of Tangible Capital Assets | | 1.9 | | 0.3 |

Amortization of Deferred Contributions | | (27.1) | | (23.1) |

Sinking Fund Earnings | | (230.7) | | (231.8) |

Losses on Foreign Exchange Settlements | | 4.5 | | 16.6 |

Decrease in Pension Liability (Note 14) | | (118.3) | | (156.6) |

Increase in Deferred Revenue | | 15.6 | | 41.9 |

(Increase) Decrease in Working Capital | | 63.8 | | (129.3) |

Net Cash From Operating Activities | | 97.6 | | 39.3 |

| | | | |

INVESTING ACTIVITIES | | | | |

| | | | |

Increase in Investments, Loans and Advances | | (198.0) | | (95.0) |

Non-Cash Adjustment - Other Comprehensive Income of | | | | |

Government Enterprises | | 7.9 | | --- |

Net Cash Used in Investing Activities | | (190.1) | | (95.0) |

| | | | |

CAPITAL TRANSACTIONS | | | | |

| | | | |

Acquisition of Capital Assets | | (820.0) | | (365.0) |

Revenue Received to Acquire Tangible Capital Assets | | 165.4 | | 43.5 |

Net Cash Used in Capital Transactions | | (654.6) | | (321.5) |

| | | | |

FINANCING ACTIVITIES | | | | |

| | | | |

Proceeds from Issuance of Funded Debt | | 1,035.0 | | 1,658.5 |

Purchase of NBEFC Debentures | | (301.6) | | (563.2) |

Received from Sinking Fund for Redemption of Debentures and | | | | |

Payment of Exchange | | 180.4 | | 376.7 |

Decrease in Obligations under Capital Leases | | (18.2) | | (17.0) |

Sinking Fund Instalments | | (143.4) | | (129.1) |

Funded Debt Matured | | (537.3) | | (755.5) |

Net Cash From Financing Activities | | 214.9 | | 570.4 |

| | | | |

INCREASE (DECREASE) IN CASH DURING YEAR | | (532.2) | | 193.2 |

CASH POSITION - BEGINNING OF YEAR | | 249.2 | | 56.0 |

CASH POSITION - END OF YEAR | | $ (283.0) | | $ 249.2 |

| | | | |

CASH REPRESENTED BY | | | | |

| | | | |

Cash Net of Short Term Borrowing (Short Term Borrowing Net of Cash) | | $ (283.0) | | $ 249.2 |

| | | | |

The accompanying notes are an integral part of these Financial Statements. | | | | |

| 2008 | PROVINCE OF NEW BRUNSWICK | 25 |

STATEMENT OF CHANGE IN NET DEBT |

for the fiscal year ended 31 March 2008 |

| | | | | |

| (millions) |

| 2008 | | 2008 | | 2007 |

| Budget | | Actual | | Actual |

| | | | | |

OPENING NET DEBT | | | | | |

| | | | | |

As Previously Published | $ (6,577.9) | | $ (6,577.9) | | $ (6,714.2) |

Prior Years' Adjustments | | | | | |

New Brunswick Electric Finance Corporation | | | | | |

Change for Financial Instruments | --- | | (46.2) | | --- |

Consolidation of New Brunswick Credit Union |

Deposit Insurance Corporation | --- | | 2.8 | | 2.8 |

| | | | | |

RESTATED OPENING NET DEBT | (6,577.9) | | (6,621.3) | | (6,711.4) |

| | | | | |

CHANGES IN YEAR | | | | | |

| | | | | |

Annual Surplus | 37.1 | | 86.7 | | 236.8 |

Other Comprehensive Income of Government | | | | | |

Enterprises | --- | | 54.1 | | --- |

Acquisition of Tangible Capital Assets | (777.8) | | (820.0) | | (365.0) |

Amortization of Tangible Capital Assets | 250.4 | | 251.3 | | 238.1 |

Amortization of Deferred Contributions | (25.5) | | (27.1) | | (23.1) |

Loss on Disposal of Tangible Capital Assets | --- | | 1.9 | | 0.3 |

Revenue Received to Acquire Tangible Capital Assets | 159.9 | | 165.4 | | 43.5 |

Net Change in Supplies Inventories | --- | | (3.1) | | (1.9) |

Net Change in Prepaid Expenses | --- | | (30.8) | | 7.6 |

| | | | | |

(INCREASE) DECREASE IN NET DEBT | (355.9) | | (321.6) | | 136.3 |

| | | | | |

NET DEBT - END OF YEAR | $ (6,933.8) | | $ (6,942.9) | | $ (6,575.1) |

| | | | | |

STATEMENT OF CHANGE IN ACCUMULATED DEFICIT |

for the fiscal year ended 31 March 2008 |

| | | | | |

| (millions) |

| 2008 | | 2008 | | 2007 |

| Budget | | Actual | | Actual |

| | | | | |

OPENING ACCUMULATED DEFICIT | | | |

| | | | | |

As Previously Published | $ (1,502.0) | | $ (1,502.0) | | $ (1,738.8) |

Prior Years' Adjustments | | | | | |

New Brunswick Electric Finance Corporation Change | | | | | |

for Financial Instruments | --- | | (46.2) | | --- |

Consolidation of New Brunswick Credit Union Deposit | | | | | |

Insurance Corporation | --- | | 2.8 | | 2.8 |

| | | | | |

RESTATED OPENING ACCUMULATED DEFICIT | (1,502.0) | | (1,545.4) | | (1,736.0) |

| | | | | |

Annual Surplus | 37.1 | | 86.7 | | 236.8 |

Other Comprehensive Income | --- | | 54.1 | | --- |

| | | | | |

ACCUMULATED DEFICIT - END OF YEAR | $ (1,464.9) | | $ (1,404.6) | | $ (1,499.2) |

| | | | | |

The accompanying notes are an integral part of these Financial Statements. |

| 26 | PROVINCE OF NEW BRUNSWICK | 2008 |

NOTES TO THE FINANCIAL STATEMENTS

31 March 2008

NOTE 1

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

a)

Provincial Reporting Entity

These financial statements include those entities which make up the Provincial Reporting Entity. The Provincial Reporting Entity is comprised of certain organizations that are controlled by the government. These organizations are the Consolidated Fund, the General Sinking Fund and the agencies, commissions and corporations listed below.

b)

Basis of Consolidation

Transactions and balances of organizations are included in these financial statements through one of the following accounting methods:

Consolidation method

This method combines the accounts of distinct organizations. It requires uniform accounting policies for the organizations except that tangible capital asset policies of these organizations are not conformed to provincial policies. Inter-organizational balances and transactions are eliminated under this method. This method reports the organizations as if they were one organization. The organizations included through the consolidation method are:

| |

Algonquin Golf Limited; | New Brunswick Highway Corporation; |

Algonquin Properties Limited; | New Brunswick Housing Corporation; |

Arts Development Trust Fund; | New Brunswick Investment Management |

Atlantic Education International Inc.; | Corporation; |

Environmental Trust Fund; | New Brunswick Tire Stewardship Board; |

Forest Protection Limited; | Regional Development Corporation; |

New Brunswick Credit Union Deposit | Regional Health Authorities; |

Insurance Corporation; | Service New Brunswick; |

New Brunswick Distance Education Network Inc.; | Sport Development Trust Fund. |

New Brunswick Energy Efficiency and | |

Conservation Agency; | |

Modified equity method

This method is used for government enterprises. Government enterprises are defined in Note 8 to these financial statements. The modified equity method reports a government enterprise’s net assets as an investment on the Province’s Statement of Financial Position. The net income of the government enterprise is reported as investment income on the Province’s Statement of Operations. Inter-organizational transactions and balances are not eliminated. All gains or losses arising from inter-organizational transactions between government enterprises and other government organizations are eliminated. The accounting policies of government enterprises are not adjusted to conform with those of other government organizations. The organizations that have been included through modified equity accounting are:

| |

Lotteries Commission of New Brunswick; | New Brunswick Municipal Finance Corporation; |

New Brunswick Electric Finance Corporation; | New Brunswick Power Group; |

New Brunswick Liquor Corporation; | New Brunswick Securities Commission. |

Transaction method

This method records only transactions between the Province and the other organizations. The transaction method was used because the appropriate methods would not produce a materially different result. The organizations included through the transaction method are:

| 2008 | PROVINCE OF NEW BRUNSWICK | 27 |

NOTES TO THE FINANCIAL STATEMENTS

31 March 2008

| |

Advisory Council on the Status of Women; | New Brunswick Insurance Board; |

Ambulance New Brunswick Inc.; | New Brunswick Legal Aid Services Commission; |

Fundy Linen Services Inc.; | New Brunswick Museum; |

Kings Landing Corporation; | New Brunswick Public Libraries Foundation; |

New Brunswick Advisory Council on Youth; | New Brunswick Research and Productivity Council; |

New Brunswick Arts Board; | Premier's Council on the Status of Disabled Persons; |

New Brunswick Crop Insurance Commission; | Provincial Holdings Ltd.; |

New Brunswick Energy and Utilities Board; | Strait Crossing Finance Inc. |

c)

Specific Accounting Policies

Accrual Accounting

Expenses are recorded for all goods and services received or consumed during the fiscal year.

Revenues and recoveries are recorded on an accrual basis with the exception of revenue from Canada under the Federal-Provincial Fiscal Arrangements and Federal Post-Secondary Education and Health Contributions Act, 1977, and the Canada-New Brunswick Tax Collection Agreement which is accrued based on information provided by Canada and is adjusted in subsequent years.

Interest revenue is recorded on outstanding loan amounts due to the Province as the interest is earned. The major categories of loans receivable are Student Assistance, Economic Development, Agriculture Development and Fisheries.

Amounts received or recorded as receivable but not earned by the end of the fiscal year are recorded as deferred revenue.

Debt Charges

Interest and other debt service charges are reported in the Statement of Operations as Service of the Public Debt except as described below:

Because government enterprises are included in the Provincial Reporting Entity through modified equity accounting, the cost of servicing their debt is not included in the Service of the Public Debt expense. The cost of servicing the debt of government enterprises is an expense included in the calculation of their net profit or loss for the year.

Interest costs imputed on the Province’s Accrued Pension Liability are recorded as part of pension expense, which is included in various expense functions.

Interest on debt to finance the Student Loan Portfolio is recorded as part of the Education and Training expense function.

Interest earned on the assets of the General Sinking Fund and on other provincial assets is reported as revenue.

Note 13 to these financial statements reports the components of the Service of the Public Debt Expense function and total debt charges.

Government Transfers

Government transfers are transfers of money, such as grants, from a government to an individual, an organization or another government for which the government making the transfer does not receive any goods or services directly in return.

| 28 | PROVINCE OF NEW BRUNSWICK | 2008 |

NOTES TO THE FINANCIAL STATEMENTS

31 March 2008

Government transfers are recognized in the Province's financial statements as expenses or revenues in the period that the events underlying the transfer occurred. Liabilities have been established for any transfers due at 31 March 2008 for which the intended recipients have met the eligibility criteria. Receivables have been established for transfers to which the Province is entitled under governing legislation, regulation or agreement.

Asset Classification

Assets are classified as either financial or non financial. Financial assets are assets that could be used to discharge existing liabilities or finance future operations and are not to be consumed in the normal course of operations. Non-financial assets are acquired, constructed or developed assets that do not provide resources to discharge existing liabilities but are employed to deliver government services, may be consumed in normal operations and are not for resale. Non-financial assets include tangible capital assets, prepaid expenses and inventories of supplies.

Short Term Investments

Short term investments are recorded at cost with supplemental information related to market values of short term investments reported in Note 6 to these financial statements.

Concessionary Loans

There are two situations where the Province charges loan disbursements entirely as expenses. These are:

Loan agreements which commit the Province to provide future grants to the debtor to be used to repay the loan.

Loan agreements which include forgiveness provisions if the forgiveness is considered likely.

In both these situations, the loan is charged to expense when it is disbursed.

Loans that are significantly concessionary because they earn a low rate of return are originally recorded as assets at the net present value of the expected future cash flows. The net present value is calculated using the Province’s borrowing rate at the time the loan was issued. The difference between the nominal value of the loan and its net present value is recorded as an expense.

Inventories

Inventories are recorded at the lower of cost or net realizable value. Inventories include supplies for use, and goods and properties held for resale. Properties held for resale are reported as a financial asset and include land and fixtures acquired or constructed for the purpose of sale. Properties held for resale also include properties acquired through foreclosure. Inventories of supplies for use are reported as a non financial asset.

Allowances

Allowances have been established for loans and accounts receivable, loan guarantees and other possible losses. These allowances are disclosed in the schedules to the financial statements.

Obligations resulting from guaranteed loans are recorded as liabilities when a loss is probable with changes in this allowance recorded annually. As with all provisions for loss, this is an estimate and reflects management’s best estimate of probable losses.

| 2008 | PROVINCE OF NEW BRUNSWICK | 29 |

NOTES TO THE FINANCIAL STATEMENTS

31 March 2008

Each outstanding loan guarantee under the Economic Development Act is reviewed on a quarterly basis. An allowance for loss on loan guarantees is established when it is determined that a loss is probable. A loss is considered probable when one or more of the following factors is present:

·

a decline in the financial position of the borrower;

·

economic conditions in which the borrower operates indicate the borrower’s inability to repay the loan;

·

collection experience for the loan.

Losses on guaranteed loans under the Agriculture Development Act and the Fisheries Development Act for classes that have similar standards are calculated using an average rate based on past experience and trends.

Amounts due to the province but deemed uncollectible are written off from the accounts of the Province once the write-off has been approved by either the Board of Management or Secretary to the Board of Management depending on the dollar value involved.

Tangible Capital Assets

Tangible capital assets are assets owned by the Province which have useful lives greater than one year. Certain dollar thresholds have been established for practical purposes. Computer hardware and software have not been capitalized in the Province’s financial statements.

Tangible capital assets are reported at gross cost. Contributions received to assist in the acquisition of tangible capital assets are reported as Deferred Capital Contributions and amortized to income at the same rate as the related asset.

Tangible capital asset policies of government entities which are consolidated in these financial statements are not adjusted to conform to Provincial policies. The types of items which could differ include amortization rates, estimates of useful lives and dollar thresholds for capitalization.

Trusts under Provincial Administration

Legally established trust funds which the Province administers but does not control are not included as Provincial assets or liabilities. Note 18 to these financial statements discloses the equity balances of the trust funds administered by the Province.

Borrowing on Behalf of New Brunswick Electric Finance Corporation

The Province, as represented by the Consolidated Fund, has issued long term debt securities on behalf of New Brunswick Electric Finance Corporation in exchange for debentures with like terms and conditions.

The New Brunswick Electric Finance Corporation debentures received by the Province are reported in Note 12 of these financial statements as a reduction of Funded Debt. This financing arrangement was used to obtain more favourable debt servicing costs. The transactions involving these securities, including the debt servicing costs, are not part of the budget plan of the Province’s Consolidated Fund.

Foreign Currency Translation and Risk Management

The Province's assets, liabilities and contingent liabilities denominated in foreign currencies are translated to Canadian dollars at the year end rates of exchange, except where such items have been hedged or are subject to interest rate and currency swap agreements. In such cases, the rates established by the hedge or the agreements are used in the translation. Exchange gains and losses are included in the Statement of Operations except for the unrealized exchange gains and losses arising on the translation of long term items, which are deferred and

| 30 | PROVINCE OF NEW BRUNSWICK | 2008 |

NOTES TO THE FINANCIAL STATEMENTS

31 March 2008

amortized on a straight line basis over the remaining life of the related assets or liabilities. Revenue and expense items are translated at the rates of exchange in effect at the respective transaction dates.

The Province borrows funds in both domestic and foreign capital markets and manages its existing debt portfolio to achieve the lowest debt costs within specified risk parameters. As a result, the Province may be exposed to foreign exchange risk. Foreign exchange or currency risk is the risk that the principal and interest payments on foreign debt will fluctuate in Canadian dollar terms due to fluctuations in foreign exchange rates.

In accordance with risk management policy guidelines, the Province uses various financial instruments and techniques to manage exposure to foreign currency risk. These financial instruments include currency forwards, cross-currency swaps and purchases of foreign denominated assets into the Province’s sinking fund.

As at 31 March 2008, the Province had outstanding $764.5 million US$ denominated debt. Of this total, $564.5 million was hedged by entering into cross-currency swaps, which convert the interest and principal payable from US to Canadian dollars.

The Province’s currency exposure was 2.1% of the total debt portfolio prior to netting out the US dollar denominated assets in the sinking fund. A one-cent change in the US/CDN$ foreign exchange rate as of March 31, 2008 would result in a $2.1 million change in the principal amount of Provincial-purpose long term-debt. The hypothetical change, a gain or loss, would be amortized over the remaining life of the related debt issue. A one-cent change would also result in a change of $0.2 million on interest payments in Service of the Public Debt.

The net currency exposure is 0.5% when the US dollar denominated assets held in the sinking fund are netted from the total Provincial-purpose debt portfolio.

Sinking Funds

The General Sinking Fund is maintained by the Minister of Finance under the authority of section 12 of the Provincial Loans Act (“Act”). This Act provides that the Minister shall maintain one or more sinking funds for the payment of funded debt either at maturity or upon redemption in advance of maturity. Typically, redemptions are only made after the related Provincial purpose portion of the debt has been outstanding a minimum of twenty years.

Sinking fund investments in bonds and debentures are reported at par value less unamortized discounts less premiums and the unamortized balance of unrealized foreign exchange gains or losses. Short-term deposits are reported at cost. The Province’s sinking fund may be invested in eligible securities as defined in the Act.

Sinking fund installments are paid into the General Sinking Fund on or before the anniversary date of each issue of funded debt, at the prescribed rate of a minimum of 1% of the outstanding principal.

New Brunswick Electric Finance Corporation (NBEFC) is contractually obligated to pay to the Province the amount of the sinking fund installment required each year in respect of the debentures issued by the Province on behalf of New Brunswick Power Corporation prior to 1 October 2004 and to NBEFC after 30 September 2004.

The following table shows the allocation of various components of the Sinking Fund between the Consolidated Fund of the Province and NBEFC.

| 2008 | PROVINCE OF NEW BRUNSWICK | 31 |

NOTES TO THE FINANCIAL STATEMENTS

31 March 2008

| | | Consolidated Fund | | | NBEFC | | | Total |

| | | | | | | | | |

Fund Equity, beginning of year | | $ | 3,968.2 | | $ | 300.5 | | $ | 4,268.7 |

Sinking Fund Earnings | | | 230.7 | | | (13.0) | | | 217.7 |

Installments | | | 143.4 | | | 35.8 | | | 179.2 |

Paid for Debt Retirement | | | (180.4) | | | (13.9) | | | (194.3) |

| | | | | | | | | |

Fund Equity, end of year | | $ | 4,161.9 | | $ | 309.4 | | $ | 4,471.3 |

Leases

Long term leases, under which the Province, as lessee, assumes substantially all the benefits and risks of ownership of leased property, are classified as capital leases although certain minimum dollar thresholds are in place for practical reasons. The present value of a capital lease is accounted for as a tangible capital asset and an obligation at the inception of the lease.

All leases under which the Province does not assume substantially all the benefits and risks of ownership related to the leased property are classified as operating leases. Each rental payment required by an operating lease is recorded as an expense when it is due.

Measurement Uncertainty

Measurement uncertainty is uncertainty in the determination of the amount at which an item is recognized in financial statements. This uncertainty exists when there is a variance between the recognized amount and another reasonably possible amount. Many items in these financial statements have been measured using estimates. Those estimates have been based on assumptions that reflect economic conditions.

Some examples of where measurement uncertainty exists are the establishment of allowances for doubtful accounts, the determination of pension expense and the calculation of transition balances for Tangible Capital Assets.

NOTE 2

BUDGET

The budget amounts included in these financial statements are the amounts published in the Main Estimates, adjusted for transfers from the Supplementary Funding Provision Program and elimination of inter-account transactions.

The Supplementary Funding Provision Program is an appropriation which provides funding to other programs for costs associated with contract settlements and other requirements not budgeted in a specific program.

Budget figures for the year ending 31 March 2008 reflect the acquisition of tangible capital assets and amortization expense. These amounts are disclosed in the Main Estimates as a separate schedule.

| 32 | PROVINCE OF NEW BRUNSWICK | 2008 |

NOTES TO THE FINANCIAL STATEMENTS

31 March 2008

NOTE 3 PRIOR PERIOD ADJUSTMENT

The financial position and the financial results of the New Brunswick Electric Finance Corporation (NBEFC) are included in the Province’s financial statements through the modified equity method. In 2005, the Canadian Institute of Chartered Accountants (CICA) issued a number of standards that dealt with the recognition, presentation and disclosure of financial instruments. NBEFC adopted these new standards for the fiscal period beginning April 1, 2007.

In accordance with the new accounting standards, the accounting policy changes were applied retroactively without restatement of prior periods. The details on the adoption of these standards can be found in the NBEFC financial statements.

The impact of these changes to the Province’s financial statements is as follows: The investment in NBEFC increased by $7.9 million and net debt decreased by the same amount. This $7.9 million resulted from the difference between the amount of annual other comprehensive income ($54.1 million), which decreased net debt and increased the investment in NBEFC, and the $46.2 million increase in opening net debt (decreased investment in NBEFC).

New Brunswick Credit Union Deposit Insurance Corporation was accounted for using the consolidation method rather than the transaction method in 2008. This resulted in a $2.8 million decrease to opening net debt for both 1 April 2006 and 1 April 2007.

NOTE 4

FISCAL RESPONSIBILITY AND BALANCED BUDGET ACT

The Fiscal Responsibility and Balanced Budget Act requires that total expenses not exceed total revenues for the period commencing 1 April 2007 and ending 31 March 2011.

The Act stipulates that any change made within the last fifteen months of the period from 1 April 2007 to 31 March 2011, or after completion of that period, in relation to the official estimates by the Government of Canada for provincial entitlements under the Federal-Provincial Fiscal Arrangements Act (Canada), the Canada-New Brunswick Tax Collection Agreement or the Comprehensive Integrated Tax Coordination Agreement, shall not be taken into account.

The surplus according to the Fiscal Responsibility and Balanced Budget Act for the period ending 31 March 2008 is as follows:

| | | | | (millions) |

| | | | | | | 2008 | | |

| | | | | | | Actual | | |

| | | | | | | | | |

Revenue | | | | | | $ | 6,962.3 | | |

Adjustments as per section 4(1) of the Act | | | | | | | --- | | |

Revenue as per Fiscal Responsibility and | | | | | | | | | |

Balanced Budget Act | | | | | | | 6,962.3 | | |

Expense | | | | | | | 6,875.6 | | |

| | | | | | | | | |

| | | | | | | | | |

Surplus for the year | | | | | | $ | 86.7 | | |

| 2008 | PROVINCE OF NEW BRUNSWICK | 33 |

NOTES TO THE FINANCIAL STATEMENTS

31 March 2008

The Province is required under the Act to report annually on the ratio of Net Debt to Gross Domestic Product (GDP). The following table presents the ratio for the years ended 31 March 2007 to 31 March 2008.

| | | (millions) |

| | | | | 2008 | | | 2007 | | |

| | | | | | | | | | |

Net Debt | | | | $ | (6,942.9) | | $ | (6,575.1) | | |

| | | | | | | | | | |

GDP (31 December) | | | | $ | 26,410.0 | | $ | 25,346.0 | | |

| | | | | | | | | | |

Ratio of Net Debt to GDP | | | | | 0.3% | | | 0.3% | | |

NOTE 5

SPECIAL PURPOSE ACCOUNTS

Special Purpose Account revenue earned but not spent accumulates as a surplus in that account and may be spent in future years for the purposes specified. At 31 March 2008, the accumulated surplus in all Special Purpose Accounts totaled $105.1 million ($95.0 million 2007). This total is a component of net debt and accumulated deficit.

Descriptions of Major Special Purpose Accounts

CMHC Funding

CMHC funding is used to provide funding for the operation of the programs that fall under the administration of the Social Housing Agreement. Fund revenues include interest earned on the fund, interest earned from second mortgages, and the cumulative excess of funding for social housing not spent to date. Expenditures from the fund are for approved CMHC program funding, any annual excess of which may be carried over for future program expenditures until the agreement expiration date in 2034.

School District Self Sustaining Accounts

Self Sustaining Accounts record school district revenue and expenses for non-educational services such as the rental of school facilities, cafeteria operations and foreign student tuition fees. These special purpose accounts also record partnership activities with third parties to provide resources, services or grants to students.

The table below summarizes the change in the accumulated Special Purpose Account surplus.

| 34 | PROVINCE OF NEW BRUNSWICK | 2008 |

NOTES TO THE FINANCIAL STATEMENTS

31 March 2008

| | | | (millions) |

| | 2007 | | 2008 |

| | Accumulated Surplus | | | Revenue | | | Expense | | | Accumulated Surplus |

Active Community School Sport Project | $ | --- | | $ | 0.3 | | $ | 0.3 | | $ | --- |

Art Smart Project | | --- | | | 0.1 | | | 0.1 | | | --- |

Arts Development Trust Fund | | --- | | | 0.7 | | | 0.7 | | | --- |

Child Centered Family Justice Fund | | 0.1 | | | 0.4 | | | 0.4 | | | 0.1 |

CMHC Funding | | 54.1 | | | 15.7 | | | 13.7 | | | 56.1 |

Environmental Trust Fund | | 7.4 | | | 9.0 | | | 7.3 | | | 9.1 |

Fish Stocking Fund | | 0.6 | | | 0.3 | | | 0.2 | | | 0.7 |

Fred Magee Account | | 0.4 | | | --- | | | --- | | | 0.4 |

Grand Lake Meadows | | 0.1 | | | --- | | | --- | | | 0.1 |

Historic Places | | --- | | | 0.5 | | | 0.4 | | | 0.1 |

Hospital Liability Protection Account | | --- | | | 3.0 | | | 3.0 | | | --- |

International Projects | | 0.1 | | | 2.2 | | | 2.2 | | | 0.1 |

Johann Wordel Account | | 0.1 | | | --- | | | --- | | | 0.1 |

Land Management Account | | 8.7 | | | 1.9 | | | 0.5 | | | 10.1 |

Library Account | | 0.1 | | | 0.4 | | | 0.3 | | | 0.2 |

Medical Research Assistance Account | | 3.2 | | | 0.1 | | | 0.2 | | | 3.1 |

Municipal Police Assistance | | 2.2 | | | 1.3 | | | 1.0 | | | 2.5 |

National Safety Code Agreement | | --- | | | 0.2 | | | 0.2 | | | --- |

Natural Resources Recoverable Projects | | --- | | | 0.1 | | | 0.1 | | | --- |

NB 911 Service Fund | | 1.3 | | | 3.4 | | | 2.3 | | | 2.4 |

NB Community College Scholarship Account | | 0.9 | | | 0.1 | | | 0.1 | | | 0.9 |

Parlee Beach Maintenance | | --- | | | 0.1 | | | 0.1 | | | --- |

Public/Private Partnership Projects | | 0.2 | | | --- | | | --- | | | 0.2 |

Renovation of Old Government House | | 0.3 | | | --- | | | --- | | | 0.3 |

School District Scholarship and Trusts | | --- | | | 0.1 | | | 0.1 | | | --- |

School District Self Sustaining Accounts | | 8.7 | | | 14.2 | | | 11.4 | | | 11.5 |

Sport Development Trust Fund | | --- | | | 0.5 | | | 0.5 | | | --- |

Strait Crossing Finance Inc. | | --- | | | 0.1 | | | 0.1 | | | --- |

Suspended Driver - Alcohol Re-Education | | --- | | | 0.3 | | | 0.3 | | | --- |

Trail Management Trust Fund | | 1.5 | | | 1.2 | | | 1.1 | | | 1.6 |

Training Recoverable Projects | | 2.5 | | | 2.5 | | | 2.8 | | | 2.2 |

Victim Services Account | | 1.3 | | | 2.6 | | | 1.7 | | | 2.2 |

Wildlife Trust Fund | | 1.2 | | | 1.1 | | | 1.2 | | | 1.1 |

$ | 95.0 | | $ | 62.4 | | $ | 52.3 | | $ | 105.1 |

NOTE 6

SHORT TERM INVESTMENTS

The fair value of short-term investments at March 31, 2008 is not materially different from the carrying value. Short-term investments primarily consist of investments in banker’s acceptances and term deposits.

NOTE 7

OBLIGATIONS UNDER CAPITAL LEASES

The total future principal and interest payments for capital leases amount to $1,540.2 million ($1,616.7 million 2007). That amount includes $798.9 million ($817.1 million 2007) in principal and $741.3 million ($799.6 million 2007) in interest.

| 2008 | PROVINCE OF NEW BRUNSWICK | 35 |

NOTES TO THE FINANCIAL STATEMENTS

31 March 2008

Minimum annual principal and interest payments in each of the next five years are as follows:

Fiscal Year | | (millions) |

| | |

2008-2009 | $ | 76.4 |

2009-2010 | | 76.8 |

2010-2011 | | 77.0 |

2011-2012 | | 77.6 |

2012-2013 | | 77.5 |

NOTE 8

GOVERNMENT ENTERPRISES

A Government Enterprise is an organization accountable to the Legislative Assembly that has the power to contract in its own name, has the financial and operating authority to carry on a business, sells goods and services to customers outside the Provincial Reporting Entity as its principal activity, and that can, in the normal course of its operations, maintain its operations and meet its liabilities from revenues received from sources outside the Provincial Reporting Entity.

The following is a list of Government Enterprises, and their fiscal year ends, which are included in the Provincial Reporting Entity as described in Note 1 to these financial statements. In addition we have included summary information for the NB Power Group in the narrative section following the table below. The financial results of the NB Power Group are included in New Brunswick Electric Finance Corporation’s financial statements using the modified equity method.

| |

Lotteries Commission of New Brunswick (Lotteries) | 31-03-08 |

New Brunswick Liquor Corporation (Liquor) | 31-03-08 |

New Brunswick Municipal Finance Corporation (Municipal Finance) | 31-12-07 |

New Brunswick Electric Finance Corporation (NB Electric Finance) | 31-03-08 |

New Brunswick Power Group (NB Power Group) | 31-03-08 |

New Brunswick Securities Commission (Securities) | 31-03-08 |

The following table presents condensed financial information of these Government Enterprises.

| 36 | PROVINCE OF NEW BRUNSWICK | 2008 |

NOTES TO THE FINANCIAL STATEMENTS

31 March 2008

| | (millions) |

| | | | | | Municipal | | NB Electric | | | | |

| | Lotteries | | Liquor | | Finance | | Finance | | Securities | | Total |

Assets | | | | | | | | | | | | |

Cash and | | | | | | | | | | | | |

Equivalents | | $ --- | | $ 0.2 | | $ 1.0 | | $ 0.3 | | $ 1.6 | | $ 3.1 |

Receivables | | 1.2 | | 3.5 | | 4.6 | | 347.7 | | --- | | 357.0 |

Prepaids | | --- | | 0.5 | | --- | | --- | | 0.1 | | 0.6 |

Inventories | | --- | | 23.9 | | --- | | --- | | --- | | 23.9 |

Investments | | --- | | --- | | 0.8 | | 349.7 | | 1.0 | | 351.5 |

Deferred Charges | | --- | | 0.6 | | --- | | --- | | --- | | 0.6 |

Fixed Assets | | --- | | 11.9 | | --- | | --- | | 0.4 | | 12.3 |

Long Term Notes | | | | | | | | | | | | |

Receivable | | --- | | --- | | 565.7 | | 3,172.4 | | --- | | 3,738.1 |

Total Assets | | $ 1.2 | | $ 40.6 | | $ 572.1 | | $ 3,870.1 | | $ 3.1 | | $ 4,487.1 |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Liabilities | | | | | | | | | | | | |

Payables | | $ --- | | $ 17.1 | | $ 4.6 | | $ 319.1 | | $ 0.7 | | $ 341.5 |

Other Long Term | | | | | | | | | | | | |

Liabilities | | --- | | --- | | --- | | 129.2 | | --- | | 129.2 |

Long Term Debt | | --- | | --- | | 566.5 | | 3,712.8 | | --- | | 4,279.3 |

Sinking Funds | | --- | | --- | | --- | | (365.5) | | --- | | (365.5) |

Total Liabilities | | --- | | 17.1 | | 571.1 | | 3,795.6 | | 0.7 | | 4,384.5 |

| | | | | | | | | | | | |

Equity | | | | | | | | | | | | |

Retained Earnings | | 1.2 | | 23.5 | | 1.0 | | 49.4 | | 2.4 | | 77.5 |

Accumulated Other | | | | | | | | | | | | |

Comprehensive Income | | --- | | --- | | --- | | 25.1 | | --- | | 25.1 |

Total Equity | | 1.2 | | 23.5 | | 1.0 | | 74.5 | | 2.4 | | 102.6 |

Total Liabilities and | | | | | | | | | | | | |

Equity | | $ 1.2 | | $ 40.6 | | $ 572.1 | | $ 3,870.1 | | $ 3.1 | | $ 4,487.1 |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Net Income | | | | | | | | | | | | |

Revenue | | $ 128.0 | | $ 381.9 | | $ 28.3 | | $ 402.5 | | $ 10.8 | | $ 951.5 |

Expenses | | (11.0) | | (237.0) | | (1.0) | | (45.4) | | (4.4) | | (298.8) |

Interest and Related | | | | | | | | | | | | |

Expense | | --- | | --- | | (27.4) | | (252.6) | | --- | | (280.0) |

Net Income | | $ 117.0 | | $ 144.9 | | $ (0.1) | | $ 104.5 | | $ 6.4 | | $ 372.7 |