2014-2015

2014-2015 Economic Outlook

Published by:

Department of Finance

Province of New Brunswick

P.O. Box 6000

Fredericton, New Brunswick

E3B 5H1

Canada

Internet: www.gnb.ca/0024/index-e.asp

February 4, 2014

Cover:

Government Services (GS 9643)

Translation:

Translation Bureau, Government Services

Printing and Binding:

Printing Services, New Brunswick Internal Services Agency

ISBN 978-1-55396-377-6

Printed in New Brunswick

Think Recycling!

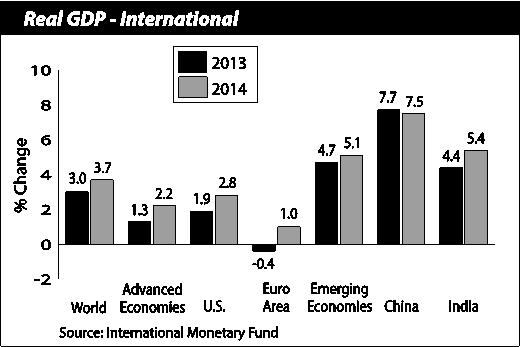

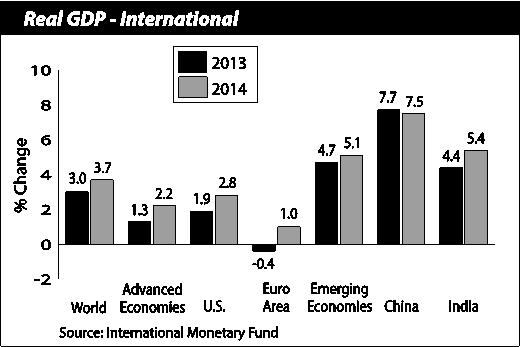

Global Economy

| · | Global economic output grew by 3.0% in 2013, comparable to growth in 2012. According to the International Monetary Fund (IMF), advanced economies grew by 1.3% in 2013, while emerging markets and developing economies expanded by 4.7%. |

| · | Real Gross Domestic Product (GDP) growth will again be led by emerging market economies in 2014. As indicated by the IMF, global output is set to expand by 3.7% in 2014, with emerging economies advancing by 5.1%. |

| · | Growth in the euro area is expected to increase modestly in 2014, driven by a smaller fiscal drag, stronger external demand and gradual improvement in private sector lending conditions. |

| · | The euro area’s core economies – Germany, France, Italy and Spain – are all expected to post stronger growth in 2014 than in 2013. The United Kingdom’s economy is also showing signs of progress. |

| · | China and India will be the main drivers of growth among emerging and developing economies in 2014. However, the pace of economic activity in these countries will be tempered due to sluggish growth among their trading partners and dampened domestic activity.

|

| · | The U.S. economy is expected to grow by 2.8% in 2014, higher than the 2013 rate of 1.9%. Acceleration of the recovery into 2014 is expected to result from less government restraint, continued accommodative monetary policy, better management of household credit and a continued resurgence in the housing market. |

| · | Risks to the U.S. recovery stem mainly from weaker private domestic demand if the effects of automatic federal government spending cuts, tax increases and recent tightening in financing conditions are stronger than anticipated. |

| · | In light of improving economic conditions, the U.S. Federal Reserve began tapering asset purchases in January 2014. A reduced level of purchases will continue to put downward pressure on longer-term interest rates, supporting mortgage markets and making financial conditions more accommodating. |

| · | It is expected the Federal Reserve will keep the federal funds rate at current levels (between 0 and 0.25%) as long as the unemployment rate remains above 6.5% and inflation continues to be well-anchored. This monetary policy stance will likely remain after the asset purchase program ends and the economic recovery strengthens. |

| · | Housing activity should continue its upward trend. The National Association of Home Builders expects housing starts to reach

1.1 million in 2014, up roughly 25% over the 2013 level but still well below pre-recessionary levels. |

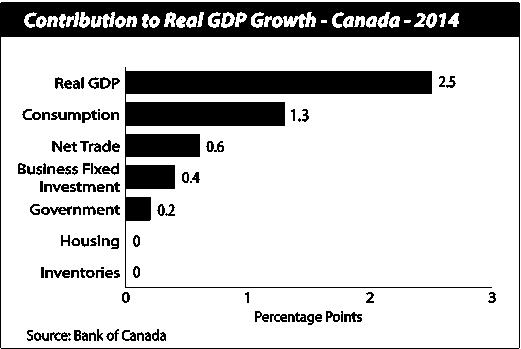

Canadian Economy

| · | Supported largely by an improvement in net trade as well as private consumption, initial indicators suggest the Canadian economy expanded by 1.8% in 2013, on par with 2012 growth. |

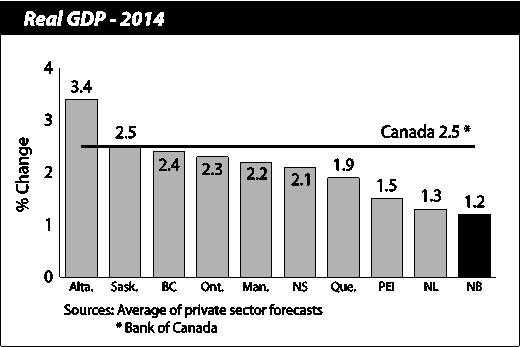

| · | Gains in 2013 were limited by slower-than-expected export growth and weak business fixed investment. Central and eastern provinces had the weakest growth rates in the country. |

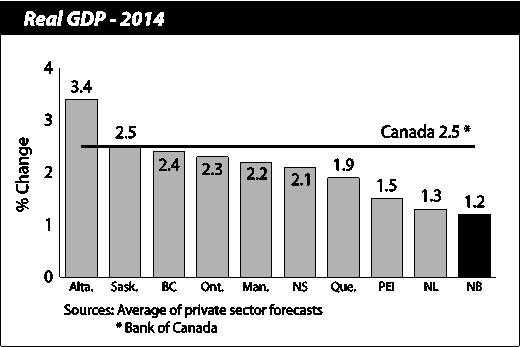

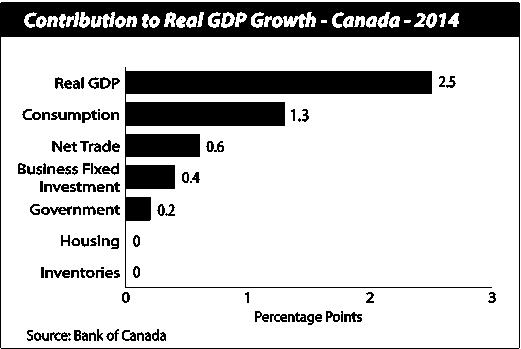

| · | According to the Bank of Canada, the Canadian economy is set to grow by 2.5% in 2014. Following a weaker-than-expected performance in 2013, the Bank anticipates economic momentum will build through 2014 as U.S. business and residential investment expands. |

| · | Despite a slowing in household credit and a gradual rise in mortgage interest rates, household consumption is expected to be a positive contributor to growth in 2014, owing to growth in disposable income. Credit conditions remain supportive of household expenditures with effective borrowing rates at low levels. |

| · | Fiscal consolidation among governments is expected to be scaled back somewhat in 2014, increasing the contribution of public expenditures to economic activity. Business investment should improve, fueled by expanded exports to the U.S. |

| · | The Canada Mortgage and Housing Corporation expects housing starts to remain stable in 2014, around 184,700 units. Further momentum in employment and economic growth will be offset by a potential increase in mortgage rates, determining the pace of housing activity. |

| · | Elevated levels of household debt and overpricing in some regional housing markets remain an important downside risk to the Canadian economy. The IMF recently stated that if the level of historically high household debt persists, any negative growth impacts could be amplified. |

| · | In January 2014, the Bank of Canada kept its target for the overnight rate at 1%. Improved economic activity in 2014 could give rise to increased interest rates if domestic momentum builds faster than expected – especially if consumer credit remains at elevated levels. |

| · | The gap between Western Canada Select crude oil prices and world oil prices, which contributed to slower economic growth over the first half of 2013, is expected to hover around current levels into 2014. As a result of these price disparities, additional investment in pipeline infrastructure geared towards expansion of supply is likely to contribute to increased economic growth over the medium-term. |

| · | According to private sector forecasts, economic growth in 2014 is expected to be strongest in the western provinces. |

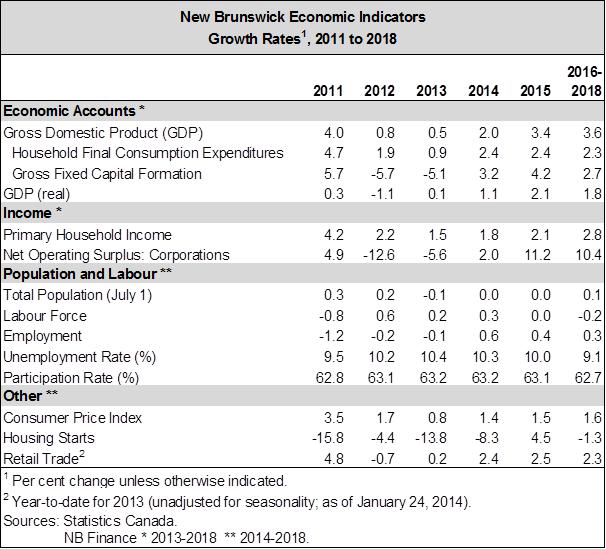

New Brunswick Economy

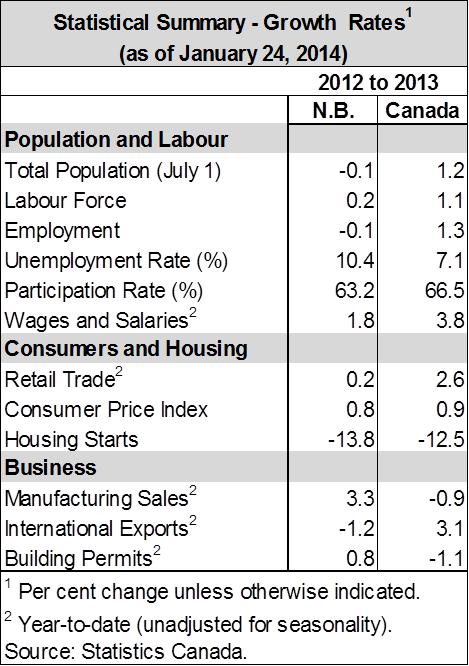

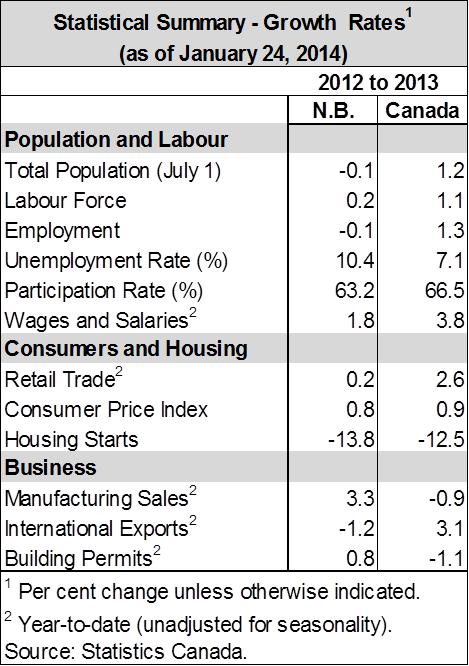

| · | The Department of Finance estimates real economic growth of 0.1% in 2013, down from 0.5% projected at budget last year. This estimate is slightly more prudent than the latest consensus among private sector forecasters as it reflects weakened economic conditions. |

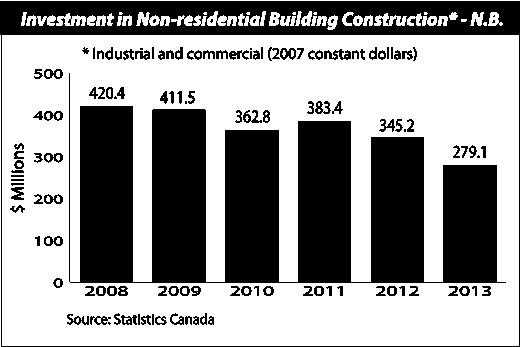

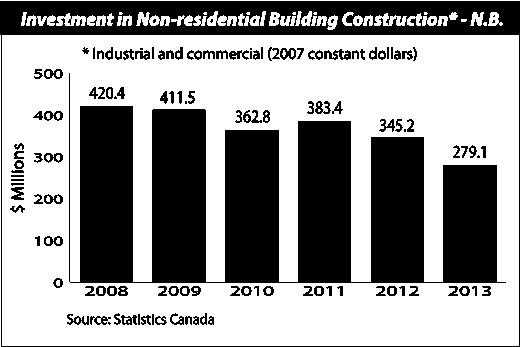

| · | Growth was impacted in 2013 by the closure of Brunswick Mine, the completion of several major projects and the need for sustainable budgets by all levels of government. Slower employment, weaker exports and flat consumer expenditures also constrained growth. |

| · | Part-time job growth partially offset full-time declines leaving overall employment down for the year. Job growth shifted from the service sector to the goods-producing sector, with gains in construction, agriculture and natural resources. |

| · | Although retail sales growth was flat in 2013, signs of improvement were evident as the year progressed, with seasonally adjusted increases in eight of the last eleven months. A solid performance was observed in motor vehicle and parts dealers, the single largest retail subsector. |

| · | Income growth has been less robust. However, wages and salaries for the first three quarters of 2013 show that both goods-producing and service-producing industries are on track to post positive gains for the year. |

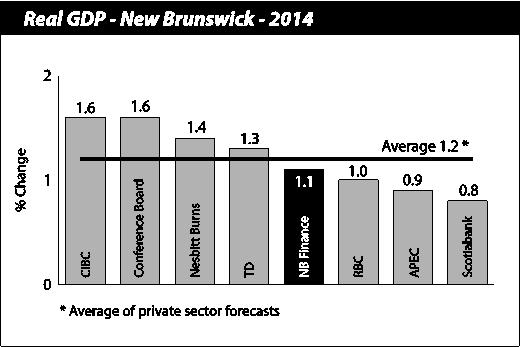

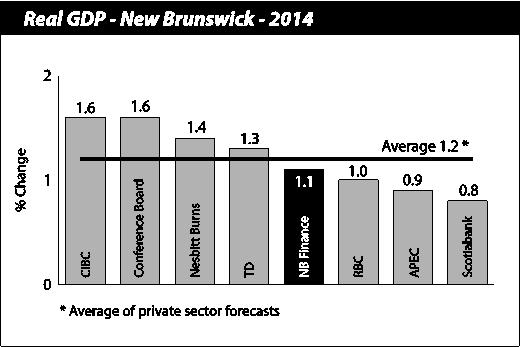

| · | The Department of Finance anticipates an improvement in real GDP growth of 1.1% in 2014, consistent with the consensus among private sector forecasters of 1.2%. |

| · | A stronger domestic economy in 2014 will be supported by a modest improvement in investment activity – led by gains in the primary and agriculture sectors – and a pickup in export demand. |

| · | With U.S. housing starts expected to top 1.1 million and 1.5 million in 2014 and 2015 respectively, forestry exports should post healthy gains. Overall, international trade should be further strengthened by a weaker Canadian dollar. |

| · | Building on upward momentum over the second half of 2013, employment in New Brunswick should improve in 2014. Job gains will be supported by increased activity in the forestry and trade sectors but employment growth will still be relatively muted until proposed major projects materialize. |

| · | Primary household income growth is expected to remain weak until the provincial labour market shows sustained improvement, resulting in continued slow growth in consumer spending over the medium-term. |

| · | The need for sustainable budget balances will limit the extent to which all levels of government will contribute to economic growth in the near-term. |

| · | Looking ahead to 2015, renewed strength in the U.S. and Canada should continue to enhance the province’s exports. Upward potential also exists in the mining sector through increased production by small base metal producers. With this anticipated pickup in activity, current expectations are for real GDP growth to advance to 2.1%. |

| · | Construction of the Sisson Brook tungsten mine is expected to contribute to growth over the 2014-2016 period should the project receive the necessary regulatory approval. An endorsement would signify considerable investment at the development and construction phases, and production would maintain jobs and substantial economic activity throughout its 27-year lifespan. |

| · | The proposed Energy East Pipeline represents significant economic potential pending regulatory approval in 2015. The construction phase alone carries with it $2 billion in investment spending over its three-year horizon. |

| · | The Comprehensive Economic and Trade Agreement (CETA) will open up the European Union market to New Brunswick exporters, particularly within the seafood and forest products industries, allowing for further trade growth. |

| · | Natural gas development over the medium-term could boost investment spending, job creation and government revenues if the project is economically viable. |

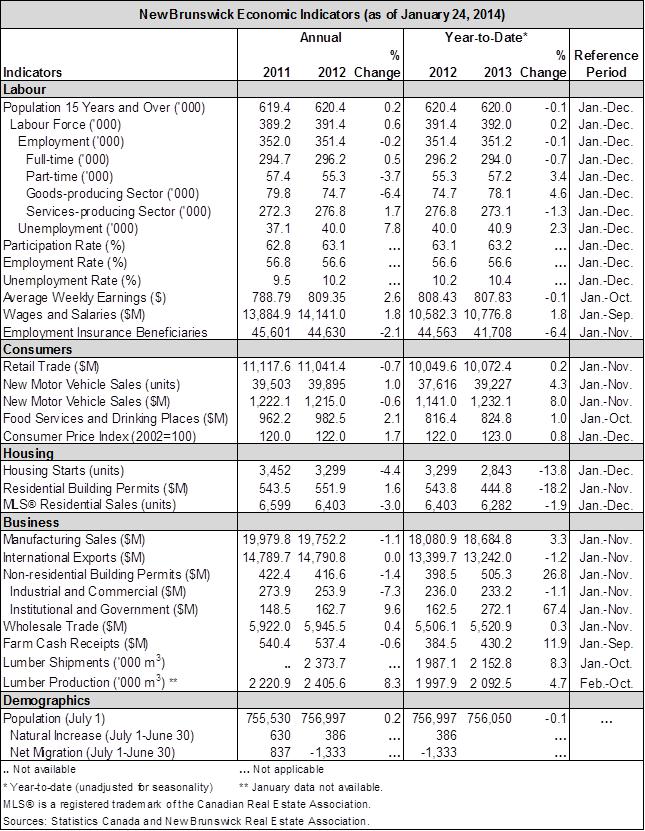

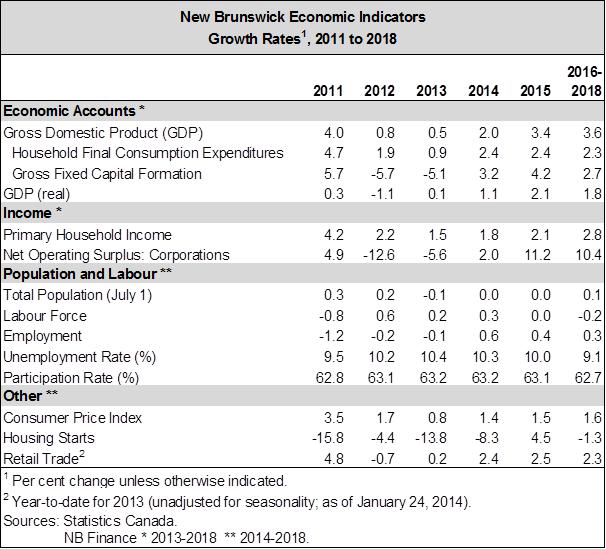

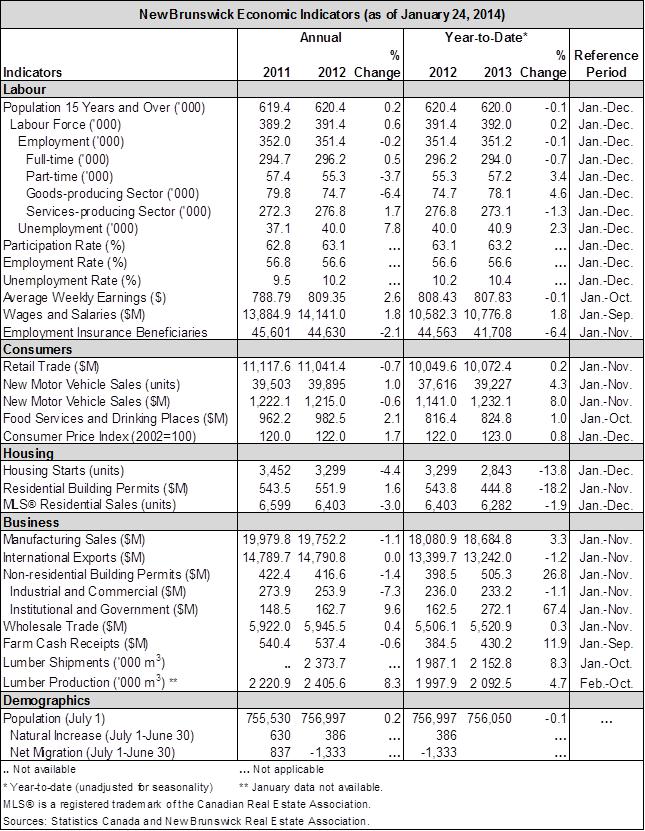

New Brunswick Economic Indicators