UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-6094 |

|

THE LATIN AMERICA EQUITY FUND, INC. |

(Exact name of registrant as specified in charter) |

|

Eleven Madison Avenue, New York, New York | | 10010 |

(Address of principal executive offices) | | (Zip code) |

|

J. Kevin Gao, Esq. |

The Latin America Equity Fund, Inc. |

Eleven Madison Avenue |

New York, New York 10010 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (212) 325-2000 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | January 1, 2008 to June 30, 2008 | |

| | | | | | | | | |

Item 1. Reports to Stockholders.

THE LATIN AMERICA

EQUITY FUND, INC.

SEMI-ANNUAL REPORT

JUNE 30, 2008

(unaudited)

LAQ-SAR-0608

LETTER TO SHAREHOLDERS (UNAUDITED)

August 18, 2008

Dear Shareholder:

For the semiannual period ended June 30, 2008, The Latin America Equity Fund, Inc. (the "Fund") had an increase in its net asset value (NAV) of 4.44%, assuming reinvestment of dividends and distributions, net of all fees, expenses and taxes. By comparison, the Morgan Stanley Capital International DailyTR Net Emerging Markets Latin America Index* ("MSCI Latin America") had an increase of 9.32% (total return index, net of foreign taxation) for the period. Based on market price, the Fund's shares rose 5.52% during the period.

Market Review: Brazil continues to outperform

Global equity markets have been weak in the first half of 2008, plagued by a combination of higher oil prices, higher inflation (driven by food and energy prices) and lower economic growth. This is particularly true in the United States and Europe, where the credit crunch has exacted a heavy toll on financial companies as the deleveraging process works its way through the economy. However, although returns in the first half of 2008 were far lower than in recent years, given the volatile state of global equity markets, Latin American equities have actually outperformed most other regions of the world. Consider that during the same period, the MSCI Emerging Markets Index (price only) fell by 12.7%, while the MSCI World Index (price only) fell by 11.7%.

For the first time in many months, macroeconomic fundamentals are giving investors cause for concern as the rise in food and energy prices begins to feed through into inflationary expectations. The Central Banks of Brazil, Mexico, Chile, Peru and Colombia are all in tightening mode.

Although commodity prices remain firm at present, the combination of higher oil prices and the crisis in many financial and real estate markets in the developed world have raised the specter of stagflation.

Within Latin America, Brazil was the clear driver among the major markets, boosted at the end of April by Standard and Poor's somewhat unexpected decision to upgrade Brazilian sovereign risk to investment grade. Mexico and Chile were laggards. Among the peripheral markets, Argentina was the top performer. The picture, however, is distorted by the outperformance of index heavyweight Tenaris (2.3% of the Fund as of June 30, 2008). Outside of Tenaris, Argentina performed poorly. Additionally, Colombia and Peru underperformed. In the case of Colombia, share prices were negatively impacted by MSCI's announcement that they were considering downgrading Colombia to "Frontier Market" status due to the continuing existence of capital controls.

Strategic Review and Outlook: Anticipating continued economic stability

In the course of January and February, for the first time in many years, we reduced our exposure to Brazil due to concerns about increasing risk aversion, the prospect of slower global growth, and lower commodity prices. The underweight was achieved mostly by reducing our exposure to the steel, other materials, and financial sectors. We did not anticipate the impact of S&P's upgrade of Brazil and this hurt our relative performance.

1

LETTER TO SHAREHOLDERS (UNAUDITED) (CONTINUED)

We believe that the environment in the second half of 2008 is likely to be significantly more challenging for the asset class, given that several of the key recent drivers are no longer present: a) domestic demand conditions are likely to become tougher given higher interest rates and slowing growth; b) external demand conditions are also likely to soften as economic activity in the United States and Europe slows, raising important questions about the level of commodity prices; and c) strengthening currencies around the region have meant higher imports and pressure on exporters, putting stress on the current account in spite of high commodity prices. To us, the risk seems to be more on the side of currency depreciation, rather than currency appreciation.

We remain relatively underweight the stocks and markets most exposed to global growth. Additionally, we remain:

• Underweight commodity names, particularly in the steel sector, but also base and precious metals;

• Neutral in bulk commodities, notably iron ore;

• Overweight in names oriented to domestic demand and names sensitive to demand for credit;

• Overweight in names exposed to infrastructure investment; and

• Underweight in Brazil and Chile, while overweight in Mexico and Colombia.

We continue to believe that this period of market turbulence will prove to have been an excellent buying opportunity for emerging market assets. We remain on the lookout for mispriced stocks with good fundamentals, good management, and that are executing their business models well. In our defensive mood, we tend to favor stocks with strong balance sheets, good free cash flow and proven business models.

With a longer term perspective, we remain bullish on the prospects for equities in Latin America. The underlying supply/demand fundamentals for materials, as a result of demand from the Asia Pacific region in particular, are clearly supportive. If external demand for raw materials constitutes the base upon which the economic model rests, the next phase will be driven by the progressive deepening of domestic financial markets and further dismantling of barriers to trade and investment, coupled with the deregulation of sectors of the economy previously reserved for the State. These are all factors that should lead to further investment and job creation, accompanied by credit penetration, leading ultimately to the creation of wealth and the consolidation of a growing middle class. We believe that this scenario will provide excellent investment opportunities for investors over the years to come.

Respectfully,

| |  | |

|

Matthew J.K. Hickman

Chief Investment Officer ** | | George Hornig

Chief Executive Officer and President *** | |

|

2

LETTER TO SHAREHOLDERS (UNAUDITED) (CONTINUED)

International investing entails special risk considerations, including currency fluctuations, lower liquidity, economic and political risks, and differences in accounting methods; these risks are generally heightened for emerging-market investments.

In addition to historical information, this report contains forward-looking statements, which may concern, among other things, domestic and foreign market, industry and economic trends and developments and government regulation and their potential impact on the Fund's investments. These statements are subject to risks and uncertainties and actual trends, developments and regulations in the future and their impact on the Fund could be materially different from those projected, anticipated or implied. The Fund has no obligation to update or revise forward-looking statements.

* The Morgan Stanley Capital International DailyTR Net Emerging Markets Latin America Index is a total return free float-adjusted market capitalization index that is designed to measure equity-market performance in Latin America, including an assumption for the reinvestment of dividends, net of all foreign taxes payable. It is the exclusive property of Morgan Stanley Capital International Inc. Investors cannot invest directly in an index.

** Matthew J.K. Hickman, Director, is a Portfolio Manager specializing in Latin American equities and has primary responsibility for management of the Fund's assets. He has specialized in Latin American financial markets since 1987. He joined Credit Suisse in 2003 from Compass Group Investment Advisors, where he was General Manager of the private wealth management division based in Santiago, Chile. For much of Mr. Hickman's career he worked as a sell-side equity analyst at various investment banks, focusing on Latin American telecommunications companies and several Latin American country markets. Prior to this, he worked at Rothschild Asset Management where he was a member of the management team for the Five Arrows Chile Fund. Mr. Hickman holds a BA in Modern Languages from Cambridge University and a diploma in corporate finance from London Business School. He is fluent in Spanish, Portuguese and French. He is also the Chief Investment Offic er of The Chile Fund, Inc.

*** George Hornig is a Managing Director of Credit Suisse. He is the Chief Operating Officer of Alternative Investments and Chairman of the Asset Management Americas Operating Committee. Mr. Hornig has been associated with Credit Suisse since 1999.

3

THE LATIN AMERICA EQUITY FUND, INC.

PORTFOLIO SUMMARY

JUNE 30, 2008 (UNAUDITED)

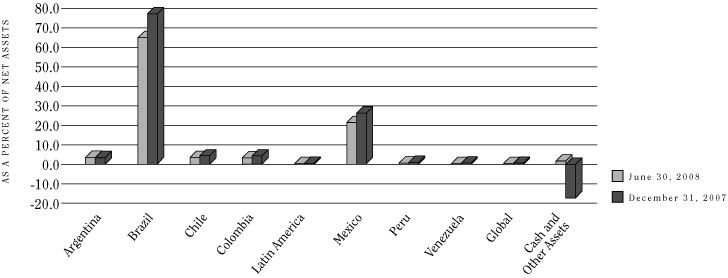

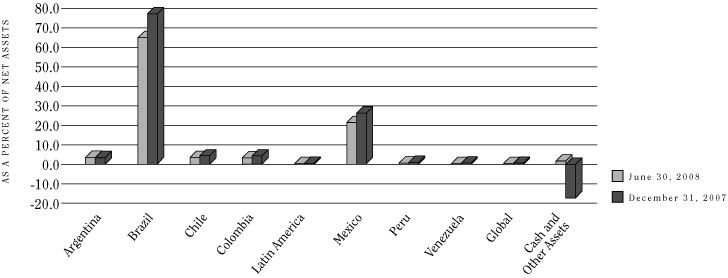

GEOGRAPHIC ASSET BREAKDOWN

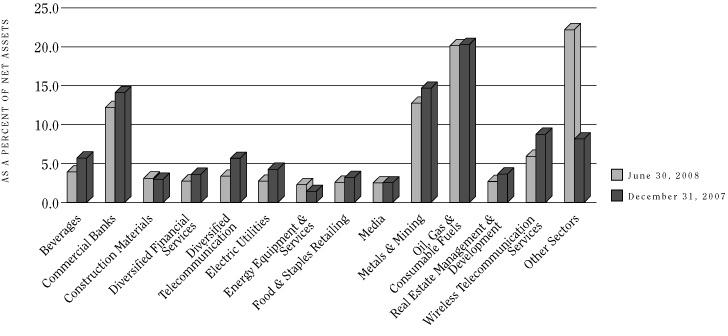

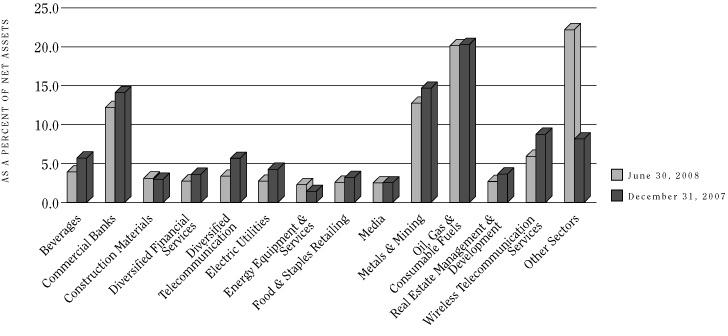

SECTOR ALLOCATION

4

THE LATIN AMERICA EQUITY FUND, INC.

PORTFOLIO SUMMARY (CONTINUED)

JUNE 30, 2008 (UNAUDITED)

TOP 10 HOLDINGS, BY ISSUER

| | Holding | | Sector | | Country | | Percent of

Net Assets | |

| | 1. | | | Petróleo Brasileiro S.A. | | Oil, Gas & Consumable Fuels | | Brazil | | | 20.3 | | |

| | 2. | | | Companhia Vale do Rio Doce | | Metals & Mining | | Brazil | | | 9.1 | | |

| | 3. | | | América Móvil, SAB de C.V. | | Wireless Telecommunication Services | | Mexico | | | 6.0 | | |

| | 4. | | | Cemex SAB de C.V. | | Construction Materials | | Mexico | | | 3.1 | | |

| | 5. | | | Fomento Economico Mexicano, S.A. de C.V. | | Beverages | | Mexico | | | 2.5 | | |

| | 6. | | | Tenaris S.A. | | Energy Equipment & Services | | Argentina | | | 2.3 | | |

| | 7. | | | Banco Bradesco S.A. | | Commercial Banks | | Brazil | | | 2.3 | | |

| | 8. | | | Investimentos Itaú S.A. | | Commercial Banks | | Brazil | | | 1.7 | | |

| | 9. | | | Banco Itaú Holding Financeira S.A. | | Commercial Banks | | Brazil | | | 1.6 | | |

| | 10. | | | União de Bancos Brasileiros S.A. | | Commercial Banks | | Brazil | | | 1.5 | | |

5

THE LATIN AMERICA EQUITY FUND, INC.

AVERAGE ANNUAL RETURNS

JUNE 30, 2008 (UNAUDITED)

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years | |

| Net Asset Value (NAV) | | | 22.50 | % | | | 45.77 | % | | | 44.75 | % | | | 20.58 | % | |

| Market Value | | | 26.31 | % | | | 47.87 | % | | | 46.76 | % | | | 22.39 | % | |

Credit Suisse may waive fees and/or reimburse expenses, without which performance would be lower. Waivers and/or reimbursements are subject to change and may be discontinued at any time. Returns represent past performance. Total investment return at net asset value is based on changes in the net asset value of fund shares and assumes reinvestment of dividends and distributions, if any. Total investment return at market value is based on changes in the market price at which the fund's shares traded on the stock exchange during the period and assumes reinvestment of dividends and distributions, if any, at actual prices pursuant to the fund's dividend reinvestment program. Because the fund's shares trade in the stock market based on investor demand, the fund may trade at a price higher or lower than its NAV. Therefore, returns are calculated based on share price and NAV. Past performance is no guarantee of future results. The current performance of the fund may be lower or higher than the figures shown. The fund's yield, return and market price and NAV will fluctuate. Performance information current to the most recent month-end is available by calling 800-293-1232.

The annualized gross expense ratio is 1.24%. The annualized net expense ratio after fee waivers and/or expense reimbursements is 1.24%.

6

THE LATIN AMERICA EQUITY FUND, INC.

SCHEDULE OF INVESTMENTS

JUNE 30, 2008 (UNAUDITED)

| Description | | No. of

Shares | | Value | |

| EQUITY OR EQUITY-LINKED SECURITIES-98.33% | |

| ARGENTINA-3.10% | |

| CAPITAL MARKETS-0.42% | |

| Pampa Holding SA, GDR†† | | | 3,002,825 | | | $ | 1,459,827 | | |

| COMMERCIAL BANKS-0.19% | |

| Banco Patagonia SA, BDR† | | | 55,800 | | | | 673,600 | | |

| ENERGY EQUIPMENT & SERVICES-2.32% | |

| Tenaris S.A., ADR | | | 109,200 | | | | 8,135,400 | | |

| THRIFTS & MORTGAGE FINANCE-0.17% | |

| Banco Hipotecario S.A., ADR† | | | 157,700 | | | | 589,341 | | |

TOTAL ARGENTINA

(Cost $8,030,014) | | | 10,858,168 | | |

| Brazil-65.60% | |

| AIR FREIGHT & LOGISTICS-0.62% | |

Log-in Logistica

Intermodal SA† | | | 289,663 | | | | 2,185,449 | | |

| AIRLINES-1.10% | |

| Tam S.A., PN | | | 202,400 | | | | 3,858,389 | | |

| BEVERAGES-1.19% | |

Companhia de Bebidas

das Americas, ADR | | | 11,200 | | | | 660,240 | | |

Companhia de Bebidas

das Americas, ADR, PN | | | 55,512 | | | | 3,516,685 | | |

| | | | 4,176,925 | | |

| BUILDING PRODUCTS-0.05% | |

Companhia Providencia

Industria e Comercio† | | | 48,900 | | | | 169,405 | | |

| CAPITAL MARKETS-0.22% | |

| Clean Energy Brazil PLC† | | | 477,912 | | | | 727,604 | | |

Clean Energy Brazil PLC,

warrants (Strike GBp 100,

expiring 12/18/11)† | | | 126,750 | | | | 31,531 | | |

| | | | 759,135 | | |

| Description | | No. of

Shares | | Value | |

| COMMERCIAL BANKS-8.55% | |

| Banco Bradesco S.A., PN | | | 388,109 | | | $ | 8,050,120 | | |

Banco Industrial e

Comercial SA, PN† | | | 334,593 | | | | 1,735,550 | | |

Banco Itaú Holding

Financeira S.A., PN | | | 268,025 | | | | 5,493,628 | | |

| Banco Panamericano SA† | | | 573,500 | | | | 3,209,148 | | |

| Investimentos Itaú S.A., PN | | | 951,361 | | | | 6,083,207 | | |

União de Bancos

Brasileiros S.A., GDR | | | 42,100 | | | | 5,343,753 | | |

| | | | 29,915,406 | | |

| COMPUTERS & PERIPHERALS-0.30% | |

| Positivo Informatica SA | | | 103,600 | | | | 1,041,537 | | |

| DIVERSIFIED FINANCIAL SERVICES-1.42% | |

| Bradespar S.A., PN | | | 180,800 | | | | 4,982,373 | | |

| DIVERSIFIED TELECOMMUNICATION-3.12% | |

Brasil Telecom

Participações S.A. | | | 32,621 | | | | 1,087,025 | | |

Brasil Telecom

Participações S.A., ADR | | | 14,100 | | | | 1,034,517 | | |

| GVT Holding SA† | | | 123,900 | | | | 3,038,101 | | |

Telecomunicações de

São Paulo S.A., PN | | | 65,600 | | | | 1,849,833 | | |

Tele Norte Leste

Participações S.A., ON | | | 134,623 | | | | 3,917,229 | | |

| | | | 10,926,705 | | |

| ELECTRIC UTILITIES-2.43% | |

Centrais Elétricas

Brasileiras S.A., PNB | | | 82,423 | | | | 1,349,965 | | |

Companhia Energética de

Minas Gerais, ADR | | | 121,146 | | | | 2,974,134 | | |

| EDP - Energias do Brasil S.A. | | | 77,551 | | | | 1,555,408 | | |

| Terna Participações S.A. | | | 131,118 | | | | 2,638,023 | | |

| | | | 8,517,530 | | |

| FOOD PRODUCTS-2.32% | |

| Cosan S.A. Industria e Comercio | | | 170,013 | | | | 2,960,931 | | |

Marfrig Frigorificos e

Comercio de Alimentos SA† | | | 93,000 | | | | 1,213,298 | | |

See accompanying notes to financial statements.

7

THE LATIN AMERICA EQUITY FUND, INC.

SCHEDULE OF INVESTMENTS (CONTINUED)

JUNE 30, 2008 (UNAUDITED)

| Description | | No. of

Shares | | Value | |

| FOOD PRODUCTS (CONTINUED) | |

| Perdigao S.A. | | | 95,684 | | | $ | 2,599,501 | | |

| Sao Martinho SA | | | 82,400 | | | | 1,341,817 | | |

| | | | 8,115,547 | | |

| HEALTH CARE PROVIDERS & SERVICES-0.69% | |

| Diagnosticos da America S.A. | | | 93,399 | | | | 2,425,262 | | |

| HOUSEHOLD DURABLES-0.31% | |

| Springs Global Participacoes SA† | | | 121,000 | | | | 1,084,093 | | |

INDEPENDENT POWER PRODUCERS &

ENERGY TRADERS-0.69% | |

Companhia Energetica de

Sao Paulo, PN† | | | 41,700 | | | | 859,956 | | |

| Tractebel Energia S.A. | | | 104,652 | | | | 1,572,576 | | |

| | | | 2,432,532 | | |

| INSURANCE-1.03% | |

| Sul America SA† | | | 197,000 | | | | 3,604,338 | | |

| INTERNET & CATALOG RETAIL-0.63% | |

B2W Compania Global

do Varejo | | | 60,000 | | | | 2,214,021 | | |

| IT SERVICES-0.33% | |

| Redecard SA | | | 59,800 | | | | 1,165,169 | | |

| MACHINERY-0.83% | |

| Metalfrio Solutions SA† | | | 124,620 | | | | 1,517,692 | | |

| Weg S.A. | | | 109,499 | | | | 1,385,863 | | |

| | | | 2,903,555 | | |

| MEDIA-0.77% | |

Net Servicos de

Comunicacao SA, PN† | | | 211,403 | | | | 2,698,196 | | |

| METALS & MINING-11.29% | |

Companhia Vale do

Rio Doce, ADR, PNA | | | 1,072,500 | | | | 32,003,400 | | |

| Gerdau S.A., PN | | | 114,912 | | | | 2,774,361 | | |

Usinas Siderúrgicas de

Minas Gerais S.A. | | | 26,248 | | | | 1,249,276 | | |

| Description | | No. of

Shares | | Value | |

| METALS & MINING (CONTINUED) | |

Usinas Siderúrgicas de

Minas Gerais S.A., PNA | | | 70,375 | | | $ | 3,495,520 | | |

| | | | 39,522,557 | | |

| MULTILINE RETAIL-0.77% | |

| Lojas Americanas S.A., PN | | | 191,124 | | | | 1,261,743 | | |

| Lojas Renner S.A. | | | 71,300 | | | | 1,429,138 | | |

| | | | 2,690,881 | | |

| OIL, GAS & CONSUMABLE FUELS-20.29% | |

| Petróleo Brasileiro S.A., ADR | | | 1,226,000 | | | | 71,046,700 | | |

| PAPER & FOREST PRODUCTS-0.48% | |

Suzano Papel e

Celulose S.A., PN | | | 39,400 | | | | 643,331 | | |

Votorantim Celulose e

Papel S.A., PN | | | 38,612 | | | | 1,046,566 | | |

| | | | 1,689,897 | | |

| PERSONAL PRODUCTS-0.18% | |

| Natura Cosmeticos S.A. | | | 59,037 | | | | 612,456 | | |

| REAL ESTATE MANAGEMENT & DEVELOPMENT-2.73% | |

| General Shopping Brasil SA† | | | 317,000 | | | | 2,491,355 | | |

| Klabin Segall S.A. | | | 104,781 | | | | 655,499 | | |

MRV Engenharia e

Participacoes† | | | 14,373 | | | | 320,806 | | |

Multiplan Empreendimentos

Imobiliarios SA† | | | 176,800 | | | | 2,156,504 | | |

PDG Realty SA

Empreendimentos e

Particpações | | | 206,498 | | | | 2,971,857 | | |

| Trisul S.A.† | | | 200,000 | | | | 949,387 | | |

| | | | 9,545,408 | | |

| ROAD & RAIL-2.23% | |

| All America Latina Logistica | | | 237,400 | | | | 3,079,259 | | |

| Localiza Rent a Car SA | | | 229,100 | | | | 2,549,557 | | |

| Tegma Gestao Logistica SA | | | 173,280 | | | | 2,164,774 | | |

| | | | 7,793,590 | | |

See accompanying notes to financial statements.

8

THE LATIN AMERICA EQUITY FUND, INC.

SCHEDULE OF INVESTMENTS (CONTINUED)

JUNE 30, 2008 (UNAUDITED)

| Description | | No. of

Shares | | Value | |

| TEXTILES, APPAREL & LUXURY GOODS-0.27% | |

Companhia de Tecidos Norte

de Minas S.A., PN | | | 192,000 | | | $ | 953,662 | | |

| TRANSPORTATION INFRASTRUCTURE-0.76% | |

| Obrascon Huarte Lain Brasil S.A. | | | 85,672 | | | | 1,438,191 | | |

| Wilson Sons Ltd., BDR† | | | 95,900 | | | | 1,229,425 | | |

| | | | 2,667,616 | | |

TOTAL BRAZIL

(Cost $97,506,772) | | | 229,698,334 | | |

| CHILE-3.63% | |

| BEVERAGES-0.27% | |

| Viña Concha y Toro S.A. | | | 540,000 | | | | 930,487 | | |

| COMMERCIAL BANKS-0.33% | |

| Banco Santander Chile S.A. | | | 28,113,969 | | | | 1,142,272 | | |

| DIVERSIFIED TELECOMMUNICATION-0.29% | |

Empresa Nacional de

Telecomunicaciones S.A. | | | 77,000 | | | | 1,022,867 | | |

| ELECTRIC UTILITIES-0.33% | |

| Enersis S.A. | | | 3,780,000 | | | | 1,169,257 | | |

| FOOD & STAPLES RETAILING-0.24% | |

| Cencosud S.A. | | | 280,000 | | | | 835,404 | | |

INDEPENDENT POWER PRODUCERS &

ENERGY TRADERS-0.78% | |

Empresa Nacional de

Electricidad S.A. | | | 1,249,910 | | | | 1,800,089 | | |

| Gener S.A. | | | 2,609,014 | | | | 920,866 | | |

| | | | 2,720,955 | | |

| INDUSTRIAL CONGLOMERATES-0.51% | |

| Antarchile S.A. | | | 33,025 | | | | 548,067 | | |

| Empresas Copec S.A. | | | 98,000 | | | | 1,227,441 | | |

| | | | 1,775,508 | | |

| PAPER & FOREST PRODUCTS-0.39% | |

| Empresas CMPC S.A. | | | 45,000 | | | | 1,366,354 | | |

| Description | | No. of

Shares | | Value | |

| WATER UTILITIES-0.49% | |

Inversiones Aguas

Metropolitanas S.A., ADR†† | | | 84,144 | | | $ | 1,732,104 | | |

TOTAL CHILE

(Cost $9,208,471) | | | 12,695,208 | | |

| COLOMBIA-3.43% | |

| COMMERCIAL BANKS-1.46% | |

| Bancolombia S.A. | | | 440,412 | | | | 3,417,089 | | |

| Bancolombia S.A., ADR | | | 14,200 | | | | 445,738 | | |

Corporacion Financiera

Colombiana | | | 172,457 | | | | 1,238,615 | | |

| | | | 5,101,442 | | |

| DIVERSIFIED FINANCIAL SERVICES-1.01% | |

| Suramericana de Inversiones S.A. | | | 428,416 | | | | 3,526,150 | | |

| FOOD & STAPLES RETAILING-0.67% | |

| Almacenes Exito S.A., GDR† †† | | | 356,000 | | | | 2,370,223 | | |

| METALS & MINING-0.29% | |

| Acerias Paz del Rio S.A.† | | | 32,217,991 | | | | 1,013,410 | | |

TOTAL COLOMBIA

(Cost $10,926,601) | | | 12,011,225 | | |

| LATIN AMERICA-0.14% | |

| VENTURE CAPITAL-0.14% | |

J.P. Morgan Latin America

Capital Partners, L.P.†‡#

(Cost $841,494) | | | 2,428,022 | | | | 478,806 | | |

| MEXICO-21.53% | |

| BEVERAGES-2.50% | |

Fomento Economico

Mexicano, S.A. de C.V., ADR | | | 192,436 | | | | 8,757,762 | | |

| COMMERCIAL BANKS-0.98% | |

Grupo Financiero

Banorte S.A.B. de C.V. | | | 727,700 | | | | 3,425,301 | | |

See accompanying notes to financial statements.

9

THE LATIN AMERICA EQUITY FUND, INC.

SCHEDULE OF INVESTMENTS (CONTINUED)

JUNE 30, 2008 (UNAUDITED)

| Description | | No. of

Shares | | Value | |

| CONSTRUCTION & ENGINEERING-0.87% | |

Empresas ICA S.A.B. de

C.V., ADR† | | | 122,155 | | | $ | 3,034,330 | | |

| CONSTRUCTION MATERIALS-3.13% | |

| Cemex SAB de C.V., ADR† | | | 444,565 | | | | 10,980,756 | | |

| DIVERSIFIED FINANCIAL SERVICES-0.35% | |

| Bolsa Mexicana de Valores SA† | | | 875,000 | | | | 1,236,443 | | |

| FOOD & STAPLES RETAILING-1.68% | |

Controladora Comercial

Mexicana S.A. de C.V. | | | 441,920 | | | | 1,327,422 | | |

Wal-Mart de México, S.A. de

C.V., Series V | | | 832,817 | | | | 3,304,191 | | |

Wal-Mart de México, S.A. de

C.V., Series V, ADR | | | 31,594 | | | | 1,258,702 | | |

| | | | 5,890,315 | | |

| HOTELS, RESTAURANTS & LEISURE-0.26% | |

| Alsea, S.A. de C.V. | | | 711,600 | | | | 897,118 | | |

| HOUSEHOLD DURABLES-1.43% | |

| Consorcio ARA, S.A. de C.V. | | | 812,600 | | | | 750,790 | | |

Corporación GEO, S.A. de

C.V., Series B† | | | 350,200 | | | | 1,172,913 | | |

Urbi, Desarrollos Urbanos, S.A.

de C.V.† | | | 887,438 | | | | 3,079,064 | | |

| | | | 5,002,767 | | |

| MEDIA-1.81% | |

| Grupo Televisa S.A., ADR | | | 179,000 | | | | 4,227,980 | | |

| Grupo Televisa S.A., CPO | | | 2,100 | | | | 9,952 | | |

| Megacable Holdings SAB de CV† | | | 716,350 | | | | 2,085,002 | | |

| | | | 6,322,934 | | |

| METALS & MINING-1.24% | |

Grupo Mexico SA de

C.V., Class B | | | 1,905,924 | | | | 4,326,538 | | |

| PHARMACEUTICALS-0.69% | |

| Genomma Lab Internacional SA | | | 1,570,000 | | | | 2,422,710 | | |

| Description | | No. of

Shares | | Value | |

| TRANSPORTATION INFRASTRUCTURE-0.61% | |

Grupo Aeroportuario del

Centro Norte, S.A.B.

de C.V., ADR | | | 61,394 | | | $ | 1,017,913 | | |

Grupo Aeroportuario del

Pacifico S.A. de C.V., ADR | | | 38,121 | | | | 1,119,614 | | |

| | | | 2,137,527 | | |

| WIRELESS TELECOMMUNICATION SERVICES-5.98% | |

América Móvil SAB de C.V.,

Series L | | | 6,008,655 | | | | 15,879,236 | | |

América Móvil SAB de C.V.,

Series L, ADR | | | 95,700 | | | | 5,048,175 | | |

| | | | 20,927,411 | | |

TOTAL MEXICO

(Cost $53,931,366) | | | 75,361,912 | | |

| PERU-0.35% | |

| COMMERCIAL BANKS-0.35% | |

Credicorp Limited

(Cost $620,683) | | | 14,900 | | | | 1,223,588 | | |

| VENEZUELA-0.44% | |

| COMMERCIAL BANKS-0.44% | |

Mercantil Servicios

Financieros, C.A., ADR

(Cost $1,240,868) | | | 36,358 | | | | 1,527,254 | | |

| GLOBAL-0.11% | |

| VENTURE CAPITAL-0.11% | |

Emerging Markets

Ventures I L.P.†‡#

(Cost $843,254) | | | 2,237,292 | | | | 385,351 | | |

TOTAL EQUITY OR EQUITY-LINKED

SECURITIES (Cost $183,149,523) | | | 344,239,846 | | |

| SHORT-TERM INVESTMENTS-0.95% | |

| CHILEAN MUTUAL FUND-0.11% | |

Fondo Mutuo Corporativo

BancoEstado

(Cost $416,797) | | | 166,883 | | | | 381,781 | | |

See accompanying notes to financial statements.

10

THE LATIN AMERICA EQUITY FUND, INC.

SCHEDULE OF INVESTMENTS (CONTINUED)

JUNE 30, 2008 (UNAUDITED)

| Description | | Principal

Amount

(000's) | | Value | |

| GRAND CAYMAN-0.84% | |

Citibank N.A., overnight deposit,

1.35%, 7/1/08

(Cost $2,938,000) | | $ | 2,938 | | | $ | 2,938,000 | | |

TOTAL SHORT-TERM INVESTMENTS

(Cost $3,354,797) | | | 3,319,781 | | |

TOTAL INVESTMENTS-99.28%

(Cost $186,504,320) | | | 347,559,627 | | |

CASH AND OTHER ASSETS IN EXCESS

OF LIABILITES-0.72% | | | 2,533,090 | | |

| NET ASSETS-100.00% | | $ | 350,092,717 | | |

† Non-income producing security.

†† SEC Rule 144A security. Such securities are traded only among "qualified institutional buyers."

‡ Restricted security, not readily marketable; security is valued at fair value as determined in good faith by, or under the direction of, the Board of Directors under procedures established by the Board of Directors. (See Notes B and H.)

# As of June 30, 2008, the aggregate amount of open commitments for the Fund is $888,814. (See Note H.)

ADR American Depositary Receipts.

BDR Brazilian Depositary Receipts.

CPO Ordinary Participation Certificates.

GDR Global Depositary Receipts.

ON Ordinary Shares.

PN Preferred Shares.

PNA Preferred Shares, Class A.

PNB Preferred Shares, Class B.

See accompanying notes to financial statements.

11

THE LATIN AMERICA EQUITY FUND, INC.

STATEMENT OF ASSETS AND LIABILITIES

JUNE 30, 2008 (UNAUDITED)

| ASSETS | |

| Investments, at value (Cost $186,504,320) (Notes B,E,G) | | $ | 347,559,627 | | |

| Foreign currencies (Cost $104,983) | | | 94,627 | | |

| Receivables: | |

| Investments sold | | | 3,023,784 | | |

| Dividends | | | 553,387 | | |

| Prepaid expenses | | | 7,778 | | |

| Total Assets | | | 351,239,203 | | |

| LIABILITIES | |

| Due to custodian | | | 3,481 | | |

| Payables: | |

| Investment advisory fees (Note C) | | | 698,362 | | |

| Administration fees (Note C) | | | 72,096 | | |

| Directors' fees | | | 37,645 | | |

| Investments purchased | | | 40,042 | | |

| Chilean repatriation taxes | | | 74,181 | | |

| Other accrued expenses | | | 220,679 | | |

| Total Liabilities | | | 1,146,486 | | |

| NET ASSETS (applicable to 6,302,847 shares of common stock outstanding) (Note D) | | $ | 350,092,717 | | |

| NET ASSETS CONSIST OF | |

Capital stock, $0.001 par value; 6,302,847 shares issued and outstanding

(100,000,000 shares authorized) | | $ | 6,303 | | |

| Paid-in capital | | | 139,658,046 | | |

| Undistributed net investment income | | | 2,450,650 | | |

| Accumulated net realized gain on investments and foreign currency related transactions | | | 46,932,042 | | |

Net unrealized appreciation in value of investments and translation of other

assets and liabilities denominated in foreign currencies | | | 161,045,676 | | |

| Net assets applicable to shares outstanding | | $ | 350,092,717 | | |

| NET ASSET VALUE PER SHARE ($350,092,717 ÷ 6,302,847) | | $ | 55.55 | | |

| MARKET PRICE PER SHARE | | $ | 49.92 | | |

See accompanying notes to financial statements.

12

THE LATIN AMERICA EQUITY FUND, INC.

STATEMENT OF OPERATIONS

FOR THE SIX MONTHS ENDED JUNE 30, 2008 (UNAUDITED)

| INVESTMENT INCOME | |

| Income (Note B): | |

| Dividends | | $ | 4,081,260 | | |

| Interest | | | 74,805 | | |

| Net investment gain allocated from partnerships | | | 484,974 | | |

| Less: Foreign taxes withheld | | | (335,609 | ) | |

| Total Investment Income | | | 4,305,430 | | |

| Expenses: | |

| Investment advisory fees (Note C) | | | 1,336,803 | | |

| Custodian fees | | | 239,421 | | |

| Administration fees (Note C) | | | 149,774 | | |

| Directors' fees | | | 51,387 | | |

| Accounting fees | | | 44,465 | | |

| Legal fees | | | 25,424 | | |

| Audit and tax fees | | | 24,772 | | |

| Printing (Note C) | | | 21,940 | | |

| Shareholder servicing fees | | | 9,573 | | |

| Insurance | | | 4,216 | | |

| Stock exchange listing fees | | | 664 | | |

| Miscellaneous | | | 12,152 | | |

| Brazilian taxes (Note B) | | | 808 | | |

| Chilean repatriation taxes (Note B) | | | 34,739 | | |

| Total Expenses | | | 1,956,138 | | |

| Less: Fee waivers (Note C) | | | (4,978 | ) | |

| Net Expenses | | | 1,951,160 | | |

| Net Investment Income | | | 2,354,270 | | |

NET REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS AND

FOREIGN CURRENCY RELATED TRANSACTIONS | |

| Net realized gain from: | |

| Investments | | | 39,847,915 | | |

| Foreign currency related transactions | | | 36,974 | | |

Net change in unrealized depreciation in value of investments and translation

of other assets and liabilities denominated in foreign currencies | | | (27,481,705 | ) | |

| Net realized and unrealized gain on investments and foreign currency related transactions | | | 12,403,184 | | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 14,757,454 | | |

See accompanying notes to financial statements.

13

THE LATIN AMERICA EQUITY FUND, INC.

STATEMENT OF CHANGES IN NET ASSETS

| | | For the Six Months

Ended June 30, 2008

(unaudited) | | For the Year Ended

December 31, 2007 | |

| INCREASE IN NET ASSETS | |

| Operations: | |

| Net investment income | | $ | 2,354,270 | | | $ | 4,510,977 | | |

| Net realized gain on investments and foreign currency related transactions | | | 39,884,889 | | | | 65,617,477 | | |

Net change in unrealized appreciation/(depreciation) in value of investments

and translation of other assets and liabilities denominated in foreign

currencies | | | (27,481,705 | ) | | | 53,144,688 | | |

| Net increase in net assets resulting from operations | | | 14,757,454 | | | | 123,273,142 | | |

| Dividends and distributions to shareholders: | |

| Net investment income | | | — | | | | (4,816,468 | ) | |

| Net realized gain on investments | | | — | | | | (74,458,333 | ) | |

| Total dividends and distributions to shareholders | | | — | | | | (79,274,801 | ) | |

| Capital share transactions (Note I): | |

Cost of 8,100 and 11,293 shares, respectively, purchased under

the share repurchase program | | | (363,682 | ) | | | (585,158 | ) | |

| Total increase in net assets | | | 14,393,772 | | | | 43,413,183 | | |

| NET ASSETS | |

| Beginning of period | | | 335,698,945 | | | | 292,285,762 | | |

| End of period* | | $ | 350,092,717 | | | $ | 335,698,945 | | |

* Includes undistibuted net investment income of $2,450,650 and $96,380, respectively.

See accompanying notes to financial statements.

14

This page intentionally left blank.

15

THE LATIN AMERICA EQUITY FUND, INC.

Financial Highlights§

Contained below is per share operating performance data for a share of common stock outstanding, total investment return, ratios to average net assets and other supplemental data for each period indicated. This information has been derived from information provided in the financial statements and market price data for the Fund's shares.

| | | For the

Six Months

Ended

June 30, 2008 | |

| | | (unaudited) | |

| PER SHARE OPERATING PERFORMANCE | |

| Net asset value, beginning of period | | $ | 53.19 | | |

| Net investment income/(loss) | | | 0.37 | | |

Net realized and unrealized gain/(loss) on investments

and foreign currency related transactions | | | 1.98 | | |

| Net increase/(decrease) in net assets resulting from operations | | | 2.35 | | |

| Dividends and distributions to shareholders: | |

| Net investment income | | | — | | |

Net realized gain on investments and

foreign currency related transactions | | | — | | |

| Total dividends and distributions to shareholders | | | — | | |

| Anti-dilutive impact due to capital shares tendered or repurchased | | | 0.01 | | |

| Net asset value, end of period | | $ | 55.55 | | |

| Market value, end of period | | $ | 49.92 | | |

| Total investment return (a) | | | 5.52 | % | |

| RATIOS/SUPPLEMENTAL DATA | |

| Net assets, end of period (000 omitted) | | $ | 350,093 | | |

| Ratio of expenses to average net assets (b) | | | 1.24 | %(d) | |

| Ratio of expenses to average net assets, excluding fee waivers | | | 1.24 | %(d) | |

| Ratio of expenses to average net assets, excluding taxes | | | 1.22 | %(d) | |

| Ratio of net investment income/(loss) to average net assets | | | 1.69 | %(d) | |

| Portfolio turnover rate | | | 8.75 | % | |

§ Per share amounts prior to November 10, 2000 have been restated to reflect a conversion factor of 0.9175 for shares issued in connection with the merger of The Latin America Investment Fund, Inc. and The Latin America Equity Fund, Inc.

* Based on actual shares outstanding on November 21, 2001 (prior to the 2001 tender offer) and December 31, 2001.

** Based on actual shares outstanding on November 6, 2002 (prior to the 2002 tender offer) and December 31, 2002.

† Based on average shares outstanding.

‡ Includes a $0.01 per share decrease to the Fund's net asset value per share resulting from the dilutive impact of shares issued pursuant to the Fund's automatic dividend reinvestment program.

# Impact of the Fund's self-tender program.

(a) Total investment return at market value is based on the changes in market price of a share during the period and assumes reinvestment of dividends and distributions, if any, at actual prices pursuant to the Fund's dividend reinvestment program.

(b) Ratios reflect actual expenses incurred by the Fund. Amounts are net of fee waivers and inclusive of taxes.

(c) Ratio includes the effect of a reversal of Chilean repatriation tax accrual; excluding the reversal, the ratio would have been 2.36%.

(d) Annualized.

See accompanying notes to financial statements.

16

THE LATIN AMERICA EQUITY FUND, INC.

Financial Highlights

| | | For the Years Ended December 31, | |

| | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 | | 2000 | | 1999 | | 1998 | |

| PER SHARE OPERATING PERFORMANCE | |

| Net asset value, beginning of period | | $ | 46.23 | | | $ | 35.25 | | | $ | 24.39 | | | $ | 17.74 | | | $ | 11.55 | | | $ | 15.06 | | | $ | 16.60 | | | $ | 18.57 | | | $ | 10.96 | | | $ | 18.77 | | |

| Net investment income/(loss) | | | 0.71 | † | | | 0.63 | | | | 0.61 | | | | 0.45 | † | | | 0.34 | † | | | 0.01 | ** | | | 0.41 | * | | | (0.11 | )† | | | 0.07 | † | | | 0.16 | | |

Net realized and unrealized gain/(loss) on investments

and foreign currency related transactions | | | 18.79 | | | | 15.78 | | | | 11.03 | | | | 6.66 | | | | 5.99 | | | | (3.41 | ) | | | (1.50 | ) | | | (2.44 | ) | | | 7.07 | | | | (7.85 | )‡ | |

| Net increase/(decrease) in net assets resulting from operations | | | 19.50 | | | | 16.41 | | | | 11.64 | | | | 7.11 | | | | 6.33 | | | | (3.40 | ) | | | (1.09 | ) | | | (2.55 | ) | | | 7.14 | | | | (7.69 | ) | |

| Dividends and distributions to shareholders: | |

| Net investment income | | | (0.76 | ) | | | (0.56 | ) | | | (0.50 | ) | | | (0.46 | ) | | | (0.14 | ) | | | (0.21 | ) | | | (0.57 | ) | | | (0.08 | ) | | | — | | | | (0.12 | ) | |

Net realized gain on investments and

foreign currency related transactions | | | (11.79 | ) | | | (4.87 | ) | | | (0.28 | ) | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | |

| Total dividends and distributions to shareholders | | | (12.55 | ) | | | (5.43 | ) | | | (0.78 | ) | | | (0.46 | ) | | | (0.14 | ) | | | (0.21 | ) | | | (0.57 | ) | | | (0.08 | ) | | | — | | | | (0.12 | ) | |

| Anti-dilutive impact due to capital shares tendered or repurchased | | | 0.01 | | | | — | | | | — | | | | — | | | | — | | | | 0.10 | # | | | 0.12 | # | | | 0.66 | | | | 0.47 | | | | — | | |

| Net asset value, end of period | | $ | 53.19 | | | $ | 46.23 | | | $ | 35.25 | | | $ | 24.39 | | | $ | 17.74 | | | $ | 11.55 | | | $ | 15.06 | | | $ | 16.60 | | | $ | 18.57 | | | $ | 10.96 | | |

| Market value, end of period | | $ | 47.31 | | | $ | 43.43 | | | $ | 30.46 | | | $ | 21.64 | | | $ | 15.26 | | | $ | 9.67 | | | $ | 12.15 | | | $ | 12.875 | | | $ | 13.76 | | | $ | 7.834 | | |

| Total investment return (a) | | | 42.45 | % | | | 61.62 | % | | | 44.06 | % | | | 45.04 | % | | | 59.15 | % | | | (18.83 | )% | | | (1.07 | )% | | | (5.87 | )% | | | 75.65 | % | | | (46.63 | )% | |

| RATIOS/SUPPLEMENTAL DATA | |

| Net assets, end of period (000 omitted) | | $ | 335,699 | | | $ | 292,286 | | | $ | 222,852 | | | $ | 154,214 | | | $ | 112,178 | | | $ | 73,045 | | | $ | 112,009 | | | $ | 145,281 | | | $ | 123,262 | | | $ | 86,676 | | |

| Ratio of expenses to average net assets (b) | | | 1.14 | % | | | 1.44 | % | | | 1.33 | % | | | 1.41 | % | | | 1.37 | % | | | 3.06 | % | | | 1.51 | % | | | 2.13 | % | | | 2.14 | % | | | 2.41 | % | |

| Ratio of expenses to average net assets, excluding fee waivers | | | 1.14 | % | | | 1.45 | % | | | 1.33 | % | | | 1.41 | % | | | 1.37 | % | | | 3.06 | % | | | 1.51 | % | | | 2.19 | % | | | 2.22 | % | | | 2.60 | % | |

| Ratio of expenses to average net assets, excluding taxes | | | 1.11 | % | | | 1.19 | % | | | 1.26 | % | | | 1.40 | % | | | 1.49 | % | | | 1.52 | % | | | 1.40 | % | | | 2.03 | % | | | 2.05 | % | | | 1.77 | % | |

| Ratio of net investment income/(loss) to average net assets | | | 1.28 | % | | | 1.49 | % | | | 2.13 | % | | | 2.36 | % | | | 2.49 | %(c) | | | 0.21 | % | | | 2.52 | % | | | (0.55 | )% | | | 0.46 | % | | | 1.12 | % | |

| Portfolio turnover rate | | | 26.33 | % | | | 46.05 | % | | | 75.60 | % | | | 69.80 | % | | | 62.62 | % | | | 75.28 | % | | | 101.73 | % | | | 125.83 | % | | | 161.71 | % | | | 142.35 | % | |

17

THE LATIN AMERICA EQUITY FUND, INC.

NOTES TO FINANCIAL STATEMENTS

JUNE 30, 2008 (UNAUDITED)

NOTE A. ORGANIZATION

The Latin America Equity Fund, Inc. (the "Fund") is registered under the Investment Company Act of 1940, as amended, as a closed-end, non-diversified management investment company.

NOTE B. SIGNIFICANT ACCOUNTING POLICIES

Use of Estimates: The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America ("GAAP") requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Security Valuation: The net asset value of the Fund is determined daily as of the close of regular trading on the New York Stock Exchange, Inc. (the "Exchange") on each day the Exchange is open for business. The Fund's equity investments are valued at market value, which is generally determined using the closing price on the exchange or market on which the security is primarily traded at the time of valuation (the "Valuation Time"). If no sales are reported, equity investments are generally valued at the most recent bid quotation as of the Valuation Time or at the lowest ask quotation in the case of a short sale of securities. Debt securities with a remaining maturity greater than 60 days are valued in accordance with the price supplied by a pricing service, which may use a matrix, formula or other objective method that takes into consideration market indic es, yield curves and other specific adjustments. Debt obligations that will mature in 60 days or less are valued on the basis of amortized cost, which approximates market value, unless it is determined that this method would not represent fair value. Investments in mutual funds are valued at the mutual fund's closing net asset value per share on the day of valuation.

Securities and other assets for which market quotations are not readily available, or whose values have been materially affected by events occurring before the Fund's Valuation Time, but after the close of the securities' primary market, are valued at fair value as determined in good faith by, or under the direction of, the Board of Directors under procedures established by the Board of Directors. The Fund may utilize a service provided by an independent third party which has been approved by the Board of Directors to fair value certain securities. When fair-value pricing is employed, the prices of securities used by a fund to calculate its net asset value may differ from quoted or published prices for the same securities. At June 30, 2008, the Fund held 0.25% of its net assets in securities valued at fair value as determined in good faith under procedures established by the Board of Directors with an aggregate cost of $1,684,748 and fair va lue of $864,157. The Fund's estimate of fair value assumes a willing buyer and a willing seller neither acting under the compulsion to buy or sell. Although these securities may be resold in privately negotiated transactions, the prices realized on such sales could differ from the prices originally paid by the Fund or the current carrying values, and the difference could be material.

The Fund adopted Financial Accounting Standards Board Statement of Financial Accounting Standards No. 157, Fair Value Measurements ("FAS 157"), effective January 1, 2008. In accordance with FAS 157, fair value is defined as the price that the Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. FAS 157 established a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

18

THE LATIN AMERICA EQUITY FUND, INC.

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

JUNE 30, 2008 (UNAUDITED)

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk, for example, the risk inherent in a particular valuation technique used to measure fair value including such a pricing model and/or the risk inherent in the inputs to the valuation technique. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity's own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances. The three-tier hierarchy of inputs is summarized in the three broad Levels listed below.

• Level 1—quoted prices in active markets for identical investments

• Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.)

• Level 3—significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments)

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used as of June 30, 2008 in valuing the Fund's investments carried at value:

| Valuation Inputs | | Investments

in Securities | | Other

Financial

Instruments* | |

| Level 1—Quoted Prices | | $ | 343,757,470 | | | $ | — | | |

Level 2—Other Significant

Observable Inputs | | | 2,938,000 | | | | — | | |

Level 3—Significant

Unobservable Inputs | | | 864,157 | | | | — | | |

| Total | | $ | 347,559,627 | | | $ | — | | |

* Other financial instruments include futures, forwards and swap contracts.

Following is a reconciliation of investments in which significant unobservable inputs (Level 3) were used in determining value:

| | | Investments

in Securities | | Other

Financial

Instruments* | |

| Balance as of 12/31/07 | | $ | 1,484,849 | | | $ | — | | |

Accrued discounts/

premiums | | | — | | | | — | | |

Realized gain/loss and

change in unrealized

appreciation | | | 80,025 | | | | — | | |

| Net purchases/sales | | | (700,717 | ) | | | — | | |

Net transfers in and/or

out of Level 3 | | | — | | | | — | | |

| Balance as of 06/30/08 | | $ | 864,157 | | | | — | | |

Net change in unrealized

appreciation from

investments still held

as of 06/30/08 | | $ | 80,025 | | | $ | — | | |

* Other financial instruments include futures, forwards and swap contracts.

19

THE LATIN AMERICA EQUITY FUND, INC.

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

JUNE 30, 2008 (UNAUDITED)

Short-Term Investment: The Fund sweeps available cash into a short-term time deposit available through Brown Brothers Harriman & Co., the Fund's custodian. The short-term time deposit is a variable rate account classified as a short-term investment.

Investment Transactions and Investment Income: Investment transactions are accounted for on a trade date basis. The cost of investments sold is determined by use of the specific identification method for both financial reporting and U.S. income tax purposes. Interest income is accrued as earned; dividend income is recorded on the ex-dividend date.

Taxes: No provision is made for U.S. income or excise taxes as it is the Fund's intention to continue to qualify as a regulated investment company and to make the requisite distributions to its shareholders sufficient to relieve it from all or substantially all U.S. income and excise taxes.

Income received by the Fund from sources within Latin America may be subject to withholding and other taxes imposed by such countries. Also, certain Latin American countries impose taxes on funds remitted or repatriated from such countries.

Brazil imposes a Contibução Provisoria sobre Movimentaçãoes Financieras ("CMPF") tax that applies to foreign exchange transactions related to dividends carried out by financial institutions. The tax rate is 0.38%. For the six months ended June 30, 2008, the Fund incurred $808 of such expense.

For Chilean securities the Fund accrues foreign taxes on realized gains and repatriation taxes in an amount equal to what the Fund would owe if the securities were sold and the proceeds repatriated on the valuation date as a liability and reduction of realized/unrealized gains. Taxes on foreign income are recorded when the related income is recorded. For the six months ended June 30, 2008, the Fund accrued $34,739.

During June 2006, the Financial Accounting Standards Board ("FASB") issued FASB Interpretation 48 ("FIN 48 or the "Interpretation"), Accounting for Uncertainty in Income Taxes—an interpretation of FASB statement 109. The Fund has reviewed its' current tax positions and has determined that no provision for income tax is required in the Fund's financial statements. The Fund's federal tax returns for the prior three fiscal years remain subject to examination by the Internal Revenue Service.

Foreign Currency Translations: The books and records of the Fund are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars on the following basis:

(I) market value of investment securities, assets and liabilities at the valuation date rate of exchange; and

(II) purchases and sales of investment securities, income and expenses at the relevant rates of exchange prevailing on the respective dates of such transactions.

The Fund does not isolate that portion of gains and losses on investments in equity securities which is due to changes in the foreign exchange rates from that which is due to changes in market prices of equity securities. Accordingly, realized and unrealized foreign currency gains and losses with respect to such securities are included in the reported net realized and unrealized gains and losses on investment transactions balances.

The Fund reports certain foreign currency related transactions and foreign taxes withheld on security transactions as components of realized gains for financial reporting purposes, whereas such foreign currency related transactions are treated as ordinary income for U.S. federal income tax purposes.

20

THE LATIN AMERICA EQUITY FUND, INC.

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

JUNE 30, 2008 (UNAUDITED)

Net unrealized currency gains or losses from valuing foreign currency denominated assets and liabilities at period end exchange rates are reflected as a component of net unrealized appreciation/depreciation in value of investments, and translation of other assets and liabilities denominated in foreign currencies.

Net realized foreign exchange gains or losses represent foreign exchange gains and losses from transactions in foreign currencies and forward foreign currency contracts, exchange gains or losses realized between the trade date and settlement date on security transactions, and the difference between the amounts of interest and dividends recorded on the Fund's books and the U.S. dollar equivalent of the amounts actually received.

Distributions of Income and Gains: The Fund distributes at least annually to shareholders substantially all of its net investment income and net realized short-term capital gains, if any. The Fund determines annually whether to distribute any net realized long-term capital gains in excess of net realized short-term capital losses, including capital loss carryovers, if any. An additional distribution may be made to the extent necessary to avoid the payment of a 4% U.S. federal excise tax. Dividends and distributions to shareholders are recorded by the Fund on the ex-dividend date.

The character of distributions made during the year from net investment income or net realized gains may differ from their ultimate characterization for U.S. income tax purposes due to U.S. generally accepted accounting principles/tax differences in the character of income and expense recognition.

Partnership Accounting Policy: The Fund records its pro-rata share of the income/(loss) and capital gains/(losses) allocated from the underlying partnerships and adjusts the cost of the underlying partnerships accordingly. These amounts are included in the Fund's Statement of Operations.

Other: The Fund invests in securities of foreign countries and governments which involve certain risks in addition to those inherent in domestic investments. Such risks generally include, among others, currency risk (fluctuations in currency exchange rates), information risk (key information may be inaccurate or unavailable) and political risk (expropriation, nationalization or the imposition of capital or currency controls or punitive taxes). Other risks in investing in foreign securities include liquidity and valuation risks.

Some countries require governmental approval for the repatriation of investment income, capital or the proceeds of sales of securities by foreign investors. In addition, if there is a deterioration in a country's balance of payments or for other reasons, a country may impose temporary restrictions on foreign capital remittances abroad. Amounts repatriated prior to the end of specified periods may be subject to taxes as imposed by a foreign country.

The Latin American securities markets are substantially smaller, less liquid and more volatile than the major securities markets in the United States. A high proportion of the securities of many companies in Latin American countries may be held by a limited number of persons, which may limit the number of securities available for the investment by the Fund. The limited liquidity of Latin American country securities markets may also affect the Fund's ability to acquire or dispose of securities at the price and time it wishes to do so.

The Fund, subject to local investment limitations, may invest up to 10% of its assets (at the time of commitment) in illiquid equity securities, including securities of private equity funds (whether in corporate or partnership form) that invest primarily in emerging markets. When investing through another investment fund, the Fund will bear its proportionate share of the

21

THE LATIN AMERICA EQUITY FUND, INC.

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

JUNE 30, 2008 (UNAUDITED)

expenses incurred by the fund, including management fees. Such securities are expected to be illiquid which may involve a high degree of business and financial risk and may result in substantial losses. Because of the current absence of any liquid trading market for these investments, the Fund may take longer to liquidate these positions than would be the case for publicly traded securities. Although these securities may be resold in privately negotiated transactions, the prices realized on such sales could be substantially less than those originally paid by the Fund or the current carrying values and these differences could be material. Further, companies whose securities are not publicly traded may not be subject to the disclosure and other investor protection requirements applicable to companies whose securities are publicly traded.

NOTE C. AGREEMENTS

Credit Suisse Asset Management, LLC ("Credit Suisse") serves as the Fund's investment adviser with respect to all investments. Credit Suisse receives as compensation for its advisory services from the Fund, an annual fee, calculated weekly and paid quarterly, equal to 1.00% of the first $100 million of the Fund's average weekly market value or net assets (whichever is lower), 0.90% of the next $50 million and 0.80% of amounts over $150 million. For the six months ended June 30, 2008, Credit Suisse earned $1,336,803 for advisory services, of which Credit Suisse waived $4,978. Credit Suisse also provides certain administrative services to the Fund and is reimbursed by the Fund for costs incurred on behalf of the Fund (up to $20,000 per annum). For the six months ended June 30, 2008, Credit Suisse was reimbursed $2,842 for administrative services rendered to the Fund.

CELFIN CAPITAL Servicios Financieros S.A. ("Celfin") serves as the Fund's sub-adviser with respect to Chilean investments. As compensation for its services, Celfin is paid a fee, out of the advisory fees payable to Credit Suisse, calculated weekly and paid quarterly at an annual rate of 0.10% of the Fund's average weekly market value or net assets (whichever is lower). For the six months ended June 30, 2008, these sub-advisory fees amounted to $151,561.

For the six months ended June 30, 2008, Celfin earned approximately $11,921 in brokerage commissions from portfolio transactions executed on behalf of the Fund.

Bear Stearns Funds Management Inc. ("BSFM") serves as the Fund's U.S. administrator. The Fund pays BSFM a monthly fee that is calculated weekly based on the Fund's average weekly net assets. For the six months ended June 30, 2008, BSFM earned $87,120 for administrative services. Effective August 1, 2008, BSFM no longer serves as the Fund's administrator, and was replaced by Brown Brothers Harriman & Co.

Celfin Capital S.A. Administradora de Fondos de Capital Extranjero ("AFCE") serves as the Fund's Chilean administrator. For its services, AFCE is paid an annual fee by the Fund equal to the greater of 2,000 Unidad de Fomentos ("U.F.s") (approximately $78,000 at June 30, 2008) or 0.10% of the Fund's average weekly market value or net assets invested in Chile (whichever is lower) and an annual reimbursement of out-of-pocket expenses not to exceed 500 U.F.s. In addition, an accounting fee is also paid to AFCE. For the six months ended June 30, 2008, the administration fees and accounting fees amounted to $59,812 and $3,391 respectively.

Merrill Corporation ("Merrill"), an affiliate of Credit Suisse, has been engaged by the Fund to provide certain financial printing services. For the six months ended June 30, 2008, Merrill was paid $3,251 for its services to the Fund.

The Independent Directors receive fifty percent (50%) of their annual retainer in the form of shares. Beginning in 2008, the Independent Directors can elect to receive up to 100% of their annual retainer in

22

THE LATIN AMERICA EQUITY FUND, INC.

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

JUNE 30, 2008 (UNAUDITED)

shares of the Fund. Directors as a group own less than 1% of the Fund's outstanding shares.

NOTE D. CAPITAL STOCK

The authorized capital stock of the Fund is 100,000,000 shares of common stock, $0.001 par value. Of the 6,302,847 shares outstanding at June 30, 2008, Credit Suisse owned 13,746 shares.

NOTE E. INVESTMENT IN SECURITIES

For the six months ended June 30, 2008, purchases and sales of securities, other than short-term investments, were $30,265,698 and $91,244,285, respectively.

NOTE F. CREDIT FACILITY

The Fund, together with other funds/portfolios advised by Credit Suisse (collectively, the "Participating Funds"), participates in a $50 million committed, unsecured, line of credit facility ("Credit Facility") with Deutsche Bank, A.G. as administrative agent and syndication agent and State Street Bank and Trust Company as operations agent for temporary or emergency purposes. Under the terms of the Credit Facility, the Participating Funds pay an aggregate commitment fee at a rate of 0.10% per annum on the average unused amount of the Credit Facility, which is allocated among the Participating Funds in such manner as is determined by the governing Boards of the Participating Funds. In addition, the Participating Funds pay interest on borrowings at the Federal Funds rate plus 0.50%. Effective June 2008, Deutsche Bank A.G. no longer serves as administrator and syndication agent to the credit facility. During the six months ended June 30, 2008, the Fund had no borrowings under the Credit Facility.

NOTE G. FEDERAL INCOME TAXES

Income and capital gain distributions are determined in accordance with federal income tax regulations, which may differ from GAAP.

At June 30, 2008, the identified cost for federal income tax purposes, as well as the gross unrealized appreciation from investments for those securities having an excess of value over cost, gross unrealized depreciation from investments for those securities having an excess of cost over value and the net unrealized appreciation from investments were $186,504,320, $169,549,840, $(8,494,533) and $161,055,307, respectively.

23

THE LATIN AMERICA EQUITY FUND, INC.

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

JUNE 30, 2008 (UNAUDITED)

NOTE H. RESTRICTED SECURITIES

Certain of the Fund's investments are restricted as to resale and are valued at fair value as determined in good faith by, or under the direction of, the Board of Directors under procedures established by the Board of Directors in the absence of readily ascertainable market values.

| Security | | Number

of

Shares | | Acquisition

Date(s) | | Cost | | Fair

Value at

06/30/08 | | Value Per

Share | | Percent

of Net

Assets | | Distributions

Received | | Open

Commitments | |

Emerging Markets

Ventures I L.P. | | | 2,237,292 | | | 01/22/98-01/10/06 | | $ | 843,254 | | | $ | 385,351 | | | | 0.17 | | | | 0.11 | | | $ | 2,438,852 | | | $ | 262,708 | | |

J.P. Morgan Latin America

Capital Partners, L.P. | | | 2,428,022 | | | 04/10/00-12/27/07 | | | 841,494 | | | | 478,806 | | | | 0.20 | | | | 0.14 | | | | 2,428,541 | | | | 626,106 | | |

| Total | | | | | | $ | 1,684,748 | | | $ | 864,157 | | | | | | 0.25 | | | $ | 4,867,393 | | | $ | 888,814 | | |

The Fund may incur certain costs in connection with the disposition of the above securities.

NOTE I. SHARE REPURCHASE PROGRAM

Share Repurchase Program: The Board of Directors of the Fund, at a meeting held on November 15, 2007, authorized management to make open market purchases from time to time in an amount up to 10% of the Fund's outstanding shares whenever the Fund's shares are trading at a discount to net asset value of 12% or more. Open market purchases may also be made within the discretion of management if the discount is less than 12%. The Board has instructed management to report repurchase activity to it regularly, and to post the number of shares repurchased on the Fund's website on a monthly basis. For the six months ended June 30, 2008, the Fund repurchased 8,100 of its shares for a total cost of $363,682 at a weighted discount of 8.99% from its net asset value.

NOTE J. CONTINGENCIES

In the normal course of business, the Fund may provide general indemnifications pursuant to certain contracts and organizational documents. The Fund's maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and, therefore, cannot be estimated: however, based on experience, the risk of loss from such claims is considered remote.

NOTE K. RECENT ACCOUNTING PRONOUNCEMENTS

In March 2008, FASB issued Statement of Financial Accounting Standards No. 161, Disclosures about Derivative Instruments and Hedging Activities ("FAS 161"), an amendment of FASB Statement No. 133. FAS 161 requires enhanced disclosures about (a) how and why an entity uses derivative instruments, (b) how derivative instruments and hedging activities are accounted for, and (c) how derivative instruments and related hedging activities affect a fund's financial position, financial performance, and cash flows. Manage ment of the Funds does not believe the adoption of FAS 161 will materially impact the financial statement amounts, but will require additional disclosures. This will include qualitative and quantitative disclosures on derivative positions existing at period end and the effect of using derivatives during the reporting period. FAS 161 is effective for financial statements issued for fiscal years and interim periods beginning after November 15, 2008.

24

RESULTS OF ANNUAL MEETING OF SHAREHOLDERS (UNAUDITED)

On April 10, 2008, the Annual Meeting of Shareholders of the Fund (the "Meeting") was held and the following matter was voted upon:

(1) To elect two directors to the Board of Directors of the Fund:

| Name of Director | | For | | Withheld | |

| James J. Cattano (Class II) | | | 3,340,432 | | | | 1,661,507 | | |

| Steven N. Rappaport (Class II) | | | 3,338,187 | | | | 1,663,752 | | |

In addition to the directors elected at the Meeting, Enrique R. Arzac, Lawrence J. Fox, and Martin M. Torino continue to serve as directors of the Fund. Subsequent to this meeting, Lawrence D. Haber resigned as a Director of the Fund.

25

IMPORTANT PRIVACY CHOICES FOR CONSUMERS (UNAUDITED)

We are committed to maintaining the privacy of every current and prospective customer. We recognize that you entrust important personal information to us, and we wish to assure you that we take seriously our responsibilities in protecting and safeguarding this information.

In connection with making available investment products and services to current and potential customers, we may obtain nonpublic personal information about you. This information may include your name, address, e-mail address, social security number, account number, assets, income, financial situation, transaction history and other personal information.

We may collect nonpublic information about you from the following sources:

• Information we receive on applications, forms, questionnaires, web sites, agreements or in the course of establishing or maintaining a customer relationship; and

• Information about your transactions with us, our affiliates, or others.

We do not disclose any nonpublic personal information about our customers or former customers to anyone, except with your consent or as otherwise permitted by law.

In cases where we believe that additional products and services may be of interest to you, we may share the information described above with our affiliates.

We may also disclose this information to firms that perform services on our behalf. These agents and service providers are required to treat the information confidentially and use it only for the purpose for which it is provided.

We restrict access to nonpublic personal information about you to those employees, agents or other parties who need to know that information to provide products or services to you or in connection with your investments with or through us. We maintain physical, electronic and procedural safeguards that comply with federal standards to guard your nonpublic personal information.

Note: This notice is provided to clients and prospective clients of Credit Suisse Asset Management, LLC ("Credit Suisse"), and Credit Suisse Asset Management Securities, Inc., and shareholders and prospective shareholders in Credit Suisse sponsored and advised investment companies, including Credit Suisse Funds, and other consumers and customers, as applicable. This notice is not intended to be incorporated in any offering materials but is merely a statement of our current Privacy Policy, and may be amended from time to time upon notice to you. This notice is dated as of May 14, 2008.

26

PROXY VOTING AND PORTFOLIO HOLDINGS INFORMATION (UNAUDITED)

Information regarding how the Fund voted proxies related to its portfolio securities during the 12-month period ended June 30, of each year, as well as the policies and procedures that the Fund uses to determine how to vote proxies relating to its portfolio securities are available:

• By calling 1-800-293-1232;

• On the Fund's website, www.credit-suisse.com/us

• On the website of the Securities and Exchange Commission, www.sec.gov.

The Fund files a complete schedule of its portfolio holdings for the first and third quarters of its fiscal year with the SEC on Form N-Q. The Fund's Forms N-Q are available on the SEC's website at www.sec.gov and may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information on the operation of the SEC's Public Reference Room may be obtained by calling 1-202-551-8090.

Notice is hereby given in accordance with Section 23(c) of the Investment Company Act of 1940, as amended, that The Latin America Equity Fund, Inc. may from time to time purchase shares of its capital stock in the open market.

27

DIVIDEND REINVESTMENT AND CASH PURCHASE PLAN (UNAUDITED)

The Latin America Equity Fund, Inc. (the "Fund") offers a Dividend Reinvestment and Cash Purchase Plan (the "Plan") to its common stockholders. The Plan offers common stockholders a prompt and simple way to reinvest net investment income dividends and capital gains and other periodic distributions in shares of the Fund's common stock. Computershare Trust Company, N.A. ("Computershare") acts as Plan Agent for stockholders in administering the Plan.

Participation in the Plan is voluntary. In order to participate in the Plan, you must be a registered holder of at least one share of stock of the Fund. If you are a beneficial owner of the Fund having your shares registered in the name of a bank, broker or other nominee, you must first make arrangements with the organization in whose name your shares are registered to have the shares transferred into your own name. Registered shareholders can join the Plan via the Internet by going to www.computershare.com, authenticating your online account, agreeing to the Terms and Conditions of online "Account Access" and completing an online Plan Enrollment Form. Alternatively, you can complete the Plan Enrollment Form and return it to Computershare at the address below.

By participating in the Plan, your dividends and distributions will be promptly paid to you in additional shares of common stock of the Fund. The number of shares to be issued to you will be determined by dividing the total amount of the distribution payable to you by the greater of (i) the net asset value per share ("NAV") of the Fund's common stock on the payment date, or (ii) 95% of the market price per share of the Fund's common stock on the payment date. If the NAV of the Fund's common stock is greater than the market price (plus estimated brokerage commissions) on the payment date, then Computershare (or a broker-dealer selected by Computershare) shall endeavor to apply the amount of such distribution on your shares to purchase shares of Fund common stock in the open market.

You should be aware that all net investment income dividends and capital gain distributions are taxable to you as ordinary income and capital gain, respectively, whether received in cash or reinvested in additional shares of the Fund's common stock.

The Plan also permits participants to purchase shares of the Fund through Computershare. You may invest $100 or more monthly, with a maximum of $100,000 in any annual period. Computershare will purchase shares for you on the open market on the 25th of each month or the next trading day if the 25th is not a trading day.

There is no service fee payable by Plan participants for dividend reinvestment. For voluntary cash payments, Plan participants must pay a service fee of $5.00 per transaction. Plan participants will also be charged a pro rata share of the brokerage commissions for all open market purchases ($0.03 per share as of October 2006). Participants will also be charged a service fee of $5.00 for each sale and brokerage commissions of $0.03 per share (as of October 2006).

You may terminate your participation in the Plan at any time by requesting a certificate or a sale of your shares held in the Plan. Your withdrawal will be effective immediately if your notice is received by Computershare prior to any dividend or distribution record date; otherwise, such termination will be effective only with respect to any subsequent dividend or distribution. Your dividend participation option will remain the same unless you withdraw all of your whole and fractional Plan shares, in which case your participation in the Plan will be terminated and you will receive subsequent dividends and capital gains distributions in cash instead of shares.

28

DIVIDEND REINVESTMENT AND CASH PURCHASE PLAN (UNAUDITED) (CONTINUED)

If you want further information about the Plan, including a brochure describing the Plan in greater detail, please contact Computershare as follows:

| By Internet: | | www.computershare.com | |

|

| By phone: | | (800) 730-6001 (U.S. and Canada) | |

|

| | | (781) 575-3100 (Outside U.S. and Canada) | |

|

| | | Customer service associates are available from 9:00 a.m. to 5:00 p.m. Eastern time, Monday through Friday | |

|

| By mail: | | The Latin America Equity Fund, Inc. | |

|

| | | c/o Computershare | |

|

| | | P.O. Box 43078 | |

|

| | | Providence, Rhode Island 02940-3078 | |

|

| | | All notices, correspondence, questions or other communications sent by mail should be sent by registered or certified mail, return receipt requested. | |

|

The Plan may be terminated by the Fund or Computershare upon notice in writing mailed to each participant at least 30 days prior to any record date for the payment of any dividend or distribution.

29

This page intentionally left blank.

This page intentionally left blank.

This page intentionally left blank.

FUNDS MANAGED BY CREDIT SUISSE ASSET MANAGEMENT, LLC

CLOSED-END FUNDS

Single Country

The Chile Fund, Inc. (AMEX: CH)

The First Israel Fund, Inc. (AMEX: ISL)

The Indonesia Fund, Inc. (AMEX: IF)

Multiple Country

The Emerging Markets Telecommunications Fund, Inc. (AMEX: ETF)

The Latin America Equity Fund, Inc. (AMEX: LAQ)

Fixed Income

Credit Suisse Asset Management Income Fund, Inc. (AMEX: CIK)

Credit Suisse High Yield Bond Fund (AMEX: DHY)

Literature Request—Call today for free descriptive information on the closed-end funds listed above at 800-293-1232 or visit our website at www.credit-suisse.com/us.

OPEN-END FUNDS

Credit Suisse Absolute Return Fund

Credit Suisse Cash Reserve Fund

Credit Suisse Commodity Return Strategy Fund

Credit Suisse Global Fixed Income Fund

Credit Suisse Global Small Cap Fund

Credit Suisse High Income Fund

Credit Suisse International Focus Fund

Credit Suisse Large Cap Blend Fund

Credit Suisse Large Cap Growth Fund

Credit Suisse Large Cap Value Fund

Credit Suisse Mid-Cap Core Fund

Credit Suisse Small Cap Core Fund

Fund shares are not deposits or other obligations of Credit Suisse Asset Management, LLC or any affiliate, are not FDIC-insured and are not guaranteed by Credit Suisse Asset Management, LLC or any affiliate. Fund investments are subject to investment risks, including loss of your investment. There are special risk considerations associated with international, global, emerging-market, small-company, private equity, high-yield debt, single-industry, single-country and other special, aggressive or concentrated investment strategies. Past performance cannot guarantee future results.

More complete information about a fund, including charges and expenses, is provided in the Prospectus, which should be read carefully before investing. You may obtain copies by calling Credit Suisse Funds at 800-927-2874. Performance information current to the most recent month-end is available at www.credit-suisse.com/us.

Credit Suisse Asset Management Securities, Inc., Distributor.

33

DIRECTORS AND CORPORATE OFFICERS

| Enrique R. Arzac | | Chairman of the Board of

Directors | |

|

| James J. Cattano | | Director | |

|

| Lawrence J. Fox | | Director | |

|

| Steven N. Rappaport | | Director | |

|

| Martin M. Torino | | Director | |

|

| George Hornig | | Chief Executive

Officer and President | |

|

| Matthew J.K. Hickman | | Chief Investment Officer | |

|

J. Kevin Gao

| | Chief Legal Officer,

Senior Vice President and

Secretary | |

|

| Emidio Morizio | | Chief Compliance Officer | |

|

| Michael A. Pignataro | | Chief Financial Officer | |

|

| Cecilia Chau | | Treasurer | |

|

INVESTMENT ADVISER

Credit Suisse Asset Management, LLC

Eleven Madison Avenue

New York, NY 10010

INVESTMENT SUB-ADVISER

Celfin Capital Servicios Financieros S.A.

Apoquindo 3721, Piso 19

Santiago, Chile

ADMINISTRATOR AND CUSTODIAN

Brown Brothers Harriman & Co.

40 Water Street

Boston, MA 02109

SHAREHOLDER SERVICING AGENT

Computershare Trust Company, N.A.

P.O. Box 43078

Providence, RI 02940

INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM

PricewaterhouseCoopers LLP

100 East Pratt Street

Baltimore, MD 21202

LEGAL COUNSEL

Willkie Farr & Gallagher LLP

787 Seventh Avenue

New York, NY 10019

This report, including the financial statements herein, is sent to the shareholders of the Fund for their information. The financial information included herein is taken from the records of the Fund without examination by independent registered public accountants who do not express an opinion thereon. It is not a prospectus, circular or representation intended for use in the purchase or sale of shares of the Fund or of any securities mentioned in this report.

LAQ-SAR-0608

Item 2. Code of Ethics.

This item is inapplicable to a semi-annual report on Form N-CSR.

Item 3. Audit Committee Financial Expert.

This item is inapplicable to a semi-annual report on Form N-CSR.

Item 4. Principal Accountant Fees and Services.

This item is inapplicable to a semi-annual report on Form N-CSR.

Item 5. Audit Committee of Listed Registrants.

This item is inapplicable to a semi-annual report on Form N-CSR.

Item 6. Schedule of Investments.