UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06096

The Torray Fund

(Exact name of registrant as specified in charter)

7501 Wisconsin Avenue, Suite 750 West

Bethesda, MD 20814

(Address of principal executive offices) (Zip code)

William M Lane

Torray LLC

7501 Wisconsin Avenue, Suite 750 West

Bethesda, MD 20814

(Name and address of agent for service)

(301) 493-4600

Registrant's telephone number, including area code

Date of fiscal year end: December 31, 2019

Date of reporting period: December 31, 2019

Item 1. Report to Stockholders.

The

TORRAY

FUND

ANNUAL REPORT

December 31, 2019

The Torray Fund

Suite 750 W

7501 Wisconsin Avenue

Bethesda, Maryland 20814

funds.torray.com

(301) 493-4600

(855) 753-8174

Please see page 2 for important information regarding access to The Torray Fund Annual and Semi-Annual Shareholder Reports.

The Torray Fund

Letter to Shareholders

January 29, 2020

Dear Fellow Shareholders:

The Torray Fund gained 19.89% in 2019, compared to 31.49% for the Standard & Poor’s 500 Index and 26.54% for the Russell 1000 Value Index. While the Fund’s return was strong in absolute terms, it was at the same time impacted by our average 9.50% cash position and several of our more cyclical holdings.

Since our mid-year report, we have trimmed several positions as they reached our portfolio limits of roughly 5% and liquidated holdings in four companies - Western Union, Corteva, Viacom and HP, Inc. Proceeds from these transactions were used to increase the DuPont position and establish a new investment in Kraft Heinz, the fifth largest food/beverage company in the world. As a result of these transactions, cash reserves rose to 11.2% of the Fund at the close of 2019. Kraft Heinz is undergoing management and operational changes intended to enhance long-term growth and profitability. In addition, the company has a forward price earnings ratio of only 11-to-1 and a dividend yield of 5%.

A decade after the Great Recession of 2008-09, with unemployment at record lows and the economy maintaining a positive trajectory, Federal Reserve policy remains accommodative and the government is spending $1 trillion more than it collects in taxes. (As if this were not large enough, the Congressional Budget Office recently projected that the annual deficit will rise to $2 trillion by 2028.) The persistence of these policies has contributed to the increased value of many assets – the stated objective of policymakers at the outset – perhaps leading investors to believe continuation of such policies will lead to even higher asset prices. We believe the risks are not well understood, however, and investors should maintain a healthy respect for preservation of capital in this environment. Historically low short-term interest rates, for example, have encouraged some investors to discount the safety and liquidity of savings accounts and favor riskier assets such as common stocks, long-term bonds, high yield bonds, private equity, etc. One result is a current 10-year US Treasury yield of 1.7% (below the annual inflation rate), having averaged 2.4% over the last decade which is the lowest of any decade before the 1950s. Additionally, the forward price earnings ratio of the S&P 500 is now 18.5-to-1, matching its highest level during the 10-year equity market advance.

Given these conditions, it is not surprising that equity valuations are above average or that returns of growth companies have exceeded those of companies deemed to have more moderate prospects. We do not know when the benign financial conditions will change, or when the disparities between growth and value will normalize, but students of history understand change is inherent in financial markets. As always, we are concerned about paying too much for an uncertain future. We are, therefore, comfortable with total return prospects for the Fund, which we feel is priced for modest expectations at 12.9-to-1 forward earnings.

In closing, we are very grateful for your long-term support and trust.

Sincerely,

| |  |  |  |

| | | | |

| | Robert E. Torray | Shawn M. Hendon | Brian R. Zaczynski |

The Torray Fund

IMPORTANT INFORMATION

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s prospectus, annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website, https://funds.torray.com/literature.html, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you invest through a financial intermediary and have already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling 1-800-626-9769 or by contacting the Fund in writing c/o U.S. Bank Global Fund Services, P.O. Box 701, Milwaukee, WI 53201-0701.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can call 1-800-626-9769 or contact the Fund in writing c/o U.S. Bank Global Fund Services, P.O. Box 701, Milwaukee, WI 53201-0701, to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary, or all funds held with the fund complex if you invest directly with the Fund.

| | | |

| | Mutual fund investing involves risk including the possible loss of principal value. At times, the Fund’s portfolio may be more concentrated than that of a more diversified fund subjecting it to greater fluctuation and risk. | |

| | | |

The Torray Fund

PERFORMANCE DATA

As of December 31, 2019 (unaudited)

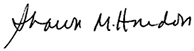

Average Annual Returns on an Investment in

The Torray Fund vs. the S&P 500 Index

For the periods ended December 31, 2019:

| | | | | | Since | |

| | | | | | Inception | |

| | 1 Year | 3 Years | 5 Years | 10 Years | 12/31/90 | |

| The Torray Fund | 19.89% | 6.30% | 6.25% | 9.89% | 9.69% | |

| S&P 500 Index | 31.49% | 15.27% | 11.70% | 13.56% | 10.44% | |

Cumulative Returns for the 29 years ended December 31, 2019

| | The Torray Fund | 1,359.97% | |

| | S&P 500 Index | 1,682.65% | |

The returns quoted represent past performance and do not guarantee future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher.

The Torray Fund

PERFORMANCE DATA (continued)

As of December 31, 2019 (unaudited)

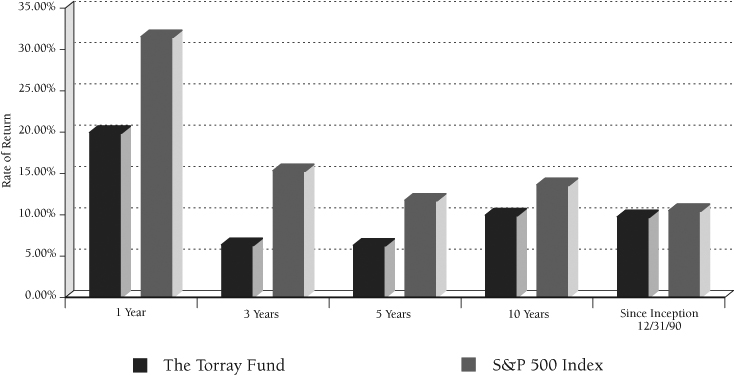

Change in Value of $10,000 Invested

on December 31, 1990 (commencement of operations) to:

| | 12/31/90 | 12/31/95 | 12/31/00 | 12/31/05 | 12/31/10 | 12/31/15 | 12/31/19 |

| The Torray Fund | $10,000 | $23,774 | $54,563 | $64,476 | $63,039 | $106,342 | $145,997 |

| S&P 500 Index | $10,000 | $21,544 | $49,978 | $51,354 | $57,511 | $103,952 | $178,265 |

The returns quoted represent past performance and do not guarantee future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher. For performance current to the most recent month end, please call (800) 626-9769. The returns shown do not reflect the deduction of taxes a shareholder would pay on the redemption of fund shares and distributions. As of the most recent prospectus, the Fund’s Gross Expense Ratio is 1.17%. The Fund’s net expense ratio is 1.08% after fee waivers and expense reimbursements made pursuant to an operating expense limitation agreement between Torray LLC and the Fund. Such agreement will contractually remain in effect through April 30, 2020. Returns on both The Torray Fund and the S&P 500 Index assume reinvestment of all dividends and distributions. The S&P 500 Index is an unmanaged index consisting of 500 U.S. large-cap stocks. It is not possible to invest directly in an index. Current and future portfolio holdings are subject to change and risk. Mutual fund investing involves risk, including the possible loss of principal value. At times, the Fund’s portfolio may be more concentrated than that of a more diversified fund, subjecting it to greater fluctuation and risk.

The Torray Fund

FUND PROFILE

As of December 31, 2019 (unaudited)

DIVERSIFICATION (% of net assets)

Financials | | | 36.8 | % |

Industrials | | | 11.0 | % |

Information Technology | | | 11.0 | % |

Health Care | | | 9.1 | % |

Energy | | | 7.1 | % |

Materials | | | 4.3 | % |

Communication Services | | | 3.5 | % |

Consumer Discretionary | | | 3.5 | % |

Consumer Staples | | | 2.5 | % |

Short-Term Investments | | | 11.3 | % |

Other Assets and Liabilities, Net | | | (0.1 | )% |

| | | | 100.0 | % |

TOP TEN EQUITY HOLDINGS (% of net assets)

| 1. | | Bank of America Corp. | | | 5.1 | % |

| 2. | | American Express Co. | | | 5.0 | % |

| 3. | | Loews Corp. | | | 4.7 | % |

| 4. | | Marsh & McLennan Cos., Inc. | | | 4.3 | % |

| 5. | | Cisco Systems, Inc. | | | 3.9 | % |

| 6. | | American International Group, Inc. | | | 3.9 | % |

| 7. | | Johnson & Johnson | | | 3.9 | % |

| 8. | | BP plc – ADR | | | 3.9 | % |

| 9. | | Eaton Corp. Plc | | | 3.8 | % |

| 10. | | Intel Corp. | | | 3.7 | % |

| | | | | | 42.2 | % |

PORTFOLIO CHARACTERISTICS

Net Assets (millions) | | $409 |

Number of Equity Holdings | | 26 |

Portfolio Turnover | | 11.05% |

P/E Multiple (forward) | | 12.91x |

Trailing Weighted Average Dividend Yield | | 2.46% |

Market Capitalization (billion) | Average | $146.0 |

| | Median | $85.5 |

The Torray Fund

SCHEDULE OF INVESTMENTS

As of December 31, 2019

Shares | | | | Market Value | |

| COMMON STOCKS 88.8% | | | |

| | | | | | |

36.8% FINANCIALS† | | | |

| | 589,300 | | Bank of America Corp. | | $ | 20,755,146 | |

| | 164,100 | | American Express Co. | | | 20,428,809 | |

| | 364,400 | | Loews Corp. | | | 19,127,356 | |

| | 156,818 | | Marsh & McLennan Cos., Inc. | | | 17,471,093 | |

| | 311,700 | | American International Group, Inc. | | | 15,999,561 | |

| | 65,400 | | Berkshire Hathaway, Inc. – Class B* | | | 14,813,100 | |

| | 92,950 | | Chubb Limited | | | 14,468,597 | |

| | 99,100 | | JPMorgan Chase & Co. | | | 13,814,540 | |

| | 253,400 | | Wells Fargo & Co. | | | 13,632,920 | |

| |

| |

| | | 150,511,122 | |

| 11.0% INDUSTRIALS | | | | |

| | 166,350 | | Eaton Corp. Plc | | | 15,756,672 | |

| | 63,400 | | General Dynamics Corp. | | | 11,180,590 | |

| | 63,600 | | Stanley Black & Decker, Inc. | | | 10,541,064 | |

| | 677,447 | | General Electric Co. | | | 7,560,308 | |

| | | | | | | 45,038,634 | |

| 11.0% INFORMATION TECHNOLOGY | | | | |

| | 336,900 | | Cisco Systems, Inc. | | | 16,157,724 | |

| | 252,700 | | Intel Corp. | | | 15,124,095 | |

| | 103,550 | | International Business Machines Corp. | | | 13,879,842 | |

| | | | | | | 45,161,661 | |

| 9.1% HEALTH CARE | | | | |

| | 108,924 | | Johnson & Johnson | | | 15,888,744 | |

| | 40,150 | | Becton Dickinson & Co. | | | 10,919,595 | |

| | 34,650 | | UnitedHealth Group Inc. | | | 10,186,407 | |

| | | | | | | 36,994,746 | |

| 7.1% ENERGY | | | | |

| | 417,620 | | BP plc – ADR | | | 15,760,979 | |

| | 224,900 | | Royal Dutch Shell plc – ADR – Class A | | | 13,264,602 | |

| | | | | | | 29,025,581 | |

See notes to the financial statements.

The Torray Fund

SCHEDULE OF INVESTMENTS (continued)

As of December 31, 2019

Shares | | | | Market Value | |

| 4.3% MATERIALS | | | |

| | 159,820 | | DuPont de Nemours, Inc. | | $ | 10,260,444 | |

| | 133,533 | | Dow, Inc. | | | 7,308,261 | |

| | | | | | | 17,568,705 | |

| 3.5% COMMUNICATION SERVICES | | | | |

| | 864,500 | | TEGNA, Inc. | | | 14,428,505 | |

| | | | | | | | |

| 3.5% CONSUMER DISCRETIONARY | | | | |

| | 391,300 | | General Motors Co. | | | 14,321,580 | |

| | | | | | | | |

| 2.5% CONSUMER STAPLES | | | | |

| | 318,145 | | Kraft Heinz Co. | | | 10,221,999 | |

| TOTAL COMMON STOCKS | | | | |

| (cost $233,066,489) | | | 363,272,533 | |

| | | | | | | | |

| SHORT-TERM INVESTMENTS 11.3% | | | | |

| 5.4% MONEY MARKET FUND | | | | |

| | 22,194,391 | | Fidelity Institutional Money Market Funds Government | | | | |

| | | | Portfolio – Class I, 1.49%^ | | | 22,194,391 | |

| | | | | | | | |

| | | | | | |

| 5.9% U.S. TREASURY OBLIGATION | | | | |

| $ 24,000,000 |

| U.S. Treasury Bill, 1.49%□, 1/30/2020 | | | 23,970,227 | |

| TOTAL SHORT-TERM INVESTMENTS | | | | |

| (cost $46,164,618) | | | 46,164,618 | |

| TOTAL INVESTMENTS 100.1% | | | | |

| (cost $279,231,107) | | | 409,437,151 | |

| OTHER ASSETS AND LIABILITIES, NET (0.1)% | | | (476,055 | ) |

| TOTAL NET ASSETS 100.0% | | $ | 408,961,096 | |

| † | As of December 31, 2019, the Fund had a significant portion of its assets invested in this sector. See Note 8 in the Notes to the Financial Statements. |

| * | Non-income producing security. |

| ^ | The rate shown is the annualized seven-day effective yield as of December 31, 2019. |

□ | Rate shown is effective yield as of December 31, 2019. |

ADR – American Depositary Receipt

The above industry classifications are based upon the Global Industry Classification Standard (“GICS”®). GICS was developed by and is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use.

See notes to the financial statements.

The Torray Fund

STATEMENT OF ASSETS AND LIABILITIES

As of December 31, 2019

| ASSETS: | | | |

| Investments in securities at value | | | |

| (cost $279,231,107) | | $ | 409,437,151 | |

| Dividends & interest receivable | | | 157,253 | |

| Prepaid expenses | | | 31,660 | |

| TOTAL ASSETS | | | 409,626,064 | |

| | | | | |

| LIABILITIES: | | | | |

| Payable for fund shares redeemed | | | 255,915 | |

| Payable to investment manager | | | 312,593 | |

| Accrued expenses and other liabilities | | | 96,460 | |

| TOTAL LIABILITIES | | | 664,968 | |

| | | | | |

| NET ASSETS | | $ | 408,961,096 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

| Shares of beneficial interest ($1 stated value, | | | | |

| 8,066,517 shares outstanding, unlimited shares authorized) | | $ | 8,066,517 | |

| Paid-in capital in excess of par | | | 263,918,346 | |

| Total distributable earnings | | | 136,976,233 | |

| | | | | |

| TOTAL NET ASSETS | | $ | 408,961,096 | |

| Net Asset Value, Offering and Redemption Price per Share | | $ | 50.70 | |

See notes to the financial statements.

The Torray Fund

STATEMENT OF OPERATIONS

For the year ended December 31, 2019

| INVESTMENT INCOME: | | | |

| Dividend income (net of withholding of $137,301) | | $ | 9,516,065 | |

| Interest income | | | 833,412 | |

| Total investment income | | | 10,349,477 | |

| | | | | |

| EXPENSES: | | | | |

| Management fees (See Note 4) | | | 4,003,907 | |

| Fund administration & accounting fees | | | 177,790 | |

| Transfer agent fees & expenses | | | 157,086 | |

| Trustees’ fees | | | 75,994 | |

| Legal fees | | | 49,765 | |

| Insurance expense | | | 40,721 | |

| Federal & state registration fees | | | 34,432 | |

| Audit fees | | | 24,000 | |

| Custody fees | | | 16,779 | |

| Printing, postage & mailing fees | | | 13,907 | |

| Compliance support fees | | | 8,002 | |

| Total expenses before waiver | | | 4,602,383 | |

| Less: waiver from investment manager (See Note 4) | | | (359,841 | ) |

| Net expenses | | | 4,242,542 | |

| | | | | |

| NET INVESTMENT INCOME | | | 6,106,935 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN ON INVESTMENTS: | | | | |

| Net realized gain on investments | | | 10,569,258 | |

| Net change in unrealized appreciation on investments | | | 54,800,764 | |

| Net realized and unrealized gain on investments | | | 65,370,022 | |

| | | | | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 71,476,957 | |

See notes to the financial statements.

The Torray Fund

STATEMENTS OF CHANGES IN NET ASSETS

For the years indicated:

| | | Year Ended | | | Year Ended | |

| | | 12/31/19 | | | 12/31/18 | |

| Increase (Decrease) in Net Assets | | | | | | |

| Resulting from Operations: | | | | | | |

| Net investment income | | $ | 6,106,935 | | | $ | 5,408,288 | |

| Net realized gain on investments | | | 10,569,258 | | | | 3,354,740 | |

| Net change in unrealized | | | | | | | | |

| appreciation on investments | | | 54,800,764 | | | | (53,248,227 | ) |

| Net increase (decrease) in net assets | | | | | | | | |

| resulting from operations | | | 71,476,957 | | | | (44,485,199 | ) |

| | | | | | | | | |

| Distributions to Shareholders: | | | | | | | | |

| Total distributions to shareholders | | | (10,944,198 | ) | | | (8,305,241 | ) |

| | | | | | | | | |

| Shares of Beneficial Interest: | | | | | | | | |

| Net decrease from share transactions (Note 5) | | | (22,544,609 | ) | | | (23,924,783 | ) |

| Total increase (decrease) in net assets | | | 37,988,150 | | | | (76,715,223 | ) |

| Net Assets – Beginning of Year | | | 370,972,946 | | | | 447,688,169 | |

| Net Assets – End of Year | | $ | 408,961,096 | | | $ | 370,972,946 | |

See notes to the financial statements.

The Torray Fund

FINANCIAL HIGHLIGHTS

For a Fund share outstanding throughout each year.

PER SHARE DATA:

| | | Years ended December 31: | |

| | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

| Net Asset Value, Beginning of Year | | $ | 43.450 | | | $ | 49.600 | | | $ | 47.600 | | | $ | 45.510 | | | $ | 48.110 | |

| Investment operations | | | | | | | | | | | | | | | | | | | | |

Net investment income(1) | | | 0.739 | | | | 0.619 | | | | 0.550 | | | | 0.563 | | | | 0.445 | |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | |

| gain (loss) on securities | | | 7.862 | | | | (5.806 | ) | | | 5.091 | | | | 5.780 | | | | (1.088 | ) |

| Total from investment operations | | | 8.601 | | | | (5.187 | ) | | | 5.641 | | | | 6.343 | | | | (0.643 | ) |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.953 | ) | | | (0.620 | ) | | | (0.576 | ) | | | (0.560 | ) | | | (0.479 | ) |

| Net capital gains | | | (0.398 | ) | | | (0.343 | ) | | | (3.065 | ) | | | (3.693 | ) | | | (1.478 | ) |

| Total distributions | | | (1.351 | ) | �� | | (0.963 | ) | | | (3.641 | ) | | | (4.253 | ) | | | (1.957 | ) |

| Net Asset Value, End of Year | | $ | 50.700 | | | $ | 43.450 | | | $ | 49.600 | | | $ | 47.600 | | | $ | 45.510 | |

TOTAL RETURN(2) | | | 19.89 | % | | | -10.60 | % | | | 12.07 | % | | | 14.29 | % | | | -1.36 | % |

| | | | | | | | | | | | | | | | | | | | | |

| SUPPLEMENTAL DATA AND RATIOS: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000’s omitted) | | $ | 408,961 | | | $ | 370,973 | | | $ | 447,688 | | | $ | 428,418 | | | $ | 393,778 | |

| Ratios of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before expense waiver | | | 1.15 | % | | | 1.16 | % | | | 1.16 | % | | | 1.07 | % | | | 1.16 | % |

| After expense waiver | | | 1.06 | % | | | 1.07 | % | | | 1.07 | % | | | 1.07 | % | | | 1.16 | % |

| Ratios of net investment income | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | 1.53 | % | | | 1.28 | % | | | 1.11 | % | | | 1.19 | % | | | 0.95 | % |

| Portfolio turnover rate | | | 11.05 | % | | | 4.18 | % | | | 19.38 | % | | | 9.46 | % | | | 10.77 | % |

(1) | Calculated based on average amount of shares outstanding during the period. |

(2) | Past performance is not predictive of future performance. Returns assume reinvestment of all dividends and distributions. |

See notes to the financial statements.

The Torray Fund

NOTES TO FINANCIAL STATEMENTS

As of December 31, 2019

NOTE 1 — ORGANIZATION

The Torray Fund (“Fund”) is a separate diversified series of The Torray Fund (“Trust”). The Trust is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company. The Trust is organized as a business trust under Massachusetts law. The Fund’s investment objectives are to build investor wealth over extended periods and to minimize shareholder capital gains tax liability by limiting the realization of long- and short-term gains. The Fund invests principally in common stock of larger-capitalization companies that generally have demonstrated records of profitability, conservative financial structures and shareholder-oriented management. The Fund seeks to invest in such companies when it believes that valuations are modest relative to earnings, cash flow or asset values. Large capitalization companies are those with market capitalizations of $8 billion or more. Investments are held as long as the issuers’ fundamentals remain intact, and the Fund believes issuers’ shares are reasonably valued. There can be no assurance that the Fund’s investment objectives will be achieved. The Fund is an investment company and accordingly follows the investment companies accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 Financial Services – Investment Companies.

NOTE 2 — SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

Security Valuation – All investments in securities are recorded at their estimated fair value, as described in Note 3.

Federal Income Taxes – The Fund complies with the requirements of subchapter M of the Internal Revenue Code of 1986, as amended, necessary to qualify as a regulated investment company and distributes substantially all net taxable investment income and net realized gains to shareholders in a manner which results in no tax cost to the Fund. Therefore, no federal income tax provision is required. As of and during the year ended December 31, 2019, the Fund did not have any tax positions that did not meet the “more-likely-than-not” threshold of being sustained by the applicable tax authority. As of and during the year ended December 31, 2019, the Fund did not have liabilities for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits on uncertain tax positions as income tax expense in the Statement of Operations. As of and during the year ended December 31, 2019, the Fund did not incur any interest or penalties. The Fund is not subject to examination by U.S. tax authorities for tax years prior to December 31, 2016.

Security Transactions and Investment Income – The Fund follows industry practice and records security transactions on the trade date. Realized gains and losses on sales of securities are calculated on the basis of identified cost. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and regulations. Discounts and premiums on securities purchased are amortized over the expected life of the respective securities using the constant yield method. Non-cash dividend income is recognized at the fair value of property received.

The Torray Fund

NOTES TO FINANCIAL STATEMENTS (continued)

As of December 31, 2019

The Fund distributes all net investment income, if any, quarterly and net realized capital gains, if any, annually. Distributions to shareholders are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, GAAP requires that they be reclassified in the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset values per share of the Fund. For the year ended December 31, 2019, the Fund decreased paid-in capital by $2,665 and increased total distributable earnings by $2,665.

Use of Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

NOTE 3 — SECURITIES VALUATION

The Fund has adopted authoritative fair value accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value, a discussion of changes in valuation techniques and related inputs during the period and expanded disclosure of valuation levels for major security types. These inputs are summarized in the three broad levels listed below:

| | • | Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access.

|

| | • | Level 2 – Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

|

| | • | Level 3 – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

Following is a description of the valuation techniques applied to the Fund’s major categories of assets and liabilities measured at fair value on a recurring basis. The Fund’s investments are carried at fair value.

Equity Securities – Securities that are primarily traded on a national securities exchange are valued at the last sale price on the exchange on which they are primarily traded on the day of valuation or, if there has been no sale on such day, at the mean between the bid and ask prices. Securities traded primarily in the Nasdaq Global Market System for

The Torray Fund

NOTES TO FINANCIAL STATEMENTS (continued)

As of December 31, 2019

which market quotations are readily available are valued using the Nasdaq Official Closing Price (“NOCP”). If the NOCP is not available, such securities are valued at the last sale price on the day of valuation, or if there has been no sale on such day, at the mean between the bid and ask prices. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy. If the market for a particular security is not active, and the mean between bid and ask prices is used, these securities are categorized in Level 2 of the fair value hierarchy.

Short-Term Investments – Investments in money market funds are valued at their net asset value per share. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy. Short-term debt securities (maturing in 60 days or less), such as U.S. Treasury Bills, are valued at amortized cost, which approximates market value and are categorized in Level 2 of the fair value hierarchy.

Securities for which market quotations are not readily available, or if the closing price does not represent fair value, are valued following procedures approved by the Board of Trustees. As of December 31, 2019, no Fund portfolio securities were priced in accordance with such procedures.

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities. The following is a summary of the inputs used to value the Fund’s securities as of December 31, 2019:

| | | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| | Common Stocks | | $ | 363,272,533 | | | $ | — | | | $ | — | | | $ | 363,272,533 | |

| | Short-Term Investments | | | 22,194,391 | | | | 23,970,227 | | | | — | | | | 46,164,618 | |

| | Total Investments in Securities | | $ | 385,466,924 | | | $ | 23,970,227 | | | $ | — | | | $ | 409,437,151 | |

Refer to the Schedule of Investments for further information on the classification of investments.

NOTE 4 — MANAGEMENT FEES AND OTHER TRANSACTIONS WITH AFFILIATES

The Trust has an agreement (“Management Contract”) with Torray LLC (the “Manager”) to furnish investment advisory services and to pay for certain operating expenses of the Fund. Pursuant to the Management Contract between the Trust and the Manager, the Manager is entitled to receive, on a monthly basis, an annual management fee equal to 1.00% of the Fund’s average daily net assets. For the year ended December 31, 2019, the Fund incurred management fees of $4,003,907.

The Manager and the Fund have entered into an Operating Expenses Limitation Agreement (the “Agreement”) whereby the Manager has contractually agreed for the term of Agreement to waive its management fee and reimburse the Fund for its current Operating Expenses so as to limit the Fund’s current Operating Expenses to an annual rate, expressed as a percentage of the Fund’s average annual net assets, to 1.00%. For purposes of the Agreement, the term “Operating Expenses” includes the Manager’s management fee and all other expenses necessary or appropriate for the operation of the Fund, excluding any front-end or contingent deferred loads, taxes, leverage, interest, brokerage

The Torray Fund

NOTES TO FINANCIAL STATEMENTS (continued)

As of December 31, 2019

commissions, acquired fund fees and expenses, trustee fees and expenses, auditor fees and expenses, legal fees and expenses, insurance costs, registration and filing fees, printing, postage and mailing expenses, expenses incurred in connection with any merger or reorganization, or extraordinary expenses such as litigation. Fees waived and expenses paid by the Manager are not eligible for recoupment. The Agreement will remain in effect until April 30, 2020.

U.S. Bancorp Fund Services, LLC (the “Administrator”), doing business as U.S. Bank Global Fund Services, acts as the Fund’s Administrator, Transfer Agent, and Fund Accountant. U.S. Bank, N.A. (the “Custodian”) serves as the Custodian to the Fund. The Custodian is an affiliate of the Administrator. The Administrator performs various administrative and accounting services for the Fund. The Administrator prepares various federal and state regulatory filings, reports and returns for the Fund; prepares reports and materials to be supplied to the Trustees; monitors the activities of the Custodian; coordinates the payment of the Fund’s expenses and reviews the Fund’s expense accruals. As compensation for its services, the Administrator is entitled to a monthly fee at an annual rate based upon the average daily net assets of the Fund, subject to annual minimums. Fees incurred by the Fund for administration and accounting, transfer agency, custody and compliance support services for the year ended December 31, 2019, are disclosed in the Statement of Operations.

Certain officers and Trustees of the Fund are also officers and/or shareholders of the Advisor, and are not paid by the Fund for serving in such capacities.

NOTE 5 — SHARES OF BENEFICIAL INTEREST TRANSACTIONS

Transactions in shares of beneficial interest were as follows:

| | | | Year ended | | | Year ended | |

| | | | 12/31/19 | | | 12/31/18 | |

| | | | Shares | | | Amount | | | Shares | | | Amount | |

| | Shares sold | | | 18,545 | | | $ | 897,164 | | | | 48,032 | | | $ | 2,332,073 | |

| | Reinvestment of distributions | | | 202,561 | | | | 10,049,147 | | | | 163,010 | | | | 7,687,188 | |

| | Shares redeemed | | | (691,898 | ) | | | (33,490,920 | ) | | | (700,333 | ) | | | (33,944,044 | ) |

| | | | | (470,792 | ) | | $ | (22,544,609 | ) | | | (489,291 | ) | | $ | (23,924,783 | ) |

As of December 31, 2019, the Trust’s officers, Trustees and affiliated persons and their families directly or indirectly controlled 1,744,606 shares or 21.63% of the Fund.

NOTE 6 — INVESTMENT TRANSACTIONS

Purchases and sales of investment securities, other than short-term investments, for the year ended December 31, 2019, aggregated $39,475,385 and $57,437,801, respectively.

NOTE 7 — TAX MATTERS

Distributions to shareholders are determined in accordance with United States federal income tax regulations, which may differ from GAAP.

The Torray Fund

NOTES TO FINANCIAL STATEMENTS (continued)

As of December 31, 2019

The tax character of distributions paid during the year ended December 31, 2019, and the year ended December 31, 2018, were as follows:

| | | | 2019 | | | 2018 | | |

| | Distributions paid from: | | | | | | | |

| | Ordinary Income* | | $ | 7,774,740 | | | $ | 8,305,241 | | |

| | Long-Term Capital Gains | | | 3,169,458 | | | | — | | |

| | | | $ | 10,944,198 | | | $ | 8,305,241 | | |

* For federal income tax purposes, distributions of short-term capital gains are treated as ordinary income.

As of December 31, 2019, the components of distributable earnings on a tax basis were as follows:

| | Undistributed long-term capital gain | | $ | 6,770,189 | | |

| | Unrealized appreciation | | | 130,206,044 | | |

| | Total accumulated earnings | | $ | 136,976,233 | | |

As of December 31, 2019, the Fund did not have any capital loss carryovers. A regulated investment company may elect for any taxable year to treat any portion of any qualified late year loss as arising on the first day of the next taxable year. Qualified late year losses are certain capital and ordinary losses which occur during the portion of the Fund’s taxable year subsequent to October 31. For the taxable period ended December 31, 2019, the Fund does not plan to defer any late year losses.

The cost basis of investments for federal income tax purposes for the year ended December 31, 2019, were as follows:

| | | | 2019 | | |

| | Gross unrealized appreciation | | $ | 142,081,318 | | |

| | Gross unrealized depreciation | | | (11,875,274 | ) | |

| | Net unrealized appreciation | | | 130,206,044 | | |

| | Cost | | $ | 279,231,107 | | |

NOTE 8 — SECTOR RISK

As of December 31, 2019, the Fund had a significant portion of its assets invested in the financials sector. The financials sector may be more greatly impacted by the performance of the overall economy, interest rates, competition, and consumer confidence spending.

The Torray Fund

NOTES TO FINANCIAL STATEMENTS (continued)

As of December 31, 2019

For purposes of financial statement reporting, 36.8% of portfolio holdings at period end were classified according to Global Industry Classification Standards (GICS) as belonging to the Financials sector. However, the Fund believes the actual Financials concentration risk to be below that shown for the Financials sector, as several of the constituent companies are diversified holding companies, with portions of their businesses falling outside the sector.

NOTE 9 — COMMITMENTS AND CONTINGENCIES

The Fund indemnifies its officers and Trustees for certain liabilities that may arise from their performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred.

NOTE 10 — RECENT ACCOUNTING PRONOUNCEMENTS

In August 2018, the FASB issued Accounting Standards Update (ASU) No. 2018-13 “Fair Value Measurement (Topic 820): Disclosure Framework – Changes to the Disclosure Requirements for Fair Value Measurement” (“ASU 2018-13”) which includes amendments intended to improve the effectiveness of disclosures in the notes to financial statements. For example, ASU 2018-13 includes additional disclosures regarding the range and weighted average of significant unobservable inputs used to develop Level 3 fair value measurements, and clarifications to the narrative description of measurement uncertainty disclosures. ASU 2018-13 is effective for interim and annual periods beginning after December 15, 2019. Management has evaluated the implications of certain provisions of ASU 2018-13 and has elected to early adopt all aspects of the amendments effective with the Fund’s financial statements within this Annual Report.

NOTE 11 — SUBSEQUENT EVENTS

Management has evaluated the impact of all subsequent events on the Fund through the date these financial statements were issued and has determined that there were no subsequent events requiring recognition or disclosure in the financial statement.

The Torray Fund

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Trustees and the Shareholders of The Torray Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of The Torray Fund (the “Fund”), including the schedule of investments, as of December 31, 2019, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended and the financial highlights for each of the years in the five-year period then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of December 31, 2019, and the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended and its financial highlights for each of the years in the five-year period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’ management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities law and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audit we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risk of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2019 by correspondence with the custodian. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

BBD, LLP

We have served as the auditor of The Torray Fund since 1997.

Philadelphia, Pennsylvania

February 28, 2020

The Torray Fund

FUND MANAGEMENT

As of December 31, 2019 (unaudited)

The Trust is overseen by a Board of Trustees (the “Board”), which has delegated the day-to-day management to the officers of the Trust. The Board meets regularly to review the Fund’s activities, contractual arrangements, and performance. The Trustees and officers serve until their successors are elected and qualified, or until the Trustee or Officer dies, resigns or is removed, or becomes disqualified.

Information pertaining to the Trustees and officers of the Trust is set forth below. The Statement of Additional Information (SAI) includes information about the Trustees and is available without charge, upon request, by calling (855) 753-8174.

| | | | No. of | |

| | | | Portfolios in | |

| Name, Age, | Term of Office | | Fund Complex | Other |

| Address* and | and Length of | Principal Occupation(s) | Overseen by | Directorships |

| Position(s) with the Trust | Time Served | During Past Five Years | Trustee | Held |

| INDEPENDENT TRUSTEES |

| | | | | |

| Carol T. Crawford (76) | Indefinite Term | Attorney and International | 1 | None |

| Trustee | Since 2006 | Trade Consultant, | | |

| | | McLean, VA | | |

| | | | | |

| Bruce C. Ellis (75) | Indefinite Term | Private Investor, | 1 | None |

| Trustee | Since 1993 | Bethesda, MD | | |

| | | | | |

| Wayne H. Shaner (72)** | Indefinite Term | Managing Partner, | 1 | None |

| Trustee and Chairman | Since 1993 | Rockledge Partners, LLC, | | |

| of the Board | | Investment Advisory Firm, | | |

| | | Easton, MD (Jan. 2004-present) | | |

The Torray Fund

FUND MANAGEMENT (continued)

As of December 31, 2019 (unaudited)

| | | | No. of | |

| | | | Portfolios in | |

| Name, Age, | Term of Office | | Fund Complex | Other |

| Address* and | and Length of | Principal Occupation(s) | Overseen by | Directorships |

| Position(s) with the Trust | Time Served | During Past Five Years | Trustee | Held |

| INTERESTED TRUSTEES AND OFFICERS OF THE TRUST |

| | | | | |

| William M Lane (69)*** | Indefinite Term | Executive Vice President and | 1 | None |

| Trustee, Treasurer | Since 1990 | Secretary, Torray LLC, | | |

| and Secretary | | Bethesda, MD (Oct. 2005-present) | | |

| | | | | |

| Robert E. Torray (82)*** | Indefinite Term | Chairman, Torray LLC, | N/A | None |

| President | Since 2007 | Bethesda, MD (2005-present) | | |

| | | | | |

| Suzanne E. Kellogg (37) | Indefinite Term | Chief Compliance Officer and | N/A | None |

| Chief Compliance Officer | Since 2017 | Anti-Money Laundering Officer, | | |

| and Anti-Money | | Torray LLC, Bethesda, MD | | |

| Laundering Officer | | (Jul. 2017-present); | | |

| | | Compliance Manager, | | |

| | | FINRA, Washington, DC | | |

| | | (Sep. 2016-Jul. 2017); | | |

| | | Consultant, Torray LLC, Bethesda, | | |

| | | MD (Jun. 2016-Sep. 2017); | | |

| | | Chief Compliance Officer, | | |

| | | TAMRO Capital Partners, | | |

| | | Alexandria, VA (Nov. 2012-Apr. 2016) | | |

| * | All addresses are c/o The Torray Fund, 7501 Wisconsin Avenue, Suite 750W, Bethesda, MD 20814. |

| ** | Mr. Shaner is deemed to be an independent Trustee effective as of January 1, 2011. |

| *** | Mr. Lane and Mr. Torray, by virtue of their employment with Torray LLC, the Trust’s investment adviser, are considered “interested persons” of the Trust, as that term is defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended. |

The Torray Fund

FACTORS CONSIDERED BY THE BOARD OF TRUSTEES IN CONNECTION WITH ITS APPROVAL OF THE CONTINUATION OF THE TRUST’S MANAGEMENT AGREEMENT WITH THE MANAGER (unaudited)

The Torray Fund (“Trust”) has entered into a Management Contract (the “Agreement”) with Torray LLC (“Manager”) pursuant to which the Manager provides investment management and other services to The Torray Fund, a series of the Trust (“Fund”). In accordance with the Investment Company Act of 1940, the Trust’s Board of Trustees (“Board”), including a majority of the Trustees who are not “interested persons” of the Trust as that term is defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended (“Independent Trustees”) is required, on an annual basis, to consider the continuation of the Agreement with the Manager, and this must take place at an in-person meeting of the Board. The relevant provisions of the Investment Company Act of 1940, as amended (“1940 Act”) specifically provide that it is the duty of the Board to request and evaluate such information as the Board determines is reasonably necessary to allow them to properly consider the continuation of the Agreement, and it is the duty of the Manager to furnish the Trustees with such information that is responsive to the Board’s request.

At the in-person meeting of the Board on September 17, 2019, the Board, including all of the Interested Trustees, considered and approved the continuation of the Agreement. Prior to the meeting, the Trustees received and considered information from the Manager designed to provide the Trustees with the information necessary to evaluate the terms of the Agreement (“Support Materials”). Before voting to approve the continuation of the Agreement, the Trustees and the Independent Trustees reviewed the Support Materials with counsel to the Fund, as well as a memorandum from such counsel discussing the legal standards applicable to their consideration of the continuation of the Agreement. The Manager also met with the Trustees and provided further information regarding the management services it provides to the Fund under the Agreement (“Management Services”), including but not limited to information regarding its overall investment philosophy with respect to the Fund. The Independent Trustees also convened in executive session with Counsel to discuss matters related to the continuation of the Agreement prior to voting on its renewal.

In determining whether to approve the continuation of the Agreement, the Trustees considered all factors they believed relevant to such determination, including the following: (1) the nature, extent, and quality of the Management Services; (2) the investment performance of the Fund; (3) the cost of the Management Services and the profits that the Manager realizes from its relationship with the Fund; (4) the extent to which the Manager realizes economies of scale as the Fund grows and whether fees for the Management Services reflect these economies for the benefit of the Fund’s investors; (5) management fees paid by the Fund and the net and total expense ratios of the Fund compared other similar mutual funds; and (6) any other benefits that the Manager derives from its relationship with the Fund.

Based upon the Manager’s presentation and Support Materials, the Board concluded that the overall arrangements between the Fund and the Manager as set forth in the Agreement are fair and reasonable in light of the services performed, fees paid, and such other matters as the Trustees considered relevant in the exercise of their reasonable judgment. In their deliberations, the Trustees did not identify any particular information that was all-important or controlling. The material factors and conclusions that formed the basis of the Trustees’ determination to approve the continuation of the Agreement are summarized below.

Nature, Extent and Quality of Services. With respect to the nature, extent and quality of services that Manager renders, the Trustees considered the scope of services provided under the Agreement, which includes, but are not limited to, the following: (1) investing the Fund’s assets consistent with the Fund’s investment objective, policies and restrictions; (2) making investment decisions and placing all orders for the purchase and sale of portfolio securities and cash

The Torray Fund

FACTORS CONSIDERED BY THE BOARD OF TRUSTEES IN CONNECTION WITH ITS APPROVAL OF THE CONTINUATION OF THE TRUST’S MANAGEMENT AGREEMENT WITH THE MANAGER (unaudited) (continued)

instruments; (3) pursuant to its Operating Expense Limitation Agreement with the Trust, paying for the administration, fund accounting, custody, transfer agency and distribution services that are provided to the Fund; (4) monitoring the compliance of the Fund’s investment portfolio with applicable Federal securities laws and regulations and Internal Revenue standards; and (5) providing the interested Trustee, Chief Financial officer and Chief Compliance Officer of the Fund and paying the salaries, fees and expenses of such persons. The Trustees also considered the long-term investment philosophy and the significant industry experience of the Manager’s personnel involved in servicing the Fund, noting their high quality. In addition, the Trustees reviewed the Manager’s brokerage and best-execution procedures and observed that they were reasonable and consistent with standard industry practice. The Trustees also noted that while the Manager is permitted to use soft dollars to acquire proprietary and third-party research, it receives only proprietary research. They further noted that such research is provided on an unsolicited basis and is not the motivation for the selection of broker-dealers. Finally, the Trustees discussed the state of the Manager’s compliance program, including the Manager’s increased emphasis on cybersecurity and the new liquidity rules affecting the Fund. The Board also noted the significant resources that the Manager had expended to enhance the compliance program. The Trustees concluded that they were satisfied with the nature, extent and quality of services provided by the Manager pursuant to the Agreement.

Performance of the Fund. The Board next reviewed the Fund’s performance as reported in the Meeting Materials for the period ending July 31, 2019. The Trustees discussed the Manager’s focus on long-term investing and risk management, as well as the fact that the Fund tends to underperform in strong markets and outperform in down markets. The Trustees noted the Fund’s positive year to date return and positive returns for the one, three, five- and ten-year periods, all as of July 31, 2019. The Trustees further noted that despite the positive returns, the Fund underperformed its benchmark, the S&P 500 Index, for the one, three, five- and 10-year periods ended July 31, 2019, and slightly underperformed the benchmark for the since inception period ended July 31, 2019. The Trustees recognized, however, that underperformance compared to the S&P 500 Index is not unexpected given the small number of growth tech stocks (none of which the Fund owns) that have dominated the S&P 500 Index’s performance in the extended current bull market. The Trustees observed that the Fund’s performance over the long term has generally been more consistent with its benchmark than shorter-term performance. The Trustees also reviewed comparisons of the Fund’s performance with peer group funds in the Fund’s Morningstar category, US Large Value Funds, noting that while the Fund’s year-to-date and one-year performance beat the average and median performance of funds in that Morningstar category, the Fund underperformed when compared to the Morningstar category performance for the three-year, five-year, and 10-year periods. After further discussion, the Trustees concluded that they were satisfied with the Fund’s performance.

Cost of Advisory Services and Profitability. The Trustees considered and discussed with the Manager the profitability to the Manager of its relationship with the Fund (as reflected in a profitability analysis provided by the Manager), the overall profitability of the Manager (as reflected in a P&L statement of the Manager as of July 31, 2019), and the Manager’s balance sheet as of the same date. The Trustees also discussed with the Manager the fund-related expenses that it bears from its own profits, including paying the fees of the Fund’s primary service providers and paying distribution and platform fees, as well as other expenses that the Manager bears under its operating expenses limitation agreement with the Fund. Mr. Lane indicated that the Manager is dedicating significant resources to grow both its mutual fund and separate account businesses, and in that regard, has a marketing services agreement with ENDEAVOUR Investment Partners, LLC, a marketing consultant and strategist, to assist in the marketing of both the

The Torray Fund

FACTORS CONSIDERED BY THE BOARD OF TRUSTEES IN CONNECTION WITH ITS APPROVAL OF THE CONTINUATION OF THE TRUST’S MANAGEMENT AGREEMENT WITH THE MANAGER (unaudited) (continued)

mutual funds and separate account businesses across all investment strategies. The Trustees also discussed the growth of the two other mutual funds that the Manager sub-advises which have a different investment strategy and a different portfolio manager than the Fund, as well as another mutual fund that the Manager advises, also with a different investment strategy and a different portfolio manager than the Fund. The Trustees inquired and received responses from the Manager concerning how much each of these endeavors contribute to the Manager’s revenues and expenses relative to the revenues and expenses of the Fund. It was noted that Transamerica, the sponsor of two of these funds, had recently informed the Manager that it will be reorganizing the two Transamerica Funds that the Manager currently sub-advises into two other Transamerica Funds in October 2019 and that the Manager will not be retained. Finally, the Trustees discussed with the Manager its insurance coverage, new business and potential new business opportunities, and succession planning. After further discussion, the Trustees concluded that the Manager’s profitability with respect to the Fund is reasonable, that its assets and revenues were sufficient to provide the services called for by the Agreement, and that the Manager’s assets, coupled with its insurance coverage, were sufficient to cover potential liabilities incurred under the Agreement.

Comparative Fee and Expense Data; Economies of Scale. The Trustees discussed the Fund’s management fee of 1.00% and its current net expense ratio of 1.07%. The Trustees noted that the management fee payable to the Manager is in the form of a partial “unified fee,” an arrangement wherein the Manager pays certain expenses of the Fund from its management fee, and that comparative fee data for such arrangements is not readily available from data sources such as Morningstar. They also noted that the Manager has entered into an Operating Expense Limitation Agreement (“OELA”) with the Fund, which remains in effect. The Trustees then discussed that the Manager receives a net management fee of approximately 91 basis points after payment of fees to Fund Services and other required waivers and reimbursements made pursuant to the OELA. They also considered that because the Fund has no rule 12b-l or shareholder service fees, the Manager pays certain distribution and platform expenses exclusively from its own profits, noting that expense amounted to approximately four basis points. The Trustees then focused their attention on the gross and net expense ratios of comparable funds, noting that the Fund’s expense ratios are slightly higher when compared to those funds within the Morningstar U.S. Large Value Funds category, the Fund’s designated Morningstar category. The Trustees discussed economies of scale with the Manager and considered the Manager’s representation that the Fund’s asset level is not high enough to warrant breakpoints in the management fee. The Trustees also noted that the Manager advises 22 separate accounts in a similar investment style to that of the Fund, and that with respect to 21 of these accounts, the Manager charged a significantly lower basis point fee, while the 22nd account (whose purpose is to maintain a composite of this investment style) charged no management fee. The Trustees further noted however, that management of the Fund entails many additional regulatory and compliance responsibilities and higher costs, and therefore would be expected to have a higher fee. After further discussion, the Trustees concluded that the fees paid to the Manager under the Agreement and the Fund’s overall expenses were reasonable, and were not inflated to cover distribution-related expenses.

Other Benefits. The Trustees considered the Manager’s representation that it does not derive any other benefits from its relationship with the Fund and concluded that Manager does not receive any additional financial or other benefits from its relationship with the Fund.

The Torray Fund

PORTFOLIO HOLDINGS, PROXY VOTING AND PROCEDURES

As of December 31, 2019 (unaudited)

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the Commission’s website at http://www.sec.gov. The Fund’s Forms N-Q may be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C. Information on the operation of the Commissions Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling 1-855-753-8174.

Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available without charge, upon request, by calling 1-855-753-8174; and on the Commission’s website at http://www.sec.gov.

The Torray Fund

ABOUT YOUR FUND’S EXPENSES

As of December 31, 2019 (unaudited)

We believe it is important for you to understand the impact of costs on your investment. All mutual funds have operating expenses. As a shareholder of the Fund, you incur ongoing costs, including management fees, and other fund expenses. Operating expenses, which are deducted directly from the Fund’s gross income, directly reduce the investment return of the Fund.

A mutual fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples below are based on an investment of $1,000 made at the beginning of the period and held for the entire period from July 1, 2019 to December 31, 2019.

The table below illustrates the Fund’s cost in two ways:

Actual Fund Return This section helps you estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the third column shows the operating expenses that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for the Fund under the heading “Expenses Paid During Period” below.

Hypothetical 5% Return This section is intended to help you compare your Fund’s costs with those of other mutual funds. It assumes that the Fund had an annual return of 5% before expenses, and that the expense ratio is unchanged. In this case, because the return used is not the Fund’s actual return, the results do not apply to your investment. The example is useful in making comparisons because the Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess the Fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that expenses shown in the table are meant to highlight and help you compare ongoing costs only. The Fund does not charge transactions fees, such as purchase or redemption fees, nor does it carry a “sales load.”

The calculation assumes no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

More information about the Fund’s expenses, including recent annual expense ratios, can be found in this report. For additional information on operating expenses and other shareholder costs, please refer to the Fund’s prospectus.

| | | Beginning | Ending | |

| | | Account Value | Account Value | Expenses Paid |

| | | July 1, 2019 | December 31, 2019 | During Period(1) |

| | Based on Actual Fund Return(2) | $1,000.00 | $1,042.10 | $5.46 |

| | Based on Hypothetical 5% Return (before expenses) | $1,000.00 | $1,019.86 | $5.40 |

(1) | Expenses are equal to the Fund’s annualized expense ratio for the most recent six-month period of 1.06%, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

(2) | Based on the actual returns for the six-month period ended December 31, 2019 of 4.21%. |

The Torray Fund

TAX INFORMATION

As of December 31, 2019 (unaudited)

We are required to advise you within 60 days of the Fund’s fiscal year end regarding the Federal tax status of certain distributions received by shareholders during such fiscal year. The information below is provided for the Fund’s fiscal year ended December 31, 2019. All designations are based on financial information available as of the date of this annual report and, accordingly are subject to change. For each item it is the intention of the Fund to designate the maximum amount permitted under the Internal Revenue Code and the regulations thereunder.

Qualified Dividend Income/Dividends Received Deduction

For the fiscal year ended December 31, 2019, certain dividends paid by the Fund may be reported as qualified dividend income and may be eligible for taxation at capital gain rates. The percentage of dividends declared from ordinary income designated as qualified dividend income was 100.00% for the Fund.

For corporate shareholders, the percent of ordinary income distributions qualifying for the corporate dividends received deduction for the fiscal year ended December 31, 2019, was 96.97% for the Fund.

The percentage of taxable ordinary income distributions that are designated as short-term capital gain distributions under Internal Revenue Section 871(k)(2)(C) for the Fund was 0.00%.

Dividends and distributions received by retirement plans such as IRA’s, Keogh-type plans and 403(b) plans need not be reported as taxable income. However, many retirement plan trusts may need this information for their information reporting.

The Torray Fund

PRIVACY NOTICE

The Fund collects only relevant information about you that the law allows or requires it to have in order to conduct its business and properly service you. The Fund collects financial and personal information about you (“Personal Information”) directly (e.g., information on account applications and other forms, such as your name, address, and social security number, and information provided to access account information or conduct account transactions online, such as password, account number, e-mail address, and alternate telephone number), and indirectly (e.g., information about your transactions with us, such as transaction amounts, account balance and account holdings).

The Fund does not disclose any non-public personal information about its shareholders or former shareholders other than for everyday business purposes such as to process a transaction, service an account, respond to court orders and legal investigations or as otherwise permitted by law. Third parties that may receive this information include companies that provide transfer agency, technology and administrative services to the Fund, as well as the Fund’s investment adviser who is an affiliate of the Fund. If you maintain a retirement/educational custodial account directly with the Fund, we may also disclose your Personal Information to the custodian for that account for shareholder servicing purposes. The Fund limits access to your Personal Information provided to unaffiliated third parties to information necessary to carry out their assigned responsibilities to the Fund. All shareholder records will be disposed of in accordance with applicable law. The Fund maintains physical, electronic and procedural safeguards to protect your Personal Information and requires its third-party service providers with access to such information to treat your Personal Information with the same high degree of confidentiality.

In the event that you hold shares of the Fund through a financial intermediary, including, but not limited to, a broker-dealer, credit union, bank or trust company, the privacy policy of your financial intermediary governs how your non-public personal information is shared with unaffiliated third parties.

TRUSTEES

Carol T. Crawford

Bruce C. Ellis

William M Lane

Wayne H. Shaner

INVESTMENT ADVISOR

Torray LLC

OFFICERS

Robert E. Torray

William M Lane

Nicholas C. Haffenreffer

Shawn M. Hendon

Suzanne E. Kellogg

INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

BBD, LLP

1835 Market Street, 3rd Floor

Philadelphia, PA 19103

ADMINISTRATOR AND TRANSFER AGENT

U.S. Bancorp Fund Services, LLC

615 E. Michigan Street

Milwaukee, WI 53202

LEGAL COUNSEL

Bernstein Shur

100 Middle Street, 6th Floor

Portland, ME 04104

Distributed by Foreside Funds Distributors LLC

400 Berwyn Park, 899 Cassatt Road

Berwyn, PA 19132

Date of first use, February 2020

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus. All indices are unmanaged groupings of stocks that are not available for investment.

Item 2. Code of Ethics.

The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer and principal financial officer. The registrant has not made any substantive amendments to its code of ethics during the period covered by this period.

The registrant has not granted any waivers from any provisions of the code of ethics during the period covered by this report.

A copy of the registrant’s code of ethics that applies to the registrant’s principal executive officer and principal financial officer is filed herewith.

Item 3. Audit Committee Financial Expert.

The Registrant’s Board of Trustees has not designated an audit committee financial expert. The Registrant has determined that it will retain the services of an independent third party to assist it if circumstances arise that require specific investment company auditing expertise.

Item 4. Principal Accountant Fees and Services.

The registrant has engaged its principal accountant to perform audit services, audit-related services, tax services and other services during the past two fiscal periods. “Audit services” refer to performing an audit of the registrant's annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for the past fiscal year. “Audit-related services” refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit. “Tax services” refer to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning, including reviewing the Fund’s tax returns and distribution calculations. There were no “other services” provided by the principal accountant. For the fiscal years ended December 31, 2019 and December 31, 2018, the Fund’s principal accountant was BBD, LLP. The following table details the aggregate fees billed or expected to be billed for each of the last two fiscal periods for audit fees, audit-related fees, tax fees and other fees by the principal accountant.

| | FYE 12/31/2019 | FYE 12/31/2018 |

Audit Fees | $22,000 | $22,000 |

Audit-Related Fees | $0 | $0 |

Tax Fees | $2,000 | $2,000 |

All Other Fees | $0 | $0 |

| | | |

The audit committee has adopted pre-approval policies and procedures that require the audit committee to pre‑approve all audit and non‑audit services of the registrant, including services provided to any entity affiliated with the registrant.

The percentage of fees billed by BBD, LLP applicable to non-audit services pursuant to waiver of pre-approval requirement was as follows:

| | FYE 12/31/2019 | FYE 12/31/2018 |

Audit-Related Fees | 0% | 0% |

Tax Fees | 0% | 0% |

All Other Fees | 0% | 0% |

All of the principal accountant’s hours spent on auditing the registrant’s financial statements were attributed to work performed by full‑time permanent employees of the principal accountant.

The following table indicates the non-audit fees billed or expected to be billed by the registrant’s accountant for services to the registrant and to the registrant’s investment adviser (and any other controlling entity, etc.—not sub-adviser) for the past year. The audit committee of the board of trustees/directors has considered whether the provision of non-audit services that were rendered to the registrant's investment adviser is compatible with maintaining the principal accountant's independence and has concluded that the provision of such non-audit services by the accountant has not compromised the accountant’s independence.

Non-Audit Related Fees | FYE 12/31/2019 | FYE 12/31/2018 |

Registrant | $0 | $0 |

Registrant’s Investment Adviser | $0 | $0 |

Item 5. Audit Committee of Listed Registrants.

Not applicable to registrants who are not listed issuers (as defined in Rule 10A-3 under the Securities Exchange Act of 1934).

Item 6. Schedule of Investments.

| (a) | Schedule of Investments is included as part of the report to shareholders filed under Item 1 of this Form. |

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 9. Purchases of Equity Securities by Closed‑End Management Investment Company and Affiliated Purchases.

Not applicable to open-end investment companies.

Item 10. Submission of Matters to a Vote of Security Holders.

There have been no material changes to the procedures by which shareholders may recommend nominees to the registrant’s board of trustees.

Item 11. Controls and Procedures.

(a) | The Registrant’s President and Treasurer have reviewed the Registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) as of a date within 90 days of the filing of this report, as required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d‑15(b) under the Securities Exchange Act of 1934. Based on their review, such officers have concluded that the disclosure controls and procedures are effective in ensuring that information required to be disclosed in this report is appropriately recorded, processed, summarized and reported and made known to them by others within the Registrant and by the Registrant’s service provider. |

(b) | There were no significant changes in the Registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Registrant's internal control over financial reporting. |

Item 12. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 13. Exhibits.

(a) | (1) Any code of ethics or amendment thereto, that is subject of the disclosure required by Item 2, to the extent that the registrant intends to satisfy Item 2 requirements through filing an exhibit. Filed herewith. |

(2) Certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Filed herewith.

(3) Any written solicitation to purchase securities under Rule 23c‑1 under the Act sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable to open-end investment companies.

(4) Change in the registrant’s independent public accountant. There was no change in the registrant’s independent public accountant for the period covered by this report.

| (b) | Certification pursuant to Section 906 of the Sarbanes‑Oxley Act of 2002. Furnished herewith. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) The Torray Fund

By (Signature and Title)* /s/ Robert E. Torray

Robert E. Torray, President

Date March 6, 2020

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By (Signature and Title)* /s/ Robert E. Torray

Robert E. Torray, President

Date March 6, 2020

By (Signature and Title)* /s/ William M Lane

William M Lane, Treasurer

Date March 6, 2020

* Print the name and title of each signing officer under his or her signature.