2014 Annual report

Delivering sustainable shareholder returns

Contents

| | | | |

| Strategic report | | | | |

| Performance highlights | | | 1 | |

| Group overview | | | 2 | |

| Chairman’s letter | | | 4 | |

| Chief executive’s statement | | | 5 | |

| Strategic context | | | 7 | |

| Group strategy | | | 8 | |

| Business model | | | 11 | |

| Key performance indicators | | | 12 | |

| Risk factors | | | 14 | |

| Capital allocation | | | 18 | |

| Sustainable development | | | 20 | |

Independent limited assurance report | | | 27 | |

| Product groups | | | | |

Aluminium | | | 28 | |

Copper | | | 30 | |

Diamonds & Minerals | | | 32 | |

Energy | | | 34 | |

Iron Ore | | | 36 | |

| Exploration | | | 38 | |

| Technology & Innovation | | | 39 | |

| Financial overview | | | 40 | |

| Five year review | | | 41 | |

| |

| Directors’ report | | | | |

| Directors’ report | | | 44 | |

| Board of directors | | | 49 | |

| Executive Committee | | | 52 | |

| Corporate governance | | | 53 | |

| Remuneration Report | | | | |

Annual statement by the Remuneration | | | | |

Committee chairman | | | 64 | |

Remuneration Policy | | | 66 | |

Remuneration Implementation Report | | | 74 | |

| |

| Financial statements | | | | |

| Group income statement | | | 103 | |

| Group statement of comprehensive income | | | 104 | |

| Group cash flow statement | | | 105 | |

| Group balance sheet | | | 106 | |

| Group statement of changes in equity | | | 107 | |

| Notes to the 2014 financial statements | | | 110 | |

| Rio Tinto plc company balance sheet | | | 175 | |

| Rio Tinto financial information by business unit | | | 178 | |

| Australian Corporations Act – summary of ASIC relief | | | 183 | |

| Directors’ declaration | | | 184 | |

| Auditor’s independence declaration | | | 185 | |

| Independent auditors’ report | | | 186 | |

| Financial summary 2005-2014 | | | 192 | |

| Summary financial data | | | 194 | |

| |

| Production, reserves and operations | | | | |

| Metals and minerals production | | | 195 | |

| Ore reserves | | | 199 | |

| Mines and production facilities | | | 212 | |

| |

| Additional information | | | | |

| Shareholder information | | | 220 | |

| UK Listing Rules cross reference table | | | 226 | |

| Financial calendar | | | 227 | |

| Contact details | | | 228 | |

Navigating through Rio Tinto’s Annual and Strategic report

As of 2013, the UK’s regulatory reporting framework requires companies to produce a strategic report. The intention is to provide investors with the option of receiving a document which is more concise than the full annual report, and which is strategic in its focus.

The first 41 pages of Rio Tinto’s 2014 Annual report constitute its 2014 Strategic report. References to page numbers beyond 41 are references to pages in the full 2014 Annual report. This is available online atriotinto.com/ar2014 or shareholders may obtain a hard copy free of charge by contacting Rio Tinto’s registrars, whose details are set out on page 228.

Please visit Rio Tinto’s website to learn more about the Group’s performance in 2014.

|

This Annual report, which includes the Group’s 2014 Strategic report, complies with Australian and UK reporting requirements. Copies of Rio Tinto’s shareholder documents – the 2014 Annual report and 2014 Strategic report, along with the 2015 Notices of annual general meeting – are available to view on the Group’s website:riotinto.com |

Rio Tinto is reducing the print run of this document to be more environmentally friendly. We encourage you to visit:riotinto.com/ar2014 to access a full library of PDFs of this Annual report.

Cautionary statement about forward-looking statements

This document contains certain forward-looking statements with respect to the financial condition, results of operations and business of the Rio Tinto Group. These statements are forward-looking statements within the meaning of Section 27A of the US Securities Act of 1933, and Section 21E of the US Securities Exchange Act of 1934. The words “intend”, “aim”, “project”, “anticipate”, “estimate”, “plan”, “believes”, “expects”, “may”, “should”, “will”, “target”, “set to” or similar expressions, commonly identify such forward-looking statements.

Examples of forward-looking statements in this Annual report include those regarding estimated ore reserves, anticipated production or construction dates, costs, outputs and productive lives of assets or similar factors. Forward-looking statements involve known and unknown risks, uncertainties, assumptions and other factors set forth in this document that are beyond the Group’s control. For example, future ore reserves will be based in part on market prices that may vary significantly from current levels. These may materially affect the timing and feasibility of particular developments. Other factors include the ability to produce and transport products profitably, demand for our products, changes to the assumptions regarding the recoverable value of our tangible and intangible assets, the effect of foreign currency exchange rates on market prices and operating costs, and activities by governmental authorities, such as changes in taxation or regulation, and political uncertainty.

In light of these risks, uncertainties and assumptions, actual results could be materially different from projected future results expressed or implied by these forward-looking statements which speak only as to the date of this Annual report. Except as required by applicable regulations or by law, the Group does not undertake any obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events. The Group cannot guarantee that its forward-looking statements will not differ materially from actual results.

For this annual report on Form 20-F, certain pages of the Rio Tinto Annual Report 2014 have been omitted. The Form 20-F is consistent with the page numbering of the Rio Tinto Annual Report 2014.

Performance highlights

2014 results demonstrate clear delivery against our commitments

In 2014, Rio Tinto made a commitment to materially increase cash returns to shareholders. The Group delivered this through a 12 per cent increase in the full year dividend and announced a US$2.0 billion share buy-back. These represent a total cash return to shareholders, in respect of 2014, of almost US$6.0 billion.

During 2014, Rio Tinto’s continued financial and operating discipline enabled the Group to offset much of the impact of lower commodity prices. By increasing volumes and reducing costs, Rio Tinto achieved underlying earnings(a) of US$9.3 billion and maintained the EBITDA margin(b) at 39 per cent. Free cash flow was assisted by a further reduction in capital expenditure(c) and a successful programme to release working capital. As a consequence, net debt(d) reduced by US$5.6 billion to US$12.5 billion.

Decisive early action taken throughout the Group delivered the strong balance sheet, enabling the additional material cash return to shareholders.

With lower commodity prices and uncertain global economic trends, the operating environment remains tough. However, in these conditions Rio Tinto’s qualities and competitive advantages deliver superior value. The Group’s combination of world-class assets, disciplined capital allocation, balance sheet strength, operating and commercial excellence, and a culture of safety and integrity gives Rio Tinto confidence in its ability to continue generating sustainable returns for shareholders.

| | | | | | | | | | | | | | | | |

| | | | | Year to 31 December | | 2014 | | | 2013 | | | Change | |

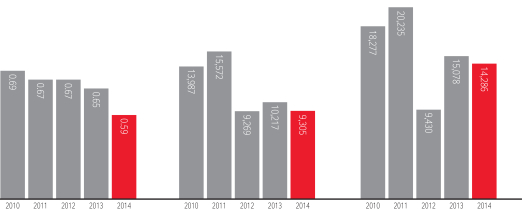

| | Pg 12 | | Underlying earnings (US$ millions)(a) | | | 9,305 | | | | 10,217 | | | | -9% | |

| | | | Net earnings (US$ millions)(a) | | | 6,527 | | | | 3,665 | | | | +78% | |

| | Pg 12 | | Net cash generated from operating activities (US$ millions) | | | 14,286 | | | | 15,078 | | | | -5% | |

| | Pg 13 | | Capital expenditure (US$ millions)(c) | | | 8,162 | | | | 13,001 | | | | -37% | |

| | | | Underlying earnings per share (US cents) | | | 503.4 | | | | 553.1 | | | | -9% | |

| | | | Basic earnings per share (US cents) | | | 353.1 | | | | 198.4 | | | | +78% | |

| | | | | Ordinary dividends per share (US cents) | | | 215.0 | | | | 192.0 | | | | +12% | |

| | | | | | | | | | | | | | | | |

| | | | | At 31 December | | 2014 | | | 2013 | | | Change | |

| | Pg 13 | | Net debt (US$ millions)(d) | | | 12,495 | | | | 18,055 | | | | -31% | |

| | | | | Gearing ratio(e) | | | 19% | | | | 25% | | | | -6% | |

The financial results are prepared in accordance with IFRS and are audited.

| (a) | Underlying earnings is the key financial performance indicator which management uses internally to assess performance. It is presented here to provide greater understanding of the underlying business performance of the Group’s operations. Net and underlying earnings relate to profit attributable to the owners of Rio Tinto. Underlying earnings is defined and reconciled to net earnings on pages 124 and 125. |

| (b) | EBITDA margin is defined as Group underlying EBITDA divided by product group total revenues as per the Financial information by business unit on pages 178 and 179 where it is reconciled to profit on ordinary activities before finance items and taxation. |

| (c) | Capital expenditure is presented gross, before taking into account any disposals of property, plant and equipment. |

| (d) | Net debt is defined and reconciled to the balance sheet on page 41. |

| (e) | Gearing ratio is defined as net debt divided by the sum of net debt and total equity at each period end. |

Revenues and earnings

| – | | Achieved consolidated sales revenues of US$47.7 billion, as a US$5.4 billion (pre-tax) decline in pricing was partially offset by US$3.0 billion from higher volumes. |

| – | | Sustained the EBITDA margin at 39 per cent, unchanged from 2013, with volume gains and cost improvements offsetting the impact of lower prices. |

| – | | Achieved underlying earnings of US$9.3 billion, nine per cent lower than 2013 despite the US$4.1 billion (post-tax) impact of lower prices. |

| – | | Delivered underlying earnings per share of 503.4 US cents. |

| – | | Generated net earnings of US$6.5 billion, reflecting non-cash exchange rate losses of US$1.9 billion, a US$0.4 billion charge following the repeal of the Minerals Resource Rent Tax and other charges of US$0.5 billion. An impairment charge of US$1.2 billion mainly related to the Kitimat project as reported at the half year was mostly offset by an impairment reversal of US$1.0 billion in the second half of 2014 related to an uplift in carrying value for the Pacific Aluminium business. |

Production

| – | Set production records for iron ore and Hunter Valley thermal coal, and delivered a strong operational performance in bauxite, copper and aluminium. |

Cash flow and balance sheet

| – | Achieved US$4.8 billion of sustainable operating cash cost improvements and exploration and evaluation savings since 2012, of which US$1.5 billion were in 2014. |

| – | Generated net cash from operating activities of US$14.3 billion, including working capital improvements of US$1.5 billion, principally from lower inventories and lower receivables. |

| – | Reduced capital expenditure by US$4.8 billion to US$8.2 billion in 2014, reflecting completion of existing major projects and continued capital discipline. |

| – | Decreased net debt by US$5.6 billion in 2014 to US$12.5 billion at 31 December 2014, with gearing of 18.6 per cent. This compares with US$18.1 billion and 25.2 per cent gearing at 31 December 2013. |

Capital returns

| – | Increased full year dividend by 12 per cent to 215 US cents per share. |

| – | Announced an additional capital return of US$2.0 billion, which comprises a A$500 million (c. US$0.4 billion) off-market share buy-back tender of Rio Tinto Limited shares and the balance of approximately US$1.6 billion for an on-market buy-back of Rio Tinto plc shares. |

| – | These represent a total cash return to shareholders, in respect of 2014, of almost US$6.0 billion, an increase of approximately 64 per cent on 2013. |

Group overview

Introduction to Rio Tinto

Rio Tinto is a leading global mining group that focuses on finding, mining and processing the Earth’s mineral resources. Our goal is to deliver strong and sustainable shareholder returns from our portfolio of world-class assets and our compelling pipeline of projects.

We take a long-term, disciplined approach, developing and running long-life, low-cost, expandable operations that are capable of delivering value throughout the cycle. Supported by our Exploration and Technology & Innovation groups, our five product groups represent a diversity of commodities that give us exposure to demand across the economic development spectrum(a).

Supporting our world-class assets is a company of world-class people who are the foundation of our success. This 60,000-strong workforce, across more than 40 countries, pulls together as a powerful team committed to getting the best out of our operations. Their safety is always our first concern. We also foster a culture of innovation, where our people are proud to achieve and are always learning.

Our vision is to be a company that is admired and respected for delivering superior value, as the industry’s most trusted partner. Our operations give us the opportunity to create mutual benefit with the communities, regions and countries in which we work, and our metals and minerals are transformed into end products that contribute to higher living standards. (Find out more on page 11.)

Underpinning everything we do are our values: respect, integrity, teamwork and accountability. They are fundamental to the way we operate and engage with those around us, and form the foundation of a long-term, reliable business that generates sustainable returns for shareholders.

Aluminium product group

Building on more than a century of experience and expertise, Rio Tinto is a global leader in the aluminium industry. Our business includes high-quality bauxite mines, large-scale alumina refineries, and some of the world’s lowest-cost, most technologically-advanced primary aluminium smelters.

Products

Bauxite

Bauxite is the natural ore used to make aluminium. It is refined into alumina which is smelted into aluminium metal. Our wholly- and partly-owned bauxite mines are located in Australia, Brazil and Guinea.

Alumina

Alumina (aluminium oxide) is extracted from bauxite via a refining process. Approximately four tonnes of bauxite are required to produce two tonnes of alumina, which in turn makes one tonne of aluminium metal. Our wholly- and partly-owned alumina refineries are located in Australia, Brazil and Canada.

Aluminium

Aluminium is a unique and versatile modern metal. Light, strong, flexible, corrosion-resistant and infinitely recyclable, aluminium is one of the most widely-used metals in the world. Its largest markets are transportation, machinery and construction. Our smelters are mainly concentrated in Canada. We also have plants in France, Australia, New Zealand, Iceland, the UK and Oman.

Strategic advantages

| – | | Access to the largest and best-quality bauxite ore reserves in the industry, strategically located to serve growing Chinese bauxite demand. |

| – | | One of the lowest-cost bauxite producers. |

| – | | Unrivalled hydropower position, which delivers significant cost and other advantages in an energy intensive industry and today’s carbon- constrained world. |

| – | | Rio Tinto has a first-quartile cost position for aluminium smelting, with industry-leading smelting technology. |

| | |

| Key production locations | | Key sales destinations |

– Canada | | – Asia |

– Europe | | – Americas |

– Australia | | – Europe |

Full operating review on page 28.

Copper product group

Rio Tinto’s Copper group is made up of four world-class operating assets and two attractive development projects. We are managing the portfolio to bring on new production when the market demands it.

Products

Copper

Copper is a malleable, corrosion resistant, antimicrobial metal and a highly effective conductor of heat and electricity. It is an essential component of nearly all modern electrical systems, including renewable energy sources such as solar, wind, geothermal and hydro-electric technologies. Global information and communication technologies rely on it, as do hybrid and electric cars and hospitals and medical facilities, where it is used to prevent the spread of diseases and infections. We produce gold, silver and molybdenum as co-products of our copper production.

Gold

Gold is used as a store of value. It is also highly conductive, malleable and inert, making it a key component in the electronics, chemical production, jewellery, aerospace and medical industries.

Silver

Silver has applications in art, science, and industry. It is used in many electronic devices, in aerospace applications and semiconductors. A precious metal, silver is used to make jewellery and as an investment.

Molybdenum

Molybdenum is a metallic element frequently used to produce stainless steel and other metal alloys. It enhances the metal’s toughness, high-temperature strength and corrosion resistance.

Strategic advantages

| – | | A portfolio of high-quality assets and growth opportunities. |

| – | | Attractive growth options that can be delivered when the market requires. |

| – | | Clear pathway to deliver superior profitability. |

| – | | Industry-leading technology and innovation. |

| | |

| Key production locations | | Key sales destinations |

– US | | – US |

– Chile | | – China |

– Mongolia | | – Japan |

Full operating review on page 30.

| (a) | On 27 February 2015, Rio Tinto announced that it would be streamlining its portfolio of assets into four product groups: Aluminium, Copper & Coal, Diamonds & Minerals and Iron Ore, with immediate effect. The coal assets of the former Energy product group became part of a new Copper & Coal product group, and the uranium assets of the former Energy product group became part of the Diamonds & Minerals product group. In this Annual report, references to Copper, Diamonds & Minerals and Energy refer to the product groups as they existed in 2014. |

Diamonds & Minerals product group

The Diamonds & Minerals product group comprises a suite of industry-leading, demand-led businesses, which include mining, refining and marketing operations across four sectors. Rio Tinto Diamonds is one of the world’s leading diamond producers, active in mining, manufacturing, selling, and marketing diamonds. Rio Tinto Minerals is a world leader in borates, with mines, processing plants, and commercial and research facilities. Dampier Salt is one of the world’s largest producers of seaborne salt. Rio Tinto Iron & Titanium is an industry leader in high-grade titanium dioxide feedstocks. The Diamonds & Minerals group also includes the Simandou iron ore project in Guinea, one of the largest known undeveloped high-grade iron ore resources in the world.

Products

Diamonds

Diamonds are an important component in both affordable and higher- end jewellery. We are able to service all established and emerging markets as we produce the full range of diamonds in terms of size, quality and colour distribution.

Titanium dioxide

The minerals ilmenite and rutile, together with titanium dioxide slag, can be transformed into a white titanium dioxide pigment or titanium metal. The white pigment is a key component in paints, plastics, paper, inks, textiles, food, sunscreen and cosmetics. Titanium metal’s key properties of light weight, chemical inertness and high strength make it ideal for use in medical applications and in the aerospace industry.

Borates

Refined borates are used in hundreds of products and processes. They are a vital ingredient of many home and automotive applications, and are essential nutrients for crops. They are commonly used in glass and ceramic applications including fibreglass, television screens, floor and wall tiles, and heat-resistant glass.

Salt

Salt is one of the basic raw materials for the chemicals industry and is indispensable to a wide array of automotive, construction and electronic products, as well as for water treatment, food and healthcare. Other products include high purity iron, metal powders and zircon.

Strategic advantages

| – | | Portfolio of industry-leading businesses operating in attractive markets. |

| – | | Demand-led, integrated operations that are responsive to the changing external environment. |

| – | | Poised to benefit from mid to late-cycle demand growth as consumption increases in emerging markets. |

| | |

| Key production locations | | Key sales destinations |

– North America | | – North America |

– Australia | | – South East Asia |

– South Africa | | – India |

Full operating review on page 32.

Energy product group

Energy is essential for modern life and the demand for energy continues to grow. Rio Tinto’s Energy product group produced coal and uranium, two important sources of energy from mining. The thermal coal and uranium we produce is used to generate electricity and our uranium is subject to strict safeguards and non-proliferation conditions to ensure it is only used for peaceful purposes. We also produce coking or metallurgical coal, which is an important ingredient in steel and cement production. We have operations, exploration and development projects in Australia, Namibia, South Africa and Canada.

Products

Coal

Coal is a cost effective and abundant energy source and we are a leading supplier to the seaborne thermal coal market. Thermal coal is used for electricity generation in power stations. We also produce higher-value coking or metallurgical coal, which produces steel when mixed in furnaces with iron ore. We have five operating mines in Australia and one in South Africa.

Uranium

Uranium is one of the most powerful known natural energy sources, and is used in the production of clean, stable, base-load electricity. After uranium ore is mined, it is processed into uranium oxide. This is the product that is sold for processing into fuel rods for use in nuclear power stations. We have uranium operations in Australia and Namibia, and an exploration project in Canada.

Strategic advantages

| – | | Premium Australian coal assets located close to existing infrastructure and growing Asian markets. |

| – | | Successfully transforming the business by reducing costs, increasing productivity and improving our position on the cost curve. |

| – | | Strong product stewardship strategy, including investment in technologies to reduce emissions from our products. |

| | |

| Key production locations | | Key sales destinations |

– Australia | | – Japan |

– Namibia | | – South Korea |

| | | – Taiwan |

Full operating review on page 34.

Iron Ore product group

Rio Tinto operates a world-class iron ore portfolio, supplying the global seaborne iron ore trade. We are well positioned to benefit from continuing demand across China and the developing world. In Western Australia, the majority of our production continues to achieve industry-leading margins through effective cost saving measures, automation and a relentless focus on optimising operational efficiencies and marketing expertise.

Products

Iron ore

Iron ore is the key ingredient in the production of steel, one of the most fundamental and durable products for modern-day living, with uses from railways to paperclips. Our iron ore mines are located in Australia and Canada.

Strategic advantages

| – | | Proximity of the expanded Pilbara operations in Australia to Asian markets. |

| – | | Position as lowest cost major iron ore producer in the Pilbara, with a Pilbara cash unit cost of US$19.50 in 2014. |

| – | | World-class assets comprising a seamless supply chain with unencumbered optionality. |

| – | | A premium product suite driving strong customer relationships supported by technical and commercial marketing expertise. |

| | |

| Key production locations | | Key sales destinations |

– Australia | | – China |

– Canada | | – Japan |

| | | – South Korea |

Full operating review on page 36.

Chairman’s letter

Dear shareholders,

During 2014, your company maintained its steadfast commitment to generate sustainable shareholder returns by supplying the commodities essential for modern life. As this report shows, we delivered strong financial and operational performance against a challenging market backdrop. Our success is underpinned by our strong safety performance, operational excellence,values-driven approach and the best people in the industry.

I am very pleased to report we delivered on our commitments during 2014. We achieved underlying earnings of US$9.3 billion and our focus on cash generation led to net cash from operating activities of US$14.3 billion. We exceeded our cost reduction target and lowered net debt significantly while reducing capital expenditure to US$8.2 billion.

Most importantly we fulfilled our promise to you, the owners of our company, to materially increase cash returns. Our primary commitment in terms of shareholder returns is our progressive dividend policy. In February 2015 we announced a 12 per cent increase in our full year dividend as well as a US$2.0 billion share buy-back. These represent a total cash return to shareholders, in respect of 2014, of almost US$6.0 billion. They underscore the confidence your board has in the resilience and strength of the company despite ongoing uncertainties in our external markets. We believe that delivering returns to shareholders is an important component of our overall approach to creating shareholder value.

Value through the economic cycle

This improved performance reflects the strategic approach the company has embedded throughout our more than 140 year history: to invest in and operate long-life, low-cost, expandable operations in the most attractive industry sectors. We focus on the best assets, because they are capable of delivering value throughout the cycle.

Volatility has become a characteristic of the rapidly-evolving world in which we operate. Each year presents a new economic challenge. The past six months in particular have seen increased uncertainty in energy, metals and foreign exchange markets. The prices for many of the commodities we produce were significantly lower during 2014, with average iron ore prices down 30 per cent year-on-year.

However, given the decisive action we have taken over the past two years, your company is in a strong position to capitalise on the positive long-term fundamentals for our key commodities, despite the short-term market challenges.

Rio Tinto’s position as a pre-eminent supplier of raw materials and refined metals and minerals products places us in an enviable position. At a time of significant distress for late-entrant or high-cost producers, Rio Tinto has been able to go about its business in a disciplined and orderly way. This is due to our world-class assets, the quality of our products and customer relationships, and the decisive actions we have taken to strengthen our balance sheet.

We continue to focus on maximising returns from our existing assets while ensuring only the best growth projects attract fresh capital.

We also continue to optimise our portfolio, and in 2014 divested the Clermont Joint Venture and Rio Tinto Coal Mozambique coal businesses, the Søral and Alucam aluminium businesses, and the Copper group’s Sulawesi and Pebble projects.

As we disclosed in October 2014, Glencore contacted Rio Tinto regarding a potential merger in July 2014. The Rio Tinto board, after consultation with its financial and legal advisers, concluded unanimously that a combination was not in the best interests of Rio Tinto shareholders.

A responsible and transparent business

The methods the company employs to deliver superior results are as important as the results themselves. We remain deeply committed to being a responsible company providing products the world over to support economic improvement and social progress.

We operate in a complex and interconnected world where global and local issues – such as biodiversity, climate change, livelihoods, and regional economic development – bring both risk and opportunity to the design, development and management of our operations.

Society’s expectations are increasing, and we will continue to listen carefully to our stakeholders, as we strive to create mutual value.

Our operations can have a substantial positive economic impact on the regions and countries in which we operate. Over the past four years, our economic contribution has exceeded US$230 billion.

We lead our industry with our ongoing commitment to tax transparency, publishing our annual Taxes Paid report to hold ourselves and host governments to account. We hope others will be encouraged to follow our example.

It is through this combination of facilitating social development, acting as a catalyst for growth, and behaving in an environmentally responsible way, that we manage our risks and deliver value for you, our shareholders, and also create projects of worth for the communities in which we work.

Governance – a balance of diversity and depth

The past year has again seen a broadening of experience and diversity on your board as we welcomed a number of new non-executive directors. Michael L’Estrange joined the board in September 2014 and Megan Clark in November. They bring to Rio Tinto a mix of backgrounds deeply relevant to our strategy and culture, including mining, science and technology, public policy and international relations. At our Australian annual general meeting in early May, Lord Kerr and Michael Fitzpatrick will step down after many years of wonderful service. I thank them both for their dedication and immense contribution to Rio Tinto.

I am delighted that Sam Walsh and Chris Lynch agreed to extend their tenure with open-ended contracts. They have provided transformative leadership since 2013, and I am confident that their experience will continue to drive the delivery of sustainable results.

A key role of the board is to ensure it has the appropriate succession arrangements for its senior leadership team and that it has the next generation of leaders moving through the company.

Rio Tinto has always prided itself on the breadth and depth of the talent within our organisation, and the capabilities of our people – across more than 40 countries – are highly regarded. I would like to thank Sam, the Executive Committee, and all of our 60,000 employees across the world for their commitment, leadership and resilience.

Looking forward with confidence

Markets are challenging, and in this environment investors seek strength, reliability and consistency. It is in these periods that your company thrives and the quality of its assets, operational excellence and balance sheet strength shines through.

Let me assure you that your board, our management, and all our people, are committed to delivering sustainable returns to you, our shareholders.

Thank you for your continued investment in Rio Tinto. I look forward to reviewing progress in 2015 with you next year.

| | |

| | |

| Jan du Plessis | | |

| Chairman | | |

| 4 March 2015 | | |

Chief executive’s statement

Dear shareholders,

Your company had a strong year, making truly satisfying progress towards building a safer, more resilient, world-class business. Our relentless focus on improving performance at all of our operations, driving down costs and strengthening our balance sheet has enabled us to deliver materially increased cash returns to shareholders. We remain committed to pursuing further improvement in the year ahead.

In 2014 we delivered excellent results and upheld our commitment to improve performance and strengthen the balance sheet. In challenging conditions we delivered on, and in many cases exceeded, expectations.

It is clear that in the short term we will continue to face challenging commodity markets as economic and geopolitical uncertainty continues. Divergent monetary policy paths in Europe, the US and parts of Asia are contributing to financial volatility. China is now experiencing slower, but still significant, economic growth as it rebalances its economic priorities from investment towards consumption.

But we also know that against a backdrop of uncertainty, Rio Tinto thrives. Our combination of world-class assets, disciplined capital allocation, balance sheet strength, operating and commercial excellence, and our culture of safety and integrity gives me confidence we are best placed to make the most of the positive long-term demand fundamentals to generate sustainable returns.

Our strong 2014 results are first and foremost due to the efforts of our hardworking and dedicated employees around the world. I had the great pleasure of visiting many of our operations during the year, and yet again I was inspired by the commitment of our people, and impressed by their expertise. I thank them all for their contributions.

I would like to thank the Executive Committee – including Alfredo Barrios and Greg Lilleyman who we welcomed to the team this year – for their strong and passionate leadership.

Putting safety first

We strive to put safety first in everything we do. From small things such as starting our meetings with what we call a “safety share”, to supporting community mental health initiatives and understanding our critical risks, safety is deeply embedded in our culture.

We reduced our all injury frequency rate by nine per cent in 2014 compared with 2013. This was our best year ever in terms of injury rate performance, and over the past five years we have reduced our all injury frequency rate by 14.5 per cent.

However success really means everyone returning home safely, every day. Therefore it is with much sadness I report the deaths of two employees at managed operations during 2014. In February, at the Gove alumina refinery in Australia, our colleague Darryl Manderson died due to an equipment incident while carrying out maintenance work. In November, Enrick Gagnon died when a landslide derailed an iron ore train in Canada. I was also greatly saddened by two further fatalities earlier in 2015, at QIT Madagascar Minerals and at Zululand Anthracite Colliery in South Africa. Both of these 2015 fatalities are currently being investigated.

These deaths have had a major impact on the family, friends and workmates of these colleagues. We will learn from these tragedies to prevent future ones.

Although our safety performance leads our industry, we need to be constantly vigilant and focused on improvement. We refreshed our safety strategy in 2014 and our goal, above all, remains to eliminate fatalities.

Managing a world-class portfolio

Over decades and across our product suite we have built a strong portfolio of businesses. Across the Group in 2014, we saw numerous examples of the strength of our portfolio. Among the highlights of our operational performance were the production records we set for iron ore and Hunter Valley thermal coal.

Our Pilbara iron ore business reached its 290 Mt/a run rate two months ahead of schedule. Expanding our Pilbara operations to 360 Mt/a rests comfortably with our view of the longer-term demand for iron ore. These operations are world class in terms of assets, optionality, and low-cost operating performance, as well as in our marketing expertise and leading-edge application of technology.

The expansion translated into excellent product group earnings and cash flow for Iron Ore. Despite significant price declines for its products, Iron Ore’s underlying earnings reached US$8.1 billion. This was a reduction of only 18 per cent on 2013, thanks to continued cost reduction efforts and the favourable effect of the weaker Australian dollar.

The turnaround of our Aluminium business continued in 2014. Higher prices for aluminium and our focus on efficiency and productivity saw the product group’s underlying earnings more than double, from US$557 million in 2013 to US$1.2 billion in 2014. Our bauxite business is generating handsome margins, but more work is needed in the alumina side of the portfolio. So we have set some tough targets for 2015, and we expect alumina’s profile to steadily improve.

The Copper group delivered an 11 per cent increase in underlying earnings. This was despite a seven per cent reduction in average copper prices, and reflects the group’s success in reducing costs and boosting productivity. Copper also increased production volumes and made more good progress in simplifying the portfolio.

The Diamonds & Minerals group continued to focus on maximising cash flow matching capacity to the market – the right approach for these specialist products. The product group achieved underlying earnings of US$401 million, a 15 per cent increase on 2013, as higher volumes and lower costs more than offset lower prices in the minerals portfolio.

Lower prices across the coal sector decreased our Energy group’s earnings by US$434 million. Not all of this could be offset by the good progress the Energy team continued to make in reducing operating costs and maximising efficiencies. Ultimately this resulted in a loss of US$210 million of underlying earnings.

All of our product groups have high-quality growth options, which we continue to pursue in a disciplined manner. We believe we have the right capital allocation framework and the right level of spending to support value-accretive growth while ensuring we retain a strong balance sheet and meet our commitment to deliver sustainable returns.

As part of our continued focus on efficiency and costs, we announced on 27 February 2015 that we would be streamlining our product group structure, with immediate effect. Under the new arrangements, Rio Tinto’s world-class portfolio of assets has been condensed into four product groups: Aluminium, Copper & Coal, Diamonds & Minerals and Iron Ore.

I would like to recognise the significant contributions of Jacynthe Côté and Harry Kenyon-Slaney who left or will leave the company during 2014 and early 2015 respectively. I thank them both and wish them both well.

Focus and agility

In many respects, our industry-leading businesses are where others wish to be; however, now is not the time for complacency.

We must anticipate, adapt and respond with urgency to changing conditions, sustaining our focus on efficiency in areas that make a difference – rein in our costs, ensure every dollar is spent wisely and remove wasteful working capital.

Rio Tinto’s balance sheet is strong and sound and we are committed to maintaining this position. In a period of market instability, a robust balance sheet is a major advantage. It protects the business, it protects shareholders and it creates a platform for future growth. It provides flexibility to undertake future projects – as and when required – and to find the best ways to reward shareholders.

On page 10, you can read more about the areas we will be focusing on in 2015 as we strive to enhance our performance even further.

Delivering sustainable value

In 2014, your company fulfilled its commitment to deliver greater value for shareholders. In doing so, we have also created value for many of our partners around the world who are so integral to the continuing success of our business.

I believe the quality and commitment of our people sets us apart, as does the way they embrace and embody our values: respect, integrity, teamwork and accountability.

I would like to thank our employees for their dedication and hard work, our stakeholders for continuing to partner with us, and you, our shareholders for investing in our company.

| | |

| | |

| Sam Walsh AO | | |

| Chief executive | | |

| 4 March 2015 | | |

Strategic context

Global economy

The positive momentum in developed economies in late 2013 fuelled expectations of an acceleration in global growth, but that faded in early 2014. In the end, the US remained one of the few bright spots in the global economy in 2014 while China’s slowdown became more entrenched. Europe failed to emerge meaningfully from imposed austerity, Japan’s growth was negatively impacted by a consumption tax hike and emerging economies suffered from the delayed recovery in global trade. As a result, the global economy grew by only just over three per cent in 2014, in line with growth in the previous two years, and below the International Monetary Fund’s forecast of 3.7 per cent growth at the start of the year.

Despite most economies continuing to deal with consequences from the 2008/09 global financial crisis (GFC), volatility in financial markets fell to low levels during the first part of 2014. Equity markets reached record levels, supported by sustained loose monetary policies. Nervousness however returned to the markets towards the end of year on the back of rising geopolitical tensions, a very sharp drop in oil prices and reminders of fragilities in the eurozone.

In China, growth in 2014 came just below the government’s target of 7.5 per cent. The new leadership attempted to bring the credit boom of the past five years under control while preventing a contagion from weak property and export sectors to the broader economy. This balancing act is likely to continue into 2015 and we expect China’s GDP growth to slow further to around seven per cent. The economy is in the middle of a long-signalled transition away from the investment-led and commodity-intensive growth model of the past couple of decades towards a stronger focus on consumption and services as well as a cleaner environment. This “new normal” implies still-significant but slower GDP growth and maturing commodity demand.

Among developed economies, monetary policies are moving on divergent paths. The US managed to shrug off severe winter disruptions at the start of 2014 to sustain a robust pace of growth. Manufacturing activity was strong throughout the year and the labour market strengthened appreciably. As a result, the Federal Reserve unwound its Quantitative Easing (QE) programme and the focus has now shifted towards the timing of the first interest rate hike in the US since the financial crisis, expected in 2015. In contrast, the European Central Bank has embarked on a new QE initiative in an attempt to kick-start a recovery in Europe’s periphery countries, stimulate growth in the core beyond Germany and counter growing deflation risks. With the Bank of Japan also extending its QE programme in October 2014 there is an increasingly pronounced dual track in the post-GFC recovery process within Organisation for Economic Co-operation and Development (OECD) economies.

The divergent monetary policies are putting upward pressure on the US dollar, which rallied strongly against most currencies in the later part of 2014. Meanwhile, the euro fell to a nine-year low against the US currency by the start of 2015. The broad US dollar strength, combined with weaker metals and minerals prices, also put downward pressure on commodity-dependent currencies such as the Australian and Canadian dollars, both of which depreciated by around eight per cent in the course of 2014. Unlike foreign exchange, the US bond market was resilient to the anticipated shift in monetary policy last year. This could reflect concerns that even as developed economies finally emerge from post-GFC adjustment, they might only return to a growth trajectory that is lower than that of the early-2000s.

Drivers of commodity prices

Long-term structural economic trends are important drivers of future commodity prices through their effects on commodity demand. The economic development and urbanisation of emerging countries goes through an initial investment-led growth phase, which is particularly commodity-intensive. This benefits commodities such as steel and copper used in construction and infrastructure. As economies evolve, other commodities such as light metals, energy products and industrial minerals tend to take over as the main enablers of consumption-led growth models.

While the macroeconomic environment provides a common demand context, supply-side factors can result in stark structural differences between commodities. In principle, commodity prices will tend to have a relationship with the cost of developing and extracting metal and mineral resources. However the exact nature of that relationship depends on barriers to entry and exit, which are specific to each sector and evolve over time.

The long-term nature of mining investment, combined with high capital-intensity and long project lead-times, tends to result in cyclical investment patterns in the industry as a whole, which also translates into cyclical commodity prices.

Across many commodity sectors, the general supply trends in recent years have pointed towards fewer discoveries, falling ore grades and maturing existing operations as well as greater complexity of projects. In a context of accelerating demand from China, a period of higher prices and margins was required to incentivise the necessary supply-side response. With supply finally catching up with demand for most commodities, focus has naturally switched towards managing margin compressions and extracting productivity gains from recent investment instead of committing significant capital into new projects.

Commodity markets

The subdued global macro environment combined with strong supply resulted in significant downturns for most commodity prices in 2014 and into 2015.

Prices for iron ore, which had been one of the most resilient commodities in 2013, were down 30 per cent on average year-on-year in 2014. The addition of seaborne iron ore capacity exceeded demand growth, tipping the markets into oversupply. Pressured by falling prices, about 125 million tonnes of high cost production from China and non-traditional seaborne suppliers exited the market in 2014. The continued ramp-up of committed supply is expected to once again exceed the growth in iron ore demand in 2015. However, with further exits of high-cost producers anticipated, the market will be more in balance.

Thermal and metallurgical coal had already experienced large price falls in 2013 and continued on a declining trend in 2014, reaching five- and seven-year lows respectively. Production has been slow to react to the new price environment, in particular in China where State Owned Enterprises account for a large share of output, which, combined with further cost reductions across the industry, led to lower prices.

Aluminium was one of the few commodities to see an increase in prices in 2014 when considering rising regional premiums. A combination of continued stock financing and more disciplined supply contributed to the improved market environment. Indonesia’s bauxite ore export ban remained in place throughout 2014, resulting in higher Chinese demand for alumina and bauxite from alternative sources. Lower bauxite inventories in China should support imports of Australian bauxite into China in 2015.

In copper, despite the stronger ramp-up in new mine supply, low reported inventories moderated the price decline in 2014. Concerns over near-term demand have weighed more heavily on copper prices so far in 2015.

Titanium dioxide prices remained under pressure in 2014 as inventories continued to be absorbed.

Outlook

Economic growth is likely to remain modest and only mildly supportive for commodity demand in the near term. The start of 2015 suggests it will be a challenging year with continued industry-wide margin compression. The falls in oil prices and applicable exchange rates will provide some relief for miners, but could also delay the exit of higher cost producers. It is therefore likely that the industry will continue to put strong controls over capital budgets and further focus on productivity, costs and margins.

Although the outlook for our operating environment remains tough, Rio Tinto is positioned to perform better than many competitors in challenging conditions. Our strong balance sheet and world-class portfolio are competitive advantages that equip us to generate sustainable returns through the cycle.

Group strategy

External pressures continue

The mining industry is cyclical. Following a decade-long growth phase, it has now firmly entered a period of lower prices, driven by a subdued global macro environment combined with strong supply. We expect the current phase of margin compression to continue as previously committed supply enters our markets and the key drivers of demand growth taper off. Meanwhile, volatility – a feature of the macroeconomic environment since the global financial crisis – is expected to continue, bringing with it further short-term risk.

Our response to this has been to continue to focus on productivity, cost reductions and capital discipline – squeezing maximum returns out of our existing businesses while ensuring only the best growth projects attract capital. Others in the sector have embarked upon similar paths. Inefficiencies are being exposed, and so reductions in costs and capital expenditure, productivity improvements, and project deferrals and cancellations have become widespread across the mining industry.

Despite the uncertain conditions that we currently face, the long-term outlook for our sector remains positive. These factors drive demand for the minerals and metals we produce, as essential ingredients of modern life. They make our business a sustainable and valuable one to be in.

Consistent strategy underpinned by six value drivers

In today’s challenging market conditions it is all the more important to have a clear and effective strategy. We remain convinced that our longstanding and consistent strategy is the right one: to invest in and operate long-life, low-cost, expandable operations in the most attractive industry sectors.

Sustainable shareholder returns

In 2014 we reaffirmed our commitment to deliver sustainable returns to shareholders. Six critical value drivers underpin this commitment, and combine to create a platform for our ongoing success.

1. World-class portfolio

At the heart of Rio Tinto is a portfolio of world-class assets – from our Pilbara iron ore business, to our Queensland bauxite ore reserves, hydro-powered aluminium smelters, our global suite of copper mines and sector-leading energy, diamonds and minerals assets. We use a clear strategic framework to assess our existing assets and new opportunities – taking into account the industry attractiveness and the competitive advantage of each asset, and its capacity to deliver best-in-class returns.

2. Quality growth

We have a compelling pipeline of near-term and longer dated projects across the portfolio. By reinforcing capital discipline and reshaping our projects, we have retained significant, high quality growth despite significantly reducing our capital expenditure. Our project pipeline has a compelling internal rate of return and is expected to deliver strong compound annual growth.

3. Operating and commercial excellence

The safety of our people is core to everything we do, and we remain at the forefront of the industry in safety performance. A well-run operation is a safe operation.

We have established a leading position in the development and use of technology and innovation – allowing us to increase productivity and reduce risk. As the industry faces increasingly complex geological, environmental and cost pressures, our technology advantage will be an increasingly important value driver.

Our commercial activities aim to ensure we reap the maximum value from each of our businesses. Our marketing teams work hand-in-hand with our operations, so that our resource management is fully aligned to the market.

Over the years we have leveraged our understanding of customer needs to create new markets for our products, including high temperature Weipa bauxite, and champagne and pink diamonds. We deploy industry-leading capabilities in supply chain optimisation and a variety of logistics solutions across the Group – and have in-house centres of excellence for value-in-use analysis, pricing and contracting strategies. Together, these activities allow us to manage risk and capture value in all market conditions.

4. Balance sheet strength

In a cyclical and capital intensive industry such as mining, a strong balance sheet is essential in order to preserve optionality and generate shareholder wealth at all points in the cycle. We target a net gearing ratio of 20 to 30 per cent in order to maintain our robust balance sheet – and aim to stay at the lower end of this range at the current point in the cycle. This positions us favourably to withstand current industry pressures, protect shareholders and seize on any opportunities these market conditions create.

5. Capital allocation discipline

We have a consistent and disciplined approach to capital allocation. Our first allocation is to essential sustaining capital for our operations. Next, we fund our primary contract with our shareholders – the progressive dividend. Finally, we assess the best use of the remaining capital between alternatives of compelling growth, debt reduction and further cash returns to shareholders. At each stage, we apply stringent governance and assessment criteria as we seek to maximise return on every dollar spent.

6. Free cash flow generation

Over recent years we have made improvements to our business – increasing our productivity, reducing operating and capital costs and delivering incremental volume expansions from high quality projects. Together with the quality of our asset base, these actions enhance our capacity to generate free cash flows, and underpin our confidence in our ability to deliver sustainable returns to shareholders.

Progress against strategy

| | |

| What we said we would do in 2014 | | What we did |

| World-class portfolio | | |

| Continue reshaping our portfolio | | Announced or completed asset sales of US$3.9 billion since 2013 (see page 19) |

| Curtail the Gove alumina refinery during the first half of 2014 | | Production at Gove curtailed in May 2014 (see pages 28 to 29) |

| Keep sustaining capital expenditure at 2013 levels of around US$3 billion | | Reduced sustaining capital expenditure to US$2.7 billion (see page 13) |

| Quality growth | | |

| Reduce total capital expenditure to less than US$11 billion in 2014 and to around US$8 billion in 2015, while delivering steady growth | | Reduced capital expenditure from US$13.0 billion in 2013 to US$8.2 billion, completing two major projects which enabled us to bring on significant new volumes (see page 18) |

| Continue to progress key evaluation projects at a pace that matches our overall view of investment priorities | | Progressed studies at South of Embley (bauxite), La Granja and Resolution (copper), Zulti South (titanium dioxide), Mount Pleasant (thermal coal) and Ranger 3 Deeps (uranium) (see pages 28 to 37) |

| Ramp up the Pilbara operations to reach an annual production rate of 290 Mt/a before the end of the first half of 2014 | | Annual production rate of 290 Mt/a from the Pilbara reached in May 2014, two months ahead of schedule. |

| Increase Pilbara mine production capacity by 60 Mt/a between 2014 and 2017, by focusing predominately on brownfield expansions and low-cost productivity gains | | 40 Mt/a of low-cost, brownfield growth in implementation. Investment decision on Silvergrass mine not required in 2015. (see pages 36 to 37) |

| Continue to discuss the pathway forward for Oyu Tolgoi underground expansion with the Government of Mongolia | | Continued discussions with the Government of Mongolia over the development pathway. Finalised underground feasibility study and technical report (see pages 30 to 31) |

| Operating and commercial excellence | | |

| Target, above all, the elimination of workplace fatalities | | Regrettably, our Group had two fatalities at our managed operations during 2014 (see page 22) |

| Achieve year-on-year improvement in AIFR and lost time injuries | | Our all injury frequency rate (AIFR) improved from 0.65 per 200,000 hours worked in 2013 to 0.59 in 2014 (see page 22) |

| Improve how we manage critical risks and learn from serious potential accidents | | Updated our safety strategy to confirm our focus on injury reduction and strengthen our emphasis on fatality elimination and catastrophic event prevention (see page 22) |

| Deliver further savings to reach US$3 billion full-year improvement in 2014 versus 2012 in operating cash costs | | Achieved a further US$1.3 billion of operating unit cash cost improvements in 2014, delivering total operating cash cost savings of US$3.6 billion versus 2012 (see page 40) |

| Maintain the reduced exploration and evaluation spend achieved in 2013 | | Reduced exploration and evaluation spend by a further US$0.2 billion (see page 38) |

| Increase sales volumes at Oyu Tolgoi | | Increased mined copper and gold production at Oyu Tolgoi by 94% and 275% respectively compared with 2013, with copper sales increasing seven-fold (see pages 30 to 31) |

| | |

| What we said we would do in 2014 | | What we did |

| Balance sheet strength | | |

| Pay down debt to a more sustainable level | | Reduced net debt from US$22.1 billion in June 2013 to US$12.5 billion at 31 December 2014. The gearing ratio at the end of 2014 was 18.6%, compared with 25.2% at the end of 2013 (see page 13) |

| Capital allocation discipline | | |

| Continue to apply our enhanced capital allocation systems and controls | | Maintained “cash generation offices” to strengthen the focus on cash and improve visibility for senior managers in this area Continued to reinforce Investment Committee approvals process (see pages 18 to 19) |

| Allocate capital in the following order of priority: essential sustaining capital expenditure; progressive dividends; iterative cycle of compelling growth, debt reduction, and further cash returns to shareholders | | Disciplined capital allocation framework adhered to, resulting in: sustaining capital of US$2.7 billion, progressive dividend of US$3.7 billion, compelling growth of US$5.5 billion and net debt reduction of US$5.6 billion (see pages 18 to 19) |

| Free cash flow generation | | |

| Reduce working capital | | Released US$1.5 billion of working capital (see page 1) |

| Materially increase returns to shareholders | | Increased our progressive dividend by 12 per cent and announced on 12 February 2015 a share buy-back of US$2.0 billion (a combined increase of 64 per cent compared with 2013) (see pages 18 to 19) |

Our 2015 strategic priorities

We will continue to focus on our critical value drivers in 2015, in order to meet our commitment to deliver sustainable returns to shareholders.

As always, we will maintain our relentless focus on safety, as measured by both the elimination of fatalities and minimising all injury frequency rates and lost time injuries.

We will continue to shape our world-class portfolio – ensuring that we focus on only the highest returning assets in our preferred industry sectors, and that our capital is deployed in the most efficient way.

We will further enhance our portfolio as we complete a number of key growth projects, including the infrastructure for our 360 Mt/a iron ore expansion and our new Kitimat smelter. Beyond this, we will progress our South of Embley bauxite project and will continue our work on creating the conditions necessary to further advance the underground expansion of Oyu Tolgoi. Importantly, we will deliver measured, value-adding growth while reducing our capital expenditure to less than US$7.0 billion in 2015.

Our strong focus on costs will continue in 2015, as we target further operating cash cost savings of US$750 million and continue to optimise our working capital. We will further leverage our strength in technology and innovation, and our leading commercial capabilities, to ensure we remain the supplier of choice to our customers and maximise the cash generated from every business.

Maintaining our balance sheet strength will remain a core priority. We aim to maintain our gearing ratio at the low end of the 20 per cent to 30 per cent range.

Business model

How we create value

Rio Tinto owns a portfolio of world-class assets, the result of investment decisions made in line with our longstanding strategy. The way we find, develop and operate these assets; the way we market the minerals and metals we produce; and the legacy we leave at the end of these assets’ lives enables us to create value and deliver sustainable shareholder returns.

Through productivity improvements, cost reductions and prudent growth we preserve and enhance value from our portfolio. We commit to finding ever safer, smarter and more sustainable ways to run our businesses, and our competitive advantages – which spring from a combination of our assets, our people, our capabilities and our values – keep us strong throughout the cycle.

Explore and evaluate

Our experienced in-house exploration team has a proven track record of discovering Tier 1 orebodies: the highest-value deposits that are profitable throughout the commodity cycle. We maximise opportunities by exploring for and evaluating deposits in new geographies and in our preferred commodities. We also explore the orbits of our current operations, like Weipa in Australia or Bingham Canyon in the US, which sustains the value of our existing businesses. So that we can keep our focus on targets that are important to Rio Tinto, we operate the majority of exploration programmes ourselves, rather than outsourcing. We will, however, partner with others if it gives us access to attractive opportunities, or skills, that we do not possess in-house, and which support the quality of our exploration pipeline.

Our orebody knowledge allows us to find value-enhancing ways of developing our resources and positioning our products in the marketplace, and helps support the Group’s investment decision-making. Our geological expertise gives us the confidence to keep hunting for the most elusive discoveries. And we have a strong tradition of developing and applying innovative technologies to resolve specific exploration challenges.

Develop

We develop orebodies for long-term value delivery. We have strengthened our investment assessment criteria, our levels of independent review of opportunities and our investment approval processes. We approve investment only in opportunities that, after prudent assessment, offer attractive returns that are well above our cost of capital.

During the development phase, we plan the most efficient configuration for mining the orebody and for getting the products to market. We work closely with our customers, to create demand for the optimal suite of products, thus maximising value over the deposit’s lifetime. Once the value of the resource is confirmed, and internal and external approvals are received, the project moves into implementation and construction. We aim to deliver projects on time and on budget – such as reaching our targeted 290 Mt/a annual production rate from the Pilbara iron ore operations in May 2014, two months ahead of schedule.

Mine and process

We create value by safely and efficiently operating assets that fit with our strategy. By focusing on operating excellence we will sustain our low-cost leadership position and drive our operations even further down the cost curve.

Our global operating model allows us to implement standard processes and systems across the Group, for instance in procurement, operations and maintenance. This increases the life of our equipment and optimises the extraction of ore. In turn, we enjoy higher production and reduced costs, and we maximise value.

Our commitment to technology and innovation sets us apart from our peers and allows us to take advantage of opportunities that may not be available to others. Our world-class technologies bring us ongoing productivity benefits, and help us tailor our products to our customers’ needs. Through our network of partnerships with academia, technology suppliers and other experts, we gain access to knowledge and technical prowess that augment our own capabilities.

Market and deliver

Supplying high-quality products, which have been developed to meet our customers’ needs, is the basis of our business. Our diverse portfolio of metals

and minerals allows us to respond to demand across the development cycle: we supply basic raw materials and refined products that are the building blocks of added-value goods. Most of our customers are industrial companies that process our products further and supply numerous sectors – including construction and infrastructure, automotive, machinery, energy and consumer goods.

Our marketing teams work closely with our operations, so that our resource management is fully aligned to the market, and we innovate and improve our products and services to maximise value to customers.

We are constantly adding to our knowledge of our markets and our customers’ requirements, allowing us to improve our investment decisions. In many cases, we are responsible for delivering product to our customers, and do so efficiently, reliably and cost-effectively. We have capabilities across a variety of logistics solutions, including our own networks of rail, ports and ships.

Close down and rehabilitate

We integrate closure planning throughout an asset’s life cycle, from the earliest stages of project development, and aim to progressively rehabilitate as much land as possible before closure. When a resource reaches the end of its life, we seek sustainable and beneficial future land uses, to minimise financial, social and environmental impact. We work together with our stakeholders to identify post-closure options that take into account their concerns and their priorities for the use of the land. By partnering with external conservation organisations, we access expertise that helps us improve our rehabilitation performance. Our approach helps us to maintain a positive reputation and uphold our licence to operate.

Read more about how we embed sustainability throughout our business on pages 20 to 26.

Delivering value for our stakeholders

Rio Tinto’s primary focus is on the delivery of value for our shareholders. We balance disciplined investment with prudent management of our balance sheet and cash returns to shareholders. We offer a long-term investment opportunity, and commit to sustainable growth in returns to shareholders through our progressive dividend policy. As we work, fixed on this core aim, our activities also give us the opportunity to create value for our other stakeholders, in a variety of ways.

Customers

We supply our customers with the right products at the right time. They then add further value, by turning them into the end products that society needs to make modern life work.

Communities

Our operations create employment and career development opportunities for our local communities, as well as business opportunities for local suppliers. Communities often benefit from the infrastructure we put in place to serve our facilities and, once our operations are closed, we restore the sites – often for community use, new industry, or back to native vegetation.

Our people

We invest in our people throughout their careers, offering diverse employment prospects, opportunities for development, and competitive rewards and benefits that have a clear link to performance.

Governments

We are often a major economic contributor to the local, state and national jurisdictions in which we operate. Our tax and sovereign equity contributions enable governments to develop and maintain public works, services and institutions. We work together to facilitate growth of diverse and sustainable economies that endure far beyond the active life of our operations.

Suppliers

By seeking a balance of global, national and local supply capability, and supporting local supplier development, we drive value for our shareholders and deliver economic benefits for the communities in which we operate.

Key performance indicators

Our key performance indicators (KPIs) enable us to measure our financial and sustainable development performance. Their relevance to our strategy and our performance against these measures in 2014 are explained below.

Some KPIs are used as a measure in the long-term incentive arrangements for the remuneration of executives. These are identified with this symbol:

KPI trend data

The Group’s performance against each KPI is covered in more detail in later sections of this Annual report. Explanations of the actions taken by management to maintain and improve performance against each KPI support the data.

See the Remuneration Report on

page 64

Notes

| (a) | The accounting information in these charts is drawn up in accordance with IFRS. |

| (b) | Underlying earnings is the key financial performance indicator which management uses internally to assess performance. It is presented here as a measure of earnings to provide greater understanding of the underlying business performance of the Group’s operations. Items excluded from net earnings to arrive at underlying earnings are explained in note 2 to the 2014 financial statements. Both net earnings and underlying earnings deal with amounts attributable to the owners of Rio Tinto. However, IFRS requires that the profit for the year reported in the income statement should also include earnings attributable to non-controlling interests in subsidiaries. |

| | | | | | |

| Indicator | | | | | | |

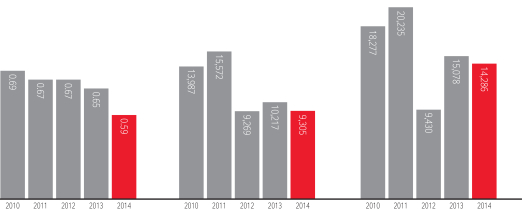

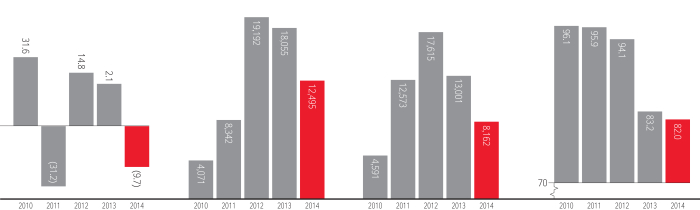

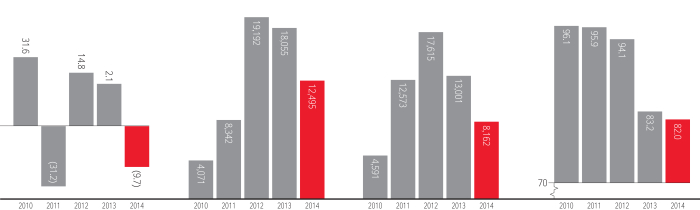

All injury frequency rate (AIFR) Per 200,000 hours worked | | Underlying earnings(a) (b) US$ millions | | Net cash generated from operating activities(a) US$ millions |

| | | |

| Relevance to strategy | | | | | | |

| The safety of our people is core to everything we do. Our goal is zero harm, including, above all, the elimination of workplace fatalities. We are committed to reinforcing our strong safety culture, and improving safety leadership. | | This is the key financial performance indicator used across the Group. It gives insight to cost management, production growth and performance efficiency. We are focused on reducing our costs and increasing productivity to improve earnings and deliver sustainable returns to shareholders. | | Net cash generated from operating activities is a complementary measure demonstrating conversion of underlying earnings to cash. It provides additional insight to how we are managing costs and increasing efficiency and productivity across the business in order to deliver increased returns. | | |

| | | |

| Performance | | | | | | |

| | |

| | | |

| Our AIFR has improved by 14 per cent over the last five years. We improved our AIFR by nine per cent from 2013. However, we did not meet our goal of zero fatalities and two people died while working at Rio Tinto managed operations in 2014. | | Underlying earnings have decreased by US$912 million compared with 2013. This reflects strong volumes (primarily in iron ore), favourable exchange rates, operating cash cost improvements and reductions in exploration and evaluation expenditure, which largely offset the unfavourable effect of price movements on major commodities. | | Net cash generated from operating activities of US$14,286 million, which include US$298 million of dividends from equity accounted units, are five per cent lower than in 2013, primarily as a result of lower prices which were partially offset by higher volumes, cash cost improvements and favourable movements in working capital. | | |

| | | |

| Definition | | | | | | |

| AIFR is calculated based on the number of injuries per 200,000 hours worked. This includes medical treatment cases, and restricted work-day and lost-day injuries for employees and contractors. | | Items excluded from net earnings to arrive at underlying earnings are explained in note 2 to the 2014 financial statements. | | Net cash generated from operating activities represents the cash generated by the Group’s consolidated operations, after payment of interest, taxes, and dividends to non-controlling interests in subsidiaries. | | |

| | | |

| More information | | | | | | |

| Page 22 | | Pages 178 to 179 | | Page 105 | | |

| | | | | | | | |

| | | | | | | | | |

| | Total shareholder return (TSR) % | | Net debt(a) US$ millions | | Capital expenditure(a) US$ millions | | Greenhouse gas (GHG) emissions intensity Indexed relative to 2008 (2008 being equivalent to 100) |

| | | | | | | | | |

| | The aim of our strategy is to maximise total shareholder return over the long term. This KPI measures performance in terms of shareholder wealth generation. We also monitor our relative TSR performance against peers. | | Net debt is a measure of how we are managing our balance sheet and capital structure. A strong balance sheet is essential for withstanding external pressures and seizing opportunities through the cycle. We constantly evaluate and balance the alternative uses for our cash between disciplined investment, strengthening our balance sheet, and returning cash to investors. | | We adopt a consistent approach to capital allocation. We are committed to a disciplined and rigorous investment process – investing capital only in assets that, after prudent assessment, offer attractive returns that are well above our cost of capital. | | Our GHG performance is an important indicator of our commitment and ability to manage exposure to future climate policy and legislative costs, and is closely linked to our energy use and cost. We are focusing on reducing the energy intensity of our operations as well as the carbon intensity of our energy, including through the development and implementation of innovative technologies. |

| | | | | | | | | |

| |  |

| | | | |

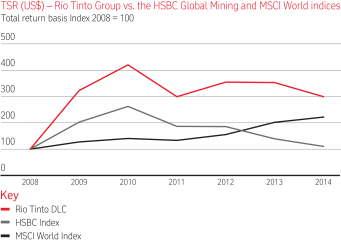

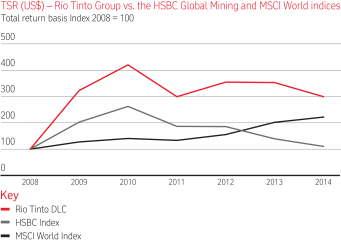

| | Rio Tinto’s TSR performance over the five-year period from 2010 to 2014 was characterised by continued nervousness in global equity markets. Total dividends paid in calendar year 2014 were 204.5 US cents per share, a 15 per cent increase on 2013. The subdued global macro environment coupled with a strong supply response caused prices for many of our commodities to decrease, which, in turn, pushed the Rio Tinto plc and Rio Tinto Limited share prices lower in 2014. These factors resulted in the Rio Tinto Group registering a TSR of -9.7 per cent in 2014. | | Net debt decreased from US$18,055 million at 31 December 2013 to US$12,495 million at 31 December 2014 due to operating cash inflows from divestment proceeds and the Turquoise Hill rights offering far exceeding outflows relating to capital expenditure and the increased dividend payment. | | Capital expenditure declined by US$4,839 million or 37 per cent to US$8,162 million in 2014, following the completion of five major capital projects in 2013 (Pilbara iron ore infrastructure expansion to 290 Mt/a, Oyu Tolgoi copper/gold mine, AP60 aluminium smelter, Kestrel coking coal mine and Argyle underground diamond mine). | | We have reduced our total GHG emissions intensity by 18 per cent between 2008 and 2014. This is largely a result of the aluminium smelter divestments (Ningxia in 2009, Sebree and Saint Jean in 2013), closure of the Lynemouth smelter in 2012, commissioning of our low intensity AP60 smelter in late 2013 and improved measurement methodology for coal seam gas at our Australian coal mines. |

| | | | | | | | | |

| | TSR combines share price appreciation and dividends paid to show the total return to the shareholder. | | Net debt is calculated as: the net borrowings after adjusting for amounts due to equity accounted units originally funded by Rio Tinto, cash and cash equivalents, other liquid resources and derivatives related to net debt. This is further explained in note 24 “Consolidated net debt” to the 2014 financial statements. | | Capital expenditure comprises the cash outflow on purchases of property, plant and equipment, and intangible assets. | | Our GHG emissions intensity measure is the change in total GHG emissions per unit of commodity production relative to a base year. Total GHG emissions are direct emissions, plus emissions from imports of electricity and steam, minus electricity and steam exports and net carbon credits purchased from, or sold to, recognised sources. |

| | | | | | | | | |

| | Page 90 | | Page 141 | | Pages 180 to 181 | | Page 24 |

Risk factors

The focus on the six value drivers articulated on pages 8 to 10 has been accompanied by a significant review of the risk factors the business faces.

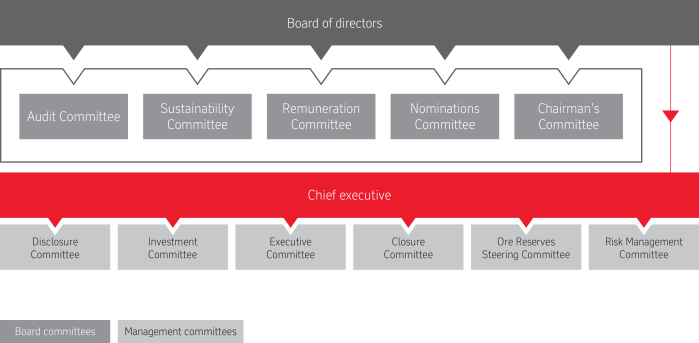

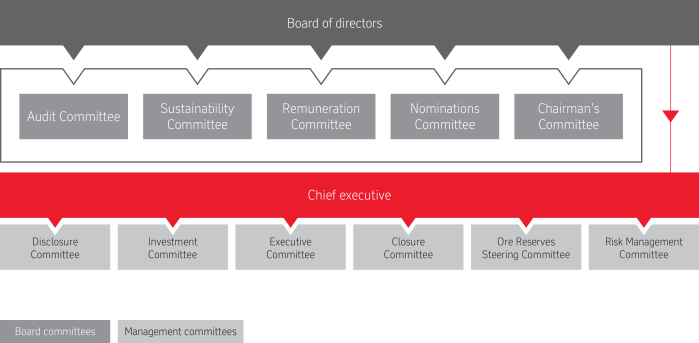

Overview of Rio Tinto’s risk management framework

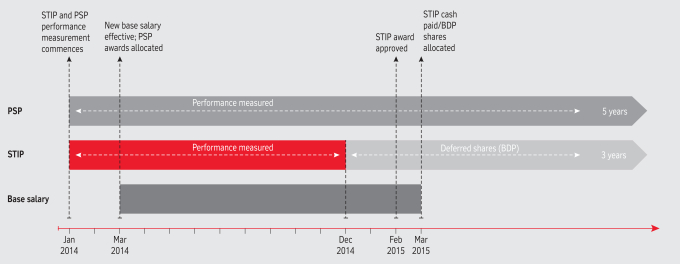

Our risk management framework recognises that managing risk effectively is an integral part of how we create value, and fundamental to our business success. The responsibility for identifying and managing risks lies with all of Rio Tinto’s managers and business leaders. They operate within the Group-wide framework to ensure that risks are managed within agreed thresholds. The framework, underpinned by Rio Tinto’s Risk policy and standard, includes clearly-defined oversight responsibilities for the board of directors and the Executive Committee, supported by the Risk Management Committee. It also outlines the roles played by central support functions, by Group Risk, and by Group Audit & Assurance to support effective risk analysis and management across Rio Tinto.