Annual report 2019

Our purpose As pioneers in mining and metals, we produce materials essential to human progress

Contents Strategic report Our business 2019 at a glance 4 Chairman’s statement 6 Chief Executive’s statement 10 Financial statements Our business model 14 Our values 15 Group income statement 146 Strategic context 16 Group statement of comprehensive income 147 Our stakeholders 18 Group cash flow statement 148 Our strategy 20 Group balance sheet 149 Key performance indicators 22 Group statement of changes in equity 150 Chief Financial Officer’s statement 27 Reconciliation with Australian Accounting Standards 151 Financial review 29 Outline of dual listed companies structure and basis Portfolio management 38 of financial statements 151 Notes to the 2019 financial statements 152 Business reviews Rio Tinto financial information Iron Ore 40 by business unit 252 Aluminium 44 Copper and Diamonds 48 Energy and Minerals 52 Production, reserves and operations Growth and Innovation 56 Commercial 58 Metals and minerals production 270 Ore reserves 273 Sustainability 60 Mines and production facilities 282 Risk report Additional information Risk management 71 Principal risks and uncertainties 74 Independent limited assurance report Five-year review 81 – Sustainability 290 Shareholder information 292 Contact details 299 Directors’ report Cautionary statement about forward-looking statements 300 Governance Board of Directors 84 Executive Committee 86 Chairman’s governance review 88 How the Board works 90 Matters discussed in 2019 91 Our stakeholders 92 For this Annual report on Form 20-F, certain pages have been omitted. Board effectiveness 94 The Form 20-F is consistent with the page numbering of the Evaluating our performance 96 Annual report. Nominations Committee report 98 Audit Committee report 100 Sustainability Committee report 104 Compliance with governance codes and standards 106 Remuneration report Annual statement by the Remuneration Committee Chairman 110 Remuneration at a glance 113 Implementation report 116 Additional statutory disclosure 139

Our strategy is to create superior value for shareholders by meeting our customers’ needs, maximising cash from our world-class assets and allocating capital with discipline. Image to be retouched 2019 financial highlights $21.2bn $7.2bn underlying EBITDA total dividends declared $10.4bn $3.7bn underlying earnings net debt $9.2bn 24% free cash flow return on capital employed (ROCE)

Strategic report Our business Traditional owners near Amrun, 2019 at a glance 4 our newest bauxite mine in Queensland, Australia. Chairman’s statement 6 Chief Executive’s statement 10 Our business model 14 Our values 15 Strategic context 16 Our stakeholders 18 Our strategy 20 Key performance indicators 22 Chief Financial Officer’s statement 27 Financial review 29 Portfolio management 38 Business reviews Iron Ore 40 Aluminium 44 Copper and Diamonds 48 Energy and Minerals 52 Growth and Innovation 56 Commercial 58 Sustainability 60 Risk report Risk management 71 Principal risks and uncertainties 74 Five-year review 81 2 Annual report 2019 | riotinto.com

Image to be retouched Strategic report Strategic Annual report 2019 | riotinto.com 3

Strategic report 2019 at a glance Our business comprises a portfolio of world-class assets that generate strong cash flows through the cycle. Group highlights $14.9bn 50% net cash generated from operating activities total shareholder return (% over five years) (2018: $11.8bn) (2018: 33%) 636 US cents 0.42 underlying earnings per share all injury frequency rate (AIFR) (2018: 512 US cents) (2018: 0.44) 443 US cents 46% total dividend per share reduction in absolute emissions (2018: 550 US cents) (since 2008, managed operations) A train travels through the Pilbara region of Western Australia, home to our iron ore business. 4 Annual report 2019 | riotinto.com

2019 at a glance Strategic report Strategic �ro�� r���n�� Pilbara managed iron ore operations Fe 16 4 1,700 4 Iron Ore km Iron ore is the primary component of steel. In the mines ports rail power Pilbara region of Western Australia, we have a network plants world-class, integrated portfolio of iron ore assets as well as certain salt assets; we are one of the leading contributors to the seaborne market. Our �n��r��in� quality product suite, including our flagship Pilbara Production* (100% basis) ������ Blend™of iron ore, is well positioned to benefit from continued demand across China, Japan and 326.7mt other markets. $24.1bn $16.1bn iron ore (2018: $18.7bn) (2018: $11.4bn) (2018: 337.8mt) �ro�� r���n�� Managed and non-managed operations Al 4 14 4 7 Aluminium Aluminium is one of the world’s fastest-growing mines smelters refineries hydro major metals. Lightweight and recyclable, it is found power in everything from jet engines to electric vehicles to plants smartphones. Our vertically integrated aluminium portfolio spans from high-quality bauxite mines to �n��r��in� alumina refineries to smelters which, in Canada, are Production* (our share) ������ powered entirely by clean, renewable energy and located in the first decile of the cost curve. 55.1mt 3,171kt $10.3bn $2.3bn bauxite aluminium (2018: $12.2bn) (2018: $3.1bn) (2018: 50.4mt) (2018: 3,231kt) �ro�� r���n�� Managed and non-managed operations Cu 5 1 3 Copper and Diamonds Copper plays a key role in electrification and power mines smelter power generation, including in renewable energy and plants electric vehicles. Our operations span the globe, from Mongolia to the US, and occupy various stages of the mining lifecycle. Our two diamond mines in �n��r��in� Australia and Canada make us one of the largest Production* (our share) ������ producers, and our white and coloured diamonds are some of the world’s most sought-after gems. 577kt $5.8bn $2.1bn mined copper (2018: $6.5bn) (2018: $2.8bn) (2018: 608kt) �ro�� r���n�� Managed operations Ti, B, Fe 6 7 5 3 Energy and Minerals Our Energy and Minerals product group comprises mines processing ports projects materials essential to a wide variety of industries, facilities including renewable energy and agriculture. We produce titanium dioxide, borates, high-grade iron ore pellets and concentrate and uranium. Production* (our share) �n��r��in� Our Ventures division is also exploring growth ������ opportunities in battery metals. 1,206kt 10.5mt titanium dioxide iron ore pellets and # $5.2bn $1.8bn slag concentrates (2018: $5.5bn) (2018: $2.1bn) (2018: 1,116kt) (2018: 9.0mt) * To allow production numbers to be compared on a like-for-like basis, we have excluded production from asset divestments completed in 2018 from our share of prior year production data. The financial data above includes the results of divested assets up to the date of sale. # Year on year decrease attributable to divestments. Annual report 2019 | riotinto.com 5

Strategic report 6 Annual report 2019 | riotinto.com

“�We aim to achieve and 2019 highlights report Strategic maintain industry- Our value over volume strategy, capital discipline, and strong markets leading safety and for some of our key commodities enabled us to deliver a robust financial sustainability performance in 2019. �ota� �i�i�e��� �ec�are� ������ear or�i�ar� �i�i�e�� performance, per ��are operational excellence, ���� ���ci�� �i�i��n� ��.��n ���� ��� capital discipline and ���� or�in�r� �i�i��n� the financial strength ��.��n ���� ��� to invest throughout ���� ��� the cycle, while ���� ��� providing superior ���� ��� returns to our shareholders.” $7.2bn 382 US cents (2018: $13.5bn) Simon Thompson per share Chairman (2018: 307 US cents per share) 26 February 2020 $10.4bn $45.1bn underlying earnings direct economic contribution Shareholder returns policy Our shareholder returns policy balances We expect total cash returns to shareholders three factors: to be in the range of 40-60% of underlying –– Maintaining a strong balance sheet earnings through the cycle. For our –– Investing for future growth shareholder returns policy, see page 36. –– Directly rewarding shareholders Annual report 2019 | riotinto.com 7

Strategic report Chairman’s statement Rio Tinto produces Mining is a highly competitive, capital- and In order to develop future growth options, including energy-intensive, long-cycle industry that has the Resolution copper project in the US and the materials essential major impacts, both positive and negative, on Winu copper-gold exploration project in Australia, society and the environment. To deliver long-term, in 2019, we boosted exploration and evaluation to human progress. sustainable success, we need to meet or surpass expenditure from $488 million to $624 million. our customers’ expectations; invest in developing There is hardly any the skills and capabilities of our people and the Sustainability productive capacity of our assets; build mutually In parallel with this report, we have published our aspect of modern life beneficial relationships with our suppliers and second report on climate change, which has been technology partners; protect the environment; guided by the recommendations of the Taskforce that our products do bring lasting social and economic benefits to our on Climate-related Financial Disclosure (TCFD). local communities and host governments; and The report includes our new 2030 targets to reduce not touch, and our reward our shareholders. our emissions intensity by 30% and our absolute emissions by 15% from 2018 levels. To deliver these 46,000 employees We aim to achieve and maintain industry-leading targets, we will spend approximately $1 billion over safety and sustainability performance, operational five years in climate-related projects, and research work hard – every excellence, capital discipline and the financial and development. We also report on progress in strength to invest throughout the cycle, while developing a feasible pathway towards our longer shift, every day providing superior returns to our shareholders. term ambition of net zero emissions by 2050. In 2019, I am pleased to report that your company – to safely fulfil has made good progress in all of these areas. The mining and metals value chain includes numerous “hard to abate” sectors, such as our purpose. Performance aluminium smelting, steel making and shipping, Safety is our top priority. In 2019, all of our safety where there are significant technological and performance indicators improved and we had zero economic hurdles to the development of viable fatalities. This is an outstanding achievement that decarbonisation pathways. In order to address reflects years of hard work and commitment by these challenges, we have established a number of the leadership team and all of our employees and technology partnerships that collectively represent suppliers. But we are not complacent, and we know a fundamental pillar of our sustainability strategy. that we now need to sustain this success. However, there are limits to what business can achieve alone. Enabling regulation, such as Overall, the operating performance of the Group carbon pricing, is essential to incentivise the was satisfactory, despite a number of challenges decarbonisation of these sectors, together with during the year, and our value over volume measures to maintain the competitiveness of strategy, capital discipline, and strong markets trade-exposed industries. Urgent, coordinated for some of our key commodities enabled us to government action is therefore needed to deliver a robust financial performance in 2019. encourage such investment within the timeframe required by the Paris Agreement. Underlying earnings increased to $10.4 billion (2018: $8.8 billion), underlying EBITDA rose to We have also made good progress in other areas $21.2 billion (2018: $18.1 billion), representing an of sustainability. For example, we have continued underlying EBITDA margin of 47% (2018: 42%), to promote industry-leading practices in tax and free cash flow amounted to $9.2 billion (2018: transparency by publishing our mineral $7.0 billion). As a result, we were able to maintain development contracts and the beneficial our strong balance sheet, while maintaining our ownership of our managed and non-managed joint track record of superior returns to shareholders. ventures. We believe that such transparency helps The Board has recommended a final ordinary to build trust and will result in better social and dividend of 231 US cents per share, taking total economic outcomes over the long term. dividends declared to shareholders announced this year to $7.2 billion. Tax payments and economic contribution In 2019, we paid $4.5 billion in corporate taxes to We continue to invest in high-return projects to governments around the world, helping our host sustain and grow our production capacity, including governments to provide vital services to their in our iron ore operations in Australia and the citizens and to pursue their development goals. Kennecott copper mine in the US. We also continue Our direct economic contribution to the to make progress with the Oyu Tolgoi underground communities in which we operate – including development in Mongolia, one of the most complex community investment, development capital projects in the world today. contributions and payments to landowners – was $45.1 billion. While the monetary amount is clearly significant, equally important are the opportunities we have created for many thousands of people and local businesses to grow and to prosper. 8 Annual report 2019 | riotinto.com

Chairman’s statement Engagement The Board report Strategic As expectations continue to increase about the This year, the Board bid farewell to Ann Godbehere role of business in society, it is vital that the Board and Dame Moya Greene, who stepped down as hears first hand from stakeholders about their non-executive directors in May and June, perceptions of our performance and the opportunities respectively. I am delighted to welcome Hinda and challenges that lie ahead. This year, we held Gharbi, Jennifer Nason and Ngaire Woods, who join civil society roundtables in Australia, Canada and the Board in 2020. We look forward to benefiting the US. The discussions focused on climate change from their insights and expertise in natural and the environment, industry lobbying and our resources, finance, technology, governance and impact on the communities in which we operate. public policy. We have already acted on much of the valuable feedback that we received at these events – for A look ahead example, by engaging with industry associations in Looking ahead, we continue to face significant Australia and elsewhere on climate change policy; geopolitical uncertainties and we are currently intensifying our focus on delivering our water evaluating the impact of the Covid-19 virus on our monitoring and resettlement compensation business as we enter a new decade, I am pleased commitments to herders in Mongolia; and seeking to say Rio Tinto continues to be well positioned to to improve how we communicate our environmental create long-term, sustainable value for all of performance to the local community and civil our stakeholders. society in Madagascar. We also engaged with customers and suppliers, commissioning a customer attitudes’ survey and inviting a major supplier and technology partner to present their views of Rio Tinto to the Board. Simon Thompson Board members continue to engage with Rio Tinto Chairman employees around the world. Almost 500 people 26 February 2020 attended our second “Employee AGM” in Montreal and individual Board members held smaller town halls in Australia, Madagascar, Singapore, South Africa and the US. The most frequent topics raised by employees in the Q&A sessions at these events related to sustainability, culture and behaviours, and technological change, emphasising the importance that our employees attach to our performance in these critical areas. Some examples of how engagement with our employees has shaped the Board’s thinking and decision- making can be found on pages 92 and 93. Visits to our sites and global hubs are one of the most rewarding parts of my job as Chairman and I am always impressed by the pride and commitment of our employees and the extraordinary scope of the innovations taking place across the Group. I would like to thank J-S, the leadership team and all of our employees for their hard work and dedication over the year, and to congratulate them on their achievements. We look forward to meeting many of our shareholders at our annual general meetings in April and May 2020, in London and Brisbane, respectively. In addition to routine matters, we will be asking shareholders to approve the appointment of KPMG as our new auditors from 1 January 2020. Annual report 2019 | riotinto.com 9

Strategic report 10 Annual report 2019 | riotinto.com

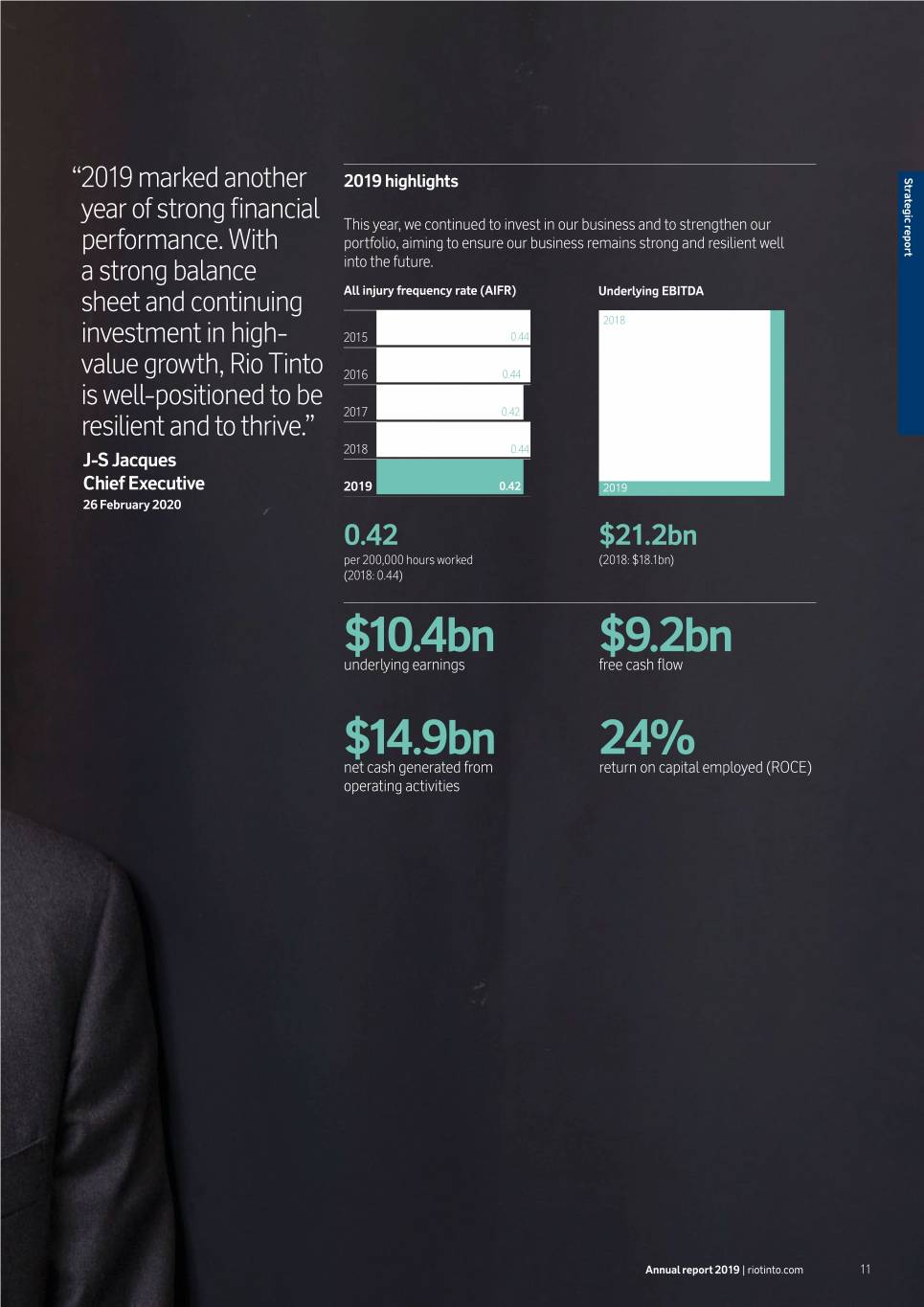

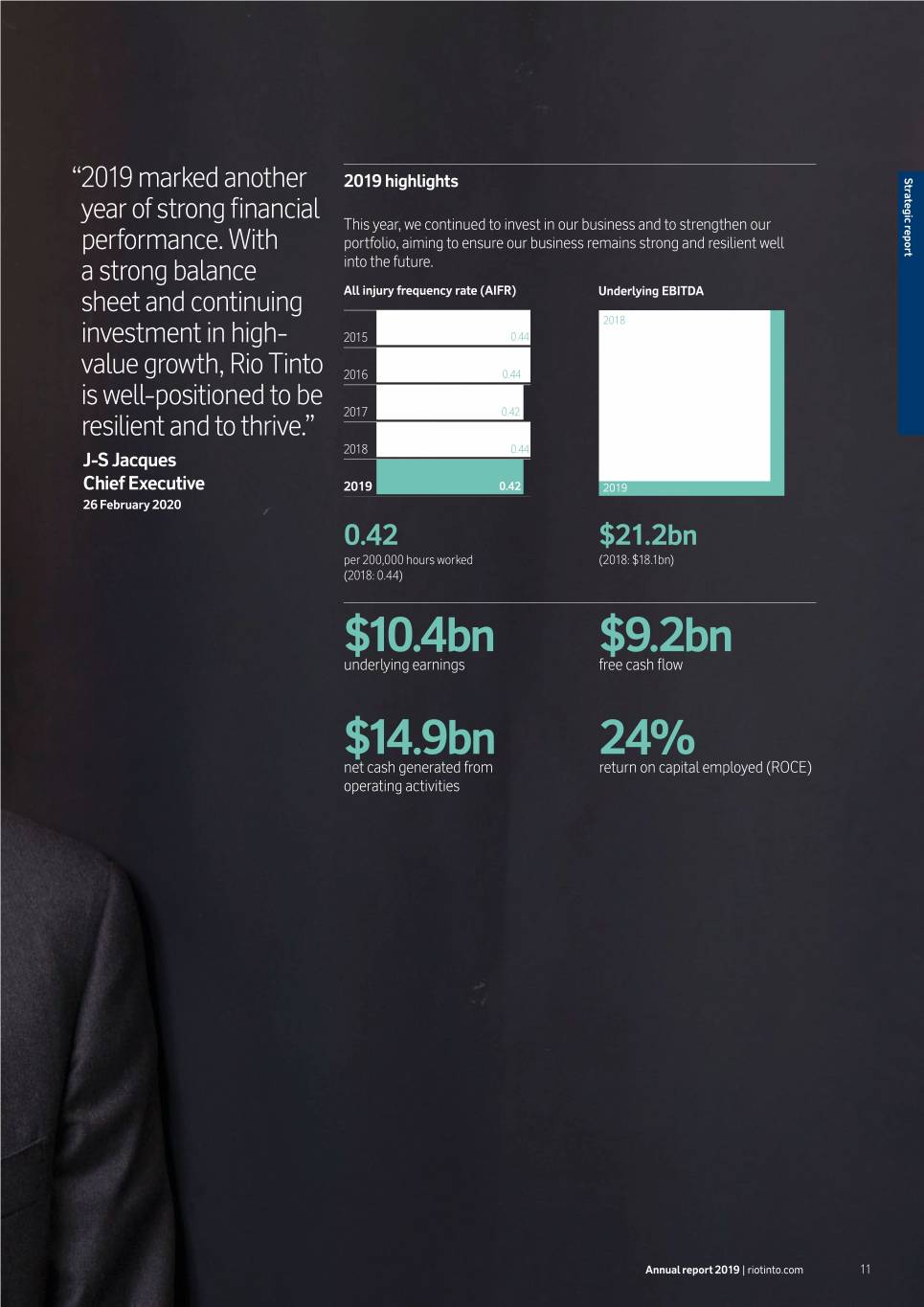

“�2019 marked another 2019 highlights report Strategic year of strong financial This year, we continued to invest in our business and to strengthen our performance. With portfolio, aiming to ensure our business remains strong and resilient well a strong balance into the future. sheet and continuing All �n�ur� �re�uen�� rate �A���� �n�erl��n� �����A ���� investment in high- ���� �.�� value growth, Rio Tinto ���� �.�� is well-positioned to be ���� �.�� resilient and to thrive.” ���� �.�� �J-S Jacques Chief Executive 2019 0��2 ���� 26 February 2020 0.42 $21.2bn per 200,000 hours worked (2018: $18.1bn) (2018: 0.44) $10.4bn $9.2bn underlying earnings free cash flow $14.9bn 24% net cash generated from return on capital employed (ROCE) operating activities Annual report 2019 | riotinto.com 11

Strategic report Chief Executive’s statement Over the past years, With a strong balance sheet and our continuing In our Energy and Minerals (E&M) product group, investment in high-value growth, sustainability and a favourable pricing environment, combined with our aim has been workforce capabilities, we are well positioned to be improved operational performance, contributed to resilient, and to thrive, in a new era of complexity. strong results. In 2019, E&M delivered underlying constant: to deliver EBITDA of $1.8 billion, 41% higher than 2018 I am grateful to our employees and partners (excluding divested coal assets). superior shareholder around the world who made our success possible, particularly in safety. As I look back on our Portfolio value and contribute performance in 2019, I am most proud of our teams’ This year, we continued to strengthen our portfolio efforts here. We improved our all injury frequency by increasing investment in high-value growth to society as we rate (AIFR), which was 0.42 this year (down from projects to ensure our business remains strong 0.44 in 2018), reflecting lower severity rates. We and resilient well into the future. produce the materials also ended the year with no fatalities and improved process safety performance. While this is a In December, for example, we announced a essential to modern meaningful achievement, we know we cannot be $1.5 billion investment at our Kennecott copper complacent; we will continue to make safety our mine in Utah, in the US, which will serve to extend life. Our strong focus number one priority, with the aim of sending operations to 2032. In November, we announced everyone home safely at the end of every shift, a $749 million investment in our Greater Tom Price on generating cash every day. operations, in the Pilbara, to help sustain the production capacity of our iron ore business. from our world-class Performance In April, we announced we would sustain current 2019 marked another year of strong financial capacity and extend the life of our Richards Bay assets allows us to do performance for our company, driven by favourable Minerals operation through the investment of iron ore pricing and stronger operational $463 million in the Zulti South project. After a exactly this. performance in the second half of the year. number of security incidents, construction of this project is currently on hold; we will assess We delivered underlying EBITDA of $21.2 billion restarting construction after operations normalise. and an underlying EBITDA margin of 47%. Operating cash flow for the year was $14.9 billion, In April, we committed $302 million of additional free cash flow was $9.2 billion and we ended the expenditure to advance the Resolution Copper year with net debt of $3.7 billion – a strong project in Arizona, in the US, to fund additional 0.42 balance sheet supports our resilience and drilling, orebody studies, infrastructure all injury frequency rate (AIFR) provides optionality. improvements and permitting activities as the project moves to the final stage of permitting. As a result, we were able to announce a record final ordinary dividend of $3.7 billion, or 231 US cents At the Oyu Tolgoi underground copper and gold per share, bringing the full year ordinary dividend mine, in Mongolia, we completed the primary 47% to 382 US cents per share. In total, we announced production shaft – a key milestone – in October Group underlying EBITDA margin $7.2 billion in cash returns to shareholders this 2019. Work continues on the mine design and, year, bringing the total returns declared since 2016 overall, we remain within the cost and schedule to $36 billion. ranges announced in July 2019. We continue to expect to complete the mine design in the first half From an operational perspective, in the first half of 2020 and the definitive estimate of cost and $3.7bn of this year we experienced some challenges in schedule in the second half of 2020. net debt our iron ore business in the Pilbara, in Western Australia, which we proactively addressed, closing To create options for future growth, this year also the year with solid production momentum. Overall, saw us maintain our industry-leading investment shipments for the year were 3% lower than in 2018, in exploration. In 2019, we invested $624 million primarily due to these operational challenges and in 69 programmes in seven commodities across weather-related incidents. Despite this, our Pilbara 17 countries, with copper remaining the focus. For iron ore operations delivered a 72% underlying free example, we were pleased that our Winu copper- on board (FOB) EBITDA margin in 2019. gold exploration project, in Western Australia, had some early success; we ended 2019 with phase 2 In aluminium, this year the market recorded drilling well underway. significant price decreases in alumina and aluminium. Despite these challenges, our We also continued our work to make our portfolio aluminium business maintained its position as the as efficient as possible, in part through the use of sector leader, delivering an EBITDA margin of 26% technology and innovation, including automation. from integrated operations and a 21% increase in We begin 2020 with a fleet of 183 autonomous third-party bauxite sales. trucks, which, in the Pilbara, cost 15% less to operate than an equivalent manned truck. Rio Tinto In copper, our 2019 operational performance was is also home to the world’s largest autonomous affected by lower grades at all operations, which we drill fleet – 26 drills – which this year, in our Pilbara partly offset by higher throughput and productivity iron ore business, unlocked a 25% increase in improvements. Our average realised copper price productivity and a 40% improvement in equipment for the year was down 7% compared to 2018; in utilisation. AutoHaul™, our automated rail network 2019, the London Metal Exchange (LME) recorded a decline of 8%. 12 Annual report 2019 | riotinto.com

Chief Executive’s statement in Western Australia, also continues to play an To continue to improve our performance, we plan With $20 billion of capital expenditure planned report Strategic important role in increasing efficiency; to date, it to spend approximately $1 billion over the next five over the next three years, we will continue has increased capacity by 10mt, a figure we expect years in climate-related projects, research and disciplined investment in our business, renewing to see increase with further optimisation. development, partnerships and other activities to many of our operations through the replacement enhance the climate resilience of our business. For of mines and major equipment and by investing Partners example, in early 2020, we announced a $98 million in growth, notably at Oyu Tolgoi. Once again this year, our focus on partnership investment to build a 34 MW solar plant at our new continued and intensified – we are very clear that Koodaideri iron ore mine in the Pilbara, alongside Sustainability and partnership will remain no business can have sustainable, meaningful a lithium-ion battery energy storage system. The important priorities and indeed, will play an impact on its own. Partnership is a core enabler of plant and battery will limit our annual carbon dioxide increasingly important role across all aspects of our sustainability strategy, and I was very pleased emissions by about 90,000 tonnes (compared to our business. And our promise to our employees with our progress in forming new, innovative conventional gas-powered generation). This is the and contractors – to do everything we can to connections across the value chain. equivalent of taking about 28,000 cars off the road. keep them safe, healthy, and equipped to meet this new era’s challenges and opportunities – For example, recognising that students need the People is as strong as ever. skills to keep pace with a rapidly changing world, This year, I again spent a significant amount of we launched an innovative partnership in Australia time with our employees, visiting 17 assets and And our purpose – to produce materials essential with leading start-up accelerator BlueChilli and each of our global hubs and satellite offices. Over to human progress – will guide our company into Amazon Web Services. Our collective aim is to the course of the year, I held more than 30 town what promises to be an exciting future. fast-track the development of skills needed for halls and small group discussions in 20 locations. the digital future, including critical thinking, I continue to be impressed by our employees’ problem-solving, automation, systems design energy, creativity and ambition, and am proud of and data analytics. Rio Tinto will invest $7 million the efforts we have made to strengthen our culture (A$10 million) in this four-year national and improve innovation, world-class technical J-S Jacques programme, which will crowd-source ideas from talent and commercial capability. All three are Chief Executive other start-ups as well as schools and universities. critical to our success, today and into the future. 26 February 2020 And in Canada, we signed a historic agreement We continued building our innovation culture with the Innu community of Ekuanitshit. Named through initiatives like our Pioneering Pitch “Uauitshitun,” or “mutual support” in the Innu programme, in which our employees are language, the agreement is designed to generate encouraged to come up with new, creative ideas economic development opportunities in a variety of on how to strengthen and improve our business, ways. For example, we will support Innu businesses and then pitch them to a panel of Rio Tinto judges, by providing health and safety training and improving who award up to $250,000 and expert support to their competitiveness in the procurement process. implement the best of them. In 2019, thanks to our $1bn We will also partner in other areas such as environment, employees’ ingenuity, Pioneering Pitch identified to be spent in climate-related projects land stewardship, and traditional practices and $35 million in potential benefit to our business. education, through pre-employment vocational training and school programmes. We also strengthened the technical capability of our employees, including by expanding our Centres We also strengthened our commitment to climate of Excellence (CoEs) from three to eight. Our CoEs change, which has been part of our strategic pool the company’s technical expertise in areas Investing thinking for well over two decades. Since 2008, such as tailings, geotechnical engineering and we have reduced absolute emissions from our process and underground mining safety, allowing managed operations by 46% (18% excluding our experts to collaborate more effectively while A$10m divestments). Today, 76% of our electricity also providing our operations with an easy to in building skills for the digital future consumption at managed operations is supplied access, ready resource. RioExcel, our programme from renewable energy. Most of our operations now for recognising and promoting our technical in Australia have significantly lower carbon intensities than experts, also continued to progress, with 50 sector averages. We announced new climate and employees taking part in 2019. environmental partnerships in 2019, including our initiative with China Baowu Steel Group, our A look ahead customer in China, and Tsinghua University. We As we end one decade and begin another, our believe it is important to work with our customers focus will remain on delivering our value over and suppliers to help support mutual goals to volume strategy, and striving to ensure our reduce emissions and strengthen the resilience company remains strong, resilient and able to of our businesses. deliver superior returns to shareholders in the short, medium and long term. In 2020, we set a new ambition: to reach net zero emissions across our operations by 2050. We also This year, we did significant work on developing set new targets – to reduce our emissions intensity scenarios to help us understand what we need to by 30% and our absolute emissions by 15%, both by do to thrive in this era of increasing complexity. Our 2030 and from 2018 levels. And overall, our growth focus on innovation, operational and commercial between now and 2030 will be carbon neutral. excellence, as well as high-value growth, will be key. Annual report 2019 | riotinto.com 13

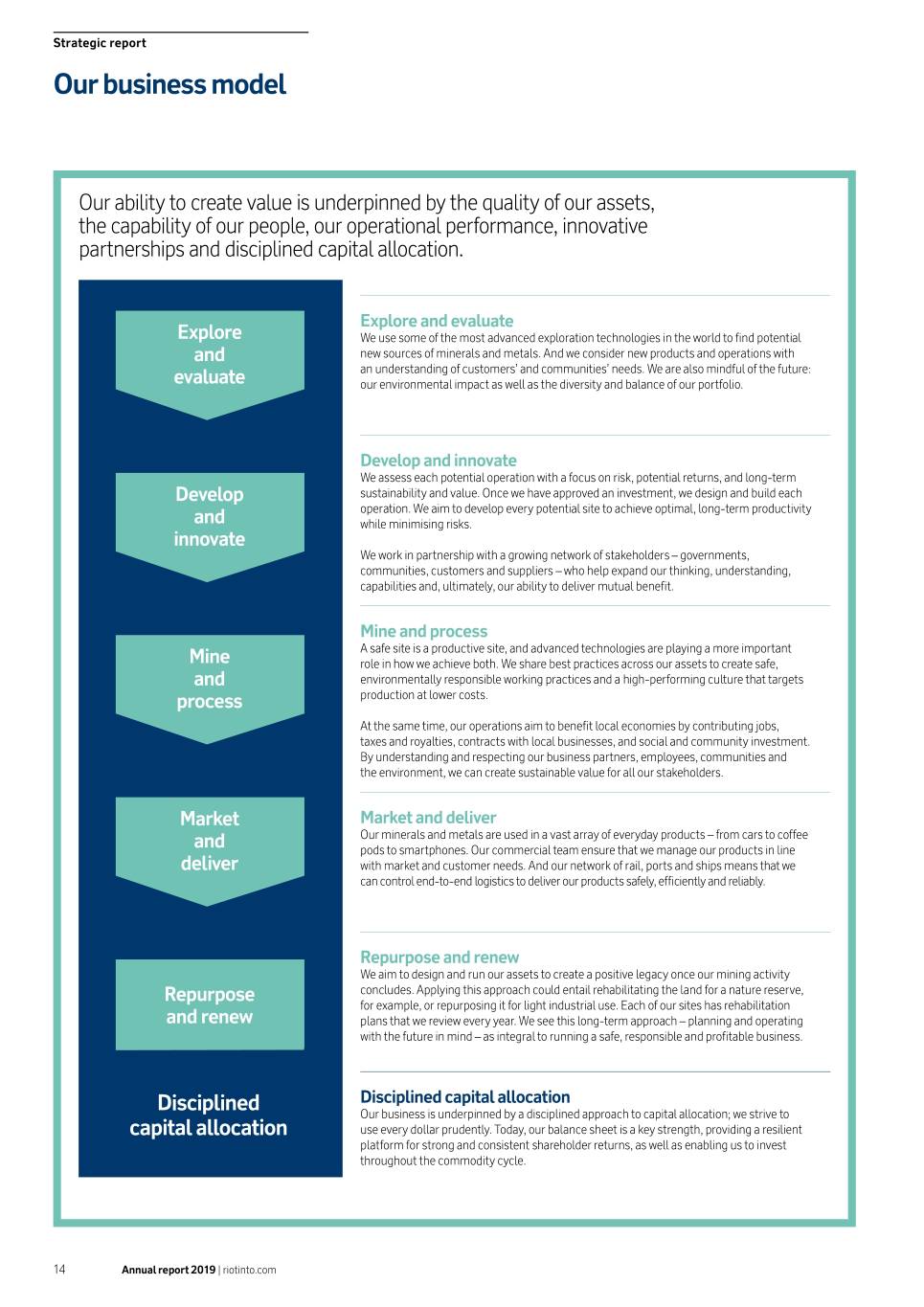

Strategic report Our business model Our ability to create value is underpinned by the quality of our assets, the capability of our people, our operational performance, innovative partnerships and disciplined capital allocation. Explore and evaluate Explore We use some of the most advanced exploration technologies in the world to find potential and new sources of minerals and metals. And we consider new products and operations with an understanding of customers’ and communities’ needs. We are also mindful of the future: evaluate our environmental impact as well as the diversity and balance of our portfolio. �Develop and innovate We assess each potential operation with a focus on risk, potential returns, and long-term Develop sustainability and value. Once we have approved an investment, we design and build each operation. We aim to develop every potential site to achieve optimal, long-term productivity and while minimising risks. innovate We work in partnership with a growing network of stakeholders – governments, communities, customers and suppliers – who help expand our thinking, understanding, capabilities and, ultimately, our ability to deliver mutual benefit. �Mine and process A safe site is a productive site, and advanced technologies are playing a more important Mine role in how we achieve both. We share best practices across our assets to create safe, and environmentally responsible working practices and a high-performing culture that targets process production at lower costs. At the same time, our operations aim to benefit local economies by contributing jobs, taxes and royalties, contracts with local businesses, and social and community investment. By understanding and respecting our business partners, employees, communities and the environment, we can create sustainable value for all our stakeholders. Market �Market and deliver Our minerals and metals are used in a vast array of everyday products – from cars to coffee and pods to smartphones. Our commercial team ensure that we manage our products in line deliver with market and customer needs. And our network of rail, ports and ships means that we can control end-to-end logistics to deliver our products safely, efficiently and reliably. �Repurpose and renew We aim to design and run our assets to create a positive legacy once our mining activity Repurpose concludes. Applying this approach could entail rehabilitating the land for a nature reserve, for example, or repurposing it for light industrial use. Each of our sites has rehabilitation and renew plans that we review every year. We see this long-term approach – planning and operating with the future in mind – as integral to running a safe, responsible and profitable business. Disciplined capital allocation Disciplined Our business is underpinned by a disciplined approach to capital allocation; we strive to capital allocation use every dollar prudently. Today, our balance sheet is a key strength, providing a resilient platform for strong and consistent shareholder returns, as well as enabling us to invest throughout the commodity cycle. 14 Annual report 2019 | riotinto.com

Our values Strategic report Strategic Our values reflect our commitment to the safety, rights and wellbeing of our employees, the integrity of our business and supply chain, and respect for the environment. Safety Caring for human life and wellbeing above everything else We make the safety and wellbeing of our employees, contractors and communities our number one priority. Always. Safely looking after the environment is an essential part of our care for future generations. Teamwork Collaborating for success We work together with colleagues, partners and communities globally to deliver the products our customers need. We learn from each other to improve our performance and achieve success. Respect Fostering inclusion and embracing diversity We recognise and respect diverse cultures, communities and points of view. We treat each other with fairness and dignity to make the most of everyone’s contributions. Integrity Having the courage and commitment to do the right thing We do the right thing, even when this is challenging. We take ownership of what we do and say. And we are honest and clear with each other, and with everyone we work with. This helps us to build trust. Excellence Being the best we can be for superior performance We challenge ourselves and others to create lasting value and achieve high performance. We adopt a pioneering mindset and aim to do better every day. An employee at our aluminium operations in Quebec, Canada. Annual report 2019 | riotinto.com 15

Strategic report Strategic context The forces shaping the world influence our thinking about our strategy; the actions we take in response will determine the strength and resilience of our business. Our strategy is formulated through the lens of plausible scenarios. We expect to face greater complexity as we move into a new decade, which we believe will be characterised by the interplay between three global forces: geopolitics, society and technology. 16 Annual report 2019 | riotinto.com

Strategic context Strategic report Strategic Technology Society Geopolitics The transition to the fourth stage of Sustainability, including climate change, is Since the middle of the 20th century, geopolitics industrialisation, in which technology becomes becoming an ever more pressing challenge facing has been defined by globalisation – a dominant interwoven into increasing aspects of everyday life, society. Many would argue that the pursuit of force that culminated with the development of continues. This era will be defined by a step change sustainable goals can be constrained by a lack of China, which has been unprecedented in terms of in digital connectivity and ‘intelligent’ systems that accompanying social progress, including efforts to scale and speed. However, while the development can gather and analyse data and communicate with address social and economic inequality. Business gap between countries has narrowed significantly other systems, supported by advanced analytics has an important role to play in addressing each of over the past decade, it is also true that and artificial intelligence. There is no doubt the these challenges – but the private sector cannot globalisation has not benefitted people equally within transition has already been deeply transformative address the unprecedented challenge of climate countries. This is, in turn, fragmenting the social and in some sectors, resulting in a mix of disruption and change alone. It needs to work within strong and political landscape around the world and arguably new opportunity. Whether and how quickly this will predictable policy frameworks and alongside leading to the rise of nationalism and the distrust of a translate to a broader boost in global economic robust local and global institutions promoting political and business establishment that is perceived productivity and growth remains uncertain. inclusive and sustainable growth. by some to be biased towards a global elite. Similarly, while the mining industry has arguably This is certainly the case for our industry. While This change in the geopolitical cycle is further been at the forefront of automating mobile a safe, sustainable approach to mining is critical, accentuated by a marked shift in the relationship equipment over the past decade, the scope of it must also include a strong focus on local between the US and China. Arguably, the world’s digital transformation in the sector has been fairly communities, including jobs and employment, most important relationship stands at a significant limited. Nevertheless, technology and digital will and the effective management of shared resources, juncture as China’s economy reaches maturity and need to play a key role in the industry’s renewed such as air and water, land and waste, through the continues to progress along the New Era roadmap productivity effort, which remains essential after mining life cycle. The mining industry must also be articulated by President Xi Jinping. The interplay a long period of productivity declines during the part of the solution in the global effort to address between geopolitics and technology will be China boom. This effort will require companies climate change. This will require the industry, particularly important as the US and China vie like ours to further develop and strengthen including our business, to work together across the for leadership in the transition to the fourth partnerships – with original equipment full value chain to develop materials with a reduced industrial revolution. This could potentially lead manufacturers, research institutions and environmental footprint and support the transition to divergent technology standards and ecosystems technology providers – to drive and further to a lower-carbon economy. with implications for the structure of global integrate technological innovation in mining. supply chains. Ultimately, addressing societal challenges requires Furthermore, the interplay between technology and broad and deep collaboration, domestically and The mining industry, which is heavily dependent society brings uncertainties related to the future of globally, and the mobilisation of a complex web of on free trade and growth, will need to be resilient in work, as well as the geopolitical and social tensions stakeholders around shared interests. Today, the this new phase of geopolitics. We have already seen that emerge from a greater concentration of wealth international institutions that helped preserve a shift in the industry’s competitive landscape, with and data in large technology companies. On the global stability for much of the 20th century are more acquisitions and minerals development being other hand, innovation and a continued drop in the themselves under pressure, reflecting tensions made by Chinese companies as part of the Chinese cost of low-carbon technologies may lower barriers between segments of society and the established government’s global development strategy known to a faster transition to a more sustainable, geopolitical order. as the Belt and Road Initiative. Ensuring a secure lower-carbon world. supply of critical minerals is also becoming a growing concern for many countries. This points to a potential future in which the market is defined by evolving relationships between host countries of mineral resources and countries, such as China, whose economies generate large demand. Society A world where climate change and the environment, as well as inclusive growth and sustainability, are critical. Technology Geopolitics A world where automation, A world of growing political data and artificial intelligence fragmentation and drive improved performance. nationalism. Annual report 2019 | riotinto.com 17

Strategic report Our stakeholders As a mining and metals company, we recognise the impact our business can have on our many stakeholders and the wider responsibilities this brings. We work hard to understand our stakeholders’ needs and expectations. We want our success to allow us to invest to meet our obligations to our employees, our customers, suppliers, local communities and host governments, as well as to generate superior returns for our shareholders. There is more detailed information on our stakeholder engagement in the Sustainability section on pages 60 to 70 of this Annual report, and we set out how the Board takes account of stakeholder interests (our ‘section 172(1) Statement’) in the Governance section on pages 92 to 93. Students in the Pilbara region of Western Australia, home to our iron ore business. 18 Annual report 2019 | riotinto.com

Our stakeholders Strategic report Strategic Employees Communities and governments Our 46,000 employees in 36 countries are our most important asset. They Trust and partnership with the communities and governments that host our want to work in an environment where they are safe and respected, and have operations is vital. the opportunity to learn, reach their potential and develop successful careers in a company they can be proud of. Each of these groups has a strong interest not only in the employment opportunities our business creates, both directly and indirectly, but also the We know that engaged employees make a productive and innovative business, wider societal benefits that accrue – be it taxes and royalties or the millions and we have a wide range of activities aimed at understanding their views. In we invest in our communities every year. Understandably, these groups are addition to the day-to-day engagement within teams, we hold numerous town also concerned with the potential environmental and cultural impacts our halls with our Chief Executive and other senior leaders, and have regular operations may have. conversations via our Yammer social platform. We regularly engage with our communities and host governments on a wide By listening in this way, we continue to refine how and what we offer to meet range of topics, including employment opportunities, taxes and royalties, the varying needs of our workforce. We do this by, for example, further environmental protection and local procurement. In our Pilbara iron ore investing in leadership development, as we know leaders are key to engaging business, for example, we conduct an annual survey – called Local Voices – and developing employees; by reviewing how we recognise individuals for their that provides real-time insights to inform decision-making. contribution and excellence; and by setting clear expectations for how we treat each other to bring our organisational values to life and give people a voice. We actively engage in dialogue around global social issues and the environment, including climate change. For example, this year we announced We conduct a six-monthly employee engagement survey to help measure a partnership in China to explore ways to improve environmental performance our progress and to further understand how people feel about the company across the entire steel value chain, in which our iron ore business plays an and its direction. important part. Customers and suppliers Investors Our business works with long-term horizons – our investments must often Our investors include global investment funds, pension funds and corporate deliver returns for decades, not years – and both our customers and suppliers bondholders, as well as tens of thousands of individuals, all of whom have have an interest in developing partnerships that allow them to consistently trusted us with their capital and wish to earn a financial return. share the benefits of our work together. This in turn requires trust and transparency: they want to know that we will do what we say we will do. They are interested in understanding how we run our business: our strategy, our focus on operational excellence and sustainability, the views of our We work closely with customers and suppliers, and in doing so, bring their leadership, including on capital allocation – and the performance that results voice, and the needs of a dynamic market, into our operational, investment and from the confluence of these. We are often also asked about the purpose, production decisions. For example, by extending our supply chain into Chinese values and culture of the Group, as well as the threats and opportunities that ports, we have enabled access to new customers, created value through affect delivery of our strategy. product screening and blending, and increased the optionality in our supply chain. In addition, by working closely with our suppliers we have captured We aim to deliver superior returns to our investors throughout the commodity supply chain innovation to deliver improved operational performance. We have cycle, and we have a comprehensive communication and engagement also continued to enhance how we engage with our markets, customers and programme in addition to our annual general meetings (AGMs) in the UK and suppliers, in part by using technology, data and analytics. We are continuing Australia. In 2018, for example, in addition to our usual programme of meetings to pilot the latest technologies, including blockchain and paperless solutions, and engagement, we held two investor seminars focused on sustainability; and to evolve the way we conduct our business and make our transactions more in late 2019, we held a seminar to update investors on our progress against efficient, safe and cost-effective. our strategy. Our suppliers are vital to our business success and we are continuing to work to improve our partnerships with them. We consider a supply chain of strong local suppliers to be good for our business, local communities and the economy. We are continuing to develop local procurement strategies designed to increase opportunities for businesses to be a part of the Rio Tinto supply chain. Annual report 2019 | riotinto.com 19

Strategic report Our strategy Portfolio People Performance Partners Our strategy is to create superior Our portfolio of low-cost, long-life Attracting, developing and retaining Safety is our number one priority. We look Partnerships and collaboration are value for shareholders by meeting assets delivers attractive returns the best people is crucial to our success. to generate value from mine to market essential to the long-term success of customers’ needs, maximising cash through the cycle. After a significant We continue to strengthen our technical and also to prioritise value over volume our business. We work closely with portfolio reshaping, we are invested and commercial capabilities through our in our investment decisions. We work technology partners, local suppliers, from our world-class assets and in commodities with strong, Centres of Excellence, and are committed to maximise value in other ways – for governments, community groups, allocating capital with discipline. long-term fundamentals and to building an inclusive and diverse example, by developing new markets for industry leaders and NGOs at all stages material growth opportunities. workforce across our global business. our materials, including as part of the of the mining lifecycle, from exploration transition to a low-carbon economy. to rehabilitation and closure. We believe Our strategy comprises four key areas: We focus on operational excellence to this gives us a competitive edge and Portfolio improve efficiency. also allows us to work more thoughtfully Low-cost, long-life assets that deliver attractive returns and responsibly, and to deliver real benefits to all our stakeholders. People Building capability to drive performance Performance Investing in our business Recognising and promoting Progressing safety Partnering to address Safety, operational and commercial excellence To sustain the strength and resilience of our technical expertise We ended 2019 with strong performance in safety, climate change drive superior margins and returns business, in 2019 we continued to invest in We launched an initiative – RioExcel – to recognise improving our process safety and recording our We have long recognised the reality of climate high-return projects. For example, in December, the important role our technical experts play in first fatality-free year since we began operations, change and its potential to affect our business, Partners we announced a $1.5 billion investment at our delivering our strategy, including safety, growth almost 147 years ago. While we recognise the our communities and our world. However, we also Working with others for future success Kennecott copper mine in Utah, in the US, which and operational excellence. The programme efforts, Group-wide, that led to this performance, recognise that no business can make a meaningful will serve to extend operations to 2032. In supports the career progression and development we know we cannot be complacent. And we again contribution on its own. To that end, this year we November, we announced a $749 million of technical experts – in fields ranging from geology pledge to do everything we can to continually continued to form partnerships to help address investment in our Greater Tom Price operations, to process engineering to asset management and improve, and send everyone home safe and healthy. the climate change challenge. in the Pilbara region of Western Australia, to help data and optimisation – who wish to remain in sustain the production capacity of our iron ore technical roles, rather than become operational or In 2019, we introduced our safety maturity In September, we signed a memorandum of business. In April, we announced we would sustain line leaders. It provides those recognised as experts model (SMM) to expand on our successful critical understanding (MOU) with China Baowu Steel current capacity and extend the life of our Richards with a platform for further career and development risk management (CRM) programme. SMM Group and Tsinghua University to develop and Bay Minerals (RBM) operation, in South Africa, opportunities and exposure across the Group. incorporates a holistic approach to risk, work implement new methods to reduce carbon through the investment of $463 million in the Zulti planning and execution, as well as learning, emissions and improve environmental South project. Construction is currently on hold In 2019, 50 people across our technical disciplines improvement and leadership engagement, performance across the steel value chain. after a number of security incidents – we will assess were recognised as experts – individuals whose including the continued focus on CRM and learning The MOU will enable the formation of a joint a restart after normalisation of operations at RBM. unique contributions help our company challenge from potentially fatal incidents (PFIs). Our working group tasked with identifying a pathway to the status quo, introduce innovative solutions for operations completed an initial self-assessment reducing carbon emissions across the entire steel Also in April, we committed $302 million of safely managing our technical risks, and deliver to familiarise themselves with the model. This was value chain, which accounts for 7-9% of the world’s additional expenditure to advance the Resolution productivity gains. then followed by a baseline assessment and an carbon emissions. Copper project in Arizona, in the US, to fund end-of-year assessment led by Group HSE, and additional drilling, ore body studies, infrastructure RioExcel delivers a deeper pool of technical supported by an independent operational leader. In November, we partnered with the Natural improvements and permitting activities as the expertise for our business – a source of competitive We were pleased that they demonstrated a strong Sciences and Engineering Research Council of project moves to the final stage of permitting. advantage, a more engaged and collaborative improvement over their baseline assessments, Canada (NSERC) to fund a new Industrial Research And in March, we completed the commissioning technical workforce and safer, more productive particularly in leadership and engagement. Across Chair in Climate Change and Water Security at of our $1.9 billion Amrun bauxite mine on the Cape and future-ready operations. the Group, using a nine-point scale, we saw the University of Northern British Columbia. York Peninsula in Queensland, Australia. The mine improvement to an average maturity of 4.5 The C$1.5 million from NSERC and Rio Tinto and associated processing and port facilities will (classified as evolving) from a baseline of 3.4 support research by Dr. Stephen Déry to quantify replace production from our depleting East Weipa (classified as basic). the roles of climate variability, climate change and mine and increase annual bauxite export capacity 50+ water management in the Nechako River basin’s by around 10 million tonnes. men and women recognised via RioExcel water supply. Our Kitimat aluminium smelter is located in British Columbia, with clean hydropower AIFR 0.42 supplied by the Nechako reservoir. down from 0.44 in 2018, marking a strong $5.5bn performance in safety invested to grow and sustain the strength of our business C$1.5m in research funding from NSERC and Rio Tinto Employees at Oyu Tolgoi, where 93% of our employees are Mongolian. 20 Annual report 2019 | riotinto.com

Our strategy Strategic report Strategic Portfolio People Performance Partners Our portfolio of low-cost, long-life Attracting, developing and retaining Safety is our number one priority. We look Partnerships and collaboration are assets delivers attractive returns the best people is crucial to our success. to generate value from mine to market essential to the long-term success of through the cycle. After a significant We continue to strengthen our technical and also to prioritise value over volume our business. We work closely with portfolio reshaping, we are invested and commercial capabilities through our in our investment decisions. We work technology partners, local suppliers, in commodities with strong, Centres of Excellence, and are committed to maximise value in other ways – for governments, community groups, long-term fundamentals and to building an inclusive and diverse example, by developing new markets for industry leaders and NGOs at all stages material growth opportunities. workforce across our global business. our materials, including as part of the of the mining lifecycle, from exploration transition to a low-carbon economy. to rehabilitation and closure. We believe We focus on operational excellence to this gives us a competitive edge and improve efficiency. also allows us to work more thoughtfully and responsibly, and to deliver real benefits to all our stakeholders. Investing in our business Recognising and promoting Progressing safety Partnering to address To sustain the strength and resilience of our technical expertise We ended 2019 with strong performance in safety, climate change business, in 2019 we continued to invest in We launched an initiative – RioExcel – to recognise improving our process safety and recording our We have long recognised the reality of climate high-return projects. For example, in December, the important role our technical experts play in first fatality-free year since we began operations, change and its potential to affect our business, we announced a $1.5 billion investment at our delivering our strategy, including safety, growth almost 147 years ago. While we recognise the our communities and our world. However, we also Kennecott copper mine in Utah, in the US, which and operational excellence. The programme efforts, Group-wide, that led to this performance, recognise that no business can make a meaningful will serve to extend operations to 2032. In supports the career progression and development we know we cannot be complacent. And we again contribution on its own. To that end, this year we November, we announced a $749 million of technical experts – in fields ranging from geology pledge to do everything we can to continually continued to form partnerships to help address investment in our Greater Tom Price operations, to process engineering to asset management and improve, and send everyone home safe and healthy. the climate change challenge. in the Pilbara region of Western Australia, to help data and optimisation – who wish to remain in sustain the production capacity of our iron ore technical roles, rather than become operational or In 2019, we introduced our safety maturity In September, we signed a memorandum of business. In April, we announced we would sustain line leaders. It provides those recognised as experts model (SMM) to expand on our successful critical understanding (MOU) with China Baowu Steel current capacity and extend the life of our Richards with a platform for further career and development risk management (CRM) programme. SMM Group and Tsinghua University to develop and Bay Minerals (RBM) operation, in South Africa, opportunities and exposure across the Group. incorporates a holistic approach to risk, work implement new methods to reduce carbon through the investment of $463 million in the Zulti planning and execution, as well as learning, emissions and improve environmental South project. Construction is currently on hold In 2019, 50 people across our technical disciplines improvement and leadership engagement, performance across the steel value chain. after a number of security incidents – we will assess were recognised as experts – individuals whose including the continued focus on CRM and learning The MOU will enable the formation of a joint a restart after normalisation of operations at RBM. unique contributions help our company challenge from potentially fatal incidents (PFIs). Our working group tasked with identifying a pathway to the status quo, introduce innovative solutions for operations completed an initial self-assessment reducing carbon emissions across the entire steel Also in April, we committed $302 million of safely managing our technical risks, and deliver to familiarise themselves with the model. This was value chain, which accounts for 7-9% of the world’s additional expenditure to advance the Resolution productivity gains. then followed by a baseline assessment and an carbon emissions. Copper project in Arizona, in the US, to fund end-of-year assessment led by Group HSE, and additional drilling, ore body studies, infrastructure RioExcel delivers a deeper pool of technical supported by an independent operational leader. In November, we partnered with the Natural improvements and permitting activities as the expertise for our business – a source of competitive We were pleased that they demonstrated a strong Sciences and Engineering Research Council of project moves to the final stage of permitting. advantage, a more engaged and collaborative improvement over their baseline assessments, Canada (NSERC) to fund a new Industrial Research And in March, we completed the commissioning technical workforce and safer, more productive particularly in leadership and engagement. Across Chair in Climate Change and Water Security at of our $1.9 billion Amrun bauxite mine on the Cape and future-ready operations. the Group, using a nine-point scale, we saw the University of Northern British Columbia. York Peninsula in Queensland, Australia. The mine improvement to an average maturity of 4.5 The C$1.5 million from NSERC and Rio Tinto and associated processing and port facilities will (classified as evolving) from a baseline of 3.4 support research by Dr. Stephen Déry to quantify replace production from our depleting East Weipa (classified as basic). the roles of climate variability, climate change and mine and increase annual bauxite export capacity 50+ water management in the Nechako River basin’s by around 10 million tonnes. men and women recognised via RioExcel water supply. Our Kitimat aluminium smelter is located in British Columbia, with clean hydropower AIFR 0.42 supplied by the Nechako reservoir. down from 0.44 in 2018, marking a strong $5.5bn performance in safety invested to grow and sustain the strength of our business C$1.5m in research funding from NSERC and Rio Tinto Annual report 2019 | riotinto.com 21

Strategic report Key performance indicators The Board uses a range of financial and non-financial metrics, reported Key performance All injury frequency rate (AIFR) Key performance Total shareholder return (TSR)1 Underlying earnings and underlying EBITDA indicator definition The number of injuries per 200,000 hours worked by employees indicator definition Combination of share price appreciation (using annual average Underlying earnings represent net earnings attributable to the periodically, to measure Group and contractors at operations that we manage. AIFR includes share price) and dividends paid and reinvested to show the total owners of Rio Tinto, adjusted to exclude items which do not medical treatment cases, restricted workday and lost-day injuries. return to the shareholder over the preceding five years. reflect the underlying performance of the Group’s operations. performance against the four key These items are explained in note 2 of the financial statements. areas of our strategy (portfolio, Underlying EBITDA represents profit before tax, net finance people, performance and partners). items, depreciation and amortisation. It excludes the EBITDA impact of the items mentioned above. This year we reviewed our key performance indicators (KPIs) and made the following changes: –– We have added return on capital employed (ROCE). Strategic pillar People Performance Partners Strategic pillar Portfolio Performance Portfolio Performance This measures how efficiently we generate profits from our assets, reflecting our strategy of investing in a portfolio of low-cost, long-life assets that deliver Relevance to strategy Safety is our number one priority, one of our core values and Relevance to strategy Our strategy aims to maximise shareholder returns through the These financial KPIs measure how well we are managing costs, attractive returns throughout the cycle. & executive an essential component of everything we do. Our goals are to & executive commodity cycle, and TSR is a direct measure of that. increasing productivity and generating the most revenue from –– We have added free cash flow, which measures net cash remuneration maintain zero fatalities, prevent catastrophic events and reduce remuneration each of our assets. returned by the business after investment in sustaining injuries. We continually reinforce our safety culture, in part by Link to executive remuneration and growth capital expenditure. improving leadership and simplifying tools and systems. Reflected in long-term incentive plans, measured equally Link to executive remuneration –– We have removed capital expenditure as a standalone key against the EMIX Global Mining Index and the MSCI World Index Underlying earnings is reflected in the short-term incentive plan; performance indicator as this is a component of the new Link to executive remuneration (see page 113). in the longer term, both measures influence TSR, which is the free cash flow metric. Included in the short-term incentive plan (see page 113). primary measure for long-term incentive plans (see page 113). Non-financial metrics for measuring the people strategic pillar have been developed, including the development in Associated risks –– HSE Associated risks –– Market –– Market 2019 of a culture and values scorecard. In 2020, we will –– Operational and people –– Strategic –– Communities and other key stakeholders consider which of these internal metrics will be used as –– Communities and other key stakeholders –– Operational and people published KPIs in future annual reports. Five-year trend All in�ur� �re�uenc� rate �A���� Five-year trend ��r ������� �o�r� �or��� ���� �.�� ���� �.�� ���� �.�� ���� �.�� 2019 0��2 Performance We experienced no fatalities in 2019 and overall delivered strong Performance The share prices of Rio Tinto plc and Rio Tinto Limited reached Underlying earnings of $10.4 billion were $1.6 billion higher than in 2019 safety performance. We reduced our AIFR slightly to 0.42 (from in 2019 new highs in 2019. TSR performance over the five-year period in 2018. Underlying EBITDA of $21.2 billion was $3.1 billion higher 0.44 in 2018) and continued to improve our catastrophic event was driven principally by movements in commodity prices and than 2018. The 17% increase in underlying EBITDA resulted from prevention through a step-change in managing process safety changes in the global macro environment. Rio Tinto significantly higher iron ore prices, partly offset by lower prices for aluminium and more assurance over major hazard risks. Over the past five outperformed the EMIX Global Mining Index over the five-year and copper, higher costs and the absence of contributions from years, our AIFR performance has been strong. period, and slightly outperformed the MSCI World Index. assets divested in 2018. Forward plan We will: Forward plan We will continue to focus on generating the free cash flow from our We will continue to drive superior margins and returns through –– Continue to implement our critical-risk management programme operations that allows us to return cash to shareholders (short-term a focus on operational and commercial excellence and our value and safety maturity model returns) while investing in the business (long-term returns). over volume approach. –– Strengthen our safety leadership and coaching programmes –– Work more closely with contractors and joint-venture partners to improve our safety record –– Continue to implement our major hazard standards, including process safety, water and tailings, with strong assurance processes –– Simplify critical safety tools 1 The TSR calculation for each period is based on the change in the calendar year average share prices for Rio Tinto plc and Rio Tinto Limited over the preceding five years. This is consistent with the methodology used for calculating the vesting outcomes for Performance Share Awards (PSA). The data presented in this chart accounts for the dual corporate structure of Rio Tinto. 22 Annual report 2019 | riotinto.com

Key performance indicators Strategic report Strategic Key performance All injury frequency rate (AIFR) Key performance Total shareholder return (TSR)1 Underlying earnings and underlying EBITDA indicator definition The number of injuries per 200,000 hours worked by employees indicator definition Combination of share price appreciation (using annual average Underlying earnings represent net earnings attributable to the and contractors at operations that we manage. AIFR includes share price) and dividends paid and reinvested to show the total owners of Rio Tinto, adjusted to exclude items which do not medical treatment cases, restricted workday and lost-day injuries. return to the shareholder over the preceding five years. reflect the underlying performance of the Group’s operations. These items are explained in note 2 of the financial statements. Underlying EBITDA represents profit before tax, net finance items, depreciation and amortisation. It excludes the EBITDA impact of the items mentioned above. Strategic pillar People Performance Partners Strategic pillar Portfolio Performance Portfolio Performance Relevance to strategy Safety is our number one priority, one of our core values and Relevance to strategy Our strategy aims to maximise shareholder returns through the These financial KPIs measure how well we are managing costs, & executive an essential component of everything we do. Our goals are to & executive commodity cycle, and TSR is a direct measure of that. increasing productivity and generating the most revenue from remuneration maintain zero fatalities, prevent catastrophic events and reduce remuneration each of our assets. injuries. We continually reinforce our safety culture, in part by Link to executive remuneration improving leadership and simplifying tools and systems. Reflected in long-term incentive plans, measured equally Link to executive remuneration against the EMIX Global Mining Index and the MSCI World Index Underlying earnings is reflected in the short-term incentive plan; Link to executive remuneration (see page 113). in the longer term, both measures influence TSR, which is the Included in the short-term incentive plan (see page 113). primary measure for long-term incentive plans (see page 113). Associated risks –– HSE Associated risks –– Market –– Market –– Operational and people –– Strategic –– Communities and other key stakeholders –– Communities and other key stakeholders –– Operational and people Five-year trend All in�ur� �re�uenc� rate �A���� Five-year trend �ota� ��are�o��er ret�r� ��S�� ���er��i�g ear�i�g� a�� ���er��i�g ������ ��r ������� �o�r� �or��� measured over the preceding �ve years � mi��ion� (using annual average share price) �n��r��in� ������ �n��r��in� ��rnin�� ���� �.�� ����� ���� �.�� 2015 (18.2%) ���� ������ ����� ���� �.�� 2016 (40.7%) ���� ������ ����� ���� �.�� 2017 5.8% ���� ������ ����� 2019 0��2 2018 33.4% ���� ������ ������ ���� ����� ���� ������ Performance We experienced no fatalities in 2019 and overall delivered strong Performance The share prices of Rio Tinto plc and Rio Tinto Limited reached Underlying earnings of $10.4 billion were $1.6 billion higher than in 2019 safety performance. We reduced our AIFR slightly to 0.42 (from in 2019 new highs in 2019. TSR performance over the five-year period in 2018. Underlying EBITDA of $21.2 billion was $3.1 billion higher 0.44 in 2018) and continued to improve our catastrophic event was driven principally by movements in commodity prices and than 2018. The 17% increase in underlying EBITDA resulted from prevention through a step-change in managing process safety changes in the global macro environment. Rio Tinto significantly higher iron ore prices, partly offset by lower prices for aluminium and more assurance over major hazard risks. Over the past five outperformed the EMIX Global Mining Index over the five-year and copper, higher costs and the absence of contributions from years, our AIFR performance has been strong. period, and slightly outperformed the MSCI World Index. assets divested in 2018. Forward plan We will: Forward plan We will continue to focus on generating the free cash flow from our We will continue to drive superior margins and returns through –– Continue to implement our critical-risk management programme operations that allows us to return cash to shareholders (short-term a focus on operational and commercial excellence and our value and safety maturity model returns) while investing in the business (long-term returns). over volume approach. –– Strengthen our safety leadership and coaching programmes –– Work more closely with contractors and joint-venture partners to improve our safety record –– Continue to implement our major hazard standards, including process safety, water and tailings, with strong assurance processes –– Simplify critical safety tools 1 The TSR calculation for each period is based on the change in the calendar year average share prices for Rio Tinto plc and Rio Tinto Limited over the preceding five years. This is consistent with the methodology used for calculating the vesting outcomes for Performance Share Awards (PSA). The data presented in this chart accounts for the dual corporate structure of Rio Tinto. Annual report 2019 | riotinto.com 23

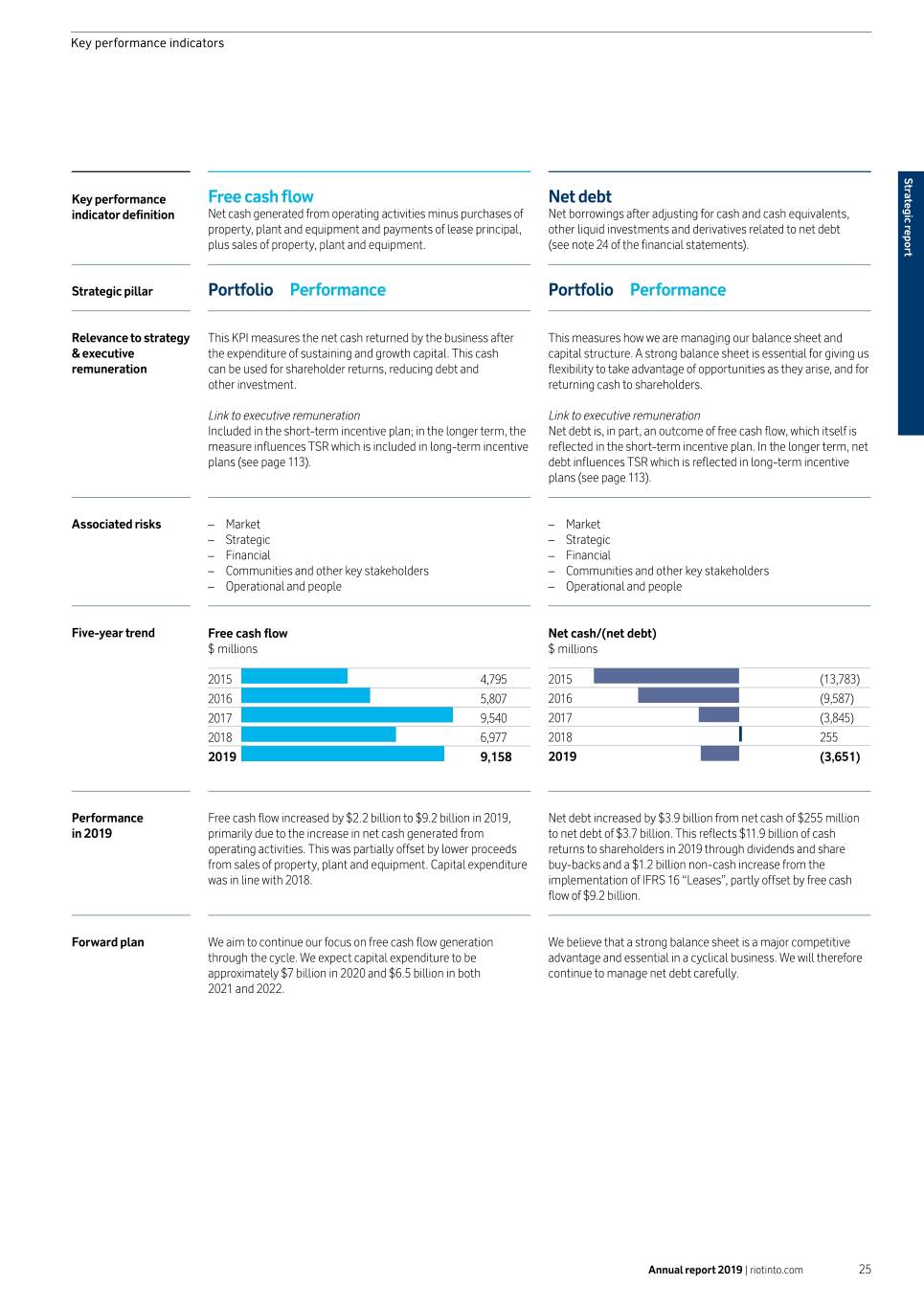

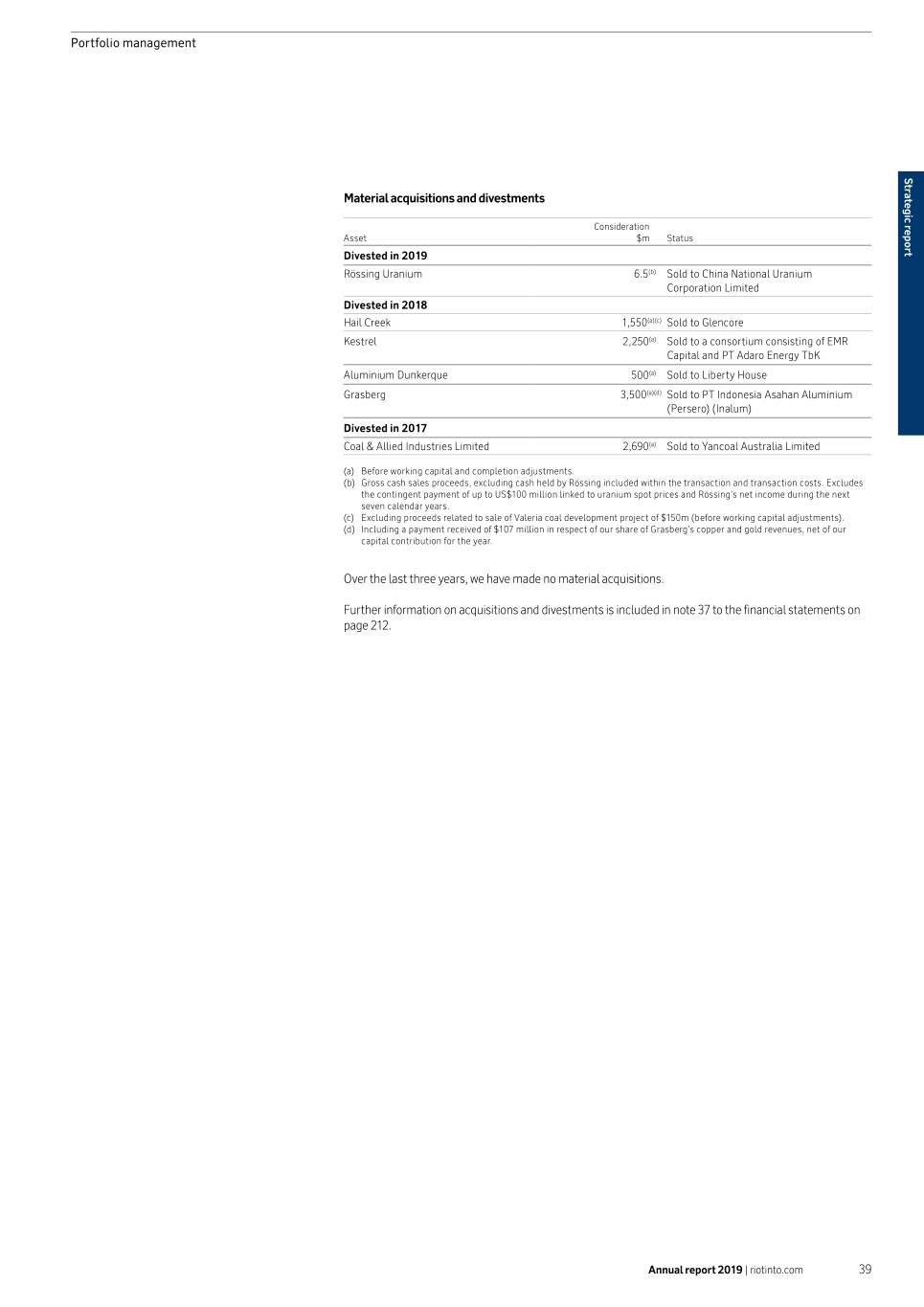

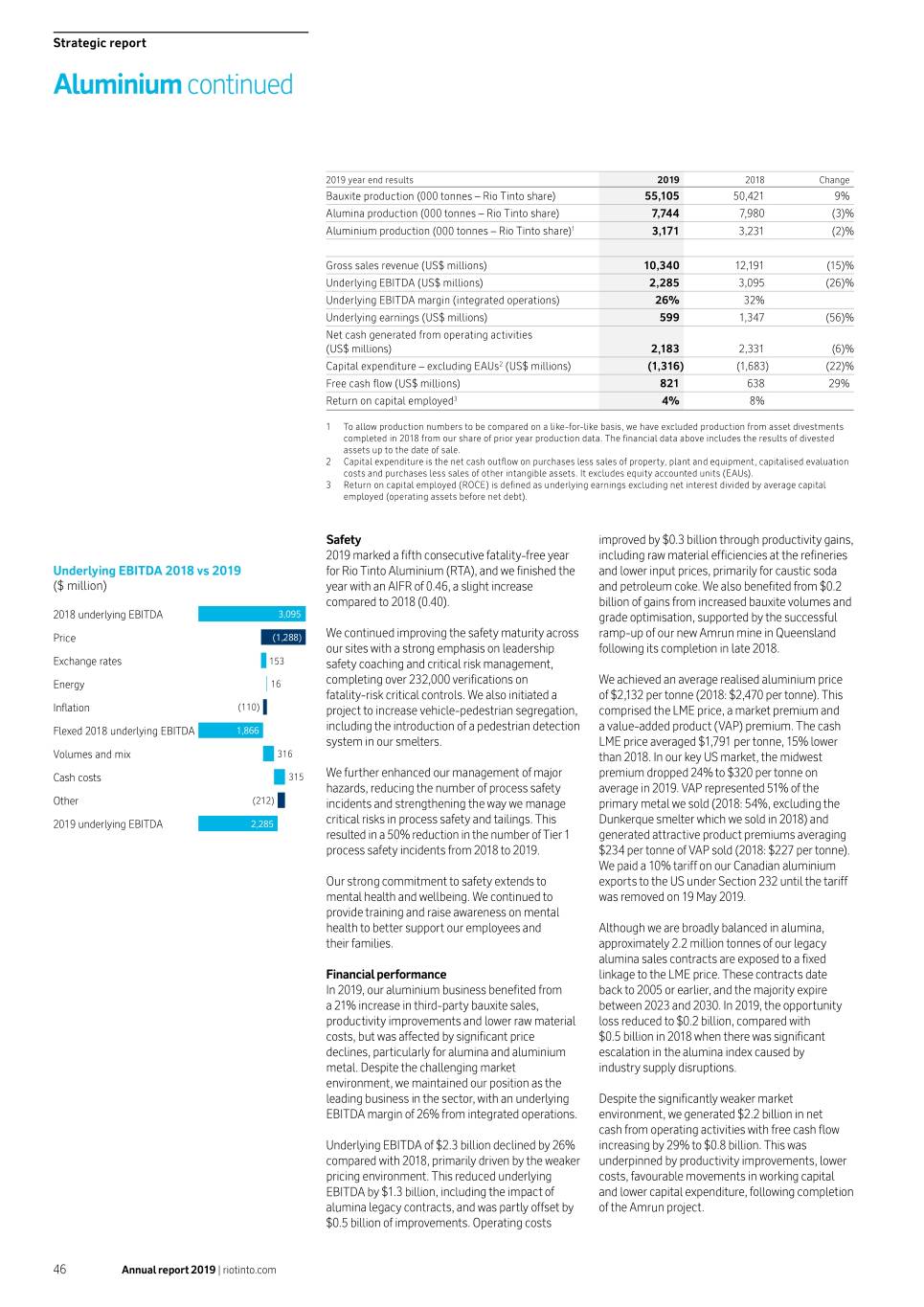

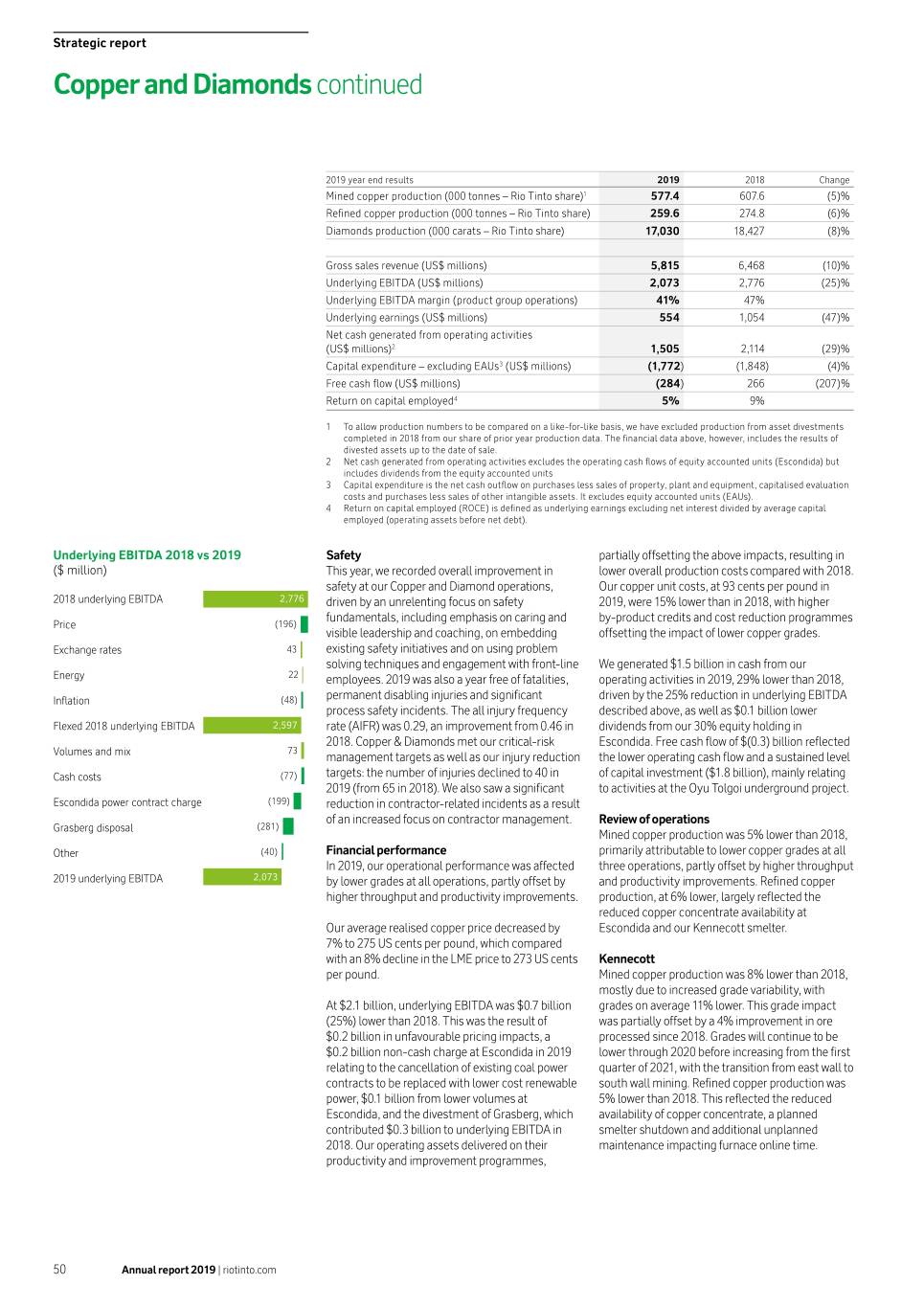

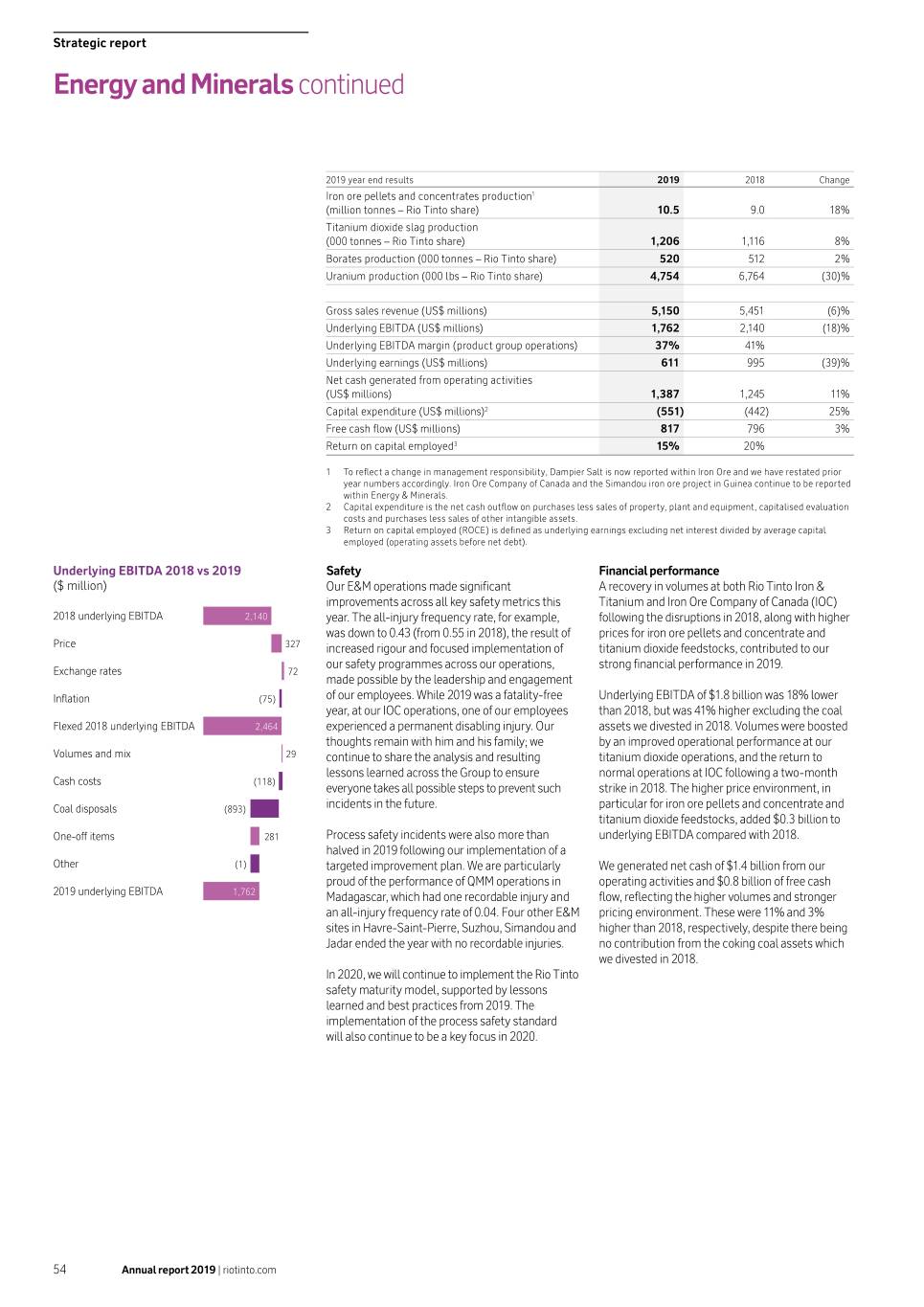

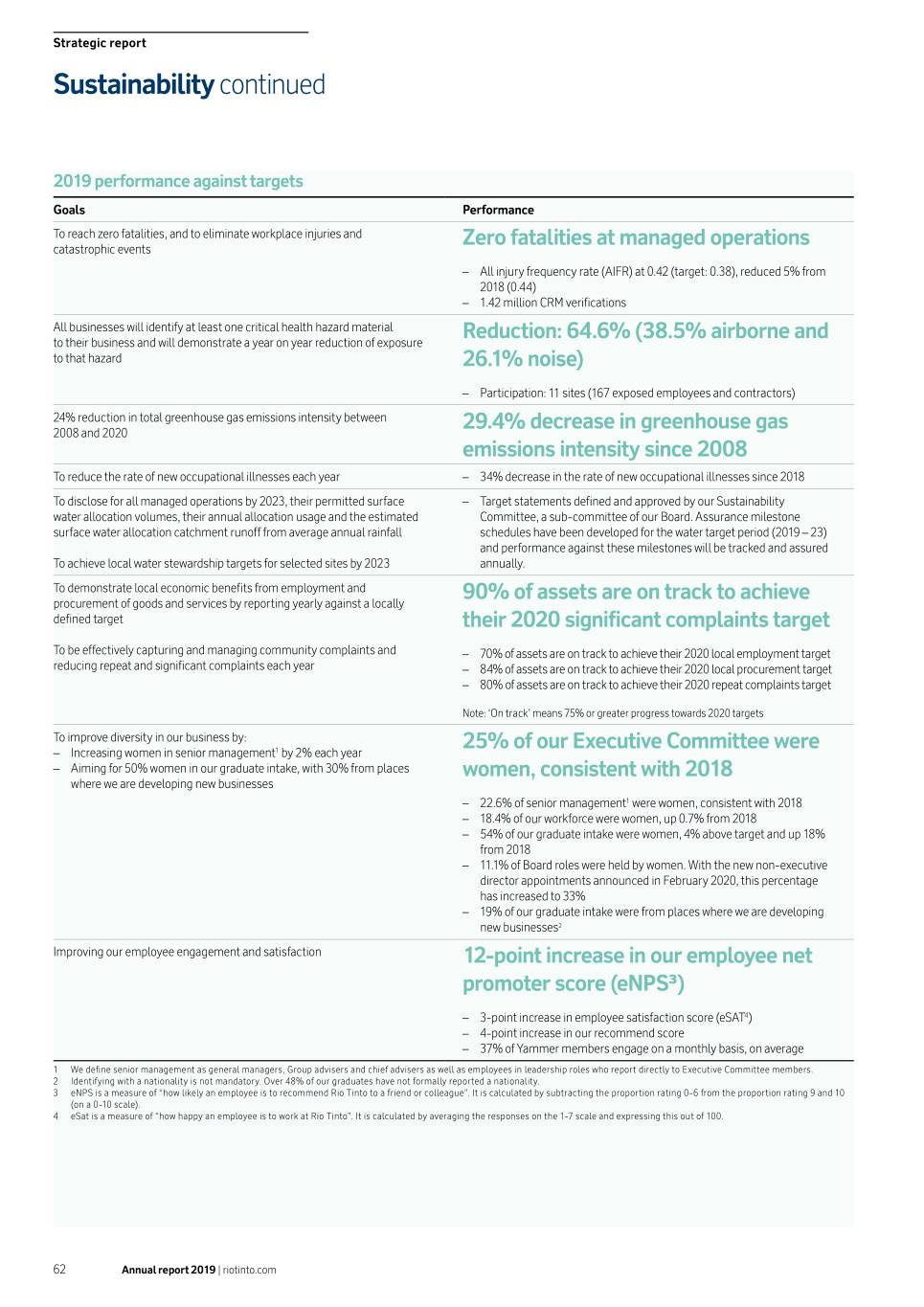

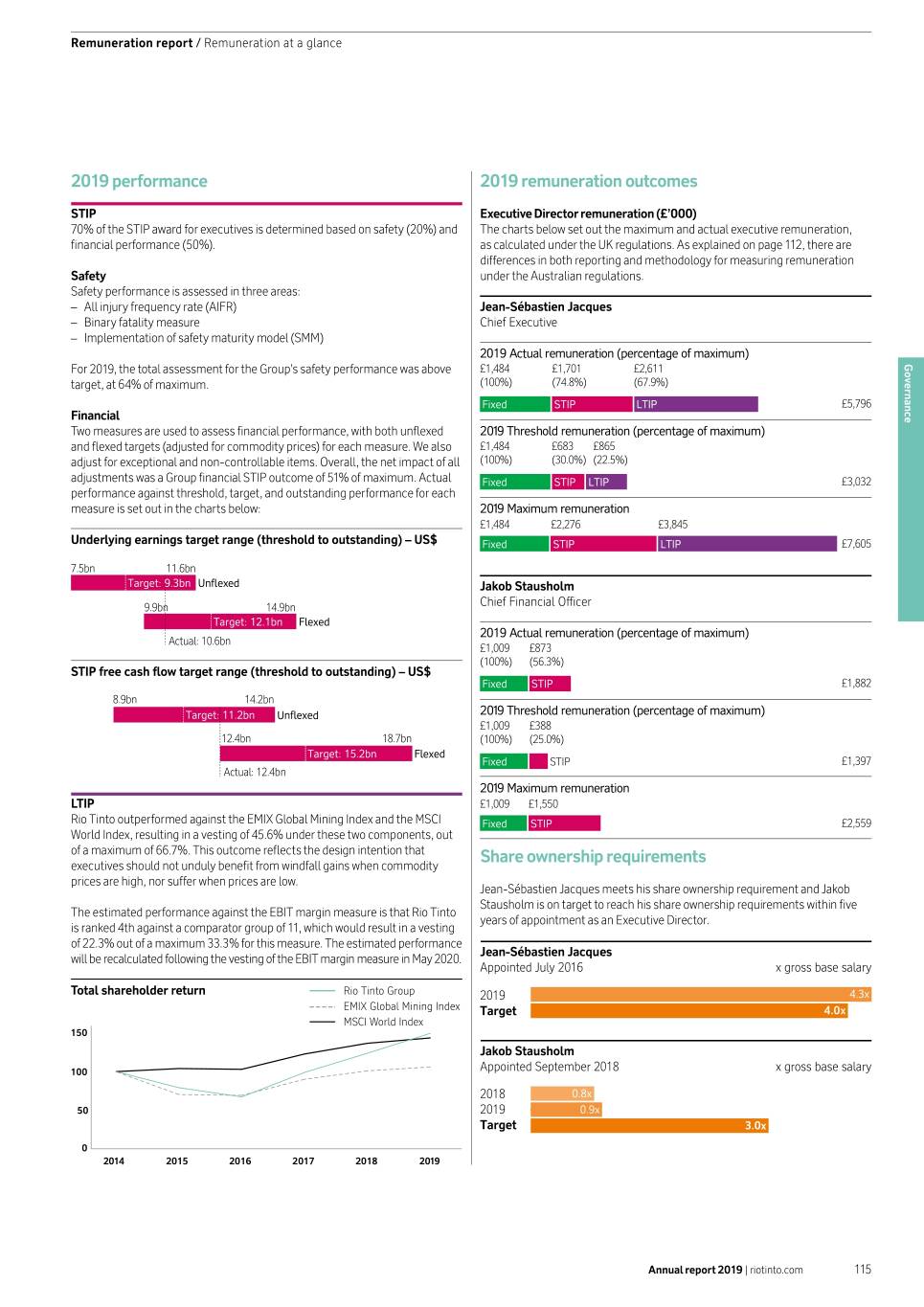

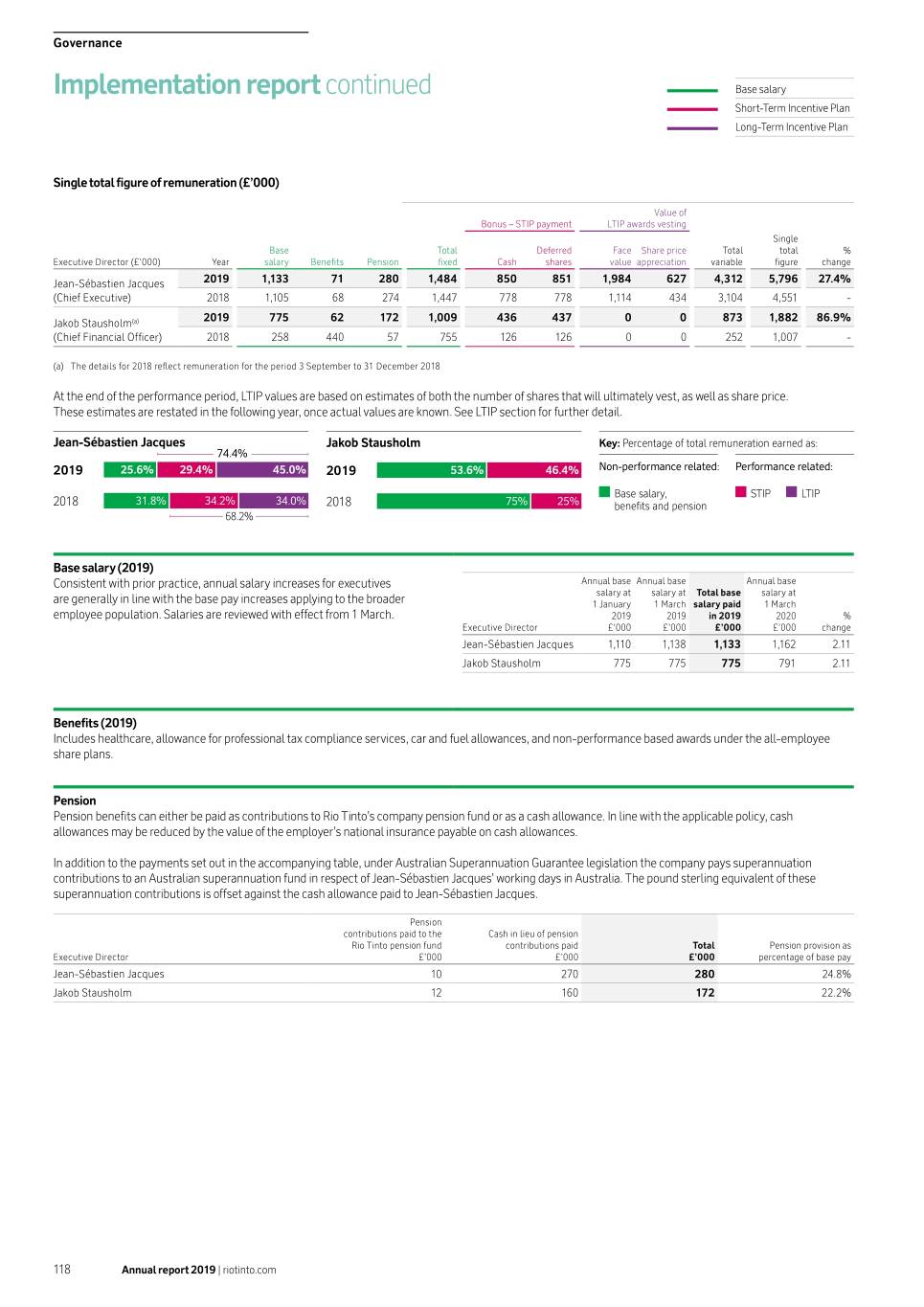

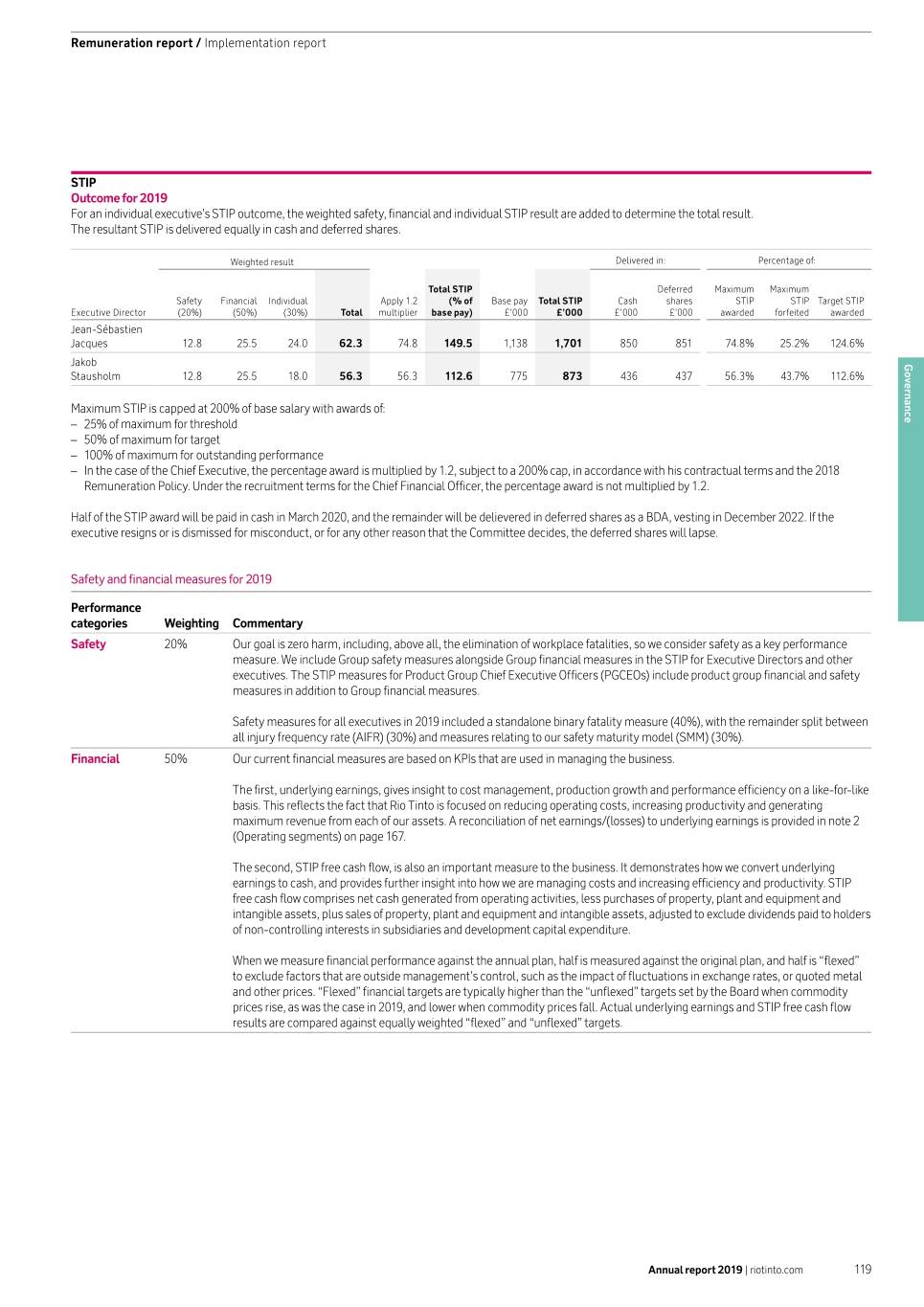

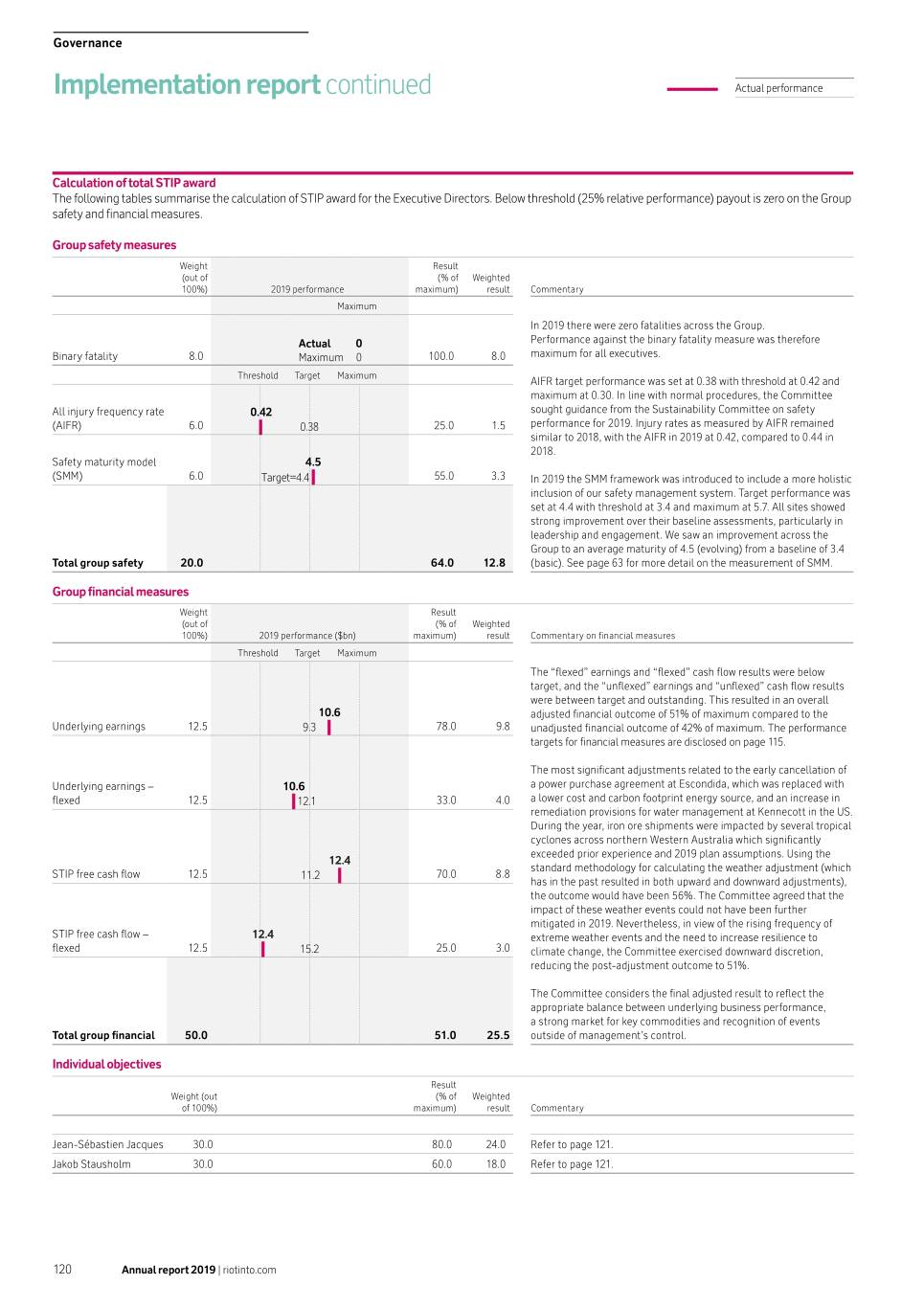

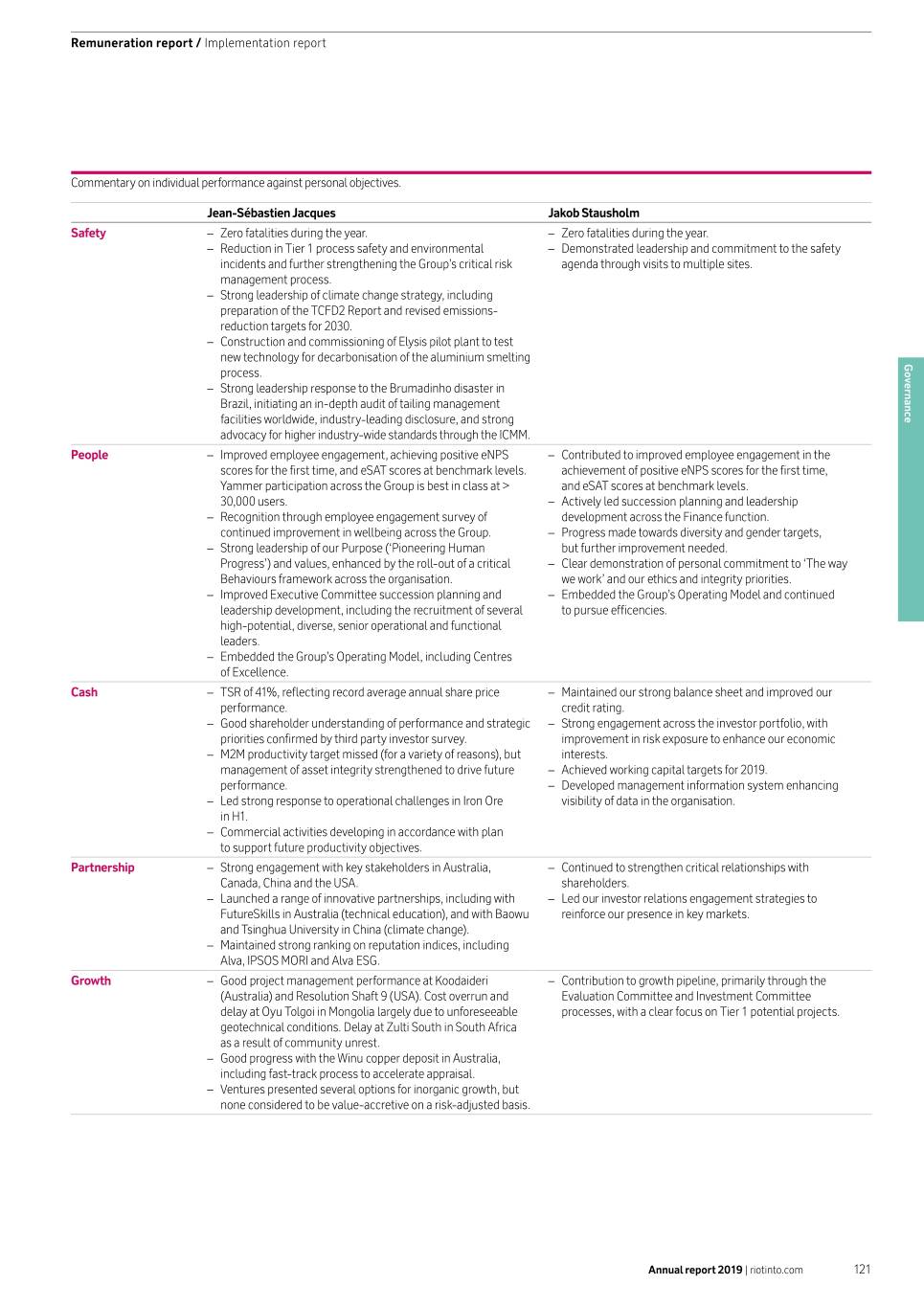

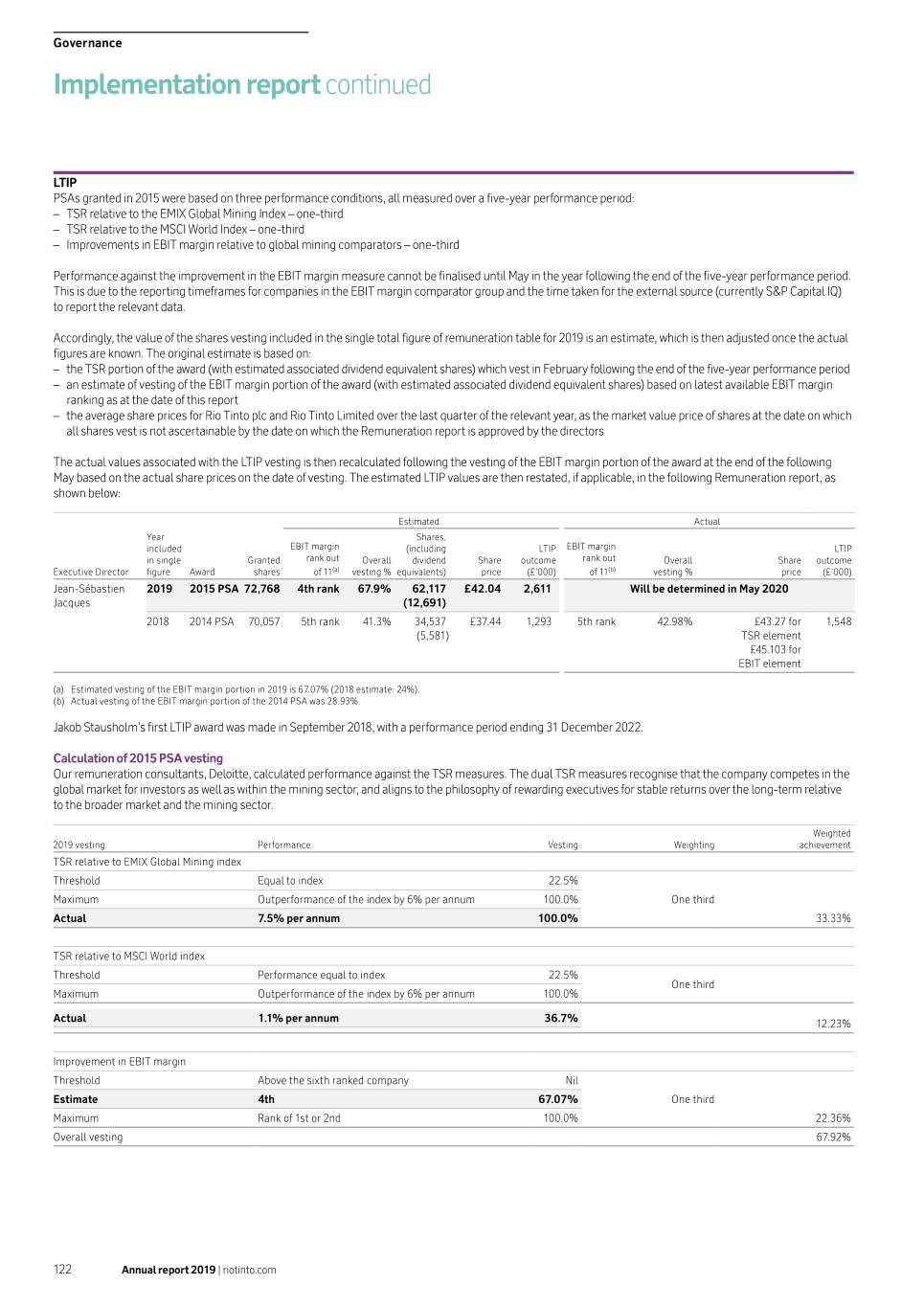

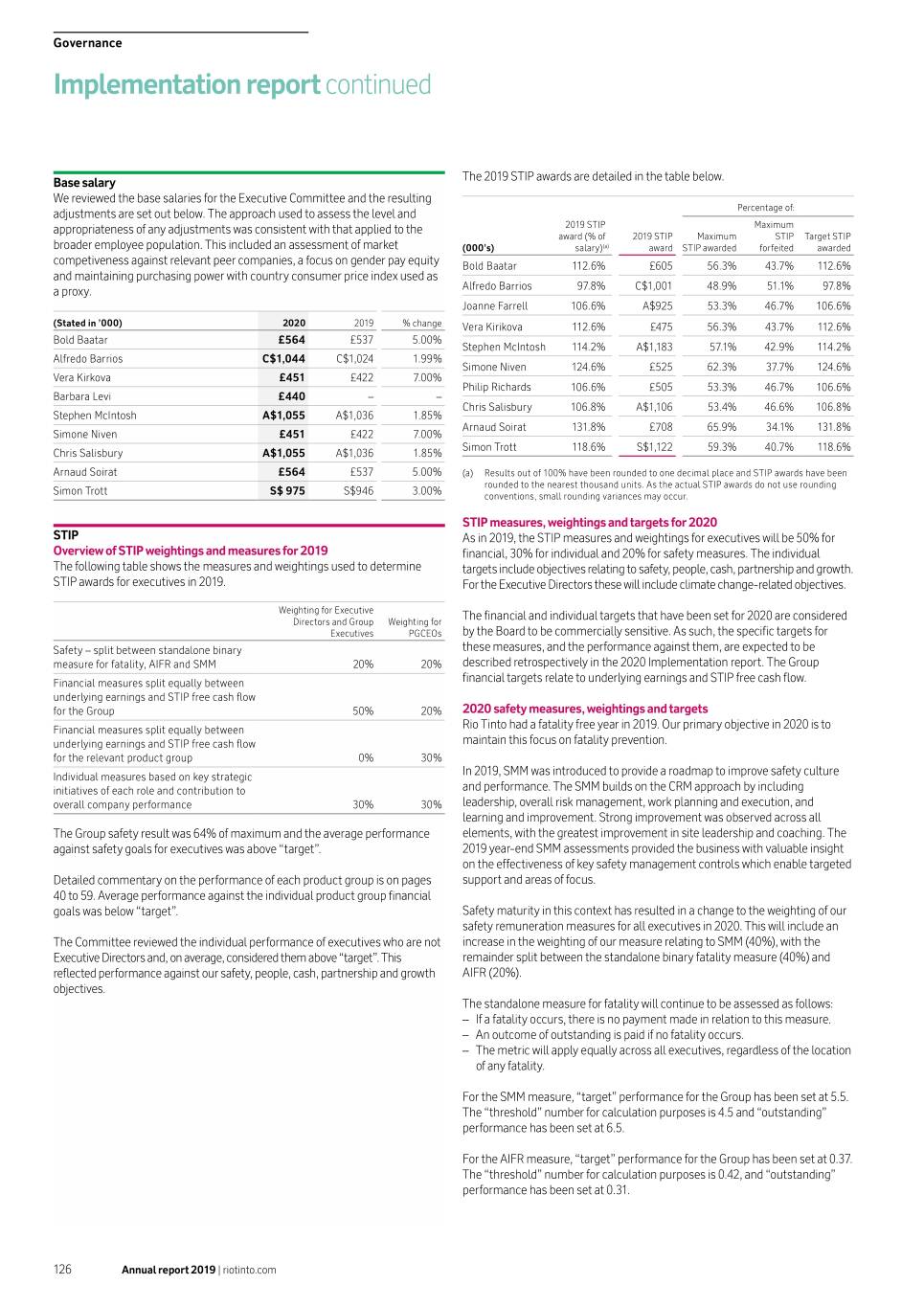

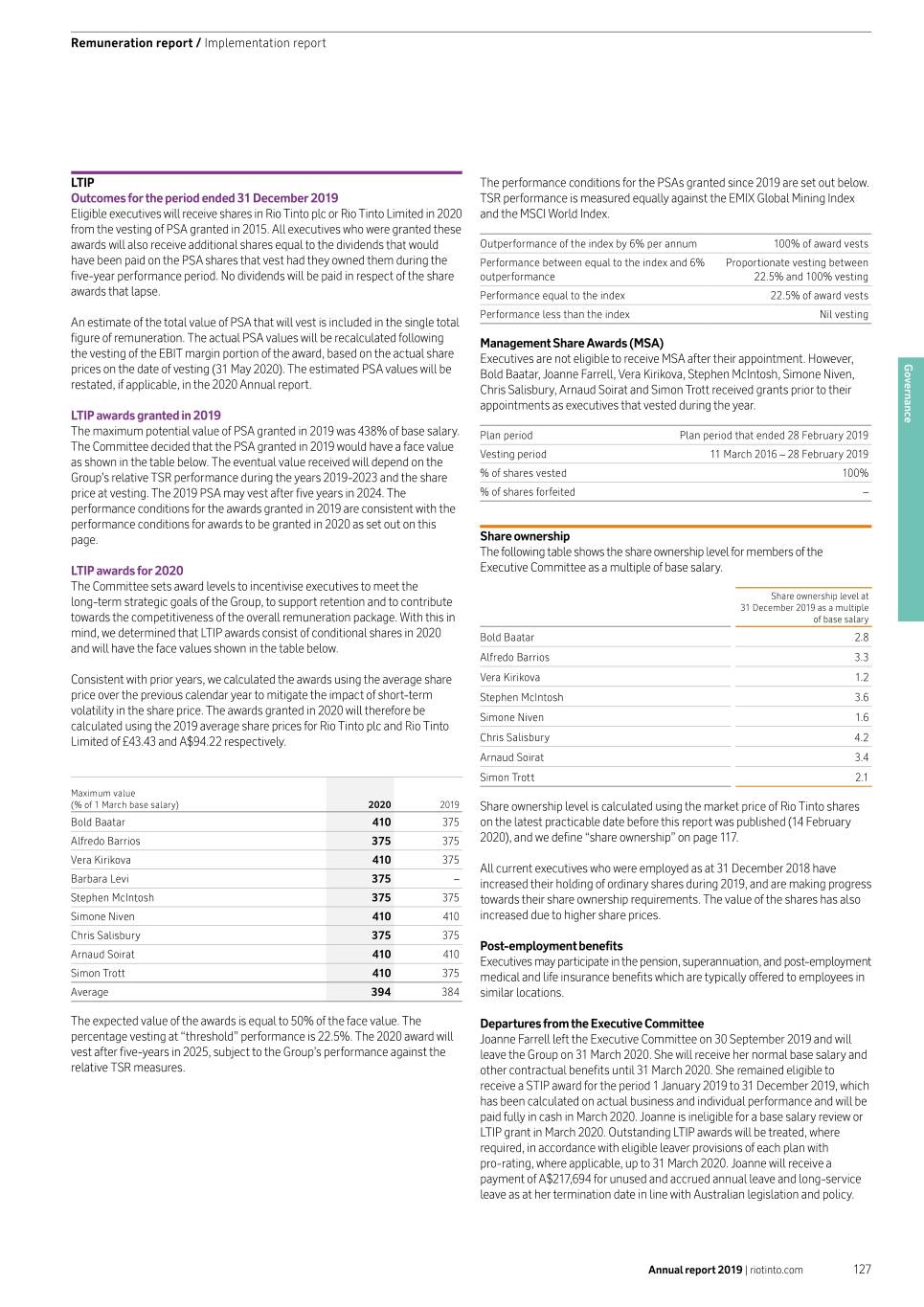

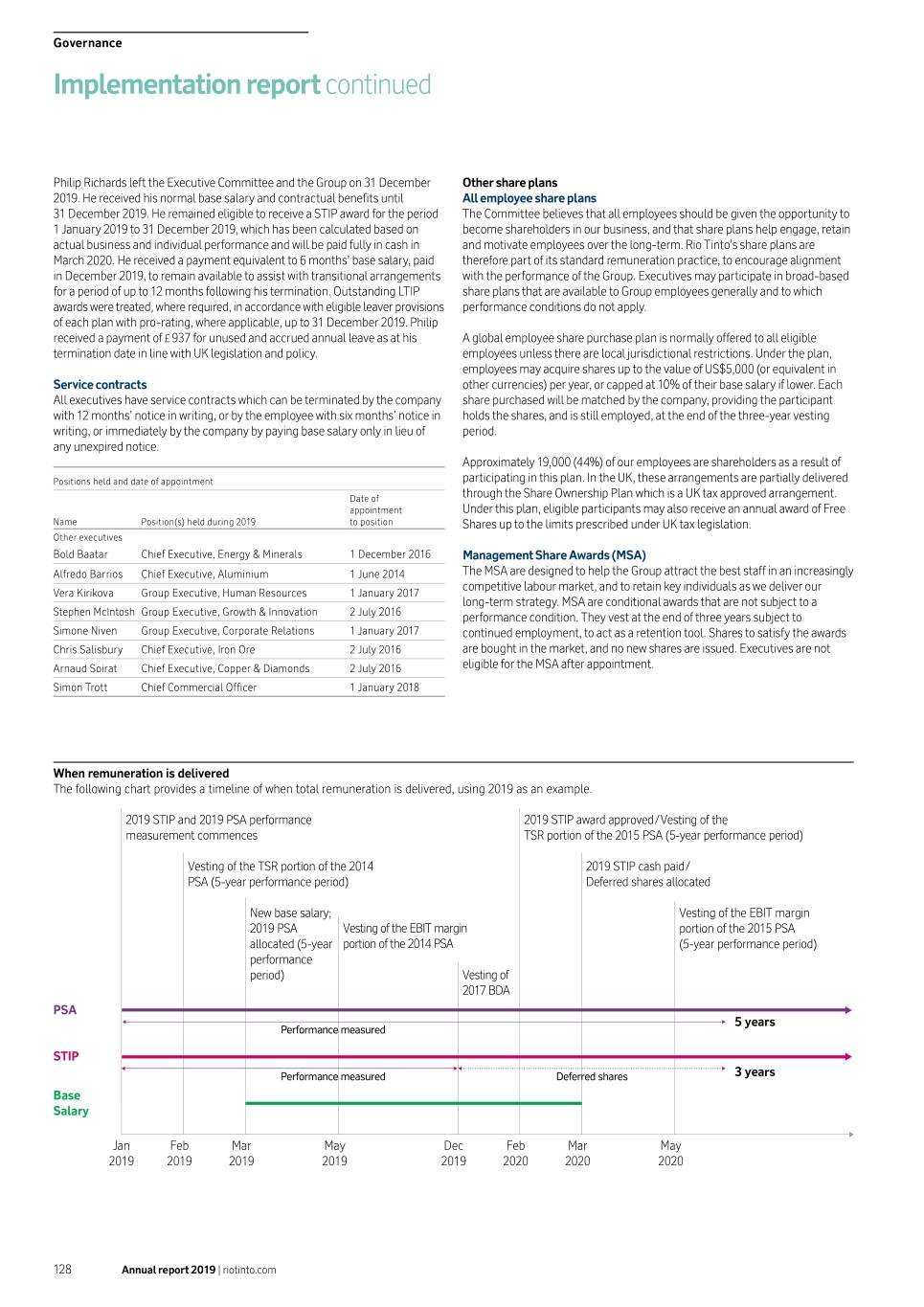

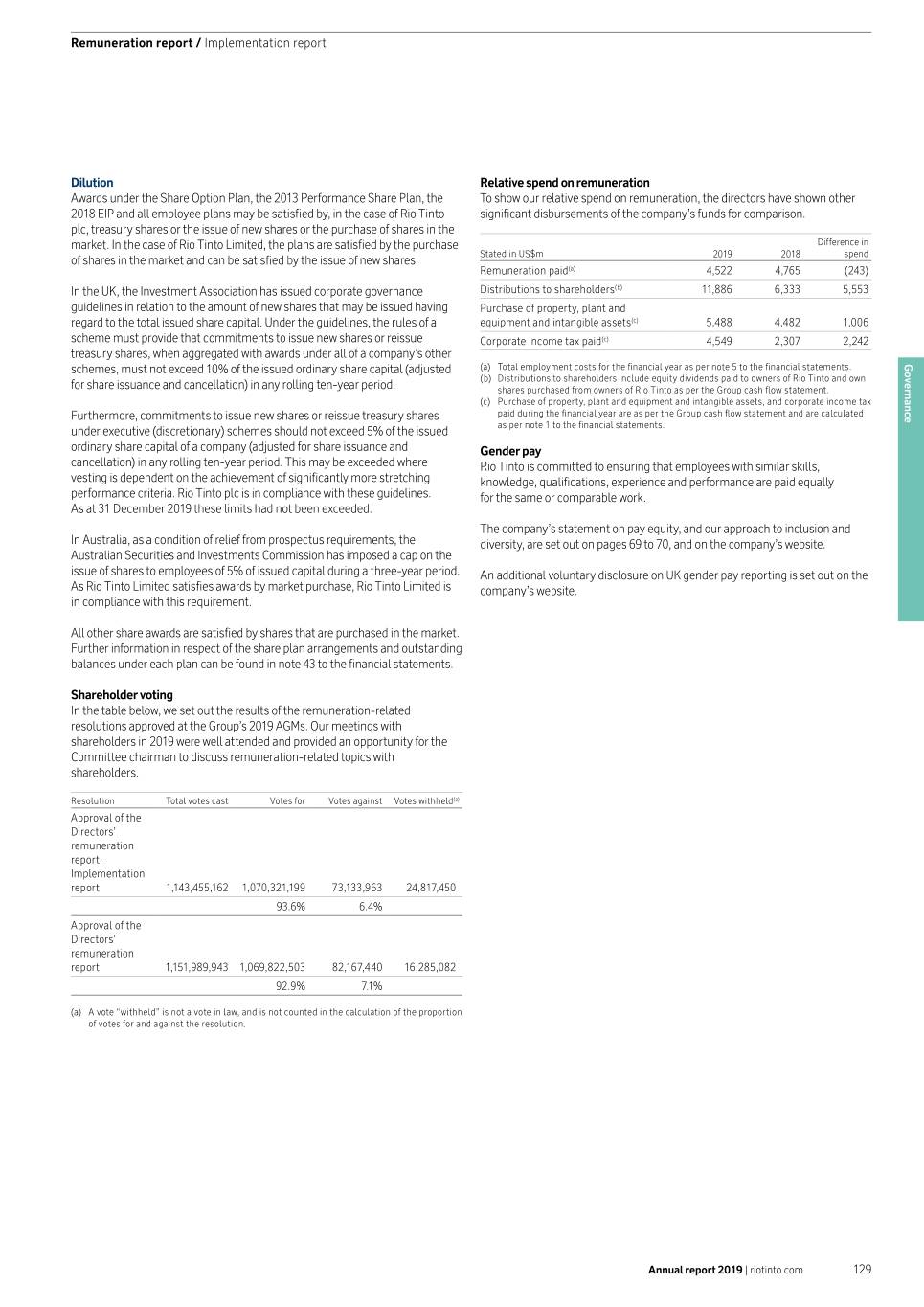

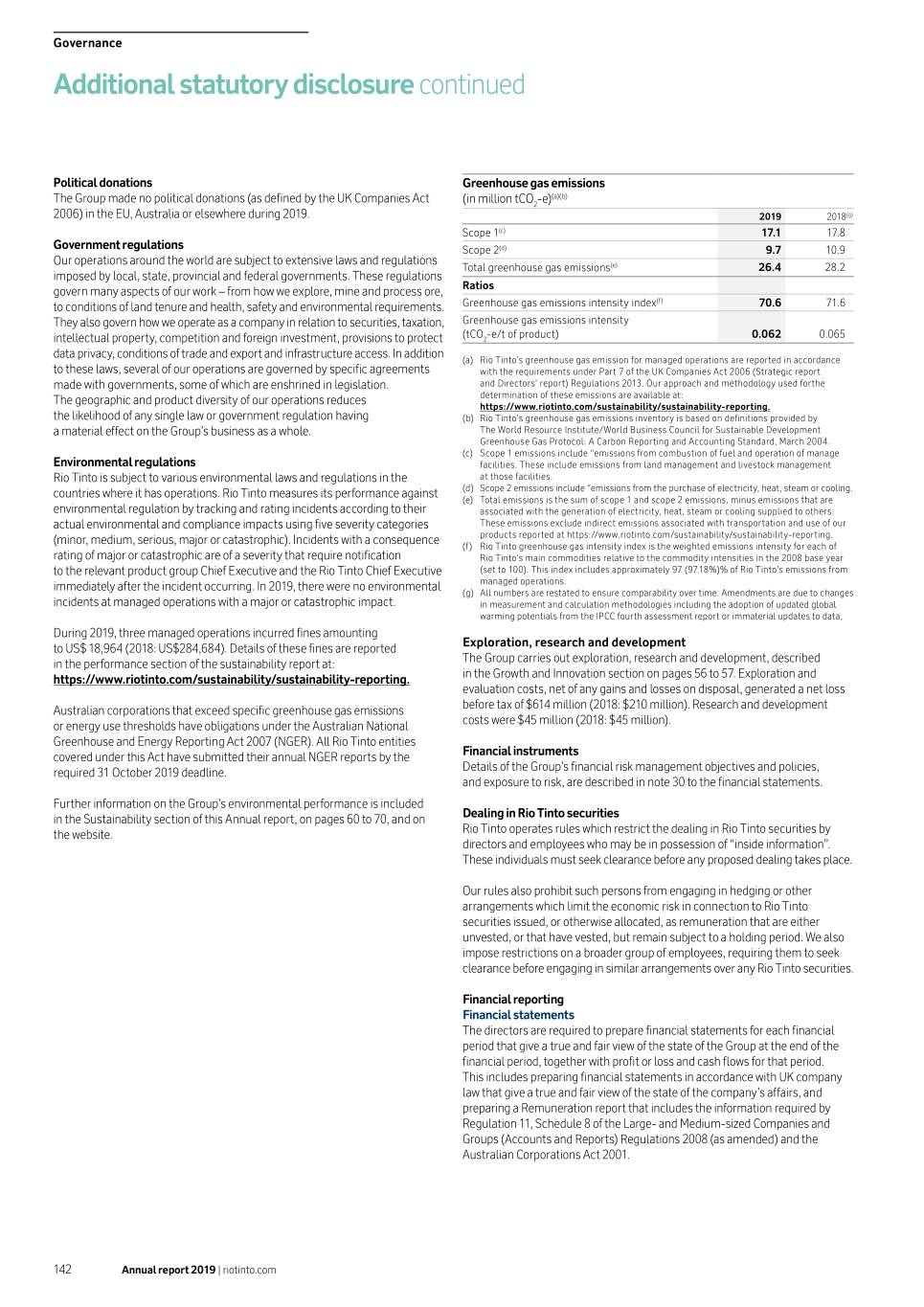

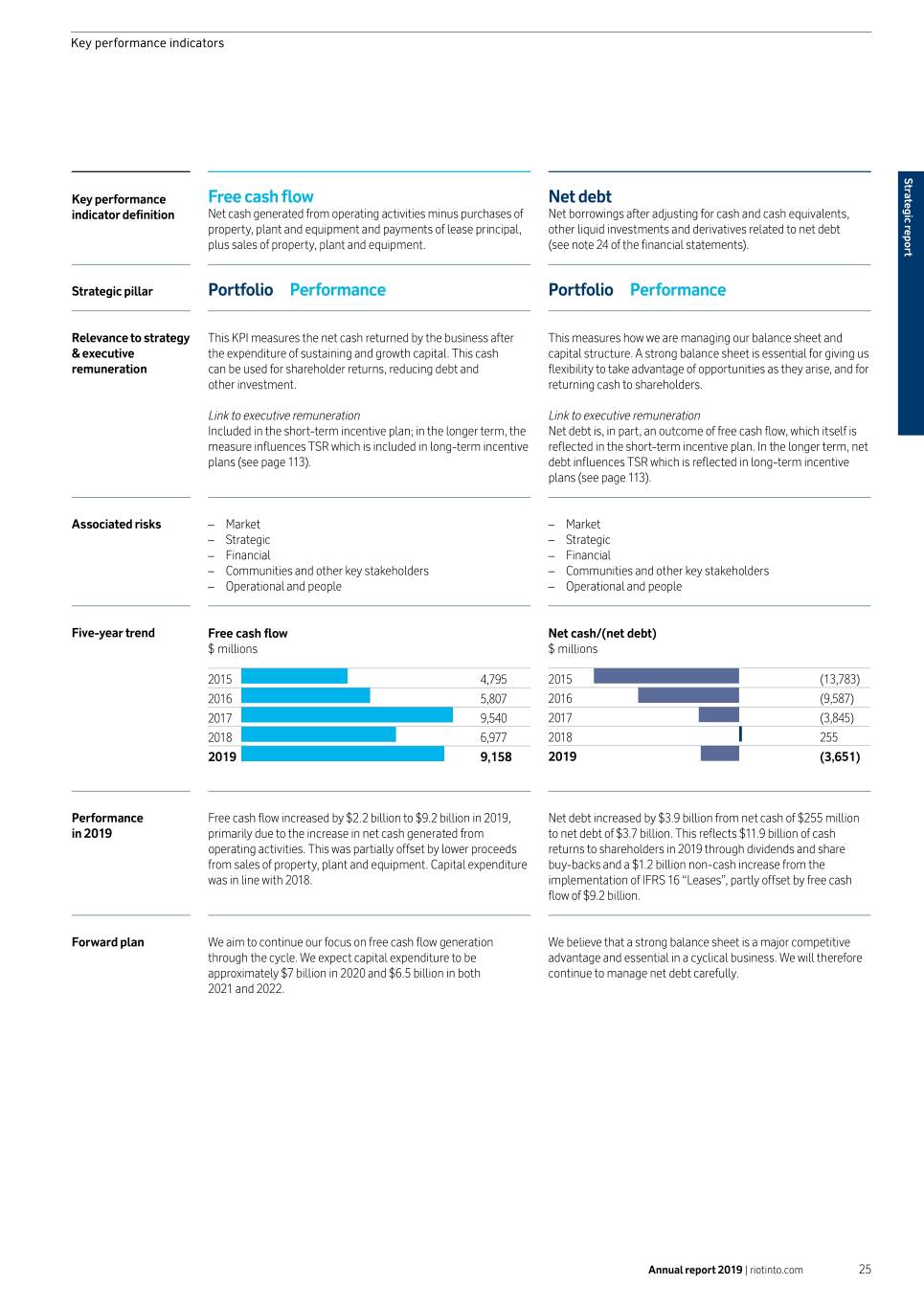

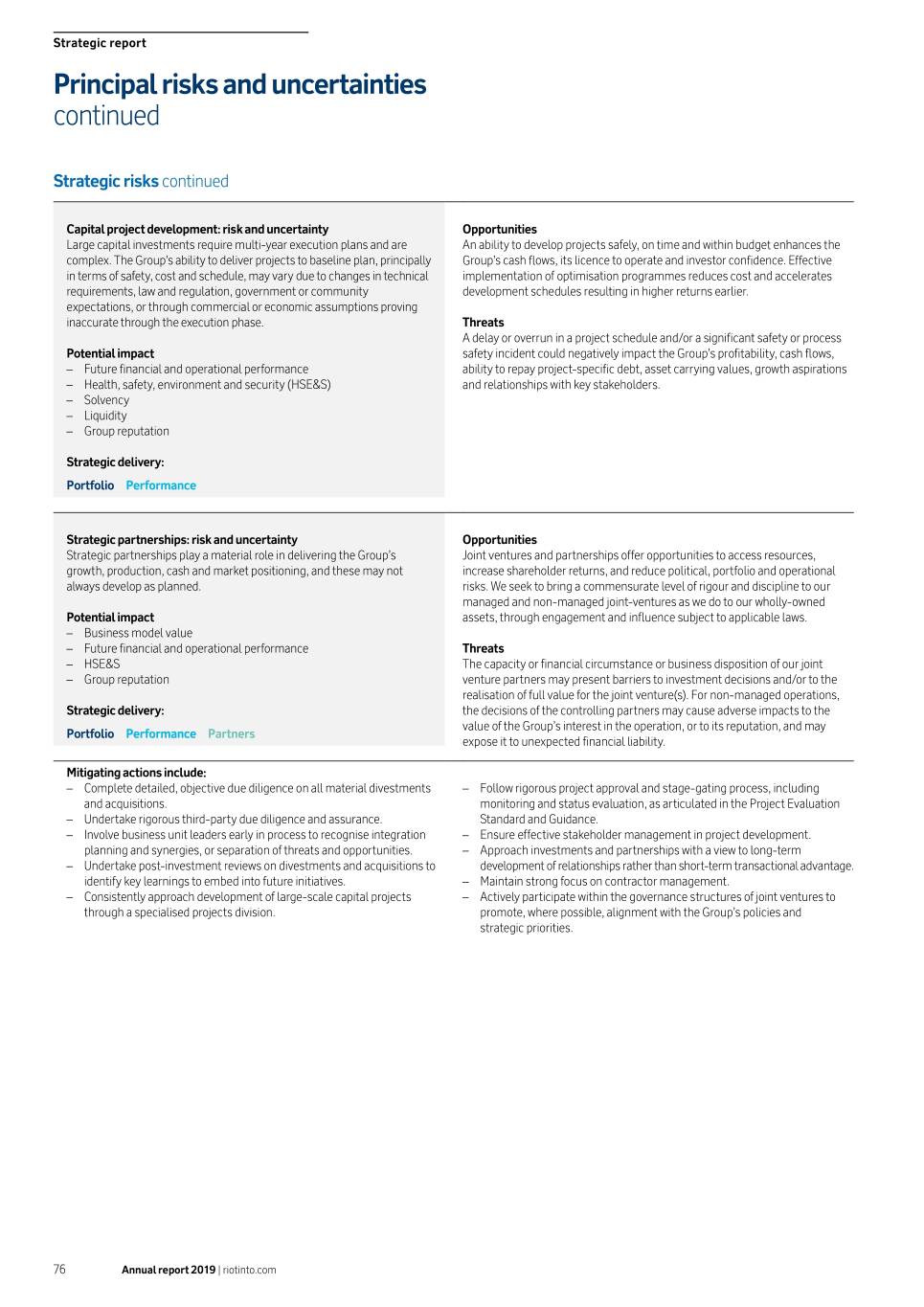

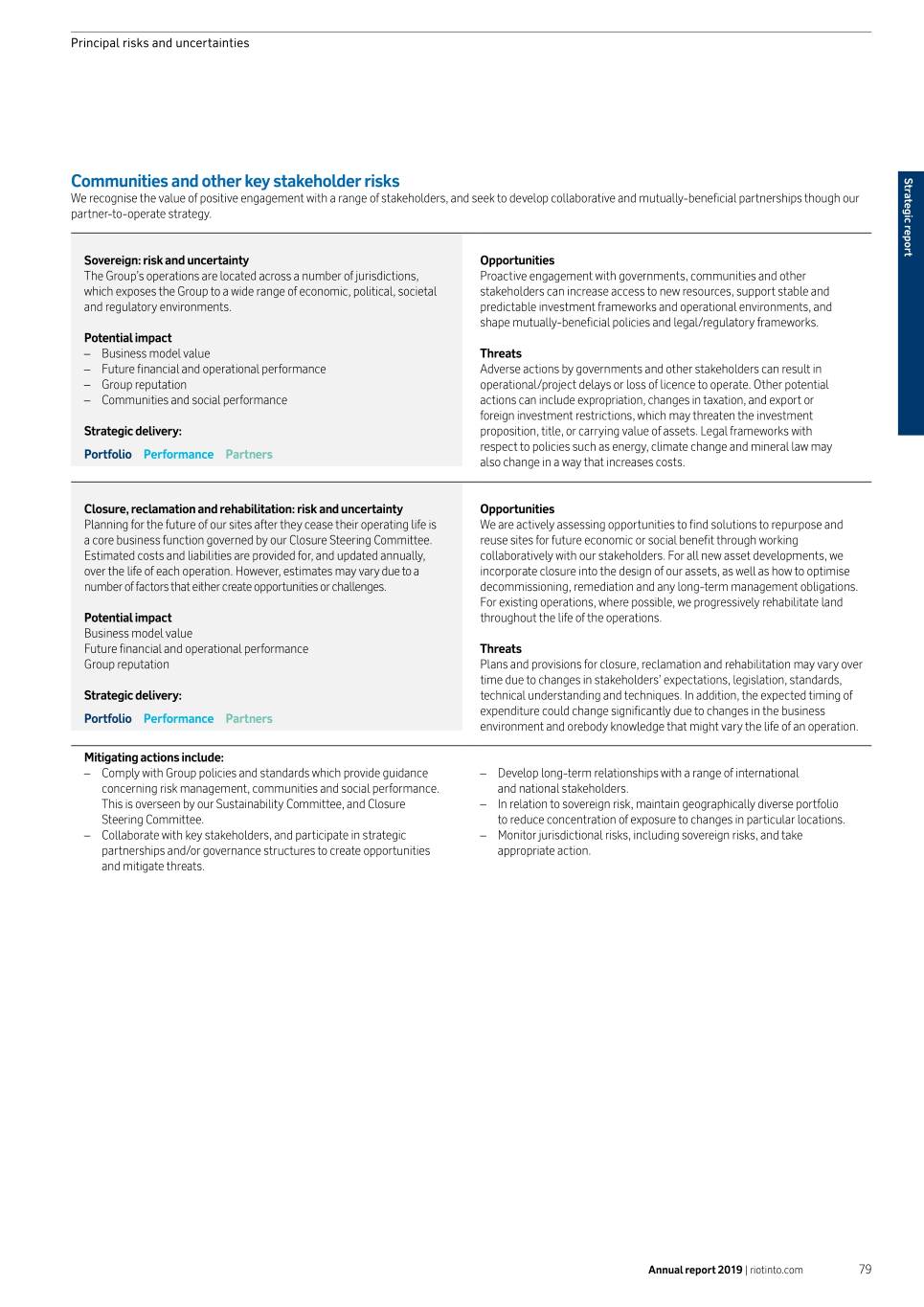

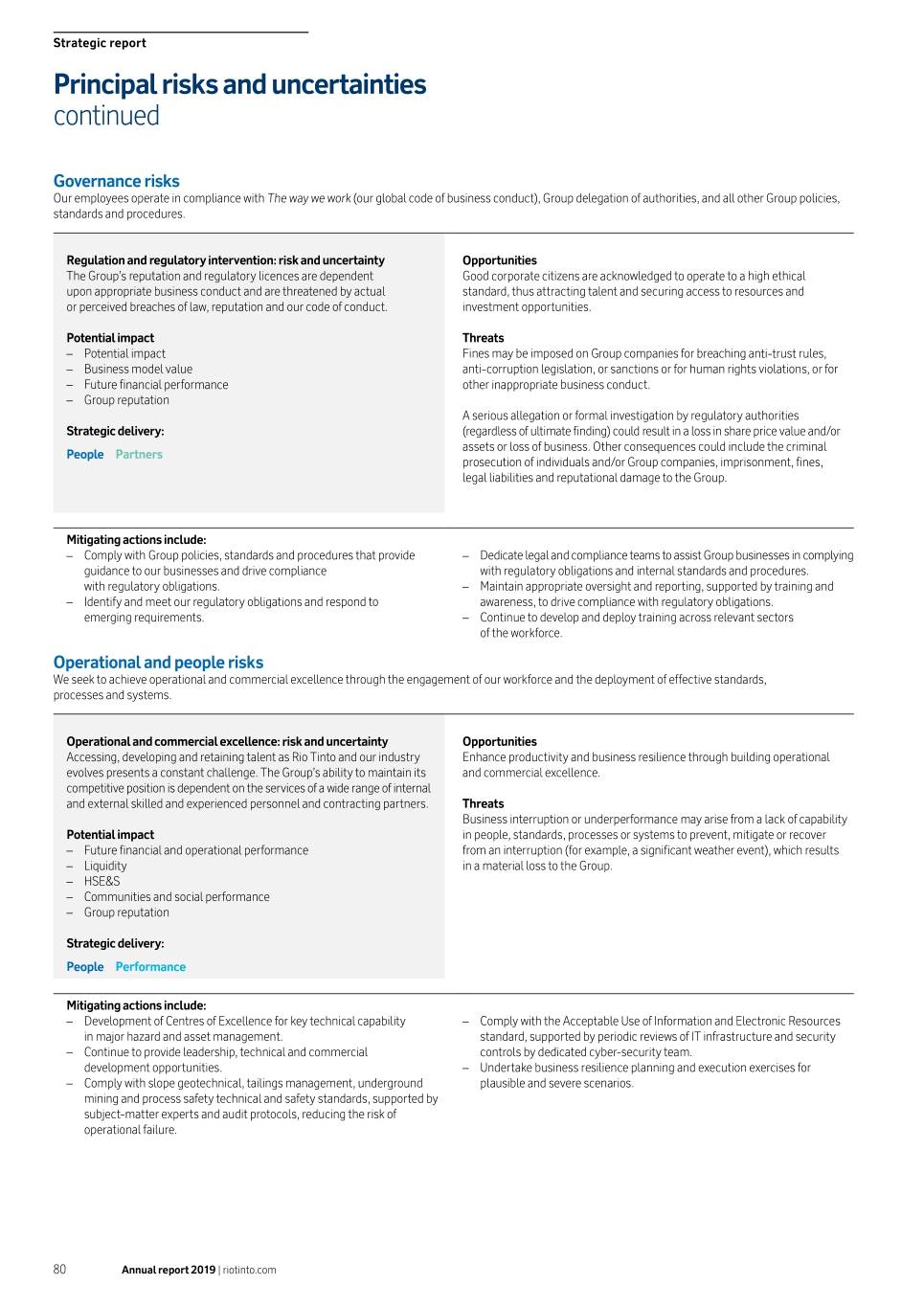

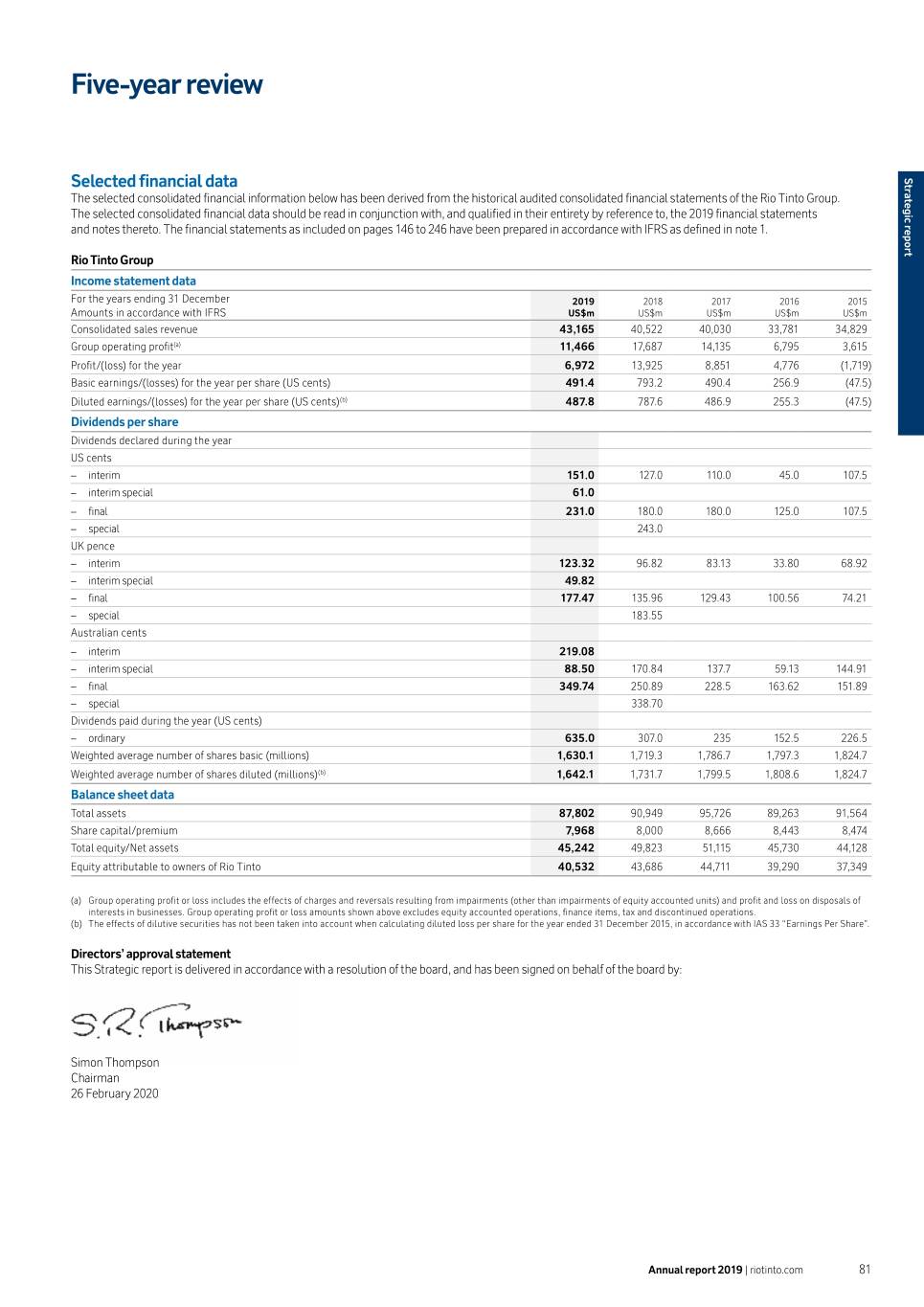

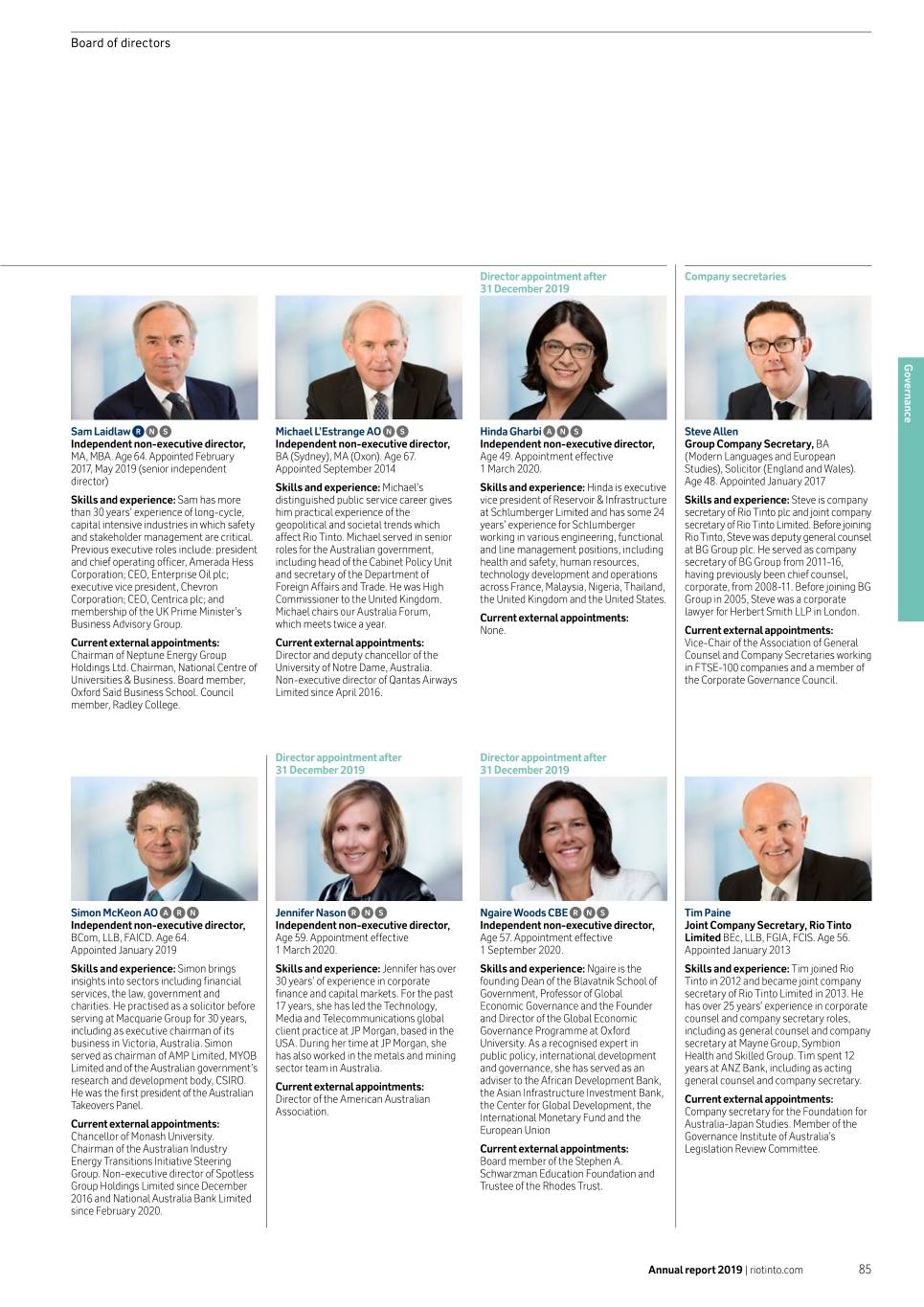

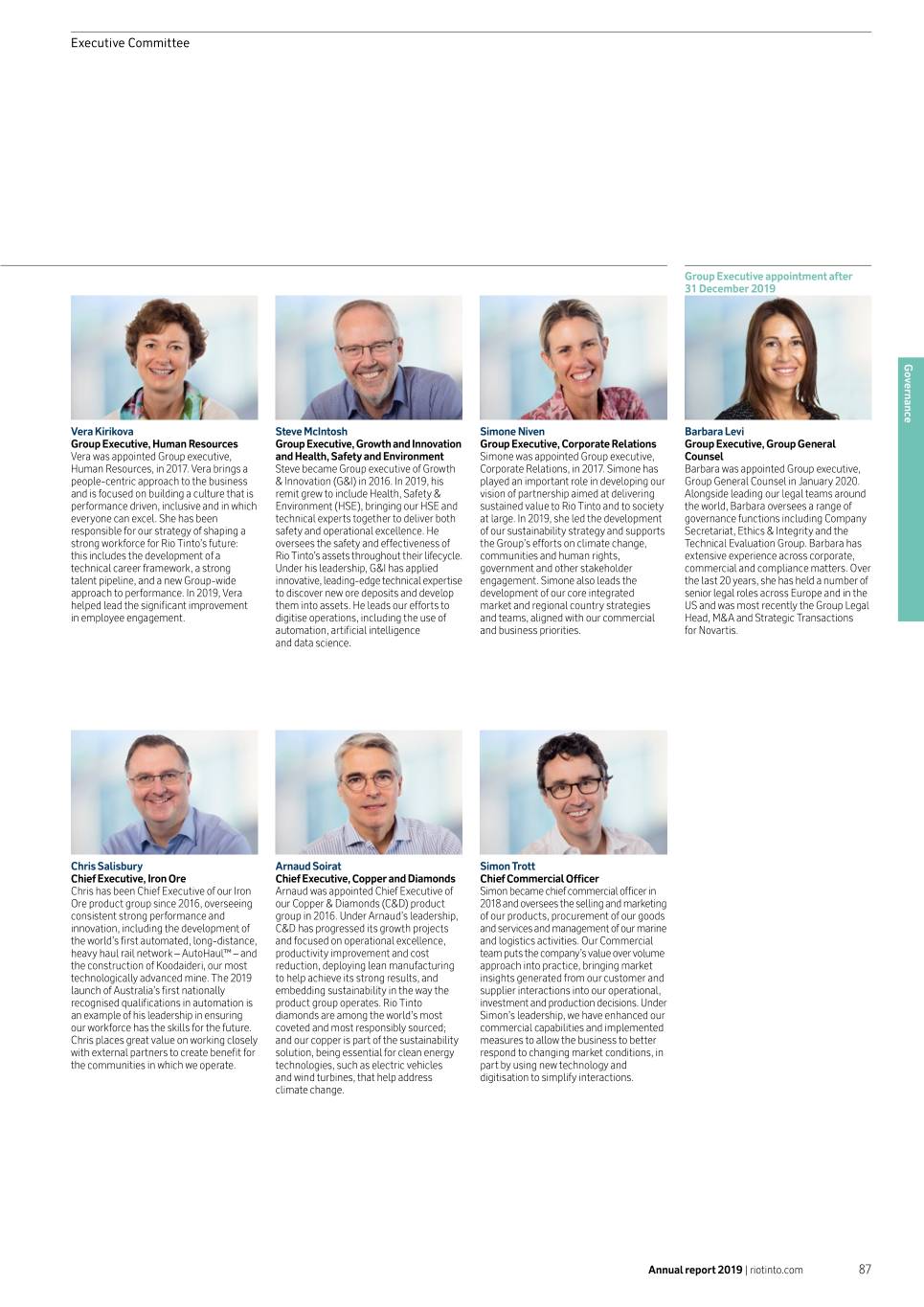

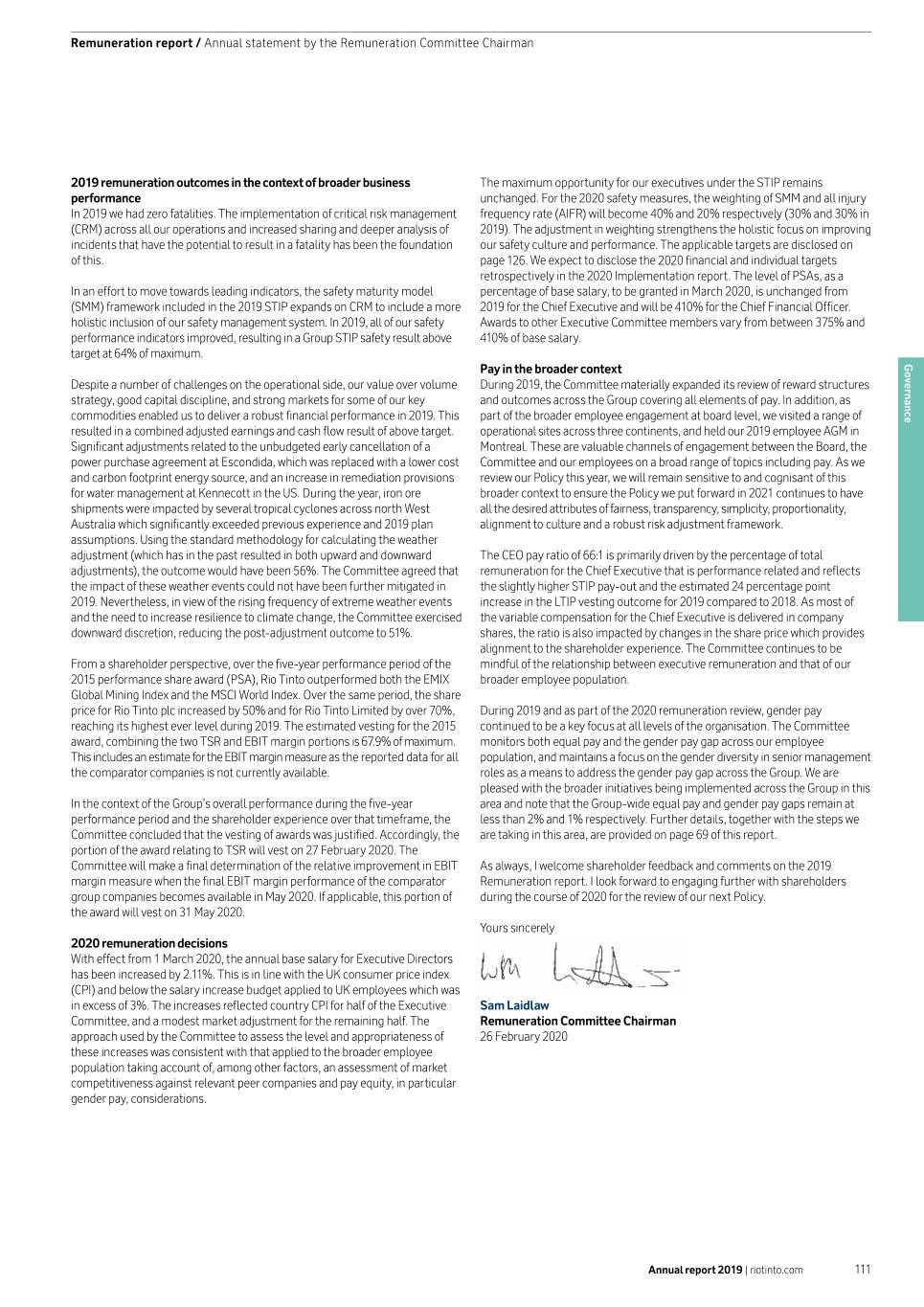

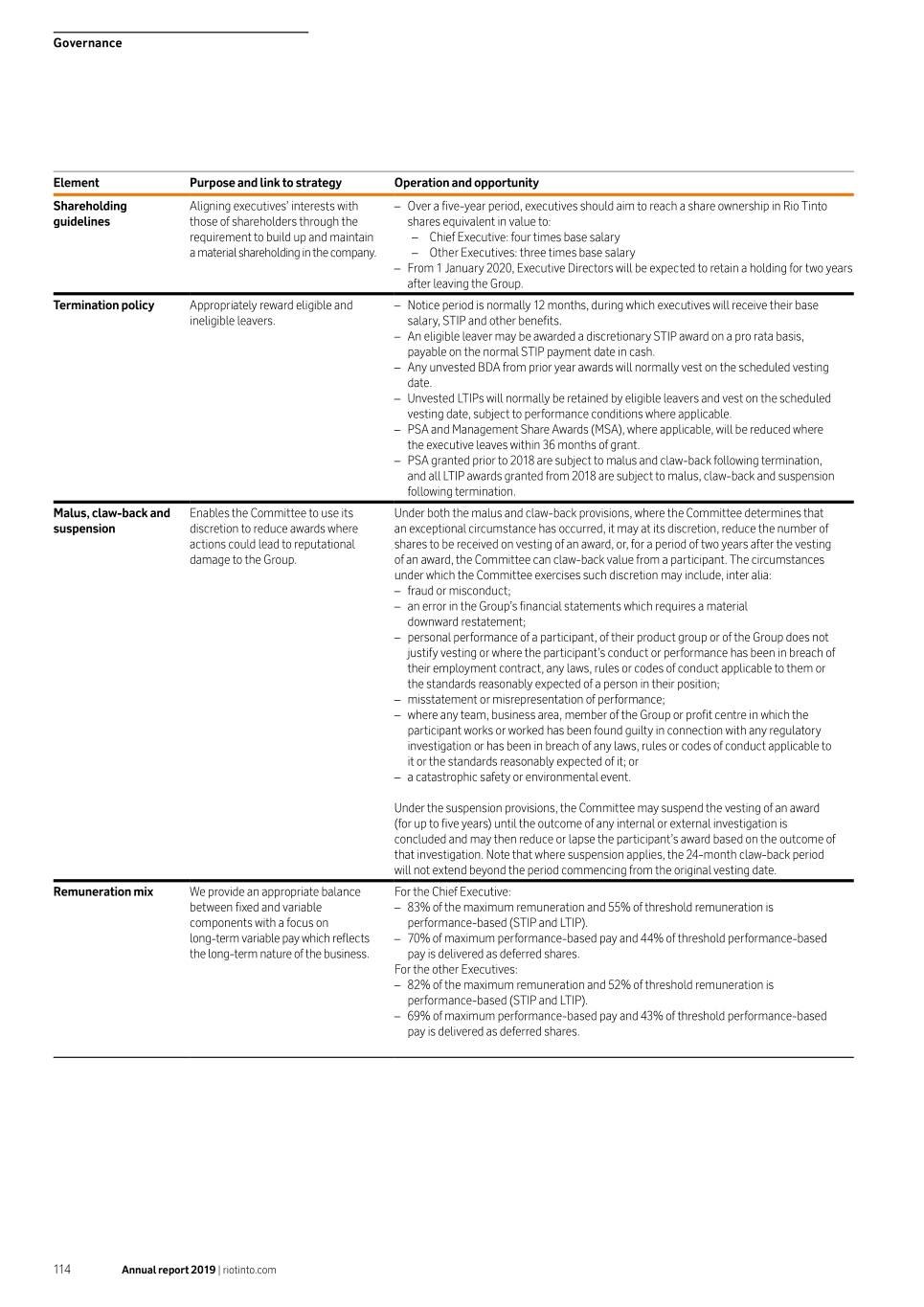

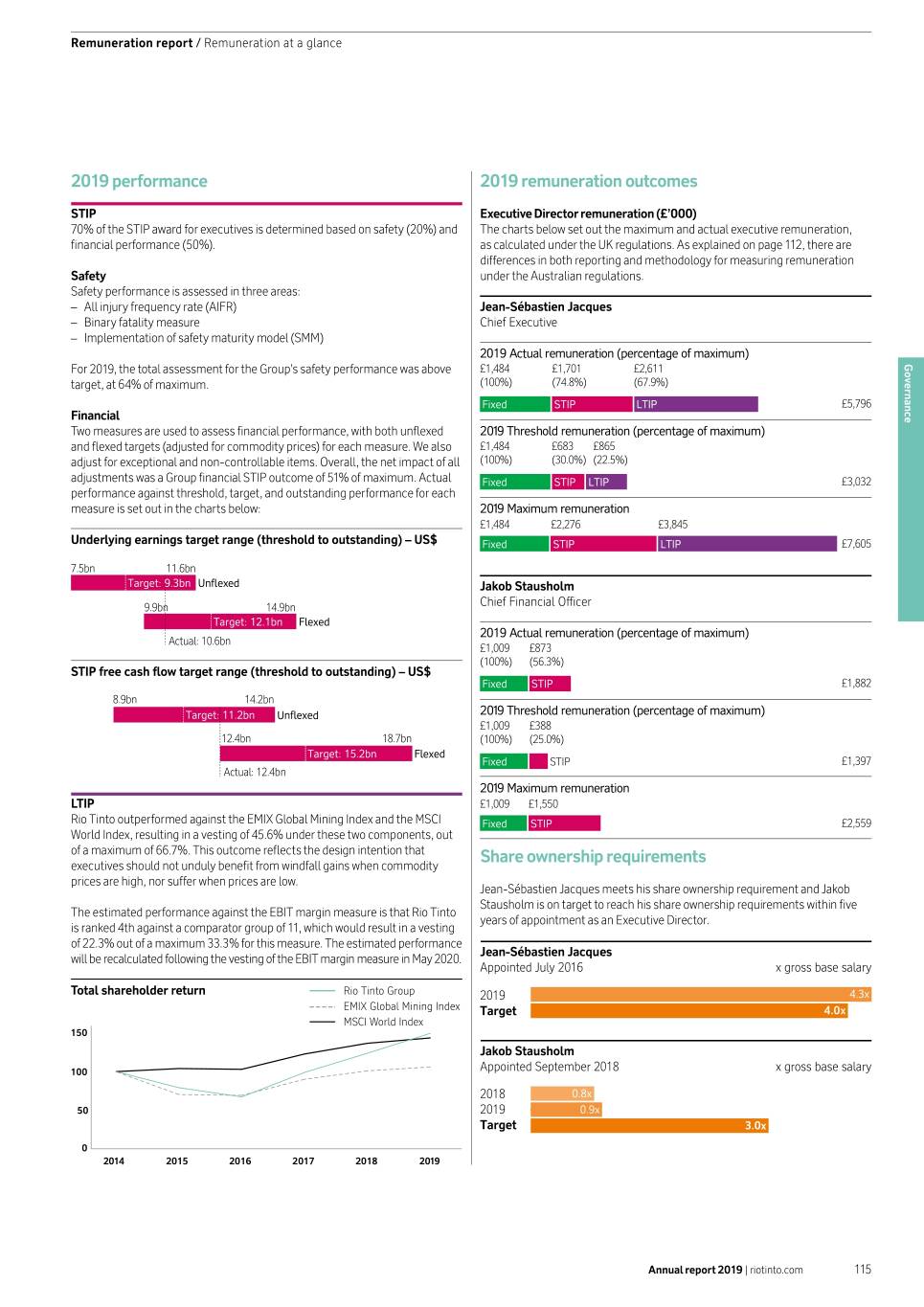

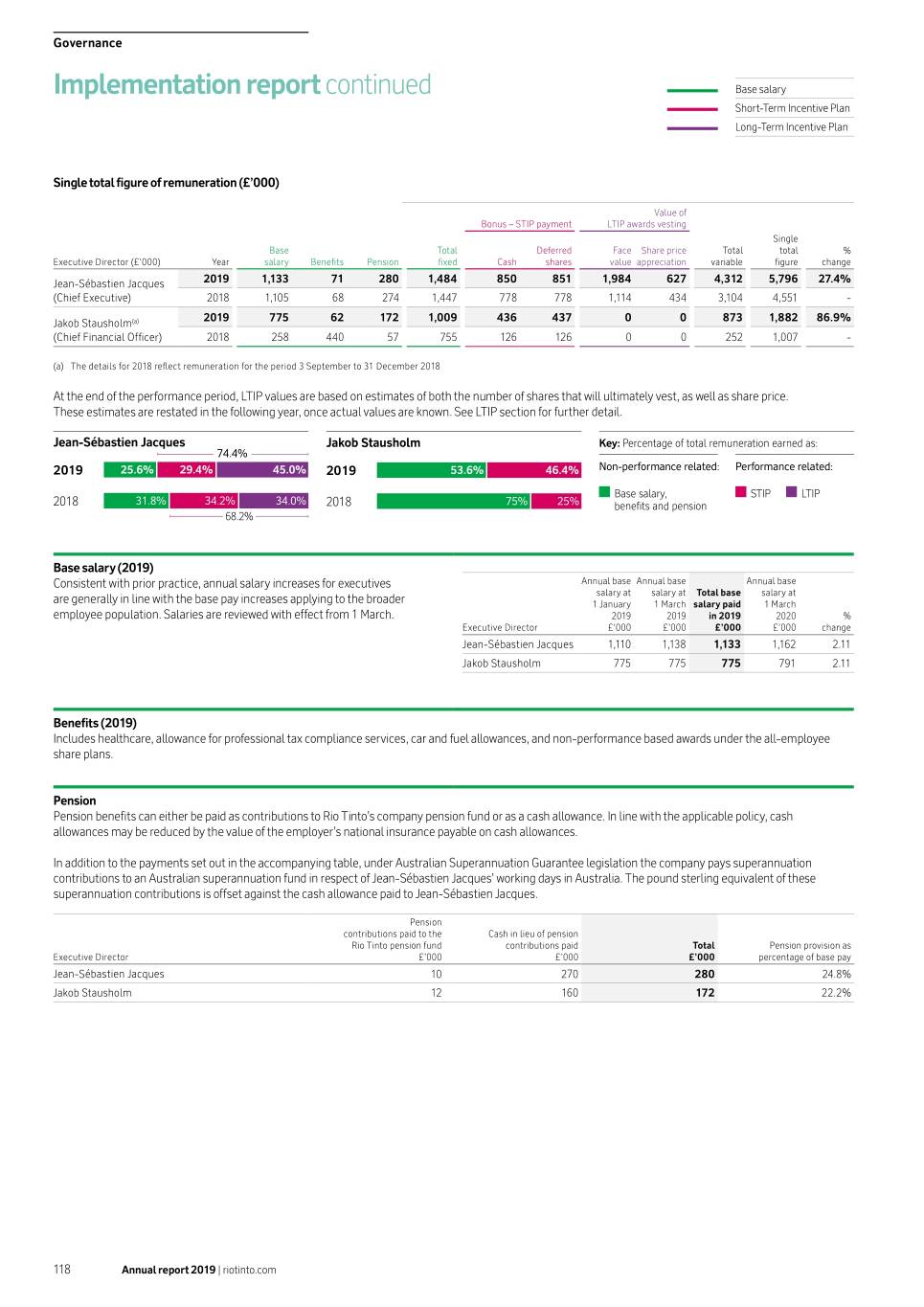

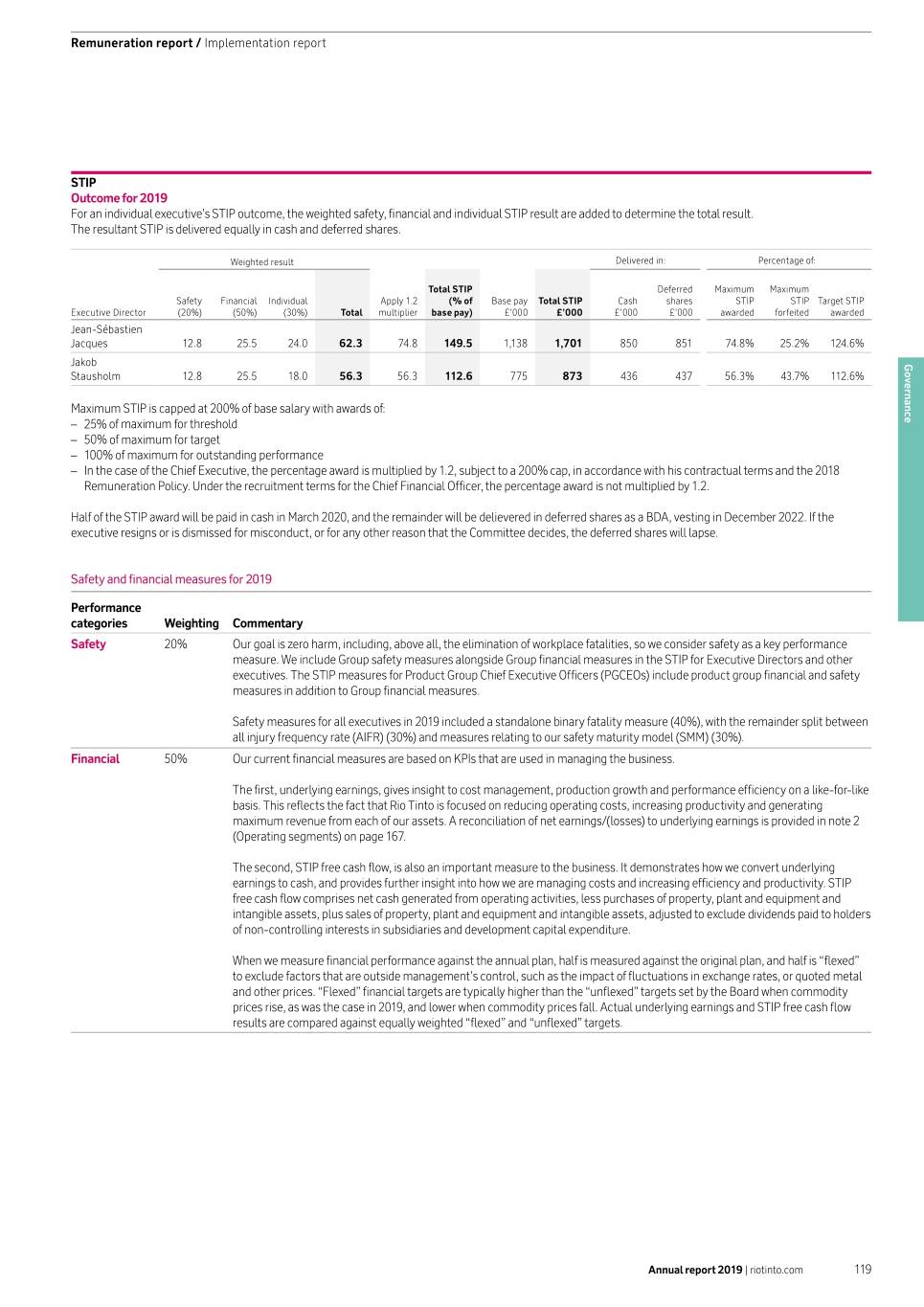

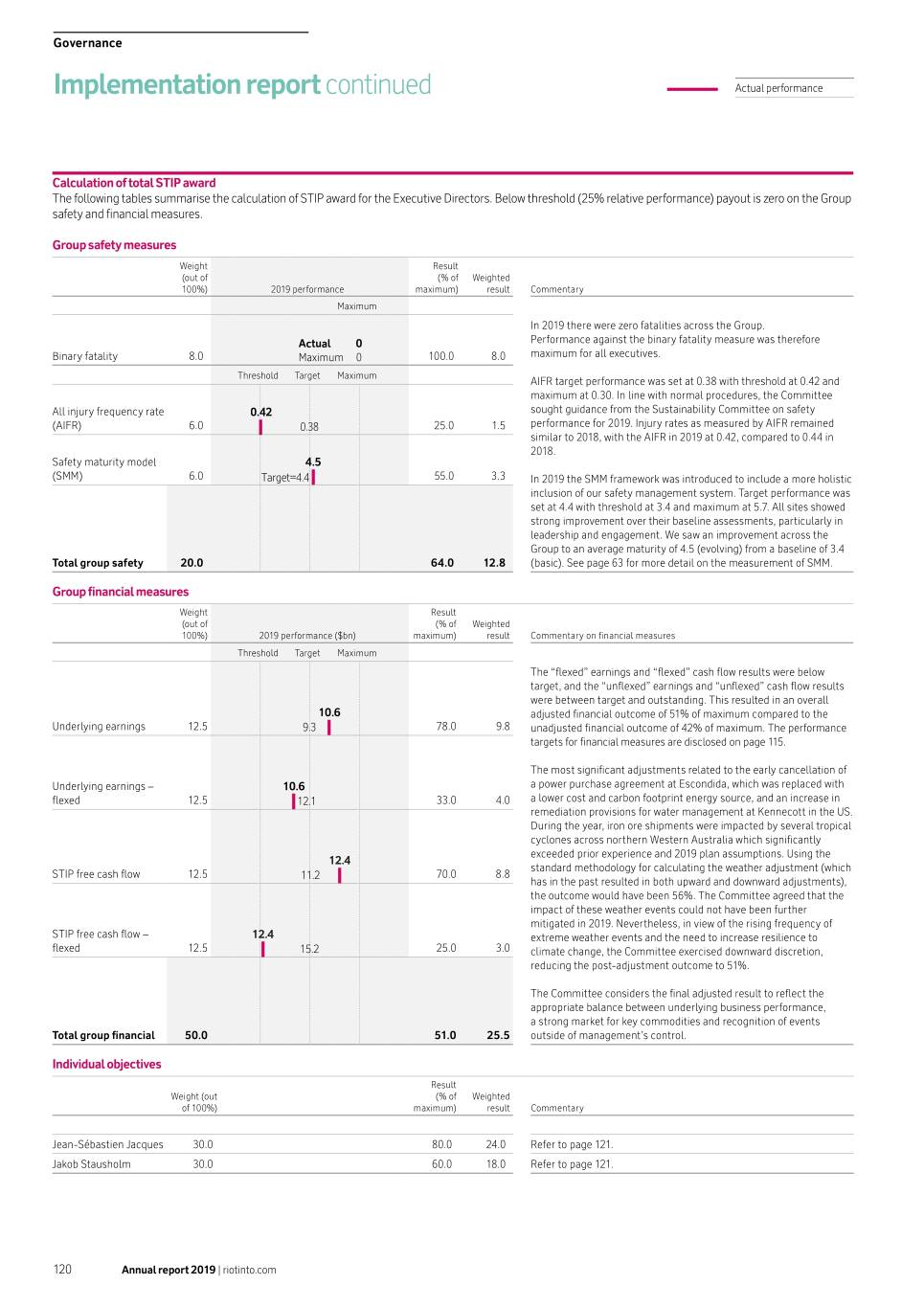

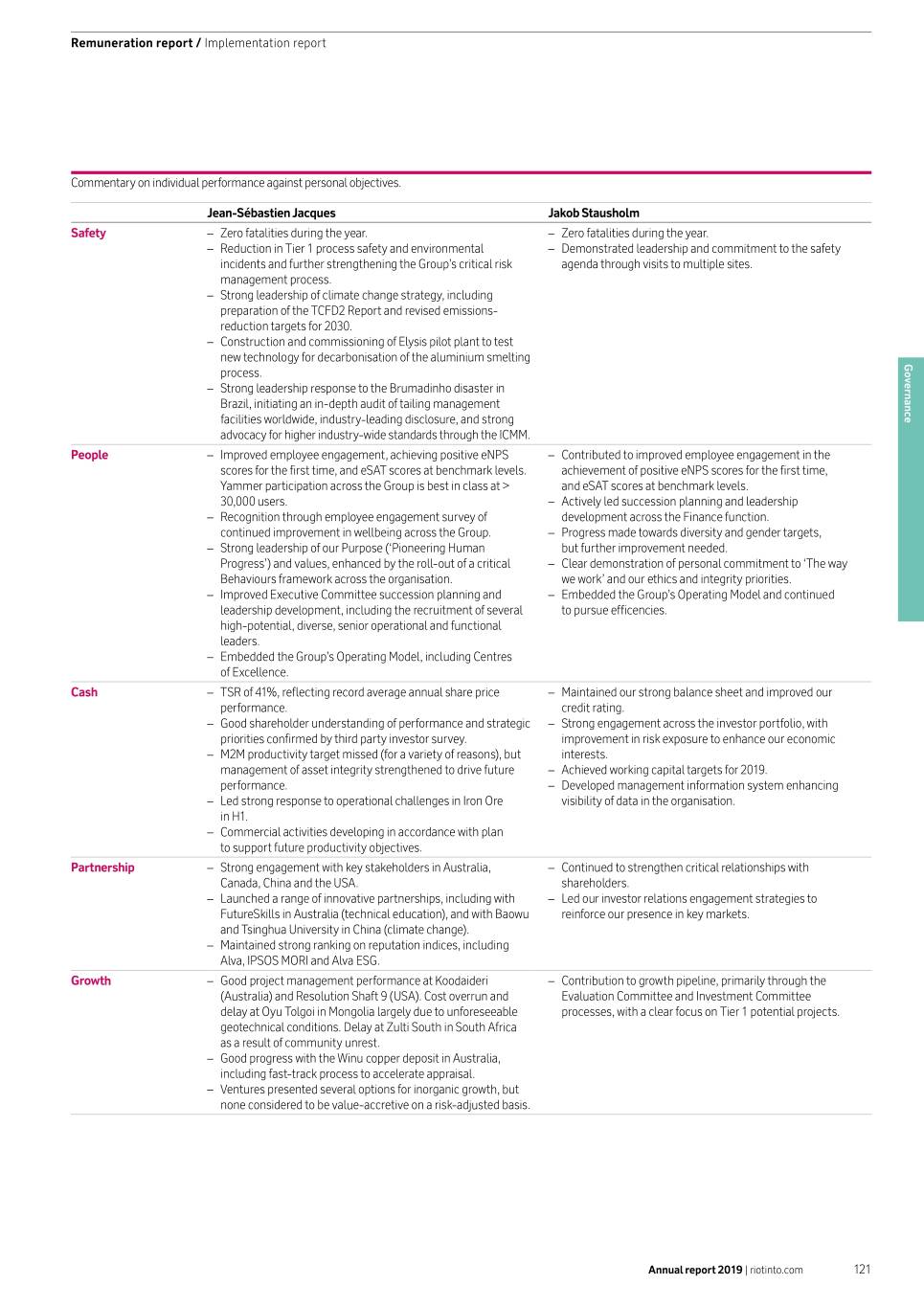

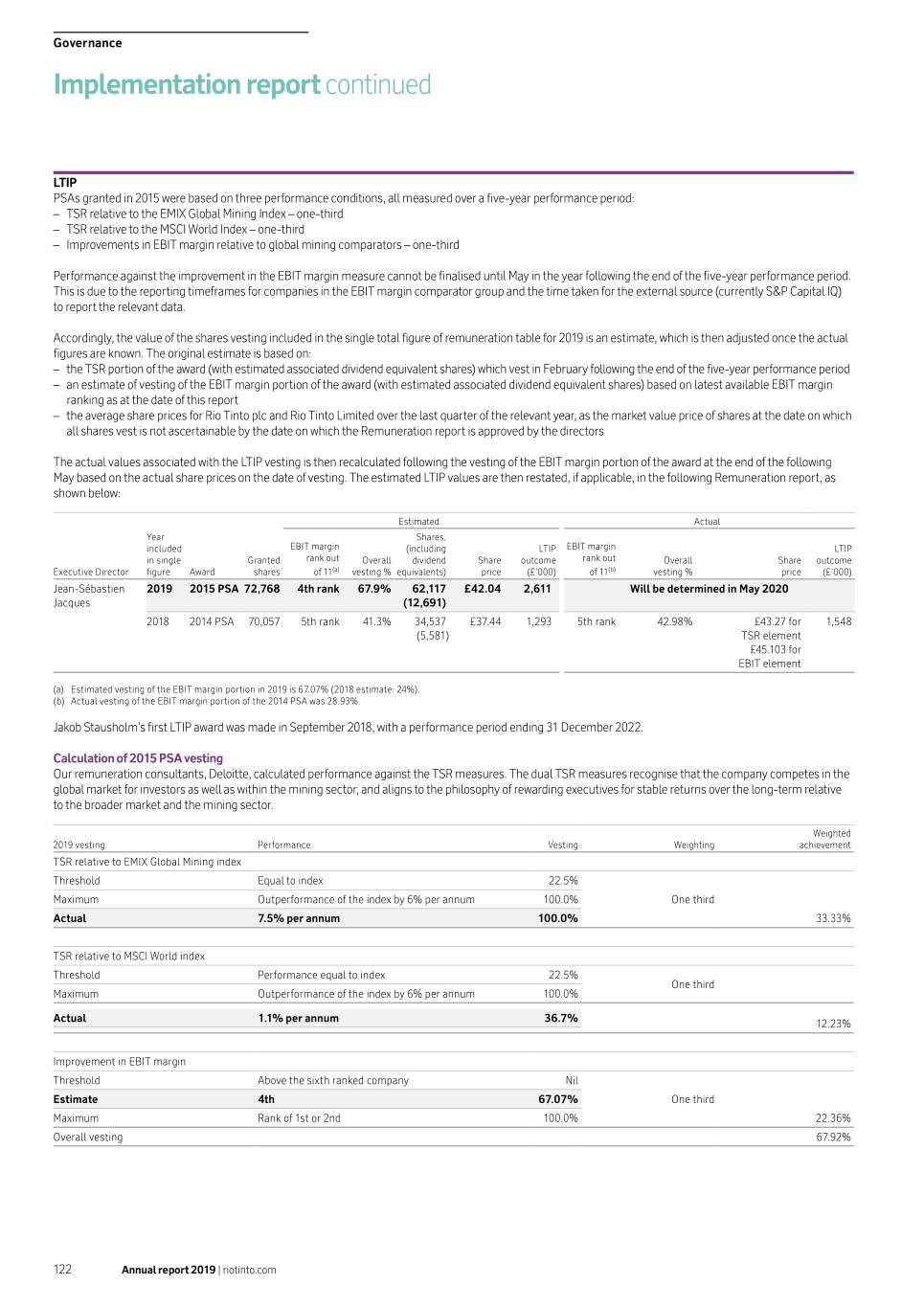

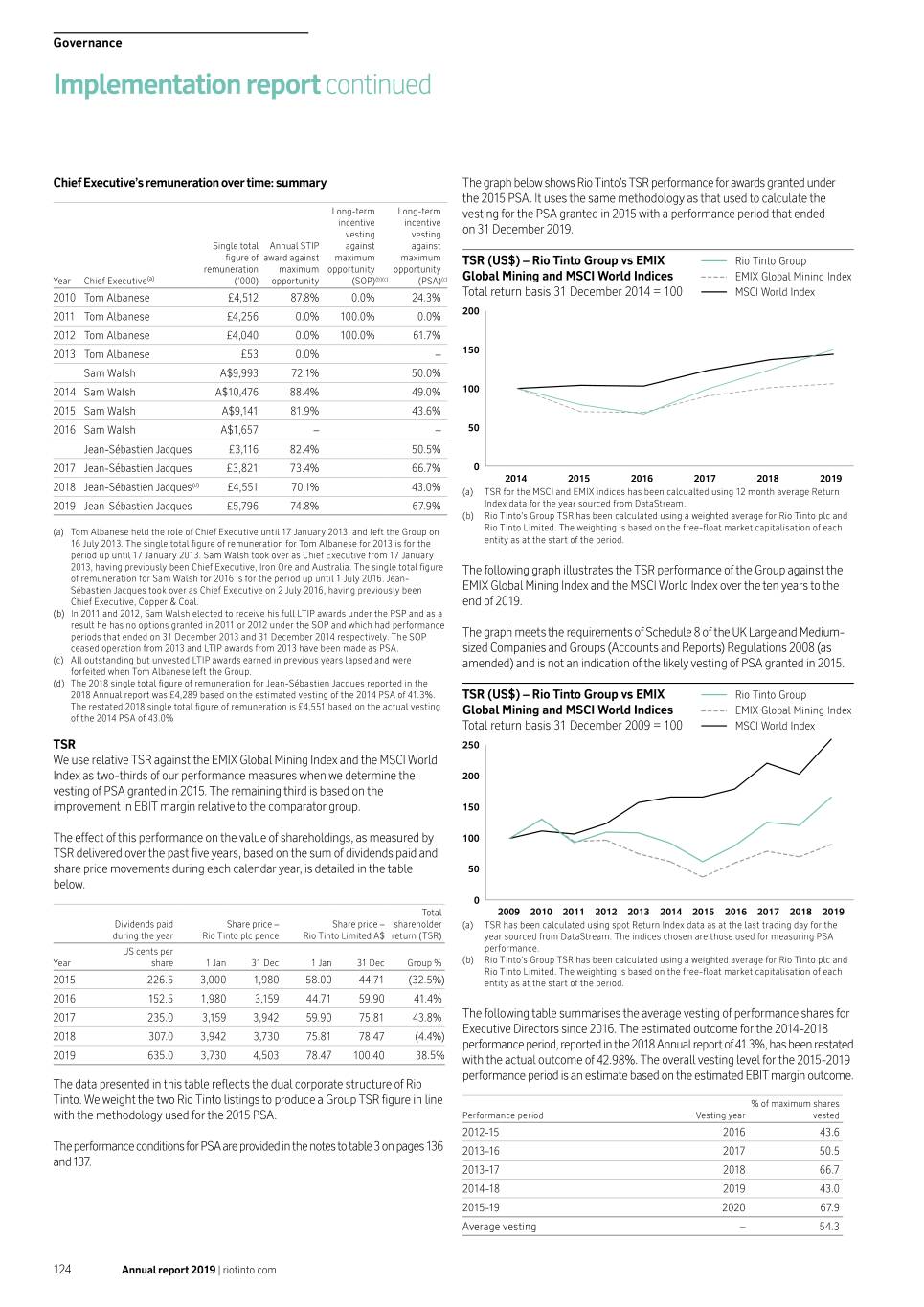

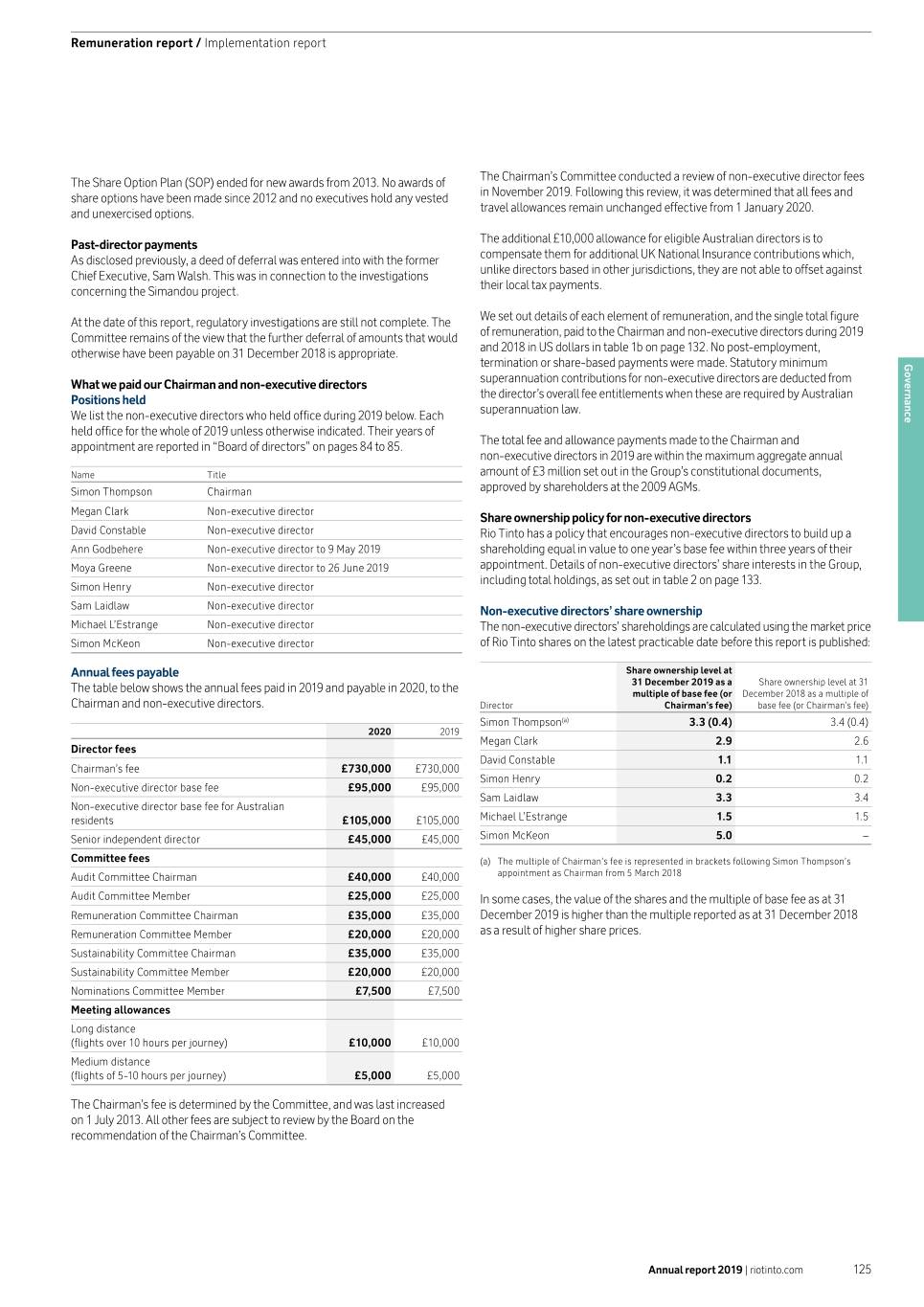

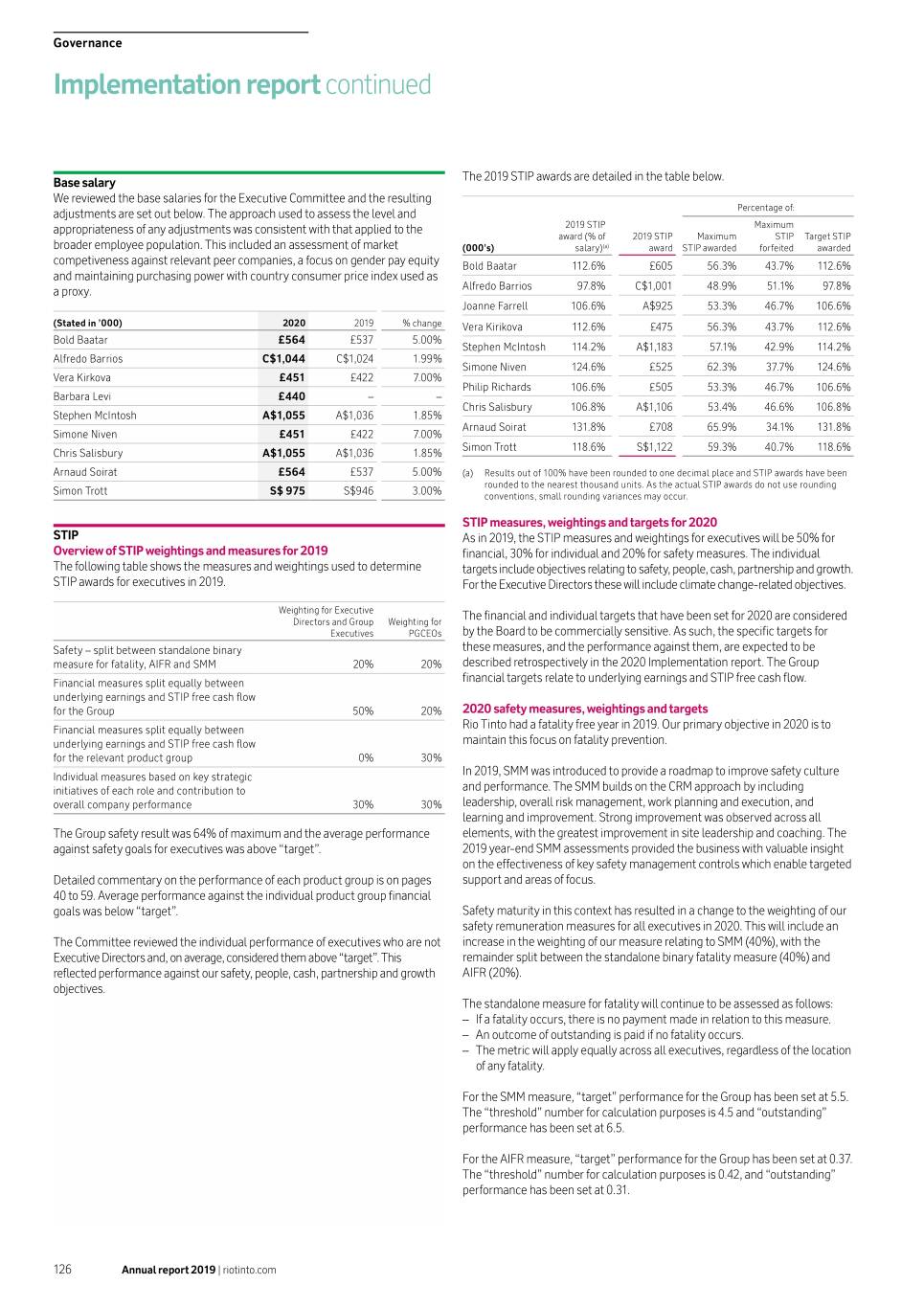

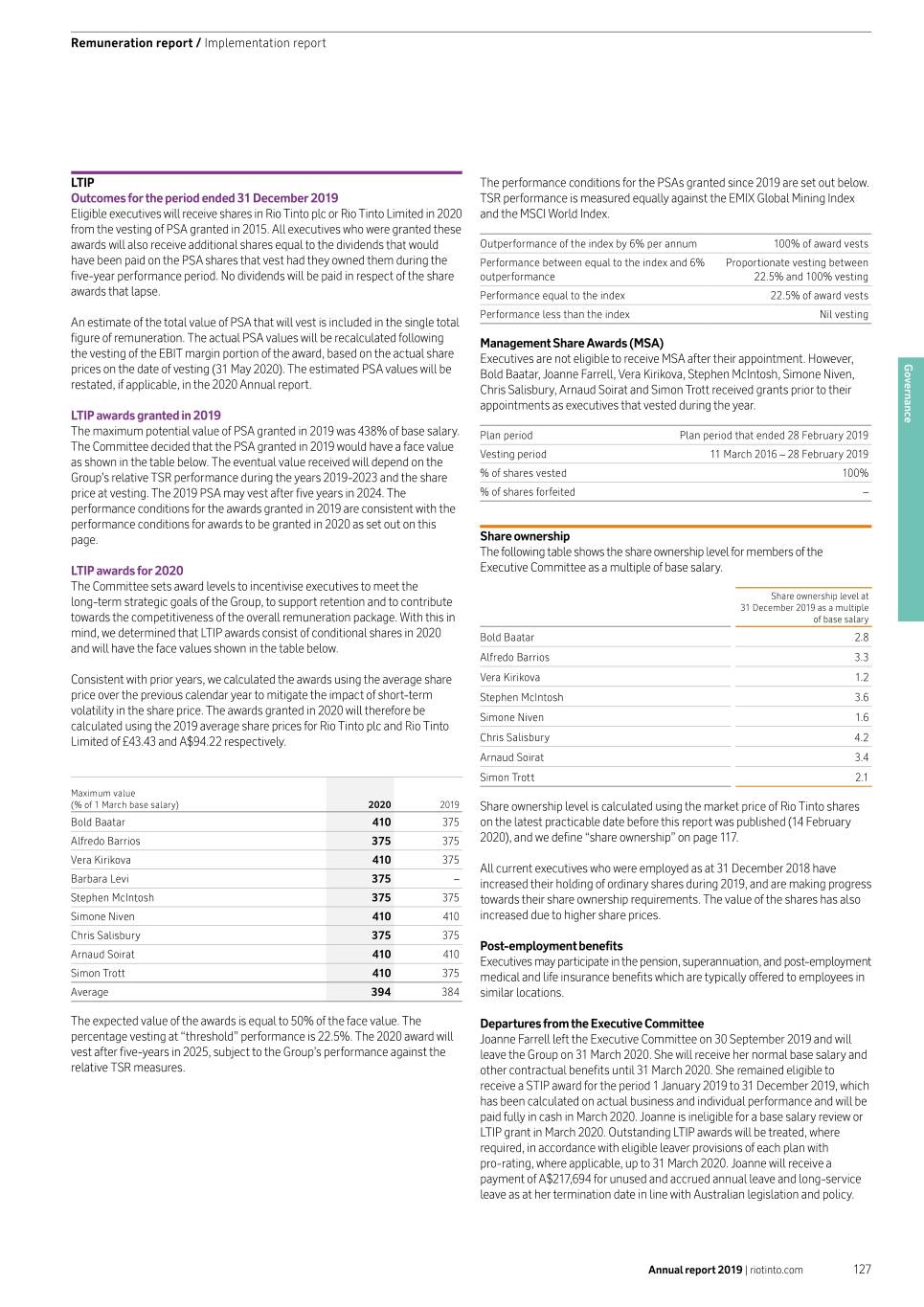

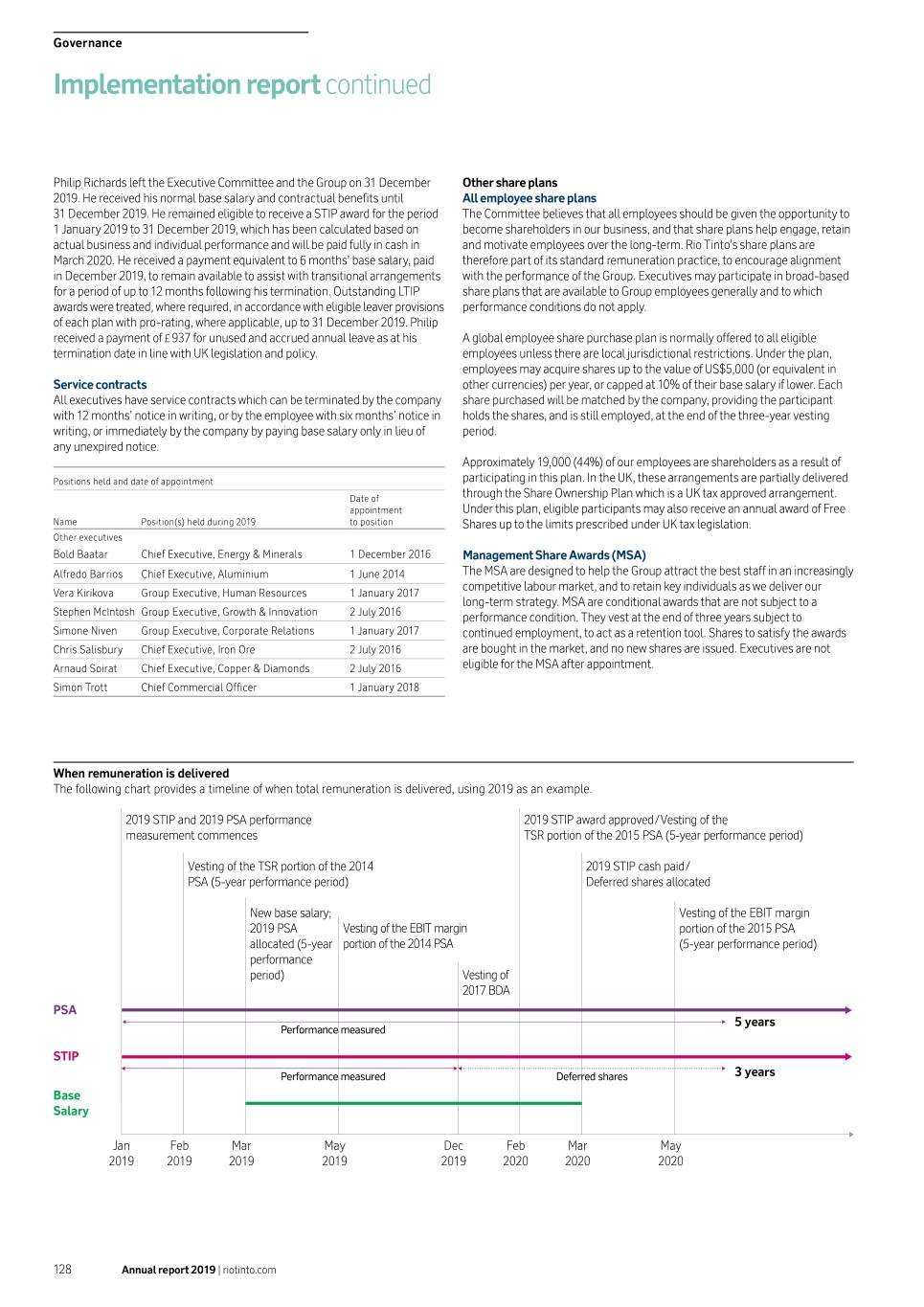

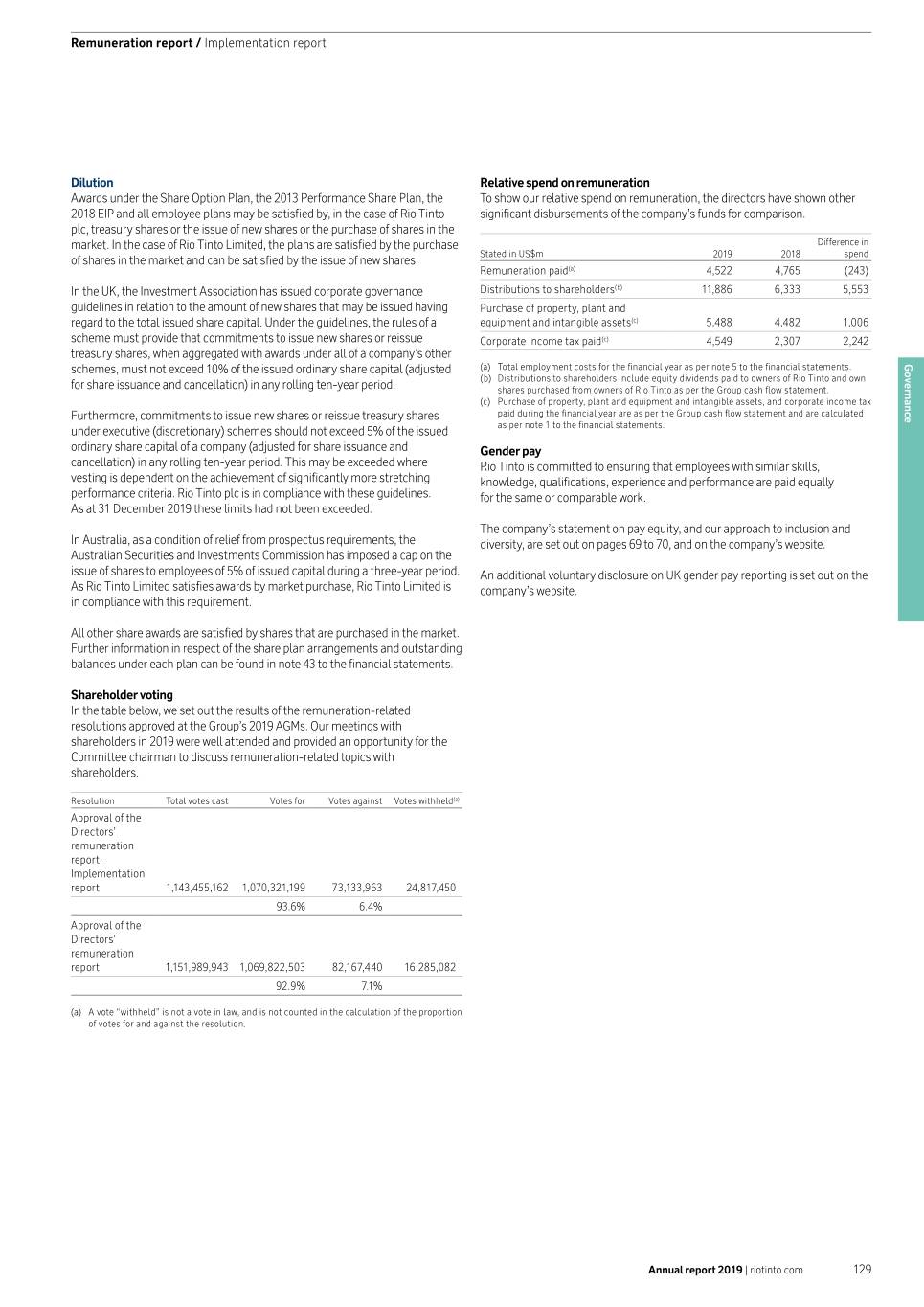

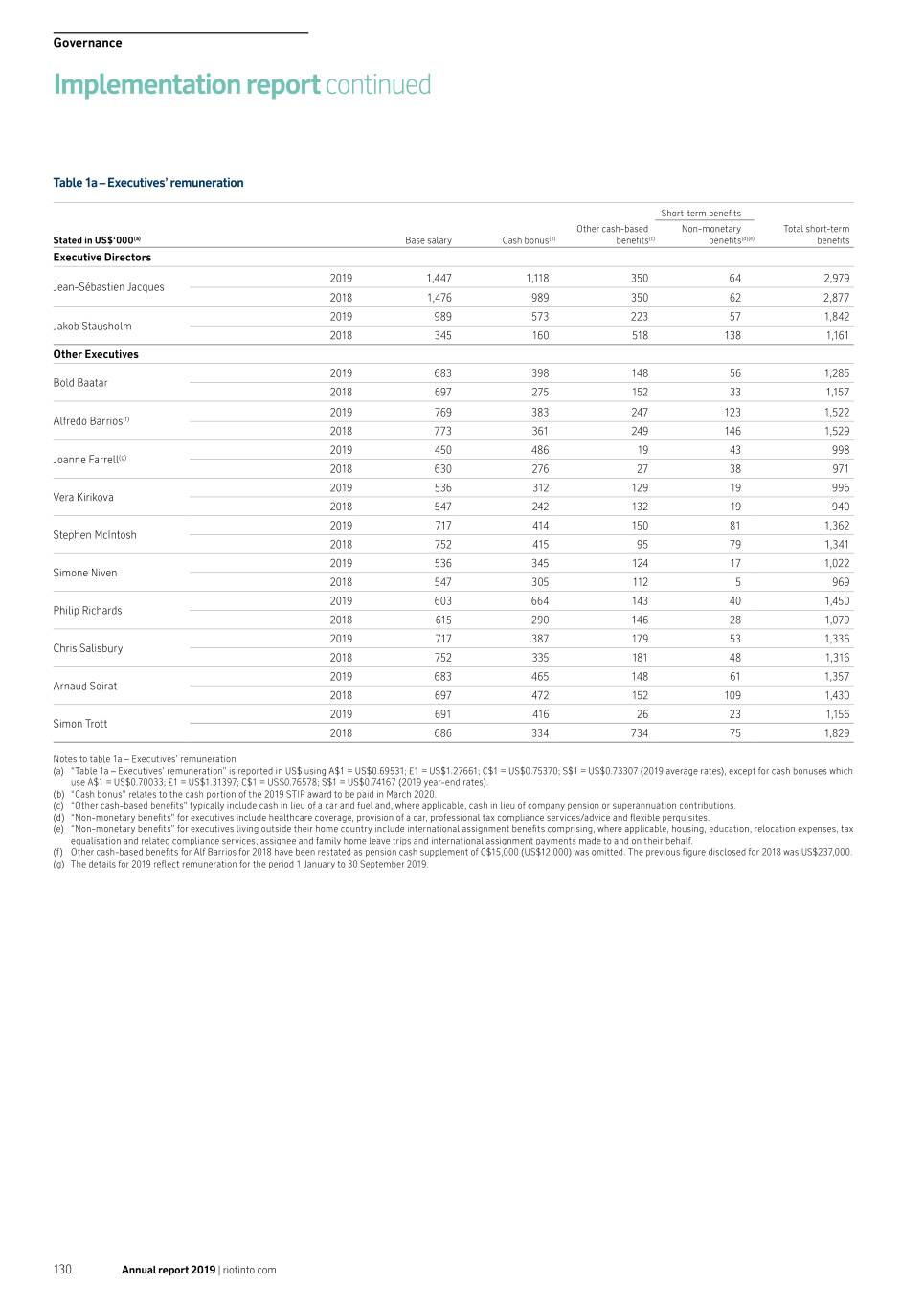

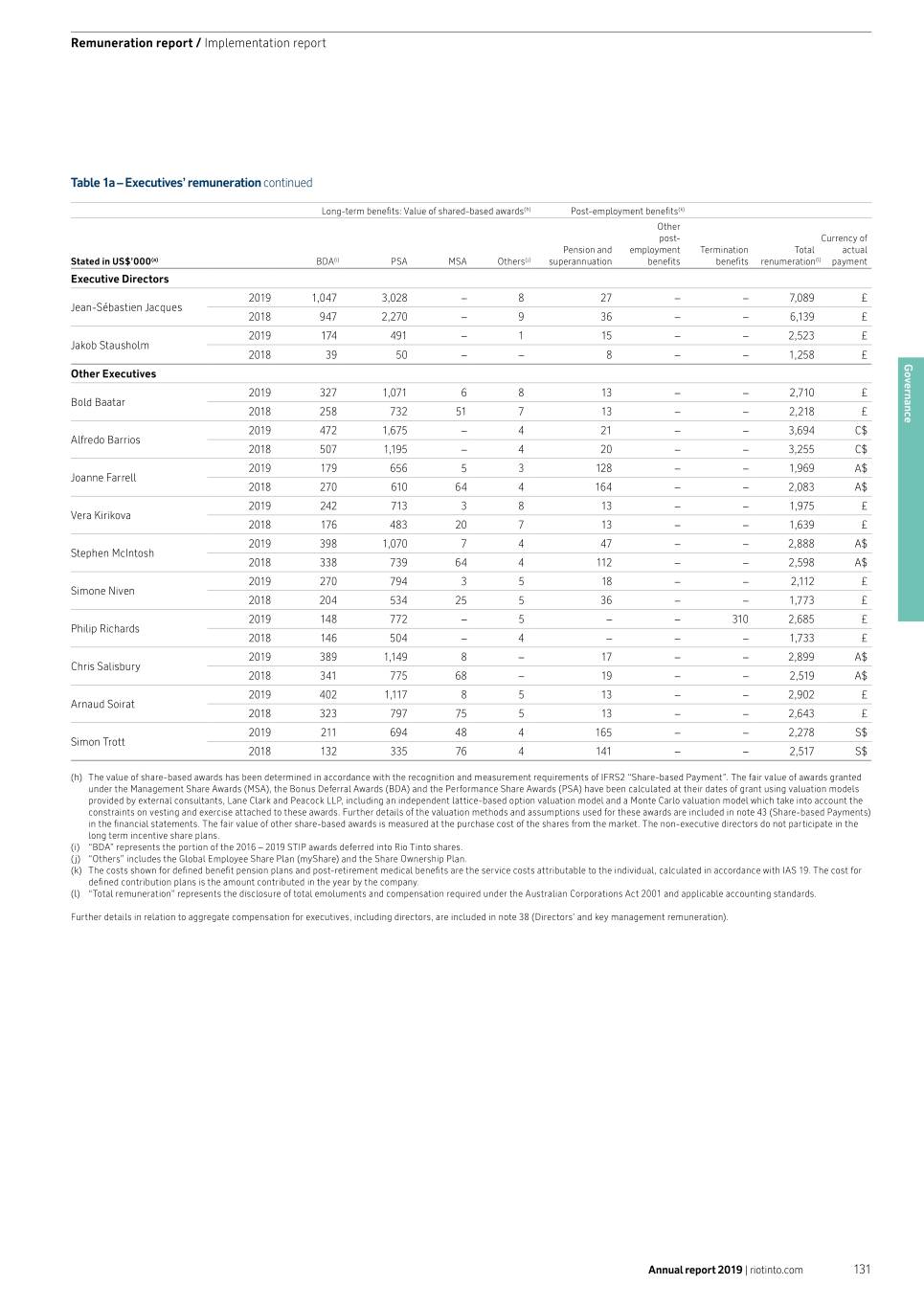

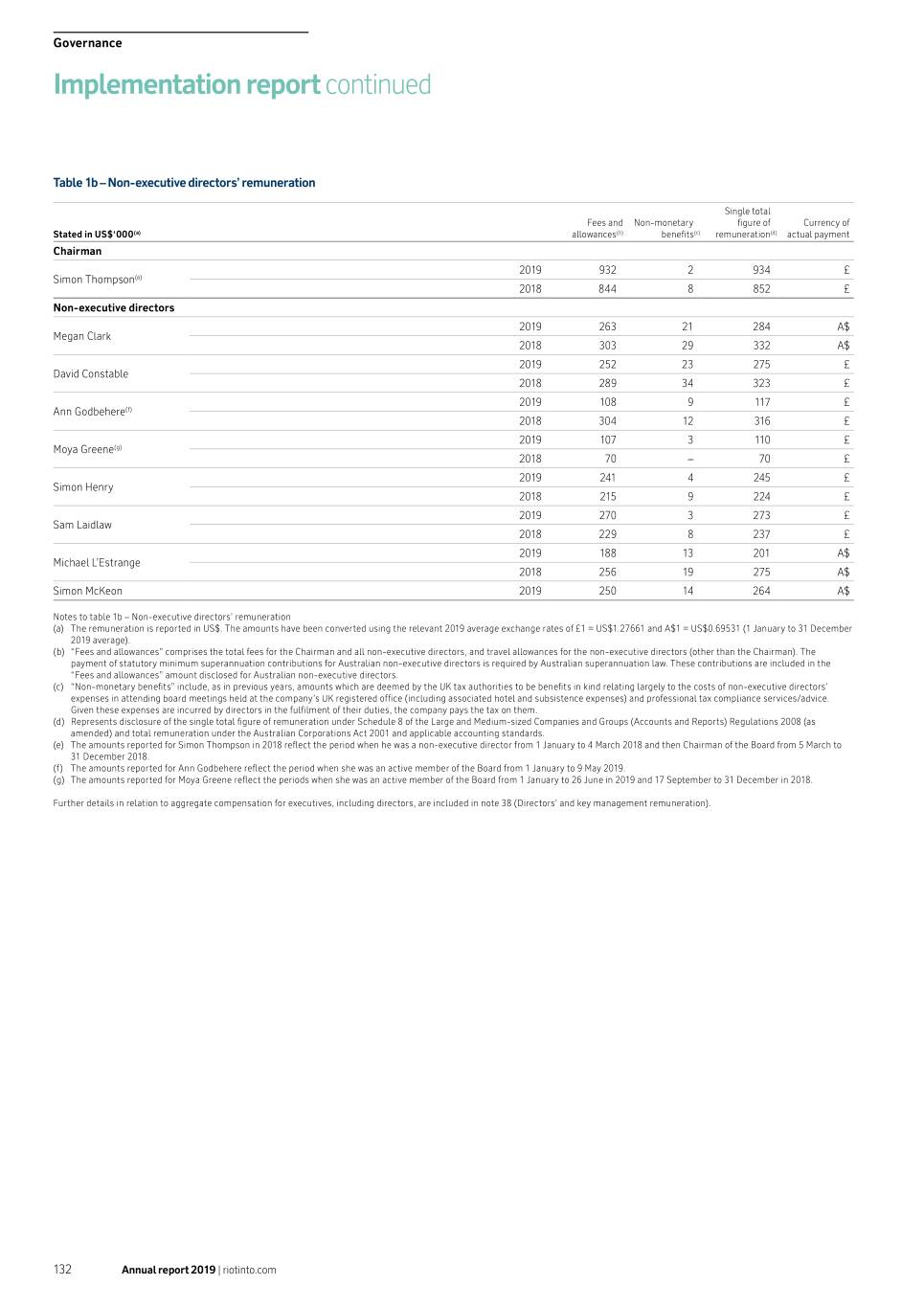

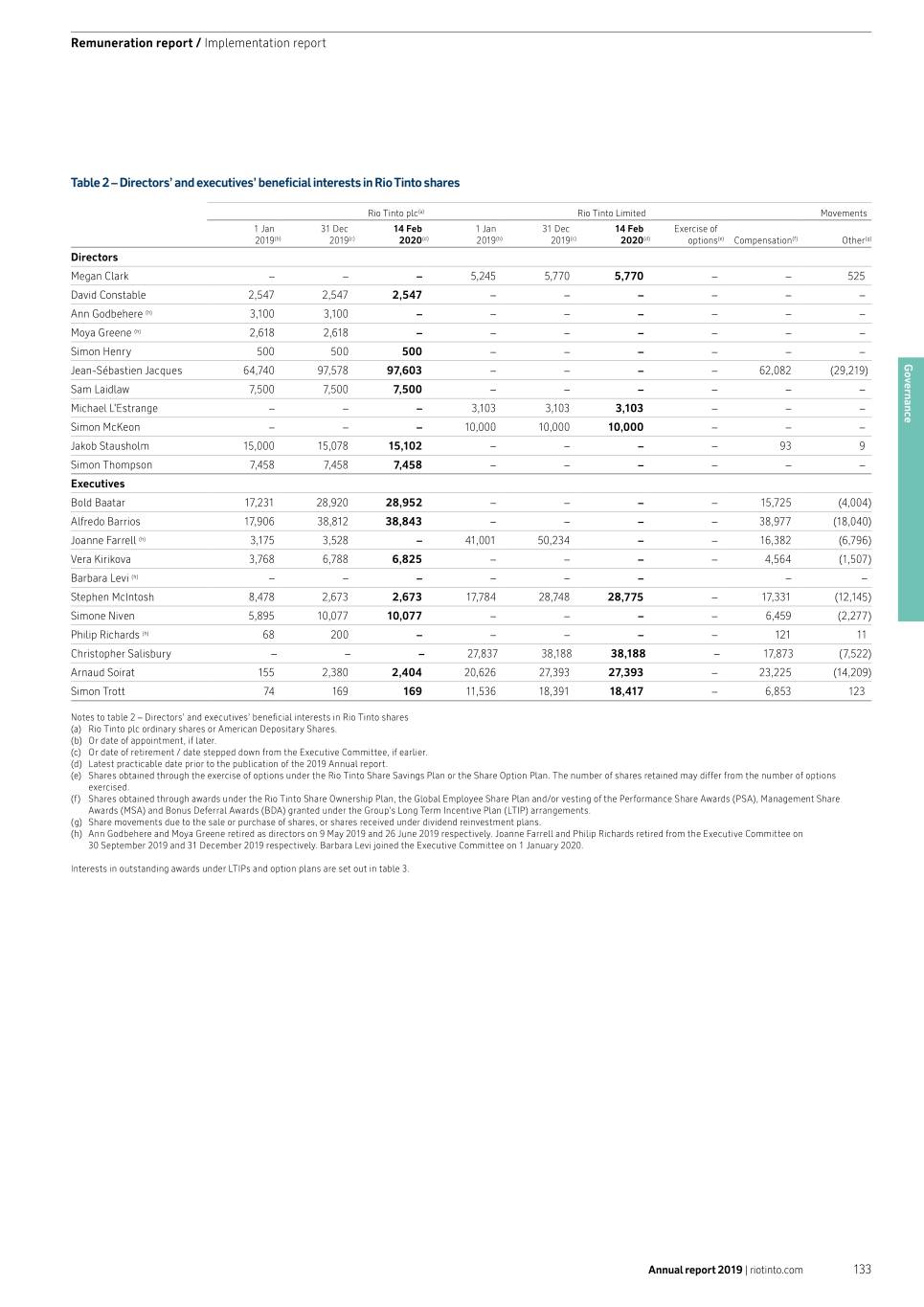

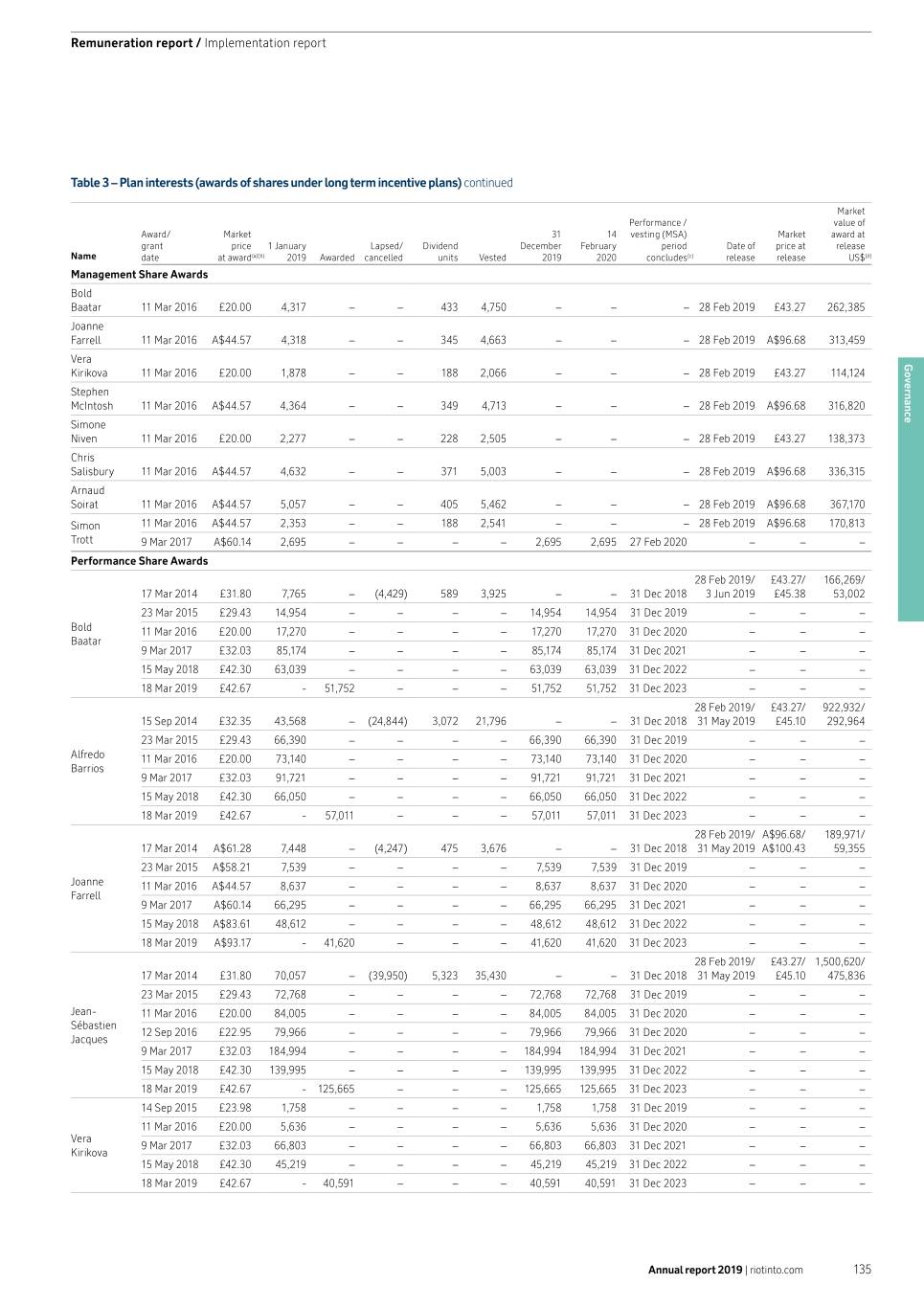

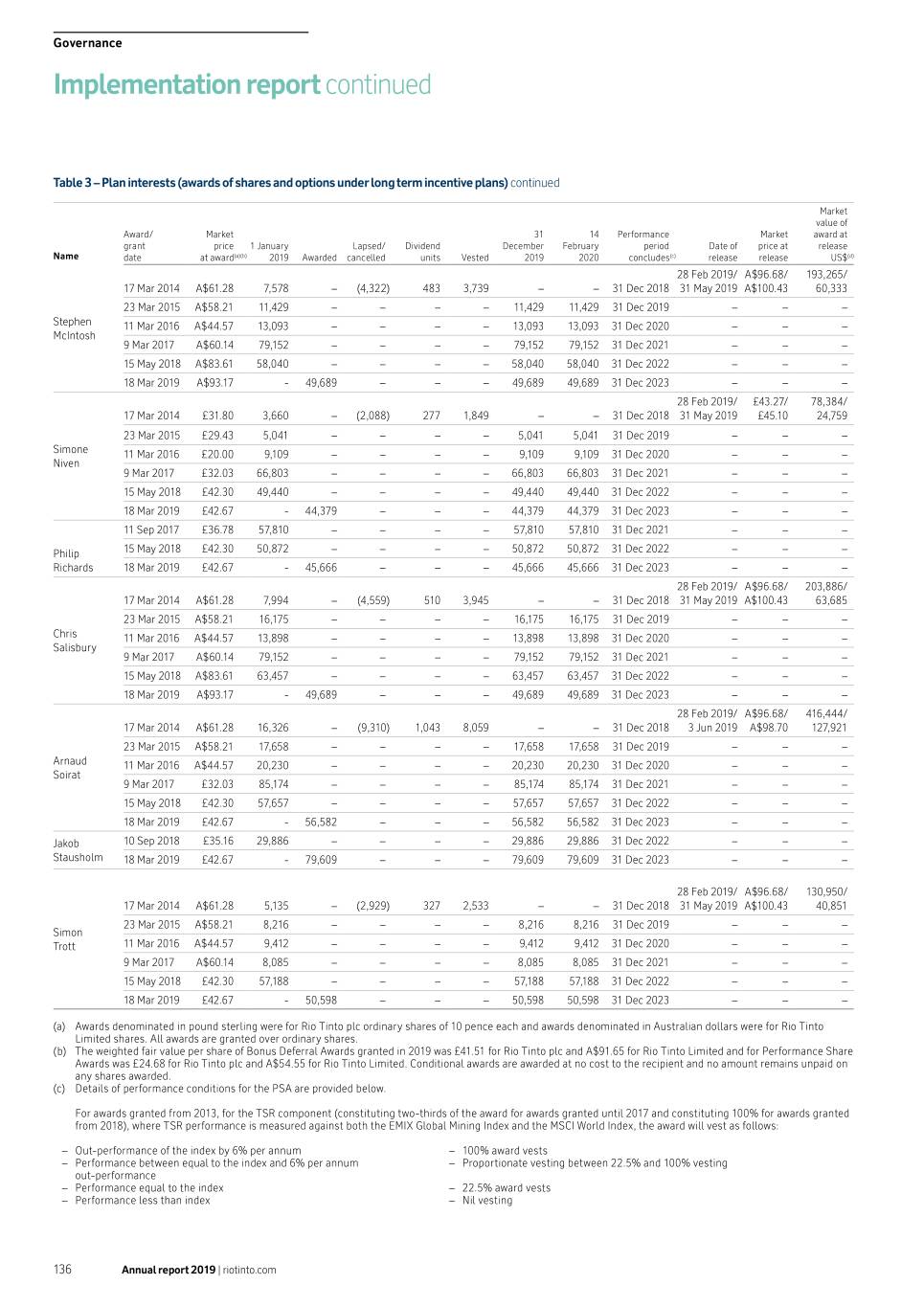

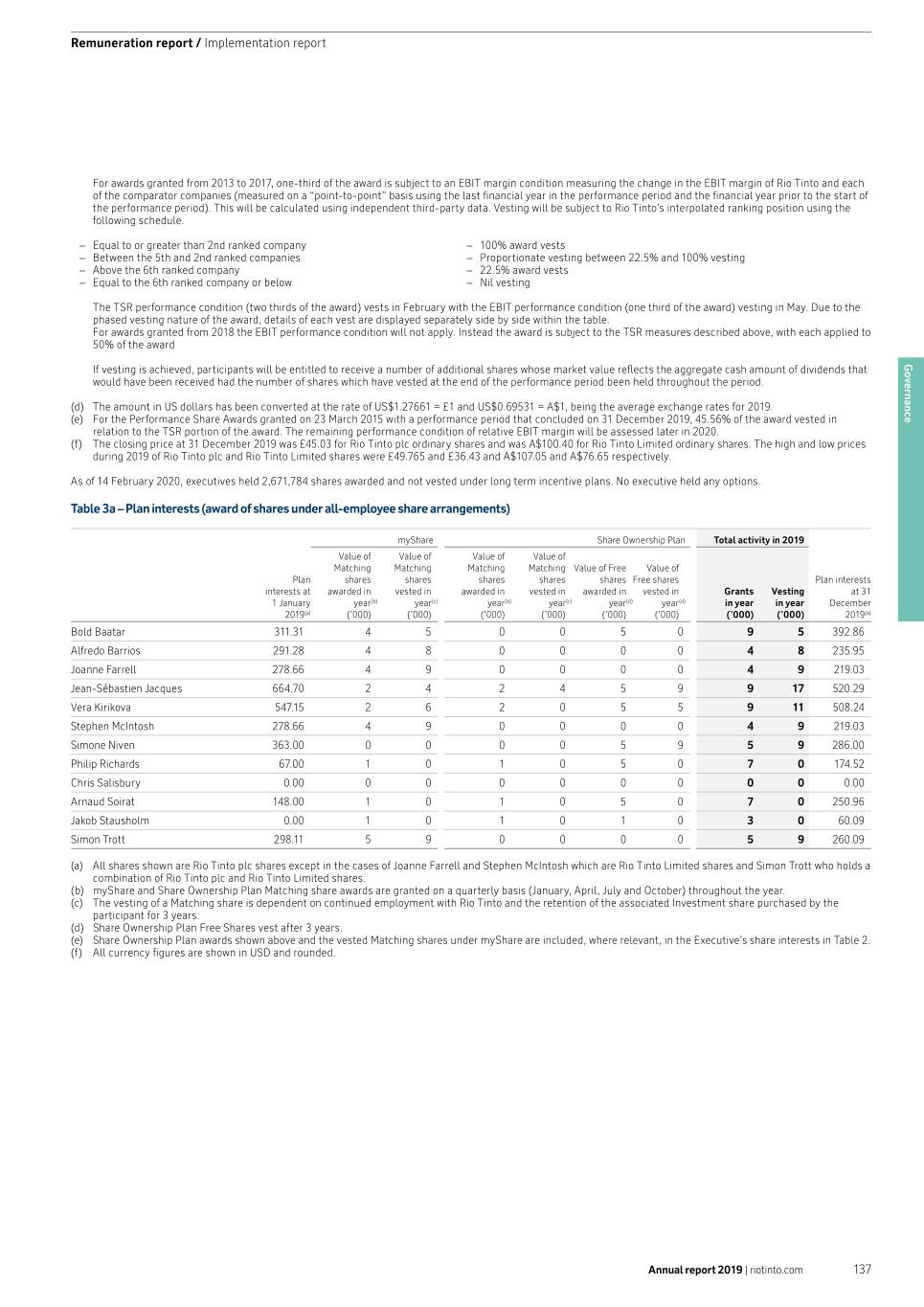

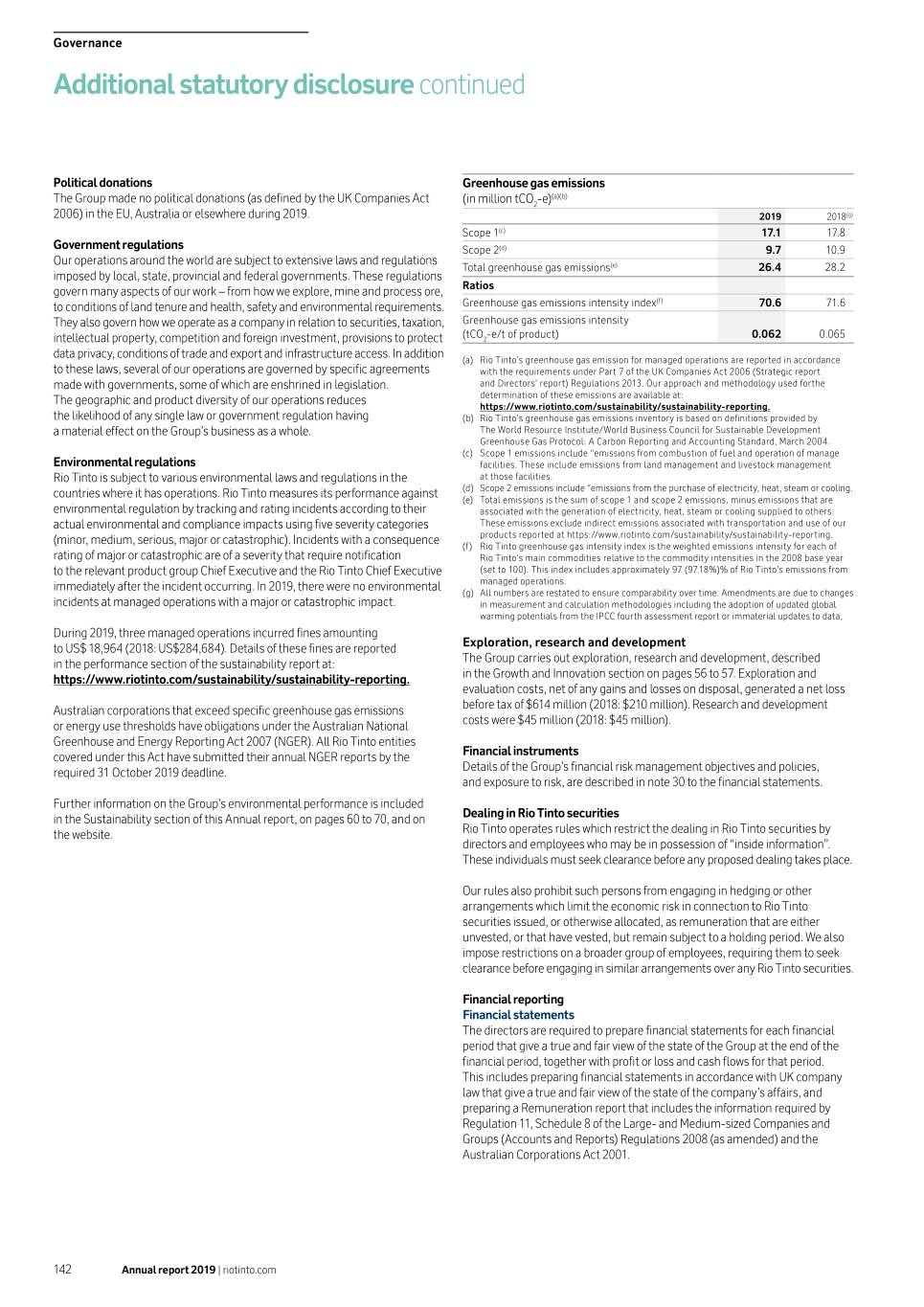

Strategic report Key performance indicators continued Key performance Return on capital employed (ROCE) Net cash generated from operating activities Key performance Free cash flow Net debt indicator definition Underlying earnings before interest divided by average capital Cash generated by our operations after tax and interest, including indicator definition Net cash generated from operating activities minus purchases of Net borrowings after adjusting for cash and cash equivalents, employed (operating assets before net debt). dividends received from equity accounted units and dividends property, plant and equipment and payments of lease principal, other liquid investments and derivatives related to net debt paid to non-controlling interests in subsidiaries. plus sales of property, plant and equipment. (see note 24 of the financial statements). Strategic pillar Portfolio Performance Portfolio Performance Strategic pillar Portfolio Performance Portfolio Performance Relevance to strategy Our portfolio of low-cost, long-life assets delivers attractive This KPI measures our ability to convert underlying Relevance to strategy This KPI measures the net cash returned by the business after This measures how we are managing our balance sheet and & executive returns throughout the cycle and has been reshaped significantly earnings into cash. & executive the expenditure of sustaining and growth capital. This cash capital structure. A strong balance sheet is essential for giving us remuneration in recent years. ROCE measures how efficiently we generate remuneration can be used for shareholder returns, reducing debt and flexibility to take advantage of opportunities as they arise, and for profits from investment in our portfolio of assets. Link to executive remuneration other investment. returning cash to shareholders. Included in the short-term incentive plan; in the longer term, the Link to executive remuneration measure influences TSR which is included in long-term incentive Link to executive remuneration Link to executive remuneration Underlying earnings, as a component of ROCE, is included in plans (see page 113). Included in the short-term incentive plan; in the longer term, the Net debt is, in part, an outcome of free cash flow, which itself is the short-term incentive plan. In the longer term, ROCE also measure influences TSR which is included in long-term incentive reflected in the short-term incentive plan. In the longer term, net influences TSR, which is included in long-term incentive plans. plans (see page 113). debt influences TSR which is reflected in long-term incentive plans (see page 113). Associated risks –– Market –– Market Associated risks –– Market –– Market –– Strategic –– Communities and other key stakeholders –– Strategic –– Strategic –– Financial –– Operational and people –– Financial –– Financial –– Operational and people –– Communities and other key stakeholders –– Communities and other key stakeholders –– Operational and people –– Operational and people Five-year trend �et�r� o� capita� e�p�o�e� ������ �et ca�� ge�erate� �ro� operati�g acti�itie� Five-year trend � � mi��ion� ���� �� ���� ����� ���� ��� ���� ����� ���� ��� ���� ������ ���� ��� ���� ������ ���� ��� ���� ������ Performance ROCE increased five percentage points to 24% in 2019, reflecting Net cash generated from operating activities of $14.9 billion Performance Free cash flow increased by $2.2 billion to $9.2 billion in 2019, Net debt increased by $3.9 billion from net cash of $255 million in 2019 the increase in underlying earnings driven by higher iron ore was 26% higher than 2018. This was primarily due to higher iron in 2019 primarily due to the increase in net cash generated from to net debt of $3.7 billion. This reflects $11.9 billion of cash prices combined with the restructuring of our portfolio through ore prices and favourable working capital movements, partly operating activities. This was partially offset by lower proceeds returns to shareholders in 2019 through dividends and share divestments and investment in growth. offset by higher taxes paid in 2019 relating to the 2018 coking from sales of property, plant and equipment. Capital expenditure buy-backs and a $1.2 billion non-cash increase from the coal disposals. was in line with 2018. implementation of IFRS 16 “Leases”, partly offset by free cash flow of $9.2 billion. Forward plan We will continue to focus on maximising returns from our assets We will focus on effectively converting earnings into cash, Forward plan We aim to continue our focus on free cash flow generation We believe that a strong balance sheet is a major competitive over the short, medium and long term. We will also maintain our underpinned by operational and commercial excellence, through the cycle. We expect capital expenditure to be advantage and essential in a cyclical business. We will therefore disciplined and rigorous approach and invest capital only in including our careful management of working capital. approximately $7 billion in 2020 and $6.5 billion in both continue to manage net debt carefully. projects that we believe will deliver returns that are well above 2021 and 2022. our cost of capital. 24 Annual report 2019 | riotinto.com