UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

811-06110

Western Asset Funds, Inc.

(Exact name of registrant as specified in charter)

100 International Drive, Baltimore, MD, 21202

(Address of principal executive offices) (Zip code)

Marc A. De Oliveira

Franklin Templeton

100 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code:

877-6LM-FUND/656-3863

Date of fiscal year end: December 31

Date of reporting period: June 30, 2024

| ITEM 1. | REPORT TO STOCKHOLDERS. |

The Semi-Annual Report to Stockholders is filed herewith.

| | |

Western Asset Core Bond Fund | |

| Class A [WABAX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Western Asset Core Bond Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at 877-6LM-FUND/656-3863.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Class A | $40 | 0.81% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $12,737,545,184 |

Total Number of Portfolio Holdings* | 2,446 |

Portfolio Turnover Rate | 35% |

| * | Does not include derivatives, except purchased options, if any. |

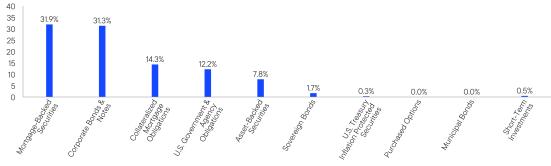

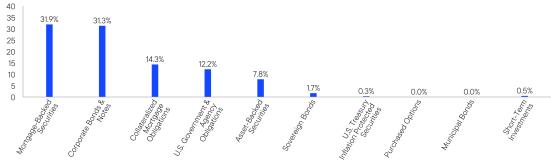

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition*,† (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| † | Certain categories may represent less than 0.1%. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Western Asset Core Bond Fund | PAGE 1 | 7833-STSR-0824 |

31.931.314.312.27.81.70.30.00.00.5

| | |

Western Asset Core Bond Fund | |

| Class C [WABCX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Western Asset Core Bond Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at 877-6LM-FUND/656-3863.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Class C | $75 | 1.51% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $12,737,545,184 |

Total Number of Portfolio Holdings* | 2,446 |

Portfolio Turnover Rate | 35% |

| * | Does not include derivatives, except purchased options, if any. |

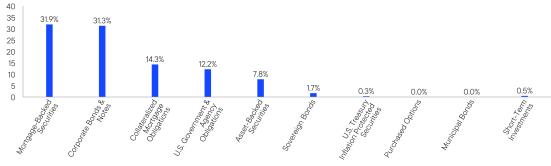

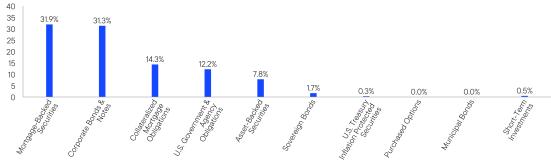

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition*,† (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| † | Certain categories may represent less than 0.1%. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Western Asset Core Bond Fund | PAGE 1 | 7832-STSR-0824 |

31.931.314.312.27.81.70.30.00.00.5

| | |

Western Asset Core Bond Fund | |

| Class C1 [LWACX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Western Asset Core Bond Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at 877-6LM-FUND/656-3863.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Class C1 | $70 | 1.42% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $12,737,545,184 |

Total Number of Portfolio Holdings* | 2,446 |

Portfolio Turnover Rate | 35% |

| * | Does not include derivatives, except purchased options, if any. |

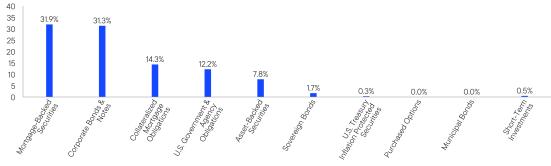

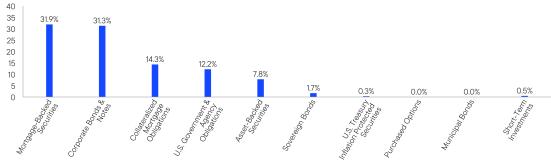

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition*,† (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| † | Certain categories may represent less than 0.1%. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Western Asset Core Bond Fund | PAGE 1 | 7837-STSR-0824 |

31.931.314.312.27.81.70.30.00.00.5

| | |

Western Asset Core Bond Fund | |

| Class FI [WAPIX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Western Asset Core Bond Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at 877-6LM-FUND/656-3863.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Class FI | $41 | 0.83% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $12,737,545,184 |

Total Number of Portfolio Holdings* | 2,446 |

Portfolio Turnover Rate | 35% |

| * | Does not include derivatives, except purchased options, if any. |

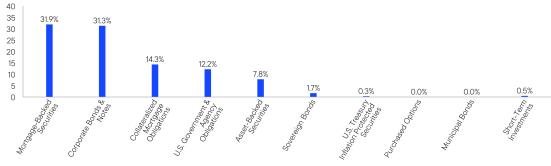

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition*,† (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| † | Certain categories may represent less than 0.1%. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Western Asset Core Bond Fund | PAGE 1 | 7592-STSR-0824 |

31.931.314.312.27.81.70.30.00.00.5

| | |

Western Asset Core Bond Fund | |

| Class R [WABRX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Western Asset Core Bond Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at 877-6LM-FUND/656-3863.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Class R | $56 | 1.13% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $12,737,545,184 |

Total Number of Portfolio Holdings* | 2,446 |

Portfolio Turnover Rate | 35% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition*,† (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| † | Certain categories may represent less than 0.1%. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Western Asset Core Bond Fund | PAGE 1 | 7831-STSR-0824 |

31.931.314.312.27.81.70.30.00.00.5

| | |

Western Asset Core Bond Fund | |

| Class I [WATFX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Western Asset Core Bond Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at 877-6LM-FUND/656-3863.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Class I | $22 | 0.45% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $12,737,545,184 |

Total Number of Portfolio Holdings* | 2,446 |

Portfolio Turnover Rate | 35% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition*,† (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| † | Certain categories may represent less than 0.1%. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Western Asset Core Bond Fund | PAGE 1 | 7027-STSR-0824 |

31.931.314.312.27.81.70.30.00.00.5

| | |

Western Asset Core Bond Fund | |

| Class IS [WACSX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Western Asset Core Bond Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at 877-6LM-FUND/656-3863.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Class IS | $21 | 0.42% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $12,737,545,184 |

Total Number of Portfolio Holdings* | 2,446 |

Portfolio Turnover Rate | 35% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition*,† (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| † | Certain categories may represent less than 0.1%. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Western Asset Core Bond Fund | PAGE 1 | 7275-STSR-0824 |

31.931.314.312.27.81.70.30.00.00.5

Not applicable.

| ITEM 3. | AUDIT COMMITTEE FINANCIAL EXPERT. |

Not applicable.

| ITEM 4. | PRINCIPAL ACCOUNTANT FEES AND SERVICES. |

Not applicable.

| ITEM 5. | AUDIT COMMITTEE OF LISTED REGISTRANTS. |

Not applicable.

| ITEM 6. | SCHEDULE OF INVESTMENTS. |

| (a) | Please see schedule of investments contained in the Financial Statements and Financial Highlights included under Item 7 of this Form N-CSR. |

| ITEM 7. | FINANCIAL STATEMENTS AND FINANCIAL HIGHLIGHTS FOR OPEN-END MANAGEMENT INVESTMENT COMPANIES. |

Western Asset

Core Bond Fund

Financial Statements and Other Important Information

Semi-Annual | June 30, 2024

Financial Statements and Other Important Information — Semi-Annual

Schedule of Investments (unaudited)June 30, 2024 Western Asset Core Bond Fund

(Percentages shown based on Fund net assets)

| | | | | |

Mortgage-Backed Securities — 32.7% |

|

Federal Home Loan Mortgage Corp. (FHLMC) | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) (1 year FTSE USD IBOR Consumer Cash Fallbacks + 1.619%) | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) (1 year FTSE USD IBOR Consumer Cash Fallbacks + 1.621%) | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) (1 year FTSE USD IBOR Consumer Cash Fallbacks + 1.627%) | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) (5 year Treasury Constant Maturity Rate + 1.285%) | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Gold | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Gold | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Gold | | | | |

See Notes to Financial Statements.

Western Asset Core Bond Fund 2024 Semi-Annual Report

Schedule of Investments (unaudited) (cont’d)June 30, 2024 Western Asset Core Bond Fund

(Percentages shown based on Fund net assets)

| | | | | |

|

Federal Home Loan Mortgage Corp. (FHLMC) Gold | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Gold | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Gold | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Gold | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Gold | | | | |

| |

|

Federal National Mortgage Association (FNMA) | | | | |

Federal National Mortgage Association (FNMA) | | | | |

Federal National Mortgage Association (FNMA) | | | | |

Federal National Mortgage Association (FNMA) | | | | |

Federal National Mortgage Association (FNMA) | | | | |

Federal National Mortgage Association (FNMA) | | | | |

Federal National Mortgage Association (FNMA) | | | | |

Federal National Mortgage Association (FNMA) | | | | |

Federal National Mortgage Association (FNMA) | | | | |

Federal National Mortgage Association (FNMA) | | | | |

Federal National Mortgage Association (FNMA) | | | | |

Federal National Mortgage Association (FNMA) | | | | |

Federal National Mortgage Association (FNMA) | | | | |

Federal National Mortgage Association (FNMA) | | | | |

See Notes to Financial Statements.

Western Asset Core Bond Fund 2024 Semi-Annual Report

Western Asset Core Bond Fund

(Percentages shown based on Fund net assets)

| | | | | |

|

Federal National Mortgage Association (FNMA) | | | | |

Federal National Mortgage Association (FNMA) | | | | |

Federal National Mortgage Association (FNMA) | | | | |

Federal National Mortgage Association (FNMA) | | | | |

Federal National Mortgage Association (FNMA) | | | | |

Federal National Mortgage Association (FNMA) | | | | |

Federal National Mortgage Association (FNMA) | | | | |

Federal National Mortgage Association (FNMA) | | | | |

Federal National Mortgage Association (FNMA) | | | | |

Federal National Mortgage Association (FNMA) | | | | |

Federal National Mortgage Association (FNMA) (Federal Reserve U.S. 12 mo. Cumulative Avg 1 Year CMT + 1.831%) | | | | |

| |

|

Government National Mortgage Association (GNMA) | | | | |

Government National Mortgage Association (GNMA) | | | | |

Government National Mortgage Association (GNMA) | | | | |

Government National Mortgage Association (GNMA) | | | | |

Government National Mortgage Association (GNMA) | | | | |

Government National Mortgage Association (GNMA) | | | | |

Government National Mortgage Association (GNMA) | | | | |

Government National Mortgage Association (GNMA) | | | | |

See Notes to Financial Statements.

Western Asset Core Bond Fund 2024 Semi-Annual Report

Schedule of Investments (unaudited) (cont’d)June 30, 2024 Western Asset Core Bond Fund

(Percentages shown based on Fund net assets)

| | | | | |

|

Government National Mortgage Association (GNMA) | | | | |

Government National Mortgage Association (GNMA) II | | | | |

Government National Mortgage Association (GNMA) II | | | | |

Government National Mortgage Association (GNMA) II | | | | |

Government National Mortgage Association (GNMA) II | | | | |

Government National Mortgage Association (GNMA) II | | | | |

Government National Mortgage Association (GNMA) II | | | | |

Government National Mortgage Association (GNMA) II | | | | |

Government National Mortgage Association (GNMA) II | | | | |

Government National Mortgage Association (GNMA) II | | | | |

Government National Mortgage Association (GNMA) II | | | | |

Government National Mortgage Association (GNMA) II | | | | |

Government National Mortgage Association (GNMA) II | | | | |

Government National Mortgage Association (GNMA) II | | | | |

Government National Mortgage Association (GNMA) II | | | | |

| |

|

Total Mortgage-Backed Securities (Cost — $4,433,374,573) | |

Corporate Bonds & Notes — 32.1% |

Communication Services — 3.1% |

Diversified Telecommunication Services — 0.9% |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

See Notes to Financial Statements.

Western Asset Core Bond Fund 2024 Semi-Annual Report

Western Asset Core Bond Fund

(Percentages shown based on Fund net assets)

| | | | | |

|

Diversified Telecommunication Services — continued |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Telefonica Emisiones SA, Senior Notes | | | | |

Telefonica Emisiones SA, Senior Notes | | | | |

Verizon Communications Inc., Senior Notes | | | | |

Verizon Communications Inc., Senior Notes | | | | |

Verizon Communications Inc., Senior Notes | | | | |

Verizon Communications Inc., Senior Notes | | | | |

Verizon Communications Inc., Senior Notes | | | | |

Verizon Communications Inc., Senior Notes | | | | |

Verizon Communications Inc., Senior Notes | | | | |

Verizon Communications Inc., Senior Notes | | | | |

Verizon Communications Inc., Senior Notes | | | | |

Verizon Communications Inc., Senior Notes | | | | |

Verizon Communications Inc., Senior Notes | | | | |

Verizon Communications Inc., Senior Notes | | | | |

Verizon Communications Inc., Senior Notes | | | | |

Verizon Communications Inc., Senior Notes | | | | |

Verizon Communications Inc., Senior Notes | | | | |

Verizon Communications Inc., Senior Notes | | | | |

Verizon Communications Inc., Senior Notes | | | | |

Total Diversified Telecommunication Services | |

|

Walt Disney Co., Senior Notes | | | | |

Walt Disney Co., Senior Notes | | | | |

Warnermedia Holdings Inc., Senior Notes | | | | |

Warnermedia Holdings Inc., Senior Notes | | | | |

Warnermedia Holdings Inc., Senior Notes | | | | |

Warnermedia Holdings Inc., Senior Notes | | | | |

Warnermedia Holdings Inc., Senior Notes | | | | |

Warnermedia Holdings Inc., Senior Notes | | | | |

| |

See Notes to Financial Statements.

Western Asset Core Bond Fund 2024 Semi-Annual Report

Schedule of Investments (unaudited) (cont’d)June 30, 2024 Western Asset Core Bond Fund

(Percentages shown based on Fund net assets)

| | | | | |

|

|

Charter Communications Operating LLC/ Charter Communications Operating Capital Corp., Senior Secured Notes | | | | |

Charter Communications Operating LLC/ Charter Communications Operating Capital Corp., Senior Secured Notes | | | | |

Charter Communications Operating LLC/ Charter Communications Operating Capital Corp., Senior Secured Notes | | | | |

Charter Communications Operating LLC/ Charter Communications Operating Capital Corp., Senior Secured Notes | | | | |

Charter Communications Operating LLC/ Charter Communications Operating Capital Corp., Senior Secured Notes | | | | |

Charter Communications Operating LLC/ Charter Communications Operating Capital Corp., Senior Secured Notes | | | | |

Charter Communications Operating LLC/ Charter Communications Operating Capital Corp., Senior Secured Notes | | | | |

Charter Communications Operating LLC/ Charter Communications Operating Capital Corp., Senior Secured Notes | | | | |

Charter Communications Operating LLC/ Charter Communications Operating Capital Corp., Senior Secured Notes | | | | |

Charter Communications Operating LLC/ Charter Communications Operating Capital Corp., Senior Secured Notes | | | | |

Charter Communications Operating LLC/ Charter Communications Operating Capital Corp., Senior Secured Notes | | | | |

Charter Communications Operating LLC/ Charter Communications Operating Capital Corp., Senior Secured Notes | | | | |

Charter Communications Operating LLC/ Charter Communications Operating Capital Corp., Senior Secured Notes | | | | |

See Notes to Financial Statements.

Western Asset Core Bond Fund 2024 Semi-Annual Report

Western Asset Core Bond Fund

(Percentages shown based on Fund net assets)

| | | | | |

|

|

Charter Communications Operating LLC/ Charter Communications Operating Capital Corp., Senior Secured Notes | | | | |

Charter Communications Operating LLC/ Charter Communications Operating Capital Corp., Senior Secured Notes | | | | |

Charter Communications Operating LLC/ Charter Communications Operating Capital Corp., Senior Secured Notes | | | | |

Charter Communications Operating LLC/ Charter Communications Operating Capital Corp., Senior Secured Notes | | | | |

Charter Communications Operating LLC/ Charter Communications Operating Capital Corp., Senior Secured Notes | | | | |

Comcast Corp., Senior Notes | | | | |

Comcast Corp., Senior Notes | | | | |

Comcast Corp., Senior Notes | | | | |

Comcast Corp., Senior Notes | | | | |

Comcast Corp., Senior Notes | | | | |

Comcast Corp., Senior Notes | | | | |

Comcast Corp., Senior Notes | | | | |

Comcast Corp., Senior Notes | | | | |

Comcast Corp., Senior Notes | | | | |

Comcast Corp., Senior Notes | | | | |

Comcast Corp., Senior Notes | | | | |

Comcast Corp., Senior Notes | | | | |

Comcast Corp., Senior Notes | | | | |

Comcast Corp., Senior Notes | | | | |

Comcast Corp., Senior Notes | | | | |

Comcast Corp., Senior Notes | | | | |

Comcast Corp., Senior Notes | | | | |

Comcast Corp., Senior Notes | | | | |

| | | | |

| | | | |

Time Warner Cable LLC, Senior Secured Notes | | | | |

Time Warner Cable LLC, Senior Secured Notes | | | | |

See Notes to Financial Statements.

Western Asset Core Bond Fund 2024 Semi-Annual Report

Schedule of Investments (unaudited) (cont’d)June 30, 2024 Western Asset Core Bond Fund

(Percentages shown based on Fund net assets)

| | | | | |

|

|

Time Warner Cable LLC, Senior Secured Notes | | | | |

Time Warner Cable LLC, Senior Secured Notes | | | | |

Time Warner Cable LLC, Senior Secured Notes | | | | |

| |

Wireless Telecommunication Services — 0.5% |

T-Mobile USA Inc., Senior Notes | | | | |

T-Mobile USA Inc., Senior Notes | | | | |

T-Mobile USA Inc., Senior Notes | | | | |

T-Mobile USA Inc., Senior Notes | | | | |

T-Mobile USA Inc., Senior Notes | | | | |

T-Mobile USA Inc., Senior Notes | | | | |

T-Mobile USA Inc., Senior Notes | | | | |

T-Mobile USA Inc., Senior Notes | | | | |

T-Mobile USA Inc., Senior Notes | | | | |

Total Wireless Telecommunication Services | |

|

Total Communication Services | |

Consumer Discretionary — 1.7% |

|

Ford Motor Co., Senior Notes | | | | |

General Motors Co., Senior Notes | | | | |

General Motors Co., Senior Notes | | | | |

General Motors Co., Senior Notes | | | | |

General Motors Co., Senior Notes | | | | |

General Motors Co., Senior Notes | | | | |

General Motors Financial Co. Inc., Senior Notes | | | | |

| |

|

Amazon.com Inc., Senior Notes | | | | |

Amazon.com Inc., Senior Notes | | | | |

Amazon.com Inc., Senior Notes | | | | |

Amazon.com Inc., Senior Notes | | | | |

| | | | |

| | | | |

| | | | |

| |

See Notes to Financial Statements.

Western Asset Core Bond Fund 2024 Semi-Annual Report

Western Asset Core Bond Fund

(Percentages shown based on Fund net assets)

| | | | | |

|

Hotels, Restaurants & Leisure — 0.9% |

Las Vegas Sands Corp., Senior Notes | | | | |

Las Vegas Sands Corp., Senior Notes | | | | |

McDonald’s Corp., Senior Notes | | | | |

McDonald’s Corp., Senior Notes | | | | |

McDonald’s Corp., Senior Notes | | | | |

McDonald’s Corp., Senior Notes | | | | |

McDonald’s Corp., Senior Notes | | | | |

McDonald’s Corp., Senior Notes | | | | |

McDonald’s Corp., Senior Notes | | | | |

Sands China Ltd., Senior Notes | | | | |

Sands China Ltd., Senior Notes | | | | |

Sands China Ltd., Senior Notes | | | | |

Sands China Ltd., Senior Notes | | | | |

Sands China Ltd., Senior Notes | | | | |

Total Hotels, Restaurants & Leisure | |

Household Durables — 0.0%†† |

Newell Brands Inc., Senior Notes | | | | |

|

Home Depot Inc., Senior Notes | | | | |

Home Depot Inc., Senior Notes | | | | |

Home Depot Inc., Senior Notes | | | | |

Home Depot Inc., Senior Notes | | | | |

Home Depot Inc., Senior Notes | | | | |

Lowe’s Cos. Inc., Senior Notes | | | | |

Lowe’s Cos. Inc., Senior Notes | | | | |

| |

Textiles, Apparel & Luxury Goods — 0.0%†† |

| | | | |

| | | | |

Total Textiles, Apparel & Luxury Goods | |

|

Total Consumer Discretionary | |

|

|

Anheuser-Busch Cos. LLC/Anheuser-Busch InBev Worldwide Inc., Senior Notes | | | | |

Anheuser-Busch InBev Worldwide Inc., Senior Notes | | | | |

Anheuser-Busch InBev Worldwide Inc., Senior Notes | | | | |

See Notes to Financial Statements.

Western Asset Core Bond Fund 2024 Semi-Annual Report

Schedule of Investments (unaudited) (cont’d)June 30, 2024 Western Asset Core Bond Fund

(Percentages shown based on Fund net assets)

| | | | | |

|

|

Anheuser-Busch InBev Worldwide Inc., Senior Notes | | | | |

Anheuser-Busch InBev Worldwide Inc., Senior Notes | | | | |

Coca-Cola Co., Senior Notes | | | | |

Constellation Brands Inc., Senior Notes | | | | |

| |

|

| | | | |

| | | | |

Mondelez International Inc., Senior Notes | | | | |

| |

Personal Care Products — 0.2% |

Haleon US Capital LLC, Senior Notes | | | | |

Haleon US Capital LLC, Senior Notes | | | | |

Haleon US Capital LLC, Senior Notes | | | | |

Kenvue Inc., Senior Notes | | | | |

Total Personal Care Products | |

|

Altria Group Inc., Senior Notes | | | | |

Altria Group Inc., Senior Notes | | | | |

Altria Group Inc., Senior Notes | | | | |

Altria Group Inc., Senior Notes | | | | |

Altria Group Inc., Senior Notes | | | | |

Altria Group Inc., Senior Notes | | | | |

Altria Group Inc., Senior Notes | | | | |

Altria Group Inc., Senior Notes | | | | |

BAT Capital Corp., Senior Notes | | | | |

BAT Capital Corp., Senior Notes | | | | |

BAT Capital Corp., Senior Notes | | | | |

BAT Capital Corp., Senior Notes | | | | |

Philip Morris International Inc., Senior Notes | | | | |

Philip Morris International Inc., Senior Notes | | | | |

Philip Morris International Inc., Senior Notes | | | | |

Philip Morris International Inc., Senior Notes | | | | |

Philip Morris International Inc., Senior Notes | | | | |

See Notes to Financial Statements.

Western Asset Core Bond Fund 2024 Semi-Annual Report

Western Asset Core Bond Fund

(Percentages shown based on Fund net assets)

| | | | | |

|

|

Reynolds American Inc., Senior Notes | | | | |

Reynolds American Inc., Senior Notes | | | | |

| |

|

| |

|

Energy Equipment & Services — 0.0%†† |

Halliburton Co., Senior Notes | | | | |

Oil, Gas & Consumable Fuels — 5.8% |

Apache Corp., Senior Notes | | | | |

Apache Corp., Senior Notes | | | | |

Apache Corp., Senior Notes | | | | |

Apache Corp., Senior Notes | | | | |

Apache Corp., Senior Notes | | | | |

BP Capital Markets America Inc., Senior Notes | | | | |

BP Capital Markets America Inc., Senior Notes | | | | |

BP Capital Markets America Inc., Senior Notes | | | | |

BP Capital Markets America Inc., Senior Notes | | | | |

BP Capital Markets America Inc., Senior Notes | | | | |

Cameron LNG LLC, Senior Secured Notes | | | | |

Cameron LNG LLC, Senior Secured Notes | | | | |

Columbia Pipelines Operating Co. LLC, Senior Notes | | | | |

Columbia Pipelines Operating Co. LLC, Senior Notes | | | | |

Continental Resources Inc., Senior Notes | | | | |

Continental Resources Inc., Senior Notes | | | | |

Coterra Energy Inc., Senior Notes | | | | |

Coterra Energy Inc., Senior Notes | | | | |

Devon Energy Corp., Senior Notes | | | | |

Devon Energy Corp., Senior Notes | | | | |

Devon Energy Corp., Senior Notes | | | | |

Devon Energy Corp., Senior Notes | | | | |

Devon Energy Corp., Senior Notes | | | | |

Devon Energy Corp., Senior Notes | | | | |

See Notes to Financial Statements.

Western Asset Core Bond Fund 2024 Semi-Annual Report

Schedule of Investments (unaudited) (cont’d)June 30, 2024 Western Asset Core Bond Fund

(Percentages shown based on Fund net assets)

| | | | | |

|

Oil, Gas & Consumable Fuels — continued |

Diamondback Energy Inc., Senior Notes | | | | |

Diamondback Energy Inc., Senior Notes | | | | |

Diamondback Energy Inc., Senior Notes | | | | |

Ecopetrol SA, Senior Notes | | | | |

El Paso Natural Gas Co. LLC, Senior Notes | | | | |

Energy Transfer LP, Senior Notes | | | | |

Energy Transfer LP, Senior Notes | | | | |

Energy Transfer LP, Senior Notes | | | | |

Energy Transfer LP, Senior Notes | | | | |

Energy Transfer LP, Senior Notes | | | | |

Energy Transfer LP, Senior Notes | | | | |

Energy Transfer LP, Senior Notes | | | | |

Energy Transfer LP, Senior Notes | | | | |

Energy Transfer LP, Senior Notes | | | | |

Energy Transfer LP, Senior Notes | | | | |

Energy Transfer LP, Senior Notes | | | | |

Enterprise Products Operating LLC, Senior Notes | | | | |

Enterprise Products Operating LLC, Senior Notes | | | | |

Enterprise Products Operating LLC, Senior Notes | | | | |

Enterprise Products Operating LLC, Senior Notes | | | | |

Enterprise Products Operating LLC, Senior Notes | | | | |

Enterprise Products Operating LLC, Senior Notes | | | | |

Enterprise Products Operating LLC, Senior Notes | | | | |

Enterprise Products Operating LLC, Senior Notes | | | | |

Enterprise Products Operating LLC, Senior Notes | | | | |

Enterprise Products Operating LLC, Senior Notes | | | | |

Enterprise Products Operating LLC, Senior Notes | | | | |

Enterprise Products Operating LLC, Senior Notes | | | | |

See Notes to Financial Statements.

Western Asset Core Bond Fund 2024 Semi-Annual Report

Western Asset Core Bond Fund

(Percentages shown based on Fund net assets)

| | | | | |

|

Oil, Gas & Consumable Fuels — continued |

Enterprise Products Operating LLC, Senior Notes | | | | |

Enterprise Products Operating LLC, Senior Notes (5.375% to 2/15/28 then 3 mo. Term SOFR + 2.832%) | | | | |

EOG Resources Inc., Senior Notes | | | | |

EOG Resources Inc., Senior Notes | | | | |

| | | | |

Exxon Mobil Corp., Senior Notes | | | | |

Exxon Mobil Corp., Senior Notes | | | | |

Exxon Mobil Corp., Senior Notes | | | | |

Exxon Mobil Corp., Senior Notes | | | | |

KazMunayGas National Co. JSC, Senior Notes | | | | |

KazMunayGas National Co. JSC, Senior Notes | | | | |

KazMunayGas National Co. JSC, Senior Notes | | | | |

Kinder Morgan Energy Partners LP, Senior Notes | | | | |

Kinder Morgan Energy Partners LP, Senior Notes | | | | |

Kinder Morgan Energy Partners LP, Senior Notes | | | | |

Kinder Morgan Energy Partners LP, Senior Notes | | | | |

Kinder Morgan Energy Partners LP, Senior Notes | | | | |

Kinder Morgan Energy Partners LP, Senior Notes | | | | |

Kinder Morgan Inc., Senior Notes | | | | |

Kinder Morgan Inc., Senior Notes | | | | |

Kinder Morgan Inc., Senior Notes | | | | |

Kinder Morgan Inc., Senior Notes | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

See Notes to Financial Statements.

Western Asset Core Bond Fund 2024 Semi-Annual Report

Schedule of Investments (unaudited) (cont’d)June 30, 2024 Western Asset Core Bond Fund

(Percentages shown based on Fund net assets)

| | | | | |

|

Oil, Gas & Consumable Fuels — continued |

| | | | |

| | | | |

Occidental Petroleum Corp., Senior Notes | | | | |

Occidental Petroleum Corp., Senior Notes | | | | |

Occidental Petroleum Corp., Senior Notes | | | | |

Occidental Petroleum Corp., Senior Notes | | | | |

Occidental Petroleum Corp., Senior Notes | | | | |

Occidental Petroleum Corp., Senior Notes | | | | |

Occidental Petroleum Corp., Senior Notes | | | | |

Occidental Petroleum Corp., Senior Notes | | | | |

Occidental Petroleum Corp., Senior Notes | | | | |

Occidental Petroleum Corp., Senior Notes | | | | |

Occidental Petroleum Corp., Senior Notes | | | | |

Occidental Petroleum Corp., Senior Notes | | | | |

Occidental Petroleum Corp., Senior Notes | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Pertamina Persero PT, Senior Notes | | | | |

Petroleos del Peru SA, Senior Notes | | | | |

Petroleos del Peru SA, Senior Notes | | | | |

Pioneer Natural Resources Co., Senior Notes | | | | |

Pioneer Natural Resources Co., Senior Notes | | | | |

Pioneer Natural Resources Co., Senior Notes | | | | |

Reliance Industries Ltd., Senior Notes | | | | |

Reliance Industries Ltd., Senior Notes | | | | |

Shell International Finance BV, Senior Notes | | | | |

Shell International Finance BV, Senior Notes | | | | |

Shell International Finance BV, Senior Notes | | | | |

Shell International Finance BV, Senior Notes | | | | |

Southern Natural Gas Co. LLC, Senior Notes | | | | |

Targa Resources Corp., Senior Notes | | | | |

Tennessee Gas Pipeline Co. LLC, Senior Notes | | | | |

Transcontinental Gas Pipe Line Co. LLC, Senior Notes | | | | |

Transcontinental Gas Pipe Line Co. LLC, Senior Notes | | | | |

See Notes to Financial Statements.

Western Asset Core Bond Fund 2024 Semi-Annual Report

Western Asset Core Bond Fund

(Percentages shown based on Fund net assets)

| | | | | |

|

Oil, Gas & Consumable Fuels — continued |

Western Midstream Operating LP, Senior Notes | | | | |

Western Midstream Operating LP, Senior Notes | | | | |

Williams Cos. Inc., Senior Notes | | | | |

Williams Cos. Inc., Senior Notes | | | | |

Williams Cos. Inc., Senior Notes | | | | |

Williams Cos. Inc., Senior Notes | | | | |

Williams Cos. Inc., Senior Notes | | | | |

Williams Cos. Inc., Senior Notes | | | | |

Williams Cos. Inc., Senior Notes | | | | |

Williams Cos. Inc., Senior Notes | | | | |

Williams Cos. Inc., Senior Notes | | | | |

Total Oil, Gas & Consumable Fuels | |

|

| |

|

|

ABN AMRO Bank NV, Subordinated Notes | | | | |

Banco Santander SA, Senior Notes | | | | |

Banco Santander SA, Senior Notes (4.175% to 3/24/27 then 1 year Treasury Constant Maturity Rate + 2.000%) | | | | |

Bank of America Corp., Senior Notes | | | | |

Bank of America Corp., Senior Notes | | | | |

Bank of America Corp., Senior Notes (1.319% to 6/19/25 then SOFR + 1.150%) | | | | |

Bank of America Corp., Senior Notes (1.898% to 7/23/30 then SOFR + 1.530%) | | | | |

Bank of America Corp., Senior Notes (2.572% to 10/20/31 then SOFR + 1.210%) | | | | |

Bank of America Corp., Senior Notes (2.592% to 4/29/30 then SOFR + 2.150%) | | | | |

Bank of America Corp., Senior Notes (2.972% to 2/4/32 then SOFR + 1.330%) | | | | |

Bank of America Corp., Senior Notes (3.419% to 12/20/27 then 3 mo. Term SOFR + 1.302%) | | | | |

Bank of America Corp., Senior Notes (3.593% to 7/21/27 then 3 mo. Term SOFR + 1.632%) | | | | |

See Notes to Financial Statements.

Western Asset Core Bond Fund 2024 Semi-Annual Report

Schedule of Investments (unaudited) (cont’d)June 30, 2024 Western Asset Core Bond Fund

(Percentages shown based on Fund net assets)

| | | | | |

|

|

Bank of America Corp., Senior Notes (3.946% to 1/23/48 then 3 mo. Term SOFR + 1.452%) | | | | |

Bank of America Corp., Senior Notes (3.970% to 3/5/28 then 3 mo. Term SOFR + 1.332%) | | | | |

Bank of America Corp., Senior Notes (3.974% to 2/7/29 then 3 mo. Term SOFR + 1.472%) | | | | |

Bank of America Corp., Senior Notes (4.083% to 3/20/50 then 3 mo. Term SOFR + 3.412%) | | | | |

Bank of America Corp., Senior Notes (4.330% to 3/15/49 then 3 mo. Term SOFR + 1.782%) | | | | |

Bank of America Corp., Senior Notes (4.376% to 4/27/27 then SOFR + 1.580%) | | | | |

Bank of America Corp., Senior Notes (4.571% to 4/27/32 then SOFR + 1.830%) | | | | |

Bank of America Corp., Subordinated Notes | | | | |

Bank of America Corp., Subordinated Notes | | | | |

Bank of America Corp., Subordinated Notes | | | | |

Bank of America Corp., Subordinated Notes | | | | |

Bank of America Corp., Subordinated Notes (2.482% to 9/21/31 then 5 year Treasury Constant Maturity Rate + 1.200%) | | | | |

Bank of Montreal, Senior Notes | | | | |

Bank of Montreal, Subordinated Notes (3.803% to 12/15/27 then USD 5 year ICE Swap Rate + 1.432%) | | | | |

Bank of Nova Scotia, Senior Notes | | | | |

Bank of Nova Scotia, Senior Notes | | | | |

Bank of Nova Scotia, Subordinated Notes (4.588% to 5/4/32 then 5 year Treasury Constant Maturity Rate + 2.050%) | | | | |

Barclays PLC, Senior Notes (4.972% to 5/16/28 then 3 mo. USD LIBOR + 1.902%) | | | | |

Barclays PLC, Subordinated Notes (5.088% to 6/20/29 then 3 mo. USD LIBOR + 3.054%) | | | | |

BNP Paribas SA, Senior Notes | | | | |

BNP Paribas SA, Senior Notes | | | | |

See Notes to Financial Statements.

Western Asset Core Bond Fund 2024 Semi-Annual Report

Western Asset Core Bond Fund

(Percentages shown based on Fund net assets)

| | | | | |

|

|

BNP Paribas SA, Senior Notes (2.219% to 6/9/25 then SOFR + 2.074%) | | | | |

BNP Paribas SA, Senior Notes (3.052% to 1/13/30 then SOFR + 1.507%) | | | | |

BNP Paribas SA, Senior Notes (5.125% to 1/13/28 then 1 year Treasury Constant Maturity Rate + 1.450%) | | | | |

BNP Paribas SA, Senior Notes (5.198% to 1/10/29 then 3 mo. Term SOFR + 2.829%) | | | | |

BNP Paribas SA, Senior Notes (5.894% to 12/5/33 then SOFR + 1.866%) | | | | |

BNP Paribas SA, Subordinated Notes (4.375% to 3/1/28 then USD 5 year ICE Swap Rate + 1.483%) | | | | |

BPCE SA, Subordinated Notes | | | | |

Citigroup Inc., Senior Notes | | | | |

Citigroup Inc., Senior Notes | | | | |

Citigroup Inc., Senior Notes | | | | |

Citigroup Inc., Senior Notes (2.561% to 5/1/31 then SOFR + 1.167%) | | | | |

Citigroup Inc., Senior Notes (2.572% to 6/3/30 then SOFR + 2.107%) | | | | |

Citigroup Inc., Senior Notes (3.106% to 4/8/25 then SOFR + 2.842%) | | | | |

Citigroup Inc., Senior Notes (3.520% to 10/27/27 then 3 mo. Term SOFR + 1.413%) | | | | |

Citigroup Inc., Senior Notes (3.785% to 3/17/32 then SOFR + 1.939%) | | | | |

Citigroup Inc., Senior Notes (3.980% to 3/20/29 then 3 mo. Term SOFR + 1.600%) | | | | |

Citigroup Inc., Senior Notes (4.412% to 3/31/30 then SOFR + 3.914%) | | | | |

Citigroup Inc., Senior Notes (4.658% to 5/24/27 then SOFR + 1.887%) | | | | |

Citigroup Inc., Senior Notes (4.910% to 5/24/32 then SOFR + 2.086%) | | | | |

Citigroup Inc., Subordinated Notes | | | | |

Citigroup Inc., Subordinated Notes | | | | |

Citigroup Inc., Subordinated Notes | | | | |

Citigroup Inc., Subordinated Notes | | | | |

See Notes to Financial Statements.

Western Asset Core Bond Fund 2024 Semi-Annual Report

Schedule of Investments (unaudited) (cont’d)June 30, 2024 Western Asset Core Bond Fund

(Percentages shown based on Fund net assets)

| | | | | |

|

|

Citigroup Inc., Subordinated Notes | | | | |

Citigroup Inc., Subordinated Notes | | | | |

Citigroup Inc., Subordinated Notes | | | | |

Citigroup Inc., Subordinated Notes | | | | |

Citigroup Inc., Subordinated Notes | | | | |

Cooperatieve Rabobank UA, Senior Notes | | | | |

Cooperatieve Rabobank UA, Senior Notes | | | | |

Cooperatieve Rabobank UA, Senior Notes (1.339% to 6/24/25 then 1 year Treasury Constant Maturity Rate + 1.000%) | | | | |

Cooperatieve Rabobank UA, Senior Notes (3.649% to 4/6/27 then 1 year Treasury Constant Maturity Rate + 1.220%) | | | | |

Cooperatieve Rabobank UA, Senior Notes (3.758% to 4/6/32 then 1 year Treasury Constant Maturity Rate + 1.420%) | | | | |

Credit Agricole SA, Senior Notes (1.907% to 6/16/25 then SOFR + 1.676%) | | | | |

Credit Agricole SA, Subordinated Notes (4.000% to 1/10/28 then USD 5 year ICE Swap Rate + 1.644%) | | | | |

Danske Bank A/S, Senior Notes (0.976% to 9/10/24 then 1 year Treasury Constant Maturity Rate + 0.550%) | | | | |

Danske Bank A/S, Senior Notes (3.244% to 12/20/24 then 3 mo. USD LIBOR + 1.591%) | | | | |

Danske Bank A/S, Senior Notes (4.298% to 4/1/27 then 1 year Treasury Constant Maturity Rate + 1.750%) | | | | |

HSBC Holdings PLC, Senior Notes (2.848% to 6/4/30 then SOFR + 2.387%) | | | | |

HSBC Holdings PLC, Senior Notes (4.041% to 3/13/27 then 3 mo. Term SOFR + 1.808%) | | | | |

HSBC Holdings PLC, Subordinated Notes | | | | |

Intesa Sanpaolo SpA, Subordinated Notes | | | | |

JPMorgan Chase & Co., Senior Notes (2.083% to 4/22/25 then SOFR + 1.850%) | | | | |

JPMorgan Chase & Co., Senior Notes (2.522% to 4/22/30 then SOFR + 2.040%) | | | | |

JPMorgan Chase & Co., Senior Notes (2.545% to 11/8/31 then SOFR + 1.180%) | | | | |

See Notes to Financial Statements.

Western Asset Core Bond Fund 2024 Semi-Annual Report

Western Asset Core Bond Fund

(Percentages shown based on Fund net assets)

| | | | | |

|

|

JPMorgan Chase & Co., Senior Notes (2.580% to 4/22/31 then 3 mo. Term SOFR + 1.250%) | | | | |

JPMorgan Chase & Co., Senior Notes (3.109% to 4/22/40 then 3 mo. Term SOFR + 2.460%) | | | | |

JPMorgan Chase & Co., Senior Notes (3.109% to 4/22/50 then SOFR + 2.440%) | | | | |

JPMorgan Chase & Co., Senior Notes (4.203% to 7/23/28 then 3 mo. Term SOFR + 1.522%) | | | | |

JPMorgan Chase & Co., Senior Notes (4.452% to 12/5/28 then 3 mo. Term SOFR + 1.592%) | | | | |

JPMorgan Chase & Co., Senior Notes (4.493% to 3/24/30 then 3 mo. Term SOFR + 3.790%) | | | | |

JPMorgan Chase & Co., Subordinated Notes | | | | |

JPMorgan Chase & Co., Subordinated Notes | | | | |

JPMorgan Chase & Co., Subordinated Notes | | | | |

JPMorgan Chase & Co., Subordinated Notes | | | | |

Lloyds Banking Group PLC, Senior Notes | | | | |

Lloyds Banking Group PLC, Subordinated Notes | | | | |

Mitsubishi UFJ Financial Group Inc., Senior Notes (3.837% to 4/17/25 then 1 year Treasury Constant Maturity Rate + 1.125%) | | | | |

Mitsubishi UFJ Financial Group Inc., Senior Notes (4.080% to 4/19/27 then 1 year Treasury Constant Maturity Rate + 1.300%) | | | | |

PNC Bank NA, Subordinated Notes | | | | |

PNC Financial Services Group Inc., Senior Notes (5.582% to 6/12/28 then SOFR + 1.841%) | | | | |

PNC Financial Services Group Inc., Senior Notes (5.812% to 6/12/25 then SOFR + 1.322%) | | | | |

Royal Bank of Canada, Senior Notes | | | | |

Royal Bank of Canada, Senior Notes | | | | |

Royal Bank of Canada, Senior Notes | | | | |

See Notes to Financial Statements.

Western Asset Core Bond Fund 2024 Semi-Annual Report

Schedule of Investments (unaudited) (cont’d)June 30, 2024 Western Asset Core Bond Fund

(Percentages shown based on Fund net assets)

| | | | | |

|

|

Santander UK Group Holdings PLC, Subordinated Notes | | | | |

Toronto-Dominion Bank, Senior Notes | | | | |

Toronto-Dominion Bank, Senior Notes | | | | |

Truist Financial Corp., Senior Notes (6.047% to 6/8/26 then SOFR + 2.050%) | | | | |

| | | | |

US Bancorp, Senior Notes (2.215% to 1/27/27 then SOFR + 0.730%) | | | | |

US Bancorp, Senior Notes (5.775% to 6/12/28 then SOFR + 2.020%) | | | | |

US Bancorp, Senior Notes (5.836% to 6/10/33 then SOFR + 2.260%) | | | | |

Wells Fargo & Co., Senior Notes | | | | |

Wells Fargo & Co., Senior Notes | | | | |

Wells Fargo & Co., Senior Notes (2.188% to 4/30/25 then SOFR + 2.000%) | | | | |

Wells Fargo & Co., Senior Notes (2.879% to 10/30/29 then 3 mo. Term SOFR + 1.432%) | | | | |

Wells Fargo & Co., Senior Notes (3.350% to 3/2/32 then SOFR + 1.500%) | | | | |

Wells Fargo & Co., Senior Notes (4.478% to 4/4/30 then 3 mo. Term SOFR + 4.032%) | | | | |

Wells Fargo & Co., Senior Notes (5.013% to 4/4/50 then 3 mo. Term SOFR + 4.502%) | | | | |

Wells Fargo & Co., Subordinated Notes | | | | |

Wells Fargo & Co., Subordinated Notes | | | | |

Wells Fargo & Co., Subordinated Notes | | | | |

Wells Fargo & Co., Subordinated Notes | | | | |

Wells Fargo & Co., Subordinated Notes | | | | |

Wells Fargo & Co., Subordinated Notes | | | | |

Wells Fargo & Co., Subordinated Notes | | | | |

| |

|

Bank of New York Mellon Corp., Senior Notes | | | | |

Charles Schwab Corp., Senior Notes | | | | |

Charles Schwab Corp., Senior Notes (6.136% to 8/24/33 then SOFR + 2.010%) | | | | |

UBS AG/Stamford CT, Senior Notes | | | | |

See Notes to Financial Statements.

Western Asset Core Bond Fund 2024 Semi-Annual Report

Western Asset Core Bond Fund

(Percentages shown based on Fund net assets)

| | | | | |

|

Capital Markets — continued |

Goldman Sachs Capital II, Ltd. GTD (3 mo. Term SOFR + 1.029%) | | | | |

Goldman Sachs Group Inc., Senior Notes | | | | |

Goldman Sachs Group Inc., Senior Notes | | | | |

Goldman Sachs Group Inc., Senior Notes | | | | |

Goldman Sachs Group Inc., Senior Notes | | | | |

Goldman Sachs Group Inc., Senior Notes | | | | |

Goldman Sachs Group Inc., Senior Notes (2.383% to 7/21/31 then SOFR + 1.248%) | | | | |

Goldman Sachs Group Inc., Senior Notes (2.650% to 10/21/31 then SOFR + 1.264%) | | | | |

Goldman Sachs Group Inc., Senior Notes (2.908% to 7/21/41 then SOFR + 1.472%) | | | | |

Goldman Sachs Group Inc., Senior Notes (3.210% to 4/22/41 then SOFR + 1.513%) | | | | |

Goldman Sachs Group Inc., Senior Notes (3.615% to 3/15/27 then SOFR + 1.846%) | | | | |

Goldman Sachs Group Inc., Senior Notes (3.691% to 6/5/27 then 3 mo. Term SOFR + 1.772%) | | | | |

Goldman Sachs Group Inc., Senior Notes (3.814% to 4/23/28 then 3 mo. Term SOFR + 1.420%) | | | | |

Goldman Sachs Group Inc., Senior Notes (4.223% to 5/1/28 then 3 mo. Term SOFR + 1.563%) | | | | |

Goldman Sachs Group Inc., Subordinated Notes | | | | |

Goldman Sachs Group Inc., Subordinated Notes | | | | |

Goldman Sachs Group Inc., Subordinated Notes | | | | |

KKR Group Finance Co. II LLC, Senior Notes | | | | |

Morgan Stanley, Senior Notes (2.188% to 4/28/25 then SOFR + 1.990%) | | | | |

Morgan Stanley, Senior Notes (2.239% to 7/21/31 then SOFR + 1.178%) | | | | |

Morgan Stanley, Senior Notes (2.511% to 10/20/31 then SOFR + 1.200%) | | | | |

Morgan Stanley, Senior Notes (2.699% to 1/22/30 then SOFR + 1.143%) | | | | |

See Notes to Financial Statements.

Western Asset Core Bond Fund 2024 Semi-Annual Report

Schedule of Investments (unaudited) (cont’d)June 30, 2024 Western Asset Core Bond Fund

(Percentages shown based on Fund net assets)

| | | | | |

|

Capital Markets — continued |

Morgan Stanley, Senior Notes (3.622% to 4/1/30 then SOFR + 3.120%) | | | | |

Morgan Stanley, Senior Notes (3.772% to 1/24/28 then 3 mo. Term SOFR + 1.402%) | | | | |

Morgan Stanley, Senior Notes (4.431% to 1/23/29 then 3 mo. Term SOFR + 1.890%) | | | | |

State Street Corp., Senior Notes | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

UBS Group AG, Senior Notes | | | | |

UBS Group AG, Senior Notes | | | | |

UBS Group AG, Senior Notes | | | | |

UBS Group AG, Senior Notes | | | | |

UBS Group AG, Senior Notes (1.305% to 2/2/26 then SOFR + 0.980%) | | | | |

UBS Group AG, Senior Notes (2.593% to 9/11/24 then SOFR + 1.560%) | | | | |

UBS Group AG, Senior Notes (2.746% to 2/11/32 then 1 year Treasury Constant Maturity Rate + 1.100%) | | | | |

UBS Group AG, Senior Notes (3.091% to 5/14/31 then SOFR + 1.730%) | | | | |

UBS Group AG, Senior Notes (4.194% to 4/1/30 then SOFR + 3.730%) | | | | |

UBS Group AG, Senior Notes (4.488% to 5/12/25 then 1 year Treasury Constant Maturity Rate + 1.550%) | | | | |

UBS Group AG, Senior Notes (4.751% to 5/12/27 then 1 year Treasury Constant Maturity Rate + 1.750%) | | | | |

UBS Group AG, Senior Notes (9.016% to 11/15/32 then SOFR + 5.020%) | | | | |

| |

|

American Express Co., Senior Notes | | | | |

See Notes to Financial Statements.

Western Asset Core Bond Fund 2024 Semi-Annual Report

Western Asset Core Bond Fund

(Percentages shown based on Fund net assets)

| | | | | |

|

Financial Services — 0.6% |

AerCap Ireland Capital DAC/AerCap Global Aviation Trust, Senior Notes | | | | |

AerCap Ireland Capital DAC/AerCap Global Aviation Trust, Senior Notes | | | | |

AerCap Ireland Capital DAC/AerCap Global Aviation Trust, Senior Notes | | | | |

Berkshire Hathaway Energy Co., Senior Notes | | | | |

Berkshire Hathaway Finance Corp., Senior Notes | | | | |

ILFC E-Capital Trust II, Ltd. GTD (3 mo. Term SOFR + 2.062%) | | | | |

Mastercard Inc., Senior Notes | | | | |

PayPal Holdings Inc., Senior Notes | | | | |

PayPal Holdings Inc., Senior Notes | | | | |

USAA Capital Corp., Senior Notes | | | | |

| | | | |

| | | | |

| |

|

Aon North America Inc., Senior Notes | | | | |

Brighthouse Financial Inc., Senior Notes | | | | |

Chubb INA Holdings LLC, Senior Notes | | | | |

Guardian Life Global Funding, Secured Notes | | | | |

MetLife Inc., Junior Subordinated Notes | | | | |

Principal Life Global Funding II, Secured Notes | | | | |

Teachers Insurance & Annuity Association of America, Subordinated Notes | | | | |

Teachers Insurance & Annuity Association of America, Subordinated Notes | | | | |

| |

|

| |

|

|

AbbVie Inc., Senior Notes | | | | |

AbbVie Inc., Senior Notes | | | | |

AbbVie Inc., Senior Notes | | | | |

AbbVie Inc., Senior Notes | | | | |

AbbVie Inc., Senior Notes | | | | |

See Notes to Financial Statements.

Western Asset Core Bond Fund 2024 Semi-Annual Report

Schedule of Investments (unaudited) (cont’d)June 30, 2024 Western Asset Core Bond Fund

(Percentages shown based on Fund net assets)

| | | | | |

|

Biotechnology — continued |

AbbVie Inc., Senior Notes | | | | |

AbbVie Inc., Senior Notes | | | | |

AbbVie Inc., Senior Notes | | | | |

Gilead Sciences Inc., Senior Notes | | | | |

Gilead Sciences Inc., Senior Notes | | | | |

| |

Health Care Equipment & Supplies — 0.4% |

Abbott Laboratories, Senior Notes | | | | |

Becton Dickinson & Co., Senior Notes | | | | |

Becton Dickinson & Co., Senior Notes | | | | |

Medtronic Inc., Senior Notes | | | | |

Roche Holdings Inc., Senior Notes | | | | |

Solventum Corp., Senior Notes | | | | |

Solventum Corp., Senior Notes | | | | |

Solventum Corp., Senior Notes | | | | |

Solventum Corp., Senior Notes | | | | |

Total Health Care Equipment & Supplies | |

Health Care Providers & Services — 1.5% |

| | | | |

Cigna Group, Senior Notes | | | | |

Cigna Group, Senior Notes | | | | |

Cigna Group, Senior Notes | | | | |

CommonSpirit Health, Secured Notes | | | | |

CVS Health Corp., Senior Notes | | | | |

CVS Health Corp., Senior Notes | | | | |

CVS Health Corp., Senior Notes | | | | |

CVS Health Corp., Senior Notes | | | | |

CVS Health Corp., Senior Notes | | | | |

CVS Health Corp., Senior Notes | | | | |

CVS Health Corp., Senior Notes | | | | |

CVS Health Corp., Senior Notes | | | | |

CVS Health Corp., Senior Notes | | | | |

CVS Health Corp., Senior Notes | | | | |

CVS Health Corp., Senior Notes | | | | |

CVS Pass-Through Trust, Secured Trust | | | | |

CVS Pass-Through Trust, Senior Secured Trust | | | | |

Elevance Health Inc., Senior Notes | | | | |

Elevance Health Inc., Senior Notes | | | | |

See Notes to Financial Statements.

Western Asset Core Bond Fund 2024 Semi-Annual Report

Western Asset Core Bond Fund

(Percentages shown based on Fund net assets)

| | | | | |

|

Health Care Providers & Services — continued |

Elevance Health Inc., Senior Notes | | | | |

Elevance Health Inc., Senior Notes | | | | |

Humana Inc., Senior Notes | | | | |

Humana Inc., Senior Notes | | | | |

Humana Inc., Senior Notes | | | | |

Humana Inc., Senior Notes | | | | |

Humana Inc., Senior Notes | | | | |

Humana Inc., Senior Notes | | | | |

UnitedHealth Group Inc., Senior Notes | | | | |

UnitedHealth Group Inc., Senior Notes | | | | |

UnitedHealth Group Inc., Senior Notes | | | | |

UnitedHealth Group Inc., Senior Notes | | | | |

UnitedHealth Group Inc., Senior Notes | | | | |

UnitedHealth Group Inc., Senior Notes | | | | |

UnitedHealth Group Inc., Senior Notes | | | | |

UnitedHealth Group Inc., Senior Notes | | | | |

UnitedHealth Group Inc., Senior Notes | | | | |

UnitedHealth Group Inc., Senior Notes | | | | |

UnitedHealth Group Inc., Senior Notes | | | | |

UnitedHealth Group Inc., Senior Notes | | | | |

UnitedHealth Group Inc., Senior Notes | | | | |

UnitedHealth Group Inc., Senior Notes | | | | |

Total Health Care Providers & Services | |

|

Bristol-Myers Squibb Co., Senior Notes | | | | |

Bristol-Myers Squibb Co., Senior Notes | | | | |

Bristol-Myers Squibb Co., Senior Notes | | | | |

Bristol-Myers Squibb Co., Senior Notes | | | | |

Bristol-Myers Squibb Co., Senior Notes | | | | |

Bristol-Myers Squibb Co., Senior Notes | | | | |

Eli Lilly & Co., Senior Notes | | | | |

Eli Lilly & Co., Senior Notes | | | | |

Eli Lilly & Co., Senior Notes | | | | |

Johnson & Johnson, Senior Notes | | | | |

Merck & Co. Inc., Senior Notes | | | | |

Pfizer Inc., Senior Notes | | | | |

Pfizer Inc., Senior Notes | | | | |

Pfizer Inc., Senior Notes | | | | |

See Notes to Financial Statements.

Western Asset Core Bond Fund 2024 Semi-Annual Report

Schedule of Investments (unaudited) (cont’d)June 30, 2024 Western Asset Core Bond Fund

(Percentages shown based on Fund net assets)

| | | | | |

|

Pharmaceuticals — continued |

Pfizer Investment Enterprises Pte Ltd., Senior Notes | | | | |

| | | | |

| |

|

| |

|

Aerospace & Defense — 1.0% |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

General Dynamics Corp., Senior Notes | | | | |

L3Harris Technologies Inc., Senior Notes | | | | |

L3Harris Technologies Inc., Senior Notes | | | | |

Lockheed Martin Corp., Senior Notes | | | | |

Lockheed Martin Corp., Senior Notes | | | | |

Lockheed Martin Corp., Senior Notes | | | | |

Lockheed Martin Corp., Senior Notes | | | | |

Northrop Grumman Corp., Senior Notes | | | | |

Northrop Grumman Corp., Senior Notes | | | | |

Northrop Grumman Corp., Senior Notes | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Total Aerospace & Defense | |

Air Freight & Logistics — 0.3% |

DP World Ltd., Senior Notes | | | | |

DP World Ltd., Senior Notes | | | | |

Total Air Freight & Logistics | |

See Notes to Financial Statements.

Western Asset Core Bond Fund 2024 Semi-Annual Report

Western Asset Core Bond Fund

(Percentages shown based on Fund net assets)

| | | | | |

|

Building Products — 0.0%†† |

Carrier Global Corp., Senior Notes | | | | |

Carrier Global Corp., Senior Notes | | | | |

| |

Commercial Services & Supplies — 0.1% |

Cintas Corp. No 2, Senior Notes | | | | |

Republic Services Inc., Senior Notes | | | | |

Waste Connections Inc., Senior Notes | | | | |

Total Commercial Services & Supplies | |

Electrical Equipment — 0.1% |

Eaton Corp., Senior Notes | | | | |

Emerson Electric Co., Senior Notes | | | | |

Total Electrical Equipment | |

Ground Transportation — 0.1% |

Burlington Northern Santa Fe LLC, Senior Notes | | | | |

Union Pacific Corp., Senior Notes | | | | |

Union Pacific Corp., Senior Notes | | | | |

Union Pacific Corp., Senior Notes | | | | |

Union Pacific Corp., Senior Notes | | | | |

Union Pacific Corp., Senior Notes | | | | |

Total Ground Transportation | |

Industrial Conglomerates — 0.1% |

Honeywell International Inc., Senior Notes | | | | |

Passenger Airlines — 0.1% |

Delta Air Lines Inc., Senior Notes | | | | |

Delta Air Lines Inc./SkyMiles IP Ltd., Senior Secured Notes | | | | |

Delta Air Lines Inc./SkyMiles IP Ltd., Senior Secured Notes | | | | |

| |

Trading Companies & Distributors — 0.1% |

Air Lease Corp., Senior Notes | | | | |

Air Lease Corp., Senior Notes | | | | |

Total Trading Companies & Distributors | |

|

| |

Information Technology — 1.1% |

Semiconductors & Semiconductor Equipment — 0.8% |

Broadcom Inc., Senior Notes | | | | |

Broadcom Inc., Senior Notes | | | | |

See Notes to Financial Statements.

Western Asset Core Bond Fund 2024 Semi-Annual Report

Schedule of Investments (unaudited) (cont’d)June 30, 2024 Western Asset Core Bond Fund

(Percentages shown based on Fund net assets)

| | | | | |

|

Semiconductors & Semiconductor Equipment — continued |

Broadcom Inc., Senior Notes | | | | |

Broadcom Inc., Senior Notes | | | | |

Intel Corp., Senior Notes | | | | |

Intel Corp., Senior Notes | | | | |

Intel Corp., Senior Notes | | | | |

| | | | |

Micron Technology Inc., Senior Notes | | | | |

Micron Technology Inc., Senior Notes | | | | |

NVIDIA Corp., Senior Notes | | | | |

NXP BV/NXP Funding LLC/NXP USA Inc., Senior Notes | | | | |

Texas Instruments Inc., Senior Notes | | | | |

Texas Instruments Inc., Senior Notes | | | | |

TSMC Arizona Corp., Senior Notes | | | | |

TSMC Arizona Corp., Senior Notes | | | | |

Total Semiconductors & Semiconductor Equipment | |

|

Microsoft Corp., Senior Notes | | | | |

Oracle Corp., Senior Notes | | | | |

Oracle Corp., Senior Notes | | | | |

Oracle Corp., Senior Notes | | | | |

Oracle Corp., Senior Notes | | | | |

Oracle Corp., Senior Notes | | | | |

| |

|

Total Information Technology | |

|

|

MEGlobal BV, Senior Notes | | | | |

MEGlobal BV, Senior Notes | | | | |

| | | | |

Orbia Advance Corp. SAB de CV, Senior Notes | | | | |

Orbia Advance Corp. SAB de CV, Senior Notes | | | | |

| |

|

Anglo American Capital PLC, Senior Notes | | | | |

Anglo American Capital PLC, Senior Notes | | | | |

Anglo American Capital PLC, Senior Notes | | | | |

See Notes to Financial Statements.

Western Asset Core Bond Fund 2024 Semi-Annual Report

Western Asset Core Bond Fund

(Percentages shown based on Fund net assets)

| | | | | |

|

Metals & Mining — continued |

Barrick North America Finance LLC, Senior Notes | | | | |

Barrick PD Australia Finance Pty Ltd., Senior Notes | | | | |

BHP Billiton Finance USA Ltd., Senior Notes | | | | |

Freeport-McMoRan Inc., Senior Notes | | | | |

Freeport-McMoRan Inc., Senior Notes | | | | |

Glencore Funding LLC, Senior Notes | | | | |

Glencore Funding LLC, Senior Notes | | | | |

Southern Copper Corp., Senior Notes | | | | |

Southern Copper Corp., Senior Notes | | | | |

Vale Overseas Ltd., Senior Notes | | | | |

Vale Overseas Ltd., Senior Notes | | | | |

Vale Overseas Ltd., Senior Notes | | | | |

| |

Paper & Forest Products — 0.1% |

Suzano Austria GmbH, Senior Notes | | | | |

|

| |

|

|

WEA Finance LLC/Westfield UK & Europe Finance PLC, Senior Notes | | | | |

WEA Finance LLC/Westfield UK & Europe Finance PLC, Senior Notes | | | | |

|

| |

|

Electric Utilities — 1.0% |

American Transmission Systems Inc., Senior Notes | | | | |

Cleveland Electric Illuminating Co., Senior Notes | | | | |

Comision Federal de Electricidad, Senior Notes | | | | |

Comision Federal de Electricidad, Senior Notes | | | | |

Duke Energy Corp., Senior Notes | | | | |

Exelon Corp., Senior Notes | | | | |

FirstEnergy Corp., Senior Notes | | | | |

FirstEnergy Corp., Senior Notes | | | | |

See Notes to Financial Statements.

Western Asset Core Bond Fund 2024 Semi-Annual Report

Schedule of Investments (unaudited) (cont’d)June 30, 2024 Western Asset Core Bond Fund

(Percentages shown based on Fund net assets)

| | | | | |

|

Electric Utilities — continued |

FirstEnergy Corp., Senior Notes | | | | |

MidAmerican Energy Co., First Mortgage Bonds | | | | |

Mid-Atlantic Interstate Transmission LLC, Senior Notes | | | | |

Pacific Gas and Electric Co., First Mortgage Bonds | | | | |

Pacific Gas and Electric Co., First Mortgage Bonds | | | | |

Pacific Gas and Electric Co., First Mortgage Bonds | | | | |

Pacific Gas and Electric Co., First Mortgage Bonds | | | | |

Perusahaan Perseroan Persero PT Perusahaan Listrik Negara, Senior Notes | | | | |

Perusahaan Perseroan Persero PT Perusahaan Listrik Negara, Senior Notes | | | | |

Perusahaan Perseroan Persero PT Perusahaan Listrik Negara, Senior Notes | | | | |

Perusahaan Perseroan Persero PT Perusahaan Listrik Negara, Senior Notes | | | | |

SCE Recovery Funding LLC, Senior Secured Notes | | | | |

Southern California Edison Co., First Mortgage Bonds | | | | |

| |

|

Consolidated Edison Co. of New York Inc., Senior Notes | | | | |

Consolidated Edison Co. of New York Inc., Senior Notes | | | | |

| |

|

| |

Total Corporate Bonds & Notes (Cost — $4,585,660,752) | |

Collateralized Mortgage Obligations(g) — 14.6% |

Angel Oak Mortgage Trust, 2022-3 A1 | | | | |

Arbor Realty Commercial Real Estate Notes Ltd., 2022-FL1 A (30 Day Average SOFR + 1.450%) | | | | |

See Notes to Financial Statements.

Western Asset Core Bond Fund 2024 Semi-Annual Report

Western Asset Core Bond Fund

(Percentages shown based on Fund net assets)

| | | | | |

Collateralized Mortgage Obligations(g) — continued |

AREIT LLC, 2022-CRE7 A (1 mo. Term SOFR + 2.242%) | | | | |

AREIT Trust, 2022-CRE6 A (30 Day Average SOFR + 1.250%) | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Benchmark Mortgage Trust, 2020-B21 B | | | | |

Benchmark Mortgage Trust, 2020-IG1 AS | | | | |

Benchmark Mortgage Trust, 2021-B25 XA, IO | | | | |

BHMS, 2018-ATLS A (1 mo. Term SOFR + 1.547%) | | | | |

BMP, 2024-MF23 A (1 mo. Term SOFR + 1.372%) | | | | |

BRAVO Residential Funding Trust, 2022- NQM3 A1 | | | | |

BX Commercial Mortgage Trust, 2019-IMC A (1 mo. Term SOFR + 1.046%) | | | | |

BX Commercial Mortgage Trust, 2021-XL2 A (1 mo. Term SOFR + 0.803%) | | | | |

BX Commercial Mortgage Trust, 2022-LP2 A (1 mo. Term SOFR + 1.013%) | | | | |

BX Commercial Mortgage Trust, 2023-XL3 A (1 mo. Term SOFR + 1.761%) | | | | |

BX Commercial Mortgage Trust, 2024-XL5 A (1 mo. Term SOFR + 1.392%) | | | | |

BX Trust, 2022-LBA6 A (1 mo. Term SOFR + 1.000%) | | | | |

BX Trust, 2024-VLT4 B (1 mo. Term SOFR + 1.941%) | | | | |

CAMB Commercial Mortgage Trust, 2019- LIFE A (1 mo. Term SOFR + 1.367%) | | | | |

CD Mortgage Trust, 2016-CD2 A4 | | | | |

Citigroup Commercial Mortgage Trust, 2014- GC25 AS | | | | |

Citigroup Commercial Mortgage Trust, 2016-C2 B | | | | |

Citigroup Commercial Mortgage Trust, 2016-P6 A4 | | | | |

See Notes to Financial Statements.

Western Asset Core Bond Fund 2024 Semi-Annual Report

Schedule of Investments (unaudited) (cont’d)June 30, 2024 Western Asset Core Bond Fund

(Percentages shown based on Fund net assets)

| | | | | |

Collateralized Mortgage Obligations(g) — continued |

Citigroup Commercial Mortgage Trust, 2017-B1 A3 | | | | |

Citigroup Commercial Mortgage Trust, 2017-C4 A4 | | | | |

Citigroup Commercial Mortgage Trust, 2017-P7 B | | | | |

Citigroup Commercial Mortgage Trust, 2019-C7 A4 | | | | |

Cold Storage Trust, 2020-ICE5 A (1 mo. Term SOFR + 1.014%) | | | | |

COLT Mortgage Loan Trust, 2022-2 A1, Step bond (2.994% to 2/25/26 then 3.994%) | | | | |

Commercial Mortgage Trust, 2013-300P B | | | | |

Commercial Mortgage Trust, 2014-277P A | | | | |

Commercial Mortgage Trust, 2015-CR24 AM | | | | |

Commercial Mortgage Trust, 2017-PANW A | | | | |

Commercial Mortgage Trust, 2020-CX A | | | | |

| | | | |

CSAIL Commercial Mortgage Trust, 2019- C15 A4 | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

CSMC Trust, 2020-FACT A (1 mo. Term SOFR + 1.714%) | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

CSMC Trust, 2022-7R 1A1 (30 Day Average SOFR + 4.500%) | | | | |

CSMC Trust, 2022-CNTR A (1 mo. Term SOFR + 3.944%) | | | | |

| | | | |

DBCG Mortgage Trust, 2017-BBG A | | | | |

See Notes to Financial Statements.

Western Asset Core Bond Fund 2024 Semi-Annual Report

Western Asset Core Bond Fund

(Percentages shown based on Fund net assets)

| | | | | |

Collateralized Mortgage Obligations(g) — continued |

DBJPM Mortgage Trust, 2016-C1 B | | | | |

DC Commercial Mortgage Trust, 2023-DC A | | | | |

Deephaven Residential Mortgage Trust, 2022-1 A1 | | | | |

Deutsche Mortgage Securities Inc. Mortgage Loan Trust, 2004-4 7AR2 (1 mo. Term SOFR + 0.564%) | | | | |

Deutsche Mortgage Securities Inc. Mortgage Loan Trust, 2006-PR1 4AF1 (1 mo. Term SOFR + 0.404%) | | | | |

Ellington Financial Mortgage Trust, 2022-1 A1 | | | | |

EverBank Mortgage Loan Trust, 2018-1 A22 | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Multiclass Certificates, 2020-RR02 BX, IO | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Multiclass Certificates, 2020-RR07 AX, IO | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Multifamily ML Certificates, 2020-ML07 XUS, IO | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Multifamily PC REMIC Trust, 2019-RR01 X, IO | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Multifamily Structured Pass-Through Certificates, K062 X1, IO | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Multifamily Structured Pass-Through Certificates, K072 X1, IO | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Multifamily Structured Pass-Through Certificates, K091 X1, IO | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Multifamily Structured Pass-Through Certificates, K093 X1, IO | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Multifamily Structured Pass-Through Certificates, K095 XAM, IO | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Multifamily Structured Pass-Through Certificates, K101 X1, IO | | | | |

See Notes to Financial Statements.

Western Asset Core Bond Fund 2024 Semi-Annual Report

Schedule of Investments (unaudited) (cont’d)June 30, 2024 Western Asset Core Bond Fund

(Percentages shown based on Fund net assets)

| | | | | |

Collateralized Mortgage Obligations(g) — continued |

Federal Home Loan Mortgage Corp. (FHLMC) Multifamily Structured Pass-Through Certificates, K105 X1, IO | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Multifamily Structured Pass-Through Certificates, K106 X1, IO | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Multifamily Structured Pass-Through Certificates, K110 X1, IO | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Multifamily Structured Pass-Through Certificates, K115 X1, IO | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Multifamily Structured Pass-Through Certificates, K116 X1, IO | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Multifamily Structured Pass-Through Certificates, K120 X1, IO | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Multifamily Structured Pass-Through Certificates, K121 X1, IO | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Multifamily Structured Pass-Through Certificates, K124 X1, IO | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Multifamily Structured Pass-Through Certificates, K128 X1, IO | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Multifamily Structured Pass-Through Certificates, K133 X1, IO | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Multifamily Structured Pass-Through Certificates, K136 X1, IO | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Multifamily Structured Pass-Through Certificates, K142 X1, IO | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Multifamily Structured Pass-Through Certificates, K143 X1, IO | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Multifamily Structured Pass-Through Certificates, K145 X1, IO | | | | |

See Notes to Financial Statements.

Western Asset Core Bond Fund 2024 Semi-Annual Report

Western Asset Core Bond Fund

(Percentages shown based on Fund net assets)

| | | | | |

Collateralized Mortgage Obligations(g) — continued |

Federal Home Loan Mortgage Corp. (FHLMC) Multifamily Structured Pass-Through Certificates, K146 X1, IO | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Multifamily Structured Pass-Through Certificates, K147 X1, IO | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Multifamily Structured Pass-Through Certificates, K148 X1, IO | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Multifamily Structured Pass-Through Certificates, K149 X1, IO | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Multifamily Structured Pass-Through Certificates, K151 X1, IO | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Multifamily Structured Pass-Through Certificates, K154 X1, IO | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Multifamily Structured Pass-Through Certificates, K155 X1, IO | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Multifamily Structured Pass-Through Certificates, K159 X1, IO | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Multifamily Structured Pass-Through Certificates, K736 X1, IO | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Multifamily Structured Pass-Through Certificates, K737 X1, IO | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Multifamily Structured Pass-Through Certificates, K741 X1, IO | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Multifamily Structured Pass-Through Certificates, K742 X1, IO | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Multifamily Structured Pass-Through Certificates, K1511 X1, IO | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Multifamily Structured Pass-Through Certificates, K1515 X1, IO | | | | |

See Notes to Financial Statements.

Western Asset Core Bond Fund 2024 Semi-Annual Report

Schedule of Investments (unaudited) (cont’d)June 30, 2024 Western Asset Core Bond Fund

(Percentages shown based on Fund net assets)

| | | | | |

Collateralized Mortgage Obligations(g) — continued |

Federal Home Loan Mortgage Corp. (FHLMC) Multifamily Structured Pass-Through Certificates, K1516 X1, IO | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Multifamily Structured Pass-Through Certificates, K1517 X1, IO | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Multifamily Structured Pass-Through Certificates, K1520 X1, IO | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Multifamily Structured Pass-Through Certificates, KC05 X1, IO | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Multifamily Structured Pass-Through Certificates, S8FX A2 | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Reference REMIC, R007 ZA | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) REMIC, 2957 ZA, PAC | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) REMIC, 3242 SC, IO (-1.000 x 30 Day Average SOFR + 6.176%) | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) REMIC, 3281 AI, IO (-1.000 x 30 Day Average SOFR + 6.316%) | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) REMIC, 3368 AI, IO (-1.000 x 30 Day Average SOFR + 5.916%) | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) REMIC, 3621 SB, IO (-1.000 x 30 Day Average SOFR + 6.116%) | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) REMIC, 3639 EY | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) REMIC, 3947 SG, IO (-1.000 x 30 Day Average SOFR + 5.836%) | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) REMIC, 3973 SA, IO (-1.000 x 30 Day Average SOFR + 6.376%) | | | | |

See Notes to Financial Statements.

Western Asset Core Bond Fund 2024 Semi-Annual Report

Western Asset Core Bond Fund

(Percentages shown based on Fund net assets)

| | | | | |

Collateralized Mortgage Obligations(g) — continued |