UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06110

Western Asset Funds, Inc.

(Exact name of registrant as specified in charter)

55 Water Street, New York, NY 10041

(Address of principal executive offices) (Zip code)

Robert I. Frenkel, Esq.

Legg Mason & Co., LLC

100 First Stamford Place

Baltimore, MD 21202

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-888-425-6432

Date of fiscal year end: December 31

Date of reporting period: June 30, 2010

| ITEM 1. | REPORT TO STOCKHOLDERS. |

The Semi-Annual Report to Stockholders is filed herewith.

June 30, 2010

Semi-Annual Repor t

Western Asset

Non-U.S. Opportunity Bond Portfolio

INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

| | |

| II | | Western Asset Non-U.S. Opportunity Bond Portfolio |

Fund objective

The Fund seeks to maximize total return, consistent with prudent investment management.

| | |

| Letter from the president | | |

Dear Shareholder,

We are pleased to provide the semi-annual report of Western Asset Non-U.S. Opportunity Bond Portfolio for the six-month reporting period ended June 30, 2010.

Please read on for Fund performance information and a detailed look at prevailing economic and market conditions during the Fund’s reporting period.

As always, we remain committed to providing you with excellent service and a full spectrum of investment choices. We also remain committed to supplementing the support you receive from your financial advisor. One way we accomplish this is through our website, www.leggmason.com/individual investors. Here you can gain immediate access to market and investment information, including:

| Ÿ | | Fund prices and performance, |

| Ÿ | | Market insights and commentaries from our portfolio managers, and |

| Ÿ | | A host of educational resources. |

We look forward to helping you meet your financial goals.

Sincerely,

R. Jay Gerken, CFA

President

July 30, 2010

| | |

| Western Asset Non-U.S. Opportunity Bond Portfolio | | III |

Investment commentary

Economic review

While the overall U.S. economy continued to expand, economic data generally weakened toward the end of the six months ended June 30, 2010. Economic growth overseas was mixed, as many developed countries experienced challenging conditions, while emerging market countries generally enjoyed solid expansions. The combination of these factors had significant implications for the financial markets.

Looking back, the U.S. Department of Commerce reported that U.S. gross domestic product (“GDP”)i contracted four consecutive quarters, beginning in the third quarter of 2008 through the second quarter of 2009. Economic conditions then began to improve in the third quarter of 2009, as GDP growth was 1.6%. A variety of factors helped the economy to regain its footing, including the government’s $787 billion stimulus program. Economic growth then accelerated during the fourth quarter of 2009, as GDP growth was 5.0%. A slower drawdown in business inventories and renewed consumer spending were contributing factors spurring the economy’s higher growth rate. While the recovery continued during the first half of 2010, it did so at a more modest pace, as GDP growth was 3.7% during the first quarter of 2010 and an estimated 2.4% during the second quarter. The slower pace of growth in the second quarter was due, in part, to slower consumer spending, which rose an annualized 1.6% during the quarter, versus a 1.9% gain over the first three months of the year.

Even before GDP growth turned positive, there were signs that the economy was on the mend. The manufacturing sector, as measured by the Institute for Supply Management’s PMIii, rose to 52.8 in August 2009, the first time it surpassed 50 since January 2008 (a reading below 50 indicates a contraction, whereas a reading above 50 indicates an expansion). While June 2010’s PMI reading of 56.2 was lower than May’s reading of 59.7, manufacturing has now expanded eleven consecutive months according to PMI data. The manufacturing sector’s growth remained fairly broad-based with thirteen of the eighteen industries tracked by the Institute for Supply Management expanding during June.

After experiencing sharp job losses in 2009, the U.S. Department of Labor reported that over one million new positions were added during the first five months of 2010. Included in that total, however, were 700,000 temporary government jobs tied to the 2010

Census. In June, 225,000 of these temporary positions were eliminated, offsetting private sector growth and resulting in a net loss of 125,000 jobs for the month. However, the unemployment rate fell to 9.5% in June, versus 9.7% and 9.9% in May and April, respectively.

There was mixed news in the housing market during the period. According to the National Association of Realtors, existing home sales increased 7.0% and 8.0% in March and April, respectively, after sales had fallen for the period from December 2009 through February 2010. The rebound was largely attributed to people rushing to take advantage of the government’s $8,000 tax credit for first-time home buyers that expired at the end of April. However, with the end of the tax credit, existing home sales then declined 2.2% and 5.1% in May and June, respectively. In addition, the inventory of unsold homes increased 2.5% to 3.99 million in June. Looking at home prices, the S&P/Case-Shiller Home Price Indexiii indicated that month-to-month U.S. home prices rose 1.3% in May. This marked the second straight monthly increase following six consecutive months of declining prices.

Outside of the U.S., economic news was dominated by the sovereign debt crisis in Europe. In May, the European Union and International Monetary Fund (“IMF”) announced a €750 billion ($955 billion) plan to aid fiscally-troubled Eurozone countries. Despite this, investors were skeptical that the bailout plan would be sufficient to stem the contagion of the debt crisis to other peripheral European countries. Given the economic strains in the Eurozone, the IMF projected that growth in the region will be a modest 1% in 2010. Expectations for Japan’s economy are better but still relatively tepid, as the IMF’s forecast for the country’s economy is a 2.4% expansion in 2010. In contrast, many emerging market countries are experiencing strong economic growth. The IMF projected that China’s economy will expand 10.5% in 2010 and India’s economy will grow 9.4% during the year.

Financial market overview

During the first half of the reporting period, the financial markets were largely characterized by healthy investor risk appetite and solid results by lower-quality bonds. However, the market experienced a sharp sell-off during the second half of the reporting period, during which risk aversion returned and investors flocked to the relative safety of U.S. Treasury securities.

| | |

| IV | | Western Asset Non-U.S. Opportunity Bond Portfolio |

Investment commentary (cont’d)

Given certain pockets of weakness in the economy, including elevated unemployment in the U.S., the Federal Reserve Board (“Fed”)iv remained cautious. At its meeting in June 2010, the Fed said it “will maintain the target range for the federal funds ratev at 0 to 1/4 percent and continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels of the federal funds rate for an extended period.”

However, the Fed took several steps in reversing its accommodative monetary stance. On February 18, 2010, the Fed raised the discount rate, the interest rate it charges banks for temporary loans, from 1/2 to 3/4 percent. The Fed also concluded its $1.25 trillion mortgage securities purchase program at the end of the first quarter of 2010. However, the Fed left the door open for future stimulus measures if needed. In the minutes of its June meeting that were released on July 14th (after the reporting period ended), the Fed said, “In addition to continuing to develop and test instruments to exit from the period of unusually accommodative monetary policy, the Committee would need to consider whether further policy stimulus might become appropriate if the outlook were to worsen appreciably.”

As a result of the economic challenges in the Eurozone, the European Central Bank (“ECB”) kept interest rates at 1% during the reporting period. The ECB has kept rates at this historic low since the middle of 2009. Similar stances were taken by the Bank of England and the Bank of Japan, keeping rates at 0.5% and 0.1%, respectively, during the six months ended June 30, 2010. In contrast, a number of emerging market countries, including China, India and Brazil, raised interest rates during the reporting period in an effort to tame inflation.

Fixed-income market review

Continuing the trend that began in the second quarter of 2009, nearly every spread sector (non-Treasury) outperformed equal-durationvi Treasuries during the first half of the reporting period. Over that time, investor confidence was high given encouraging economic data, continued low interest rates,

benign inflation and rebounding corporate profits. However, robust investor appetite was replaced with heightened risk aversion toward the end of April and during the month of May. This was due to the escalating sovereign debt crisis in Europe, uncertainties regarding new financial reforms in the U.S. and some worse-than-expected economic data. Most spread sectors then produced positive absolute returns in June, as investor demand for these securities began to again increase.

Both short- and long-term U.S. Treasury yields fluctuated during the period but generally moved lower. When the period began, two- and ten-year Treasury yields were 1.14% and 3.85%, respectively. Two- and ten-year Treasury yields initially rose, reaching as high as 1.18% and 4.01%, respectively, in early April. Yields then largely declined amid the investor “flight to quality.” On June 30, 2010, two- and ten-year Treasury yields reached their lows for the reporting period: 0.61% and 2.97%, respectively. Over the six-month reporting period, the yield curvevii flattened, with longer-term Treasury yields declining more than their shorter-term counterparts. For the six months ended June 30, 2010, the Barclays Capital U.S. Aggregate Indexviii returned 5.33%. In contrast, the Barclays Capital Global Aggregate Index (Hedged)ix returned 4.00% over the same time frame.

Emerging market debt prices rallied over the reporting period, posting positive returns each month during the reporting period except for May 2010. This impressive performance was triggered by strong economic growth in many emerging market countries, solid domestic demand and generally robust investor demand for the asset class. The JPMorgan Emerging Markets Bond Index Global (“EMBI Global”)x returned 5.37% over the six months ended June 30, 2010.

Performance review

For the six months ended June 30, 2010, Class I shares of Western Asset Non-U.S. Opportunity Bond Portfolio returned 5.45%. The Fund’s unmanaged benchmark, the Citigroup World Government Bond Ex-U.S. Index (Hedged)xi, returned 2.69% for the same period. The Lipper International Income Funds Category Average1 returned -1.25% over the same time frame.

| 1 | Lipper, Inc., a wholly-owned subsidiary of Reuters, provides independent insight on global collective investments. Returns are based on the six-month period ended June 30, 2010, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 100 funds in the Fund’s Lipper category. |

| | |

| Western Asset Non-U.S. Opportunity Bond Portfolio | | V |

| | | |

| Performance Snapshot as of June 30, 2010 (unaudited) | |

| | | 6 months | |

| Western Asset Non-U.S. Opportunity Bond Portfolio: | | | |

Class I1 | | 5.45 | % |

| Citigroup World Government Bond Ex-U.S. Index (Hedged) | | 2.69 | % |

| Lipper International Income Funds Category Average | | -1.25 | % |

The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value, investment returns and yields will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.leggmason.com/individualinvestors.

Fund returns assume the reinvestment of all distributions, including returns of capital, if any, at net asset value and the deduction of all Fund expenses. Returns have not been adjusted to include the deduction of taxes that a shareholder would pay on Fund distributions. Performance figures for periods shorter than one year represent cumulative figures and are not annualized.

Performance figures reflect expense reimbursements and/or fee waivers, without which the performance would have been lower.

The 30-Day SEC Yield for the period ended June 30, 2010 for Class I shares was 1.64%. Absent current expense reimbursements and/or fee waivers, the 30-Day SEC Yield for Class I shares would have been 1.60%. The 30-Day SEC Yield is the average annualized net investment income per share for the 30-day period indicated and is subject to change.

|

| Total Annual Operating Expenses (unaudited) |

As of the Fund’s most current prospectus dated April 30, 2010, the gross total operating expense ratio for Class I shares was 0.70%.

Actual expenses may be higher. For example, expenses may be higher than those shown if average net assets decrease. Net assets are more likely to decrease and Fund expense ratios are more likely to increase when markets are volatile.

As a result of a contractual expense limitation agreement, Class I shares’ operating expenses, other than interest, brokerage, taxes, deferred organizational expenses and extraordinary expenses, will be waived and/or reimbursed at an annual rate of 0.04%. The expense limitation agreement cannot be terminated prior to April 30, 2011 without the Board of Directors’ consent.

As always, thank you for your confidence in our stewardship of your assets.

Sincerely,

R. Jay Gerken, CFA

President

July 30, 2010

RISKS: Fixed-income securities involve interest rate, credit, inflation and reinvestment risks. As interest rates rise, the value of fixed-income securities falls. Derivatives, such as options, futures and swaps, can be illiquid, may disproportionately increase losses, and have a potentially large impact on Fund performance. International investments are subject to special risks including currency fluctuations and social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets. The use of leverage may increase volatility and possibility of loss. Asset-backed, mortgage-backed or mortgage-related securities are subject to prepayment and extension risks. The Fund is not diversified, which means that it is permitted to invest a higher percentage of its assets in any one issuer than a diversified fund. This may magnify the Fund’s losses from events affecting a particular issuer. Please see the Fund’s prospectus for more information on these and other risks.

All investments are subject to risk including the possible loss of principal. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole. Projections and forecasts are inherently limited and should not be relied upon as indicators of future performance. Investors should not use this information as the sole basis for investment decisions.

| 1 | Class I shares were formerly known as Institutional Class shares. The share class was renamed in April 2010. |

| | |

| VI | | Western Asset Non-U.S. Opportunity Bond Portfolio |

| i | Gross domestic product (“GDP”) is the market value of all final goods and services produced within a country in a given period of time. |

| ii | The Institute for Supply Management’s PMI is based on a survey of purchasing executives who buy the raw materials for manufacturing at more than 350 companies. It offers an early reading on the health of the manufacturing sector. |

| iii | The S&P/Case-Shiller Home Price Index measures the residential housing market, tracking changes in the value of the residential real estate market in twenty metropolitan regions across the United States. |

| iv | The Federal Reserve Board (“Fed”) is responsible for the formulation of policies designed to promote economic growth, full employment, stable prices and a sustainable pattern of international trade and payments. |

| v | The federal funds rate is the rate charged by one depository institution on an overnight sale of immediately available funds (balances at the Federal Reserve) to another depository institution; the rate may vary from depository institution to depository institution and from day to day. |

| vi | Duration is the measure of the price sensitivity of a fixed-income security to an interest rate change of 100 basis points. Calculation is based on the weighted average of the present values for all cash flows. |

| vii | The yield curve is the graphical depiction of the relationship between the yield on bonds of the same credit quality but different maturities. |

| viii | The Barclays Capital U.S. Aggregate Index is a broad-based bond index comprised of government, corporate, mortgage- and asset-backed issues, rated investment grade or higher, and having at least one year to maturity. |

| ix | The Barclays Capital Global Aggregate Index (Hedged) is an index comprised of several other Barclays Capital indices that measure fixed-income performance of regions around the world. |

| x | The JPMorgan Emerging Markets Bond Index Global (“EMBI Global”) tracks total returns for U.S. dollar-denominated debt instruments issued by emerging market sovereign and quasi-sovereign entities: Brady bonds, loans, Eurobonds and local market instruments. |

| xi | The Citigroup World Government Bond Ex-U.S. Index (Hedged) encompasses an all-inclusive universe of institutionally traded bonds, including all fixed-rate bonds with remaining maturities of one year or longer with amounts outstanding of at least the equivalent of $25 million USD. This Index excludes the U.S. and is currency-hedged as a means of achieving low-risk interest rate diversification. |

| | |

| Western Asset Non-U.S. Opportunity Bond Portfolio 2010 Semi-Annual Report | | 1 |

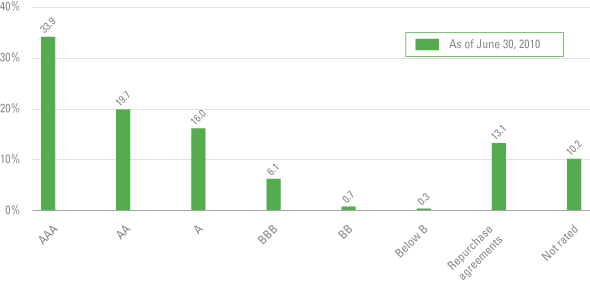

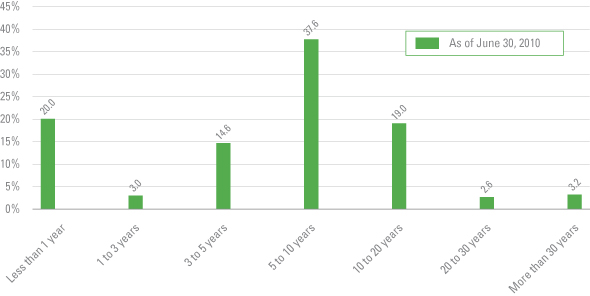

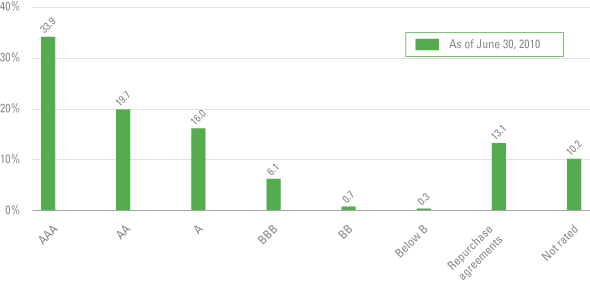

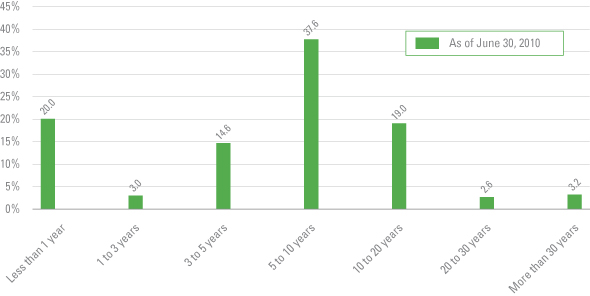

Fund at a glance† (unaudited)

Standard & Poor’s Debt Ratings1 (%) as a percent of total investments

Maturity Schedule (%) as a percent of total investments

| † | The bar graphs above represent the composition of the Fund’s investments as of June 30, 2010 and do not include derivatives such as Futures Contracts, Options Written and Swaps. The Fund is actively managed. As a result, the composition of the Fund’s investments is subject to change at any time. |

| 1 | Source: Standard & Poor’s Rating Service. The ratings shown are based on each portfolio security’s rating as determined by Standard & Poor’s (“S&P”), a Nationally Recognized Statistical Ratings Organization (“NRSRO”). These ratings are the opinions of S&P and are not measures of quality or guarantees of performance. Securities held by the Fund may be rated by other NRSROs, and these ratings may be higher or lower. The Fund itself has not been rated by a NRSRO and the credit quality of the investments in the Fund’s portfolio does not apply to the stability or safety of the Fund. |

| | |

| 2 | | Western Asset Non-U.S. Opportunity Bond Portfolio 2010 Semi-Annual Report |

Fund expenses (unaudited)

Example

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested on January 1, 2010 and held for the six months ended June 30, 2010.

Actual expenses

The table below titled “Based on Actual Total Return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period”.

| | | | | | | | | | | | | | | |

| Based on actual total return1 |

| | | Actual Total

Return2 | | | Beginning

Account

Value | | Ending

Account

Value | | Annualized

Expense

Ratio | | | Expenses

Paid

During

the

Period3 |

| Class I4 | | 5.45 | % | | $ | 1,000 | | $ | 1,054.50 | | 0.76 | % | | $ | 3.87 |

Hypothetical example for comparison purposes

The table below titled “Based on Hypothetical Total Return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front-end or back-end sales charges (loads). Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | |

| Based on hypothetical total return1 |

| | | Hypothetical

Annualized

Total Return | | | Beginning

Account

Value | | Ending

Account

Value | | Annualized

Expense

Ratio | | | Expenses

Paid

During

the

Period3 |

| Class I4 | | 5.00 | % | | $ | 1,000.00 | | $ | 1,021.03 | | 0.76 | % | | $ | 3.81 |

| 1 | For the six months ended June 30, 2010. |

| 2 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value. Total return is not annualized, as it may not be representative of the total return for the year. Performance figures may reflect compensating balance arrangements and/or expense reimbursements. In the absence of compensating balance arrangements and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

| 3 | Expenses (net of compensating balance arrangements and/or expense reimbursements) are equal to each class’ respective annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (181), then divided by 365. |

| 4 | In April 2010, Institutional Class shares were renamed Class I shares. |

| | |

| Western Asset Non-U.S. Opportunity Bond Portfolio 2010 Semi-Annual Report | | 3 |

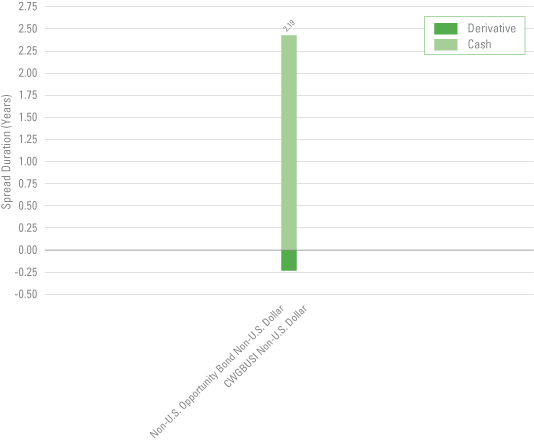

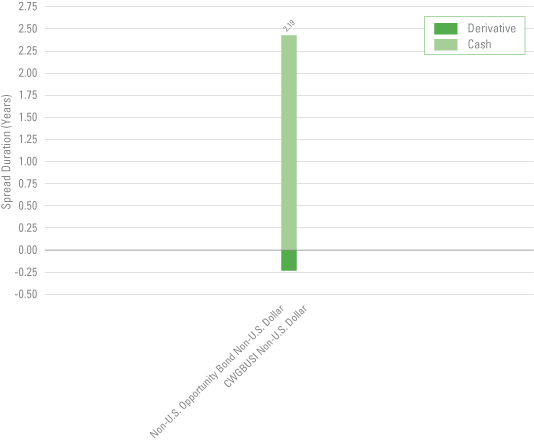

Spread duration (unaudited)

Economic exposure — June 30, 2010

Spread duration is defined as the change in value for a 100 basis point change in the spread relative to Treasuries. The spread over Treasuries is the annual risk-premium demanded by investors to hold non-Treasury securities. This chart highlights the market sector exposure of the Fund’s portfolio and the exposure relative to the selected benchmark as of the end of the reporting period.

| | |

| CWGBUSI | | —Citigroup World Government Ex-U.S. Index (Hedged) |

| | |

| 4 | | Western Asset Non-U.S. Opportunity Bond Portfolio 2010 Semi-Annual Report |

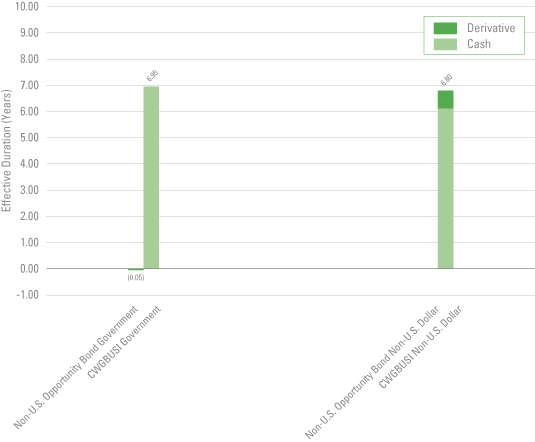

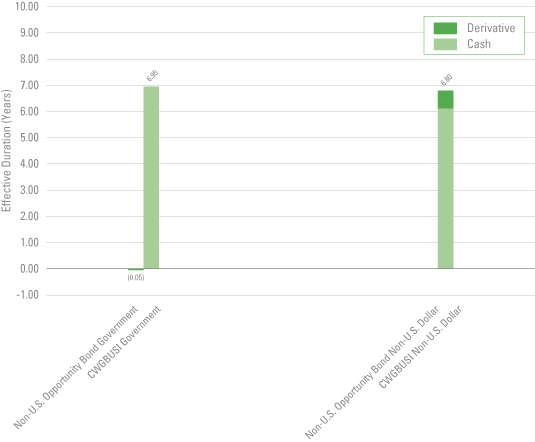

Effective duration (unaudited)

Interest rate exposure — June 30, 2010

Effective duration is defined as the change in value for a 100 basis point change in Treasury yields. This chart highlights the interest rate exposure of the Fund’s portfolio relative to the selected benchmark as of the end of the reporting period.

| | |

| CWGBUSI | | —Citigroup World Government Ex-U.S. Index (Hedged) |

| | |

| Western Asset Non-U.S. Opportunity Bond Portfolio 2010 Semi-Annual Report | | 5 |

Schedule of investments (unaudited)

June 30, 2010

Western Asset Non-U.S. Opportunity Bond Portfolio

| | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | Face

Amount† | | | Value | |

| Sovereign Bonds — 45.2% | | | | | | | | | | | | |

Brazil — 1.0% | | | | | | | | | | | | |

Brazil Nota do Tesouro Nacional, Notes | | 10.000 | % | | 1/1/12 | | 1,428,000 | BRL | | $ | 730,614 | |

Canada — 3.1% | | | | | | | | | | | | |

Government of Canada | | 4.000 | % | | 6/1/16 | | 2,300,000 | CAD | | | 2,330,248 | |

France — 1.0% | | | | | | | | | | | | |

France Government Bond OAT, Bonds | | 4.000 | % | | 4/25/60 | | 560,000 | EUR | | | 732,663 | |

Germany — 4.2% | | | | | | | | | | | | |

Bundesrepublik Deutschland, Bonds | | 3.750 | % | | 1/4/19 | | 770,000 | EUR | | | 1,038,767 | |

Bundesrepublik Deutschland, Bonds | | 3.250 | % | | 1/4/20 | | 1,610,000 | EUR | | | 2,093,018 | |

Total Germany | | | | | | | | | | | 3,131,785 | |

Greece — 0.7% | | | | | | | | | | | | |

Hellenic Republic | | 2.300 | % | | 7/25/30 | | 588,610 | EUR | | | 285,393 | |

Hellenic Republic Government Bond, Senior Bonds | | 4.600 | % | | 9/20/40 | | 360,000 | EUR | | | 220,848 | |

Total Greece | | | | | | | | | | | 506,241 | |

Japan — 15.8% | | | | | | | | | | | | |

Development Bank of Japan | | 1.750 | % | | 3/17/17 | | 100,000,000 | JPY | | | 1,212,582 | |

Development Bank of Japan | | 2.300 | % | | 3/19/26 | | 240,000,000 | JPY | | | 2,917,848 | |

Government of Japan | | 0.400 | % | | 6/15/11 | | 179,000,000 | JPY | | | 2,029,396 | |

Government of Japan | | 0.900 | % | | 3/20/14 | | 58,000,000 | JPY | | | 672,293 | |

Government of Japan | | 1.500 | % | | 9/20/18 | | 312,400,000 | JPY | | | 3,731,533 | |

Government of Japan | | 0.390 | % | | 7/20/20 | | 30,000,000 | JPY | | | 325,906 | (a) |

Government of Japan | | 2.100 | % | | 3/20/27 | | 22,000,000 | JPY | | | 264,475 | |

Government of Japan | | 2.100 | % | | 6/20/29 | | 58,000,000 | JPY | | | 689,254 | |

Total Japan | | | | | | | | | | | 11,843,287 | |

Netherlands — 0.5% | | | | | | | | | | | | |

Netherlands Government Bond | | 4.000 | % | | 1/15/37 | | 260,000 | EUR | | | 354,304 | |

Norway — 3.9% | | | | | | | | | | | | |

Government of Norway | | 4.250 | % | | 5/19/17 | | 17,600,000 | NOK | | | 2,940,173 | |

Poland — 8.2% | | | | | | | | | | | | |

Republic of Poland | | 5.750 | % | | 9/23/22 | | 21,460,000 | PLN | | | 6,189,812 | |

United Kingdom — 6.8% | | | | | | | | | | | | |

United Kingdom Treasury Gilt, Bonds | | 4.500 | % | | 3/7/19 | | 3,100,000 | GBP | | | 5,083,535 | |

Total Sovereign Bonds (Cost — $33,410,775) | | | | | | | | | | | 33,842,662 | |

| Corporate Bonds & Notes — 33.6% | | | | | | | | | | | | |

| Consumer Staples — 0.6% | | | | | | | | | | | | |

Tobacco — 0.6% | | | | | | | | | | | | |

Imperial Tobacco Group PLC | | 7.250 | % | | 9/15/14 | | 310,000 | EUR | | | 441,309 | |

| Energy — 0.2% | | | | | | | | | | | | |

Oil, Gas & Consumable Fuels — 0.2% | | | | | | | | | | | | |

Dong Energy A/S | | 4.000 | % | | 12/16/16 | | 60,000 | EUR | | | 76,659 | |

Dong Energy A/S | | 4.875 | % | | 12/16/21 | | 50,000 | EUR | | | 64,918 | |

Total Energy | | | | | | | | | | | 141,577 | |

| Financials — 30.5% | | | | | | | | | | | | |

Capital Markets — 1.4% | | | | | | | | | | | | |

Goldman Sachs Group Inc. | | 5.125 | % | | 10/23/19 | | 150,000 | EUR | | | 179,572 | |

Goldman Sachs Group Inc., Medium-Term Notes | | 6.375 | % | | 5/2/18 | | 374,000 | EUR | | | 494,332 | |

See Notes to Financial Statements.

| | |

| 6 | | Western Asset Non-U.S. Opportunity Bond Portfolio 2010 Semi-Annual Report |

Schedule of investments (unaudited) (cont’d)

June 30, 2010

Western Asset Non-U.S. Opportunity Bond Portfolio

| | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | Face

Amount† | | | Value | |

Capital Markets — continued | | | | | | | | | | | | |

Goldman Sachs Group Inc., Subordinated Notes | | 4.750 | % | | 10/12/21 | | 127,000 | EUR | | $ | 135,484 | |

Lehman Brothers Holdings Inc. | | 4.625 | % | | 3/14/19 | | 1,300,000 | EUR | | | 159 | (b) |

UBS AG London, Senior Notes | | 6.000 | % | | 4/18/18 | | 200,000 | EUR | | | 273,592 | |

Total Capital Markets | | | | | | | | | | | 1,083,139 | |

Commercial Banks — 11.2% | | | | | | | | | | | | |

Australia & New Zealand Banking Group Ltd., Subordinated Notes | | 5.125 | % | | 9/10/19 | | 250,000 | EUR | | | 323,724 | |

Barclays Back PLC | | 5.250 | % | | 5/27/14 | | 390,000 | EUR | | | 512,193 | |

Barclays Bank PLC, Subordinated Notes | | 6.000 | % | | 1/23/18 | | 250,000 | EUR | | | 315,255 | |

BNP Paribas, Subordinated Bonds | | 5.019 | % | | 4/13/17 | | 100,000 | EUR | | | 94,771 | (a)(c) |

BPCE SA, Subordinated Notes | | 9.000 | % | | 3/17/15 | | 400,000 | EUR | | | 450,742 | (a)(c) |

Commonwealth Bank of Australia, Subordinated Notes | | 5.500 | % | | 8/6/19 | | 200,000 | EUR | | | 266,798 | |

Dexia Municipal Agency | | 1.550 | % | | 10/31/13 | | 282,000,000 | JPY | | | 3,214,905 | |

HT1 Funding GmbH, Subordinated Bonds | | 6.352 | % | | 6/30/17 | | 266,000 | EUR | | | 191,917 | (c) |

Intesa Sanpaolo SpA, Medium-Term Notes | | 5.750 | % | | 5/28/18 | | 400,000 | EUR | | | 501,906 | (a) |

Lloyds TSB Bank PLC, Subordinated Notes | | 6.500 | % | | 3/24/20 | | 819,000 | EUR | | | 942,671 | |

Royal Bank of Scotland PLC, Senior Notes | | 4.875 | % | | 1/20/17 | | 50,000 | EUR | | | 59,907 | |

Royal Bank of Scotland PLC, Senior Notes | | 6.934 | % | | 4/9/18 | | 550,000 | EUR | | | 663,688 | |

Shinsei Bank Ltd. | | 3.750 | % | | 2/23/16 | | 100,000 | EUR | | | 103,636 | (a)(d) |

Swedbank AB | | 5.570 | % | | 9/27/17 | | 100,000 | EUR | | | 124,871 | (a) |

UniCredit SpA | | 4.375 | % | | 1/29/20 | | 200,000 | EUR | | | 252,673 | |

Westpac Banking Corp., Senior Notes | | 7.250 | % | | 2/11/20 | | 400,000 | AUD | | | 339,563 | |

Total Commercial Banks | | | | | | | | | | | 8,359,220 | |

Diversified Financial Services — 16.3% | | | | | | | | | | | | |

Banca Italease SpA | | 1.016 | % | | 2/8/12 | | 50,000 | EUR | | | 59,248 | (a) |

Banca Italease SpA | | 0.968 | % | | 3/14/12 | | 50,000 | EUR | | | 59,086 | (a) |

Bank of America Corp. | | 7.000 | % | | 6/15/16 | | 400,000 | EUR | | | 549,489 | |

Bank of America Corp., Subordinated Notes | | 4.000 | % | | 3/28/18 | | 100,000 | EUR | | | 110,946 | (a) |

Caisse Refinancement de l’Habitat | | 4.200 | % | | 4/25/11 | | 485,000 | EUR | | | 607,181 | |

Citigroup Inc. | | 7.375 | % | | 6/16/14 | | 300,000 | EUR | | | 411,930 | |

Citigroup Inc., Senior Notes | | 7.375 | % | | 9/4/19 | | 230,000 | EUR | | | 314,091 | |

Eksportfinans ASA | | 1.600 | % | | 3/20/14 | | 365,000,000 | JPY | | | 4,256,375 | |

European Investment Bank | | 4.250 | % | | 12/7/10 | | 1,512,000 | GBP | | | 2,292,883 | |

European Investment Bank | | 1.900 | % | | 1/26/26 | | 186,000,000 | JPY | | | 2,146,663 | (d) |

GE Capital European Funding | | 5.375 | % | | 1/23/20 | | 150,000 | EUR | | | 196,447 | |

Investor AB | | 4.875 | % | | 11/18/21 | | 90,000 | EUR | | | 118,157 | |

Kreditanstalt fuer Wiederaufbau | | 2.600 | % | | 6/20/37 | | 42,000,000 | JPY | | | 517,837 | |

Landesbank Hessen-Thueringen Girozentrale | | 5.375 | % | | 3/7/12 | | 200,000 | GBP | | | 316,205 | |

Resona Bank Ltd. | | 4.125 | % | | 9/27/12 | | 200,000 | EUR | | | 226,227 | (a)(c)(d) |

Total Diversified Financial Services | | | | | | | | | | | 12,182,765 | |

Insurance — 1.6% | | | | | | | | | | | | |

Aviva PLC, Subordinated Notes | | 5.250 | % | | 10/2/23 | | 320,000 | EUR | | | 377,616 | (a) |

AXA | | 6.211 | % | | 10/5/17 | | 200,000 | EUR | | | 188,319 | (a)(c) |

Mapfre SA | | 5.921 | % | | 7/24/37 | | 400,000 | EUR | | | 381,623 | (a) |

Muenchener Rueckversicherungs-Gesellschaft AG (MunichRe), Subordinated Bonds | | 5.767 | % | | 6/12/17 | | 250,000 | EUR | | | 264,441 | (a)(c) |

Total Insurance | | | | | | | | | | | 1,211,999 | |

Total Financials | | | | | | | | | | | 22,837,123 | |

See Notes to Financial Statements.

| | |

| Western Asset Non-U.S. Opportunity Bond Portfolio 2010 Semi-Annual Report | | 7 |

Western Asset Non-U.S. Opportunity Bond Portfolio

| | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | Face

Amount† | | | Value |

| Telecommunication Services — 1.3% | | | | | | | | | | | |

Diversified Telecommunication Services — 1.3% | | | | | | | | | | | |

British Telecommunications PLC | | 5.250 | % | | 1/22/13 | | 75,000 | EUR | | $ | 96,488 |

British Telecommunications PLC | | 5.250 | % | | 6/23/14 | | 194,000 | EUR | | | 250,793 |

British Telecommunications PLC, Senior Notes | | 6.125 | % | | 7/11/14 | | 76,000 | EUR | | | 101,860 |

Deutsche Telekom International Finance BV | | 7.125 | % | | 7/11/11 | | 108,000 | EUR | | | 139,132 |

France Telecom SA, Senior Notes | | 5.625 | % | | 5/22/18 | | 100,000 | EUR | | | 141,309 |

Koninklijke (Royal) KPN N.V. | | 5.000 | % | | 11/13/12 | | 149,000 | EUR | | | 194,140 |

Telecom Italia SpA | | 5.250 | % | | 3/17/55 | | 100,000 | EUR | | | 95,220 |

Total Telecommunication Services | | | | | | | | | | | 1,018,942 |

| Utilities — 1.0% | | | | | | | | | | | |

Electric Utilities — 0.2% | | | | | | | | | | | |

Electricite de France (EDF) | | 4.625 | % | | 9/11/24 | | 100,000 | EUR | | | 128,455 |

Water Utilities — 0.8% | | | | | | | | | | | |

Anglian Water Services Ltd | | 6.250 | % | | 6/27/16 | | 230,000 | EUR | | | 324,898 |

Thames Water Utilities Cayman Finance Ltd. | | 6.125 | % | | 2/4/13 | | 200,000 | EUR | | | 267,393 |

Total Water Utilities | | | | | | | | | | | 592,291 |

Total Utilities | | | | | | | | | | | 720,746 |

Total Corporate Bonds & Notes (Cost — $26,134,835) | | | | | | | | | | | 25,159,697 |

| Non-U.S. Treasury Inflation Protected Securities — 3.0% | | | | | | | | | | | |

Canada — 0.4% | | | | | | | | | | | |

Government of Canada, Bonds | | 4.000 | % | | 12/1/31 | | 203,078 | CAD | | | 281,662 |

France — 1.6% | | | | | | | | | | | |

Republic of France | | 4.000 | % | | 4/25/55 | | 930,000 | EUR | | | 1,213,798 |

Japan — 1.0% | | | | | | | | | | | |

Government of Japan, Bonds | | 1.300 | % | | 9/10/17 | | 67,456,000 | JPY | | | 753,411 |

Total Non-U.S. Treasury Inflation Protected Securities (Cost — $2,126,458) | | | | | | | | | | | 2,248,871 |

Total Investments before Short-Term Investments (Cost — $61,672,068) | | | | | | | | | | | 61,251,230 |

| Short-Term Investments — 12.3% | | | | | | | | | | | |

Repurchase Agreements — 12.3% | | | | | | | | | | | |

Goldman Sachs & Co. repurchase agreement dated 6/30/10; Proceeds at maturity — $7,100,004; (Fully collateralized by U.S. government agency obligations, 6.625% due 11/15/30; Market value — $7,240,050) | | 0.020 | % | | 7/1/10 | | 7,100,000 | | | | 7,100,000 |

Morgan Stanley repurchase agreement dated 6/30/10; Proceeds at maturity — $2,098,001; (Fully collateralized by U.S. government agency obligations, 2.610% due 4/15/14; Market value — $2,150,449) | | 0.010 | % | | 7/1/10 | | 2,098,000 | | | | 2,098,000 |

Total Short-Term Investments (Cost — $9,198,000) | | | | | | | | | | | 9,198,000 |

Total Investments — 94.1% (Cost — $70,870,068#) | | | | | | | | | | | 70,449,230 |

Other Assets in Excess of Liabilities — 5.9% | | | | | | | | | | | 4,388,868 |

Total Net Assets — 100.0% | | | | | | | | | | $ | 74,838,098 |

See Notes to Financial Statements.

| | |

| 8 | | Western Asset Non-U.S. Opportunity Bond Portfolio 2010 Semi-Annual Report |

Schedule of investments (unaudited) (cont’d)

June 30, 2010

Western Asset Non-U.S. Opportunity Bond Portfolio

| † | Face amount denominated in U.S. dollars, unless otherwise noted. |

| (a) | Variable rate security. Interest rate disclosed is that which is in effect at June 30, 2010. |

| (b) | The coupon payment on these securities is currently in default as of June 30, 2010. |

| (c) | Security has no maturity date. The date shown represents the next call date. |

| (d) | Security is exempt from registration under Rule 144A of the Securities Act of 1933. This security may be resold in transactions that are exempt from registration, normally to qualified institutional buyers. This security has been deemed liquid pursuant to guidelines approved by the Board of Directors, unless otherwise noted. |

| # | Aggregate cost for federal income tax purposes is substantially the same. |

| | |

Abbreviations used in this schedule: |

| AUD | | — Australian Dollar |

| BRL | | — Brazilian Real |

| CAD | | — Canadian Dollar |

| EUR | | — Euro |

| GBP | | — British Pound |

| JPY | | — Japanese Yen |

| NOK | | — Norwegian Krone |

| PLN | | — Polish Zloty |

See Notes to Financial Statements.

| | |

| Western Asset Non-U.S. Opportunity Bond Portfolio 2010 Semi-Annual Report | | 9 |

Statement of assets and liabilities (unaudited)

June 30, 2010

| | | |

| |

| Assets: | | | |

Investments, at value (Cost — $61,672,068) | | $ | 61,251,230 |

Repurchase agreement, at value (Cost — $9,198,000) | | | 9,198,000 |

Foreign currency, at value (Cost — $187,550) | | | 197,725 |

Cash | | | 986 |

Unrealized appreciation on forward currency contracts | | | 4,457,638 |

Receivable for Fund shares sold | | | 2,691,419 |

Interest receivable | | | 1,035,888 |

Foreign currency collateral for open futures contracts, at value (Cost — $429,397) | | | 414,732 |

Unrealized appreciation on swaps | | | 86,583 |

Receivable from broker — variation margin on open futures contracts | | | 65,476 |

Deposits with brokers for open futures contracts | | | 35,541 |

Prepaid expenses | | | 20,373 |

Total Assets | | | 79,455,591 |

| |

| Liabilities: | | | |

Unrealized depreciation on forward currency contracts | | | 4,392,429 |

Payable for Fund shares repurchased | | | 77,453 |

Premiums received for open swaps | | | 39,568 |

Investment management fee payable | | | 23,168 |

Directors’ fees payable | | | 1,179 |

Payable for open swap contracts | | | 1,002 |

Accrued expenses | | | 82,694 |

Total Liabilities | | | 4,617,493 |

| Total Net Assets | | $ | 74,838,098 |

| |

| Net Assets: | | | |

Par value (Note 5) | | $ | 7,774 |

Paid-in capital in excess of par value | | | 71,388,479 |

Accumulated net investment loss | | | (1,960,467) |

Accumulated net realized gain on investments, futures contracts, written options, swap contracts

and foreign currency transactions | | | 5,681,186 |

Net unrealized depreciation on investments, futures contracts, swap contracts and foreign currencies | | | (278,874) |

| Total Net Assets | | $ | 74,838,098 |

| |

| Shares Outstanding | | | 7,774,011 |

| |

| Net Asset Value | | | $9.63 |

See Notes to Financial Statements.

| | |

| 10 | | Western Asset Non-U.S. Opportunity Bond Portfolio 2010 Semi-Annual Report |

Statement of operations (unaudited)

For the Six Months Ended June 30, 2010

| | | |

| |

| Investment Income: | | | |

Interest | | $ | 1,177,973 |

| |

| Expenses: | | | |

Investment management fee (Note 2) | | | 159,279 |

Custody fees | | | 29,356 |

Transfer agent fees | | | 25,987 |

Shareholder reports | | | 20,322 |

Audit and tax | | | 18,139 |

Legal fees | | | 16,657 |

Registration fees | | | 6,805 |

Directors’ fees | | | 1,933 |

Miscellaneous expenses | | | 3,866 |

Total Expenses | | | 282,344 |

Less: Fee waivers and/or expense reimbursements (Note 2) | | | (14,086) |

Net Expenses | | | 268,258 |

| Net Investment Income | | | 909,715 |

| |

Realized and Unrealized Gain (Loss) on Investments, Futures Contracts, Written Options, Swap Contracts

and Foreign Currency Transactions (Notes 1, 3 and 4): | | | |

Net Realized Gain (Loss) From: | | | |

Investment transactions | | | (1,771,355) |

Futures contracts | | | 125,600 |

Written options | | | 124,429 |

Swap contracts | | | (61,986) |

Foreign currency transactions | | | 6,954,802 |

Net Realized Gain | | | 5,371,490 |

Change in Net Unrealized Appreciation/Depreciation From: | | | |

Investments | | | (476,376) |

Futures contracts | | | 83,086 |

Written options | | | 97,525 |

Swap contracts | | | 98,469 |

Foreign currencies | | | (2,312,939) |

Change in Net Unrealized Appreciation/Depreciation | | | (2,510,235) |

| Net Gain on Investments, Futures Contracts, Written Options, Swap Contracts and Foreign Currency Transactions | | | 2,861,255 |

| Increase in Net Assets from Operations | | $ | 3,770,970 |

See Notes to Financial Statements.

| | |

| Western Asset Non-U.S. Opportunity Bond Portfolio 2010 Semi-Annual Report | | 11 |

Statements of changes in net assets

| | | | | | |

For the Six Months Ended June 30, 2010 (unaudited) and the Year Ended December 31, 2009 | | 2010 | | 2009 |

| | |

| Operations: | | | | | | |

Net investment income | | $ | 909,715 | | $ | 2,366,873 |

Net realized gain (loss) | | | 5,371,490 | | | (1,573,113) |

Change in net unrealized appreciation/depreciation | | | (2,510,235) | | | 3,001,667 |

Increase in Net Assets From Operations | | | 3,770,970 | | | 3,795,427 |

| | |

| Distributions to Shareholders From (Note 1): | | | | | | |

Net realized gains | | | (59,129) | | | (641,931) |

Decrease in Net Assets from Distributions to Shareholders | | | (59,129) | | | (641,931) |

| | |

| Fund Share Transactions (Note 5): | | | | | | |

Net proceeds from sale of shares | | | 17,959,619 | | | 25,242,828 |

Reinvestment of distributions | | | 40,500 | | | 478,260 |

Cost of shares repurchased | | | (27,178,462) | | | (52,932,163) |

Decrease in Net Assets From Fund Share Transactions | | | (9,178,343) | | | (27,211,075) |

Decrease in Net Assets | | | (5,466,502) | | | (24,057,579) |

| | |

| Net Assets: | | | | | | |

Beginning of period | | | 80,304,600 | | | 104,362,179 |

End of period* | | $ | 74,838,098 | | $ | 80,304,600 |

* Includes accumulated net investment loss of: | | | $(1,960,467) | | | $(2,870,182) |

See Notes to Financial Statements.

| | |

| 12 | | Western Asset Non-U.S. Opportunity Bond Portfolio 2010 Semi-Annual Report |

Financial highlights

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For a share of each class of capital stock outstanding throughout each year ended December 31, unless otherwise noted: | |

Class I1 | | 20102 | | | 2009 | | | 20083 | | | 20084 | | | 20074 | | | 20064 | | | 20054 | |

| | | | | | | |

| Net asset value, beginning of period | | | $9.14 | | | | $8.77 | | | | $9.93 | | | | $9.75 | | | | $9.59 | | | | $10.98 | | | | $10.52 | |

| | | | | | | |

| Income (loss) from operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.12 | 5 | | | 0.23 | 5 | | | 0.24 | 5 | | | 0.37 | 5 | | | 0.36 | 5 | | | 0.64 | | | | 0.19 | |

Net realized and unrealized gain (loss) | | | 0.38 | | | | 0.20 | | | | 0.21 | | | | (0.16) | | | | 0.00 | 6 | | | (0.07) | | | | 0.57 | |

Total income from operations | | | 0.50 | | | | 0.43 | | | | 0.45 | | | | 0.21 | | | | 0.36 | | | | 0.57 | | | | 0.76 | |

| | | | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | — | | | | — | | | | (1.61) | | | | — | | | | (0.20) | | | | (1.16) | | | | (0.29) | |

Net realized gains | | | (0.01) | | | | (0.06) | | | | — | | | | (0.03) | | | | — | | | | (0.80) | | | | (0.01) | |

Total distributions | | | (0.01) | | | | (0.06) | | | | (1.61) | | | | (0.03) | | | | (0.20) | | | | (1.96) | | | | (0.30) | |

| | | | | | | |

| Net asset value, end of period | | | $9.63 | | | | $9.14 | | | | $8.77 | | | | $9.93 | | | | $9.75 | | | | $9.59 | | | | $10.98 | |

Total return7 | | | 5.45 | % | | | 4.95 | % | | | 4.49 | % | | | 2.11 | % | | | 3.89 | % | | | 5.33 | % | | | 7.60 | % |

| | | | | | | |

| Net assets, end of period (000s) | | $ | 74,838 | | | $ | 80,305 | | | $ | 104,362 | | | $ | 205,654 | | | $ | 177,308 | | | $ | 90,421 | | | $ | 89,170 | |

| | | | | | | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 0.80 | %8 | | | 0.70 | % | | | 0.62 | %8 | | | 0.59 | % | | | 0.64 | % | | | 0.74 | % | | | 0.68 | % |

Net expenses9 | | | 0.76 | 8 | | | 0.66 | | | | 0.58 | 8,10 | | | 0.55 | 10 | | | 0.55 | 10 | | | 0.55 | 10 | | | 0.55 | 10 |

Net investment income | | | 2.57 | 8 | | | 2.7 | | | | 3.2 | 8 | | | 3.7 | | | | 3.7 | | | | 3.3 | | | | 3.2 | |

| | | | | | | |

| Portfolio turnover rate | | | 47 | % | | | 87 | % | | | 52 | % | | | 68 | % | | | 118 | % | | | 140 | % | | | 41 | % |

| 1 | In April 2010, Institutional Class shares were renamed Class I shares. |

| 2 | For the six months ended June 30, 2010 (unaudited). |

| 3 | For the period April 1, 2008 through December 31, 2008. |

| 4 | For the year ended March 31. |

| 5 | Per share amounts have been calculated using the average shares method. |

| 6 | Amount represents less than $0.005 per share. |

| 7 | Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. Total returns for periods of less than one year are not annualized. |

| 9 | Reflects fee waivers and/or expense reimbursements. |

| 10 | The impact of compensating balance arrangements to the expense ratio was less than 0.01%. |

See Notes to Financial Statements.

| | |

| Western Asset Non-U.S. Opportunity Bond Portfolio 2010 Semi-Annual Report | | 13 |

Notes to financial statements (unaudited)

1. Organization and significant accounting policies

Western Asset Non-U.S. Opportunity Bond Portfolio (the “Fund”) is a separate non-diversified investment series of Western Asset Funds, Inc. (the “Corporation”). The Corporation, a Maryland corporation, is registered under the Investment Company Act of 1940, as amended (“1940 Act”), as an open-end management investment company.

The Fund offers three classes of shares: Class IS, Class I and Class FI. Prior to April 2010, Class IS, Class I and Class FI shares were known as Institutional Select Class, Institutional Class and Financial Intermediary Class shares, respectively. Shares in the Class FI bear a distribution fee. Class IS shares and Class FI shares have not commenced operations. The income and expenses of the Fund are allocated proportionately to each class of shares based on daily net assets, except for Rule 12b-1 distribution fees, which are charged only on the Class FI shares, and transfer agent and shareholder servicing expenses, and certain other expenses, which are determined separately for each class.

The following are significant accounting policies consistently followed by the Fund and are in conformity with U.S. generally accepted accounting principles (“GAAP”). Estimates and assumptions are required to be made regarding assets, liabilities and changes in net assets resulting from operations when financial statements are prepared. Changes in the economic environment, financial markets and any other parameters used in determining these estimates could cause actual results to differ. Subsequent events have been evaluated through the date the financial statements were issued.

(a) Investment valuation. Debt securities are valued at the last quoted bid price provided by an independent pricing service that are based on transactions in debt obligations, quotations from bond dealers, market transactions in comparable securities and various other relationships between securities. Publicly traded foreign government debt securities are typically traded internationally in the over-the-counter market and are valued at the bid price as of the close of business of that market. Futures contracts are valued daily at the settlement price established by the board of trade or exchange on which they are traded. Equity securities for which market quotations are available are valued at the last reported sales price or official closing price on the primary market or exchange on which they trade. When prices are not readily available, or are determined not to reflect fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded, but before the Fund calculates its net asset value, the Fund may value these securities at fair value as determined in accordance with procedures approved by the Fund’s Board of Directors. Short-term obligations with maturities of 60 days or less are valued at the amortized cost, which approximates fair value.

The Fund has adopted Financial Accounting Standards Board Codification Topic 820 (“ASC Topic 820”). ASC Topic 820 establishes a single definition of fair value, creates a three-tier hierarchy as a framework for measuring fair value based on inputs used to value the Fund’s investments, and requires additional disclosure about fair value. The hierarchy of inputs is summarized below.

| Ÿ | | Level 1 — quoted prices in active markets for identical investments |

| Ÿ | | Level 2 — other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| Ÿ | | Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The Fund uses valuation techniques to measure fair value that are consistent with the market approach and/or income approach, depending on the type of the security and the particular circumstance. The market approach uses prices and other relevant information generated by market transactions involving identical or comparable securities. The income approach uses valuation techniques to convert future amounts of cash flow to a single present amount.

| | |

| 14 | | Western Asset Non-U.S. Opportunity Bond Portfolio 2010 Semi-Annual Report |

Notes to financial statements (unaudited) (cont’d)

The following is a summary of the inputs used in valuing the Fund’s assets carried at fair value:

| | | | | | | | | | | |

| Description | | Quoted Prices

(Level 1) | | Other Significant

Observable Inputs

(Level 2) | | Significant

Unobservable

Inputs

(Level 3) | | Total |

| Long-term investments†: | | | | | | | | | | | |

Sovereign bonds | | | — | | $ | 33,842,662 | | — | | $ | 33,842,662 |

Corporate bonds & notes | | | — | | | 25,159,697 | | — | | | 25,159,697 |

Non-U.S. treasury inflation protected securities | | | — | | | 2,248,871 | | — | | | 2,248,871 |

| Total long-term investments | | | — | | $ | 61,251,230 | | — | | $ | 61,251,230 |

| Short-term investments† | | | — | | | 9,198,000 | | — | | | 9,198,000 |

| Total investments | | | — | | $ | 70,449,230 | | — | | $ | 70,449,230 |

| Other financial instruments: | | | | | | | | | | | |

Futures contracts | | $ | 65,792 | | | — | | — | | $ | 65,792 |

Options on futures | | | 1,249 | | | — | | — | | | 1,249 |

Forward foreign currency contracts | | | — | | $ | 65,209 | | — | | | 65,209 |

Credit default swaps on credit indices — buy protection‡ | | | — | | | 47,015 | | — | | | 47,015 |

| Total other financial instruments | | $ | 67,041 | | $ | 112,224 | | — | | $ | 179,265 |

| Total | | $ | 67,041 | | $ | 70,561,454 | | — | | $ | 70,628,495 |

| † | See Schedule of Investments for additional detailed categorizations. |

| ‡ | Values include any premiums paid or received with respect to swap contracts. |

Following is a reconciliation of investments in which significant unobservable inputs (Level 3) were used in determining fair value:

| | | |

| Investments in Securities | | Corporate

Bonds & Notes |

| Balance as of December 31, 2009 | | $ | 2,702 |

| Accrued premiums/discounts | | | 437 |

| Realized gain/(loss)1 | | | — |

| Change in unrealized appreciation (depreciation)2 | | | (2,980) |

| Net purchases (sales) | | | — |

| Transfers in to Level 3 | | | — |

| Transfers out of Level 3 | | | (159) |

| Balance as of June 30, 2010 | | | — |

Net change in unrealized appreciation (depreciation) for investments in securities still held at June 30, 20102 | | | — |

| 1 | This amount is included in net realized gain (loss) from investment transactions in the accompanying Statement of Operations. |

| 2 | This amount is included in the change in net unrealized appreciation (depreciation) in the accompanying Statement of Operations. Change in unrealized appreciation (depreciation) includes net unrealized appreciation (depreciation) resulting from changes in investment values during the reporting period and the reversal of previously recorded unrealized appreciation (depreciation) when gains or losses are realized. |

(b) Repurchase agreements. The Fund may enter into repurchase agreements with institutions that its investment adviser has determined are creditworthy. Each repurchase agreement is recorded at cost. Under the terms of a typical repurchase agreement, a fund takes possession of an underlying debt obligation subject to an obligation of the seller to repurchase, and of the fund to resell, the obligation at an agreed-upon price and time, thereby determining the yield during a fund’s holding period. When entering into repurchase agreements, it is the Fund’s policy that its custodian or a third party custodian, acting on the Fund’s behalf, take possession of the underlying collateral securities, the market value of which, at all times, at least equals the principal amount of the repurchase transaction, including accrued interest. To the extent that any repurchase transaction maturity exceeds one business day, the value of the collateral is marked to market and measured against the value of the agreement in an effort to ensure the adequacy of the collateral. If the counterparty defaults, the Fund generally has the right to use the collateral to satisfy the terms of the repurchase transaction. However, if the market value of the collateral declines during the period in which the Fund seeks to assert its rights or if bankruptcy proceedings are commenced with respect to the seller of the security, realization of the collateral by the Fund may be delayed or limited.

(c) Inflation-indexed bonds. Inflation-indexed bonds are fixed-income securities whose principal value or interest rate is periodically adjusted according to the rate of inflation. As the index measuring inflation

| | |

| Western Asset Non-U.S. Opportunity Bond Portfolio 2010 Semi-Annual Report | | 15 |

changes, the principal value or interest rate of inflation-indexed bonds will be adjusted accordingly. Inflation adjustments to the principal amount of inflation-indexed bonds are reflected as an increase or decrease to investment income on the Statement of Operations. Repayment of the original bond principal upon maturity (as adjusted for inflation) is guaranteed in the case of U.S. Treasury inflation-indexed bonds. For bonds that do not provide a similar guarantee, the adjusted principal value of the bond repaid at maturity may be less than the original principal.

(d) Forward foreign currency contracts. The Fund may enter into a forward foreign currency contract to hedge against foreign currency exchange rate risk on its non-U.S. dollar denominated securities or to facilitate settlement of a foreign currency denominated portfolio transaction. A forward foreign currency contract is an agreement between two parties to buy and sell a currency at a set price with delivery and settlement at a future date. The contract is marked-to-market daily and the change in value is recorded by the Fund as an unrealized gain or loss. When a forward foreign currency contract is closed, through either delivery or offset by entering into another forward foreign currency contract, the Fund recognizes a realized gain or loss equal to the difference between the value of the contract at the time it was opened and the value of the contract at the time it is closed.

Forward foreign currency contracts involve elements of market risk in excess of the amounts reflected on the Statement of Assets and Liabilities. The Fund bears the risk of an unfavorable change in the foreign exchange rate underlying the forward foreign currency contract. Risks may also arise upon entering into these contracts from the potential inability of the counterparties to meet the terms of their contracts.

(e) Written options. When the Fund writes an option, an amount equal to the premium received by the Fund is recorded as a liability, the value of which is marked to market daily to reflect the current market value of the option written. If the option expires, the premium received is recorded as a realized gain. When a written call option is exercised, the difference between the premium received plus the option exercise price and the Fund’s basis in the underlying security (in the case of a covered written call option), or the cost to purchase the underlying security (in the case of an uncovered written call option), including brokerage commission, is recognized as a realized gain or loss. When a written put option is exercised, the amount of the premium received is subtracted from the cost of the security purchased by the Fund from the exercise of the written put option to form the Fund’s basis in the underlying security purchased. The writer or buyer of an option traded on an exchange can liquidate the position before the exercise of the option by entering into a closing transaction. The cost of a closing transaction is deducted from the original premium received resulting in a realized gain or loss to the Fund.

The risk in writing a covered call option is that the Fund may forego the opportunity of profit if the market price of the underlying security increases and the option is exercised. The risk in writing a put option is that the Fund may incur a loss if the market price of the underlying security decreases and the option is exercised. The risk in writing a call option is that the Fund is exposed to the risk of loss if the market price of the underlying security increases. In addition, there is the risk that the Fund may not be able to enter into a closing transaction because of an illiquid secondary market.

(f) Futures contracts. The Fund may use futures contracts to gain exposure to, or hedge against, changes in the value of interest rates or foreign currencies. A futures contract represents a commitment for the future purchase or sale of an asset at a specified price on a specified date.

Upon entering into a futures contract, the Fund is required to deposit cash or cash equivalents with a broker in an amount equal to a certain percentage of the contract amount. This is known as the “initial margin” and subsequent payments (“variation margin”) are made or received by the Fund each day, depending on the daily fluctuation in the value of the contract. For certain futures, including foreign denominated futures, variation margin is not settled daily, but is recorded as a net variation margin payable or receivable. Futures contracts are valued daily at the settlement price established by the board of trade or exchange on which they are traded. The daily changes in contract value are recorded as unrealized gains or losses in the Statement of Operations and the Fund recognizes a realized gain or loss when the contract is closed.

Futures contracts involve, to varying degrees, risk of loss in excess of the amounts reflected in the financial statements. In addition, there is the risk that the Fund may not be able to enter into a closing transaction because of an illiquid secondary market.

| | |

| 16 | | Western Asset Non-U.S. Opportunity Bond Portfolio 2010 Semi-Annual Report |

Notes to financial statements (unaudited) (cont’d)

(g) Swap agreements. The Fund may invest in swaps for the purpose of managing its exposure to interest rate, credit or market risk, or for other purposes. The use of swaps involves risks that are different from those associated with ordinary portfolio transactions.

Swap contracts are marked to market daily and changes in value are recorded as unrealized appreciation/(depreciation). Gains or losses are realized upon termination of the swap agreement. Periodic payments and premiums received or made by the Fund are recognized in the Statement of Operations as realized gains or losses, respectively. Collateral, in the form of restricted cash or securities, may be required to be held in segregated accounts with the Fund’s custodian in compliance with the terms of the swap contracts. Securities held as collateral for swap contracts are identified in the Schedule of Investments and restricted cash, if any, is identified on the Statement of Assets and Liabilities. Risks may exceed amounts recorded in the Statement of Assets and Liabilities. These risks include changes in the returns of the underlying instruments, failure of the counterparties to perform under the contracts’ terms, and the possible lack of liquidity with respect to the swap agreements.

Payments received or made at the beginning of the measurement period are reflected as a premium or deposit, respectively, on the Statement of Assets and Liabilities. These upfront payments are amortized over the life of the swap and are recognized as realized gain or loss in the Statement of Operations. A liquidation payment received or made at the termination of the swap is recognized as realized gain or loss in the Statement of Operations. Net periodic payments received or paid by the Fund are recognized as realized gain or loss at the time of receipt or payment in the Statement of Operations.

As disclosed in the Fund’s summary of open swap contracts, the aggregate fair value of credit default swaps in a net liability position as of June 30, 2010 was $0. The Fund did not hold or post collateral for its swap transactions. If a defined credit event had occurred as of June 30, 2010, the swaps’ credit-risk-related contingent features would have been triggered and the Fund would have been required to pay up to $0 less the value of the contracts’ related reference obligations.

Credit default swaps

The Fund may enter into credit default swap (“CDS”) contracts for investment purposes, to manage its credit risk or to add leverage. CDS agreements involve one party making a stream of payments to another party in exchange for the right to receive a specified return in the event of a default by a third party, typically corporate or sovereign issuers, on a specified obligation, or in the event of a write-down, principal shortfall, interest shortfall or default of all or part of the referenced entities comprising a credit index. The Fund may use a CDS to provide protection against defaults of the issuers (i.e., to reduce risk where the Fund has exposure to a sovereign issuer) or to take an active long or short position with respect to the likelihood of a particular issuer’s default. As a seller of protection, the Fund generally receives an upfront payment or a stream of payments throughout the term of the swap provided that there is no credit event. If the Fund is a seller of protection and a credit event occurs, as defined under the terms of that particular swap agreement, the maximum potential amount of future payments (undiscounted) that the Fund could be required to make under a credit default swap agreement would be an amount equal to the notional amount of the agreement. These amounts of potential payments will be partially offset by any recovery of values from the respective referenced obligations. As a seller of protection, the Fund effectively adds leverage to its portfolio because, in addition to its total net assets, the Fund is subject to investment exposure on the notional amount of the swap. As a buyer of protection, the Fund generally receives an amount up to the notional value of the swap if a credit event occurs.

Implied spreads are the theoretical prices a lender receives for credit default protection. When spreads rise, market perceived credit risk rises and when spreads fall, market perceived credit risk falls. The implied credit spread of a particular referenced entity reflects the cost of buying/selling protection and may include upfront payments required to enter into the agreement. Wider credit spreads and decreasing market values, when compared to the notional amount of the swap, represent a deterioration of the referenced entity’s credit soundness and a greater likelihood or risk of default or other credit event occurring as defined under the terms of the agreement. Credit spreads utilized in determining the period end market value of credit default swap agreements on corporate or sovereign issues are disclosed in the Notes to Financial Statements and serve as an indicator of the current status of the payment/performance risk and represent the likelihood or risk of default for credit derivatives. For credit default swap agreements on asset-backed securities and credit indices, the quoted market prices and resulting values, particularly in relation to the notional

| | |

| Western Asset Non-U.S. Opportunity Bond Portfolio 2010 Semi-Annual Report | | 17 |

amount of the contract as well as the annual payment rate, serve as an indication of the current status of the payment/performance risk.

The Fund’s maximum risk of loss from counterparty risk, as the protection buyer, is the fair value of the contract (this risk is mitigated by the posting of collateral by the counterparty to the Fund to cover the Fund’s exposure to the counterparty). As the protection seller, the Fund’s maximum risk is the notional amount of the contract. Credit default swaps are considered to have credit risk-related contingent features since they require payment by the protection seller to the protection buyer upon the occurrence of a defined credit event.

Entering into a CDS agreement involves, to varying degrees, elements of credit, market and documentation risk in excess of the related amounts recognized on the Statement of Assets and Liabilities. Such risks involve the possibility that there will be no liquid market for these agreements, that the counterparty to the agreement may default on its obligation to perform or disagree as to the meaning of the contractual terms in the agreement, and that there will be unfavorable changes in net interest rates.

(h) Foreign currency translation. Investment securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts based upon prevailing exchange rates on the date of valuation. Purchases and sales of investment securities and income and expense items denominated in foreign currencies are translated into U.S. dollar amounts based upon prevailing exchange rates on the respective dates of such transactions.

The Fund does not isolate that portion of the results of operations resulting from fluctuations in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Net realized foreign exchange gains or losses arise from sales of foreign currencies, including gains and losses on forward foreign currency contracts, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the values of assets and liabilities, other than investments in securities, on the date of valuation, resulting from changes in exchange rates.

Foreign security and currency transactions may involve certain considerations and risks not typically associated with those of U.S. dollar denominated transactions as a result of, among other factors, the possibility of lower levels of governmental supervision and regulation of foreign securities markets and the possibility of political or economic instability.

(i) Credit and market risk. Investments in securities that are collateralized by residential real estate mortgages are subject to certain credit and liquidity risks. When market conditions result in an increase in default rates of the underlying mortgages and foreclosure values of underlying real estate properties are materially below the outstanding amount of these underlying mortgages, collection of the full amount of accrued interest and principal on these investments may be doubtful. Such market conditions may significantly impair the value and liquidity of these investments and may result in a lack of correlation between their credit ratings and values.

(j) Security transactions and investment income. Security transactions are accounted for on a trade date basis. Interest income, adjusted for amortization of premium and accretion of discount, is recorded on the accrual basis. Dividend income is recorded on the ex-dividend date. The cost of investments sold is determined by use of the specific identification method. To the extent any issuer defaults or a credit event occurs that impacts the issuer, a Fund may halt any additional interest income accruals and consider the realizability of interest accrued up to the date of default or credit event.

(k) Distributions to shareholders. Distributions from net investment and distributions of net realized gains, if any are declared at least annually. Distributions to shareholders of the Fund are recorded on the ex-dividend date and are determined in accordance with income tax regulations, which may differ from GAAP.

| | |

| 18 | | Western Asset Non-U.S. Opportunity Bond Portfolio 2010 Semi-Annual Report |

Notes to financial statements (unaudited) (cont’d)

(l) Share class accounting. Investment income, common expenses and realized/unrealized gains (losses) on investments are allocated to the various classes of the Fund on the basis of daily net assets of each class. Fees relating to a specific class are charged directly to that share class.

(m) Compensating balance arrangements. The Fund has an arrangement with its custodian bank whereby a portion of the custodian’s fees is paid indirectly by credits earned on the Fund’s cash on deposit with the bank.

(n) Federal and other taxes. It is the Fund’s policy to comply with the federal income and excise tax requirements of the Internal Revenue Code of 1986 (the “Code”), as amended, applicable to regulated investment companies. Accordingly, the Fund intend to distribute its taxable income and net realized gains, if any, to shareholders in accordance with timing requirements imposed by the Code. Therefore, no federal income tax provision is required in the Fund’s financial statements.

Management has analyzed the Fund’s tax positions taken on federal income tax returns for all open tax years and has concluded that as of June 30, 2010, no provision for income tax is required in the Fund’s financial statements. The Fund’s federal and state income and federal excise tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by Internal Revenue Service and state departments of revenue.

Under the applicable foreign tax laws, a withholding tax may be imposed on interest, dividends and capital gains at various rates.

(o) Reclassification. GAAP requires that certain components of net assets be reclassified to reflect permanent differences between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share.

2. Investment management agreement and other transactions with affiliates

The Fund has an investment management agreement with Legg Mason Partners Fund Advisor, LLC (“LMPFA”). Western Asset Management Company Limited (“WAML”) is the investment adviser. Western Asset Management Company Pte Ltd. (“Western Singapore”) and Western Asset Management Company Ltd (“Western Japan”) share advisory responsibilities with WAML. LMPFA, WAML, Western Singapore and Western Japan are wholly-owned subsidiaries of Legg Mason, Inc. (“Legg Mason”).

LMPFA provides the Fund with management and administrative services for which the Fund pays a fee, computed daily and payable monthly, at an annual rate of the Fund’s average daily net assets. The manager has agreed to forgo fees and/or reimburse operating expenses (other than interest, taxes, extraordinary expenses and brokerage commissions) so that total operating expenses are not expected to exceed the Fee Cap for Class IS and Class FI. With respect to Class I shares, the manager has contractually agreed to forgo fees and/or reimburse operating expenses at an amount equal to a specified rate of the Fund’s average daily net assets attributable to such share class (“Flat Waiver”). WAML also agreed to waive their advisory fees (which is paid by LMPFA, and not the Fund) in corresponding amounts under both the Fee Cap and the Flat Waiver. This arrangement cannot be terminated prior to April 30, 2011 without the Board’s consent.

With respect to Class IS and Class FI, the manager is permitted to recapture amounts forgone or reimbursed to a class within three years after the day on which the manager earned the fee or incurred the expense if the class’s total annual operating expenses have fallen to a level below the lower of the limit described below or the limit then in effect. The following chart shows the annual rates of management fees, fee caps or flat waivers (as applicable), management fees waived and potential fees which may be recaptured for the Fund’s share classes.

| | | | | | | | | | | | | | |

| | | Asset

Breakpoint for

Management

Fee | | Management

Fee | | | Fee

Cap | | Flat Waiver | | | Management

Fees

(Waived)/

Recaptured | | Maximum

Amount

Subject to

Recapture |

| Class I† | | All asset levels | | 0.450 | % | | — | | 0.04 | % | | (14,086) | | — |

| † | In April 2010, Institutional Class shares were renamed Class I shares. |

| | |

| Western Asset Non-U.S. Opportunity Bond Portfolio 2010 Semi-Annual Report | | 19 |

Legg Mason Investor Services, LLC (“LMIS”), a wholly-owned broker-dealer subsidiary of Legg Mason serves as distributor of the Fund’s shares.

3. Investments

During the six months ended June 30, 2010, the aggregate cost of purchases and proceeds from sales of investments (excluding short-term investments) were as follows:

| | | |

| Purchases | | $ | 30,367,320 |

| Sales | | | 36,803,292 |

At June 30, 2010, the aggregate gross unrealized appreciation and depreciation of investments for federal income tax purposes were substantially as follows:

| | | |

| Gross unrealized appreciation | | $ | 5,167,356 |

| Gross unrealized depreciation | | | (5,588,194) |

| Net unrealized depreciation | | $ | (420,838) |

At June 30, 2010, the Fund had the following open futures contracts:

| | | | | | | | | | | | | |

| | | Number of

Contracts | | Expiration

Date | | Basis

Value | | Market

Value | | Unrealized

Gain (Loss) |

| Contracts to Buy: | | | | | | | | | | | | | |

| German Euro Bobl | | 22 | | 9/10 | | $ | 3,227,793 | | $ | 3,252,805 | | $ | 25,012 |

| German Euro Bund | | 33 | | 9/10 | | | 5,182,198 | | | 5,221,409 | | | 39,211 |