UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

Investment Company Act file number: | | 811-06110 |

Western Asset Funds, Inc.

| | |

| 385 East Colorado Boulevard, Pasadena, CA 91101 |

| Address of Principal Executive Offices: |

Robert I. Frenkel, Esq.

Legg Mason & Co., LLC

100 Light Street

Baltimore, MD 21202

|

| Name and address of agent for service: |

Registrant’s telephone number, including area code: 1-888-425-6432

Date of fiscal year end: December 31,

Date of reporting period: June 30, 2009

| Item 1. | Report to Shareholders |

Investment Commentary

and Semi-Annual Report to

Shareholders

June 30, 2009

Western Asset Funds, Inc.

Western Asset Core Bond Portfolio

Western Asset Core Plus Bond Portfolio

Contents

For more information, visit us on the web

at www.westernassetfunds.com.

Investment Commentary

Western Asset Funds, Inc.

For the Six Months Ended June 30, 2009

Financial Market Overview

To a great extent, the financial markets in 2008 were characterized by periods of extreme volatility, illiquidity, frozen credit conditions and heightened risk aversion. Collectively, this caused investors to flock to the safety of short-term Treasuries, driving their yields lower and their prices higher. In contrast, non-Treasuries generally performed poorly, with their spreads moving, in some cases, to historically wide levels.

The market then largely stabilized during the six-month reporting period ended June 30, 2009. A return to more normal market conditions was due, in part, to the aggressive actions taken by the Federal Reserve Board (“Fed”)A, the U.S. Department of the Treasury and other government agencies. Looking back, in 2008 the Fed took several actions to improve liquidity in the credit markets. In March 2008, it established a new lending program allowing certain brokerage firms, known as primary dealers, to also borrow from its discount window. In mid-September 2008, it announced an $85 billion rescue plan for ailing AIG and pumped $70 billion into the financial system as the Lehman Brothers bankruptcy and mounting troubles at other financial firms roiled the markets. Toward the end of the year, the Fed took additional measures to thaw the frozen credit markets, including the purchase of debt issued by Fannie Mae and Freddie Mac, as well as introducing the Term Asset-Backed Securities Loan Facility (“TALF”).

In March 2009, the Fed continued to pursue aggressive measures as it announced its intentions to:

| | • | | Purchase up to an additional $750 billion of agency mortgage-backed securities, bringing its total purchases of these securities to up to $1.25 trillion in 2009. |

| | • | | Increase its purchases of agency debt this year by up to $100 billion to a total of up to $200 billion. |

| | • | | Buy up to $300 billion of longer-term Treasury securities over the next six months. |

After reducing the federal funds rateB from 5.25% in August 2007 to a range of 0 to 1/4 percent in December 2008—a historic low—the Fed has maintained this stance thus far in 2009. In conjunction with its June meeting, the Fed stated that it “will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions are likely to warrant exceptionally low levels of the federal funds rate for an extended period.”

The U.S. Department of the Treasury has also taken an active role in attempting to stabilize the financial system, as it orchestrated the government’s takeover of mortgage giants Fannie Mae and Freddie Mac in September 2008. In October, the Treasury’s $700 billion Troubled Asset Relief Program (“TARP”) was approved by Congress and signed into law by former President Bush. Then, in March 2009, Treasury Secretary Geithner introduced the Public-Private Partnership Investment Program (“PPIP”), which is intended to facilitate the purchase of troubled mortgage assets from bank balance sheets. The Treasury also announced its intentions to conduct “stress tests” for major banks to determine if they needed to bolster their capital levels. The results of the stress tests were released in May, and were not as dire as initially feared.

Economic Review

Even though conditions in the financial markets improved during the first half of 2009, the U.S. economy continued to face numerous headwinds. Looking back, the U.S. Department of Commerce reported that third and fourth quarter 2008 U.S. gross domestic product (“GDP”)C contracted 2.7% and 5.4%, respectively. Economic contraction has continued in 2009 as GDP fell 6.4% during the first quarter and the advance estimate for the second quarter is a 1.0% decline. The economy’s more modest contraction in the second quarter was due, in part, to smaller declines in exports and business spending.

While economic news was largely bleak during the first quarter of 2009, there were some indications that things were becoming “less negative” during the second quarter. While the unemployment rate continued to move higher, the number of jobs lost on a monthly basis subsided from the pace earlier in the year. Another strain on the economy, the long-ailing housing market, may also be getting closer to reaching a bottom. After plunging late last year, new single-family home starts have been fairly stable in recent months. In addition, while home prices continued to fall, the pace of the decline has moderated. Other recent economic news also seemed to be “less negative.” Inflation remained low, manufacturing contracted at a slower pace than during the first quarter of the year and inventory levels were drawn down.

The Investment Commentary is not a part of the Semi-Annual Report to Shareholders.

ii

Investment Commentary

Market Review

Both short- and long-term Treasury yields fluctuated during the reporting period. This was often prompted by changing perceptions regarding the economy, future Fed policy decisions and the government’s initiatives to stabilize the financial system. When the reporting period began, Treasury yields were extremely low, given numerous “flights to quality” in 2008 that were triggered by the financial crisis. After starting the period at 0.76% and 2.25%, respectively, two- and ten-year Treasury yields drifted even lower (and their prices higher) in mid-January 2009. Yields generally moved higher (and their prices lower) until early June. Two- and ten-year yields peaked at 1.42% and 3.98%, respectively, before falling and ending the period at 1.11% and 3.53%.

Over the six months ended June 30, 2009, longer-term yields moved higher than their shorter-term counterparts due to fears of future inflation given the government’s massive stimulus program. In a reversal from 2008, investor risk aversion faded as the six-month reporting period progressed, driving spread sector (non-Treasury) prices higher. For the six-month period ended June 30, 2009, the Barclays Capital U.S. Aggregate IndexD returned 1.90%.

Looking Ahead

Despite the market turmoil in 2009, we maintained our investment discipline and remained committed to our investments in the spread sectors. This patience was rewarded, as these securities significantly outperformed U.S. Treasuries during the reporting period.

Looking ahead, there continues to be uncertainties surrounding the economy. As such, we could experience periods of increased market volatility as investors seek to interpret incoming economic data. In such an environment, we believe it is extremely important to have a long-term perspective for your investment portfolio and remain focused on your ultimate financial goals.

Western Asset Management Company

July 31, 2009

The views expressed in this and subsequent commentaries reflect those solely of Western Asset Management Company (“Western Asset”) as of the date of the commentary and may differ from those of Legg Mason, Inc. or its affiliates. Any such views are subject to change at any time based on market or other conditions, and Western Asset and Legg Mason Investor Services, LLC disclaim any responsibility to update such views. These views are not intended to be a forecast of future events, a guarantee of future results or investment advice. Forecasts are inherently limited and should not be relied upon as an indication of actual or future performance. Because investment decisions for the Western Asset Funds are based on numerous factors, these views may not be relied upon as an indication of trading intent on behalf of any Western Asset or Legg Mason Fund. The information contained herein has been prepared from sources believed to be reliable, but is not guaranteed by Western Asset or Legg Mason Investor Services, LLC as to its accuracy or completeness.

Please note that an investor cannot invest directly in an index.

| A | | The Federal Reserve Board (“Fed”) is responsible for the formulation of policies designed to promote economic growth, full employment, stable prices and a sustainable pattern of international trade and payments. |

| B | | The federal funds rate is the rate charged by one depository institution on an overnight sale of immediately available funds (balances at the Federal Reserve) to another depository institution; the rate may vary from depository institution to depository institution and from day to day. |

| C | | Gross domestic product (“GDP”) is the market value of all final goods and services produced within a country in a given period of time. |

| D | | The Barclays Capital (formerly Lehman Brothers) U.S. Aggregate Index is a broad-based bond index comprised of government, corporate, mortgage- and asset-backed issues, rated investment grade or higher, and having at least one year to maturity. |

The Investment Commentary is not a part of the Semi-Annual Report to Shareholders.

iii

Investment Commentary

Performance Information

Western Asset Core Bond Portfolio

Total returns for the Fund for various periods ended June 30, 2009 are presented below, along with those of comparative indices:

| | | | | | | | | | |

| | | | | Average Annual Total Returns |

| | | Six

Months | | One

Year | | Five

Years | | Ten

Years | | Since

Inception |

Western Asset Core Bond Portfolio: | | | | | | | | | | |

Institutional Class | | +8.53% | | -0.78% | | +2.27% | | +5.06% | | +6.91% |

Financial Intermediary Class | | +8.39% | | -1.05% | | +2.01% | | N/A | | +4.71% |

Institutional Select Class | | +8.52% | | N/A | | N/A | | N/A | | +0.84% |

Barclays Capital U.S. Aggregate IndexA | | +1.90% | | +6.05% | | +5.01% | | +5.98% | | +7.09% |

Lipper Intermediate Investment Grade Debt Funds Category AverageB | | +5.38% | | +2.12% | | +3.26% | | +4.84% | | +6.46% |

The performance data quoted represent past performance and do not guarantee future results. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website at www.westernassetfunds.com. The investment return and principal value of the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Calculations assume the reinvestment of all distributions, including returns of capital, if any, at net asset value and the deduction of all fund expenses. Performance would have been lower if fees and expenses had not been waived and/or reimbursed in various periods. Performance figures for periods shorter than one year represent cumulative figures and are not annualized. Please note that the Institutional Select Class has been in existence for less than one year. Results for longer periods may differ, in some cases, substantially.

The inception dates of the Institutional, Financial Intermediary and Institutional Select Classes are September 4, 1990, July 22, 1999 and August 29, 2008, respectively. The Index inception return is for the period beginning September 4, 1990. The Lipper inception return is for the period beginning August 31, 1990. All Index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

The gross expense ratios for the Institutional, Financial Intermediary and Institutional Select Classes were 0.49%, 0.83% and 0.48%, respectively, as indicated in the Fund’s most current prospectus dated July 1, 2009. These expenses include management fees, 12b-1 distribution fees and other expenses. As a result of contractual expense limitations, the ratio of expenses, other than interest, brokerage, taxes, deferred organizational expenses and extraordinary expenses, to average net assets will not exceed 0.75% for Financial Intermediary Class shares and 0.50% for Institutional Select Class shares until April 30, 2010.

Actual expenses may be higher. For example, expenses may be higher than those shown if average net assets decrease. Net assets are more likely to decrease and Fund expense ratios are more likely to increase when markets are volatile.

For the six months ended June 30, 2009, Institutional Class shares of Western Asset Core Bond Portfolio returned 8.53%. The Fund’s unmanaged benchmark, the Barclays Capital U.S. Aggregate Index, returned 1.90% over the same time frame. The Lipper Intermediate Investment Grade Debt Funds Category Average returned 5.38% for the same period.

A return to more normal market conditions, including improved liquidity and signs that the economy may be bottoming, caused investor risk aversion to decrease, triggering a strong rally in the spread sectors (non-Treasuries). Against this backdrop, the Fund significantly outperformed its benchmark during the reporting period.

The largest contributor to the Fund’s performance was its exposure to investment grade corporate bonds. In particular, the Fund’s holdings in the Financials sector were rewarded as their spreads substantially narrowed versus their historically wide levels that occurred during the financial crisis in 2008. In fact, returns for the April to May 2009 period were among the highest total

The Investment Commentary is not a part of the Semi-Annual Report to Shareholders.

iv

Investment Commentary

returns ever in the U.S. corporate bond market, according to Barclays Capital. An allocation to U.S. Treasury Inflation-Protected Securities (“TIPS”)C was beneficial as fears of deflation were replaced with concerns about future inflation given the government’s massive stimulus program. Exposure to agency mortgage-backed securities was also rewarded. Marginally offsetting these strong results was the Fund’s underweight exposure to commercial mortgage-backed securities which advanced during the period.

The Fund employed U.S. Treasury and Eurodollar futures and options, as well as interest rate swaps/swaptions and credit default swaps during the reporting period, which had an overall negative impact on performance. With the exception of credit default swaps, these strategies were used to manage the portfolio’s durationD and yield curveE exposure. Treasury futures and options along with interest rate swaps were used to hedge duration in the front and intermediate part of the yield curve, while Eurodollar futures and options helped to manage interest rate risk at the front end of the yield curve. The strategies we used for interest rate management enhanced the Fund’s results. Credit default swaps were used to increase our exposure to the corporate and non-agency mortgage-backed sectors. Our credit default swaps used to adjust our corporate exposure were a slight contributor to performance. In contrast, credit default swaps used to adjust our non-agency exposure detracted from performance over the period.

There were several adjustments made to the Fund’s portfolio over the six-month period. We decreased our allocation to agency mortgage-backed securities and redeployed those assets into corporate securities, agency debentures and U.S. Treasuries. Overall, these changes positively contributed to the Fund’s performance.

Western Asset Management Company

July 21, 2009

Investment Risks: All investments are subject to risk including the loss of principal. Past performance is no guarantee of future results. Bonds are subject to a variety of risks, including interest rate, credit and inflation risk. As interest rates rise, bond prices fall, reducing the value of the Fund’s share price. Mortgage-backed securities involve more risk, including prepayment and extension risks, than other investments in fixed-income securities. The Fund may use derivatives, such as options, futures and swaps, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on Fund performance. Please see the Fund’s prospectus for more information on these and other risks.

Please note that an investor cannot invest directly in an index.

| A | | The Barclays Capital (formerly Lehman Brothers) U.S. Aggregate Index is a broad-based bond index comprised of government, corporate, mortgage- and asset-backed issues, rated investment grade or higher, and having at least one year to maturity. |

| B | | Lipper, Inc., a wholly-owned subsidiary of Reuters, provides independent insight on global collective investments. The Lipper Intermediate Investment Grade Debt Funds Category Average is comprised of the Fund’s peer group of mutual funds. |

| C | | U.S. Treasury Inflation-Protected Securities (“TIPS”) are inflation-indexed securities issued by the U.S. Treasury in five-year, ten-year and twenty-year maturities. The principal is adjusted to the Consumer Price Index, the commonly used measure of inflation. The coupon rate is constant, but generates a different amount of interest when multiplied by the inflation-adjusted principal. |

| D | | Duration is the measure of the price sensitivity of a fixed-income security to an interest rate change of 100 basis points. Calculation is based on the weighted average of the present values for all cash flows. |

| E | | The yield curve is the graphical depiction of the relationship between the yield on bonds of the same credit quality but different maturities. |

The Investment Commentary is not a part of the Semi-Annual Report to Shareholders.

v

Investment Commentary

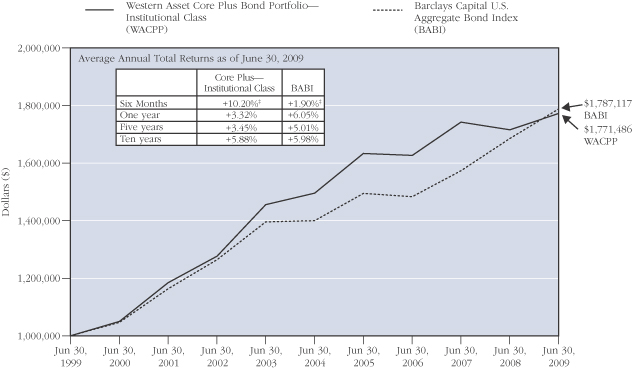

Performance Information—Continued

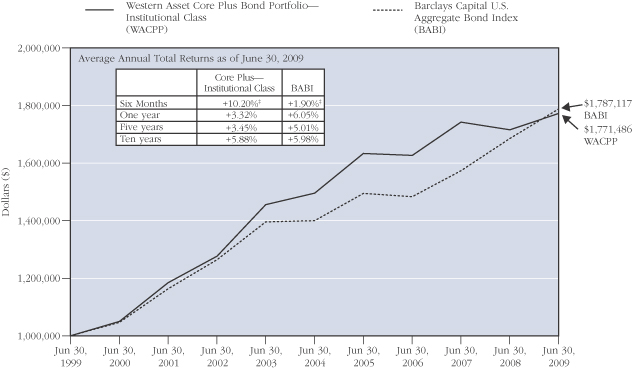

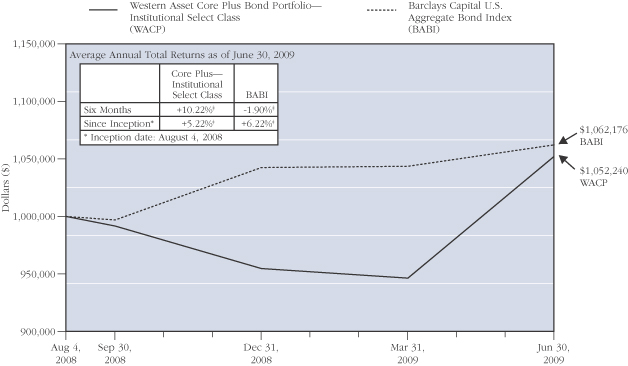

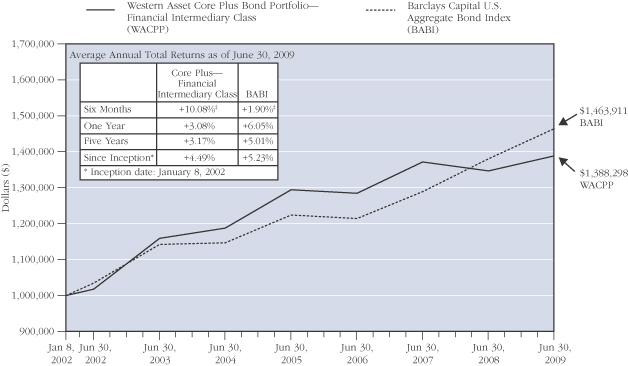

Western Asset Core Plus Bond Portfolio

Total returns for the Fund for various periods ended June 30, 2009 are presented below, along with those of comparative indices:

| | | | | | | | | | |

| | | | | Average Annual Total Returns |

| | | Six

Months | | One

Year | | Five

Years | | Ten

Years | | Since

Inception |

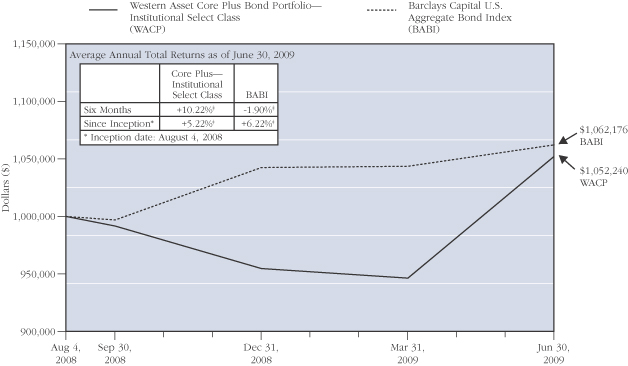

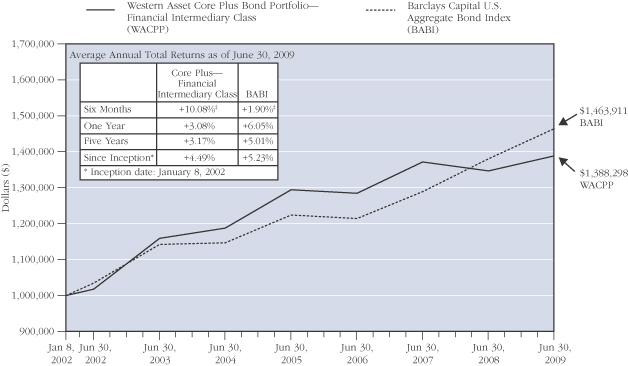

Western Asset Core Plus Bond Portfolio: | | | | | | | | | | |

Institutional Class | | +10.20% | | +3.32% | | +3.45% | | +5.88% | | +5.48% |

Financial Intermediary Class | | +10.08% | | +3.08% | | +3.17% | | N/A | | +4.49% |

Institutional Select Class | | +10.22% | | N/A | | N/A | | N/A | | +5.22% |

Barclays Capital U.S. Aggregate IndexA | | +1.90% | | +6.05% | | +5.01% | | +5.98% | | +5.70% |

Lipper Intermediate Investment Grade Debt Funds Category AverageB | | +5.38% | | +2.12% | | +3.26% | | +4.84% | | +4.56% |

The performance data quoted represent past performance and do not guarantee future results. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website at www.westernassetfunds.com. The investment return and principal value of the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Calculations assume the reinvestment of all distributions, including returns of capital, if any, at net asset value and the deduction of all fund expenses. Performance would have been lower if fees and expenses had not been waived and/or reimbursed in various periods. Performance figures for periods shorter than one year represent cumulative figures and are not annualized. Please note that the Institutional Select Class has been in existence for less than one year. Results for longer periods may differ, in some cases, substantially.

The inception dates of the Institutional, Financial Intermediary and Institutional Select Classes are July 8, 1998, January 8, 2002 and August 4, 2008, respectively. The Index inception return is for the period beginning July 8, 1998. The Lipper inception return is for the period beginning June 30, 1998. All Index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

The gross expense ratios for the Institutional, Financial Intermediary and Institutional Select Classes were 0.47%, 0.85% and 0.44%, respectively, as indicated in the Fund’s most current prospectus dated July 1, 2009. These expenses include management fees, 12b-1 distribution fees and other expenses. As a result of contractual expense limitations, the ratio of expenses, other than interest, brokerage, taxes, deferred organizational expenses and extraordinary expenses, to average net assets will not exceed 0.70% for Financial Intermediary Class shares and 0.45% for Institutional Select Class shares until April 30, 2010.

Actual expenses may be higher. For example, expenses may be higher than those shown if average net assets decrease. Net assets are more likely to decrease and Fund expense ratios are more likely to increase when markets are volatile.

For the six months ended June 30, 2009, Institutional Class shares of Western Asset Core Plus Bond Portfolio returned 10.20%. The Fund’s unmanaged benchmark, the Barclays Capital U.S. Aggregate Index, returned 1.90% over the same time frame. The Lipper Intermediate Investment Grade Debt Funds Category Average returned 5.38% for the same period.

While 2008 was largely characterized as being highly volatile, with several investor “flights to quality” due to the escalating financial crisis, conditions in the fixed-income markets largely stabilized over the first half of 2009. During this time, investor risk aversion declined, helping the spread sectors (non-Treasuries) to generate strong results. Given this environment, the Fund significantly outperformed its benchmark.

The largest contributor to the Fund’s performance was its exposure to investment grade corporate bonds. In particular, the Fund’s holdings in the Financials sector were rewarded as their spreads substantially narrowed versus their historically wide levels

The Investment Commentary is not a part of the Semi-Annual Report to Shareholders.

vi

Investment Commentary

that occurred during the financial crisis in 2008. The Fund’s high-yield bond holdings—led by its securities in the Industrials and Financials sectors—also boosted the Fund’s performance. It’s interesting to note that returns for the April to May 2009 period were among the highest total returns ever in the U.S. corporate bond market, according to Barclays Capital. An allocation to U.S. Treasury Inflation-Protected Securities (“TIPS”)C was beneficial as fears of deflation were replaced with concerns about future inflation given the government’s massive stimulus program. The Fund also benefited from its exposure to agency mortgage-backed securities and from its holdings of non-U.S. bonds and emerging market debt.

Marginally offsetting these strong results were the Fund’s exposure to non-agency residential mortgage securities and an underweight to commercial mortgage-backed securities. A long durationD position also slightly detracted from performance, as did our agency debentures and asset-backed securities exposure.

The Fund employed U.S. Treasury and Eurodollar futures and options, as well as interest rate swaps/swaptions and credit default swaps during the reporting period, which had an overall positive impact on performance. With the exception of credit default swaps, these strategies were used to manage the portfolio’s duration and yield curveE exposure. Treasury futures and options along with interest rate swaps were used to hedge duration in the front and intermediate part of the yield curve, while Eurodollar futures and options helped to manage interest rate risk at the front end of the yield curve. The strategies we used for interest rate management enhanced the Fund’s results. Credit default swaps were used to increase our exposure to the corporate and non-agency mortgage-backed sectors. Our credit default swaps used to adjust our corporate exposure were a large contributor to performance. In contrast, credit default swaps used to adjust our non-agency exposure detracted from performance over the period.

There were several adjustments made to the Fund’s portfolio over the six-month period. We decreased the allocation to agency mortgage-backed securities and redeployed those assets into corporate securities, agency debentures and U.S. Treasuries. Overall, these changes positively contributed to the Fund’s performance.

Western Asset Management Company

July 21, 2009

Investment Risks: All investments are subject to risk including the loss of principal. Past performance is no guarantee of future results. Bonds are subject to a variety of risks, including interest rate, credit and inflation risk. As interest rates rise, bond prices fall, reducing the value of the Fund’s share price. The Fund may invest in high-yield bonds, which are rated below investment grade and carry more risk than higher-rated securities. Mortgage-backed securities involve more risk, including prepayment and extension risks, than other investments in fixed-income securities. Non-U.S. investments are subject to currency fluctuations, social, economic and political risk. These risks are magnified in emerging markets. The Fund may use derivatives, such as options, futures and swaps, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on Fund performance. Please see the Fund’s prospectus for more information on these and other risks.

Please note that an investor cannot invest directly in an index.

| A | | The Barclays Capital (formerly Lehman Brothers) U.S. Aggregate Index is a broad-based bond index comprised of government, corporate, mortgage- and asset-backed issues, rated investment grade or higher, and having at least one year to maturity. |

| B | | Lipper, Inc., a wholly-owned subsidiary of Reuters, provides independent insight on global collective investments. The Lipper Intermediate Investment Grade Debt Funds Category Average is comprised of the Fund’s peer group of mutual funds. |

| C | | U.S. Treasury Inflation-Protected Securities (“TIPS”) are inflation-indexed securities issued by the U.S. Treasury in five-year, ten-year and twenty-year maturities. The principal is adjusted to the Consumer Price Index, the commonly used measure of inflation. The coupon rate is constant, but generates a different amount of interest when multiplied by the inflation-adjusted principal. |

| D | | Duration is the measure of the price sensitivity of a fixed-income security to an interest rate change of 100 basis points. Calculation is based on the weighted average of the present values for all cash flows. |

| E | | The yield curve is the graphical depiction of the relationship between the yield on bonds of the same credit quality but different maturities. |

The Investment Commentary is not a part of the Semi-Annual Report to Shareholders.

vii

Western Asset Funds, Inc.

Western Asset Core Bond Portfolio

Western Asset Core Plus Bond Portfolio

Semi-Annual Report to Shareholders

June 30, 2009

Semi-Annual Report to Shareholders

Expense Example (Unaudited)

Western Asset Core Bond Portfolio

As a shareholder of the Fund, you incur ongoing costs, including management fees, distribution (12b-1) fees on Financial Intermediary Class shares, and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

Actual Expenses

The first line for each class in the table below provides information about actual account values and actual expenses for each Class. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account if your shares were held for the entire period. The example are based on an investment of $1,000 invested on January 1, 2009 and held through June 30, 2009. The ending values assume dividends were reinvested at the time they were paid.

Hypothetical Examples for Comparison Purposes

The second line for each class in the table below provides information about hypothetical account values and hypothetical expenses based on the relevant class’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the class’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples for the relevant classes that appear in the shareholder reports of other funds. Because the example is intended to be comparable to the examples provided by other funds, it is based on a hypothetical investment of $1,000 invested on January 1, 2009 and held through June 30, 2009 for each class. The ending values assume dividends were reinvested at the time they were paid.

| | | | | | | | | |

| | | Beginning

Account Value

1/1/09 | | Ending

Account Value

6/30/09 | | Expenses PaidA

During the Period

1/1/09 to 6/30/09 |

Institutional Class: | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,085.30 | | $ | 2.53 |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,022.36 | | | 2.46 |

Institutional Select Class: | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,085.20 | | $ | 2.27 |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,022.61 | | | 2.21 |

Financial Intermediary Class: | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,083.90 | | $ | 3.88 |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,021.08 | | | 3.76 |

| A | | These calculations are based on expenses incurred from January 1, 2009 to June 30, 2009. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratios of 0.49%, 0.44% and 0.75% for the Institutional Class, Institutional Select Class and Financial Intermediary Class, respectively, multiplied by the average values over the period, multiplied by the number of days in the most recent fiscal period then divided by 365. |

1

Semi-Annual Report to Shareholders

Performance Information (Unaudited)

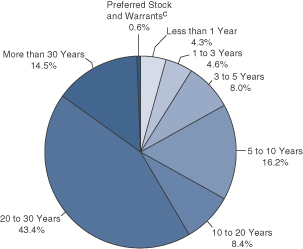

Western Asset Core Bond Portfolio

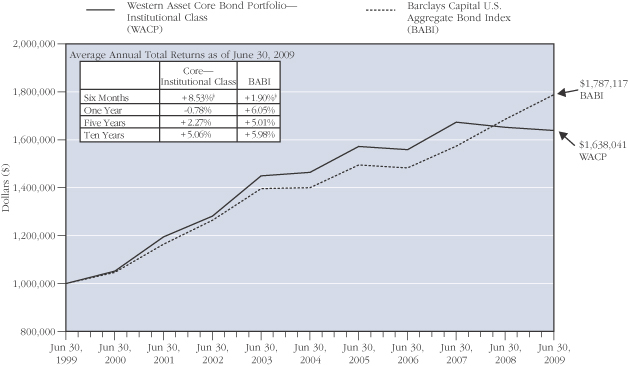

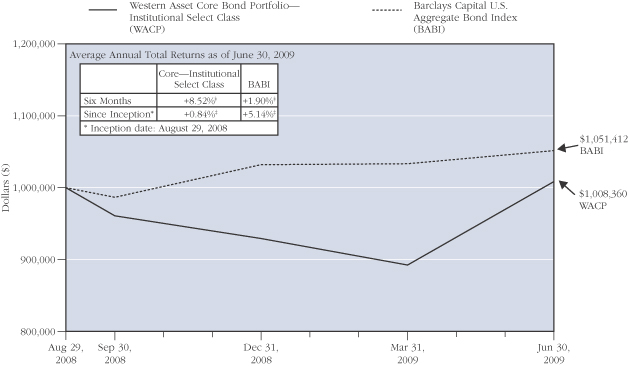

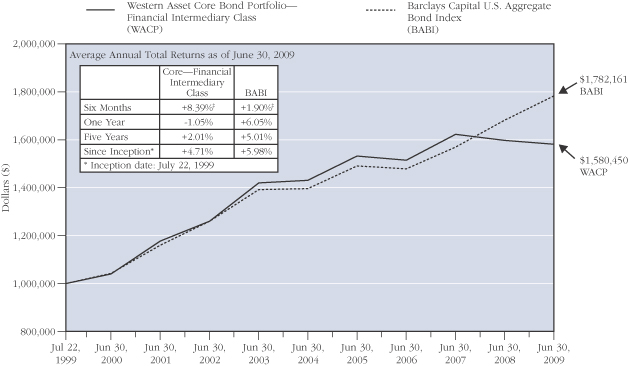

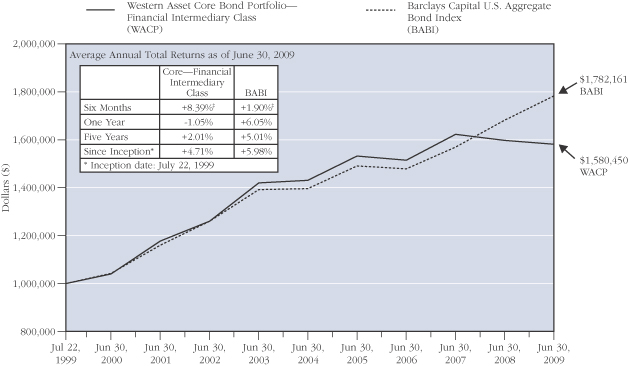

The graphs compare the Fund’s total returns to that of an appropriate broad-based securities market index. The graphs illustrate the cumulative total return of an initial $1,000,000 investment in the Institutional Class, Institutional Select Class and Financial Intermediary Class of the Fund, for the periods indicated. The line for the Fund represents the total return after deducting all Fund investment management and other administrative expenses and the transaction costs of buying and selling securities. The line representing the securities market index does not include any transaction costs associated with buying and selling securities in the index or other investment management or administrative expenses.

Total return measures investment performance in terms of appreciation or depreciation in the Fund’s net asset value per share, plus dividends and any capital gain distributions. It assumes that dividends and distributions were reinvested at the time they were paid. Returns (and the graphs and tables found below) do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Average annual returns tend to smooth out variations in a fund’s return, so that they differ from actual year-to-year results.

Bonds are subject to a variety of risks, including interest rate, credit and inflation risk. Non-U.S. investments are subject to currency fluctuations, social, economical and political risk.

Growth of a $1,000,000 Investment—Institutional Class

The performance data quoted represent past performance and do not guarantee future results. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month-end performance information, please visit www.westernassetfunds.com. The investment return and principal value of the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Calculations assume reinvestment of all distributions, including returns of capital, if any, at net asset value and the deduction of all fund expenses. Performance would have been lower if fees had not been waived in various periods.

2

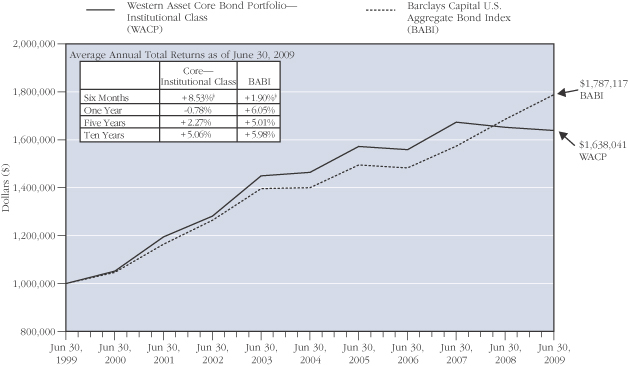

Semi-Annual Report to Shareholders

Growth of a $1,000,000 Investment—Institutional Select Class

The performance data quoted represent past performance and do not guarantee future results. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month-end performance information, please visit www.westernassetfunds.com. The investment return and principal value of the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Calculations assume reinvestment of all distributions, including returns of capital, if any, at net asset value and the deduction of all fund expenses. Performance would have been lower if fees had not been waived in various periods.

3

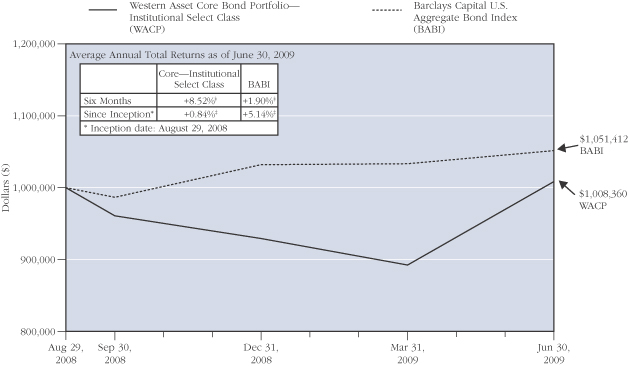

Semi-Annual Report to Shareholders

Performance Information (Unaudited)—Continued

Growth of a $1,000,000 Investment—Financial Intermediary Class

The performance data quoted represent past performance and do not guarantee future results. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month-end performance information, please visit www.westernassetfunds.com. The investment return and principal value of the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Calculations assume reinvestment of all distributions, including returns of capital, if any, at net asset value and the deduction of all fund expenses. Performance would have been lower if fees had not been waived in various periods.

4

Semi-Annual Report to Shareholders

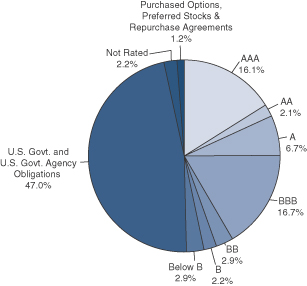

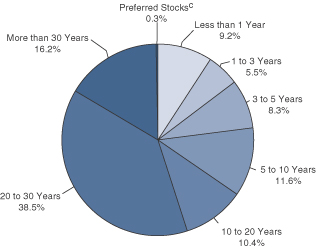

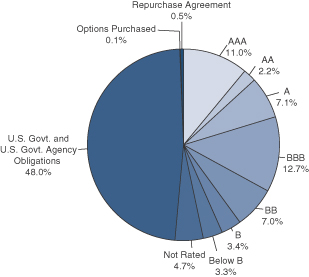

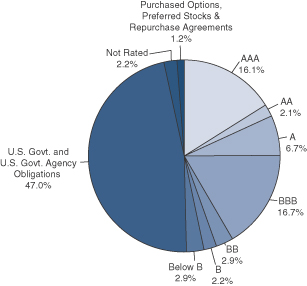

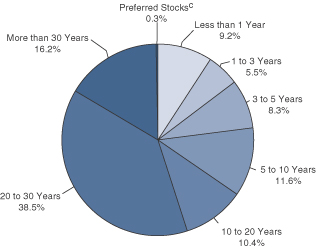

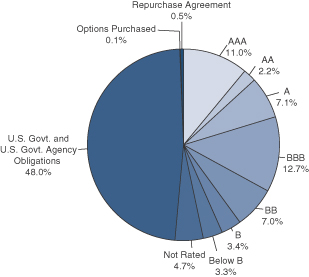

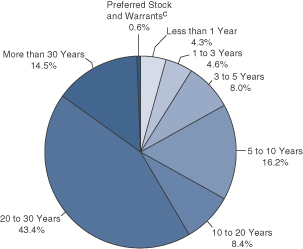

Portfolio Composition (Unaudited) (as of June 30, 2009)A

Standard & Poor’s Debt RatingsB

(as a percentage of the portfolio)

Maturity Schedule

(as a percentage of the portfolio)

| A | | The pie charts above represent the composition of the Fund’s portfolio as of June 30, 2009 and do not include derivatives such as Futures Contracts, Options Written, and Swaps. The Fund is actively managed. As a result, the composition of the portfolio holdings and sectors are subject to change at any time. |

| B | | Source: Standard & Poor’s. These ratings are the opinions of S&P and not absolute measures of quality or guarantees of performance. |

| C | | Preferred stocks do not have defined maturity dates. |

5

Semi-Annual Report to Shareholders

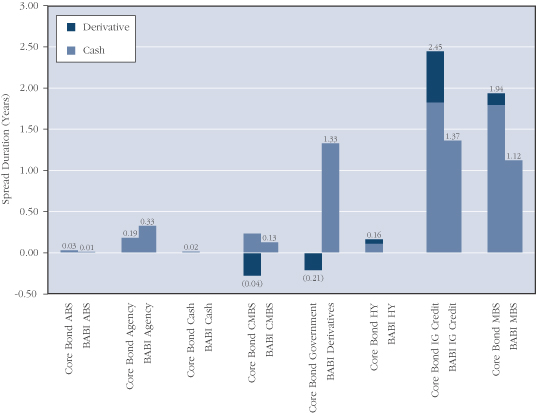

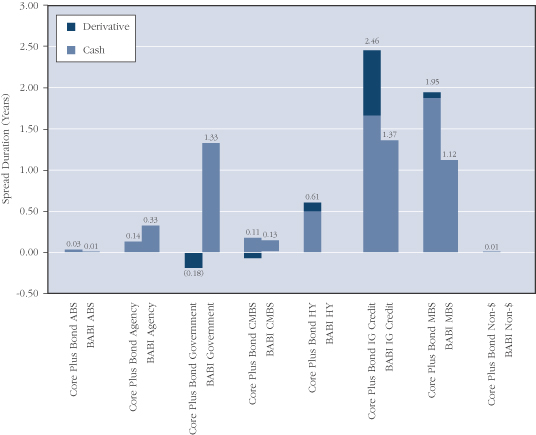

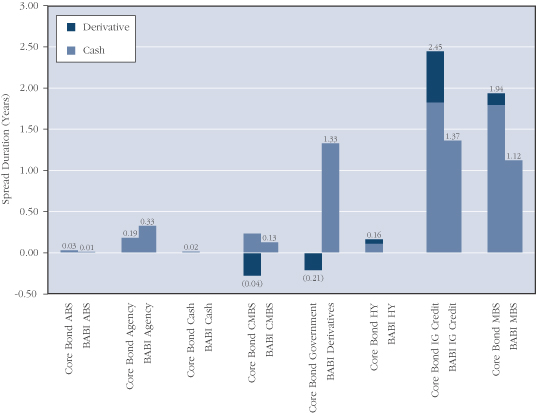

Spread Duration

Western Asset Core Bond Portfolio

June 30, 2009 (Unaudited)

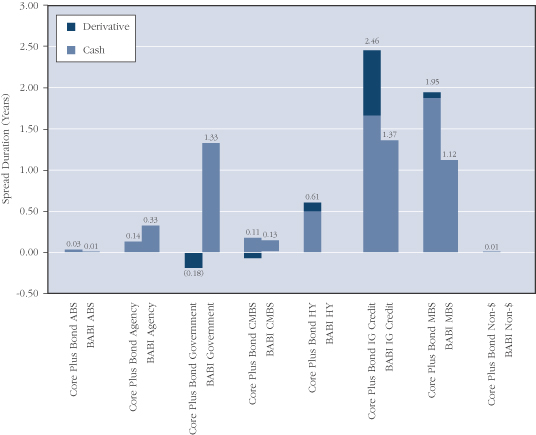

Economic Exposure

Spread duration is defined as the change in value for a 100 basis point change in the spread relative to Treasuries. The spread over Treasuries is the annual risk-premium demanded by investors to hold non-Treasury securities. This chart highlights the market sector exposure of the Fund’s portfolio and the exposure relative to the selected benchmark as of the end of the reporting period.

ABS — Asset Backed Securities

BABI — Barclays Capital U.S. Aggregate Index

CMBS — Commercial Mortgage Backed Securities

HY — High Yield

IG Credit — Investment Grade Credit

MBS — Mortgage Backed Securities

6

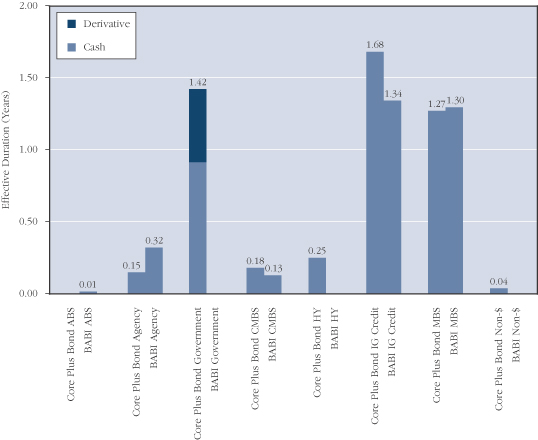

Semi-Annual Report to Shareholders

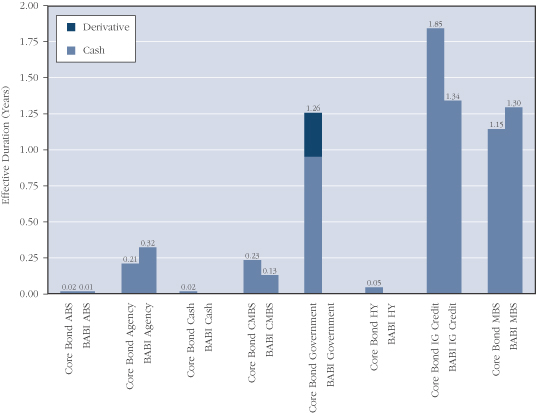

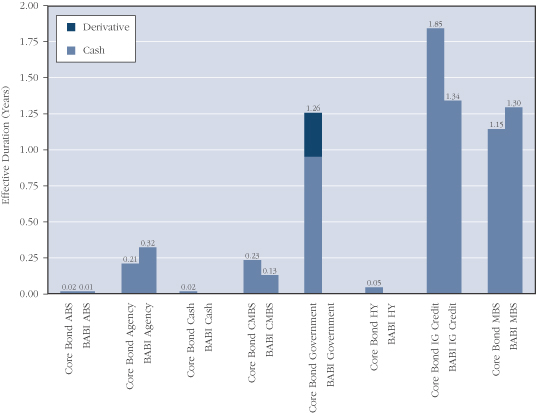

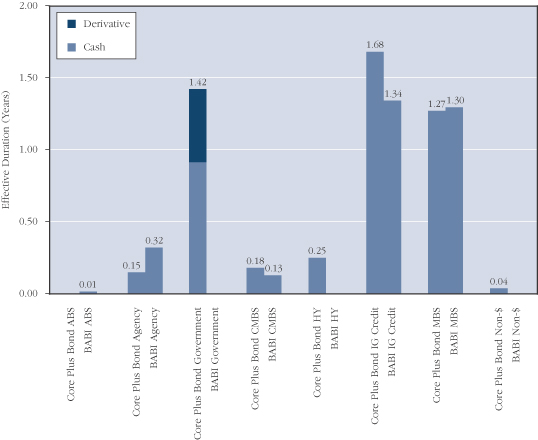

Effective Duration

Western Asset Core Bond Portfolio

June 30, 2009 (Unaudited)

Interest Rate Exposure

Effective duration is defined as the change in value for a 100 basis point change in Treasury yields. This chart highlights the interest rate exposure of the Fund’s portfolio relative to the selected benchmark as of the end of the reporting period.

ABS — Asset Backed Securities

BABI — Barclays Capital U.S. Aggregate Index

CMBS — Commercial Mortgage Backed Securities

HY — High Yield

IG Credit — Investment Grade Credit

MBS — Mortgage Backed Securities

7

Semi-Annual Report to Shareholders

Portfolio of Investments

Western Asset Core Bond Portfolio

June 30, 2009 (Unaudited)

| | | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR/

SHARES | | VALUE | |

| | | | | | | | | | | | | |

Long-Term Securities | | 104.7% | | | | | | | | | | | |

| | | | | |

Corporate Bonds and Notes | | 29.2% | | | | | | | | | | | |

| | | | | |

Aerospace and Defense | | N.M. | | | | | | | | | | | |

United Technologies Corp. | | | | 5.400% | | 5/1/35 | | $ | 1,460,000 | | $ | 1,426,426 | |

| | | | | | | | | | | | | |

| | | | | |

Airlines | | 1.7% | | | | | | | | | | | |

Continental Airlines Inc. | | | | 6.900% | | 1/2/18 | | | 2,392,508 | | | 2,081,482 | |

Continental Airlines Inc. | | | | 6.820% | | 5/1/18 | | | 548,237 | | | 433,107 | |

Continental Airlines Inc. | | | | 6.545% | | 2/2/19 | | | 4,183,620 | | | 3,869,849 | |

Continental Airlines Inc. | | | | 5.983% | | 4/19/22 | | | 4,000,000 | | | 3,300,000 | |

Continental Airlines Inc. | | | | 6.703% | | 12/15/22 | | | 3,305,517 | | | 2,776,634 | |

Delta Air Lines Inc. | | | | 7.379% | | 5/18/10 | | | 607,713 | | | 592,520 | |

Delta Air Lines Inc. | | | | 7.570% | | 11/18/10 | | | 7,136,000 | | | 6,814,880 | |

Delta Air Lines Inc. | | | | 7.111% | | 9/18/11 | | | 15,600,000 | | | 14,508,000 | |

Delta Air Lines Inc. | | | | 6.821% | | 8/10/22 | | | 10,525,888 | | | 8,736,487 | |

Northwest Airlines Corp. | | | | 7.575% | | 3/1/19 | | | 5,147,144 | | | 3,860,358 | |

Northwest Airlines Inc. | | | | 1.535% | | 5/20/14 | | | 2,374,363 | | | 1,780,772 | A |

Southwest Airlines Co. | | | | 5.125% | | 3/1/17 | | | 2,640,000 | | | 2,268,895 | |

US Airways Pass-Through Trust | | | | 6.850% | | 1/30/18 | | | 10,063,668 | | | 7,346,478 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | 58,369,462 | |

| | | | | | | | | | | | | |

Automobiles | | N.M. | | | | | | | | | | | |

DaimlerChrysler NA Holding Corp. | | | | 5.875% | | 3/15/11 | | | 700,000 | | | 711,637 | |

General Motors Corp. | | | | 9.450% | | 11/1/11 | | | 160,000 | | | 26,400 | B |

General Motors Corp. | | | | 9.400% | | 7/15/21 | | | 43,000 | | | 5,160 | B |

General Motors Corp. | | | | 8.100% | | 6/15/24 | | | 23,000 | | | 2,702 | B |

General Motors Corp. | | | | 0.000% | | 3/15/36 | | | 567,000 | | | 31,185 | B,C |

| | | | | | | | | | | | | |

| | | | | | | | | | | | 777,084 | |

| | | | | | | | | | | | | |

Building Products | | 0.2% | | | | | | | | | | | |

Masco Corp. | | | | 7.125% | | 8/15/13 | | | 3,320,000 | | | 2,947,772 | |

Masco Corp. | | | | 6.125% | | 10/3/16 | | | 4,120,000 | | | 3,459,135 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | 6,406,907 | |

| | | | | | | | | | | | | |

Capital Markets | | 1.1% | | | | | | | | | | | |

Goldman Sachs Capital II | | | | 5.793% | | 12/29/49 | | | 770,000 | | | 469,277 | C |

Lehman Brothers Holdings Capital Trust VII | | | | 5.857% | | 11/29/49 | | | 1,300,000 | | | 130 | B,C |

Lehman Brothers Holdings Inc. | | | | 6.200% | | 9/26/14 | | | 4,370,000 | | | 644,575 | B |

Lehman Brothers Holdings Inc. | | | | 6.500% | | 7/19/17 | | | 11,920,000 | | | 1,192 | B |

Lehman Brothers Holdings Inc. | | | | 6.750% | | 12/28/17 | | | 29,990,000 | | | 2,999 | B |

Merrill Lynch and Co. Inc. | | | | 6.110% | | 1/29/37 | | | 3,510,000 | | | 2,710,966 | |

Morgan Stanley | | | | 4.750% | | 4/1/14 | | | 3,070,000 | | | 2,899,891 | |

8

Semi-Annual Report to Shareholders

| | | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR/

SHARES | | VALUE | |

| | | | | | | | | | | | | |

Corporate Bonds and Notes—Continued | | | | | | | | | | | | | |

| | | | | |

Capital Markets—Continued | | | | | | | | | | | | | |

Morgan Stanley | | | | 1.557% | | 10/18/16 | | $ | 4,040,000 | | $ | 3,267,613 | A |

The Bear Stearns Cos. Inc. | | | | 6.400% | | 10/2/17 | | | 17,120,000 | | | 17,150,388 | |

The Goldman Sachs Group Inc. | | | | 5.625% | | 1/15/17 | | | 9,935,000 | | | 9,442,353 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | 36,589,384 | |

| | | | | | | | | | | | | |

Commercial Banks | | 1.2% | | | | | | | | | | | |

Bank One Corp. | | | | 7.875% | | 8/1/10 | | | 4,500,000 | | | 4,718,056 | |

Bank One Corp. | | | | 5.900% | | 11/15/11 | | | 2,000,000 | | | 2,094,570 | |

HBOS Treasury Services PLC | | | | 5.250% | | 2/21/17 | | | 2,500,000 | | | 2,068,737 | D |

SunTrust Capital VIII | | | | 6.100% | | 12/15/36 | | | 14,970,000 | | | 9,724,213 | C |

Wachovia Capital Trust III | | | | 5.800% | | 3/15/49 | | | 6,130,000 | | | 3,678,000 | C |

Wachovia Corp. | | | | 5.750% | | 6/15/17 | | | 16,100,000 | | | 15,883,600 | |

Wells Fargo Capital X | | | | 5.950% | | 12/15/36 | | | 1,890,000 | | | 1,398,600 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | 39,565,776 | |

| | | | | | | | | | | | | |

Commercial Services and Supplies | | 0.4% | | | | | | | | | | | |

Waste Management Inc. | | | | 6.375% | | 11/15/12 | | | 2,530,000 | | | 2,686,569 | |

Waste Management Inc. | | | | 5.000% | | 3/15/14 | | | 3,440,000 | | | 3,361,121 | |

Waste Management Inc. | | | | 7.125% | | 12/15/17 | | | 6,000,000 | | | 5,982,732 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | 12,030,422 | |

| | | | | | | | | | | | | |

Communications Equipment | | 0.2% | | | | | | | | | | | |

Motorola Inc. | | | | 8.000% | | 11/1/11 | | | 5,600,000 | | | 5,637,509 | |

| | | | | | | | | | | | | |

| | | | | |

Consumer Finance | | 3.3% | | | | | | | | | | | |

American Express Co. | | | | 6.800% | | 9/1/66 | | | 4,460,000 | | | 3,211,200 | C |

American General Finance Corp. | | | | 6.900% | | 12/15/17 | | | 4,070,000 | | | 2,203,832 | |

Capital One Financial Corp. | | | | 6.150% | | 9/1/16 | | | 3,170,000 | | | 2,805,545 | |

Ford Motor Credit Co. | | | | 7.375% | | 10/28/09 | | | 50,175,000 | | | 49,744,900 | |

Ford Motor Credit Co. | | | | 7.875% | | 6/15/10 | | | 6,310,000 | | | 5,993,648 | |

Ford Motor Credit Co. | | | | 7.375% | | 2/1/11 | | | 6,435,000 | | | 5,825,445 | |

Ford Motor Credit Co. | | | | 7.250% | | 10/25/11 | | | 5,910,000 | | | 5,111,783 | |

GMAC LLC | | | | 7.750% | | 1/19/10 | | | 3,493,000 | | | 3,405,675 | D |

GMAC LLC | | | | 7.250% | | 3/2/11 | | | 519,000 | | | 474,885 | D |

GMAC LLC | | | | 7.500% | | 12/31/13 | | | 1,449,000 | | | 1,122,975 | D |

GMAC LLC | | | | 0.000% | | 6/15/15 | | | 220,000 | | | 94,600 | E |

GMAC LLC | | | | 8.000% | | 12/31/18 | | | 1,207,000 | | | 766,445 | D |

SLM Corp. | | | | 5.375% | | 5/15/14 | | | 3,000,000 | | | 2,411,130 | |

SLM Corp. | | | | 5.625% | | 8/1/33 | | | 42,895,000 | | | 26,409,508 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | 109,581,571 | |

| | | | | | | | | | | | | |

9

Semi-Annual Report to Shareholders

Portfolio of Investments—Continued

Western Asset Core Bond Portfolio—Continued

| | | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR/

SHARES | | VALUE | |

| | | | | | | | | | | | | |

Corporate Bonds and Notes—Continued | | | | | | | | | | | | | |

| | | | | |

Diversified Financial Services | | 4.0% | | | | | | | | | | | |

Air 2 US | | | | 8.027% | | 10/1/19 | | $ | 8,610,007 | | $ | 6,113,105 | D |

BAC Capital Trust XIV | | | | 5.630% | | 12/31/49 | | | 500,000 | | | 250,000 | C |

Citigroup Inc. | | | | 8.500% | | 5/22/19 | | | 2,420,000 | | | 2,461,719 | |

Citigroup Inc. | | | | 6.125% | | 8/25/36 | | | 2,000,000 | | | 1,489,332 | |

Citigroup Inc. | | | | 5.875% | | 5/29/37 | | | 17,000,000 | | | 13,283,426 | |

Citigroup Inc. | | | | 6.875% | | 3/5/38 | | | 17,330,000 | | | 15,305,267 | |

General Electric Capital Corp. | | | | 2.125% | | 12/21/12 | | | 21,370,000 | | | 21,222,953 | |

General Electric Capital Corp. | | | | 6.875% | | 1/10/39 | | | 23,700,000 | | | 21,332,678 | |

General Electric Capital Corp. | | | | 6.375% | | 11/15/67 | | | 22,960,000 | | | 15,319,394 | C |

HSBC Finance Corp. | | | | 8.000% | | 7/15/10 | | | 690,000 | | | 716,344 | |

HSBC Finance Corp. | | | | 7.000% | | 5/15/12 | | | 700,000 | | | 721,678 | |

HSBC Finance Corp. | | | | 6.375% | | 11/27/12 | | | 440,000 | | | 447,544 | |

ILFC E-Capital Trust I | | | | 5.900% | | 12/21/65 | | | 10,600,000 | | | 3,922,000 | C,D |

ILFC E-Capital Trust II | | | | 6.250% | | 12/21/65 | | | 4,160,000 | | | 1,539,200 | C,D |

J.P. Morgan and Co. Inc. | | | | 0.000% | | 2/15/12 | | | 2,000,000 | | | 1,732,640 | A |

JPMorgan Chase and Co. | | | | 2.125% | | 12/26/12 | | | 8,450,000 | | | 8,407,260 | |

JPMorgan Chase and Co. | | | | 5.750% | | 1/2/13 | | | 3,770,000 | | | 3,887,914 | |

JPMorgan Chase and Co. | | | | 6.125% | | 6/27/17 | | | 7,855,000 | | | 7,761,046 | |

Liberty Media LLC | | | | 3.750% | | 2/15/30 | | | 290,000 | | | 104,400 | F |

PHH Corp. | | | | 7.125% | | 3/1/13 | | | 5,010,000 | | | 4,003,291 | |

TNK-BP Finance SA | | | | 7.875% | | 3/13/18 | | | 1,435,000 | | | 1,183,875 | D |

Unilever Capital Corp. | | | | 7.125% | | 11/1/10 | | | 1,730,000 | | | 1,847,145 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | 133,052,211 | |

| | | | | | | | | | | | | |

Diversified Telecommunication Services | | 0.9% | | | | | | | | | | | |

AT&T Inc. | | | | 5.100% | | 9/15/14 | | | 4,960,000 | | | 5,152,389 | |

AT&T Inc. | | | | 6.550% | | 2/15/39 | | | 14,610,000 | | | 14,584,023 | |

BellSouth Corp. | | | | 4.750% | | 11/15/12 | | | 440,000 | | | 455,543 | |

BellSouth Corp. | | | | 5.200% | | 9/15/14 | | | 4,270,000 | | | 4,445,228 | |

CenturyTel Inc. | | | | 6.000% | | 4/1/17 | | | 4,120,000 | | | 3,718,300 | |

Verizon Global Funding Corp. | | | | 7.250% | | 12/1/10 | | | 2,220,000 | | | 2,363,727 | |

Verizon Global Funding Corp. | | | | 7.375% | | 9/1/12 | | | 5,000 | | | 5,594 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | 30,724,804 | |

| | | | | | | | | | | | | |

Electric Utilities | | 0.7% | | | | | | | | | | | |

Exelon Corp. | | | | 5.625% | | 6/15/35 | | | 345,000 | | | 277,705 | |

FirstEnergy Corp. | | | | 6.450% | | 11/15/11 | | | 290,000 | | | 302,690 | |

FirstEnergy Corp. | | | | 7.375% | | 11/15/31 | | | 10,610,000 | | | 10,014,333 | |

Pacific Gas and Electric Co. | | | | 6.050% | | 3/1/34 | | | 940,000 | | | 975,191 | |

Pacific Gas and Electric Co. | | | | 5.800% | | 3/1/37 | | | 7,330,000 | | | 7,366,635 | |

10

Semi-Annual Report to Shareholders

| | | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR/

SHARES | | VALUE | |

| | | | | | | | | | | | | |

Corporate Bonds and Notes—Continued | | | | | | | | | | | | | |

| | | | | |

Electric Utilities—Continued | | | | | | | | | | | | | |

Progress Energy Inc. | | | | 7.100% | | 3/1/11 | | $ | 1,488,000 | | $ | 1,582,571 | |

The Cleveland Electric Illuminating Co. | | | | 5.700% | | 4/1/17 | | | 630,000 | | | 613,781 | |

The Detroit Edison Co. | | | | 6.125% | | 10/1/10 | | | 920,000 | | | 953,204 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | 22,086,110 | |

| | | | | | | | | | | | | |

Food and Staples Retailing | | 1.5% | | | | | | | | | | | |

CVS Lease Pass-Through Trust | | | | 6.117% | | 1/10/13 | | | 3,181,297 | | | 3,080,135 | D |

CVS Lease Pass-Through Trust | | | | 6.036% | | 12/10/28 | | | 34,463,106 | | | 29,445,967 | D,G |

The Kroger Co. | | | | 6.400% | | 8/15/17 | | | 580,000 | | | 614,904 | |

The Kroger Co. | | | | 6.150% | | 1/15/20 | | | 850,000 | | | 868,473 | |

Wal-Mart Stores Inc. | | | | 5.800% | | 2/15/18 | | | 9,150,000 | | | 9,967,498 | |

Wal-Mart Stores Inc. | | | | 6.200% | | 4/15/38 | | | 5,410,000 | | | 5,813,916 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | 49,790,893 | |

| | | | | | | | | | | | | |

Food Products | | 0.3% | | | | | | | | | | | |

General Mills Inc. | | | | 5.700% | | 2/15/17 | | | 3,580,000 | | | 3,768,505 | |

Sara Lee Corp. | | | | 6.250% | | 9/15/11 | | | 5,500,000 | | | 5,813,054 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | 9,581,559 | |

| | | | | | | | | | | | | |

Gas Utilities | | 0.2% | | | | | | | | | | | |

Southern Natural Gas Co. | | | | 8.000% | | 3/1/32 | | | 7,390,000 | | | 7,819,470 | |

| | | | | | | | | | | | | |

| | | | | |

Health Care Providers and Services | | 1.9% | | | | | | | | | | | |

AmerisourceBergen Corp. | | | | 5.625% | | 9/15/12 | | | 3,520,000 | | | 3,470,470 | |

AmerisourceBergen Corp. | | | | 5.875% | | 9/15/15 | | | 3,050,000 | | | 2,907,092 | |

Cardinal Health Inc. | | | | 5.800% | | 10/15/16 | | | 3,530,000 | | | 3,416,853 | |

Cardinal Health Inc. | | | | 5.850% | | 12/15/17 | | | 12,985,000 | | | 12,146,494 | |

HCA Inc. | | | | 5.750% | | 3/15/14 | | | 35,430,000 | | | 28,344,000 | |

Tenet Healthcare Corp. | | | | 7.375% | | 2/1/13 | | | 6,584,000 | | | 5,925,600 | |

Tenet Healthcare Corp. | | | | 9.000% | | 5/1/15 | | | 1,250,000 | | | 1,259,375 | D |

Tenet Healthcare Corp. | | | | 10.000% | | 5/1/18 | | | 1,250,000 | | | 1,312,500 | D |

WellPoint Inc. | | | | 5.875% | | 6/15/17 | | | 900,000 | | | 880,835 | |

WellPoint Inc. | | | | 7.000% | | 2/15/19 | | | 2,780,000 | | | 2,873,872 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | 62,537,091 | |

| | | | | | | | | | | | | |

Hotels, Restaurants and Leisure | | 0.2% | | | | | | | | | | | |

Marriott International Inc. | | | | 5.810% | | 11/10/15 | | | 4,400,000 | | | 3,853,260 | |

Starwood Hotels and Resorts Worldwide Inc. | | | | 7.875% | | 5/1/12 | | | 3,050,000 | | | 2,806,000 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | 6,659,260 | |

| | | | | | | | | | | | | |

11

Semi-Annual Report to Shareholders

Portfolio of Investments—Continued

Western Asset Core Bond Portfolio—Continued

| | | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR/

SHARES | | VALUE | |

| | | | | | | | | | | | | |

Corporate Bonds and Notes—Continued | | | | | | | | | | | | | |

| | | | | |

Household Durables | | 0.1% | | | | | | | | | | | |

Pulte Homes Inc. | | | | 8.125% | | 3/1/11 | | $ | 3,480,000 | | $ | 3,497,400 | |

| | | | | | | | | | | | | |

| | | | | |

Independent Power Producers and Energy Traders | | 0.2% | | | | | | | | | | | |

TXU Corp. | | | | 6.500% | | 11/15/24 | | | 1,090,000 | | | 546,178 | |

TXU Corp. | | | | 6.550% | | 11/15/34 | | | 9,930,000 | | | 4,773,937 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | 5,320,115 | |

| | | | | | | | | | | | | |

Industrial Conglomerates | | 0.7% | | | | | | | | | | | |

Tyco International Ltd./Tyco International Finance SA | | | | 7.000% | | 12/15/19 | | | 3,380,000 | | | 3,325,660 | |

Tyco International Ltd./Tyco International Finance SA | | | | 6.875% | | 1/15/21 | | | 22,895,000 | | | 21,649,832 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | 24,975,492 | |

| | | | | | | | | | | | | |

Insurance | | 2.2% | | | | | | | | | | | |

American International Group Inc. | | | | 5.850% | | 1/16/18 | | | 2,370,000 | | | 1,253,846 | |

American International Group Inc. | | | | 6.250% | | 3/15/37 | | | 12,690,000 | | | 3,140,775 | |

ASIF Global Financing XIX | | | | 4.900% | | 1/17/13 | | | 1,210,000 | | | 1,029,385 | D |

Marsh and McLennan Cos. Inc. | | | | 5.150% | | 9/15/10 | | | 3,070,000 | | | 3,076,582 | |

MetLife Inc. | | | | 6.400% | | 12/15/36 | | | 46,870,000 | | | 33,512,050 | |

The Travelers Cos. Inc. | | | | 6.250% | | 3/15/37 | | | 37,460,000 | | | 30,191,411 | C |

| | | | | | | | | | | | | |

| | | | | | | | | | | | 72,204,049 | |

| | | | | | | | | | | | | |

Leisure Equipment and Products | | 0.3% | | | | | | | | | | | |

Eastman Kodak Co. | | | | 7.250% | | 11/15/13 | | | 15,200,000 | | | 9,272,000 | |

| | | | | | | | | | | | | |

| | | | | |

Media | | 1.7% | | | | | | | | | | | |

CBS Corp. | | | | 7.625% | | 1/15/16 | | | 2,750,000 | | | 2,592,381 | |

Comcast Corp. | | | | 6.500% | | 1/15/15 | | | 1,200,000 | | | 1,272,822 | |

Comcast Corp. | | | | 6.500% | | 1/15/17 | | | 1,500,000 | | | 1,591,295 | |

Comcast Corp. | | | | 6.950% | | 8/15/37 | | | 3,130,000 | | | 3,263,585 | |

Cox Communications Inc. | | | | 7.875% | | 8/15/09 | | | 9,640,000 | | | 9,697,753 | |

News America Inc. | | | | 6.200% | | 12/15/34 | | | 105,000 | | | 89,638 | |

News America Inc. | | | | 6.650% | | 11/15/37 | | | 700,000 | | | 629,661 | |

Reed Elsevier Capital Inc. | | | | 8.625% | | 1/15/19 | | | 4,740,000 | | | 5,385,474 | |

Time Warner Cable Inc. | | | | 6.200% | | 7/1/13 | | | 6,470,000 | | | 6,817,077 | |

Time Warner Cable Inc. | | | | 8.750% | | 2/14/19 | | | 1,180,000 | | | 1,374,632 | |

Time Warner Cable Inc. | | | | 8.250% | | 4/1/19 | | | 8,630,000 | | | 9,791,745 | |

Time Warner Cable Inc. | | | | 6.750% | | 6/15/39 | | | 2,950,000 | | | 2,871,208 | |

12

Semi-Annual Report to Shareholders

| | | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR/

SHARES | | VALUE | |

| | | | | | | | | | | | | |

Corporate Bonds and Notes—Continued | | | | | | | | | | | | | |

| | | | | |

Media—Continued | | | | | | | | | | | | | |

Viacom Inc. | | | | 5.750% | | 4/30/11 | | $ | 8,580,000 | | $ | 8,783,878 | |

Viacom Inc. | | | | 6.250% | | 4/30/16 | | | 3,400,000 | | | 3,349,544 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | 57,510,693 | |

| | | | | | | | | | | | | |

Multi-Utilities | | 0.1% | | | | | | | | | | | |

Dominion Resources Inc. | | | | 5.125% | | 12/15/09 | | | 50,000 | | | 50,633 | |

Dominion Resources Inc. | | | | 4.750% | | 12/15/10 | | | 570,000 | | | 585,825 | |

Dominion Resources Inc. | | | | 5.700% | | 9/17/12 | | | 2,050,000 | | | 2,180,583 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | 2,817,041 | |

| | | | | | | | | | | | | |

Multiline Retail | | 0.1% | | | | | | | | | | | |

Target Corp. | | | | 4.000% | | 6/15/13 | | | 4,445,000 | | | 4,408,680 | |

| | | | | | | | | | | | | |

| | | | | |

Oil, Gas and Consumable Fuels | | 3.9% | | | | | | | | | | | |

Anadarko Petroleum Corp. | | | | 5.950% | | 9/15/16 | | | 14,503,000 | | | 14,309,008 | |

Anadarko Petroleum Corp. | | | | 6.450% | | 9/15/36 | | | 1,325,000 | | | 1,191,064 | |

Conoco Inc. | | | | 6.950% | | 4/15/29 | | | 2,780,000 | | | 2,995,492 | |

ConocoPhillips | | | | 6.500% | | 2/1/39 | | | 10,660,000 | | | 11,346,856 | |

El Paso Natural Gas Co. | | | | 8.375% | | 6/15/32 | | | 3,610,000 | | | 3,926,712 | |

Hess Corp. | | | | 8.125% | | 2/15/19 | | | 5,610,000 | | | 6,386,727 | |

Hess Corp. | | | | 7.875% | | 10/1/29 | | | 3,840,000 | | | 4,165,041 | |

Hess Corp. | | | | 7.300% | | 8/15/31 | | | 8,695,000 | | | 8,975,353 | |

KazMunaiGaz Exploration Production-GDR | | | | 8.375% | | 7/2/13 | | | 5,830,000 | | | 5,378,175 | D |

Kerr-McGee Corp. | | | | 6.875% | | 9/15/11 | | | 17,000,000 | | | 17,929,322 | |

Kerr-McGee Corp. | | | | 6.950% | | 7/1/24 | | | 650,000 | | | 603,119 | |

Kinder Morgan Energy Partners LP | | | | 7.125% | | 3/15/12 | | | 4,650,000 | | | 4,972,240 | |

Kinder Morgan Energy Partners LP | | | | 5.000% | | 12/15/13 | | | 3,180,000 | | | 3,129,018 | |

Kinder Morgan Energy Partners LP | | | | 6.000% | | 2/1/17 | | | 990,000 | | | 982,144 | |

Kinder Morgan Energy Partners LP | | | | 6.950% | | 1/15/38 | | | 410,000 | | | 397,163 | |

Pemex Project Funding Master Trust | | | | 6.625% | | 6/15/35 | | | 14,213,000 | | | 12,854,692 | |

Sonat Inc. | | | | 7.625% | | 7/15/11 | | | 5,000,000 | | | 4,899,160 | |

Tennessee Gas Pipeline Co. | | | | 8.375% | | 6/15/32 | | | 1,110,000 | | | 1,207,383 | |

The Williams Cos. Inc. | | | | 8.125% | | 3/15/12 | | | 3,240,000 | | | 3,357,774 | |

The Williams Cos. Inc. | | | | 7.500% | | 1/15/31 | | | 7,262,000 | | | 6,390,560 | |

The Williams Cos. Inc. | | | | 8.750% | | 3/15/32 | | | 3,240,000 | | | 3,256,200 | |

XTO Energy Inc. | | | | 7.500% | | 4/15/12 | | | 10,379,000 | | | 11,497,316 | |

XTO Energy Inc. | | | | 6.750% | | 8/1/37 | | | 320,000 | | | 334,065 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | 130,484,584 | |

| | | | | | | | | | | | | |

13

Semi-Annual Report to Shareholders

Portfolio of Investments—Continued

Western Asset Core Bond Portfolio—Continued

| | | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR/

SHARES | | VALUE | |

| | | | | | | | | | | | | |

Corporate Bonds and Notes—Continued | | | | | | | | | | | | | |

| | | | | |

Paper and Forest Products | | 0.1% | | | | | | | | | | | |

Weyerhaeuser Co. | | | | 6.750% | | 3/15/12 | | $ | 2,775,000 | | $ | 2,775,999 | |

| | | | | | | | | | | | | |

| | | | | |

Pharmaceuticals | | 0.4% | | | | | | | | | | | |

Roche Holdings Inc. | | | | 6.000% | | 3/1/19 | | | 4,330,000 | | | 4,616,997 | D |

Wyeth | | | | 5.950% | | 4/1/37 | | | 9,750,000 | | | 10,086,648 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | 14,703,645 | |

| | | | | | | | | | | | | |

Real Estate Investment Trusts (REITs) | | 0.1% | | | | | | | | | | | |

Health Care Property Investors Inc. | | | | 6.450% | | 6/25/12 | | | 3,550,000 | | | 3,454,913 | |

| | | | | | | | | | | | | |

| | | | | |

Specialty Retail | | 0.7% | | | | | | | | | | | |

Autozone Inc. | | | | 6.950% | | 6/15/16 | | | 5,620,000 | | | 5,763,001 | |

Home Depot Inc. | | | | 4.625% | | 8/15/10 | | | 1,380,000 | | | 1,405,938 | |

Home Depot Inc. | | | | 5.250% | | 12/16/13 | | | 2,740,000 | | | 2,815,208 | |

Home Depot Inc. | | | | 5.400% | | 3/1/16 | | | 4,250,000 | | | 4,242,439 | |

Limited Brands Inc. | | | | 6.125% | | 12/1/12 | | | 9,420,000 | | | 9,044,877 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | 23,271,463 | |

| | | | | | | | | | | | | |

Thrifts and Mortgage Finance | | 0.5% | | | | | | | | | | | |

Countrywide Financial Corp. | | | | 6.250% | | 5/15/16 | | | 18,400,000 | | | 16,324,020 | |

| | | | | | | | | | | | | |

| | | | | |

Wireless Telecommunication Services | | 0.3% | | | | | | | | | | | |

Sprint Capital Corp. | | | | 8.375% | | 3/15/12 | | | 7,935,000 | | | 7,815,975 | |

Sprint Capital Corp. | | | | 6.900% | | 5/1/19 | | | 230,000 | | | 190,325 | |

Sprint Capital Corp. | | | | 8.750% | | 3/15/32 | | | 1,050,000 | | | 845,250 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | 8,851,550 | |

| | | | | | | | | | | | | |

Total Corporate Bonds and Notes

(Cost—$1,129,756,972) | | | | | | | | | | | | 972,507,583 | |

Asset-Backed Securities | | 3.8% | | | | | | | | | | | |

| | | | | |

Fixed Rate Securities | | 0.8% | | | | | | | | | | | |

Conseco Finance Securitizations Corp. 2000-5 | | | | 7.960% | | 2/1/32 | | | 3,550,683 | | | 2,099,297 | |

Drive Auto Receivables Trust 2006-2 A3 | | | | 5.330% | | 4/15/14 | | | 20,143,133 | | | 18,983,398 | D |

E-Trade RV and Marine Trust A3-1 | | | | 3.620% | | 10/8/18 | | | 133,986 | | | 130,508 | |

Equity One ABS Inc. 2003-3 | | | | 4.995% | | 12/25/33 | | | 4,068,582 | | | 2,728,029 | |

Green Tree Financial Corp. 1996-5 | | | | 8.100% | | 7/15/26 | | | 407,940 | | | 46,988 | |

Patrons’ Legacy 2003-IV | | | | 5.775% | | 12/23/63 | | | 5,800,000 | | | 4,654,119 | D,H |

| | | | | | | | | | | | | |

| | | | | | | | | | | | 28,642,339 | |

| | | | | | | | | | | | | |

14

Semi-Annual Report to Shareholders

| | | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR/

SHARES | | VALUE | |

| | | | | | | | | | | | | |

Asset-Backed Securities—Continued | | | | | | | | | | | | | |

| | | | | |

Indexed SecuritiesA | | 3.0% | | | | | | | | | | | |

Amortizing Residential Collateral Trust 2005-BC5 M1 | | | | 1.349% | | 7/25/32 | | $ | 2,354,520 | | $ | 1,452,318 | |

Asset-Backed Funding Certificates 2002-SB1 | | | | 0.744% | | 12/25/30 | | | 1,185,315 | | | 746,027 | |

Bear Stearns Asset Backed Securities Trust 2007-HE6 1A1 | | | | 1.564% | | 8/25/37 | | | 9,546,498 | | | 5,044,550 | |

Brazos Higher Education Authority Inc. 2005-1 | | | | 1.252% | | 9/26/16 | | | 2,597,029 | | | 2,397,603 | |

CDC Mortgage Capital Trust 2002-HE1 | | | | 0.934% | | 1/25/33 | | | 457,551 | | | 328,016 | |

CIT Group Home Equity Loan Trust 2002-1 | | | | 0.604% | | 3/25/33 | | | 278,463 | | | 246,369 | |

Citigroup Mortgage Loan Trust Inc. 2007-SHL1 A | | | | 0.714% | | 11/25/46 | | | 4,418,853 | | | 1,653,093 | D |

Countrywide Asset-Backed Certificates 2003-BC3 | | | | 0.934% | | 9/25/33 | | | 467,213 | | | 256,584 | |

Fleet Home Equity Loan Trust 2003-1 | | | | 0.565% | | 1/20/33 | | | 1,586,276 | | | 958,550 | |

GMAC Mortgage Corp. Loan Trust 2004-VF1 A1 | | | | 1.064% | | 2/25/31 | | | 44,652,684 | | | 17,575,801 | D |

GMAC Mortgage Corp. Loan Trust 2005-HE3 A1VN | | | | 0.569% | | 2/25/36 | | | 19,770,568 | | | 5,155,153 | H |

GSAMP Trust 2006-S4 | | | | 0.404% | | 5/25/36 | | | 1,649,779 | | | 206,430 | |

Lehman XS Trust 2005-5N | | | | 0.614% | | 11/25/35 | | | 7,394,189 | | | 3,093,003 | |

Lehman XS Trust 2006-2N 1A1 | | | | 0.574% | | 2/25/46 | | | 13,950,646 | | | 5,842,765 | |

Lehman XS Trust 2006-GP4 | | | | 0.384% | | 8/25/46 | | | 1,594,848 | | | 1,292,332 | |

Long Beach Mortgage Loan Trust 2000-1 | | | | 0.835% | | 1/21/31 | | | 186,033 | | | 122,057 | |

Long Beach Mortgage Loan Trust 2006-9 2A3 | | | | 0.474% | | 10/25/36 | | | 3,200,000 | | | 763,562 | |

Merrill Lynch Mortgage Investors Trust 2007-SD1 A1 | | | | 0.764% | | 2/25/47 | | | 41,436,928 | | | 21,893,769 | |

MSDWCC Heloc Trust 2005-1 | | | | 0.504% | | 7/25/17 | | | 1,450,276 | | | 607,525 | |

Provident Bank Home Equity Loan Trust 1999-3 | | | | 1.094% | | 1/25/31 | | | 602,389 | | | 216,951 | |

RAAC 2007-SP3 A1 | | | | 1.514% | | 9/25/37 | | | 817,744 | | | 506,961 | |

Residential Asset Mortgage Products Inc. 2003-RS2 | | | | 0.994% | | 3/25/33 | | | 149,081 | | | 66,189 | |

Residential Asset Securities Corp. 2001-KS2 | | | | 0.774% | | 6/25/31 | | | 243,758 | | | 148,941 | |

Residential Asset Securities Corp.

2001-KS3 AII | | | | 0.774% | | 9/25/31 | | | 93,452 | | | 56,604 | |

SACO I Trust 2005-10 1A | | | | 0.574% | | 6/25/36 | | | 3,714,999 | | | 1,019,111 | |

SACO I Trust 2005-8 A1 | | | | 0.594% | | 11/25/20 | | | 1,054,764 | | | 426,935 | |

15

Semi-Annual Report to Shareholders

Portfolio of Investments—Continued

Western Asset Core Bond Portfolio—Continued

| | | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR/

SHARES | | VALUE | |

| | | | | | | | | | | | | |

Asset-Backed Securities—Continued | | | | | | | | | | | | | |

| | | | | |

Indexed Securities—Continued | | | | | | | | | | | | | |

Securitized Asset Backed Receivables LLC Trust 2007-BR2 A2 | | | | 0.544% | | 2/25/37 | | $ | 43,130,928 | | $ | 17,069,535 | |

SLM Student Loan Trust 2006-5 | | | | 1.082% | | 7/25/17 | | | 10,506,775 | | | 10,499,898 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | 99,646,632 | |

| | | | | | | | | | | | | |

Total Asset-Backed Securities

(Cost—$246,983,365) | | | | | | | | | | | | 128,288,971 | |

Mortgage-Backed Securities | | 19.3% | | | | | | | | | | | |

| | | | | |

Fixed Rate Securities | | 7.4% | | | | | | | | | | | |

Banc of America Commercial Mortgage Inc. 2006-3 A4 | | | | 5.889% | | 7/10/44 | | | 20,000,000 | | | 15,880,860 | |

Banc of America Commercial Mortgage Inc. 2007-5 A3 | | | | 5.620% | | 2/10/51 | | | 3,710,000 | | | 2,782,823 | |

Citicorp Mortgage Securities Inc. 2003-7 A1 | | | | 4.750% | | 8/25/18 | | | 5,909,414 | | | 5,645,248 | |

Commercial Mortgage Asset Trust

1999-C1 A3 | | | | 6.640% | | 1/17/32 | | | 692,049 | | | 695,884 | |

Countrywide Alternative Loan Trust 2003-20CB 1A1 | | | | 5.500% | | 10/25/33 | | | 9,050,881 | | | 7,532,030 | |

Credit Suisse Mortgage Capital Certificates 2006-C5 A3 | | | | 5.311% | | 12/15/39 | | | 14,800,000 | | | 10,143,560 | |

GE Capital Commercial Mortgage Corp. 2007-C1 A4 | | | | 5.543% | | 12/10/49 | | | 1,330,000 | | | 918,769 | |

GMAC Commercial Mortgage Securities Inc 2006-C1 A4 | | | | 5.238% | | 11/10/45 | | | 3,800,000 | | | 3,147,247 | |

GS Mortgage Securities Corp. II 2005-GG4 | | | | 4.680% | | 7/10/39 | | | 12,900,000 | | | 12,418,551 | |

GSR Mortgage Loan Trust 2005-4F 1A1 | | | | 4.500% | | 4/25/20 | | | 5,857,573 | | | 5,505,204 | |

JP Morgan Chase Commercial Mortgage Securities Corp. 2007-LDPX A3 | | | | 5.420% | | 5/15/49 | | | 31,000,000 | | | 22,818,774 | |

LB-UBS Commercial Mortgage Trust 2005-C3 AAB | | | | 4.664% | | 7/15/30 | | | 15,000,000 | | | 14,419,006 | |

LB-UBS Commercial Mortgage Trust 2005-C5 | | | | 4.954% | | 9/15/30 | | | 9,730,000 | | | 8,336,805 | |

MASTR Reperforming Loan Trust 2005-1 | | | | 6.500% | | 8/25/34 | | | 915,128 | | | 947,014 | D |

MASTR Reperforming Loan Trust 2005-1 1A3 | | | | 7.000% | | 8/25/34 | | | 7,448,527 | | | 8,193,380 | D |

Morgan Stanley Capital I 2005-HQ6 | | | | 4.989% | | 8/13/42 | | | 8,370,000 | | | 7,150,768 | |

Prime Mortgage Trust 2006-DR1 1A1 | | | | 5.500% | | 5/25/35 | | | 21,630,064 | | | 20,474,208 | D |

Prime Mortgage Trust 2006-DR1 1A2 | | | | 6.000% | | 5/25/35 | | | 9,704,310 | | | 9,300,974 | D |

Prime Mortgage Trust 2006-DR1 2A2 | | | | 6.000% | | 5/25/35 | | | 40,806,213 | | | 28,353,944 | D |

Residential Accredit Loans Inc.

2007-QS4 3A9 | | | | 6.000% | | 3/25/37 | | | 8,300,000 | | | 3,606,743 | |

16

Semi-Annual Report to Shareholders

| | | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR/

SHARES | | VALUE | |

| | | | | | | | | | | | | |

Mortgage-Backed Securities—Continued | | | | | | | | | | | | | |

| | | | | |

Fixed Rate Securities—Continued | | | | | | | | | | | | | |

Residential Asset Mortgage Products Inc. 2005-SL2 | | | | 7.500% | | 2/25/32 | | $ | 2,983,825 | | $ | 1,611,265 | H |

Residential Asset Securitization Trust 2003-A14 | | | | 4.750% | | 2/25/19 | | | 33,913,996 | | | 33,394,688 | |

Structured Asset Securities Corp. 2003-29 1A1 | | | | 4.750% | | 9/25/18 | | | 19,839,243 | | | 19,733,847 | |

WaMu Mortgage Pass-Through Certificates 2003-S7 A1 | | | | 4.500% | | 8/25/18 | | | 3,532,247 | | | 3,461,051 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | 246,472,643 | |

| | | | | | | | | | | | | |

Indexed SecuritiesA | | 8.1% | | | | | | | | | | | |

American Home Mortgage Assets 2006-4 | | | | 0.524% | | 10/25/46 | | | 886,862 | | | 287,859 | |

American Home Mortgage Investment Trust 2006-2 1A1 | | | | 0.394% | | 6/25/46 | | | 1,367,251 | | | 1,136,230 | |

Amortizing Residential Collateral Trust 2002-BC1M | | | | 0.594% | | 1/1/32 | | | 1,684,161 | | | 757,872 | |

Banc of America Funding Corp. 2005-E | | | | 3.433% | | 6/20/35 | | | 11,091,636 | | | 4,575,029 | |

Bear Stearns Adjustable Rate Mortgage Trust 2004-9 24A1 | | | | 5.448% | | 11/25/34 | | | 14,789,009 | | | 13,163,370 | |

Bear Stearns Mortgage Funding Trust 2007-AR5 1A1A | | | | 0.484% | | 6/25/47 | | | 7,161,000 | | | 2,894,491 | |

Citigroup Mortgage Loan Trust Inc. 2005-HE2 | | | | 0.714% | | 5/25/35 | | | 2,139,033 | | | 1,280,532 | D |

Countrywide Alternative Loan Trust 2005-14 | | | | 0.524% | | 5/25/35 | | | 6,393,093 | | | 2,878,509 | |

Countrywide Alternative Loan Trust

2005-17 1A1 | | | | 0.574% | | 7/25/35 | | | 8,115,686 | | | 3,778,426 | |

Countrywide Alternative Loan Trust

2005-17 2A1 | | | | 0.554% | | 7/25/35 | | | 17,299,411 | | | 7,227,668 | |

Countrywide Alternative Loan Trust

2005-38 A3 | | | | 0.664% | | 9/25/35 | | | 5,347,117 | | | 2,432,520 | |

Countrywide Alternative Loan Trust

2005-56 3A1 | | | | 0.604% | | 11/25/35 | | | 743,322 | | | 324,843 | |

Countrywide Alternative Loan Trust

2005-59 1A1 | | | | 0.644% | | 11/20/35 | | | 2,294,808 | | | 1,036,439 | |

Countrywide Alternative Loan Trust

2005-85CB 2A5 | | | | 1.414% | | 2/25/36 | | | 7,996,365 | | | 2,306,580 | |

Countrywide Alternative Loan Trust 2006-0A7 | | | | 0.524% | | 6/25/46 | | | 10,396,009 | | | 3,971,147 | |

Countrywide Alternative Loan Trust 2006-OA2 A1 | | | | 0.525% | | 5/20/46 | | | 4,909,622 | | | 1,957,905 | |

17

Semi-Annual Report to Shareholders

Portfolio of Investments—Continued

Western Asset Core Bond Portfolio—Continued

| | | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR/

SHARES | | VALUE | |

| | | | | | | | | | | | | |

Mortgage-Backed Securities—Continued | | | | | | | | | | | | | |

| | | | | |

Indexed Securities—Continued | | | | | | | | | | | | | |

Countrywide Home Loans 2005-03 1A2 | | | | 0.604% | | 4/25/35 | | $ | 9,002,154 | | $ | 4,038,219 | |

Countrywide Home Loans 2005-09 1A1 | | | | 0.614% | | 5/25/35 | | | 8,918,983 | | | 3,995,046 | |

Countrywide Home Loans 2005-09 2A1 | | | | 0.534% | | 5/25/35 | | | 4,887,484 | | | 2,097,436 | |

Deutsche Mortgage Securities Inc.

2004-4 7AR2 | | | | 0.764% | | 6/25/34 | | | 1,958,803 | | | 1,411,909 | |

Downey Savings and Loan Association Mortgage Loan Trust 2005-AR6 | | | | 0.603% | | 10/19/45 | | | 3,349,164 | | | 1,483,877 | |

First Horizon Alternative Mortgage Securities 2006-FA8 1A8 | | | | 0.684% | | 2/25/37 | | | 4,038,893 | | | 1,787,893 | |

GMAC Mortgage Corp. Loan Trust

2004-AR2 3A | | | | 4.490% | | 8/19/34 | | | 27,244,061 | | | 23,720,071 | |

Greenpoint Mortgage Funding Trust 2005-AR1 | | | | 0.534% | | 6/25/45 | | | 6,540,755 | | | 2,781,403 | |

Greenpoint Mortgage Funding Trust 2005-AR4 | | | | 0.574% | | 10/25/45 | | | 1,260,383 | | | 625,951 | |

Greenpoint Mortgage Funding Trust 2006-AR4 | | | | 0.414% | | 9/25/46 | | | 19,183,425 | | | 15,409,120 | |

Greenpoint Mortgage Funding Trust 2006-AR5 | | | | 0.394% | | 10/25/46 | | | 23,901,917 | | | 18,617,710 | |

GSMPS Mortgage Loan Trust 2005-RP2 | | | | 0.664% | | 3/25/35 | | | 14,014,884 | | | 12,733,434 | D |

Harborview Mortgage Loan Trust 2005-7 | | | | 3.477% | | 6/19/45 | | | 13,235,900 | | | 5,295,407 | H |

Harborview Mortgage Loan Trust

2006-14 2A1A | | | | 0.463% | | 3/19/38 | | | 703,753 | | | 270,763 | |

Harborview Mortgage Loan Trust

2006-9 2A1A | | | | 0.523% | | 11/19/36 | | | 852,194 | | | 330,430 | |

Harborview Mortgage Loan Trust

2007-7 2A1A | | | | 1.314% | | 11/25/47 | | | 53,486,315 | | | 20,299,116 | |

Impac Secured Assets Corp. 2005-2 | | | | 0.634% | | 3/25/36 | | | 1,153,781 | | | 474,169 | |

Impac Secured Assets Corp. 2006-2 2A1 | | | | 0.664% | | 8/25/36 | | | 2,537,725 | | | 1,406,758 | |

IndyMac Inda Mortgage Loan Trust 2007-AR7 1A1 | | | | 6.142% | | 11/25/37 | | | 6,773,151 | | | 4,418,445 | |

Luminent Mortgage Trust 2007-2 2A1 | | | | 0.544% | | 5/25/37 | | | 357,584 | | | 146,609 | |

MASTR Adjustable Rate Mortgages Trust 2007-3 22A2 | | | | 0.524% | | 5/25/47 | | | 34,908,000 | | | 14,490,464 | |

Medallion Trust 2003-1G | | | | 0.799% | | 12/21/33 | | | 1,326,617 | | | 1,057,892 | H |

Merrill Lynch Mortgage Investors Inc. 2005-A3 A1 | | | | 0.584% | | 4/25/35 | | | 630,293 | | | 365,087 | |

MLCC Mortgage Investors Inc. 2003-B | | | | 0.654% | | 4/25/28 | | | 1,720,071 | | | 1,367,922 | |

MLCC Mortgage Investors Inc. 2006-1 1A | | | | 4.677% | | 2/25/36 | | | 599,570 | | | 520,271 | H |

18

Semi-Annual Report to Shareholders

| | | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR/

SHARES | | VALUE | |

| | | | | | | | | | | | | |

Mortgage-Backed Securities—Continued | | | | | | | | | | | | | |

| | | | | |

Indexed Securities—Continued | | | | | | | | | | | | | |

Residential Accredit Loans Inc.

2006-QO10 A1 | | | | 0.474% | | 1/25/37 | | $ | 15,694,034 | | $ | 6,314,732 | |

Structured Adjustable Rate Mortgage Loan Trust 2005-19XS | | | | 0.634% | | 10/25/35 | | | 1,374,415 | | | 619,031 | |

Structured Asset Mortgage Investments Inc. 2006-AR6 | | | | 0.504% | | 7/25/46 | | | 15,295,845 | | | 5,356,411 | |

Structured Asset Mortgage Investments Inc. 2006-AR7 A1A | | | | 0.524% | | 8/25/36 | | | 33,603,616 | | | 13,841,555 | |

WaMu Alternative Mortgage Pass-Through Certificates 2007-OA4 A1A | | | | 2.100% | | 4/25/47 | | | 22,781,891 | | | 9,108,168 | |

WaMu Mortgage Pass-Through Certificates 2005-AR06 2A1A | | | | 0.544% | | 4/25/45 | | | 8,177,820 | | | 4,188,700 | |

WaMu Mortgage Pass-Through Certificates 2005-AR08 1A1A | | | | 0.584% | | 7/25/45 | | | 8,810,768 | | | 4,169,861 | |

WaMu Mortgage Pass-Through Certificates 2005-AR11 | | | | 0.634% | | 8/25/45 | | | 22,585,231 | | | 12,249,247 | |

WaMu Mortgage Pass-Through Certificates 2005-AR13 A1A1 | | | | 0.604% | | 10/25/45 | | | 13,597,783 | | | 7,113,826 | |

WaMu Mortgage Pass-Through Certificates 2005-AR13 B10 | | | | 1.514% | | 10/25/45 | | | 3,720,359 | | | 48,974 | D |

WaMu Mortgage Pass-Through Certificates 2005-AR17 A1A2 | | | | 0.604% | | 12/25/45 | | | 8,320,411 | | | 3,689,645 | |

WaMu Mortgage Pass-Through Certificates 2005-AR19 A1A1 | | | | 0.584% | | 12/25/45 | | | 16,301,494 | | | 7,636,298 | |

WaMu Mortgage Pass-Through Certificates 2005-AR19 A1A2 | | | | 0.604% | | 12/25/45 | | | 16,458,844 | | | 7,691,728 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | 271,182,998 | |

| | | | | | | | | | | | | |

Stripped Securities | | N.M. | | | | | | | | | | | |

FFCA Secured Lending Corp. 1999-1A | | | | 1.283% | | 9/18/25 | | | 2,685,957 | | | 61,807 | D,G,I1 |

LB-UBS Commercial Mortgage Trust 2001-C3 X | | | | 1.144% | | 6/15/36 | | | 15,282,068 | | | 231,016 | D,G,I1 |

Structured Mortgage Asset Residential Trust 1991-8 | | | | 0.014% | | 1/25/23 | | | 557,396 | | | 62 | G,I1 |

| | | | | | | | | | | | | |

| | | | | | | | | | | | 292,885 | |

| | | | | | | | | | | | | |

Variable Rate SecuritiesJ | | 3.8% | | | | | | | | | | | |

Banc of America Commercial Mortgage Inc. 2005-5 A4 | | | | 5.115% | | 10/10/45 | | | 10,000 | | | 8,538 | |

19

Semi-Annual Report to Shareholders

Portfolio of Investments—Continued

Western Asset Core Bond Portfolio—Continued

| | | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR/

SHARES | | VALUE | |

| | | | | | | | | | | | | |

Mortgage-Backed Securities—Continued | | | | | | | | | | | | | |

| | | | | |

Variable Rate Securities—Continued | | | | | | | | | | | | | |

Citigroup Mortgage Loan Trust Inc. 2005-5 3A2A | | | | 5.625% | | 10/25/35 | | $ | 4,199,897 | | $ | 2,842,931 | |

Credit Suisse Mortgage Capital Certificates 2006-C1 A4 | | | | 5.609% | | 2/15/39 | | | 4,180,000 | | | 3,381,719 | |

Credit Suisse Mortgage Capital Certificates A3-C2 | | | | 5.846% | | 3/15/39 | | | 32,000,000 | | | 22,866,806 | |

Deutsche Mortgage Securities Inc. 2005-WF1 1A3 | | | | 5.119% | | 6/26/35 | | | 11,730,000 | | | 7,587,980 | D |

GE Capital Commercial Mortgage Corp. 2005-C4 | | | | 5.513% | | 11/10/45 | | | 10,000 | | | 8,416 | |

Greenwich Capital Commercial Funding Corp. 2006-GG7 | | | | 6.115% | | 7/10/38 | | | 8,370,000 | | | 6,865,767 | |