QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrantý

|

| Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12

|

A.D.A.M., INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

May 30, 2002

Dear Shareholder:

You are cordially invited to attend the 2002 Annual Meeting of Shareholders of A.D.A.M., Inc. to be held on June 21, 2002 at 1600 RiverEdge Parkway, Suite 800, Atlanta, Georgia 30328-4658. The meeting will begin promptly at 9:00 a.m., local time, and we hope that it will be possible for you to attend.

The items of business are listed in the Notice of Annual Meeting and are more fully addressed in the Proxy Statement provided herewith.

Please date, sign and return your proxy card in the enclosed envelope at your convenience to assure that your shares will be represented and voted at the Annual Meeting even if you cannot attend. If you attend the annual meeting, you may vote your shares in person even though you have previously signed and returned your proxy.

On behalf of your Board of Directors, thank you for your continued support and interest in A.D.A.M., Inc.

Notice of Annual Meeting of Shareholders

to be held June 21, 2002

The Annual Meeting of Shareholders of A.D.A.M., Inc. (the "Company" or "A.D.A.M.") will be held at 1600 RiverEdge Parkway, Suite 800, Atlanta, Georgia 30328-4658, on Friday, June 21, 2002 at 9:00 a.m., local time, for the following purposes:

- (1)

- To elect one director to serve until the 2004 Annual Meeting of Shareholders and two directors to serve until the 2005 Annual Meeting of Shareholders;

- (2)

- To ratify the appointment of PricewaterhouseCoopers LLP as the Company's independent auditors for the fiscal year ending December 31, 2002;

- (3)

- To vote on a proposal to adopt the Company's 2002 Stock Incentive Plan; and

- (4)

- To transact such other business as may properly come before the meeting or any adjournment thereof.

Only the holders of record of common stock, par value $0.01, of the Company at the close of business on May 20, 2002 are entitled to notice of and to vote at the Annual Meeting of Shareholders and any adjournment thereof. A list of shareholders as of the close of business on May 20, 2002 will be available at the Annual Meeting of Shareholders for examination by any shareholder, his agent or his attorney.

Your attention is directed to the Proxy Statement provided with this Notice.

By Order of the Board of Directors,

Robert S. Cramer, Jr.

Chairman of the Board and Chief Executive Officer

Atlanta, Georgia

May 30, 2002

Whether or not you expect to attend the annual meeting, please complete, sign and date the enclosed proxy and return it promptly in the enclosed envelope, which does not require any postage if mailed in the United States. If you attend the meeting, you may revoke the proxy and vote your shares in person.

A.D.A.M., INC.

1600 RiverEdge Parkway, Suite 800

Atlanta, Georgia 30328

Proxy Statement

for Annual Meeting of Shareholders

to be held June 21, 2002

The 2002 Annual Meeting of Shareholders (the "Annual Meeting") of A.D.A.M., Inc. (the "Company" or "A.D.A.M.") will be held on June 21, 2002, for the purposes set forth in the Notice of Annual Meeting of Shareholders attached hereto. The enclosed form of proxy is solicited by the Board of Directors of the Company (the "Board" or "Board of Directors") and the cost of the solicitation will be borne by the Company. When the proxy is properly executed and returned, the shares it represents will be voted as directed at the Annual Meeting or any adjournment thereof or, if no direction is indicated, such shares will be voted in favor of the proposals set forth in the Notice of Annual Meeting of Shareholders attached hereto. Any shareholder giving a proxy has the power to revoke it at any time before it is voted. All proxies delivered pursuant to this solicitation are revocable at any time at the option of the persons executing them by giving written notice to the Secretary of the Company, by delivering a later-dated proxy or by voting in person at the Annual Meeting.

Record Date

Only shareholders of record as of the close of business on May 20, 2002 (the "record date") will be entitled to vote at the Annual Meeting. As of that date, the Company had outstanding 7,564,284 shares of common stock, $0.01 par value ("Common Stock"). Shareholders of record as of the close of business on May 20, 2002 are entitled to one vote for each share of Common Stock held. No cumulative voting rights are authorized and dissenters' rights for shareholders are not applicable to the matters being proposed. It is anticipated that this Proxy Statement and the accompanying proxy will first be mailed to shareholders of the Company on or about May 30, 2002.

Voting and Proxies

The presence in person or by proxy of holders of a majority of the shares of Common Stock outstanding on the record date will constitute a quorum for the transaction of business at the Annual Meeting or any adjournment thereof. The affirmative vote of a plurality of the shares present in person or by proxy and entitled to vote is required to elect directors. With respect to any other matter that may properly come before the Annual Meeting, the approval of any such matter would require a greater number of votes cast in favor of the matter than the number of votes cast opposing such matter. Shares held by nominees for beneficial owners will be counted for purposes of determining whether a quorum is present if the nominee has the discretion to vote on at least one of the matters presented even if the nominee may not exercise discretionary voting power with respect to other matters and voting instructions have not been received from the beneficial owner (a "broker non-vote"). Broker non-votes will not be counted as votes for or against matters presented for shareholder consideration. Abstentions with respect to a proposal are counted for purposes of establishing a quorum. If a quorum is present, abstentions have no effect on the outcome of any vote.

ELECTION OF DIRECTORS

(Item 1)

Under the Bylaws of the Company, the number of directors constituting the Board is fixed at no greater than nine. The Bylaws divide the Board into three classes with the directors in each class serving a term of three years. There is one director, Mark Kishel, who has been nominated to stand for reelection as director until the annual meeting of shareholders in 2004 and two directors, Robert S. Cramer, Jr. and John W. McClaugherty, who have been nominated to stand for reelection as directors until the annual meeting of shareholders in 2005. In addition to these nominees, there is one director continuing to serve

on the Board whose term expires in 2003 and one director continuing to serve on the Board whose term expires in 2004. Effective March 20, 2002, Linda B. Davis, whose term was to expire at the annual meeting of shareholders in 2003, resigned from the Board.

Except as otherwise provided herein, the proxy solicited hereby cannot be voted for the election of a person to fill a directorship for which no nominee is named in this Proxy Statement. The Board has no reason to believe that the nominees will be unavailable for election as a director. However, if at the time of the Annual Meeting the nominees should be unable to serve or, for good cause, will not serve, the person named in the proxy will vote as recommended by the Board to elect substitute nominees recommended by the Board. In no event, however, can a proxy be voted to elect more than three directors.

The following list sets forth the name of the nominees for election to the Board, or until his successor is duly elected and qualified. Such list also contains, as to each nominee and incumbent director, certain biographical information, a brief description of principal occupation and business experience during the past five years and certain other information, which information has been furnished by the respective individuals.

Recommendation of the Board of Directors

The Board unanimously recommends a vote FOR Robert S. Cramer, Jr. and John W. McClaugherty to hold office until the annual meeting of shareholders in 2005 and for Mark Kishel to hold office until the annual meeting of shareholders in 2004 or until his successor is duly elected and qualified.

Nominee for Election to Term Expiring in 2004

Mark Kishel, M.D. (Age 55) Dr. Kishel joined A.D.A.M.'s Board of Directors in November 2001. Dr. Kishel currently serves on the Board of Directors of Immucor, Inc. (Nasdaq NM: BLUD), an international in vitro diagnostic company and is a healthcare consultant through his company, E-Medicine Solutions. Inc. Dr. Kishel was Executive Vice President and Chief Medical Officer for Blue Cross Blue Shield of Georgia from 1993 until its acquisition by Wellpoint in 2001. Dr. Kishel is a board certified pediatrician and a Fellow of the American Academy of Pediatrics. He has practiced pediatrics and family medicine, and over the years, has served in executive medical director roles for several national insurance carriers, including Travelers, HealthAmerica and Lincoln National. He has served on the Blue Cross Blue Shield Association's National Medical Council. Dr. Kishel also served as a director and founder of the Center for Healthcare Improvement, a collaborative research venture between the Medical College of Georgia and Blue Cross and Blue Shield of Georgia, and is currently a director of the Boys and Girls Club of Metro Atlanta.

Nominees for Election to Term Expiring in 2005

Robert S. Cramer, Jr. (Age 41) Mr. Cramer, a co-founder of the Company, has served as Chairman of the Board and a Director since the Company's inception in March 1990, and Chief Executive Officer since September 1996. Mr. Cramer currently serves on the Board of Directors of The Port.com, an Internet technology company he co-founded in 1999. Mr. Cramer also serves as Chairman of the Board of the Atlanta Task Force for the Homeless, a community-wide non profit organization working with and on the behalf of homeless people.

John W. McClaugherty. (Age 44) Mr. McClaugherty, a co-founder of the Company, has served as a Director of the Company since its inception in March 1990. Currently, Mr. McClaugherty serves as President of beBetter Networks, Inc., a human resource productivity company. He has served as its president since its inception in September 1999. Prior thereto, Mr. McClaugherty served as President of J.S.K., Inc., a medical illustration company from 1994 to 1999. Mr. McClaugherty served as Chief Executive Officer of the Company from its inception until March 1994.

2

Directors Continuing in Office until 2003

Francis J. Tedesco. (Age 58) Dr. Tedesco has been a Director of the Company since July 1996. In January 2001, Dr. Tedesco was appointed as President Emeritus of the Medical College of Georgia ("MCG") and Professor Emeritus of Medicine, Surgery, School of Graduate Studies of the MCG. Prior to this, Dr. Tedesco served as Chief Executive Officer of Health Sciences University and as President of the MCG from 1988 to 2001, and has been a Professor of Medicine at MCG from 1981 to 2001. He has been a consultant to Dwight David Eisenhower Medical Center—Fort Gordon, Georgia; Veterans Administration Medical Center—Augusta, Georgia and Walter Reed Army Medical Center—Washington, D.C. Prior to coming to MCG in 1978, Dr. Tedesco held academic appointments beginning in 1971 at the Hospital of the University of Pennsylvania; Washington University School of Medicine, St. Louis, Missouri; and University of Miami School of Medicine. Dr. Tedesco currently serves on the Board of Directors and is Vice President of the Georgia Division of the American Cancer Society, is Chairman of beBetter Networks, Inc., is a member of the CDC Foundation Board of Visitors, serves on the Ty Cobb Foundation Scholarship Board, and serves on the Board of Directors of VerifyMD.com, Inc.

Directors Continuing in Office until 2004

Daniel S. Howe. (Age 42) Mr. Howe has been a Director of the Company since December 1996. Mr. Howe is President of DSH Enterprises, Inc., a real estate development and investment company, and has served in that capacity since January 1990. DSH Enterprises focuses on shopping centers, freestanding drug stores and other commercial property in the Southeastern United States.

Meetings of the Board of Directors

During the year ended December 31, 2001, the Board held nine meetings. Each director that served during the year ended December 31, 2001 attended at least 75% of all Board meetings and meetings held by committees on which the individual director served in the year ended December 31, 2001, except for Ms. Davis who missed three of nine board meetings.

Committees of the Board of Directors

The Board has standing Audit, Stock Repurchase and Compensation/Stock Option Committees that assist it in discharging its responsibilities. These committees, their members and functions are discussed below.

The Audit Committee, which held one meeting during the year ended December 31, 2001, is responsible for recommending independent accountants, reviewing with the accountants the scope and results of the audit engagement, and consulting with independent accountants and management with regard to our accounting methods and control procedures. At the beginning of the year ended December 31, 2001, the Audit Committee was composed of Messrs. Howe (Chairman) and McClaugherty. At a February 26, 2001 Board meeting, the Board voted to change the composition of this committee in order to comply with rules of the Nasdaq National Market. As a result of the vote, the Audit Committee is currently comprised of Messrs. Howe (Chairman) and McClaugherty and Dr. Tedesco.

The Stock Repurchase Committee, which held no meetings during the year ended December 31, 2001, is responsible for the Company's repurchase of its own shares pursuant to the Stock Repurchase Program. The Stock Repurchase Committee is composed of Messrs. Cramer (Chairman) and Howe.

The Compensation/Stock Option Committee, which held one meeting during the year ended December 31, 2001, is responsible for reviewing recommendations from the Chairman of the Board of Directors with regard to the compensation of officers of A.D.A.M. and reporting to the Board of Directors its recommendations with regard to such compensation and is responsible for operating and administering the Company's 1991 Employee Stock Option Plan, its Amended and Restated 1992 Stock Option Plan and its

3

2002 Stock Incentive Plan. The Compensation/Stock Option Committee is comprised of Dr. Tedesco (Chairman) and Mr. McClaugherty.

Audit Committee Report

We have reviewed and discussed the Company's audited financial statements for the year ended December 31, 2001 with management and have discussed with PricewaterhouseCoopers LLP, certified public accountants, the independent auditors and accountants for the Company, the matters required to be discussed by SAS 61 (Codification of Statements on Auditing Standards, AU Section 380) with respect to those statements.

We have received and reviewed the letter from PricewaterhouseCoopers LLP required by Independence Standards Board Standard No. 1 (Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees) and have discussed with PricewaterhouseCoopers LLP its independence in connection with its audit of the Company's most recent financial statements. Based on this review and these discussions, we recommended to the Board of Directors that these audited financial statements be included in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2001.

Daniel S. Howe, John W. McClaugherty and Francis J. Tedesco comprised the Audit Committee at the time of the filing of the Annual Report on Form 10-K. Messrs. Howe and McClaugherty and Dr. Tedesco are independent, as defined in Rule 4200(a)(14) of the National Association of Securities Dealer's listing standards.

The information in the foregoing paragraphs shall not be deemed to be soliciting material, or be filed with the SEC or subject to Regulation 14A or 14C or to liabilities of Section 18 of the Securities Act, nor shall it be deemed to be incorporated by reference into any filing under the Securities Act or the Exchange Act, except to the extent that we specifically incorporate these paragraphs by reference.

Compensation Committee Interlocks and Insider Participation

During the year ended December 31, 2001, Dr. Tedesco and Mr. McClaugherty were members of the Compensation/Stock Option Committee. During the year ended December 31, 2001, we entered into a sublease agreement with beBetter Networks, Inc., a company which Mr. McClaugherty serves as president and Dr. Tedesco serves as a board member. BeBetter pays A.D.A.M. 8,333 shares of its common stock per month with a fair value of $3,511 as rent. We did not engage in any transactions with Dr. Tedesco during 2001. Mr. McClaugherty formerly served as an officer of A.D.A.M. from inception until March 1994.

Compensation of Directors

To date, directors have not received cash compensation for their services as directors of A.D.A.M. On January 2, 2001, each non-employee director of the Company was awarded an option to purchase 25,000 shares of A.D.A.M. common stock. Such options have a term of ten years from the date of grant and vest one year from the date of grant. Each option has an exercise price of $1.94 per share.

4

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

(Item 2)

The Board of Directors of the Company, upon the recommendation of the Audit Committee, has appointed PricewaterhouseCoopers LLP to serve as independent auditors of the Company for the year ending December 31, 2002, subject to ratification of this appointment by the shareholders of the Company. PricewaterhouseCoopers LLP has served as independent auditors of the Company for many years and is considered by management of the Company to be well qualified. The Company has been advised by PricewaterhouseCoopers LLP that neither it nor any member thereof has any financial interest, direct or indirect, in the Company or any of its subsidiaries in any capacity. One or more representatives of PricewaterhouseCoopers LLP will be present at the Annual Meeting, will have an opportunity to make a statement if he or she desires to do so and will be available to respond to appropriate questions.

Recommendation of the Board of Directors

The Board of Directors of the Company recommends a vote for the proposal to ratify the appointment of PricewaterhouseCoopers LLP as independent auditors of the Company for the year ending December 31, 2002. Proxies received by the Board of Directors will be so voted unless shareholders specify in their proxies a contrary choice.

APPROVAL OF 2002 STOCK INCENTIVE PLAN

(Item 3)

General

In March 2002, subject to shareholder approval, the Company's Board of Directors adopted the A.D.A.M., Inc. 2002 Stock Incentive Plan (the "Plan") for employees, consultants and independent agents who are contributing significantly to the business of the Company or its subsidiaries as determined by the Company's Board of Directors or the committee administering the Plan. The Plan provides for the grant of incentive and non-qualified stock options, as well as restricted stock and stock appreciation rights, to purchase up to 1,500,000 shares of common stock at the discretion of the Board of Directors of the Company or a committee designated by the Board of Directors to administer the Plan.

Under the terms of the Plan, the Board of Directors may grant options to purchase shares of Common Stock to officers and employees of the Company or of a subsidiary of the Company, as well as to consultants or independent agents. As of May 30, 2002, approximately 60 officers and employees were eligible to participate in the Plan.

As of May 30, 2002, the Company has granted options to purchase 30,000 shares of common stock pursuant to the Plan.

Description of Proposed Amendment

A copy of the Plan is attached hereto as Appendix "A."The Board of Directors recommends that shareholders vote "FOR" the proposal to adopt the Plan. The affirmative vote of a majority of the shares of the Company's common stock represented in person or by proxy at the Annual Meeting is necessary for the approval of the proposed to adopt the Plan.

Description of the Plan

Effective Date. The effective date of the Plan is March 11, 2002. The Plan shall be unlimited in duration and, in the event of Plan termination, shall remain in effect as long as any awards under it are outstanding; provided, however, that to the extent required by the Internal Revenue Code of 1986, as amended (the "Code"), no incentive stock options may be granted under the Plan on a date that is more than ten years from the date the Plan was adopted.

5

Shares Reserved for the Plan. The maximum number of shares which shall be reserved and made available for sale under the Plan shall be 1,500,000 shares of our common stock. However, the number of shares available for issuance under the Plan shall automatically increase on the first trading day of each calendar year beginning January 1, 2003, by an amount equal to 3% of the shares of common stock outstanding on the trading day immediately preceding January 1, but in no event shall any annual increase exceed 250,000 shares. Any shares subject to an option which for any reason expires or is terminated unexercised may again be subject to an option under the Plan.

In the event of a corporate transaction involving the Company, including a stock split or dividend, recapitalization, reorganization, merger, consolidation or the like, the Company may adjust awards to facilitate the transaction or to preserve the benefits or potential benefits of the awards. This might include adjustment of the number of securities subject to outstanding awards and the exercise price.

Persons Eligible to Participate in the Plan. Under the Plan, options may be granted only to officers and employees of Standard Management or its subsidiaries, as well as certain consultants and independent agents to us. In determining the persons to whom options will be granted and the number of shares to be covered by each option, the Board of Directors or the committee shall take into account the duties of each recipient, their present and potential contributions to our success, the anticipated number of years of effective service remaining, and any other factors as they shall deem relevant in connection with accomplishing the purposes of the Plan.

Administration of the Plan. The Plan shall be administered by the Board of Directors or a committee composed of not less than two members appointed by the Board of Directors from among its members (the "Committee"). With respect to any awards to an executive officer, each member of the Committee shall be a "non-employee director" as such term is defined in Rule 16b-3 under the Securities Exchange Act of 1934, or any successor regulation. Subject to the provisions of the Plan, the Board of Directors or the Committee has the authority to determine the persons to whom options shall be granted and to determine exercise prices, vesting requirements, the term of and the number of shares covered by each option.

Exercise Price, Terms of Exercise and Payment for Shares. Each option granted under the Plan will be represented by an Option Agreement which shall set forth the terms particular to that option, including the number of shares covered by the option, the exercise price, the term of the option and any vesting requirements.

The exercise price of options granted under the Plan will be determined by the Board of Directors or the Committee, but in no event shall such exercise price be less than 100% of the fair market value of our common stock on the date of grant of the option in the case of qualified incentive stock options. In the case of non-qualified stock options, the limitations with respect to the exercise price shall not be applicable.

Options may be purchased in whole or in part by the optionee, but in no event later than 10 years from the date of the grant. Any incentive stock option granted under the Plan to an individual who owns more than 10% of the total combined voting power of all classes of our stock may not be purchased at a price less than 110% of the fair market value on the day the option is granted, and no such option may be exercised more than five years from the date of grant. The purchase price for the shares shall be paid in cash or shares of common stock, or a combination of both. Common stock purchased pursuant to an option must be paid for in full at the time of purchase. Upon payment, we will deliver stock certificates for such shares to the optionee.

Termination of Employment, Assignment and Other Limitations. In the event that a holder of an incentive stock option granted under the Plan ceases to be our employee for any reason other than his or her death or total and permanent disability, any option or unexercised portion thereof, which is otherwise exercisable on the date of such termination, shall expire no more than three months from the date of such

6

termination or at the end of the term of the Option Agreement, whichever comes first. Any options which are not exercisable on the date of such termination shall immediately terminate.

Upon the death or total and permanent disability of the holder of an option, any incentive stock option or unexercised portion thereof which is otherwise exercisable shall expire within one year of the date of such death or disability. Any incentive stock options which were not exercisable on the date of such death or disability may, in the discretion of the Board of Directors or the Committee, become immediately exercisable for a period of one year from the date of such death or disability or until the end of the term of the Option Agreement, whichever comes first.

With respect to non-qualified option grants, limitations with respect to termination of employment or death shall be determined on a case by case basis by the Board of Directors or the Committee at the time of the non-qualified option grant.

Awards under the Plan are non-transferable except by will or under the laws of descent and distribution.

Limitation on Number of Shares That May be Purchased. For incentive stock options granted under the Plan, the aggregate fair market value (determined at the time the option was granted) of the shares with respect to which incentive stock options are exercisable for the first time by an optionee during any calendar year shall not exceed $100,000. This limitation does not apply to non-qualified option grants.

Amendment and Termination of the Plan. The Board of Directors may at any time and from time to time terminate, modify or amend the Plan in any respect, except that without shareholder approval the Board of Directors may not (i) increase the maximum number of shares for which options may be granted under the Plan, or (ii) change the class of persons eligible for qualified incentive stock options.

Incentive Stock Options. All stock options granted or to be granted under the Plan which are designated as incentive stock options are intended to be incentive stock options as defined in Section 422 of the Code.

Under the provisions of Section 422 of the Code, neither the holder of an incentive stock option nor we will recognize income, gain, deduction or loss upon the grant or exercise of an incentive stock option. An optionee will be taxed only when the stock acquired upon exercise of his incentive stock option is sold or otherwise disposed of in a taxable transaction. If at the time of such sale or disposition the optionee has held the shares for the required holding period (the later of (i) two years from the date the option was granted, or (ii) one year from the date of the transfer of the shares to the optionee upon exercise of the option), the optionee will recognize long-term capital gain or loss, as the case may be, based upon the difference between his exercise price and the net proceeds of the sale. However, if the optionee disposes of the shares before the end of such holding period, the optionee will recognize ordinary income on such disposition in an amount equal to the lesser of:

(a) gain on the sale or other disposition; or

(b) the amount by which the fair market value of the shares on the date of exercise exceeded the option exercise price, with any excess gain being capital gain, long-term or short-term, depending on whether or not the shares had previously been held for more than one year on the date of sale or other taxable disposition.

The foregoing discussion and the reference to capital gain or loss treatment therein assume that the option shares are a capital asset in the hands of the optionee. A sale or other disposition which results in the recognition of ordinary income to the optionee will also result in a corresponding income tax deduction for us.

7

The Plan permits an optionee to pay all or part of the purchase price for shares acquired pursuant to exercise of an incentive stock option by transferring to us other shares of our common stock owned by the optionee. Section 422 of the Code provides that an option will continue to be treated as an incentive stock option even if an optionee exercises such incentive stock option with previously acquired stock of the corporation granting the option. Accordingly, except as noted below with respect to certain "statutory option stock," an optionee who exercises an incentive stock option in whole or in part by transferring to us shares of our common stock will recognize no gain or loss upon such exercise.

Section 424(c)(3) of the Code provides that if "statutory option stock" is transferred in connection with the exercise of an incentive stock option, and if the holding period requirements under Section 422(a)(1) of the Code are not met with respect to such statutory option stock before such transfer, then ordinary income will be recognized as a result of the transfer of statutory option stock. However, the incentive stock option stock acquired through the exchange of statutory option stock will still qualify for favorable tax treatment under Section 422 of the Code.

Incentive stock options offer two principal tax benefits: (1) the possibility of converting ordinary income into capital gain to the extent of the excess of fair market value over option price at the time of exercise, and (2) the deferral of recognition of gain until disposition of the stock acquired upon the exercise of the option.

The Taxpayer Relief Act of 1997 (the "1997 Tax Act") and the Restructuring and Reform Bill of 1998 (the "1998 Tax Act") made significant changes to individual capital gains tax rates. The 1997 Tax Act generally reduced the maximum tax rate for gains realized by individual taxpayers from the sale of capital assets held for more than eighteen months from 28% to 20% (18% if the property has been held for more than five years and is acquired and sold after the year 2000). For capital assets held for more than one year but not more than eighteen months, the maximum tax rate remains at 28%, as it was under prior law. In addition, taxpayers otherwise subject to the 15% rate bracket will be entitled to a 10% maximum tax rate on long-term capital gains (18% if the property has been held for more than five years and is sold after the year 2000). These rates and holding periods will apply to the extent of any dispositions during any tax year ending before January 1, 1998. The 1998 Tax Act eliminated the eighteen month holding period for most capital assets, including shares of stock with the effect that most capital assets that are held for more than twelve months but not more than eighteen months will be subject to the 20% capital gains rate, rather than the 28% rate. In addition, the 1998 Tax Act clarified that gains on capital assets held for more than twelve months, rather than eighteen months will be considered long-term capital gains. The new maximum tax rates for long-term capital gains will apply for purposes of both the regular income tax and the alternative minimum tax. However, the excess of the fair market value of shares acquired through the exercise of an incentive stock option over the exercise price is taken into account in computing an individual taxpayer's alternative minimum taxable income. Thus, the exercise of an incentive stock option could result in the imposition of an alternative minimum tax liability.

In general, an option granted under the Plan which is designated as an incentive stock option will be taxed as described above. However, in some circumstances an option which is designated as an incentive stock option will be treated as a non-qualified stock option and the holder taxed accordingly. For example, a change in the terms of an option which gives the employee additional benefits may be treated as the grant of a new option. Unless all the criteria for treatment as an incentive stock option are met on the date the "new option" is considered granted (such as the requirement that the exercise price of the option be not less than the fair market value of the stock as of the date of the grant), the option will be treated and taxed as a non-qualified stock option.

Non-Qualified Stock Options. All options granted or to be granted under the Plan which do not qualify as incentive stock options are non-statutory options not entitled to special tax treatment under Section 422 of the Code.

8

A participant in the Plan will recognize taxable income upon the grant of a non-qualified stock option only if such option has a readily ascertainable fair market value as of the date of the grant. In such a case, the recipient will recognize taxable ordinary income in an amount equal to the excess of the fair market value of the option as of such date over the price, if any, paid for such option. No income would then be recognized on the exercise of the option, and when the shares obtained through the exercise of the option are disposed of in a taxable transaction, the resulting gain or loss would be capital gain or loss (assuming the shares are a capital asset in the hands of the optionee). However, under the applicable Treasury Regulations, the non-qualified stock options issued under the Plan will not have a readily ascertainable fair market value unless at the time such options are granted similar options of ours are actively traded on an established market. We presently has no such actively traded options.

Upon the exercise of a non-statutory option not having a readily ascertainable fair market value, the optionee recognizes ordinary income in an amount equal to the excess of the fair market value of the shares on the date of exercise over the option exercise price for those shares. We are not entitled to an income tax deduction with respect to the grant of a non-statutory stock option or the sale of stock acquired pursuant thereto. We generally are permitted a deduction equal to the amount of ordinary income the optionee is required to recognize as a result of the exercise of a non-statutory stock option.

The Plan permits the Committee to allow an optionee to pay all or part of the purchase price for shares acquired pursuant to an exercise of a non-statutory option by transferring to us any other shares of our common stock owned by the optionee. If an optionee exchanges previously acquired common stock pursuant to the exercise of a non-qualified stock option, the Internal Revenue Service has ruled that the optionee will not be taxed on the unrealized appreciation of the shares surrendered in the exchange. In other words, the optionee is not taxed on the difference between his or her cost basis for the old shares and their fair market value on the date of the exchange, even though the previously acquired shares are valued at the current market price for purposes of paying all or part of the option price.

Basis and Holding Period of Shares. In most cases, the basis in shares acquired upon the exercise of a non-qualified option will be equal to the fair market value of the shares on the employee's income recognition date, and the holding period for determining gains and losses on a subsequent disposition of such shares will begin on such date. In the case of an incentive stock option, the basis of the shares acquired on the exercise of the option will be equal to the option's exercise price, and the holding period of the shares will begin on the date the incentive stock option is exercised. However, if shares of previously acquired stock are surrendered to pay the exercise price of an incentive stock option or a non-qualified stock option, the basis and holding period of the shares received in exchange therefor are determined differently. The basis of the shares surrendered to pay the exercise price becomes the basis of an equal number of new shares received upon the exercise of the option, and the holding period of the new shares will include the holding period of the shares surrendered to pay the exercise price (except for the purpose of meeting the holding period required by Section 422 of the Code). The remaining shares received upon the exercise of an incentive option will have a basis equal to any cash paid on the exercise and any gain recognized on the disposition of statutory option stock under Section 424(c)(3) of the Code. The remaining shares received upon the exercise of a non-qualified option will have a basis equal to the fair market value of such shares less any cash paid on the exercise (the amount included in the optionee's taxable income). The holding period for such remaining shares will begin on the date of receipt by the optionee.

General. The Plan is not qualified under Section 401(a) of the Code and is not subject to the provisions of the Employee Retirement Income Security Act of 1974.

The preceding discussion is based upon federal tax laws and regulations in effect on the date of this proxy statement, which are subject to change, and upon an interpretation of the statutory provisions of the Code, its legislative history and related income tax regulations. Furthermore, the foregoing is only a general discussion of the federal income tax consequences of the Plan and does not purport to be a complete

9

description of all federal income tax aspects of the Plan. Option holders may also be subject to state and local taxes in connection with the grant or exercise of options granted under the Plan and the sale or other disposition of shares acquired upon exercise of the options. Each employee receiving a grant of options should consult with his or her personal tax advisor regarding federal, state and local consequences of participating in the Plan.

Recommendation of the Board of Directors

The Board of Directors of the Company recommends a vote for the proposal to adopt the Company's 2002 Stock Incentive Plan. Proxies received by the Board of Directors will be so voted unless shareholders specify in their proxies a contrary choice.

10

COMMON STOCK OWNERSHIP BY MANAGEMENT

AND PRINCIPAL SHAREHOLDERS

The following table sets forth the beneficial ownership of shares of common stock as of May 20, 2002 for (1) directors of A.D.A.M., (2) the Named Executive Officers (as defined below), (3) the directors and executive officers of A.D.A.M. as a group and (4) each shareholder of A.D.A.M. holding more than a 5% interest in A.D.A.M. Unless otherwise indicated in the footnotes, all of such interests are owned directly, and the indicated person or entity has sole voting and disposition power.

Name and Address of Beneficial Owner(1)

| | Number of Shares

Beneficially Owned

| | Percent of Class(2)

| |

|---|

| Robert S. Cramer(3) | | 1,114,953 | | 14.7 | % |

| Kevin S. Noland(4) | | 130,708 | | 1.7 | % |

| Daniel S. Howe(5) | | 77,083 | | 1.0 | % |

| John W. McClaugherty(6) | | 57,702 | | * | |

| Francis J. Tedesco, M.D.(7) | | 64,250 | | * | |

| Mark Kishel, M.D. | | 0 | | * | |

| Addison-Wesley Longman, Inc.(8) | | 700,000 | | 9.3 | % |

| All executive officers and directors as a group (6 persons)(9) | | 1,444,696 | | 19.1 | % |

- *

- Represents less than 1%.

- (1)

- Unless otherwise indicated, the addresses of the persons listed is c/o the Company, 1600 River Edge Parkway, Suite 800, Atlanta, Georgia 30328-4658.

- (2)

- Based on 7,564,284 shares outstanding. Except as indicated in the footnotes set forth below, the persons named in the table, to A.D.A.M.'s knowledge, have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them. The number of shares shown as owned by, and the voting power of, individual shareholders include shares which are not currently outstanding but which such shareholders are entitled to acquire or will be entitled to acquire within 60 days. Such shares are deemed to be outstanding for the purpose of computing the percentage of outstanding common stock owned by the particular shareholder, but are not deemed to be outstanding for the purpose of computing the percentage ownership of any other person.

- (3)

- Includes 460,500 shares issuable upon exercise of outstanding options and 60,000 shares issuable upon exercise of outstanding warrants.

- (4)

- Includes 130,208 shares issuable upon exercise of outstanding options.

- (5)

- Includes 59,083 shares issuable upon exercise of outstanding options.

- (6)

- Includes 54,500 shares issuable upon exercise of outstanding options.

- (7)

- Includes 54,583 shares issuable upon exercise of outstanding options.

- (8)

- The address of this shareholder is 1330 Avenue of the Americas, New York, New York 10019.

- (9)

- Includes 765,540 shares issuable upon exercise of outstanding options and 60,000 shares issuable upon exercise of outstanding warrants.

Executive Officers

Robert S. Cramer. Biography appears in "Agenda Item One—Election of Directors."

Kevin S. Noland. Since joining the Company in 1994, Mr. Noland has been extensively involved in marketing, communications and brand building for A.D.A.M. From 1994 to 1996, Mr. Noland was strategic in A.D.A.M.'s development and growth of its consumer retail products group. He served as Director of

11

Marketing from 1996 to 1998 and was named Vice President of Marketing and Corporate Communications in 1999. Mr. Noland has served as A.D.A.M.'s Chief Operating Officer since September 2000. Mr. Noland has an extensive background in sales, marketing and operations with leading technology companies, including General Electric and Borland International and several successful technology start-ups.

EXECUTIVE COMPENSATION

Summary Compensation Table

The table below sets forth certain information relating to the compensation earned during the years ended December 31, 2001 and 2000 and the nine months ended December 31, 1999 by our Chief Executive Officer and each of the other highest paid executive officers whose total annual salary and bonus exceeded $100,000 during the year ended December 31, 2001 (collectively, the "Named Executive Officers").

| |

| | Annual Compensation

| | Long Term

Compensation

| |

| |

|---|

Name and Principal Position

| | Period (1)

| | Salary ($)

| | Bonus ($)

| | Other

Annual

Compensation($)

| | Securities

Underlying

Options (#)

| | All Other

Compensation($)

| |

|---|

Robert S. Cramer, Jr.

Chief Executive Officer | | CY01

CY00

TP99 | | $

$

$ | 250,027

225,000

140,082 | | $

| 60,000

—

— | | $

| 141,000

—

— | (2)

| 490,000

200,000

40,000 |

(4)

| $

$

| 1,856

1,906

1,906 | (3)

(3)

(3) |

Kevin S. Noland

Chief Operating Officer |

|

CY01

CY00

TP99 |

|

$

$

$ |

143,750

101,600

69,000 |

|

$

$

$ |

11,840

11,400

6,965 |

|

|

—

—

— |

|

75,000

69,375

12,000 |

|

|

—

—

— |

|

- (1)

- "CY01" represents calendar 2001, "CY00" represents calendar 2000, and "TP99" represents the nine months ended December 31, 1999.

- (2)

- Represents gains from the sale of stock upon exercise of in-the-money stock options.

- (3)

- Represents life insurance premiums paid on behalf of such executive officer.

- (4)

- During calendar 2001, Mr. Cramer forfeited his rights to 145,000 of these options as well as 195,000 options issued in January 1999.

Option Grants in Last Fiscal Year

The following table provides information regarding stock options granted to the Named Executive Officers during the year ended December 31, 2001.

| | Individual Grants

| | Potential Realizable

Value at Assumed

Annual Rates of

Stock Appreciation for

Option Term(1)

|

|---|

| | Number of

Securities

Underlying

Options

Granted(#)

| | % of Total

Options

Granted to

Employees in

Fiscal Year

| |

| |

|

|---|

| | Exercise

or Base

Price

($/Share)(1)

| |

|

|---|

Name

| | Expiration

Date

|

|---|

| | 5%

| | 10%

|

|---|

| Robert S. Cramer, Jr. | | 150,000 | (2) | 12.8 | % | $ | 1.94 | | 01/01/11 | | $ | 474,008 | | $ | 754,779 |

| Robert S. Cramer, Jr.(3) | | 340,000 | | 29.1 | | | 2.14 | | 09/05/11 | | | 1,185,184 | | | 1,887,207 |

| Kevin S. Noland | | 75,000 | | 6.4 | | | 1.94 | | 01/01/11 | | | 237,004 | | | 377,390 |

- (1)

- The potential realizable value illustrates value that might be realized upon exercise of the options immediately prior to the expiration of their term, assuming the specified compounded rates of appreciation on the common stock over the term of the options. These numbers do not take into

12

account plan provisions providing for termination of the options following termination of employment or non-transferability.

- (2)

- Prior to December 31, 2001, Mr. Cramer exercised these options.

- (3)

- During the year ended December 31, 2001, Mr. Cramer forfeited his rights to 340,000 previously granted options.

Aggregate Option Exercises in Last Fiscal Year and Fiscal Year-End Option Value Table

The following table shows the number and value of exercisable and unexercisable options held by the Named Executive Officers as of December 31, 2001. No stock appreciation rights were outstanding during the year ended December 31, 2001.

| | Number of Securities Underlying

Unexercised Options

at Fiscal Year-End(#)

| | Value of Unexercised

in-the Money Options

at Fiscal Year-End($)

|

|---|

Name

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable(2)

|

|---|

| Robert S. Cramer, Jr.(1) | | 447,167 | | 43,333 | | $ | 292,400 | | $ | 0.00 |

| Kevin S. Noland | | 101,208 | | 95,667 | | | 26,000 | | | 79,500 |

- (1)

- Does not include warrants to purchase 60,000 shares of common stock issued in connection with the loan by Mr. Cramer to the Company of $500,000 on December 31, 1999.

- (2)

- The closing price of our common stock on December 31, 2001 was $3.00.

We have not awarded stock appreciation rights to any employee, we have no long-term incentive plans, as that term is defined in SEC regulations, and we have no defined benefit or actuarial plans covering any of our employees.

Employment Agreement

We entered into an employment agreement with Mr. Cramer that is currently scheduled to expire on December 31, 2002 (the "Expiration Date") and is automatically renewable for successive one-year periods unless either party gives written notice of non-renewal. This agreement also may be terminated by us with or without cause or upon Mr. Cramer's death or inability to perform his duties due to disability for a period of twelve consecutive months. If the agreement is terminated prior to the Expiration Date for any reason, except by Mr. Cramer, by us for cause or upon Mr. Cramer's death or disability, we must continue to pay Mr. Cramer's base salary and bonus either (1) for the period from the date of termination through the Expiration Date if the agreement is terminated prior to the first anniversary thereof or (2) for the two year period following the date of termination if the agreement is terminated after the first anniversary thereof. If the agreement is terminated because of the death or disability of Mr. Cramer, we must pay Mr. Cramer or his beneficiaries his base salary and bonus for a period of one year following the date of termination; provided, however, that, in the case of termination for disability, we may elect, in lieu of making such payments, to provide Mr. Cramer with disability insurance coverage. The agreement provides for a minimum annual base salary of $120,000 and for annual discretionary bonuses. The agreement also contains a two-year non-competition, customer and employee non-solicitation and confidentiality provision.

We have entered into an employment agreement with Kevin S. Noland that shall continue indefinitely until terminated in accordance with the agreement. This agreement may be terminated by us with or without cause, by Mr. Noland for good reason or without good reason or upon Mr. Noland's death or inability to perform his duties due to disability for a period of three consecutive months. If we terminate the agreement prior to the expiration date for cause, by Mr. Noland without good reason or by the death of

13

Mr. Noland, then all obligations of the Company to provide compensation and benefits under this Agreement shall cease on that date. If we terminate the agreement prior to the expiration date without cause, by Mr. Noland for good reason, or because of the disability of Mr. Noland, then we must continue to pay Mr. Noland's base salary for the period from the date of termination for up to twelve months. The agreement provides for a minimum annual base salary of $150,000. The agreement also contains a one-year noncompetition and nonsolicitation of customers, and a two-year nonsolicitation of employees as well as confidentiality provisions.

We have executed Employee Confidentiality, Non-disclosure and Non-competition Agreements with all executive officers and senior management.

Report on Repricing of Options

We have from time to time since 1991 granted stock options to our employees to purchase shares of our common stock. Certain of these options were canceled at the option of their holders on January 14, 1999, and then replaced that day on a one-for-one basis with new options with an exercise price equal to the closing market price that day. The repricing of options reflects the consistent application of our policy as determined by our Compensation/Stock Option Committee of the Board of Directors. The Compensation/Stock Option Committee and Board of Directors believe that incentive options should be granted at exercise prices equal to or not materially in excess of the market price of our common stock in order to provide maximum incentive to employees, including senior executives.

In March 2000, the Financial Accounting Standards Board issued Interpretation No. 44, "Accounting for Certain Transactions Involving Stock Compensation-an Interpretation of APB Opinion No. 25") ("FIN 44"). This opinion provides guidance on the accounting for certain stock option transactions and subsequent amendments to stock option transactions. FIN 44 was effective July 1, 2000, but certain conclusions cover specific events that occur after either December 15, 1998 or January 12, 2000. The adoption of FIN 44 did not have a material impact on A.D.A.M.'s financial position or results of operations for the year ended December 31, 2001. This interpretation requires variable accounting treatment for options that have been modified from their original terms. Accordingly, compensation cost shall be adjusted for increases or decreases in the intrinsic value of the modified awards in subsequent periods and until the awards have been exercised, forfeited, or expired. As of December 31, 2001, the Company had 221,200 outstanding options with an exercise price of $5.25 that are considered variable under this interpretation. Because the stock price since the effective date of July 1, 2000 has been below $5.25, the Company has not recorded any compensation cost related to the repriced options issued on January 14, 1999.

14

Equity Compensation Plan Information

The table below reflects information regarding our equity compensation plans as of May 20, 2002:

Plan category

| | (a)

Number of

securities to be issued upon exercise of outstanding options, warrants and rights

| | (b)

Weighted-average exercise price

of outstanding options, warrants and rights

| | (c)

Number of

securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))

| |

|---|

| Equity compensation plans approved by securityholders | | 2,988,823 | (1) | $ 4.64 | | 0 | (1) |

| Equity compensation plans not approved by securityholders | | 25,000 | | $11.11 | | 0 | |

| | |

| | | |

| |

| Total | | 3,013,823 | | | | 0 | |

| | |

| | | |

| |

- (1)

- Issued under the Company's Amended and Restated 1992 Stock Option Plan. This plan has terminated and no further grants will be made under it.

CERTAIN TRANSACTIONS

Transactions with Significant Shareholder

During the years ended December 31, 2001 and 2000, the Company sold approximately $112,000 and $92,000, respectively, of a product to a company, which owns shares in the Company. During the years ended December 31, 2001 and 2000, the Company sold approximately $25,000 and $6,000, respectively, of product to a subsidiary of the company which owns shares in A.D.A.M. The Company earned royalty revenues of approximately $367,000 and $372,000, respectively, related to this subsidiary during the years ended December 31, 2001 and 2000. Additionally, the Company purchased approximately $13,000 and $15,000, respectively of product from this subsidiary during the years ended December 31, 2001 and 2000, and recorded royalty expenses of approximately of $130,000 and $170,000, respectively.

On June 22, 2001, A.D.A.M. sold its 50 percent ownership interest in the intellectual property rights associated with the A.D.A.M./Benjamin Cummings Interactive Physiology Series to Pearson Education, Inc. for $1,950,000 in cash resulting in a net gain $1,808,000 after expenses. The purchase price was determined through arms' length negotiations. Pearson Education, Inc. jointly developed and co-owned the A.D.A.M./Benjamin Cummings Interactive Physiology Series with ADAM. The A.D.A.M./Benjamin Cummings Interactive Physiology Series is a learning tool available in both CD-ROM and Web-enabled versions that educates students on physiological concepts and processes associated with the human body's major systems. Linda B. Davis, an A.D.A.M. board member until her resignation on March 20, 2002, is an officer of Benjamin Cummings, a publishing imprint of Addison Wesley Longman, Inc.

Sublease with A.D.A.M. Board Member

On April 2, 2001, for a term beginning on January 1, 2001, the Company signed an 18-month sublease agreement with a company whose president is an A.D.A.M. board member. The Company is due 8,333 shares of the tenant's common stock monthly over the term of the agreement. The shares are valued at the fair market value of the leased space and are recorded on the Company's balance sheet as a long-term asset. As of March 31, 2002, the shares were valued at approximately $53,000. The Company evaluates the asset for impairment at the end of each reporting period. Additionally, the Company received warrants to purchase 25,000 common shares of the tenant that fully vested on January 1, 2002.

15

Promissory Note with A.D.A.M.'s Chief Executive Officer

On May 30, 2001, the Company received a full-recourse Promissory Note from its Chief Executive Officer for approximately $341,000. The note earns interest of 6.25% per annum and is due in full on or before May 29, 2006. Part of the note, $291,000, is secured by 150,000 shares of A.D.A.M.'s common stock and is recorded in shareholders' equity. As of March 31, 2002, interest has been accrued on this note of approximately $18,000.

Investment and Sublease with ThePort Network, Inc.("ThePort")

During the year ended December 31, 2001, the Company acquired an additional preferred stock interest in ThePort for $275,000 in cash. During the three months ended March 31, 2002, the Company accepted 70,220 shares of common stock valued at approximately $18,000 in ThePort pursuant to the sublease between the parties (see paragraph below). As of March 31, 2002, A.D.A.M.'s ownership interest in ThePort was an approximate 24%.

In connection with the preferred stock investment, the Company entered into a five-year agreement whereby the Company will have exclusive distribution rights to ThePort's products within the healthcare industry. As of March 31, 2002, A.D.A.M. has pre-paid $125,000 of the contract fee to be applied against future subscription fees. The Company has committed to generate $1,500,000 in subscription fees during the initial term of the agreement.

During the year ended December 31, 2001, the Company's Chief Operating Officer was appointed to the Board of Directors of ThePort. The Company's Chief Executive Officer currently serves on the Board of Directors of ThePort, has acquired an approximate 18% voting interest in ThePort and during the year ended December 31, 2001, accepted a convertible note from ThePort for $425,000.

On April 10, 2002, for a term beginning on November 1, 2001, the Company signed an 8-month sublease agreement with ThePort. The Company is due 14,044 shares of ThePort's common stock monthly over the term of the agreement. The shares are valued at the fair market value of the leased space.

The results of operations of ThePort have been accounted for as an equity investment and accordingly, the Company records its share of the results of operations in the condensed consolidated financial statements of the Company. The Company recorded its share of ThePort's losses of approximately $55,000 for the three months ended March 31, 2002 and its share of ThePort's losses of approximately $342,000 for the twelve months ended December 31, 2001. At March 31, 2002 and December 31, 2002, the carrying value of this investment was approximately $3,000 and $40,000, respectively.

It is our policy that all future transactions, if any, with affiliated parties will be approved by the disinterested members of our Board of Directors, a committee of the Board or by the shareholders of the Company.

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The Compensation/Stock Option Committee (the "Compensation Committee"), which is composed of two non-employee directors, is responsible for developing and making recommendations to the Board with respect to the Company's compensation plans and policies for the Company's executive officers as well as the Board of Directors. In carrying out this responsibility, the Compensation Committee approves the design of all compensation plans applicable to executive officers and directors, reviews and approves performance goals, establishes award opportunities, oversees the ongoing operation of the various plans and makes recommendations to the Board regarding certain of these matters. In addition, the Compensation Committee, pursuant to authority delegated by the Board, determines on an annual basis the base salaries to be paid to the Chief Executive Officer and each of the other executive officers. The Compensation Committee also, in conjunction with the Board, reviews compensation policies applicable to executive officers as well as directors and considers the relationship of corporate performance to that compensation.

16

Executive Officer Compensation Philosophy

The objectives of the Company's executive compensation program are to: (1) support the achievement of desired Company performance; and (2) provide compensation that will attract and retain superior talent and reward performance. In carrying out these objectives, the Compensation Committee considers current corporate performance, the potential for future performance gains, whether shareholder value has been or will be enhanced, and competitive market conditions for executives in similar positions at local, regional and national software companies having similar revenues and number of employees. Those factors are evaluated and considered for each officer on an annual basis, including consideration of the contribution made by each officer over the prior fiscal year. The Company's compensation package for its officers includes both short-term and long-term features in the form of base salary, variable compensation keyed to Company performance and stock options which are granted periodically at the discretion of the Compensation Committee. As a result, the Company's executive compensation provides an overall level of compensation opportunity that is competitive with companies in our industry of comparable size and complexity. The Compensation Committee will use its discretion to set executive compensation at a level that, in its judgment, is warranted by external, internal or individual circumstances. The Compensation Committee also believes that stock ownership by management and stock-based performance compensation arrangements are beneficial in aligning management's and shareholders' interests in the enhancement of shareholder value.

Executive Officer Compensation

The Company's executive officer compensation is comprised of base salary, grants under the Amended and Restated 1992 Stock Option Plan and 2002 Stock Incentive Plan, and various benefits, including medical plans which are generally available to employees of the Company.

Base Salary. The salaries for executive officers are reviewed annually and are approved by the Compensation Committee. In determining base salaries, the Compensation Committee takes into consideration individual experience and performance as well as other circumstances particular to the Company.

Stock Option Program. The grant of stock options is designed to align the interests of executive officers with those of shareholders in the Company's long-term performance. Options granted under the plans have an exercise price equal to at least 100% of the fair market value of the Company's Common Stock on the date of grant and expire not later than ten years from the date of grant. It has generally been the practice of the Compensation Committee to grant stock options which vest ratably over a three-year period from the date of the grant. The Compensation Committee and the Board of Directors, however, maintain discretion to make other types of grants. Option awards for officers other than the Chief Executive Officer are based on recommendations made by the Chief Executive Officer and on the Compensation Committee's assessment of how the respective individual contributes to the Company. The factors considered in this assessment are identical to those set forth under the heading, Base Salary.

Other Benefits. The Company provides medical benefits to executive officers. These benefits are comparable to those generally available to Company employees. The Company also funds life insurance policies on the behalf of Mr. Cramer. The amount funded under policies and the amount of insurance provided to the executive is commensurate with the executive's salary and level of responsibility.

Compensation of the Chairman of the Board and Chief Executive Officer

Mr. Cramer serves as the Chairman of the Board and Chief Executive Officer under an employment contract, dated December 21, 1994, which was approved by the Compensation Committee. Under the employment contract, Mr. Cramer's compensation is principally composed of a minimum base salary of $120,000 and annual discretionary bonuses. On November 15, 1999, the Board approved a base salary for Mr. Cramer for calendar 2000 of $250,000. On July 1, 2000, the Board requested and Mr. Cramer agreed

17

to reduce his salary to $200,000 per year until the end of calendar 2000. On January 1, 2001, Mr. Cramer's salary returned to $250,000 per year until such time as the Board votes to change his salary. During the year ended December 31, 2001, the Company made contributions to a life insurance policy on behalf of Mr. Cramer. The value of the benefit related to such policy was estimated to be $2,000,000.

Policy with Respect to the $1 Million Deduction Limit.

The Omnibus Budget Reconciliation Act of 1993 placed certain limits on the deductibility of non-performance based executive compensation for a company's employees, unless certain requirements are met. The Compensation Committee does not believe that there is a risk of losing deductions under the new law. However, in the future, the Compensation Committee intends to consider carefully any plan or compensation arrangement that might result in the disallowance of compensation deductions that may be lost versus the broader interests of the Company to be served by paying adequate compensation for services rendered, before adopting any plan or compensation arrangement. The Compensation Committee believes that its compensation philosophies are suited to retaining and rewarding executives who contribute to the success of the Company in achieving its business objectives and increasing stockholders value. The Company further believes that the program strikes an appropriate balance among the interests and needs of the Company, its shareholders and its executives.

The Compensation/Stock Option Committee

Francis J. Tedesco, M.D. (Chairman)

John W. McClaugherty

The Compensation Committee Report on executive compensation shall not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the acts except to the extent that the Company specifically incorporates this information by reference, and shall not otherwise be deemed filed under such Act.

18

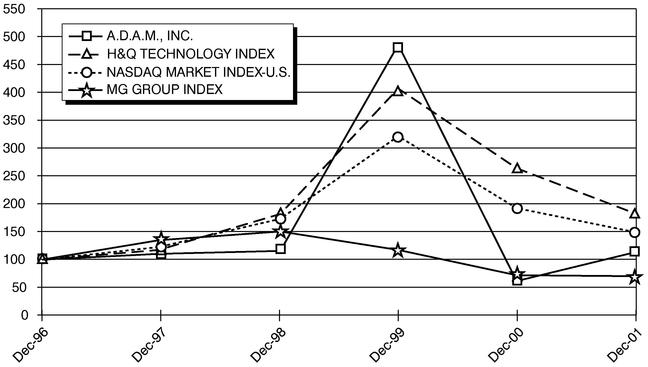

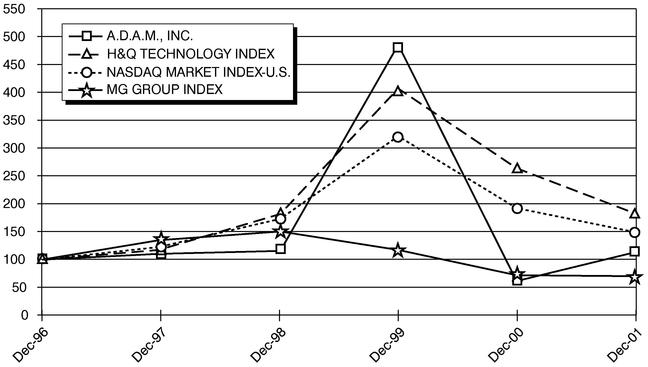

STOCK PRICE PERFORMANCE GRAPH

The following stock price performance graph compares the market performance of the Company's Common Stock to the Nasdaq Stock Market—U.S., J.P. Morgan H&Q Technology Index and the Media General Financial Services Healthcare Information Services Index. The stock price performance graph assumes an investment of $100 in the Company, the J.P. Morgan H&Q Technology Index, the Nasdaq Market Index-U.S. and the Media General Financial Services Healthcare Information Services Index on January 1, 1997 and further assumes the reinvestment of all dividends. Stock price performance, presented quarterly for the period from January 1, 1997 through December 31, 2001 is not necessarily indicative of future results. For this graph, the Company has included a new comparative index, the Media General Financial Services Healthcare Information Services Index. The reason for including this index is that the J.P. Morgan H&Q Technology Index was discontinued in April 2002. Therefore, information was available and included for the year ended December 31, 2001, but will not be available and included for the year ended December 31, 2002.

COMPARE 5-YEAR CUMULATIVE TOTAL RETURN

AMONG A.D.A.M., INC.,

NASDAQ MARKET INDEX, J.P. MORGAN H&Q TECHNOLOGY INDEX

AND MG GROUP INDEX

ASSUMES $100 INVESTED ON JAN. 1, 1997

ASSUMES DIVIDEND REINVESTED

FISCAL YEAR ENDING DEC. 31, 2001

| | A.D.A.M.

| | J.P. Morgan H&Q

Technology

| | Media General Healthcare

Information Services Index

| | Nasdaq Market Index-U.S.

|

|---|

| Dec-96 | | 100.00 | | 100.00 | | 100.00 | | 100.00 |

| Dec-97 | | 109.52 | | 117.24 | | 133.87 | | 122.47 |

| Dec-98 | | 115.48 | | 182.36 | | 150.97 | | 172.70 |

| Dec-99 | | 485.71 | | 407.27 | | 117.42 | | 320.93 |

| Dec-00 | | 61.80 | | 263.28 | | 70.81 | | 192.93 |

| Dec-01 | | 114.29 | | 181.99 | | 69.30 | | 148.92 |

The Stock Price Performance Graph shall not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Acts except to the extent that the Company specifically incorporates this information by reference, and shall not otherwise be deemed filed under such Act.

19

OTHER MATTERS

Section 16(A) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires executive officers and directors of the Company and persons who beneficially own more than ten percent of the Company's Common Stock to file with the Securities and Exchange Commission certain reports, and to furnish copies thereof to the Company, with respect to each such person's beneficial ownership of the Company's equity securities. Based solely upon a review of the copies of such reports furnished to the Company and certain representations of such persons, all such persons have complied with the applicable reporting requirements.

Independent Public Accountants

PricewaterhouseCoopers LLP has audited the accounts of the Company and its subsidiaries for the year ending December 31, 2001 and has been appointed by the Board of Directors to continue in that capacity for the Company's fiscal year ending December 31, 2002. A representative of PricewaterhouseCoopers LLP will be present at the Annual Meeting, will have the opportunity to make a statement and will be available to respond to appropriate questions.

Audit Fees. The aggregate fees billed by PricewaterhouseCoopers LLP for professional services rendered for the audit of the Company's annual financial statements for the year ending December 31, 2001 and the review of the financial statements included in the Company's Form 10-Qs for that year were $99,500.

Financial Information Systems Design and Implementation Fees. During 2001, PricewaterhouseCoopers LLP did not perform any services with regard to financial information systems design and implementation.

All Other Fees. The aggregate fees for non-audit services provided in 2001 by PricewaterhouseCoopers LLP were $36,346.

The Audit Committee does not consider the provision of the non-audit services to be incompatible with maintaining PricewaterhouseCoopers LLP's independence.

Report to Shareholders for the Year Ended December 31, 2001

The Annual Report of the Company for the year ending December 31, 2001, including audited financial statements, accompanies this Proxy Statement. This Annual Report does not form any part of the material for the solicitation of proxies.

Shareholder Proposals

Any shareholder proposals intended to be presented at the Company's 2003 Annual Meeting of Shareholders must be received by the Company on or before February 1, 2003 to be eligible for inclusion in the proxy statement and form of proxy to be distributed by the Board of Directors in connection with such meeting. In general, any shareholder proposal to be considered at next year's annual meeting but not included in the proxy statement must be submitted in writing to the principal executive offices of the Company, not less than 60 days prior to the 2003 annual meeting. However, if the Company sends out notice or publicly discloses the date of the 2003 annual meeting of the shareholders within 40 days prior to such meeting, then a shareholder will be able to submit a proposal for consideration within ten days of the notice or public announcement of such meeting. Any notification to bring any proposal before the 2003 annual meeting of the shareholders must comply with the requirements of the Company's bylaws. You may obtain a copy of the relevant bylaw provisions by contacting the Company's Corporate Secretary.

20

Other Matters

The Board of Directors knows of no other matters to be brought before the Annual Meeting.

Expenses Of Solicitation

The cost of solicitation of proxies will be borne by the Company. In an effort to have as large a representation at the meeting as possible, special solicitation of proxies may, in certain instances, be made personally or by telephone, telegraph or mail by one or more employees of the Company. The Company also will reimburse brokers, banks, nominees and other fiduciaries for postage and reasonable clerical expenses of forwarding the proxy material to their principals who are beneficial owners of the Company's Common Stock.

By Order of the Board of Directors,

Robert S. Cramer, Jr.

Chairman of the Board and Chief Executive Officer

Atlanta, Georgia

May 30, 2002

21

APPENDIX A

A.D.A.M., INC.

2002 STOCK INCENTIVE PLAN

A.D.A.M., INC.

2002 STOCK INCENTIVE PLAN

ARTICLE 1

GENERAL

Section 1.1 Purpose. TheA.D.A.M., Inc. 2002 Stock Incentive Plan (the "Plan") has been established byA.D.A.M., Inc. (the "Company") to (i) attract and retain high caliber employees and consultants; (ii) motivate Participants, by means of appropriate incentives, to achieve long-range goals; (iii) provide incentive compensation opportunities that are competitive with those of other similar companies; and (iv) further identify Participants' interests with those of the Company's other shareholders through compensation that is based on the Company's common stock; and thereby promote the long-term financial interest of the Company and the Related Companies, including the growth in value of the Company's equity and enhancement of long-term shareholder return.

Section 1.2 Participation. Subject to the terms and conditions of the Plan, the Committee shall determine and designate, from time to time, from among the Eligible Persons, those persons who will be granted one or more Awards under the Plan, and thereby become participants in the Plan (the "Participants"). In the discretion of the Committee, a Participant may be granted any Award permitted under the provisions of the Plan, and more than one Award may be granted to a Participant. Awards may be granted as alternatives to or replacement of awards outstanding under the Plan, or any other plan or arrangement of the Company or a Related Company (including a plan or arrangement of a business or entity, all or a portion of which is acquired by the Company or a Related Company).

Section 1.3 Operation, Administration and Definitions. The operation and administration of the Plan, including the Awards made under the Plan, shall be subject to the provisions ofArticle 4(relating to operation and administration). Capitalized terms in the Plan shall be defined as set forth in the Plan (including the definition provisions ofArticle 7of the Plan).

ARTICLE 2

OPTIONS AND STOCK APPRECIATION RIGHTS

Section 2.1 Options. The grant of an option (the"Option") entitles the Participant to purchase shares of stock at an Exercise Price established by the Committee. Options granted under thisArticle 2may be either Incentive Stock Options or Non-Qualified Stock Options, as determined in the discretion of the Committee. An "Incentive Stock Option" or "ISO" is an Option that is intended to qualify as, and that satisfies the requirements applicable to, an "incentive stock option" described in section 422(b) of the Code. A "Non-Qualified Stock Option" is an Option that is not intended to be, or does not qualify as, an "incentive stock option" as that term is described in section 422(b) of the Code. To the extent that the aggregate Fair Market Value (determined at time of grant) of the shares of Stock subject to ISOs granted to a Participant under the Plan and under any other stock option plan adopted by the Company or a Related Company that first become exercisable in any calendar year exceeds $100,000, such options shall be treated as Non-Qualified Stock Options.