QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12

|

A.D.A.M., INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

April 28, 2003

Dear Shareholder:

You are cordially invited to attend the 2003 Annual Meeting of Shareholders of A.D.A.M., Inc. to be held on June 5, 2003 at 1600 RiverEdge Parkway, Suite 100, Atlanta, Georgia 30328-4658. The meeting will begin promptly at 9:00 a.m., local time, and we hope that it will be possible for you to attend.

The items of business are listed in the Notice of Annual Meeting and are more fully addressed in the Proxy Statement following the Notice.

Please date, sign and return your proxy card in the enclosed envelope at your convenience to assure that your shares will be represented and voted at the Annual Meeting even if you cannot attend. If you attend the annual meeting, you may vote your shares in person even though you have previously signed and returned your proxy.

On behalf of your Board of Directors, thank you for your continued support and interest in A.D.A.M., Inc.

| | | Sincerely, |

|

|

/s/ ROBERT S. CRAMER, JR.

Robert S. Cramer, Jr.

Chairman of the Board and Chief Executive Officer |

Whether or not you expect to attend the annual meeting, please complete, sign and date the enclosed proxy and return it promptly in the enclosed envelope, which does not require any postage if mailed in the united states. If you attend the meeting, you may revoke the proxy and vote your shares in person.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD JUNE 5, 2003

The Annual Meeting of Shareholders of A.D.A.M., Inc. (the "Company") will be held at 1600 RiverEdge Parkway, Suite 100, Atlanta, Georgia 30328-4658, on Thursday, June 5, 2003 at 9:00 a.m., local time, for the following purposes:

- (1)

- To elect one director to serve until the 2006 Annual Meeting of Shareholders;

- (2)

- To ratify the appointment of PricewaterhouseCoopers LLP as the Company's independent auditors for the fiscal year ending December 31, 2003; and

- (3)

- To transact such other business as may properly come before the meeting or any adjournment thereof.

Only the holders of record of the Company's common stock, par value $0.01 per share, at the close of business on April 15, 2003 are entitled to notice of and to vote at the Annual Meeting of Shareholders and any adjournment or postponement thereof. A list of shareholders as of the close of business on April 15, 2003 will be available at the Annual Meeting for examination by any shareholder, his agent or his attorney.

| | | By Order of the Board of Directors, |

|

|

/s/ ROBERT S. CRAMER, JR.

Robert S. Cramer, Jr.

Chairman of the Board and Chief Executive Officer |

Atlanta, Georgia

April 28, 2003

A.D.A.M., INC.

1600 RiverEdge Parkway, Suite 100

Atlanta, Georgia 30328

PROXY STATEMENT

FOR ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD JUNE 5, 2003

The 2003 Annual Meeting of Shareholders of A.D.A.M., Inc. (the "Company" or "A.D.A.M.") will be held on June 5, 2003, for the purposes set forth in the preceding Notice of Annual Meeting of Shareholders. The enclosed form of proxy is solicited by the Board of Directors of the Company and the cost of the solicitation will be borne by the Company. When the proxy is properly executed and returned, the shares it represents will be voted as directed at the Annual Meeting or any adjournment thereof or, if no direction is indicated, such shares will be voted in favor of the proposals set forth in the Notice of Annual Meeting of Shareholders attached hereto. All proxies delivered pursuant to this solicitation are revocable at any time at the option of the persons executing them by giving written notice to the Secretary of the Company, by delivering a later-dated proxy or by voting in person at the Annual Meeting.

Record Date

Only shareholders of record as of the close of business on the record date of April 15, 2003 will be entitled to vote at the Annual Meeting. As of that date, the Company had outstanding 7,116,384 shares of common stock, $0.01 par value per share. Shareholders of record as of the close of business on April 15, 2003 are entitled to one vote for each share of common stock held. No cumulative voting rights are authorized and dissenters' rights for shareholders are not applicable to the matters being proposed. This Proxy Statement and the accompanying proxy will first be mailed to shareholders of the Company on or about May 5, 2003.

Voting and Proxies

The presence in person or by proxy of holders of a majority of the shares of common stock outstanding on the record date will constitute a quorum for the transaction of business at the Annual Meeting or any adjournment thereof. The affirmative vote of a plurality of the shares present in person or by proxy and entitled to vote is required to elect directors. With respect to any other matter that may properly come before the Annual Meeting, the approval of any such matter would require a greater number of votes cast in favor of the matter than the number of votes cast opposing such matter. Shares held by nominees for beneficial owners will be counted for purposes of determining whether a quorum is present if the nominee has the discretion to vote on at least one of the matters presented even if the nominee may not exercise discretionary voting power with respect to other matters and voting instructions have not been received from the beneficial owner (a "broker non-vote"). Broker non-votes will not be counted as votes for or against matters presented for shareholder consideration. Abstentions with respect to a proposal are counted for purposes of establishing a quorum. If a quorum is present, abstentions have no effect on the outcome of any vote.

ELECTION OF DIRECTORS

(ITEM 1)

The Board of Directors of the Company presently consists of five directors, divided among three classes, with the directors in each class serving staggered three-year terms. The term of one director, Francis J. Tedesco, will expire at the Annual Meeting. Dr. Tedesco has been nominated to stand for reelection as director until the Annual Meeting of Shareholders in 2006. There are four directors whose terms will not expire at the Annual Meeting, with two directors having terms expiring in 2004 and two directors having terms expiring in 2005.

Nominee for Election to Term Expiring in 2006

Francis J. Tedesco, M.D., age 59, has been a director of the Company since July 1996. In January 2001, Dr. Tedesco was appointed as President Emeritus of the Medical College of Georgia ("MCG") and Professor Emeritus of Medicine, Surgery, School of Graduate Studies of MCG. Prior to this, Dr. Tedesco served as Chief Executive Officer of Health Sciences University and as President of MCG from 1988 to 2001, and was a Professor of Medicine at MCG from 1981 to 2001. He has been a consultant to Dwight David Eisenhower Medical Center—Fort Gordon, Georgia; Veterans Administration Medical Center—Augusta, Georgia; and Walter Reed Army Medical Center—Washington, D.C. Prior to coming to MCG in 1978, Dr. Tedesco held academic appointments beginning in 1971 at the Hospital of the University of Pennsylvania; Washington University School of Medicine, St. Louis, Missouri; and University of Miami School of Medicine. Dr. Tedesco currently serves on the Board of Directors and is Vice President of the Georgia Division of the American Cancer Society, is Chairman of beBetter Networks, Inc., is a member of the CDC Foundation Board of Visitors, serves on the Ty Cobb Foundation Scholarship Board, and serves on the Board of Directors of VerifyMD.com, Inc.

The Board unanimously recommends a vote "FOR" the reelection of Dr. Francis J. Tedesco.

Directors Continuing in Office Until 2004

Mark Kishel, M.D, age 57, joined A.D.A.M.'s Board of Directors in November 2001. Prior to serving on the Board, Dr. Kishel was Executive Vice President and Chief Medical Officer for Blue Cross Blue Shield of Georgia from 1993 until its acquisition by Wellpoint in 2001. Dr. Kishel is a board certified pediatrician and a Fellow of the American Academy of Pediatrics. He has practiced pediatrics and family medicine, and has served in executive medical director roles for several national insurance carriers, including Travelers, HealthAmerica and Lincoln National. He has served on the Blue Cross Blue Shield Association's National Medical Council. Dr. Kishel also served as a director and founder of the Center for Healthcare Improvement, a collaborative research venture between the Medical College of Georgia and Blue Cross and Blue Shield of Georgia, and is currently a director of the Boys and Girls Club of Metro Atlanta. Dr. Kishel currently serves on the Board of Directors of Immucor, Inc. (Nasdaq NM: BLUD), an international in vitro diagnostic company, and is a healthcare consultant through his company, E-Medicine Solutions. Inc.

Daniel S. Howe, age 42, has been a director of the Company since December 1996. Mr. Howe is President of DSH Enterprises, Inc., a real estate development and investment company, and has served in that capacity since January 1990. DSH Enterprises focuses on shopping centers, freestanding drug stores and other commercial property in the Southeastern United States.

Directors Continuing in Office until 2005

Robert S. Cramer, Jr., age 42, a co-founder of the Company, has served as Chairman of the Board and a director since the Company's inception in March 1990, and Chief Executive Officer since September 1996. Mr. Cramer currently serves on the Board of Directors of The Port.com, an Internet technology company he co-founded in 1999. Mr. Cramer also serves as Chairman of the Board of the Atlanta Task Force for the Homeless, a community-wide non profit organization working with and on the behalf of homeless people.

2

John W. McClaugherty, age 43, a co-founder of the Company, has served as a director of the Company since its inception in March 1990. Currently, Mr. McClaugherty serves as President of beBetter Networks, Inc., a human resource productivity company. He has served as its president since its inception in September 1999. Prior to that, Mr. McClaugherty served as President of J.S.K., Inc., a medical illustration company, from 1994 to 1999. Mr. McClaugherty served as Chief Executive Officer of the Company from its inception until March 1994.

Meetings of the Board of Directors

During the year ended December 31, 2002, the Board held eight meetings. Each director that served during the year ended December 31, 2002 attended at least 75% of all Board meetings and meetings held by committees on which the individual director served.

Committees of the Board of Directors

The Board has standing Audit and Compensation/Stock Option Committees that assist it in discharging its responsibilities. These committees, their members and their functions are discussed below.

The Audit Committee, which held three meetings during 2002, is responsible for recommending independent accountants, reviewing with the independent accountants the scope and results of the audit engagement, and consulting with independent accountants and management with regard to the Company's accounting methods and control procedures. The Audit Committee is presently composed of Messrs. Howe (Chairman) and McClaugherty and Dr. Tedesco. Messrs. Howe and McClaugherty and Dr. Tedesco are each independent, as defined in Rule 4200(a)(14) of the National Association of Securities Dealer's listing standards. The Audit Committee has not adopted a written charter.

The Compensation/Stock Option Committee, which held one meeting during 2002, is responsible for reviewing recommendations from the Chairman of the Board of Directors with regard to the compensation of officers of A.D.A.M. and reporting to the Board of Directors its recommendations with regard to such compensation and is responsible for operating and administering the Company's Amended and Restated 1992 Stock Option Plan and its 2002 Stock Incentive Plan. The Compensation/Stock Option Committee is presently comprised of Dr. Tedesco (Chairman) and Mr. McClaugherty.

The Board of Directors does not have a standing nominating committee, such function being reserved to the full Board of Directors.

Compensation Committee Interlocks and Insider Participation

During 2002, Dr. Tedesco and Mr. McClaugherty were members of the Compensation/Stock Option Committee. During 2001, the Company entered into a sublease agreement with BeBetter Networks, Inc., of which Mr. McClaugherty serves as president and Mr. Tedesco serves as a director. Through December 31, 2002, BeBetter paid the Company approximately 8,333 common shares of BeBetter Network's stock per month with a fair value of $3,511 as rent. The Company is not presently collecting any lease payments from BeBetter. Mr. McClaugherty served as an officer of the Company from its inception until March 1994.

Compensation of Directors

To date, directors have not received cash compensation for their services as directors of A.D.A.M. On January 2, 2002, each non-employee director of the Company was awarded an option to purchase 35,000 shares of A.D.A.M. common stock. The options have a term of ten years from the date of grant and become exercisable one year from the date of grant. Each option has an exercise price of $3.06 per share.

3

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

(ITEM 2)

The Board of Directors of the Company, upon the recommendation of the Audit Committee, has appointed PricewaterhouseCoopers LLP to serve as independent auditors of the Company for the year ending December 31, 2003, subject to ratification of this appointment by the shareholders of the Company. PricewaterhouseCoopers LLP has served as independent auditors of the Company for many years and is considered by management of the Company to be well qualified. The Company has been advised by PricewaterhouseCoopers LLP that neither it nor any of its members has any financial interest, direct or indirect, in the Company or any of its subsidiaries in any capacity. One or more representatives of PricewaterhouseCoopers LLP are expected to be present at the Annual Meeting, will have an opportunity to make a statement if he or she desires to do so and will be available to respond to appropriate questions.

Audit Fees. The aggregate fees billed by PricewaterhouseCoopers LLP for professional services rendered for the audit of the Company's annual financial statements for the year ending December 31, 2002 and the review of the financial statements included in the Company's Form 10-Qs for that year were $96,000.

Financial Information Systems Design and Implementation Fees. During 2002, PricewaterhouseCoopers LLP did not perform any services with regard to financial information systems design and implementation.

All Other Fees. The aggregate fees for non-audit services provided in 2002 by PricewaterhouseCoopers LLP were $58,625.

The Audit Committee does not consider the provision of the non-audit services to be incompatible with maintaining PricewaterhouseCoopers LLP's independence.

The Board of Directors of the Company recommends a vote FOR the proposal to ratify the appointment of PricewaterhouseCoopers LLP as independent auditors of the Company for the year ending December 31, 2003.

4

AUDIT COMMITTEE REPORT

We have reviewed and discussed the Company's audited financial statements for the year ended December 31, 2002 with management and have discussed with PricewaterhouseCoopers LLP, certified public accountants, the independent auditors and accountants for the Company, the matters required to be discussed by SAS 61 (Codification of Statements on Auditing Standards, AU Section 380) with respect to those statements.

We have received and reviewed the letter from PricewaterhouseCoopers LLP required by Independence Standards Board Standard No. 1 (Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees) and have discussed with PricewaterhouseCoopers LLP its independence in connection with its audit of the Company's most recent financial statements. Based on this review and these discussions, we recommended to the Board of Directors that these audited financial statements be included in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2002.

Daniel S. Howe (Chairman)

John W. McClaugherty

Francis J. Tedesco

The information in the foregoing Audit Committee Report shall not be deemed to be soliciting material, or be filed with the SEC or subject to Regulation 14A or 14C or to liabilities of Section 18 of the Securities Act, nor shall it be deemed to be incorporated by reference into any filing under the Securities Act or the Exchange Act, except to the extent that the Company specifically incorporates such Report by reference.

5

COMMON STOCK OWNERSHIP BY MANAGEMENT

AND PRINCIPAL SHAREHOLDERS

The following table sets forth information regarding the beneficial ownership of shares of the Company's common stock, as of April 15, 2003, by the Company's directors and executive officers and each shareholder holding more than 5% of the Company's common stock. Unless otherwise indicated in the footnotes, all shares are owned directly, and the indicated person or entity has sole voting and disposition power.

Name

| | Number of

Shares Beneficially

Owned

| | Percent of

Class (1)

| |

|---|

| Robert S. Cramer (2) | | 1,290,053 | | 18.3 | % |

| Kevin S. Noland (3) | | 327,375 | | 4.65 | % |

| Daniel S. Howe (4) | | 112,083 | | 1.6 | % |

| John W. McClaugherty (5) | | 89,712 | | 1.2 | % |

| Francis J. Tedesco, M.D. (6) | | 99,250 | | 1.4 | % |

| Mark Kishel, M.D. (7) | | 40,000 | | 1.0 | % |

| All executive officers and directors as a group (6 persons) (8) | | 1,958,473 | | 28.2 | % |

- (1)

- Based on 7,041,384 shares outstanding. The number of shares shown as owned by, and the voting power of, individual shareholders include shares which are not currently outstanding but which such shareholders are entitled to acquire or will be entitled to acquire within 60 days. Such shares are deemed to be outstanding for the purpose of computing the percentage of outstanding common stock owned by the particular shareholder, but are not deemed to be outstanding for the purpose of computing the percentage ownership of any other person.

- (2)

- Includes 516,667 shares issuable upon exercise of outstanding options and 60,000 shares issuable upon exercise of outstanding warrants. Mr. Cramer's business address is c/o A.D.A.M., Inc., 1600 RiverEdge Parkway, Suite 100, Atlanta, Georgia 30328-4658.

- (3)

- Includes 205,208 shares issuable upon exercise of outstanding options.

- (4)

- Includes 94,083 shares issuable upon exercise of outstanding options.

- (5)

- Includes 89,500 shares issuable upon exercise of outstanding options.

- (6)

- Includes 89,583 shares issuable upon exercise of outstanding options.

- (7)

- Includes 35,000 shares issuable upon exercise of outstanding options.

- (8)

- Includes 1,030,041 shares issuable upon exercise of outstanding options and 60,000 shares issuable upon exercise of outstanding warrants.

Executive Officers

Robert S. Cramer. Biographical information regarding Mr. Cramer appears under "Agenda Item One—Election of Directors."

Kevin S. Noland. Mr. Noland, age 40, has served as the Company's Chief Operating Officer since September 2000. He served as Director of Marketing from 1996 to 1998 and was named Vice President of Marketing and Corporate Communications in 1999. Prior to joining the Company in 1994, Mr. Noland held positions in sales, marketing and product development with leading technology companies including General Electric, Borland Software Corp., Central Point Software (acquired by Symantec Corp.) and several startup and turnaround ventures.

6

EXECUTIVE COMPENSATION

The table below sets forth certain information relating to the compensation earned during the last three years by each of the Company's executive officers.

| |

| | Annual Compensation

| | Long Term

Compensation

| |

|

|---|

Name and Principal Position

| | Period

| | Salary

| | Bonus

| | Other

Annual

Compensation

| | Securities

Underlying

Options (#)

| | All Other

Compensation(2)

|

|---|

Robert S. Cramer, Jr.

Chief Executive Officer | | 2002

2001

2000 | | $

$

$ | 265,000

250,027

225,000 | | $

$

| 30,000

60,000

— | |

$

| —

141,000

— |

(1)

| 160,000

490,000 200,000 |

(3) | $

$

$ | 1,229

1,856

1,906 |

Kevin S. Noland

Chief Operating Officer | | 2002

2001

2000 | | $

$

$ | 150,000

143,750

101,600 | |

$

$ | —

11,840

11,400 | | | —

—

— | | 125,000

75,000

69,375 | | | —

—

— |

- (1)

- Represents gains from the sale of stock upon the exercise of in-the-money stock options.

- (2)

- Represents life insurance premiums paid on behalf of the executive officer.

- (3)

- During 2001, Mr. Cramer forfeited his rights to 145,000 of these options as well as 195,000 options issued in January 1999.

Option Grants in Last Fiscal Year

The following table provides information regarding stock options granted to the Company's executive officers during the year ended December 31, 2002.

Individual Grants

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term (1)

|

|---|

| |

| | % of Total Options Granted To Employees In Fiscal Year

| |

| |

|

|---|

Name

| | Number of Securities Underlying Options

Granted (#)

| | Exercise or

Base Price

($)

| | Expiration

Date

|

|---|

| | 5% ($)

| | 10% ($)

|

|---|

| Robert S. Cramer, Jr. | | 160,000 | | 17.8 | % | 3.06 | | 01/13/2012 | | 797,507 | | 1,269,896 |

| Kevin S. Noland | | 125,000 | | 13.9 | % | 3.06 | | 01/13/2012 | | 623,052 | | 992,106 |

- (1)

- The potential realizable value portion of the foregoing table illustrates value that might be realized upon exercise of the options immediately prior to the expiration of their term, assuming the specified compounded rates of appreciation on the common stock over the term of the options. These numbers do not take into account plan provisions providing for termination of the option following termination of employment or non-transferability.

Aggregate Option Exercises in Last Fiscal Year and Fiscal Year-End Option Value Table

The following table shows the number and value of exercisable and unexercisable options held by the Company's executive officers as of December 31, 2002. The Company has not awarded stock

7

appreciation rights ("SARs") to any employee, has no long-term incentive plans, as that term is defined in SEC regulations, and has no defined benefit or actuarial plans covering any of its employees.

| | Number of Securities Underlying Unexercised Options/SARs at Fiscal Year End (#)

| | Value of Unexercised

In-The-Money Options/

SARs at Fiscal

Year End ($)

|

|---|

Name

| | Exercisable/

Unexercisable

| | Exercisable/

Unexercisable (2)

|

|---|

| Robert S. Cramer, Jr. (1) | | 440,000/175,000 | | 0/0 |

| Kevin S. Noland | | 138,542/183,333 | | 0/0 |

- (1)

- Does not include warrants to purchase 60,000 shares of common stock issued in connection with a $500,000 loan by Mr. Cramer to A.D.A.M. on December 31, 1999.

- (2)

- The exercise price of all options held by the Company's executive officers exceeded the closing price of the Company's common stock on December 31, 2002.

Employment Agreements

The Company entered into an amended and restated employment agreement with Robert S. Cramer, Jr. in October 2002. The initial term of the agreement will expire on December 31, 2006, following which the agreement will be automatically extended for successive one-year periods unless either party gives notice of non-renewal. The agreement provides that Mr. Cramer will serve as the Company's Chairman and Chief Executive Officer and be entitled to receive a base annual salary of $250,000, which may be increased in the discretion of the board of directors. In addition, Mr. Cramer is entitled to receive a bonus of approximately $105,000 in May of each of 2003, 2004, 2005 and 2006, which will be payable by offsetting amounts owed by Mr. Cramer to the Company under the promissory note executed by Mr. Cramer in favor of the Company during 2001 (see Item 13). In the event Mr. Cramer's employment is terminated without cause or in connection with a change in control, he will be entitled the offset the full amount of any remaining bonuses under the agreement against the promissory note. In addition, if Mr. Cramer's employment agreement is terminated without cause or as a result of death or disability, the Company shall be obligated to pay his then-current base salary for a period of one year following the termination date. The agreement also contains two-year confidentiality, employee and customer nonsolicitation, and noncompetition provisions.

The Company has entered into an employment agreement with Kevin S. Noland that shall continue indefinitely until terminated in accordance with its terms. The agreement provides that Mr. Noland will serve as the Company's Chief Operating Officer and be entitled to receive a base annual salary of $150,000, which may be increased in the discretion of the board of directors. The agreement may be terminated by either party with or without cause. In the event the agreement is terminated by the Company without cause or by Mr. Noland with cause, the Company shall continue to pay Mr. Noland's then current base salary for a period of one year following the termination date. The agreement also contains two-year confidentiality and employee nonsolicitation provisions and one-year noncompetition and customer nonsolicitation provisions.

The Company has also executed Employee Confidentiality and Nondisclosure Agreements with all executive officers and senior management.

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The Compensation/Stock Option Committee (the "Compensation Committee"), which is composed of two non-employee directors, is responsible for developing and making recommendations to the Board with respect to the Company's compensation plans and policies for the Company's executive officers as well as the Board of Directors. In carrying out this responsibility, the Compensation

8

Committee approves the design of all compensation plans applicable to executive officers and directors, reviews and approves performance goals, establishes award opportunities, oversees the ongoing operation of the various plans and makes recommendations to the Board regarding certain of these matters. In addition, the Compensation Committee, pursuant to authority delegated by the Board, determines on an annual basis the base salaries to be paid to the Chief Executive Officer and each of the other executive officers. The Compensation Committee also, in conjunction with the Board, reviews compensation policies applicable to executive officers as well as directors and considers the relationship of corporate performance to that compensation.

Executive Officer Compensation Philosophy

The objectives of the Company's executive compensation program are to support the achievement of desired Company performance and provide compensation that will attract and retain superior talent and reward performance. In carrying out these objectives, the Compensation Committee considers current corporate performance, the potential for future performance gains, whether shareholder value has been or will be enhanced, and competitive market conditions for executives in similar positions at local, regional and national companies having similar revenues and number of employees. Those factors are evaluated and considered for each officer on an annual basis, including consideration of the contribution made by each officer during the prior fiscal year. The Company's compensation package for its officers includes both short-term and long-term features in the form of base salary, variable compensation keyed to Company performance and stock options which are granted periodically at the discretion of the Compensation Committee. As a result, the Company's executive compensation provides an overall level of compensation opportunity that is competitive with companies in the Company's industry of comparable size and complexity. The Compensation Committee will use its discretion to set executive compensation at a level that, in its judgment, is warranted by external, internal or individual circumstances. The Compensation Committee also believes that stock ownership by management and stock-based performance compensation arrangements are beneficial in aligning management's and shareholders' interests in the enhancement of shareholder value.

Executive Officer Compensation

The Company's executive officer compensation is comprised of base salary, grants under the Amended and Restated 1992 Stock Option Plan and 2002 Stock Incentive Plan, and various benefits, including medical plans which are generally available to employees of the Company.

Base Salary. The Compensation Committee reviews executive compensation annually, unless a previously specified salary level has been established in an executive's employment contract. Annual salary recommendations are generally based on peer group and national industry surveys of executive compensation packages for companies of a similar size in our industry, as well as evaluations of the individual executive's past and expected future performance. Similarly, the base salary of the Chief Executive Officer is determined based on a review of competitive compensation data, the Chief Executive Officer's overall compensation package, and an assessment of his past performance and expected future performance in leading the Company.

Bonuses. The amount of any annual bonus to be paid to executive officers is determined based upon an evaluation of such factors as individual performance, increases in the Company's revenue, net income, net income per share and market penetration, as well as the executive's contribution to the Company's performance.

Stock Option Program. The grant of stock options is designed to align the interests of executive officers with those of shareholders in the Company's long-term performance. Options granted under the plans have an exercise price equal to at least 100% of the fair market value of the Company's common stock on the date of grant and expire not later than ten years from the date of grant. It has

9

generally been the practice of the Compensation Committee to grant stock options which vest ratably over a three-year period from the date of the grant. The Compensation Committee and the Board of Directors, however, maintain discretion to make other types of grants. Option awards for officers other than the Chief Executive Officer are based on recommendations made by the Chief Executive Officer and on the Compensation Committee's assessment of how the respective individual contributes to the Company. The factors considered in this assessment are identical to those set forth under the heading "Base Salary."

Other Benefits. The Company provides medical benefits to executive officers. These benefits are comparable to those generally available to Company employees. The Company also funds life insurance policies on the behalf of Mr. Cramer. The amount funded under policies and the amount of insurance provided to the executive is commensurate with the executive's salary and level of responsibility.

Compensation of the Chairman of the Board and Chief Executive Officer

The Company entered into an amended and restated employment agreement with Robert S. Cramer, Jr. in October 2002. The agreement provides that Mr. Cramer will serve as the Company's Chairman and Chief Executive Officer and be entitled to receive a base annual salary of $250,000, which may be increased in the discretion of the board of directors. In 2002, Mr. Cramer's base salary under the agreement did not increase from the prior year. In addition, Mr. Cramer received a bonus of $30,000 during 2002 and options to purchase 160,000 shares of the Company's common stock.

Policy with Respect to the $1 Million Deduction Limit

The Omnibus Budget Reconciliation Act of 1993 placed certain limits on the deductibility of non-performance based executive compensation for a company's employees, unless certain requirements are met. The Compensation Committee does not believe that there is a risk of losing deductions under this law. However, in the future, the Compensation Committee intends to consider carefully any plan or compensation arrangement that might result in the disallowance of compensation deductions that may be lost versus the broader interests of the Company to be served by paying adequate compensation for services rendered, before adopting any plan or compensation arrangement. The Compensation Committee believes that its compensation philosophies are suited to retaining and rewarding executives who contribute to the success of the Company in achieving its business objectives and increasing stockholders value. The Company further believes that the program strikes an appropriate balance among the interests and needs of the Company, its shareholders and its executives.

Francis J. Tedesco, M.D. (Chairman)

John W. McClaugherty

The preceding Compensation Committee Report on executive compensation shall not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act or Exchange Act except to the extent that the Company specifically incorporates this information by reference.

10

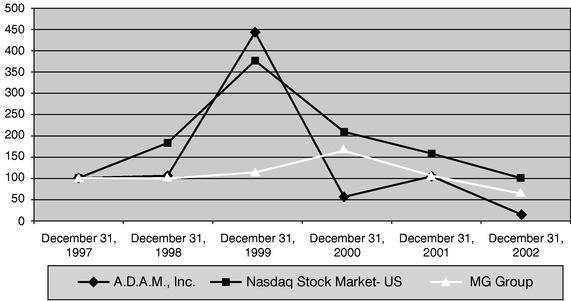

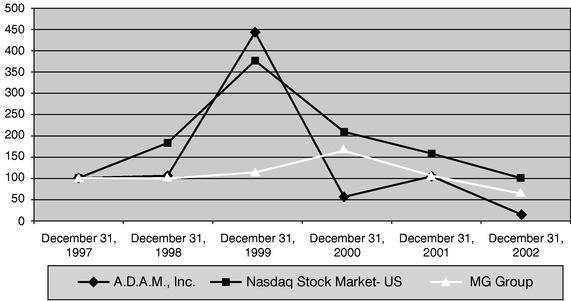

STOCK PRICE PERFORMANCE GRAPH

The following stock price performance graph compares the market performance over the five-year period commencing December 31, 1997 of the Company's common stock to the Nasdaq Stock Market—U.S. and the Media General Financial Services Healthcare Information Services Index. The stock price performance graph assumes an investment of $100 in the Company, the Nasdaq Market Index—U.S. and the Media General Financial Services Healthcare Information Services Index on December 31, 1997 and further assumes the reinvestment of all dividends. Stock price performance as reflected in the table below is not necessarily indicative of future results.

ASSUMES $100 INVESTED ON DEC. 31, 1997

ASSUMES DIVIDENDS REINVESTED

THROUGH DEC. 31, 2002

| | A.D.A.M., Inc.

| | Nasdaq Stock Market—US

| | MG Group

|

|---|

| December 31, 1997 | | 100.00 | | 100.00 | | 100.00 |

| December 31, 1998 | | 105.21 | | 183.33 | | 98.80 |

| December 31, 1999 | | 442.71 | | 375.88 | | 113.18 |

| December 31, 2000 | | 56.25 | | 209.32 | | 165.09 |

| December 31, 2001 | | 104.17 | | 158.48 | | 105.41 |

| December 31, 2002 | | 15.63 | | 100.64 | | 64.14 |

11

The Stock Price Performance Graph shall not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the federal securities laws except to the extent that the Company specifically incorporates this information by reference.

CERTAIN TRANSACTIONS

During 2002, the Company acquired an additional preferred stock interest in ThePort, for $250,000 in cash, resulting in approximately 24% voting interest as of December 31, 2002. In connection with a preferred stock investment of $275,000 during 2001, the Company had entered into a five-year agreement whereby the Company would have exclusive distribution rights to ThePort's products within the healthcare industry. As of December 31, 2001, the Company had pre-paid $125,000 of the contract fee to be applied against future subscription fees. the Company had committed to generate $1,500,000 in subscription fees during the initial term of the agreement. On February 14, 2003, ThePort agreed to accept a payment of $125,000 from the Company. This payment releases the Company from the minimum guarantee and provides the Company non-exclusive right to ThePort's products within the healthcare industry.

The Company's Chief Executive Officer, who currently serves as the Chairman of the Board of Directors of ThePort, acquired an approximately 14% voting interest in ThePort and has accepted convertible notes from and made loans to ThePort for $425,000 in 2001 and $185,000 in 2002. The results of operations of this entity have been accounted for as an equity investment and accordingly, the Company records its share of ThePort's results of operations in the Company's consolidated financial statements. For the year ended December 31, 2002, the Company recorded its share of ThePort's losses of $248,000. At December 31, 2002, the carrying value of this investment was $0.

On May 30, 2001, the Company received a full-recourse promissory note from its Chief Executive Officer for approximately $341,000. The note earns interest of 6.25% per annum and is due in full on or before June 5, 2006. Part of the note, or $291,000, is secured by 150,000 shares of the Company's common stock owned by this executive. As of December 31, 2002, approximately $34,000 of interest has been earned and recorded on this note. During 2002, approximately $6,000 had been received for payment of interest and the unpaid balance of principal and interest as of December 31, 2002 was approximately $369,000.

OTHER MATTERS

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires executive officers and directors of the Company and persons who beneficially own more than ten percent of the Company's common stock to file with the Securities and Exchange Commission certain reports, and to furnish copies thereof to the Company, with respect to each such person's beneficial ownership of the Company's equity securities. Based solely upon a review of the copies of such reports furnished to the Company and certain representations of such persons, all such persons have complied with the applicable reporting requirements.

Report to Shareholders for the Year Ended December 31, 2002

The Annual Report of the Company for the year ending December 31, 2002, including audited financial statements, accompanies this Proxy Statement. This Annual Report does not form any part of the material for the solicitation of proxies.

Shareholder Proposals

Any shareholder proposals intended to be presented at the Company's 2004 Annual Meeting of Shareholders must be received by the Company on or before January 4, 2004 to be eligible for

12

inclusion in the proxy statement and form of proxy to be distributed by the Board of Directors in connection with such meeting. In general, any shareholder proposal to be considered at next year's annual meeting but not included in the proxy statement must be submitted in writing to the principal executive offices of the Company, not less than 60 days prior to the 2004 annual meeting. However, if the Company sends out notice or publicly discloses the date of the 2004 annual meeting of the shareholders within 40 days prior to such meeting, then a shareholder will be able to submit a proposal for consideration within ten days of the notice or public announcement of such meeting. Any notification to bring any proposal before the 2004 annual meeting of the shareholders must comply with the requirements of the Company's bylaws. You may obtain a copy of the relevant bylaw provisions by contacting the Company's Corporate Secretary.

Other Matters to be Acted on at the Annual Meeting

The Board of Directors knows of no other matters to be brought before the Annual Meeting.

Expenses Of Solicitation

The cost of solicitation of proxies will be borne by the Company. In an effort to have as large a representation at the meeting as possible, special solicitation of proxies may, in certain instances, be made personally or by telephone, telegraph or mail by one or more employees of the Company. The Company also will reimburse brokers, banks, nominees and other fiduciaries for postage and reasonable clerical expenses of forwarding the proxy material to their principals who are beneficial owners of the Company's common stock.

| | | By Order of the Board of Directors, |

|

|

/s/ ROBERT S. CRAMER, JR.

Robert S. Cramer, Jr.

Chairman of the Board and Chief Executive Officer |

Atlanta, Georgia

April 28, 2003

13

A.D.A.M., INC.

1600 RiverEdge Parkway, Suite 100

Atlanta, Georgia 30328

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

FOR THE 2003 ANNUAL MEETING OF SHAREHOLDERS

The undersigned hereby appoints Robert S. Cramer and Kevin S. Noland, or either of them, with power of substitution to each, the proxies of the undersigned to vote the common stock of the undersigned at the Annual Meeting of Shareholders of A.D.A.M., Inc. to be held on June 5, 2003 at 9:00 a.m. at our offices located at 1600 RiverEdge Parkway, Suite 100, Atlanta, Georgia 30328, and any adjournments or postponements thereof:

- 1.

- To elect Francis J. Tedesco to the Board of Directors to serve for a term of three years or until his successor is elected and qualified.

THE BOARD OF DIRECTORS FAVORS A VOTE "FOR" THE ABOVE PROPOSALS AND UNLESS INSTRUCTIONS TO THE CONTRARY ARE INDICATED IN THE SPACE PROVIDED, THIS PROXY WILL BE SO VOTED.

| | | Please date and sign this Proxy exactly as name(s) appears on the mailing label. |

|

|

|

|

|

|

|

|

Print Name(s): |

|

|

| | | | |

|

|

|

|

|

|

|

|

NOTE: When signing as an attorney, trustee, executor, administrator or guardian, please give your title as such. If a corporation or partnership, give full name by authorized officer. In the case of joint tenants, each joint owner must sign. |

|

|

Dated: , 2003 |

QuickLinks

ELECTION OF DIRECTORS (ITEM 1)RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS (ITEM 2)AUDIT COMMITTEE REPORTCOMMON STOCK OWNERSHIP BY MANAGEMENT AND PRINCIPAL SHAREHOLDERSEXECUTIVE COMPENSATIONCOMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATIONSTOCK PRICE PERFORMANCE GRAPHCERTAIN TRANSACTIONSOTHER MATTERS