united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number: 811-06113

The Caldwell & Orkin Funds, Inc.

(Exact name of registrant as specified in charter)

100 S. Ashley Drive, Suite 895

Tampa, Florida 33602

(Address of principal executive offices)(Zip code)

Derek Pilecki

2502 N. Rocky Point Drive, Suite 665

Tampa, Florida 33607

(Name and address of agent for service)

Copies to:

Jesse Halle

Ultimus Fund Solutions, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

Registrant’s telephone number, including area code: 1-813-282-7870

Date of fiscal year end: April 30

Date of reporting period: October 31, 2024

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Gator Capital Long/Short Fund

Semi-Annual Shareholder Report - October 31, 2024

This semi-annual shareholder report contains important information about Gator Capital Long/Short Fund (the "Fund") for the period of May 1, 2024 to October 31, 2024. You can find additional information about the Fund at https://funddocs.filepoint.com/gator/. You can also request this information by contacting us at (800) 467-7903.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Gator Capital Long/Short Fund | $154 | 2.87% |

How did the Fund perform during the reporting period?

The Fund outperformed the S&P 500 over the last six months. Long positions in insurance, brokerage, and regional banks drove the outperformance for the year. Short positions in banking and real estate detracted from performance.

The top five contributors during the six month period were Jackson Financial (long), Robinhood Markets (long), Western Alliance Bancorp (long), UMB Financial (long), and Axos (long).

The top five detractors during the six month period were Columbia Banking System (short), Hingham Institution for Savings, (short), Capitol Federal Financial (short), MGIC Investment Corp (short), and Bank of Hawaii (short).

We ended the period with gross long exposure of 97% and gross short exposure of 25% for a total gross exposure of 122% and net exposure of 73%.

Thank you for entrusting us with a portion of your wealth. We are grateful for investors like you who believe and trust in our strategy. As always, we welcome the opportunity to speak with you and discuss the Fund.

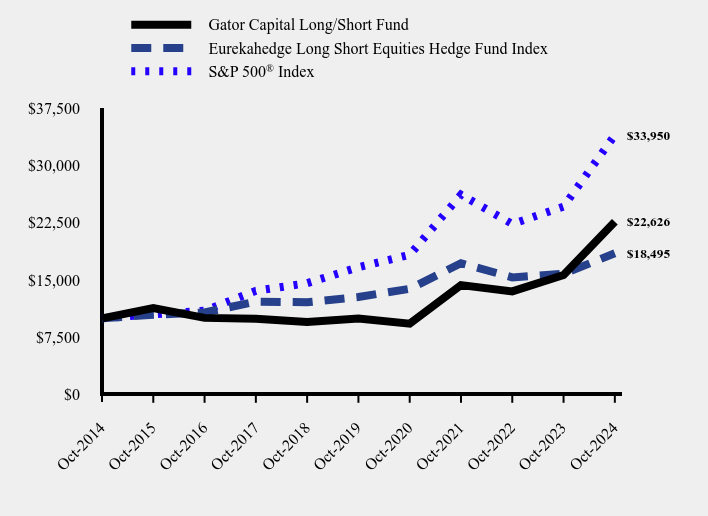

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Gator Capital Long/Short Fund | Eurekahedge Long Short Equities Hedge Fund Index | S&P 500® Index |

|---|

| Oct-2014 | $10,000 | $10,000 | $10,000 |

| Oct-2015 | $11,342 | $10,455 | $10,520 |

| Oct-2016 | $10,055 | $10,759 | $10,994 |

| Oct-2017 | $9,939 | $12,187 | $13,593 |

| Oct-2018 | $9,508 | $12,096 | $14,591 |

| Oct-2019 | $9,977 | $12,790 | $16,681 |

| Oct-2020 | $9,295 | $13,860 | $18,301 |

| Oct-2021 | $14,342 | $17,197 | $26,155 |

| Oct-2022 | $13,515 | $15,350 | $22,334 |

| Oct-2023 | $15,658 | $15,821 | $24,599 |

| Oct-2024 | $22,626 | $18,495 | $33,950 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Gator Capital Long/Short Fund | 44.50% | 17.79% | 8.51% |

| Eurekahedge Long Short Equities Hedge Fund Index | 16.90% | 7.66% | 6.34% |

S&P 500® Index | 38.02% | 15.27% | 13.00% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

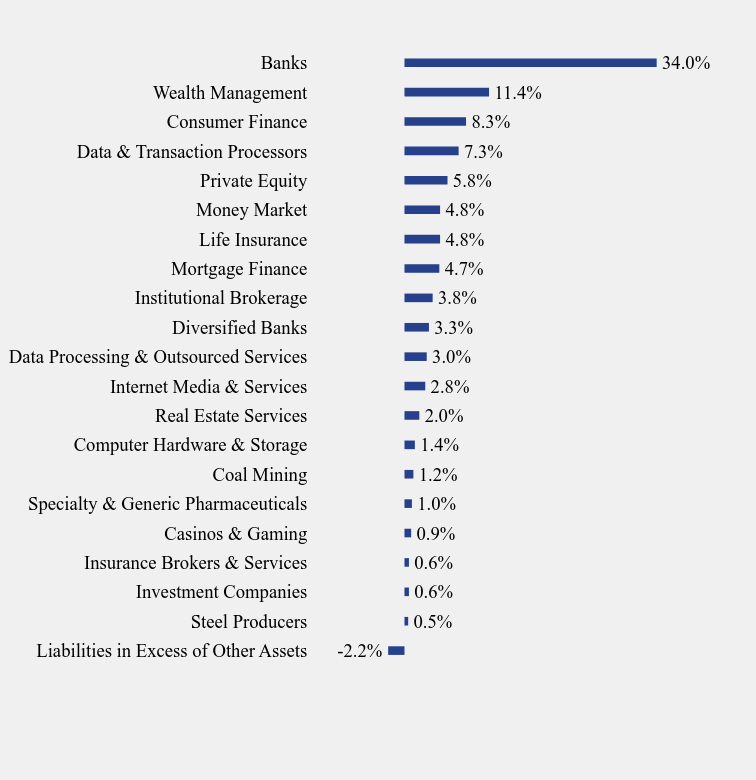

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -2.2% |

| Steel Producers | 0.5% |

| Investment Companies | 0.6% |

| Insurance Brokers & Services | 0.6% |

| Casinos & Gaming | 0.9% |

| Specialty & Generic Pharmaceuticals | 1.0% |

| Coal Mining | 1.2% |

| Computer Hardware & Storage | 1.4% |

| Real Estate Services | 2.0% |

| Internet Media & Services | 2.8% |

| Data Processing & Outsourced Services | 3.0% |

| Diversified Banks | 3.3% |

| Institutional Brokerage | 3.8% |

| Mortgage Finance | 4.7% |

| Life Insurance | 4.8% |

| Money Market | 4.8% |

| Private Equity | 5.8% |

| Data & Transaction Processors | 7.3% |

| Consumer Finance | 8.3% |

| Wealth Management | 11.4% |

| Banks | 34.0% |

- Net Assets$41,114,687

- Number of Portfolio Holdings81

- Advisory Fee $189,483

- Portfolio Turnover53%

No material changes occurred during the period ended October 31, 2024.

Gator Capital Long/Short Fund (COAGX)

Semi-Annual Shareholder Report - October 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://funddocs.filepoint.com/gator/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Item 2. Code of Ethics.

Not applicable – disclosed with annual report

Item 3. Audit Committee Financial Expert.

Not applicable – disclosed with annual report

Item 4. Principal Accountant Fees and Services.

Not applicable – disclosed with annual report

Item 5. Audit Committee of Listed Registrants.

Not applicable – disclosed with annual report

Item 6. Investments.

The Registrant’s schedule of investments in unaffiliated issuers is included in the Financial Statements under Item 7 of this form.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

| Table of Contents | Gator Capital Long/Short Fund |

| October 31, 2024 (Unaudited) | |

| Schedule of Investments | | 2 |

| Schedule of Securities Sold Short | | 5 |

| Statement of Assets and Liabilities | | 7 |

| Statement of Operations | | 8 |

| Statements of Changes in Net Assets | | 9 |

| Financial Highlights | | 10 |

| Notes to Financial Statements | | 11 |

| Director Approval of the Investment Advisory Agreement | | 18 |

| Gator Capital Long/Short Fund | Schedule of Investments |

| | October 31, 2024 (Unaudited) |

| | | Shares | | | Fair Value | |

| COMMON STOCKS — LONG — 91.17% | | | | | | | | |

| Banks — 34.06% | | | | | | | | |

| Axos Financial, Inc.(a) | | | 25,000 | | | $ | 1,693,000 | |

| Banc of California, Inc. | | | 56,600 | | | | 869,376 | |

| Bank OZK | | | 3,600 | | | | 157,500 | |

| Bridgewater Bancshares, Inc.(a) | | | 24,000 | | | | 350,400 | |

| Business First Bancshares, Inc. | | | 2,040 | | | | 53,428 | |

| Chain Bridge Bancorp, Inc.(a) | | | 21,000 | | | | 468,300 | |

| ConnectOne Bancorp, Inc. | | | 14,142 | | | | 342,802 | |

| Customers Bancorp, Inc.(a) | | | 18,200 | | | | 839,566 | |

| Dime Community Bancshares, Inc. | | | 7,063 | | | | 212,384 | |

| First Business Financial Services, Inc. | | | 7,500 | | | | 321,000 | |

| First Citizens BancShares, Inc., Class A | | | 900 | | | | 1,743,615 | |

| First Internet Bancorp | | | 10,000 | | | | 349,700 | |

| OFG Bancorp | | | 19,991 | | | | 805,038 | |

| Old Second Bancorp, Inc. | | | 43,900 | | | | 720,838 | |

| OP Bancorp | | | 38,573 | | | | 571,266 | |

| Pinnacle Financial Partners, Inc. | | | 11,000 | | | | 1,159,950 | |

| UMB Financial Corp. | | | 15,000 | | | | 1,645,950 | |

| Webster Financial Corp. | | | 15,000 | | | | 777,000 | |

| Western Alliance Bancorp | | | 11,094 | | | | 923,132 | |

| | | | | | | | 14,004,245 | |

| Casinos & Gaming — 0.88% | | | | | | | | |

| Caesars Entertainment, Inc.(a) | | | 9,000 | | | | 360,450 | |

| | | | | | | | | |

| Coal Mining — 1.20% | | | | | | | | |

| SunCoke Energy, Inc. | | | 48,000 | | | | 494,880 | |

| | | | | | | | | |

| Computer Hardware & Storage — 1.42% | | | | | | | | |

| Dell Technologies, Inc., Class C | | | 4,000 | | | | 494,520 | |

| Hewlett Packard Enterprise Co. | | | 4,500 | | | | 87,705 | |

| | | | | | | | 582,225 | |

| Consumer Finance — 6.84% | | | | | | | | |

| OneMain Holdings, Inc. | | | 12,500 | | | | 620,875 | |

| SLM Corp. | | | 68,000 | | | | 1,498,040 | |

| Synchrony Financial | | | 12,600 | | | | 694,764 | |

| | | | | | | | 2,813,679 | |

See accompanying notes which are an integral part of these financial statements.

| 2 | 1-800-467-7903 | https://gatorcapital.com/mutual-funds/gator-capital-long-short-fund/ |

| Gator Capital Long/Short Fund | Schedule of Investments |

| | October 31, 2024 (Unaudited) |

| | | Shares | | | Fair Value | |

| Data & Transaction Processors — 7.30% | | | | | | | | |

| Block, Inc., Class A(a) | | | 12,000 | | | $ | 867,840 | |

| Global Payments, Inc. | | | 10,600 | | | | 1,099,326 | |

| Visa, Inc., Class A | | | 1,900 | | | | 550,715 | |

| WEX, Inc.(a) | | | 2,801 | | | | 483,453 | |

| | | | | | | | 3,001,334 | |

| Data Processing & Outsourced Services — 2.99% | | | | | | | | |

| PayPal Holdings, Inc.(a) | | | 15,500 | | | | 1,229,150 | |

| | | | | | | | | |

| Diversified Banks — 3.26% | | | | | | | | |

| Barclays PLC - ADR | | | 108,000 | | | | 1,340,280 | |

| | | | | | | | | |

| Institutional Brokerage — 3.79% | | | | | | | | |

| Interactive Brokers Group, Inc., Class A | | | 10,200 | | | | 1,556,316 | |

| | | | | | | | | |

| Insurance Brokers & Services — 0.59% | | | | | | | | |

| Kingstone Companies, Inc.(a) | | | 22,629 | | | | 240,320 | |

| | | | | | | | | |

| Internet Media & Services — 2.76% | | | | | | | | |

| Meta Platforms, Inc., Class A | | | 2,000 | | | | 1,135,160 | |

| | | | | | | | | |

| Investment Companies — 0.62% | | | | | | | | |

| BBX Capital, Inc.(a) | | | 32,801 | | | | 255,520 | |

| | | | | | | | | |

| Life Insurance — 4.77% | | | | | | | | |

| Genworth Financial, Inc., Class A(a) | | | 39,000 | | | | 262,860 | |

| Jackson Financial, Inc., Class A | | | 17,000 | | | | 1,699,150 | |

| | | | | | | | 1,962,010 | |

| Private Equity — 5.87% | | | | | | | | |

| The Carlyle Group, Inc. | | | 20,000 | | | | 1,000,600 | |

| Victory Capital Holdings, Inc., Class A | | | 23,590 | | | | 1,413,748 | |

| | | | | | | | 2,414,348 | |

| Real Estate Services — 1.99% | | | | | | | | |

| Anywhere Real Estate, Inc.(a) | | | 212,500 | | | | 820,250 | |

| | | | | | | | | |

| Specialty & Generic Pharmaceuticals — 1.02% | | | | | | | | |

| Viatris, Inc. | | | 36,000 | | | | 417,600 | |

See accompanying notes which are an integral part of these financial statements.

| Semi-Annual Financial Statements | October 31, 2024 | 3 |

| Gator Capital Long/Short Fund | Schedule of Investments |

| | October 31, 2024 (Unaudited) |

| | | Shares | | | Fair Value | |

| Steel Producers — 0.50% | | | | | | | | |

| United States Steel Corp. | | | 5,250 | | | $ | 203,962 | |

| | | | | | | | | |

| Wealth Management — 11.31% | | | | | | | | |

| Ameriprise Financial, Inc. | | | 2,500 | | | | 1,275,750 | |

| Robinhood Markets, Inc., Class A(a) | | | 76,000 | | | | 1,785,240 | |

| Stifel Financial Corp. | | | 12,000 | | | | 1,243,440 | |

| Virtus Investment Partners, Inc. | | | 1,600 | | | | 346,192 | |

| | | | | | | | 4,650,622 | |

| TOTAL COMMON STOCKS — LONG — | | | | | | | | |

| (Cost $23,477,824) | | | | | | | 37,482,351 | |

| PREFERRED STOCKS — LONG — 6.15% | | | | | | | | |

| Specialty Finance — 6.15% | | | | | | | | |

| AG Mortgage Investment Trust, Inc., Series C, 8.00% | | | 36,000 | | | | 906,480 | |

| Chimera Investment Corp., Series B, 8.00% | | | 14,391 | | | | 365,100 | |

| Chimera Investment Corp., Series D, 8.00% | | | 19,717 | | | | 491,939 | |

| Federal National Mortgage Association, Series O, 7.00%(a) | | | 9,625 | | | | 75,749 | |

| Federal National Mortgage Association, Series R, 7.63%(a) | | | 20,250 | | | | 77,152 | |

| SLM Corp., Series B, 1.70% | | | 8,276 | | | | 613,086 | |

| | | | | | | | 2,529,506 | |

| TOTAL PREFERRED STOCKS — LONG — | | | | | | | | |

| (Cost $1,942,854) | | | | | | | 2,529,506 | |

| MONEY MARKET FUNDS — 4.84% | | | | | | | | |

| First American Treasury Obligations Fund - Class X, 4.74%(b) | | | 1,990,138 | | | | 1,990,138 | |

| | | | | | | | | |

| TOTAL MONEY MARKET FUNDS | | | | | | | | |

| (Cost $1,990,138) | | | | | | | 1,990,138 | |

| TOTAL INVESTMENTS — 102.16% | | | | | | | | |

| (Cost $27,410,816) | | | | | | | 42,001,995 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (2.16)% | | | | | | | (887,308 | ) |

| NET ASSETS — 100.00% | | | | | | $ | 41,114,687 | |

| (a) | Non-income producing security. |

| (b) | Rate disclosed is the seven day effective yield as of October 31, 2024. |

ADR - American Depositary Receipt.

See accompanying notes which are an integral part of these financial statements.

| 4 | 1-800-467-7903 | https://gatorcapital.com/mutual-funds/gator-capital-long-short-fund/ |

| Gator Capital Long/Short Fund | Schedule of Securities Sold Short |

| | October 31, 2024 (Unaudited) |

| | | Shares | | | Fair Value | |

| COMMON STOCKS — SHORT — (25.80)% | | | | | | | | |

| Banks — (13.46)% | | | | | | | | |

| Bank of Hawaii Corp. | | | (10,000 | ) | | $ | (722,300 | ) |

| Capitol Federal Financial, Inc. | | | (165,800 | ) | | | (1,068,581 | ) |

| Commerce Bancshares, Inc. | | | (4,084 | ) | | | (255,250 | ) |

| First Financial Bankshares, Inc. | | | (6,250 | ) | | | (225,875 | ) |

| Hingham Institution for Savings | | | (2,354 | ) | | | (596,786 | ) |

| Northwest Bancshares, Inc. | | | (9,142 | ) | | | (121,497 | ) |

| Park National Corp. | | | (1,700 | ) | | | (293,726 | ) |

| Renasant Corp. | | | (19,000 | ) | | | (648,090 | ) |

| Seacoast Banking Corporation of Florida | | | (7,600 | ) | | | (202,920 | ) |

| Toronto-Dominion Bank (The) | | | (15,000 | ) | | | (829,050 | ) |

| United Bankshares, Inc. | | | (15,100 | ) | | | (568,968 | ) |

| | | | | | | | (5,533,043 | ) |

| Commercial Vehicles — 0.00% | | | | | | | | |

| Nikola Corp.(a) | | | (333 | ) | | | (1,309 | ) |

| | | | | | | | | |

| Diversified Banks — (1.98)% | | | | | | | | |

| Bank of America Corp. | | | (19,500 | ) | | | (815,490 | ) |

| | | | | | | | | |

| Industrial Wholesale & Rental — (1.19)% | | | | | | | | |

| SiteOne Landscape Supply, Inc.(a) | | | (3,500 | ) | | | (489,090 | ) |

| | | | | | | | | |

| Infrastructure Software — (0.09)% | | | | | | | | |

| Upstart Holdings, Inc.(a) | | | (800 | ) | | | (38,944 | ) |

| | | | | | | | | |

| Internet Media & Services — (0.22)% | | | | | | | | |

| Opendoor Technologies, Inc.(a) | | | (50,800 | ) | | | (88,900 | ) |

| | | | | | | | | |

| Investment Management — (0.94)% | | | | | | | | |

| T. Rowe Price Group, Inc. | | | (3,500 | ) | | | (384,510 | ) |

| | | | | | | | | |

| Mortgage Finance — (1.31)% | | | | | | | | |

| Essent Group Ltd. | | | (9,000 | ) | | | (540,090 | ) |

| | | | | | | | | |

| Non-Alcoholic Beverages — (0.03)% | | | | | | | | |

| Oatly Group AB - ADR(a) | | | (15,651 | ) | | | (12,790 | ) |

See accompanying notes which are an integral part of these financial statements.

| Semi-Annual Financial Statements | October 31, 2024 | 5 |

| Gator Capital Long/Short Fund | Schedule of Securities Sold Short |

| | October 31, 2024 (Unaudited) |

| | | Shares | | | Fair Value | |

| Office REITs — (3.38)% | | | | | | | | |

| Boston Properties, Inc. | | | (5,200 | ) | | $ | (418,912 | ) |

| Corporate Office Properties Trust | | | (15,000 | ) | | | (483,000 | ) |

| Cousins Properties, Inc. | | | (16,000 | ) | | | (490,080 | ) |

| | | | | | | | (1,391,992 | ) |

| P&C Insurance — (3.18)% | | | | | | | | |

| Lemonade, Inc.(a) | | | (1,442 | ) | | | (34,276 | ) |

| NMI Holdings, Inc., Class A(a) | | | (12,191 | ) | | | (471,548 | ) |

| Radian Group, Inc. | | | (23,000 | ) | | | (802,930 | ) |

| | | | | | | | (1,308,754 | ) |

| Packaged Food — (0.02)% | | | | | | | | |

| Beyond Meat, Inc.(a) | | | (1,600 | ) | | | (9,744 | ) |

| | | | | | | | | |

| TOTAL COMMON STOCKS — SHORT | | | | | | | | |

| (Proceeds Received $10,907,163) | | | | | | | (10,614,656 | ) |

| EXCHANGE-TRADED FUNDS — SHORT — (0.21)% | | | | | | | | |

| Direxion Daily Financial Bear 3X Shares | | | (11,700 | ) | | | (86,112 | ) |

| TOTAL EXCHANGE-TRADED FUNDS — SHORT | | | | | | | | |

| (Proceeds Received $499,663) | | | | | | | (86,112 | ) |

| TOTAL SECURITIES SOLD SHORT — (26.01)% | | | | | | | | |

| (Proceeds Received $11,406,826) | | | | | | $ | (10,700,768 | ) |

| (a) | Non-income producing security. |

ADR - American Depositary Receipt

See accompanying notes which are an integral part of these financial statements.

| 6 | 1-800-467-7903 | https://gatorcapital.com/mutual-funds/gator-capital-long-short-fund/ |

| Gator Capital Long/Short Fund | Statement of Assets and Liabilities |

| | October 31, 2024 (Unaudited) |

| ASSETS | | | | |

| Investments is securities at fair value (cost $27,410,816) | | $ | 42,001,995 | |

| Deposit held by broker for securities sold short | | | 10,476,998 | |

| Receivable for fund shares sold | | | 5 | |

| Receivable for investments sold | | | 269,383 | |

| Dividends and interest receivable | | | 14,819 | |

| Prepaid expenses | | | 20,537 | |

| Total Assets | | | 52,783,737 | |

| | | | | |

| LIABILITIES | | | | |

| Payable for dividends declared on short sales | | | 5,794 | |

| Securities sold short, at value (proceeds received $11,406,826) | | | 10,700,768 | |

| Payable for investments purchased | | | 876,681 | |

| Payable to Adviser | | | 34,868 | |

| Payable to Administrator | | | 7,241 | |

| Other accrued expenses | | | 43,698 | |

| Total Liabilities | | | 11,669,050 | |

| | | | | |

| Net Assets | | $ | 41,114,687 | |

| | | | | |

| Net Assets consist of: | | | | |

| Paid-in capital | | | 25,343,050 | |

| Accumulated earnings | | | 15,771,637 | |

| Net Assets | | $ | 41,114,687 | |

| | | | | |

| Shares outstanding, par value $0.10 per share (30,000,000 authorized shares) | | | 879,185 | |

| | | | | |

| Net asset value, offering price and redemption price per share(a) | | $ | 46.76 | |

| (a) | Redemption price may differ from net asset value if redemption fee is applied. |

See accompanying notes which are an integral part of these financial statements.

| Semi-Annual Financial Statements | October 31, 2024 | 7 |

| Gator Capital Long/Short Fund | Statement of Operations |

| | For the six months ended October 31, 2024 (Unaudited) |

| INVESTMENT INCOME | | | | |

| Dividend income (net of foreign taxes withheld of $2,904) | | $ | 657,718 | |

| Interest income | | | 30,000 | |

| Total investment income | | | 687,718 | |

| | | | | |

| EXPENSES | | | | |

| Investment Advisory fees | | | 189,483 | |

| Legal | | | 23,858 | |

| Directors’ fees and expenses | | | 18,904 | |

| Miscellaneous | | | 18,467 | |

| Administration | | | 16,985 | |

| Registration | | | 14,407 | |

| Fund accounting | | | 13,237 | |

| Transfer agent | | | 10,094 | |

| Compliance Services | | | 9,325 | |

| Audit and tax preparation | | | 8,890 | |

| Report printing | | | 6,489 | |

| Insurance | | | 4,259 | |

| Custodian | | | 3,603 | |

| Sub transfer agent fees | | | 3,306 | |

| Pricing | | | 1,011 | |

| Interest | | | 219 | |

| Dividend expense on securities sold short | | | 203,607 | |

| Net operating expenses | | | 546,144 | |

| Net investment income | | | 141,574 | |

| | | | | |

| NET REALIZED AND CHANGE IN UNREALIZED GAIN (LOSS) ON INVESTMENTS | | | | |

| Net realized gain (loss) from: | | | | |

| Investments | | | 1,436,058 | |

| Securities sold short | | | (1,026,122 | ) |

| Change in unrealized appreciation on: | | | | |

| Investments | | | 3,806,765 | |

| Securities sold short | | | 294,818 | |

| NET REALIZED AND CHANGE IN UNREALIZED GAIN ON INVESTMENTS AND SECURITIES SOLD SHORT | | | 4,511,519 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 4,653,093 | |

See accompanying notes which are an integral part of these financial statements.

| 8 | 1-800-467-7903 | https://gatorcapital.com/mutual-funds/gator-capital-long-short-fund/ |

| Gator Capital Long/Short Fund | Statements of Changes in Net Assets |

| | | For the Six Months Ended

October 31,

2024

(Unaudited) | | | For the

Year Ended

April 30,

2024 | |

| INCREASE (DECREASE) IN NET ASSETS DUE TO: | | | | | | | | |

| Operations | | | | | | | | |

| Net investment income | | $ | 141,574 | | | $ | 386,362 | |

| Net realized gain on investments, securities sold short and foreign currency transactions | | | 409,936 | | | | 564,093 | |

| Net change in unrealized appreciation of investments, securities sold short and foreign currency translations | | | 4,101,583 | | | | 6,775,834 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | | 4,653,093 | | | | 7,726,289 | |

| | | | | | | | | |

| CAPITAL TRANSACTIONS | | | | | | | | |

| Proceeds from shares sold | | | 4,748,238 | | | | 6,915,076 | |

| Amount paid for shares redeemed | | | (2,121,813 | ) | | | (1,182,806 | ) |

| Proceeds from redemption fees (Note 1) | | | 11,091 | | | | 1,504 | |

| NET INCREASE IN NET ASSETS RESULTING FROM CAPITAL TRANSACTIONS | | | 2,637,516 | | | | 5,733,774 | |

| TOTAL INCREASE IN NET ASSETS | | | 7,290,609 | | | | 13,460,063 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of period | | | 33,824,078 | | | | 20,364,015 | |

| End of period | | $ | 41,114,687 | | | $ | 33,824,078 | |

| | | | | | | | | |

| SHARE TRANSACTIONS | | | | | | | | |

| Shares sold | | | 106,867 | | | | 190,228 | |

| Shares redeemed | | | (48,132 | ) | | | (34,800 | ) |

| Net increase in shares outstanding | | | 58,735 | | | | 155,428 | |

See accompanying notes which are an integral part of these financial statements.

| Semi-Annual Financial Statements | October 31, 2024 | 9 |

| Gator Capital Long/Short Fund | Financial Highlights |

| | |

| (For a share outstanding during each period) | |

| | | For the

Six Months Ended

October 31,

2024

(Unaudited) | | | For the

Year Ended

April 30,

2024 | | | For the

Year Ended

April 30,

2023 | | | For the

Year Ended

April 30,

2022 | | | For the

Year Ended

April 30,

2021 | | | For the

Year Ended

April 30,

2020 | |

| Selected Per Share Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 41.23 | | | $ | 30.62 | | | $ | 29.31 | | | $ | 29.17 | | | $ | 15.21 | | | $ | 20.86 | |

| Investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income(a) | | | 0.13 | | | | 0.53 | | | | (0.04 | ) | | | (0.32 | ) | | | (0.10 | ) | | | (0.20 | ) |

| Net realized and unrealized gain (loss) on investments | | | 5.40 | | | | 10.08 | | | | 1.35 | | | | 0.46 | | | | 14.06 | | | | (5.45 | ) |

| Total from investment operations | | | 5.53 | | | | 10.61 | | | | 1.31 | | | | 0.14 | | | | 13.96 | | | | (5.65 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Paid-in capital from redemption fees | | | — | (b) | | | — | (b) | | | — | (b) | | | — | (b) | | | — | (b) | | | — | (b) |

| Net asset value, end of period | | $ | 46.76 | | | $ | 41.23 | | | $ | 30.62 | | | $ | 29.31 | | | $ | 29.17 | | | $ | 15.21 | |

| Total Return(c) | | | 4.69 | %(d) | | | 34.65 | % | | | 4.47 | % | | | 0.48 | % | | | 91.78 | % | | | (27.09 | )% |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | | $ | 41,115 | | | $ | 33,824 | | | $ | 20,364 | | | $ | 19,878 | | | $ | 20,963 | | | $ | 12,259 | |

| Ratios to Average Net Assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratio of net expenses to average net assets(e) | | | 0.73 | %(f) | | | 3.07 | % | | | 3.13 | % | | | 3.07 | % | | | 3.56 | % | | | 3.60 | % |

| Ratio of expenses to average net assets before waiver by Adviser | | | 0.73 | %(f) | | | 3.19 | % | | | 3.55 | % | | | 3.38 | % | | | 4.10 | % | | | 4.08 | % |

| Ratio of net investment income (loss) to average net assets | | | 0.19 | %(f) | | | 1.51 | % | | | (0.12 | )% | | | (1.07 | )% | | | (0.47 | )% | | | (1.00 | )% |

| Portfolio Turnover Rate | | | 53 | %(d) | | | 40 | % | | | 52 | % | | | 55 | % | | | 38 | % | | | 87 | % |

| (a) | Calculated using average shares outstanding. |

| (b) | Rounds to less than $0.005 per share. |

| (c) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

| (d) | Not annualized. |

| (e) | Excluding dividend and interest expense, the ratios of net expenses to average net assets were 4.69% for the six months ended October 31, 2024 and 2.00% for the fiscal years ended April 30, 2024, 2023, 2022, 2021 and 2020. |

| (f) | Annualized. |

See accompanying notes which are an integral part of these financial statements.

| 10 | 1-800-467-7903 | https://gatorcapital.com/mutual-funds/gator-capital-long-short-fund/ |

| Gator Capital Long/Short Fund | Notes to Financial Statements |

| | October 31, 2024 (Unaudited) |

1. ORGANIZATION

The Gator Capital Long/Short Fund (the “Fund”), formerly the Caldwell & Orkin - Gator Capital Long/Short Fund, is the only investment portfolio of The Caldwell & Orkin Funds, Inc. (the “Company”), an open-end, diversified management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”), and incorporated under the laws of the State of Maryland on August 15, 1989. The Fund’s investment objective is to provide long-term capital growth with a short-term focus on capital preservation. Gator Capital Management, LLC, the Fund’s investment adviser (the “Adviser”), uses a fundamental driven, multi-dimensional investment process focusing on active allocation, security selection and surveillance to achieve the Fund’s investment objective.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies”. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Regulatory Update – Tailored Shareholder Reports for Mutual Funds and Exchange-Traded Funds (“ETFs”) – Effective January 24, 2023, the Securities and Exchange Commission adopted rule and form amendments that have resulted in changes to the design and delivery of shareholder reports of mutual funds and ETFs, requiring them to transmit concise and visually engaging streamlined annual and semiannual reports to shareholders that highlight key information. Other information, including financial statements, no longer appears in a streamlined shareholder report but is available online, delivered free of charge upon request, and filed on a semiannual basis on Form N-CSR.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Securities Valuation

Securities are stated at the closing price on the date at which the net asset value (“NAV”) is being determined. If the date of determination is not a trading date, or the closing price is not otherwise available, the last bid price is used for a fair value instead. Debt securities are valued at the price provided by an independent pricing service. Any assets or securities for which

| Semi-Annual Financial Statements | October 31, 2024 | 11 |

| Gator Capital Long/Short Fund | Notes to Financial Statements |

| | October 31, 2024 (Unaudited) |

market quotations are not readily available are valued at fair value as determined in good faith by or under the direction of the Fund’s Board of Directors (the “Board”) in accordance with the Fund’s Fair Value Pricing Policy.

Securities Transactions and Related Investment Income

The Fund follows industry practice and records securities transactions on trade date for financial reporting purposes. Dividend income is recorded on the ex-dividend date. Realized gains and losses from investment transactions are determined using the specific identification method. Interest income which includes amortization of premium and accretion of discount, is accrued as earned.

Fair Value Measurements

A three-tier hierarchy has been established to classify fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

| ● | Level 1 – unadjusted quoted prices in active markets for identical investments and/or registered investment companies where the value per share is determined and published and is the basis for current transactions for identical assets or liabilities at the valuation date |

| ● | Level 2 – quoted prices which are not active quoted prices for similar assets or liabilities in active markets or inputs other than quoted process that are observable (either directly or indirectly) for substantially the full term of the asset of liability |

| ● | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments based on the best information available) |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy which is reported, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

| 12 | 1-800-467-7903 | https://gatorcapital.com/mutual-funds/gator-capital-long-short-fund/ |

| Gator Capital Long/Short Fund | Notes to Financial Statements |

| | October 31, 2024 (Unaudited) |

The following is a summary of the inputs used as of October 31, 2024 in valuing the Fund’s investments carried at value:

| Investments in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Assets | | | | | | | | | | | | | | | | |

| Common Stocks* | | $ | 37,482,351 | | | $ | — | | | $ | — | | | $ | 37,482,351 | |

| Preferred Stocks* | | | 2,529,506 | | | | — | | | | — | | | | 2,529,506 | |

| Money Market Funds | | | 1,990,138 | | | | — | | | | — | | | | 1,990,138 | |

| Total | | $ | 42,001,995 | | | $ | — | | | $ | — | | | $ | 42,001,995 | |

| | | | | | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | | | | | |

| Securities Sold Short | | | | | | | | | | | | | | | | |

| Common Stocks* | | $ | (10,614,656 | ) | | $ | — | | | $ | — | | | $ | (10,614,656 | ) |

| Exchange-Traded Funds | | | (86,112 | ) | | | — | | | | — | | | | (86,112 | ) |

| Total | | $ | (10,700,768 | ) | | $ | — | | | $ | — | | | $ | (10,700,768 | ) |

| * | Refer to the Fund’s Schedule of Investments for industry classifications. |

The Fund did not hold any assets at any time during the reporting period in which significant unobservable inputs were used in determining fair value; therefore, no reconciliation of Level 3 securities is included for this reporting period.

Share Valuation

The NAV per share of the Fund is calculated by dividing the sum of the value of the securities held by the Fund, plus cash or other assets, minus all liabilities (including estimated accrued expenses) by the total number of shares outstanding for the Fund, rounded to the nearest cent. The Fund’s shares will not be priced on the days on which the New York Stock Exchange is closed for trading. The offering and redemption price per share for the Fund is equal to the Fund’s NAV per share.

The Fund charges a 2.00% redemption fee on shares held less than 90 days. These fees are deducted from the redemption proceeds otherwise payable to the shareholder. The Fund will retain the fee charged as paid-in capital and such fees become part of the Fund’s daily NAV calculation. For the six months ended October 31, 2024, the Fund recorded $11,091 in redemption fee proceeds.

Federal Income Taxes

The Fund makes no provision for federal income tax or excise tax. The Fund has qualified and intends to qualify each year as a regulated investment company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. The Fund also intends to distribute sufficient net investment income and net capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

| Semi-Annual Financial Statements | October 31, 2024 | 13 |

| Gator Capital Long/Short Fund | Notes to Financial Statements |

| | October 31, 2024 (Unaudited) |

The Fund may be subject to taxes imposed by countries in which it invests. Such taxes are generally based on income and/or capital gains earned or repatriated. Taxes are accrued and applied to net investment income, net realized gains and unrealized appreciation as such income and/or gains are earned.

The Fund recognizes tax benefits or expenses of uncertain tax positions only when the position is “more likely than not” to be sustained assuming examination by tax authorities. Management of the Fund has reviewed tax positions taken in tax years that remain subject to examination by all major tax jurisdictions, including federal (i.e., the previous three tax year ends and the interim tax period since then, as applicable) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements and does not expect this to change over the next twelve months. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the six months ended October 31, 2024, the Fund did not incur any interest or penalties.

3. FEES AND OTHER TRANSACTIONS WITH AFFILIATES AND OTHER SERVICE PROVIDERS

The Fund has entered into a management agreement (the “Management Agreement”) with the Adviser pursuant to which the Adviser provides space, facilities, equipment and personnel necessary to perform administrative and investment management services for the Fund. The Management Agreement provides that the Adviser is responsible for the management of the Fund’s portfolio. For such services and expenses assumed by the Adviser, the Fund pays a monthly advisory fee at incremental annual rates as follows:

| Advisory Fee | Average Daily Net Assets |

| 1.00% | Up to $250 million |

| 0.90% | In excess of $250 million but not greater than $500 million |

| 0.80% | In excess of $500 million |

The Adviser has agreed to reimburse the Fund to the extent necessary to prevent the Fund’s annual ordinary operating expenses (excluding taxes, expenses related to the execution of portfolio transactions and the investment activities of the Fund such as, for example, interest, dividend expenses on securities sold short, brokerage commissions and fees and expenses charged to the Fund by any investment company in which the Fund invests and extraordinary charges such as litigation costs) from exceeding 2.00% of the Fund’s average net assets. During the six months ended October 31, 2024, the Adviser earned $189,483 from the Fund, before the waiver described above.

Ultimus Fund Solutions, LLC (“the Administrator”) provides fund accounting, fund administration and transfer agency services under a Master Services Agreement to the Fund. The Fund pays the Administrator fees for its services under the Master Services Agreement. In addition, the Fund pays out-of-pocket expenses including, but not limited to postage, supplies and costs of

| 14 | 1-800-467-7903 | https://gatorcapital.com/mutual-funds/gator-capital-long-short-fund/ |

| Gator Capital Long/Short Fund | Notes to Financial Statements |

| | October 31, 2024 (Unaudited) |

pricing the Fund’s securities. For the six months ended October 31, 2024, the Administrator earned fees of $16,985 for administration services, $13,237 for fund accounting services, $10,094 for transfer agent services.

Ultimus Fund Distributors, LLC (the “Distributor”) serves as distributor to the Fund. The Fund does not pay the Distributor for these services. The Distributor is a wholly-owned subsidiary of the Administrator.

Certain officers of the Fund are also officers of the Administrator and the Distributor.

4. DIRECTOR COMPENSATION

Effective October 1, 2024, the Fund pays each Director, in cash, an annual fee of $14,000 per year, plus $1,500 for each in-person meeting attended and $1,000 for each telephonic meeting attended. Prior to October 1, 2024, the Fund paid each Director, in cash, an annual fee of $8,000 per year, plus $1,500 for each in-person meeting attended and $1,000 for each telephonic meeting attended. The Fund also reimburses Directors’ actual out-of-pocket expenses relating to attendance at meetings.

5. INVESTMENT PORTFOLIO TRANSACTIONS

During the six months ended October 31, 2024, the Fund purchased $12,886,653 and sold $14,485,477 of securities, excluding securities sold short and short-term investments.

Short Sales and Segregated Cash

Short sales are transactions in which the Fund sells a security it does not own, in anticipation of a decline in the market value of that security. To initiate such a transaction, the Fund must borrow the security to deliver to the buyer upon the short sale; the Fund is then obligated to replace the security borrowed by purchasing it in the open market at some later date, completing the transaction.

The Fund will incur a loss if the market price of the security increases between the date of the short sale and the date on which the Fund replaces the borrowed security. The Fund will realize a gain if the security declines in value between those dates.

All short sales must be fully collateralized. The Fund maintains the collateral in segregated accounts consisting of cash and/or U.S. Government securities sufficient to collateralize the market value of its short positions. Typically, the segregated cash with brokers and other financial institutions exceeds the minimum required. Deposits with brokers for securities sold short are invested in money market instruments. Segregated cash is held at the custodian in the name of the broker per a tri-party agreement between the Fund, the custodian, and the broker.

| Semi-Annual Financial Statements | October 31, 2024 | 15 |

| Gator Capital Long/Short Fund | Notes to Financial Statements |

| | October 31, 2024 (Unaudited) |

The Fund may also sell short “against the box”, i.e., the Fund enters into a short sale as described above, while holding an offsetting long position in the same security which it sold short. If the Fund enters into a short sale against the box, it will segregate an equivalent amount of securities owned by the Fund as collateral while the short sale is outstanding.

The Fund limits the value of its short positions (excluding short sales “against the box”) to 60% of the Fund’s total net assets. At October 31, 2024, the Fund had approximately 26% of its total net assets in short positions.

For the six months ended October 31, 2024, the cost of investments purchased to cover short sales and the proceeds from investments sold short were $5,086,938 and $7,283,090, respectively.

6. FEDERAL TAX INFORMATION

As of October 31, 2024, the net unrealized appreciation (depreciation) of investments, including short securities, for tax purposes was as follows:

| Gross unrealized appreciation | | $ | 16,469,930 | |

| Gross unrealized depreciation | | | (1,187,157 | ) |

| Net unrealized appreciation on investments | | $ | 15,282,773 | |

| Tax cost of investments | | $ | 16,018,453 | |

At April 30, 2024, the Fund’s most recent fiscal year end, the components of accumulated earnings (deficit) on a tax basis were as follows:

| Undistributed ordinary income | | $ | 386,362 | |

| Accumulated capital losses | | | (399,453 | ) |

| Unrealized appreciation | | | 11,131,535 | |

| Total accumulated earnings | | $ | 11,118,544 | |

The difference between book basis and tax basis unrealized appreciation is attributable primarily to the tax deferral of wash losses and investments in partnerships and certain other investments.

As of April 30, 2024, the Fund has available for tax purposes an unused capital loss carryforward of $399,453 of short-term capital losses with no expiration, which is available to offset against future taxable net capital gains. During the fiscal year ended April 30, 2024, the Fund utilized $427,161 of available capital loss carryforward.

GAAP requires that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. For the year ended There were no reclassifications for the tax year ended April 30, 2024.

| 16 | 1-800-467-7903 | https://gatorcapital.com/mutual-funds/gator-capital-long-short-fund/ |

| Gator Capital Long/Short Fund | Notes to Financial Statements |

| | October 31, 2024 (Unaudited) |

7. COMMITMENTS AND CONTINGENCIES

Under the Fund’s organizational documents, its officers and directors are indemnified against certain liability arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that may contain general indemnification clauses, which may permit indemnification to the extent permissible under applicable law. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred.

8. SUBSEQUENT EVENTS

Management of the Fund has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date at which these financial statements were issued. Based upon this evaluation, management has determined there were no items requiring adjustment of the financial statements or additional disclosure.

| Semi-Annual Financial Statements | October 31, 2024 | 17 |

| Gator Capital Long/Short Fund | Director Approval of the

Investment Advisory Agreement |

| | October 31, 2024 (Unaudited) |

At a meeting held in person on June 14, 2024, at which all of the Directors were present, the Board, including the Directors who are not “interested persons,” as defined by the Investment Company Act of 1940, as amended (the “1940 Act”) (the “Independent Directors”), of Caldwell & Orkin Funds, Inc. (the “Company”), voting separately, reviewed and approved the investment advisory agreement with Gator Capital Management, LLC (the “Adviser”) (the “Advisory Agreement”). In the course of their deliberations, the Board was advised by legal counsel. The Board received and reviewed a substantial amount of information provided by the Adviser in response to requests of the Board and legal counsel.

In considering the approval of the Advisory Agreement and reaching their conclusions with respect thereto, the Board was briefed by counsel on its fiduciary duties and responsibilities in reviewing and approving the Advisory Agreement and the types of information that should be reviewed by them and their responsibilities in making an informed decision regarding the approval of the Advisory Agreement. The Board also reviewed and analyzed various factors that the Directors determined were relevant, including: (1) the nature, extent and quality of the services to be provided by the Adviser to the Gator Capital Long/Short Fund (the “Fund”) and the Adviser’s experience managing registered investment companies; (2) the performance of the Adviser in managing investments for clients of the Adviser other than the Fund; (3) the costs of the services to be provided and profits to be realized by the Adviser from its relationship with the Fund, as well as fee rates charged by the Adviser and other advisers for comparable strategies; (4) the extent to which economies of scale may be realized as the Fund grows and whether management fee levels reflect these economies of scale for the benefit of the Fund’s investors; and (5) other benefits to be derived by the Adviser from its relationship with the Fund. The Board’s analysis of the foregoing factors included, but was not limited to, the following:

Nature, Extent and Quality of Services. The Board considered the operating and investment advisory services provided by the Adviser to the Fund, including, without limitation, its investment advisory services, its coordination of services for the Fund among the Fund’s service providers, its compliance procedures and practices, its efforts to promote the Fund and assist in its distribution and its provision of officers for the Company. Based on the foregoing information, the Board determined that the nature, extent and quality of the management and advisory services provided by the Adviser were appropriate for the Fund.

Performance of the Fund and the Adviser. The Board considered the investment performance of the Adviser in managing investments for the Fund on an absolute basis and also compared the performance of the Fund with the performance of the peer group funds managed by other advisers and the Fund’s benchmarks. In addition, the Board considered the consistency of the Adviser’s management of the Fund with the Fund’s investment objective and policies, and long-term performance of the Fund. Following its evaluation of the Adviser’s performance and that of the Fund in such capacities, the Board concluded that the performance of both the Adviser and the Fund was satisfactory.

| 18 | 1-800-467-7903 | https://gatorcapital.com/mutual-funds/gator-capital-long-short-fund/ |

| Gator Capital Long/Short Fund | Director Approval of the

Investment Advisory Agreement |

| | October 31, 2024 (Unaudited) |

Cost of Services and Projected Profits of the Adviser with respect to the Fund. In reviewing the cost of services and the profitability that the Adviser derives from its relationship with the Fund, the Board considered that continuing the Advisory Agreement would result in no changes to the fees charged to the Fund, and that the services provided in exchange for such fees would be appropriate. Additionally, the Board discussed the Adviser’s staffing, personnel and methods of operating; the financial condition of the Adviser and the level of commitment to the Fund and the Adviser by the principals of the Adviser; the asset level of the Fund; and the overall fees and expenses of the Fund.

The Board compared the fees and expenses of the Fund to other funds similar in terms of the type of fund, the style of investment management, the size of the fund and the nature of the fund’s investment strategy, among other factors. The Board observed that the management fee charged by the Adviser is generally below the average charged by its peers (as chosen by the Adviser) and that the Fund’s expense ratio was higher than the average of its peers. In addition, the Directors took note of the expense limitation provisions within the Advisory Agreement and the financial capacity of the Adviser to fulfill its obligations under the Advisory Agreement. Following these comparisons and considerations as well as further discussion of the foregoing, the Board determined that the fees paid to the Adviser by the Fund under the Advisory Agreement are appropriate and within the range of what would have been negotiated at arm’s length.

Economies of Scale. Following discussion of the Fund’s asset level, expectations for growth, levels of fees and the expense limitation agreement, the Board concluded that the Fund’s fee arrangement was appropriate, and that the Fund’s overall fee structure provided for savings and protection for shareholders at lower asset levels through the Fund’s expense limitation agreement that is part of the Advisory Agreement.

Other Benefits Derived by the Adviser from its Relationship with the Fund. The Board considered that, other than the advisory fee and name promotion, there are no material “fall-out” or ancillary benefits that accrue to the Adviser as a result of its relationship with the Fund. Based on the foregoing information, the Board concluded that such potential benefits are immaterial to its consideration and approval of the Advisory Agreement.

After considering the above factors as well as other factors, the Board unanimously concluded that the terms of the Advisory Agreement were fair and reasonable and approved the Advisory Agreement for a one-year renewal period.

| Semi-Annual Financial Statements | October 31, 2024 | 19 |

This Page is Intentionally Left Blank.

This Page is Intentionally Left Blank.

GATOR CAPITAL LONG/SHORT FUND

BOARD OF DIRECTORS Frederick T. Blumer, Independent Chairman Derek Pilecki, President Bevin E. Franks Rhett E. Ingerick | | TRANSFER, REDEMPTION

& DIVIDEND

DISBURSING AGENT Ultimus Fund Solutions, LLC P.O. Box 46707 Cincinnati, OH 45246-0707 | | LEGAL COUNSEL Kilpatrick Townsend & Stockton LLP 1001 West Fourth Street Winston-Salem, NC 27101-2400 |

| | | | | |

INVESTMENT ADVISER Gator Capital Management, LLC 2502 N. Rocky Point Drive, Suite 665 Tampa, FL 33607 | | CUSTODIAN U.S. Bank, N.A. 425 Walnut Street Cincinnati, OH 45202 | | |

| | | | | |

DISTRIBUTOR Ultimus Fund Distributors, LLC 225 Pictoria Drive, Suite 450 Cincinnati, OH 45246 | | | | |

The Gator Capital Long/Short Fund’s (the “Fund”) portfolio may or may not have positions in any of the companies referenced in this Report to Shareholders as of any date after April 30, 2024. The commentary reflects the views of the investment manager through the end of the period or through the date of this report, as the case may be. Of course, these views are subject to change as market and other conditions warrant. These financial statements are submitted for the general information of the Fund’s shareholders. They are not authorized for distribution to prospective investors unless preceded or accompanied by an effective Fund Prospectus.

Availability of Proxy Voting Policy & Procedures, Proxy Voting Record and Code of Ethics - A description of a) the policies and procedures the Fund uses to determine how to vote proxies relating to portfolio securities, b) how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, and c) the Code of Ethics applicable to the principal officers of the Fund are available without charge, upon request, by calling toll-free (800) 467-7903, or on the Securities and Exchange Commission’s website at www.sec.gov.

Fund Information - For more information about the Fund please call (800) 467-7903 or visit the Fund’s website at https://gatorcapital.com/mutual-funds/gator-capital-long-short-fund/.

Gator Capital Management, LLC

2502 N. Rocky Point Drive, Suite 665

Tampa, FL 33607

Item 8. Changes in and Disagreements with Accountants for Open-End Management Investment Companies.

Not applicable

Item 9. Proxy Disclosures for Open-End Management Investment Companies.

Not applicable

Item 10. Remuneration Paid to Directors, Officers, and Others of Open-End Management Investment Companies.

Included under Item 7

Item 11. Statement Regarding Basis for Approval of Investment Advisory Contract.

Included under Item 7

Item 12. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable

Item 13. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable

Item 14. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable

Item 15. Submission of Matters to a Vote of Security Holders.

None

Item 16. Controls and Procedures

| (a) | The registrant’s Principal Executive Officer and Principal Financial Officer have concluded that the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Act) are effective in design and operation and are sufficient to form the basis of the certifications required by Rule 30a-(2) under the Act, based on their evaluation of these disclosure controls and procedures as of a date within 90 days of this report on Form N-CSR. |

| (b) | There were no changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) during the period covered by this report that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting. |

Item 17. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies.

Not applicable

Item 18. Recovery of Erroneously Awarded Compensation.

Item 19. Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| (Registrant) | The Caldwell & Orkin Funds, Inc. | |

| | | |

| By (Signature and Title) | /s/ Derek Pilecki | |

| | Derek Pilecki, President and Principal Executive Officer | |

| | | |

| Date | 1/2/2025 | | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By (Signature and Title) | /s/ Derek Pilecki |

| | Derek Pilecki, President and Principal Executive Officer |

| | |

| Date | 1/2/2025 | | |

| | |

| By (Signature and Title) | /s/ Zachary P. Richmond |

| | Zachary P. Richmond, Treasurer and Principal Financial Officer |

| | |

| Date | 1/2/2025 | | |