UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| | x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | | For the fiscal year ended December 31, 2008 |

or

| | ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | | For the transition period from ______________ to ______________ |

Commission file number: 0-19986

CELL GENESYS, INC.

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 94-3061375 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. employer identification number) |

| |

400 Oyster Point Boulevard, Suite 525 South San Francisco, CA | | 94080 |

| (Address of principal executive offices) | | (Zip Code) |

(650) 266-3000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12 (b) of the Act:

| | |

Title of each class | | Name of exchange on which registered |

| Common Stock, $.001 Par Value | | The NASDAQ Stock Market LLC |

| Preferred Shares Purchase Rights | | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check One):

| | | | | | | | | | |

| Large accelerated filer | | ¨ | | | | | Accelerated filer | | x | |

| Non-accelerated filer | | ¨ | | | (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ | |

Indicate by check mark whether the registrant is a shell company, as defined in Rule 12b-2 of the Exchange Act. Yes ¨ No x

As of June 30, 2008, the last business day of the registrant’s most recently completed second fiscal quarter the approximate aggregate market value of shares held by non-affiliates of the registrant (based on the closing sale price of shares on the NASDAQ Global Market on June 30, 2008) was $221.6 million, which excludes 652,779 shares of common stock held by directors and officers, and any stockholders whose ownership exceeded ten percent of the shares outstanding at June 30, 2008. Exclusion of these shares does not constitute a determination that each such person is an affiliate of the registrant.

As of March 6, 2009, the number of outstanding shares of the registrant’s Common Stock was 86,809,651.

DOCUMENTS INCORPORATED BY REFERENCE

Specified portions of the registrant’s Proxy Statement for the 2009 Annual Meeting of Stockholders, to be filed within 120 days of the end of the fiscal year covered by this Annual Report on Form 10-K, are incorporated by reference into Part III of this Annual Report on Form 10-K. Except with respect to information specifically incorporated by reference into this Annual Report on Form 10-K, the Proxy Statement for the 2009 Annual Meeting of Stockholders is not deemed to be filed as part hereof.

TABLE OF CONTENTS

2

PART I

Statements made in this document other than statements of historical fact, including statements about us and our subsidiaries and our respective clinical trials, research programs, product pipelines, current and potential corporate partnerships, licenses and intellectual property, the adequacy of capital reserves and anticipated operating results and cash expenditures, are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. As forward-looking statements, they are subject to a number of uncertainties that could cause actual results to differ materially from the statements made, including risks associated with the ability to successfully complete a strategic transaction, the success of research and product development programs, the issuance and validity of patents, the development and protection of proprietary technologies, the ability to raise capital, operating expense levels and other risks. Reference is made to discussions about risks associated with product development programs, intellectual property and other risks that may affect us under Item 1A, “Risk Factors” below. We do not undertake any obligation to update forward-looking statements. The following should be read in conjunction with our consolidated financial statements located elsewhere in this Annual Report on Form 10-K for the year ended December 31, 2008 and in other documents filed by us from time to time with the Securities and Exchange Commission.

In this Annual Report on Form 10-K, “Cell Genesys,” “we,” “us,” “our” and “the Registrant” refer to Cell Genesys, Inc.

Overview

We are a biotechnology company that was focused on the development and commercialization of novel biological therapies for patients with cancer. We were developing cell-based cancer immunotherapies and oncolytic virus therapies to treat different types of cancer. Our clinical stage cancer programs involved cell- or viral-based products that have been modified to impart disease-fighting characteristics that are not found in conventional chemotherapeutic agents. As part of our GVAX(TM) cancer immunotherapy programs, we initiated two Phase 3 clinical trials for GVAX immunotherapy for prostate cancer in July 2004 and June 2005, respectively, each under a Special Protocol Assessment, or SPA, with the United States Food and Drug Administration, or FDA. In March 2008, we entered into a worldwide collaboration agreement with Takeda Pharmaceutical Company Limited, or Takeda, for the development and commercialization of GVAX immunotherapy for prostate cancer. In August 2008, we terminated enrollment and administration of GVAX immunotherapy for prostate cancer in VITAL-2, the second of the two Phase 3 clinical trials in advanced prostate cancer. This action was taken based on the recommendation of the study’s Independent Data Monitoring Committee, or IDMC, which, in a routine safety review meeting of both the VITAL-1 and VITAL-2 trials, observed an imbalance in deaths between the two treatment arms of the VITAL-2 study, with a higher number of deaths in the GVAX immunotherapy in combination with Taxotere® (docetaxel) arm compared to the Taxotere plus prednisone arm. As a result, in September 2008 the FDA placed a partial clinical hold on the GVAX Phase 3 program for prostate cancer. In October 2008, we terminated the VITAL-1 Phase 3 clinical trial based on the results of a previously unplanned futility analysis conducted at our request by the IDMC which indicated that the trial had less than a 30 percent chance of meeting its predefined endpoint of an improvement in survival. In view of the termination of both the VITAL-1 and VITAL-2 trials, we placed on hold further development of GVAX immunotherapy for prostate cancer and implemented a substantial restructuring plan that resulted in the reduction of our staff of 290 by approximately 80 percent as of December 31, 2008, and approximately 90 percent as of the date of this report, with further reductions anticipated in the first half of 2009 as additional activities are phased out, and also resulted in Takeda terminating our collaborative agreement in December 2008.

Cell Genesys, Inc. was incorporated in the State of Delaware in 1988. Our common stock trades on the NASDAQ Global Market under the symbol “CEGE.” In January 2009, we temporarily relocated our principal executive offices to 24590 Clawiter Road, Hayward, CA 94545 from 500 Forbes Boulevard, South San

3

Francisco, California 94080. In February 2009, we relocated our principal executive offices to 400 Oyster Point Boulevard, Suite 525, South San Francisco, CA 94080. Our phone number is (650) 266-3000. Our Internet home page is located athttp://www.cellgenesys.com;however, the information in, or that can be accessed through, our home page is not part of this report. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act are available, free of charge, on or through our Internet home page as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission, or SEC.

In March 2008, we entered into a worldwide collaborative agreement with Takeda for the development and commercialization of GVAX immunotherapy for prostate cancer. Under the terms of the agreement we granted exclusive worldwide commercial rights to GVAX immunotherapy for prostate cancer for the prevention, diagnosis, and treatment of prostate cancer and other urological neoplasms or urological hyperplasias. In exchange for these rights and in consideration for prior costs incurred by us in the development of GVAX immunotherapy for prostate cancer, Takeda made a non-refundable and non-creditable upfront payment of $50 million. We received full payment of the $50 million in April 2008.

Additionally, Takeda agreed to pay for all external development costs associated with the ongoing Phase 3 clinical development of GVAX immunotherapy for prostate cancer, including the cost of product, all internal and external additional development costs and all commercialization costs. As of December 31, 2008, we have received payments from Takeda of $23.9 million for development costs. We also have a receivable of $6.5 million due from Takeda for such costs incurred in the quarter ended December 31, 2008 which we collected in February 2009. Our decision to place on hold further development of GVAX immunotherapy for prostate cancer was agreed to by Takeda and resulted in Takeda terminating our collaborative agreement in December 2008. Further reimbursement revenue from Takeda will end during the first quarter of 2009.

In May 2008, we received gross proceeds of $30.0 million in a registered direct offering, before deducting placement agents’ fees and stock issuance costs of approximately $1.9 million, resulting in net proceeds of approximately $28.1 million, from the sale of 7.1 million shares of our common stock at $4.22 per share and warrants to purchase 8.5 million shares of our common stock at a price of $10.00 per share. The offering was made pursuant to our effective May 2007 shelf registration statement on Form S-3. These warrants became exercisable on November 14, 2008 for a period of seven years thereafter.

In October 2008, we repurchased an aggregate of approximately $26.3 million face value of our 3.125% Convertible Senior Notes due 2011, or Notes, at an overall discount of approximately 60 percent from face value in a series of privately negotiated transactions with institutional holders of the Notes, for aggregate consideration of approximately $10.5 million in cash, plus accrued but unpaid interest. This purchase of debt resulted in a net gain of approximately $15.5 million and a reduction of annualized interest expense by approximately $0.8 million.

In October 2008 we received a Nasdaq Staff Deficiency Letter, or Nasdaq Letter, indicating that we had become non-compliant with the minimum $1.00 bid price requirement for continued listing on The Nasdaq Global Market. The Nasdaq Letter indicated that in light of extraordinary market conditions, Nasdaq had determined to suspend enforcement of the minimum bid price and market value of publicly held shares requirements through January 16, 2009. Accordingly, the Nasdaq Letter stated that we have 180 calendar days from January 20, 2009, or until July 20, 2009, to regain compliance. Subsequently, on December 19, 2008, NASDAQ announced that given the continued extraordinary market conditions, NASDAQ is extending the suspension of the minimum bid price and market value of publicly held shares requirements through April 20, 2009. Accordingly, we now have until October 27, 2009 to regain compliance. Compliance would be achieved if the bid price of our common stock closed at $1.00 per share or more for a minimum of 10 consecutive days during that period.

4

In December 2008, we entered into an agreement to terminate our South San Francisco headquarters facility lease. Under the terms of the agreement, the lease terminated on January 2, 2009. In consideration of the early termination of the lease, we paid the landlord a total fee of $14.7 million in December 2008. Additionally, the landlord gave us an exclusive, irrevocable license to use the facility for general office purposes until January 30, 2009.

In December 2008, we repurchased an aggregate of approximately $47.8 million face value of our Notes, at an overall discount of 60 percent from face value in a tender offer for aggregate consideration of approximately $19.1 million in cash, plus accrued but unpaid interest. This purchase of debt resulted in a net gain of approximately $27.2 million and a further reduction of annualized interest expense by approximately $1.5 million.

In March 2009, we entered into agreements to terminate our Hayward manufacturing facility leases. The termination agreements are subject to certain conditions. Subject to fulfillment or waiver of these conditions, the leases will terminate by March 31, 2009. In consideration of the early termination of the leases, we will pay the landlords an aggregate amount of $3.6 million and issue one million shares of our common stock.

We are exploring strategic alternatives, including merger with or acquisition by another company, further restructuring of our company, allocation of our resources toward other biopharmaceutical product areas, sale of the company’s assets, and liquidation of the company. We have engaged Lazard in connection with the evaluation of strategic alternatives.

We ended 2008 with $86.1 million in cash, cash equivalents and short-term investments, including $2.9 million of restricted cash and investments. We have maintained our financial position through strategic management of our resources including access to debt and equity financing and funding from various corporate collaborations and licensing agreements. Prior to our announcement in October 2008 that we placed on hold the further development of GVAX immunotherapy for prostate cancer, we continued to deploy the majority of our research and development resources to advance GVAX immunotherapy for prostate cancer. Expenses related to GVAX immunotherapy for leukemia, GVAX immunotherapy for pancreatic cancer, the oncolytic virus therapy CG0070 and other potential product candidates in preclinical studies were a minor proportion of our overall spending in research and development activities. During 2008, 2007, and 2006, our research and development expenses were $92.5 million, $106.1 million, and $96.3 million, respectively. We expect total research and development expenses, excluding restructuring costs, to decrease significantly as a result of the announcement that we placed on hold the further development of GVAX immunotherapy for prostate cancer and are implementing a substantial restructuring plan.

Our GVAX™ Cancer Immunotherapy Program

Our GVAX immunotherapies are cancer treatments designed to stimulate the patient’s immune system to effectively fight cancer. GVAX cancer immunotherapies are comprised of tumor cells that are genetically modified to secrete an immune-stimulating cytokine known as granulocyte-macrophage colony-stimulating factor, or GM-CSF, and are then irradiated for safety. Since GVAX cancer immunotherapies consist of whole tumor cells, the cancer patient’s immune system can be activated against multiple tumor cell components, or antigens, potentially resulting in greater clinical benefit than if the immunotherapy consisted of only a single tumor cell component. Additionally, the secretion of GM-CSF by the modified tumor cells can greatly enhance the immune response by recruiting and activating dendritic cells at the injection site, a critical step in the optimal response by the immune system to any immunotherapy product. The antitumor immune response which occurs throughout the body following administration of a GVAX product can potentially result in the destruction of tumor cells that persist or recur following surgery, radiation therapy or chemotherapy treatment.

More than 1,000 patients have received our GVAX cancer immunotherapies in multiple Phase 1, Phase 2 and Phase 3 clinical trials to date, and the immunotherapies have been shown to have a favorable side effect profile that avoids many of the toxicities associated with conventional cancer therapies. GVAX cancer

5

immunotherapies can be conveniently administered in an outpatient setting as an injection into the skin, a site where immune cells, including in particular dendritic cells, can be optimally accessed and activated. Our GVAX cancer immunotherapies were being tested as non patient-specific, or allogeneic, products. We intended to develop these immunotherapies as “off-the-shelf” pharmaceutical products.

GVAX Immunotherapy for Prostate Cancer

Our GVAX immunotherapy for prostate cancer is a non patient-specific product comprised of two genetically-modified prostate cancer cell lines. We intended to develop and manufacture this immunotherapy as an “off-the-shelf” pharmaceutical for use after hormonal therapy for advanced-stage prostate cancer. Prostate cancer is the second leading cause of cancer death in men in the United States, with approximately 30,000 men dying each year from the disease. When a man is diagnosed with early-stage prostate cancer, he is treated with either a prostatectomy, which is the surgical removal of the prostate, and/or radiation therapy. If the patient relapses, he is treated with hormone therapy to suppress testosterone in order to reduce the growth of the tumor. When the hormone therapy fails, the patient may or may not be treated with chemotherapy depending upon whether the disease has spread, or metastasized, to other parts of the body. We had designed our Phase 3 clinical trials to evaluate whether GVAX immunotherapy for prostate cancer was superior to standard chemotherapy in patients who have ceased responding to, or have become refractory to, hormone therapy and have metastatic disease.

We have completed five Phase 1 and Phase 2 clinical trials of our GVAX immunotherapy for prostate cancer in approximately 200 patients with various stages of recurrent prostate cancer, and the immunotherapy has had a favorable safety profile in each trial. These clinical trials included two Phase 2 clinical trials in hormone-refractory prostate cancer, or HRPC, patients with radiologic evidence of metastatic, or spreading disease, which was the target population for our Phase 3 trials. These trials were designed to evaluate the safety and efficacy of the immunotherapy, as well as treatment regimens for Phase 3 clinical trials.

We were conducting two Phase 3 clinical trials of GVAX immunotherapy for prostate cancer in metastatic HRPC. The first Phase 3 clinical trial, referred to as VITAL-1, commenced in July 2004 and compared GVAX immunotherapy for prostate cancer to Taxotere chemotherapy administered with prednisone in metastatic HRPC patients who are asymptomatic with respect to cancer-related pain. The VITAL-1 trial was designed to demonstrate superior survival in the patients receiving GVAX cancer immunotherapy compared to patients receiving Taxotere plus prednisone therapy. VITAL-1 was fully enrolled with a total of 626 patients. In January 2008, we announced that the IDMC for VITAL-1 completed a pre-planned interim analysis in the timeframe originally estimated and recommended that the study continue. As is customary to preserve study blinding, the IDMC provided us no additional information other than the recommendation to continue the trial. The second Phase 3 clinical trial, referred to as VITAL-2, commenced in June 2005 and compared GVAX immunotherapy for prostate cancer plus Taxotere chemotherapy to Taxotere chemotherapy plus prednisone with respect to a survival benefit in metastatic HRPC patients with cancer-related pain.

In August 2008, we terminated the VITAL-2 trial. We ended the trial as recommended by the study’s IDMC which, in a routine safety review meeting of both the VITAL-1 and VITAL-2 trials, observed an imbalance in deaths between the two treatment arms of the VITAL-2 study, with a higher number of deaths in the GVAX immunotherapy in combination with Taxotere arm compared to the Taxotere plus prednisone arm. We conducted an initial analysis of the incomplete clinical trial data set that was reviewed by the IDMC in August 2008. The analysis has revealed no apparent imbalance in patient baseline characteristics with respect to both demographic and disease prognostic factors. In addition, no significant toxicities in the GVAX immunotherapy plus Taxotere combination therapy arm were observed that could explain the imbalance in deaths and in fact, the vast majority of deaths in both treatment arms were reported as due to progression of prostate cancer. In September 2008, the FDA, as expected, placed a partial clinical hold on the GVAX Phase 3 program for prostate cancer as a result of our announcement in August 2008 of the termination of the VITAL-2 trial. In October 2008, we terminated the VITAL-1 Phase 3 clinical trial of GVAX immunotherapy based on the results of a previously unplanned futility

6

analysis conducted at our request by the study’s IDMC which indicated that the trial had less than a 30 percent chance of meeting its predefined endpoint of an improvement in survival. In view of the termination of both the VITAL-1 and VITAL-2 trials, we ended further development of GVAX immunotherapy for prostate cancer.

Government Regulations

FDA and Other Foreign Regulation

Prescription pharmaceutical products and biologics are subject to extensive pre- and post-marketing regulation by the FDA including regulations that govern the testing, manufacturing, safety, efficacy, labeling, storage, record-keeping, advertising and promotion of the products under the Federal Food, Drug and Cosmetic Act and the Public Health Services Act, and by comparable agencies in most foreign countries. The process required by the FDA before a new drug or biologic may be marketed in the U.S. generally involves the following:

| | • | | completion of preclinical laboratory and animal testing; |

| | • | | submission of an Investigational New Drug, or IND application, which must become effective before clinical trials may begin; |

| | • | | performance of adequate and well controlled human clinical trials to establish the safety and efficacy of the proposed drug’s or biologic’s intended use; and |

| | • | | approval by the FDA of a New Drug Application, or NDA, in the case of a drug, or of a Biologics License Application, or BLA, for a biologic. |

Foreign countries have similar requirements.

Preclinical Testing. The activities required before a pharmaceutical agent may be marketed begin with preclinical testing. Preclinical tests include laboratory evaluation of potential products and animal studies to assess the potential safety and efficacy of the product and its formulations. The results of these studies and other information, including chemistry, manufacturing and controls, must be submitted to the FDA or comparable foreign agencies and regulatory bodies as part of an application which must be reviewed and approved before proposed clinical testing can begin. Clinical trials involve the administration of the investigational new drug to healthy volunteers or to patients under the supervision of a qualified principal investigator. Clinical trials are conducted in accordance with Good Clinical Practices under protocols that detail the objectives of the study, the parameters to be used to monitor safety, and the efficacy criteria to be evaluated. Each protocol must be submitted for regulatory approval. Further, each clinical study must be conducted under the auspices of an independent institutional review board at the institution at which the study is conducted. The institutional review board considers, among other things, ethical factors and the safety of human subjects. In addition, certain protocols involving the use of genetically modified products must also be reviewed by the Recombinant DNA Advisory Committee of the National Institutes of Health as well as similar bodies in many European countries.

Clinical Trial Phases. Typically, human clinical trials are conducted in three phases that may overlap. In Phase 1, clinical trials are conducted with a small number of patients to determine the early safety profile and pharmacology of the new therapy. In Phase 2, clinical trials are conducted with groups of patients afflicted with a specific disease in order to determine preliminary efficacy, optimal dosages and expanded evidence of safety. In Phase 3, large scale, multicenter, comparative clinical trials are conducted with patients afflicted with a target disease in order to provide enough data for the statistical proof of efficacy and safety required by the FDA and other regulatory agencies. In the case of products for life-threatening diseases, the initial human testing is generally done in the target patients rather than in healthy volunteers. Since these patients are already afflicted with the target disease, it is possible that such studies may provide some results traditionally obtained in Phase 2 clinical trials. These trials are frequently referred to as Phase 1/2 clinical trials. Although the preliminary Phase 1/2 and Phase 2 clinical trials of our GVAX cancer immunotherapies and oncolytic virus therapies have shown a

7

generally favorable safety profile to date, there can be no assurance that such therapies or products will be tolerated at higher doses or that the clinical efficacy or safety of such therapy or product will be demonstrated in later stage testing.

Marketing Approvals. The results of the preclinical and clinical testing, together with chemistry, manufacturing and controls information, are submitted to regulatory agencies in order to obtain approval to commence commercial sales. In responding to such an application, regulatory agencies may grant marketing approval, request additional information or further research, or deny the application if they determine that the application does not satisfy their regulatory approval criteria. Approval for a pharmaceutical or biologic product may not be granted on a timely basis, if at all, or if granted may not cover all the clinical indications for which approval is sought, or may contain significant limitations in the form of warnings, precautions or contraindications with respect to conditions of use.

In the United States we had utilized the procedure called a Special Protocol Assessment, or SPA, for GVAX immunotherapy for prostate cancer. Under this procedure, a sponsor may seek the FDA’s agreement on the design and analysis of a clinical trial intended to form the primary basis of an effectiveness claim. If the FDA agrees in writing, its agreement may not be changed after the trial begins except in limited circumstances, such as the FDA determining that a substantial scientific issue essential in determining the safety or effectiveness of the product was identified after the trial had begun. If the outcome of the trial is successful, the sponsor will ordinarily be able to rely on it as the basis for approval with respect to effectiveness. While we had received the FDA’s agreement on a SPA for each of our Phase 3 VITAL-1 and VITAL-2 trials, there could have been no assurance that these trials would have a successful outcome or that we would have ultimately received approval for this product.

Satisfaction of pre-market approval requirements for new drugs and biologics typically takes several years, and the actual time required may vary substantially based upon the type, complexity and novelty of the product or targeted disease. Government regulation may delay or prevent marketing of potential products for a considerable period of time and impose costly procedures upon our activities. Success in early stage clinical trials or with prior versions of products does not assure success in later stage clinical trials. Data obtained from clinical activities are not always conclusive and may be susceptible to varying interpretations that could delay, limit or prevent regulatory approval.

Post-Marketing Regulations. Once approved, regulatory agencies may withdraw the product approval if compliance with pre- and/or post-marketing regulatory standards is not maintained or if problems occur after the product reaches the marketplace. In addition, they may require post-marketing studies, referred to as Phase 4 studies, to monitor the effect of an approved product, and may limit further marketing of the product based on the results of these post-market studies. The FDA and other foreign regulatory agencies have broad post-market regulatory and enforcement powers, including the ability to levy fines and penalties, suspend or delay issuance of approvals, seize or recall products, or withdraw approvals.

Manufacturing. Our manufacturing facilities are subject to periodic inspection by the FDA, the United States Drug Enforcement Administration, or DEA, and other domestic and foreign authorities where applicable, and must comply with cGMP regulations. Manufacturers of biologics also must comply with general biological product standards. Failure to comply with the statutory and regulatory requirements subjects the manufacturer to possible legal or regulatory action, such as suspension of manufacturing, seizure of product, or mandatory or voluntary recall of a product. Adverse experiences with the product must be reported to the FDA and foreign agencies and could result in the imposition of market restrictions through labeling changes or in product removal. Product approvals may be withdrawn if compliance with regulatory requirements is not maintained or if problems concerning safety or efficacy of the product occur following approval.

Advertising and Promotion. With respect to both pre- and post-market product advertising and promotion, the FDA and similar foreign agencies impose a number of complex regulations on entities that advertise and promote pharmaceuticals and biologics, which include, among other things, standards and regulations relating to

8

direct-to-consumer advertising, off-label promotion, industry sponsored scientific and educational activities, and promotional activities involving the Internet. These agencies have very broad enforcement authority and failure to abide by these regulations can result in penalties including the issuance of a warning letter directing the entity to correct deviations from requisite standards, a requirement that future advertising and promotional materials be pre-cleared by the FDA or relevant foreign agencies, and foreign, state and federal civil and criminal investigations and prosecutions.

Other Government Regulations

We are subject to various laws and regulations regarding laboratory practices, the experimental use of animals, and the use and disposal of hazardous or potentially hazardous substances in connection with our research. In each of these areas, as above, the government has broad regulatory and enforcement powers, including the ability to levy fines and civil penalties, suspend or delay issuance of approvals, seize or recall products, and withdraw approvals, any one or more of which could have a material adverse effect upon us.

In addition to laws and regulations enforced by the FDA, we are also subject to comparable foreign regulations, regulation under National Institutes of Health guidelines, as well as under the Controlled Substances Act, the Occupational Safety and Health Act, the Environmental Protection Act, the Toxic Substances Control Act, the Resource Conservation and Recovery Act and other present and potential foreign, federal, state or local laws and regulations as our research and development involves the controlled use of hazardous materials, chemicals, viruses and various radioactive compounds.

Manufacturing

Our Hayward, California manufacturing facility, which we operated according to cGMP regulations, consisted of 51,000 square feet of manufacturing space and 50,000 square feet of laboratory and office space. Our Hayward manufacturing facility had the capacity to manufacture products for Phase 3 trials of our prostate cancer immunotherapy. It was designed to produce one or more types of biological products at a scale suitable for Phase 3 trials and potential commercial market launch. It is currently being maintained in a clean idle state.

Corporate Collaborations

Takeda Pharmaceutical Company Limited

We entered into a worldwide collaborative agreement with Takeda for the development and commercialization of GVAX immunotherapy for prostate cancer which has been terminated. Under the terms of the agreement, effective March 31, 2008, we granted exclusive worldwide commercial rights to GVAX immunotherapy for prostate cancer for the prevention, diagnosis, and treatment of prostate cancer and other urological neoplasms or urological hyperplasias. In exchange for these rights and in consideration for prior costs incurred by us in the development of GVAX immunotherapy for prostate cancer, Takeda made a non-refundable and non-creditable upfront payment of $50 million. We received full payment of the $50 million in April 2008.

Additionally, Takeda agreed to pay for all external development costs associated with the ongoing Phase 3 clinical development of GVAX immunotherapy for prostate cancer, including the cost of product, all internal and external additional development costs and all commercialization costs. Our decision to place on hold further development of GVAX immunotherapy for prostate cancer was agreed to by Takeda and resulted in Takeda terminating our collaborative agreement in December 2008. Further reimbursement revenue from Takeda will end during the first quarter of 2009.

Novartis AG

In July 2003, we announced a global alliance between Novartis AG and ourselves for the development and commercialization of oncolytic virus therapies. Under the agreement, we also acquired exclusive worldwide rights to certain oncolytic virus therapy products and related intellectual property of Genetic Therapy, Inc., or

9

GTI, an affiliate of Novartis, as well as certain related intellectual property of Novartis. We also received a payment of $28.5 million from Novartis to be dedicated to the further development of several oncolytic virus therapy products developed by both ourselves and GTI, for which Novartis has certain marketing options. In exchange, we issued to Novartis and GTI 1,999,840 shares of our common stock, with the result that Novartis became the holder of approximately five percent (as of the time of the issuance) of our outstanding common stock. In addition, the agreement provided the basis for the sharing of future additional development costs and potential profits for certain oncolytic virus products on a worldwide basis. Upon the exercise of certain options by Novartis, development costs and profits are to be shared on an approximately equal basis in the United States. Novartis will be responsible for the development costs for markets outside the United States and pay us a royalty on potential future sales outside the United States. Novartis is also required to reimburse us on a cost-plus basis for products that we manufacture for them to sell outside of the United States.

In September 2004, the terms of our agreement with Novartis were amended to include the grant to us of a non-exclusive worldwide perpetual license to all patent rights of Novartis relating to GM-CSF, a component of our GVAX cancer immunotherapies, in the field of gene therapy. This license bears a low single digit royalty. Also included in the agreement was acknowledgment that certain GVAX cancer immunotherapy products, such as our GVAX immunotherapy for prostate cancer, would not require this license and hence would not be subject to future royalty payments to Novartis. In January 2009, we entered into discussions with Novartis to terminate this agreement.

Medarex, Inc.

In May 2003, we entered into a research and development collaboration with Medarex, Inc. to evaluate combination therapy with our GVAX immunotherapy for prostate cancer and Medarex’s anti-CTLA-4 antibody called ipilimumab. Preclinical studies indicate that ipilimumab may enhance the activity of GVAX cancer immunotherapies. We initiated a Phase 1 trial of this combination therapy in September 2004 which was expanded in April 2007 to treat up to a total of approximately 25 to 30 patients. We formally terminated this trial in November 2008 as a result of the decision to end further development of GVAX immunotherapy for prostate cancer.

Patents and Trade Secrets

The patent positions and proprietary rights of pharmaceutical and biotechnology firms, including us, are generally uncertain and involve complex legal and factual questions. We believe there will continue to be significant litigation in the industry regarding patent and other intellectual property rights.

As of December 31, 2008, we had 400 U.S. and non-U.S. patents issued or granted to us or available for use by us based on licensing arrangements and 256 U.S. and non-U.S. applications pending in our name or available for use by us based on licensing arrangements. We are currently prosecuting our patent applications in various patent offices around the world, but we cannot be certain whether any given patent application filed by us or our licensors will result in the issuance of a patent or if any given patent issued to us or our licensors will later be challenged and invalidated. Nor can we be certain whether any given patent that may be issued to us or our licensors will provide any significant proprietary protection to our products and business.

Litigation or other proceedings may also be necessary to enforce or defend our proprietary rights and patents. To determine who was first to make an invention claimed in a United States patent application or patent and thus be entitled to a patent, the United States Patent and Trademark Office, or USPTO, can declare an interference proceeding. In the United States, patents may be revoked or invalidated in court actions or in reexamination proceedings in the USPTO. In Europe, patents can be revoked through opposition or nullity proceedings. Such litigation or proceedings could result in substantial cost or distraction to us, or result in an adverse decision as to our or our licensors’ patent applications and patents. We are not currently involved in any interference proceedings concerning our or our licensors’ patent applications and patents. We may be involved in such proceedings in the future.

10

Competitors may have filed patent applications and obtained patents and may in the future file patent applications and obtain patents relating to our products and technologies. We are aware of competing intellectual property relating to our technologies and products. From time to time we have received communications from third parties claiming to have conflicting rights relating to components of our products and technologies. Regardless of their ultimate merit, any infringement or other intellectual property claims against our products and technologies may be expensive and time-consuming to litigate and may divert management attention. If any such claim were successful, we could be required to obtain licenses to a third party’s technologies, patents or other proprietary rights or to their biological or chemical reagents in order to develop and market our products. Moreover, we may choose to voluntarily seek such a license in order to avoid the expense and uncertainty of fully defending our position. In either event, such a license may not be available to us on acceptable terms or on any terms, and we may have to discontinue that portion of our business, or such third party may seek an injunction to prevent us from practicing their proprietary technology. In addition, to the extent we license our intellectual property to other parties, we may incur expenses as a result of contractual agreements in which we indemnify those licensing our technologies against losses incurred if practicing our intellectual property infringes upon the proprietary rights of others. The failure to license any technologies or biological or chemical reagents required to develop or commercialize our technologies or products at reasonable cost may harm our business, results of operations, financial condition, cash flow and future prospects. We are not currently involved in any litigation concerning our competitors’ patent applications and patents. We may be involved in such litigation in the future.

No assurance can be given that others will not independently develop substantially equivalent proprietary information and techniques, or otherwise gain access to our trade secrets or disclose such technology, or that we can meaningfully protect our rights to our unpatented trade secrets.

We require our employees and consultants to execute confidentiality agreements upon the commencement of employment and consulting relationships with us. These agreements provide that all confidential information developed by or made known to an individual during the course of the employment or consulting relationship generally must be kept confidential. In the case of employees, the agreements provide that all inventions conceived by the individual, while employed by us, relating to our business are our exclusive property. While we have implemented reasonable business measures to protect confidential information, these agreements may not provide meaningful protection for our trade secrets in the event of unauthorized use or disclosure of such information.

Competition

We faced substantial competition in the development of products for cancer and other diseases. This competition from other manufacturers of the same types of products and from manufacturers of different types of products designed for the same uses is expected to continue in both U.S. and international markets. Cancer immunotherapies and oncolytic virus therapies are rapidly evolving areas in the biotechnology industry and are expected to undergo many changes in the coming years as a result of technological advances. We are currently aware of a number of groups that are developing cancer immunotherapies and oncolytic virus therapies including early-stage and established biotechnology companies, pharmaceutical companies, academic institutions, government agencies and research institutions. Examples in the cancer immunotherapy area include Dendreon Corporation, which is undertaking a Phase 3 trial in prostate cancer and has filed a BLA with the FDA, and Onyvax Ltd., which has commenced Phase 2 trials in prostate cancer. Antigenics, Inc., and Oncothyreon Inc. are also developing immunotherapy products for other types of cancers.

11

Human Resources

As of December 31, 2008, we employed 61 people. As of December 31, 2008, all remaining employees were engaged in restructuring and activities related to the evaluation of and implementation of strategic alternatives for the business. Accordingly, as of December 31, 2008, no employees were engaged in research, development and manufacturing operations. Since December 31, 2008, we have further reduced our workforce to 21 people as of the date of this report.

Our ability to successfully complete our restructuring and/or strategic alternative activities and/or further develop our business will depend in large part upon our ability to retain employees. We compete for qualified employees with other companies, research and academic institutions, government entities and other organizations. Our termination of our VITAL-1 and VITAL-2 trials of GVAX immunotherapy for prostate cancer and restructuring plan could make it difficult to retain existing employees.

Executive Officers

Our executive officers and their ages as of February 28, 2009, were as follows:

| | | | |

Name | | Age | | Position |

Stephen A. Sherwin, M.D. | | 60 | | Chairman of the Board and Chief Executive Officer |

Sharon E. Tetlow | | 49 | | Senior Vice President and Chief Financial Officer |

Carol C. Grundfest | | 54 | | Senior Vice President, Regulatory Affairs and Portfolio Management |

Christine B. McKinley (1) | | 55 | | Senior Vice President, Human Resources |

Robert H. Tidwell | | 65 | | Senior Vice President, Corporate Development |

Marc L. Belsky | | 53 | | Vice President, Finance and Chief Accounting Officer |

| (1) | terminated on February 28, 2009 |

Dr. Sherwin, chairman of the board and chief executive officer, joined Cell Genesys in March 1990. Dr. Sherwin has served as chief executive officer since the Company’s inception, and in March 1994 he was elected to the additional position of chairman of the board of directors. From 1983 to 1990, Dr. Sherwin held various positions at Genentech, Inc., a biotechnology company, most recently as vice president of clinical research. Prior to 1983, Dr. Sherwin was on the staff of the National Cancer Institute. Dr. Sherwin currently serves as the chairman of the board of Ceregene, Inc., a former subsidiary of Cell Genesys, which he co-founded in 2001. Dr. Sherwin was also a co-founder of Abgenix, Inc, another former subsidiary of Cell Genesys, which was acquired by Amgen in 2006. He is also a director of Neurocrine Biosciences, Inc. and Rigel Pharmaceuticals, Inc. Dr. Sherwin, who also serves as a board member and a vice chair of the board of the Biotechnology Industry Organization, holds a B.A. in biology from Yale University, an M.D. from Harvard Medical School and is board-certified in internal medicine and medical oncology.

Ms. Tetlow, senior vice president and chief financial officer, joined Cell Genesys in June 2005. Between 2004 and 2005, Ms. Tetlow was a venture partner at Apax Partners, a private equity firm. From 1999 to 2004, Ms. Tetlow was chief financial officer for diaDexus, a pharmacogenomics company. From 1998 to 1999, she was chief financial officer at Reprogen, and prior to that, between 1988 and 1998, she held senior financial management positions in other biotechnology companies including Terrapin Technologies, Inc. (now Telik, Inc.), Synergen (now part of Amgen, Inc.) and Genentech, Inc. Ms. Tetlow received an M.B.A. from the Graduate School of Business, Stanford University, and a Bachelor of Arts and Science from the University of Delaware.

Ms. Grundfest, senior vice president, regulatory affairs and portfolio management, joined Cell Genesys in July 2003. Prior to joining Cell Genesys, Ms. Grundfest served as an independent consultant providing advice, analysis and recommendations regarding the regulation and approval of pharmaceutical products in the United States from 2000 to 2003. From 1998 to 2000, Ms. Grundfest served as executive director of project management and strategic planning at Systemix, Inc. and Genetic Therapy, Inc. (affiliates of Novartis AG). Ms. Grundfest also

12

held senior regulatory positions with Roche Global Development and Syntex from 1990 to 1996, as well as served as assistant vice president, research and development at the Pharmaceutical Research and Manufacturers of America from 1982 to 1990. Ms. Grundfest received an M.H.S. in environmental health sciences from The Johns Hopkins University, School of Public Health and a B.S. in biology from Stanford University.

Ms. McKinley, senior vice president, human resources, joined Cell Genesys in August 1994. From 1985 to 1994, she was with Nellcor Puritan Bennett, Inc., where the last position she held was corporate human resources director. Previously, Ms. McKinley also worked at Genentech, Inc. from 1978 to 1984 in various human resource positions. She received a B.A. in psychology from the University of California, Santa Barbara.

Mr. Tidwell, senior vice president, corporate development, joined Cell Genesys in August 2000. Prior to joining Cell Genesys, Mr. Tidwell was vice president of business development at Calydon, Inc. from 1998 to 2000. Mr. Tidwell has also held various management positions with such companies as Boston Life Sciences, where he served as chief operating officer from 1993 to 1994, Genetics Institute, where he was vice president of marketing and business development from 1988 to 1993, and Eli Lilly and Company, where he held various positions including director of worldwide pharmaceutical licensing, between 1969 and 1985. Mr. Tidwell holds an M.B.A. from The Ohio State Graduate School of Business and a Bachelor of Pharmacy from The Ohio State School of Pharmacy.

Mr. Belsky, vice president, finance and chief accounting officer, joined Cell Genesys in December 2006. Prior to joining Cell Genesys, Mr. Belsky served as vice president, Global Visa Commerce from 2005 to 2006, for Visa International. Mr. Belsky held senior management positions in other companies including chief financial officer at Active Aero Group from 2003 to 2005 and DataWave Systems, Inc. from 2001 to 2003, as well as senior finance and banking positions at Michigan National Corporation from 1986 to 2001. Mr. Belsky started his career as an auditor with Coopers & Lybrand. Mr. Belsky is a certified public accountant, a certified treasury professional, and received an M.B.A. from the University of Michigan and a B.S. in accounting from Wayne State University.

13

Medical Advisory Board

We have established a medical advisory board that includes several prominent leaders in the field of oncology which was discontinued as of December 31, 2008. During 2008, the board consisted of the following individuals:

| | |

Name | | Scientific Position |

Bruce Chabner, M.D. | | Clinical Director Massachusetts General Hospital Cancer Center Professor of Medicine, Harvard Medical School |

| |

Jordan U. Gutterman, M.D. | | Chief of the Section of Cellular and Molecular Growth Regulation Department of Molecular Therapeutics Professor of Medicine University of Texas M.D. Anderson Cancer Center |

| |

I. Craig Henderson, M.D. | | Adjunct Professor of Hematology/Oncology University of California, San Francisco |

| |

Ronald Levy, M.D. | | Robert K. Summy and Helen K. Summy Professor of Medicine Chief of the Division of Oncology Stanford University School of Medicine |

| |

William Nelson, M.D., Ph.D. | | Associate Professor of Oncology, Pathology, Pharmacology and Medicine, and Urology Sidney Kimmel Comprehensive Cancer Center The Johns Hopkins University |

| |

John T. Potts, Jr., M.D. | | Director of Research, Massachusetts General Hospital Physician-in-Chief Emeritus Jackson Distinguished Professor of Clinical Medicine Harvard Medical School |

| |

Joan H. Schiller, M.D. | | Deputy Director of the Cancer Center and Chair of Hematology/Oncology University of Texas Southwestern Medical Center |

Dr. Potts, who is also a member of our board of directors, serves as a liaison between the medical advisory board and the board of directors, making periodic reports on the findings of the medical advisory board to the board of directors.

14

Investors in Cell Genesys, Inc. should carefully consider the risks described below before making an investment decision. The risks described below may not be the only ones relating to our company. This description includes any material changes to and supersedes the description of the risk factors associated with our business previously disclosed in Item 1A of our Quarterly Report on Form 10-Q for the three months ended September 30, 2008. Additional risks that we currently believe are immaterial may also impair our business operations. Our business, results of operation, financial condition, cash flow and future prospects and the trading price of our common stock and our abilities to repay our convertible notes could be harmed as a result of any of these risks, and investors may lose all or part of their investment. In assessing these risks, investors should also refer to the other information contained or incorporated by reference in this Annual Report on Form 10-K, including our consolidated financial statements and related notes, and our other filings from time to time with the Securities and Exchange Commission, or SEC.

The continuation of our business as a going concern may depend on our ability to identify and successfully complete a strategic transaction.

We terminated both the VITAL-1 and VITAL-2 trials and ended further development of GVAX immunotherapy for prostate cancer and have implemented a substantial restructuring plan approved by our Board of Directors. We had previously devoted substantially all of our research, development and clinical efforts and financial resources toward the development of GVAX immunotherapy for prostate cancer, and we have only limited early stage product candidates in clinical or preclinical development. As a result, we expect it to be difficult or impossible to raise the additional financing required to continue to operate our business as currently structured. We accordingly are exploring strategic alternatives, including merger with or acquisition by another company, further restructuring of our company and allocation of our resources toward other biopharmaceutical product areas, and sale of the company’s assets and liquidation of the company. We cannot predict whether we will be able to identify strategic transactions on a timely basis or at all. We also cannot predict whether any such transaction, once identified, would be approved by our stockholders, if approval is required, or consummated on favorable terms. We anticipate that any such transaction would be time-consuming and may require us to incur significant additional costs regardless even if completed. If we are unable to identify and complete an alternate strategic transaction, our business may be liquidated. In any case, our stockholders and noteholders could lose some or all of their investment in our common stock.

We have only limited early stage product candidates in clinical or preclinical development from which we can potentially generate any revenue from product sales.

As a result of terminating both the VITAL-1 and VITAL-2 trials we placed on hold the further development of GVAX immunotherapy for prostate cancer. We only have early stage product candidates in clinical or preclinical development. We do not expect to generate any revenue from product sales for at least the next several years, if ever.

We will need substantial additional funds to continue operations, and our ability to generate funds is extremely limited and depends on many factors beyond our control.

We will need substantial additional funds for lease obligations related to our manufacturing facility in Hayward, California, and for principal and interest payments related to our debt financing obligations.

Our future capital requirements will depend on, and could increase as a result of many factors, including, but not limited to:

| | • | | the progress of implementing our restructuring plan; |

| | • | | whether we acquire other biopharmaceutical products or technologies; |

| | • | | our ability to outlicense our technology and the terms of those outlicensings; |

15

| | • | | the principal amount of our debt that remains outstanding; and |

| | • | | the costs we incur in obtaining, defending and enforcing patent and other proprietary rights or gaining the freedom to operate under the patents of others. |

As mentioned above, we have recently terminated our VITAL-1 and VITAL-2 trials. As a result, it will be difficult or impossible for us to raise additional financing. If adequate funds are not available, we may not be able to pursue other biopharmaceutical product areas, or be required to sell or merge the company or liquidate the company.

We may not be able to maintain our listing on The NASDAQ Global Market.

On October 21, 2008, we received a Nasdaq Staff Deficiency Letter, or Nasdaq Letter, indicating that we had become non-compliant with the minimum $1.00 bid price per share requirement for continued listing on The Nasdaq Global Market as set forth in Nasdaq Marketplace Rule 4450(a)(5) because the price of our stock closed below the minimum bid price of $1.00 per share for a period of 30 consecutive business days. The Nasdaq Letter indicated that in light of extraordinary market conditions, Nasdaq has determined to suspend enforcement of the minimum bid price and market value of publicly held shares requirements through January 16, 2009. Accordingly, the Nasdaq Letter stated that in accordance with Nasdaq Marketplace Rule 4450(e)(2), we have 180 calendar days from January 20, 2009, or until July 20, 2009, to regain compliance. Subsequently, on December 19, 2008, NASDAQ announced that given the continued extraordinary market conditions, NASDAQ is extending the suspension of the minimum bid price and market value of publicly held shares requirements through April 20, 2009. Accordingly we now have until October 27, 2009 to regain compliance. Companies listed on NASDAQ are required to maintain a minimum closing bid price of $1.00 per share. NASDAQ uses the consolidated closing bid price to determine whether a company complies with this requirement. If a company trades for 30 consecutive business days below the $1.00 minimum closing bid price requirement, NASDAQ will send a deficiency notice to the company advising that it has been afforded a “compliance period” of 180 calendar days to regain compliance with the applicable requirements. Thereafter, Capital Market companies can receive an additional 180-day compliance period if they meet all initial inclusion requirements for the Capital Market, except for the bid price requirement. If a Global Select Market or Global Market company is unable to comply with the bid price requirement prior to the expiration of its 180-day compliance period, it may transfer to the NASDAQ Capital Market, so as to take advantage of the additional compliance period offered on that market, provided it meets all requirements for initial listing on the NASDAQ Capital Market, except for the bid price requirement.

Stocks trading on the NASDAQ Capital Market rather than the NASDAQ Global Market tend to be more volatile and less liquid as trading volumes are generally significantly lower on the NASDAQ Capital Market. Furthermore, if we are unable to meet the listing requirements of the NASDAQ Capital Market, we could be delisted from NASDAQ entirely, which would likely result in even less trading volume and liquidity in our common stock.

We may not be able to raise additional funds necessary to continue operating as a going concern on favorable terms, or at all.

Because of our capital requirements, we will need to raise additional funds to continue operations. From time to time, we may seek to access the public or private debt and equity markets. Our announcement that we have terminated the VITAL-1 and VITAL-2 Phase 3 trials of GVAX immunotherapy for prostate cancer has significantly depressed our stock price and severely impaired our ability to raise additional funds. As a result, it will be difficult or impossible for us to raise additional capital. We also may seek to raise additional capital through outlicensing technologies or third-party collaborations. If adequate funds are not available on favorable terms, or at all, we will not be able to pursue certain strategic options, including allocating our resources to other biopharmaceutical product areas.

16

Alternatively, we may need to seek funds through arrangements with collaborative partners or others that require us to relinquish rights to technologies or product candidates that we would otherwise seek to develop or commercialize ourselves. These arrangements could harm our business, results of operations, financial condition, cash flow or future prospects. Currently, we do not have collaborative partners as Takeda terminated our collaborative agreement on December 1, 2008, effective March 1, 2009, upon which time this collaborative partnership will no longer be a source of revenue. We may not be successful in entering into additional collaborative partnerships on favorable terms, if at all. Certain of our oncolytic virus therapy products are currently subject to future commercialization rights belonging to Novartis AG, which at its option may provide further development funding for these products. However, in January 2009, we entered into discussions with Novartis to terminate this agreement. Our efforts to raise capital through such outlicensing activities may fail. Failure to enter into new corporate relationships may harm our business.

Our business, financial condition, results of operations, cash flow and future prospects could suffer as a result of future strategic alternatives.

We may engage in a future merger with or acquisition by another company or investments that could dilute our existing stockholders or cause us to incur contingent liabilities, commitments, debt or significant expense. In the course of pursuing strategic alternatives at this time or in the ordinary course of business in the future, we may evaluate potential acquisitions or investments in related businesses, products or technologies.

Future mergers with or acquisitions by another company could subject us to a number of risks, including, but not limited to:

| | • | | the loss of key personnel and business relationships; |

| | • | | difficulties associated with assimilating and integrating the new personnel, intellectual property and operations of the acquired companies; |

| | • | | the expense associated with maintenance of diverse standards, controls, procedures, employees and clients; and |

| | • | | our inability to generate revenue from acquired technology sufficient to meet our objectives in undertaking the acquisition or even to offset the associated acquisition and maintenance costs. |

As a result of such risks, a merger with or an acquisition by another company or investment could harm our business, results of operations, financial condition, cash flow and future prospects.

We expect to continue to incur substantial losses and negative cash flow from operations and may not become profitable in the future.

We have incurred an accumulated deficit since our inception. As of December 31, 2008, our accumulated deficit was $538.1 million. We expect to incur operating losses for the foreseeable future. In the past, these losses were due primarily to the expansion of development programs, clinical trials and manufacturing activities in connection with the development of GVAX immunotherapy for prostate cancer, which we have ended, and, to a lesser extent, general and administrative expenses, at a time when we have yet to realize any product revenues. We have only limited early stage candidates in clinical or preclinical development, and we do not expect to realize any revenues from product sales in the next several years, if ever. We also have substantial lease obligations related to our manufacturing facility in Hayward, California. We expect that losses will fluctuate from quarter to quarter as we implement our substantial restructuring plan and expense restructuring charges. We cannot guarantee that we will ever achieve positive cash flow or profitability.

17

Our substantial indebtedness could harm our financial condition.

We have a significant amount of debt. As of March 9, 2009, we had $68.3 million aggregate principal amount of outstanding convertible notes due in 2011. Our annual interest payment on these notes is approximately $2.1 million. Our substantial indebtedness could harm our business, results of operations, financial condition, cash flow and future prospects. For example, it could:

| | • | | make it more difficult for us to satisfy our obligations with respect to the convertible notes; |

| | • | | increase our vulnerability to general adverse economic and industry conditions; |

| | • | | limit our ability to raise or borrow additional funds for future working capital, capital expenditures, research and development and other general corporate requirements, limit our ability to pursue strategic alternatives, including merger or acquisition transactions, or allocation of resources to new product areas; and |

| | • | | limit our flexibility to react to changes in our business and the industry in which we operate. |

We may not have sufficient funds to pay principal and interest on our outstanding convertible notes due in 2011 when due.

We have substantial indebtedness, but currently no significant source of revenues. As a result, we may seek from time to time to purchase or retire additional amounts of our outstanding convertible debt through cash purchases and/or exchanges for other securities of our company in open market transactions, privately negotiated transactions and/or a tender offer, if we can do so on attractive terms. If we were unable to repurchase these notes on favorable terms, or at all, or obtain additional financing or revenues from other sources, we may not have sufficient cash remaining for operations which could result in bankruptcy. Additionally, if we buy back our outstanding convertible debt through cash purchases it will reduce our cash balance which may impair our ability to execute strategic alternatives, or leave us without sufficient cash remaining for operations, which could harm our financial condition.

If we reallocate our resources to other biopharmaceutical product areas, we may not be successful in developing a new product candidate and we will be subject to all the risks and uncertainties associated with research and development of new biopharmaceutical product candidates.

We may explore the possibility of reallocating our resources towards other biopharmaceutical product areas. We cannot guarantee that any such allocation would result in the identification and successful development of a commercially viable product candidate. The development of biopharmaceutical product candidates is subject to a number of risks and uncertainties, including but not limited to:

| | • | | the time, costs and uncertainty associated with the clinical testing required to demonstrate the safety and effectiveness of our products and obtain regulatory approvals; |

| | • | | the ability to raise sufficient funds to fund the research and development of product candidates; |

| | • | | the ability to find third party collaborators to assist or share in the costs of product development, and potential dependence on strategic partners and third party collaborators, to the extent we rely on them for future sales, marketing or distribution; |

| | • | | the ability to protect the intellectual property rights associated with a product candidate; |

| | • | | ability to comply with ongoing regulatory requirements; |

18

| | • | | government restrictions on the pricing and profitability of prescription pharmaceuticals in the United States and elsewhere; and |

| | • | | the extent to which third-party payers, including government agencies, private health care insurers and other health care payers, such as health maintenance organizations, and self-insured employee plans, will cover and pay for newly approved therapies. |

The commercial value of our patents is uncertain.

As of December 31, 2008, we had 400 U.S. and non-U.S. patents issued or granted to us or available for use by us based on licensing arrangements and 256 U.S. and non-U.S. applications pending in our name or available for use by us based on licensing arrangements. The patent positions of pharmaceutical and biotechnology firms, including ours, are generally uncertain and involve complex legal and factual questions. We believe that there will continue to be significant litigation in the industry regarding patent and other intellectual property rights. We cannot be certain whether any given patent application filed by us or our licensors will result in the issuance of a patent or if any given patent issued to us or our licensors will later be challenged and invalidated. Nor can we be certain whether any given patent that may be issued to us or our licensors will provide any significant proprietary protection to our products and business. Competitors may have filed patent applications or received patents and may file additional patent applications and obtain additional patents that may prevent patents being issued to us or our licensors or limit the scope of those patents. Depending upon their filing date, patent applications in the United States are confidential until the patent applications are published, typically eighteen months after their filing date, or patents are issued. Outside the United States, patent applications are confidential until they are published, typically eighteen months after their first filing date. In addition, publication of discoveries in the scientific or patent literature tends to lag behind actual discoveries by several to many months. Accordingly, we cannot be sure that we or our licensors were the first creator of inventions covered by our or our licensors’ pending patent applications or issued patents or that we or our licensors were the first to file patent applications for these inventions. In addition, because patents have a limited life, subject to potential extensions, patents issued to us or our licensors may have expired prior to or have limited term remaining after the first commercial sale of a related product. As a result, the commercial value of these patents might be limited. The strategic alternatives we are exploring include the sale of our assets, but we may not be able to sell our intellectual property at attractive prices or for any price, or our competitors may challenge our ownership.

We may have to engage in litigation to determine the scope and validity of competitors’ patents and proprietary rights, which, if we do not prevail, could harm our business, results of operations, financial condition, cash flow and future prospects.

Competitors may have filed patent applications and obtained patents and may in the future file patent applications and obtain patents relating to our products and technologies. We are aware of competing intellectual property relating to our technologies and products. From time to time we have received communications from third parties claiming to have conflicting rights relating to components of our products and technologies. Regardless of their ultimate merit, any infringement or other intellectual property claims against our products and technologies may be expensive and time-consuming to litigate and may divert management attention. If any such claim were successful, we could be required to obtain licenses to a third party’s technologies, patents or other proprietary rights or to their biological or chemical reagents in order to develop and market our products. Moreover, we may choose to voluntarily seek such a license in order to avoid the expense and uncertainty of fully defending our position. In either event, such a license may not be available to us on acceptable terms or on any terms, and we may have to discontinue that portion of our business, or such third party may seek an injunction to prevent us from practicing their proprietary technology. In addition, to the extent we license our intellectual property to other parties, we may incur expenses as a result of contractual agreements in which we indemnify those licensing our technologies against losses incurred if practicing our intellectual property infringes upon the proprietary rights of others. The failure to license any technologies or biological or chemical reagents required to develop or commercialize our technologies or products at reasonable cost may harm our business, results of operations, financial condition, cash flow and future prospects.

19

We may have to engage in litigation, which could result in substantial cost or distraction, to enforce or defend our patents and which, if we do not prevail, could harm our business and make us more vulnerable to competition.

In the future, we may have to engage in litigation to enforce or defend our proprietary rights and patents. To determine who was first to make an invention claimed in a U.S. patent application or patent and thus be entitled to a patent, the USPTO can declare an interference proceeding. In the United States, patents may be revoked or invalidated in court actions or in reexamination proceedings in front of the USPTO. In Europe, patents can be revoked through opposition or nullity proceedings. Such litigation or proceedings could result in substantial cost or distraction to us. These proceedings could potentially result in an adverse decision as to our or our licensors’ patent applications and patents.

We cannot predict the outcome of interference, reexamination, opposition or nullity proceedings or patent litigation that we may become involved with in the future. An adverse result in any of these proceedings could have an adverse effect on our intellectual property position in the technologies to which the patent applications or patents involved in the proceedings are directed and on our business in related areas. If we lose in any such proceeding, our patents or patent applications that are the subject matter of the proceeding may be invalidated or may not be issued as patents. We also may be required to obtain a license from the prevailing party.

Our ability to protect and control unpatented trade secrets, know-how and other technological innovation is limited.

We have a limited ability to protect and control unpatented trade secrets, know-how and other technological innovation. Our competitors may independently develop similar or better proprietary information and techniques and disclose them publicly. Also, others may gain access to our trade secrets, and we may not be able to meaningfully protect our rights to our unpatented trade secrets. In addition, confidentiality agreements and other measures may not provide meaningful protection for our trade secrets in the event of unauthorized use or disclosure of such information. Failure to protect and control such trade secrets, know-how and innovation could harm our competitive position.

Inventions or processes discovered by our outside scientific collaborators or consultants may not become our property, which may affect our competitive position.

We have relied on the continued availability of outside scientific collaborators to perform research for us. As these scientific collaborators are not our employees, we have had limited control over their activities. Our arrangements with these collaborators, as well as those with our scientific consultants, provide that any rights we obtain as a result of their research efforts will be subject to the rights of the research institutions for which they work. For these reasons, inventions or processes discovered by our scientific collaborators or consultants may not become our property.

If we fail to maintain an effective system of internal controls, we may not be able to accurately report our financial results, maintain investor confidence or prevent fraud.

Effective internal controls are necessary for us to provide reliable financial reports, maintain investor confidence and prevent fraud. As part of our examination of our internal systems in response to Sarbanes-Oxley requirements, we have discovered in the past, and may in the future discover, areas of our internal controls that could be improved. None of these issues have risen to the level that we were unable to attest to the effectiveness of our internal controls when we were required to do so. We cannot be certain that any measures that we take to improve our internal controls will ensure that we implement and maintain adequate controls over our financial processes and reporting in the future. In addition, as a result of our recent restructuring, we have significantly reduced our number of employees and there can be no guarantee that we will be able to retain employees with the requisite expertise to maintain an effective system of internal controls. Any failure to implement required new or improved controls, or difficulties encountered in their implementation, could harm our operating results or cause

20

us to fail to meet our reporting obligations. Inferior internal controls could also cause investors to lose confidence in our reported financial information, which could have a negative effect on the trading price of our common stock.

We may in the future be exposed to product liability claims, which could harm our business, results of operations, financial condition and cash flow.

Clinical trials or marketing of any of our potential products, including the recently terminated VITAL-1 and VITAL-2 trials of GVAX immunotherapy for prostate cancer, may expose us to liability claims resulting from the use of our products. These claims might be made by clinical trial participants and associated parties, consumers, health care providers, sellers of our products or others. A claim, particularly resulting from a clinical trial, or a product recall could harm our business, results of operations, financial condition, cash flow and future prospects.

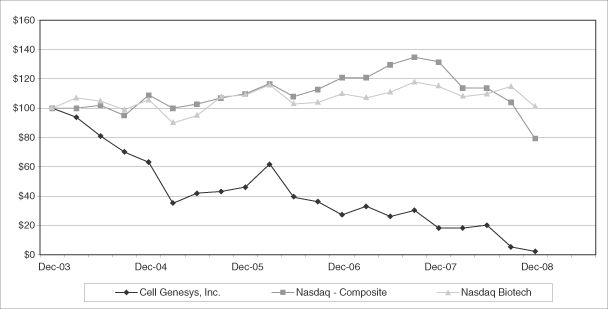

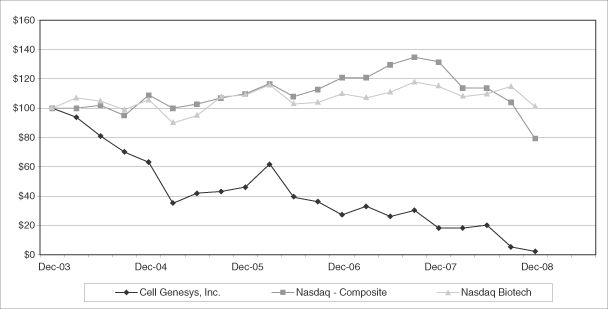

Insurance coverage is increasingly more difficult and costly to obtain or maintain.