UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File number: 811-06136

HOMESTEAD FUNDS, INC.

��

(Exact name of registrant as specified in charter)

4301 Wilson Boulevard

Arlington, VA 22203

(Address of principal executive office – Zip code)

Kelly Whetstone, Esq.

Homestead Funds, Inc.

4301 Wilson Boulevard

Arlington, VA 22203

(Name and address of agent for service)

Copies to:

Bibb L. Strench, Esq.

Seward & Kissel LLP

901 K Street, NW

Washington, DC 20001

(Name and addresses of agent for service)

Registrant’s telephone number, including area code: (703) 907-5953

Date of fiscal year end: December 31

Date of reporting period: June 30, 2015

Item 1. Reports to Stockholders.

Semi-Annual Report

June 30, 2015

Our Funds

Daily Income Fund (HDIXX)

Short-Term Government Securities Fund (HOSGX)

Short-Term Bond Fund (HOSBX)

Stock Index Fund (HSTIX)

Value Fund (HOVLX)

Growth Fund (HNASX)

Small-Company Stock Fund (HSCSX)

International Value Fund (HISIX)

Table of Contents

The investment commentaries on the following pages were prepared for each fund by its portfolio manager(s). The views expressed are those of the portfolio manager(s) for each fund as of June 30, 2015; since that date, those views might have changed. The opinions stated might contain forward-looking statements and discuss the impact of domestic and foreign markets, industry and economic trends, and governmental regulations on the funds and their holdings. Such statements are subject to uncertainty, and the impact on the funds might be materially different from what is described here.

Past performance does not guarantee future results.

Investments in fixed-income funds are subject to interest rate, credit and inflation risk. Equity funds, in general, are subject to style risk, the chance that returns on stocks within the style category in which the fund invests will trail returns of stocks representing other style categories or the market overall.

Homestead Funds

2015 Semi-Annual Report

August 19, 2015

Dear Shareholders:

As Homestead Funds approaches the anniversary of its 25th year in business, I want to say how pleased I am to be part of an organization helping to fulfill NRECA’s mission of service to the cooperative community. The vision that inspired the launch of the fund company—to deliver top-notch and affordable money management services to the employees of NRECA member systems and their families—is a core focus of our business objectives and strategic planning decisions today.

Since joining the firm in January of this year, I have had the opportunity to hear from a number of our customers and get a better sense of their needs and what we can do to align our business to best meet them. Company management has also engaged with your board of directors on a number of changes that we believe to be in the best interests of shareholders.

Following management’s recommendation, Homestead Funds’ board of directors recently approved a change to the Daily Income Fund that was described in a supplement to the prospectus. As explained, on or before October 14, 2016, the fund will become a government money market fund and assets will be invested almost entirely in government securities, rather than a mix of government securities, commercial paper and short-term corporate securities, as is the case now.

This transition means that we will not have to impose the liquidity fees or redemption gates that were part of the Securities and Exchange Commission’s new rules governing money market funds. Further, we can preserve the fund’s stable net asset value. The Daily Income Fund is now and will continue to be managed to maintain a constant $1.00 share price. Shareholders with check-writing privileges will continue be able to redeem shares by check.

The board of directors, also based on a recommendation from company management, voted to terminate the contract of the sub-advisor to the International Value Fund. RE Advisers and the board of directors regularly review sub-advisory contracts, evaluating performance, fees and services. Management and the board believe shareholder interests are best served by the change and are actively engaged in the search for a new sub-advisor.

Both of these changes are described in more detail in the prospectus, which is available on the Homestead Funds’ website.

As we chart a course for the company’s next quarter century of growth, RE Advisers will continue to focus on stewardship, working with your board of directors to provide attractive investment options that seek to deliver competitive long-term performance for a prudent level of risk and at a reasonable cost.

I hope you will take a few minutes to read how your portfolio managers directed fund assets in the first half of 2015, the performance results and their outlook for the coming months.

Sincerely,

Stephen Kaszynski, CFA

Director, President and CEO

Homestead Funds and RE Advisers

Stephen Kaszynski, CFA

Director, President and CEO

An investment in the Daily Income Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. While this fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in this fund.

Daily Income Fund

Performance Evaluation | Prepared by the Fund’s Investment Advisor, RE Advisers Corporation

Fund Performance

The Daily Income Fund earned a total return of 0.01 percent for the first half of 2015. The seven-day current annualized yield was 0.01 percent on June 30, 2015, unchanged from the end of 2014. Interest income for the fund is netted against operating expenses. With interest income at historic lows, RE Advisers continues to waive fees and/or reimburse expenses to assist the fund in maintaining a positive yield. As long as the Federal Reserve (the Fed) continues to maintain a federal funds rate close to zero, the Daily Income Fund will continue to earn very little interest income, which is the only component of return in a money market fund.

Market Conditions

The U.S. economy regained its footing in the later part of the first half of 2015 and looks to be on more solid ground as we enter the second half of the year. An unusually tough winter for much of the country was said to be the major cause for an unexpected decline in gross domestic product (GDP) of 0.2 percent in the first quarter of 2015. However, as was the case with 2014, a negative GDP in the first quarter was then followed by a second quarter of much greater strength. At this time, the general consensus among economists is that GDP rose at an annual rate of 2.8 percent in the second quarter of 2015.

The Fed, under the leadership of Chairwoman Janet Yellen, continued its policy of maintaining historically low short-term interest rates—a policy that was initially established in December 2008. The Fed’s policy is designed to accomplish its dual mandate of fostering maximum employment and price stability. The Federal Open Market Committee (FOMC, the Fed’s policy making body) has not revised its target for the federal funds rate—still set at 0.00 percent to 0.25 percent—since this policy was established.

An analysis of the data by the Fed suggests a moderately expanding economy, improved labor market, growth in household spending and a stronger housing sector. However, business fixed investment and net exports remained relatively soft. In addition, inflation remained below the FOMC’s long-term objective of 2 percent. This partly reflects earlier declines in energy prices and decreasing prices of non-energy imports. Therefore, with an official unemployment rate under 6 percent, an economy growing between 2 percent and 4 percent, improved labor markets (where weekly initial jobless claims remained under 300,000) and an improving housing sector, a rise in interest rates to more normalized levels should be expected this year. As far as timing, Fed policy makers have said repeatedly that they will be both patient and data driven in their efforts to normalize monetary policy.

| | |

| Investment Advisor: RE Advisers |

| |

| | Marc Johnston, CFP, ChFC, CAIA Money Market Portfolio Manager BA, General Arts, Villanova University; MBA, Northeastern University |

| |

| | |

Outlook

Barring any unusual events that interrupt economic growth or roil global political stability, 2015 may be the year in which the Fed finally thinks conditions are right to support a normalization of interest rates. In such an environment, short-term, risk-free rates should approximate the rate of inflation, and longer term rates should reflect a term premium.

In closing, we’d like to remind shareholders about some recently announced fund changes. On June 17, 2015, in response to the Securities and Exchange Commission’s adoption of the final amendments to Rule 2a-7 of the Investment Company Act of 1940, which governs money market funds, Homestead Funds’ board of directors, after carefully reviewing the money market funds options available, unanimously approved the conversion of the Daily Income Fund to a government money market fund. Accordingly, the fund, on or before October 14, 2016, will change its principal investment strategy to invest at least 99.5% of its total assets in U.S. government securities, repurchase agreements fully collateralized by U.S. government securities and cash.

The Rule also requires that the board of directors consider whether the imposition of liquidity fees on redemptions and/or redemption gates (fees and gates) in the event the fund’s liquid weekly assets were to fall below a designated threshold are in the best interest of the fund. Liquidity fees and redemption gates are optional for government money market funds. The board determined that fees and gates were not in the best interest of the fund, and as such, no fees and gates will be applied to the fund.

The fund’s name and fundamental investment objective of earning current income and maintaining a stable net asset value of $1.00 per share will not change.

Daily Income Fund

| | | | | | | | | | | | |

| Average Annual Total Returns (periods ended 06/30/15) | | | | | | | | | |

| | | |

| | | 1 YR % | | | 5 YR % | | | 10 YR % | |

Daily Income Fund | | | 0.01 | | | | 0.01 | | | | 1.28 | |

| | | | |

| Yield | | | |

Annualized 7-day current yield quoted 06/30/15 | | | 0.01% | |

| | | | | | | | |

| Security Diversification | | | |

| |

| | | % of Total Investments | |

| | | as of 12/31/14 | | | as of 06/30/15 | |

Commercial paper | | | 71.7 | | | | 62.7 | |

U.S. Government obligations | | | 17.8 | | | | 20.5 | |

Corporate bonds | | | 0.9 | | | | 7.0 | |

Short-term and other assets | | | 9.6 | | | | 9.8 | |

Total | | | 100.0% | | | | 100.0% | |

| | | | | | | | |

| Maturity | | | | | | |

| | |

| | | as of 12/31/14 | | | as of 06/30/15 | |

Average Weighted Maturity | | | 42 days | | | | 50 days | |

The returns quoted in the above table represent past performance, which is no guarantee of future results. Current performance may be higher or lower than that shown above. Returns and the principal value of your investment may be worth more or less than its original cost. An investment in the Daily Income Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. While the Daily Income Fund seeks to maintain a constant $1.00 per share price, it is possible to lose money investing in the fund. The Daily Income Fund’s average annual total returns are net of any fee waivers and reimbursements. Returns do no reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares.

Short-Term Government Securities

and Short-Term Bond Funds

Performance Evaluation | Prepared by the Funds’ Investment Advisor, RE Advisers Corporation

Fund Performance

The Short-Term Government Securities Fund had a total return of 0.68 percent for the first half of 2015, trailing its benchmark’s return of 0.94 percent. While all of the fund’s sectors generated positive returns, the corporate sector was the standout performer as the various financing issues guaranteed by the Export-Import Bank benefitted from a relatively stable yield curve and robust demand for higher yielding government guaranteed paper. The U.S. government and agency obligations sector also benefitted from the same factors. The fund’s cash position was the largest relative drag on performance.

Positions were added in the corporate sector, utilizing FDIC-guaranteed certificates of deposit and Export-Import Bank guaranteed issues. We also added to positions in the government and agency sector using U.S. Treasuries and issuance from the U.S. Department of Housing and Urban Development. There were no additional investments into the mortgage-backed, asset-backed or municipal sectors.

The Short-Term Bond Fund had a total of return of 0.31 percent for the first half of 2015, trailing its benchmark’s return of 1.01 percent. While all but one of the fund’s sectors generated positive returns, the U.S. government and agency sector was the standout performer. The municipal sector was an drag on performance as debt obligations of the Puerto Rico Sales Tax Financing Corporation accounted for nearly two-thirds of the sector underperformance (see note below).

Positions were added in all sectors with the exception of mortgages. In general, yield spreads widened modestly during the period.

A Note about the Fund’s Puerto Rico Holdings: With the exception of the sales tax bonds, 100 percent of the remaining Puerto Rico positions are insured by strongly capitalized financial entities, with ratings recently affirmed by Standard & Poor’s of at least AA-. At the July 13, 2015 bondholder meeting hosted by the Puerto Rico Government Development Bank, it was made clear in the Q&A that not all Puerto Rico debt obligations are “unpayable”. The sales tax bonds are special revenue bonds that are serviced by a pledged percentage of the Commonwealth’s sales tax receipts, with a collection mechanism that segregates those monies from the General Fund. There is a non-impairment covenant by the Commonwealth and multiple legal opinions that the pledged sales tax revenues are not available to its General Fund.

Market Conditions

As we entered 2015, market participants’ discussions continued to revolve around Federal Reserve monetary policy, with the question becoming, not “will they hike” but “when will they hike.” The fervent prognostication ended with a thud at midyear given worries about the rapid meltdown in Chinese equities, the potential for Greece not reaching a deal with its European creditors and being forced out of the Euro, and the Governor of Puerto Rico stating that the Commonwealth’s debts are “unpayable” and must be restructured. While Treasury yields inside of five years were sharply lower in January (compared with year-end levels) due to the plunge in crude oil prices and slowdown in economic activity, by June yields were sharply higher as the economic slump (which was at least in part weather related) ended, crude oil prices rebounded and eurozone economic activity at the margin was stronger than expected; therefore, the discussion shifted to domestic monetary policy revolving around the initial “lift-off” date for the Fed’s first rate hike since 2006. By the end of June, rates had declined to levels modestly below year-end 2014 levels on the aforementioned market worries.

While Chinese GDP has risen 7 percent through the fiscal year that ended March 31, 2015, its stock market, as measured by the Shanghai Stock Exchange Composite Index, dropped 17 percent from its recent peak in June through month-end and an astonishing 32 percent through July 9, 2015, stoking fears about an imminent economic slowdown. Greece has failed to win a financing package and risks a total economic and financial collapse as the Greek government and people have rejected further austerity as a condition to additional bailout funding, which so far has resulted in a growing shortage of goods and bank lines at ATMs to retrieve what little cash is left. The economic damage appears to be contained to Greece itself, but the markets are still wary. While the Puerto Rico situation is obviously of importance to holders of Puerto Rican debt issues, the damage has seemingly not spread to the rest of the municipal market.

Domestic GDP declined 0.2 percent in the first quarter yet rose a respectable 2.9 percent for the year ended March 31, 2015, as compared with 1.9 percent for the same period in 2014. West Texas crude oil, which ended the year just above $53 per barrel, averaged over $56 per barrel for the first half of 2015 and ended the quarter at over $59 but now sits little changed for the year as the Chinese market meltdown hit the broad commodities markets hard. The June unemployment rate stands at 5.3 percent versus 5.6 percent at year-end, while the broader U-6 unemployment rate fell to 10.5 percent from 11.2 percent during the same time period. So far in 2015, monthly job gains have averaged 208,000 per month, somewhat lower than the 239,000 during last year’s same time period. The Consumer Price Index (CPI) was flat for the fiscal year that ended May 31, 2015, due primarily to the plunge in oil. This is compared with a 2.1 percent rise for the same period in 2014. Core CPI (excludes food and energy) rose 1.7 percent for the same time period in 2015 versus 2.0 percent in 2014.

Performance Evaluation | Prepared by the Funds’ Investment Advisor, RE Advisers Corporation (Continued)

The ISM Manufacturing Index averaged 52.6 in the first half of 2015 as compared with 54.5 in 2014’s first half. Industrial production rose a modest 1.4 percent for the fiscal year that ended May 31, 2015, compared with 4.3 percent one year earlier. U.S. auto sales continue to be strong, averaging 16.8 million in annual sales compared with 16.1 million in the previous year period. Total retail sales for the fiscal year that ended May 31, 2015, rose 2.7 percent as compared with 4.3 percent in the previous time period. Housing starts have averaged 1.04 million at an annual rate so far in 2015, modestly higher than the .97 million in 2014. Existing home sales are averaging 5.07 million so far this year versus 4.76 million a year ago. The University of Michigan Consumer sentiment for the first half of 2015 averaged 94.9, significantly stronger than the 81.9 reading a year earlier.

The Federal Open Market Committee (the Fed’s policymaking body) continues to maintain a federal funds target in a range of 0.00 percent to 0.25 percent. At the June FOMC meeting, officials “…saw economic conditions as continuing to approach those consistent with warranting a start…” to interest rate increases at some point. The FOMC indicated it was likely to raise rates twice in 2015, assuming economic conditions continue to improve with additional employment gains and progress toward their 2 percent inflation goal. The FOMC also mentioned risks revolving around both China and Greece, and both situations have, in general, deteriorated further since the meeting. In a July 10, 2015, speech Fed Chairperson Janet Yellen reiterated the June FOMC view that the Fed is on track to raise interest rates later this year but remains cautious over various headwinds such as weak wage growth, the low labor participation rate and lack of a strong business capital spending cycle. She added that it would be wrong for the markets to overemphasize the Fed’s first rate hike, since rate increases are likely to be gradual going forward, suggesting that interest rates will stay at low levels for some time.

Outlook

Over the weekend of July 11, 2015, Greece capitulated to its European creditors’ demands for immediate action to qualify for up to €86 billion of aid, the amount needed to avoid a chaotic exit from the euro. Given that this deal is worse than the one the Greek citizenry voted down in a referendum held July 5, 2015, average citizens will understandably not feel very enthusiastic about their and their country’s plight.

As this is being written, world equity markets are giving a big thumbs up to improved sentiment regarding China. The previously mentioned Shanghai Index is up 7 percent off of its July 9 bottom and the flight to safety into U.S. Treasuries has dissipated somewhat. Assuming that the Greek deal gets done and Chinese worries continue to fade, we expect Federal Reserve monetary policy will again move to center stage.

It is clear that the Fed wants to move short-term interest rates away from emergency levels to a range that is still very

| | |

| Investment Advisor: RE Advisers |

| |

| | Doug Kern, CFA Senior Fixed Income Portfolio Manager BS, Business Administration; MBA Finance, Pennsylvania State University |

| |

| | |

accommodative, but policymakers are having a hard time thinking through the increased market volatility that will almost certainly accompany the initial hike. Given the length of the time rates have spent close to 0.00 percent, the Fed is likely to communicate its intentions as never before. The good news for the Fed is that its “dot plot” (a chart showing each committee member’s projection for the federal funds rate at various different future dates) has, in general, moved closer to the market’s consensus view. This alignment of expectations should help to limit volatility somewhat. It may be that the initial hike will be the most problematic for the market; the worse the reaction, the less tightening the Fed may ultimately end up doing.

We believe that the first rate hike is likely to be in September or possibly October of this year, while the market’s best guess is December. We doubt the first hike would come in December because 1) the psychological damage before the Christmas holiday could dampen holiday spending and 2) it could have a possible negative effect on year-end bank funding. In a best-case scenario, the markets are looking at early 2016. Until the road map is clearer, we will continue to maintain both funds’ durations well below their respective benchmarks.

Short-Term Government Securities Fund

| | | | | | | | | | | | |

| Average Annual Total Returns (periods ended 06/30/15) | | | | | | | | | |

| | | |

| | | 1 YR % | | | 5 YR % | | | 10 YR % | |

Short-Term Government Securities Fund | | | 0.97 | | | | 1.06 | | | | 2.48 | |

BofA Merrill Lynch 1-5 Year U.S. Treasury Index | | | 1.38 | | | | 1.37 | | | | 3.08 | |

| | | | | | | | |

| Security Diversification | | | | | | |

| |

| | | % of Total Investments | |

| | | as of 12/31/14 | | | as of 06/30/15 | |

Government-guaranteed agencies | | | 52.9 | | | | 39.6 | |

Corporate bonds | | | 18.7 | | | | 21.0 | |

U.S. Treasuries | | | 13.1 | | | | 18.0 | |

Mortgage-backed securities | | | 4.6 | | | | 4.0 | |

Municipal bonds | | | 4.4 | | | | 2.9 | |

Asset-backed securities | | | 0.4 | | | | 0.3 | |

Short-term and other assets | | | 5.9 | | | | 14.2 | |

Total | | | 100.0% | | | | 100.0% | |

| | | | | | | | |

| Maturity | | | | | | |

| | |

| | | as of 12/31/14 | | | as of 06/30/15 | |

Average Weighted Maturity | | | 2.09 | | | | 2.16 | |

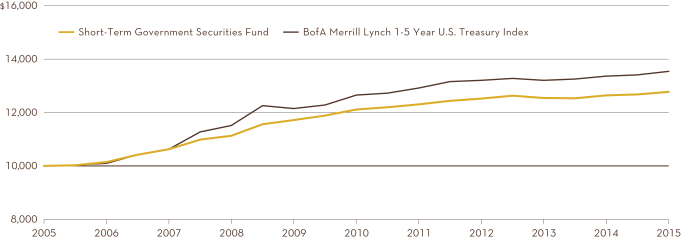

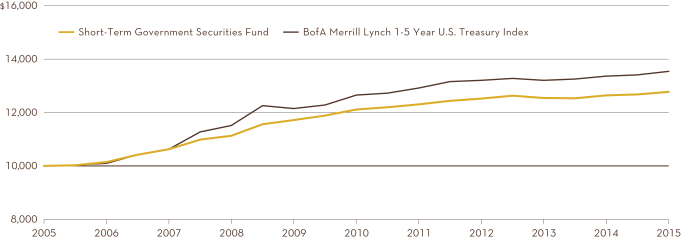

Comparison of the change in value of a $10,000 investment in the fund and the BofA Merrill Lynch 1-5 Year U.S. Treasury Index made on June 30, 2005.

The returns quoted in the above table and chart represent past performance, which is no guarantee of future results. Current performance may be higher or lower than that shown above. Returns and the principal value of your investment will fluctuate such that shares, when redeemed, may be worth more or less than their original cost. The Short-Term Government Securities Fund’s average annual total returns are net of any fee waivers and reimbursements. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares.

Short-Term Bond Fund

| | | | | | | | | | | | |

| Average Annual Total Returns (periods ended 06/30/15) | | | | | | | | | |

| | | |

| | | 1 YR % | | | 5 YR % | | | 10 YR % | |

Short-Term Bond Fund | | | 0.61 | | | | 2.35 | | | | 3.75 | |

BofA Merrill Lynch 1-5 Year Corp./Gov. Index | | | 1.34 | | | | 1.91 | | | | 3.39 | |

| | | | | | | | |

| Security Diversification | | | |

| |

| | | % of Total Investments | |

| | | as of 12/31/14 | | | as of 06/30/15 | |

Corporate bonds | | | 25.9 | | | | 30.3 | |

Asset-backed securities | | | 24.8 | | | | 24.8 | |

Municipal bonds | | | 24.8 | | | | 22.7 | |

Yankee bonds | | | 9.1 | | | | 9.9 | |

U.S. Government obligations | | | 7.9 | | | | 6.5 | |

Mortgage-backed securities | | | 3.7 | | | | 3.4 | |

Short-term and other assets | | | 3.8 | | | | 2.4 | |

Total | | | 100.0% | | | | 100.0% | |

| | | | | | | | |

| Maturity | | | | | | |

| | |

| | | as of 12/31/14 | | | as of 06/30/15 | |

Average Weighted Maturity | | | 2.37 | | | | 2.28 | |

Comparison of the change in value of a $10,000 investment in the fund and the BofA Merrill Lynch 1-5 Year Corp./Gov. Index made on June 30, 2005.

The returns quoted in the above table and chart represent past performance, which is no guarantee of future results. Current performance may be higher or lower than that shown above. Returns and the principal value of your investment will fluctuate such that shares, when redeemed, may be worth more or less than their original cost. The Short-Term Bond Fund’s average annual total returns are net of any fee waivers and reimbursements. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares.

Stock Index Fund

Performance Evaluation | Prepared by the Fund’s Investment Advisor, BlackRock Fund Advisors

Index and Fund Performance

For the six months ended June 30, 2015, the U.S. large cap market metric and the Stock Index Fund’s benchmark, the Standard & Poor’s (S&P) 500 Index, advanced 1.23 percent, compared to the fund’s return of 0.91 percent. The S&P 500 Index is a market capitalization-weighted index composed of 500 common stocks issued by large-capitalization companies in a wide range of industries. The stocks included in this index collectively represent a substantial portion of all common stocks publicly traded in the United States.

From a sector perspective, health care stocks (+9.56 percent) generated the strongest returns in the S&P 500 Index, followed by consumer discretionary (+6.81 percent) and telecommunication services (+3.19 percent). Information technology (+0.72 percent) and materials (+0.50 percent) posted slight gains for the first half of the year. Conversely, financials (-0.33 percent) and consumer staples (-0.77 percent) edged down. Negative results came from the industrials (-3.06 percent) and energy (-4.68 percent) sectors. Utilities stocks (-10.67 percent) were the worst performers in the index.

During the six-month period, as changes were made to the composition of the S&P 500 Index, the Master Portfolio in which the fund invests purchased and sold securities to maintain its objective of replicating the risks and return of the benchmark index.

Market Conditions

The year started with U.S. stock prices falling as lower oil prices punished the energy sector and the negative impact of a stronger dollar began to show in the earnings of large global exporting companies. High valuations in U.S. stocks drove equity investors toward more appealing opportunities overseas. U.S. stocks rebounded in February thanks to increased merger and acquisition activity and strong earnings reports from cyclical technology companies. However, stock prices came under pressure again in March as an improving labor market furthered the appreciation of the U.S. dollar and raised investors’ focus on the timing of an expected Federal Reserve move toward tightening policy. U.S. equities came back into favor in April, after a powerful rally in European equities left valuations in the United States looking more appealing by comparison. U.S. stocks continued to outperform international markets in the following months as increasing turmoil around Greece’s debt troubles drove investors to the relative stability of U.S. markets.

A clear sign of strength has yet to emerge from the blurry U.S. economic picture, as uptrends in the housing and labor markets stand in contrast with consumer caution and productivity languor. This economic unevenness together with still quiescent inflation has kept the Federal Reserve tentative on when to start raising short-term interest rates. However, hiring strength and a modest but concrete pickup in wage growth point to a possible acceleration in the second half of 2015. More investors are now penciling in an autumn rate hike—a significant event that could push market volatility beyond the unusually low levels of the past few years, but we think most of the ups and downs will be short-lived for stocks.

Stock Index Fund

| | | | | | | | | | | | |

| Average Annual Total Returns (periods ended 06/30/15) | | | | | | | | | |

| | | |

| | | 1 YR % | | | 5 YR % | | | 10 YR % | |

Stock Index Fund | | | 6.87 | | | | 16.70 | | | | 7.29 | |

Standard & Poor’s 500 Stock Index | | | 7.42 | | | | 17.34 | | | | 7.89 | |

| | | | |

| Industry Diversification* | | | |

| |

| | | % of Total Long Term Investments

as of 06/30/15 | |

Information technology | | | 19.6 | |

Financials | | | 16.6 | |

Health Care | | | 15.4 | |

Consumer discretionary | | | 12.8 | |

Industrials | | | 10.1 | |

Consumer staples | | | 9.4 | |

Energy | | | 7.8 | |

Materials | | | 3.2 | |

Utilities | | | 2.8 | |

Telecommunication services | | | 2.3 | |

Total | | | 100.0% | |

| | | | |

| Top Ten Equity Holdings* | | | |

| |

| | | % of Total Long Term Investments

as of 06/30/15 | |

Apple, Inc. | | | 4.0 | |

Microsoft Corp. | | | 2.0 | |

Exxon Mobil Corp. | | | 1.9 | |

Johnson & Johnson | | | 1.5 | |

General Electric Co. | | | 1.5 | |

Wells Fargo & Co. | | | 1.4 | |

JPMorgan Chase & Co. | | | 1.4 | |

Berkshire Hathaway, Inc. | | | 1.4 | |

Procter & Gamble Co. | | | 1.2 | |

Pfizer, Inc. | | | 1.1 | |

Total | | | 17.4% | |

Comparison of the change in value of a $10,000 investment in the fund and the Standard & Poor’s 500 Stock Index made on June 30, 2005.

The returns quoted in the above table and chart represent past performance, which is no guarantee of future results. Current performance may be higher or lower than that shown above. Returns and the principal value of your investment will fluctuate such that shares, when redeemed, may be worth more or less than their original cost. The Stock Index Fund’s average annual total returns are net of any fee waivers and reimbursements. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares.

| * | Industry diversification and top holdings information is for the S&P 500 Index Master Portfolio, managed by BlackRock Fund Advisors, the portfolio in which the Stock Index Fund invests all of its investable assets. Please refer to the Appendix for the complete annual report of the S&P 500 Index Master Portfolio. |

Value Fund

Performance Evaluation | Prepared by the Fund’s Investment Advisor, RE Advisers Corporation

Fund Performance

The Value Fund decreased -0.21 percent for the first half of 2015, and its benchmark index, the unmanaged S&P 500 Index, increased 1.23 percent. The fund’s lower-than-index results were due primarily to the results in its consumer discretionary, information technology and industrials sector holdings.

Results in the consumer discretionary positions detracted from relative results, with Genuine Parts Company and Dillard’s being the notable laggards. These two stocks did very well in 2014 as investors expected better results from lower oil prices. This reversed itself somewhat in the first half of 2015.

The fund’s information technology holdings did not fare well compared with the index in the first half of 2015. The fund was underweight in the information technology sector, and the fund’s sector holdings depreciated while the index’s sector position recorded a slight increase. Within information technology, Intel Corporation, Hewlett-Packard and Cisco Systems were the stocks that detracted the most from relative results.

The fund’s industrials results were below those of the sector and the overall index. The bulk of the poor results were due to the depreciation in the stock of Southwest Airlines Co. and Parker-Hannifin Corp. The impact of falling oil prices benefited Southwest’s stock price in the second half of 2014, while the rebound of oil prices in the first half of 2015 had a negative impact on the stock.

The performance of the fund’s health care positions made the greatest positive contribution to first-half results. These stocks as a group generated a return above the sector and the overall index. The announced acquisition of Hospira by Pfizer—both companies are represented in the fund’s portfolio—was also positive for performance as share prices for both companies moved higher on the news. The proposed merger is expected to close by the end of 2015. Also, Bristol-Meyers Squibb received a second-use FDA approval for its immuno-oncology compound Opdivo two and a half months after its first-use approval, and this development was positively received by investors.

The materials sector recovered from a weak second half 2014, led by Avery Dennison and Dow Chemical. The fund’s materials stocks collectively outpaced the sector and the overall index results.

The fund’s consumer staples positions fared well against the sector and well above that of the overall index. The index’s consumer staples sector decreased slightly during the first half of the year, while the fund’s Consumer Discretionary positions increased 8 percent. WhiteWave Foods and J.M. Smuckers led this sector’s results.

A new name added to the fund during the first half of the year was American International Group. American International Group provides property/casualty insurance, life insurance and retirement services in both domestic and international markets.

Outlook

U.S. GDP is projected to exceed 3 percent growth in the second half of 2015. Another factor supportive of economic growth is that the impact of lower oil prices has yet to fully play out.

| | |

| Investment Advisor: RE Advisers |

| |

| | Mark Ashton, CFA Senior Equity Portfolio Manager BS, Finance, University of Utah; MBA, Marketing Research, University of Southern California |

| |

| | Prabha Carpenter, CFA Senior Equity Portfolio Manager BA, Economics, University of Madras; MBA with distinction in Finance and BS in Business Economics, The American University |

| |

| | Gregory Halter, CFA Senior Equity Portfolio Manager BBA, Finance, Cleveland State University |

The U. S. economy has shown positive indications in employment, housing and manufacturing. Energy companies and related industries are working through the effects of lower oil and gas prices. However, there will be changes in the economy as all businesses and the global economy adjust to the United States’ incrementally declining dependence upon imported oil.

Recent Fed commentary about increasing interest rates indicates that action may happen in September. However, any interest rate increases will depend on the strength of the economy in the second half of the 2015. Historically, rising interest rates early in an economic expansion—as long as they are not extreme—have been positive for equities as an indication of an improving business environment. We would expect past experience would continue this next time around.

The markets have gone through an extended period where company managements have returned capital to shareholders via share repurchases and increased dividends. Some of this has come as the result of “activist” shareholders. We have also seen an increase in mergers and acquisitions. Perhaps this reflects company managements’ decisions to deploy capital in a slightly more aggressive manner or an expectation of rising borrowing costs in the near future.

We continue to search for companies with attractive prospects, strong financials and reasonable valuations.

| | | | |

| 10 | | Performance Evaluation | | |

Value Fund

| | | | | | | | | | | | |

| Average Annual Total Returns (periods ended 06/30/15) | | | | | | | | | |

| | | |

| | | 1 YR % | | | 5 YR % | | | 10 YR % | |

Value Fund | | | 4.73 | | | | 16.34 | | | | 7.76 | |

Standard & Poor’s 500 Stock Index | | | 7.42 | | | | 17.34 | | | | 7.89 | |

| | | | |

| Industry Diversification | | | |

| |

| | | % of Total Investments

as of 06/30/15 | |

Health care | | | 22.9 | |

Industrials | | | 16.0 | |

Energy | | | 14.7 | |

Information technology | | | 13.6 | |

Financials | | | 11.4 | |

Materials | | | 9.4 | |

Consumer discretionary | | | 6.7 | |

Consumer staples | | | 2.9 | |

Utilities | | | 0.4 | |

Short-term and other assets | | | 2.0 | |

Total | | | 100.0% | |

| | | | |

| Top Ten Equity Holdings | | | |

| |

| | | % of Total Investments

as of 06/30/15 | |

Bristol-Myers Squibb Co. | | | 5.2 | |

Pfizer, Inc. | | | 4.0 | |

Cisco Systems, Inc. | | | 4.0 | |

Dow Chemical Co. (The) | | | 3.9 | |

General Electric Co. | | | 3.9 | |

Intel Corp. | | | 3.9 | |

JPMorgan Chase & Co. | | | 3.8 | |

Hospira, Inc. | | | 3.6 | |

Avery Dennison Corp. | | | 3.4 | |

Honeywell International Inc. | | | 3.1 | |

Total | | | 38.8% | |

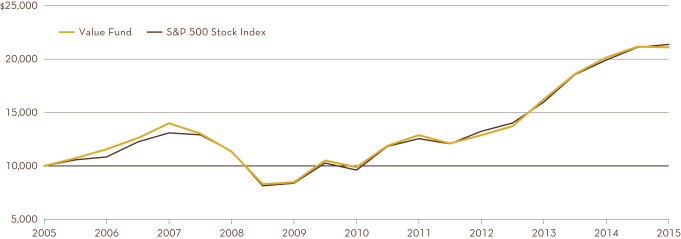

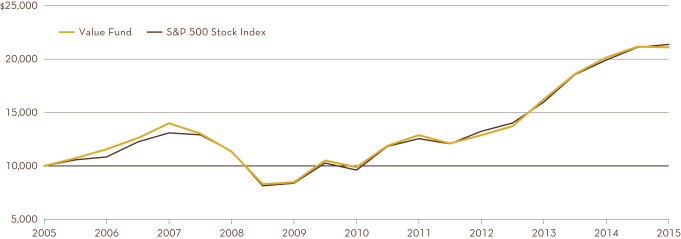

Comparison of the change in value of a $10,000 investment in the fund and the Standard & Poor’s 500 Stock Index made on June 30, 2005.

The returns quoted in the above table and chart represent past performance, which is no guarantee of future results. Current performance may be higher or lower than that shown above. Returns and the principal value of your investment will fluctuate such that shares, when redeemed, may be worth more or less than their original cost. The Value Fund’s average annual total returns are net of any fee waivers and reimbursements. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares.

| | | | | | |

| | Performance Evaluation | | | 11 | |

Growth Fund

Performance Evaluation | Prepared by the Fund’s Subadvisor, T. Rowe Price Associates

Fund Performance

The Growth Fund returned 5.93 percent for the first half of 2015 and outperformed the Russell 1000 Growth Index, which returned 3.96 percent. Stock selection, especially in health care and consumer discretionary, boosted the fund’s performance relative to the index. Overall, sector allocation contributed as well.

Portfolio Review

In addition to positive stock selection, an overweight position to health care—the best-performing sector within the index over the time period—contributed to relative performance. Our out-of-benchmark position in Valeant Pharmaceuticals was a notable contributor. The company continued to make value-enhancing acquisitions with its purchase of Salix Pharmaceuticals in February, which helped shares advance. Management subsequently indicated that it expects Salix, which develops treatments for gastrointestinal disorders, to contribute $1 billion in revenue this year. Valeant also benefited from gains in Asia and Mexico as well as in its contact lens and dermatology businesses.

Stock selection in the consumer discretionary sector was also a significant factor in the portfolio’s outperformance of the index. An overweight allocation to Amazon.com proved beneficial. The company’s shares soared after it announced strong Amazon Prime membership growth and that it would begin breaking out financial results for its Amazon Web Services unit. The stock rose further after the profitability of Amazon Web Services reported by the firm was much higher than expected.

An area of relative weakness was information technology, where stock selection and group weighting proved detrimental. An underweight allocation to Apple hurt relative performance as strong iPhone sales persisted. We remain underweight in Apple as we believe that a decelerating product cycle will eventually hamper iPhone growth. Despite the additional products and services that the company has launched or is preparing to launch, it is unclear how durable these launches will be in contributing to Apple’s growth beyond the iPhone 6 upgrade cycle.

Baidu, a non-index position, was also a detractor for the information technology sector. Shares struggled during the period as management provided second-quarter guidance that suggested more modest growth acceleration than expected. Heavy investments in mobile products have weighed on profits but are beginning to positively affect the company as traffic and monetization on mobile are growing and should continue to improve as more products are introduced. Baidu’s online to offline business also continues to gain traction.

| | |

| Subadvisor: T. Rowe Price Associates |

| |

| | Robert Sharps, CFA Lead Portfolio Manager BS, Accounting, Towson University; MBA, Finance, the Wharton School, University of Pennsylvania |

| |

| | |

Outlook

As we look ahead to the second half of 2015, our key concerns are the events unfolding in Greece and China. While Greece captured most of the headlines toward the end of the first half of the year, China’s situation is potentially more worrisome, considering it is the world’s second-largest economy. A continued deterioration of the Chinese economy could produce far greater ripple effects to global economic growth than Greece.

Aside from these macroeconomic headwinds, equity market strength during the past five years has made it more challenging to unearth attractive investment opportunities outside of a few key sectors. We are focused heavily in health care stocks, where the fundamentals remain sound and valuations are generally attractive. The sector has also benefited from merger and acquisition activity, which we expect to continue. We also have significant exposure to consumer discretionary and business services stocks. Moving forward, we will focus on identifying all-seasons growth companies with the ability to increase earnings even in a volatile macro environment.

| | | | |

| 12 | | Performance Evaluation | | |

Growth Fund

| | | | | | | | | | | | |

| Average Annual Total Returns (periods ended 06/30/15) | | | | | | | | | |

| | | |

| | | 1 YR % | | | 5 YR % | | | 10 YR % | |

Growth Fund* | | | 11.16 | | | | 19.34 | | | | 10.26 | |

Russell 1000 Growth Index | | | 10.56 | | | | 18.59 | | | | 9.10 | |

Standard & Poor’s 500 Stock Index | | | 7.42 | | | | 17.34 | | | | 7.89 | |

| | | | |

| Industry Diversification | | | |

| |

| | | % of Total Investments

as of 06/30/15 | |

Health care | | | 29.2 | |

Information technology | | | 23.9 | |

Consumer discretionary | | | 19.1 | |

Industrials | | | 14.6 | |

Financials | | | 6.1 | |

Energy | | | 2.8 | |

Materials | | | 1.9 | |

Consumer staples | | | 0.7 | |

Short-term and other assets | | | 1.7 | |

Total | | | 100.0% | |

| | | | |

| Top Ten Equity Holdings | | | |

| |

| | | % of Total Investments

as of 06/30/15 | |

Amazon.com, Inc. | | | 4.9 | |

Visa Inc. (Class A) | | | 4.0 | |

Boeing Co. (The) | | | 3.9 | |

Priceline Group, Inc. (The) | | | 3.6 | |

Danaher Corp. | | | 3.3 | |

Alexion Pharmaceuticals Inc. | | | 3.1 | |

McKesson Corp. | | | 3.1 | |

Google Inc. (Class A) | | | 2.9 | |

Morgan Stanley | | | 2.7 | |

Valeant Pharmaceuticals International, Inc. | | | 2.7 | |

Total | | | 34.2% | |

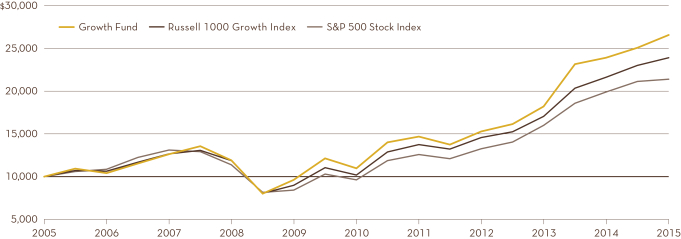

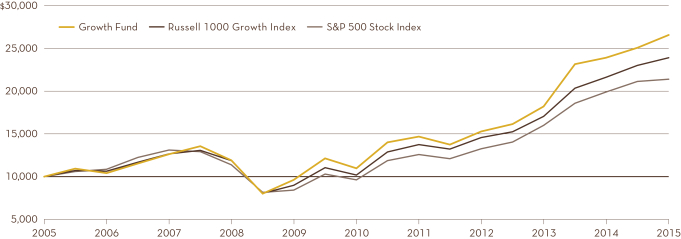

Comparison of the change in value of a $10,000 investment in the fund and its benchmark indices made on June 30, 2005.

The returns quoted in the above table and chart represent past performance, which is no guarantee of future results. Current performance may be higher or lower than that shown above. Returns and the principal value of your investment will fluctuate such that shares, when redeemed, may be worth more or less than their original cost. The Growth Fund’s average annual total returns are net of any fee waivers and reimbursements. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares.

| * | Performance information for the Growth Fund (formerly the Nasdaq-100 Index Tracking StockSM Fund) reflects its previous investment strategy from inception through December 5, 2008, of matching, as closely as possible, before expenses, the performance of the Nasdaq-100 Stock Index. |

| | | | | | |

| | Performance Evaluation | | | 13 | |

Small-Company Stock Fund

Performance Evaluation | Prepared by the Fund’s Investment Advisor, RE Advisers Corporation

Fund Performance

The Small-Company Stock Fund increased 3.11 percent in the first half of 2015 trailing its benchmark index the Russell 2000, which increased 4.75 percent. The fund’s returns in information technology and industrials detracted from results, while the returns in the materials, financials and consumer staples sectors aided overall results.

The fund’s information technology positions, while underweight relative to the index’s sector positions, delivered a negative return for the first six months. The index’s information technology sector and overall index generated positive results. Western Digital and Rofin-Sinar were the primary detractors to the fund’s results in 2015’s first half.

The fund had a large position in the industrials sector. The fund’s industrial positions generated a return less than that of the index’s industrials sector and that of the overall index. Knight Transportation, Werner Enterprises, Applied Industrial Technologies, Orion Marine Group and Gorman Rupp detracted from the portfolio’s industrial sector results. Positive contributions came from Dycom Industries and Polypore International. Polypore accepted a buyout agreement with Asahi Kasei and 3M Corporation in the first half of 2015. The acquisition is expected to close in the third quarter of 2015.

Materials made a positive contribution to the fund’s first half returns, outpacing the sector and the overall index. Positive results came from Olin Corporation and Westlake Chemical Corp. After an extended period of underperformance, financials came to life in the first half with help from Texas Capital Bancshares, National Penn Bancshares and Cardinal Bank. The fund’s financial holdings appreciated more than the sector and almost as much as the overall index.

The fund’s returns in consumer staples exceeded those for the sector and those of the overall index. Cal-Maine Foods and WhiteWave Foods led this sector’s results for the fund.

New names added to the fund during the first half of the year included 1) Burke & Herbert Bank & Trust, a commercial bank serving consumers and businesses through offices in northern Virginia; 2) Cal-Maine Foods, which produces, cleans, grades, packs and sells fresh eggs; 3) Glacier Bancorp, a holding company for a commercial bank serving consumers and businesses in six states in the northern Rocky Mountain area of the U.S.; 4) Libbey, which designs, manufactures and markets glass tableware used by foodservice, industrial, premium and retail customers; 5) NeuStar, a provider of real-time information and analysis to the Internet, telecommunications, technology, financial services, retail and media sectors; 6) Primoris Services Corporation, a provider of a wide range of engineering, construction and fabrication services to municipalities, utilities and energy-related companies; 7) Rentrak Corporation, a generator of audience viewership measurement for the entertainment industry and also a developer of a database currency for the television and digital media market; and 8) State Bank Financial Corporation, a bank holding company serving Atlanta and counties in central Georgia.

| | |

| Investment Advisor: RE Advisers |

| |

| | Mark Ashton, CFA Senior Equity Portfolio Manager BS, Finance, University of Utah; MBA, Marketing Research, University of Southern California |

| |

| | Prabha Carpenter, CFA Senior Equity Portfolio Manager BA, Economics, University of Madras; MBA with distinction in Finance and BS in Business Economics, The American University |

| |

| | Gregory Halter, CFA Senior Equity Portfolio Manager BBA, Finance, Cleveland State University |

Names eliminated from the fund in the first half of 2015 were Matthews International Corporation, Southcoast Financial Corporation and Cal-Maine Foods. The fund’s uncharacteristically short holding period for Cal-Maine Foods was the result of significant appreciation in share price shortly after its initial purchase and a substantial alteration to the original investment thesis. The uncertainty about the business greatly increased with the outbreak of avian flu within the egg-laying bird inventory. As a result, the shares were sold.

Outlook

As 2015 rounds the mid-year mark, our general feeling is for the economy to be stronger in the second half than it was in the first half of 2015. Economic indicators are encouraging in the areas of employment, housing and manufacturing. In total, this has led to forecasts of U.S. GDP to exceed 3 percent growth in the second half of 2015.

Recent events have brought to the forefront significant volatility with the Chinese stock market and weakness in its economy. This comes on the heels of Greece’s debt repayment uncertainty. It would seem that while the U.S. economic backdrop continues to be positive, the outlook for some overseas markets has become less certain, at least for the present.

Regardless of the economic environment, we continue to search for and uncover attractive investment opportunities. While valuations remain somewhat elevated, some of the price volatility in the first half of the year has provided values that are compelling. We continue to find companies with attractive business models and better prospects for the future that we believe will benefit investors over the longer-term.

We appreciate your continued trust and investment.

| | | | |

| 14 | | Performance Evaluation | | |

Small-Company Stock Fund

| | | | | | | | | | | | |

| Average Annual Total Returns (periods ended 06/30/15) | | | | | | | | | |

| | | |

| | | 1 YR % | | | 5 YR % | | | 10 YR % | |

Small-Company Stock Fund | | | 8.56 | | | | 19.00 | | | | 11.45 | |

Russell 2000 Index | | | 6.49 | | | | 17.08 | | | | 8.40 | |

| | | | |

| Industry Diversification | | | |

| |

| | | % of Total Investments

as of 06/30/15 | |

Industrials | | | 25.7 | |

Consumer discretionary | | | 22.1 | |

Financials | | | 16.3 | |

Information technology | | | 11.1 | |

Materials | | | 8.4 | |

Consumer staples | | | 2.4 | |

Health care | | | 1.8 | |

Energy | | | 0.9 | |

Short-term and other assets | | | 11.3 | |

Total | | | 100.0% | |

| | | | |

| Top Ten Equity Holdings | | | |

| |

| | | % of Total Investments

as of 06/30/15 | |

Dycom Industries, Inc. | | | 5.4 | |

iShares Core S&P Small-Cap | | | 3.8 | |

iShares Russell 2000 Value | | | 3.8 | |

Encore Capital Group, Inc. | | | 3.7 | |

Knight Transportation, Inc. | | | 2.9 | |

Werner Enterprises, Inc. | | | 2.7 | |

Rofin-Sinar Technologies, Inc. | | | 2.7 | |

Cooper Tire & Rubber Co. | | | 2.7 | |

Fred’s, Inc. (Class A) | | | 2.6 | |

BJ’s Restaurants, Inc. | | | 2.6 | |

Total | | | 32.9% | |

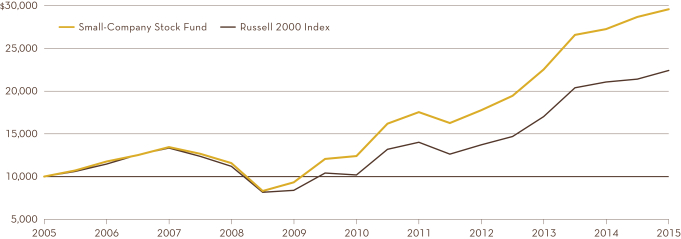

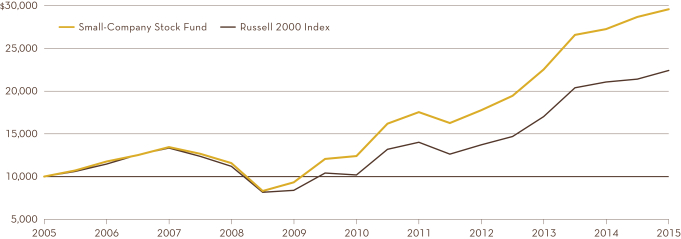

Comparison of the change in value of a $10,000 investment in the fund and the Russell 2000 Index made on June 30, 2005.

The returns quoted in the above table and chart represent past performance, which is no guarantee of future results. Current performance may be higher or lower than that shown above. Returns and the principal value of your investment will fluctuate such that shares, when redeemed, may be worth more or less than their original cost. The Small-Company Stock Fund’s average annual total returns are net of any fee waivers and reimbursements. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares.

| | | | | | |

| | Performance Evaluation | | | 15 | |

International Value Fund

Performance Evaluation | Prepared by the Fund’s Subadvisor, Mercator Asset Management, L.P.

Fund Performance

For the six-month period ending June 30, 2015, the International Value Fund returned 5.16 percent versus the MSCI EAFE Index, which returned 5.52 percent.

Portfolio Review

International equities throughout the first half of the year were characterized by heightened volatility, yet finished the period roughly flat. Mixed macroeconomic news flow was prevalent throughout the six-month period and investors were confronted with continued U.S. dollar strength and geopolitical uncertainty. Despite these factors, your portfolio registered solid gains during the first half of the year. The fund’s European holdings continued to perform strongly as the economic recovery gained pace. Several of the fund’s Japanese holdings performed well throughout the six-month period; however, holdings in Southeast Asia detracted performance as the region suffered from concerns over slow growth. Since the beginning of the year, our value investment style has continued to underperform growth investment style—a trend that has been in place for much of the past decade.

The best performing sectors over the six-month period were energy, industrials and information technology, while financials, utilities and health care detracted. Specific stocks that contributed to performance were Intesa, MS & AD Insurance and Mitsui Chemicals, while Krung Thai Bank, Hyundai Motor Company and Posco detracted. From a country standpoint, the best performers included Australia, the U.K. and Germany, while South Korea, Thailand and the Netherlands detracted.

We continue to find many undervalued opportunities across the globe, with five new purchases initiated during the six-month period: Leopalace21, Georg Fischer, BAM Group, Societe Generale and Marine Harvest. We also sold out of five positions: Guangzhou Auto, Lixil Group, Bangkok Bank, Hyundai Motor and Givaudan.

Outlook

Global economic growth continues to improve with the U.S. leading the rest of the world. The eurozone also continues to improve; bank lending has started to grow, business confidence is rebounding and consumer prices are moving back into positive territory. Early signs of a normalization of interest rates in Europe can be seen, likely ending the deflationary scare of recent months. In this regard, rising bond yields should not be seen as a negative. The weak Euro continues to act as a tailwind for the economy as a whole and for many export-oriented companies.

In spite of the uncertainty created by ongoing negotiations between Greece and the rest of the eurozone, with Greece representing less than 2 percent of the eurozone economy, its

| | |

| Subadvisor, Mercator Asset Management, L.P. |

| |

| | James Chaney Portfolio Manager BS, University of Massachusetts; MS, Northeastern University; MBA, Columbia University Graduate School of Business |

| |

| | |

effect on European economic activity should be limited. Of greater concern is the impact on politics in the region. While not an immediate risk, it does point to the necessity for the eurozone to further its efforts in moving toward a true monetary, fiscal and political union.

We remain overweight in equities in continental Europe. While earnings are beginning to recover, they are still almost 40 percent below prior peak levels. Profit margins have significant room to expand and balance sheets are sound. With interest rates likely to remain low for an extended period, a highly competitive currency, and an economy that is finally starting to grow, we believe Europe is the most attractive region globally and should offer substantial returns over the coming quarters.

The Japanese market should continue to be supported by stronger earnings. Prime Minister Shinzo Abe’s ambitious goal ending Japan’s deflationary spiral is starting to work. Structural reforms are impacting corporate behavior, where the emphasis on improving returns on equity and better governance is driving profit growth. With household ownership of Japanese equities well below the rest of the developed world and a plan to increase allocation to equities in large government-related pension funds, demand for equities in Japan should be well supported.

Emerging markets continue to underperform as an asset class. While it’s difficult to generalize about such a diverse group of economies, they have suffered from a slowdown in growth and fears of rising interest rates in the developed world. Valuations are becoming more attractive with emerging market equities trading at close to a 30 percent discount to the developed world, and trading at an 18 percent discount relative to their historical price-to-book value. However, in the near term, we expect earnings growth to be stronger in regions such as Europe and Japan where economic growth is accelerating. We continue to look at the emerging market asset class opportunistically.

In spite of our style being out of favor, emerging markets underperforming as an asset class and our early positioning in Europe, we believe that as the economic cycle gathers pace, particularly in Europe, as interest rates normalize globally and as risk appetite returns to pre-crisis norms, our investment style should produce strong relative performance for a multiyear period.

| | | | |

| 16 | | Performance Evaluation | | |

International Value Fund

| | | | | | | | | | | | |

| Average Annual Total Returns (periods ended 06/30/15) | | | | | | | | | |

| | | |

| | | 1 YR % | | | 5 YR % | | | 10 YR % | |

International Value Fund* | | | -7.71 | | | | 7.16 | | | | 4.68 | |

MSCI® EAFE® Index | | | -4.22 | | | | 9.54 | | | | 5.12 | |

| | | | |

| Country Diversification | | | |

| | | % of Total Investments

as of 06/30/15 | |

Japan | | | 18.9 | |

France | | | 14.0 | |

Switzerland | | | 12.0 | |

Netherlands | | | 7.2 | |

Italy | | | 6.5 | |

Britain | | | 6.4 | |

Spain | | | 5.6 | |

Hong Kong | | | 5.1 | |

Germany | | | 4.8 | |

Thailand | | | 2.7 | |

Republic of South Korea | | | 2.5 | |

Sweden | | | 2.4 | |

Singapore | | | 2.1 | |

Denmark | | | 1.5 | |

Australia | | | 1.4 | |

Israel | | | 1.2 | |

Norway | | | 0.7 | |

Short-term and other assets | | | 5.0 | |

Total | | | 100.0% | |

| | | | |

| Top Ten Equity Holdings | | | |

| | | % of Total Investments

as of 06/30/15 | |

Intesa Sanpaolo SpA | | | 3.7 | |

AEGON NV | | | 2.8 | |

WPP Group plc | | | 2.8 | |

Daimler AG REG | | | 2.8 | |

MS & AD Insurance Group Holdings, Inc. | | | 2.6 | |

Compagnie de Saint-Gobain SA | | | 2.6 | |

Mitsui Chemicals, Inc. | | | 2.6 | |

Nissan Motor Co., Ltd. | | | 2.6 | |

Sumitomo Mitsui Trust Holdings, Inc. | | | 2.6 | |

DSM NV | | | 2.4 | |

Total | | | 27.5% | |

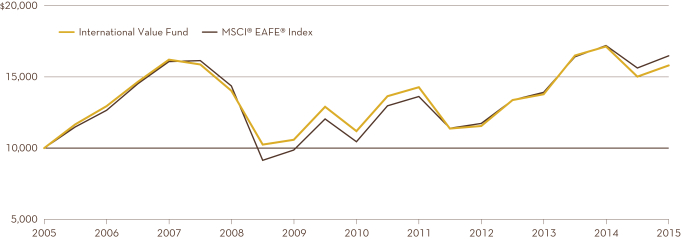

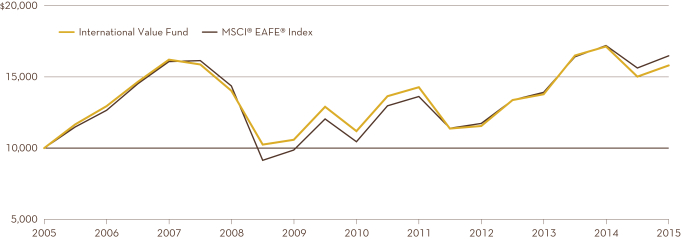

Comparison of the change in value of a $10,000 investment in the fund and the MSCI® EAFE® Index made on June 30, 2005.

The returns quoted in the above table and chart represent past performance, which is no guarantee of future results. Current performance may be higher or lower than that shown above. Returns and the principal value of your investment will fluctuate such that shares, when redeemed, may be worth more or less than their original cost. The International Value Fund’s average annual total returns are net of any fee waivers and reimbursements. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares.

| * | The performance information for the International Value Fund (formerly the International Stock Index Fund) reflects its investment experience in the State Street MSCI® EAFE® Index Portfolio from inception through October 16, 2005, and in the Vanguard Developed Markets Index Fund from October 17, 2005 to June 9, 2006. Mercator Asset Management, L.P.‘s role as subadvisor began June 12, 2006. |

| | | | | | |

| | Performance Evaluation | | | 17 | |

Expense Example

As a shareholder, you incur two types of costs: (1) transaction costs; and (2) ongoing costs, including management fees, service fees, and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in each of the Homestead Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at January 1, 2015 and held through June 30, 2015.

Actual Expenses

The first line for each Fund in the table on the following page provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Individual Retirement Arrangements (IRAs) and Educational Savings Accounts (ESAs) are charged a $15.00 annual custodial fee. The charge is automatically deducted from your account in the fourth quarter of each year or, if you close your account, at the time of redemption. A fee is collected for each IRA or ESA, as distinguished by account type (Traditional IRA, Roth IRA, or ESA) and Social Security Number. For example, if you have both a Traditional IRA and a Roth IRA account, each would be charged a fee. But only one fee would be collected for each account type, regardless of the number of Funds held by each account type. These fees are not included in the example below. If included, the costs shown would be higher.

Hypothetical Example for Comparison Purposes

The second line for each Fund in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect the custodial account fee. Therefore, the hypothetical information in the example is useful in comparing your ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if the custodial account fee was included, your costs would have been higher.

Expense Example (Continued)

| | | | | | | | | | | | | | | | |

| Daily Income Fund | | Beginning

Account Value

January 1, 2015 | | | Ending

Account Value

June 30, 2015 | | | Expenses Paid

During the Perioda | | | Annualized Expense

Ratio for the

Six Month Period

Ended June 30, 2015 | |

Actual Return | | $ | 1,000.00 | | | $ | 1,000.05 | | | $ | 0.56 | | | | 0.11% | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,024.48 | | | $ | 0.57 | | | | 0.11% | |

| | |

| Short-Term Government Securities Fund | | | | | | | | |

Actual Return | | $ | 1,000.00 | | | $ | 1,006.82 | | | $ | 3.61 | | | | 0.73% | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.39 | | | $ | 3.64 | | | | 0.73% | |

| | |

| Short-Term Bond Fund | | | | | | | | |

Actual Return | | $ | 1,000.00 | | | $ | 1,003.20 | | | $ | 3.68 | | | | 0.74% | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.31 | | | $ | 3.71 | | | | 0.74% | |

| | |

| Stock Index Fundb | | | | | | | | |

Actual Return | | $ | 1,000.00 | | | $ | 1,011.66 | | | $ | 2.87 | | | | 0.57% | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,022.15 | | | $ | 2.88 | | | | 0.57% | |

| | |

| Value Fund | | | | | | | | |

Actual Return | | $ | 1,000.00 | | | $ | 1,001.40 | | | $ | 2.99 | | | | 0.60% | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,022.00 | | | $ | 3.02 | | | | 0.60% | |

| | |

| Growth Fund | | | | | | | | |

Actual Return | | $ | 1,000.00 | | | $ | 1,061.42 | | | $ | 4.75 | | | | 0.93% | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.36 | | | $ | 4.65 | | | | 0.93% | |

| | |

| Small-Company Stock Fund | | | | | | | | |

Actual Return | | $ | 1,000.00 | | | $ | 1,037.88 | | | $ | 4.38 | | | | 0.87% | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.67 | | | $ | 4.34 | | | | 0.87% | |

| | |

| International Value Fund | | | | | | | | |

Actual Return | | $ | 1,000.00 | | | $ | 1,054.60 | | | $ | 4.96 | | | | 0.97% | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.13 | | | $ | 4.88 | | | | 0.97% | |

| a. | The dollar amounts shown as “Expenses Paid During the Period” are equal to each Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 181, then divided by 365. |

| b. | The Stock Index Fund is a feeder fund that invests substantially all of its assets in a Master Portfolio. The example reflects the expenses of both the feeder fund and the Master Portfolio. |

Regulatory and Shareholder Matters

Proxy Voting Policies and Procedures

The policies and procedures used to determine how to vote proxies relating to the Funds’ portfolio securities are available online at homesteadfunds.com and, without charge, upon request by calling 800-258-3030. This information is also available on the Securities and Exchange Commission’s website at sec.gov.

Proxy Voting Record

For the most recent twelve-month period ended June 30, information regarding how proxies relating to portfolio securities were voted on behalf of each of the Funds is available, without charge, upon request by calling 800-258-3030 and on the Securities and Exchange Commission’s website at sec.gov.

Quarterly Disclosure of Portfolio Holdings

The Funds file complete schedules of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. Portfolio holdings for the second and fourth quarters of each fiscal year are filed as part of the Funds’ semi-annual and annual reports. The Funds’ Form N-Q, semi-annual and annual reports are available on the Commission’s website at sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330. The most recent quarterly portfolio holdings and semi-annual and annual report also can be accessed on the Funds’ website at homesteadfunds.com.

| | | | |

| 20 | | Regulatory and Shareholder Matters | | |

Portfolio of Investments

Daily Income Fund | June 30, 2015 | (Unaudited)

| | | | | | | | | | | | | | |

Corporate Bonds | 7.0% of portfolio | | | | | | | | | | | | | | |

| | | | |

| | | Interest Rate | | | Maturity Date | | Face Amount | | | Value | |

PACCAR Financial Corp. | | | 0.75 | % | | 08/14/15 | | $ | 3,500,000 | | | $ | 3,502,229 | |

Toyota Motor Credit Corp. | | | 0.88 | | | 07/17/15 | | | 1,400,000 | | | | 1,400,445 | |

Wal-Mart Stores, Inc. | | | 2.25 | | | 07/08/15 | | | 508,000 | | | | 508,205 | |

Wal-Mart Stores, Inc. | | | 1.50 | | | 10/25/15 | | | 2,000,000 | | | | 2,008,003 | |

Wells Fargo & Co. | | | 1.50 | | | 07/01/15 | | | 5,526,000 | | | | 5,526,000 | |

Total Corporate Bonds (Cost $12,944,882) | | | | | | | | | | | | | 12,944,882 | |

Commercial Paper | 62.7% of portfolio | | | | | | | | | | | | | | |

Abbott Laboratories (a) | | | 0.12 | | | 07/20/15 | | | 3,100,000 | | | | 3,099,804 | |

Abbott Laboratories (a) | | | 0.15 | | | 07/27/15 | | | 420,000 | | | | 419,955 | |

Air Liquide US LLC (a) | | | 0.15 | | | 07/17/15 | | | 2,200,000 | | | | 2,199,853 | |

Air Liquide US LLC (a) | | | 0.16 | | | 07/23/15 | | | 5,000,000 | | | | 4,999,511 | |

Air Products & Chemicals Inc. (a) | | | 0.11 | | | 07/02/15 | | | 1,000,000 | | | | 999,997 | |

Air Products & Chemicals Inc. (a) | | | 0.11 | | | 07/31/15 | | | 3,000,000 | | | | 2,999,725 | |

American Honda Finance Corp. | | | 0.12 | | | 07/06/15 | | | 3,000,000 | | | | 2,999,950 | |

American Honda Finance Corp. | | | 0.12 | | | 07/07/15 | | | 3,000,000 | | | | 2,999,940 | |

American Honda Finance Corp. | | | 0.11 | | | 08/07/15 | | | 2,000,000 | | | | 1,999,774 | |

Apple, Inc. (a) | | | 0.09 | | | 08/18/15 | | | 5,000,000 | | | | 4,999,400 | |

BMW US Capital LLC (a) | | | 0.12 | | | 07/27/15 | | | 2,150,000 | | | | 2,149,814 | |

BMW US Capital LLC (a) | | | 0.12 | | | 08/05/15 | | | 3,500,000 | | | | 3,499,592 | |

BMW US Capital LLC (a) | | | 0.12 | | | 08/11/15 | | | 2,000,000 | | | | 1,999,727 | |

Chevron Corp. (a) | | | 0.10 | | | 07/13/15 | | | 2,000,000 | | | | 1,999,933 | |

Chevron Corp. (a) | | | 0.12 | | | 09/21/15 | | | 2,000,000 | | | | 1,999,453 | |

Chevron Corp. (a) | | | 0.12 | | | 09/25/15 | | | 4,000,000 | | | | 3,998,853 | |

Coca-Cola Co. (a) | | | 0.10 | | | 07/29/15 | | | 1,000,000 | | | | 999,922 | |

Coca-Cola Co. (a) | | | 0.10 | | | 08/11/15 | | | 1,000,000 | | | | 999,886 | |

Coca-Cola Co. (a) | | | 0.13 | | | 08/28/15 | | | 1,000,000 | | | | 999,791 | |

Conocophillips Qatar Funding Ltd. (a) | | | 0.12 | | | 08/21/15 | | | 2,000,000 | | | | 1,999,660 | |

Conocophillips Qatar Funding Ltd. (a) | | | 0.14 | | | 09/14/15 | | | 1,500,000 | | | | 1,499,562 | |

Conocophillips Qatar Funding Ltd. (a) | | | 0.14 | | | 09/22/15 | | | 2,000,000 | | | | 1,999,354 | |

Emerson Electric Co. (a) | | | 0.12 | | | 08/19/15 | | | 2,000,000 | | | | 1,999,673 | |

Emerson Electric Co. (a) | | | 0.12 | | | 08/20/15 | | | 2,000,000 | | | | 1,999,667 | |

Emerson Electric Co. (a) | | | 0.12 | | | 09/09/15 | | | 3,000,000 | | | | 2,999,300 | |

Essilor International SA (a) | | | 0.12 | | | 07/16/15 | | | 2,000,000 | | | | 1,999,900 | |

Essilor International SA (a) | | | 0.10 | | | 07/24/15 | | | 2,000,000 | | | | 1,999,872 | |

Essilor International SA (a) | | | 0.16 | | | 08/04/15 | | | 2,000,000 | | | | 1,999,698 | |

Essilor International SA (a) | | | 0.15 | | | 08/07/15 | | | 2,750,000 | | | | 2,749,576 | |

Exxon Mobil Corp. | | | 0.11 | | | 08/03/15 | | | 5,000,000 | | | | 4,999,496 | |

General Electric Capital Corp. | | | 0.12 | | | 08/10/15 | | | 3,000,000 | | | | 2,999,600 | |

General Electric Capital Corp. | | | 0.15 | | | 09/08/15 | | | 3,000,000 | | | | 2,999,138 | |

Honeywell International (a) | | | 0.14 | | | 08/27/15 | | | 750,000 | | | | 749,834 | |

Honeywell International (a) | | | 0.15 | | | 09/01/15 | | | 874,000 | | | | 873,774 | |

Honeywell International (a) | | | 0.21 | | | 09/24/15 | | | 1,000,000 | | | | 999,504 | |

Honeywell International (a) | | | 0.20 | | | 10/05/15 | | | 2,000,000 | | | | 1,998,933 | |

John Deere Bank SA (a) | | | 0.10 | | | 07/07/15 | | | 4,000,000 | | | | 3,999,933 | |

Nestle Capital Corp. (a) | | | 0.11 | | | 07/09/15 | | | 3,500,000 | | | | 3,499,915 | |

Nestle Capital Corp. (a) | | | 0.11 | | | 09/23/15 | | | 4,000,000 | | | | 3,998,973 | |

PACCAR Financial Corp. | | | 0.14 | | | 07/27/15 | | | 2,500,000 | | | | 2,499,747 | |

Siemans Capital Co. LLC (a) | | | 0.18 | | | 09/25/15 | | | 2,500,000 | | | | 2,498,925 | |

Toyota Motor Credit Corp. | | | 0.10 | | | 07/10/15 | | | 5,000,000 | | | | 4,999,875 | |

Toyota Motor Credit Corp. | | | 0.11 | | | 07/22/15 | | | 2,275,000 | | | | 2,274,854 | |

United Technologies Corp. (a) | | | 0.12 | | | 07/31/15 | | | 4,200,000 | | | | 4,199,580 | |

Walt Disney Co. (The) (a) | | | 0.10 | | | 07/15/15 | | | 1,500,000 | | | | 1,499,942 | |

Walt Disney Co. (The) (a) | | | 0.11 | | | 09/24/15 | | | 4,100,000 | | | | 4,098,935 | |

Total Commercial Paper (Cost $116,802,100) | | | | | | | | | | | | | 116,802,100 | |

| | | | | | |

| The accompanying notes are an integral part of these financial statements. | | Portfolio of Investments | | | 21 | |

Portfolio of Investments | Daily Income Fund | June 30, 2015 | (Unaudited) (Continued)

| | | | | | | | | | | | | | |

| U.S. Government Obligations | 20.5% of portfolio | | | | | | | | | | | |

| | | | |

| | | Interest Rate | | | Maturity Date | | Face Amount | | | Value | |

U.S. Treasury Note | | | 0.25 | % | | 07/15/15 | | $ | 4,000,000 | | | $ | 4,000,282 | |

U.S. Treasury Note | | | 4.25 | | | 08/15/15 | | | 2,000,000 | | | | 2,010,409 | |

U.S. Treasury Note | | | 1.25 | | | 08/31/15 | | | 3,000,000 | | | | 3,005,813 | |

U.S. Treasury Note | | | 0.25 | | | 09/15/15 | | | 2,000,000 | | | | 2,000,943 | |

U.S. Treasury Note | | | 1.25 | | | 09/30/15 | | | 3,000,000 | | | | 3,008,602 | |

U.S. Treasury Note | | | 0.25 | | | 09/30/15 | | | 2,000,000 | | | | 2,001,023 | |

U.S. Treasury Note | | | 0.25 | | | 10/15/15 | | | 5,000,000 | | | | 5,002,706 | |

U.S. Treasury Note | | | 1.25 | | | 10/31/15 | | | 4,000,000 | | | | 4,014,431 | |

U.S. Treasury Note | | | 4.50 | | | 11/15/15 | | | 6,000,000 | | | | 6,098,264 | |

U.S. Treasury Note | | | 1.38 | | | 11/30/15 | | | 4,000,000 | | | | 4,021,271 | |

U.S. Treasury Note | | | 0.25 | | | 12/15/15 | | | 3,000,000 | | | | 3,002,679 | |

Total U.S. Government Obligations (Cost $38,166,423) | | | | | | | | | | | | | 38,166,423 | |

Money Market Fund | 9.8% of portfolio | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | Shares | | | | |

State Street Institutional Liquid Reserves Fund (Premier Class) | | | 0.11 | (b) | | | | | 18,276,690 | | | | 18,276,690 | |

Total Money Market Fund (Cost $18,276,690) | | | | | | | | | | | | | 18,276,690 | |

| | | | | |

Total Investments in Securities (Cost $186,190,095) | 100% | | | | | | | | | | | | $ | 186,190,095 | |

| (a) | Security was purchased pursuant to Rule 144A under the Securities Act of 1933 and may be resold in transactions exempt from registration normally to qualified institutional buyers. The security has been determined to be liquid under criteria established by the Fund’s Board of Directors. The total of such securities at period-end amounts to $88,029,726 and represents 47.3% of total investments. |

| (b) | 7-day yield at June 30, 2015. |

| LLC | – Limited Liability Company |

| | | | |

| 22 | | Portfolio of Investments | | The accompanying notes are an integral part of these financial statements. |

Portfolio of Investments

Short-Term Government Securities Fund | June 30, 2015 | (Unaudited)

| | | | | | | | | | | | | | |

Corporate Bonds | 21.0% of portfolio | | | | | | | | | | |

| | | | |

| | | Interest Rate | | | Maturity Date | | Face Amount | | | Value | |

Ally Bank | | | 0.95 | % | | 09/25/15 | | $ | 250,000 | | | $ | 250,392 | |

Altitude Investments 17 LLC | | | 2.68 | | | 11/08/25 | | | 888,672 | | | | 874,951 | |

American Express Bank FSB | | | 1.55 | | | 10/23/17 | | | 250,000 | | | | 250,394 | |

American Express Centurion Bank | | | 1.45 | | | 06/04/18 | | | 250,000 | | | | 248,287 | |

Banco Bilbao Vizcaya Argentaria Puerto Rico | | | 1.50 | | | 04/20/17 | | | 150,000 | | | | 150,078 | |

Capital One Bank USA NA | | | 1.65 | | | 07/09/18 | | | 250,000 | | | | 249,853 | |

Comenity Capital Bank | | | 0.75 | | | 02/25/16 | | | 250,000 | | | | 250,513 | |

Discover Bank | | | 1.05 | | | 09/26/16 | | | 250,000 | | | | 250,068 | |

Ethiopian Leasing (2012) LLC | | | 2.68 | | | 07/30/25 | | | 176,445 | | | | 180,147 | |

FirstBank Puerto Rico | | | 0.70 | | | 11/30/15 | | | 250,000 | | | | 250,368 | |

GE Capital Bank | | | 1.50 | | | 10/17/17 | | | 250,000 | | | | 250,811 | |

Goldman Sachs Bank USA | | | 1.00 | | | 01/30/17 | | | 200,000 | | | | 200,640 | |

Lulwa Ltd. | | | 1.83 | | | 03/26/25 | | | 829,059 | | | | 813,481 | |

Mexican Aircraft Finance IV | | | 2.54 | | | 07/13/25 | | | 436,404 | | | | 442,640 | |

Mexican Aircraft Finance V | | | 2.33 | | | 01/14/27 | | | 489,583 | | | | 488,805 | |

Micron Semiconductor Asia PTE LTD | | | 1.26 | | | 01/15/19 | | | 2,796,800 | | | | 2,797,575 | |