UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File number: 811-06136

HOMESTEAD FUNDS, INC.

(Exact name of registrant as specified in charter)

4301 Wilson Boulevard

Arlington, VA 22203

(Address of principal executive office – Zip code)

Danielle Sieverling

Homestead Funds, Inc.

4301 Wilson Boulevard

Arlington, VA 22203

(Name and address of agent for service)

Copies to:

Bryan Chegwidden, Esq.

Ropes & Gray, LLP

1211 Avenue of the Americas

New York, NY 10036-8704

(Name and addresses of agent for service)

Registrant’s telephone number, including area code: (703) 907-5993

Date of fiscal year end: December 31

Date of reporting period: June 30, 2017

| Item 1. | Reports to Stockholders. |

Semi-Annual Report

June 30, 2017

Our Funds

Daily Income Fund (HDIXX)

Short-Term Government Securities Fund (HOSGX)

Short-Term Bond Fund (HOSBX)

Stock Index Fund (HSTIX)

Value Fund (HOVLX)

Growth Fund (HNASX)

Small-Company Stock Fund (HSCSX)

International Equity Fund (HISIX)

Table of Contents

The investment commentaries on the following pages were prepared for each fund by its portfolio manager(s). The views expressed are those of the portfolio manager(s) on July 17, 2017, for each fund as of June 30, 2017. Since that date, those views might have changed. The opinions stated might contain forward-looking statements and discuss the impact of domestic and foreign markets, industry and economic trend and governmental regulations on the funds and their holdings. Such statements are subject to uncertainty, and the impact on the funds might be materially different from what is described here.

Past performance does not guarantee future results.

Investors are advised to consider fund objectives, risks, charges and expenses before investing. The prospectus contains this and other information and should be read carefully before you invest. To obtain a prospectus, call 800.258.3030 or download a PDF at homesteadfunds.com.

President’s Letter

2017 Semi-Annual Report

July 17, 2017

Dear Shareholders:

Stock markets continued their upward trajectory in the first half of the year, building on an eight-year trend line. The S&P 500 and Dow Jones Industrial Average stock indexes touched new highs in late June before pulling back slightly. Shares rallied on strong earnings reports and seemed unfazed by increasing political uncertainty, which further clouded the outlook for tax reform and other pro-growth initiatives.

The first half of the year also brought continued signs of improving economic activity in the U.S. and abroad, including further declines in the unemployment rate and slow but steady increases in gross domestic product (GDP). The Federal Reserve remained on a course to gradually bring interest rates back to normal levels and raised its target for overnight deposits in March and again in June. Short-term interest rates rose in line with the federal funds rate, but longer-term interest rates softened as growth and inflation outlooks moderated.

As you’ll read in the letters that follow, our portfolio managers currently view equity valuations as somewhat stretched relative to historical averages, and this could reign in stocks’ ability to make significant further progress in the second half of the year. Another caution flag and theme reinforced in our portfolio managers’ commentary is implementation risk. The prospect of easing regulatory burdens, lower tax rates and other pro-business changes have been helping to propel the market forward, but the administration has so far struggled to make good on its plans. With stocks currently trading at what we believe to be premium prices, we expect the equity markets will need to see continued earnings and revenue growth and some progress in the pro-growth policy initiatives championed by the administration in order to move substantially higher in the second half of 2017.

Investing is a long-term proposition. If you have a balanced portfolio crafted for your risk tolerance and time horizon, we believe you shouldn’t be overly concerned about short-term volatility. But sometimes emotions cloud the long-term view. If this happens, remember that our on-staff financial planners are available to listen and offer guidance.

We appreciate your continued trust and investment. Please read ahead for more on our portfolio managers’ strategies and the impact of their decisions on fund performance.

Sincerely,

Stephen J. Kaszynski

Director, President and CEO

Homestead Funds

Stephen Kaszynski, CFA

Director, President and CEO

Daily Income Fund

Performance Evaluation | Prepared by the Fund’s Investment Advisor, RE Advisers Corporation

Performance

The Daily Income Fund earned an annualized return of 0.04 percent for the first half of 2017. The seven-day current annualized yield was 0.18 percent on June 30, 2017, considerably above the 0.01 percent on December 31, 2016. Interest income for the fund is netted against operating expenses. With the Federal Reserve raising the federal funds rate band to between 1.00 percent and 1.25 percent in June 2017, the Daily Income Fund was able to earn enough interest income (which is the only component of return in a money market fund) to cover all of its expenses and provide income to its shareholders without relying on RE Advisers’ voluntary fee waiver to assist the fund in maintaining a positive yield.

Market Conditions

The U.S. economy continued to improve in 2017 as the year progressed. After an unexpectedly soft 1.2 percent rise in gross domestic product (GDP) in the first quarter of 2017, the general consensus among economists is for GDP to rise at an annual rate of approximately 2.5 percent in the second quarter of 2017. In addition, despite changes to the political landscape, Fed forecasts still indicate only a relatively modest 2.2 percent gain in GDP for all of 2017.

Although the Fed’s analysis of the data suggests moderate overall economic expansion since the beginning of the year, specific issues remain. On the positive side, household spending has picked up in recent months and business fixed investment continued to improve. Several labor market measurements during the first half of 2017 continued to show sustained improvement: initial jobless claims fell below 275,000, continuing claims dropped to less than 2.1 million and the unemployment rate declined to under 4.5 percent. However, wage gains were relatively tepid at approximately 2.5 percent, with much of this caused by almost nonexistent growth in labor productivity. In our view, an improvement in productivity will be essential to economic growth in general, and wage gains in particular. On a 12-month basis, inflation (even excluding food and energy prices) has declined and is expected to remain below the Federal Open Market Committee’s (FOMC, the Fed’s policy-making body) objective of 2 percent in the near term but stabilize around that 2 percent objective in the medium term.

| | |

| Investment Advisor: RE Advisers |

| |

| | Marc Johnston, CFP, ChFC, CAIA Money Market Portfolio Manager BA, General Arts, Villanova University; MBA, Northeastern University |

| |

| | |

Outlook

The FOMC raised its target for the federal funds rate to between 1.00 percent and 1.25 percent in June 2017, but investors are unsure of the timing and magnitude of future rate hikes given the new political and economic environment. Forecasts by the Fed after the rate hike in December 2016 for the number of increases in 2017 indicated four hikes. However, this was before the Fed unexpectedly announced in June how it plans to unwind its $4.5 trillion balance sheet and the proposed start date of this reduction process. These details have slightly altered the market’s expectation for the FOMC’s future actions. Now, markets expect the third and last rate hike in this tightening cycle to occur in December, bringing the federal funds rate to between 1.25 percent and 1.5 percent.

As we have said in the past, only time will tell how many rate hikes the economy and markets will support. Assuming moderate growth in the U.S. economy, continued improvement in labor markets, stability in financial markets and a steepening (as opposed to flattening) yield curve, we believe that we are most likely to see a continued normalization of interest rates in 2017 and 2018. However, with the FOMC being the very cautious decision maker that it is, we expect that the timing and size of interest rate increases and the portfolio unwinding process will remain very much dependent upon the data and the stability of the situation at the time.

The timing of this continued interest rate normalization process notwithstanding, investors in money market funds such as the Daily Income Fund are finally beginning to see income on their investment as the Fed has allowed short-term rates to rise to higher levels.

Daily Income Fund

| | | | | | | | | | | | |

| Average Annual Total Returns (periods ended 06/30/17) | | | | | | | | | |

| | | |

| | | 1 YR % | | | 5 YR % | | | 10 YR % | |

Daily Income Fund | | | 0.02 | | | | 0.01 | | | | 0.48 | |

| | | | | | | | | | | | | | | | |

| Yield | | | | | | | | | | | | |

Annualized 7-day current yield quoted 06/30/17 | | | | | | | | | | | | | | | 0.18% | |

| | | | | | | | |

| Security Diversification | | | | | | |

| |

| | | % of Total Investments | |

| | | as of 12/31/16 | | | as of 06/30/17 | |

U.S. government agencies | | | 59.1 | | | | 60.9 | |

U.S. Treasuries | | | 22.7 | | | | 24.7 | |

Short-term and other assets | | | 18.2 | | | | 14.4 | |

Total | | | 100.0% | | | | 100.0% | |

| | | | | | | | |

| Maturity | | | | | | |

| | |

| | | as of 12/31/16 | | | as of 06/30/17 | |

Average Weighted Maturity | | | 43 days | | | | 45 days | |

The returns quoted in the above table represent past performance, which is no guarantee of future results. Current performance may be higher or lower than that shown above. To obtain the most recent month-end returns please call 800-258-3030 or visit homesteadfunds.com. Returns and the principal value of your investment will fluctuate such that shares, when redeemed, may be worth more or less than their original cost. You could lose money by investing in the Daily Income Fund. Although the fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. An investment in the Daily Income Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The fund’s sponsor has no legal obligation to provide financial support to the fund, and you should not expect that the sponsor will provide financial support to the fund at any time.

The Daily Income Fund’s average annual total returns are net of any fee waivers and reimbursements. The fund’s advisor waived a portion of its management fee and/or reimbursed fund expenses during the periods shown. Had the advisor not done so, the fund’s total returns would have been lower. The expenses used are as of the most recent period-end and may fluctuate over time. Returns include the reinvestment of dividends. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares.

Short-Term Government Securities Fund

Performance Evaluation | Prepared by the Funds’ Investment Advisor, RE Advisers Corporation

Performance

The Short-Term Government Securities Fund returned 0.73 percent for the first half of 2017, closely tracking its benchmark index, the BofA Merrill Lynch 1-5 Year U.S. Treasury Index, which returned 0.75 percent.

The fund maintained and benefited from overall lower interest rate exposure relative to the benchmark throughout the period. Additionally, the fund’s allocation to out-of-benchmark issuers in the corporate sector through issuers guaranteed by the Export-Import Bank of the U.S., and FDIC guaranteed certificates of deposit, contributed positively during the period.

The fund added holdings in short-term amortizing asset-backed securities and the corporate sector through high-quality issuers with a preference for floating rate securities. We believe that floating rate securities provide a natural hedge in the current rising interest rate environment.

Market Conditions

The Federal Open Market Committee (FOMC), the Federal Reserve’s policy-making committee, continued the gradual pace of rate increases, delivering two rate hikes during the reporting period. The labor market has continued to strengthen with the unemployment rate improving to 4.4 percent at the end of June from 4.7 percent at the end of 2016. Economic activity, as measured by real gross domestic product (GDP), continued to grow modestly at about 2 percent during the reporting period. Household spending has picked up, and business fixed investment continued to expand on the back of continued optimism for new fiscal policies from the Trump administration. However, monetary policy has also remained accommodative since inflation remained somewhat below the Fed’s long-term goal of 2 percent. The latest reading on core personal consumption expenditures (PCE) stood at 1.39 percent at the end of May 2017, down from 1.74 percent at the end of 2016. The FOMC expects inflation to stabilize around its 2 percent objective over the medium term.

The FOMC announced during the June meeting that it expects to begin a process for drawing down its balance sheet this year, following years of bond buying to support the weak economy. The FOMC plans to normalize its balance sheet by trimming reinvestments in Treasuries at a rate of $6 billion per month initially and mortgage-backed securities at $4 billion per month. That combined $10 billion monthly cap would be increased in increments of $10 billion at three-month intervals over 12 months until it reaches a total of $50 billion per month. By reducing holdings in a gradual and predictable manner, the Fed seeks to avoid potential market disruption.

During the first quarter of 2017, risk assets continued to rally after Donald Trump’s inauguration on January 20. The new administration took steps to roll back rules and laws implemented during President Obama’s tenure with a goal of increasing economic activity. This included a push to repeal the Dodd-Frank Act and approval of the Keystone XL pipeline. However, controversy surrounding the election and Russia’s potential involvement have distracted and slowed the pace in which the new administration has been able to agree on tax reform, new trade policies and infrastructure spending to drive higher growth.

Outlook

The economy remains on solid footing and we believe it should continue to expand at a moderate pace. Measures of business and consumer confidence remain near highs during this economic cycle. The Fed’s outlook for the labor market has been positive, and we expect further gains in the near term. Wage growth remains stuck in the mid-2-percent area as of June 2017, much less than the 3 percent expansion of the 2000s. According to its June 2017 statement, the FOMC expects that economic conditions will evolve in a manner that will warrant gradual increases in the federal funds rate but confirmed that policy decisions will ultimately depend on the economic outlook as informed by incoming data.

On the fiscal side, we expect that President Trump’s administration will be able to deliver on some of its policy reforms and that this will eventually help drive growth above 2 percent. Nevertheless, in our view, there are also downside risks associated with any significant distractions stemming from the Russia investigation. We continue to maintain the fund’s duration below the benchmark’s, as we believe interest rates remain too low and the economy continues to perform at a stable pace.

Short-Term Government Securities Fund

| | | | | | | | | | | | |

| Average Annual Total Returns (periods ended 06/30/17) | | | | | | | | | |

| | | |

| | | 1 YR % | | | 5 YR % | | | 10 YR % | |

Short-Term Government Securities Fund | | | –0.35 | | | | 0.58 | | | | 1.95 | |

BofA Merrill Lynch 1-5 Year U.S. Treasury Index | | | –0.53 | | | | 0.87 | | | | 2.65 | |

| | | | | | | | |

| Security Diversification | | | | | | |

| |

| | | % of Total Investments | |

| | | as of 12/31/16 | | | as of 06/30/17 | |

Corporate bonds-government guaranteed* | | | 32.4 | | | | 30.0 | |

U.S. government agencies | | | 35.8 | | | | 29.5 | |

U.S. Treasuries | | | 19.8 | | | | 19.0 | |

Corporate bonds-other* | | | 0.7 | | | | 6.9 | |

Certificates of deposit* | | | 4.9 | | | | 4.3 | |

Mortgage-backed securities | | | 3.9 | | | | 3.4 | |

Asset-backed securities | | | 1.1 | | | | 3.0 | |

Municipal bonds | | | — | | | | 0.3 | |

Short-term and other assets | | | 1.4 | | | | 3.6 | |

Total | | | 100.0% | | | | 100.0% | |

| * | Labeled as corporate bonds in prior reports. |

| | | | | | | | |

| Maturity | | | | | | |

| | |

| | | as of 12/31/16 | | | as of 06/30/17 | |

Average Weighted Maturity | | | 2.23 | | | | 1.96 | |

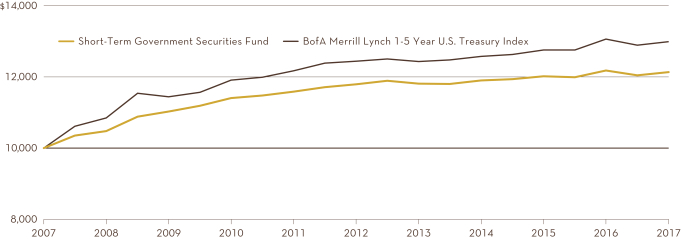

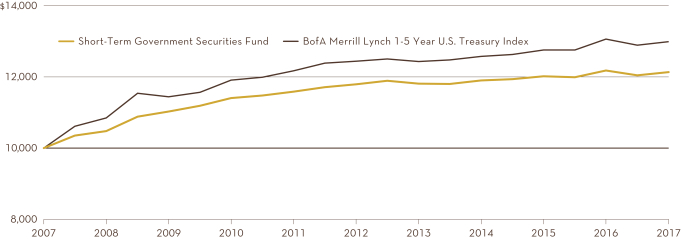

Comparison of the change in value of a $10,000 investment in the fund and the BofA Merrill Lynch 1-5 Year U.S. Treasury Index made on June 30, 2007.

The returns quoted in the above table and chart represent past performance, which is no guarantee of future results. Current performance may be higher or lower than that shown above. To obtain the most recent month-end returns please call 800-258-3030 or visit homesteadfunds.com. Returns and the principal value of your investment will fluctuate such that shares, when redeemed, may be worth more or less than their original cost. The Short-Term Government Security Fund’s average annual total returns are net of any fee waivers and reimbursements. The fund’s advisor waived a portion of its management fee during the periods shown. Had the advisor not done so, the fund’s total returns would have been lower. The expenses used are as of the most recent period-end and may fluctuate over time. Returns include the reinvestment of dividends and capital gains. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares.

Short-Term Bond Fund

Performance Evaluation | Prepared by the Funds’ Investment Advisor, RE Advisers Corporation

Performance

For the first half of 2017, the Short-Term Bond Fund had a total return of 1.20 percent, exceeding its benchmark, the BofA Merrill Lynch 1-5 Year Corporate/Government Index, which returned 1.11 percent. The primary contributor of the fund’s outperformance was its substantial credit exposure relative to the benchmark.

All of the sectors comprising the fund’s portfolio had positive returns during the first half of 2017 with the asset-backed sector in particular generating very strong returns. The weakest sector was municipals, primarily a result of the noticeable decline in market value of the fund’s two positions in the Puerto Rico Sales Tax Financing Corp., a credit that has become embroiled in the Title III filing by the Commonwealth of Puerto Rico on May 3, 2017, after creditor negotiations failed.

Positions were added in all sectors except mortgages, with a special focus in the asset-backed sector using automobile and personal loan senior structures. The fund added to its holdings of municipals, utilizing both insured and corporate-backed issues, and high-quality finance names with a particular bias toward insurance-company guaranteed investment contracts. Positions in short-term U.S. Treasury securities were liquidated and proceeds were reinvested in higher-yielding commercial paper.

Market Conditions

The November 2016 presidential election of Donald Trump sparked a surge in bond yields as growth and inflationary expectations soared, but the market started 2017 with relative calm as the news was more fully digested. While Federal Reserve rhetoric suggested the possibility of four rate hikes in 2017, the market never bought the argument until late February when multiple Fed officials convinced investors that the March Federal Open Market Committee (FOMC) meeting was a “live” meeting that could indeed result in a rate hike. Yields rose in anticipation of the meeting, but then gradually trended lower as the quarter rolled on. Commodity weakness, softer economic numbers and a lack of wage pressures convinced the market that the Fed’s peak target for short-term interest rates would fall short of its own projections, resulting in a general flattening of the yield curve. Late in the quarter, however, yields started to ratchet higher as Fed rhetoric not only remained “hawkish” but also was joined by the European Central Bank (ECB) in late June when ECB President Mario Draghi hinted the ECB might start winding down its stimulus in response to accelerating growth in Europe.

Credit performed well in the first half of 2017, as a combination of generally positive earnings news, still low interest rates and massive investor demand essentially put a floor under the market. For the first half of the year, the Barclays Investment Grade Credit Index narrowed by 15 basis points, ending the month of June at the tightest credit spreads of the year.

The U.S. economy’s gross domestic product (GDP) increased 2.1 percent for the year ended March 31, 2017. In spite of still modest economic growth, labor markets continued to improve. The June unemployment rate fell to 4.4 percent from 4.7 percent in December, and an average of 180,000 non-farm payrolls were added monthly. Yet wages rose by only 2.5 percent in the year ended June 30, 2017, down from 2.6 percent one year earlier. While the headline Consumer Price Index (CPI) rose at an annual rate of 1.6 percent for the year ended June 30, 2017, as compared with 1 percent for the year earlier, the Fed’s preferred inflation measure, the PCE Core Price Index, rose 1.39 percent for the year ended May 31, 2017, down from 1.64 percent 12 months earlier. Manufacturing remained firm, with the ISM Manufacturing Purchasing Managers Index averaging 56.4 for the first six months of 2017 as compared with 51.5 for the second half of 2016. Industrial production rose 2 percent in the year ended June 30, 2017, bouncing back from the prior year’s 0.8 percent decline.

Outlook

As of this writing, bond yields are once again dipping on somewhat softer economic data—the June CPI and retail sales reports—less than 48 hours after Fed Chair Janet Yellen delivered a “dovish” Humphrey-Hawkins testimony to Congress, and Fed funds futures are suggesting no further rate hikes in 2017. One could argue there is sufficient bad news to support that view: crude oil has not been able to sustain a rally; wages have been stagnant; and Washington has not been able to deliver on promises to pass a health care reform bill, lower taxes, or boost infrastructure spending. In our opinion, this leaves little margin for error should Washington surprise on the upside. Also as of this writing, the S&P 500 is hitting an all-time high, perhaps not just because the probability of rising interest rates has abated for now, but also because better growth is seen down the road.

Our view remains that the Fed’s tightening cycle will continue in a somewhat methodical fashion. With bonds leaving little room for positive economic data, we believe it remains prudent to keep the fund’s duration short relative to the benchmark.

Short-Term Bond Fund

| | | | | | | | | | | | |

| Average Annual Total Returns (periods ended 06/30/17) | | | | | | | | | |

| | | |

| | | 1 YR % | | | 5 YR % | | | 10 YR % | |

Short-Term Bond Fund | | | 1.21 | | | | 1.78 | | | | 3.32 | |

BofA Merrill Lynch 1-5 Year Corp./Gov. Index | | | 0.13 | | | | 1.37 | | | | 3.00 | |

| | | | | | | | |

| Security Diversification | | | | | | |

| |

| | | % of Total Investments | |

| | | as of 12/31/16 | | | as of 06/30/17 | |

Corporate bonds | | | 33.4 | | | | 31.4 | |

Municipal bonds | | | 20.3 | | | | 22.0 | |

Asset-backed securities | | | 22.6 | | | | 20.5 | |

Yankee bonds | | | 13.3 | | | | 12.2 | |

U.S. government obligations | | | 5.5 | | | | 2.7 | |

Mortgage-backed securities | | | 2.6 | | | | 2.2 | |

Certificates of deposit* | | | 0.5 | | | | 0.5 | |

Short-term and other assets | | | 1.8 | | | | 8.5 | |

Total | | | 100.0% | | | | 100.0% | |

| * | Labeled as corporate bonds in prior reports. |

| | | | | | | | |

| Maturity | | | | | | |

| | |

| | | as of 12/31/16 | | | as of 06/30/17 | |

Average Weighted Maturity | | | 1.94 | | | | 1.79 | |

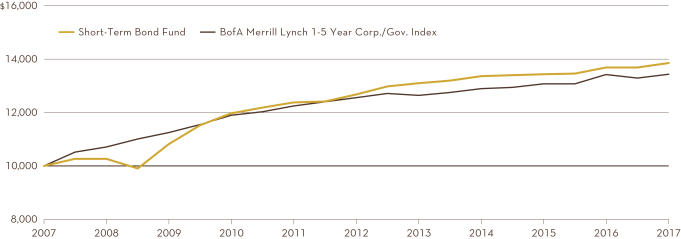

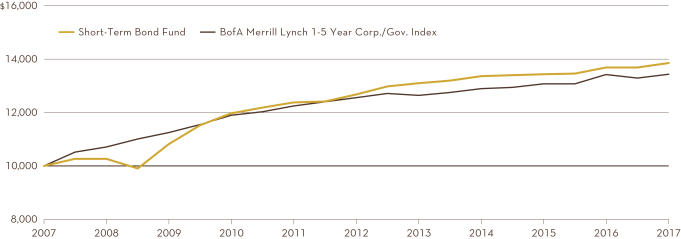

Comparison of the change in value of a $10,000 investment in the fund and the BofA Merrill Lynch 1-5 Year Corp./Gov. Index made on June 30, 2007.

The returns quoted in the above table and chart represent past performance, which is no guarantee of future results. Current performance may be higher or lower than that shown above. To obtain the most recent month-end returns please call 800-258-3030 or visit homesteadfunds.com. Returns and the principal value of your investment will fluctuate such that shares, when redeemed, may be worth more or less than their original cost. The Short-Term Bond Fund’s average annual total returns are net of any fee waivers and reimbursements. The expenses used are as of the most recent period-end and may fluctuate over time. Returns include the reinvestment of dividends and capital gains. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares.

Stock Index Fund

Performance Evaluation | Prepared by the Master Portfolio’s Investment Advisor, BlackRock Fund Advisors

Performance

For the six months ended June 30, 2017, the U.S. large-cap market metric and the fund’s benchmark, the S&P 500 Stock Index, gained 9.34 percent. The Stock Index Fund’s 9.06 percent return closely tracked the index’s. The S&P 500 Stock Index is a market capitalization-weighted index composed of 500 common stocks issued by large-capitalization companies in a wide range of industries. The stocks included in the index collectively represent a substantial portion of all common stocks publicly traded in the U.S.

During the six-month period, as changes were made to the composition of the S&P 500 Index, the Master Portfolio in which the fund invests purchased and sold securities to maintain its objective of replicating the risks and return of the index.

Market Conditions

The reflation trade in the U.S. continued to gain steam in the first quarter of the year. Macro data highlighted continued economic growth and a strengthening labor market, which supported the Federal Reserve’s decision to increase the federal funds rate by 25 basis points (0.25 percent) in March. The Fed’s summary of economic projections indicated that it will maintain a gradual pace of tightening should current economic trends continue.

Expectations of the new administration’s policies also boosted market sentiment, sending several U.S. equity indices to record highs. The inauguration of President Trump in late January stoked risk-on appetite, as pledges of tax relief and increased fiscal spending were supportive of cyclical stocks. However, the final weeks of the first quarter of 2017 saw some profit taking as investor optimism waned after the failed attempt to repeal the Affordable Care Act called into question whether the new administration will be able to push through further reforms in 2017. Despite these setbacks, U.S. equities finished the quarter strong and the 10-year Treasury yield added 31 basis points in the quarter.

The S&P 500 Stock Index hit an all-time high in June amid a strong overall second quarter, but appreciated at a slower rate than in the first quarter as political risk and high valuation metrics influenced investor sentiment.

The health care sector contributed the most to the S&P 500 Index’s return during the second quarter. The sector benefited from positive investor sentiment on industry prospects following the House passing the Republican’s health care reform bill, as well as a leaked draft of an executive order relaxing drug price regulations being made public. The financial sector was the second largest contributor to return during the second quarter, benefiting from positive stress test results, the Fed June rate hike, and the House passage of the Financial Choice Act, intended to roll back some provisions of the Dodd-Frank Act.

The technology sector also performed strongly. Facebook, Apple, Amazon, Netflix, Google (FAANG) and semiconductor companies performed strongly throughout most of the quarter before some late-quarter profit-taking and valuation concerns.

Subtracting the most from the overall index return in the second quarter was the telecommunication sector. Telecommunication stocks weighed on the index, as the industry faced industry pressures, which weighed on earnings releases and sell-side forecasts. The energy sector was also a detractor. Surging U.S. production levels and swelling inventories overshadowed efforts made by the Organization of Petroleum Exporting Countries (OPEC) to stabilize crude oil. OPEC’s agreement in late May to extend the duration of its crude output cut was unable to support the market—the price of a barrel of West Texas Intermediate crude oil fell 8.9 percent in the quarter, which weighed particularly heavily on upstream energy companies.

Political risk was a headwind to U.S. equities during the second quarter. President Trump’s firing of FBI Director James Comey on May 9 and the subsequent developments regarding the investigation of pre-election correspondence between Trump administration members and Russian officials were an enduring source of negative market sentiment. The largest single day fall of the S&P 500 in the second quarter came in the wake of the House Oversight Committee’s request for all documents from the meetings between President Trump and FBI Director Comey on May 17.

Although the Fed continued with monetary policy normalization, the yield on the 10-year U.S. Treasury compressed by nine basis points to 2.31 percent in the quarter. The Fed increased the federal funds rate by 25 basis points at the June meeting, to between 1 percent and 1.25 percent, citing strength in the labor market and business spending, despite relatively weak inflation trends throughout the quarter.

The strongest returns in the S&P 500 Index in the second quarter came from health care (+7.10 percent). Increases were seen across most sectors, with notable results in industrials (+4.73 percent), financials (4.25 percent) and information technology (+4.14 percent). In contrast, negative results came from telecommunication services (–7.05 percent) and energy (–6.36 percent).

Stock Index Fund

| | | | | | | | | | | | |

| Average Annual Total Returns (periods ended 06/30/17) | | | | | | | | | |

| | | |

| | | 1 YR % | | | 5 YR % | | | 10 YR % | |

Stock Index Fund | | | 17.25 | | | | 14.02 | | | | 6.61 | |

Standard & Poor’s 500 Stock Index | | | 17.90 | | | | 14.63 | | | | 7.18 | |

| | | | |

| Sector Diversification* | | | |

| |

| | | % of Total Net Assets

as of 06/30/17 | |

Information technology | | | 21.8 | |

Financials | | | 14.2 | |

Health care | | | 14.2 | |

Consumer discretionary | | | 12.0 | |

Industrials | | | 10.0 | |

Consumer staples | | | 8.9 | |

Energy | | | 5.9 | |

Utilities | | | 3.1 | |

Real estate | | | 2.9 | |

Materials | | | 2.8 | |

Telecommunication services | | | 2.1 | |

Short-term and other assets | | | 2.1 | |

Total | | | 100.0% | |

| Top Ten Equity Holdings* | | | |

| |

| | | % of Total Net Assets

as of 06/30/17 | |

Apple, Inc. | | | 3.5 | |

Microsoft Corp. | | | 2.5 | |

Amazon.com, Inc. | | | 1.8 | |

Facebook, Inc. (Class A) | | | 1.7 | |

Johnson & Johnson | | | 1.7 | |

Exxon Mobil Corp. | | | 1.6 | |

JPMorgan Chase & Co. | | | 1.5 | |

Berkshire Hathaway, Inc. (Class B) | | | 1.5 | |

Alphabet, Inc. (Class A) | | | 1.3 | |

Alphabet, Inc. (Class C) | | | 1.3 | |

Total | | | 18.4% | |

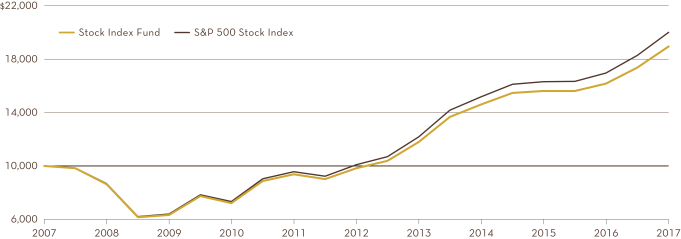

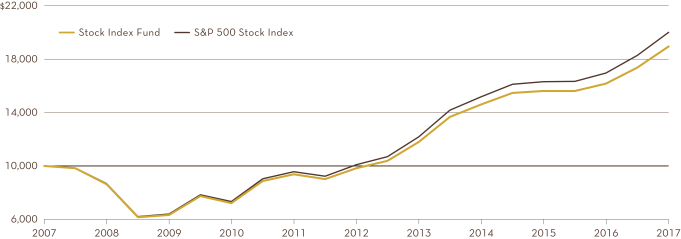

Comparison of the change in value of a $10,000 investment in the fund and the Standard & Poor’s 500 Stock Index made on June 30, 2007.

The returns quoted in the above table and chart represent past performance, which is no guarantee of future results. Current performance may be higher or lower than that shown above. To obtain the most recent month-end returns please call 800-258-3030 or visit homesteadfunds.com. Returns and the principal value of your investment will fluctuate such that shares, when redeemed, may be worth more or less than their original cost. The Stock Index Fund’s average annual total returns are net of any fee waivers and reimbursements.The expenses used are as of the most recent period-end and may fluctuate over time. Returns include the reinvestment of dividends and capital gains. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares.

| * | Sector diversification and top holdings information is for the S&P 500 Index Master Portfolio, managed by BlackRock Fund Advisors, the portfolio in which the Stock Index Fund invests all of its investable assets. Please refer to the Appendix for the complete annual report of the S&P 500 Index Master Portfolio. |

Value Fund

Performance Evaluation | Prepared by the Fund’s Investment Advisor, RE Advisers Corporation

Performance

The Value Fund increased 6.67 percent during the first six months of 2017 and its benchmark index, the S&P 500 Value Stock Index, increased 4.85 percent. The fund’s higher-than-index results were due primarily to the performance of its industrials, materials and information technology sector holdings. Energy and consumer discretionary positions detracted from overall results.

Portfolio Review

The fund’s industrials position was over weighted compared with the benchmark and outpaced both the benchmark’s sector results and that of the overall index. Notable contributors to the results were Southwest Airlines, Parker-Hannifin and Honeywell International.

The fund’s materials position appreciated slightly more than 14 percent during the first half of 2017, outpacing the return for the index’s sector holdings and the index overall. Primary contributors were Avery Dennison and Dow Chemical.

The fund’s above-index exposure to the information technology sector was positive for performance as these holdings appreciated more than the overall index. Primary contributors were Visa, Alphabet and Microsoft Corporation. The detractor was Intel Corporation.

The fund’s energy position was slightly underweighted compared with the benchmark, but the fund’s energy sector holdings declined more than the benchmark’s energy sector results. The lower-than-benchmark sector results were the result of declines in the stock prices of QEP Resources, Marathon Oil and ConocoPhillips.

The fund was underweight in consumer discretionary and its results for the first half of 2017 were slightly negative versus an increase in the benchmark’s sector position. Genuine Parts and Cooper Tire & Rubber were the primary detractors.

New names added to the fund during the reporting period were Apache Corporation and Royal Dutch Shell Plc. Names eliminated from the fund were General Electric, AbbVie and QEP Resources.

Outlook

As the second half of 2017 begins, investors continue to assess the potential outcome of any changes in health care legislation, tax reform and regulation—uncertainty surrounding all has been weighing on the markets. On the positive side, the U.S. economy has shown improvement during the reporting period. Manufacturing has strengthened some, employment has been strong and the housing market has been positive.

2017 forecasts for U.S. gross domestic product (GDP) growth fall within a range of 2.0–2.5 percent. Oil prices have drifted from the mid-$50s per barrel to the mid-$40s, in part as a result of Organization of Petroleum Exporting Countries’ (OPEC) November agreement to limit production, but offset by shale oil production in the U.S. We believe that the present $40+/barrel price should be high enough for oil and gas exploration and production to increase in the U.S., and hopefully low enough that it aids economic activity over the course of 2017.

Recent Fed commentary indicates perhaps one or two further interest rate increases for 2017. We believe the number and extent of any increases will be predicated on the overall strength of the economy. Rising rates in 2017 should be a reflection of an improving economy, in our view. In the past, slowly rising interest rates have been positive for equities as an indicator of an improving business environment. We would expect similar results.

Regardless of the overall economy’s direction, we search for value. TE Connectivity and Johnson Controls are examples of one area where we are finding value now. Both are participants in the “Internet of Things,” a vast network of objects and machines sharing data and communicating via wired and wireless networks. “Smart devices” and other digital innovations are gaining momentum in many industries and require collecting vast amounts of data via sensors, which is something TE Connectivity focuses on. TE’s product offerings span many industries, including transportation, industrial and communications, with special capabilities for harsh environments within these industries. Additionally, we have found that energy use and efficiency continue to grow in importance, not only in new building construction but also over the life of the building. Johnson Controls focuses on environmental control of buildings. We expect these companies to benefit from the further adoption and integration of new technologies across the economic spectrum.

We appreciate your continued trust and investment.

| | |

| Investment Advisor: RE Advisers |

| |

| | Mark Ashton, CFA Senior Equity Portfolio Manager BS, Finance, University of Utah; MBA, Marketing Research, University of Southern California |

| |

| | Prabha Carpenter, CFA Senior Equity Portfolio Manager BA, Economics, University of Madras; MBA with distinction in Finance and BS in Business Economics, The American University |

| | | | |

| 10 | | Performance Evaluation | | |

Value Fund

| | | | | | | | | | | | |

| Average Annual Total Returns (periods ended 06/30/17) | | | | | | | | | |

| | | |

| | | 1 YR % | | | 5 YR % | | | 10 YR % | |

Value Fund | | | 15.15 | | | | 14.20 | | | | 5.98 | |

Standard & Poors’s 500 Value Index | | | 15.86 | | | | 13.82 | | | | 5.25 | |

Standard & Poor’s 500 Stock Index | | | 17.90 | | | | 14.63 | | | | 7.18 | |

| | | | |

| Sector Diversification | | | |

| |

| | | % of Total Investments

as of 06/30/17 | |

Information technology | | | 20.9 | |

Health care | | | 18.9 | |

Financials | | | 16.2 | |

Industrials | | | 15.7 | |

Materials | | | 11.0 | |

Energy | | | 9.7 | |

Consumer discretionary | | | 5.0 | |

Short-term and other assets | | | 2.6 | |

Total | | | 100.0% | |

| Top Ten Equity Holdings | | | |

| |

| | | % of Total Investments

as of 06/30/17 | |

Southwest Airlines Co. | | | 5.2 | |

JPMorgan Chase & Co. | | | 4.7 | |

Avery Dennison Corp. | | | 4.6 | |

Dow Chemical Co. (The) | | | 4.5 | |

Cisco Systems, Inc. | | | 4.2 | |

Bristol-Myers Squibb Co. | | | 4.0 | |

Intel Corp. | | | 4.0 | |

Parker-Hannifin Corp. | | | 3.9 | |

Honeywell International Inc. | | | 3.7 | |

Pfizer, Inc. | | | 3.7 | |

Total | | | 42.5% | |

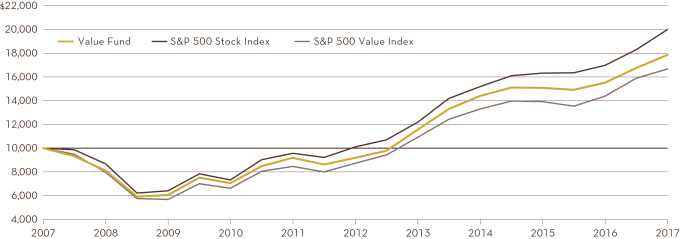

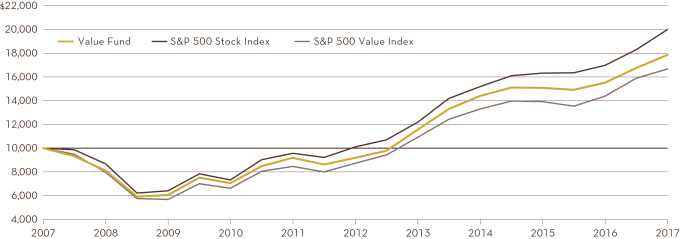

Comparison of the change in value of a $10,000 investment in the fund and its benchmark indices made on June 30, 2007.

The returns quoted in the above table and chart represent past performance, which is no guarantee of future results. Current performance may be higher or lower than that shown above. To obtain the most recent month-end returns please call 800-258-3030 or visit homesteadfunds.com. Returns and the principal value of your investment will fluctuate such that shares, when redeemed, may be worth more or less than their original cost. The Value Fund’s average annual total returns are net of any fee waivers and reimbursements. The expenses used are as of the most recent period-end and may fluctuate over time. Returns include the reinvestment of dividends and capital gains. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares.

| | | | | | |

| | Performance Evaluation | | | 11 | |

Growth Fund

Performance Evaluation | Prepared by the Fund’s Subadvisor, T. Rowe Price Associates

Performance

The Growth Fund’s return of 19.61 percent in the first half of 2017 was above the Russell 1000 Growth Index’s return of 13.99 percent, the fund’s primary benchmark index. Broadly speaking, both stock selection and sector allocation contributed to relative performance.

Portfolio Review

Despite a detracting overweight relative to the benchmark, the consumer discretionary sector was the leading contributor due to stock selection. Amazon.com was a key area of strength. Shares of the firm traded higher following its latest quarterly report, with top- and bottom-line results coming in ahead of consensus expectations. Expansion of its fulfilment and logistics networks has helped drive accelerated growth while allowing it to meet the needs of its increasing global footprint. Amazon Web Services, the company’s highly profitable cloud-computing business, also continues to grow at a rapid clip. Priceline and Tesla also added relative value for the sector. Priceline contributed to relative performance over the first half of 2017 as the online travel agency continued to generate strong results, with the most recent quarter coming in well ahead of consensus analyst expectations and previously issued guidance. Along with beating on earnings per share, bookings easily topped consensus estimates and room night growth continued to accelerate. In our view, the strength of the company’s business model remains underappreciated; we think Priceline has a long runway for growth with a top-notch management, a strong balance sheet, and a robust business model. Shares of Tesla continued to trade higher as the company remains on track to begin production of the Model 3 in July. The overwhelming demand for Model 3, Tesla’s first mass-market car, confirms the broad appeal of all-electric vehicles and helps support the company’s mission of accelerating the world’s transition to sustainable energy and transport.

Our overweight allocation to information technology—the top-performing sector in the benchmark—contributed to relative performance in the first half of the year. At the end of 2016, information technology stocks pulled back as investors rotated out of this sector and into financials and cyclical industries deemed to benefit the most from the policies proposed by the incoming U.S. presidential administration. However, the sector came back into favor throughout the period as the initial euphoria faded and investors turned back to fundamentals. It became clear that many of the policies that sparked optimism in the market would take much longer to implement and likely look much different if and when they actually come to pass. We remain overweight given what we view as attractive secular growth opportunities available in many innovative companies whose businesses we believe can thrive regardless of which way the political winds are blowing. Stock holdings like

Alibaba Group Holding also boosted relative returns for the sector. China’s largest e-commerce player provided revenue guidance for the current fiscal year that was significantly higher than expected, driven by the strength in its core Chinese e-commerce business as it continues to benefit from improving user engagement and ongoing mobile monetization efforts. The company is also experiencing strong growth from its cloud-computing business AliCloud and is rapidly transforming into a global leader of data services.

The health care sector added to relative returns due to stock holdings like Intuitive Surgical. The firm’s robotic da Vinci Surgical System continued to see growing adoption. Global procedure growth accelerated in the latest quarter, and the increased transparency into the company’s R&D pipeline—atypical relative to its ultra-secretive behavior historically—was another positive development that we think reflects management’s increased confidence in the commercial viability and regulatory pathways of its product pipeline.

Relative performance benefited from our significant underweight allocation to consumer staples. We have been consistently underweight given what we believe to be the sector’s lack of growth and stretched valuations. The Federal Reserve’s decision to raise interest rates at its March meeting took some of the air out of the sector as demand from yield-starved investors dried up. Fed minutes also signaled a faster pace of rate hikes for 2017, which may lead investors to migrate back toward the bond market for their income needs.

The financials sector was the only area of relative weakness during the period. Both stock selection and an overweight allocation hindered results.

Outlook

We believe that global equity markets can generate modest gains in the second half of the year. We are cautious, however, that a fresh catalyst for economic growth would be needed before more substantial gains for cyclically sensitive stocks—a revival of the reflation trade—could be expected. Given the controversies surrounding President Trump, it is not clear whether his administration has the political capital to achieve the sweeping reforms necessary to spur economic growth and accelerate the recovery in corporate earnings. For this reason, we continue to focus attention on sectors we believe have specific growth drivers.

| | | | |

| 12 | | Performance Evaluation | | |

Growth Fund

| | | | | | | | | | | | |

| Average Annual Total Returns (periods ended 06/30/17) | | | | | | | |

| | | |

| | | 1 YR % | | | 5 YR % | | | 10 YR % | |

Growth Fund* | | | 31.19 | | | | 17.10 | | | | 10.31 | |

Russell 1000 Growth Index | | | 20.42 | | | | 15.30 | | | | 8.91 | |

Standard & Poor’s 500 Stock Index | | | 17.90 | | | | 14.63 | | | | 7.18 | |

| | | | |

| Sector Diversification | | | |

| |

| | | % of Total Investments

as of 06/30/17 | |

Information technology | | | 38.2 | |

Consumer discretionary | | | 21.9 | |

Health care | | | 20.1 | |

Industrials | | | 7.9 | |

Financials | | | 6.4 | |

Consumer staples | | | 1.5 | |

Telecommunication | | | 1.0 | |

Real estate | | | 0.6 | |

Short-term and other assets | | | 2.4 | |

Total | | | 100.0% | |

| Top Ten Equity Holdings | | | |

| |

| | | % of Total Investments

as of 06/30/17 | |

Amazon.com, Inc. | | | 7.4 | |

Priceline Group, Inc. (The) | | | 5.3 | |

Facebook, Inc. (Class A) | | | 4.5 | |

Alphabet Inc. (Class A) | | | 4.5 | |

Visa Inc. (Class A) | | | 4.2 | |

Apple Inc. | | | 4.0 | |

Microsoft Corp. | | | 4.0 | |

Boeing Co. (The) | | | 3.3 | |

Unitedhealth Group Inc. | | | 2.9 | |

Intuitive Surgical, Inc. | | | 2.5 | |

Total | | | 42.6% | |

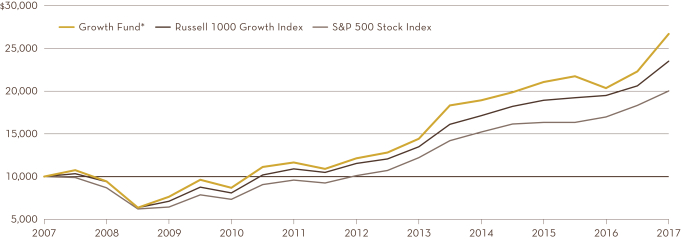

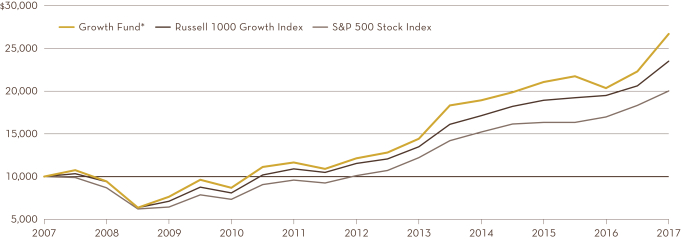

Comparison of the change in value of a $10,000 investment in the fund and its benchmark indices made on June 30, 2007.

The returns quoted in the above table and chart represent past performance, which is no guarantee of future results. Current performance may be higher or lower than that shown above. To obtain the most recent month-end returns please call 800-258-3030 or visit homesteadfunds.com. Returns and the principal value of your investment will fluctuate such that shares, when redeemed, may be worth more or less than their original cost. The Growth Fund’s average annual total returns are net of any fee waivers and reimbursements. The fund’s advisor waived a portion of its management fee and/or reimbursed fund expenses during the periods shown. Had the advisor not done so, the fund’s total returns would have been lower. The expenses used are as of the most recent period-end and may fluctuate over time. Returns include the reinvestment of dividends and capital gains. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares.

| * | Performance information for the Growth Fund (formerly the Nasdaq-100 Index Tracking StockSM Fund) reflects its previous investment strategy from inception through December 5, 2008, of matching, as closely as possible, before expenses, the performance of the Nasdaq-100 Stock Index. |

| | | | | | |

| | Performance Evaluation | | | 13 | |

Small-Company Stock Fund

Performance Evaluation | Prepared by the Fund’s Investment Advisor, RE Advisers Corporation

Performance

The fund increased 1.24 percent in the first six months of 2017 trailing its benchmark index the Russell 2000 Index, which increased 4.99 percent. The fund’s returns in the industrials, materials and financials sectors aided results, while the returns in the consumer discretionary, health care and information technology sectors detracted from overall results.

Portfolio Review

The fund’s industrials position was positive for performance in 2017’s first half due to the fund’s above-index exposure to this sector and the fund’s position increasing more than the index’s industrials position. N.N. Inc., Dycom Industries and BWX Technologies were important contributors.

The fund was overweight in materials relative to the index, and the fund’s materials stocks appreciated more than the index’s sector position. The primary contributors to the performance were PolyOne and Summit Materials.

The fund had a slight overweight position in the financials sector compared with the benchmark. The fund’s overall financial positions appreciated in the first half of 2017, while the index’s financials holdings decreased. Contributors included Encore Capital Group, FB Financial and Kinsale Capital Group.

Consumer discretionary detracted from the fund’s results due to a slight overweight position and the fund’s position depreciating while the index’s consumer discretionary stocks increased. The difficulties of 2016 continued into 2017 for portions of retail, restaurants and distributors. Primary detractors were Fred’s, Francesca’s Holdings and Core-Mark Holdings.

New names added to the fund during the first half of 2017 included Comfort Systems and QTS Realty Trust. QTS is a web infrastructure company that provides data center and cloud services to more than 1,000 customers. It is organized as a real estate investment trust. Names eliminated from the fund were Wendy’s Company and Cardinal Financial, which was acquired by United Bankshares.

Outlook

As we look to the second half of 2017, our general feeling seems to be one of optimism, though tempered by the uncertainty surrounding health care legislation, tax reform and regulatory changes that are now before the U.S. Congress. We believe economic indicators continue to be encouraging in the areas of the industrial economy and for employment and housing.

Regardless of the economic environment, we continue to search for and uncover what we believe to be attractive investment opportunities. An aspect of our approach, no matter the overall economic environment, is to find companies that we believe can increase efficiencies and productivity for themselves, as well as their customers. With potential for acceleration in the economy, the environment going forward may be more favorable for our style than during the past two years. While valuations remain somewhat elevated, some of the recent stock price volatility has provided valuations that are more compelling, in our view. We are finding companies with what we believe are attractive businesses and better prospects for the future that we believe will benefit investors over the longer term.

We appreciate your continued trust and investment.

| | | | |

| 14 | | Performance Evaluation | | |

Small-Company Stock Fund

| | | | | | | | | | | | |

| Average Annual Total Returns (periods ended 06/30/17) | | | | | | | | | |

| | | |

| | | 1 YR % | | | 5 YR % | | | 10 YR % | |

Small-Company Stock Fund | | | 16.51 | | | | 13.02 | | | | 9.30 | |

Russell 2000 Index | | | 24.60 | | | | 13.70 | | | | 6.92 | |

| | | | |

| Sector Diversification | | | |

| |

| | | % of Total Investments

as of 06/30/17 | |

Industrials | | | 39.8 | |

Financials | | | 20.4 | |

Consumer discretionary | | | 12.6 | |

Information technology | | | 10.9 | |

Materials | | | 8.4 | |

Health care | | | 2.8 | |

Consumer staples | | | 2.0 | |

Energy | | | 1.6 | |

Real estate | | | 0.5 | |

Short-term and other assets | | | 1.0 | |

Total | | | 100.0% | |

| | | | |

| Top Ten Equity Holdings | | | |

| |

| | | % of Total Investments

as of 06/30/17 | |

Dycom Industries, Inc. | | | 8.2 | |

Knight Transportation, Inc. | | | 4.1 | |

Encore Capital Group, Inc. | | | 4.0 | |

Applied Industrial Technologies, Inc. | | | 3.5 | |

Texas Capital Bancshares, Inc. | | | 3.3 | |

PolyOne Corp. | | | 3.2 | |

Werner Enterprises, Inc. | | | 3.1 | |

NN, Inc. | | | 3.0 | |

Cracker Barrel Old Country Store, Inc. | | | 2.8 | |

ManTech International Corp. (Class A) | | | 2.8 | |

Total | | | 38.0% | |

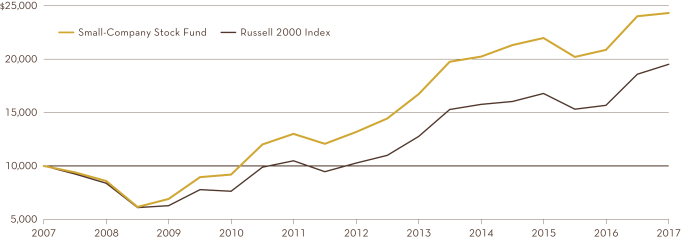

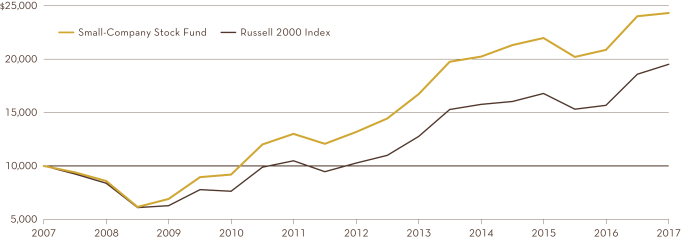

Comparison of the change in value of a $10,000 investment in the fund and the Russell 2000 Index made on June 30, 2007.

The returns quoted in the above table and chart represent past performance, which is no guarantee of future results. Current performance may be higher or lower than that shown above. To obtain the most recent month-end returns please call 800-258-3030 or visit homesteadfunds.com. Returns and the principal value of your investment will fluctuate such that shares, when redeemed, may be worth more or less than their original cost. The Small-Company Stock Fund’s average annual total returns are net of any fee waivers and reimbursements. The expenses used are as of the most recent period-end and may fluctuate over time. Returns include the reinvestment of dividends and capital gains. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares.

| | | | | | |

| | Performance Evaluation | | | 15 | |

International Equity Fund

Performance Evaluation | Prepared by the Fund’s Subadvisor, Harding Loevner LP

Performance

For the six-month period ending June 30, 2017, the International Equity Fund outperformed its benchmark, the MSCI EAFE Index, increasing 16.62 percent versus the 13.81 percent return for the index.

Portfolio Review

The fund’s portfolio’s overweight relative to the benchmark in the top-performing information technology (IT) sector contributed to relative performance. We slightly outperformed the benchmark’s strong IT sector return in the first half of 2017 with strong returns from both Samsung Electronics and Taiwan Semiconductor. Our stable but slower-growing software and services companies, like Dassault Systémes and SAP, underperformed while our holding in Naspers, the South African Internet and media investment company with a large stake in Tencent, is classified in the consumer discretionary sector.

Security selection was strongest in financial services, as most of our emerging market banks outperformed, including Mexican bank Banorte and Turkish lender Garanti Bank. In addition, Asian life insurer AIA Group continued its run of outperformance following record growth in the first quarter of 2017. In consumer staples, Nestlé and Unilever were strong, as investors rewarded managements’ steps to shake up their businesses after activist investors rattled their cage a bit. On the other hand, energy companies Schlumberger and Tenaris underperformed the already-weak energy sector.

Viewed geographically, our outperformance stemmed from good stock selection in the Pacific ex-Japan, emerging markets (EM), and Japan regions. AIA Group and Australian plasma protein company, CSL Limited, drove outperformance in Pacific ex-Japan, with CSL Limited successfully entering the Chinese market following its purchase of a stake in a domestic blood-plasma collection operator. Our EM holdings had a positive total effect on fund performance due not only to the previously referenced banks but also to Naspers and IT heavyweights Samsung Electronics and Taiwan Semiconductor. In Japan, the strong stock selection was led by MonotaRO, the distributor of maintenance, repair, and operation (MRO) products, and Keyence, the industrial sensor maker.

Outlook

The investment environment has become increasingly challenging for investors concerned with the quality, growth and price tripod that forms the foundation of Harding Loevner’s investment philosophy. Quality as a stand-alone factor has become expensive in stock-price terms, in spite of the surge in value stocks last year. We have noted the investment industry’s efforts to reverse-engineer the successful performance that high-quality portfolios have enjoyed over the past decade, constructing “smart beta” portfolios using quantitative tools to identify companies with similar high-quality attributes. These approaches implicitly promise future outperformance similar to that observed in the past. Smart beta approaches overlap with other managers employing optimization software to create “low volatility” portfolios that appeal to investors fearful of the inherent ups and downs of stock market investing, overlapping simply because the stocks of high-quality companies have traded with much more subdued gyrations than the average stock in past market tempests. The broader emphasis on quality, enshrined in the documenting by academics of a quality factor effect, and commercialized through the creation of ”quality” indexes as benchmarks for passive money, has meant more persistent, and decreasingly price-sensitive, demand for the stocks of high-quality companies.

Our portfolio response has been to redouble our attention to the other two legs of our philosophical stool: growth and price. If quality is fashionable, based on either a blind embrace of its prior success or a backward-looking fear of another financial crisis, then we believe the fruitful way forward must be one that is discerning and resists that fear. In the past 12 months, the route has involved an emphasis on price, encompassing the strong value rally capped by the “Trump bump,” but it has also coalesced around companies achieving faster growth.

| | | | |

| 16 | | Performance Evaluation | | |

| | |

| Subadvisor: Harding Loevner LP |

| |

| | Ferrill D. Roll, CFA Co-Lead Portfolio Manager BA, Economics, Stanford University |

| |

| | Alexander T. Walsh, CFA Co-Lead Portfolio Manager BA, North American Studies, McGill University |

International Equity Fund

| | | | | | | | | | | | |

| Average Annual Total Returns (periods ended 06/30/17) | | | | | | | | | |

| | | 1 YR % | | | 5 YR % | | | 10 YR % | |

International Equity Fund* | | | 18.60 | | | | 8.95 | | | | 0.90 | |

MSCI® EAFE® Index | | | 20.27 | | | | 8.69 | | | | 1.03 | |

| | | | |

| Country Diversification | | | |

| | | % of Total Investments

as of 06/30/17 | |

Germany | | | 19.5 | |

Japan | | | 15.1 | |

Britain | | | 11.8 | |

France | | | 10.1 | |

Switzerland | | | 8.2 | |

Sweden | | | 4.5 | |

Hong Kong | | | 4.3 | |

Spain | | | 4.1 | |

Israel | | | 2.9 | |

Singapore | | | 2.7 | |

Canada | | | 2.3 | |

United States of America | | | 2.0 | |

South Africa | | | 1.4 | |

Italy | | | 1.2 | |

Republic of South Korea | | | 1.1 | |

Australia | | | 1.0 | |

Taiwan | | | 1.0 | |

China | | | 0.8 | |

Mexico | | | 0.8 | |

Brazil | | | 0.5 | |

India | | | 0.5 | |

Turkey | | | 0.3 | |

Short-term and other assets | | | 3.9 | |

Total | | | 100.0% | |

| | | | |

| Top Ten Equity Holdings | | | |

| | | % of Total Investments

as of 06/30/17 | |

AIA Group Ltd. | | | 4.3 | |

Allianz SE REG | | | 3.8 | |

Dassault Systèmes SA | | | 3.8 | |

Bayer AG REG | | | 3.8 | |

Nestlé SA REG | | | 3.7 | |

SAP SE ADR | | | 3.4 | |

Roche Holding AG REG | | | 3.4 | |

Keyence Corp. | | | 3.2 | |

Royal Dutch Shell plc (Class B) | | | 3.0 | |

Banco Bilboa Vizcaya Argentaria SA | | | 3.0 | |

Total | | | 35.4% | |

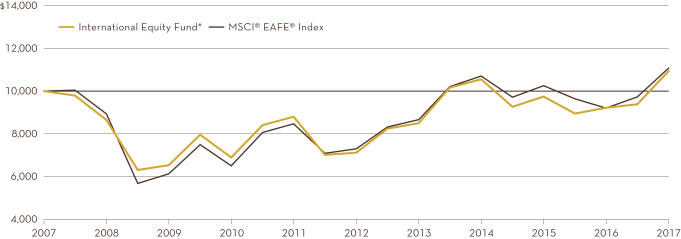

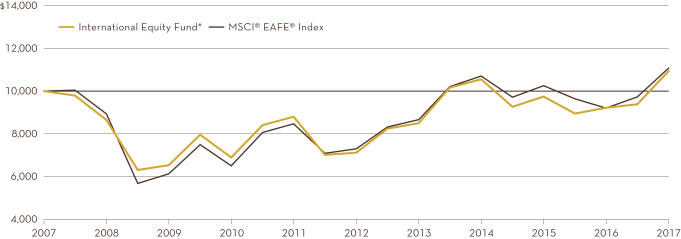

Comparison of the change in value of a $10,000 investment in the fund and the MSCI® EAFE® Index made on June 30, 2007.

The returns quoted in the above table and chart represent past performance, which is no guarantee of future results. Current performance may be higher or lower than that shown above. To obtain the most recent month-end returns please call 800-258-3030 or visit homesteadfunds.com. Returns and the principal value of your investment will fluctuate such that shares, when redeemed, may be worth more or less than their original cost. The International Equity Fund’s average annual total returns are net of any fee waivers and reimbursements. The fund’s advisor waived a portion of its management fee during the periods shown. Had the advisor not done so, the fund’s total returns would have been lower. The expenses used are as of the most recent period-end and may fluctuate over time. Returns include the reinvestment of dividends and capital gains. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares.

| * | Performance information for the International Equity Fund (formerly the International Value Fund) reflects its performance as an actively managed fund subadvised by Mercator Asset Management from December 31, 2006 to September 14, 2015, as a passively managed portfolio directed by SSGA Funds Management Inc. from September 15, 2015 to January 8, 2016 and, after a transition, as an actively managed fund subadvised by Harding Loevner LP from January 15, 2016 to period end. |

| | | | | | |

| | Performance Evaluation | | | 17 | |

Expense Example

As a shareholder, you incur two types of costs: (1) transaction costs; and (2) ongoing costs, including management fees, service fees, and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in each of the Homestead Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at January 1, 2017 and held through June 30, 2017.

Actual Expenses

The first line for each Fund in the table on the following page provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Individual Retirement Arrangements (IRAs) and Educational Savings Accounts (ESAs) are charged a $15.00 annual custodial fee. The charge is automatically deducted from your account in the fourth quarter of each year or, if you close your account, at the time of redemption. A fee is collected for each IRA or ESA, as distinguished by account type (Traditional IRA, Roth IRA, or ESA) and Social Security Number. For example, if you have both a Traditional IRA and a Roth IRA account, each would be charged a fee. But only one fee would be collected for each account type, regardless of the number of Funds held by each account type. These fees are not included in the example below. If included, the costs shown would be higher.

Hypothetical Example for Comparison Purposes

The second line for each Fund in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect the custodial account fee. Therefore, the hypothetical information in the example is useful in comparing your ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if the custodial account fee was included, your costs would have been higher.

Expense Example (Continued)

| | | | | | | | | | | | | | | | |

| Daily Income Fundb | | Beginning

Account Value

January 1, 2017 | | | Ending

Account Value

June 30, 2017 | | | Expenses Paid

During the Perioda | | | Annualized Expense Ratio for the

Six Month Period

Ended

June 30, 2017 | |

Actual Return | | $ | 1,000.00 | | | $ | 1,000.20 | | | $ | 2.96 | | | | 0.60% | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,022.04 | | | $ | 2.99 | | | | 0.60% | |

| | |

| Short-Term Government Securities Fundb | | | | | | | | |

Actual Return | | $ | 1,000.00 | | | $ | 1,007.32 | | | $ | 3.74 | | | | 0.75% | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.26 | | | $ | 3.76 | | | | 0.75% | |

| | |

| Short-Term Bond Fund | | | | | | | | |

Actual Return | | $ | 1,000.00 | | | $ | 1,012.06 | | | $ | 3.73 | | | | 0.75% | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.27 | | | $ | 3.75 | | | | 0.75% | |

| | |

| Stock Index Fundc | | | | | | | | |

Actual Return | | $ | 1,000.00 | | | $ | 1,094.09 | | | $ | 2.89 | | | | 0.56% | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,022.24 | | | $ | 2.79 | | | | 0.56% | |

| | |

| Value Fund | | | | | | | | |

Actual Return | | $ | 1,000.00 | | | $ | 1,068.58 | | | $ | 3.11 | | | | 0.61% | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.99 | | | $ | 3.04 | | | | 0.61% | |

| | |

| Growth Fund | | | | | | | | |

Actual Return | | $ | 1,000.00 | | | $ | 1,212.84 | | | $ | 5.19 | | | | 0.95% | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.26 | | | $ | 4.75 | | | | 0.95% | |

| | |

| Small-Company Stock Fund | | | | | | | | |

Actual Return | | $ | 1,000.00 | | | $ | 1,012.46 | | | $ | 4.40 | | | | 0.88% | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.59 | | | $ | 4.42 | | | | 0.88% | |

| | |

| International Equity Fundb | | | | | | | | |

Actual Return | | $ | 1,000.00 | | | $ | 1,178.14 | | | $ | 5.33 | | | | 0.99% | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.06 | | | $ | 4.95 | | | | 0.99% | |

|

a. The dollar amounts shown as “Expenses Paid During the Period” are equal to each Fund’s annualized expense ratio multiplied by the average account

value over the period, multiplied by 181, then divided by 365 (to reflect the half-year period). b. Reflects fee waiver and expense limitation agreements in effect during the period. c. The Stock Index Fund is a feeder fund that invests substantially all of its assets in a Master Portfolio. The example reflects the expenses of both the

feeder fund and the Master Portfolio. |

Regulatory and Shareholder Matters

Proxy Voting Policies and Procedures

The policies and procedures used to determine how to vote proxies relating to the Funds’ portfolio securities are available online at homesteadfunds.com and, without charge, upon request by calling 800-258-3030. This information is also available on the Securities and Exchange Commission’s website at sec.gov.

Proxy Voting Record

For the most recent twelve-month period ended June 30, information regarding how proxies relating to portfolio securities were voted on behalf of each of the Funds is available, without charge, upon request by calling 800-258-3030. This information is also available online at homesteadfunds.com and on the Securities and Exchange Commission’s website at sec.gov.

Quarterly Disclosure of Portfolio Holdings

The Funds file complete schedules of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. Portfolio holdings for the second and fourth quarters of each fiscal year are filed as part of the Funds’ semi-annual and annual reports. The Funds’ Form N-Q, semi-annual and annual reports are available on the Commission’s website at sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330. The most recent quarterly portfolio holdings and semi-annual and annual report also can be accessed on the Funds’ website at homesteadfunds.com.

Principal Risks

You may lose money by investing in the Funds. Below are summaries of some, but not all, of the principal risks of investing in one or more of the Funds, each of which could adversely affect a Fund’s NAV, yield and total return. Each risk listed below does not necessarily apply to each Fund, and you should read each Fund’s prospectus carefully for a description of the principal risks associated with investing in a particular Fund.

| • | | Asset-Backed and Mortgage-Backed Securities Risk The risk that defaults, or perceived increases in the risk of defaults, on the obligations underlying asset-backed and mortgage-backed securities, including mortgage pass-through securities and collateralized mortgage obligations (“CMOs”), significant credit downgrades and illiquidity may impair the value of the securities. These securities also present a higher degree of prepayment risk (when repayment of principal occurs before scheduled maturity resulting in the Fund having to reinvest proceeds at a lower interest rate) and extension risk (when rates of repayment of principal are slower than expected, which may lock in a below-market interest rate, increase the security’s duration, and reduce the value of the security) than do other types of fixed income securities. Enforcing rights against the underlying assets or collateral may be difficult, and the underlying assets or collateral may be insufficient if the issuer defaults. |

| • | | Commercial Paper Risk Investments in commercial paper are subject to the risk that the issuer cannot issue enough new commercial paper to satisfy its obligations with respect to its outstanding commercial paper, also known as rollover risk. Commercial paper is generally unsecured, which increases the credit risk associated with this type of investment. The value of commercial paper may be affected by changes in the credit rating or financial condition of the issuing entities. The value of commercial paper will tend to fall when interest rates rise and rise when interest rates fall. |

| • | | Concentration Risk To the extent the Master Portfolio concentrates in a particular industry, it may be more susceptible to economic conditions and risks affecting that industry. |

| • | | Corporate Bond Risk Corporate debt securities are subject to the risk of the issuer’s inability to meet principal and interest payments on the obligations and may also be subject to price volatility due to factors such as interest rates, market perception of the creditworthiness of the issuer and general market liquidity. |

| • | | Currency Risk Foreign currencies may experience steady or sudden devaluation relative to the U.S. dollar or other currencies, adversely affecting the value of the Fund’s investments. The value of the Fund’s assets may be affected favorably or unfavorably by currency exchange rates, currency exchange control regulations, and restrictions or prohibitions on the repatriation of foreign currencies. Because the Fund’s net asset value is determined on the basis of U.S. dollars, if the local currency of a foreign market depreciates against the U.S. dollar, you may lose money even if the foreign market prices of the Fund’s holdings rise. |

Debt Securities Risks

| • | | Credit risk: the risk that an issuer or counterparty will fail to pay its obligations to the Fund when they are due. As a result, the Fund’s income might be reduced, the value of the Fund’s investment might fall, and/or the Fund could lose the entire amount of its investment. Changes in the financial condition of an issuer or counterparty, changes in specific economic, social or political conditions that affect a particular type of security or other instrument or an issuer, and changes in economic, social or political conditions generally can increase the risk of default by an issuer or counterparty, which can affect a security’s or other instrument’s credit quality or value and an issuer’s or counterparty’s ability to pay interest and principal when due. The values of securities also may decline for a number of other reasons that relate directly to the issuer, such as management performance, financial leverage and |

| | | | |

| 20 | | Regulatory and Shareholder Matters | | |

Regulatory and Shareholder Matters (Continued)

| | reduced demand for the issuer’s goods and services, as well as the historical and prospective earnings of the issuer and the value of its assets. |

| • | | Extension risk: the risk that if interest rates rise, repayments of principal on certain debt securities, including, but not limited to, floating rate loans and mortgage-related securities, may occur at a slower rate than expected and the expected maturity of those securities could lengthen as a result. Securities that are subject to extension risk generally have a greater potential for loss when prevailing interest rates rise, which could cause their values to fall sharply. |

| • | | Interest rate risk: the risk that debt instruments will change in value because of changes in interest rates. The value of an instrument with a longer duration (whether positive or negative) will be more sensitive to changes in interest rates than a similar instrument with a shorter duration. Bonds and other debt instruments typically have a positive duration. The value of a debt instrument with positive duration will generally decline if interest rates increase. |

| • | | Depositary Receipts Risk depositary receipts in which the Fund may invest are receipts listed on U.S. exchanges that are issued by banks or trust companies that entitle the holder to all dividends and capital gains that are paid out on the underlying foreign shares. Investments in depositary receipts may be less liquid than the underlying shares in their primary trading market. |

| • | | Derivatives Risk The risk that an investment in derivatives will not perform as anticipated by the Adviser, cannot be closed out at a favorable time or price, or will increase the Fund’s volatility; that derivatives may create investment leverage; that, when a derivative is used as a substitute for or alternative to a direct cash investment, the transaction may not provide a return that corresponds precisely with that of the cash investment; or that, when used for hedging purposes, derivatives will not provide the anticipated protection, causing the Fund to lose money on both the derivatives transaction and the exposure the Fund sought to hedge. The counterparty to a derivatives contract may be unable or unwilling to make timely settlement payments, return the Fund’s margin, or otherwise honor its obligations. Changes in regulation relating to a mutual fund’s use of derivatives and related instruments could potentially limit or impact the Fund’s ability to invest in derivatives, limit a Fund’s ability to employ certain strategies that use derivatives and adversely affect the value or performance of derivatives and the Fund. |