RE Advisers has agreed, as part of the Expense Limitation Agreement entered into with Homestead Funds effective May 1, 2021, with respect to each Fund, to waive its management fee and/or reimburse all Fund operating expenses, excluding certain non-recurring expenses, such as interest, taxes, brokerage commissions, other expenditures that are capitalized in accordance with generally accepted accounting principles, expenses not incurred in the ordinary course of business, or, in the case of each Fund other than the Stock Index Fund, fees and expenses associated with an investment in another investment company or any company that would be an investment company under Section 3(a) of the Act, but for the exceptions to that definition provided for in Sections 3(c)(1) and 3(c)(7) of the Act, which in any year exceed 0.60% of the average daily net assets of the Daily Income, 0.75% of the average daily net assets of the Short-Term Government Securities and Stock Index Funds; 0.80% of the average daily net assets of the Short-Term Bond and Intermediate Bond Funds; 1.00% of the average daily net assets of Rural America Growth & Income Fund, Growth Fund, and International Equity Fund; 1.25% of the average daily net assets of Value Fund, and 1.50% of the average daily net assets of Small-Company Stock Fund. Prior to May 1, 2021, the expense limitations were 0.80% for the Daily Income Fund, 0.95% for the Growth Fund and 0.99% for the International Equity Fund.

Pursuant to the Expense Limitation Agreement, management fees waived for the period ended June 30, 2021 amounted to $18,500 for Short-Term Government Securities Fund, $82,415 for Intermediate Bond Fund, $28,902 for Rural America Growth & Income Fund, and $97,454 for International Equity Fund.

On August 14, 2009, RE Advisers voluntarily agreed to waive fees and/or reimburse expenses, to the extent necessary to assist the Daily Income Fund in attempting to maintain a positive yield (the "temporary waiver"). The temporary waiver continued from 2009 through May 11, 2017. RE Advisers began voluntarily waiving fees for this Fund again on April 20, 2020. Per the temporary waiver, RE Advisers waived $589,553 of management fees for the Daily Income Fund for the six month period ended June 30, 2021.

For the period beginning September 7, 2015 through January 14, 2016, RE Advisers, pursuant to a contractual waiver with the International Equity Fund, waived from the management fee due to it from International Equity Fund the amount equal to the subadvisory fees it would have paid to Mercator Asset Management L.P., the Fund's subadvisor prior to September 7, 2015, less the amount it paid to SSGA FM for subadvisory services during such period.

Under a Deferred Compensation Plan (the “Plan”), Independent Directors or Trustees of the Funds may elect to defer receipt of all or a specified portion of their compensation. Deferred amounts are credited with the earnings and losses equal to those made as if the deferred amounts were invested in one or more of the Funds, as designated by each participating Independent Director / Trustee. Deferred amounts remain in the Fund until distributed in accordance with the Plan. The liability is reflected as Independent Director / Trustee's deferred compensation on the Statement of Assets and Liabilities and the expense is included in Director, Trustee and Board meeting expenses on the Statement of Operations.

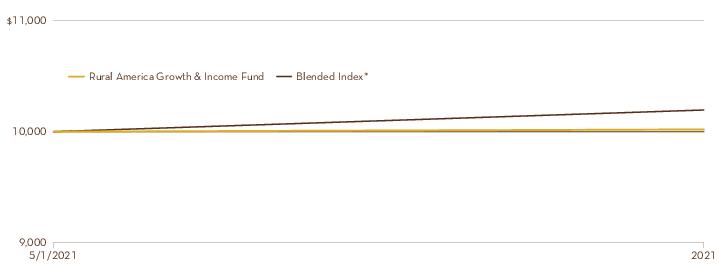

As of June 30, 2021, one shareholder of record, an omnibus account, held approximately 11% of the net assets of the Small-Company Stock Fund, and one shareholder of record, the Adviser, held approximately 36% of the net assets in the Rural America Growth & Income Fund. No other shareholders, including omnibus accounts, held more than 10% of the outstanding shares of any of the Funds.