UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File number: 811-06136

HOMESTEAD FUNDS, INC.

(Exact name of registrant as specified in charter)

4301 Wilson Boulevard

Arlington, VA 22203

(Address of principal executive office – Zip code)

Danielle Sieverling

Homestead Funds, Inc.

4301 Wilson Boulevard

Arlington, VA 22203

(Name and address of agent for service)

Copies to:

Bryan Chegwidden, Esq.

Ropes & Gray LLP

1211 Avenue of the Americas

New York, NY 10036-8704

(Name and addresses of agent for service)

Registrant’s telephone number, including area code: (703) 907-5993

Date of fiscal year end: December 31

Date of reporting period: June 30, 2018

Item 1. Reports to Stockholders.

Semi-Annual Report

June 30, 2018

Our Funds

Daily Income Fund (HDIXX)

Short-Term Government Securities Fund (HOSGX)

Short-Term Bond Fund (HOSBX)

Stock Index Fund (HSTIX)

Value Fund (HOVLX)

Growth Fund (HNASX)

Small-Company Stock Fund (HSCSX)

International Equity Fund (HISIX)

The investment commentaries on the following pages were prepared for each fund by its portfolio manager(s). The views expressed are those of the portfolio manager(s) on July 17, 2018, for each fund as of June 30, 2018. Since that date, those views might have changed. The opinions stated might contain forward-looking statements and discuss the impact of domestic and foreign markets, industry and economic trends, and governmental regulations on the funds and their holdings. Such statements are subject to uncertainty, and the impact on the funds might be materially different from what is described here.

Past performance does not guarantee future results.

Investors are advised to consider fund objectives, risks, charges and expenses before investing. The prospectus contains this and other information and should be read carefully before you invest. To obtain a prospectus, call 800.258.3030 or download a PDF at homesteadfunds.com.

President's Letter

2018 Semi-Annual Report

July 17, 2018

Dear Shareholders,

I’m very pleased to introduce myself to you as the CEO and president of Homestead Funds. In the months that I have spent learning about the fund company — its origin and purpose — and now as I get to know our staff of tenured professionals, I continue to be impressed by who we are as a company. We have a truly unique mission that remains at the heart of what we do today and is very much in our sights as we look to the future.

Writing to you at the midpoint of 2018, the financial markets have exhibited higher levels of volatility this year as stocks have reached peak levels and the Federal Reserve has continued on a path to normalize interest rates. Reaching peak levels does not imply that stocks are about to come tumbling down. In fact, economic activity and company profits could continue in this zone for quite some time. But at these elevated valuation levels, we are cautious of market risks. In particular, we are watching the developments around global trade tensions, an issue that continues to escalate, particularly between the U.S. and China.

Against this difficult market backdrop, five of our six active equity and bond funds generated a total return above their benchmark index for the six months ending June 30, 2018. In the letters that follow, portfolio managers detail their strategies and the impacts on fund performance. I also invite you to visit homesteadfunds.com for the latest management commentary and other resources that can help you understand how your investment is performing and set reasonable expectations for returns and volatility.

In closing, it’s an honor to lead a company that exists to do well for investors — to add value as money managers — but also to be true to our heritage and roots in the rural electric cooperative community. This is something that differentiates Homestead Funds from any other mutual fund company, and it lends passion and commitment to our work every day. I thank you for your continued support of the funds and look forward to communicating regularly with you in the future.

Thank you for your investment with Homestead Funds.

Sincerely,

Mark D. Santero

Director, President and CEO

Homestead Funds

Mark Santero

Director, President and CEO

Daily Income Fund

Performance Evaluation | Prepared by the Fund's Investment Advisor, RE Advisers Corporation

Performance

The Daily Income Fund earned an annualized return of 0.41 percent for the first half of 2018. The seven-day current annualized yield was 1.10 percent as of June 30, 2018, much changed from the 0.45 percent as of December 31, 2017. Interest income for the fund is netted against operating expenses. With the Federal Reserve raising the federal funds rate band two times in the first half of 2018 (the last being to between 1.75 percent and 2.00 percent in June 2018), the fund earned enough interest income (which is the only component of return in a money market fund) to cover all of its expenses and provide income to its shareholders.

Market Conditions

The U.S. economy continued to improve in 2018 as the year progressed. After a fairly soft 2.0 percent rise in gross domestic product (GDP) in the first quarter of 2018, the economy showed strength in the second quarter with an estimated GDP increase of 3.4 percent. The general consensus among economists is for GDP to rise by an annual rate of approximately 2.8 percent in the second half of 2018. In addition, despite changes to the political, regulatory and tax law landscapes, Fed forecasts still only indicate a relatively modest 2.4 percent gain in GDP for all of 2019.

Although the Fed’s analysis of the data suggests continued overall economic expansion since the beginning of 2018, specific issues remain. On the positive side, household spending has expanded at a moderate pace, while business fixed investment has continued to grow strongly. Several labor market measurements during the first half of 2018 continued to show strong growth: Initial jobless claims fell below 250,000, continuing claims trended below 1.9 million and the unemployment rate declined to 4.0 percent. However, wage gains were still relatively mild at approximately 2.7 percent, largely influenced by the lack of strong growth in labor productivity. Although there were signs of improvement this year, we believe a sustained improvement in productivity will be essential to economic growth in general and to wage gains in particular for the rest of 2018 and beyond. On a 12-month basis, overall inflation (even that which excludes food and energy prices) has moved closer to 2 percent with indicators of longer-term inflation expectations little changed.

Outlook

After the Federal Open Market Committee (FOMC), the Fed’s policy-making committee, revised its target for the federal funds rate to between 1.75 percent and 2.00 percent in June 2018, the question usually is how many rate hikes seem likely for the rest of 2018 given the Fed’s leadership and possibly more robust economic environment. Forecasts by the Fed after the rate hike in June 2018 indicated two more hikes in

| Investment Advisor: RE Advisers Corporation |

| Marc Johnston, CFP, ChFC, CAIAMoney Market Portfolio ManagerBA, General Arts, Villanova University;

MBA, Northeastern University |

2018. However, with the FOMC being the very cautious decision maker that it is, the timing and size of interest rate increases and the portfolio unwinding process remain very much dependent upon the data and the stability of the situation at the time, in our view. Assuming continued growth in the U.S. economy, continued improvement in labor markets, stability in financial markets and a steepening (as opposed to flattening) yield curve, we believe that we are most likely to see a continued, gradual normalization of interest rates for the rest of this year into next year. In addition, with inflation on a 12-month basis expected to remain somewhat near the FOMC’s 2 percent objective in the medium term, we believe monetary policy is likely to remain accommodative to support a strong labor market and a sustained return to 2 percent inflation. The risks to the economic outlook appear roughly balanced.

The timing of this continued interest rate normalization process notwithstanding, we believe that investors in money market funds such as the Daily Income Fund will continue to see income on their investment in 2018 as the Fed raises short-term rates to higher levels. In our view, this trend is likely to continue into 2019; therefore, we must be prepared to operate in that type of environment going forward. We will prudently take advantage of higher yielding investments as they become available, and consistent with our management of the fund as a government money market fund.

| Average Annual Total Returns (periods ended 06/30/18) | | | |

| | 1 YR % | 5 YR % | 10 YR % |

| Daily Income Fund | 0.57 | 0.12 | 0.18 |

| Yield | |

| Annualized 7-day current yield quoted 6/30/18 | 1.10% |

| Security Diversification |

| | % of Total Investments |

| | as of 12/31/17 | as of 6/30/18 |

| U.S. government & agency obligations | 89.5 | 89.5 |

| Short-term and other assets | 10.5 | 10.5 |

| Total | 100.0% | 100.0% |

| Maturity | | |

| | as of 12/31/17 | as of 06/30/18 |

| Average Weighted Maturity | 38 days | 40 days |

The returns quoted in the above table represent past performance, which is no guarantee of future results. Current performance may be higher or lower than that shown above. To obtain the most recent month-end returns please call 800-258-3030 or visit homesteadfunds.com. Returns and the principal value of your investment will fluctuate such that shares, when redeemed, may be worth more or less than their original cost. You could lose money by investing in the Daily Income Fund. Although the fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. An investment in the Daily Income Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The fund’s sponsor has no legal obligation to provide financial support to the fund, and you should not expect that the sponsor will provide financial support to the fund at any time.

The Daily Income Fund’s average annual total returns are net of any fee waivers and reimbursements. The fund’s advisor waived a portion of its management fee and/or reimbursed fund expenses during the five- and 10-year periods. Had the advisor not done so, the fund’s total returns would have been lower. The expenses used are as of the most recent period-end and may fluctuate over time. Returns include the reinvestment of dividends. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares.

Short-Term Government Securities Fund

Performance Evaluation | Prepared by the Fund's Investment Advisor, RE Advisers Corporation

Performance

The Short-Term Government Securities Fund returned 0.04 percent for the first half of 2018, outperforming its benchmark index, the ICE BofA Merrill Lynch 1-5 Year U.S. Treasury Index, which returned –0.25 percent.

The fund benefited from overall lower interest rate exposure relative to the benchmark throughout the period. Additionally, the fund’s allocation to out-of-benchmark issuers in the corporate sector through issuers guaranteed by the Export-Import Bank of the United States and Federal Deposit Insurance Corporation guaranteed certificates of deposit contributed positively during the period.

The fund gradually added holdings in U.S. Treasuries, short-term amortizing asset-backed securities and the corporate sector through high-quality issuers with a preference for one- to three-year maturities. We believe that the front-end part of the curve offers a compelling risk/reward profile in the current Federal Reserve rate hike cycle.

Market Conditions

The Federal Open Market Committee (FOMC), the Fed’s policy-making committee, continued the gradual pace of rate increases, delivering two rate hikes during the period. The labor market has made steady progress with the unemployment rate improving to 4.0 percent at the end of June from 4.1 percent at the end of 2017. Economic activity, as measured by real gross domestic product, continues to grow modestly around 2.8 percent on the back of tax legislation passed by Congress at the end of 2017. Monetary policy remained accommodative, supporting strong labor market conditions and price stability. Inflation has risen closer to the Fed’s long-term goal of 2 percent. The May 2018 reading on core personal consumption expenditures (PCE) stood at 1.96 percent from 1.52 percent at the end of 2017. The FOMC expects that further gradual increases in the target range for the federal funds rate will be warranted over the coming periods.

Treasury yields rose during the period in anticipation of stronger economic conditions and the increased probability that the FOMC would raise the federal funds rate one more time this year than was previously expected. Three-month LIBOR and two-year, three-year and five-year Treasury yields rose 64, 64, 65 and 53 basis points respectively. The steeper rise in short rates brought about a flattening of the yield curve, with the closely watched two-year versus 10-year spread finishing at 32.8 basis points at midyear from 51.8 at the end of 2017.

The first half of 2018 experienced the return of volatility to the markets. The Chicago Board Options Exchange Volatility Index (VIX) rose above 20 multiple times after remaining

| Investment Advisor: RE Advisers Corporation |

| Mauricio Agudelo, CFASenior Fixed Income Portfolio ManagerBS, Finance, The University of Maryland,

Robert H. Smith School of Business |

fairly muted during 2017. Geopolitical concerns and the risk of escalation to a global trade war due to tariffs imposed by the Trump administration contributed to the increase in volatility. The U.S. has imposed tariffs on imported goods with the intention of narrowing the trade deficit with multiple countries, most notably China.

Outlook

The economy continues to deliver solid and stable growth and, in our view, should continue to expand at a moderate pace. While global growth has pulled back a bit, we believe that overall the environment remains healthy with the U.S. Purchasing Managers’ Index, an indicator of economic strength, still in the mid-50s. Consumer confidence indices appear solid with retail sales showing signs of strength. The Fed’s outlook for the labor market remains positive with the unemployment rate below 4 percent and wages increasing 2.7 percent on a year-over-year basis. In our view, consumer price inflation, as measured by the 12-month percentage change in the price index for PCE, should remain near or slightly above the 2 percent goal. According to its June 2018 statement, the FOMC expects that determining the timing and size of future adjustments to the target range for the federal funds rate will depend on the assessment of realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective.

On the fiscal side, we expect President Trump’s administration to continue imposing tariffs on goods produced by global trade partners with the ultimate goal of negotiating better trade agreements that will be beneficial to the U.S. economy. Nevertheless, there could be downside risks to any significant escalation of tariffs as other countries could respond in kind, potentially triggering a global economic slowdown. We continue to maintain the fund’s duration below the benchmark’s as we believe interest rates will likely continue their gradual upward course, assuming the economy continues to perform at a stable pace.

Short-Term Government Securities Fund

| Average Annual Total Returns (periods ended 06/30/18) | | | |

| | 1 YR % | 5 YR % | 10 YR % |

| Short-Term Government Securities Fund | 0.19 | 0.58 | 1.50 |

| ICE BofAML 1-5 Year U.S. Treasury Index | -0.35 | 0.81 | 1.79 |

| Security Diversification |

| | % of Total Investments |

| | as of 12/31/17 | as of 6/30/18 |

| U.S. government & agency obligations | 49.0 | 52.0 |

| Corporate bonds-government guaranteed | 28.4 | 24.1 |

| Corporate bonds-other | 4.7 | 9.7 |

| Certificates of deposit | 3.8 | 3.8 |

| Mortgage-backed securities | 2.9 | 2.4 |

| Asset-backed securities | 2.7 | 2.3 |

| Municipal bonds | 0.3 | 0.3 |

| Short-term and other assets | 8.2 | 5.4 |

| Total | 100.0% | 100.0% |

| Maturity | | |

| | as of 12/31/17 | as of 06/30/18 |

| Average Weighted Maturity | 1.76 | 1.89 |

Performance Comparison

Comparison of the change in value of a $10,000 investment in the fund and the ICE BofAML 1-5 Year U.S. Treasury Index made on June 30, 2008.

The returns quoted in the above table and chart represent past performance, which is no guarantee of future results. Current performance may be higher or lower than that shown above. To obtain the most recent month-end returns please call 800-258-3030 or visit homesteadfunds.com. Returns and the principal value of your investment will fluctuate such that shares, when redeemed, may be worth more or less than their original cost. The Short-Term Government Securities Fund’s average annual total returns are net of any fee waivers and reimbursements. The fund’s advisor waived a portion of its management fee during the periods shown. Had the advisor not done so, the fund's total returns would have been lower. The expenses used are as of the most recent period-end and may fluctuate over time. Returns include the reinvestment of dividends and capital gains. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares.

Short-Term Bond Fund

Performance Evaluation | Prepared by the Fund's Investment Advisor, RE Advisers Corporation

Performance

The Short-Term Bond Fund returned 0.59 percent for the first half of 2018, outperforming its benchmark index, the ICE BofA Merrill Lynch 1-5 Year Corporate/Government Index, which returned –0.32 percent. The fund’s defensive positioning relative to the benchmark, as measured by effective duration, was the primary contributor to outperformance.

The fund benefited from overall lower interest rate exposure relative to the benchmark in a period where rates gradually increased. The fund’s allocation to the asset-backed sector was also positive for performance. Additionally, the fund benefitted from a strong recovery in its two municipal positions in the Puerto Rico Sales Tax Financing Corp.

The fund gradually added holdings in U.S. Treasuries, short-term asset-backed securities and the corporate sector through high-quality issuers with a preference for one- to three-year maturities. We believe that the front-end part of the credit curve offers an attractive risk/reward profile in the current economic cycle.

Market Conditions

The Federal Open Market Committee (FOMC), the Federal Reserve’s policy-making committee, continued the gradual pace of rate increases, delivering two rate hikes during the period. The labor market has made steady progress with the unemployment rate improving to 4.0 percent at the end of June from 4.1 percent at the end of 2017. Economic activity, real gross domestic product, continues to grow modestly around 2.8 percent on the back of tax legislation passed by Congress at the end of 2017. Monetary policy remained accommodative, supporting strong labor market conditions and price stability. Inflation has risen closer to the Fed’s long-term goal of 2 percent. The May 2018 reading on core personal consumption expenditures (PCE) stood at 1.96 percent from 1.52 percent at the end of 2017. The FOMC expects that further gradual increases in the target range for the federal funds rate will be warranted over the coming periods.

Treasury yields rose during the period in anticipation of stronger economic conditions and the increased probability that the FOMC would raise the federal funds rate one more time this year than was previously expected. Three-month LIBOR and two-year, three-year and five-year Treasury yields rose 64, 64, 65 and 53 basis points respectively. The steeper rise in short rates brought about a flattening of the yield curve, with the closely watched two-year versus 10-year spread finishing at 32.8 basis points at midyear from 51.8 at the end of 2017.

The first half of 2018 experienced the return of volatility to the markets. Corporate credit spreads widened by more than 20 bps during the period, as measured by the Bloomberg Barclays U.S. Credit Index. The risk of escalation to a global

| Investment Advisor: RE Advisers Corporation |

| Mauricio Agudelo, CFASenior Fixed Income Portfolio ManagerBS, Finance, The University of Maryland,

Robert H. Smith School of Business |

trade war due to tariffs imposed by the Trump administration contributed to the increase in volatility. Emerging market currencies have shown notable depreciation relative to the U.S. dollar. In Europe, concerns about the political situation in Italy and its potential economic implications for the eurozone prompted a significant widening in risk spreads on debt issuance of Italian and other Yankee banks.

Outlook

The economy continues to deliver solid and stable growth and, in our view, should continue to expand at a moderate pace. While global growth has pulled back a bit, we believe that overall the environment remains healthy with the U.S. Purchasing Managers’ Index, an indicator of economic strength, still in the mid-50s. Consumer confidence indices appear solid with retail sales showing signs of strength. The Fed’s outlook for the labor market remains positive with the unemployment rate below 4 percent and wages increasing 2.7 percent on a year-over-year basis. In our view, consumer price inflation, as measured by the 12-month percentage change in the price index for PCE should remain near or slightly above the 2 percent goal. According to its June 2018 statement, the FOMC expects that determining the timing and size of future adjustments to the target range for the federal funds rate will depend on the assessment of realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective.

On the fiscal side, we expect President Trump’s administration to continue imposing tariffs on goods produced by global trade partners with the ultimate goal of negotiating better trade agreements that will be beneficial to the U.S. economy. Nevertheless, there could be downside risks to any significant escalation of tariffs as other countries could respond in kind, potentially triggering a global economic slowdown. We continue to maintain the fund’s duration below the benchmark’s as we believe interest rates will likely continue their gradual upward course, assuming the economy continues to perform at a stable pace.

| Average Annual Total Returns (periods ended 06/30/18) | | | |

| | 1 YR % | 5 YR % | 10 YR % |

| Short-Term Bond Fund | 1.04 | 1.34 | 3.15 |

| ICE BofAML 1-5 Year Corp./Gov. Index | -0.16 | 1.19 | 2.28 |

| Security Diversification |

| | % of Total Investments |

| | as of 12/31/17 | as of 6/30/18 |

| Corporate bonds-other | 29.2 | 34.3 |

| Asset-backed securities | 20.4 | 22.3 |

| Municipal bonds | 20.1 | 17.5 |

| Yankee bonds | 11.6 | 11.4 |

| U.S. government & agency obligations | 6.0 | 10.7 |

| Mortgage-backed securities | 1.9 | 1.1 |

| Certificates of deposit | 0.4 | 0.3 |

| Corporate bonds-government guaranteed | 0.1 | 0.1 |

| Short-term and other assets | 10.3 | 2.3 |

| Total | 100.0% | 100.0% |

| Maturity | | |

| | as of 12/31/17 | as of 06/30/18 |

| Average Weighted Maturity | 1.72 | 1.70 |

Performance Comparison

Comparison of the change in value of a $10,000 investment in the fund and the ICE BofAML 1-5 Year Corp./Gov. Index made on June 30, 2008.

The returns quoted in the above table and chart represent past performance, which is no guarantee of future results. Current performance may be higher or lower than that shown above. To obtain the most recent month-end returns please call 800-258-3030 or visit homesteadfunds.com. Returns and the principal value of your investment will fluctuate such that shares, when redeemed, may be worth more or less than their original cost. The Short-Term Bond Fund’s average annual total returns are net of any fee waivers and reimbursements. The expenses used are as of the most recent period-end and may fluctuate over time. Returns include the reinvestment of dividends and capital gains. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares.

Stock Index Fund

Performance Evaluation | Prepared by the Master Portfolio’s Investment Advisor, BlackRock Fund Advisors

Performance

For the six-month period ended June 30, 2018, the U.S. large cap market metric and the fund’s benchmark, the Standard & Poor’s 500 Index (the S&P 500), gained 2.65 percent. The Stock Index Fund followed closely behind with a 2.39 percent return. The S&P 500 is a market capitalization-weighted index composed of 500 common stocks issued by large-capitalization companies in a wide range of industries. The stocks included in this index collectively represent a substantial portion of all common stocks publicly traded in the United States.

During the six-month period, as changes were made to the composition of the S&P 500, the master portfolio in which the fund invests purchased and sold securities to maintain its objective of replicating the risks and return of the index.

Market Conditions

In the beginning of 2018, the low volatility regime that helped global equity markets reach record highs in 2017 continued to support U.S. markets. Further fueled by tax-reform optimism, January saw markets rally, led higher by momentum and information technology names. However, as the first quarter of 2018 progressed, a combination of economic over-heating concerns, the return of volatility, rising yields and the specter of trade wars weighed on markets.

From a sector standpoint, technology and consumer discretionary stocks outperformed, due to their impressive early-quarter runs. Later in the first quarter of 2018, negative headlines regarding regulation of tech stocks (considered after the breach of consumer data by Facebook), artificial intelligence and Facebook’s usage of user data weighed on the sector. Although the first quarter of 2018 was plagued with volatility, the defensive sectors of telecommunications and consumer staples were the worst performing in the S&P 500.

Contrary to what the U.S. equity market’s lackluster performance would suggest, the U.S. economy remained healthy in the first quarter of 2018. The unemployment rate remained at multi-decade lows and consumer confidence was high by historical standards. This supported the Federal Reserve’s decision to increase interest rates in March and to revise higher their rate hike expectations for 2019. The combination of increased interest rate expectations, a strong economic backdrop and technical issues regarding the deficit drove selling in U.S. Treasuries. The 10-year U.S. Treasury yield increased by 0.33 percent in the first quarter of 2018 to 2.75 percent.

Despite the fluid headlines and ongoing threats regarding the topic of U.S. protectionism in the second quarter of 2018, investors found confidence in strong U.S. economic data and

earnings growth. On the macroeconomic front, the U.S. unemployment rate struck 3.8 percent, the lowest level since 1975. Economic reports throughout the second quarter of 2018 also indicated strong economic conditions. Additionally, the core personal consumption expenditure hit the Fed’s target rate of 2 percent, supporting its decision to raise rates in June. The central bank has also signaled the likelihood of two additional hikes this year. On the earnings front, the aggregate earnings growth of S&P 500 constituents was 26.6 percent based on Thomson Reuters IBES estimates. Both of these factors were supportive for the index broadly and pushed volatility lower in the second quarter of 2018. The average level of the Chicago Board Options Exchange Volatility Index was 15.3 in the second quarter, lower than the 17.4 experienced in the first quarter of 2018.

From a sector standpoint, energy outperformed as a prolonged period of higher crude oil prices increased the attractiveness of energy company shares. In addition to the fact that West Texas Intermediate crude appreciated throughout the second quarter of 2018 and reached $77 per barrel in June, the exercising of cost discipline by U.S. producers, evident from low levels of capital expenditure from first-quarter earnings reports, was supportive for investor sentiment given uncertainty over OPEC production plans.

Elsewhere, financials underperformed all other sectors, led lower by shares of diversified financial services companies. While deregulation provided a tailwind for regional banks, investor sentiment on the broader sector was fraught by the narrowing term structure of the U.S. Treasury curve, uncertainty ahead of the Comprehensive Capital Analysis and Review stress tests (an annual exercise by the Fed to assess the largest bank holding companies operating in the United States), and global protectionism.

For the six-month period ended June 30, 2018, the strongest returns in the S&P 500 Index came from consumer discretionary (11.47 percent) and information technology (10.87 percent). Negative returns were found in consumer staples (–8.92 percent), telecommunication services (–8.35 percent), industrials (–4.70 percent), financials (–4.09 percent), materials (–3.08 percent) and telecommunication services (–0.94 percent). All remaining sectors had positive returns.

| Average Annual Total Returns (periods ended 06/30/18) | | | |

| | 1 YR % | 5 YR % | 10 YR % |

| Stock Index Fund | 13.75 | 12.82 | 9.57 |

| Standard & Poor's 500 Stock Index | 14.37 | 13.42 | 10.17 |

| Sector Diversification* | |

| | % of Total Investments

as of 6/30/18 |

| Information technology | 25.2 |

| Health care | 13.8 |

| Financials | 13.4 |

| Consumer discretionary | 12.6 |

| Industrials | 9.4 |

| Consumer staples | 6.8 |

| Energy | 6.2 |

| Utilities | 2.9 |

| Real estate | 2.8 |

| Materials | 2.5 |

| Telecommunication services | 1.9 |

| Short-term and other assets | 2.5 |

| Total | 100.0% |

| Top Ten Equity Holdings* | |

| | % of Total Investments

as of 6/30/18 |

| Apple, Inc. | 3.8 |

| Microsoft Corp. | 3.2 |

| Amazon.com, Inc. | 2.9 |

| Alphabet, Inc., Class A & C | 2.8 |

| Facebook, Inc., Class A | 2.0 |

| Berkshire Hathaway, Inc., Class B | 1.5 |

| JPMorgan Chase & Co. | 1.5 |

| Exxon Mobil Corp. | 1.5 |

| Johnson & Johnson | 1.4 |

| Bank of America Corp. | 1.1 |

| Total | 21.7% |

Performance Comparison

Comparison of the change in value of a $10,000 investment in the fund and the Standard & Poor's 500 Stock Index made on June 30, 2008.

The returns quoted in the above table and chart represent past performance, which is no guarantee of future results. Current performance may be higher or lower than that shown above. To obtain the most recent month-end returns please call 800-258-3030 or visit homesteadfunds.com. Returns and the principal value of your investment will fluctuate such that shares, when redeemed, may be worth more or less than their original cost. The Stock Index Fund’s average annual total returns are net of any fee waivers and reimbursements. The expenses used are as of the most recent period-end and may fluctuate over time. Returns include the reinvestment of dividends and capital gains. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares.

* Sector diversification and top holdings information is for the S&P 500 Index Master Portfolio, managed by BlackRock Fund Advisors, the portfolio in which the Stock Index Fund invests all of its investable assets. Please refer to the Appendix for the complete annual report of the S&P 500 Index Master Portfolio.

Value Fund

Performance Evaluation | Prepared by the Fund's Investment Advisor, RE Advisers Corporation

Performance

The Value Fund posted a –2.17 percent return for the first six months of 2018 while its benchmark index, the Standard & Poor’s 500 Value Index, returned –2.22 percent. The fund’s slightly higher than index performance results were due primarily to strength in the fund’s information technology holdings. Materials stocks, consumer discretionary equities and industrials positions detracted from results during the period.

Portfolio Review

The fund was overweight information technology issues versus the index, and the fund’s information technology holdings outperformed the index’s sector returns. Stocks contributing to the favorable results included Cisco, Microsoft, Visa, Intel and Alphabet.

Lack of exposure to consumer staples stocks was a positive for fund performance as this group was among the index’s worst-performing sectors.

The telecommunications services sector added to results. Verizon was the fund’s single holding in this grouping.

The fund’s energy holdings outperformed the benchmark’s energy sector results, though the fund was slightly underweight the sector versus the index. Conoco Phillips, Marathon Oil and Royal Dutch Shell led performance in this sector.

Health care stocks contributed to the fund’s performance. The fund was overweight in the sector compared with the index. The fund’s holdings exhibited positive performance during the period, while the benchmark’s holdings were down marginally for the first six months of the year.

Generally speaking, large-cap financial stocks were down for the first half of 2018. The fund being underweight the sector versus the benchmark benefitted in terms of relative performance.

The fund’s above-index weighting to materials stocks detracted from results. One of the holdings, DowDupont, will be discussed in more detail later in this report.

The fund’s consumer discretionary sector positions declined during the period. The fund’s exposure to auto-related stocks and limited exposure to internet/direct marketing/specialty retail impacted sector performance. The auto parts provider LKQ detracted from performance during the first half.

The fund’s industrials position detracted from results. The fund had an above-index allocation to this sector, and the fund’s stocks underperformed the index’s. Detractors included Parker Hannifin and Southwest Airlines.

| Investment Advisor: RE Advisers Corporation |

| Prabha Carpenter, CFASenior Equity Portfolio ManagerBA, Economics, University of Madras; MBA with distinction in Finance and BS in Business Economics, The American University |

Outlook

For the second half of 2018, the economic backdrop looks to be supportive of further growth. The synchronized global growth gathering momentum in the first quarter appeared less robust in the second. However, the U.S. economy remains on solid footing with real gross domestic product (GDP) expected to grow 2.9 percent for the year. Consumer confidence measures have also remained strong. The employment backdrop is strengthening: Payrolls are up, participation rates are increasing and wage gains are moderate. Earnings for the S&P 500 are expected to exhibit double-digit, high-teens growth in coming quarters as they have in the first half of the year. The tailwinds of strong macro variables and favorable tax policies have been offset by headwinds of trade wars, tariffs and protectionism. These pronouncements shift constantly. The full effect of these policy shifts and the impact on companies and industries are being discerned.

The Federal Reserve is expected to raise rates two more times in this calendar year if economic growth remains strong. We believe that trade issues could add to inflationary pressures and diminish GDP growth.

We continue to search for opportunities that will reward shareholders over the long haul. The fund has benefited in the past from spin-offs and divestitures. One name in the materials sector that we believe is poised to benefit from such an event is DowDupont, with related financial filings anticipated in the second half of 2018. The spin into a specialty chemicals company, a materials company and an agriculture entity is being engineered by Ed Breen, who successfully orchestrated the division of Tyco a few years ago. Fund shareholders benefitted from his stewardship of Tyco in the early 2000s, and we anticipate similar success with Breen’s leadership of DowDupont. In our view, the present stock price does not reflect the returns-based valuation that will eventually be accorded the new entities.

| Average Annual Total Returns (periods ended 06/30/18) | | | |

| | 1 YR % | 5 YR % | 10 YR % |

| Value Fund | 12.05 | 11.57 | 9.46 |

| Standard & Poor's 500 Value Index | 7.58 | 10.45 | 8.44 |

| Sector Diversification | |

| | % of Total Investments

as of 6/30/18 |

| Information technology | 25.7 |

| Health care | 17.4 |

| Financials | 16.1 |

| Industrials | 12.7 |

| Energy | 11.3 |

| Materials | 11.1 |

| Consumer discretionary | 3.3 |

| Telecommunication services | 1.1 |

| Short-term and other assets | 1.3 |

| Total | 100.0% |

| Top Ten Equity Holdings | |

| | % of Total Investments

as of 6/30/18 |

| Cisco Systems, Inc. | 4.8 |

| Avery Dennison Corp. | 4.7 |

| Intel Corp. | 4.7 |

| Visa Inc., Class A | 4.6 |

| DowDuPont, Inc. | 4.6 |

| JPMorgan Chase & Co. | 4.3 |

| Southwest Airlines Co. | 4.2 |

| Microsoft Corp. | 4.1 |

| Pfizer, Inc. | 3.9 |

| Bristol-Myers Squibb Co. | 3.9 |

| Total | 43.8% |

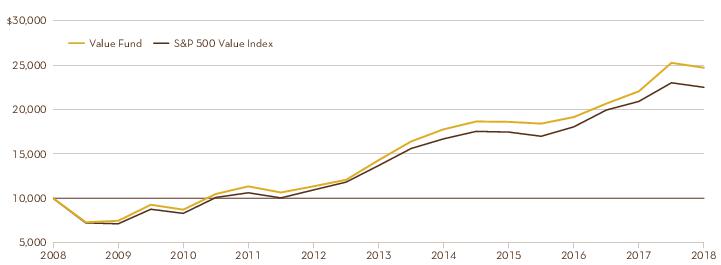

Performance Comparison

Comparison of the change in value of a $10,000 investment in the fund and its benchmark indices made on June 30, 2008.

The returns quoted in the above table and chart represent past performance, which is no guarantee of future results. Current performance may be higher or lower than that shown above. To obtain the most recent month-end returns please call 800-258-3030 or visit homesteadfunds.com. Returns and the principal value of your investment will fluctuate such that shares, when redeemed, may be worth more or less than their original cost. The Value Fund’s average annual total returns are net of any fee waivers and reimbursements. The expenses used are as of the most recent period-end and may fluctuate over time. Returns include the reinvestment of dividends and capital gains. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares.

Performance Evaluation

11

Growth Fund

Performance Evaluation | Prepared by the Fund's Subadvisor, T. Rowe Price Associates

Performance

The Growth Fund posted a 12.02 percent return in the first half of 2018 and outperformed the 7.25 percent advance for the Russell 1000 Growth Index, the fund’s benchmark. Broadly speaking, both stock selection and sector allocation contributed to relative performance.

Portfolio Review

An overweight allocation and stock choices like Amazon.com and Netflix led the consumer discretionary sector to be the top contributor to relative performance during the period. At Amazon.com, core retail strength in North America, accelerating revenue and margin expansion within Amazon Web Services, and growth of ad revenue drove above-consensus top-line and bottom-line results. In addition to its dominant e-commerce and cloud-computing businesses, both of which we believe still have substantial growth runways, the company continues to reinvest profits into such other business segments as devices and video. In our view, such initiatives bode well for future growth and enhance the overall value proposition of its expanding ecosystem. The company’s push into advertising also continues to gain traction as more consumers begin their product search on Amazon’s platform. Netflix shares traded upward as both domestic and international subscription growth continues to outpace expectations, driven by strong content lineup and growth of bundling deals. As viewership builds on an aggregate and per-subscriber basis, we anticipate that Netflix will continue to improve the viewing experience, thereby increasing the company’s negotiating leverage with content suppliers globally and increasing its competitive positioning against regional companies.

Stock selection in industrials and business services was beneficial, and underweighting the sector also helped. Boeing was one of the strong positions. Shares of Boeing rose as operating margins continued to expand thanks to favorable delivery volume and mix within commercial aircraft, and better-than-expected revenue growth from defense and services. We continue to believe that the company is well positioned for several years of healthy earnings and free cash flow growth, supported by its robust backlog of orders and tailwinds from secular growth in global air traffic as the middle class in emerging markets continues to expand.

Stock selection in information technology was mainly responsible for excess returns, while overweighting the sector also had a positive impact. Salesforce.com and Intuit were key areas of strength. Large deal activity; strong international growth; and the accelerating growth of service, marketing and commerce cloud computing drove above-consensus top-line results, causing shares of Salesforce to climb. In our view, Salesforce.com is an outstanding business for its leadership in cloud computing, specifically software- as-a-service, and boasts a highly recurring subscription

| Subadvisor: T. Rowe Price Associates |

| Taymour Tamaddon, CFAPortfolio ManagerBS, Applied Physics, Cornell University;

MBA, Finance, Dartmouth |

business model. The consumer tax segment benefited from a shift to a high-end product mix and an increase in customer purchases of secondary products, which helped to lift Intuit shares. We believe Intuit’s dominant market position and transition to software-as-a-service will expand the company’s addressable market, leading to above-average earnings growth in the long term.

Underweighting the materials sector had a positive impact on relative performance as the sector underperformed the broader benchmark.

In contrast, the financials sector was the largest detractor from relative performance due primarily to adverse stock selection. Morgan Stanley shares came under pressure due to several news items including investor concerns over European instability due to political unrest in Italy and news that transaction revenue from retail clients had slowed significantly in the second quarter, weighing on results of the company's wealth management division. Nevertheless, we believe that the company's shift away from fixed income, currency and commodity trading toward higher margin, less capital-intensive asset management should bolster earnings growth over time.

Outlook

We are encouraged by the solid performance of U.S. large-cap growth stocks, which posted solid second-quarter gains and ended the first half of 2018 with positive returns. However, investor sentiment has deteriorated somewhat due to geopolitical issues, including the tide of protectionism, new tariffs and rising U.S. interest rates. We are expecting and positioned for a potentially challenging stock market environment that delivers only moderate returns. This more guarded stance stems from uncertainties related to the sustainability of profit margins. As a result, large-cap growth stock valuations appear relatively expensive; we are uncovering fewer durable growth companies that offer compelling value. Nevertheless, we believe that good stock selection can continue to drive outperformance. We remain constructive on many individual companies in the information technology and health care sectors, where we are finding stocks that offer attractive relative value.

| Average Annual Total Returns (periods ended 06/30/18) | | | |

| | 1 YR % | 5 YR % | 10 YR % |

| Growth Fund* | 28.93 | 18.98 | 13.82 |

| Russell 1000 Growth Index | 22.51 | 16.36 | 11.83 |

| Sector Diversification | |

| | % of Total Investments

as of 6/30/18 |

| Information technology | 41.1 |

| Consumer discretionary | 23.1 |

| Health care | 18.6 |

| Industrials | 7.5 |

| Financials | 4.5 |

| Real estate | 1.2 |

| Consumer staples | 1.1 |

| Utilities | 1.1 |

| Short-term and other assets | 1.8 |

| Total | 100.0% |

| Top Ten Equity Holdings | |

| | % of Total Investments

as of 6/30/18 |

| Amazon.com, Inc. | 8.5 |

| Microsoft Corp. | 5.5 |

| Booking Holdings, Inc. | 4.9 |

| Facebook, Inc., Class A | 4.8 |

| Boeing Co. | 4.6 |

| Visa Inc., Class A | 4.5 |

| Alphabet, Inc., Class A | 4.2 |

| UnitedHealth Group, Inc. | 2.9 |

| Alibaba Group Holding Ltd. ADR | 2.5 |

| Alphabet, Inc., Class C | 2.4 |

| Total | 44.8% |

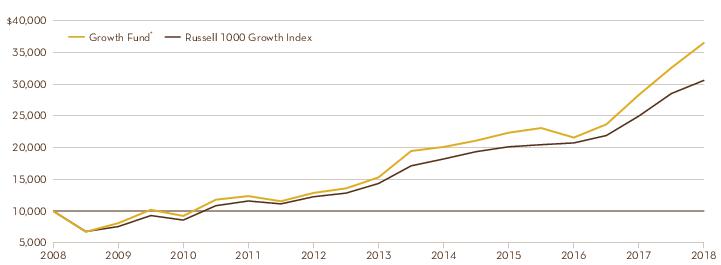

Performance Comparison

Comparison of the change in value of a $10,000 investment in the fund and its benchmark indices made on June 30, 2008.

The returns quoted in the above table and chart represent past performance, which is no guarantee of future results. Current performance may be higher or lower than that shown above. To obtain the most recent month-end returns please call 800-258-3030 or visit homesteadfunds.com. Returns and the principal value of your investment will fluctuate such that shares, when redeemed, may be worth more or less than their original cost. The Growth Fund’s average annual total returns are net of any fee waivers and reimbursements. The fund's advisor waived a portion of its management fee during the five- and 10-year periods. Had the advisor not done so, the fund's total returns would have been lower. The expenses used are as of the most recent period-end and may fluctuate over time. Returns include the reinvestment of dividends and capital gains. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares.

* Performance information for the Growth Fund (formerly the Nasdaq-100 Index Tracking StockSM Fund) reflects its previous investment strategy from inception through December 5, 2008, of matching, as closely as possible, before expenses, the performance of the Nasdaq-100 Stock Index.

Performance Evaluation

13

Small-Company Stock Fund

Performance Evaluation | Prepared by the Fund's Investment Advisor, RE Advisers Corporation

Performance

The Small-Company Stock Fund returned –1.73 percent for the first six months of 2018, versus a return of 7.66 percent for the Russell 2000, the fund’s benchmark. Generally speaking, the fund’s holdings did not receive favorable market attention during this time. The fund has historically been underweight in health care, especially biotechnology, due to its binary outcome profiles and associated risk. During this period, biotechnology stocks comprised the index’s largest sector position, and these holdings generated double-digit returns. The second area of fund relative underperformance versus the benchmark was in the information technology sector. Although the fund’s information technology services holdings performed well during the period, its electronic equipment holdings and internet software and services holdings detracted from sector results. Industrials, an overweight sector for the fund, also performed poorly.

Portfolio Review

A number of the fund’s consumer discretionary holdings performed well in the first half of 2018. BJ’s Restaurants reported strong traffic trends and sales growth. G-III Apparel reported strength in sales, earnings and progress on business initiatives.

The fund’s financial sector holdings slightly outperformed the benchmark. Encore Capital detracted from results. Encore’s acquisition of Cabot Credit Management, completed in July 2018, weighed on the stock. In insurance holdings, an overweight sector position relative to the benchmark, both Kinsale and National General Holdings were strong performers. In banking, one of the fund’s holdings, State Bank Financial, received a takeover offer from a larger Texas bank for a premium multiple to tangible book value.

The fund’s health care holdings performed well during the period. Specifically, Steris benefitted from both a favorable competitive landscape as a competitor’s sterilization division was disrupted by a transaction during the period as well as introduction of consolidated sterile processing locations to U.S. hospitals.

Names added to the fund during the period included Interface, a manufacturer of modular carpets for institutional markets and luxury vinyl tiles. Interface’s new management is focused on growth, greater operational efficiencies and newer products utilizing research and development.

| Investment Advisor: RE Advisers Corporation |

| Prabha Carpenter, CFASenior Equity Portfolio ManagerBA, Economics, University of Madras; MBA with distinction in Finance and BS in Business Economics, The American University |

Outlook

Small business optimism was strong as reported by the National Federation of Independent Business in its June report. And the economic backdrop, in our view, remains supportive of continued domestic and global growth.

For the first half of 2018, small capitalization stocks, represented by the Russell 2000, have outpaced larger capitalization stocks, represented by the Standard & Poor’s 500 Index. Lower tax rates and the perception that smaller companies are less exposed to the vicissitudes of trade wars have favored this group. However, the first-half performance of the Russell 2000 was concentrated in a few sectors. Industrials as a sector did not really contribute to the benchmark’s performance. We anticipate that investors will recognize some of the fund’s “overlooked” holdings in the industrials sector in future periods. For example, as broadband infrastructure is built out, and the need for high-speed constant connection is met, Dycom, a fund holding of long standing, stands to realize stronger earnings growth. As investors, we are patient with fund holdings that are in the midst of transformations from prosaic, low-margin businesses to higher-margin, higher-valuation enterprises. In this category is NN, Inc. NN, Inc. has sold its bearing components business, purchased health care-related operations, paid off some high-cost debt, and stated that there may be further refinement of its portfolio offerings and deleveraging — which we believe are all attainable goals. We do not believe that the current valuation reflects the changes made or prospects for NN, Inc.’s future.

Benchmark comparisons periodically obscure our long-term focus and success over longer time periods. We continue to manage the portfolio with a focus on fundamentals, seeking to identify “values” overlooked by the market. We do not seek to replicate the benchmark’s sector weightings, as evidenced by the fund’s high active share.

| Average Annual Total Returns (periods ended 06/30/18) | | | |

| | 1 YR % | 5 YR % | 10 YR % |

| Small-Company Stock Fund | 8.71 | 9.57 | 11.90 |

| Russell 2000 Index | 17.57 | 12.46 | 10.60 |

| Sector Diversification | |

| | % of Total Investments

as of 6/30/18 |

| Industrials | 33.6 |

| Financials | 22.4 |

| Information technology | 14.7 |

| Consumer discretionary | 12.2 |

| Materials | 9.1 |

| Health care | 4.4 |

| Energy | 0.8 |

| Short-term and other assets | 2.8 |

| Total | 100.0% |

| Top Ten Equity Holdings | |

| | % of Total Investments

as of 6/30/18 |

| Dycom Industries, Inc. | 6.6 |

| Encore Capital Group, Inc. | 4.8 |

| PolyOne Corp. | 4.7 |

| Applied Industrial Technologies, Inc. | 4.3 |

| State Bank Financial Corp. | 4.2 |

| BJ’s Restaurants, Inc. | 4.2 |

| Kinsale Capital Group, Inc. | 3.8 |

| STERIS PLC | 3.8 |

| Cracker Barrel Old Country Store, Inc. | 3.5 |

| Werner Enterprises, Inc. | 3.2 |

| Total | 43.1% |

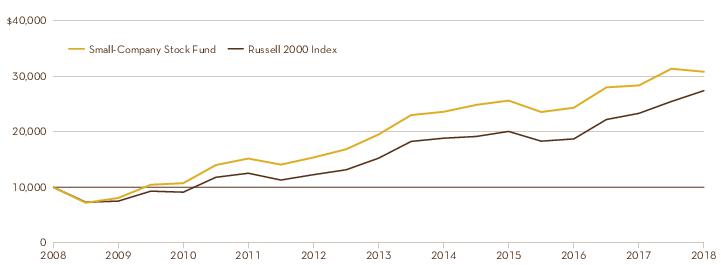

Performance Comparison

Comparison of the change in value of a $10,000 investment in the fund and the Russell 2000 Index made on June 30, 2008.

The returns quoted in the above table and chart represent past performance, which is no guarantee of future results. Current performance may be higher or lower than that shown above. To obtain the most recent month-end returns please call 800-258-3030 or visit homesteadfunds.com. Returns and the principal value of your investment will fluctuate such that shares, when redeemed, may be worth more or less than their original cost. The Small-Company Stock Fund’s average annual total returns are net of any fee waivers and reimbursements. The expenses used are as of the most recent period-end and may fluctuate over time. Returns include the reinvestment of dividends and capital gains. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares.

Performance Evaluation

15

International Equity Fund

Performance Evaluation | Prepared by the Fund's Subadvisor, Harding Loevner LP

Performance

For the six-month period ending June 30, 2018, the International Equity Fund outperformed its benchmark, the MSCI EAFE Index, increasing 0.82 percent versus the –2.75 percent return for the index.

Portfolio Review

The positive relative performance derived primarily from good stock selection, although the fund’s overweight in information technology (IT), one of the strongest-performing sectors, also worked in its favor. Within IT, 3D-design software developer Dassault Systèmes and banking software provider Temenos were both additive, particularly as the latter had high earnings growth and accelerating software licensing growth. Health care was led by blood plasma specialist CSL Limited and medical information provider M3. M3 rose on the news that the company acquired an American clinical trials firm, signaling entry into the large and profitable U.S. market. In financials, DBS Group of Singapore led as the bank signaled larger distributions of capital to shareholders with a surprising increase in the company’s regular dividend plus a special dividend. DBS Group’s strong performance, alongside gains from GF Banorte, HDFC, and AIA Group, were enough to offset the losses associated with our holdings in Spain’s BBVA and Brazil’s Itaú Unibanco.

Viewed by region, our stock selection was strong in Europe, both in and out of the eurozone. In France, all of the fund’s five holdings gained, led by Dassault Systèmes. In Germany the fund benefitted from gains in Symrise, Linde and enterprise software developer SAP. Outside of the eurozone, Switzerland was boosted by good results from hearing-aid maker Sonova and Temenos. The fund’s holdings in Japan also added to relative performance from a regional perspective, led by M3 and Sysmex, the clinical-testing equipment manufacturer. On the other side of the ledger, industrial robot manufacturer Fanuc dragged on stock selection in Japan after management cautioned that declining smartphone demand, rising foreign exchange rates and global trade friction could threaten the company’s profitability in coming years.

Outlook

The suggestion that we are in an environment of rising interest rates will likely not surprise even casual readers of the financial press. In the U.S., the 0.25 percent hike in June 2018 by the Federal Reserve was the seventh such increase in the past three years.

Rising interest rates can have an impact on corporate profits, stock valuations, and more generally economic growth and capital flows. We believe that higher interest rates are likely to hurt corporate profits as the costs of capital rise. In our view,

| Subadvisor: Harding Loevner LP |

| Ferrill D. Roll, CFACo-Lead Portfolio ManagerBA, Economics, Stanford University |

| Alexander T. Walsh, CFACo-Lead Portfolio ManagerBA, North American Studies, McGill University |

reduced capital expenditures can decelerate economic growth. Rising rates are also viewed as negative for stock valuations, as company share prices should reflect the discounted value of their future cash flows. Over time, higher rates do the job central banks ask them to do: reduce liquidity and slow spending. The nature of economic cycles portends that this could result in economic recession.

The impact of rising rates also affects global capital flows. U.S. rates have oversized influence because of the U.S. dollar’s role as a reserve currency: Many companies and countries, particularly in emerging markets, raise debt in U.S. dollars. Globally, low nominal interest rates and easy monetary policies have papered over many financial vulnerabilities, including the rise in debt in emerging markets.

Our investment philosophy features three components: quality, growth and valuation. All three will play their roles in more challenging economic times. In an environment of rising interest rates, we’ve found that our requirement of a strong balance sheet and cash flow has protected our investments when liquidity tightens. While we hope to own many secular growth businesses, we believe that many of our businesses will be impacted if global growth slows (or, in recessions, declines), and we must be skeptical about forecasts, anticipating ways in which we could be wrong-footed.

The final pillar of our investment philosophy, valuation, is potentially the most problematic for us and for growth investors generally. For years, while share prices have been rising, we have talked about how we found market valuations challenging, but noted that, with growth scarce in a slow-to-heal world, we would be more tolerant of higher valuations than in other circumstances. With growth now under threat cyclically but the prices of the fastest-growing companies still rising, market valuations remain a fraught issue.

International Equity Fund

| Average Annual Total Returns (periods ended 06/30/18) | | | |

| | 1 YR % | 5 YR % | 10 YR % |

| International Equity Fund* | 10.76 | 7.35 | 3.43 |

| MSCI®EAFE®Index | 6.84 | 6.44 | 2.84 |

| Country Diversification | |

| | % of Total Investments

as of 6/30/18 |

| Germany | 18.2 |

| Japan | 17.1 |

| France | 11.0 |

| Switzerland | 9.6 |

| Britain | 9.1 |

| Hong Kong | 4.7 |

| Sweden | 3.9 |

| Spain | 3.4 |

| Singapore | 2.9 |

| Israel | 2.7 |

| Canada | 2.1 |

| United States of America | 1.9 |

| South Africa | 1.5 |

| Australia | 1.3 |

| Italy | 1.3 |

| China | 1.2 |

| Denmark | 1.0 |

| Republic of South Korea | 1.0 |

| Taiwan, India, Brazil & Mexico | 2.3 |

| Short-term and other assets | 3.8 |

| Total | 100.0% |

| Top Ten Equity Holdings | |

| | % of Total Investments

as of 6/30/18 |

| AIA Group Ltd. | 4.7 |

| Dassault Systèmes SE | 3.7 |

| Bayer AG REG | 3.7 |

| Royal Dutch Shell PLC, Class B | 3.7 |

| Allianz SE REG | 3.5 |

| Nestlé SA ADR | 3.3 |

| M3, Inc. | 3.1 |

| L’Oréal SA | 3.0 |

| FANUC Corp. | 2.9 |

| DBS Group Holdings Ltd. | 2.9 |

| Total | 34.5% |

Performance Comparison

Comparison of the change in value of a $10,000 investment in the fund and the MSCI®EAFE®Index made on June 30, 2008.

The returns quoted in the above table and chart represent past performance, which is no guarantee of future results. Current performance may be higher or lower than that shown above. To obtain the most recent month-end returns please call 800-258-3030 or visit homesteadfunds.com. Returns and the principal value of your investment will fluctuate such that shares, when redeemed, may be worth more or less than their original cost. The International Equity Fund’s average annual total returns are net of any fee waivers and reimbursements. The fund’s advisor waived a portion of its management fee during the periods shown. Had the advisor not done so, the fund's total returns would have been lower. The expenses used are as of the most recent period-end and may fluctuate over time. Returns include the reinvestment of dividends and capital gains. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares.

* Performance information for the International Equity Fund (formerly the International Value Fund) reflects its performance as an actively managed fund subadvised by Mercator Asset Management from June 30, 2008 to September 14, 2015, as a passively managed portfolio directed by SSGA Funds Management Inc. from September 15, 2015 to January 8, 2016 and, after a transition, as an actively managed fund subadvised by Harding Loevner LP from January 15, 2016 to period end.

Performance Evaluation

17

As a shareholder, you incur two types of costs: (1) transaction costs; and (2) ongoing costs, including management fees, service fees, and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in each of the Homestead Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at January 1, 2018 and held through June 30, 2018.

Actual Expenses

The first line for each Fund in the table on the following page provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Individual Retirement Arrangements (IRAs) and Educational Savings Accounts (ESAs) are charged a $15.00 annual custodial fee. The charge is automatically deducted from your account in the fourth quarter of each year or, if you close your account, at the time of redemption. A fee is collected for each IRA or ESA, as distinguished by account type (Traditional IRA, Roth IRA, or ESA) and Social Security Number. For example, if you have both a Traditional IRA and a Roth IRA account, each would be charged a fee. But only one fee would be collected for each account type, regardless of the number of Funds held by each account type. These fees are not included in the example below. If included, the costs shown would be higher.

Hypothetical Example for Comparison Purposes

The second line for each Fund in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect the custodial account fee. Therefore, the hypothetical information in the example is useful in comparing your ongoing costs only, and will not help you determine the

relative total costs of owning different funds. In addition, if the custodial account fee was included, your costs would have been higher.

Expense Example (Continued)

| Daily Income Fund | Beginning Account Value

January 1, 2018 | Ending Account Value

June 30, 2018 | Expenses Paid During the Perioda | Annualized Expense Ratio for the Six Month Period Ended

June 30, 2018 |

| Actual Return | $1,000.00 | $1,004.10 | $3.60 | 0.72% |

| Hypothetical Return (5% return before expenses) | $1,000.00 | $1,021.41 | $3.63 | 0.72% |

| Short-Term Government Securities Fundb | | | | |

| Actual Return | $1,000.00 | $1,000.40 | $3.72 | 0.75% |

| Hypothetical Return (5% return before expenses) | $1,000.00 | $1,021.28 | $3.76 | 0.75% |

| Short-Term Bond Fund | | | | |

| Actual Return | $1,000.00 | $1,005.90 | $3.78 | 0.76% |

| Hypothetical Return (5% return before expenses) | $1,000.00 | $1,021.23 | $3.81 | 0.76% |

| Stock Index Fundc | | | | |

| Actual Return | $1,000.00 | $1,023.90 | $2.74 | 0.55% |

| Hypothetical Return (5% return before expenses) | $1,000.00 | $1,022.29 | $2.74 | 0.55% |

| Value Fund | | | | |

| Actual Return | $1,000.00 | $978.30 | $2.91 | 0.59% |

| Hypothetical Return (5% return before expenses) | $1,000.00 | $1,022.06 | $2.98 | 0.59% |

| Growth Fund | | | | |

| Actual Return | $1,000.00 | $1,120.20 | $4.60 | 0.87% |

| Hypothetical Return (5% return before expenses) | $1,000.00 | $1,020.66 | $4.38 | 0.87% |

| Small-Company Stock Fund | | | | |

| Actual Return | $1,000.00 | $982.70 | $4.34 | 0.88% |

| Hypothetical Return (5% return before expenses) | $1,000.00 | $1,020.62 | $4.42 | 0.88% |

| International Equity Fundb | | | | |

| Actual Return | $1,000.00 | $1,008.20 | $4.93 | 0.99% |

| Hypothetical Return (5% return before expenses) | $1,000.00 | $1,020.09 | $4.95 | 0.99% |

| a. | The dollar amounts shown as “Expenses Paid During the Period” are equal to each Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 181, then divided by 365 (to reflect the half-year period). |

| b. | Reflects fee waiver and expense limitation agreements in effect during the period. |

| c. | The Stock Index Fund is a feeder fund that invests substantially all of its assets in a Master Portfolio. The example reflects the expenses of both the feeder fund and the Master Portfolio. |

Regulatory and Shareholder Matters

Proxy Voting Policies and Procedures

The policies and procedures used to determine how to vote proxies relating to the Funds’ portfolio securities are available online at homesteadfunds.com and, without charge, upon request by calling 800-258-3030. This information is also available on the Securities and Exchange Commission’s website at sec.gov.

Proxy Voting Record

For the most recent twelve-month period ended June 30, information regarding how proxies relating to portfolio securities were voted on behalf of each of the Funds is available, without charge, upon request by calling 800-258-3030. This information is also available online at homesteadfunds.com and on the Securities and Exchange Commission’s website at sec.gov.

Quarterly Disclosure of Portfolio Holdings

The Funds file complete schedules of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. Portfolio holdings for the second and fourth quarters of each fiscal year are filed as part of the Funds’ semi-annual and annual reports. The Funds’ Form N-Q, semi-annual and annual reports are available on the Commission’s website at sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330. The most recent quarterly portfolio holdings and semi-annual and annual report also can be accessed on the Funds’ website at homesteadfunds.com.

Principal Risks

You may lose money by investing in the Funds. Below are summaries of some, but not all, of the principal risks of investing in one or more of the Funds, each of which could adversely affect a Fund’s NAV, yield and total return. Each risk listed below does not necessarily apply to each Fund, and you should read each Fund’s prospectus carefully for a description of the principal risks associated with investing in a particular Fund.

• Asset-Backed and Mortgage-Backed Securities Risk The risk that defaults, or perceived increases in the risk of defaults, on the obligations underlying asset-backed and mortgage-backed securities, including mortgage pass-through securities and collateralized mortgage obligations (“CMOs”), significant credit downgrades and illiquidity may impair the value of the securities. These securities also present a higher degree of prepayment risk (when repayment of principal occurs before scheduled maturity resulting in the Fund having to reinvest proceeds at a lower interest rate) and extension risk (when rates of repayment of principal are slower than expected, which may lock in a below-market interest rate, increase the security’s duration, and reduce the value of the security) than do other types of fixed income securities. Enforcing

rights against the underlying assets or collateral may be difficult, and the underlying assets or collateral may be insufficient if the issuer defaults.

• Commercial Paper Risk Investments in commercial paper are subject to the risk that the issuer cannot issue enough new commercial paper to satisfy its obligations with respect to its outstanding commercial paper, also known as rollover risk. Commercial paper is generally unsecured, which increases the credit risk associated with this type of investment. The value of commercial paper may be affected by changes in the credit rating or financial condition of the issuing entities. The value of commercial paper will tend to fall when interest rates rise and rise when interest rates fall.

• Concentration Risk To the extent the fund concentrates in a particular industry, it may be more susceptible to economic conditions and risks affecting that industry.

• Corporate Bond Risk Corporate debt securities are subject to the risk of the issuer’s inability to meet principal and interest payments on the obligations and may also be subject to price volatility due to factors such as interest rates, market perception of the creditworthiness of the issuer and general market liquidity.

• Currency Risk Foreign currencies may experience steady or sudden devaluation relative to the U.S. dollar or other currencies, adversely affecting the value of the Fund’s investments. The value of the Fund’s assets may be affected favorably or unfavorably by currency exchange rates, currency exchange control regulations, and restrictions or prohibitions on the repatriation of foreign currencies. Because the Fund’s net asset value is determined on the basis of U.S. dollars, if the local currency of a foreign market depreciates against the U.S. dollar, you may lose money even if the foreign market prices of the Fund’s holdings rise.

• Debt Securities Risks

Credit Risk The risk that an issuer or counterparty will fail to pay its obligations to the Fund when they are due. As a result, the Fund’s income might be reduced, the value of the Fund’s investment might fall, and/or the Fund could lose the entire amount of its investment. Changes in the financial condition of an issuer or counterparty, changes in specific economic, social or political conditions that affect a particular type of security or other instrument or an issuer, and changes in economic, social or political conditions generally can increase the risk of default by an issuer or counterparty, which can affect a security’s or other instrument’s credit quality or value and an issuer’s or counterparty’s ability to pay interest and principal when due. The values of securities also may decline for a number of other reasons that relate directly to the issuer, such as management performance, financial leverage and reduced demand for the issuer’s goods and services, as well as the historical and prospective earnings of the issuer and the value of its assets.

Regulatory and Shareholder Matters

Regulatory and Shareholder Matters (Continued)

Extension Risk The risk that if interest rates rise, repayments of principal on certain debt securities, including, but not limited to, floating rate loans and mortgage-related securities, may occur at a slower rate than expected and the expected maturity of those securities could lengthen as a result. Securities that are subject to extension risk generally have a greater potential for loss when prevailing interest rates rise, which could cause their values to fall sharply.

Interest Rate Risk The risk that debt instruments will change in value because of changes in interest rates. The value of an instrument with a longer duration (whether positive or negative) will be more sensitive to changes in interest rates than a similar instrument with a shorter duration. Bonds and other debt instruments typically have a positive duration. The value of a debt instrument with positive duration will generally decline if interest rates increase.

• Depositary Receipts Risk Depositary receipts in which the Fund may invest are receipts listed on U.S. exchanges that are issued by banks or trust companies that entitle the holder to all dividends and capital gains that are paid out on the underlying foreign shares. Investments in depositary receipts may be less liquid than the underlying shares in their primary trading market.

• Derivatives Risk The risk that an investment in derivatives will not perform as anticipated by the Adviser, cannot be closed out at a favorable time or price, or will increase the Fund’s volatility; that derivatives may create investment leverage; that, when a derivative is used as a substitute for or alternative to a direct cash investment, the transaction may not provide a return that corresponds precisely with that of the cash investment; or that, when used for hedging purposes, derivatives will not provide the anticipated protection, causing the Fund to lose money on both the derivatives transaction and the exposure the Fund sought to hedge. The counterparty to a derivatives contract may be unable or unwilling to make timely settlement payments, return the Fund’s margin, or otherwise honor its obligations. Changes in regulation relating to a mutual fund’s use of derivatives and related instruments could potentially limit or impact the Fund’s ability to invest in derivatives, limit a Fund’s ability to employ certain strategies that use derivatives and adversely affect the value or performance of derivatives and the Fund.

• Emerging and Frontier Market Risk The risk that investing in emerging and frontier markets will be subject to greater political and economic instability, greater volatility in currency exchange rates, less developed securities markets, possible trade barriers, currency transfer restrictions, a more limited number of potential buyers and issuers, an emerging market country’s dependence on revenue from particular commodities or international aid, less governmental supervision and regulation, unavailability of currency hedging techniques,

differences in auditing and financial reporting standards, thinner trading markets, different clearing and settlement procedures and custodial services, and less developed legal systems than in many more developed countries. The securities of emerging market companies may trade less frequently and in smaller volumes than more widely held securities. These risks are generally greater for investments in frontier market countries, which typically have smaller economies or less developed capital markets than traditional emerging market countries.

• Equity Securities Risk Equity securities generally have greater price volatility than fixed-income securities. The market price of equity securities owned by the Fund may go up or down, sometimes rapidly or unpredictably. Equity securities may decline in value due to factors affecting the issuer, equity securities markets generally, particular industries represented in those markets or the issuer itself.

• Focused Investment Risk A fund that invests a substantial portion of its assets in a particular market, industry, sector, group of industries or sectors, country, region, group of countries or asset class is subject to greater risk than a fund that invests in a more diverse investment portfolio. In addition, the value of such a fund is more susceptible to any single economic, market, political or regulatory or other occurrence affecting, for example, the particular markets, industries, regions, sectors or asset classes in which the fund is invested. This is because, for example, issuers in a particular market, industry, region, sector or asset class may react similarly to specific economic, market, regulatory, political or other developments. The particular markets, industries, regions, sectors or asset classes in which the Fund may focus its investments may change over time and the Fund may alter its focus at inopportune times.