UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File number: 811-06136

HOMESTEAD FUNDS, INC.

(Exact name of registrant as specified in charter)

4301 Wilson Boulevard

Arlington, VA 22203

(Address of principal executive office – Zip code)

Danielle Sieverling

Homestead Funds, Inc.

4301 Wilson Boulevard

Arlington, VA 22203

(Name and address of agent for service)

Copies to:

Bryan Chegwidden, Esq.

Ropes & Gray LLP

1211 Avenue of the Americas

New York, NY 10036-8704

(Name and addresses of agent for service)

Registrant’s telephone number, including area code: (703) 907-5993

Date of fiscal year end: December 31

Date of reporting period: December 31, 2018

Item 1. Reports to Stockholders.

Annual Report

December 31, 2018

Our Funds

Daily Income Fund (HDIXX)

Short-Term Government Securities Fund (HOSGX)

Short-Term Bond Fund (HOSBX)

Stock Index Fund (HSTIX)

Value Fund (HOVLX)

Growth Fund (HNASX)

Small-Company Stock Fund (HSCSX)

International Equity Fund (HISIX)

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary. Instead, the reports will be made available on the Fund’s website (www.homesteadfunds.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling 800.258.3030, option 1, or by sending an email request to Homestead Funds at invest@homesteadfunds.com.

Beginning on January 1, 2019, you may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can call 800.258.3030, option 1, or send an email request to invest@homesteadfunds.com to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held with the fund complex if you invest directly with the Fund.

The investment commentaries on the following pages were prepared for each fund by its portfolio manager(s). The views expressed are those of the portfolio manager(s) on January 17, 2019, for each fund as of December 31, 2018. Since that date, those views might have changed. The opinions stated might contain forward-looking statements and discuss the impact of domestic and foreign markets, industry and economic trends, and governmental regulations on the funds and their holdings. Such statements are subject to uncertainty, and the impact on the funds might be materially different from what is described here.

Past performance does not guarantee future results.

Investors are advised to consider fund objectives, risks, charges and expenses before investing. The prospectus contains this and other information and should be read carefully before you invest. To obtain a prospectus, call 800.258.3030 or download a PDF at homesteadfunds.com.

President's Letter

2018 Annual Report

January 17, 2019

Dear Shareholders,

In an economy with unemployment at cyclical lows, inflation right around the Federal Reserve’s preferred 2 percent target, and businesses and consumers spending happily through much of the year, there was enough good news through most of 2018 for investors to shake off looming worries.

In the fourth quarter though, we essentially witnessed a tipping point for the market stressors. China and oil prices continued to be a troublesome duo, reminiscent of the market pullback in 2015 to 2016. A pileup of data points about a weakening economy in China — lackluster loan growth, tighter credit conditions, slower-than-expected retail sales and industrial output — reinforced the case for a downgraded global outlook that investors worried over throughout the year.

After a rough quarter, there is reason to be moderately optimistic for the year ahead. Most analysts already expected slower earnings and gross domestic product growth for 2019, and those measures could continue to be positive even with the year-end shocks. The Fed also has newfound “wiggle room” in its policy options, having raised rates in recent years up to a more normal level and retreated from the extreme liquidity it used during the financial crisis.

We realize that market volatility and the corresponding jolts to account values can be difficult to accept. I want to remind you that we have a team of registered representatives, including several Certified Financial Planners®, who work with investors daily. Our associates can help you understand the factors influencing the capital markets and check that your levels of exposure to different asset classes are in line with your goals. Please feel free to give us a call at 800.258.3030, option 2.

We also want to make you aware of some recent changes to portfolio management. RE Advisers, the investment advisor for five of the eight Homestead Funds, took steps in 2018 and early 2019 to bolster its portfolio management staffing. In February 2018, equity analyst Peter Blackstone was added to the team, and early in 2019 senior equity portfolio manager Jim Polk joined Prabha Carpenter as a co-manager of the Value and Small-Company Stock Funds. On the fixed-income side, RE Advisers welcomed portfolio manager Ivan Naranjo in November 2018. Ivan co-manages the Short-Term Government and Short-Term Bond Funds along with senior fixed-income portfolio manager Mauricio Agudelo. Harding Loevner, the subadvisor for the International Equity Fund, announced that portfolio manager Andrew West became a lead portfolio manager of the fund in January 2019, replacing Alexander Walsh. Ferrill Roll continues as the strategy’s other lead portfolio manager. Alexander remains a portfolio manager of the fund. The assignment change was made in anticipation of Alexander’s retirement at the end of 2019.

I want to thank all of our investors for their confidence and loyalty, especially through this past challenging year for capital markets.

Sincerely,

Mark D. Santero

CEO, President, and Director

Homestead Funds

Mark Santero

CEO, President and Director

Daily Income Fund

Performance Evaluation | Prepared by the Fund's Investment Advisor, RE Advisers Corporation

Performance

The fund earned an annualized return of 1.08 percent for 2018. The seven-day current annualized yield was 1.58 percent as of December 31, 2018, much changed from the 0.45 percent on December 31, 2017. We sought to enhance the fund's performance in the second half of the year by lowering the percentage of short-term assets from approximately 10 percent to 7 percent so we could take advantage of increasing yields in government securities. Interest income for the fund is netted against operating expenses. With the Federal Reserve raising the federal funds rate band four times in 2018 (the last being to between 2.25 percent and 2.50 percent in December 2018), the fund earned enough interest income to cover all of its expenses and provide income to its shareholders.

Market Conditions

The U.S. economy continued to improve as 2018 progressed; however, questions remained as to how long that improvement might last. After a fairly soft 2.0 percent rise in gross domestic product (GDP) in the first quarter of 2018, the economy showed strength in the second and third quarters with GDP increases of 4.2 percent and 3.4 percent, respectively. The general consensus among economists is for GDP to rise by an annual rate of approximately 3.1 percent in the fourth quarter of 2018. Despite the growth seen in 2018, Fed forecasts still only indicate a relatively modest 2.3 percent gain in GDP for all of 2019.

Although the Fed’s analysis of the data suggests good overall economic activity in 2018, specific issues remain. Household spending continued to grow strongly, while the growth of business fixed investment moderated somewhat from its earlier rapid pace. Several labor market measurements during 2018 continued to show strong growth: Initial jobless claims remain below 250,000, continuing claims trended below 1.7 million and the unemployment rate declined to 3.9 percent. Wages gains have moved up slightly to approximately 3.2 percent, largely influenced by some second-half growth in labor productivity. Although this is an improvement over 2017, we believe sustained improvement in productivity will be essential to economic growth in general, and wage gains in particular for 2019 and beyond. On a 12-month basis, overall inflation (even that which excludes food and energy prices) has remained near 2.0 percent, and expectations for longer-term inflation were little changed.

Outlook

After the Federal Open Market Committee (FOMC), the Fed’s policy-making body, revised its target for the federal funds rate to between 2.25 percent and 2.50 percent in December 2018, the question is, how many rate hikes seem likely for

| Investment Advisor: RE Advisers Corporation |

| Marc Johnston, CFP, ChFC, CAIAMoney Market Portfolio ManagerBA, General Arts, Villanova University;

MBA, Northeastern University |

2019 given the Fed’s leadership and a more uncertain economic environment? Forecasts by the Fed after the rate hike in December 2018 indicated possibly two hikes will take place in 2019; however, the FOMC is a very cautious decision maker. The timing and size of interest rate increases and the pace of the portfolio unwinding process will remain very much dependent upon the data and the stability of the situation at the time, in our view. Assuming continued growth in the U.S. economy, improvement in labor markets, stability in financial markets and a steepening (as opposed to flattening or inverting) yield curve, we believe that we are most likely to see a continued yet slower normalization of interest rates in 2019. In addition, with inflation on a 12-month basis expected to remain somewhat near the FOMC’s 2.0 percent objective in the medium term, we believe monetary policy is likely to remain slightly accommodative to support a strong labor market and a sustained return to 2 percent inflation. The risks to the economic outlook appear roughly balanced, in our view.

The timing of this continued interest rate normalization process notwithstanding, we believe that investors in money market funds will continue to see income on their investment in 2019 if the Fed raises short-term rates to higher levels. We must be prepared to operate in that type of environment by constantly adjusting the investment mix and weighted average maturity of the portfolio. We will prudently take advantage of the higher-yielding investments as they become available and in keeping with our management of the fund as a government money market fund.

| Average Annual Total Returns (periods ended 12/31/18) | | | |

| | 1 YR % | 5 YR % | 10 YR % |

| Daily Income Fund | 1.08 | 0.26 | 0.16 |

| Yield | |

| Annualized 7-day current yield quoted 12/31/18 | 1.58% |

| Security Diversification |

| | % of Total Investments |

| | as of 12/31/17 | as of 12/31/18 |

| U.S. government and agency obligations | 89.5 | 94.4 |

| Short-term and other assets | 10.5 | 5.6 |

| Total | 100.0% | 100.0% |

| Maturity | | |

| | as of 12/31/17 | as of 12/31/18 |

| Average weighted maturity | 38 days | 39 days |

The returns quoted in the above table represent past performance, which is no guarantee of future results. Current performance may be higher or lower than that shown above. To obtain the most recent month-end returns, please call 800.258.3030 or visit homesteadfunds.com. Returns and the principal value of your investment will fluctuate such that shares, when redeemed, may be worth more or less than their original cost. You could lose money by investing in the Daily Income Fund. Although the fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. An investment in the Daily Income Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The fund’s sponsor has no legal obligation to provide financial support to the fund, and you should not expect that the sponsor will provide financial support to the fund at any time.

The Daily Income Fund’s average annual total returns are net of any fee waivers and reimbursements. The fund’s advisor waived a portion of its management fee and/or reimbursed fund expenses during the five- and 10-year periods. Had the advisor not done so, the fund’s total returns would have been lower. The expenses used are as of the most recent period-end and may fluctuate over time. Returns include the reinvestment of dividends. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares.

Short-Term Government Securities Fund

Performance Evaluation | Prepared by the Fund's Investment Advisor, RE Advisers Corporation

Performance

The fund returned 1.20 percent for the year ended December 31, 2018, trailing the ICE BofA Merrill Lynch 1-5 Year U.S. Treasury Index return of 1.52 percent.

The fund benefited most of the year from overall lower interest rate exposure as measured by duration relative to the benchmark throughout the period. Additionally, the fund’s out-of-benchmark allocation to short-term amortizing asset-backed securities and high-quality corporate issuers, including floating rate notes, contributed positively during the period. The fund also benefited from its holdings in higher-yielding issuers guaranteed by the Export-Import Bank of the U.S. However, the risk-off environment experienced during the fourth quarter provided a flight to quality lowering Treasury yields by nearly 40 basis points, and the yield curve flattened even further. As a consequence, the yield compression detracted from performance.

The fund added holdings in short-end maturity U.S. Treasuries as rates continued to gradually rise from multi-year low levels. The fund also added holdings in the corporate sector through issuers guaranteed by the Export-Import Bank of the U.S.

Market Conditions

The Federal Open Market Committee (FOMC), the Federal Reserve’s policy-making committee, continued the gradual pace of rate increases, delivering the four rate hikes forecasted at the end of 2017. The FOMC increased the federal funds rate from 1.25 percent to 1.50 percent at the end of 2017 to 2.25 percent to 2.50 percent at the end of 2018. Front-end yields responded by increasing throughout most of the period, and two-year versus five-year Treasury yields flattened by 30 basis points. Three-month Libor increased 110 basis points ending the year at 2.81 percent.

The Fed’s dual mandate of maximum employment and price stability continued to be the main focus; however, monetary policy remained less accommodative, and the Fed’s unwind of its balance sheet continued on auto pilot. Economic activity continued on solid footing supported by tax reform passed at the end of 2017 with real gross domestic product year over year increasing from 2.50 percent in December 2017 to 3.0 percent at the end of September 2018. The labor market remained robust and the unemployment rate held steady near multi-decade lows below 4 percent for most of the year. Core inflation increased near the FOMC’s long-term target of 2 percent. The latest reading on core personal consumption expenditures (PCE) stood at 1.87 percent at the end of November 2018 versus 1.63 percent at the end of December 2017. The FOMC expects inflation to remain stable over the next 12 months near the 2 percent target.

President Trump’s administration ramped up the pressure on global trade partners during the month of March as the U.S. put in place tariffs on steel and aluminum imports. The

| Investment Advisor: RE Advisers Corporation |

| Mauricio Agudelo, CFASenior Fixed Income Portfolio ManagerBS, Finance, The University of Maryland,

Robert H. Smith School of Business |

| Ivan Naranjo, CFA, FRMFixed Income Portfolio ManagerBS, Finance, The University of Maryland,

Robert H. Smith School of Business |

administration had trade disputes with all of the United States' major partners, including Mexico and Canada and more importantly China. Subsequently, China responded with tit-for-tat tariffs on U.S. goods, escalating a trade war and tensions. As the year went on, sectors more exposed to trade war risk sold off. President Trump and President Xi agreed to a trade truce of 90 days at the end of 2018 in an effort to resolve the trade dispute.

Outlook

We remain cautiously optimistic on the economy and believe that growth will moderate toward the mid-2 percent range. In our view, monetary policy will be less accommodative going forward, driven by the Fed’s unwind of its balance sheet and rate increases during this cycle. According to its December statement, the FOMC expects two additional rate hikes in 2019, based on a reading of the “dot plot.” Market participants, however, are expecting a range of zero to one rate increases.

On the fiscal side, we expect the administration to continue discussions with China regarding trade and tariffs and eventually come to a resolution. As it stands, it appears that this spat could, in our view, slow the global economy to the point of ending the current economic cycle. We intend to gradually increase our holdings in U.S. Treasuries and narrow the gap in duration relative to the benchmark over the coming year as we believe that the existing economic conditions show signs of cooling.

Short-Term Government Securities Fund

| Average Annual Total Returns (periods ended 12/31/18) | | | |

| | 1 YR % | 5 YR % | 10 YR % |

| Short-Term Government Securities Fund | 1.20 | 0.83 | 1.23 |

| ICE BofAML 1-5 Year U.S. Treasury Index | 1.52 | 1.09 | 1.33 |

| Security Diversification |

| | % of Total Investments |

| | as of 12/31/17 | as of 12/31/18 |

| U.S. government and agency obligations | 49.0 | 58.1 |

| Corporate bonds–government guaranteed | 28.4 | 21.3 |

| Corporate bonds–other | 4.7 | 8.4 |

| Asset-backed securities | 2.7 | 3.4 |

| Mortgage-backed securities | 2.9 | 2.2 |

| Certificates of deposit | 3.8 | 1.5 |

| Municipal bonds | 0.3 | 0.3 |

| Short-term and other assets | 8.2 | 4.8 |

| Total | 100.0% | 100.0% |

| Maturity | | |

| | as of 12/31/17 | as of 12/31/18 |

| Average weighted maturity | 1.76 | 1.71 |

Performance Comparison

Comparison of the change in value of a $10,000 investment in the fund and the ICE BofAML 1-5 Year U.S. Treasury Index made on December 31, 2008.

The returns quoted in the above table and chart represent past performance, which is no guarantee of future results. Current performance may be higher or lower than that shown above. To obtain the most recent month-end returns, please call 800.258.3030 or visit homesteadfunds.com. Returns and the principal value of your investment will fluctuate such that shares, when redeemed, may be worth more or less than their original cost. The Short-Term Government Securities Fund’s average annual total returns are net of any fee waivers and reimbursements. The fund’s advisor waived a portion of its management fee during the periods shown. Had the advisor not done so, the fund's total returns would have been lower. The expenses used are as of the most recent period-end and may fluctuate over time. Returns include the reinvestment of dividends and capital gains. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares.

Short-Term Bond Fund

Performance Evaluation | Prepared by the Fund's Investment Advisor, RE Advisers Corporation

Performance

The fund returned 1.69 percent for the year ended December 31, 2018, outperforming its benchmark index, the ICE BofA Merrill Lynch 1-5 Year Corporate/Government Index, which returned 1.40 percent.

The fund benefited most of the year from overall lower interest rate exposure as measured by duration relative to the benchmark throughout the period. Additionally, the fund’s allocation to the asset-backed sector contributed to the fund's outperformance. The fund also benefitted from a strong recovery in its two municipal positions in the Puerto Rico Sales Tax Financing Corp.

The fund gradually added holdings in U.S. Treasuries, short-term asset-backed securities and the corporate sector through high-quality issuers with a preference for one- to three-year maturities. We believe that the front-end part of the credit curve offers an attractive risk/reward profile in the current economic cycle.

Market Conditions

The Federal Open Market Committee (FOMC), the Federal Reserve’s policy-making committee, continued the gradual pace of rate increases, delivering the four rate hikes forecasted at the end of 2017. The FOMC increased the federal funds rate from 1.25 percent to 1.50 percent at the end of 2017 to 2.25 percent to 2.50 percent at the end of 2018. Front-end yields responded by increasing throughout most of the period, and two-year versus five-year Treasury yields flattened by 30 basis points. Three-month Libor increased 110 basis points ending the year at 2.81 percent.

The Fed’s dual mandate of maximum employment and price stability continued to be the main focus; however, monetary policy remained less accommodative, and the Fed’s unwind of its balance sheet continued on auto pilot. Economic activity continued on solid footing supported by tax reform passed at the end of 2017 with real gross domestic product year over year increasing from 2.50 percent in December 2017 to 3.0 percent at the end of September 2018. The labor market remained robust and the unemployment rate held steady near multi-decade lows below 4 percent for most of the year. Core inflation increased near the FOMC’s long-term target of 2 percent. The latest reading on core personal consumption expenditures (PCE) stood at 1.87 percent at the end of November 2018 versus 1.63 percent at the end of December 2017. The FOMC expects inflation to remain stable over the next 12 months near the 2 percent target.

The year 2018 experienced the return of volatility to the markets. Corporate credit spreads widened by more than 50 bps during the period, as measured by the Bloomberg Barclays U.S. Credit Index. The risk of escalation to a global trade war due to tariffs imposed by the Trump administration contributed to the increase in volatility. Market participants also became leery of corporate issuers in general, as the size of the BBB-rated universe increased significantly. Investors grew nervous about the trade war, rising rates and just how long the economic cycle could last.

| Investment Advisor: RE Advisers Corporation |

| Mauricio Agudelo, CFASenior Fixed Income Portfolio ManagerBS, Finance, The University of Maryland,

Robert H. Smith School of Business |

| Ivan Naranjo, CFA, FRMFixed Income Portfolio ManagerBS, Finance, The University of Maryland,

Robert H. Smith School of Business |

Outlook

We remain cautiously optimistic on the economy and believe that growth will moderate toward the mid-2 percent range. In our view, monetary policy will be less accommodative going forward driven by the Fed’s unwind of its balance sheet and rate increases during this cycle. According to its December statement, the FOMC expects two additional rate hikes in 2019, based on a reading of the “dot plot.” Market participants, however, are expecting a range of zero to one rate increases.

On the fiscal side, we expect the administration to continue discussions with China regarding trade and tariffs and eventually come to a resolution. As it stands, it appears that this spat could, in our view, slow the global economy to the point of ending the current economic cycle. We intend to gradually increase our holdings in U.S. Treasuries as economic conditions show signs of cooling.

We believe that at this stage in the economic cycle, it’s wise to remain invested in higher-quality assets with strong fundamentals. The combination of trade-related issues and the Fed’s withdrawal of easy money could, in our view, contribute to increased volatility in risky assets. We intend to take advantage of the rise in yields from multi-year lows to narrow the gap in duration relative to the benchmark over the coming year as economic conditions show signs of cooling.

| Average Annual Total Returns (periods ended 12/31/18) | | | |

| | 1 YR % | 5 YR % | 10 YR % |

| Short-Term Bond Fund | 1.69 | 1.41 | 3.64 |

| ICE BofAML 1-5 Year Corp./Gov. Index | 1.40 | 1.37 | 2.17 |

| Security Diversification |

| | % of Total Investments |

| | as of 12/31/17 | as of 12/31/18 |

| Corporate bonds–other | 29.2 | 37.4 |

| Asset-backed securities | 20.4 | 21.7 |

| Municipal bonds | 20.1 | 14.5 |

| U.S. government and agency obligations | 6.0 | 11.4 |

| Yankee bonds | 11.6 | 10.3 |

| Mortgage-backed securities | 1.9 | 0.8 |

| Corporate bonds–government guaranteed | 0.1 | 0.0 |

| Certificates of deposit | 0.4 | 0.0 |

| Short-term and other assets | 10.3 | 3.9 |

| Total | 100.0% | 100.0% |

| Maturity | | |

| | as of 12/31/17 | as of 12/31/18 |

| Average weighted maturity | 1.72 | 1.52 |

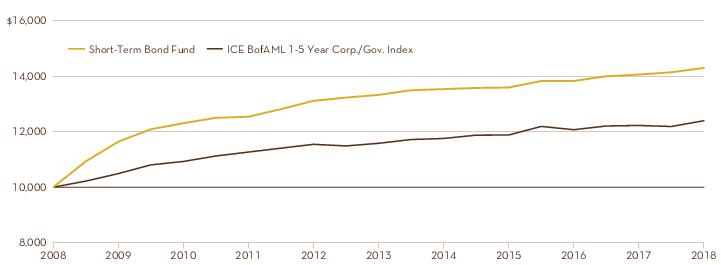

Performance Comparison

Comparison of the change in value of a $10,000 investment in the fund and the ICE BofAML 1-5 Year Corp./Gov. Index made on December 31, 2008.

The returns quoted in the above table and chart represent past performance, which is no guarantee of future results. Current performance may be higher or lower than that shown above. To obtain the most recent month-end returns, please call 800.258.3030 or visit homesteadfunds.com. Returns and the principal value of your investment will fluctuate such that shares, when redeemed, may be worth more or less than their original cost. The Short-Term Bond Fund’s average annual total returns are net of any fee waivers and reimbursements. The expenses used are as of the most recent period-end and may fluctuate over time. Returns include the reinvestment of dividends and capital gains. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares.

Stock Index Fund

Performance Evaluation | Prepared by the Master Portfolio’s Investment Advisor, BlackRock Fund Advisors

Performance

For the 12 months ended December 31, 2018, the U.S. large cap market metric and the fund’s benchmark, the Standard & Poor’s 500 Index (the “S&P 500 Index”), returned –4.38 percent. The fund’s return was –4.95%. The S&P 500 Index is a market capitalization-weighted index composed of 500 common stocks issued by large-capitalization companies in a wide range of industries.

During the 12-month period, as changes were made to the composition of the S&P 500 Index, the master portfolio in which the fund invests purchased and sold securities to maintain its objective of replicating the risks and return of the index.

Market Conditions

In the beginning of the first quarter of 2018, the low volatility regime that helped global equity markets reach record highs in 2017 continued to support U.S. markets. Further fueled by tax-reform optimism, January saw markets rally, led higher by momentum and information technology names. As the first quarter progressed, however, a combination of economic overheating concerns, the return of volatility, rising yields and the specter of trade wars weighed on markets.

From a sector standpoint, technology and consumer discretionary stocks outperformed, due to their impressive early-quarter runs. Although the first quarter of 2018 was plagued with volatility, the defensive sectors of telecommunications and consumer staples were the worst performing in the S&P 500 Index.

Contrary to what the U.S. equity market’s lackluster performance would suggest, the U.S. economy remained healthy in the first quarter of 2018. This supported the Federal Reserve’s decision to increase interest rates in March and to revise higher its rate hike expectations for 2019.

Despite the fluid headlines and ongoing threats regarding the topic of U.S. protectionism in the second quarter of 2018, investors found confidence in strong U.S. economic data and earnings growth. On the macroeconomic front, the U.S. unemployment rate struck 3.8 percent, the lowest level since 1975. Additionally, the core personal consumption expenditure hit the Fed’s target rate of 2 percent, supporting its decision to raise rates in June. From a sector standpoint, energy outperformed, as a prolonged period of higher crude oil prices increased the attractiveness of energy company shares.

In the third quarter of 2018, U.S. large cap equities reached all-time highs as impressive economic growth and earnings results fueled risk-on appetite and outweighed the specter of trade wars. Despite the announcement of tariffs on

$505 billion of Chinese goods and China’s retaliatory measures, U.S. equity volatility was limited. Macroeconomic releases continued to showcase strength in both labor and economic conditions. The strength of the economy allowed the Fed to raise the target range of the benchmark federal funds rate from 2 percent to 2.25 percent.

In the fourth quarter of 2018, 10 out of the 11 Global Industry Classification Standard equity sectors moved lower. The utilities sector (1.36 percent) was the only sector to advance, as lower interest rates and a flight to safety throughout the fourth quarter benefited the traditionally defensive sector.

Conversely, the energy sector (–23.78 percent) trailed the market, as a decline in crude oil provided a headwind; however, it was the information technology sector (–17.34 percent) that deducted the most from the index’s overall total return (–3.6 percent), as lowered corporate earnings guidance weighed on investor sentiment.

More broadly, concerns over Fed policy, Sino-American trade tensions and a potential slowdown in growth contributed to investor anxiety throughout the fourth quarter. The quarter began with Fed Chair Jerome Powell’s comment that the U.S. federal funds rate was “a long way from neutral.” The hawkish comment drove a temporary sell-off in Treasuries; however, this was short lived, as declines in energy prices and softness in portions of the U.S. economy contributed to a reduction in inflation expectations. This was accompanied by a broad-based risk-off in December — the worst December performance on record since 1931 — and the 10-year U.S. Treasury yield ending the quarter lower than its intra-quarter highs.

For the one-year period ended December 31, 2018, the largest negative returns for the S&P 500 Index came from the energy (–18.08 percent), materials (–14.70 percent) and industrials (–13.29 percent) sectors; however, the health care (6.41 percent), utilities (4.11 percent) and information technology (3.37 percent) sectors contributed positively to overall return.

Disclosure

On September 28, 2018, the telecommunication services sector was expanded and renamed communication services. Some securities previously assigned to information technology or consumer discretionary were reclassified as communication services. Additionally, some securities previously assigned to information technology were reclassified as consumer discretionary. Drivers of relative performance and comments on portfolio positioning for the 12-month period represent the sectors where the securities were assigned after reclassification.

| Average Annual Total Returns (periods ended 12/31/18) | | | |

| | 1 YR % | 5 YR % | 10 YR % |

| Stock Index Fund | -4.95 | 7.90 | 12.51 |

| Standard & Poor's 500 Stock Index | -4.38 | 8.49 | 13.12 |

| Sector Diversification* | |

| | % of Total Investments

as of 12/31/18 |

| Information technology | 19.3 |

| Health care | 15.0 |

| Financials | 12.9 |

| Communication services | 9.8 |

| Consumer discretionary | 9.6 |

| Industrials | 9.1 |

| Consumer staples | 7.0 |

| Energy | 5.1 |

| Utilities | 3.3 |

| Real estate | 2.9 |

| Materials | 2.6 |

| Short-term and other assets | 3.4 |

| Total | 100.0% |

| Top 10 Equity Holdings | |

| | % of Total Investments

as of 12/31/18 |

| Microsoft Corp. | 3.6 |

| Apple, Inc. | 3.3 |

| Alphabet, Inc. | 2.9 |

| Amazon.com, Inc. | 2.8 |

| Berkshire Hathaway, Inc. | 1.8 |

| Johnson & Johnson | 1.6 |

| JPMorgan Chase & Co. | 1.5 |

| Facebook, Inc. | 1.4 |

| Exxon Mobil Corp. | 1.3 |

| Pfizer, Inc. | 1.1 |

| Total | 21.3% |

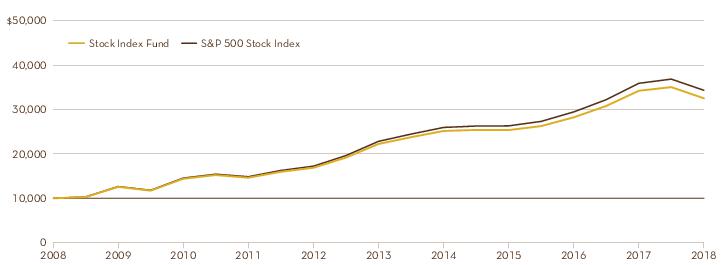

Performance Comparison

Comparison of the change in value of a $10,000 investment in the fund and the Standard & Poor's 500 Stock Index made on December 31, 2008.

The returns quoted in the above table and chart represent past performance, which is no guarantee of future results. Current performance may be higher or lower than that shown above. To obtain the most recent month-end returns, please call 800.258.3030 or visit homesteadfunds.com. Returns and the principal value of your investment will fluctuate such that shares, when redeemed, may be worth more or less than their original cost. The Stock Index Fund’s average annual total returns are net of any fee waivers and reimbursements. The expenses used are as of the most recent period-end and may fluctuate over time. Returns include the reinvestment of dividends and capital gains. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares.

Sector diversification and top holdings information is for the S&P 500 Index Master Portfolio, managed by BlackRock Fund Advisors, the portfolio in which the Stock Index Fund invests all of its investable assets. Please refer to the Appendix for the complete annual report of the S&P 500 Index Master Portfolio.

* On September 28, 2018, the telecommunication services sector was expanded and renamed communication services. Some securities previously assigned to information technology or consumer discretionary were reclassified as communication services. Additionally, some securities previously assigned to information technology were reclassified as consumer discretionary.

Value Fund

Performance Evaluation | Prepared by the Fund's Investment Advisor, RE Advisers Corporation

Performance

The fund returned –6.36 percent during 2018, while its benchmark index, the S&P 500 Value Index, returned –8.95 percent. The fund’s better-than-index return was due primarily to the results in its information technology, health care, communications services and energy sector holdings, while consumer discretionary, materials and financials holdings detracted from overall results.

Portfolio Review

The fund’s information technology position was overweight compared with the benchmark and outperformed the benchmark’s sector results. Notable contributors included Microsoft, Visa, Cisco and Intel.

Health care positions contributed next in terms of order of magnitude. The fund was overweight and outperformed this sector versus the benchmark. Within this sector, health care equipment and pharmaceuticals generated double-digit returns for the fund. Pfizer, Abbott and Merck were the notable contributors.

Communications services results were also positive. The fund was underweight in this sector versus the benchmark but outperformed the benchmark’s sector results. Verizon was a leading contributor in this sector.

Energy contributed favorably versus the benchmark, as the fund was slightly underweight this sector versus the index, leading to outperformance. ConocoPhillips contributed double-digit returns to the fund during the period.

Consumer discretionary holdings contributed negatively to results. This sector incudes the auto component and distributor industry categories, which underperformed the sector overall. Genuine Parts generated positive results on the year for the fund, but LKQ Corporation and others detracted from the fund’s performance.

Materials detracted from results, largely due to our exposure to two industries within this sector — chemicals and packaging — which were both down for the year. Detractors for the period include DowDupont and Avery Dennison.

Financials detracted from results. The fund’s bank holdings were slightly underweight the benchmark’s sector weighting but outperformed the benchmark’s sector results. The fund’s insurance holdings were overweight versus the benchmark and underperformed the benchmark’s sector results. American International Group and Allstate were both down for the year and detracted from results.

A new name added to the fund during the year was Tyler Technologies. Names eliminated from the fund were: Flowserve Corporation, Apache Corporation, Cooper Tire and Rubber Company, Adient plc, Applied Industrial Technologies, American International Group and LKQ Corporation.

| Investment Advisor: RE Advisers Corporation |

| Prabha Carpenter, CFASenior Equity Portfolio ManagerBA, Economics, University of Madras; MBA with distinction in Finance and BS in Business Economics, The American University |

Outlook

It was a volatile year. The markets started the year strong with prospects for synchronized global growth in the U.S., China and Europe. There was a pullback in early February with concerns about the pervasiveness and strength of economic growth. The markets rallied through early October, establishing new highs. Then with heightened trade tensions, higher interest rates and comments by the U.S. Federal Reserve indicating continued rate increases and the shrinking of its balance sheet, the market gave up its gains. The markets have rebounded from lows established on December 24, 2018, with additional clarity from the Fed and prospects for continued dialogue between U.S. and China on trade.

The U.S. economy continues to expand, but we expect growth will moderate toward the mid-2 percent range. In contrast to 2017, there appears to be a synchronized slowdown globally. Earnings growth for the first three quarters of 2018 was at double-digit rates but — based on companies that have reported thus far — the fourth quarter rate looks to be less robust. For 2019, earnings growth rates are forecast to be in the high single-digit ranges for U.S. companies in general.

Regardless of the economic backdrop, we continue to seek out exceptional companies with the potential to generate superior returns over time. Following the fourth quarter’s broad market decline, equity valuations are now at what we believe to be more attractive levels.

Disclosure

On September 28, 2018, the telecommunication services sector was expanded and renamed communication services. Some securities previously assigned to information technology or consumer discretionary were reclassified as communication services. Additionally, some securities previously assigned to information technology were reclassified as consumer discretionary. Drivers of relative performance and comments on portfolio positioning for the 12-month period represent the sectors where the securities were assigned after reclassification.

| Average Annual Total Returns (periods ended 12/31/18) | | | |

| | 1 YR % | 5 YR % | 10 YR % |

| Value Fund | -6.36 | 7.58 | 12.46 |

| Standard & Poor's 500 Value Index | -8.95 | 6.06 | 11.21 |

| Sector Diversification* | |

| | % of Total Investments

as of 12/31/18 |

| Information technology | 22.6 |

| Health care | 21.9 |

| Financials | 13.7 |

| Industrials | 12.2 |

| Materials | 10.2 |

| Energy | 10.2 |

| Communication services | 5.5 |

| Consumer discretionary | 2.7 |

| Short-term and other assets | 1.0 |

| Total | 100.0% |

| Top 10 Equity Holdings | |

| | % of Total Investments

as of 12/31/18 |

| Visa Inc. | 5.4 |

| Pfizer, Inc. | 5.0 |

| Microsoft Corp. | 5.0 |

| Southwest Airlines Co. | 4.5 |

| Cisco Systems, Inc. | 4.4 |

| DowDuPont, Inc. | 4.3 |

| Bristol-Myers Squibb Co. | 4.3 |

| Parker-Hannifin Corp. | 4.2 |

| Avery Dennison Corp. | 4.1 |

| Alphabet, Inc. | 4.0 |

| Total | 45.2% |

Performance Comparison

Comparison of the change in value of a $10,000 investment in the fund and the Standard & Poor's 500 Value Index made on December 31, 2008.

The returns quoted in the above table and chart represent past performance, which is no guarantee of future results. Current performance may be higher or lower than that shown above. To obtain the most recent month-end returns, please call 800.258.3030 or visit homesteadfunds.com. Returns and the principal value of your investment will fluctuate such that shares, when redeemed, may be worth more or less than their original cost. The Value Fund’s average annual total returns are net of any fee waivers and reimbursements. The expenses used are as of the most recent period-end and may fluctuate over time. Returns include the reinvestment of dividends and capital gains. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares.

* On September 28, 2018, the telecommunication services sector was expanded and renamed communication services. Some securities previously assigned to information technology or consumer discretionary were reclassified as communication services. Additionally, some securities previously assigned to information technology were reclassified as consumer discretionary.

Performance Evaluation

11

Growth Fund

Performance Evaluation | Prepared by the Fund's Subadvisor, T. Rowe Price Associates

Performance

The fund delivered a positive return of 3.96 percent for the 12-month period and significantly outperformed the Russell 1000 Growth Index, the fund’s benchmark, which returned –1.51 percent. Stock selection was the primary reason for relative outperformance, particularly within the information technology sector, the largest overall contributor. Sector weightings also contributed substantially to relative results.

Portfolio Review

Information technology was the largest contributor to relative results, owing to security selection. Shares of Red Hat gained as growing demand for hybrid cloud solutions and a record number of large deals fueled topline growth. Shares traded higher after the announcement that the company would be acquired by IBM.

Below-benchmark exposure to Apple bolstered relative performance, as shares sold off due to softer-than-expected demand for the latest iPhone launch, particularly among consumers in China. The fund’s limited position is due to our concerns over saturation and elongation of replacement cycles for smartphones.

VMware benefited from a better overall on-premise IT spending environment as well as better execution and mix, with broad-based topline growth across several product categories.

Both stock choices and an underweight in industrials and business services had a positive relative impact, due in large part to above-benchmark exposure to Boeing, which benefited from continued expansion of operating margins, driven by favorable delivery volume and mix within commercial aircraft, as well as better-than-expected revenue growth from defense and services.

Health care also contributed on a relative basis, due to both stock selection and a favorable overweight. Accelerated growth in the number of global procedures being performed by da Vinci, the company’s robotic surgical system, helped drive shares of Intuitive Surgical higher. We believe that procedure growth — which we view as the engine of the business model — could get an additional boost as Intuitive rolls out its new and more affordable system, the da Vinci X.

An overweight to consumer discretionary, together with beneficial security selection, also contributed to relative performance.

In contrast, stock selection in financials was a notable detractor, driven in part by shares of Charles Schwab and Morgan Stanley. Within the sector, we focus on capital markets firms that have distinctive company-specific growth opportunities.

An overweight to communication services also weighed on relative performance. Within the sector, we are focused on companies that we believe are benefiting from the shift of

| Subadvisor: T. Rowe Price Associates |

| Taymour Tamaddon, CFAPortfolio ManagerBS, Applied Physics, Cornell University;

MBA, Finance, Dartmouth |

advertising spending to digital and social media channels. We also favor wireless communication services firms that we believe have strong company-specific growth prospects.

Stock choices in consumer staples also detracted from relative results, particularly an overweight position in Philip Morris International, whose shares declined sharply during the period.

Outlook

Although the market sell-off that occurred in the fourth quarter was painful, we were not surprised to see a downturn, given the length of the bull market and the third-quarter rally that pushed some equity valuations to what appeared to us to be overly elevated levels. Entering 2019, our expectations are more muted than they were a year ago, although we do not believe a near-term recession is likely. We believe corporate earnings and economic growth will probably increase at a slower pace than in 2018 but should remain positive. We are concerned about the effects of the U.S./China trade dispute, although a resolution to the standoff could boost markets. Regarding monetary policy, we believe a couple of additional interest rate hikes by the Federal Reserve could be a positive development if labor markets continue to tighten, because we believe higher rates could leave the Fed better positioned to take appropriate action whenever the next recession occurs.

Disclosure

On September 28, 2018, the telecommunication services sector was expanded and renamed communication services. Some securities previously assigned to information technology or consumer discretionary were reclassified as communication services. Additionally, some securities previously assigned to information technology were reclassified as consumer discretionary. Drivers of relative performance and comments on portfolio positioning for the 12-month period represent the sectors where the securities were assigned after reclassification.

| Average Annual Total Returns (periods ended 12/31/18) | | | |

| | 1 YR % | 5 YR % | 10 YR % |

| Growth Fund | 3.96 | 11.72 | 17.54 |

| Russell 1000 Growth Index | -1.51 | 10.40 | 15.29 |

| Sector Diversification* | |

| | % of Total Investments

as of 12/31/18 |

| Information technology | 26.0 |

| Health care | 21.0 |

| Consumer discretionary | 20.5 |

| Communication services | 15.4 |

| Industrials | 8.8 |

| Financials | 4.1 |

| Utilities | 1.1 |

| Consumer staples | 1.0 |

| Short-term and other assets | 2.1 |

| Total | 100.0% |

| Top 10 Equity Holdings | |

| | % of Total Investments

as of 12/31/18 |

| Amazon.com, Inc. | 8.3 |

| Alphabet, Inc. | 7.2 |

| Microsoft Corp. | 6.5 |

| Boeing Co. | 5.1 |

| Visa Inc. | 4.8 |

| Facebook, Inc. | 3.8 |

| UnitedHealth Group, Inc. | 3.1 |

| Cigna Corp. | 2.9 |

| Tencent Holdings Ltd. ADR | 2.4 |

| Intuitive Surgical, Inc. | 2.3 |

| Total | 46.4% |

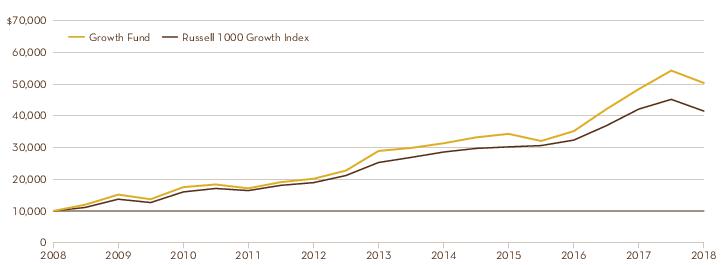

Performance Comparison

Comparison of the change in value of a $10,000 investment in the fund and the Russell 1000 Growth Index made on December 31, 2008.

The returns quoted in the above table and chart represent past performance, which is no guarantee of future results. Current performance may be higher or lower than that shown above. To obtain the most recent month-end returns, please call 800.258.3030 or visit homesteadfunds.com. Returns and the principal value of your investment will fluctuate such that shares, when redeemed, may be worth more or less than their original cost. The Growth Fund’s average annual total returns are net of any fee waivers and reimbursements. The fund's advisor waived a portion of its management fee during the five- and 10-year periods. Had the advisor not done so, the fund's total returns would have been lower. The expenses used are as of the most recent period-end and may fluctuate over time. Returns include the reinvestment of dividends and capital gains. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares.

* On September 28, 2018, the telecommunication services sector was expanded and renamed communication services. Some securities previously assigned to information technology or consumer discretionary were reclassified as communication services. Additionally, some securities previously assigned to information technology were reclassified as consumer discretionary.

Performance Evaluation

13

Small-Company Stock Fund

Performance Evaluation | Prepared by the Fund's Investment Advisor, RE Advisers Corporation

Performance

The fund returned –26.18 percent in 2018, trailing its benchmark index the Russell 2000 Index, which returned –11.01 percent.

The benchmark’s performance leaders in 2018 and other recent years have been concentrated in a narrow group of companies. This trend worked against our traditional value approach to investing, with a focus on fundamentals. Other factors including quantitative easing, which has helped the non-earners and the companies with strained balance sheets outperform, and the trend toward passive investing and programmatic trading have also created headwinds for active money managers with a focus on fundamentals.

Portfolio Review

The industrials sector of the benchmark posted a double-digit decline in 2018. The machinery companies were key detractors, followed by the construction companies. Dycom, a long-term holding, was hurt by delays in permitting the build-out of 5G capabilities. The fund took gains and reduced its exposure to Dycom in 2018. The fund also pared back its overall exposure to this sector with the eliminations of Manitowoc, NCI Building Systems, Orion and Radiant Logistics.

Trucking, which benefited generally from ecommerce growth and the strong economy, also hurt results. In our view, the fund’s trucking portfolio is composed of exceptionally sound companies with solid management teams, attractive balance sheets, and robust compliance and technology frameworks that have rewarded stockholders for decades. But in 2018, even with strong earnings results and favorable forward guidance, these stocks performed poorly. We continue to hold these companies because we believe a secular shift in consumer behavior is underappreciated by industry analysts and the quarterly results will continue to exceed those from previous cycles.

Materials stocks also detracted from results. A confluence of short-term pricing, one of the wettest years on record and subsequent inventory issues hurt Summit. We believe that Summit will benefit over the long haul as America’s highways and bridges are repaired and rebuilt, an initiative both parties in Congress appear to support. Also in the materials sector, we added the specialty chemical company Ingevity at what we consider to be an attractive valuation.

Financials, a sector that had provided strength earlier in the year, succumbed to losses in the fourth quarter. The flatness of the yield curve and fears of a recession in the offing hurt overall performance. Encore, a consumer finance company, made an opportunistic acquisition midyear that was not favorably received by the markets. Within financials, the fund’s insurance holdings did well. Kinsale and National General posted double-digit gains for the year, contributing positively to the fund’s performance.

| Investment Advisor: RE Advisers Corporation |

| Prabha Carpenter, CFASenior Equity Portfolio ManagerBA, Economics, University of Madras; MBA with distinction in Finance and BS in Business Economics, The American University |

In information technology, Belden, a long-term holding, detracted from results in large part due to an underperforming division within its Enterprise Solutions business. In our view, had it not been for the distraction of this unit, Belden would have had an otherwise strong performance in 2018. We are encouraged that management has committed to improving the performance or evaluating alternatives for this real-time broadcasting unit.

We added two health care names in 2018. AMN Healthcare Services provides workforce and staffing solutions, and ICU Medical is a medical technologies company with a focus on vascular therapy, oncology and critical care products.

Outlook

The year ended very differently than it began, with stocks tumbling in the fourth quarter on fears of escalating trade tensions and the possibility of a global growth slowdown. But we believe there are reasons for moderate optimism. While the pace of earnings and gross domestic product growth are expected to be somewhat muted relative to recent prior years, these measures are still expected to be positive. The labor market remains strong. Equity valuations are now more reasonable following the fourth quarter selloff, in our view.

We believe that many of the companies represented in the portfolio maintain competitive advantages that will reward shareholders over the long run. The weighted average return on equity for the portfolio is higher than that of the benchmark, an indication of financial strength. We think the fund’s holdings will receive favorable market attention when fundamentals again matter and there is broader sector participation.

| Average Annual Total Returns (periods ended 12/31/18) | | | |

| | 1 YR % | 5 YR % | 10 YR % |

| Small-Company Stock Fund | -26.18 | 0.12 | 12.38 |

| Russell 2000 Index | -11.01 | 4.41 | 11.97 |

| Sector Diversification | |

| | % of Total Investments

as of 12/31/18 |

| Industrials | 22.9 |

| Financials | 21.9 |

| Information technology | 16.0 |

| Consumer discretionary | 14.5 |

| Materials | 8.2 |

| Health care | 7.9 |

| Communication services | 0.6 |

| Energy | 0.3 |

| Short-term and other assets | 7.7 |

| Total | 100.0% |

| Top 10 Equity Holdings | |

| | % of Total Investments

as of 12/31/18 |

| STERIS PLC | 4.2 |

| BJ’s Restaurants, Inc. | 4.2 |

| Dycom Industries, Inc. | 3.9 |

| Encore Capital Group, Inc. | 3.7 |

| Cracker Barrel Old Country Store, Inc. | 3.5 |

| ManTech International Corp. | 3.5 |

| Werner Enterprises, Inc. | 3.5 |

| Core-Mark Holding Company, Inc. | 3.5 |

| National General Holdings Corp. | 3.4 |

| Descartes Systems Group Inc. (The) | 3.4 |

| Total | 36.8% |

Performance Comparison

Comparison of the change in value of a $10,000 investment in the fund and the Russell 2000 Index made on December 31, 2008.

The returns quoted in the above table and chart represent past performance, which is no guarantee of future results. Current performance may be higher or lower than that shown above. To obtain the most recent month-end returns, please call 800.258.3030 or visit homesteadfunds.com. Returns and the principal value of your investment will fluctuate such that shares, when redeemed, may be worth more or less than their original cost. The Small-Company Stock Fund’s average annual total returns are net of any fee waivers and reimbursements. The expenses used are as of the most recent period-end and may fluctuate over time. Returns include the reinvestment of dividends and capital gains. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares.

Performance Evaluation

15

International Equity Fund

Performance Evaluation | Prepared by the Fund's Subadvisor, Harding Loevner LP

Performance

In 2018, the fund outperformed its benchmark, the MSCI EAFE Index. The fund returned –12.74 percent versus the –13.79 percent return for the benchmark.

Portfolio Review

The fund’s better relative return this year was driven by both positive stock selection — especially in financials and information technology (IT) — and positive sector allocation, namely its large holdings in health care and lightweight in consumer discretionary. Within the fund’s financials holdings, Hong Kong-based insurer AIA Group, Brazil’s Itaú Unibanco and Singapore’s DBS Group all outperformed the sector. In IT, Dassault Systèmes led the fund’s good relative returns. While the fund’s overweight to health care was additive, its holdings detracted, led by German life sciences company Bayer. Stock selection in communication services also hurt performance, especially three companies exposed to the Chinese internet and social media industry: 1) Baidu; 2) Weibo, a social media platform; and 3) South Africa’s Naspers, which holds a large stake in Tencent, the Chinese online games and social media giant.

Viewed geographically, poor stock selection in Japan (Fanuc and Sysmex) and in emerging markets (EMs) (Baidu, Weibo, Aspen, and Naspers) only partially offset positive selection across other regions. In Europe outside the eurozone, all five of the fund’s Swiss holdings added to its relative performance. Pacific ex-Japan benefited from financial companies AIA and DBS. France’s Dassault, L’Oréal and industrial gases company Air Liquide were the fund’s top performers within the eurozone.

Outlook

One risk that we have focused on for the past several years is the increasingly high prices commanded by stocks of high-quality growth companies. Over the past two years or so, the fund has reduced or sold a larger-than-usual number of holdings that had reached what we considered to be extremely rich valuations. Those proceeds have been reinvested in other companies whose share prices were less pricey, sometimes due to a sharp decline following a business hiccup that we deemed temporary. Those shifts away from the most highly priced stocks now seem — at least emotionally — too incremental. In hindsight, however, we’re doubtful that the fund would have reinvested the proceeds of additional sales into companies that would have weathered this market decline much better. In our view, it wasn’t cheaper valuations that helped; it was avoiding the stocks of the fastest-growing companies, whatever their valuations.

Moving ahead, we are unwilling to reduce either our emphasis of growth or of quality, and we will continue to invest the fund in companies that we believe exhibit both.

| Subadvisor: Harding Loevner LP |

| Ferrill D. Roll, CFACo-Lead Portfolio ManagerBA, Economics, Stanford University |

| Alexander T. Walsh, CFACo-Lead Portfolio ManagerBA, North American Studies, McGill University |

But we do worry about the bias we manifest in favor of multinational businesses; these companies are repeatedly recognized by our process. We believe that they tend to be more diversified and less cyclical, with higher profit margins and returns on capital; thus, in our view they are able to operate with less leverage while investing around broader growth opportunities. As the trade war worsens, it becomes an attack on the bounty of globalization and the efficiencies of global supply chains that have, in our view, benefited consumers everywhere while bolstering the profits of those companies most adept at exploiting them. If global supply chains are further disrupted, we will be working overtime to identify companies that we believe are less exposed, using the same analytical framework that led the fund in the past to so many beneficiaries of trade — that is, our criteria of competitive advantage, good growth prospects, sound management and financial strength.

International Equity Fund

| Average Annual Total Returns (periods ended 12/31/18) | | | |

| | 1 YR % | 5 YR % | 10 YR % |

| International Equity Fund* | -12.74 | 0.61 | 5.20 |

| MSCI® EAFE® Index | -13.79 | 0.53 | 6.32 |

| Country Diversification | |

| | % of Total Investments

as of 12/31/18 |

| Japan | 17.0 |

| Germany | 16.9 |

| Switzerland | 11.5 |

| France | 10.8 |

| Britain | 7.2 |

| Sweden | 5.4 |

| Hong Kong | 4.1 |

| Singapore | 3.4 |

| United States of America | 3.4 |

| Israel | 3.3 |

| Spain | 3.0 |

| Canada | 2.2 |

| South Africa | 1.3 |

| Taiwan | 1.1 |

| Denmark | 1.0 |

| Republic of South Korea | 1.0 |

| Brazil | 1.0 |

| Italy | 0.9 |

| China, India, Mexico and Russia | 2.2 |

| Short-term and other assets | 3.3 |

| Total | 100.0% |

| Top 10 Equity Holdings | |

| | % of Total Investments

as of 12/31/18 |

| AIA Group Ltd. | 4.1 |

| Allianz SE REG | 4.0 |

| Nestlé SA ADR | 4.0 |

| Royal Dutch Shell PLC | 3.5 |

| DBS Group Holdings Ltd. | 3.4 |

| Check Point Software Technologies Ltd. | 3.3 |

| L’Oréal SA | 3.2 |

| Keyence Corp. | 2.9 |

| Bayer AG REG | 2.9 |

| Air Liquide SA | 2.9 |

| Total | 34.2% |

Performance Comparison

Comparison of the change in value of a $10,000 investment in the fund and the MSCI® EAFE® Index made on December 31, 2008.

The returns quoted in the above table and chart represent past performance, which is no guarantee of future results. Current performance may be higher or lower than that shown above. To obtain the most recent month-end returns, please call 800.258.3030 or visit homesteadfunds.com. Returns and the principal value of your investment will fluctuate such that shares, when redeemed, may be worth more or less than their original cost. The International Equity Fund’s average annual total returns are net of any fee waivers and reimbursements. The fund’s advisor waived a portion of its management fee during the periods shown. Had the advisor not done so, the fund's total returns would have been lower. The expenses used are as of the most recent period-end and may fluctuate over time. Returns include the reinvestment of dividends and capital gains. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares.

* Performance information for the International Equity Fund (formerly the International Value Fund) reflects its performance as an actively managed fund subadvised by Mercator Asset Management from December 31, 2008, to September 14, 2015; as a passively managed portfolio directed by SSGA Funds Management Inc. from September 15, 2015, to January 8, 2016; and, after a transition, as an actively managed fund subadvised by Harding Loevner LP from January 15, 2016, to period-end.

Performance Evaluation

17

As a shareholder, you incur two types of costs: (1) transaction costs; and (2) ongoing costs, including management fees, service fees, and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in each of the Homestead Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at July 1, 2018 and held through December 31, 2018.

Actual Expenses

The first line for each Fund in the table on the following page provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Individual Retirement Arrangements (IRAs) and Educational Savings Accounts (ESAs) are charged a $15.00 annual custodial fee. The charge is automatically deducted from your account in the fourth quarter of each year or, if you close your account, at the time of redemption. A fee is collected for each IRA or ESA, as distinguished by account type (Traditional IRA, Roth IRA, or ESA) and Social Security Number. For example, if you have both a Traditional IRA and a Roth IRA account, each would be charged a fee. But only one fee would be collected for each account type, regardless of the number of Funds held by each account type. These fees are not included in the example below. If included, the costs shown would be higher.

Hypothetical Example for Comparison Purposes

The second line for each Fund in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect the custodial account fee. Therefore, the hypothetical information in the example is useful in comparing your ongoing costs only, and will not help you determine the

relative total costs of owning different funds. In addition, if the custodial account fee was included, your costs would have been higher.

Expense Example (Continued)

| Daily Income Fund | Beginning Account Value

July 1, 2018 | Ending Account Value

December 31, 2018 | Expenses Paid During the Perioda | Annualized Expense Ratio for the Six Month Period Ended

December 31, 2018 |

| Actual Return | $1,000.00 | $1,006.70 | $3.83 | 0.76% |

| Hypothetical Return (5% return before expenses) | $1,000.00 | $1,021.18 | $3.86 | 0.76% |

| Short-Term Government Securities Fundb | | | | |

| Actual Return | $1,000.00 | $1,011.60 | $3.80 | 0.75% |

| Hypothetical Return (5% return before expenses) | $1,000.00 | $1,021.22 | $3.82 | 0.75% |

| Short-Term Bond Fund | | | | |

| Actual Return | $1,000.00 | $1,011.00 | $3.94 | 0.78% |

| Hypothetical Return (5% return before expenses) | $1,000.00 | $1,021.09 | $3.96 | 0.78% |

| Stock Index Fundc | | | | |

| Actual Return | $1,000.00 | $926.60 | $2.79 | 0.57% |

| Hypothetical Return (5% return before expenses) | $1,000.00 | $1,022.11 | $2.93 | 0.57% |

| Value Fund | | | | |

| Actual Return | $1,000.00 | $958.10 | $3.00 | 0.61% |

| Hypothetical Return (5% return before expenses) | $1,000.00 | $1,021.93 | $3.10 | 0.61% |

| Growth Fund | | | | |

| Actual Return | $1,000.00 | $919.40 | $4.11 | 0.85% |

| Hypothetical Return (5% return before expenses) | $1,000.00 | $1,020.71 | $4.33 | 0.85% |

| Small-Company Stock Fund | | | | |

| Actual Return | $1,000.00 | $755.50 | $4.13 | 0.93% |

| Hypothetical Return (5% return before expenses) | $1,000.00 | $1,020.30 | $4.75 | 0.93% |

| International Equity Fundb | | | | |

| Actual Return | $1,000.00 | $864.40 | $4.66 | 0.99% |

| Hypothetical Return (5% return before expenses) | $1,000.00 | $1,020.00 | $5.05 | 0.99% |

| a. | The dollar amounts shown as “Expenses Paid During the Period” are equal to each Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 184, then divided by 365 (to reflect the half-year period). |

| b. | Reflects fee waiver and expense limitation agreements in effect during the period. |

| c. | The Stock Index Fund is a feeder fund that invests substantially all of its assets in a Master Portfolio. The example reflects the expenses of both the feeder fund and the Master Portfolio. |

Regulatory and Shareholder Matters

Proxy Voting Policies and Procedures

The policies and procedures used to determine how to vote proxies relating to the Funds’ portfolio securities are available online at homesteadfunds.com and, without charge, upon request by calling 800-258-3030. This information is also available on the Securities and Exchange Commission’s website at sec.gov.

Proxy Voting Record

For the most recent twelve-month period ended June 30, information regarding how proxies relating to portfolio securities were voted on behalf of each of the Funds is available, without charge, upon request by calling 800-258-3030. This information is also available online at homesteadfunds.com and on the Securities and Exchange Commission’s website at sec.gov.

Quarterly Disclosure of Portfolio Holdings

The Funds file complete schedules of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. Form N-Q will be replaced by Form N-PORT beginning in 2019. Portfolio holdings for the second and fourth quarters of each fiscal year are filed as part of the Funds’ semi-annual and annual reports. The Funds’ Form N-Q, (and, when effective and filed, Forms N-PORT) semi-annual and annual reports are available on the Commission’s website at sec.gov. The most recent quarterly portfolio holdings and semi-annual and annual report also can be accessed on the Funds’ website at homesteadfunds.com.

Principal Risks

You may lose money by investing in the Funds. Below are summaries of some, but not all, of the principal risks of investing in one or more of the Funds, each of which could adversely affect a Fund’s NAV, yield and total return. Each risk listed below does not necessarily apply to each Fund, and you should read each Fund’s prospectus carefully for a description of the principal risks associated with investing in a particular Fund.

• Asset-Backed and Mortgage-Backed Securities Risk The risk that defaults, or perceived increases in the risk of defaults, on the obligations underlying asset-backed and mortgage-backed securities, including mortgage pass-through securities and collateralized mortgage obligations (“CMOs”), significant credit downgrades and illiquidity may impair the value of the securities. These securities also present a higher degree of prepayment risk (when repayment of principal occurs before scheduled maturity resulting in the Fund having to reinvest proceeds at a lower interest rate) and extension risk (when rates of repayment of principal are slower than expected, which may lock in a below-market interest rate, increase the security’s duration, and reduce the value of the security) than do other types of fixed income securities. Enforcing

rights against the underlying assets or collateral may be difficult, and the underlying assets or collateral may be insufficient if the issuer defaults.

• Commercial Paper Risk Investments in commercial paper are subject to the risk that the issuer cannot issue enough new commercial paper to satisfy its obligations with respect to its outstanding commercial paper, also known as rollover risk. Commercial paper is generally unsecured, which increases the credit risk associated with this type of investment. The value of commercial paper may be affected by changes in the credit rating or financial condition of the issuing entities. The value of commercial paper will tend to fall when interest rates rise and rise when interest rates fall.

• Concentration Risk To the extent the fund concentrates in a particular industry, it may be more susceptible to economic conditions and risks affecting that industry.

• Corporate Bond Risk Corporate debt securities are subject to the risk of the issuer’s inability to meet principal and interest payments on the obligations and may also be subject to price volatility due to factors such as interest rates, market perception of the creditworthiness of the issuer and general market liquidity.

• Currency Risk Foreign currencies may experience steady or sudden devaluation relative to the U.S. dollar or other currencies, adversely affecting the value of the Fund’s investments. The value of the Fund’s assets may be affected favorably or unfavorably by currency exchange rates, currency exchange control regulations, and restrictions or prohibitions on the repatriation of foreign currencies. Because the Fund’s net asset value is determined on the basis of U.S. dollars, if the local currency of a foreign market depreciates against the U.S. dollar, you may lose money even if the foreign market prices of the Fund’s holdings rise.

• Debt Securities Risks

Credit Risk The risk that an issuer or counterparty will fail to pay its obligations to the Fund when they are due. As a result, the Fund’s income might be reduced, the value of the Fund’s investment might fall, and/or the Fund could lose the entire amount of its investment. Changes in the financial condition of an issuer or counterparty, changes in specific economic, social or political conditions that affect a particular type of security or other instrument or an issuer, and changes in economic, social or political conditions generally can increase the risk of default by an issuer or counterparty, which can affect a security’s or other instrument’s credit quality or value and an issuer’s or counterparty’s ability to pay interest and principal when due. The values of securities also may decline for a number of other reasons that relate directly to the issuer, such as management performance, financial leverage and reduced demand for the issuer’s goods and services, as well as the historical and prospective earnings of the issuer and the value of its assets.

Regulatory and Shareholder Matters

Regulatory and Shareholder Matters (Continued)

Extension Risk The risk that if interest rates rise, repayments of principal on certain debt securities, including, but not limited to, floating rate loans and mortgage-related securities, may occur at a slower rate than expected and the expected maturity of those securities could lengthen as a result. Securities that are subject to extension risk generally have a greater potential for loss when prevailing interest rates rise, which could cause their values to fall sharply.

Interest Rate Risk The risk that debt instruments will change in value because of changes in interest rates. The value of an instrument with a longer duration (whether positive or negative) will be more sensitive to changes in interest rates than a similar instrument with a shorter duration. Bonds and other debt instruments typically have a positive duration. The value of a debt instrument with positive duration will generally decline if interest rates increase.

• Depositary Receipts Risk Depositary receipts in which the Fund may invest are receipts listed on U.S. exchanges that are issued by banks or trust companies that entitle the holder to all dividends and capital gains that are paid out on the underlying foreign shares. Investments in depositary receipts may be less liquid than the underlying shares in their primary trading market.

• Derivatives Risk The risk that an investment in derivatives will not perform as anticipated by the Adviser, cannot be closed out at a favorable time or price, or will increase the Fund’s volatility; that derivatives may create investment leverage; that, when a derivative is used as a substitute for or alternative to a direct cash investment, the transaction may not provide a return that corresponds precisely with that of the cash investment; or that, when used for hedging purposes, derivatives will not provide the anticipated protection, causing the Fund to lose money on both the derivatives transaction and the exposure the Fund sought to hedge. The counterparty to a derivatives contract may be unable or unwilling to make timely settlement payments, return the Fund’s margin, or otherwise honor its obligations. Changes in regulation relating to a mutual fund’s use of derivatives and related instruments could potentially limit or impact the Fund’s ability to invest in derivatives, limit a Fund’s ability to employ certain strategies that use derivatives and adversely affect the value or performance of derivatives and the Fund.

• Emerging and Frontier Market Risk The risk that investing in emerging and frontier markets will be subject to greater political and economic instability, greater volatility in currency exchange rates, less developed securities markets, possible trade barriers, currency transfer restrictions, a more limited number of potential buyers and issuers, an emerging market country’s dependence on revenue from particular commodities or international aid, less governmental supervision and regulation, unavailability of currency hedging techniques,