QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant /X/ |

| Filed by a Party other than the Registrant / / |

Check the appropriate box: |

| / / | | Preliminary Proxy Statement |

| / / | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| /X/ | | Definitive Proxy Statement |

| / / | | Definitive Additional Materials |

| / / | | Soliciting Material Pursuant to §240.14a-12

|

SAUER-DANFOSS INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| /X/ | | No fee required |

| / / | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| / / | | Fee paid previously with preliminary materials. |

| / / | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

250 Parkway Drive, Suite 270

Lincolnshire, Illinois 60069

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 4, 2003

TO OUR STOCKHOLDERS:

The annual meeting of stockholders of Sauer-Danfoss Inc., a Delaware corporation, will be held at the Hyatt Regency Newport, One Goat Island, Newport, Rhode Island 02840, on Wednesday, June 4, 2003, commencing at 8:30 a.m. local time. At the meeting, stockholders will act on the following matters:

- 1.

- To elect ten (10) directors for a term expiring at the annual meeting of stockholders to be held in 2004, and until their respective successors are duly elected and shall qualify.

- 2.

- To ratify the appointment of KPMG LLP as the Company's independent accountants for 2003.

- 3.

- To transact such other business as may properly come before the meeting or any postponement, adjournment, or adjournments.

Stockholders of record at the close of business on April 10, 2003 are entitled to notice of and to vote at the annual meeting or any postponement, adjournment, or adjournments.

Whether or not you expect to attend the Annual Meeting, please either complete, date, sign, and return the accompanying proxy card in the provided envelope or vote your shares by telephone or via the Internet using the instructions on the enclosed proxy card as promptly as possible in order to ensure your representation at the meeting. Even if you have given your proxy, whether by mail, by telephone, or via the Internet, you may still vote in person if you attend the meeting. If your shares are held of record by a broker, bank, or other nominee ("Street Name") you will need to obtain from the record holder and bring to the meeting a proxy issued in your name, authorizing you to vote the shares.

Lincolnshire, Illinois

April 25, 2003

SAUER-DANFOSS INC.

250 Parkway Drive, Suite 270

Lincolnshire, Illinois 60069

PROXY STATEMENT

April 25, 2003

GENERAL INFORMATION

Solicitation and Revocability of Proxies

The enclosed proxy is being solicited on behalf of the Board of Directors of Sauer-Danfoss Inc. (the "Company") for use at the annual meeting of the stockholders to be held on June 4, 2003 (the "Annual Meeting"), and at any postponement, adjournment, or adjournments. Most stockholders have a choice of voting via the Internet, by using a toll-free telephone number, or by completing a proxy card and mailing it in the envelope provided. Check your proxy card or the information forwarded by your bank, broker, or other holder of record to see which options are available to you. Please be aware that if you vote over the Internet, you may incur costs such as telecommunication and Internet access charges for which you will be responsible. The telephone voting facilities for stockholders of record will be available until 11:00 am CDT on June 3, 2003 and the Internet voting facilities will be available until 12:00 pm CDT on June 3, 2003, the day prior to the Annual Meeting.

Any proxy given does not affect your right to vote in person at the meeting and may be revoked at any time before it is exercised by notifying Kenneth D. McCuskey, Corporate Secretary, by mail, telegram, or facsimile, by timely delivery of a properly executed, later-dated proxy (including an Internet or telephone vote) or by appearing at the Annual Meeting in person and voting by ballot. Persons whose shares are held of record by a brokerage house, bank, or other nominee and who wish to vote at the meeting, must obtain from the record holder a proxy issued in such person's name.

The Company intends to mail this Proxy Statement and the accompanying proxy on or about April 25, 2003.

Expense of Solicitation

The Company will bear the entire cost of solicitation of proxies, including the preparation, assembly, printing, and mailing of this Proxy Statement, the accompanying proxy and any additional information furnished to stockholders. The Company will reimburse banks, brokerage houses, custodians, nominees, and fiduciaries for reasonable expenses incurred in forwarding proxy material to beneficial owners. In addition to solicitations by mail, regular employees and directors of the Company may, but without compensation other than their regular compensation, solicit proxies in person or by telephone, facsimile or electronic means. The Company does not expect to pay any compensation for the solicitation of proxies.

1

Voting of Proxies

All shares entitled to vote and represented by properly completed proxies received prior to the Annual Meeting and not revoked will be voted in accordance with the instructions on the proxy.If no instructions are indicated on a properly completed proxy, the shares represented by that proxy will be voted for the election of the nominees for director designated below and for ratification of the appointment of KPMG LLP as independent accountants of the Company for 2003.

Persons Entitled to Vote

Only holders of common stock of the Company of record as of the close of business on April 10, 2003 are entitled to notice of and to vote at the Annual Meeting. At the close of business on that date, 47,418,768 shares of common stock were outstanding. Holders of common stock are entitled to one (1) vote for each share held on all matters to be voted upon. Shares cannot be voted at the Annual Meeting unless the owner is present in person or represented by proxy. The directors shall be elected by an affirmative vote of a plurality of the shares that are entitled to vote on the election of directors and that are represented at the meeting by stockholders who are present in person or by proxy, assuming a quorum is present. The ten nominees for directors receiving the greatest number of votes at the Annual Meeting will be elected as directors. For all other matters to be voted upon at the Annual Meeting, the affirmative vote of a majority of shares present in person or represented by proxy, and entitled to vote on the matter, is necessary for approval.

When a broker or other nominee holding shares for a customer votes on one proposal, but does not vote on another proposal because the broker or nominee does not have discretionary voting power with respect to such proposal and has not received instructions from the beneficial owner, it is referred to as a "Broker Nonvote." Properly executed proxies marked "Abstain" or proxies required to be treated as "Broker Nonvotes" will be treated as present for purposes of determining whether there is a quorum at the meeting. Abstentions will be considered shares entitled to vote in the tabulation of votes cast on proposals presented to the stockholders and will have the same effect as negative votes. Broker Nonvotes are counted towards a quorum, but are not counted for any purpose in determining whether a matter has been approved.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information as of March 17, 2003, with respect to shares of common stock of the Company that were owned beneficially by: (i) each beneficial owner of more than 5% of the outstanding shares of common stock; (ii) each of the directors; (iii) each of the executive officers of the Company named in the Summary Compensation table; and (iv) all executive officers and directors of the Company as a group.

2

Beneficial Owners, Directors, and Executive Officers

| | Number of Shares

Beneficially

Owned(1)

| | Percent of

Outstanding

Shares

| |

|---|

| Klaus Murmann & Co. KG(2) | | 36,629,787 | (3) | 77.2 | % |

| Danfoss Murmann Holding A/S(4) | | 35,415,962 | (5) | 74.7 | % |

| Danfoss A/S(4) | | 35,415,962 | (5) | 74.7 | % |

| Sauer Holding GmbH(2) | | 36,629,787 | (3) | 77.2 | % |

| Sauer GmbH(2) | | 10,474,000 | (6) | 22.1 | % |

| Klaus H. Murmann, Director and Chairman(2) | | 36,629,787 | (3) | 77.2 | % |

| Hannelore Murmann(2) | | 36,629,787 | (3) | 77.2 | % |

| Nicola Keim, Director(2) | | 36,633,787 | (3) | 77.3 | % |

| Sven Murmann, Director(2) | | 36,633,787 | (3) | 77.3 | % |

| Ulrike Murmann-Knuth(2) | | 36,629,787 | (3) | 77.2 | % |

| Jan Murmann(2) | | 36,629,787 | (3) | 77.2 | % |

| Anja Murmann-Mbappe(2) | | 36,629,787 | (3) | 77.2 | % |

| Brigitta Zoellner(2) | | 36,629,787 | (3) | 77.2 | % |

| Christa Zoellner(2) | | 36,629,787 | (3) | 77.2 | % |

| David L. Pfeifle, Former Chief Executive Officer | | 282,200 | | | * |

| David J. Anderson, Director, President and Chief Executive Officer | | 145,000 | (7) | | * |

| Niels Erik Hansen, Former Executive Vice President—Work Function and Control Products | | 0 | | 0 | % |

| James R. Wilcox, Executive Vice President and Chief Operating Officer | | 120,750 | | | * |

| Karl J. Schmidt, Executive Vice President and Chief Financial Officer | | 0 | | 0 | % |

| Don O'Grady, Former Vice President—Human Resources | | 0 | | 0 | % |

| Jørgen Clausen, Director and Vice Chairman | | 61,000 | | | * |

| Ole Steen Andersen, Director | | 3,000 | | | * |

| Johannes F. Kirchhoff, Director | | 4,400 | | | * |

| Hans Kirk, Director | | 3,000 | | | * |

| F. Joseph Loughrey, Director | | 5,000 | (8) | | * |

| Richard M. Schilling, Director | | 9,000 | | | * |

| Steven H. Wood, Director | | 0 | | 0 | % |

| All directors and executive officers as a group (20 persons) | | 37,376,937 | (9) | 78.8 | % |

- *

- Represents less than 1%.

- (1)

- Unless otherwise indicated in the following notes, each of the stockholders named in this table has sole voting and investment power with respect to the shares shown as beneficially owned. The following footnotes describe those shares which are beneficially owned by more than one person listed above.

- (2)

- The mailing address for each of these entities and persons is c/o Sauer Holding GmbH, Krokamp 35, 24539 Neumünster, Federal Republic of Germany.

- (3)

- These shares include 10,474,000 shares owned directly by Sauer GmbH, a German limited liability company, 7,913,825 shares owned directly by Sauer Holding GmbH, a German limited liability company ("Sauer Holding"), and 18,241,962 shares owned directly by Danfoss Murmann Holding A/S (the "Holding Company"). Sauer GmbH possesses only shared dispositive power and no voting power

3

over 10,361,500 of the shares which it owns directly, as to which an irrevocable voting proxy (the "Voting Proxy") has been granted to the Holding Company. Sauer Holding possesses only shared voting and dispositive power over 6,812,500 of the shares which it owns directly. As a result of its 100% ownership of Sauer GmbH, Sauer Holding has shared voting and dispositive power over 112,500 of the shares owned directly by Sauer GmbH. As a result of its 50% voting power over the Holding Company, Sauer Holding has shared voting and dispositive power over the 18,241,962 shares owned directly by the Holding Company and over the 10,361,500 shares owned directly by Sauer GmbH that are subject to the Voting Proxy. Sauer Holding disclaims beneficial ownership of the 28,715,962 shares directly owned in the aggregate by Sauer GmbH and the Holding Company. As a result of its 100% ownership of Sauer Holding, Klaus Murmann & Co. KG, a German partnership ("Murmann KG"), has shared voting and dispositive power over the 36,629,787 shares owned in the aggregate by Sauer GmbH, Sauer Holding, and the Holding Company. Klaus H. Murmann and Hannelore Murmann, as the general partners of Murmann KG, and Nicola Keim, Sven Murmann, Ulrike Murmann-Knuth, Anja Murmann-Mbappe, Jan Murmann, Brigitta Zoellner and Christa Zoellner, as limited partners of Murmann KG who share the power to vote on investment decisions, also have shared voting and dispositive power over these 36,629,787 shares. Murmann KG, Klaus H. Murmann, Hannelore Murmann, Nicola Keim, Sven Murmann, Ulrike Murmann-Knuth, Anja Murmann-Mbappe, Jan Murmann, Brigitta Zoellner and Christa Zoellner each disclaim beneficial ownership of the 36,629,787 shares owned directly in the aggregate by Sauer GmbH, Sauer Holding, and the Holding Company.

- (4)

- The mailing address for each of these entities is DK-6430 Nordborg, Denmark.

- (5)

- These shares include 18,241,962 shares owned directly by the Holding Company. As a result of its 50% voting power over the Holding Company, Danfoss A/S has shared voting and dispositive power over these shares. These shares also include 10,361,500 shares owned directly by Sauer GmbH, that are subject to the Voting Proxy. The Holding Company has sole voting power, but no dispositive power (sole or shared), over these shares. Danfoss A/S has shared voting and dispositive power over these shares. These shares also include 6,812,500 shares owned directly by Sauer Holding, as to which the Holding Company and Danfoss A/S have shared voting and dispositive power. The Holding Company disclaims beneficial ownership of 6,812,500 of these shares. Danfoss A/S disclaims beneficial ownership of all 35,415,962 of these shares.

- (6)

- These shares are owned directly by Sauer GmbH but, pursuant to the Voting Proxy, Sauer GmbH has neither sole nor shared voting or dispositive power over 10,361,500 of these shares.

- (7)

- Mr. Anderson disclaims beneficial ownership with respect to 50,000 of these shares which are owned directly by his wife.

- (8)

- Mr. Loughrey disclaims beneficial ownership with respect to 2,000 of these shares which are owned directly by his wife.

- (9)

- Includes stock owned by the spouses and children of certain directors and executive officers.

4

ELECTION OF DIRECTORS

The Board of Directors of the Company (the "Board") has nominated ten current directors for election. Richard M. Schilling, who has been a director of the Company since April 1990, is retiring from the Board effective as of the June 4, 2003 annual meeting of stockholders. All directors are elected annually.

Each of the ten nominees for directors are currently directors and if elected, will serve until the 2004 Annual Meeting and until a successor has been elected and qualified, or until such director's earlier death, resignation, or removal.

Each share is entitled to one vote for each of ten directors. The persons named in the accompanying proxy will vote it for the election of the nominees named below as directors unless otherwise directed by the stockholder. Each nominee has consented to be named and to continue to serve if elected. In the unanticipated event that a nominee becomes unavailable for election for any reason, the proxies will be voted for the other nominees and for any substitute.

Nominees to Serve for Directors

Ole Steen Andersen, age 56, has been a director of the Company since May 3, 2000. Mr. Andersen has been Executive Vice President and Chief Financial Officer of Danfoss A/S since April 1, 2000 and a member of its Executive Committee for more than the past five years. For more than five years prior to April 2000, he served as Executive Vice President of Danfoss A/S. He is also Chairman of the Board of Cowi A/S, an independent consulting company delivering services within the fields of engineering, environmental science, and economics, and Deputy Chairman of the Board of Lundbeck A/S, a pharmaceutical firm.

David J. Anderson, age 55, a director of the Company since July 1, 2002, has been President and Chief Executive Officer of the Company and President of Sauer-Danfoss (US) Company, the primary U.S. operating subsidiary of the Company, since July 1, 2002. He served as Executive Vice President—Strategic Business Development of the Company from May 3, 2000, until July 1, 2002. Since joining the Company in 1984, Mr. Anderson has held various senior management positions with the Company and Sauer-Danfoss (US) Company with increasing responsibility. He is a member of the Executive Committee of the Board.

Jørgen M. Clausen, age 54, has been a director and Vice Chairman of the Company since May 3, 2000. He has served as the President and Chief Executive Officer and a member of the Executive Committee of Danfoss A/S for more than the past five years. He is also Chairman of the Board of Risoe National Laboratories, a Danish government-owned research organization, and a member of the Academy of Technical Sciences, a non-profit organization promoting the technical sciences in Denmark. He is a member of the Nominating Committee of the Board.

Nicola Keim, age 42, has been a director of the Company since April 1990. Ms. Keim served as a Member of the Supervisory Board of Sauer Getriebe from November 1990 through June 1997. She is employed part-time as counsel in the human resources department of HypoVereinsbank, a German bank. Ms. Keim is the daughter of Klaus H. Murmann, Chairman of the Company and a sister of Sven Murmann, a director of the Company.

Johannes F. Kirchhoff, age 45, has been a director of the Company since April 1997. Mr. Kirchhoff has been owner and Managing Director of the FAUN Umwelttechnik GmbH & Co. KG, a German

5

manufacturer of vehicles for waste disposal, since December 1994. He is Chairman of the Compensation Committee of the Board and a member of the Audit Committee of the Board.

Hans Kirk, age 60, has been a director of the Company since May 3, 2000. He has served as Executive Vice President and Chief Operating Officer and a member of the Executive Committee of Danfoss A/S for more than the past five years. He is also a director of NIRAS Group, a Danish construction consulting company and a director of The Danish Technological Institute, an independent institution approved by the Danish authorities to provide technological services to businesses and the community.

F. Joseph Loughrey, age 53, has been a director of the Company since June 23, 2000. He has served as Executive Vice President of Cummins Inc. and President—Engine Business since October 1999. From 1996 to 1999, Mr. Loughrey served as Executive Vice President of Cummins Engine Company and Group President—Industrial and Chief Technical Officer. He also is a director of Tower Automotive, Inc., a manufacturer of assemblies and modules for vehicle structures and suspension systems for original equipment manufacturers of automobiles. Mr. Loughrey is a member of the Audit Committee and the Compensation Committee of the Board.

Klaus H. Murmann, age 71, a director of the Company since April 1990, is currently Chairman. From 1987 to May 3, 2000, he served as Chairman and Chief Executive Officer of the Company and its predecessor. He retired as an active employee of the Company as of December 31, 2002. Mr. Murmann founded Sauer Getriebe in 1967, which, as a licensee of and later joint venture partner with Sundstrand Corporation, has been involved in the hydrostatics business since 1967. He is Chairman of the Board of Gothaer Insurance Group, Cologne, a German insurance company, Chairman of the Board of PSV AG, a German national pension fund, a member of the board of Bankgesellschaft Berlin AG, Berlin, a German bank, a member of the board of EON Energie AG, a German utility company, and a nonexecutive director of GKN PLC, United Kingdom, an engineering company. Klaus Murmann is the father of Nicola Keim and Sven Murmann, each of whom is a director of the Company. He is a member of the Executive Committee and the Nominating Committee of the Board.

Sven Murmann, age 35, has been a director of the Company since April 1994. Mr. Murmann has been Managing Director of Sauer Holding GmbH, an investment company controlled by the Murmann family, and Managing Director of Management Systems GmbH, a German software company owned by Sauer Holding, since February 2000. He served as Manager of HAKO Holding GmbH & Co., a global manufacturer of indoor and outdoor cleaning equipment based in Germany from August 2000 to August 2002. He served an internship at IBM from December 1, 1999 through May 31, 2000. He served as an Assistant Professor at the University of Zurich from October 1997 to October 1999. Mr. Murmann is the son of Klaus H. Murmann, Chairman of the Company and a brother of Nicola Keim, a director of the Company.

Steven H. Wood, age 45, has been a director of the Company since January 1, 2003. He has served as Executive Vice President and Chief Financial Officer of Maytag Corporation since 2000 and from 1996 to 2000 he was Vice President-Financial Reporting and Audit of Maytag. Mr. Wood held various other financial leadership positions within Maytag from 1989 to 1996. He is a member of the Audit Committee and Compensation Committee of the Board.

The Board recommends that stockholders vote FOR the election of the nominees named above as directors.

6

Agreement Regarding Nominees for Director

Entities and persons under the control of Klaus H. Murmann, a director and Chairman of the Company (the "Murmann Family") and Danfoss A/S ("Danfoss") have entered into an agreement regarding their ownership of the common stock owned by Danfoss Murmann Holding A/S (the "Holding Company Agreement"). Pursuant to the Holding Company Agreement, the Murmann Family and Danfoss will each identify for recommendation to the Company's Nominating Committee three candidates for Director who may be associated with the Murmann Family or Danfoss. In addition, the Murmann Family and Danfoss will each identify for recommendation two additional candidates for Director. One such candidate recommended by the Murmann Family will be the Company's Chief Executive Officer and President and the remaining three such candidates must be independent from and not associated or affiliated with the Murmann Family or Danfoss. With respect to the current nominees for election as Directors, Klaus H. Murmann, Nicola Keim and Sven Murmann were recommended by the Murmann Family and Messrs. Andersen, Clausen and Kirk were recommended by Danfoss.

Board Committees and Meetings

The Board held four meetings during 2002. The Board has an Executive Committee, an Audit Committee, a Compensation Committee and a Nominating Committee. Each director attended at least 75% of the aggregate of the total number of meetings of the Board and the total number of meetings held by all committees of the Board on which the director served during 2002.

Executive Committee. The Executive Committee possesses all of the powers of the Board, except for certain powers specifically reserved by Delaware law to the Board. The Executive Committee held no formal meetings during 2002 but took action four times by unanimous written consent. Klaus H. Murmann and David J. Anderson are the current members of the Executive Committee.

Audit Committee. The Audit Committee is currently composed of four directors, none of whom is an employee of the Company. The Audit Committee is directly responsible for the appointment, compensation, retention and oversight of the independent auditors. The Committee also reviews the scope of the annual audit activities of the independent auditors and the Company's internal auditors, reviews audit results and administers the Code of Business Conduct and Lawful Practices. The Audit Committee held four meetings during 2002. The Audit Committee currently consists of Messrs. Schilling (Chairman), Kirchhoff, Loughrey and Wood.

The Company's Board of Directors has adopted a written charter for the Audit Committee. The members of the Audit Committee are independent, as independence is defined in Sections 303.01(B)(2)(a) and (3) of the New York Stock Exchange's current listing standards.

Compensation Committee. The Compensation Committee is currently composed of four directors, none of whom is an employee of the Company. The Compensation Committee reviews and determines the salaries of the executive officers of the Company and administers the Company's Annual Officer Performance Incentive Plan and 1998 Long-Term Incentive Plan. The Compensation Committee met four times and held three teleconference meetings in 2002. The current members of the Compensation Committee are Messrs. Kirchhoff (Chairman), Loughrey, Schilling and Wood.

Nominating Committee. The current members of the Nominating Committee are Messrs. Clausen and Klaus Murmann. The Nominating Committee recommends to the Board proposed nominees whose

7

election at the next annual meeting of stockholders will be recommended by the Board. The Nominating Committee met once and also acted once by unanimous written consent in 2002. The Committee has not established any procedures with respect to considering nominees recommended by stockholders.

Compensation of Directors

Directors who are not employees of the Company receive quarterly retainers of $5,000 ($20,000 per annum), plus $1,000 for each Board meeting attended and $500 for participation in a telephonic meeting, together with expenses relating to their duties as directors. The Vice Chairman, if not an employee, receives a quarterly retainer of $10,000 ($40,000 per annum) and the Chairman, if not an employee, receives a quarterly retainer of $20,000 ($80,000 per annum).

Pursuant to the Non-Employee Director Stock Option and Restricted Stock Plan, the Board has determined that following each annual meeting of stockholders, each non-employee director shall receive 1,000 shares of Restricted Common Stock of the Company. All shares of Restricted Common Stock of the Company will vest on the third anniversary of the date of grant. The non-employee directors will have voting and dividend rights with respect to the Restricted Common Stock, but the Restricted Common Stock will be forfeited upon termination of service from the Board for any reason prior to the third anniversary of the grant, unless otherwise determined by the Board in its discretion.

REPORT OF THE AUDIT COMMITTEE

In fulfilling its oversight responsibilities, the Audit Committee of the Board of Directors of Sauer-Danfoss Inc. (the "Corporation") reviewed the scope of the annual audit activities of the independent auditors and the Corporation's internal auditors. The Audit Committee has discussed with KPMG, the Corporation's independent auditors, the overall scope and plans for their audit. The Audit Committee met with KPMG, with and without management present, to discuss the results of their examinations, their evaluations of the Corporation's internal controls and the overall quality of the Corporation's financial reporting. The Audit Committee continued to monitor the scope and adequacy of the Corporation's internal auditing program.

The Audit Committee met with both management and KPMG to review and discuss the audited financial statements.

The Audit Committee reviewed with KPMG their judgments as to the quality and acceptability of the Corporation's accounting principles. The Audit Committee's review included discussion with KPMG of the matters required to be discussed pursuant toStatement on Auditing Standards No. 61, "Communications With Audit Committees."

The Audit Committee has received and reviewed the written disclosures and the letter from KPMG required by theIndependence Standards Board, Standard No. 1, "Independence Discussions With Audit Committees," and has discussed with KPMG, among other things, matters relating to its independence. The Audit Committee has also considered the compatibility of the nonaudit services provided by KPMG with its independence.

Based on the reviews and discussions referred to above, the Audit Committee recommends to the Board of Directors that the audited financial statements for the year ended December 31, 2002 be included in the Corporation's Annual Report on Form 10-K for the year ended December 31, 2002.

8

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth information concerning total compensation awarded or paid to or earned by each person who served as the Chief Executive Officer during 2002, the four other most highly compensated executive officers of the Company, who served in such capacities as of December 31, 2002 (the "Named Executive Officers"), and one individual for whom disclosure would have been provided, but for the fact that the individual was not serving as an executive officer at the end of the year, for services rendered to the Company in all capacities during each of the last three fiscal years ended December 31, 2002.

SUMMARY COMPENSATION TABLE

| | Annual Compensation

| | Long Term Compensation

|

|---|

| |

| |

| |

| |

| | Awards

| | Payouts

|

|---|

Name and Principal Position

| | Year

| | Salary($)

| | Bonus($)

| | Other Annual

Compensation

($)

| | Restricted Stock

Awards($)(1)(2)

| | LTIP

Payouts ($)

|

|---|

David L. Pfeifle(3)

Former President and

Chief Executive Officer | | 2002

2001

2000 | | 503,827

400,000

368,416 | (4)

| 159,950

0

179,050 | | 25,810

19,512

7,277 | | —

—

— | | —

—

78,750 |

David J. Anderson(3)

President and

Chief Executive Officer |

|

2002

2001

2000 |

|

413,515

187,562

170,160 |

(5)

|

177,001

0

62,023 |

|

7,889

2,390

2,271 |

|

—

—

— |

|

—

—

109,375 |

James R. Wilcox

Executive Vice President

and Chief Operating Officer |

|

2002

2001

2000 |

|

393,031

240,712

41,540 |

(5)

|

175,257

0

15,141 |

|

9,549

4,910

461 |

|

—

—

— |

|

—

—

— |

Karl J. Schmidt

Executive Vice President

and Chief Financial Officer |

|

2002

2001

2000 |

|

251,054

NA

NA |

|

179,504

NA

NA |

|

4,548

NA

NA |

|

—

NA

NA |

|

—

NA

NA |

Klaus H. Murmann

Chairman and Former

Chief Executive Officer |

|

2002

2001

2000 |

|

250,000

250,000

333,333 |

|

165,430

0

262,000 |

|

12,678

8,130

2,770 |

|

—

—

— |

|

—

—

— |

Don A. O'Grady

Former Vice President—

Human Resources |

|

2002

2001

2000 |

|

200,782

115,941

NA |

|

130,887

103,200

NA |

|

5,175

1,917

NA |

|

—

—

NA |

|

—

—

NA |

Niels Erik Hansen

Former Executive Vice

President—Work

Function and Control

Products |

|

2002

2001

2000 |

|

316,228

405,052

200,000 |

(6)

(7)

|

0

0

97,200 |

|

7,743

9,756

3,324 |

|

—

—

— |

|

—

—

— |

- (1)

- Performance Units granted in 2002 are set forth below in the table under"Long-Term Incentive Plan Awards."

9

- (2)

- On December 31, 2002, the Named Executive Officers held the following target number of Performance Units with the following value, based on the closing per share price of common stock of the Company on December 31, 2002, of $7.90: Mr. Pfeifle—74,067 Units with a value of $585,129; Mr. Anderson—28,174 Units with a value of $222,575; Mr. Murmann—45,277 Units with a value of $357,688; Mr. Schmidt—16,242 Units with a value of $128,312; Mr. Wilcox—34,103 Units with a value of $269,414; Mr. O'Grady—18,483 Units with a value of $146,016; and Mr. Hansen—0 Units with a value of $0. These Units are performance-based target units and, unless otherwise determined by the Committee, are only paid out if and when the performance goals (described below in the table under"Long-Term Incentive Plan Awards") are satisfied. Each of the Named Executive Officers has the right to receive dividend equivalents on the target number of Performance Units.

- (3)

- Mr. Pfeifle retired and resigned as President and Chief Executive Officer of the Company effective July 1, 2002, and Mr. Anderson assumed the positions of President and Chief Executive Officer on the same date.

- (4)

- Includes a pro-rata payment to Mr. Pfeifle in the amount of $253,500 for Performance Units previously issued under the Long-Term Incentive Plan and a payment for unused accrued vacation of $39,458.

- (5)

- Includes two months salary, grossed up for taxes, for relocation allowances for moves to the Chicago area.

- (6)

- Mr. Hansen resigned as an officer of the Company effective July 1, 2002 but remained employed as a special assistant to the President. The amount set forth under salary includes $159,931 paid to him in his capacity as an officer of the Company.

- (7)

- Includes three months salary, grossed up for taxes, for relocation allowances for moves from Europe to the United States.

Long-Term Incentive Awards

The following table sets forth, for the Named Executive Officers, certain information regarding grants made in 2002 under the Sauer-Danfoss Inc. 1998 Long-Term Incentive Plan.

10

LONG-TERM INCENTIVE PLAN—AWARDS IN LAST FISCAL YEAR

| |

| |

| | Estimated Future Payouts Under Non-Stock Price-Based

Plans(2)

| |

|---|

| |

| | Performance

or other

period until

maturation or

payout

| |

|---|

| | Number of

shares, units or

other rights

(#)(1)

| |

|---|

Name and Principal Position

| | Threshold

(#)

| | Target

(#)

| | Maximum

(#)

| |

|---|

Klaus H. Murmann

Chairman | | 16,241 | | 3 Years | | 8,121 | | 16,241 | | 24,362 | |

David L. Pfeifle

Former President and

Chief Executive Officer |

|

27,609 |

|

3 Years |

|

13,805 |

|

27,609 |

|

41,414 |

|

David J. Anderson

President and

Chief Executive Officer |

|

12,993 |

|

3 Years |

|

6,497 |

|

12,993 |

|

19,490 |

|

Karl J. Schmidt

Executive Vice President

and Chief Financial Officer |

|

16,242 |

|

3 Years |

|

8,121 |

|

16,242 |

|

24,363 |

|

James R. Wilcox

Executive Vice President

and Chief Operating Officer |

|

16,566 |

|

3 Years |

|

8,283 |

|

16,566 |

|

24,849 |

|

Don A. O'Grady

Former Vice President—

Human Resources |

|

9,355 |

|

3 Years |

|

(3 |

) |

(3 |

) |

(3 |

) |

Niels Erik Hansen

Former Executive Vice

President—Work Function

and Control Products |

|

20,464 |

|

3 Years |

|

(3 |

) |

(3 |

) |

(3 |

) |

- (1)

- Above awards were made in accordance with the terms of the Sauer-Danfoss Inc. 1998 Long-Term Incentive Plan. The awards are the target number of Performance Units with the actual number of units to be based on performance. Dividend equivalents are paid on the units at the same rate and at the same time as dividends on the number of shares of common stock equal to the target number of units. Target awards are based upon a percentage of base salary and vary depending upon the individual's position and responsibilities within the organization.

- (2)

- Estimated Future Payouts are based upon the Simple Average Actual Return on Net Assets (RONA) as derived from the consolidated financial statements of the Company for the Performance Period of January 1, 2002 to December 31, 2004. The achievement of 15% RONA will result in payment of the threshold amount (50% of Target); achievement of 20% RONA will result in payment of the Target amount (100% of Target); and achievement of 25% RONA will result in payment of the Maximum amount (150% of Target). The Compensation Committee, in its sole discretion, may pay earned Performance Units in the form of cash or in shares of the Company's common stock. The number of

11

shares of common stock to be issued, if any, shall equal the number of earned Performance Units designated by the Compensation Committee to be paid in shares. The amount of cash, if any, shall be equal to the fair market value of a share of common stock of the Company as of the close of the applicable performance period multiplied by the number of earned Performance Units designated by the Compensation Committee to be paid in cash.

- (3)

- Units for Mr. O'Grady and Mr. Hansen were forfeited pursuant to the terms of the Sauer-Danfoss Inc. 1998 Long-Term Incentive Plan.

Equity Compensation Plan Information

Plan Category

| | Number of securities

to be issued upon

exercise of outstanding

options, warrants

and rights

(a)

| | Weighted-average

exercise price of

outstanding options,

warrants and rights

(b)

| | Number of securities

remaining available

for future issuance

under equity compensation

plans (excluding

securities reflected

in column (a)

(c)

| |

|---|

| Equity compensation plans approved by security holders | | 0 | | 0 | | 1,842,329(1

266,000(2 | )

) |

| Equity compensation plans not approved by security holders | | N/A | | N/A | | N/A | |

| | |

| |

| |

| |

| | Total | | 0 | | 0 | | 2,068,329 | |

- (1)

- The Sauer-Danfoss Inc. 1998 Long-Term Incentive Plan is an incentive compensation plan that permits the grant of Non-Qualified Stock Options, Incentive Stock Options, Stock Appreciation Rights, Restricted Stock, Performance Shares and Performance Units, and Other Incentive Awards. The number of shares remaining available for future issuance under this Plan is 1,842,329, provided, however, that the remaining maximum number of Shares of Restricted Stock that may be granted is 1,041,600. All outstanding grants under this Plan as of December 31, 2002, were in the form of Performance Units, which may be paid either in shares of Common Stock of the Company or cash, or any combination thereof, as may be determined in the discretion of the Compensation Committee.

- (2)

- The Sauer-Danfoss Inc. Non-Employee Director Stock Option and Restricted Stock Plan is an incentive compensation plan that permits the grant of Non-Qualified Stock Options and Shares of Restricted Stock. The number of shares remaining available for future issuance under this Plan, in the form of either options or Restricted Stock or any combination thereof, is 226,000. All outstanding grants under this Plan are currently in the form of Restricted Stock.

Retirement Plans

U.S. Retirement Plan. The following table sets forth the estimated annual benefits payable under the Sauer-Danfoss Employees' Retirement Plan (the "U.S. Retirement Plan") to participants retiring at a normal retirement date of January 1, 2003, for the specified average annual earnings and years of participation. The benefits have been calculated on the basis of a straight-life annuity.

12

U.S. RETIREMENT PLAN TABLE

| | YEARS OF PARTICIPATION

|

|---|

Average

Annual

Earnings

|

|---|

| | 15

| | 20

| | 25

| | 30

|

|---|

| $150,000 | | $36,987 | | $49,317 | | $61,646 | | $73,935 |

| $175,000 | | $43,810 | | $58,414 | | $73,017 | | $87,572 |

| $200,000 | | $47,680 | | $63,573 | | $79,466 | | $95,307 |

| $225,000 | | $47,680 | | $63,573 | | $79,466 | | $95,307 |

| $250,000 | | $47,680 | | $63,573 | | $79,466 | | $95,307 |

| $275,000 | | $47,680 | | $63,573 | | $79,466 | | $95,307 |

NOTE: Compensation shown is for the final year in each calculation. In order to obtain Final Average Compensation, historic salary growth was assumed to have been 5% per year.

Under the U.S. Retirement Plan, the monthly amount of Mr. Anderson's retirement benefit at his normal retirement date (the date the participant reaches age 65) is calculated pursuant to a formula contained in the plan based on (i) the average of the participant's highest five-year annual earnings less an offset for Social Security benefits and (ii) the participant's years of participation in the Retirement Plan. Messrs. Hansen's, Schmidt's and Wilcox's benefits are provided by a 2% of pay annual credit under the "cash balance" component of the Retirement Plan. Mr. Wilcox's benefit is a combination of the cash balance component and a prior benefit under the retirement plan (7.721 years of prior service).

The U.S. Retirement Plan is a defined benefit pension plan intended to be qualified under Section 401(a) of the Code. Benefits are based only on salary and any sales commissions (the Company currently pays no sales commissions). The current compensation covered by the U.S. Retirement Plan for Messrs. Anderson, Hansen, Schmidt and Wilcox are the amounts set forth under "Salary" in the Summary Compensation Table, excluding relocation allowances. No other Named Executive Officer participated in the U.S. Retirement Plan.

Messrs. Anderson, Hansen, Schmidt and Wilcox have completed 18.417, 1.25, 1.0 and 9.721 years of participation, respectively, and their estimated annual U.S. Retirement Plan benefits at their normal retirement dates, assuming their present salaries and present Social Security benefits remain unchanged, would be $102,386, $5,807, $9,184 and $25,770 respectively.

U.S. Supplemental Plan. The Code generally limits to $160,000, indexed for inflation, the amount of any annual benefit that may be paid from the U.S. Retirement Plan. Moreover, the Retirement Plan may consider no more than $200,000 as indexed for inflation, of a participant's annual compensation in determining that participant's retirement benefit. In recognition of these two limitations, the Company has adopted a Supplemental Retirement Benefit Plan (the "U.S. Supplemental Plan"). The U.S. Supplemental Plan is designed to provide supplemental retirement benefits to the extent that a participant's benefits under the Retirement Plan are limited by either the $160,000 annual benefit limitation or the $200,000 annual compensation limitation. Under the U.S. Supplemental Plan, however, the actual payment of supplemental benefits is entirely at the discretion of the Company.

At January 1, 2003, Messrs. Anderson, Hansen, Schmidt and Wilcox were eligible to participate in the U.S. Supplemental Plan. The estimated annual supplemental retirement benefit for Messrs. Anderson, Hansen, Schmidt and Wilcox at their normal retirement dates at age 65, assuming their present salaries

13

until retirement, would be $136,872, $3,282, $2,677 and $3,529, respectively. No other Named Executive Officer is entitled to benefits under the U.S. Supplemental Plan.

European Pension Plans. The Company has a Post-Retirement Care Agreement with Mr. Klaus Murmann that provides for the payment to him of an annual retirement benefit in the amount of 285,720 Euros. These benefits commenced on January 1, 2003, the date Mr. Murmann retired from regular employment with the Company. In the event Mr. Murmann leaves a surviving spouse, his spouse would be entitled to a straight-life annuity benefit equal to 60% of the benefit payable to Mr. Murmann.

Employment And Severance Arrangements

The Company has entered into employment contracts with Messrs. Anderson, Wilcox and Schmidt that provide for annual base salaries of not less than $425,000, $350,000 and $260,000 respectively, along with participation in the Company's bonus plan, benefit plans and perquisites for which they are currently eligible and in any plans substituted therefore. Each of the named Executives is also eligible for not less than four weeks' paid vacation in any twelve-month period.

If the Executive terminates the contract for good reason, or if the Company terminates the contract without good cause, the contract provides that the termination date shall be no earlier than 30 days following the date on which a notice of termination is delivered. In the event of such termination, the Executive shall be entitled to receive: a) any accrued benefits; b) a pro-rata annual incentive; c) a lump sum payment in cash equal to the Executive's base salary and target incentive opportunity multiplied by one and one-half; d) continuation of medical plan benefits for one year, provided that such benefits would be reduced to the extent comparable medical benefits are made available from a successor employer; and e) executive level career outplacement services.

The contracts contain a change-in-control provision in the event the Executive's employment is terminated within two years following a change-in-control, unless such termination is: (i) by the Company for cause; (ii) by reason of Death, Disability or Retirement; or (iii) by the Executive without Good Reason, then in lieu of all other benefits provided to the Executive, the Company shall pay to the Executive: (a) any accrued benefits; (b) a pro-rata annual incentive payment; (c) a lump-sum payment in cash equal to the Executive's base salary and target incentive opportunity multiplied by one and a half; and (d) a lump sum payment in cash equal to ten percent of the Executive's base salary in lieu of medical plan benefits.

In case of termination due to death, the Executive's estate or representative shall be entitled to receive any accrued benefits plus a lump sum payment in cash equal to one year's base salary and a pro-rata incentive amount. For those immediate family members who were participating in the Company's medical benefit plan as of the date of death, medical benefits shall continue for the one-year period immediately following the date of death.

Should an Executive be incapable of performing his principal duties because of physical or mental incapacity for a period of 180 consecutive days in any 12-month period, they shall be considered disabled and employment terminated. The Executive shall be entitled to: (a) accrued benefits; (b) a lump sum payment in cash equal to one year's base salary; (c) the pro-rata annual incentive; and (d) the continuation of medical benefits for one year.

14

The contracts contain a covenant not to compete for a term of 18 months following termination of the contract. The contracts also contain covenants prohibiting the disclosure of confidential information and developments and the solicitation of customers and employees.

In addition to the above terms and conditions, Mr. Schmidt's contract provides that as a hiring bonus for the calendar years 2002, 2003 and 2004 his minimum compensation shall be no less than his base salary plus 65% of the target payouts under the Annual Officer Performance Incentive Plan and the Long-Term Incentive Plan.

Mr. Don O'Grady resigned as Vice President, Human Resources of the Company effective as of January 6, 2003. Pursuant to a Termination Agreement entered into with Mr. O'Grady, the Company made lump-sum payments of $186,700 (one year's base salary minus $13,300 owed to the Company) and $105,886.83 which is 75% of the long-term incentive payment he would have received from his prior employer, as agreed upon as part of his offer of employment with the Company. The Company also has agreed to pay health and dental insurance benefit premiums on Mr. O'Grady's behalf through June 30, 2003.

Mr. Niels Erik Hansen resigned as Executive Vice President-Work Function and Control Products and an officer of the Company effective as of July 1, 2002. Mr. Hansen continues employment with the Company in the position of Special Assignment to the President and Chief Executive Officer through June 30, 2003. Mr. Hansen is compensated at the annual rate of $315,000 for this assignment.

Mr. David Pfeifle retired as President and Chief Executive Officer of the Company effective as of July 1, 2002. The Company entered into a contract agreement with Mr. Pfeifle to perform services to assist the Company in development and design of compensation and benefit programs. Mr. Pfeifle is to be paid under this agreement at the rate of $1,500 per full day of service. During 2002, a total of $11,812 was paid to Mr. Pfeifle for these services.

Indebtedness of Management

The Company made non-interest bearing loans during 2002 to Mr. Anderson in the total amount of $225,000, which loan was repaid in full on December 23, 2002; and to Mr. Wilcox in the total amount of $190,000, which loan was repaid in full on December 2, 2002. The purpose of the loans was to assist said Officers in relocating to the Company's new headquarters near Chicago, Illinois.

Report of the Compensation Committee

The Compensation Committee of the Board (the "Committee") establishes and administers the executive compensation program for the officers of the Company ("Executives"), including base salaries, the Company's Annual Officer Performance Incentive Plan and the Company's 1998 Long-Term Incentive Plan. The Committee currently consists of four non-employee directors, who have no interlocking relationships.

15

Compensation Philosophy and Objectives

During 2002 the Committee adopted a Global Reward Philosophy that contains the following compensation philosophy and objectives as they pertain to Executives:

- (a)

- Global compensation and benefit programs must help attract, motivate, and retain the people needed to achieve the Company's business goals and success.

- (b)

- These programs must support the Company's vision, core competencies and business values, driving behaviors and performance that enhance the return to Stockholders.

- (c)

- Such programs should support employee involvement, be market driven, reward success, create shared responsibility, maximize value, be administered with both ethics and integrity and provide balance between the interests of Stockholders and Employees.

The current components of the Company's executive total compensation program include:

- (a)

- An annual base salary;

- (b)

- An annual variable cash performance incentive;

- (c)

- Long-term stock-based incentives; and

- (d)

- A competitive benefit package.

These components consider individual performance, the Company's performance, and survey data regarding comparable positions at other companies in the industries served by the Company.

It is the intent of the Committee to provide to the Company's Executives a total compensation package that will be targeted at the competitive market median with the opportunity to achieve the 75th percentile through variable pay, long-term incentive programs and personal growth.

Base Salaries

In December 2001 the Committee reviewed and approved 2002 annual base salaries for the Company's Executives. The Committee based its decision on market survey data, the performance of each Executive and the recommendations of the Company's Chief Executive Officer.

Incentive Compensation Plans

The Committee approved participation of the Company's Executives in the Sauer-Danfoss Inc. Annual Officer Performance Incentive Plan for 2002. The incentive opportunity levels are according to the Executive's position and responsibilities, and are based on achievement of Return On Net Assets and Revenue Growth. The 2002 cash incentives paid to Executives are at 82.5% of target based on achievement of 7.2% Return on Net Assets and 5.0% Sales Growth to Market.

The Committee approved new awards during 2002 of Performance Units, as allowed under the terms of the Sauer-Danfoss Inc. 1998 Long-Term Incentive Plan ("Long-Term Incentive Plan"). Threshold, Target and Maximum performance-related payouts based on Return On Net Assets over a three-year performance period were approved. Participation and Target Awards were approved according to the Executive's position and responsibilities. The Committee, in its sole discretion, may pay earned Performance Units in the form of cash or in shares of common stock (or in a combination thereof). The

16

number of shares of common stock to be issued, if any, shall equal the number of earned Performance Units designated by the Committee to be paid in shares. The amount of cash, if any, shall be equal to the fair market value of a share of common stock of the Company as of the close of the applicable performance period multiplied by the number of Performance Units designated by the Committee to be paid in cash.

In addition, the three-year performance period for the Performance Units granted in 2000 under the Long-Term Incentive Plan ended December 31, 2002. The threshold of a 15% average RONA was not achieved due to the downturn in the general economic environment, coupled with specific market contractions and the expenses and integration issues relating to the merger with the Danfoss Fluid Power Companies in early 2000. The Company and the Compensation Committee did, however, wish to recognize the valuable service provided by Executives during the last three years and therefore deemed it desirable to pay a special retention cash bonus in recognition of services for the past three years in an amount equal to the fair market value on December 31, 2002 of 40% of the target number of Performance Units granted to each participant.

CHIEF EXECUTIVE OFFICER ("CEO") COMPENSATION

Mr. Pfeifle and Mr. Anderson both served as CEO at different times during 2002. The Company's employment contract with Mr. Pfeifle provided for an annual salary of not less than $300,000, which amount was to be reviewed annually. The Committee increased Mr. Pfeifle's base annual salary for 2002 to $425,000 plus the issuance of an additional $100,000 in Performance Unit value under the Long-Term Incentive Plan. As result of his retirement on June 30, 2002, Mr. Pfeifle received $253,500.25 as a pro- rata payment for those Performance Units previously issued under the Long-Term Incentive Plan as part of his annual salary. Mr. Pfeifle also received a prorated annual cash incentive in the amount of $104,379.94, which was 82.5% of target based on achievement of 7.2% Return on Net Assets and 5.0% Sales Growth to Market. He also received a prorated special cash bonus, as described above, in the amount of $55,569.92.

Upon becoming CEO on July 1, 2002, following Mr. Pfeifle's retirement, the Committee increased Mr. Anderson's base salary to $425,000. The cash incentive earned by Mr. Anderson for 2002 was $155,994.46, which was 82.5% of target based on achievement of 7.2% Return on Net Assets and 5.0% Sales Growth to Market. This payment was made in accordance with the terms of the Sauer-Danfoss Inc. Annual Officer Performance Incentive Plan. Mr. Anderson received a special cash retention bonus, described above, in the amount of $21,006.10.

DEDUCTIBILITY OF EXECUTIVE COMPENSATION

Internal Revenue Code Section 162(m) limits the deductibility by the Company of compensation in excess of $1,000,000 paid to each of the Named Executive Officers. The compensation paid to each of the Named Executive Officers did not exceed $1,000,000 in 2002 and the Company does not anticipate that any of its Named Executive Officers for 2003 will receive compensation in excess of $1,000,000 in 2003.

Mr. Wood's name is not associated with the report because he was not a member of the Compensation Committee during 2002.

17

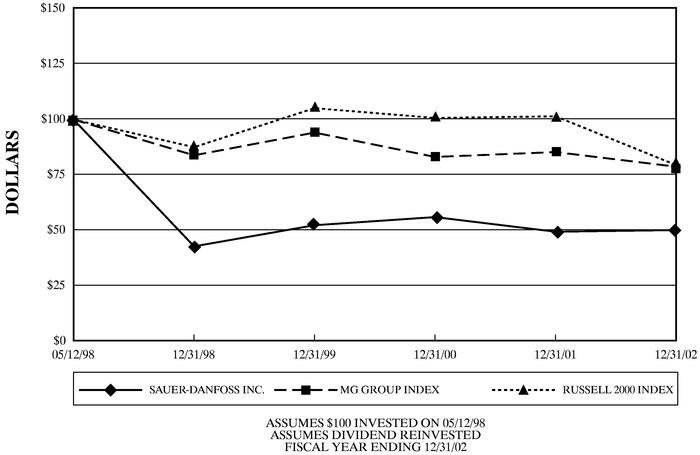

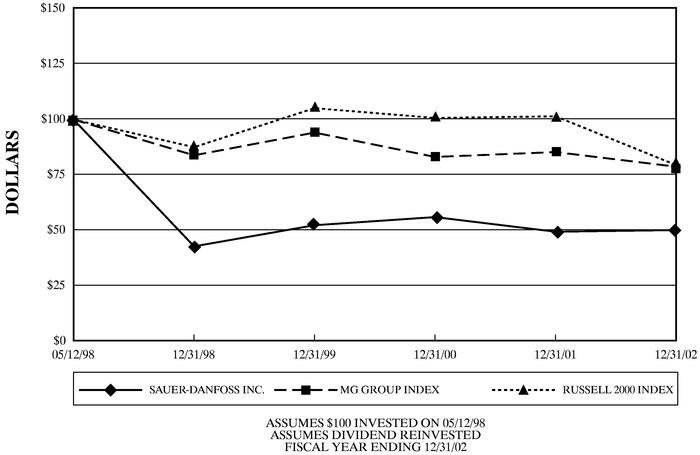

Performance Graph

The following graph shows a comparison of the cumulative total returns from May 12, 1998 (the date of the Company's initial public offering of its common stock), to December 31, 2002, for the Company, the Russell 2000 Index, and the Media General Financial Services, Inc.—Diversified Machinery Index ("MG Group Index").

COMPARE CUMULATIVE TOTAL RETURN

AMONG SAUER-DANFOSS INC.,

RUSSELL 2000 INDEX AND MG GROUP INDEX

18

RATIFICATION OF APPOINTMENT OF

INDEPENDENT ACCOUNTANTS

The audit Committee of the Board has appointed KPMG LLP as independent accountants to examine the consolidated financial statements of the Company and its subsidiaries for 2003, subject to ratification of the stockholders at the Annual Meeting. A representative of KPMG LLP is expected to be present at the Annual Meeting and will have the opportunity to make a statement if he or she so desires and to respond to appropriate questions. The affirmative vote of a majority of the shares present and entitled to vote on this item at the Annual Meeting is necessary for the approval of the appointment of KPMG LLP as independent accountants for 2003. In the event stockholders do not ratify the appointment of KPMG LLP, the appointment will be reconsidered by the Audit Committee. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of different independent auditors at anytime during the year if they determine that such a change would be in the best interests of the Company and its stockholders.

Fees paid to KPMG LLP for services relating to the year ended December 31, 2002, were:

| | | Audit Fees | | $ | 778,900 |

| | | | |

|

|

|

Financial Information Systems Design and Implementation Fees |

|

|

0 |

| | | | |

|

|

|

All Other Fees: |

|

|

|

|

|

Audit Related Fees |

|

|

146,072 |

|

|

Tax Matters |

|

|

540,184 |

|

|

Other |

|

|

3,386 |

| | | | |

|

| | | Total All Other Fees | | $ | 1,468,542 |

| | | | |

|

The Board recommends that stockholders vote FOR ratification of the appointment of KPMG LLP as the Company's independent accountants for 2003.

ADDITIONAL INFORMATION

Notice Requirements

To permit the Company and its stockholders to deal with stockholder proposals in an informed and orderly manner, the Bylaws of the Company establish an advance notice procedure. No stockholder proposals, nominations for the election of directors or other business may be brought before an annual meeting unless written notice of such proposal or other business is received by the Secretary of the Company at 2800 E. 13th Street, Ames, Iowa 50010 not less than 120 calendar days in advance of the date that the Company's proxy statement was released to stockholders in connection with the previous year's Annual Meeting. Such notice must contain certain specified information concerning the matters to be brought before the meeting as well as the stockholder submitting the proposal. For the Company's annual meeting in the year 2004, the Company must receive this notice on or before December 26, 2003. A copy of the applicable Bylaw provisions may be obtained, without charge, upon written request to the Secretary of the Company at 2800 E. 13th Street, Ames, Iowa 50010.

19

In addition, stockholder proposals intended to be included in the Company's Proxy Statement for the annual meeting in 2004 must be received by the Secretary of the Company at 2800 E. 13th Street, Ames, Iowa 50010, not later than December 26, 2003. Such proposals must comply with certain rules and regulations promulgated by the Securities and Exchange Commission.

Discretionary Authority

If any other matters are properly presented at the Annual Meeting for consideration, including, among other things, consideration of a motion to adjourn the Annual Meeting to another time or place, the persons named as proxies and acting thereunder will have discretion to vote on those matters to the same extent as the person delivering the proxy would be entitled to vote. If any other matter is properly brought before the Annual Meeting, proxies in the enclosed form returned to the Company prior to the Annual Meeting will be voted in accordance with the recommendation of the Board or, in the absence of such a recommendation, in accordance with the judgment of the proxy holder. At the date this Proxy Statement went to press, the Company did not anticipate that any other matters would be properly brought before the Annual Meeting.

Section 16(a) Beneficial Ownership Reporting Compliance

Based solely upon a review of Forms 3, 4, and 5 furnished to Registrant pursuant to Section 16(a) of the Securities Exchange Act of 1934 with respect to the fiscal year ended December 31, 2002, Registrant believes that all of such reports required to be filed during such fiscal year by Registrant's officers, directors, and 10% beneficial owners were timely filed except for the reports described in this paragraph. During 2002 Richard Jarboe and Thomas K. Kittel, Vice Presidents of the Company, each filed one untimely Form 4 with respect to one transaction in Registrant's common stock. Both of these Forms 4 were subsequently filed.

Form 10-K

The Company will mail without charge, upon written request, a copy of its Annual Report on Form 10-K filed with the Securities and Exchange Commission, including the financial statements, schedules, and list of exhibits. Requests should be sent to Kenneth D. McCuskey, Corporate Secretary, at 2800 E. 13th Street, Ames, Iowa 50010.

April 25, 2003

20

ANNUAL MEETING OF STOCKHOLDERS

Wednesday, June 4, 2003

8:30 a.m. local time

HYATT REGENCY NEWPORT

One Goat Island

Newport, Rhode Island 02840

| | Sauer-Danfoss Inc.

250 Parkway Drive

Lincolnshire, Illinois 60069 | proxy |

|

This proxy is solicited by the Board of Directors for use at the Annual Meeting on June 4, 2003.

The shares of Common Stock of Sauer-Danfoss Inc. you are entitled to vote will be voted as you specify on the reverse side.

If no choice is specified, the proxy will be voted "FOR" all nominees for director listed on the reverse side and "FOR" Item 2.

By signing the proxy, you revoke all prior proxies and appoint Klaus H. Murmann and David J. Anderson, and each of them, with full power of substitution, as proxies to vote your shares on the matters shown on the reverse side, andin their discretion on any other matters which may properly come before the Annual Meeting and all adjournments. A majority of said proxies, or any substitute or substitutes, who shall be present and act at the meeting (or if only one shall be present and act, then that one) shall have all the powers of said proxies hereunder.

See reverse for voting instructions.

There are three ways to vote your Proxy

Your telephone or Internet vote authorizes the Named Proxies to vote your shares in the same manner as if you marked, signed and returned your proxy card.

VOTE BY PHONE — TOLL FREE — 1-800-240-6326 — QUICK *** EASY *** IMMEDIATE

- •

- Use any touch-tone telephone to vote your proxy 24 hours a day, 7 days a week, until 11:00 a.m. (CT) on June 3, 2003, the day prior to the meeting.

- •

- You will be prompted to enter your 3-digit Company Number and your 7-digit Control Number (these numbers are located on the proxy card) and the last 4-digits of the U.S. Social Security Number or Tax Identification Number for this account. If you do not have a U.S. SSN or TIN please enter 4 zeros.

- •

- Follow the simple instructions the Voice provides you.

VOTE BY INTERNET — http://www.eproxy.com/shs/ — QUICK *** EASY *** IMMEDIATE

- •

- Use the Internet to vote your proxy 24 hours a day, 7 days a week, until 12:00 p.m. (CT) on June 3, 2003, the day prior to the meeting.

- •

- You will be prompted to enter you 3-digit Company Number, your 7-digit Control Number (these numbers are located on the proxy card) and the last 4-digits of the U.S. Social Security Number or Tax Identification Number for this account to obtain your records and create an electronic ballot. If you do not have a U.S. SSN or TIN please leave blank.

VOTE BY MAIL

Mark, sign and date your proxy card and return it in the postage-paid envelope we've provided or return it toSauer-Danfoss Inc., c/o Shareowner ServicesSM, P.O Box 64873, St. Paul, Minnesota 55164-0873.

If you vote by Phone or Internet, please do not mail your Proxy Card

/*\ Please detach here /*\

ý Please mark your votes as in this example.

The Board of Directors Recommends a Vote FOR all Nominees listed below and FOR Item 2.

| 1. | | Election of

directors: | | 01 Ole Steen Andersen

02 David J. Anderson

03 Jørgen M. Clausen

04 Nicola Keim

05 Johannes F. Kirchhoff | | 06 Hans Kirk

07 F. Joseph Loughrey

08 Klaus H. Murmann

09 Sven Murmann

10 Steven H. Wood | | o | | Vote FOR

all nominess

(except as marked) | o | | Vote WITHHELD

from all nominees |

(Instructions: To withhold authority to vote for any indicated nominee, write the number(s) of the nominee(s) in the box provided to the right.) |

|

|

2. |

|

To ratify the appointment of KPMG LLP as independent accountants. |

|

o For o Against o Abstain

|

THIS PROXY WHEN PROPERLY EXECUTED AND RETURNED WILL BE VOTED AS DIRECTED OR, IF NO DIRECTION IS GIVEN, WILL BE VOTEDFOR ALL NOMINEES LISTED ABOVE ANDFOR ITEM 2.

Address Change? Mark Box

Indicate changes below: |

|

o |

|

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature(s) in Box

Please sign exactly as your name(s) appear on Proxy. If held in joint tenancy, all persons must sign. Trustees, administrators, etc., should include title and authority. Corporations should provide full name of corporation and title of authorized officer signing the proxy. |

QuickLinks

GENERAL INFORMATIONSECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENTELECTION OF DIRECTORSREPORT OF THE AUDIT COMMITTEEEXECUTIVE COMPENSATIONSUMMARY COMPENSATION TABLELONG-TERM INCENTIVE PLAN—AWARDS IN LAST FISCAL YEAREquity Compensation Plan InformationU.S. RETIREMENT PLAN TABLERATIFICATION OF APPOINTMENT OF INDEPENDENT ACCOUNTANTSADDITIONAL INFORMATION