QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

Sauer-Danfoss Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

NOTICE OF 2004 ANNUAL MEETING

PROXY STATEMENT FOR 2004 ANNUAL MEETING

2003 ANNUAL REPORT

TABLE OF CONTENTS

| |

| |

| | Page No.

|

|---|

| I. | | Notice of 2004 Annual Meeting | | I-1 |

II. |

|

Proxy Statement |

|

II-1 |

|

|

General Information |

|

II-1 |

| | | | | Solicitation and Revocability of Proxies | | II-1 |

| | | | | Expense of Solicitation | | II-1 |

| | | | | Voting of Proxies | | II-2 |

| | | | | Persons Entitled to Vote | | II-2 |

|

|

Security Ownership of Certain Beneficial Owners and Management |

|

II-2 |

|

|

Governance of the Company |

|

II-5 |

| | | | | Executive Committee | | II-5 |

| | | | | Audit Committee | | II-5 |

| | | | | Compensation Committee | | II-6 |

| | | | | Nominating Committee | | II-6 |

| | | | | Consideration of Nominees, Qualifications and Procedures | | II-6 |

| | | | | Agreement Regarding Nominees for Director | | II-8 |

| | | | | Stockholder Communications with the Board | | II-8 |

| | | | | Code of Conduct and Code of Ethics | | II-8 |

| | | | | Compensation of Directors | | II-9 |

| | | | | Related Transaction | | II-9 |

|

|

Report of the Audit Committee |

|

II-10 |

|

|

Executive Compensation |

|

II-11 |

| | | | | Summary Compensation Table | | II-11 |

| | | | | Stock Options | | II-12 |

| | | | | Long-Term Incentive Awards | | II-14 |

| | | | | Retirement Plans | | II-15 |

| | | | | Employment and Severance Arrangements | | II-17 |

| | | | | Report of the Compensation Committee | | II-18 |

| | | | | Performance Graph | | II-21 |

|

|

Item 1—Election of Directors |

|

II-22 |

| | | | | Nominees to Serve for Directors | | II-22 |

|

|

Item 2—Ratification of Appointment of Independent Accountants |

|

II-24 |

| | | | | Fees to Independent Auditors for 2003 and 2002 | | II-24 |

| | | | | Policy Regarding Pre-Approval of Audit and Non-Audit Services of

Independent Auditors | |

II-24 |

|

|

Additional Information |

|

II-25 |

| | | | | Notice Requirements | | II-25 |

| | | | | Discretionary Authority | | II-25 |

| | | | | Section 16(a) Beneficial Ownership Reporting Compliance | | II-25 |

| | | | | Form 10-K | | II-26 |

|

|

Exhibit A—Audit Committee Charter |

|

II-27 |

| | | Exhibit B—Compensation Committee Charter | | II-34 |

III. |

|

2003 Annual Report |

|

III-1 |

|

|

Business |

|

III-1 |

| | | NYSE Price Range, Dividends | | III-1 |

| | | Management's Discussion and Analysis of Financial Condition and

Results of Operations | |

III-2 |

| | | Consolidated Statements of Income | | III-25 |

| | | Consolidated Balance Sheets | | III-26 |

| | | Consolidated Statement of Stockholders' Equity and Comprehensive Income | | III-27 |

| | | Consolidated Statements of Cash Flow | | III-28 |

| | | Notes to Consolidated Financial Statements | | III-29 |

| | | Report of Management | | III-62 |

| | | Independent Auditors' Report | | III-63 |

| | | Selected Financial Data | | III-64 |

| | | Chairman, Vice Chairman and Executive Officers and Directors | | III-65 |

| | | Corporate Data | | III-66 |

2

SAUER-DANFOSS INC.

250 Parkway Drive, Suite 270

Lincolnshire, Illinois 60069

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 5, 2004

TO OUR STOCKHOLDERS:

The annual meeting of stockholders of Sauer-Danfoss Inc., a Delaware corporation, will be held at The Hotel at Gateway Center, U.S. 30 and Elwood Drive, Ames, Iowa 50010, on Wednesday, May 5, 2004, commencing at 8:30 a.m. local time. At the meeting, stockholders will act on the following matters:

- 1.

- To elect ten (10) directors for a term expiring at the annual meeting of stockholders to be held in 2005, and until their respective successors are duly elected and shall qualify.

- 2.

- To ratify the appointment of KPMG LLP as the Company's independent accountants for 2004.

- 3.

- To transact such other business as may properly come before the meeting or any postponement, adjournment, or adjournments.

Stockholders of record at the close of business on March 22, 2004 are entitled to notice of and to vote at the annual meeting or any postponement, adjournment, or adjournments.

Whether or not you expect to attend the Annual Meeting, please either complete, date, sign, and return the accompanying proxy card in the provided envelope or vote your shares by telephone or via the Internet using the instructions on the enclosed proxy card as promptly as possible in order to ensure your representation at the meeting. Even if you have given your proxy, whether by mail, by telephone, or via the Internet, you may still vote in person if you attend the meeting. If your shares are held of record by a broker, bank, or other nominee ("Street Name") you will need to obtain from the institution that holds your shares and bring to the meeting a proxy issued in your name, authorizing you to vote the shares.

|

|

By order of the Board of Directors, |

|

|

Kenneth D. McCuskey

Corporate Secretary |

Lincolnshire, Illinois

April 2, 2004 |

|

|

I-1

SAUER-DANFOSS INC.

250 Parkway Drive, Suite 270

Lincolnshire, Illinois 60069

PROXY STATEMENT

April 2, 2004

GENERAL INFORMATION

Solicitation and Revocability of Proxies

The enclosed proxy is being solicited on behalf of the Board of Directors of Sauer-Danfoss Inc. (the "Company") for use at the annual meeting of the stockholders to be held on May 5, 2004 (the "Annual Meeting"), and at any postponement, adjournment, or adjournments. Most stockholders have a choice of voting via the Internet, by using a toll-free telephone number, or by completing a proxy card and mailing it in the envelope provided. Check your proxy card or the information forwarded by your bank, broker, or other holder of record to see which options are available to you. Please be aware that if you vote over the Internet, you may incur costs such as telecommunication and Internet access charges for which you will be responsible. The telephone voting facilities for stockholders of record will be available until 12:00 pm CDT on May 4, 2004 and the Internet voting facilities will be available until 12:00 pm CDT on May 4, 2004, the day prior to the Annual Meeting.

Any proxy given does not affect your right to vote in person at the meeting and may be revoked at any time before it is exercised by notifying Kenneth D. McCuskey, Corporate Secretary, by mail, telegram, or facsimile, by timely delivery of a properly executed, later-dated proxy (including an Internet or telephone vote) or by appearing at the Annual Meeting in person and voting by ballot. Persons whose shares are held of record by a brokerage house, bank, or other nominee and who wish to vote at the meeting, must obtain from the institution holding their shares a proxy issued in such person's name.

The Company intends to mail this Proxy Statement and the accompanying proxy on or about April 2, 2004.

Expense of Solicitation

The Company will bear the entire cost of solicitation of proxies, including the preparation, assembly, printing, and mailing of this Proxy Statement, the accompanying proxy and any additional information furnished to stockholders. The Company will reimburse banks, brokerage houses, custodians, nominees, and fiduciaries for reasonable expenses incurred in forwarding proxy material to beneficial owners. In addition to solicitations by mail, regular employees and directors of the Company may, but without compensation other than their regular compensation, solicit proxies in person or by telephone, facsimile or electronic means. The Company does not expect to pay any compensation for the solicitation of proxies.

II-1

Voting of Proxies

All shares entitled to vote and represented by properly completed proxies received prior to the Annual Meeting and not revoked will be voted in accordance with the instructions on the proxy.If no instructions are indicated on a properly completed proxy, the shares represented by that proxy will be voted for the election of the nominees for director designated below and for ratification of the appointment of KPMG LLP as independent accountants of the Company for 2004.

Persons Entitled to Vote

Only holders of common stock of the Company of record as of the close of business on March 22, 2004 are entitled to notice of and to vote at the Annual Meeting. At the close of business on that date, 47,432,268 shares of common stock were outstanding. Holders of common stock are entitled to one (1) vote for each share held on all matters to be voted upon. Shares cannot be voted at the Annual Meeting unless the owner is present in person or represented by proxy. The directors shall be elected by an affirmative vote of a plurality of the shares that are entitled to vote on the election of directors and that are represented at the meeting by stockholders who are present in person or by proxy, assuming a quorum is present. The ten nominees for directors receiving the greatest number of votes at the Annual Meeting will be elected as directors. For all other matters to be voted upon at the Annual Meeting, the affirmative vote of a majority of shares present in person or represented by proxy, and entitled to vote on the matter, is necessary for approval.

When a broker or other nominee holding shares for a customer votes on one proposal, but does not vote on another proposal because the broker or nominee does not have discretionary voting power with respect to such proposal and has not received instructions from the beneficial owner, it is referred to as a "Broker Nonvote." Properly executed proxies marked "Abstain" or proxies required to be treated as "Broker Nonvotes" will be treated as present for purposes of determining whether there is a quorum at the meeting. Abstentions will be considered shares entitled to vote in the tabulation of votes cast on proposals presented to the stockholders and will have the same effect as negative votes. Broker Nonvotes are counted towards a quorum, but are not counted for any purpose in determining whether a matter has been approved.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information as of February 13, 2004, with respect to shares of common stock of the Company that were owned beneficially by: (i) each beneficial owner of more than 5% of the outstanding shares of common stock; (ii) each of the directors; (iii) each of the executive officers of

II-2

the Company named in the Summary Compensation table; and (iv) all executive officers and directors of the Company as a group.

Beneficial Owners, Directors, and Executive Officers

| | Number of Shares Beneficially

Owned(1)

| | Percent of

Outstanding

Shares

| |

|---|

| Klaus Murmann & Co. KG(2) | | 36,629,787 | (3) | 77.2 | % |

| Danfoss Murmann Holding A/S(4) | | 35,415,962 | (5) | 74.7 | % |

| Danfoss A/S(4) | | 35,415,962 | (5) | 74.7 | % |

| Sauer Holding GmbH(2) | | 36,629,787 | (3) | 77.2 | % |

| Sauer GmbH(2) | | 10,474,000 | (6) | 22.1 | % |

| Klaus H. Murmann, Director and Chairman(2) | | 36,631,287 | (3) | 77.2 | % |

| Hannelore Murmann(2) | | 36,631,287 | (3) | 77.2 | % |

| Nicola Keim, Director(2) | | 36,635,287 | (3) | 77.2 | % |

| Sven Murmann, Director(2) | | 36,635,287 | (3) | 77.2 | % |

| Ulrike-Murmann-Knuth(2) | | 36,629,787 | (3) | 77.2 | % |

| Jan Murmann(2) | | 36,629,787 | (3) | 77.2 | % |

| Anja Murmann-Mbappe(2) | | 36,629,787 | (3) | 77.2 | % |

| Brigitta Zoellner(2) | | 36,629,787 | (3) | 77.2 | % |

| Christa Zoellner(2) | | 36,629,787 | (3) | 77.2 | % |

| David J. Anderson, Director, President and Chief Executive Officer | | 145,000 | (7) | * | |

| James R. Wilcox, Executive Vice President and Chief Operating Officer | | 120,750 | | * | |

| Karl J. Schmidt, Executive Vice President and Chief Financial Officer, and Treasurer | | 0 | | 0 | % |

| Hans J. Cornett, Executive Vice President—Sales and Marketing | | 0 | | 0 | % |

| Albert Zahalka, Vice President—Mobile Electronics | | 7,500 | | * | |

| Jørgen Clausen, Director and Vice Chairman | | 62,500 | | * | |

| Ole Steen Andersen, Director | | 4,500 | | * | |

| Johannes F. Kirchhoff, Director | | 5,900 | | * | |

| Hans Kirk, Director | | 4,500 | | * | |

| F. Joseph Loughrey, Director | | 6,500 | (8) | * | |

| Steven H. Wood, Director | | 1,500 | | * | |

| All directors and executive officers as a group (20 persons) | | 37,372,437 | (9) | 78.8 | % |

- *

- Represents less than 1%.

- (1)

- Unless otherwise indicated in the following notes, each of the stockholders named in this table has sole voting and investment power with respect to the shares shown as beneficially owned. The following footnotes describe those shares which are beneficially owned by more than one person listed above.

- (2)

- The mailing address for each of these entities and persons is c/o Sauer Holding GmbH, Krokamp 35, 24539 Neumünster, Federal Republic of Germany.

- (3)

- These shares include 10,474,000 shares owned directly by Sauer GmbH, a German limited liability company, 7,913,825 shares owned directly by Sauer Holding GmbH, a German limited liability company ("Sauer Holding"), and 18,241,962 shares owned directly by Danfoss Murmann Holding A/S

II-3

("the Holding Company"). Sauer GmbH possesses only shared dispositive power and no voting power over 10,361,500 of the shares which it owns directly, as to which an irrevocable voting proxy (the "Voting Proxy") has been granted to the Holding Company. Sauer Holding possesses only shared voting and dispositive power over 6,812,500 of the shares which it owns directly. As a result of its 100% ownership of Sauer GmbH, Sauer Holding has shared voting and dispositive power over 112,500 of the shares owned directly by Sauer GmbH. As a result of its 50% voting power over the Holding Company, Sauer Holding has shared voting and dispositive power over the 18,241,962 shares owned directly by the Holding Company and over the 10,361,500 shares owned directly by Sauer GmbH that are subject to the Voting Proxy. Sauer Holding disclaims beneficial ownership of the 28,715,962 shares directly owned in the aggregate by Sauer GmbH and the Holding Company. As a result of its 100% ownership of Sauer Holding, Klaus Murmann & Co. KG, a German partnership ("Murmann KG"), has shared voting and dispositive power over the 36,629,787 shares owned in the aggregate by Sauer GmbH, Sauer Holding, and the Holding Company. Klaus H. Murmann and Hannelore Murmann, as the general partners of Murmann KG, and Nicola Keim, Sven Murmann, Ulrike Murmann-Knuth, Anja Murmann-Mbappe, Jan Murmann, Brigitta Zoellner and Christa Zoellner, as limited partners of Murmann KG who share the power to vote on investment decisions, also have shared voting and dispositive power over these 36,629,787 shares. Murmann KG, Klaus H. Murmann, Hannelore Murmann, Nicola Keim, Sven Murmann, Ulrike Murmann-Knuth, Anja Murmann-Mbappe, Jan Murmann, Brigitta Zoellner and Christa Zoellner each disclaim beneficial ownership of the 36,629,787 shares owned directly in the aggregate by Sauer GmbH, Sauer Holding, and the Holding Company. Hannelore Murmann further disclaims beneficial ownership of 1,500 shares owned directly by Klaus H. Murmann.

- (4)

- The mailing address for each of these entities is DK-6430 Nordborg, Denmark.

- (5)

- These shares include 18,241,962 shares owned directly by the Holding Company. As a result of its 50% voting power over the Holding Company, Danfoss A/S has shared voting and dispositive power over these shares. These shares also include 10,361,500 shares owned directly by Sauer GmbH that are subject to the Voting Proxy. The Holding Company has sole voting power, but no dispositive power (sole or shared), over these shares. Danfoss A/S has shared voting and dispositive power over these shares. These shares also include 6,812,500 shares owned directly by Sauer Holding, as to which the Holding Company and Danfoss A/S have shared voting and dispositive power. The Holding Company disclaims beneficial ownership of 6,812,500 of these shares. Danfoss A/S disclaims beneficial ownership of all 35,415,962 of these shares.

- (6)

- These shares are owned directly by Sauer GmbH but, pursuant to the Voting Proxy, Sauer GmbH has neither sole nor shared voting or dispositive power over 10,361,500 of these shares.

- (7)

- Mr. Anderson disclaims beneficial ownership with respect to 50,000 of these shares which are owned directly by his wife.

- (8)

- Mr. Loughrey disclaims beneficial ownership with respect to 2,000 of these shares which are owned directly by his wife.

- (9)

- Includes stock owned by the spouses and children of certain directors and executive officers.

II-4

GOVERNANCE OF THE COMPANY

The Company's Board of Directors (the "Board"), currently has ten members, three of whom meet the New York Stock Exchange standard for independence. The Board has an Executive Committee, an Audit Committee, a Compensation Committee and a Nominating Committee. All members of the Audit Committee and Compensation Committee are independent directors, but the two members of the Nominating Committee are not independent. The corporate governance listing standards of the New York Stock Exchange provide that a company of which more than 50% of the voting power is held by an individual, a group or another company need not comply with the Exchange's listing standards requiring that a majority of the Board be independent and that listed companies have a nominating/corporate governance committee and a compensation committee each composed entirely of independent directors with a written charter that addresses specific items. The Company considers itself to be a controlled company because approximately 74.7% of the voting power of the Company's common stock is owned or controlled by Danfoss Murmann Holding A/S. Accordingly, the Company has elected to utilize the exemption from the requirement that a majority of the Board be independent and from the provisions relating to a nominating/corporate governance committee.

The Board held four meetings during 2003. Each director attended at least 75% of the aggregate of the total number of meetings of the Board and the total number of meetings held by all committees of the Board on which the directors served during 2003, except that Hans Kirk attended 50% of such meetings. It is the policy of the Board that each director of the Company is expected to attend annual meetings of the stockholders of the Corporation, it being understood, however, that a director infrequently may be unable to attend annual meetings of the stockholders of the Company due to illness, a previously scheduled meeting of importance or other irreconcilable conflict. All of the directors attended the Company's annual stockholders meeting in June of 2003, except for Mr. Kirk.

The non-management directors of the Company have adopted a schedule to meet in private session at the end of each regular meeting of the Board without any management director or executive officer being present. The non-management directors have also adopted the policy that the Chairman of the Board, or in his absence, the Vice Chairman, shall preside at all such meetings, provided that the Chairman or Vice Chairman is not an executive officer or a management employee of the Company.

Executive Committee

The Executive Committee possesses all of the powers of the Board, except for certain powers specifically reserved by Delaware law to the Board. The Executive Committee held no formal meetings during 2003 but took action one time by unanimous written consent. Klaus H. Murmann and David J. Anderson are the current members of the Executive Committee.

Audit Committee

The Audit Committee is currently composed of three directors, none of whom is an employee of the Company. The Audit Committee currently consists of Messrs. Wood (Chairman), Kirchhoff and Loughrey. All of the members of the Audit Committee are independent, as independence is defined in Sections 303.01(B)(2)(a) and (3) of the New York Stock Exchange's current listing standards. In addition, the Board has determined that at least one member of the Audit Committee meets the New York Stock Exchange listing standard of having accounting or related financial management expertise.

II-5

The Board has also determined that Steven H. Wood meets the Securities and Exchange Commission's ("SEC") criteria of an "audit committee financial expert." Mr. Wood's extensive background and experience includes formerly serving as Executive Vice President and Chief Financial Officer of Maytag Corporation. Mr. Wood is a Certified Public Accountant and prior to joining Maytag, he was an auditor with Ernst & Young, a public accounting firm. Mr. Wood is independent as that term is used in Item 7(d)(3)(iv) of Schedule 14A of the SEC's rules under the Securities Exchange Act of 1934.

The Audit Committee is directly responsible for the appointment, compensation, retention and oversight of the independent auditors. The Committee also reviews the scope of the annual audit activities of the independent auditors and the Company's internal auditors, reviews audit and quarterly results and administers the Worldwide Code of Business Conduct and Lawful Practices and the Code of Ethics. All of the Committee's duties and responsibilities are set forth in a written Audit Committee Charter which was significantly revised by the Board in June 2003 and further amended in March 2004 and is attached to this Proxy Statement as Exhibit A. The Charter can also be viewed on the Company's website at www.sauer-danfoss.com. The Audit Committee held four meetings and two telephonic meetings during 2003.

Compensation Committee

The Compensation Committee is currently composed of three directors, none of whom is an employee of the Company. The Compensation Committee reviews and determines the salaries of the executive officers of the Company and administers the Company's Annual Officer Performance Incentive Plan, 1998 Long-Term Incentive Plan and the Supplemental Executive Retirement Plans. All of the duties of the Compensation Committee are set forth in a written Charter adopted by the Board in March 2004, a copy of which is attached as Exhibit B. The Charter can also be viewed on the Company's website at www.sauer-danfoss.com. The Compensation Committee held four meetings in 2003. The current members of the Compensation Committee are Messrs. Kirchhoff (Chairman), Loughrey and Wood, all of whom are independent as defined under the current listing standards of the New York Stock Exchange.

Nominating Committee

The current members of the Nominating Committee are Messrs. Clausen and Klaus Murmann, neither of whom is independent under the New York Stock Exchange's current listing standards. The Nominating Committee recommends to the Board proposed nominees whose election at the next annual meeting of stockholders will be recommended by the Board. The Nominating Committee acted once by unanimous written consent in 2003. The Nominating Committee does not currently have a written charter.

Consideration of Nominees, Qualifications and Procedures

The Nominating Committee of the Board adopted the policy in March 2004 that it will consider qualified candidates for director that are suggested by stockholders. Stockholders can recommend qualified candidates for director by writing to: Nominating Committee, Attention: Kenneth D. McCuskey, Corporate Secretary, Sauer-Danfoss Inc., 2800 East 13th Street, Ames, Iowa 50010. Recommendations should set forth detailed information regarding the candidate, including the person's background, education, business, community and educational experience, other Boards of Directors of publicly held corporations on which the candidate currently serves or has served in the past and other qualifications of the candidate to serve as a director of the Company. All recommendations must be received by January 1 in order to be considered as a nominee for director at the annual meeting of stockholders to be held in

II-6

such year. Recommendations that are received that meet the conditions set forth above shall be forwarded to the Nominating Committee for further review and consideration.

The Nominating Committee is responsible for recommending to the full Board of Directors nominees for election as directors. In evaluating director nominees, the Nominating Committee shall consider, among other things, the following factors:

- •

- The needs of the Company with respect to the particular talents and experience of its directors;

- •

- The extent to which the candidate would contribute to the range of talent, skill and expertise appropriate for the Board;

- •

- The ability of the candidate to represent the interests of the stockholders of the Company;

- •

- The candidate's standards of integrity, commitment and independence of thought and judgment;

- •

- The candidate's ability to dedicate sufficient time, energy and attention to the diligent performance of his or her duties as a director of the Company, taking into account the candidate's services on other boards, including public and private company boards as well as not-for-profit boards, and other business and professional commitments of the candidate;

- •

- The knowledge, skills and experience of the candidate, including experience in the Company's industry, business, finance, administration or public service, in light of prevailing business conditions;

- •

- Experience with accounting rules and practices;

- •

- Familiarity with national and international business matters; and

- •

- The desire to balance the considerable benefit of continuity with the periodic injection of the fresh perspective provided by new members.

The Nominating Committee will also consider such other relevant factors as it deems appropriate, including the current composition of the Board, the need for independent directors, the need for Audit Committee expertise and the evaluations of other candidates. Other than considering the factors set forth above, there are no stated minimum criteria for director nominees.

The Nominating Committee will identify candidates by first evaluating the current members of the Board of Directors willing to continue in service. If any member of the Board does not wish to continue in service or if the Nominating Committee or the Board decides not to re-nominate a member for election to the Board, the Nominating Committee shall identify the desired skills and experience of a new candidate in light of the factors set forth above. Current members of the Board of Directors may be polled for suggestions as to individuals meeting the criteria of the Nominating Committee, and qualified candidates recommended by stockholders shall be considered. Research may be performed to identify qualified individuals. The Nominating Committee may, but shall not be required to, engage third parties to identify or evaluate or assist in identifying potential candidates. The Nominating Committee has from time to time utilized an executive search firm to assist in identifying potential candidates.

In connection with its evaluation of candidates, the Nominating Committee shall determine which, if any, candidates shall be interviewed, and if warranted, one or more members of the Nominating Committee, and others as appropriate, shall interview prospective candidates in person or by telephone. After completing this evaluation and interview process, the Nominating Committee shall make a

II-7

recommendation to the full Board of Directors as to the persons who should be nominated by the Board of Directors.

Agreement Regarding Nominees for Director

Entities and persons under the control of Klaus H. Murmann, a director and Chairman of the Company (the "Murmann Family") and Danfoss A/S ("Danfoss") have entered into an agreement regarding their ownership of the common stock owned by Danfoss Murmann Holding A/S (the "Holding Company Agreement"). Pursuant to the Holding Company Agreement, the Murmann Family and Danfoss will each identify for recommendation to the Company's Nominating Committee three candidates for Director who may be associated with the Murmann Family or Danfoss. In addition, the Murmann Family and Danfoss will each identify for recommendation two additional candidates for Director. One such candidate recommended by the Murmann Family will be the Company's Chief Executive Officer and President and the remaining three such candidates must be independent from and not associated or affiliated with the Murmann Family or Danfoss. With respect to the current nominees for election as Directors, Klaus H. Murmann, Nicola Keim and Sven Murmann were recommended by the Murmann Family and Messrs. Andersen, Clausen and Kirk were recommended by Danfoss.

Stockholder Communications with the Board

The Board in March 2004, adopted a policy regarding stockholder communications with the Board. Stockholders and other parties interested in communicating directly with the Board of Directors may do so by writing to: Board of Directors, Attn: Kenneth D. McCuskey, Corporate Secretary, Sauer-Danfoss Inc., 2800 East 13th Street, Ames, Iowa 50010. Under the policy, the Corporate Secretary reviews all such correspondence and regularly forwards to all members of the Board a summary of all such correspondence and copies of all correspondence that, in the opinion of the Corporate Secretary, deals with the functions of the Board or committees thereof or that he otherwise determines requires their attention. The Corporate Secretary maintains a log of all correspondence received by the Company that is addressed to members of the Board and directors may at any time review such log and request copies of any such correspondence. Letters containing concerns relating to accounting, internal controls or auditing matters will immediately be brought to the attention of the Company's Internal Corporate Counsel and handled in accordance with procedures established by the Audit Committee with respect to such matters.

Code of Conduct and Code of Ethics

The Company has had a code of conduct in effect for a number of years. The current version, the Sauer-Danfoss Inc. Worldwide Code of Legal and Ethical Business Conduct (the "Code of Conduct") was adopted by the Board in September 2002. The Code of Conduct applies to every employee, agent, representative, consultant and director of the Company. The Code of Conduct requires that the Company's employees, agents, representatives, consultants and directors avoid conflicts of interest, comply with all laws and other legal requirements, conduct business in an honest and ethical manner and otherwise act with integrity and in the Company's best interests.

Overall administration of the Code of Conduct is the responsibility of the Audit Committee and the day-to-day administration of the Code of Conduct is the responsibility of the Corporate Business Conduct Committee that assists the Company's employees in complying with the requirements of the Code of Conduct. Employees are encouraged to report any conduct that they believe in good faith to be an actual or apparent violation of the Code of Conduct.

II-8

The Company has also adopted the Sauer-Danfoss Inc. Code of Ethics for Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer or Controller and Other Senior Finance Staff (the "Code of Ethics"). The Code of Ethics is intended to comply with the provisions of Section 406 of the Sarbanes-Oxley Act of 2002 and regulations of the SEC. The Code of Ethics is intended to promote honesty and integrity, the avoidance of conflicts of interests, full, accurate, and timely disclosure of financial reports, and compliance with laws and regulations and other matters.

The Code of Conduct and the Code of Ethics are posted on the Company's website at www.sauer-danfoss.com. The Company will mail without charge, upon written request, a copy of the Code of Conduct and/or Code of Ethics. Requests should be sent to Kenneth D. McCuskey, Corporate Secretary at 2800 East 13thStreet, Ames, Iowa 50010.

Compensation of Directors

Directors who are not employees of the Company receive quarterly retainers of $6,000 ($24,000 per annum), plus $1,000 for each Board meeting attended and $500 for participation in a telephonic meeting, together with expenses relating to their duties as directors. A non-employee director that serves as a chair of a committee shall receive an additional $500 for attending a meeting and an additional $250 for each telephonic meeting in which he participates of a committee for which he serves as chair. The Vice Chairman, if not an employee, receives a total quarterly retainer of $10,000 ($40,000 per annum) and the Chairman, if not an employee, receives a total quarterly retainer of $20,000 ($80,000 per annum).

Pursuant to the Non-Employee Director Stock Option and Restricted Stock Plan, the Board has determined that following each annual meeting of stockholders, each non-employee director shall receive 1,500 shares of Restricted Common Stock of the Company. All shares of Restricted Common Stock of the Company will vest on the third anniversary of the date of grant. The non-employee directors will have voting and dividend rights with respect to the Restricted Common Stock, but the Restricted Common Stock will be forfeited upon termination of service from the Board for any reason prior to the third anniversary of the grant, unless otherwise determined by the Board in its discretion.

Related Transaction

The Board approved the payment of $300,000 in 2003 to sponsor an 85-foot sailing yacht, named UCA, owned by Klaus Murmann, Chairman and a director of the Company, in connection with UCA's participation in open seas competitive racing. The Audit Committee of the Company approved the expenditure of an additional $150,000 in 2004 with respect to the sponsorship of UCA. Mr. Murmann has leased the yacht to a third party entity for the amount of 3,000 Euros per month, and such entity bears all the expenses of maintaining and operating the racing yacht with respect to competitive racing. It is anticipated that the lease will continue through the end of 2004. Mr. Murmann participates in some of UCA's racing competition as its skipper, including the 2003 DaimlerChrysler North Atlantic Challenge from Newport, Rhode Island to Hamburg, Germany, in which UCA recorded the fastest time of all participating yachts. UCA also has nine other sponsors that assist in financing its participation in international races. In return for its sponsorship, the Company's logo is embossed on the main sail of the yacht and the Company has the right to, and did several times in 2003, entertain customers, suppliers and employees on the yacht. In addition, the Board believes that sponsorship of UCA will increase the Company's international visibility.

II-9

REPORT OF THE AUDIT COMMITTEE

In fulfilling its oversight responsibilities, the Audit Committee of the Board of Directors of Sauer-Danfoss Inc. (the "Corporation"), reviewed the scope of the annual audit activities of the independent auditors and the Corporation's internal auditors. The Audit Committee has discussed with KPMG, the Corporation's independent auditors, the overall scope and plans for their audit. The Audit Committee met with KPMG, with and without management present, to discuss the results of their audits, their evaluations of the Corporation's internal controls and the overall quality of the Corporation's financial reporting. The Audit Committee continued to monitor the scope and adequacy of the Corporation's internal auditing program.

The Audit Committee met with both management and KPMG to review and discuss the audited financial statements.

The Audit Committee reviewed with KPMG their judgments as to the quality and acceptability of the Corporation's accounting principles. The Audit Committee's review included discussion with KPMG of the matters required to be discussed pursuant toStatement on Auditing Standards No. 61, "Communications With Audit Committees," as amended.

The Audit Committee has received and reviewed the written disclosures and the letter from KPMG required by theIndependence Standards Board, Standard No. 1, "Independence Discussions With Audit Committees," and has discussed with KPMG, among other things, matters relating to its independence. The Audit Committee has also considered the compatibility of the nonaudit services provided by KPMG with its independence.

Based on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements for the year ended December 31, 2003 be included in the Corporation's Annual Report on Form 10-K for the year ended December 31, 2003.

|

|

AUDIT COMMITTEE:

Steven H. Wood, Chairman

Johannes F. Kirchhoff

F. Joseph Loughrey |

II-10

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth information concerning total compensation awarded or paid to or earned by the Chief Executive Officer during 2003 and the four other most highly compensated executive officers of the Company, who served in such capacities as of December 31, 2003 (the "Named Executive Officers"), for services rendered to the Company in all capacities during each of the last three fiscal years ended December 31, 2003.

SUMMARY COMPENSATION TABLE

| | Annual Compensation

| | Long Term Compensation

|

|---|

| |

| |

| |

| |

| | Awards

| | Payouts

|

|---|

Name and Principal Position

| | Year

| | Salary($)

| | Bonus($)

| | Other Annual

Compensation

($)

| | Restricted Stock

Awards($)(1)(2)

| | LTIP

Payouts ($)

|

|---|

David J. Anderson

President

and Chief Executive Officer | | 2003

2002

2001 | | 444,369

413,515

187,562 |

(3)

| 186,635

177,001

0 | | —

83,046

— |

(4)

| —

—

— | | —

—

— |

James R. Wilcox

Executive Vice President

and Chief Operating Officer |

|

2003

2002

2001 |

|

365,815

393,031

240,712 |

(3)

|

153,642

175,257

0 |

|

—

89,847

— |

(5)

|

—

—

— |

|

—

—

— |

Karl J. Schmidt

Executive Vice President

and Chief Financial Officer,

and Treasurer |

|

2003

2002

2001 |

|

321,355

251,054

NA |

(3)

|

246,156

179,504

NA |

|

98,404

—

NA |

(6)

|

—

—

NA |

|

—

—

NA |

Hans J. Cornett

Executive Vice President—

Sales and Marketing |

|

2003

2002

2001 |

|

221,609

210,906

221,877 |

(7) |

93,076

119,314

0 |

|

—

—

— |

|

—

—

— |

|

—

—

— |

Albert Zahalka

Vice President—

Mobile Electronics |

|

2003

2002

2001 |

|

191,934

182,770

175,511 |

|

76,006

47,215

0 |

|

193,789

156,547

147,559 |

(8)

(9)

(10) |

—

—

— |

|

—

—

— |

- (1)

- Performance Units granted in 2003 are set forth below in the table under"Long-Term Incentive Plan Awards".

- (2)

- On December 31, 2003, the Named Executive Officers held the following target number of Performance Units with the following value, based on the closing per share price of common stock of the Company on December 31, 2003, of $16.20: Mr. Anderson—57,466 Units with a value of $930,949; Mr. Wilcox—52,677 Units with a value of $853,367; Mr. Schmidt—34,212 Units with a value of $554,234; Mr. Cornett—34,053 Units with a value of $551,659; and Mr. Zahalka—25,047 Units with a value of $405,761. These Units are performance-based target units and, unless otherwise determined by the Committee, are only paid out if and when the performance goals (described below in the table under"Long-Term Incentive Plan Awards") are satisfied. Each of the Named Executive Officers receives dividend equivalents on the target number of Performance Units.

- (3)

- Includes two months salary, grossed up for taxes, for dislocation allowances for moves to the Chicago area.

II-11

- (4)

- Includes $70,838 in reimbursement for relocation expenses for move to the Chicago area.

- (5)

- Includes $84,156 in reimbursement for relocation expenses for move to the Chicago area.

- (6)

- Includes $79,508 in reimbursement for relocation expenses for move to the Chicago area.

- (7)

- Includes three months salary, grossed up for taxes, for dislocation allowance for moves from Europe to the United States.

- (8)

- Includes $175,612 for foreign assignment allowances.

- (9)

- Consists of foreign assignment allowances of $156,547.

- (10)

- Consists of foreign assignment allowances of $89,009 and relocation allowance of $58,550.

Stock Options

STOCK OPTION GRANTS IN LAST FISCAL YEAR

The following table contains information concerning the stock option grants made to each of the Named Executive Officers during 2003.

| | Individual Grants

| |

| |

|

|---|

| | Number of

Securities

Underlying

Options

Granted

(#)(1)

| |

| |

| |

| | Potential Realizable Value

at Assumed Annual Rates

of Stock Price Appreciation

for Option Term

|

|---|

| | Percent of Total

Options Granted

to Employees in

Fiscal Year

| |

| |

|

|---|

Name

| | Exercise

Price

Per Share

| | Expiration Date

|

|---|

| | 5%

| | 10%

|

|---|

| David J. Anderson | | 41,087 | | 12.08 | % | $ | 8.17 | | 3/5/2013 | | $ | 211,187 | | $ | 534,953 |

James R. Wilcox |

|

28,761 |

|

8.46 |

% |

|

8.17 |

|

3/5/2013 |

|

|

147,832 |

|

|

374,468 |

Karl J. Schmidt |

|

20,544 |

|

6.04 |

% |

|

8.17 |

|

3/5/2013 |

|

|

105,596 |

|

|

267,483 |

Hans J. Cornett |

|

17,423 |

|

5.12 |

% |

|

8.17 |

|

3/5/2013 |

|

|

89,554 |

|

|

226,847 |

Albert Zahalka |

|

9,771 |

|

2.87 |

% |

|

8.17 |

|

3/5/2013 |

|

|

50,223 |

|

|

127,218 |

- (1)

- Options were granted under the 1998 Long-Term Incentive Plan and have a grant price that is equal to the fair market value on the date of grant. Such options become exercisable on the third anniversary of the grant, subject to the Company achieving a minimum average return on net assets ("RONA") of 10% over the three-year period. Achievement of a 10% RONA results in 50% of the option shares being exercisable, achievement of 15% RONA results in 100% of the option shares being exercisable and achievement of 20% RONA results in 200% of the option shares being exercisable. Vesting is contingent upon continued service with the Company. The options generally have a maximum term of ten years.

II-12

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR END VALUES

| |

| |

| | Number of Securities

Underlying Unexercised

Options at

December 31, 2003

| |

| |

|

|---|

| |

| |

| | Value of Unexercised In-The-Money Options at

December 31, 2003(1)

|

|---|

| | Shares

Acquired

On

Exercise(#)

| |

|

|---|

Name

| | Value

Realized

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| David J. Anderson | | 0 | | 0 | | 0 | | 41,087 | | N/A | | $ | 329,929 |

James R. Wilcox |

|

0 |

|

0 |

|

0 |

|

28,761 |

|

N/A |

|

|

230,951 |

Karl J. Schmidt |

|

0 |

|

0 |

|

0 |

|

20,544 |

|

N/A |

|

|

164,968 |

Hans J. Cornett |

|

0 |

|

0 |

|

0 |

|

17,423 |

|

N/A |

|

|

139,907 |

Albert Zahalka |

|

0 |

|

0 |

|

0 |

|

9,771 |

|

N/A |

|

|

78,461 |

- (1)

- Represents the closing price per share of underlying shares on the last day of the fiscal year less the option exercise price multiplied by the number of shares. The closing price per share was $16.20 on the last trading day of the fiscal year as reported on the New York Stock Exchange.

II-13

Long-Term Incentive Awards

The following table sets forth, for the Named Executive Officers, certain information regarding grants made in 2003 under the Sauer-Danfoss Inc. 1998 Long-Term Incentive Plan.

LONG-TERM INCENTIVE PLAN—AWARDS IN LAST FISCAL YEAR

| |

| |

| | Estimated Future Payouts Under Non-Stock Price-Based

Plans(2)

|

|---|

| |

| | Performance

or other

period until

maturation or

payout

|

|---|

| | Number of

shares, units or

other rights

(#)(1)

|

|---|

Name and Principal Position

| | Threshold

(#)

| | Target

(#)

| | Maximum

(#)

|

|---|

David J. Anderson

President and

Chief Executive Officer | | 35,939 | | 3 Years | | 17,970 | | 35,939 | | 71,878 |

James R. Wilcox

Executive Vice President

and Chief Operating Officer |

|

25,158 |

|

3 Years |

|

12,579 |

|

25,158 |

|

50,316 |

Karl J. Schmidt

Executive Vice President

and Chief Financial Officer,

and Treasurer |

|

17,970 |

|

3 Years |

|

8,985 |

|

17,970 |

|

35,940 |

Hans J. Cornett

Executive Vice President—

Sales and Marketing |

|

15,240 |

|

3 Years |

|

7,620 |

|

15,240 |

|

30,480 |

Albert Zahalka

Vice President—

Mobile Electronics |

|

8,547 |

|

3 Years |

|

4,273 |

|

8,547 |

|

17,094 |

- (1)

- Above awards were made in accordance with the terms of the Sauer-Danfoss Inc. 1998 Long-Term Incentive Plan. The awards are the target number of Performance Units with the actual number of units to be based on performance. Dividend equivalents are paid on the units at the same rate and at the same time as dividends on the number of shares of common stock equal to the target number of units. Target awards are based upon a percentage of base salary and vary depending upon the individual's position and responsibilities within the organization.

- (2)

- Estimated Future Payouts are based upon the Simple Average Actual Return on Net Assets (RONA) as derived from the consolidated financial statements of the Company for the Performance Period of January 1, 2003 to December 31, 2005. The achievement of 10% RONA will result in payment of the threshold amount (50% of Target); achievement of 15% RONA will result in payment of the Target amount (100% of Target); and achievement of 20% RONA will result in payment of the Maximum amount (200% of Target). The Compensation Committee, in its sole discretion, may pay earned Performance Units in the form of cash or in shares of the Company's common stock. The number of shares of common stock to be issued, if any, shall equal the number of earned Performance Units

II-14

designated by the Compensation Committee to be paid in shares. The amount of cash, if any, shall be equal to the fair market value of a share of common stock of the Company as of the close of the applicable performance period multiplied by the number of earned Performance Units designated by the Compensation Committee to be paid in cash.

EQUITY COMPENSATION PLAN INFORMATION

Plan Category

| | Number of securities

to be issued upon

exercise of outstanding

options, warrants

and rights

(a)

| | Weighted-average

exercise price of

outstanding options,

warrants and rights

(b)

| | Number of securities

remaining available

for future issuance

under equity compensation

plans (excluding

securities reflected

in column (a)

(c)

| |

|---|

| Equity compensation plans approved by security holders | | 335,315 | | 8.17 | | 1,184,824(1

207,500(2 | )

) |

| Equity compensation plans not approved by security holders | | N/A | | N/A | | N/A | |

| | |

| |

| |

| |

| | Total | | 335,315 | | 8.17 | | 1,392,324 | |

- (1)

- The Sauer-Danfoss Inc. 1998 Long-Term Incentive Plan is an incentive compensation plan that permits the grant of Non-Qualified Stock Options, Incentive Stock Options, Stock Appreciation Rights, Restricted Stock, Performance Shares and Performance Units, and Other Incentive Awards. The number of shares remaining available for future issuance under this Plan is 1,184,824, provided, however, that the remaining maximum number of Shares of Restricted Stock that may be granted is 1,029,450. Outstanding grants under this Plan as of December 31, 2003, consisted of 335,315 Non-Qualified Stock Options and 709,311 of Performance Units which may be paid either in shares of Common Stock of the Company or cash, or any combination thereof, as may be determined in the discretion of the Compensation Committee.

- (2)

- The Sauer-Danfoss Inc. Non-Employee Director Stock Option and Restricted Stock Plan is an incentive compensation plan that permits the grant of Non-Qualified Stock Options and Shares of Restricted Stock. The number of shares remaining available for future issuance under this Plan, in the form of either options or Restricted Stock or any combination thereof, is 207,500. All outstanding grants under this Plan are currently in the form of Restricted Stock.

Retirement Plans

U.S. Retirement Plan. The following table sets forth the estimated annual benefits payable under the Sauer-Danfoss Employees' Retirement Plan (the "U.S. Retirement Plan") to participants retiring at a normal retirement date of January 1, 2004, for the specified average annual earnings and years of participation. The benefits have been calculated on the basis of a straight-life annuity.

II-15

U.S. RETIREMENT PLAN TABLE

| | YEARS OF PARTICIPATION

|

|---|

Average

Annual

Earnings

|

|---|

| | 15

| | 20

| | 25

| | 30

|

|---|

| $150,000 | | $36,766 | | $49,030 | | $61,287 | | $73,505 |

| $175,000 | | $43,587 | | $58,127 | | $72,658 | | $87,142 |

| $200,000 | | $49,285 | | $65,726 | | $82,157 | | $98,535 |

| $225,000 | | $49,857 | | $66,488 | | $83,110 | | $99,678 |

| $250,000 | | $49,857 | | $66,488 | | $83,110 | | $99,678 |

| $275,000 | | $49,857 | | $66,488 | | $83,110 | | $99,678 |

NOTE: Compensation shown is for the final year in each calculation. In order to obtain Final Average Compensation, historic salary growth was assumed to have been 5% per year.

Under the U.S. Retirement Plan, the monthly amount of Mr. Anderson's retirement benefit at his normal retirement date (the date the participant reaches age 65) is calculated pursuant to a formula contained in the plan based on (i) the average of the participant's highest five-year annual earnings less an offset for Social Security benefits and (ii) the participant's years of participation in the Retirement Plan. Messrs. Cornett's, Schmidt's, Wilcox's and Zahalka's benefits are provided by a 2% of pay annual credit under the "cash balance" component of the Retirement Plan. Messrs. Wilcox's and Zahalka's benefit is a combination of the cash balance component and a prior benefit under the retirement plan (7.7 and 1.8 years of prior service, respectively).

The U.S. Retirement Plan is a defined benefit pension plan intended to be qualified under Section 401(a) of the Code. Benefits are based only on salary and any sales commissions (the Company currently pays no sales commissions). The current compensation covered by the U.S. Retirement Plan for Messrs. Anderson, Cornett, Schmidt, Wilcox and Zahalka are the amounts set forth under "Salary" in the Summary Compensation Table. No other Named Executive Officer participated in the U.S. Retirement Plan.

Messrs. Anderson, Cornett, Schmidt, Wilcox and Zahalka have completed 19.4, 2.2, 2.0, 10.7 and 4.8 years of participation, respectively, and their estimated annual U.S. Retirement Plan benefits at their normal retirement dates, assuming their present salaries and present Social Security benefits remain unchanged, would be $105,168, $5,206, $6,480, $24,897 and $10,327, respectively.

U.S. Supplemental Plan. The Code generally limits to $165,000, indexed for inflation, the amount of any annual benefit that may be paid from the U.S. Retirement Plan. Moreover, the Retirement Plan may consider no more than $205,000 as indexed for inflation, of a participant's annual compensation in determining that participant's retirement benefit. In recognition of these two limitations, the Company has adopted a Supplemental Retirement Benefit Plan (the "U.S. Supplemental Plan"). The U.S. Supplemental Plan is designed to provide supplemental retirement benefits to the extent that a participant's benefits under the Retirement Plan are limited by either the $165,000 annual benefit limitation or the $205,000 annual compensation limitation. Under the U.S. Supplemental Plan, however, the actual payment of supplemental benefits is entirely at the discretion of the Company.

At January 1, 2004, Messrs. Anderson, Cornett, Schmidt and Wilcox were eligible to participate in the U.S. Supplemental Plan. The estimated annual supplemental retirement benefit for Messrs. Anderson,

II-16

Cornett, Schmidt and Wilcox at their normal retirement dates at age 65, assuming their present salaries until retirement, would be $166,846, $897, $2,133 and $3,254, respectively. No other Named Executive Officer is entitled to benefits under the U.S. Supplemental Plan.

The Company has also adopted a Supplemental Executive Savings Retirement Plan ("SESRP") which provides for Company contributions for certain participants in the Company's defined contribution retirement plan (the "U.S. 401(k) Plan"). Under the U.S. 401(k) Plan, for certain participants, the Company makes base contributions of 2% of eligible compensation and a matching contribution of up to 2% of eligible compensation. The Code and the U.S. 401(k) Plan place certain limitations on participants' ability to receive Company base or Company matching contributions into the U. S. 401(k) Plan, including the annual limitation on eligible compensation of $205,000, indexed for inflation, and the annual employee elective deferral limitation of $13,000, indexed for inflation. Participants whose Company contributions into the U.S. 401(k) Plan are limited by these provisions are eligible to receive Company contributions to the SESRP, to the extent of such limitation. Mr. Anderson is not a participant in the SESRP, as he is not eligible for Company contributions into the U.S. 401(k) Plan. Messrs. Cornett, Schmidt, Wilcox and Zahalka are participants in the SESRP and their accrued benefits under the SESRP as of December 31, 2003 are $1,174, $2,384, $10,776 and $186, respectively. Participants in the SESRP are able to direct their account balance into a variety of hypothetical investment alternatives that mirror investment alternatives and returns available under the U.S. 401(k) Plan.

Employment And Severance Arrangements

The Company has entered into employment contracts with Messrs. Anderson, Wilcox, Schmidt, Cornett and Zahalka that provide for annual base salaries of not less than $425,000, $350,000, $260,000, $210,000 and $182,000 respectively, along with participation in the Company's bonus plan, benefit plans and perquisites for which they are currently eligible and in any plans substituted therefore. Each of the named Executives is also eligible for not less than four weeks' paid vacation in any twelve-month period.

If the Executive terminates the contract for good reason, or if the Company terminates the contract without good cause, the contract provides that the termination date shall be no earlier than 30 days following the date on which a notice of termination is delivered. In the event of such termination, the Executive shall be entitled to receive: a) any accrued benefits; b) a pro-rata annual incentive; c) a lump sum payment in cash equal to the Executive's base salary and target annual incentive opportunity multiplied by one and one-half; d) continuation of medical plan benefits for one year, provided that such benefits would be reduced to the extent comparable medical benefits are made available from a successor employer; and e) executive level career outplacement services.

The contracts contain a change-in-control provision in the event the Executive's employment is terminated within two years following a change-in-control, unless such termination is: (i) by the Company for cause; (ii) by reason of Death, Disability or Retirement; or (iii) by the Executive without Good Reason, then in lieu of all other benefits provided to the Executive, the Company shall pay to the Executive: (a) any accrued benefits; (b) a pro-rata annual incentive payment; (c) a lump-sum payment in cash equal to the Executive's base salary and target incentive opportunity multiplied by one and one-half; and (d) a lump sum payment in cash equal to ten percent of the Executive's base salary in lieu of medical plan benefits.

In case of termination due to death, the Executive's estate or representative shall be entitled to receive any accrued benefits plus a lump sum payment in cash equal to one year's base salary and a

II-17

pro-rata incentive amount. For those immediate family members who were participating in the Company's medical benefit plan as of the date of death, medical benefits shall continue for the one-year period immediately following the date of death.

Should an Executive be incapable of performing his principal duties because of physical or mental incapacity for a period of 180 consecutive days in any 12-month period, they shall be considered disabled and employment terminated. The Executive shall be entitled to: (a) accrued benefits; (b) a lump sum payment in cash equal to one year's base salary; (c) the pro-rata annual incentive; and (d) the continuation of medical benefits for one year.

The contracts contain a covenant not to compete for a term of 18 months following termination of the contract. The contracts also contain covenants prohibiting the disclosure of confidential information and developments and the solicitation of customers and employees.

In addition to the above terms and conditions, Mr. Schmidt's contract provides that as a hiring bonus for the calendar years 2002, 2003 and 2004 his minimum compensation shall be no less than his base salary plus 65% of the target payouts under the Annual Officer Performance Incentive Plan and the Long-Term Incentive Plan.

Report of the Compensation Committee

The Compensation Committee of the Board (the "Committee") establishes and administers the executive compensation program for the officers of the Company ("Executives"), including base salaries, the Company's Annual Officer Performance Incentive Plan and the Company's 1998 Long-Term Incentive Plan. The Committee currently consists of three non-employee directors, who have no interlocking relationships. The report is as follows:

Compensation Philosophy and Objectives

The Committee has adopted a Global Reward Philosophy that contains the following compensation philosophy and objectives as they pertain to Executives:

- (a)

- Global compensation and benefit programs must help attract, motivate, and retain the people needed to achieve the Company's business goals and success.

- (b)

- These programs must support the Company's vision, core competencies and business values, driving behaviors and performance that enhance the return to stockholders.

- (c)

- Such programs should support employee involvement, be market driven, reward success, create shared responsibility, maximize value, be administered with both ethics and integrity and provide balance between the interests of stockholders and employees.

The current components of the Company's executive total compensation program include:

- (a)

- An annual base salary;

- (b)

- An annual variable cash performance incentive;

- (c)

- Long-term stock-based incentives; and

- (d)

- A competitive benefit package.

II-18

These components consider individual performance, the Company's performance, and market data regarding comparable positions at other companies in similar industries served by the Company.

It is the intent of the Committee to provide to the Company's Executives a total compensation package that will be targeted at the competitive market median with the opportunity to achieve the 75th percentile through variable pay, long-term incentive programs and personal growth.

Base Salaries

In December 2002 the Committee reviewed and approved 2003 annual base salaries for the Company's Executives. The Committee based its decision on market survey data, the performance of each Executive and the recommendations of the Company's Chief Executive Officer.

Incentive Compensation Plans

The Committee approved participation of the Company's Executives in the Sauer-Danfoss Inc. Annual Officer Performance Incentive Plan for 2003. The incentive opportunity levels are according to the Executive's position and responsibilities, and are based on achievement of Earnings Before Interest and Taxes ("EBIT") and Sales Growth. The achievement of 4.5% EBIT (adjusted for unbudgeted net plant closing costs) and 11.8% Sales Growth (adjusted for budgeted currency exchange rates) resulted in a calculated payment of 90% of target. The Compensation Committee exercised its discretion under the Plan to reduce the payout awards by the maximum of 20 percentage points to 70% of target, which the Committee deemed more appropriate in view of the less than expected performance in 2003.

The Committee approved new awards during 2003 comprised of two-thirds Performance Units and one-third Non-Qualified Stock Options, as allowed under the terms of the Sauer-Danfoss Inc. 1998 Long-Term Incentive Plan ("Long-Term Incentive Plan"). Threshold, Target and Maximum performance-related payouts based on Return On Net Assets ("RONA") over a three-year performance period were approved. Participation and Target Awards were approved according to the Executive's position and responsibilities. The Committee, in its sole discretion, may pay earned Performance Units in the form of cash or in shares of common stock (or in a combination thereof). The number of shares of common stock to be issued, if any, shall equal the number of earned Performance Units designated by the Committee to be paid in shares. The amount of cash, if any, shall be equal to the fair market value of a share of common stock of the Company as of the close of the applicable performance period multiplied by the number of Performance Units designated by the Committee to be paid in cash. The Non-Qualified Stock Options have a three-year vesting period and shall expire ten years from the date of award.

In addition, the three-year performance period for the Performance Units granted in 2001 under the Long-Term Incentive Plan ended December 31, 2003. The threshold of a 15% average RONA was not achieved and, therefore, no payout was made on the Performance Units.

Chief Executive Officer ("CEO") Compensation

The Company's employment contract with Mr. Anderson provides for an annual salary of not less than $425,000. The Committee increased Mr. Anderson's base salary to $442,000 for 2003. The cash incentive earned by Mr. Anderson for 2003 under the Sauer-Danfoss Inc. Annual Officer Performance Incentive Plan was $186,635.13, which was 70% of target, representing a 20 percentage points reduction from the original target as discussed above underIncentive Compensation Plans.

II-19

Deductibility Of Executive Compensation

Internal Revenue Code Section 162(m) limits the deductibility by the Company of compensation in excess of $1,000,000 paid to each of the Named Executive Officers. The compensation paid to each of the Named Executive Officers did not exceed $1,000,000 in 2003 and the Company does not anticipate that any of its Named Executive Officers for 2004 will receive compensation in excess of $1,000,000 in 2004.

II-20

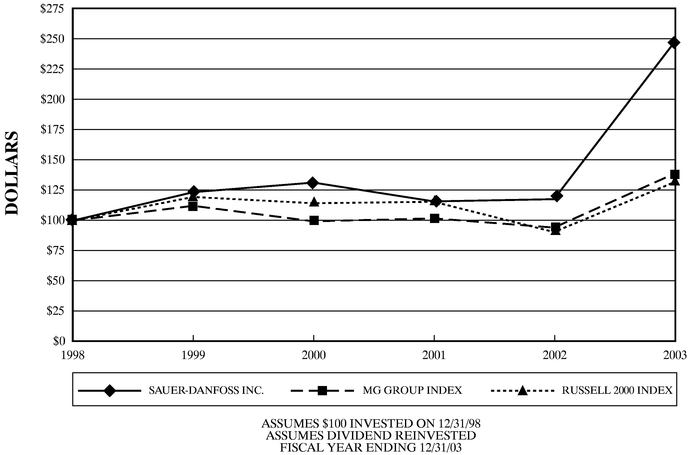

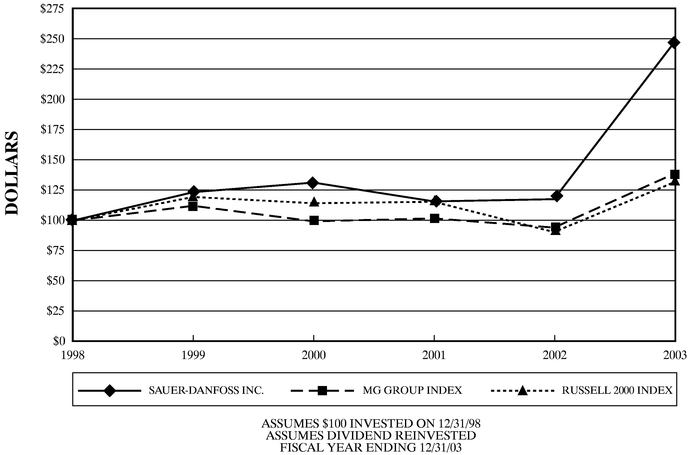

Performance Graph

The following graph shows a comparison of the cumulative total returns from December 31, 1998 to December 31, 2003, for the Company, the Russell 2000 Index, and the Media General Financial Services, Inc.—Diversified Machinery Index ("MG—Diversified Machinery Index").

COMPARE CUMULATIVE TOTAL RETURN

AMONG SAUER-DANFOSS INC.,

RUSSELL 2000 INDEX AND MG GROUP INDEX

II-21

ITEM 1—ELECTION OF DIRECTORS

The Board of Directors of the Company (the "Board") has nominated ten current directors for election. All directors are elected annually.

Each of the ten nominees for directors are currently directors and if elected, will serve until the 2005 Annual Meeting and until a successor has been elected and qualified, or until such director's earlier death, resignation, or removal.

Each share is entitled to one vote for each of ten directors. The persons named in the accompanying proxy will vote it for the election of the nominees named below as directors unless otherwise directed by the stockholder. Each nominee has consented to be named and to continue to serve if elected. In the unanticipated event that a nominee becomes unavailable for election for any reason, the proxies will be voted for the other nominees and for any substitute.

Nominees to Serve for Directors

Ole Steen Andersen, age 57, has been a director of the Company since May 3, 2000. Mr. Andersen has been Executive Vice President and Chief Financial Officer of Danfoss A/S since April 1, 2000 and a member of its Executive Committee for more than the past five years. For more than five years prior to April, 2000, he served as Executive Vice President of Danfoss A/S. He is also Chairman of the Board of Cowi A/S, an independent Danish consulting company delivering services within the fields of engineering, environmental science, and economics.

David J. Anderson, age 56, a director of the Company since July 1, 2002, has been President and Chief Executive Officer of the Company and President of Sauer-Danfoss (US) Company, the primary U.S. operating subsidiary of the Company, since July 1, 2002. He served as Executive Vice President—Strategic Business Development of the Company from May 3, 2000, until July 1, 2002. Since joining the Company in 1984, Mr. Anderson has held various senior management positions with the Company and Sauer-Danfoss (US) Company with increasing responsibility. He is a member of the Executive Committee of the Board. He is also a member of the Board of the National Fluid Power Association.

Jørgen M. Clausen, age 55, has been a director and Vice Chairman of the Company since May 3, 2000. He has served as the President and Chief Executive Officer and a member of the Executive Committee of Danfoss A/S for more than the past five years. He is also Chairman of the Board of Risoe National Laboratories, a Danish government-owned research organization, and Chairman of Junior Achievement/Young Enterprise Europe. He is a member of the Nominating Committee of the Board.

Nicola Keim, age 43, has been a director of the Company since April 1990. Ms. Keim, a licensed German lawyer, served as a Member of the Supervisory Board of Sauer Getriebe from November 1990 through June 1997. Ms. Keim is the daughter of Klaus H. Murmann, Chairman of the Company and a sister of Sven Murmann, a director of the Company.

Johannes F. Kirchhoff, age 46, has been a director of the Company since April 1997. Mr. Kirchhoff has been owner and Managing Director of FAUN Umwelttechnik GmbH & Co. KG, a German manufacturer of vehicles for waste disposal, since December 1994. He is Chairman of the Compensation Committee of the Board and a member of the Audit Committee of the Board.

II-22

Hans Kirk, age 61, has been a director of the Company since May 3, 2000. He has served as Executive Vice President and Chief Operating Officer and a member of the Executive Committee of Danfoss A/S for more than the past five years. He is also a director of NIRAS Group, a Danish construction consulting company and a director of The Danish Technological Institute, an independent institution approved by the Danish authorities to provide technological services to businesses and the community.

F. Joseph Loughrey, age 54, has been a director of the Company since June 23, 2000. He has served as Executive Vice President of Cummins Inc. and President—Engine Business since October 1999. From 1996 to 1999, Mr. Loughrey served as Executive Vice President of Cummins Engine Company and Group President—Industrial and Chief Technical Officer. He also is a director of Tower Automotive, Inc., a global designer and manufacturer of structural components and assemblies and suspension systems for original equipment manufacturers of automobiles. Mr. Loughrey is a member of the Audit Committee and the Compensation Committee of the Board.

Klaus H. Murmann, age 72, a director of the Company since April 1990, is currently Chairman. From 1987 to May 3, 2000, he served as Chairman and Chief Executive Officer of the Company and its predecessor. He retired as an active employee of the Company as of December 31, 2002. Mr. Murmann founded Sauer Getriebe in 1967, which, as a licensee of and later joint venture partner with Sundstrand Corporation, has been involved in the hydrostatics business since 1967. He is Chairman of the Board of Gothaer Insurance Company, Cologne, a German insurance company, Chairman of the Board of PSV AG, Cologne, a German national pension fund, a member of the board of Bankgesellschaft Berlin AG, a German bank, and a nonexecutive director of GKN PLC, United Kingdom, an engineering company. Klaus Murmann is the father of Nicola Keim and Sven Murmann, each of whom is a director of the Company. He is a member of the Executive Committee and the Nominating Committee of the Board.

Sven Murmann, age 36, has been a director of the Company since April 1994. Mr. Murmann is Managing Director of Sauer Holding GmbH, an investment company controlled by the Murmann family, a position he has held since February 2000. He previously served as Manager of HAKO Holding GmbH & Co., a global manufacturer of indoor and outdoor cleaning equipment based in Germany from August 2000 to August 2002. He served an internship at IBM from December 1, 1999 through May 31, 2000. He served as an Assistant Professor at the University of Zurich from October 1997 to October 1999. Mr. Murmann is the son of Klaus H. Murmann, Chairman of the Company and a brother of Nicola Keim, a director of the Company.

Steven H. Wood, age 46, has been a director of the Company since January 1, 2003. He was formerly Executive Vice President and Chief Financial Officer of Maytag Corporation from 2000 until July 2003, and from 1996 to 2000 he was Vice President—Financial Reporting and Audit of Maytag. Mr. Wood held various other financial leadership positions within Maytag from 1989 to 1996. Mr. Wood is a Certified Public Accountant and prior to joining Maytag, he was an auditor with Ernst & Young, a public accounting firm. He is Chairman of the Audit Committee and a member of the Compensation Committee of the Board.

The Board recommends that stockholders vote FOR the election of the nominees named above as directors.

II-23

ITEM 2—RATIFICATION OF APPOINTMENT OF

INDEPENDENT ACCOUNTANTS

The Audit Committee of the Board has appointed KPMG LLP as independent accountants to audit the consolidated financial statements of the Company and its subsidiaries for 2004, subject to ratification of the stockholders at the Annual Meeting. A representative of KPMG LLP is expected to be present at the Annual Meeting and will have the opportunity to make a statement if he or she so desires and to respond to appropriate questions. The affirmative vote of a majority of the shares present and entitled to vote on this item at the Annual Meeting is necessary for the approval of the appointment of KPMG LLP as independent accountants for 2004. In the event stockholders do not ratify the appointment of KPMG LLP, the appointment will be reconsidered by the Audit Committee. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of different independent auditors at any time during the year if they determine that such a change would be in the best interests of the Company and its stockholders.

Fees to Independent Auditors for 2003 and 2002

The following table presents fees for professional services rendered by KPMG LLP for the audit of the Company's Annual Financial Statements for the years ended December 31, 2003 and 2002 and fees billed for other services rendered by KPMG LLP during those periods:

| | 2003

| | 2002

|

|---|

| Audit Fees | | $ | 1,045,000 | | $ | 778,900 |

| Audit Related Fees(1) | | | 142,000 | | | 222,000 |

| Tax Fees(2) | | | 561,000 | | | 540,184 |

| All Other Fees (3) | | | 16,000 | | | 3,386 |

- (1)

- Consists principally of employee benefit plan audits, financial due diligence for acquisitions, statutory accounting assistance and internal control documentation analysis.

- (2)

- Consists of international and U.S. tax planning and compliance services, and expatriate tax services.

- (3)

- Consists of assistance related to foreign country business requirements.

Policy Regarding Pre-Approval of Audit and Non-Audit Services of Independent Auditors