QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

Sauer-Danfoss Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

NOTICE OF 2008 ANNUAL MEETING

PROXY STATEMENT FOR 2008 ANNUAL MEETING

2007 ANNUAL REPORT

TABLE OF CONTENTS

| |

| | Page No.

|

|---|

| I. | | Chairman's Letter | | I-1 |

|

|

Notice of 2008 Annual Meeting |

|

I-2 |

II. |

|

Proxy Statement |

|

II-1 |

|

|

General Information |

|

II-1 |

|

|

Solicitation and Revocability of Proxies |

|

II-1 |

| | | Expense of Solicitation | | II-1 |

| | | Voting of Proxies | | II-1 |

| | | Persons Entitled to Vote | | II-2 |

|

|

Security Ownership of Certain Beneficial Owners and Management |

|

II-3 |

|

|

Prospective Change in Control Transaction |

|

II-4 |

|

|

Governance of the Company |

|

II-6 |

|

|

Basis for Board Determination of Independence of Directors |

|

II-6 |

| | | Executive Committee | | II-7 |

| | | Audit Committee | | II-7 |

| | | Compensation Committee | | II-8 |

| | | Nominating Committee | | II-8 |

| | | Consideration of Nominees, Qualifications and Procedures | | II-8 |

| | | Agreement Regarding Nominees for Director | | II-9 |

| | | Stockholder Communications with the Board | | II-10 |

| | | Code of Conduct and Code of Ethics | | II-10 |

| | | Transactions with Related Persons | | II-11 |

| | | Review, Approval or Ratification of Transactions with Related Persons | | II-11 |

|

|

Report of the Audit Committee |

|

II-12 |

|

|

Executive Compensation |

|

II-13 |

|

|

Compensation Discussion and Analysis |

|

II-13 |

|

|

Role of Compensation Committee and Management in Executive Compensation

Matters |

|

II-13 |

| | | Executive Compensation Goals and Objectives | | II-13 |

| | | Hewitt Market Review—2007 | | II-15 |

| | | Elements of Executive Compensation Program | | II-15 |

|

|

Base Salary |

|

II-16 |

| | | Annual Incentive Awards | | II-16 |

| | | Long-Term Incentive Awards | | II-18 |

| | | Retirement & Savings Plans | | II-21 |

| | | Additional Cash Compensation and Perquisites | | II-22 |

| | | Other Potential Post-Employment Compensation | | II-23 |

|

|

Stock Ownership Guidelines |

|

II-24 |

| | | Financial Accounting and Tax Impacts of Executive Compensation Program | | II-24 |

| | | Compensation Committee Interlocks and Insider Participation | | II-24 |

| | | Compensation Committee Report | | II-25 |

|

|

Summary Compensation Table |

|

II-26 |

| | | Grants of Plan-Based Awards Table | | II-28 |

| | | Summary Compensation And Grants Of Plan-Based Awards Narrative | | II-29 |

| | | Stock Awards | | II-29 |

| | | Non-Equity Incentive Compensation | | II-29 |

| | | Outstanding Equity Awards At Fiscal Year-End Table | | II-31 |

| | | Option Exercises and Stock Vested Table | | II-32 |

| | | Pension Benefits Table | | II-32 |

| | | Pension Benefits Narrative | | II-32 |

|

|

Sauer-Danfoss Employees' Retirement Plan |

|

II-32 |

| | | Sauer-Danfoss Supplemental Retirement Plan | | II-33 |

| | | German Company Pension Scheme | | II-34 |

|

|

Nonqualified Deferred Compensation Table |

|

II-34 |

| | | Nonqualified Deferred Compensation Narrative | | II-35 |

| | | Elective Deferred Compensation Plans for Cash Compensation | | II-35 |

| | | Elective Deferred Compensation Plan for Long-Term Incentive Compensation | | II-36 |

| | | Supplemental Executive Savings and Retirement Plan | | II-37 |

|

|

Potential Payments Upon Termination or Change in Control |

|

II-37 |

|

|

Potential Payments Upon Termination or Change in Control Table |

|

II-38 |

|

|

Payments Due To Death Or Disability |

|

II-38 |

| | | Payments Due To Termination By Company Without Cause & Termination By

Employee With Good Reason | | II-39 |

| | | Payments Following A Change In Control | | II-39 |

| | | Key Employment Agreement Provisions | | II-40 |

|

|

Director Compensation Table |

|

II-41 |

| | | Director Compensation Narrative | | II-41 |

|

|

Item 1—Election of Directors |

|

II-43 |

|

|

Nominees to Serve for Directors |

|

II-43 |

|

|

Item 2—Ratification of Appointment of Independent Registered Public Accounting Firm |

|

II-45 |

|

|

Fees to Independent Registered Public Accounting Firm for 2007 and 2006 |

|

II-45 |

| | | Policy Regarding Pre-Approval of Audit and Non-Audit Services of Independent

Registered Public Accounting Firm | | II-45 |

|

|

Item 3—Elimination of Supermajority Stockholder Voting Provisions From the Company's Certificate of Incorporation |

|

II-46 |

|

|

Description of Supermajority Provisions Being Eliminated |

|

II-46 |

| | | Rationale for Proposed Elimination of Supermajority Voting Provisions | | II-47 |

| | | Interest of Directors and Executive Officers | | II-47 |

| | | Restatement of Certificate of Incorporation | | II-48 |

| | | Requisite Vote | | II-48 |

| | | Recommendation | | II-48 |

|

|

Additional Information |

|

II-48 |

|

|

Notice Requirements |

|

II-48 |

| | | Discretionary Authority | | II-49 |

| | | Section 16(a) Beneficial Ownership Reporting Compliance | | II-49 |

| | | Form 10-K | | II-49 |

| III. | | Appendix A—Proposed Amended and Restated Certificate of Incorporation | | III-1 |

IV. |

|

2007 Annual Report |

|

IV-1 |

|

|

Business |

|

IV-1 |

| | | NYSE Price Range, Dividends by Quarter | | IV-1 |

| | | Certifications | | IV-1 |

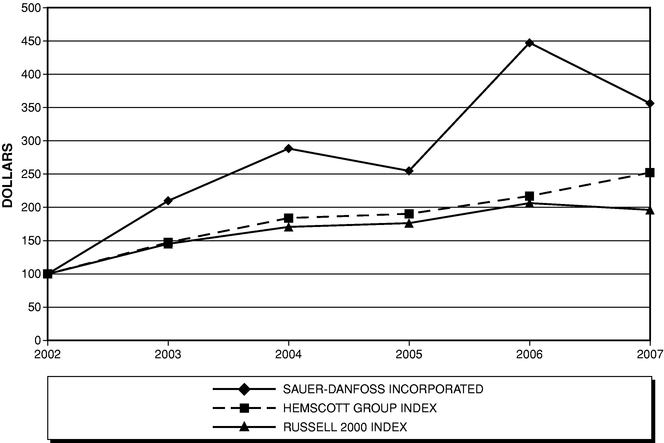

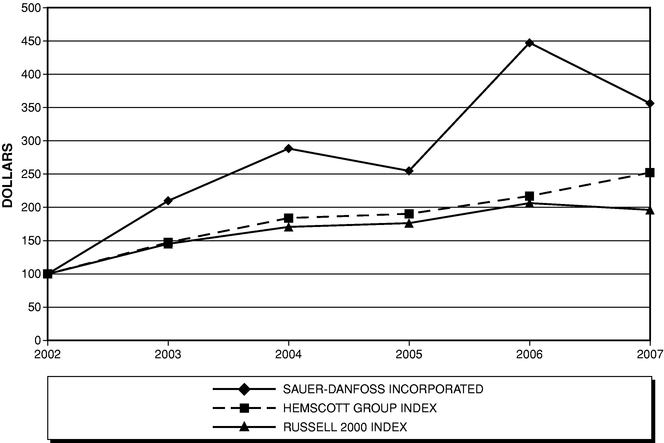

| | | Performance Graph | | IV-2 |

| | | Management's Discussion and Analysis of Financial Condition and Results of

Operations | | IV-3 |

| | | Consolidated Statements of Income | | IV-20 |

| | | Consolidated Balance Sheets | | IV-21 |

| | | Consolidated Statement of Stockholders' Equity and Comprehensive Income | | IV-22 |

| | | Consolidated Statements of Cash Flows | | IV-23 |

| | | Notes to Consolidated Financial Statements | | IV-24 |

| | | Report of Management | | IV-58 |

| | | Reports of Independent Registered Public Accounting Firm | | IV-59 |

| | | Selected Financial Data | | IV-61 |

| | | Chairman, Vice Chairman, Chairman Emeritus and Executive Officers and Directors | | IV-63 |

| | | Corporate Data | | IV-64 |

SAUER-DANFOSS INC.

250 Parkway Drive, Suite 270

Lincolnshire, Illinois 60069

Krokamp 35

24539 Neumünster, Germany

April 28, 2008

Dear Fellow Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of Sauer-Danfoss Inc. to be held on Thursday, June 12, 2008 at Gateway Hotel and Conference Center, 2100 Green Hills Drive, Ames, Iowa 50014 at 8:30 A.M., local time.

The attached Notice of Annual Meeting and Proxy Statement describe the formal business to be transacted at the Annual Meeting. At the Annual Meeting, stockholders will be asked to elect ten directors, to ratify the appointment of our auditor, and to approve amendments to the Sauer-Danfoss certificate of incorporation (as amended to date) that will eliminate the 80% supermajority voting requirement for stockholder approval of amendments to Articles FIFTH through TENTH of our certificate of incorporation and stockholder-approved amendments to our bylaws.

YOUR VOTE IS IMPORTANT, REGARDLESS OF THE NUMBER OF SHARES YOU OWN. WE URGE YOU TO SIGN, DATE AND MAIL THE ENCLOSED PROXY CARD AS SOON AS POSSIBLE EVEN IF YOU CURRENTLY PLAN TO ATTEND THE ANNUAL MEETING. This will not prevent you from voting in person, but will assure that your vote is counted if you are unable to attend the meeting.

It is always a pleasure for me and the other members of our Board of Directors to meet with our stockholders.

On behalf of our Board of Directors, thank you for your continued interest and support.

| | | Sincerely, |

|

|

|

| | | Jørgen M. Clausen

Chairman of the Board of Directors |

I-1

SAUER-DANFOSS INC.

250 Parkway Drive, Suite 270

Lincolnshire, Illinois 60069

Krokamp 35

24539 Neumünster, Germany

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 12, 2008

TO OUR STOCKHOLDERS:

The annual meeting of stockholders of Sauer-Danfoss Inc., a Delaware corporation, will be held at Gateway Hotel & Conference Center, 2100 Green Hills Drive, Ames, Iowa 50014, on Thursday, June 12, 2008, commencing at 8:30 a.m. local time. At the meeting, stockholders will act on the following matters:

- 1.

- To elect ten (10) directors for a term expiring at the annual meeting of stockholders to be held in 2009 and until their respective successors are duly elected and shall qualify.

- 2.

- To ratify the appointment of KPMG LLP as the Company's independent registered public accounting firm for 2008.

- 3.

- To consider and vote upon a proposal to amend and restate the Company's existing Amended and Restated Certificate of Incorporation (the "Certificate of Incorporation") in order to delete provisions requiring the approval of at least 80% of the outstanding shares of the capital stock of the Company entitled to vote generally in the election of directors for the amendment, alteration, or repeal of any provisions of (i) Articles FIFTH through TENTH of the Certificate of Incorporation, or (ii) the Company's Amended and Restated Bylaws (the "Bylaws") (or the adoption of new bylaws in replacement thereof) by our stockholders, and to effectively replace such supermajority threshold with a simple majority threshold.

- 4.

- To transact such other business as may properly come before the meeting or any postponement or adjournment.

Stockholders of record at the close of business on April 16, 2008 are entitled to notice of and to vote at the annual meeting or any postponement, adjournment, or adjournments.

Whether or not you expect to attend the Annual Meeting, please either complete, date, sign, and return the accompanying proxy card in the provided envelope or vote your shares by telephone or via the Internet using the instructions on the enclosed proxy card as promptly as possible in order to ensure your representation at the meeting. Even if you have given your proxy, whether by mail, by telephone, or via the Internet, you may still vote in person if you attend the meeting. If your shares are held of record by a broker, bank, or other nominee ("Street Name") you will need to obtain from the institution that holds your shares and bring to the meeting a proxy issued in your name, authorizing you to vote the shares.

| | | By order of the Board of Directors, |

| | |  |

| | | Kenneth D. McCuskey

Corporate Secretary |

Lincolnshire, Illinois

April 28, 2008

I-2

SAUER-DANFOSS INC.

250 Parkway Drive, Suite 270

Lincolnshire, Illinois 60069

Krokamp 35

24539 Neumünster, Germany

PROXY STATEMENT

April 28, 2008

GENERAL INFORMATION

Solicitation and Revocability of Proxies

The enclosed proxy is being solicited on behalf of the Board of Directors of Sauer-Danfoss Inc. (the "Company") for use at the annual meeting of the stockholders to be held on June 12, 2008 (the "Annual Meeting"), and at any postponement or adjournment. Most stockholders have a choice of voting via the Internet, by using a toll-free telephone number, or by completing a proxy card and mailing it in the envelope provided. Check your proxy card or the information forwarded by your bank, broker, or other holder of record to see which options are available to you. Please be aware that if you vote over the Internet, you may incur costs such as telecommunication and Internet access charges for which you will be responsible. The telephone voting facilities and the Internet voting facilities for stockholders of record will be available until 11:59 pm CDT on June 11, 2008, one day prior to the Annual Meeting.

Any proxy given does not affect your right to vote in person at the meeting and may be revoked at any time before it is exercised by notifying Kenneth D. McCuskey, Corporate Secretary, by mail, telegram, or facsimile, by timely delivery of a properly executed, later-dated proxy (including an Internet or telephone vote) or by appearing at the Annual Meeting in person and voting by ballot. Persons whose shares are held of record by a brokerage house, bank, or other nominee and who wish to vote at the meeting, must obtain from the institution holding their shares a proxy issued in such person's name.

The Company intends to mail this Proxy Statement and the accompanying proxy on or about April 28, 2008.

Expense of Solicitation

The Company will bear the entire cost of solicitation of proxies, including the preparation, assembly, printing, and mailing of this Proxy Statement, the accompanying proxy and any additional information furnished to stockholders. The Company will reimburse banks, brokerage houses, custodians, nominees, and fiduciaries for reasonable expenses incurred in forwarding proxy material to beneficial owners. In addition to solicitations by mail, officers, other regular employees and directors of the Company may, but without compensation other than their regular compensation, solicit proxies in person or by telephone, facsimile or electronic means. The Company has retained Innisfree M&A Incorporated ("Innisfree") to assist in soliciting proxies. The Company will bear the entire cost of Innisfree's solicitation services, which has been set at $15,000 plus certain variable expenses.

Voting of Proxies

All shares entitled to vote and represented by properly completed proxies received prior to the Annual Meeting and not revoked will be voted in accordance with the instructions on the proxy.If no instructions are indicated on a properly completed proxy, the shares represented by that proxy will be voted for the election of the nominees for director designated below, for ratification of the appointment of

II-1

KPMG LLP as independent registered public accounting firm of the Company for 2008, and for the amendment and restatement of the Company's Amended and Restated Certificate of Incorporation (the "Certificate of Incorporation").

Persons Entitled to Vote

Only holders of common stock of the Company of record as of the close of business on April 16, 2008 are entitled to notice of and to vote at the Annual Meeting. At the close of business on that date, 48,258,663 shares of common stock were outstanding. Holders of common stock are entitled to one (1) vote for each share held on all matters to be voted upon. Shares cannot be voted at the Annual Meeting unless the owner is present in person or represented by proxy. The directors shall be elected by an affirmative vote of a plurality of the shares that are entitled to vote on the election of directors and that are represented at the meeting by stockholders who are present in person or by proxy, assuming a quorum is present. The ten nominees for director receiving the greatest number of votes at the Annual Meeting will be elected as directors.

The proposal to amend the Company's Certificate of Incorporation in order to eliminate the 80% supermajority voting requirements requires the affirmative "FOR" vote of at least 80% of the holders of the outstanding shares of capital stock entitled to vote generally in the election of directors. Because passage of this proposal requires the vote of at least 80% of the holders of the shares of capital stock outstanding and entitled to vote, an abstention or Broker Nonvote (as described below) as to this matter will have the effect of a vote "AGAINST." The New York Stock Exchange has advised the Company that it considers the proposed amendment to be a sufficiently "routine" matter to permit brokers, banks, and other nominees to use their discretion to vote shares as to which they do not receive instructions from the beneficial owners.

For all other matters to be voted upon at the Annual Meeting, the affirmative vote of a majority of shares present in person or represented by proxy, and entitled to vote on the matter, is necessary for approval.

When a broker or other nominee holding shares for a customer votes on one proposal, but does not vote on another proposal because the broker or nominee does not have discretionary voting power with respect to such proposal and has not received instructions from the beneficial owner, it is referred to as a "Broker Nonvote." Properly executed proxies marked "Abstain" or proxies required to be treated as "Broker Nonvotes" will be treated as present for purposes of determining whether there is a quorum at the meeting. Abstentions will be considered shares entitled to vote in the tabulation of votes cast on proposals presented to the stockholders and will have the same effect as negative votes. Broker Nonvotes are counted towards a quorum, but are not counted for any purpose in determining whether a matter has been approved.

II-2

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information as of April 16, 2008, with respect to shares of common stock of the Company that were owned beneficially by: (i) each beneficial owner of more than 5% of the outstanding shares of common stock; (ii) each of the directors; (iii) each of the named executive officers of the Company; and (iv) all executive officers and directors of the Company as a group.

Beneficial Owners, Directors, and Executive Officers

| | Number of Shares

Beneficially

Owned (1)

| | Percent of

Outstanding

Shares

| |

|---|

| Sauer Holding GmbH(2) | | 36,629,787 | (3) | 75.9 | % |

| Danfoss Murmann Holding A/S(4) | | 35,415,962 | (5) | 73.4 | % |

| Danfoss A/S(4) | | 35,415,962 | (5) | 73.4 | % |

| NWQ Investment Management Company, LLC(6) | | 2,637,536 | (7) | 5.5 | % |

| Klaus H. Murmann, Director and Chairman Emeritus | | 7,500 | | * | |

| Nicola Keim, Director | | 11,500 | | * | |

| Sven Murmann, Director and Vice Chairman | | 11,500 | | * | |

| David J. Anderson, Director, President and Chief Executive Officer | | 70,570 | | * | |

| Karl J. Schmidt, Executive Vice President and Chief Financial Officer | | 24,059 | | * | |

| Hans J. Cornett, Executive Vice President and Chief Marketing Officer | | 41,273 | | * | |

| Thomas K. Kittel, Executive Vice President and President—Propel Division | | 164,564 | | * | |

| Wolfgang Schramm, Executive Vice President and President—Controls Division | | 8,365 | | * | |

| James R. Wilcox, Former Executive Vice President and President—Work Function Division | | 30,383 | | * | |

| Finn Lyhne, Former Vice President—Electric Drives | | 6,652 | | * | |

| Jørgen Clausen, Director and Chairman | | 68,500 | | * | |

| Ole Steen Andersen, Director | | 10,500 | | * | |

| Johannes F. Kirchhoff, Director | | 11,900 | | * | |

| Hans Kirk, Director | | 10,500 | | * | |

| F. Joseph Loughrey, Director | | 12,500 | (8) | * | |

| Steven H. Wood, Director | | 7,500 | | * | |

| Niels B. Christiansen, Director Nominee | | 0 | | * | |

| Kim Fausing, Director Nominee | | 0 | | * | |

| William E. Hoover, Jr., Director Nominee | | 0 | | * | |

| Frederik Lotz, Director Nominee | | 0 | | * | |

| Sven Ruder, Director Nominee | | 0 | | * | |

| All directors and executive officers as a group (18 persons) | | 524,795 | (9) | 1.1 | % |

- *

- Represents less than 1%.

- (1)

- Unless otherwise indicated in the following notes, each of the stockholders named in this table has sole voting and investment power with respect to the shares shown as beneficially owned. The following footnotes describe those shares which are beneficially owned by more than one person listed above.

- (2)

- The mailing address for Sauer Holding GmbH is Krokamp 35, 24539 Neumünster, Germany.

- (3)

- These shares include 18,087,825 shares owned directly by Sauer Holding GmbH, a German limited liability company ("Sauer Holding"), 300,000 shares owned directly by SDW Stiftung Deutsche Wirtschaft, a German foundation (the "Stiftung"), and 18,241,962 shares owned directly by Danfoss Murmann Holding A/S (the "Holding Company"). Because of an irrevocable voting proxy (the "Voting Proxy") and other contractual arrangements with the Holding Company and Danfoss A/S, Sauer Holding possesses shared voting and dispositive power over 17,174,000 of the shares which it owns directly. Sauer Holding possesses shared voting, but no dispositive, power over the 300,000 shares owned directly by the Stiftung. As a result of its 50% voting power over the Holding Company, Sauer Holding has shared voting and dispositive power over the 18,241,962 shares owned directly by

II-3

the Holding Company. Sauer Holding disclaims beneficial ownership of the 18,541,962 shares directly owned in the aggregate by the Holding Company and the Stiftung. Klaus H. Murmann, Nicola Keim, and Sven Murmann, directors of the Company who are members of Sauer Holding, have neither shared nor sole voting or dispositive power over the 36,329,787 shares directly owned in the aggregate by Sauer Holding, the Holding Company, and the Stiftung for purposes of calculating beneficial ownership under Section 13(d) of the Exchange Act; nevertheless, their membership in Sauer Holding is noted here to avoid misunderstanding.

- (4)

- The mailing address for each of these entities is DK-6430 Nordborg, Denmark.

- (5)

- These shares include 18,241,962 shares owned directly by the Holding Company. As a result of its 50% voting power over the Holding Company, Danfoss A/S has shared voting and dispositive power over these shares. These shares also include 10,361,500 shares owned directly by Sauer Holding that are subject to the Voting Proxy. The Holding Company has sole voting power, but no dispositive power (sole or shared), over these shares. Danfoss A/S has shared voting and dispositive power over these shares. These shares also include 6,812,500 shares owned directly by Sauer Holding, as to which the Holding Company and Danfoss A/S have shared voting and dispositive power. The Holding Company disclaims beneficial ownership of 6,812,500 of these shares.

- (6)

- The mailing address for this entity is 2049 Century Park East, 16th Floor, Los Angeles, California 90067.

- (7)

- NWQ Investment Management Company, LLC ("NWQ") has sole voting power over 2,393,486 of these shares and sole dispositive power over all 2,637,536 of these shares. This information is taken from a Schedule 13G filed by NWQ on February 14, 2008.

- (8)

- Mr. Loughrey disclaims beneficial ownership with respect to 3,000 of these shares which are owned directly by his wife.

- (9)

- Includes stock owned by the spouses and children of certain directors and executive officers. These shares do not include the shares reported above that are owned by Messrs. Wilcox and Lyhne, neither of whom was an executive officer of the Company as of April 16, 2008.

Prospective Change in Control Transaction

On March 10, 2008, Danfoss A/S ("Danfoss") and Sauer Holding GmbH ("Sauer Holding") entered into a Share Purchase Agreement (the "Purchase Agreement") pursuant to which Danfoss agreed to purchase, and Sauer Holding agreed to sell, a controlling interest in the Company (the "Share Purchase Transaction"). The closing of the Share Purchase Transaction is conditioned, among other things, on the stockholders' approval of the amendment and restatement of the Company's Certificate of Incorporation. The consummation of the Share Purchase Transaction will result in a change in control of the Company, as Sauer Holding will sell to Danfoss (i) 8,358,561 shares of the Company's common stock and (ii) all of the remaining issued and outstanding shares of Danfoss Murmann Holding A/S, a Danish corporation jointly owned by Sauer Holding and Danfoss (the "Holding Company"). By virtue of the Share Purchase Transaction, control of a majority of the issued and outstanding shares of the Company's common stock will shift from Danfoss and Sauer Holding jointly, to Danfoss alone.

At closing of the Share Purchase Transaction, Sauer Holding and Danfoss intend to execute a Stockholders Agreement (the "Stockholders Agreement") that will replace the Joint Venture Agreement, dated January 22, 2000, as amended as of February 22, 2000, by and among Danfoss, Sauer Holding and the Holding Company (the "Joint Venture Agreement"), in governing the rights and obligations of the parties with respect to their ownership and control of the Company and the Company's common stock that they hold (including arrangements with respect to the composition of the Company's Board of Directors and the consequent alteration of the existing rights of Danfoss and Sauer Holding with respect to the nomination of members of the Company's Board of Directors).

The Share Purchase Transaction and the Stockholders Agreement to be executed at closing of the Share Purchase Transaction will alter Sauer Holding's and Danfoss' respective rights to nominate members of the Company's Board of Directors. As is presently the case under the Joint Venture Agreement, the

II-4

Stockholders Agreement will provide that the Company's Board of Directors will consist of ten (10) members. However, under the Stockholders Agreement, Sauer Holding will possess nomination rights with respect to two such members (one independent and one non-independent) and Danfoss will possess nomination rights with respect to eight such members (two independent and six non-independent members) (each determination of independence to be made in accordance with the rules of the New York Stock Exchange). The contractual rights of Sauer Holding and Danfoss under the Joint Venture Agreement with respect to the Nominating Committee of the Company's Board of Directors will be effectively terminated under the prospective Stockholders Agreement.

The Share Purchase Transaction and the Stockholders Agreement to be executed at closing of the Share Purchase Transaction will furthermore result in the creation of various new contractual rights and obligations of Sauer Holding and Danfoss vis-à-vis one another related to transfers of Company common stock by them. Under the Stockholders Agreement, Sauer Holding will grant to Danfoss the right to purchase from Sauer Holding (via exercise of a call option), and Danfoss will grant to Sauer Holding the right to sell to Danfoss (via exercise of a put option), the remaining 10,029,264 shares of Company common stock held by Sauer Holding, in two equal stages of 5,014,632 shares each, during the 21-day windows of time (starting on August 1, 2010 and August 1, 2012, respectively) following the delivery of the Company's audited financial statements to Sauer Holding for the Company's 2009 and 2011 fiscal years, respectively. The exact purchase price for the shares subject to the call option and put option will be calculated based on the Company's operating income and adjusted with respect to the net debt level in the 2009 and 2011 fiscal years, respectively, but will fall within the range of $29.67 and $49.45 per share, subject to adjustment as a result of stock splits, reclassifications of stock, combinations of stock, or similar transactions. Under the prospective Stockholders Agreement, Danfoss will have the right, at any time, to accelerate its exercise of either or both stages of the call option by electing to purchase Sauer Holding's shares of Company common stock subject to such option at a price equal to $49.45 per share, subject to adjustment as a result of stock splits, reclassifications of stock, combinations of stock, or similar transactions. Sauer Holding, on the other hand, will be entitled to accelerate its exercise of either or both stages of its put option and to sell its shares of Company common stock subject to such option to Danfoss at a price equal to $29.67 or $39.56 per share (depending on the identity of the third party involved in the transaction giving rise to the acceleration right), subject to adjustment as a result of stock splits, reclassifications of stock, combinations of stock, or similar transactions, only under certain limited circumstances. The number of shares subject to the put and call options will be subject to reduction based on shares of Company common stock sold by Sauer Holding as a result of Danfoss' exercise of drag-along rights or Sauer Holding's exercise of tag-along rights under the Stockholders Agreement.

In addition to the put and call options, the Stockholders Agreement provides for drag-along rights and a right of first refusal for Danfoss, and tag-along rights for Sauer Holding. These rights would apply in the case of a proposal by either Danfoss or Sauer Holding to sell shares of Company common stock to a third party.

The Purchase Agreement provides that the obligation of Danfoss and Sauer Holding to close the Share Purchase Transaction is subject to several conditions precedent. One condition, mentioned above, is that the stockholders approve the proposed amendment and restatement of the Certificate of Incorporation. Another condition is that the Board of Directors abolish the Company's Executive Committee and the Company's Nominating Committee. The closing is further conditioned on the Company's adoption of a set of Amended and Restated Bylaws (the "Amended and Restated Bylaws"). The Amended and Restated Bylaws, if adopted, will be changed by, among other things, removing the current 80% supermajority voting requirement that would apply under the current Bylaws if the Board of Directors were to vote on certain major transactions, including but not limited to, a sale of substantially all of the Company's assets, a merger, or an amendment to the Certificate of Incorporation or Bylaws. Each of these conditions to the closing of the Share Purchase Transaction will make it easier for Danfoss and directors nominated by Danfoss to direct the policies, business, and affairs of the Company, subject to the requirements of the Stockholders Agreement.

II-5

GOVERNANCE OF THE COMPANY

The Company's Board of Directors (the "Board") currently has ten members, three of whom meet the New York Stock Exchange standard for independence. The Board has an Executive Committee, an Audit Committee, a Compensation Committee, and a Nominating Committee. All members of the Audit Committee and Compensation Committee are independent directors, but the two members of the Nominating Committee are not independent. The corporate governance listing standards of the New York Stock Exchange provide that a company of which more than 50% of the voting power is held by an individual, a group or another company (a "controlled company") need not comply with the Exchange's listing standards requiring that a majority of the Board be independent and that listed companies have a nominating/corporate governance committee and a compensation committee each composed entirely of independent directors with a written charter that addresses specific items. The Company considers itself to be a controlled company because approximately 73.4% of the voting power of the Company's common stock is owned or controlled by Danfoss Murmann Holding A/S. Accordingly, the Company has elected to utilize the exemption from the requirement that a majority of the Board be independent and from the provisions relating to a nominating/corporate governance committee.

The Board held four meetings during 2007. Each director attended at least 75% of the aggregate of the total number of meetings of the Board and the total number of meetings held by all committees of the Board on which the directors served during 2007. It is the policy of the Board that each director of the Company is expected to attend annual meetings of the stockholders of the Corporation, it being understood, however, that a director infrequently may be unable to attend annual meetings of the stockholders of the Company due to illness, a previously scheduled meeting of importance or other irreconcilable conflict. All of the directors attended the Company's annual stockholders meeting in June of 2007.

The non-management directors of the Company have adopted a schedule to meet in private session at the end of or prior to each regular meeting of the Board without any management director or executive officer being present. The non-management directors have also adopted the policy that the Chairman of the Board, or in his absence, the Vice Chairman, shall preside at all such meetings. In addition, at least once a year, only independent, non-employee directors shall meet in private session.

Basis for Board Determination of Independence of Directors

The Board has adopted Corporate Governance Guidelines (the "Guidelines"), that provide, among other things, that at least three directors must be independent. The Guidelines can be viewed on the Company's investor relations website athttp://ir.sauer-danfoss.com, and the Company will mail, without charge, a copy of the Guidelines upon written request to Kenneth D. McCuskey, Corporate Secretary at 2800 East 13th Street, Ames, Iowa 50010. To be considered "independent" under the Guidelines, a person must be determined by the Board to have no material relations, directly or indirectly, with the Company or its affiliates or any other director or elected officer of the Company, and must otherwise be independent as that term is defined under the listing standards of the New York Stock Exchange, but also without the appearance of any conflict in serving as a director. In addition to applying these guidelines, the Board shall consider all relevant facts and circumstances in making an independence determination.

The Board undertook its annual review of director independence with respect to the three persons considered independent at its meeting on March 12, 2008. The Board determined whether the three persons under consideration met the objective listing standards of the New York Stock Exchange regarding the definition of "independent director," which standards provide that a director is not independent if:

- •

- The director is, or has been within the last three years, an employee of the Company, or an immediate family member is, or has been within the last three years, an executive officer of the Company.

II-6

- •

- The director has received, or has an immediate family member who has received, during any twelve-month period within the last three years, more than $100,000 in direct compensation from the Company, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service).

- •

- (A) The director or an immediate family member is a current partner of a firm that is the Company's internal or external auditor; (B) the director is a current employee of such a firm; (C) the director has an immediate family member who is a current employee of such a firm and who participates in the firm's audit, assurance or tax compliance (but not tax planning) practice; or (D) the director or an immediate family member was within the last three years (but is no longer) a partner or employee of such a firm and personally worked on the Company's audit within that time.

- •

- The director or an immediate family member is, or has been within the last three years, employed as an executive officer of another company where any of the Company's present executive officers at the same time serves or served on that Company's compensation committee.

- •

- The director is a current employee, or an immediate family member is a current executive officer, of a company that has made payments to, or received payments from, the Company for property or services in an amount which, in any of the last three fiscal years, exceeds the greater of $1 million, or 2% of such other company's consolidated gross revenues.

The Board also considered whether there were any other transactions or relations between each of said three persons or any member of his immediate family and the Company and its subsidiaries and affiliates that would affect the independence of such persons and concluded that there were none.

As a result of its review, the Board affirmatively determined that Johannes F. Kirchhoff, F. Joseph Loughrey and Steven H. Wood are independent of the Company and its management under the standards set forth in the Guidelines.

Executive Committee

The Executive Committee possesses all of the powers of the Board, except for certain powers specifically reserved by Delaware law to the Board. The Executive Committee held two meetings and several telephone conferences during 2007. Jørgen M. Clausen, Sven Murmann, and David J. Anderson are the current members of the Executive Committee.

Audit Committee

The Audit Committee is currently composed of three directors, none of whom is an employee of the Company. The Audit Committee currently consists of Messrs. Wood (Chairman), Kirchhoff and Loughrey. All of the members of the Audit Committee are independent within the meaning of the Securities and Exchange Commission's ("SEC") regulations, the current listing standards of the New York Stock Exchange and the Company's Corporate Governance Guidelines. In addition, the Board has determined that at least one member of the Audit Committee meets the New York Stock Exchange listing standard of having accounting or related financial management expertise.

The Board has also determined that Steven H. Wood meets the SEC's criteria of an "audit committee financial expert." Mr. Wood's extensive background and experience includes presently serving as Chief Financial Officer of Becker-Underwood, Inc., a supplier of non-pesticide specialty chemical and biological products within the agricultural, landscape, turf, and horticulture industries, and formerly serving as Vice President and Corporate Controller of Metaldyne Corporation, a global designer and supplier of metal-based components, assemblies and modules for the automotive industry, and before that as Executive Vice President and Chief Financial Officer of Maytag Corporation. Prior to joining Maytag, he was an auditor with Ernst & Young, a public accounting firm, and successfully completed the examination for Certified

II-7

Public Accountants. Mr. Wood is independent as that term is used in the New York Stock Exchange's listing standards relating to director independence.

The Audit Committee is directly responsible for the appointment, compensation, retention and oversight of the independent registered public accounting firm. The Committee also reviews the scope of the annual audit activities of the independent registered public accounting firm and the Company's internal auditors, reviews audit and quarterly results and administers the Worldwide Code of Legal and Ethical Business Conduct and the Code of Ethics for Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer or Controller and Other Senior Finance Staff. All of the Committee's duties and responsibilities are set forth in a written Audit Committee Charter. The Charter can be viewed on the Company's investor relations website athttp://ir.sauer-danfoss.com and the Company will mail, without charge, a copy of the Audit Committee Charter upon written request to Kenneth D. McCuskey, Corporate Secretary at 2800 East 13th Street, Ames, Iowa 50010. The Audit Committee held four meetings and four telephonic meetings during 2007.

Compensation Committee

The Compensation Committee is currently composed of three directors, none of whom is an employee of the Company. The current members of the Compensation Committee are Messrs. Kirchhoff (Chairman), Loughrey and Wood, all of whom are independent as defined under the current listing standards of the New York Stock Exchange. The Compensation Committee reviews and determines the salaries of the executive officers of the Company and administers the Company's Annual Officer Performance Incentive Plan, the 1998 Long-Term Incentive Plan, the 2006 Omnibus Incentive Plan, the Deferred Compensation Plan for Selected Employees, the 409A Deferred Compensation Plan for Selected Employees, and the Supplemental Executive Savings & Retirement Plan. All of the duties of the Compensation Committee are set forth in a written Charter last amended and restated as of April 27, 2005, which can be viewed on the Company's investor relations website athttp://ir.sauer-danfoss.com and the Company will mail, without charge, a copy of the Compensation Committee Charter upon written request to Kenneth D. McCuskey, Corporate Secretary at 2800 East 13th Street, Ames, Iowa 50010. The Compensation Committee held four meetings and one telephonic meeting in 2007.

Nominating Committee

The current members of the Nominating Committee are Messrs. Jørgen M. Clausen and Klaus H. Murmann, neither of whom is independent under the New York Stock Exchange's current listing standards. The Nominating Committee recommends to the Board proposed nominees whose election at the next annual meeting of stockholders will be recommended by the Board. The Nominating Committee acted once by unanimous written consent in 2007. The Nominating Committee does not currently have a written charter, but does follow the guidelines described in the following section.

Consideration of Nominees, Qualifications and Procedures

The Nominating Committee adopted the policy in March 2004 that it will consider qualified candidates for director that are suggested by stockholders. Stockholders can recommend qualified candidates for director by writing to: Chairman of the Board of Directors, Attention: Kenneth D. McCuskey, Corporate Secretary, Sauer-Danfoss Inc., 2800 East 13th Street, Ames, Iowa 50010. Recommendations should set forth detailed information regarding the candidate, including the person's background, education, business, community and educational experience, other Boards of Directors of publicly held corporations on which the candidate currently serves or has served in the past and other qualifications of the candidate to serve as a director of the Company. All recommendations must be received by January 1 in order to be considered as a nominee for director at the annual meeting of stockholders to be held in such year. Recommendations that are received that meet the conditions set forth above shall be forwarded to the Board for further review and consideration.

II-8

The Nominating Committee is responsible for recommending to the full Board nominees for election as directors. In evaluating director nominees, the Nominating Committee considers, among other things, the following factors:

- •

- The needs of the Company with respect to the particular talents and experience of its directors

- •

- The extent to which the candidate would contribute to the range of talent, skill and expertise appropriate for the Board

- •

- The ability of the candidate to represent the interests of the stockholders of the Company

- •

- The candidate's standards of integrity, commitment and independence of thought and judgment

- •

- The candidate's ability to dedicate sufficient time, energy and attention to the diligent performance of his or her duties as a director of the Company, taking into account the candidate's services on other boards, including public and private company boards as well as not-for-profit boards, and other business and professional commitments of the candidate

- •

- The knowledge, skills and experience of the candidate, including experience in the Company's industry, business, finance, administration or public service, in light of prevailing business conditions

- •

- Experience with accounting rules and practices

- •

- Familiarity with national and international business matters

- •

- The desire to balance the considerable benefit of continuity with the periodic injection of the fresh perspective provided by new members

The Nominating Committee also considers such other relevant factors as it deems appropriate, including the current composition of the Board, the need for independent directors, the need for Audit Committee expertise and the evaluations of other candidates. Other than considering the factors set forth above, there are no stated minimum criteria for director nominees.

The Nominating Committee identifies candidates by first evaluating the current members of the Board willing to continue in service. If any member of the Board does not wish to continue in service or if the Nominating Committee or the Board decides not to re-nominate a member for election to the Board, the Nominating Committee shall identify the desired skills and experience of a new candidate in light of the factors set forth above. Current members of the Board may be polled for suggestions as to individuals meeting the criteria of the Nominating Committee, and qualified candidates recommended by stockholders shall be considered. Research may be performed to identify qualified individuals. The Nominating Committee may, but shall not be required to, engage third parties to identify or evaluate or assist in identifying potential candidates. The Nominating Committee has from time to time utilized an executive search firm to assist in identifying potential candidates.

In connection with its evaluation of candidates, the Nominating Committee shall determine which, if any, candidates shall be interviewed, and if warranted, one or more members of the Nominating Committee, and others as appropriate, shall interview prospective candidates in person or by telephone. After completing this evaluation and interview process, the Nominating Committee shall make a recommendation to the full Board as to the persons who should be nominated by the Board.

Agreement Regarding Nominees for Director

Entities and persons under the control of Klaus H. Murmann, Chairman Emeritus and a director of the Company, and Sven Murmann, Vice Chairman and a director of the Company (the "Murmann Family"), and Danfoss are parties to the Joint Venture Agreement, which contains certain agreements regarding their ownership and voting of the Company common stock owned by the Holding Company. In

II-9

anticipation of closing of the Share Purchase Transaction and execution of the Stockholders Agreement, the Murmann Family and Danfoss have agreed to proceed under the terms of the prospective Stockholders Agreement rather than the terms of the Joint Venture Agreement for purposes of making nominations for the election of the Board at the Annual Meeting. Pursuant to the prospective Stockholders Agreement, the Murmann Family will identify one non-independent and one independent candidate for director and Danfoss will identify six non-independent and two independent candidates for director for recommendation to the Board. With respect to the current nominees for election as directors, Sven Murmann was the non-independent nominee recommended by the Murmann Family and Niels B. Christiansen, Jørgen M. Clausen, Kim Fausing, William E. Hoover, Jr., Frederik Lotz, and Sven Ruder were the non-independent nominees recommended by Danfoss. Johannes F. Kirchhoff was the independent nominee recommended by the Murmann Family, and F. Joseph Loughrey and Steven H. Wood were the independent nominees recommended by Danfoss.

Stockholder Communications with the Board

The Corporate Governance Guidelines of the Company set forth the method by which stockholders may communicate with the Board. Stockholders and other parties interested in communicating directly with the Chairman of the Board or with the non-management directors as a group or with the entire Board of Directors as a group or with an individual director may do so in writing addressed to such person or group at: Sauer-Danfoss Inc., 2800 East 13th Street, Ames, Iowa 50010, Attn: Corporate Secretary. The Corporate Secretary shall review all such correspondence and shall forward all those not deemed frivolous, threatening or otherwise inappropriate to each member of the group or to the individual director to whom the correspondence is directed. The Corporate Secretary shall maintain a log of all correspondence received by the Company that is addressed to members of the Board and directors may at any time review such log and request copies of any such correspondence. Letters containing concerns relating to accounting, internal controls or auditing matters will immediately be brought to the attention of the Company's Internal Corporate Counsel and handled in accordance with procedures established by the Audit Committee with respect to such matters.

Code of Conduct and Code of Ethics

The Company's Worldwide Code of Legal and Ethical Business Conduct (the "Code of Conduct") has been in effect for a number of years and was last updated in January 2007. The Code of Conduct applies to every employee, agent, representative, consultant and director of the Company. The Code of Conduct requires that the Company's employees, agents, representatives, consultants and directors avoid conflicts of interest, comply with all laws and other legal requirements, conduct business in an honest and ethical manner and otherwise act with integrity and in the Company's best interests.

Overall administration of the Code of Conduct is the responsibility of the Audit Committee. Day-to-day administration of the Code of Conduct is the responsibility of the Corporate Business Conduct Committee that assists the Company's employees in complying with the requirements of the Code of Conduct. Employees are encouraged to report any conduct that they believe in good faith to be an actual or apparent violation of the Code of Conduct.

The Company has also adopted the Sauer-Danfoss Inc. Code of Ethics for Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer or Controller and Other Senior Finance Staff (the "Code of Ethics"). The Code of Ethics is intended to comply with the provisions of Section 406 of the Sarbanes-Oxley Act of 2002 and regulations of the SEC. The Code of Ethics is intended to promote honesty and integrity, the avoidance of conflicts of interests, full, accurate, and timely disclosure of financial reports, and compliance with laws and regulations and other matters.

The Code of Conduct and the Code of Ethics are posted on the Company's investor relations website athttp://ir.sauer-danfoss.com. The Company will mail without charge, upon written request, a copy of the

II-10

Code of Conduct and/or Code of Ethics. Requests should be sent to Kenneth D. McCuskey, Corporate Secretary at 2800 East 13th Street, Ames, Iowa 50010.

Transactions with Related Persons

In connection with the acquisition of Danfoss Fluid Power on May 3, 2000, the Company entered into several agreements with Danfoss to purchase ongoing operational services from Danfoss. These services include rental of shared facilities, administrative support and information technology support. Fees are paid on a monthly basis. Total expense recognized for goods and services purchased from Danfoss for 2007 was approximately $72.4 million. Danfoss is an indirect beneficial owner of more than 5% of the outstanding common stock of the Company.

For a number of years, the Company has sold products to FAUN Umwelttechnik GmbH & Co. KG, which is owned by Johannes F. Kirchhoff, a director of the Company, and members of his family. These sales are made pursuant to purchase orders entered into in the ordinary course of business. Sales in 2007 totaled approximately $1.7 million.

Review, Approval or Ratification of Transactions with Related Persons

The Company has a written policy pursuant to which the Company informs all of its directors and executive officers, as well as other personnel who serve in positions that give them routine knowledge of potential transactions with related persons, that they must inform specified individuals in management of transactions that meet the definitions provided in Item 404(a) of Regulation S-K ("related-person transactions"). Potential related-person transactions are reviewed by the Company's Audit Committee, which has the authority to approve or deny any such transaction. At least once per quarter, the Company's Secretary inquires of the individuals designated to receive reports of potential related-person transactions and relays any previously unreported transactions to the Audit Committee.

II-11

REPORT OF THE AUDIT COMMITTEE

The Audit Committee of the Board of Directors (the "Board") of Sauer-Danfoss Inc. (the "Corporation") acts under the Sauer-Danfoss Inc. Audit Committee Charter, as amended and restated by the Board on February 22, 2006, which Charter provides that the purpose of the Audit Committee is to represent and assist the Board with the oversight of:

- •

- the accounting, reporting and financial practices of the Corporation and its subsidiaries, including the integrity of the Corporation's financial statements;

- •

- the functioning of the Corporation's systems of internal accounting and financial controls;

- •

- the independent registered public accounting firm's qualifications and independence;

- •

- the performance of the Corporation's internal audit functions and the independent registered public accounting firm;

- •

- the Corporation's compliance with legal and regulatory requirements, and its ethics programs as established by management and the Board, including the Corporation's Worldwide Code of Legal and Ethical Business Conduct and any separate ethics code that relates to the integrity of the Corporation's financial reporting or applies to the Chief Executive Officer, Chief Financial Officer, or other senior financial officers.

Management has the primary responsibility for the Corporation's financial statements and the financial reporting process, including the system of internal controls. The full text of the Audit Committee Charter is available under the Corporate Governance section of the Corporation's investor relations website athttp://ir.sauer-danfoss.com.

In fulfilling its oversight responsibilities, the Audit Committee has discussed with KPMG LLP ("KPMG"), the Corporation's independent registered public accounting firm, the overall scope and plans for their audit. The Audit Committee met with both management and KPMG to review and discuss the audited financial statements.

The Audit Committee reviewed with KPMG their judgments as to the quality and acceptability of the Corporation's accounting principles. The Audit Committee's review included discussion with KPMG of the matters required to be discussed pursuant toStatement on Auditing Standards No. 61, as adopted by the Public Company Accounting Oversight Board in Rule 3200T.

The Audit Committee has received and reviewed the written disclosures and the letter from KPMG required by theIndependence Standards Board, Standard No. 1, "Independence Discussions With Audit Committees," as adopted by the Public Company Accounting Oversight Board in Rule 3600T, and has discussed with KPMG, among other things, matters relating to its independence. The Audit Committee has also considered the compatibility of the non-audit services provided by KPMG with its independence.

Based on the reviews and discussions referred to above, the Audit Committee recommends to the Board of Directors that the audited financial statements for the year ended December 31, 2007 be included in the Corporation's Annual Report on Form 10-K for the year ended December 31, 2007, for filing with the Securities and Exchange Commission.

| | | Members of the Audit Committee: |

|

|

Steven H. Wood, Chairman

Johannes F. Kirchhoff

F. Joseph Loughrey |

March 12, 2008 |

|

|

II-12

EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

Sauer-Danfoss Inc. (the "Company" or "we") presents this Compensation Discussion and Analysis ("CD&A") to discuss its executive compensation program. Our Chief Executive Officer (the "CEO"), Chief Financial Officer (the "CFO") and other executive officers participate in the executive compensation program.

The Summary Compensation Table on page II-26 and the subsequent disclosure tables reflect compensation paid to our CEO, CFO and to certain other executive officers (collectively, the "Named Executive Officers" or "NEOs"). In general, this CD&A discussion applies equally to each of the NEOs. Where needed for clarification, we have provided information on the treatment of individual NEOs.

Under SEC rules, we are reporting information in the Summary Compensation Table for Mr. Anderson as CEO, for Mr. Schmidt as CFO and for Messrs. Cornett, Kittel and Schramm as the three most highly compensated executive officers of the Company, other than the CEO and CFO. We are also reporting information in the Summary Compensation Table for Messrs. Wilcox and Lyhne, who were considered executive officers at some time during 2007 and who would have been among the top three most highly compensated executive officers, had they still been executive officers at year end.

Role of Compensation Committee and Management in Executive Compensation Matters

The Compensation Committee of our Board of Directors (the "Committee") consists of three independent directors as defined by current New York Stock Exchange listing standards. The Committee has the final say and ultimate authority in all matters relating to our executive compensation program. The Committee's authority encompasses areas such as:

- •

- The overall design of our executive compensation program

- •

- The determination of individual compensation elements and amounts for specific executives

- •

- The determination of incentive compensation performance measures and targets

From time to time, the Committee uses Hewitt Associates, LLP ("Hewitt") as its consultant with respect to executive compensation matters. At the request of the Committee in 2007, Hewitt performed a market-based review of certain executive compensation elements, as detailed later in the CD&A section entitled "Hewitt Market Review—2007." Hewitt also provided historical return on net assets results for a broad range of industrial companies to assist the Committee in developing performance targets under the Company's long-term incentive plan. Hewitt's sole consulting relationship with the Company is related to the work done directly for the Committee.

Management's role with respect to executive compensation matters is limited to making recommendations to the Committee, based on Management's understanding of the Company's compensation and performance objectives. Management's recommendations to the Committee include the CEO's annual performance evaluations of the other executive officers along with the CEO's recommendation for annual base salary changes for each such officer based on individual performance and market comparisons. The Committee considers Management's input and recommendations, but exercises independent judgment in making final decisions with respect to all matters affecting our executive compensation program.

Executive Compensation Goals and Objectives

The Sauer-Danfoss Total Rewards Strategy, newly adopted and approved by the Committee in 2007, provides a general framework for Total Rewards offerings to all employees on a global basis.

II-13

Our executive compensation program fits within our Total Rewards Strategy and is designed to meet certain goals and objectives. Specifically, we designed our executive compensation program to enable us to:

- •

- Attract, motivate and retain quality leaders

- •

- Promote teamwork and cooperation on a global basis

- •

- Tie executive compensation levels to changes in shareholder value

- •

- Tie executive compensation levels to business results

- •

- Preserve the tax deductibility of our executive compensation

We design our executive compensation program to reward performance. Within the program, we combine individual, business unit, division and company-wide performance elements. For our senior executives and Named Executive Officers, company-wide performance elements generally have the greatest impact on total compensation. We stress company-wide performance elements for the Named Executive Officers because they have the greatest impact on shareholder value creation. Company-wide performance elements also help us to promote global teamwork and cooperation among business units and divisions.

The following analysis shows how the Company's performance against preestablished performance targets can impact our executive officers' compensation levels. Performance Based Compensation Earned, as presented below, equals the sum of the Stock Awards column and the Non-Equity Incentive Plan Compensation column in our Summary Compensation Table. The Total Compensation amount comes directly from the Summary Compensation Table. 2006 data is not presented for Messrs. Schramm and Lyhne because they were not Named Executive Officers in 2006.

| | Year

| | Performance

Based

Compensation

Earned

| | Total

Compensation

| | Performance

Based

Percentage

| |

|---|

| David J. Anderson | | 2007 | | 459,386 | | 1,410,980 | | 32.6 | % |

| David J. Anderson | | 2006 | | 1,219,447 | | 2,083,149 | | 58.5 | % |

| Karl J. Schmidt | | 2007 | | 303,763 | | 668,161 | | 45.5 | % |

| Karl J. Schmidt | | 2006 | | 611,597 | | 995,088 | | 61.5 | % |

| Hans J. Cornett | | 2007 | | 283,714 | | 627,554 | | 45.2 | % |

| Hans J. Cornett | | 2006 | | 559,966 | | 907,007 | | 61.7 | % |

| Thomas K. Kittel | | 2007 | | 177,531 | | 569,270 | | 31.2 | % |

| Thomas K. Kittel | | 2006 | | 385,712 | | 746,343 | | 51.7 | % |

| Wolfgang Schramm | | 2007 | | 216,565 | | 470,316 | | 46.0 | % |

| James R. Wilcox | | 2007 | | (474,817 | ) | 1,158,437 | | — | |

| James R. Wilcox | | 2006 | | 935,290 | | 1,475,069 | | 63.4 | % |

| Finn Lyhne | | 2007 | | 164,772 | | 543,167 | | 30.3 | % |

The reduction in Performance Based Compensation Earned from 2006 to 2007 for the Named Executive Officers resulted from the Company's failure to meet its minimum profitability threshold under the Annual Incentive Plan. This reduction in Performance Based Compensation Earned was the primary reason for the decline in Total Compensation for the Named Executive Officers from 2006 to 2007.

Mr. Wilcox's Performance Based Compensation Earned shows as a negative amount in 2007, due to the forfeiture of certain Stock Awards upon his termination of employment in 2007. The negative amount represents a reversal of financial statement expense that had been recognized in prior years on these forfeited Stock Awards. Mr. Wilcox's Total Compensation for 2007 includes the value of certain post-termination compensation paid to him, as discussed elsewhere in this CD&A.

We design our executive compensation program to be market-based. Based on a review of survey data from a variety of external sources, we believe our executive compensation program is comparable to, and

II-14

competitive with, the market median of compensation programs for similarly sized companies in similar industries. In comparing our executive compensation program to market, we consider such items as the proper balance between fixed and variable compensation and the proper annual and long-term incentive target opportunities. In our market comparisons, we generally look to survey data related to durable goods manufacturing companies with comparable revenue size.

We also consider internal equity in the administration of our executive compensation program. We perform a formal job evaluation process for all executive positions, rating them on a point-factor basis. We then use the position ratings to help ensure that our executive compensation program is aligned for comparable positions on a global basis.

The Committee routinely reviews our executive compensation program and its individual elements in light of the goals and objectives outlined above.

Hewitt Market Review—2007

In 2007, the Committee engaged Hewitt to perform a market-based review of executive officer base salaries and incentive compensation awards. As part of its review, Hewitt provided market data on base salaries and target levels, expressed as a percentage of base salary, for annual and long-term incentive awards. Hewitt's market data was based on its review of data for a comparator group of companies based on similar revenue size and industry (industrial manufacturing). Hewitt recommended and the Committee approved the comparator group which consisted of the following companies:

ACCO Brands Corporation

Ametek, Inc.

AMSTED Industries, Inc.

Andersen Corporation

Applied Industrial Technologies

Arch Chemicals, Inc.

Ash Grove Cement Company

Brady Corporation

C.R. Bard, Inc.

Cameron International Corp.

Chaparral Steel Company

Church & Dwight Corp.

Curtiss-Wright Corporation | | Dade Behring, Inc.

Dal-Tile International Inc.

Edwards Lifesciences LLC

Energizer Holdings, Inc.

Federal Signal

Fleetwood Enterprises, Inc.

Flowserve Corporation

H.B. Fuller Company

Herman Miller, Inc.

Hospira, Inc.

Hubbell Incorporated

Jacuzzi Brands, Inc.

Joy Global Inc. | | Kaman Corporation

Kennametal Inc.

Martin Marietta Materials, Inc.

Metaldyne Corporation

Milacron Inc.

Olin Corporation

OMNOVA Solutions Inc.

Polaris Industries, Inc.

Revlon Inc.

Scotts Miracle-Gro Company

Sensient Technologies Corp.

The Stanley Works | | Steelcase Inc.

Tecumseh Products Co.

Teradyne, Inc.

Thomas & Betts Corp.

Tupperware Corporation

United Space Alliance

Valmont Industries, Inc.

WL Gore & Associates, Inc.

Walter Industries, Inc.

Waters Corporation

Woodward Governor Co.

Worthington Industries, Inc. |

The Committee considered the Hewitt market data, along with other Company provided data, in determining 2007 base salary and incentive plan target percentage levels. One change made in 2007 involved a lowering of the maximum possible payout under the Long-Term Incentive Plan Awards from 200% to 156%. This reduction was proposed by the Company and approved by the Committee so that the economic value of long-term incentive award grants would be more consistent with median market practice.

Elements Of Executive Compensation Program

Our executive compensation program is comprised of the following elements which are described in further detail below:

- •

- Base Salary

- •

- Annual Incentive Awards

- •

- Long-Term Incentive Awards

- •

- Retirement & Savings Plans

- •

- Additional Cash Compensation and Perquisites

II-15

- •

- Other Potential Post-Employment Compensation

Base Salary

We provide a base salary to our CEO and executive officers. The Committee determines the base salary for the CEO and our executive officers each year based upon a variety of factors.

A key factor in the Committee's determination of base salaries is a comparison to benchmark market data. In 2007, the Committee reviewed the following data for benchmark purposes:

- •

- Market survey information for similar positions in companies like ours in size and industry

- •

- The Hewitt comparator group data discussed above

We target our base salaries at the 50th percentile for similar positions within the benchmark group. The following factors also impact base salary determinations and will cause the base salaries to differ from the 50th percentile target:

- •

- The Board of Directors' annual performance evaluation of the CEO relative to established objectives

- •

- The CEO's annual performance evaluations of the other executives relative to established objectives

- •

- Individual experience and expertise

- •

- Internal equity

With one exception, the base salary of each of our Named Executive Officers for 2007 was within an acceptable range (+/- 15%) of the benchmark market median. The sole exception is the CEO's base salary, which was below the benchmark market median by slightly over 20% in 2007. This situation has arisen over time and is caused, in part, by the Company's sizeable growth in recent years. The Committee recognizes this shortfall and has been working to correct the situation.

Base salaries are one of the most readily comparable elements of compensation between different companies. We consider maintaining adequate annual base salary levels to be critical towards the stated goal of attracting, motivating and retaining quality leaders. By considering individual performance ratings in the annual base salary review process, our strongest performing executive officers will generally receive the largest percentage increases in annual base salary each year. This helps us meet our goal of motivating quality leaders and strengthens the tie between executive compensation and business results.

Annual Incentive Awards

We provide Annual Incentive Award opportunities to our CEO and executive officers under the Company's Omnibus Incentive Plan. For 2007, the Annual Incentive Awards were designed to pay out a target percentage of a participant's base salary based upon achievement of certain earnings before interest and taxes ("EBIT") margins on a Divisional, Business Unit, and/or Total Company basis. To promote teamwork and cooperation across Divisions and business units, the Named Executive Officers generally participate in the Annual Incentive Plan on a Total Company basis. In 2006, Thomas Kittel participated in the Annual Incentive Plan based, in part, on the results of our Propel Division. In 2007, Finn Lyhne participated in the Annual Incentive Plan based, in part, on the results of our Mobile Electronics business unit.

Actual payouts under the Annual Incentive Awards can range from 25% to 200% of target, depending upon achieved EBIT margins. Below certain minimum EBIT margin thresholds, no payout will be made under the Annual Incentive Awards. The Committee determines the target percentage of each executive

II-16

officer's base salary for Annual Incentive Award purposes based on a review of market survey information for similar positions in comparable companies and also based on internal equity.

For 2007 the Annual Incentive Plan's target, threshold and maximum payouts, expressed as a percentage of base salary, for each of our Named Executive Officers was as follows:

| | Threshold

Payout

Percentage

| | Target

Payout

Percentage

| | Maximum

Payout

Percentage

| |

|---|

| David J. Anderson | | 22.5 | % | 90 | % | 180 | % |

| Karl J. Schmidt | | 15 | % | 60 | % | 120 | % |

| Hans J. Cornett | | 15 | % | 60 | % | 120 | % |

| Thomas K. Kittel | | 15 | % | 60 | % | 120 | % |

| Wolfgang Schramm | | 15 | % | 60 | % | 120 | % |

| James R. Wilcox | | 15 | % | 60 | % | 120 | % |

| Finn Lyhne | | 6.25 | % | 25 | % | 50 | % |

In 2007, the Committee authorized an increase in Mr. Anderson's target payout percentage from 60% to 90%. This increase stemmed from a review of market data for CEO positions within the benchmark group.

Mr. Wilcox's right to an Annual Incentive Award payout based on Company performance for 2007 was forfeited upon his termination of employment in 2007. Under the terms of Mr. Wilcox's separation, he was provided a pro-rata Annual Incentive payout for 2007 based on his original target percentage of 60%. The value of this pro-rata Annual Incentive payment is shown later in this CD&A.

Prior to 2007, our Annual Incentive Awards included both a sales growth target and an EBIT margin target. Beginning in 2007, the sales growth target has been eliminated from our Annual Incentive Awards. At the same time, a sales growth element was added to our Long-Term Incentive Award targets. We made this change to reflect the fact that our sales efforts are generally longer-term in nature and to recognize that the combination of growth and profitability are keys to longer-term shareholder value creation.

The Committee reviews and approves the EBIT margin levels that are required to earn the target payout at the beginning of each year. These levels are generally tied to our annual operating budgets. Our annual budgeting process produces aggressive goals which are considered to have a reasonable chance of being met through strong operating performance. We use EBIT margin performance factors to encourage and reward profitability on a Total Company and/or Divisional or Business Unit basis.

We have determined that the Annual Incentive Award EBIT margin targets and their basis for computation involve confidential financial information and that disclosure could result in competitive harm to the Company. Therefore, we have not disclosed these targets within this CD&A and proxy statement.

The following table, which shows the five-year payout history under the Annual Incentive awards for our Total Company measure, provides an indication of the difficulty in meeting the performance goals. The

II-17

2003 payout percentage of 70% includes a discretionary 20% reduction in payout percentage as allowed by the Plan.

Year

| | Earned

Payout

As A

Percentage

Of Target

| |

|---|

| 2007 | | 0 | % |

| 2006 | | 113 | % |

| 2005 | | 45 | % |

| 2004 | | 136 | % |

| 2003 | | 70 | % |

Under the Omnibus Incentive Plan, the Committee reserves the discretion to reduce, but not increase, the final payouts to executive officers. During 2006, the Committee authorized final payouts based on the achieved sales growth and EBIT margin performance, without reduction. In 2007, no annual incentive awards were earned by the Named Executive Officers because threshold EBIT margins were not attained.

With a clear relationship between financial results and payouts, our Annual Incentive Awards program helps us link our executive officer compensation levels to achieved business results. As a market-based program, it also helps us attract, motivate and retain quality leaders. Finally, the design of the shareholder-approved Omnibus Incentive Plan and the Annual Incentive Awards made thereunder helps ensure the tax deductibility of the Annual Incentive Awards earned in 2006.

Long-Term Incentive Awards

We provide Long-Term Incentive Awards to our CEO and executive officers. The Omnibus Incentive Plan sets forth the terms and conditions under which our Long-Term Incentive Awards are made. The Company's established practice is to make Long-Term Incentive Award grants once each year, at the time of its regularly scheduled first quarter Compensation Committee meeting. The Omnibus Incentive Plan allows for a variety of forms of Long-Term Incentive Awards (e.g., Stock Options, Performance Units, Restricted Stock). The Omnibus Incentive Plan also provides for a variety of performance measures for performance-based Long-Term Incentive Awards (e.g., Return on Sales, Return on Net Assets, Total Shareholder Return).