United States

Securities and Exchange Commission

Washington, D.C. 20549

Form N-CSR

Certified Shareholder Report of Registered Management Investment Companies

811-6165

(Investment Company Act File Number)

Federated Municipal Securities Income Trust

_______________________________________________________________

(Exact Name of Registrant as Specified in Charter)

Federated Investors Funds

4000 Ericsson Drive

Warrendale, Pennsylvania 15086-7561

(Address of Principal Executive Offices)

(412) 288-1900

(Registrant's Telephone Number)

Peter J. Germain, Esquire

Federated Investors Tower

1001 Liberty Avenue

Pittsburgh, Pennsylvania 15222-3779

(Name and Address of Agent for Service)

(Notices should be sent to the Agent for Service)

Date of Fiscal Year End:08/31/19

Date of Reporting Period:08/31/19

| Item 1. | Reports to Stockholders |

Annual Shareholder Report

August 31, 2019

| Share Class | Ticker | A | FMOAX | B | FMOBX | C | FMNCX |

| | F | FHTFX | Institutional | FMYIX | |

Federated Municipal High Yield Advantage Fund

Fund Established 1987

A Portfolio of Federated Municipal Securities Income Trust

IMPORTANT NOTICE REGARDING REPORT DELIVERY

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund's shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund or your financial intermediary electronically by contacting your financial intermediary (such as a broker-dealer or bank); other shareholders may call the Fund at 1-800-341-7400, Option 4.

You may elect to receive all future reports in paper free of charge. You can inform the Fund or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports by contacting your financial intermediary (such as a broker-dealer or bank); other shareholders may call the Fund at 1-800-341-7400, Option 4. Your election to receive reports in paper will apply to all funds held with the Fund complex or your financial intermediary.

Not FDIC Insured ■ May Lose Value ■ No Bank Guarantee

J. Christopher

Donahue

President

Federated Municipal High Yield Advantage Fund

Letter from the President

Dear Valued Shareholder,

I am pleased to present the Annual Shareholder Report for your fund covering the period from September 1, 2018 through August 31, 2019. This report includes Management's Discussion of Fund Performance, a complete listing of your fund's holdings, performance information and financial statements along with other important fund information.

In addition, our website, FederatedInvestors.com, offers easy access to Federated resources that include timely fund updates, economic and market insights from our investment strategists, and financial planning tools.

Thank you for investing with Federated. I hope you find this information useful and look forward to keeping you informed.

Sincerely,

J. Christopher Donahue, President

CONTENTS

| 1 |

| 8 |

| 9 |

| 36 |

| 41 |

| 43 |

| 44 |

| 45 |

| 58 |

| 60 |

| 62 |

| 68 |

| 75 |

| 75 |

Management's Discussion of Fund Performance (unaudited)

The total return of Federated Municipal High Yield Advantage Fund (the “Fund”), based on net asset value for the 12-month reporting period ended August 31, 2019 (“reporting period”), was 8.76% for Class A and Class F Shares, 7.96% for Class B Shares, 7.97% for Class C Shares and 9.04% for Institutional Shares. The 9.04% total return of the Institutional Shares consisted of 4.30% of tax-exempt dividends and reinvestments and appreciation of 4.74% in the net asset value of the shares.1 The Fund's broad-based securities market index, the S&P Municipal Bond Index (the “Main Index”), had a total return of 8.26% during the reporting period. The total return of the 25% S&P A and Higher/25% BBB/50% High Yield, All 3-Year Plus Sub-Index (the “Blended Index”)2 was 9.67% during the reporting period. The total return of the Morningstar High Yield Muni Funds Average (MHYMFA),3a peer group average for the Fund, was 8.41% during the reporting period. The Fund's and the MHYMFA's total returns for the most recently completed fiscal year reflected actual cash flows, transaction costs and other expenses, which were not reflected in the total return of any index.

During the reporting period, the Fund's investment strategy focused on: (a) security selection; (b) selection of intermediate- to long-term, tax-exempt municipal bonds that typically yield more than short-term, tax-exempt municipal bonds due to the upward sloping yield curve; (c) active adjustment of the Fund's duration4 (which indicates the portfolio's sensitivity to changes in interest rates);5 (d) allocation of the Fund's portfolio among securities of similar issuers (referred to as “sectors”); and (e) credit quality.6 These were the most significant factors affecting the Fund's performance relative to the Blended Index during the reporting period.

The following discussion will focus on the performance of the Fund's Institutional Shares.

Market OVERVIEW

During the reporting period, 10-year U.S. Treasury yields decreased from a high of 3.24% in November 2018 to a low of 1.47% in August 2019 and averaged 2.55%.

Economic activity in the U.S. expanded at a moderate pace despite the global economic and financial setbacks during the reporting period. The slope of the U.S. Treasury curve was unusually flat by historical standards, which in the past has often been associated with a deterioration in future macroeconomic performance.

Inflation showed signs of picking up during the reporting period; however, it continued to run below the two percent target inflation rate of the Federal Reserve (the “Fed”). Inflation readings have been held down in 2019 due to factors such as the decline in oil prices, softer inflation abroad, and appreciation

Annual Shareholder Report

in the dollar despite strengthening labor market conditions and rising input costs for industry. The Fed's decision to raise the federal funds target rate two times by ¼ percent each time during the reporting period was mostly anticipated by the markets. In determining the size and timing of changes in the federal funds' target rate, changes in the Federal Open Market Committee's indicators of maximum employment and a two percent inflation target are essential. The Fed reaffirmed that adjustments to the policy path would depend on assessments of how the economic outlook and risks to the outlook are evolving. Then in July 2019, the Fed reduced the federal funds target rate by ¼ of a percent in reaction to global developments, potential impacts on the economic outlook as well as muted inflation pressure. The minutes of the Fed meeting stated that uncertainties remain concerning their outlook for sustained economic expansion, strong labor market conditions and inflation near the Committee's 2% objective.

Over the reporting period, the labor market continued to strengthen and economic activity rose at a solid rate. Although the availability of economic data was more limited than usual because of the partial federal government shutdown that extended from December 2018 to January 2019, job gains had been strong and the unemployment rate remained low. Consumers continued to spend at a strong rate and were supported by the strong job market and rising income. However, recent data suggested that foreign economic growth was more subdued, especially in the Euro area, and that the Chinese economy expanded at a slower pace than earlier in the year. Additional downside risks include an increase in some foreign and domestic government policy uncertainties, including those associated with a hard Brexit, an escalation in international trade policy tensions with China and possible tariffs imposed on several European trading partners. The escalation of trade conflicts with China and several European trading partners has had a significant impact on equity and fixed income markets. Those impacts are related to concerns about U.S. and world Gross Domestic Product (“GDP”) growth going forward, impacts to consumer and investor sentiment and any reactions by the Fed concerning monetary policy in the future.

Major U.S. tax reform occurred through the passage of the Tax Cut and Jobs Act of 2018 (“Tax Reform Act”), which reduced both corporate and individual tax rates. The top tax rate for individuals declined from 39.6% to 37% and either eliminated, modified or limited numerous deductions. The municipal bond market was spared many of the potentially negative tax law changes that were proposed, such as the limitation on the tax exemption for municipal bond interest. As a result, the impact on the municipal bond market from the Tax Reform Act being implemented has not been significant. The supply of municipal debt has been to some degree reduced as a result of the disallowance of advanced refunding's by municipal issuers. The modestly lower corporate tax rate has reduced the demand for holding municipal debt by banks and to a lesser degree by insurance companies.

Annual Shareholder Report

Credit quality continued to be generally stable. However, fiscal distress continued to be a focal point for states such as New Jersey and Illinois during the reporting period. The municipal bond market's technical (supply and demand) position was mostly favorable over the reporting period. The national issuance of municipal debt in 2019 so far has been relatively comparable to previous periods, even though the ability to advance refund existing debt became disallowed. Flows from investors into intermediate, long and high-yield municipal bonds were very positive for a significant portion of the reporting period.

YIELD CURVE AND MATURITY

During the reporting period, the Fund's distribution of maturities along the yield curve, relative to the Blended Index, contributed positively to Fund performance. The Fund's relative underweight allocation of short bonds and relative overweight of longer bonds benefited from the flattening yield curve over the reporting period and contributed positive performance against the Blended Index.

DURATION

As determined at the end of the reporting period, the Fund's dollar-weighted average duration was 5.0 years, down from 5.4 years at the beginning of the reporting period. Duration management remained a significant component of the Fund's investment strategy. During the reporting period, the Fund's modified duration ranged from 83-98% of the Blended Index, with the second half of the reporting period featuring longer relative durations. However the Fund's relatively short duration in a falling-rate environment contributed negatively to Fund performance versus the Blended Index.

SECTOR allocation

During the reporting period, the Fund's best-performing sectors were Public Power, Other Transportation and Local General Obligation bonds. Lagging sectors included Multi-Family Housing, Life Care and Pre-Refunded bonds. As a whole, performance due to the Fund's sector allocations lagged behind the Blended Index during the reporting period.

SECURITY SELECTION

Performance contribution from individual security selection was essentially neutral relative to the Blended Index.

CREDIT QUALITY

During the reporting period, the Fund increased its holdings in non-rated and non-investment grade bonds7 relative to the Blended Index. Over the course of the reporting period, the contribution due to the Fund's credit allocation was essentially neutral as compared to the Blended Index.

Annual Shareholder Report

| 1 | Income may be subject to state taxes, local taxes and the federal alternative minimum tax for individuals (AMT). |

| 2 | The Blended Index is being used for comparison purposes because, although it is not the Fund's broad-based securities market index, the Fund's investment adviser (the “Adviser”) believes it more closely reflects the market sectors in which the Fund invests. Please see the footnotes to the line graphs under “Fund Performance and Growth of a $10,000 Investment” below for the definition of, and more information about, the Main Index and the Blended Index. |

| 3 | Please see the footnotes to the line graphs under “Fund Performance and Growth of a $10,000 Investment” below for the definition of, and more information about, the MHYMFA. |

| 4 | Duration is a measure of a security's price sensitivity to changes in interest rates. Securities with longer durations are more sensitive to changes in interest rates than securities with shorter durations. For purposes of this Management Discussion of Fund Performance, duration is determined using a third-party analytical system. |

| 5 | Bond prices are sensitive to changes in interest rates, and a rise in interest rates can cause a decline in their prices. |

| 6 | Credit ratings pertain only to the securities in the portfolio and do not protect Fund shares against market risk. |

| 7 | Investment-grade securities and noninvestment-grade securities may either be: (a) rated by a nationally recognized statistical ratings organization or rating agency; or (b) unrated securities that the Fund's Adviser believes are of comparable quality. The rating agencies that provided the ratings for rated securities include Standard and Poor's, Moody's Investor Services, Inc. and Fitch Rating Service. When ratings vary, the highest rating is used. Credit ratings of “AA” or better are considered to be high credit quality; credit ratings of “A” are considered high or medium/good quality; and credit ratings of “BBB” are considered to be medium/good credit quality, and the lowest category of investment-grade securities; credit ratings of “BB” and below are lower-rated, noninvestment-grade securities or junk bonds; and credit ratings of “CCC” or below are noninvestment-grade securities that have high default risk. Any credit quality breakdown does not give effect to the impact of any credit derivative investments made by the Fund. Credit ratings are an indication of the risk that a security will default. They do not protect a security from credit risk. Lower-rated bonds typically offer higher yields to help compensate investors for the increased risk associated with them. Among these risks are lower creditworthiness, greater price volatility, more risk to principal and income than with higher-rated securities and increased possibilities of default. |

Annual Shareholder Report

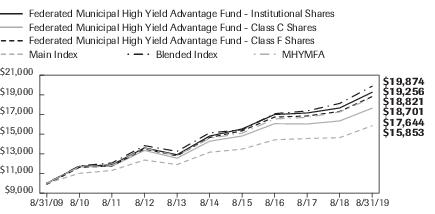

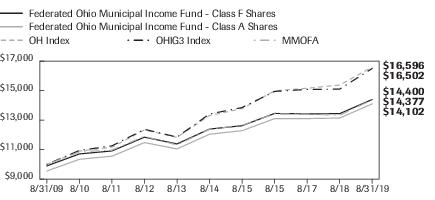

FUND PERFORMANCE AND GROWTH OF A $10,000 INVESTMENT

The graph below illustrates the hypothetical investment of $10,0001 in Federated Municipal High Yield Advantage Fund(the “Fund”) from August 31, 2009 to August 31, 2019, compared to the S&P Municipal Bond Index (Main Index),2S&P 25% A and Higher/25% BBB/50% High Yield, All 3-Year Plus Sub-Index, a custom blended index (Blended Index),3and the Morningstar High Yield Muni Funds Average (MHYMFA).4 The Average Annual Total Return table below shows returns for each class averaged over the stated periods.

Growth of A $10,000 Investment

Growth of $10,000 as of August 31, 2019

| Federated Municipal High Yield Advantage Fund - | Institutional Shares | Class C Shares | Class F Shares | Main Index | Blended Index | MHYMFA |

| F | F | F | I | I | I |

| 8/31/2009 | 10,000 | 10,000 | 9,900 | 10,000 | 10,000 | 10,000 |

| 8/31/2010 | 11,724 | 11,669 | 11,625 | 11,019 | 11,781 | 11,697 |

| 8/31/2011 | 11,874 | 11,732 | 11,775 | 11,308 | 12,068 | 11,812 |

| 8/31/2012 | 13,605 | 13,342 | 13,491 | 12,367 | 13,830 | 13,574 |

| 8/31/2013 | 12,903 | 12,557 | 12,794 | 11,905 | 13,245 | 12,815 |

| 8/31/2014 | 14,801 | 14,276 | 14,654 | 13,162 | 15,130 | 14,574 |

| 8/31/2015 | 15,527 | 14,809 | 15,332 | 13,475 | 15,443 | 15,092 |

| 8/31/2016 | 16,994 | 16,063 | 16,738 | 14,423 | 17,079 | 16,549 |

| 8/31/2017 | 17,150 | 16,031 | 16,849 | 14,555 | 17,358 | 16,705 |

| 8/31/2018 | 17,660 | 16,342 | 17,306 | 14,643 | 18,121 | 17,255 |

| 8/31/2019 | 19,256 | 17,644 | 18,821 | 15,853 | 19,874 | 18,701 |

41 graphic description end -->

| ■ | The returns shown for Class C Shares include the maximum contingent deferred sales charge of 1.00% as applicable. |

| ■ | Total returns shown for Class F Shares include the maximum sales charge of 1.00% ($10,000 investment minus $100 sales charge =$9,900) and the maximum contingent deferred sales charge of 1.00% as applicable. |

The Fund offers multiple share classes whose performance may be greater than or less than its other share class(es) due to differences in sales charges and expenses. See the Average Annual Total Return table below for the returns of additional classes not shown in the line graph above.

Annual Shareholder Report

Average Annual Total Returnsfor the Period Ended 8/31/2019

(returns reflect all applicable sales charges and contingent deferred sales charges as specified below in footnote #1)

| | 1 Year | 5 Years | 10 Years |

| Class A Shares | 3.85% | 4.16% | 6.14% |

| Class B Shares | 2.46% | 4.01% | 6.00% |

| Class C Shares | 6.97% | 4.33% | 5.84% |

| Class F Shares | 6.68% | 4.92% | 6.53% |

| Institutional Shares5 | 9.04% | 5.40% | 6.77% |

| Main Index | 8.26% | 3.79% | 4.72% |

| Blended Index | 9.67% | 5.61% | 7.11% |

| MHYMFA | 8.41% | 5.17% | 6.52% |

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month-end performance and after-tax returns, visit FederatedInvestors.com or call 1-800-341-7400. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured.

| 1 | Represents a hypothetical investment of $10,000 in the Fund after deducting applicable sales charges: For Class A Shares, the maximum sales charge of 4.50% ($10,000 investment minus $450 sales charge = $9,550); for Class B Shares, the maximum contingent deferred sales charge is 5.50% on any redemption less than one year from the purchase date; for Class C Shares, a 1.00% contingent deferred sales charge would be applied on any redemption less than one year from the purchase date; for Class F Shares, the maximum sales charge of 1.00% ($10,000 investment minus $100 sales charge = $9,900) and a contingent deferred sales charge of 1.00% would be applied on any redemption less than three years from the purchase date. The Fund's performance assumes the reinvestment of all dividends and distributions. The Main Index, Blended Index and MHYMFA have been adjusted to reflect reinvestment of dividends on securities in the indexes and the average. |

| 2 | The Main Index is a broad, comprehensive, market value-weighted index composed of approximately 55,000 bond issues that are exempt from U.S. federal income taxes or subject to AMT. Eligibility criteria for inclusion in the Main Index include, but are not limited to: the bond issuer must be a state (including the Commonwealth of Puerto Rico and U.S. territories) or a local government or a state or local government entity where interest on the bond is exempt from U.S. federal income taxes or subject to the AMT; the bond must be held by a mutual fund for which Standard & Poor's Securities Evaluations, Inc. provides prices; it must be denominated in U.S. dollars and have a minimum par amount of $2 million; and the bond must have a minimum term to maturity and/or call date greater than or equal to one calendar month. The Main Index is rebalanced monthly. The Main Index is not adjusted to reflect sales charges, expenses and other fees that the Securities and Exchange Commission (SEC) requires to be reflected in the Fund's performance. The Main Index is unmanaged, and, unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an index. |

| 3 | The Blended Index is a custom blended index that represents, by market weighting, 25% of the A-rated and higher component of the Main Index, 25% of the BBB-rated component of the Main Index and 50% |

Annual Shareholder Report

| | of the below investment grade (bonds with ratings of less than BBB-/Baa3) component of the Main Index, all with remaining maturities of three years or more. The Blended Index is not adjusted to reflect sales charges, expenses and other fees that the SEC requires to be reflected in the Fund's performance. The Blended Index is unmanaged, and, unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an index. |

| 4 | Morningstar figures represent the average of the total returns reported by all the funds designated by Morningstar as falling into the respective category indicated. They do not reflect sales charges. The Morningstar figures in the Growth of $10,000 line graph are based on historical return information published by Morningstar and reflect the return of the funds comprising the category in the year of publication. Because the funds designated by Morningstar as falling into the category can change over time, the Morningstar figures in the line graph may not match the Morningstar figures in the Average Annual Total Returns table, which reflect the return of the funds that currently comprise the category. |

| 5 | The Fund's Institutional Shares commenced operations on June 11, 2013. For the period prior to the commencement of operations of Institutional Shares, the performance information shown is for the Fund's Class F Shares, adjusted to reflect the expenses of the Fund's Institutional Shares for each year for which the Fund's Institutional Shares expenses would have exceeded the actual expenses paid by the Fund's Class F Shares. |

Annual Shareholder Report

Portfolio of Investments Summary Table (unaudited)

At August 31, 2019, the Fund's sector composition1 was as follows:

| Sector Composition | Percentage of

Total Net Assets |

| Senior Care | 11.4% |

| Dedicated Tax | 9.8% |

| Primary/Secondary Education | 9.7% |

| Industrial Development Bond/Pollution Control Revenue Bond | 9.5% |

| Incremental Tax | 8.4% |

| Hospital | 7.2% |

| Tobacco | 5.6% |

| Toll Road | 4.8% |

| General Obligation—Local | 4.6% |

| Other Utility | 3.7% |

| Other2 | 24.8% |

| Other Assets and Liabilities—Net3 | 0.5% |

| TOTAL | 100.0% |

| 1 | Sector classifications, and the assignment of holdings to such sectors, are based upon the economic sector and/or revenue source of the underlying obligor, as determined by the Fund's Adviser. For securities that have been enhanced by a third-party guarantor, such as bond insurers and banks, sector classifications are based upon the economic sector and/or revenue source of the underlying obligor, as determined by the Fund's Adviser. |

| 2 | For purposes of this table, sector classifications constitute 74.7% of the Fund's total net assets. Remaining sectors have been aggregated under the designation “Other.” |

| 3 | Assets, other than investments in securities, less liabilities. See Statement of Assets and Liabilities. |

Annual Shareholder Report

Portfolio of Investments

August 31, 2019

Principal

Amount | | | Value |

| | | MUNICIPAL BONDS—97.3% | |

| | | Alabama—1.3% | |

| $500,000 | | Huntsville, AL Special Care Facilities Financing Authority (Redstone Village), Retirement Facilities Revenue Bonds (Series 2011A), (Original Issue Yield: 7.625%), 7.500%, 1/1/2047 | $438,135 |

| 1,500,000 | | Huntsville, AL Special Care Facilities Financing Authority (Redstone Village), Retirement Facility Revenue Bonds (Series 2007), (Original Issue Yield: 5.600%), 5.500%, 1/1/2043 | 1,090,170 |

| 2,000,000 | | Jefferson County, AL Sewer System, Senior Lien Sewer Revenue Current Interest Warrants (Series 2013-A), (Original Issue Yield: 5.650%), (Assured Guaranty Municipal Corp. INS), 5.500%, 10/1/2053 | 2,326,820 |

| 2,000,000 | | Jefferson County, AL Sewer System, Senior Lien Sewer Revenue Current Interest Warrants (Series 2013A), (Original Issue Yield: 5.450%), (Assured Guaranty Municipal Corp. INS), 5.250%, 10/1/2048 | 2,307,880 |

| 835,000 | | Selma, AL IDB (International Paper Co.), Gulf Opportunity Zone Bonds (Series 2010A), 5.800%, 5/1/2034 | 859,273 |

| 790,000 | 1 | Tuscaloosa County, AL IDA (Hunt Refining Co.), Gulf Opportunity Zone Refunding Bonds (Series 2019A), 5.250%, 5/1/2044 | 912,245 |

| | | TOTAL | 7,934,523 |

| | | Alaska—0.0% | |

| 1,000,000 | 2,3 | Alaska Industrial Development and Export Authority (Boys & Girls Home & Family Services, Inc.), Community Provider Revenue Bonds (Series 2007C), 6.000%, 12/1/2036 | 50,000 |

| | | Arizona—2.9% | |

| 650,000 | 1 | Arizona State Industrial Development Authority Education Revenue (Basis Schools, Inc. Obligated Group), (Series 2017D), 5.000%, 7/1/2051 | 709,228 |

| 500,000 | 1 | Arizona State Industrial Development Authority Education Revenue (Basis Schools, Inc. Obligated Group), Education Revenue Bonds (Series 2017G), 5.000%, 7/1/2051 | 545,560 |

| 1,000,000 | 1 | Arizona State Industrial Development Authority Education Revenue (Doral Academy of Nevada FMMR), Revenue Bonds (Series 2019A), 5.000%, 7/15/2049 | 1,096,540 |

| 1,750,000 | 1 | Arizona State Industrial Development Authority Education Revenue (Pinecrest Academy of Nevada), Horizon, Inspirada and St. Rose Campus Education Revenue Bonds (Series 2018A), 5.750%, 7/15/2048 | 1,976,940 |

| 4,000,000 | | Maricopa County, AZ Pollution Control Corp. (Public Service Co., NM), PCR Refunding Bonds (Series 2003A), 6.250%, 1/1/2038 | 4,102,920 |

| 1,000,000 | 1 | Maricopa County, AZ, IDA (Paradise Schools), Revenue Refunding Bonds, 5.000%, 7/1/2047 | 1,084,620 |

| 1,500,000 | | Phoenix, AZ IDA (GreatHearts Academies), Education Facility Revenue Bonds (Series 2014A), 5.000%, 7/1/2044 | 1,637,670 |

Annual Shareholder Report

Principal

Amount | | | Value |

| | | MUNICIPAL BONDS—continued | |

| | | Arizona—continued | |

| $1,000,000 | | Phoenix, AZ IDA (GreatHearts Academies), Education Facility Revenue Bonds (Series 2016A), 5.000%, 7/1/2046 | $1,108,220 |

| 3,000,000 | | Salt Verde Financial Corp., AZ, Senior Gas Revenue Bonds (Series 2007), (Original Issue Yield: 5.100%), (Citigroup, Inc. GTD), 5.000%, 12/1/2037 | 4,156,770 |

| 1,000,000 | | Tempe, AZ IDA (Mirabella at ASU), Revenue Bonds (Series 2017A), 6.125%, 10/1/2047 | 1,151,330 |

| 430,000 | 1 | Verrado Community Facilities District No. 1, AZ, District GO Refunding Bonds (Series 2013A), 6.000%, 7/15/2027 | 466,735 |

| | | TOTAL | 18,036,533 |

| | | California—7.0% | |

| 750,000 | 1 | California School Finance Authority (KIPP LA), School Facility Revenue Bonds (Series 2014A), 5.125%, 7/1/2044 | 839,130 |

| 565,000 | 1 | California School Finance Authority (KIPP LA), School Facility Revenue Bonds (Series 2015A), 5.000%, 7/1/2045 | 640,727 |

| 500,000 | 1 | California School Finance Authority (KIPP LA), School Facility Revenue Bonds (Series 2017A), 5.000%, 7/1/2047 | 586,830 |

| 2,000,000 | | California State Municipal Finance Authority (LINXS APM Project), Senior Lien Revenue Bonds (Series 2018A), 5.000%, 6/1/2048 | 2,399,960 |

| 1,000,000 | 1 | California State School Finance Authority Charter School Revenue (Bright Star Schools-Obligated Group), Charter School Revenue Bonds (Series 2017), 5.000%, 6/1/2047 | 1,086,760 |

| 500,000 | 1 | California State School Finance Authority Charter School Revenue (Rocketship Public Schools), Revenue Bonds (Series 2017G), 5.000%, 6/1/2047 | 543,730 |

| 1,100,000 | 1 | California State School Finance Authority Charter School Revenue (Summit Public Schools Obligated Group), (Series 2017), 5.000%, 6/1/2053 | 1,276,077 |

| 500,000 | | California State, Various Purpose GO Bonds, 4.000%, 4/1/2049 | 575,460 |

| 2,250,000 | 1 | California Statewide Communities Development Authority (Loma Linda University Medical Center), Revenue Bonds (Series 2016A), 5.250%, 12/1/2056 | 2,571,615 |

| 1,555,000 | | Community Facilities District No. 2016 of the County of Orange (CFD 2016-1 (Village of Esencia)), Special Tax Revenue Bonds (Series 2016A), 5.000%, 8/15/2046 | 1,791,702 |

| 1,000,000 | | Community Facilities District No. 2017 of the County of Orange (CFD 2017-1 (Village of Esencia)), Improvement Area No.1 Special Tax Revenue Bonds (Series 2018A), 5.000%, 8/15/2047 | 1,189,590 |

| 500,000 | | Corona-Norco USD Community Facilities District No. 98-1, CA, 2013 Special Tax Refunding Bonds, 5.000%, 9/1/2032 | 570,440 |

| 3,000,000 | | Foothill/Eastern Transportation Corridor Agency, CA, Toll Road Refunding Revenue Bonds (Series 2013A), (Original Issue Yield: 6.400%), 6.000%, 1/15/2053 | 3,554,040 |

| 95,000 | | Irvine, CA (Irvine, CA Reassessment District No. 13-1), Limited Obligation Improvement Bonds, 5.000%, 9/2/2028 | 108,398 |

Annual Shareholder Report

Principal

Amount | | | Value |

| | | MUNICIPAL BONDS—continued | |

| | | California—continued | |

| $365,000 | | Irvine, CA (Irvine, CA Reassessment District No. 13-1), Limited Obligation Improvement Bonds, 5.000%, 9/2/2029 | $415,801 |

| 180,000 | | Irvine, CA (Irvine, CA Reassessment District No. 13-1), Limited Obligation Improvement Bonds, 5.000%, 9/2/2030 | 204,334 |

| 1,300,000 | | Irvine, CA Community Facilities District No. 2013-3 (Great Park Improvement Area No. 4), Special Tax Bonds (Series 2016), 4.000%, 9/1/2049 | 1,384,591 |

| 1,000,000 | | Irvine, CA Community Facilities District No. 2013-3 (Great Park Improvement Area No.1), Special Tax Bonds (Series 2014), 5.000%, 9/1/2049 | 1,110,050 |

| 3,000,000 | | Los Angeles Department of Water & Power (Los Angeles, CA Department of Water & Power (Electric/Power System)), Revenue Refunding Bonds (Series 2017B), 5.000%, 7/1/2038 | 3,716,190 |

| 850,000 | | Los Angeles, CA Department of Airports (Los Angeles International Airport), Subordinate Revenue Bonds (Series 2017A), 5.000%, 5/15/2047 | 1,013,888 |

| 1,000,000 | | Los Angeles, CA Harbor Department, Revenue Refunding Bonds (Series 2014A), 5.000%, 8/1/2044 | 1,151,400 |

| 2,500,000 | | M-S-R Energy Authority, CA, Gas Revenue Bonds (Series 2009A), (Citigroup, Inc. GTD), 7.000%, 11/1/2034 | 3,887,800 |

| 1,000,000 | | Palomar Health, CA Revenue, (Series 2016), 5.000%, 11/1/2039 | 1,156,930 |

| 485,000 | | Poway, CA Unified School District (Community Facilities District No. 6 (4S Ranch)), Special Tax Bonds (Series 2012), 5.000%, 9/1/2033 | 539,344 |

| 1,000,000 | | Roseville, CA Special Tax (Fiddyment Ranch CFD No. 1), Special Tax Refunding Revenue Bonds (Series 2017), 5.000%, 9/1/2034 | 1,200,120 |

| 305,000 | | San Bernardino County, CA Housing Authority (Glen Aire Park & Pacific Palms), Subordinated Revenue Bonds, 7.250%, 4/15/2042 | 210,301 |

| 1,250,000 | | San Buenaventura, CA (Community Memorial Health System), Revenue Bonds (Series 2011), 8.000%, 12/1/2031 | 1,414,462 |

| 2,000,000 | | San Francisco, CA City & County Airport Commission, Second Series Revenue Bonds (Series 2019E), 5.000%, 5/1/2040 | 2,484,020 |

| 1,000,000 | | San Francisco, CA City & County Redevelopment Financing Agency (Mission Bay North Redevelopment), Tax Allocation Bonds (Series 2011C), (Original Issue Yield: 6.860%), (United States Treasury PRF 2/1/2021@100), 6.750%, 8/1/2041 | 1,082,260 |

| 1,280,000 | | San Francisco, CA City & County Redevelopment Financing Agency (Mission Bay North Redevelopment), Tax Allocation Refunding Bonds (Series 2016A), (National Public Finance Guarantee Corporation INS), 5.000%, 8/1/2041 | 1,519,168 |

| 500,000 | | San Francisco, CA City & County Redevelopment Financing Agency (Mission Bay South Redevelopment), Tax Allocation Refunding Bonds (Series 2016C), (National Public Finance Guarantee Corporation INS), 5.000%, 8/1/2041 | 593,075 |

Annual Shareholder Report

Principal

Amount | | | Value |

| | | MUNICIPAL BONDS—continued | |

| | | California—continued | |

| $ 1,200,000 | | Santa Margarita, CA Water District Community Facilities District No. 2013-1, Special Tax Bonds (Series 2013), (Original Issue Yield: 5.700%), 5.625%, 9/1/2043 | $1,336,668 |

| 990,000 | | Western Riverside Water & Wastewater Financing Authority, CA, Local Agency Revenue Refunding Bonds (Series 2016A), 5.000%, 9/1/2044 | 1,157,043 |

| | | TOTAL | 43,311,904 |

| | | Colorado—8.2% | |

| 750,000 | | Arista, CO Metropolitan District, Special Revenue Refunding and Improvement Bonds (Series 2018A), 5.000%, 12/1/2038 | 798,623 |

| 1,000,000 | | Banning Lewis Ranch Metropolitan District No.4, LT GO Bonds (Series 2018A), 5.750%, 12/1/2048 | 1,062,480 |

| 1,000,000 | | Banning Lewis Ranch Regional Metropolitan District, LT GO Bonds (Series 2018A), 5.375%, 12/1/2048 | 1,066,220 |

| 1,500,000 | | Base Village Metropolitan District No. 2, LT GO Refunding Bonds (Series 2016A), 5.750%, 12/1/2046 | 1,585,140 |

| 2,750,000 | | Castle Oaks, CO Metropolitan District No. 3, LT GO Tax Refunding Bonds (Series 2017), 5.000%, 12/1/2047 | 2,826,945 |

| 1,500,000 | | Centerra Metropolitian District No. 1, CO, Special Revenue Refunding and Improvement Bonds (Series 2017), (Original Issue Yield: 5.100%), 5.000%, 12/1/2047 | 1,587,135 |

| 2,000,000 | | Central Platte Valley, CO Metropolitan District, GO Refunding Bonds (Series 2013A), 5.625%, 12/1/2038 | 2,293,860 |

| 1,250,000 | | Central Platte Valley, CO Metropolitan District, GO Refunding Bonds (Series 2013A), 6.000%, 12/1/2038 | 1,462,637 |

| 1,000,000 | | Central Platte Valley, CO Metropolitan District, GO Refunding Bonds (Series 2014), 5.000%, 12/1/2043 | 1,083,620 |

| 1,000,000 | 1 | Colorado Educational & Cultural Facilities Authority (Loveland Classical School), School Improvement Revenue Bonds (Series 2016), 5.000%, 7/1/2046 | 1,063,460 |

| 1,625,000 | | Colorado Educational & Cultural Facilities Authority (Skyview Academy), Charter School Refunding & Improvement Revenue Bonds (Series 2014), 5.500%, 7/1/2049 | 1,732,364 |

| 1,000,000 | | Colorado Educational & Cultural Facilities Authority (University Lab School), Charter School Refunding & Improvement Revenue Bonds (Series 2015), (Original Issue Yield: 5.020%), 5.000%, 12/15/2045 | 1,084,400 |

| 1,500,000 | | Colorado Health Facilities Authority (Christian Living Communities), Revenue Refunding Bonds (Series 2016), 5.000%, 1/1/2037 | 1,657,485 |

| 800,000 | | Colorado Health Facilities Authority (Volunteers of America Care Facilities), Health & Residential Care Facilities Revenue Bonds (Series 2007), 5.300%, 7/1/2037 | 800,392 |

| 2,000,000 | | Colorado High Performance Transport Enterprise Revenue, C-470 Express Lanes Senior Revenue Bonds (Series 2017), 5.000%, 12/31/2056 | 2,207,860 |

| 2,000,000 | | Colorado State Health Facilities Authority Revenue (Frasier Meadows Manor, Inc.), (Series 2017A), 5.250%, 5/15/2047 | 2,268,920 |

Annual Shareholder Report

Principal

Amount | | | Value |

| | | MUNICIPAL BONDS—continued | |

| | | Colorado—continued | |

| $1,500,000 | | Copperleaf Metropolitan District No. 2, CO, LT GO Refunding Bonds (Series 2015), 5.750%, 12/1/2045 | $1,576,680 |

| 1,250,000 | | Denver Connection West Metropolitan District, LT GO Bonds (Series 2017A), 5.375%, 8/1/2047 | 1,313,712 |

| 1,000,000 | | Denver, CO City & County Department of Aviation (Denver, CO City & County Airport Authority), Airport System Revenue Bonds (Series 2018A), (Original Issue Yield: 4.070%), 4.000%, 12/1/2048 | 1,113,120 |

| 500,000 | | Denver, CO Convention Center Hotel Authority, Senior Revenue Refunding Bonds (Series 2016), 5.000%, 12/1/2040 | 584,235 |

| 1,000,000 | 1 | Denver, CO Health & Hospital Authority, Revenue Refunding Bonds (Series 2017A), 5.000%, 12/1/2034 | 1,194,840 |

| 750,000 | | Eagle County, CO Air Terminal Corp., Revenue Refunding Bonds (Series 2011A), 6.000%, 5/1/2027 | 805,478 |

| 1,500,000 | | Lakes at Centerra Metropolitan District No. 2, LT GO Refunding and Improvement Bonds (Series 2018A), 5.250%, 12/1/2047 | 1,605,540 |

| 1,250,000 | | Leyden Rock Metropolitan District No. 10, CO, LT GO Refunding & Improvement Bonds (Series 2016A), 5.000%, 12/1/2045 | 1,316,087 |

| 2,500,000 | | North Range, CO Metropolitan District No. 2, LT GO and Special Revenue Refunding and Improvement Bonds (Series 2017A), 5.750%, 12/1/2047 | 2,649,400 |

| 1,500,000 | | Park 70 Metropolitan District, CO, General Obligation Refunding and Improvement Bonds (Series 2016), 5.000%, 12/1/2046 | 1,686,630 |

| 2,000,000 | | Public Authority for Colorado Energy, Natural Gas Purchase Revenue Bonds (Series 2008), (Original Issue Yield: 6.630%), (Bank of America Corp. GTD), 6.250%, 11/15/2028 | 2,602,060 |

| 1,500,000 | | Sierra Ridge Metropolitan District No. 2, LT GO Bonds (Series 2016A), 5.500%, 12/1/2046 | 1,581,195 |

| 2,500,000 | | St. Vrain Lakes, CO Metropolitan District No.2, Limited Tax GO Senior Bonds (Series 2017A), 5.125%, 12/1/2047 | 2,624,250 |

| 1,220,000 | | STC Metropolitan District No. 2, CO, LT GO Senior Bonds (Series 2015A), (Original Issue Yield: 6.250%), 6.000%, 12/1/2038 | 1,260,663 |

| 1,500,000 | | Sterling Ranch Community Authority Board, CO (Sterling Ranch Metropolitan District No. 2, CO), Limited Tax Supported Revenue Senior Bonds (Series 2015A), (Original Issue Yield: 5.830%), 5.750%, 12/1/2045 | 1,570,470 |

| 1,030,000 | | Tallyn's Reach Metropolitan District No. 3, CO, LT GO Refunding & Improvement Bonds (Series 2013), 5.125%, 11/1/2038 | 1,104,623 |

| 2,000,000 | | Three Springs Metropolitan District No. 3, CO, Property Tax Supported Revenue Bonds (Series 2010), 7.750%, 12/1/2039 | 2,047,980 |

| | | TOTAL | 51,218,504 |

| | | Connecticut—0.8% | |

| 1,000,000 | | Connecticut Development Authority (Bombardier, Inc.), Airport Facility Revenue Bonds, 7.950%, 4/1/2026 | 999,810 |

Annual Shareholder Report

Principal

Amount | | | Value |

| | | MUNICIPAL BONDS—continued | |

| | | Connecticut—continued | |

| $1,500,000 | | Connecticut State Special Transportation Fund, Special Tax Obligation Bonds Transportation Infrastructure Purpose (Series 2018B), 5.000%, 10/1/2038 | $1,857,855 |

| 1,835,000 | 1 | Mohegan Tribe of Indians of Connecticut Gaming Authority, Priority Distribution Payment Refunding Bonds (Series 2015C), (Original Issue Yield: 6.375%), 6.250%, 2/1/2030 | 2,068,504 |

| | | TOTAL | 4,926,169 |

| | | Delaware—1.1% | |

| 1,350,000 | 1 | Delaware Economic Development Authority (ASPIRA of Delaware Charter Operations, Inc.), Charter School Revenue Bonds (Series 2016A), 5.000%, 6/1/2051 | 1,459,633 |

| 1,905,000 | | Delaware Economic Development Authority (Delmarva Power and Light Co.), Gas Facilities Refunding Bonds, 5.400%, 2/1/2031 | 1,970,742 |

| 3,000,000 | 1 | Millsboro, DE Special Obligations (Plantation Lakes Special Development District), Special Tax Revenue Refunding Bonds (Series 2018), (Original Issue Yield: 5.300%), 5.250%, 7/1/2048 | 3,274,590 |

| | | TOTAL | 6,704,965 |

| | | District of Columbia—1.9% | |

| 1,030,000 | | District of Columbia (KIPP DC), Revenue Bonds (Series 2013A), (United States Treasury PRF 7/1/2023@100), 6.000%, 7/1/2043 | 1,219,365 |

| 2,000,000 | | District of Columbia Revenue (Friendship Public Charter School, Inc.), Revenue Bonds (Series 2012A), 5.000%, 6/1/2042 | 2,148,140 |

| 1,000,000 | | District of Columbia Revenue (Friendship Public Charter School, Inc.), Revenue Bonds (Series 2016A), 5.000%, 6/1/2046 | 1,138,820 |

| 1,000,000 | | District of Columbia Revenue (Ingleside at Rock Creek), Project Revenue Bonds (Series 2017A), (Original Issue Yield: 5.250%), 5.000%, 7/1/2052 | 1,074,180 |

| 1,000,000 | | Metropolitan Washington, DC Airports Authority, Airport System Revenue Refunding Bonds (Series 2018A), 5.000%, 10/1/2038 | 1,241,370 |

| 1,000,000 | | Metropolitan Washington, DC Airports Authority, Revenue Refunding Bonds (Series 2017A), 5.000%, 10/1/2047 | 1,200,160 |

| 3,000,000 | | Metropolitan Washington, DC Airports Authority, Revenue Refunding Bonds (Series 2019A), 5.000%, 10/1/2039 | 3,785,820 |

| | | TOTAL | 11,807,855 |

| | | Florida—4.6% | |

| 1,250,000 | | Alta Lakes, FL Community Development District, Special Assessment Bonds (Series 2019), 4.625%, 5/1/2049 | 1,290,250 |

| 145,000 | | Arborwood, FL Community Development District, Special Assessment Revenue Bonds (Series 2014A-1), (Original Issue Yield: 6.900%), 6.900%, 5/1/2036 | 158,511 |

| 3,000,000 | 1,3 | Collier County, FL IDA (Arlington of Naples), Continuing Care Community Revenue Bonds (Series 2013A), (Original Issue Yield: 8.375%), 8.250%, 5/15/2049 | 2,893,110 |

Annual Shareholder Report

Principal

Amount | | | Value |

| | | MUNICIPAL BONDS—continued | |

| | | Florida—continued | |

| $1,000,000 | | Florida State Mid-Bay Authority, First Senior Lien Revenue Bonds (Series 2015A), 5.000%, 10/1/2040 | $1,141,110 |

| 1,000,000 | | Harbor Bay, FL Community Development District, Special Assessment District Area One (Series 2019A-1), (Original Issue Yield: 4.140%), 4.100%, 5/1/2048 | 1,000,750 |

| 555,000 | | Lakewood Ranch Stewardship District, FL (Indigo Expansion Area Project), Special Assessment Revenue Bonds (Series 2019), 4.000%, 5/1/2049 | 557,631 |

| 1,000,000 | | Lakewood Ranch Stewardship District, FL (Lakewood Centre North), Special Assessment Revenue Bonds (Series 2015), (Original Issue Yield: 4.960%), 4.875%, 5/1/2045 | 1,052,660 |

| 1,000,000 | | Lakewood Ranch Stewardship District, FL (Lakewood National & Polo Run), Special Assessment Bonds, (Original Issue Yield: 5.400%), 5.375%, 5/1/2047 | 1,103,050 |

| 1,000,000 | | Lakewood Ranch Stewardship District, FL (Northeast Sector Project—Phase 1B), Special Assessment Revenue Bonds (Series 2018), 5.450%, 5/1/2048 | 1,109,660 |

| 1,280,000 | | Lakewood Ranch Stewardship District, FL (Villages of Lakewood Ranch South), Special Assessment Revenue Bonds (Series 2016), (Original Issue Yield: 5.160%), 5.125%, 5/1/2046 | 1,363,738 |

| 2,000,000 | | Lee County, FL IDA (Cypress Cove at Healthpark), Healthcare Facilities Refunding Revenue Bonds (Series 2012), 6.500%, 10/1/2047 | 2,202,860 |

| 2,000,000 | | Martin County, FL Health Facilities Authority (Martin Memorial Medical Center), Hospital Revenue Bonds (Series 2012), (Original Issue Yield: 5.530%), (United States Treasury PRF 11/15/2021@100), 5.500%, 11/15/2042 | 2,189,560 |

| 1,000,000 | | Miami-Dade County, FL Aviation, Aviation Revenue Refunding Bonds (Series 2014A), 5.000%, 10/1/2036 | 1,144,910 |

| 745,000 | | Midtown Miami, FL Community Development District, Special Assessment & Revenue Refunding Bonds (Series 2014A), (Original Issue Yield: 5.250%), 5.000%, 5/1/2037 | 789,335 |

| 1,000,000 | | Palm Beach County, FL Health Facilities Authority (Sinai Residences of Boca Raton), Revenue Bonds (Series 2014A), (Original Issue Yield: 7.625%), 7.500%, 6/1/2049 | 1,131,410 |

| 1,405,000 | | Pinellas County, FL Educational Facilities Authority (Pinellas Preparatory Academy), Revenue Bonds (Series 2011A), (United States Treasury PRF 9/15/2021@100), 7.125%, 9/15/2041 | 1,564,861 |

| 145,000 | 2,3 | Reunion East Community Development District, FL, Special Assessment Bonds (Series 2002A-1), 7.375%, 5/1/2033 | 1 |

| 135,000 | | Reunion East Community Development District, FL, Special Assessment Refunding Bonds (2015-1), 6.600%, 5/1/2033 | 147,045 |

| 1,000,000 | | South Lake County, FL Hospital District (South Lake Hospital, Inc.), Revenue Bonds (Series 2009A), (Original Issue Yield: 6.300%), 6.250%, 4/1/2039 | 1,002,950 |

| 495,000 | | Talavera, FL Community Development District, Capital Improvement Revenue Bonds (Series 2019), 4.350%, 5/1/2040 | 508,345 |

Annual Shareholder Report

Principal

Amount | | | Value |

| | | MUNICIPAL BONDS—continued | |

| | | Florida—continued | |

| $770,000 | | Talavera, FL Community Development District, Capital Improvement Revenue Bonds (Series 2019), 4.500%, 5/1/2050 | $790,613 |

| 1,000,000 | | Tolomato Community Development District, FL, Special Assessment Refunding Bonds (Series 2019C), 4.400%, 5/1/2040 | 1,030,120 |

| 1,000,000 | | Tolomato Community Development District, FL, Special Assessment Refunding Bonds Subordinate Lien (Series 2019A-2), 4.250%, 5/1/2037 | 1,030,390 |

| 290,000 | | Tolomato Community Development District, FL, Special Assessment Revenue Bonds (Series 2015-1), 0.000%, (Step Coupon 11/1/2021@6.610%)/(Original Issue Yield: 6.930%), 5/1/2040 | 245,963 |

| 175,000 | | Tolomato Community Development District, FL, Special Assessment Revenue Bonds (Series 2015-2), 0.000%, (Step Coupon 11/1/2024@6.610%)/(Original Issue Yield: 6.752%), 5/1/2040 | 122,519 |

| 190,000 | 2,3 | Tolomato Community Development District, FL, Special Assessment Revenue Bonds (Series 2015-3), 6.610%, 5/1/2040 | 2 |

| 155,000 | 2,3 | Tolomato Community Development District, FL, Special Assessment Revenue Bonds (Series 3), 6.550%, 5/1/2027 | 2 |

| 70,000 | | Tolomato Community Development District, FL, Special Assessment Revenue Bonds (Series A-4), 0.000%, (Step Coupon 5/1/2022@6.610%), 5/1/2040 | 60,021 |

| 995,000 | | Verandah West, FL Community Development District, Capital Improvement Revenue Refunding Bonds (Series 2013), (Original Issue Yield: 5.125%), 5.000%, 5/1/2033 | 1,034,342 |

| 2,000,000 | | Willow Walk, FL Community Development District, Special Assessment Bonds (Series 2015), 5.625%, 5/1/2045 | 2,137,680 |

| | | TOTAL | 28,803,399 |

| | | Georgia—0.6% | |

| 1,645,000 | | Atlanta, GA Development Authority Senior Health Care Facilities (Georgia Proton Treatment Center), Revenue Bonds (Series 2017A-1), (Original Issue Yield: 7.250%), 7.000%, 1/1/2040 | 1,811,408 |

| 1,000,000 | | Atlanta, GA Water & Wastewater, Revenue Refunding Bonds (Series 2015), 5.000%, 11/1/2040 | 1,182,930 |

| 500,000 | | Rockdale County, GA Development Authority (Pratt Paper, LLC), Revenue Refunding Bonds (Series 2018), 4.000%, 1/1/2038 | 532,780 |

| | | TOTAL | 3,527,118 |

| | | Hawaii—0.2% | |

| 1,000,000 | | Hawaii State Airports Systems Revenue Bonds (Series 2018A), 5.000%, 7/1/2048 | 1,215,730 |

| | | Idaho—0.5% | |

| 3,000,000 | | Idaho Health Facilities Authority (Terraces of Boise), Revenue Bonds (Series 2013A), (Original Issue Yield: 8.250%), 8.125%, 10/1/2049 | 3,412,590 |

| | | Illinois—9.9% | |

| 1,875,000 | | Chicago, IL Board of Education, UT GO Dedicated Refunding Bonds (Series 2018D), (Original Issue Yield: 5.210%), 5.000%, 12/1/2046 | 2,113,237 |

Annual Shareholder Report

Principal

Amount | | | Value |

| | | MUNICIPAL BONDS—continued | |

| | | Illinois—continued | |

| $3,300,000 | | Chicago, IL Board of Education, UT GO Dedicated Revenue Bonds (Series 2017A), (Original Issue Yield: 7.650%), 7.000%, 12/1/2046 | $4,194,630 |

| 4,200,000 | | Chicago, IL Board of Education, UT GO Dedicated Revenue Bonds (Series 2017H), 5.000%, 12/1/2046 | 4,683,546 |

| 1,000,000 | | Chicago, IL Board of Education, UT GO Dedicated Revenue Refunding Bonds (Series 2018A), 5.000%, 12/1/2030 | 1,172,420 |

| 1,000,000 | | Chicago, IL Board of Education, UT GO Dedicated Revenue Refunding Bonds (Series 2018A), 5.000%, 12/1/2031 | 1,166,940 |

| 500,000 | | Chicago, IL Motor Fuel Tax, Motor Fuel Tax Revenue Refunding Bonds (Series 2013), (Assured Guaranty Municipal Corp. INS), 5.000%, 1/1/2033 | 557,075 |

| 1,125,000 | | Chicago, IL O'Hare International Airport (Trips Obligated Group), Senior Special Facilities Revenue Bonds (Series 2018), 5.000%, 7/1/2048 | 1,330,200 |

| 385,000 | | Chicago, IL O'Hare International Airport, General Airport Senior Lien Revenue Refunding Bonds (Series 2016B), 5.000%, 1/1/2041 | 452,829 |

| 275,000 | | Chicago, IL O'Hare International Airport, General Airport Third Lien Revenue Bonds (Series 2011A), (Original Issue Yield: 5.940%), 5.750%, 1/1/2039 | 290,854 |

| 1,000,000 | | Chicago, IL Sales Tax, Revenue Refunding Bonds (Series 2002), (United States Treasury PRF 1/1/2025@100), 5.000%, 1/1/2032 | 1,197,720 |

| 1,250,000 | | Chicago, IL Water Revenue, Second Lien Water Revenue Bonds (Series 2014), 5.000%, 11/1/2044 | 1,399,025 |

| 625,000 | | Chicago, IL, UT GO Bonds (Series 2009C), (Original Issue Yield: 5.160%), 5.000%, 1/1/2034 | 626,525 |

| 3,000,000 | | Chicago, IL, UT GO Bonds (Series 2015A), (Original Issue Yield: 5.640%), 5.500%, 1/1/2033 | 3,412,740 |

| 3,000,000 | | Chicago, IL, UT GO Refunding Bonds (Series 2014A), (Original Issue Yield: 5.140%), 5.000%, 1/1/2035 | 3,263,280 |

| 2,500,000 | | Chicago, IL, UT GO Refunding Bonds (Series 2017A), (Original Issue Yield: 6.200%), 6.000%, 1/1/2038 | 2,997,450 |

| 1,250,000 | | Chicago, IL, UT GO Refunding Bonds (Series 2019A), 5.000%, 1/1/2044 | 1,422,600 |

| 315,000 | | DuPage County, IL (Naperville Campus LLC), Special Tax Bonds (Series 2006), 5.625%, 3/1/2036 | 316,824 |

| 2,000,000 | | Illinois Finance Authority (Admiral at the Lake), Revenue Refunding Bonds (Series 2017), 5.500%, 5/15/2054 | 2,168,880 |

| 800,000 | | Illinois Finance Authority (Dekalb Supportive Living Facility), Multi-Family Housing Revenue Bonds (Series 2007), 6.100%, 12/1/2041 | 800,144 |

| 1,250,000 | | Illinois Finance Authority (Noble Network of Charter Schools), Education Revenue Bonds (Series 2015), 5.000%, 9/1/2032 | 1,376,263 |

| 1,500,000 | | Illinois Finance Authority (Uno Charter School Network, Inc.), Charter School Refunding & Improvement Revenue Bonds (Series 2011A), 7.125%, 10/1/2041 | 1,608,480 |

Annual Shareholder Report

Principal

Amount | | | Value |

| | | MUNICIPAL BONDS—continued | |

| | | Illinois—continued | |

| $1,100,000 | | Illinois Finance Authority Educational Facility Revenue (Rogers Park Montessori School Project), Senior Revenue Bonds (Series 2014A), 6.125%, 2/1/2045 | $1,205,204 |

| 1,700,000 | | Illinois State Toll Highway Authority, Toll Highway Senior Revenue Bonds (Series 2019 A), 4.000%, 1/1/2039 | 1,954,898 |

| 2,000,000 | | Illinois State, UT GO Bonds (Series 2013A), 5.000%, 4/1/2035 | 2,147,580 |

| 5,000,000 | | Illinois State, UT GO Bonds (Series 2017D), 5.000%, 11/1/2027 | 5,870,950 |

| 2,025,000 | | Illinois State, UT GO Bonds (Series June 2013), (Original Issue Yield: 5.650%), 5.500%, 7/1/2038 | 2,222,640 |

| 1,485,000 | | Illinois State, UT GO Bonds (Series May 2014), 5.000%, 5/1/2023 | 1,629,223 |

| 1,000,000 | | Illinois State, UT GO Bonds (Series of February 2014), (Original Issue Yield: 5.040%), 5.000%, 2/1/2039 | 1,083,710 |

| 3,000,000 | | Illinois State, UT GO Refunding Bonds (Series 2018A), 5.000%, 10/1/2032 | 3,525,840 |

| 410,000 | | Illinois State, UT GO Refunding Bonds (Series May 2012), 5.000%, 8/1/2025 | 440,410 |

| 2,000,000 | | Metropolitan Pier & Exposition Authority, IL, McCormick Place Expansion Project Bonds (Series 2015A), 5.500%, 6/15/2053 | 2,251,860 |

| 2,000,000 | 4 | Metropolitan Pier & Exposition Authority, IL, McCormick Place Expansion Project Bonds (Series 2017A), (Original Issue Yield: 5.250%), 12/15/2056 | 498,300 |

| 1,000,000 | | Metropolitan Pier & Exposition Authority, IL, McCormick Place Expansion Project Bonds (Series 2017A), 5.000%, 6/15/2057 | 1,121,480 |

| 1,000,000 | | Sales Tax Securitization Corp., IL, Sales Tax Revenue Bonds (Series 2017A), 5.000%, 1/1/2030 | 1,199,560 |

| | | TOTAL | 61,703,317 |

| | | Indiana—1.5% | |

| 1,250,000 | 2,3 | Carmel, IN (Barrington of Carmel), Revenue Bonds (Series 2012A), (Original Issue Yield: 7.200%), 7.125%, 11/15/2042 | 875,000 |

| 1,000,000 | 2,3 | Carmel, IN (Barrington of Carmel), Revenue Bonds (Series 2012A), (Original Issue Yield: 7.300%), 7.125%, 11/15/2047 | 700,000 |

| 4,000,000 | | Indiana State Finance Authority (Ohio River Bridges East End Crossing), Tax-Exempt Private Activity Bonds (Series 2013), 5.250%, 1/1/2051 | 4,420,200 |

| 1,000,000 | 1 | Indiana State Finance Authority (Res Polyflow Indiana Project), Exempt Facility Revenue Bonds (Series 2019 Green Bonds, (Original Issue Yield: 7.125%), 7.000%, 3/1/2039 | 1,032,850 |

| 2,000,000 | | Rockport, IN (AK Steel Corp.), Revenue Refunding Bonds (Series 2012-A), 7.000%, 6/1/2028 | 2,062,580 |

| | | TOTAL | 9,090,630 |

Annual Shareholder Report

Principal

Amount | | | Value |

| | | MUNICIPAL BONDS—continued | |

| | | Iowa—1.7% | |

| $966,001 | | Iowa Finance Authority (Deerfield Retirement Community, Inc.), Lifespace GTD Senior Living Facility Revenue Refunding Bonds (Series 2014A), 5.400%, 11/15/2046 | $1,041,050 |

| 206,686 | 2 | Iowa Finance Authority (Deerfield Retirement Community, Inc.), Senior Living Facility Revenue Refunding Bonds (Series 2014B), 2.000%, 5/15/2056 | 2,583 |

| 995,000 | | Iowa Finance Authority (Iowa Fertilizer Co. LLC), Midwestern Disaster Area Revenue Bonds (Series 2013) Exchange Bonds (Series B) TOBs, 5.250%, Mandatory Tender 12/1/2037 | 1,082,590 |

| 3,000,000 | | Iowa Finance Authority (Iowa Fertilizer Co. LLC), Midwestern Disaster Area Revenue Bonds (Series 2013), (Original Issue Yield: 5.300%), 5.250%, 12/1/2025 | 3,288,120 |

| 3,750,000 | | Tobacco Settlement Financing Corp., IA, Tobacco Settlement Asset-Backed Bonds (Series 2005C), (Original Issue Yield: 5.780%), 5.500%, 6/1/2042 | 3,750,825 |

| 1,060,000 | | Xenia Rural Water District, Water Revenue Refunding Capital Loan Notes (Series 2016), 5.000%, 12/1/2041 | 1,226,176 |

| | | TOTAL | 10,391,344 |

| | | Kansas—0.0% | |

| 45,000 | | Kansas State Development Finance Authority (Adventist Health System/Sunbelt Obligated Group), Revenue Bonds, (Original Issue Yield: 5.950%), (United States Treasury PRF 11/15/2019@100), 5.750%, 11/15/2038 | 45,395 |

| | | Kentucky—0.7% | |

| 1,250,000 | | Kentucky Economic Development Finance Authority (Miralea), Revenue Bonds (Series 2011A), (Original Issue Yield: 7.400%), (United States Treasury PRF 5/15/2021@100), 7.375%, 5/15/2046 | 1,379,938 |

| 3,000,000 | | Kentucky Economic Development Finance Authority (Miralea), Revenue Bonds (Series 2016A), 5.000%, 5/15/2046 | 3,207,270 |

| | | TOTAL | 4,587,208 |

| | | Louisiana—0.8% | |

| 1,000,000 | | Calcasieu Parish, LA Memorial Hospital Service District (Lake Charles Memorial Hospital), Hospital Revenue Refunding Bonds (Series 2019), 5.000%, 12/1/2039 | 1,192,040 |

| 30,000 | | Louisiana Public Facilities Authority (Ochsner Clinic Foundation), Refunding Revenue Bonds (Series 2016), (United States Treasury PRF 5/15/2026@100), 5.000%, 5/15/2047 | 37,010 |

| 970,000 | | Louisiana Public Facilities Authority (Ochsner Clinic Foundation), Refunding Revenue Bonds (Series 2016), 5.000%, 5/15/2047 | 1,122,756 |

| 1,000,000 | | Louisiana Public Facilities Authority (Ochsner Clinic Foundation), Revenue Bonds (Series 2011), (Original Issue Yield: 6.650%), (United States Treasury PRF 5/15/2021@100), 6.500%, 5/15/2037 | 1,090,000 |

| 1,500,000 | | Tobacco Settlement Financing Corp., LA, Tobacco Settlement Asset-Backed Refunding Bonds (Series 2013A), 5.250%, 5/15/2035 | 1,655,415 |

| | | TOTAL | 5,097,221 |

Annual Shareholder Report

Principal

Amount | | | Value |

| | | MUNICIPAL BONDS—continued | |

| | | Maine—0.8% | |

| $1,000,000 | | Maine Health & Higher Educational Facilities Authority (Eastern Maine Healthcare Systems Obligated Group), Revenue Bonds (Series 2016A), 5.000%, 7/1/2046 | $1,129,630 |

| 1,335,000 | | Maine Health & Higher Educational Facilities Authority (MaineGeneral Medical Center), Revenue Bonds (Series 2011), 7.500%, 7/1/2032 | 1,473,493 |

| 2,000,000 | 1 | Maine State Finance Authority Solid Waste Disposal (Casella Waste Systems, Inc.), Revenue Bonds (Series 2005R-3), 5.250%, 1/1/2025 | 2,273,620 |

| | | TOTAL | 4,876,743 |

| | | Maryland—2.0% | |

| 500,000 | | Baltimore, MD (Harbor Point), Special Obligation Refunding Bonds (Series 2016), (Original Issue Yield: 5.160%), 5.125%, 6/1/2043 | 537,200 |

| 1,500,000 | | Baltimore, MD Convention Center Hotel Revenue (Baltimore Hotel Corp.), Convention Center Hotel Revenue Refunding Bonds (Series 2017), 5.000%, 9/1/2046 | 1,732,935 |

| 955,000 | | Baltimore, MD Special Obligation (East Baltimore Research Park), Special Obligation Revenue Refunding Bonds (Series 2017A), 5.000%, 9/1/2038 | 1,061,139 |

| 1,980,000 | 5 | Frederick County, MD (Jefferson Technology Park), Tax Increment & Special Tax B Limited Obligation Bonds (Series 2013B), (Original Issue Yield: 7.300%), 7.125%, 7/1/2043 | 1,841,400 |

| 1,060,000 | | Maryland State Economic Development Corp. (CONSOL Energy, Inc.), Port Facilities Refunding Revenue Bonds (Series 2010), 5.750%, 9/1/2025 | 1,090,941 |

| 200,000 | | Maryland State Economic Development Corp. (Ports America Chesapeake, Inc.), Transportation Facilities Revenue Refunding Bonds (Series 2017A), 5.000%, 6/1/2032 | 246,498 |

| 450,000 | | Maryland State Economic Development Corp. (Ports America Chesapeake, Inc.), Transportation Facilities Revenue Refunding Bonds (Series 2017A), 5.000%, 6/1/2035 | 551,223 |

| 1,000,000 | | Maryland State Economic Development Corp. (Purple Line Transit Partners LLC), Private Activity Revenue Bonds (Series 2016D Green Bonds), 5.000%, 3/31/2051 | 1,136,600 |

| 1,000,000 | 1 | Prince Georges County, MD (Westphalia Town Center), Special Obligation Revenue Bonds (Series 2018), (Original Issue Yield: 5.330%), 5.250%, 7/1/2048 | 1,117,210 |

| 1,000,000 | | Prince Georges County, MD Revenue Authority (Suitland-Naylor Road Project), Special Obligation Bonds (Series 2016), 5.000%, 7/1/2046 | 1,074,550 |

| 1,000,000 | | Rockville, MD Mayor & City Council Economic Development Revenue (Ingleside at King Farm), (Series 2017B), 5.000%, 11/1/2047 | 1,119,070 |

| 1,000,000 | | Westminster, MD (Lutheran Village at Miller's Grant, Inc.), Revenue Bonds (Series 2014A), (Original Issue Yield: 6.300%), 6.250%, 7/1/2044 | 1,123,420 |

| | | TOTAL | 12,632,186 |

Annual Shareholder Report

Principal

Amount | | | Value |

| | | MUNICIPAL BONDS—continued | |

| | | Massachusetts—0.7% | |

| $1,000,000 | 1 | Massachusetts Development Finance Agency (Newbridge on the Charles), Revenue Refunding Bonds (Series 2017), 5.000%, 10/1/2057 | $1,105,190 |

| 2,000,000 | | Massachusetts Development Finance Agency (Partners Healthcare Systems), Revenue Refunding Bonds (Series 2016Q), 5.000%, 7/1/2047 | 2,367,140 |

| 800,000 | | Massachusetts Development Finance Agency (Tufts Medical Center), Revenue Bonds (Series 2011I), (United States Treasury PRF 1/1/2021@100), 7.250%, 1/1/2032 | 863,744 |

| | | TOTAL | 4,336,074 |

| | | Michigan—2.3% | |

| 1,000,000 | | Detroit, MI City School District, School Building & Site Improvement Refunding Bonds (Series 2012A), (Michigan School Bond Qualification and Loan Program GTD), 5.000%, 5/1/2031 | 1,092,320 |

| 1,500,000 | | Detroit, MI Sewage Disposal System (Great Lakes, MI Water Authority Sewage Disposal System), Senior Lien Revenue Refunding Bonds (Series 2012A), (Original Issue Yield: 5.300%), 5.250%, 7/1/2039 | 1,643,475 |

| 1,000,000 | | Michigan State Finance Authority Revenue (Great Lakes, MI Water Authority Sewage Disposal System), Senior Lien Revenue Bonds (Series 2014 C-7), (National Public Finance Guarantee Corporation INS), 5.000%, 7/1/2032 | 1,154,200 |

| 1,000,000 | | Michigan State Finance Authority Revenue (Great Lakes, MI Water Authority Water Supply System), Senior Lien Revenue Bonds (Series 2014 D-6), (National Public Finance Guarantee Corporation INS), 5.000%, 7/1/2036 | 1,147,100 |

| 2,000,000 | | Michigan State Finance Authority Revenue (Public Lighting Authority), Local Government Loan Program Revenue Bonds (Series 2014B), 5.000%, 7/1/2044 | 2,224,460 |

| 5,000,000 | | Michigan Tobacco Settlement Finance Authority, Tobacco Settlement Asset-Backed Bonds (Series 2007A), (Original Issue Yield: 6.250%), 6.000%, 6/1/2048 | 5,025,100 |

| 1,500,000 | | Plymouth, MI Educational Center Charter School, Public School Academy Revenue Refunding Bonds, Series 2005, 5.625%, 11/1/2035 | 969,900 |

| 1,000,000 | | University of Michigan (The Regents of), General Revenue Bonds (Series 2015), 5.000%, 4/1/2040 | 1,208,080 |

| | | TOTAL | 14,464,635 |

| | | Minnesota—2.4% | |

| 750,000 | | Baytown Township, MN (St. Croix Preparatory Academy), Charter School Lease Revenue Refunding Bonds (Series 2016A), 4.000%, 8/1/2041 | 766,342 |

| 1,100,000 | | Baytown Township, MN (St. Croix Preparatory Academy), Charter School Lease Revenue Refunding Bonds (Series 2016A), 4.250%, 8/1/2046 | 1,135,871 |

| 2,000,000 | | Duluth, MN EDA (St. Luke's Hospital of Duluth Obligated Group), Health Care Facilities Revenue Bonds (Series 2012), 6.000%, 6/15/2039 | 2,218,580 |

Annual Shareholder Report

Principal

Amount | | | Value |

| | | MUNICIPAL BONDS—continued | |

| | | Minnesota—continued | |

| $1,700,000 | | Forest Lake, MN (Lakes International Language Academy), Charter School Lease Revenue Bonds (Series 2014A), 5.750%, 8/1/2044 | $1,832,124 |

| 1,000,000 | | Forest Lake, MN (Lakes International Language Academy), Charter School Lease Revenue Bonds (Series 2018A), 5.375%, 8/1/2050 | 1,116,420 |

| 3,000,000 | 1 | Minneapolis, MN Charter School Lease Revenue (Twin Cities International School), (Series 2017A), (Original Issue Yield: 5.150%), 5.000%, 12/1/2047 | 3,066,870 |

| 2,000,000 | | St. Cloud, MN Charter School (Stride Academy), Lease Revenue Bonds (Series 2016A), 5.000%, 4/1/2046 | 1,365,440 |

| 2,000,000 | | St. Paul and Ramsey County, MN Housing and Redevelopment Authority (Twin Cities Academy), Charter School Lease Revenue Bonds (Series 2015A), 5.375%, 7/1/2050 | 2,153,360 |

| 325,000 | | Winona, MN Port Authority (Bluffview Montessori School Project), Lease Revenue Bonds (Series 2016A), 4.500%, 6/1/2036 | 328,299 |

| 750,000 | | Winona, MN Port Authority (Bluffview Montessori School Project), Lease Revenue Bonds (Series 2016A), 4.750%, 6/1/2046 | 760,118 |

| | | TOTAL | 14,743,424 |

| | | Mississippi—0.2% | |

| 945,000 | | Warren County, MS Gulf Opportunity Zone (International Paper Co.), Gulf Opportunity Zone Bonds (Series 2011A), 5.375%, 12/1/2035 | 1,026,478 |

| | | Missouri—0.9% | |

| 1,000,000 | | Kansas City, MO IDA, Airport Special Obligation Bonds (Kansas City International Airport Terminal Modernization Project) Series 2019B, 5.000%, 3/1/2035 | 1,258,990 |

| 2,000,000 | 1 | Kansas City, MO Redevelopment Authority (Kansas City Convention Center Headquarters Hotel CID), Revenue Bonds (Series 2018B), (Original Issue Yield: 5.079%), 5.000%, 2/1/2050 | 2,186,300 |

| 1,000,000 | | Kirkwood, MO IDA (Aberdeen Heights Project), Retirement Community Revenue Bonds (Series 2017A), 5.250%, 5/15/2050 | 1,122,870 |

| 880,000 | | St. Joseph, MO IDA (Living Community St. Joseph Project), Healthcare Revenue Bonds, 7.000%, 8/15/2032 | 880,246 |

| | | TOTAL | 5,448,406 |

| | | Montana—0.4% | |

| 900,000 | | Kalispell, MT Housing and Healthcare Facilities (Immanuel Lutheran Corp.), Revenue Bonds (Series 2017A), 5.250%, 5/15/2047 | 972,558 |

| 1,250,000 | | Kalispell, MT Housing and Healthcare Facilities (Immanuel Lutheran Corp.), Revenue Bonds (Series 2017A), 5.250%, 5/15/2052 | 1,347,450 |

| | | TOTAL | 2,320,008 |

| | | Nebraska—1.5% | |

| 2,500,000 | | Central Plains Energy Project, NE, Gas Project Revenue Bonds (Project No. 3) (Series 2012), (Goldman Sachs Group, Inc. GTD), 5.250%, 9/1/2037 | 2,750,875 |

Annual Shareholder Report

Principal

Amount | | | Value |

| | | MUNICIPAL BONDS—continued | |

| | | Nebraska—continued | |

| $ 4,700,000 | | Central Plains Energy Project, NE, Gas Project Revenue Bonds (Project No. 3) (Series 2017A), (Goldman Sachs Group, Inc. GTD), 5.000%, 9/1/2042 | $6,666,245 |

| | | TOTAL | 9,417,120 |

| | | Nevada—0.9% | |

| 905,000 | 1 | Director of the State of Nevada Department of Business and Industry (Doral Academy of Nevada CS), Charter School Revenue Bonds (Series 2017A), 5.000%, 7/15/2047 | 973,382 |

| 1,000,000 | 1 | Director of the State of Nevada Department of Business and Industry (Somerset Academy of Las Vegas), Charter School Lease Revenue Bonds (Series 2018A), 5.000%, 12/15/2048 | 1,071,050 |

| 1,000,000 | | Las Vegas, NV (Summerlin Village 24 SID No. 812), Local Improvement Bonds (Series 2015), 5.000%, 12/1/2035 | 1,099,870 |

| 1,500,000 | | Las Vegas, NV Redevelopment Agency, Tax Increment Revenue Refunding Bonds (Series 2016), 5.000%, 6/15/2045 | 1,722,330 |

| 700,000 | | North Las Vegas, NV Special Improvement District No. 64 (Valley Vista), Local Improvement Bonds (Series 2019), 4.625%, 6/1/2049 | 743,491 |

| | | TOTAL | 5,610,123 |

| | | New Hampshire—0.3% | |

| 1,500,000 | 1 | New Hampshire Health and Education Facilities Authority (Hillside Village), Revenue Bonds (Series 20017A), (Original Issue Yield: 6.375%), 6.125%, 7/1/2052 | 1,629,210 |

| | | New Jersey—4.3% | |

| 1,000,000 | | Essex County, NJ Improvement Authority (Covanta Energy Corp.), Solid Waste Disposal Revenue Bonds (Series 2015), 5.250%, 7/1/2045 | 1,016,600 |

| 3,255,000 | | New Jersey EDA (New Jersey State), School Facilities Construction Bonds (Series 2015 WW), 5.250%, 6/15/2040 | 3,714,248 |

| 580,000 | | New Jersey EDA (New Jersey State), School Facilities Construction Refunding Bonds (Series 2017 DDD), 5.000%, 6/15/2042 | 673,374 |

| 3,000,000 | | New Jersey EDA (New Jersey State), School Facilities Construction Revenue Refunding Bonds (Series 2013NN), 5.000%, 3/1/2030 | 3,291,180 |

| 1,335,000 | | New Jersey EDA (Port Newark Container Terminal LLC), Special Facilities Revenue and Refunding Bonds (Series 2017), 5.000%, 10/1/2047 | 1,546,704 |

| 1,000,000 | | New Jersey EDA (UMM Energy Partners LLC), Energy Facility Revenue Bonds (Series 2012A), (Original Issue Yield: 5.190%), 5.125%, 6/15/2043 | 1,066,160 |

| 1,500,000 | | New Jersey EDA (United Airlines, Inc.), Special Facilities Revenue Bonds (Series 2003), 5.500%, 6/1/2033 | 1,692,450 |

| 2,500,000 | | New Jersey EDA (United Airlines, Inc.), Special Facility Revenue Bonds (Series 1999), 5.250%, 9/15/2029 | 2,760,025 |

| 1,125,000 | | New Jersey EDA (United Airlines, Inc.), Special Facility Revenue Bonds (Series 2000B), 5.625%, 11/15/2030 | 1,308,218 |

Annual Shareholder Report

Principal

Amount | | | Value |

| | | MUNICIPAL BONDS—continued | |

| | | New Jersey—continued | |

| $1,280,000 | | New Jersey EDA Motor Vehicle Surcharge Revenue, Subordinate Revenue Refunding Bonds (Series 2017A), 5.000%, 7/1/2033 | $1,510,886 |

| 1,200,000 | | New Jersey State Transportation Trust Fund Authority (New Jersey State), Transportation System Bonds (Series 2011A), 6.000%, 6/15/2035 | 1,287,372 |

| 1,000,000 | | New Jersey State Transportation Trust Fund Authority (New Jersey State), Transportation System Bonds (Series 2018A), 5.000%, 12/15/2036 | 1,196,590 |

| 500,000 | | South Jersey Port Corp., Subordinate Marine Terminal Revenue Bonds (Series 2017B), 5.000%, 1/1/2048 | 582,490 |

| 4,610,000 | | Tobacco Settlement Financing Corp., NJ, Tobacco Settlement Asset-Backed Subordinate Refunding Bonds (Series 2018B), 5.000%, 6/1/2046 | 5,156,101 |

| | | TOTAL | 26,802,398 |

| | | New Mexico—0.5% | |

| 1,000,000 | | New Mexico State Hospital Equipment Loan Council (Gerald Champion Regional Medical Center), Hospital Improvement and Refunding Revenue Bonds (Series 2012A), (Original Issue Yield: 5.700%), 5.500%, 7/1/2042 | 1,089,970 |

| 2,000,000 | 1 | Winrock Town Center, NM Tax Increment Development District 1, Senior Lien Gross Receipts Tax Increment Bonds (Series 2015), (Original Issue Yield: 6.120%), 6.000%, 5/1/2040 | 2,067,300 |

| | | TOTAL | 3,157,270 |

| | | New York—5.0% | |

| 1,000,000 | 1 | Build NYC Resource Corporation (Albert Einstein School of Medicine, Inc.), Revenue Bonds (Series 2015), 5.500%, 9/1/2045 | 1,149,940 |

| 5,000,000 | 4 | Glen Cove, NY Local Economic Assistance Corp. (Garvies Point Public Improvement Project), Capital Appreciation Revenue Bonds (Series 2016B), (Original Issue Yield: 6.000%), 1/1/2045 | 1,768,600 |

| 1,550,000 | | Glen Cove, NY Local Economic Assistance Corp. (Garvies Point Public Improvement Project), Revenue Bonds (Series 2016A), (Original Issue Yield: 5.080%), 5.000%, 1/1/2056 | 1,687,516 |

| 20,000 | | Hudson Yards Infrastructure Corp. NY, Hudson Yards Senior Revenue Bonds (Series 2012A), (United States Treasury PRF 2/15/2021@100), 5.750%, 2/15/2047 | 21,385 |

| 2,000,000 | | Metropolitan Transportation Authority, NY (MTA Transportation Revenue), Revenue Bonds (Series 2014D-1), 5.000%, 11/15/2039 | 2,312,320 |

| 5,000,000 | 1,6 | Metropolitan Transportation Authority, NY (MTA Transportation Revenue), Trust Receipts/Certificates (Series 2019-FG0227) MUNINVs, (Assured Guaranty Municipal Corp. INS), 5.010%, 11/15/2046 | 6,361,150 |

| 1,500,000 | | Nassau County, NY IDA (Amsterdam at Harborside), Continuing Care Retirement Community Fixed Rate Revenue Bonds (Series 2014A), 6.700%, 1/1/2049 | 1,503,015 |

Annual Shareholder Report

Principal

Amount | | | Value |

| | | MUNICIPAL BONDS—continued | |

| | | New York—continued | |

| $593,608 | | Nassau County, NY IDA (Amsterdam at Harborside), Continuing Care Retirement Community Fixed Rate Revenue Bonds (Series 2014C), 2.000%, 1/1/2049 | $96,461 |

| 1,000,000 | | New York Counties Tobacco Trust VI, Tobacco Settlement Pass-Through Bonds (Series 201A-2B), 5.000%, 6/1/2051 | 1,048,280 |

| 2,000,000 | 1 | New York Liberty Development Corporation (3 World Trade Center), Revenue Bonds (Series 2014 Class 1), 5.000%, 11/15/2044 | 2,219,540 |

| 1,000,000 | 1 | New York Liberty Development Corporation (3 World Trade Center), Revenue Bonds (Series 2014 Class 2), 5.375%, 11/15/2040 | 1,130,410 |

| 2,900,000 | | New York Transportation Development Corporation (American Airlines, Inc.), Special Facility Revenue Refunding Bonds (Series 2016), 5.000%, 8/1/2031 | 3,062,922 |

| 1,000,000 | | New York Transportation Development Corporation (Delta Air Lines, Inc.), LaGuardia Airport Terminals Special Facilities Revenue Bonds (Series 2018), 5.000%, 1/1/2034 | 1,211,740 |

| 1,120,000 | | Newburgh, NY, UT GO Bonds (Series 2012A), (Original Issue Yield: 5.400%), 5.250%, 6/15/2029 | 1,231,653 |

| 1,185,000 | | Newburgh, NY, UT GO Bonds (Series 2012A), 5.500%, 6/15/2030 | 1,308,655 |

| 1,000,000 | | Niagara Area Development Corporation, NY (Covanta Energy Corp.), Solid Waste Disposal Facility Revenue Refunding Bonds (Series 2018A), 4.750%, 11/1/2042 | 1,063,870 |

| 2,500,000 | | Port Authority of New York and New Jersey (JFK International Air Terminal LLC), Special Project Bonds (Series 8), (Original Issue Yield: 6.150%), 6.000%, 12/1/2042 | 2,643,450 |

| 1,000,000 | | TSASC, Inc. NY, Tobacco Settlement Asset Backed Senior Refunding Bonds (Series 2017A), 5.000%, 6/1/2041 | 1,116,710 |

| | | TOTAL | 30,937,617 |

| | | North Carolina—0.9% | |

| 2,250,000 | | North Carolina Department of Transportation (I-77 HOT Lanes), Tax-Exempt Private Activity Revenue Bonds (Series 2015), 5.000%, 6/30/2054 | 2,504,475 |

| 1,000,000 | | North Carolina Medical Care Commission (United Methodist Retirement Homes), Revenue Refunding Bonds (Series 2017A), 5.000%, 10/1/2037 | 1,126,900 |

| 1,000,000 | | North Carolina Medical Care Commission (United Methodist Retirement Homes), Revenue Refunding Bonds (Series 2017A), 5.000%, 10/1/2047 | 1,115,790 |

| 1,000,000 | | North Carolina Medical Care Commission (Whitestone Project), Retirement Facilities First Mortgage Revenue Bonds (Series 2011A), (Original Issue Yield: 8.000%), (United States Treasury PRF 3/1/2021@100), 7.750%, 3/1/2041 | 1,095,450 |

| | | TOTAL | 5,842,615 |

Annual Shareholder Report

Principal

Amount | | | Value |

| | | MUNICIPAL BONDS—continued | |

| | | Ohio—4.3% | |

| $1,000,000 | | American Municipal Power-Ohio, Inc. (American Municipal Power, Prairie State Energy Campus Project), Refunding Revenue Bonds (Series 2015A), 5.000%, 2/15/2039 | $1,135,650 |

| 2,000,000 | | Buckeye Tobacco Settlement Financing Authority, OH, Tobacco Settlement Asset-Backed Bonds (Series 2007A-2), (Original Issue Yield: 5.950%), 5.875%, 6/1/2030 | 2,012,720 |

| 4,020,000 | | Buckeye Tobacco Settlement Financing Authority, OH, Tobacco Settlement Asset-Backed Bonds (Series 2007A-2), (Original Issue Yield: 6.070%), 5.875%, 6/1/2047 | 4,040,100 |

| 3,655,000 | | Buckeye Tobacco Settlement Financing Authority, OH, Tobacco Settlement Asset-Backed Bonds (Series A-2), 6.500%, 6/1/2047 | 3,746,375 |

| 1,000,000 | | Cuyahoga County, OH Hospital Authority (MetroHealth System), Hospital Revenue Bonds (Series 2017), 5.500%, 2/15/2057 | 1,176,530 |

| 1,500,000 | | Hamilton County, OH (Life Enriching Communities), Healthcare Revenue Bonds (Series 2011A), (Original Issue Yield: 6.750%), (United States Treasury PRF 1/1/2021@100), 6.625%, 1/1/2046 | 1,608,060 |

| 2,000,000 | | Muskingum County, OH (Genesis Healthcare Corp.), Hospital Facilities Revenue Bonds (Series 2013), (Original Issue Yield: 5.080%), 5.000%, 2/15/2044 | 2,157,360 |

| 4,000,000 | | Northeast OH Regional Sewer District, Wastewater Improvement Revenue & Refunding Bonds (Series 2014), 5.000%, 11/15/2044 | 4,642,840 |

| 1,800,000 | 1 | Ohio Air Quality Development Authority (AMG Vanadium LLC), Exempt Facilities Revenue Bonds (Series 2019), 5.000%, 7/1/2049 | 2,005,326 |

| 1,000,000 | | Ohio Air Quality Development Authority (Pratt Paper, LLC), Exempt Facilities Revenue Bonds (Series 2017), 4.500%, 1/15/2048 | 1,085,530 |

| 1,125,000 | | Ohio State Hospital Revenue (University Hospitals Health System, Inc.), Hospital Revenue Bonds (Series 2016A), 5.000%, 1/15/2041 | 1,313,302 |

| 1,000,000 | | Ohio State Treasurer Private Activity (Portsmouth Gateway Group LLC), Revenue Bonds (Series 2015), 5.000%, 6/30/2053 | 1,118,790 |

| 750,000 | | Southeastern Ohio Port Authority, OH (Memorial Health System, OH), Hospital Facilities Revenue Refunding & Improvement Bonds (Series 2012), (Original Issue Yield: 6.020%), 6.000%, 12/1/2042 | 817,193 |

| | | TOTAL | 26,859,776 |

| | | Oklahoma—1.7% | |

| 1,000,000 | | Oklahoma Development Finance Authority (OU Medicine), Hospital Revenue Bonds (Series 2018B), 5.500%, 8/15/2057 | 1,217,070 |

| 2,000,000 | | Tulsa, OK Industrial Authority (Montereau, Inc.), Senior Living Community Revenue Bonds (Series 2010A), (Original Issue Yield: 7.500%), (United States Treasury PRF 5/1/2020@100), 7.250%, 11/1/2045 | 2,078,120 |

| 1,750,000 | | Tulsa, OK Industrial Authority (Montereau, Inc.), Senior Living Community Revenue Refunding Bonds (Series 2017), 5.250%, 11/15/2045 | 1,996,978 |

| 3,000,000 | | Tulsa, OK Municipal Airport Trust (American Airlines, Inc.), Refunding Revenue Bonds (Series 2000B), 5.500%, 6/1/2035 | 3,304,560 |

Annual Shareholder Report

Principal

Amount | | | Value |

| | | MUNICIPAL BONDS—continued | |

| | | Oklahoma—continued | |

| $1,500,000 | | Tulsa, OK Municipal Airport Trust (American Airlines, Inc.), Refunding Revenue Bonds (Series 2015) TOBs, 5.000%, Mandatory Tender 6/1/2025 | $1,708,665 |

| | | TOTAL | 10,305,393 |

| | | Oregon—0.5% | |

| 440,000 | | Clackamas County, OR Hospital Facilities Authority (Mary's Woods at Marylhurst, Inc.), Senior Living Revenue Bonds (Series2018A), 5.000%, 5/15/2038 | 492,932 |

| 635,000 | | Clackamas County, OR Hospital Facilities Authority (Mary's Woods at Marylhurst, Inc.), Senior Living Revenue Bonds (Series2018A), 5.000%, 5/15/2043 | 705,371 |

| 400,000 | | Clackamas County, OR Hospital Facilities Authority (Mary's Woods at Marylhurst, Inc.), Senior Living Revenue Bonds (Series2018A), 5.000%, 5/15/2048 | 443,220 |

| 500,000 | | Clackamas County, OR Hospital Facilities Authority (Mary's Woods at Marylhurst, Inc.), Senior Living Revenue Bonds (Series2018A), 5.000%, 5/15/2052 | 552,920 |

| 250,000 | | Yamhill County, OR Hospital Authority (Friendsview Retirement Community), Revenue Refunding Bonds (Series 2016A), 5.000%, 11/15/2036 | 281,267 |

| 550,000 | | Yamhill County, OR Hospital Authority (Friendsview Retirement Community), Revenue Refunding Bonds (Series 2016A), 5.000%, 11/15/2051 | 610,841 |

| | | TOTAL | 3,086,551 |

| | | Pennsylvania—3.7% | |

| 1,000,000 | 1 | Allentown, PA Neighborhood Improvement Zone Development Authority, City Center Refunding Project Tax Revenue Bonds (Series 2017), 5.000%, 5/1/2042 | 1,125,700 |

| 3,715,000 | | Allentown, PA Neighborhood Improvement Zone Development Authority, Tax Revenue Bonds (Series 2012A), 5.000%, 5/1/2042 | 3,920,960 |