| | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM N-CSR |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| MANAGEMENT INVESTMENT COMPANIES |

| | |

| Investment Company Act file number: (811- 05989) | |

| | |

| Exact name of registrant as specified in charter: Putnam Utilities Growth and Income Fund |

| |

| Address of principal executive offices: One Post Office Square, Boston, Massachusetts 02109 |

| | |

| Name and address of agent for service: | Beth S. Mazor, Vice President |

| | One Post Office Square |

| | Boston, Massachusetts 02109 |

| |

| Copy to: | John W. Gerstmayr, Esq. |

| | Ropes & Gray LLP |

| | One International Place |

| | Boston, Massachusetts 02110 |

| | |

| Registrant’s telephone number, including area code: | (617) 292-1000 |

| | | |

| Date of fiscal year end: October 31, 2008 | | |

| |

| Date of reporting period: November 1, 2007 — April 30, 2008 |

Item 1. Report to Stockholders:

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940:

What makes Putnam different?

In 1830, Massachusetts Supreme Judicial Court Justice Samuel Putnam established The Prudent Man Rule, a legal foundation for responsible money management.

THE PRUDENT MAN RULE

All that can be required of a trustee to invest is that he shall conduct himself faithfully and exercise a sound discretion. He is to observe how men of prudence, discretion, and intelligence manage their own affairs, not in regard to speculation, but in regard to the permanent disposition of their funds, considering the probable income, as well as the probable safety of the capital to be invested.

A time-honored tradition in money management

Since 1937, our values have been rooted in a profound sense of responsibility for the money entrusted to us.

A prudent approach to investing

We use a research-driven team approach to seek consistent, dependable, superior investment results over time, although there is no guarantee a fund will meet its objectives.

Funds for every investment goal

We offer a broad range of mutual funds and other financial products so investors and their financial representatives can build diversified portfolios.

A commitment to doing what’s right for investors

With a focus on investment performance, below-average expenses, and in-depth information about our funds, we put the interests of investors first and seek to set the standard for integrity and service.

Industry-leading service

We help investors, along with their financial representatives, make informed investment decisions with confidence.

Putnam Utilities

Growth and

Income Fund

4| 30| 08

Semiannual Report

| |

| Message from the Trustees | 2 |

| About the fund | 4 |

| Performance snapshot | 6 |

| Interview with your fund’s Portfolio Leader | 7 |

| Performance in depth | 13 |

| Expenses | 16 |

| Portfolio turnover | 18 |

| Risk | 19 |

| Your fund’s management | 20 |

| Terms and definitions | 22 |

| Trustee approval of management contract | 24 |

| Other information for shareholders | 30 |

| Financial statements | 31 |

| Brokerage commissions | 51 |

Cover photograph: © Marco Cristofori

Message from the Trustees

Dear Fellow Shareholder:

The past six months have presented the economy with the most serious set of challenges in many years, and the financial markets have reflected the uncertainty of the situation. However, given the circumstances, the economy has held up relatively well. In fact, for late 2007 and early 2008, economic growth has held steady at a rate of 0.6%. To be sure, current economic indicators present a mixed picture, but another, more likely, outcome is that the economy will weather this rough patch. The Federal Reserve Board has cut interest rates sharply and provided financial markets with ample liquidity, while Congress and the White House have come forward with a timely fiscal package of tax rebates and investment incentives. A growing number of economists now believe that the economy may avert a recession.

It is always unsettling to see the markets and one’s investment returns declining. Times like these are a reminder of why it is important to keep a long-term perspective, ensure your portfolio is well diversified, and seek the counsel of your financial representative.

Starting this month, we have changed the portfolio manager’s commentary in this report to a question-and-answer format. We feel this new approach makes the information more readable and accessible, and we hope you think so as well.

2

Lastly, we would like to take this opportunity to welcome new shareholders to the fund and to thank all of our investors for your continued confidence in Putnam Investments.

Putnam Utilities Growth and Income Fund:

A diversified approach to utilities investing

Many stock funds offer the potential for growth but produce little or no income for investors. Putnam Utilities Growth and Income Fund pursues both capital growth and current income through investments in the utilities sector. However, as utilities stock prices have appreciated in recent years, the industry’s dividend yield has declined.

Public utilities have a history of consistent dividend payouts to investors. These securities are valued as an alternative to bonds, especially during periods of low interest rates, when investors look outside the bond market for income. In recent years, the income-producing power of utilities holdings has grown stronger, because of legislation in 2003 that reduced the federal tax on dividends. Many investors have been able to keep more dividend income, though there is no assurance that this tax reduction will continue.

Another positive influence is the price of natural gas, which affects not only the natural gas industry, but any industry that uses gas in its production or delivery process. Gas is widely used to produce electricity; as gas prices rise and fall, the cost of electricity tends to follow suit. Since the demand for electricity is usually stable even as prices fluctuate, an industry-wide increase in prices can lead to higher profits for electric utilities that use less costly fuels, such as nuclear.

The fund may invest in bonds as well as stocks, in both domestic and foreign markets, across several industries with varying degrees of regulation, and in companies of different sizes. A key part of the fund’s strategy, particularly during periods of uncertainty, is to maintain a solid foundation of securities in stable-demand industries such as electric power, telecommunications, and natural gas.

Guided by this approach, the management team is committed to finding rewarding opportunities for income and growth by anticipating developments that affect the utilities sector.

International investing involves certain risks, such as currency fluctuations, economic instability, and political developments. The fund may invest a portion of its assets in small and/or midsize companies. Such investments increase the risk of greater price fluctuations.

The fund invests in fewer issuers or concentrates its investments by region or sector, and involves more risk than a fund that invests more broadly. The use of derivatives involves special risks and may result in losses. Mutual funds that invest in bonds are subject to certain risks including interest-rate risk, credit risk, and inflation risk. As interest rates rise, the prices of bonds fall. Long-term bonds are more exposed to interest-rate risk than short-term bonds. Unlike bonds, bond funds have ongoing fees and expenses.

Major industries in the utilities sector

Electric utilities Companies that generate, transmit, or distribute electricity.

Natural gas utilities Companies that transmit, store, or distribute natural gas.

Regional Bells Companies that provide access to voice communications networks within a specific geographic region.

Telecommunications Companies that provide voice, data, and video communications products and services.

Telephone Companies that provide fixed-line and wireless telephone communications services.

Water utilities Companies that provide services related to water or wastewater.

Certain key developments have affected electric and gas utilities

since the inception of Putnam Utilities Growth and Income Fund.

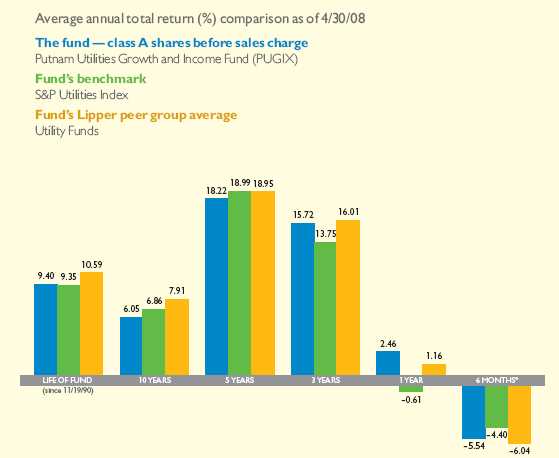

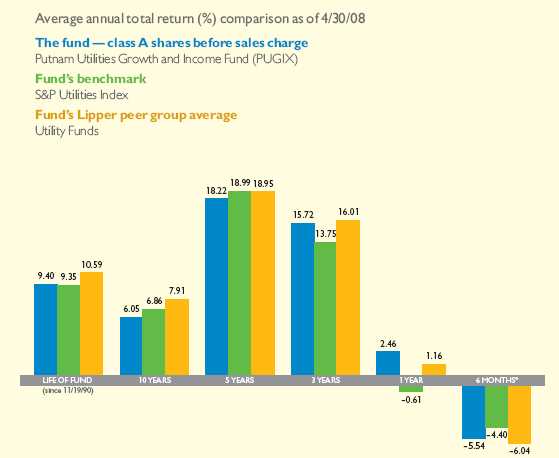

Performance snapshot

Putnam Utilities Growth

and Income Fund

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will fluctuate, and you may have a gain or a loss when you sell your shares. Performance of class A shares assumes reinvestment of distributions and does not account for taxes. Fund returns in the bar chart do not reflect a sales charge of 5.75%; had they, returns would have been lower. See pages 7 and 13–15 for additional performance information. For a portion of the periods, this fund may have limited expenses, without which returns would have been lower. A 1% short-term trading fee may apply. To obtain the most recent month-end performance, visit www.putnam.com.

* Returns for the six-month period are not annualized, but cumulative.

6

The period in review

Michael, thanks for taking the time today to discuss Utilities Growth and Income Fund. How did the fund perform for the six-month period that ended April 30, 2008?

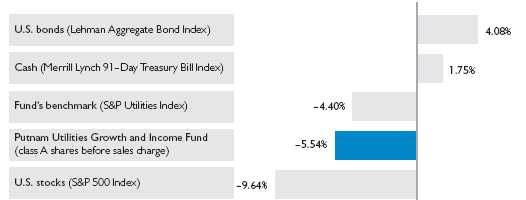

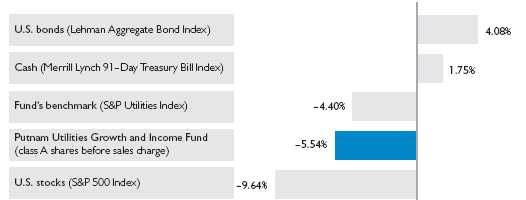

The fund had a loss of 5.54%, but outperformed the median comparable utility fund among its Lipper peer group, which returned a negative 6.04% . The fund did, however, underperform its benchmark, the S&P Utilities Index, which posted a decline of 4.40% .

Please describe the market environment during the period, particularly the impact that the credit crisis and rising energy prices had on the fund’s performance.

As a result of the credit crisis, the market environment was negative for all stocks, including the usually defensive utilities. Although the financial performance of utilities is less vulnerable to the credit markets than some other groups, some investors were anxious to take profits and exit the

Broad market index and fund performance

This comparison shows your fund’s performance in the context of broad market indexes for the six months ended 4/30/08. See page 6 and pages 13–15 for additional fund performance information. Index descriptions can be found on page 23.

7

market. And utilities, which have experienced a good run over the past five years, gave these investors the opportunity to sell something that had appreciated in value. So, for a while over the winter, utilities were one of the more poorly performing groups.

What’s important to note is that the financial condition of nearly all utilities is good: They are not overly sensitive to the mortgage crisis, and, in our opinion, their business outlook is healthy.

Because oil is seldom used as a generating fuel, oil prices do not have a major direct impact on utility operations. Oil prices, however, influence natural gas prices, which are quite important to the utilities as a group. Electricity prices tend to reflect natural gas prices, wherever free markets in power prevail, because natural gas accounts for most of the costs of the highest-cost generating plants. But the majority of plants generate with coal or nuclear fuel, whose relatively stable prices keep the costs of these generating plants down. As power prices rise, their profit margins expand.

In this challenging market environment, what were the holdings that helped the fund’s performance relative to its benchmark?

Utilities in North America and Europe resisted the decline better than global telecom stocks and utilities in the Asia-Pacific region. U.S. utilities that

Top 10 holdings

This table shows the fund’s top 10 holdings and the percentage of the fund’s net assets that each represented as of 4/30/08. Also shown is each holding’s market sector and the specific industry within that sector. Holdings will vary over time.

| | |

| HOLDING (percentage of fund’s net assets) | SECTOR | INDUSTRY |

|

| Exelon Corp. (8.1%) | Utilities & power | Electric utilities |

|

| Entergy Corp. (4.5%) | Utilities & power | Electric utilities |

|

| FPL Group, Inc. (3.8%) | Utilities & power | Electric utilities |

|

| FirstEnergy Corp. (3.7%) | Utilities & power | Electric utilities |

|

| PG&E Corp. (3.5%) | Utilities & power | Electric utilities |

|

| Public Service Enterprise Group, Inc. (3.4%) | Utilities & power | Electric utilities |

|

| Dominion Resources, Inc. (3.4%) | Utilities & power | Electric utilities |

|

| Edison International (3.0%) | Utilities & power | Electric utilities |

|

| Equitable Resources, Inc. (2.5%) | Utilities & power | Natural gas utilities |

|

| Sempra Energy (2.5%) | Utilities & power | Natural gas utilities |

|

8

own natural gas-production assets performed especially well because of the rise in natural gas prices and, in some cases, upward revisions in the estimates of how much natural gas they held in their reserves. The biggest contributor was Equitable Resources, but Energen and MDU Resources also did well. FirstEnergy benefited from the progress of favorable electricity legislation in Ohio that enhanced the company’s market position. Wisconsin Energy has both a large capital spending budget and a supportive regulatory commission, resulting in rapid rate-base growth, which in turn should produce strong earnings growth, in our view.

Among the fund’s overseas holdings, Suez SA [France] rose on the belief that a merger with Gaz de France will win approval later this year. Telecom providers Digi.com [Malaysia] and StarHub [Singapore] continued to benefit from strong growth in the Asian market.

Let’s discuss some of the fund’s holdings that detracted from performance during the period.

Comverge, which supplies software that helps utilities manage customer energy use — for example, by remotely controlling their air conditioning on hot days —provides a valuable service, but it is a new company with a new concept. As a result, it is vulnerable to market corrections, and

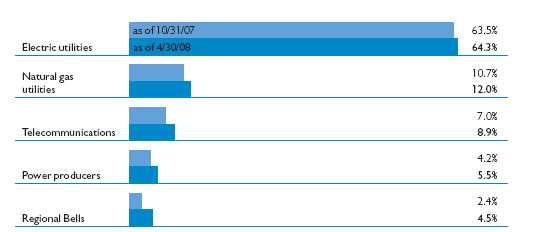

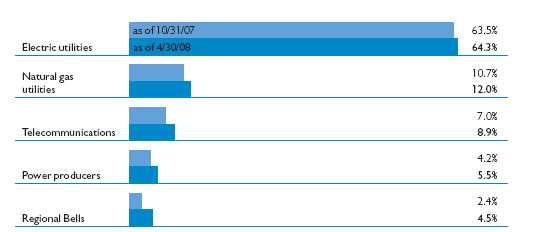

Comparison of top industry weightings

This chart shows how the fund’s top weightings have changed over the past six months. Weightings are shown as a percentage of net assets. Holdings will vary over time.

9

was a major detractor from performance. In general, the more-regulated utilities in the fund’s portfolio underperformed. These include, most significantly, PG&E, Sierra Pacific Resources, Northeast Utilities, and CMS Energy. Although we are overweight utilities that are able to capitalize on the strong power market, we maintain a balanced portfolio that includes more regulated names in cases where we feel that these utilities have solid support for their stocks’ valuations. Deutsche Post AG [Germany], while providing a utility-like service, trades like a utility/industrial hybrid and underperformed the utility group fo r this period. Idearc, the Verizon yellow pages business, has been hurt by the economic downturn. Asciano Group [Australia] is an infrastructure company with seaport and rail assets and some cyclical exposure. Tenaga Nasional [Malaysia] has suffered from political and regulatory setbacks.

Michael, what is your outlook?

While the overall stock market could be hurt by recession and financial dislocation, utilities, particularly those in North America and Europe, are reporting strong earnings and improved balance sheets. At least in the short term, this is likely to continue, although we are wary of changes that could threaten their performance. Utilities that are profiting from strong power markets, such as Ohio-based FirstEnergy, have done especially well. FirstEnergy has benefited from structural and regulatory changes and market tightness. For these utilities to maintain their strong position, however, will require both political adeptness and only limited increases in generating capacity. The biggest risk is that prices and profits will rise so high that a consumer backlash, followed by a political reaction, will ensue. More regulated utilities, such as PG&E, have not fared as well, on average, but face similar risks. Their rising construction budge ts — the consequence of years of under-investment — are causing the rate bases of these utilities to grow at an accelerating rate. With rate-base growth comes not only rate increases and earnings growth, but also the threat of consumer resistance and a political or regulatory response that could result in lower returns. In addition, measures will likely be implemented to discourage coal generation or to make it much cleaner and, as a consequence, more expensive.

As for global telecom, it is an industry in flux, with cellular carriers generally profiting at the expense of landline operators in most regions. Although risks may be increasing in global telecom — and there is sensitivity to an economic slowdown — valuations reflect most of the problems.

How are you positioning Utilities Growth and Income Fund’s portfolio to take advantage of these opportunities and minimize risks?

We believe that the prospective return potential among the market-sensitive utilities is great enough to compensate for

10

their risk, so we are overweight this sector, but we are careful to maintain a reasonable balance and not overweight these stocks too much. Among the more regulated utilities, where we are monitoring the risk of a backlash, we are mindful of the views of regulators and the nature of the relationship between them and the utilities. Also, we favor, and are overweight, nuclear generators and others that are generating little or no carbon emissions. In addition, we own a diversified portfolio of telecom operators, with an emphasis on cellular players.

Thank you, Michael, for your time and insights today.

I N T H E N E W S

For the first time since the Great Depression, the U.S. Federal Reserve has extended financing to non-banks — specifically, primary dealers such as securities broker-dealers — as part of its ongoing attempt to inject liquidity into the struggling credit markets. The so-called Primary Dealer Credit Facility (PDCF), established in March, allows the Federal Reserve Bank of New York to provide overnight cash reserves to primary dealers in exchange for a broad range of collateral. The new credit facility aims to help primary dealers in providing financing to participants in capital markets and to promote an overall orderly functioning of the markets. The PDCF will remain in effect for six months and may be extended if the Fed deems it necessary.

Of special interest

We are pleased to report that effective March 2008, your fund’s dividend was increased 21.15%, from $0.052 to $0.063 per class A share. Amounts for other share classes may vary slightly. This increase was possible due to a number of portfolio holdings increasing their dividend rates.

The views expressed in this report are exclusively those of Putnam Management. They are not meant as investment advice.

The fund invests in fewer issuers or concentrates its investments by region or sector, and involves more risk than a fund that invests more broadly. The use of derivatives involves special risks and may result in losses. Mutual funds that invest in bonds are subject to certain risks including interest-rate risk, credit risk, and inflation risk. As interest rates rise, the prices of bonds fall. Long-term bonds are more exposed to interest-rate risk than short-term bonds. Unlike bonds, bond funds have ongoing fees and expenses.

Please note that the holdings discussed in this report may not have been held by

11

the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future.

International investing involves certain risks, such as currency fluctuations, economic instability, and political developments. The fund may invest a portion of its assets in small and/or midsize companies. Such investments increase the risk of greater price fluctuations.

12

Your fund’s performance

This section shows your fund’s performance, price, and distribution information for periods ended April 30, 2008, the end of the first half of its current fiscal year. In accordance with regulatory requirements for mutual funds, we also include performance as of the most recent calendar quarter-end and expense information taken from the fund's current prospectus. Performance should always be considered in light of a fund’s investment strategy. Data represents past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance information does not reflect any deduction for taxes a shareholder may owe on fund distributions or on the redemption of fund shares. For the most recent month-end performance, please visit the Individual Investors section of www.putnam.com or call Pu tnam at 1-800-225-1581. Class Y shares are generally only available to corporate and institutional clients and clients in other approved programs. See the Terms and Definitions section in this report for definitions of the share classes offered by your fund.

Fund performance

Total return for periods ended 4/30/08

| | | | | | | | | | |

| | Class A | | Class B | | Class C | | Class M | | Class R | Class Y |

| (inception dates) | (11/19/90) | | (4/27/92) | | (7/26/99) | | (3/1/95) | | (12/1/03) | (10/4/05) |

| | NAV | POP | NAV | CDSC | NAV | CDSC | NAV | POP | NAV | NAV |

|

| Annual average | | | | | | | | | | |

| (life of fund) | 9.40% | 9.03% | 8.58% | 8.58% | 8.59% | 8.59% | 8.87% | 8.64% | 9.13% | 9.44% |

|

| 10 years | 80.00 | 69.70 | 66.94 | 66.94 | 66.98 | 66.98 | 71.29 | 65.33 | 75.61 | 81.12 |

| Annual average | 6.05 | 5.43 | 5.26 | 5.26 | 5.26 | 5.26 | 5.53 | 5.16 | 5.79 | 6.12 |

|

| 5 years | 130.93 | 117.67 | 122.64 | 120.64 | 122.62 | 122.62 | 125.59 | 117.73 | 128.06 | 132.36 |

| Annual average | 18.22 | 16.83 | 17.36 | 17.15 | 17.36 | 17.36 | 17.67 | 16.84 | 17.93 | 18.37 |

|

| 3 years | 54.95 | 46.07 | 51.48 | 48.48 | 51.47 | 51.47 | 52.58 | 47.18 | 53.70 | 55.91 |

| Annual average | 15.72 | 13.46 | 14.85 | 14.08 | 14.84 | 14.84 | 15.12 | 13.75 | 15.40 | 15.96 |

|

| 1 year | 2.46 | –3.42 | 1.66 | –3.35 | 1.67 | 0.67 | 1.95 | –1.64 | 2.19 | 2.66 |

|

| 6 months | –5.54 | –10.96 | –5.94 | –10.63 | –5.91 | –6.85 | –5.79 | –9.09 | –5.72 | –5.47 |

|

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. After sales charge returns (public offering price, or POP) for class A and M shares reflect a maximum 5.75% and 3.50% load, respectively, as of 1/2/08. Class B share returns reflect the applicable contingent deferred sales charge (CDSC), which is 5% in the first year, declining to 1% in the sixth year, and is eliminated thereafter. Class C shares reflect a 1% CDSC for the first year and is eliminated thereafter. Class R and Y shares have no initial sales charge or CDSC. Performance for class B, C, M, R, and Y shares before their inception is derived from the historical performance of class A shares, adjusted for the applicable sales charge (or CDSC) and, except for class Y shares, the higher operating expenses for such shares.

For a portion of the periods, this fund may have limited expenses, without which returns would have been lower.

A 1% short-term trading fee may be applied to shares exchanged or sold within 7 days of purchase.

13

Comparative index returns

For periods ended 4/30/08

| | | | |

| | |

| | | S&P Utilities | | Lipper Utility Funds |

| | | Index | | category average* |

|

| Annual average | | |

| (life of fund) | 9.35% | 10.59% |

|

| 10 years | 94.22 | 117.35 |

| Annual average | 6.86 | 7.91 |

|

| 5 years | 138.57 | 140.07 |

| Annual average | 18.99 | 18.95 |

|

| 3 years | 47.18 | 56.60 |

| Annual average | 13.75 | 16.01 |

|

| 1 year | -0.61 | 1.16 |

|

| 6 months | -4.40 | –6.04 |

|

Index and Lipper results should be compared to fund performance at net asset value.

* Over the 6-month, 1-year, 3-year, 5-year, 10-year, and life-of-fund periods ended 4/30/08, there were 101, 100, 88, 67, 45, and 9 funds, respectively, in this Lipper category.

Fund price and distribution information

For the six-month period ended 4/30/08

| | | | | | | | |

| Distributions | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Number | 2 | 2 | 2 | 2 | 2 | 2 |

|

| Income | $0.127 | $0.067 | $0.073 | $0.089 | $0.110 | $0.147 |

|

| Capital gains | — | — | — | — | — | — |

|

| Total | $0.127 | $0.067 | $0.073 | $0.089 | $0.110 | $0.147 |

|

| Share value: | NAV | POP | NAV | NAV | NAV | POP | NAV | NAV |

|

| 10/31/07 | 16.27 | 17.26* | 16.19 | 16.17 | 16.25 | 16.84* | 16.24 | 16.28 |

|

| 4/30/08 | 15.24 | 16.17 | 15.16 | 15.14 | 15.22 | 15.77 | 15.20 | 15.24 |

|

| Current yield | | | | | | | | |

| (end of period) | | | | | | | | |

|

| Current | | | | | | | | |

| dividend rate1 | 1.65% | 1.56% | 0.87% | 0.95% | 1.13% | 1.09% | 1.45% | 1.92% |

|

| Current 30-day | | | | | | | | |

| SEC yield2 | N/A | 1.94 | 1.32 | 1.33 | N/A | 1.51 | 1.82 | 2.31 |

|

The classification of distributions, if any, is an estimate. Final distribution information will appear on your year-end tax forms.

* Reflects an increase in sales charges that took effect on 1/2/08.

1 Most recent distribution, excluding capital gains, annualized and divided by NAV or POP at end of period.

2 Based only on investment income and calculated using the maximum offering price for each share class, in accordance with SEC guidelines.

14

Fund performance as of most recent calendar quarter

Total return for periods ended 3/31/08

| | | | | | | | | | |

| | Class A | | Class B | | Class C | | Class M | | Class R | Class Y |

| (inception dates) | (11/19/90) | | (4/27/92) | | (7/26/99) | | (3/1/95) | | (12/1/03) | (10/4/05) |

| | NAV | POP | NAV | CDSC | NAV | CDSC | NAV | POP | NAV | NAV |

|

| Annual average | | | | | | | | | | |

| (life of fund) | 9.08% | 8.71% | 8.26% | 8.26% | 8.26% | 8.26% | 8.54% | 8.31% | 8.81% | 9.12% |

|

| 10 years | 66.24 | 56.70 | 54.22 | 54.22 | 54.18 | 54.18 | 58.05 | 52.56 | 62.19 | 67.26 |

| Annual average | 5.21 | 4.59 | 4.43 | 4.43 | 4.42 | 4.42 | 4.68 | 4.31 | 4.95 | 5.28 |

|

| 5 years | 132.91 | 119.57 | 124.56 | 122.56 | 124.35 | 124.35 | 127.21 | 119.39 | 130.12 | 134.35 |

| Annual average | 18.42 | 17.03 | 17.56 | 17.35 | 17.54 | 17.54 | 17.84 | 17.02 | 18.14 | 18.57 |

|

| 3 years | 47.82 | 39.38 | 44.53 | 41.53 | 44.41 | 44.41 | 45.55 | 40.47 | 46.71 | 48.74 |

| Annual average | 13.91 | 11.70 | 13.06 | 12.27 | 13.03 | 13.03 | 13.33 | 11.99 | 13.63 | 14.15 |

|

| 1 year | 0.06 | –5.70 | –0.67 | –5.60 | –0.73 | –1.71 | –0.45 | –3.94 | –0.22 | 0.32 |

|

| 6 months | –4.79 | –10.27 | –5.12 | –9.84 | –5.16 | –6.10 | –5.04 | –8.35 | –4.90 | –4.66 |

|

Fund’s annual operating expenses

For the fiscal year ended 10/31/07

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Total annual fund | | | | | | |

| operating expenses | 1.18% | 1.93% | 1.93% | 1.68% | 1.43% | 0.93% |

|

Expense information in this table is taken from the most recent prospectus, is subject to change, and may differ from that shown in the next section and in the financial highlights of this report. Expenses are shown as a percentage of average net assets.

15

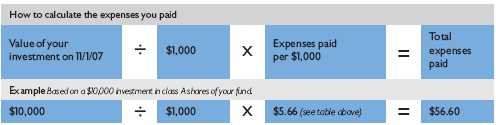

Your fund’s expenses

As a mutual fund investor, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. In the most recent six-month period, your fund limited these expenses; had it not done so, expenses would have been higher. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial representative.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Putnam Utilities Growth and Income Fund from November 1, 2007, to April 30, 2008. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | | |

| | | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Expenses paid per $1,000* | | $ 5.66 | $ 9.26 | $ 9.27 | $ 8.06 | $ 6.86 | $ 4.45 |

|

| Ending value (after expenses) | | $944.60 | $940.60 | $940.90 | $942.10 | $942.80 | $945.30 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 4/30/08. The expense ratio may differ for each share class (see the last table in this section). Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

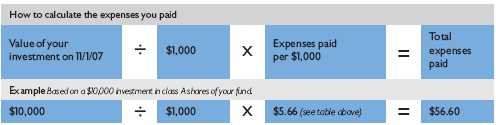

Estimate the expenses you paid

To estimate the ongoing expenses you paid for the six months ended April 30, 2008, use the calculation method below. To find the value of your investment on November 1, 2007, call Putnam at 1-800-225-1581.

16

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | | |

| | | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Expenses paid per $1,000* | | $ 5.87 | $ 9.62 | $ 9.62 | $ 8.37 | $ 7.12 | $ 4.62 |

|

| Ending value (after expenses) | | $1,019.05 | $1,015.32 | $1,015.32 | $1,016.56 | $1,017.80 | $1,020.29 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 4/30/08. The expense ratio may differ for each share class (see the last table in this section). Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

Compare expenses using industry averages

You can also compare your fund’s expenses with the average of its peer group, as defined by Lipper, an independent fund-rating agency that ranks funds relative to others that Lipper considers to have similar investment styles or objectives. The expense ratio for each share class shown below indicates how much of your fund’s average net assets have been used to pay ongoing expenses during the period.

| | | | | | | |

| | | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Your fund's annualized | | | | | | | |

| expense ratio | | 1.17% | 1.92% | 1.92% | 1.67% | 1.42% | 0.92% |

|

| Average annualized expense | | | | | | | |

| ratio for Lipper peer group* | | 1.20% | 1.95% | 1.95% | 1.70% | 1.45% | 0.95% |

|

* Putnam is committed to keeping fund expenses below the Lipper peer group average expense ratio and will limit fund expenses if they exceed the Lipper average. The Lipper average is a simple average of front-end load funds in the peer group that excludes 12b-1 fees as well as any expense offset and brokerage service arrangements that may reduce fund expenses. To facilitate the comparison in this presentation, Putnam has adjusted the Lipper average to reflect the 12b-1 fees carried by each class of shares other than class Y shares, which do not incur 12b-1 fees. Investors should note that the other funds in the peer group may be significantly smaller or larger than the fund, and that an asset-weighted average would likely be lower than the simple average. Also, the fund and Lipper report expense data at different times and for different periods. The fund’s expense ratio shown here is annualized data for the most rec ent six-month period, while the quarterly updated Lipper average is based on the most recent fiscal year-end data available for the peer group funds as of 3/31/08.

17

Your fund’s portfolio turnover

Putnam funds are actively managed by teams of experts who buy and sell securities based on intensive analysis of companies, industries, economies, and markets. Portfolio turnover is a measure of how often a fund’s managers buy and sell securities for your fund. A portfolio turnover of 100%, for example, means that the managers sold and replaced securities valued at 100% of a fund’s average portfolio value within a given period. Funds with high turnover may be more likely to generate capital gains that must be distributed to shareholders as taxable income. High turnover may also cause a fund to pay more brokerage commissions and other transaction costs, which may detract from performance.

Funds that invest in bonds or other fixed-income instruments may have higher turnover than funds that invest only in stocks. Short-term bond funds tend to have higher turnover than longer-term bond funds, because shorter-term bonds will mature or be sold more frequently than longer-term bonds. You can use the table below to compare your fund’s turnover with the average turnover for funds in its Lipper category.

Turnover comparisons

Percentage of holdings that change every year

| | | | | |

| | 2007 | 2006 | 2005 | 2004 | 2003 |

|

| Putnam Utilities Growth | | | | | |

| and Income Fund | 42% | 65% | 39% | 30% | 40% |

|

| Lipper Utility Funds | | | | | |

| category average | 85% | 104% | 122% | 203% | 231% |

|

Turnover data for the fund is calculated based on the fund’s fiscal-year period, which ends on October 31. Turnover data for the fund’s Lipper category is calculated based on the average of the turnover of each fund in the category for its fiscal year ended during the indicated year. Fiscal years vary across funds in the Lipper category, which may limit the comparability of the fund’s portfolio turnover rate to the Lipper average. Comparative data for 2007 is based on information available as of 12/31/07.

18

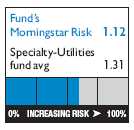

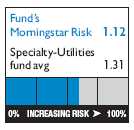

Your fund’s risk

This risk comparison is designed to help you understand how your fund compares with other funds. The comparison utilizes a risk measure developed by Morningstar, an independent fund-rating agency. This risk measure is referred to as the fund’s Morningstar Risk.

Your fund’s Morningstar® Risk

Your fund’s Morningstar Risk is shown alongside that of the average fund in its Morningstar category. The risk bar broadens the comparison by translating the fund’s Morningstar Risk into a percentile, which is based on the fund’s ranking among all funds rated by Morningstar as of March 31, 2008. A higher Morningstar Risk generally indicates that a fund’s monthly returns have varied more widely.

Morningstar determines a fund’s Morningstar Risk by assessing variations in the fund’s monthly returns — with an emphasis on downside variations — over a 3-year period, if available. Those measures are weighted and averaged to produce the fund’s Morningstar Risk. The information shown is provided for the fund’s class A shares only; information for other classes may vary. Morningstar Risk is based on historical data and does not indicate future results. Morningstar does not purport to measure the risk associated with a current investment in a fund, either on an absolute basis or on a relative basis. Low Morningstar Risk does not mean that you cannot lose money on an investment in a fund. Copyright 2008 Morningstar, Inc. All Rights Reserved. The information contained herein (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

19

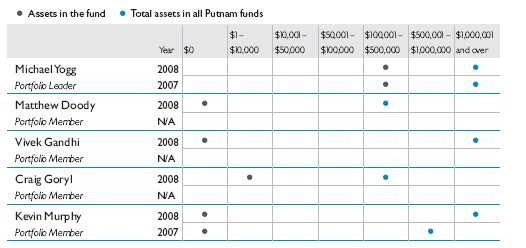

Your fund’s management

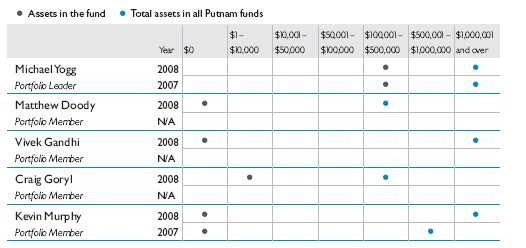

Your fund is managed by the members of the Putnam Large-Cap Equity Research and Core Fixed-Income teams. Michael Yogg is the Portfolio Leader, and Matthew Doody, Vivek Gandhi, Craig Goryl, and and Kevin Murphy are Portfolio Members, of your fund. The Portfolio Leader and Portfolio Members coordinate the teams’ management of the fund.

For a complete listing of the members of the Putnam Large-Cap Equity Research and Core Fixed-Income teams, including those who are not Portfolio Leaders or Portfolio Members of your fund, please visit the Individual Investors section of www.putnam.com.

Investment team fund ownership

The table below shows how much the fund’s current Portfolio Leader and Portfolio Members have invested in the fund and in all Putnam mutual funds (in dollar ranges). Information shown is as of April 30, 2008, and April 30, 2007.

N/A indicates the individual was not a Portfolio Leader or Portfolio Member as of 4/30/07.

Trustee and Putnam employee fund ownership

As of April 30, 2008, all of the Trustees of the Putnam funds owned fund shares. The table below shows the approximate value of investments in the fund and all Putnam funds as of that date by the Trustees and Putnam employees. These amounts include investments by the Trustees’ and employees’ immediate family members and investments through retirement and deferred compensation plans.

| | |

| | | Total assets in |

| | Assets in the fund | all Putnam funds |

|

| Trustees | $ 153,000 | $ 87,000,000 |

|

| Putnam employees | $2,681,000 | $626,000,000 |

|

20

Other Putnam funds managed by the Portfolio Leader and Portfolio Members

Kevin Murphy is also a Portfolio Member of Putnam Income Fund, Putnam Diversified Income Trust, Putnam Premier Income Trust, and Putnam Master Intermediate Income Trust.

Michael Yogg, Matthew Doody, Vivek Gandhi, Craig Goryl, and Kevin Murphy may also manage other accounts and variable trust funds advised by Putnam Management or an affiliate.

Changes in your fund’s Portfolio Leader and Portfolio Members

During the reporting period ended April 30, 2008, Portfolio Members Matthew Doody, Vivek Gandhi, and Craig Goryl joined your fund’s management team, following the departure of Portfolio Member Stephen Burgess.

21

Terms and definitions

Important terms

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Net asset value (NAV) is the price, or value, of one share of a mutual fund, without a sales charge. NAVs fluctuate with market conditions. NAV is calculated by dividing the net assets of each class of shares by the number of outstanding shares in the class.

Public offering price (POP) is the price of a mutual fund share plus the maximum sales charge levied at the time of purchase. POP performance figures shown here assume the 5.75% maximum sales charge for class A shares and 3.50% for class M shares.

Contingent deferred sales charge (CDSC) is generally a charge applied at the time of the redemption of class B or C shares and assumes redemption at the end of the period. Your fund’s class B CDSC declines from a 5% maximum during the first year to 1% during the sixth year. After the sixth year, the CDSC no longer applies. The CDSC for class C shares is 1% for one year after purchase.

Current yield is the annual rate of return earned from dividends or interest of an investment. Current yield is expressed as a percentage of the price of a security, fund share, or principal investment.

Share classes

Class A shares are generally subject to an initial sales charge and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class B shares are not subject to an initial sales charge. They may be subject to a CDSC.

Class C shares are not subject to an initial sales charge and are subject to a CDSC only if the shares are redeemed during the first year.

Class M shares have a lower initial sales charge and a higher 12b-1 fee than class A shares and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class R shares are not subject to an initial sales charge or CDSC and are available only to certain defined contribution plans.

Class Y shares are not subject to an initial sales charge or CDSC, and carry no 12b-1 fee. They are generally only available to corporate and institutional clients and clients in other approved programs.

22

Comparative indexes

Lehman Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

Merrill Lynch 91-Day Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

S&P 500 Index is an unmanaged index of common stock performance.

S&P Utilities Index is an unmanaged index of common stocks issued by utility companies.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

Lipper is a third-party industry-ranking entity that ranks mutual funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

23

Trustee approval of management contract

General conclusions

The Board of Trustees of the Putnam funds oversees the management of each fund and, as required by law, determines annually whether to approve the continuance of your fund’s management contract with Putnam Investment Management (“Putnam Management”) and the sub-management contract between Putnam Management’s affiliate, Putnam Investments Limited (“PIL”), and Putnam Management. In this regard, the Board of Trustees, with the assistance of its Contract Committee consisting solely of Trustees who are not “interested persons” (as such term is defined in the Investment Company Act of 1940, as amended) of the Putnam funds (the “Independent Trustees”), requests and evaluates all information it deems reasonably necessary under the circumstances. Over the course of several months ending in June 2007, the Contract Committee met several times to consider the information provided by Putnam Management and other information develo ped with the assistance of the Board’s independent counsel and independent staff. The Contract Committee reviewed and discussed key aspects of this information with all of the Independent Trustees. The Contract Committee recommended, and the Independent Trustees approved, the continuance of your fund’s management contract and sub-management contract, effective July 1, 2007. (Because PIL is an affiliate of Putnam Management and Putnam Management remains fully responsible for all services provided by PIL, the Trustees have not evaluated PIL as a separate entity, and all subsequent references to Putnam Management below should be deemed to include reference to PIL as necessary or appropriate in the context.)

In addition, in anticipation of the sale of Putnam Investments to Great-West Lifeco, at a series of meetings ending in March 2007, the Trustees reviewed and approved new management and distribution arrangements to take effect upon the change of control. Shareholders of all funds approved the management contracts in May 2007, and the change of control transaction was completed on August 3, 2007. Upon the change of control, the management contracts that were approved by the Trustees in June 2007 automatically terminated and were replaced by new contracts that had been approved by shareholders. In connection with their review for the June 2007 continuance of the Putnam funds’ management contracts, the Trustees did not identify any facts or circumstances that would alter the substance of the conclusions and recommendations they made in their review of the contracts to take effect upon the change of control.

The Independent Trustees’ approval was based on the following conclusions:

• That the fee schedule in effect for your fund represented reasonable compensation in light of the nature and quality of the services being provided to the fund, the fees paid by competitive funds and the costs incurred by Putnam Management in providing such services, and

• That this fee schedule represented an appropriate sharing between fund shareholders and Putnam Management of such economies of scale as may exist in the management of the fund at current asset levels.

24

These conclusions were based on a comprehensive consideration of all information provided to the Trustees and were not the result of any single factor. Some of the factors that figured particularly in the Trustees’ deliberations and how the Trustees considered these factors are described below, although individual Trustees may have evaluated the information presented differently, giving different weights to various factors. It is also important to recognize that the fee arrangements for your fund and the other Putnam funds are the result of many years of review and discussion between the Independent Trustees and Putnam Management, that certain aspects of such arrangements may receive greater scrutiny in some years than others, and that the Trustees’ conclusions may be based, in part, on their consideration of these same arrangements in prior years.

Management fee schedules and categories; total expenses

The Trustees reviewed the management fee schedules in effect for all Putnam funds, including fee levels and breakpoints, and the assignment of funds to particular fee categories. In reviewing fees and expenses, the Trustees generally focused their attention on material changes in circumstances — for example, changes in a fund’s size or investment style, changes in Putnam Management’s operating costs or responsibilities, or changes in competitive practices in the mutual fund industry — that suggest that consideration of fee changes might be warranted. The Trustees concluded that the circumstances did not warrant changes to the management fee structure of your fund, which had been carefully developed over the years, re-examined on many occasions and adjusted where appropriate. The Trustees focused on two areas of particular interest, as discussed further below:

• Competitiveness. The Trustees reviewed comparative fee and expense information for competitive funds, which indicated that, in a custom peer group of competitive funds selected by Lipper Inc., your fund ranked in the 67th percentile in management fees and in the 40th percentile in total expenses (less any applicable 12b-1 fees) as of December 31, 2006 (the first percentile being the least expensive funds and the 100th percentile being the most expensive funds). (Because the fund’s custom peer group is smaller than the fund’s broad Lipper Inc. peer group, this expense information may differ from the Lipper peer expense information found elsewhere in this report.) The Trustees noted that expense ratios for a number of Putnam funds, which show the percentage of fund assets used to pay for management and administrative services, distribution (12b-1) fees and other expe nses, had been increasing recently as a result of declining net assets and the natural operation of fee breakpoints.

The Trustees noted that the expense ratio increases described above were currently being controlled by expense limitations implemented in January 2004 and which Putnam Management had committed to maintain at least through 2007. In anticipation of the change of control of Putnam Investments, the Trustees requested, and received a commitment from Putnam Management and Great-West Lifeco, to extend this program through at least June 30, 2009. These expense limitations give effect to a commitment by Putnam Management that

25

the expense ratio of each open-end fund would be no higher than the average expense ratio of the competitive funds included in the fund’s relevant Lipper universe (exclusive of any applicable 12b-1 charges in each case). The Trustees observed that this commitment to limit fund expenses has served shareholders well since its inception.

In order to ensure that the expenses of the Putnam funds continue to meet evolving competitive standards, the Trustees requested, and Putnam Management agreed, to extend for the twelve months beginning July 1, 2007, an additional expense limitation for certain funds at an amount equal to the average expense ratio (exclusive of 12b-1 charges) of a custom peer group of competitive funds selected by Lipper to correspond to the size of the fund. This additional expense limitation will be applied to those open-end funds that had above-average expense ratios (exclusive of 12b-1 charges) based on the custom peer group data for the period ended December 31, 2006. This additional expense limitation will not be applied to your fund because it had a below-average expense ratio relative to its custom peer group.

• Economies of scale. Your fund currently has the benefit of breakpoints in its management fee that provide shareholders with significant economies of scale, which means that the effective management fee rate of a fund (as a percentage of fund assets) declines as a fund grows in size and crosses specified asset thresholds. Conversely, as a fund shrinks in size — as has been the case for many Putnam funds in recent years — these breakpoints result in increasing fee levels. In recent years, the Trustees have examined the operation of the existing breakpoint structure during periods of both growth and decline in asset levels. The Trustees concluded that the fee schedules in effect for the funds represented an appropriate sharing of economies of scale at current asset levels. In reaching this conclusion, the Trustees considered the Contract Committee’s stated intent to continue to work with Putnam Management to plan for an eventual resumption in the growth of assets, and to consider the potential economies that might be produced under various growth assumptions.

In connection with their review of the management fees and total expenses of the Putnam funds, the Trustees also reviewed the costs of the services to be provided and profits to be realized by Putnam Management and its affiliates from the relationship with the funds. This information included trends in revenues, expenses and profitability of Putnam Management and its affiliates relating to the investment management and distribution services provided to the funds. In this regard, the Trustees also reviewed an analysis of Putnam Management’s revenues, expenses and profitability with respect to the funds’ management contracts, allocated on a fund-by-fund basis.

26

Investment performance during the review period

The quality of the investment process provided by Putnam Management represented a major factor in the Trustees’ evaluation of the quality of services provided by Putnam Management under your fund’s management contract. The Trustees were assisted in their review of the Putnam funds’ investment process and performance by the work of the Investment Process Committee of the Trustees and the Investment Oversight Committees of the Trustees, which had met on a regular monthly basis with the funds’ portfolio teams throughout the year. The Trustees concluded that Putnam Management generally provides a high-quality investment process — as measured by the experience and skills of the individuals assigned to the management of fund portfolios, the resources made available to such personnel, and in general the ability of Putnam Management to attract and retain high-quality personnel — but also recognized that this does not guarantee favorable investm ent results for every fund in every time period. The Trustees considered the investment performance of each fund over multiple time periods and considered information comparing each fund’s performance with various benchmarks and with the performance of competitive funds.

The Trustees noted the satisfactory investment performance of many Putnam funds. They also noted the disappointing investment performance of certain funds in recent years and discussed with senior management of Putnam Management the factors contributing to such underperformance and actions being taken to improve performance. The Trustees recognized that, in recent years, Putnam Management has made significant changes in its investment personnel and processes and in the fund product line to address areas of underperformance. In particular, they noted the important contributions of Putnam Management’s leadership in attracting, retaining and supporting high-quality investment professionals and in systematically implementing an investment process that seeks to merge the best features of fundamental and quantitative analysis. The Trustees indicated their intention to continue to monitor performance trends to assess the effectiveness of these changes and to evaluate whether additional changes to address areas of underperformance are warranted.

In the case of your fund, the Trustees considered that your fund’s class A share cumulative total return performance at net asset value was in the following percentiles of its Lipper Inc. peer group (Lipper Utility Funds) for the one-, three- and five-year periods ended March 31, 2007 (the first percentile being the best-performing funds and the 100th percentile being the worst-performing funds):

| | |

| One-year period | Three-year period | Five-year period |

|

| 15th | 73rd | 69th |

27

(Because of the passage of time, these performance results may differ from the performance results for more recent periods shown elsewhere in this report. Over the one-, three- and five-year periods ended March 31, 2007, there were 98, 76, and 68 funds, respectively, in your fund’s Lipper peer group.* Past performance is no guarantee of future returns.)

As a general matter, the Trustees concluded that cooperative efforts between the Trustees and Putnam Management represent the most effective way to address investment performance problems. The Trustees noted that investors in the Putnam funds have, in effect, placed their trust in the Putnam organization, under the oversight of the funds’ Trustees, to make appropriate decisions regarding the management of the funds. Based on the responsiveness of Putnam Management in the recent past to Trustee concerns about investment performance, the Trustees concluded that it is preferable to seek change within Putnam Management to address performance shortcomings. In the Trustees’ view, the alternative of terminating a management contract and engaging a new investment adviser for an underperforming fund would entail significant disruptions and would not provide any greater assurance of improved investment performance.

Brokerage and soft-dollar allocations; other benefits

The Trustees considered various potential benefits that Putnam Management may receive in connection with the services it provides under the management contract with your fund. These include benefits related to brokerage and soft-dollar allocations, whereby a portion of the commissions paid by a fund for brokerage may be used to acquire research services that may be useful to Putnam Management in managing the assets of the fund and of other clients. The Trustees indicated their continued intent to monitor the potential benefits associated with the allocation of fund brokerage to ensure that the principle of seeking “best price and execution” remains paramount in the portfolio trading process.

The Trustees’ annual review of your fund’s management contract also included the review of its distributor’s contract and distribution plan with Putnam Retail Management Limited Partnership and the custodian agreement and investor servicing agreement with Putnam Fiduciary Trust Company (“PFTC”), each of which provides benefits to affiliates of Putnam Management. In the case of the custodian agreement, the Trustees considered that, effective January 1, 2007, the Putnam funds had engaged State Street Bank and Trust Company as custodian and began to transition the responsibility for providing custody services away from PFTC.

* The percentile rankings for your fund’s class A share annualized total return performance in the Lipper Utility Funds category for the one-, five-, and ten-year periods ended March 31, 2008, were 48%, 60%, and 79%, respectively. Over the one-, five-, and ten-year periods ended March 31, 2008, the fund ranked 49th out of 102, 41st out of 68, and 36th out of 45 funds, respectively. Note that this more recent information was not available when the Trustees approved the continuance of your fund’s management contract.

28

Comparison of retail and institutional fee schedules

The information examined by the Trustees as part of their annual contract review has included for many years information regarding fees charged by Putnam Management and its affiliates to institutional clients such as defined benefit pension plans, college endowments, etc. This information included comparison of such fees with fees charged to the funds, as well as a detailed assessment of the differences in the services provided to these two types of clients. The Trustees observed, in this regard, that the differences in fee rates between institutional clients and the funds are by no means uniform when examined by individual asset sectors, suggesting that differences in the pricing of investment management services to these types of clients reflect to a substantial degree historical competitive forces operating in separate market places. The Trustees considered the fact that fee rates across all asset sectors are higher on average for funds than for institutional cli ents, as well as the differences between the services that Putnam Management provides to the Putnam funds and those that it provides to institutional clients of the firm, but did not rely on such comparisons to any significant extent in concluding that the management fees paid by your fund are reasonable.

29

Other information for shareholders

Important notice regarding delivery of shareholder documents

In accordance with SEC regulations, Putnam sends a single copy of annual and semiannual shareholder reports, prospectuses, and proxy statements to Putnam shareholders who share the same address, unless a shareholder requests otherwise. If you prefer to receive your own copy of these documents, please call Putnam at 1-800-225-1581, and Putnam will begin sending individual copies within 30 days.

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2007, are available in the Individual Investors section of www.putnam.com, and on the SEC’s Web site, www.sec.gov. If you have questions about finding forms on the SEC’s Web site, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Forms N-Q on the SEC’s Web site at www.sec.gov. In addition, the fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for information about the SEC’s Web site or the operation of the Public Reference Room.

30

Financial statements

A guide to financial statements

These sections of the report, as well as the accompanying Notes, constitute the fund’s financial statements.

The fund’s portfolio lists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and noninvestment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal period.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned. Dividend sources are estimated at the time of declaration. Actual results may vary. Any non-taxable return of capital cannot be determined until final tax calculations are completed after the end of the fund’s fiscal year.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlight table also includes the current reporting period.

31

The fund’s portfolio 4/30/08 (Unaudited)

COMMON STOCKS (99.3%)*

| | | |

| | Shares | | Value |

|

| Cable Television (0.2%) | | | |

| Comcast Corp. Class A (S) | 48,400 | $ | 994,620 |

|

| |

| Electric Utilities (64.3%) | | | |

| Allegheny Energy, Inc. | 44,600 | | 2,399,480 |

| Alliant Energy Corp. | 112,734 | | 4,246,690 |

| American Electric Power Co., Inc. | 81,600 | | 3,641,808 |

| CenterPoint Energy, Inc. (S) | 212,100 | | 3,228,162 |

| Chubu Electric Power, Inc. (Japan) | 147,700 | | 3,468,418 |

| CMS Energy Corp. | 774,190 | | 11,287,690 |

| Consolidated Edison, Inc. (S) | 100,500 | | 4,180,800 |

| Constellation Energy Group, Inc. | 133,595 | | 11,308,817 |

| Dominion Resources, Inc. (S) | 480,850 | | 20,864,082 |

| DPL, Inc. (S) | 206,151 | | 5,737,182 |

| DTE Energy Co. (S) | 158,000 | | 6,368,980 |

| Duke Energy Corp. (S) | 733,901 | | 13,437,727 |

| E.On AG (Germany) | 52,748 | | 10,744,599 |

| Edison International | 349,245 | | 18,220,112 |

| Electric Power Development Co. (Japan) | 59,800 | | 2,251,533 |

| Electricite de France (France) | 54,622 | | 5,708,090 |

| Enel SpA (Italy) | 684,613 | | 7,447,271 |

| Entergy Corp. | 243,807 | | 28,003,672 |

| Exelon Corp. | 582,852 | | 49,822,189 |

| FirstEnergy Corp. | 298,356 | | 22,567,648 |

| FPL Group, Inc. | 349,096 | | 23,141,574 |

| Iberdrola SA (Spain) | 485,580 | | 7,114,198 |

| ITC Holdings Corp. | 143,200 | | 7,987,696 |

| Northeast Utilities | 271,463 | | 7,144,906 |

| NSTAR | 69,300 | | 2,232,153 |

| PG&E Corp. | 540,356 | | 21,614,240 |

| PNM Resources, Inc. | 525,900 | | 7,620,291 |

| Progress Energy, Inc. | 128,631 | | 5,401,216 |

| Public Service Enterprise Group, Inc. | 475,740 | | 20,889,743 |

| RWE AG (Germany) | 59,184 | | 6,818,434 |

| SCANA Corp. | 76,600 | | 3,020,338 |

| Sierra Pacific Resources | 778,625 | | 10,612,659 |

| Southern Co. (The) (S) | 297,321 | | 11,069,261 |

| Suez SA (France) | 167,522 | | 11,823,692 |

| Tohoku Electric Power Co., Inc. (Japan) | 49,500 | | 1,125,549 |

| Wisconsin Energy Corp. | 298,078 | | 14,146,782 |

| | | | 396,697,682 |

|

| |

| Energy (Other) (0.4%) | | | |

| Comverge, Inc. † (S) | 103,950 | | 1,363,824 |

| Covanta Holding Corp. † (S) | 38,046 | | 1,013,165 |

| | | | 2,376,989 |

32

COMMON STOCKS (99.3%)* continued

| | | |

| | Shares | | Value |

|

| Engineering & Construction (0.5%) | | | |

| Bouygues SA (France) | 38,675 | $ | 2,895,784 |

|

| |

| Natural Gas Utilities (12.0%) | | | |

| Energen Corp. | 61,800 | | 4,217,232 |

| Equitable Resources, Inc. | 233,803 | | 15,517,505 |

| MDU Resources Group, Inc. (S) | 169,757 | | 4,900,885 |

| NiSource, Inc. (S) | 153,800 | | 2,753,020 |

| Questar Corp. (S) | 162,128 | | 10,056,800 |

| Sempra Energy | 271,073 | | 15,361,707 |

| Spectra Energy Corp. | 274,900 | | 6,790,030 |

| Toho Gas Co., Ltd. (Japan) | 303,000 | | 1,477,335 |

| Tokyo Gas Co., Ltd. (Japan) | 966,000 | | 3,720,602 |

| Williams Cos., Inc. (The) | 257,992 | | 9,158,716 |

| | | | 73,953,832 |

|

| |

| Power Producers (5.5%) | | | |

| AES Corp. (The) † | 776,148 | | 13,473,929 |

| Dynegy, Inc. Class A † | 463,996 | | 3,999,646 |

| Mirant Corp. † | 154,100 | | 6,335,051 |

| NRG Energy, Inc. † (S) | 143,500 | | 6,306,825 |

| Ormat Technologies, Inc. (S) | 79,100 | | 3,899,630 |

| | | | 34,015,081 |

|

| |

| Regional Bells (4.5%) | | | |

| AT&T, Inc. | 381,694 | | 14,775,375 |

| Verizon Communications, Inc. | 335,460 | | 12,908,501 |

| | | | 27,683,876 |

|

| |

| Telecommunications (8.9%) | | | |

| BT Group PLC (United Kingdom) | 1,035,831 | | 4,554,074 |

| Digi.com Berhad (Malaysia) | 443,700 | | 3,411,693 |

| France Telecom SA (France) | 210,027 | | 6,606,701 |

| Koninklijke (Royal) KPN NV (Netherlands) | 307,503 | | 5,629,441 |

| NTT DoCoMo, Inc. (Japan) | 1,723 | | 2,551,108 |

| Sprint Nextel Corp. (S) | 387,900 | | 3,099,321 |

| StarHub, Ltd. (Singapore) | 1,010,650 | | 2,271,318 |

| Swisscom AG (Switzerland) | 4,281 | | 1,530,719 |

| Telefonica SA (Spain) | 480,470 | | 13,960,131 |

| Telekom Austria AG (Austria) | 106,325 | | 2,635,161 |

| Telus Corp. (Canada) | 68,759 | | 3,059,988 |

| Vodafone Group PLC (United Kingdom) | 1,721,912 | | 5,448,461 |

| | | | 54,758,116 |

|

| |

| Telephone (0.3%) | | | |

| Hellenic Telecommunication Organization (OTE) SA | | | |

| (Greece) | 73,622 | | 2,186,777 |

33

COMMON STOCKS (99.3%)* continued

| | | |

| | Shares | | Value |

|

| Transportation Services (1.8%) | | | |

| Asciano Group (Australia) | 379,000 | $ | 1,446,439 |

| Deutsche Post AG (Germany) | 122,238 | | 3,818,883 |

| Macquarie Airports (Australia) | 1,002,426 | | 2,964,616 |

| Macquarie Infrastructure Group (Australia) | 1,055,912 | | 2,816,275 |

| | | | 11,046,213 |

|

| |

| Utilities & Power (0.9%) | | | |

| Babcock & Brown Wind Partners (Australia) | 1,526,991 | | 2,274,730 |

| EDF Energies Nouvelles SA (France) | 26,775 | | 1,804,115 |

| Tenaga Nasional Berhad (Malaysia) | 867,400 | | 1,803,028 |

| | | | 5,881,873 |

|

| |

| Total common stocks (cost $444,528,552) | | $ | 612,490,843 |

| | | |

SHORT-TERM INVESTMENTS (11.8%)*

| | | | |

| | | |

| | Principal amount/shares | | Value |

|

| Short-term investments held as collateral for loaned | | | |

| securities with yields ranging from 1.96% to 3.11% | | | |

| and due dates ranging from May 1, 2008 | | | |

| to June 27, 2008 (d) | $ | 69,972,512 | $ | 69,878,452 |

| Putnam Prime Money Market Fund (e) | 2,882,488 | | 2,882,488 |

|

| |

| Total short-term investments (cost $72,760,940) | | $ | 72,760,940 |

| | | |

TOTAL INVESTMENTS

| | | |

|

| Total investments (cost $517,289,492) | | $ | 685,251,783 |

* Percentages indicated are based on net assets of $616,751,563.

† Non-income-producing security.

(d) See Note 1 to the financial statements.

(e) See Note 5 to the financial statements regarding investments in Putnam Prime Money Market Fund.

(S) Securities on loan, in part or in entirety, at April 30, 2008.

DIVERSIFICATION BY COUNTRY

Distribution of investments by country of issue at April 30, 2008 (as a percentage of Portfolio Value):

| | | | |

| | |

| United States | 78.0% | |

| France | 4.7 | |

| Germany | 3.5 | |

| Spain | 3.4 | |

| Japan | 2.4 | |

| United Kingdom | 1.6 | |

| Australia | 1.5 | |

| Italy | 1.2 | |

| Netherlands | 0.9 | |

| Malaysia | 0.8 | |

| Canada | 0.5 | |

| Other | 1.5 | |

| | |

| | |

| Total | 100.0% | |

The accompanying notes are an integral part of these financial statements.

34

Statement of assets and liabilities 4/30/08 (Unaudited)

| |

| ASSETS | |

|

| Investment in securities, at value, including $68,133,822 of securities on loan (Note 1): | |

| Unaffiliated issuers (identified cost $514,407,004) | $682,369,295 |

| Affiliated issuers (identified cost $2,882,488) (Note 5) | 2,882,488 |

|

| Cash | 282,268 |

|

| Dividends, interest and other receivables | 978,382 |

|

| Receivable for shares of the fund sold | 344,071 |

|

| Receivable for securities sold | 2,401,819 |

|

| Foreign tax reclaim | 60,261 |

|

| Total assets | 689,318,584 |

|

| |

| LIABILITIES | |

|

| Payable to custodian (Note 2) | 30,353 |

|

| Payable for shares of the fund repurchased | 1,123,545 |

|

| Payable for compensation of Manager (Notes 2 and 5) | 1,016,023 |

|

| Payable for investor servicing fees (Note 2) | 78,296 |

|

| Payable for custodian fees (Note 2) | 6,434 |

|

| Payable for Trustee compensation and expenses (Note 2) | 168,645 |

|

| Payable for administrative services (Note 2) | 1,865 |

|

| Payable for distribution fees (Note 2) | 156,287 |

|

| Collateral on securities loaned, at value (Note 1) | 69,878,452 |

|

| Other accrued expenses | 107,121 |

|

| Total liabilities | 72,567,021 |

|

| Net assets | $616,751,563 |

|

| |

| REPRESENTED BY | |

|

| Paid-in capital (Unlimited shares authorized) (Notes 1 and 4) | $443,543,619 |

|

| Undistributed net investment income (Note 1) | 1,308,134 |

|

| Accumulated net realized gain on investments | |

| and foreign currency transactions (Note 1) | 3,940,410 |

|

| Net unrealized appreciation of investments and assets | |

| and liabilities in foreign currencies | 167,959,400 |

|

| Total — Representing net assets applicable to capital shares outstanding | $616,751,563 |

(Continued on next page)

35

Statement of assets and liabilities (Continued)

| |

| COMPUTATION OF NET ASSET VALUE AND OFFERING PRICE | |

|

| Net asset value and redemption price per class A share | |

| ($557,295,563 divided by 36,571,697 shares) | $15.24 |

|

| Offering price per class A share | |

| (100/94.25 of $15.24)* | $16.17 |

|

| Net asset value and offering price per class B share | |

| ($41,642,496 divided by 2,746,267 shares)** | $15.16 |

|

| Net asset value and offering price per class C share | |

| ($7,588,821 divided by 501,308 shares)** | $15.14 |

|

| Net asset value and redemption price per class M share | |

| ($3,692,429 divided by 242,681 shares) | $15.22 |

|

| Offering price per class M share | |

| (100/96.50 of $15.22)* | $15.77 |

|

| Net asset value, offering price and redemption price per class R share | |

| ($864,771 divided by 56,879 shares) | $15.20 |

|

| Net asset value, offering price and redemption price per class Y share | |

| ($5,667,483 divided by 371,847 shares) | $15.24 |

* On single retail sales of less than $50,000. On sales of $50,000 or more the offering price is reduced.

** Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

The accompanying notes are an integral part of these financial statements.

36

Statement of operations Six months ended 4/30/08 (Unaudited)

| |

| INVESTMENT INCOME | |

|

| Dividends (net of foreign tax of $252,486) | $ 8,447,213 |

|

| Interest (including interest income of $178,863 from | |

| investments in affiliated issuers) (Note 5) | 180,088 |

|

| Securities lending | 103,188 |

|

| Total investment income | 8,730,489 |

| |

| |

| EXPENSES | |

|

| Compensation of Manager (Note 2) | 2,128,160 |

|

| Investor servicing fees (Note 2) | 580,255 |

|

| Custodian fees (Note 2) | 10,341 |

|

| Trustee compensation and expenses (Note 2) | 19,932 |

|

| Administrative services (Note 2) | 16,990 |

|

| Distribution fees — Class A (Note 2) | 705,576 |

|

| Distribution fees — Class B (Note 2) | 227,667 |

|

| Distribution fees — Class C (Note 2) | 33,744 |

|

| Distribution fees — Class M (Note 2) | 14,480 |

|

| Distribution fees — Class R (Note 2) | 1,911 |

|

| Other | 135,741 |

|

| Non-recurring costs (Notes 2 and 6) | 1,072 |

|

| Costs assumed by Manager (Notes 2 and 6) | (1,072) |

|

| Fees waived and reimbursed by Manager (Note 5) | (3,733) |

|

| Total expenses | 3,871,064 |

|

| Expense reduction (Note 2) | (77,357) |

|

| Net expenses | 3,793,707 |

|

| Net investment income | 4,936,782 |

|

| Net realized gain on investments (Notes 1 and 3) | 13,732,369 |

|

| Net realized gain on foreign currency transactions (Note 1) | 13,670 |

|

| Net unrealized depreciation of assets and liabilities | |

| in foreign currencies during the period | (8,518) |

|

| Net unrealized depreciation of investments during the period | (57,518,825) |

|

| Net loss on investments | (43,781,304) |

|

| Net decrease in net assets resulting from operations | $(38,844,522) |

The accompanying notes are an integral part of these financial statements.

37

Statement of changes in net assets

INCREASE (DECREASE) IN NET ASSETS

| | | |

| Six months ended | | Year ended |

| | 4/30/08* | | 10/31/07 |

|

| Operations: | | | |

| Net investment income | $ 4,936,782 | | $9,174,598 |

|

| Net realized gain on investments | | | |

| and foreign currency transactions | 13,746,039 | | 63,097,016 |

|

| Net unrealized appreciation (depreciation) of investments | | | |

| and assets and liabilities in foreign currencies | (57,527,343) | | 85,590,961 |

|

| Net increase (decrease) in net assets resulting from operations | (38,844,522) | | 157,862,575 |

|

| Distributions to shareholders (Note 1): | | | |

|

| From ordinary income | | | |

|

| Net investment income | | | |

|

| Class A | (4,692,693) | | (7,567,576) |

|

| Class B | (198,855) | | (325,961) |

|

| Class C | (32,217) | | (33,792) |

|

| Class M | (22,501) | | (31,274) |

|

| Class R | (5,566) | | (5,314) |

|

| Class Y | (52,646) | | (74,156) |

|