| | | |

| | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

|

| FORM N-CSR |

|

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| MANAGEMENT INVESTMENT COMPANIES |

|

| Investment Company Act file number: (811-05989) | |

| |

| Exact name of registrant as specified in charter: | Putnam Global Utilities Fund |

| |

| Address of principal executive offices: One Post Office Square, Boston, Massachusetts 02109 |

|

| Name and address of agent for service: | Beth S. Mazor, Vice President |

| | One Post Office Square |

| | Boston, Massachusetts 02109 |

| |

| Copy to: | | John W. Gerstmayr, Esq. |

| | Ropes & Gray LLP |

| | 800 Boylston Street |

| | Boston, Massachusetts 02199-3600 |

| |

| Registrant’s telephone number, including area code: | (617) 292-1000 |

| |

| Date of fiscal year end: August 31, 2011 | | |

| | |

| Date of reporting period: September 1, 2010 — February 28, 2011 |

Item 1. Report to Stockholders:

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940:

Putnam

Global Utilities

Fund

Semiannual report

2 | 28 | 11

| | | |

| Message from the Trustees | 1 | | |

| | |

| About the fund | 2 | | |

| | |

| Performance snapshot | 4 | | |

| | |

| Interview with your fund’s portfolio manager | 5 | | |

| | |

| Your fund’s performance | 11 | | |

| | |

| Your fund’s expenses | 13 | | |

| | |

| Terms and definitions | 15 | | |

| | |

| Other information for shareholders | 16 | | |

| | |

| Financial statements | 17 | | |

| | |

Message from the Trustees

Dear Fellow Shareholder:

The U.S. economy and stock market continue to show resilience, even in the face of rising head winds around the globe. On March 9, 2011, U.S. equities marked the two-year anniversary of the beginning of the most powerful bull market since the 1950s, with the S&P 500 Index doubling from its 2009 low.

While Putnam maintains a positive outlook for U.S. equities and the overall economy in 2011, we believe volatility will punctuate the year ahead. Civil unrest in the Middle East and North Africa, high unemployment, rising oil prices, and Japan’s earthquake, tsunami, and nuclear crisis have all created a climate of uncertainty. In addition, the U.S. fixed-income market continues to struggle, as yields have risen and bond prices have fallen. We believe that Putnam’s active, research-intensive approach is well suited to uncovering opportunities in this environment.

In developments affecting oversight of your fund, we wish to thank Richard B. Worley and Myra R. Drucker, who have retired from the Board of Trustees, for their many years of dedicated and thoughtful leadership.

Lastly, we would like to take this opportunity to welcome new shareholders to the fund and to thank all of our investors for your continued confidence in Putnam.

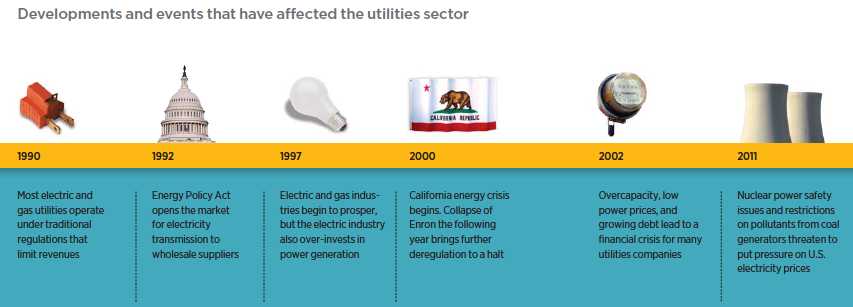

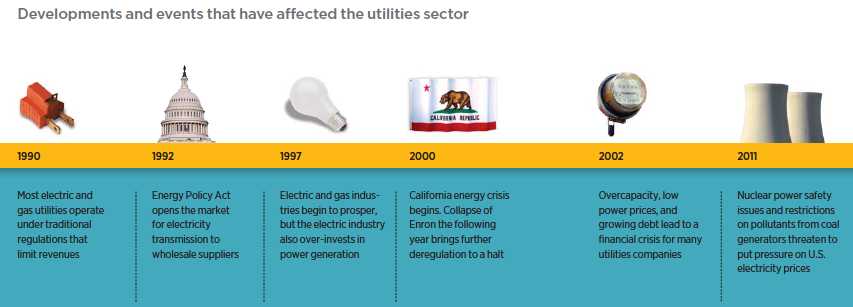

About the fund

Investing in the utilities sector for over 20 years

Many stock funds offer the potential for growth but produce little or no income for investors. Putnam Global Utilities Fund pursues both capital growth and current income through investments in the utilities sector. The fund targets industries that can profit from the global demand for utilities. It can invest in bonds as well as stocks, in both domestic and international markets, and across several industries with varying degrees of regulation.

The fund, which is part of Putnam’s suite of global sector funds, invests in utilities and their related industries in markets around the world.

Although the fund’s portfolio can include businesses of all sizes and at different stages of growth, established corporations are the norm in the utilities sector. Utilities have a history of consistent dividend payouts to investors. Their securities are valued as an alternative to bonds, especially during periods of low interest rates, when investors look outside the bond market for income.

The fund’s strategy, particularly during periods of uncertainty, is to maintain a solid foundation of securities in stable-demand industries, such as electric power and natural gas. Guided by this approach, the fund’s manager is committed to finding rewarding opportunities for income and growth by anticipating developments that affect the utilities sector worldwide. The manager conducts intensive research with support from analysts on Putnam’s Global Equity Research team.

Consider these risks before investing: International investing involves certain risks, such as currency fluctuations, economic instability, and political developments. Additional risks may be associated with emerging-market securities, including illiquidity and volatility. The use of derivatives involves special risks and may result in losses. Growth stocks may be more susceptible to earnings disappointments, and value stocks may fail to rebound. The use of short selling may result in losses if the securities appreciate in value. The fund’s policy of concentrating on a limited group of industries and the fund’s non-diversified status, which means the fund may invest in fewer issuers, can increase the fund’s vulnerability to common economic forces and may result in greater losses and volatility.

Sector investing at Putnam

In recent decades, innovation and business growth have propelled stocks in different industries to market-leading performance. Finding these stocks, many of which are in international markets, requires rigorous research and in-depth knowledge of global markets.

Putnam’s sector funds invest in nine sectors worldwide and offer active management, risk controls, and the expertise of dedicated sector analysts. The funds’ managers invest with flexibility and precision, using fundamental research to hand select stocks for the portfolios.

All sectors in one fund:

Putnam Global Sector Fund

A portfolio of individual Putnam Global Sector Funds that provides exposure to all sectors of the MSCI World Index.

Individual sector funds:

Global Consumer Fund

Retail, hotels, restaurants, media, food and beverages

Global Energy Fund

Oil and gas, energy equipment and services

Global Financials Fund

Commercial banks, insurance, diversified financial services, mortgage finance

Global Health Care Fund

Pharmaceuticals, biotechnology, health-care services

Global Industrials Fund

Airlines, railroads, trucking, aerospace and defense, construction, commercial services

Global Natural Resources Fund

Metals, chemicals, oil and gas, forest products

Global Technology Fund

Software, computers, Internet services

Global Telecommunications Fund

Diversified and wireless telecommunications services

Global Utilities Fund

Electric, gas, and water utilities

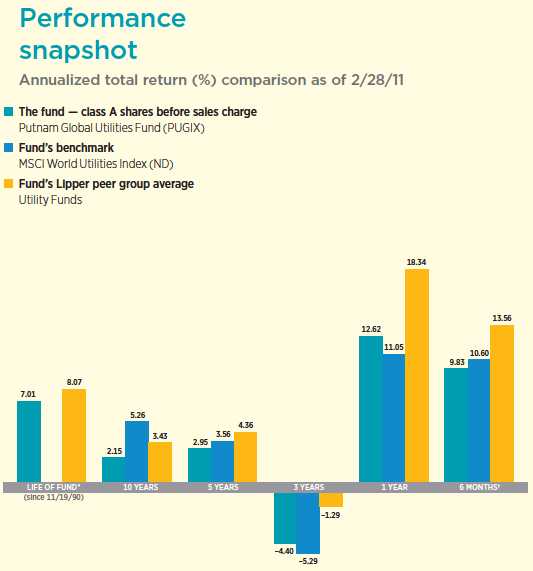

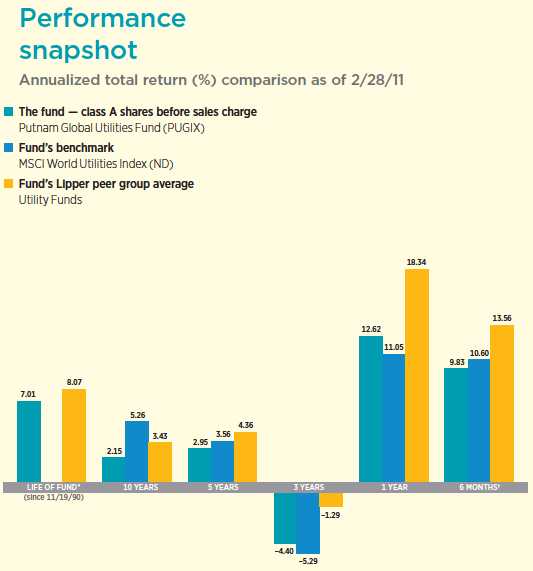

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will fluctuate, and you may have a gain or a loss when you sell your shares. Performance of class A shares assumes reinvestment of distributions and does not account for taxes. Fund returns in the bar chart do not reflect a sales charge of 5.75%; had they, returns would have been lower. See pages 5 and 11–12 for additional performance information. For a portion of the periods, the fund had expense limitations, without which returns would have been lower. A short-term trading fee of 1% may apply to redemptions or exchanges from certain funds within the time period specified in the fund’s prospectus. To obtain the most recent month-end performance, visit putnam.com.

* The fund’s benchmark, the MSCI World Utilities Index (ND), was introduced on 1/1/01, which post-dates the inception of the fund’s class A shares.

† Returns for the six-month period are not annualized, but cumulative.

4

Interview with your fund’s portfolio manager

Michael Yogg

How did Putnam Global Utilities Fund perform for the semiannual period ending February 28, 2011?

For the six-month period, the fund’s class A shares delivered a return of 9.83% at net asset value (NAV). That performance, however, lagged both its benchmark, the MSCI World Utilities Index (ND), which returned 10.60%, and its peer group, Lipper Utility Funds, which averaged 13.56%.

In a strong period for utilities, the fund’s underweight position in Europe detracted from performance as compared to the benchmark. Relative to its peer group, however, the fund’s disciplined focus on utility investments sets it apart from many of its peers, whose universe of investments often includes telecommunications and energy, both of which outperformed utilities during the period.

We believe the fund’s strict focus on utilities offers investors a unique, disciplined sector opportunity amid Putnam’s diverse lineup of funds, which can offer investors broader exposure to other sectors, such as telecommunications and energy.

What was the market and sector environment like during the period?

Equity markets continued their two-year bull market run with another strong six months. Equity markets in North America, Europe, and Asia did particularly well September through February, reflecting growing optimism about the economic and financial recovery.

The period was not without hiccups, however; sporadic sovereign debt concerns created periods of volatility, while turmoil in the Middle East and North Africa and rising oil prices pressured markets in February. None of these factors, however, was strong enough to derail the market’s upward trend.

This comparison shows your fund’s performance in the context of broad market indexes for the six months ended 2/28/11. See pages 4 and 11–12 for additional fund performance information. Index descriptions can be found on page 15.

5

Utility stocks certainly joined in this upward trajectory; however, since utilities are more defensive stocks, their appreciation was more muted than the broader equity markets.

What market factors drove the fund’s performance?

The fund held an overweight position in regulated utilities, which aided performance when they outperformed companies with exposure to power markets.

Conversely, we underweighted Europe versus its benchmark in contrast to North America and Asia. This detracted from the fund’s relative performance when Europe outperformed. We still believe, however, that our underweight to Europe is the right strategy in the longer term. Prior to the last period, European utilities had underperformed for an extended period because of weak power markets, sovereign debt concerns, and the threat of taxation of generation facilities in several European countries. The stock of many of these same utilities rebounded early in 2011 as these concerns receded somewhat. Even so, we believe the problems are far from being solved.

In the case of Japan, prior to the devastating earthquake and tsunami that occurred after the end of the period, the entire utility sector had been hurt by the extremely conservative management style of many of the utilities, including the excessive sale of stock.

You mentioned the catastrophe in Japan, which damaged nuclear, thermal, and hydropower facilities. How are you managing the portfolio and your Japanese utility holdings in the wake of this disaster?

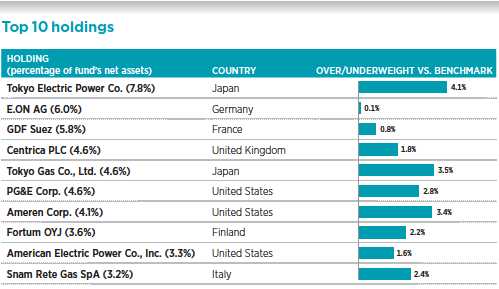

At the time of the disaster in March, we held an overweight position in Japan, though we were underweight Japanese electric utilities. Still, the Japanese disaster caused major problems for the portfolio because of our large position in Tokyo Electric Power Company (TEPCO). We believe that utility investors are conservative investors, or at least are seeking

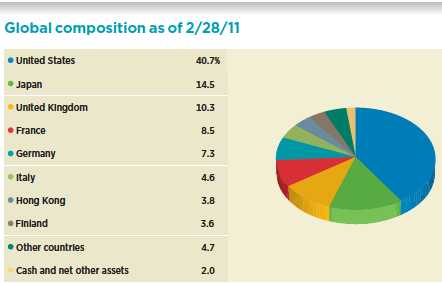

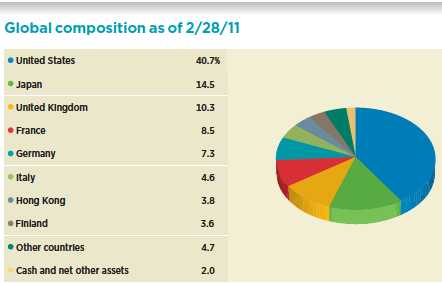

Country/territory allocations are shown as a percentage of the fund’s net assets. Summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of derivative securities and the exclusion of as-of trades, if any, and the use of different classifications of securities for presentation purposes. Weightings will vary over time.

6

some safety and stability in the portion of their portfolios they invest in utilities.

Given the extreme uncertainty of the Japan situation and our belief that TEPCO had made some mistakes early on for which it could be found liable, we wanted to liquidate our position in that one stock fairly quickly. We sold all of our shares in TEPCO on the first day there was significant trading volume in the stock. The other Japanese stocks in the portfolio were less affected, and we have held on to them, though with the sale of TEPCO we are underweight Japan.

Which holdings helped performance?

Even though European power markets have been weak, we did identify the Nordic market as an exception. As a result, we established an overweight position in Fortum, a Finnish energy generator, whose shares appreciated during the period. In Asia, the fund also benefited from owning Cheung Kong Infrastructure of Hong Kong, which has used its financial resources to invest opportunistically in infrastructure projects around the world. Cheung Kong shares also increased in value during the period.

AES, an American power company that invests around the world, afforded us an opportunity to capture a bit more return in exchange for the risk of volatility. AES is one of only a few utilities with a beta greater than 1.0. Beta is a measure of a security’s volatility in comparison to the market as a whole. When a company’s beta is greater than 1.0, it typically means the stock has the opportunity to outperform in a strong market, while underperforming in a weaker market. In the

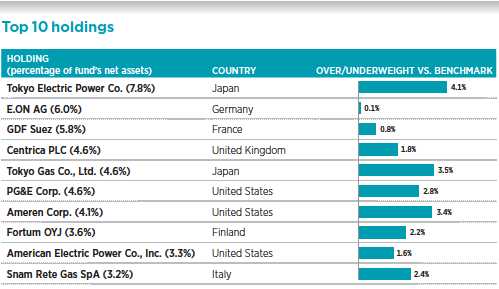

This table shows the fund’s top 10 holdings by percentage of the fund’s net assets as of 2/28/11. Short-term holdings are excluded. Holdings will vary over time.

7

currently strong climate, this holding paid off with a greater than 20% return for the period.

In Europe, our holding in Endesa, a Spanish utility with substantial Latin American assets, participated strongly in the region’s rally. In the United States, the fund also benefited from NV Energy and CMS Energy, two utilities that were boosted by improved economies and more favorable regulations in their states, Nevada and Michigan, respectively. We still hold all of these companies in our portfolio.

What were some examples of holdings that detracted from performance?

TEPCO and Tokyo Gas, both major holdings, declined over the semiannual period, hurting our performance. TEPCO made a tactical mistake by selling too much stock in its last public offering, diluting its price. In fact, the price declined so sharply that we decided to increase our position, even though we disapproved of management’s actions. When TEPCO declined, Japanese electrics declined across the board. In the wake of that decline, investors sold Tokyo Gas to buy into the depressed electric sector, furthering our losses.

Another holding, PPL Corporation of Pennsylvania, was hurt by management’s decision to diversify its generation business by acquiring distribution properties. While this strategy may be beneficial for PPL in the long term, the diversification strategy required the sale of significant amounts of stock, depressing the price even more. PG&E Corp., a public utility that distributes electricity and natural gas primarily in northern and central California, was another holding that hurt performance. PG&E has been hurt by concerns over increased California regulation, especially given the company’s gas line explosion in San Bruno in September 2010. We believe, however, that the regulatory problems are exaggerated by some Wall Street analysts, and that the San Bruno accident, while terrible in human terms, will not be a major financial hit due to the company’s insurance coverage.

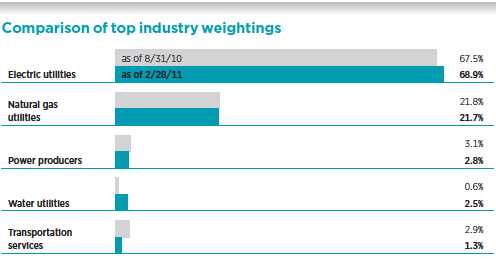

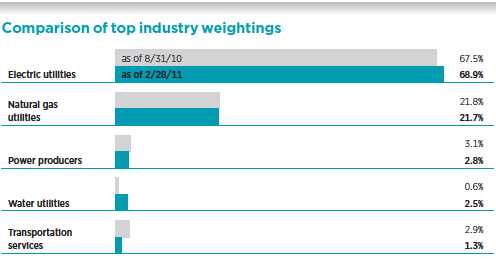

This chart shows how the fund’s top weightings have changed over the past six months. Weightings are shown as a percentage of net assets. Summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of derivative securities and the exclusion of as-of trades, if any, and the use of different classifications of securities for presentation purposes. Holdings will vary over time.

8

Where do you see the biggest global opportunities and risks in the sector right now?

We believe the greatest opportunity lies with those companies that can make meaningful contributions toward solving our global environmental and climate-change problems. Over the long term, companies building renewable generation facilities or those developing clean-coal technology hold enormous promise. Over the short term, however, much of our progress may well come from natural gas, which is relatively clean and releases half the carbon dioxide of coal. That’s why we believe regulators and the market will reward natural gas burners, companies building new gas plants, and especially those replacing coal with gas. In terms of risks on the horizon, the biggest ones are more macro-related than industry-specific, including turmoil in North Africa and the Middle East, and the financial health of sovereign nations, particularly in the periphery of Europe. In the coming years, investors in the sector need to be mindful of currency inflation and greater-than-expected environmental degradation.

What is your outlook for the next six months, and how have you positioned the fund to take advantage?

After nearly a year of relative underperformance, we believe utilities may be poised to outperform the broader market, with recent concerns mentioned previously resulting in discounted utility stock prices. While we do not anticipate power and natural gas prices rebounding, we cannot imagine them falling much farther. In the United States, we expect more stringent environmental regulation in coming years, which could force the closure of many coal plants, thus reducing power supply and supporting prices. Over time, we expect that the portfolio could have increased exposure to merchant generators, while decreasing exposure to more regulated companies.

Thank you, Michael, for your time and insights today.

The views expressed in this report are exclusively those of Putnam Management. They are not meant as investment advice.

Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk.

Portfolio Manager Michael Yogg is Utilities Sector Team Leader at Putnam. He has a Ph.D. and an M.A. from Harvard University, and a B.A. from Yale University. A CFA charterholder, he joined Putnam in 1997 and has been in the investment industry since 1978.

9

IN THE NEWS

Oil prices have surged in the past several months, pushed higher by political strife in Egypt and Libya and rising demand from around the globe. A barrel of Brent crude oil jumped to $111.80 on February 28, 2011, from $82.31 at the end of September 2010. With the United States showing signs of economic growth, the concern is that rising oil prices could tip the economy back into recession. If oil remains elevated for an extended period of time, consumer spending — the primary engine of GDP growth — could be significantly reduced. A more manageable price for oil today is generally considered to be between $90 and $100. This is not the first time in recent years that oil prices have exhibited significant price swings. In early July 2008, oil peaked at $146.08, but the global economic slowdown diminished worldwide demand for oil, knocking down the price to a low of $36.61 by late December of that year.

10

Your fund’s performance

This section shows your fund’s performance, price, and distribution information for periods ended February 28, 2011, the end of the first half of its current fiscal year. In accordance with regulatory requirements for mutual funds, we also include performance as of the most recent calendar quarter-end and expense information taken from the fund’s current prospectus. Performance should always be considered in light of a fund’s investment strategy. Data represent past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance information does not reflect any deduction for taxes a shareholder may owe on fund distributions or on the redemption of fund shares. For the most recent month-end performance, please visit the Individual Investors section at putnam.com or call Putnam at 1-800-225-1581. Class R and class Y shares are not available to all investors. See the Terms and Definitions section in this report for definitions of the share classes offered by your fund.

Fund performance Total return for periods ended 2/28/11

| | | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

| (inception dates) | (11/19/90) | (4/27/92) | (7/26/99) | (3/1/95) | (12/1/03) | (10/4/05) |

|

| | NAV | POP | NAV | CDSC | NAV | CDSC | NAV | POP | NAV | NAV |

|

| Annual average | | | | | | | | | | |

| (life of fund) | 7.01% | 6.70% | 6.21% | 6.21% | 6.21% | 6.21% | 6.49% | 6.30% | 6.74% | 7.08% |

|

| 10 years | 23.65 | 16.59 | 14.64 | 14.64 | 14.68 | 14.68 | 17.60 | 13.49 | 20.61 | 25.30 |

| Annual average | 2.15 | 1.55 | 1.38 | 1.38 | 1.38 | 1.38 | 1.63 | 1.27 | 1.89 | 2.28 |

|

| 5 years | 15.64 | 8.97 | 11.34 | 9.34 | 11.26 | 11.26 | 12.74 | 8.77 | 14.19 | 17.01 |

| Annual average | 2.95 | 1.73 | 2.17 | 1.80 | 2.16 | 2.16 | 2.43 | 1.70 | 2.69 | 3.19 |

|

| 3 years | –12.64 | –17.66 | –14.64 | –17.02 | –14.65 | –14.65 | –13.96 | –16.95 | –13.35 | –12.02 |

| Annual average | –4.40 | –6.27 | –5.14 | –6.03 | –5.14 | –5.14 | –4.89 | –6.00 | –4.66 | –4.18 |

|

| 1 year | 12.62 | 6.16 | 11.88 | 6.88 | 11.77 | 10.77 | 12.06 | 8.14 | 12.38 | 12.92 |

|

| 6 months | 9.83 | 3.51 | 9.44 | 4.44 | 9.40 | 8.40 | 9.57 | 5.79 | 9.64 | 9.97 |

|

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. After-sales-charge returns (public offering price, or POP) for class A and M shares reflect a maximum 5.75% and 3.50% load, respectively. Class B share returns reflect the applicable contingent deferred sales charge (CDSC), which is 5% in the first year, declining over time to 1% in the sixth year, and is eliminated thereafter. Class C shares reflect a 1% CDSC for the first year that is eliminated thereafter. Class R and Y shares have no initial sales charge or CDSC. Performance for class B, C, M, R, and Y shares before their inception is derived from the historical performance of class A shares, adjusted for the applicable sales charge (or CDSC) and the higher operating expenses for such shares, except for class Y shares, for which 12b-1 fees are not applicable.

For a portion of the periods, the fund had expense limitations, without which returns would have been lower.

Class B share performance does not reflect conversion to class A shares.

A short-term trading fee of 1% may apply to redemptions or exchanges from certain funds within the time period specified in the fund’s prospectus.

11

Comparative index returns For periods ended 2/28/11

| | |

| | MSCI World Utilities Index (ND) | Lipper Utility Funds category average† |

|

| Annual average (life of fund) | —* | 8.07% |

|

| 10 years | 66.92% | 43.13 |

| Annual average | 5.26 | 3.43 |

|

| 5 years | 19.13 | 24.45 |

| Annual average | 3.56 | 4.36 |

|

| 3 years | –15.04 | –3.47 |

| Annual average | –5.29 | –1.29 |

|

| 1 year | 11.05 | 18.34 |

|

| 6 months | 10.60 | 13.56 |

|

Index and Lipper results should be compared to fund performance at net asset value.

* The fund’s benchmark, the MSCI World Utilities Index (ND), was introduced on 1/1/01, which post-dates the inception of the fund’s class A shares.

† Over the 6-month, 1-year, 3-year, 5-year, 10-year, and life-of-fund periods ended 2/28/11, there were 84, 81, 76, 66, 48, and 3 funds, respectively, in this Lipper category.

Fund price and distribution information For the six-month period ended 2/28/11

| | | | | | | | |

| Distributions | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Number | 2 | 2 | 2 | 2 | 2 | 2 |

|

| Income | $0.187 | $0.143 | $0.146 | $0.159 | $0.174 | $0.201 |

|

| Capital gains | — | — | — | — | — | — |

|

| Total | $0.187 | $0.143 | $0.146 | $0.159 | $0.174 | $0.201 |

|

| Share value | NAV | POP | NAV | NAV | NAV | POP | NAV | NAV |

|

| 8/31/10 | $10.63 | $11.28 | $10.58 | $10.55 | $10.61 | $10.99 | $10.60 | $10.63 |

|

| 2/28/11 | 11.48 | 12.18 | 11.43 | 11.39 | 11.46 | 11.88 | 11.44 | 11.48 |

|

The classification of distributions, if any, is an estimate. Final distribution information will appear on your year-end tax forms.

Fund performance as of most recent calendar quarter

Total return for periods ended 3/31/11

| | | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

| (inception dates) | (11/19/90) | (4/27/92) | (7/26/99) | (3/1/95) | (12/1/03) | (10/4/05) |

|

| | NAV | POP | NAV | CDSC | NAV | CDSC | NAV | POP | NAV | NAV |

|

| Annual average | | | | | | | | | | |

| (life of fund) | 6.69% | 6.38% | 5.89% | 5.89% | 5.89% | 5.89% | 6.16% | 5.97% | 6.42% | 6.76% |

|

| 10 years | 19.57 | 12.72 | 10.86 | 10.86 | 10.94 | 10.94 | 13.73 | 9.73 | 16.61 | 21.24 |

| Annual average | 1.80 | 1.20 | 1.04 | 1.04 | 1.04 | 1.04 | 1.29 | 0.93 | 1.55 | 1.94 |

|

| 5 years | 12.13 | 5.65 | 7.95 | 5.97 | 7.96 | 7.96 | 9.31 | 5.45 | 10.69 | 13.56 |

| Annual average | 2.32 | 1.11 | 1.54 | 1.17 | 1.54 | 1.54 | 1.80 | 1.07 | 2.05 | 2.58 |

|

| 3 years | –17.34 | –22.11 | –19.20 | –21.46 | –19.18 | –19.18 | –18.56 | –21.41 | –17.96 | –16.70 |

| Annual average | –6.15 | –7.99 | –6.86 | –7.74 | –6.85 | –6.85 | –6.61 | –7.72 | –6.39 | –5.91 |

|

| 1 year | 3.02 | –2.92 | 2.30 | –2.70 | 2.27 | 1.27 | 2.49 | –1.08 | 2.76 | 3.29 |

|

| 6 months | 0.06 | –5.70 | –0.33 | –5.25 | –0.31 | –1.29 | –0.19 | –3.70 | –0.06 | 0.19 |

|

12

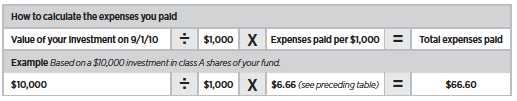

Your fund’s expenses

As a mutual fund investor, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. Using the following information, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial representative.

Expense ratios

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Total annual operating expenses for the fiscal year | | | | | |

| ended 8/31/10* | 1.34% | 2.09% | 2.09% | 1.84% | 1.59% | 1.09% |

|

| Annualized expense ratio for the six-month period | | | | | | |

| ended 2/28/11 | 1.28% | 2.03% | 2.03% | 1.78% | 1.53% | 1.03% |

|

Fiscal-year expense information in this table is taken from the most recent prospectus, is subject to change, and may differ from that shown for the annualized expense ratio and in the financial highlights of this report. Expenses are shown as a percentage of average net assets.

* Restated to reflect projected expenses under a management contract effective 1/1/10.

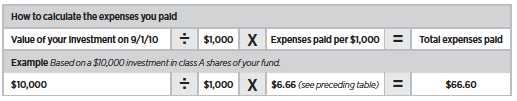

Expenses per $1,000

The following table shows the expenses you would have paid on a $1,000 investment in the fund from September 1, 2010, to February 28, 2011. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Expenses paid per $1,000*† | $6.66 | $10.54 | $10.54 | $9.25 | $7.95 | $5.36 |

|

| Ending value (after expenses) | $1,098.30 | $1,094.40 | $1,094.00 | $1,095.70 | $1,096.40 | $1,099.70 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 2/28/11. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

13

Estimate the expenses you paid

To estimate the ongoing expenses you paid for the six months ended February 28, 2011, use the following calculation method. To find the value of your investment on September 1, 2010, call Putnam at 1-800-225-1581.

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the following table shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Expenses paid per $1,000*† | $6.41 | $10.14 | $10.14 | $8.90 | $7.65 | $5.16 |

|

| Ending value (after expenses) | $1,018.45 | $1,014.73 | $1,014.73 | $1,015.97 | $1,017.21 | $1,019.69 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 2/28/11. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

14

Terms and definitions

Important terms

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Net asset value (NAV) is the price, or value, of one share of a mutual fund, without a sales charge. NAVs fluctuate with market conditions. NAV is calculated by dividing the net assets of each class of shares by the number of outstanding shares in the class.

Public offering price (POP) is the price of a mutual fund share plus the maximum sales charge levied at the time of purchase. POP performance figures shown here assume the 5.75% maximum sales charge for class A shares and 3.50% for class M shares.

Contingent deferred sales charge (CDSC) is generally a charge applied at the time of the redemption of class B or C shares and assumes redemption at the end of the period. Your fund’s class B CDSC declines over time from a 5% maximum during the first year to 1% during the sixth year. After the sixth year, the CDSC no longer applies. The CDSC for class C shares is 1% for one year after purchase.

Share classes

Class A shares are generally subject to an initial sales charge and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class B shares are not subject to an initial sales charge. They may be subject to a CDSC.

Class C shares are not subject to an initial sales charge and are subject to a CDSC only if the shares are redeemed during the first year.

Class M shares have a lower initial sales charge and a higher 12b-1 fee than class A shares and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class R shares are not subject to an initial sales charge or CDSC and are available only to certain defined contribution plans.

Class Y shares are not subject to an initial sales charge or CDSC, and carry no 12b-1 fee. They are generally only available to corporate and institutional clients and clients in other approved programs.

Comparative indexes

Barclays Capital Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

BofA (Bank of America) Merrill Lynch U.S. 3-Month Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

MSCI World Utilities Index (ND) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets in the utilities sector.

S&P 500 Index is an unmanaged index of common stock performance.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

Lipper is a third-party industry-ranking entity that ranks mutual funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

15

Other information for shareholders

Important notice regarding delivery of shareholder documents

In accordance with SEC regulations, Putnam sends a single copy of annual and semiannual shareholder reports, prospectuses, and proxy statements to Putnam shareholders who share the same address, unless a shareholder requests otherwise. If you prefer to receive your own copy of these documents, please call Putnam at 1-800-225-1581, and Putnam will begin sending individual copies within 30 days.

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2010, are available in the Individual Investors section of putnam.com, and on the SEC’s website, www.sec.gov. If you have questions about finding forms on the SEC’s website, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Forms N-Q on the SEC’s website at www.sec.gov. In addition, the fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for information about the SEC’s website or the operation of the Public Reference Room.

Trustee and employee fund ownership

Putnam employees and members of the Board of Trustees place their faith, confidence, and, most importantly, investment dollars in Putnam mutual funds. As of February 28, 2011, Putnam employees had approximately $372,000,000 and the Trustees had approximately $69,000,000 invested in Putnam mutual funds. These amounts include investments by the Trustees’ and employees’ immediate family members as well as investments through retirement and deferred compensation plans.

16

Financial statements

A guide to financial statements

These sections of the report, as well as the accompanying Notes, constitute the fund’s financial statements.

The fund’s portfolio lists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and non-investment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal period.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned. Dividend sources are estimated at the time of declaration. Actual results may vary. Any non-taxable return of capital cannot be determined until final tax calculations are completed after the end of the fund’s fiscal year.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlights table also includes the current reporting period.

17

The fund’s portfolio 2/28/11 (Unaudited)

| | |

| COMMON STOCKS (96.7%)* | Shares | Value |

|

| Electric utilities (67.6%) | | |

| AES Corp. (The) † | 734,948 | $9,091,307 |

|

| AGL Energy, Ltd. (Australia) | 280,182 | 4,180,945 |

|

| Alliant Energy Corp. | 76,934 | 3,029,661 |

|

| Ameren Corp. | 424,759 | 11,876,262 |

|

| American Electric Power Co., Inc. | 266,150 | 9,522,847 |

|

| CMS Energy Corp. S | 430,590 | 8,293,163 |

|

| E.ON AG (Germany) | 526,946 | 17,292,598 |

|

| EDF (France) | 171,668 | 7,657,149 |

|

| Edison International | 199,945 | 7,421,958 |

|

| Endesa SA (Spain) | 149,326 | 4,524,218 |

|

| Energias de Portugal (EDP) SA (Portugal) | 180,385 | 684,212 |

|

| Entergy Corp. | 104,807 | 7,462,258 |

|

| Fortum OYJ (Finland) | 333,000 | 10,318,918 |

|

| Great Plains Energy, Inc. | 182,800 | 3,509,760 |

|

| Iberdrola SA (Spain) | 457,453 | 3,992,485 |

|

| ITC Holdings Corp. S | 37,600 | 2,577,480 |

|

| Kansai Electric Power, Inc. (Japan) | 124,700 | 3,275,988 |

|

| Kyushu Electric Power Co., Inc. (Japan) | 121,000 | 2,812,394 |

|

| National Grid PLC (United Kingdom) | 762,462 | 7,082,528 |

|

| Northeast Utilities | 63,405 | 2,158,306 |

|

| NV Energy, Inc. | 279,125 | 4,100,346 |

|

| Pepco Holdings, Inc. | 93,000 | 1,741,890 |

|

| PG&E Corp. | 284,056 | 13,083,619 |

|

| Pinnacle West Capital Corp. S | 85,324 | 3,603,233 |

|

| Power Assets Holdings, Ltd. (Hong Kong) | 1,053,000 | 6,884,687 |

|

| PPL Corp. | 320,584 | 8,152,451 |

|

| Terna SPA (Italy) | 834,282 | 3,848,513 |

|

| Tokyo Electric Power Co. (Japan) | 867,600 | 22,460,113 |

|

| Wisconsin Energy Corp. | 49,778 | 2,946,858 |

|

| | | 193,586,147 |

| Natural gas utilities (21.7%) | | |

| Centrica PLC (United Kingdom) | 2,381,248 | 13,174,836 |

|

| GDF Suez (France) | 410,125 | 16,629,061 |

|

| Sempra Energy | 129,643 | 6,900,897 |

|

| Snam Rete Gas SpA (Italy) | 1,683,156 | 9,209,406 |

|

| Tokyo Gas Co., Ltd. (Japan) | 2,946,000 | 13,168,432 |

|

| UGI Corp. | 99,500 | 3,173,055 |

|

| | | 62,255,687 |

| Oil and gas (0.8%) | | |

| Questar Corp. | 121,900 | 2,178,353 |

|

| | | 2,178,353 |

| Power producers (2.8%) | | |

| Cheung Kong Infrastructure Holdings, Ltd. (Hong Kong) | 786,000 | 3,890,345 |

|

| International Power PLC (United Kingdom) | 752,392 | 4,091,801 |

|

| | | 7,982,146 |

18

| | |

| COMMON STOCKS (96.7%)* cont. | Shares | Value |

|

| Transportation services (1.3%) | | |

| Deutsche Post AG (Germany) | 200,210 | $3,672,691 |

|

| | | 3,672,691 |

| Water Utilities (2.5%) | | |

| American Water Works Co., Inc. | 74,468 | 2,065,742 |

|

| Northumbrian Water Group PLC (United Kingdom) | 264,742 | 1,402,301 |

|

| Severn Trent PLC (United Kingdom) | 75,032 | 1,815,062 |

|

| United Utilities Group PLC (United Kingdom) | 208,615 | 2,009,098 |

|

| | | 7,292,203 |

| | | |

| Total common stocks (cost $233,282,820) | | $276,967,227 |

| |

| |

| CONVERTIBLE PREFERRED STOCKS (1.4%)* | Shares | Value |

|

| Great Plains Energy, Inc. $6.00 cv. pfd. | 20,446 | $1,276,853 |

|

| PPL Corp. $4.75 cv. pfd. | 52,239 | 2,784,861 |

|

| Total convertible preferred stocks (cost $3,984,314) | | $4,061,714 |

| |

| |

| SHORT-TERM INVESTMENTS (5.1%)* | Principal amount/shares | Value |

|

| U.S. Treasury Bills for effective yields ranging from 0.24% | | |

| to 0.25%, October 20, 2011 | $341,000 | $340,466 |

|

| U.S. Treasury Bills for an effective yield of 0.23%, | | |

| July 28, 2011 ## | 150,000 | 149,856 |

|

| U.S. Treasury Bills for an effective yield of 0.21%, | | |

| June 2, 2011 | 379,000 | 378,797 |

|

| Putnam Cash Collateral Pool, LLC 0.21% d | 11,057,720 | 11,057,720 |

|

| Putnam Money Market Liquidity Fund 0.17% e | 2,593,510 | 2,593,510 |

|

| Total short-term investments (cost $14,520,349) | | $14,520,349 |

| |

| |

| TOTAL INVESTMENTS | | |

|

| Total investments (cost $251,787,483) | | $295,549,290 |

Notes to the fund’s portfolio

Unless noted otherwise, the notes to the fund’s portfolio are for the close of the fund’s reporting period, which ran from September 1, 2010 through February 28, 2011 (the reporting period).

* Percentages indicated are based on net assets of $286,567,122.

† Non-income-producing security.

## This security, in part or in entirety, was pledged and segregated with the custodian for collateral on certain derivatives contracts at the close of the reporting period.

d See Note 1 to the financial statements regarding securities lending. The rate quoted in the security description is the annualized 7-day yield of the fund at the close of the reporting period.

e See Note 6 to the financial statements regarding investments in Putnam Money Market Liquidity Fund. The rate quoted in the security description is the annualized 7-day yield of the fund at the close of the reporting period.

S Securities on loan, in part or in entirety, at the close of the reporting period.

At the close of the reporting period, the fund maintained liquid assets totaling $60,030 to cover certain derivatives contracts.

19

| | | | |

| DIVERSIFICATION BY COUNTRY | | | | |

|

| Distribution of investments by country of risk at the close of the reporting period (as a percentage of Portfolio Value): |

| |

| United States | 42.3% | | Hong Kong | 3.8% |

| |

|

| Japan | 14.7 | | Finland | 3.6 |

| |

|

| United Kingdom | 10.4 | | Spain | 3.0 |

| |

|

| France | 8.5 | | Australia | 1.5 |

| |

|

| Germany | 7.4 | | Portugal | 0.2 |

| |

|

| Italy | 4.6 | | Total | 100.0% |

| | |

FORWARD CURRENCY CONTRACTS at 2/28/11 (aggregate face value $64,388,147) (Unaudited)

| | | | | | |

| | | | | | Unrealized |

| | Contract | Delivery | | Aggregate | appreciation/ |

| Counterparty | Currency | type | date | Value | face value | (depreciation) |

|

| Bank of America, N.A. | | | | | |

|

| Australian Dollar | Sell | 3/16/11 | $856,291 | $849,814 | $(6,477) |

|

| British Pound | Sell | 3/16/11 | 1,645,951 | 1,633,308 | (12,643) |

|

| Euro | Sell | 3/16/11 | 1,168,333 | 1,167,470 | (863) |

|

| Barclays Bank PLC | | | | | |

|

| British Pound | Buy | 3/16/11 | 55,304 | 54,898 | 406 |

|

| Euro | Buy | 3/16/11 | 1,784,378 | 1,783,099 | 1,279 |

|

| Hong Kong Dollar | Sell | 3/16/11 | 832,434 | 832,539 | 105 |

|

| Citibank, N.A. | | | | |

|

| British Pound | Sell | 3/16/11 | 4,391,644 | 4,358,408 | (33,236) |

|

| Euro | Buy | 3/16/11 | 196,516 | 192,859 | 3,657 |

|

| Hong Kong Dollar | Sell | 3/16/11 | 2,805,906 | 2,806,439 | 533 |

|

| Credit Suisse AG | | | | |

|

| British Pound | Buy | 3/16/11 | 4,290,795 | 4,258,019 | 32,776 |

|

| Euro | Buy | 3/16/11 | 8,732,548 | 8,722,999 | 9,549 |

|

| Japanese Yen | Sell | 3/16/11 | 395,724 | 397,670 | 1,946 |

|

| Deutsche Bank AG | | | | |

|

| Euro | Sell | 3/16/11 | 1,326,760 | 1,325,857 | (903) |

|

| Goldman Sachs International | | | |

|

| Australian Dollar | Sell | 3/16/11 | 1,463,526 | 1,452,081 | (11,445) |

|

| Euro | Buy | 3/16/11 | 1,260,380 | 1,258,984 | 1,396 |

|

| Japanese Yen | Sell | 3/16/11 | 2,066,387 | 2,076,486 | 10,099 |

|

| HSBC Bank USA, National Association | | |

|

| Australian Dollar | Buy | 3/16/11 | 780,120 | 774,012 | 6,108 |

|

| British Pound | Buy | 3/16/11 | 1,127,068 | 1,118,451 | 8,617 |

|

| Euro | Sell | 3/16/11 | 2,203,630 | 2,202,051 | (1,579) |

|

| Hong Kong Dollar | Buy | 3/16/11 | 3,469,334 | 3,470,752 | (1,418) |

|

| JPMorgan Chase Bank, N.A. | | | | |

|

| British Pound | Sell | 3/16/11 | 79,215 | 78,611 | (604) |

|

| Canadian Dollar | Buy | 3/16/11 | 3,979,267 | 3,892,551 | 86,716 |

|

| Euro | Buy | 3/16/11 | 864,312 | 863,430 | 882 |

|

| Hong Kong Dollar | Sell | 3/16/11 | 88,228 | 88,255 | 27 |

|

| Japanese Yen | Sell | 3/16/11 | 390,209 | 392,174 | 1,965 |

|

20

FORWARD CURRENCY CONTRACTS at 2/28/11 (aggregate face value $64,388,147) (Unaudited) cont.

| | | | | | |

| | | | | | | Unrealized |

| | | Contract | Delivery | | Aggregate | appreciation/ |

| Counterparty | Currency | type | date | Value | face value | (depreciation) |

|

| Royal Bank of Scotland PLC (The) | | | | | |

|

| | British Pound | Sell | 3/16/11 | $5,033,986 | $4,996,174 | $(37,812) |

|

| | Euro | Buy | 3/16/11 | 645,440 | 644,954 | 486 |

|

| | Japanese Yen | Sell | 3/16/11 | 831,407 | 835,589 | 4,182 |

|

| State Street Bank and Trust Co. | | | | | |

|

| | Australian Dollar | Sell | 3/16/11 | 669,372 | 664,267 | (5,105) |

|

| | Euro | Sell | 3/16/11 | 2,241,995 | 2,239,719 | (2,276) |

|

| UBS AG | | | | | | |

|

| | British Pound | Buy | 3/16/11 | 2,363,768 | 2,346,162 | 17,606 |

|

| | Euro | Buy | 3/16/11 | 3,323,800 | 3,322,309 | 1,491 |

|

| Westpac Banking Corp. | | | | | |

|

| | British Pound | Buy | 3/16/11 | 1,603,497 | 1,591,185 | 12,312 |

|

| | Euro | Buy | 3/16/11 | 1,011,423 | 1,010,552 | 871 |

|

| | Japanese Yen | Buy | 3/16/11 | 682,469 | 686,019 | (3,550) |

|

| Total | | | | | | $85,098 |

Accounting Standards Codification ASC 820 Fair Value Measurements and Disclosures (ASC 820) establishes a three-level hierarchy for disclosure of fair value measurements. The valuation hierarchy is based upon the transparency of inputs to the valuation of the fund’s investments. The three levels are defined as follows:

Level 1 — Valuations based on quoted prices for identical securities in active markets.

Level 2 — Valuations based on quoted prices in markets that are not active or for which all significant inputs are observable, either directly or indirectly.

Level 3 — Valuations based on inputs that are unobservable and significant to the fair value measurement.

The following is a summary of the inputs used to value the fund’s net assets as of the close of the reporting period:

| | | | |

| | | |

| | | Valuation inputs | |

|

| Investments in securities: | Level 1 | Level 2 | Level 3 |

|

| Common stocks: | | | |

|

| Energy | $2,178,353 | $— | $— |

|

| Transportation | 3,672,691 | — | — |

|

| Utilities and power | 214,443,279 | 56,672,904 | — |

|

| Total common stocks | 220,294,323 | 56,672,904 | — |

| Convertible preferred stocks | — | 4,061,714 | — |

|

| Short-term investments | 2,593,510 | 11,926,839 | — |

|

| Totals by level | $222,887,833 | $72,661,457 | $— |

| | | | |

| | | Valuation inputs | |

|

| Other financial instruments: | Level 1 | Level 2 | Level 3 |

|

| Forward currency contracts | $— | $85,098 | $— |

|

| Totals by level | $— | $85,098 | $— |

The accompanying notes are an integral part of these financial statements.

21

Statement of assets and liabilities 2/28/11 (Unaudited)

| |

| ASSETS | |

|

| Investment in securities, at value, including $10,805,391 of securities on loan (Note 1): | |

| Unaffiliated issuers (identified cost $238,136,253) | $281,898,060 |

| Affiliated issuers (identified cost $13,651,230) (Notes 1 and 6) | 13,651,230 |

|

| Foreign currency (cost $1,114,271) (Note 1) | 1,126,072 |

|

| Cash | 9 |

|

| Dividends, interest and other receivables | 517,877 |

|

| Receivable for shares of the fund sold | 84,889 |

|

| Receivable for investments sold | 1,816,291 |

|

| Unrealized appreciation on forward currency contracts (Note 1) | 203,009 |

|

| Total assets | 299,297,437 |

| |

| LIABILITIES | |

|

| Payable for investments purchased | 577,745 |

|

| Payable for shares of the fund repurchased | 421,909 |

|

| Payable for compensation of Manager (Note 2) | 138,094 |

|

| Payable for investor servicing fees (Note 2) | 66,448 |

|

| Payable for custodian fees (Note 2) | 13,725 |

|

| Payable for Trustee compensation and expenses (Note 2) | 158,451 |

|

| Payable for administrative services (Note 2) | 1,055 |

|

| Payable for distribution fees (Note 2) | 118,998 |

|

| Unrealized depreciation on forward currency contracts (Note 1) | 117,911 |

|

| Collateral on securities loaned, at value (Note 1) | 11,057,720 |

|

| Other accrued expenses | 58,259 |

|

| Total liabilities | 12,730,315 |

| |

| Net assets | $286,567,122 |

|

| |

| REPRESENTED BY | |

|

| Paid-in capital (Unlimited shares authorized) (Notes 1 and 4) | $274,940,653 |

|

| Undistributed net investment income (Note 1) | 1,714,785 |

|

| Accumulated net realized loss on investments and foreign currency transactions (Note 1) | (33,947,750) |

|

| Net unrealized appreciation of investments and assets and liabilities in foreign currencies | 43,859,434 |

|

| Total — Representing net assets applicable to capital shares outstanding | $286,567,122 |

(Continued on next page)

22

Statement of assets and liabilities (Continued)

| |

| COMPUTATION OF NET ASSET VALUE AND OFFERING PRICE | |

|

| Net asset value and redemption price per class A share | |

| ($268,793,638 divided by 23,414,803 shares) | $11.48 |

|

| Offering price per class A share (100/94.25 of $11.48)* | $12.18 |

|

| Net asset value and offering price per class B share ($7,572,456 divided by 662,479 shares)** | $11.43 |

|

| Net asset value and offering price per class C share ($3,961,051 divided by 347,643 shares)** | $11.39 |

|

| Net asset value and redemption price per class M share ($1,700,362 divided by 148,351 shares) | $11.46 |

|

| Offering price per class M share (100/96.50 of $11.46)* | $11.88 |

|

| Net asset value, offering price and redemption price per class R share | |

| ($1,282,079 divided by 112,046 shares) | $11.44 |

|

| Net asset value, offering price and redemption price per class Y share | |

| ($3,257,536 divided by 283,738 shares) | $11.48 |

|

* On single retail sales of less than $50,000. On sales of $50,000 or more the offering price is reduced.

** Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

The accompanying notes are an integral part of these financial statements.

23

Statement of operations Six months ended 2/28/11 (Unaudited)

| |

| INVESTMENT INCOME | |

|

| Dividends (net of foreign tax of $161,661) | $5,468,321 |

|

| Interest (including interest income of $1,740 from investments in affiliated issuers) (Note 6) | 4,810 |

|

| Securities lending (Note 1) | 64,460 |

|

| Total investment income | 5,537,591 |

| |

| EXPENSES | |

|

| Compensation of Manager (Note 2) | 901,581 |

|

| Investor servicing fees (Note 2) | 485,726 |

|

| Custodian fees (Note 2) | 14,668 |

|

| Trustee compensation and expenses (Note 2) | 15,332 |

|

| Administrative services (Note 2) | 5,118 |

|

| Distribution fees — Class A (Note 2) | 334,817 |

|

| Distribution fees — Class B (Note 2) | 39,907 |

|

| Distribution fees — Class C (Note 2) | 18,931 |

|

| Distribution fees — Class M (Note 2) | 6,213 |

|

| Distribution fees — Class R (Note 2) | 3,007 |

|

| Other | 54,940 |

|

| Total expenses | 1,880,240 |

| | |

| Expense reduction (Note 2) | (15,420) |

|

| Net expenses | 1,864,820 |

| |

| Net investment income | 3,672,771 |

|

| |

| Net realized gain on investments (Notes 1 and 3) | 14,331,057 |

|

| Net realized gain on foreign currency transactions (Note 1) | 167,831 |

|

| Net unrealized appreciation of assets and liabilities in foreign currencies during the period | 1,168,334 |

|

| Net unrealized appreciation of investments during the period | 7,544,353 |

|

| Net gain on investments | 23,211,575 |

| |

| Net increase in net assets resulting from operations | $26,884,346 |

|

The accompanying notes are an integral part of these financial statements.

24

Statement of changes in net assets

| | |

| INCREASE (DECREASE) IN NET ASSETS | Six months ended 2/28/11* | Year ended 8/31/10 |

|

| Operations: | | |

| Net investment income | $3,672,771 | $7,885,933 |

|

| Net realized gain (loss) on investments | | |

| and foreign currency transactions | 14,498,888 | (5,407,446) |

|

| Net unrealized appreciation (depreciation) of investments | | |

| and assets and liabilities in foreign currencies | 8,712,687 | (3,348,417) |

|

| Net increase (decrease) in net assets resulting from operations | 26,884,346 | (869,930) |

|

| Distributions to shareholders (Note 1): | | |

| From ordinary income | | |

| Net investment income | | |

|

| Class A | (4,536,018) | (10,556,537) |

|

| Class B | (104,446) | (329,268) |

|

| Class C | (50,095) | (113,719) |

|

| Class M | (23,909) | (58,250) |

|

| Class R | (18,895) | (42,041) |

|

| Class Y | (58,396) | (132,484) |

|

| Redemption fees (Note 1) | 537 | 3,001 |

|

| Decrease from capital share transactions (Note 4) | (19,101,492) | (38,635,102) |

|

| Total increase (decrease) in net assets | 2,991,632 | (50,734,330) |

| |

| NET ASSETS | | |

|

| Beginning of period | 283,575,490 | 334,309,820 |

|

| End of period (including undistributed net investment income | | |

| of $1,714,785 and $2,833,773, respectively) | $286,567,122 | $283,575,490 |

|

* Unaudited

The accompanying notes are an integral part of these financial statements.

25

Financial highlights (For a common share outstanding throughout the period)

| | | | | | | | | | | | | |

| INVESTMENT OPERATIONS: | | LESS DISTRIBUTIONS: | | RATIOS AND SUPPLEMENTAL DATA: | |

|

| | | | | | | | | | | | | Ratio of net | |

| | | | | | | | | | | | Ratio | investment | |

| | Net asset | | Net realized | | | | | | | | of expenses | income (loss) | |

| | value, | | and unrealized | Total from | From | | | Net asset | Total return | Net assets, | to average | to average | Portfolio |

| beginning | Net investment | gain (loss) | investment | net investment | Total | Redemption | value, end | at net asset | end of period | net assets | net assets | turnover |

| Period ended | of period | income (loss) a | on investments | operations | income | distributions | fees e | of period | value (%) b | (in thousands) | (%) c | (%) | (%) |

|

| Class A | | | | | | | | | | | | | |

| February 28, 2011** | $10.63 | .14 h | .90 | 1.04 | (.19) | (.19) | — | $11.48 | 9.83 * | $268,794 | .64* | 1.29*h | 21* |

| August 31, 2010 | 11.04 | .28 | (.29) | (.01) | (.40) | (.40) | — | 10.63 | (.15) | 265,549 | 1.36 d | 2.63 d | 44 |

| August 31, 2009 ‡ | 10.69 | .29 | .33 | .62 | (.27) | (.27) | — | 11.04 | 6.07 * | 309,088 | 1.02*d | 2.95*d | 77* |

| October 31, 2008 | 16.27 | .32 | (5.63) | (5.31) | (.27) | (.27) | — | 10.69 | (33.07) | 358,048 | 1.18 d | 2.21 d | 28 |

| October 31, 2007 | 12.82 | .22 | 3.43 | 3.65 | (.20) | (.20) | — | 16.27 | 28.64 | 595,786 | 1.18 d | 1.51 d | 42 |

| October 31, 2006 | 10.97 | .22 g | 1.86 | 2.08 | (.23) | (.23) | — | 12.82 | 19.22 | 519,557 | 1.22 d,g | 1.88 d,g | 65 |

| October 31, 2005 | 9.58 | .22 f | 1.38 | 1.60 | (.21) | (.21) | — | 10.97 | 16.76 f | 473,589 | 1.22 d | 2.11 d,f | 39 |

|

| Class B | | | | | | | | | | | | | |

| February 28, 2011** | $10.58 | .10 h | .89 | .99 | (.14) | (.14) | — | $11.43 | 9.44 * | $7,572 | 1.01* | .92*h | 21* |

| August 31, 2010 | 10.99 | .19 | (.29) | (.10) | (.31) | (.31) | — | 10.58 | (.96) | 8,496 | 2.11 d | 1.81 d | 44 |

| August 31, 2009 ‡ | 10.64 | .23 | .33 | .56 | (.21) | (.21) | — | 10.99 | 5.44 * | 14,064 | 1.64*d | 2.30*d | 77* |

| October 31, 2008 | 16.19 | .21 | (5.61) | (5.40) | (.15) | (.15) | — | 10.64 | (33.61) | 23,825 | 1.93 d | 1.45 d | 28 |

| October 31, 2007 | 12.75 | .11 | 3.41 | 3.52 | (.08) | (.08) | — | 16.19 | 27.71 | 51,537 | 1.93 d | .79 d | 42 |

| October 31, 2006 | 10.91 | .13 g | 1.85 | 1.98 | (.14) | (.14) | — | 12.75 | 18.31 | 62,195 | 1.97 d,g | 1.18 d,g | 65 |

| October 31, 2005 | 9.53 | .14 f | 1.37 | 1.51 | (.13) | (.13) | — | 10.91 | 15.86 f | 81,553 | 1.97 d | 1.37 d,f | 39 |

|

| Class C | | | | | | | | | | | | | |

| February 28, 2011** | $10.55 | .10 h | .89 | .99 | (.15) | (.15) | — | $11.39 | 9.40 * | $3,961 | 1.01* | .92*h | 21* |

| August 31, 2010 | 10.96 | .20 | (.29) | (.09) | (.32) | (.32) | — | 10.55 | (.90) | 3,638 | 2.11 d | 1.85 d | 44 |

| August 31, 2009 ‡ | 10.62 | .23 | .32 | .55 | (.21) | (.21) | — | 10.96 | 5.39 * | 4,043 | 1.64*d | 2.34*d | 77* |

| October 31, 2008 | 16.17 | .22 | (5.61) | (5.39) | (.16) | (.16) | — | 10.62 | (33.61) | 4,473 | 1.93 d | 1.50 d | 28 |

| October 31, 2007 | 12.74 | .11 | 3.41 | 3.52 | (.09) | (.09) | — | 16.17 | 27.74 | 6,247 | 1.93 d | .74 d | 42 |

| October 31, 2006 | 10.91 | .13 g | 1.84 | 1.97 | (.14) | (.14) | — | 12.74 | 18.24 | 4,699 | 1.97 d,g | 1.15 d,g | 65 |

| October 31, 2005 | 9.53 | .14 f | 1.37 | 1.51 | (.13) | (.13) | — | 10.91 | 15.91 f | 4,333 | 1.97 d | 1.37 d,f | 39 |

|

| Class M | | | | | | | | | | | | | |

| February 28, 2011** | $10.61 | .12 h | .89 | 1.01 | (.16) | (.16) | — | $11.46 | 9.57 * | $1,700 | .89* | 1.05*h | 21* |

| August 31, 2010 | 11.02 | .23 | (.30) | (.07) | (.34) | (.34) | — | 10.61 | (.66) | 1,642 | 1.86 d | 2.12 d | 44 |

| August 31, 2009 ‡ | 10.67 | .25 | .33 | .58 | (.23) | (.23) | — | 11.02 | 5.66 * | 2,005 | 1.43*d | 2.53*d | 77* |

| October 31, 2008 | 16.25 | .25 | (5.64) | (5.39) | (.19) | (.19) | — | 10.67 | (33.47) | 2,368 | 1.68 d | 1.69 d | 28 |

| October 31, 2007 | 12.80 | .15 | 3.42 | 3.57 | (.12) | (.12) | — | 16.25 | 28.05 | 3,946 | 1.68 d | 1.01 d | 42 |

| October 31, 2006 | 10.95 | .16 g | 1.86 | 2.02 | (.17) | (.17) | — | 12.80 | 18.64 | 3,438 | 1.72 d,g | 1.42 d,g | 65 |

| October 31, 2005 | 9.57 | .17 f | 1.37 | 1.54 | (.16) | (.16) | — | 10.95 | 16.11 f | 3,925 | 1.72 d | 1.62 d,f | 39 |

|

| Class R | | | | | | | | | | | | | |

| February 28, 2011** | $10.60 | .13 h | .88 | 1.01 | (.17) | (.17) | — | $11.44 | 9.64 * | $1,282 | .76* | 1.17*h | 21* |

| August 31, 2010 | 11.01 | .25 | (.29) | (.04) | (.37) | (.37) | — | 10.60 | (.40) | 1,095 | 1.61 d | 2.37 d | 44 |

| August 31, 2009 ‡ | 10.66 | .28 | .32 | .60 | (.25) | (.25) | — | 11.01 | 5.89 * | 1,207 | 1.22*d | 2.78*d | 77* |

| October 31, 2008 | 16.24 | .28 | (5.63) | (5.35) | (.23) | (.23) | — | 10.66 | (33.28) | 1,046 | 1.43 d | 1.95 d | 28 |

| October 31, 2007 | 12.80 | .17 | 3.44 | 3.61 | (.17) | (.17) | — | 16.24 | 28.35 | 702 | 1.43 d | 1.16 d | 42 |

| October 31, 2006 | 10.96 | .18 g | 1.86 | 2.04 | (.20) | (.20) | — | 12.80 | 18.88 | 309 | 1.47 d,g | 1.59 d,g | 65 |

| October 31, 2005 | 9.57 | .20 f | 1.38 | 1.58 | (.19) | (.19) | — | 10.96 | 16.53 f | 221 | 1.47 d | 1.84 d,f | 39 |

|

| Class Y | | | | | | | | | | | | | |

| February 28, 2011** | $10.63 | .16 h | .89 | 1.05 | (.20) | (.20) | — | $11.48 | 9.97 * | $3,258 | .51* | 1.41*h | 21* |

| August 31, 2010 | 11.04 | .31 | (.29) | .02 | (.43) | (.43) | — | 10.63 | .10 | 3,155 | 1.11 d | 2.84 d | 44 |

| August 31, 2009 ‡ | 10.69 | .32 | .32 | .64 | (.29) | (.29) | — | 11.04 | 6.27 * | 3,902 | .81*d | 3.18*d | 77* |

| October 31, 2008 | 16.28 | .36 | (5.65) | (5.29) | (.30) | (.30) | — | 10.69 | (32.94) | 3,570 | .93 d | 2.47 d | 28 |

| October 31, 2007 | 12.82 | .25 | 3.44 | 3.69 | (.23) | (.23) | — | 16.28 | 29.03 | 5,526 | .93 d | 1.75 d | 42 |

| October 31, 2006 | 10.97 | .24 g | 1.86 | 2.10 | (.25) | (.25) | — | 12.82 | 19.51 | 3,723 | .97 d,g | 2.14 d,g | 65 |

| October 31, 2005 † | 11.59 | .10 | (.72) | (.62) | — | — | — | 10.97 | (5.35) * | 3,781 | .07*d | .07*d | 39 |

|

See notes to financial highlights at the end of this section.

The accompanying notes are an integral part of these financial statements.

Financial highlights (Continued)

* Not annualized.

** Unaudited.

† For the period October 4, 2005 (commencement of operations) to October 31, 2005.

‡ For the ten months ended August 31, 2009. The fund changed its fiscal year end from October 31 to August 31.

a Per share net investment income (loss) has been determined on the basis of the weighted average number of shares outstanding during the period.

b Total return assumes dividend reinvestment and does not reflect the effect of sales charges.

c Includes amounts paid through expense offset and brokerage/service arrangements (Note 2).

d Reflects an involuntary contractual expense limitation in effect during the period. For periods prior to August 31, 2009, certain fund expenses were waived in connection with the fund’s investment in Putnam Prime Money Market Fund. As a result of such limitation and/or waivers, the expenses of each class reflect a reduction of the following amounts:

| |

| | Percentage of |

| | average net assets |

|

| August 31, 2010 | 0.02% |

|

| August 31, 2009 | 0.22 |

|

| October 31, 2008 | 0.01 |

|

| October 31, 2007 | <0.01 |

|

| October 31, 2006 | 0.01 |

|

| October 31, 2005 | <0.01 |

|

e Amount represents less than $0.01 per share.

f Reflects a non-recurring accrual related to Putnam Management’s settlement with the Securities and Exchange Commission (the SEC) regarding brokerage allocation practices, which amounted to the following amounts:

| | |

| | | Percentage of |

| | Per share | average net assets |

|

| Class A | $0.01 | 0.06% |

|

| Class B | 0.01 | 0.06 |

|

| Class C | 0.01 | 0.06 |

|

| Class M | 0.01 | 0.06 |

|

| Class R | 0.01 | 0.06 |

|

g Reflects a non-recurring reimbursement from Putnam Investments relating to the calculation of certain amounts paid by the fund to Putnam in previous years for transfer agent services, which amounted to less than $0.01 per share and 0.01% of average net assets for the period ended October 31, 2006.

h Reflects a dividend received by the fund from a single issuer which amounted to the following amounts:

| | |

| | | Percentage of |

| | Per share | average net assets |

|

| Class A | $0.04 | 0.39% |

|

| Class B | 0.04 | 0.37 |

|

| Class C | 0.04 | 0.40 |

|

| Class M | 0.04 | 0.39 |

|

| Class R | 0.05 | 0.41 |

|

| Class Y | 0.04 | 0.39 |

|

The accompanying notes are an integral part of these financial statements.

28

Notes to financial statements 2/28/11(Unaudited)

Note 1: Significant accounting policies

Putnam Global Utilities Fund (the fund), is a Massachusetts business trust, which is registered under the Investment Company Act of 1940, as amended, as a non-diversified, open-end management investment company. The fund seeks capital growth and current income primarily through investments in equity securities issued by public utility companies. The fund concentrates its investments in a limited number of sectors and involves more risk than a fund that invests more broadly.

The fund offers class A, class B, class C, class M, class R and class Y shares. Class A and class M shares are sold with a maximum front-end sales charge of 5.75% and 3.50%, respectively, and generally do not pay a contingent deferred sales charge. Class B shares, which convert to class A shares after approximately eight years, do not pay a front-end sales charge and are subject to a contingent deferred sales charge if those shares are redeemed within six years of purchase. Class C shares have a one-year 1.00% contingent deferred sales charge and do not convert to class A shares. Class R shares, which are not available to all investors, are sold at net asset value. The expenses for class A, class B, class C, class M and class R shares may differ based on the distribution fee of each class, which is identified in Note 2. Class Y shares, which are sold at net asset value, are generally subject to the same expenses as class A, class B, class C, class M and class R shares, but do not bear a distribution fee. Class Y shares are not available to all investors.

A 1.00% redemption fee may apply on any shares that are redeemed (either by selling or exchanging into another fund) within 90 days of purchase. The redemption fee is accounted for as an addition to paid-in-capital.

Investment income, realized and unrealized gains and losses and expenses of the fund are borne pro-rata based on the relative net assets of each class to the total net assets of the fund, except that each class bears expenses unique to that class (including the distribution fees applicable to such classes). Each class votes as a class only with respect to its own distribution plan or other matters on which a class vote is required by law or determined by the Trustees. If the fund were liquidated, shares of each class would receive their pro-rata share of the net assets of the fund. In addition, the Trustees declare separate dividends on each class of shares.

In the normal course of business, the fund enters into contracts that may include agreements to indemnify another party under given circumstances. The fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be, but have not yet been, made against the fund. However, the fund’s management team expects the risk of material loss to be remote.

The following is a summary of significant accounting policies consistently followed by the fund in the preparation of its financial statements. The preparation of financial statements is in conformity with accounting principles generally accepted in the United States of America and requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities in the financial statements and the reported amounts of increases and decreases in net assets from operations. Actual results could differ from those estimates. Subsequent events after the Statement of assets and liabilities date through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. Unless otherwise noted, the “reporting period” represents the period from September 1, 2010 through February 28, 2011.

A) Security valuation Investments for which market quotations are readily available are valued at the last reported sales price on their principal exchange, or official closing price for certain markets, and are classified as Level 1 securities. If no sales are reported — as in the case of some securities traded over-the-counter — a security is valued at its last reported bid price and is generally categorized as a Level 2 security.

Many securities markets and exchanges outside the U.S. close prior to the close of the New York Stock Exchange and therefore the closing prices for securities in such markets or on such exchanges may not fully reflect events that occur after such close but before the close of the New York Stock Exchange. Accordingly, on certain days, the fund will fair value foreign equity securities taking into account multiple factors including movements in the U.S. securities markets, currency valuations and comparisons to the valuation of American Depository Receipts, exchange-traded funds and futures contracts. These securities, which will generally represent a transfer from a Level 1 to a Level 2 security, will be classified as Level 2. The number of days on which fair value prices will be used will depend on market activity and it is possible that fair value prices will be used by the fund to a significant extent. At the close of the reporting period, fair value pricing was used for certain foreign securities in the portfolio. Securities quoted in foreign currencies, if any, are translated into U.S. dollars at the current exchange rate.

29

To the extent a pricing service or dealer is unable to value a security or provides a valuation that Putnam Investment Management, LLC (Putnam Management), the fund’s manager, an indirect wholly-owned subsidiary of Putnam Investments, LLC, does not believe accurately reflects the security’s fair value, the security will be valued at fair value by Putnam Management. Certain investments, including certain restricted and illiquid securities and derivatives, are also valued at fair value following procedures approved by the Trustees. These valuations consider such factors as significant market or specific security events such as interest rate or credit quality changes, various relationships with other securities, discount rates, U.S. Treasury, U.S. swap and credit yields, index levels, convexity exposures and recovery rates. These securities are classified as Level 2 or as Level 3 depending on the priority of the significant inputs.

Such valuations and procedures are reviewed periodically by the Trustees. The fair value of securities is generally determined as the amount that the fund could reasonably expect to realize from an orderly disposition of such securities over a reasonable period of time. By its nature, a fair value price is a good faith estimate of the value of a security in a current sale and does not reflect an actual market price, which may be different by a material amount.

B) Security transactions and related investment income Security transactions are recorded on the trade date (the date the order to buy or sell is executed). Gains or losses on securities sold are determined on the identified cost basis.

Interest income is recorded on the accrual basis. Dividend income, net of applicable withholding taxes, is recognized on the ex-dividend date except that certain dividends from foreign securities, if any, are recognized as soon as the fund is informed of the ex-dividend date. Non-cash dividends, if any, are recorded at the fair market value of the securities received. Dividends representing a return of capital or capital gains, if any, are reflected as a reduction of cost and/or as a realized gain. All premiums/discounts are amortized/accreted on a yield-to-maturity basis.

C) Foreign currency translation The accounting records of the fund are maintained in U.S. dollars. The market value of foreign securities, currency holdings, and other assets and liabilities is recorded in the books and records of the fund after translation to U.S. dollars based on the exchange rates on that day. The cost of each security is determined using historical exchange rates. Income and withholding taxes are translated at prevailing exchange rates when earned or incurred. The fund does not isolate that portion of realized or unrealized gains or losses resulting from changes in the foreign exchange rate on investments from fluctuations arising from changes in the market prices of the securities. Such gains and losses are included with the net realized and unrealized gain or loss on investments. Net realized gains and losses on foreign currency transactions represent net realized exchange gains or losses on closed forward currency contracts, disposition of foreign currencies, currency gains and losses realized between the trade and settlement dates on securities transactions and the difference between the amount of investment income and foreign withholding taxes recorded on the fund’s books and the U.S. dollar equivalent amounts actually received or paid. Net unrealized appreciation and depreciation of assets and liabilities in foreign currencies arise from changes in the value of open forward currency contracts and assets and liabilities other than investments at the period end, resulting from changes in the exchange rate. Investments in foreign securities involve certain risks, including those related to economic instability, unfavorable political developments, and currency fluctuations, not present with domestic investments. The fund may be subject to taxes imposed by governments of countries in which it invests. Such taxes are generally based on either income or gains earned or repatriated. The fund accrues and applies such taxes to net investment income, net realized gains and net unrealized gains as income and/or capital gains are earned. In some cases, the fund may be entitled to reclaim all or a portion of such taxes, and such reclaim amounts, if any, are reflected as an asset on the fund’s books. In many cases, however, the fund may not receive such amounts for an extended period of time, depending on the country of investment.