|

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| WASHINGTON, DC 20549 |

| |

| SCHEDULE 14A |

| (RULE 14A-101) |

| |

| INFORMATION REQUIRED IN PROXY STATEMENT |

| |

| SCHEDULE 14A INFORMATION |

| |

| Proxy Statement Pursuant to Section 14(a) |

| of the Securities Exchange Act of 1934 |

| |

| Filed by the Registrant / X / |

| |

| Filed by a Party other than the Registrant / / |

Check the appropriate box:

/ X / Preliminary Proxy Statement.

/ / Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e) (2)).

/ / Definitive Proxy Statement.

/ / Definitive Additional Materials.

/ / Soliciting Material under § 240.14a-12.

|

| PUTNAM AMERICAN GOVERNMENT INCOME FUND |

| PUTNAM ARIZONA TAX EXEMPT INCOME FUND |

| PUTNAM ASSET ALLOCATION FUNDS |

| PUTNAM CALIFORNIA TAX EXEMPT INCOME FUND |

| PUTNAM CONVERTIBLE SECURITIES FUND |

| PUTNAM DIVERSIFIED INCOME TRUST |

| PUTNAM EQUITY INCOME FUND |

| PUTNAM EUROPE EQUITY FUND |

| THE PUTNAM FUND FOR GROWTH AND INCOME |

| PUTNAM FUNDS TRUST |

| THE GEORGE PUTNAM FUND OF BOSTON (d/b/a GEORGE PUTNAM BALANCED |

| FUND) |

| PUTNAM GLOBAL EQUITY FUND |

| PUTNAM GLOBAL HEALTH CARE FUND |

| PUTNAM GLOBAL INCOME TRUST |

| PUTNAM GLOBAL NATURAL RESOURCES FUND |

| PUTNAM GLOBAL UTILITIES FUND |

| PUTNAM HIGH INCOME SECURITIES FUND |

| PUTNAM HIGH YIELD ADVANTAGE FUND |

| PUTNAM HIGH YIELD TRUST |

|

| PUTNAM INCOME FUND |

| PUTNAM INTERNATIONAL EQUITY FUND |

| PUTNAM INVESTMENT FUNDS |

| PUTNAM INVESTORS FUND |

| PUTNAM MANAGED MUNICIPAL INCOME TRUST |

| PUTNAM MASSACHUSETTS TAX EXEMPT INCOME FUND |

| PUTNAM MASTER INTERMEDIATE INCOME TRUST |

| PUTNAM MUNICIPAL OPPORTUNITIES TRUST |

| PUTNAM MICHIGAN TAX EXEMPT INCOME FUND |

| PUTNAM MINNESOTA TAX EXEMPT INCOME FUND |

| PUTNAM MONEY MARKET FUND |

| PUTNAM MULTI-CAP GROWTH FUND |

| PUTNAM MUNICIPAL OPPORTUNITIES TRUST |

| PUTNAM NEW JERSEY TAX EXEMPT INCOME FUND |

| PUTNAM NEW YORK TAX EXEMPT INCOME FUND |

| PUTNAM OHIO TAX EXEMPT INCOME FUND |

| PUTNAM PENNSYLVANIA TAX EXEMPT INCOME FUND |

| PUTNAM PREMIER INCOME TRUST |

| PUTNAM RETIREMENTREADY FUNDS |

| PUTNAM TAX EXEMPT INCOME FUND |

| PUTNAM TAX EXEMPT MONEY MARKET FUND |

| PUTNAM TAX-FREE INCOME TRUST |

| PUTNAM U.S. GOVERNMENT INCOME TRUST |

| PUTNAM VARIABLE TRUST |

| PUTNAM VOYAGER FUND |

| |

| |

| (Name of Registrant as Specified in its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, |

| if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

/ X / No fee required.

/ / Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to ExchangeAct Rule 0-11 (set forth the amount on which the filing fee is calculated and state howit was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

/ / Fee paid previously with preliminary materials.

/ / Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) andidentify the filing for which the offsetting fee was paid previously. Identify the previousfiling by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

A message from Putnam Investments and the Trustees of the Putnam funds

A few minutes of your time now can help save time and expenses later.

Dear Fellow Shareholder:

We are asking for your vote on important matters affecting your investment in the Putnam funds. The Putnam funds will hold a special shareholder meeting on February 27, 2014 in Boston, Massachusetts. We are asking you — and all shareholders — to consider and vote on the important matters described below.

You may conveniently vote by:•Visitingthe website listed on the proxy card.

•Callingby telephone, using the toll-free number listed on the proxy card.

•Mailingthe enclosed proxy card — be sure to sign, date, and return the card in the enclosed postage-paid envelope.

Of course, you are also welcome to attend the special shareholder meeting on February 27, 2014 and vote your shares in person.

The Trustees of the Putnam funds unanimously recommend that you vote “FOR” all proposals described below.

1. Approving new management contracts.Shareholders of all Putnam funds, including your fund, are being asked to approve a new management contract with Putnam Investment Management, LLC (“Putnam Management”), your fund’s investment adviser. The proposed new management contract is identical (except for its effective date and initial term) to your fund’s current management contract with Putnam Management.

On October 8, 2013, The Honourable Paul G. Desmarais, who was the controlling shareholder of Power Corporation of Canada, Putnam Management’s ultimate parent company, passed away. Upon his death, voting control of the shares of Power Corporation of Canada that Mr. Desmarais controlled was transferred to a family trust. (See pages [ ] to [ ] for further details.) The transfer of voting control of these shares may have constituted an “assignment” of the management contract between Putnam Management and your fund, resulting in its automatic termination as required by law. The transfer of voting control will not have any practical impact on the operations of Putnam Management or your fund. You are being asked to approve a new management contract for your fund to ensure that Putnam Management is able to continue to manage your fund.

2. Electing Trustees.Shareholders of all open-end Putnam funds are being asked to elect Trustees at the upcoming special meeting. (Shareholders of the closed-end Putnam funds will be asked to elect Trustees at their 2014 annual meeting, expected to be held in April 2014.) Although Trustees do not manage fund portfolios, they play an important role in protecting shareholders. Trustees are responsible for approving the fees paid to your fund’s investment adviser and its affiliates, reviewing overall fund expenses, selecting the fund’s auditors, monitoring conflicts of interest, overseeing the fund’s compliance with federal securities laws, and voting proxies for the fund’s portfolio securities. All but one of your fund’s Trustees currently is independent of the fund and Putnam Management.

3. Approving an Amended and Restated Declaration of Trust.Shareholders of all open-end Putnam funds are being asked to authorize the Trustees to adopt a single form of Amended and Restated Declaration of Trust for each Trust. The open-end Putnam funds operate under thirty-eight distinct

declarations of trust, which were created at different times in the past and differ from each other in several ways. The Amended and Restated Declaration of Trust will benefit the affected funds by harmonizing the terms of these governing documents, eliminating the inefficiencies inherent in operating under a variety of declarations of trust, allowing increased flexibility in the management of your fund, modernizing and streamlining governance provisions, reducing the risks and costs of potential litigation and eliminating certain ambiguities and inconsistencies.

4. Other Matters.Shareholders of three funds are being asked to approve changes to certain investment policies designed to conform their operations with those of other Putnam funds.

Detailed information regarding these proposals may be found in the enclosed proxy statement.

Please vote today

We encourage you to sign and return your proxy card today or, alternatively, online or by telephone using the voting control number that appears on your proxy card. Delaying your vote will increase fund expenses if further mailings are required. Your shares will be voted on your behalf exactly as you have instructed.If you sign the proxy card without specifying your vote, your shares will be voted in accordance with the Trustees’ recommendations.

Your vote is extremely important. If you have questions, please call toll-free [[ ]] or contact your financial advisor.

We appreciate your participation and prompt response, and thank you for investing in the Putnam funds.

| |

| Table of Contents | |

| |

| Notice of a Special Meeting of Shareholders | 1 |

|

| Trustees’ Recommendations | 3 |

|

| The Proposals | |

|

| 1. APPROVING A NEW MANAGEMENT CONTRACT | 4 |

|

| 2. ELECTING TRUSTEES | 10 |

|

| 3. APPROVING AN AMENDED AND | |

| RESTATED DECLARATION OF TRUST | 18 |

|

| 4. APPROVING AN AMENDMENT TO A | |

| FUNDAMENTAL INVESTMENT | |

| RESTRICTION — COMMODITIES | 23 |

|

| 5. APPROVING A CHANGE IN FUNDAMENTAL INVESTMENT | |

| POLICY — NON-DIVERSIFIED STATUS | 24 |

|

| Further Information About Voting and the | |

| Special Meeting | 25 |

|

| Fund Information | 29 |

|

| Appendix A — Number of Shares Outstanding | |

| as of the Record Date | A-1 |

|

| Appendix B — Forms of Proposed | |

| Management Contract | B-1 |

|

| Appendix C — Management Contracts: | |

| Dates and Approvals | C-1 |

|

| Appendix D — Management Contracts: Fees | D-1 |

|

| Appendix E — Current Sub-Management and | |

| Sub-Advisory Contract | E-1 |

|

| Appendix F — Description of Contract | |

| Approval Process | F-1 |

|

| Appendix G — Auditors | G-1 |

|

| Appendix H — Dollar Range and Number of Shares | |

| Beneficially Owned | H-1 |

|

| Appendix I — Trustee Compensation Table | I-1 |

|

| Appendix J — Other Similar Funds Advised | |

| by Putnam Management | J-1 |

|

| Appendix K — Payments to Putnam | |

| Management and its Affiliates | K-1 |

|

| Appendix L — 5% Beneficial Ownership | L-1 |

|

| Appendix M — Form of Amended and | |

| Restated Declaration of Trust | M-1 |

|

| Appendix N — Table of Constituent Series | |

| of each Trust of the open-end Putnam funds | N-1 |

|

PROXY CARD(S) ENCLOSED

If you have any questions, please call toll-free [[ ]] or call your financial advisor.

Important Notice Regarding the Availability of Proxy Materials for the Special Shareholder Meeting to be Held on February 27, 2014.

The proxy statement is available at [[https:// ]]

Notice of a Special Meeting

of Shareholders

To the Shareholders of:

PUTNAM AMERICAN GOVERNMENT INCOME FUND

PUTNAM ARIZONA TAX EXEMPT INCOME FUND

PUTNAM ASSET ALLOCATION FUNDS

PUTNAM DYNAMIC ASSET ALLOCATION

BALANCED FUND

PUTNAM DYNAMIC ASSET ALLOCATION

CONSERVATIVE FUND

PUTNAM DYNAMIC ASSET ALLOCATION GROWTH FUND

PUTNAM CALIFORNIA TAX EXEMPT INCOME FUND

PUTNAM CONVERTIBLE SECURITIES FUND

PUTNAM DIVERSIFIED INCOME TRUST

PUTNAM EQUITY INCOME FUND

PUTNAM EUROPE EQUITY FUND

THE PUTNAM FUND FOR GROWTH AND INCOME

PUTNAM FUNDS TRUST

PUTNAM ABSOLUTE RETURN 100 FUND

PUTNAM ABSOLUTE RETURN 300 FUND

PUTNAM ABSOLUTE RETURN 500 FUND

PUTNAM ABSOLUTE RETURN 700 FUND

PUTNAM ASIA PACIFIC EQUITY FUND

PUTNAM CAPITAL SPECTRUM FUND

PUTNAM DYNAMIC ASSET ALLOCATION EQUITY FUND

PUTNAM DYNAMIC RISK ALLOCATION FUND

PUTNAM EMERGING MARKETS EQUITY FUND

PUTNAM EMERGING MARKETS INCOME FUND

PUTNAM EQUITY SPECTRUM FUND

PUTNAM FLOATING RATE INCOME FUND

PUTNAM GLOBAL CONSUMER FUND

PUTNAM GLOBAL DIVIDEND FUND

PUTNAM GLOBAL ENERGY FUND

PUTNAM GLOBAL FINANCIALS FUND

PUTNAM GLOBAL INDUSTRIALS FUND

PUTNAM GLOBAL SECTOR FUND

PUTNAM GLOBAL TECHNOLOGY FUND

PUTNAM GLOBAL TELECOMMUNICATIONS FUND

PUTNAM INTERMEDIATE-TERM MUNICIPAL INCOME FUND

PUTNAM INTERNATIONAL VALUE FUND

PUTNAM LOW VOLATILITY EQUITY FUND

PUTNAM MONEY MARKET LIQUIDITY FUND

PUTNAM MULTI-CAP CORE FUND

PUTNAM RETIREMENT INCOME FUND LIFESTYLE 2

PUTNAM RETIREMENT INCOME FUND LIFESTYLE 3

PUTNAM SHORT DURATION INCOME FUND

PUTNAM SHORT TERM INVESTMENT FUND

PUTNAM SHORT-TERM MUNICIPAL INCOME FUND

PUTNAM SMALL CAP GROWTH FUND

PUTNAM STRATEGIC VOLATILITY EQUITY FUND

THE GEORGE PUTNAM FUND OF BOSTON (d/b/a GEORGE

PUTNAM BALANCED FUND)

PUTNAM GLOBAL EQUITY FUND

PUTNAM GLOBAL HEALTH CARE FUND

PUTNAM GLOBAL INCOME TRUST

PUTNAM GLOBAL NATURAL RESOURCES FUND

PUTNAM GLOBAL UTILITIES FUND

PUTNAM HIGH INCOME SECURITIES FUND*

PUTNAM HIGH YIELD ADVANTAGE FUND

PUTNAM HIGH YIELD TRUST

PUTNAM INCOME FUND

PUTNAM INTERNATIONAL EQUITY FUND

PUTNAM INVESTMENT FUNDS

PUTNAM CAPITAL OPPORTUNITIES FUND

PUTNAM GROWTH OPPORTUNITIES FUND

PUTNAM INTERNATIONAL CAPITAL

OPPORTUNITIES FUND

PUTNAM INTERNATIONAL GROWTH FUND

PUTNAM MULTI-CAP VALUE FUND

PUTNAM RESEARCH FUND

PUTNAM SMALL CAP VALUE FUND

PUTNAM INVESTORS FUND

PUTNAM MANAGED MUNICIPAL INCOME TRUST*

PUTNAM MASSACHUSETTS TAX EXEMPT INCOME FUND

PUTNAM MASTER INTERMEDIATE INCOME TRUST*

PUTNAM MUNICIPAL OPPORTUNITIES TRUST*

PUTNAM MICHIGAN TAX EXEMPT INCOME FUND

PUTNAM MINNESOTA TAX EXEMPT INCOME FUND

PUTNAM MONEY MARKET FUND

PUTNAM MULTI-CAP GROWTH FUND

PUTNAM NEW JERSEY TAX EXEMPT INCOME FUND

PUTNAM NEW YORK TAX EXEMPT INCOME FUND

PUTNAM OHIO TAX EXEMPT INCOME FUND

PUTNAM PENNSYLVANIA TAX EXEMPT INCOME FUND

PUTNAM PREMIER INCOME TRUST*

PUTNAM RETIREMENTREADY FUNDS

PUTNAM RETIREMENTREADY 2055 FUND

PUTNAM RETIREMENTREADY 2050 FUND

PUTNAM RETIREMENTREADY 2045 FUND

PUTNAM RETIREMENTREADY 2040 FUND

PUTNAM RETIREMENTREADY 2035 FUND

PUTNAM RETIREMENTREADY 2030 FUND

PUTNAM RETIREMENTREADY 2025 FUND

PUTNAM RETIREMENTREADY 2020 FUND

PUTNAM RETIREMENTREADY 2015 FUND

PUTNAM RETIREMENT INCOME FUND LIFESTYLE 1

PUTNAM TAX EXEMPT INCOME FUND

PUTNAM TAX EXEMPT MONEY MARKET FUND

PUTNAM TAX-FREE INCOME TRUST

PUTNAM AMT-FREE MUNICIPAL FUND

PUTNAM TAX-FREE HIGH YIELD FUND

PUTNAM U.S. GOVERNMENT INCOME TRUST

PUTNAM VARIABLE TRUST

PUTNAM VT ABSOLUTE RETURN 500 FUND

PUTNAM VT AMERICAN GOVERNMENT INCOME FUND

PUTNAM VT CAPITAL OPPORTUNITIES FUND

PUTNAM VT DIVERSIFIED INCOME FUND

PUTNAM VT EQUITY INCOME FUND

PUTNAM VT GEORGE PUTNAM BALANCED FUND

PUTNAM VT GLOBAL ASSET ALLOCATION FUND

PUTNAM VT GLOBAL EQUITY FUND

PUTNAM VT GLOBAL HEALTH CARE FUND

PUTNAM VT GLOBAL UTILITIES FUND

PUTNAM VT GROWTH AND INCOME FUND

PUTNAM VT GROWTH OPPORTUNITIES FUND

PUTNAM VT HIGH YIELD FUND

PUTNAM VT INCOME FUND

PUTNAM VT INTERNATIONAL EQUITY FUND

PUTNAM VT INTERNATIONAL GROWTH FUND

PUTNAM VT INTERNATIONAL VALUE FUND

PUTNAM VT INVESTORS FUND

PUTNAM VT MONEY MARKET FUND

PUTNAM VT MULTI-CAP GROWTH FUND

PUTNAM VT MULTI-CAP VALUE FUND

PUTNAM VT RESEARCH FUND

PUTNAM VT SMALL CAP VALUE FUND

PUTNAM VT VOYAGER FUND

PUTNAM VOYAGER FUND

* Denotes closed-end funds; all other funds are open-end funds This is the formal agenda for your fund’s special shareholder meeting. It tells you what proposals will be voted on and the time and place of the special meeting, in the event you attend in person.

A special meeting of Shareholders of your fund will be held on February 27, 2014 at 11:00 a.m., Boston time, at the principal offices of the funds, One Post Office Square, Boston, Massachu-setts 02109, to consider the following proposals, in each case as applicable to the particular funds listed in the table below:

| | |

| Proposal | Proposal Description | Affected Funds |

|

| 1. | Approving a proposed new management contract | All funds |

| | for your fund | |

|

| 2. | Electing Trustees | All open-end funds |

|

| 3. | Approving an Amended and Restated Declaration | All open-end funds |

| | of Trust for your fund | |

|

| 4. | Approving an amendment to a fundamental | Putnam Dynamic Asset Allocation Conservative Fund |

| | investment restriction with respect to investments | |

| | in commodities | |

|

| 5. | Approving a change in fundamental investment policy | Putnam Global Consumer Fund |

| | with respect to diversification of investments | Putnam Global Financials Fund |

|

By Michael J. Higgins, Clerk, and by the Trustees

Jameson A. Baxter, Chair

Liaquat Ahamed

Ravi Akhoury

Barbara M. Baumann

Charles B. Curtis

Robert J. Darretta

Katinka Domotorffy

John A. Hill

Paul L. Joskow

Kenneth R. Leibler

Robert E. Patterson

George Putnam, III

Robert L. Reynolds

W. Thomas Stephens

In order for you to be represented at your fund’s special shareholder meeting, we urge you to record your voting instructions over the Internet or by telephone or to mark, sign, date, and mail the enclosed proxy card(s) in the postage-paid envelope provided.

December 23, 2013

Proxy Statement

This document gives you the information you need to vote on the proposals. Much of the information is required under rules of the Securities and Exchange Commission; some of it is technical. If there is anything you don’t understand, please call our proxy information line at _____________ or call your financial advisor.

Why has a special meeting of shareholders been called?

The 1940 Act, which regulates investment companies such as your fund, requires management contracts to terminate automatically upon an “assignment” of the contract, which includes a “change of control” affecting an investment company’s investment adviser. Until his death on October 8, 2013, The Honourable Paul G. Desmarais, directly and through holding companies controlled by him, controlled a majority of the voting shares of Power Corporation of Canada, the ultimate parent company of Putnam Management, your fund’s investment adviser. Upon Mr. Desmarais’ death, voting control over Power Corporation of Canada shares was transferred to The Desma-rais Family Residuary Trust. Throughout this proxy statement, this transfer of voting control of Power Corporation of Canada shares is referred to as the “Transfer.” Because Putnam Management is indirectly controlled by Power Corporation of Canada, the Transfer may have resulted in a change of control of Putnam Management and an assignment of your fund’s management contract within the meaning of the Investment Company Act of 1940, as amended (the “1940 Act”). This means that, even though the Transfer will not have any impact on the operations of Putnam Management, it is possible that your fund’s management contract with Putnam Management terminated automatically upon the Transfer. To eliminate any ambiguity as to the effectiveness of your fund’s management contract, a special meeting of shareholders has been called so that shareholders may approve a new management contract with Putnam Management to allow Putnam Management to continue as your fund’s investment adviser.

Will the Transfer affect Putnam Management?

The Transfer will not have any effect on Putnam Management or your fund.

Does the proposed new management contract differ from your fund’s current management contract?

The proposed new management contract is identical to your fund’s current management contract, except for its effective date and initial term and other non-substantive changes. There will be no change in the services that your fund will receive or to the fees and costs that your fund will bear.

What other proposals are being presented to shareholders at the special meeting?

In addition to being asked to approve a new management contract with Putnam Management, you are being asked to vote for the election of trustees and to authorize the Trustees to adopt an Amended and Restated Declaration of Trust for your fund. Shareholders of Putnam Dynamic Asset Allocation Conservative Fund are also being asked to approve an amendment to that fund’s fundamental investment restriction with respect to commodities, and shareholders of Putnam Global Consumer Fund and Putnam Global Financials Fund are also being asked to approve an amendment to those funds’ fundamental investment policies with respect to diversification of investments.

Who is asking for your vote?

The enclosed proxy is solicited by the Trustees of the Putnam funds for use at the special meeting of shareholders of each fund to be held on Thursday, February 27, 2014 and, if your fund’s meeting is adjourned, at any later meetings, for the purposes stated in the Notice of a Special Meeting (see previous pages). The Notice of a Special Meeting, the proxy card and this proxy statement are being mailed beginning on or about December 23, 2013.

How do your fund’s Trustees recommend that shareholders vote on the proposals?

The Trustees unanimously recommend that you voteFOReach proposal.

Please see the table beginning on page [ ] for a list of the affected funds for each proposal.

Who is eligible to vote?

Shareholders of record of each fund at the close of business on Monday, December 2, 2013 (the “Record Date”) are entitled to be present and to vote at the special meeting or any adjournment.

The number of shares of each fund outstanding on the Record Date is shown inAppendix A. Each share is entitled to one vote, with fractional shares voting proportionately. Shares represented by your duly executed proxy card will be voted in accordance with your instructions. If you sign and return the proxy card but don’t fill in a vote, your shares will be voted in accordance with the Trustees’ recommendations. If any other business comes before your fund’s special meeting, your shares will be voted at the discretion of the persons designated on the proxy card.

Shareholders of each fund vote separately with respect to the proposal to approve a new management contract and the proposed changes in investment policies. Shareholders of all series of a trust vote together with respect to the other proposals. The name of each trust is indicated in bold in the Notice of a Special Meeting of Shareholders, with the funds that are series of that trust appearing below its name. The outcome of a vote affecting one fund does not affect any other fund, except where series of a trust vote together as a single class. No proposal is contingent upon the outcome of any other proposal.

The Proposals

1. APPROVING A NEW MANAGEMENT CONTRACT FOR YOUR FUND

Background Information

Putnam Management, your fund’s investment adviser, is majority owned (indirectly through other companies) by Power Corporation of Canada, a diversified international management and holding company with interests in companies in the financial services, communications and other business sectors. Until his death on October 8, 2013, The Honourable Paul G. Desmarais controlled a majority of the voting shares of Power Corporation of Canada, directly and through holding companies that he controlled.

Since 1996, Mr. Desmarais’ two sons, Paul Desmarais, Jr. and André Desmarais, have managed the day-to-day affairs of Power Corporation of Canada, serving as Chairman and Co-Chief Executive Officer and President and Co-Chief Executive Officer, respectively. Until his death, The Honourable Paul G. Desmarais served as Director of Power Corporation of Canada and Chairman of the Executive Committee of the Board of Directors. He also served as Director of Power Financial Corporation, a majority-owned subsidiary of Power Corporation of Canada, and continued to exercise voting control over a majority of the voting shares of Power Corporation of Canada. However, he did not participate actively in the management or affairs of Putnam Investments, LLC, the parent company of Putnam Management (“Putnam Investments”). Paul Desmarais, Jr. and André Desmarais, in addition to their executive roles at Power Corporation of Canada, are active members of the Boards of Directors of numerous subsidiaries of Power Corporation of Canada, including Putnam Investments.

Following Mr. Desmarais’ death, voting control of the shares of Power Corporation of Canada that he owned directly and controlled indirectly was transferred to The Desmarais Family Residuary Trust, a trust established pursuant to the Last Will and Testament of The Honourable Paul G. Desmarais. (This transfer of voting control of Power Corporation of Canada shares is referred to as the “Transfer” throughout this proxy statement.) There are five trustees of The Desmarais Family Residuary Trust, consisting of Mr. Desmarais’ two sons, Paul Desmarais, Jr. and André Desmarais, his widow, Jacqueline Desmarais, and Guy Fortin and Michel Plessis-Bélair. The family member trustees (or the family member successor trustees) effectively determine how the shares of Power Corporation of Canada owned or controlled by The Desmarais Family Residuary Trust will be voted.

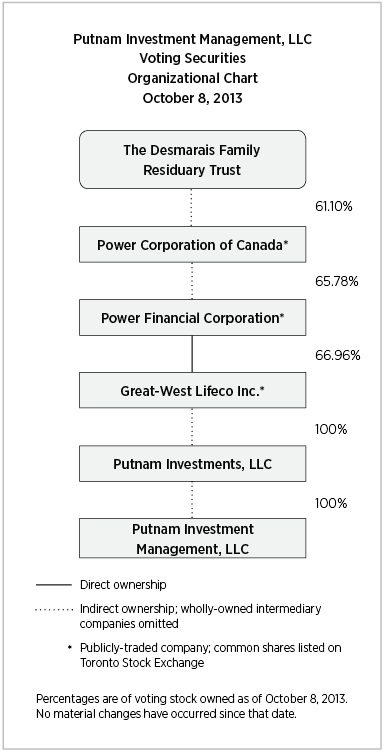

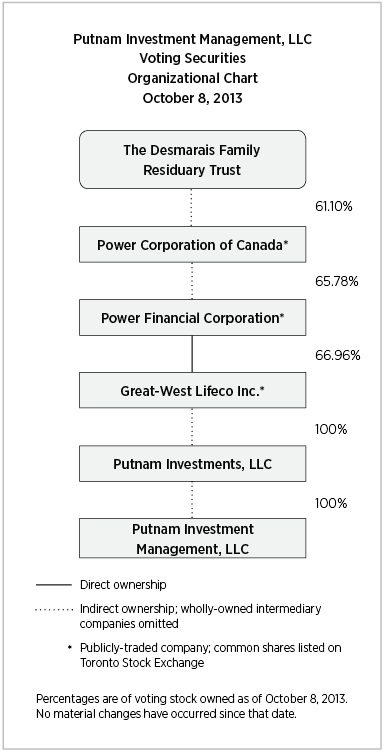

The Transfer has not impacted the ownership of any of the companies owned, directly or indirectly, by Power Corporationof Canada. As indicated in the accompanying chart, Power Corporation of Canada continues to own a majority of the voting shares of Power Financial Corporation, which in turn owns a majority of the voting shares of Great-West Lifeco Inc. All of the voting shares of Putnam Investments are owned by Great-West Lifeco Inc. Putnam Investments, through a series of wholly-owned holding companies, is the sole owner of Putnam Management. The address of The Desmarais Family Residuary Trust is 759 Victoria Square, Montreal, Quebec H2Y 2J7. The address of Power Corporation of Canada and Power Financial Corporation is 751 Victoria Square, Montreal, Quebec H2Y 2J3. The address of Great-West Lifeco Inc. is 100 Osborne Street North, Winnipeg, Manitoba, R3C 3A5. The address of Putnam Investments and Putnam Management is One Post Office Square, Boston, Massachusetts 02109.

Representatives of Power Corporation of Canada, Power Financial Corporation, and Great-West Lifeco have confirmed that the Transfer will not impact Putnam Investments’ operations. Paul Desmarais, Jr. and André Desmarais, who as trustees of The Desmarais Family Residuary Trust determine how to vote the shares of Power Corporation of Canada that are controlled by the trust, continue to serve as Co-Chief Executive Officers of Power Corporation of Canada and as Directors of Putnam Investments. In these roles, they will continue to oversee the operations and affairs of Power Corporation of Canada and its subsidiary companies, including Putnam Investments. Putnam Investments will continue to operate as a separate business unit within the Power Corporation of Canada group of companies, overseen by its separate Board of Directors, and will retain its existing management team. There are no current plans to make any changes to the operations of the funds as a result of the Transfer. In particular, the funds have been advised that there are no current plans to make changes with respect to existing management fees, expense limitations, distribution arrangements, or the quality of any services provided to the funds or their shareholders as a result of the Transfer. In addition, the Putnam brand, Putnam Investments’ current business strategy and Putnam Management’s investment management philosophy will not change as a result of the Transfer and there will not be any disruption or change for fund shareholders or the Putnam organization.

Although the Transfer is unrelated to, and will not have any impact on, the operations of Putnam Management and your fund, it is possible that the Transfer, as a technical matter under the 1940 Act, constitutes a “change of control” of Putnam Management. Under the 1940 Act, which regulates investment companies such as the Putnam funds, investment advisory contracts are required to terminate automatically when there is a change of control of the investment adviser. Fund shareholders must then approve new investment advisory contracts so that the fund may continue to receive advisory services.

The Interim Management Contracts

Each of the Putnam funds’ management contracts with Putnam Management terminates automatically in the event of an “assignment.” In light of the possibility that the Transfer constituted a change of control of Putnam Management and therefore an assignment of your fund’s management contract, Putnam Management is currently providing services to your fund under an interim management contract.

Rule 15a-4 under the 1940 Act allows an investment company to enter into an interim management contract with a maximum term of 150 days without first obtaining shareholder approval, so that the investment company may receive investment management services without interruption following an assignment of a previous management contract. Shortly after Mr. Desmarais’ death, the Putnam funds’ Board of Trustees met in person on October 18, 2013 and approved interim management contracts for each of the Putnam funds, effective as of October 8, 2013.Consistent with the 1940 Act and Rule 15a-4 thereunder, each interim management contract will continue in effect until the earlier to occur of (i) approval by a “majority of the outstanding voting securities,” as defined in the 1940 Act, of a new management contract and (ii) March 7, 2014, which is the 150th day after October 8, 2013, unless the Securities and Exchange Commission or its staff permit the contract to remain in effect for a longer period. Each fund’s interim management contract is identical to the contract it replaced, except for its date and the provisions regarding the term of the contract and for certain non-substantive changes.

The Proposed New Management Contract; Comparison with your Fund’s Prior Management Contract

To eliminate any ambiguity as to the status of your fund’s management contract, the Trustees have concluded that it is in the best interests of your fund’s shareholders to call a special meeting so that shareholders may approve a new management contract with Putnam Management and Putnam Management can continue as your fund’s investment adviser. At an in-person meeting on November 21 and 22, 2013, the Trustees unanimously approved, and recommend to the shareholders of each fund that they approve, a new management contract between each fund and Putnam Management. The form of the proposed new management contract for your fund is attached atAppendix B. You should refer toAppendix Bfor the complete terms of your fund’s proposed management contract.

The terms of the proposed new management contract (described generally below) are identical to those of the previous management contract except for the effective dates and initial term and for certain non-substantive changes. The date of each fund’s previous management contract, the date on which it was last submitted to a vote of shareholders, and the purpose of the submission is set forth inAppendix C.

Fees.There is no change in the rate of the fees that the funds will pay Putnam Management under the proposed new management contracts. The current fee schedule for investment management services and administrative services for each fund is set forth inAppendix D. The actual fees paid by some funds are subject to expense limitations, which are unaffected by the Transfer.

Investment Management Services.The proposed new management contract for your fund provides that Putnam Management will furnish continuously an investment program for the fund, determining what investments to purchase, hold, sell or exchange and what portion of the fund’s assets will be held uninvested, in compliance with the fund’s governing documents, investment objectives, policies and restrictions, and subject to the oversight and control of the Trustees. As indicated above, Putnam Management’s responsibilities under the proposed new management contract are identical to those under both the previous management contract and the current interim management contract.

Putnam Management is authorized under the proposed new management contract to place orders for the purchase and sale of portfolio investments for your fund with brokers or dealers that Putnam Management selects. Putnam Management must select brokers and dealers, and place orders, using its best efforts to obtain for the funds the most favorable price and execution available, except that Putnam Management may pay higher brokerage commissions if it determines in good faith that the commission is reasonable in relation to the value of brokerage and research services provided by the broker or dealer (a practice commonly known as “soft dollars”). Putnam Management may make this determination in terms of either the particular transaction or Putnam Management’s overall responsibilities with respect to a fund and to other clients of Putnam Management for which Putnam Management exercises investment discretion. Putnam Management’s use of soft dollars is subject to policies established by the Trustees from time to time and applicable guidance issued by the Securities and Exchange Commission.

Delegation of Responsibilities.The proposed new management contract for your fund expressly provides that Putnam Management may, in its discretion and with the approval of the Trustees (including a majority of the Trustees who are not “interested persons”) and, if required, the approval of shareholders, delegate responsibilities under the contract to one or more sub-advisers or sub-administrators. The separate costs of employing any sub-adviser or sub-administrator must be borne by Putnam Management or the sub-adviser or sub-administrator, not by the fund. Putnam Management is responsible for overseeing the performance of any sub-adviser or sub-administrator and remains fully responsible to the fund under the proposed new management contract regardless of whether it delegates any responsibilities.

At present, Putnam Management has delegated certain responsibilities to affiliated sub-advisers, as described below under the heading “Sub-Adviser Arrangements.” The sub-management and sub-advisory contracts governing these arrangements, like the management contracts, terminate upon a change of control of Putnam Management. In connection with their approval of the interim management contracts, the Trustees approved the continuance of the existing sub-management and sub-advisory contracts with these sub-advisers at their in-person meeting held on October 18, 2013. If your fund’s shareholders approve the proposed new management contract, pursuant to the new management contract Putnam Management will enter into equivalent sub-management and sub-advisory contracts with these affiliated sub-advisers, effective at the time the new management contract becomes effective. See “Sub-Adviser Arrangements” below for a description of the sub-advisers, and seeAppendix Efor copies of the current sub-management and sub-advisory contracts. The new sub-management and sub-advisory contracts will be identical to the current sub-management and sub-advisory contracts except for theireffective dates and initial term. Consistent with current law and interpretations of the Securities and Exchange Commission staff, it is not necessary for shareholders to approve the sub-management and sub-advisory contracts. (Shareholder approval would be required were Putnam Management to delegate any of its advisory responsibilities to advisers that are not subsidiaries of Putnam Investments.) Shareholders should be aware that a vote to approve your fund’s new management contract will have the effect of voting for the continuation of these arrangements.

Administrative Services.Like the previous management contract and the current interim management contract, the proposed new management contract provides that Putnam Management will manage, supervise and conduct the other (i.e., non-investment) affairs and business of each fund and incidental matters. These administrative services include providing suitable office space for the fund and administrative facilities, such as bookkeeping, clerical personnel and equipment necessary for the efficient conduct of the fund’s affairs, including determination of the net asset value of the fund, but excluding shareholder accounting services.

Putnam Management has delegated certain administrative, pricing and bookkeeping services to State Street Bank and Trust Company. This delegation was not affected by the Transfer.

Expenses.Like the previous management contract and the current interim management contract, the proposed new management contract requires Putnam Management to bear the expenses associated with (i) furnishing all necessary investment and management facilities, including salaries of personnel, required for it to execute its duties faithfully, (ii) providing suitable office space for each fund and (iii) providing administrative services. The proposed new management contract also provides that the fund will pay the fees of its Trustees and will reimburse Putnam Management for compensation paid to officers and persons assisting officers of the fund, and all or part of the cost of suitable office space, utilities, support services and equipment used by such officers and persons, as the Trustees may determine. Under this provision, the fund will bear the costs of the Trustees’ independent staff, which assists the Trustees in overseeing each of the funds.

Term and Termination.If approved by shareholders of your fund, the proposed new management contract will become effective upon its execution and will remain in effect continuously, unless terminated under the termination provisions of the contract. Like the previous management contract and the current interim management contract, the proposed new management contract provides that the management contract may be terminated at any time, by either Putnam Management or the fund by not less than 60 days’ written notice to the other party and without the payment of any penalty by Putnam Management or the fund. A fund may effect termination by vote of a majority of its Trustees or by the affirmative vote of a “majority of the

outstanding voting securities” of the fund, as defined in the 1940 Act. The proposed new management contract also will terminate automatically in the event of its “assignment.”

The proposed new management contract will, unless terminated as described above, continue until June 30, 2014 and will continue in effect from year to year thereafter so long as its continuance is approved at least annually by (i) the Trustees of the fund or the shareholders by the affirmative vote of a majority of the outstanding shares of the fund and (ii) a majority of the Trustees who are not “interested persons” of the fund or of Putnam Management, by vote cast in person at a meeting called for the purpose of voting on such approval.

Limitation of Liability.Under the proposed new management contract, Putnam Management is not liable to a fund or to any shareholder of the fund for any act or omission in the course of, or connected with, rendering services under the proposed management contract, unless there is willful misfeasance, bad faith or gross negligence on the part of Putnam Management or reckless disregard of its obligations and duties under the proposed management contract.

As required under each fund’s Declaration of Trust, the proposed new management contract contains a notice provision stating that the fund’s Declaration of Trust is on file with the Secretary of The Commonwealth of Massachusetts and that the proposed management contract is executed on behalf of the Trustees as Trustees of the fund and not individually. Also, the fund’s obligations arising out of the proposed management contract are limited only to the assets and property of the fund and are not binding on any of the Trustees, officers or shareholders individually.

Amendments; Defined Terms.The proposed new management contract may only be amended in writing, and any amendments must be approved in a manner consistent with the 1940 Act, the rules and regulations under the 1940 Act and any applicable guidance or interpretations of the Securities and Exchange Commission or its staff. Similarly, certain terms used in the proposed new management contract are used as defined in the 1940 Act, the rules and regulations under the 1940 Act and any applicable guidance or interpretation of the Securities and Exchange Commission or its staff.

Sub-Adviser Arrangements

Sub-Management Contract.Putnam Management has retained an affiliate, Putnam Investments Limited (“PIL”), as the sub-manager for a portion of the funds’ assets as determined by Putnam Management from time to time (an “Allocated Sleeve”). PIL is currently authorized to serve as the sub-manager, to the extent determined by Putnam Management from time to time, for each of the funds. PIL is a wholly owned subsidiary of The Putnam Advisory Company, LLC (“PAC”), which is itself a subsidiary of Putnam Investments.

PIL serves as sub-manager for the funds under a sub-management contract between Putnam Management and PIL. Under the sub-management contract, Putnam Management (and not the fund) pays a quarterly sub-management fee to PIL for its services at the annual rates set forth in the accompanying table, in each case measured as a percentage of the average aggregate net asset value of assets invested in an Allocated Sleeve.

| | |

| Fee | Funds Covered by Sub-Management Fee |

| |

| 0.40% | Putnam Arizona Tax Exempt Income Fund | Putnam Municipal Opportunities Trust |

| | Putnam California Tax Exempt Income Fund | Putnam Michigan Tax Exempt Income Fund |

| | Putnam Diversified Income Trust | Putnam Minnesota Tax Exempt Income Fund |

| | Putnam Emerging Markets Income Fund | Putnam New Jersey Tax Exempt Income Fund |

| | Putnam Floating Rate Income Fund | Putnam New York Tax Exempt Income Fund |

| | Putnam Intermediate-Term Municipal Income Fund | Putnam Ohio Tax Exempt Income Fund |

| | The George Putnam Fund of Boston | Putnam Pennsylvania Tax Exempt |

| | (d/b/a George Putnam Balanced Fund) | Income Fund |

| | Putnam Global Income Trust | Putnam Premier Income Trust |

| | Putnam High Income Securities Fund | Putnam Tax Exempt Income Fund |

| | Putnam High Yield Advantage Fund | Putnam AMT-Free Municipal Fund |

| | Putnam High Yield Trust | Putnam Tax-Free High Yield Fund |

| | Putnam Managed Municipal Income Trust | Putnam VT Diversified Income Fund |

| | Putnam Massachusetts Tax Exempt Income Fund | Putnam VT High Yield Fund |

| | Putnam Master Intermediate Income Trust | Putnam VT George Putnam Balanced Fund |

| |

| 0.25% | Putnam American Government Income Fund | Putnam Tax Exempt Money Market Fund |

| | Putnam Income Fund | Putnam U.S. Government Income Trust |

| | Putnam Money Market Fund | Putnam VT American Government Income Fund |

| | Putnam Short Duration Income Fund | Putnam VT Income Fund |

| | Putnam Short-Term Municipal Income Fund | Putnam VT Money Market Fund |

| |

| 0.20% | Putnam Money Market Liquidity Fund | |

| | Putnam Short Term Investment Fund | |

| |

| 0.35% | All other funds | |

Under the terms of the sub-management contract, PIL, at its own expense, furnishes continuously an investment program for the portion of each fund that Putnam Management allocates to PIL from time to time and makes investment decisions on behalf of these portions of the fund, subject to Putnam Management’s supervision. Putnam Management may also, at its discretion, request PIL to provide assistance with purchasing and selling securities for the fund, including order placement with certain broker-dealers. PIL, at its expense, furnishes all necessary investment and management facilities, including salaries of personnel, required for it to execute its duties.

The sub-management contract provides that PIL is not subject to any liability to Putnam Management, the fund or any shareholder of the fund for any act or omission in the course of or connected with rendering services to the fund in the absence of PIL’s willful misfeasance, bad faith, gross negligence or reckless disregard of its obligations and duties.

The sub-management contract may be terminated with respect to a fund without penalty by vote of the Trustees or theshareholders of the fund, or by PIL or Putnam Management, on not less than 30 days’ nor more than 60 days’ written notice. The sub-management contract also terminates without payment of any penalty in the event of its assignment. Subject to applicable law, it may be amended by a majority of the Trustees who are not “interested persons” of Putnam Management or the fund. The sub-management contract provides that it will continue in effect only so long as such continuance is approved at least annually by vote of either the Trustees or the shareholders and, in either case, by a majority of the Trustees who are not “interested persons” of Putnam Management or the fund. In each of the foregoing cases, the vote of the shareholders is the affirmative vote of a “majority of the outstanding voting securities” as defined in the 1940 Act.

Sub-Advisory Contract.PAC has been retained as a sub-adviser for a portion of the assets of the funds identified in the accompanying table (collectively referred to herein as the “PAC Funds”) as determined from time to time by Putnam Management or, with respect to portions of such fund’s assets for which PIL acts as sub-adviser as described above, by PIL.

| |

| The following is a complete list of the PAC Funds: |

| |

| Putnam Absolute Return 100 Fund | Putnam Global Natural Resources Fund |

| Putnam Absolute Return 300 Fund | Putnam Global Sector Fund |

| Putnam Absolute Return 500 Fund | Putnam Global Technology Fund |

| Putnam Absolute Return 700 Fund | Putnam Global Telecommunications Fund |

| Putnam Asia Pacific Equity Fund | Putnam Global Utilities Fund |

| Putnam Capital Spectrum Fund | Putnam International Equity Fund |

| Putnam Dynamic Asset Allocation Balanced Fund | Putnam International Growth Fund |

| Putnam Dynamic Asset Allocation Conservative Fund | Putnam International Value Fund |

| Putnam Dynamic Asset Allocation Equity Fund | Putnam Research Fund |

| Putnam Dynamic Asset Allocation Growth Fund | Putnam Retirement Income Fund Lifestyle 2 |

| Putnam Emerging Markets Equity Fund | Putnam Retirement Income Fund Lifestyle 3 |

| Putnam Equity Spectrum Fund | Putnam VT Absolute Return 500 Fund |

| Putnam Europe Equity Fund | Putnam VT Global Asset Allocation Fund |

| Putnam Global Consumer Fund | Putnam VT Global Equity Fund |

| Putnam Global Dividend Fund | Putnam VT Global Health Care Fund |

| Putnam Global Energy Fund | Putnam VT Global Utilities Fund |

| Putnam Global Equity Fund | Putnam VT International Equity Fund |

| Putnam Global Financials Fund | Putnam VT International Growth Fund |

| Putnam Global Health Care Fund | Putnam VT International Value Fund |

| Putnam Global Industrials Fund | Putnam VT Research Fund |

PAC serves as sub-adviser under the sub-advisory contract. Pursuant to the terms of the sub-advisory contract, Putnam Management or, with respect to portions of a PAC Fund’s assets for which PIL acts as sub-adviser, PIL (and not the fund) pays a quarterly sub-advisory fee to PAC for its services at the annual rate of 0.35% of the average aggregate net asset value of the portion of such fund with respect to which PAC acts as sub-adviser.

Under the terms of the sub-advisory contract, PAC, at its own expense, furnishes continuously an investment program for that portion of a fund that is allocated to PAC from time to time by Putnam Management or PIL, as applicable, and makes investmentdecisions on behalf of such portion of the fund, subject to the supervision of Putnam Management or PIL, as applicable. PAC, at its expense, furnishes all necessary investment and management facilities, including salaries of personnel, required for it to execute its duties.

The sub-advisory contract provides that PAC is not subject to any liability to Putnam Management, PIL, a PAC Fund or any shareholder of such fund for any act or omission in the course of or connected with rendering services to the fund in the absence of PAC’s willful misfeasance, bad faith, gross negligence or reckless disregard of its obligations and duties.

The sub-advisory contract may be terminated without penalty by vote of the Trustees or the shareholders of the relevant PAC Fund, or by PAC, PIL or Putnam Management, on not less than 30 days’ nor more than 60 days’ written notice. The sub-advisory contract also terminates without payment of any penalty in the event of its assignment. Subject to applicable law, it may be amended by a majority of the Trustees who are not “interested persons” of Putnam Management or the PAC fund. The sub-advisory contract provides that it will continue in effect only so long as its continuance is approved at least annually by vote of either the Trustees or shareholders of the respective PAC Fund and, in either case, by a majority of the Trustees who are not “interested persons” of Putnam Management or the PAC Fund. In each of the foregoing cases, the vote of the shareholders of a PAC Fund is the affirmative vote of a “majority of the outstanding voting securities” as defined in the 1940 Act.

To the extent that the Transfer may have constituted a “change of control” of Putnam Management, terminating automatically the funds’ previous management contracts, then the funds’ sub-management contract and the sub-advisory contract would also have terminated. To ensure that your fund did not lose the benefit of PIL’s or PAC’s services, at their in-person meeting held on October 18, 2013, the Trustees approved the continuance of the sub-management contract with PIL and the sub-advisory contract with PIL and PAC. The sub-management contract and sub-advisory contract are not interim in nature and will continue in effect through June 30, 2014. However, as described above, Putnam Management, PIL and PAC intend to enter into new sub-management and sub-advisory contracts contemporaneously with the execution of the proposed new management contracts if the new management contracts are approved by fund shareholders. SeeAppendix Efor copies of the current sub-management and sub-advisory contracts.

What did the Trustees consider in evaluating the proposed new management contracts?

In considering whether to approve the proposed new management contracts, as well as the interim management contracts, the Trustees took into account that they had recently approved the annual continuation of all of the previous management contracts and the sub-management and sub-advisory contracts for the Putnam funds in June 2013. That approval, on which the Trustees voted at an in-person meeting held on June 20 and 21, 2013, followed a lengthy process during which the Trustees considered a variety of factors that the Trustees considered to have a bearing on the contracts.Appendix Fcontains a general description of the Trustees’ deliberations.

At their in-person meeting on October 18, 2013, the Trustees, including the Trustees who are not “interested persons” as defined in the 1940 Act, considered the potential implications of Mr. Desmarais’ death and the Transfer. To address the possibility that the Transfer constituted an assignment of the funds’ management contracts, on October 18, 2013, the Trustees unanimously voted to approve interim management contractsfor the funds. The Trustees considered that, except for the effective date (October 8, 2013) and duration (until the earlier of either (i) March 7, 2014 (which, pursuant to Rule 15a-4 under the 1940 Act, represents the maximum allowable 150-day duration of an interim management contract) or (ii) the effective date of new management contracts that have been approved by fund shareholders, unless the Securities and Exchange Commission or its staff permits the contracts’ continuance through a later date), the interim management contracts were identical to the funds’ previous management contracts. Under the interim management contracts, Putnam Management provides investment advisory services to each fund on essentially the same terms and conditions, and for the same fees, as it did under the previous management contracts.

On November 21 and 22, 2013, the Trustees met in person to discuss further the Transfer and the possibility that a change of control of Putnam Management had occurred. The Trustees considered the approval of new management contracts for each fund, proposed to become effective upon their execution following approval by shareholders, as well as calling a special meeting of fund shareholders and filing a preliminary proxy statement. They reviewed the terms of the proposed new management contracts and the disclosure included in the preliminary proxy statement. They noted that, as described above, the terms of the proposed new management contracts were identical to the previous management contracts, except for the effective dates and initial terms and for certain non-substantive changes. In particular, the Trustees considered:

• Information about the operations of The Desmarais Family Residuary Trust, including that Paul Desmarais, Jr. and André Desmarais, Mr. Desmarais’ sons, were expected to exercise, jointly, voting control over the Power Corporation of Canada shares controlled by The Desmarais Family Residuary Trust.

• That Paul Desmarais, Jr. and André Desmarais had been playing active managerial roles at Power Corporation of Canada, with responsibility for the oversight of Power Corporation of Cana-da’s subsidiaries, including Putnam Investments, since Power Corporation of Canada had acquired Putnam Investments in 2007, including serving as Directors of Putnam Investments, and that the Transfer would not affect their responsibilities as officers of Power Corporation of Canada.

• The intention expressed by representatives of Power Corporation of Canada, Power Financial Corporation, and Great-West Lifeco that there would be no change to the operations or management of Putnam Investments, to Putnam Management’s management of the funds or to investment, advisory and other services provided to the funds by Putnam Management and its affiliates as a result of the Transfer.

• Putnam Management’s assurances that, following the Transfer, Putnam Management would continue to provide the same level of services to each fund and that the Transfer will not have an adverse impact on the ability of Putnam Management and

its affiliates to continue to provide high quality investment advisory and other services to the funds.

• Putnam Management’s assurances that there are no current plans to make any changes to the operations of the funds, existing management fees, expense limitations, distribution arrangements, or the quality of any services provided to the funds or their shareholders, as a result of the Transfer.

• The benefits that the funds have received and may potentially receive as a result of Putnam Management being a member of the Power Corporation of Canada group of companies, which promotes the stability of the Putnam organization.

• The commitment of Putnam Investments to bear a reasonable share of the expenses incurred by the Putnam funds in connection with the Transfer, including one-half of the costs associated with this proxy solicitation (see page [ ] below).

Based upon the foregoing considerations, the Trustees concluded that, to eliminate any ambiguity as to the status of your fund’s management contract, it was in the best interests of your fund’s shareholders to call a special meeting so that shareholders may approve a new management contract with Putnam Management and Putnam Management can continue as your fund’s investment adviser. On November 22, 2013, the Trustees, including all of the Trustees present who are not “interested persons” of the funds or Putnam Investments, unanimously approved the proposed new management contracts and determined to recommend their approval to the shareholders of the Putnam funds.

What is the voting requirement for approving the proposal?

Approval of your fund’s proposed new management contract requires the affirmative vote of a “majority of the outstanding voting securities” of the fund, which is defined under the 1940 Act to bethe lesser of(a) more than 50% of the outstanding shares of the fund, or (b) 67% or more of the shares of the fund present (in person or by proxy) at the special meeting if more than 50% of the outstanding shares of the fund are present at the meeting in person or by proxy.The Trustees unanimously recommend that shareholders vote FOR the proposed new management contracts.

2. ELECTING TRUSTEES

Affected funds:All open-end funds (i.e. all funds except Putnam High Income Securities Fund, Putnam Managed Municipal Income Trust, Putnam Master Intermediate Income Trust, Putnam Municipal Opportunities Trust, and Putnam Premier Income Trust)

Who are the nominees for Trustees?

The Board Policy and Nominating Committee of the Board is responsible for making recommendations concerning the nominees for Trustees of your fund. The Board Policy and Nominating Committee consists solely of Trustees who are not “interested persons” (as defined in the 1940 Act) of yourfund. Those Trustees who are not “interested persons” of your fund are referred to as “Independent Trustees” in this Section II. of this proxy statement.

The Board, based on the recommendation of the Board Policy and Nominating Committee, has fixed the number of Trustees of your fund at 14 and recommends that you vote for the election of the nominees described in the following pages. Each nominee is currently a Trustee of your fund and of the other Putnam funds.

Your fund does not regularly hold an annual shareholder meeting, but may from time to time schedule a special meeting. Except for Putnam Asia Pacific Equity Fund and Putnam International Value Fund, each of which held a special meeting in 2011, the last such meeting was held in 2009.

Biographical Information For The Fund’s Nominees.

The Board’s nominees for Trustees and their backgrounds are shown in the following pages. This information includes each nominee’s name, year of birth, principal occupation(s) during the past 5 years, and other information about the nominee’s professional background, including other directorships the nominee holds. Each Trustee oversees all of the Putnam funds and serves until the election and qualification of his or her successor, or until he or she sooner dies, resigns, retires, or is removed. The address of all of the Trustees is One Post Office Square, Boston, Massachusetts 02109. As of September 30, 2013, there were 116 Putnam funds.

Independent Trustees

Liaquat Ahamed(Born 1952)

Trustee since 2012

Mr. Ahamed is the Pulitzer Prize-winning author ofLords of Finance: The Bankers Who Broke the World. His articles on economics have appeared in the New York Times, ForeignAffairs, and the Financial Times.

Mr. Ahamed serves as a director of Aspen Insurance Co., a New York Stock Exchange company, and is the Chair of the Aspen Board’s Investment Committee. He is a Trustee of the Brookings Institution, where he serves as Chair of the Investment Committee. He is also a director of the Rohatyn Group, an emerging-market fund complex that manages money for institutions. Mr. Ahamed was previously the Chief Executive Officer of Fischer Francis Trees & Watts, Inc., a fixed income investment management subsidiary of BNP Paribas. He was formerly the head of the investment division at the World Bank, and is a member of the Foreign Affairs Policy Board of the U.S. Department of State.

Mr. Ahamed holds a B.A. in economics from Trinity College, Cambridge University and an M.A. in economics from Harvard University.

Ravi Akhoury(Born 1947)

Trustee since 2009

Mr. Akhoury serves as a Trustee of the Rubin Museum, serving on the Investment Committee, and of the American India Foundation. Mr. Akhoury is also a Director ofRAGE Frameworks, Inc. and English Helper, Inc. (each a private software company).

Previously, Mr. Akhoury served as a Director of Jacob Ballas Capital India (a non-banking finance company focused on private equity advisory services) and a member of its Compensation Committee. He was also a Director and on the Compensation Committee of MaxIndia/New York Life Insurance Company in India. He was also Vice President and Investment Policy Committee member of Fischer Francis Trees & Watts, a fixed income investment management firm. He has also served on the Board of Bharti Telecom (an Indian telecommunications company), serving as a member of its Audit and Compensation Committees, and as a Director and member of the Audit Committee on the Board of Thompson Press (a publishing company). From 1992 to 2007, he was Chairman and CEO of MacKay Shields, a multi-product investment management firm with over $40 billion in assets under management.

Mr. Akhoury graduated from the Indian Institute of Technology with a B.S. in Engineering and obtained an M.S. in Quantitative Methods from SUNY at Stony Brook.

Barbara M. Baumann(Born 1955)

Trustee since 2010

Ms. Baumann is President and Owner of Cross Creek Energy Corporation, a strategic consultant to domestic energy firms and direct investor in energy projects.

Ms. Baumann currently serves as a Director of SM Energy Company (a publicly held U.S. exploration and production company) and UNS Energy Corporation (a publicly held electric and gas utility in Arizona). She is a director of Cody Resources management (a private company in the energy and ranching businesses). Ms. Baumann is a Trustee of Mount Holyoke College. She is a former Chair of the Board and a current Board member of Girls Inc. of Metro Denver, and serves on the Finance Committee of The Children’s Hospital of Colorado, as well as the Investment Committee of The Denver Foundation.

Until May 2012, Ms. Baumann was a Director of CVR Energy (a publicly held petroleum refiner and fertilizer manufacturer). Prior to 2003, Ms. Baumann was Executive Vice President of Associated Energy Managers, a domestic private equity firm. From 1981 until 2000, she held a variety of financial and operational management positions with the global energy company Amoco Corporation and its successor, BP, most recently serving as Commercial Operations Manager of its Western Business Unit.Ms. Baumann holds an M.B.A. from The Wharton School of the University of Pennsylvania and a B.A. from Mount Holyoke College.

Jameson A. Baxter(Born 1943)

Trustee since 1994, Vice Chair from 2005 to2011 and Chair since 2011

Ms. Baxter is the President of Baxter Associates, Inc., a private investment firm.

Ms. Baxter serves as Chair of the Mutual FundDirectors Forum, Director of the Adirondack Land Trust and Trustee of the Nature Conservancy’s Adirondack Chapter. Until 2011, Ms. Baxter was a director of ASHTA Chemical, Inc. Until 2007, she was a Director of Banta Corporation (a printing and supply chain management company), Ryerson, Inc. (a metals service corporation), and Advocate Health Care. She has also served as a director on a number of other boards, including BoardSource (formerly the National Center for Nonprofit Boards), Intermatic Corporation (a manufacturer of energy control products), and MB Financial. She is Chair Emeritus of the Board of Trustees of Mount Holyoke College, having served as Chair for five years.

Ms. Baxter has held various positions in investment banking and corporate finance, including Vice President of and Consultant to First Boston Corporation and Vice President and Principal of the Regency Group. She is a graduate of Mount Holyoke College.

Charles B. Curtis(Born 1940)

Trustee since 2001

Mr. Curtis serves as Senior Advisor to the Center for Strategic and International Studies and is President Emeritus of the Nuclear Threat Initiative (a private foundation dealing with nationalsecurity issues).

Mr. Curtis is a member of the Council on Foreign Relations and the U.S. State Department International Security Advisory Board. He also serves as a Director of Edison International and Southern California Edison.

Mr. Curtis is an attorney with over 15 years in private practice and 19 years in various positions in public service, including service at the Department of Treasury, the U.S. House of Representatives, the Securities and Exchange Commission, the Federal Energy Regulatory Commission and the Department of Energy.

Robert J. Darretta(Born 1946)

Trustee since 2007

Mr. Darretta serves as Director of UnitedHealth Group, a diversified health-care company.

Until April 2007, Mr. Darretta was Vice Chairman of the Board of Directors of Johnson & Johnson,one of the world’s largest and most broadly based health-care companies. Prior to 2007, he had responsibility for Johnson & Johnson’s finance, investor relations, information technology, and procurement functions. He served as Johnson & Johnson Chief Financial Officer for a decade, prior to which he spent two

years as Treasurer of the corporation and over 10 years leading various Johnson & Johnson operating companies. From 2009 until 2012, Mr. Darretta served as the Health Care Industry Adviser to Permira, a global private equity firm.

Mr. Darretta received a B.S. in Economics from Villanova University.

Katinka Domotorffy(Born 1975)

Trustee since 2012

Ms. Domotorffy is a voting member of the Investment Committee of the Anne Ray Charitable Trust, part of the Margaret A. Cargill Philanthropies. She also serves as the Vice Chairof Reach Out and Read of Greater New York, an organization dedicated to promoting childhood literacy.

Until December 2011, Ms. Domotorffy was Partner, Chief Investment Officer, and Global Head of Quantitative Investment Strategies at Goldman Sachs Asset Management.

Ms. Domotorffy holds a BSc in Economics from the University of Pennsylvania and an MSc in Accounting and Finance from the London School of Economics.

John A. Hill(Born 1942)

Trustee since 1985 and Chairman from 2000to 2011

Mr. Hill is founder and Vice-Chairman of First Reserve Corporation, the leading private equity buyout firm specializing in the world-wide energy industry, with offices in Greenwich, Connecticut; Houston, Texas; London, England; and Hong Kong, China. The firm’s investments on behalf of some of the nation’s largest pension and endowment funds are currently concentrated in 31 companies with annual revenues in excess of $15 billion, which employ over 100,000 people in 23 countries.

Mr. Hill is a Director of Devon Energy Corporation (a leading independent natural gas and oil exploration and production company) and various private companies owned by First Reserve, and serves as a Trustee of Sarah Lawrence College where he serves as Chairman and also chairs the Investment Committee. He is also a member of the Advisory Board of the Millstein Center for Global Markets and Corporate Ownership at The Columbia University Law School.

Prior to forming First Reserve in 1983, Mr. Hill served as President of F. Eberstadt and Company, an investment banking and investment management firm. Between 1969 and 1976, Mr. Hill held various senior positions in Washington, D.C. with the federal government, including Deputy Associate Director of the Office of Management and Budget and Deputy Administrator of the Federal Energy Administration during the Ford Administration.

Born and raised in Midland, Texas, he received his B.A. in Economics from Southern Methodist University and pursued graduate studies as a Woodrow Wilson Fellow.

Paul L. Joskow(Born 1947)

Trustee since 1997

Dr. Joskow is an economist and President of the Alfred P. Sloan Foundation (a philanthropic institution focused primarily on research and education on issues related to science,technology, and economic performance). He is the Elizabeth and James Killian Professor of Economics, Emeritus at the Massachusetts Institute of Technology (MIT), where he joined the faculty in 1972. Dr. Joskow was the Director of the Center for Energy and Environmental Policy Research at MIT from 1999 through 2007.

Dr. Joskow serves as a Trustee of Yale University, as a Director of TransCanada Corporation (an energy company focused on natural gas transmission, oil pipelines, and power services) and of Exelon Corporation (an energy company focused on power services), and as a member of the Board of Overseers of the Boston Symphony Orchestra. Prior to August 2007, he served as a Director of National Grid (a UK-based holding company with interests in electric and gas transmission and distribution and telecommunications infrastructure). Prior to July 2006, he served as President of the Yale University Council. Prior to February 2005, he served on the Board of the Whitehead Institute for Biomedical Research (a non-profit research institution). Prior to February 2002, he was a Director of State Farm Indemnity Company (an automobile insurance company), and prior to March 2000, he was a Director of New England Electric System (a public utility holding company).

Dr. Joskow has published seven books and numerous articles on industrial organization, government regulation of industry, and competition policy. He is active in industry restructuring, environmental, energy, competition, and privatization policies — having served as an advisor to governments and corporations worldwide. Dr. Joskow holds a Ph.D. and M.Phil. from Yale University and a B.A. from Cornell University.

Kenneth R. Leibler(Born 1949)

Trustee since 2006

Mr. Leibler is a founder and former Chairman of the Boston Options Exchange, an electronic marketplace for the trading of derivative securities.

Mr. Leibler currently serves on the Board of Trustees of Beth Israel Deaconess Hospital in Boston. He is also a Director of Northeast Utilities, which operates New England’s largest energy delivery system, and, until November 2010, was a Director of Ruder Finn Group, a global communications and advertising firm. Prior to December 2006, he served as a Director of the Optimum Funds group. Prior to October 2006, he served as a Director of ISO New England, the organization responsible for the operation of the electric generation system in the New England states. Prior to 2000, Mr. Leibler was a Director of the Investment Company Institute in Washington, D.C.

Prior to January 2005, Mr. Leibler served as Chairman and Chief Executive Officer of the Boston Stock Exchange. Prior to January 2000, he served as President and Chief Executive Officer of Liberty Financial Companies, a publicly traded diver-sified asset management organization. Prior to June 1990, Mr. Leibler served as President and Chief Operating Officer of the American Stock Exchange (AMEX), and at the time was the youngest person in AMEX history to hold the title of President. Prior to serving as AMEX President, he held the position of Chief Financial Officer, and headed its management and marketing operations. Mr. Leibler graduated with a degree in Economics from Syracuse University.

Robert E. Patterson(Born 1945)

Trustee since 1984

Mr. Patterson is Co-Chairman of Cabot Properties, Inc. (a private equity firm investing in commercial real estate) and Chairman of its Investment Committee.

Mr. Patterson is past Chairman and served as a Trustee of the Joslin Diabetes Center. He previously was a Trustee of the Sea Education Association. Prior to December 2001, Mr. Patterson was President and Trustee of Cabot Industrial Trust (a publicly traded real estate investment trust). Prior to February 1998, he was Executive Vice President and Director of Acquisitions of Cabot Partners Limited Partnership (a registered investment adviser involved in institutional real estate investments). Prior to 1990, he served as Executive Vice President of Cabot, Cabot & Forbes Realty Advisors, Inc. (the predecessor company of Cabot Partners).

Mr. Patterson practiced law and held various positions in state government, and was the founding Executive Director of the Massachusetts Industrial Finance Agency. Mr. Patterson is a graduate of Harvard College and Harvard Law School.

George Putnam, III(Born 1951)

Trustee since 1984

Mr. Putnam is Chairman of New Generation Research, Inc. (a publisher of financial advisory and other research services), and President of New Generation Advisors, LLC (a registeredinvestment adviser to private funds). Mr. Putnam founded the New Generation companies in 1986.

Mr. Putnam is a Director of The Boston Family Office, LLC (a registered investment adviser). He is a Trustee of Epiphany School and a Trustee of the Marine Biological Laboratory in Woods Hole, Massachusetts. Prior to June 2007, Mr. Putnam was President of the Putnam funds. Until 2010, he was a Trustee of St. Mark’s School, until 2006, he was a Trustee of Shore Country Day School, and until 2002, he was a Trustee of the Sea Education Association.

Mr. Putnam previously worked as an attorney with the law firm of Dechert LLP (formerly known as Dechert Price & Rhoads) in Philadelphia. He is a graduate of Harvard College, Harvard Business School, and Harvard Law School.

W. Thomas Stephens(Born 1942)

Trustee from 1997 to 2008, and since 2009

Mr. Stephens retired as Chairman and Chief Executive Officer of Boise Cascade, LLC (a paper, forest products and timberland assets company) in December 2008.

Mr. Stephens is a Director of TransCanada Pipelines, Ltd. (an energy infrastructure company).Until 2010, Mr. Stephens was a Director of Boise Inc. (a manufacturer of paper and packaging products). Until 2004, Mr. Stephens was a Director of Xcel Energy Incorporated (a public utility company), Qwest Communications and Norske Canada, Inc. (a paper manufacturer). Until 2003, Mr. Stephens was a Director of Mail-Well, Inc. (a diversified printing company). He served as Chairman of Mail-Well until 2001 and as CEO of MacMillan-Bloedel, Ltd. (a forest products company) until 1999.

Prior to 1996, Mr. Stephens was Chairman and Chief Executive Officer of Johns Manville Corporation (a manufacturing company). He holds B.S. and M.S. degrees from the University of Arkansas.

Interested Trustee*

Robert L. Reynolds(Born 1952)

Trustee since 2008 and President of the

Putnam funds since July 2009

Mr. Reynolds is President and Chief Executive Officer of Putnam Investments, a member of Putnam Investments’ Executive Board ofDirectors, and President of the Putnam funds. He has more than 30 years of investment and financial services experience.

Prior to joining Putnam Investments in 2008, Mr. Reynolds was Vice Chairman and Chief Operating Officer of Fidelity Investments from 2000 to 2007. During this time, he served on the Board of Directors for FMR Corporation, Fidelity Investments Insurance Ltd., Fidelity Investments Canada Ltd., and Fidelity Management Trust Company. He was also a Trustee of the Fidelity Family of Funds. From 1984 to 2000, Mr. Reynolds served in a number of increasingly responsible leadership roles at Fidelity.

Mr. Reynolds serves on several not-for-profit boards, including those of the West Virginia University Foundation, Concord Museum, Dana-Farber Cancer Institute and Boston Chamber of Commerce. He is a member of the Chief Executives Club of Boston, the National Innovation Initiative, and the Council on Competitiveness, and he is a former President of the Commercial Club of Boston.

Mr. Reynolds received a B.S. in Business Administration/Finance from West Virginia University.

* Trustee who is an “interested person” as defined in the 1940 Act of the fund and Putnam Management. Mr. Reynolds is deemed an “interested person” by virtue of his position as an officer of the fund and Putnam Management. Mr. Reynolds is the President and Chief Executive Officer of Putnam Investments and the President of your fund and each of the other Putnam funds.

The Board Policy and Nominating Committee is responsible for recommending proposed nominees for election to the Board of Trustees for its approval. In recommending the election or appointment of the current Board members as Trustees, the Committee generally considered the educational, business and professional experience of each Trustee in determining his or her qualifications to serve as a Trustee of the fund, including the Trustee’s record of service as a director or trustee of public and private organizations. This included, as applicable, their previous service as a member of the Board of Trustees of the Putnam funds, during which they have demonstrated a high level of diligence and commitment to the interests of fund shareholders and the ability to work effectively and collegially with other members of the Board. The Committee also considered, among other factors, the particular attributes described below with respect to the various individual Trustees.

Independent Trustees:

Liaquat Ahamed — Mr. Ahamed’s experience as Chief Executive Officer of a major investment management organization and as head of the investment division at the World Bank, as well as his experience as an author of economic literature.

Ravi Akhoury — Mr. Akhoury’s experience as Chairman and Chief Executive Officer of a major investment management organization.

Barbara M. Baumann — Ms. Baumann’s experience in the energy industry as a consultant, an investor, and in both financial and operational management positions at a global energy company, and her service as a director of three NYSE companies.