UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(RULE 14a-101)

Information required in proxy statement

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant / X /

Filed by a Party other than the Registrant / /

Check the appropriate box:

/ / Preliminary Proxy Statement.

/ / Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e) (2)).

/ X / Definitive Proxy Statement.

/ / Definitive Additional Materials.

/ / Soliciting Material under § 240.14a-12.

PUTNAM ASSET ALLOCATION FUNDS

PUTNAM CALIFORNIA TAX EXEMPT INCOME FUND

PUTNAM CONVERTIBLE SECURITIES FUND

PUTNAM DIVERSIFIED INCOME TRUST

PUTNAM FOCUSED INTERNATIONAL EQUITY FUND

PUTNAM FUNDS TRUST

GEORGE PUTNAM BALANCED FUND

PUTNAM GLOBAL HEALTH CARE FUND

PUTNAM GLOBAL INCOME TRUST

PUTNAM HIGH YIELD FUND

PUTNAM INCOME FUND

PUTNAM INTERNATIONAL EQUITY FUND

PUTNAM INVESTMENT FUNDS

PUTNAM LARGE CAP VALUE FUND

PUTNAM MASSACHUSETTS TAX EXEMPT INCOME FUND

PUTNAM MINNESOTA TAX EXEMPT INCOME FUND

PUTNAM MONEY MARKET FUND

PUTNAM MORTGAGE SECURITIES FUND

PUTNAM NEW JERSEY TAX EXEMPT INCOME FUND

PUTNAM NEW YORK TAX EXEMPT INCOME FUND

PUTNAM OHIO TAX EXEMPT INCOME FUND

PUTNAM PENNSYLVANIA TAX EXEMPT INCOME FUND

PUTNAM SUSTAINABLE LEADERS FUND

PUTNAM TARGET DATE FUNDS

PUTNAM TAX EXEMPT INCOME FUND

PUTNAM TAX-FREE INCOME TRUST

PUTNAM VARIABLE TRUST

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement,

if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

/ X / No fee required.

/ / Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

/ / Fee paid previously with preliminary materials.

/ / Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

A message from Putnam

Investments and the Trustees

of the Putnam funds

| | |

| | |

| | |

| Putnam Asset Allocation Funds | |

| Putnam California Tax Exempt Income Fund | |

| Putnam Convertible Securities Fund | |

| Putnam Diversified Income Trust | |

| Putnam Focused International Equity Fund | |

| Putnam Funds Trust | |

| George Putnam Balanced Fund | |

| Putnam Global Health Care Fund | |

| Putnam Global Income Trust | |

| Putnam High Yield Fund | |

| Putnam Income Fund | |

| Putnam International Equity Fund | |

| Putnam Investment Funds | |

| Putnam Large Cap Value Fund | |

| Putnam Massachusetts Tax Exempt Income Fund | |

| Putnam Minnesota Tax Exempt Income Fund | |

| Putnam Money Market Fund | |

| Putnam Mortgage Securities Fund | |

| Putnam New Jersey Tax Exempt Income Fund | |

| Putnam New York Tax Exempt Income Fund | |

| Putnam Ohio Tax Exempt Income Fund | |

| Putnam Pennsylvania Tax Exempt Income Fund | |

| Putnam Sustainable Leaders Fund | |

| Putnam Target Date Funds | |

| Putnam Tax Exempt Income Fund | |

| Putnam Tax-Free Income Trust | |

| Putnam Variable Trust | |

| | |

A few minutes of your time now can help save time and expenses later.

Dear Fellow Shareholder:

We are asking for your vote on important matters affecting your investment in one or more of the Putnam open-end funds. These Putnam funds will hold a special shareholder meeting on June 29, 2022 in Boston, Massachusetts. We are asking you — and all shareholders — to consider and vote on the important matters described below.

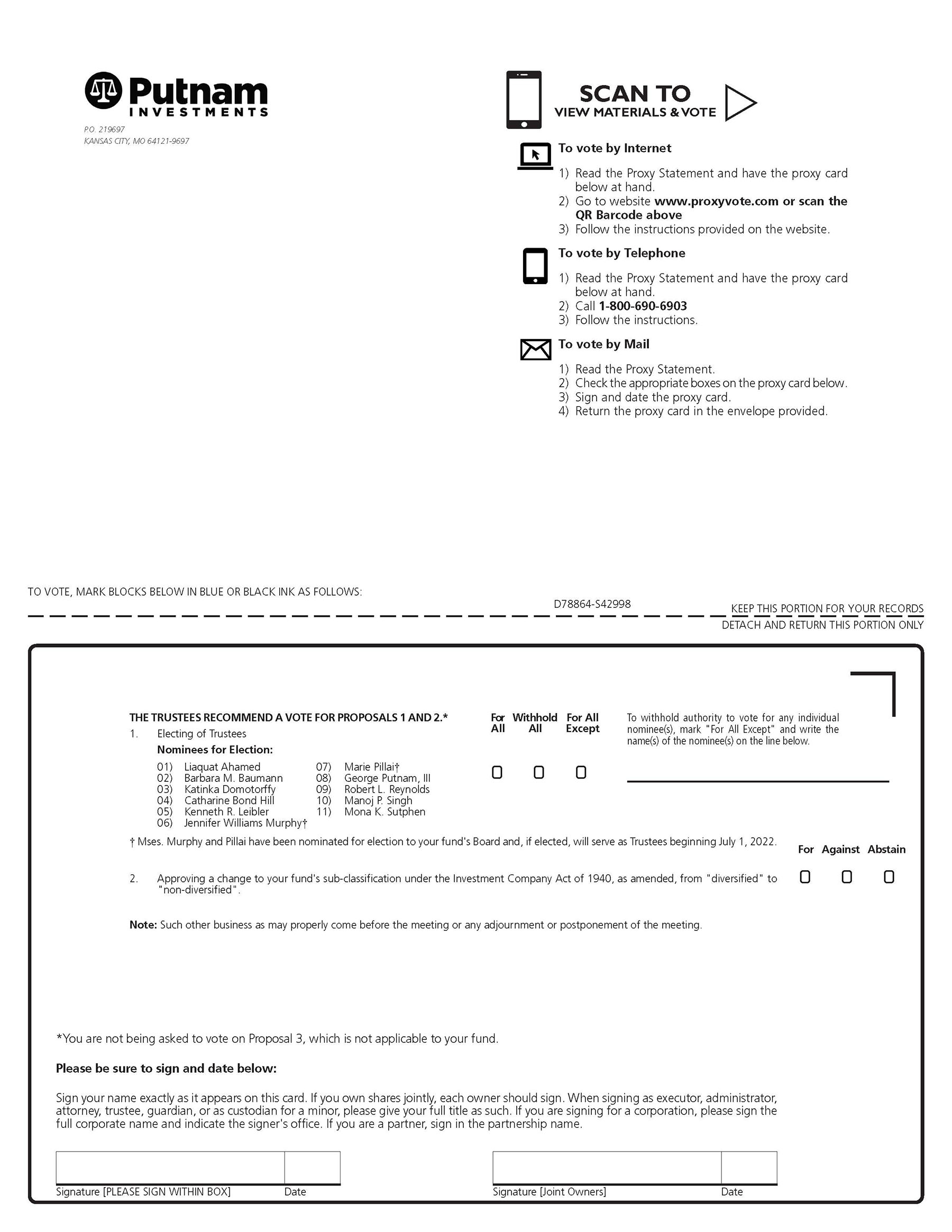

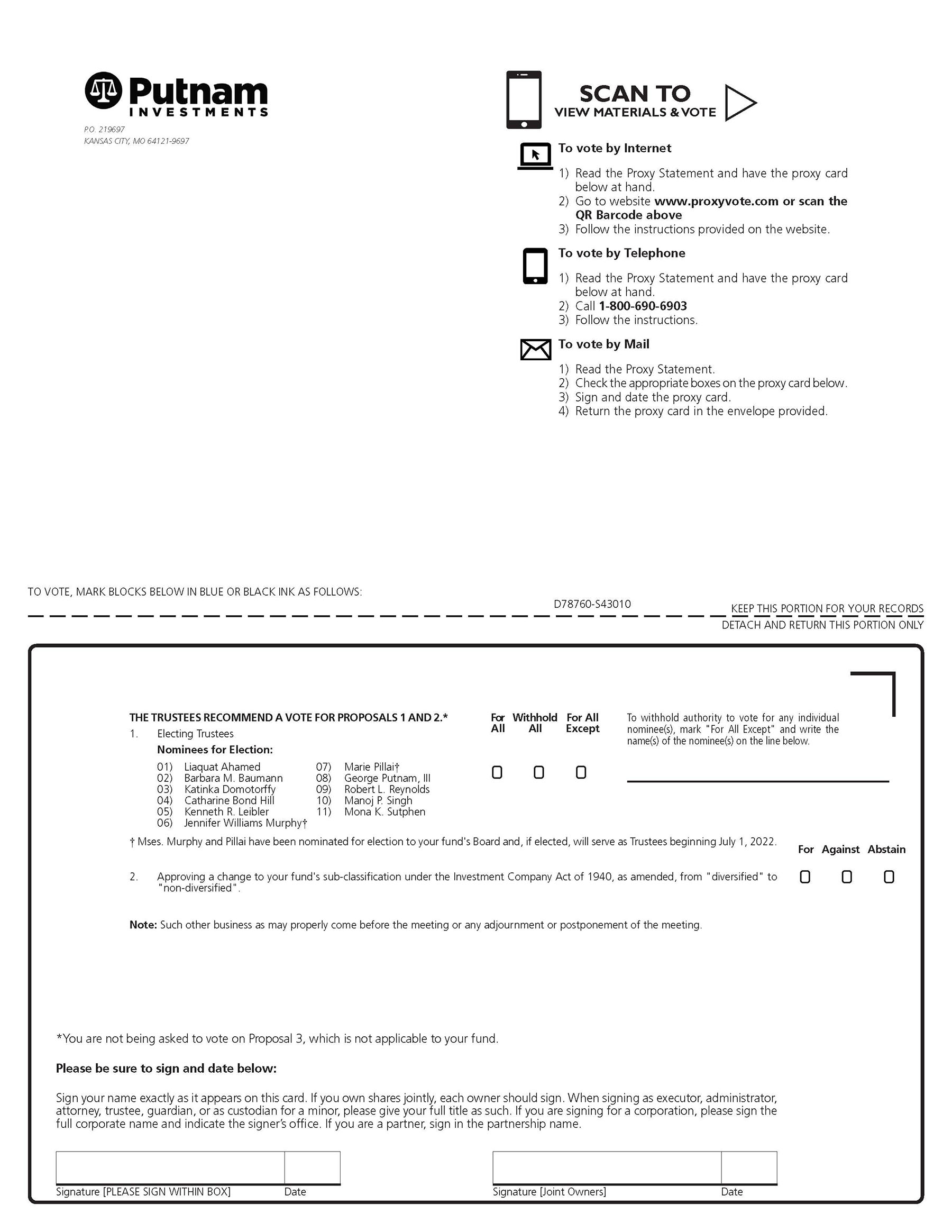

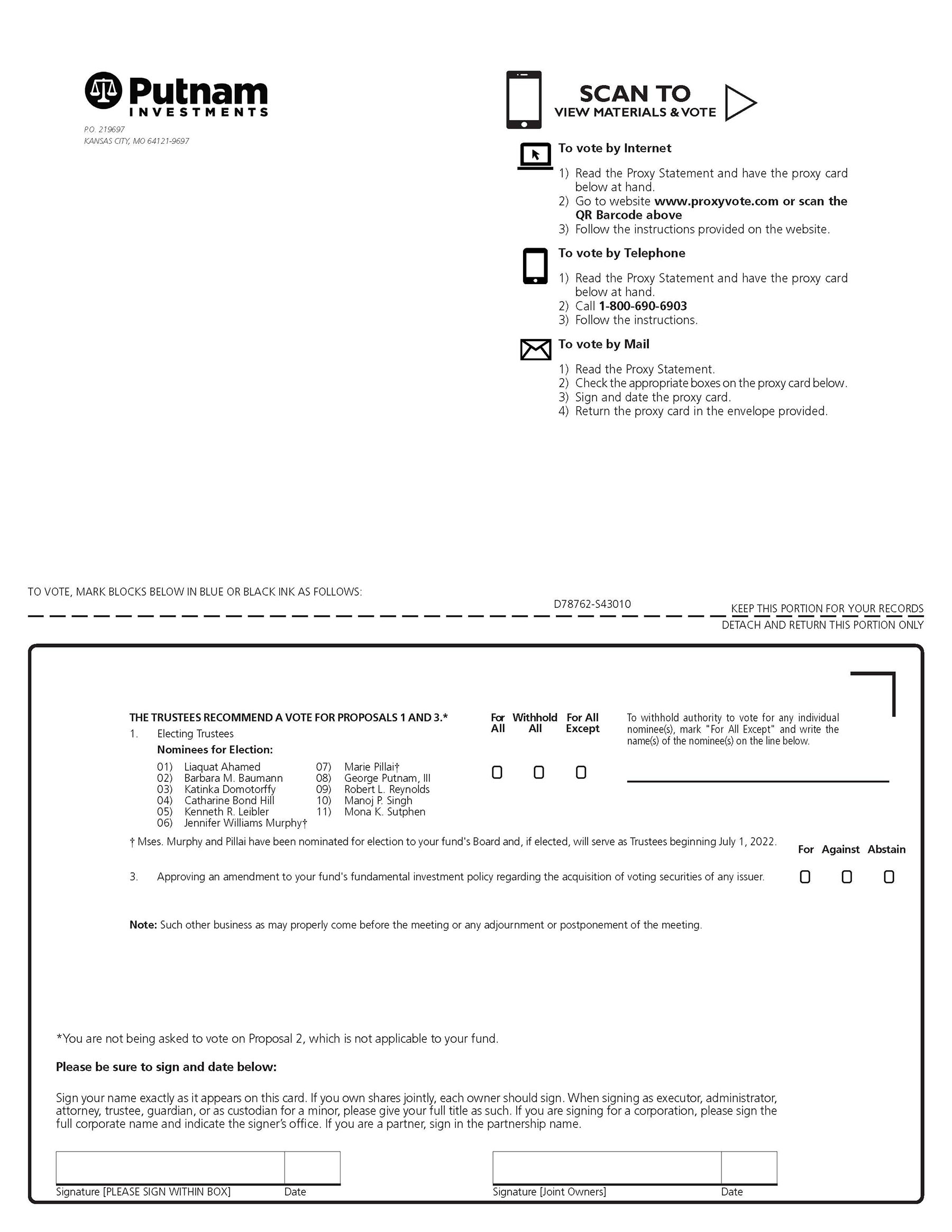

You may vote conveniently by:

• Visiting the website listed on the proxy card.

• Calling by telephone, using the toll-free number listed on the proxy card.

• Mailing the enclosed proxy card — be sure to sign, date, and return the card in the enclosed postage-paid envelope.

Of course, you are also welcome to attend the special shareholder meeting on June 29, 2022, and vote your shares during the meeting. The Trustees of the Putnam funds unanimously recommend that you vote “FOR” all proposals described below.

1. Electing Trustees.

Shareholders of all open-end Putnam funds, including your fund, are being asked to elect Trustees at the upcoming special meeting. Although Trustees do not manage fund portfolios, they play an important role in protecting shareholders. Trustees are responsible for approving the fees paid to your fund’s investment adviser and its affiliates, reviewing overall fund expenses, selecting the fund’s auditors, monitoring conflicts of interest, overseeing the fund’s compliance with federal securities laws, and voting proxies for the fund’s portfolio securities. All but one of your fund’s Trustees currently are independent of the fund and Putnam Investment Management, LLC (“Putnam Management”). All of the current Trustees work on your behalf and have been nominated for re-election, except for two Trustees who are retiring. The Trustees have also nominated Jennifer Williams Murphy and Marie Pillai to stand for election to your fund’s Board. If elected, Mses. Murphy and Pillai will serve as Trustees beginning July 1, 2022. Each other nominee is currently a Trustee of your fund and of the other Putnam funds and, if elected, will continue to serve in that capacity without interruption.

We recommend you vote to elect all Trustees.

2. Approving a change to certain funds’ sub-classification under the Investment Company Act of 1940 from “diversified” to “non-diversified.”

Shareholders of Putnam Emerging Markets Equity Fund, Putnam Growth Opportunities Fund, Putnam VT Emerging Markets Equity Fund, and Putnam VT Growth Opportunities Fund are being asked to approve a change in those funds’ sub-classifications under the Investment Company Act of 1940, as amended (the “1940 Act”), from “diversified” to “non-diversified.” In order to meet the requirements of the funds’ current diversification classification, the funds currently must limit purchases of certain companies relative to their weights in the corresponding benchmark index, even if Putnam Management finds them to be attractive investment opportunities. As a non-diversified fund, each fund would have greater flexibility to

invest more of its assets in the securities of fewer issuers than it currently does as a diversified fund. This means that each fund would be able, if desired for investment purposes, to invest a greater portion of its assets in one or more of the large constituents of the corresponding index. Each fund would be exposed to non-diversification risk, as its ability to invest more of its assets in the securities of fewer issuers would increase its vulnerability to factors affecting a single investment. If shareholders approve this change with respect to a fund, the fund’s fundamental investment policies regarding diversification of investments will be changed to reflect that the fund is non-diversified.

We recommend that you vote to change these funds’ sub-classification under the 1940 Act from “diversified” to “non-diversified.”

3. Approving an amendment to certain funds’ fundamental investment policy regarding the acquisition of voting securities of any issuer.

Shareholders of six funds are being asked to approve an amendment to those funds’ fundamental investment policy regarding the acquisition of voting securities of any issuer. The amendment is designed to standardize the investment policies with those of other Putnam funds and to provide portfolio managers with added investment flexibility.

We recommend you vote to approve the amendment to these funds’ fundamental investment policy regarding the acquisition of voting securities of any issuer.

Detailed information regarding these proposals may be found in the enclosed proxy statement.

Please vote today.

We encourage you to sign and return your proxy card today or, alternatively, to vote online or by telephone using the voting control number that appears on your proxy card. Delaying your vote will increase fund expenses if further mailings are required. Your shares will be voted on your behalf exactly as you have instructed. If you sign the proxy card without specifying your vote, your shares will be voted in accordance with the Trustees’ recommendations.

Your vote is extremely important. If you have questions, please call toll-free 1-833-501-4818 or contact your financial professional.

We appreciate your participation and prompt response, and thank you for investing in the Putnam funds.

May 20, 2022

Table of Contents

| | |

| Notice of Special Meeting of Shareholders | 1 |

| Trustees’ Recommendations | 4 |

| The Proposals | 6 |

| 1. ELECTING TRUSTEES | 6 |

2. APPROVING A CHANGE TO CERTAIN FUNDS’ SUB-CLASSIFICATION

UNDER THE INVESTMENT COMPANY ACT OF 1940, AS AMENDED,

FROM “DIVERSIFIED” TO “NON-DIVERSIFIED” | 18 |

3. APPROVING AN AMENDMENT TO CERTAIN FUNDS’ FUNDAMENTAL

INVESTMENT POLICY REGARDING THE ACQUISITION OF

VOTING SECURITIES OF ANY ISSUER | 21 |

| Further Information About Voting and the Special Meeting | 24 |

| Fund Information | 30 |

| | |

| Appendix A—Number of Shares Outstanding as of the Record Date | A-1 |

| Appendix B—Auditors | B-1 |

| Appendix C—Dollar Range and Number of Shares Beneficially Owned | C-1 |

| Appendix D—Trustee Compensation Table | D-1 |

| Appendix E—5% Beneficial Ownership | E-1 |

PROXY CARD(S) ENCLOSED

If you have any questions, please call toll-free 1-833-501-4818 or call your financial professional.

Important Notice Regarding the Availability of Proxy Materials for the Special Shareholder Meeting to be Held on June 29, 2022.

The proxy statement is available at https://www.putnam.com/static/pdf/email/all-putnam-funds-proxy-statement.pdf.

Notice of Special Meeting of Shareholders

To the Shareholders of:

PUTNAM ASSET ALLOCATION FUNDS

PUTNAM DYNAMIC ASSET ALLOCATION BALANCED FUND

PUTNAM DYNAMIC ASSET ALLOCATION CONSERVATIVE FUND

PUTNAM DYNAMIC ASSET ALLOCATION GROWTH FUND

PUTNAM INCOME STRATEGIES PORTFOLIO

PUTNAM CALIFORNIA TAX EXEMPT INCOME FUND

PUTNAM CONVERTIBLE SECURITIES FUND

PUTNAM DIVERSIFIED INCOME TRUST

PUTNAM FOCUSED INTERNATIONAL EQUITY FUND

PUTNAM FUNDS TRUST

PUTNAM DYNAMIC ASSET ALLOCATION EQUITY FUND

PUTNAM DYNAMIC RISK ALLOCATION FUND

PUTNAM EMERGING MARKETS EQUITY FUND

PUTNAM FIXED INCOME ABSOLUTE RETURN FUND

PUTNAM FLOATING RATE INCOME FUND

PUTNAM FOCUSED EQUITY FUND

PUTNAM GLOBAL TECHNOLOGY FUND

PUTNAM INTERMEDIATE-TERM MUNICIPAL INCOME FUND

PUTNAM INTERNATIONAL VALUE FUND

PUTNAM MORTGAGE OPPORTUNITIES FUND

PUTNAM MULTI-ASSET ABSOLUTE RETURN FUND

PUTNAM MULTI-CAP CORE FUND

PUTNAM SHORT DURATION BOND FUND

PUTNAM SHORT TERM INVESTMENT FUND

PUTNAM SHORT-TERM MUNICIPAL INCOME FUND

PUTNAM SMALL CAP GROWTH FUND

PUTNAM ULTRA SHORT DURATION INCOME FUND

GEORGE PUTNAM BALANCED FUND

PUTNAM GLOBAL HEALTH CARE FUND

PUTNAM GLOBAL INCOME TRUST

PUTNAM HIGH YIELD FUND

PUTNAM INCOME FUND

PUTNAM INTERNATIONAL EQUITY FUND

PUTNAM INVESTMENT FUNDS

PUTNAM GOVERNMENT MONEY MARKET FUND

PUTNAM GROWTH OPPORTUNITIES FUND

PUTNAM INTERNATIONAL CAPITAL OPPORTUNITIES FUND

PUTNAM PANAGORA RISK PARITY FUND

PUTNAM RESEARCH FUND

PUTNAM SMALL CAP VALUE FUND

PUTNAM SUSTAINABLE FUTURE FUND

PUTNAM LARGE CAP VALUE FUND

PUTNAM MASSACHUSETTS TAX EXEMPT INCOME FUND

PUTNAM MINNESOTA TAX EXEMPT INCOME FUND

PUTNAM MONEY MARKET FUND

PUTNAM MORTGAGE SECURITIES FUND

PUTNAM NEW JERSEY TAX EXEMPT INCOME FUND

PUTNAM NEW YORK TAX EXEMPT INCOME FUND

PUTNAM OHIO TAX EXEMPT INCOME FUND

PUTNAM PENNSYLVANIA TAX EXEMPT INCOME FUND

PUTNAM SUSTAINABLE LEADERS FUND

PUTNAM TARGET DATE FUNDS

PUTNAM RETIREMENT ADVANTAGE MATURITY FUND

PUTNAM RETIREMENT ADVANTAGE 2065 FUND

PUTNAM RETIREMENT ADVANTAGE 2060 FUND

PUTNAM RETIREMENT ADVANTAGE 2055 FUND

PUTNAM RETIREMENT ADVANTAGE 2050 FUND

PUTNAM RETIREMENT ADVANTAGE 2045 FUND

PUTNAM RETIREMENT ADVANTAGE 2040 FUND

PUTNAM RETIREMENT ADVANTAGE 2035 FUND

PUTNAM RETIREMENT ADVANTAGE 2030 FUND

PUTNAM RETIREMENT ADVANTAGE 2025 FUND

PUTNAM RETIREMENTREADY MATURITY FUND

PUTNAM RETIREMENTREADY 2065 FUND

PUTNAM RETIREMENTREADY 2060 FUND

PUTNAM RETIREMENTREADY 2055 FUND

PUTNAM RETIREMENTREADY 2050 FUND

PUTNAM RETIREMENTREADY 2045 FUND

PUTNAM RETIREMENTREADY 2040 FUND

PUTNAM RETIREMENTREADY 2035 FUND

PUTNAM RETIREMENTREADY 2030 FUND

PUTNAM RETIREMENTREADY 2025 FUND

PUTNAM TAX EXEMPT INCOME FUND

PUTNAM TAX-FREE INCOME TRUST

PUTNAM STRATEGIC INTERMEDIATE MUNICIPAL FUND

PUTNAM TAX-FREE HIGH YIELD FUND

PUTNAM VARIABLE TRUST

PUTNAM VT DIVERSIFIED INCOME FUND

PUTNAM VT EMERGING MARKETS EQUITY FUND

PUTNAM VT FOCUSED INTERNATIONAL EQUITY FUND

PUTNAM VT GEORGE PUTNAM BALANCED FUND

PUTNAM VT GLOBAL ASSET ALLOCATION FUND

PUTNAM VT GLOBAL HEALTH CARE FUND

PUTNAM VT GOVERNMENT MONEY MARKET FUND

PUTNAM VT GROWTH OPPORTUNITIES FUND

PUTNAM VT HIGH YIELD FUND

PUTNAM VT INCOME FUND

PUTNAM VT INTERNATIONAL EQUITY FUND

PUTNAM VT INTERNATIONAL VALUE FUND

PUTNAM VT LARGE CAP VALUE FUND

PUTNAM VT MORTGAGE SECURITIES FUND

PUTNAM VT MULTI-ASSET ABSOLUTE RETURN FUND

PUTNAM VT MULTI-CAP CORE FUND

PUTNAM VT RESEARCH FUND

PUTNAM VT SMALL CAP GROWTH FUND

PUTNAM VT SMALL CAP VALUE FUND

PUTNAM VT SUSTAINABLE FUTURE FUND

PUTNAM VT SUSTAINABLE LEADERS FUND

This is the formal agenda for your fund’s special shareholder meeting. It tells you what proposals will be voted on and the time and place of the special meeting, in case you wish to attend in person.

A special meeting of shareholders of your fund (the “Meeting”) will be held on June 29, 2022 at 11:00 a.m., Eastern Time, at the principal offices of the funds, 100 Federal Street, Boston, Massachusetts, 02110, to consider the following proposals, in each case as applicable to the particular funds listed in the table below:

| Proposal | Proposal Description | Affected Funds |

| 1. | Electing Trustees | All funds |

| 2. | Approving a change to certain funds’ sub-classification under the Investment Company Act of 1940, as amended, from “diversified” to “non-diversified” | Putnam Emerging Markets Equity Fund

Putnam Growth Opportunities Fund

Putnam VT Emerging Markets Equity Fund

Putnam VT Growth Opportunities Fund |

| 3. | Approving an amendment to certain funds’ fundamental investment policy regarding the acquisition of voting securities of any issuer | George Putnam Balanced Fund

Putnam Dynamic Asset Allocation Balanced Fund

Putnam Dynamic Asset Allocation Conservative Fund

Putnam Dynamic Asset Allocation Growth Fund

Putnam VT George Putnam Balanced Fund

Putnam VT Global Asset Allocation Fund |

As part of our effort to maintain a safe and healthy environment at the annual meeting, each fund and the Trustees are closely monitoring statements issued by the Centers for Disease Control and Prevention (cdc.gov) regarding the coronavirus pandemic. For that reason, the Trustees reserve the right to reconsider the date, time and/or means of convening your fund’s meeting.

By Michael J. Higgins, Clerk, and by the Trustees

Kenneth R. Leibler, Chair

| Liaquat Ahamed | Paul L. Joskow |

| Ravi Akhoury | George Putnam, III |

| Barbara M. Baumann | Robert L. Reynolds |

| Katinka Domotorffy | Manoj P. Singh |

| Catharine Bond Hill | Mona K. Sutphen |

In order for you to be represented at your fund’s special shareholder meeting, we urge you to record your voting instructions over the Internet or by telephone or to mark, sign, date, and mail the enclosed proxy card(s) in the postage-paid envelope provided.

May 20, 2022

Proxy Statement

This document gives you the information you need to vote on the proposals. Much of the information is required under rules of the Securities and Exchange Commission (the “SEC”); some of it is technical. If there is anything you don’t understand, please call toll-free 1-833-501-4818 or call your financial professional.

What proposals are being presented to shareholders at the special meeting?

Shareholders of all open-end Putnam funds are being asked to vote to elect the trustees. Shareholders of Putnam Emerging Markets Equity Fund, Putnam Growth Opportunities Fund, Putnam VT Emerging Markets Equity Fund, and Putnam VT Growth Opportunities Fund are also being asked to approve a change to those funds’ sub-classifications under the Investment Company Act of 1940, as amended (the “1940 Act”), from “diversified” to “non-diversified.” Shareholders of George Putnam Balanced Fund, Putnam Dynamic Asset Allocation Balanced Fund, Putnam Dynamic Asset Allocation Conservative Fund, Putnam Dynamic Asset Allocation Growth Fund, Putnam VT George Putnam Balanced Fund, and Putnam VT Global Asset Allocation Fund are also being asked to approve an amendment to those funds’ fundamental investment policy regarding the acquisition of voting securities of any issuer.

Who is asking for your vote?

The enclosed proxy is solicited by the Trustees of the open-end Putnam funds for use at each fund’s special meeting of shareholders to be held on June 29, 2022 and, if a fund’s meeting is adjourned, at any later meetings, for the purposes stated in the Notice of Special Meeting of Shareholders (see previous pages). The Notice of Special Meeting of Shareholders, the proxy card, and this proxy statement are being mailed beginning on or about May 20, 2022.

How do your fund’s Trustees recommend that shareholders vote on the proposals?

The Trustees unanimously recommend that you vote:

1. FOR electing your fund’s nominees for Trustees;

2. FOR approving a change to Putnam Emerging Markets Equity Fund’s, Putnam Growth Opportunities Fund’s, Putnam VT Emerging Markets Equity Fund’s, and Putnam VT Growth Opportunities Fund’s sub-classification under the 1940 Act from “diversified” to “non-diversified”; and

3. FOR approving an amendment to George Putnam Balanced Fund’s, Putnam Dynamic Asset Allocation Balanced Fund’s, Putnam Dynamic Asset Allocation Conservative Fund’s, Putnam Dynamic Asset Allocation Growth Fund’s, Putnam VT George Putnam Balanced Fund’s, and Putnam VT Global Asset Allocation Fund’s fundamental investment policy regarding the acquisition of voting securities of any issuer.

Who is eligible to vote?

Shareholders of record of each fund at the close of business on April 1, 2022 (the “Record Date”) are entitled to be present and to vote at the special meeting or, if it is adjourned, at any later sessions.

The number of shares of each fund outstanding on the Record Date is shown in Appendix A. Each share is entitled to one vote, with fractional shares voting proportionately. Shares represented by your duly executed proxy card will be voted in accordance with your instructions. If you sign and return the proxy card but don’t fill in a vote, your shares will be voted in accordance with the Trustees’ recommendations. If any other business comes before your fund’s special meeting, your shares will be voted at the discretion of the persons designated on the proxy card.

Shareholders of all series of a trust vote together with respect to the election of Trustees. Shareholders of each fund vote separately with respect to each other proposal. The name of each trust is indicated in bold in the Notice of a Special Meeting of Shareholders, with the funds that are series of that trust appearing below its name. The outcome of a vote affecting one fund does not affect any other fund, except where series of a trust vote together as a single class. No proposal is contingent upon the outcome of any other proposal.

The Proposals

Affected funds: All funds

Who are the nominees for Trustees?

The Board Policy and Nominating Committee of the Board is responsible for recommending nominees for Trustees of your fund. The Board Policy and Nominating Committee consists solely of Trustees who are not “interested persons” (as defined in the 1940 Act) of your fund or of Putnam Management. Those Trustees who are not “interested persons” of your fund or of Putnam Management are referred to as “Independent Trustees” throughout this proxy statement.

The Board, based on the recommendation of the Board Policy and Nominating Committee, has fixed the number of Trustees of your fund at 11 and recommends that you vote for the election of the nominees described in the following pages. Each fund currently has eleven Trustees on its Board. Two of your fund’s current Trustees, Paul L. Joskow and Ravi Akhoury, are retiring and are not standing for re-election to your fund’s Board, and each will serve until June 30, 2022, when he will retire. The Trustees have nominated Jennifer Williams Murphy and Marie Pillai to stand for election to your fund’s Board. If elected, Mses. Murphy and Pillai will serve as Trustees beginning July 1, 2022, following Dr. Joskow’s and Mr. Akhoury’s retirements. Each other nominee is currently a Trustee of your fund and of the other Putnam funds and, if elected, will continue to serve in that capacity without interruption.

Biographical information for the Fund’s nominees.

The Board’s nominees for Trustees and their backgrounds are shown in the following pages. This information includes each nominee’s name, year of birth, principal occupation(s) during the past five years, and other information about the nominee’s professional background, including other directorships the nominee holds. Each of the current Trustees oversees all of the Putnam funds and serves until the election and qualification of his or her successor, or until he or she sooner dies, resigns, retires, or is removed. The address of all of the Trustees/nominees is 100 Federal Street, Boston, Massachusetts 02110. As of March 31, 2022, there were 100 Putnam funds.

Independent Trustee Nominees

| Name, Address1, Year of | | |

| Birth, Position(s) Held with | | |

| Fund and Length of Service | | |

| as a Putnam Fund Trustee2 | Principal Occupation(s) During Past 5 Years | Other Directorships Held by Trustee |

| Liaquat Ahamed | Author; won Pulitzer Prize for Lords of Finance: The Bankers | Chairman of the Sun Valley Writers Conference, a literary not-for-profit |

| (Born 1952), | Who Broke the World. | organization; and a Trustee of the Journal of Philosophy. |

| Trustee since 2012 | | |

| Barbara M. Baumann | President of Cross Creek Energy Corporation, a strategic | Director of Devon Energy Corporation, a publicly traded independent natural gas |

| (Born 1955), | consultant to domestic energy firms and direct investor in energy | and oil exploration and production company; Director of National Fuel Gas |

| Trustee since 2010 | projects. | Company, a publicly traded energy company that engages in the production, |

| | | gathering, transportation, distribution, and marketing of natural gas; Senior |

| | | Advisor to the energy private equity firm First Reserve; Director of three private, |

| | | independent oil and gas exploration and production companies: Ascent Resources, |

| | | LLC, Texas American Resources Company II, LLC, and IOG Resources, LLC; |

| | | Member of the Finance Committee of the Children’s Hospital of Colorado; |

| | | Member of the Investment Committee of the Board of The Denver Foundation; |

| | | and previously, a Director of publicly traded companies Buckeye Partners, LP, |

| | | UNS Energy Corporation, CVR Energy Company, and SM Energy Corporation. |

| Katinka Domotorffy | Voting member of the Investment Committees of the Anne Ray | Director of the Great Lakes Science Center; and Director of College Now Greater |

| (Born 1975), | Foundation and Margaret A. Cargill Foundation, part of the | Cleveland. |

| Trustee since 2012 | Margaret A. Cargill Philanthropies. | |

| Catharine Bond Hill | Managing Director of Ithaka S+R, a not-for-profit service that | Director of Yale-NUS College; and Trustee of Yale University. |

| (Born 1954), | helps the academic community navigate economic and | |

| Trustee since 2017 | technological change. From 2006 to 2016, Dr. Hill served as the 10th | |

| | president of Vassar College. | |

| Kenneth R. Leibler | Vice Chairman Emeritus of the Board of Trustees of Beth Israel | Director of Eversource Corporation, which operates New England’s largest |

| (Born 1949), | Deaconess Hospital in Boston. Member of the Investment | energy delivery system; previously the Chairman of the Boston Options |

| Trustee since 2006, | Committee of the Boston Arts Academy Foundation. | Exchange, an electronic market place for the trading of listed derivatives |

| Vice Chair from 2016 | | securities; previously the Chairman and Chief Executive Officer of the Boston |

| to 2018 and Chair | | Stock Exchange; and previously the President and Chief Operating Officer of the |

| since 2018 | | American Stock Exchange. |

| Jennifer Williams Murphy3 | Chief Executive Officer and Founder of Runa Digital Assets, | Previously, a Director of Western Asset Mortgage Capital Corporation. |

| (Born 1964), | LLC, an institutional investment advisory firm specializing in | |

| Trustee Nominee | active management of digital assets. Until 2021, Chief Operating | |

| | Officer of Western Asset Management, LLC, a global | |

| | investment adviser, and Chief Executive Officer and President | |

| | of Western Asset Mortgage Capital Corporation, a mortgage | |

| | finance real estate investment trust. | |

| Marie Pillai3 | Senior Advisor, Hunter Street Partners, LP, an asset-oriented | Director of the Catholic Community Foundation of Minnesota; Investment |

| (Born 1954), | private investment firm; Specialty Leader and Member of the | Advisory Board Member of the University of Minnesota; Member of the Board of |

| Trustee Nominee | Curriculum Committee of the Center for Board Certified | the Bush Foundation, a non-profit organization supporting community problem- |

| | Fiduciaries, a public benefit corporation providing coursework | solving in Minnesota, North Dakota and South Dakota; previously, a Board |

| | for developing fiduciaries. Until 2019, Vice President, Chief | Member of Catholic Charities of St. Paul and Minneapolis. |

| | Investment Officer and Treasurer of General Mills, Inc., a global | |

| | food company. | |

| George Putnam, III | Chairman of New Generation Research, Inc., a publisher of | Director of The Boston Family Office, LLC, a registered investment advisor; |

| (Born 1951), | financial advisory and other research services, and President of | Director of the Gloucester Marine Genomics Institute; previously a Trustee of the |

| Trustee since 1984 | New Generation Advisors, LLC, a registered investment adviser | Marine Biological Laboratory; and previously a Trustee of Epiphany School. |

| | to private funds. | |

| Manoj P. Singh | Until 2015, Chief Operating Officer and global managing | Director of ReNew Energy Global Plc, a publicly traded renewable energy |

| (Born 1952), | director at Deloitte Touche Tohmatsu, Ltd., a global professional | company; Director of Abt Associates, a global research firm working in the fields |

| Trustee since 2017 | services organization, serving on the Deloitte U.S. Board of | of health, social and environmental policy, and international development; Trustee |

| | Directors and the boards of Deloitte member firms in China, | of Carnegie Mellon University; Director of Pratham USA, an organization |

| | Mexico and Southeast Asia. | dedicated to children’s education in India; member of the advisory board of |

| | | Altimetrik, a business transformation and technology solutions firm; and Director |

| | | of DXC Technology, a global IT services and consulting company. |

| Mona K. Sutphen | Partner, Investment Strategies at The Vistria Group, a private | Director of Spotify Technology S.A., a publicly traded audio content streaming |

| (Born 1967), | investment firm focused on middle-market market companies in | service; Director of Unitek Learning, a private nursing and medical services |

| Trustee since 2020 | the healthcare, education, and financial services industries. From | education provider in the United States; Board Member, International Rescue |

| | 2014 to 2018, Partner at Macro Advisory Partners, a global | Committee; Co-Chair of the Board of Human Rights First; Trustee of Mount |

| | consulting firm. | Holyoke College; Member of the Advisory Board for the Center on Global |

| | | Energy Policy at Columbia University’s School of International and Public |

| | | Affairs; previously Director of Pattern Energy and Pioneer Natural Resources, |

| | | pulblicly traded energy companies; and previously Managing Director of UBS |

| | | AG. |

Interested Trustee Nominee

| Name, Address1, Year of | | |

| Birth, Position(s) Held with | | |

| Fund and Length of Service | | |

| as a Putnam Fund Trustee2 | Principal Occupation(s) During Past 5 Years | Other Directorships Held by Trustee |

| Robert L. Reynolds4 | President and Chief Executive Officer of Putnam Investments; | Director of the Concord Museum; Director of Dana-Farber Cancer Institute; |

| (Born 1952), | member of Putnam Investments' Board of Directors; and Chair | Director of the U.S. Ski & Snowboard Foundation; Chair of the Boston Advisory |

| Trustee since 2008 | of Great-West Lifeco U.S. LLC. Prior to 2019, also President | Board of the American Ireland Fund; National Council Co-Chair of the American |

| | and Chief Executive Officer of Great-West Financial, a financial | Enterprise Institute; Executive Committee Member of Greater Boston Chamber of |

| | services company that provides retirement savings plans, life | Commerce; Member of U.S. Chamber of Commerce, Center for Capital Markets |

| | insurance, and annuity and executive benefits products, and of | Competitiveness; Chair of Massachusetts High Technology Council; Member of |

| | Great-West Lifeco U.S. LLC, a holding company that owns | the Chief Executives Club of Boston; Member of the Massachusetts General |

| | Putnam Investments and Great-West Financial, and a member of | Hospital President’s Council; Director and former Chair of the Massachusetts |

| | Great-West Financial's Board of Directors. | Competitive Partnership; and former Chair of the West Virginia University |

| | | Foundation. |

Current Independent Trustees Not Nominated for Re-Election

| Name, Address1, Year of | | |

| Birth, Position(s) Held with | | |

| Fund and Length of Service | | |

| as a Putnam Fund Trustee2 | Principal Occupation(s) During Past 5 Years | Other Directorships Held by Trustee |

| Ravi Akhoury5 | Private Investor | Director of English Helper, Inc., a private software company; previously a |

| (Born 1947), | | Trustee of the Rubin Museum, serving on the Investment Committee; and |

| Trustee since 2009 | | previously a Director of RAGE Frameworks, Inc. |

| Paul L. Joskow5 | The Elizabeth and James Killian Professor of Economics, | Vice Chair of the Board of Directors of the Whitehead Institute of Biomedical Research, |

| (Born 1947), | Emeritus at the Massachusetts Institute of Technology (MIT). | a non-profit biomedical research institute; a Director of Exelon Corporation, an energy |

| Trustee since 1997 | From 2008 to 2017, the President of the Alfred P. Sloan | company focused on power services; and a Member Emeritus of the Board of Advisors |

| | Foundation, a philanthropic institution focused primarily on | of the Boston Symphony Orchestra. |

| | research and education on issues related to science, technology, | |

| | and economic performance. | |

1 The address of each Trustee/Nominee is 100 Federal Street, Boston, MA 02110.

2 Each Trustee serves for an indefinite term, until his or her resignation, retirement during the year he or she reaches age 75, death, or removal.

3 Mses. Murphy and Pillai have been nominated for election to your fund’s Board and, if elected, will serve as Trustees beginning July 1, 2022.

4 Trustee who is an “interested person” (as defined in the 1940 Act) of the fund and Putnam Management. Mr. Reynolds is deemed an “interested person” by virtue of his positions as an officer of the fund and Putnam Management. Mr. Reynolds is the President and Chief Executive Officer of Putnam Investments, LLC and President of your fund and each of the other Putnam funds, exclusive of the four exchange-traded funds in Putnam ETF Trust.

5 Mr. Akhoury and Dr. Joskow are retiring and are not standing for re-election to your fund’s Board. Each will serve until June 30, 2022, when he will retire.

Most of the Trustees have served on the Board for many years. The Board Policy and Nominating Committee is responsible for recommending proposed nominees for election to the Board of Trustees for its approval. In recommending the election of the nominees as Trustees, the Committee generally considered the educational, business and professional experience of each nominee in determining his or her qualifications to serve as a Trustee of the fund, including the nominee’s record of service as a director or trustee of public and private organizations. This included each current Trustee’s previous service as a member of the Board of Trustees of the Putnam funds, during which he or she has demonstrated a high level of diligence and commitment to the interests of fund shareholders and the ability to work effectively and collegially with other members of the Board. The Committee also considered, among other factors, the particular attributes described below with respect to the various individual Trustees/nominees.

Independent Trustee Nominees:

Liaquat Ahamed — Mr. Ahamed’s experience as Chief Executive Officer of a major investment management organization and as head of the investment division at the World Bank, as well as his experience as an author of economic literature.

Barbara M. Baumann — Ms. Baumann’s experience in the energy industry as a consultant, an investor, and in both financial and operational management positions at a global energy company, and her service as a director of multiple New York Stock Exchange companies.

Katinka Domotorffy — Ms. Domotorffy’s experience as Chief Investment Officer and Global Head of Quantitative Investment Strategies at a major asset management organization.

Catharine Bond Hill — Dr. Hill’s education and experience as an economist and as president and provost of colleges in the United States.

Kenneth R. Leibler — Mr. Leibler’s extensive experience in the financial services industry, including as Chief Executive Officer of a major asset management organization, and his service as a director of various public and private companies.

Jennifer Williams Murphy — Ms. Murphy’s experience as Chief Operating Officer of a major global investment management organization and as Chief Executive Officer of an investment advisory firm specializing in digital assets.

Marie Pillai — Ms. Pillai’s experience as Vice President, Chief Investment Officer and Treasurer of a global food company.

George Putnam, III — Mr. Putnam’s training and experience as an attorney, his experience as the founder and Chief Executive Officer of an investment management firm and his experience as an author of various publications on the subject of investments.

Manoj P. Singh — Mr. Singh’s experience as Chief Operating Officer and global managing director of a global professional services organization that provided accounting, consulting, tax, risk management, and financial advisory services.

Mona K. Sutphen — Ms. Sutphen’s extensive experience advising corporate, philanthropic and institutional investors on the intersection of geopolitics, policy and markets, as well as her prior service as White House Deputy Chief of Staff for Policy and as a US Foreign Service Officer, her work advising financial services companies on macro risks, and her service as a director of public companies.

Interested Trustee Nominee:

Robert L. Reynolds — Mr. Reynolds’s extensive experience as a senior executive of one of the largest mutual fund organizations in the United States and his current role as the President and Chief Executive Officer of Putnam Investments.

Current Independent Trustees Not Nominated for Re-Election:

Ravi Akhoury — Mr. Akhoury’s experience as Chairman and Chief Executive Officer of a major investment management organization.

Paul L. Joskow — Dr. Joskow’s education and experience as a professional economist familiar with financial economics and related issues and his service on multiple for-profit boards.

Each of the nominees has agreed to serve as a Trustee, if elected. If any nominee is unable to serve or for good cause will not serve at the time of the special meeting, which is not anticipated, the Trustees may vote for other nominees at their discretion, or the Trustees may fix the number of Trustees at fewer than 11 for your fund.

What are the Trustees’ responsibilities?

Your fund’s Trustees are responsible for the general oversight of your fund’s affairs. The Trustees regularly review your fund’s investment performance as well as the quality of other services provided to your fund and its shareholders by Putnam Management and its affiliates, including administration and shareholder servicing. Currently, Putnam Management and its affiliates provide administrative services to your fund. At least annually, the Trustees review and evaluate the fees and operating expenses paid by your fund for these services and negotiate changes if they deem it appropriate. In carrying out these responsibilities, the Trustees are assisted by an independent administrative staff and by your fund’s auditors, independent counsel, and other experts as appropriate, selected by and responsible to the Trustees.

Board Leadership Structure. Currently, all but one of your fund’s Trustees are Independent Trustees, meaning that they are not considered “interested persons” of your fund or Putnam Management. Mses. Murphy and Pillai also qualify as Independent Trustees. These Independent Trustees must vote separately to approve all financial arrangements and other agreements with your fund’s investment manager and other affiliated parties. The role of the Independent Trustees has been characterized as that of a “watchdog” charged with oversight to protect shareholders’ interests against overreaching and abuse by those who are in a position to control or influence a fund. Your fund’s Independent Trustees meet regularly as a group in executive session (i.e., without representatives of Putnam Management or its affiliates present). An Independent Trustee currently serves as chair of the Board.

Board Committees. Taking into account the number, the diversity, and the complexity of the funds overseen by the Board and the aggregate amount of assets under management, your fund’s Trustees have determined that the efficient conduct of the Board’s affairs makes it desirable to delegate responsibility for certain specific matters to committees of the Board. The Executive Committee, Contract Committee, Audit, Compliance and Risk Committee, and Board Policy and Nominating Committee are authorized to take action on certain matters as specified in their charters or in policies and procedures relating to the governance of the funds; with respect to other matters, these committees review and evaluate and make recommendations to the Trustees as they deem appropriate. The other committees also review and evaluate matters specified in their charters and make recommendations to the Trustees as they deem appropriate. Each committee may utilize the resources of your fund’s independent staff, independent counsel and independent registered public accountants as well as other experts. The committees meet as often as appropriate, either in conjunction with regular meetings of the Trustees or otherwise. The membership and chair of each committee are appointed by the Trustees upon recommendation of the Board Policy and Nominating Committee. Each committee is chaired by an Independent Trustee and,

except as noted below, the membership and chairs of each committee consist exclusively of Independent Trustees.

The Trustees have determined that this committee structure also allows the Board to focus more effectively on the oversight of risk as part of its broader oversight of the funds’ affairs. While risk management is the primary responsibility of the funds’ investment manager, the Trustees receive reports and presentations regarding investment risks, compliance risks and other risks. The Board and certain committees also meet periodically with the funds’ and Putnam Management’s Chief Compliance Officer to receive compliance reports and with Putnam Management’s Chief Risk Officer to receive reports regarding risk oversight. In addition, the Board and its Investment Oversight Committees meet periodically with the portfolio managers of the funds to receive reports regarding the management of the funds. The Board’s committee structure allows separate committees to focus on different aspects of these risks and their potential impact on some or all of the funds and to discuss with the funds’ investment manager how it monitors and controls risks.

The Board recognizes that the reports it receives concerning risk management matters are, by their nature, typically summaries of the relevant information. Moreover, the Board recognizes that not all risks that may affect your fund can be identified in advance; that it may not be practical or cost-effective to eliminate or to mitigate certain risks; that it may be necessary to bear certain risks (such as investment-related risks) in seeking to achieve your fund’s investment objectives; and that the processes, procedures and controls employed to address certain risks may be limited in their effectiveness. As a result of the foregoing and for other reasons, the Board’s risk management oversight is subject to substantial limitations.

Audit, Compliance and Risk Committee. The Audit, Compliance and Risk Committee provides oversight on matters relating to the integrity of the funds’ financial statements, compliance with legal and regulatory requirements, Codes of Ethics issues, and certain aspects of overseeing Putnam Management’s risk assessment and risk management. This oversight is discharged by regularly meeting with management, the funds’ independent registered public accountants, the fund’s and Putnam Management’s Chief Compliance Officer, and Putnam Management’s Chief Risk Officer, and remaining current with respect to industry developments. Duties of this Committee also include the review and evaluation of all matters and relationships pertaining to the funds’ independent registered public accountants, including their independence. The Committee also oversees all dividends and distributions by the funds. The Committee makes recommendations to the Trustees of the funds regarding the amount and timing of distributions paid by the funds, and determines such matters when the Trustees are not in session. The Committee also oversees the policies and procedures pursuant to which Putnam Management prepares recommendations for dividends and distributions, and meets regularly with representatives of Putnam Management to review the implementation of these policies and procedures. The Committee reports to the Trustees and makes recommendations to the Trustees regarding these matters. Information about the fees billed to the fund by the funds’ registered public accountant, as well as information about the Committee’s pre-approval policies relating to the work performed by the funds’ registered public accountant, is included in Appendix B of this proxy statement. Each member of the Committee is an Independent Trustee. Each member of the Committee also is “independent,” as that term is interpreted for purposes of Rule 10A-3(b)(1) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the listing standards of the New York Stock Exchange. The Board has adopted a written charter for the Committee, a current copy of which is available at www.putnam.com/about-putnam/ at the bottom of that page. The Committee currently consists of Messrs. Singh (Chair) and Akhoury, Ms. Domotorffy and Drs. Hill and Joskow. Mr. Singh and Drs. Hill and Joskow have each been designated an “audit committee financial expert” within the meaning of applicable SEC rules.

Board Policy and Nominating Committee. The Board Policy and Nominating Committee reviews matters pertaining to the operations of the Board and its committees, the compensation of the Trustees, and the conduct of legal affairs for the Putnam funds. The Committee also oversees the voting of proxies associated with portfolio investments of the Putnam funds, with the goal of ensuring that these proxies are voted in the best interest of each fund’s shareholders. The Committee reports to the Trustees and makes recommendations to the Trustees regarding these matters.

The Committee evaluates and recommends all candidates for election as Trustees and recommends the appointment of members and chairs of each Board committee. The Committee also identifies prospective nominees for election as Trustee by considering individuals that come to its attention through the recommendation of current Trustees, Putnam Management or shareholders. Candidates properly submitted by shareholders will be considered and evaluated on the same basis as candidates recommended by other sources. The Committee will consider nominees for Trustee recommended by shareholders of a fund provided that the recommendations are submitted by the date disclosed in the fund’s proxy statement and otherwise comply with the fund’s by-laws and applicable securities laws, including Rule 14a-8 under the Exchange Act. The Committee may, but is not required to, engage a third-party professional search firm to assist it in identifying and evaluating potential nominees.

When evaluating a potential candidate for membership on the Board, the Committee considers the skills and characteristics that it determines would most benefit the Putnam funds at the time the evaluation is made. The Committee may take into account a wide variety of attributes in considering potential Trustee candidates, including, but not limited to: (i) availability and commitment of a candidate to attend meetings and perform his or her responsibilities to the Board, (ii) other board experience, (iii) relevant industry and related experience, (iv) educational background, (v) financial expertise, (vi) an assessment of the candidate’s ability, judgment and expertise, (vii) an assessment of the perceived needs of the Board and its committees at that point in time, and (viii) overall Board composition. The Committee generally believes that the Board benefits from diversity of background, experience, and views among its members, and considers this as a factor in evaluating the composition of the Board, but has not adopted any specific policy in this regard. In connection with this evaluation, the Committee will determine whether to interview prospective nominees, and, if warranted, one or more members of the Committee, and other Trustees and representatives of the funds, as appropriate, will interview prospective nominees in person or by telephone. Once this evaluation is completed, the Committee recommends such candidates as it determines appropriate to the Independent Trustees for nomination, and the Independent Trustees select the nominees after considering the recommendation of the Committee. The Board has adopted a written charter for the Committee, a current copy of which is available at www.putnam.com/about-putnam/ at the bottom of that page. The Committee is composed entirely of Independent Trustees and currently consists of Dr. Joskow (Chair), Messrs. Leibler and Putnam, and Ms. Baumann.

Brokerage Committee. The Brokerage Committee reviews the Putnam funds’ policies regarding the execution of portfolio trades and Putnam Management’s practices and procedures relating to the implementation of those policies. The Committee reviews periodic reports on the cost and quality of execution of portfolio transactions and the extent to which brokerage commissions have been used (i) by Putnam Management to obtain brokerage and research services generally useful to it in managing the portfolios of the funds and of its other clients, and (ii) by the funds to pay for certain fund expenses. The Committee reports to the Trustees and makes recommendations to the Trustees regarding these matters. The Committee currently consists of Messrs. Ahamed (Chair), Leibler, and Putnam, and Mses. Baumann and Sutphen.

Contract Committee. The Contract Committee reviews and evaluates at least annually all arrangements pertaining to (i) the engagement of Putnam Management and its affiliates to provide services to the Putnam funds, (ii) the expenditure of the open-end funds’ assets for distribution purposes pursuant to Distribution Plans of the open-end Putnam funds, and (iii) the engagement of other persons to provide material services to the funds, including in particular those instances where the cost of services is shared between the funds and Putnam Management and its affiliates or where Putnam Management or its affiliates have a material interest. The Committee also reviews the proposed organization of new fund products, proposed structural changes to existing funds, and matters relating to closed-end funds. In addition, the Committee also reviews communications with, and the quality of services provided to, shareholders and oversees the marketing and sale of fund shares by Putnam Retail Management. The Committee reports and makes recommendations to the Trustees regarding these matters. The Committee currently consists of Messrs. Putnam (Chair), Ahamed, and Leibler, and Mses. Baumann and Sutphen.

Executive Committee. The functions of the Executive Committee are twofold. The first is to ensure that the Putnam funds’ business may be conducted at times when it is not feasible to convene a meeting of the Trustees or for the Trustees to act by written consent. The Committee may exercise any or all of the power and authority of the Trustees when the Trustees are not in session. The second is to review annual and ongoing goals, objectives and priorities for the Board and to facilitate coordination of all efforts between the Trustees and Putnam Management on behalf of the shareholders of the funds. The Committee currently consists of Messrs. Leibler (Chair) and Putnam and Ms. Baumann.

Investment Oversight Committees. The Investment Oversight Committees regularly meet with investment personnel of Putnam Management to review the investment performance and strategies of the funds in light of their stated goals and policies. The Committees seek to identify any compliance issues that are unique to the applicable categories of funds and work with the appropriate Board committees to ensure that any such issues are properly addressed. The Committees review the proposed investment objectives, policies and restrictions of new fund products and proposed changes to investment objectives, policies and restrictions of existing funds. Investment Oversight Committee A currently consists of Mses. Domotorffy (Chair) and Sutphen, Messrs. Ahamed, Reynolds and Singh, and Dr. Joskow. Investment Oversight Committee B currently consists of Messrs. Akhoury (Chair), Leibler, and Putnam, Ms. Baumann, and Dr. Hill.

Pricing Committee. The Pricing Committee oversees the valuation of assets of the Putnam funds and reviews the funds’ policies and procedures for achieving accurate and timely pricing of fund shares. The Committee oversees implementation of these policies, including fair value determinations of individual securities made by Putnam Management or other designated agents of the funds. The Committee also reviews (i) compliance by money market funds with Rule 2a-7 under the 1940 Act, (ii) in-kind redemptions by fund affiliates, (iii) the correction of occasional pricing errors, and (iv) Putnam Management’s oversight of pricing vendors. The Committee reports to the Trustees and makes recommendations to the Trustees regarding these matters. The Committee currently consists of Messrs. Singh (Chair) and Akhoury, Ms. Domotorffy, and Dr. Hill.

How large of a stake do the Trustees have in the Putnam family of funds?

The Trustees allocate their investments among the Putnam funds based on their own investment needs. The number of shares beneficially owned by each Trustee and nominee for Trustee, as well as the value of each Trustee’s and nominee’s holdings in each fund and in all of the Putnam funds as of December 31, 2021 is included in Appendix C. As a group, the Trustees/nominees owned shares of the Putnam funds valued at approximately $77 million, as of March 31, 2022.

As of March 31, 2022, to the knowledge of your fund, each Trustee/nominee, and the officers and Trustees/nominees of the fund as a group, owned less than 1% of the outstanding shares of each class of each fund, except as listed in Appendix C.

How can shareholders communicate with the Trustees?

The Board provides a process for shareholders to send communications to the Trustees. Shareholders may direct communications to the Board as a whole or to specified individual Trustees by submitting them in writing to the following address:

| |

| The Putnam Funds |

| Attention: “Board of Trustees” or any specified Trustee(s) |

| 100 Federal Street |

| Boston, Massachusetts 02110 |

Written communications must include the shareholder’s name, be signed by the shareholder, refer to the Putnam fund(s) in which the shareholder holds shares, and include the class and number of shares held by the shareholder as of a recent date.

Representatives of the funds’ transfer agent will review all communications sent to Trustees and, as deemed appropriate, will provide copies and/or summaries of communications to the Trustees.

How often do the Trustees meet?

The Trustees currently hold regular in-person meetings eight times each year, usually over a two-day period, to review the operations of the Putnam funds. (During the COVID-19 pandemic, the Trustees have held meetings by videoconference or teleconference rather than in person.) A portion of these meetings is devoted to meetings of various committees of the Board that focus on particular matters. Each Independent Trustee generally attends several formal committee meetings during each regular meeting of the Trustees, including meetings with senior investment personnel and portfolio managers to review recent performance and the current investment climate for selected funds. These meetings ensure that fund performance is reviewed in detail on at least an annual basis. The committees of the Board, including the Executive Committee, may also meet on special occasions as the need arises. During the calendar year 2021, each Trustee attended at least 75% of the Board and applicable committee meetings noted for each fund and the average Trustee participated in approximately 38 committee and Board meetings.

The number of times the full Board and each committee met during calendar year 2021 is shown in the table below:

| | |

| Board of Trustees | 12 |

| Audit, Compliance and Risk Committee | 13 |

| Board Policy and Nominating Committee | 9 |

| Brokerage Committee | 2 |

| Contract Committee | 8 |

| Executive Committee | 1 |

| Investment Oversight Committee A | 6 |

| Investment Oversight Committee B | 6 |

| Pricing Committee | 8 |

The funds do not have a formal policy with respect to Trustee attendance at shareholder meetings. While various Trustees may attend shareholder meetings from time to time, your fund’s Trustees did not attend the last shareholder meeting of your fund. The Trustees are generally represented at shareholder meetings by their independent staff and independent counsel.

What are some of the ways in which the Trustees represent shareholder interests?

Among other ways, the Trustees seek to represent shareholder interests:

• by reviewing your fund’s investment performance with your fund’s investment personnel;

• by discussing with senior management of Putnam Management steps being taken to address any performance deficiencies;

• by reviewing the quality of the various other services provided to your fund and its shareholders by Putnam Management and its affiliates;

• by reviewing in depth the fees paid by each fund and by negotiating with Putnam Management, if appropriate, to ensure that the fees remain reasonable and competitive with those of comparable funds, while at the same time providing Putnam Management sufficient resources to continue to provide high quality services in the future;

• by reviewing brokerage costs and fees, allocations among brokers, and soft dollar expenditures (if applicable);

• by discussing shareholder outreach initiatives with senior management of Putnam Management;

• by reviewing the specific concerns of closed-end fund shareholders;

• by monitoring potential conflicts of interest between the Putnam funds, including your fund, and Putnam Management and its affiliates to ensure that the funds continue to be managed in the best interests of their shareholders; and

• by monitoring potential conflicts among funds managed by Putnam Management to ensure that shareholders continue to realize the benefits of participation in a large and diverse family of funds.

What are the Trustees paid for their services?

Each Independent Trustee of the funds receives an annual retainer fee and additional fees for each Trustee meeting attended and for certain related services. Independent Trustees also are reimbursed for expenses they incur relating to their service as Trustees. All of the current Independent Trustees of the funds are Trustees of all of the Putnam funds.

The Trustees periodically review their fees to ensure that the fees continue to be appropriate in light of their responsibilities as well as in relation to fees paid to trustees of other mutual fund complexes. The Board Policy and Nominating Committee, which consists solely of Independent Trustees of the funds, estimates that committee and Trustee meeting time, together with the appropriate preparation, requires the equivalent of at least four business days per regular Trustee meeting.

Under a Retirement Plan in effect for Trustees of the Putnam funds elected to the Board before 2003 (the “Plan”), each eligible Trustee who retires with at least five years of service as a Trustee of the funds is entitled to receive an annual retirement benefit equal to one-half of the average annual attendance and retainer fees paid to such Trustee for calendar years 2003, 2004 and 2005. This retirement benefit is payable during a Trustee’s lifetime, beginning the year following retirement, for the number of years of service through December 31, 2006. A death benefit, also available under the Plan, ensures that the Trustee and his or her beneficiaries will receive benefit payments for the lesser of an aggregate period of (i) ten years or (ii) such Trustee’s total years of service.

The Plan Administrator (currently the Board Policy and Nominating Committee) may terminate or amend the Plan at any time, but no termination or amendment will result in a reduction in the amount of benefits (i) currently being paid to a Trustee at the time of such termination or amendment, or (ii) to which a current Trustee would have been entitled had he or she retired immediately prior to such termination or amendment. The Trustees have terminated the Plan with respect to any Trustee first elected to the Board after 2003.

The table found in Appendix D includes the year each Trustee became a Trustee of the Putnam funds, the fees paid to each of those Trustees by each fund included in this proxy statement for its most recent fiscal year (ended prior to March 31, 2022), and the fees paid to each of those Trustees by all of the Putnam funds during calendar year 2021. Mses. Murphy and Pillai did not serve as Trustees of the Board during any fund’s recently completed fiscal year or during the calendar year 2021 and are therefore not included in the table in Appendix D.

Why should you vote for your fund’s nominees?

The nominees for election as Trustees are independent, experienced, and highly qualified fiduciaries who exercise strong fund governance practices.

Independent

• The Chair of your fund, Kenneth R. Leibler, is independent of Putnam Management and has served on the Board for 16 years. He also has extensive experience in the financial services industry, including as Chief Executive Officer of a major asset management organization, and has served as a director of various public and private companies;

• 10 of the 11 Trustee nominees, and both of the nominees who do not currently serve as Trustees, are independent of Putnam Management; and

• The Independent Trustees are assisted by an independent administrative staff and legal counsel who are selected by the Independent Trustees and are independent of Putnam Management.

Highly Qualified

• The nominees have significant current and past related industry experience, and have a demonstrated history of actively pursuing the interests of fund shareholders;

• The Board includes individuals with substantial professional accomplishments and prior experience in a variety of fields, including investment management, economics, finance, energy, and professional services; and

• The Board has taken actions that directly benefit shareholders — liquidity events such as mergers and, in the case of the closed-end funds, tender offers when in the best interests of all shareholders; a share repurchase program for the closed-end funds that has made a contribution to investment return; a significant decrease in 2006 in management fee rates for certain Putnam funds; and various efforts to improve shareholder relations.

Strong Governance Practices

• The Board includes a combination of long-tenured and newer members, bringing diverse perspectives to fund oversight;

• The Board has a well-established committee and oversight structure for the Putnam funds, which has been developed over a long period of time; and

• The funds do not have a staggered board structure or other takeover defenses.

What is the voting requirement for electing Trustees?

All of the funds within a trust will vote together on the election of Trustees as a single class. If a quorum for your trust is present at the special meeting, all nominees receiving votes cast will be elected as Trustees of your trust. Under a plurality vote, the candidates who receive the highest number of votes will be elected, even if they receive approval from less than a majority of the votes cast. Because the nominees are running unopposed, all eleven nominees are expected to be elected as Trustees, as all nominees who receive votes in favor will be elected, and votes not cast or votes withheld will have no effect on the election outcome. The name of each trust is indicated in bold in the Notice of a Special Meeting of Shareholders on page 2, with the funds that are series of that trust appearing below its name.

Who is bearing the costs associated with the proposal, including proxy-related costs?

The expenses of the preparation of proxy statements and related materials, including printing, delivery and solicitation costs, attributable to Proposal 1 will be borne by the funds pro rata based on the number of shareholder accounts.

What are the Trustees recommending?

The Trustees unanimously recommend that shareholders vote “FOR” the election of your fund’s nominees.

2. APPROVING A CHANGE TO CERTAIN FUNDS’ SUB-CLASSIFICATION UNDER THE INVESTMENT COMPANY ACT OF 1940 FROM “DIVERSIFIED” TO “NON-DIVERSIFIED”

Affected funds: Putnam Emerging Markets Equity Fund, Putnam Growth Opportunities Fund, Putnam VT Emerging Markets Equity Fund, and Putnam VT Growth Opportunities Fund only

What is this proposal?

The Trustees recommend that shareholders approve a change to the sub-classification under the 1940 Act from “diversified” to “non-diversified” for each of the following funds: Putnam Emerging Markets Equity Fund, Putnam Growth Opportunities Fund, Putnam VT Emerging Markets Equity Fund, and Putnam VT Growth Opportunities Fund (for purposes of this Proposal 2, the “funds”). As a non-diversified fund, each fund would have greater flexibility to invest more of its assets in the securities of fewer issuers than it would as a diversified fund.

Each fund is currently sub-classified as a “diversified” fund under the 1940 Act. As a diversified fund, a fund is generally limited as to the size of its investment in any single issuer. The 1940 Act sets forth the requirements that must be met for an investment company to be diversified. The 1940 Act requires that to qualify as a “diversified” fund, a fund may not, with respect to at least 75% of the value of its total assets, invest in securities of any issuer if, immediately after the investment, more than 5% of the total assets of the fund (taken at current value) would be invested in the securities of that issuer or the fund would hold more than 10% of the outstanding voting securities of the issuer. (These percentage limitations do not apply to cash or cash items (including receivables), securities issued by investment companies, or any “Government security.” A Government security is any security issued or guaranteed as to principal or interest by the United States, or by a person controlled or supervised by and acting as an instrumentality of the government of the United Sates pursuant to authority granted by the Congress of the United Sates, or any certificate of deposit for any of the forgoing.) The remaining 25% of a fund’s total assets is not subject to this restriction. This means that, with respect to the remaining 25% of a fund’s total assets, a diversified fund may invest more than 5% of its total assets in the securities of one issuer and may hold more than 10% of an issuer’s outstanding voting securities. These 1940 Act requirements do not apply to an investment company that is non-diversified. As a result, compared with a non-diversified fund, a diversified fund would be generally expected to have lesser exposures to individual portfolio securities.

The change to each fund’s sub-classification under the 1940 Act from diversified to non-diversified is being proposed because the markets in which the fund invests include a small number of dominant companies. For example, as of March 29, 2022, more than 35% of the corresponding benchmark index for Putnam Growth Opportunities Fund and Putnam VT Growth Opportunities Fund, and more than 7% of the corresponding benchmark index for Putnam Emerging Markets Equity Fund and Putnam VT Emerging Markets Equity Fund, each of which broadly represents the markets in which the funds are likely to invest, are composed of companies that each represent more than 5% (by market capitalization) of the index. In order to meet the requirements of the funds’ current diversification classification, the funds currently must limit purchases of these companies relative to their weights in the corresponding benchmark index, even if Putnam Management finds them to be attractive investment opportunities. Putnam Management believes that the proposed change would allow the funds’ portfolio managers to more effectively implement each fund’s investment strategy by providing greater flexibility to manage each fund, including, if desired for investment purposes, by investing a greater portion of the fund’s assets in one or more of the largest constituents of the index. While the proposed change to the diversification status of each fund will provide greater flexibility in executing each fund’s investment program, it is not expected to materially impact the way each fund is managed. However, as a non-diversified fund, the fund would be exposed to non-diversification risk, as its ability to invest more of its assets in the securities of fewer issuers would

increase its vulnerability to factors affecting a single investment; therefore, the fund may be more exposed to the risks of loss and volatility than a fund that invests more broadly.

The Trustees, subject to shareholder approval, have approved the proposed change to each fund’s sub-classification from a diversified fund to a non-diversified fund. In recommending that shareholders approve this change, the Trustees noted that, in order to meet the requirements of the funds’ current diversification classification, the funds currently must limit purchases of certain companies relative to their weights in the corresponding benchmark index even if Putnam Management finds them to be attractive investment opportunities. The Trustees also considered Putnam Management’s representation that this change would allow it to more effectively implement each fund’s investment strategy by providing greater flexibility to manage each fund, including, if desired for investment purposes, by investing a greater portion of the fund’s assets in one or more of the largest constituents of the index.

Under the 1940 Act, shareholder approval is required to permit a fund to change its sub-classification from diversified to non-diversified. Assuming shareholder approval, the proposed change in each fund’s sub-classification will take effect on July 1, 2022.

To implement this change, each fund’s fundamental investment policies regarding diversification of investments will be restated. By way of background, the 1940 Act requires registered investment companies like the funds to have fundamental investment policies governing specified investment practices, including with respect to diversification. Fundamental investment policies can be changed only by a shareholder vote.

Currently, each Fund has two fundamental investment policies regarding diversification, which are intended to track the 1940 Act requirements for diversified funds and which, like the 1940 Act requirements, apply with respect to 75% of the fund’s total assets. Because each fund avails itself of favorable tax treatment as a “regulated investment company” under applicable provisions of the Internal Revenue Code of 1986, as amended (the “Code”), the fund is also subject to comparable diversification requirements under the Code with respect to 50% of its total assets. If shareholders approve the fund becoming non-diversified, the 1940 Act diversification requirements will no longer apply to the fund, and the fund’s fundamental investment policies regarding diversification will be restated so that they would apply only with respect to 50% of the fund’s total assets (consistent with the Code requirements). The restated policies will allow the fund to take advantage of the additional flexibility it will have as a non-diversified fund under the 1940 Act to invest more of its assets in the securities of fewer issuers.

One of the current fundamental investment policies regarding diversification of investments prohibits each fund, with respect to 75% of its total assets, from acquiring more than 10% of the outstanding voting securities of any issuer. This current fundamental investment policy is more restrictive than required by the Code for regulated investment companies, whether diversified or non-diversified under the 1940 Act, because it does not exclude Government securities or securities of other investment companies as permitted by the applicable provisions of the Code. The revised fundamental investment policy for the fund would exclude these investments from the general requirement. The proposed change would permit the fund greater flexibility to invest in certain U.S. government securities and in the securities of other investment companies without limiting its right to exercise voting power with respect to those securities.

The current and proposed fundamental investment policies for each fund are set forth below (deleted language is in strike-through text and new language is in bold text):

| Current Fundamental Investment Policy | Proposed Fundamental Investment Policy |

| [Each fund may not and will not:] | [Each fund may not and will not:] |

| 1. With respect to 75% of its total assets, invest in securities of any issuer if, immediately after such investment, more than 5% of the total assets of the fund (taken at current value) would be invested in the securities of such issuer; provided that this limitation does not apply to obligations issued or guaranteed as to interest or principal by the U.S. government or its agencies or instrumentalities or to securities issued by other investment companies. | 1. With respect to 75% 50% of its total assets, invest in securities of any issuer if, immediately after such investment, more than 5% of the total assets of the fund (taken at current value) would be invested in the securities of such issuer; provided that this limitation does not apply to obligations issued or guaranteed as to interest or principal by the U.S. government or its agencies or instrumentalities or to securities issued by other investment companies. |

2. With respect to 75% of its total assets, acquire more than 10% of the voting securities of any issuer. |

2. With respect to 75% 50% of its total assets, acquire more than 10% of the voting securities of any issuer; provided that this limitation does not apply to obligations issued or guaranteed as to interest or principal by the U.S. government or its agencies or instrumentalities or to securities issued by other investment companies. |

What is the voting requirement for approving the proposal?

With respect to each fund, approving this proposal requires the affirmative vote of a “majority of the outstanding voting securities” of the fund, which is defined under the 1940 Act to be the lesser of (a) 67% or more of the voting securities of the fund that are present or represented by proxy at the shareholder meeting if the holders of more than 50% of the outstanding voting securities of the fund are present or represented by proxy at the shareholder meeting, or (b) more than 50% of the outstanding voting securities of the fund.

What is the plan for implementation if the proposal is approved?

If shareholders approve the proposal, it is anticipated that the change to each fund’s sub-classification from diversified to non-diversified, as well as the related amendments to the fund’s fundamental investment policies regarding diversification of investments, would take effect on July 1, 2022.

What if the proposal is not approved by shareholders?

If shareholders do not approve a fund becoming non-diversified, the fund would continue to be managed as a diversified fund and the fund’s current fundamental investment policies regarding diversification of investments would remain in effect.

Who is bearing the costs associated with the proposal, including proxy-related costs?

The expenses of the preparation of proxy statements and related materials, including printing, delivery and solicitation costs, attributable to Proposal 2 will be borne by the funds affected by Proposal 2 pro rata based on the number of shareholder accounts.

What are the Trustees recommending?

The Trustees unanimously recommend that shareholders approve a change to your fund’s sub-classification under the Investment Company Act of 1940 from “diversified” to “non-diversified.”

3. APPROVING AN AMENDMENT TO CERTAIN FUNDS’ FUNDAMENTAL INVESTMENT POLICY REGARDING ACQUISITION OF VOTING SECURITIES OF ANY ISSUER

Affected fund: George Putnam Balanced Fund, Putnam Dynamic Asset Allocation Balanced Fund, Putnam Dynamic Asset Allocation Conservative Fund, Putnam Dynamic Asset Allocation Growth Fund, Putnam VT George Putnam Balanced Fund, and Putnam VT Global Asset Allocation Fund only

What is the proposal?

The Trustees recommend that the fundamental investment policy with respect to the acquisition of voting securities of any issuer be revised for each of the following funds: George Putnam Balanced Fund, Putnam Dynamic Asset Allocation Balanced Fund, Putnam Dynamic Asset Allocation Conservative Fund, Putnam Dynamic Asset Allocation Growth Fund, Putnam VT George Putnam Balanced Fund, and Putnam VT Global Asset Allocation Fund (for purposes of this Proposal 3, the “funds”).

By way of background, the 1940 Act requires registered investment companies like the funds to have fundamental investment policies governing specified investment practices, including with respect to the diversification of their investments. Fundamental investment policies can be changed only by a shareholder vote.