UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | |

¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | | Definitive Proxy Statement | | |

¨ | | Definitive Additional Materials | | |

¨ | | Soliciting Material Pursuant to §240.14a-12 | | |

Rentech, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

RENTECH, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MARCH 17, 2005

You are cordially invited to attend the annual meeting of shareholders of Rentech, Inc. to be held at the Magnolia Ballroom, 817 17thStreet, Denver, Colorado, on Thursday, March 17, 2005 at 9:00 a.m. (local time) for the following purposes:

| | 1. | To elect two directors for terms of three years each; |

| | 2. | To vote upon a proposal to amend the Company’s Restated Articles of Incorporation to increase the number of authorized shares of common stock from 150,000,000 to 250,000,000 shares. |

| | 3. | To vote upon a proposal to amend the Company’s Restated Articles of Incorporation to increase the number of authorized shares of preferred stock from 1,000,000 to 10,000,000. |

| | 4. | To vote upon a proposal to adopt the 2005 Stock Option Plan. |

| | 5. | To transact such other business as may properly come before the meeting or any adjournments or postponements of the meeting. |

Accompanying this notice is a form of proxy, a proxy statement, and a copy of Rentech’s 2004 annual report to shareholders. The 2004 annual report to shareholders is not a part of the proxy solicitation material.

Only holders of record of the common stock of Rentech at the close of business on January 14, 2005 will be entitled to notice of and to vote at the meeting and any adjournments or postponements of the meeting.

|

By Order of the Board of Directors, |

|

|

RONALD C. BUTZ |

| Secretary |

Denver, Colorado

Date: January 24, 2005

YOUR VOTE IS IMPORTANT

This proxy statement is furnished in connection with the solicitation of proxies by the Company, on behalf of the Board of Directors, for the 2005 annual meeting of shareholders. The proxy statement and the related proxy form are being distributed on or about January 20, 2005. You can vote your shares using one of the following methods:

| | • | | Vote through the Internet at the Website shown on the proxy card. |

| | • | | Vote by telephone using the toll-free number shown on the proxy card. |

| | • | | Complete and return a written proxy card. |

| | • | | Attend the Company’s 2005 annual meeting of shareholders and vote. |

Votes submitted through the Internet or by telephone must be received by 4:00 p.m. Eastern Time, on March 16, 2005. Internet and telephone voting are available 24 hours per day. If you vote via Internet or telephone, you do not need to return a proxy card.

You are invited to attend the meeting; however, to ensure your representation at the meeting, you are urged to vote via the Internet or telephone, or mark, sign, date and return the enclosed proxy card as promptly as possible in the postage-prepaid envelope enclosed for that purpose. Any shareholder attending the meeting may vote in person even if he or she has voted via the Internet or telephone, or returned a proxy card.

RENTECH, INC.

1331 17th Street, Suite 720

Denver, Colorado 80202

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MARCH 17, 2005

This proxy statement is furnished to shareholders in connection with the solicitation by the Board of Directors of Rentech, Inc. of proxies for use at the annual meeting of shareholders to be held at the Magnolia Ballroom, 817 17th Street, Denver, Colorado, on Thursday, March 17, 2005 at 9:00 a.m., local time, and at any adjournments or postponements of the meeting.

Rentech anticipates that this proxy statement and the accompanying form of proxy will be first sent or given to shareholders on or about January 25, 2005.

VOTING SECURITIES AND VOTING RIGHTS

Only shareholders of record at the close of business on January 14, 2005 are entitled to vote at the annual meeting or any adjournments or postponements of the meeting. On that date, 92,037,883 shares of common stock were outstanding. Each share of common stock outstanding on that date entitles the holder to one vote on each matter submitted to a vote at the meeting. Cumulative voting is not allowed.

Shareholders may vote in person or by proxy at the annual meeting. All properly executed proxies received prior to the commencement of voting at the meeting, and which have not been revoked, will be voted in accordance with the directions given. If no specific instructions are given for a matter to be voted upon, the proxy holders will vote the shares covered by proxies received by them (i) FOR the election of the nominees to the Board of Directors; (ii) FOR the amendment to the Company’s Restated Articles of Incorporation to increase the authorized shares of common stock; (iii) FOR the amendment to the Company’s Restated Articles of Incorporation to increase the authorized shares of preferred stock; (iv) FOR approval of the proposal to adopt the 2005 Stock Option Plan; and (v) in accordance with the directors’ recommendations on any other matters that may come before the meeting.

A quorum for the transaction of business at the meeting requires the presence at the annual meeting, in person or by proxy, of the holders of a majority of the shares entitled to vote at the meeting. If a quorum is present, the two nominees for election as directors who receive the greatest number of votes cast for the election of directors at the meeting will be elected. The proposals to amend the Restated Articles of Incorporation will be approved if the votes cast in favor of the proposal constitute a majority of the outstanding shares of common stock. The proposal to approve adoption of the 2005 Stock Option Plan and any other matters submitted to a vote of the shareholders will be approved if they receive the affirmative vote of the holders of a majority of shares present in person or by proxy and entitled to vote on the matter. If brokers have not received any instruction from their customers on how to vote the customer’s shares on a particular proposal, the brokers are allowed to vote on routine matters but not on non-routine proposals. The absence of votes by brokers on non-routine matters are “broker non-votes.” Abstentions and broker non-votes will be counted as present for purposes of establishing a quorum, but will have no effect on the election of directors. Abstentions and broker non-votes will have the effect of a vote against the proposals to amend the Restated Articles of Incorporation.

1

Any shareholder giving a proxy has the power to revoke it at any time before the meeting. It may be revoked by mailing to our principal executive offices at 1331 17th Street, Suite 720, Denver, Colorado 80202, Attn: Secretary, an instrument of revocation or a duly executed proxy bearing a later date. If you vote electronically via the Internet or telephone, a proxy may be revoked by the submission of a later electronic proxy. A proxy may also be revoked by attending the meeting and giving our Secretary a vote in person (subject to the restriction that a shareholder holding shares in street name must bring to the meeting a legal proxy from the broker, bank or other nominee holding that shareholder’s shares which confirms that shareholder’s beneficial ownership of the shares and gives the shareholder the right to vote the shares).

Rentech will bear the cost of solicitation of proxies, including expenses in connection with preparing and mailing this proxy statement. We will furnish copies of solicitation materials to brokerage houses, fiduciaries, and custodians to forward to beneficial owners of our common stock held in their names. In addition, we will reimburse brokerage firms and other persons representing beneficial owners of stock for their expenses in forwarding solicitation materials to such beneficial owners. Original solicitation of proxies by mail may be supplemented by telephone, facsimile and personal solicitation by our directors, officers and other employees. No additional compensation will be paid to our directors, officers or other employees for these services.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

There are six positions on Rentech’s Board of Directors. The board is divided into three classes of two directors each. The directors in each class are elected for three years and until the election and qualification of their successors.

Thomas L. Bury and Dennis L. Yakobson have been nominated for reelection as directors for a term of three years each. The two nominees are presently members of the Board of Directors. All other members of the Board of Directors will continue in office until the expiration of their respective terms at the 2006 or 2007 annual meetings of shareholders.

If your vote is properly submitted, it will be voted for the election of the nominees, unless contrary instructions are specified. Each nominee has consented to serve if elected. Although the Board of Directors has no reason to believe that either of the nominees will be unable to serve as a director, should that occur, the persons appointed as proxies in the accompanying proxy card will vote, unless the number of nominees or directors is reduced by the Board of Directors, for such other nominee or nominees as the Board of Directors may designate.

Information Regarding Nominees for Election to the Board of Directors:

Dennis L. Yakobson, President, Chief Executive Officer, and Chairman of the Board – Mr. Yakobson, age 68, is our Chief Executive Officer. He has served as a director of Rentech and chairman of the board since 1983 and is one of the founders. He was employed as vice president of administration and finance of Nova Petroleum Corporation, Denver, Colorado, from 1981 to 1983. From 1979 to 1983, he served as a director and secretary of Nova Petroleum Corporation, Denver, Colorado. He resigned those positions in November 1983 to become a director and assume the presidency of Rentech. From 1976 to 1981 he served as a director, secretary and treasurer of Power Resources Corporation, Denver, a mineral exploration company, and was employed by it as vice president-land. From 1975 to 1976 he was employed by Wyoming Mineral Corporation in Denver as a contract administrator. From 1971 through 1975 he was employed by Martin Marietta Corporation, Denver, as marketing engineer in space systems. From 1969 to 1971 he was employed by Martin Marietta (now Lockheed Martin Corporation) in a similar position. From 1960 to 1969 he was employed by Grumman Aerospace Corporation, his final position with it being contract administrator with responsibility for negotiation of prime contracts with governmental agencies. He is a director of GTL Energy Pty Ltd., a private company based in Adelaide, Australia. He received a B.S. degree in Civil Engineering from Cornell University in 1959 and a Masters Degree in Business Administration from Adelphi University in 1963.

Thomas L. Bury, Director – Mr. Bury, age 62, was appointed a member of our Board of Directors effective November 12, 2004. He was a founding shareholder and served as Chief Financial Officer of Tecta America Corp., a

2

member of the construction industry supplying aggregate building materials, from its organization in 1998 until completion in September 2000 of its merger that consolidated ten businesses in the construction industry. Since then he has advised investors on business valuations and acquisition strategies. Mr. Bury has over 30 years of experience as a financial officer, including financial disciplines in multi-division companies and development of planning and financial systems. He has extensive knowledge of treasury, banking, acquisitions, divestitures and corporate planning, as well as company and strategy valuation methods. Prior to founding Tecta America Corp., he was Chief Financial Officer of Redland PLC’s aggregate businesses in North America, and had responsibility for its financial functions from 1987 through 1998. From 1972 through 1987, Mr. Bury worked for Fischbach Corporation, primarily serving as Chief Financial Officer of its subsidiary, Natkin & Company, a $500 million nationwide mechanical contractor. He received his Bachelor of Science Degree in Business Administration from Bowling Green State University. After serving in the U.S. Army in Vietnam, he received his Masters of Business Administration from Syracuse University.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR ELECTION OF THE NOMINEES.

Information Regarding Continuing Directors With Terms Expiring in 2007:

Ronald C. Butz, Vice President, Chief Operating Officer, Secretary and Director – Mr. Butz, age 67, has served as a director of Rentech since 1984. In October 1989, Mr. Butz was appointed vice president of Rentech, in June 1990 he was appointed secretary, and in May 1998 he became chief operating officer. From 1984 to 1989, Mr. Butz was employed as president of Capital Growth, Inc., a privately-held Colorado corporation providing investment services and venture capital consulting. From 1982 to 1983, Mr. Butz was a shareholder, vice president and chief operating officer of World Agricultural Systems, Ltd., a privately-held Colorado corporation specializing in the international marketing of commodity storage systems. From 1966 to 1982, Mr. Butz was a practicing attorney in Denver, Colorado with the firm of Grant, McHendrie, Haines and Crouse, P.C. He received a Bachelor of Science degree in Civil Engineering from Cornell University in 1961 and a Juris Doctor degree from the University of Denver in 1965.

Douglas L. Sheeran, Director – Mr. Sheeran, age 66, has served as a director of Rentech since 1998. Since August 2002, Mr. Sheeran has been a Principal of Phoenix Group International, a search firm serving the private equity and venture capital markets. From 1986 to that date, he was managing director of FCI, Inc., a human resource consulting firm located in Shrewsbury, New Jersey which specialized in executive staffing, merger planning and organizational effectiveness. From 1973 until 1986 Mr. Sheeran was employed by Purolator Automotive Group and became Vice President, Human Resources, with responsibilities for multiple North American business units. He held a number of human resource positions of increasing scope and responsibility with Home Life Insurance Company from 1960 to 1962, Kraft Foods from 1962 to 1965, Electronic Associates Inc. from 1965 to 1968, and Celanese Corporation from 1968 to 1973. These positions covered a range of labor relations, organizational development, compensation and benefit responsibilities at both operating sites and corporate staff. He received a Bachelor of Arts degree in Industrial Psychology from Miami University, Oxford, Ohio, in 1960.

Information Regarding Continuing Director With Term Expiring in 2006:

Erich W. Tiepel, Director – Dr. Tiepel, age 61, has served as a director of Rentech since 1983. Dr. Tiepel has 23 years of experience in all phases of process design and development, plant management and operations for chemical processing plants. Since 1981, Dr. Tiepel has been a principal owner, president and director of Resource Technologies Group, Inc. (RTG), a privately owned company he founded. RTG is a high technology consulting organization specializing in process engineering, water treatment, hazardous waste remediation, and regulatory affairs. From 1977 to 1981 he was project manager for Wyoming Mineral Corporation, a subsidiary of Westinghouse Electric Corp., Lakewood, Colorado, where his responsibilities included management of the design, contraction and operation of ground water treatment systems for ground water cleanup programs. From 1971 to 1976 he was a principal project engineer for process research for Westinghouse Research Labs. From 1967 to 1971, he was a trainee of the National Science Foundation at the University of Florida in Gainesville, Florida. He obtained a Bachelor of Science degree in Chemical Engineering from the University of Cincinnati in 1967, and a Ph.D. in Chemical Engineering from the University of Florida in 1971.

3

EXECUTIVE OFFICERS AND OTHER KEY MANAGERS

Information concerning the business experience of Mr. Butz and Mr. Yakobson, who serve as executive officers and directors of Rentech, is provided under the previous section titled “ELECTION OF DIRECTORS.”

Charles B. Benham, Vice President-Research and Development – Dr. Benham, age 68, is one of our founders and has been an officer of Rentech since our inception in 1981. He served as our president until 1983 and as one of our directors from inception until 1996. From 1977 to 1981, Dr. Benham worked at the Solar Energy Research Institute in Golden, Colorado, on thermal and chemical processes for converting agricultural crop residues to diesel fuel, on thermochemical transport of solar energy using ammonia decomposition and steam reforming of methane, and on high temperature applications of solar energy. He was employed at the Naval Weapons Center, China Lake, California, from 1958 through 1977 where he was engaged in research and development on thermal and chemical processes for converting municipal solid wastes to liquid hydrocarbon fuels, thermochemical analyses of solid-fueled and ramjet engines, combustor modeling, rocket motor thrust vector control, rocket motor thrust augmentation, catalyst behavior in carbon monoxide oxidation, and in liquid hydrocarbon fuels for ramjet applications. Dr. Benham is the author of several published articles in the fields of liquid fuel production from organic waste, catalyst pellet behavior and rocket propulsion. He received a Bachelor of Science degree in Mechanical Engineering from the University of Colorado in 1958, and a Master of Science degree in Engineering in 1964 and a Ph.D. in Engineering (energy and kinetics) in 1970, both from the University of California, Los Angeles.

Mark S. Bohn, Vice President-Engineering – Dr. Bohn, age 54, another of our founders, served as one of our directors from inception until 1998. Since November 9, 1998 he has been employed by us as Vice President-Engineering. He became president of Rentech Services Corporation upon its organization as a wholly-owned subsidiary in 1999. From 1978 to November 1998, he was employed by Midwest Research Institute at the Solar Energy Research Institute in Golden, Colorado. He was employed from 1976 through 1978 at the General Motors Research Laboratories in Warren, Michigan. Dr. Bohn is a registered Professional Engineer in Colorado and a Member of the American Society of Mechanical Engineers and the American Institute of Chemical Engineers. He has published numerous articles on liquid fuel production, organic waste, heat transfer, power cycles, aerodynamics, optics, acoustics, solar thermal energy, and co-authored the textbookPrinciples of Heat Transfer. He received a Bachelor of Science degree in Mechanical Engineering from Georgia Institute of Technology, Atlanta, Georgia, in 1972, and a Master of Science degree in Mechanical Engineering in 1973 and a Ph.D. in Mechanical Engineering in 1976, both from the California Institute of Technology, Pasadena, California.

Claude C. Corkadel, III, Vice President-Strategic Programs — Mr. Corkadel, age 55, was appointed Vice President – Strategic Programs of Rentech, effective January 1, 2004. For 28 years, from 1972 to 2000, Mr. Corkadel worked for Mobil Oil Corporation in various management positions. These offices included President and Country Manager of Mobil Philippines, Planning Manager for Mobil Nigeria, Strategic Planning Manager for the Alternative Energy Division (including coal, uranium, oil shale and synthetic fuels projects), Global Director for Mobil’s special products business and a member of the transition team for Africa under the ExxonMobil merger. His responsibilities in these positions included developing market entry strategies, technical product & business development, and strategic planning. After retiring from Mobil in January 2000, he worked as a special consultant for several small entrepreneurial businesses, and held executive positions during key development periods. During 2000 and early 2001, he was president of Nova Lending, an online mortgage company in Colorado Springs, Colorado. In later 2001 and 2002, he was President and CEO of WellDog, Inc, of Laramie, Wyoming, a technology development company working on cutting edge down- hole sensing devices for the oil and gas industry. He consulted exclusively for Rentech starting February 2003. Mr. Corkadel is a graduate of Colorado School of Mines with a B.S. degree in Metallurgical Engineering and a minor in Mineral Economics. He obtained an M.B.A. in Finance from Drexel University in 1981.

Geoffrey S. Flagg, Chief Financial Officer — Mr. Flagg, age 34, was appointed our Chief Financial Officer in January 2004. Mr. Flagg is a Certified Public Accountant and has been involved in auditing and accounting of publicly traded companies since 1996. From September 1996 through June 2000, he was an Audit Associate at the national accounting firm of BDO Seidman, L.L.P. While there, he was responsible for planning, performing and managing financial statement audits for a variety of public and private companies, including our annual audit and quarterly reviews. From June 2000 through January 2001, he was the controller of Wholetree.com, a software development company. From January 2001 through December 2003, Mr. Flagg served as our corporate controller. He received a Bachelor of Science in Accounting from the University of Colorado at Denver in 1996.

4

Jim D. Fletcher, President and General Manager, Petroleum Mud Logging, Inc. – Mr. Fletcher, age 59, has been president of Petroleum Mud Logging, Inc. since August 1999. Mr. Fletcher has been employed in the mud logging services industry since 1973. From 1995 to August 1999, Mr. Fletcher was employed by Penson Well Logging as its general manager and marketing officer. From 1988 through 1994, Mr. Fletcher worked for Petroleum Mud Logging, Inc. of Oklahoma City, as a mud logging technician. This corporation sold its assets to Rentech, Inc. in 1999, which is continuing the business. After the purchase by Rentech, Petroleum Mud Logging then named Mr. Fletcher as its general manager, and he continues in that position. From 1981 to 1988, Mr. Fletcher was employed by OFT Exploration in Oklahoma City as a well site geologist, and also worked as a consulting geologist. His first work experience was with Dresser Industries in 1973 to 1974 as a mud logger. Mr. Fletcher obtained a B.S. in Business Administration and a minor in Geology and Economics from Southwestern State College of Oklahoma in 1974.

Frank L. Livingston, President and General Manager, OKON, Inc. – Mr. Livingston, age 62, has served as president and general manager of OKON, Inc. since Rentech acquired that subsidiary in March 1997. Mr. Livingston joined OKON in 1975 as sales manager and was promoted to Vice President of Sales in 1984. Mr. Livingston also became a 24% owner of OKON at that time. In addition to his sales and marketing responsibilities, he was also responsible for manufacturing and research and development of new products for OKON. Mr. Livingston also served on OKON’s board of directors. Since the sale of OKON to Rentech in 1997, Mr. Livingston continues to serve on OKON’s board of directors. From 1971 to 1975 Mr. Livingston was employed by Gates Rubber Co. in Denver, Colorado as a sales and marketing manager for a specialty chemical venture start-up business within the company. He also worked as a research market analyst for the venture group. Projects of the venture group included specialty chemicals and lead-acid battery technology, as well as rubber products made by the company for off-shore oil exploration and production. He was employed by Mallinckrodt Chemical Co. from 1965 to 1971. While with it, he worked as a process research chemist and formulator prior to becoming a specialty marketing manager for the industrial chemical division. He received a Bachelor of Science Degree in Chemistry from Colorado State University in 1965.

Gary A. Roberts, President, REN Corporation – Mr. Roberts, age 66, has been President of REN Corporation since founding the company in 1979. Prior to starting REN, Mr. Roberts was a Research Engineer in the School of Mechanical Engineering at Oklahoma State University. As a Program Manager at the Fluid Power Research Center, he was responsible for projects to develop testing concepts and equipment for the U.S. Army and numerous industrial sponsors. Mr. Roberts was a United States delegate to ISO TC131, the International Standards body which developed standard testing procedures for the fluid power industry. From 1963 to 1970, he served as Manager of Quality Engineering for Cessna Fluid Power Division, Hutchinson, Kansas. Mr. Roberts is a Registered Professional Engineer in California. He holds an Associate Degree in Business Administration from the Hutchinson Community College as well as Bachelor of Science and Master of Science Degrees in Engineering from Oklahoma State University.

Richard O. Sheppard, Vice President, Marketing and President, Rentech Development Corporation – Mr. Sheppard, age 56, joined us in January 1998 as director of sales and marketing of our Rentech Process, and was appointed as President of Rentech Development Corporation in April 2004. Prior to joining Rentech he was engaged in the project development of independent electrical power plants ranging in size from 25 megawatts to 250 megawatts in the United States, South America, and Central America. He held positions as Vice President Development with Flatiron Constructors from 1996 to 1999, Wellhead Electric Co. from 1992 to 1996, and Ultrasystems Power Corporation and Engineers from 1988 to 1992. Previous employers were Kaiser Power Corporation from 1983 to 1988, and Merck Chemical (Calgon) International from 1974 to 1983. Mr. Sheppard was a Lieutenant in the United States Navy from 1969 to 1974. He obtained a Bachelor of Science degree in Chemical Engineering from the University of Idaho in 1969 and earned a Master of Business Administration degree in Finance and Marketing from St. Mary College, California, in 1980.

There are no family relationships among the executive officers. There are no arrangements or understandings between any officer and any other person pursuant to which that officer was selected.

5

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information as of December 15, 2004 by (i) all persons who own of record or are known to the Company to beneficially own more than 5% of the issued and outstanding shares of the Company’s common stock and (ii) by each director, each director nominee, each of the executive officers named in the tables under “Executive Compensation,” and by all executive officers and directors as a group:

| | | | | |

Directors and Executive Officers(1)(2)

| | Amount and Nature of

Beneficial Ownership(3)

| | Percent

of Class

| |

Charles B. Benham | | 915,907 | | 1 | % |

Mark S. Bohn(4) | | 950,459 | | 1.04 | % |

Thomas L. Bury | | 41,000 | | * | |

Ronald C. Butz(5) | | 1,081,680 | | 1.19 | % |

Claude C. Corkadel III | | 169,737 | | * | |

Geoffrey S. Flagg | | 121,236 | | * | |

Jim D. Fletcher | | 36,800 | | * | |

Frank L. Livingston | | 106,000 | | * | |

Gary A. Roberts | | 20,000 | | * | |

Douglas L. Sheeran | | 350,850 | | * | |

Richard O. Sheppard | | 225,000 | | * | |

Erich W. Tiepel | | 645,725 | | * | |

Dennis L. Yakobson(6) | | 1,058,548 | | 1.16 | % |

All Directors and Executive Officers as a Group (13 persons) | | 5,722,942 | | 6.4 | % |

| | |

Beneficial Owners of More than 5%

| | Amount and Nature of

Beneficial Ownership

| | Percent

of Class

| |

C. David Callaham(7) | | 8,194,173 | | 9.1 | % |

| (1) | Except as otherwise noted and subject to applicable community property laws, each stockholder has sole voting and investment power with respect to the shares beneficially owned. The business address of each director and executive officer is c/o Rentech, Inc., 1331 17th Street, Suite 720, Denver, CO 80202. |

| (2) | Shares of common stock subject to options that are exercisable within 60 days are deemed outstanding for purposes of computing the percentage ownership of such person, but are not deemed outstanding for purposes of computing the percentage ownership of any other person. The following shares of common stock subject to stock options or convertible promissory notes issued to evidence deferred salary are included in the table: |

| | • | | Charles B. Benham – 160,000 under options and 70,684 under note; |

| | • | | Mark S. Bohn – 110,000 under options and 79,736 under note; |

| | • | | Thomas L. Bury – 40,000 under options; |

| | • | | Ronald C. Butz – 205,000 under options and 97,857 under note; |

| | • | | Claude C. Corkadel III – 50,000 under options; |

| | • | | Geoffrey S. Flagg – 100,000 under options; |

| | • | | Jim D. Fletcher – 32,000 under options; |

| | • | | Frank L. Livingston – 106,000 under options; |

| | • | | Gary A. Roberts – 15,000 under options; |

| | • | | Douglas L. Sheeran – 110,000 under options; |

| | • | | Richard O. Sheppard – 150,000 under options; |

| | • | | Erich W. Tiepel – 150,000 under options; |

| | • | | Dennis L. Yakobson – 205,000 under options and 148,690 under note. |

| (3) | Information with respect to beneficial ownership is based upon information furnished by each stockholder or contained in filings with the Securities and Exchange Commission. |

| (4) | Includes 31,187 shares owned by a trust of which Mr. Bohn is the single trustee with sole dispositive power. |

| (5) | Excludes 150,000 shares owned by his spouse, as to which Mr. Butz disclaims beneficial ownership. |

6

| (6) | Excludes 26,000 shares owned by his spouse, as to which Mr. Yakobson disclaims beneficial ownership. |

| (7) | Mr. Callaham’s address is 10804 N.E. Highway 99, Vancouver, WA 98686. This information is based on records available to us, including 2,719,520 shares underlying Rentech’s convertible promissory notes and stock purchase warrants that are subject to exercise by him. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Rentech’s executive officers and directors are required to file reports of ownership and changes in ownership of Rentech’s securities with the Securities and Exchange Commission as required under provisions of Section 16(a) of the Securities Exchange Act of 1934. Based solely on our review of Securities and Exchange Commission filings and amendments to those forms submitted to it, Rentech believes that during the last fiscal year all directors and executive officers have complied with the applicable filing requirements.

MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

The Board of Directors held seven meetings during the fiscal year ended September 30, 2004. Actions were also taken during the year by the unanimous written resolutions of the directors. Each of our directors attended at least 75% of the meetings of the Board of Directors held during the period for which he has been a director or of the meetings of committees of the Board of Directors on which he served during the period that he served. Each director attended the annual meeting of shareholders held in 2004 and are reimbursed for their expenses incurred in attending meetings. Directors who are not employees of Rentech are not paid fees for their services. Instead, they have been granted shares of Rentech’s common stock as payment during the last fiscal year, at the rate of 25,000 shares each for a year of service as a director.

The Board of Directors has three standing committees, an Audit Committee, a Compensation Committee and a Nominating Committee. The Board of Directors has determined that the members of our Board of Directors other than Mr. Butz and Mr. Yakobson are “independent” within the meaning of the listing standards of the American Stock Exchange. The Board of Directors has also determined that each member of the Audit Committee is “independent” within the meaning of the rules of the Securities and Exchange Commission. Each of our Audit Committee, Compensation Committee and Nominating Committee are comprised of independent directors.

The charters of our Audit Committee and Nominating Committee are available on the Corporate Governance section of our website athttp://www.rentechinc.com. The Board of Directors regularly reviews developments in corporate governance and modifies these policies and charters as warranted. Modifications are reflected on our website at the address previously given.

The Audit Committee of the Board of Directors has been delegated responsibility for reviewing with the independent auditors the plans and results of the audit engagement; reviewing the adequacy, scope and results of the internal accounting controls and procedures; reviewing the degree of independence of the auditors; reviewing the auditors’ fees; and recommending the engagement of the auditors to the full Board of Directors. During fiscal 2004, the Audit Committee consisted of John J. Ball, John P. Diesel and Dr. Tiepel, all of whom were independent directors of the Company as defined by Section 121(A) of the listing standards of the American Stock Exchange. During fiscal 2004, the Audit Committee met six times.

The Audit Committee currently consists of Mr. Bury, Mr. Sheeran and Dr. Tiepel. Rentech has determined that a member of the Audit Committee of the Board of Directors, Thomas L. Bury, qualifies as an “audit committee financial expert” as defined in Item 401(h) of Regulation S-K, and that he is “independent” as that term is used in Item 7(d)(3)(iv) of Schedule 14A under the Securities Exchange Act of 1934.

The Compensation Committee is currently comprised of Mr. Douglas L. Sheeran and Dr. Erich W. Tiepel. Neither of them is or has been an employee of the Company. The Compensation Committee reviews and approves executive officer compensation and stock option grants, administers the Company’s stock option plans and establishes compensation philosophy for executive officers. The committee met four times during the last fiscal year.

7

The Nominating Committee consists of Mr. Sheeran and Dr. Tiepel. Each member of the Committee meets the independence requirements defined in the listing standards of the American Stock Exchange. The primary duty of the Committee is to make recommendations to the Board of Directors regarding recruitment of new directors and re-election of incumbent directors. The committee met six times during fiscal year 2004.

EXECUTIVE COMPENSATION

Compensation

The following tables show the compensation paid by us or any of our subsidiaries during the fiscal years indicated, to our chief executive officer and our four most highly compensated executive officers other than the chief executive officer.

Summary Compensation Table

| | | | | | | | | | | | | | | | |

| | | Annual Compensation

| | Long-Term Compensation

Awards

| | Payouts

|

| (a) | | (b) | | (c) | | (d) | | (e) | | (f) | | (g) | | (h) | | (i) |

Name and Principal Position

| | Year

| | Salary

| | Bonus

| | Other Annual

Compensation

| | Restricted

Stock

Award(s)

| | Securities

Underlying

Options/SARs

| | LTIP

Payouts

| | All Other

Compensation

|

| | | | | ($) | | ($) | | ($) | | ($) | | (#) | | ($) | | ($) |

Dennis L. Yakobson

Chief Executive Officer

Officer(1) | | 2004

2003

2002 | | $ 256,497

$ 247,322

$ 238,383 | | —

—

— | | —

—

— | | —

—

— | | 25,000

—

95,000 | | —

—

— | | —

—

— |

| | | | | | | | |

Ronald C. Butz

Chief Operating Officer(2) | | 2004

2003

2002 | | $ 227,350

$ 219,218

$ 211,294 | | —

—

— | | —

—

— | | —

—

— | | 25,000

—

95,000 | | —

—

— | | —

—

— |

| | | | | | | | |

Charles B. Benham

Vice President

Research & Development(3) | | 2004

2003

2002 | | $ 162,418

$ 156,609

$ 150,948 | | —

—

— | | —

—

— | | —

—

— | | 20,000

—

90,000 | | —

—

— | | —

—

— |

| | | | | | | | |

Mark S. Bohn

Vice President

Engineering(4) | | 2004

2003

2002 | | $ 162,418

$ 156,609

$ 150,948 | | —

—

— | | —

—

— | | —

—

— | | 20,000

—

40,000 | | —

—

— | | —

—

— |

| | | | | | | | |

Richard O. Sheppard

Vice President

GTL Marketing | | 2004

2003

2002 | | $ 129,150

$ 111,000

$ 112,000 | | —

—

— | | —

—

— | | —

—

— | | 65,000

—

50,000 | | —

—

— | | —

—

— |

| (1) | Of this amount, $5,903, $29,061, and $64,300, were non-funded deferred compensation as of September 30, 2004, 2003, and 2002, respectively, with a balance of non-funded deferred compensation as of September 30, 2004, 2003 and 2002 of $244,455, $238,551 and $209,490, respectively. Of this amount, $65,468 and $28,504 were non-funded notes payable to related party with a balance of $74,819 and $32,082 as of September 30, 2004 and 2003, respectively, including accrued interest. |

| (2) | Of this amount, $781, $22,769, and $54,622, were non-funded deferred compensation as of September 30, 2004, 2003, and 2002, respectively, with a balance of non-funded deferred compensation as of September 30, 2004, 2003 and 2002 of $180,196, $179,415 and $156,646, respectively. Of this amount, $37,376 and $4,443 were non-funded notes payable to related party with a balance of $43,492 and $7,233 as of September 30, 2004 and 2003, respectively, including accrued interest. |

| (3) | Of this amount, $0, $0 and $17,017 were non-funded deferred compensation as of September 30, 2004, 2003 and 2002, respectively, with a balance of non-funded deferred compensation as of September 30, 2004, 2003 and 2002 of $-0-, $9,996 and $22,080, respectively. Of this amount, $26,833 and $0 were non-funded notes payable to related party with a balance of $31,418 and $1,104 as of September 30, 2004 and 2003, respectively, including accrued interest. |

8

| (4) | Of this amount, $0, $0 and $17,017 were non-funded deferred compensation as of September 30, 2004, 2003 and 2002, respectively, with a balance of non-funded deferred compensation as of September 30, 2004, 2003 and 2002 of $9,996, $9,996 and $22,080, respectively. Of this amount, $30,509 and $2,953 were non-funded notes payable to related party with a balance of $35,437 and $4,805 as of September 30, 2004 and 2003, respectively, including accrued interest. |

Option/SAR Grants

The following table sets forth information with respect to the named executives concerning the grant of stock options and/or limited SARs during the last fiscal year. All the options were granted at the fair market value on the date of grant as determined by the Board of Directors.

Option/SAR Grants in Last Fiscal Year*

| | | | | | | | | | | | | |

| | | Individual Grants

| | Grant Date Value

|

Name

| | Number of Securities Underlying Options/SARs Granted (#)

| | % of Total Options/SARs Granted to Employees in Fiscal Year

| | | Exercise or Base Price ($/Sh)

| | Expiration Date

| | Grant Date Present Value

|

Dennis L. Yakobson | | 25,000 | | 2.9 | % | | $ | 0.90 | | 03/30/2009 | | $ | 22,500 |

Ronald C. Butz | | 25,000 | | 2.9 | % | | $ | 0.90 | | 03/30/2009 | | $ | 22,500 |

Charles B. Benham | | 20,000 | | 2.4 | % | | $ | 0.90 | | 03/30/2009 | | $ | 18,000 |

Mark S. Bohn | | 20,000 | | 2.4 | % | | $ | 0.90 | | 03/30/2000 | | $ | 18,000 |

Richard O. Sheppard | | 65,000 | | 7.6 | % | | $ | 0.90 | | 03/30/2009 | | $ | 13,500 |

| (1) | The options were subject to exercise upon the date of grant. |

| (2) | 15,000 options at $0.90 expiring 03/30/2009 and 50,000 options at $0.94 expiring 09/16/2009. |

The following table sets forth information with respect to the named executives, concerning the exercise of options and limited SARs during the last fiscal year and unexercised options and limited SARs held as of the end of the last fiscal year.

Aggregated Option/SAR Exercises in Last Fiscal Year and FY-End Option/SAR Values:

| | | | | | | | | | | |

Name

| | Shares

Acquired

On Exercise

(#)

| | Value

Realized ($)

| | Number of

Securities

Underlying

Unexercised

Options/SARs

at FY-End(#)

Exercisable/

Unexercisable

| | | Value of

Unexercised In-the-Money

Options/SARs at FY-End

Exercisable/

Unexercisable ($)

|

Dennis L. Yakobson | | 35,000 | | $ | 13,480 | | 180,000 | (1) | | $ | 45,050 |

Ronald C. Butz | | 35,000 | | $ | 13,475 | | 180,000 | (1) | | | 45,050 |

Charles B. Benham | | 9,770 | | $ | 3,761 | | 160,000 | (1) | | | 42,900 |

Mark S. Bohn | | 0 | | $ | 11,550 | | 110,000 | (1) | | | 18,400 |

Richard O. Sheppard | | 75,000 | | $ | 40,250 | | 125,000 | (1) | | | 24,500 |

9

The following table provides information as of September 30, 2004 with respect to our compensation plans, including individual compensation arrangements, under which our equity securities are authorized for issuance.

| | | | | | | |

Plan category

| | Number of securities

to be issued upon exercise of

outstanding options,

warrants and rights

| | Weighted-average

exercise price of

outstanding options,

warrants and rights

| | Number of securities remaining

available for future

issuance under equity

compensation plans

|

Equity compensation plans approved by security holders | | 1,511,000 | | $ | 0.75 | | 157,000 |

Equity compensation plans not approved by security holders(1)(2) | | 5,496,102 | | $ | 1.06 | | 0 |

| | |

| |

|

| |

|

Total | | 7,007,102 | | $ | 2.53 | | 430,000 |

| (1) | Includes stock options to purchase 1,210,500 shares of common stock issued as compensation to employees pursuant to individual grants that were approved by the Board of Directors. These options may be exercised for terms of five years from the dates of the grants. The exercise prices payable in cash upon exercise of the options are the market value of our stock on the day of the respective grants. |

| (2) | Includes 410,000 shares of common stock underlying warrants issued to consultants pursuant to individual compensation arrangements. These warrants have expiration dates ranging between one and five years from the dates of the grants. The exercise prices of these warrants range between $0.63 and $0.94 per share, and are not based on the market value of our stock on the day of the respective grants. |

Employment Contracts

Executive officers generally are elected at the annual director meeting immediately following the annual shareholder meeting. Any officer or agent elected or appointed by the Board of Directors may be removed by the Board whenever in its judgment our best interests will be served thereby, without prejudice to contractual rights, if any, of the person so removed.

We have entered into employment agreements with Mr. Yakobson, Mr. Butz, Dr. Benham and Dr. Bohn. These agreements provide for annual base salaries which may be increased by us from time to time, with annual cost of living increases. In addition, each employment agreement entitles the employee to participate in employee benefit plans that we may from time to time offer to our employees.

Each agreement is for an initial term of three years. Upon the expiration of each year, the term is extended for one year, unless either we or the employee elect not to extend the term, so that a three-year term remains in effect, unless one party has rejected the extension. Under each agreement, employment may be terminated as follows:

| | • | | by us upon the employee’s death, disability or cause; |

| | • | | by the employee if the employee’s annual salary is decreased; the employee is relocated without consent; we have breached the employment agreement; we have purported to terminate the employee without giving reasonable notice of the basis; or upon disability. |

If employment is terminated by reason of death, we will continue to pay salary monthly for 12 months, or if for disability, we will pay an amount equal to the employee’s annual salary upon termination. If we wrongfully terminate the employee’s employment, we are required to pay severance pay in a lump sum equal to three times the annual salary, and other damages resulting from our breach, including those for loss of employee benefits during the remaining term of the agreement.

By each agreement, the employee is prohibited from disclosing to third parties, directly or indirectly, our trade secrets, either during or after the employee’s employment with our company, other than as required in the performance of the employee’s duties while employed by us. The agreement also provides that the employee will not have or claim any right, title or interest in any invention owned by us. The employee also agrees to irrevocably assign to us all of the employee’s right, title and interest in and to any and all inventions and concepts made, or conceived by the employee during his or her period of employment with us and which related to our business, whether or not developed on the

10

employee’s own time. Each employee further agrees that during the period of employment with us and for a period of three years following the termination of employment, the employee will not compete with us, and for a period of one year, not to solicit our business customers or employees to discontinue or change their relationship with us.

Our success with our technology and in implementing our business plan to develop advanced technology businesses are both substantially dependent upon the contributions of our executive officers, scientists and key employees. At this stage of our development, economic success of the Rentech Process depends upon acquiring and then designing changes to an existing nitrogen fertilizer plant to use our technology and operating it effectively. That effort requires knowledge, skills, and relationships unique to our key personnel. Moreover, to successfully compete with our Rentech Process and other technologies, we will be required to engage in continuous research and development regarding processes, products, markets and costs. Loss of the services of the executive officers or other key employees could have a material adverse effect on our business, operating results and financial condition. We do not have key man life insurance. We believe our employment contracts with our key personnel will be extended.

401(k) Plan

We have a 401(k) plan. Employees who are at least 21 years of age are eligible to participate in the plan and share in the employer matching contribution. The employer is currently matching 75% of the first 6% of the participant’s salary deferrals. All participants who have completed 1,000 hours of service and who are employed on the last day of the plan year are eligible to share in the non-matching employer contributions. Employer matching and non-matching contributions vest immediately in years in which the plan is not top-heavy. During years in which the plan is top-heavy, employer matching and non-matching contributions vest 100% after three years of service. We contributed $143,963, $163,651, and $134,094 to the plan for the years ended September 30, 2004, 2003, and 2002.

PROPOSAL NO. 2

AMENDMENT TO THE AMENDED AND RESTATED ARTICLES OF INCORPORATION

TO INCREASE THE AUTHORIZED SHARES OF COMMON STOCK

The Board of Directors has adopted, and recommended that the shareholders approve, an amendment to our Restated Articles of Incorporation to increase the number of authorized shares of common stock from 150,000,000 to 250,000,000 shares. The proposed amendment would change Section 4.1 by increasing the number of authorized shares of common stock as shown in italics in the following restatement of Section 4.1:

“4.1. The amount of authorized capital stock of this corporation is250,000,000 shares of common stock, each share having $.01 par value, and 1,000,000 shares of preferred stock, each share having $10.00 par value. All shares when issued shall be fully paid and nonassessable, the private property of shareholders, and shall not be liable for corporate debts. The Board of Directors shall have the authority to divide shares of preferred stock into series and, within the limitations provided by law, to fix and determine the relative rights and preferences of the shares of any series so established, including the right to redeem all or any part of the outstanding preferred stock upon such terms as may have been established upon its issuance.”

If adopted, the amendment would become effective upon the filing of articles of amendment with the Colorado Secretary of State. This would occur as soon as practical following the meeting.

Purpose and Effect of the Proposed Amendment

The purpose and effect of the proposed amendment is to authorize 250,000,000 shares of common stock for issuance, instead of the 150,000,000 shares now authorized. The amendment will not change other provisions of Section 4.1, including either the number of authorized shares of preferred stock or the provisions governing issuance of preferred stock. The relative rights and limitations of the common stock would remain unchanged. Neither common stock nor the preferred stock that could be issued by the Board of Directors, has or would have preemptive rights. Cumulative voting is not and would not be permitted in the election of directors.

11

Since our organization in 1981, our revenues from operations have not been adequate to fund our operating expenses. We have historically obtained capital for financing our working capital needs by the sale of shares of our common stock or convertible promissory notes and stock purchase warrants convertible into shares of common stock. As of December 15, 2004, we had issued 90,165,801 shares of our common stock. We had also issued convertible promissory notes, stock purchase warrants, and stock options that could be converted into an additional 12,928,047 shares of common stock. The total of these issued and reserved shares as of December 15, 2004 comprises 103,093,848 shares of the 150,000,000 shares authorized to be issued.We anticipate issuing additional shares of our common stock from among those currently authorized in connection with our proposed acquisition of Royster-Clark Nitrogen, Inc. and its nitrogen fertilizer plant located in East Dubuque, Illinois.The number of currently authorized shares that we might issue for this purpose is unknown, and depends upon the market price of our stock in the near future. We believe that after the acquisition we will have issued a substantial part of the approximately 46,900,000 shares currently available for issuance.The proposal to authorize additional shares is to meet needs we anticipate after acquisition of the plant.

We believe that we will need to rely upon additional sales of our common stock and securities convertible into common stock to accomplish our plan, after acquiring the East Dubuque plant, to convert it to use coal and our Fischer-Tropsch technology, as well as to meet other business objectives not yet identified. We anticipate needing to obtain working capital until we are able to operate at a profit, which we have not yet demonstrated we can accomplish. The Board of Directors believes that it is prudent to have additional shares of common stock available in the future for general corporate purposes, including but not limited to, acquisitions, stock dividends, stock splits or other recapitalizations, grants of stock as compensation, stock options and raising equity capital. The Board of Directors believes that failure of the shareholders to approve the proposed amendment to authorize issuance of additional shares of common stock would adversely affect our financing capabilities, our financial condition, and our business plan for activities after acquisition of the Royster-Clark plant.

We have no specific plans to issue any of the additional shares of common stock that the proposed amendment would authorize.

The Board is authorized to issue shares of common stock for consideration it deems adequate and as may be permitted by law. If the Board of Directors deems it to be in our best interests and the best interests of our shareholders to issue additional shares of common stock or securities convertible into stock in the future from authorized shares, it will generally not seek further authorization by vote of the shareholders, unless authorization is otherwise required by law or regulations. Our shareholders have no preemptive right to acquire additional shares of common stock. This means that current shareholders do not have a right to purchase any new issue of shares of common stock in order to maintain their proportionate ownership interests in the Company.

To the extent that additional authorized shares of common stock are issued in the future, they will decrease the existing shareholders’ percentage equity ownership. Also, depending upon the price at which shares might be issued, they could have a dilutive effect upon earnings per share and on the voting power of existing shareholders, among other impacts. They could also reduce the amounts available upon our liquidation, if that should occur.

The increase in the authorized number of shares of common stock could have an anti-takeover effect. The Board of Directors’ ability to issue additional shares in the future could dilute the voting power of a person seeking control of Rentech. That possibility could deter or make more difficult a merger, tender offer, proxy contest or other extraordinary corporate transaction opposed by the Board of Directors. Neither the Board of Directors nor our management know of any current efforts to obtain control of Rentech by anyone.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS APPROVAL OF THE PROPOSAL TO AMEND THE RESTATED ARTICLES OF INCORPORATION TO INCREASE THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK FROM 150,000,000 TO 250,000,000.

12

PROPOSAL NO. 3

AMENDMENT TO THE RESTATED ARTICLES OF INCORPORATION

TO INCREASE THE AUTHORIZED SHARES OF PREFERRED STOCK

The Board of Directors has adopted, and recommended that the shareholders approve, an amendment to our Restated Articles of Incorporation to increase the number of authorized shares of preferred stock from 1,000,000 to 10,000,000 shares. This proposed amendment is independent of Proposal No. 2, and would change Section 4.1 by increasing the number of authorized shares of preferred stock as shown in italics in the following restatement of Section 4.1:

“4.1. The amount of authorized capital stock of this corporation is 150,000,000 shares of common stock, each share having $.01 par value, and10,000,000 shares of preferred stock, each share having $10.00 par value. All shares when issued shall be fully paid and nonassessable, the private property of shareholders, and shall not be liable for corporate debts. The Board of Directors shall have the authority to divide shares of preferred stock into series and, within the limitations provided by law, to fix and determine the relative rights and preferences of the shares of any series so established, including the right to redeem all or any part of the outstanding preferred stock upon such terms as may have been established upon its issuance.”

If adopted, the amendment would become effective upon the filing of articles of amendment with the Colorado Secretary of State. This would occur as soon as practical following the meeting.

Purpose and Effect of the Proposed Amendment

The purpose and effect of the proposed amendment is to authorize 10,000,000 shares of preferred stock for issuance, instead of the 1,000,000 shares now authorized. The amendment will not change other provisions of Section 4.1, including either the number of authorized shares of common stock or the provisions governing issuance of preferred stock. The relative rights and limitations of the preferred and common stock would remain unchanged. Neither common stock nor the preferred stock that could be issued by the Board of Directors, has or would have preemptive rights. Cumulative voting is not and would not be permitted in the election of directors.

Since our organization in 1981, our revenues from operations have not been adequate to fund our operating expenses. We have historically obtained capital for financing our working capital needs by the sale of shares of our common stock or convertible promissory notes and stock purchase warrants convertible into shares of common stock. As an additional source of financing, we have also previously issued shares of our preferred stock that were convertible into shares of common stock. We believe that we may need to rely upon additional sales of our preferred stock until we are able to operate at a profit, which we have not yet demonstrated we can accomplish, and to accomplish our business plan to finance the expenses we incur after acquiring the East Dubuque plant to convert it to use coal and our Fischer-Tropsch technology. The Board of Directors believes that failure of the shareholders to approve the proposed amendment to authorize issuance of additional shares of preferred stock would adversely affect our financing capabilities, our financial condition, and our business plan for activities after acquisition of the East Dubuque plant.

We believe that our financing needs and business objectives that might be met through the sale of shares of preferred stock is important to our economic viability and business plan for the future. The Board of Directors believes that it is prudent to have additional shares of preferred stock available in the future for general corporate purposes, including but not limited to, acquisitions, the shareholder rights plan and raising equity capital.

We have no specific plans to issue any of the additional shares of preferred stock that the proposed amendment would authorize.

The Board is authorized to issue shares of preferred stock for consideration it deems adequate and on such terms as may be permitted by law. If the Board of Directors deems it to be in our best interests and the best interests of our shareholders to issue additional shares of preferred stock or securities convertible into stock in the future from authorized shares, it will generally not seek further authorization by vote of the shareholders, unless authorization is otherwise required by law or regulations. Our shareholders have no preemptive right to acquire additional shares of our preferred stock. This means that current shareholders do not have a right to purchase any new issue of shares of our preferred stock in order to maintain their proportionate ownership interests in the Company.

13

Our Board of Directors is authorized to issue shares of preferred stock without the approval of our shareholders. Shares of preferred stock may be issued in one or more series, the terms of which will be determined at the time of issuance by the Board. These rights may include voting rights, preferences as to dividends and upon liquidation, conversion and redemption rights, and mandatory redemption provisions pursuant to sinking funds or otherwise. To the extent that additional authorized shares of preferred stock that are convertible into common stock are issued in the future and then converted into common stock, those shares of common stock will decrease the existing shareholders’ percentage equity ownership. Also, depending upon the price and terms at which preferred shares might be issued, they could have a dilutive effect upon earnings per share and on the voting power of existing shareholders, among other impacts. They could also reduce the amounts available upon our liquidation, if that should occur.

The increase in the authorized number of shares of preferred stock could have an anti-takeover effect. The Board of Directors’ ability to issue such shares in the future could dilute the voting power of a person seeking control of Rentech. That possibility could deter or make more difficult a merger, tender offer, proxy contest or other extraordinary corporate transaction opposed by the Board of Directors. Neither the Board of Directors nor our management know of any current efforts to obtain control of Rentech by anyone.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS APPROVAL OF THE PROPOSAL TO AMEND THE RESTATED ARTICLES OF INCORPORATION TO INCREASE THE NUMBER OF AUTHORIZED SHARES OF PREFERRED STOCK FROM 1,000,000 TO 10,000,000.

PROPOSAL NO. 4

ADOPTION OF THE 2005 STOCK OPTION PLAN

The stockholders are asked to consider and vote upon a proposal to approve the 2005 Stock Option Plan (2005 Plan) that was adopted and ratified by the Board of Directors on December 21, 2004 subject to shareholder approval. The primary provisions of the 2005 Plan are described in the following paragraphs.

The Board of Directors believes that the 2005 Plan will help attract, retain and motivate Rentech’s key employees, directors and consultants, as well as achieve the goal of aligning management and shareholder interests, and is therefore in the company’s best interests.

Adoption of the 2005 Stock Option Plan requires the affirmative vote of at least a majority of the shares voting on such matter.THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR THE ADOPTION OF THE 2005 PLAN.

Summary of the 2005 Plan:

Shares Subject to the 2005 Plan. The aggregate number of shares of Rentech’s common stock that may be issued to grantees under the 2005 Plan is 1,000,000 shares. The 2005 Plan provides for appropriate adjustment in the number of shares subject to the 2005 Plan and to the grants previously made if there is a stock split, stock dividend, reorganization or other relevant change affecting Rentech’s corporate structure or its equity securities. If shares under a grant are not issued to the extent permitted prior to the expiration or forfeiture of the grant, then those shares would again be available for inclusion in future grants. No grant shall be made under the 2005 Plan after December 21, 2014, but awards granted prior to or on that date may extend beyond that time.

Administration. The 2005 Plan is administered by the Compensation Committee, the members of which meet the SEC definition of “disinterested directors” and the IRS definition of “outside directors.” The Compensation Committee recommends the participants and awards of stock options, establishes rules and regulations for the operation of the 2005 Plan and recommends option terms, vesting schedules and number of shares subject to grants. With respect to any awards granted, other than those to executive officers and anyone else subject to Section 16 of the Securities Exchange Act of 1934, the Compensation Committee may delegate to the Chief Executive Officer its authority to select the participants and determine option terms, vesting schedules and number of shares subject to each grant.

14

Eligible Participants. All employees are considered responsible for contributing to the management, growth and profitability of the business of Rentech, and all employees, directors, and consultants are eligible to be selected to receive grants under the 2005 Plan. As of December 15, 2004 there were approximately 110 employees, two of whom are employee-directors, and three independent directors who are eligible to receive stock option grants. No grants of stock options have been made or planned at this time.

Stock Options.Options granted under the 2005 Plan will be in the form of either incentive stock options (ISOs), which meet the requirements of Section 422 of the Internal Revenue Code (the Code), or nonqualified stock options (NSOs), which do not meet such requirements. Only employees may receive ISOs. The term of an option will be fixed by the stock option committee, but no option may have a term of more than ten years from the date of grant. Options will be exercisable at such times as determined by the stock option committee. The option exercise price is the fair market value of our common stock on the date of grant which is determined by the average of the closing bid and asked prices of a share of common stock on the date of grant if the date of grant is a trading date, or, if not, on the most recently completed trading date prior to the date of grant, as reported by the American Stock Exchange. (On December 28, 2004, the closing sale price of a share of common stock was $2.59). The date of grant is the date on which the stock option committee grants an award or such other date as the stock option committee may designate at the time of the award. The grantee will pay the option price in cash or, if permitted by the stock option committee, by delivering to the Company shares of common stock already owned by the grantee that have a fair market value equal to the option exercise price.

Code Limitations on Incentive Stock Options. The Code currently places the following limitations on the award of ISOs. No ISO may be granted to a participant who owns, at the date of grant, in excess of 10% of the total outstanding common stock unless the exercise price of the ISO is at least 110% of the fair market value on the date of grant and the term of the ISO is no more than five years from the date of grant. The total fair market value of shares subject to ISOs which are exercisable for the first time by any optionee in any given calendar year cannot exceed $100,000 (valued as of the date of grant). No ISO may be exercisable more than three months following termination of employment for any reason other than death or disability, nor more than one year with respect to disability terminations.

Transferability of Awards. All stock options are non-transferable and may be exercised during the grantee’s lifetime only by the grantee and may not be transferred other than by will or by the laws of descent and distribution. No award of an option may be assigned, pledged, hypothecated or otherwise alienated or encumbered (whether by operation of law or otherwise), and any attempt to do so shall be null and void. ISOs will be non-transferable in accordance with the provisions of the Code.

Termination of Employment. Vested options can be exercised for a period no longer than one year after the death or disability of the grantee. Unless an earlier date is fixed by the Compensation Committee at the time of grant, unvested portions of stock options immediately expire upon termination of employment for any other reason, but vested portions of the options may be exercised for up to six months following the termination, unless termination is for cause. If the Company terminates employment for cause, all unexercised awards expire upon the termination. Termination of employment by a participant will not be deemed to occur upon: (i) transfer of a participant among the Company and its subsidiaries; and (ii) a leave of absence for a company-approved purpose. Termination of ISOs will be in accordance with the provisions of the Code.

Conditions Upon Exercise of Stock Options. Shares of stock may not be issued or delivered upon exercise of a stock option until the optionee pays in full the exercise price and any required tax withholding and, if applicable, the completion of registration and listing of the shares or qualification as a private placement and the obtaining of any other required approvals.

Federal Tax Consequences. There are no Federal income tax consequences to a participant or Rentech upon the grant of an ISO or NSO. Otherwise, however, ISOs and NSOs are treated differently for income tax purposes.

An optionee is not taxed on the grant or exercise of an ISO. The difference between the exercise price and the fair market value of the shares on the exercise date will, however, be a preference item for purposes of the alternative minimum tax. If an optionee holds the shares acquired upon exercise of an ISO for at least two years following grant and at least one year following exercise, the optionee’s gain, if any, upon a subsequent disposition of such shares is long-term capital gain. The measure of the gain is the difference between the proceeds received on disposition and the optionee’s

15

basis in the shares (which generally equals the exercise price). If an optionee disposes of stock acquired pursuant to exercise of an ISO before satisfying the one and two-year holding periods previously described, the optionee will recognize both ordinary income and capital gain in the year of disposition. The amount of the ordinary income will be the lesser of: (i) the amount realized on disposition less the optionee’s adjusted basis in the stock (usually the exercise price), or (ii) the difference between the fair market value of the stock on the exercise date and the exercise price. The balance of the consideration received on such a disposition will be long-term capital gain if the stock had been held for at least one year following exercise of the ISO. The Company is not entitled to an income tax deduction on the grant or exercise of an ISO or on the optionee’s disposition of the shares after satisfying the holding period requirements previously described. If the holding periods are not satisfied, the Company will be entitled to a deduction in the year the optionee disposes of the shares, in an amount equal to the ordinary income recognized by the optionee.

An optionee is not taxed on the grant of an NSO. On exercise, however, the optionee recognizes ordinary income equal to the difference between the exercise price and the fair market value of the shares on the date of exercise. Rentech is entitled to an income tax deduction in the year of exercise in the amount recognized by the optionee as ordinary income. Any gain or subsequent disposition of the shares is long-term capital gain if the shares are held for at least one year following exercise. Rentech does not receive a deduction for this gain.

Amendments and Discontinuance. The Board of Directors may amend, alter or discontinue the 2005 Plan, provided that any such amendment, alteration or discontinuance does not impair the rights of any grantee, without his or her consent, under any stock option previously granted. The Board of Directors may not, without shareholder approval, (i) increase the total number of shares reserved for issuance under the 2005 Plan, (ii) change the employees or class of employees eligible to participate in the 2005 Plan, or (iii) extend the maximum option period as provided in the 2005 Plan.

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The Compensation Committee was composed of two independent, non-employee directors of the Company during the 2004 fiscal year. Neither of the members were former employees of the Company. The members are Douglas L. Sheeran and Dr. Erich W. Tiepel. The Compensation Committee’s primary function is to review and recommend salary levels, bonus plans, and stock option grants to executive officers.

The overall intent for executive compensation is to establish levels of compensation that are adequate to encourage high levels of individual performance for the benefit of the Company, and that are sufficiently competitive to attract and retain executives with the skills and experience appropriate for the success of the Company. The principal components of executive compensation include cash salaries and stock options. The Compensation Committee considers job performance, responsibilities, experience, contribution to the Company’s objectives, the goal of achieving positive earnings, and internal pay equity among the executive officers and employees in general. These factors are considered subjectively in the aggregate, and none of the factors is accorded a specific weight.

The compensation of the Chief Executive Officer is based on the responsibilities that the position requires, the nature of the position, the expertise of that employee in our primary field of business, and the cash requirements of the Company.

COMPENSATION COMMITTEE

Douglas L. Sheeran

Dr. Erich W. Tiepel

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The current members of the Compensation Committee are Mr. Sheeran and Dr. Tiepel. No member of the Compensation Committee has at any time been an officer or employee of our company. None of our executive officers serves as a member of the compensation committee or board of directors of any other entity that has an executive officer serving as a member of our Board of Directors or Compensation Committee.

16

AUDIT COMMITTEE REPORT

The Audit Committee of the Board of Directors is composed entirely of independent directors, as independence is defined by the listing standards of the American Stock Exchange. The Audit Committee assists the Board of Directors with overseeing the accounting and financial reporting processes of Rentech and the audits of the financial statements of the Company.

In fulfilling its responsibilities during the past fiscal year, the committee:

| • | | Discussed with the independent accountants, among other issues, the matters to be discussed by Statement of Auditing Standards No. 61 (Communication with Audit Committee); |

| • | | Received the written disclosures and the letter from the auditors required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committee), and discussed with the independent auditors their independence; |

| • | | Discussed the overall audit process and reviewed related reports; |

| • | | Involved the independent accountants in the committee’s review of Rentech’s financial statements and related reports with management; |

| • | | Provided independent accountants the full access to the committee and the Board, to report on appropriate matters; |

| • | | Discussed with the independent accountants matters required to be reviewed by generally accepted auditing standards; |

| • | | Assessed the competence and qualification of Ehrhardt Keefe Steiner & Hottman P.C. to serve as Rentech’s auditors; and |

| • | | Reviewed and discussed the audited financial statements with Rentech’s management. |

In addition, the committee considered the quality and adequacy of Rentech’s internal controls and the status of pending litigation, taxation matters and other areas of oversight to the financial reporting and audit process that the committee determined appropriate.

Based on these reviews and discussions, the committee recommended to the Board of Directors, and the Board has approved, the Annual Report on Form 10-K for the fiscal year ended September 30, 2004. Subsequent to such recommendation, the Board has approved inclusion of the audited financial statements in the Annual Report on Form 10-K for filing with the Securities and Exchange Commission.

The report and opinion of Ehrhardt Keefe Steiner & Hottman P.C. are filed separately in Rentech’s Annual Report on Form 10-K for the fiscal year ended September 30, 2004 and should be read in conjunction with the information contained in this section of the Proxy Statement and the review of the audited financial statements.

AUDIT COMMITTEE

Thomas L. Bury

Douglas L. Sheeran

Dr. Erich W. Tiepel

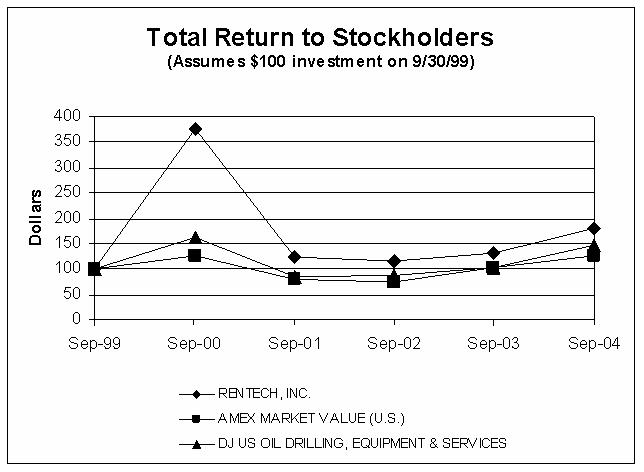

In accordance with the rules and regulations of the SEC, neither the report of the Audit Committee, the Compensation Committee, nor the performance graph appearing in this Proxy Statement will be deemed to be “soliciting material” or to be “filed” with the SEC or subject to Regulations 14A or 14C of the Securities Exchange Act of 1934 or to the liabilities of Section 18 of the Exchange Act, and will not be deemed to be incorporated by reference into any filing under the Securities Act of 1933 or the Exchange Act, notwithstanding any general incorporation by reference of this Proxy Statement into any other filed document.

NOMINATING COMMITTEE REPORT AND SHAREHOLDER COMMUNICATIONS

The Nominating Committee’s primary duty is to make recommendations to the Board of Directors regarding

17