| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| FORM N-CSR |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES |

| Investment Company Act file number 811-06199 |

| Brown Capital Management Mutual Funds |

| (Exact name of registrant as specified in charter) |

| 1201 N. Calvert Street, Baltimore, Maryland 21202 |

| (Address of principal executive offices) (Zip code) |

| Capitol Services, Inc. |

| 1675 S. State Street, Suite B, Dover, Delaware 19901 |

| (Name and address of agent for service) |

| With a copy to: |

| John H. Lively |

| The Law Offices of John H. Lively & Associates, Inc. |

| A member firm of The 1940 Act Law GroupTM |

| 11300 Tomahawk Creek Parkway, Suite 310 |

| Leawood, Kansas 66211 |

| Registrant’s telephone number, including area code: 410.837.3234 |

| Date of fiscal year end: March 31 |

| Date of reporting period: March 31, 2017 |

Item 1. REPORTS TO STOCKHOLDERS.

| ||

| ||

| A N N U A L R E P O R T | |||

| March 31, 2017 | |||

| Small Company Fund International Equity Fund Mid Company Fund International Small Company Fund | |||

| Table of Contents |

| The Brown Capital Management Small Company Fund | 1 | ||

Management Discussion of Fund Performance | 1 | ||

Schedule of Investments | 6 | ||

| The Brown Capital Management International Equity Fund | 8 | ||

Management Discussion of Fund Performance | 8 | ||

Schedule of Investments | 13 | ||

| The Brown Capital Management Mid Company Fund | 16 | ||

Management Discussion of Fund Performance | 16 | ||

Schedule of Investments | 21 | ||

| The Brown Capital Management International Small Company Fund | 23 | ||

Management Discussion of Fund Performance | 23 | ||

Schedule of Investments | 27 | ||

| Statements of Assets and Liabilities | 30 | ||

| Statements of Operations | 31 | ||

| Statements of Changes in Net Assets | 32 | ||

| Financial Highlights | 35 | ||

| Notes to Financial Statements | 43 | ||

| Report of Independent Registered Public Accounting Firm | 51 | ||

| Fund Expenses | 52 | ||

| Additional Information | 53 | ||

| Trustees and Officers | 57 |

| The Brown Capital Management Small Company Fund | ||

| Management Discussion of Fund Performance | March 31, 2017 (Unaudited) | |

Small Company Fund – Investor and Institutional Share Classes

Your Small Company Fund posted solid results for the fiscal year ending March 31, 2017, outpacing the broad market as measured by the S&P 500, the stylized small cap growth index as measured by the Russell 2000 Growth. The Investor Share Class of the Fund ranked 26th percentile out of 617 peer funds based on total returns for the fiscal year ending March 31, 2017 in Morningstar’s Small Growth Category.

Before discussing your portfolio results, we are excited to share that Brown Capital Management has been investing in the small company arena for 25 years (your Fund was launched one year later). While milestones remind us of where we’ve been, you can be confident that the team’s commitment remains focused on where we’re going as long-term investors.

How did we mark this milestone? During the fiscal year, we added a new team member who reflects the talent, experience and chemistry which defines the cultural drivers behind our time-tested results. We are fortunate to do what we love in a firm that encourages us to construct an investment program that favors our research intensive approach.

We know who we are as investors and what we believe. The Brown Capital Management Small Company Fund invests in a portfolio of 40 to 65 small growth companies with the potential to become larger companies. Our dedicated investment team focuses on what they believe to be Exceptional Companies that save time, lives, money and headaches or provide a compelling value proposition to consumers. Through our research-intensive process, we believe that a company’s capacity to grow earnings hinges on four critically important criteria around revenue. When applied over a three- to five-year evaluation horizon and implemented within a benchmark agnostic framework, our low turnover approach has the potential to generate attractive long-term returns.

Portfolio Review

As noted above, your Fund posted a positive absolute return for the fiscal year. The portfolio is not managed for one-year outcomes, which do not inform well on our investment approach. Long-term performance better reflects the portfolio of exceptional companies that your team identifies, researches and owns.

The largest exposures in the Fund were in the Medical/Healthcare and Business Services categories (you may recall the team’s use of proprietary categories in lieu of Russell sectors given its benchmark agnostic approach). Consistent with a fundamental approach, there were diverse drivers to performance over the fiscal year. Below are select contributors and detractors as well as newly established and eliminated positions.

Leading Contributors

Cognex provides machine vision systems. These systems capture and analyze visual information in order to automate tasks in manufacturing and logistics processes. End users employ machine vision in applications where human vision is inadequate to meet requirements for size, accuracy and speed. The company drives revenue by increasing adoption rates as well as expanding applications for machine vision. The company reported strong financial results during the year, as it continues to execute on its growth plan.

Veeva Systems provides cloud-based software solutions to the global life sciences industry. These solutions include: Veeva CRM, the core customer relationship management solution, Veeva Vault, the regulated content management and collaboration solution, Veeva Network, the customer master data management solution and Veeva OpenKey, the data and related services solution. The company continues to grow revenues by selling new solutions to existing customers, capturing new customers within existing markets and entering adjacent markets. The company reported stronger than expected financial results during the year, which contributed to its recent strong performance.

Incyte develops and commercializes small molecule drugs. These drugs treat serious unmet medical needs including myelofibrosis and polycythemia. The company continues to drive revenue growth by expanding the number of drugs on the market, expanding the number of diseases that each drug addresses and expanding the pipeline of future drugs.

Leading Detractors

Proto Labs manufactures low volume custom parts and prototypes for design engineers. Through a proprietary e-commerce platform and a highly automated manufacturing process, the company has reduced the time and cost required to produce machined and molded parts. The company continues to grow revenues by adding new materials, offering larger and more complex parts and adding new manufacturing techniques. Despite the recent price volatility, we believe Proto Labs’ long term prospects remain intact.

| Annual Report | March 31, 2017 | 1 | |

| The Brown Capital Management Small Company Fund | ||

| Management Discussion of Fund Performance | March 31, 2017 (Unaudited) | |

Meridian Bioscience develops, manufactures and sells diagnostic test kits for gastrointestinal, viral, respiratory and parasitic infectious diseases as well as elevated blood lead levels. The diagnostic division focuses on areas of the market that are underserved by current diagnostic products due to difficult sample handling requirements (stool, blood, urine and other body fluids). Over the long term, we believe Meridian will expand its menu of diagnostic tests which will increase utilization and drive revenue growth. The company’s recent underperformance was driven by strong competition and pricing pressure across several key testing segments.

Endologix manufactures and sells medical devices that treat aortic disorders. The Company’s primary product treats abdominal aortic aneurysms (AAA) through minimally invasive endovascular repair. These devices reduce morbidity/recovery time for patients, save hospitals money through lower length of stay and save the medical system money through a lower cost alternative to a highly invasive complicated surgical procedure. Regulatory uncertainty concerning the company’s products has caused the recent underperformance.

Companies Purchased

Endologix manufactures and sells medical devices that treat aortic disorders, as described in the previous paragraph.

Inogen manufactures portable oxygen concentrators (POCs) to treat patients with hypoxemia. Hypoxemia is an abnormally low concentration of oxygen in the blood and can result in damage to other organs, costly hospitalizations and death. Oxygen concentrators increase the concentration of oxygen in air inhaled which makes it easier for the lungs to absorb the necessary amount of oxygen.

Zoës Kitchen is a fast growing, fast-casual restaurant concept serving a distinct menu of fresh, wholesome, Mediterranean-inspired dishes delivered with Southern hospitality. The Company operates over 200 restaurants across 20 states. We believe the Company will drive revenue and earnings growth thorough unit growth, expanded revenue per unit and margin expansion.

Paycom provides user friendly, end-to-end, Human Capital Management (HCM) SaaS software that gives clients and their employees real time access to accurate information and analytics about their workforce and jobs. The software manages the entire employment lifecycle from recruitment to retirement, by providing the core system of record for a client’s workforce in a single database.

Cardiovascular Systems sells medical devices that treat advanced stages of arterial disease. The company’s flagship technology helps remove calcified plaque deposits that have accumulated in arterial vessels. Calcified lesions are difficult to treat and lead to increased complications. By reducing the plaque, the device enables the doctor to deliver more effective and more durable treatment options. The market for treating patients with severely calcified arteries is large, under-served and lightly penetrated.

Ironwood Pharmaceuticals markets and sells Linzess for the treatment of irritable bowel syndrome with constipation or chronic idiopathic constipation. The company also sells Zurampic and Duzallow for the treatment of uncontrolled gout. The company plans to grow revenue by expanding the number of patients using their drugs as well as bringing new drugs to market.

Companies Sold

FEI Company designs, manufactures and sells complex microscopy workflow solutions, including high resolution electron and ion beam microscopes, and other products. These solutions enable research organizations to view, manipulate and analyze objects on a nanometer scale. During the year, Thermo Fisher acquired FEI Company for $107.50 per share, representing a nearly 14% premium to the company’s previous day closing price of $94.58.

DTS provides premier audio solutions for mobile, home and automotive markets. Their products include surround sound and audio enhancement capabilities which are utilized in theaters, televisions, computers, video games, cars, and other applications. The company was acquired for $42.50 per share which represents a 24% premium to the previous day closing price of $34.33.

Textura Corporation is a leading provider of payment, procurement, and delivery software tools to the construction industry. The tools electronically streamline what have traditionally been manual paper-based processes involving owners/developers, general contractors and subcontractors. Textura was acquired out of the portfolio for $26.00 per share, which represents a 31% premium to the company’s previous day closing price of $19.89.

Closing Thoughts

As you can imagine, we regularly receive questions about why our performance is up or down. When your Fund experiences a good quarter or good year, the reasons are often due to decisions made by the team long before the performance results arrived. As an example, when a holding is down for one quarter, we may be asked, “What did you get wrong?” Or if a holding performs well over the long-term, the curiosity is, “What did

| 2 | www.browncapital.com | |

| The Brown Capital Management Small Company Fund | ||

| Management Discussion of Fund Performance | March 31, 2017 (Unaudited) | |

the market get wrong?” We’ve heard these questions for decades and our response is the same today. We do not know the time frame of the market. We only know our own long-term time horizon and the research scrutiny we put into every name in your portfolio.

In Grit: The Power of Passion and Perseverance, psychologist Angela Duckworth suggests a formula for long-term success. It includes two equations: Talent x Effort = Skill; Skill x Effort = Achievement. The emphasis on Effort is not lost by your team on the road to Achievement. At Brown Capital, we bring stamina to investing as a marathon, not a sprint. For every innovative company that we own, there are hundreds that don’t meet our criteria to deliver sustainable and profitable long-term growth.

Over the past year, it’s been hard to miss the headlines surrounding passive investing. We strongly believe in the merits of long-term active investing. But even as a benchmark agnostic manager, we are aware of trends in the marketplace. Our observation is that the media coverage has mostly focused on large liquid indices (like the S&P 500) and on so-called benchmark hugging managers (which are accused of underperforming the indices). These phenomena are not a distraction to portfolio management or to researching small companies that are early in their corporate development. Rather than forecast about market cycles or reversion to the mean, we are encouraged by your Fund’s history of navigating through the economy’s ebbs and flows with consistency, dedication and... grit.

Thank you for your confidence and investment with Brown Capital Management.

Disclosures

Peer Group Rankings reflect performance when compared to similarly managed funds as defined by rating agency, Morningstar. In this ratings systems the top performer(s) is reflected in first percentile (1st Percentile) and the worst performer(s) in the one hundredth percentile (100th Percentile). Actual numerical peer rankings unavailable via Morningstar only percentile outcomes.

S&P 500® – The S&P 500® Index is the Standard & Poor’s composite index of 500 stocks, a widely recognized, unmanaged index of common stock prices. You cannot invest directly into an index.

The Russell 2000® Growth Index measures the performance of those Russell 2000 companies with higher forecasted growth values. You cannot invest directly into an index.

Morningstar Small Growth Category – Small-growth portfolios focus on faster-growing companies whose shares are at the lower end of the market capitalization range. These portfolios tend to favor companies up-and-coming industries or young firms in their early growth stages. Because these businesses are fast-growing and often richly valued, their stocks tend to be volatile. Stocks in the bottom 10% of the capitalization of the U.S. equity market are defined as small-cap. Growth is defined based on fast growth (high growth rates for earnings, sales, book value and cash flow) and high valuations (high price ratios and low dividend yields). For the 3, 5 and 10 year periods, the Investor Share Class of the Small Company Fund was ranked 4th percentile out of 560, 2nd percentile out of 492, and 1st percentile out of 362 as of 3/31/17 based on total returns relative to our peers in the Morningstar Small Growth Category.

| Annual Report | March 31, 2017 | 3 | |

| The Brown Capital Management Small Company Fund | ||

| March 31, 2017 (Unaudited) | ||

Growth of a hypothetical $10,000 investment – Investor Class

This graph assumes an initial investment of $10,000 at March 31, 2007. All dividends and distributions are reinvested. This graph depicts the performance of The Brown Capital Management Small Company Fund (the “Fund”) Investor Class versus the Russell 2000® Index and the Russell 2000® Growth Index. It is important to note that the Fund is a professionally managed mutual fund while the indices are not available for investment and are unmanaged. The comparison is shown for illustrative purposes only.

Performance (as of March 31, 2017)

| Average Annual Total Returns | Total Annual | |||||||||||

| Since Inception | Fund Operating | |||||||||||

| 1 Year | 3 Year | 5 Year | 10 Year | 12/31/92 | Expenses | |||||||

| The Brown Capital Management Small Company Fund - | ||||||||||||

Investor Class | 24.75% | 10.30% | 15.28% | 12.30% | 12.11% | 1.27% | ||||||

| The Brown Capital Management Small Company Fund - | ||||||||||||

Institutional Class | 25.01% | 10.52% | 15.51% | 12.42% | 12.16% | 1.07% | ||||||

| S&P 500® Index | 17.17% | 10.37% | 13.30% | 7.51% | 9.85% | |||||||

| Russell 2000® Index | 26.22% | 7.22% | 12.35% | 7.12% | 9.35% | |||||||

| Russell 2000® Growth Index | 23.03% | 6.72% | 12.10% | 8.06% | 7.50% | |||||||

| Morningstar Small Growth Category | 22.57% | 5.41% | 10.69% | 7.43% | 9.67% | |||||||

| SCF-Investor Percentile Ranking vs | ||||||||||||

Total Funds in M-Star Small Growth Category* | 26/617 | 4/560 | 2/492 | 1/362 | N/A | |||||||

| SCF-Institutional Percentile Ranking vs | ||||||||||||

Total Funds in M-Star Small Growth Category* | 25/617 | 4/560 | 1/492 | 1/362 | N/A | |||||||

The performance information quoted above represents past performance, which is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. An investor may obtain performance data current to the most recent month-end by visiting www.browncapital.com.

The expense ratios shown is from the Fund’s prospectus dated July 29, 2016. These numbers may vary from the expense ratios shown elsewhere in this report because it is based on a different time period.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Average annual total returns are historical in nature and measure net investment income and capital gain or loss from portfolio investments assuming reinvestments of distributions.

Investing in the securities of small companies generally is perceived to involve greater risk than investing in larger domestic companies. Therefore, investments in the Fund may involve a greater degree of risk than investments in other mutual funds that seek capital growth by larger domestic companies.

| 4 | www.browncapital.com | |

| The Brown Capital Management Small Company Fund | ||

| March 31, 2017 (Unaudited) | ||

The Institutional Class of the Fund commenced operations on December 15, 2011. The historical performance shown for periods prior to December 15, 2011 was calculated synthetically using the performance and the fees and expenses of the Investor Class. If the Institutional Class had been available during the periods prior to December 15, 2011, the performance shown may have been different. Please refer to the Fund’s prospectus for further details concerning historical performance.

The S&P 500® Index is the Standard & Poor’s composite index of 500 stocks, a widely recognized, unmanaged index of common stock prices.

The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® Index, which is made up of 3,000 of the biggest U.S. stocks.

The Russell 2000® Growth Index measures the performance of those Russell 2000 companies with higher forecasted growth values.

Morningstar Small Growth Category – Small-growth portfolios focus on faster-growing companies whose shares are at the lower end of the market-capitalization range. These portfolios tend to favor companies up-and-coming industries or young firms in their early growth stages. Because these businesses are fast-growing and often richly valued, their stocks tend to be volatile. Stocks in the bottom 10% of the capitalization of the U.S. equity market are defined as smallcap. Growth is defined based on fast growth (high growth rates for earnings, sales, book value and cash flow) and high valuations (high price ratios and low dividend yields).

You cannot invest directly in an index.

Note: Diversification does not eliminate the risk of experiencing investment losses.

| Annual Report | March 31, 2017 | 5 | |

| The Brown Capital Management Small Company Fund | |

| Schedule of Investments | March 31, 2017 |

| Shares | Value (Note 1) | |||||

| COMMON STOCKS - 96.58% | ||||||

| Business Services 26.22% | ||||||

| 7,017,735 | ACI Worldwide, Inc.(a)(b) | $ | 150,109,352 | |||

| 1,544,314 | ANSYS, Inc.(a) | 165,040,837 | ||||

| 1,001,048 | Ellie Mae, Inc.(a) | 100,375,083 | ||||

| 2,338,679 | Guidewire Software, Inc.(a) | 131,737,788 | ||||

| 4,347,608 | NIC, Inc.(b) | 87,821,681 | ||||

| 304,711 | Nuance Communications, Inc.(a) | 5,274,547 | ||||

| 1,317,829 | Paycom Software, Inc.(a) | 75,788,346 | ||||

| 1,983,740 | PROS Holdings, Inc.(a)(b) | 47,986,671 | ||||

| 1,134,714 | Tyler Technologies, Inc.(a) | 175,381,396 | ||||

| 939,515,701 | ||||||

| Consumer Related - 1.12% | ||||||

| 211,801 | Dolby Laboratories, Inc. Class A | 11,100,491 | ||||

| 1,571,820 | Zoe’s Kitchen, Inc.(a)(b) | 29,078,670 | ||||

| 40,179,161 | ||||||

| Industrial Products & Systems - 16.68% | ||||||

| 1,743,048 | Balchem Corp.(b) | 143,662,016 | ||||

| 2,528,462 | Cognex Corp. | 212,264,385 | ||||

| 1,551,016 | Diodes, Inc.(a) | 37,301,935 | ||||

| 906,355 | DMC Global, Inc.(b) | 11,238,802 | ||||

| 384,664 | FLIR Systems, Inc. | 13,955,610 | ||||

| 727,019 | Geospace Technologies Corp.(a)(b) | 11,799,518 | ||||

| 1,970,237 | Proto Labs, Inc.(a)(b) | 100,679,111 | ||||

| 1,853,028 | Sun Hydraulics Corp.(b) | 66,912,841 | ||||

| 597,814,218 | ||||||

| Information/Knowledge Management - 17.44% | ||||||

| 1,827,932 | American Software, Inc. - Class A(b) | 18,791,141 | ||||

| 2,696,297 | Blackbaud, Inc.(b) | 206,725,091 | ||||

| 3,161,446 | Manhattan Associates, Inc.(a) | 164,553,264 | ||||

| 3,408,789 | NetScout Systems, Inc.(a) | 129,363,542 | ||||

| 4,308,257 | Quality Systems, Inc.(a)(b) | 65,657,837 | ||||

| 1,610,995 | Vocera Communications, Inc.(a)(b) | 40,001,006 | ||||

| 625,091,881 | ||||||

| Medical/Health Care - 30.44% | ||||||

| 1,579,364 | Abaxis, Inc.(b) | 76,599,154 | ||||

| 433,232 | ABIOMED, Inc.(a) | 54,240,646 | ||||

| 1,053,807 | Bio - Techne Corp. | 107,119,482 | ||||

| 430,257 | Bruker Corp. | 10,037,896 | ||||

| 1,986,273 | Cantel Medical Corp. | 159,100,467 | ||||

| 130,965 | Cardiovascular Systems, Inc.(a) | 3,703,035 | ||||

| 4,174,522 | Endologix, Inc.(a)(b) | 30,223,539 | ||||

| 855,447 | Incyte Corp.(a) | 114,347,601 | ||||

| 696,525 | Inogen, Inc.(a) | 54,022,479 | ||||

| 2,444,967 | Ironwood Pharmaceuticals, Inc.(a) | 41,711,137 | ||||

| 2,871,319 | Medidata Solutions, Inc.(a) | 165,646,393 | ||||

| 2,457,216 | Meridian Bioscience, Inc.(b) | 33,909,581 | ||||

| 2,511,552 | Quidel Corp.(a)(b) | 56,861,537 | ||||

| 3,569,159 | Veeva Systems, Inc. - Class A(a) | 183,026,474 | ||||

| 1,090,549,421 | ||||||

| 6 | www.browncapital.com | |

| The Brown Capital Management Small Company Fund | ||

| Schedule of Investments | March 31, 2017 | |

| Shares | Value (Note 1) | |||||

| COMMON STOCKS - 96.58% (continued) | ||||||

| Miscellaneous - 4.68% | ||||||

| 2,555,909 | Neogen Corp.(a)(b) | $ | 167,539,835 | |||

Total Common Stocks (Cost $1,890,338,032) | 3,460,690,217 | |||||

| SHORT TERM INVESTMENTS - 3.64% | ||||||

| 130,355,330 | Dreyfus Government Cash Management Institutional Shares, 0.66%(c) | 130,355,330 | ||||

Total Short Term Investments (Cost $130,355,330) | 130,355,330 | |||||

| Total Value of Investments (Cost $2,020,693,362) - 100.22% | 3,591,045,547 | |||||

| Liabilities in Excess of Other Assets - (0.22)% | (7,945,228) | |||||

| Net Assets - 100.00% | $ | 3,583,100,319 | ||||

| (a) | Non-income producing investment. | |

| (b) | Affiliated company - The Fund owns greater than 5% of the outstanding voting securities of this issuer. See Note 1 for more information. | |

| (c) | Represents 7 day effective yield at March 31, 2017. |

See Notes to Financial Statements.

Summary of Investments by Sector

| Sector | % of Net Assets | Value | |||

| Business Services | 26.22% | $ | 939,515,701 | ||

| Cash & Equivalents | 3.64% | 130,355,330 | |||

| Consumer Related | 1.12% | 40,179,161 | |||

| Industrial Products & Systems | 16.68% | 597,814,218 | |||

| Information/Knowledge Management | 17.44% | 625,091,881 | |||

| Medical/Health Care | 30.44% | 1,090,549,421 | |||

| Miscellaneous | 4.68% | 167,539,835 | |||

| Liabilities in excess of other assets | (0.22)% | (7,945,228) | |||

| Total | 100.00% | $ | 3,583,100,319 | ||

The Fund’s classifications of issuers into sectors, industries and sub-industries may differ for financial reporting purposes than for other reporting and compliance purposes. The classifications for purposes of this financial report are unaudited.

| Annual Report | March 31, 2017 | 7 | |

| The Brown Capital Management International Equity Fund | ||

| Management Discussion of Fund Performance | March 31, 2017 (Unaudited) | |

International Equity Fund – Investor and Institutional Share Classes

For the fiscal year ended March 31, 2017, your portfolio lagged both broad market indices, as measured by MSCI EAFE Small Cap index, the MSCI ACWI ex-US Small Cap index. The Investor Share Class of the Fund ranked 98th percentile out of 377 peer funds based on total returns for the fiscal year ending March 31, 2017 in Morningstar’s newly recategorized Foreign Large Growth Category after residing in the Foreign Large Blend Category for the better part of the last nine years.

Portfolio Review

This was a very difficult performance year for the Fund relative to the above international market indices. Broadly, the financials sector was the largest contributor to market performance. Banks, in particular, represented the largest contributing industry in the sector. Perhaps the prospect of a rising interest rate environment, and hence, improved bank profitability played a role. At present, our financials exposure is much less than our benchmarks, and we own no banks. Additionally, the fee based financials that we do own reacted negatively to the Brexit1 vote in June 2016 and did not recover from their declines before fiscal year end.

Our bottom-up, long-term approach to growth stock investing has yielded concentrations in three sectors worth noting- health care, consumer staples, and consumer discretionary. All three sectors were laggard performers in this past fiscal year. Health care was a particular challenge as concerns were raised about the sustainability of drug pricing in the U.S. market Due to the U.S. presidential election cycle, it got even more attention.

While these were overall portfolio challenges, our investment program consists of a concentrated collection of exceptional growth companies, whose individual success or failure will drive the program’s performance over time.

Leading Contributors

Canadian Natural Resources is an Alberta-based oil and gas company with several growth projects. In June, the company set forth guidance of 8% annual production growth through 2019, which flows from its extensive, long-life asset base. This compares to major integrated oil companies, which generally indicate flattish production profiles over the next several years. Additionally, this company-specific news was helped by a “tail wind” of energy prices increasing over the previous year. The stock was up over 23% for the past fiscal year and remains an important holding in the fund.

Yamaha Motor Co., based in Japan, is one of the world’s largest manufacturers of motorcycles, as well as the market leader in U.S. marine outboard motors. For the fiscal year, the shares rose over 44%. This was also a solid performance recovery, as the previous fiscal year showed particular weakness, down over 35%. We continue to view Yamaha as a solid franchise with good growth prospects, particularly in its emerging markets with a growing middle class like Indonesia and Brazil.

Carl Zeiss, based in Germany, makes equipment to diagnose, treat and manage the most common eye disorders like cataracts and glaucoma. The company has a history of new product innovation, which has underpinned stable, steady revenue growth. For the year, Carl Zeiss shares increased 38%.

Leading Detractors

Novo Nordisk, based in Denmark, is the global leader in diabetes care. The shares fell over 36% for the year due in part to higher than expected pricing pressure in the U.S. market. Pricing pressure is especially difficult in the long acting insulin space, and in bids for large contracts with managed care organizations. While we recognize the pricing challenges, we continue to see Novo Nordisk as well placed to grow over time as diabetes remains underdiagnosed and undertreated globally. Our confidence is based on the company’s record and success launching innovative products, and its strong diabetes care pipeline, backed by category-leading research and development efforts.

Japan Tobacco is the country’s leading tobacco company, and a globally leading tobacco company. While earnings results reported during the December quarter were below expectations, the stock only declined 6.7% in local currency. Post the U.S. presidential election results, the Japanese Yen declined over 10% vs. the USD. While the yen has strengthened almost 5% since the December quarter, Japan Tobacco’s stock price remained down 22% for the fiscal year. Japan Tobacco continues to remain a holding in our fund.

Paddy Power Betfair is an Ireland-based on-line and retail gaming and sports-betting company with operations in Ireland, the United Kingdom, and Australia. Success has come from the sophisticated use of information technology coupled with unique marketing programs. In the previous fiscal year, Paddy Power merged with a comparably successful company, Betfair. However, in the wake of the Brexit vote, the stock declined 19%, and was down 22% for the fiscal year. Paddy Power Betfair remains a holding in our fund.

| 8 | www.browncapital.com | |

| The Brown Capital Management International Equity Fund | ||

| Management Discussion of Fund Performance | March 31, 2017 (Unaudited) | |

Companies Purchased

During the fiscal year, one new stock joined our investment program- CyberAgent Inc. CyberAgent Inc. is a Japan-based, internet-focused advertising agency. In addition, the company is a leading producer of mobile games, and other media assets focused on the Japanese market. The company had fiscal year 2016 US dollar equivalent revenue of $2.8 billion, and a US dollar equivalent market cap of $3.3 billion. Over the past five years, the company’s revenue has grown at a compounded annual rate of over 21%. The company has a return on equity (ROE)2 of over 18%, an operating margin of over 11%, and very little debt. The company’s longer term growth prospects remain attractive to us.

Companies Sold

Management Consulting Group is a UK based-professional services firm. Although well-managed, the business has been challenged over the past several years and undergone a significant amount of change, including the disposal of a substantial part of its consultancy operations. We exited our remaining position.

Adient and PrairieSky Royalt were both spinoffs, received and eliminated during the fiscal year.

Adient PLC is an Ireland-headquartered company that makes seating systems for the automotive industry. Adient joined our investment program as a part of the merger between Tyco International and Johnson Controls PLC. Adient, formerly a division of Johnson Controls, was renamed and spun out to shareholders. After completing our review, we eliminated our position.

PrairieSky Royalty LTD is an Alberta-based company that generates revenue from collecting royalties on Canadian oil and gas assets. This business was spun out of Canadian Natural Resources. After completing our review, we eliminated our position.

Closing Thoughts

Our investment program is compact, balanced and diversified, currently holding 49 stocks across 18 different countries. The top ten positions represent 34% of total assets. We continue to search for new holdings while concurrently monitoring existing holdings in your portfolio for their continued suitability.

Our International team seeks to invest for the long-term in high-quality growth stocks with durable business franchises. Our investment process is characterized by direct, independent, fundamental research to construct a compact portfolio of 40 to 70 high-quality growth companies with high-return prospects domiciled outside the United States. While we do not know the direction of the markets going forward, we feel confident that a well researched collection of quality growth companies can build significant value for our clients over time.

We appreciate your continued support of Brown Capital Management.

Disclosures

| 1 | Brexit: an abbreviation for “British exit,” which refers to the June 23, 2016, referendum whereby British citizens voted to exit the European Union. | |

| 2 | Return on Equity (ROE) is the amount of net income returned as a percentage of shareholders equity. |

Peer Group Rankings reflect performance when compared to similarly managed funds as defined by rating agency, Morningstar. In these ratings systems the top performer(s) is reflected in first percentile (1st Percentile) and the worst performer(s) in the one hundredth percentile (100th Percentile). Actual numerical peer rankings unavailable via Morningstar only percentile outcomes.

EAFE – The MSCI EAFE International Gross Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is design to measure the equity market performance of developed markets excluding the U.S. and Canada. You cannot invest directly into an index.

AC World (ex US) – The MSCI All Country World Index excluding the U.S. is a free-float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. You cannot invest directly into an index.

Morningstar Foreign Large-Blend Category – portfolios invest in a variety of big international stocks. Most of these portfolios divide their assets among a dozen or more developed markets, including Japan, Britain, France, and Germany. These portfolios primarily invest in stocks that have market caps in the top 70% of each economically integrated market (such as Europe or Asia ex-Japan). The blend style is assigned to portfolios where neither growth nor value characteristics predominate. These portfolios typically will have less than 20% of assets invested in U.S. stocks.

| Annual Report | March 31, 2017 | 9 | |

| The Brown Capital Management International Equity Fund | ||

| Management Discussion of Fund Performance | March 31, 2017 (Unaudited) | |

Morningstar Foreign Large Growth Category – portfolios focus on high-priced growth stocks, mainly outside of the United States. Most of these portfolios divide their assets among a dozen or more developed markets, including Japan, Britain, France, and Germany. These portfolios primarily invest in stocks that have market caps in the top 70% of each economically integrated market (such as Europe or Asia ex-Japan). Growth is defined based on fast growth (high growth rates for earnings, sales, book value, and cash flow) and high valuations (high price ratios and low dividend yields). These portfolios typically will have less than 20% of assets invested in U.S. stocks. For the 3, 5 and 10 year periods, the Investor Share Class of the International Equity Fund was ranked 69th percentile out of 311, 13th percentile out of 263, and 80th percentile out of 185 as of 3/31/17 based on total returns relative to our peers in the Morningstar Foreign Large Growth Category.

| 10 | www.browncapital.com | |

| The Brown Capital Management International Equity Fund | ||

| March 31, 2017 (Unaudited) | ||

This graph assumes an initial investment of $10,000 at March 31, 2007. All dividends and distributions are reinvested. This graph depicts the performance of The Brown Capital Management International Equity Fund (the “Fund”) Investor Class versus the MSCI All Country World Ex USA Index and the MSCI EAFE International Gross Index. It is important to note that the Fund is a professionally managed mutual fund while the indices are not available for investment and are unmanaged. The comparison is shown for illustrative purposes only.

Performance (as of March 31, 2017)

| Total | ||||||||||||||

| Annual | Net Annual | |||||||||||||

| Since | Fund | Fund | ||||||||||||

| Average Annual Total Returns | Inception | Operating | Operating | |||||||||||

| 1 Year | 3 Year | 5 Year | 10 Year | 5/28/99 | Expenses | Expenses | ||||||||

| The Brown Capital Management International Equity Fund - Investor Class | 1.60% | 0.18% | 7.36% | 0.85% | 3.77% | 2.05% | 1.26% | |||||||

| The Brown Capital Management International Equity Fund - Institutional Class | 2.09% | 0.43% | 7.52% | 0.92% | 3.82% | 1.80% | 1.01% | |||||||

| MSCI EAFE International Gross Index | 12.25% | 0.96% | 6.32% | 1.53% | 4.35% | |||||||||

| MSCI All Country World Ex USA Index | 13.70% | 1.03% | 4.84% | 1.82% | 4.95% | |||||||||

| Morningstar Foreign Large Blend Category | 10.98% | 0.40% | 5.02% | 0.96% | N/A | |||||||||

| Morningstar Foreign Large Growth Category | 8.64% | 1.10% | 5.55% | 1.99% | N/A | |||||||||

| IEF-Investor Percentile Ranking vs Total Funds in M-Star Foreign Large Blend Category | 98/377 | 69/311 | 13/263 | 80/185 | N/A | |||||||||

| IEF-Institutional Percentile Ranking vs Total Funds in M-Star Foreign Large Blend Category | 97/377 | 61/311 | 11/263 | 78/185 | N/A | |||||||||

The performance information quoted above represents past performance, which is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. An investor may obtain performance data current to the most recent month-end by visiting www.browncapital.com.

The expense ratios shown are from the Fund’s prospectus dated July 29, 2016. These numbers may vary from the expense ratios shown elsewhere in this report because it is based on a different time period.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Average annual total returns are historical in nature and measure net investment income and capital gain or loss from portfolio investments assuming reinvestments of distributions.

| Annual Report | March 31, 2017 | 11 | |

| The Brown Capital Management International Equity Fund | ||

| March 31, 2017 (Unaudited) | ||

Investing in the securities of foreign companies generally involves greater risk than investing in larger, more established domestic companies. Therefore, investments in the Fund may involve a greater degree of risk than investments in other mutual funds that invest in larger, more established domestic companies.

The Institutional Class of the Fund commenced operations on August 1, 2014. The historical performance shown for periods prior to August 1, 2014 was calculated synthetically using the performance and the fees and expenses of the Investor Class. If the Institutional Class had been available during the periods prior to August 1, 2014, the performance shown may have been different. Please refer to the Fund’s prospectus for further details concerning historical performance.

The MSCI EAFE International Gross Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index maintained by Morgan Stanley Capital International (MSCI) that is designed to measure the equity market performance of developed markets excluding the U.S. and Canada.

The MSCI All Country World Index Ex USA Index is a market-capitalization-weighted index maintained by Morgan Stanley Capital International (MSCI) and designed to provide a broad measure of stock performance throughout the world, with the exception of U.S.-based companies. The index includes both developed and emerging markets.

Morningstar Foreign Large Blend Category – Foreign large-blend portfolios invest in a variety of big international stocks. Most of these portfolios divide their assets among a dozen or more developed markets, including Japan, Britain, France, and Germany. These portfolios primarily invest in stocks that have market caps in the top 70% of each economically integrated market (such as Europe or Asia ex-Japan). The blend style is assigned to portfolios where neither growth nor value characteristics predominate. These portfolios typically will have less than 20% of assets invested in U.S. stocks.

Morningstar Foreign Large Growth Category – portfolios focus on high-priced growth stocks, mainly outside of the United States. Most of these portfolios divide their assets among a dozen or more developed markets, including Japan, Britain, France, and Germany. These portfolios primarily invest in stocks that have market caps in the top 70% of each economically integrated market (such as Europe or Asia ex-Japan). Growth is defined based on fast growth (high growth rates for earnings, sales, book value, and cash flow) and high valuations (high price ratios and low dividend yields). These portfolios typically will have less than 20% of assets invested in U.S. stocks.

You cannot invest directly in an index.

Note: Diversification does not eliminate the risk of experiencing investment losses.

| 12 | www.browncapital.com | |

| The Brown Capital Management International Equity Fund | ||

| Schedule of Investments | March 31, 2017 | |

| Shares | Value (Note 1) | ||||

| COMMON STOCKS - 97.07% | |||||

| Bermuda - 2.02% | |||||

| 12,830 | Invesco, Ltd. | $ | 392,983 | ||

| 20,796 | Nabors Industries, Ltd. | 271,804 | |||

| 664,787 | |||||

| Canada - 3.67% | |||||

| 29,700 | Canadian Natural Resources, Ltd. | 972,394 | |||

| 18,627 | Dominion Diamond Corp. | 235,595 | |||

| 1,207,989 | |||||

| Denmark - 2.11% | |||||

| 20,246 | Novo Nordisk A/S Class B | 695,325 | |||

| Finland - 1.55% | |||||

| 11,653 | Kone OYJ Class B | 511,678 | |||

| France - 6.43% | |||||

| 5,240 | Dassault Systemes SE | 453,576 | |||

| 3,052 | Essilor International SA | 370,844 | |||

| 2,230 | Ingenico Group SA | 210,443 | |||

| 4,895 | Sanofi | 441,885 | |||

| 5,135 | Societe BIC SA | 639,833 | |||

| 2,116,581 | |||||

| Germany - 6.09% | |||||

| 5,331 | Bayerische Motoren Werke AG | 486,305 | |||

| 17,606 | Carl Zeiss Meditec AG | 750,908 | |||

| 7,820 | SAP SE | 767,333 | |||

| 2,004,546 | |||||

| Hong Kong - 2.30% | |||||

| 794,146 | Kingdee International Software Group Co., Ltd.(a) | 328,020 | |||

| 155,443 | Kingsoft Corp., Ltd. | 428,036 | |||

| 756,056 | |||||

| Ireland - 15.67% | |||||

| 23,473 | Avadel Pharmaceuticals PLC(a)(b) | 227,219 | |||

| 14,352 | DCC PLC | 1,263,210 | |||

| 15,612 | ICON PLC (a) | 1,244,589 | |||

| 13,671 | Johnson Controls International PLC | 575,822 | |||

| 5,402 | Paddy Power Betfair PLC | 579,167 | |||

| 5,218 | Shire PLC | 304,719 | |||

| 465,178 | Total Produce PLC | 967,692 | |||

| 5,162,418 | |||||

| Israel - 3.25% | |||||

| 7,923 | Check Point Software Technologies, Ltd.(a) | 813,375 | |||

| 8,025 | Teva Pharmaceutical Industries, Ltd.(b) | 257,522 | |||

| 1,070,897 | |||||

| Italy - 1.98% | |||||

| 37,506 | Azimut Holding SpA | 653,387 | |||

| Annual Report | March 31, 2017 | 13 | |

| The Brown Capital Management International Equity Fund | ||

| Schedule of Investments | March 31, 2017 | |

| Shares | Value (Note 1) | ||||

| COMMON STOCKS - 97.07% (continued) | |||||

| Japan - 10.46% | |||||

| 8,900 | CyberAgent, Inc. | $ | 263,411 | ||

| 25,699 | Japan Tobacco, Inc. | 835,165 | |||

| 39,110 | Mitsubishi Estate Co., Ltd. | 713,135 | |||

| 43,433 | Rakuten, Inc. | 434,993 | |||

| 18,867 | Sapporo Holdings, Ltd. | 510,102 | |||

| 28,602 | Yamaha Motor Co., Ltd. | 688,781 | |||

| 3,445,587 | |||||

| Mexico - 2.36% | |||||

| 87,414 | Fomento Economico Mexicano SAB de CV | 776,173 | |||

| Netherlands - 5.65% | |||||

| 26,722 | QIAGEN NV | 774,137 | |||

| 26,139 | Wolters Kluwer NV | 1,086,543 | |||

| 1,860,680 | |||||

| Singapore - 0.35% | |||||

| 117,224 | UOB-Kay Hian Holdings, Ltd. | 116,901 | |||

| South Africa - 1.54% | |||||

| 17,263 | Sasol, Ltd.(b) | 507,532 | |||

| Spain - 2.02% | |||||

| 27,111 | Grifols SA | 664,918 | |||

| Switzerland - 12.73% | |||||

| 210 | Chocoladefabriken Lindt & Spruengli AG | 1,190,835 | |||

| 408 | Givaudan SA | 734,820 | |||

| 8,744 | Nestle SA | 670,869 | |||

| 3,514 | Roche Holding AG | 897,400 | |||

| 1,948 | The Swatch Group AG | 697,597 | |||

| 4,191,521 | |||||

| United Kingdom - 16.89% | |||||

| 109,910 | BAE Systems PLC | 884,763 | |||

| 23,458 | Carnival Corp. | 1,381,911 | |||

| 25,477 | Diageo PLC | 728,897 | |||

| 305,917 | Man Group PLC | 564,577 | |||

| 71,430 | RELX PLC | 1,399,698 | |||

| 63,071 | UBM PLC | 604,121 | |||

| 5,563,967 | |||||

| Total Common Stocks (Cost $27,602,068) | 31,970,943 | ||||

| SHORT TERM INVESTMENTS - 2.62% | |||||

| 861,986 | Dreyfus Government Cash Management Institutional Shares, 0.66%(c) | 861,986 | |||

| Total Short Term Investments (Cost $861,986) | 861,986 | ||||

| Total Value of Investments (Cost $28,464,054) - 99.69% | 32,832,929 | ||||

| Other Assets in Excess of Liabilities - 0.31% | 102,544 | ||||

| Net Assets - 100.00% | $ | 32,935,473 | |||

| 14 | www.browncapital.com | |

| The Brown Capital Management International Equity Fund | ||

| Schedule of Investments | March 31, 2017 | |

| (a) | Non-income producing investment. | |

| (b) | American Depositary Receipt. | |

| (c) | Represents 7 day effective yield at March 31, 2017. |

See Notes to Financial Statements.

Summary of Investments by Sector

| Sector | % of Net Assets | Value | |||

| Cash & Equivalents | 2.62% | $ | 861,986 | ||

| Consumer Discretionary | 15.60% | 5,136,286 | |||

| Consumer Staples | 17.26% | 5,679,733 | |||

| Energy | 5.32% | 1,751,730 | |||

| Financials | 5.23% | 1,727,848 | |||

| Health Care | 20.12% | 6,629,466 | |||

| Industrials | 19.31% | 6,361,547 | |||

| Information Technology | 9.12% | 3,000,783 | |||

| Materials | 2.95% | 970,415 | |||

| Real Estate | 2.16% | 713,135 | |||

| Other assets in excess of liabilities | 0.31% | 102,544 | |||

| Total | 100.00% | $ | 32,935,473 | ||

The Fund’s classifications of issuers into sectors, industries and sub-industries may differ for financial reporting purposes than for other reporting and compliance purposes. The classifications for purposes of this financial report are unaudited.

| Annual Report | March 31, 2017 | 15 | |

| The Brown Capital Management Mid Company Fund | ||

| Management Discussion of Fund Performance | March 31, 2017 (Unaudited) | |

Mid Company Fund – Investor and Institutional Class

Your Mid Company Fund underperformed the broad market, as measured by the S&P 500, the stylized index, as measured by the Russell Midcap Growth Index. The Investor Share Class of the Fund ranked 94th percentile out of 591 peer funds based on total returns for the fiscal year ending March 31, 2017 in Morningstar’s Mid-Cap Growth Category.

Portfolio Review

Before discussing your portfolio results, we are delighted to share that Brown Capital Management has been investing in medium –sized companies for 25 years (your Fund has a 15 year track record).While milestones remind us of where we’ve been, you can be confident that the commitment remains focused on where we are going as long-term investors.

How have we marked this approaching milestone? During the fiscal year, we added two new investment team members who reflect the talent, experience and chemistry which defines the cultural drivers behind Brown success. We are fortunate to do what we love in a firm that encourages us to construct an investment program that favors our research intensive approach.

We began the year with a sense of urgency and purpose. Our short term results have affected our long-term track record. it’s important to remember that we are the same manager. We are still the same investors applying our time tested approach, only with frustrating outcomes. The Fund is unchanged from a fundamental research perspective as we execute our investment process with renewed rigor.

If you are evaluating our Fund for the first time, we welcome you to join us as we continue this journey seeking out exceptional mid-sized growth companies. If you are a client, we thank you for your patience, for your words of encouragement and for your support. We look forward to updating you along the way and to demonstrating our ability to generate strong long-term results.

Leading Contributors

Masimo Corporation is a medical technology company that develops and manufactures noninvasive patient monitoring technologies, including optical blood constituent, optical organ oximetry, electrical brain function, acoustic respiration and optical gas monitoring devices. The company has one of the strongest technology portfolios in its industry and has gradually accumulated a loyal and recurring customer base. Its product introductions have exceeded expectations in terms of both sales growth and profitability. There remains a large addressable market for its products and it should continue to gain market for the foreseeable future.

Quanta Services, Inc. is an engineering and construction firm active in the electric power, oil, and gas infrastructure industries. After previously facing a severe share price decline related to its oil and gas exposure its stock price has appreciated sharply as the oil and gas customer base has stabilized and new oil pipeline work has more recently become available. In response to the sharp stock price appreciation and knowledge that Quanta’s project work can be inconsistent we have slightly trimmed our position size.

Evercore Partners Inc. is an independent investment banking, advisory and investment management firm. Evercore has benefitted from increased capital markets activity and strong recruiting as evident from market share gains over the past several years. As the economic cycle progresses we believe Evercore’s clients will continue to pursue capital raising actions and mergers as a means to propel their growth and that Evercore will capture a greater share of their business.

Leading Detractors

Stericycle Inc. is the United States’ largest medical waste management company providing services to hospitals and independent medical clinics. Although we remain confident in the company’s competitive position, recent consolidation among its smaller independent medical clinic clients has been a headwind to revenue growth and margins. Despite the near-term challenges we believe the company has crafted a more proactive strategy for dealing with these customers and we continue to patiently await the full deployment of this new strategy.

Michael Kors Holdings Ltd. is a designer of accessible luxury sportswear, accessories, footwear and apparel. Selling a product that is luxurious but affordable is challenging and Michael Kors was successful for many years. More recently it has become clear that the company over expanded its product distribution and the loss of brand cache has translated into lower prices, margins, and profits. In response to the deterioration we have eliminated the investment and chosen to replace it with higher quality and more durable business franchises.

| 16 | www.browncapital.com | |

| The Brown Capital Management Mid Company Fund | ||

| Management Discussion of Fund Performance | March 31, 2017 (Unaudited) | |

Under Armour Inc. markets and distributes athletic apparel and footwear. The past four quarterly reports have featured disappointing sales, disappointing earnings and a disappointing outlook. Under Armour has historically been successful in gaining market share in the athletic apparel and footwear industry and the size of its competitors indicates that the company could grow appreciably larger if it could regain its past design and innovation edge. In response to continued disappointments we are re-evaluating our thesis on the company.

Companies Purchased

Broadridge Financial Solutions Inc. provides investor communications and technology solutions to banks, broker-dealers, mutual funds and corporate issuers. We are impressed by the savings and efficiencies that Broadridge Financial provides to its customers and we see a long growth runway for this company that supports the continued digitization of the financial services industry.

Fastenal Co. is a leading broad line wholesaler of industrial and construction supplies serving over 400,000 customer accounts with more than 1.4m products. We feel the company offers customers significant supply chain savings and business efficiencies. As the company continues to gain a greater share of customer spending we expect it to grow materially faster than the U.S. industrial economy.

Guidewire Software Inc. provides software for the property and casualty insurance industry. We believe the company is transforming the industry, enabling customers to upgrade their underwriting, policy administration, claims management and billing processes. The company continues to have relatively low industry penetration and we believe it offers many more years of attractive growth.

Companies Sold

FEI Co. is a supplier of scientific instruments for nanoscale applications and solutions for technology, natural resources, scientific, and industrial end markets. FEI has been a solid contributor to our investment portfolio with strong earnings growth. In the past year the company was acquired by Thermo Fisher Scientific, Inc. in an all cash deal. Since its acquisition we have replaced it with other compelling investments.

Dick’s Sporting Goods, Inc. is a retailer of sports equipment, apparel, footwear, and accessories. We sold Dick’s primarily due to valuation.

Gentherm, Inc. manufactures and markets thermal management technologies for the automotive and industrial end-markets. Financial results have been lower than expected due to softness in their automotive end and global power generation businesses. Coupled with weaker financial guidance we have decided that the company likely lacks significant competitive advantages and have eliminated the position to focus on more promising long-term investments.

Closing Thoughts

As you can imagine, we regularly receive questions about why our performance is up or down. When your Fund experiences a good quarter or good year, the reasons are often due to decisions made by the team long before the performance results arrived. As an example, when a holding is down for one quarter, we may be asked, “What did you get wrong?” Or if a holding performs well over the long-term, the curiosity is, “What did the market get wrong? ” We’ve heard these questions for decades and our response is the same today. We do not know the time frame of the market. We only know our own long-term time horizon and the research scrutiny we put into every name in your portfolio.

In Grit: The Power of Passion and Perseverance, psychologist Angela Duckworth suggests a formula for long-term success. It includes two equations: Talent x Effort = Skill; Skill x Effort = Achievement. The emphasis on Effort is not lost by your team on the road to Achievement. At Brown Capital, we bring stamina to investing as a marathon, not a sprint. For every innovative company that we own, there are hundreds that don’t meet our criteria to deliver sustainable and profitable long-term growth.

Over the past year, it’s been hard to miss the headlines surrounding passive investing. We strongly believe in the merits of long-term active investing. But even as a benchmark agnostic manager, we are aware of trends in the marketplace. Our observation is that the media coverage has mostly focused on large liquid indices (like the S&P 500) and on so-called benchmark hugging managers (which are accused of underperforming the indices). These phenomena are not a distraction to portfolio management or to researching small companies that are early in their corporate development. Rather than forecast about market cycles or reversion to the mean, we are encouraged by your history of navigating through the economy’s ebbs and flows with consistency, dedication and... grit.

Thank you for your confidence and investment with Brown Capital Management.

| Annual Report | March 31, 2017 | 17 | |

| The Brown Capital Management Mid Company Fund | ||

| Management Discussion of Fund Performance | March 31, 2017 (Unaudited) | |

Disclosures

Peer Group Rankings reflect performance when compared to similarly managed funds as defined by rating agency Morningstar. In this ratings systems the top performer(s) is reflected in first percentile (1st Percentile) and the worst performer(s) in the one hundredth percentile (100th Percentile). Actual numerical peer rankings unavailable via Morningstar only percentile outcomes.

S&P 500® – The S&P 500® Index is the Standard & Poor’s composite index of 500 stocks, a widely recognized, unmanaged index of common stock prices. You cannot invest directly in an index.

The Russell Midcap® Growth Index measures the performance of those Russell Midcap companies with higher price-to-book ratios and higher

forecasted growth values. You cannot invest directly in an index ..

Morningstar Mid-Cap Growth Category – Some mid-cap growth portfolios invest in stocks of all sizes, thus leading to a mid-cap profile, but others focus on midsize companies. Mid-cap growth portfolios target U.S. firms that are projected to growth faster than other mid-cap stocks, therefore commanding relatively higher prices. The U.S. mid-cap range for market capitalization typically falls between $1 billion-$8 billion and represents 20% of the total capitalization of the U.S. equity markets. Growth is defined based on fast growth (high growth rates for earnings, sales, book value, and cash flow) and high valuations (high price ratios and low dividend yields). For the 3, 5 and 10 year periods, the Investor Share Class of the Mid Company Fund was ranked 98th percentile out of 540, 98th percentile out of 463, and 38th percentile out of 340 as of 3/31/17 based on total returns relative to our peers in the Morningstar Mid-Cap Growth Category.

| 18 | www.browncapital.com | |

| The Brown Capital Management Mid Company Fund | ||

| March 31, 2017 (Unaudited) | ||

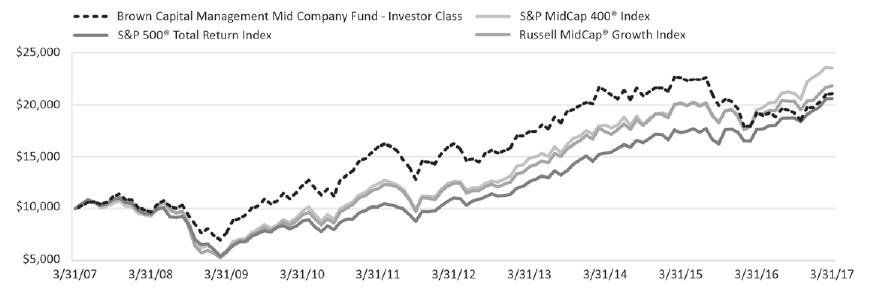

Growth of a hypothetical $10,000 investment - Investor Class

This graph assumes an initial investment of $10,000 at March 31, 2007. All dividends and distributions are reinvested. This graph depicts the performance of The Brown Capital Management Mid Company Fund (the “Fund”) Investor Class versus the S&P 500® Total Return Index, the S&P MidCap 400® Index and the Russell MidCap® Growth Index. It is important to note that the Fund is a professionally managed mutual fund while the indices are not available for investment and are unmanaged. The comparison is shown for illustrative purposes only.

Performance (as of March 31, 2017)

| Average Annual Total Returns | Total Annual | Net Annual | ||||||||||||||||||||

| Since | Fund | Fund | ||||||||||||||||||||

| Inception | Operating | Operating | ||||||||||||||||||||

| 1 Year | 3 Year | 5 Year | 10 Year | 9/30/02 | Expenses | Expenses | ||||||||||||||||

| Brown Capital Management Mid Company | ||||||||||||||||||||||

Fund - Investor Class | 9.83% | -0.49% | 5.40% | 7.76% | 9.47% | 1.61% | 1.16% | |||||||||||||||

| Brown Capital Management Mid Company | ||||||||||||||||||||||

Fund - Institutional Class | 10.20% | -0.22% | 5.71% | 7.93% | 9.58% | 1.36% | 0.91% | |||||||||||||||

| S&P 500® Total Return Index | 17.17% | 10.37% | 13.30% | 7.51% | 9.85% | |||||||||||||||||

| S&P MidCap 400® Index | 20.92% | 9.36% | 13.32% | 8.96% | 12.02% | |||||||||||||||||

| Russell MidCap® Growth Index | 14.07% | 7.88% | 11.95% | 8.13% | 11.85% | |||||||||||||||||

| Morningstar Mid-Cap Growth Category | 15.55% | 6.06% | 10.32% | 7.29% | 11.05% | |||||||||||||||||

| MCF-Investor Percentile Ranking vs. | ||||||||||||||||||||||

Total Funds in M-Star Mid Growth Category | 94/591 | 98/540 | 98/463 | 38/340 | N/A | |||||||||||||||||

| MCF-Institutional Percentile Ranking vs. | ||||||||||||||||||||||

Total Funds in M-Star Mid Growth Category | 92/591 | 97/540 | 97/463 | 34/340 | N/A | |||||||||||||||||

The performance information quoted above represents past performance, which is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. An investor may obtain performance data current to the most recent month-end by visiting www.browncapital.com.

The expense ratios shown are from the Fund’s prospectus dated July 29, 2016. These numbers may vary from the expense ratios shown elsewhere in this report because it is based on a different time period.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Average annual total returns are historical in nature and measure net investment income and capital gain or loss from portfolio investments assuming reinvestments of distributions.

| Annual Report | March 31, 2017 | 19 | |

| The Brown Capital Management Mid Company Fund | ||

| March 31, 2017 (Unaudited) | ||

Investing in the securities of mid-sized companies generally involves greater risk than investing in larger, more established companies. Therefore, investments in the Fund may involve a greater degree of risk than investments in other mutual funds that seek capital growth by investing in larger, more established companies.

The Institutional Class of the Fund commenced operations on December 15, 2011. The historical performance shown for periods prior to December 15, 2011 was calculated synthetically using the performance and the fees and expenses of the Investor Class. If the Institutional Class had been available during the periods prior to December 15, 2011, the performance shown may have been different. Please refer to the Fund’s prospectus for further details concerning historical performance.

The S&P 500® Total Return Index is the Standard & Poor’s composite index of 500 stocks, a widely recognized, unmanaged index of common stock prices.

The S&P MidCap 400® Index measures stocks that have a total market capitalization that ranges from roughly $737 million to $11.8 billion dollars.

The Russell MidCap® Growth Index measures the performance of those Russell MidCap companies with higher price-to-book ratios and higher forecasted growth values.

Morningstar Mid-Cap Growth Category – Some mid-cap growth portfolios invest in stocks of all sizes, thus leading to a mid-cap profile, but others focus on midsize companies. Mid-cap growth portfolios target U.S. firms that are projected to grow faster than other mid-cap stocks, therefore commanding relatively higher prices. The U.S. mid-cap range for market capitalization typically falls between $1 billion-$8 billion and represents 20% of the total capitalization of the U.S. equity markets. Growth is defined based on fast growth (high growth rates for earnings, sales, book value, and cash flow) and high valuations (high price ratios and low dividend yields).

You cannot invest directly in an index.

Note: Diversification does not eliminate the risk of experiencing investment losses.

| 20 | www.browncapital.com | |

| The Brown Capital Management Mid Company Fund | ||

| Schedule of Investments | March 31, 2017 | |

| Shares | Value (Note 1) | |||||

| COMMON STOCKS - 96.60% | ||||||

| Business Services - 9.09% | ||||||

| 4,118 | Ellie Mae, Inc.(a) | $ | 412,912 | |||

| 2,334 | Equifax, Inc. | 319,151 | ||||

| 3,227 | FactSet Research Systems, Inc. | 532,165 | ||||

| 3,581 | Tyler Technologies, Inc.(a) | 553,479 | ||||

| 1,817,707 | ||||||

| Consumer Related - 17.18% | ||||||

| 4,989 | Expedia, Inc. | 629,462 | ||||

| 10,064 | LKQ Corp.(a) | 294,573 | ||||

| 12,216 | Norwegian Cruise Line Holdings, Ltd.(a) | 619,718 | ||||

| 2,019 | O’Reilly Automotive, Inc.(a) | 544,807 | ||||

| 9,815 | Tractor Supply Co. | 676,941 | ||||

| 1,905 | Ulta Beauty, Inc.(a) | 543,363 | ||||

| 6,450 | Under Armour, Inc. - Class A(a) | 127,581 | ||||

| 3,436,445 | ||||||

| Financial Services - 12.87% | ||||||

| 10,308 | Broadridge Financial Solutions, Inc. | 700,429 | ||||

| 16,504 | The Charles Schwab Corp. | 673,528 | ||||

| 7,630 | Evercore Partners, Inc. - Class A | 594,377 | ||||

| 8,899 | T. Rowe Price Group, Inc. | 606,467 | ||||

| 2,574,801 | ||||||

| Industrial Products & Systems - 15.26% | ||||||

| 2,347 | Acuity Brands, Inc. | 478,788 | ||||

| 3,021 | Cognex Corp. | 253,613 | ||||

| 12,308 | Fastenal Co. | 633,862 | ||||

| 5,963 | JB Hunt Transport Services, Inc. | 547,045 | ||||

| 5,104 | MSC Industrial Direct Co. - Class A | 524,487 | ||||

| 16,536 | Quanta Services, Inc.(a) | 613,651 | ||||

| 3,051,446 | ||||||

| Information/Knowledge Management - 19.03% | ||||||

| 7,136 | Akamai Technologies, Inc.(a) | 426,019 | ||||

| 4,107 | ANSYS, Inc. (a) | 438,915 | ||||

| 9,722 | Blackbaud, Inc. | 745,386 | ||||

| 9,328 | Guidewire Software, Inc.(a) | 525,446 | ||||

| 6,928 | Manhattan Associates, Inc.(a) | 360,602 | ||||

| 4,474 | MasterCard, Inc. - Class A | 503,191 | ||||

| 5,296 | MAXIMUS, Inc. | 329,411 | ||||

| 5,521 | Red Hat, Inc.(a) | 477,567 | ||||

| 3,806,537 | ||||||

| Medical/Health Care - 19.90% | ||||||

| 5,184 | Celgene Corp.(a) | 645,045 | ||||

| 5,542 | Cerner Corp.(a) | 326,147 | ||||

| 2,568 | Jazz Pharmaceuticals PLC(a) | 372,694 | ||||

| 7,525 | Masimo Corp.(a) | 701,782 | ||||

| 8,565 | PAREXEL International Corp.(a) | 540,537 | ||||

| 2,976 | Shire PLC(b) | 518,508 | ||||

| 3,721 | Stericycle, Inc.(a) | 308,434 | ||||

| 6,804 | Veeva Systems, Inc. - Class A(a) | 348,909 | ||||

| Annual Report | March 31, 2017 | 21 | |

| The Brown Capital Management Mid Company Fund | ||

| Schedule of Investments | March 31, 2017 | |

| Shares | Value (Note 1) | |||||

| COMMON STOCKS - 96.60% (continued) | ||||||

| Medical/Health Care - 19.90% (continued) | ||||||

| 1,388 | Waters Corp.(a) | $ | 216,958 | |||

| 3,979,014 | ||||||

| Miscellaneous - 3.27% | ||||||

| 18,287 | PulteGroup, Inc. | 430,659 | ||||

| 6,189 | Toll Brothers, Inc.(a) | 223,485 | ||||

| 654,144 | ||||||

Total Common Stocks (Cost $12,866,822) | 19,320,094 | |||||

| SHORT TERM INVESTMENTS - 3.49% | ||||||

| 698,926 | Dreyfus Government Cash Management Institutional Shares, 0.66%(c) | 698,926 | ||||

Total Short Term Investments (Cost $698,926) | 698,926 | |||||

Total Value of Investments (Cost $13,565,748) - 100.09% | 20,019,020 | |||||

Liabilities in Excess of Other Assets - (0.09)% | (18,307) | |||||

Net Assets - 100.00% | $ | 20,000,713 | ||||

| (a) | Non-income producing investment. | |

| (b) | American Depositary Receipt. | |

| (c) | Represents 7 day effective yield at March 31, 2017. |

See Notes to Financial Statements.

Summary of Investments by Sector

| Sector | % of Net Assets | Value | ||||

| Business Services | 9.09% | $ | 1,817,707 | |||

| Cash & Equivalents | 3.49% | 698,926 | ||||

| Consumer Related | 17.18% | 3,436,445 | ||||

| Financial Services | 12.87% | 2,574,801 | ||||

| Industrial Products & Systems | 15.26% | 3,051,446 | ||||

| Information/Knowledge Management | 19.03% | 3,806,537 | ||||

| Medical/Health Care | 19.90% | 3,979,014 | ||||

| Miscellaneous | 3.27% | 654,144 | ||||

| Liabilities in excess of other assets | (0.09)% | (18,307) | ||||

| Total | 100.00% | $ | 20,000,713 | |||

The Fund’s classifications of issuers into sectors, industries and sub-industries may differ for financial reporting purposes than for other reporting and compliance purposes. The classifications for purposes of this financial report are unaudited.

| 22 | www.browncapital.com | |

| The Brown Capital Management International Small Company Fund | ||

| Management Discussion of Fund Performance | March 31, 2017 (Unaudited) | |

International Small Company Fund – Investor and Institutional Share Classes

Your International Small Company Fund performed well on both an absolute and relative basis for the fiscal year ended March 31, 2017. The Fund outperformed the MSCI EAFE Small Cap index, the MSCI ACWI ex-US Small Cap index. The Investor Share Class of the Fund ranked 1st percentile out of 128 peer funds based on total returns for the fiscal year ending March 31, 2017 in Morningstar’s Foreign Small/Mid Growth Category.

March 31, 2017 marks 1½ years since the Fund’s inception and we caution that it is too short a period to draw any meaningful conclusions about long-term results.

Portfolio Review

Certainly, this fiscal year was a year of surprises – the Brexit vote passed in the United Kingdom, Donald Trump won the US Presidential election, and Prime Minister Renzi resigned in Italy. It was also a year in which foreign stocks lagged domestic stocks (EAFE was up 12.25% while the S&P was up 17.17%), partially due to a strong US dollar. Healthcare lagged, energy recovered, and financials bounced in the December quarter. Currency issues abounded as China devalued the Yuan, India withdrew Rupee notes, and Venezuela’s Bolivar collapsed.

For Brown Capital Management’s investment in international small companies, however, it was business as usual. We continue to employ an investment process that focuses on individual companies and the company specific fundamentals that enable or inhibit their ability to be successful. Despite a barrage of unexpected world events, our enthusiasm for quality, durable, small growth companies is not diminished.

The portfolio’s construction represents balance across geographic regions as well as across our custom sectors of Medical/Health Care, Business Services, Information/Knowledge Management, Consumer Related, Industrial Products & Systems, and Miscellaneous. Of these sectors, Medical/Health Care and Information/Knowledge Management provided the biggest contributions to returns, primarily due to company specific factors. We highlight three companies that contributed and three that detracted below.

At year-end, the portfolio is fully invested (cash less than 3%) in 44 company holdings in 18 countries. The top ten holdings represent 40% of the portfolio. We continue our active research activities, monitoring existing holdings and searching for new, exceptional small company holdings for your portfolio. We highlight three new positions and two eliminations in the fund below.

Leading Contributors

Evotec is a Germany-based drug discovery company that helps pharmaceutical partners to develop new medicines using proprietary screening capability. During the year, the company announced a collaboration agreement with Celgene Corporation to identify disease-modifying therapeutics for a broad range of neurodegenerative diseases using Evotec’s iPSC infrastructure. The stock was up 171% for the year. We continue to like Evotec’s drug development capability.

MercadoLibre, based in Argentina, is the dominant on line marketplace in Latin America. The company runs auctions, sells fixed price items and develops on line store fronts for big retailers, and has enhanced its core marketplace with payment, credit, and shipping services. This well managed, leading company is delivering strong growth and the stock was up 80% for the year.

GW Pharmaceuticals is a United Kingdom-based pharmaceutical company that develops new medicines using proprietary research in the area of cannabinoids. In the September quarter, the company announced further positive clinical data for Epidiolex, used to treat certain forms of epilepsy, and hired advisors after receiving inquiries about a possible acquisition of the company. The stock was up 54% for the year. We think GW Pharmaceuticals has the platform necessary to develop innovative medicines.

Leading Detractors

Sirtex Medical is an Australia-based pharmaceutical company focused on treatments for liver cancer. Its primary product, SIRFLOX, delivers radiation therapy selectively to cancers in the liver. The company posted disappointing results as it addressed management and operational issues in its Americas region, which represents about one-third of the revenue. Although the stock was down 38% for the year, it continues to be held in the portfolio.

Kakaku.com, based in Japan, is a price comparison service for retailers and a reservation service for restaurants. The stock declined 26% during the year, as the company conveyed a more muted outlook for fiscal year 2018, citing lower revenue associated with the electronics market. We continue to like Kakaku.com’s ability to develop profitable on-line businesses.

Vectura, based in the United Kingdom, develops inhaled therapies for respiratory diseases, such as asthma and chronic obstructive pulmonary disease (COPD). During the year, partner GlaxoSmithKline passed on acquiring additional patents, and Flutiform, marketed for asthma, failed to

| Annual Report | March 31, 2017 | 23 | |

| The Brown Capital Management International Small Company Fund | ||

| Management Discussion of Fund Performance | March 31, 2017 (Unaudited) | |

meet primary endpoints in a trial for COPD. For the year, the stock was down 18%. We continue to think Vectura has an emerging respiratory therapy franchise.

Companies Purchased

There were two new holdings added to the fund and one new name received as a spin-off from an existing holding:

Mobileye, an Israeli developer of software and systems to process visual information needed in advanced vehicle safety systems and autonomous vehicles, was added to the portfolio in the December quarter. Subsequently, the company made an unexpected announcement in the March quarter that it agreed to be acquired by Intel. The transaction is expected to close this year.

Another new holding is Kinaxis, a Canadian company that provides supply chain management software as a service (SaaS) that allows its clients to coordinate increasingly complex and global supply chains. We are encouraged by its growth prospects with existing and new clients, and expansion opportunities in new industry segments and geographies outside of North America.

The fund received shares in department store operator Lifestyle China, which was spun-out of the portfolio holding Lifestyle International. This is currently a small position.

Companies Sold

There were two positions eliminated during the year, both due to corporate buyouts.

Gameloft, a France-based video game publisher, significantly for mobile devices, was acquired by French media company Vivendi. The transaction closed in the June quarter.

Fleetmatics, an Irish online fleet tracking service provider, was acquired by Verizon Communications. The transaction closed in the December quarter.

Closing Thoughts

The International Small Company Service employs a long-term, quality-oriented, and research-driven process that seeks to identify, invest in and monitor a concentrated collection of 40 to 65 exceptional, small growth companies located outside the United States.

Brown Capital Management’s International Team is very pleased to be managing money on your behalf. While we do not know the direction of the markets going forward, we are confident that a well-researched collection of quality, small growth companies will build significant value for our clients over time.

Disclosures