UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06199

Brown Capital Management Mutual Funds

(Exact name of registrant as specified in charter)

1201 N. Calvert Street, Baltimore, Maryland 21202

(Address of principal executive offices) (Zip code)

Capitol Services, Inc.

1675 S. State Street, Suite B, Dover, Delaware 19901

(Name and address of agent for service)

With a copy to:

John H. Lively

Practus, LLP

11300 Tomahawk Creek Parkway, Suite 310

Leawood, Kansas 66211

Registrant’s telephone number, including area code: 410.837.3234

Date of fiscal year end: March 31

Date of reporting period: March 31, 2020

Item 1. REPORTS TO STOCKHOLDERS.

Annual Report

Small Company Fund

Investor Shares (BCSIX)

(CUSIP Number 115291833)

Institutional Shares (BCSSX)

(CUSIP Number 115291403)

Mid Company Fund

Investor Shares (BCMSX)

(CUSIP Number 115291809)

Institutional Shares (BCMIX)

(CUSIP Number 115291783)

International Equity Fund

Investor Shares (BCIIX)

(CUSIP Number 115291858)

Institutional Shares (BCISX)

(CUSIP Number 115291767)

International Small Company Fund

Investor Shares (BCSVX)

(CUSIP Number 115291742)

Institutional Shares (BCSFX)

(CUSIP Number 115291759)

March 31, 2020

Table of Contents

1 | |

1 | |

6 | |

|

|

8 | |

8 | |

14 | |

|

|

16 | |

16 | |

21 | |

|

|

The Brown Capital Management International Small Company Fund | 24 |

24 | |

29 | |

|

|

32 | |

|

|

34 | |

|

|

35 | |

|

|

39 | |

|

|

47 | |

|

|

55 | |

|

|

56 | |

|

|

57 | |

|

|

60 |

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Funds’ annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website (www.browncapital.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by enrolling at www.browncapital.com.

Any time before January 1, 2021, you may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with a Fund, you can call 1-877-892-4226 to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held with the fund complex if you invest directly with a Fund.

| |

March 31, 2020 (Unaudited) |

Small Company Fund – Investor and Institutional Share Classes

The Small Company Fund outperformed its benchmark for the fiscal year ended March 31, 2020, with the Investor shares returning -8.55%, versus -18.58% for the Russell 2000® Growth Index. The final quarter of the fiscal year, when the COVID-19 pandemic swept across the globe, had a disproportionate impact on both the Fund and markets more broadly. While we remain committed to our long-term investment philosophy, this annual review is accordingly more reflective of recent events than usual.

Portfolio Review

During the final quarter of the fiscal year ended March 31, 2020, efforts to mitigate the spread of the novel coronavirus had an acute impact on industries including airlines, restaurants and hospitality, while fears of a coordinated global slowdown weighed on energy. This led to a sharp pullback in markets, more than offsetting solid gains over the first three quarters. While reasons for pullbacks vary, the market response tends to be more predictable, with investors preferring durable companies that are better able to withstand the potential impacts of a recession.

As we discussed in our March quarterly commentary, we believe that during uncertain times you can take comfort in the intentional durability of the Exceptional Growth Companies in the Brown Capital Management Small Company Fund. We target companies that possess durable revenue streams, sustainable competitive advantages and strong balance sheets. We spend much of our time trying to ascertain how mission-critical a company is to its clients, the value it provides, and thus the degree to which its revenue should sustain and grow over time, even in a difficult economic environment like the current one. The benefit of a strong balance sheet is perhaps obvious in times of distress. It provides companies the opportunity to weather the storm without needing to raise capital, and even strategically acquire competitors. We also seek companies that are profitable or should reach profitability within our 3-5 year evaluation horizon. Profitability is an important part of durability, as higher margins soften the blow to earnings and cash flows when revenues decline, and they give management greater flexibility in deciding how best to respond to a crisis. We believe most companies in the Fund have a solid balance sheet with a significant net cash position and margins that generate strong free cash flow.

This purposeful focus on durability has mitigated the worst impacts of prior shocks on the Fund, such as the financial crisis of 2008-9 and the dot-com meltdown in 2000. It similarly gives us confidence the Fund is well positioned to weather the current challenge, eventual recovery and beyond. While we are not market-index experts, the historic nature of the market decline, coupled with the durability of the Fund, likely led to some of the outperformance this past year.

Two of the top contributors and detractors to the Small Company Fund this past year are detailed below.

Leading Contributors

● | Quidel Corporation sells rapid diagnostic-testing solutions to physician offices, hospitals, clinical laboratories and reference laboratories. These diagnostic solutions detect a variety of diseases—infectious, cardiovascular, women’s health, gastrointestinal and autoimmune. Quidel’s diagnostic tests are faster, easier to use, and more accurate than competitors’ tests. The efficiency and accuracy of Quidel’s tests, combined with the development of new tests, should continue to drive company growth. |

In March 2020, the Food and Drug Administration granted Emergency Use Authorization to Quidel for a COVID-19 real-time diagnostic test. Quidel is also developing a rapid test targeted for release this fall. In addition to a stronger-than-normal flu season, the company should benefit from an increase in flu testing as protocols for COVID-19 require a test for other causes of the coronavirus’s symptoms such as the flu. Longer term, COVID-19 should highlight the value of rapid, accurate testing. These recent factors likely drove Quidel’s outperformance for the fiscal year.

● | Tyler Technologies provides software solutions to the public sector to increase workflow efficiency and accuracy. Tyler’s solutions improve local governments’ and agencies’ ability to manage back-office functions such as financial management, court and judicial processes, property taxes, appraisals, public safety, citizen services, public records and school districts. Better systems save time and money and enable local governments and agencies to be more accessible and responsive to citizens’ needs. These benefits are enabling Tyler to sell additional solutions to existing customers and to add new customers. For instance, Tyler has traditionally sold to state and local governments. Over the past two years, the company has acquired eight related businesses to expand offerings to federal agencies. Finally, Tyler is investing in its solutions by adding functionality and moving to a cloud-based subscription model. |

Tyler reported strong bookings for its new subscription products over the last few quarters, which contributed to the company’s outperformance for the year.

Annual Report | March 31, 2020 | 1 |

The Brown Capital Management Small Company Fund |

|

Management Discussion of Fund Performance | March 31, 2020 (Unaudited) |

Leading Detractors

● | Glaukos Corporation is a medical-device company specializing in the treatment of glaucoma. The company’s flagship product, the iStent, more effectively treats the condition, which is the second leading cause of blindness. Glaucoma develops from improper drainage that causes a buildup of fluid at the front of the eye, increasing intraocular pressure (IOP) and damaging the optic nerve. Glaucoma is primarily treated by topical drugs that have poor patient compliance as well as side effects. The permanent iStent opens up the drainage canal, lowering the IOP, while addressing the patient-compliance issue. We believe the company will drive revenue growth by penetrating the large glaucoma market with the iStent and bringing other pipeline products to market. |

Glaukos underperformed this year, as the majority of its revenue is from elective procedures that are now subject to delay due to the novel coronavirus. This will likely impact Glaukos’s clinical trials too, pushing out some longer-term growth drivers. Despite these headwinds, our long-term thesis remains intact.

● | Abiomed manufactures and sells minimally invasive heart-recovery devices called the Impella. The Impella is a small device that pumps blood during cardiac procedures, alleviating pressure from the ventricle wall and allowing the heart to rest. Improved hemodynamic support gives cardiologists time to achieve more complete revascularization, which improves patient outcomes. Increased appreciation of the superior patient outcomes through clinical studies and real-world evidence, together with continued expansion of Abiomed’s portfolio of FDA-approved devices, should drive significantly greater adoption and long-term revenue growth. |

During 2019, Abiomed reported weaker-than-expected earnings results and announced changes to its sales strategy targeting U.S. hospitals. Despite the negative results, we believe the company’s products remain compelling, and increasing physician awareness will drive Abiomed’s products toward becoming the accepted standard of care. We believe that Abiomed’s long-term growth prospects remain intact.

During the year, seven new companies were added to the Small Company Fund and four were eliminated. A selection of three newly established and three eliminated companies follows.

Companies Purchased

● | Tandem Diabetes Care develops and manufactures insulin pumps that help patients manage diabetes. The company designs hardware and software solutions to meet the specific needs of diabetics. The company’s insulin pumps have a modern user interface, broad capabilities, and are easier to upgrade than other insulin pumps. Tandem, in partnership with Dexcom, has one of the most advanced Automated Insulin Delivery (AID) systems on the market. We expect this strong competitive position to drive market-share gains in the U.S., and together with international expansion to result in strong long-term growth. |

● | Anaplan makes the leading enterprise, cloud-based software for connected strategic business planning across finance, sales, supply chain, human resources and marketing. The software allows customers to create and manage planning models using a common data repository, leading to more integrated planning processes. To react quickly to changes in today’s dynamic business environment, companies are looking for more modern, collaborative and integrated planning solutions. Enabling analysts and managers from multiple areas to work on integrated plans using a single data set improves collaboration and coordination. As Anaplan is the only enterprise platform that can offer connected planning at scale, we expect the company to continue enjoying strong growth. |

● | Datadog is a leading SaaS-based IT-monitoring and analytics platform for developers, IT operations and business users. The platform automates the monitoring of infrastructure, application performance and networks, including real-time events affecting this performance. The platform is differentiated by providing a unified view across all cloud infrastructure, applications, logs and networks via a visual interface configured to the needs of individual users. Specifically, the platform accelerates time-to-market of new software; reduces the time needed to resolve problems; improves infrastructure efficiency; and enables a better understanding of customer behavior. We believe this puts Datadog in a leading position to capitalize on double-digit growth in the large IT-monitoring market. |

Companies Sold

| ● | Ellie Mae provides software that helps streamline and organize the mortgage process. These solutions involve customer relationship management, loan processing, underwriting, disclosure and closing documents, compliance with regulations, and other functions. We added Ellie Mae to the Small Company Fund in April 2015. In April 2019, the company was acquired by Thoma Bravo, a private equity firm, for $99.00 per share in cash, a 21% premium. |

| ● | Meridian Bioscience develops, manufactures and sells diagnostic test kits for gastrointestinal, viral, respiratory and parasitic infectious diseases, as well as elevated blood-lead levels. We first purchased Meridian in May 2007. We expected the company to generate much stronger and more consistent revenue growth. We think the company’s lower-than-expected investment into new product development, |

2 | www.browncapital.com |

The Brown Capital Management Small Company Fund |

|

Management Discussion of Fund Performance | March 31, 2020 (Unaudited) |

coupled with an increasingly competitive landscape, has diminished Meridian’s market presence and revenue durability. As a result, we sold Meridian from the Fund.

● | Incyte Corporation provides a leading treatment called Jakifi for bone-marrow disorders and cancers including myelofibrosis and polycythemia vera. Incyte also has a pipeline of drugs in clinical trials, although two of the most promising recent pipeline drugs disappointed, namely baricitinib for the treatment of rheumatoid arthritis, and epacadostat for the treatment of multiple tumors in the head, neck, bladder and kidneys. Given the large size of the company, with revenue of $2.2 billion in the most recent fiscal year, the maturing of the Jakifi franchise, and the diminished outlook for the development pipeline, this holding of more than 20 years graduated from the Fund. |

Closing Thoughts

In October 2019, we mourned the passing of Bob Hall, one of the portfolio managers on the Small Company Fund. Bob had retired in June 2019 after more than a quarter century of service at Brown Capital Management and a half century in the industry. Bob Hall and Keith Lee started the Small Company strategy more than 28 years ago, and together with Eddie Brown they developed the principles of Exceptional Growth Company investing. Bob was an enormous influence on how Brown Capital invests, even beyond the Small Company strategy. For example, Bob said that when you find Exceptional Growth Companies, “Hold on to them as long as they exhibit exceptional characteristics. Don’t overreact or over-manage.” Bob’s insights into the importance of being patient and letting returns compound is just one way that he helped all of our portfolios. Bob Hall was an exceptional investor and an even better human being. We shall miss him.

In the December 2019 quarter, Brown Capital made an exciting organizational announcement. Keith A. Lee, president of Brown Capital and a senior portfolio manager on the Small Company Team, took on the additional role of chief investment officer. For several months prior, Keith had been working with the other portfolio management teams at Brown Capital to leverage the philosophy and process that the Small Company team honed over the years. The role of CIO is in recognition of Keith’s cross-team leadership. In addition, we hired Michael L. Forster, CPA, CGMA as chief operating officer and chief financial officer. Mike’s role as COO/CFO is a newly created one in which he assumes management responsibilities from Chief Administrative Officer Cecil E. Flamer, CPA, CGMA, and from Keith. Mike is taking on oversight of administration, finance and IT responsibilities from Cecil, as well as the operations, compliance and trading functions from Keith. Cecil has announced that he will retire on June 30, 2020.

During the March 2020 quarter, we welcomed two additions to our firm’s Management Committee: Damien Davis, managing director and senior portfolio manager on our Small Company Fund; and Mike Forster, our chief operating officer and chief financial officer. We think the deep understanding of our investment philosophy and the fresh ideas they bring will serve us well as we move forward. You can find more details on these announcements on our website at browncapital.com/blog.

Thank you for your continued support of Brown Capital Management.

Disclosures

The Russell 2000® Growth Index measures the performance of those Russell 2000 companies with higher forecasted growth values.

You cannot invest directly into an index.

Past performance is not a guarantee of future results.

Annual Report | March 31, 2020 | 3 |

The Brown Capital Management Small Company Fund |

March 31, 2020 (Unaudited)

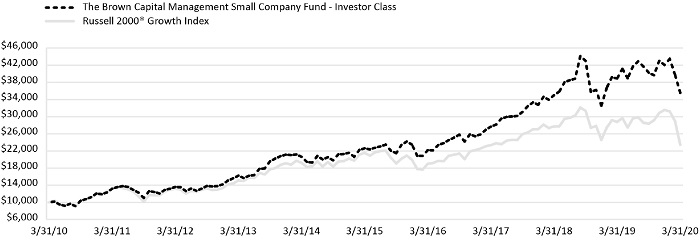

Growth of a hypothetical $10,000 investment - Investor Class

This graph assumes an initial investment of $10,000 at March 31, 2010. All dividends and distributions are reinvested. This graph depicts the performance of The Brown Capital Management Small Company Fund (the “Fund”) Investor Class versus the Russell 2000® Growth Index. It is important to note that the Fund is a professionally managed mutual fund while the index is not available for investment and is unmanaged. The comparison is shown for illustrative purposes only.

Performance (as of March 31, 2020)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Annual | ||||||||||||||

|

| Average Annual Total Returns | Since Inception |

|

| Fund Operating | |||||||||||||||

|

| 1 Year |

| 3 Year |

| 5 Year |

| 10 Year |

| 12/31/92 |

|

| Expenses | ||||||||

The Brown Capital Management Small Company Fund - Investor Class |

|

| -8.55 | % |

| 8.72 | % |

| 9.49 | % |

| 13.53 | % |

| 11.73 | % |

|

|

| 1.26 | % |

The Brown Capital Management Small Company Fund - Institutional Class |

|

| -8.37 | % |

| 8.94 | % |

| 9.71 | % |

| 13.71 | % |

| 11.80 | % |

|

|

| 1.06 | % |

Russell 2000® Growth Index |

|

| -18.58 | % |

| 0.10 | % |

| 1.70 | % |

| 8.89 | % |

| 6.66 | % |

|

|

|

|

|

Morningstar Small Growth Category |

|

| -16.92 | % |

| 2.41 | % |

| 3.03 | % |

| 9.05 | % |

| 8.83 | % |

|

|

|

|

|

SCF-Investor Percentile Ranking vs Total Funds in M-Star Small Growth Category |

|

| 10/635 |

|

| 15/577 |

|

| 5/502 |

|

| 2/381 |

|

| N/A |

|

|

|

|

|

|

SCF-Institutional Percentile Ranking vs Total Funds in M-Star Small Growth Category |

|

| 10/635 |

|

| 14/577 |

|

| 4/502 |

|

| 2/381 |

|

| N/A |

|

|

|

|

|

|

The performance information quoted above represents past performance, which is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. An investor may obtain performance data current to the most recent month-end by visiting www.browncapital.com.

The expense ratios shown are from the Fund’s prospectus dated July 30, 2019. These numbers may vary from the expense ratios shown elsewhere in this report because it is based on a different time period.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Average annual total returns are historical in nature and measure net investment income and capital gain or loss from portfolio investments assuming reinvestments of distributions.

Investing in the securities of small companies generally is perceived to involve greater risk than investing in larger domestic companies. Therefore, investments in the Fund may involve a greater degree of risk than investments in other mutual funds that seek capital growth by larger domestic companies.

4 | www.browncapital.com |

The Brown Capital Management Small Company Fund |

March 31, 2020 (Unaudited)

The Institutional Class of the Fund commenced operations on December 15, 2011. The historical performance shown for periods prior to December 15, 2011 was calculated synthetically using the performance and the fees and expenses of the Investor Class. If the Institutional Class had been available during the periods prior to December 15, 2011, the performance shown may have been different. Please refer to the Fund’s prospectus for further details concerning historical performance.

The Russell 2000® Growth Index measures the performance of those Russell 2000 companies with higher forecasted growth values.

Morningstar Small Growth Category – Small-growth portfolios focus on faster-growing companies whose shares are at the lower end of the market-capitalization range. These portfolios tend to favor companies in up-and-coming industries or young firms in their early growth stages. Because these businesses are fast-growing and often richly valued, their stocks tend to be volatile. Stocks in the bottom 10% of the capitalization of the U.S. equity market are defined as smallcap. Growth is defined based on fast growth (high growth rates for earnings, sales, book value and cash flow) and high valuations (high price ratios and low dividend yields).

You cannot invest directly in an index.

Note: Diversification does not eliminate the risk of experiencing investment losses.

Annual Report | March 31, 2020 | 5 |

The Brown Capital Management Small Company Fund

| Schedule of Investments | March 31, 2020 |

| Shares | Value (Note 1) | |||||||

| COMMON STOCKS - 96.60% | ||||||||

| Business Services - 23.21% | ||||||||

| 298,881 | ACI Worldwide, Inc.(a) | $ | 7,217,976 | |||||

| 708,726 | ANSYS, Inc.(a) | 164,757,533 | ||||||

| 1,376,002 | Guidewire Software, Inc.(a) | 109,130,719 | ||||||

| 2,459,442 | NIC, Inc. | 56,567,166 | ||||||

| 943,301 | Paycom Software, Inc.(a) | 190,556,235 | ||||||

| 3,390,445 | PROS Holdings, Inc.(a)(b) | 105,205,508 | ||||||

| 2,557,315 | Q2 Holdings, Inc.(a)(b) | 151,035,024 | ||||||

| 859,537 | Tyler Technologies, Inc.(a) | 254,904,293 | ||||||

| 1,039,374,454 | ||||||||

| Consumer Related - 1.89% | ||||||||

| 2,179,063 | Alarm.com Holdings, Inc.(a) | 84,787,341 | ||||||

| Industrial Products & Systems - 15.65% | ||||||||

| 1,879,920 | Balchem Corp.(b) | 185,585,702 | ||||||

| 5,116,891 | Cognex Corp. | 216,035,138 | ||||||

| 1,253,373 | DMC Global, Inc.(b) | 28,840,113 | ||||||

| 2,944,811 | Helios Technologies, Inc.(b) | 111,667,233 | ||||||

| 2,087,270 | Proto Labs, Inc.(a)(b) | 158,903,865 | ||||||

| 701,032,051 | ||||||||

| Information/Knowledge Management - 18.35% | ||||||||

| 1,922,201 | Alteryx, Inc. - Class A(a) | 182,935,869 | ||||||

| 1,838,316 | American Software, Inc. - Class A(b) | 26,122,470 | ||||||

| 726,542 | Anaplan, Inc.(a) | 21,985,161 | ||||||

| 904,936 | Appfolio, Inc. - Class A(a)(b) | 100,402,649 | ||||||

| 1,806,628 | Blackbaud, Inc. | 100,358,186 | ||||||

| 682,398 | Datadog, Inc. - Class A(a) | 24,552,680 | ||||||

| 3,169,624 | Manhattan Associates, Inc.(a) | 157,910,668 | ||||||

| 2,299,776 | NetScout Systems, Inc.(a) | 54,435,698 | ||||||

| 4,323,754 | NextGen Healthcare, Inc.(a)(b) | 45,139,992 | ||||||

| 1,420,696 | Smartsheet, Inc. - Class A(a) | 58,973,091 | ||||||

| 2,292,529 | Vocera Communications, Inc.(a)(b) | 48,693,316 | ||||||

| 821,509,780 | ||||||||

| Medical/Health Care - 32.19% | ||||||||

| 905,880 | ABIOMED, Inc.(a) | 131,497,541 | ||||||

| 785,728 | Bio-Techne Corp. | 148,989,743 | ||||||

| 1,883,718 | Cantel Medical Corp. | 67,625,476 | ||||||

| 3,138,112 | Cardiovascular Systems, Inc.(a)(b) | 110,492,923 | ||||||

| 515,978 | Cyclerion Therapeutics, Inc.(a) | 1,367,342 | ||||||

| 419,128 | Endologix, Inc.(a) | 289,575 | ||||||

| 2,460,624 | Glaukos Corp.(a)(b) | 75,934,857 | ||||||

| 1,909,164 | Inogen, Inc.(a)(b) | 98,627,412 | ||||||

| 1,800,895 | iRhythm Technologies, Inc.(a)(b) | 146,502,808 | ||||||

| 9,980,218 | Ironwood Pharmaceuticals, Inc.(a)(b) | 100,700,400 | ||||||

| 703,787 | OrthoPediatrics Corp.(a) | 27,898,117 | ||||||

| 2,474,038 | Quidel Corp.(a)(b) | 241,985,657 | ||||||

| 543,208 | Tandem Diabetes Care, Inc.(a) | 34,955,435 | ||||||

| 1,626,337 | Veeva Systems, Inc. - Class A(a) | 254,310,317 | ||||||

| 1,441,177,603 | ||||||||

| 6 | www.browncapital.com |

The Brown Capital Management Small Company Fund

| Schedule of Investments | March 31, 2020 |

| Shares | Value (Note 1) | |||||||

| COMMON STOCKS - 96.60% (continued) | ||||||||

| Miscellaneous - 5.31% | ||||||||

| 3,547,514 | Neogen Corp.(a)(b) | $ | 237,647,963 | |||||

| Total Common Stocks (Cost $2,726,476,304) | 4,325,529,192 | |||||||

| SHORT TERM INVESTMENTS - 3.47% | ||||||||

| 155,341,230 | Dreyfus Government Cash Management Institutional Shares, 0.29%(c) | 155,341,230 | ||||||

| Total Short Term Investments (Cost $155,341,230) | 155,341,230 | |||||||

| Total Value of Investments (Cost $2,881,817,534) - 100.07% | 4,480,870,422 | |||||||

| Liabilities in Excess of Other Assets - (0.07)% | (3,341,898 | ) | ||||||

| Net Assets - 100.00% | $ | 4,477,528,524 | ||||||

| (a) | Non-income producing investment. |

| (b) | Affiliated company - The Fund owns greater than 5% of the outstanding voting securities of this issuer. See Note 1 for more information. |

| (c) | Represents 7 day effective yield at March 31, 2020. |

See Notes to Financial Statements.

Summary of Investments by Sector (Unaudited)

| Sector | % of Net Assets | Value | ||||||

| Business Services | 23.21 | % | $ | 1,039,374,454 | ||||

| Consumer Related | 1.89 | % | 84,787,341 | |||||

| Industrial Products & Systems | 15.65 | % | 701,032,051 | |||||

| Information/Knowledge Management | 18.35 | % | 821,509,780 | |||||

| Medical/Health Care | 32.19 | % | 1,441,177,603 | |||||

| Miscellaneous | 5.31 | % | 237,647,963 | |||||

| Short Term Investments | 3.47 | % | 155,341,230 | |||||

| Liabilities in Excess of Other Assets | (0.07 | )% | (3,341,898 | ) | ||||

| Total | 100.00 | % | $ | 4,477,528,524 | ||||

The Fund’s classifications of issuers into sectors, industries and sub-industries may differ for financial reporting purposes than for other reporting and compliance purposes. The classifications for purposes of this financial report are unaudited.

| Annual Report | March 31, 2020 | 7 |

March 31, 2020 (Unaudited) | |

Mid Company Fund – Investor and Institutional Share Classes

The beginning of our fiscal year feels like a lifetime ago. Back in April 2019, investors were focused on the ongoing trade war between the U.S. and China, U.S. presidential impeachment, Brexit1, civil unrest in Hong Kong and slowing global economic indicators. While some of these issues have been resolved, they were all subordinated in importance when the novel coronavirus’s deadly potential became apparent in the final quarter of the fiscal year. By March 31, 2020, the virus had taken tens of thousands of human lives, crushed global domestic product (GDP) and prompted unprecedented fiscal and monetary stimulus efforts. Against this backdrop, the S&P 500 fell precipitously for the quarter, declining 19.60%. Although this market drop is unwelcome, it does reflect some recovery. At one point in the quarter, the S&P was down more than 30%, and U.S. stock market operations were even halted intraday to dampen the volatility.

Portfolio Review

For the fiscal year ended March 31, 2020, the Mid Company Fund (Investor share class) declined 3.22%, outperforming the Russell Midcap® Growth Index, which fell 9.45%. While we construct our Fund with the long term in mind, we believe it fared well in this sharply down market, thanks to the attributes of the companies we invest in. Let us explain.

Those familiar with us know that we look to invest in what we believe to be Exceptional Growth Companies. These are companies whose products or services save time, lives, money or headaches, or provide a compelling value to the consumer. They often sell products or services integral to the customers they serve. It may be a software provider like Jack Henry & Associates that powers banking operations, or a technology platform like MarketAxess that facilitates more efficient fixed income trading. We believe Exceptional Growth Companies tend to be market leaders in growing industries, whose business models are difficult to replicate. In addition, we prefer companies with strong balance sheets, high margins and attractive returns on capital—or the ability to generate the latter two in the foreseeable future.

We believe this Exceptional Growth Company bias in our portfolio can be helpful during periods of market distress like we experienced toward the end of the fiscal year. Historically, the stock prices of these companies hold up better in times of market turmoil. For example, during the Financial Crisis (Sept. 30, 2007 to March 31, 2009), the Mid Company Fund declined 31.06%, 16.05 percentage points better than the Russell Mid Cap® Growth’s drop of 47.11%. To be clear, this does not guarantee our portfolio will outperform in declining markets nor do we manage our portfolio to minimize downside volatility. But a focus on Exceptional Growth Companies does provide a useful framework to review how our portfolio holdings fared over the last year.

At present, we own 40 companies in the Fund, and are fully invested with cash below 5% of the Fund’s assets.

Leading Contributors

● | Shopify provides turnkey, cloud-based, business-to-consumer ecommerce solutions primarily to small and medium-sized businesses. Dubbed the “anti-Amazon,” Shopify’s platform facilitates multichannel transactions while enabling companies to build and promote their own brand at a significantly lower cost than the competition. In 2019, the company grew sales 47%, passing eBay to become the second-largest U.S. ecommerce platform, behind only Amazon. We believe Shopify should surpass eBay on a global basis by the end of 2020. Shopify’s move upmarket with Shopify Plus (for larger companies) and burgeoning fulfillment operation provide additional growth drivers, expanding its total addressable market to nearly $100 billion, by our estimation. The ecommerce industry is growing double digits yet still accounts for less than 20% of total U.S. and global retail sales. The ongoing pandemic appears to have accelerated digital commerce adoption. The company’s chief technology officer recently said that Shopify is handling web traffic comparable to Black Friday and is still growing. Although some of this web traffic will recede when global social-distancing efforts are reduced, we believe Shopify will exit this period with far more customers than before. In our opinion, Shopify offers a compelling value proposition and an easy-to-use product that should enjoy many more years of strong revenue and profit growth. |

● | DexCom is a leading manufacturer and marketer of continuous glucose monitors or CGMs. CGMs deliver real-time blood-sugar readings via a handheld device or mobile app, allowing people with diabetes to better manage the disease. CGM popularity has exploded over the past three years and is rapidly replacing self-monitoring (i.e., finger sticks) as the standard of care. DexCom vastly exceeded analysts’ estimates in 2019 as sales increased 43%. User growth was closer to 50% for the year, with active patients approaching 650,000 at year’s end. DexCom achieved GAAP profitability for the first time in 2019, posting a 9.6% operating margin versus the low-to-mid single-digit level predicted by most analysts. Inroads into the pharmacy channel are reducing barriers to access, and partnerships with insulin-delivery device companies should further improve medical outcomes and quality of life for diabetics. We believe there are greater opportunities in the future. Current CGM usage is almost exclusively within the insulin-dependent population of 5-7 million people in the U.S. and Europe. Less than half of this group uses a DexCom CGM or a competing monitoring device, but we expect penetration to approach 80-85% over time. Beyond that, untapped potential for CGMs in non-insulin-dependent, gestational and pre-diabetic |

8 | www.browncapital.com |

The Brown Capital Management Mid Company Fund | |

Management Discussion of Fund Performance | March 31, 2020 (Unaudited) |

populations number in the tens of millions. All of this, coupled with the upcoming release in 2020 of its highly anticipated latest-generation CGM, the G7, drove up the stock more than 100% during the fiscal year. We remain excited about the company’s prospects.

Leading Detractors

● | Norwegian Cruise Line Holdings is the third-largest cruise line operator in the world, with 27 ships and $6.5 billion in sales as of the end of 2019. Its major brands include Norwegian Cruise Line, Oceania Cruises and Regent Seven Seas Cruises. On March 13, 2020, in response to the spreading coronavirus, the company suspended all cruise voyages scheduled between March 13 and April 11. Two weeks later, Norwegian extended the moratorium to May 10, as the contagion showed few signs of abating. Cruise lines and virtually all travel-related companies have performed poorly. Norwegian was no exception, as its shares declined 80% and it is now scrambling to improve its balance sheet amid a new federal ban on cruises for 100 days. The massive disruption caused by COVID-19 clearly requires us to review Norwegian’s long-term growth prospects, but we were already re-evaluating our investment thesis before the pandemic. Several things attracted us to Norwegian when we first invested in the company more than four years ago. A new CEO, the opportunity to expand into China and a renewed commitment to generate higher returns on capital piqued our interest. We were also attracted to the oligopolistic industry structure and a recent acquisition. All of this made us believe the company would enjoy many years of solid revenue and earnings growth. Instead, results have been mixed; returns improved somewhat but the Chinese market was an abject failure, with customer demand and spending trends well below management’s expectations. Furthermore, macroeconomic weakness in Europe and hurricanes in the Eastern Caribbean in 2017 and 2019 led to a capacity oversupply and pricing concerns, as competition intensified in the remaining regions. More importantly, we began to question whether the company met our criteria of an Exceptional Growth Company as our team evolved and we applied added scrutiny to our portfolio holdings. In light of our continuing review of the company, we did not add to our position despite the sharp share-price decline. |

● | Ulta Beauty is a retailer of beauty products and salon services. In a crowded retail landscape, Ulta has grown and differentiated itself by catering to a core group of beauty enthusiasts who appreciate the company’s broad array of both mass and prestige products that are regularly styled to reflect new trends in the product category. Although the company’s share price declined almost 30% in August when Ulta’s 12% quarterly revenue growth failed to meet analyst consensus estimate forecasts, shares are currently under pressure as national social-distancing efforts have closed many of Ulta’s stores. Based on our research and comments from Ulta’s management, we believe the August shortfall was largely driven by a lull in the current cosmetics product cycle that weighed on results for most North American beauty companies. Also, we believe the ongoing pandemic is poised to close more department-store beauty counters, with several of them rumored to be filing for bankruptcy. This should support Ulta’s continued share gains against these competitors. We remain encouraged by the strength of Ulta’s customer-loyalty program, strong investments in its internet business, and recently announced store remodels. In our opinion, Ulta remains one of the best-positioned growth retailers and we added to our position amid the share-price weakness. |

Companies Purchased

● | Charles River Laboratories is an essential products and services provider to the global pharmaceutical and biotechnology industries. In 2019, Charles River was involved in 85% of the drugs approved by the FDA. Through its three primary business units, the company produces drug-research models, conducts drug-safety trials and discovery services, and sells supplies for manufacturing biologic compounds and testing them for impurities. Charles River’s research-models business is the industry’s market-share leader. The biotechnology industry’s increased emphasis on rare diseases is a secular tailwind to Charles River’s three business lines. The company currently produces approximately 50% of small research models for Western markets. We believe that the company’s research-model dominance offers attractive near-term profitability, while its drug-trial services and biologic-compound manufacturing businesses offer an attractive long-term growth opportunity. |

● | MarketAxess is a leading electronic-trading platform for fixed income securities. The company is the largest institutional electronic-trading venue for previously issued emerging-market, U.S. investment-grade, and U.S. high-yield debt, with more than 50% market share in each category. Currently, the U.S. fixed income market is largely conducted via over-the-phone transactions. Electronic trading represents less than 20% of trading volume in the fixed income categories that MarketAxess targets. This is well below the penetration rate of other asset classes like futures and equities, where 70-90% of trades occur electronically. Moving to electronic trading offers fixed income brokers and buyers greater efficiency, cost savings and improved trading liquidity. We believe the benefits of MarketAxess’s trading platform, combined with the currently low penetration rate of electronic trading, create a compelling growth story. |

● | Omnicell is a leading provider of automated pharmacy and business-analytics software solutions for hospitals, long-term care centers and retail pharmacies. According to the FDA, medication errors cause at least one death every day and injure 1.3 million people annually in the U.S. Furthermore, an estimated 11% of all hospital admissions are related to medication non-adherence. Omnicell’s products and services tackle these challenges through on-site devices and cloud-based solutions to deliver virtually zero dispensing errors in central pharmacies, 66% cost reductions in IV drug compounding, 90% medication adherence and 2-10% reductions in direct drug costs in hospitals. Omnicell’s automated medicine-dispensing cabinets and robotic�� pharmacies increase automation and allow healthcare |

Annual Report | March 31, 2020 | 9 |

The Brown Capital Management Mid Company Fund | |

Management Discussion of Fund Performance | March 31, 2020 (Unaudited) |

providers to spend more time with patients. We believe the benefits in lives saved and lower healthcare costs, coupled with early-stage adoption of several of Omnicell’s solutions, provide years of attractive and steady growth.

● | Teladoc Health is the largest global provider of comprehensive telehealth services, offering convenient and low-cost virtual consultations with a diverse array of health-care professionals. Teladoc derives 80% of its revenue from the U.S. and the rest from international markets. Telehealth is significantly underutilized, representing well under 10% of medical consultations globally. Such neglect comes at a cost, as Teladoc estimates $35 billion in U.S. emergency-room and urgent-care costs could be avoided through wider adoption of telehealth services. Lack of awareness and regulatory hurdles have inhibited broader uptake historically but this is beginning to change. The Kaiser Family Foundation saw telehealth offerings for their largest plans rise to 74% in 2018 from 27% in 2015. Last April, the Centers for Medicare and Medicaid Services made telehealth available to all 20 million Medicare Advantage participants, not just members residing in rural areas, as it did previously. While not part of our original thesis, the ongoing coronavirus pandemic could materially increase Teladoc’s growth trajectory as Americans are encouraged to use telehealth rather than visiting doctors’ offices. All said, we believe Teladoc is an Exceptional Growth Company and expect it to expand revenues at a mid-20s rate for the foreseeable future. Earnings may appreciate even faster once it achieves profitability. |

Companies Sold

● | Ellie Mae provides software and services to the residential mortgage industry. The mortgage origination process is notoriously complex and inefficient. Ellie Mae addresses these issues with an integrated, paperless and automated software solution that improves compliance, quality and time to closing. Part of our investment thesis was that Ellie Mae could introduce greater automation into the mortgage process and spur customers to increase spending per mortgage by 200% as traditional manual processes were eliminated. In an effort to drive greater adoption of its premium products, Ellie Mae began allowing a significant portion of customers to only pay for the software when a mortgage was successfully issued, rather than charging a normal monthly subscription fee. This strategy worked enormously well when mortgage rates were low, but when mortgage rates rose in late 2018, revenue growth abruptly stopped and Ellie demonstrated far more cyclicality than we initially expected. On April 17, 2019, the company was acquired by the private equity firm, Thoma Bravo, and we believe we exited our position at a reasonable price. |

● | J.B. Hunt Transport Services provides logistics services in the intermodal-rail, truck-brokerage and truckload-shipping industries. Although the company has substantial market share in the intermodal industry, conversions to intermodal rail typically occur in response to oil prices above $60 per barrel or to truck-driver shortages. Although the number of truck drivers continues to ebb with U.S. employment trends, recent and sustained declines in energy prices have made intermodal-rail shipping less attractive, reducing the growth potential for J.B. Hunt’s large intermodal business. In August 2019, as oil prices were around $50 per barrel, we became convinced that energy prices were unlikely to return to the historic highs that had been a tailwind for J.B. Hunt’s growth. Additionally, we did not believe the company’s truck-brokerage and truckload businesses had enough of a competitive advantage to satisfy our growth expectations. In response to this less attractive outlook, we sold our position to fund more compelling long-term investment opportunities. |

● | Red Hat produces open-source software solutions that provide high performance, scalable and reliable information-technology infrastructure for enterprise customers. Red Hat’s software has been a key enabler of companies operating their software in the cloud. Additionally, many companies are operating in a hybrid cloud atmosphere, with employees using a combination of cloud-based software tools and on-premise software. Red Hat’s solutions have been an excellent tool for allowing software users to operate seamlessly in these hybrid environments. Although we were enthusiastic owners of this company which grew sales 15%-20% annually, in late 2018 IBM struck a deal to acquire Red Hat. IBM’s mainframe products have been losing market share to cloud-software infrastructure vendors for many years, and IBM offered a substantial premium to acquire Red Hat to help stem IBM’s market-share losses. In July 2019 we received proceeds from the sale and have used them to acquire shares of new and existing holdings in the portfolio. |

● | Ultimate Software Group is a leading cloud provider of human-capital-management software. The human-resources industry is undergoing rapid technological transformation and Ultimate is at the forefront of this change. We believe Ultimate is the leading alternative for middle-market companies that are looking for software that does more than just payroll management, including talent management, recruiting and training. Customers have responded favorably to Ultimate’s products and the company enjoyed 97% annual customer retention. The company also delivered a rapid growth rate via new customer adoption and cross-selling new products into the existing customer base. In February 2019, Ultimate’s board of directors recommended accepting a corporate buyout led by Hellman & Friedman. We eliminated our position following the completion of that transaction in May 2019. |

10 | www.browncapital.com |

The Brown Capital Management Mid Company Fund | |

Management Discussion of Fund Performance | March 31, 2020 (Unaudited) |

Closing Thoughts

While the world copes with the effects of COVID-19, Brown Capital remains focused on finding and investing in what we believe to be Exceptional Growth Companies. Indeed, little has changed for us outside of the precautions we are taking of limiting travel, working remotely, practicing social distancing and following other government guidelines. As you can imagine, we have received numerous questions about our business since the pandemic began: “Have you experienced significant outflows?”, “Have you shut down any products?”, and “Have you laid off staff?” Fortunately, we are privileged to manage money for like-minded, long-term clients so the answer to the aforementioned questions is simply No. We believe the resilience of our portfolios has been matched by the relative strength of our business as we saw net inflows over the reporting period and our assets under management is greater on March 31, 2020 than at the start of 2019.

We made a number of internal changes. In the December 2019 quarter, Brown Capital made an exciting organizational announcement. Keith A. Lee, president of Brown Capital and a senior portfolio manager on the Small Company Team, took on the additional role of chief investment officer. For several months prior, Keith had been working with the other portfolio management teams at Brown Capital to leverage the philosophy and process that the Small Company team honed over the years. The role of CIO is in recognition of Keith’s cross-team leadership. In addition, we hired Michael L. Forster, CPA, CGMA as chief operating officer and chief financial officer. Mike’s role as COO/CFO is a newly created one in which he assumes management responsibilities from Chief Administrative Officer Cecil E. Flamer, CPA, CGMA, and from Keith. Mike is taking on oversight of administration, finance and IT responsibilities from Cecil, as well as the operations, compliance and trading functions from Keith. Cecil has announced that he will retire on June 30, 2020.

During the March 2020 quarter, we welcomed two additions to our firm’s Management Committee: Damien Davis, managing director and senior portfolio manager on our Small Company Fund; and Mike Forster, our chief operating officer and chief financial officer. We think the deep understanding of our investment philosophy and the fresh ideas they bring will serve us well as we move forward. You can find more details on these announcements on our website at browncapital.com/blog.

Thank you for your continued support of Brown Capital Management.

Disclosures

1 | Brexit: an abbreviation for “British exit,” which refers to the June 23, 2016, referendum whereby British citizens voted to exit the European Union. |

S&P 500 Index: The S&P 500 or Standard & Poor’s 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. The index is widely regarded as the best gauge of large-cap U.S. equities.

Russell Midcap® Growth Index: The Russell Midcap® Growth Index measures the performance of those Russell Midcap companies with higher price-to-book ratios and higher forecasted growth values.

You cannot invest directly in an index.

Past performance is not a guarantee of future results.

Annual Report | March 31, 2020 | 11 |

The Brown Capital Management Mid Company Fund |

|

| March 31, 2020 (Unaudited) |

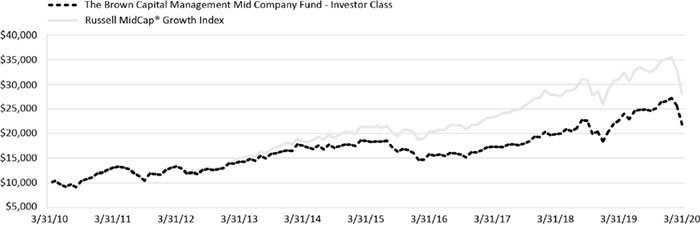

Growth of a hypothetical $10,000 investment - Investor Class

This graph assumes an initial investment of $10,000 at March 31, 2010. All dividends and distributions are reinvested. This graph depicts the performance of The Brown Capital Management Mid Company Fund (the “Fund”) Investor Class versus the Russell MidCap® Growth Index. It is important to note that the Fund is a professionally managed mutual fund while the index is not available for investment and is unmanaged. The comparison is shown for illustrative purposes only.

Performance (as of March 31, 2020)

|

|

|

|

|

| Total |

|

|

| Annual | Net Annual | ||||

|

|

|

|

| Since | Fund | Fund |

| Average Annual Total Returns | Inception | Operating | Operating | |||

| 1 Year | 3 Year | 5 Year | 10 Year | 9/30/02 | Expenses | Expenses |

The Brown Capital Management Mid Company Fund - Investor Class | -3.22% | 8.21% | 3.40% | 8.15% | 9.25% | 2.06% | 1.15% |

The Brown Capital Management Mid Company Fund - Institutional Class | -2.99% | 8.48% | 3.67% | 8.40% | 9.39% | 1.81% | 0.90% |

Russell MidCap® Growth Index | -9.45% | 6.53% | 5.61% | 10.89% | 10.92% |

|

|

Morningstar Mid-Cap Growth Category | -9.86% | 5.69% | 4.91% | 9.81% | 9.74% |

|

|

MCF-Investor Percentile Ranking vs.Total Funds | 11/611 | 20/567 | 68/498 | 78/386 | N/A |

|

|

MCF-Institutional Percentile Ranking vs.Total Funds in M-Star Mid-Cap Growth Category | 10/611 | 19/567 | 65/498 | 75/386 | N/A |

|

|

The performance information quoted above represents past performance, which is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. An investor may obtain performance data current to the most recent month-end by visiting www.browncapital.com.

The expense ratios shown are from the Fund’s prospectus dated July 30, 2019, for the Institutional Class and from the amended prospectus dated November 1, 2019 for the Investor Class. These numbers may vary from the expense ratios shown elsewhere in this report because it is based on a different time period.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Average annual total returns are historical in nature and measure net investment income and capital gain or loss from portfolio investments assuming reinvestments of distributions.

12 | www.browncapital.com |

The Brown Capital Management Mid Company Fund |

|

| March 31, 2020 (Unaudited) |

Investing in the securities of mid-sized companies generally involves greater risk than investing in larger, more established companies. Therefore, investments in the Fund may involve a greater degree of risk than investments in other mutual funds that seek capital growth by investing in larger, more established companies.

The Institutional Class of the Fund commenced operations on December 15, 2011. The historical performance shown for periods prior to December 15, 2011 was calculated synthetically using the performance and the fees and expenses of the Investor Class. If the Institutional Class had been available during the periods prior to December 15, 2011, the performance shown may have been different. Please refer to the Fund’s prospectus for further details concerning historical performance.

The Russell MidCap® Growth Index measures the performance of those Russell MidCap companies with higher price-to-book ratios and higher forecasted growth values.

Morningstar Mid-Cap Growth Category – Some mid-cap growth portfolios invest in stocks of all sizes, thus leading to a mid-cap profile, but others focus on midsize companies. Mid-cap growth portfolios target U.S. firms that are projected to grow faster than other mid-cap stocks, therefore commanding relatively higher prices. The U.S. mid-cap range for market capitalization typically falls between $1 billion-$8 billion and represents 20% of the total capitalization of the U.S. equity markets. Growth is defined based on fast growth (high growth rates for earnings, sales, book value, and cash flow) and high valuations (high price ratios and low dividend yields).

You cannot invest directly in an index.

Note: Diversification does not eliminate the risk of experiencing investment losses.

Annual Report | March 31, 2020 | 13 |

| The Brown Capital Management Mid Company Fund | |

| Schedule of Investments | March 31, 2020 |

| Shares | Value (Note 1) | |||||

| COMMON STOCKS - 97.38% | ||||||

| Business Services - 20.64% | ||||||

| 8,107 | Bright Horizons Family Solutions, Inc.(a) | $ | 826,914 | |||

| 11,972 | Envestnet, Inc.(a) | 643,854 | ||||

| 6,186 | Equifax, Inc. | 738,918 | ||||

| 4,272 | Jack Henry & Associates, Inc. | 663,185 | ||||

| 15,875 | RealPage, Inc.(a) | 840,264 | ||||

| 4,263 | Tyler Technologies, Inc.(a) | 1,264,235 | ||||

| 4,977,370 | ||||||

| Consumer Related - 8.59% | ||||||

| 648 | Chipotle Mexican Grill, Inc.(a) | 424,051 | ||||

| 3,961 | Expedia, Inc. | 222,885 | ||||

| 9,529 | LKQ Corp.(a) | 195,440 | ||||

| 8,507 | Norwegian Cruise Line Holdings, Ltd.(a) | 93,237 | ||||

| 1,093 | O'Reilly Automotive, Inc.(a) | 329,048 | ||||

| 2,607 | Tractor Supply Co. | 220,422 | ||||

| 2,927 | Ulta Beauty, Inc.(a) | 514,274 | ||||

| 7,825 | Under Armour, Inc. - Class A(a) | 72,068 | ||||

| 2,071,425 | ||||||

| Financial Services - 10.91% | ||||||

| 7,717 | Broadridge Financial Solutions, Inc. | 731,803 | ||||

| 3,427 | FleetCor Technologies, Inc.(a) | 639,273 | ||||

| 2,372 | MarketAxess Holdings, Inc. | 788,856 | ||||

| 4,829 | T Rowe Price Group, Inc. | 471,552 | ||||

| 2,631,484 | ||||||

| Industrial Products & Systems - 12.67% | ||||||

| 17,557 | Cognex Corp. | 741,257 | ||||

| 27,878 | Fastenal Co. | 871,187 | ||||

| 5,737 | IPG Photonics Corp.(a) | 632,676 | ||||

| 5,405 | Quanta Services, Inc. | 171,501 | ||||

| 8,664 | SiteOne Landscape Supply, Inc.(a) | 637,844 | ||||

| 3,054,465 | ||||||

| Information/Knowledge Management - 17.67% | ||||||

| 2,772 | ANSYS, Inc.(a) | 644,407 | ||||

| 4,613 | Autodesk, Inc.(a) | 720,089 | ||||

| 3,509 | Blackbaud, Inc. | 194,925 | ||||

| 7,088 | Guidewire Software, Inc.(a) | 562,149 | ||||

| 14,564 | Manhattan Associates, Inc.(a) | 725,578 | ||||

| 3,391 | Shopify, Inc. - Class A(a) | 1,413,810 | ||||

| 4,260,958 | ||||||

| Medical/Health Care - 26.90% | ||||||

| 2,329 | Align Technology, Inc.(a) | 405,129 | ||||

| 3,670 | Cerner Corp. | 231,173 | ||||

| 3,936 | Charles River Laboratories International, Inc.(a) | 496,763 | ||||

| 4,080 | DexCom, Inc.(a) | 1,098,622 | ||||

| 3,767 | Edwards Lifesciences Corp.(a) | 710,531 | ||||

| 1,210 | Jazz Pharmaceuticals PLC(a) | 120,685 | ||||

| 5,448 | Masimo Corp.(a) | 964,950 | ||||

| 9,215 | Omnicell, Inc.(a) | 604,320 | ||||

| 1,418 | Teladoc Health, Inc.(a) | 219,804 | ||||

| 14 | www.browncapital.com |

| The Brown Capital Management Mid Company Fund | |

| Schedule of Investments | March 31, 2020 |

| Shares | Value (Note 1) | |||||

| COMMON STOCKS - 97.38% (continued) | ||||||

| Medical/Health Care - 26.90% (continued) | ||||||

| 6,356 | Veeva Systems, Inc. - Class A(a) | $ | 993,888 | |||

| 5,462 | Zoetis, Inc. | 642,823 | ||||

| 6,488,688 | ||||||

| Total Common Stocks (Cost $18,272,630) | 23,484,390 | |||||

| SHORT TERM INVESTMENTS - 3.70% | ||||||

| 892,268 | Dreyfus Government Cash Management Institutional Shares, 0.29%(b) | 892,268 | ||||

| Total Short Term Investments (Cost $892,268) | 892,268 | |||||

| Total Value of Investments (Cost $19,164,898) - 101.08% | 24,376,658 | |||||

| Liabilities in Excess of Other Assets - (1.08)% | (259,335) | |||||

| Net Assets - 100.00% | $ | 24,117,323 | ||||

| (a) | Non-income producing investment. |

| (b) | Represents 7 day effective yield at March 31, 2020. |

See Notes to Financial Statements.

Summary of Investments by Sector (Unaudited)

| Sector | % of Net Assets | Value | ||||||

| Business Services | 20.64% | $ | 4,977,370 | |||||

| Consumer Related | 8.59% | 2,071,425 | ||||||

| Financial Services | 10.91% | 2,631,484 | ||||||

| Industrial Products & Systems | 12.67% | 3,054,465 | ||||||

| Information/Knowledge Management | 17.67% | 4,260,958 | ||||||

| Medical/Health Care | 26.90% | 6,488,688 | ||||||

| Short Term Investments | 3.70% | 892,268 | ||||||

| Liabilities in Excess of Other Assets | (1.08)% | (259,335 | ) | |||||

| Total | 100.00% | $ | 24,117,323 | |||||

The Fund's classifications of issuers into sectors, industries and sub-industries may differ for financial reporting purposes than for other reporting and compliance purposes. The classifications for purposes of this financial report are unaudited.

| Annual Report | March 31, 2020 | 15 |

| The Brown Capital Management International Equity Fund | |

| Management Discussion of Fund Performance | March 31, 2020 (Unaudited) |

International Equity Fund – Investor and Institutional Share Classes

The International Equity Fund posted negative performance for the fiscal year ended March 31, 2020, with the Investor Share Class returning -5.85%, which was well ahead of the MSCI EAFE Index return of -13.93% and the MSCI AC World (Ex US) Index return of -15.14%. For the year, the Fund ranked in the 74th percentile (top 26%) out of 466 peer funds based on total returns in Morningstar’s Foreign Large Growth Category.

Portfolio Review

This fiscal year began during one of the longest bull markets in history and ended with the fastest plunge into a bear market ever. The COVID-19 pandemic, like the Great Financial Crisis1 and Brexit2, is a “Black Swan”3event that rather suddenly thrusts global markets and economies into unexpected turmoil. In just a few weeks in February 2020, we went from exchanging Valentine’s Day treats and planning Spring Break vacations to stockpiling essentials and homeschooling our children. At Brown Capital, we have seen exogenous shocks before and built our portfolios upon the principles of Exceptional Growth Company investing. A core feature of Exceptional Growth Companies is durable revenue growth, not only when the macroeconomic tide is high, but also when the tide goes out altogether.

As COVID-19 was first tanking international equity markets, we were coincidently finishing up a comprehensive review of our International Equity Fund portfolio that had lasted several months. As a reminder, our goal in the Fund is to find and invest in what we believe to be 40-70 Exceptional Growth Companies that save time, lives, money and headaches, or provide exceptional value to customers. In general, given our 3-5 year initial evaluation horizon, we ask questions such as: “Will this company be profitable enough to reinvest in growth initiatives?”, “What new products and services will drive future growth?” and “Do our portfolio holdings still meet our criteria of an Exceptional Growth Company?.” In our recent examination, we specifically scrutinized our holdings through the lens of durable revenue growth.

This multiquarter review resulted in us executing a higher-than-average number of new buys and sells during the period, as discussed below. It’s important to note that our actions coincided with the onset of the novel coronavirus, as opposed to being driven by this external force. We believe the changes we have made have resulted in holdings with higher, more durable revenue growth and a portfolio that is better positioned to weather short-term shocks throughout a full business cycle.

In addition to our comprehensive review, we responded to the pandemic by performing a coronavirus-oriented, company-by-company analysis focused on liquidity and balance-sheet risk. While we regularly review our company holdings, this difficult period demanded a thorough re-examination of our holdings. This review specifically led to the elimination ofCarnival Corporation, as discussed below. We remain vigilant about risks and opportunities in these extraordinary times of rising unemployment, unprecedented government and central bank responses, and the global disruption of daily life.

At present, we own 40 companies across 15 countries. The portfolio is fully invested and cash remains below 5% of the Fund’s assets.

Leading Contributors

Among our top contributors for the period wereCarl Zeiss Meditec andGrifols.

| • | Carl Zeiss Meditec is a Germany-based, ophthalmology-focused medical technology company. It has a culture and history of innovation in optics dating back to 1846. Much more recently, Zeiss invented a less-invasive alternative to Lasik surgery called ReLEx SMILE. With the help of ReLEx SMILE and other products, the company grew revenues nearly 14% year over year in 2019, as its products took share in the $12-billion surgical and diagnostic ophthalmology market. This market is expanding about 4-5% a year, which means Carl Zeiss grew nearly three times as fast as the market. We believe Carl Zeiss’s management team has guided the company to greater profitability by extending its technology leadership in cataracts and by increasing high-margin recurring revenue. We remain optimistic that new products such as the ReLEx SMILE will help Carl Zeiss deliver above-market growth rates in the future, especially once elective surgeries resume. |

| • | Grifols S.A. saves lives by producing plasma-based products to treat rare, chronic and life-threatening diseases. Grifols is Europe’s leading plasma company and one of the dominant players globally. It is arguably the most vertically integrated company within the industry. In December 2019, Grifols presented Phase-2 study results for AMBAR, a treatment for Alzheimer’s disease. The new data shows a reduction in the progression of the disease in patients with mild-to-moderate Alzheimer’s, sending Grifols shares higher. Grifols’s revenue growth has remained resilient during the COVID-19 pandemic. First quarter revenues grew nearly 12% over last year, while plasma-collections operations were deemed essential businesses. We remain optimistic about the company’s ability to find innovative therapies derived from plasma. Grifols is even working on a treatment for COVID-19 using convalescent plasma, or antibodies derived from COVID-19 patients. |

Leading Detractors

Our top two detractors for the period wereIpsen andCarnival Corporation.

| • | Ipsendevelops, manufactures and sells pharmaceuticals worldwide. The French specialty-pharmaceutical company focuses in the therapeutic areas of oncology, neuroscience, consumer healthcare and rare diseases. Ipsen’s highest-revenue drug, Somatuline, is the |

| 16 | www.browncapital.com |

| The Brown Capital Management International Equity Fund | |

| Management Discussion of Fund Performance | March 31, 2020 (Unaudited) |

first and only FDA-approved treatment to slow the growth of gastrointestinal and pancreatic neuroendocrine tumors. Ipsen performed poorly in the fiscal year as concerns built about future generic competition to Somatuline. Additionally, the recently acquired drugs Palovarotene and Onviyde now have lower peak revenues than previously believed. These disappointments have led to turnover in senior management. We remain optimistic about Ipsen’s ability to drive growth from its pipeline, which includes roughly 20 drugs in clinical trials currently.

| • | Carnival Corporation is the world’s largest cruise-ship company with a portfolio of nine leading cruise lines and more than 100 cruise ships in total. The novel coronavirus has all but halted travel in the cruise industry. The degree of operating leverage in this business is significant. The company estimates that it will need at least $1 billion per month in capital as long as vessels are not cruising. In response to these unprecedented conditions, management fully utilized its available credit and raised more than $6.5 billion in new capital from senior secured notes, convertible bonds, and nearly $600 million in equity. Given the uncertainty around Carnival’s revenue durability and balance-sheet strength over the medium term, we chose to eliminate our position this quarter. |

Companies Purchased

As mentioned above, the International Team made a comprehensive review of the portfolio resulting in more activity than in past periods. In the fiscal year, we established new positions inAbcam, CyberArk, The Descartes Systems Group, GMO Payment Gateway, Kakaku.com, M3, MonotaRO, Ocado Group, Partners Group, REA Group and SimCorp.Generally, we believe these companies have long-term growth prospects and meet the four criteria of an Exceptional Growth Company—deliverability of growth plan, defensibility of market presence, durability of revenue growth and profitability to fuel and sustain the business.

Companies Sold

During the period, we soldAvadel Pharmaceuticals, BAE Systems, Canadian Natural Resources, Carnival, Johnson Controls, Kone, Man Group, Mitsubishi Estate, Nestle, Sanofi, Sapporo, Sasol, Societe BIC, Swatch Group, Teva Pharmaceutical Industries, Total Produce and Yamaha Motor.There are four primary reasons we sell a holding: the reasons for our purchase have changed, we have determined the company to be a mistake, we think the company is overvalued, or we sell for tactical considerations or better ideas. Generally, these companies no longer met our standard of an Exceptional Growth Company; thus, the reasons for our purchase changed or we deemed them a mistake.

To see the rationale behind our portfolio changes, let’s considerNestle (sold) andOcado (bought) as an illustrative example. Nestle is a mature, global packaged food company with a wide range of goods from chocolate to coffee. In the past, we have written about how Nestle was trying to grow by globalizing its business and penetrating many of its target markets. Ocado, also in the food business, is a U.K.-based company that has built a profitable, end-to-end solution for selling groceries online. The solution includes a customer interface (website or mobile app), inventory management, robotic picking and optimized delivery routes. Ocado has begun partnering with grocers all over the world to roll out this solution. These partnerships allow the company to collect a percentage of the revenues that flow through its partners’ systems. As revenues grow from these partnerships, so will returns on capital, as Ocado will not bear the majority of the capital burden required to build new Customer Fulfillment Centers (CFC). CFCs are large warehouses where the picking and sorting of orders occurs, a key component of selling groceries online. While the market for grocery items will likely grow in the low to mid-single digits, the channel shift to online may help accelerate Ocado’s growth into the double digits into the foreseeable future.

Closing Thoughts

While the world copes with the effects of COVID-19, Brown Capital remains focused on finding and investing in what we believe to be Exceptional Growth Companies. Indeed, little has changed for us outside of the precautions we are taking of limiting travel, working remotely, practicing social distancing and following other government guidelines. As you can imagine, we have received numerous questions about our business since the pandemic began: “Have you experienced significant outflows?”, “Have you shut down any products?”, and “Have you laid off staff?” Fortunately, we are privileged to manage money for like-minded, long-term clients so the answer to the aforementioned questions is simply No. We believe the resilience of our portfolios has been matched by the relative strength of our business as we saw net inflows over the reporting period and our assets under management is greater on March 31, 2020 than at the start of 2019.

We made a number of internal changes. In the December 2019 quarter, Brown Capital made an exciting organizational announcement. Keith A. Lee, president of Brown Capital and a senior portfolio manager on the Small Company Team, took on the additional role of chief investment officer. For several months prior, Keith had been working with the other portfolio management teams at Brown Capital to leverage the philosophy and process that the Small Company team honed over the years. The role of CIO is in recognition of Keith’s cross-team leadership. In addition, we hiredMichael L. Forster, CPA, CGMA as chief operating officer and chief financial officer. Mike’s role as COO/CFO is a newly created one in which he assumes management responsibilities from Chief Administrative OfficerCecil E. Flamer, CPA, CGMA, and from Keith. Mike is taking on oversight of administration, finance and IT responsibilities from Cecil, as well as the operations, compliance and trading functions from Keith. Cecil has announced that he will retire on June 30, 2020.

During the March 2020 quarter, we welcomed two additions to our firm’s Management Committee:Damien Davis, managing director and senior portfolio manager on our Small Company Fund; andMike Forster, our chief operating officer and chief financial officer. We think the deep

| Annual Report | March 31, 2020 | 17 |

| The Brown Capital Management International Equity Fund | |

| Management Discussion of Fund Performance | March 31, 2020 (Unaudited) |

understanding of our investment philosophy and the fresh ideas they bring will serve us well as we move forward. You can find more details on these announcements on our website at browncapital.com/blog.

Thank you for your continued support of Brown Capital Management.

Disclosures

| 1 | Great Financial Crisis: The financial crisis of 2007–08, also known as the global financial crisis (GFC), was a severe worldwide economic crisis. It is considered by many economists to have been the most serious financial crisis since the Great Depression of the 1930s. |

| 2 | Brexit: an abbreviation for "British exit," which refers to the June 23, 2016, referendum whereby British citizens voted to exit the European Union. |

| 3 | Black Swan: An unpredictable or unforeseen event, typically one with extreme consequences. |

MSCI EAFE Index: The MSCI EAFE International Gross Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is design to measure the equity market performance of developed markets excluding the U.S. and Canada. You cannot invest directly into an index.

MSCI AC World (Ex US) Index: The MSCI All Country World ex USA Small Cap Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets, excluding the United States.

Peer Group Rankings reflect performance when compared to similarly managed funds as defined by rating agency, Morningstar. In these ratings systems the top performer(s) is reflected in first percentile (1st Percentile) and the worst performer(s) in the one hundredth percentile (100th Percentile). Actual numerical peer rankings are unavailable via Morningstar, only percentile outcomes are available.

Morningstar Foreign Large Growth Category – portfolios focus on high-priced growth stocks, mainly outside of the United States. Most of these portfolios divide their assets among a dozen or more developed markets, including Japan, Britain, France, and Germany. These portfolios primarily invest in stocks that have market caps in the top 70% of each economically integrated market (such as Europe or Asia ex-Japan). Growth is defined based on fast growth (high growth rates for earnings, sales, book value, and cash flow) and high valuations (high price ratios and low dividend yields). These portfolios typically will have less than 20% of assets invested in U.S. stocks. For the 3, 5, and 10 year periods, the Investor Share Class of the International Equity Fund was ranked 43rd percentile out of 409, 52nd percentile out of 340, and 64th percentile out of 248 as of 3/31/20 based on total returns relative to our peers in the Morningstar Foreign Large Growth Category.

You cannot invest directly in an index.

Past performance is not a guarantee of future results.

| 18 | www.browncapital.com |

| The Brown Capital Management International Equity Fund | |

| March 31, 2020 (Unaudited) |

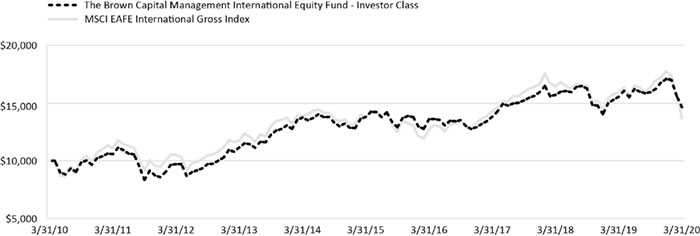

Growth of a hypothetical $10,000 investment - Investor Class

This graph assumes an initial investment of $10,000 at March 31, 2010. All dividends and distributions are reinvested. This graph depicts the performance of The Brown Capital Management International Equity Fund (the “Fund”) Investor Class versus the MSCI EAFE International Gross Index. It is important to note that the Fund is a professionally managed mutual fund while the index is not available for investment and is unmanaged. The comparison is shown for illustrative purposes only.

Performance(as of March 31, 2020)

| Total | ||||||||||||||

| Annual | Net Annual | |||||||||||||

| Since | Fund | Fund | ||||||||||||

| Average Annual Total Returns | Inception | Operating | Operating | |||||||||||

| 1 Year | 3 Year | 5 Year | 10 Year | 5/28/99 | Expenses | Expenses | ||||||||

| The Brown Capital Management International Equity Fund - Investor Class | -5.85% | 1.94% | 1.19% | 3.90% | 3.51% | 1.84% | 1.26% | |||||||

| The Brown Capital Management International Equity Fund - Institutional Class | -5.63% | 2.21% | 1.44% | 4.06% | 3.58% | 1.60% | 1.01% | |||||||

| MSCI EAFE® International Gross Index | -13.93% | -1.33% | -0.13% | 3.20% | 3.51% | |||||||||

| Morningstar Foreign Large Growth Category | -8.45% | 2.22% | 1.86% | 4.49% | 4.42% | |||||||||

| IEF-Investor Percentile Ranking vs Total Funds in M-Star Foreign Large Growth Category | 26/466 | 43/409 | 52/340 | 64/248 | N/A | |||||||||

| IEF-Institutional Percentile Ranking vs Total Funds in M-Star Foreign Large Growth Category | 24/466 | 41/409 | 49/340 | 58/248 | N/A | |||||||||

The performance information quoted above represents past performance, which is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. An investor may obtain performance data current to the most recent month-end by visiting www.browncapital.com.

The expense ratios shown are from the Fund’s prospectus dated July 30, 2019. These numbers may vary from the expense ratios shown elsewhere in this report because it is based on a different time period.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Average annual total returns are historical in nature and measure net investment income and capital gain or loss from portfolio investments assuming reinvestments of distributions.

| Annual Report | March 31, 2020 | 19 |

| The Brown Capital Management International Equity Fund | |

| March 31, 2020 (Unaudited) |