UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06223

Legg Mason Tax Free Income Fund

(Exact name of registrant as specified in charter)

55 Water Street, New York, NY 10041

(Address of principal executive offices) (Zip code)

Robert I. Frenkel, Esq.

Legg Mason & Co., LLC

100 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-877-721-1926

Date of fiscal year end: March 31

Date of reporting period: September 30, 2011

| ITEM 1. | REPORT TO STOCKHOLDERS. |

The Semi-Annual Report to Stockholders is filed herewith.

September 30, 2011

Semi-Annual Repor t

Legg Mason

Investment Counsel

Maryland Tax-Free Income Trust

INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

| | |

| II | | Legg Mason Investment Counsel Maryland Tax-Free Income Trust |

Fund objective

The Fund seeks a high level of current income exempt from federal and Maryland state and local income taxes*, consistent with prudent investment risk and preservation of capital.

| * | Certain investors may be subject to the federal alternative minimum tax (“AMT”), and state and local taxes may apply. Capital gains, if any, are fully taxable. Please consult your personal tax or legal adviser. |

Letter to our shareholders

Dear Shareholder,

We are pleased to provide the semi-annual report of Legg Mason Investment Counsel Maryland Tax-Free Income Trust for the six-month reporting period ended September 30, 2011. Please read on for Fund performance information and a detailed look at prevailing economic and market conditions during the Fund’s reporting period.

As always, we remain committed to providing you with excellent service and a full spectrum of investment choices. We also remain committed to supplementing the support you receive from your financial advisor. One way we accomplish this is through our website, www.leggmason.com/individualinvestors. Here you can gain immediate access to market and investment information, including:

| Ÿ | | Fund prices and performance, |

| Ÿ | | Market insights and commentaries from our portfolio managers, and |

| Ÿ | | A host of educational resources. |

We look forward to helping you meet your financial goals.

Sincerely,

| | |

| |  |

| |

| Mark R. Fetting | | R. Jay Gerken, CFA |

| Chairman | | President |

October 28, 2011

| | | | |

| Legg Mason Investment Counsel Maryland Tax-Free Income Trust | | | III | |

Investment commentary

Economic review

Although the U.S. economy continued to grow over the six months ended September 30, 2011, the pace of the expansion was disappointing, which resulted in a significant shift in investor sentiment. During the first month of the period, there were expectations of an improving economy and generally robust investor risk appetite. However, as the reporting period progressed, weakening economic data, the downgrading of U.S. government securities by Standard & Poor’s (“S&P”) and the European debt crisis resulted in increased investor risk aversion.

U.S. gross domestic product (“GDP”)i growth, as reported by the U.S. Department of Commerce, has been less robust than during most other periods exiting a severe recession. GDP growth was 2.3% during the fourth quarter of 2010 and 3.0% for calendar 2010 as a whole. The Commerce Department then reported that first and second quarter 2011 GDP growth were 0.4% and 1.3%, respectively. This moderation in growth during the first half of the calendar year was due to a variety of factors, including less robust export activity and a deceleration in consumer spending given higher oil and food prices. The advance estimate for third quarter GDP growth was 2.5%. Accelerating growth was attributed, in part, to higher consumer spending, which grew 2.4% in the third quarter, versus a modest 0.7% gain in the second quarter.

Turning to the job market, while there was some modest improvement in early 2011 (before the reporting period began), unemployment again moved higher and remained elevated throughout the reporting period. After dipping below 9.0% in February and March 2011 (to 8.9% and 8.8%, respectively), unemployment, as reported by the U.S. Department of Labor, moved back to 9.0% in April. Unemployment stayed above 9.0% over the next five months and ended September at 9.1%. Additionally, as of the end of the reporting period, approximately fourteen million Americans looking for work had yet to find a job, and more than 44% of these individuals have been out of work for more than six months.

The housing market continued to experience challenges during the reporting period. Looking back, existing-home sales moved somewhat higher toward the end of 2010 and in January 2011, according to the National Association of Realtors (“NAR”). However, existing-home sales then declined during five of the next eight months. At the end of September, the inventory of unsold homes was an 8.5 month supply at the current sales level, versus an 8.4 month supply in August. Existing-home prices were weak versus a year ago, with the NAR reporting that the median existing-home price for all housing types was $165,400 in September 2011, down 3.5% from September 2010.

Even the manufacturing sector, one of the stalwarts of the economy in recent years, softened during much of the reporting period. Based on the Institute for Supply Management’s PMI (“PMI”)ii, the manufacturing sector grew twenty-six consecutive months since it began expanding in August 2009. In February 2011 (before the reporting period began), the manufacturing sector expanded at its fastest pace since May 2004, with a reading of 61.4 (a reading below 50 indicates a contraction, whereas a reading above 50 indicates an expansion). The PMI generally moderated during the reporting period, reaching a low of 50.6 in August — the worst reading in two years. Manufacturing activity then modestly increased to 51.6 in September.

Financial market overview

While lower-quality U.S. bonds generated positive results early in the reporting period, these gains were later erased. This setback was triggered by a variety of factors, including concerns regarding the global economy, the ongoing European sovereign debt crisis and the S&P down-

| | |

| IV | | Legg Mason Investment Counsel Maryland Tax-Free Income Trust |

Investment commentary (cont’d)

grade of U.S. Treasuries. Against this backdrop, investors sought refuge in higher-quality securities as their sentiment became generally more negative.

The Federal Reserve Board (“Fed”)iii took a number of actions as it sought to meet its dual mandate of fostering maximum employment and price stability. In November 2010 (prior to the beginning of the reporting period), the Fed announced a second round of quantitative easing (often referred to as “QE2”) to help stimulate the economy, entailing the purchase of $600 billion of long-term U.S. Treasury securities by the end of the second quarter of 2011.

In June, the Fed announced that QE2 would end on schedule at the end of the month. However, given ongoing strains on the economy, it made no overtures toward reversing any of its accommodative policies, and stated it would “maintain its existing policy of reinvesting principal payments from its securities holdings” rather than seeking to reduce the size of its balance sheet.

Also, as has been the case since December 2008, the Fed kept the federal funds rateiv at a historically low range between zero and 0.25%. In addition, in August 2011, the Fed declared its intention to keep the federal funds rate between zero and 0.25% until mid-2013.

At its meeting in September 2011, the Fed announced its intention to purchase $400 billion of longer-term Treasury securities and to sell an equal amount of shorter-term Treasury securities by June 2012 (often referred to as “Operation Twist”). The Fed said, “This program should put downward pressure on longer-term interest rates and help make broader financial conditions more accommodative.”

Fixed income market review

The spread sectors (non-Treasuries) began the reporting period on a positive note, as they rallied in April 2011. Risk aversion then increased given a host of disappointing economic data, a further escalation of the European sovereign debt crisis and the S&P rating downgrade of U.S. sovereign debt. While the spread sectors generally posted positive results during the six-month reporting period, they tended to underperform equal-durationv Treasuries.

Both short- and long-term Treasury yields fluctuated but, overall, moved lower during the six months ended September 30, 2011. When the period began, two- and ten-year Treasury yields were 0.80% and 3.47%, respectively. In the beginning of the reporting period, yields initially moved higher given expectations for stronger growth in 2011 and the potential for rising inflation, with two- and ten-year Treasury yields peaking at 0.85% and 3.59%, respectively, in April 2011. Yields then declined during much of the remainder of the period due to disappointing economic data and increased risk aversion. During the height of the flight to quality in September, two-year Treasuries hit their low for the reporting period of 0.16% and ten-year Treasuries reached their reporting period trough of 1.72%. When the period ended on September 30, 2011, two-year Treasury yields were 0.25% and ten-year Treasury yields were 1.92%.

The municipal bond market outperformed its taxable bond counterpart over the six months ended September 30, 2011. Over that period, the Barclays Capital Municipal Bond Indexvi and the Barclays Capital U.S. Aggregate Indexvii returned 7.85% and 6.20%, respectively. The municipal bond market outperformed the taxable bond market during five of the six months of the period given improving tax revenues, a sharp decline in new issuance, increased demand and low default rates. Additionally, investor sentiment improved as a number of states made progress toward shoring up their financial situation by raising taxes and cutting expenses.

| | | | |

| Legg Mason Investment Counsel Maryland Tax-Free Income Trust | | | V | |

Performance review

For the six months ended September 30, 2011, Class A shares of Legg Mason Investment Counsel Maryland Tax-Free Income Trust, excluding sales charges, returned 7.63%. The Fund’s unmanaged benchmark, the Barclays Capital Municipal Bond Index, returned 7.85% for the same period. The Lipper Maryland Municipal Debt Funds Category Average1 returned 7.84% over the same time frame.

Certain investors may be subject to the federal alternative minimum tax, and state and local taxes may apply. Capital gains, if any, are fully taxable. Please consult your personal tax or legal adviser.

| | | | |

Performance Snapshot as of September 30, 2011

(unaudited) | |

| (excluding sales charges) | | 6 months | |

| Legg Mason Investment Counsel Maryland Tax-Free Income Trust: | |

Class A | | | 7.63 | % |

Class C | | | 7.32 | % |

Class I | | | 7.80 | % |

| Barclays Capital Municipal Bond Index | | | 7.85 | % |

| Lipper Maryland Municipal Debt Funds Category Average | | | 7.84 | % |

The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value, investment returns and yields will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.leggmason.com/individualinvestors.

All share class returns assume the reinvestment of all distributions, including returns of capital, if any, at net asset value and the deduction of all Fund expenses. Returns have not been adjusted to include sales charges that may apply or the deduction of taxes that a shareholder would pay on Fund distributions. If sales charges were reflected, the performance quoted would be lower. Performance figures for periods shorter than one year represent cumulative figures and are not annualized.

Fund performance figures reflect fee waivers and/or expense reimbursements, without which the performance would have been lower.

The 30-Day SEC Yields for the period ended September 30, 2011 for Class A, Class C and Class I shares were 3.15%, 2.69% and 3.47%, respectively. Absent fee waivers and/or expense reimbursements, the 30-Day SEC Yields for Class A, Class C and Class I shares would have been 2.94%, 2.47% and 3.21%, respectively. The 30-Day SEC Yield is subject to change and is based on the yield to maturity of the Fund’s investments over a 30-day period and not on the dividends paid by the Fund, which may differ.

|

| Total Annual Operating Expenses (unaudited) |

As of the Fund’s current prospectus dated July 31, 2011, the gross total annual operating expense ratios for Class A, Class C and Class I shares were 0.84%, 1.43% and 0.78%, respectively.

Actual expenses may be higher. For example, expenses may be higher than those shown if average net assets decrease. Net assets are more likely to decrease and Fund expense ratios are more likely to increase when markets are volatile.

As a result of expense limitation arrangements, the ratio of expenses, other than brokerage, interest, dividend expense on short sales, taxes, extraordinary expenses and acquired fund fees and expenses, to average net assets is not expected to exceed 0.70% for Class A shares, 1.25% for Class C shares and 0.45% for Class I shares. These expense limitation arrangements cannot be terminated prior to December 31, 2013 without the Board of Trustees’ consent.

The manager is permitted to recapture amounts waived or reimbursed to a class within three years after the year in which the manager earned the fee or incurred the expense if the class’ total annual operating expenses have fallen to a level below the expense limitation in effect at the time the fees were earned or the expenses incurred.

| 1 | Lipper, Inc., a wholly-owned subsidiary of Reuters, provides independent insight on global collective investments. Returns are based on the six-month period ended September 30, 2011, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 35 funds in the Fund’s Lipper category, and excluding sales charges. |

| | |

| VI | | Legg Mason Investment Counsel Maryland Tax-Free Income Trust |

Investment commentary (cont’d)

As always, thank you for your confidence in our stewardship of your assets.

Sincerely,

R. Jay Gerken, CFA

President

October 28, 2011

RISKS: Bonds are subject to a variety of risks, including interest rate, credit and inflation risks. As interest rates rise, bond prices fall, reducing the value of a fixed-income investment. Municipal securities purchased by the Fund may be adversely affected by changes in the financial condition of municipal issuers and insurers, regulatory and political developments, uncertainties and public perceptions, and other factors. As a “non-diversified” fund, an investment in the Fund will entail greater price risk than an investment in a diversified fund because a higher percentage of investments among fewer issuers may result in greater fluctuation in the total market value of the Fund’s portfolio. Please see the Fund’s prospectus for a more complete discussion of these and other risks, and the Fund’s investment strategies.

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

| i | Gross domestic product (“GDP”) is the market value of all final goods and services produced within a country in a given period of time. |

| ii | The Institute for Supply Management's PMI is based on a survey of purchasing executives who buy the raw materials for manufacturing at more than 350 companies. It offers an early reading on the health of the manufacturing sector. |

| iii | The Federal Reserve Board (“Fed”) is responsible for the formulation of policies designed to promote economic growth, full employment, stable prices and a sustainable pattern of international trade and payments. |

| iv | The federal funds rate is the rate charged by one depository institution on an overnight sale of immediately available funds (balances at the Federal Reserve) to another depository institution; the rate may vary from depository institution to depository institution and from day to day. |

| v | Duration is the measure of the price sensitivity of a fixed-income security to an interest rate change of 100 basis points. Calculation is based on the weighted average of the present values for all cash flows. |

| vi | The Barclays Capital Municipal Bond Index is a market value weighted index of investment grade municipal bonds with maturities of one year or more. |

| vii | The Barclays Capital U.S. Aggregate Index is a broad-based bond index comprised of government, corporate, mortgage- and asset-backed issues, rated investment grade or higher, and having at least one year to maturity. |

| | | | |

| Legg Mason Investment Counsel Maryland Tax-Free Income Trust 2011 Semi-Annual Report | | | 1 | |

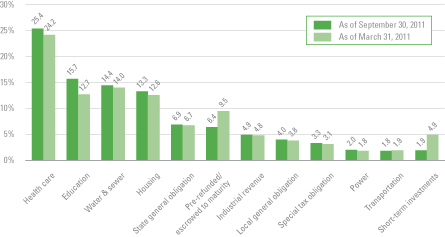

Fund at a glance† (unaudited)

Investment breakdown (%) as a percent of total investments

| † | The bar graph above represents the composition of the Fund’s investments as of September 30, 2011 and March 31, 2011. The Fund is actively managed. As a result, the composition of the Fund’s investments is subject to change at any time. |

| | |

| 2 | | Legg Mason Investment Counsel Maryland Tax-Free Income Trust 2011 Semi-Annual Report |

Fund expenses (unaudited)

Example

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs, including front-end and back-end sales charges (loads) on purchase payments; and (2) ongoing costs, including management fees; service and/or distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested on April 1, 2011 and held for the six months ended September 30, 2011.

Actual expenses

The table below titled “Based on Actual Total Return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period”.

Hypothetical example for comparison purposes

The table below titled “Based on Hypothetical Total Return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front-end or back-end sales charges (loads). Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Based on actual total return1 | | | | | | | | Based on hypothetical total return1 | | | | |

| | | Actual Total

Return

Without

Sales

Charges2 | | | Beginning

Account

Value | | | Ending

Account

Value | | | Annualized

Expense

Ratio | | | Expenses

Paid

During

the

Period3 | | | | | | | Hypothetical

Annualized

Total Return | | | Beginning

Account

Value | | | Ending

Account

Value | | | Annualized

Expense

Ratio | | | Expenses

Paid

During

the

Period3 | |

| Class A | | | 7.63 | % | | $ | 1,000.00 | | | $ | 1,076.30 | | | | 0.64 | % | | $ | 3.32 | | | | | Class A | | | 5.00 | % | | $ | 1,000.00 | | | $ | 1,021.80 | | | | 0.64 | % | | $ | 3.23 | |

| Class C | | | 7.32 | | | | 1,000.00 | | | | 1,073.20 | | | | 1.24 | | | | 6.43 | | | | | Class C | | | 5.00 | | | | 1,000.00 | | | | 1,018.80 | | | | 1.24 | | | | 6.26 | |

| Class I | | | 7.80 | | | | 1,000.00 | | | | 1,078.00 | | | | 0.45 | | | | 2.34 | | | | | Class I | | | 5.00 | | | | 1,000.00 | | | | 1,022.75 | | | | 0.45 | | | | 2.28 | |

| 1 | For the six months ended September 30, 2011. |

| 2 | Assumes the reinvestment of all distributions, including the returns of capital, if any, at net asset value and does not reflect the deduction of the applicable sales charge with respect to Class A shares or the applicable contingent deferred sales charges (“CDSC”) with respect to Class C shares. Total return is not annualized, as it may not be representative of the total return for the year. Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

| 3 | Expenses (net of compensating balance arrangements, fee waivers and/or expense reimbursements) are equal to each class’ respective annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), then divided by 366. |

| | | | |

| Legg Mason Investment Counsel Maryland Tax-Free Income Trust 2011 Semi-Annual Report | | | 3 | |

Schedule of investments (unaudited)

September 30, 2011

Legg Mason Investment Counsel Maryland Tax-Free Income Trust

| | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | Face

Amount | | | Value | |

| Municipal Bonds — 95.3% | | | | | | | | | | | | | | |

Education — 15.2% | | | | | | | | | | | | | | |

City of Annapolis, Maryland, EDR and Refunding Revenue Bonds: | | | | | | | | | | | | | | |

St. John’s College Facility | | | 5.500 | % | | 10/1/18 | | $ | 220,000 | | | $ | 220,752 | |

St. John’s College Facility | | | 5.500 | % | | 10/1/23 | | | 490,000 | | | | 491,397 | |

St. John’s College Facility | | | 5.000 | % | | 10/1/27 | | | 1,135,000 | | | | 1,132,514 | |

St. John’s College Facility | | | 5.000 | % | | 10/1/36 | | | 2,465,000 | | | | 2,399,826 | |

Maryland Health & Higher EFA Revenue Bonds: | | | | | | | | | | | | | | |

College of Notre Dame of Maryland Issue, NATL | | | 5.300 | % | | 10/1/18 | | | 925,000 | | | | 1,043,594 | |

Loyola College Issue | | | 5.000 | % | | 10/1/40 | | | 2,000,000 | | | | 2,050,800 | |

Maryland Institute College of Art | | | 5.000 | % | | 6/1/36 | | | 5,000,000 | | | | 4,868,350 | |

Maryland Institute College of Art | | | 5.000 | % | | 6/1/42 | | | 800,000 | | | | 768,448 | |

The Johns Hopkins University Issue | | | 5.000 | % | | 7/1/33 | | | 3,000,000 | | | | 3,111,630 | |

Maryland State EDC, Student Housing Revenue Bonds: | | | | | | | | | | | | | | |

University of Maryland, College Park Projects | | | 5.750 | % | | 6/1/33 | | | 500,000 | | | | 510,755 | |

University of Maryland, College Park Projects | | | 5.800 | % | | 6/1/38 | | | 1,500,000 | | | | 1,522,170 | |

Maryland State EDC, Utility Infrastructure Revenue: | | | | | | | | | | | | | | |

University of Maryland, College Park Project | | | 5.000 | % | | 7/1/16 | | | 3,700,000 | | | | 4,130,125 | |

University of Maryland, College Park Project | | | 5.000 | % | | 7/1/17 | | | 1,000,000 | | | | 1,126,010 | |

University System of Maryland Auxiliary Facility and Tuition Revenue Bonds | | | 5.000 | % | | 10/1/21 | | | 2,500,000 | | | | 2,835,350 | |

Westminster, Maryland, Education Facilities Refunding Revenue Bonds, McDaniel College Inc. | | | 5.000 | % | | 11/1/31 | | | 3,500,000 | | | | 3,329,550 | |

Total Education | | | | | | | | | | | | | 29,541,271 | |

Health Care — 24.7% | | | | | | | | | | | | | | |

Baltimore County, Maryland, Revenue Bonds, Catholic Health Initiatives | | | 5.000 | % | | 9/1/20 | | | 1,050,000 | | | | 1,152,133 | |

Maryland State Health & Higher EFA Revenue: | | | | | | | | | | | | | | |

Carroll County General Hospital Issue | | | 6.000 | % | | 7/1/37 | | | 1,000,000 | | | | 1,006,280 | |

Suburban Hospital | | | 5.500 | % | | 7/1/16 | | | 500,000 | | | | 547,240 | |

Maryland State Health & Higher EFA Revenue Bonds: | | | | | | | | | | | | | | |

Anne Arundel Health System | | | 6.750 | % | | 7/1/29 | | | 2,000,000 | | | | 2,275,760 | |

Board of Child Care Issue | | | 5.500 | % | | 7/1/18 | | | 1,110,000 | | | | 1,131,878 | |

Calvert Health Systems Issue | | | 5.500 | % | | 7/1/39 | | | 2,000,000 | | | | 2,043,600 | |

Carroll County General Hospital Issue | | | 5.750 | % | | 7/1/22 | | | 1,000,000 | | | | 1,010,580 | |

Carroll County General Hospital Issue | | | 6.000 | % | | 7/1/26 | | | 2,000,000 | | | | 2,022,280 | |

Carroll County General Hospital Issue | | | 5.750 | % | | 7/1/27 | | | 1,050,000 | | | | 1,056,762 | |

Carroll County General Hospital Issue | | | 5.800 | % | | 7/1/32 | | | 2,000,000 | | | | 2,010,720 | |

College of Notre Dame of Maryland | | | 4.000 | % | | 10/1/25 | | | 1,645,000 | | | | 1,648,701 | |

See Notes to Financial Statements.

| | |

| 4 | | Legg Mason Investment Counsel Maryland Tax-Free Income Trust 2011 Semi-Annual Report |

Schedule of investments (unaudited) (cont’d)

September 30, 2011

Legg Mason Investment Counsel Maryland Tax-Free Income Trust

| | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | Face

Amount | | | Value | |

Health Care — continued | | | | | | | | | | | | | | |

Helix Health Issue, AMBAC | | | 5.250 | % | | 8/15/38 | | $ | 3,000,000 | | | $ | 3,100,980 | |

Johns Hopkins Medical Institutions | | | 5.000 | % | | 5/15/35 | | | 1,300,000 | | | | 1,361,958 | |

Johns Hopkins Medicine, Howard County General Hospital Acquisition Issue, NATL | | | 5.000 | % | | 7/1/29 | | | 2,000,000 | | | | 2,000,440 | |

Mercy Medical Center Inc. | | | 5.500 | % | | 7/1/42 | | | 3,445,000 | | | | 3,316,295 | |

Peninsula Regional Medical Center Issue | | | 5.000 | % | | 7/1/19 | | | 1,000,000 | | | | 1,063,580 | |

Peninsula Regional Medical Center Issue | | | 5.000 | % | | 7/1/26 | | | 2,435,000 | | | | 2,492,539 | |

Refunding, Kennedy Krieger Issue | | | 5.125 | % | | 7/1/22 | | | 3,000,000 | | | | 2,949,960 | |

Refunding, MedStar Health Issue | | | 5.500 | % | | 8/15/25 | | | 785,000 | | | | 824,297 | |

Refunding, Mercy Ridge | | | 4.750 | % | | 7/1/34 | | | 3,200,000 | | | | 2,859,936 | |

The Johns Hopkins Hospital Issue | | | 0.000 | % | | 7/1/19 | | | 4,000,000 | | | | 2,989,120 | |

Union Hospital of Cecil County Issue | | | 5.500 | % | | 7/1/22 | | | 250,000 | | | | 252,723 | |

University of Maryland Medical System | | | 5.000 | % | | 7/1/34 | | | 1,000,000 | | | | 1,020,500 | |

University of Maryland Medical System | | | 5.000 | % | | 7/1/41 | | | 1,500,000 | | | | 1,516,275 | |

Washington County Hospital Association | | | 5.000 | % | | 1/1/17 | | | 500,000 | | | | 526,290 | |

Washington County Hospital Issue | | | 4.000 | % | | 1/1/15 | | | 1,000,000 | | | | 1,026,250 | |

Washington County Hospital Issue | | | 4.750 | % | | 1/1/16 | | | 1,000,000 | | | | 1,047,990 | |

Washington County Hospital Issue | | | 5.250 | % | | 1/1/23 | | | 500,000 | | | | 513,325 | |

Washington County Hospital Issue | | | 5.750 | % | | 1/1/38 | | | 2,000,000 | | | | 1,999,800 | |

Washington County Hospital Issue | | | 6.000 | % | | 1/1/43 | | | 1,000,000 | | | | 1,010,760 | |

Total Health Care | | | | | | | | | | | | | 47,778,952 | |

Housing — 12.9% | | | | | | | | | | | | | | |

Community Development Administration, Maryland Department of Housing and Community Development Residential Revenue Bonds | | | 5.200 | % | | 9/1/22 | | | 1,790,000 | | | | 1,790,609 | (a) |

Community Development Administration, Maryland Department of Housing and Community Development Residential Revenue Bonds | | | 5.375 | % | | 9/1/22 | | | 145,000 | | | | 145,061 | (a) |

Community Development Administration, Maryland Department of Housing and Community Development Residential Revenue Bonds | | | 5.375 | % | | 9/1/24 | | | 2,000,000 | | | | 2,000,660 | (a) |

Community Development Administration, Maryland Department of Housing and Community Development Residential Revenue Bonds | | | 4.500 | % | | 9/1/29 | | | 2,490,000 | | | | 2,495,777 | |

Community Development Administration, Maryland Department of Housing and Community Development Residential Revenue Bonds | | | 4.750 | % | | 9/1/29 | | | 1,000,000 | | | | 1,015,850 | |

Community Development Administration, Maryland Department of Housing and Community Development Residential Revenue Bonds | | | 5.050 | % | | 9/1/39 | | | 1,980,000 | | | | 1,998,295 | |

See Notes to Financial Statements.

| | | | |

| Legg Mason Investment Counsel Maryland Tax-Free Income Trust 2011 Semi-Annual Report | | | 5 | |

Legg Mason Investment Counsel Maryland Tax-Free Income Trust

| | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | Face

Amount | | | Value | |

Housing — continued | | | | | | | | | | | | | | |

Maryland State Community Development Administration, Department of Housing & Community Development | | | 5.375 | % | | 9/1/39 | | $ | 1,500,000 | | | $ | 1,531,560 | |

Maryland State Community Development Administration, Department of Housing & Community Development | | | 4.800 | % | | 9/1/42 | | | 4,165,000 | | | | 4,021,724 | (a) |

Maryland State Community Development Administration, Department of Housing and Community Development, Local Government Infrastructure | | | 4.000 | % | | 6/1/30 | | | 5,485,000 | | | | 5,538,637 | |

Montgomery County, Maryland, Revenue Bonds: | | | | | | | | | | | | | | |

Housing Opportunities Commission, Single Family Mortgage | | | 4.875 | % | | 7/1/25 | | | 1,000,000 | | | | 1,037,590 | |

Housing Opportunities Commission, Single Family Mortgage | | | 5.000 | % | | 7/1/27 | | | 1,395,000 | | | | 1,402,547 | (a) |

Montgomery County, MD, Housing Opportunities Commission, Multi-Family Revenue, Housing Development | | | 4.625 | % | | 7/1/41 | | | 2,000,000 | | | | 2,015,560 | |

Total Housing | | | | | | | | | | | | | 24,993,870 | |

Industrial Revenue — 4.7% | | | | | | | | | | | | | | |

IDA of Prince George’s County, Maryland, Subordinated Lease Revenue Bonds: | | | | | | | | | | | | | | |

Upper Marlboro Justice Center Expansion Project, NATL | | | 5.125 | % | | 6/30/15 | | | 3,340,000 | | | | 3,604,228 | |

Upper Marlboro Justice Center Expansion Project, NATL | | | 5.000 | % | | 6/30/19 | | | 1,000,000 | | | | 1,062,220 | |

Maryland EDC, EDR, Lutheran World Relief Inc. and Immigration and Refugee Service | | | 5.250 | % | | 4/1/29 | | | 565,000 | | | | 539,490 | |

Maryland IDA, EDR Bonds, National Aquarium in Baltimore Facility | | | 5.000 | % | | 11/1/19 | | | 500,000 | | | | 500,290 | |

Maryland IDA, Refunding Revenue Bonds, American Center for Physics Headquarters Facility | | | 5.250 | % | | 12/15/15 | | | 320,000 | | | | 322,877 | |

Puerto Rico Commonwealth Government Development Bank, NATL | | | 4.750 | % | | 12/1/15 | | | 3,000,000 | | | | 3,121,950 | |

Total Industrial Revenue | | | | | | | | | | | | | 9,151,055 | |

Local General Obligation — 3.8% | | | | | | | | | | | | | | |

Anne Arundel County, Maryland, GO Bonds, Consolidated General Improvement Bonds | | | 4.500 | % | | 3/1/23 | | | 1,000,000 | | | | 1,105,850 | |

Baltimore County, Maryland, GO Bonds | | | 4.000 | % | | 8/1/23 | | | 1,270,000 | | | | 1,409,332 | |

Baltimore County, Maryland, GO Bonds, Metropolitan District Bonds, 70th Issue | | | 4.250 | % | | 9/1/26 | | | 1,000,000 | | | | 1,053,330 | |

Frederick County, Maryland, GO Bonds, Public Facilities Refunding Bonds | | | 5.000 | % | | 7/1/15 | | | 1,000,000 | | | | 1,158,400 | |

Howard County, Maryland, GO Bonds, Consolidated Public Improvement Project and Refunding Bonds | | | 5.000 | % | | 8/15/19 | | | 1,000,000 | | | | 1,226,170 | |

See Notes to Financial Statements.

| | |

| 6 | | Legg Mason Investment Counsel Maryland Tax-Free Income Trust 2011 Semi-Annual Report |

Schedule of investments (unaudited) (cont’d)

September 30, 2011

Legg Mason Investment Counsel Maryland Tax-Free Income Trust

| | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | Face

Amount | | | Value | |

Local General Obligation — continued | | | | | | | | | | | | | | |

Mayor and City Council of Baltimore, City of Baltimore, Maryland, GO Bonds, Consolidated Public Improvement Refunding Bonds, FGIC | | | 0.000 | % | | 10/15/11 | | $ | 940,000 | | | $ | 939,840 | |

Queen Anne’s County, Maryland, Public Facilities Refunding Bonds, NATL | | | 5.000 | % | | 11/15/16 | | | 500,000 | | | | 576,640 | |

Total Local General Obligation | | | | | | | | | | | | | 7,469,562 | |

Power — 2.0% | | | | | | | | | | | | | | |

Puerto Rico Electric Power Authority, Power Revenue | | | 5.000 | % | | 7/1/28 | | | 3,740,000 | | | | 3,816,707 | |

Pre-Refunded/Escrowed to Maturity — 6.2% | | | | | | | | | | | | | | |

City of Baltimore, Maryland, Mayor and City Council of Baltimore, Project and Refunding Revenue Bonds, Water Projects | | | 5.000 | % | | 7/1/24 | | | 3,800,000 | | | | 4,785,682 | (b) |

Maryland State Health & Higher EFA Revenue: | | | | | | | | | | | | | | |

Howard County General Hospital Issue | | | 5.500 | % | | 7/1/21 | | | 2,825,000 | | | | 3,058,458 | (b) |

LifeBridge Health Issue | | | 5.250 | % | | 7/1/18 | | | 1,640,000 | | | | 1,849,707 | (c) |

University of Maryland Medical Systems | | | 6.000 | % | | 7/1/32 | | | 1,000,000 | | | | 1,042,490 | (c) |

Maryland-National Capital Park and Planning Commission, Prince George’s County, Maryland, Park Acquisition and Development GO Bonds | | | 5.125 | % | | 5/1/21 | | | 1,310,000 | | | | 1,314,755 | (c) |

Total Pre-Refunded/Escrowed to Maturity | | | | | | | | | | | | | 12,051,092 | |

Special Tax Obligation — 3.3% | | | | | | | | | | | | | | |

Frederick County, MD, Special Obligation, Urbana Community Development Authority | | | 5.000 | % | | 7/1/30 | | | 3,000,000 | | | | 3,046,470 | |

Puerto Rico Sales Tax Financing Corp., Sales Tax Revenue | | | 5.500 | % | | 8/1/28 | | | 2,000,000 | | | | 2,180,040 | |

Puerto Rico Sales Tax Financing Corp., Sales Tax Revenue | | | 6.000 | % | | 8/1/39 | | | 1,000,000 | | | | 1,090,660 | |

Total Special Tax Obligation | | | | | | | | | | | | | 6,317,170 | |

State General Obligation — 6.7% | | | | | | | | | | | | | | |

Commonwealth of Puerto Rico, GO Bonds: | | | | | | | | | | | | | | |

Public Improvement Bonds | | | 5.000 | % | | 7/1/25 | | | 2,000,000 | | | | 2,015,100 | |

Public Improvement Bonds | | | 6.000 | % | | 7/1/39 | | | 5,000,000 | | | | 5,177,650 | |

State of Maryland, GO Bonds, State and Local Facilities Loan | | | 5.500 | % | | 3/1/15 | | | 5,000,000 | | | | 5,813,600 | |

Total State General Obligation | | | | | | | | | | | | | 13,006,350 | |

Transportation — 1.8% | | | | | | | | | | | | | | |

Department of Transportation of Maryland, Consolidated Transportation Bonds | | | 5.500 | % | | 2/1/15 | | | 3,000,000 | | | | 3,470,970 | |

See Notes to Financial Statements.

| | | | |

| Legg Mason Investment Counsel Maryland Tax-Free Income Trust 2011 Semi-Annual Report | | | 7 | |

Legg Mason Investment Counsel Maryland Tax-Free Income Trust

| | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | Face

Amount | | | Value | |

Water & Sewer — 14.0% | | | | | | | | | | | | | | |

City of Baltimore, Maryland, Mayor and City Council of Baltimore, Project and Refunding Revenue Bonds: | | | | | | | | | | | | | | |

Wastewater Projects, FGIC | | | 5.000 | % | | 7/1/22 | | $ | 1,910,000 | | | $ | 2,225,245 | |

Water Projects, FGIC | | | 5.000 | % | | 7/1/24 | | | 1,890,000 | | | | 2,201,944 | |

Water Projects, FGIC | | | 5.125 | % | | 7/1/42 | | | 1,000,000 | | | | 1,008,990 | |

City of Baltimore, Maryland, Mayor and City Council of Baltimore, Project and Revenue Bonds, Wastewater Projects, AGM | | | 5.000 | % | | 7/1/33 | | | 4,000,000 | | | | 4,295,080 | |

City of Baltimore, Maryland, Project Revenue Bonds, Water Projects, AMBAC | | | 5.000 | % | | 7/1/23 | | | 1,000,000 | | | | 1,131,700 | |

Northeast Maryland Waste Disposal Authority, Solid Waste Revenue, AMBAC | | | 5.500 | % | | 4/1/16 | | | 3,425,000 | | | | 3,643,241 | (a) |

Washington Suburban Sanitary District, Maryland, Montgomery and Prince George’s Counties, Water Supply Refunding Bonds | | | 5.250 | % | | 6/1/16 | | | 1,650,000 | | | | 1,963,220 | |

Washington Suburban Sanitary District, Maryland, Montgomery and Prince George’s Counties, Water Supply Refunding Bonds | | | 5.750 | % | | 6/1/17 | | | 2,000,000 | | | | 2,482,500 | |

Washington Suburban Sanitary District, Maryland, Montgomery and Prince George’s Counties, Water Supply Refunding Bonds | | | 6.000 | % | | 6/1/18 | | | 2,705,000 | | | | 3,451,553 | |

Washington Suburban Sanitary District, Maryland, Montgomery and Prince George’s Counties, Water Supply Refunding Bonds | | | 6.000 | % | | 6/1/19 | | | 3,665,000 | | | | 4,730,819 | |

Total Water & Sewer | | | | | | | | | | | | | 27,134,292 | |

Total Investments before Short-Term Investments (Cost — $171,621,915) | | | | 184,731,291 | |

| Short-Term Investments — 1.9% | | | | | | | | | | | | | | |

General Obligation — 1.0% | | | | | | | | | | | | | | |

Washington Suburban Sanitation District, MD, GO, BAN, SPA-Helaba | | | 0.220 | % | | 6/1/23 | | | 1,800,000 | | | | 1,800,000 | (d)(e) |

Health Care — 0.8% | | | | | | | | | | | | | | |

Maryland State Health & Higher EFA Revenue, Johns Hopkins University | | | 0.080 | % | | 7/1/36 | | | 1,600,000 | | | | 1,600,000 | (d)(e) |

Industrial Revenue — 0.1% | | | | | | | | | | | | | | |

Maryland State EDC Revenue, American Urological Association | | | 0.370 | % | | 9/1/32 | | | 190,000 | | | | 190,000 | (d)(e) |

Total Short-Term Investments (Cost — $3,590,000) | | | | | | | | | | 3,590,000 | |

Total Investments — 97.2 % (Cost — $175,211,915#) | | | | | | | | | | | | | 188,321,291 | |

Other Assets in Excess of Liabilities — 2.8% | | | | | | | | | | | | | 5,431,492 | |

Total Net Assets — 100.0% | | | | | | | | | | | | $ | 193,752,783 | |

See Notes to Financial Statements.

| | |

| 8 | | Legg Mason Investment Counsel Maryland Tax-Free Income Trust 2011 Semi-Annual Report |

Schedule of investments (unaudited) (cont’d)

September 30, 2011

Legg Mason Investment Counsel Maryland Tax-Free Income Trust

| (a) | Income from this issue is considered a preference item for purposes of calculating the alternative minimum tax (“AMT”). |

| (b) | Bonds are escrowed to maturity by government securities and/or U.S. government agency securities and are considered by the manager to be triple-A rated even if issuer has not applied for new ratings. |

| (c) | Pre-Refunded bonds are escrowed with U.S. government obligations and/or U.S. government agency securities and are considered by the manager to be triple-A rated even if issuer has not applied for new ratings. |

| (d) | Variable rate demand obligations have a demand feature under which the Fund can tender them back to the issuer or liquidity provider on no more than 7 days notice. |

| (e) | Maturity date shown is the final maturity date. The security may be sold back to the issuer before final maturity. |

| # | Aggregate cost for federal income tax purposes is substantially the same. |

| | |

Abbreviations used in this schedule: |

| AGM | | — Assured Guaranty Municipal Corporation — Insured Bonds |

| AMBAC | | — American Municipal Bond Assurance Corporation — Insured Bonds |

| BAN | | — Bond Anticipation Notes |

| EDC | | — Economic Development Corporation |

| EDR | | — Economic Development Revenue |

| EFA | | — Educational Facilities Authority |

| FGIC | | — Financial Guaranty Insurance Company — Insured Bonds |

| GO | | — General Obligation |

| IDA | | — Industrial Development Authority |

| NATL | | — National Public Finance Guarantee Corporation — Insured Bonds |

| SPA | | — Standby Bond Purchase Agreement — Insured Bonds |

| | | | |

| Ratings table* | | | |

| Standard & Poor’s/Moody’s/Fitch** | | | | |

| AAA/Aaa | | | 18.2 | % |

| AA/Aa | | | 33.3 | |

| A | | | 24.9 | |

| BBB/Baa | | | 20.7 | |

| A-1/VMIG 1 | | | 1.9 | |

| NR | | | 1.0 | |

| | | | 100.0 | % |

| * | As a percentage of total investments. |

| ** | The ratings shown are based on each portfolio security’s rating as determined by Standard & Poor’s, Moody’s or Fitch, each a Nationally Recognized Statistical Rating Organization (“NRSRO”). These ratings are the opinions of the NRSRO and are not measures of quality or guarantees of performance. Securities may be rated by other NRSROs, and these ratings may be higher or lower. In the event that a security is rated by multiple NRSROs and receives different ratings, the Fund will treat the security as being rated in the highest rating category received from a NRSRO. |

| | See pages 9 through 13 for definitions of ratings. |

See Notes to Financial Statements.

| | | | |

| Legg Mason Investment Counsel Maryland Tax-Free Income Trust 2011 Semi-Annual Report | | | 9 | |

Bond ratings

The definitions of the applicable rating symbols are set forth below:

Long-term security ratings (unaudited)

Standard & Poor’s Ratings Service (“Standard & Poor’s”) Long-term Issue Credit Ratings — Ratings from “AA” to “CCC” may be modified by the addition of a plus (+) or minus (–) sign to show relative standings within the major rating categories.

AAA | — | An obligation rated “AAA” has the highest rating assigned by Standard & Poor’s. The obligor’s capacity to meet its financial commitment on the obligation is extremely strong. |

AA | — | An obligation rated “AA” differs from the highest-rated obligations only to a small degree. The obligor’s capacity to meet its financial commitment on the obligation is very strong. |

A | — | An obligation rated “A” is somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than obligations in higher-rated categories. However, the obligor’s capacity to meet its financial commitment on the obligation is still strong. |

BBB | — | An obligation rated “BBB” exhibits adequate protection parameters. However, adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity of the obligor to meet its financial commitment on the obligation. |

BB | — | An obligation rated “BB” is less vulnerable to nonpayment than other speculative issues. However, it faces major ongoing uncertainties or exposure to adverse business, financial, or economic conditions, which could lead to the obligor’s inadequate capacity to meet its financial commitment on the obligation. |

B | — | An obligation rated “B” is more vulnerable to nonpayment than obligations rated “BB”, but the obligor currently has the capacity to meet its financial commitment on the obligation. Adverse business, financial, or economic conditions will likely impair the obligor’s capacity or willingness to meet its financial commitment on the obligation. |

CCC | — | An obligation rated “CCC” is currently vulnerable to nonpayment, and is dependent upon favorable business, financial, and economic conditions for the obligor to meet its financial commitment on the obligation. In the event of adverse business, financial, or economic conditions, the obligor is not likely to have the capacity to meet its financial commitment on the obligation. |

CC | — | An obligation rated “CC” is currently highly vulnerable to nonpayment. |

C | — | The “C” rating may be used to cover a situation where a bankruptcy petition has been filed or similar action has been taken, but payments on this obligation are being continued. |

D | — | An obligation rated “D” is in payment default. The “D” rating category is used when payments on an obligation are not made on the date due, even if the applicable grace period has not expired, unless Standard & Poor’s believes that such payments will be made during |

| | |

| 10 | | Legg Mason Investment Counsel Maryland Tax-Free Income Trust 2011 Semi-Annual Report |

Long-term security ratings (unaudited) (cont’d)

| | such grace period. The “D” rating also will be used upon the filing of a bankruptcy petition or the taking of a similar action if payments of an obligation are jeopardized. |

Moody’s Investors Service (“Moody’s”) Long-term Obligation Ratings — Numerical modifiers 1, 2 and 3 may be applied to each generic rating from “Aa” to “Caa,” where 1 is the highest and 3 the lowest ranking within its generic category.

Aaa | — | Obligations rated “Aaa” are judged to be of the highest quality, with minimal credit risk. |

Aa | — | Obligations rated “Aa” are judged to be of high quality and are subject to very low credit risk. |

A | — | Obligations rated “A” are considered upper-medium grade and are subject to low credit risk. | |

Baa | — | Obligations rated “Baa” are subject to moderate credit risk. They are considered medium grade and as such may possess certain speculative characteristics. |

Ba | — | Obligations rated “Ba” are judged to have speculative elements and are subject to substantial credit risk. |

B | — | Obligations rated “B” are considered speculative and are subject to high credit risk. |

Caa | — | Obligations rated “Caa” are judged to be of poor standing and are subject to very high credit risk. |

Ca | — | Obligations rated “Ca” are highly speculative and are likely in, or very near, default, with some prospect of recovery for principal and interest. |

C | — | Obligations rated “C” are the lowest rated class and are typically in default, with little prospect of recovery for principal and interest. |

Fitch Ratings Service (“Fitch”) Structured, Project & Public Finance Obligations — Ratings from “AA” to “CCC” may be modified by the addition of a plus (+) or minus (–) sign to show relative standings within the major rating categories.

AAA | — | Obligations rated “AAA” by Fitch denote the lowest expectation of default risk. They are assigned only in cases of exceptionally strong capacity for payment of financial commitments. This capacity is highly unlikely to be adversely affected by foreseeable events. |

AA | — | Obligations rated “AA” denote expectations of very low default risk. They indicate very strong capacity for payment of financial commitments. This capacity is not significantly vulnerable to foreseeable events. |

A | — | Obligations rated “A” denote expectations of low default risk. The capacity for payment of financial commitments is considered strong. This capacity may, nevertheless, be more vulnerable to adverse business or economic conditions than is the case for higher ratings. |

BBB | — | Obligations rated “BBB” indicate that expectations of default risk are currently low. The capacity for payment of financial commitments is considered adequate but adverse business or economic conditions are more likely to impair this capacity. |

| | | | |

| Legg Mason Investment Counsel Maryland Tax-Free Income Trust 2011 Semi-Annual Report | | | 11 | |

BB | — | Obligations rated “BB” indicate an elevated vulnerability to default risk, particularly in the event of adverse changes in business or economic conditions over time; however, business or financial flexibility exists which supports the servicing of financial commitments. |

B | — | Obligations rated “B” indicate that material default risk is present, but a limited margin of safety remains. Financial commitments are currently being met; however, capacity for continued payment is vulnerable to deterioration in the business and economic environment. |

CCC | — | Default is a real possibility. |

CC | — | Default of some kind appears probable. |

C | — | Default is imminent or inevitable, or the issuer is in standstill. |

NR | — | Indicates that the obligation is not rated by Standard & Poor’s, Moody’s or Fitch. |

Short-term security ratings (unaudited)

Standard & Poor’s Municipal Short-Term Notes Ratings

SP-1 | — | A short-term obligation rated “SP-1” is rated in the highest category by Standard & Poor’s. Strong capacity to pay principal and interest. An issue determined to possess a very strong capacity to pay debt service is given a plus (+) designation. |

SP-2 | — | A short-term obligation rated “SP-2” is a Standard & Poor’s rating indicating satisfactory capacity to pay principal and interest, with some vulnerability to adverse financial and economic changes over the term of the notes. |

SP-3 | — | A short-term obligation rated “SP-3” is a Standard & Poor’s rating indicating speculative capacity to pay principal and interest. |

Standard & Poor’s Short-Term Issues Credit Ratings

A-1 | — | A short-term obligation rated “A-1” is rated in the highest category by Standard & Poor’s. The obligor’s capacity to meet its financial commitment on the obligation is strong. Within this category, certain obligations are designated with a plus sign (+). This indicates that the obligor’s capacity to meet its financial commitment on these obligations is extremely strong. |

A-2 | — | A short-term obligation rated “A-2” by Standard & Poor’s is somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than obligations in higher rating categories. However, the obligor’s capacity to meet its financial commitment on the obligation is satisfactory. |

A-3 | — | A short-term obligation rated “A-3” by Standard & Poor’s exhibits adequate protection parameters. However, adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity of the obligor to meet its financial commitment on the obligation. |

| | |

| 12 | | Legg Mason Investment Counsel Maryland Tax-Free Income Trust 2011 Semi-Annual Report |

Short-term security ratings (unaudited) (cont’d)

B | — | A short-term obligation rated “B” by Standard & Poor’s is regarded as having significant speculative characteristics. Ratings of “B-1”, “B-2” and “B-3” may be assigned to indicate finer distinctions within the “B” category. The obligor currently has the capacity to meet its financial commitment on the obligation; however, it faces major ongoing uncertainties which could lead to the obligor’s inadequate capacity to meet its financial commitment on the obligation. |

Moody’s Variable Rate Demand Obligations (VRDO) Ratings

VMIG 1 | — | Moody’s highest rating for issues having a variable rate demand feature — VRDO. This designation denotes superior credit quality. Excellent protection is afforded by the superior short-term credit strength of the liquidity provider and structural and legal protections that ensure the timely payment of purchase price on demand. |

VMIG 2 | — | This designation denotes strong credit quality. Good protection is afforded by the strong short-term credit strength of the liquidity provider and structural and legal protections that ensure the timely payment of purchase price on demand. |

VMIG 3 | — | This designation denotes acceptable credit quality. Adequate protection is afforded by the strong short-term credit strength of the liquidity provider and structural and legal protections that ensure the timely payment of purchase price on demand. |

Moody’s Short-Term Municipal Obligations Ratings

MIG 1 | — | Moody’s highest rating for short-term municipal obligations. This designation denotes superior credit quality. Excellent protection is afforded by established cash flows, highly reliable liquidity support, or demonstrated broad-based access to the market for refinancing. |

MIG 2 | — | This designation denotes strong credit quality. Margins of protection are ample, although not as large as the preceding group. |

MIG 3 | — | This designation denotes acceptable credit quality. Liquidity and cash flow protection may be narrow, and market access for refinancing is likely to be less well-established. |

SG | — | This designation denotes speculative-grade credit quality. Debt instruments in this category may lack sufficient margins of protection. |

Moody’s Short-Term Obligations Ratings

P-1 | — | Moody’s highest rating for commercial paper and for VRDO prior to the advent of the VMIG 1 rating. Have a superior ability to repay short-term debt obligations. |

P-2 | — | Have a strong ability to repay short-term debt obligations. |

P-3 | — | Have an acceptable ability to repay short-term debt obligations. |

NP | — | Issuers do not fall within any of the Prime rating categories. |

Fitch’s Short-Term Issuer or Obligations Ratings

F1 | — | Fitch’s highest rating indicating the strongest intrinsic capacity for timely payment of financial commitments; may have an added “+” to denote any exceptionally strong credit feature. |

| | | | |

| Legg Mason Investment Counsel Maryland Tax-Free Income Trust 2011 Semi-Annual Report | | | 13 | |

F2 | — | Fitch rating indicating good intrinsic capacity for timely payment of financial commitments. |

F3 | — | Fitch rating indicating intrinsic capacity for timely payment of financial commitments is adequate. |

NR | — | Indicates that the obligation is not rated by Standard & Poor’s, Moody’s or Fitch. |

| | |

| 14 | | Legg Mason Investment Counsel Maryland Tax-Free Income Trust 2011 Semi-Annual Report |

Statement of assets and liabilities (unaudited)

September 30, 2011

| | | | |

|

| Assets: | |

Investments, at value (Cost — $175,211,915) | | $ | 188,321,291 | |

Cash | | | 3,467,324 | |

Interest receivable | | | 2,320,672 | |

Receivable for Fund shares sold | | | 187,678 | |

Prepaid expenses | | | 21,662 | |

Other assets | | | 1,404 | |

Total Assets | | | 194,320,031 | |

| |

| Liabilities: | | | | |

Payable for Fund shares repurchased | | | 319,844 | |

Investment management fee payable | | | 52,181 | |

Distributions payable | | | 50,836 | |

Service and/or distribution fees payable | | | 34,801 | |

Accrued expenses | | | 109,586 | |

Total Liabilities | | | 567,248 | |

| Total Net Assets | | $ | 193,752,783 | |

| |

| Net Assets: | | | | |

Par value (Note 8) | | $ | 11,605 | |

Paid-in capital in excess of par value | | | 181,383,870 | |

Undistributed net investment income | | | 22,162 | |

Accumulated net realized loss on investments | | | (774,230) | |

Net unrealized appreciation on investments | | | 13,109,376 | |

| Total Net Assets | | $ | 193,752,783 | |

| |

| Shares Outstanding: | | | | |

Class A | | | 8,762,956 | |

Class C | | | 1,748,894 | |

Class I | | | 1,093,544 | |

| |

| Net Asset Value: | | | | |

Class A (and redemption price) | | | $16.69 | |

Class C* | | | $16.69 | |

Class I (and redemption price) | | | $16.70 | |

| Maximum Public Offering Price Per Share: | | | | |

Class A (based on maximum initial sales charge of 4.25%) | | | $17.43 | |

| * | Redemption price per share is NAV of Class C shares reduced by a 1.00% CDSC if shares are redeemed within one year from purchase payment (See Note 2). |

See Notes to Financial Statements.

| | | | |

| Legg Mason Investment Counsel Maryland Tax-Free Income Trust 2011 Semi-Annual Report | | | 15 | |

Statement of operations (unaudited)

For the Six Months Ended September 30, 2011

| | | | |

|

| Investment Income: | |

Interest | | $ | 4,426,206 | |

| |

| Expenses: | | | | |

Investment management fee (Note 2) | | | 521,784 | |

Service and/or distribution fees (Notes 2 and 5) | | | 210,108 | |

Transfer agent fees (Note 5) | | | 47,741 | |

Registration fees | | | 20,318 | |

Shareholder reports | | | 20,059 | |

Legal fees | | | 16,569 | |

Trustees’ fees | | | 15,432 | |

Custody fees | | | 15,180 | |

Audit and tax | | | 14,729 | |

Fund accounting fees | | | 671 | |

Insurance | | | 589 | |

Miscellaneous expenses | | | 7,120 | |

Total Expenses | | | 890,300 | |

Less: Fee waivers and/or expense reimbursements (Notes 2 and 5) | | | (210,869) | |

Net Expenses | | | 679,431 | |

| Net Investment Income | | | 3,746,775 | |

| |

| Unrealized Gain on Investments (Notes 1 and 3): | | | | |

Change in Net Unrealized Appreciation (Depreciation) on Investments | | | 10,200,619 | |

| Increase in Net Assets from Operations | | $ | 13,947,394 | |

See Notes to Financial Statements.

| | |

| 16 | | Legg Mason Investment Counsel Maryland Tax-Free Income Trust 2011 Semi-Annual Report |

Statements of changes in net assets

| | | | | | | | |

For the Six Months Ended September 30, 2011 (unaudited) and the Year Ended March 31, 2011 | | September 30 | | | March 31 | |

|

| Operations: | |

Net investment income | | $ | 3,746,775 | | | $ | 7,749,813 | |

Net realized loss | | | — | | | | (262,061) | |

Change in net unrealized appreciation (depreciation) | | | 10,200,619 | | | | (8,444,657) | |

Increase (Decrease) in Net Assets From Operations | | | 13,947,394 | | | | (956,905) | |

| | |

| Distributions to Shareholders From (Notes 1 and 7): | | | | | | | | |

Net investment income | | | (3,746,775) | | | | (7,749,813) | |

Decrease in Net Assets From Distributions to Shareholders | | | (3,746,775) | | | | (7,749,813) | |

| | |

| Fund Share Transactions (Note 8): | | | | | | | | |

Net proceeds from sale of shares | | | 11,516,956 | | | | 36,499,368 | |

Reinvestment of distributions | | | 3,430,168 | | | | 6,994,545 | |

Cost of shares repurchased | | | (18,355,097) | | | | (45,637,540) | |

Decrease in Net Assets From Fund Share Transactions | | | (3,407,973) | | | | (2,143,627) | |

Increase (Decrease) in Net Assets | | | 6,792,646 | | | | (10,850,345) | |

| | |

| Net Assets: | | | | | | | | |

Beginning of period | | | 186,960,137 | | | | 197,810,482 | |

End of period* | | $ | 193,752,783 | | | $ | 186,960,137 | |

* Includes undistributed net investment income of: | | | $22,162 | | | | $22,162 | |

See Notes to Financial Statements.

| | | | |

| Legg Mason Investment Counsel Maryland Tax-Free Income Trust 2011 Semi-Annual Report | | | 17 | |

Financial highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

For a share of each class of beneficial interest outstanding throughout each year ended March 31,

unless otherwise noted: | |

| Class A Shares1 | | 20112 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

| | | | | | |

| Net asset value, beginning of period | | | $15.82 | | | | $16.50 | | | | $15.58 | | | | $15.89 | | | | $16.28 | | | | $16.25 | |

| | | | | | |

| Income (loss) from operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.33 | | | | 0.64 | | | | 0.63 | | | | 0.68 | | | | 0.67 | | | | 0.68 | |

Net realized and unrealized gain (loss) | | | 0.87 | | | | (0.68) | | | | 0.92 | | | | (0.31) | | | | (0.39) | | | | 0.06 | |

Total income (loss) from operations | | | 1.20 | | | | (0.04) | | | | 1.55 | | | | 0.37 | | | | 0.28 | | | | 0.74 | |

| | | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.33) | | | | (0.64) | | | | (0.63) | | | | (0.68) | | | | (0.67) | | | | (0.68) | |

Net realized gains | | | — | | | | — | | | | — | | | | — | | | | (0.00) | 3 | | | (0.03) | |

Total distributions | | | (0.33) | | | | (0.64) | | | | (0.63) | | | | (0.68) | | | | (0.67) | | | | (0.71) | |

| | | | | | |

| Net asset value, end of period | | | $16.69 | | | | $15.82 | | | | $16.50 | | | | $15.58 | | | | $15.89 | | | | $16.28 | |

Total return4 | | | 7.63 | % | | | (0.32) | % | | | 10.08 | % | | | 2.46 | % | | | 1.76 | % | | | 4.64 | % |

| | | | | | |

| Net assets, end of period (000s) | | | $146,296 | | | | $145,959 | | | | $168,589 | | | | $145,672 | | | | $149,392 | | | | $144,559 | |

| | | | | | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 0.86 | %5 | | | 0.84 | % | | | 0.89 | % | | | 1.03 | % | | | 0.96 | % | | | 0.97 | % |

Net expenses6,7,8 | | | 0.64 | 5 | | | 0.63 | | | | 0.65 | | | | 0.70 | | | | 0.70 | | | | 0.70 | |

Net investment income | | | 4.03 | 5 | | | 3.88 | | | | 3.88 | | | | 4.40 | | | | 4.15 | | | | 4.16 | |

| | | | | | |

| Portfolio turnover rate | | | 2 | % | | | 15 | % | | | 6 | % | | | 8 | % | | | 6 | % | | | 9 | % |

| 1 | Per share amounts have been calculated using the average shares method. |

| 2 | For the six months ended September 30, 2011 (unaudited). |

| 3 | Amount represents less than $0.005 per share. |

| 4 | Performance figures, exclusive of sales charges, may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. Total returns for periods of less than one year are not annualized. |

| 6 | As a result of an expense limitation arrangement, the ratio of expenses, other than brokerage, interest, dividend expense on short sales, taxes, extraordinary expenses and acquired fund fees and expenses, to average net assets of Class A shares did not exceed 0.70%. This expense limitation arrangement cannot be terminated prior to December 31, 2013 without the Board of Trustees’ consent. |

| 7 | Reflects fee waivers and/or expense reimbursements. |

| 8 | The impact of compensating balance arrangements, if any, was less than 0.01%. |

See Notes to Financial Statements.

| | |

| 18 | | Legg Mason Investment Counsel Maryland Tax-Free Income Trust 2011 Semi-Annual Report |

Financial highlights (cont’d)

| | | | | | | | | | | | | | | | |

For a share of each class of beneficial interest outstanding throughout each year ended March 31, unless otherwise noted: | |

| Class C Shares1 | | 20112 | | | 2011 | | | 2010 | | | 20093 | |

| | | | |

| Net asset value, beginning of period | | | $15.82 | | | | $16.50 | | | | $15.58 | | | | $15.59 | |

| | | | |

| Income (loss) from operations: | | | | | | | | | | | | | | | | |

Net investment income | | | 0.28 | | | | 0.54 | | | | 0.52 | | | | 0.07 | |

Net realized and unrealized gain (loss) | | | 0.87 | | | | (0.68) | | | | 0.94 | | | | 0.01 | |

Total income (loss) from operations | | | 1.15 | | | | (0.14) | | | | 1.46 | | | | 0.08 | |

| | | | |

| Less distributions from: | | | | | | | | | | | | | | | | |

Net investment income | | | (0.28) | | | | (0.54) | | | | (0.54) | | | | (0.09) | |

Total distributions | | | (0.28) | | | | (0.54) | | | | (0.54) | | | | (0.09) | |

| | | | |

| Net asset value, end of period | | | $16.69 | | | | $15.82 | | | | $16.50 | | | | $15.58 | |

Total return4 | | | 7.32 | % | | | (0.90) | % | | | 9.44 | % | | | 0.53 | % |

| | | | |

| Net assets, end of period (000s) | | | $29,196 | | | | $28,186 | | | | $21,000 | | | | $1,965 | |

| | | | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.45 | %5 | | | 1.43 | % | | | 1.52 | % | | | 1.99 | %5 |

Net expenses6,7,8 | | | 1.24 | 5 | | | 1.21 | | | | 1.20 | | | | 1.17 | 5 |

Net investment income | | | 3.43 | 5 | | | 3.31 | | | | 3.22 | | | | 3.51 | 5 |

| | | | |

| Portfolio turnover rate | | | 2 | % | | | 15 | % | | | 6 | % | | | 8 | % |

| 1 | Per share amounts have been calculated using the average shares method. |

| 2 | For the six months ended September 30, 2011 (unaudited). |

| 3 | For the period February 5, 2009 (inception date) to March 31, 2009. |

| 4 | Performance figures, exclusive of CDSC, may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. Total returns for periods of less than one year are not annualized. |

| 6 | As a result of an expense limitation arrangement, the ratio of expenses, other than brokerage, interest, dividend expense on short sales, taxes, extraordinary expenses and acquired fund fees and expenses, to average net assets of Class C shares did not exceed 1.25%. This expense limitation arrangement cannot be terminated prior to December 31, 2013 without the Board of Trustees’ consent. |

| 7 | Reflects fee waivers and/or expense reimbursements. |

| 8 | The impact of compensating balance arrangements, if any, was less than 0.01%. |

See Notes to Financial Statements.

| | | | |

| Legg Mason Investment Counsel Maryland Tax-Free Income Trust 2011 Semi-Annual Report | | | 19 | |

| | | | | | | | | | | | | | | | |

For a share of each class of beneficial interest outstanding throughout each year ended March 31, unless otherwise noted: | |

| Class I Shares1,2 | | 20113 | | | 2011 | | | 2010 | | | 20094 | |

| | | | |

| Net asset value, beginning of period | | | $15.82 | | | | $ 16.51 | | | | $15.58 | | | | $15.83 | |

| | | | |

| Income (loss) from operations: | | | | | | | | | | | | | | | | |

Net investment income | | | 0.34 | | | | 0.67 | | | | 0.66 | | | | 0.47 | |

Net realized and unrealized gain (loss) | | | 0.88 | | | | (0.69) | | | | 0.94 | | | | (0.24) | |

Total income (loss) from operations | | | 1.22 | | | | (0.02) | | | | 1.60 | | | | 0.23 | |

| | | | |

| Less distributions from: | | | | | | | | | | | | | | | | |

Net investment income | | | (0.34) | | | | (0.67) | | | | (0.67) | | | | (0.48) | |

Total distributions | | | (0.34) | | | | (0.67) | | | | (0.67) | | | | (0.48) | |

| | | | |

| Net asset value, end of period | | | $16.70 | | | | $15.82 | | | | $16.51 | | | | $15.58 | |

Total return5 | | | 7.80 | % | | | (0.21) | % | | | 10.38 | % | | | 1.58 | % |

| | | | |

| Net assets, end of period (000s) | | | $18,261 | | | | $12,815 | | | | $8,221 | | | | $3,296 | |

| | | | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | |

Gross expenses | | | 0.73 | %6 | | | 0.78 | % | | | 0.90 | % | | | 1.22 | %6 |

Net expenses7,8,9 | | | 0.45 | 6 | | | 0.45 | | | | 0.45 | | | | 0.45 | 6 |

Net investment income | | | 4.20 | 6 | | | 4.08 | | | | 4.04 | | | | 4.72 | 6 |

| | | | |

| Portfolio turnover rate | | | 2 | % | | | 15 | % | | | 6 | % | | | 8 | % |

| 1 | Effective October 5, 2009, Institutional Class shares were renamed as Class I shares. |

| 2 | Per share amounts have been calculated using the average shares method. |

| 3 | For the six months ended September 30, 2011 (unaudited). |

| 4 | For the period July 30, 2008 (inception date) to March 31, 2009. |

| 5 | Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. Total returns for periods of less than one year are not annualized. |

| 7 | As a result of an expense limitation arrangement, the ratio of expenses, other than brokerage, interest, dividend expense on short sales, taxes, extraordinary expenses and acquired fund fees and expenses, to average net assets of Class I shares did not exceed 0.45%. This expense limitation arrangement cannot be terminated prior to December 31, 2013 without the Board of Trustees’ consent. |

| 8 | Reflects fee waivers and/or expense reimbursements. |

| 9 | The impact of compensating balance arrangements, if any, was less than 0.01%. |

See Notes to Financial Statements.

| | |

| 20 | | Legg Mason Investment Counsel Maryland Tax-Free Income Trust 2011 Semi-Annual Report |

Notes to financial statements (unaudited)

1. Organization and significant accounting policies

Legg Mason Investment Counsel Maryland Tax-Free Income Trust (the “Fund”) is a separate non-diversified investment series of Legg Mason Tax-Free Income Fund (the “Trust”). The Trust, a Massachusetts business trust, is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company.

The following are significant accounting policies consistently followed by the Fund and are in conformity with U.S. generally accepted accounting principles (“GAAP”). Estimates and assumptions are required to be made regarding assets, liabilities and changes in net assets resulting from operations when financial statements are prepared. Changes in the economic environment, financial markets and any other parameters used in determining these estimates could cause actual results to differ. Subsequent events have been evaluated through the date the financial statements were issued.

(a) Investment valuation. The valuations for fixed income securities and certain derivative instruments are typically the prices supplied by independent third party pricing services, which may use market prices or broker/dealer quotations or a variety of fair valuation techniques and methodologies. Short-term fixed income securities that will mature in 60 days or less are valued at amortized cost, unless it is determined that using this method would not reflect an investment’s fair value. Equity securities for which market quotations are available are valued at the last reported sales price or official closing price on the primary market or exchange on which they trade. If independent third party pricing services are unable to supply prices for a portfolio investment, or if the prices supplied are deemed by the manager to be unreliable, the market price may be determined by the manager using quotations from one or more broker/dealers. When reliable prices are not readily available, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded, but before the Fund calculates its net asset value, the Fund values these securities as determined in accordance with procedures approved by the Fund’s Board of Trustees.

The Fund has adopted Financial Accounting Standards Board Codification Topic 820 (“ASC Topic 820”). ASC Topic 820 establishes a single definition of fair value, creates a three-tier hierarchy as a framework for measuring fair value based on inputs used to value the Fund’s investments, and requires additional disclosure about fair value. The hierarchy of inputs is summarized below.

| Ÿ | | Level 1 — quoted prices in active markets for identical investments |

| Ÿ | | Level 2 — other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| Ÿ | | Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

| | | | |

| Legg Mason Investment Counsel Maryland Tax-Free Income Trust 2011 Semi-Annual Report | | | 21 | |

The Fund uses valuation techniques to measure fair value that are consistent with the market approach and/or income approach, depending on the type of security and the particular circumstance. The market approach uses prices and other relevant information generated by market transactions involving identical or comparable securities. The income approach uses valuation techniques to discount estimated future cash flows to present value.

The following is a summary of the inputs used in valuing the Fund’s assets carried at fair value:

| | | | | | | | | | | | | | | | |

| ASSETS | |

| Description | | Quoted Prices (Level 1) | | | Other Significant

Observable Inputs (Level 2) | | | Significant

Unobservable

Inputs (Level 3) | | | Total | |

| Municipal bonds† | | | — | | | $ | 184,731,291 | | | | — | | | $ | 184,731,291 | |

| Short-term investments† | | | — | | | | 3,590,000 | | | | — | | | | 3,590,000 | |

| Total investments | | | — | | | $ | 188,321,291 | | | | — | | | $ | 188,321,291 | |

| † | See Schedule of Investments for additional detailed categorizations. |

(b) Concentration risk. The Fund invests substantially all of its assets in securities issued by or on behalf of the State of Maryland, its political subdivisions, municipalities, agencies, instrumentalities, and public authorities. Changes in economic conditions in, or governmental policies of, the State of Maryland could have a significant impact on the performance of the Fund.

The Fund may focus a significant amount of its investments in a single sector of the municipal securities market. In doing so, the Fund is more susceptible to factors adversely affecting that sector than a fund not following that practice.

The Fund may invest a significant portion of assets in securities issued by local governments or public authorities that are rated according to their particular creditworthiness, which may vary significantly from the state’s general obligations. The value of the Fund’s shares will be more susceptible to being materially impacted by a single economic, political or regulatory event affecting those issuers or their securities than shares of a diversified fund.

(c) Security transactions and investment income. Security transactions are accounted for on a trade date basis. Interest income, adjusted for amortization of premium and accretion of discount, is recorded on the accrual basis. The cost of investments sold is determined by use of the specific identification method. To the extent any issuer defaults or a credit event occurs that impacts the issuer, the Fund may halt any additional interest income accruals and consider the realizability of interest accrued up to the date of default or credit event.

(d) Distributions to shareholders. Distributions from net investment income of the Fund are declared each business day to shareholders of record, and are paid monthly. The Fund intends to satisfy conditions that will enable interest from municipal securities, which is exempt from federal and certain state income taxes, to retain such tax-exempt status when distributed to the shareholders of the Fund.

| | |

| 22 | | Legg Mason Investment Counsel Maryland Tax-Free Income Trust 2011 Semi-Annual Report |

Notes to financial statements (unaudited) (cont’d)

Distributions of net realized gains, if any, are taxable and are declared at least annually. Distributions to shareholders of the Fund are recorded on the ex-dividend date and are determined in accordance with income tax regulations, which may differ from GAAP.

(e) Share class accounting. Investment income, common expenses and realized/unrealized gains (losses) on investments are allocated to the various classes of the Fund on the basis of daily net assets of each class. Fees relating to a specific class are charged directly to that share class.

(f) Compensating balance arrangements. The Fund has an arrangement with its custodian bank whereby a portion of the custodian’s fees is paid indirectly by credits earned on the Fund’s cash on deposit with the bank.