Congaree Acquisition Announcement Investor Presentation NASDAQ: CARO January 6, 2016

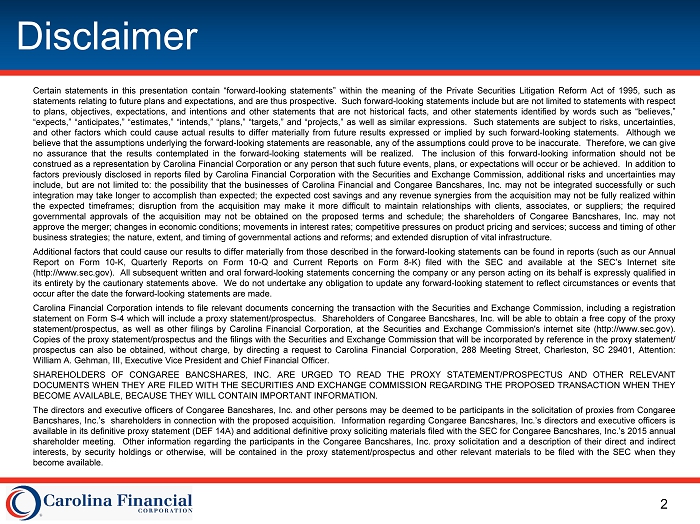

2 Disclaimer Certain statements in this presentation contain “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 , such as statements relating to future plans and expectations, and are thus prospective . Such forward - looking statements include but are not limited to statements with respect to plans, objectives, expectations, and intentions and other statements that are not historical facts, and other statements identified by words such as “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “targets,” and “projects,” as well as similar expressions . Such statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from future results expressed or implied by such forward - looking statements . Although we believe that the assumptions underlying the forward - looking statements are reasonable, any of the assumptions could prove to be inaccurate . Therefore, we can give no assurance that the results contemplated in the forward - looking statements will be realized . The inclusion of this forward - looking information should not be construed as a representation by Carolina Financial Corporation or any person that such future events, plans, or expectations will occur or be achieved . In addition to factors previously disclosed in reports filed by Carolina Financial Corporation with the Securities and Exchange Commission, additional risks and uncertainties may include, but are not limited to : the possibility that the businesses of Carolina Financial and Congaree Bancshares, Inc . may not be integrated successfully or such integration may take longer to accomplish than expected ; the expected cost savings and any revenue synergies from the acquisition may not be fully realized within the expected timeframes ; disruption from the acquisition may make it more difficult to maintain relationships with clients, associates, or suppliers ; the required governmental approvals of the acquisition may not be obtained on the proposed terms and schedule ; the shareholders of Congaree Bancshares, Inc . may not approve the merger ; changes in economic conditions ; movements in interest rates ; competitive pressures on product pricing and services ; success and timing of other business strategies ; the nature, extent, and timing of governmental actions and reforms ; and extended disruption of vital infrastructure . Additional factors that could cause our results to differ materially from those described in the forward - looking statements can be found in reports (such as our Annual Report on Form 10 - K, Quarterly Reports on Form 10 - Q and Current Reports on Form 8 - K) filed with the SEC and available at the SEC’s Internet site (http : //www . sec . gov) . All subsequent written and oral forward - looking statements concerning the company or any person acting on its behalf is expressly qualified in its entirety by the cautionary statements above . We do not undertake any obligation to update any forward - looking statement to reflect circumstances or events that occur after the date the forward - looking statements are made . Carolina Financial Corporation intends to file relevant documents concerning the transaction with the Securities and Exchange Commission, including a registration statement on Form S - 4 which will include a proxy statement/prospectus . Shareholders of Congaree Bancshares, Inc . will be able to obtain a free copy of the proxy statement/prospectus, as well as other filings by Carolina Financial Corporation, at the Securities and Exchange Commission's internet site (http : //www . sec . gov) . Copies of the proxy statement/prospectus and the filings with the Securities and Exchange Commission that will be incorporated by reference in the proxy statement/ prospectus can also be obtained, without charge, by directing a request to Carolina Financial Corporation, 288 Meeting Street, Charleston, SC 29401 , Attention : William A . Gehman, III, Executive Vice President and Chief Financial Officer . SHAREHOLDERS OF CONGAREE BANCSHARES, INC . ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS WHEN THEY ARE FILED WITH THE SECURITIES AND EXCHANGE COMMISSION REGARDING THE PROPOSED TRANSACTION WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION . The directors and executive officers of Congaree Bancshares, Inc . and other persons may be deemed to be participants in the solicitation of proxies from Congaree Bancshares, Inc . ’s shareholders in connection with the proposed acquisition . Information regarding Congaree Bancshares, Inc . ’s directors and executive officers is available in its definitive proxy statement (DEF 14 A) and additional definitive proxy soliciting materials filed with the SEC for Congaree Bancshares, Inc . ’s 2015 annual shareholder meeting . Other information regarding the participants in the Congaree Bancshares, Inc . proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available .

3 North Carolina South Carolina Greenville Charlotte Raleigh Greensboro Myrtle Beach Wilmington Charleston Columbia Augusta Savannah Florence Winston Salem Asheville Congaree Acquisition Overview Branch (27) Loan Production Office (2) CNRB Branch (2) • Important step in Carolina Financial’s mission to be “The Trusted Community Bank of Choice” and the leading community banking franchise in the Carolinas – Market expansion to demographically attractive and contiguous Columbia, SC MSA • Financially compelling acquisition – Immediate and meaningful EPS accretion – Tangible book value dilution earned back in less than three years (2) – Internal rate of return greater than 20% – Pro forma regulatory ratios above “well - capitalized” guidelines • Attractive target with strong core deposit base • Cultural fit – similar customers and familiar management team • Opportunity for substantial upside – Ability to introduce Carolina Financial’s products and services to the Columbia market and existing Congaree customers Financially & Strategically Compelling Transaction Attractive Market Expansion (1) Includes the assumption of $1.6 million of preferred stock (2) Uses the “cross - over” methodology Source: SNL Financial LC Congaree Acquisition • Carolina Financial executed a definitive agreement to acquire Congaree Bancshares, Inc. – $117 million asset bank headquartered in Cayce, South Carolina – Deal price of $8.10 per share (~$16.3 million aggregate (1) ) equal to 119% of tangible book value per share – Consideration comprised of 60% stock and 40% cash

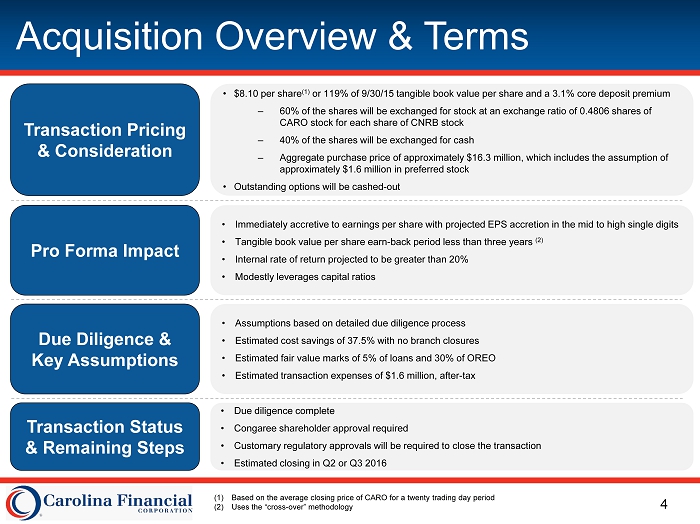

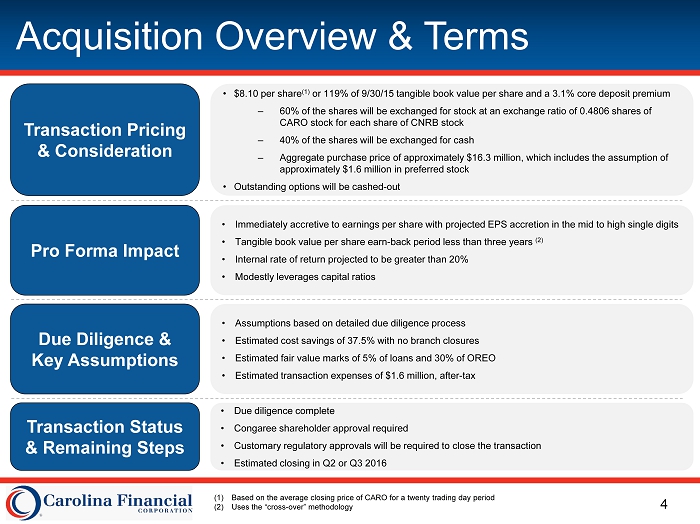

4 Acquisition Overview & Terms • $ 8.10 per share (1 ) or 119% of 9/30/15 tangible book value per share and a 3.1% core deposit premium – 60% of the shares will be exchanged for stock at an exchange ratio of 0.4806 shares of CARO stock for each share of CNRB stock – 40% of the shares will be exchanged for cash – Aggregate purchase price of approximately $16.3 million, which includes the assumption of approximately $1.6 million in preferred stock • Outstanding options will be cashed - out • Immediately accretive to earnings per share with projected EPS accretion in the mid to high single digits • Tangible book value per share earn - back period less than three years (2) • Internal rate of return projected to be greater than 20% • Modestly leverages capital ratios • Assumptions based on detailed due diligence process • Estimated cost savings of 37.5% with no branch closures • Estimated fair value marks of 5% of loans and 30% of OREO • Estimated transaction expenses of $1.6 million, after - tax Transaction Pricing & Consideration Pro Forma Impact Due Diligence & Key Assumptions Transaction Status & Remaining Steps • Due diligence complete • Congaree shareholder approval required • Customary regulatory approvals will be required to close the transaction • Estimated closing in Q2 or Q3 2016 (1) Based on the average closing price of CARO for a twenty trading day period (2) Uses the “cross - over” methodology

5 Transaction Rationale x Attractive opportunity to continue to execute on strategic objectives of disciplined, profitable growth x Scarce market expansion opportunity – one of the few opportunities to acquire in the Columbia market x Columbia market has strong demographic characteristics and complements recent expansion into the Greenville MSA x Positive financial implications – strong EPS accretion and modest TBV dilution with attractive earn - back period x Deploys some of the proceeds of recent common stock offering x Manageable size for streamlined integration / limited opportunity cost

6 Overview of Congaree Bancshares, Inc. Congaree Financial Highlights • Congaree Bancshares, Inc., headquartered in Cayce, SC, operates two banking offices in the Columbia, SC MSA • The company is listed on the OTC Pink under the symbol “CNRB” and has a market capitalization of $10.5 million (1) • Congaree is the holding company for its sole commercial bank subsidiary, Congaree State Bank (1) Market data as of December 31, 2015 Note: Year - to - date financial data as of September 30, 2015 Source: SNL Financial LC Congaree Branch Map (Dollars in thousands, except per share data) Congaree Bancshares, Inc. (Cayce, SC) Company Overview Date Established (Bank) 10/16/2006 Closing Price (12/31/15) $5.95 Chief Executive Officer Charles Kirby (62) Market Capitalization ($MMs) $10.5 Chief Financial Officer Charlie Lovering (47) Price / Tangible Book 87.4% Employees 23 Price / LTM EPS NM Dividend Yield 0.00% Balance Sheet Highlights 2012 2013 2014 9/15 YTD Total Assets 113,454$ 112,539$ 112,922$ 116,689$ Total Net Loans 79,406 76,650 77,420 80,466 Total Deposits 94,803 91,130 87,958 95,827 Total Equity 12,449 12,409 13,345 13,582 Tangible Common Equity 10,183 10,125 11,781 12,018 Profitability 2012 2013 2014 9/15 YTD Net Income 1,017$ 1,023$ 1,358$ 232$ Net Income Avail. to Common 819 884 1,199 127 Diluted Earnings Per Share 0.46 0.50 0.68 0.07 Tangible Book Value Per Share 5.77 5.73 6.68 6.81 Common Dividends Per Share 0.00 0.00 0.00 0.00 Performance Ratios (%) 2012 2013 2014 9/15 YTD ROAA 0.86 0.91 1.21 0.27 ROAE 7.9 8.3 11.0 2.3 ROATCE 8.5 8.9 11.3 1.4 Net Interest Margin 4.08 4.11 3.99 4.09 Efficiency Ratio 76 78 82 82 Non-Int. Income / Avg. Assets 0.32 0.31 0.32 0.44 Non-Int. Expense / Avg. Assets 3.45 3.55 3.33 3.66 Capital Ratios (%) 2012 2013 2014 9/15 YTD Tang. Common Equity / Tang. Assets 9.0 9.0 10.4 10.3 Leverage Ratio (Bank) 10.2 10.8 10.6 10.8 Tier 1 Capital Ratio (Bank) 14.7 15.2 14.6 13.8 Total Risk Based Capital Ratio (Bank) 16.0 16.5 15.9 15.1 Asset Quality (Bank Level) (%) 2012 2013 2014 9/15 YTD NPAs / Assets 5.08 4.06 3.72 2.32 Reserves / NPAs 22 29 24 41 NCOs / Average Loans 0.97 0.49 0.86 0.15 Note: Consolidated financial data unless indicated otherwise Columbia, SC

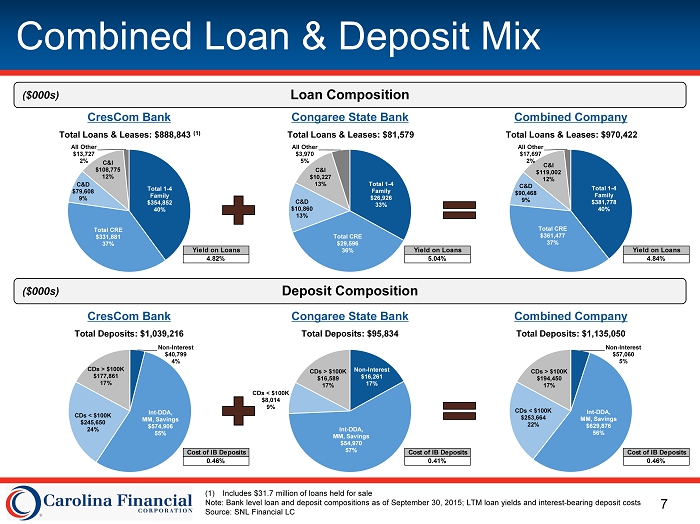

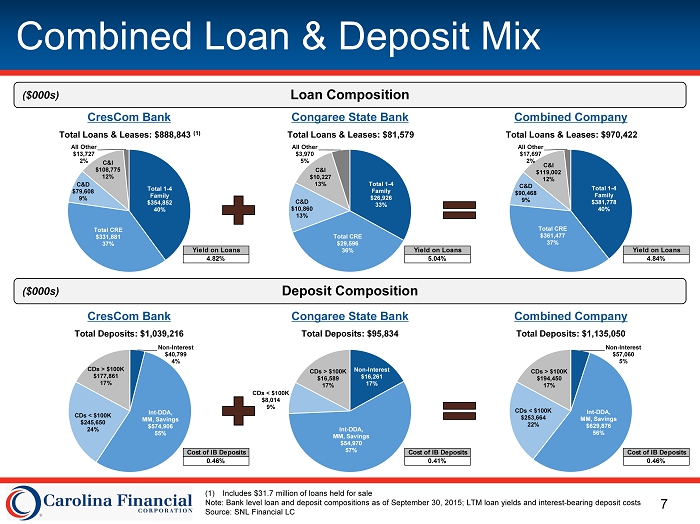

7 Combined Loan & Deposit Mix Loan Composition ($000s) Deposit Composition ($000s) Total Deposits : $1,039,216 Total Deposits : $95,834 Total Deposits: $1,135,050 Total Loans & Leases: $888,843 (1) Total Loans & Leases: $81,579 Total Loans & Leases: $970,422 CresCom Bank Congaree State Bank Combined Company CresCom Bank Congaree State Bank Combined Company Total 1 - 4 Family $354,852 40% Total CRE $331,881 37% C&D $79,608 9% C&I $108,775 12% All Other $13,727 2% Total 1 - 4 Family $26,926 33% Total CRE $29,596 36% C&D $10,860 13% C&I $10,227 13% All Other $3,970 5% Total 1 - 4 Family $381,778 40% Total CRE $361,477 37% C&D $90,468 9% C&I $119,002 12% All Other $17,697 2% Non - Interest $40,799 4% Int - DDA, MM, Savings $574,906 55% CDs < $100K $245,650 24% CDs > $100K $177,861 17% Non - Interest $16,261 17% Int - DDA, MM, Savings $54,970 57% CDs < $100K $8,014 9% CDs > $100K $16,589 17% Non - Interest $57,060 5% Int - DDA, MM, Savings $629,876 56% CDs < $100K $253,664 22% CDs > $100K $194,450 17% (1) Includes $31.7 million of loans held for sale Note: Bank level loan and deposit compositions as of September 30, 2015; LTM loan yields and interest - bearing deposit costs Source: SNL Financial LC Yield on Loans 4.82% Yield on Loans 5.04% Cost of IB Deposits 0.41% Yield on Loans 4.84% Cost of IB Deposits 0.46% Cost of IB Deposits 0.46%

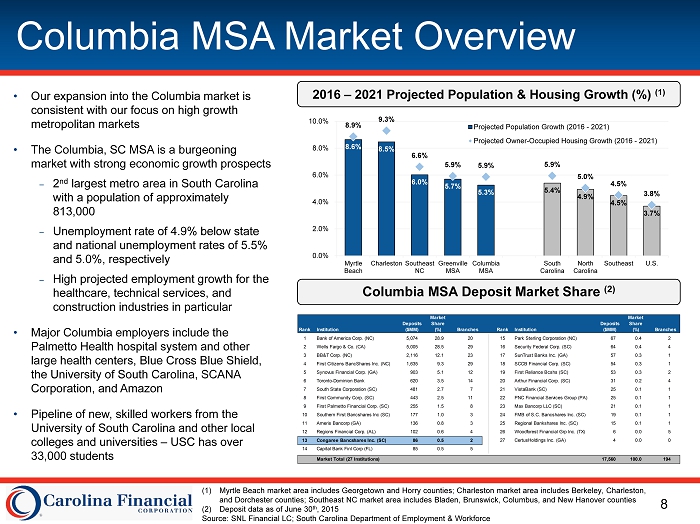

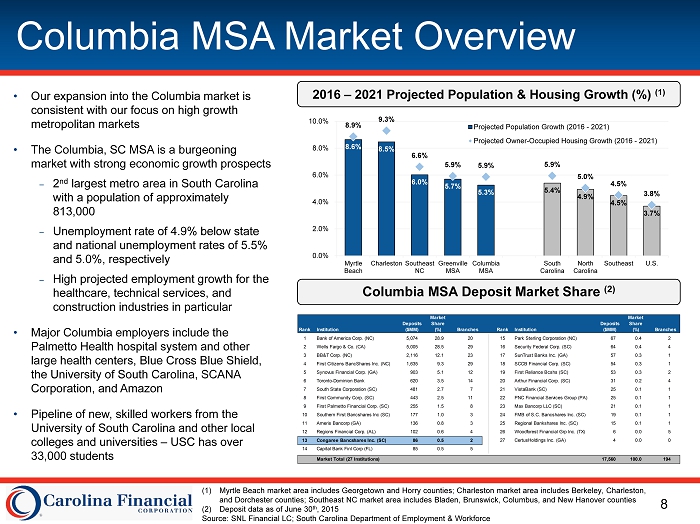

8 Columbia MSA Market Overview (1) Myrtle Beach market area includes Georgetown and Horry counties; Charleston market area includes Berkeley, Charleston, and Dorchester counties; Southeast NC market area includes Bladen, Brunswick, Columbus, and New Hanover counties (2) Deposit data as of June 30 th , 2015 Source: SNL Financial LC; South Carolina Department of Employment & Workforce 2016 – 2021 Projected Population & Housing Growth (%) (1) Columbia MSA Deposit Market Share (2) 8.6% 8.5% 6.0% 5.7% 5.3% 5.4% 4.9% 4.5% 3.7% 8.9% 9.3% 6.6% 5.9% 5.9% 5.9% 5.0% 4.5% 3.8% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% Myrtle Beach Charleston Southeast NC Greenville MSA Columbia MSA South Carolina North Carolina Southeast U.S. Projected Population Growth (2016 - 2021) Projected Owner-Occupied Housing Growth (2016 - 2021) Rank Institution Deposits ($MM) Market Share (%) Branches Rank Institution Deposits ($MM) Market Share (%) Branches 1 Bank of America Corp. (NC) 5,074 28.9 20 15 Park Sterling Corporation (NC) 67 0.4 2 2 Wells Fargo & Co. (CA) 5,005 28.5 29 16 Security Federal Corp. (SC) 64 0.4 4 3 BB&T Corp. (NC) 2,116 12.1 23 17 SunTrust Banks Inc. (GA) 57 0.3 1 4 First Citizens BancShares Inc. (NC) 1,635 9.3 29 18 SCCB Financial Corp. (SC) 54 0.3 1 5 Synovus Financial Corp. (GA) 903 5.1 12 19 First Reliance Bcshs (SC) 53 0.3 2 6 Toronto-Dominion Bank 620 3.5 14 20 Arthur Financial Corp. (SC) 31 0.2 4 7 South State Corporation (SC) 481 2.7 7 21 VistaBank (SC) 25 0.1 1 8 First Community Corp. (SC) 443 2.5 11 22 PNC Financial Services Group (PA) 25 0.1 1 9 First Palmetto Financial Corp. (SC) 255 1.5 8 23 Max Bancorp LLC (SC) 21 0.1 1 10 Southern First Bancshares Inc (SC) 177 1.0 3 24 FMB of S.C. Bancshares Inc. (SC) 19 0.1 1 11 Ameris Bancorp (GA) 136 0.8 3 25 Regional Bankshares Inc. (SC) 15 0.1 1 12 Regions Financial Corp. (AL) 102 0.6 4 26 Woodforest Financial Grp Inc. (TX) 6 0.0 5 13 Congaree Bancshares Inc. (SC) 86 0.5 2 27 CertusHoldings Inc. (GA) 4 0.0 0 14 Capital Bank Finl Corp (FL) 85 0.5 5 Market Total (27 Institutions) 17,560 100.0 194 • Our expansion into the Columbia market is consistent with our focus on high growth metropolitan markets • The Columbia, SC MSA is a burgeoning market with strong economic growth prospects – 2 nd largest metro area in South Carolina with a population of approximately 813,000 – Unemployment rate of 4.9% below state and national unemployment rates of 5.5% and 5.0%, respectively – High projected employment growth for the healthcare, technical services, and construction industries in particular • Major Columbia employers include the Palmetto Health hospital system and other large health centers, Blue Cross Blue Shield, the University of South Carolina, SCANA Corporation, and Amazon • Pipeline of new, skilled workers from the University of South Carolina and other local colleges and universities – USC has over 33,000 students

Carolina Financial Corporation

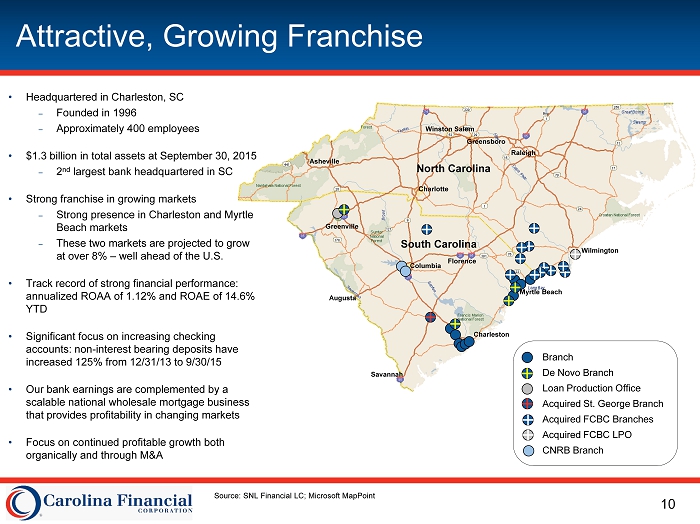

10 Attractive, Growing Franchise Source: SNL Financial LC; Microsoft MapPoint North Carolina South Carolina Greenville Charlotte Raleigh Greensboro Myrtle Beach Wilmington Charleston Columbia Augusta Savannah Florence Winston Salem Asheville • Headquartered in Charleston, SC – Founded in 1996 – Approximately 400 employees • $1.3 billion in total assets at September 30, 2015 – 2 nd largest bank headquartered in SC • Strong franchise in growing markets – Strong presence in Charleston and Myrtle Beach markets – These two markets are projected to grow at over 8% – well ahead of the U.S. • Track record of strong financial performance: annualized ROAA of 1.12% and ROAE of 14.6% YTD • Significant focus on increasing checking accounts: non - interest bearing deposits have increased 125% from 12/31/13 to 9/30/15 • Our bank earnings are complemented by a scalable national wholesale mortgage business that provides profitability in changing markets • Focus on continued profitable growth both organically and through M&A Branch De Novo Branch Loan Production Office Acquired St. George Branch Acquired FCBC Branches Acquired FCBC LPO CNRB Branch

11 Superior Market Performance Stock Price Performance | Since Listing on October 9 , 2013 (1) Full underwriters’ overallotment subsequently exercised for total gross proceeds from the offering of $34.5 million Note: Market data as of December 31, 2015 Source: SNL Financial LC; OTC Markets 0 40,000 80,000 120,000 160,000 200,000 240,000 280,000 320,000 $4.00 $6.00 $8.00 $10.00 $12.00 $14.00 $16.00 $18.00 $20.00 Oct-13 Jan-14 Apr-14 Jul-14 Oct-14 Jan-15 Apr-15 Jul-15 Oct-15 CARO Volume CARO Price Nasdaq Bank Indexed to CARO $18.00 10/9/13: Listed on the OTC Bulletin Board at $7.81 per share 7/1/14: Listed on NASDAQ 12/9/15: Completed $34.5 million common stock offering (1) 2/21/14: Completed acquisition of First Federal of South Carolina’s St. George, SC branch (announced on 8/28/13) 8/7/14: Announced acquisition of 13 branches from First Community Bancshares, Inc. 12/12/14: Completed acquisition of 13 branches from First Community Bancshares, Inc.

12 Carolina Financial Investment Rationale Wholesale Mortgage Platform • Opportunity to capture significant profits in mortgage cycles • Ability to scale up and down to maintain profitability • Significant management expertise Strong Credit Quality • Significantly improved credit quality • Low level of NPAs when excluding performing TDRs • Net recoveries in 2014 and YTD Continued Opportunity for M&A • Pending acquisition of Congaree • Recently completed two branch acquisitions totaling 14 branches • Actively evaluating opportunities in the marketplace Proven Ability to Deploy Capital • Strong organic growth in attractive South Carolina and North Carolina markets • Demonstrated success at M&A growth – both branch and whole bank M&A • Disciplined focus on profitable growth Experienced Management Team • New management team named in 2012 • Deep team with strong past experience and local roots Strong Franchise in Growth Markets • Core markets have strong demographics • Significant market share in Charleston and Myrtle Beach • Expanding in Greenville, SC; Wilmington, NC; and other nearby growth markets Strengthening Bank Earnings • The bank segment is generating attractive profitability and is positioned to improve • Strong NIM, lower credit costs, and increased operating leverage have contributed to these goals Focus on Improving Funding • Significant increase in the level of non - interest bearing deposits • Proven model to grow checking accounts Improving Net Interest Margin • Net interest margin has increased from 2013 levels • Significant reduction in the cost of funds