SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement x Definitive Proxy Statement ¨ Definitive Additional Materials ¨ Soliciting Material Pursuant to Section 240.14a-12 | | ¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

Worldwide Restaurant Concepts, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

| (1) | | Title of each class of securities to which transaction applies: |

| (2) | | Aggregate number of securities to which transaction applies: |

| (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | | Proposed maximum aggregate value of transaction: |

¨ Fee paid previously with preliminary materials.

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| (1) | | Amount Previously Paid: |

| (2) | | Form, Schedule or Registration Statement No.: |

July 26, 2002

TO OUR STOCKHOLDERS:

You are cordially invited to attend the Annual Meeting of Stockholders of Worldwide Restaurant Concepts, Inc. (formerly known as Sizzler International, Inc.) to be held at the Radisson Hotel at 15433 Ventura Boulevard, Sherman Oaks, California 91403, on Wednesday, August 28, 2002 at 3:30 p.m. In the attached Notice of Annual Meeting of Stockholders and Proxy Statement, we describe the matters expected to be acted upon at the Annual Meeting. We are enclosing our 2002 Annual Report on Form 10-K with this letter.

Your vote is very important. Whether or not you expect to attend the Annual Meeting, please complete, sign and date the enclosed proxy card and return it as promptly as possible.

| Sincerely, |

|

Phillip D. Matthews Chairman of the Board |

July 26, 2002

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held August 28, 2002

To the Stockholders of

Worldwide Restaurant Concepts, Inc.:

The Annual Meeting of Stockholders of Worldwide Restaurant Concepts, Inc., a Delaware corporation formerly known as Sizzler International, Inc. (the “Company”), will be held at the Radisson Hotel at 15433 Ventura Boulevard, Sherman Oaks, California 91403, on Wednesday, August 28, 2002 at 3:30 p.m. for the following purposes:

1. To elect three directors to serve until the 2005 Annual Meeting of Stockholders and until their successors are elected and qualified;

2. To ratify the appointment of Deloitte & Touche LLP as the Company’s independent auditors for the fiscal year ending April 30, 2003; and

3. To transact such other business as may properly come before the meeting or any adjournment of the meeting.

The Board of Directors has fixed the close of business on July 1, 2002 as the record date for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting and any adjournment or postponement thereof.

In order to constitute a quorum for the conduct of business at the Annual Meeting, holders of a majority of all outstanding shares of Common Stock must be present in person or be represented by proxy. We hope that you will take this opportunity to take an active part in the affairs of the Company by voting on the business to come before the meeting, either by executing and returning the enclosed proxy in the postage paid, return envelope provided or by casting your vote in person at the meeting.

| By Order of the Board of Directors, |

|

Michael B. Green Secretary |

WORLDWIDE RESTAURANT CONCEPTS, INC.

15301 Ventura Boulevard, Building B-Suite 300

Sherman Oaks, California 91403

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

August 28, 2002

SOLICITATION OF PROXIES

This Proxy Statement is being furnished in connection with the solicitation of proxies by the Board of Directors of Worldwide Restaurant Concepts, Inc., a Delaware corporation (the “Company”). The proxies are intended to be used at the Company’s 2002 Annual Meeting of Stockholders, and any adjournment or postponement thereof (the “Annual Meeting”). The Annual Meeting is to be held at 3:30 p.m. on Wednesday, August 28, 2002 at the Radisson Valley Center Hotel, 15433 Ventura Boulevard, Sherman Oaks, California 91403 for the purposes set forth in the accompanying notice.

This Proxy Statement is being mailed on or about July 26, 2002 to stockholders entitled to notice of and to vote at the Annual Meeting. A copy of the Company’s Annual Report on Form 10-K for the fiscal year ended April 30, 2002, which includes the Company’s financial statements as of and for the year ended April 30, 2002, accompanies this Proxy Statement.Stockholders may obtain an additional copy of the Company’s Annual Report on Form 10-K and a list of the exhibits thereto without charge by written request to the Chief Financial Officer of the Company, 15301 Ventura Boulevard, Building B-Suite 300, Sherman Oaks, California 91403.

A form of proxy also is enclosed with this Proxy Statement. The shares represented by each properly executed unrevoked proxy will be voted as directed by the stockholder executing the proxy. If no direction is made, the shares represented by each properly executed unrevoked proxy will be voted FOR the election of the nominees named below under the heading “Election of Directors” to the Company’s Board of Directors, and FOR the ratification of Deloitte & Touche LLP as the Company’s independent auditors for the fiscal year ending April 30, 2003. If any of the nominees become unavailable as a candidate before his election, the proxies may be voted, in the discretion of the proxy holders, for the election of other nominees. If any matter other than the proposals described in this Proxy Statement properly comes before the Annual Meeting, it is the intention of the proxy holders to vote the proxies in accordance with their best judgment.

A stockholder giving a proxy may revoke it at any time before it is voted by filing written notice of revocation with Michael B. Green, Secretary of the Company, at 15301 Ventura Boulevard, Building B-Suite 300, Sherman Oaks, California 91403, or by appearing at the Annual Meeting and voting in person, or by giving a valid proxy bearing a later date.

RECORD DATE AND VOTING

Only stockholders of record at the close of business on July 1, 2002 (the “Record Date”) are entitled to notice of and to vote at the Annual Meeting and any adjournment thereof. As of the Record Date, there were 29,230,135 issued shares of Common Stock, 2,000,000 of which were held by the Company as treasury stock. A total of 27,230,135 shares of Common Stock outstanding as of the Record Date (constituting all of the then outstanding shares of Common Stock other than shares held by the Company as treasury stock) are entitled to be voted. Shares of Common Stock held by the Company as treasury stock are not entitled to be voted.

Each holder of a share of Common Stock that is entitled to be voted is entitled to one vote per share on all matters to be voted on by the Company’s stockholders, except in the event of cumulative voting for the election of directors. The presence, either in person or by proxy, of persons entitled to vote a majority in voting interest of the Company’s outstanding Common Stock will constitute a quorum for the transaction of business at the Annual Meeting.

1

If a broker, bank custodian, nominee or other record holder of Common Stock indicates on a proxy that it does not have discretionary authority to vote certain shares, the shares held by such record holders will be considered “broker nonvotes.” The shares considered broker nonvotes with respect to the ratification of Deloitte & Touche LLP will be counted for purposes of determining the presence of a quorum for the transaction of business, but will not be counted as shares entitled to vote on the matter and will have no effect on the result of the vote.

The Company will appoint one or more inspectors to act at the Annual Meeting. The inspector’s duties will include determining the shares represented at the Annual Meeting and the presence (or absence) of a quorum and tabulating the votes of stockholders.

Election of Directors. Election of a director requires affirmative votes of the holders of a plurality of the shares present and in person or represented by proxy at a meeting at which a quorum is present. Accordingly, the three persons receiving the greatest number of votes shall be elected as directors. Since only affirmative votes count for this purpose, withheld votes will not affect the outcome, except that they will count in determining the presence of a quorum.

The Company’s Certificate of Incorporation permits cumulative voting with respect to the election of directors. Although the proxy holders do not presently intend to cumulate votes, if one or more stockholders gives notice at the Annual Meeting, prior to voting, of an intention to cumulate for a nominated director, then all shares may be voted cumulatively. Cumulative voting means that each share is entitled to a number of votes equal to the number of directors to be elected. Such votes may be cast for one nominee or distributed among two or more nominees.

Ratification of Independent Auditors. Assuming that a quorum is present at the Annual Meeting, the affirmative vote of holders of a majority of the shares of the Company’s Common Stock represented and voting, in person or by proxy, at the Annual Meeting and entitled to vote on the matter is required for the appointment of Deloitte & Touche LLP as the Company’s independent auditors for the fiscal year ending on April 30, 2003. With respect to the ratification of Deloitte & Touche LLP, a stockholder may mark the accompanying form of proxy to (i) vote for the matter, (ii) vote against the matter, or (iii) abstain from voting on the matter. Proxies marked to abstain from voting with respect to the appointment of Deloitte & Touche LLP will be counted for purposes of determining the presence of a quorum and as a vote against the matter.

EACH STOCKHOLDER WHO DOES NOT EXPECT TO ATTEND THE ANNUAL MEETING IN PERSON IS URGED TO EXECUTE THE PROXY AND RETURN IT PROMPTLY IN THE ENCLOSED ENVELOPE.

INFORMATION ABOUT THE COMPANY

The Company (together with its subsidiaries) owns and operates, and franchises to others, restaurants that do business under the Sizzler® service mark in the United States and abroad. Sizzler® restaurants operate in the mid-scale casual dining market and feature a selection of grilled steak, chicken and seafood entrees, sandwiches and specialty platters as well as a fresh fruit and salad bar in a family environment. The Company also is the holder of an 87.2% interest in a 15-unit chain of restaurants in the San Diego, Orange County, San Bernardino County and Phoenix markets that do business under the trade name “Pat & Oscar’sSM”. Pat & Oscar’sSM restaurants operate in the quick casual market and feature a selection of pizza, pasta, chicken, ribs and salad entrees. The Company also operates “KFC®” quick service restaurants featuring fried chicken, sandwiches and various side orders in Queensland, Australia.

2

PRINCIPAL STOCKHOLDERS

As of June 30, 2002, according to filings with the Securities and Exchange Commission and to the best knowledge of the Company, the following persons are the beneficial owners of more than 5% of the outstanding shares of the Common Stock of the Company.

Name and Address

| | Amount and Nature of Beneficial Ownership(1)

| | | Percent Of Class(2)

| |

|

James A. Collins 6101 West Centinela Avenue Culver City, California 90230 | | 3,854,911 | (3) | | 13.4 | % |

|

FMR Corp. (“FMR”) (4)82 Devonshire Street Boston, Massachusetts 02109 | | 2,713,800 | | | 9.4 | % |

|

Dimensional Fund Advisors Inc. (“DFAI”) (5) 1299 Ocean Avenue, 11th Floor Santa Monica, California 90401 | | 1,652,434 | | | 5.7 | % |

|

Strong Capital Management (“Strong”) 100 Heritage Reserve Menomonee Falls, WI 53051 | | 1,523,130 | (6) | | 5.3 | % |

| (1) | | Unless otherwise indicated, possesses sole voting and dispositive power for all shares of Common Stock the beneficial ownership of which is ascribed. |

| (2) | | In accordance with rules of the Securities and Exchange Commission, percentages were calculated on the basis of the amount of outstanding shares, excluding shares held by or for the account of the Company, plus shares deemed outstanding pursuant to Rule 13d-3(d)(1) under the Securities Exchange Act of 1934, as amended. |

| (3) | | Does not include 334,483 shares of Common Stock held by an independent trustee for the benefit of Mr. Collins’ adult children, as to which shares Mr. Collins disclaims beneficial ownership. |

| (4) | | FMR is the parent company of Fidelity Management and Research Company (“Fidelity”), a registered investment adviser. Fidelity acts as investment adviser to various investment companies. |

| (5) | | DFAI and its affiliates disclaim beneficial ownership of any Common Stock. According to their SEC filings, DFAI and its affiliates may be deemed to be beneficial owners of the shares as a result of serving as investment adviser and investment managers of various portfolios. |

| (6) | | According to its SEC filing, Strong lacks sole voting or dispositive power with respect to any of the shares of Common Stock, and possesses shared voting power with respect to 1,342,710 shares and shared dispositive power with respect to 1,523,130 shares. Strong is a registered investment adviser whose clients (none of whom has more than 5% of the outstanding shares of the Common Stock) have the right to receive or the power to direct the receipt of, dividends on or the proceeds of the sale of the shares. |

3

PROPOSAL NO. 1 – ELECTION OF DIRECTORS

The Board of Directors consists of seven members, divided into three classes. The term of Class I (consisting of two members) expires at the 2004 Annual Meeting, the term of Class II (consisting of three members) expires at the 2002 Annual Meeting, and the term of Class III (consisting of two members) expires at the 2003 Annual Meeting. The Board of Directors has nominated incumbent Class II directors Charles L. Boppell, Phillip D. Matthews and Robert A. Muh to serve as directors of the Company until the 2005 Annual Meeting.

Certain information concerning the nominees and the incumbent directors whose terms continue after the Annual Meeting is set forth below:

NOMINEES FOR ELECTION AT THE ANNUAL MEETING

Name and Age | Present Principal Occupation and Five Year Business Experience |

Class II: If elected, term will expire in 2005

| Charles L. Boppell (60) | President and Chief Executive Officer of the Company since 1999. Director of the Company since 1999. President and Chief Executive Officer of La Salsa Holding Co. (1993-1999). Director, Fresh Choice, Inc. |

| Phillip D. Matthews (64) | Director of the Company since 1997. Chief Executive Officer of Sutter Securities, Inc. (1992-1997, 1998 to the present). President, Financial Services International (1987-1992; 1997-1998). Trustee, Massachusetts Institute of Technology (1988 to present) and Director, Dayrunner, Inc. (2001-present). |

| Robert A. Muh (64) | Director of the Company since 1997. Chief Executive Officer of Sutter Securities, Inc. (1992-1997, 1998 to the present). President, Financial Services International (1987-1992; 1997-1998). Trustee, Massachusetts Institute of Technology (1988 to present) and Director, Dayrunner, Inc. (2001-present). |

INCUMBENT DIRECTORS WHOSE TERMS CONTINUE AFTER THE ANNUAL MEETING

Name and Age | Present Principal Occupation and Five Year Business Experience |

Class II: Term expires in 2003

| Barry E. Krantz (58) | Director of the Company since 1997. Restaurant industry consultant since 1995. Consultant to the Company (December 1, 1996 to September 30, 1999). President and Chief Operating Officer, Family Restaurants, Inc. (1994-1995). Chief Operating Officer, Restaurant Enterprises Group, Inc. (1993-1994). President, Family Restaurant Division of Restaurant Enterprises Group, Inc. (1989-1994). Director, Fresh Choice, Inc. |

| Kevin W. Perkins (50) | Executive Vice President of the Company and President and Chief Executive Officer of International Operations of the Company since 1997. Director of the Company (1994 to present). President and Chief Executive Officer of the Company (1994-1997). |

4

Class I: Term expires in 2004

| James A. Collins (75) | Chairman Emeritus of the Board of the Company since 1999. Director of the Company and its predecessor Collins Foods International, Inc. since 1968. Chairman of the Board of the Company and its predecessor Collins Foods International (1968-1999). Chief Executive Officer of the Company from 1997 until 1999 |

| Charles F. Smith (69) | Director of the Company since 1995. President of Charles F. Smith & Co., Inc., an investment banking firm (1984 to present). Director, FirstFed Financial Corp., TransOcean Distribution, Ltd. and Anworth Mortgage Asset Corp. Trustee, St. John’s Hospital Foundation and Marymount High School. |

Except as otherwise indicated, during the past five years none of the directors has been employed by or has carried on his occupation in any corporation or organization which is a parent, subsidiary or other affiliate of the Company.

THE BOARD OF DIRECTORS AND CERTAIN OF ITS COMMITTEES

At the end of fiscal 2002, the Company’s Board of Directors consisted of seven directors, including the seven current directors. Phillip D. Matthews is the Chairman of the Board. The Board of Directors has an Audit Committee, a Compensation and Stock Option Committee, and a Nominating Committee.

The Board of Directors of the Company held six meetings during fiscal 2002. Each director attended 75% or more of the aggregate of the total number of meetings of the Board of Directors and the total number of meetings held by committees of the board on which he served. During fiscal 2002, the Nominating Committee adopted, and the Board approved Board Governance Guidelines and excerpts of significant guidelines are listed in Exhibit A.

Charles F. Smith (Chairman), Phillip D. Matthews and Robert A. Muh comprised the Audit Committee. The Audit Committee met six times during fiscal 2002. The Audit Committee recommends to the Board of Directors the appointment of the Company’s independent auditors, reviews the fee arrangements and scope of the annual audit and considers the comments of the independent auditors with respect to internal accounting controls. The Board of Directors considers Mr. Smith, Mr. Matthews and Mr. Muh to be “independent” within the meaning of Sections 303.01(B)(2)(a) and (3) of the NYSE’s listing standards.

Phillip D. Matthews (Chairman), Barry E. Krantz and Robert A. Muh comprised the Compensation and Stock Option Committee, which met four times during fiscal 2002. The Compensation and Stock Option Committee approves officers’ salaries, administers executive compensation plans, reviews and approves the grant of options and restricted stock and approves bonus schedules for Company employees.

Robert A. Muh (Chairman), Phillip D. Matthews and James A. Collins comprised the Nominating Committee, which met once during fiscal 2002. The Nominating Committee has the responsibility of recommending candidates for election to the Board of Directors at the Annual Meeting of Stockholders and filling vacancies or newly created directorships. The Nominating Committee will consider nominees recommended by holders of the Company’s Common Stock. Stockholders desiring to make recommendations should submit them in writing to the Company at its principal executive offices, marked to the attention of “Chairman, Nominating Committee.”

Under the Company’s compensation policy for non-employee directors, each non-employee director is entitled to an annual retainer fee of $20,000 and a meeting fee of $1,000 for attending each meeting of the Board of Directors and each committee meeting not held in conjunction with a Board meeting. In addition, the Chairman of the Board receives an annual retainer fee of $25,000, the Chairman Emeritus receives an annual retainer fee of $30,000, and each committee chairman receives an annual retainer fee of $3,500 for each committee of which such director is a chairman.

The Company has a 1997 Non-Employee Directors’ Stock Incentive Plan (the “Directors’ Plan”). Under the Directors’ Plan, each director who is not an employee or officer of the Company or any of its parent or subsidiary corporations (a “Non-Employee Director”) is entitled to receive options to purchase shares of the Company’s Common Stock (“Options”). The Directors’ Plan provides for the issuance of up to 775,000 shares of the Company’s Common

5

Stock pursuant to exercise of Options. Options consist of Initial Options, Annual Options, Designated Committee Options, and Deferred Fees Options.

Initial Options. On the date that any person becomes a Non-Employee Director of the Company, such person is automatically granted an Option to purchase 1,000 shares of Common Stock (an “Initial Option”). The exercise price per share of an Initial Option is the fair market value per share of the Common Stock on the date of grant. Initial Options generally may not be exercised before the first anniversary of the date of grant. In addition, until the second anniversary of the date of grant, the holder of an Initial Option generally may not exercise more than 50% of the aggregate number of shares subject to such option.

Annual Options. On the first business day of each calendar year during the term of the Directors’ Plan, each eligible Non-Employee Director then in office is automatically granted an option (an “Annual Option”), the grant of which is such date in January, to purchase 2,000 shares of Common Stock at the fair market value of these shares on such date. Annual Options become exercisable no less than one year from the date of grant. To be eligible, a Non-Employee Director must not have been granted any discretionary options in lieu of Annual Options for the relevant calendar year. The following directors have been granted discretionary options in lieu of Annual Options and are not eligible for Annual Options through calendar year 2002: Barry E. Krantz, Phillip D. Matthews, Robert A. Muh, and Charles F. Smith.

Designated Committee Options. Each Non-Employee Director that is a member of a “Designated Committee” is entitled to receive Designated Committee Options. In lieu of attendance or other cash fees from the Company for participation on such committee, each Designated Committee member is automatically granted, on the date of each meeting of the Designated Committee attended by such Director, a Designated Committee Option to purchase 1,000 shares of Common Stock. The exercise price per share of a Designated Committee Option is the fair market value per share of the Common Stock on the date of grant, less $2.00. Designated Committee Options are exercisable immediately upon the date of grant. Currently, there are no Designated Committees of the Board of Directors, and the Company does not expect to grant any additional Designated Committee Options.

Deferred Fees Options. Each Non-Employee Director is entitled to elect to receive, in lieu of all or a specified portion of annual retainer fees for each of the remaining calendar years of his or her term (a “Plan Year”), an annual Deferred Fees Option. The number of shares of Common Stock subject to the Deferred Fees Option for each Plan Year is equal to the nearest number of whole shares determined in accordance with the following formula:

Annual Retainer or percentage thereof

| 50% of Fair Market Value per share | | = Number of Shares |

“Annual Retainer,” as defined in the Directors’ Plan, means the amount of fixed fees to which the Non-Employee Director is entitled for serving as a director of the Company in the relevant Plan Year. As defined, the Annual Retainer assumes no change in the director’s compensation from that in effect as of the date in January on which the Option is granted. Annual Retainer does not include fees for attendance at meetings of the Board of Directors or any committee of the Board of Directors or for any other services to be provided to the Company. The fair market value of the Common Stock is determined as of the date of grant.

The exercise price per share of a Deferred Fees Option is 50% of the fair market value per share of the Common Stock on the date of grant. In this manner, upon grant of a Deferred Fees Option the aggregate spread between the Option’s exercise price and the value of the underlying Common Stock is equal to the amount of Annual Retainer fees the Non-Employee Director has elected to forego. Deferred Fees Options generally may not be exercised before the expiration of six months after the date of grant. In addition, until the end of the first anniversary of the date of grant, the holder of a Deferred Fees Option generally may not exercise more than 50% of the aggregate number of shares subject to such option.

6

TRANSACTIONS WITH DIRECTORS AND MANAGEMENT

The Company has an employment agreement with its Chief Executive Officer. (See “Executive Compensation — Employment Contract.”)

The Company formerly was a party to a services agreement dated May 5, 1999 with director Charles F. Smith. Under the agreement, Mr. Smith was available to provide consulting services from time to time on a mutually agreed upon basis regarding corporate business asset dispositions and financings. The agreement provided for compensation to Mr. Smith of $2,000 per day for services rendered and reimbursement of Mr. Smith’s reasonable out of pocket expenses incurred at the Company’s request. During the 2002 fiscal year, no compensation was paid Mr. Smith under the services agreement, which was terminated by mutual agreement on April 22, 2002.

The Company formerly leased approximately 36,000 square feet of headquarters office premises from Pacifica Plaza Office Building, a limited partnership (“Pacifica”). James A. Collins, his spouse and his brother-in-law are among the partners and own a majority interest of Pacifica. Mr. Collins is the Company’s Chairman Emeritus of the Board. Under the four-year lease, which expired on October 31, 2001, the Company was responsible for rent payments of approximately $34,000 a month during the period through December 1999 (except for an initial four months of abated rent), and approximately $42,000 a month thereafter through October 31, 2001. Base rent under the lease was predicated upon the terms of a sublease negotiated between the Company and Digital Equipment Corporation (“DEC”), a tenant of Pacifica. In lieu of a sublease between the Company and DEC, the Company elected to enter into a direct lease with Pacifica for the headquarters office premises upon the condition that DEC be responsible for the difference between rent under its former lease with Pacifica (plus utilities) and the Company’s base rent under the lease. The Company believed these terms were competitive at the time it entered into the lease.

On August 30, 2000, the Company acquired an 82% equity position in FFPE, LLC, a Delaware limited liability company (“FFPE”), which then owned and operated eight “Oscar’s” restaurants (subsequently renamed “Pat & Oscar’sSM”) in the San Diego, Orange County and Phoenix areas (the “Acquisition”). The seller was FFPE Holding Company, Inc., a Delaware corporation (“Holdings”) owned, directly or indirectly, entirely by John Sarkisian and members of his immediate family. In connection with the Acquisition, Mr. Sarkisian, a principal of Holdings, became an executive officer of the Company in the capacity of Chief Executive Officer (“CEO”) of FFPE upon the close of the Acquisition and Mr. Sarkisian served in that capacity until April 12, 2002 when his employment with FFPE terminated.

As part of the purchase price for the sale, Holdings received cash of $15.2 million and warrants to purchase 1,250,000 shares of the Company’s Common Stock at $4 per share, exercisable over 5 years. In addition, Holdings is entitled to “earn-out” cash consideration if specified revenues, profitability and growth targets are met through February, 2003. No earn-out payments have been made to date.

In connection with the Acquisition, the Company entered into agreements with Mr. Sarkisian, his sister and his parents under which they agreed to perform services for the Company’s Pat & Oscar’s division. Pursuant to a three-year employment agreement, Mr. Sarkisian had agreed to perform services as CEO of FFPE for a base salary of $200,000 a year, plus a bonus of up to 20% and other benefits. Mr. Sarkisian’s employment agreement terminated on April 12, 2002 and he was paid an aggregate of $248,000 during fiscal 2002. On June 11, 2002 Mr. Sarkisian filed a lawsuit against the Company and Charles L. Boppell, its Chief Executive Officer alleging wrongful termination, breach of contract, fraud and misrepresentation. The Company believes Mr. Sarkisian’s lawsuit is without merit and will vigorously defend itself against the allegations.

Pursuant to a one-year employment agreement with Mr. Sarkisian’s sister, Tamara Moore (formerly Tamara Sarkisian-Celmo), Ms. Moore agreed to perform services as President of FFPE for a base salary of $150,000 a year, plus a bonus of up to 20% and other benefits. Although Ms. Moore’s employment agreement expired on August 30, 2001, Ms. Moore continued in the employ of FFPE as President until March 7, 2002 when she resigned. She was paid an aggregate of $162,000 in fiscal 2002. From time to time, Mr. Sarkisian’s parents perform consulting services for FFPE, for which they received an aggregate of $48,000 in fiscal 2002.

Under the terms of the Purchase Agreement, Holdings acquired a 10-year put option to sell its 18% membership interest in FFPE to the Company. Each of the two options has a ten-year term and is exercisable for a price determined either by an agreed-upon fixed price for the first two years after the acquisition or thereafter on a formula based in part on a multiple of FFPE’s earnings less indebtedness. One of the options, pertaining to that portion of Holding’s 18%

7

membership interest in FFPE representing Ms. Moore’s 5.2% ownership interest, was exercised on June 28, 2002 in which the Company acquired Ms. Moore’s 5.2% ownership interest for the agreed upon fixed price of approximately $1.0 Million. Therefore, as of June 30, 2002, FFPE was owned 87.2% by the Company and 12.8% by Holdings. The remaining option, pertaining to the 12.8% portion of Holdings membership interest in FFPE representing Mr. Sarkisian’s ownership interest in Holdings, is exercisable only after August 30, 2002.

In addition, under the terms of the Acquisition, the Company acquired a ten-year call option to purchase Holdings’ 18% membership interest in FFPE and is exercisable either by an agreed-upon fixed price for the first two years after the acquisition or thereafter on a formula based in part on a multiple of FFPE’s earnings less indebtedness. The option to purchase is exercisable by the Company at any time. All of Holdings’ membership interest in FFPE formerly was subject to a security interest in favor of the Company securing the performance of the selling parties’ continuing indemnity obligation to the Company under the terms of the Acquisition for a period of eighteen months which expired on February 28, 2002. Although certain of the selling parties’ indemnity obligations remain in effect, Holdings’ membership interests in FFPE are no longer subject to a security interest in favor of the Company.

The Company had a revolving credit facility with FFPE under which it provided funds of up to $9.5 million for the expansion of the Pat & Oscar’s division. Facility advances bear interest at The Bank of New York’s prime rate plus one percent (1%) per annum and are payable on August 30, 2005. The credit facility was extended for an additional five years with additional funding of $5 million for continuing expansion of Pat & Oscar’sSM restaurant locations. Under the credit facility, an aggregate of $10.2 million of indebtedness was outstanding as of June 30, 2002.

Through FFPE, the Company leases the real property used in connection with the operation of two Pat & Oscar’sSM restaurants from entities owned by John Sarkisian and members or former members of his family. The Pat & Oscar’sSM restaurant located in Temecula, California is leased from SRA Ventures, LLC, a California limited liability company (“SRA Ventures”). John Sarkisian and his spouse, parents, sister, and former brother-in-law are the partners of SRA Ventures. Under the 126-month lease, the Company is responsible for rent payments of approximately $26,000 per month through June 1, 2007. Rent adjustments will occur at the end of each lease year to reflect any change in the cost of living. The Company also has the option to extend the lease with two additional terms of five years each.

The Pat & Oscar’sSM restaurant located in Carlsbad, California is leased from Oscar’s Carlsbad, LLC, a California limited liability company (“Oscar’s Carlsbad”). John Sarkisian and his parents and sister are the members of Oscar’s Carlsbad. Under the 10-year lease, the Company is responsible for rent payments of approximately $17,000 per month through 2007 and $20,000 per month through the end of the term. The Company also has the option to extend the lease with two additional terms of five years each. The base rent during any option term shall be based on fair market value.

In fiscal 2002, John Sarkisian and members of his family were indebted to the Company for approximately $1,085,000 of post-closing purchase price adjustment relating to the Acquisition. $800,000 of such indebtedness was released to the Company out of the purchase escrow established in connection with the Acquisition and the remaining $285,000 is to be deducted from the earn-out or if the earn-out is less than $285,000 the deficiency will be forgiven.

As a material consideration for his employment as President/CEO of Sizzler USA, on October 15, 2001, Sizzler USA extended an unsecured, non-interest-bearing loan in the amount of $200,000 to Kenneth Cole. The proceeds of the loan were to be used to pay two promissory notes executed by Mr. Cole in favor of his former employer as payment for shares of stock of his former employer purchased by Mr. Cole. Mr. Cole will repay Sizzler USA upon the sale of the stock, if such sale should occur. Any deficiency will be forgiven by Sizzler USA over a five-year period provided Mr. Cole remains employed by Sizzler USA. Should Mr. Cole cease being employed by Sizzler USA, any deficiency remaining will become immediately due and payable.

8

STOCK OWNERSHIP OF MANAGEMENT

The following table sets forth certain information regarding the equity securities of the Company beneficially owned by each director of the Company, each executive officer named in the Summary Compensation Table on page 22, and all directors and executive officers of the Company as a group on June 30, 2002.

Name

| | Amount and Nature of Beneficial Ownership of Common Stock(1)(2)

| | | Percent of Class(4)

| |

Directors | | | | | | |

|

| Phillip D. Matthews | | 165,035 | | | * | |

| James A. Collins | | 3,854,911 | (3) | | 13.4 | % |

| Charles L. Boppell | | 760,000 | | | 2.6 | % |

| Barry E. Krantz | | 70,752 | | | * | |

| Robert A. Muh | | 174,911 | | | * | |

| Kevin W. Perkins | | 505,830 | | | 1.8 | % |

| Charles F. Smith | | 214,500 | | | * | |

|

Executive Officers not also Directors | | | | | | |

|

| A. Keith Wall (age 49) | | 28,334 | | | * | |

| Diane M. Hardesty (age 51) | | 71,669 | | | * | |

| Kenneth Cole (age 48) | | 50,000 | | | * | |

| John Sarkisian (age 44) | | 13,334 | | | * | |

All Directors and Executive Officers as a group (16 persons) | | 6,090,762 | | | 21.1 | % |

| * | | Less than one percent (1%) of class. |

| (1) | | Possesses sole voting and investment power. |

| (2) | | Includes shares issuable pursuant to options exercisable within 60 days of June 30, 2002 in the following amounts: Mr. Matthews — 73,975, Mr. Boppell — 625,000 shares, Mr. Krantz — 40,752 shares, Mr. Muh — 101,911 shares, Mr. Perkins — 120,000 shares, Mr. Smith — 94,154 shares, and all directors and executive officers as a group — 1,369,465 shares. |

| (3) | | Does not include 334,483 shares of common stock held by an independent trustee for the benefit of Mr. Collins’ adult children as to which shares Mr. Collins disclaims beneficial ownership. |

| (4) | | In accordance with rules of the Securities and Exchange Commission, percentages were calculated on the basis of the amount of outstanding shares, excluding shares held by or for the account of the Company, plus shares deemed outstanding pursuant to Rule 13d-3(d)(1) under the Securities Exchange Act of 1934, as amended. |

Section 16(b) Beneficial Ownership Reporting Compliance

The Company is required to identify any director, officer or beneficial owner of in excess of 10% of the Common Stock who failed to timely file with the Securities and Exchange Commission a required report relating to ownership and changes in ownership of the Company’s equity securities. Based on material provided to the Company, all such persons complied with all applicable filing requirements during fiscal 2002.

9

REPORT OF THE COMPENSATION AND STOCK OPTION COMMITTEE

It is the duty of the Compensation and Stock Option Committee (the “Committee”) to administer the Company’s various compensation and incentive plans, including its 1997 Employee Stock Incentive Plan, the annual Management Incentive Plan, the Executive Supplemental Benefit Plan (“SERP”) and the 2001 AMG Restricted Stock Incentive Plan. In addition, the Committee reviews compensation levels in light of the performance of members of senior management, including the five most highly compensated executive officers. The Committee reviews all aspects of compensation for senior management with the Board of Directors.

The Committee is composed entirely of independent outside directors. No member of the Committee is a former or current officer or employee of the Company or any of its subsidiaries. During fiscal 2002, the Committee consisted of Phillip D. Matthews (Chairman), Barry E. Krantz and Robert A. Muh.

From time to time, the Company retains the services of outside compensation consulting firms to assist the Committee in connection with the performance of its various duties. These firms provide advice to the Committee with respect to the reasonableness of compensation paid to senior management of the Company. Typically, this advice takes into account how the Company’s compensation programs compare to those of competing companies as well as the Company’s performance. Members of the Committee also review compensation surveys and analysis provided by such firms, including material prepared by the Company’s human resources personnel.

The Committee reviewed and approved bonus payments for fiscal 2002, the bonus plan for fiscal 2003, stock option grants to employees, Company contributions to its profit-sharing plan, compensation packages for new executives and test equity programs for FFPE.

Salary

The Committee makes salary decisions in a structured annual review. In the case of senior management other than the CEO, the decisions typically are based on recommendations from the CEO. Based on such recommendations, for fiscal 2002 the Committee approved salary increases for certain members of senior management, subject to the CEO’s approval and/or adjustments.

For fiscal 2002, the Committee continued the salary of Charles L. Boppell, Chief Executive Officer of the Company, at $370,000 per year as provided for by his employment agreement. The Committee believes that Mr. Boppell’s salary is comparable to that of CEO’s at competing companies.

Bonus Program

The compensation policy of the Company, which is endorsed by the Committee, is that a substantial portion of the annual compensation of each officer relate to and must be contingent upon the performance of the Company or a business unit, the enhancement of stockholder value, and/or the individual contributions of each officer. As a result, much of an executive officer’s potential compensation is “at risk” under an annual bonus compensation program.

The Company’s bonus compensation program is designed to motivate key managerial personnel who have the direct ability to influence short and long-term corporate results and to reward them for the successful achievement of corporate objectives. The program provides for the payment of bonuses based upon the attainment of certain corporate performance criteria, which are reviewed and annually reset by the Committee. For fiscal 2002, the program was tailored to each of the Company’s operating divisions: Sizzler USA, International-Corporate, International-Sizzler, International-KFC, Pat & Oscar’s and WRC. For a division to be allocated any bonus for fiscal 2002, the division was required to achieve an “entry threshold” of targeted earnings before interest and taxes (“EBIT”) or, in the case of international divisions other than WRC, earnings before interest, taxes, and parent company overhead allocations (“EBITPCOA”). If the entry threshold were achieved, the division would be allocated a bonus pool for distribution among the bonus program participants in the division. The amount of the allocation was equal to a percentage of the EBIT or EBITPCOA achieved by that division, respectively, and the precise percentage was determined in accordance with a scale that increased depending on the percentage of targeted EBIT or EBITPCOA attained by the division. For WRC, the bonus was based on achievement of a net income target. The scale provided for a bonus pool amount of 40% of the bonus target for achieving 85% of the EBIT, EBITCOA or net income target and increasing to 100% of the bonus pool amount for achieving 100% of the target EBIT, EBITCOA or net income goal. In addition, if any division or WRC attained in excess of 100% of its targeted EBIT, EBITPCOA or net income, the amount of the bonus pool allocation was to be

10

increased by an amount equal to 15% of such excess earnings. Each participant in a division or WRC that attained its target was entitled to receive a cash bonus equal to such individual’s assigned bonus percent. Each participant’s bonus percent was based on the individual’s responsibilities and position with the Company.

The Committee approved a fiscal 2002 cash bonus of $334,000 for Mr. Boppell in accordance with the foregoing formula.

Stock Option Program

The Committee strives to create a direct link between the long-term interests of executives and stockholders. Through the use of stock-based incentives, the Committee focuses the attention of its executives on managing the Company from the perspective of an owner with an equity stake.

As part of his joining the Company as CEO, as of February 8, 1999, Mr. Boppell was granted the option to purchase 1,000,000 shares of the Company’s Common Stock at an exercise price of $2.19 a share, the fair market value per share as of the date of grant. The option vests and becomes exercisable over a five-year period, at the rate of 200,000 shares in each of fiscal 2000, 2001, 2002, 2003 and 2004. On August 29, 2001, Mr. Boppell was granted the option to purchase an additional 75,000 shares of the Company’s Common Stock at an exercise price of $1.20 a share, the fair market value per share as of the date of grant. The option vests and becomes exercisable over a three-year period, at the rate of 25,000 shares in each of fiscal 2003, 2004 and 2005.

In fiscal 2002, the Committee considered and approved stock option grants aggregating 696,500 shares of Common Stock to certain eligible employees. The number of stock options received by each of the recipients generally was based on his or her responsibilities and relative position in the Company. The exercise price of these options equals the fair market value per share of the Company’s stock on the date of grant, and the options are exercisable over a three-year period.

Since no economic benefit is conferred by the stock options granted to the Company’s officers unless stock prices rise, the Committee believes that these grants further the goals of increasing stockholder wealth and giving management a stake in the Company.

Compensation and Stock Option Committee

Phillip D. Matthews, Chairman

Barry E. Krantz

Robert A. Muh

Sherman Oaks, California

July 26, 2002

The foregoing Report of the Compensation and Stock Option Committee and the Performance Graph included in this Proxy Statement shall not be deemed to be incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent the Company specifically incorporates this Report or the Performance Graph by reference therein, and shall not be deemed soliciting material or otherwise deemed filed under either of such Acts, or be subject to Regulation 14A or 14C (other than as provided in Item 7 thereof) or to the liabilities of Section 18 of the Securities Exchange Act of 1934, as amended.

11

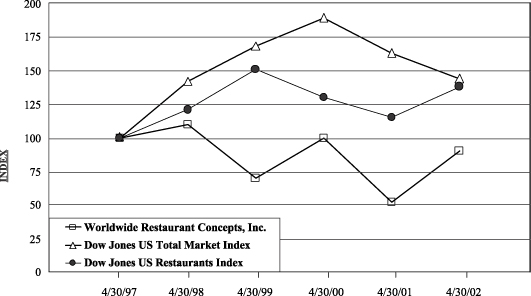

Stock Performance Graph

The following graph compares the cumulative total return for the Company’s Common Stock with the comparable cumulative returns of (i) a broad market index (the Dow Jones US Total Market Index) and (ii) a published industry or lines of business index (the Dow Jones US Restaurants Index). The graph covers the time period from the end of fiscal 1997 until the end of fiscal 2002. It assumes $100 invested on April 30, 1997 in WRC stock and $100 invested at that time in each of the indices. The comparison assumes that all dividends are reinvested.

12

EXECUTIVE COMPENSATION

Summary Compensation Table

| | | Year

| | Annual Compensation(1)

| | Long Term Compensation

|

| | | | | Restricted Stock Awards($)

| | Stock Options(#)

| | All Other Compensation($)(7)

|

Name and Principal Position at April 30, 2002

| | | Salary($)

| | Bonus($)(2)

| | | |

| Charles L. Boppell | | 2002 | | 370,000 | | 334,000 | | — | | 75,000 | | — |

| Chief Executive Officer and Director | | 2001 | | 370,000 | | — | | — | | — | | — |

| | 2000 | | 350,000 | | 200,000 | | — | | — | | — |

|

| Kevin W. Perkins (3) | | 2002 | | 207,000 | | 111,000 | | — | | — | | — |

| Chief Executive Officer/International Division and Director | | 2001 | | 244,000 | | 123,000 | | 0 | | — | | — |

| | 2000 | | 310,000 | | 211,000 | | — | | — | | — |

|

| Kenneth Cole (4) | | 2002 | | 259,000 | | 74,000 | | — | | 150,000 | | — |

| Chief Executive Officer and President, Sizzler USA | | 2001 | | — | | — | | — | | — | | — |

| | 2000 | | — | | — | | — | | — | | — |

|

| Diane M. Hardesty | | 2002 | | 175,000 | | 69,000 | | — | | 35,000 | | — |

| Vice President and Chief Administrative Officer | | 2001 | | 172,000 | | 10,000 | | — | | 30,000 | | — |

| | 2000 | | 165,000 | | 41,000 | | — | | — | | — |

|

| A. Keith Wall (5) | | 2002 | | 165,000 | | 67,000 | | — | | 45,000 | | — |

| Vice President and Chief Financial Officer | | 2001 | | 22,000 | | — | | — | | 40,000 | | — |

| | 2000 | | — | | — | | — | | — | | — |

|

| John Sarkisian (6) | | 2002 | | 200,000 | | 33,000 | | — | | 40,000 | | — |

| Former Chief Executive Officer, Pat & Oscar’s | | 2001 | | 152,000 | | 22,000 | | — | | 40,000 | | — |

| | 2000 | | — | | — | | — | | — | | — |

| (1) | | In addition to salary and bonus, certain of the named executives may receive other annual compensation in the form of automobile allowance and cost reimbursement, reimbursements for legal and tax assistance, and executive medical plan costs. For fiscal 2000, 2001 and 2002, no such items of other annual compensation exceeded the lesser of $50,000 or 10% of total salary and bonus for any named executive. |

| (2) | | Bonuses are attributed to the fiscal year with respect to which they are earned rather than paid. |

| (3) | | Restricted stock may be granted to eligible employees at the discretion of the Board of Directors for an amount that is not less than the par value of such shares. Dividends, when paid, are paid on all restricted stock. All restricted shares are subject to limitations on sale or other disposition thereof, which terminate upon the satisfaction of certain criteria established by the Board of Directors at the time of the sale. As of the end of fiscal 2002, the aggregate restricted stock holdings outstanding, valued as of the end of fiscal 2002, are as follows: Mr. Perkins, 198,090 shares valued at $406,000. However in fiscal 2001 Mr. Perkins purchased the restricted shares at the fair market value on the day of the grant. |

| (4) | | Mr. Cole became Chief Executive Officer and President of Sizzler USA on May 14, 2001. |

| (5) | | Mr. Wall became Chief Financial Officer on March 3, 2001. |

13

| (6) | | Mr. Sarkisian became Chief Executive Officer of Pat & Oscar’s on August 30, 2000 and ceased to be employed by Pat & Oscar’s on April 12, 2002. |

| (7) | | Certain executive officers receive the benefit of life insurance provided by the Company. For fiscal 2000, 2001 and 2002, the cost of premiums did not exceed $3,000 for any named executive officer. |

Option Grants in the Last Fiscal Year

The following table sets forth grants of options to purchase shares of the Company’s Common Stock during the fiscal year ended April 30, 2002 to the executive officers named in the Summary Compensation Table:

| | | INDIVIDUAL GRANTS

| | Grant Date Present Value($)(3)

|

Name

| | Securities Underlying Options Created(#)(1)

| | Total Options Granted to Employees in Fiscal Year(%)

| | | Exercise or Base Price ($/SH)(2)

| | Expiration Date

| |

| Charles L. Boppell | | 75,000 | | 9.4 | % | | $ | 1.20 | | 8/29/11 | | 53,000 |

| Kenneth Cole | | 150,000 | | 18.8 | % | | $ | 1.54 | | 5/14/11 | | 136,000 |

| Diane M. Hardesty | | 35,000 | | 4.4 | % | | $ | 1.20 | | 8/29/11 | | 25,000 |

| John Sarkisian(4) | | 40,000 | | 5.0 | % | | $ | 1.20 | | 7/12/02 | | 28,000 |

| A. Keith Wall | | 45,000 | | 5.6 | % | | $ | 1.20 | | 8/29/11 | | 32,000 |

| (1) | | Incentive stock options granted pursuant to the Company’s 1997 Employee Stock Incentive Plan. The options become exercisable in equal amounts in each of the three years after the date of grant. The 1997 Employee Stock Incentive Plan has provisions about the impact of a change of control, death, disability, retirement and termination of employment on the exercisability of options. |

| (2) | | Based on the market price per share for the Company’s Common Stock as of August 29, 2001, except for Kenneth Cole which is as of May 14, 2001, Mr. Cole’s hire date. |

| (3) | | In accordance with rules of the Securities and Exchange Commission, the Company used the Black-Scholes option-pricing model to estimate the present value as of the grant date of the option. The Company cannot predict or estimate the future price of its Common Stock, and no option pricing model, including the Black-Scholes model, can accurately determine the value of an option. Accordingly, the Company can make no assurance that the value realized by the officer, if any, will be at or near the value estimated in accordance with the Black-Scholes model. The assumptions that the Company used for the valuation include: 65.6% price volatility, 4.6% weighted average risk-free rate of return, 0.0% dividend yield, and a single option exercise at the end of five years. The Company made no adjustment for non-transferability or risk of forfeiture. |

| (4) | | As of April 12, 2002, Mr. Sarkisian ceased to be employed by Pat & Oscar’s. |

14

Executive Supplemental Benefit Plan

During fiscal 2002, the Company maintained an Executive Supplemental Benefit Plan (“SERP”). Under the SERP, the normal retirement date is the later of the participant’s sixty-fifth birthday or the date the participant achieves 10 years of service under the SERP. Participants who retire at the normal retirement date are entitled to receive 65% of the average for their three highest years of earnings, comprised of base salary and standard bonus, but excluding any other cash bonus or form of remuneration, during the last five years of employment, reduced by 50% of the participant’s primary social security benefit and by the annuitized value of the participant’s account balance under the profit sharing portion of the Company’s Employee Savings Plan. Such benefits are payable as a life and survivor annuity. Participants who retire between the ages of 55 and 65 and who have completed 15 years of service under the SERP are entitled to receive reduced benefits based on age and the number of years of service completed. The Company has terminated the SERP, except with regard to the eleven former eligible employees who currently are participants and receiving benefits.

Employment Contract

The Company is a party to a five-year employment agreement with Charles L. Boppell, its Chief Executive Officer. The agreement, entered into on February 8, 1999, sets forth Mr. Boppell’s position and responsibilities with the Company. Under the agreement, Mr. Boppell was to receive a minimum annual base salary of $350,000 over the term of the agreement. In fiscal 2001, Mr. Boppell’s salary was increased to $370,000 and remained at that amount for fiscal 2002. The agreement entitles Mr. Boppell to participation in the Management Incentive Plan or other bonus program, disability benefits, and other fringe benefits and perquisites generally available to executive officers of the Company. The agreement expires on February 7, 2004.

Under the employment agreement, the Company may terminate the executive’s employment for cause. “For Cause” is defined to include the executive’s (a) breach of his covenants contained in the agreement, (b) entry of a plea of guilty or nolo contendere for any crime involving moral turpitude or any felony punishable by imprisonment or his conviction of any such offense, (c) commission of any act of fraud related to his duties, and (d) willful misconduct, dishonesty or gross negligence in performance of his duties.

The Company may terminate the executive’s employment without cause upon thirty (30) days notice. Upon a termination without cause, the executive is entitled to termination benefits. The termination benefits include continuation payments, 18 months of health insurance benefits, and a prorated portion of his performance bonus for the year of his termination. The continuation payments, consisting of base salary plus average historical bonus, commence following the termination date and continue for one year.

Mr. Boppell may terminate his employment with the Company on just grounds upon 30 days notice. “Just Grounds” is defined to include (a) any material breach by the Company of its covenants contained in the agreement, (b) a material reduction or expansion in the scope of Mr. Boppell’s authority and duties and responsibilities inconsistent with his capacity as Chief Executive Officer, (c) a relocation of the Company’s principal executive offices to a location more than 50 miles from its present location, or (d) a change in control in the ownership of the Company. Upon a termination for just grounds (other than a change in control of the Company), the agreement provides for the same termination benefits as would be provided upon a termination by the Company without cause. In the event of a change of control, the agreement entitles Mr. Boppell to a lump sum severance payment equal to two years of base salary and average historical bonus.

In connection with the employment agreement, the Company granted to Mr. Boppell an option to purchase 1,000,000 shares of the Company’s Common Stock at an exercise price of $2.19 a share. The option vests and becomes exercisable over a five-year period, at the rate of 200,000 shares in each of fiscal 2000, 2001, 2002, 2003 and 2004. The number of shares and the exercise price are subject to adjustment under certain events. In the event of termination of the employment agreement by the Company without cause, or termination by Mr. Boppell for just grounds, Mr. Boppell is entitled, in addition to any then vested options, to retain a prorated portion of optioned shares that would otherwise have vested during the year of his termination. In the event of a change of control in the Company, the agreement provides for the acceleration of the vesting and exercisability of the entire unvested portion of the grant.

15

REPORT OF THE AUDIT COMMITTEE

To the Board of Directors of Worldwide Restaurant Concepts, Inc.:

We have reviewed and discussed with management the Company’s audited financial statements as of and for the year ended April 30, 2002.

We have discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61,Communication with Audit Committees,as amended, by the Auditing Standards Board of the American Institute of Certified Public Accountants.

We have received and reviewed the written disclosures and the letter from the independent auditors required by Independence Standard No. 1,Independence Discussions with Audit Committees,as amended, by the Independence Standards Board, and have discussed with the auditors the auditors’ independence.

Based on the reviews and discussions referred to above, we recommend to the Board of Directors that the financial statements referred to above be included in the Company’s Annual Report on Form 10-K for the year ended April 30, 2002.

We have reviewed the charter adopted two years ago and concluded that the charter is adequate and no modifications are necessary at this time.

Charles F. Smith, Chairman

Phillip D. Matthews

Robert A. Muh

Sherman Oaks, California

July 26, 2002

The foregoing Report of the Audit Committee contained in this proxy statement shall not be deemed to be incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent the Company specifically incorporates this Report by reference therein, and shall not be deemed soliciting material or otherwise deemed filed under either of such Acts, or be subject to Regulation 14A or 14C (other than as provided in Item 7 thereof) or to the liabilities of Section 18 of the Securities Exchange Act of 1934, as amended.

RELATIONSHIP WITH INDEPENDENT AUDITORS

Deloitte & Touche LLP served as the Company’s independent auditors for the year ended April 30, 2002.

Audit Fees: The aggregate fees billed to the Company for professional services rendered by Deloitte & Touche LLP for the audit of the Company’s financial statements for its 2002 fiscal year, and the review of the financial statements included in the Company’s Form 10-K for that year, were $170,000.

Non-Audit Fees: The aggregate fees billed to the Company for all tax and other professional services (other than audit services) rendered by Deloitte & Touche LLP were $0.

Financial Information Systems Design and Implementation Fees: The fees paid to Deloitte & Touche LLP for financial information systems design and implementation were $0.

The appointment of independent auditors is approved annually by the Board of Directors based in part on the recommendation of the Audit Committee. In making its recommendations, the Audit Committee reviews both the audit scope and estimated audit fees for the coming year. On May 20, 2002, the Board of Directors, upon the recommendation of the Audit Committee, unanimously appointed Deloitte and Touche LLP to replace Arthur Andersen LLP as the Company’s independent auditors for purposes of completing the year-end audit for fiscal 2002 and to serve as the Company’s independent auditors for fiscal 2003, ending on April 30, 2003. The appointment of Deloitte & Touche LLP

16

is subject to ratification by the Company’s stockholders. Arthur Andersen LLP’s reports on the Company’s consolidated financial statements for the past two years did not contain an adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope or accounting principles.

During the Company’s two most recent fiscal years and through May 24, 2002 (the date the Company filed a current report on Form 8-K disclosing its decision to no longer engage Arthur Andersen LLP), there were no disagreements with Arthur Andersen LLP on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure which, if not resolved to Arthur Andersen LLP’s satisfaction, would have caused them to make reference to the subject matter in connection with their report on the Company’s consolidated financial statements for such years; and there were no reportable events, as listed in Item 304(a)(1)(v) of the Regulation S-K.

During the Company’s two most recent fiscal years and through May 24, 2002, the Company did not consult Deloitte & Touche LLP with respect to the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s consolidated financial statements, or any other matters or reportable events listed in items 304(a)(2)(i) and (ii) of Regulation S-K.

PROPOSAL NO. 2—RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

The Board of Directors, upon the recommendation of the Audit Committee, has appointed Deloitte & Touche LLP as the Company’s independent auditors for fiscal 2003, ending on April 30, 2003. In taking this action, the members of the Board of Directors and the Audit Committee considered Deloitte & Touche LLP’s independence with respect to the services to be performed and its general reputation for adherence to professional auditing standards.

There will be presented at the Annual Meeting a proposal for the ratification of the appointment of Deloitte & Touche LLP, which the Board of Directors believes is advisable and in the best of interests of the stockholders. The Board of Directors recommends a vote FOR this proposal.

COST OF SOLICITATION

The entire cost of soliciting proxies will be borne by the Company, including expenses in connection with preparing and mailing proxy solicitation materials. The Company has engaged American Stock Transfer & Trust Company to solicit proxies from brokers, banks, other institutional holders, non-objecting beneficial owners (“NOBO’s”) and individual holders of record. The Company also has agreed to reimburse the firm for mailing and certain other costs. The Company anticipates the total cost to be paid under the agreement, which also provides for numerous additional services unrelated to solicitation, will be approximately $15,000.

In addition, proxies may be solicited by certain officers, directors and regular employees of the Company, without extra compensation, by telephone, telecopy or personal interview. Although there is no formal agreement to do so, the Company will reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable expenses in sending proxies and proxy material to the beneficial owners of the Company’s Common Stock.

STOCKHOLDER PROPOSALS FOR 2003 ANNUAL MEETING

Any stockholder proposal to be considered for presentation at the 2003 Annual Meeting of Stockholders, including any nomination of directors to the Board, must be received by the Company at its principal executive offices located at 15301 Ventura Boulevard, Building B-Suite 300, Sherman Oaks, California 91403, on or before March 28, 2003 for inclusion in the Company’s Proxy Statement and form of Proxy.

OTHER MATTERS

The Corporation’s by-laws require that there be furnished to the Corporation written notice with respect to the nomination of a person for election as a director (other than a person nominated by or at the direction of the Board of Directors), as well as the submission of a proposal (other than a proposal submitted by or at the direction of the Board of Directors), at an annual meeting of stockholders. In order for any such nomination or submission to be proper, the notice must contain certain information concerning the nominating or proposing stockholder and the nominee or the proposal, as the case may be, and must be furnished to the Corporation not less than 90 days in advance of such meeting or, if later, the seventh day following the first public announcement of the date of such meeting. In the case of the 2002

17

Annual Meeting, this deadline date was May 30, 2002. A copy of the applicable by-law provisions may be obtained, without charge, upon written request to the Secretary of the Corporation at its principal executive office.

In the event that the Corporation receives notice of a stockholder proposal prior to the date specified by its by-laws, then, so long as the Corporation includes in its proxy statement advice on the nature of the matter and how the named proxies intend to vote the shares for which they have received discretionary authority, such proxies may exercise discretionary authority with respect to such matter, subject to limited exceptions. The Corporation has not received notice of any matters to be submitted for consideration at the Annual Meeting other than those set forth in the accompanying notice and, accordingly, if any matters properly come before the Annual Meeting for action, the enclosed proxy will be voted on such matters in accordance with the best judgment of the persons named in the proxy.

| By Order of the Board of Directors |

|

|

Michael B. Green Secretary |

Sherman Oaks, California

July 26, 2002

18

EXHIBIT A

EXCERPTS FROM

WORLDWIDE RESTAURANT CONCEPTS, INC.

BOARD GOVERNANCE GUIDELINES

The Board of Directors of Worldwide Restaurant Concepts, Inc. (“WRC” or the “Company”) has adopted general guidelines regarding certain key corporate governance issues. These guidelines will be subject to evaluation, review and change. They will be formally reviewed and evaluated annually by the Nominating Committee of the Board of Directors and by the full Board as appropriate. The guidelines establish a general framework for addressing certain corporate governance issues. The following summarizes these guidelines:

| | • | | The Board will choose a Chairperson from one of the independent directors. Upon the concurrence of a majority of the independent directors, the Chairperson may be the Chief Executive Officer, in which case an independent Lead Director will be chosen by the independent directors elected on an annual basis to work closely with the Chief Executive Officer in setting the Board agenda. |

| | • | | The Board shall recommend the election of its own members as delegated to the Nominating Committee with direct input from the Chairperson as well as the Chief Executive Officer. |

| | • | | A former Chief Executive Officer serving on the Board will be considered a management director for one year after employment by the company but will not be eligible to serve on the Audit Committee or Compensation Committee for a period of three years. |

| | • | | Directors should not stand for re-election after the age of 72. |

| | • | | Decisions on matters of corporate governance will be made by the independent directors. |

| | • | | The independent directors of the Board will meet in Executive Session after each Board meeting with the Chairperson or Lead Director facilitating the meeting. |

| | • | | The Board will consist of 7-9 members. |

| | • | | A substantial majority of the Board members should be independent directors, and the Audit Committee and Compensation And Stock Option Committee members will all be independent directors. The Nominating Committee will have a majority of independent directors. |

| | • | | Directors should have no relationship with the Company that might compromise their position as an independent director. All business or financial relations with the Company must be disclosed and the Board, in consultation with counsel, will determine if the director is no longer independent. |

| | • | | The current Board committees are the Audit Committee, the Nominating Committee and the Compensation And Stock Option Committee. There may be occasions in which the Board will form a new committee or disband an existing committee. |

| | • | | The full Board is responsible through the Nominating Committee for the assignment of Board members to various committees. Each committee chairperson has the authority to appoint, on a temporary basis, one or more independent directors to the committee that he or she chairs. The independent Board Members shall evaluate the Chief Executive Officer on an annual basis. This evaluation will be used by the Compensation And Stock Option Committee when considering compensation, which shall be approved by the independent directors. |

| | • | | The independent Chairperson or the Lead Director is responsible to report annually to the Board regarding the Board’s performance, and will conduct a formal survey of directors on a bi-annual basis. |

| | • | | There should be an annual report to the Board by the Chief Executive Officer regarding succession planning. The Board will discuss these succession plans in executive session and provide the Chief Executive Officer with appropriate comments. |

A-1

PROXY CARD

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

WORLDWIDE RESTAURANT CONCEPTS, INC.

2002 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD AUGUST 28, 2002

The undersigned stockholder of WORLDWIDE RESTAURANT CONCEPTS, INC., a Delaware corporation (the “Company”), hereby acknowledges receipt of the Notice of Annual Meeting of Stockholders and Proxy Statement dated July 26, 2002, and hereby revokes all prior proxies and appoints Charles L. Boppell and A. Keith Wall, or either one of them, proxies and attorneys-in-fact, with full power to each of substitution and resubstitution, on behalf and in the name of the undersigned, to represent the undersigned at the 2002 Annual Meeting of Stockholders of the Company (the “Annual Meeting”) to be held on August 28, 2002, at 3:30 p.m., local time, at the Radisson Hotel, 15433 Ventura Blvd., Sherman Oaks, CA 91403, and at any adjournment or postponement thereof, and to vote all shares of Common Stock of the Company which the undersigned would be entitled to vote if then and there personally present, on the matters set forth on the reverse side and upon such other matters as may properly come before the Annual Meeting or any adjournments or postponements thereof, hereby revoking any proxies heretofore given.

THE SHARES REPRESENTED BY THIS PROXY WILL BE VOTED AS DIRECTED OR IF NO CONTRARY DIRECTION IS INDICATED WILL BE VOTED FOR PROPOSALS 1 AND 2 ON THE REVERSE SIDE HEREOF IN FAVOR OF MANAGEMENT’S RECOMMENDATIONS AND FOR SUCH OTHER MATTERS AS MAY PROPERLY COME BEFORE THE MEETING AS SAID PROXIES DEEM ADVISABLE AND IN THE BEST INTEREST OF THE COMPANY.

(IMPORTANT — TO BE MARKED, SIGNED AND DATED ON REVERSE SIDE)

Please date, sign and mail your

proxy card back as soon as possible!

Annual Meeting of Stockholders of

WORLDWIDE RESTAURANT CONCEPTS, INC.

To be held on

August 28, 2002

3:30 P.M.

Please Detach and Mail in the Envelope Provided

A x Please mark your votes as in this example.

1. Election of Class II Directors: For Withheld

¨ ¨

Nominees: Charles L. Boppell, Phillip A. Matthews, Robert A. Muh

For all nominees except as noted below.

¨

2. Proposal to ratify the appointment of Deloitte & Touche LLP as the Company’s independent auditors.

FOR AGAINST ABSTAIN

¨ ¨ ¨

THE SHARES REPRESENTED BY THIS PROXY WILL BE VOTED AS DIRECTED OR IF NO CONTRARY DIRECTION IS INDICATED WILL BE VOTED FOR PROPOSALS 1 AND 2 ABOVE AND IN THE DISCRETION OF THE PROXIES UPON SUCH OTHER MATTERS WHICH MAY PROPERLY COME BEFORE THE MEETING AND ANY ADJOURNMENTS OR POSTPONEMENTS THEREOF.

Mark here for address change and note ¨

Signature: Date: Signature: Date:

NOTE: | | (This proxy should be marked, dated and signed by the stockholder(s) exactly as such stockholder’s name appears hereon and returned promptly in the enclosed envelope. If shares are held by joint tenants or as community property, both should sign exactly as their names appear hereon. When signing as attorney, executor, administrator, trustee or guardian, please give title as such. If a corporation, please sign in full corporate name by president or other authorized officer. If a partnership or limited liability company, please sign in name of partnership or limited liability company by authorized person.) |