SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement x Definitive Proxy Statement ¨ Definitive Additional Materials ¨ Soliciting Material Pursuant to Section 240.14a-12 | | ¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

Worldwide Restaurant Concepts, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

| (1) | | Title of each class of securities to which transaction applies: |

| (2) | | Aggregate number of securities to which transaction applies: |

| (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | | Proposed maximum aggregate value of transaction: |

¨ Fee paid previously with preliminary materials.

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| (1) | | Amount Previously Paid: |

| (2) | | Form, Schedule or Registration Statement No.: |

[LETTERHEAD OF WORLDWIDE RESTAURANT CONCEPTS]

July 24, 2003

TO OUR STOCKHOLDERS:

You are cordially invited to attend the Annual Meeting of Stockholders of Worldwide Restaurant Concepts, Inc. to be held at the Radisson Valley Center Hotel at 15433 Ventura Boulevard, Sherman Oaks, California 91403, on Tuesday, August 26, 2003 at 3:30 p.m. In the attached Notice of Annual Meeting of Stockholders and Proxy Statement, we describe the matters expected to be acted upon at the Annual Meeting. We are enclosing our 2003 Annual Report on Form 10-K with this letter.

Your vote is very important. Whether or not you expect to attend the Annual Meeting, please complete, sign and date the enclosed proxy card and return it as promptly as possible.

Sincerely |

|

/s/ PHILLIP D. MATTHEWS |

Phillip D. Matthews Chairman of the Board |

[LETTERHEAD OF WORLDWIDE RESTAURANT CONCEPTS]

July 24, 2003

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held August 26, 2003

To the Stockholders of

Worldwide Restaurant Concepts, Inc.:

The Annual Meeting of Stockholders of Worldwide Restaurant Concepts, Inc., a Delaware corporation (the “Company”), will be held at the Radisson Hotel at 15433 Ventura Boulevard, Sherman Oaks, California 91403, on Tuesday, August 26, 2003 at 3:30 p.m. for the following purposes:

1. To elect two directors to serve until the 2006 Annual Meeting of Stockholders and until their successors are elected and qualified;

2. To vote upon a proposal to amend the Company’s 1997 Employee Stock Incentive Plan to increase the number of shares of Common Stock for which options may be granted or which may be sold as Restricted Stock under the Plan and to adopt a prohibition on the repricing of options;

3. To ratify the appointment of Deloitte & Touche LLP as the Company’s independent auditors for the fiscal year ending May 2, 2004; and

4. To transact such other business as may properly come before the meeting or any adjournment of the meeting.

The Board of Directors has fixed the close of business on July 1, 2003 as the record date for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting and any adjournment or postponement thereof.

In order to constitute a quorum for the conduct of business at the Annual Meeting, holders of a majority of all outstanding shares of Common Stock must be present in person or be represented by proxy. We hope that you will take this opportunity to take an active part in the affairs of the Company by voting on the business to come before the meeting, either by executing and returning the enclosed proxy in the postage paid, return envelope provided or by casting your vote in person at the meeting.

By Order of the Board of Directors,

/s/ MICHAEL B. GREEN

Michael B. Green

Secretary

WORLDWIDE RESTAURANT CONCEPTS, INC.

15301 Ventura Boulevard, Building B-Suite 300

Sherman Oaks, California 91403

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

August 26, 2003

SOLICITATION OF PROXIES

This Proxy Statement is being furnished in connection with the solicitation of proxies by the Board of Directors of Worldwide Restaurant Concepts, Inc., a Delaware corporation (the “Company”). The proxies are intended to be used at the Company’s 2003 Annual Meeting of Stockholders, and any adjournment or postponement thereof (the “Annual Meeting”). The Annual Meeting is to be held at 3:30 p.m. on Tuesday, August 26, 2003 at the Radisson Valley Center Hotel, 15433 Ventura Boulevard, Sherman Oaks, California 91403 for the purposes set forth in the accompanying notice.

This Proxy Statement is being mailed on or about July 24, 2003 to stockholders entitled to notice of and to vote at the Annual Meeting. A copy of the Company’s Annual Report on Form 10-K for the fiscal year ended April 27, 2003, which includes the Company’s financial statements as of and for the year ended April 27, 2003, accompanies this Proxy Statement.Stockholders may obtain an additional copy of the Company’s Annual Report on Form 10-K and a list of the exhibits thereto without charge by written request to the Chief Financial Officer of the Company, 15301 Ventura Boulevard, Building B-Suite 300, Sherman Oaks, California 91403.

A form of proxy also is enclosed with this Proxy Statement. The shares represented by each properly executed unrevoked proxy will be voted as directed by the stockholder executing the proxy. If no direction is made, the shares represented by each properly executed unrevoked proxy will be voted FOR the election of the nominees named below under the heading “Election of Directors” to the Company’s Board of Directors, FOR approval of the amendment to the Company’s 1997 Employee Stock Incentive Plan and FOR the ratification of Deloitte & Touche LLP as the Company’s independent auditors for the fiscal year ending May 2, 2004. If any of the nominees becomes unavailable as a candidate before his election, the proxies may be voted, in the discretion of the proxy holders, for the election of other nominees. If any matter other than the proposals described in this Proxy Statement properly comes before the Annual Meeting, it is the intention of the proxy holders to vote the proxies in accordance with their best judgment.

A stockholder giving a proxy may revoke it at any time before it is voted by filing written notice of revocation with Michael B. Green, Secretary of the Company, at 15301 Ventura Boulevard, Building B-Suite 300, Sherman Oaks, California 91403, or by appearing at the Annual Meeting and voting in person, or by giving a valid proxy bearing a later date.

RECORD DATE AND VOTING

Only stockholders of record at the close of business on July 1, 2003 (the “Record Date”) are entitled to notice of and to vote at the Annual Meeting and any adjournment thereof. As of the Record Date, there were 29,317,804 issued shares of Common Stock, 2,000,000 of which were held by the Company as treasury stock. A total of 27,317,804 shares of Common Stock outstanding as of the Record Date (constituting all of the then outstanding shares of Common Stock other than shares held by the Company as treasury stock) are entitled to be voted. Shares of Common Stock held by the Company as treasury stock are not entitled to be voted.

Each holder of a share of Common Stock that is entitled to be voted is entitled to one vote per share on all matters to be voted on by the Company’s stockholders, except in the event of cumulative voting for the election of directors. The presence, either in person or by proxy, of persons holding a majority in voting interest of the Company’s outstanding Common Stock will constitute a quorum for the transaction of business at the Annual Meeting.

1

If a broker, bank custodian, nominee or other record holder of Common Stock indicates on a proxy that it does not have discretionary authority to vote certain shares, the shares held by such record holders will be considered “broker nonvotes.” The shares considered broker nonvotes will be counted for purposes of determining the presence of a quorum for the transaction of business, but will not be counted as shares entitled to vote on any matter and will have no effect on the result of the vote on any such matter.

The Company will appoint one or more inspectors to act at the Annual Meeting. The inspector’s duties will include determining the shares represented at the Annual Meeting and the presence (or absence) of a quorum and tabulating the votes of stockholders.

Election of Directors. Election of a director requires the affirmative vote of the holders of a plurality of the shares present and in person or represented by proxy at a meeting at which a quorum is present. Accordingly, as two directors are to be elected at the Annual Meeting the two persons receiving the greatest number of votes shall be elected as directors. Since only affirmative votes count for this purpose, withheld votes will not affect the outcome, except that they will count in determining the presence of a quorum.

The Company’s Certificate of Incorporation permits cumulative voting with respect to the election of directors. Although the proxy holders do not presently intend to cumulate votes, if one or more stockholders give notice at the Annual Meeting, prior to voting, of an intention to cumulate for a nominated director, then all shares may be voted cumulatively. Cumulative voting means that each share is entitled to a number of votes equal to the number of directors to be elected. Such votes may be cast for one nominee or distributed among two or more nominees.

Amendment to Company Plan. Assuming that a quorum is present at the Annual Meeting, the affirmative vote of holders of a majority of the shares of the Company’s Common Stock represented and voting, in person or by proxy, at the Annual Meeting and entitled to vote on the matter is required for approval of the amendment to the Company’s 1997 Employee Stock Incentive Plan. With respect to the amendment to the Company’s 1997 Employee Stock Incentive Plan, a stockholder may mark the accompanying form of proxy to (i) vote for the matter, (ii) vote against the matter, or (iii) abstain from voting on the matter. Proxies marked to abstain from voting with respect to the amendment to the Company’s 1997 Employee Stock Incentive Plan will be counted for the purpose of determining the presence of a quorum and as a vote against the matter.

Ratification of Independent Auditors. Assuming that a quorum is present at the Annual Meeting, the affirmative vote of holders of a majority of the shares of the Company’s Common Stock represented and voting, in person or by proxy, at the Annual Meeting and entitled to vote on the matter is required for the appointment of Deloitte & Touche LLP as the Company’s independent auditors for the fiscal year ending on May 2, 2004. With respect to the ratification of Deloitte & Touche LLP, a stockholder may mark the accompanying form of proxy to (i) vote for the matter, (ii) vote against the matter, or (iii) abstain from voting on the matter. Proxies marked to abstain from voting with respect to the appointment of Deloitte & Touche LLP will be counted for purposes of determining the presence of a quorum and as a vote against the matter.

EACH STOCKHOLDER WHO DOES NOT EXPECT TO ATTEND THE ANNUAL MEETING IN PERSON IS URGED TO EXECUTE THE PROXY AND RETURN IT PROMPTLY IN THE ENCLOSED ENVELOPE.

INFORMATION ABOUT THE COMPANY

The Company (together with its subsidiaries) owns and operates, and franchises to others, restaurants that do business under the Sizzler® service mark in the United States and abroad. Sizzler® restaurants operate in the mid-scale casual dining market and feature a selection of grilled steak, chicken and seafood entrees, sandwiches and specialty platters as well as a fresh fruit and salad bar in a family environment. The Company also is the holder of an 87.2% interest in a 21-unit chain of restaurants in the San Diego, Orange County, Riverside, San Bernardino County and Phoenix markets that do business under the trade name “Pat & Oscar’s®.” Pat & Oscar’s® restaurants operate in the quick casual market and feature a selection of pizza, pasta, chicken, ribs and salad entrees as well as fresh home made breadsticks served hot from the oven. The Company also operates “KFC®” quick service restaurants featuring fried chicken, sandwiches and various side orders in Queensland, Australia.

2

PRINCIPAL STOCKHOLDERS

As of June 30, 2003, according to filings with the Securities and Exchange Commission and to the best knowledge of the Company, the following persons are the beneficial owners of more than 5% of the outstanding shares of the Common Stock of the Company.

Name and Address

| | Amount and Nature of Beneficial Ownership(1)

| | | Percent Of Class(2)

| | | |

James A. Collins 6101 West Centinela Avenue Culver City, California 90230 | | 3,854,911 | (3) | | 13.0 | % | | |

| | | |

FMR Corp. (“FMR”) (4) 82 Devonshire Street Boston, Massachusetts 02109 | | 2,413,600 | | | 8.2 | % | | |

| | | |

Dimensional Fund Advisors Inc. (“DFAI”) (5) 1299 Ocean Avenue, 11th Floor Santa Monica, California 90401 | | 1,627,934 | | | 5.5 | % | | |

| | | |

Strong Capital Management (“Strong”) 100 Heritage Reserve Menomonee Falls, WI 53051 | | 2,035,725 | (6) | | 6.9 | % | | |

| (1) | | Unless otherwise indicated, possesses sole voting and dispositive power for all shares of Common Stock the beneficial ownership of which is ascribed. |

| (2) | | In accordance with rules of the Securities and Exchange Commission, percentages were calculated on the basis of the amount of outstanding shares, excluding shares held by or for the account of the Company, plus shares deemed outstanding pursuant to Rule 13d-3(d)(1) under the Securities Exchange Act of 1934, as amended. |

| (3) | | Does not include 334,483 shares of Common Stock held by an independent trustee for the benefit of Mr. Collins’ adult children, as to which shares Mr. Collins disclaims beneficial ownership. |

| (4) | | FMR is the parent company of Fidelity Management and Research Company, a registered investment adviser. Fidelity acts as investment adviser to various investment companies. |

| (5) | | DFAI and its affiliates disclaim beneficial ownership of any Common Stock. According to their SEC filings, DFAI and its affiliates may be deemed to be beneficial owners of the shares as a result of serving as investment adviser and investment manager of various portfolios. |

| (6) | | According to its SEC filings, Strong lacks sole voting or dispositive power with respect to all of the shares of Common Stock, and possesses shared voting power with respect to none of the shares and shared dispositive power with respect to 2,035,725 shares. Strong is a registered investment adviser whose clients (none of whom has more than 5% of the outstanding shares of the Common Stock) have the right to receive or the power to direct the receipt of, dividends on the proceeds of the sale of the shares. |

3

PROPOSAL NO. 1 – ELECTION OF DIRECTORS

The Board of Directors consists of eight members, divided into three classes. The term of Class I (consisting of three members) expires at the 2004 Annual Meeting, the term of Class II (consisting of three members) expires at the 2005 Annual Meeting, and the term of Class III (consisting of two members) expires at the 2003 Annual Meeting. The Board of Directors has renominated incumbent Class III director Barry E. Krantz and nominated Leonard H. Dreyer to serve as directors of the Company until the 2006 Annual Meeting. Incumbent Director Kevin W. Perkins and the Board mutually determined that Mr. Perkins, an Executive Vice President of the Company and President of its International Division, would not seek reelection so that another independent director could be added to the Board in furtherance of sound corporate governance principles and the promotion of best practices.

Certain information concerning the nominees and the incumbent directors whose terms continue after the Annual Meeting is set forth below:

NOMINEES FOR ELECTION AT THE ANNUAL MEETING

| Name and Age | | Present Principal Occupation and Five Year Business Experience |

| |

| Class III: If elected, term will expire in 2006 | | |

| |

Barry E. Krantz (59) | | Director of the Company since 1997. Restaurant industry consultant since 1995. Consultant to the Company (1996-1999). President and Chief Operating Officer, Family Restaurants, Inc. (1994-1995). Chief Operating Officer, Restaurant Enterprises Group, Inc. (1993-1994). President, Family Restaurant Division of Restaurant Enterprises Group, Inc. (1989-1994). Director, Fresh Choice, Inc. |

| |

| Leonard H. Dreyer (59) | | Restaurant industry consultant since 2001. Chairman of the Board (1994-1999), Chief Executive Officer & President (1994-2001) and Executive Vice President and Chief Financial Officer (1990-1994), Marie Callender’s Pies Shops, Inc. Director, Marine Corps Scholarship Foundation Chairman (1999-2000). University Advancement Foundation, California State University at Fullerton. |

4

INCUMBENT DIRECTORS WHOSE TERMS CONTINUE AFTER THE ANNUAL MEETING

| Class I: Term expires in 2004 | | |

| |

| James A. Collins (76) | | Chairman Emeritus of the Board of the Company since 1999. Director of the Company and its predecessor Collins Foods International, Inc. since 1968. Chairman of the Board of the Company and its predecessor Collins Foods International (1968-1999). Chief Executive Officer of the Company (1997-1999). |

| |

| Peggy T. Cherng, Ph.D. (55) | | Director of the Company since June 9, 2003. President and Chief Executive Officer, Panda Restaurant Group. Director, Children’s Hospital Los Angeles, National Restaurant Association, Methodist Hospital of Southern California, and Member, Board of Visitors, Peter F. Drucker Graduate School of Management, Claremont Graduate University. |

| |

| Charles F. Smith (70) | | Director of the Company since 1995. President of Charles F. Smith & Co., Inc., an investment banking firm (1984 to present). Director, FirstFed Financial Corp., TransOcean Distribution, Ltd. and Anworth Mortgage Asset Corp. Trustee, St. John’s Hospital Foundation and Marymount High School. |

| |

| Class II: Term expires in 2005 | | |

| |

| Charles L. Boppell (61) | | President and Chief Executive Officer of the Company since 1999. Director of the Company since 1999. President and Chief Executive Officer of La Salsa Holding Co. (1993-1999). Director, Fresh Choice, Inc. |

| |

| Phillip D. Matthews (65) | | Chairman of the Board of the Company since 1999. Director of the Company since 1997. Lead Director and Chairman of the Executive Committee of Wolverine World Wide, Inc. Chairman of the Board of Wolverine World Wide, Inc. (1993-1996). Chairman, Reliable Company (1993-1997). Director, Washington Mutual, Inc., and Wolverine World Wide, Inc. |

| |

| Robert A. Muh (65) | | Director of the Company since 1997. Chief Executive Officer of Sutter Securities, Inc. (1992-1997, 1998 to the present). President, Financial Services International (1987-1992; 1997-1998). Trustee, Massachusetts Institute of Technology and Director, Dayrunner, Inc. |

Except as otherwise indicated, during the past five years none of the directors has been employed by or has carried on his or her occupation in any corporation or organization which is a parent, subsidiary or other affiliate of the Company.

5

THE BOARD OF DIRECTORS AND CERTAIN OF ITS COMMITTEES

At the end of fiscal 2003, the Company’s Board of Directors consisted of seven directors and one vacancy. On June 9, 2003, Peggy Cherng, Ph.D. was elected by the Board of Directors to fill the vacancy in the newly created directorship. Phillip D. Matthews is the Chairman of the Board. The Board of Directors has an Audit Committee, a Compensation and Stock Option Committee, a Nominating Committee and a Corporate Development Committee.

The Board of Directors of the Company held six meetings during fiscal 2003. Each director attended 75% or more of the aggregate of the total number of meetings of the Board of Directors and the total number of meetings held by committees of the board on which he served.

Charles F. Smith (Chairman), Phillip D. Matthews and Robert A. Muh comprised the Audit Committee. The Audit Committee met eight times during fiscal 2003. The Audit Committee has sole responsibility for the appointment, retention and replacement of the Company’s independent auditors (subject to stockholder ratification), reviews the fee arrangements and scope of the annual audit and considers the comments of the independent auditors with respect to internal accounting controls. The Audit Committee assists the Board of Directors in reviewing and monitoring the financial statements of the Company and its compliance with legal and regulatory requirements. At each meeting, the Audit Committee meets separately with the independent auditors. The Audit Committee recently amended its charter to meet the new requirements and the amended charter is included in this Proxy Statement as Appendix A. The Board of Directors considers Mr. Smith, Mr. Matthews and Mr. Muh to be “independent” within the meaning of Sections 303.01(B)(2)(a) and (3) of the NYSE’s listing standards. All members are “financially literate” under the NYSE’s listing standards, and at least one member has such accounting or related financial management expertise as to be considered an “audit committee financial expert” under the Securities and Exchange Commission rules.

Phillip D. Matthews (Chairman), Barry E. Krantz and Charles F. Smith comprised the Compensation and Stock Option Committee, which met five times during fiscal 2003. The Compensation and Stock Option Committee approves officers’ salaries, administers executive compensation plans, reviews and approves the grant of options and restricted stock and approves bonus schedules for Company employees. During fiscal 2003, the committee approved an equity plan for regional and restaurant management of the Company’s Pat & Oscar’s division modeled after industry practice.

Robert A. Muh (Chairman), Barry E. Krantz and James A. Collins comprised the Nominating Committee, which met three times during fiscal 2003. The Nominating Committee has the responsibility for recommending candidates for election to the Board of Directors at the Annual Meeting of Stockholders and filling vacancies or newly created directorships. The Nominating Committee will consider nominees recommended by holders of the Company’s Common Stock. Stockholders desiring to make recommendations should submit them in writing to the Company at its principal executive offices, marked to the attention of “Chairman, Nominating Committee.” During fiscal 2003, the Nominating Committee interviewed several candidates for the newly created director position, recommended to the Board the election of Peggy Cherng and also reviewed and monitored corporate governance matters, including new legal requirements, emerging trends and best practices.

Robert A. Muh (Chairman), Phillip D. Matthews and Charles L. Boppell comprised the Corporate Development Committee, which met three times during fiscal 2003. The Corporate Development Committee was formed in fiscal 2003 and charged with the overall responsibility for reviewing the Company’s existing business segments and recommending acquisitions and/or divestitures of Company assets. During fiscal 2003, the committee reviewed the terms of the August 2000 Australian Management Group (“AMG”) transaction and recommended changes to the Board, which has resulted in a tentative agreement between the Company and the members of the AMG.

Under the Company’s current compensation policy for non-employee directors adopted in June 2003, each non-employee director is entitled to an Annual Retainer fee of $20,000, $5,000 of which consists of a grant of stock options to purchase shares of the Company’s common stock based upon the fair market value thereof on the first business day of each calendar year, meeting fees of $1,000 for attending in person each meeting of the Board of Directors and each committee meeting not held in conjunction with a Board meeting and $500 for meetings attended telephonically. In addition, the Chairman of the Board receives an additional Annual Retainer fee of $25,000, the Chairman Emeritus receives an additional Annual Retainer fee of $30,000, and each committee chairman receives an additional Annual Retainer fee of $3,500 for each committee of which such director is a chairman, except the Chairman of the Audit Committee receives an additional Annual Retainer fee of $7,500 in recognition of the additional responsibilities imposed upon the Audit Committee and its Chairman as a result of the new statutory and regulatory requirements.

6

The Company has in place a 1997 Non-Employee Directors’ Stock Incentive Plan (the “Directors’ Plan”), which was amended in June 2003. Under the Directors’ Plan, each director who is not an employee or officer of the Company or any of its parent or subsidiary corporations (a “Non-Employee Director”) is entitled to receive options to purchase shares of the Company’s Common Stock (“Options”). The Directors’ Plan provides for the issuance of up to 775,000 shares of the Company’s Common Stock pursuant to exercise of Options. Options consist of Initial Options, Annual Options, Designated Committee Options, and Deferred Fees Options. As amended, the Directors’ Plan provides as follows:

Initial Options. On the date that any person becomes a Non-Employee Director of the Company, such person is automatically granted an Option to purchase 3,000 shares of Common Stock (an “Initial Option”). The exercise price per share of an Initial Option is the fair market value per share of the Common Stock on the date of grant. Initial Options generally may not be exercised before the first anniversary of the date of grant. In addition, until the second anniversary of the date of grant, the holder of an Initial Option generally may not exercise more than 50% of the aggregate number of shares subject to such option.

Annual Options. On the first business day of each calendar year during the term of the Directors’ Plan, each eligible Non-Employee Director then in office is automatically granted an option (an “Annual Option”) to purchase 3,000 shares of Common Stock based upon the fair market value thereof on such date. Annual Options become exercisable no less than one year from the date of grant.

Designated Committee Options. Each Non-Employee Director that is a member of a “Designated Committee” is entitled to receive Designated Committee Options. In lieu of payment of cash fees from the Company for participation on such committee, each Designated Committee member is automatically granted, on the date of each meeting of the Designated Committee attended by such Director, a Designated Committee Option to purchase 1,000 shares of Common Stock. The exercise price per share of a Designated Committee Option is the fair market value per share of the Common Stock on the date of grant, less $2.00. Designated Committee Options are exercisable immediately upon the date of grant. Currently, there are no Designated Committees of the Board of Directors, and the Company presently has no plan to grant any additional Designated Committee Options.

Deferred Fees Options. Each Non-Employee Director is entitled to elect to receive, in lieu of the $15,000 cash portion of the Annual Retainer or a specified portion thereof, for each of the remaining calendar years of his or her term (a “Plan Year”), an annual Deferred Fees Option. The number of shares of Common Stock subject to the Deferred Fees Option for each Plan Year is equal to the nearest number of whole shares determined in accordance with the following formula:

Annual Cash Retainer or portion thereof | | = | | Number of Shares |

50% of Fair Market Value per share | | |

“Annual Retainer,” as defined in the Directors’ Plan, means the amount of fixed fees payable in cash to which the Non-Employee Director is entitled for serving as a director of the Company in the relevant Plan Year. As defined, the Annual Retainer assumes no change in the director’s compensation from that in effect as of the date in January on which the Option is granted. Annual Retainer does not include fees for attendance at meetings of the Board of Directors or any committee of the Board of Directors or for any other services to be provided to the Company. The fair market value of the Common Stock is determined as of the date of grant.

The exercise price per share of a Deferred Fees Option is 50% of the fair market value per share of the Common Stock on the date of grant. In this manner, upon grant of a Deferred Fees Option the aggregate spread between the Option’s exercise price and the value of the underlying Common Stock is equal to the amount of Annual Retainer fees the Non-Employee Director has elected to forego. Deferred Fees Options generally may not be exercised before the expiration of six months after the date of grant. In addition, until the end of the first anniversary of the date of grant, the holder of a Deferred Fees Option generally may not exercise more than 50% of the aggregate number of shares subject to such option.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF THE NOMINEES.

7

TRANSACTIONS WITH DIRECTORS AND MANAGEMENT

The Company has an employment agreement with its Chief Executive Officer. (See “Executive Compensation —Employment Contract.”)

On August 30, 2000, the Company acquired an 82% equity position in FFPE, LLC, a Delaware limited liability company (“FFPE”), which then owned and operated eight “Oscar’s” restaurants (subsequently renamed “Pat & Oscar’s®”) in the San Diego, Orange County and Phoenix areas (the “Acquisition”). The seller was FFPE Holding Company, Inc., a Delaware corporation (“Holdings”) owned, directly or indirectly, primarily by John Sarkisian and members of his immediate family. In connection with the Acquisition, Mr. Sarkisian, a principal of Holdings, became an executive officer of the Company in the capacity of Chief Executive Officer (“CEO”) of FFPE upon the close of the Acquisition, and Mr. Sarkisian served in that capacity until April 12, 2002 when his employment with FFPE terminated.

As part of the purchase price for the sale, Holdings received cash of $15.2 million and warrants to purchase 1,250,000 shares of the Company’s Common Stock at $4 per share, exercisable over 5 years. In addition, Holdings was entitled to “earn-out” cash consideration if specified revenues, profitability and growth targets were met by FFPE through February 2003. The Company has calculated the net total amount of the earn-out due and owing to Holdings to be approximately $1.0 million. However, Holdings has contested the accuracy of the calculation and no earn-out payments have been made to date.

In connection with the Acquisition, the Company entered into agreements with Mr. Sarkisian, his sister Tamara Moore and his parents under which they agreed to perform services for the Company’s Pat & Oscar’s division. Pursuant to a three-year employment agreement, Mr. Sarkisian had agreed to perform services as CEO of FFPE for a base salary of $200,000 a year, plus a bonus of up to 20% and other benefits. Mr. Sarkisian’s employment agreement terminated on April 12, 2002. On June 11, 2002, Mr. Sarkisian filed a lawsuit in the Superior Court of the state of California, county of San Diego, against the Company and Charles L. Boppell, its Chief Executive Officer alleging wrongful termination, breach of contract, fraud and misrepresentation. On June 13, 2003, the Court ruled in favor of the Company and Mr. Boppell on all issues, but the Court has not yet entered final judgment. Mr. Sarkisian will have 60 days from service of the notice of entry of judgment in which to file a notice of appeal.

Under the terms of the Acquisition, Holdings acquired two 10-year put options to sell up to all of its remaining 18% membership interest in FFPE to the Company. Each of the two options had a ten-year term and was exercisable for a price determined either by an agreed-upon fixed price for the first two years after the acquisition or thereafter on a formula based in part on a multiple of FFPE’s earnings less indebtedness. One of the options, pertaining to that portion of Holdings’ 18% membership interest in FFPE representing Ms. Moore’s 5.2% ownership interest, was exercised on June 28, 2002 in which the Company acquired Ms. Moore’s entire ownership interest for the agreed-upon contract price of approximately $1.0 million in cash. Accordingly, as of June 30, 2002, FFPE was owned 87.2% by the Company and 12.8% by Holdings.

In addition, under the terms of the Acquisition, the Company acquired a ten-year call option to purchase Holdings’ 18% membership interest in FFPE, which was exercisable either by an agreed-upon fixed price for the first two years after the acquisition or thereafter on a formula based in part on a multiple of FFPE’s earnings less indebtedness. The option to purchase was exercisable by the Company at any time. On October 9, 2002, the Company exercised its call option on Mr. Sarkisian’s 12.8% ownership interest at an exercise price of approximately $1.4 million, calculated in accordance with the above-referenced formula. In his lawsuit, Mr. Sarkisian contested both the calculation of the amount owing under the call option and whether he had the right to retain one-half of his ownership interest.

Under the terms of the Acquisition, the Company entered into a revolving credit facility with FFPE under which it provided funds of up to $9.5 million for the expansion of the Pat & Oscar’s division with facility advances bearing interest at The Bank of New York’s prime rate plus one percent (1%) per annum. Principal and interest are payable on August 30, 2005. In fiscal 2003, the credit facility was extended for an additional five years with additional funding of $5 million for continuing the expansion of Pat & Oscar’s. Under the credit facility and subsequent additional extensions of credit to the Pat & Oscar’s division, an aggregate of approximately $16.7 million of indebtedness was outstanding as of June 30, 2003.

Through FFPE, the Company leases the real property used in connection with the operation of two Pat & Oscar’s®restaurants from entities owned by John Sarkisian and members or former members of his family. The Pat & Oscar’s®

8

restaurant located in Temecula, California is leased from SRA Ventures, LLC, a California limited liability company (“SRA Ventures”). John Sarkisian and his spouse, parents, sister, and former brother-in-law are believed to be the partners of SRA Ventures. Under the 126-month lease, the Company is responsible for rent payments of approximately $26,000 per month through June 1, 2007. Rent adjustments will occur at the end of each lease year to reflect any change in the cost of living. The Company also has the option to extend the lease with two additional terms of five years each.

The Pat & Oscar’s® restaurant located in Carlsbad, California is leased from Oscar’s Carlsbad, LLC, a California limited liability company (“Oscar’s Carlsbad”). John Sarkisian and his parents and sister are believed to be the members of Oscar’s Carlsbad. Under the 10-year lease, the Company is responsible for rent payments of approximately $17,000 per month through 2007 and $20,000 per month through the end of the term. The Company also has the option to extend the lease with two additional terms of five years each. The base rent during any option term shall be based on fair market value.

In fiscal 2003, John Sarkisian and members of his family were indebted to the Company for approximately $1,085,000 of post-closing purchase price adjustment relating to the Acquisition. $800,000 of such indebtedness was previously released to the Company out of the purchase escrow established in connection with the Acquisition and the remaining $285,000 is to be deducted from the earn-out. The Company calculated the net earn-out due and owing to be approximately $1.0 million, but Mr. Sarkisian contested that calculation and it was an issue in his lawsuit.

As a material consideration for his employment as President/CEO of Sizzler USA, on October 15, 2001 Sizzler USA extended an unsecured, non-interest-bearing loan in the amount of $200,000 to Kenneth Cole. The proceeds of the loan were to be used to pay two promissory notes executed by Mr. Cole in favor of his former employer as payment for shares of stock of his former employer purchased by Mr. Cole. Mr. Cole will repay Sizzler USA upon the sale of the stock, when and if such a sale occurs. Any deficiency will be forgiven by Sizzler USA over a five-year period provided Mr. Cole remains employed by Sizzler USA. Should Mr. Cole cease being employed by Sizzler USA, any deficiency remaining will become immediately due and payable.

STOCK OWNERSHIP OF MANAGEMENT

The following table sets forth certain information regarding the equity securities of the Company beneficially owned by each director of the Company, each executive officer named in the Summary Compensation Table on page 19, and all directors and executive officers of the Company as a group on June 30, 2003.

Name

| | Amount and Nature of Beneficial Ownership of Common Stock(1)(2)

| | | Percent of

Class(4)

| |

Directors | | | | | | |

| | |

Phillip D. Matthews | | 191,084 | | | * | |

James A. Collins | | 3,854,911 | (3) | | 13.0 | % |

Charles L. Boppell | | 1,045,900 | | | 3.5 | % |

Peggy T. Cherng | | 0 | | | * | |

Barry E. Krantz | | 72,752 | | | * | |

Robert A. Muh | | 200,960 | | | * | |

Kevin W. Perkins | | 505,830 | | | 1.7 | % |

Charles F. Smith | | 247,613 | | | * | |

| | |

Executive Officers not also Directors | | | | | | |

| | |

A. Keith Wall (age 50) | | 70,000 | | | * | |

Kenneth Cole (age 49) | | 122,700 | | | * | |

Robert Holden (age 45) | | 63,650 | | | * | |

All Directors and Executive Officers as a group (17 persons) | | 6,695,402 | | | 22.6 | % |

| * | | Less than one percent (1%) of class. |

| (1) | | Possesses sole voting and investment power. |

9

| (2) | | Includes shares issuable pursuant to options exercisable within 60 days of June 30, 2003 in the following amounts: Mr. Matthews — 100,024 shares, Mr. Boppell — 875,000 shares, Mr. Krantz — 42,752 shares, Mr. Muh — 127,960 shares, Mr. Perkins — 120,000 shares, Mr. Smith — 127,267 shares, and all directors and executive officers as a group — 1,864,838 shares. |

| (3) | | Does not include 334,483 shares of Common Stock held by an independent trustee for the benefit of Mr. Collins’ adult children as to which shares Mr. Collins disclaims beneficial ownership. |

| (4) | | In accordance with rules of the Securities and Exchange Commission, percentages were calculated on the basis of the amount of outstanding shares, excluding shares held by or for the account of the Company, plus shares deemed outstanding pursuant to Rule 13d-3(d)(1) under the Securities Exchange Act of 1934, as amended. |

Section 16(b) Beneficial Ownership Reporting Compliance

The Company is required to identify any director, officer or beneficial owner of in excess of 10% of the Common Stock who failed to timely file with the Securities and Exchange Commission a required report relating to ownership and changes in ownership of the Company’s equity securities. Based solely on the Company’s review of Forms 3, 4 and 5 furnished to it during or with respect to fiscal 2003, all such persons complied with such applicable filing requirements during fiscal 2003.

REPORT OF THE COMPENSATION AND STOCK OPTION COMMITTEE

It is the duty of the Compensation and Stock Option Committee (the “Committee”) to administer the Company’s various compensation and incentive plans, including its 1997 Employee Stock Incentive Plan, the annual Management Incentive Plan, the Collins Foods Share Option Plan, The Stay Bonus Plan For Collins Foods Group Pty Ltd and the Productivity Option Bonus Plan For Collins Foods Group Pty Ltd. In addition, the Committee reviews compensation levels in light of the performance of members of senior management, including the five most highly compensated executive officers. The Committee reviews all aspects of compensation for senior management with the Board of Directors.

The Committee is composed entirely of independent directors. No member of the Committee is a former or current officer or employee of the Company or any of its subsidiaries. During fiscal 2003, the Committee consisted of Phillip D. Matthews (Chairman), Barry E. Krantz and Charles F. Smith.

From time to time, the Company retains the services of outside compensation consulting firms to assist the Committee in connection with the performance of its various duties. These firms provide advice to the Committee with respect to the reasonableness of compensation paid to senior management of the Company. Typically, this advice takes into account how the Company’s compensation programs compare to those of competing companies as well as the Company’s performance. Members of the Committee also review compensation surveys and analysis provided by such firms, including material prepared by the Company’s human resources personnel.

The Committee reviewed and approved bonus payments for fiscal 2003, the bonus plan for fiscal 2004, stock option grants to employees, Company contributions to its profit-sharing plan, compensation packages for new executives and approved a partnership equity plan for regional and restaurant management at the Pat & Oscar’s division.

Salary

The Committee makes salary decisions in a structured annual review. In the case of senior management other than the CEO, the decisions typically are based on recommendations from the CEO. Based on such recommendations, for fiscal 2003 the Committee approved salary increases for certain members of senior management, subject to the CEO’s approval and/or adjustments.

For fiscal 2003, the Committee in its discretion increased the salary of Charles L. Boppell, Chief Executive Officer of the Company, to $400,000 per year, as provided for in his employment agreement. The Committee believes that Mr. Boppell’s salary is comparable to that of CEOs at competing companies.

10

Bonus Program

The compensation policy of the Company, which is endorsed by the Committee, is that a substantial portion of the annual compensation of each officer is related to and must be contingent upon the performance of the Company or a business unit, the enhancement of stockholder value, and/or the individual contributions of each said officer. As a result, much of an executive officer’s potential compensation is “at risk” under an annual bonus compensation program.

The Company’s bonus compensation program is designed to motivate key managerial personnel who have the direct ability to influence short and long-term corporate results and to reward them for the successful achievement of corporate objectives. The program provides for the payment of bonuses based upon the attainment of certain corporate performance criteria, which are reviewed and annually reset by the Committee. For fiscal 2003, the program was tailored to each of the Company’s operating divisions: Sizzler USA, International-Corporate, International-Sizzler, International-KFC, Pat & Oscar’s and WRC. For a division to be allocated any bonus for fiscal 2003, the division was required to achieve an Aentry threshold” of targeted earnings before interest and taxes (“EBIT”) or, in the case of international divisions other than WRC, earnings before interest, taxes, and parent company overhead allocations (“EBITPCOA”). If the entry threshold was achieved, the division would be allocated a bonus pool for distribution among the bonus program participants in the division. The amount of the allocation was equal to a percentage of the EBIT or EBITPCOA achieved by that division, respectively, and the precise percentage was determined in accordance with a scale that increased depending on the percentage of targeted EBIT or EBITPCOA attained by the division. For WRC, the bonus was based on achievement of a net income target. The scale provided for a bonus pool amount of 40% of the bonus target for achieving 85% of the EBIT, EBITCOA or net income target and increasing to 100% of the bonus pool amount for achieving 100% of the target EBIT, EBITCOA or net income goal. In addition, if any division attained in excess of 100% of its targeted EBIT, EBITPCOA or net income, the amount of the bonus pool allocation was to be increased by an amount equal to 15% of such excess earnings. Each participant in a division that attained its target was entitled to receive a cash bonus equal to such individual’s assigned bonus percent. Each participant’s bonus percent was based on the individual’s responsibilities and position with the Company.

The Committee approved a fiscal 2003 cash bonus of $284,000 for Mr. Boppell in accordance with the foregoing formula.

Stock Option Program

The Committee strives to create a direct link between the long-term interests of executives and stockholders. Through the use of stock-based incentives, the Committee focuses the attention of its executives on managing the Company from the perspective of an owner with an equity stake.

As part of his joining the Company as CEO as of February 8, 1999, Mr. Boppell was granted the option to purchase 1,000,000 shares of the Company’s Common Stock at an exercise price of $2.19 a share, the fair market value per share as of the date of grant. The option vests and becomes exercisable over a five-year period, at the rate of 200,000 shares in each of fiscal 2000, 2001, 2002, 2003 and 2004. On August 29, 2001, Mr. Boppell was granted the option to purchase an additional 75,000 shares of the Company’s Common Stock at an exercise price of $1.20 a share, the fair market value per share as of the date of grant. The option vests and becomes exercisable over a three-year period, at the rate of 25,000 shares in each of fiscal 2003, 2004 and 2005. On June 24, 2002, Mr. Boppell was granted the option to purchase an additional 75,000 shares of the Company’s Common Stock at an exercise price of $2.59 per share, the fair market value per share as of the date of grant. The option vests and becomes exercisable over a three-year period, at the rate of 25,000 shares in each of fiscal 2004, 2005 and 2006.

The Committee believes that Mr. Boppell’s total compensation package for fiscal 2003, including his base salary, bonus and stock option awards are consistent with the total compensation packages for CEOs in comparable companies in the restaurant industry based upon data obtained via surveys, proxy statements and outside consultants.

11

In fiscal 2003, the Committee considered and approved stock option grants aggregating 646,000 shares of Common Stock to certain eligible employees. The number of stock options received by each of the recipients generally was based on his or her responsibilities and relative position in the Company. The exercise price of these options equals the fair market value per share of the Company’s common stock on the date of grant, and the options are exercisable over a three-year period. The Committee also reviewed The Productivity Option Bonus Plan For Collins Foods Group Pty Ltd and determined that the eligible members of the AMG were entitled to the grant of Productivity Options and authorized the commencement of the required actions to determine the option price.

The Committee believes that the number of shares included in these stock option awards were reasonable and prudent and by giving management a stake in the Company also further the goals of increasing shareholder value.

Compensation and Stock Option Committee

Phillip D. Matthews, Chairman

Barry E. Krantz

Charles F. Smith

Sherman Oaks, California

July 24, 2003

12

The foregoing Report of the Compensation and Stock Option Committee and the Performance Graph included in this Proxy Statement shall not be deemed to be incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent the Company specifically incorporates this Report or the Performance Graph by reference therein, and shall not be deemed soliciting material or otherwise deemed filed under either of such Acts, or be subject to Regulation 14A or 14C (other than as provided in Item 7 thereof) or to the liabilities of Section 18 of the Securities Exchange Act of 1934, as amended.

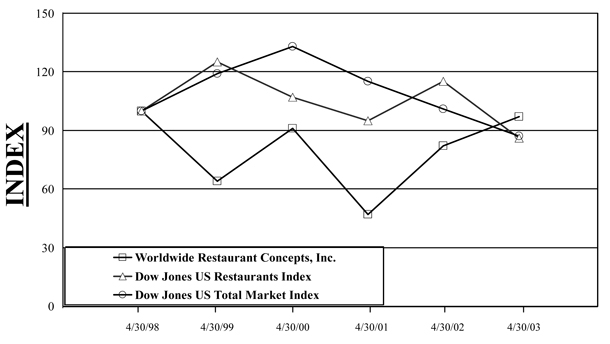

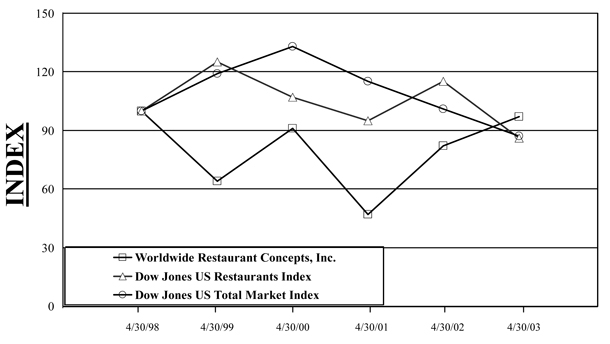

Stock Performance Graph

The following graph compares the cumulative total return for the Company’s Common Stock with the comparable cumulative returns of (i) a broad market index (the Dow Jones US Total Market Index) and (ii) a published industry or lines of business index (the Dow Jones US Restaurants Index). The graph covers the time period from the end of fiscal 1998 until the end of fiscal 2003. It assumes $100 invested on April 30, 1998 in WRC stock and $100 invested at that time in each of the indices. The comparison assumes that all dividends are reinvested.

| | | 4/30/98 | | 4/30/99 | | 4/30/00 | | 4/30/01 | | 4/30/02 | | 4/30/02 |

Worldwide Restaurant Concepts, Inc. | | 100 | | 64 | | 91 | | 47 | | 82 | | 97 |

Dow Jones US Restaurants Index | | 100 | | 125 | | 107 | | 95 | | 115 | | 86 |

Dow Jones US Total Market Index | | 100 | | 119 | | 133 | | 115 | | 101 | | 87 |

13

PROPOSAL 2

AMENDMENT TO THE 1997 EMPLOYEE STOCK INCENTIVE PLAN

General

The 1997 Employee Stock Incentive Plan (the “Employee Plan”) was adopted by the Board of Directors on October 16, 1997 and approved by the stockholders on November 18, 1997. An amendment to the Employee Plan to increase the number of shares of Common Stock reserved for issuance thereunder from 1,000,000 to 2,800,000 was approved by the Board of Directors on June 17, 1998 and approved by the stockholders on August 18, 1998, and a second amendment to increase the number of shares reserved for issuance thereunder from 2,800,000 to 3,800,000 shares was approved by the Board of Directors on June 28, 2001 and approved by the stockholders on August 29, 2001.

As amended, a total of 3,800,000 shares of Common Stock are reserved for issuance under the Employee Plan. As of June 30, 2003, options to purchase 3,650,000 shares had been granted and remained outstanding, leaving only 150,000 shares available for future grants under the Employee Plan.

On June 24, 2003, the Board unanimously authorized an amendment to the Employee Plan (the “Employee Plan Amendment”). Subject to stockholder approval, the Employee Plan Amendment provides for an increase in the number of shares of Common Stock reserved for issuance under the Employee Plan from 3,800,000 to 5,000,000 and adopts a prohibition on the repricing of options. It is the view of the Board that an increase is advisable in order to enable the Company to continue to attract and retain highly qualified employees, and that the amount of the increase is appropriate under the circumstances. The Board adopted the repricing prohibition in furtherance of sound corporate governance principles and the promotion of best practices.

Proposed Amendment to Increase the Number of Shares Reserved for Issuance under the Employee Plan

Stockholder approval is hereby being sought for the Employee Plan Amendment. Currently, the total number of shares of Common Stock reserved for issuance under the Employee Plan is 3,800,000. If the Employee Plan Amendment is approved, the total number of shares of Common Stock reserved for issuance under the Employee Plan will be 5,000,000, reflecting an increase of 1,200,000 shares.

The Company’s executive officers have an interest in approval of this proposal, in that they, along with all other individuals eligible to participate in the Plan, will be eligible for grants of options and other awards under the Employee Plan.

A description of the Employee Plan and the Employee Plan Amendment follows Proposal 2.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE AMENDMENT TO THE EMPLOYEE PLAN TO INCREASE THE NUMBER OF SHARES RESERVED FOR ISSUANCE THEREUNDER AND TO PROHIBIT THE REPRICING OF OPTIONS

DESCRIPTION OF THE COMPANY’S

1997 EMPLOYEE STOCK INCENTIVE PLAN

Stockholders are being asked to approve an amendment to the Worldwide Restaurant Concepts, Inc. 1997 Employee Stock Incentive Plan, under which an aggregate of 5,000,000 shares of the Company’s Common Stock will be authorized for issuance under the Plan. The Employee Plan is an important part of the Company’s compensation program and is essential to its ability to attract and retain highly qualified employees. The proposed Employee Plan Amendment is necessary to enable the Company to continue providing options to new and current employees.

The Employee Plan and the Employee Plan Amendment are described in detail below. The summary of the provisions of the Employee Plan and Employee Plan Amendment, which follows, is not intended to be complete, and is qualified in its entirety by the Employee Plan and Employee Plan Amendment. The Employee Plan Amendment is attached hereto as Appendix “B,” however, due to its length, the Employee Plan is not included with this Proxy Statement. Stockholders may obtain a copy of the Employee Plan, without charge, by written request to: Michael B. Green, Secretary, Worldwide Restaurant Concepts, Inc., 15301 Ventura Boulevard, Building B-Suite 300, Sherman Oaks, California 91403, telephone number (818) 662-9800.

14

Shares Subject to the Plan

Assuming approval of the proposed Employee Plan Amendment, an aggregate of 5,000,000 shares of the Company’s Common Stock will be reserved for issuance under the Employee Plan. If any option granted pursuant to the Employee Plan expires or terminates for any reason without being exercised in whole or in part, or any other award terminates without being issued, then the shares released from such option or terminated award will again become available for grant and purchase under the Employee Plan.

Eligibility

Any person employed by the Company or any of its subsidiaries on a salaried basis, including any director so employed (a “Participant”), is eligible to receive awards under the Employee Plan. Approximately 500 individuals are currently eligible to participate in the Employee Plan. There is no limit on the aggregate maximum number of shares of Common Stock that a Participant is eligible to receive at any time during the term of the Employee Plan. The Company receives no consideration from Participants in connection with the granting of awards under the Employee Plan (other than the purchase price at which restricted shares may be sold and the exercise price of options granted under the Plan).

Administration

The Employee Plan is administered by the Compensation and Stock Option Committee appointed by the Board and consisting of Board members who are “Non-Employee Directors” as defined in the Employee Plan. Subject to the terms of the Employee Plan, the Committee determines the persons who are to receive awards, the number of shares or amount of cash subject to each such award and the terms and conditions of such awards. The Committee also has the authority to construe and interpret any of the provision of the Employee Plan or any awards granted thereunder.

Stock Options

The Employee Plan permits the granting of stock options that are intended to qualify either as Incentive Options (“IOs”), Nonqualified Options (“NQOs”) or Discount Options.

The option exercise price for each IO share will be no less than 100% of the “fair market value” (as defined in the Employee Plan) of a share of Common Stock at the time such option is granted, except in the case of a 10% stockholder, for whom the exercise price must be at least 110% of the fair market value. The option exercise price for each NQO will be no less than the fair market value of a share of Common Stock at the time such option is granted. The option exercise price for each Discount Option will be less than the fair market value of a share of Common Stock at the time such option is granted, but not less than the greater of (a) 50% of the fair market value of a share of Common Stock at the time of the option grant or (b) the par value of a share of Common Stock.

The exercise price of options granted under the Employee Plan generally must be paid in full in cash concurrently with the exercise. However, the Committee may provide in an option agreement that payment of the exercise price may be made, in whole or in part, (1) by delivery and surrender of shares of the Company’s Common Stock having a fair market value on the date of surrender equal to the aggregate exercise price of the option; or (2) by reducing the number of shares of Common Stock to be delivered to the optionee upon exercise of such option, such reduction to be valued on the basis of the aggregate fair market value on the date of exercise of the additional shares of Common Stock that would otherwise have been delivered to such optionee upon exercise of such option.

Options granted under the Employee Plan will expire on (a) the earlier of the tenth anniversary (or the fifth anniversary in the case of a 10% stockholder) of the date of grant or (b) within a certain time after the Optionee’s termination of employment with the Company (as set forth in the Option Agreement).

The Employee Plan does not permit any option under the plan to be granted at an exercise price of less than the greater of (a) 50% of the fair market value of a share of Common Stock at the time of the option grant or (b) the par value of the Company’s Common Stock. The Company’s acceptance of payment of the exercise price in shares of its Common Stock is subject to any applicable prohibition on acquisition by the Company of its own shares.

Restricted Share Awards

15

The Committee may sell restricted shares to Participants either in addition to, or in tandem with, other awards under the Employee Plan. Restricted shares are subject to such restrictions as the Committee may impose. These restrictions may be based upon completion of a specified number of years of service with the Company or upon completion of performance goals as set out in advance. Prior to the grant of any award, the Committee must: (a) determine the nature, length and starting date of any performance period for restricted stock awards; (b) select from among the performance factors to be used to measure performance goals, if any; and (c) determine the number of shares that may be awarded to the Participant. Prior to the payment of any award, the Committee must determine the extent to which such award has been earned. Performance goals selected by the Committee generally involve the following types of criteria: (a) net revenue and/or net income; (b) earnings before income taxes and amortization growth; (c) operating income and/or operating income growth; (d) net income and/or net income growth; (e) earnings per share and/or earnings per share growth; (f) total stockholder return and/or total return growth; (g) return on equity; (h) economic value added; and (i) individual confidential business objectives. The purchase price for such awards must be no less than the par value of the Company’s Common Stock on the date of the award. Payment of the purchase price for restricted shares must be in cash in full on the date of sale.

Stock Appreciation Rights

The Committee may grant stock appreciation rights to Participants in tandem with stock options under the Employee Plan. Stock appreciation rights (“SARs”) entitle the recipient of an option to elect to surrender all or part of his or her option in lieu of exercise of such option. Holders of SARs may make such an election, at their option, subject to the approval of the Committee. Holders of SARs electing to surrender all or part of an option may receive cash, shares of the Company’s Common Stock or a combination of both having an aggregate fair market value on the date of surrender equal to the excess of (i) the aggregate fair market value on the date of such surrender of the Common Stock otherwise issuable upon exercise of such option or part thereof so surrendered, over and above (ii) the exercise price of such option or part thereof so surrendered.

If the grant of an option under the Employee Plan includes the grant of a SAR, the SAR will be subject to certain conditions and restrictions, unless waived by the Committee. The conditions and restrictions include restrictions on receipt of cash upon exercise of the SAR unless the Company shall have filed all reports and statements required under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) during the year prior to exercise and continues to publicly release quarterly and annual summary statements of sales and earnings on a regular basis. Elections by SAR holders to receive cash in full or partial settlement of an SAR must be made between the third and twelfth business day following such a quarterly or annual release. Exercise of a SAR also is subject to other requirements of the Exchange Act.

Mergers, Consolidations and Changes of Control

In the event of certain changes in control of the Company, all outstanding options and SARs granted under the Employee Plan become fully exercisable, and all restrictions imposed upon restricted shares sold under the Employee Plan terminate, on the date of such change of control (defined as the “Acceleration Date”).

The Employee Plan and all outstanding options and SARs granted thereunder terminate on the first of the following to occur: (i) a dissolution or liquidation of the Company, (ii) a reorganization, merger, or consolidation of the Company as a result of which the outstanding securities of the class then subject to the Employee Plan are exchanged for or converted into cash, property, and/or securities not issued by the Company, which reorganization, merger, or consolidation shall have been affirmatively recommended by the Board to the stockholders of the Company, or (iii) a sale of substantially all of the property and assets of the Company.

Termination or Amendment

The Board may terminate or amend the Employee Plan, including amending any form of award agreement or instrument to be executed pursuant to the Plan. The Board may not, without the approval of stockholders, amend the Employee Plan in any manner that requires stockholder approval pursuant to the Employee Plan.

16

Term of the Employee Plan

The Employee Plan became effective upon adoption by the Board and will continue until terminated by action of the Board or by any of the events or transactions specified above under “Mergers, Consolidations and Changes of Control.” Restricted shares may not be sold, and options may not be granted, after January 1, 2007.

Federal Income Tax Information

THE FOLLOWING INFORMATION IS A GENERAL SUMMARY AS OF THE DATE OF THIS PROXY STATEMENT OF THE FEDERAL INCOME TAX CONSEQUENCES TO THE COMPANY AND PARTICIPANTS OF PARTICIPATION IN THE EMPLOYEE PLAN. THE FEDERAL TAX LAWS MAY CHANGE AND THE FEDERAL, STATE AND LOCAL TAX CONSEQUENCES FOR EACH PARTICIPANT WILL DEPEND UPON HIS OR HER INDIVIDUAL CIRCUMSTANCES. EACH PARTICIPANT IS ENCOURAGED TO SEEK THE ADVICE OF A QUALIFIED TAX ADVISOR REGARDING THE TAX CONSEQUENCES OF PARTICIPATION IN THE EMPLOYEE PLAN.

Incentive Stock Options.The Participant will recognize no income upon grant of an IO and incur no tax on its exercise unless Participant is subject to the Alternative Minimum Tax (“AMT”). If the Participant holds the stock acquired upon exercise of an IO (the “IO Shares”) for more than one year after the date the option was exercised and for more than two years after the option was granted, the Participant generally will realize long-term capital gain or loss (rather than ordinary income or loss) upon disposition of the IO Shares. This gain or loss will be equal to the difference between the amount realized upon such disposition and the amount paid for the IO Shares. If the Participant disposes of IO Shares prior to the expiration of either required holding period (a “disqualifying disposition”), then the gain realized upon such disqualifying disposition, up to the difference between the fair market value of the IO Shares on the date of exercise (or, if less, the amount realized on a sale of such shares) and the option exercise price, will be treated as ordinary income. Any additional gain will be treated as capital gain.

Alternative Minimum Tax.The difference between the exercise price and fair market value of the IO Shares on the date of exercise of an IO is an adjustment to income for purposes of the AMT. The AMT (imposed to the extent it exceeds the taxpayer’s regular tax) is generally 26% of an individual taxpayer’s alternative minimum taxable income (28% in the case of alternative minimum taxable income in excess of $175,000). Alternative minimum taxable income is determined by adjusting regular taxable income for certain items, increasing that income by tax preference items and reducing this amount by the applicable exemption amount ($49,000 in case of a joint return, subject to reduction under certain circumstances). If a disqualifying disposition of the IO Shares occurs in the same calendar year as exercise of the IO, there is no adjustment with respect to those IO Shares. Also, upon a sale of IO Shares that is not a disqualifying disposition, alternative minimum taxable income is reduced in the year of sale by the excess of the fair market value of the IO shares at exercise over the amount paid for the IO Shares.

Nonqualified Stock Options.A Participant will not recognize any taxable income at the time an NQO is granted. However, upon exercise of an NQO, the Participant generally must include in income as compensation an amount equal to the difference between the fair market value of the NSO shares on the date of exercise and the Participant’s exercise price. The included amount will be treated as ordinary income by the Participant and will be subject to withholding by the Company (either by payment in cash or withholding out of the Participant’s salary). Upon resale of the NSO shares by the Participant, any subsequent appreciation or depreciation in the value of the shares will be treated as capital gain or loss.

Capital Gain Tax Rate.Short-term capital gains (i.e., on assets held 12 months or less) are taxed at the same rate as ordinary income. Long-term capital gains (i.e., on assets held for more than 12 months) are taxed at a maximum rate of 20%, (to the extent that the gains do not place the taxpayer in a tax bracket of over 15%, the gains will be taxed at 10%). In addition, for tax years after December 31, 2000, gain from the sale or exchange of property held for more than five years and the holding period for which begins after December 31, 2000 which would otherwise be taxed at the 20% rate will be taxed at the 18% rate. These capital gain tax rates are more favorable than the 39.6% maximum tax rate applicable to ordinary income. Capital gains may be offset by capital losses and up to $3,000 of capital losses may be offset annually against ordinary income.

Restricted Stock.Restricted stock will generally be subject to tax at the time of receipt of shares of Common Stock or cash, unless there are restrictions that enable the Participant to defer tax. At the time that tax is incurred, the tax treatment will be similar to that discussed above for NQOs.

17

Tax Treatment of the Company.Subject to the limitations imposed by Section 162 (m) of the Internal Revenue Code, the Company will generally be entitled to a deduction in connection with the exercise of an NQO by a Participant or upon the receipt of restricted stock by a Participant, to the extent that Participant recognizes ordinary income, and provided that the Company complies with IRS reporting requirements relating to the income. The Company will be entitled to a deduction in connection with the disposition of IO shares only to the extent that the Participant recognizes ordinary income on a disqualifying disposition for the IO Shares, and provided that the Company complies with IRS reporting requirements relating to the income. The Company will treat any transfer of record ownership of shares as a disposition, unless it is notified to the contrary. In order to enable the Company to learn of disqualifying dispositions and ascertain the amount of the deduction to which it is entitled, Participants will be required to notify the Company in writing of the date and terms of any disqualifying dispositions of IO Shares.

ERISA

The Company believes that the Employee Plan is not subject to any provision of the Employee Retirement Income Security Act of 1974 (“ERISA”).

18

EXECUTIVE COMPENSATION

Summary Compensation Table

Name and Principal Position at April 30, 2003

| | | | | | Long Term Compensation

|

| | | | Annual Compensation(1)

| | Restricted

Stock

Awards | | Securities

Under-

lying Options | | All Other Compen-

sation |

| | Year

| | Salary($)

| | Bonus($)(2)

| | ($)

| | (#)

| | ($)(8)

|

Charles L. Boppell Chief Executive Officer and Director | | 2003 2002 2001 | | 400,000 370,000 370,000 | | 284,000 334,000 — | | — — — | | 75,000 75,000 — | | — — — |

| | | | | | |

Kevin W. Perkins (3) Chief Executive Officer/ International Division and Director | | 2003 2002 2001 | | 227,000 207,000 244,000 | | 172,000 111,000 123,000 | | — 0 — | | — — — | | — — — |

| | | | | | |

Kenneth Cole (4) Chief Executive Officer/President Sizzler USA | | 2003 2002 2001 | | 286,000 259,000 — | | 114,000 74,000 — | | — — — | | 60,000 150,000 — | | — — — |

| | | | | | |

A. Keith Wall (5) Vice President and Chief Financial Officer | | 2003 2002 2001 | | 182,000 165,000 22,000 | | 64,000 67,000 — | | — — — | | 40,000 45,000 40,000 | | — — — |

| | | | | | |

Robert Holden (6) Chief Executive Officer/President Pat & Oscar’s | | 2003 2002 2001 | | 200,000 153,000 — | | 25,000 78,000 — | | — — — | | 60,000 60,000 — | | — — — |

| | | | | | |

Diane Hardesty (7) Former Vice President and Chief Administrative Officer | | 2003 2002 2001 | | 87,000 175,000 172,000 | | — 69,000 10,000 | | — — — | | 30,000 35,000 30,000 | | — — — |

| (1) | | In addition to salary and bonus, certain of the named executives may receive other annual compensation in the form of automobile allowance and cost reimbursement, reimbursements for legal and tax assistance, and executive medical plan costs. For fiscal 2001, 2002 and 2003, no such items of other annual compensation exceeded the lesser of $50,000 or 10% of total salary and bonus for any named executive. |

| (2) | | Bonuses are attributed to the fiscal year with respect to which they are earned rather than paid. |

| (3) | | Restricted stock may be granted to eligible employees at the discretion of the Board of Directors for an amount that is not less than the par value of such shares. Dividends, when paid, are paid on all restricted stock. All restricted shares are subject to limitations on sale or other disposition thereof, which terminate upon the satisfaction of certain criteria established by the Board of Directors at the time of the sale. As of the end of fiscal 2003, the aggregate restricted stock holdings outstanding, valued as of the end of fiscal 2003, are as follows: Mr. Perkins, 198,090 shares valued at $505,000. However in fiscal 2001 Mr. Perkins purchased the restricted shares at the fair market value on the day of the grant. |

| (4) | | Mr. Cole became Chief Executive Officer and President of Sizzler USA on May 14, 2001. |

19

| (5) | | Mr. Wall became Chief Financial Officer on March 3, 2001. |

| (6) | | Mr. Holden became Chief Operating Officer of Pat & Oscar’s on June 18, 2001 and was promoted to Chief Executive Officer and President on April 12 , 2002. |

| (7) | | As of October 22, 2002, Ms. Hardesty ceased to be employed by the Company. |

| (8) | | Certain executive officers receive the benefit of life insurance provided by the Company. For fiscal 2001, 2002 |

and 2003, the cost of premiums did not exceed $3,000 for any named executive officer.

Option Grants in the Last Fiscal Year

The following table sets forth grants of options to purchase shares of the Company’s Common Stock during the fiscal year ended April 27, 2003 to the executive officers named in the Summary Compensation Table:

| | | INDIVIDUAL GRANTS

| | |

Name

| | Number of

Securities Underlying

Options Granted(#)(1)

| | % of Total

Options

Granted to

Employees

in Fiscal Year(%)

| | | Exercise

or Base Price ($/SH)(2)

| | Expi-

ration Date

| | Grant

Date Present

Value ($)(3)

|

Charles L. Boppell | | 75,000 | | 10.8 | % | | $ | 2.59 | | 6/24/12 | | 112,000 |

Kevin W. Perkins | | 0 | | 0 | % | | | | | | | |

Kenneth Cole | | 60,000 | | 8.6 | % | | $ | 2.59 | | 6/24/12 | | 90,000 |

A. Keith Wall | | 40,000 | | 5.6 | % | | $ | 2.59 | | 6/24/12 | | 60,000 |

Robert Holden | | 60,000 | | 8.6 | % | | $ | 2.59 | | 6/24/12 | | 90,000 |

Diane Hardesty(4) | | 30,000 | | 4.3 | % | | $ | 2.59 | | 6/24/12 | | 45,000 |

| (1) | | Incentive stock options granted pursuant to the Company’s 1997 Employee Stock Incentive Plan. The options become exercisable in equal amounts in each of the three years after the date of grant. The 1997 Employee Stock Incentive Plan has provisions about the impact of a change of control, death, disability, retirement and termination of employment on the exercisability of options. |

| (2) | | Based on the market price per share for the Company’s Common Stock as of June 24, 2002. |

| (3) | | In accordance with rules of the Securities and Exchange Commission, the Company used the Black-Scholes option-pricing model to estimate the present value as of the grant date of the option. The Company cannot predict or estimate the future price of its Common Stock, and no option pricing model, including the Black-Scholes model, can accurately determine the value of an option. Accordingly, the Company can make no assurance that the value realized by the officer, if any, will be at or near the value estimated in accordance with the Black-Scholes model. The assumptions that the Company used for the valuation include: 65.1 % price volatility, 3.8% weighted average risk-free rate of return, 0.0% dividend yield, and a single option exercise at the end of five years. The Company made no adjustment for non-transferability or risk of forfeiture. |

| (4) | | As of October 22, 2002, Ms. Hardesty ceased to be employed by the Company. |

20

FISCAL 2003 YEAR-END OPTION VALUE TABLE

The following table sets forth the number of all unexercised options and the aggregate dollar value of all unexercised “in-the money” options held by the executive officers named in the Summary Compensation Table as of the end of fiscal 2003. On April 25, 2003, the final trading day of the fiscal year, the closing sale price on the NYSE of a share of the Company’s Common Stock was $2.55. The value of the unexercised, in-the-money options held by such officers was based on the closing sale price minus the relevant exercise price. There were no options exercised by such officers during fiscal 2003.

Fiscal 2003 Year-End Option Value Table

| | | Number of Shares Subject to Unexercised Options at April 27, 2003

| | Value of Unexercised In- the-Money Options at April 27, 2003

|

Name

| | Exercisable

| | Non-exercisable

| | Exercisable

| | Non-exercisable

|

Charles L. Boppell | | 825,000 | | 325,000 | | $ | 321,750 | | $ | 139,500 |

Kevin W. Perkins | | 120,000 | | 0 | | $ | 0 | | $ | 0 |

Kenneth Cole | | 50,000 | | 160,000 | | $ | 50,500 | | $ | 101,000 |

A. Keith Wall | | 41,667 | | 83,333 | | $ | 42,917 | | $ | 51,833 |

Robert Holden | | 20,000 | | 100,000 | | $ | 27,000 | | $ | 54,000 |

Diane Hardesty | | 71,667 | | 63,333 | | $ | 45,250 | | $ | 31,500 |

| | |

| |

| |

|

| |

|

|

| | | 1,128,334 | | 731,666 | | $ | 487,417 | | $ | 377,833 |

FISCAL 2003 YEAR-END EQUITY COMPENSATION PLAN INFORMATION

| | | (a) | | (b) | | (c) |

Plan Category

| | Number of Securities to

be issued upon exercise

of outstanding options,

warrants, and rights

| | Weighted-average

exercise price of

outstanding options,

warrants, and rights.

| | Number of securities

remaining available for

future issuance under

equity compensation plans

(excluding securities

reflected in column (a)

|

Equity compensation plans approved by security holders | | 3,422,000 | | $ | 2.09 | | 704,000 |

Equity compensation plans not approved by security holders | | — | | | — | | — |

Total | | 3,422,000 | | $ | 2.09 | | 704,000 |

There are no equity compensation plans of the Company, under which equity securities of the Company are authorized for issuance, that have not been approved by the stockholders.

21

Executive Supplemental Benefit Plan