UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06279

Harris Associates Investment Trust

(Exact name of Registrant as specified in charter)

111 South Wacker Drive, Suite 4600

Chicago, Illinois 60606-4319

(Address of principal executive offices) (Zip code)

| | Joseph J. Allessie, Esq. Harris Associates L.P. 111 South Wacker Drive, Suite 4600 Chicago, Illinois 60606-4319 | | Ndenisarya M. Meekins, Esq. K&L Gates LLP 1601 K Street, N.W. Washington, D.C. 20006-1600 |

| (Name and address of agents for service) |

Registrant's telephone number, including area code: (312) 646-3600

Date of fiscal year end: 09/30/24

Date of reporting period: March 31, 2024

Item 1. Reports to Shareholders.

| (a) | Following is a copy of the semi-annual report transmitted to shareholders pursuant to Rule 30e-1 under the Act. |

OAKMARK FUNDS

SEMI-ANNUAL REPORT | MARCH 31, 2024

OAKMARK FUND

OAKMARK SELECT FUND

OAKMARK GLOBAL FUND

OAKMARK GLOBAL SELECT FUND

OAKMARK INTERNATIONAL FUND

OAKMARK INTERNATIONAL SMALL CAP FUND

OAKMARK EQUITY AND INCOME FUND

OAKMARK BOND FUND

Oakmark Funds

2024 Semi-Annual Report

Fund Expenses | | | 1 | | |

U.S. Equity Market Commentary | | | 2 | | |

Oakmark Fund | |

Summary Information | | | 4 | | |

Portfolio Manager Commentary | | | 5 | | |

Schedule of Investments | | | 6 | | |

Oakmark Select Fund | |

Summary Information | | | 8 | | |

Portfolio Manager Commentary | | | 9 | | |

Schedule of Investments | | | 10 | | |

Oakmark Global Fund | |

Summary Information | | | 12 | | |

Portfolio Manager Commentary | | | 13 | | |

Schedule of Investments | | | 14 | | |

Oakmark Global Select Fund | |

Summary Information | | | 16 | | |

Portfolio Manager Commentary | | | 17 | | |

Schedule of Investments | | | 19 | | |

International Equity Market Commentary | | | 20 | | |

Oakmark International Fund | |

Summary Information | | | 22 | | |

Portfolio Manager Commentary | | | 23 | | |

Schedule of Investments | | | 24 | | |

Oakmark International Small Cap Fund | |

Summary Information | | | 26 | | |

Portfolio Manager Commentary | | | 27 | | |

Schedule of Investments | | | 28 | | |

Fixed Income Market Commentary | | | 30 | | |

Oakmark Equity and Income Fund | |

Summary Information | | | 36 | | |

Portfolio Manager Commentary | | | 37 | | |

Schedule of Investments | | | 39 | | |

Oakmark Bond Fund | |

Summary Information | | | 48 | | |

Portfolio Manager Commentary | | | 49 | | |

Schedule of Investments | | | 51 | | |

Financial Statements | |

Statements of Assets and Liabilities | | | 55 | | |

Statements of Operations | | | 58 | | |

Statements of Changes in Net Assets | | | 61 | | |

Notes to Financial Statements | | | 77 | | |

Financial Highlights | | | 87 | | |

Disclosure Regarding Investment Advisory

Agreements Approval | | | 95 | | |

Disclosures and Endnotes | | | 99 | | |

Trustees and Officers | | | 105 | | |

As permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Oakmark Funds' annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the re-ports. Instead, the reports will be made available on Oakmark.com, and you will be notified by mail each time a re-port is posted and provided with a website link to access the re-port. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you hold your shares directly | |

with the Funds, by calling 1-800-OAKMARK (625-6275) or visiting Oakmark.com. | |

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you hold your shares directly with the Funds, you can call 1-800-OAKMARK (625-6275) to let the Funds know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Funds you hold directly or all Funds you hold through your financial intermediary, as applicable. | |

FORWARD-LOOKING STATEMENT DISCLOSURE

One of our most important responsibilities as mutual fund managers is to communicate with shareholders in an open and direct manner. Some of our comments in our letters to shareholders are based on current management expectations and are considered "forward-looking statements." Actual future results, however, may prove to be different from our expectations. You can identify forward-looking statements by words such as "estimate," "may," "will," "expect," "believe,"

"plan" and other similar terms. We cannot promise future returns. Our opinions are a reflection of our best judgment at the time this report is compiled, and we disclaim any obligation to update or alter forward-looking statements as a result of new information, future events or otherwise.

Oakmark.com

U.S. Equity Market Commentary March 31, 2024

William C. Nygren, CFA

Portfolio Manager

oakmx@oakmark.com

oaklx@oakmark.com

oakwx@oakmark.com

At Oakmark, we are long-term investors. We attempt to identify growing businesses that are managed to benefit their shareholders. We will purchase stock in those businesses only when priced substantially below our estimate of intrinsic value. After purchase, we patiently wait for the gap between stock price and intrinsic value to close.

Last quarter, the S&P 500 Index1 hit a new high every month as did each of our U.S. Funds. In March, I wrote a piece for our website discussing why new highs are important to us. On one of the recent new high days, I heard a portfolio manager on TV urging caution because it is "dangerous" to invest after new highs.

In the past 50 years, selling after the S&P 500 reached a new high would have allowed an investor to avoid four very painful declines: 44% after the dot-com bubble popped in 2000, 38% entering the great financial crisis in 2007, 19% in the 2020 Covid-19 shutdown, and 25% in 2022 when inflation and interest rates sharply increased. As with many market-timing schemes, the positive result from those correct calls has made selling after a new high a popular strategy.

But if we look back at the past 50 years (600 months), the S&P 500 achieved a new high in 156 of those months—or 26% of the time. It's much more common than people think. Despite those four very timely sell signals, selling all the new highs would have given many more sell signals that destroyed value. An investor who sold every new high and waited for a lower re-entry price would have missed the opportunity to make more than 200 times their money by just buying and holding the S&P 500 for 50 years.

As you know, we aren't market timers at Oakmark because we don't believe we can be right often enough to overcome the strong tailwind of rising equity values. Our approach to new highs is to do what we always do: make sure we sell those stocks that have achieved our price targets and reinvest in stocks that are selling well below our estimates of value. Today's market is giving us ample opportunity to find stocks we believe are inexpensive, despite the elevated P/E2 ratio of the S&P 500. For example, since the beginning of 2023, the stocks we added to the Oakmark Fund had a median P/E of 12 times 2024 estimates, just over half the S&P 500 multiple. We believe that by staying invested while always shifting the portfolio to the stocks that appear least expensive, we will achieve results far superior to moving in and out of cash.

Motley Fool Interview

Last quarter I was interviewed by John Rotonti for The Motley Fool. Below is an excerpt from that interview and you can find the full interview here. John also hosts a new podcast, "The JRo Show." Here are links to two episodes about Oakmark: one is an interview with me and the other is with Mike Nicolas and Alex Fitch.

John Rotonti: In a recent Morningstar podcast chief investment officer for T. Rowe Price Investment Management David Giroux said, "GARP4 investing over long periods of time generates the highest returns in the market—beats value, beats growth, and has better risk-adjusted returns than those two as

well..." My take is that he's really describing value investing (buying an above-average business at an average multiple with the thesis that the multiple should be higher)? What are your thoughts?

Bill Nygren: Buying great businesses at average prices is as much value investing as buying average businesses at great prices. The idea that every business trading at a low P/E2, P/B3, P/anything ratio is a "value stock" is just plain stupid. Some businesses are truly inferior and deserve to sell at low multiples. GARP4 is a segment of value investing. Munger says always invert. What would GAUP (Growth at Unreasonable Price) be? It would be a price-insensitive style of investing, much like momentum investing. It would be the opposite of value.

John Rotonti: If I remember correctly, you previously owned Amazon in the [Oakmark] Fund and sold it for a roughly 100% return. Was selling it a mistake? If you take into account where you redeployed the funds, taxes, opportunity cost, sticking to your proven framework, and everything else, do you think previously selling Amazon stock was a mistake?

Bill Nygren: We bought Amazon in 2014 and no doubt we would have made more had we kept it than reinvested the sales proceeds. Looking only at results, I guess you would conclude it was a mistake. But it's one I'd make again in the same circumstance. We bought Amazon back then because it was selling at what we believed was an unjustified discount to other retailers using a price-to-sales metric. After about a year, Amazon had risen to roughly what we thought the retail business was worth. Amazon Web Services (AWS) was brand new, and analyst reports were starting to attribute large potential valuations to it. We thought it was way too early to conclude that AWS would become one of two winners in the cloud business. Because the stock price fully reflected the values that we thought we understood, our process required us to sell it. That same process has kept us out of trouble in countless other situations. Because of that, I don't look back on selling Amazon as a mistake. (And as you know, now that the AWS value seems better defined, we again own Amazon on the theory that it sells at a discount to the sum of the retail and AWS businesses.)5

John Rotonti: Do you look for ten-baggers or even multi-baggers of larger size than 10x? Specifically, do you ever ask your analyst if they think the stock can 10x in a reasonable amount of time? Why or why not?

Bill Nygren: We don't set out looking for them, but have ended up owning some anyway (Visa, Mastercard, Apple, TE Connectivity, Capital One Financial). When we bought those stocks we thought we were buying fifty cents on the dollar, but the magnitude and duration of growth positively surprised us. I think a mistake young analysts often make is being too anxious to claim a win and recommend selling a successful stock too

See accompanying Disclosures and Endnotes on page 99.

2 OAKMARK FUNDS

U.S. Equity Market Commentary (continued) March 31, 2024

early. With experience, analysts learn to reassess their sell targets both up and down based on new fundamental information. Many times, when stocks are first recommended, the analysts present models that they think are conservative. We try to avoid conservatism in favor of better being able to rank order our Approved List based on attractiveness.

John Rotonti: Why is paying a low P/E multiple so important to compounded returns?

Bill Nygren: I'd like to slightly shift the question to, "Why is it so important to pay a low price relative to business value?" While that always translates to a low multiple on some metric, it doesn't have to mean a low P/E multiple. Efficient market theorists will say that regardless of the price you pay, you can get a fair return relative to the risk you incur. However, if you believe as we do, that most of the time a stock will trade reasonably close to intrinsic business value, then buying at a discount to business value beats a mostly efficient market. By purchasing at a discount to value, risk is reduced because the expected terminal price is a higher percentage of business value. Further, reward is amplified for the same reason, the terminal value is a higher percentage of business value. The efficient market hypothesis would say that an investor's holding period return should roughly match the change in business value during that time. To that, we add the increase in price due to the gap closing between initial price and initial value. Note that paying more than business value has exactly the opposite effect.

John Rotonti: What makes the investing process at Harris/Oakmark repeatable? Why will the proven process endure once you, Clyde McGregor, David Herro, and Tony Coniaris decide to retire?

Bill Nygren: First, let me make clear that we are not the first generation of leaders at Harris|Oakmark. The firm had a successful investing record before any of us joined, and I expect that will continue long after we are gone. Second, it is important to understand that there is a long list of current employees who contribute to our success today. Most of our investment decisions are made by people other than the four you mentioned.

I think most firms struggle with generational transitions because they typically have a dominant leader who fully controls decision making until they retire. That means that the retiring leader is replaced by someone who is new to being responsible for decision making, which of course, is a big risk. At Harris|Oakmark, our structure is much more horizontal, with democratic decision making on most products. So, when we retire, we are replaced by investors who for years have been responsible for important decisions. Further, we only hire investment teammates who believe in value investing, meaning we won't be facing a change in investment philosophy as today's leaders retire.

John Rotonti: What is your definition of a value trap? What types of stocks do you think are the most likely to end up being value traps? Do you think that companies with low or declining terminal values are susceptible to being value traps? And what actions do you take to actively try to avoid investing in potential value traps?

Bill Nygren: We define value traps as companies where value does not increase with time. The term would primarily be applied to structurally disadvantaged companies that currently trade at low multiples. To avoid them, we require analysts to

project business value seven years into the future. If the combination of expected annual value growth and dividend yield doesn't at least match the market, we won't buy them.

Of course, sometimes we expect value to grow as time passes, but we turn out to be wrong. We try to sell those mistakes as rapidly as we can. We track an analyst's estimated business value from the time the stock goes on our Approved List, and if actual growth meaningfully lags projected growth, the stock is given extra attention, including extra reviews, devil's advocate reviews and maybe even changing the analyst who covers the stock. The goal is to make the path of least resistance selling the stock rather than holding it.

John Rotonti: ...What sorts of conversation are you and your team having around the performance of the U.S. stock market in 2023 and around market valuations?

Bill Nygren: First, I think it highlights how hard market timing is. Most market timers a year ago were talking about what a tough year 2023 would be for equities. Our discussion has mostly been about the growth/value performance chasm. At the end of 2021, we agreed with most value investors that low P/E stocks had become unusually undervalued because of the decade-long bull market in growth. While 2022 was a relatively good year for value, dodging much of the S&P's decline, that entirely reversed in 2023. We look back on the two-year period and are surprised that growth has slightly outperformed despite the increase in interest rates. Because high P/E stocks have their cash generation further into the future than low P/E stocks do, they generally perform worse when interest rates rise. Given the attractive starting point for low P/E stocks at the beginning of 2022, and the subsequent underperformance, we again think low P/E stocks are unusually attractive today.

John Rotonti: Thoughts on the Magnificent 76?

Bill Nygren: We own a lot of Alphabet, so I can't say we think they are all grossly overvalued. I don't have much to add to a topic that dominated financial news in 2023, but one point I think is generally missed is that the group's strong performance has really increased the technology industry concentration in the S&P 500, and to an even greater degree, the Russell Growth7 and NASDAQ8. Many investors who have been taught to think of index investing as low risk may be unaware of how risky those investments have become.

John Rotonti: Have you ever considered launching a family office after you retire from day-to-day at Harris|Oakmark and shift more into a mentorship role at the firm?

Bill Nygren: No, I haven't considered that. I expect to stay with Harris|Oakmark for an extended period, eventually transferring my current responsibilities to the younger generation, but maintaining a role as an external spokesperson and internal mentor. I've been very happy having my assets invested in Harris|Oakmark and expect that to continue when I eventually retire.

See accompanying Disclosures and Endnotes on page 99.

Oakmark.com 3

A shareholder of each Fund incurs ongoing costs, including investment advisory fees, transfer agent fees and other Fund expenses. The examples below are intended to help shareholders understand the ongoing costs (in dollars) of investing in each Fund and to compare these costs with the ongoing costs of investing in other funds.

The following table provides information about actual account values and actual Fund expenses as well as hypothetical account values and hypothetical fund expenses for shares of each Fund.

ACTUAL EXPENSES

The following table shows the expenses a shareholder would have paid on a $1,000 investment in each Fund from October 1, 2023 to March 31, 2024, as well as how much a $1,000 investment would be worth at the close of the period, assuming actual Fund returns and expenses. A shareholder can estimate expenses incurred for the period by dividing the account value at March 31, 2024, by $1,000 and multiplying the result by the number in the "Actual—Expenses Paid During Period" column shown below.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The following table provides information about hypothetical account values and hypothetical expenses for shares of each Fund based on actual expense ratios and an assumed rate of return of 5% per year before expenses, which are not the Funds' actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or actual expenses shareholders paid for the period. Shareholders may use this information to compare the ongoing costs of investing in a Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as redemption fees. Therefore, the "Hypothetical—Expenses Paid During Period" column of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. If these transaction costs were included, the total costs would have been higher.

| | | | | ACTUAL | | HYPOTHETICAL

(5% annual return

before expenses) | | | |

| | Beginning

Account Value

(10/01/23) | | Ending

Account Value

(03/31/24) | | Expenses

Paid During

Period* | | Ending

Account Value

(03/31/24) | | Expenses

Paid During

Period* | | Annualized

Expense

Ratio | |

Oakmark Fund | |

Investor Class | | $ | 1,000.00 | | | $ | 1,245.30 | | | $ | 5.00 | | | $ | 1,020.55 | | | $ | 4.50 | | | | 0.89 | % | |

Advisor Class | | $ | 1,000.00 | | | $ | 1,246.40 | | | $ | 3.93 | | | $ | 1,021.50 | | | $ | 3.54 | | | | 0.70 | % | |

Institutional Class | | $ | 1,000.00 | | | $ | 1,246.60 | | | $ | 3.76 | | | $ | 1,021.65 | | | $ | 3.39 | | | | 0.67 | % | |

R6 Class | | $ | 1,000.00 | | | $ | 1,246.90 | | | $ | 3.48 | | | $ | 1,021.90 | | | $ | 3.13 | | | | 0.62 | % | |

Oakmark Select Fund | |

Investor Class | | $ | 1,000.00 | | | $ | 1,217.40 | | | $ | 5.49 | | | $ | 1,020.05 | | | $ | 5.00 | | | | 0.99 | % | |

Advisor Class | | $ | 1,000.00 | | | $ | 1,218.10 | | | $ | 4.82 | | | $ | 1,020.65 | | | $ | 4.39 | | | | 0.87 | % | |

Institutional Class | | $ | 1,000.00 | | | $ | 1,218.60 | | | $ | 4.27 | | | $ | 1,021.15 | | | $ | 3.89 | | | | 0.77 | % | |

R6 Class | | $ | 1,000.00 | | | $ | 1,219.10 | | | $ | 4.05 | | | $ | 1,021.35 | | | $ | 3.69 | | | | 0.73 | % | |

Oakmark Global Fund | |

Investor Class | | $ | 1,000.00 | | | $ | 1,122.40 | | | $ | 6.05 | | | $ | 1,019.30 | | | $ | 5.76 | | | | 1.14 | % | |

Advisor Class | | $ | 1,000.00 | | | $ | 1,123.60 | | | $ | 4.99 | | | $ | 1,020.30 | | | $ | 4.75 | | | | 0.94 | % | |

Institutional Class | | $ | 1,000.00 | | | $ | 1,123.70 | | | $ | 4.78 | | | $ | 1,020.50 | | | $ | 4.55 | | | | 0.90 | % | |

R6 Class | | $ | 1,000.00 | | | $ | 1,124.10 | | | $ | 4.62 | | | $ | 1,020.65 | | | $ | 4.39 | | | | 0.87 | % | |

Oakmark Global Select Fund | |

Investor Class | | $ | 1,000.00 | | | $ | 1,117.00 | | | $ | 6.03 | | | $ | 1,019.30 | | | $ | 5.76 | | | | 1.14 | % | |

Advisor Class | | $ | 1,000.00 | | | $ | 1,118.00 | | | $ | 5.14 | | | $ | 1,020.15 | | | $ | 4.90 | | | | 0.97 | % | |

Institutional Class | | $ | 1,000.00 | | | $ | 1,118.70 | | | $ | 4.82 | | | $ | 1,020.45 | | | $ | 4.60 | | | | 0.91 | % | |

R6 Class | | $ | 1,000.00 | | | $ | 1,118.70 | | | $ | 4.50 | | | $ | 1,020.75 | | | $ | 4.29 | | | | 0.85 | % | |

Oakmark International Fund | |

Investor Class | | $ | 1,000.00 | | | $ | 1,088.20 | | | $ | 5.48 | | | $ | 1,019.75 | | | $ | 5.30 | | | | 1.05 | % | |

Advisor Class | | $ | 1,000.00 | | | $ | 1,089.10 | | | $ | 4.60 | | | $ | 1,020.60 | | | $ | 4.45 | | | | 0.88 | % | |

Institutional Class | | $ | 1,000.00 | | | $ | 1,089.50 | | | $ | 4.18 | | | $ | 1,021.00 | | | $ | 4.04 | | | | 0.80 | % | |

R6 Class | | $ | 1,000.00 | | | $ | 1,089.60 | | | $ | 3.92 | | | $ | 1,021.25 | | | $ | 3.79 | | | | 0.75 | % | |

Oakmark International Small Cap Fund | |

Investor Class | | $ | 1,000.00 | | | $ | 1,120.40 | | | $ | 7.10 | | | $ | 1,018.30 | | | $ | 6.76 | | | | 1.34 | % | |

Advisor Class | | $ | 1,000.00 | | | $ | 1,121.10 | | | $ | 6.26 | | | $ | 1,019.10 | | | $ | 5.96 | | | | 1.18 | % | |

Institutional Class | | $ | 1,000.00 | | | $ | 1,121.80 | | | $ | 5.78 | | | $ | 1,019.55 | | | $ | 5.50 | | | | 1.09 | % | |

R6 Class | | $ | 1,000.00 | | | $ | 1,122.10 | | | $ | 5.68 | | | $ | 1,019.65 | | | $ | 5.40 | | | | 1.07 | % | |

Oakmark Equity and Income Fund | |

Investor Class | | $ | 1,000.00 | | | $ | 1,153.50 | | | $ | 4.63 | | | $ | 1,020.70 | | | $ | 4.34 | | | | 0.86 | % | |

Advisor Class | | $ | 1,000.00 | | | $ | 1,155.20 | | | $ | 3.34 | | | $ | 1,021.90 | | | $ | 3.13 | | | | 0.62 | % | |

Institutional Class | | $ | 1,000.00 | | | $ | 1,154.80 | | | $ | 3.18 | | | $ | 1,022.05 | | | $ | 2.98 | | | | 0.59 | % | |

R6 Class | | $ | 1,000.00 | | | $ | 1,154.90 | | | $ | 3.02 | | | $ | 1,022.20 | | | $ | 2.83 | | | | 0.56 | % | |

Oakmark Bond Fund | |

Investor Class | | $ | 1,000.00 | | | $ | 1,074.50 | | | $ | 3.84 | | | $ | 1,021.30 | | | $ | 3.74 | | | | 0.74 | % | |

Advisor Class | | $ | 1,000.00 | | | $ | 1,074.00 | | | $ | 2.80 | | | $ | 1,022.30 | | | $ | 2.73 | | | | 0.54 | % | |

Institutional Class | | $ | 1,000.00 | | | $ | 1,075.50 | | | $ | 2.70 | | | $ | 1,022.40 | | | $ | 2.63 | | | | 0.52 | % | |

R6 Class | | $ | 1,000.00 | | | $ | 1,076.10 | | | $ | 2.28 | | | $ | 1,022.80 | | | $ | 2.23 | | | | 0.44 | % | |

* The Annualized Expense Ratio is calculated using each class' actual net expenses incurred during the preceding six-month period divided by the average net assets of that class during the period.

Oakmark.com 1

Oakmark Fund March 31, 2024

Summary Information

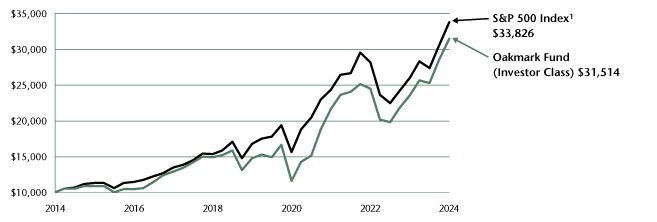

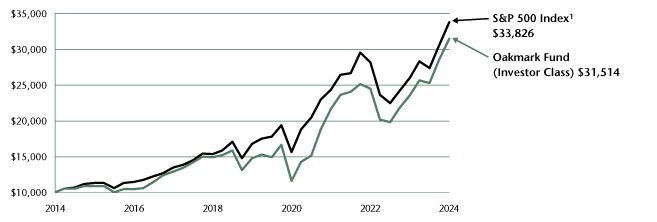

VALUE OF A $10,000 INVESTMENT

(Unaudited)

PERFORMANCE

| | | | | Average Annual Total Returns (as of 03/31/2024) | | | |

(Unaudited) | | Total Return

Last 3 Months | | 1-year | | 3-year | | 5-year | | 10-year | | Since

Inception | | Inception

Date | |

Oakmark Fund (Investor Class) | | | 10.27 | % | | | 33.52 | % | | | 13.26 | % | | | 16.35 | % | | | 12.16 | % | | | 12.96 | % | | 08/05/91 | |

S&P 500 Index | | | 10.56 | % | | | 29.88 | % | | | 11.49 | % | | | 15.05 | % | | | 12.96 | % | | | 10.51 | % | | | |

Dow Jones Industrial Average10 | | | 6.14 | % | | | 22.18 | % | | | 8.65 | % | | | 11.31 | % | | | 11.76 | % | | | 10.81 | % | | | |

Lipper Large Cap Value Fund Index11 | | | 10.11 | % | | | 24.72 | % | | | 9.75 | % | | | 11.94 | % | | | 9.85 | % | | | 9.24 | % | | | |

Oakmark Fund (Advisor Class) | | | 10.33 | % | | | 33.79 | % | | | 13.49 | % | | | 16.55 | % | | | N/A | | | | 14.00 | % | | 11/30/16 | |

Oakmark Fund (Institutional Class) | | | 10.34 | % | | | 33.83 | % | | | 13.51 | % | | | 16.60 | % | | | N/A | | | | 14.05 | % | | 11/30/16 | |

Oakmark Fund (R6 Class) | | | 10.34 | % | | | 33.89 | % | | | 13.56 | % | | | N/A | | | | N/A | | | | 18.02 | % | | 12/15/20 | |

The graph and table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Past performance is no guarantee of future results. The performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted. Total return includes change in share prices and, in each case, includes reinvestment of dividends and capital gain distributions. The investment return and principal value vary so that an investor's shares, when redeemed, may be worth more or less than the original cost. To obtain the most recent month-end performance, please visit Oakmark.com.

TOP TEN EQUITY HOLDINGS9 | | % of Net Assets | |

Alphabet, Inc., Class A | | | 3.1 | | |

ConocoPhillips | | | 2.7 | | |

General Motors Co. | | | 2.7 | | |

Charles Schwab Corp. | | | 2.7 | | |

Citigroup, Inc. | | | 2.7 | | |

Wells Fargo & Co. | | | 2.7 | | |

IQVIA Holdings, Inc. | | | 2.5 | | |

Deere & Co. | | | 2.5 | | |

Fiserv, Inc. | | | 2.5 | | |

Capital One Financial Corp. | | | 2.5 | | |

FUND STATISTICS | |

Ticker* | | OAKMX | |

Number of Equity Holdings | | 55 | |

Net Assets | | $22.1 billion | |

Weighted Average Market Cap | | $144.9 billion | |

Median Market Cap | | $52.4 billion | |

Net Expense Ratio - Investor Class*^ | | 0.91% | |

* This information is related to the Investor Class. Please visit Oakmark.com for information related to the Advisor, Institutional and R6 Classes.

^ The Expense Ratio is from the Fund's prospectus dated January 28, 2024. The actual Gross and Net Expense Ratios for the period can be found in the Financial Highlights section of this report.

SECTOR ALLOCATION | | % of Net Assets | |

Financials | | | 39.6 | | |

Communication Services | | | 9.9 | | |

Energy | | | 9.0 | | |

Health Care | | | 7.8 | | |

Industrials | | | 6.6 | | |

Consumer Discretionary | | | 5.9 | | |

Consumer Staples | | | 5.2 | | |

Information Technology | | | 3.9 | | |

Materials | | | 3.1 | | |

Real Estate | | | 2.2 | | |

Short-Term Investments and Other | | | 6.8 | | |

See accompanying Disclosures and Endnotes on page 99.

4 OAKMARK FUNDS

Oakmark Fund March 31, 2024

Portfolio Manager Commentary

William C. Nygren, CFA

Portfolio Manager

oakmx@oakmark.com

Michael A. Nicolas, CFA

Portfolio Manager

oakmx@oakmark.com

Robert F. Bierig

Portfolio Manager

oakmx@oakmark.com

The Oakmark Fund ("the Fund") returned 10.27% during the first quarter, fractionally underperforming the S&P 500 Index's return of 10.56%. Since its inception in August 1991, the Fund has returned an average of 12.96% per year, outperforming the S&P 500 Index's return of 10.51% over the same period.

In the first quarter, our largest contributing sectors were financials and consumer discretionary and there were no detractors. The largest individual contributors for the period were General Motors and Kroger, and our largest detractors were Charter Communications and Warner Bros. Discovery. Each of these businesses traded at meaningful discounts to our estimates of intrinsic value, so we purchased additional shares of all of them during the quarter. Amid the outperformance of growth stocks to start the year, we are finding attractive opportunities to buy stocks that meet our value investment criteria.

We initiated three new holdings and eliminated five others during the quarter.

We sold our positions in Amazon, HCA Healthcare, Hilton Worldwide, Meta Platforms and PHINIA during the period. Each position approached our estimate of intrinsic value, so we sold them in favor of more compelling alternatives, in our view.

The following is a brief description of our new holdings:

Deere & Company is a leading manufacturer of agricultural equipment with dominant market share in North America and Brazil. Despite its brand strength, technological capabilities and distribution advantages, the company's stock price has recently fallen due to fears about a downturn in the agriculture business cycle. Longer term, world population and food demand are expected to increase annually yet land and labor devoted to agriculture are expected to decline. Deere seems well-positioned to benefit from this dynamic as farms will have to become more productive. We were pleased to purchase shares in Deere at a low double-digit multiple of our estimate of normal earnings power.

Delta Air Lines is a leading global airline. Of the big three U.S.-based airlines (Delta, United and American), we see Delta as the most competitively advantaged. We believe the company's years of industry-leading operational performance and investments in the customer experience have established Delta as the premium brand in the industry. We also think its geographically optimal hubs, high local market share, robust loyalty program and unique corporate culture all support healthy returns on capital. Delta currently trades at 6x our estimate of normalized earnings per share13. We believe this is an attractive valuation for a competitively advantaged and growing business in an out-of-favor industry.

Kenvue became the largest standalone consumer health company following its split-off from Johnson & Johnson in May 2023. The company's highly recognizable brands, such as

Neutrogena, Listerine, Tylenol and Band-Aid, have been market share leaders in their respective categories for generations. However, Kenvue's first year as a public company was clouded by litigation and market share losses in certain categories. As a result, Kenvue now trades for just 16.5x trailing earnings, a substantial discount to the market and other consumer health and packaged goods companies. We see an opportunity for the company to improve efficiency and re-invest the cost savings into increased product development and marketing, which should help improve its growth and brand equity.

We thank you, our fellow shareholders, for your investment in the Oakmark Fund.

See accompanying Disclosures and Endnotes on page 99.

Oakmark.com 5

Oakmark Fund March 31, 2024 (Unaudited)

Schedule of Investments (in thousands)

| | | Shares | | Value | |

COMMON STOCKS - 93.2% | |

FINANCIALS - 39.6% | |

FINANCIAL SERVICES - 23.8% | |

Charles Schwab Corp. | | | 8,183 | | | $ | 591,958 | | |

Fiserv, Inc. (a) | | | 3,490 | | | | 557,772 | | |

Capital One Financial Corp. | | | 3,659 | | | | 544,789 | | |

Intercontinental Exchange, Inc. | | | 3,875 | | | | 532,569 | | |

Ally Financial, Inc. | | | 11,959 | | | | 485,420 | | |

American Express Co. | | | 1,908 | | | | 434,387 | | |

Bank of New York Mellon Corp. | | | 7,041 | | | | 405,675 | | |

KKR & Co., Inc. | | | 3,930 | | | | 395,279 | | |

State Street Corp. | | | 4,825 | | | | 373,054 | | |

Goldman Sachs Group, Inc. | | | 735 | | | | 307,002 | | |

Global Payments, Inc. | | | 1,750 | | | | 233,905 | | |

BlackRock, Inc. | | | 275 | | | | 229,267 | | |

Moody's Corp. | | | 430 | | | | 168,952 | | |

| | | | | | 5,260,029 | | |

BANKS - 10.4% | |

Citigroup, Inc. | | | 9,319 | | | | 589,346 | | |

Wells Fargo & Co. | | | 10,163 | | | | 589,048 | | |

Bank of America Corp. | | | 12,524 | | | | 474,891 | | |

First Citizens BancShares, Inc., Class A | | | 203 | | | | 331,905 | | |

Truist Financial Corp. | | | 7,860 | | | | 306,383 | | |

| | | | | | 2,291,573 | | |

INSURANCE - 5.4% | |

American International Group, Inc. | | | 6,943 | | | | 542,719 | | |

Willis Towers Watson PLC | | | 1,575 | | | | 433,125 | | |

Reinsurance Group of America, Inc. | | | 1,182 | | | | 227,990 | | |

| | | | | | 1,203,834 | | |

| | | | | | 8,755,436 | | |

COMMUNICATION SERVICES - 9.9% | |

MEDIA & ENTERTAINMENT - 9.9% | |

Alphabet, Inc., Class A (a) | | | 4,544 | | | | 685,796 | | |

Comcast Corp., Class A | | | 11,500 | | | | 498,525 | | |

Charter Communications, Inc., Class A (a) | | | 1,408 | | | | 409,269 | | |

Warner Bros. Discovery, Inc. (a) | | | 31,287 | | | | 273,135 | | |

Walt Disney Co. | | | 1,750 | | | | 214,130 | | |

Liberty Broadband Corp., Class C (a) | | | 2,020 | | | | 115,605 | | |

| | | | | | 2,196,460 | | |

ENERGY - 9.0% | |

ConocoPhillips | | | 4,684 | | | | 596,141 | | |

EOG Resources, Inc. | | | 4,067 | | | | 519,869 | | |

Phillips 66 | | | 2,761 | | | | 450,982 | | |

APA Corp. | | | 12,585 | | | | 432,666 | | |

| | | | | | 1,999,658 | | |

| | | Shares | | Value | |

HEALTH CARE - 7.8% | |

HEALTH CARE EQUIPMENT & SERVICES - 4.5% | |

Centene Corp. (a) | | | 6,445 | | | $ | 505,803 | | |

Baxter International, Inc. | | | 5,990 | | | | 256,013 | | |

CVS Health Corp. | | | 2,744 | | | | 218,861 | | |

| | | | | | 980,677 | | |

PHARMACEUTICALS, BIOTECHNOLOGY & LIFE SCIENCES - 3.3% | |

IQVIA Holdings, Inc. (a) | | | 2,220 | | | | 561,416 | | |

Danaher Corp. | | | 700 | | | | 174,804 | | |

| | | | | | 736,220 | | |

| | | | | | 1,716,897 | | |

INDUSTRIALS - 6.6% | |

CAPITAL GOODS - 5.3% | |

Deere & Co. | | | 1,360 | | | | 558,645 | | |

Masco Corp. | | | 4,224 | | | | 333,221 | | |

Fortune Brands Innovations, Inc. | | | 3,255 | | | | 275,558 | | |

| | | | | | 1,167,424 | | |

TRANSPORTATION - 1.0% | |

Delta Air Lines, Inc. | | | 4,568 | | | | 218,665 | | |

COMMERCIAL & PROFESSIONAL SERVICES - 0.3% | |

Equifax, Inc. | | | 290 | | | | 77,581 | | |

| | | | | | 1,463,670 | | |

CONSUMER DISCRETIONARY - 5.9% | |

AUTOMOBILES & COMPONENTS - 4.9% | |

General Motors Co. | | | 13,062 | | | | 592,361 | | |

Magna International, Inc. | | | 4,950 | | | | 269,676 | | |

BorgWarner, Inc. | | | 6,620 | | | | 229,979 | | |

| | | | | | 1,092,016 | | |

CONSUMER DISCRETIONARY DISTRIBUTION & RETAIL - 1.0% | |

eBay, Inc. | | | 4,253 | | | | 224,463 | | |

| | | | | | 1,316,479 | | |

CONSUMER STAPLES - 5.2% | |

CONSUMER STAPLES DISTRIBUTION & RETAIL - 2.4% | |

Kroger Co. | | | 9,225 | | | | 527,025 | | |

FOOD, BEVERAGE & TOBACCO - 1.7% | |

Altria Group, Inc. | | | 8,510 | | | | 371,206 | | |

HOUSEHOLD & PERSONAL PRODUCTS - 1.1% | |

Kenvue, Inc. | | | 11,600 | | | | 248,936 | | |

| | | | | | 1,147,167 | | |

INFORMATION TECHNOLOGY - 3.9% | |

SOFTWARE & SERVICES - 2.3% | |

Salesforce, Inc. | | | 985 | | | | 296,662 | | |

Oracle Corp. | | | 1,754 | | | | 220,345 | | |

| | | | | | 517,007 | | |

See accompanying Notes to Financial Statements.

6 OAKMARK FUNDS

Oakmark Fund March 31, 2024 (Unaudited)

Schedule of Investments (in thousands) (continued)

| | | Shares | | Value | |

COMMON STOCKS - 93.2% (continued) | |

INFORMATION TECHNOLOGY - 3.9% (continued) | |

TECHNOLOGY HARDWARE & EQUIPMENT - 1.6% | |

TE Connectivity Ltd. | | | 1,214 | | | $ | 176,386 | | |

Cisco Systems, Inc. | | | 3,470 | | | | 173,188 | | |

| | | | | | 349,574 | | |

| | | | | | 866,581 | | |

MATERIALS - 3.1% | |

Corteva, Inc. | | | 7,710 | | | | 444,618 | | |

Celanese Corp. | | | 1,432 | | | | 246,103 | | |

| | | | | | 690,721 | | |

REAL ESTATE - 2.2% | |

REAL ESTATE MANAGEMENT & DEVELOPMENT - 2.2% | |

CBRE Group, Inc., Class A (a) | | | 4,966 | | | | 482,894 | | |

TOTAL COMMON STOCKS - 93.2%

(COST $14,947,318) | | | | | 20,635,963 | | |

| | | Par Value | | Value | |

SHORT-TERM INVESTMENTS - 7.9% | |

REPURCHASE AGREEMENT - 7.5% | |

Fixed Income Clearing Corp. Repurchase

Agreement, 5.32% dated 03/28/24 due

04/01/24, repurchase price $1,656,169,

collateralized by United States Treasury

Notes, 0.125% - 5.000% due

10/15/25 - 12/15/25, aggregate value

plus accrued interest of $1,688,295

(Cost: $1,655,191) | | $ | 1,655,191 | | | | 1,655,191 | | |

U.S. GOVERNMENT BILL - 0.4% | |

U.S. Treasury Bills, 5.37%,

due 06/18/24 (b)

(Cost $98,872) | | | 100,000 | | | | 98,877 | | |

TOTAL SHORT-TERM INVESTMENTS - 7.9%

(COST $1,754,063) | | | | | 1,754,068 | | |

TOTAL INVESTMENTS - 101.1%

(COST $16,701,381) | | | | | 22,390,031 | | |

Liabilities In Excess of Other Assets - (1.1)% | | | | | (252,994 | ) | |

TOTAL NET ASSETS - 100.0% | | | | $ | 22,137,037 | | |

(a) Non-income producing security.

(b) The rate shown represents the annualized yield at the time of purchase; not a coupon rate.

See accompanying Notes to Financial Statements.

Oakmark.com 7

Oakmark Select Fund March 31, 2024

Summary Information

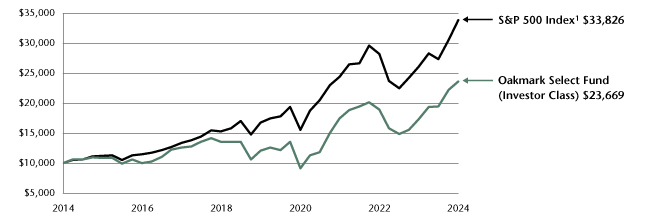

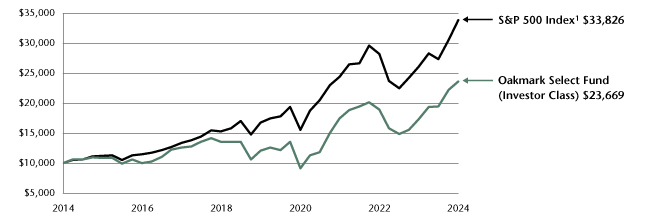

VALUE OF A $10,000 INVESTMENT

(Unaudited)

PERFORMANCE

| | | | | Average Annual Total Returns (as of 03/31/2024) | | | |

| (Unaudited) | | Total Return

Last 3 Months | | 1-year | | 3-year | | 5-year | | 10-year | | Since

Inception | | Inception

Date | |

Oakmark Select Fund (Investor Class) | | | 6.22 | % | | | 36.95 | % | | | 10.66 | % | | | 14.42 | % | | | 9.00 | % | | | 11.93 | % | | 11/01/96 | |

S&P 500 Index | | | 10.56 | % | | | 29.88 | % | | | 11.49 | % | | | 15.05 | % | | | 12.96 | % | | | 9.62 | % | | | |

Lipper Multi-Cap Value Fund Index12 | | | 9.04 | % | | | 23.06 | % | | | 8.85 | % | | | 10.97 | % | | | 8.40 | % | | | 7.99 | % | | | |

Oakmark Select Fund (Advisor Class) | | | 6.25 | % | | | 37.11 | % | | | 10.80 | % | | | 14.56 | % | | | N/A | | | | 9.95 | % | | 11/30/16 | |

Oakmark Select Fund (Institutional Class) | | | 6.29 | % | | | 37.24 | % | | | 10.90 | % | | | 14.65 | % | | | N/A | | | | 10.02 | % | | 11/30/16 | |

Oakmark Select Fund (R6 Class) | | | 6.29 | % | | | 37.29 | % | | | 10.94 | % | | | N/A | | | | N/A | | | | 15.33 | % | | 12/15/20 | |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Past performance is no guarantee of future results. The performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted. Total return includes change in share prices and, in each case, includes reinvestment of dividends and capital gain distributions. The investment return and principal value vary so that an investor's shares, when redeemed, may be worth more or less than the original cost. To obtain the most recent month-end performance, please visit Oakmark.com.

TOP TEN EQUITY HOLDINGS9 | | % of Net Assets | |

IQVIA Holdings, Inc. | | | 7.4 | | |

CBRE Group, Inc., Class A | | | 7.3 | | |

Alphabet, Inc., Class A | | | 6.5 | | |

Capital One Financial Corp. | | | 6.1 | | |

Lithia Motors, Inc. | | | 5.9 | | |

First Citizens BancShares, Inc., Class A | | | 5.9 | | |

Paycom Software, Inc. | | | 5.7 | | |

Charles Schwab Corp. | | | 5.5 | | |

Intercontinental Exchange, Inc. | | | 4.8 | | |

Charter Communications, Inc., Class A | | | 3.9 | | |

FUND STATISTICS | |

Ticker* | | OAKLX | |

Number of Equity Holdings | | 22 | |

Net Assets | | $6.6 billion | |

Weighted Average Market Cap | | $201.2 billion | |

Median Market Cap | | $72 billion | |

Net Expense Ratio - Investor Class*^ | | 1.00% | |

* This information is related to the Investor Class. Please visit Oakmark.com for information related to the Advisor, Institutional and R6 Classes.

^ The Expense Ratio is from the Fund's prospectus dated January 28, 2024. The actual Gross and Net Expense Ratios for the period can be found in the Financial Highlights section of this report.

SECTOR ALLOCATION | | % of Net Assets | |

Financials | | | 37.4 | | |

Communication Services | | | 12.9 | | |

Energy | | | 11.2 | | |

Industrials | | | 8.3 | | |

Health Care | | | 7.4 | | |

Real Estate | | | 7.3 | | |

Consumer Discretionary | | | 6.0 | | |

Information Technology | | | 3.3 | | |

Short-Term Investments and Other | | | 6.2 | | |

See accompanying Disclosures and Endnotes on page 99.

8 OAKMARK FUNDS

Oakmark Select Fund March 31, 2024

Portfolio Manager Commentary

William C. Nygren, CFA

Portfolio Manager

oaklx@oakmark.com

Robert F. Bierig

Portfolio Manager

oaklx@oakmark.com

Alexander E. Fitch, CFA

Portfolio Manager

oaklx@oakmark.com

The Oakmark Select Fund ("the Fund") returned 6.22% during the first quarter compared to 10.56% for the S&P 500 Index, giving back a small amount of our strong relative performance over the past few quarters. Since its inception in November 1996, the Fund has returned an average of 11.93% per year, outperforming the S&P 500 Index's annualized total return of 9.62% over the same period.

In the first quarter, the largest contributing sectors were financials and energy. We slightly reduced our financials weighting due to the good price performance of our holdings in this area, but we continue to believe the sector offers an unusual number of bargains. The largest detracting sectors were communication services and consumer discretionary. The largest individual contributors were First Citizens BancShares and KKR, and the largest individual detractors were Charter Communications and Lithia Motors. Amid the outperformance of growth stocks to start the year, we are finding attractive opportunities to buy stocks that meet our value investment criteria.

We initiated one new holding during the quarter, Deere & Company:

Deere & Company is a leading manufacturer of agricultural equipment with dominant market share in North America and Brazil. Despite its brand strength, technological capabilities and distribution advantages, the company's stock price has recently fallen due to fears about a downturn in the agriculture business cycle. Longer term, world population and food demand are expected to increase annually yet land and labor devoted to agriculture are expected to decline. Deere seems well-positioned to benefit from this dynamic as farms will have to become more productive. We were pleased to purchase shares in Deere at a low double-digit multiple of our estimate of normal earnings power.

We sold our shares in Liberty Broadband to realize losses for taxable investors, and we increased our holdings in Charter Communications by an approximately equivalent dollar amount. Liberty's primary holding is its stake in Charter. Therefore, we view these holdings as largely substitutable.

We thank you, our fellow shareholders, for your investment in the Oakmark Select Fund.

See accompanying Disclosures and Endnotes on page 99.

Oakmark.com 9

Oakmark Select Fund March 31, 2024 (Unaudited)

Schedule of Investments (in thousands)

| | | Shares | | Value | |

COMMON STOCKS - 93.8% | |

FINANCIALS - 37.4% | |

FINANCIAL SERVICES - 27.7% | |

Capital One Financial Corp. | | | 2,690 | | | $ | 400,484 | | |

Charles Schwab Corp. | | | 5,048 | | | | 365,168 | | |

Intercontinental Exchange, Inc. | | | 2,322 | | | | 319,147 | | |

Fiserv, Inc. (a) | | | 1,313 | | | | 209,910 | | |

Ally Financial, Inc. | | | 4,826 | | | | 195,879 | | |

American Express Co. | | | 800 | | | | 182,038 | | |

KKR & Co., Inc. | | | 1,525 | | | | 153,384 | | |

| | | | | | 1,826,010 | | |

BANKS - 9.7% | |

First Citizens BancShares, Inc., Class A | | | 236 | | | | 385,505 | | |

Wells Fargo & Co. | | | 4,360 | | | | 252,691 | | |

| | | | | | 638,196 | | |

| | | | | | 2,464,206 | | |

COMMUNICATION SERVICES - 12.9% | |

MEDIA & ENTERTAINMENT - 12.9% | |

Alphabet, Inc., Class A (a) | | | 2,853 | | | | 430,652 | | |

Charter Communications, Inc., Class A (a) | | | 874 | | | | 253,981 | | |

Warner Bros. Discovery, Inc. (a) | | | 19,057 | | | | 166,368 | | |

| | | | | | 851,001 | | |

ENERGY - 11.2% | |

ConocoPhillips | | | 1,894 | | | | 241,057 | | |

Phillips 66 | | | 1,461 | | | | 238,640 | | |

APA Corp. | | | 4,211 | | | | 144,767 | | |

EOG Resources, Inc. | | | 871 | | | | 111,295 | | |

| | | | | | 735,759 | | |

INDUSTRIALS - 8.3% | |

COMMERCIAL & PROFESSIONAL SERVICES - 5.7% | |

Paycom Software, Inc. | | | 1,881 | | | | 374,415 | | |

CAPITAL GOODS - 2.6% | |

Deere & Co. | | | 423 | | | | 173,784 | | |

| | | | | | 548,199 | | |

HEALTH CARE - 7.4% | |

PHARMACEUTICALS, BIOTECHNOLOGY & LIFE SCIENCES - 7.4% | |

IQVIA Holdings, Inc. (a) | | | 1,924 | | | | 486,662 | | |

REAL ESTATE - 7.3% | |

REAL ESTATE MANAGEMENT & DEVELOPMENT - 7.3% | |

CBRE Group, Inc., Class A (a) | | | 4,919 | | | | 478,309 | | |

CONSUMER DISCRETIONARY - 6.0% | |

CONSUMER DISCRETIONARY DISTRIBUTION & RETAIL - 6.0% | |

Lithia Motors, Inc. | | | 1,299 | | | | 390,817 | | |

| | | Shares | | Value | |

INFORMATION TECHNOLOGY - 3.3% | |

SOFTWARE & SERVICES - 3.3% | |

Salesforce, Inc. | | | 728 | | | $ | 219,380 | | |

TOTAL COMMON STOCKS - 93.8%

(COST $4,386,742) | | | | | 6,174,333 | | |

| | | Par Value | | Value | |

SHORT-TERM INVESTMENTS - 6.4% | |

REPURCHASE AGREEMENT - 6.4% | |

Fixed Income Clearing Corp. Repurchase

Agreement, 5.32% dated 03/28/24 due

04/01/24, repurchase price $424,254,

collateralized by United States Treasury

Notes, 0.250% - 4.250% due

09/30/25 - 10/15/25, aggregate

value plus accrued interest of $432,484

(Cost: $424,003) | | $ | 424,003 | | | | 424,003 | | |

TOTAL SHORT-TERM INVESTMENTS - 6.4%

(COST $424,003) | | | | | 424,003 | | |

TOTAL INVESTMENTS - 100.2%

(COST $4,810,745) | | | | | 6,598,336 | | |

Liabilities In Excess of Other Assets - (0.2)% | | | | | (13,856 | ) | |

TOTAL NET ASSETS - 100.0% | | | | $ | 6,584,480 | | |

(a) Non-income producing security.

See accompanying Notes to Financial Statements.

10 OAKMARK FUNDS

This page intentionally left blank.

Oakmark.com 11

Oakmark Global Fund March 31, 2024

Summary Information

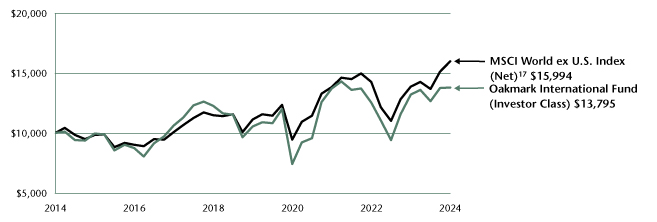

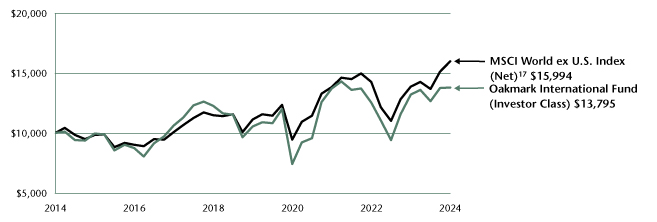

VALUE OF A $10,000 INVESTMENT

(Unaudited)

PERFORMANCE

| | | | | Average Annual Total Returns (as of 03/31/2024) | | | |

| (Unaudited) | | Total Return

Last 3 Months | | 1-year | | 3-year | | 5-year | | 10-year | | Since

Inception | | Inception

Date | |

Oakmark Global Fund (Investor Class) | | | 4.35 | % | | | 10.68 | % | | | 2.87 | % | | | 8.69 | % | | | 6.02 | % | | | 9.38 | % | | 08/04/99 | |

MSCI World Index (Net) | | | 8.88 | % | | | 25.11 | % | | | 8.60 | % | | | 12.07 | % | | | 9.39 | % | | | 6.18 | % | | | |

Lipper Global Fund Index15 | | | 8.93 | % | | | 23.39 | % | | | 5.76 | % | | | 10.22 | % | | | 7.99 | % | | | 6.25 | % | | | |

Oakmark Global Fund (Advisor Class) | | | 4.42 | % | | | 10.90 | % | | | 3.07 | % | | | 8.87 | % | | | N/A | | | | 8.62 | % | | 11/30/16 | |

Oakmark Global Fund (Institutional Class) | | | 4.42 | % | | | 10.95 | % | | | 3.09 | % | | | 8.91 | % | | | N/A | | | | 8.67 | % | | 11/30/16 | |

Oakmark Global Fund (R6 Class) | | | 4.45 | % | | | 10.95 | % | | | 3.12 | % | | | N/A | | | | N/A | | | | 6.76 | % | | 12/15/20 | |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Past performance is no guarantee of future results. The performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted. Total return includes change in share prices and, in each case, includes reinvestment of dividends and capital gain distributions. The investment return and principal value vary so that an investor's shares, when redeemed, may be worth more or less than the original cost. To obtain the most recent month-end performance, please visit Oakmark.com.

TOP TEN EQUITY HOLDINGS9 | | % of Net Assets | |

Lloyds Banking Group PLC | | | 4.6 | | |

Mercedes-Benz Group AG | | | 4.2 | | |

| CNH Industrial NV | | | 3.9 | | |

Alphabet, Inc., Class A | | | 3.3 | | |

General Motors Co. | | | 3.2 | | |

Bayer AG | | | 3.2 | | |

IQVIA Holdings, Inc. | | | 3.2 | | |

Prudential PLC | | | 3.1 | | |

Julius Baer Group Ltd. | | | 3.1 | | |

Bank of America Corp. | | | 3.1 | | |

FUND STATISTICS | |

Ticker* | | OAKGX | |

Number of Equity Holdings | | 45 | |

Net Assets | | $1.2 billion | |

Weighted Average Market Cap | | $158.9 billion | |

Median Market Cap | | $48.8 billion | |

Net Expense Ratio - Investor Class*^ | | 1.13% | |

* This information is related to the Investor Class. Please visit Oakmark.com for information related to the Advisor, Institutional and R6 Classes.

^ The Expense Ratio is from the Fund's prospectus dated January 28, 2024. The actual Gross and Net Expense Ratios for the period can be found in the Financial Highlights section of this report.

SECTOR ALLOCATION | | % of Net Assets | |

Financials | | | 34.1 | | |

Consumer Discretionary | | | 17.1 | | |

Health Care | | | 13.2 | | |

Communication Services | | | 9.3 | | |

Industrials | | | 8.3 | | |

Information Technology | | | 7.5 | | |

Consumer Staples | | | 3.4 | | |

Energy | | | 2.5 | | |

Materials | | | 1.9 | | |

Short-Term Investments and Other | | | 2.7 | | |

GEOGRAPHIC ALLOCATION | |

| | | % of Equity | |

North America | | | 54.6 | | |

United States | | | 54.6 | | |

Europe | | | 41.5 | | |

Germany* | | | 13.7 | | |

United Kingdom | | | 10.3 | | |

Switzerland | | | 7.2 | | |

France* | | | 4.4 | | |

Netherlands* | | | 2.7 | | |

Belgium* | | | 1.7 | | |

Ireland* | | | 1.5 | | |

| | | % of Equity | |

Asia | | | 3.9 | | |

South Korea | | | 2.1 | | |

China | | | 1.8 | | |

* Euro currency countries comprise 24.0% of equity investments.

See accompanying Disclosures and Endnotes on page 99.

12 OAKMARK FUNDS

Oakmark Global Fund March 31, 2024

Portfolio Manager Commentary

David G. Herro, CFA

Portfolio Manager

oakgx@oakmark.com

Anthony P. Coniaris, CFA

Portfolio Manager

oakgx@oakmark.com

Jason E. Long, CFA

Portfolio Manager

oakgx@oakmark.com

M. Colin Hudson, CFA

Portfolio Manager

oakgx@oakmark.com

John A. Sitarz, CFA, CPA

Portfolio Manager

oakgx@oakmark.com

The first quarter reflected strong absolute returns for the Oakmark Global Fund ("the Fund"). The Fund generated a 4.35% return in the first quarter, compared to a 8.88% return for the MSCI World Index (net)14. Since its inception in August 1999, the Fund has returned an average of 9.38% per year, outperforming the MSCI World Index's return of 6.18% over the same period.

The most significant individual stock contributors for the quarter were Daimler Truck Holding (Germany), General Motors (U.S.) and Corebridge Financial (U.S.). The largest detractors were St. James's Place (U.K.), Charter Communications (U.S.) and Bayer (Germany).

Daimler Truck Holding was a top contributor during the quarter. In March, the truck and bus manufacturer released strong fourth-quarter results, accompanied by 2024 margin guidance that significantly exceeded consensus expectations. The expected margin resilience is in spite of a weaker global truck market and is a result of management's decisive actions to improve pricing, drive higher service penetration and increase the flexibility of the cost base. This is most evident in the Mercedes-Benz segment, primarily serving the European and Latin American markets, which increased its adjusted EBIT16 margin from less than 1% in 2019 to over 10% last year. We are impressed by management's execution following the 2021 spin-off from the former Daimler Group and believe the company is positioned to earn structurally higher through-cycle margins than in the past. We met with CEO Martin Daum following the release and continue to see an attractive upside for this investment.

St. James's Place was a top detractor during the quarter. In January, the wealth manager reported net inflows for 2023 that were £4.6 billion lower than in 2022. The disappointing update came on the heels of the company's announcement of a large overhaul of its fee structure. In February, the company reported full-year 2023 results. Underlying cash results fell below our expectations primarily due to the margin from new business and other revenues and expenses. The big miss, in our view, was the large provision charge that St. James's Place took to account for potential client reimbursements. There were increasing complaints from clients that the company was charging them without actually dispensing any advice. St. James's Place conducted

an internal investigation, which cited service gaps that existed before the company implemented Salesforce in 2021. The provision charge covers the appointment of an investigative assessment, the anticipated cost of refunding service fees, the administration costs to operate the refund program, and an interest expense to compensate for the time value of money. We met with management following the release of results and continue to believe in the long-term prospects of St. James's Place.

During the first quarter, we purchased one new position (Centene) and sold one holding (Danaher).

Centene (U.S.) is a large health insurer specializing in three major government-sponsored programs: Medicaid, Marketplace and Medicare Advantage. Each of these programs benefits from long-term secular tailwinds. In Medicaid, states are steadily outsourcing their programs to managed care companies like Centene to help reduce costs and improve care quality. Managed Medicaid penetration has increased meaningfully over the past two decades, and we expect further gains over time. In Marketplace, growth is driven by the trend toward more individuals buying health insurance. Centene holds the top market share in both of these programs and is well-positioned to capitalize on their continued growth. Finally, in Centene's Medicare Advantage business, past missteps will result in losses next year, but we believe Centene can turn its Medicare Advantage segment around and generate positive earnings in the next few years. Centene currently trades for about 9x our estimate of normal earnings power, which we believe is a compelling value for a business that generates healthy returns on capital and is capable of growing EPS13 at a low double-digit rate.

Geographically, we ended the quarter with 54.6% of the portfolio in the U.S., 31.2% in Europe, 10.3% in the U.K. and 3.9% in Asia, as a percent of equity. In the first quarter, Germany, Australia and Canada were the top contributors to the relative performance of countries owned. The U.K., U.S. and Switzerland detracted the most from relative performance.

See accompanying Disclosures and Endnotes on page 99.

Oakmark.com 13

Oakmark Global Fund March 31, 2024 (Unaudited)

Schedule of Investments (in thousands)

| | | Shares | | Value | |

COMMON STOCKS - 97.3% | |

FINANCIALS - 34.1% | |

FINANCIAL SERVICES - 15.8% | |

Julius Baer Group Ltd. (Switzerland) | | | 657 | | | $ | 37,946 | | |

Capital One Financial Corp. (United States) | | | 240 | | | | 35,704 | | |

Fiserv, Inc. (United States) (a) | | | 205 | | | | 32,683 | | |

Corebridge Financial, Inc. (United States) | | | 994 | | | | 28,569 | | |

Intercontinental Exchange, Inc. (United States) | | | 180 | | | | 24,779 | | |

St. James's Place PLC (United Kingdom) | | | 3,592 | | | | 21,059 | | |

KKR & Co., Inc. (United States) | | | 94 | | | | 9,424 | | |

| | | | | | 190,164 | | |

INSURANCE - 10.6% | |

Prudential PLC (United Kingdom) | | | 4,048 | | | | 37,962 | | |

Allianz SE (Germany) | | | 103 | | | | 30,967 | | |

Willis Towers Watson PLC (United States) | | | 110 | | | | 30,195 | | |

American International Group, Inc.

(United States) | | | 376 | | | | 29,368 | | |

| | | | | | 128,492 | | |

BANKS - 7.7% | |

Lloyds Banking Group PLC (United Kingdom) | | | 84,231 | | | | 55,027 | | |

Bank of America Corp. (United States) | | | 998 | | | | 37,829 | | |

| | | | | | 92,856 | | |

| | | | | | 411,512 | | |

CONSUMER DISCRETIONARY - 17.1% | |

AUTOMOBILES & COMPONENTS - 7.4% | |

Mercedes-Benz Group AG (Germany) | | | 632 | | | | 50,310 | | |

General Motors Co. (United States) | | | 850 | | | | 38,556 | | |

| | | | | | 88,866 | | |

CONSUMER DISCRETIONARY DISTRIBUTION & RETAIL - 5.6% | |

Prosus NV (Netherlands) | | | 1,024 | | | | 32,112 | | |

Alibaba Group Holding Ltd. (China) | | | 2,357 | | | | 21,156 | | |

Amazon.com, Inc. (United States) (a) | | | 78 | | | | 14,125 | | |

| | | | | | 67,393 | | |

CONSUMER DURABLES & APPAREL - 4.1% | |

Kering SA (France) | | | 90 | | | | 35,690 | | |

Brunswick Corp. (United States) | | | 150 | | | | 14,478 | | |

| | | | | | 50,168 | | |

| | | | | | 206,427 | | |

HEALTH CARE - 13.2% | |

PHARMACEUTICALS, BIOTECHNOLOGY & LIFE SCIENCES - 9.5% | |

Bayer AG (Germany) | | | 1,245 | | | | 38,173 | | |

IQVIA Holdings, Inc. (United States) (a) | | | 151 | | | | 38,161 | | |

Agilent Technologies, Inc. (United States) | | | 107 | | | | 15,497 | | |

Roche Holding AG (Switzerland) | | | 54 | | | | 13,677 | | |

Novartis AG (Switzerland) | | | 102 | | | | 9,882 | | |

| | | | | | 115,390 | | |

| | | Shares | | Value | |

HEALTH CARE EQUIPMENT & SERVICES - 3.7% | |

Centene Corp. (United States) (a) | | | 296 | | | $ | 23,246 | | |

Envista Holdings Corp. (United States) (a) | | | 988 | | | | 21,132 | | |

| | | | | | 44,378 | | |

| | | | | | 159,768 | | |

COMMUNICATION SERVICES - 9.3% | |

MEDIA & ENTERTAINMENT - 9.3% | |

Alphabet, Inc., Class A (United States) (a) | | | 267 | | | | 40,238 | | |

Interpublic Group of Cos., Inc.

(United States) | | | 1,022 | | | | 33,343 | | |

Charter Communications, Inc., Class A

(United States) (a) | | | 76 | | | | 21,972 | | |

Liberty Broadband Corp., Class C

(United States) (a) | | | 152 | | | | 8,705 | | |

Warner Bros. Discovery, Inc.

(United States) (a) | | | 911 | | | | 7,952 | | |

| | | | | | 112,210 | | |

INDUSTRIALS - 8.3% | |

CAPITAL GOODS - 6.9% | |

CNH Industrial NV (United States) | | | 3,632 | | | | 47,072 | | |

Daimler Truck Holding AG (Germany) | | | 576 | | | | 29,158 | | |

Travis Perkins PLC (United Kingdom) | | | 748 | | | | 6,888 | | |

| | | | | | 83,118 | | |

TRANSPORTATION - 1.4% | |

Ryanair Holdings PLC ADR (Ireland) (b) | | | 122 | | | | 17,695 | | |

| | | | | | 100,813 | | |

INFORMATION TECHNOLOGY - 7.5% | |

TECHNOLOGY HARDWARE & EQUIPMENT - 5.2% | |

Samsung Electronics Co. Ltd. (South Korea) | | | 397 | | | | 23,803 | | |

TE Connectivity Ltd. (United States) | | | 138 | | | | 20,101 | | |

Cisco Systems, Inc. (United States) | | | 369 | | | | 18,437 | | |

| | | | | | 62,341 | | |

SOFTWARE & SERVICES - 2.3% | |

Capgemini SE (France) | | | 68 | | | | 15,717 | | |

SAP SE (Germany) | | | 63 | | | | 12,285 | | |

| | | | | | 28,002 | | |

| | | | | | 90,343 | | |

CONSUMER STAPLES - 3.4% | |

CONSUMER STAPLES DISTRIBUTION & RETAIL - 1.7% | |

Kroger Co. (United States) | | | 359 | | | | 20,515 | | |

FOOD, BEVERAGE & TOBACCO - 1.7% | |

Anheuser-Busch InBev SA (Belgium) | | | 335 | | | | 20,400 | | |

| | | | | | 40,915 | | |

See accompanying Notes to Financial Statements.

14 OAKMARK FUNDS

Oakmark Global Fund March 31, 2024 (Unaudited)

Schedule of Investments (in thousands) (continued)

| | | Shares | | Value | |

COMMON STOCKS - 97.3% (continued) | |

ENERGY - 2.5% | |

ConocoPhillips (United States) | | | 234 | | | $ | 29,785 | | |

MATERIALS - 1.9% | |

Glencore PLC (Switzerland) | | | 4,223 | | | | 23,204 | | |

TOTAL COMMON STOCKS - 97.3%

(COST $903,431) | | | | | 1,174,977 | | |

| | | Par Value | | Value | |

SHORT-TERM INVESTMENT - 3.6% | |

REPURCHASE AGREEMENT - 3.6% | |

Fixed Income Clearing Corp. Repurchase

Agreement, 5.32% dated 03/28/24 due

04/01/24, repurchase price $44,054,

collateralized by United States Treasury

Notes, 0.125% - 4.250% due 10/15/25,

aggregate value plus accrued interest of

$44,908 (Cost: $44,028) | | $ | 44,028 | | | | 44,028 | | |

TOTAL SHORT-TERM INVESTMENTS - 3.6%

(COST $44,028) | | | | | 44,028 | | |

TOTAL INVESTMENTS - 100.9%

(COST $947,459) | | | | | 1,219,005 | | |

Foreign Currencies (Cost $0) (d) - 0.0% (c) | | | | | 0 | (d) | |

Liabilities In Excess of Other Assets - (0.9)% | | | | | (10,929 | ) | |

TOTAL NET ASSETS - 100.0% | | | | $ | 1,208,076 | | |

(a) Non-income producing security.

(b) Sponsored American Depositary Receipt

(c) Amount rounds to less than 0.1%.

(d) Amount rounds to less than $1,000.

See accompanying Notes to Financial Statements.

Oakmark.com 15

Oakmark Global Select Fund March 31, 2024

Summary Information

VALUE OF A $10,000 INVESTMENT

(Unaudited)

PERFORMANCE

| | | | | Average Annual Total Returns (as of 03/31/2024) | | | |

| (Unaudited) | | Total Return

Last 3 Months | | 1-year | | 3-year | | 5-year | | 10-year | | Since

Inception | | Inception

Date | |

Oakmark Global Select Fund (Investor Class) | | | 2.95 | % | | | 15.78 | % | | | 1.74 | % | | | 8.73 | % | | | 6.35 | % | | | 7.60 | % | | 10/02/06 | |

MSCI World Index (Net) | | | 8.88 | % | | | 25.11 | % | | | 8.60 | % | | | 12.07 | % | | | 9.39 | % | | | 7.42 | % | | | |

Lipper Global Fund Index15 | | | 8.93 | % | | | 23.39 | % | | | 5.76 | % | | | 10.22 | % | | | 7.99 | % | | | 6.69 | % | | | |

Oakmark Global Select Fund (Advisor Class) | | | 3.00 | % | | | 15.94 | % | | | 1.90 | % | | | 8.88 | % | | | N/A | | | | 7.46 | % | | 11/30/16 | |

Oakmark Global Select Fund (Institutional Class) | | | 3.05 | % | | | 16.02 | % | | | 1.97 | % | | | 8.97 | % | | | N/A | | | | 7.53 | % | | 11/30/16 | |

Oakmark Global Select Fund (R6 Class) | | | 3.04 | % | | | 16.13 | % | | | 2.02 | % | | | N/A | | | | N/A | | | | 5.59 | % | | 12/15/20 | |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Past performance is no guarantee of future results. The performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted. Total return includes change in share prices and, in each case, includes reinvestment of dividends and capital gain distributions. The investment return and principal value vary so that an investor's shares, when redeemed, may be worth more or less than the original cost. To obtain the most recent month-end performance, please visit Oakmark.com.

TOP TEN EQUITY HOLDINGS9 | | % of Net Assets | |

Alphabet, Inc., Class A | | | 6.3 | | |

| CNH Industrial NV | | | 5.9 | | |

Lloyds Banking Group PLC | | | 5.9 | | |

Fiserv, Inc. | | | 5.6 | | |

Capital One Financial Corp. | | | 5.4 | | |

IQVIA Holdings, Inc. | | | 5.3 | | |

Mercedes-Benz Group AG | | | 5.2 | | |

American International Group, Inc. | | | 5.1 | | |

Charter Communications, Inc., Class A | | | 5.1 | | |

Intercontinental Exchange, Inc. | | | 5.0 | | |

FUND STATISTICS | |

Ticker* | | OAKWX | |

Number of Equity Holdings | | 22 | |

Net Assets | | $1.1 billion | |

Weighted Average Market Cap | | $254.9 billion | |

Median Market Cap | | $55.5 billion | |

Net Expense Ratio - Investor Class*^ | | 1.14% | |

* This information is related to the Investor Class. Please visit Oakmark.com for information related to the Advisor, Institutional and R6 Classes.

^ The Expense Ratio is from the Fund's prospectus dated January 28, 2024. The actual Gross and Net Expense Ratios for the period can be found in the Financial Highlights section of this report.

SECTOR ALLOCATION | | % of Net Assets | |

Financials | | | 31.6 | | |

Health Care | | | 17.0 | | |

Consumer Discretionary | | | 14.7 | | |

Communication Services | | | 12.7 | | |

Consumer Staples | | | 7.6 | | |

Industrials | | | 5.9 | | |

Energy | | | 4.9 | | |

Information Technology | | | 4.5 | | |

Short-Term Investments and Other | | | 1.1 | | |

GEOGRAPHIC ALLOCATION | |

| | | % of Equity | |

North America | | | 60.4 | | |

United States | | | 60.4 | | |

Europe | | | 31.4 | | |

United Kingdom | | | 9.7 | | |

Germany* | | | 9.5 | | |

Switzerland | | | 4.2 | | |

| | | % of Equity | |

Europe (cont'd) | |

Netherlands* | | | 4.0 | | |

France* | | | 4.0 | | |

Asia | | | 8.2 | | |

South Korea | | | 5.9 | | |

China | | | 2.3 | | |

* Euro currency countries comprise 17.5% of equity investments.

See accompanying Disclosures and Endnotes on page 99.

16 OAKMARK FUNDS

Oakmark Global Select Fund March 31, 2024

Portfolio Manager Commentary

David G. Herro, CFA

Portfolio Manager

oakwx@oakmark.com

Anthony P. Coniaris, CFA

Portfolio Manager

oakwx@oakmark.com

Eric Liu, CFA

Portfolio Manager

oakwx@oakmark.com

M. Colin Hudson, CFA

Portfolio Manager

oakwx@oakmark.com

John A. Sitarz, CFA, CPA

Portfolio Manager

oakwx@oakmark.com

The Oakmark Global Select Fund ("the Fund") returned 2.95% for the quarter, underperforming the MSCI World Index (net)14, which returned 8.88%. Since its inception in October 2006, the Fund has returned an average of 7.60% per year, outperforming the MSCI World Index's return of 7.42% over the same period.

Fiserv (U.S.) was a top contributor during the quarter. The company is a leader in merchant acquiring, issuer processing services, and core banking software. During the time we have held the stock, Fiserv, under the leadership of CEO Frank Bisignano, has delivered peer-leading organic growth, meaningful margin expansion, and mid-teens earnings-per-share growth. We believe the company can deliver similarly impressive results over the medium term, yet today the shares still trade at a meaningful discount to the S&P 500 Index1. We believe that Fiserv is performing well and remains an attractive investment.

Charter Communications (U.S.) was a top detractor during the quarter. In February, the stock price fell when the company reported that broadband subscribers declined 0.2% sequentially. We anticipate that broadband subscriber growth will remain challenging in the near term due to a heightened competitive environment and the likely wind-down of a government subsidy program. However, we expect these competitive forces will abate over the medium term and that Charter's broadband subscriber base will return to normal growth. In the meantime, the company continues to grow earnings, invest in high-return capital projects and repurchase stock. We maintain our belief in the long-term prospects of Charter Communications.

We purchased new positions in Reckitt Benckiser Group (U.K.), IQVIA Holdings (U.S.) and Centene (U.S.) during the first quarter.

Reckitt Benckiser Group is a global consumer products company with leading brands in consumer health, infant nutrition, home care and hygiene. We like that more than half of the company's sales are generated from consumer health products, which is a category with meaningful barriers to entry, high margins and attractive growth. Additionally, we believe the company's improved execution, particularly in sales and supply chain management, along with its investments in growth reacceleration, provide potential for future margin expansion. However, Reckitt's stock is trading meaningfully off its highs

following an adverse verdict in a product liability lawsuit over its infant formula product. Although there is a legal liability risk for Reckitt, we believe that the rare nature of the alleged disease in question limits the scope of this liability, well below the share price movement to date. This has afforded us the opportunity to purchase shares of Reckitt at a discount to our estimate of its intrinsic value.

Fears about biotech funding and the sell-off in the broader life sciences area created an opportunity for us to invest in IQVIA, which we view as a high-quality business, at an attractive valuation. We believe that IQVIA is positioned to benefit from the trends of advanced therapeutics and personalized medicine given its ability to perform decentralized clinical trials that require digital capabilities. In our view, IQVIA can grow even further due to its data and software capabilities that enable the company to deliver real-world evidence so that biopharma companies and other health care providers can satisfy their regulatory and reimbursement mandates. We also appreciate CEO Ari Bousbib's strong track record on operations and capital allocation, and we are impressed by his large equity holdings in the company, which give him significant skin in the game. We were pleased to purchase shares of IQVIA at a discount to our estimate of its intrinsic value.

Centene is a large health insurer specializing in three major government-sponsored programs: Medicaid, Marketplace and Medicare Advantage. Each of these programs benefits from long-term secular tailwinds. In Medicaid, states are steadily outsourcing their programs to managed care companies like Centene to help reduce costs and improve care quality. Managed Medicaid penetration has increased meaningfully over the past two decades, and we expect further gains over time. In Marketplace, growth is driven by the trend toward more individuals buying health insurance. Centene holds the top market share in both of these programs and is well-positioned to capitalize on their continued growth. Finally, in Centene's Medicare Advantage business, past missteps will result in losses next year, but we believe Centene can turn its Medicare Advantage segment around and generate positive earnings in the next few years. Centene currently trades for about 9x our estimate of normal earnings power, which we believe is a compelling value for a

See accompanying Disclosures and Endnotes on page 99.

Oakmark.com 17

Oakmark Global Select Fund March 31, 2024

Portfolio Manager Commentary (continued)

business that generates healthy returns on capital and is capable of growing EPS13 at a low double-digit rate.

During the quarter, we also sold our positions in SAP (Germany), CBRE Group (U.S.) and Danaher (U.S.) as they approached our estimate of intrinsic value.

Geographically, we ended the quarter with 60.4% of the portfolio in the U.S., 21.7% in Europe, 9.7% in the U.K., and 8.2% in Asia.

We thank you for your continued support.

See accompanying Disclosures and Endnotes on page 99.

18 OAKMARK FUNDS

Oakmark Global Select Fund March 31, 2024 (Unaudited)

Schedule of Investments (in thousands)

| | | Shares | | Value | |

COMMON STOCKS - 94.3% | |

FINANCIALS - 31.6% | |

FINANCIAL SERVICES - 16.0% | |

Fiserv, Inc. (United States) (a) | | | 372 | | | $ | 59,446 | | |

Capital One Financial Corp. (United States) | | | 383 | | | | 56,980 | | |

Intercontinental Exchange, Inc. (United States) | | | 391 | | | | 53,749 | | |

| | | | | | 170,175 | | |

BANKS - 10.5% | |

Lloyds Banking Group PLC (United Kingdom) | | | 95,510 | | | | 62,396 | | |

Bank of America Corp. (United States) | | | 1,313 | | | | 49,780 | | |

| | | | | | 112,176 | | |

INSURANCE - 5.1% | |

American International Group, Inc.

(United States) | | | 689 | | | | 53,886 | | |

| | | | | | 336,237 | | |

HEALTH CARE - 17.0% | |

PHARMACEUTICALS, BIOTECHNOLOGY & LIFE SCIENCES - 13.6% | |

IQVIA Holdings, Inc. (United States) (a) | | | 224 | | | | 56,521 | | |

Bayer AG (Germany) | | | 1,445 | | | | 44,330 | | |

Roche Holding AG (Switzerland) | | | 172 | | | | 43,808 | | |

| | | | | | 144,659 | | |

HEALTH CARE EQUIPMENT & SERVICES - 3.4% | |

Centene Corp. (United States) (a) | | | 466 | | | | 36,556 | | |

| | | | | | 181,215 | | |

CONSUMER DISCRETIONARY - 14.7% | |

CONSUMER DISCRETIONARY DISTRIBUTION & RETAIL - 9.5% | |

Prosus NV (Netherlands) | | | 1,360 | | | | 42,653 | | |

Amazon.com, Inc. (United States) (a) | | | 186 | | | | 33,627 | | |

Alibaba Group Holding Ltd. (China) | | | 2,699 | | | | 24,225 | | |

| | | | | | 100,505 | | |

AUTOMOBILES & COMPONENTS - 5.2% | |

Mercedes-Benz Group AG (Germany) | | | 697 | | | | 55,534 | | |

| | | | | | 156,039 | | |

COMMUNICATION SERVICES - 12.7% | |

MEDIA & ENTERTAINMENT - 12.7% | |

Alphabet, Inc., Class A (United States) (a) | | | 448 | | | | 67,609 | | |

Charter Communications, Inc., Class A

(United States) (a) | | | 185 | | | | 53,818 | | |

NAVER Corp. (South Korea) | | | 103 | | | | 14,343 | | |

| | | | | | 135,770 | | |

CONSUMER STAPLES - 7.6% | |

FOOD, BEVERAGE & TOBACCO - 3.9% | |

Danone SA (France) | | | 646 | | | | 41,740 | | |

HOUSEHOLD & PERSONAL PRODUCTS - 3.7% | |

Reckitt Benckiser Group PLC (United Kingdom) | | | 692 | | | | 39,402 | | |

| | | | | | 81,142 | | |

| | | Shares | | Value | |

INDUSTRIALS - 5.9% | |

CAPITAL GOODS - 5.9% | |

CNH Industrial NV (United States) | | | 4,833 | | | $ | 62,636 | | |

ENERGY - 4.8% | |

ConocoPhillips (United States) | | | 406 | | | | 51,663 | | |

TOTAL COMMON STOCKS - 94.3%

(COST $809,152) | | | | | 1,004,702 | | |

PREFERRED STOCKS - 4.5% | |

TECHNOLOGY HARDWARE, STORAGE & PERIPHERALS - 4.5% | |

Samsung Electronics Co. Ltd. (South Korea) | | | 953 | | | | 47,550 | | |

TOTAL PREFERRED STOCKS - 4.5%

(COST $41,883) | | | | | 47,550 | | |

| | | Par Value | | Value | |

SHORT-TERM INVESTMENTS - 6.1% | |

REPURCHASE AGREEMENT - 6.1% | |

Fixed Income Clearing Corp. Repurchase

Agreement, 5.32% dated 03/28/24 due

04/01/24, repurchase price $64,876,

collateralized by a United States Treasury

Note, 0.250% due 09/30/25, value plus

accrued interest of $66,134 (Cost: $64,837) | | $ | 64,837 | | | | 64,837 | | |

TOTAL SHORT-TERM INVESTMENTS - 6.1%

(COST $64,837) | | | | | 64,837 | | |

TOTAL INVESTMENTS - 104.9%

(COST $915,872) | | | | | 1,117,089 | | |

Foreign Currencies (Cost $0) (c) - 0.0% (b) | | | | | 0 | (c) | |

Liabilities In Excess of Other Assets - (4.9)% | | | | | (52,106 | ) | |

TOTAL NET ASSETS - 100.0% | | | | $ | 1,064,983 | | |

(a) Non-income producing security.

(b) Amount rounds to less than 0.1%.

(c) Amount rounds to less than $1,000.

See accompanying Notes to Financial Statements.

Oakmark.com 19

International Equity Market Commentary March 31, 2024

David G. Herro, CFA

Portfolio Manager