UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06279

Harris Associates Investment Trust

(Exact name of Registrant as specified in charter)

111 South Wacker Drive, Suite 4600

Chicago, Illinois 60606-4319

(Address of principal executive offices) (Zip code)

| | Rana J. Wright Harris Associates L.P. 111 South Wacker Drive, Suite 4600 Chicago, Illinois 60606-4319 | | Ndenisarya M. Bregasi, Esq. K&L Gates LLP 1601 K Street, N.W. Washington, D.C. 20006-1600 |

| | (Name and address of agents for service) |

Registrant's telephone number, including area code: (312) 646-3600

Date of fiscal year end: 09/30/20

Date of reporting period: 03/31/21

Item 1. Reports to Shareholders.

OAKMARK FUNDS

SEMI-ANNUAL REPORT | MARCH 31, 2021

OAKMARK FUND

OAKMARK SELECT FUND

OAKMARK GLOBAL FUND

OAKMARK GLOBAL SELECT FUND

OAKMARK INTERNATIONAL FUND

OAKMARK INTERNATIONAL SMALL CAP FUND

OAKMARK EQUITY AND INCOME FUND

OAKMARK BOND FUND

Oakmark Funds

2021 Semi-Annual Report

Fund Expenses | | | 1 | | |

Commentary on Oakmark and Oakmark Select Funds | | | 2 | | |

Oakmark Fund | |

Summary Information | | | 4 | | |

Portfolio Manager Commentary | | | 5 | | |

Schedule of Investments | | | 6 | | |

Oakmark Select Fund | |

Summary Information | | | 10 | | |

Portfolio Manager Commentary | | | 11 | | |

Schedule of Investments | | | 12 | | |

Oakmark Global Fund | |

Summary Information | | | 14 | | |

Portfolio Manager Commentary | | | 15 | | |

Schedule of Investments | | | 17 | | |

Oakmark Global Select Fund | |

Summary Information | | | 20 | | |

Portfolio Manager Commentary | | | 21 | | |

Schedule of Investments | | | 22 | | |

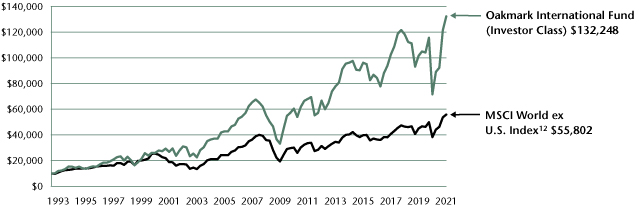

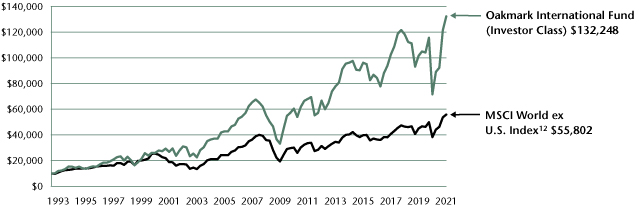

Oakmark International Fund | |

Summary Information | | | 24 | | |

Portfolio Manager Commentary | | | 25 | | |

Schedule of Investments | | | 26 | | |

Oakmark International Small Cap Fund | |

Summary Information | | | 30 | | |

Portfolio Manager Commentary | | | 31 | | |

Schedule of Investments | | | 32 | | |

Oakmark Equity and Income Fund | |

Summary Information | | | 36 | | |

Portfolio Manager Commentary | | | 37 | | |

Schedule of Investments | | | 39 | | |

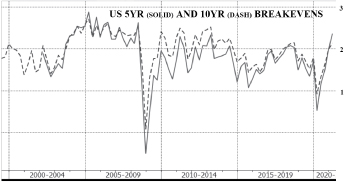

Oakmark Bond Fund | |

Summary Information | | | 44 | | |

Portfolio Manager Commentary | | | 45 | | |

Schedule of Investments | | | 47 | | |

Financial Statements | |

Statements of Assets and Liabilities | | | 50 | | |

Statements of Operations | | | 52 | | |

Statements of Changes in Net Assets | | | 54 | | |

Notes to Financial Statements | | | 68 | | |

Financial Highlights | | | 80 | | |

Disclosures and Endnotes | | | 96 | | |

Trustees and Officers | | | 101 | | |

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Oakmark Funds' annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on Oakmark.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you hold your shares directly with the Funds, by calling 1-800-OAKMARK (625-6275) or visiting Oakmark.com. | |

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you hold your shares directly with the Funds, you can call 1-800-OAKMARK (625-6275) to let the Funds know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Funds you hold directly or all Funds you hold through your financial intermediary, as applicable.

FORWARD-LOOKING STATEMENT DISCLOSURE

One of our most important responsibilities as mutual fund managers is to communicate with shareholders in an open and direct manner. Some of our comments in our letters to shareholders are based on current management expectations and are considered "forward-looking statements." Actual future results, however, may prove to be different from our expectations. You can identify forward-looking statements by words such as "estimate", "may", "will", "expect", "believe",

"plan" and other similar terms. We cannot promise future returns. Our opinions are a reflection of our best judgment at the time this report is compiled, and we disclaim any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise.

Oakmark.com

Fund Expenses (Unaudited)

A shareholder of each Fund incurs ongoing costs, including investment advisory fees, transfer agent fees and other Fund expenses. The examples below are intended to help shareholders understand the ongoing costs (in dollars) of investing in each Fund and to compare these costs with the ongoing costs of investing in other funds.

The following table provides information about actual account values and actual Fund expenses as well as hypothetical account values and hypothetical fund expenses for shares of each Fund.

ACTUAL EXPENSES

The following table shows the expenses a shareholder would have paid on a $1,000 investment in each Fund from October 1, 2020 to March 31, 2021, as well as how much a $1,000 investment would be worth at the close of the period, assuming actual Fund returns and expenses. A shareholder can estimate expenses incurred for the period by dividing the account value at March 31, 2021, by $1,000 and multiplying the result by the number in the "Actual—Expenses Paid During Period" column shown below.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The following table provides information about hypothetical account values and hypothetical expenses for shares of each Fund based on actual expense ratios and an assumed rate of return of 5% per year before expenses, which are not the Funds' actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or actual expenses shareholders paid for the period. Shareholders may use this information to compare the ongoing costs of investing in a Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as redemption fees. Therefore, the "Hypothetical—Expenses Paid During Period" column of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. If these transaction costs were included, the total costs would have been higher.

| | | | | ACTUAL | | HYPOTHETICAL

(5% annual return

before expenses) | | | |

| | Beginning

Account Value

(10/1/20) | | Ending

Account Value

(3/31/21) | | Expenses

Paid During

Period* | | Ending

Account Value

(3/31/21) | | Expenses

Paid During

Period* | | Annualized

Expense

Ratio | |

Oakmark Fund | |

Investor Class | | $ | 1,000.00 | | | $ | 1,435.10 | | | $ | 5.46 | | | $ | 1,020.44 | | | $ | 4.53 | | | | 0.90 | % | |

Advisor Class | | $ | 1,000.00 | | | $ | 1,436.30 | | | $ | 4.43 | | | $ | 1,021.29 | | | $ | 3.68 | | | | 0.73 | % | |

Institutional Class | | $ | 1,000.00 | | | $ | 1,436.70 | | | $ | 4.07 | | | $ | 1,021.59 | | | $ | 3.38 | | | | 0.67 | % | |

Service Class | | $ | 1,000.00 | | | $ | 1,433.50 | | | $ | 6.73 | | | $ | 1,019.40 | | | $ | 5.59 | | | | 1.11 | % | |

R6 Class | | $ | 1,000.00 | | | $ | 1,177.80 | | | $ | 2.02 | (a) | | $ | 1,021.74 | | | $ | 3.23 | | | | 0.64 | % | |

Oakmark Select Fund | |

Investor Class | | $ | 1,000.00 | | | $ | 1,469.20 | | | $ | 6.09 | | | $ | 1,020.00 | | | $ | 4.99 | | | | 0.99 | % | |

Advisor Class | | $ | 1,000.00 | | | $ | 1,469.80 | | | $ | 5.48 | | | $ | 1,020.49 | | | $ | 4.48 | | | | 0.89 | % | |

Institutional Class | | $ | 1,000.00 | | | $ | 1,470.70 | | | $ | 4.74 | | | $ | 1,021.09 | | | $ | 3.88 | | | | 0.77 | % | |

Service Class | | $ | 1,000.00 | | | $ | 1,467.20 | | | $ | 7.32 | | | $ | 1,019.00 | | | $ | 5.99 | | | | 1.19 | % | |

R6 Class | | $ | 1,000.00 | | | $ | 1,171.00 | | | $ | 2.36 | (a) | | $ | 1,021.19 | | | $ | 3.78 | | | | 0.75 | % | |

Oakmark Global Fund | |

Investor Class | | $ | 1,000.00 | | | $ | 1,437.50 | | | $ | 6.87 | | | $ | 1,019.30 | | | $ | 5.69 | | | | 1.13 | % | |

Advisor Class | | $ | 1,000.00 | | | $ | 1,438.80 | | | $ | 5.78 | | | $ | 1,020.19 | | | $ | 4.78 | | | | 0.95 | % | |

Institutional Class | | $ | 1,000.00 | | | $ | 1,439.30 | | | $ | 5.47 | | | $ | 1,020.44 | | | $ | 4.53 | | | | 0.90 | % | |

Service Class | | $ | 1,000.00 | | | $ | 1,436.30 | | | $ | 8.20 | | | $ | 1,018.20 | | | $ | 6.79 | | | | 1.35 | % | |

R6 Class | | $ | 1,000.00 | | | $ | 1,131.00 | | | $ | 2.75 | (a) | | $ | 1,020.49 | | | $ | 4.48 | | | | 0.89 | % | |

Oakmark Global Select Fund | |

Investor Class | | $ | 1,000.00 | | | $ | 1,379.60 | | | $ | 6.59 | | | $ | 1,019.40 | | | $ | 5.59 | | | | 1.11 | % | |

Advisor Class | | $ | 1,000.00 | | | $ | 1,380.80 | | | $ | 5.64 | | | $ | 1,020.19 | | | $ | 4.78 | | | | 0.95 | % | |

Institutional Class | | $ | 1,000.00 | | | $ | 1,381.40 | | | $ | 5.22 | | | $ | 1,020.54 | | | $ | 4.43 | | | | 0.88 | % | |

R6 Class | | $ | 1,000.00 | | | $ | 1,126.40 | | | $ | 2.59 | (a) | | $ | 1,020.74 | | | $ | 4.23 | | | | 0.84 | % | |

Oakmark International Fund | |

Investor Class | | $ | 1,000.00 | | | $ | 1,433.20 | | | $ | 6.07 | | | $ | 1,019.95 | | | $ | 5.04 | | | | 1.00 | % | |

Advisor Class | | $ | 1,000.00 | | | $ | 1,434.30 | | | $ | 5.16 | | | $ | 1,020.69 | | | $ | 4.28 | | | | 0.85 | % | |

Institutional Class | | $ | 1,000.00 | | | $ | 1,435.10 | | | $ | 4.61 | | | $ | 1,021.14 | | | $ | 3.83 | | | | 0.76 | % | |

Service Class | | $ | 1,000.00 | | | $ | 1,431.90 | | | $ | 7.28 | | | $ | 1,018.95 | | | $ | 6.04 | | | | 1.20 | % | |

R6 Class | | $ | 1,000.00 | | | $ | 1,100.70 | | | $ | 2.35 | (a) | | $ | 1,021.09 | | | $ | 3.88 | | | | 0.77 | % | |

Oakmark International Small Cap Fund | |

Investor Class | | $ | 1,000.00 | | | $ | 1,405.30 | | | $ | 8.16 | | | $ | 1,018.15 | | | $ | 6.84 | | | | 1.36 | % | |

Advisor Class | | $ | 1,000.00 | | | $ | 1,405.60 | | | $ | 7.26 | | | $ | 1,018.90 | | | $ | 6.09 | | | | 1.21 | % | |

Institutional Class | | $ | 1,000.00 | | | $ | 1,407.00 | | | $ | 6.66 | | | $ | 1,019.40 | | | $ | 5.59 | | | | 1.11 | % | |

Service Class | | $ | 1,000.00 | | | $ | 1,403.40 | | | $ | 9.77 | | | $ | 1,016.80 | | | $ | 8.20 | | | | 1.63 | % | |

R6 Class | | $ | 1,000.00 | | | $ | 1,129.10 | | | $ | 3.37 | (a) | | $ | 1,019.50 | | | $ | 5.49 | | | | 1.09 | % | |

Oakmark Equity and Income Fund | |

Investor Class | | $ | 1,000.00 | | | $ | 1,279.70 | | | $ | 4.77 | | | $ | 1,020.74 | | | $ | 4.23 | | | | 0.84 | % | |

Advisor Class | | $ | 1,000.00 | | | $ | 1,280.70 | | | $ | 3.70 | | | $ | 1,021.69 | | | $ | 3.28 | | | | 0.65 | % | |

Institutional Class | | $ | 1,000.00 | | | $ | 1,281.50 | | | $ | 3.36 | | | $ | 1,021.99 | | | $ | 2.97 | | | | 0.59 | % | |

Service Class | | $ | 1,000.00 | | | $ | 1,278.50 | | | $ | 5.91 | | | $ | 1,019.75 | | | $ | 5.24 | | | | 1.04 | % | |

R6 Class | | $ | 1,000.00 | | | $ | 1,116.70 | | | $ | 1.75 | (a) | | $ | 1,022.09 | | | $ | 2.87 | | | | 0.57 | % | |

Oakmark Bond Fund | |

Advisor Class | | $ | 1,000.00 | | | $ | 1,015.20 | | | $ | 3.06 | | | $ | 1,021.89 | | | $ | 3.07 | | | | 0.61 | % | |

Institutional Class | | $ | 1,000.00 | | | $ | 1,016.70 | | | $ | 2.26 | | | $ | 1,022.69 | | | $ | 2.27 | | | | 0.45 | % | |

R6 Class | | $ | 1,000.00 | | | $ | 994.30 | | | $ | 1.27 | (a) | | $ | 1,022.74 | | | $ | 2.22 | | | | 0.44 | % | |

* Expenses are calculated using the Annualized Expense Ratio, multiplied by the average account value over the period, multiplied by 182 and divided by 365 (to reflect one-half year period)

(a) Expenses are calculated using the Annualized Expense Ratio, multiplied by the average account value over the period, multiplied by 106 and divided by 365 (to reflect number of days the class was open)

Oakmark.com 1

Oakmark and Oakmark Select Funds March 31, 2021

Portfolio Manager Commentary

William C. Nygren, CFA

Portfolio Manager

oakmx@oakmark.com

oaklx@oakmark.com

oakwx@oakmark.com

At Oakmark, we are long-term investors. We attempt to identify growing businesses that are managed to benefit their shareholders. We will purchase stock in those businesses only when priced substantially below our estimate of intrinsic value. After purchase, we patiently wait for the gap between stock price and intrinsic value to close.

"We laughed and said they are trying to put a computer on a phone, that it won't work. We are now 3-4 years too late."

Anonymous BlackBerry employee letter quoted in Think Again by Adam Grant

What a difference a year makes

When writing this commentary a year ago, the United States was close to completing its lockdown for "15 days to flatten the curve." I wrote about the 34% decline in the S&P 500 Index,1 the abrupt transition to work from home, the benefits of rebalancing portfolios and our focus on owning companies that could prosper in the unlikely event the shutdown lingered. The commentary (https://oakmark.com/news-insights/bill-nygren-market-commentary-1q20/) closed with this paragraph:

"We are hopeful that three months from now, when you read our second-quarter commentary, the Cubs will be playing baseball, we will be eating inside of restaurants and we will all be rescheduling the trips we've had to cancel. If that has happened, we believe the economy will likely recover quickly as will the stock market. But if it takes longer to return to normal, know that we have weighted our portfolios toward companies that we believe can survive a longer downturn and that we fully expect can emerge stronger on the other side."

In hindsight, that sounds so naïve! A full year later, Dr. Fauci is still leading the daily news, restaurant capacity is still limited, vacations are still being deferred and the Cubs have yet to play in front of live fans (though they will be allowed 25% of capacity for opening day). But the lingering effect of Covid-19 didn't stop the stock market. On March 23, 2021, the S&P 500 recorded its largest one-year price increase in the past 85 years, 75%. And just a few days earlier, on March 18, the Oakmark Fund recorded its largest ever one-year increase of 113%. Last year was just another example of how difficult the market timing game can be and why Oakmark doesn't play it. Instead of trying to time the market, we encourage you to consider portfolio rebalancing. If you invested near the low last March to restore your equity allocation, congratulations, but now you may want to make sure it hasn't grown too large.

Following a painful four years for value investors, we've finally had two consecutive quarters where value has outperformed growth, the first time in more than four years. In my September commentary (https://oakmark.com/news-insights/bill-nygren-market-commentary-3q20/), I wrote about the stock market having seemingly bifurcated into two markets: one including many tech and other rapid growth stocks that had become very expensive relative to historic norms and one with more traditional businesses that had not. The two-quarter outperformance of value has done very little to change that. Low P/E2 stocks remain priced at historically large discounts to

high-growth stocks. Though we certainly don't expect the market or our Funds to reproduce the returns of the past year, we remain excited about the prospects for our portfolios. We expect the market's two-tiered valuation gap to continue to narrow, and we believe our Funds are positioned to benefit.

Think Again

We attribute our outperformance over the past year to two primary factors: how quickly we rethought our financial models at the onset of the pandemic and our much longer forecast horizon. While most investors worried about how bad 2020 might be, we focused on how good things could be in 2025. As is often the case during a crisis, we had more confidence in our accuracy forecasting 2025 than 2020. Certainly, the economic downturn made us think again about many of the assumptions that underlie our business value estimates, but for most companies, we found that the loss in intrinsic value was much less than the stock price decline.

In his book Think Again,3 author Adam Grant points out, "Intelligence is traditionally viewed as the ability to think and learn. Yet in a turbulent world, there's another set of cognitive skills that might matter more: the ability to rethink and unlearn." The quote at the top of the page, a classic example of not rethinking assumptions, came from an employee at BlackBerry. In 2009, BlackBerry accounted for nearly half the smartphone market, but in five short years, its market share fell to 1% because it refused to rethink the importance of its physical keyboard. It's nearly impossible to maintain success in either business or investing without frequently rethinking one's assumptions.

Grant, quoting work by his colleague Phil Tetlock, says we often get so caught up preaching, prosecuting or politicking that we don't take time to rethink our own views. Investment professionals spend a lot of time preaching about the merits of their favorite investments, prosecuting those who disagree and politicking to broaden support for their beliefs. In contrast, Grant says if you think like a scientist, you simply search for the truth. He says, if you are truly a scientist, you are "expected to doubt what you know, be curious about what you don't know, and update your views based on new data." Scientists' work is also subject to replication and extensive peer review, which results in rejecting incorrect theories. Grant's book was not aimed specifically at investors, but it sure could have been. His description of thinking like a scientist is exactly what Oakmark asks of its research analysts. Further, we also submit each analyst's research to extensive internal peer review to reduce our error rate. If investors can't shift to scientist mode and search for new information that might change their minds, they are doomed.

See accompanying Disclosures and Endnotes on page 96.

2 OAKMARK FUNDS

Oakmark and Oakmark Select Funds March 31, 2021

Portfolio Manager Commentary (continued)

Before you're tempted to dismiss this by saying investors tend to be smarter than average, Grant quotes studies showing that the higher someone's IQ, the more resistant they are to rethinking their beliefs. He explains, "In psychology there are at least two biases that drive this pattern. One is confirmation bias: seeing what we expect to see. The other is desirability bias: seeing what we want to see. These biases don't just prevent us from applying our intelligence. They can actually contort our intelligence into a weapon against the truth." That's one reason it can be so difficult for a smart investor to give up on a stock when its thesis comes into question.

Grant extensively discusses how intelligent people can fall prey to the psychological irony referred to as the Dunning-Kruger effect—the inverse relationship between our competence in a subject and our confidence in our opinion. It's why in a group of football fans, the most vocal critic is often the one who knows the least about the sport. It may also explain our unwillingness to ask for directions when we are lost. Our brain is telling us to rely on ourselves at the very time it is most important to challenge our assumptions and seek new input. As investors, we can't ever think we know so much that we don't need to bother with new information.

We've written previously about the delicate balancing act facing investors between seemingly contradictory traits. You have to be patient, but you can't be stubborn. Risk averse, but not fearful. Confident, but not arrogant. It's no wonder that investing is such a challenge. Grant believes that the state for optimum decision-making is "confident humility—having faith in our capability while appreciating that we may not have the right solution or even be addressing the right problem. That gives us enough doubt to reexamine our old knowledge and enough confidence to pursue new insights." The best investors are

always seeking new information, especially information that could prove them wrong.

In scientist mode, getting to the right answer is more important than being right. If you were to observe Oakmark's weekly meetings where new stock ideas are presented, you might ask how colleagues at a firm that so highly values collaboration and collegiality can have such aggressive arguments with one another. But, as Grant asserts, "The absence of conflict is not harmony, it's apathy." Clearly, our investment team is not apathetic about stocks we are considering buying! The more mistakes we can identify before we invest, the better off our clients will be. Grant goes on to say that "when I argue with someone it's not a display of disrespect—it's a sign of respect. It means I value their views enough to contest them. If their opinion didn't matter to me, I wouldn't bother." The intensity of our debates definitely shows that Oakmark's investment team has a lot of mutual respect for each other. And that's why after our knockdown, drag-out arguments, we can all enjoy lunch together.

In closing, I'll largely repeat what I said a year ago. We hope that by the time we are writing our next quarterly report, most of us will have had the opportunity to be vaccinated and will be well on our way to enjoying the freedoms we took for granted before 2020. By next quarter, capacity limits at restaurants and Wrigley Field should be much higher, families will again take summer vacations, employees will return to the office and someone other than Dr. Fauci will lead the evening news. If those things happen, we expect a very strong economy. Importantly, as we continue to rethink our assumptions, the window for the return to normal is narrowing. Last year, as the disease progressed, the debate became which year would finally be normal again. Now, it's which quarter. That's progress.

See accompanying Disclosures and Endnotes on page 96.

Oakmark.com 3

Oakmark Fund March 31, 2021

Summary Information

VALUE OF A $10,000 INVESTMENT

Since Inception - 08/05/91 (Unaudited)

PERFORMANCE

| | | | Average Annual Total Returns (as of 03/31/21) | | | |

| (Unaudited) | | Total Return

Last 3 Months | | 1-year | | 3-year | | 5-year | | 10-year | | Since

Inception | | Inception

Date | |

Oakmark Fund (Investor Class) | | | 15.52 | % | | | 87.43 | % | | | 13.40 | % | | | 15.83 | % | | | 13.57 | % | | | 12.93 | % | | 08/05/91 | |

S&P 500 Index | | | 6.18 | % | | | 56.35 | % | | | 16.78 | % | | | 16.29 | % | | | 13.91 | % | | | 10.41 | % | | | |

Dow Jones Industrial Average4 | | | 8.29 | % | | | 53.78 | % | | | 13.61 | % | | | 15.99 | % | | | 13.09 | % | | | 11.04 | % | | | |

Lipper Large Cap Value Fund Index5 | | | 11.05 | % | | | 58.83 | % | | | 11.98 | % | | | 12.93 | % | | | 10.95 | % | | | 9.19 | % | | | |

Oakmark Fund (Advisor Class) | | | 15.59 | % | | | 87.69 | % | | | 13.53 | % | | | N/A | | | | N/A | | | | 14.36 | % | | 11/30/16 | |

Oakmark Fund (Institutional Class) | | | 15.61 | % | | | 87.81 | % | | | 13.61 | % | | | N/A | | | | N/A | | | | 14.42 | % | | 11/30/16 | |

Oakmark Fund (Service Class) | | | 15.47 | % | | | 86.97 | % | | | 13.10 | % | | | 15.52 | % | | | 13.23 | % | | | 9.17 | % | | 04/05/01 | |

Oakmark Fund (R6 Class) | | | 15.61 | % | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | 17.78 | % | | 12/15/20 | |

The graph and table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Past performance is no guarantee of future results. The performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted. Total return includes change in share prices and, in each case, includes reinvestment of dividends and capital gain distributions. The investment return and principal value vary so that an investor's shares, when redeemed, may be worth more or less than the original cost. To obtain the most recent month-end performance, please visit Oakmark.com.

TOP TEN EQUITY HOLDINGS6 | | % of Net Assets | |

Ally Financial, Inc. | | | 4.0 | | |

Alphabet, Inc., Class A | | | 3.6 | | |

Bank of America Corp. | | | 3.6 | | |

Capital One Financial Corp. | | | 3.5 | | |

Citigroup, Inc. | | | 3.3 | | |

Facebook, Inc., Class A | | | 3.1 | | |

EOG Resources, Inc. | | | 2.9 | | |

The Charles Schwab Corp. | | | 2.8 | | |

Comcast Corp., Class A | | | 2.7 | | |

General Motors Co. | | | 2.6 | | |

FUND STATISTICS | |

Ticker* | | OAKMX | |

Number of Equity Holdings | | 51 | |

Net Assets | | $15.2 billion | |

Weighted Average Market Cap | | $165.6 billion | |

Median Market Cap | | $60.4 billion | |

Gross Expense Ratio - Investor Class (as of 12/15/20)* | | 0.93% | |

Net Expense Ratio - Investor Class (as of 12/15/20)*† | | 0.91% | |

* This information is related to the Investor Class. Please visit Oakmark.com for information related to the Advisor, Institutional and R6 Classes.

† The net expense ratio reflects a contractual advisory fee waiver agreement through January 27, 2022, as per the Prospectus dated 12/15/2020.

SECTOR ALLOCATION | | % of Net Assets | |

Financials | | | 34.0 | | |

Communication Services | | | 14.3 | | |

Information Technology | | | 11.9 | | |

Consumer Discretionary | | | 11.8 | | |

Health Care | | | 7.3 | | |

Energy | | | 6.5 | | |

Industrials | | | 6.5 | | |

Consumer Staples | | | 4.6 | | |

Real Estate | | | 1.1 | | |

Short-Term Investments and Other | | | 2.0 | | |

See accompanying Disclosures and Endnotes on page 96.

4 OAKMARK FUNDS

Oakmark Fund March 31, 2021

Portfolio Manager Commentary

William C. Nygren, CFA

Portfolio Manager

oakmx@oakmark.com

Kevin Grant, CFA

Portfolio Manager

oakmx@oakmark.com

Michael A. Nicolas, CFA

Portfolio Manager

oakmx@oakmark.com

The Oakmark Fund produced a 15.5% return during the first quarter, which compares to the S&P 500 Index's1 return of 6.2% for the same period. The economic recovery that began late last year carried into the first quarter, benefitting many of our cyclical holdings. In a reversal from what transpired during the first quarter of 2020, both interest rates and oil prices increased meaningfully during the recent quarter, helping many of our financial and energy holdings. Indeed, our worst performing sectors during 2020 are among our best performers year to date (financials, energy) and our holdings in these sectors still trade at healthy discounts to our intrinsic value estimates.

Our highest contributors during the first quarter were EOG Resources and Ally Financial and our largest detractors were Netflix and Charter Communications. No individual position cost the Fund more than 20 basis points of performance. Each sector contributed to the Fund's performance during the period and the strongest returns were generated by our energy, real estate and financial holdings. As often happens during a cyclical recovery, our holdings that withstood the initial downturn the best, such as those within the communication services and technology sectors, were some of our weakest performers during the most recent quarter.

We initiated a new position in Altria, which commands roughly 50% of the cigarette and smokeless tobacco market in the U.S. Both of these markets are duopolies that we believe have exhibited strong pricing power over time. While the shares trade at a low multiple of reported earnings, Altria also owns valuable stakes in other non-core businesses, including ~10% of AB InBev, 35% of Juul and 45% of Cronos. Excluding the values of these stakes and their respective earnings contribution, we were able to purchase shares of Altria for less than seven times our estimate of next year's earnings. This compares to other consumer brands with less favorable earnings growth profiles that trade for three times Altria's multiple. The company also has several promising reduced-risk products that may appeal to tobacco users, including On! and iQOS. We believe these products position the company well to help consumers slowly transition to a tobacco-free future. We expect management to return the vast majority of future earnings to shareholders given the company's strong balance sheet, high free cash flow conversion and limited capital requirements.

We elected to retain a position in ConocoPhillips following its all-stock acquisition of portfolio holding Concho Resources after determining that the combined entity was nearly as undervalued as stand-alone Concho. We believe Conoco is one of the highest quality independent oil producers in the world today. The company has decades of low-cost drilling inventory in attractive oil basins, minimal leverage and industry-leading returns on invested capital. Conoco management has built this enviable competitive position through years of shrewd capital allocation and efficient operations. This includes a history of

accretive divestitures and opportunistic acquisitions, the latest example being Concho. For Conoco, the Concho deal adds some of the highest quality acreage in the Permian Basin at an attractive all-in cost, with an opportunity to create incremental value by eliminating duplicative costs and monetizing excess acreage. We believe this value-focused approach to both acquisitions and divestitures is rare in oil and gas and we are pleased to invest alongside these stewards of capital. The shares are priced at a double-digit free cash flow yield and a discount to peers on most earnings metrics, so we took advantage of the opportunity to own the business at an attractive price.

Aptiv and Parker Hannifin approached our estimates of intrinsic value and were, therefore, eliminated during the period. Both companies were longstanding investments of the Fund and produced successful outcomes. We continue to believe that Aptiv is a well-positioned auto supplier that is likely to continue outgrowing light vehicle production for the foreseeable future, but this dynamic is now more fully appreciated by the market. We believe Parker Hannifin, one of our longest tenured positions, is a high-quality, well-managed industrial with strong competitive positions in good end markets. However, after the market price reflected these positives, we elected to sell to pursue more attractive alternatives that were priced at steeper discounts to our estimates of intrinsic value.

We thank you, our fellow shareholders, for your investment and continued support of the Oakmark Fund.

See accompanying Disclosures and Endnotes on page 96.

Oakmark.com 5

Oakmark Fund March 31, 2021 (Unaudited)

Schedule of Investments (in thousands)

| | | Shares | | Value | |

COMMON STOCKS - 98.0% | |

FINANCIALS - 34.0% | |

DIVERSIFIED FINANCIALS - 21.3% | |

Ally Financial, Inc. | | | 13,423 | | | $ | 606,858 | | |

Capital One Financial Corp. | | | 4,164 | | | | 529,786 | | |

The Charles Schwab Corp. | | | 6,600 | | | | 430,188 | | |

The Goldman Sachs Group, Inc. | | | 1,105 | | | | 361,335 | | |

State Street Corp. | | | 3,951 | | | | 331,907 | | |

American Express Co. | | | 2,004 | | | | 283,488 | | |

The Bank of New York Mellon Corp. | | | 4,786 | | | | 226,308 | | |

S&P Global, Inc. | | | 473 | | | | 166,759 | | |

KKR & Co., Inc. | | | 3,300 | | | | 161,205 | | |

Moody's Corp. | | | 502 | | | | 149,864 | | |

| | | | | | 3,247,698 | | |

BANKS - 8.7% | |

Bank of America Corp. | | | 13,976 | | | | 540,712 | | |

Citigroup, Inc. | | | 6,904 | | | | 502,274 | | |

Wells Fargo & Co. | | | 7,000 | | | | 273,490 | | |

| | | | | | 1,316,476 | | |

INSURANCE - 4.0% | |

American International Group, Inc. | | | 7,233 | | | | 334,228 | | |

Reinsurance Group of America, Inc. | | | 2,134 | | | | 268,969 | | |

| | | | | | 603,197 | | |

| | | | | | 5,167,371 | | |

COMMUNICATION SERVICES - 14.3% | |

MEDIA & ENTERTAINMENT - 13.5% | |

Alphabet, Inc., Class A (a) | | | 269 | | | | 555,055 | | |

Facebook, Inc., Class A (a) | | | 1,611 | | | | 474,606 | | |

Comcast Corp., Class A | | | 7,709 | | | | 417,140 | | |

Netflix, Inc. (a) | | | 588 | | | | 306,788 | | |

Charter Communications, Inc., Class A (a) | | | 487 | | | | 300,180 | | |

| | | | | | 2,053,769 | | |

TELECOMMUNICATION SERVICES - 0.8% | |

T-Mobile US, Inc. (a) | | | 1,000 | | | | 125,290 | | |

| | | | | | 2,179,059 | | |

INFORMATION TECHNOLOGY - 11.9% | |

SOFTWARE & SERVICES - 10.2% | |

Gartner, Inc. (a) | | | 1,668 | | | | 304,552 | | |

DXC Technology Co. | | | 9,139 | | | | 285,688 | | |

Fiserv, Inc. (a) | | | 2,000 | | | | 238,080 | | |

Automatic Data Processing, Inc. | | | 1,149 | | | | 216,533 | | |

Workday, Inc., Class A (a) | | | 857 | | | | 212,855 | | |

Visa, Inc., Class A | | | 881 | | | | 186,471 | | |

Mastercard, Inc., Class A | | | 300 | | | | 106,744 | | |

| | | | | | 1,550,923 | | |

TECHNOLOGY HARDWARE & EQUIPMENT - 1.7% | |

TE Connectivity, Ltd. | | | 2,051 | | | | 264,772 | | |

| | | | | | 1,815,695 | | |

| | | Shares | | Value | |

CONSUMER DISCRETIONARY - 11.8% | |

CONSUMER SERVICES - 6.7% | |

Booking Holdings, Inc. (a) | | | 162 | | | $ | 376,502 | | |

MGM Resorts International (b) | | | 8,682 | | | | 329,833 | | |

Hilton Worldwide Holdings, Inc. | | | 2,572 | | | | 311,018 | | |

| | | | | | 1,017,353 | | |

AUTOMOBILES & COMPONENTS - 2.6% | |

General Motors Co. | | | 6,846 | | | | 393,371 | | |

RETAILING - 2.5% | |

eBay, Inc. | | | 4,376 | | | | 267,968 | | |

Qurate Retail, Inc., Class A | | | 9,976 | | | | 117,313 | | |

| | | | | | 385,281 | | |

| | | | | | 1,796,005 | | |

HEALTH CARE - 7.3% | |

HEALTH CARE EQUIPMENT & SERVICES - 5.7% | |

HCA Healthcare, Inc. | | | 1,683 | | | | 316,975 | | |

Humana, Inc. | | | 748 | | | | 313,599 | | |

CVS Health Corp. | | | 3,078 | | | | 231,571 | | |

| | | | | | 862,145 | | |

PHARMACEUTICALS, BIOTECHNOLOGY & LIFE SCIENCES - 1.6% | |

Regeneron Pharmaceuticals, Inc. (a) | | | 524 | | | | 247,876 | | |

| | | | | | 1,110,021 | | |

ENERGY - 6.5% | |

EOG Resources, Inc. | | | 6,099 | | | | 442,329 | | |

APA Corp. | | | 13,744 | | | | 246,014 | | |

Diamondback Energy, Inc. | | | 2,600 | | | | 191,074 | | |

ConocoPhillips | | | 2,156 | | | | 114,187 | | |

| | | | | | 993,604 | | |

INDUSTRIALS - 6.5% | |

CAPITAL GOODS - 6.5% | |

Caterpillar, Inc. (b) | | | 1,420 | | | | 329,209 | | |

General Electric Co. | | | 24,000 | | | | 315,120 | | |

Cummins, Inc. | | | 777 | | | | 201,328 | | |

General Dynamics Corp. | | | 800 | | | | 145,248 | | |

| | | | | | 990,905 | | |

CONSUMER STAPLES - 4.6% | |

FOOD, BEVERAGE & TOBACCO - 4.6% | |

Constellation Brands, Inc., Class A | | | 1,485 | | | | 338,557 | | |

Keurig Dr Pepper, Inc. | | | 5,978 | | | | 205,461 | | |

Altria Group, Inc. | | | 3,000 | | | | 153,480 | | |

| | | | | | 697,498 | | |

REAL ESTATE - 1.1% | |

CBRE Group, Inc., Class A (a) | | | 2,000 | | | | 158,220 | | |

TOTAL COMMON STOCKS - 98.0%

(COST $7,404,934) | | | | | 14,908,378 | | |

See accompanying Notes to Financial Statements.

6 OAKMARK FUNDS

Oakmark Fund March 31, 2021 (Unaudited)

Schedule of Investments (in thousands) (continued)

| | | Par Value | | Value | |

SHORT-TERM INVESTMENT - 2.2% | |

REPURCHASE AGREEMENT - 2.2% | |

Fixed Income Clearing Corp. Repurchase

Agreement, 0.00% dated 03/31/21 due

04/01/21, repurchase price $338,138,

collateralized by United States

Treasury Note, 0.125% due 03/31/23,

value plus accrued interest of $344,901

(Cost: $338,138) | | $ | 338,138 | | | $ | 338,138 | | |

TOTAL SHORT-TERM INVESTMENTS - 2.2%

(COST $338,138) | | | | | 338,138 | | |

TOTAL INVESTMENTS - 100.2%

(COST $7,743,072) | | | | | 15,246,516 | | |

Foreign Currencies (Cost $0) - 0.0% (c) | | | | | 0 | (d) | |

Liabilities In Excess of Other Assets - (0.2)% | | | | | (27,872 | ) | |

TOTAL NET ASSETS - 100.0% | | | | $ | 15,218,644 | | |

(a) Non-income producing security

(b) All or a portion of this investment is held in connection with one or more options within the Fund.

(c) Amount rounds to less than 0.1%.

(d) Amount rounds to less than $1,000.

See accompanying Notes to Financial Statements.

Oakmark.com 7

Oakmark Fund March 31, 2021 (Unaudited)

Schedule of Investments (in thousands) (continued)

WRITTEN OPTIONS

Description | | Exercise

Price | | Expiration

Date | | Number of

Contracts | | Notional

Amount | | Market

Value | | Premiums

(Received)

by Fund | | Unrealized

Gain/(Loss) | |

CALLS | |

Caterpillar, Inc. | | $ | 220.00 | | | 5/21/21 | | | (10,000 | ) | | $ | (231,870 | ) | | $ | (17,700 | ) | | $ | (15,957 | ) | | $ | (1,743 | ) | |

Caterpillar, Inc. | | $ | 210.00 | | | 5/21/21 | | | (4,000 | ) | | $ | (92,748 | ) | | $ | (10,020 | ) | | $ | (6,124 | ) | | $ | (3,896 | ) | |

MGM Resorts International | | $ | 38.00 | | | 6/18/21 | | | (22,143 | ) | | $ | (84,121 | ) | | $ | (7,529 | ) | | $ | (9,833 | ) | | $ | 2,304 | | |

MGM Resorts International | | $ | 39.00 | | | 6/18/21 | | | (10,684 | ) | | $ | (40,589 | ) | | $ | (3,093 | ) | | $ | (4,731 | ) | | $ | 1,638 | | |

MGM Resorts International | | $ | 37.00 | | | 6/18/21 | | | (7,173 | ) | | $ | (27,250 | ) | | $ | (2,654 | ) | | $ | (3,040 | ) | | $ | 386 | | |

| | | | | | | | | $ | (476,578 | ) | | $ | (40,996 | ) | | $ | (39,685 | ) | | $ | (1,311 | ) | |

See accompanying Notes to Financial Statements.

8 OAKMARK FUNDS

This page intentionally left blank.

Oakmark.com 9

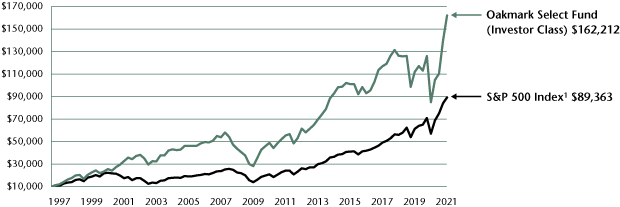

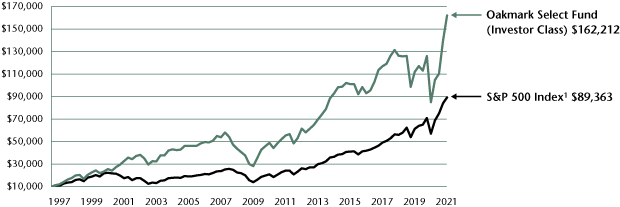

Oakmark Select Fund March 31, 2021

Summary Information

VALUE OF A $10,000 INVESTMENT

Since Inception - 11/01/96 (Unaudited)

PERFORMANCE

| | | | Average Annual Total Returns (as of 03/31/21) | | | |

| (Unaudited) | | Total Return

Last 3 Months | | 1-year | | 3-year | | 5-year | | 10-year | | Since

Inception | | Inception

Date | |

Oakmark Select Fund (Investor Class) | | | 16.08 | % | | | 90.57 | % | | | 8.67 | % | | | 11.75 | % | | | 11.30 | % | | | 12.09 | % | | 11/01/96 | |

S&P 500 Index | | | 6.18 | % | | | 56.35 | % | | | 16.78 | % | | | 16.29 | % | | | 13.91 | % | | | 9.39 | % | | | |

Lipper Multi-Cap Value Fund Index7 | | | 13.05 | % | | | 66.68 | % | | | 9.58 | % | | | 10.90 | % | | | 9.68 | % | | | 7.89 | % | | | |

Oakmark Select Fund (Advisor Class) | | | 16.09 | % | | | 90.77 | % | | | 8.81 | % | | | N/A | | | | N/A | | | | 9.36 | % | | 11/30/16 | |

Oakmark Select Fund (Institutional Class) | | | 16.15 | % | | | 90.99 | % | | | 8.87 | % | | | N/A | | | | N/A | | | | 9.42 | % | | 11/30/16 | |

Oakmark Select Fund (Service Class) | | | 16.00 | % | | | 90.15 | % | | | 8.43 | % | | | 11.46 | % | | | 10.99 | % | | | 9.20 | % | | 12/31/99 | |

Oakmark Select Fund (R6 Class) | | | 16.15 | % | | | — | | | | — | | | | N/A | | | | N/A | | | | 17.10 | % | | 12/15/20 | |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Past performance is no guarantee of future results. The performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted. Total return includes change in share prices and, in each case, includes reinvestment of dividends and capital gain distributions. The investment return and principal value vary so that an investor's shares, when redeemed, may be worth more or less than the original cost. To obtain the most recent month-end performance, please visit Oakmark.com.

TOP TEN EQUITY HOLDINGS6 | | % of Net Assets | |

Alphabet, Inc., Class A | | | 10.1 | | |

CBRE Group, Inc., Class A | | | 9.5 | | |

Ally Financial, Inc. | | | 6.1 | | |

Citigroup, Inc. | | | 5.9 | | |

Bank of America Corp. | | | 5.4 | | |

Charter Communications, Inc., Class A | | | 5.0 | | |

Capital One Financial Corp. | | | 5.0 | | |

Facebook, Inc., Class A | | | 4.8 | | |

American International Group, Inc. | | | 4.5 | | |

General Electric Co. | | | 4.4 | | |

FUND STATISTICS | |

Ticker* | | OAKLX | |

Number of Equity Holdings | | 24 | |

Net Assets | | $4.8 billion | |

Weighted Average Market Cap | | $256.0 billion | |

Median Market Cap | | $47.7 billion | |

Gross Expense Ratio - Investor Class (as of 12/15/20)* | | 1.03% | |

Net Expense Ratio - Investor Class (as of 12/15/20)*† | | 1.01% | |

* This information is related to the Investor Class. Please visit Oakmark.com for information related to the Advisor, Institutional and R6 Classes.

† The net expense ratio reflects a contractual advisory fee waiver agreement through January 27, 2022, as per the Prospectus dated 12/15/2020.

SECTOR ALLOCATION | | % of Net Assets | |

Financials | | | 29.4 | | |

Communication Services | | | 23.8 | | |

Consumer Discretionary | | | 14.9 | | |

Real Estate | | | 9.5 | | |

Health Care | | | 6.0 | | |

Energy | | | 5.4 | | |

Industrials | | | 4.4 | | |

Consumer Staples | | | 4.3 | | |

Short-Term Investments and Other | | | 2.3 | | |

See accompanying Disclosures and Endnotes on page 96.

10 OAKMARK FUNDS

Oakmark Select Fund March 31, 2021

Portfolio Manager Commentary

William C. Nygren, CFA

Portfolio Manager

oaklx@oakmark.com

Anthony P. Coniaris, CFA

Portfolio Manager

oaklx@oakmark.com

Win Murray

Portfolio Manager

oaklx@oakmark.com

The Oakmark Select Fund was up 16.1% for the quarter, ahead of the S&P 500 Index's1 6.2% return. For the trailing 12-month period, the Fund increased by 90.6%, compared to the S&P's 56.4% return. The preponderance of that one-year outperformance came from November onwards, after data was announced indicating that effective vaccines would launch in the upcoming months.

Clients regularly ask us, "How do you incorporate macroeconomic factors and forecasts into your investment process?" Our answer is always, "We don't. We just assume things will be normal five years from now." By "normal," we mean that everything should pretty much look like it always does, with extremes moving toward their long-term levels. In other words, if current interest rates are negative or the current oil price is $20 or current unemployment is 12% or if there's some currency exchange rate that means a Big Mac in Europe would cost $40 American dollars, we don't extrapolate those conditions into perpetuity. We assume that five years from now, natural market forces will have worked in such a way as to produce a rational economic backdrop.

Most of the time, this keeps us in line with most other investors' expectations. This means that we don't have a unique or ideological macroeconomic belief that shapes our portfolios. In normal environments (i.e., most of the time), our returns are driven by what we do best: identifying individual businesses that sell at a substantial discount to our estimate of their intrinsic value or what we consider to be their private market values.

However, on rare occasions, the idea that things will be normal in five years looks like a heroically outlier opinion. The last time this occurred, pre-pandemic, was in 2008 during the depths of the global financial crisis. The market was in a state of panic, presuming that the world economy was almost irreparably broken. Our belief that markets would return to normal wasn't widely shared and, thus, our portfolios were loaded with cyclical recovery investments that looked far too cheap relative to our assessment of their intrinsic values. In retrospect, our portfolio positioning proved correct.

Similarly, even in the first few months of the pandemic, we had faith that human ingenuity and market forces would develop solutions that would enable something that resembled normal life (and normal economic activity) to recur. As such, the assumptions underpinning our company valuations presumed future cash flows that were likely higher than the market was forecasting at the time and, thus, our bottom-up portfolios were full of "return to normal" stocks that were priced, in our minds, far too cheaply. We didn't know when "normal" would occur, so we sold out of some cyclical companies with high debt loads (unsure as to whether they could survive an extended downturn), replacing them with similarly valued companies that had better balance sheets. In retrospect, the recovery happened even

more rapidly than we had thought, and these trades, while prudent, weren't necessary.

The most significant contributors to performance during the quarter were CBRE Group (+26%) and Alphabet (+18%). The most significant detractors were Charter Communications (-7%) and Netflix (-4%). We continue to hold all of these investments, as they are still selling at a sizable discount to our estimates of their intrinsic values.

We bought two new positions in the Fund this quarter: Humana and First Citizens BancShares. The rationale behind our Humana purchase is well articulated in the Oakmark Equity and Income letter (https://oakmark.com/news-insights/oakmark-equity-and-income-fund-first-quarter-2021/) this quarter. First Citizens BancShares is a well-run, undervalued community bank that we believe is creating significant shareholder value through a nicely timed merger with CIT Group. Note that we consider our purchases of the A & B share classes of First Citizens and of CIT Group to be investments in the same entity.

We eliminated our longstanding position in TE Connectivity during the quarter. The company is still selling at a discount to our estimate of its intrinsic value, but that discount has narrowed as TE's stock price has increased sharply in recent quarters. As such, we don't believe the stock is attractive enough to merit holding in a concentrated portfolio.

Thank you, our fellow shareholders, for your continued investment in our Fund.

See accompanying Disclosures and Endnotes on page 96.

Oakmark.com 11

Oakmark Select Fund March 31, 2021 (Unaudited)

Schedule of Investments (in thousands)

| | | Shares | | Value | |

COMMON STOCKS - 97.7% | |

FINANCIALS - 29.4% | |

BANKS - 13.8% | |

Citigroup, Inc. | | | 3,862 | | | $ | 280,960 | | |

Bank of America Corp. | | | 6,603 | | | | 255,486 | | |

CIT Group, Inc. | | | 1,357 | | | | 69,874 | | |

First Citizens BancShares, Inc., Class A | | | 56 | | | | 46,745 | | |

First Citizens BancShares, Inc., Class B | | | 7 | | | | 5,345 | | |

| | | | | | 658,410 | | |

DIVERSIFIED FINANCIALS - 11.1% | |

Ally Financial, Inc. (a) | | | 6,440 | | | | 291,139 | | |

Capital One Financial Corp. | | | 1,875 | | | | 238,544 | | |

| | | | | | 529,683 | | |

INSURANCE - 4.5% | |

American International Group, Inc. | | | 4,619 | | | | 213,458 | | |

| | | | | | 1,401,551 | | |

COMMUNICATION SERVICES - 23.8% | |

MEDIA & ENTERTAINMENT - 23.8% | |

Alphabet, Inc., Class A (b) | | | 234 | | | | 483,065 | | |

Charter Communications, Inc., Class A (b) | | | 389 | | | | 239,959 | | |

Facebook, Inc., Class A (b) | | | 783 | | | | 230,617 | | |

Netflix, Inc. (b) | | | 350 | | | | 182,372 | | |

| | | | | | 1,136,013 | | |

CONSUMER DISCRETIONARY - 14.9% | |

CONSUMER SERVICES - 10.5% | |

Booking Holdings, Inc. (b) | | | 82 | | | | 191,047 | | |

MGM Resorts International (a) | | | 4,688 | | | | 178,078 | | |

Hilton Worldwide Holdings, Inc. | | | 1,116 | | | | 135,004 | | |

| | | | | | 504,129 | | |

AUTOMOBILES & COMPONENTS - 4.4% | |

Lear Corp. | | | 1,150 | | | | 208,438 | | |

| | | | | | 712,567 | | |

REAL ESTATE - 9.5% | |

CBRE Group, Inc., Class A (a) (b) | | | 5,755 | | | | 455,243 | | |

HEALTH CARE - 6.0% | |

HEALTH CARE EQUIPMENT & SERVICES - 5.8% | |

HCA Healthcare, Inc. | | | 764 | | | | 143,957 | | |

Humana, Inc. | | | 317 | | | | 132,902 | | |

| | | | | | 276,859 | | |

PHARMACEUTICALS, BIOTECHNOLOGY & LIFE SCIENCES - 0.2% | |

Regeneron Pharmaceuticals, Inc. (b) | | | 20 | | | | 9,463 | | |

| | | | | | 286,322 | | |

ENERGY - 5.4% | |

EOG Resources, Inc. | | | 2,054 | | | | 148,950 | | |

APA Corp. | | | 6,000 | | | | 107,400 | | |

| | | | | | 256,350 | | |

| | | Shares | | Value | |

INDUSTRIALS - 4.4% | |

CAPITAL GOODS - 4.4% | |

General Electric Co. | | | 16,000 | | | $ | 210,080 | | |

CONSUMER STAPLES - 4.3% | |

FOOD, BEVERAGE & TOBACCO - 4.3% | |

Constellation Brands, Inc., Class A | | | 910 | | | | 207,389 | | |

TOTAL COMMON STOCKS - 97.7%

(COST $2,265,730) | | | | | 4,665,515 | | |

| | | Par Value | | Value | |

SHORT-TERM INVESTMENTS - 2.8% | |

REPURCHASE AGREEMENT - 2.8% | |

Fixed Income Clearing Corp. Repurchase

Agreement, 0.00% dated 03/31/21 due

04/01/21, repurchase price $133,733,

collateralized by United States

Treasury Note, 0.125% due 03/31/23,

value plus accrued interest of $136,408

(Cost: $133,733) | | $ | 133,733 | | | | 133,733 | | |

TOTAL SHORT-TERM INVESTMENTS - 2.8%

(COST $133,733) | | | | | 133,733 | | |

TOTAL INVESTMENTS - 100.5%

(COST $2,399,463) | | | | | 4,799,248 | | |

Liabilities In Excess of Other Assets - (0.5)% | | | | | (25,226 | ) | |

TOTAL NET ASSETS - 100.0% | | | | $ | 4,774,022 | | |

(a) All or a portion of this investment is held in connection with one or more options within the Fund.

(b) Non-income producing security

See accompanying Notes to Financial Statements.

12 OAKMARK FUNDS

Oakmark Select Fund March 31, 2021 (Unaudited)

Schedule of Investments (in thousands) (continued)

WRITTEN OPTIONS

Description | | Exercise

Price | | Expiration

Date | | Number of

Contracts | | Notional

Amount | | Market

Value | | Premiums

(Received)

by Fund | | Unrealized

Gain/(Loss) | |

CALLS | |

Ally Financial, Inc. | | $ | 40.00 | | | 6/18/21 | | | (2,000 | ) | | $ | (9,042 | ) | | $ | (1,280 | ) | | $ | (958 | ) | | $ | (322 | ) | |

CBRE Group, Inc., Class A | | $ | 70.00 | | | 6/18/21 | | | (15,000 | ) | | $ | (118,665 | ) | | $ | (16,050 | ) | | $ | (11,879 | ) | | $ | (4,171 | ) | |

CBRE Group, Inc., Class A | | $ | 75.00 | | | 6/18/21 | | | (5,000 | ) | | $ | (39,555 | ) | | $ | (3,450 | ) | | $ | (3,702 | ) | | $ | 252 | | |

MGM Resorts International | | $ | 38.00 | | | 5/21/21 | | | (8,201 | ) | | $ | (31,156 | ) | | $ | (2,284 | ) | | $ | (3,664 | ) | | $ | 1,380 | | |

MGM Resorts International | | $ | 39.00 | | | 5/21/21 | | | (11,799 | ) | | $ | (44,824 | ) | | $ | (2,779 | ) | | $ | (5,199 | ) | | $ | 2,420 | | |

| | | | | | | | | $ | (243,242 | ) | | $ | (25,843 | ) | | $ | (25,402 | ) | | $ | (441 | ) | |

See accompanying Notes to Financial Statements.

Oakmark.com 13

Oakmark Global Fund March 31, 2021

Summary Information

VALUE OF A $10,000 INVESTMENT

Since Inception - 08/04/99 (Unaudited)

PERFORMANCE

| | | | Average Annual Total Returns (as of 03/31/21) | | | |

| (Unaudited) | | Total Return

Last 3 Months | | 1-year | | 3-year | | 5-year | | 10-year | | Since

Inception | | Inception

Date | |

Oakmark Global Fund (Investor Class) | | | 11.05 | % | | | 85.83 | % | | | 9.27 | % | | | 12.76 | % | | | 8.83 | % | | | 10.31 | % | | 08/04/99 | |

MSCI World Index | | | 4.92 | % | | | 54.03 | % | | | 12.81 | % | | | 13.36 | % | | | 9.88 | % | | | 5.85 | % | | | |

Lipper Global Fund Index9 | | | 3.72 | % | | | 58.61 | % | | | 11.42 | % | | | 12.80 | % | | | 8.79 | % | | | 6.31 | % | | | |

Oakmark Global Fund (Advisor Class) | | | 11.08 | % | | | 86.17 | % | | | 9.41 | % | | | N/A | | | | N/A | | | | 12.64 | % | | 11/30/16 | |

Oakmark Global Fund (Institutional Class) | | | 11.11 | % | | | 86.21 | % | | | 9.47 | % | | | N/A | | | | N/A | | | | 12.71 | % | | 11/30/16 | |

Oakmark Global Fund (Service Class) | | | 10.98 | % | | | 85.38 | % | | | 8.98 | % | | | 12.46 | % | | | 8.49 | % | | | 10.37 | % | | 10/10/01 | |

Oakmark Global Fund (R6 Class) | | | 11.08 | % | | | — | | | | — | | | | N/A | | | | N/A | | | | 13.10 | % | | 12/15/20 | |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Past performance is no guarantee of future results. The performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted. Total return includes change in share prices and, in each case, includes reinvestment of dividends and capital gain distributions. The investment return and principal value vary so that an investor's shares, when redeemed, may be worth more or less than the original cost. To obtain the most recent month-end performance, please visit Oakmark.com.

TOP TEN EQUITY HOLDINGS6 | | % of Net Assets | |

Alphabet Inc., Class C | | | 5.7 | | |

Lloyds Banking Group PLC | | | 5.3 | | |

General Motors Co. | | | 4.9 | | |

TE Connectivity, Ltd. | | | 4.3 | | |

Bayer AG | | | 4.3 | | |

Daimler AG | | | 4.1 | | |

Bank of America Corp. | | | 3.9 | | |

Credit Suisse Group AG | | | 3.7 | | |

Allianz SE | | | 3.5 | | |

Naspers, Ltd., N Shares | | | 3.0 | | |

FUND STATISTICS | |

Ticker* | | OAKGX | |

Number of Equity Holdings | | 48 | |

Net Assets | | $1.6 billion | |

Weighted Average Market Cap | | $162.2 billion | |

Median Market Cap | | $45.7 billion | |

Gross Expense Ratio - Investor Class (as of 12/15/20)* | | 1.14% | |

Net Expense Ratio - Investor Class (as of 12/15/20)*† | | 1.12% | |

* This information is related to the Investor Class. Please visit Oakmark.com for information related to the Advisor, Institutional and R6 Classes.

† The net expense ratio reflects a contractual advisory fee waiver agreement through January 27, 2022, as per the Prospectus dated 12/15/2020.

SECTOR ALLOCATION | | % of Net Assets | |

Financials | | | 22.5 | | |

Consumer Discretionary | | | 19.6 | | |

Communication Services | | | 13.4 | | |

Industrials | | | 12.3 | | |

Information Technology | | | 12.0 | | |

Health Care | | | 11.4 | | |

Materials | | | 2.8 | | |

Consumer Staples | | | 2.3 | | |

Energy | | | 1.2 | | |

Short-Term Investments and Other | | | 2.5 | | |

GEOGRAPHIC ALLOCATION | |

| | % of Equity | |

North America | | | 47.1 | | |

United States | | | 47.1 | | |

Europe | | | 42.9 | | |

Germany* | | | 16.2 | | |

United Kingdom | | | 14.7 | | |

Switzerland | | | 8.6 | | |

Ireland* | | | 1.3 | | |

Belgium* | | | 1.2 | | |

France* | | | 0.9 | | |

| | | % of Equity | |

Asia | | | 3.8 | | |

China | | | 1.6 | | |

Japan | | | 1.1 | | |

India | | | 1.1 | | |

Africa | | | 3.1 | | |

South Africa | | | 3.1 | | |

Australasia | | | 2.4 | | |

Australia | | | 2.4 | | |

Latin America | | | 0.7 | | |

Mexico | | | 0.7 | | |

* Euro currency countries comprise 19.6% of equity investments.

See accompanying Disclosures and Endnotes on page 96.

14 OAKMARK FUNDS

Oakmark Global Fund March 31, 2021

Portfolio Manager Commentary

David G. Herro, CFA

Portfolio Manager

oakgx@oakmark.com

Clyde S. McGregor, CFA

Portfolio Manager

oakgx@oakmark.com

Anthony P. Coniaris, CFA

Portfolio Manager

oakgx@oakmark.com

Jason E. Long, CFA

Portfolio Manager

oakgx@oakmark.com

Quarter Review

It was an eventful quarter. Israel experienced another inconclusive election, Turkey's Recep Tayyip Erdogan fired another central bank head and caused a local currency crisis, Italy installed former European Central Bank leader Mario Draghi as prime minister, and the Suez Canal was blocked for six days due to a grounded container ship, which threw logistics out of balance around the world. And this is just a small sample of global events. In the financial sphere, failures of both a family office hedge fund and a little-known supply chain finance entity caused significant losses for funding institutions. These events are all symptomatic of the global attempt to regain equilibrium from a massive pandemic, but they also reflect an environment of historically low interest rates, which have encouraged risk-taking and heavy use of leverage. Fortunately, Covid-19 vaccine development has been a source of hope. At this time last year, few believed that effective vaccines could be developed in less than three to five years, but the medical/pharmaceutical industry met the challenge and exceeded expectations. Although conditions are still far from normal, we are getting closer and one of our regular questions to corporate managers is how they expect the new "normal" will be different from the old "normal."

Securities markets have also gone through an interesting period. In March, Japan's Nikkei Index10 crossed the 30,000 mark for the first time since the early 1990s. Beginning in November, European and North American stocks rotated toward value investing, though U.S. market returns continued to dominate European markets. In part, the U.S. outperformance may derive from greater Covid-19 vaccination success. However, given that the S&P 500 Index1 has nearly tripled the return of the Euro Stoxx 5011 over the past decade, we anticipate some reversion to the mean. Compared to U.S. stocks, European companies sell for lower average price/earnings ratios2 yet have greater expectations for earning improvement this year. Last year in this report, we wrote that then-current opportunities available across the globe would provide the foundation for strong future returns and we think that the past 12 months have validated that opinion. As prices have started to recover from their pandemic lows, our search for value has led us to new areas of the market (as the five purchases discussed below demonstrate).

The Oakmark Global Fund gained 11.1% in the quarter, which compares to the MSCI World Index's8 4.9% return in the period and the Lipper Global Fund Index's 3.7% return. For the first six months of the Fund's fiscal year, the Fund returned 43.8%, the MSCI World Index returned 19.6% and the Lipper Global Fund Index9 returned 20.5%. Since its inception in 1999, the Fund has achieved a compound annual rate of return of 10.3%,

which compares to 5.9% for the MSCI World Index and 6.3% for the Lipper Global Fund Index.

General Motors (U.S.), Daimler (Germany), Alphabet (U.S.), Bank of America (U.S.) and Lloyds Banking Group (U.K.) were the largest contributors to the quarter's return. The U.S., U.K. and Germany contributed most to return, reversing their outcomes from the year-ago quarter. Credit Suisse (Switzerland), Continental (Germany), Liberty Broadband (U.S.), Mastercard (U.S.) and Arconic (U.S.) detracted from the Fund's return. The countries that detracted were Switzerland, Belgium and China.

For the first six months of the Fund's fiscal year, the U.S., U.K. and Germany contributed most to investment return, while China was the only detractor. General Motors led the contributor list, followed by Lloyds Banking Group, CNH Industrial (U.K.), Alphabet and Daimler. Only three stocks detracted: Alibaba Group (China), Novartis (Switzerland) and SAP (Germany—a new purchase, discussed below).

Portfolio Activity

The strong performance of the Fund's equity holdings spurred considerable portfolio action on our part. During the quarter, we introduced five names to the portfolio and eliminated two. But this understates the actual activity level. We also pruned back 21 holdings as their prices increased. In November, equity market conditions began to rotate in favor of value, and we have taken advantage of this positive turn to upgrade the quality of the portfolio. We believe that after such a strong rally in equities, the portfolio will benefit from higher quality and increased diversification.

We initiated two new international holdings in the quarter and three from the U.S. Beginning alphabetically, Capgemini is Europe's largest IT consulting firm—an attractive sector that is growing faster than the economy as companies continue to outsource this function in a relentless pursuit of greater efficiency. Over the past decade, the French-based firm has radically transformed its business model to focus more on its digital products, diversify its client base and make its delivery model more cost effective. Yet investors have not fairly appreciated these changes. Approximately 60% of the company's sales are now digital—one of the highest levels in the industry. This should enable Capgemini to enjoy a wave of corporate technology investment as Covid-19 prompts companies to accelerate their digital transformation roadmaps. In addition, the company has a strong business model, comparable to its U.S.- and Indian-based peers, and we believe it generates an excellent return on invested capital, converts a substantial amount of earnings into cash, trades at a significant discount to its peers and offers an

See accompanying Disclosures and Endnotes on page 96.

Oakmark.com 15

Oakmark Global Fund March 31, 2021

Portfolio Manager Commentary (continued)

attractive absolute valuation. Given the company's strong future growth outlook, promising merger-and-acquisition opportunities, and ongoing margin improvement, we believe Capgemini offers exciting potential to add shareholder value.

Second alphabetically is U.S.-based Fiserv. Following its transformative acquisition of First Data Corporation in 2019, Fiserv is now a top provider of digital banking solutions, core account processing software and merchant acquiring services in the U.S. The company's mission-critical software and services generate highly recurring revenue and are tied to strong secular growth trends within both digital payments and banking. We expect Fiserv's revenues to grow in the mid- to high-single-digits over the coming years and that the company will enjoy significant margin expansion as it realizes the cost synergies from the First Data acquisition. We estimate this will produce near-term earnings per share growth of over 20%. Furthermore, with its significant free cash flow generation and excess debt capacity, the company should be able to return about 35% of its market capitalization through dividends and share repurchases over the next five years, in our view. We believe Fiserv offers an attractive risk-adjusted return potential for a well-managed business that trades for a market multiple of our estimate of normal earnings.

The second new U.S. equity purchase was General Dynamics, a leading U.S. defense contractor and owner of the world's premier business jet franchise (Gulfstream). We were able to purchase this high-quality and durable business at a meaningful discount to our estimate of its intrinsic value after a series of near-term concerns hurt its share price. Taking a longer term view, the company's business jet franchise should benefit from a multi-year investment program in new, differentiated product. Also, its free cash flow conversion is set to improve materially and the company is poised to benefit from a highly visible ramp up in revenue related to next generation nuclear-powered submarines. As these positives come into clearer view, we expect sentiment to improve, along with the company's share price.

The third U.S. addition was Humana, a leader and near pure play in the fastest growing sector of managed care, Medicare Advantage. Each year, more seniors choose Medicare Advantage over traditional Medicare due to the compelling combination of lower costs and expanded benefits. Humana's scale advantages and focus on senior care allow the company to make targeted investments in its members' health, culminating in fewer unnecessary hospitalizations and lower chronic care costs. Much of these savings are then reinvested in the health plan, resulting in a continuously improving customer value proposition. The company's brand also resonates well in the marketplace and has helped drive double-digit annual membership growth over the past decade—well above the rest of the industry. Further, we believe Humana has a long runway ahead as it benefits from an aging population and continued conversion of the approximately 60% of seniors who are still enrolled in traditional Medicare. Yet Humana's shares are currently trading at a nearly 20% discount to the S&P 500 earnings multiple, which we believe doesn't give the company enough credit for its durable competitive advantages and strong secular growth outlook.

Finally, SAP is the largest European enterprise software company and the global leader in enterprise resource planning (ERP) software products. Its share price underperformed both

the broader market and its software peers over the past year as a result of a revised business strategy, unveiled in October 2020, which called for an accelerated transition to the cloud. This transition will depress near-term revenue and profits as upfront license sales become overtime subscription payments, but long term, this move will increase growth and improve customer economics. This short-term setback gave us an opportunity to invest in one of the most defensive software companies in the market. The company's recent IPO of a portion of Qualtrics highlights the disconnect between how the market values SAP's parts compared to its whole. We expect SAP to accelerate to high single-digit, top-line growth over the next five years as the economic benefits of its cloud transition become apparent.

We eliminated Samsung and Rolls-Royce. Samsung approached our estimate of intrinsic value, and we redeployed this capital into more attractive opportunities. We have owned the company on several occasions and we would welcome the opportunity to own this security again at the right price.

Rolls-Royce is one of the leading producers of wide-body aircraft engines, which are typically used in larger airplanes designed for long-haul and international travel. The Covid-19 pandemic has materially hurt the company's business. Although we expect travel will rebound strongly following vaccine distribution, we believe it will take longer for long-haul and international travel to revert back to pre-pandemic levels. As a result, our intrinsic value estimate fell quite materially during the pandemic, though we continued to hold our position since the share price remained below our estimate of intrinsic value. As the share price moved closer to our estimate of intrinsic value in the fourth quarter, we began reducing our position until we were fully exited during the past quarter. We allocated the capital from the divesture of Rolls-Royce into securities with strong risk-return profiles.

The net effect of this activity and the volatile market action was to increase the U.S. portfolio weight from 44% to 46%. As always, we do not set top-down targets for these weights. Instead, we populate the portfolio with the most attractive opportunities wherever they may be found.

Currency Hedges

We defensively hedge a portion of the Fund's exposure to currencies that we believe to be overvalued versus the U.S. dollar. As of quarter end, we found the Swiss franc to be overvalued and have hedged approximately 14% of the Fund's franc exposure.

Thank you for being our partners in the Oakmark Global Fund. Please feel free to contact us with your questions or comments.

See accompanying Disclosures and Endnotes on page 96.

16 OAKMARK FUNDS

Oakmark Global Fund March 31, 2021 (Unaudited)

Schedule of Investments (in thousands)

| | | Shares | | Value | |

COMMON STOCKS - 97.5% | |

FINANCIALS - 22.5% | |

BANKS - 11.2% | |

Lloyds Banking Group PLC

(United Kingdom) (a) | | | 140,448 | | | $ | 82,357 | | |

Bank of America Corp. (United States) | | | 1,590 | | | | 61,525 | | |

Axis Bank, Ltd. (India) (a) | | | 1,732 | | | | 16,521 | | |

Citigroup, Inc. (United States) | | | 194 | | | | 14,077 | | |

| | | | | | 174,480 | | |

DIVERSIFIED FINANCIALS - 6.4% | |

Credit Suisse Group AG (Switzerland) | | | 5,580 | | | | 58,459 | | |

Julius Baer Group, Ltd. (Switzerland) (a) | | | 654 | | | | 41,815 | | |

| | | | | | 100,274 | | |

INSURANCE - 4.9% | |

Allianz SE (Germany) | | | 215 | | | | 54,807 | | |

Prudential PLC (United Kingdom) | | | 1,051 | | | | 22,327 | | |

| | | | | | 77,134 | | |

| | | | | | 351,888 | | |

CONSUMER DISCRETIONARY - 19.6% | |

AUTOMOBILES & COMPONENTS - 12.7% | |

General Motors Co. (United States) | | | 1,323 | | | | 76,031 | | |

Daimler AG (Germany) | | | 716 | | | | 63,831 | | |

Continental AG (Germany) | | | 308 | | | | 40,693 | | |

Toyota Motor Corp. (Japan) | | | 228 | | | | 17,742 | | |

| | | | | | 198,297 | | |

RETAILING - 4.5% | |

Naspers, Ltd., N Shares (South Africa) | | | 196 | | | | 46,789 | | |

Alibaba Group Holding, Ltd. (China) (a) | | | 431 | | | | 12,191 | | |

Alibaba Group Holding, Ltd. ADR (China) (a) (b) | | | 52 | | | | 11,813 | | |

| | | | | | 70,793 | | |

CONSUMER SERVICES - 1.8% | |

Booking Holdings, Inc. (United States) (a) | | | 7 | | | | 16,938 | | |

Compass Group PLC (United Kingdom) (a) | | | 569 | | | | 11,460 | | |

| | | | | | 28,398 | | |

CONSUMER DURABLES & APPAREL - 0.6% | |

Cie Financiere Richemont SA, Class A (Switzerland) | | | 95 | | | | 9,092 | | |

| | | | | | 306,580 | | |

COMMUNICATION SERVICES - 13.4% | |

MEDIA & ENTERTAINMENT - 11.4% | |

Alphabet, Inc., Class C (United States) (a) | | | 43 | | | | 88,753 | | |

Liberty Broadband Corp., Class C

(United States) (a) | | | 248 | | | | 37,267 | | |

The Interpublic Group of Cos., Inc.

(United States) | | | 1,152 | | | | 33,652 | | |

Grupo Televisa SAB ADR (Mexico) (a) (b) | | | 1,281 | | | | 11,349 | | |

Charter Communications, Inc., Class A

(United States) (a) | | | 11 | | | | 6,972 | | |

| | | | | | 177,993 | | |

| | | Shares | | Value | |

TELECOMMUNICATION SERVICES - 2.0% | |

Liberty Global PLC, Class A (United Kingdom) (a) | | | 1,259 | | | $ | 32,316 | | |

| | | | | | 210,309 | | |

INDUSTRIALS - 12.3% | |

CAPITAL GOODS - 11.0% | |

CNH Industrial N.V. (United Kingdom) (a) | | | 2,922 | | | | 45,215 | | |

Howmet Aerospace, Inc. (United States) | | | 1,030 | | | | 33,097 | | |

Travis Perkins PLC (United Kingdom) (a) | | | 1,442 | | | | 30,634 | | |

Flowserve Corp. (United States) | | | 615 | | | | 23,849 | | |

Johnson Controls International PLC (United States) | | | 341 | | | | 20,354 | | |

General Dynamics Corp. (United States) | | | 100 | | | | 18,174 | | |

| | | | | | 171,323 | | |

TRANSPORTATION - 1.3% | |

Ryanair Holdings PLC ADR (Ireland) (a) (b) | | | 169 | | | | 19,405 | | |

Ryanair Holdings PLC (Ireland) (a) | | | 62 | | | | 1,209 | | |

| | | | | | 20,614 | | |

| | | | | | 191,937 | | |

INFORMATION TECHNOLOGY - 12.0% | |

SOFTWARE & SERVICES - 7.7% | |

Mastercard, Inc., Class A (United States) | | | 100 | | | | 35,534 | | |

Oracle Corp. (United States) | | | 483 | | | | 33,878 | | |

SAP SE (Germany) | | | 171 | | | | 20,964 | | |

Fiserv, Inc. (United States) (a) | | | 137 | | | | 16,249 | | |

Capgemini SE (France) | | | 85 | | | | 14,480 | | |

| | | | | | 121,105 | | |

TECHNOLOGY HARDWARE & EQUIPMENT - 4.3% | |

TE Connectivity, Ltd. (United States) | | | 519 | | | | 67,008 | | |

| | | | | | 188,113 | | |

HEALTH CARE - 11.4% | |

HEALTH CARE EQUIPMENT & SERVICES - 5.8% | |

Tenet Healthcare Corp. (United States) (a) | | | 768 | | | | 39,928 | | |

Humana, Inc. (United States) | | | 66 | | | | 27,629 | | |

Envista Holdings Corp. (United States) (a) | | | 559 | | | | 22,799 | | |

| | | | | | 90,356 | | |

PHARMACEUTICALS, BIOTECHNOLOGY & LIFE SCIENCES - 5.6% | |

Bayer AG (Germany) | | | 1,057 | | | | 66,910 | | |

Novartis AG (Switzerland) | | | 248 | | | | 21,176 | | |

| | | | | | 88,086 | | |

| | | | | | 178,442 | | |

MATERIALS - 2.8% | |

Incitec Pivot, Ltd. (Australia) (a) | | | 16,395 | | | | 36,238 | | |

Arconic Corp. (United States) (a) | | | 306 | | | | 7,770 | | |

| | | | | | 44,008 | | |

See accompanying Notes to Financial Statements.

Oakmark.com 17

Oakmark Global Fund March 31, 2021 (Unaudited)

Schedule of Investments (in thousands) (continued)

| | | Shares | | Value | |

COMMON STOCKS - 97.5% (continued) | |

CONSUMER STAPLES - 2.3% | |

FOOD, BEVERAGE & TOBACCO - 2.3% | |

Keurig Dr Pepper, Inc. (United States) | | | 526 | | | $ | 18,082 | | |

Anheuser-Busch InBev SA/NV (Belgium) | | | 287 | | | | 18,065 | | |

| | | | | | 36,147 | | |

ENERGY - 1.2% | |

Nov, Inc. (United States) | | | 1,357 | | | | 18,618 | | |

TOTAL COMMON STOCKS - 97.5%

(COST $977,219) | | | | | 1,526,042 | | |

WARRANT - 0.0% (C) | |

CONSUMER DISCRETIONARY - 0.0% (c) | |

Cie Financiere Richemont SA (Switzerland) (a) | | | 414 | | | | 157 | | |

TOTAL WARRANTS - 0.0%

(COST $ - ) | | | | | 157 | | |

| | | Par Value | | Value | |

SHORT-TERM INVESTMENT - 2.5% | |

REPURCHASE AGREEMENT - 2.5% | |

Fixed Income Clearing Corp. Repurchase

Agreement, 0.00% dated 03/31/21 due

04/01/21, repurchase price $39,580,

collateralized by United States

Treasury Note, 0.125% due 03/31/23,

value plus accrued interest of $40,371

(Cost: $39,580) | | $ | 39,580 | | | | 39,580 | | |

TOTAL SHORT-TERM INVESTMENTS - 2.5%

(COST $39,580) | | | | | 39,580 | | |

TOTAL INVESTMENTS - 100.0%

(COST $1,016,799) | | | | | 1,565,779 | | |

Foreign Currencies (Cost $0) - 0.0% (c) | | | | | 0 | (d) | |

Liabilities In Excess of Other Assets - 0.0% (c) | | | | | (272 | ) | |

TOTAL NET ASSETS - 100.0% | | | | $ | 1,565,507 | | |

(a) Non-income producing security

(b) Sponsored American Depositary Receipt

(c) Amount rounds to less than 0.1%.

(d) Amount rounds to less than $1,000.

See accompanying Notes to Financial Statements.

18 OAKMARK FUNDS

Oakmark Global Fund March 31, 2021 (Unaudited)

Schedule of Investments (in thousands) (continued)

FORWARD FOREIGN CURRENCY CONTRACT (in thousands)

| | | Local

Contract

Amount | | Base

Contract

Amount | | Settlement

Date | | Valuation at

3/31/21 | | Unrealized

Appreciation/

(Depreciation) | |

Foreign Currency Sold: | |

Swiss Franc | | | 17,228 | | | $ | 19,526 | | | 06/16/21 | | $ | 18,267 | | | $ | 1,259 | | |

| | | | | | | | | $ | 18,267 | | | $ | 1,259 | | |

See accompanying Notes to Financial Statements.

Oakmark.com 19

Oakmark Global Select Fund March 31, 2021

Summary Information

VALUE OF A $10,000 INVESTMENT

Since Inception - 10/02/06 (Unaudited)

PERFORMANCE

| | | | Average Annual Total Returns (as of 03/31/21) | | | |

| (Unaudited) | | Total Return

Last 3 Months | | 1-year | | 3-year | | 5-year | | 10-year | | Since

Inception | | Inception

Date | |

Oakmark Global Select Fund (Investor Class) | | | 10.87 | % | | | 80.73 | % | | | 9.86 | % | | | 12.17 | % | | | 10.23 | % | | | 8.86 | % | | 10/02/06 | |

MSCI World Index | | | 4.92 | % | | | 54.03 | % | | | 12.81 | % | | | 13.36 | % | | | 9.88 | % | | | 7.18 | % | | | |

Lipper Global Fund Index9 | | | 3.72 | % | | | 58.61 | % | | | 11.42 | % | | | 12.80 | % | | | 8.79 | % | | | 6.89 | % | | | |

Oakmark Global Select Fund (Advisor Class) | | | 10.93 | % | | | 80.92 | % | | | 10.00 | % | | | N/A | | | | N/A | | | | 11.49 | % | | 11/30/16 | |

Oakmark Global Select Fund (Institutional Class) | | | 10.93 | % | | | 81.11 | % | | | 10.06 | % | | | N/A | | | | N/A | | | | 11.56 | % | | 11/30/16 | |