UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06279

Harris Associates Investment Trust

(Exact name of Registrant as specified in charter)

111 South Wacker Drive, Suite 4600

Chicago, Illinois 60606-4319

(Address of principal executive offices) (Zip code)

Joseph J. Allessie, Esq. Harris Associates L.P. 111 South Wacker Drive, Suite 4600 Chicago, Illinois 60606-4319 | | Ndenisarya M. Meekins, Esq. K&L Gates LLP 1601 K Street, N.W. Washington, D.C. 20006-1600 |

| (Name and address of agents for service) |

Registrant's telephone number, including area code: (312) 646-3600

Date of fiscal year end: 09/30/24

Date of reporting period: 09/30/24

Item 1. Reports to Shareholders.

(a) Following are copies of the annual report transmitted to shareholders pursuant to Rule 30e-1 under the Act.

TABLE OF CONTENTS

0000872323harrisoakmark:HarrisAssociatesIndexMSCIWorldIndexNet2223BroadBasedIndexMember2023-06-30

Annual Shareholder Report

September 30, 2024

This annual shareholder report contains important information about Oakmark Fund (the "Fund") for the period of October 1, 2023 to September 30, 2024.You can find additional information about the Fund at: oakmark.com/our-funds/?tab=documents. You can also request this information without charge by contacting us at 1-800-OAKMARK (625-6275) or contacting your intermediary.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor Class | $102 | 0.89% |

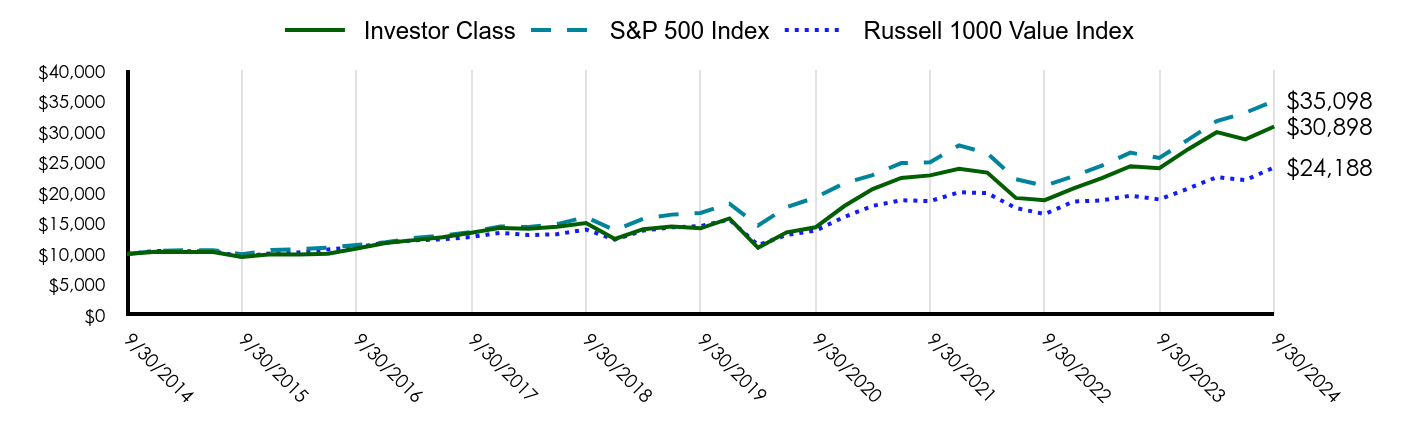

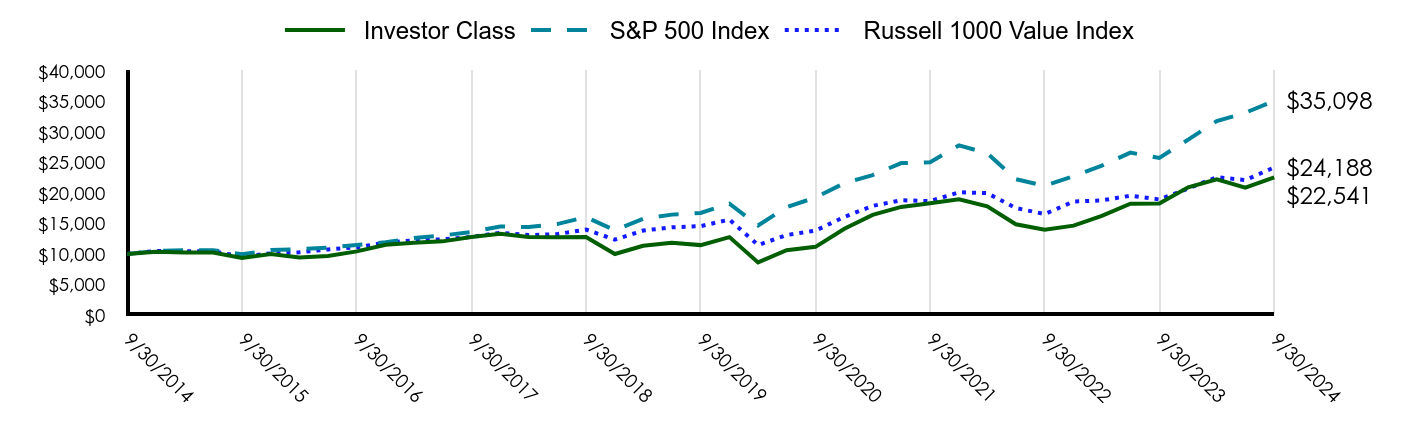

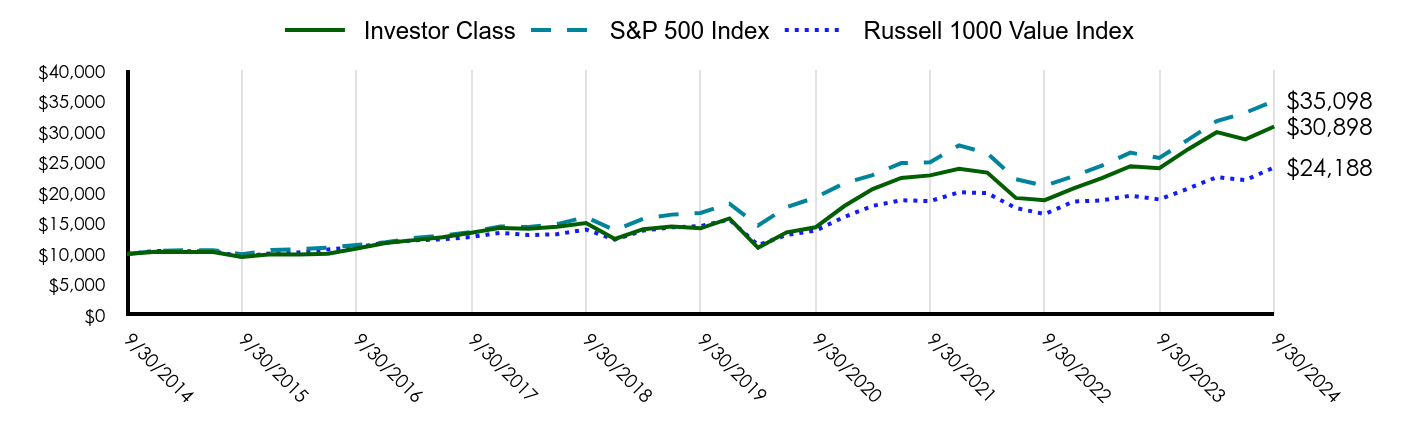

How did the Fund perform last year and what affected its performance?

Oakmark Fund Investor Class returned 28.39% for the fiscal year ended September 30, 2024, underperforming its benchmark, the S&P 500 Index, which returned 36.35% over the same period.

At the equity sector level Financials and Industrials performed the strongest, while Energy and Materials were the worst performing sectors.

At the equity holdings level, KKR led the positive contributors followed by Capital One Financial and CBRE Group. APA, Charter Communications and ConocoPhillips were the worst performing equities.

Total return based on $10,000 investment (as of September 30, 2024)

| Investor Class | S&P 500 Index | Russell 1000 Value Index |

|---|

| 9/30/2014 | $10,000 | $10,000 | $10,000 |

| 12/31/2014 | $10,364 | $10,493 | $10,498 |

| 3/31/2015 | $10,305 | $10,593 | $10,422 |

| 6/30/2015 | $10,333 | $10,622 | $10,434 |

| 9/30/2015 | $9,513 | $9,939 | $9,558 |

| 12/31/2015 | $9,955 | $10,638 | $10,098 |

| 3/31/2016 | $9,893 | $10,782 | $10,263 |

| 6/30/2016 | $10,024 | $11,047 | $10,733 |

| 9/30/2016 | $10,880 | $11,472 | $11,107 |

| 12/31/2016 | $11,782 | $11,911 | $11,849 |

| 3/31/2017 | $12,266 | $12,633 | $12,236 |

| 6/30/2017 | $12,734 | $13,023 | $12,400 |

| 9/30/2017 | $13,467 | $13,607 | $12,787 |

| 12/31/2017 | $14,273 | $14,511 | $13,469 |

| 3/31/2018 | $14,148 | $14,401 | $13,087 |

| 6/30/2018 | $14,449 | $14,896 | $13,242 |

| 9/30/2018 | $15,061 | $16,044 | $13,997 |

| 12/31/2018 | $12,456 | $13,875 | $12,356 |

| 3/31/2019 | $14,053 | $15,769 | $13,830 |

| 6/30/2019 | $14,506 | $16,447 | $14,361 |

| 9/30/2019 | $14,207 | $16,727 | $14,557 |

| 12/31/2019 | $15,817 | $18,244 | $15,635 |

| 3/31/2020 | $11,006 | $14,668 | $11,456 |

| 6/30/2020 | $13,538 | $17,682 | $13,093 |

| 9/30/2020 | $14,375 | $19,260 | $13,825 |

| 12/31/2020 | $17,856 | $21,600 | $16,072 |

| 3/31/2021 | $20,628 | $22,934 | $17,880 |

| 6/30/2021 | $22,465 | $24,895 | $18,811 |

| 9/30/2021 | $22,881 | $25,040 | $18,664 |

| 12/31/2021 | $23,963 | $27,801 | $20,115 |

| 3/31/2022 | $23,334 | $26,522 | $19,966 |

| 6/30/2022 | $19,184 | $22,252 | $17,528 |

| 9/30/2022 | $18,824 | $21,165 | $16,543 |

| 12/31/2022 | $20,761 | $22,766 | $18,597 |

| 3/31/2023 | $22,443 | $24,473 | $18,785 |

| 6/30/2023 | $24,383 | $26,612 | $19,550 |

| 9/30/2023 | $24,065 | $25,741 | $18,932 |

| 12/31/2023 | $27,175 | $28,750 | $20,731 |

| 3/31/2024 | $29,967 | $31,785 | $22,594 |

| 6/30/2024 | $28,774 | $33,147 | $22,104 |

| 9/30/2024 | $30,898 | $35,098 | $24,188 |

Average annual total returns (%)

| Fund | 1 Year | 5 Years | 10 Years |

|---|

| Investor Class | 28.39% | 16.81% | 11.94% |

| S&P 500 Index | 36.35% | 15.98% | 13.38% |

| Russell 1000 Value Index | 27.76% | 10.69% | 9.23% |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results. To obtain the most recent month-end performance, please visit oakmark.com/our-funds/?tab=documents.

| Total Net Assets | $23,077,845,142 |

| # of Portfolio Holdings | 55 |

| Portfolio Turnover Rate | 42% |

| Total Advisory Fees Paid | $123,116,141 |

What did the Fund invest in? (as a % of total net assets)

| Alphabet, Inc., Class A | 3.1% |

| Fiserv, Inc. | 3.1% |

| Deere & Co. | 2.9% |

| Citigroup, Inc. | 2.9% |

| Charles Schwab Corp. | 2.7% |

| General Motors Co. | 2.7% |

| Intercontinental Exchange, Inc. | 2.7% |

| American International Group, Inc. | 2.7% |

| CBRE Group, Inc., Class A | 2.7% |

| IQVIA Holdings, Inc. | 2.7% |

| Financials | 39.0% |

| Communication Services | 9.7% |

| Industrials | 9.5% |

| Energy | 8.4% |

| Health Care | 8.4% |

| Consumer Discretionary | 6.2% |

| Consumer Staples | 5.1% |

| Materials | 3.3% |

| Information Technology | 2.9% |

| Real Estate | 2.7% |

| Short Term Investments & Other, Net | 4.8% |

| Total | 100.0% |

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, scan the QR code or visit oakmark.com/our-funds/?tab=documents.

Phone: 1-800-OAKMARK (625-6275)

You may have consented to receive one shareholder report at your address if you and one or more individuals in your home have an account with the Fund (householding). If you wish to receive individual copies of your shareholder report, contact + 1-800-OAKMARK (625-6275) or contact your intermediary.

Annual Shareholder Report

September 30, 2024

Annual Shareholder Report

September 30, 2024

This annual shareholder report contains important information about Oakmark Fund (the "Fund") for the period of October 1, 2023 to September 30, 2024.You can find additional information about the Fund at: oakmark.com/our-funds/?tab=documents. You can also request this information without charge by contacting us at 1-800-OAKMARK (625-6275) or contacting your intermediary.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Advisor Class | $80 | 0.70% |

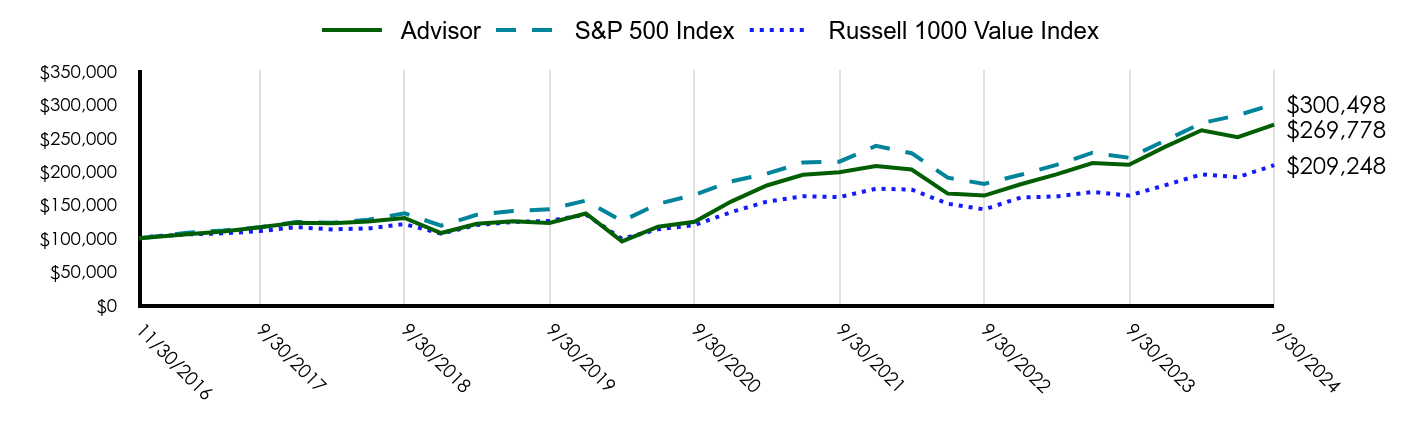

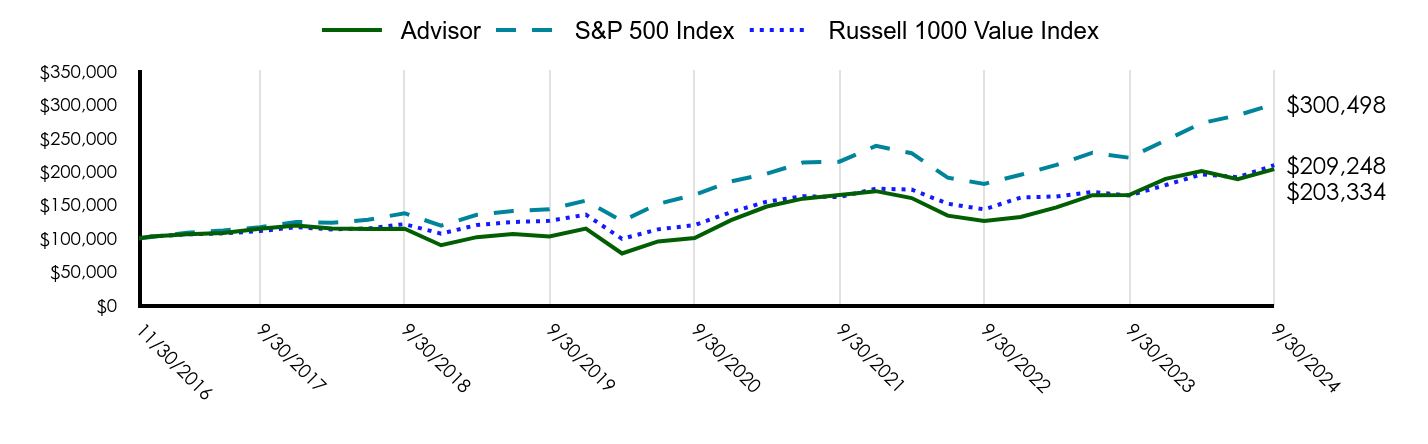

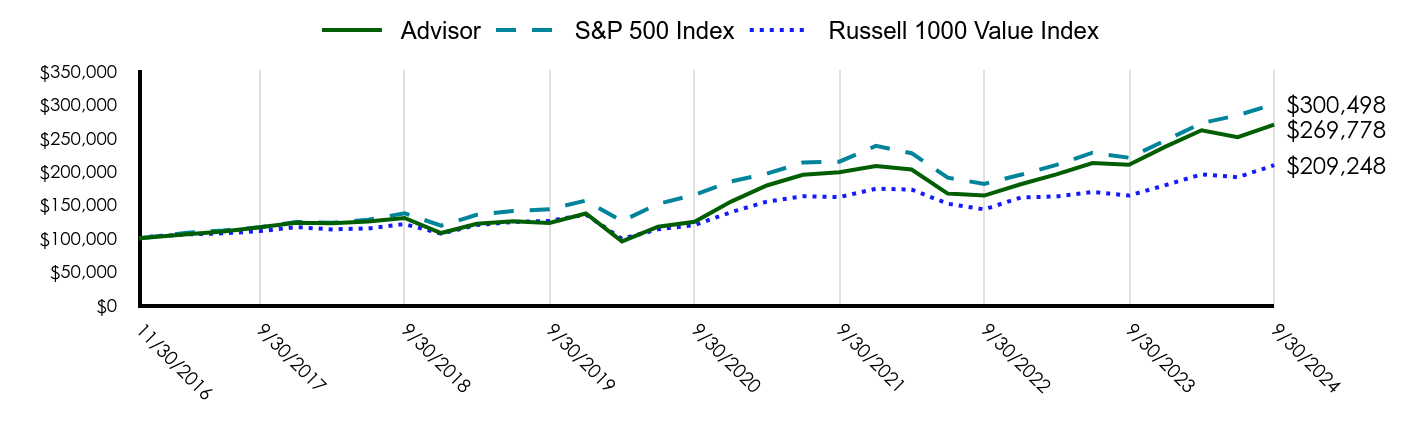

How did the Fund perform last year and what affected its performance?

Oakmark Fund Advisor returned 28.63% for the fiscal year ended September 30, 2024, underperforming its benchmark, the S&P 500 Index, which returned 36.35% over the same period.

At the equity sector level Financials and Industrials performed the strongest, while Energy and Materials were the worst performing sectors.

At the equity holdings level, KKR led the positive contributors followed by Capital One Financial and CBRE Group. APA, Charter Communications and ConocoPhillips were the worst performing equities.

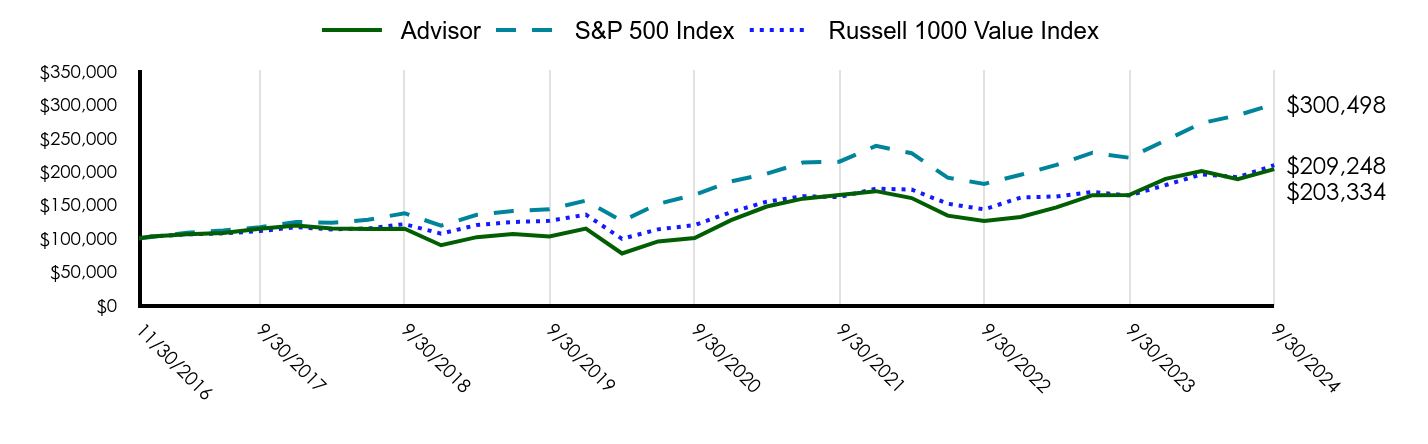

Total return based on $100,000 investment (as of September 30, 2024)

| Advisor | S&P 500 Index | Russell 1000 Value Index |

|---|

| 11/30/2016 | $100,000 | $100,000 | $100,000 |

| 12/31/2016 | $101,626 | $101,977 | $102,500 |

| 3/31/2017 | $105,844 | $108,163 | $105,852 |

| 6/30/2017 | $109,909 | $111,503 | $107,270 |

| 9/30/2017 | $116,286 | $116,499 | $110,617 |

| 12/31/2017 | $123,276 | $124,240 | $116,513 |

| 3/31/2018 | $122,209 | $123,297 | $113,216 |

| 6/30/2018 | $124,855 | $127,530 | $114,552 |

| 9/30/2018 | $130,190 | $137,364 | $121,081 |

| 12/31/2018 | $107,714 | $118,793 | $106,890 |

| 3/31/2019 | $121,555 | $135,005 | $119,642 |

| 6/30/2019 | $125,485 | $140,816 | $124,237 |

| 9/30/2019 | $122,912 | $143,207 | $125,926 |

| 12/31/2019 | $136,895 | $156,196 | $135,257 |

| 3/31/2020 | $95,278 | $125,585 | $99,103 |

| 6/30/2020 | $117,226 | $151,384 | $113,265 |

| 9/30/2020 | $124,507 | $164,902 | $119,596 |

| 12/31/2020 | $154,710 | $184,934 | $139,031 |

| 3/31/2021 | $178,832 | $196,354 | $154,672 |

| 6/30/2021 | $194,844 | $213,140 | $162,730 |

| 9/30/2021 | $198,572 | $214,381 | $161,461 |

| 12/31/2021 | $208,068 | $238,021 | $174,006 |

| 3/31/2022 | $202,741 | $227,075 | $172,719 |

| 6/30/2022 | $166,758 | $190,513 | $151,630 |

| 9/30/2022 | $163,719 | $181,211 | $143,108 |

| 12/31/2022 | $180,666 | $194,913 | $160,882 |

| 3/31/2023 | $195,384 | $209,526 | $162,507 |

| 6/30/2023 | $212,382 | $227,843 | $169,121 |

| 9/30/2023 | $209,731 | $220,385 | $163,777 |

| 12/31/2023 | $236,932 | $246,151 | $179,336 |

| 3/31/2024 | $261,410 | $272,134 | $195,458 |

| 6/30/2024 | $251,129 | $283,792 | $191,216 |

| 9/30/2024 | $269,778 | $300,498 | $209,248 |

Average annual total returns (%)

| Fund | 1 Year | 5 Years | Since Inception 11/30/16 |

|---|

| Advisor | 28.63% | 17.03% | 13.50% |

| S&P 500 Index | 36.35% | 15.98% | 15.08% |

| Russell 1000 Value Index | 27.76% | 10.69% | 9.88% |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results. To obtain the most recent month-end performance, please visit oakmark.com/our-funds/?tab=documents.

| Total Net Assets | $23,077,845,142 |

| # of Portfolio Holdings | 55 |

| Portfolio Turnover Rate | 42% |

| Total Advisory Fees Paid | $123,116,141 |

What did the Fund invest in? (as a % of total net assets)

| Alphabet, Inc., Class A | 3.1% |

| Fiserv, Inc. | 3.1% |

| Deere & Co. | 2.9% |

| Citigroup, Inc. | 2.9% |

| Charles Schwab Corp. | 2.7% |

| General Motors Co. | 2.7% |

| Intercontinental Exchange, Inc. | 2.7% |

| American International Group, Inc. | 2.7% |

| CBRE Group, Inc., Class A | 2.7% |

| IQVIA Holdings, Inc. | 2.7% |

| Financials | 39.0% |

| Communication Services | 9.7% |

| Industrials | 9.5% |

| Energy | 8.4% |

| Health Care | 8.4% |

| Consumer Discretionary | 6.2% |

| Consumer Staples | 5.1% |

| Materials | 3.3% |

| Information Technology | 2.9% |

| Real Estate | 2.7% |

| Short Term Investments & Other, Net | 4.8% |

| Total | 100.0% |

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, scan the QR code or visit oakmark.com/our-funds/?tab=documents.

Phone: 1-800-OAKMARK (625-6275)

You may have consented to receive one shareholder report at your address if you and one or more individuals in your home have an account with the Fund (householding). If you wish to receive individual copies of your shareholder report, contact + 1-800-OAKMARK (625-6275) or contact your intermediary.

Annual Shareholder Report

September 30, 2024

Annual Shareholder Report

September 30, 2024

This annual shareholder report contains important information about Oakmark Fund (the "Fund") for the period of October 1, 2023 to September 30, 2024.You can find additional information about the Fund at: oakmark.com/our-funds/?tab=documents. You can also request this information without charge by contacting us at 1-800-OAKMARK (625-6275) or contacting your intermediary.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Class | $75 | 0.66% |

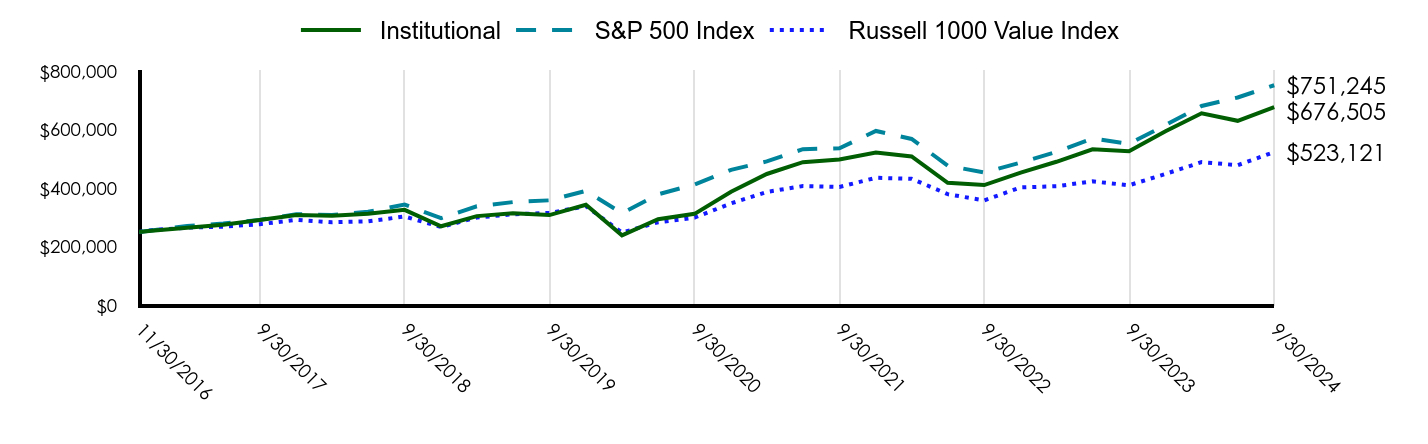

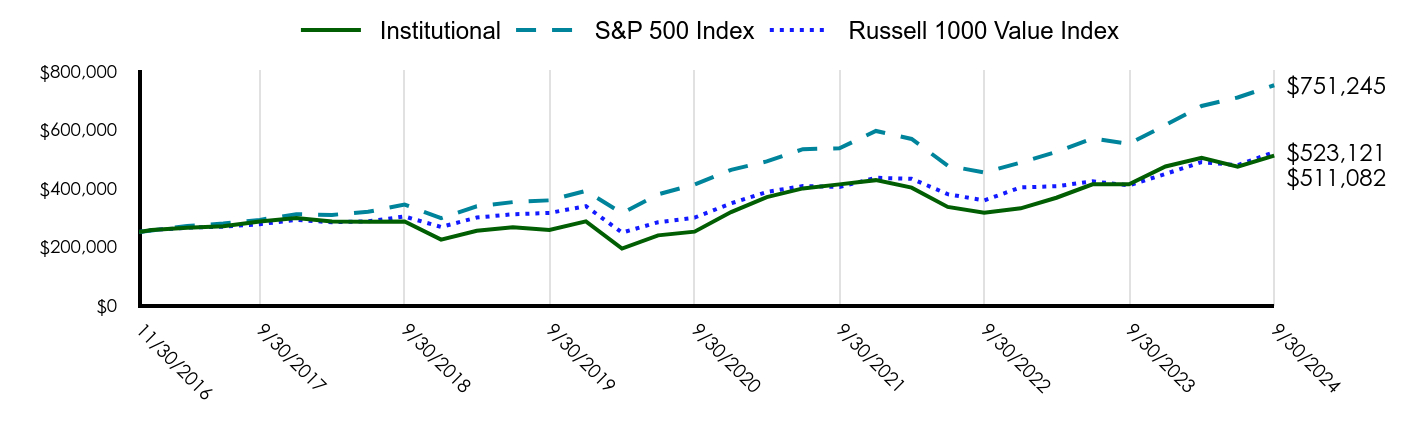

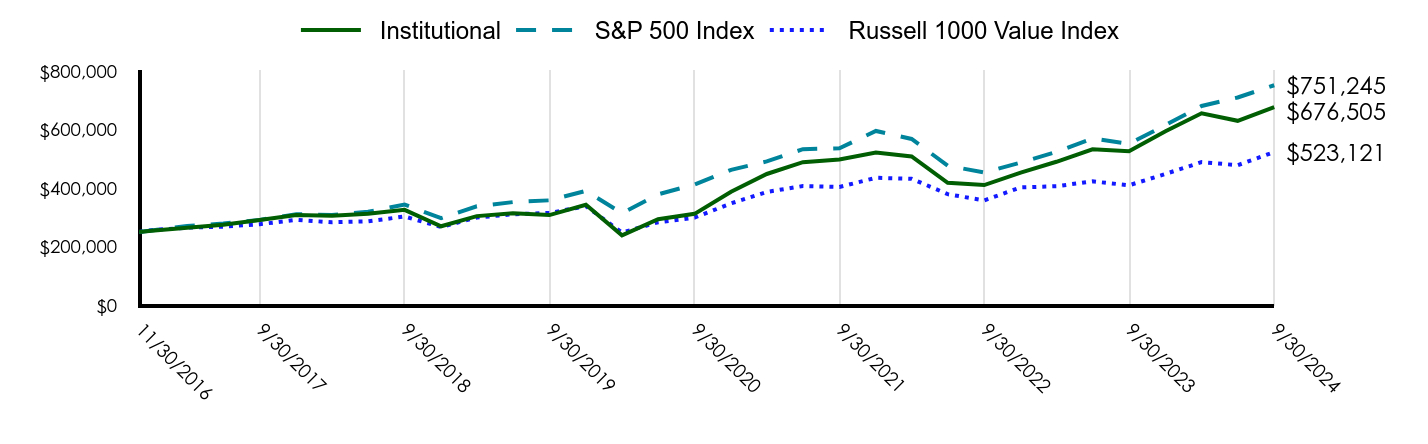

How did the Fund perform last year and what affected its performance?

Oakmark Fund Institutional returned 28.68% for the fiscal year ended September 30, 2024, underperforming its benchmark, the S&P 500 Index, which returned 36.35% over the same period.

At the equity sector level Financials and Industrials performed the strongest, while Energy and Materials were the worst performing sectors.

At the equity holdings level, KKR led the positive contributors followed by Capital One Financial and CBRE Group. APA, Charter Communications and ConocoPhillips were the worst performing equities.

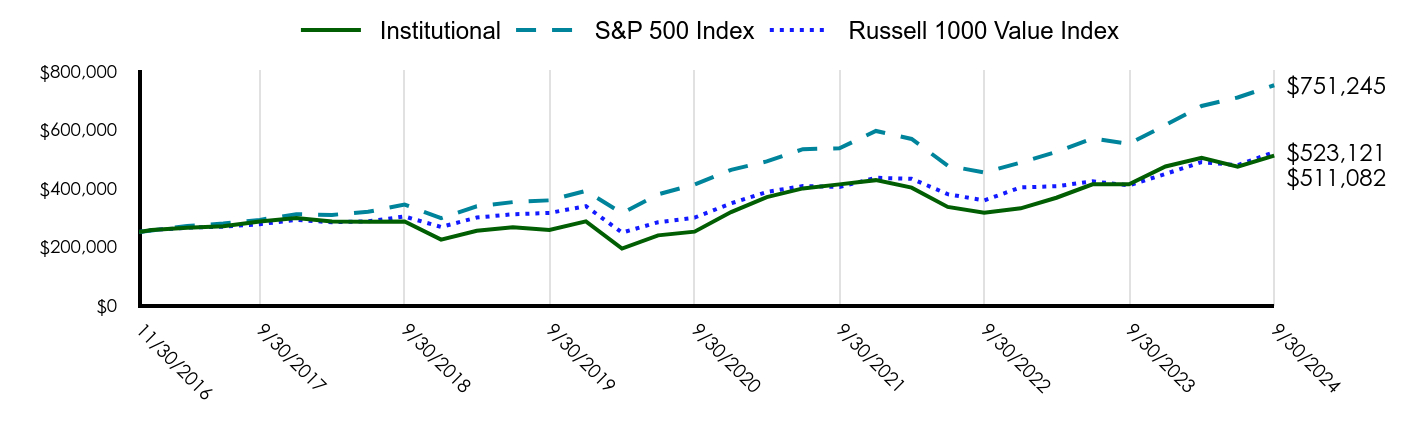

Total return based on $250,000 investment (as of September 30, 2024)

| Institutional | S&P 500 Index | Russell 1000 Value Index |

|---|

| 11/30/2016 | $250,000 | $250,000 | $250,000 |

| 12/31/2016 | $254,029 | $254,942 | $256,250 |

| 3/31/2017 | $264,576 | $270,407 | $264,629 |

| 6/30/2017 | $274,772 | $278,757 | $268,175 |

| 9/30/2017 | $290,715 | $291,247 | $276,542 |

| 12/31/2017 | $308,225 | $310,599 | $291,282 |

| 3/31/2018 | $305,593 | $308,241 | $283,039 |

| 6/30/2018 | $312,245 | $318,826 | $286,379 |

| 9/30/2018 | $325,623 | $343,410 | $302,702 |

| 12/31/2018 | $269,436 | $296,982 | $267,226 |

| 3/31/2019 | $304,132 | $337,514 | $299,106 |

| 6/30/2019 | $314,040 | $352,040 | $310,591 |

| 9/30/2019 | $307,685 | $358,018 | $314,815 |

| 12/31/2019 | $342,699 | $390,490 | $338,143 |

| 3/31/2020 | $238,573 | $313,962 | $247,758 |

| 6/30/2020 | $293,638 | $378,460 | $283,162 |

| 9/30/2020 | $311,865 | $412,255 | $298,991 |

| 12/31/2020 | $387,570 | $462,336 | $347,577 |

| 3/31/2021 | $448,070 | $490,885 | $386,679 |

| 6/30/2021 | $488,259 | $532,850 | $406,825 |

| 9/30/2021 | $497,597 | $535,951 | $403,652 |

| 12/31/2021 | $521,406 | $595,051 | $435,016 |

| 3/31/2022 | $508,056 | $567,688 | $431,797 |

| 6/30/2022 | $417,886 | $476,284 | $379,074 |

| 9/30/2022 | $410,270 | $453,029 | $357,770 |

| 12/31/2022 | $452,799 | $487,282 | $402,205 |

| 3/31/2023 | $489,731 | $523,814 | $406,268 |

| 6/30/2023 | $532,332 | $569,607 | $422,803 |

| 9/30/2023 | $525,734 | $550,961 | $409,442 |

| 12/31/2023 | $593,982 | $615,377 | $448,339 |

| 3/31/2024 | $655,393 | $680,336 | $488,645 |

| 6/30/2024 | $629,663 | $709,480 | $478,041 |

| 9/30/2024 | $676,505 | $751,245 | $523,121 |

Average annual total returns (%)

| Fund | 1 Year | 5 Years | Since Inception 11/30/16 |

|---|

| Institutional | 28.68% | 17.07% | 13.55% |

| S&P 500 Index | 36.35% | 15.98% | 15.08% |

| Russell 1000 Value Index | 27.76% | 10.69% | 9.88% |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results. To obtain the most recent month-end performance, please visit oakmark.com/our-funds/?tab=documents.

| Total Net Assets | $23,077,845,142 |

| # of Portfolio Holdings | 55 |

| Portfolio Turnover Rate | 42% |

| Total Advisory Fees Paid | $123,116,141 |

What did the Fund invest in? (as a % of total net assets)

| Alphabet, Inc., Class A | 3.1% |

| Fiserv, Inc. | 3.1% |

| Deere & Co. | 2.9% |

| Citigroup, Inc. | 2.9% |

| Charles Schwab Corp. | 2.7% |

| General Motors Co. | 2.7% |

| Intercontinental Exchange, Inc. | 2.7% |

| American International Group, Inc. | 2.7% |

| CBRE Group, Inc., Class A | 2.7% |

| IQVIA Holdings, Inc. | 2.7% |

| Financials | 39.0% |

| Communication Services | 9.7% |

| Industrials | 9.5% |

| Energy | 8.4% |

| Health Care | 8.4% |

| Consumer Discretionary | 6.2% |

| Consumer Staples | 5.1% |

| Materials | 3.3% |

| Information Technology | 2.9% |

| Real Estate | 2.7% |

| Short Term Investments & Other, Net | 4.8% |

| Total | 100.0% |

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, scan the QR code or visit oakmark.com/our-funds/?tab=documents.

Phone: 1-800-OAKMARK (625-6275)

You may have consented to receive one shareholder report at your address if you and one or more individuals in your home have an account with the Fund (householding). If you wish to receive individual copies of your shareholder report, contact + 1-800-OAKMARK (625-6275) or contact your intermediary.

Annual Shareholder Report

September 30, 2024

Annual Shareholder Report

September 30, 2024

This annual shareholder report contains important information about Oakmark Fund (the "Fund") for the period of October 1, 2023 to September 30, 2024.You can find additional information about the Fund at: oakmark.com/our-funds/?tab=documents. You can also request this information without charge by contacting us at 1-800-OAKMARK (625-6275) or contacting your intermediary.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| R6 | $71 | 0.62% |

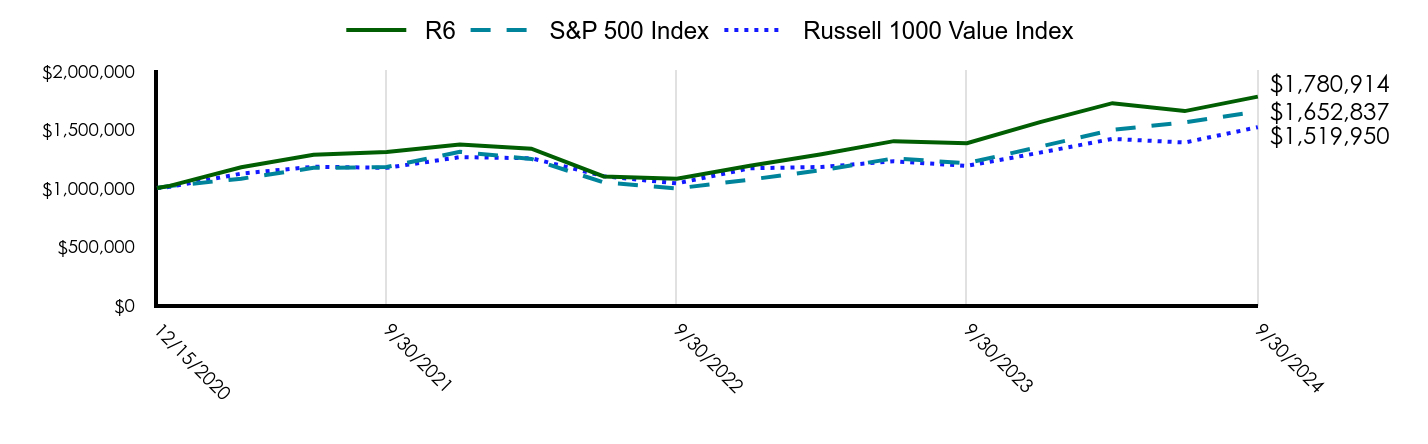

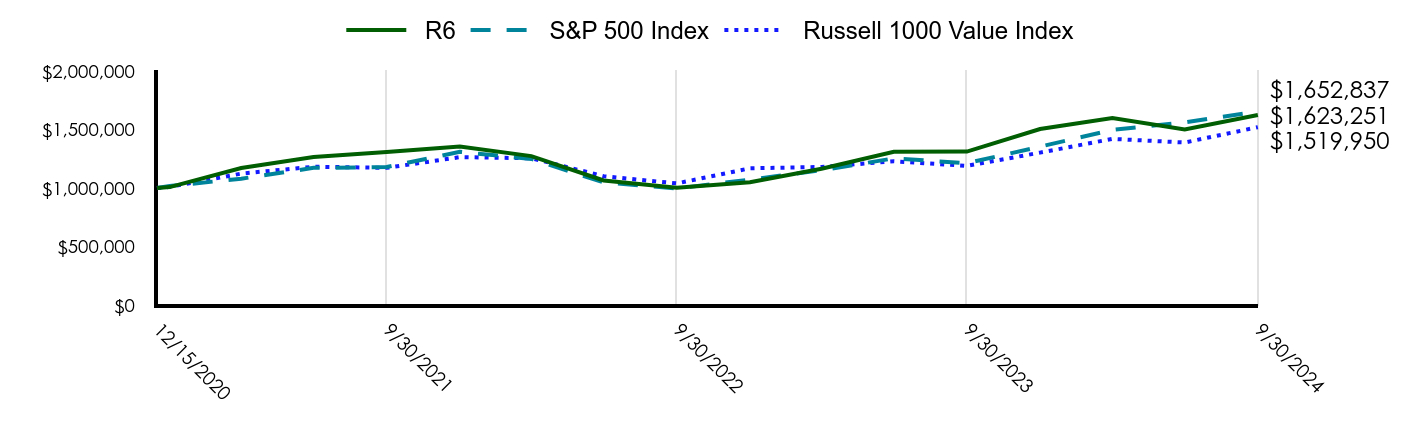

How did the Fund perform last year and what affected its performance?

Oakmark Fund R6 returned 28.74% for the fiscal year ended September 30, 2024, underperforming its benchmark, the S&P 500 Index, which returned 36.35% over the same period.

At the equity sector level Financials and Industrials performed the strongest, while Energy and Materials were the worst performing sectors.

At the equity holdings level, KKR led the positive contributors followed by Capital One Financial and CBRE Group. APA, Charter Communications and ConocoPhillips were the worst performing equities.

Total return based on $1,000,000 investment (as of September 30, 2024)

| R6 | S&P 500 Index | Russell 1000 Value Index |

|---|

| 12/15/2020 | $1,000,000 | $1,000,000 | $1,000,000 |

| 12/31/2020 | $1,018,774 | $1,017,200 | $1,009,900 |

| 3/31/2021 | $1,177,788 | $1,080,012 | $1,123,514 |

| 6/30/2021 | $1,283,533 | $1,172,340 | $1,182,049 |

| 9/30/2021 | $1,308,188 | $1,179,164 | $1,172,829 |

| 12/31/2021 | $1,371,107 | $1,309,191 | $1,263,958 |

| 3/31/2022 | $1,336,009 | $1,248,988 | $1,254,604 |

| 6/30/2022 | $1,099,072 | $1,047,887 | $1,101,417 |

| 9/30/2022 | $1,079,049 | $996,723 | $1,039,518 |

| 12/31/2022 | $1,190,946 | $1,072,086 | $1,168,626 |

| 3/31/2023 | $1,288,318 | $1,152,461 | $1,180,429 |

| 6/30/2023 | $1,400,599 | $1,253,210 | $1,228,472 |

| 9/30/2023 | $1,383,361 | $1,212,188 | $1,189,652 |

| 12/31/2023 | $1,563,180 | $1,353,911 | $1,302,669 |

| 3/31/2024 | $1,724,888 | $1,496,829 | $1,419,779 |

| 6/30/2024 | $1,657,303 | $1,560,950 | $1,388,970 |

| 9/30/2024 | $1,780,914 | $1,652,837 | $1,519,950 |

Average annual total returns (%)

| Fund | 1 Year | Since Inception 12/15/20 |

|---|

| R6 | 28.74% | 16.44% |

| S&P 500 Index | 36.35% | 14.17% |

| Russell 1000 Value Index | 27.76% | 11.69% |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results. To obtain the most recent month-end performance, please visit oakmark.com/our-funds/?tab=documents.

| Total Net Assets | $23,077,845,142 |

| # of Portfolio Holdings | 55 |

| Portfolio Turnover Rate | 42% |

| Total Advisory Fees Paid | $123,116,141 |

What did the Fund invest in? (as a % of total net assets)

| Alphabet, Inc., Class A | 3.1% |

| Fiserv, Inc. | 3.1% |

| Deere & Co. | 2.9% |

| Citigroup, Inc. | 2.9% |

| Charles Schwab Corp. | 2.7% |

| General Motors Co. | 2.7% |

| Intercontinental Exchange, Inc. | 2.7% |

| American International Group, Inc. | 2.7% |

| CBRE Group, Inc., Class A | 2.7% |

| IQVIA Holdings, Inc. | 2.7% |

| Financials | 39.0% |

| Communication Services | 9.7% |

| Industrials | 9.5% |

| Energy | 8.4% |

| Health Care | 8.4% |

| Consumer Discretionary | 6.2% |

| Consumer Staples | 5.1% |

| Materials | 3.3% |

| Information Technology | 2.9% |

| Real Estate | 2.7% |

| Short Term Investments & Other, Net | 4.8% |

| Total | 100.0% |

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, scan the QR code or visit oakmark.com/our-funds/?tab=documents.

Phone: 1-800-OAKMARK (625-6275)

You may have consented to receive one shareholder report at your address if you and one or more individuals in your home have an account with the Fund (householding). If you wish to receive individual copies of your shareholder report, contact + 1-800-OAKMARK (625-6275) or contact your intermediary.

Annual Shareholder Report

September 30, 2024

Annual Shareholder Report

September 30, 2024

This annual shareholder report contains important information about Oakmark Select Fund (the "Fund") for the period of October 1, 2023 to September 30, 2024.You can find additional information about the Fund at: oakmark.com/our-funds/?tab=documents. You can also request this information without charge by contacting us at 1-800-OAKMARK (625-6275) or contacting your intermediary.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor Class | $111 | 0.99% |

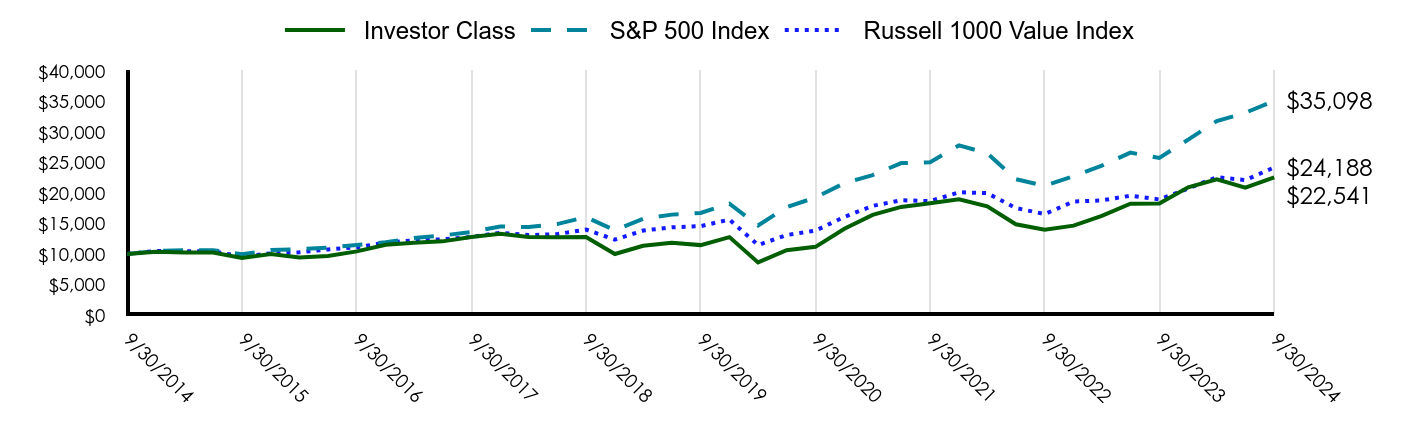

How did the Fund perform last year and what affected its performance?

Oakmark Select Fund Investor Class returned 23.42% for the fiscal year ended September 30, 2024, underperforming its benchmark, the S&P 500 Index, which returned 36.35% over the same period.

At the equity sector level the Financials and Real Estate contributed the most to returns, while Energy and Industrials were the worst performing sectors.

At the equity holdings level, CBRE Group led the positive contributors followed by Capital One Financial and KKR. Charter Communications, APA and Paycom Software were the worst performing equities.

Total return based on $10,000 investment (as of September 30, 2024)

| Investor Class | S&P 500 Index | Russell 1000 Value Index |

|---|

| 9/30/2014 | $10,000 | $10,000 | $10,000 |

| 12/31/2014 | $10,339 | $10,493 | $10,498 |

| 3/31/2015 | $10,238 | $10,593 | $10,422 |

| 6/30/2015 | $10,225 | $10,622 | $10,434 |

| 9/30/2015 | $9,325 | $9,939 | $9,558 |

| 12/31/2015 | $9,969 | $10,638 | $10,098 |

| 3/31/2016 | $9,415 | $10,782 | $10,263 |

| 6/30/2016 | $9,666 | $11,047 | $10,733 |

| 9/30/2016 | $10,421 | $11,472 | $11,107 |

| 12/31/2016 | $11,495 | $11,911 | $11,849 |

| 3/31/2017 | $11,840 | $12,633 | $12,236 |

| 6/30/2017 | $12,062 | $13,023 | $12,400 |

| 9/30/2017 | $12,777 | $13,607 | $12,787 |

| 12/31/2017 | $13,302 | $14,511 | $13,469 |

| 3/31/2018 | $12,784 | $14,401 | $13,087 |

| 6/30/2018 | $12,731 | $14,896 | $13,242 |

| 9/30/2018 | $12,768 | $16,044 | $13,997 |

| 12/31/2018 | $9,993 | $13,875 | $12,356 |

| 3/31/2019 | $11,339 | $15,769 | $13,830 |

| 6/30/2019 | $11,853 | $16,447 | $14,361 |

| 9/30/2019 | $11,448 | $16,727 | $14,557 |

| 12/31/2019 | $12,760 | $18,244 | $15,635 |

| 3/31/2020 | $8,609 | $14,668 | $11,456 |

| 6/30/2020 | $10,611 | $17,682 | $13,093 |

| 9/30/2020 | $11,167 | $19,260 | $13,825 |

| 12/31/2020 | $14,133 | $21,600 | $16,072 |

| 3/31/2021 | $16,406 | $22,934 | $17,880 |

| 6/30/2021 | $17,712 | $24,895 | $18,811 |

| 9/30/2021 | $18,314 | $25,040 | $18,664 |

| 12/31/2021 | $18,945 | $27,801 | $20,115 |

| 3/31/2022 | $17,795 | $26,522 | $19,966 |

| 6/30/2022 | $14,870 | $22,252 | $17,528 |

| 9/30/2022 | $13,985 | $21,165 | $16,543 |

| 12/31/2022 | $14,638 | $22,766 | $18,597 |

| 3/31/2023 | $16,235 | $24,473 | $18,785 |

| 6/30/2023 | $18,249 | $26,612 | $19,550 |

| 9/30/2023 | $18,264 | $25,741 | $18,932 |

| 12/31/2023 | $20,932 | $28,750 | $20,731 |

| 3/31/2024 | $22,235 | $31,785 | $22,594 |

| 6/30/2024 | $20,858 | $33,147 | $22,104 |

| 9/30/2024 | $22,541 | $35,098 | $24,188 |

Average annual total returns (%)

| Fund | 1 Year | 5 Years | 10 Years |

|---|

| Investor Class | 23.42% | 14.51% | 8.47% |

| S&P 500 Index | 36.35% | 15.98% | 13.38% |

| Russell 1000 Value Index | 27.76% | 10.69% | 9.23% |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results. To obtain the most recent month-end performance, please visit oakmark.com/our-funds/?tab=documents.

| Total Net Assets | $6,674,153,732 |

| # of Portfolio Holdings | 22 |

| Portfolio Turnover Rate | 57% |

| Total Advisory Fees Paid | $43,269,266 |

What did the Fund invest in? (as a % of total net assets)

| CBRE Group, Inc., Class A | 7.6% |

| Alphabet, Inc., Class A | 7.3% |

| First Citizens BancShares, Inc., Class A | 7.0% |

| IQVIA Holdings, Inc. | 6.8% |

| Deere & Co. | 6.5% |

| Lithia Motors, Inc. | 6.2% |

| Paycom Software, Inc. | 5.5% |

| Salesforce, Inc. | 5.0% |

| Charles Schwab Corp. | 4.9% |

| Capital One Financial Corp. | 4.9% |

| Financials | 30.0% |

| Communication Services | 12.9% |

| Industrials | 12.0% |

| Health Care | 10.7% |

| Energy | 9.4% |

| Real Estate | 7.6% |

| Consumer Discretionary | 6.2% |

| Information Technology | 5.0% |

| Short Term Investments & Other, Net | 6.2% |

| Total | 100.0% |

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, scan the QR code or visit oakmark.com/our-funds/?tab=documents.

Phone: 1-800-OAKMARK (625-6275)

You may have consented to receive one shareholder report at your address if you and one or more individuals in your home have an account with the Fund (householding). If you wish to receive individual copies of your shareholder report, contact + 1-800-OAKMARK (625-6275) or contact your intermediary.

Annual Shareholder Report

September 30, 2024

Annual Shareholder Report

September 30, 2024

This annual shareholder report contains important information about Oakmark Select Fund (the "Fund") for the period of October 1, 2023 to September 30, 2024.You can find additional information about the Fund at: oakmark.com/our-funds/?tab=documents. You can also request this information without charge by contacting us at 1-800-OAKMARK (625-6275) or contacting your intermediary.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Advisor Class | $97 | 0.87% |

How did the Fund perform last year and what affected its performance?

Oakmark Select Fund Advisor returned 23.56% for the fiscal year ended September 30, 2024, underperforming its benchmark, the S&P 500 Index, which returned 36.35% over the same period.

At the equity sector level the Financials and Real Estate contributed the most to returns, while Energy and Industrials were the worst performing sectors.

At the equity holdings level, CBRE Group led the positive contributors followed by Capital One Financial and KKR. Charter Communications, APA and Paycom Software were the worst performing equities.

Total return based on $100,000 investment (as of September 30, 2024)

| Advisor | S&P 500 Index | Russell 1000 Value Index |

|---|

| 11/30/2016 | $100,000 | $100,000 | $100,000 |

| 12/31/2016 | $102,671 | $101,977 | $102,500 |

| 3/31/2017 | $105,795 | $108,163 | $105,852 |

| 6/30/2017 | $107,799 | $111,503 | $107,270 |

| 9/30/2017 | $114,238 | $116,499 | $110,617 |

| 12/31/2017 | $118,968 | $124,240 | $116,513 |

| 3/31/2018 | $114,385 | $123,297 | $113,216 |

| 6/30/2018 | $113,961 | $127,530 | $114,552 |

| 9/30/2018 | $114,335 | $137,364 | $121,081 |

| 12/31/2018 | $89,544 | $118,793 | $106,890 |

| 3/31/2019 | $101,611 | $135,005 | $119,642 |

| 6/30/2019 | $106,244 | $140,816 | $124,237 |

| 9/30/2019 | $102,632 | $143,207 | $125,926 |

| 12/31/2019 | $114,458 | $156,196 | $135,257 |

| 3/31/2020 | $77,247 | $125,585 | $99,103 |

| 6/30/2020 | $95,245 | $151,384 | $113,265 |

| 9/30/2020 | $100,260 | $164,902 | $119,596 |

| 12/31/2020 | $126,936 | $184,934 | $139,031 |

| 3/31/2021 | $147,360 | $196,354 | $154,672 |

| 6/30/2021 | $159,159 | $213,140 | $162,730 |

| 9/30/2021 | $164,609 | $214,381 | $161,461 |

| 12/31/2021 | $170,348 | $238,021 | $174,006 |

| 3/31/2022 | $160,066 | $227,075 | $172,719 |

| 6/30/2022 | $133,791 | $190,513 | $151,630 |

| 9/30/2022 | $125,848 | $181,211 | $143,108 |

| 12/31/2022 | $131,767 | $194,913 | $160,882 |

| 3/31/2023 | $146,206 | $209,526 | $162,507 |

| 6/30/2023 | $164,408 | $227,843 | $169,121 |

| 9/30/2023 | $164,568 | $220,385 | $163,777 |

| 12/31/2023 | $188,670 | $246,151 | $179,336 |

| 3/31/2024 | $200,460 | $272,134 | $195,458 |

| 6/30/2024 | $188,133 | $283,792 | $191,216 |

| 9/30/2024 | $203,334 | $300,498 | $209,248 |

Average annual total returns (%)

| Fund | 1 Year | 5 Years | Since Inception 11/30/16 |

|---|

| Advisor | 23.56% | 14.65% | 9.48% |

| S&P 500 Index | 36.35% | 15.98% | 15.08% |

| Russell 1000 Value Index | 27.76% | 10.69% | 9.88% |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results. To obtain the most recent month-end performance, please visit oakmark.com/our-funds/?tab=documents.

| Total Net Assets | $6,674,153,732 |

| # of Portfolio Holdings | 22 |

| Portfolio Turnover Rate | 57% |

| Total Advisory Fees Paid | $43,269,266 |

What did the Fund invest in? (as a % of total net assets)

| CBRE Group, Inc., Class A | 7.6% |

| Alphabet, Inc., Class A | 7.3% |

| First Citizens BancShares, Inc., Class A | 7.0% |

| IQVIA Holdings, Inc. | 6.8% |

| Deere & Co. | 6.5% |

| Lithia Motors, Inc. | 6.2% |

| Paycom Software, Inc. | 5.5% |

| Salesforce, Inc. | 5.0% |

| Charles Schwab Corp. | 4.9% |

| Capital One Financial Corp. | 4.9% |

| Financials | 30.0% |

| Communication Services | 12.9% |

| Industrials | 12.0% |

| Health Care | 10.7% |

| Energy | 9.4% |

| Real Estate | 7.6% |

| Consumer Discretionary | 6.2% |

| Information Technology | 5.0% |

| Short Term Investments & Other, Net | 6.2% |

| Total | 100.0% |

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, scan the QR code or visit oakmark.com/our-funds/?tab=documents.

Phone: 1-800-OAKMARK (625-6275)

You may have consented to receive one shareholder report at your address if you and one or more individuals in your home have an account with the Fund (householding). If you wish to receive individual copies of your shareholder report, contact + 1-800-OAKMARK (625-6275) or contact your intermediary.

Annual Shareholder Report

September 30, 2024

Annual Shareholder Report

September 30, 2024

This annual shareholder report contains important information about Oakmark Select Fund (the "Fund") for the period of October 1, 2023 to September 30, 2024.You can find additional information about the Fund at: oakmark.com/our-funds/?tab=documents. You can also request this information without charge by contacting us at 1-800-OAKMARK (625-6275) or contacting your intermediary.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Class | $85 | 0.76% |

How did the Fund perform last year and what affected its performance?

Oakmark Select Fund Institutional returned 23.69% for the fiscal year ended September 30, 2024, underperforming its benchmark, the S&P 500 Index, which returned 36.35% over the same period.

At the equity sector level the Financials and Real Estate contributed the most to returns, while Energy and Industrials were the worst performing sectors.

At the equity holdings level, CBRE Group led the positive contributors followed by Capital One Financial and KKR. Charter Communications, APA and Paycom Software were the worst performing equities.

Total return based on $250,000 investment (as of September 30, 2024)

| Institutional | S&P 500 Index | Russell 1000 Value Index |

|---|

| 11/30/2016 | $250,000 | $250,000 | $250,000 |

| 12/31/2016 | $256,678 | $254,942 | $256,250 |

| 3/31/2017 | $264,488 | $270,407 | $264,629 |

| 6/30/2017 | $269,497 | $278,757 | $268,175 |

| 9/30/2017 | $285,655 | $291,247 | $276,542 |

| 12/31/2017 | $297,524 | $310,599 | $291,282 |

| 3/31/2018 | $286,064 | $308,241 | $283,039 |

| 6/30/2018 | $285,005 | $318,826 | $286,379 |

| 9/30/2018 | $285,939 | $343,410 | $302,702 |

| 12/31/2018 | $223,973 | $296,982 | $267,226 |

| 3/31/2019 | $254,220 | $337,514 | $299,106 |

| 6/30/2019 | $265,808 | $352,040 | $310,591 |

| 9/30/2019 | $256,839 | $358,018 | $314,815 |

| 12/31/2019 | $286,402 | $390,490 | $338,143 |

| 3/31/2020 | $193,290 | $313,962 | $247,758 |

| 6/30/2020 | $238,393 | $378,460 | $283,162 |

| 9/30/2020 | $251,006 | $412,255 | $298,991 |

| 12/31/2020 | $317,838 | $462,336 | $347,577 |

| 3/31/2021 | $369,156 | $490,885 | $386,679 |

| 6/30/2021 | $398,821 | $532,850 | $406,825 |

| 9/30/2021 | $412,528 | $535,951 | $403,652 |

| 12/31/2021 | $426,996 | $595,051 | $435,016 |

| 3/31/2022 | $401,307 | $567,688 | $431,797 |

| 6/30/2022 | $335,554 | $476,284 | $379,074 |

| 9/30/2022 | $315,655 | $453,029 | $357,770 |

| 12/31/2022 | $330,620 | $487,282 | $402,205 |

| 3/31/2023 | $366,887 | $523,814 | $406,268 |

| 6/30/2023 | $412,589 | $569,607 | $422,803 |

| 9/30/2023 | $413,191 | $550,961 | $409,442 |

| 12/31/2023 | $473,748 | $615,377 | $448,339 |

| 3/31/2024 | $503,534 | $680,336 | $488,645 |

| 6/30/2024 | $472,670 | $709,480 | $478,041 |

| 9/30/2024 | $511,082 | $751,245 | $523,121 |

Average annual total returns (%)

| Fund | 1 Year | 5 Years | Since Inception 11/30/16 |

|---|

| Institutional | 23.69% | 14.75% | 9.56% |

| S&P 500 Index | 36.35% | 15.98% | 15.08% |

| Russell 1000 Value Index | 27.76% | 10.69% | 9.88% |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results. To obtain the most recent month-end performance, please visit oakmark.com/our-funds/?tab=documents.

| Total Net Assets | $6,674,153,732 |

| # of Portfolio Holdings | 22 |

| Portfolio Turnover Rate | 57% |

| Total Advisory Fees Paid | $43,269,266 |

What did the Fund invest in? (as a % of total net assets)

| CBRE Group, Inc., Class A | 7.6% |

| Alphabet, Inc., Class A | 7.3% |

| First Citizens BancShares, Inc., Class A | 7.0% |

| IQVIA Holdings, Inc. | 6.8% |

| Deere & Co. | 6.5% |

| Lithia Motors, Inc. | 6.2% |

| Paycom Software, Inc. | 5.5% |

| Salesforce, Inc. | 5.0% |

| Charles Schwab Corp. | 4.9% |

| Capital One Financial Corp. | 4.9% |

| Financials | 30.0% |

| Communication Services | 12.9% |

| Industrials | 12.0% |

| Health Care | 10.7% |

| Energy | 9.4% |

| Real Estate | 7.6% |

| Consumer Discretionary | 6.2% |

| Information Technology | 5.0% |

| Short Term Investments & Other, Net | 6.2% |

| Total | 100.0% |

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, scan the QR code or visit oakmark.com/our-funds/?tab=documents.

Phone: 1-800-OAKMARK (625-6275)

You may have consented to receive one shareholder report at your address if you and one or more individuals in your home have an account with the Fund (householding). If you wish to receive individual copies of your shareholder report, contact + 1-800-OAKMARK (625-6275) or contact your intermediary.

Annual Shareholder Report

September 30, 2024

Annual Shareholder Report

September 30, 2024

This annual shareholder report contains important information about Oakmark Select Fund (the "Fund") for the period of October 1, 2023 to September 30, 2024.You can find additional information about the Fund at: oakmark.com/our-funds/?tab=documents. You can also request this information without charge by contacting us at 1-800-OAKMARK (625-6275) or contacting your intermediary.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| R6 | $82 | 0.73% |

How did the Fund perform last year and what affected its performance?

Oakmark Select Fund R6 returned 23.75% for the fiscal year ended September 30, 2024, underperforming its benchmark, the S&P 500 Index, which returned 36.35% over the same period.

At the equity sector level the Financials and Real Estate contributed the most to returns, while Energy and Industrials were the worst performing sectors.

At the equity holdings level, CBRE Group led the positive contributors followed by Capital One Financial and KKR. Charter Communications, APA and Paycom Software were the worst performing equities.

Total return based on $1,000,000 investment (as of September 30, 2024)

| R6 | S&P 500 Index | Russell 1000 Value Index |

|---|

| 12/15/2020 | $1,000,000 | $1,000,000 | $1,000,000 |

| 12/31/2020 | $1,008,192 | $1,017,200 | $1,009,900 |

| 3/31/2021 | $1,170,972 | $1,080,012 | $1,123,514 |

| 6/30/2021 | $1,264,860 | $1,172,340 | $1,182,049 |

| 9/30/2021 | $1,308,549 | $1,179,164 | $1,172,829 |

| 12/31/2021 | $1,354,479 | $1,309,191 | $1,263,958 |

| 3/31/2022 | $1,272,978 | $1,248,988 | $1,254,604 |

| 6/30/2022 | $1,064,581 | $1,047,887 | $1,101,417 |

| 9/30/2022 | $1,001,871 | $996,723 | $1,039,518 |

| 12/31/2022 | $1,049,371 | $1,072,086 | $1,168,626 |

| 3/31/2023 | $1,164,717 | $1,152,461 | $1,180,429 |

| 6/30/2023 | $1,310,014 | $1,253,210 | $1,228,472 |

| 9/30/2023 | $1,311,714 | $1,212,188 | $1,189,652 |

| 12/31/2023 | $1,504,477 | $1,353,911 | $1,302,669 |

| 3/31/2024 | $1,599,068 | $1,496,829 | $1,419,779 |

| 6/30/2024 | $1,501,266 | $1,560,950 | $1,388,970 |

| 9/30/2024 | $1,623,251 | $1,652,837 | $1,519,950 |

Average annual total returns (%)

| Fund | 1 Year | Since Inception 12/15/20 |

|---|

| R6 | 23.75% | 13.63% |

| S&P 500 Index | 36.35% | 14.17% |

| Russell 1000 Value Index | 27.76% | 11.69% |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results. To obtain the most recent month-end performance, please visit oakmark.com/our-funds/?tab=documents.

| Total Net Assets | $6,674,153,732 |

| # of Portfolio Holdings | 22 |

| Portfolio Turnover Rate | 57% |

| Total Advisory Fees Paid | $43,269,266 |

What did the Fund invest in? (as a % of total net assets)

| CBRE Group, Inc., Class A | 7.6% |

| Alphabet, Inc., Class A | 7.3% |

| First Citizens BancShares, Inc., Class A | 7.0% |

| IQVIA Holdings, Inc. | 6.8% |

| Deere & Co. | 6.5% |

| Lithia Motors, Inc. | 6.2% |

| Paycom Software, Inc. | 5.5% |

| Salesforce, Inc. | 5.0% |

| Charles Schwab Corp. | 4.9% |

| Capital One Financial Corp. | 4.9% |

| Financials | 30.0% |

| Communication Services | 12.9% |

| Industrials | 12.0% |

| Health Care | 10.7% |

| Energy | 9.4% |

| Real Estate | 7.6% |

| Consumer Discretionary | 6.2% |

| Information Technology | 5.0% |

| Short Term Investments & Other, Net | 6.2% |

| Total | 100.0% |

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, scan the QR code or visit oakmark.com/our-funds/?tab=documents.

Phone: 1-800-OAKMARK (625-6275)

You may have consented to receive one shareholder report at your address if you and one or more individuals in your home have an account with the Fund (householding). If you wish to receive individual copies of your shareholder report, contact + 1-800-OAKMARK (625-6275) or contact your intermediary.

Annual Shareholder Report

September 30, 2024

Annual Shareholder Report

September 30, 2024

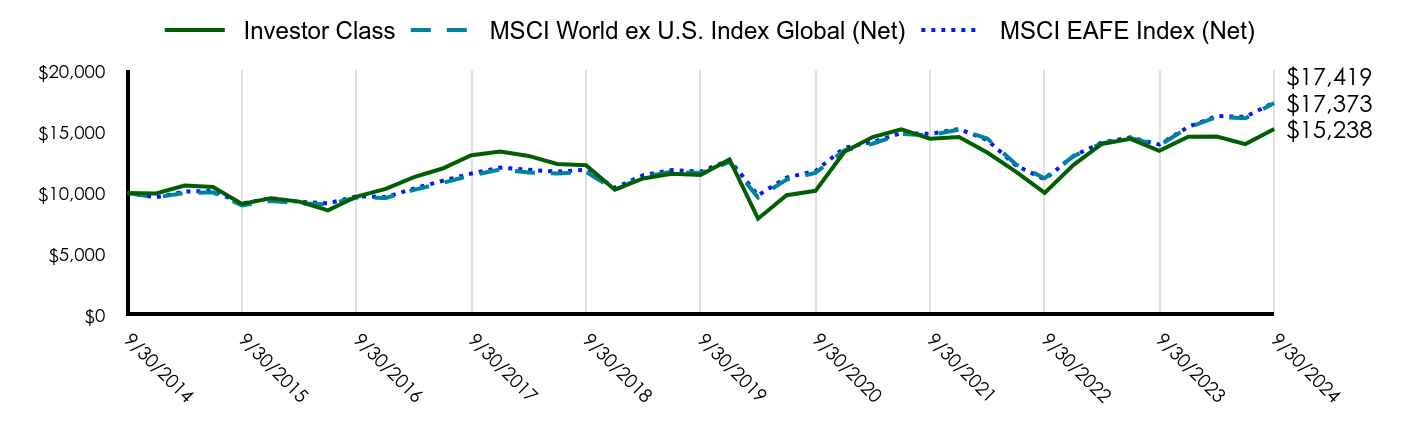

This annual shareholder report contains important information about Oakmark Global Fund (the "Fund") for the period of October 1, 2023 to September 30, 2024.You can find additional information about the Fund at: oakmark.com/our-funds/?tab=documents. You can also request this information without charge by contacting us at 1-800-OAKMARK (625-6275) or contacting your intermediary.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor Class | $122 | 1.12% |

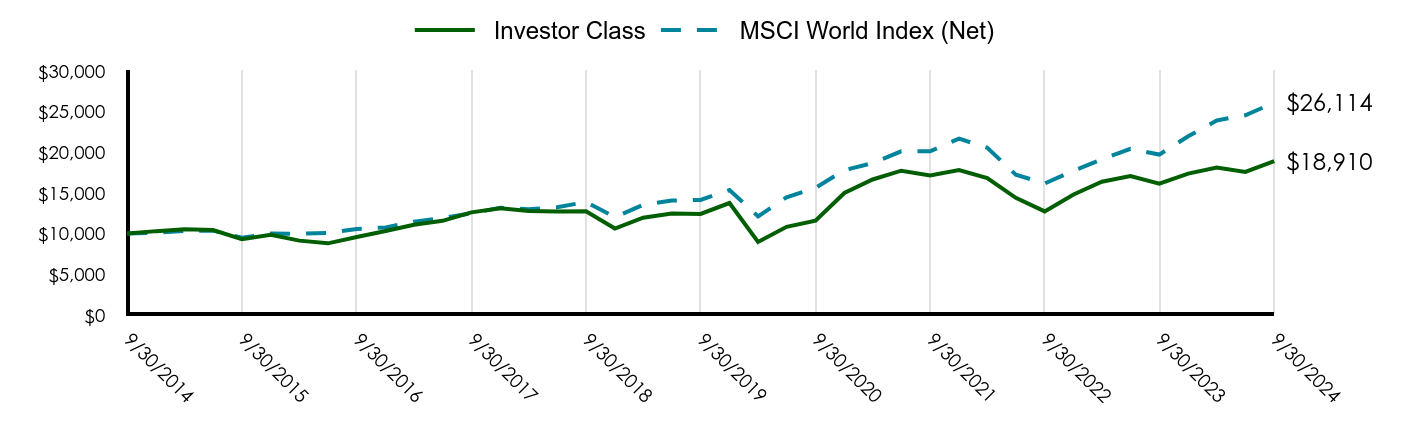

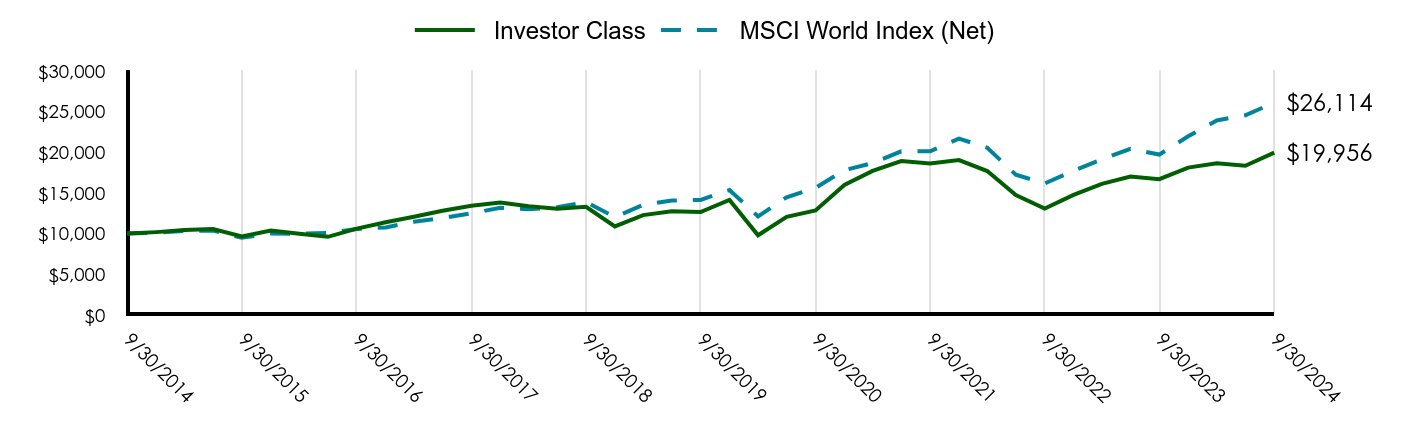

How did the Fund perform last year and what affected its performance?

Oakmark Global Fund Investor Class returned 17.06% for the fiscal year ended September 30, 2024, underperforming its benchmark, the MSCI World Index, which returned 32.43% over the same period.

The Fund’s exposure to the United States and United Kingdom contributed most to returns, while exposure to France and South Korea detracted most from returns.

At the equity sector level Financials and Consumer Discretionary performed the strongest, while Energy and Communication Services were the worst performing sectors.

At the equity holdings level, Lloyds Banking Group (U.K.) led the positive contributors followed by Capital One Financial (U.S.) and Fiserv (U.S.). Kering (France), Charter Communications (U.S.) and Bayer (Germany) were the worst performing equities.

Total return based on $10,000 investment (as of September 30, 2024)

| Investor Class | MSCI World Index (Net) |

|---|

| 9/30/2014 | $10,000 | $10,000 |

| 12/31/2014 | $10,305 | $10,101 |

| 3/31/2015 | $10,524 | $10,335 |

| 6/30/2015 | $10,432 | $10,367 |

| 9/30/2015 | $9,308 | $9,491 |

| 12/31/2015 | $9,853 | $10,013 |

| 3/31/2016 | $9,137 | $9,978 |

| 6/30/2016 | $8,803 | $10,078 |

| 9/30/2016 | $9,581 | $10,569 |

| 12/31/2016 | $10,312 | $10,765 |

| 3/31/2017 | $11,095 | $11,451 |

| 6/30/2017 | $11,572 | $11,912 |

| 9/30/2017 | $12,612 | $12,489 |

| 12/31/2017 | $13,104 | $13,176 |

| 3/31/2018 | $12,768 | $13,007 |

| 6/30/2018 | $12,729 | $13,233 |

| 9/30/2018 | $12,741 | $13,892 |

| 12/31/2018 | $10,619 | $12,028 |

| 3/31/2019 | $11,955 | $13,529 |

| 6/30/2019 | $12,470 | $14,071 |

| 9/30/2019 | $12,425 | $14,146 |

| 12/31/2019 | $13,763 | $15,357 |

| 3/31/2020 | $8,964 | $12,124 |

| 6/30/2020 | $10,839 | $14,471 |

| 9/30/2020 | $11,588 | $15,618 |

| 12/31/2020 | $15,001 | $17,799 |

| 3/31/2021 | $16,658 | $18,675 |

| 6/30/2021 | $17,738 | $20,121 |

| 9/30/2021 | $17,146 | $20,119 |

| 12/31/2021 | $17,822 | $21,682 |

| 3/31/2022 | $16,836 | $20,565 |

| 6/30/2022 | $14,401 | $17,236 |

| 9/30/2022 | $12,732 | $16,169 |

| 12/31/2022 | $14,820 | $17,748 |

| 3/31/2023 | $16,382 | $19,121 |

| 6/30/2023 | $17,081 | $20,426 |

| 9/30/2023 | $16,155 | $19,719 |

| 12/31/2023 | $17,376 | $21,970 |

| 3/31/2024 | $18,132 | $23,921 |

| 6/30/2024 | $17,587 | $24,551 |

| 9/30/2024 | $18,910 | $26,114 |

Average annual total returns (%)

| Fund | 1 Year | 5 Years | 10 Years |

|---|

| Investor Class | 17.06% | 8.76% | 6.58% |

| MSCI World Index (Net) | 32.43% | 13.04% | 10.07% |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results. To obtain the most recent month-end performance, please visit oakmark.com/our-funds/?tab=documents.

| Total Net Assets | $1,174,155,547 |

| # of Portfolio Holdings | 47 |

| Portfolio Turnover Rate | 48% |

| Total Advisory Fees Paid | $9,325,543 |

What did the Fund invest in? (as a % of total net assets)

| Bayer AG | 4.0% |

| CNH Industrial NV | 3.8% |

| Mercedes-Benz Group AG | 3.5% |

| Alphabet, Inc., Class A | 3.1% |

| Kering SA | 3.1% |

| IQVIA Holdings, Inc. | 3.0% |

| Centene Corp. | 3.0% |

| Interpublic Group of Cos., Inc. | 3.0% |

| Corebridge Financial, Inc. | 2.9% |

| Capital One Financial Corp. | 2.8% |

| United States | 54.2% |

| Germany | 10.8% |

| United Kingdom | 8.4% |

| Switzerland | 8.0% |

| France | 5.1% |

| Netherlands | 3.9% |

| Ireland | 3.1% |

| China | 2.0% |

| South Korea | 2.0% |

| Belgium | 1.7% |

| Other | 0.3% |

| Other Assets and Liabilities, Net | 0.5% |

| Total | 100.0% |

| Financials | 28.9% |

| Health Care | 17.1% |

| Consumer Discretionary | 16.7% |

| Communication Services | 9.5% |

| Industrials | 8.0% |

| Information Technology | 5.8% |

| Consumer Staples | 5.0% |

| Materials | 4.0% |

| Energy | 1.7% |

| Short Term Investments & Other, Net | 3.3% |

| Total | 100.0% |

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, scan the QR code or visit oakmark.com/our-funds/?tab=documents.

Phone: 1-800-OAKMARK (625-6275)

You may have consented to receive one shareholder report at your address if you and one or more individuals in your home have an account with the Fund (householding). If you wish to receive individual copies of your shareholder report, contact + 1-800-OAKMARK (625-6275) or contact your intermediary.

Annual Shareholder Report

September 30, 2024

Annual Shareholder Report

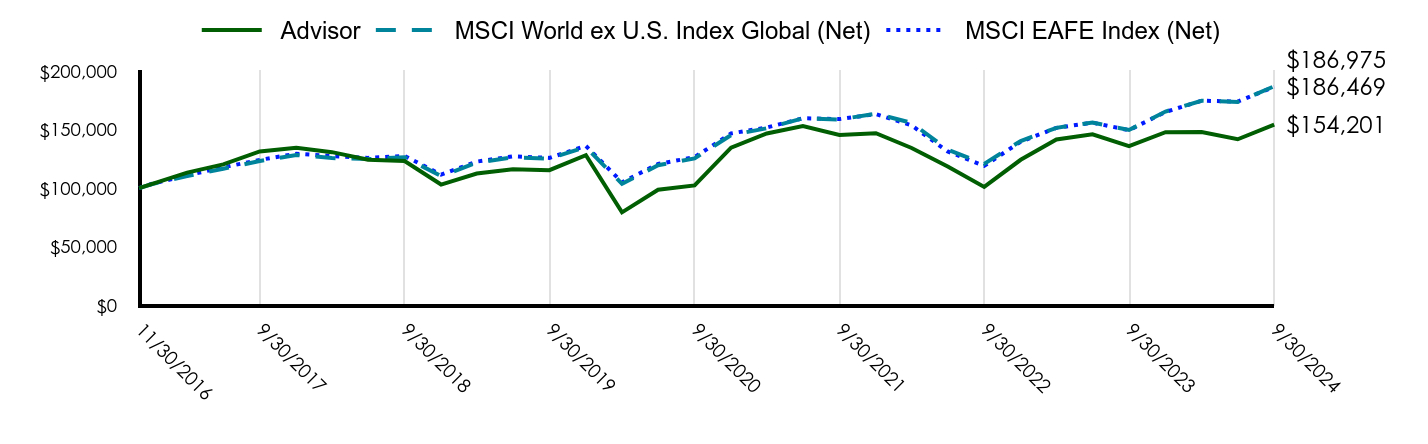

September 30, 2024

This annual shareholder report contains important information about Oakmark Global Fund (the "Fund") for the period of October 1, 2023 to September 30, 2024.You can find additional information about the Fund at: oakmark.com/our-funds/?tab=documents. You can also request this information without charge by contacting us at 1-800-OAKMARK (625-6275) or contacting your intermediary.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Advisor Class | $101 | 0.93% |

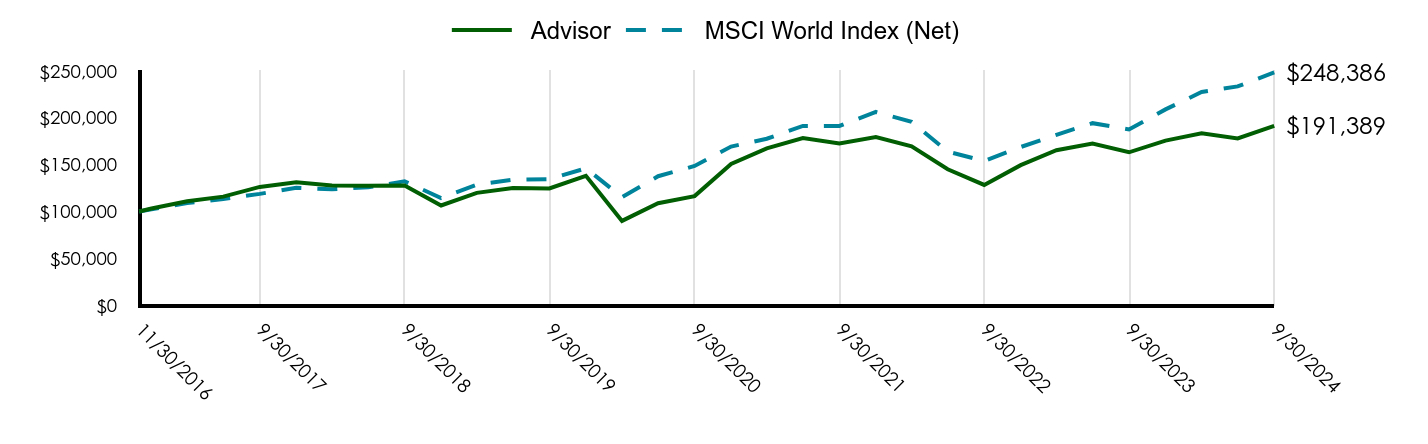

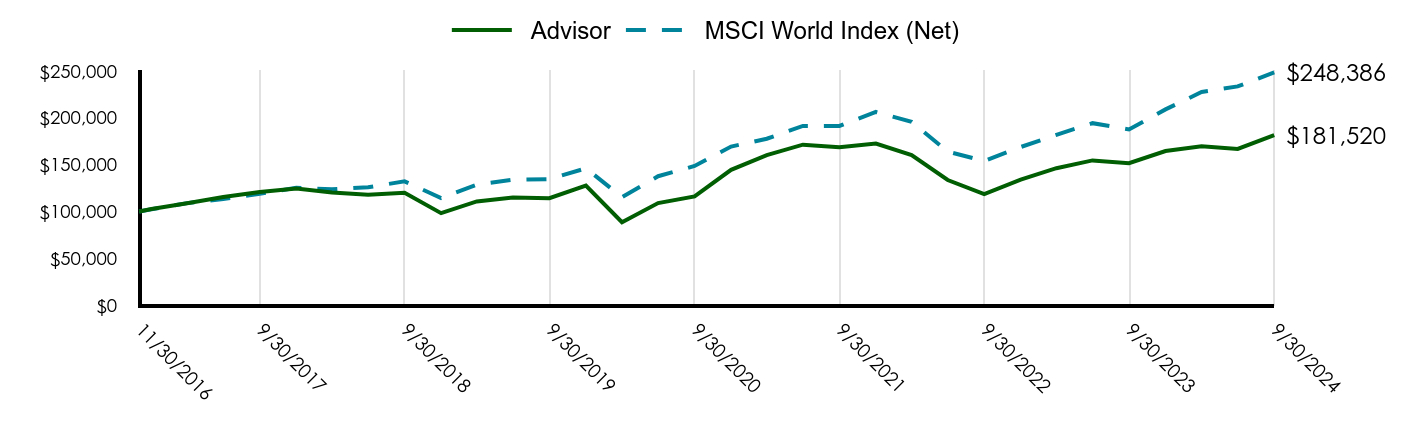

How did the Fund perform last year and what affected its performance?

Oakmark Global Fund Advisor returned 17.28% for the fiscal year ended September 30, 2024, underperforming its benchmark, the MSCI World Index, which returned 32.43% over the same period.

The Fund’s exposure to the United States and United Kingdom contributed most to returns, while exposure to France and South Korea detracted most from returns.

At the equity sector level Financials and Consumer Discretionary performed the strongest, while Energy and Communication Services were the worst performing sectors.

At the equity holdings level, Lloyds Banking Group (U.K.) led the positive contributors followed by Capital One Financial (U.S.) and Fiserv (U.S.). Kering (France), Charter Communications (U.S.) and Bayer (Germany) were the worst performing equities.

Total return based on $100,000 investment (as of September 30, 2024)

| Advisor | MSCI World Index (Net) |

|---|

| 11/30/2016 | $100,000 | $100,000 |

| 12/31/2016 | $103,123 | $102,393 |

| 3/31/2017 | $110,985 | $108,921 |

| 6/30/2017 | $115,834 | $113,307 |

| 9/30/2017 | $126,231 | $118,789 |

| 12/31/2017 | $131,217 | $125,329 |

| 3/31/2018 | $127,851 | $123,724 |

| 6/30/2018 | $127,494 | $125,869 |

| 9/30/2018 | $127,613 | $132,138 |

| 12/31/2018 | $106,423 | $114,411 |

| 3/31/2019 | $119,868 | $128,689 |

| 6/30/2019 | $125,028 | $133,838 |

| 9/30/2019 | $124,621 | $134,553 |

| 12/31/2019 | $138,118 | $146,069 |

| 3/31/2020 | $89,946 | $115,319 |

| 6/30/2020 | $108,857 | $137,643 |

| 9/30/2020 | $116,384 | $148,557 |

| 12/31/2020 | $150,746 | $169,297 |

| 3/31/2021 | $167,448 | $177,630 |

| 6/30/2021 | $178,394 | $191,385 |

| 9/30/2021 | $172,544 | $191,372 |

| 12/31/2021 | $179,393 | $206,233 |

| 3/31/2022 | $169,562 | $195,606 |

| 6/30/2022 | $145,087 | $163,944 |

| 9/30/2022 | $128,323 | $153,800 |

| 12/31/2022 | $149,452 | $168,819 |

| 3/31/2023 | $165,332 | $181,870 |

| 6/30/2023 | $172,436 | $194,291 |

| 9/30/2023 | $163,190 | $187,565 |

| 12/31/2023 | $175,599 | $208,977 |

| 3/31/2024 | $183,357 | $227,535 |

| 6/30/2024 | $177,894 | $233,523 |

| 9/30/2024 | $191,389 | $248,386 |

Average annual total returns (%)

| Fund | 1 Year | 5 Years | Since Inception 11/30/16 |

|---|

| Advisor | 17.28% | 8.96% | 8.64% |

| MSCI World Index (Net) | 32.43% | 13.04% | 12.32% |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results. To obtain the most recent month-end performance, please visit oakmark.com/our-funds/?tab=documents.

| Total Net Assets | $1,174,155,547 |

| # of Portfolio Holdings | 47 |

| Portfolio Turnover Rate | 48% |

| Total Advisory Fees Paid | $9,325,543 |

What did the Fund invest in? (as a % of total net assets)

| Bayer AG | 4.0% |

| CNH Industrial NV | 3.8% |

| Mercedes-Benz Group AG | 3.5% |

| Alphabet, Inc., Class A | 3.1% |

| Kering SA | 3.1% |

| IQVIA Holdings, Inc. | 3.0% |

| Centene Corp. | 3.0% |

| Interpublic Group of Cos., Inc. | 3.0% |

| Corebridge Financial, Inc. | 2.9% |

| Capital One Financial Corp. | 2.8% |

| United States | 54.2% |

| Germany | 10.8% |

| United Kingdom | 8.4% |

| Switzerland | 8.0% |

| France | 5.1% |

| Netherlands | 3.9% |

| Ireland | 3.1% |

| China | 2.0% |

| South Korea | 2.0% |

| Belgium | 1.7% |

| Other | 0.3% |

| Other Assets and Liabilities, Net | 0.5% |

| Total | 100.0% |

| Financials | 28.9% |

| Health Care | 17.1% |

| Consumer Discretionary | 16.7% |

| Communication Services | 9.5% |

| Industrials | 8.0% |

| Information Technology | 5.8% |

| Consumer Staples | 5.0% |

| Materials | 4.0% |

| Energy | 1.7% |

| Short Term Investments & Other, Net | 3.3% |

| Total | 100.0% |

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, scan the QR code or visit oakmark.com/our-funds/?tab=documents.

Phone: 1-800-OAKMARK (625-6275)

You may have consented to receive one shareholder report at your address if you and one or more individuals in your home have an account with the Fund (householding). If you wish to receive individual copies of your shareholder report, contact + 1-800-OAKMARK (625-6275) or contact your intermediary.

Annual Shareholder Report

September 30, 2024

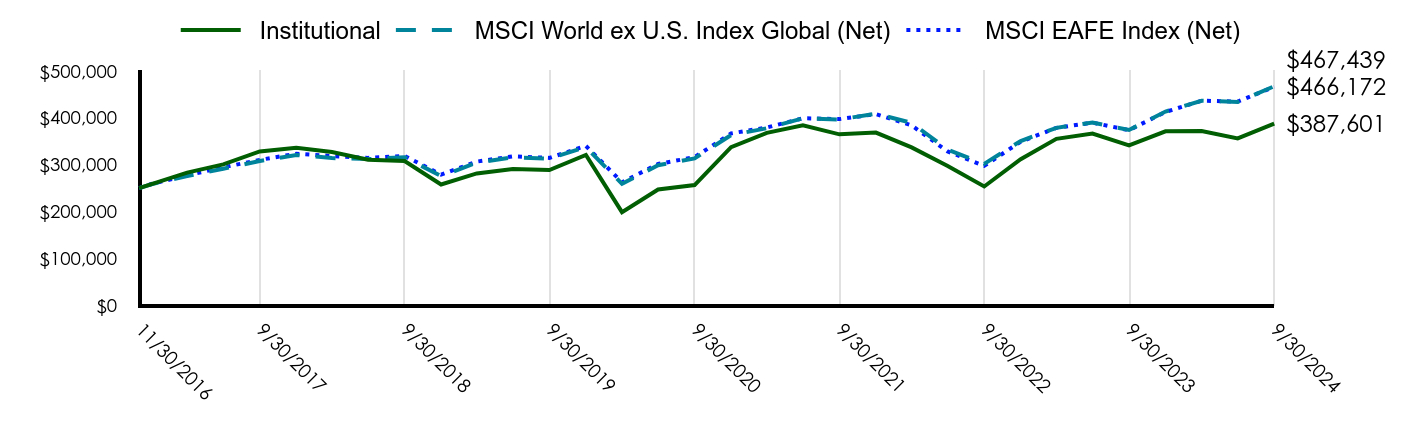

Annual Shareholder Report

September 30, 2024

This annual shareholder report contains important information about Oakmark Global Fund (the "Fund") for the period of October 1, 2023 to September 30, 2024.You can find additional information about the Fund at: oakmark.com/our-funds/?tab=documents. You can also request this information without charge by contacting us at 1-800-OAKMARK (625-6275) or contacting your intermediary.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Class | $97 | 0.89% |

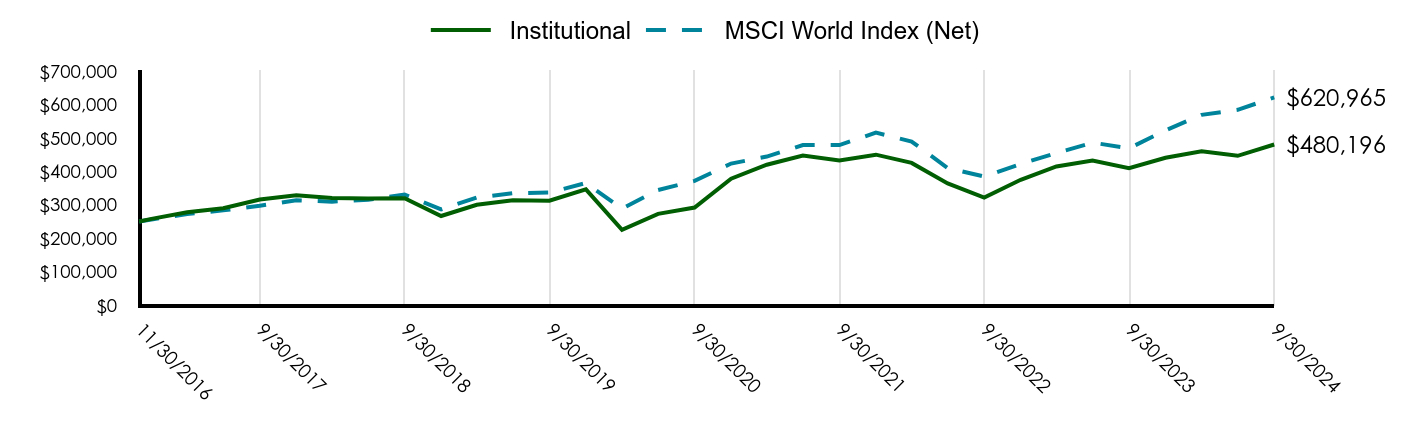

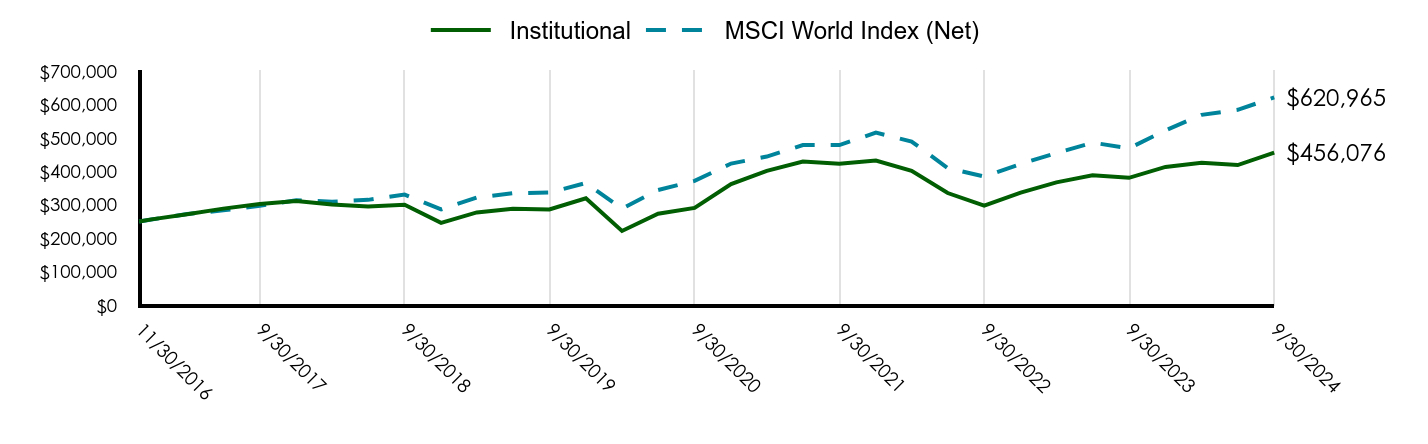

How did the Fund perform last year and what affected its performance?

Oakmark Global Fund Institutional returned 17.33% for the fiscal year ended September 30, 2024, underperforming its benchmark, the MSCI World Index, which returned 32.43% over the same period.

The Fund’s exposure to the United States and United Kingdom contributed most to returns, while exposure to France and South Korea detracted most from returns.

At the equity sector level Financials and Consumer Discretionary performed the strongest, while Energy and Communication Services were the worst performing sectors.

At the equity holdings level, Lloyds Banking Group (U.K.) led the positive contributors followed by Capital One Financial (U.S.) and Fiserv (U.S.). Kering (France), Charter Communications (U.S.) and Bayer (Germany) were the worst performing equities.

Total return based on $250,000 investment (as of September 30, 2024)

| Institutional | MSCI World Index (Net) |

|---|

| 11/30/2016 | $250,000 | $250,000 |

| 12/31/2016 | $257,807 | $255,982 |

| 3/31/2017 | $277,461 | $272,303 |

| 6/30/2017 | $289,677 | $283,267 |

| 9/30/2017 | $315,760 | $296,974 |

| 12/31/2017 | $328,290 | $313,323 |

| 3/31/2018 | $319,968 | $309,309 |

| 6/30/2018 | $319,077 | $314,673 |

| 9/30/2018 | $319,473 | $330,346 |

| 12/31/2018 | $266,456 | $286,028 |

| 3/31/2019 | $300,117 | $321,723 |

| 6/30/2019 | $313,151 | $334,594 |

| 9/30/2019 | $312,131 | $336,383 |

| 12/31/2019 | $345,946 | $365,172 |

| 3/31/2020 | $225,407 | $288,297 |

| 6/30/2020 | $272,774 | $344,108 |

| 9/30/2020 | $291,627 | $371,391 |

| 12/31/2020 | $377,764 | $423,243 |

| 3/31/2021 | $419,738 | $444,074 |

| 6/30/2021 | $447,168 | $478,464 |

| 9/30/2021 | $432,507 | $478,430 |

| 12/31/2021 | $449,774 | $515,583 |

| 3/31/2022 | $425,125 | $489,015 |

| 6/30/2022 | $363,763 | $409,861 |

| 9/30/2022 | $321,730 | $384,500 |

| 12/31/2022 | $374,694 | $422,048 |

| 3/31/2023 | $414,522 | $454,676 |

| 6/30/2023 | $432,470 | $485,728 |

| 9/30/2023 | $409,281 | $468,913 |

| 12/31/2023 | $440,443 | $522,442 |

| 3/31/2024 | $459,908 | $568,838 |

| 6/30/2024 | $446,337 | $583,807 |

| 9/30/2024 | $480,196 | $620,965 |

Average annual total returns (%)

| Fund | 1 Year | 5 Years | Since Inception 11/30/16 |

|---|

| Institutional | 17.33% | 9.00% | 8.69% |

| MSCI World Index (Net) | 32.43% | 13.04% | 12.32% |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results. To obtain the most recent month-end performance, please visit oakmark.com/our-funds/?tab=documents.

| Total Net Assets | $1,174,155,547 |

| # of Portfolio Holdings | 47 |

| Portfolio Turnover Rate | 48% |

| Total Advisory Fees Paid | $9,325,543 |

What did the Fund invest in? (as a % of total net assets)

| Bayer AG | 4.0% |

| CNH Industrial NV | 3.8% |

| Mercedes-Benz Group AG | 3.5% |

| Alphabet, Inc., Class A | 3.1% |

| Kering SA | 3.1% |

| IQVIA Holdings, Inc. | 3.0% |

| Centene Corp. | 3.0% |

| Interpublic Group of Cos., Inc. | 3.0% |

| Corebridge Financial, Inc. | 2.9% |

| Capital One Financial Corp. | 2.8% |

| United States | 54.2% |

| Germany | 10.8% |

| United Kingdom | 8.4% |

| Switzerland | 8.0% |

| France | 5.1% |

| Netherlands | 3.9% |

| Ireland | 3.1% |

| China | 2.0% |

| South Korea | 2.0% |

| Belgium | 1.7% |

| Other | 0.3% |

| Other Assets and Liabilities, Net | 0.5% |

| Total | 100.0% |

| Financials | 28.9% |

| Health Care | 17.1% |

| Consumer Discretionary | 16.7% |

| Communication Services | 9.5% |

| Industrials | 8.0% |

| Information Technology | 5.8% |

| Consumer Staples | 5.0% |

| Materials | 4.0% |

| Energy | 1.7% |

| Short Term Investments & Other, Net | 3.3% |

| Total | 100.0% |

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, scan the QR code or visit oakmark.com/our-funds/?tab=documents.

Phone: 1-800-OAKMARK (625-6275)

You may have consented to receive one shareholder report at your address if you and one or more individuals in your home have an account with the Fund (householding). If you wish to receive individual copies of your shareholder report, contact + 1-800-OAKMARK (625-6275) or contact your intermediary.

Annual Shareholder Report

September 30, 2024

Annual Shareholder Report

September 30, 2024

This annual shareholder report contains important information about Oakmark Global Fund (the "Fund") for the period of October 1, 2023 to September 30, 2024.You can find additional information about the Fund at: oakmark.com/our-funds/?tab=documents. You can also request this information without charge by contacting us at 1-800-OAKMARK (625-6275) or contacting your intermediary.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| R6 | $93 | 0.86% |

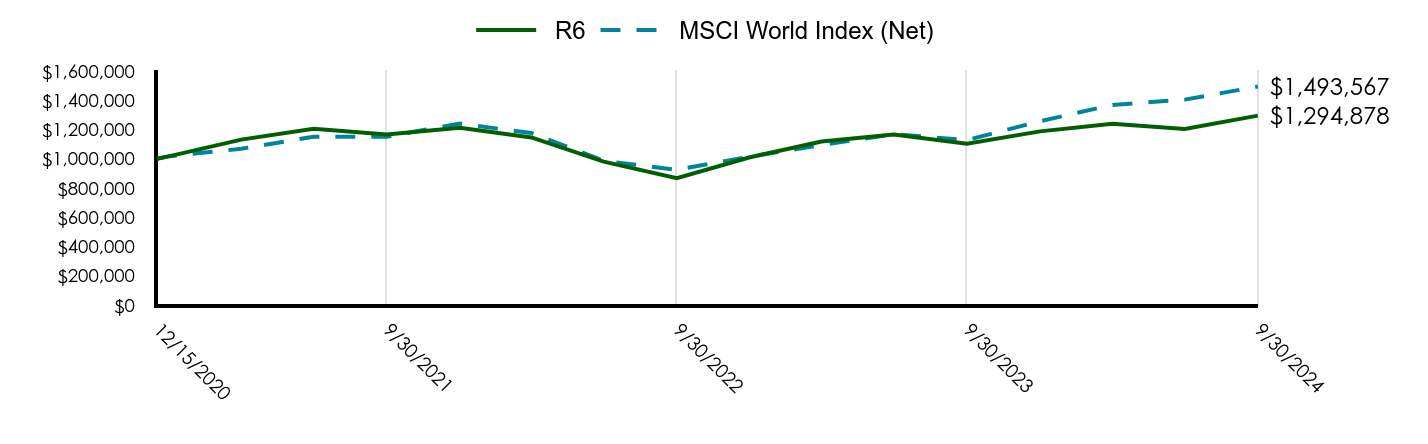

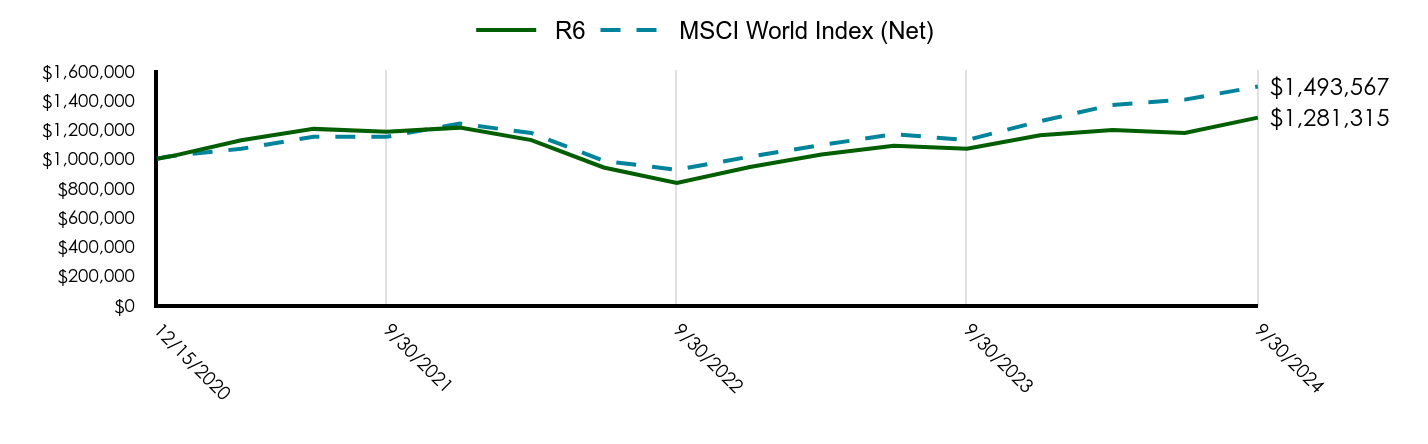

How did the Fund perform last year and what affected its performance?

Oakmark Global Fund R6 returned 17.37% for the fiscal year ended September 30, 2024, underperforming its benchmark, the MSCI World Index, which returned 32.43% over the same period.

The Fund’s exposure to the United States and United Kingdom contributed most to returns, while exposure to France and South Korea detracted most from returns.

At the equity sector level Financials and Consumer Discretionary performed the strongest, while Energy and Communication Services were the worst performing sectors.

At the equity holdings level, Lloyds Banking Group (U.K.) led the positive contributors followed by Capital One Financial (U.S.) and Fiserv (U.S.). Kering (France), Charter Communications (U.S.) and Bayer (Germany) were the worst performing equities.

Total return based on $1,000,000 investment (as of September 30, 2024)

| R6 | MSCI World Index (Net) |

|---|

| 12/15/2020 | $1,000,000 | $1,000,000 |

| 12/31/2020 | $1,018,164 | $1,018,000 |

| 3/31/2021 | $1,130,975 | $1,068,102 |

| 6/30/2021 | $1,205,226 | $1,150,818 |

| 9/30/2021 | $1,165,711 | $1,150,736 |

| 12/31/2021 | $1,212,122 | $1,240,100 |

| 3/31/2022 | $1,145,676 | $1,176,197 |

| 6/30/2022 | $980,609 | $985,812 |

| 9/30/2022 | $867,650 | $924,814 |

| 12/31/2022 | $1,010,348 | $1,015,126 |

| 3/31/2023 | $1,117,742 | $1,093,603 |

| 6/30/2023 | $1,166,140 | $1,168,290 |

| 9/30/2023 | $1,103,258 | $1,127,846 |

| 12/31/2023 | $1,187,279 | $1,256,595 |

| 3/31/2024 | $1,240,154 | $1,368,189 |

| 6/30/2024 | $1,203,179 | $1,404,193 |

| 9/30/2024 | $1,294,878 | $1,493,567 |

Average annual total returns (%)

| Fund | 1 Year | Since Inception 12/15/20 |

|---|

| R6 | 17.37% | 7.05% |

| MSCI World Index (Net) | 32.43% | 11.16% |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results. To obtain the most recent month-end performance, please visit oakmark.com/our-funds/?tab=documents.

| Total Net Assets | $1,174,155,547 |

| # of Portfolio Holdings | 47 |

| Portfolio Turnover Rate | 48% |

| Total Advisory Fees Paid | $9,325,543 |

What did the Fund invest in? (as a % of total net assets)

| Bayer AG | 4.0% |

| CNH Industrial NV | 3.8% |

| Mercedes-Benz Group AG | 3.5% |

| Alphabet, Inc., Class A | 3.1% |

| Kering SA | 3.1% |

| IQVIA Holdings, Inc. | 3.0% |

| Centene Corp. | 3.0% |

| Interpublic Group of Cos., Inc. | 3.0% |

| Corebridge Financial, Inc. | 2.9% |

| Capital One Financial Corp. | 2.8% |

| United States | 54.2% |

| Germany | 10.8% |

| United Kingdom | 8.4% |

| Switzerland | 8.0% |

| France | 5.1% |

| Netherlands | 3.9% |

| Ireland | 3.1% |

| China | 2.0% |

| South Korea | 2.0% |

| Belgium | 1.7% |

| Other | 0.3% |

| Other Assets and Liabilities, Net | 0.5% |

| Total | 100.0% |

| Financials | 28.9% |

| Health Care | 17.1% |

| Consumer Discretionary | 16.7% |

| Communication Services | 9.5% |

| Industrials | 8.0% |

| Information Technology | 5.8% |

| Consumer Staples | 5.0% |

| Materials | 4.0% |

| Energy | 1.7% |

| Short Term Investments & Other, Net | 3.3% |

| Total | 100.0% |

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, scan the QR code or visit oakmark.com/our-funds/?tab=documents.

Phone: 1-800-OAKMARK (625-6275)

You may have consented to receive one shareholder report at your address if you and one or more individuals in your home have an account with the Fund (householding). If you wish to receive individual copies of your shareholder report, contact + 1-800-OAKMARK (625-6275) or contact your intermediary.

Annual Shareholder Report

September 30, 2024

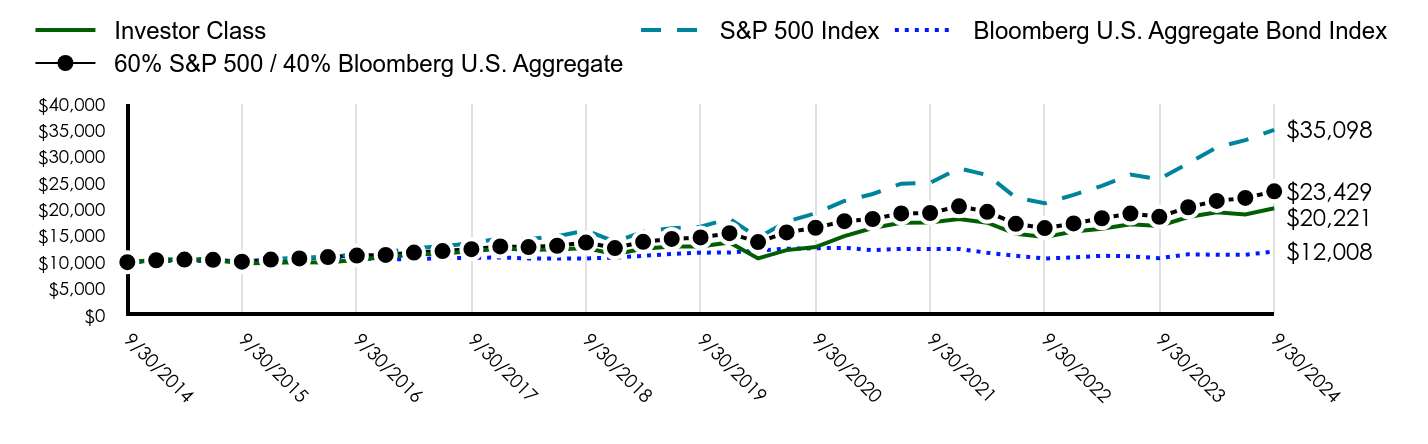

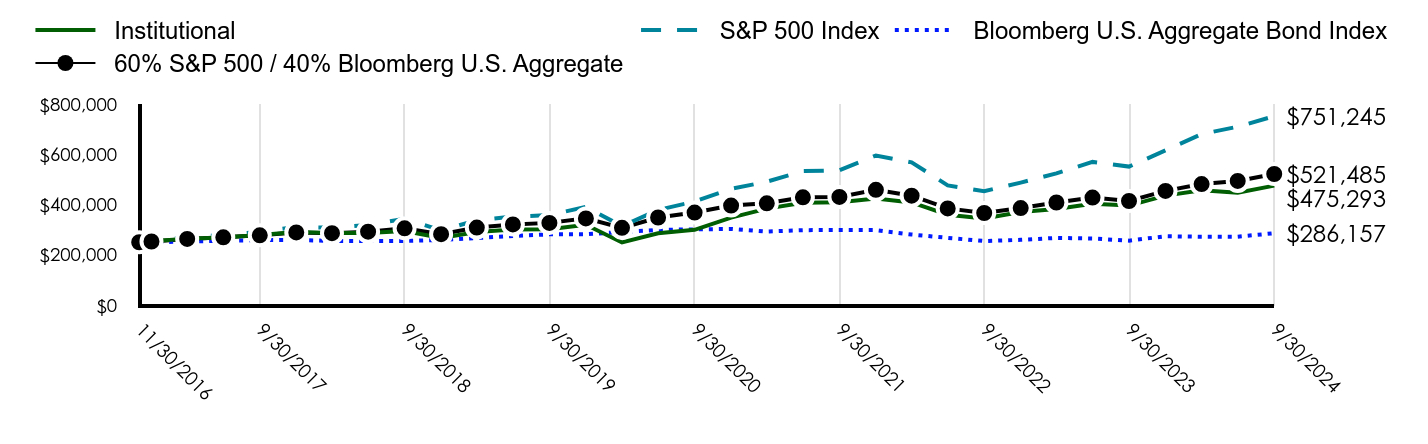

Oakmark Equity and Income Fund

Annual Shareholder Report

September 30, 2024

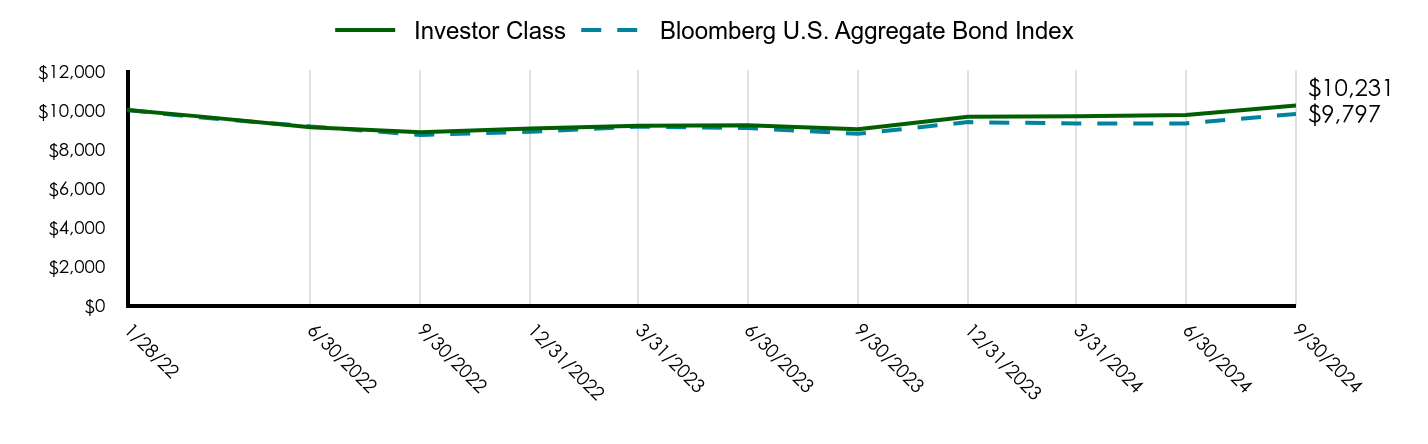

This annual shareholder report contains important information about Oakmark Equity and Income Fund (the "Fund") for the period of October 1, 2023 to September 30, 2024.You can find additional information about the Fund at: oakmark.com/our-funds/?tab=documents. You can also request this information without charge by contacting us at 1-800-OAKMARK (625-6275) or contacting your intermediary.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor Class | $93 | 0.85% |

How did the Fund perform last year and what affected its performance?

Oakmark Equity and Income Fund Investor Class returned 19.78% for the fiscal year ended September 30, 2024, underperforming its benchmark, the S&P 500 Index, which returned 36.35% over the same period.

At the equity sector level Financials and Industrials performed the strongest, while Communication Services and Energy were the worst performing sectors.

At the equity holdings level, Fiserv led the positive contributors followed by Bank of America and KKR. Charter Communications, Warner Bros. Discovery, and BorgWarner were the worst performing equities.

Fixed income securities contributed to absolute returns during the year.

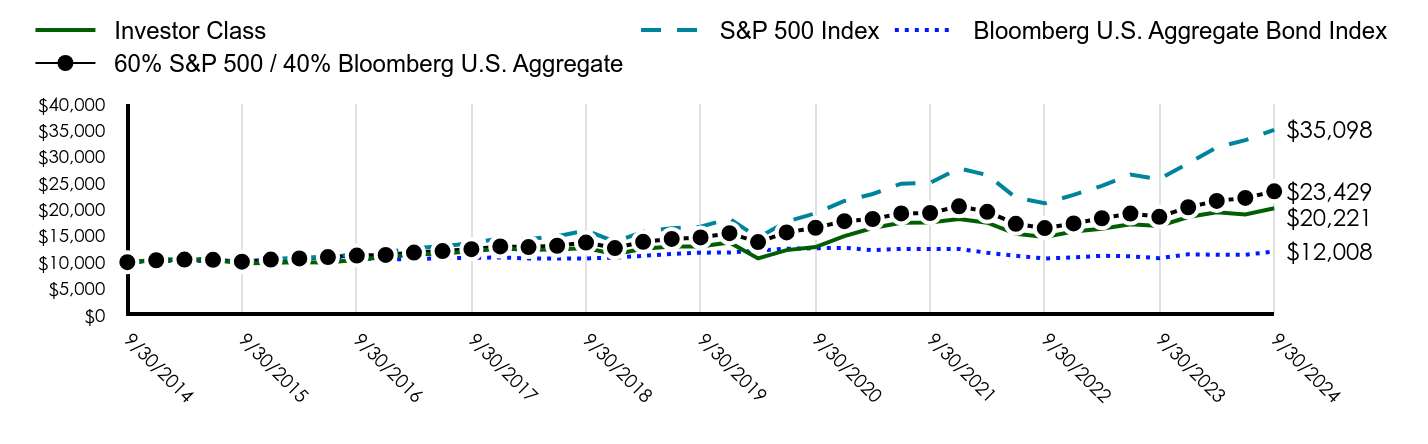

Total return based on $10,000 investment (as of September 30, 2024)

| Investor Class | S&P 500 Index | Bloomberg U.S. Aggregate Bond Index | 60% S&P 500 / 40% Bloomberg U.S. Aggregate |

|---|

| 9/30/2014 | $10,000 | $10,000 | $10,000 | $10,000 |

| 12/31/2014 | $10,375 | $10,493 | $10,179 | $10,367 |

| 3/31/2015 | $10,469 | $10,593 | $10,343 | $10,502 |

| 6/30/2015 | $10,476 | $10,622 | $10,169 | $10,448 |

| 9/30/2015 | $9,747 | $9,939 | $10,294 | $10,094 |

| 12/31/2015 | $9,898 | $10,638 | $10,236 | $10,499 |

| 3/31/2016 | $9,974 | $10,782 | $10,546 | $10,720 |

| 6/30/2016 | $9,933 | $11,047 | $10,779 | $10,974 |

| 9/30/2016 | $10,463 | $11,472 | $10,828 | $11,248 |

| 12/31/2016 | $10,984 | $11,911 | $10,506 | $11,371 |

| 3/31/2017 | $11,439 | $12,633 | $10,592 | $11,821 |

| 6/30/2017 | $11,634 | $13,023 | $10,745 | $12,108 |

| 9/30/2017 | $12,063 | $13,607 | $10,837 | $12,473 |

| 12/31/2017 | $12,572 | $14,511 | $10,879 | $12,987 |

| 3/31/2018 | $12,369 | $14,401 | $10,720 | $12,861 |

| 6/30/2018 | $12,397 | $14,896 | $10,703 | $13,117 |

| 9/30/2018 | $12,701 | $16,044 | $10,705 | $13,719 |

| 12/31/2018 | $11,525 | $13,875 | $10,881 | $12,682 |

| 3/31/2019 | $12,537 | $15,769 | $11,201 | $13,863 |

| 6/30/2019 | $12,970 | $16,447 | $11,546 | $14,412 |

| 9/30/2019 | $12,992 | $16,727 | $11,808 | $14,694 |

| 12/31/2019 | $13,750 | $18,244 | $11,829 | $15,497 |

| 3/31/2020 | $10,721 | $14,668 | $12,201 | $13,811 |

| 6/30/2020 | $12,289 | $17,682 | $12,555 | $15,650 |

| 9/30/2020 | $12,875 | $19,260 | $12,633 | $16,533 |

| 12/31/2020 | $14,944 | $21,600 | $12,718 | $17,779 |

| 3/31/2021 | $16,476 | $22,934 | $12,289 | $18,190 |

| 6/30/2021 | $17,466 | $24,895 | $12,514 | $19,252 |

| 9/30/2021 | $17,535 | $25,040 | $12,520 | $19,329 |

| 12/31/2021 | $18,165 | $27,801 | $12,522 | $20,599 |

| 3/31/2022 | $17,486 | $26,522 | $11,779 | $19,555 |

| 6/30/2022 | $15,377 | $22,252 | $11,227 | $17,281 |

| 9/30/2022 | $14,757 | $21,165 | $10,693 | $16,460 |

| 12/31/2022 | $15,818 | $22,766 | $10,893 | $17,347 |

| 3/31/2023 | $16,334 | $24,473 | $11,216 | $18,331 |

| 6/30/2023 | $17,205 | $26,612 | $11,122 | $19,222 |

| 9/30/2023 | $16,882 | $25,741 | $10,762 | $18,599 |

| 12/31/2023 | $18,561 | $28,750 | $11,496 | $20,410 |

| 3/31/2024 | $19,474 | $31,785 | $11,407 | $21,623 |

| 6/30/2024 | $19,047 | $33,147 | $11,415 | $22,185 |

| 9/30/2024 | $20,221 | $35,098 | $12,008 | $23,429 |

Average annual total returns (%)

| Fund | 1 Year | 5 Years | 10 Years |

|---|

| Investor Class | 19.78% | 9.25% | 7.30% |

| S&P 500 Index | 36.35% | 15.98% | 13.38% |

| Bloomberg U.S. Aggregate Bond Index | 11.57% | 0.33% | 1.84% |

| 60% S&P 500 / 40% Bloomberg U.S. Aggregate | 25.98% | 9.78% | 8.89% |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results. To obtain the most recent month-end performance, please visit oakmark.com/our-funds/?tab=documents.

| Total Net Assets | $6,545,850,138 |

| # of Portfolio Holdings | 259 |

| Portfolio Turnover Rate | 38% |

| Total Advisory Fees Paid | $33,797,093 |

What did the Fund invest in? (as a % of total net assets)

| U.S. Treasury Notes, 2.875%, due 05/15/32 | 3.2% |

| Alphabet, Inc., Class A | 3.0% |

| Fiserv, Inc. | 2.6% |

| Glencore PLC | 2.0% |

| IQVIA Holdings, Inc. | 1.9% |

| Centene Corp. | 1.9% |

| Charles Schwab Corp. | 1.8% |

| Deere & Co. | 1.8% |

| Charter Communications, Inc., Class A | 1.7% |

| American International Group, Inc. | 1.7% |

| Common Stocks | 60.1% |

| Corporate Bonds | 16.5% |

| Government and Agency Securities | 8.0% |

| Mortgage-Backed Securities | 4.3% |

| Asset Backed Securities | 3.8% |

| Collateralized Mortgage Obligations | 3.1% |

| Bank Loans | 2.1% |

| Short-Term Investments | 1.8% |

| Convertible Bond | 0.2% |

| Preferred Stocks | 0.1% |

| Total | 100.0% |

| Financials | 36.7% |

| Consumer Discretionary | 12.4% |

| Communication Services | 9.3% |

| Industrials | 8.1% |

| U.S. Government | 8.0% |

| Health Care | 7.2% |

| Materials | 4.3% |

| Energy | 4.2% |

| Consumer Staples | 3.8% |

| Real Estate | 2.0% |

| Information Technology | 2.0% |

| Utilities | 0.2% |

| Short Term Investments & Other, Net | 1.8% |

| Total | 100.0% |

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, scan the QR code or visit oakmark.com/our-funds/?tab=documents.

Phone: 1-800-OAKMARK (625-6275)

You may have consented to receive one shareholder report at your address if you and one or more individuals in your home have an account with the Fund (householding). If you wish to receive individual copies of your shareholder report, contact + 1-800-OAKMARK (625-6275) or contact your intermediary.

Oakmark Equity and Income Fund

Annual Shareholder Report

September 30, 2024

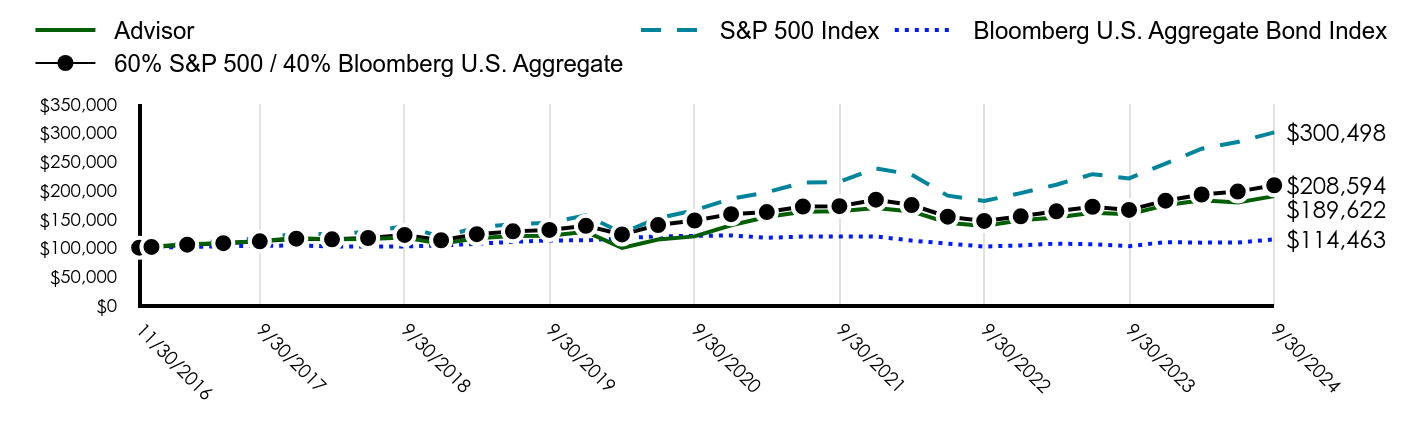

Oakmark Equity and Income Fund

Annual Shareholder Report

September 30, 2024

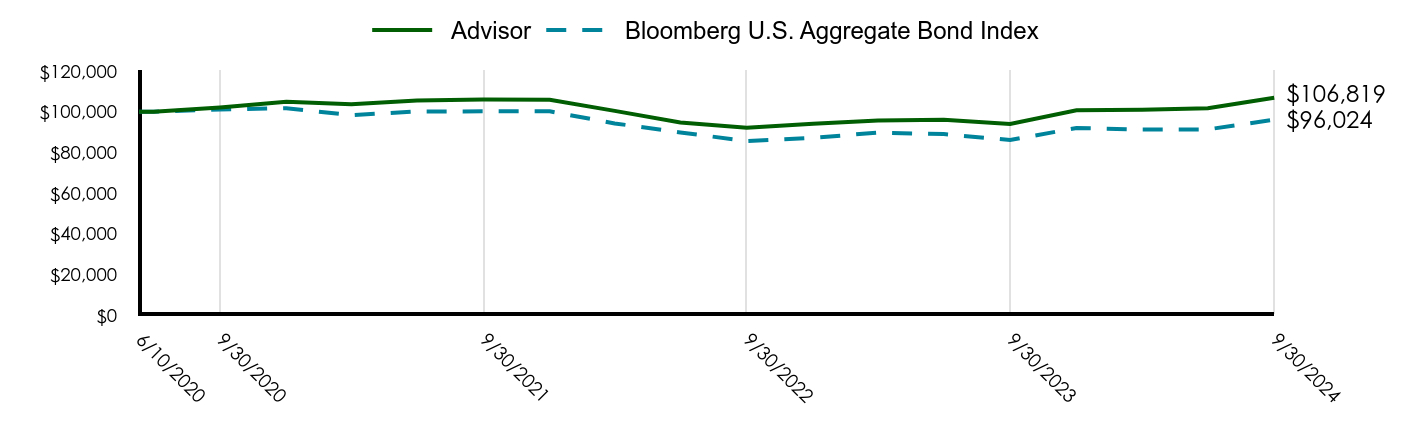

This annual shareholder report contains important information about Oakmark Equity and Income Fund (the "Fund") for the period of October 1, 2023 to September 30, 2024.You can find additional information about the Fund at: oakmark.com/our-funds/?tab=documents. You can also request this information without charge by contacting us at 1-800-OAKMARK (625-6275) or contacting your intermediary.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Advisor Class | $68 | 0.62% |

How did the Fund perform last year and what affected its performance?

Oakmark Equity and Income Fund Advisor returned 20.06% for the fiscal year ended September 30, 2024, underperforming its benchmark, the S&P 500 Index, which returned 36.35% over the same period.

At the equity sector level Financials and Industrials performed the strongest, while Communication Services and Energy were the worst performing sectors.

At the equity holdings level, Fiserv led the positive contributors followed by Bank of America and KKR. Charter Communications, Warner Bros. Discovery, and BorgWarner were the worst performing equities.

Fixed income securities contributed to absolute returns during the year.

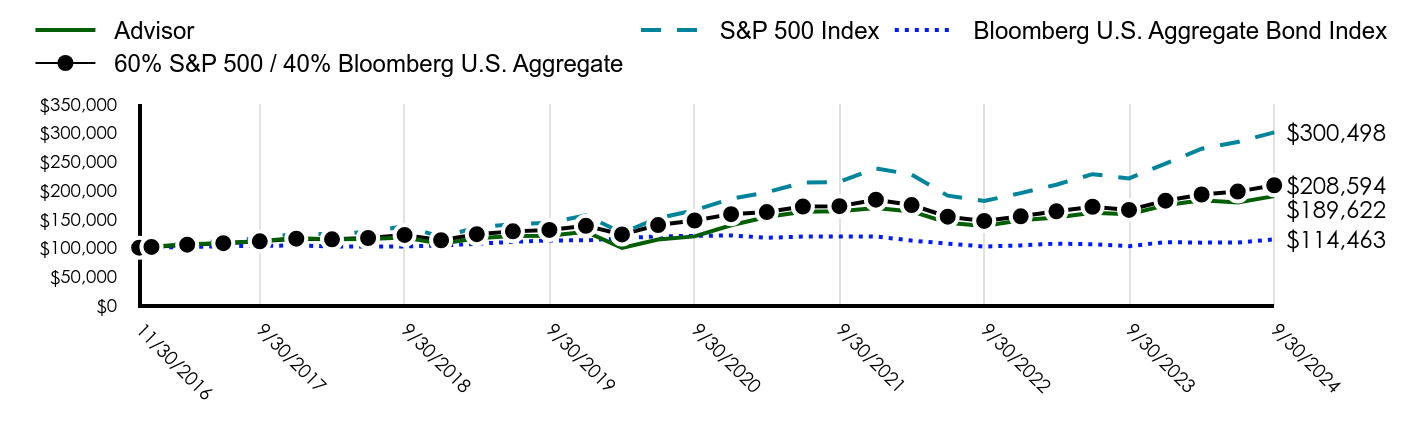

Total return based on $100,000 investment (as of September 30, 2024)

| Advisor | S&P 500 Index | Bloomberg U.S. Aggregate Bond Index | 60% S&P 500 / 40% Bloomberg U.S. Aggregate |

|---|

| 11/30/2016 | $100,000 | $100,000 | $100,000 | $100,000 |

| 12/31/2016 | $101,535 | $101,977 | $100,140 | $101,240 |

| 3/31/2017 | $105,772 | $108,163 | $100,961 | $105,239 |

| 6/30/2017 | $107,608 | $111,503 | $102,425 | $107,796 |

| 9/30/2017 | $111,645 | $116,499 | $103,296 | $111,052 |

| 12/31/2017 | $116,396 | $124,240 | $103,699 | $115,627 |

| 3/31/2018 | $114,552 | $123,297 | $102,185 | $114,505 |

| 6/30/2018 | $114,878 | $127,530 | $102,021 | $116,784 |

| 9/30/2018 | $117,698 | $137,364 | $102,041 | $122,145 |

| 12/31/2018 | $106,853 | $118,793 | $103,715 | $112,910 |

| 3/31/2019 | $116,318 | $135,005 | $106,764 | $123,422 |

| 6/30/2019 | $120,334 | $140,816 | $110,052 | $128,310 |

| 9/30/2019 | $120,533 | $143,207 | $112,551 | $130,825 |

| 12/31/2019 | $127,614 | $156,196 | $112,753 | $137,968 |

| 3/31/2020 | $99,570 | $125,585 | $116,305 | $122,957 |

| 6/30/2020 | $114,135 | $151,384 | $119,678 | $139,335 |

| 9/30/2020 | $119,614 | $164,902 | $120,420 | $147,193 |

| 12/31/2020 | $138,899 | $184,934 | $121,227 | $158,292 |

| 3/31/2021 | $153,193 | $196,354 | $117,141 | $161,948 |

| 6/30/2021 | $162,540 | $213,140 | $119,285 | $171,406 |

| 9/30/2021 | $163,266 | $214,381 | $119,345 | $172,092 |

| 12/31/2021 | $169,175 | $238,021 | $119,357 | $183,398 |

| 3/31/2022 | $162,949 | $227,075 | $112,279 | $174,100 |

| 6/30/2022 | $143,433 | $190,513 | $107,013 | $153,852 |

| 9/30/2022 | $137,701 | $181,211 | $101,930 | $146,544 |

| 12/31/2022 | $147,688 | $194,913 | $103,836 | $154,443 |

| 3/31/2023 | $152,612 | $209,526 | $106,909 | $163,200 |

| 6/30/2023 | $160,854 | $227,843 | $106,011 | $171,131 |

| 9/30/2023 | $157,939 | $220,385 | $102,587 | $165,586 |

| 12/31/2023 | $173,742 | $246,151 | $109,584 | $181,715 |

| 3/31/2024 | $182,446 | $272,134 | $108,729 | $192,508 |

| 6/30/2024 | $178,549 | $283,792 | $108,805 | $197,514 |

| 9/30/2024 | $189,622 | $300,498 | $114,463 | $208,594 |

Average annual total returns (%)

| Fund | 1 Year | 5 Years | Since Inception 11/30/16 |

|---|

| Advisor | 20.06% | 9.49% | 8.51% |

| S&P 500 Index | 36.35% | 15.98% | 15.08% |

| Bloomberg U.S. Aggregate Bond Index | 11.57% | 0.33% | 1.73% |

| 60% S&P 500 / 40% Bloomberg U.S. Aggregate | 25.98% | 9.78% | 9.84% |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results. To obtain the most recent month-end performance, please visit oakmark.com/our-funds/?tab=documents.

| Total Net Assets | $6,545,850,138 |

| # of Portfolio Holdings | 259 |

| Portfolio Turnover Rate | 38% |

| Total Advisory Fees Paid | $33,797,093 |

What did the Fund invest in? (as a % of total net assets)

| U.S. Treasury Notes, 2.875%, due 05/15/32 | 3.2% |

| Alphabet, Inc., Class A | 3.0% |

| Fiserv, Inc. | 2.6% |

| Glencore PLC | 2.0% |

| IQVIA Holdings, Inc. | 1.9% |

| Centene Corp. | 1.9% |

| Charles Schwab Corp. | 1.8% |

| Deere & Co. | 1.8% |

| Charter Communications, Inc., Class A | 1.7% |

| American International Group, Inc. | 1.7% |

| Common Stocks | 60.1% |

| Corporate Bonds | 16.5% |

| Government and Agency Securities | 8.0% |

| Mortgage-Backed Securities | 4.3% |

| Asset Backed Securities | 3.8% |

| Collateralized Mortgage Obligations | 3.1% |

| Bank Loans | 2.1% |

| Short-Term Investments | 1.8% |

| Convertible Bond | 0.2% |

| Preferred Stocks | 0.1% |

| Total | 100.0% |

| Financials | 36.7% |

| Consumer Discretionary | 12.4% |

| Communication Services | 9.3% |

| Industrials | 8.1% |

| U.S. Government | 8.0% |

| Health Care | 7.2% |

| Materials | 4.3% |

| Energy | 4.2% |

| Consumer Staples | 3.8% |

| Real Estate | 2.0% |

| Information Technology | 2.0% |

| Utilities | 0.2% |

| Short Term Investments & Other, Net | 1.8% |

| Total | 100.0% |

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, scan the QR code or visit oakmark.com/our-funds/?tab=documents.

Phone: 1-800-OAKMARK (625-6275)

You may have consented to receive one shareholder report at your address if you and one or more individuals in your home have an account with the Fund (householding). If you wish to receive individual copies of your shareholder report, contact + 1-800-OAKMARK (625-6275) or contact your intermediary.

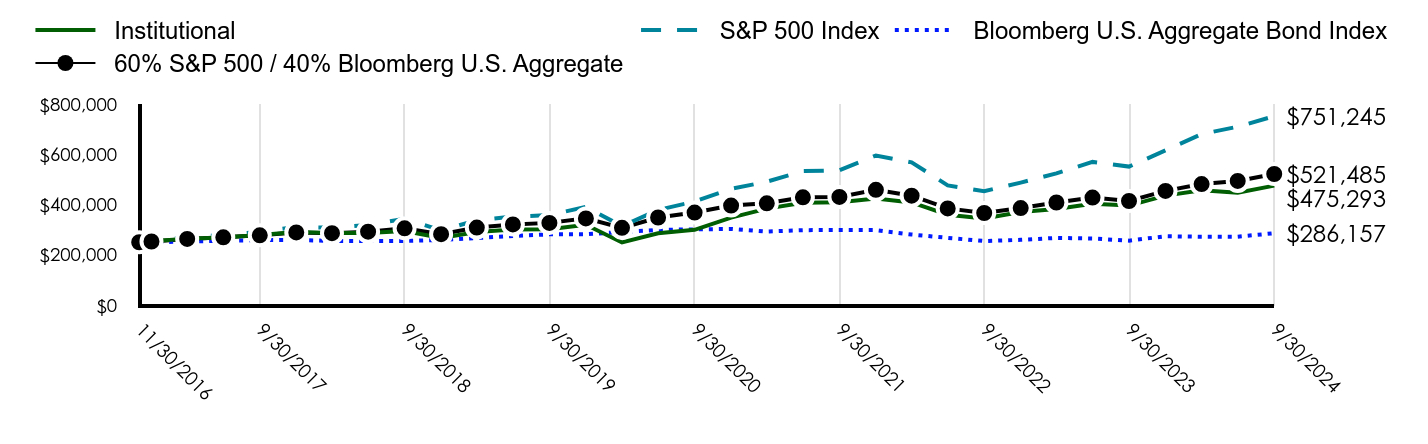

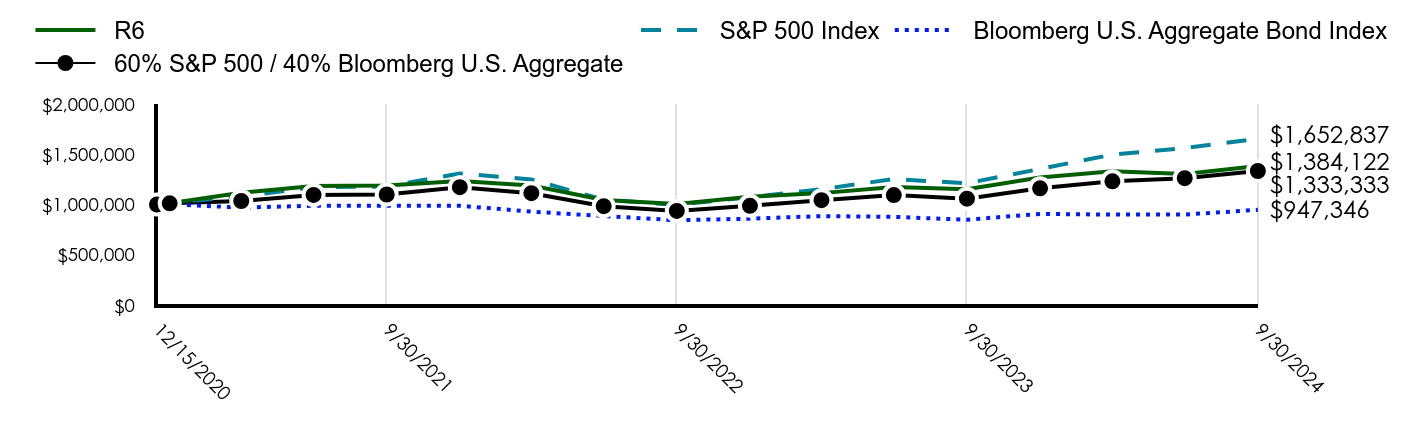

Oakmark Equity and Income Fund

Annual Shareholder Report

September 30, 2024

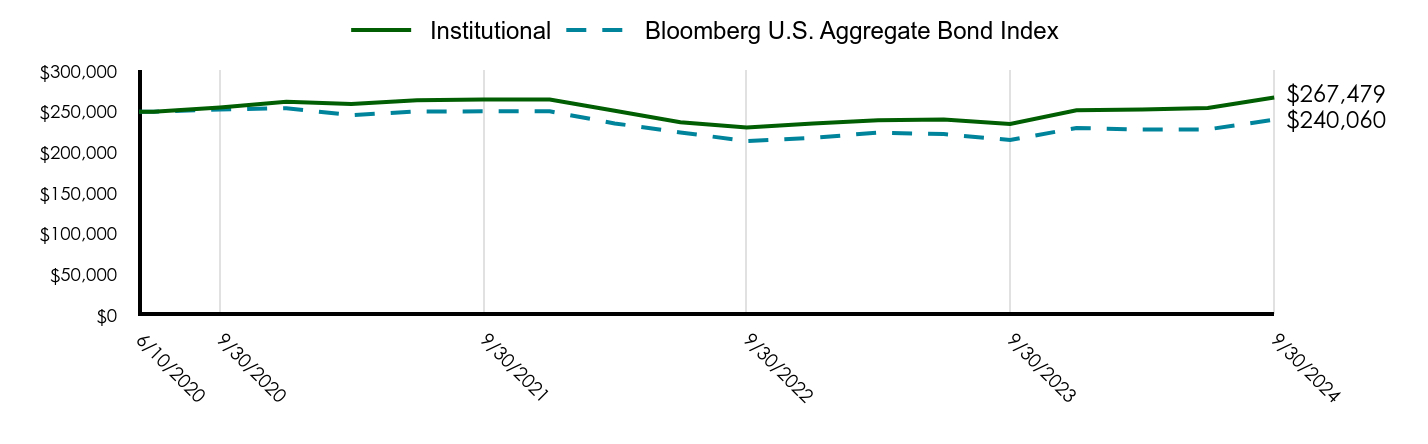

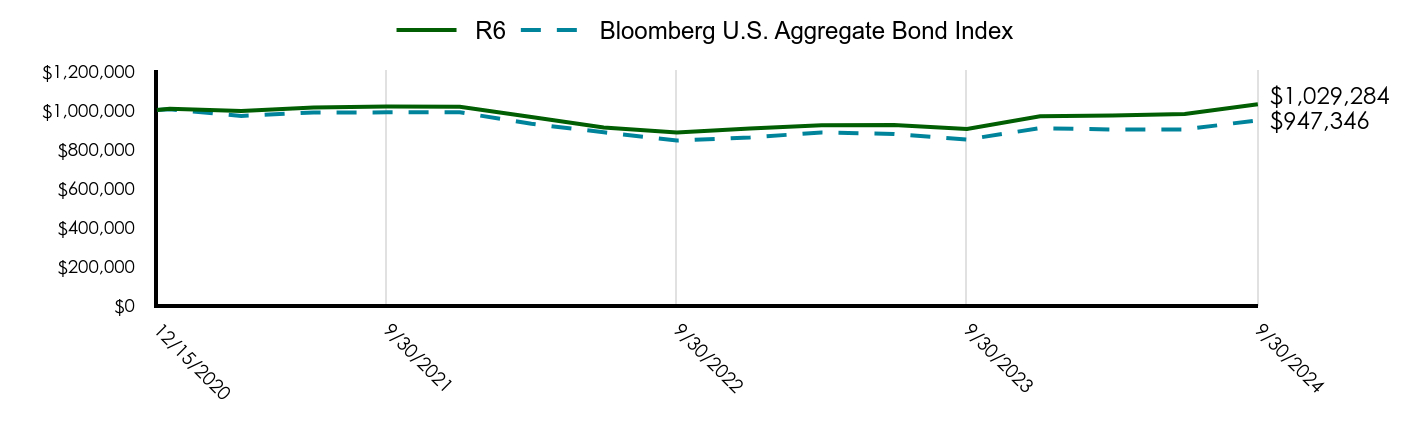

Oakmark Equity and Income Fund

Annual Shareholder Report

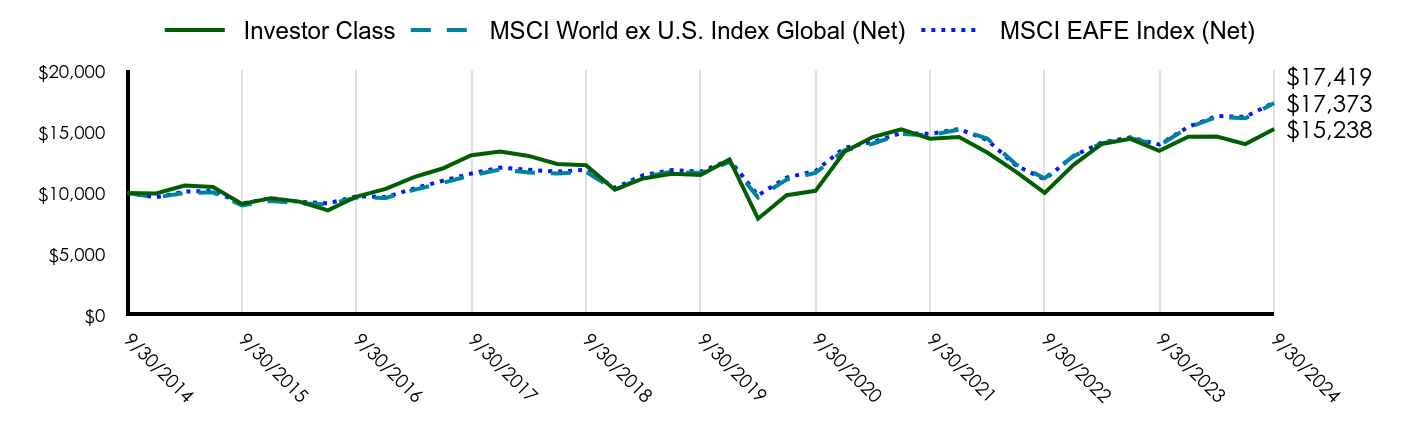

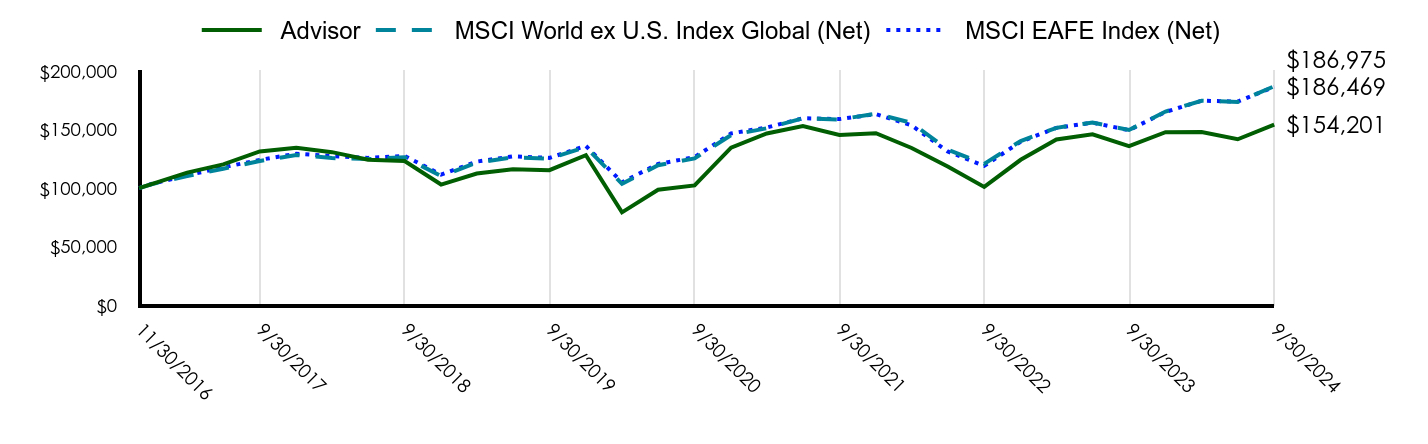

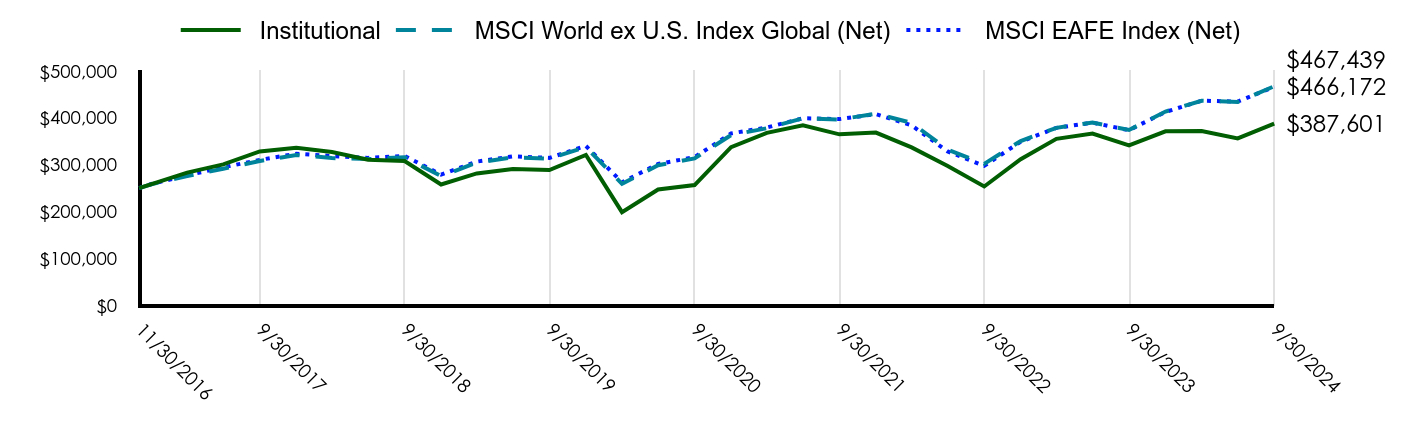

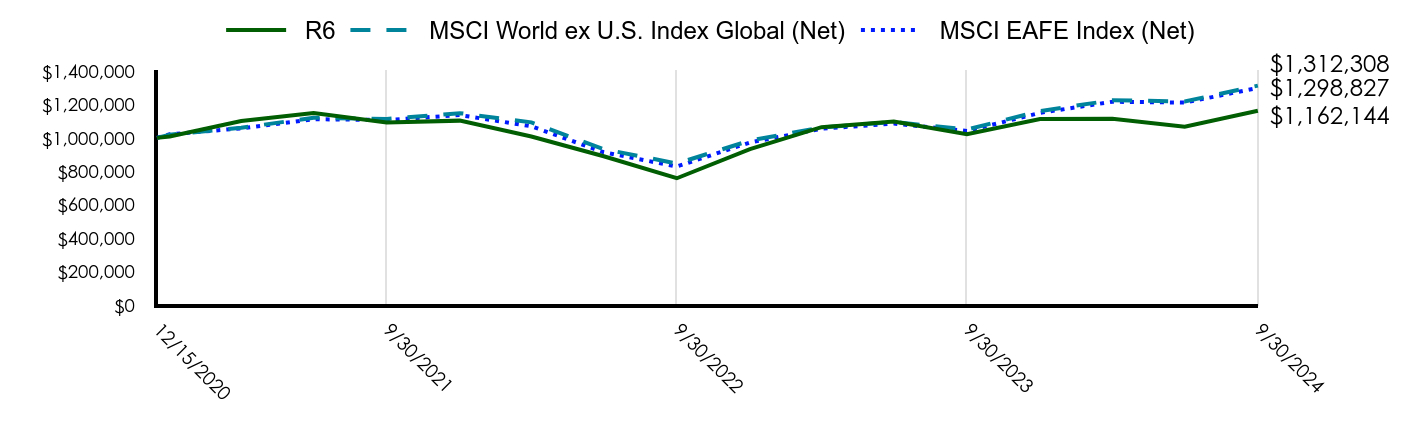

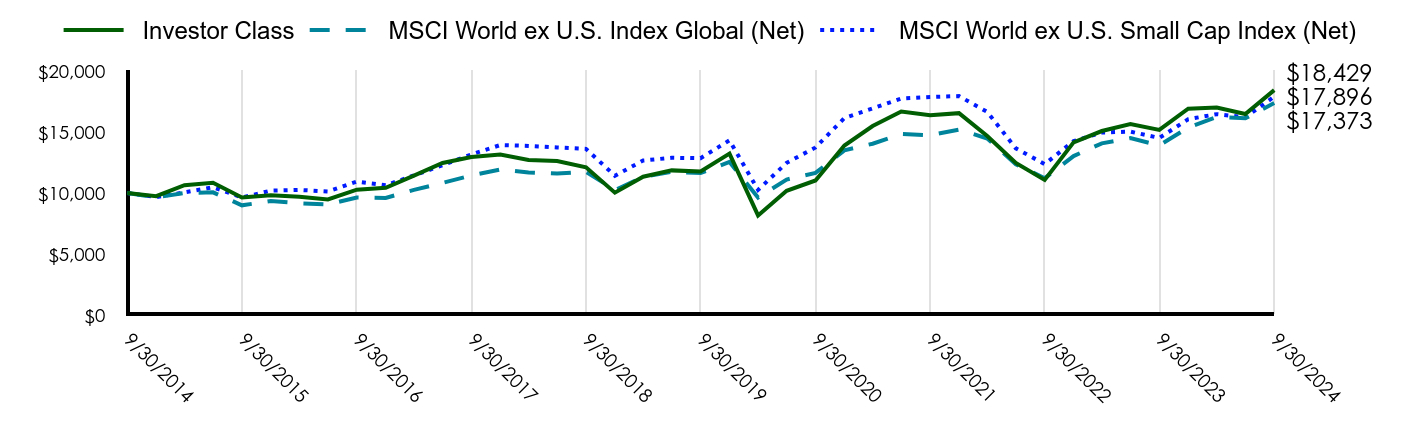

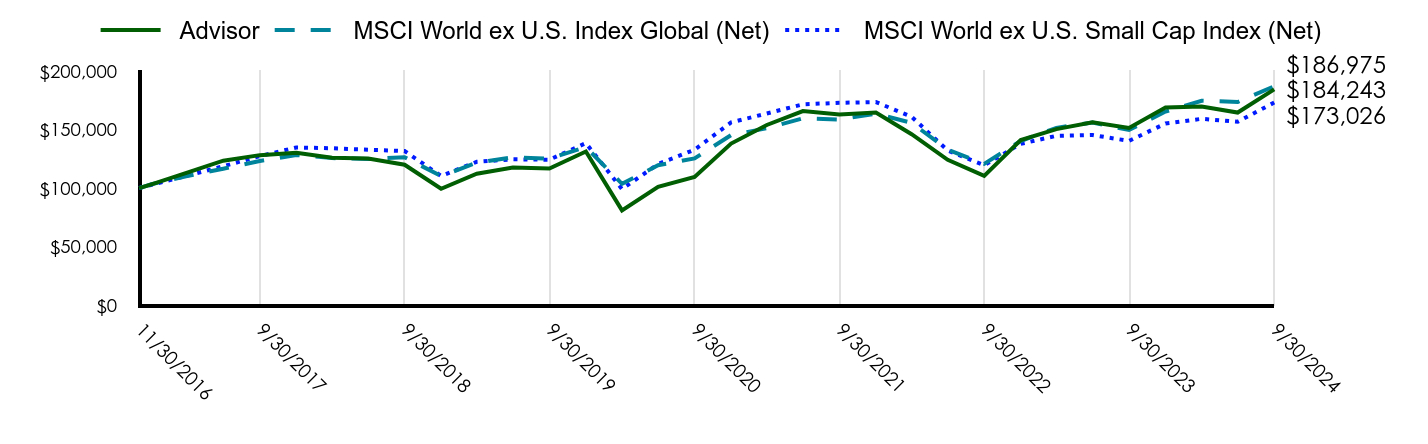

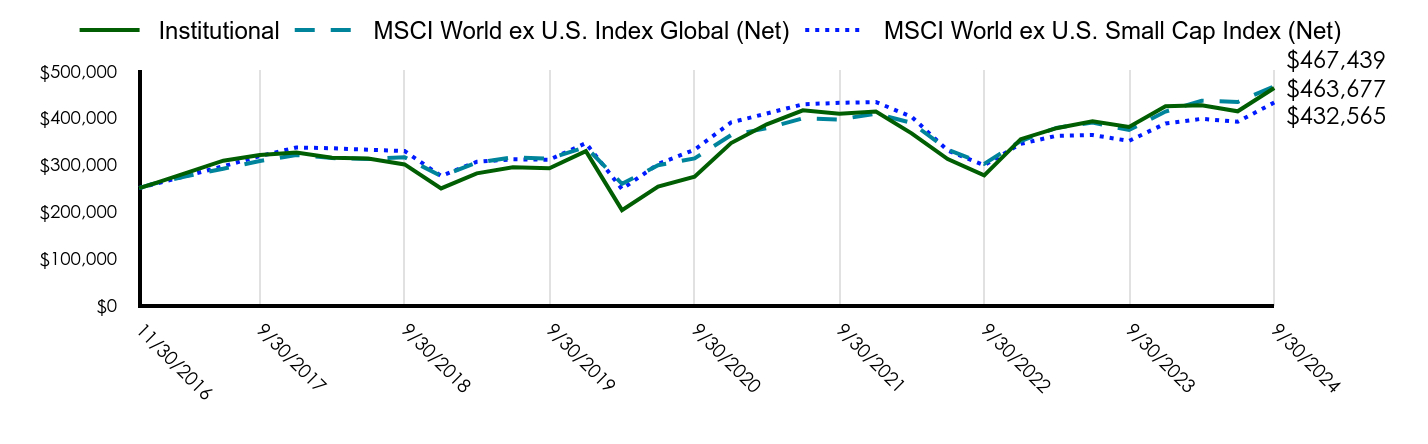

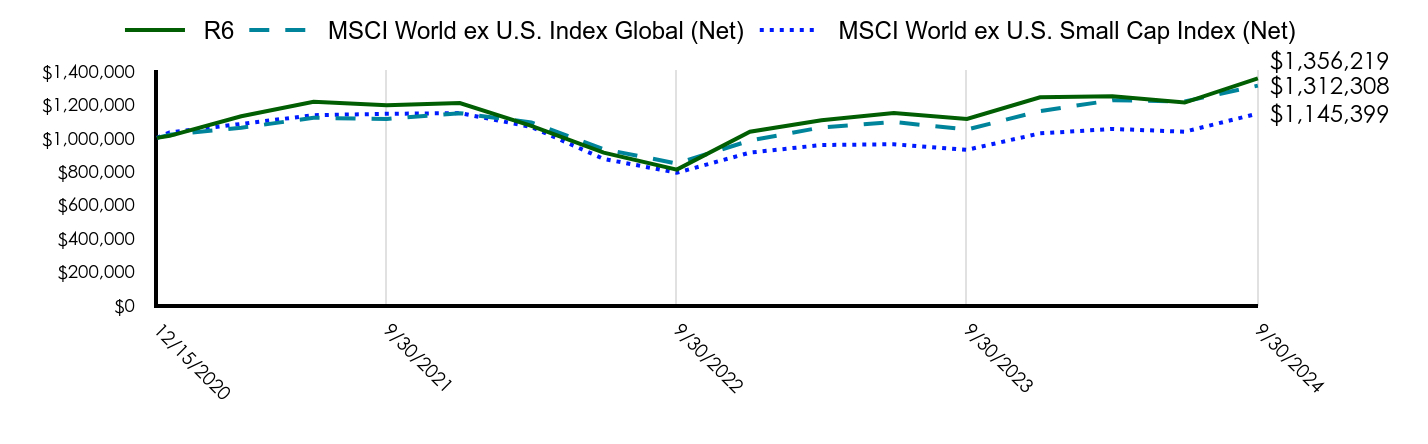

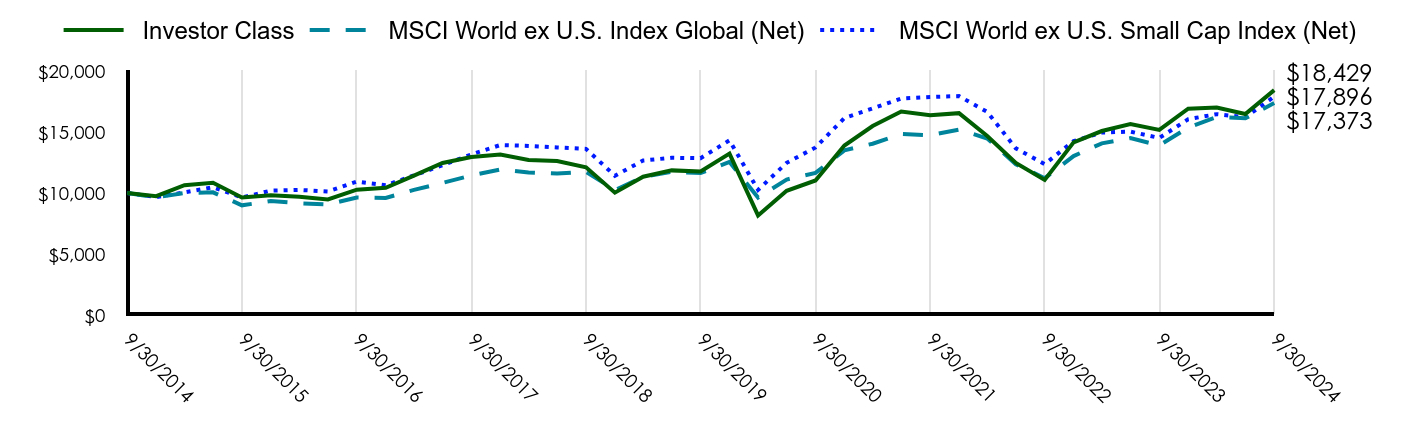

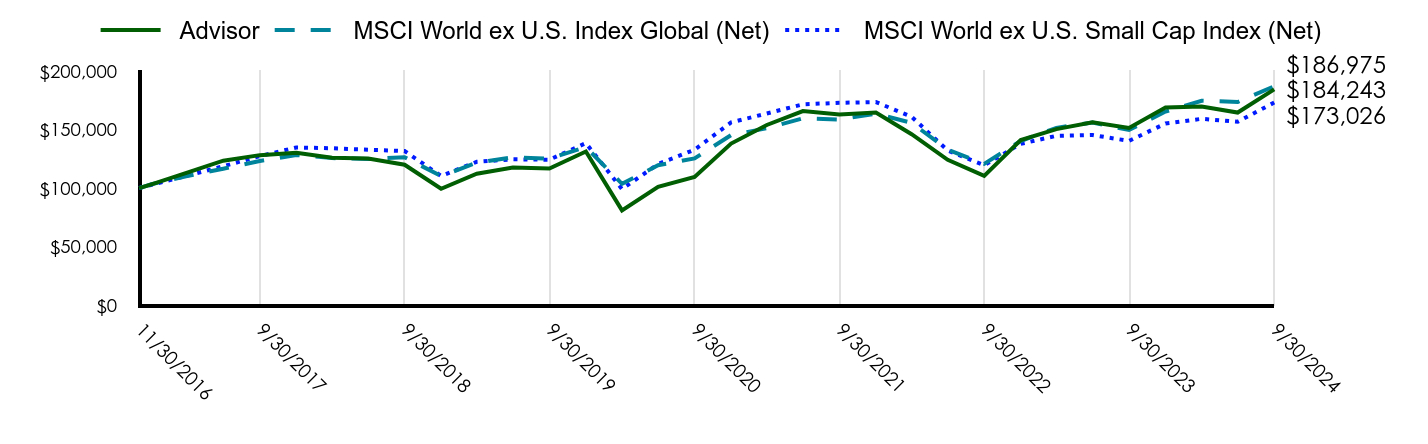

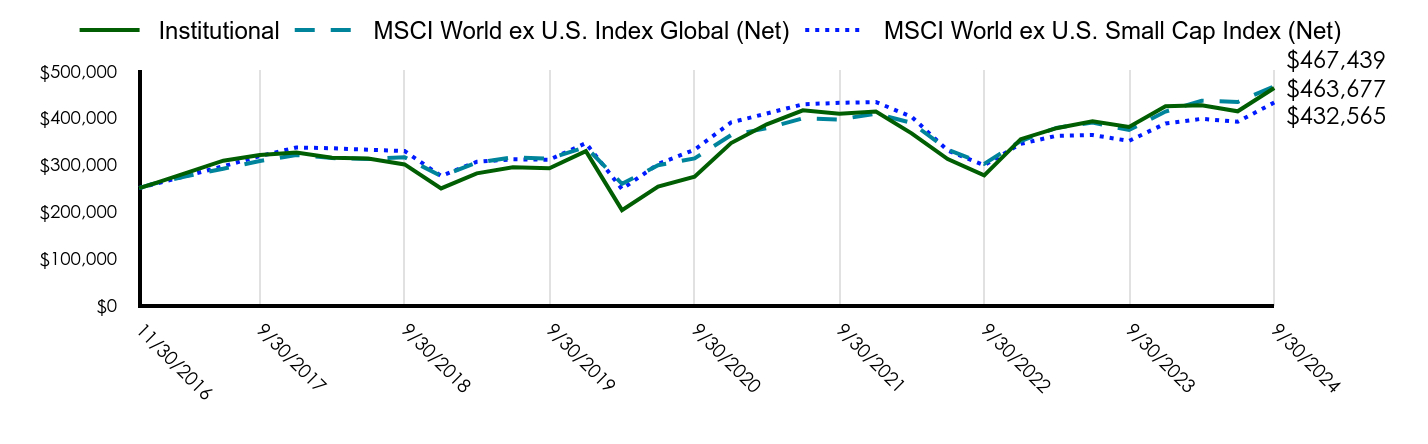

September 30, 2024