UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06279

Harris Associates Investment Trust

(Exact name of Registrant as specified in charter)

111 South Wacker Drive, Suite 4600

Chicago, Illinois 60606-4319

(Address of principal executive offices) (Zip code)

| Rana J. Wright Harris Associates L.P. 111 South Wacker Drive, Suite 4600 Chicago, Illinois 60606-4319 | Ndenisarya M. Bregasi, Esq. K&L Gates LLP 1601 K Street, N.W. Washington, D.C. 20006-1600 | |

(Name and address of agents for service)

Registrant's telephone number, including area code: (312) 646-3600

Date of fiscal year end: 09/30/23

Date of reporting period: 09/30/23

Item 1. Reports to Shareholders.

(a) Following is a copy of the annual report transmitted to shareholders pursuant to Rule 30e-1 under the Act.

OAKMARK FUNDS

ANNUAL REPORT | SEPTEMBER 30, 2023

OAKMARK FUND

OAKMARK SELECT FUND

OAKMARK GLOBAL FUND

OAKMARK GLOBAL SELECT FUND

OAKMARK INTERNATIONAL FUND

OAKMARK INTERNATIONAL SMALL CAP FUND

OAKMARK EQUITY AND INCOME FUND

OAKMARK BOND FUND

Oakmark Funds

2023 Annual Report

President's Letter | | | 1 | | |

Expense Example | | | 3 | | |

U.S. Equity Market Commentary | | | 4 | | |

Oakmark Fund | |

Summary Information | | | 6 | | |

Portfolio Manager Commentary | | | 7 | | |

Schedule of Investments | | | 9 | | |

Oakmark Select Fund | |

Summary Information | | | 12 | | |

Portfolio Manager Commentary | | | 13 | | |

Schedule of Investments | | | 14 | | |

Oakmark Global Fund | |

Summary Information | | | 16 | | |

Portfolio Manager Commentary | | | 17 | | |

Schedule of Investments | | | 19 | | |

Oakmark Global Select Fund | |

Summary Information | | | 22 | | |

Portfolio Manager Commentary | | | 23 | | |

Schedule of Investments | | | 25 | | |

International Equity Market Commentary | | | 26 | | |

Oakmark International Fund | |

Summary Information | | | 28 | | |

Portfolio Manager Commentary | | | 29 | | |

Schedule of Investments | | | 31 | | |

Oakmark International Small Cap Fund | |

Summary Information | | | 34 | | |

Portfolio Manager Commentary | | | 35 | | |

Schedule of Investments | | | 37 | | |

Fixed Income Market Commentary | | | 40 | | |

Oakmark Equity and Income Fund | |

Summary Information | | | 42 | | |

Portfolio Manager Commentary | | | 43 | | |

Schedule of Investments | | | 46 | | |

Oakmark Bond Fund | |

Summary Information | | | 54 | | |

Portfolio Manager Commentary | | | 55 | | |

Schedule of Investments | | | 56 | | |

Financial Statements | |

Statements of Assets and Liabilities | | | 61 | | |

Statements of Operations | | | 64 | | |

Statements of Changes in Net Assets | | | 67 | | |

Notes to Financial Statements | | | 83 | | |

Financial Highlights | | | 92 | | |

Report of Independent Registered Public Accounting Firm | | | 100 | | |

Liquidity Risk Management Program Disclosure | | | 102 | | |

Federal Tax Information | | | 103 | | |

Disclosures and Endnotes | | | 103 | | |

Trustees and Officers | | | 106 | | |

As permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Oakmark Funds' annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on Oakmark.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you hold your shares directly | |

with the Funds, by calling 1-800-OAKMARK (625-6275) or visiting Oakmark.com. | |

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you hold your shares directly with the Funds, you can call 1-800-OAKMARK (625-6275) to let the Funds know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Funds you hold directly or all Funds you hold through your financial intermediary, as applicable. | |

FORWARD-LOOKING STATEMENT DISCLOSURE

One of our most important responsibilities as mutual fund managers is to communicate with shareholders in an open and direct manner. Some of our comments in our letters to shareholders are based on current management expectations and are considered "forward-looking statements." Actual future results, however, may prove to be different from our expectations. You can identify forward-looking statements by words such as "estimate", "may", "will", "expect", "believe",

"plan" and other similar terms. We cannot promise future returns. Our opinions are a reflection of our best judgment at the time this report is compiled, and we disclaim any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise.

Oakmark.com

Oakmark Funds September 30, 2023

President's Letter

Rana J. Wright

President of Oakmark Funds

Dear Oakmark Funds' Shareholders,

Warm greetings to you from Chicago. We are pleased to report that all eight of the Oakmark Funds (the "Funds") delivered strong absolute performance and outperformed their respective style and broad market benchmarks for the fiscal year ended September 30, 2023. And while history demonstrates that markets and performance can be volatile over the short term, our shareholders' patience has been rewarded this fiscal year.

At Oakmark, we are long-term investors with a time horizon for our investments of three to five years. We know it can be frustrating to wait for the market to come around to our intrinsic value estimate of a company and we expect that wait can include periods of underperformance. In fact, many of the holdings that were large detractors from performance last year emerged this year as large contributors. We took advantage of the heightened market volatility over the past several years and when companies traded off due to short-term market concerns or style headwinds, we added them to the Funds' portfolios. We were rewarded for many of those investments this year. As we look forward, traditional value companies, both U.S. and international, seem particularly attractive to us at their current valuations. We continue to find interesting opportunities in undervalued areas of the market and we are confident in how the Funds are currently positioned. Even so, we remain vigilant as we look to the future while the companies in which we invest continue to come around to our intrinsic value estimates.

A Long-Term Approach to Talent Management

At Oakmark, we believe the true value of what we do is found in our people. The strength and depth of our investment teams are a hallmark of the Oakmark name. Just like

we take a long-term view with our investments, we also take a long-term and deliberate approach to preparing for changes in our investment teams. I'd like to highlight a few milestones for our teams and remind you of two investment team transitions for the Funds this year.

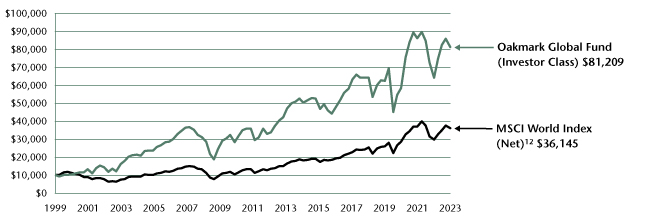

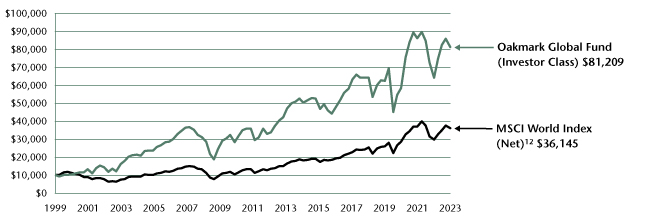

Portfolio Manager Clyde McGregor informed us that he will retire at the end of 2023. We celebrate Clyde's 40+ years of service to our firm and its clients. His positive impact has been enormous, and he has set a very high bar for others to follow. During his career, Clyde was instrumental in growing the Oakmark Funds from inception to more than $50 billion in assets today. Since the inception of the Oakmark Equity and Income Fund in 1995, the Fund has delivered 9.31% of annualized performance, outperforming the Lipper Balanced Fund Index1 return by 273 bps. Since the inception of the Oakmark Global Fund in 1999, the Fund has delivered annualized performance of 9.06%, outperforming the MSCI World benchmark by 360 bps. Clyde has been an integral leader on the investment teams, helping to cultivate and develop many investment analysts who have emerged as the next generation of leaders. In addition to his investment acumen, he's set an example of always putting clients first. We will miss him dearly and wish him some well-deserved relaxation during retirement.

In August 2022, we announced that Clyde would transition his portfolio management responsibilities in anticipation of his eventual retirement. As of December 31, 2023, Clyde's portfolio management responsibilities will cease for the Oakmark Global and Oakmark Equity and Income Funds and he will retire from Harris Associates. Successful investment team transitions are critical for our shareholders and Clyde leaves the Funds in the capable hands of his

1 The Lipper Balanced Fund Index measures the equal weighted performance of the 30 largest U.S. balanced funds as defined by Lipper. This index is unmanaged and investors cannot invest directly in this index.

See accompanying Disclosures and Endnotes on page 103.

Oakmark.com 1

Oakmark Funds September 30, 2023

President's Letter (continued)

co-portfolio managers. We have the upmost confidence in the abilities of David Herro, Tony Coniaris, Jason Long, Colin Hudson and John Sitarz for the Oakmark Global Fund and Colin Hudson, Adam Abbas, Michael Nicolas and Alex Fitch for the Oakmark Equity and Income Fund to continue to deliver excellent investment results for shareholders.

In August 2023, we announced the appointment of Eric Liu as co-portfolio manager of the Oakmark International Fund, alongside David Herro and Mike Manelli. Eric joined Harris Associates in 2009 and has served as a co-portfolio manager for the Oakmark Global Select Fund since 2016. His competitive drive and investment prowess have brought meaningful contributions to the success of the Funds over time, and we are delighted to have his specific talents on the Oakmark International Fund.

In addition to the investment team changes, I would like to recognize four of our portfolio managers who reached important work milestones this year.

• Bill Nygren celebrates his 40th year at the firm. Bill serves as a co-portfolio manager on the Oakmark, Oakmark Select and Oakmark Global Select Funds.

• Mike Nicolas celebrates his 10th year at the firm. Mike serves as a co-portfolio manager on the Oakmark and Oakmark Equity and Income Funds.

• John Sitarz celebrates his 10th year at the firm. John serves as a co-portfolio manager on the Oakmark Global and Oakmark Global Select Funds.

• Adam Abbas celebrates his 5th year at the firm. Adam serves as a co-portfolio manager on the Oakmark Bond and Oakmark Equity and Income Funds.

Across the Funds, the portfolio managers have an average of 24 years of investment experience with an average of 18 years at Harris Associates. We consider this a competitive advantage.

Oakmark Bond Fund Anniversary

This year commemorates the three-year anniversary of the Oakmark Bond Fund, our first solely dedicated fixed income product. We are pleased to announce that the Fund received its first Morningstar rating, and it was awarded the coveted 5 stars. The 5-star rating is reserved for funds per-

forming in the top 10% of their category. Congratulations on this great accomplishment to co-portfolio managers Adam Abbas and Colin Hudson, along with our entire fixed income team.

Personal Investment in the Funds

Each year, we share our level of personal investments in the Funds as a further demonstration of our belief in what we do at Harris Associates. For every holding in our portfolios, we look for management teams that think and act like owners of the business and treat their shareholders like partners. We stand beside you as fellow shareholders and have done so for years. In fact, with Clyde's retirement, we were reminded of an email he sent to his fellow portfolio managers and analysts back in 2005. In the email, Clyde contrasted his experience at our firm with David Swensen's assertion from his book, "Unconventional Success: A Fundamental Approach to Personal Investment2," that the mutual fund industry was a colossal failure. As part of his argument, Swensen noted that mutual fund managers rarely own a significant stake in the funds that they manage. Clyde stated that this was not the case at Oakmark and how proud he was to work at our firm. At the end of that year, as of December 31, 2005, employees owned in excess of $200 million of Oakmark Funds. Eighteen years later, we are proud to report that as of September 30, 2023, the value of Oakmark Funds owned by Harris Associates' employees, our families, the Funds' officers and our trustees was more than $877 million. This level of investment exemplifies our personal conviction in Harris Associates' investment philosophy and our commitment to managing your Funds with integrity.

As we approach 2024, our focus remains on the consistent application of our value investment philosophy with the goal of achieving positive rates of return for our shareholders. We are excited about the opportunities we see in the market and believe our Funds remain attractive investments for the future. We are thankful for the trust you have placed with us as shareholders of the Oakmark Funds and look forward to continuing to add value for you over the long term.

2 Swensen, David F. (2005). Unconventional Success: A Fundamental Approach to Personal Investment. Washington DC: Free Press.

See accompanying Disclosures and Endnotes on page 103.

2 OAKMARK FUNDS

A shareholder of each Fund incurs ongoing costs, including investment advisory fees, transfer agent fees and other Fund expenses. The examples below are intended to help shareholders understand the ongoing costs (in dollars) of investing in each Fund and to compare these costs with the ongoing costs of investing in other funds.

The following table provides information about actual account values and actual Fund expenses as well as hypothetical account values and hypothetical fund expenses for shares of each Fund.

ACTUAL EXPENSES

The following table shows the expenses a shareholder would have paid on a $1,000 investment in each Fund from April 1, 2023 to September 30, 2023, as well as how much a $1,000 investment would be worth at the close of the period, assuming actual Fund returns and expenses. A shareholder can estimate expenses incurred for the period by dividing the account value at September 30, 2023, by $1,000 and multiplying the result by the number in the "Actual—Expenses Paid During Period" column shown below.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The following table provides information about hypothetical account values and hypothetical expenses for shares of each Fund based on actual expense ratios and an assumed rate of return of 5% per year before expenses, which are not the Funds' actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or actual expenses shareholders paid for the period. Shareholders may use this information to compare the ongoing costs of investing in a Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as redemption fees. Therefore, the "Hypothetical—Expenses Paid During Period" column of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. If these transaction costs were included, the total costs would have been higher.

| | | | | ACTUAL | | HYPOTHETICAL

(5% annual return

before expenses) | | | |

| | Beginning

Account Value

(04/01/23) | | Ending

Account Value

(09/30/23) | | Expenses

Paid During

Period* | | Ending

Account Value

(09/30/23) | | Expenses

Paid During

Period* | | Annualized

Expense

Ratio | |

Oakmark Fund | |

Investor Class | | $ | 1,000.00 | | | $ | 1,072.20 | | | $ | 4.68 | | | $ | 1,020.56 | | | $ | 4.56 | | | | 0.90 | % | |

Advisor Class | | $ | 1,000.00 | | | $ | 1,073.40 | | | $ | 3.64 | | | $ | 1,021.56 | | | $ | 3.55 | | | | 0.70 | % | |

Institutional Class | | $ | 1,000.00 | | | $ | 1,073.50 | | | $ | 3.53 | | | $ | 1,021.66 | | | $ | 3.45 | | | | 0.68 | % | |

R6 Class | | $ | 1,000.00 | | | $ | 1,073.80 | | | $ | 3.28 | | | $ | 1,021.91 | | | $ | 3.19 | | | | 0.63 | % | |

Oakmark Select Fund | |

Investor Class | | $ | 1,000.00 | | | $ | 1,125.00 | | | $ | 5.27 | | | $ | 1,020.10 | | | $ | 5.01 | | | | 0.99 | % | |

Advisor Class | | $ | 1,000.00 | | | $ | 1,125.60 | | | $ | 4.69 | | | $ | 1,020.66 | | | $ | 4.46 | | | | 0.88 | % | |

Institutional Class | | $ | 1,000.00 | | | $ | 1,126.20 | | | $ | 4.10 | | | $ | 1,021.21 | | | $ | 3.90 | | | | 0.77 | % | |

R6 Class | | $ | 1,000.00 | | | $ | 1,126.20 | | | $ | 3.89 | | | $ | 1,021.41 | | | $ | 3.70 | | | | 0.73 | % | |

Oakmark Global Fund | |

Investor Class | | $ | 1,000.00 | | | $ | 986.10 | | | $ | 5.63 | | | $ | 1,019.40 | | | $ | 5.72 | | | | 1.13 | % | |

Advisor Class | | $ | 1,000.00 | | | $ | 987.00 | | | $ | 4.68 | | | $ | 1,020.36 | | | $ | 4.76 | | | | 0.94 | % | |

Institutional Class | | $ | 1,000.00 | | | $ | 987.40 | | | $ | 4.48 | | | $ | 1,020.56 | | | $ | 4.56 | | | | 0.90 | % | |

R6 Class | | $ | 1,000.00 | | | $ | 987.00 | | | $ | 4.33 | | | $ | 1,020.71 | | | $ | 4.41 | | | | 0.87 | % | |

Oakmark Global Select Fund | |

Investor Class | | $ | 1,000.00 | | | $ | 1,036.50 | | | $ | 5.77 | | | $ | 1,019.40 | | | $ | 5.72 | | | | 1.13 | % | |

Advisor Class | | $ | 1,000.00 | | | $ | 1,037.10 | | | $ | 4.90 | | | $ | 1,020.26 | | | $ | 4.86 | | | | 0.96 | % | |

Institutional Class | | $ | 1,000.00 | | | $ | 1,037.10 | | | $ | 4.60 | | | $ | 1,020.56 | | | $ | 4.56 | | | | 0.90 | % | |

R6 Class | | $ | 1,000.00 | | | $ | 1,038.10 | | | $ | 4.29 | | | $ | 1,020.86 | | | $ | 4.26 | | | | 0.84 | % | |

Oakmark International Fund | |

Investor Class | | $ | 1,000.00 | | | $ | 959.60 | | | $ | 5.16 | | | $ | 1,019.80 | | | $ | 5.32 | | | | 1.05 | % | |

Advisor Class | | $ | 1,000.00 | | | $ | 960.20 | | | $ | 4.32 | | | $ | 1,020.66 | | | $ | 4.46 | | | | 0.88 | % | |

Institutional Class | | $ | 1,000.00 | | | $ | 960.60 | | | $ | 3.98 | | | $ | 1,021.01 | | | $ | 4.10 | | | | 0.81 | % | |

R6 Class | | $ | 1,000.00 | | | $ | 961.00 | | | $ | 3.69 | | | $ | 1,021.31 | | | $ | 3.80 | | | | 0.75 | % | |

Oakmark International Small Cap Fund | |

Investor Class | | $ | 1,000.00 | | | $ | 1,006.20 | | | $ | 6.74 | | | $ | 1,018.35 | | | $ | 6.78 | | | | 1.34 | % | |

Advisor Class | | $ | 1,000.00 | | | $ | 1,006.80 | | | $ | 5.99 | | | $ | 1,019.10 | | | $ | 6.02 | | | | 1.19 | % | |

Institutional Class | | $ | 1,000.00 | | | $ | 1,006.80 | | | $ | 5.53 | | | $ | 1,019.55 | | | $ | 5.57 | | | | 1.10 | % | |

R6 Class | | $ | 1,000.00 | | | $ | 1,006.80 | | | $ | 5.38 | | | $ | 1,019.70 | | | $ | 5.42 | | | | 1.07 | % | |

Oakmark Equity and Income Fund | |

Investor Class | | $ | 1,000.00 | | | $ | 1,033.60 | | | $ | 4.38 | | | $ | 1,020.76 | | | $ | 4.36 | | | | 0.86 | % | |

Advisor Class | | $ | 1,000.00 | | | $ | 1,034.90 | | | $ | 3.16 | | | $ | 1,021.96 | | | $ | 3.14 | | | | 0.62 | % | |

Institutional Class | | $ | 1,000.00 | | | $ | 1,035.20 | | | $ | 3.01 | | | $ | 1,022.11 | | | $ | 2.99 | | | | 0.59 | % | |

R6 Class | | $ | 1,000.00 | | | $ | 1,035.20 | | | $ | 2.86 | | | $ | 1,022.26 | | | $ | 2.84 | | | | 0.56 | % | |

Oakmark Bond Fund | |

Investor Class | | $ | 1,000.00 | | | $ | 979.90 | | | $ | 3.67 | | | $ | 1,021.36 | | | $ | 3.75 | | | | 0.74 | % | |

Advisor Class | | $ | 1,000.00 | | | $ | 982.00 | | | $ | 2.68 | | | $ | 1,022.36 | | | $ | 2.74 | | | | 0.54 | % | |

Institutional Class | | $ | 1,000.00 | | | $ | 980.90 | | | $ | 2.58 | | | $ | 1,022.46 | | | $ | 2.64 | | | | 0.52 | % | |

R6 Class | | $ | 1,000.00 | | | $ | 980.30 | | | $ | 2.18 | | | $ | 1,022.86 | | | $ | 2.23 | | | | 0.44 | % | |

* The Annualized Expense Ratio is calculated using each class's actual net expenses incurred during the preceding six-month period divided by the average net assets of that class during the period.

See accompanying Disclosures and Endnotes on page 103.

Oakmark.com 3

September 30, 2023

U.S. Equity Market Commentary

William C. Nygren, CFA

Portfolio Manager

oakmx@oakmark.com

oaklx@oakmark.com

oakwx@oakmark.com

At Oakmark, we are long-term investors. We attempt to identify growing businesses that are managed to benefit their shareholders. We will purchase stock in those businesses only when priced substantially below our estimate of intrinsic value. After purchase, we patiently wait for the gap between stock price and intrinsic value to close.

"There is no such thing as growth stocks or value stocks as Wall Street generally portrays them, as contrasting asset classes. Growth is part of the value equation."

-Warren Buffett

In the decade ending in 2021, the Russell Growth 1000 Index doubled the performance of the Russell 1000 Value Index. That partially reversed last year when the Russell Value outperformed the Russell Growth by 22 percentage points. As a result, value investors thought we might have the wind at our backs for a while. But just as quickly, Russell Growth climbed back in 2023, outperforming the Russell Value Index by 24 percentage points, erasing Value's 2022 gains. This unusually large divergence has made growth versus value a popular discussion topic despite no agreement on what the terms mean. Let's look into our definition of value, and the opportunity we see today for price-sensitive investors.

Oakmark is Value

Oakmark is known as a leading practitioner of value investing. Each Oakmark fund follows a value investing discipline and usually falls in Morningstar's Large Value category. But we often get asked, "Wait a minute, you say you're a value investor, how can you own XYZ?" And, of course, the question never refers to General Motors or Capital One, holdings trading near book value with single-digit P/E ratios. Instead, it is typically about stocks, like Alphabet, that are trading above the S&P 500 P/E1 ratio. We love the question because it provides us the opportunity to explain what value investing means to us.

History of Value Investing

Benjamin Graham, who co-authored Security Analysis2 in 1934, is generally viewed as the father of value investing. In that book, Graham encouraged avoiding speculation by investing with a margin of safety, meaning paying such a low price that if you were only partially correct you weren't likely to lose money. Graham understood that owning a stock wasn't just a certificate; it was a fractional interest in a business. Further, business value was closely tied to shareholders' equity, or book value, which was a relatively stable number. Stock prices, however, generally correlated more to earnings than book value, so they were more volatile. He believed that investors could purchase depressed shares when earnings were low and then patiently wait for better times when the price would climb back to book value.

Nearly 90 years later, many still think of value investing as buying below book value and waiting for a reversion to the mean. In fact, Investopedia states that, "A price-to-book ratio under 1.0 typically indicates an undervalued stock." Eugene Fama, professor at the University of Chicago, and Kenneth French, professor at Dartmouth College, showed that, on average, low

price-to-book stocks performed well from 1963-1990.2 Why did it work so well? The U.S. was primarily an industrial economy, and earnings were tightly tied to physical assets. Earnings rose during good times and fell during bad, but book value acted like an anchor that limited the swings. And just as a boat returns to its anchor when the wind dies down, stock prices usually returned to book value.

Growth investors paid little attention to book value, instead looking for growing earnings. Because companies with above-average earnings growth tended to sell at high price-to-book ratios, growth and value investors lived in separate worlds that rarely overlapped. Investors referred to a "growth versus value" continuum with cheap stocks that didn't grow very much at one end and high-growth businesses that were very expensive at the other. Growth investors owned exciting businesses, but value investors got the last laugh because their boring stocks usually made more money.

The Value of Intangible Assets

In 1988, Warren Buffett shocked his followers by purchasing Coca-Cola. It was an excellent business, the kind that was too expensive for value investors. But Buffett explained that accounting rules prevented Coca-Cola from putting its brand name on its balance sheet and noted that the company's "most valuable asset is on the balance sheet at zero." When he included an estimate of the company's brand value, Buffett could see that he was buying Coca-Cola at less than its true business value.

In the 1990s, Oakmark applied that approach to other intangibles, such as R&D and customer acquisition costs. We adjusted financial statements to reflect the long-term benefit of spending that increased customers or developed new products. That showed us that some cable TV and biotechnology companies were cheap relative to their business value. Over the years, as the U.S. moved from an industrial economy to a knowledge economy, adjusting for intangibles—or, as we say, "income statement investing"—became necessary for more companies. By the early 2000s, value investors were lamenting the failure of low price-to-book investing. At Oakmark, we believed this was a failure of accounting principles, not value investing.

Growth Can Be Cheap or Expensive

The idea that value investing is limited to outdated, competitively disadvantaged companies selling at low P/E ratios couldn't be further from our definition of value. In fact, one of my favorite questions from investors is, "What would you do if 'value' got expensive?" What they are really asking is how we would respond if below-average businesses sold at average prices. Well, then they wouldn't be undervalued. But the better businesses that should be selling at higher P/E ratios would be.

See accompanying Disclosures and Endnotes on page 103.

4 OAKMARK FUNDS

September 30, 2023

U.S. Equity Market Commentary (continued)

Buying great businesses at average prices is just as much value investing as buying average businesses at great prices.

It is simply inaccurate to position value as the opposite of growth. I like what Buffett said, "Growth is part of the value equation." Investors should pay somewhat more for faster growing businesses, though the premium is often more than we can justify. But when the market underprices growth, buying faster growing businesses is value investing.

So, how does Oakmark differ from growth investors? We are willing to pay premium multiples for faster growing businesses as evidenced by our holdings of companies like Alphabet, Amazon and Salesforce. But the big difference is how far into the future we are willing to project above-average growth. Our analysts model financial statements for the next two years and then apply a growth rate for the next five years, giving us a seven-year forecast. If a stock can't grow into a below-market P/E ratio in that time, we aren't likely to consider owning it. I can almost hear you asking, "What about the 'compounders' that we 'know' will keep growing well beyond seven years?" Yes, some will. But the growth graveyard is full of companies that early in my career were considered "compounders:" Pitney Bowes (mailing machines), Yellow Pages, newspapers, cable networks, landline phones, drug companies (before patent cliffs became so steep), TV and radio stations, mainframe computers, and yes, mutual fund managers, just to name a few. It's a humbling list, and it keeps us from using a dim crystal ball to justify the highest P/E stocks.

The Opportunity Today

This idea that, at the right price, growth can be a value is terribly confusing to those who treat growth as the opposite of value. The opposite of cheap isn't growth; it's expensive. So instead of looking at growth versus value, we look at low P/E versus high P/E. A convenient way is to rank order the S&P 500 by P/E ratio, comparing number 50 to number 450. Currently, the 50th lowest P/E stock sells just over 8 times earnings, and the 50th highest sells at 60. So, the highest priced stocks are about 7 times more expensive than the lowest priced. Over the 30-plus years we have data, the P/E ratio averages about 4, bouncing between 3 and 5. (So, if there are 50 stocks below 10 times earnings, there are 50 over 40.) It was meaningfully higher only one time—when it hit 9 times at the end of the internet and tech bubble in 2000.

When we compare the 50 lowest ranked companies by P/E ratio on the S&P 500 today to the ones that made that list in previous periods, we don't observe any decline in business quality. Therefore, considering both the relatively high price of the higher P/E companies and the solid business quality of the lower P/E companies—we believe that low P/E stocks today present a better hunting ground than they normally do. Last year we bought depressed stocks of high-growth businesses, such as Uber, at a double-digit free cash flow yield; Workday at a low price relative to sales; and Adobe at only a slightly higher than average P/E ratio. This year, after strong outperformance, we sold them and bought much lower P/E stocks. Here's a fun way to think of it: In 2022, we bought a share of Adobe for about three shares of CVS Health. (CVS was just under $100 and Adobe under $300). This year we sold Adobe to buy more than six shares of CVS. (Adobe increased to well over $400 and CVS fell to $70.) We thought Adobe was cheap when we bought it,

despite it being a high-growth business, and that CVS was fully priced when we sold it, despite it having a below-average P/E ratio.

As Benjamin Graham said, "The intelligent investor is a realist who sells to optimists and buys from pessimists." The optimists who buy exciting businesses regardless of price have been on quite a run, resulting in today's unusually wide spread of P/E ratios. Just as we recommend that investors rebalance their exposure to stocks and bonds after periods of extreme performance—selling what went up to buy what went down—we think investors should do the same for investment styles. Following strong outperformance, selling some high P/E stocks to buy low P/E stocks might both reduce your risk and increase your expected return. That's why the Oakmark Fund today looks more like a traditional value fund than it has in a long time.

See accompanying Disclosures and Endnotes on page 103.

Oakmark.com 5

Oakmark Fund September 30, 2023

Summary Information

VALUE OF A $10,000 INVESTMENT

Since Inception - 08/05/91 (Unaudited)

PERFORMANCE

| | | | Average Annual Total Returns (as of 09/30/2023) | | | |

| (Unaudited) | | Total Return

Last 3 Months | | 1-year | | 3-year | | 5-year | | 10-year | | Since

Inception | | Inception

Date | |

Oakmark Fund (Investor Class) | | | -1.31 | % | | | 27.84 | % | | | 18.74 | % | | | 9.83 | % | | | 11.19 | % | | | 12.40 | % | | 08/05/91 | |

S&P 500 Index4 | | | -3.27 | % | | | 21.62 | % | | | 10.15 | % | | | 9.92 | % | | | 11.91 | % | | | 9.96 | % | | | |

Dow Jones Industrial Average5 | | | -2.10 | % | | | 19.18 | % | | | 8.62 | % | | | 7.14 | % | | | 10.79 | % | | | 10.36 | % | | | |

Lipper Large Cap Value Fund Index6 | | | -2.14 | % | | | 17.90 | % | | | 12.32 | % | | | 7.20 | % | | | 9.00 | % | | | 8.74 | % | | | |

Oakmark Fund (Advisor Class) | | | -1.25 | % | | | 28.10 | % | | | 18.98 | % | | | 10.01 | % | | | N/A | | | | 11.45 | % | | 11/30/16 | |

Oakmark Fund (Institutional Class) | | | -1.24 | % | | | 28.14 | % | | | 19.01 | % | | | 10.06 | % | | | N/A | | | | 11.50 | % | | 11/30/16 | |

Oakmark Fund (R6 Class) | | | -1.23 | % | | | 28.20 | % | | | N/A | | | | N/A | | | | N/A | | | | 12.34 | % | | 12/15/20 | |

The graph and table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Past performance is no guarantee of future results. The performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted. Total return includes change in share prices and, in each case, includes reinvestment of dividends and capital gain distributions. The investment return and principal value vary so that an investor's shares, when redeemed, may be worth more or less than the original cost. To obtain the most recent month-end performance, please visit Oakmark.com.

TOP TEN EQUITY HOLDINGS7 | | % of Net Assets | |

Alphabet, Inc., Class A | | | 3.5 | | |

ConocoPhillips | | | 2.8 | | |

KKR & Co., Inc. | | | 2.8 | | |

Intercontinental Exchange, Inc. | | | 2.7 | | |

Capital One Financial Corp. | | | 2.7 | | |

Wells Fargo & Co. | | | 2.7 | | |

American International Group, Inc. | | | 2.4 | | |

EOG Resources, Inc. | | | 2.4 | | |

Charter Communications, Inc., Class A | | | 2.4 | | |

Comcast Corp., Class A | | | 2.4 | | |

FUND STATISTICS | |

Ticker* | | OAKMX | |

Number of Equity Holdings | | | 61 | | |

Net Assets | | | $16.9 billion | | |

Weighted Average Market Cap | | | $158.5 billion | | |

Median Market Cap | | | $38.8 billion | | |

Expense Ratio - Investor Class*^ | | | 0.89 | % | |

* This information is related to the Investor Class. Please visit Oakmark.com for information related to the Advisor, Institutional and R6 Classes.

^ The Expense Ratio is from the Fund's prospectus dated January 28, 2023. The actual Gross and Net Expense Ratios for the year ended September 30, 2023 can be found in the Financial Highlights section of this report.

SECTOR ALLOCATION | | % of Net Assets | |

Financials | | | 38.9 | | |

Communication Services | | | 12.9 | | |

Consumer Discretionary | | | 9.7 | | |

Energy | | | 8.3 | | |

Health Care | | | 7.0 | | |

Industrials | | | 5.0 | | |

Information Technology | | | 4.7 | | |

Consumer Staples | | | 4.1 | | |

Real Estate | | | 2.1 | | |

Materials | | | 2.0 | | |

Short-Term Investments and Other | | | 5.3 | | |

See accompanying Disclosures and Endnotes on page 103.

6 OAKMARK FUNDS

Oakmark Fund September 30, 2023

Portfolio Manager Commentary

William C. Nygren, CFA

Portfolio Manager

oakmx@oakmark.com

Michael A. Nicolas, CFA

Portfolio Manager

oakmx@oakmark.com

Robert F. Bierig, CFA

Portfolio Manager

oakmx@oakmark.com

The Oakmark Fund ("the Fund") returned –1.31% during the third quarter, 15.91% calendar year to date, and 27.84% for the fiscal year. These returns compared to the S&P 500 Total Return Index's –3.27% in the third quarter, 13.07% for the calendar year, and 21.62% for the fiscal year. We are pleased that the Fund has outperformed despite the large headwind to value as demonstrated by the Russell 1000 Growth Index8 beating the Russell 1000 Value Index9 by 2,300 basis points year to date. Amid this backdrop, we are finding cheap stocks on traditional value metrics that we expect to drive attractive risk-adjusted returns over the long term.

Our highest contributing securities for the third quarter were ConocoPhillips and Charter Communications, and our largest detractors were General Motors and Capital One Financial. From a sector perspective, energy and communication services contributed the most to our total return for the quarter, while financials and industrials detracted the most. For the fiscal year period, the Fund's highest contributing securities were Meta Platforms and Oracle, while the biggest detractors were Charles Schwab and Bank of America. Our investments within the communications services and financials sectors contributed most to our performance while no individual sector detracted more than 20 basis points from our total return over this fiscal year period. We continue to own each of the investments referenced above given their discounts to our estimate of business value.

We initiated six new holdings and eliminated three others during the third quarter. Specifically, we sold our positions in Booking Holdings, PACCAR and Workday as each investment approached our estimate of intrinsic value. We believe our recent purchases, described below, are more attractive on a risk-adjusted return basis.

Centene Corporation

Centene is one of the largest health insurers in the U.S. The company specializes in three major government-sponsored programs: Medicaid, Marketplace and Medicare Advantage. Each of these benefits from long-term secular tailwinds. In Medicaid, states are steadily outsourcing their programs to managed care companies, like Centene, as it helps states reduce costs and improve care quality. Indeed, Managed Medicaid penetration has increased from 25% of total Medicaid spend in 2010 to 60% today, and we expect further gains over time. In Marketplace, growth is driven by the trend toward more individuals buying health insurance. Centene holds the #1 market share in both of these programs and is well positioned to capitalize on their continued growth. The stock trades for 10x consensus 2024 EPS10, but this doesn't tell the whole story. Past missteps in Centene's Medicare business will result in that segment losing $0.80 per share next year. We believe Centene can turn Medicare around and generate positive earnings in the next few years. This could increase EPS by more than $1 per share and reduce the P/E ratio

to just 8.5x. We think that's good value for a business that generates healthy returns on capital and is capable of growing EPS at a low double-digit rate.

Cisco Systems

Cisco is the leading networking solutions company. Networking equipment becomes more important as businesses modernize their IT infrastructure, and Cisco is well positioned to capture this demand given its broad portfolio and highly effective go-to-market strategy. Cisco is transitioning away from selling mainly transactional hardware and toward selling more software and subscriptions. This shift is expected to accelerate revenue growth, improve operating margins and build recurring revenue. Despite these notable business improvements, Cisco still trades near a trough valuation relative to the S&P 500 Index. More recently, Cisco announced its intention to acquire Splunk, a leader in security and observability, adding to its already strong position in the increasingly important security market. At a low-teens multiple of our estimate of normalized earnings, Cisco is trading comfortably below our estimate of intrinsic value.

Corteva Inc.

Corteva is a leading provider of seed and crop protection chemicals. We believe the seed and crop protection markets have sizeable barriers to entry due to the duration and magnitude of investment required to compete. Both industries require constant innovation: Farmers expect seed yield improvement each year while nature develops immunity to crop protection chemicals over time. As a result, advantages accrue to the largest players with the most R&D resources. Within this context, we believe Corteva is very well positioned. The company has scale, well-recognized brands, a loyal customer base, and a promising R&D pipeline. In addition, we see idiosyncratic opportunities for Corteva to improve its profitability over time, and we believe the current management team is executing well against this opportunity. More recently, the stock has been pressured by near-term headwinds related to inventory destocking and declining crop prices. We see this weakness as an opportunity to invest in a high-quality and defensible business at a discount to both its own historical trading multiple and private market transactions.

CVS Health

CVS is a diversified health care conglomerate with leading positions across multiple aspects of health services. The company owns the #1 pharmacy benefit manager, #1 retail pharmacy, #1 specialty pharmacy, #3 commercial health insurer and #3 Medicare Advantage organization in the U.S. Managed care and pharmacy benefits management have proven to be good businesses over time, characterized by healthy underlying growth and excellent free cash flow generation. CVS has

See accompanying Disclosures and Endnotes on page 103.

Oakmark.com 7

Oakmark Fund September 30, 2023

Portfolio Manager Commentary (continued)

underperformed the S&P 500 by more than 40 percentage points over the past 12 months, impacted by a cloud of company-specific and legislative concerns. While we are not dismissive of these potential risks and headwinds, we believe the market has become overly pessimistic. This created an attractive opportunity to invest in what we view as a durable, competitively advantaged and well-managed enterprise at a high-single-digit multiple of earnings.

Danaher Corporation

Danaher is a global leader in life sciences tools and diagnostics. We are impressed by Danaher's excellent track record of creating shareholder value through smart capital allocation and world-class operational execution. The company's business mix has shifted dramatically in recent years following a series of transformative acquisitions and divestitures. We believe these portfolio improvements leave the company attractively positioned in some of the industry's fastest growing, most profitable niches within life sciences. Near-term headwinds related to the pandemic are overshadowing this attractive long-term outlook, in our view. More specifically, Danaher sells diagnostic tests and critical inputs needed for manufacturing Covid-19 vaccines. As Covid-19 demand has normalized, Danaher experienced sales headwinds and channel destocking, pressuring its stock price. The shares now trade at a discount to both peers and private market transactions, giving us an attractive opportunity to invest in what we view as a high-quality, resilient business at a discounted valuation.

Phillips 66

Phillips 66 is an integrated downstream energy company that operates refineries, pipelines, chemical manufacturing facilities and retail fuel stations. Like most U.S.-based oil refiners, Phillips 66 is currently enjoying abnormally high margins thanks to today's historically tight market for refined products. Given the market's concern that current refining margins are unsustainable, Phillips 66 trades for just 7x this year's EPS. However, unlike other refiners, the majority of Phillips 66's intrinsic value comes from its non-refining business segments, providing a more stable base of cash flow. Even if refining margins eventually return to historical average levels, we believe we are paying a single-digit multiple of normalized earnings for a collection of advantaged midstream and downstream assets. We think this is an attractive price for a solid business where management is returning the vast majority of free cash flow to shareholders.

We take into consideration the tax efficiency of the Fund to help maximize after-tax returns. As a result, we do not anticipate paying a capital gains distribution this year.

We thank you, our fellow shareholders, for your investment in the Oakmark Fund.

See accompanying Disclosures and Endnotes on page 103.

8 OAKMARK FUNDS

Oakmark Fund September 30, 2023

Schedule of Investments (in thousands)

| | | Shares | | Value | |

COMMON STOCKS - 94.8% | |

FINANCIALS - 38.9% | |

FINANCIAL SERVICES - 24.2% | |

KKR & Co., Inc. | | | 7,680 | | | $ | 473,088 | | |

Intercontinental Exchange, Inc. | | | 4,175 | | | | 459,355 | | |

Capital One Financial Corp. | | | 4,709 | | | | 457,008 | | |

Charles Schwab Corp. | | | 6,883 | | | | 377,877 | | |

Ally Financial, Inc. | | | 13,359 | | | | 356,421 | | |

Fiserv, Inc. (a) | | | 3,150 | | | | 355,824 | | |

American Express Co. | | | 2,158 | | | | 321,922 | | |

State Street Corp. | | | 4,600 | | | | 308,003 | | |

Bank of New York Mellon Corp. | | | 6,741 | | | | 287,484 | | |

Goldman Sachs Group, Inc. | | | 855 | | | | 276,652 | | |

Global Payments, Inc. | | | 2,200 | | | | 253,858 | | |

Moody's Corp. | | | 480 | | | | 151,721 | | |

| | | | | | 4,079,213 | | |

BANKS - 9.4% | |

Wells Fargo & Co. | | | 11,113 | | | | 454,077 | | |

Bank of America Corp. | | | 12,524 | | | | 342,893 | | |

Citigroup, Inc. | | | 6,844 | | | | 281,502 | | |

First Citizens BancShares, Inc., Class A | | | 189 | | | | 260,839 | | |

Truist Financial Corp. | | | 8,360 | | | | 239,180 | | |

| | | | | | 1,578,491 | | |

INSURANCE - 5.3% | |

American International Group, Inc. | | | 6,793 | | | | 411,643 | | |

Willis Towers Watson PLC | | | 1,655 | | | | 345,829 | | |

Reinsurance Group of America, Inc. | | | 922 | | | | 133,870 | | |

| | | | | | 891,342 | | |

| | | | | | 6,549,046 | | |

COMMUNICATION SERVICES - 12.9% | |

MEDIA & ENTERTAINMENT - 12.9% | |

Alphabet, Inc., Class A (a) | | | 4,544 | | | | 594,602 | | |

Charter Communications, Inc., Class A (a) | | | 913 | | | | 401,392 | | |

Comcast Corp., Class A | | | 9,050 | | | | 401,277 | | |

Meta Platforms, Inc., Class A (a) | | | 674 | | | | 202,462 | | |

Liberty Broadband Corp., Class C (a) | | | 2,020 | | | | 184,466 | | |

Warner Bros. Discovery, Inc. (a) (b) | | | 12,587 | | | | 136,695 | | |

Pinterest, Inc., Class A (a) | | | 4,550 | | | | 122,986 | | |

Walt Disney Co. (a) | | | 1,500 | | | | 121,575 | | |

| | | | | | 2,165,455 | | |

CONSUMER DISCRETIONARY - 9.7% | |

AUTOMOBILES & COMPONENTS - 5.1% | |

General Motors Co. | | | 10,762 | | | | 354,823 | | |

BorgWarner, Inc. | | | 6,000 | | | | 242,220 | | |

Magna International, Inc. | | | 4,300 | | | | 230,523 | | |

Phinia, Inc. | | | 1,228 | | | | 32,901 | | |

| | | | | | 860,467 | | |

CONSUMER DISCRETIONARY DISTRIBUTION & RETAIL - 2.8% | |

Amazon.com, Inc. (a) | | | 2,195 | | | | 279,028 | | |

eBay, Inc. | | | 4,253 | | | | 187,506 | | |

| | | | | | 466,534 | | |

| | | Shares | | Value | |

CONSUMER SERVICES - 0.9% | |

Hilton Worldwide Holdings, Inc. | | | 1,049 | | | $ | 157,554 | | |

CONSUMER DURABLES & APPAREL - 0.9% | |

PulteGroup, Inc. (b) | | | 1,954 | | | | 144,694 | | |

| | | | | | 1,629,249 | | |

ENERGY - 8.3% | |

ConocoPhillips | | | 3,984 | | | | 477,247 | | |

EOG Resources, Inc. | | | 3,167 | | | | 401,394 | | |

APA Corp. | | | 8,085 | | | | 332,286 | | |

Phillips 66 | | | 1,550 | | | | 186,232 | | |

| | | | | | 1,397,159 | | |

HEALTH CARE - 7.0% | |

HEALTH CARE EQUIPMENT & SERVICES - 4.0% | |

Baxter International, Inc. | | | 4,690 | | | | 177,000 | | |

Centene Corp. (a) | | | 2,475 | | | | 170,459 | | |

CVS Health Corp. | | | 2,344 | | | | 163,658 | | |

HCA Healthcare, Inc. | | | 657 | | | | 161,608 | | |

| | | | | | 672,725 | | |

PHARMACEUTICALS, BIOTECHNOLOGY & LIFE SCIENCES - 3.0% | |

IQVIA Holdings, Inc. (a) | | | 1,730 | | | | 340,378 | | |

Danaher Corp. | | | 700 | | | | 173,670 | | |

| | | | | | 514,048 | | |

| | | | | | 1,186,773 | | |

INDUSTRIALS - 5.1% | |

CAPITAL GOODS - 4.1% | |

Masco Corp. | | | 5,074 | | | | 271,227 | | |

Fortune Brands Innovations, Inc. | | | 3,655 | | | | 227,164 | | |

Parker-Hannifin Corp. | | | 310 | | | | 120,751 | | |

Carlisle Cos., Inc. | | | 289 | | | | 74,975 | | |

| | | | | | 694,117 | | |

COMMERCIAL & PROFESSIONAL SERVICES - 1.0% | |

Equifax, Inc. | | | 890 | | | | 163,030 | | |

| | | | | | 857,147 | | |

INFORMATION TECHNOLOGY - 4.7% | |

SOFTWARE & SERVICES - 2.7% | |

Salesforce, Inc. (a) | | | 1,420 | | | | 287,948 | | |

Oracle Corp. | | | 1,653 | | | | 175,054 | | |

| | | | | | 463,002 | | |

TECHNOLOGY HARDWARE & EQUIPMENT - 2.0% | |

Cisco Systems, Inc. | | | 3,470 | | | | 186,547 | | |

TE Connectivity Ltd. | | | 1,214 | | | | 150,020 | | |

| | | | | | 336,567 | | |

| | | | | | 799,569 | | |

CONSUMER STAPLES - 4.1% | |

CONSUMER STAPLES DISTRIBUTION & RETAIL - 2.1% | |

Kroger Co. | | | 8,050 | | | | 360,237 | | |

See accompanying Notes to Financial Statements.

Oakmark.com 9

Oakmark Fund September 30, 2023

Schedule of Investments (in thousands) (continued)

| | | Shares | | Value | |

COMMON STOCKS - 94.8% (continued) | |

CONSUMER STAPLES - 4.1% (continued) | |

FOOD, BEVERAGE & TOBACCO - 2.0% | |

Altria Group, Inc. | | | 8,010 | | | $ | 336,821 | | |

| | | | | | 697,058 | | |

REAL ESTATE - 2.1% | |

REAL ESTATE MANAGEMENT & DEVELOPMENT - 2.1% | |

CBRE Group, Inc., Class A (a) | | | 4,766 | | | | 352,017 | | |

MATERIALS - 2.0% | |

Celanese Corp. | | | 1,532 | | | | 192,296 | | |

Corteva, Inc. | | | 2,867 | | | | 146,691 | | |

| | | | | | 338,987 | | |

TOTAL COMMON STOCKS - 94.8%

(COST $13,188,749) | | | | | 15,972,460 | | |

TOTAL PURCHASED OPTIONS - 0.0% (c)

(COST $5,553) | | | | | 1,550 | | |

| | | Par Value | | Value | |

SHORT-TERM INVESTMENTS - 5.7% | |

REPURCHASE AGREEMENT - 4.0% | |

Fixed Income Clearing Corp. Repurchase

Agreement, 5.30% dated 09/29/23 due

10/02/23, repurchase price $671,688,

collateralized by a United States Treasury

Note, 0.125% due 04/15/26, value

plus accrued interest of $684,819

(Cost: $671,391) | | $ | 671,391 | | | | 671,391 | | |

U.S. GOVERNMENT BILLS - 1.7% | |

U.S. Treasury Bills,

5.34%, due 10/26/23 (d) | | | 100,000 | | | | 99,648 | | |

U.S. Treasury Bills,

5.44%, due 12/28/23 (d) | | | 100,000 | | | | 98,714 | | |

U.S. Treasury Bills,

5.50%, due 01/23/24 (d) | | | 100,000 | | | | 98,326 | | |

Total U.S. Government Bills - 1.7%

(Cost $296,675) | | | | | 296,688 | | |

TOTAL SHORT-TERM INVESTMENTS - 5.7%

(COST $968,066) | | | | | 968,079 | | |

TOTAL INVESTMENTS - 100.5%

(COST $14,162,368) | | | | | 16,942,089 | | |

Liabilities In Excess of Other Assets - (0.5)% | | | | | (88,769 | ) | |

TOTAL NET ASSETS - 100.0% | | | | $ | 16,853,320 | | |

(a) Non-income producing security.

(b) All or a portion of this investment is held in connection with one or more options within the Fund.

(c) Amount rounds to less than 0.1%.

(d) The rate shown represents the annualized yield at the time of purchase; not a coupon rate.

(e) Security is when-issued and has been sold in advance of receipt. Under GAAP, it is deemed to be a short sale. Please refer to the Short Sales section in the Notes to the Financials.

| | | Shares | | Value | |

COMMON STOCKS SOLD SHORT - (0.1)% | |

INDUSTRIALS - (0.1)% | |

HEALTH CARE EQUIPMENT & SERVICES - (0.1)% | |

Veralto Corp. (a) (e) | | | (233 | ) | | $ | (19,731 | ) | |

TOTAL COMMON STOCKS SOLD SHORT - (0.1%)

(PROCEEDS $(18,714)) | | | | | (19,731 | ) | |

See accompanying Notes to Financial Statements.

10 OAKMARK FUNDS

Oakmark Fund September 30, 2023

Schedule of Investments (in thousands) (continued)

PURCHASED OPTIONS

Description | | Exercise

Price | | Expiration

Date | | Number of

Contracts | | Notional

Amount | | Market

Value | | Premiums

Paid

by Fund | | Unrealized

Gain/(Loss) | |

CALLS | |

Warner Bros. Discovery, Inc. | | $ | 11.50 | | | 10/13/23 | | | 100,000 | | | $ | 108,600 | | | $ | 1,550 | | | $ | 5,553 | | | $ | (4,003 | ) | |

| | | | | | | | | $ | 108,600 | | | $ | 1,550 | | | $ | 5,553 | | | $ | (4,003 | ) | |

WRITTEN OPTIONS

Description | | Exercise

Price | | Expiration

Date | | Number of

Contracts | | Notional

Amount | | Market

Value | | Premiums

(Received)

by Fund | | Unrealized

Gain/(Loss) | |

CALLS | |

Pultegroup, Inc. | | $ | 65.00 | | | 10/20/23 | | | (19,500 | ) | | $ | (144,398 | ) | | $ | (18,623 | ) | | $ | (28,645 | ) | | $ | 10,022 | | |

| | | | | | | | | $ | (144,398 | ) | | $ | (18,623 | ) | | $ | (28,645 | ) | | $ | 10,022 | | |

PUTS | |

Warner Bros. Discovery, Inc. | | $ | 11.00 | | | 10/13/23 | | | (150,000 | ) | | $ | (162,900 | ) | | $ | (6,600 | ) | | $ | (6,921 | ) | | $ | 321 | | |

| | | | | | | | | $ | (162,900 | ) | | $ | (6,600 | ) | | $ | (6,921 | ) | | $ | 321 | | |

See accompanying Notes to Financial Statements.

Oakmark.com 11

Oakmark Select Fund September 30, 2023

Summary Information

VALUE OF A $10,000 INVESTMENT

Since Inception - 11/01/96 (Unaudited)

PERFORMANCE

| | | | | Average Annual Total Returns (as of 09/30/2023) | | | |

(Unaudited) | | Total Return

Last 3 Months | | 1-year | | 3-year | | 5-year | | 10-year | | Since

Inception | | Inception

Date | |

Oakmark Select Fund (Investor Class) | | | 0.08 | % | | | 30.59 | % | | | 17.82 | % | | | 7.42 | % | | | 8.61 | % | | | 11.35 | % | | 11/01/96 | |

S&P 500 Index4 | | | -3.27 | % | | | 21.62 | % | | | 10.15 | % | | | 9.92 | % | | | 11.91 | % | | | 8.95 | % | | | |

Lipper Multi-Cap Value Fund Index11 | | | -2.15 | % | | | 17.08 | % | | | 13.33 | % | | | 6.13 | % | | | 7.69 | % | | | 7.41 | % | | | |

Oakmark Select Fund (Advisor Class) | | | 0.10 | % | | | 30.77 | % | | | 17.96 | % | | | 7.56 | % | | | N/A | | | | 7.57 | % | | 11/30/16 | |

Oakmark Select Fund (Institutional Class) | | | 0.15 | % | | | 30.90 | % | | | 18.07 | % | | | 7.64 | % | | | N/A | | | | 7.63 | % | | 11/30/16 | |

Oakmark Select Fund (R6 Class) | | | 0.13 | % | | | 30.93 | % | | | N/A | | | | N/A | | | | N/A | | | | 10.21 | % | | 12/15/20 | |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Past performance is no guarantee of future results. The performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted. Total return includes change in share prices and, in each case, includes reinvestment of dividends and capital gain distributions. The investment return and principal value vary so that an investor's shares, when redeemed, may be worth more or less than the original cost. To obtain the most recent month-end performance, please visit Oakmark.com.

TOP TEN EQUITY HOLDINGS7 | | % of Net Assets | |

Alphabet, Inc., Class A | | | 8.7 | | |

Lithia Motors, Inc. | | | 6.9 | | |

CBRE Group, Inc., Class A | | | 6.6 | | |

IQVIA Holdings, Inc. | | | 6.4 | | |

First Citizens BancShares, Inc., Class A | | | 6.3 | | |

Capital One Financial Corp. | | | 5.7 | | |

KKR & Co., Inc. | | | 5.6 | | |

Charter Communications, Inc., Class A | | | 5.0 | | |

Intercontinental Exchange, Inc. | | | 5.0 | | |

Charles Schwab Corp. | | | 4.9 | | |

FUND STATISTICS | |

Ticker* | | OAKLX | |

Number of Equity Holdings | | 21 | |

Net Assets | | $5.3 billion | |

Weighted Average Market Cap | | $215.6 billion | |

Median Market Cap | | $52.8 billion | |

Expense Ratio - Investor Class*^ | | 0.98% | |

* This information is related to the Investor Class. Please visit Oakmark.com for information related to the Advisor, Institutional and R6 Classes.

^ The Expense Ratio is from the Fund's prospectus dated January 28, 2023. The actual Gross and Net Expense Ratios for the year ended September 30, 2023 can be found in the Financial Highlights section of this report.

SECTOR ALLOCATION | | % of Net Assets | |

Financials | | | 37.9 | | |

Communication Services | | | 18.8 | | |

Energy | | | 8.4 | | |

Information Technology | | | 7.7 | | |

Consumer Discretionary | | | 6.9 | | |

Real Estate | | | 6.6 | | |

Health Care | | | 6.4 | | |

Short-Term Investments and Other | | | 7.3 | | |

See accompanying Disclosures and Endnotes on page 103.

12 OAKMARK FUNDS

Oakmark Select Fund September 30, 2023

Portfolio Manager Commentary

William C. Nygren, CFA

Portfolio Manager

oaklx@oakmark.com

Anthony P. Coniaris, CFA

Portfolio Manager

oaklx@oakmark.com

Robert F. Bierig, CFA

Portfolio Manager

oaklx@oakmark.com

Alexander E. Fitch, CFA

Portfolio Manager

oaklx@oakmark.com

The Oakmark Select Fund ("the Fund") returned 0.08% in the third quarter, 24.77% in the calendar year to date, and 30.59% in the fiscal year. These returns compare to the S&P 500 Total Return Index's –3.27% in the third quarter, 13.07% in the calendar year to date, and 21.62% in the fiscal year. We are pleased that the Fund has outperformed despite the large headwind to value as demonstrated by the Russell 1000 Growth Index8 beating the Russell 1000 Value Index9 by 2,300 basis points year to date. We expect that our disciplined approach to stock selection will continue to drive attractive returns in the long term.

The largest contributors to performance in the third quarter were Charter Communications and Alphabet and in the fiscal year were First Citizens and Oracle. The largest detractors in the third quarter were IQVIA Holdings and Capital One Financial and in the fiscal year were Meta Platforms and IQVIA Holdings. We initiated our position in IQVIA during the quarter amid the decline in the health care sector. We did not eliminate any positions.

IQVIA is a leading provider of clinical trials and related health care technology formed through the merger of Quintiles and IMS Health in 2016. We believe that IQVIA's leading data and digital capabilities enable the company to gain share of addressable clinical trial-related spending as pharma and biotech companies outsource these services to contract research organizations (CROs). In addition, we think that IQVIA has growth opportunities from delivering real-world evidence to biopharma companies and other health care providers using data to meet regulatory and reimbursement mandates. CEO Ari Bousbib has a strong track record on both operations and capital allocation and significant skin in the game through his large equity holdings in the company. We were pleased to be able to add IQVIA to the portfolio near a trough multiple of roughly 15x our estimate of normal earnings despite the company's prospects for sustainable above-average growth.

Finally, we take into consideration tax efficiency of the Fund to help maximize after-tax returns. As a result, we once again anticipate paying no capital gains distribution this year.

We thank you, our fellow shareholders, for your investment in the Oakmark Select Fund.

See accompanying Disclosures and Endnotes on page 103.

Oakmark.com 13

Oakmark Select Fund September 30, 2023

Schedule of Investments (in thousands)

| | | Shares | | Value | |

COMMON STOCKS - 92.7% | |

FINANCIALS - 37.9% | |

FINANCIAL SERVICES - 27.6% | |

Capital One Financial Corp. | | | 3,141 | | | $ | 304,863 | | |

KKR & Co., Inc. | | | 4,859 | | | | 299,296 | | |

Intercontinental Exchange, Inc. | | | 2,411 | | | | 265,253 | | |

Charles Schwab Corp. | | | 4,790 | | | | 262,968 | | |

Ally Financial, Inc. | | | 7,000 | | | | 186,762 | | |

Fiserv, Inc. (a) | | | 1,396 | | | | 157,727 | | |

| | | | | | 1,476,869 | | |

BANKS - 10.3% | |

First Citizens BancShares, Inc., Class A | | | 242 | | | | 334,379 | | |

Wells Fargo & Co. | | | 4,710 | | | | 192,440 | | |

First Citizens BancShares, Inc., Class B | | | 18 | | | | 20,989 | | |

| | | | | | 547,808 | | |

| | | | | | 2,024,677 | | |

COMMUNICATION SERVICES - 18.8% | |

MEDIA & ENTERTAINMENT - 18.8% | |

Alphabet, Inc., Class A (a) | | | 3,535 | | | | 462,593 | | |

Charter Communications, Inc., Class A (a) | | | 604 | | | | 265,607 | | |

Warner Bros. Discovery, Inc. (a) | | | 13,499 | | | | 146,599 | | |

Liberty Broadband Corp., Class C (a) | | | 1,410 | | | | 128,764 | | |

| | | | | | 1,003,563 | | |

ENERGY - 8.4% | |

ConocoPhillips | | | 1,548 | | | | 185,440 | | |

APA Corp. | | | 3,220 | | | | 132,334 | | |

EOG Resources, Inc. | | | 1,042 | | | | 132,043 | | |

| | | | | | 449,817 | | |

INFORMATION TECHNOLOGY - 7.7% | |

SOFTWARE & SERVICES - 7.7% | |

Salesforce, Inc. (a) | | | 1,284 | | | | 260,390 | | |

Oracle Corp. | | | 1,425 | | | | 150,968 | | |

| | | | | | 411,358 | | |

CONSUMER DISCRETIONARY - 6.9% | |

CONSUMER DISCRETIONARY DISTRIBUTION & RETAIL - 6.9% | |

Lithia Motors, Inc. | | | 1,242 | | | | 366,800 | | |

REAL ESTATE - 6.6% | |

REAL ESTATE MANAGEMENT & DEVELOPMENT - 6.6% | |

CBRE Group, Inc., Class A (a) | | | 4,780 | | | | 353,077 | | |

HEALTH CARE - 6.4% | |

PHARMACEUTICALS, BIOTECHNOLOGY & LIFE SCIENCES - 6.4% | |

IQVIA Holdings, Inc. (a) | | | 1,743 | | | | 342,935 | | |

TOTAL COMMON STOCKS - 92.7%

(COST $3,874,274) | | | | | 4,952,227 | | |

| | | Par Value | | Value | |

SHORT-TERM INVESTMENTS - 7.3% | |

REPURCHASE AGREEMENT - 7.3% | |

Fixed Income Clearing Corp. Repurchase

Agreement, 5.30% dated 09/29/23 due

10/02/23, repurchase price $391,512,

collateralized by a United States Treasury

Note, 4.625% due 03/15/26,

value plus accrued interest of

$399,166 (Cost: $391,340) | | $ | 391,340 | | | $ | 391,340 | | |

TOTAL SHORT-TERM INVESTMENTS - 7.3%

(COST $391,340) | | | | | 391,340 | | |

TOTAL INVESTMENTS - 100.0%

(COST $4,265,614) | | | | | 5,343,567 | | |

Liabilities In Excess of Other Assets - 0.0% (b) | | | | | (718 | ) | |

TOTAL NET ASSETS - 100.0% | | | | $ | 5,342,849 | | |

(a) Non-income producing security.

(b) Amount rounds to less than 0.1%.

See accompanying Notes to Financial Statements.

14 OAKMARK FUNDS

This page intentionally left blank.

Oakmark.com 15

Oakmark Global Fund September 30, 2023

Summary Information

VALUE OF A $10,000 INVESTMENT

Since Inception - 08/04/99 (Unaudited)

PERFORMANCE

| | | | Average Annual Total Returns (as of 09/30/2023) | | | |

| (Unaudited) | | Total Return

Last 3 Months | | 1-year | | 3-year | | 5-year | | 10-year | | Since

Inception | | Inception

Date | |

Oakmark Global Fund (Investor Class) | | | -5.42 | % | | | 26.88 | % | | | 11.71 | % | | | 4.86 | % | | | 5.60 | % | | | 9.06 | % | | 08/04/99 | |

MSCI World Index (Net)12 | | | -3.46 | % | | | 21.95 | % | | | 8.08 | % | | | 7.26 | % | | | 8.26 | % | | | 5.46 | % | | | |

Lipper Global Fund Index13 | | | -3.73 | % | | | 21.44 | % | | | 5.58 | % | | | 5.42 | % | | | 6.88 | % | | | 5.54 | % | | | |

Oakmark Global Fund (Advisor Class) | | | -5.36 | % | | | 27.17 | % | | | 11.93 | % | | | 5.04 | % | | | N/A | | | | 7.43 | % | | 11/30/16 | |

Oakmark Global Fund (Institutional Class) | | | -5.36 | % | | | 27.21 | % | | | 11.96 | % | | | 5.08 | % | | | N/A | | | | 7.48 | % | | 11/30/16 | |

Oakmark Global Fund (R6 Class) | | | -5.39 | % | | | 27.15 | % | | | N/A | | | | N/A | | | | N/A | | | | 3.59 | % | | 12/15/20 | |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Past performance is no guarantee of future results. The performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted. Total return includes change in share prices and, in each case, includes reinvestment of dividends and capital gain distributions. The investment return and principal value vary so that an investor's shares, when redeemed, may be worth more or less than the original cost. To obtain the most recent month-end performance, please visit Oakmark.com.

TOP TEN EQUITY HOLDINGS7 | | % of Net Assets | |

Lloyds Banking Group PLC | | | 4.5 | | |

Alphabet, Inc., Class A | | | 4.1 | | |

Mercedes-Benz Group AG | | | 3.6 | | |

| CNH Industrial NV | | | 3.3 | | |

Charter Communications, Inc., Class A | | | 3.2 | | |

Bayer AG | | | 3.1 | | |

Allianz SE | | | 2.8 | | |

Julius Baer Group Ltd. | | | 2.8 | | |

Daimler Truck Holding AG | | | 2.6 | | |

General Motors Co. | | | 2.6 | | |

FUND STATISTICS | |

Ticker* | | OAKGX | |

Number of Equity Holdings | | 44 | |

Net Assets | | $1.2 billion | |

Weighted Average Market Cap | | $164.7 billion | |

Median Market Cap | | $46.3 billion | |

Expense Ratio - Investor Class*^ | | 1.11% | |

* This information is related to the Investor Class. Please visit Oakmark.com for information related to the Advisor, Institutional and R6 Classes.

^ The Expense Ratio is from the Fund's prospectus dated January 28, 2023. The actual Gross and Net Expense Ratios for the year ended September 30, 2023 can be found in the Financial Highlights section of this report.

SECTOR ALLOCATION | | % of Net Assets | |

Financials | | | 32.3 | | |

Consumer Discretionary | | | 15.9 | | |

Communication Services | | | 11.5 | | |

Health Care | | | 10.4 | | |

Information Technology | | | 10.2 | | |

Industrials | | | 8.7 | | |

Energy | | | 2.4 | | |

Consumer Staples | | | 2.2 | | |

Materials | | | 2.1 | | |

Short-Term Investments and Other | | | 4.3 | | |

GEOGRAPHIC ALLOCATION | |

| | | % of Equity | |

North America | | | 48.6 | | |

United States | | | 48.6 | | |

Europe | | | 46.9 | | |

Germany* | | | 14.5 | | |

United Kingdom | | | 14.0 | | |

Switzerland | | | 6.7 | | |

France* | | | 4.7 | | |

Netherlands* | | | 2.5 | | |

Belgium* | | | 2.3 | | |

Ireland* | | | 2.2 | | |

| | | % of Equity | |

Asia | | | 4.5 | | |

South Korea | | | 2.3 | | |

China | | | 2.2 | | |

* Euro currency countries comprise 26.2% of equity investments.

See accompanying Disclosures and Endnotes on page 103.

16 OAKMARK FUNDS

Oakmark Global Fund September 30, 2023

Portfolio Manager Commentary

David G. Herro, CFA

Portfolio Manager

oakgx@oakmark.com

Clyde S. McGregor, CFA

Portfolio Manager

oakgx@oakmark.com

Anthony P. Coniaris, CFA

Portfolio Manager

oakgx@oakmark.com

Jason E. Long, CFA

Portfolio Manager

oakgx@oakmark.com

M. Colin Hudson, CFA

Portfolio Manager

oakgx@oakmark.com

John A. Sitarz, CFA

Portfolio Manager

oakgx@oakmark.com

The Oakmark Global Fund (the "Fund") returned 26.88% for the fiscal year ended September 30, 2023, outperforming its benchmark, the MSCI World Index (net)12, which returned 21.95%. For the most recent quarter, the Fund returned –5.42%, compared to the benchmark's return of –3.46%. The Fund has returned an average of 9.06% per year since its inception on August 4, 1999, outperforming the MSCI World Index (net)'s annualized gain of 5.46% over the same period.

For the quarter, our highest contributing securities were Charter Communications (U.S.), Alphabet (U.S.), and ConocoPhillips (U.S.), and our largest detractors were St. James's Place (U.K.), Interpublic Group (U.S.) and Prudential (U.K.). From a sector perspective, our strongest contributors were information technology and financials, and our biggest detractors were consumer discretionary and real estate.

Charter Communications (U.S.), a telecommunications and mass media company, was the top contributor to the Fund's performance for the quarter. Second-quarter broadband subscriptions for Charter Communications grew by 77,000 sequentially, beating consensus expectations of 13,000 and roughly doubling its growth year-over-year. Unit growth outperformed peers, even after adjusting for Charter's rural initiative, which contributed 26,000 subscriptions. Charter's mobile net adds were strong at 648,000 and net adds have been over 600,000 each of the last three quarters since Charter launched Spectrum One, which includes one free mobile line for 12 months. Adjusted earnings growth was roughly flat, but we expect it to accelerate over time as the company's financials are no longer negatively impacted by its investments in marketing personnel and the promo roll-off dynamic begins. While faster unit growth does depress adjusted earnings in the near term, we believe Charter's strategy will prove valuable to long-term shareholders.

St. James's Place (U.K.), the largest wealth manager in the U.K., was the Fund's largest detractor for the quarter. St. James's Place released weak first half of 2023 results, and management noted that it will reduce fees on certain products ahead of the new consumer duty regulation. St. James's Place plans to cap annual product management charges at 85 basis points for client bond and pension contributions after a client has been invested for

10 years, which will result in a four basis point impact to the group revenue margin. CEO Andrew Croft also believes this self-directed decision will create goodwill with the regulatory body. Both assets under management and cash earnings were slightly below our expectations, and the relatively low amount of net new money was mainly attributed to weak flows in unit trusts and individual savings accounts. Gross contributions within the unit trusts and individual savings accounts have been concentrated in lower value accounts, and these clients have been most impacted by cost-of-living pressures. Further, clients' decision to allocate more money to cash products instead of traditional investments has put additional pressure on St. James's Place as it does not have a cash management product. Lastly, market performance was lower than our estimates due to a strengthening British pound compared to the U.S. dollar. Despite these near-term headwinds, we continue to believe the company offers an attractive long-term investment. Pension reforms in the U.K. have significantly increased the number of defined contribution participants, which benefits St. James's Place by providing a sustained flow of new clients and assets under management that we believe will continue. We also like that the company's capital-light operating model generates a higher than average return on capital employed and robust cash conversion, the majority of which gets returned to shareholders.

For the first three quarters of 2023, the stocks that contributed most to returns were Alphabet, Amazon (U.S.) and Tenet Healthcare (U.S.). The stocks that detracted most from return were CNH Industrial (U.K.), St. James's Place and Prudential. From a sector perspective, our largest contributors were communication services and information technology, while real estate and consumer staples were the largest detractors.

September 30 ends the Fund's fiscal year. For that 12-month period, Oracle (U.S.) led the positive contributors followed by Alphabet and Allianz (Germany). St. James's Place, Envista Holdings (U.S.) and Credit Suisse Group (Switzerland) detracted most from returns. From a sector perspective, financials and industrials were the largest contributors, and real estate was the only detractor.

See accompanying Disclosures and Endnotes on page 103.

Oakmark.com 17

Oakmark Global Fund September 30, 2023

Portfolio Manager Commentary (continued)

Oracle (U.S.), a global software company, was the Fund's top contributor for the fiscal year, with its share price rising primarily after reporting its fiscal fourth-quarter results. More recently, Oracle announced fiscal first-quarter results, which were in line with consensus expectations. The drivers of the core business are performing well, in our view, and management expressed confidence that annual revenue growth will accelerate as planned based on demand trajectory and its strong bookings trends. For the quarter, total revenue increased 8% in constant currency (9% reported), and operating income grew 12% with margins showing improvement. Cloud and support revenue grew 11% in constant currency, powered by Fusion +20% and Netsuite +21%. The "strategic back office cloud" is now up to $6.9 billion in run-rate revenue. Infrastructure cloud and support revenue grew 14% in constant currency, powered by infrastructure cloud services +72% ex-legacy hosting services to $5.6 billion in run-rate revenue. Momentum is continuing to build as Oracle signed several deals for its cloud business greater than $1 billion in total value during the quarter and booked an additional $1.5 billion in the first week of the second quarter. We continue to believe Oracle is an attractive holding and undervalued due to our perception of its intrinsic value.

During the quarter, we initiated new positions in Brunswick and Cisco Systems. We eliminated our positions in Flowserve and Parker-Hannifin.

The Following is a Brief Description of Our New Holdings:

Brunswick (U.S.) is the leading manufacturer of marine engines, boats, and related parts and accessories. The company is commonly viewed as a cyclical boat manufacturer. The business has evolved in recent years, however, and now most of its profits come from its outboard engine business as well as its aftermarket parts and accessories segments. These are high-quality businesses in which Brunswick has material competitive advantages and they generate high returns on invested capital. The Mercury outboard business is the crown jewel. Over the past decade, Mercury has taken advantage of its leading scale to fund large investments in R&D and product development. These investments have driven consistent market share gains and enabled Mercury to carve out a dominant position in the fast-growing, high-horsepower part of the outboard market. Meanwhile, Brunswick has grown its parts and accessories business through attractive acquisitions that benefit from its broad-based distribution. The combination has shifted the business mix toward more resilient and faster growing profit streams that we believe are underappreciated today. Investors' recession fears and erroneous perception that Brunswick is a stale business have provided us with an opportunity to buy this high-quality franchise at a single-digit multiple of our estimate of mid-cycle earnings power. In our view, this is an attractive price for such a strong franchise.

Cisco Systems (U.S.) is the leading networking solutions company. Networking equipment gains importance as businesses modernize their IT infrastructure, and Cisco is well positioned to capture this demand with the broadest portfolio and the most effective go-to-market strategy. Cisco is changing its business from selling mainly transactional hardware to more software and subscriptions. This transition is expected to accelerate growth, improve operating margins and build recurring revenue. Despite these notable business improvements, Cisco still

trades near a trough valuation relative to the S&P 500 Index. More recently, Cisco announced its intention to acquire Splunk, a leader in security and observability, adding to its already strong position in the increasingly important security market. At a low-teens multiple of our estimate of normalized earnings, we think Cisco is trading at an attractive discount to our estimate of its intrinsic value.

We eliminated our positions in Flowserve (U.S.) and Parker-Hannifin (U.S.) as their share prices approached our estimates of intrinsic value.

Geographically, we ended the quarter with 48.5% of the portfolio in the U.S., 33.0% in Europe, 14.0% in the U.K. and 4.5% in Asia as a percent of equity. Over the third quarter, Switzerland and China contributed the most to return and the U.K., U.S. and Germany detracted the most. For the fiscal year, the U.S., Germany and Switzerland contributed the most to the Fund's return, while France and Mexico detracted the most from returns in the period.

We defensively hedge a portion of the Fund's exposure to currencies that we believe to be overvalued versus the U.S. dollar. However, as of quarter end, the Fund's currency exposure is unhedged.

We thank you for being our partners in the Oakmark Global Fund. We invite you to send us your comments or questions.

See accompanying Disclosures and Endnotes on page 103.

18 OAKMARK FUNDS

Oakmark Global Fund September 30, 2023

Schedule of Investments (in thousands)

| | | Shares | | Value | |

COMMON STOCKS - 95.9% | |

FINANCIALS - 32.3% | |

FINANCIAL SERVICES - 15.6% | |

Julius Baer Group Ltd. (Switzerland) | | | 516 | | | $ | 33,174 | | |

KKR & Co., Inc. (United States) | | | 469 | | | | 28,860 | | |

Capital One Financial Corp. (United States) | | | 293 | | | | 28,445 | | |

Fiserv, Inc. (United States) (a) | | | 226 | | | | 25,540 | | |

St. James's Place PLC (United Kingdom) | | | 2,483 | | | | 25,209 | | |

Intercontinental Exchange, Inc. (United States) | | | 204 | | | | 22,400 | | |

Corebridge Financial, Inc. (United States) | | | 1,093 | | | | 21,585 | | |