UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06279

Harris Associates Investment Trust

(Exact name of Registrant as specified in charter)

111 South Wacker Drive, Suite 4600

Chicago, Illinois 60606-4319

(Address of principal executive offices) (Zip code)

Kristi L. Rowsell Harris Associates L.P. 111 South Wacker Drive, Suite 4600 Chicago, Illinois 60606-4319 | Ndenisarya M. Bregasi, Esq. K&L Gates LLP 1601 K Street, N.W. Washington, D.C. 20006-1600 |

| (Name and address of agents for service) |

Registrant's telephone number, including area code: (312) 646-3600

Date of fiscal year end: 09/30/20

Date of reporting period: 09/30/20

Item 1. Reports to Shareholders.

OAKMARK FUNDS

ANNUAL REPORT | SEPTEMBER 30, 2020

OAKMARK FUND

OAKMARK SELECT FUND

OAKMARK GLOBAL FUND

OAKMARK GLOBAL SELECT FUND

OAKMARK INTERNATIONAL FUND

OAKMARK INTERNATIONAL SMALL CAP FUND

OAKMARK EQUITY AND INCOME FUND

OAKMARK BOND FUND

Oakmark Funds

2020 Annual Report

President's Letter | | | 1 | | |

Fund Expenses | | | 3 | | |

Commentary on Oakmark and Oakmark Select Funds | | | 4 | | |

Oakmark Fund | |

Summary Information | | | 8 | | |

Portfolio Manager Commentary | | | 9 | | |

Schedule of Investments | | | 11 | | |

Oakmark Select Fund | |

Summary Information | | | 14 | | |

Portfolio Manager Commentary | | | 15 | | |

Schedule of Investments | | | 16 | | |

Oakmark Global Fund | |

Summary Information | | | 18 | | |

Portfolio Manager Commentary | | | 19 | | |

Schedule of Investments | | | 21 | | |

Oakmark Global Select Fund | |

Summary Information | | | 24 | | |

Portfolio Manager Commentary | | | 25 | | |

Schedule of Investments | | | 27 | | |

Oakmark International Fund | |

Summary Information | | | 30 | | |

Portfolio Manager Commentary | | | 31 | | |

Schedule of Investments | | | 33 | | |

Oakmark International Small Cap Fund | |

Summary Information | | | 36 | | |

Portfolio Manager Commentary | | | 37 | | |

Schedule of Investments | | | 38 | | |

Oakmark Equity and Income Fund | |

Summary Information | | | 42 | | |

Portfolio Manager Commentary | | | 43 | | |

Schedule of Investments | | | 45 | | |

Oakmark Bond Fund | |

Summary Information | | | 50 | | |

Portfolio Manager Commentary | | | 51 | | |

Schedule of Investments | | | 52 | | |

Financial Statements | |

Statements of Assets and Liabilities | | | 54 | | |

Statements of Operations | | | 56 | | |

Statements of Changes in Net Assets | | | 58 | | |

Notes to Financial Statements | | | 72 | | |

Financial Highlights | | | 82 | | |

Report of Independent Registered Public Accounting Firm | | | 90 | | |

Liquidity Risk Management Program Disclosure | | | 91 | | |

Disclosure Regarding Investment Advisory Agreements

Approval | | | 92 | | |

Federal Tax Information | | | 97 | | |

Disclosures and Endnotes | | | 97 | | |

Trustees and Officers | | | 99 | | |

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Oakmark Funds' annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on Oakmark.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you hold your shares directly with the Funds, by calling 1-800-OAKMARK (625-6275) or visiting Oakmark.com. | |

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you hold your shares directly with the Funds, you can call 1-800-OAKMARK (625-6275) to let the Funds know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Funds you hold directly or all Funds you hold through your financial intermediary, as applicable.

FORWARD-LOOKING STATEMENT DISCLOSURE

One of our most important responsibilities as mutual fund managers is to communicate with shareholders in an open and direct manner. Some of our comments in our letters to shareholders are based on current management expectations and are considered "forward-looking statements." Actual future results, however, may prove to be different from our expectations. You can identify forward-looking statements by words such as "estimate", "may", "will", "expect", "believe",

"plan" and other similar terms. We cannot promise future returns. Our opinions are a reflection of our best judgment at the time this report is compiled, and we disclaim any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise.

Oakmark.com

Kristi L. Rowsell

President of the Oakmark Funds

President of Harris Associates L.P.

In my September 30th president's letter, I discussed the events of the fiscal year ended September 30, 2020. This included the challenges created by the Covid-19 pandemic for people all over the world and the many steps we at Harris Associates have taken to adapt to these difficult circumstances. I also outlined upcoming changes to our share classes, cost structure and leadership team.

I am sending this letter to share some important recent updates since that time.

Share Class Changes

As discussed in my last letter, we have revised our share class lineup and fee structure in order to reduce our overall costs and enhance our competitive position in the marketplace, especially with retirement plans. Our Advisor, Institutional and newly created R6 Classes are expected to have lower expense ratios going forward.

These changes are on track and scheduled to roll out on December 15. Please look for our upcoming prospectus update for more details and eligibility criteria. As always, we are available to assist you at 1-800-Oakmark from Monday through Friday during the hours of 8:00 a.m. to 6:00 p.m. ET.

Oakmark Bond Fund

We are pleased to announce the addition of the Oakmark Bond Fund to our mutual fund family. For decades, Harris Associates has managed fixed-income strategies for individual investors and as part of the Oakmark Equity and Income Fund. Over the past several years, we have built additional capabilities in this area and are now offering this expertise in a new Oakmark mutual fund. This diversified portfolio of bonds and other fixed-income securities will reflect the same bottom-up investment process and value

discipline applied to our equity portfolios. The Oakmark Bond Fund formally launched on June 10 under the guidance of Co-Portfolio Managers Adam Abbas and Colin Hudson. Since the Fund's inception date, it has gained enough assets to provide full diversification and to offer the Fund at a reasonable cost to investors. We have included the September 30th portfolio of investments and manager commentary for this Fund in this annual report.

Personal Investments in the Oakmark Funds

Each year, we share our level of personal investments in the Oakmark Funds as a demonstration of our belief in our investment philosophy. We want you to know that we stand beside you as fellow investors and that we, too, experience the same performance, tax consequences and client service as you do. We are proud to report that as of September 30, 2020, the value of Oakmark Funds owned by Harris Associates employees, our families, the Funds' officers and our trustees was more than $585 million. This is a substantial increase from the past year as opportunistic purchases were made during the down markets and as seed capital was accumulated for the Oakmark Bond Fund. We share this information as a testament to our personal conviction that our Funds remain attractive investments for the future.

Leadership Transitions

At year-end, Allan Reich will retire as trustee and chair of the Oakmark Board of Trustees. On behalf of Harris Associates and all of the trustees, we sincerely thank Allan for his 27 years of exemplary service. Our fund family has benefited from his seasoned wisdom about fund governance and his tireless commitment to effective communication between board members, including among board members

Oakmark.com 1

President's Letter (continued)

and Harris Associates. His distinguished legal career, in addition to his leadership with industry organizations, made him an influential and well-respected voice. We wish Allan the very best. We are happy that Tom Hayden will serve as chair starting in January. He has served on the Oakmark Board for 25 years. Tom is on the faculty of Northwestern University's Integrated Marketing Communication program, following a 30-year career in marketing and advertising. He brings considerable experience in the fields of law, policy, ethics and data governance to the board.

To close, I would like to report that our transition efforts for my retirement are going very well. Rana Wright, while continuing in her role as general counsel, will be elevated to chief administrative officer of Harris Associates and will become president of the Oakmark Funds on January 1. Chris Keller will be elevated from chief operating officer to president of Harris Associates. I will stay with the firm through the first quarter of 2021 to support these transitions.

As always, we appreciate your continued support of the Oakmark Funds.

2 OAKMARK FUNDS

Fund Expenses (Unaudited)

A shareholder of each Fund incurs ongoing costs, including investment advisory fees, transfer agent fees and other Fund expenses. The examples below are intended to help shareholders understand the ongoing costs (in dollars) of investing in each Fund and to compare these costs with the ongoing costs of investing in other funds.

The following table provides information about actual account values and actual Fund expenses as well as hypothetical account values and hypothetical fund expenses for shares of each Fund.

ACTUAL EXPENSES

The following table shows the expenses a shareholder would have paid on a $1,000 investment in each Fund from April 1, 2020 to September 30, 2020, as well as how much a $1,000 investment would be worth at the close of the period, assuming actual Fund returns and expenses. A shareholder can estimate expenses incurred for the period by dividing the account value at September 30, 2020, by $1,000 and multiplying the result by the number in the "Actual—Expenses Paid During Period" column shown below.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The following table provides information about hypothetical account values and hypothetical expenses for shares of each Fund based on actual expense ratios and an assumed rate of return of 5% per year before expenses, which are not the Funds' actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or actual expenses shareholders paid for the period. Shareholders may use this information to compare the ongoing costs of investing in a Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as redemption fees. Therefore, the "Hypothetical—Expenses Paid During Period" column of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. If these transaction costs were included, the total costs would have been higher.

| | | | ACTUAL | | HYPOTHETICAL

(5% annual return

before expenses) | | | |

| | Beginning

Account Value

(4/1/20) | | Ending

Account Value

(9/30/20) | | Expenses

Paid During

Period* | | Ending

Account Value

(9/30/20) | | Expenses

Paid During

Period* | | Annualized

Expense

Ratio | |

Oakmark Fund | |

Investor Class | | $ | 1,000.00 | | | $ | 1,306.10 | | | $ | 5.36 | | | $ | 1,020.35 | | | $ | 4.70 | | | | 0.93 | % | |

Advisor Class | | $ | 1,000.00 | | | $ | 1,306.80 | | | $ | 4.73 | | | $ | 1,020.90 | | | $ | 4.14 | | | | 0.82 | % | |

Institutional Class | | $ | 1,000.00 | | | $ | 1,307.20 | | | $ | 4.38 | | | $ | 1,021.20 | | | $ | 3.84 | | | | 0.76 | % | |

Service Class | | $ | 1,000.00 | | | $ | 1,304.30 | | | $ | 6.97 | | | $ | 1,018.95 | | | $ | 6.11 | | | | 1.21 | % | |

Oakmark Select Fund | |

Investor Class | | $ | 1,000.00 | | | $ | 1,297.10 | | | $ | 6.03 | | | $ | 1,019.75 | | | $ | 5.30 | | | | 1.05 | % | |

Advisor Class | | $ | 1,000.00 | | | $ | 1,297.90 | | | $ | 5.46 | | | $ | 1,020.25 | | | $ | 4.80 | | | | 0.95 | % | |

Institutional Class | | $ | 1,000.00 | | | $ | 1,298.60 | | | $ | 4.94 | | | $ | 1,020.70 | | | $ | 4.34 | | | | 0.86 | % | |

Service Class | | $ | 1,000.00 | | | $ | 1,296.00 | | | $ | 7.52 | | | $ | 1,018.45 | | | $ | 6.61 | | | | 1.31 | % | |

Oakmark Global Fund | |

Investor Class | | $ | 1,000.00 | | | $ | 1,292.70 | | | $ | 6.88 | | | $ | 1,019.00 | | | $ | 6.06 | | | | 1.20 | % | |

Advisor Class | | $ | 1,000.00 | | | $ | 1,293.90 | | | $ | 6.19 | | | $ | 1,019.60 | | | $ | 5.45 | | | | 1.08 | % | |

Institutional Class | | $ | 1,000.00 | | | $ | 1,293.80 | | | $ | 5.85 | | | $ | 1,019.90 | | | $ | 5.15 | | | | 1.02 | % | |

Service Class | | $ | 1,000.00 | | | $ | 1,290.70 | | | $ | 8.48 | | | $ | 1,017.60 | | | $ | 7.47 | | | | 1.48 | % | |

Oakmark Global Select Fund | |

Investor Class | | $ | 1,000.00 | | | $ | 1,310.00 | | | $ | 6.87 | | | $ | 1,019.05 | | | $ | 6.01 | | | | 1.19 | % | |

Advisor Class | | $ | 1,000.00 | | | $ | 1,310.30 | | | $ | 6.12 | | | $ | 1,019.70 | | | $ | 5.35 | | | | 1.06 | % | |

Institutional Class | | $ | 1,000.00 | | | $ | 1,311.00 | | | $ | 5.78 | | | $ | 1,020.00 | | | $ | 5.05 | | | | 1.00 | % | |

Oakmark International Fund | |

Investor Class | | $ | 1,000.00 | | | $ | 1,289.50 | | | $ | 5.67 | | | $ | 1,020.05 | | | $ | 5.00 | | | | 0.99 | % | |

Advisor Class | | $ | 1,000.00 | | | $ | 1,289.90 | | | $ | 5.15 | | | $ | 1,020.50 | | | $ | 4.55 | | | | 0.90 | % | |

Institutional Class | | $ | 1,000.00 | | | $ | 1,291.00 | | | $ | 4.64 | | | $ | 1,020.95 | | | $ | 4.09 | | | | 0.81 | % | |

Service Class | | $ | 1,000.00 | | | $ | 1,287.90 | | | $ | 7.21 | | | $ | 1,018.70 | | | $ | 6.36 | | | | 1.26 | % | |

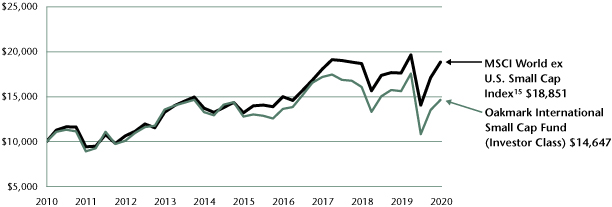

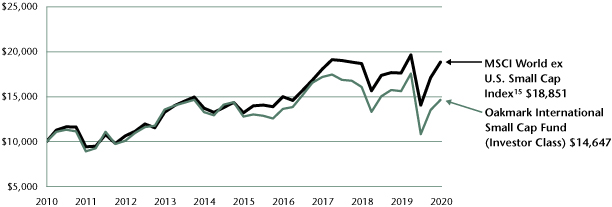

Oakmark International Small Cap Fund | |

Investor Class | | $ | 1,000.00 | | | $ | 1,350.80 | | | $ | 8.58 | | | $ | 1,017.70 | | | $ | 7.36 | | | | 1.46 | % | |

Advisor Class | | $ | 1,000.00 | | | $ | 1,352.80 | | | $ | 8.06 | | | $ | 1,018.15 | | | $ | 6.91 | | | | 1.37 | % | |

Institutional Class | | $ | 1,000.00 | | | $ | 1,352.80 | | | $ | 7.47 | | | $ | 1,018.65 | | | $ | 6.41 | | | | 1.27 | % | |

Service Class | | $ | 1,000.00 | | | $ | 1,347.90 | | | $ | 10.80 | | | $ | 1,015.80 | | | $ | 9.27 | | | | 1.84 | % | |

Oakmark Equity and Income Fund | |

Investor Class | | $ | 1,000.00 | | | $ | 1,200.90 | | | $ | 4.73 | | | $ | 1,020.70 | | | $ | 4.34 | | | | 0.86 | % | |

Advisor Class | | $ | 1,000.00 | | | $ | 1,201.30 | | | $ | 4.02 | | | $ | 1,021.35 | | | $ | 3.69 | | | | 0.73 | % | |

Institutional Class | | $ | 1,000.00 | | | $ | 1,201.70 | | | $ | 3.63 | | | $ | 1,021.70 | | | $ | 3.34 | | | | 0.66 | % | |

Service Class | | $ | 1,000.00 | | | $ | 1,199.30 | | | $ | 6.16 | | | $ | 1,019.40 | | | $ | 5.65 | | | | 1.12 | % | |

Oakmark Bond Fund | |

Advisor Class | | $ | 1,000.00 | | | $ | 1,020.40 | | | $ | 1.67 | (a) | | $ | 1,022.30 | | | $ | 2.73 | | | | 0.54 | % | |

Institutional Class | | $ | 1,000.00 | | | $ | 1,020.70 | | | $ | 1.36 | (a) | | $ | 1,022.80 | | | $ | 2.23 | | | | 0.44 | % | |

* Expenses are calculated using the Annualized Expense Ratio, multiplied by the average account value over the period, multiplied by 183 and divided by 366 (to reflect one-half year period)

(a) Expenses are calculated using the Annualized Expense Ratio, multiplied by the average account value over the period, multiplied by 112 and divided by 366 (to reflect number of days in the class was open).

Oakmark.com 3

Oakmark and Oakmark Select Funds September 30, 2020

Portfolio Manager Commentary

William C. Nygren, CFA

Portfolio Manager

oakmx@oakmark.com

oaklx@oakmark.com

oakwx@oakmark.com

At Oakmark, we are long-term investors. We attempt to identify growing businesses that are managed to benefit their shareholders. We will purchase stock in those businesses only when priced substantially below our estimate of intrinsic value. After purchase, we patiently wait for the gap between stock price and intrinsic value to close.

Are large-cap stocks really less risky?

The large-cap universe, which refers to the 250 stocks with the highest market capitalizations, is getting smaller. There were 40 newcomers to the large-cap universe in just the past year and they are much smaller businesses than those that exited. The median level of sales for these new additions was just under $2.4 billion. Compare that to the companies that exited the large-cap universe: only two of them had sales below $2.4 billion and their median sales was nearly $14 billion. The reason those new additions are now considered large cap is because the market is valuing them highly relative to their sales. The median new large-cap stock is selling at nearly 13 times its trailing sales. The companies no longer considered large cap are selling at just 1.4 times sales. Big businesses, such as Schlumberger, Phillips 66, Southwest Airlines and Dollar Tree, no longer qualify as large cap having been displaced by the likes of Square, Splunk and Snap.

Why is this important? Investors typically view large-cap stocks as less risky than small-cap stocks—and we would normally agree. Large companies usually have longer histories, more consistent profit margins and predictable competitive dynamics. As an example, it is easier to forecast the market shares a decade from now for the large insurers than for emerging online gaming companies. It is less difficult to guess the future profit margin for a large food company than it is for a new payments company that has just turned profitable. One problem with thinking that large-cap stocks are less risky is if that classification is due to a large valuation multiple rather than a large underlying business. In that case, the investor faces magnified risk: the higher risk inherent in a small business combined with the extra risk associated with a high valuation multiple.

The biggest newcomer to the large-cap list this year was Zoom Video Communications. The company has a market cap of $134 billion and sells at nearly 100 times trailing sales. With so many people working from home, video conferencing has been a lifesaver. Most days I have multiple video calls. When people talk about changes from the past six months that are likely to outlast Covid-19, increased use of video conferencing is at the top of most lists. I use Zoom frequently and love the service. But I also use Cisco Webex, Microsoft Teams, Google Meet, Apple FaceTime and Verizon BlueJeans Meetings. When I'm on a call, it's hard to remember which one I'm using because the services are so similar. Zoom's competitors are not underfunded startups, but rather are some of the biggest businesses in the world. While it is easy to project that video conferencing will grow over the next decade, there is a wide range in the growth estimates, and it is hard to predict what market shares will be, what the services will cost or what profit margins will look like. Zoom faces the uncertainties you'd expect for a young company with $1 billion of sales. But its future is much more uncertain

than you'd typically see from a $134 billion market-cap stock. Will Zoom stock perform well from here? I have no idea. But I do know the range of possible outcomes for the business is much wider than it is for most companies that enjoy a market cap above $100 billion.

One of our many financial holdings, Wells Fargo, has a market cap just under $100 billion, less than three-quarters of Zoom's cap. But Wells is one of the big three retail banks in the U.S. along with Bank of America (also a current portfolio holding) and JPMorgan. The demand for retail banking has been relatively predictable and has grown with GDP. Ten years ago, the same three banks were the largest. Due to economies of scale, their market share has grown over the past decade. It doesn't take much imagination to assume that 10 years from now, the banking industry will be larger than it is today and that these three competitively advantaged banks should have more market share. Banks have historically earned a low-to-mid teens return on their tangible equity, and we expect that to continue. The relatively narrow range of outcomes for any of the large banks stands in stark contrast to the very wide range for a small business like Zoom.

With many of the banks, including Wells and Bank of America, priced at single digit P/E ratios,1 we believe reversion to the mean is on our side. Financial stocks, including banks, have typically sold at about two-thirds of the S&P 5002 multiple. They are currently trading at seven to eight times pre-Covid-19 earnings. And if they have accurately estimated their Covid-19-related charge-offs, they should quickly return to those earnings. We believe they deserve P/E ratios at least 50% higher than their trailing P/E ratios,3 which would be consistent with their long-term average. And when (or if) interest rates eventually rise, they are expected to produce a further increase in earnings. Compared to the small businesses that are now large-cap stocks, we believe the banks are both less risky and have larger expected returns.

In the Oakmark Fund, we buy large businesses because we view them as less risky than small businesses. Rather than defining "large" based on market capitalization, we define it by business fundamentals: sales, net income or shareholders' equity (book value). If a company is in the 250 largest on any of those metrics, we consider it "large" and in our investible universe, regardless of its market capitalization. Typically, there isn't too much difference between the universe of large businesses and large-cap stocks. But at times when investors will seemingly pay any price for growth, small businesses with very high valuations begin crowding out big businesses from the large-cap universe.

Empirical Research tracks the price investors have been willing to pay for high growth. This chart compares the P/E multiples for fast growers to the lowest P/E companies.

See accompanying Disclosures and Endnotes on page 97.

4 OAKMARK FUNDS

Oakmark and Oakmark Select Funds September 30, 2020

Portfolio Manager Commentary (continued)

Ratio of the Big Growers and

Cheapest Large Capitalization Stocks

Relative Trailing-P/E Ratios1

1952 Through Late-July 2020

Source: Empirical Research Partners Analysis.

1 Equally-weighted data; excludes negative earnings during the New Economy era.

It uses a proprietary list of 75 fast growers (combining sales growth and earnings growth over varying time periods to weed out cyclical companies recovering from a downturn) and compares their P/E to the 100 lowest P/E companies in a universe that mimics the Russell 1000 Value Index.4 As you can see, for nearly 70 years, with the exception of the spike during the internet bubble in 1999, the P/E on the highest growers has typically been two to three times the P/E for the cheapest stocks. In 1999, when value investing was as out of favor as it is today, investors were paying nine times as much for rapid growers as for low multiple stocks. That premium was three to four times larger than normal.

Today, like 20 years ago, the fast growers have P/E ratios nearly 10 times higher than the lowest multiple stocks. Although low interest rates and shortcomings of GAAP5 accounting could justify a somewhat higher multiple than the 2-3x frequently observed over the past 70 years, 10 times strikes us as extreme. That large valuation spread is causing a divergence between large businesses and large-cap stocks. Of the 40 stocks that fell out of the large-cap universe over the past year, 35 qualified as large businesses based on sales, income or book value. Of the 40 that replaced them, only 9 did. This roughly doubled the number of "small business large-cap" stocks compared to a year ago. In the Oakmark Select Fund, three holdings that were considered large cap a year ago—AIG International, EOG Resources and Hilton Worldwide—are now considered mid-cap stocks. In the Oakmark Fund, we bought 10 new stocks over the past year.

Despite us considering them large businesses, only five were classified as large cap at the time of purchase.

We faced a similar situation 20 years ago when the dot-com bubble peaked, and we wrote about it in the Oakmark Fund September 2000 report (https://oakmark.com/wp-content/uploads/sites/3/2019/10/2000-Annual93000.pdf):

Oakmark—A Large Company Fund

When investors categorize equity mutual funds, they generally look at two criteria: investment style and the size of the companies being purchased. For investment style—growth or value—The Oakmark Fund is clearly a value fund. All our energy goes into identifying and buying inexpensive stocks, selling them when they are no longer inexpensive, and then repeating the process. To categorize us based on the size of companies we purchase is more difficult. Since larger companies tend to have longer operating histories and more predictable earnings streams, they tend to be less risky investments. Therefore, many investors prefer mutual funds that focus on larger companies, as we do in The Oakmark Fund.

We believe The Oakmark Fund has always invested primarily in large companies. That's because when we think of large, we think of fundamental characteristics that measure the size of underlying businesses. Using measures like sales, net income or shareholders' equity, most of our investments have been and still are in stocks that are among the 250 largest businesses in the United States. But most organizations that categorize mutual funds look instead at how Wall Street values those businesses. For example, Morningstar calls the

See accompanying Disclosures and Endnotes on page 97.

Oakmark.com 5

Oakmark and Oakmark Select Funds September 30, 2020

Portfolio Manager Commentary (continued)

250 stocks with the biggest market capitalizations "large cap." Based on their definition, a "large cap fund" primarily buys stocks that have market capitalizations over $10 billion. Because we own many stocks with market caps below $10 billion, in the last quarter Morningstar moved The Oakmark Fund from the "large cap value" to the "mid cap value" category.

This is important because we believe that investors who own funds that are still called "large cap" may not be getting the lower risk level they expect from investing in large companies. Last year, many small companies, mostly technology companies, had such high stock prices that they were categorized as large-cap stocks. By our count, the number of these small-company large-caps was five times as high as it was a decade ago! These stocks have a much higher risk profile than is typically associated with large companies. Avoiding these stocks is what has reduced the average market capitalization of our stock positions. The Oakmark Fund will continue buying stocks in large companies that we believe are priced at bargain levels. We believe this is simply acting rationally in a market that has priced many securities irrationally. And, if that means that, in this environment, our "large company value" fund gets categorized as "mid cap value," it just shows we are doing our job!

We believe those words of caution, which proved timely 20 years ago, are again applicable. If the price for growth remains this high or goes higher, we expect that more of our holdings will get classified as mid cap. Today, 250 companies have market caps above $26 billion, and to meet Morningstar's definition of large cap, companies now need a market cap of about $35 billion. (Morningstar now ranks companies by cap and sets the large-cap line at 70% of total public market cap.) Most of the large businesses our analysts are working on today have market caps below $35 billion. This means more of our new positions are likely to be mid cap than usual. Though our funds may look less large cap, it will be because we are doing the same thing we did in 2000 and have done for all the years since—buying big businesses that appear undervalued.

See accompanying Disclosures and Endnotes on page 97.

6 OAKMARK FUNDS

This page intentionally left blank.

Oakmark.com 7

Oakmark Fund September 30, 2020

Summary Information

VALUE OF A $10,000 INVESTMENT

Since Inception - 08/05/91 (Unaudited)

PERFORMANCE

| | | | | Average Annual Total Returns (as of 09/30/20) | | | |

| (Unaudited) | | Total Return

Last 3 Months | | 1-year | | 3-year | | 5-year | | 10-year | | Since

Inception | | Inception

Date | |

Oakmark Fund (Investor Class) | | | 6.18 | % | | | 1.18 | % | | | 2.20 | % | | | 8.61 | % | | | 10.97 | % | | | 11.77 | % | | 08/05/91 | |

S&P 500 Index | | | 8.93 | % | | | 15.15 | % | | | 12.28 | % | | | 14.15 | % | | | 13.74 | % | | | 9.94 | % | | | |

Dow Jones Industrial Average6 | | | 8.22 | % | | | 5.70 | % | | | 9.98 | % | | | 14.02 | % | | | 12.69 | % | | | 10.54 | % | | | |

Lipper Large Cap Value Fund Index7 | | | 4.87 | % | | | -2.41 | % | | | 3.68 | % | | | 8.52 | % | | | 9.76 | % | | | 8.37 | % | | | |

Oakmark Fund (Advisor Class) | | | 6.21 | % | | | 1.30 | % | | | 2.30 | % | | | N/A | | | | N/A | | | | 5.89 | % | | 11/30/16 | |

Oakmark Fund (Institutional Class) | | | 6.21 | % | | | 1.36 | % | | | 2.37 | % | | | N/A | | | | N/A | | | | 5.94 | % | | 11/30/16 | |

Oakmark Fund (Service Class) | | | 6.10 | % | | | 0.90 | % | | | 1.91 | % | | | 8.30 | % | | | 10.64 | % | | | 7.41 | % | | 04/05/01 | |

The graph and table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Past performance is no guarantee of future results. The performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted. Total return includes change in share prices and, in each case, includes reinvestment of dividends and capital gain distributions. The investment return and principal value vary so that an investor's shares, when redeemed, may be worth more or less than the original cost. To obtain the most recent month-end performance, please visit Oakmark.com.

TOP TEN EQUITY HOLDINGS8 | | % of Net Assets | |

Alphabet, Inc., Class A | | | 3.8 | | |

Facebook, Inc., Class A | | | 3.7 | | |

Netflix, Inc. | | | 3.6 | | |

Ally Financial, Inc. | | | 3.5 | | |

Comcast Corp., Class A | | | 3.2 | | |

Capital One Financial Corp. | | | 3.1 | | |

Bank of America Corp. | | | 3.0 | | |

Constellation Brands, Inc., Class A | | | 2.7 | | |

Booking Holdings, Inc. | | | 2.7 | | |

The Charles Schwab Corp. | | | 2.5 | | |

FUND STATISTICS | |

Ticker* | | OAKMX | |

Number of Equity Holdings | | 48 | |

Net Assets | | $11.3 billion | |

Weighted Average Market Cap | | $142.1 billion | |

Median Market Cap | | $44.5 billion | |

Gross Expense Ratio - Investor Class (as of 09/30/19)* | | 0.92% | |

Gross Expense Ratio - Investor Class (as of 09/30/20)* | | 0.96% | |

Net Expense Ratio - Investor Class (as of 09/30/20)*† | | 0.92% | |

* This information is related to the Investor Class. Please visit Oakmark.com for information related to the Advisor, Institutional and Service Classes.

† The net expense ratio reflects a contractual advisory fee waiver agreement through January 27, 2021.

SECTOR ALLOCATION | | % of Net Assets | |

Financials | | | 29.6 | | |

Communication Services | | | 17.7 | | |

Consumer Discretionary | | | 12.9 | | |

Information Technology | | | 11.3 | | |

Industrials | | | 9.3 | | |

Health Care | | | 6.6 | | |

Consumer Staples | | | 4.2 | | |

Energy | | | 1.1 | | |

Real Estate | | | 0.8 | | |

Internet & Direct Marketing Retail | | | 0.1 | | |

Short-Term Investments and Other | | | 6.4 | | |

See accompanying Disclosures and Endnotes on page 97.

8 OAKMARK FUNDS

Oakmark Fund September 30, 2020

Portfolio Manager Commentary

William C. Nygren, CFA

Portfolio Manager

oakmx@oakmark.com

Kevin Grant, CFA

Portfolio Manager

oakmx@oakmark.com

Michael A. Nicolas, CFA

Portfolio Manager

oakmx@oakmark.com

The Oakmark Fund increased 6.2% during the third quarter, compared to an 8.9% gain for the S&P 500 Index.2 For the fiscal year ending September 30, the Oakmark Fund increased 1.2%, trailing the 15.2% gain for the S&P 500. It's only fitting that unusual times produce unexpected outcomes, as illustrated by the fact that just four stocks in the S&P 500 drove approximately 70% of its total return over the past 12 months. Furthermore, the relative underperformance of the Russell 1000 Value Index4 against the S&P 500 is near an all-time high, with the former down 5% over the past fiscal year. Fortunately, we believe the magnitude of this atypically high performance dispersion presents an attractive investment environment for patient, value-oriented investors like Oakmark. Our disciplined investment process and long-term focus enable us to capitalize on dislocations between stock price and business value without having to speculate about short-term catalysts or to manage to a specific benchmark. This perspective has allowed us to outperform the market over the near 30-year life of the Oakmark Fund.

Our highest contributing securities for the fiscal year were Regeneron Pharmaceuticals and Netflix and our largest individual detractors were Citigroup and Wells Fargo. For the quarter, our best performing securities were Ally Financial and Pinterest and our largest detractors were Citigroup and EOG Resources. Our strongest contributing sectors over the past fiscal year were communication services and health care and our biggest detractors were financials and energy. In our assessment, $40 per barrel is an unsustainably low price for oil and it fails to incentivize necessary U.S. and other non-OPEC production growth. We believe that our holdings in this sector can benefit from increased cost discipline and the potential for rising prices. Although energy makes up a small percentage of the Fund's total assets, we believe our holdings in this sector offer some of the highest upside potential and should benefit from a recovery in demand over the next several years.

During the quarter, we initiated new positions in CBRE Group and Keurig Dr Pepper and we eliminated positions in Match Group and Pinterest. We took advantage of the market's heightened volatility during the first calendar quarter of this year to establish positions in both Match Group and Pinterest, which had traded down significantly, despite attractive long-term fundamental outlooks, increased user engagement and strong balance sheets. While we rarely anticipate that our thesis will play out as expeditiously as it did for both companies, the market ended up agreeing with our thesis for each in short order, and both stocks approached our estimate of intrinsic value. We expect Match Group and Pinterest will continue to grow at above-average rates for the foreseeable future and we believe they are both well managed and well positioned in their respective industries. However, we elected to sell them to pursue more

attractive alternatives that were trading at steeper discounts to our estimates of intrinsic value.

If you carefully examine our portfolio holdings, you will see a number of options positions. As you know, while minimizing taxes is not a primary investment strategy at Oakmark, maximizing long-term after-tax returns is. Realizing tax losses on stocks we believe are still attractive is an important part of achieving that goal. The September market decline gave us the opportunity to take tax losses in several of our energy and financial stocks. To maintain some economic interest in those stocks, we sold out of the money put options. After the 30-day wash sale period expires, we want to repurchase those shares, which is what will happen if the stock price falls and we are assigned on the options. If the stock price increases, the premiums we received for writing the options will capture at least some of the gain that we will have missed out on. Despite having exited several of our long-term holdings that had appreciated substantially, we anticipate that our taxable capital gain distribution will be zero this year.

We appreciate your continued support and confidence in the Oakmark Fund. Below is a brief description of our new additions during the quarter:

CBRE Group, Inc. Class A

CBRE Group is the largest commercial real estate services firm in the U.S. The company has significant scale across its various service lines and geographies, enabling it to consistently invest more than its smaller peers into the research, tools and technology that customers value. This industry-leading value proposition has driven consistent share gains for CBRE in recent years as large clients have been attracted to the company's differentiated capabilities and the best brokers have been attracted by the steady stream of clients. We expect CBRE to continue to gain market share in this highly fragmented brokerage industry for many years to come while it further transitions away from transaction-driven commissions and toward contractual fee revenues. Outsized fears around work from home have caused the company to sell for less than 9x our estimate of mid-cycle earnings. We think this is a bargain price for this high-quality and well-managed business.

Keurig Dr Pepper, Inc.

Keurig Dr Pepper is one of North America's leading beverage companies and commands dominant positions in single-serve coffee and flavored sodas. We believe single-serve coffee pods will capture almost all of the incremental growth in at-home coffee consumption because coffee drinkers increasingly prefer K-Cups over drip brewing due to its greater convenience, quality, variety and value. Keurig's competitive advantages (low-cost production, the largest installed base of brewers, exclusive

See accompanying Disclosures and Endnotes on page 97.

Oakmark.com 9

Oakmark Fund September 30, 2020

Portfolio Manager Commentary (continued)

brand partnerships) allow it to collect a toll on most pods sold in North America. The company's soda franchises remain highly profitable, and we do not expect health-related concerns about sugar to materially impact consumption trends. We believe that Keurig's brands should deliver steady growth, consistent market share gains and significant excess cash. We think the company is an above-average business trading at a meaningful discount to the broader market, its beverage peers and historical private market transactions.

See accompanying Disclosures and Endnotes on page 97.

10 OAKMARK FUNDS

Oakmark Fund September 30, 2020

Schedule of Investments (in thousands)

| | | Shares | | Value | |

COMMON STOCKS - 93.5% | |

FINANCIALS - 29.6% | |

DIVERSIFIED FINANCIALS - 20.2% | |

Ally Financial, Inc. | | | 15,623 | | | $ | 391,671 | | |

Capital One Financial Corp. | | | 4,914 | | | | 353,120 | | |

The Charles Schwab Corp. | | | 7,900 | | | | 286,217 | | |

State Street Corp. | | | 4,351 | | | | 258,133 | | |

The Goldman Sachs Group, Inc. | | | 1,105 | | | | 222,072 | | |

Moody's Corp. | | | 752 | | | | 217,930 | | |

American Express Co. | | | 2,004 | | | | 200,931 | | |

The Bank of New York Mellon Corp. | | | 5,636 | | | | 193,524 | | |

S&P Global, Inc. | | | 473 | | | | 170,413 | | |

| | | | | | 2,294,011 | | |

BANKS - 5.7% | |

Bank of America Corp. | | | 13,976 | | | | 336,670 | | |

Citigroup, Inc. (a) | | | 3,604 | | | | 155,373 | | |

Wells Fargo & Co. | | | 6,580 | | | | 154,705 | | |

| | | | | | 646,748 | | |

INSURANCE - 3.7% | |

American International Group, Inc. | | | 7,733 | | | | 212,884 | | |

Reinsurance Group of America, Inc. | | | 2,134 | | | | 203,119 | | |

| | | | | | 416,003 | | |

| | | | | | 3,356,762 | | |

COMMUNICATION SERVICES - 17.7% | |

MEDIA & ENTERTAINMENT - 16.7% | |

Alphabet, Inc., Class A (b) | | | 295 | | | | 432,521 | | |

Facebook, Inc., Class A (a) (b) | | | 1,611 | | | | 422,026 | | |

Netflix, Inc. (a) (b) | | | 818 | | | | 409,074 | | |

Comcast Corp., Class A | | | 7,709 | | | | 356,623 | | |

Charter Communications, Inc., Class A (b) | | | 427 | | | | 266,281 | | |

| | | | | | 1,886,525 | | |

TELECOMMUNICATION SERVICES - 1.0% | |

T-Mobile US, Inc. (b) | | | 1,000 | | | | 114,360 | | |

| | | | | | 2,000,885 | | |

CONSUMER DISCRETIONARY - 12.9% | |

RETAILING - 5.5% | |

Booking Holdings, Inc. (b) | | | 179 | | | | 305,528 | | |

eBay, Inc. | | | 4,376 | | | | 227,974 | | |

Qurate Retail, Inc., Class A | | | 13,030 | | | | 93,558 | | |

| | | | | | 627,060 | | |

AUTOMOBILES & COMPONENTS - 3.8% | |

General Motors Co. | | | 8,146 | | | | 241,040 | | |

Aptiv PLC | | | 2,036 | | | | 186,679 | | |

| | | | | | 427,719 | | |

CONSUMER SERVICES - 3.6% | |

Hilton Worldwide Holdings, Inc. | | | 2,572 | | | | 219,451 | | |

MGM Resorts International | | | 8,682 | | | | 188,838 | | |

| | | | | | 408,289 | | |

| | | | | | 1,463,068 | | |

| | | Shares | | Value | |

INFORMATION TECHNOLOGY - 11.3% | |

SOFTWARE & SERVICES - 9.5% | |

Gartner, Inc. (b) | | | 1,668 | | | $ | 208,457 | | |

Workday, Inc., Class A (b) | | | 857 | | | | 184,323 | | |

MasterCard, Inc., Class A | | | 542 | | | | 183,390 | | |

Visa, Inc., Class A | | | 881 | | | | 176,114 | | |

Automatic Data Processing, Inc. | | | 1,199 | | | | 167,234 | | |

DXC Technology Co. | | | 9,139 | | | | 163,133 | | |

| | | | | | 1,082,651 | | |

TECHNOLOGY HARDWARE & EQUIPMENT - 1.8% | |

TE Connectivity, Ltd. | | | 2,051 | | | | 200,440 | | |

| | | | | | 1,283,091 | | |

INDUSTRIALS - 9.3% | |

CAPITAL GOODS - 9.3% | |

Parker-Hannifin Corp. | | | 1,400 | | | | 283,369 | | |

Cummins, Inc. | | | 1,222 | | | | 258,037 | | |

Caterpillar, Inc. | | | 1,570 | | | | 234,136 | | |

General Electric Co. | | | 26,000 | | | | 161,980 | | |

General Dynamics Corp. | | | 800 | | | | 110,744 | | |

| | | | | | 1,048,266 | | |

HEALTH CARE - 6.6% | |

HEALTH CARE EQUIPMENT & SERVICES - 5.7% | |

Humana, Inc. | | | 628 | | | | 259,923 | | |

HCA Healthcare, Inc. | | | 1,683 | | | | 209,836 | | |

CVS Health Corp. | | | 3,078 | | | | 179,765 | | |

| | | | | | 649,524 | | |

PHARMACEUTICALS, BIOTECHNOLOGY & LIFE SCIENCES - 0.9% | |

Regeneron Pharmaceuticals, Inc. (a) (b) | | | 174 | | | | 97,343 | | |

| | | | | | 746,867 | | |

CONSUMER STAPLES - 4.2% | |

FOOD, BEVERAGE & TOBACCO - 4.2% | |

Constellation Brands, Inc., Class A | | | 1,635 | | | | 309,830 | | |

Keurig Dr Pepper, Inc. | | | 5,978 | | | | 164,990 | | |

| | | | | | 474,820 | | |

ENERGY - 1.1% | |

EOG Resources, Inc. (a) | | | 2,699 | | | | 96,986 | | |

Apache Corp. (a) | | | 2,744 | | | | 25,984 | | |

| | | | | | 122,970 | | |

REAL ESTATE - 0.8% | |

CBRE Group, Inc., Class A (b) | | | 1,894 | | | | 88,985 | | |

TOTAL COMMON STOCKS - 93.5%

(COST $6,833,321) | | | | | 10,585,714 | | |

PREFERRED STOCKS - 0.1% | |

INTERNET & DIRECT MARKETING RETAIL - 0.1% | |

Qurate Retail, Inc. 8.00% | | | 110 | | | | 10,843 | | |

TOTAL PREFERRED STOCKS - 0.1%

(COST $9,117) | | | | | 10,843 | | |

See accompanying Notes to Financial Statements.

Oakmark.com 11

Oakmark Fund September 30, 2020

Schedule of Investments (in thousands) (continued)

| | | Par Value | | Value | |

SHORT-TERM INVESTMENT - 7.8% | |

REPURCHASE AGREEMENT - 7.8% | |

Fixed Income Clearing Corp. Repurchase

Agreement, 0.05% dated 09/30/20 due

10/01/20, repurchase price $879,270,

collateralized by United States

Treasury Notes, 0.125% due

09/30/22 - 05/15/23, aggregate

value plus accrued interest of $896,854

(Cost: $879,268) | | $ | 879,268 | | | $ | 879,268 | | |

TOTAL SHORT-TERM INVESTMENTS - 7.8%

(COST $879,268) | | | | | 879,268 | | |

TOTAL INVESTMENTS - 101.4%

(COST $7,721,706) | | | | | 11,475,825 | | |

Foreign Currencies (Cost $0) - 0.0% (c) | | | | | 0 | (d) | |

Liabilities In Excess of Other Assets - (1.4)% | | | | | (159,475 | ) | |

TOTAL NET ASSETS - 100.0% | | | | $ | 11,316,350 | | |

(a) All or a portion of this investment is held in connection with one or more options within the Fund.

(b) Non-income producing security

(c) Amount rounds to less than 0.1%.

(d) Amount rounds to less than $1,000.

See accompanying Notes to Financial Statements.

12 OAKMARK FUNDS

Oakmark Fund September 30, 2020

Schedule of Investments (in thousands) (continued)

WRITTEN OPTIONS

Description | | Exercise

Price | | Expiration

Date | | Number of

Contracts | | Notional

Amount | | Market

Value | | Premiums

(Received)

by Fund | | Unrealized

Gain/(Loss) | |

CALLS | |

Regeneron Pharmaceuticals, Inc. | | $ | 600.00 | | | 11/20/20 | | | (300 | ) | | $ | (16,793 | ) | | $ | (569 | ) | | $ | (1,887 | ) | | $ | 1,318 | | |

Regeneron Pharmaceuticals, Inc. | | $ | 545.00 | | | 11/20/20 | | | (900 | ) | | $ | (50,380 | ) | | $ | (3,857 | ) | | $ | (8,532 | ) | | $ | 4,675 | | |

Facebook, Inc., Class A | | $ | 285.00 | | | 11/20/20 | | | (3,000 | ) | | $ | (78,570 | ) | | $ | (2,700 | ) | | $ | (4,972 | ) | | $ | 2,272 | | �� |

Netflix, Inc. | | $ | 400.00 | | | 12/18/20 | | | (3,000 | ) | | $ | (150,009 | ) | | $ | (33,487 | ) | | $ | (43,091 | ) | | $ | 9,604 | | |

Netflix, Inc. | | $ | 520.00 | | | 12/18/20 | | | (100 | ) | | $ | (5,000 | ) | | $ | (386 | ) | | $ | (679 | ) | | $ | 293 | | |

Netflix, Inc. | | $ | 410.00 | | | 12/18/20 | | | (2,000 | ) | | $ | (100,006 | ) | | $ | (20,760 | ) | | $ | (27,697 | ) | | $ | 6,937 | | |

| | | | | | | | | $ | (400,758 | ) | | $ | (61,759 | ) | | $ | (86,858 | ) | | $ | 25,099 | | |

PUTS | |

Citigroup, Inc. | | $ | 42.00 | | | 11/6/20 | | | (60,000 | ) | | $ | (258,660 | ) | | $ | (13,020 | ) | | $ | (17,007 | ) | | $ | 3,987 | | |

Diamondback Energy, Inc. | | $ | 32.50 | | | 10/12/20 | | | (26,000 | ) | | $ | (78,312 | ) | | $ | (7,529 | ) | | $ | (6,174 | ) | | $ | (1,355 | ) | |

EOG Resources, Inc. | | $ | 39.00 | | | 10/23/20 | | | (39,000 | ) | | $ | (140,166 | ) | | $ | (16,185 | ) | | $ | (10,275 | ) | | $ | (5,910 | ) | |

Apache Corp. | | $ | 11.50 | | | 10/23/20 | | | (190,000 | ) | | $ | (179,930 | ) | | $ | (41,705 | ) | | $ | (21,748 | ) | | $ | (19,957 | ) | |

Concho Resources, Inc. | | $ | 49.00 | | | 10/23/20 | | | (26,000 | ) | | $ | (114,712 | ) | | $ | (14,040 | ) | | $ | (8,670 | ) | | $ | (5,370 | ) | |

| | | | | | | | | $ | (771,780 | ) | | $ | (92,479 | ) | | $ | (63,874 | ) | | $ | (28,605 | ) | |

See accompanying Notes to Financial Statements.

Oakmark.com 13

Oakmark Select Fund September 30, 2020

Summary Information

VALUE OF A $10,000 INVESTMENT

Since Inception - 11/01/96 (Unaudited)

PERFORMANCE

| | | | Average Annual Total Returns (as of 09/30/20) | | | |

| (Unaudited) | | Total Return

Last 3 Months | | 1-year | | 3-year | | 5-year | | 10-year | | Since

Inception | | Inception

Date | |

Oakmark Select Fund (Investor Class) | | | 5.24 | % | | | -2.45 | % | | | -4.39 | % | | | 3.67 | % | | | 8.54 | % | | | 10.57 | % | | 11/01/96 | |

S&P 500 Index | | | 8.93 | % | | | 15.15 | % | | | 12.28 | % | | | 14.15 | % | | | 13.74 | % | | | 8.79 | % | | | |

Lipper Multi-Cap Value Fund Index9 | | | 4.35 | % | | | -7.11 | % | | | -0.20 | % | | | 5.35 | % | | | 8.22 | % | | | 6.69 | % | | | |

Oakmark Select Fund (Advisor Class) | | | 5.26 | % | | | -2.31 | % | | | -4.26 | % | | | N/A | | | | N/A | | | | 0.07 | % | | 11/30/16 | |

Oakmark Select Fund (Institutional Class) | | | 5.29 | % | | | -2.27 | % | | | -4.22 | % | | | N/A | | | | N/A | | | | 0.10 | % | | 11/30/16 | |

Oakmark Select Fund (Service Class) | | | 5.21 | % | | | -2.69 | % | | | -4.62 | % | | | 3.40 | % | | | 8.23 | % | | | 7.43 | % | | 12/31/99 | |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Past performance is no guarantee of future results. The performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted. Total return includes change in share prices and, in each case, includes reinvestment of dividends and capital gain distributions. The investment return and principal value vary so that an investor's shares, when redeemed, may be worth more or less than the original cost. To obtain the most recent month-end performance, please visit Oakmark.com.

TOP TEN EQUITY HOLDINGS8 | | % of Net Assets | |

Alphabet, Inc., Class A | | | 10.3 | | |

CBRE Group, Inc., Class A | | | 9.3 | | |

Charter Communications, Inc., Class A | | | 7.1 | | |

Ally Financial, Inc. | | | 6.3 | | |

TE Connectivity, Ltd. | | | 5.9 | | |

Facebook, Inc., Class A | | | 5.9 | | |

Netflix, Inc. | | | 5.1 | | |

Constellation Brands, Inc., Class A | | | 5.1 | | |

Citigroup, Inc. | | | 4.9 | | |

Bank of America Corp. | | | 4.7 | | |

FUND STATISTICS | |

Ticker* | | OAKLX | |

Number of Equity Holdings | | 21 | |

Net Assets | | $3.4 billion | |

Weighted Average Market Cap | | $203.9 billion | |

Median Market Cap | | $36.5 billion | |

Gross Expense Ratio - Investor Class (as of 09/30/19)* | | 1.07% | |

Gross Expense Ratio - Investor Class (as of 09/30/20)* | | 1.11% | |

Net Expense Ratio - Investor Class (as of 09/30/20)*† | | 1.04% | |

* This information is related to the Investor Class. Please visit Oakmark.com for information related to the Advisor, Institutional and Service Classes.

† The net expense ratio reflects a contractual advisory fee waiver agreement through January 27, 2021.

SECTOR ALLOCATION | | % of Net Assets | |

Communication Services | | | 28.4 | | |

Financials | | | 23.8 | | |

Consumer Discretionary | | | 13.6 | | |

Real Estate | | | 9.3 | | |

Information Technology | | | 5.9 | | |

Consumer Staples | | | 5.1 | | |

Health Care | | | 4.9 | | |

Energy | | | 3.7 | | |

Industrials | | | 2.9 | | |

Short-Term Investments and Other | | | 2.4 | | |

See accompanying Disclosures and Endnotes on page 97.

14 OAKMARK FUNDS

Oakmark Select Fund September 30, 2020

Portfolio Manager Commentary

William C. Nygren, CFA

Portfolio Manager

oaklx@oakmark.com

Anthony P. Coniaris, CFA

Portfolio Manager

oaklx@oakmark.com

Win Murray

Portfolio Manager

oaklx@oakmark.com

The Oakmark Select Fund was up 5.2% for the quarter, trailing the S&P 500 Index's2 8.9% return. For the fiscal year ending September 30, 2020, the Oakmark Select Fund decreased by 2.5%, compared to a 15.2% gain for the S&P 500 Index. As has been well-documented, this past year has continued a particularly difficult period for value managers; the Russell 1000 Value Index4 declined by 5.0% over the same 12-month period. We expect no capital gain distribution this year.

The most significant contributors to performance during the quarter were Ally Financial (+28%) and Charter Communications (+22%). For the full fiscal year, the most significant performers were Regeneron Pharmaceuticals (+102%) and Netflix (+87%). We continue to hold all four investments. Ally, Charter, and Netflix have large weights in the Fund, still selling at sizable discounts to our estimates of their intrinsic values despite their strong stock performance, while Regeneron is now a smaller position as its gap to value has narrowed more materially.

The most significant detractors from performance during the quarter were EOG Resources (-29%) and Citigroup (-15%). For the full year, the largest detractors were Citigroup (-35%) and Apache (-63%). All of these companies remain holdings in the Fund, and all continue to sell at a significant discount to our estimate of fair value.

Citigroup was our largest detractor for the period due to Covid-19-related concerns that have hurt the entire financial sector, as well as a handful of Citigroup-specific headlines that amplified near-term uncertainty. We believe that investors' short-term focus can cause them to miss the bigger picture. The company has remained profitable throughout the Covid-19 crisis to date. It continues to operate with significant excess capital relative to regulatory minimums, even as it has added more than $10.5B to credit reserves year to date. We believe the company is proving its resilience during a real-life stress test. Yet, despite this positive early evidence, Citigroup currently trades at only 60% of tangible book value and slightly over 5x 2019 earnings per share. Given that we think the company's normalized earnings power is greater than what it achieved in 2019, we find these valuation metrics especially attractive. As we move beyond the pandemic, we think investors' focus will shift to the underlying quality of the business and they will value the resilience Citigroup demonstrated during this crisis.

We bought one new position in the Fund this quarter, HCA Healthcare. HCA has been a longstanding holding in more diversified Oakmark portfolios, including the Oakmark Fund and the Oakmark Equity and Income Fund. We were happy to take advantage of the pandemic-driven stock price volatility to add it to the Select Fund during the quarter. HCA is the largest operator of for-profit hospitals and related health care services in the U.S. The company benefits from scale and size

advantages, an attractive geographic footprint in higher growth markets, best-in-class management and governance, and an equity-friendly approach to capital allocation. Although the Covid-19 pandemic created disruptions across the hospital sector, we believe HCA's fundamentals have held up remarkably well. Management believes the company will be in an even stronger position coming out of the crisis than it was coming into it and that demand for health care services will be robust for years to come. As the economy normalizes, we expect HCA to resume growing its operating income in the mid-single digits. At less than 10x normal earnings, the shares are selling well below our estimate of intrinsic value.

We eliminated our position in Qurate Retail during the quarter. The company is still selling at a discount to our estimate of its intrinsic value; however, that discount has narrowed as its stock price benefitted from the increase in online shopping during the quarantine. As such, we don't believe the stock is attractive enough to merit holding in a concentrated portfolio.

Thank you, our fellow shareholders, for your continued investment in our Fund.

See accompanying Disclosures and Endnotes on page 97.

Oakmark.com 15

Oakmark Select Fund September 30, 2020

Schedule of Investments (in thousands)

| | | Shares | | Value | |

COMMON STOCKS - 97.6% | |

COMMUNICATION SERVICES - 28.4% | |

MEDIA & ENTERTAINMENT - 28.4% | |

Alphabet, Inc., Class A (a) (c) | | | 238 | | | $ | 349,122 | | |

Charter Communications, Inc., Class A (a) | | | 389 | | | | 242,806 | | |

Facebook, Inc., Class A (a) | | | 760 | | | | 199,044 | | |

Netflix, Inc. (a) (b) | | | 350 | | | | 174,811 | | |

| | | | | | 965,783 | | |

FINANCIALS - 23.8% | |

DIVERSIFIED FINANCIALS - 10.5% | |

Ally Financial, Inc. | | | 8,580 | | | | 215,101 | | |

Capital One Financial Corp. | | | 1,975 | | | | 141,916 | | |

| | | | | | 357,017 | | |

BANKS - 9.6% | |

Citigroup, Inc. | | | 3,862 | | | | 166,491 | | |

Bank of America Corp. | | | 6,603 | | | | 159,076 | | |

| | | | | | 325,567 | | |

INSURANCE - 3.7% | |

American International Group, Inc. | | | 4,619 | | | | 127,169 | | |

| | | | | | 809,753 | | |

CONSUMER DISCRETIONARY - 13.6% | |

CONSUMER SERVICES - 5.8% | |

MGM Resorts International | | | 4,688 | | | | 101,953 | | |

Hilton Worldwide Holdings, Inc. | | | 1,116 | | | | 95,258 | | |

| | | | | | 197,211 | | |

RETAILING - 4.1% | |

Booking Holdings, Inc. (a) | | | 82 | | | | 140,276 | | |

AUTOMOBILES & COMPONENTS - 3.7% | |

Lear Corp. | | | 1,150 | | | | 125,407 | | |

| | | | | | 462,894 | | |

REAL ESTATE - 9.3% | |

CBRE Group, Inc., Class A (a) | | | 6,755 | | | | 317,262 | | |

INFORMATION TECHNOLOGY - 5.9% | |

TECHNOLOGY HARDWARE & EQUIPMENT - 5.9% | |

TE Connectivity, Ltd. | | | 2,053 | | | | 200,654 | | |

CONSUMER STAPLES - 5.1% | |

FOOD, BEVERAGE & TOBACCO - 5.1% | |

Constellation Brands, Inc., Class A | | | 910 | | | | 172,378 | | |

HEALTH CARE - 4.9% | |

HEALTH CARE EQUIPMENT & SERVICES - 2.8% | |

HCA Healthcare, Inc. | | | 764 | | | | 95,299 | | |

PHARMACEUTICALS, BIOTECHNOLOGY & LIFE SCIENCES - 2.1% | |

Regeneron Pharmaceuticals, Inc. (a) (b) | | | 124 | | | | 69,636 | | |

| | | | | | 164,935 | | |

| | | Shares | | Value | |

ENERGY - 3.7% | |

EOG Resources, Inc. | | | 2,054 | | | $ | 73,808 | | |

Apache Corp. | | | 5,274 | | | | 49,941 | | |

| | | | | | 123,749 | | |

INDUSTRIALS - 2.9% | |

CAPITAL GOODS - 2.9% | |

General Electric Co. | | | 16,000 | | | | 99,680 | | |

TOTAL COMMON STOCKS - 97.6%

(COST $2,188,910) | | | | | 3,317,088 | | |

| | | Par Value | | Value | |

SHORT-TERM INVESTMENTS - 2.6% | |

REPURCHASE AGREEMENT - 2.6% | |

Fixed Income Clearing Corp. Repurchase

Agreement, 0.05% dated 09/30/20 due

10/01/20, repurchase price $90,050,

collateralized by United States

Treasury Note, 2.625% due 12/31/23,

value plus accrued interest of $91,851

(Cost: $90,050) | | $ | 90,050 | | | | 90,050 | | |

TOTAL SHORT-TERM INVESTMENTS - 2.6%

(COST $90,050) | | | | | 90,050 | | |

TOTAL INVESTMENTS - 100.2%

(COST $2,278,960) | | | | | 3,407,138 | | |

Liabilities In Excess of Other Assets - (0.2)% | | | | | (8,044 | ) | |

TOTAL NET ASSETS - 100.0% | | | | $ | 3,399,094 | | |

(a) Non-income producing security

(b) All or a portion of this investment is held in connection with one or more options within the Fund.

(c) Security pledged as collateral to cover margin requirements for options

See accompanying Notes to Financial Statements.

16 OAKMARK FUNDS

Oakmark Select Fund September 30, 2020

Schedule of Investments (in thousands) (continued)

WRITTEN OPTIONS

Description | | Exercise

Price | | Expiration

Date | | Number of

Contracts | | Notional

Amount | | Market

Value | | Premiums

(Received)

by Fund | | Unrealized

Gain/(Loss) | |

CALLS | |

Regeneron Pharmaceuticals, Inc. | | $ | 600.00 | | | 11/20/20 | | | (200 | ) | | $ | (11,196 | ) | | $ | (379 | ) | | $ | (1,258 | ) | | $ | 879 | | |

Netflix, Inc. | | $ | 520.00 | | | 12/18/20 | | | (1,600 | ) | | $ | (80,005 | ) | | $ | (6,180 | ) | | $ | (10,862 | ) | | $ | 4,682 | | |

| | | | | | | | | $ | (91,201 | ) | | $ | (6,559 | ) | | $ | (12,120 | ) | | $ | 5,561 | | |

See accompanying Notes to Financial Statements.

Oakmark.com 17

Oakmark Global Fund September 30, 2020

Summary Information

VALUE OF A $10,000 INVESTMENT

Since Inception - 08/04/99 (Unaudited)

PERFORMANCE

| | | | Average Annual Total Returns (as of 09/30/20) | | | |

| (Unaudited) | | Total Return

Last 3 Months | | 1-year | | 3-year | | 5-year | | 10-year | | Since

Inception | | Inception

Date | |

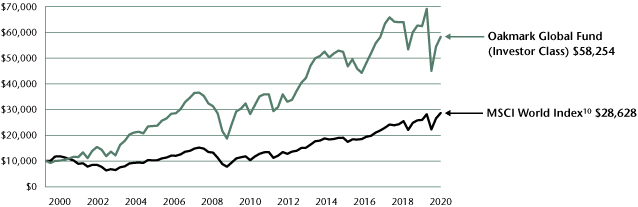

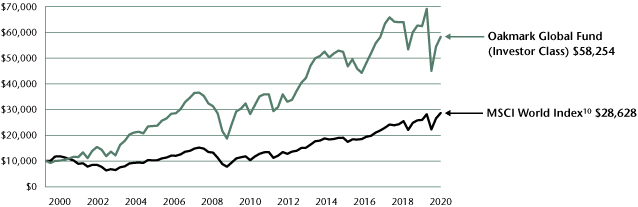

Oakmark Global Fund (Investor Class) | | | 6.92 | % | | | -6.73 | % | | | -2.78 | % | | | 4.48 | % | | | 6.27 | % | | | 8.69 | % | | 08/04/99 | |

MSCI World Index | | | 7.93 | % | | | 10.41 | % | | | 7.74 | % | | | 10.48 | % | | | 9.37 | % | | | 5.10 | % | | | |

Lipper Global Fund Index11 | | | 8.13 | % | | | 11.16 | % | | | 6.00 | % | | | 9.49 | % | | | 8.23 | % | | | 5.53 | % | | | |

Oakmark Global Fund (Advisor Class) | | | 6.91 | % | | | -6.61 | % | | | -2.67 | % | | | N/A | | | | N/A | | | | 4.04 | % | | 11/30/16 | |

Oakmark Global Fund (Institutional Class) | | | 6.91 | % | | | -6.57 | % | | | -2.62 | % | | | N/A | | | | N/A | | | | 4.10 | % | | 11/30/16 | |

Oakmark Global Fund (Service Class) | | | 6.78 | % | | | -7.01 | % | | | -3.05 | % | | | 4.18 | % | | | 5.93 | % | | | 8.56 | % | | 10/10/01 | |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Past performance is no guarantee of future results. The performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted. Total return includes change in share prices and, in each case, includes reinvestment of dividends and capital gain distributions. The investment return and principal value vary so that an investor's shares, when redeemed, may be worth more or less than the original cost. To obtain the most recent month-end performance, please visit Oakmark.com.

TOP TEN EQUITY HOLDINGS8 | | % of Net Assets | |

Mastercard, Inc., Class A | | | 6.3 | | |

Alphabet, Inc., Class C | | | 5.6 | | |

Lloyds Banking Group PLC | | | 5.1 | | |

TE Connectivity, Ltd. | | | 5.0 | | |

General Motors Co. | | | 4.1 | | |

CNH Industrial N.V. | | | 4.1 | | |

Credit Suisse Group AG | | | 3.9 | | |

Daimler AG | | | 3.6 | | |

Bank of America Corp. | | | 3.6 | | |

Liberty Broadband Corp., Class C | | | 3.1 | | |

SECTOR ALLOCATION | | % of Net Assets | |

Financials | | | 23.2 | | |

Consumer Discretionary | | | 19.0 | | |

Communication Services | | | 16.9 | | |

Information Technology | | | 14.8 | | |

Industrials | | | 13.2 | | |

Health Care | | | 5.7 | | |

Materials | | | 3.1 | | |

Energy | | | 0.9 | | |

Consumer Staples | | | 0.8 | | |

Short-Term Investments and Other | | | 2.4 | | |

FUND STATISTICS | |

Ticker* | | OAKGX | |

Number of Equity Holdings | | 45 | |

Net Assets | | $1.2 billion | |

Weighted Average Market Cap | | $126.6 billion | |

Median Market Cap | | $24.9 billion | |

Gross Expense Ratio - Investor Class (as of 09/30/19)* | | 1.23% | |

Gross Expense Ratio - Investor Class (as of 09/30/20)* | | 1.26% | |

Net Expense Ratio - Investor Class (as of 09/30/20)*† | | 1.20% | |

* This information is related to the Investor Class. Please visit Oakmark.com for information related to the Advisor, Institutional and Service Classes.

† The net expense ratio reflects a contractual advisory fee waiver agreement through January 27, 2021.

GEOGRAPHIC ALLOCATION | |

| | % of Equity | |

North America | | | 49.2 | | |

United States | | | 49.2 | | |

Europe | | | 39.9 | | |

United Kingdom | | | 16.6 | | |

Germany* | | | 11.8 | | |

Switzerland | | | 8.3 | | |

Ireland* | | | 2.4 | | |

Belgium* | | | 0.8 | | |

Asia | | | 4.7 | | |

India | | | 1.9 | | |

| | % of Equity | |

Asia (cont'd) | | | 4.7 | | |

Japan | | | 1.3 | | |

South Korea | | | 1.0 | | |

China | | | 0.5 | | |

Africa | | | 2.9 | | |

South Africa | | | 2.9 | | |

Australasia | | | 2.6 | | |

Australia | | | 2.6 | | |

Latin America | | | 0.7 | | |

Mexico | | | 0.7 | | |

* Euro currency countries comprise 15.0% of equity investments.

See accompanying Disclosures and Endnotes on page 97.

18 OAKMARK FUNDS

Oakmark Global Fund September 30, 2020

Portfolio Manager Commentary

David G. Herro, CFA

Portfolio Manager

oakgx@oakmark.com

Clyde S. McGregor, CFA

Portfolio Manager

oakgx@oakmark.com

Anthony P. Coniaris, CFA

Portfolio Manager

oakgx@oakmark.com

Jason E. Long, CFA

Portfolio Manager

oakgx@oakmark.com

Quarter Review

The summer quarter mostly continued the process of recovery that the stock market experienced since its March panic bottom. September, however, lived up to its reputation for being the month most likely to see stocks decline. Economies worldwide continued to generate erratic recovery from the Covid-19-induced recession, and periodic resurgences of the virus depressed many service industries.

Oakmark Global gained 6.9% in the quarter, which compares to a gain of 7.9% for the MSCI World Index10 and 8.1% for the Lipper Global Fund Index. For the calendar nine months, the Fund lost 15.8%, compared to a 1.7% gain for the MSCI World Index and 2.4% for the Lipper Global Fund Index.11 Finally, for the Fund's fiscal year ended September 30, the Fund lost 6.7% and the MSCI World Index gained 10.4%, while the Lipper Global Fund Index gained 11.2%. Since inception, the Fund's compound annualized return rate is 8.7%.

For the quarter, the countries that contributed most to return were the U.S., Germany and Ireland, while the U.K., Belgium and South Africa detracted from return. Daimler (Germany), Pinterest (U.S.), TE Connectivity (U.S.), Mastercard (U.S.) and Tenet Healthcare (U.S.) were the largest contributors to returns, while Rolls-Royce Holdings (U.K.), Lloyds Banking Group (U.K.), Bayer (Germany), National Oilwell Varco (U.S.) and Citigroup (U.S.) detracted most.

Over the calendar nine months, South Africa, China and Taiwan were the countries that contributed most to return, while the U.K., U.S. and Switzerland detracted most. The companies whose stocks contributed most were Pinterest, Mastercard, CoreLogic (U.S.—sold), Alphabet (U.S.) and Liberty Broadband (U.S.). The largest detractors from return were Lloyds Banking Group, Rolls-Royce, Citigroup, CNH Industrial (U.K.) and Bank of America (U.S.). The fact that the five largest contributors were all U.S.-domiciled yet the U.S. was one of the countries that detracted most from return speaks to the extreme outcomes in this turbulent time period.

For the Fund's fiscal year, the U.S., Ireland and South Africa contributed most to return, while the U.K., Australia and Mexico were the largest detractors. For the second fiscal year in a row, Mastercard was the largest contributor, followed by Pinterest, Alphabet, Daimler and Liberty Broadband. Lloyds Banking Group, Rolls-Royce, CNH Industrial, Citigroup and Howmet Aerospace (U.S.) detracted most from return for the 12 months.

The lists of detractors above collectively include almost all of the Fund's banking industry holdings and the Fund's entire financials sector has been the largest detractor throughout the

fiscal year. This reflects many factors. Central banks have suppressed interest rates across the developed world, which depresses the profit margins on banks' loan books. As well, banks have vigorously increased their reserves for bad debts in response to the Covid-19 crisis, even though actual losses incurred to date are not consistent with a major downturn. Indeed, after selling off during the early days of the pandemic, corporate bond prices now reflect an expectation of rapid recovery. Nevertheless, banks have put their share repurchase plans on hiatus and some have cut or eliminated dividends. Banks' substantial capital positions have virtually eliminated the chance that they will need to raise capital and, therefore, dilute their balance sheets. Yet share prices that declined when the Covid-19 crisis hit have not yet bounced back. In perhaps a more dramatic demonstration of the industry's poor relative market performance, 10 years ago European banks accounted for six times technology's share of the Eurozone market index while today their respective shares are roughly equal.

Value investors must decide whether the drop in bank share prices properly reflects evolving circumstance or is an overstated case. We have concluded the latter and believe that the passing of the Covid-19 crisis will allow the undervaluation to become clear. European banks are generally priced at half of book value (and in some cases even less), so modest improvements in their operating environment can have leveraged positive effects on valuations. U.S. banks are more highly valued today, reflecting stronger home market economic conditions, but they still offer considerable value if conditions ever normalize. At that time, we expect share repurchases to accelerate intrinsic value per share growth. Although holdings in this industry have proven painful in 2020, we expect future outcomes to be rewarding.

Transaction Activity

We were rather active in the quarter, culling several small holdings and initiating one new name. These actions, combined with the solid performance of U.S. stocks, resulted in a 1% increase in the Fund's U.S. allocation. The U.S. retains the largest weighting in our portfolio, but it still falls well below the ever-increasing U.S. weight in the MSCI World Index. We do not think the index's overweight in the U.S. reflects economic reality. Nevertheless, given continual U.S. outperformance, our relative underweighting has not helped the portfolio.

During the quarter, we eliminated four holdings—two U.S. and two international. On the U.S. side, we sold EOG Resources to harvest a tax loss. We continue to believe that EOG is one of the best positioned energy producers, but current economic activity has not rewarded that position. In our June letter, we

See accompanying Disclosures and Endnotes on page 97.

Oakmark.com 19

Oakmark Global Fund September 30, 2020

Portfolio Manager Commentary (continued)

wrote about the takeover offer that another holding, CoreLogic, had received. Because of this offer, the stock attained a price close to our estimate of intrinsic value and we sold our shares to purchase more attractive names.

On the international side, we disposed of Taiwan Semiconductor Manufacturing Co (TSMC) and LafargeHolcim. TSMC was sold as its share price approached our estimate of intrinsic value. We used this capital to allocate to securities with more attractive risk-reward profiles. We sold LafargeHolcim to opportunistically fund a position in Anheuser-Busch Inbev (ABI). ABI is the world's largest brewer and its global 27% market share is more than twice the volume of the #2 player. Importantly, its dominant market share positions, strong brands and vertical integration allow it to generate industry-leading margins, returns and cash flows. ABI's significant scale advantage enables it to earn more than 4x the profitability of the #2 player. The majority of the company's profitability is derived from developing markets where duopoly market structures, growing per capita income and premiumization drive attractive growth and profitability. ABI is a good example of finding opportunities during times of volatility. We have long covered the company and admired the franchise from afar, but our strict valuation criteria kept us on the sidelines. However, when the share price fell by nearly 50% due to shorter term Covid-19 concerns, we quickly ramped up our research and initiated a position. Covid-19-related closures of bars and restaurants have depressed recent operating performance, which has hurt sales in the on-trade channel and pressured the stock price. Nevertheless, we expect these headwinds will prove short term. We think that ABI's scale should enable it to outperform smaller peers during this pandemic. Notably, the company's debt structure has been smartly termed out, so it has plenty of liquidity to invest while navigating the pandemic. ABI's management has done an excellent job of creating long-term value and its interests are aligned with shareholders.

Currency Hedges

We defensively hedge a portion of the Fund's exposure to currencies that we believe to be overvalued versus the U.S. dollar. As of quarter end, we found the Swiss franc to be overvalued and have hedged approximately 17% of the Fund's franc exposure.

As always, we thank you for being our partners in the Oakmark Global Fund. We invite you to send us your comments or questions.

See accompanying Disclosures and Endnotes on page 97.

20 OAKMARK FUNDS

Oakmark Global Fund September 30, 2020

Schedule of Investments (in thousands)

| | | Shares | | Value | |

COMMON STOCKS - 97.6% | |

FINANCIALS - 23.2% | |

BANKS - 12.3% | |

Lloyds Banking Group PLC

(United Kingdom) (a) | | | 174,955 | | | $ | 59,497 | | |

Bank of America Corp. (United States) | | | 1,747 | | | | 42,095 | | |

Citigroup, Inc. (United States) | | | 498 | | | | 21,456 | | |

Axis Bank, Ltd. (India) (a) | | | 3,727 | | | | 21,451 | | |

| | | | | | 144,499 | | |

DIVERSIFIED FINANCIALS - 6.7% | |

Credit Suisse Group AG (Switzerland) | | | 4,545 | | | | 45,614 | | |

Julius Baer Group, Ltd. (Switzerland) (a) | | | 783 | | | | 33,380 | | |

| | | | | | 78,994 | | |

INSURANCE - 4.2% | |

Allianz SE (Germany) | | | 159 | | | | 30,507 | | |

Prudential PLC (United Kingdom) | | | 1,283 | | | | 18,359 | | |

| | | | | | 48,866 | | |

| | | | | | 272,359 | | |

CONSUMER DISCRETIONARY - 19.0% | |

AUTOMOBILES & COMPONENTS - 11.7% | |

General Motors Co. (United States) | | | 1,621 | | | | 47,954 | | |

Daimler AG (Germany) | | | 791 | | | | 42,666 | | |

Continental AG (Germany) | | | 301 | | | | 32,669 | | |

Toyota Motor Corp. (Japan) | | | 228 | | | | 14,986 | | |

| | | | | | 138,275 | | |

RETAILING - 4.6% | |

Naspers, Ltd. (South Africa) | | | 187 | | | | 33,054 | | |

Booking Holdings, Inc. (United States) (a) | | | 9 | | | | 14,823 | | |

Alibaba Group Holding, Ltd. (China) (a) | | | 169 | | | | 6,021 | | |

| | | | | | 53,898 | | |

CONSUMER DURABLES & APPAREL - 1.4% | |

Cie Financiere Richemont SA (Switzerland) | | | 248 | | | | 16,593 | | |

CONSUMER SERVICES - 1.3% | |

Compass Group PLC (United Kingdom) | | | 1,003 | | | | 15,134 | | |

| | | | | | 223,900 | | |

COMMUNICATION SERVICES - 16.9% | |

MEDIA & ENTERTAINMENT - 15.3% | |

Alphabet, Inc., Class C (United States) (a) | | | 45 | | | | 66,410 | | |

Liberty Broadband Corp., Class C

(United States) (a) | | | 253 | | | | 36,075 | | |

Pinterest, Inc., Class A (United States) (a) | | | 604 | | | | 25,055 | | |

The Interpublic Group of Cos., Inc.

(United States) | | | 1,211 | | | | 20,193 | | |

Live Nation Entertainment, Inc.

(United States) (a) | | | 263 | | | | 14,188 | | |

Charter Communications, Inc., Class A

(United States) (a) | | | 16 | | | | 9,802 | | |

Grupo Televisa SAB (Mexico) (a) (b) | | | 1,281 | | | | 7,916 | | |

| | | | | | 179,639 | | |

| | | Shares | | Value | |

TELECOMMUNICATION SERVICES - 1.6% | |

Liberty Global PLC, Class A (United Kingdom) (a) | | | 882 | | | $ | 18,525 | | |

| | | | | | 198,164 | | |

INFORMATION TECHNOLOGY - 14.8% | |

SOFTWARE & SERVICES - 8.9% | |

Mastercard, Inc., Class A (United States) | | | 219 | | | | 74,127 | | |

Oracle Corp. (United States) | | | 505 | | | | 30,119 | | |

| | | | | | 104,246 | | |

TECHNOLOGY HARDWARE & EQUIPMENT - 5.9% | |

TE Connectivity, Ltd. (United States) | | | 599 | | | | 58,585 | | |

Samsung Electronics Co., Ltd. (South Korea) | | | 229 | | | | 11,406 | | |

| | | | | | 69,991 | | |

| | | | | | 174,237 | | |

INDUSTRIALS - 13.2% | |

CAPITAL GOODS - 10.7% | |

CNH Industrial N.V. (United Kingdom) (a) | | | 6,139 | | | | 47,853 | | |

Travis Perkins PLC (United Kingdom) | | | 1,773 | | | | 24,838 | | |

Howmet Aerospace, Inc. (United States) | | | 1,198 | | | | 20,024 | | |

Johnson Controls International PLC

(United States) | | | 381 | | | | 15,552 | | |

Flowserve Corp. (United States) | | | 407 | | | | 11,099 | | |

Rolls-Royce Holdings PLC (United Kingdom) | | | 3,836 | | | | 6,435 | | |

| | | | | | 125,801 | | |

TRANSPORTATION - 2.5% | |

Ryanair Holdings PLC (Ireland) (a) (b) | | | 323 | | | | 26,371 | | |

Southwest Airlines Co. (United States) | | | 51 | | | | 1,909 | | |

Ryanair Holdings PLC (Ireland) (a) | | | 62 | | | | 833 | | |

| | | | | | 29,113 | | |