UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-06279 |

|

Harris Associates Investment Trust |

(Exact name of registrant as specified in charter) |

|

111 South Wacker Drive, Suite 4600

Chicago, Illinois | | 60606-4319 |

(Address of principal executive offices) | | (Zip code) |

|

Kristi L. Rowsell | Ndenisarya M. Bregasi, Esq. |

Harris Associates L.P. | K&L Gates LLP |

111 South Wacker Drive, Suite 4600 | 1601 K Street, N.W. |

Chicago, Illinois 60606-4319 | Washington, D.C. 20006-1600 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (312) 646-3600 | |

|

Date of fiscal year end: | 09/30/18 | |

|

Date of reporting period: | 09/30/18 | |

| | | | | | | | | |

Item 1. Reports to Shareholders.

OAKMARK FUNDS

ANNUAL REPORT | SEPTEMBER 30, 2018

OAKMARK FUND

OAKMARK SELECT FUND

OAKMARK EQUITY AND INCOME FUND

OAKMARK GLOBAL FUND

OAKMARK GLOBAL SELECT FUND

OAKMARK INTERNATIONAL FUND

OAKMARK INTERNATIONAL SMALL CAP FUND

Oakmark Funds

2018 Annual Report

TABLE OF CONTENTS

Fund Expenses | | | 1 | | |

Commentary on Oakmark and Oakmark Select Funds | | | 2 | | |

Oakmark Fund | |

Summary Information | | | 4 | | |

Portfolio Manager Commentary | | | 5 | | |

Schedule of Investments | | | 6 | | |

Oakmark Select Fund | |

Summary Information | | | 10 | | |

Portfolio Manager Commentary | | | 11 | | |

Schedule of Investments | | | 13 | | |

Oakmark Equity and Income Fund | |

Summary Information | | | 16 | | |

Portfolio Manager Commentary | | | 17 | | |

Schedule of Investments | | | 19 | | |

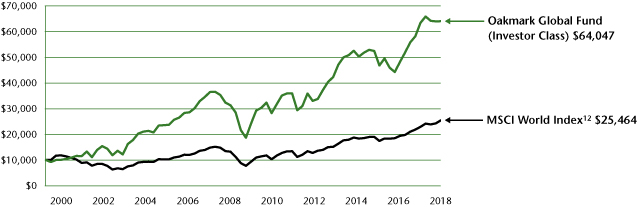

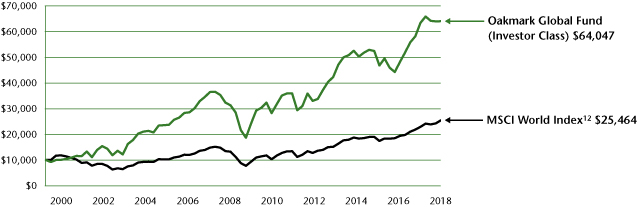

Oakmark Global Fund | |

Summary Information | | | 26 | | |

Portfolio Manager Commentary | | | 27 | | |

Schedule of Investments | | | 29 | | |

Oakmark Global Select Fund | |

Summary Information | | | 32 | | |

Portfolio Manager Commentary | | | 33 | | |

Schedule of Investments | | | 34 | | |

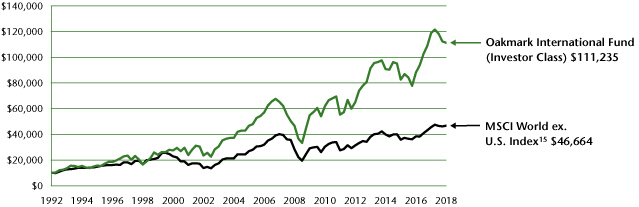

Oakmark International Fund | |

Summary Information | | | 36 | | |

Portfolio Manager Commentary | | | 37 | | |

Schedule of Investments | | | 39 | | |

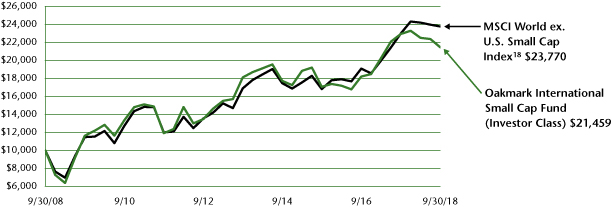

Oakmark International Small Cap Fund | |

Summary Information | | | 42 | | |

Portfolio Manager Commentary | | | 43 | | |

Schedule of Investments | | | 44 | | |

Financial Statements | |

Statements of Assets and Liabilities | | | 48 | | |

Statements of Operations | | | 50 | | |

Statements of Changes in Net Assets | | | 52 | | |

Notes to Financial Statements | | | 65 | | |

Financial Highlights | | | 76 | | |

Report of Independent Registered Public Accounting Firm | | | 84 | | |

Federal Tax Information | | | 85 | | |

Disclosures and Endnotes | | | 85 | | |

Trustees and Officers | | | 87 | | |

FORWARD-LOOKING STATEMENT DISCLOSURE

One of our most important responsibilities as mutual fund managers is to communicate with shareholders in an open and direct manner. Some of our comments in our letters to shareholders are based on current management expectations and are considered "forward-looking statements." Actual future results, however, may prove to be different from our expectations. You can identify forward-looking statements by words such as "estimate", "may", "will", "expect", "believe",

"plan" and other similar terms. We cannot promise future returns. Our opinions are a reflection of our best judgment at the time this report is compiled, and we disclaim any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise.

Oakmark.com

Fund Expenses (Unaudited)

A shareholder of each Fund incurs ongoing costs, including investment advisory fees, transfer agent fees and other Fund expenses. The examples below are intended to help shareholders understand the ongoing costs (in dollars) of investing in each Fund and to compare these costs with the ongoing costs of investing in other funds.

The following table provides information about actual account values and actual Fund expenses as well as hypothetical account values and hypothetical fund expenses for shares of each Fund.

ACTUAL EXPENSES

The following table shows the expenses a shareholder would have paid on a $1,000 investment in each Fund from April 1, 2018 to September 30, 2018, as well as how much a $1,000 investment would be worth at the close of the period, assuming actual Fund returns and expenses. A shareholder can estimate expenses incurred for the period by dividing the account value at September 30, 2018, by $1,000 and multiplying the result by the number in the "Actual—Expenses Paid During Period" column shown below.

Shares of Oakmark International Small Cap Fund, invested for 90 days or less, may be charged a 2% redemption fee upon redemption. Please consult the Funds' prospectus at Oakmark.com for more information.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The following table provides information about hypothetical account values and hypothetical expenses for shares of each Fund based on actual expense ratios and an assumed rate of return of 5% per year before expenses, which are not the Funds' actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or actual expenses shareholders paid for the period. Shareholders may use this information to compare the ongoing costs of investing in a Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as redemption fees. Therefore, the "Hypothetical—Expenses Paid During Period" column of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. If these transaction costs were included, the total costs would have been higher.

| | | | ACTUAL | | HYPOTHETICAL

(5% annual return

before expenses) | | | |

| | | Beginning

Account Value

(04/01/18) | | Ending

Account Value

(09/30/18) | | Expenses

Paid During

Period* | | Ending

Account Value

(09/30/18) | | Expenses

Paid During

Period* | | Annualized

Expense

Ratio | |

Oakmark Fund | |

Investor Class | | $ | 1,000.00 | | | $ | 1,064.60 | | | $ | 4.45 | | | $ | 1,020.76 | | | $ | 4.36 | | | | 0.86 | % | |

Advisor Class | | $ | 1,000.00 | | | $ | 1,065.30 | | | $ | 3.73 | | | $ | 1,021.46 | | | $ | 3.65 | | | | 0.72 | % | |

Institutional Class | | $ | 1,000.00 | | | $ | 1,065.50 | | | $ | 3.57 | | | $ | 1,021.61 | | | $ | 3.50 | | | | 0.69 | % | |

Service Class | | $ | 1,000.00 | | | $ | 1,063.30 | | | $ | 5.79 | | | $ | 1,019.45 | | | $ | 5.67 | | | | 1.12 | % | |

Oakmark Select Fund | |

Investor Class | | $ | 1,000.00 | | | $ | 998.70 | | | $ | 4.86 | | | $ | 1,020.21 | | | $ | 4.91 | | | | 0.97 | % | |

Advisor Class | | $ | 1,000.00 | | | $ | 999.60 | | | $ | 4.11 | | | $ | 1,020.96 | | | $ | 4.15 | | | | 0.82 | % | |

Institutional Class | | $ | 1,000.00 | | | $ | 999.60 | | | $ | 3.96 | | | $ | 1,021.11 | | | $ | 4.00 | | | | 0.79 | % | |

Service Class | | $ | 1,000.00 | | | $ | 998.00 | | | $ | 5.66 | | | $ | 1,019.40 | | | $ | 5.72 | | | | 1.13 | % | |

Oakmark Equity and Income Fund | |

Investor Class | | $ | 1,000.00 | | | $ | 1,026.80 | | | $ | 3.96 | | | $ | 1,021.16 | | | $ | 3.95 | | | | 0.78 | % | |

Advisor Class | | $ | 1,000.00 | | | $ | 1,027.50 | | | $ | 3.20 | | | $ | 1,021.91 | | | $ | 3.19 | | | | 0.63 | % | |

Institutional Class | | $ | 1,000.00 | | | $ | 1,027.50 | | | $ | 3.05 | | | $ | 1,022.06 | | | $ | 3.04 | | | | 0.60 | % | |

Service Class | | $ | 1,000.00 | | | $ | 1,025.40 | | | $ | 5.23 | | | $ | 1,019.90 | | | $ | 5.22 | | | | 1.03 | % | |

Oakmark Global Fund | |

Investor Class | | $ | 1,000.00 | | | $ | 997.80 | | | $ | 5.76 | | | $ | 1,019.30 | | | $ | 5.82 | | | | 1.15 | % | |

Advisor Class | | $ | 1,000.00 | | | $ | 998.10 | | | $ | 5.36 | | | $ | 1,019.70 | | | $ | 5.42 | | | | 1.07 | % | |

Institutional Class | | $ | 1,000.00 | | | $ | 998.50 | | | $ | 4.91 | | | $ | 1,020.16 | | | $ | 4.96 | | | | 0.98 | % | |

Service Class | | $ | 1,000.00 | | | $ | 996.20 | | | $ | 7.31 | | | $ | 1,017.75 | | | $ | 7.39 | | | | 1.46 | % | |

Oakmark Global Select Fund | |

Investor Class | | $ | 1,000.00 | | | $ | 995.70 | | | $ | 5.60 | | | $ | 1,019.45 | | | $ | 5.67 | | | | 1.12 | % | |

Advisor Class | | $ | 1,000.00 | | | $ | 996.80 | | | $ | 5.01 | | | $ | 1,020.05 | | | $ | 5.06 | | | | 1.00 | % | |

Institutional Class | | $ | 1,000.00 | | | $ | 996.80 | | | $ | 4.76 | | | $ | 1,020.31 | | | $ | 4.81 | | | | 0.95 | % | |

Oakmark International Fund | |

Investor Class | | $ | 1,000.00 | | | $ | 941.00 | | | $ | 4.72 | | | $ | 1,020.21 | | | $ | 4.91 | | | | 0.97 | % | |

Advisor Class | | $ | 1,000.00 | | | $ | 941.70 | | | $ | 4.04 | | | $ | 1,020.91 | | | $ | 4.20 | | | | 0.83 | % | |

Institutional Class | | $ | 1,000.00 | | | $ | 942.10 | | | $ | 3.80 | | | $ | 1,021.16 | | | $ | 3.95 | | | | 0.78 | % | |

Service Class | | $ | 1,000.00 | | | $ | 940.20 | | | $ | 5.93 | | | $ | 1,018.95 | | | $ | 6.17 | | | | 1.22 | % | |

Oakmark International Small Cap Fund | |

Investor Class | | $ | 1,000.00 | | | $ | 953.30 | | | $ | 6.81 | | | $ | 1,018.10 | | | $ | 7.03 | | | | 1.39 | % | |

Advisor Class | | $ | 1,000.00 | | | $ | 953.30 | | | $ | 6.66 | | | $ | 1,018.25 | | | $ | 6.88 | | | | 1.36 | % | |

Institutional Class | | $ | 1,000.00 | | | $ | 954.50 | | | $ | 5.78 | | | $ | 1,019.15 | | | $ | 5.97 | | | | 1.18 | % | |

Service Class | | $ | 1,000.00 | | | $ | 951.80 | | | $ | 8.71 | | | $ | 1,016.14 | | | $ | 9.00 | | | | 1.78 | % | |

* Expenses are calculated using the Annualized Expense Ratio, multiplied by the average account value over the period, multiplied by 183 and divided by 365 (to reflect one-half year period)

Oakmark.com 1

Oakmark and Oakmark Select Funds September 30, 2018

Portfolio Manager Commentary

William C. Nygren, CFA

Portfolio Manager

oakmx@oakmark.com

oaklx@oakmark.com

oakwx@oakmark.com

At Oakmark, we are long-term investors. We attempt to identify growing businesses that are managed to benefit their shareholders. We will purchase stock in those businesses only when priced substantially below our estimate of intrinsic value. After purchase, we patiently wait for the gap between stock price and intrinsic value to close.

Fiscal-year 2018 closed with a thud for Oakmark and Oakmark Select as both Funds' positive returns trailed the S&P 500's1 gains. As is typical, when the stocks we own in Oakmark underperform the market, the stocks we believe are most attractive and own in the more concentrated Oakmark Select Fund underperform by even more. As of quarter end, both Funds lagged behind the S&P 500 on a trailing one-, three- and five-year basis. As portfolio managers and fellow investors, we are as frustrated with those numbers as you are.

While many fund managers avoid talking about their underperformance, we'd prefer to confront ours head on. The goal of this commentary is to put our performance in perspective, explain why it happened and give you a framework for deciding what, if anything, to do about it. Because Oakmark is the more diversified portfolio and, therefore, holds more stocks than Oakmark Select, it provides more examples for this discussion, so it will be the focus of this piece. The Oakmark Select report will use a similar format to review specifics of that Fund.

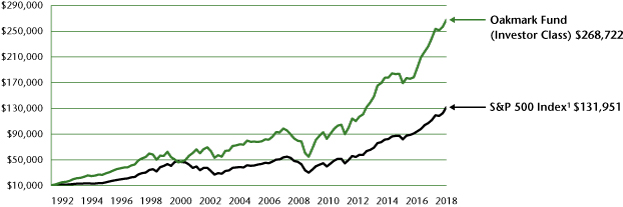

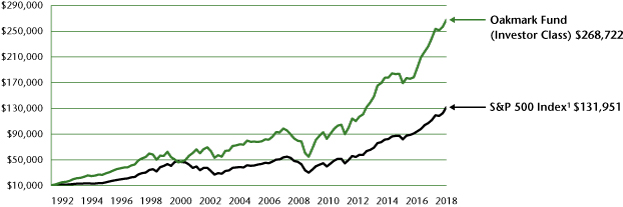

First, let's put underperformance in context. The Oakmark Fund was started in August 1991. An investor who bought and held the S&P 500 from that date until now has earned slightly more than 13 times their initial investment. An investor who bought and held the Oakmark Fund for the same period now has earned nearly 27 times their initial investment—more than twice the capital of the S&P 500 investor. Despite that long-term record, the Fund has endured many periods when the S&P 500 fared better. Oakmark trailed the S&P 500 in 50% of the rolling 12-month periods. Over rolling three-year increments, the Fund still underperformed 47% of the time. Even if we look across five-year increments, Oakmark trailed the S&P 500 in 31%. All that underperformance came despite more than doubling the S&P 500's return over 27 years.

Some long-term investors might say there is no excuse for a five-year period of underperformance. They could decide to buy a fund after its five-year record exceeds the market return and sell that fund when its five-year record trails the market. We analyzed how that strategy would have worked for an investor in the Oakmark Fund who reviewed their position at every month end. We assume this investor used proceeds from their Oakmark sales to invest in an S&P 500 index fund. Following this approach over the Fund's history, this "in-and-out" investor would have bought and sold the Fund for eight round trips. The return achieved by that investor would have fallen short of just buying and holding the S&P 500. Here are the results based on an initial investment of $10,000 in August 1991:

Strategy | | Ending Capital | |

Oakmark Buy and Hold | | $ | 268,700 | | |

S&P 500 Buy and Hold | | $ | 132,000 | | |

Oakmark/S&P 500 "In-and-Out" | | $ | 122,200 | | |

Clearly, performance chasing has been futile. (Further, the "in-and-out" investor would have been taxed on much higher realized capital gains as each sale would have been a taxable event.)

Let's look back at the past year. When we buy a stock at Oakmark, we believe it is selling at a large discount to its true value. This means there are essentially two possible versions of what the business is really worth: the consensus view of business fundamentals, as expressed in the current stock price, or our much more positive view of them. During the time we own a stock, we constantly evaluate new information to determine which view is more accurate.

In fiscal-year 2018, new information led us to conclude that the consensus view was probably more accurate than our view of five different holdings: AutoNation, General Electric Company (GE), Harley-Davidson, Qualcomm and Whirlpool. We sold all of those names, with the exception of GE. We've found that when our judgment about a business or the people running it has been in error, it is unlikely to quickly turn around, so we typically sell those stocks. GE is different because it now has a new management team, new board members and the divisions that account for most of our valuation case today—Aviation and Healthcare—have performed as expected. Our thesis does not require either a turnaround of GE's underperforming Power division or that the managers who spent years driving the bus into the ditch now drive it out.

Of the 52 companies we owned on October 1 last year, we conceded we were wrong on our business value estimates for five of them. That isn't an unusually high error rate and, in fact, the negative effect of those five stocks on the portfolio was more than fully offset by the gain in just one good holding, Netflix. This means there was more to our performance shortfall than just these five stocks.

Instead, what was unusual over the past year was the performance of the remaining 47 stocks, the ones we don't think of as mistakes. Even though these businesses generally performed consistently with our expectations, 26 underperformed the S&P 500 by more than 1000 basis points (10 percentage points). One reason for this was the unusual divergence across the 500 stocks that comprise the index.

Because the S&P 500 is a capitalization-weighted index, the largest cap stocks have a much greater impact. And although we owned some of those names, they accounted for less of our portfolio. Over half of the S&P 500's strong performance over the past 12 months was accounted for by just 13 very big stocks (e.g., Amazon, Apple). Consistent with that, the median stock in the S&P 500 underperformed the index by nearly 700 basis points. In a typical year, the median stock is much closer to the index performance. Because we weight positions based on

See accompanying Disclosures and Endnotes on page 85.

2 OAKMARK FUNDS

Oakmark and Oakmark Select Funds September 30, 2018

Portfolio Manager Commentary (continued)

perceived attractiveness rather than market capitalization, our returns usually track closer to the median S&P 5001 stock than to the index.

An additional factor was that well over half of our underperforming stocks were in cyclical industries, which tend to be more sensitive to the strength of the broad economy. This list includes banks, industrials, consumer durables (such as autos), airlines and energy companies. If we judged those stocks based on their business results alone, we would have thought the Fund had a pretty good year. But due to investors' increasing fears of a recession, the stock prices of these economically sensitive businesses performed poorly. Isn't it reasonable for investors to expect that after a nine-year recovery, a recession should be right around the corner? Although this recovery may be near a typical expiration date when measured by time, it is nowhere near a typical end when measured by the cumulative amount of above-trend growth. When one looks at recent economic performance—whether analyzing 20 years, 50 years or anywhere in between—it is almost impossible to get a regression line that shows 2018 GDP to be above trend. The chart below, which compares actual GDP from 1988–2018 to a 30-year regression line shows that current GDP has not yet even returned to the trend line.

Although nearly 100% of Oakmark's research is done bottom up (at the company level) as opposed to top down (making predictions about the economy), our analysis still needs to be based on some economic forecast. The projection our analysts always use is that, in five to seven years, the economy will be "normal," meaning near a midpoint of boom and recession levels. So, without trying to guess when the next recession will occur, our forecast assumes normal growth, meaning growth in real GDP (adjusted for inflation) averages about 2% per year.

Typically, forecasting that the future will be "normal" isn't an outlier forecast. Today, because such a high percentage of investors are anticipating a recession, a prediction of normal growth is actually very optimistic relative to consensus. That explains why, when we select the stocks that we believe are most attractive, our portfolios end up with more cyclical exposure. And because most of our companies currently use their earnings to repurchase stock, a brief period of investor skepticism and stock price weakness will actually increase our estimates of their future per-share value.

When business fundamentals outperform stock prices like this, we find stocks more attractive and our investment process takes these metrics into account. We set buy and sell targets for a stock at about 60% and 90% of our estimate of intrinsic value, respectively. When stocks rise above 90% of our estimate of business value, we sell them. At any point in time, our portfolio is a mix of some stocks priced below target and the rest priced between 60% and 90% of our estimate of value. Today, 55% of the Oakmark Fund's holdings are either below our buy targets or less than 10% above. That compares to a year ago when only 31% were priced similarly. This shift makes the Oakmark Fund more attractive in our view because it means there is greater potential for future returns.

At the end of each calendar year, we disclose the total amount our employees have invested in the Oakmark Funds. Many of us have been buying this year. We now own meaningfully more shares than we did a year ago, which will result in a higher dollar amount being disclosed next quarter, unless there is a significant market decline. We know that we apply the same process that created the long-term track record that was referenced earlier and we apply at least the same level of talent and effort to making our investment decisions. If you don't agree, you should sell our Funds, regardless of their performance. But if you do agree, and our portfolio positioning sounds logical to you, then consider joining us to take advantage of the recent weakness.

See accompanying Disclosures and Endnotes on page 85.

Oakmark.com 3

Oakmark Fund September 30, 2018

Summary Information

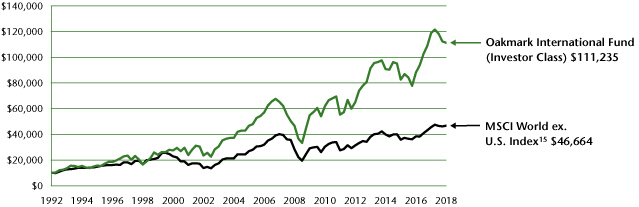

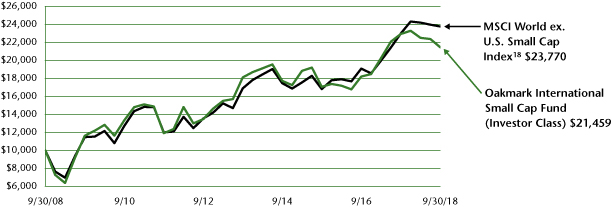

VALUE OF A $10,000 INVESTMENT

Since Inception - 08/05/91 (Unaudited)

PERFORMANCE

| | | | | Average Annual Total Returns (as of 9/30/18) | | | |

| (Unaudited) | | Total Return

Last 3 Months | | 1-year | | 3-year | | 5-year | | 10-year | | Since

Inception | | Inception

Date | |

Oakmark Fund (Investor Class) | | | 4.24 | % | | | 11.84 | % | | | 16.55 | % | | | 12.57 | % | | | 13.11 | % | | | 12.89 | % | | 08/05/91 | |

S&P 500 Index | | | 7.71 | % | | | 17.91 | % | | | 17.31 | % | | | 13.95 | % | | | 11.97 | % | | | 9.97 | % | | | | | |

Dow Jones Industrial Average2 | | | 9.63 | % | | | 20.76 | % | | | 20.49 | % | | | 14.57 | % | | | 12.22 | % | | | 10.97 | % | | | | | |

Lipper Large Cap Value Fund Index3 | | | 6.07 | % | | | 11.55 | % | | | 14.62 | % | | | 10.83 | % | | | 9.88 | % | | | 9.02 | % | | | | | |

Oakmark Fund (Advisor Class) | | | 4.27 | % | | | 11.96 | % | | | N/A | | | | N/A | | | | N/A | | | | 15.48 | % | | 11/30/16 | |

Oakmark Fund (Institutional Class) | | | 4.28 | % | | | 12.01 | % | | | N/A | | | | N/A | | | | N/A | | | | 15.51 | % | | 11/30/16 | |

Oakmark Fund (Service Class) | | | 4.18 | % | | | 11.51 | % | | | 16.21 | % | | | 12.23 | % | | | 12.78 | % | | | 8.61 | % | | 04/05/01 | |

The graph and table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Past performance is no guarantee of future results. The performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted. Total return includes change in share prices and, in each case, includes reinvestment of dividends and capital gain distributions. The investment return and principal value vary so that an investor's shares when redeemed may be worth more or less than the original cost. To obtain the most recent month-end performance, please visit Oakmark.com.

TOP TEN EQUITY HOLDINGS4 | | % of Net Assets | |

Citigroup, Inc. | | | 3.2 | | |

Alphabet, Inc., Class C | | | 3.1 | | |

Apple, Inc. | | | 2.9 | | |

CVS Health Corp. | | | 2.7 | | |

HCA Healthcare, Inc. | | | 2.5 | | |

Bank of America Corp. | | | 2.5 | | |

American International Group, Inc. | | | 2.4 | | |

Visa, Inc., Class A | | | 2.4 | | |

Regeneron Pharmaceuticals, Inc. | | | 2.4 | | |

Automatic Data Processing, Inc. | | | 2.3 | | |

FUND STATISTICS | |

Ticker* | | OAKMX | |

Number of Equity Holdings | | 58 | |

Net Assets | | $21.5 billion | |

Weighted Average Market Cap | | $159.5 billion | |

Median Market Cap | | $57.2 billion | |

Gross Expense Ratio - Investor Class (as of 09/30/17)* | | 0.90% | |

Gross Expense Ratio - Investor Class (as of 09/30/18)* | | 0.89% | |

Net Expense Ratio - Investor Class (as of 09/30/18)*† | | 0.85% | |

* This information is related to the Investor Class. Please visit Oakmark.com for information related to the Advisor, Institutional and Service Classes.

† The net expense ratio reflects a contractual advisory fee waiver agreement through January 28, 2019.

SECTOR ALLOCATION | | % of Net Assets | |

Information Technology | | | 24.8 | | |

Financials | | | 22.6 | | |

Consumer Discretionary | | | 14.8 | | |

Health Care | | | 14.2 | | |

Industrials | | | 8.2 | | |

Consumer Staples | | | 5.7 | | |

Energy | | | 5.3 | | |

Short-Term Investments and Other | | | 4.4 | | |

See accompanying Disclosures and Endnotes on page 85.

4 OAKMARK FUNDS

Oakmark Fund September 30, 2018

Portfolio Manager Commentary

William C. Nygren, CFA

Portfolio Manager

oakmx@oakmark.com

Kevin Grant, CFA

Portfolio Manager

oakmx@oakmark.com

The Oakmark Fund increased 4.2% during the third quarter, which brings the increase to 11.8% for the fiscal year ended September 30th. These are good absolute returns, but Oakmark trailed the strong performance of the S&P 5001, the Fund's benchmark, which was up 7.7% for the third quarter and up 17.9% for the past 12 months. While we are disappointed to underperform the market during the third quarter and the fiscal year, we remind investors that while the Fund has outperformed the market over longer periods of time, we are not surprised to see numerous shorter periods of underperformance along the way. (See Bill Nygren's third-quarter commentary for more on this subject.)

Our highest contributing securities for the fiscal year were Netflix and HCA Healthcare, which generated impressive total returns of 106% and 76%, respectively. Netflix continues to see strong subscriber and revenue growth and its profitability has improved, despite substantial investments in marketing and new content. Our largest individual detractors for the year were General Electric Company (GE), which was down 51%, and American Airlines Group, which was down 20%. As we've mentioned before, we were mistaken in our original assessment of GE's business and we've been frustrated by how the business and the share price have performed. We believe that GE has some very good businesses (e.g., Aviation and Healthcare), strong new management is in place and the enterprise is valued at a discount to our estimate of intrinsic value.

The highest contributing sectors for the third quarter were health care and information technology, with HCA Healthcare Inc. and Apple Inc. leading the way as the Fund's highest individual contributors. Our biggest detracting sectors for the quarter were consumer discretionary and energy. The Fund's largest individual detractors for the quarter were GE and State Street Corporation. During the quarter, we initiated positions in DXC Technology Co. and Charles Schwab Corporation (see below), and we didn't eliminate any positions.

DXC Technology Co. (DXC-$93.52)

DXC is a leading IT services company that was formed through the recent combination of Computer Sciences Corporation and Hewlett Packard Enterprise Services. The company has established a global footprint and a broad suite of technology offerings, which places it in a limited group of vendors that are able to serve the IT needs of large multinational corporations. We believe CEO Mike Lawrie is among the best turnaround managers at work today. He has a history of taking leadership of underperforming IT companies, then removing costs, divesting assets and re-directing investments into high-return opportunities—a formula that has driven tremendous gains in shareholder value over time. We expect Lawrie will continue to execute on this proven blueprint as he integrates the HP acquisition and we believe that he is uniquely suited to uncover

substantial hidden profits in this $19B business. DXC currently trades at just 10x 2019 consensus earnings, a significant discount to the S&P 500 multiple of 17x, despite DXC profits being forecasted to grow at a rate faster than the market for the foreseeable future.

Charles Schwab Corporation (SCHW-$49.15)

Schwab is the largest discount brokerage firm in the United States with more than $3 trillion in client assets and 11 million active brokerage accounts. This size provides Schwab with meaningful scale advantages over its smaller competitors. As the largest discount brokerage firm, the company is able to offer lower prices and invest more in superior customer service and technology than its peers. Schwab management calls this its "no trade-offs" policy—i.e., investing to provide the best product at the lowest price, and these investments attract even more clients to Schwab's platform. As a result, Schwab has been able to grow its client assets at a double-digit rate in recent years, and given that the company still has less than 15% market share, we believe such growth should continue for the foreseeable future. The company also meaningfully benefits from rising interest rates, as the higher rates allow Schwab to reinvest its bank deposits at higher yields. We believe the combination of client asset growth and rising interest rates should drive substantial asset growth at Schwab in the coming years, and on our estimates, the company is currently valued at a discount to the overall S&P 500 P/E5 multiple. We believe this represents a bargain price for a well above average business.

See accompanying Disclosures and Endnotes on page 85.

Oakmark.com 5

Oakmark Fund September 30, 2018

Schedule of Investments (in thousands)

| | | Shares | | Value | |

COMMON STOCKS - 95.6% | |

INFORMATION TECHNOLOGY - 24.8% | |

SOFTWARE & SERVICES - 15.8% | |

Alphabet, Inc., Class C (a) | | | 558 | | | $ | 666,262 | | |

Visa, Inc., Class A | | | 3,435 | | | | 515,559 | | |

Automatic Data Processing, Inc. | | | 3,320 | | | | 500,191 | | |

MasterCard, Inc., Class A | | | 2,120 | | | | 471,933 | | |

Oracle Corp. | | | 7,865 | | | | 405,519 | | |

Gartner, Inc. (a) | | | 1,800 | | | | 285,300 | | |

DXC Technology Co. | | | 2,600 | | | | 243,152 | | |

Facebook, Inc., Class A (a) | | | 1,200 | | | | 197,352 | | |

Alphabet, Inc., Class A (a) | | | 93 | | | | 112,371 | | |

| | | | | | 3,397,639 | | |

TECHNOLOGY HARDWARE & EQUIPMENT - 6.2% | |

Apple, Inc. | | | 2,787 | | | | 629,138 | | |

TE Connectivity, Ltd. | | | 4,936 | | | | 433,991 | | |

Flex, Ltd. (a) | | | 20,000 | | | | 262,400 | | |

| | | | | | 1,325,529 | | |

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT - 2.8% | |

Intel Corp. | | | 6,755 | | | | 319,444 | | |

Texas Instruments, Inc. | | | 2,720 | | | | 291,829 | | |

| | | | | | 611,273 | | |

| | | | | | 5,334,441 | | |

FINANCIALS - 22.6% | |

DIVERSIFIED FINANCIALS - 11.2% | |

Capital One Financial Corp. | | | 4,963 | | | | 471,119 | | |

Ally Financial, Inc. | | | 17,435 | | | | 461,156 | | |

State Street Corp. | | | 5,000 | | | | 418,900 | | |

The Bank of New York Mellon Corp. | | | 6,320 | | | | 322,238 | | |

Moody's Corp. | | | 1,706 | | | | 285,322 | | |

The Goldman Sachs Group, Inc. | | | 1,105 | | | | 247,785 | | |

The Charles Schwab Corp. | | | 4,300 | | | | 211,345 | | |

| | | | | | 2,417,865 | | |

BANKS - 7.6% | |

Citigroup, Inc. | | | 9,530 | | | | 683,682 | | |

Bank of America Corp. | | | 18,000 | | | | 530,280 | | |

Wells Fargo & Co. | | | 7,910 | | | | 415,750 | | |

| | | | | | 1,629,712 | | |

INSURANCE - 3.8% | |

American International Group, Inc. | | | 9,780 | | | | 520,687 | | |

Aon PLC | | | 1,890 | | | | 290,644 | | |

| | | | | | 811,331 | | |

| | | | | | 4,858,908 | | |

CONSUMER DISCRETIONARY - 14.8% | |

RETAILING - 4.5% | |

Netflix, Inc. (a) | | | 1,250 | | | | 467,662 | | |

Qurate Retail, Inc. (a) | | | 12,115 | | | | 269,083 | | |

Booking Holdings, Inc. (a) | | | 110 | | | | 218,240 | | |

| | | | | | 954,985 | | |

| | | Shares | | Value | |

MEDIA - 4.3% | |

Comcast Corp., Class A | | | 11,438 | | | $ | 405,034 | | |

Charter Communications, Inc., Class A (a) | | | 1,200 | | | | 391,056 | | |

News Corp., Class A | | | 10,401 | | | | 137,185 | | |

| | | | | | 933,275 | | |

AUTOMOBILES & COMPONENTS - 4.3% | |

Fiat Chrysler Automobiles N.V. (a) | | | 22,513 | | | | 394,200 | | |

General Motors Co. | | | 6,850 | | | | 230,640 | | |

Aptiv PLC | | | 2,200 | | | | 184,580 | | |

Delphi Technologies PLC | | | 3,733 | | | | 117,077 | | |

| | | | | | 926,497 | | |

CONSUMER SERVICES - 1.7% | |

MGM Resorts International | | | 9,400 | | | | 262,354 | | |

Hilton Worldwide Holdings, Inc. | | | 1,279 | | | | 103,326 | | |

| | | | | | 365,680 | | |

| | | | | | 3,180,437 | | |

HEALTH CARE - 14.2% | |

HEALTH CARE EQUIPMENT & SERVICES - 10.0% | |

CVS Health Corp. | | | 7,300 | | | | 574,659 | | |

HCA Healthcare, Inc. | | | 3,916 | | | | 544,724 | | |

Baxter International, Inc. | | | 5,300 | | | | 408,577 | | |

Medtronic PLC | | | 3,190 | | | | 313,800 | | |

UnitedHealth Group, Inc. | | | 1,145 | | | | 304,616 | | |

| | | | | | 2,146,376 | | |

PHARMACEUTICALS, BIOTECHNOLOGY & LIFE SCIENCES - 4.2% | |

Regeneron Pharmaceuticals, Inc. (a) | | | 1,262 | | | | 509,816 | | |

Bristol-Myers Squibb Co. | | | 6,500 | | | | 403,520 | | |

| | | | | | 913,336 | | |

| | | | | | 3,059,712 | | |

INDUSTRIALS - 8.2% | |

CAPITAL GOODS - 5.6% | |

Parker-Hannifin Corp. | | | 2,439 | | | | 448,653 | | |

General Electric Co. | | | 29,460 | | | | 332,604 | | |

Cummins, Inc. | | | 1,720 | | | | 251,240 | | |

Caterpillar, Inc. | | | 1,150 | | | | 175,364 | | |

| | | | | | 1,207,861 | | |

TRANSPORTATION - 2.6% | |

American Airlines Group, Inc. | | | 6,778 | | | | 280,126 | | |

FedEx Corp. | | | 1,130 | | | | 272,093 | | |

| | | | | | 552,219 | | |

| | | | | | 1,760,080 | | |

CONSUMER STAPLES - 5.7% | |

FOOD, BEVERAGE & TOBACCO - 3.9% | |

Diageo PLC (b) | | | 3,000 | | | | 425,010 | | |

Nestlé SA (b) | | | 4,965 | | | | 413,088 | | |

| | | | | | 838,098 | | |

HOUSEHOLD & PERSONAL PRODUCTS - 1.8% | |

Unilever PLC (b) | | | 7,163 | | | | 393,750 | | |

| | | | | | 1,231,848 | | |

See accompanying Notes to Financial Statements.

6 OAKMARK FUNDS

Oakmark Fund September 30, 2018

Schedule of Investments (in thousands) (continued)

| | | Shares | | Value | |

COMMON STOCKS - 95.6% (continued) | |

ENERGY - 5.3% | |

Apache Corp. | | | 8,540 | | | $ | 407,096 | | |

Anadarko Petroleum Corp. | | | 5,600 | | | | 377,496 | | |

National Oilwell Varco, Inc. | | | 5,929 | | | | 255,417 | | |

Chesapeake Energy Corp. (a) | | | 20,000 | | | | 89,800 | | |

| | | | | | 1,129,809 | | |

TOTAL COMMON STOCKS - 95.6%

(COST $12,469,532) | | | | | 20,555,235 | | |

| | | Par Value | | Value | |

SHORT-TERM INVESTMENTS - 4.2% | |

U.S. GOVERNMENT BILL - 3.7% | |

United States Treasury Bills,

2.00% - 2.03%,

due 10/04/18 - 10/18/18 (c)

(Cost $799,540) | | $ | 800,000 | | | | 799,540 | | |

GOVERNMENT AND AGENCY SECURITIES - 0.3% | |

Federal National Mortgage Association,

2.04%, due 10/01/18 (c)

(Cost $50,000) | | | 50,000 | | | | 50,000 | | |

REPURCHASE AGREEMENT - 0.2% | |

Fixed Income Clearing Corp. Repurchase

Agreement, 1.30% dated 09/28/18 due

10/01/18, repurchase price $44,266,

collateralized by a United States Treasury

Note, 2.000% due 10/31/22, value

plus accrued interest of $45,148

(Cost: $44,261) | | | 44,261 | | | | 44,261 | | |

TOTAL SHORT-TERM INVESTMENTS - 4.2%

(COST $893,801) | | | | | 893,801 | | |

TOTAL INVESTMENTS - 99.8%

(COST $13,363,333) | | | | | 21,449,036 | | |

Foreign Currencies (Cost $0) - 0.0% (d) | | | | | 0 | (e) | |

Other Assets In Excess of Liabilities - 0.2% | | | | | 51,730 | | |

TOTAL NET ASSETS - 100.0% | | | | $ | 21,500,766 | | |

(a) Non-income producing security

(b) Sponsored American Depositary Receipt

(c) The rate shown represents the annualized yield at the time of purchase; not a coupon rate.

(d) Amount rounds to less than 0.1%.

(e) Amount rounds to less than $1,000.

See accompanying Notes to Financial Statements.

Oakmark.com 7

Oakmark Fund September 30, 2018

Schedule of Investments (in thousands) (continued)

WRITTEN OPTIONS

Description | | Exercise

Price | | Expiration

Date | | Number of

Contracts | | Notional

Amount | | Market Value | | Premiums

Received by

Fund | |

PUTS | |

News Corp., Class A | | $ | 13.00 | | | 11/16/2018 | | | 100,000 | | | $ | 131,900 | | | $ | (4,000 | ) | | $ | 4,696 | | |

General Electric Co. | | | 11.50 | | | 11/09/2018 | | | 120,000 | | | | 135,480 | | | | (6,720 | ) | | | 5,456 | | |

| | | | | | | | | $ | 267,380 | | | $ | (10,720 | ) | | $ | 10,152 | | |

See accompanying Notes to Financial Statements.

8 OAKMARK FUNDS

This page intentionally left blank.

Oakmark.com 9

Oakmark Select Fund September 30, 2018

Summary Information

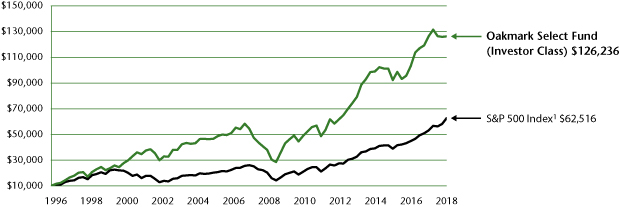

VALUE OF A $10,000 INVESTMENT

Since Inception - 11/01/96 (Unaudited)

PERFORMANCE

| | | | | Average Annual Total Returns (as of 9/30/18) | | | |

| (Unaudited) | | Total Return

Last 3 Months | | 1-year | | 3-year | | 5-year | | 10-year | | Since

Inception | | Inception

Date | |

Oakmark Select Fund (Investor Class) | | | 0.28 | % | | | -0.08 | % | | | 11.04 | % | | | 9.81 | % | | | 12.80 | % | | | 12.27 | % | | 11/01/96 | |

S&P 500 Index | | | 7.71 | % | | | 17.91 | % | | | 17.31 | % | | | 13.95 | % | | | 11.97 | % | | | 8.72 | % | | | | | |

Lipper Multi-Cap Value Fund Index6 | | | 3.86 | % | | | 7.48 | % | | | 11.96 | % | | | 9.27 | % | | | 9.38 | % | | | 7.71 | % | | | | | |

Oakmark Select Fund (Advisor Class) | | | 0.33 | % | | | 0.08 | % | | | N/A | | | | N/A | | | | N/A | | | | 7.58 | % | | 11/30/16 | |

Oakmark Select Fund (Institutional Class) | | | 0.33 | % | | | 0.10 | % | | | N/A | | | | N/A | | | | N/A | | | | 7.60 | % | | 11/30/16 | |

Oakmark Select Fund (Service Class) | | | 0.33 | % | | | -0.32 | % | | | 10.73 | % | | | 9.49 | % | | | 12.49 | % | | | 9.06 | % | | 12/31/99 | |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Past performance is no guarantee of future results. The performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted. Total return includes change in share prices and, in each case, includes reinvestment of dividends and capital gain distributions. The investment return and principal value vary so that an investor's shares when redeemed may be worth more or less than the original cost. To obtain the most recent month-end performance, please visit Oakmark.com.

TOP TEN EQUITY HOLDINGS4 | | % of Net Assets | |

Alphabet, Inc., Class C | | | 8.9 | | |

CBRE Group, Inc., Class A | | | 6.8 | | |

TE Connectivity, Ltd. | | | 6.3 | | |

Citigroup, Inc. | | | 6.2 | | |

MasterCard, Inc., Class A | | | 5.4 | | |

Fiat Chrysler Automobiles N.V. | | | 5.1 | | |

Ally Financial, Inc. | | | 5.1 | | |

Apache Corp. | | | 4.6 | | |

American International Group, Inc. | | | 4.5 | | |

Regeneron Pharmaceuticals, Inc. | | | 4.1 | | |

FUND STATISTICS | |

Ticker* | | OAKLX | |

Number of Equity Holdings | | 22 | |

Net Assets | | $6.0 billion | |

Weighted Average Market Cap | | $152.6 billion | |

Median Market Cap | | $39.0 billion | |

Gross Expense Ratio - Investor Class (as of 09/30/17)* | | 1.03% | |

Gross Expense Ratio - Investor Class (as of 09/30/18)* | | 1.04% | |

Net Expense Ratio - Investor Class (as of 09/30/18)*† | | 0.97% | |

* This information is related to the Investor Class. Please visit Oakmark.com for information related to the Advisor, Institutional and Service Classes.

† The net expense ratio reflects a contractual advisory fee waiver agreement through January 28, 2019.

SECTOR ALLOCATION | | % of Net Assets | |

Information Technology | | | 25.2 | | |

Financials | | | 23.3 | | |

Consumer Discretionary | | | 19.7 | | |

Energy | | | 11.0 | | |

Industrials | | | 6.9 | | |

Real Estate | | | 6.8 | | |

Health Care | | | 4.1 | | |

Short-Term Investments and Other | | | 3.0 | | |

See accompanying Disclosures and Endnotes on page 85

10 OAKMARK FUNDS

Oakmark Select Fund September 30, 2018

Portfolio Manager Commentary

William C. Nygren, CFA

Portfolio Manager

oaklx@oakmark.com

Anthony P. Coniaris, CFA

Portfolio Manager

oaklx@oakmark.com

Win Murray

Portfolio Manager

oaklx@oakmark.com

The Oakmark Select Fund was up 0.3% for the quarter, trailing the S&P 5001 Index's 7.7% return. For the fiscal year ending September 30, 2018, the Oakmark Select Fund decreased by –0.1%, compared to the S&P 500's 17.9% gain. As shareholders of the Fund and stewards of your capital, we are quite frustrated with this performance, but we continue to follow the same disciplined investment process that has led to our strong performance over the longer term. As referenced in the third-quarter market commentary, the market's recent general repudiation of our investment beliefs is magnified in the Select Fund, given its higher level of concentration. We'd like to use this letter to put this recent underperformance into context.

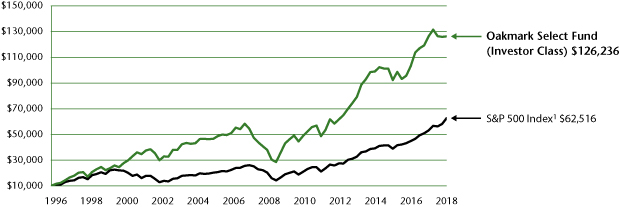

The Select Fund was started in November 1996. An investor who bought and held the S&P 500 from that date until now has earned slightly more than six times their initial investment. An investor who bought and held the Select Fund for the same period now has over 12 times their initial investment—more than twice the capital of the S&P 500 investor.

Even with that long-term record, the Fund has regularly endured long periods in which the S&P 500 fared better. In 50% of the Fund's 252 rolling 12-month periods, the Select Fund has trailed the S&P 500. Stretching the time period to three years, the Select Fund still trailed the S&P 500 43% of the time. Even when we move out to five years, the Select Fund fell short of the S&P 500 35% of the time. Yet despite all of these periods of underperformance, the Fund still generated more than double the S&P 500's return over that 22-year period.

If an investor waited to see five years of market outperformance before investing in the Oakmark Select Fund and then sold the Fund after five years of underperformance, entering and selling the Fund each time one of those triggers was met, here are the results (based on an initial investment of $10,000 in November 1996):

Strategy | | Ending Capital | |

| -Oakmark Select Buy and Hold | | $ | 126,200 | | |

| -S&P 500 Buy and Hold | | $ | 62,500 | | |

| -Select/S&P 500 "In and Out" | | $ | 59,500 | | |

Clearly, attempting to chase trailing performance has been a poor strategy. Long-time shareholders understand that we invest in companies that we believe are selling at large discounts to their intrinsic values, and these stocks are often terribly out of favor with other investors. But if we're right about these companies' underlying values, then their cash flows should eventually win out, the market will come around to our view, and the stock prices will eventually rise to our estimate of value. No one can tell the precise moment when this will happen, and if investors only focus on past results, they could miss out on periods of strong performance.

Patience, therefore, is a necessary virtue in value investing. But stubbornness in the face of contrary evidence most certainly is not. We conduct regular retrospective looks on all of the securities across the Oakmark fund complex. We particularly pay attention to companies that are falling short of our expectations. In fiscal 2018, new information led us to conclude that the negative consensus view was probably more accurate than our optimistic view for three holdings that fell short of our expectations: General Electric (GE), Harley-Davidson, and Adient. We sold Harley-Davidson. Both GE and Adient, however, brought in new management teams, and the most valuable parts of both companies' businesses (Aviation and Healthcare within GE, and Seating within Adient) have been performing essentially in line with our expectations. We also believe that both companies are currently hobbled by less significant divisions (Power in GE, and Structures in Adient) that are relatively small components of their intrinsic values. Neither company will turn around over night, but we believe that these new management teams are quite capable and that each company is worth far more than its current stock price reflects.

Significantly, most of our underperforming stocks this year were pro-cyclical: these stocks tend to have more than a typical amount of sensitivity to the health of the broad economy. This list includes our banks, industrials, consumer durables (such as autos), energy, and travel-related companies. Had we simply judged our performance based on the business results these companies reported rather than their stock prices, we would have thought we had a pretty good year.

Of the 24 stocks we owned throughout fiscal 2018, only eight produced a total return of at least 10% while owned by the Fund (in a year in which the S&P 500 increased by 18%). Of the 16 that fell short of this hurdle, three were the companies mentioned above that disappointed fundamentally relative to our expectations. Of the remaining 13 holdings whose stocks underperformed, 11 actually produced earnings results broadly in line with our expectations, but investor fears of an upcoming recession grew throughout the year, heightened by concerns about the effects of tariffs on the broader economy, which resulted in poor stock prices, despite good business performance.

In only a slight oversimplification, if we identify a business we believe is worth $100 per share, we will set a buy target of $60 and a sell target of $90 for the stock. At any given point in time, our portfolio is a mix of some stocks selling below the buy targets and others selling at all levels between the buy and sell targets. When business fundamentals outperform stock prices, stocks, in our view, become more attractive. Today, 62% of the stocks held in Oakmark Select are below our buy targets. That compares to a year ago when 25% were below the buy targets. We are applying the same processes that created the long-term

See accompanying Disclosures and Endnotes on page 85.

Oakmark.com 11

Oakmark Select Fund September 30, 2018

Portfolio Manager Commentary (continued)

track record that was referenced earlier, and are applying at least the same level of talent and effort to making our investment decisions. We believe the recent underperformance has made the Oakmark Select Fund more attractive—and we have been buying more shares of the Fund ourselves this year. We hope you consider joining us to take advantage of the recent weakness.

Thank you, our fellow shareholders, for your continued investment in our Fund.

See accompanying Disclosures and Endnotes on page 85.

12 OAKMARK FUNDS

Oakmark Select Fund September 30, 2018

Schedule of Investments (in thousands)

| | | Shares | | Value | |

COMMON STOCKS - 97.0% | |

INFORMATION TECHNOLOGY - 25.2% | |

SOFTWARE & SERVICES - 18.9% | |

Alphabet, Inc., Class C (a) | | | 444 | | | $ | 529,483 | | |

MasterCard, Inc., Class A | | | 1,439 | | | | 320,336 | | |

Oracle Corp. | | | 3,617 | | | | 186,492 | | |

Alphabet, Inc., Class A (a) | | | 73 | | | | 88,205 | | |

| | | | | | 1,124,516 | | |

TECHNOLOGY HARDWARE & EQUIPMENT - 6.3% | |

TE Connectivity, Ltd. | | | 4,243 | | | | 373,082 | | |

| | | | | | 1,497,598 | | |

FINANCIALS - 23.3% | |

BANKS - 10.1% | |

Citigroup, Inc. | | | 5,112 | | | | 366,735 | | |

Bank of America Corp. | | | 8,001 | | | | 235,697 | | |

| | | | | | 602,432 | | |

DIVERSIFIED FINANCIALS - 8.7% | |

Ally Financial, Inc. | | | 11,500 | | | | 304,175 | | |

Capital One Financial Corp. | | | 2,285 | | | | 216,906 | | |

| | | | | | 521,081 | | |

INSURANCE - 4.5% | |

American International Group, Inc. | | | 4,995 | | | | 265,944 | | |

| | | | | | 1,389,457 | | |

CONSUMER DISCRETIONARY - 19.7% | |

AUTOMOBILES & COMPONENTS - 8.7% | |

Fiat Chrysler Automobiles N.V. (a) | | | 17,434 | | | | 305,271 | | |

Adient PLC (b) | | | 5,400 | | | | 212,274 | | |

| | | | | | 517,545 | | |

MEDIA - 3.9% | |

Charter Communications, Inc., Class A (a) | | | 720 | | | | 234,634 | | |

CONSUMER SERVICES - 3.6% | |

MGM Resorts International | | | 7,584 | | | | 211,683 | | |

RETAILING - 3.5% | |

Qurate Retail, Inc. (a) | | | 9,293 | | | | 206,395 | | |

| | | | | | 1,170,257 | | |

ENERGY - 11.0% | |

Apache Corp. | | | 5,716 | | | | 272,482 | | |

Chesapeake Energy Corp. (a) | | | 44,860 | | | | 201,423 | | |

Weatherford International PLC (a) (b) | | | 67,380 | | | | 182,601 | | |

| | | | | | 656,506 | | |

INDUSTRIALS - 6.9% | |

CAPITAL GOODS - 3.5% | |

General Electric Co. | | | 18,300 | | | | 206,607 | | |

TRANSPORTATION - 3.4% | |

American Airlines Group, Inc. | | | 4,900 | | | | 202,517 | | |

| | | | | | 409,124 | | |

| | | Shares | | Value | |

REAL ESTATE - 6.8% | |

CBRE Group, Inc., Class A (a) | | | 9,248 | | | $ | 407,815 | | |

HEALTH CARE - 4.1% | |

PHARMACEUTICALS, BIOTECHNOLOGY & LIFE SCIENCES - 4.1% | |

Regeneron Pharmaceuticals, Inc. (a) | | | 600 | | | | 242,424 | | |

TOTAL COMMON STOCKS - 97.0%

(COST $3,697,133) | | | | | 5,773,181 | | |

| | | Par Value | | Value | |

SHORT-TERM INVESTMENTS - 3.0% | |

GOVERNMENT AND AGENCY SECURITIES - 1.7% | |

Federal National Mortgage Association,

2.04%, due 10/01/18 (c)

(Cost $100,000) | | $ | 100,000 | | | | 100,000 | | |

REPURCHASE AGREEMENT - 1.3% | |

Fixed Income Clearing Corp. Repurchase

Agreement, 1.30% dated 09/28/18 due

10/01/18, repurchase price $79,806,

collateralized by a United States

Treasury Note, 2.750% due

04/30/23, value plus accrued interest

of $81,397 (Cost: $79,797) | | | 79,797 | | | | 79,797 | | |

TOTAL SHORT-TERM INVESTMENTS - 3.0%

(COST $179,797) | | | | | 179,797 | | |

TOTAL INVESTMENTS - 100.0%

(COST $3,876,930) | | | | | 5,952,978 | | |

Other Assets In Excess of Liabilities - 0.0% (d) | | | | | 897 | | |

TOTAL NET ASSETS - 100.0% | | | | $ | 5,953,875 | | |

(a) Non-income producing security

(b) See Note 5 in the Notes to Financial Statements regarding investments in affiliated issuers.

(c) The rate shown represents the annualized yield at the time of purchase; not a coupon rate.

(d) Amount rounds to less than 0.1%

See accompanying Notes to Financial Statements.

Oakmark.com 13

Oakmark Select Fund September 30, 2018

Schedule of Investments (in thousands) (continued)

SCHEDULE OF TRANSACTIONS WITH AFFILIATED ISSUERS

Purchase and sale transactions and dividend and interest income earned during the period on these securities are set forth below (in thousands). The industry for the below affiliate can be found in the Schedule of Investments.

Affiliates | | Shares

Held | | Purchases

(Cost) | | Sales

(Proceeds) | | Realized

Gain/(Loss) | | Change in

Unrealized | | Dividend

Income | | Value

September 30,

2017 | | Value

September 30,

2018 | | Percent of

Net Assets | |

Adient PLC | | | 5,400 | | | $ | 663,193 | | | $ | 307,512 | | | $ | (119,685 | ) | | $ | (20,875 | ) | | $ | 3,117 | | | $ | 0 | | | $ | 212,274 | | | | 3.6 | % | |

Weatherford

International PLC | | | 67,380 | | | | 191,163 | | | | 144,317 | | | | (47,899 | ) | | | (39,546 | ) | | | 0 | | | | 229,883 | | | | 182,601 | | | | 3.1 | % | |

TOTAL | | | 72,780 | | | $ | 854,356 | | | $ | 451,829 | | | $ | (167,584 | ) | | $ | (60,421 | ) | | $ | 3,117 | | | $ | 229,883 | | | $ | 394,875 | | | | 6.7 | % | |

See accompanying Notes to Financial Statements.

14 OAKMARK FUNDS

This page intentionally left blank.

Oakmark.com 15

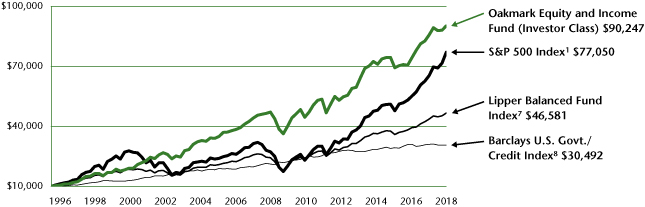

Oakmark Equity and Income Fund September 30, 2018

Summary Information

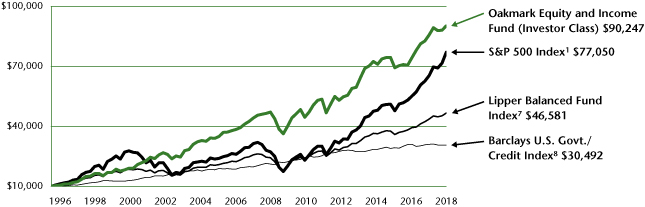

VALUE OF A $10,000 INVESTMENT

Since Inception - 11/01/95 (Unaudited)

PERFORMANCE

| | | | | Average Annual Total Returns (as of 09/30/18) | | | |

| (Unaudited) | | Total Return

Last 3 Months | | 1-year | | 3-year | | 5-year | | 10-year | | Since

Inception | | Inception

Date | |

Oakmark Equity and Income Fund (Investor Class) | | | 2.46 | % | | | 5.29 | % | | | 9.22 | % | | | 6.99 | % | | | 7.51 | % | | | 10.08 | % | | 11/01/95 | |

Lipper Balanced Fund Index | | | 3.07 | % | | | 6.91 | % | | | 9.14 | % | | | 7.29 | % | | | 7.70 | % | | | 6.95 | % | | | | | |

S&P 500 Index | | | 7.71 | % | | | 17.91 | % | | | 17.31 | % | | | 13.95 | % | | | 11.97 | % | | | 9.32 | % | | | | | |

Barclays U.S. Govt./Credit Index | | | 0.06 | % | | | -1.37 | % | | | 1.45 | % | | | 2.23 | % | | | 3.95 | % | | | 4.99 | % | | | | | |

Oakmark Equity and Income Fund (Advisor Class) | | | 2.46 | % | | | 5.42 | % | | | N/A | | | | N/A | | | | N/A | | | | 9.30 | % | | 11/30/16 | |

Oakmark Equity and Income Fund (Institutional Class) | | | 2.49 | % | | | 5.47 | % | | | N/A | | | | N/A | | | | N/A | | | | 9.32 | % | | 11/30/16 | |

Oakmark Equity and Income Fund (Service Class) | | | 2.35 | % | | | 4.99 | % | | | 8.90 | % | | | 6.67 | % | | | 7.18 | % | | | 8.45 | % | | 07/12/00 | |

The graph and table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Past performance is no guarantee of future results. The performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted. Total return includes change in share prices and, in each case, includes reinvestment of dividends and capital gain distributions. The investment return and principal value vary so that an investor's shares, when redeemed, may be worth more or less than the original cost. To obtain the most recent month-end performance, please visit Oakmark.com.

TOP TEN EQUITY HOLDINGS4 | | % of Net Assets | |

Bank of America Corp. | | | 4.8 | | |

General Motors Co. | | | 4.0 | | |

TE Connectivity, Ltd. | | | 3.7 | | |

Mastercard, Inc., Class A | | | 3.6 | | |

Nestlé SA | | | 3.0 | | |

UnitedHealth Group, Inc. | | | 2.6 | | |

CVS Health Corp. | | | 2.5 | | |

Philip Morris International, Inc. | | | 2.1 | | |

Alphabet, Inc., Class C | | | 2.0 | | |

Citigroup, Inc. | | | 2.0 | | |

FUND STATISTICS | |

Ticker* | | OAKBX | |

Number of Equity Holdings | | 45 | |

Net Assets | | $15.4 billion | |

Weighted Average Market Cap | | $127.5 billion | |

Median Market Cap | | $30.6 billion | |

Gross Expense Ratio - Investor Class (as of 09/30/17)* | | 0.87% | |

Gross Expense Ratio - Investor Class (as of 09/30/18)* | | 0.88% | |

Net Expense Ratio - Investor Class (as of 09/30/18)*† | | 0.78% | |

* This information is related to the Investor Class. Please visit Oakmark.com for information related to the Advisor, Institutional and Service Classes.

† The net expense ratio reflects a contractual advisory fee waiver agreement through January 28, 2019.

SECTOR ALLOCATION | | % of Net Assets | |

Equity Investments | |

Information Technology | | | 12.3 | | |

Financials | | | 11.2 | | |

Consumer Discretionary | | | 11.1 | | |

Health Care | | | 7.9 | | |

Consumer Staples | | | 7.2 | | |

Industrials | | | 5.0 | | |

Energy | | | 4.2 | | |

Materials | | | 1.2 | | |

Real Estate | | | 0.9 | | |

Total Equity Investments | | | 61.0 | | |

Preferred Stocks | | | 0.1 | | |

Fixed Income Investments | |

Corporate Bonds | | | 14.1 | | |

Government and Agency Securities | | | 12.4 | | |

Covertible Bond | | | 0.1 | | |

Total Fixed Income Investments | | | 26.6 | | |

Short-Term Investments and Other | | | 12.3 | | |

See accompanying Disclosures and Endnotes on page 85.

16 OAKMARK FUNDS

Oakmark Equity and Income Fund September 30, 2018

Portfolio Manager Commentary

Clyde S. McGregor, CFA

Portfolio Manager

oakbx@oakmark.com

M. Colin Hudson, CFA

Portfolio Manager

oakbx@oakmark.com

Edward J. Wojciechowski, CFA

Portfolio Manager

oakbx@oakmark.com

Some investment industry commentators have questioned the substandard performance history of traditional value equities following the financial crisis and have posited that recent economic changes have made traditional value factors, especially price-to-book ratios9, obsolete. The basic argument is that intangible assets (e.g., patents, trademarks, research & development (R&D) spending, etc.) have become an increasingly dominant proportion of a modern company's net worth and current accounting conventions fail to capture these assets adequately. In support of this view, in 1975, over 80% of the stock market value of an average company was represented by tangible book value, with intangibles representing the rest. Today those metrics are flip-flopped.

Regular readers of the Oakmark Funds' group quarterly reports know that our colleague Bill Nygren recently addressed the inadequacies of GAAP accounting. Expenditures for property, plant and equipment are capitalized as an asset on the balance sheet and depreciated over the estimated life of that equipment. But other expenditures that yield long-term benefits, such as the R&D that a pharmaceutical company puts toward a new drug or the upfront marketing expense that a software company incurs to acquire a new customer, are expensed immediately and generate no corresponding asset. To confuse things further, an intangible asset that is acquired is treated differently than one that is developed internally.

This is all very interesting, but what does this mean for us as managers of the Equity and Income Fund? Our job is to seek value wherever we can find it in both the equity and the fixed income market. To do that, however, we must recognize that value itself is always evolving and we must also evolve to keep up. When considering investing in an equity, we always ask, "What is the price we could pay for this company and earn a fair return if we had to purchase it in its entirety and could never sell it again?" When we can estimate that price and can buy the equity at a sufficient discount, we believe that we have uncovered true value. But our analysis must continually progress for us to avoid an obsolete understanding of business value.

Several decades ago, some disciples of Benjamin Graham limited their investing to companies that were selling for less than the net value of their current assets minus all liabilities (net-nets). Over time, this investing method lost relevance as the economy developed and net-nets disappeared. Similarly, we must strive to stay ahead of the wave rather than fighting to catch up. One tactic that we use to fight obsolescence is to regularly hire new investment analysts, who, although fundamentally value oriented, have different ways of understanding exactly what that means. Another is our "devil's advocate

reviews" in which an analyst is charged with attacking our collective thinking on an issue. "Evolve or die out" is true in nature, and we realize that this also applies to our investing.

Quarter and Fiscal-Year Review

The Equity and Income Fund returned 2.5% in the quarter, which compares to 3.1% for the Lipper Balanced Fund Index7, the Fund's performance benchmark. For the nine months of the calendar year, the Fund returned 1.0%, compared to 3.2% for the Lipper Balanced Fund Index. And for the 12 months ended September 30 (the Fund's fiscal year), Equity and Income earned 5.3%, which compares to 6.9% for the Lipper Balanced Fund Index. The annualized compound rate of return since inception in 1995 is 10.1%, while the corresponding return to the Lipper Balanced Fund Index is 7.0%.

HCA Healthcare, CVS, Mastercard, Dover and Oracle provided the largest contribution to portfolio return in the quarter. Detractors included General Motors (GM), Lear, PDC Energy, State Street and TE Connectivity. Contributors for the calendar year to date were MasterCard, HCA Healthcare, UnitedHealth Group, National Oilwell Varco and Charter Communications. GM, Philip Morris International, Arconic, Lear and TE Connectivity were the leading detractors for the nine months. Finally, for the Fund's fiscal year, the largest contributors were Mastercard, Bank of America, UnitedHealth Group, HCA Healthcare and Dover. The stocks that detracted most were GM, Philip Morris International, Lear, Baker Hughes and BorgWarner.

One year ago, we wrote about the strong performance of the automotive industry stocks in the portfolio. This proved to be a premature celebration, as the 12-month detractor list demonstrates all too well. We continue to believe that the automotive sector is attractively priced. Concerning GM, the Fund's second largest holding, we were very intrigued by Softbank's $2.25 billion investment in GM's Cruise Automation subsidiary. If Softbank is correct that GM's stake in Cruise Automation is worth around $9 billion, then the valuation of GM's traditional business is less than 5x EPS10, which seems absurdly cheap. GM now trades near the price where it went public in 2010 ($33). Since then, the company has cumulatively earned more than $33/share and paid out nearly $7 in dividends. Critics of the stock will point to the current economic cycle, tariffs and the long-term threat from autonomous vehicles and ride-sharing. These concerns fail to take into account our estimate that nearly 75% of GM's earnings come from pickup trucks and large SUVs—a market segment where the company has a dominant and protected competitive moat. We believe this part of the business alone is worth more than the current stock price, even without giving credit for Cruise or GM's valuable China business.

See accompanying Disclosures and Endnotes on page 85.

Oakmark.com 17

Oakmark Equity and Income Fund September 30, 2018

Portfolio Manager Commentary (continued)

Transaction Activity

During the quarter, we initiated one new holding and also eliminated one. New holding Flex is undergoing a business transformation that should result in improved margins and less cyclical, faster earnings growth. A decade ago, the company, then known as Flextronics, looked like a classic contract manufacturer. Like its peers, the company had a concentrated customer base, composed almost entirely of electronics companies, and it would manufacture products to meet customer specifications. Contract manufacturers have few meaningful competitive advantages in the low-margin manufacturing business, as their main value-add is locating production in low-cost regions.

However, since Mike McNamara took over as CEO in 2006, Flex has been diversifying its customer base to include industries such as medical, automotive and even shoe manufacturing for Nike. The company is also investing in what it calls "sketch-to-scale" capabilities, in which Flex's engineers are actually involved in the design phase of customers' products. This is a better business than contract manufacturing due to higher barriers to entry, stickier customer relationships and higher profit margins. Sketch-to-scale arrangements account for about 27% of revenues today and should be close to 40% by 2020. Recently, the stock price has been hurt by worries about tariffs and component shortages, as well as a surge in new orders, which has pressured margins and free cash flow as the company has added capacity and inventory to fulfill these orders. None of these worries will have a meaningful impact on long-term business value, and at about 10x year next 12 months EPS10 plus amortization, the stock is much too cheap, given the durable earnings growth and high return on invested capital we see ahead.

The only portfolio elimination was Wells Fargo. The Fund has a substantial commitment to the financial industry generally, and we sold Wells Fargo to fund purchases of more attractively valued securities.

Fixed Income/Fund Distributions

Over the past few years, we have often argued that "income is overpriced," which is simply another way of saying that interest rates/dividend yields are too low. Recognize that this statement has consequences: if interest rates go up from these historically low levels, bond prices go down. Given that we have struggled to find true value in income for quite some time, we have maintained a conservative, risk-averse posture in our fixed income investing. This positioning has served us well this year. With the 10-year U.S. Treasury yield finally breaking through the 3% level, the Bloomberg Barclays U.S. Aggregate Bond Index11 looks likely to be down for the year, only the fourth time since 1990.

The fixed income portion of our portfolio, however, has shown positive returns. Given the increase in interest rates, we are finally beginning to see more attractive opportunities in the fixed income market. Of course, the danger is that this increased competition from bonds could pull money away from stocks with negative consequences for equities, so we must not see this interest rate move as entirely positive. But we hope that the changing environment will give us the opportunity to increase portfolio yield and, thereby, allow for larger income distributions.

Periodically, we receive queries from shareholders along the following lines: "Why does a fund with the word 'income' in its name not provide more in the way of income distributions?" Although we are all too aware of our failings in managing this Fund, less than anticipated income may be the one that nags at us most. When we incepted the Fund in 1995, fixed income interest rates and equity dividend yields were much higher than what soon became available to us in managing the Fund. In 1995, we lived in a world where we could generate 5-8% yields in the bond portfolio and earn 2-4% dividend yields on stocks. This could allow for something like a 3% income yield on the Fund portfolio, which would be available for distribution to shareholders. Several things occurred to change this math, however. First, interest rates declined almost continuously until their 2016 bottom when the rate on the 10-year Treasury hit 1.36%. Second, corporate leaders deemphasized dividends in favor of share repurchases. And last but not least, equity prices rose, perforce reducing dividend yields.

As noted above, we are finally beginning to see more attractive opportunities in the fixed income market. We hope that the changing environment will give us the opportunity to increase portfolio yield and, thereby, allow for larger income distributions. We thank our shareholders for entrusting their assets to the Fund, especially our long-suffering income-oriented investors. We welcome your questions and comments.

See accompanying Disclosures and Endnotes on page 85.

18 OAKMARK FUNDS

Oakmark Equity and Income Fund September 30, 2018

Schedule of Investments (in thousands)

| | | Shares | | Value | |

COMMON STOCKS - 61.0% | |

INFORMATION TECHNOLOGY - 12.3% | |

SOFTWARE & SERVICES - 7.7% | |

MasterCard, Inc., Class A | | | 2,502 | | | $ | 557,059 | | |

Alphabet, Inc., Class C (a) | | | 263 | | | | 313,644 | | |

Oracle Corp. | | | 4,806 | | | | 247,803 | | |

CoreLogic, Inc. (a) | | | 1,293 | | | | 63,887 | | |

| | | | | | 1,182,393 | | |

TECHNOLOGY HARDWARE & EQUIPMENT - 4.3% | |

TE Connectivity, Ltd. | | | 6,483 | | | | 570,059 | | |

CommScope Holding Co., Inc. (a) | | | 1,938 | | | | 59,608 | | |

Flex, Ltd. (a) | | | 2,484 | | | | 32,588 | | |

| | | | | | 662,255 | | |

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT - 0.3% | |

Qorvo, Inc. (a) | | | 609 | | | | 46,857 | | |

| | | | | | 1,891,505 | | |

FINANCIALS - 11.2% | |

BANKS - 6.8% | |

Bank of America Corp. | | | 24,830 | | | | 731,492 | | |

Citigroup, Inc. | | | 4,360 | | | | 312,765 | | |

| | | | | | 1,044,257 | | |

DIVERSIFIED FINANCIALS - 3.4% | |

Ally Financial, Inc. | | | 9,173 | | | | 242,623 | | |

The Bank of New York Mellon Corp. | | | 3,030 | | | | 154,482 | | |

State Street Corp. | | | 1,551 | | | | 129,960 | | |

| | | | | | 527,065 | | |

INSURANCE - 1.0% | |

American International Group, Inc. | | | 2,869 | | | | 152,749 | | |

| | | | | | 1,724,071 | | |

CONSUMER DISCRETIONARY - 11.1% | |

AUTOMOBILES & COMPONENTS - 6.5% | |

General Motors Co. | | | 18,472 | | | | 621,939 | | |

BorgWarner, Inc. | | | 4,477 | | | | 191,510 | | |

Lear Corp. | | | 1,316 | | | | 190,883 | | |

| | | | | | 1,004,332 | | |

MEDIA - 2.2% | |

Charter Communications, Inc., Class A (a) | | | 778 | | | | 253,502 | | |

Comcast Corp., Class A | | | 2,120 | | | | 75,069 | | |

| | | | | | 328,571 | | |

RETAILING - 1.6% | |

Foot Locker, Inc. | | | 4,066 | | | | 207,305 | | |

Qurate Retail, Inc. (a) | | | 1,705 | | | | 37,878 | | |

| | | | | | 245,183 | | |

CONSUMER SERVICES - 0.4% | |

MGM Resorts International | | | 2,351 | | | | 65,623 | | |

| | | Shares | | Value | |

CONSUMER DURABLES & APPAREL - 0.4% | |

Carter's, Inc. | | | 664 | | | $ | 65,500 | | |

| | | | | | 1,709,209 | | |

HEALTH CARE - 7.9% | |

HEALTH CARE EQUIPMENT & SERVICES - 7.2% | |

UnitedHealth Group, Inc. | | | 1,506 | | | | 400,773 | | |

CVS Health Corp. | | | 4,911 | | | | 386,622 | | |

HCA Healthcare, Inc. | | | 1,796 | | | | 249,859 | | |

LivaNova PLC (a) | | | 547 | | | | 67,785 | | |

| | | | | | 1,105,039 | | |

PHARMACEUTICALS, BIOTECHNOLOGY & LIFE SCIENCES - 0.7% | |

Regeneron Pharmaceuticals, Inc. (a) | | | 271 | | | | 109,535 | | |

| | | | | | 1,214,574 | | |

CONSUMER STAPLES - 7.2% | |

FOOD, BEVERAGE & TOBACCO - 7.2% | |

Nestlé SA (b) | | | 5,623 | | | | 467,833 | | |

Philip Morris International, Inc. | | | 3,956 | | | | 322,597 | | |

Diageo PLC (b) | | | 2,198 | | | | 311,405 | | |

| | | | | | 1,101,835 | | |

INDUSTRIALS - 5.0% | |

CAPITAL GOODS - 4.2% | |

Dover Corp. | | | 2,826 | | | | 250,159 | | |

Arconic, Inc. | | | 6,587 | | | | 144,985 | | |

Johnson Controls International plc | | | 3,895 | | | | 136,315 | | |

Carlisle Cos., Inc. | | | 560 | | | | 68,184 | | |

WESCO International, Inc. (a) | | | 682 | | | | 41,884 | | |

| | | | | | 641,527 | | |

TRANSPORTATION - 0.8% | |

American Airlines Group, Inc. | | | 2,898 | | | | 119,767 | | |

| | | | | | 761,294 | | |

ENERGY - 4.2% | |

National Oilwell Varco, Inc. | | | 6,830 | | | | 294,224 | | |

Anadarko Petroleum Corp. | | | 1,417 | | | | 95,500 | | |

PDC Energy, Inc. (a) | | | 1,900 | | | | 93,043 | | |

Baker Hughes a GE Co. | | | 2,438 | | | | 82,474 | | |

Apergy Corp. (a) | | | 1,772 | | | | 77,199 | | |

| | | | | | 642,440 | | |

MATERIALS - 1.2% | |

Glencore PLC | | | 43,500 | | | | 188,065 | | |

REAL ESTATE - 0.9% | |

The Howard Hughes Corp. (a) | | | 555 | | | | 68,888 | | |

Gaming and Leisure Properties, Inc. REIT | | | 1,833 | | | | 64,599 | | |

| | | | | | 133,487 | | |

TOTAL COMMON STOCKS - 61.0%

(COST $5,211,468) | | | | | 9,366,480 | | |

See accompanying Notes to Financial Statements.

Oakmark.com 19

Oakmark Equity and Income Fund September 30, 2018

Schedule of Investments (in thousands) (continued)

| | | Shares | | Value | |

PREFERRED STOCKS - 0.1% | |

FINANCIALS - 0.1% | |

GMAC Capital Trust I (c), 8.10%

(3 mo. USD LIBOR + 5.785%), | | | 498 | | | $ | 13,084 | | |

TOTAL PREFERRED STOCKS - 0.1%

(COST $13,006) | | | | | 13,084 | | |

| | | Par Value | | Value | |

FIXED INCOME - 26.6% | |

CORPORATE BONDS - 14.1% | |

CONSUMER DISCRETIONARY - 4.0% | |

Adient Global Holdings, Ltd., 144A

4.875%, due 08/15/26 (d) | | $ | 7,000 | | | | 6,221 | | |

Amazon.com, Inc.

3.15%, due 08/22/27 | | | 9,950 | | | | 9,534 | | |

Booking Holdings, Inc.

3.60%, due 06/01/26 | | | 14,730 | | | | 14,290 | | |

3.55%, due 03/15/28 | | | 9,950 | | | | 9,512 | | |

2.75%, due 03/15/23 | | | 6,965 | | | | 6,674 | | |

BorgWarner, Inc.

4.625%, due 09/15/20 | | | 10,810 | | | | 11,028 | | |

Boyd Gaming Corp.

6.00%, due 08/15/26 | | | 4,975 | | | | 5,012 | | |

Caesars Resort Collection LLC / CRC

Finco, Inc., 144A

5.25%, due 10/15/25 (d) | | | 25,870 | | | | 24,641 | | |

CCO Holdings LLC / CCO Holdings

Capital Corp., 144A

5.125%, due 05/01/27 (d) | | | 250 | | | | 237 | | |

Charter Communications Operating LLC /

Charter Communications Operating

Capital

3.579%, due 07/23/20 | | | 29,148 | | | | 29,164 | | |

4.20%, due 03/15/28 | | | 9,950 | | | | 9,519 | | |

4.50%, due 02/01/24 | | | 2,985 | | | | 3,003 | | |

Dana, Inc.

6.00%, due 09/15/23 | | | 3,925 | | | | 4,038 | | |

Delphi Technologies PLC, 144A

5.00%, due 10/01/25 (d) | | | 1,000 | | | | 941 | | |

Dollar Tree, Inc.

3.036% (3 mo. USD LIBOR + 0.700%),

due 04/17/20 (c) | | | 6,965 | | | | 6,976 | | |

EMI Music Publishing Group North America

Holdings, Inc., 144A

7.625%, due 06/15/24 (d) | | | 4,910 | | | | 5,284 | | |

Expedia Group, Inc.

5.00%, due 02/15/26 | | | 28,360 | | | | 28,889 | | |

Foot Locker, Inc.

8.50%, due 01/15/22 | | | 4,340 | | | | 4,893 | | |

General Motors Co.

4.875%, due 10/02/23 | | | 41,400 | | | | 42,387 | | |

3.50%, due 10/02/18 | | | 29,525 | | | | 29,525 | | |

General Motors Financial Co., Inc.

3.50%, due 07/10/19 | | | 4,975 | | | | 4,997 | | |

3.10%, due 01/15/19 | | | 4,915 | | | | 4,919 | | |

Hyatt Hotels Corp.

4.375%, due 09/15/28 | | | 4,975 | | | | 4,892 | | |

| | | Par Value | | Value | |

International Game Technology PLC, 144A

6.50%, due 02/15/25 (d) | | $ | 19,600 | | | $ | 20,335 | | |

6.25%, due 02/15/22 (d) | | | 14,800 | | | | 15,337 | | |

6.25%, due 01/15/27 (d) | | | 200 | | | | 202 | | |

KFC Holding Co/Pizza Hut Holdings LLC/

Taco Bell of America LLC, 144A

5.25%, due 06/01/26 (d) | | | 1,000 | | | | 996 | | |

5.00%, due 06/01/24 (d) | | | 1,000 | | | | 992 | | |

Lear Corp.

5.25%, due 01/15/25 | | | 11,060 | | | | 11,429 | | |

5.375%, due 03/15/24 | | | 10,512 | | | | 10,808 | | |

Lithia Motors, Inc., 144A

5.25%, due 08/01/25 (d) | | | 1,990 | | | | 1,905 | | |

Live Nation Entertainment, Inc., 144A

4.87%, due 11/01/24 (d) | | | 14,935 | | | | 14,636 | | |

5.375%, due 06/15/22 (d) | | | 6,975 | | | | 7,062 | | |

5.625%, due 03/15/26 (d) | | | 4,975 | | | | 5,025 | | |

Marriott International, Inc.

4.00%, due 04/15/28 | | | 4,975 | | | | 4,870 | | |

Mattel, Inc., 144A

6.75%, due 12/31/25 (d) | | | 4,980 | | | | 4,880 | | |

MGM Resorts International

8.62%, due 02/01/19 | | | 3,532 | | | | 3,585 | | |

5.75%, due 06/15/25 | | | 2,985 | | | | 2,996 | | |

Netflix, Inc.

5.87%, due 02/15/25 | | | 11,940 | | | | 12,343 | | |

5.37%, due 02/01/21 | | | 1,990 | | | | 2,040 | | |

Netflix, Inc., 144A

4.87%, due 04/15/28 (d) | | | 31,840 | | | | 29,930 | | |

5.87%, due 11/15/28 (d) | | | 6,965 | | | | 6,939 | | |

Omnicom Group, Inc. / Omnicom

Capital, Inc.

3.62%, due 05/01/22 | | | 30,425 | | | | 30,253 | | |

6.25%, due 07/15/19 | | | 2,950 | | | | 3,025 | | |

Penn National Gaming, Inc., 144A

5.625%, due 01/15/27 (d) | | | 9,950 | | | | 9,599 | | |

Penske Automotive Group, Inc.

5.50%, due 05/15/26 | | | 11,343 | | | | 11,028 | | |

5.37%, due 12/01/24 | | | 3,580 | | | | 3,508 | | |

Sands China Ltd, 144A

5.40%, due 08/08/28 (d) | | | 5,000 | | | | 4,976 | | |

5.125%, due 08/08/25 (d) | | | 3,000 | | | | 2,993 | | |

4.60%, due 08/08/23 (d) | | | 2,000 | | | | 2,000 | | |

Scientific Games International, Inc.

10.00%, due 12/01/22 | | | 19,665 | | | | 20,820 | | |

Starbucks Corp.

3.80%, due 08/15/25 | | | 9,950 | | | | 9,884 | | |

4.00%, due 11/15/28 | | | 2,985 | | | | 2,977 | | |

Station Casinos LLC, 144A

5.00%, due 10/01/25 (d) | | | 1,990 | | | | 1,906 | | |

Tapestry, Inc.

3.00%, due 07/15/22 | | | 12,145 | | | | 11,708 | | |

4.125%, due 07/15/27 | | | 4,975 | | | | 4,718 | | |

Tempur Sealy International, Inc.

5.50%, due 06/15/26 | | | 1,965 | | | | 1,884 | | |

The Gap, Inc.

5.95%, due 04/12/21 | | | 1,965 | | | | 2,051 | | |

The William Carter Co.

5.25%, due 08/15/21 | | | 36,132 | | | | 36,493 | | |

See accompanying Notes to Financial Statements.

20 OAKMARK FUNDS

Oakmark Equity and Income Fund September 30, 2018

Schedule of Investments (in thousands) (continued)

| | | Par Value | | Value | |

FIXED INCOME - 26.6% (continued) | |

CORPORATE BONDS - 14.1% (continued) | |

CONSUMER DISCRETIONARY - 4.0% (continued) | |

Tribune Media Co.

5.875%, due 07/15/22 | | $ | 1,000 | | | $ | 1,018 | | |

Under Armour, Inc.

3.25%, due 06/15/26 | | | 12,565 | | | | 11,073 | | |

Wolverine World Wide, Inc., 144A

5.00%, due 09/01/26 (d) | | | 12,140 | | | | 11,912 | | |